UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-04257

Deutsche Variable Series I

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and Address of Agent for Service)

| Date of fiscal year end: | 12/31 |

| | |

| Date of reporting period: | 12/31/2016 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

December 31, 2016

Annual Report

Deutsche Variable Series I

Deutsche Bond VIP

Contents

3 Performance Summary 4 Management Summary 5 Portfolio Summary 6 Investment Portfolio 14 Statement of Assets and Liabilities 14 Statement of Operations 15 Statements of Changes in Net Assets 16 Financial Highlights 17 Notes to Financial Statements 25 Report of Independent Registered Public Accounting Firm 26 Information About Your Fund's Expenses 27 Tax Information 27 Proxy Voting 28 Advisory Agreement Board Considerations and Fee Evaluation 31 Board Members and Officers |

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Bond investments are subject to interest-rate, credit, liquidity and market risks to varying degrees. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investments in lower-quality ("junk bonds") and non-rated securities present greater risk of loss than investments in higher-quality securities. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Emerging markets tend to be more volatile and less liquid than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. See the prospectus for details.

Deutsche Asset Management represents the asset management activities conducted by Deutsche Bank AG or any of its subsidiaries.

Deutsche AM Distributors, Inc., 222 South Riverside Plaza, Chicago, IL 60606, (800) 621-1148

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary December 31, 2016 (Unaudited)

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund's most recent month-end performance. Performance doesn't reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns.

The gross expense ratio of the Fund, as stated in the fee table of the prospectus dated May 1, 2016 is 0.69% for Class A shares and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

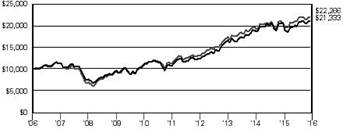

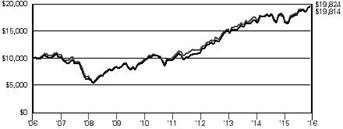

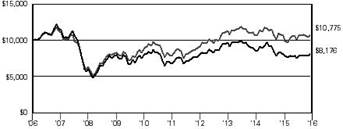

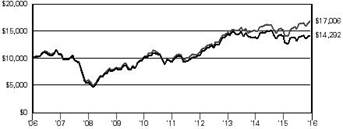

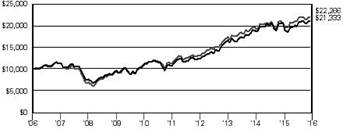

| Growth of an Assumed $10,000 Investment |

■ Deutsche Bond VIP — Class A ■ Bloomberg Barclays U.S. Aggregate Bond Index | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index representing domestic taxable investment-grade bonds, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities with an average maturity of one year or more. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| |

| Yearly periods ended December 31 | | |

| Comparative Results |

| Deutsche Bond VIP | 1-Year | 3-Year | 5-Year | 10-Year |

| Class A | Growth of $10,000 | $10,593 | $11,262 | $11,770 | $12,677 |

| Average annual total return | 5.93% | 4.04% | 3.31% | 2.40% |

| Bloomberg Barclays U.S. Aggregate Bond Index | Growth of $10,000 | $10,265 | $10,937 | $11,167 | $15,300 |

| Average annual total return | 2.65% | 3.03% | 2.23% | 4.34% |

The growth of $10,000 is cumulative.

Management Summary December 31, 2016 (Unaudited)

Following the U.S. Federal Reserve Board’s (the Fed) rate hike in December of 2015, markets were expecting a series of additional, modest rate increases to be enacted at upcoming Fed meetings. However, this outlook was upended as 2016 opened with a resurgence of concerns around slowing growth in China and weakness in energy prices, sending credit-based assets lower. Credit sentiment would rally from mid-February on, as investors were encouraged by the outlook for even more gradual Fed policy normalization and increased efforts by overseas central banks to stimulate growth, along with a rebound in oil prices off their January lows. In late June, markets were surprised by the results of a U.K. referendum which resulted in a vote to leave the European Union, leading to an investor flight to safety that pushed U.S. Treasury yields down to historical lows. However, credit-sensitive areas of the market would quickly resume their outperformance against a backdrop of supportive central banks and continued strength in commodity prices. Returns for the broad U.S. fixed-income market would turn negative in the wake of the November 8th U.S. election, as interest rates moved up in anticipation of higher growth and inflation under unified Republican control of the government. U.S. Treasury yields trended higher over November and December and economically sensitive segments of the bond market held up better than their more interest-rate-sensitive, higher-quality counterparts.

