UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-04257

DWS Variable Series I

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and Address of Agent for Service)

| Date of fiscal year end: | 12/31 |

| | |

| Date of reporting period: | 12/31/2011 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

DECEMBER 31, 2011

ANNUAL REPORT

DWS VARIABLE SERIES I

DWS Bond VIP

��

Contents

12 Statement of Assets and Liabilities 13 Statement of Operations 14 Statement of Changes in Net Assets 16 Notes to Financial Statements 23 Report of Independent Registered Public Accounting Firm 24 Information About Your Fund's Expenses 26 Investment Management Agreement Approval 29 Summary of Management Fee Evaluation by Independent Fee Consultant 31 Board Members and Officers |

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Bond investments are subject to interest-rate and credit risks. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investments in lower-quality and non-rated securities present greater risk of loss than investments in higher-quality securities. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. See the prospectus for details.

DWS Investments is part of Deutsche Bank's Asset Management division and, within the U.S., represents the retail asset management activities of Deutsche Bank AG, Deutsche Bank Trust Company Americas, Deutsche Investment Management Americas Inc. and DWS Trust Company.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary December 31, 2011

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund's most recent month-end performance. Performance doesn't reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns.

The gross expense ratio of the Fund, as stated in the fee table of the prospectus dated May 1, 2011 is 0.59% for Class A shares and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

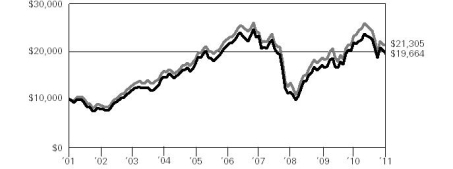

| Growth of an Assumed $10,000 Investment |

[] DWS Bond VIP — Class A [] Barclays Capital U.S. Aggregate Bond Index | The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index representing domestic taxable investment-grade bonds, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities with an average maturity of one year or more. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| |

| Yearly periods ended December 31 | |

| Comparative Results | |

| DWS Bond VIP | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | |

| Class A | Growth of $10,000 | | $ | 10,568 | | | $ | 12,422 | | | $ | 10,771 | | | $ | 13,793 | |

| Average annual total return | | | 5.68 | % | | | 7.50 | % | | | 1.50 | % | | | 3.27 | % |

| Barclays Capital U.S. Aggregate Bond Index | Growth of $10,000 | | $ | 10,784 | | | $ | 12,171 | | | $ | 13,701 | | | $ | 17,535 | |

| Average annual total return | | | 7.84 | % | | | 6.77 | % | | | 6.50 | % | | | 5.78 | % |

The growth of $10,000 is cumulative.

Management Summary December 31, 2011

During the 12-month period ended December 31, 2011, the U.S. Federal Reserve Board (the Fed) maintained the benchmark federal funds rate at near-zero levels and continued to engage in bond purchases designed to lower longer-term interest rates as it sought to stimulate economic growth. U.S. Treasury yields fell from already historically low levels for the 12 months, as for much of the year investors sought a refuge from the debt crisis in Europe. Most sectors of the bond market benefited from the declining rate environment, with high-quality corporate bonds benefiting in particular, as investors sought yields in an environment of extraordinarily low interest rates. Somewhat counterintuitive, a historic credit downgrade of U.S. debt was met by markets as a further reason to seek a "safe haven" in U.S. Treasuries.1 Corporate bonds continued to be supported by strong profits and balance sheets over the period.

During the 12-month period ended December 31, 2011, the Fund provided a total return of 5.68% (Class A shares, unadjusted for contract charges), compared with the 7.84% return of its benchmark, the Barclays Capital U.S. Aggregate Bond Index.2

The Fund's performance vs. the benchmark continued to be driven principally by exposure to more credit-sensitive fixed-income sectors. Our overweighting of investment-grade corporate bonds was the leading positive contributor to returns during the year.3 While our high-yield corporate and emerging-markets holdings benefitted from improved market sentiment during the fourth quarter, they lagged over the course of the year and ultimately detracted from relative performance. Performance also benefitted from short positions in the euro and the Australian dollar, as well as yield curve positioning.4,5 Performance over the year was constrained by short positions in German bunds (Germany government bonds), long positions in residential mortgage-backed securities and short positions in the Japanese yen.6 We continue to view credit sectors as attractive on a relative basis, especially in the new issue market. In our view, corporate fundamentals are strong, interest rates are low and debt markets are liquid. However, we continue to expect that the timetable for resolving the debt issues in Europe will be protracted and that credit markets will be jittery along the way. In addition, there is still some risk of a global recession as developed-market governments wrestle with the need to bring budgets into better balance. We will continue to monitor indicators including housing, consumer spending and job growth to determine the strength of the economic recovery and the ability to support corporate profitability on a sustainable basis.

Kenneth R. Bowling, CFA

Jamie Guenther, CFA

John Brennan

Bruce Harley, CFA, CEBS

J. Richard Robben, CFA

David Vignolo, CFA

J. Kevin Horsley, CFA, CPA

Stephen Willer, CFA

William Chepolis, CFA

Portfolio Managers

1 Credit quality measures a bond issuer's ability to repay interest and principal in a timely manner. Rating agencies assign letter designations, such as AAA, AA and so forth. The lower the rating, the higher the probability of default. Credit quality does not remove market risk and is subject to change.

2 The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index representing domestic taxable investment-grade bonds, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities with an average maturity of one year or more.

Index returns do not reflect fees or expenses and it is not possible to invest directly into an index.

3 "Overweight" means the Fund holds a higher weighting in a given sector or security than the benchmark. "Underweight" means the Fund holds a lower weighting.

4 The yield curve is a graphical representation of how yields on bonds of different maturities compare. Normally, yield curves slant up, as bonds with longer maturities typically offer higher yields than short-term bonds.

5 "Short position" refers to borrowing a security and then selling it with expectation that the security will fall in value. The security can then be purchased and repaid to the borrower at a lower price.

6 "Long position" refers to buying a security with the expectation that it will rise in value.

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

Asset Allocation (As a % of Investment Portfolio excluding Securities Lending Collateral) | 12/31/11 | 12/31/10 |

| | | |

| Mortgage-Backed Securities Pass-Throughs | 33% | 28% |

| Government & Agency Obligations | 29% | 21% |

| Corporate Bonds | 21% | 31% |

| Commercial Mortgage-Backed Securities | 6% | 9% |

| Municipal Bonds and Notes | 5% | 5% |

| Collateralized Mortgage Obligations | 3% | 4% |

| Asset-Backed | 2% | — |

| Cash Equivalents | 1% | 2% |

| | 100% | 100% |

Quality (Excludes Cash Equivalents and Securities Lending Collateral) | 12/31/11 | 12/31/10 |

| | | |

| AAA | 64% | 56% |

| AA | 5% | 5% |

| A | 7% | 7% |

| BBB | 15% | 19% |

| BB or Below | 7% | 10% |

| Not Rated | 2% | 3% |

| | 100% | 100% |

| Interest Rate Sensitivity | 12/31/11 | 12/31/10 |

| | | |

| Effective Maturity | 6.9 years | 7.3 years |

| Effective Duration | 4.9 years | 4.9 years |

Effective maturity is the weighted average of the maturity date of bonds held by the Fund taking into consideration any available maturity shortening features.

Effective duration is an approximate measure of the Fund's sensitivity to interest rate changes taking into consideration any maturity shortening features.

Asset allocation, quality and interest rate sensitivity are subject to change.

The quality ratings represent the higher of Moody's Investors Service, Inc. ("Moody's") or Standard & Poor's Corporation ("S&P") credit ratings. The ratings of Moody's and S&P represent their opinions as to the quality of the securities they rate. Credit quality measures a bond issuer's ability to repay interest and principal in a timely manner. Ratings are relative and subjective and are not absolute standards of quality. Credit quality does not remove market risk and is subject to change.

For more complete details about the Fund's investment portfolio, see page 6.

Following the Fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC's Web site at www.sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. The Fund's portfolio holdings are also posted on www.dws-investments.com from time to time. Please see the Fund's current prospectus for more information.

