June 30, 2015

Semiannual Report

Deutsche Variable Series I

Deutsche Core Equity VIP

Contents

4 Portfolio Management Team 8 Statement of Assets and Liabilities 9 Statement of Operations 9 Statement of Changes in Net Assets 13 Notes to Financial Statements 17 Information About Your Fund's Expenses 19 Advisory Agreement Board Considerations and Fee Evaluation |

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Stocks may decline in value. Fund management could be wrong in its analysis of industries, companies, economic trends and favor a security that underperforms the market. The Fund may lend securities to approved institutions. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. See the prospectus for details.

Deutsche Asset & Wealth Management represents the asset management and wealth management activities conducted by Deutsche Bank AG or any of its subsidiaries, including the Advisor and DeAWM Distributors, Inc.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary June 30, 2015 (Unaudited)

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund's most recent month-end performance. Performance doesn't reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns. While all share classes have the same underlying portfolio, their performance will differ.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated May 1, 2015 are 0.57% and 0.82% for Class A and Class B shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

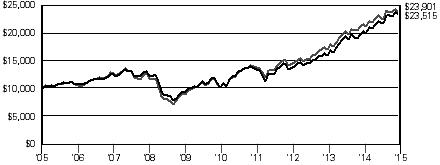

| Growth of an Assumed $10,000 Investment |

| The Russell 1000® Index is an unmanaged index that measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| |

| Yearly periods ended June 30 | |

| Comparative Results | |

| Deutsche Core Equity VIP | | 6-Month‡ | | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | |

| Class A | Growth of $10,000 | | $ | 10,549 | | | $ | 11,170 | | | $ | 17,669 | | | $ | 22,806 | | | $ | 21,768 | |

| Average annual total return | | | 5.49 | % | | | 11.70 | % | | | 20.89 | % | | | 17.93 | % | | | 8.09 | % |

Russell 1000® Index | Growth of $10,000 | | $ | 10,171 | | | $ | 10,737 | | | $ | 16,317 | | | $ | 22,470 | | | $ | 21,853 | |

| Average annual total return | | | 1.71 | % | | | 7.37 | % | | | 17.73 | % | | | 17.58 | % | | | 8.13 | % |

| Deutsche Core Equity VIP | | 6-Month‡ | | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | |

| Class B | Growth of $10,000 | | $ | 10,531 | | | $ | 11,134 | | | $ | 17,543 | | | $ | 22,501 | | | $ | 21,198 | |

| Average annual total return | | | 5.31 | % | | | 11.34 | % | | | 20.61 | % | | | 17.61 | % | | | 7.80 | % |

Russell 1000® Index | Growth of $10,000 | | $ | 10,171 | | | $ | 10,737 | | | $ | 16,317 | | | $ | 22,470 | | | $ | 21,853 | |

| Average annual total return | | | 1.71 | % | | | 7.37 | % | | | 17.73 | % | | | 17.58 | % | | | 8.13 | % |

The growth of $10,000 is cumulative.

‡ Total returns shown for periods less than one year are not annualized.

Portfolio Summary (Unaudited) Asset Allocation (As a % of Investment Portfolio excluding Securities Lending Collateral) | 6/30/15 | 12/31/14 |

| | | |

| Common Stocks | 99% | 99% |

| Cash Equivalents | 1% | 1% |

| Convertible Bond | 0% | 0% |

| Convertible Preferred Stock | 0% | — |

| | 100% | 100% |

Sector Diversification (As a % of Common Stocks, Convertible Bond and Convertible Preferred Stock) | 6/30/15 | 12/31/14 |

| | | |

| Information Technology | 20% | 20% |

| Health Care | 17% | 17% |

| Financials | 16% | 16% |

| Consumer Discretionary | 13% | 13% |

| Consumer Staples | 10% | 9% |

| Industrials | 10% | 11% |

| Energy | 7% | 8% |

| Materials | 4% | 3% |

| Utilities | 2% | 2% |

| Telecommunication Services | 1% | 1% |

| | 100% | 100% |

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund's investment portfolio, see page 5.

Following the Fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC's Web site at sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. The Fund's portfolio holdings are also posted on deutschefunds.com from time to time. Please see the Fund's current prospectus for more information.