During the 12-month period ended December 31, 2016, the portfolio provided a total return of 5.93% (Class A shares, unadjusted for contract charges) compared with the 2.65% return of its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.1

The portfolio’s positive performance vs. the benchmark was driven principally by exposure to more credit-sensitive fixed-income sectors. In particular, a significant weighting of investment-grade corporate bonds at the expense of U.S. Treasury securities was a positive contributor to returns during the year.2,3 In addition, out-of-benchmark exposure to U.S. high-yield corporate bonds worked well in an environment of narrowing credit spreads.4 Finally, exposure to structured securities in the commercial mortgage-backed and asset-backed sectors added to relative returns, as improving collateral performance and an increasing appetite for high-quality assets with incremental yield supported both sectors. The managers used derivatives as part of implementing the fund’s positioning along the yield curve as well to hedge against certain risks, with a modest negative impact on performance. While we remain generally constructive on the outlook for credit fundamentals, spreads have tightened in recent quarters and we closed the annual period with an up-in-quality bias within the credit arena. Concerns over the Fed’s resumption of tightening credit conditions are muted, and demand for yield assets continues to be supported by negative interest rates overseas.

John D. Ryan

Gary Russell, CFA

Thomas M. Farina, CFA

Gregory M. Staples, CFA

Portfolio Managers

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

1 The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged, market-value-weighted measure of Treasury issues, agency issues, corporate bond issues and mortgage securities. Index returns, unlike fund returns, do not reflect any fees or expenses. It is not possible to invest directly into an index.

2 "Overweight" means the fund holds a higher weighting in a given sector or security than the benchmark. "Underweight" means the fund holds a lower weighting.

3 Contributors and detractors incorporate both a holding’s return and its weight. If two holdings have the same return but one has a larger weighting in the fund, it will have a larger contribution to return in the period.

4 Credit spread is the additional yield provided by lower-rated bonds vs. higher-rated bonds with comparable effective maturities.

Portfolio Summary (Unaudited)

| Asset Allocation (As a % of Total Net Assets) | 12/31/16 | 12/31/15 |

| | | |

| Corporate Bonds | 49% | 22% |

| Government & Agency Obligations | 23% | 41% |

| Mortgage-Backed Securities Pass-Throughs | 19% | 23% |

| Asset-Backed | 5% | 2% |

| Collateralized Mortgage Obligations | 3% | 8% |

| Commercial Mortgage-Backed Securities | 2% | 4% |

| Short-Term U.S. Treasury Obligations | 1% | 1% |

| Municipal Bonds and Notes | — | 1% |

| Cash Equivalents, Securities Lending Collateral and other Assets and Liabilities, net | –2% | –2% |

| | 100% | 100% |

| Quality (Excludes Cash Equivalents and Securities Lending Collateral) | 12/31/16 | 12/31/15 |

| | | |

| AAA | 47% | 65% |

| AA | 5% | 3% |

| A | 10% | 4% |

| BBB | 22% | 15% |

| BB or Below | 15% | 9% |

| Not Rated | 1% | 4% |

| | 100% | 100% |

| Interest Rate Sensitivity | 12/31/16 | 12/31/15 |

| | | |

| Effective Maturity | 8.7 years | 7.4 years |

| Effective Duration | 5.9 years | 7.1 years |

The quality ratings represent the higher of Moody's Investors Service, Inc. ("Moody's"), Fitch Ratings, Inc. ("Fitch") or Standard & Poor's Corporation ("S&P") credit ratings. The ratings of Moody's, Fitch and S&P represent their opinions as to the quality of the securities they rate. Credit quality measures a bond issuer's ability to repay interest and principal in a timely manner. Ratings are relative and subjective and are not absolute standards of quality. Credit quality does not remove market risk and is subject to change.