Investment Portfolio December 31, 2011 | | | Principal Amount ($)(a) | | | Value ($) | |

| | | | |

| Corporate Bonds 27.5% | |

| Consumer Discretionary 7.1% | |

| AMC Entertainment, Inc., 8.75%, 6/1/2019 | | | 900,000 | | | | 931,500 | |

| CCO Holdings LLC, 6.5%, 4/30/2021 | | | 420,000 | | | | 425,250 | |

| DIRECTV Holdings LLC, 6.35%, 3/15/2040 | | | 315,000 | | | | 358,350 | |

| JC Penney Co., Inc., 5.65%, 6/1/2020 | | | 785,000 | | | | 769,300 | |

| Johnson Controls, Inc., 3.75%, 12/1/2021 | | | 300,000 | | | | 309,759 | |

| Levi Strauss & Co., 7.625%, 5/15/2020 (b) | | | 600,000 | | | | 612,750 | |

| MGM Resorts International, 9.0%, 3/15/2020 | | | 550,000 | | | | 609,125 | |

| NBCUniversal Media LLC: | |

| 5.15%, 4/30/2020 | | | 500,000 | | | | 556,688 | |

| 5.95%, 4/1/2041 | | | 350,000 | | | | 411,395 | |

| Norcraft Companies LP, 10.5%, 12/15/2015 | | | 100,000 | | | | 93,250 | |

| Royal Caribbean Cruises Ltd., 7.25%, 6/15/2016 | | | 750,000 | | | | 806,250 | |

| Time Warner Cable, Inc.: | |

| 4.0%, 9/1/2021 | | | 300,000 | | | | 303,518 | |

| 7.3%, 7/1/2038 | | | 40,000 | | | | 48,606 | |

| Time Warner, Inc., 7.625%, 4/15/2031 | | | 400,000 | | | | 516,353 | |

| Viacom, Inc., 2.5%, 12/15/2016 | | | 730,000 | | | | 729,723 | |

| Yum! Brands, Inc., 3.875%, 11/1/2020 | | | 465,000 | | | | 475,531 | |

| | | | | 7,957,348 | |

| Consumer Staples 2.1% | |

| Anheuser-Busch InBev Worldwide, Inc., 7.75%, 1/15/2019 | | | 750,000 | | | | 971,369 | |

| CVS Caremark Corp., 5.75%, 5/15/2041 | | | 120,000 | | | | 142,888 | |

| Kraft Foods, Inc., 5.375%, 2/10/2020 | | | 725,000 | | | | 836,542 | |

| Kroger Co., 5.4%, 7/15/2040 | | | 375,000 | | | | 404,006 | |

| | | | | 2,354,805 | |

| Energy 3.5% | |

| DCP Midstream LLC, 144A, 9.75%, 3/15/2019 | | | 480,000 | | | | 625,723 | |

| Encana Corp., 5.15%, 11/15/2041 | | | 116,000 | | | | 118,422 | |

| Enterprise Products Operating LLC, 6.125%, 10/15/2039 | | | 460,000 | | | | 513,805 | |

| ONEOK Partners LP, 6.15%, 10/1/2016 | | | 557,000 | | | | 639,608 | |

| Plains All American Pipeline LP, 8.75%, 5/1/2019 | | | 450,000 | | | | 574,872 | |

| Reliance Holdings U.S.A., Inc., 144A, 4.5%, 10/19/2020 | | | 650,000 | | | | 590,592 | |

| Weatherford International Ltd., 5.125%, 9/15/2020 | | | 700,000 | | | | 727,424 | |

| Williams Partners LP, 4.0%, 11/15/2021 | | | 112,000 | | | | 115,004 | |

| | | | | 3,905,450 | |

| | | Principal Amount ($)(a) | | | Value ($) | |

| | | | | | | | | |

| Financials 6.2% | |

| American Express Credit Corp., 2.8%, 9/19/2016 | | | | 1,000,000 | | | | 1,004,900 | |

| Bank of America Corp., 5.75%, 12/1/2017 | | | | 360,000 | | | | 340,028 | |

| Bank of New York Mellon Corp., 2.4%, 1/17/2017 | | | | 675,000 | | | | 673,475 | |

| Bunge Ltd. Finance Corp., 4.1%, 3/15/2016 | | | | 145,000 | | | | 150,151 | |

| Citigroup, Inc., 4.5%, 1/14/2022 | | | | 250,000 | | | | 240,506 | |

| CNA Financial Corp., 5.75%, 8/15/2021 | | | | 598,000 | | | | 610,215 | |

| Ford Motor Credit Co., LLC, 7.0%, 4/15/2015 | | | | 925,000 | | | | 994,375 | |

| JPMorgan Chase & Co., 5.125%, 9/15/2014 | | | | 600,000 | | | | 632,581 | |

| Lincoln National Corp., 8.75%, 7/1/2019 | | | | 325,000 | | | | 395,317 | |

| Nationwide Financial Services, Inc., 144A, 5.375%, 3/25/2021 | | | | 227,000 | | | | 222,970 | |

| Nordea Bank AB, 144A, 4.875%, 5/13/2021 | | | | 440,000 | | | | 371,891 | |

| PNC Bank NA, 6.875%, 4/1/2018 | | | | 200,000 | | | | 226,825 | |

| Prudential Financial, Inc., 7.375%, 6/15/2019 | | | | 120,000 | | | | 141,847 | |

| Red Arrow International Leasing PLC, "A", 8.375%, 6/30/2012 | RUB | | | 451,113 | | | | 13,658 | |

| SunTrust Banks, Inc., 3.6%, 4/15/2016 | | | | 185,000 | | | | 188,392 | |

| The Goldman Sachs Group, Inc., 6.0%, 6/15/2020 | | | | 500,000 | | | | 512,181 | |

| Toll Brothers Finance Corp., 8.91%, 10/15/2017 | | | | 200,000 | | | | 230,489 | |

| | | | | 6,949,801 | |

| Health Care 2.9% | |

| Amgen, Inc., 5.15%, 11/15/2041 | | | | 300,000 | | | | 311,005 | |

| Express Scripts, Inc., 7.25%, 6/15/2019 | | | | 720,000 | | | | 858,002 | |

| Gilead Sciences, Inc., 4.4%, 12/1/2021 | | | | 225,000 | | | | 238,206 | |

| McKesson Corp., 4.75%, 3/1/2021 | | | | 475,000 | | | | 538,148 | |

| Quest Diagnostics, Inc.: | |

| 4.7%, 4/1/2021 | | | | 650,000 | | | | 692,952 | |

| 6.4%, 7/1/2017 | | | | 500,000 | | | | 591,370 | |

| | | | | 3,229,683 | |

| Industrials 0.5% | |

| Burlington Northern Santa Fe LLC, 3.45%, 9/15/2021 | | | | 82,000 | | | | 84,516 | |

| CSX Corp., 6.15%, 5/1/2037 | | | | 400,000 | | | | 481,020 | |

| | | | | 565,536 | |

| Information Technology 1.7% | |

| Applied Materials, Inc., 5.85%, 6/15/2041 | | | | 500,000 | | | | 569,861 | |

| Equinix, Inc., 7.0%, 7/15/2021 | | | | 850,000 | | | | 896,750 | |

| Hewlett-Packard Co., 3.3%, 12/9/2016 | | | | 415,000 | | | | 423,758 | |

| | | | | 1,890,369 | |

| | | Principal Amount ($)(a) | | | Value ($) | |

| | | | | | | | | |

| Materials 2.1% | |

| ArcelorMittal, 6.125%, 6/1/2018 | | | 500,000 | | | | 493,781 | |

| Corporacion Nacional del Cobre — Codelco, REG S, 7.5%, 1/15/2019 | | | 600,000 | | | | 764,181 | |

| Dow Chemical Co.: | |

| 4.25%, 11/15/2020 | | | | 455,000 | | | | 472,945 | |

| 5.25%, 11/15/2041 | | | | 100,000 | | | | 105,187 | |

| Ecolab, Inc.: | |

| 4.35%, 12/8/2021 | | | | 350,000 | | | | 373,761 | |

| 5.5%, 12/8/2041 | | | | 78,000 | | | | 86,435 | |

| | | | | 2,296,290 | |

| Telecommunication Services 0.1% | |

| AT&T, Inc., 3.875%, 8/15/2021 | | | 125,000 | | | | 132,219 | |

| Utilities 1.3% | |

| DTE Energy Co., 7.625%, 5/15/2014 | | | 152,000 | | | | 172,730 | |

| Energy Future Competitive Holdings Co., 7.48%, 1/1/2017 | | | 24,287 | | | | 21,560 | |