Portfolio Management Team

Owen Fitzpatrick, CFA

Lead Portfolio Manager

Thomas M. Hynes, Jr., CFA

Brendan O'Neill, CFA

Pankaj Bhatnagar, PhD

Portfolio Managers

Investment Portfolio June 30, 2015 (Unaudited) | | | Shares | | | Value ($) | |

| | | | |

| Common Stocks 98.4% | |

| Consumer Discretionary 12.8% | |

| Auto Components 0.9% | |

| BorgWarner, Inc. | | | 37,019 | | | | 2,104,160 | |

| Hotels, Restaurants & Leisure 1.5% | |

| Bloomin' Brands, Inc. | | | 15,842 | | | | 338,227 | |

| Brinker International, Inc. | | | 35,464 | | | | 2,044,500 | |

| Las Vegas Sands Corp. (a) | | | 15,839 | | | | 832,656 | |

| | | | | | | | 3,215,383 | |

| Internet & Catalog Retail 1.3% | |

| Amazon.com, Inc.* | | | 3,303 | | | | 1,433,799 | |

| Expedia, Inc. (a) | | | 12,571 | | | | 1,374,639 | |

| | | | | | | | 2,808,438 | |

| Media 2.0% | |

| Twenty-First Century Fox, Inc. "A" | | | 47,676 | | | | 1,551,615 | |

| Walt Disney Co. | | | 24,582 | | | | 2,805,790 | |

| | | | | | | | 4,357,405 | |

| Specialty Retail 4.9% | |

| Advance Auto Parts, Inc. | | | 11,936 | | | | 1,901,285 | |

| Dick's Sporting Goods, Inc. | | | 24,752 | | | | 1,281,411 | |

| Home Depot, Inc. | | | 30,376 | | | | 3,375,685 | |

| L Brands, Inc. | | | 47,533 | | | | 4,075,004 | |

| | | | | | | | 10,633,385 | |

| Textiles, Apparel & Luxury Goods 2.2% | |

| NIKE, Inc. "B" | | | 34,100 | | | | 3,683,482 | |

| VF Corp. | | | 15,110 | | | | 1,053,771 | |

| | | | | | | | 4,737,253 | |

| Consumer Staples 10.5% | |

| Beverages 1.3% | |

| PepsiCo, Inc. | | | 31,008 | | | | 2,894,287 | |

| Food & Staples Retailing 3.3% | |

| Costco Wholesale Corp. | | | 14,887 | | | | 2,010,638 | |

| Kroger Co. | | | 41,165 | | | | 2,984,874 | |

| Rite Aid Corp.* | | | 264,973 | | | | 2,212,525 | |

| | | | | | | | 7,208,037 | |

| Food Products 4.4% | |

| ConAgra Foods, Inc. | | | 49,797 | | | | 2,177,125 | |

| Mead Johnson Nutrition Co. | | | 38,471 | | | | 3,470,853 | |

| The WhiteWave Foods Co.* | | | 80,966 | | | | 3,957,618 | |

| | | | | | | | 9,605,596 | |

| Household Products 0.7% | |

| Procter & Gamble Co. | | | 18,406 | | | | 1,440,085 | |

| Personal Products 0.8% | |

| Estee Lauder Companies, Inc. "A" | | | 20,710 | | | | 1,794,729 | |

| Energy 7.0% | |

| Energy Equipment & Services 0.7% | |

| Schlumberger Ltd. | | | 19,349 | | | | 1,667,690 | |

| Oil, Gas & Consumable Fuels 6.3% | |

| Anadarko Petroleum Corp. | | | 41,118 | | | | 3,209,671 | |

| Chevron Corp. | | | 23,303 | | | | 2,248,041 | |

| EOG Resources, Inc. | | | 29,186 | | | | 2,555,234 | |

| Occidental Petroleum Corp. | | | 37,223 | | | | 2,894,833 | |

| Phillips 66 | | | 34,556 | | | | 2,783,831 | |

| | | | | | | | 13,691,610 | |

| | | Shares | | | Value ($) | |

| | | | | | | | | |

| Financials 15.7% | |

| Banks 7.2% | |

| Citigroup, Inc. | | | 104,189 | | | | 5,755,400 | |

| JPMorgan Chase & Co. | | | 94,030 | | | | 6,371,473 | |

| Regions Financial Corp. | | | 358,096 | | | | 3,709,875 | |

| | | | | | | | 15,836,748 | |

| Capital Markets 2.1% | |

| Ameriprise Financial, Inc. | | | 17,578 | | | | 2,196,019 | |

| Bank of New York Mellon Corp. | | | 54,705 | | | | 2,295,969 | |

| | | | | | | | 4,491,988 | |

| Consumer Finance 2.1% | |

| Capital One Financial Corp. | | | 51,737 | | | | 4,551,304 | |

| Insurance 3.2% | |

| MetLife, Inc. | | | 56,726 | | | | 3,176,089 | |

| Prudential Financial, Inc. | | | 42,847 | | | | 3,749,969 | |

| | | | | | | | 6,926,058 | |

| Real Estate Investment Trusts 1.1% | |

| Prologis, Inc. (REIT) | | | 64,779 | | | | 2,403,301 | |

| Health Care 16.4% | |

| Biotechnology 4.0% | |

| Celgene Corp.* | | | 36,522 | | | | 4,226,874 | |

| Gilead Sciences, Inc. | | | 21,223 | | | | 2,484,789 | |

| Medivation, Inc.* | | | 16,783 | | | | 1,916,618 | |

| | | | | | | | 8,628,281 | |

| Health Care Equipment & Supplies 2.4% | |

| Becton, Dickinson & Co. | | | 16,862 | | | | 2,388,502 | |

| St. Jude Medical, Inc. | | | 39,663 | | | | 2,898,176 | |

| | | | | | | | 5,286,678 | |

| Health Care Providers & Services 2.8% | |

| Anthem, Inc. | | | 17,477 | | | | 2,868,675 | |

| HCA Holdings, Inc.* | | | 13,456 | | | | 1,220,728 | |

| McKesson Corp. | | | 9,269 | | | | 2,083,764 | |

| | | | | | | | 6,173,167 | |

| Life Sciences Tools & Services 1.8% | |

| Thermo Fisher Scientific, Inc. | | | 31,140 | | | | 4,040,726 | |

| Pharmaceuticals 5.4% | |

| Allergan PLC* | | | 4,679 | | | | 1,419,889 | |

| Bristol-Myers Squibb Co. | | | 17,652 | | | | 1,174,564 | |

| Merck & Co., Inc. | | | 60,906 | | | | 3,467,379 | |

| Pfizer, Inc. | | | 104,317 | | | | 3,497,749 | |

| Shire PLC (ADR) (a) | | | 8,902 | | | | 2,149,744 | |

| | | | | | | | 11,709,325 | |

| Industrials 10.2% | |

| Aerospace & Defense 2.8% | |

| Boeing Co. | | | 29,654 | | | | 4,113,603 | |

| TransDigm Group, Inc.* | | | 9,369 | | | | 2,104,933 | |

| | | | | | | | 6,218,536 | |

| Electrical Equipment 2.0% | |

| AMETEK, Inc. | | | 55,920 | | | | 3,063,298 | |

| Regal Beloit Corp. | | | 17,845 | | | | 1,295,368 | |

| | | | | | | | 4,358,666 | |

| Industrial Conglomerates 3.0% | |

| General Electric Co. | | | 129,653 | | | | 3,444,881 | |

| Roper Technologies, Inc. | | | 18,585 | | | | 3,205,169 | |

| | | | | | | | 6,650,050 | |

| Machinery 1.0% | |

| Parker-Hannifin Corp. (a) | | | 18,455 | | | | 2,146,870 | |

| | | Shares | | | Value ($) | |

| | | | | | | | | |

| Road & Rail 1.4% | |

| Norfolk Southern Corp. | | | 33,794 | | | | 2,952,244 | |

| Information Technology 19.5% | |

| Communications Equipment 1.7% | |

| Cisco Systems, Inc. | | | 88,573 | | | | 2,432,214 | |

| Palo Alto Networks, Inc.* | | | 7,021 | | | | 1,226,569 | |

| | | | | | | | 3,658,783 | |

| Internet Software & Services 3.5% | |

| Facebook, Inc. "A"* | | | 31,376 | | | | 2,690,963 | |

| Google, Inc. "A"* | | | 4,633 | | | | 2,502,005 | |

| Google, Inc. "C"* | | | 4,659 | | | | 2,425,056 | |

| | | | | | | | 7,618,024 | |

| IT Services 2.5% | |

| Cognizant Technology Solutions Corp. "A"* | | | 29,584 | | | | 1,807,287 | |

| Visa, Inc. "A" (a) | | | 55,570 | | | | 3,731,525 | |

| | | | | | | | 5,538,812 | |

| Semiconductors & Semiconductor Equipment 2.9% | |

| Analog Devices, Inc. | | | 20,586 | | | | 1,321,312 | |

| Avago Technologies Ltd. | | | 12,777 | | | | 1,698,447 | |

| Intel Corp. | | | 59,212 | | | | 1,800,933 | |

| NXP Semiconductors NV* | | | 16,325 | | | | 1,603,115 | |

| | | | | | | | 6,423,807 | |

| Software 4.2% | |

| Intuit, Inc. | | | 15,855 | | | | 1,597,708 | |

| Microsoft Corp. | | | 77,799 | | | | 3,434,826 | |

| Oracle Corp. | | | 63,214 | | | | 2,547,524 | |

| Salesforce.com, Inc.* | | | 21,065 | | | | 1,466,756 | |

| | | | | | | | 9,046,814 | |

| Technology Hardware, Storage & Peripherals 4.7% | |

| Apple, Inc. | | | 60,639 | | | | 7,605,647 | |

| EMC Corp. | | | 63,487 | | | | 1,675,422 | |

| Western Digital Corp. | | | 12,343 | | | | 967,938 | |

| | | | | | | | 10,249,007 | |

| Materials 3.6% | |

| Chemicals 2.0% | |

| Dow Chemical Co. | | | 37,215 | | | | 1,904,291 | |

| Ecolab, Inc. | | | 22,738 | | | | 2,570,986 | |

| | | | | | | | 4,475,277 | |

| Containers & Packaging 1.6% | |

| Sealed Air Corp. | | | 67,417 | | | | 3,463,886 | |

| | | Shares | | | Value ($) | |

| | | | | | | | | |

| Telecommunication Services 0.9% | |

| Wireless Telecommunication Services | |

| T-Mobile U.S., Inc.* | | | 51,257 | | | | 1,987,234 | |

| Utilities 1.8% | |

| Electric Utilities 0.7% | |

| NextEra Energy, Inc. | | | 15,854 | | | | 1,554,168 | |

| Water Utilities 1.1% | |

| American Water Works Co., Inc. | | | 50,186 | | | | 2,440,545 | |

Total Common Stocks (Cost $175,066,635) | | | | 214,988,357 | |

| | | Principal Amount ($) | | | Value ($) | |

| | | | |

| Convertible Bond 0.3% | |

| Consumer Discretionary | |

| Fiat Chrysler Automobiles NV, 7.875%, 12/15/2016 (Cost $440,000) | | | 440,000 | | | | 554,950 | |

| | | Shares | | | Value ($) | |

| | | | |

| Convertible Preferred Stock 0.1% | |

| Health Care | |

| Allergan PLC, Series A, 5.5% (Cost $300,000) | | | 300 | | | | 312,774 | |

| | |

| Securities Lending Collateral 2.6% | |

| Daily Assets Fund Institutional, 0.16% (b) (c) (Cost $5,574,636) | | | 5,574,636 | | | | 5,574,636 | |

| | |

| Cash Equivalents 0.9% | |

| Central Cash Management Fund, 0.09% (b) (Cost $2,037,386) | | | 2,037,386 | | | | 2,037,386 | |

| | | % of Net Assets | | | Value ($) | |

| | | | |

Total Investment Portfolio (Cost $183,418,657)† | | | 102.3 | | | | 223,468,103 | |

| Other Assets and Liabilities, Net | | | (2.3 | ) | | | (5,037,250 | ) |

| Net Assets | | | 100.0 | | | | 218,430,853 | |

* Non-income producing security.