Effective maturity is the weighted average of the maturity date of bonds held by the Fund taking into consideration any available maturity shortening features.

Effective duration is an approximate measure of the Fund's sensitivity to interest rate changes taking into consideration any maturity shortening features.

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund's investment portfolio, see page 6.

Following the Fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC's Web site at sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. The Fund's portfolio holdings are also posted on deutschefunds.com from time to time. Please see the Fund's current prospectus for more information.

Investment Portfolio December 31, 2016

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Corporate Bonds 48.9% |

| Consumer Discretionary 6.6% |

| AMC Networks, Inc., 5.0%, 4/1/2024 | 265,000 | 266,325 |

| Charter Communications Operating LLC: | |

| | 3.579%, 7/23/2020 | | 90,000 | 91,821 |

| | 4.908%, 7/23/2025 | | 673,000 | 709,295 |

| | 6.484%, 10/23/2045 | | 50,000 | 57,804 |

| Cox Communications, Inc., 144A, 3.35%, 9/15/2026 | 105,000 | 100,268 |

| CVS Health Corp., 5.125%, 7/20/2045 | 110,000 | 122,589 |

| Ford Motor Co., 5.291%, 12/8/2046 | 105,000 | 106,364 |

| General Motors Co.: |

| | 6.6%, 4/1/2036 | | 55,000 | 62,865 |

| | 6.75%, 4/1/2046 | | 50,000 | 58,635 |

| General Motors Financial Co., Inc.: |

| | 2.4%, 5/9/2019 | | 160,000 | 159,576 |

| | 3.2%, 7/13/2020 | | 200,000 | 200,602 |

| | 3.2%, 7/6/2021 | | 190,000 | 188,415 |

| Hilton Domestic Operating Co., Inc., 144A, 4.25%, 9/1/2024 | 310,000 | 300,700 |

| International Game Technology PLC, 144A, 6.5%, 2/15/2025 | 300,000 | 321,750 |

| Lennar Corp., 4.75%, 11/15/2022 | 300,000 | 307,500 |

| NCL Corp., Ltd., 144A, 4.75%, 12/15/2021 | | 595,000 | 594,631 |

| PulteGroup, Inc., 5.0%, 1/15/2027 | 625,000 | 593,750 |

| Sabre GLBL, Inc., 144A, 5.375%, 4/15/2023 | | 300,000 | 306,000 |

| Time Warner, Inc., 3.8%, 2/15/2027 | 115,000 | 114,347 |

| Toll Brothers Finance Corp., 4.875%, 11/15/2025 | | 300,000 | 294,750 |

| Walgreens Boots Alliance, Inc., 4.8%, 11/18/2044 | 90,000 | 92,503 |

| | 5,050,490 |

| Consumer Staples 1.6% |

| Aramark Services, Inc., 144A, 4.75%, 6/1/2026 | | 350,000 | 346,500 |

| Danone SA, 144A, 2.947%, 11/2/2026 | 225,000 | 214,714 |

| Kraft Heinz Foods Co., 4.375%, 6/1/2046 | | 115,000 | 108,212 |

| Minerva Luxembourg SA, 144A, 6.5%, 9/20/2026 | 276,000 | 265,995 |

| Molson Coors Brewing Co.: |

| | 3.0%, 7/15/2026 | | 105,000 | 99,258 |

| | 4.2%, 7/15/2046 | | 120,000 | 111,879 |

| PepsiCo, Inc., 4.45%, 4/14/2046 | 50,000 | 53,254 |

| | 1,199,812 |

| Energy 6.9% |

| Anadarko Petroleum Corp.: |

| | 4.85%, 3/15/2021 (b) | | 40,000 | 42,890 |

| | 5.55%, 3/15/2026 (b) | | 90,000 | 100,733 |

| Concho Resources, Inc., 5.5%, 4/1/2023 | 150,000 | 155,445 |

| ConocoPhillips Co., 4.15%, 11/15/2034 | 100,000 | 97,744 |

| Continental Resources, Inc., 5.0%, 9/15/2022 (b) | | 150,000 | 151,409 |

| Enbridge, Inc., 5.5%, 12/1/2046 | 120,000 | 128,402 |

| Encana Corp., 5.15%, 11/15/2041 | 145,000 | 131,582 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Energy Transfer Partners LP, 5.95%, 10/1/2043 | | 90,000 | 92,756 |