| FirstEnergy Solutions Corp., 6.8%, 8/15/2039 | | | 367,000 | | | | 410,953 | |

| Majapahit Holding BV, REG S, 7.75%, 10/17/2016 | | | 100,000 | | | | 112,250 | |

| Sempra Energy, 6.5%, 6/1/2016 | | | 650,000 | | | | 758,226 | |

| | | | | 1,475,719 | |

Total Corporate Bonds (Cost $29,249,980) | | | | 30,757,220 | |

| | |

| Mortgage-Backed Securities Pass-Throughs 41.9% | |

| Federal Home Loan Mortgage Corp.: | | | | | | | | |

| 4.5%, 6/1/2041 | | | | 2,607,348 | | | | 2,761,752 | |

| 5.491%*, 2/1/2038 | | | | 334,941 | | | | 364,563 | |

| 5.5%, with various maturities from 10/1/2023 until 8/1/2024 | | | 284,197 | | | | 309,075 | |

| 6.5%, 3/1/2026 | | | | 591,893 | | | | 661,799 | |

| 7.0%, 1/1/2038 | | | | 86,417 | | | | 96,693 | |

| Federal National Mortgage Association: | | | | | | | | |

| 2.458%*, 8/1/2037 | | | | 109,565 | | | | 116,687 | |

| 3.0%, 6/1/2026 (c) | | | | 5,725,000 | | | | 5,911,957 | |

| 3.5%, 12/1/2040 (c) | | | | 5,500,000 | | | | 5,657,266 | |

| 4.0%, with various maturities from 2/1/2040 until 9/1/2040 (c) | | | 22,864,712 | | | | 24,020,143 | |

| 5.0%, with various maturities from 2/1/2021 until 8/1/2040 | | | 2,755,054 | | | | 2,975,098 | |

| 5.108%*, 9/1/2038 | | | | 110,061 | | | | 115,455 | |

| 5.359%*, 1/1/2038 | | | | 362,458 | | | | 386,018 | |

| 5.5%, with various maturities from 12/1/2032 until 4/1/2037 | | | 1,933,870 | | | | 2,102,693 | |

| 6.0%, with various maturities from 4/1/2024 until 3/1/2025 | | | 608,908 | | | | 679,889 | |

| 6.5%, with various maturities from 3/1/2017 until 12/1/2037 | | | 689,389 | | | | 766,406 | |

| 8.0%, 9/1/2015 | | | | 10,723 | | | | 11,516 | |

Total Mortgage-Backed Securities Pass-Throughs (Cost $46,149,580) | | | | 46,937,010 | |

| | |

| | | Principal Amount ($)(a) | | | Value ($) | |

| | | | | | | | | |

| Asset-Backed 3.0% | |

| Credit Card Receivables 1.0% | |

| Citibank Omni Master Trust, "A14", Series 2009-A14A, 144A, 3.028%*, 8/15/2018 | | | 1,000,000 | | | | 1,049,006 | |

| Student Loans 2.0% | |

| Nelnet Student Loan Trust: | |

| "A1", Series 2007-1, 0.516%*, 11/27/2018 | | | | 932,759 | | | | 919,760 | |

| "A4", Series 2006-1, 0.585%*, 11/23/2022 | | | | 1,375,000 | | | | 1,355,665 | |

| | | | | 2,275,425 | |

Total Asset-Backed (Cost $3,325,707) | | | | 3,324,431 | |

| | |

| Commercial Mortgage-Backed Securities 7.3% | |

| Banc of America Commercial Mortgage, Inc., "A4", Series 2007-1, 5.451%, 1/15/2049 | | | 1,660,000 | | | | 1,803,504 | |

| Bear Stearns Commercial Mortgage Securities, Inc., "A4", Series 2007-PW16, 5.715%*, 6/11/2040 | | | 140,000 | | | | 153,273 | |

| Greenwich Capital Commercial Funding Corp., "A4", Series 2007-GG9, 5.444%, 3/10/2039 | | | 1,140,000 | | | | 1,233,920 | |

| JPMorgan Chase Commercial Mortgage Securities Corp.: | | | | | | | | |

| "A4", Series 2007-C1, 5.716%, 2/15/2051 | | | | 475,000 | | | | 514,204 | |

| "F", Series 2007-LD11, 5.817%*, 6/15/2049 | | | | 650,000 | | | | 72,246 | |

| "G", Series 2007-LD11, 144A, 5.817%*, 6/15/2049 | | | 760,000 | | | | 52,820 | |

| "H", Series 2007-LD11, 144A, 5.817%*, 6/15/2049 | | | 460,000 | | | | 22,448 | |

| "A4", Series 2007-LD12, 5.882%, 2/15/2051 | | | | 990,000 | | | | 1,075,255 | |

| LB-UBS Commercial Mortgage Trust: | | | | | | | | |

| "E", Series 2005-C2, 5.35%*, 4/15/2040 | | | | 500,000 | | | | 278,393 | |

| "A4", Series 2007-C6, 5.858%, 7/15/2040 | | | | 915,000 | | | | 1,002,288 | |

| Merrill Lynch Mortgage Trust, "ASB", Series 2007-C1, 5.834%*, 6/12/2050 | | | 590,000 | | | | 633,065 | |

| Morgan Stanley Reremic Trust, "A4A", Series 2009-GG10, 144A, 5.79%*, 8/12/2045 | | | 1,150,000 | | | | 1,289,311 | |

| Wachovia Bank Commercial Mortgage Trust, "H", Series 2007-C32, 144A, 5.74%*, 6/15/2049 | | | 770,000 | | | | 31,031 | |

Total Commercial Mortgage-Backed Securities (Cost $10,376,911) | | | | 8,161,758 | |

| | |

| Collateralized Mortgage Obligations 4.2% | |

| Countrywide Home Loans, "A2", Series 2006-1, 6.0%, 3/25/2036 | | | 552,197 | | | | 419,458 | |

| CS First Boston Mortgage Securities Corp., "10A3", Series 2005-10, 6.0%, 11/25/2035 | | | 153,330 | | | | 91,367 | |

| | | Principal Amount ($)(a) | | | Value ($) | |

| | | | | | | | | |

| Federal Home Loan Mortgage Corp., "PE", Series 2898, 5.0%, 5/15/2033 | | | | 335,000 | | | | 358,525 | |

| Federal National Mortgage Association: | | |

| ''IO", Series 2010-143, Interest Only, 5.0%, 12/25/2025 | | | | 4,462,393 | | | | 540,359 | |

| "EG", Series 2005-22, 5.0%, 11/25/2033 | | | | 750,000 | | | | 810,055 | |

| "TC", Series 2007-77, 5.5%, 9/25/2034 | | | | 370,000 | | | | 394,242 | |

| Government National Mortgage Association: | | |

| "IU", Series 2010-164, Interest Only, 2.0%, 12/20/2013 | | | | 2,592,743 | | | | 69,969 | |

| "MI", Series 2010-85, Interest Only, 4.5%, 1/20/2036 | | | | 1,780,708 | | | | 188,357 | |

| "GI", Series 2010-89, Interest Only, 4.5%, 5/20/2039 | | | | 1,223,535 | | | | 197,610 | |

| "EI", Series 2010-134, Interest Only, 4.5%, 11/20/2039 | | | | 639,304 | | | | 101,340 | |

| "DI", Series 2011-40, Interest Only, 4.5%, 12/20/2040 | | | | 3,289,647 | | | | 433,968 | |

| "IM", Series 2010-87, Interest Only, 4.75%, 3/20/2036 | | | | 1,756,616 | | | | 204,816 | |

| "IA", Series 2010-58, Interest Only, 5.0%, 3/20/2039 | | | | 2,267,536 | | | | 376,618 | |

| "KI", Series 2010-130, Interest Only, 5.5%, 9/16/2040 | | | | 388,925 | | | | 64,063 | |

| MASTR Alternative Loans Trust, "8A1", Series 2004-3, 7.0%, 4/25/2034 | | | | 11,421 | | | | 11,438 | |

| Vericrest Opportunity Loan Transferee, "B1", Series 2010-NPL1, 144A, 8.0%, 5/25/2039 | | | | 505,338 | | | | 469,696 | |