† The cost for federal income tax purposes was $183,507,720. At June 30, 2015, net unrealized appreciation for all securities based on tax cost was $39,960,383. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $42,193,859 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $2,233,476.

(a) All or a portion of these securities were on loan. In addition, "Other Assets and Liabilities, Net" may include pending sales that are also on loan. The value of securities loaned at June 30, 2015 amounted to $5,547,637, which is 2.5% of net assets.

(b) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

(c) Represents collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates.

ADR: American Depositary Receipt

REIT: Real Estate Investment Trust

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of June 30, 2015 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | |

| Common Stocks (d) | | $ | 214,988,357 | | | $ | — | | | $ | — | | | $ | 214,988,357 | |

| Convertible Bond | | | — | | | | 554,950 | | | | — | | | | 554,950 | |

| Convertible Preferred Stock | | | 312,774 | | | | — | | | | — | | | | 312,774 | |

| Short-Term Investments (d) | | | 7,612,022 | | | | — | | | | — | | | | 7,612,022 | |

| Total | | $ | 222,913,153 | | | $ | 554,950 | | | $ | — | | | $ | 223,468,103 | |

There have been no transfers between fair value measurement levels during the period ended June 30, 2015.

(d) See Investment Portfolio for additional detailed categorizations.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities | as of June 30, 2015 (Unaudited) | |

| Assets | |

Investments: Investments in non-affiliated securities, at value (cost $175,806,635) — including $5,547,637 of securities loaned | | $ | 215,856,081 | |

| Investment in Daily Assets Fund Institutional (cost $5,574,636)* | | | 5,574,636 | |

| Investment in Central Cash Management Fund (cost $2,037,386) | | | 2,037,386 | |

| Total investments in securities, at value (cost $183,418,657) | | | 223,468,103 | |

| Cash | | | 269,298 | |

| Receivable for investments sold | | | 3,367,569 | |

| Receivable for Fund shares sold | | | 72,381 | |

| Dividends receivable | | | 197,580 | |

| Interest receivable | | | 19,573 | |

| Other assets | | | 1,555 | |

| Total assets | | | 227,396,059 | |

| Liabilities | |

| Payable upon return of securities loaned | | | 5,574,636 | |

| Payable for investments purchased | | | 2,750,051 | |

| Payable for Fund shares redeemed | | | 479,286 | |

| Accrued management fee | | | 71,423 | |

| Accrued Trustees' fees | | | 549 | |

| Other accrued expenses and payables | | | 89,261 | |

| Total liabilities | | | 8,965,206 | |

| Net assets, at value | | $ | 218,430,853 | |

| Net Assets Consist of | |

| Undistributed net investment income | | | 1,186,734 | |

| Net unrealized appreciation (depreciation) on investments | | | 40,049,446 | |

| Accumulated net realized gain (loss) | | | 8,313,105 | |

| Paid-in capital | | | 168,881,568 | |

| Net assets, at value | | $ | 218,430,853 | |

Class A Net Asset Value, offering and redemption price per share ($216,414,149 ÷ 16,250,362 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | | $ | 13.32 | |

Class B Net Asset Value, offering and redemption price per share ($2,016,704 ÷ 151,465 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | | $ | 13.31 | |

* Represents collateral on securities loaned.

The accompanying notes are an integral part of the financial statements.

Statement of Operations

| for the six months ended June 30, 2015 (Unaudited) | |

| Investment Income | |

Income: Dividends | | $ | 1,846,444 | |

| Interest | | | 17,566 | |

| Income distributions — Central Cash Management Fund | | | 468 | |

| Securities lending income, including income from Daily Assets Fund Institutional, net of borrower rebates | | | 4,602 | |

| Total income | | | 1,869,080 | |

Expenses: Management fee | | | 430,907 | |

| Administration fee | | | 110,489 | |

| Services to shareholders | | | 1,298 | |

| Record keeping fee (Class B) | | | 52 | |

| Distribution service fee (Class B) | | | 2,379 | |

| Custodian fee | | | 9,079 | |

| Professional fees | | | 36,986 | |

| Reports to shareholders | | | 20,065 | |

| Trustees' fees and expenses | | | 5,399 | |

| Other | | | 5,025 | |

| Total expenses | | | 621,679 | |

| Net investment income | | | 1,247,401 | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) from investments | | | 8,406,773 | |

| Change in net unrealized appreciation (depreciation) on investments | | | 2,252,019 | |

| Net gain (loss) | | | 10,658,792 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 11,906,193 | |

The accompanying notes are an integral part of the financial statements.

Statement of Changes in Net Assets | Increase (Decrease) in Net Assets | | Six Months Ended June 30, 2015 (Unaudited) | | | Year Ended December 31, 2014 | |

Operations: Net investment income | | $ | 1,247,401 | | | $ | 1,881,277 | |

Operations: Net investment income | | $ | 1,247,401 | | | $ | 1,881,277 | |

| Net realized gain (loss) | | | 8,406,773 | | | | 17,630,326 | |

| Change in net unrealized appreciation (depreciation) | | | 2,252,019 | | | | 4,906,485 | |

| Net increase (decrease) in net assets resulting from operations | | | 11,906,193 | | | | 24,418,088 | |

Distributions to shareholders from: Net investment income: Class A | | | (1,815,630 | ) | | | (2,373,232 | ) |

| Class B | | | (11,196 | ) | | | (16,034 | ) |

Net realized gains: Class A | | | (491,871 | ) | | | — | |

| Class B | | | (4,384 | ) | | | — | |

| Total distributions | | | (2,323,081 | ) | | | (2,389,266 | ) |

Fund share transactions: Class A Proceeds from shares sold | | | 5,459,165 | | | | 9,130,365 | |

| Reinvestment of distributions | | | 2,307,501 | | | | 2,373,232 | |

| Payments for shares redeemed | | | (21,158,564 | ) | | | (36,253,798 | ) |

| Net increase (decrease) in net assets from Class A share transactions | | | (13,391,898 | ) | | | (24,750,201 | ) |

Class B Proceeds from shares sold | | | 287,005 | | | | 50,380 | |

| Reinvestment of distributions | | | 15,580 | | | | 16,034 | |

| Payments for shares redeemed | | | (179,496 | ) | | | (301,019 | ) |

| Net increase (decrease) in net assets from Class B share transactions | | | 123,089 | | | | (234,605 | ) |

| Increase (decrease) in net assets | | | (3,685,697 | ) | | | (2,955,984 | ) |

| Net assets at beginning of period | | | 222,116,550 | | | | 225,072,534 | |

| Net assets at end of period (including undistributed net investment income of $1,186,734 and $1,766,159, respectively) | | $ | 218,430,853 | | | $ | 222,116,550 | |

| Other Information | |

Class A Shares outstanding at beginning of period | | | 17,268,971 | | | | 19,342,719 | |

| Shares sold | | | 415,527 | | | | 762,045 | |

| Shares issued to shareholders in reinvestment of distributions | | | 173,366 | | | | 210,580 | |

| Shares redeemed | | | (1,607,502 | ) | | | (3,046,373 | ) |

| Net increase (decrease) in Class A shares | | | (1,018,609 | ) | | | (2,073,748 | ) |

| Shares outstanding at end of period | | | 16,250,362 | | | | 17,268,971 | |

Class B Shares outstanding at beginning of period | | | 142,262 | | | | 161,956 | |

| Shares sold | | | 21,689 | | | | 4,074 | |

| Shares issued to shareholders in reinvestment of distributions | | | 1,171 | | | | 1,423 | |

| Shares redeemed | | | (13,657 | ) | | | (25,191 | ) |

| Net increase (decrease) in Class B shares | | | 9,203 | | | | (19,694 | ) |

| Shares outstanding at end of period | | | 151,465 | | | | 142,262 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | Years Ended December 31, | |

| Class A | | Six Months Ended 6/30/15 (Unaudited) | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Selected Per Share Data | |

| Net asset value, beginning of period | | $ | 12.76 | | | $ | 11.54 | | | $ | 8.53 | | | $ | 7.46 | | | $ | 7.56 | | | $ | 6.71 | |