| Ensco PLC, 4.7%, 3/15/2021 | | 90,000 | 86,573 |

| Halliburton Co., 4.85%, 11/15/2035 | 195,000 | 205,652 |

| Kinder Morgan Energy Partners LP: |

| | 4.7%, 11/1/2042 | | 110,000 | 102,486 |

| | 6.375%, 3/1/2041 | | 20,000 | 21,695 |

| Marathon Oil Corp., 5.2%, 6/1/2045 | 150,000 | 141,383 |

| Newfield Exploration Co., 5.75%, 1/30/2022 | | 150,000 | 158,063 |

| Noble Holding International Ltd.: |

| | 5.25%, 3/16/2018 | | 30,000 | 29,925 |

| | 7.75%, 1/15/2024 | | 650,000 | 611,390 |

| ONEOK Partners LP, 3.375%, 10/1/2022 | | 70,000 | 70,292 |

| Petrobras Global Finance BV, 8.375%, 5/23/2021 | | 575,000 | 619,563 |

| Petroleos Mexicanos: |

| | 144A, 4.625%, 9/21/2023 | | 135,000 | 131,328 |

| | 144A, 5.375%, 3/13/2022 | | 157,000 | 160,765 |

| Plains All American Pipeline LP: |

| | 2.85%, 1/31/2023 | | 165,000 | 155,981 |

| | 4.3%, 1/31/2043 | | 15,000 | 12,428 |

| | 4.5%, 12/15/2026 | | 165,000 | 167,384 |

| Range Resources Corp., 4.875%, 5/15/2025 | | 150,000 | 145,313 |

| Regency Energy Partners LP, 4.5%, 11/1/2023 | | 130,000 | 131,914 |

| Rosneft Finance SA, 144A, 7.25%, 2/2/2020 | | 400,000 | 438,108 |

| Sabine Pass Liquefaction LLC, 144A, 5.0%, 3/15/2027 | 705,000 | 711,169 |

| Shell International Finance BV, 4.0%, 5/10/2046 | 75,000 | 71,719 |

| Sunoco Logistics Partners Operations LP, 5.3%, 4/1/2044 | 90,000 | 86,894 |

| Valero Energy Corp., 3.4%, 9/15/2026 | 150,000 | 143,702 |

| | 5,304,688 |

| Financials 12.9% |

| AerCap Ireland Capital Ltd., 3.95%, 2/1/2022 | | 590,000 | 595,162 |

| AIA Group Ltd., 144A, 4.5%, 3/16/2046 | 200,000 | 199,617 |

| Air Lease Corp., 3.0%, 9/15/2023 | 130,000 | 124,200 |

| ANZ New Zealand International Ltd., 144A, 2.125%, 7/28/2021 | 200,000 | 194,588 |

| Apollo Investment Corp., 5.25%, 3/3/2025 | | 120,000 | 116,781 |

| Ares Capital Corp.: |

| | 3.625%, 1/19/2022 | | 180,000 | 174,498 |

| | 3.875%, 1/15/2020 | | 200,000 | 202,795 |

| Banco de Bogota SA, 144A, 6.25%, 5/12/2026 | | 226,000 | 230,520 |

| Bank of America Corp., 3.5%, 4/19/2026 | | 150,000 | 148,001 |

| Banque Federative du Credit Mutuel SA, 144A, 2.5%, 4/13/2021 | 205,000 | 203,724 |

| Barclays Bank PLC, 144A, 6.05%, 12/4/2017 | | 470,000 | 485,551 |

| BBVA Bancomer SA, 144A, 6.75%, 9/30/2022 | | 250,000 | 272,500 |

| Blackstone Holdings Finance Co., LLC, 144A, 5.0%, 6/15/2044 | 50,000 | 49,320 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Branch Banking & Trust Co., 1.45%, 5/10/2019 | | 180,000 | 177,996 |