Total Collateralized Mortgage Obligations (Cost $5,123,946) | | | | 4,731,881 | |

| | |

| Government & Agency Obligations 36.5% | |

| Sovereign Bonds 8.1% | |

| Dominican Republic, REG S, 7.5%, 5/6/2021 | | | | 800,000 | | | | 784,000 | |

| Eskom Holdings SOC Ltd., REG S, 5.75%, 1/26/2021 | | | | 400,000 | | | | 407,000 | |

| Republic of Argentina, GDP Linked Note, 12/15/2035 (d) | | | | 410,000 | | | | 51,426 | |

| Republic of Croatia, REG S, 6.75%, 11/5/2019 | | | | 550,000 | | | | 522,500 | |

| Republic of Egypt, 9.1%, 9/20/2012 | EGP | | | 230,000 | | | | 37,540 | |

| Republic of El Salvador, REG S, 8.25%, 4/10/2032 | | | | 40,000 | | | | 43,400 | |

| Republic of Indonesia, REG S, 4.875%, 5/5/2021 | | | | 800,000 | | | | 856,000 | |

| | | Principal Amount ($)(a) | | | Value ($) | |

| | | | | | | | | |

| Republic of Lithuania: | |

| REG S, 5.125%, 9/14/2017 | | | | 200,000 | | | | 196,000 | |

| 144A, 6.125%, 3/9/2021 | | | | 225,000 | | | | 223,875 | |

| Republic of Panama: | |

| 5.2%, 1/30/2020 | | | | 425,000 | | | | 481,312 | |

| 7.125%, 1/29/2026 | | | | 220,000 | | | | 286,550 | |

| 7.25%, 3/15/2015 | | | | 80,000 | | | | 92,400 | |

| Republic of Peru, 7.35%, 7/21/2025 | | | 1,000,000 | | | | 1,325,000 | |

| Republic of Poland, 5.0%, 3/23/2022 | | | 700,000 | | | | 703,500 | |

| Republic of Serbia: | |

| REG S, 6.75%, 11/1/2024 | | | | 446,333 | | | | 421,785 | |

| REG S, 7.25%, 9/28/2021 | | | | 300,000 | | | | 292,035 | |

| Republic of South Africa, 5.5%, 3/9/2020 | | | | 750,000 | | | | 840,000 | |

| Republic of Venezuela, REG S, 7.75%, 10/13/2019 | | | 1,000,000 | | | | 715,000 | |

| Russian Federation, REG S, 5.0%, 4/29/2020 | | | | 800,000 | | | | 825,320 | |

| | | | | 9,104,643 | |

| U.S. Treasury Obligations 28.4% | |

| U.S. Treasury Bonds: | |

| 3.75%, 8/15/2041 (b) | | | | 2,000,000 | | | | 2,352,188 | |

| 4.75%, 2/15/2037 | | | | 2,000,000 | | | | 2,716,562 | |

| 5.375%, 2/15/2031 | | | | 1,000,000 | | | | 1,425,312 | |

| 7.125%, 2/15/2023 (b) | | | | 3,400,000 | | | | 5,141,970 | |

| U.S. Treasury Inflation-Indexed Note, 0.625%, 7/15/2021 | | | 2,762,843 | | | | 2,955,595 | |

| U.S. Treasury Notes: | |

| 0.5%, 10/15/2013 (b) | | | | 1,000,000 | | | | 1,004,336 | |

| 0.875%, 1/31/2012 | | | | 1,000,000 | | | | 1,000,625 | |

| 1.0%, 8/31/2016 | | | | 11,000,000 | | | | 11,120,318 | |

| 1.5%, 7/31/2016 | | | | 1,250,000 | | | | 1,292,285 | |

| 2.0%, 11/15/2021 (b) | | | | 2,700,000 | | | | 2,730,796 | |

| | | | | 31,739,987 | |

Total Government & Agency Obligations (Cost $39,068,924) | | | | 40,844,630 | |

| | |

| Loan Participations and Assignments 0.3% | |

| Sovereign Loans | |

| Gazprom, 144A, 8.125%, 7/31/2014 | | | 205,000 | | | | 221,400 | |

| Russian Agricultural Bank, REG S, 7.75%, 5/29/2018 | | | 100,000 | | | | 106,500 | |

Total Loan Participations and Assignments (Cost $302,977) | | | | 327,900 | |

| | |

| Municipal Bonds and Notes 6.8% | |

| California, University Revenues, Build America Bonds, 5.946%, 5/15/2045 (f) | | | 420,000 | | | | 489,413 | |

| Gwinnett County, GA, Development Authority Revenue, Gwinnett Stadium Project, 6.4%, 1/1/2028 (f) | | | 655,000 | | | | 750,938 | |

| Jicarilla, NM, Sales & Special Tax Revenue, Apache Nation Revenue, 144A, 5.2%, 12/1/2013 (f) | | | 260,000 | | | | 259,464 | |

| Kentucky, Asset/Liability Commission, General Fund Revenue, 3.165%, 4/1/2018 (f) | | | 1,300,000 | | | | 1,334,827 | |

| | | Principal Amount ($)(a) | | | Value ($) | |

| | | | | | | | | |

| Los Angeles, CA, Community Development Agency Tax Allocation Revenue, Adelante Eastside Project, Series C, 6.49%, 9/1/2037, INS: Radian (f) | | | 310,000 | | | | 292,290 | |

| Louisville & Jefferson County, KY, Metropolitan Sewer District & Drain Systems, Build America Bonds, 6.25%, 5/15/2043 (f) | | | 400,000 | | | | 501,952 | |

| Nashville & Davidson County, TN, Metropolitan Government, Convention Center Authority Revenue, Build America Bonds, Series B, 6.731%, 7/1/2043 (f) | | | 400,000 | | | | 482,000 | |

| New Jersey, Economic Development Authority Revenue, Series B, 6.5%, 11/1/2013, INS: AGC (f) | | | 860,000 | | | | 934,880 | |

| Port Authority New York & New Jersey, One Hundred Fiftieth Series, 4.75%, 9/15/2016 (f) | | | 930,000 | | | | 1,055,550 | |

| Rhode Island, Convention Center Authority Revenue, Civic Center, Series A, 6.06%, 5/15/2035, INS: AGMC (f) | | | 515,000 | | | | 574,931 | |

| Virgin Islands, Port Authority Marine Revenue, Series B, 5.08%, 9/1/2013, INS: AGMC (f) | | | 610,000 | | | | 618,101 | |

| Washington, Central Puget Sound Regional Transit Authority, Sales & Use Tax Revenue, Series A, 5.0%, 11/1/2036 | | | 285,000 | | | | 303,428 | |

Total Municipal Bonds and Notes (Cost $6,935,693) | | | | 7,597,774 | |

| | | Principal Amount ($)(a) | | | Value ($) | |

| | | | | | | | | |

| Short-Term U.S. Treasury Obligation 1.0% | |

| U.S. Treasury Bill, 0.015%**, 3/8/2012 (e) (Cost $1,121,971) | | | 1,122,000 | | | | 1,121,964 | |

| | | Shares | | | Value ($) | |

| | | | |

| Securities Lending Collateral 10.1% | |

| Daily Assets Fund Institutional, 0.18% (g) (h) (Cost $11,307,660) | | | 11,307,660 | | | | 11,307,660 | |

| | |

| Cash Equivalents 1.3% | |

| Central Cash Management Fund, 0.07% (g) (Cost $1,438,901) | | | 1,438,901 | | | | 1,438,901 | |

| | | % of Net Assets | | | Value ($) | |

| | | | |

Total Investment Portfolio (Cost $154,402,250)+ | | | 139.9 | | | | 156,551,129 | |

| Other Assets and Liabilities, Net | | | (39.9 | ) | | | (44,615,310 | ) |

| Net Assets | | | 100.0 | | | | 111,935,819 | |

* Floating rate securities' yields vary with a designated market index or market rate, such as the coupon-equivalent of the U.S. Treasury Bill rate. These securities are shown at their current rate as of December 31, 2011.

** Annualized yield at time of purchase; not a coupon rate.

+ The cost for federal income tax purposes was $154,402,250. At December 31, 2011, net unrealized appreciation for all securities based on tax cost was $2,148,879. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $5,333,197 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $3,184,318.

(a) Principal amount stated in U.S. dollars unless otherwise noted.

(b) All or a portion of these securities were on loan (see Notes to Financial Statements). The value of all securities loaned at December 31, 2011 amounted to $10,983,329, which is 9.8% of net assets.