Income (loss) from investment operations: Net investment incomea | | | .07 | | | | .10 | | | | .12 | | | | .15 | | | | .10 | | | | .09 | |

| Net realized and unrealized gain (loss) | | | .63 | | | | 1.25 | | | | 3.03 | | | | 1.03 | | | | (.10 | ) | | | .87 | |

| Total from investment operations | | | .70 | | | | 1.35 | | | | 3.15 | | | | 1.18 | | | | .00 | | | | .96 | |

Less distributions from: Net investment income | | | (.11 | ) | | | (.13 | ) | | | (.14 | ) | | | (.11 | ) | | | (.10 | ) | | | (.11 | ) |

| Net realized gains | | | (.03 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (.14 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| Net asset value, end of period | | $ | 13.32 | | | $ | 12.76 | | | $ | 11.54 | | | $ | 8.53 | | | $ | 7.46 | | | $ | 7.56 | |

| Total Return (%) | | | 5.49 | ** | | | 11.82 | | | | 37.33 | | | | 15.81 | | | | (.14 | ) | | | 14.40 | b |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 216 | | | | 220 | | | | 223 | | | | 180 | | | | 85 | | | | 98 | |

| Ratio of expenses before expense reductions (%) | | | .56 | * | | | .57 | | | | .56 | | | | .59 | | | | .63 | | | | .63 | |

| Ratio of expenses after expense reductions (%) | | | .56 | * | | | .57 | | | | .56 | | | | .59 | | | | .63 | | | | .60 | |

| Ratio of net investment income (%) | | | 1.13 | * | | | .86 | | | | 1.20 | | | | 1.90 | | | | 1.25 | | | | 1.32 | |

| Portfolio turnover rate (%) | | | 17 | ** | | | 48 | | | | 238 | | | | 307 | | | | 215 | | | | 145 | |

a Based on average shares outstanding during the period. b Total return would have been lower had certain expenses not been reduced. * Annualized ** Not annualized | |

| | | | | | Years Ended December 31, | |

| Class B | | Six Months Ended 6/30/15 (Unaudited) | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Selected Per Share Data | |

| Net asset value, beginning of period | | $ | 12.74 | | | $ | 11.53 | | | $ | 8.51 | | | $ | 7.45 | | | $ | 7.55 | | | $ | 6.70 | |

Income (loss) from investment operations: Net investment incomea | | | .06 | | | | .07 | | | | .10 | | | | .11 | | | | .08 | | | | .07 | |

| Net realized and unrealized gain (loss) | | | .62 | | | | 1.24 | | | | 3.03 | | | | 1.03 | | | | (.10 | ) | | | .87 | |

| Total from investment operations | | | .68 | | | | 1.31 | | | | 3.13 | | | | 1.14 | | | | (.02 | ) | | | .94 | |

Less distributions from: Net investment income | | | (.08 | ) | | | (.10 | ) | | | (.11 | ) | | | (.08 | ) | | | (.08 | ) | | | (.09 | ) |

| Net realized gains | | | (.03 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (.11 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| Net asset value, end of period | | $ | 13.31 | | | $ | 12.74 | | | $ | 11.53 | | | $ | 8.51 | | | $ | 7.45 | | | $ | 7.55 | |

| Total Return (%) | | | 5.31 | ** | | | 11.52 | | | | 37.10 | | | | 15.41 | | | | (.40 | ) | | | 14.12 | b |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 2 | | | | 2 | | | | 2 | | | | 2 | | | | 2 | | | | 2 | |

| Ratio of expenses before expense reductions (%) | | | .82 | * | | | .82 | | | | .76 | | | | .90 | | | | .88 | | | | .88 | |

| Ratio of expenses after expense reductions (%) | | | .82 | * | | | .82 | | | | .76 | | | | .90 | | | | .88 | | | | .85 | |

| Ratio of net investment income (%) | | | .88 | * | | | .60 | | | | 1.00 | | | | 1.41 | | | | .99 | | | | 1.07 | |

| Portfolio turnover rate (%) | | | 17 | ** | | | 48 | | | | 238 | | | | 307 | | | | 215 | | | | 145 | |

a Based on average shares outstanding during the period. b Total return would have been lower had certain expenses not been reduced. * Annualized ** Not annualized | |

Notes to Financial Statements (Unaudited)

A. Organization and Significant Accounting Policies

Deutsche Variable Series I (the "Series") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end, registered management investment company organized as a Massachusetts business trust. The Series consists of five diversified funds: Deutsche Bond VIP, Deutsche Capital Growth VIP, Deutsche Core Equity VIP, Deutsche CROCI® International VIP (formerly Deutsche International VIP) and Deutsche Global Small Cap VIP (individually or collectively hereinafter referred to as a "Fund" or the "Funds"). These financial statements report on Deutsche Core Equity VIP. The Series is intended to be the underlying investment vehicle for variable annuity contracts and variable life insurance policies to be offered by the separate accounts of certain life insurance companies ("Participating Insurance Companies").

Multiple Classes of Shares of Beneficial Interest. The Fund offers two classes of shares (Class A shares and Class B shares). Class B shares are subject to Rule 12b-1 distribution fees under the 1940 Act and recordkeeping fees equal to an annual rate of 0.25% and up to 0.15%, respectively, of the average daily net assets of the Class B shares of the Fund. Class A shares are not subject to such fees.

Investment income, realized and unrealized gains and losses, and certain fund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares, except that each class bears certain expenses unique to that class (including the applicable 12b-1 distribution fees and recordkeeping fees). Differences in class-level expenses may result in payment of different per share dividends by class. All shares have equal rights with respect to voting subject to class-specific arrangements.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Equity securities are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. Securities for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. Equity securities are generally categorized as Level 1.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Debt securities are valued at prices supplied by independent pricing services approved by the Fund's Board. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, prepayment speeds and other data, as well as broker quotes. If the pricing services are unable to provide valuations, debt securities are valued at the average of the most recent reliable bid quotations or evaluated prices, as applicable, obtained from broker-dealers are valued at the mean of the most recent bid and ask quotations or evaluated prices, as applicable, obtained from broker-dealers. These securities are generally categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Trustees and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors used in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund's Investment Portfolio.

Securities Lending. Brown Brothers Harriman & Co., as lending agent, lends securities of the Fund to certain financial institutions under the terms of the Security Lending Agreement. The Fund retains the benefits of owning the securities it has loaned and continues to receive interest and dividends generated by the securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at least equal to the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the security lending agreement. The Fund may invest the cash collateral into a joint trading account in an affiliated money market fund pursuant to Exemptive Orders issued by the SEC. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. If the Fund is not able to recover securities lent, the Fund may sell the collateral and purchase a replacement investment in the market, incurring the risk that the value of the replacement security is greater than the value of the collateral. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

As of June 30, 2015, the Fund had securities on loan. The value of the related collateral exceeded the value of the securities loaned at period end.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

Federal Income Taxes. The Fund is treated as a separate taxpayer as provided for in the Internal Revenue Code, as amended. It is the Fund's policy to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to the separate accounts of the Participating Insurance Companies which hold its shares.