| Capital One NA, 2.95%, 7/23/2021 | 510,000 | 511,890 |

| Credit Agricole SA, 144A, 2.375%, 7/1/2021 | | 250,000 | 246,166 |

| Credit Suisse Group Funding Guernsey Ltd., 3.8%, 6/9/2023 | 250,000 | 249,724 |

| Everest Reinsurance Holdings, Inc., 4.868%, 6/1/2044 | 100,000 | 96,991 |

| FS Investment Corp., 4.75%, 5/15/2022 | | 150,000 | 149,571 |

| GE Capital International Funding Co. Unlimited Co., 4.418%, 11/15/2035 | | 200,000 | 209,581 |

| HSBC Holdings PLC: |

| | 4.375%, 11/23/2026 | | 200,000 | 201,485 |

| | 6.375%, 12/29/2049 (b) | | 410,000 | 407,950 |

| Jefferies Group LLC, 5.125%, 4/13/2018 | | 160,000 | 165,384 |

| JPMorgan Chase & Co., 2.95%, 10/1/2026 | | 215,000 | 205,215 |

| KKR Group Finance Co. III LLC, 144A, 5.125%, 6/1/2044 | 70,000 | 66,091 |

| Legg Mason, Inc., 5.625%, 1/15/2044 | 100,000 | 97,380 |

| Loews Corp., 4.125%, 5/15/2043 | 80,000 | 76,751 |

| Macquarie Group Ltd., 144A, 6.0%, 1/14/2020 | | 390,000 | 422,532 |

| Manulife Financial Corp.: |

| | 4.9%, 9/17/2020 | | 80,000 | 85,819 |

| | 5.375%, 3/4/2046 | | 110,000 | 125,492 |

| Massachusetts Mutual Life Insurance Co., 144A, 4.5%, 4/15/2065 | 30,000 | 27,516 |

| Morgan Stanley, 3.125%, 7/27/2026 | 150,000 | 143,306 |

| Nationwide Building Society, 144A, 2.45%, 7/27/2021 | 200,000 | 197,342 |

| Nationwide Financial Services, Inc., 144A, 5.3%, 11/18/2044 | 90,000 | 93,721 |

| QBE Insurance Group Ltd., 144A, 2.4%, 5/1/2018 | 260,000 | 260,284 |

| Royal Bank of Scotland Group PLC, 3.875%, 9/12/2023 | 200,000 | 192,051 |

| Santander Holdings U.S.A., Inc., 2.7%, 5/24/2019 | 260,000 | 259,802 |

| Santander UK Group Holdings PLC, 2.875%, 8/5/2021 | 335,000 | 327,581 |

| Societe Generale SA, 144A, 7.375%, 12/29/2049 | | 476,000 | 475,200 |

| Standard Chartered PLC: |

| | 144A, 3.05%, 1/15/2021 | | 200,000 | 199,760 |

| | 144A, 4.05%, 4/12/2026 | | 225,000 | 223,074 |

| Sumitomo Mitsui Financial Group, Inc., 2.058%, 7/14/2021 | 80,000 | 77,375 |

| Suncorp-Metway Ltd., 144A, 2.1%, 5/3/2019 | | 95,000 | 94,384 |

| Swiss Re Treasury U.S. Corp., 144A, 4.25%, 12/6/2042 | 70,000 | 68,359 |

| The Goldman Sachs Group, Inc.: |

| | 3.5%, 11/16/2026 | | 65,000 | 63,504 |

| | 3.75%, 2/25/2026 | | 150,000 | 150,441 |

| Voya Financial, Inc., 4.8%, 6/15/2046 | 120,000 | 116,646 |

| Wells Fargo & Co., 3.0%, 10/23/2026 | 250,000 | 238,099 |

| Woori Bank, 144A, 4.5%, 12/29/2049 | 250,000 | 239,941 |

| | 9,941,661 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Health Care 2.8% |