(c) When-issued or delayed delivery security included.

(d) Security is linked to Argentine Republic Gross Domestic Product (GDP). Security does not pay principal over life of security or at expiration. Payments are based on growth of Argentina GDP, subject to certain conditions.

(e) At December 31, 2011, this security has been pledged, in whole or in part, to cover initial margin requirements for open futures contracts.

(f) Taxable issue.

(g) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

(h) Represents collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates.

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

AGC: Assured Guaranty Corp.

AGMC: Assured Guaranty Municipal Corp.

GDP: Gross Domestic Product

INS: Insured

Interest Only: Interest Only (IO) bonds represent the "interest only" portion of payments on a pool of underlying mortgages or mortgage-backed securities. IO securities are subject to prepayment risk of the pool of underlying mortgages.

Radian: Radian Asset Assurance, Inc.

REG S: Securities sold under Regulation S may not be offered, sold or delivered within the United States or to, or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933.

Included in the Fund are investments in mortgage- or asset-backed securities, which are interests in separate pools of mortgages or assets. Effective maturities of these investments may be shorter than stated maturities due to prepayments. Some separate investments in the Federal Home Loan Mortgage Corp. and Federal National Mortgage Association issues have similar coupon rates and have been aggregated for presentation purposes in the investment portfolio.

At December 31, 2011, open futures contracts purchased were as follows:

| Futures | Currency | Expiration Date | | Contracts | | | Notional Value ($) | | | Unrealized Appreciation ($) | |

| 10 Year Canadian Government Bond | CAD | 3/21/2012 | | | 67 | | | | 8,802,238 | | | | 94,461 | |

| United Kingdom Long Gilt Bond | GBP | 3/28/2012 | | | 17 | | | | 3,087,597 | | | | 43,531 | |

| Total unrealized appreciation | | | | 137,992 | |

At December 31, 2011, open futures contracts sold were as follows:

| Futures | Currency | Expiration Date | | Contracts | | | Notional Value ($) | | | Unrealized Appreciation/ (Depreciation) ($) | |

| 10 Year U.S. Treasury Note | USD | 3/21/2012 | | | 280 | | | | 36,715,000 | | | | (322,093 | ) |

| 30 Year U.S. Treasury Bond | USD | 3/21/2012 | | | 46 | | | | 6,661,375 | | | | (50,073 | ) |

| Euro Currency | USD | 3/19/2012 | | | 7 | | | | 1,134,700 | | | | 21,099 | |

| Federal Republic of Germany Euro-Bund | EUR | 3/8/2012 | | | 26 | | | | 4,678,767 | | | | (82,827 | ) |

| Total net unrealized depreciation | | | | (433,894 | ) |

As of December 31, 2011, the Fund had the following open forward currency exchange contracts:

| Contracts to Deliver | | In Exchange For | | Settlement Date | | Unrealized Appreciation ($) | | Counterparty |

| RUB | | | 800,000 | | USD | | | 25,827 | | 1/19/2012 | | | 1,055 | | JPMorgan Chase Securities, Inc. |

| USD | | | 2,202,816 | | CNY | | | 14,000,000 | | 1/19/2012 | | | 20,406 | | HSBC Bank U.S.A. |

| Total unrealized appreciation | | | | | 21,461 | |

| Currency Abbreviations |

CAD Canadian Dollar CNY Chinese Yuan EGP Egyptian Pound EUR Euro GBP British Pound RUB Russian Ruble USD United States Dollar |

For information on the Fund's policy and additional disclosures regarding futures contracts and forward foreign currency exchange contracts, please refer to Note B in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of December 31, 2011 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | |

| Fixed Income Investments (i) | |

| Corporate Bonds | | $ | — | | | $ | 30,757,220 | | | $ | — | | | $ | 30,757,220 | |

| Mortgage-Backed Securities Pass-Throughs | | | — | | | | 46,937,010 | | | | — | | | | 46,937,010 | |

| Asset-Backed | | | — | | | | 3,324,431 | | | | — | | | | 3,324,431 | |

| Commercial Mortgage-Backed Securities | | | — | | | | 8,161,758 | | | | — | | | | 8,161,758 | |

| Collateralized Mortgage Obligations | | | — | | | | 4,731,881 | | | | — | | | | 4,731,881 | |

| Government & Agency Obligations | | | — | | | | 40,844,630 | | | | — | | | | 40,844,630 | |

| Loan Participations and Assignments | | | — | | | | 327,900 | | | | — | | | | 327,900 | |

| Municipal Bonds and Notes | | | — | | | | 7,597,774 | | | | — | | | | 7,597,774 | |

| Short-Term U.S. Treasury Obligation | | | — | | | | 1,121,964 | | | | — | | | | 1,121,964 | |

| Short-Term Investments (i) | | | 12,746,561 | | | | — | | | | — | | | | 12,746,561 | |

| Derivatives (j) | | | 159,091 | | | | 21,461 | | | | — | | | | 180,552 | |

| Total | | $ | 12,905,652 | | | $ | 143,826,029 | | | $ | — | | | $ | 156,731,681 | |

| Liabilities | | | | | | | | | | | | | | | | |

| Derivatives (j) | | $ | (454,993 | ) | | $ | — | | | $ | — | | | $ | (454,993 | ) |

| Total | | $ | (454,993 | ) | | $ | — | | | $ | — | | | $ | (454,993 | ) |

There have been no transfers between Level 1 and Level 2 fair value measurements during the year ended December 31, 2011.

(i) See Investment Portfolio for additional detailed categorizations.

(j) Derivatives include unrealized appreciation (depreciation) on open futures contracts and forward foreign currency exchange contracts.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities | as of December 31, 2011 | |

| Assets | |

Investments: Investments in non-affiliated securities, at value (cost $141,655,689) — including $10,983,329 of securities loaned | | $ | 143,804,568 | |

Investment in Daily Assets Fund Institutional (cost $11,307,660)* | | | 11,307,660 | |

| Investment in Central Cash Management Fund (cost $1,438,901) | | | 1,438,901 | |

| Total investments, at value (cost $154,402,250) | | | 156,551,129 | |

| Foreign currency, at value (cost $72,839) | | | 68,949 | |

| Receivable for Fund shares sold | | | 77,287 | |

| Interest receivable | | | 1,104,620 | |

| Unrealized appreciation on forward foreign currency exchange contracts | | | 21,461 | |

| Foreign taxes recoverable | | | 2,315 | |

| Other assets | | | 2,244 | |

| Total assets | | | 157,828,005 | |

| Liabilities | |

| Payable upon return of securities loaned | | | 11,307,660 | |

| Payable for investments purchased — when-issued/delayed delivery securities | | | 34,365,907 | |

| Payable for Fund shares redeemed | | | 28,002 | |

| Payable for daily variation margin on futures contracts | | | 60,398 | |

| Accrued management fee | | | 37,103 | |

| Accrued expenses | | | 93,116 | |

| Total liabilities | | | 45,892,186 | |

| Net assets, at value | | $ | 111,935,819 | |

| Net Assets Consist of | |

| Undistributed net investment income | | | 4,694,271 | |

Net unrealized appreciation (depreciation) on: Investments | | | 2,148,879 | |

| Futures | | | (295,902 | ) |

| Foreign currency | | | 17,408 | |

| Accumulated net realized gain (loss) | | | (37,300,113 | ) |

| Paid-in capital | | | 142,671,276 | |

| Net assets, at value | | $ | 111,935,819 | |

Class A Net Asset Value, offering and redemption price per share ($111,935,819 ÷ 19,571,536 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | | $ | 5.72 | |

* Represents collateral on securities loaned.

The accompanying notes are an integral part of the financial statements.

Statement of Operations

| for the year ended December 31, 2011 | |

| Investment Income | |

Income: Interest | | $ | 5,305,633 | |

| Income distributions — Central Cash Management Fund | | | 13,445 | |

| Securities lending income, including income from Daily Assets Fund Institutional, net of borrower rebates | | | 8,724 | |

| Total income | | | 5,327,802 | |

Expenses: Management fee | | | 463,328 | |

| Administration fee | | | 118,802 | |

| Services to shareholders | | | 2,444 | |

| Custodian fee | | | 17,294 | |

| Audit and tax fees | | | 38,806 | |

| Legal fees | | | 21,132 | |

| Reports to shareholders | | | 49,655 | |

| Trustees' fees and expenses | | | 4,978 | |

| Other | | | 23,596 | |

| Total expenses | | | 740,035 | |

| Net investment income | | | 4,587,767 | |

| Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) from: Investments | | | 3,326,788 | |

| Swap contracts | | | (820,768 | ) |

| Futures | | | (1,433,133 | ) |

| Foreign currency | | | (75,349 | ) |

| | | | 997,538 | |

Change in net unrealized appreciation (depreciation) on: Investments | | | 2,119,299 | |

| Futures | | | (1,184,558 | ) |

| Foreign currency | | | (29,052 | ) |

| | | | 905,689 | |

| Net gain (loss) | | | 1,903,227 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 6,490,994 | |

The accompanying notes are an integral part of the financial statements.