The Fund has reviewed the tax positions for the open tax years as of December 31, 2014 and has determined that no provision for income tax and/or uncertain tax provisions is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund, if any, are declared and distributed to shareholders annually. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

Expenses. Expenses of the Series arising in connection with a specific Fund are allocated to that Fund. Other Series expenses which cannot be directly attributed to a Fund are apportioned among the Funds in the Series based upon the relative net assets or other appropriate measures.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date net of foreign withholding taxes. Realized gains and losses from investment transactions are recorded on an identified cost basis. Proceeds from litigation payments, if any, are included in net realized gain (loss) from investments.

B. Purchases and Sales of Securities

During the six months ended June 30, 2015, purchases and sales of investment securities (excluding short-term investments) aggregated $36,638,846 and $50,378,350, respectively.

C. Related Parties

Management Agreement. Under the Investment Management Agreement with Deutsche Investment Management Americas Inc. ("DIMA" or the "Advisor"), an indirect, wholly owned subsidiary of Deutsche Bank AG, the Advisor directs the investments of the Fund in accordance with its investment objectives, policies and restrictions. The Advisor determines the securities, instruments and other contracts relating to investments to be purchased, sold or entered into by the Fund.

Pursuant to the Investment Management Agreement with the Advisor, the Fund pays a monthly management fee based on the Fund's average daily net assets, computed and accrued daily and payable monthly, at the following annual rates:

| First $250 million of average daily net assets | | | .390 | % |

| Next $750 million of average daily net assets | | | .365 | % |

| Over $1 billion of average daily net assets | | | .340 | % |

Accordingly, for the six months ended June 30, 2015, the fee pursuant to the Investment Management Agreement was equivalent to an annualized rate (exclusive of any applicable waivers/reimbursements) of 0.39% of the Fund's average daily net assets.

For the period from January 1, 2015 through September 30, 2015, the Advisor has contractually agreed to waive its fees and/or reimburse certain operating expenses of the Fund to the extent necessary to maintain the total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest) of each class as follows:

Administration Fee. Pursuant to an Administrative Services Agreement, DIMA provides most administrative services to the Fund. For all services provided under the Administrative Services Agreement, the Fund pays the Advisor an annual fee ("Administration Fee") of 0.10% of the Fund's average daily net assets, computed and accrued daily and payable monthly. For the six months ended June 30, 2015, the Administration Fee was $110,489, of which $18,314 is unpaid.

Service Provider Fees. DeAWM Service Company ("DSC"), an affiliate of the Advisor, is the transfer agent, dividend-paying agent and shareholder service agent for the Fund. Pursuant to a sub-transfer agency agreement between DSC and DST Systems, Inc. ("DST"), DSC has delegated certain transfer agent, dividend-paying agent and shareholder service agent functions to DST. DSC compensates DST out of the shareholder servicing fee it receives from the Fund. For the six months ended June 30, 2015, the amounts charged to the Fund by DSC were as follows:

| Services to Shareholders | | Total Aggregated | | | Unpaid at June 30, 2015 | |

| Class A | | $ | 288 | | | $ | 143 | |

| Class B | | | 44 | | | | 15 | |

| | | $ | 332 | | | $ | 158 | |

Distribution Service Agreement. DeAWM Distributors, Inc. ("DDI"), also an affiliate of the Advisor, is the Series' Distributor. In accordance with the Master Distribution Plan, DDI receives 12b-1 fees of 0.25% of average daily net assets of Class B shares. Pursuant to the Master Distribution Plan, DDI remits these fees to the Participating Insurance Companies for various costs incurred or paid by these companies in connection with marketing and distribution of Class B shares. For the six months ended June 30, 2015, the Distribution Service Fee aggregated $2,379, of which $423 is unpaid.

Typesetting and Filing Service Fees. Under an agreement with DIMA, DIMA is compensated for providing typesetting and certain regulatory filing services to the Fund. For the six months ended June 30, 2015, the amount charged to the Fund by DIMA included in the Statement of Operations under "Reports to shareholders" aggregated $7,692, of which $6,762 is unpaid.

Trustees' Fees and Expenses. The Fund paid retainer fees to each Trustee not affiliated with the Advisor, plus specified amounts to the Board Chairperson and Vice Chairperson and to each committee Chairperson.

Affiliated Cash Management Vehicles. The Fund may invest uninvested cash balances in Central Cash Management Fund and Deutsche Variable NAV Money Fund, affiliated money market funds which are managed by the Advisor. Each affiliated money market fund seeks to provide a high level of current income consistent with liquidity and the preservation of capital. Each affiliated money market fund is managed in accordance with Rule 2a-7 under the 1940 Act, which governs the quality, maturity, diversity and liquidity of instruments in which a money market fund may invest. Central Cash Management Fund seeks to maintain a stable net asset value, and Deutsche Variable NAV Money Fund maintains a floating net asset value. The Fund indirectly bears its proportionate share of the expenses of each affiliated money market fund in which it invests. Central Cash Management Fund does not pay the Advisor an investment management fee. To the extent that Deutsche Variable NAV Money Fund pays an investment management fee to the Advisor, the Advisor will waive an amount of the investment management fee payable to the Advisor by the Fund equal to the amount of the investment management fee payable on the Fund's assets invested in Deutsche Variable NAV Money Fund.

D. Ownership of the Fund

At June 30, 2015, two participating insurance companies were owners of record of 10% or more of the total outstanding Class A shares of the Fund, each owning 47% and 30%, respectively. Two participating insurance companies were owners of record of 10% or more of the total outstanding Class B shares of the Fund, each owning 71% and 12%, respectively.

E. Line of Credit

The Fund and other affiliated funds (the "Participants") share in a $400 million revolving credit facility provided by a syndication of banks. The Fund may borrow for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Participants are charged an annual commitment fee which is allocated based on net assets, among each of the Participants. Interest is calculated at a rate per annum equal to the sum of the Federal Funds Rate plus 1.25 percent plus if the one-month LIBOR exceeds the Federal Funds Rate, the amount of such excess. The Fund may borrow up to a maximum of 33 percent of its net assets under the agreement. The Fund had no outstanding loans at June 30, 2015.

Information About Your Fund's Expenses (Unaudited)

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include contract charges, which are not shown in this section. The following tables are intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The example in the table is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (January 1, 2015 to June 30, 2015).

The tables illustrate your Fund's expenses in two ways:

—Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses (but not transaction costs) paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

—Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses (but not transaction costs) with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical Fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expense of owning different funds. If these transaction costs had been included, your costs would have been higher.

Expenses and Value of a $1,000 Investment for the six months ended June 30, 2015 | |

| Actual Fund Return | | Class A | | | Class B | |

| Beginning Account Value 1/1/15 | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value 6/30/15 | | $ | 1,054.90 | | | $ | 1,053.10 | |

| Expenses Paid per $1,000* | | $ | 2.85 | | | $ | 4.17 | |

| Hypothetical 5% Portfolio Return | | Class A | | | Class B | |

| Beginning Account Value 1/1/15 | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value 6/30/15 | | $ | 1,022.02 | | | $ | 1,020.73 | |

| Expenses Paid per $1,000* | | $ | 2.81 | | | $ | 4.11 | |

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by 181 (the number of days in the most recent six-month period), then divided by 365.

| Annualized Expense Ratios | Class A | | Class B | |

| Deutsche Variable Series I — Deutsche Core Equity VIP | .56% | | .82% | |

For more information, please refer to the Fund's prospectus.

These tables do not reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option.