| Abbott Laboratories, 2.9%, 11/30/2021 | 180,000 | 179,487 |

| Actavis, Inc., 3.25%, 10/1/2022 | 150,000 | 149,388 |

| Aetna, Inc., 2.8%, 6/15/2023 | | 85,000 | 83,726 |

| Amgen, Inc., 2.6%, 8/19/2026 | 215,000 | 197,743 |

| Anthem, Inc., 3.3%, 1/15/2023 | 60,000 | 59,899 |

| Forest Laboratories LLC, 144A, 4.875%, 2/15/2021 | 170,000 | 182,628 |

| HCA, Inc., 5.25%, 6/15/2026 | | 300,000 | 310,125 |

| Mylan NV, 144A, 5.25%, 6/15/2046 | 170,000 | 156,790 |

| Pfizer, Inc.: |

| | 4.0%, 12/15/2036 | | 120,000 | 122,946 |

| | 4.125%, 12/15/2046 | | 65,000 | 66,122 |

| Shire Acquisitions Investments Ireland DAC, 3.2%, 9/23/2026 | 263,000 | 245,730 |

| Stryker Corp.: |

| | 3.375%, 11/1/2025 | | 80,000 | 79,492 |

| | 4.625%, 3/15/2046 | | 40,000 | 40,787 |

| Teva Pharmaceutical Finance Netherlands III BV, 2.2%, 7/21/2021 | 150,000 | 143,503 |

| UnitedHealth Group, Inc.: |

| | 3.45%, 1/15/2027 | | 50,000 | 50,791 |

| | 4.2%, 1/15/2047 | | 80,000 | 80,920 |

| | 2,150,077 |

| Industrials 1.8% |

| Artesyn Embedded Technologies, Inc., 144A, 9.75%, 10/15/2020 | 15,000 | 13,725 |

| Bombardier, Inc., 144A, 8.75%, 12/1/2021 | | 495,000 | 525,319 |

| CSX Corp., 4.25%, 11/1/2066 | | 80,000 | 73,006 |

| FedEx Corp., 4.55%, 4/1/2046 | 90,000 | 90,694 |

| Molex Electronic Technologies LLC, 144A, 3.9%, 4/15/2025 | 70,000 | 68,859 |

| Northrop Grumman Corp., 3.2%, 2/1/2027 | | 170,000 | 168,198 |

| Spirit AeroSystems, Inc., 5.25%, 3/15/2022 | | 315,000 | 329,103 |

| Transurban Finance Co. Pty Ltd., 144A, 3.375%, 3/22/2027 | 130,000 | 122,835 |

| | 1,391,739 |

| Information Technology 4.5% |

| Activision Blizzard, Inc., 144A, 3.4%, 9/15/2026 | 160,000 | 151,860 |

| Apple, Inc., 3.45%, 2/9/2045 | | 60,000 | 52,959 |

| CDW LLC, 6.0%, 8/15/2022 | | 300,000 | 317,250 |

| Diamond 1 Finance Corp.: |

| | 144A, 3.48%, 6/1/2019 | | 150,000 | 153,121 |

| | 144A, 4.42%, 6/15/2021 | | 120,000 | 124,169 |

| | 144A, 5.875%, 6/15/2021 | | 1,220,000 | 1,297,991 |

| | 144A, 8.1%, 7/15/2036 | | 90,000 | 107,062 |

| eBay, Inc., 3.8%, 3/9/2022 | | 81,000 | 83,684 |

| Fidelity National Information Services, Inc., 3.625%, 10/15/2020 | 140,000 | 144,938 |

| Hewlett Packard Enterprise Co., 3.6%, 10/15/2020 | 90,000 | 91,558 |

| KLA-Tencor Corp., 4.65%, 11/1/2024 | 50,000 | 52,931 |

| Microsoft Corp., 3.45%, 8/8/2036 | 85,000 | 80,781 |

| NVIDIA Corp.: |

| | 2.2%, 9/16/2021 | | 120,000 | 117,132 |

| | 3.2%, 9/16/2026 | | 120,000 | 115,375 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Quintiles IMS, Inc., 144A, 5.0%, 10/15/2026 | | 250,000 | 250,625 |