Statement of Changes in Net Assets | | | Years Ended December 31, | |

| Increase (Decrease) in Net Assets | | 2011 | | | 2010 | |

Operations: Net investment income (loss) | | $ | 4,587,767 | | | $ | 5,460,988 | |

| Net realized gain (loss) | | | 997,538 | | | | 5,014,458 | |

| Change in net unrealized appreciation (depreciation) | | | 905,689 | | | | 3,501 | |

| Net increase (decrease) in net assets resulting from operations | | | 6,490,994 | | | | 10,478,947 | |

Distributions to shareholders from: Net investment income: Class A | | | (4,956,830 | ) | | | (6,962,542 | ) |

Fund share transactions: Class A Proceeds from shares sold | | | 13,875,163 | | | | 16,049,365 | |

| Reinvestment of distributions | | | 4,956,830 | | | | 6,962,542 | |

| Payments for shares redeemed | | | (63,808,031 | ) | | | (29,824,695 | ) |

| Net increase (decrease) in net assets from Class A share transactions | | | (44,976,038 | ) | | | (6,812,788 | ) |

| Increase (decrease) in net assets | | | (43,441,874 | ) | | | (3,296,383 | ) |

| Net assets at beginning of period | | | 155,377,693 | | | | 158,674,076 | |

| Net assets at end of period (including undistributed net investment income of $4,694,271 and $4,830,117, respectively) | | $ | 111,935,819 | | | $ | 155,377,693 | |

| Other Information | |

Class A Shares outstanding at beginning of period | | | 27,458,970 | | | | 28,638,100 | |

| Shares sold | | | 2,449,457 | | | | 2,857,267 | |

| Shares issued to shareholders in reinvestment of distributions | | | 891,516 | | | | 1,277,530 | |

| Shares redeemed | | | (11,228,407 | ) | | | (5,313,927 | ) |

| Net increase (decrease) in Class A shares | | | (7,887,434 | ) | | | (1,179,130 | ) |

| Shares outstanding at end of period | | | 19,571,536 | | | | 27,458,970 | |

The accompanying notes are an integral part of the financial statements.

| | | Years Ended December 31, | |

| Class A | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Selected Per Share Data | |

| Net asset value, beginning of period | | $ | 5.66 | | | $ | 5.54 | | | $ | 5.50 | | | $ | 6.98 | | | $ | 7.03 | |

Income (loss) from investment operations: Net investment incomea | | | .22 | | | | .19 | | | | .25 | | | | .37 | | | | .35 | |

| Net realized and unrealized gain (loss) | | | .09 | | | | .18 | | | | .26 | | | | (1.48 | ) | | | (.06 | ) |

| Total from investment operations | | | .31 | | | | .37 | | | | .51 | | | | (1.11 | ) | | | .29 | |

Less distributions from: Net investment income | | | (.25 | ) | | | (.25 | ) | | | (.47 | ) | | | (.37 | ) | | | (.34 | ) |

| Net asset value, end of period | | $ | 5.72 | | | $ | 5.66 | | | $ | 5.54 | | | $ | 5.50 | | | $ | 6.98 | |

| Total Return (%) | | | 5.68 | | | | 6.79 | | | | 10.07 | | | | (16.77 | ) | | | 4.18 | |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 112 | | | | 155 | | | | 159 | | | | 155 | | | | 229 | |

| Ratio of expenses (%) | | | .62 | | | | .59 | | | | .59 | | | | .59 | | | | .61 | |

| Ratio of net investment income (%) | | | 3.86 | | | | 3.42 | | | | 4.68 | | | | 5.76 | | | | 5.03 | |

| Portfolio turnover rate (%) | | | 219 | | | | 357 | | | | 284 | | | | 196 | | | | 185 | |

a Based on average shares outstanding during the period. | |

Notes to Financial Statements

A. Organization and Significant Accounting Policies

DWS Variable Series I (the "Series") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end, registered management investment company organized as a Massachusetts business trust. The Series consists of five diversified funds: DWS Bond VIP, DWS Growth & Income VIP, DWS Capital Growth VIP, DWS Global Small Cap Growth VIP (formerly DWS Global Opportunities VIP) and DWS International VIP (individually or collectively hereinafter referred to as a "Fund" or the "Funds"). These financial statements report on DWS Bond VIP. The Series is intended to be the underlying investment vehicle for variable annuity contracts and variable life insurance policies to be offered by the separate accounts of certain life insurance companies ("Participating Insurance Companies").

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Debt securities are valued at prices supplied by independent pricing services approved by the Trustees of the Series. If the pricing services are unable to provide valuations, securities are valued at the most recent bid quotation or evaluated price, as applicable, obtained from one or more broker-dealers. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as broker quotes. These securities are generally categorized as Level 2.

Money market instruments purchased with an original or remaining maturity of sixty days or less, maturing at par, are valued at amortized cost, which approximates value, and are categorized as Level 2. Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Futures contracts are generally valued at the settlement prices established each day on the exchange on which they are traded and are categorized as Level 1.

Swap contracts are valued daily based upon prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer. Swap contracts are generally categorized as Level 2.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and are categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Trustees and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors used in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold and with respect to debt securities; the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund's Investment Portfolio.

New Accounting Pronouncement. In May 2011, Accounting Standards Update 2011-04 (ASU 2011-04), Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs, was issued and is effective during interim and annual periods beginning after December 15, 2011. ASU 2011-04 amends Accounting Standards Codification (ASC) Topic 820, Fair Value Measurement. The amendments are the result of the work by the Financial Accounting Standards Board and the International Accounting Standards Board to develop common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP. Management is currently evaluating the application of ASU 2011-04 and its impact, if any, on the Fund's financial statements.

Securities Lending. The Fund lends securities to certain financial institutions. The Fund retains beneficial ownership of the securities it has loaned and continues to receive interest and dividends paid by the issuer of securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at least equal to the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the security lending agreement. The Fund may invest the cash collateral into a joint trading account in an affiliated money market fund pursuant to Exemptive Orders issued by the SEC. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

Loan Participations and Assignments. Loan Participations and Assignments are portions of loans originated by banks and sold in pieces to investors. These U.S. dollar-denominated fixed and floating rate loans ("Loans") in which the Fund invests, are arranged between the borrower and one or more financial institutions ("Lenders"). These Loans may take the form of Senior Loans, which are corporate obligations often issued in connection with recapitalizations, acquisitions, leveraged buy-outs and refinancings, and Sovereign Loans, which are debt instruments between a foreign sovereign entity and one or more financial institutions. The Fund invests in such Loans in the form of participations in Loans ("Participations") or assignments of all or a portion of Loans from third parties ("Assignments"). Participations typically result in the Fund having a contractual relationship only with the Lender, not with the borrower. The Fund has the right to receive payments of principal, interest and any fees to which it is entitled from the Lender selling the Participation and only upon receipt by the Lender of the payments from the borrower. In connection with purchasing Participations, the Fund generally has no right to enforce compliance by the borrower with the terms of the loan agreement relating to the Loan, or any rights of set-off against the borrower, and the Fund will not benefit directly from any collateral supporting the Loan in which it has purchased the Participation. As a result, the Fund assumes the credit risk of both the borrower and the Lender that is selling the Participation. Assignments typically result in the Fund having a direct contractual relationship with the borrower, and the Fund may enforce compliance by the borrower with the terms of the loan agreement. Senior loans held by the Fund generally in the form of Assignments but the Fund may also invest in Participations. All Loan Participations and Assignments involve interest rate risk, liquidity risk and credit risk, including the potential default or insolvency of the borrower.