For an analysis of the fees associated with an investment in the fund or similar funds, please refer to the current and hypothetical expense calculators for Variable Insurance Products which can be found at deutschefunds.com/EN/resources/calculators.jsp.

The Series' policies and procedures for voting proxies for portfolio securities and information about how the Series voted proxies related to its portfolio securities during the 12-month period ended June 30 are available on our Web site — deutschefunds.com (click on "proxy voting"at the bottom of the page) — or on the SEC's Web site — sec.gov. To obtain a written copy of the Series' policies and procedures without charge, upon request, call us toll free at (800) 728-3337.

Advisory Agreement Board Considerations and Fee Evaluation

The Board of Trustees approved the renewal of Deutsche Core Equity VIP’s investment management agreement (the "Agreement") with Deutsche Investment Management Americas Inc. ("DIMA") in September 2014.

In terms of the process that the Board followed prior to approving the Agreement, shareholders should know that:

— In September 2014, all of the Fund’s Trustees were independent of DIMA and its affiliates.

— The Trustees met frequently during the past year to discuss fund matters and dedicated a substantial amount of time to contract review matters. Over the course of several months, the Board’s Contract Committee, in coordination with the Board’s Equity Oversight Committee, reviewed comprehensive materials received from DIMA, independent third parties and independent counsel. These materials included an analysis of the Fund’s performance, fees and expenses, and profitability compiled by a fee consultant retained by the Fund’s Independent Trustees (the "Fee Consultant"). The Board also received extensive information throughout the year regarding performance of the Fund.

— The Independent Trustees regularly meet privately with counsel to discuss contract review and other matters. In addition, the Independent Trustees were advised by the Fee Consultant in the course of their review of the Fund’s contractual arrangements and considered a comprehensive report prepared by the Fee Consultant in connection with their deliberations.

— In connection with reviewing the Agreement, the Board also reviewed the terms of the Fund’s Rule 12b-1 plan, distribution agreement, administrative services agreement, transfer agency agreement and other material service agreements.

— Based on its evaluation of the information provided, the Contract Committee presented its findings and recommendations to the Board. The Board then reviewed the Contract Committee’s findings and recommendations.

In connection with the contract review process, the Contract Committee and the Board considered the factors discussed below, among others. The Board also considered that DIMA and its predecessors have managed the Fund since its inception, and the Board believes that a long-term relationship with a capable, conscientious advisor is in the best interests of the Fund. The Board considered, generally, that shareholders chose to invest or remain invested in the Fund knowing that DIMA managed the Fund, and that the Agreement was approved by the Fund’s shareholders. DIMA is part of Deutsche Bank AG ("DB"), a major global banking institution that is engaged in a wide range of financial services. The Board believes that there are advantages to being part of a global asset management business that offers a wide range of investing expertise and resources, including hundreds of portfolio managers and analysts with research capabilities in many countries throughout the world.

As part of the contract review process, the Board carefully considered the fees and expenses of each Deutsche fund overseen by the Board in light of the fund’s performance. In many cases, this led to the negotiation and implementation of expense caps. As part of these negotiations, the Board indicated that it would consider relaxing these caps in future years following sustained improvements in performance, among other considerations.

In 2012, DB combined its Asset Management (of which DIMA was a part) and Wealth Management divisions into a new Asset and Wealth Management ("AWM") division. DB has advised the Independent Trustees that the U.S. asset management business is a critical and integral part of DB, and that DB will continue to invest in AWM a significant portion of the savings it has realized by combining its Asset and Wealth Management divisions, including ongoing enhancements to AWM’s investment capabilities. DB also has confirmed its commitment to maintaining strong legal and compliance groups within the AWM division.

While shareholders may focus primarily on fund performance and fees, the Fund’s Board considers these and many other factors, including the quality and integrity of DIMA’s personnel and such other issues as back-office operations, fund valuations, and compliance policies and procedures.

Nature, Quality and Extent of Services. The Board considered the terms of the Agreement, including the scope of advisory services provided under the Agreement. The Board noted that, under the Agreement, DIMA provides portfolio management services to the Fund and that, pursuant to a separate administrative services agreement, DIMA provides administrative services to the Fund. The Board considered the experience and skills of senior management and investment personnel, the resources made available to such personnel, the ability of DIMA to attract and retain high-quality personnel, and the organizational depth and stability of DIMA. The Board reviewed the Fund’s performance over short-term and long-term periods and compared those returns to various agreed-upon performance measures, including a market index and a peer universe compiled by the Fee Consultant using information supplied by Morningstar Direct ("Morningstar"), an independent fund data service. The Board also noted that it has put into place a process of identifying "Focus Funds" (e.g., funds performing poorly relative to a peer universe), and receives more frequent reporting and information from DIMA regarding such funds, along with DIMA’s plans to address underperformance. The Board believes this process is an effective manner of identifying and addressing underperforming funds. Based on the information provided, the Board noted that for the one-, three- and five-year periods ended December 31, 2013, the Fund’s performance (Class A shares) was in the 1st quartile, 1st quartile and 1st quartile, respectively, of the applicable Morningstar universe (the 1st quartile being the best performers and the 4th quartile being the worst performers). The Board also observed that the Fund has outperformed its benchmark in the one-, three- and five-year periods ended December 31, 2013.

Fees and Expenses. The Board considered the Fund’s investment management fee schedule, operating expenses and total expense ratios, and comparative information provided by Lipper Inc. ("Lipper") and the Fee Consultant regarding investment management fee rates paid to other investment advisors by similar funds (1st quartile being the most favorable and 4th quartile being the least favorable). With respect to management fees paid to other investment advisors by similar funds, the Board noted that the contractual fee rates paid by the Fund, which include a 0.10% fee paid to DIMA under the Fund’s administrative services agreement, were lower than the median (1st quartile) of the applicable Lipper peer group (based on Lipper data provided as of December 31, 2013). The Board noted that the Fund’s Class A shares total (net) operating expenses were expected to be lower than the median (1st quartile) of the applicable Lipper expense universe (based on Lipper data provided as of December 31, 2013) ("Lipper Universe Expenses"). The Board also reviewed data comparing each share class’s total (net) operating expenses to the applicable Lipper Universe Expenses. The Board also considered how the Fund’s total (net) operating expenses compared to the total (net) operating expenses of a more customized peer group selected by Lipper (based on such factors as asset size). The Board also noted that the expense limitations agreed to by DIMA helped to ensure that the Fund’s total (net) operating expenses would remain competitive. The Board considered the Fund’s management fee rate as compared to fees charged by DIMA to comparable funds and considered differences between the Fund and the comparable funds.

The information requested by the Board as part of its review of fees and expenses also included information about institutional accounts and funds offered primarily to European investors ("Deutsche Europe funds") managed by DIMA and its affiliates. The Board noted that DIMA indicated that it manages an institutional account comparable to the Fund, but does not manage any comparable Deutsche Europe funds. The Board took note of the differences in services provided to Deutsche U.S. mutual funds ("Deutsche Funds") as compared to institutional accounts and that such differences made comparison difficult.

On the basis of the information provided, the Board concluded that management fees were reasonable and appropriate in light of the nature, quality and extent of services provided by DIMA.

Profitability. The Board reviewed detailed information regarding revenues received by DIMA under the Agreement. The Board considered the estimated costs and pre-tax profits realized by DIMA from advising the Deutsche Funds, as well as estimates of the pre-tax profits attributable to managing the Fund in particular. The Board also received information regarding the estimated enterprise-wide profitability of DIMA and its affiliates with respect to all fund services in totality and by fund. The Board and the Fee Consultant reviewed DIMA’s methodology in allocating its costs to the management of the Fund. Based on the information provided, the Board concluded that the pre-tax profits realized by DIMA in connection with the management of the Fund were not unreasonable.