| Seagate HDD Cayman, 5.75%, 12/1/2034 | | 110,000 | 93,775 |

| Tencent Holdings Ltd., 144A, 3.8%, 2/11/2025 (b) | | 250,000 | 253,237 |

| | 3,488,448 |

| Materials 5.2% |

| AngloGold Ashanti Holdings PLC, 5.125%, 8/1/2022 (b) | | 250,000 | 248,525 |

| Cemex SAB de CV, 144A, 7.75%, 4/16/2026 | | 200,000 | 221,500 |

| CF Industries, Inc.: |

| | 3.45%, 6/1/2023 | | 850,000 | 764,150 |

| | 144A, 4.5%, 12/1/2026 | | 70,000 | 68,802 |

| Equate Petrochemical BV: |

| | 144A, 3.0%, 3/3/2022 | | 365,000 | 347,648 |

| | 144A, 4.25%, 11/3/2026 | | 440,000 | 419,883 |

| Freeport-McMoRan, Inc., 2.375%, 3/15/2018 | | 150,000 | 148,875 |

| Glencore Funding LLC, 144A, 4.625%, 4/29/2024 | | 40,000 | 40,900 |

| Mexichem SAB de CV, 144A, 5.875%, 9/17/2044 | | 300,000 | 267,375 |

| Potash Corp. of Saskatchewan, Inc., 4.0%, 12/15/2026 | 85,000 | 85,538 |

| Reynolds Group Issuer, Inc., 5.75%, 10/15/2020 | | 325,000 | 335,156 |

| Rio Tinto Finance U.S.A. Ltd., 3.75%, 6/15/2025 | | 90,000 | 92,683 |

| St. Marys Cement, Inc., 144A, 5.75%, 1/28/2027 | 430,000 | 412,800 |

| Teck Resources Ltd., 144A, 8.0%, 6/1/2021 | | 135,000 | 148,500 |

| Yamana Gold, Inc., 4.95%, 7/15/2024 | 405,000 | 396,900 |

| | 3,999,235 |

| Real Estate 3.5% |

| CBL & Associates LP: |

| | (REIT), 4.6%, 10/15/2024 | | 100,000 | 93,734 |

| | (REIT), 5.25%, 12/1/2023 | | 150,000 | 147,492 |

| | (REIT), 5.95%, 12/15/2026 | | 125,000 | 125,826 |

| Crown Castle International Corp., (REIT), 5.25%, 1/15/2023 | 135,000 | 145,294 |

| Equinix, Inc., (REIT), 5.375%, 4/1/2023 | | 345,000 | 357,938 |

| Government Properties Income Trust, (REIT), 3.75%, 8/15/2019 | 110,000 | 111,208 |

| Hospitality Properties Trust, (REIT), 5.0%, 8/15/2022 | 220,000 | 232,256 |

| MGM Growth Properties Operating Partnership LP, 144A, (REIT), 4.5%, 9/1/2026 | 280,000 | 268,800 |

| MPT Operating Partnership LP, (REIT), 5.25%, 8/1/2026 | 50,000 | 49,000 |

| Omega Healthcare Investors, Inc., (REIT), 4.95%, 4/1/2024 | 130,000 | 131,726 |

| Scentre Group Trust 1, 144A, (REIT), 3.5%, 2/12/2025 | 160,000 | 157,988 |

| Select Income REIT, (REIT), 4.15%, 2/1/2022 | | 120,000 | 118,831 |

| Starwood Property Trust, Inc., 144A, 5.0%, 12/15/2021 | 460,000 | 466,164 |

| VEREIT Operating Partnership LP, (REIT), 4.125%, 6/1/2021 | 285,000 | 289,275 |

| | 2,695,532 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Telecommunication Services 1.4% |

| AT&T, Inc.: |

| | 3.4%, 5/15/2025 | | 340,000 | 327,700 |

| | 4.5%, 5/15/2035 | | 195,000 | 188,402 |

| Bharti Airtel International Netherlands BV, 144A, 5.125%, 3/11/2023 | 300,000 | 312,673 |