When-Issued/Delayed Delivery Securities. The Fund may purchase or sell securities with delivery or payment to occur at a later date beyond the normal settlement period. At the time the Fund enters into a commitment to purchase or sell a security, the transaction is recorded and the value of the transaction is reflected in the net asset value. The price of such security and the date when the security will be delivered and paid for are fixed at the time the transaction is negotiated. The value of the security may vary with market fluctuations. At the time the Fund enters into a purchase transaction it is required to segregate cash or other liquid assets at least equal to the amount of the commitment.

Certain risks may arise upon entering into when-issued or delayed delivery transactions from the potential inability of counterparties to meet the terms of their contracts or if the issuer does not issue the securities due to political, economic, or other factors. Additionally, losses may arise due to changes in the value of the underlying securities.

Federal Income Taxes. The Fund is treated as a separate taxpayer as provided for in the Internal Revenue Code, as amended. It is the Fund's policy to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to the separate accounts of the Participating Insurance Companies which hold its shares.

Under the Regulated Investment Company Modernization Act of 2010, net capital losses may be carried forward indefinitely, and their character is retained as short-term and/or long-term. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

At December 31, 2011, the Fund had a net tax basis capital loss carryforward of approximately $36,827,000, which may be applied against any realized net taxable capital gains of each succeeding year until fully utilized or until December 31, 2017, the expiration date, whichever occurs first.

In addition, from November 1, 2011 through December 31, 2011, the Fund elects to defer qualified late year losses of approximately $503,000 of net realized long-term capital losses. The Fund intends to elect to defer these losses and treat them as arising in the fiscal year ending December 31, 2012.

The Fund has reviewed the tax positions for the open tax years as of December 31, 2011 and has determined that no provision for income tax is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. The Fund will declare and distribute dividends from its net investment income, if any, annually, although additional distributions may be made if necessary. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to investments in foreign denominated investments, investments in forward foreign currency exchange contracts, futures contracts, swap contracts and certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

At December 31, 2011, the Fund's components of distributable earnings (accumulated losses) on a tax basis are as follows:

| Undistributed ordinary income* | | $ | 4,738,103 | |

| Capital loss carryforwards | | $ | (36,827,000 | ) |

| Net unrealized appreciation (depreciation) on investments | | $ | 2,148,879 | |

In addition, the tax character of distributions paid to shareholders by the Fund is summarized as follows:

| | | Years Ended December 31, | |

| | | 2011 | | | 2010 | |

| Distributions from ordinary income* | | $ | 4,956,830 | | | $ | 6,962,542 | |

* For tax purposes, short-term capital gain distributions are considered ordinary income distributions.

Expenses. Expenses of the Series arising in connection with a specific Fund are allocated to that Fund. Other Series expenses which cannot be directly attributed to a Fund are apportioned among the Funds in the Series.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis net of foreign withholding taxes. Realized gains and losses from investment transactions are recorded on an identified cost basis and may include proceeds from litigation. All discounts and premiums are accreted/amortized for both tax and financial reporting purposes.

B. Derivative Instruments

Futures Contracts. A futures contract is an agreement between a buyer or seller and an established futures exchange or its clearinghouse in which the buyer or seller agrees to take or make a delivery of a specific amount of a financial instrument at a specified price on a specific date (settlement date). For the year ended December 31, 2011, the Fund invested in interest rate futures to gain exposure to different parts of the yield curve while managing the overall duration. The Fund also entered into currency futures contracts for non-hedging purposes to seek to enhance potential gains.

Upon entering into a futures contract, the Fund is required to deposit with a financial intermediary cash or securities ("initial margin") in an amount equal to a certain percentage of the face value indicated in the futures contract. Subsequent payments ("variation margin") are made or received by the Fund dependent upon the daily fluctuations in the value and are recorded for financial reporting purposes as unrealized gains or losses by the Fund. Gains or losses are realized when the contract expires or is closed. Since all futures contracts are exchange traded, counterparty risk is minimized as the exchange's clearinghouse acts as the counterparty, and guarantees the futures against default.

Certain risks may arise upon entering into futures contracts, including the risk that an illiquid market will limit the Fund's ability to close out a futures contract prior to the settlement date and the risk that the futures contract is not well correlated with the security, index or currency to which it relates. Risk of loss may exceed amounts recognized in the Statement of Assets and Liabilities.

A summary of the open futures contracts as of December 31, 2011, is included in a table following the Fund's Investment Portfolio. For the year ended December 31, 2011, the investment in futures contracts purchased had a total notional value generally indicative of a range from $0 to approximately $14,990,000, and the investment in futures contracts sold had a total notional value generally indicative of a range from approximately $27,770,000 to $49,190,000.

Credit Default Swap Contracts. A credit default swap is a contract between a buyer and a seller of protection against pre-defined credit events for the reference entity. For the year ended December 31, 2011, the Fund bought credit default swap contracts to gain exposure to an underlying reference entity's credit quality characteristics without directly investing in that reference entity, or to hedge the risk of default on Fund securities. As a seller in the credit default swap contract, the Fund is required to pay the par (or other agreed-upon) value of the referenced entity to the counterparty with the occurrence of a credit event by a third party, such as a U.S. or foreign corporate issuer, on the reference entity, which would likely result in a loss to the Fund. In return, the Fund receives from the counterparty a periodic stream of payments over the term of the contract provided that no credit event has occurred. If no credit event occurs, the Fund keeps the stream of payments with no payment obligations. The Fund may also buy credit default swap contracts in order to hedge against the risk of a credit event on debt securities, in which case the Fund functions as the counterparty referenced above. This involves the risk that the contract may expire worthless. It also involves counterparty risk that the seller may fail to satisfy its payment obligations to the Fund with the occurrence of a credit event. When the Fund sells a credit default swap contract it will cover its commitment. This may be achieved by, among other methods, maintaining cash or liquid assets equal to the aggregate notional value of the reference entities for all outstanding credit default swap contracts sold by the Fund.

The value of the credit default swap is adjusted daily and the change in value, if any, is recorded daily as unrealized appreciation or depreciation in the Statement of Assets and Liabilities. An upfront payment, if any, made by the Fund is recorded as an asset in the Statement of Assets and Liabilities. An upfront payment, if any, received by the Fund is recorded as a liability in the Statement of Assets and Liabilities. Under the terms of the credit default swap contracts, the Fund receives or makes quarterly payments based on a specified interest rate on a fixed notional amount. These payments are recorded as a realized gain or loss in the Statement of Operations. Payments received or made as a result of a credit event or termination of the contract are recognized, net of a proportional amount of the upfront payment, as realized gains or losses in the Statement of Operations.

There are no open credit default swap contracts as of December 31, 2011. For the year ended December 31, 2011, the investment in credit default swap contracts purchased had a total notional value generally indicative of a range from $0 to approximately $5,700,000.

Total Return Swap Contracts. Total return swaps involve commitments to pay interest in exchange for a market-linked return based on a notional amount. For the year ended December 31, 2011, the Fund entered into total return swap transactions to enhance potential gains. To the extent the total return of the reference security or index underlying the total return swap exceeds or falls short of the offsetting interest rate obligation, the Fund will receive a payment or make a payment to the counterparty, respectively. Certain risks may arise when entering into swap transactions including counterparty default, liquidity or unfavorable changes in the value of the underlying reference security or index. The value of the swap is adjusted daily and the change in value, if any, is recorded as unrealized appreciation or depreciation in the Statement of Assets and Liabilities. An upfront payment, if any, made by the Fund is recorded as an asset in the Statement of Assets and Liabilities. An upfront payment, if any, received by the Fund is recorded as a liability in the Statement of Assets and Liabilities. Payments received or made at the end of each measurement period are recorded as realized gain or loss in the Statement of Operations.

There are no open contracts as of December 31, 2011. For the year ended December 31, 2011, the investment in total return swap contracts had a total notional amount generally indicative of a range from $0 to approximately $9,000,000.