Economies of Scale. The Board considered whether there are economies of scale with respect to the management of the Fund and whether the Fund benefits from any economies of scale. The Board noted that the Fund’s management fee schedule includes fee breakpoints. The Board concluded that the Fund’s fee schedule represents an appropriate sharing between the Fund and DIMA of such economies of scale as may exist in the management of the Fund at current asset levels.

Other Benefits to DIMA and Its Affiliates. The Board also considered the character and amount of other incidental benefits received by DIMA and its affiliates, including any fees received by DIMA for administrative services provided to the Fund and any fees received by an affiliate of DIMA for distribution services. The Board also considered benefits to DIMA related to brokerage and soft-dollar allocations, including allocating brokerage to pay for research generated by parties other than the executing broker dealers, which pertain primarily to funds investing in equity securities, along with the incidental public relations benefits to DIMA related to Deutsche Funds advertising and cross-selling opportunities among DIMA products and services. The Board concluded that management fees were reasonable in light of these fallout benefits.

Compliance. The Board considered the significant attention and resources dedicated by DIMA to documenting and enhancing its compliance processes in recent years. The Board noted in particular (i) the experience and seniority of DIMA’s and the Fund’s chief compliance officer; (ii) the large number of DIMA compliance personnel; and (iii) the substantial commitment of resources by DIMA and its affiliates to compliance matters.

Based on all of the information considered and the conclusions reached, the Board unanimously determined that the continuation of the Agreement is in the best interests of the Fund. In making this determination, the Board did not give particular weight to any single factor identified above. The Board considered these factors over the course of numerous meetings, certain of which were in executive session with only the Independent Trustees and counsel present. It is possible that individual Trustees may have weighed these factors differently in reaching their individual decisions to approve the continuation of the Agreement.

Notes

DeAWM Distributors, Inc.

222 South Riverside Plaza

Chicago, IL 60606

(800) 621-1148

VS1coreq-3 (R-028376-4 8/15)

June 30, 2015

Semiannual Report

Deutsche Variable Series I

Deutsche CROCI® International VIP

(formerly Deutsche International VIP)

Contents

10 Statement of Assets and Liabilities 11 Statement of Operations 12 Statement of Changes in Net Assets 15 Notes to Financial Statements 21 Information About Your Fund's Expenses 23 Advisory Agreement Board Considerations and Fee Evaluation |

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Emerging markets tend to be more volatile than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. Stocks may decline in value. The Fund will be managed on the premise that stocks with lower CROCI® Economic P/E Ratios may outperform stocks with higher CROCI® Economic P/E Ratios over time. This premise may not always be correct and prospective investors should evaluate this assumption prior to investing in the Fund. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. The Fund may lend securities to approved institutions. See the prospectus for details.

Deutsche Asset & Wealth Management represents the asset management and wealth management activities conducted by Deutsche Bank AG or any of its subsidiaries, including the Advisor and DeAWM Distributors, Inc.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary June 30, 2015 (Unaudited)

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund's most recent month-end performance. Performance doesn't reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns. While all share classes have the same underlying portfolio, their performance will differ.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated May 1, 2015 are 1.04% and 1.31% for Class A and Class B shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

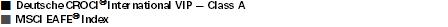

| Growth of an Assumed $10,000 Investment |

| MSCI EAFE Index is an unmanaged index that tracks international stock performance in the 21 developed markets of Europe, Australasia and the Far East. Returns reflect reinvestment of dividends net of withholding taxes. The index is calculated using closing local market prices and translates into U.S. dollars using the London close foreign exchange rates. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| |

| Yearly periods ended June 30 | |

| Comparative Results | |

Deutsche CROCI® International VIP | | 6-Month‡ | | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | |

| Class A | Growth of $10,000 | | $ | 10,628 | | | $ | 9,200 | | | $ | 12,913 | | | $ | 13,702 | | | $ | 13,378 | |

| Average annual total return | | | 6.28 | % | | | –8.00 | % | | | 8.90 | % | | | 6.50 | % | | | 2.95 | % |

MSCI EAFE® Index | Growth of $10,000 | | $ | 10,552 | | | $ | 9,578 | | | $ | 14,039 | | | $ | 15,770 | | | $ | 16,474 | |

| Average annual total return | | | 5.52 | % | | | –4.22 | % | | | 11.97 | % | | | 9.54 | % | | | 5.12 | % |

Deutsche CROCI® International VIP | | 6-Month‡ | | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | |

| Class B | Growth of $10,000 | | $ | 10,627 | | | $ | 9,191 | | | $ | 12,838 | | | $ | 13,546 | | | $ | 13,027 | |

| Average annual total return | | | 6.27 | % | | | –8.09 | % | | | 8.69 | % | | | 6.26 | % | | | 2.68 | % |

MSCI EAFE® Index | Growth of $10,000 | | $ | 10,552 | | | $ | 9,578 | | | $ | 14,039 | | | $ | 15,770 | | | $ | 16,474 | |

| Average annual total return | | | 5.52 | % | | | –4.22 | % | | | 11.97 | % | | | 9.54 | % | | | 5.12 | % |

The growth of $10,000 is cumulative.

‡ Total returns shown for periods less than one year are not annualized.

Portfolio Summary (Unaudited) Asset Allocation (As a % of Investment Portfolio excluding Securities Lending Collateral) | 6/30/15 | 12/31/14 |

| | | |

| Common Stocks | 97% | 99% |

| Cash Equivalents | 3% | 1% |

| | 100% | 100% |

Geographical Diversification

(As a % of Investment Portfolio excluding Cash Equivalents and Securities Lending Collateral) | 6/30/15 | 12/31/14 |

| | | |

| Continental Europe | 42% | 44% |

| United Kingdom | 23% | 24% |

| Japan | 23% | 21% |

| Asia (excluding Japan) | 6% | 6% |

| Australia | 6% | 5% |

| | 100% | 100% |

Sector Diversification

(As a % of Investment Portfolio excluding Cash Equivalents and Securities Lending Collateral) | 6/30/15 | 12/31/14 |

| | | |

| Materials | 27% | 23% |

| Industrials | 22% | 14% |

| Consumer Discretionary | 16% | 17% |

| Utilities | 16% | 10% |

| Health Care | 10% | 14% |

| Energy | 7% | 13% |

| Information Technology | 2% | 5% |

| Consumer Staples | — | 2% |

| Telecommunication Services | — | 2% |

| | 100% | 100% |

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund's investment portfolio, see page 7.

Following the Fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC's Web site at sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. The Fund's portfolio holdings are also posted on deutschefunds.com from time to time. Please see the Fund's current prospectus for more information.

Di Kumble, CFA

Portfolio Manager

Investment Portfolio June 30, 2015 (Unaudited) | | | Shares | | | Value ($) | |

| | | | |

| Common Stocks 96.4% | |

| Australia 5.6% | |

| BHP Billiton Ltd. | | | 106,673 | | | | 2,186,162 | |

| Origin Energy Ltd. | | | 266,029 | | | | 2,510,393 | |

| South32 Ltd.* | | | 106,673 | | | | 147,324 | |

| Woodside Petroleum Ltd. | | | 96,805 | | | | 2,563,467 | |

| (Cost $9,970,393) | | | | 7,407,346 | |

| Austria 1.7% | |

| OMV AG (Cost $3,357,604) | | | 84,021 | | | | 2,315,894 | |

| Denmark 1.9% | |

| A P Moller-Maersk AS "B" (Cost $3,134,665) | | | 1,370 | | | | 2,483,157 | |

| Finland 1.8% | |

| Fortum Oyj (Cost $2,880,400) | | | 136,799 | | | | 2,428,999 | |

| France 7.5% | |

| Electricite de France SA | | | 109,129 | | | | 2,434,455 | |

| GDF Suez | | | 128,315 | | | | 2,380,460 | |

| Kering | | | 14,670 | | | | 2,615,250 | |

| Sanofi | | | 25,721 | | | | 2,519,793 | |

| (Cost $11,344,419) | | | | 9,949,958 | |

| Germany 7.9% | |

| Continental AG | | | 10,870 | | | | 2,573,368 | |

| E.ON SE | | | 169,896 | | | | 2,265,317 | |

| K+S AG (Registered) | | | 77,806 | | | | 3,292,908 | |

| Siemens AG (Registered) | | | 24,543 | | | | 2,471,422 | |

| (Cost $11,004,817) | | | | 10,603,015 | |

| Hong Kong 2.0% | |

| CLP Holdings Ltd. (Cost $2,497,728) | | | 309,800 | | | | 2,634,691 | |

| Japan 22.2% | |

| Asahi Kasei Corp. | | | 282,000 | | | | 2,322,285 | |

| Bridgestone Corp. | | | 64,300 | | | | 2,384,979 | |

| Daiichi Sankyo Co., Ltd. (a) | | | 153,000 | | | | 2,835,838 | |

| Denso Corp. | | | 56,300 | | | | 2,813,707 | |

| JGC Corp. | | | 134,000 | | | | 2,536,211 | |

| Mitsui & Co., Ltd. | | | 195,600 | | | | 2,662,648 | |

| Nitto Denko Corp. | | | 41,800 | | | | 3,446,042 | |

| Otsuka Holdings Co., Ltd. | | | 78,400 | | | | 2,506,329 | |

| Sekisui House Ltd. | | | 172,400 | | | | 2,744,951 | |

| Sumitomo Metal Mining Co., Ltd. | | | 185,000 | | | | 2,825,093 | |

| Toyota Industries Corp. | | | 44,400 | | | | 2,540,939 | |

| (Cost $26,238,738) | | | | 29,619,022 | |

| Luxembourg 3.6% | |

| ArcelorMittal (a) | | | 253,383 | | | | 2,452,352 | |

| Tenaris SA | | | 170,069 | | | | 2,298,447 | |

| (Cost $6,294,725) | | | | 4,750,799 | |

| Netherlands 2.1% | |

| Koninklijke DSM NV (Cost $3,321,008) | | | 48,115 | | | | 2,792,070 | |

| | | Shares | | | Value ($) | |

| | | | | | | | | |

| Singapore 3.6% | |

| Keppel Corp., Ltd. | | | 402,700 | | | | 2,459,011 | |

| Singapore Airlines Ltd. | | | 299,200 | | | | 2,386,255 | |

| (Cost $5,756,413) | | | | 4,845,266 | |

| Spain 1.9% | |

| Gas Natural SDG SA (Cost $2,765,793) | | | 112,463 | | | | 2,549,412 | |

| Sweden 1.8% | |

| Telefonaktiebolaget LM Ericsson "B" (Cost $2,844,774) | | | 238,056 | | | | 2,463,437 | |

| Switzerland 10.1% | |

| ABB Ltd. (Registered)* | | | 123,403 | | | | 2,580,003 | |

| Roche Holding AG (Genusschein) | | | 9,322 | | | | 2,613,707 | |

| Sika AG (Bearer)* | | | 779 | | | | 2,746,400 | |

| Swatch Group AG (Bearer) | | | 6,101 | | | | 2,374,251 | |

| Syngenta AG (Registered) | | | 7,856 | | | | 3,193,740 | |

| (Cost $13,577,805) | | | | 13,508,101 | |

| United Kingdom 22.7% | |

| Anglo American PLC | | | 162,308 | | | | 2,342,675 | |

| Antofagasta PLC | | | 221,804 | | | | 2,400,320 | |

| Burberry Group PLC | | | 99,393 | | | | 2,448,408 | |

| Centrica PLC | | | 665,576 | | | | 2,764,462 | |

| easyJet PLC | | | 97,129 | | | | 2,364,052 | |

| GlaxoSmithKline PLC | | | 114,665 | | | | 2,386,140 | |

| Rexam PLC | | | 306,427 | | | | 2,656,641 | |

| Rio Tinto PLC | | | 59,425 | | | | 2,432,780 | |

| Rolls-Royce Holdings PLC | | | 169,930 | | | | 2,320,413 | |

| Smiths Group PLC | | | 155,880 | | | | 2,764,528 | |

| SSE PLC | | | 112,788 | | | | 2,719,149 | |

| The Weir Group PLC | | | 101,305 | | | | 2,696,594 | |

| (Cost $35,039,998) | | | | 30,296,162 | |

Total Common Stocks (Cost $140,029,280) | | | | 128,647,329 | |

| | |

| Securities Lending Collateral 3.3% | |

| Daily Assets Fund Institutional, 0.16% (b) (c) (Cost $4,329,999) | | | 4,329,999 | | | | 4,329,999 | |

| | |

| Cash Equivalents 3.3% | |

| Central Cash Management Fund, 0.09% (b) (Cost $4,451,561) | | | 4,451,561 | | | | 4,451,561 | |

| | | % of Net Assets | | | Value ($) | |

| | | | |

Total Investment Portfolio (Cost $148,810,840)† | | | 103.0 | | | | 137,428,889 | |

| Other Assets and Liabilities, Net | | | (3.0 | ) | | | (4,000,803 | ) |

| Net Assets | | | 100.0 | | | | 133,428,086 | |

* Non-income producing security.

† The cost for federal income tax purposes was $149,156,954. At June 30, 2015, net unrealized depreciation for all securities based on tax cost was $11,728,065. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $5,255,734 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $16,983,799.

(a) All or a portion of these securities were on loan. In addition, "Other Assets and Liabilities, Net" may include pending sales that are also on loan. The value of securities loaned at June 30, 2015 amounted to $4,029,622, which is 3.0% of net assets.

(b) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

(c) Represents collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates.

As of June 30, 2015, the Fund had the following open forward foreign currency exchange contracts:

| Contracts to Deliver | | In Exchange For | | Settlement Date | | Unrealized Appreciation ($) | | Counterparty |

| USD | | | 49,854 | | JPY | | | 6,100,000 | | 7/31/2015 | | | 8 | | Citigroup, Inc. |

| CHF | | | 12,917,000 | | USD | | | 13,856,617 | | 7/31/2015 | | | 24,187 | | Citigroup, Inc. |

| EUR | | | 32,300,000 | | USD | | | 36,170,541 | | 7/31/2015 | | | 146,042 | | Citigroup, Inc. |

| GBP | | | 19,895,000 | | USD | | | 31,313,974 | | 7/31/2015 | | | 60,101 | | Citigroup, Inc. |

| SGD | | | 6,539,000 | | USD | | | 4,852,733 | | 7/31/2015 | | | 79 | | Goldman Sachs & Co. |

| DKK | | | 17,013,000 | | USD | | | 2,554,709 | | 7/31/2015 | | | 10,157 | | Goldman Sachs & Co. |

| SEK | | | 21,523,000 | | USD | | | 2,605,347 | | 7/31/2015 | | | 7,395 | | Goldman Sachs & Co. |

| Total unrealized appreciation | | | 247,969 | | |

| Contracts to Deliver | | In Exchange For | | Settlement Date | | Unrealized Depreciation ($) | | Counterparty |

| AUD | | | 10,019,000 | | USD | | | 7,691,767 | | 7/31/2015 | | | (24,468 | ) | Goldman Sachs & Co. |

| HKD | | | 20,335,000 | | USD | | | 2,623,060 | | 7/31/2015 | | | (212 | ) | Goldman Sachs & Co. |

| JPY | | | 3,736,706,000 | | USD | | | 30,282,033 | | 7/31/2015 | | | (261,958 | ) | Citigroup, Inc. |

| Total unrealized depreciation | | | (286,638 | ) | |

| Currency Abbreviations |

AUD Australian Dollar CHF Swiss Franc DKK Danish Krone EUR Euro GBP British Pound HKD Hong Kong Dollar JPY Japanese Yen SEK Swedish Krona SGD Singapore Dollar USD United States Dollar |