Forward Foreign Currency Exchange Contracts. A forward foreign currency exchange contract ("forward currency contract") is a commitment to purchase or sell a foreign currency at the settlement date at a negotiated rate. The Fund is subject to foreign exchange rate risk in its securities denominated in foreign currencies. Changes in exchange rates between foreign currencies and the U.S. dollar may affect the U.S. dollar value of foreign securities or the income or gains received on these securities. To reduce the effect of currency fluctuations, the Fund may enter into forward currency contracts. For the year ended December 31, 2011, the Fund invested in forward currency contracts to hedge its exposure to changes in foreign currency exchange rates on its foreign currency denominated securities. In addition, the Fund also engaged in forward currency contracts for non-hedging purposes to seek to enhance potential gains.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and unrealized gain (loss) is recorded daily. On the settlement date of the forward currency contract, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value of the contract at the time it was closed. Certain risks may arise upon entering into forward currency contracts from the potential inability of counterparties to meet the terms of their contracts. The maximum counterparty credit risk to the Fund is measured by the unrealized gain on appreciated contracts. Additionally, when utilizing forward currency contracts to hedge, the Fund gives up the opportunity to profit from favorable exchange rate movements during the term of the contract.

A summary of the open forward currency contracts as of December 31, 2011, is included in a table following the Fund's Investment Portfolio. For the year ended December 31, 2011, the investment in forward currency contracts U.S. dollars purchased had a total contract value generally indicative of a range from approximately $26,000 to $2,593,000, and the investment in forward currency contracts U.S. dollars sold had a total contract value generally indicative of a range from $0 to approximately $4,860,000.

The following tables summarize the value of the Fund's derivative instruments held as of December 31, 2011 and the related location in the accompanying Statement of Assets and Liabilities, presented by primary underlying risk exposure:

| Asset Derivatives | | Forward Contracts | | | Futures Contracts | | | Total | |

| Interest Rate Contracts (a) | | $ | — | | | $ | 137,992 | | | $ | 137,992 | |

| Foreign Exchange Contracts (b) | | | 21,461 | | | | 21,099 | | | | 42,560 | |

| | | $ | 21,461 | | | $ | 159,091 | | | $ | 180,552 | |

Each of the above derivatives is located in the following Statement of Assets and Liabilities accounts:

(a) Includes cumulative appreciation of futures contracts as disclosed in the Investment Portfolio. Unsettled variation margin is disclosed separately within the Statement of Assets and Liabilities.

(b) Unrealized appreciation on forward foreign currency exchange contracts

| Liability Derivative | | Futures Contracts | |

| Interest Rate Contracts (a) | | $ | (454,993 | ) |

The above derivative is located in the following Statement of Assets and Liabilities account:

(a) Includes cumulative depreciation of futures contracts as disclosed in the Investment Portfolio. Unsettled variation margin is disclosed separately within the Statement of Assets and Liabilities.

Additionally, the amount of unrealized and realized gains and losses on derivative instruments recognized in Fund earnings during the year ended December 31, 2011 and the related location in the accompanying Statement of Operations is summarized in the following tables by primary underlying risk exposure:

| Realized Gain (Loss) | | Forward Contracts | | | Swap Contracts | | | Futures Contracts | | | Total | |

| Foreign Exchange Contracts (a) (b) | | $ | (84,630 | ) | | $ | — | | | $ | (512,163 | ) | | $ | (596,793 | ) |

| Interest Rate Contracts (b) | | | — | | | | 52,362 | | | | (920,970 | ) | | | (868,608 | ) |

| Credit Contracts (b) | | | — | | | | (873,130 | ) | | | — | | | | (873,130 | ) |

| | | $ | (84,630 | ) | | $ | (820,768 | ) | | $ | (1,433,133 | ) | | $ | (2,338,531 | ) |

Each of the above derivatives is located in the following Statement of Operations accounts:

(a) Net realized gain (loss) from foreign currency (Statement of Operations includes both forward currency contracts and foreign currency transactions)

(b) Net realized gain (loss) from swaps and futures, respectively

| Change in Net Unrealized Appreciation (Depreciation) | | Forward Contracts | | | Futures Contracts | | | Total | |

| Foreign Exchange Contracts (a) (b) | | $ | (25,565 | ) | | $ | 44,490 | | | $ | 18,925 | |

| Interest Rate Contracts (b) | | | — | | | | (1,229,048 | ) | | | (1,229,048 | ) |

| | | $ | (25,565 | ) | | $ | (1,184,558 | ) | | $ | (1,210,123 | ) |

Each of the above derivatives is located in the following Statement of Operations accounts:

(a) Change in net unrealized appreciation (depreciation) on foreign currency (Statement of Operations includes both forward currency contracts and foreign currency transactions)

(b) Change in net unrealized appreciation (depreciation) on swaps and futures, respectively

C. Purchases and Sales of Securities

During the year ended December 31, 2011, purchases and sales of investment securities (excluding short-term investments and U.S. Treasury obligations) aggregated $251,298,054 and $294,606,449, respectively. Purchases and sales of U.S. Treasury obligations aggregated $39,298,924 and $41,661,141, respectively.

D. Related Parties

Management Agreement. Under the Investment Management Agreement with Deutsche Investment Management Americas Inc. ("DIMA" or the "Advisor"), an indirect, wholly owned subsidiary of Deutsche Bank AG, the Advisor directs the investments of the Fund in accordance with its investment objectives, policies and restrictions. The Advisor determines the securities, instruments and other contracts relating to investments to be purchased, sold or entered into by the Fund.

Pursuant to the Investment Management Agreement with the Advisor, the Fund pays a monthly management fee based on the Fund's average daily net assets, computed and accrued daily and payable monthly, at the following annual rates:

| First $250 million of average daily net assets | | | .390 | % |

| Next $750 million of average daily net assets | | | .365 | % |

| Over $1 billion of average daily net assets | | | .340 | % |

Accordingly, for the year ended December 31, 2011, the fee pursuant to the Investment Management Agreement was equivalent to an annual effective rate of 0.39% of the Fund's average daily net assets.

Administration Fee. Pursuant to an Administrative Services Agreement, DIMA provides most administrative services to the Fund. For all services provided under the Administrative Services Agreement, the Fund pays the Advisor an annual fee ("Administration Fee") of 0.10% of the Fund's average daily net assets, computed and accrued daily and payable monthly. For the year ended December 31, 2011, the Administration Fee was $118,802, of which $9,513 is unpaid.

Service Provider Fees. DWS Investments Service Company ("DISC"), an affiliate of the Advisor, is the transfer agent, dividend-paying agent and shareholder service agent for the Fund. Pursuant to a sub-transfer agency agreement between DISC and DST Systems, Inc. ("DST"), DISC has delegated certain transfer agent, dividend-paying agent and shareholder service agent functions to DST. DISC compensates DST out of the shareholder servicing fee it receives from the Fund. For the year ended December 31, 2011, the amounts charged to the Fund by DISC aggregated $566, of which $142 is unpaid.

Typesetting and Filing Service Fees. Under an agreement with DIMA, DIMA is compensated for providing typesetting and certain regulatory filing services to the Fund. For the year ended December 31, 2011, the amount charged to the Fund by DIMA included in the Statement of Operations under "reports to shareholders" aggregated $12,237, of which $3,049 is unpaid.

Trustees' Fees and Expenses. The Fund paid each Trustee not affiliated with the Advisor retainer fees plus specified amounts for various committee services and for the Board Chairperson.

Affiliated Cash Management Vehicle. The Fund may invest uninvested cash balances in Central Cash Management Fund, which is managed by the Advisor. The Fund indirectly bears its proportionate share of the expenses of Central Cash Management Fund. Central Cash Management Fund does not pay the Advisor an investment management fee. Central Cash Management Fund seeks a high level of current income consistent with liquidity and the preservation of capital.

E. Investing in Emerging Markets

Investing in emerging markets may involve special risks and considerations not typically associated with investing in developed markets. These risks include revaluation of currencies, high rates of inflation or deflation, repatriation restrictions on income and capital, and future adverse political, social and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls or delayed settlements and may have prices more volatile or less easily assessed than those of comparable securities of issuers in developed markets.

F. Ownership of the Fund

Three participating insurance companies were owners of record of 10% or more of the total outstanding Class A shares of the Fund, owning 48%, 21% and 11%, respectively.

G. Line of Credit

The Fund and other affiliated funds (the "Participants") share in a $450 million revolving credit facility provided by a syndication of banks. The Fund may borrow for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Participants are charged an annual commitment fee which is allocated based on net assets, among each of the Participants. Interest is calculated at a rate per annum equal to the sum of the Federal Funds Rate plus 1.25 percent plus if LIBOR exceeds the Federal Funds Rate the amount of such excess. The Fund may borrow up to a maximum of 33 percent of its net assets under the agreement. The Fund had no outstanding loans at December 31, 2011.