| Verizon Communications, Inc.: |

| | 4.272%, 1/15/2036 | | 150,000 | 143,569 |

| | 4.672%, 3/15/2055 | | 115,000 | 107,998 |

| | 1,080,342 |

| Utilities 1.7% |

| AmeriGas Partners LP, 5.5%, 5/20/2025 | | 605,000 | 611,050 |

| Electricite de France SA, 144A, 4.75%, 10/13/2035 | 150,000 | 150,494 |

| NRG Energy, Inc., 144A, 6.625%, 1/15/2027 | | 270,000 | 255,150 |

| Southern Co., 3.25%, 7/1/2026 | 205,000 | 199,512 |

| Southern Power Co., Series F, 4.95%, 12/15/2046 | 87,000 | 84,776 |

| | 1,300,982 |

| Total Corporate Bonds (Cost $37,719,603) | 37,603,006 |

| |

| Mortgage-Backed Securities Pass-Throughs 19.1% |

| Federal Home Loan Mortgage Corp.: | |

| | 4.0%, 8/1/2039 | | 481,644 | 509,734 |

| | 5.5%, with various maturities from 10/1/2023 until 6/1/2035 | 928,973 | 1,043,589 |

| | 6.5%, 3/1/2026 | | 133,676 | 148,971 |

| Federal National Mortgage Association: | |

| | 3.0%*, with various maturities from 9/1/2038 until 4/1/2044 (c) | 5,243,930 | 5,211,783 |

| | 3.5%, 3/1/2046 | | 1,385,907 | 1,411,085 |

| | 5.0%, with various maturities from 10/1/2033 until 8/1/2040 | 908,796 | 994,624 |

| | 5.5%, with various maturities from 12/1/2032 until 8/1/2037 | 960,442 | 1,073,482 |

| | 6.0%, with various maturities from 4/1/2024 until 3/1/2025 | 274,943 | 311,051 |

| | 6.5%, with various maturities from 3/1/2017 until 12/1/2037 | 299,578 | 344,231 |

| Government National Mortgage Association, 4.0%, with various maturities from 2/15/2041 until 4/15/2041 | 3,447,082 | 3,667,458 |

| Total Mortgage-Backed Securities Pass-Throughs (Cost $14,516,499) | 14,716,008 |

| |

| Asset-Backed 4.8% |

| Automobile Receivables 0.6% |

| Avis Budget Rental Car Funding AESOP LLC, "C", Series 2015-1A, 144A, 3.96%, 7/20/2021 | 500,000 | 484,947 |

| Credit Card Receivables 1.3% |

| World Financial Network Credit Card Master Trust, "M", Series 2016-A, 2.33%, 4/15/2025 | 1,000,000 | 979,376 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Miscellaneous 2.9% |

| Hilton Grand Vacations Trust, "B", Series 2014-AA, 144A, 2.07%, 11/25/2026 | 186,180 | 183,828 |

| PennyMac LLC, "A1", Series 2015-NPL1, 144A, 4.0%, 3/25/2055 | 316,915 | 318,759 |

| Taco Bell Funding LLC, "A2I", Series 2016-1A, 144A, 3.832%, 5/25/2046 | 743,138 | 745,831 |

| Telos CLO Ltd., "A1", Series 2014-6A, 144A, 2.179%*, 1/17/2027 | 500,000 | 499,517 |

| Voya CLO Ltd., "C", Series 2015-1A, 144A, 4.079%*, 4/18/2027 | 500,000 | 480,214 |

| | 2,228,149 |

| Total Asset-Backed (Cost $3,721,596) | 3,692,472 |

| |

| Commercial Mortgage-Backed Securities 2.4% |

| FHLMC Multifamily Structured Pass-Through Certificates: | |

| | "X1", Series K043, Interest Only, 0.548%**, 12/25/2024 | 4,975,774 | 182,684 |

| | "X1", Series K054, Interest Only, 1.181%**, 1/25/2026 | 1,846,583 | 155,915 |

| JPMBB Commercial Mortgage Securities Trust, "A3", Series 2014-C19, 3.669%, 4/15/2047 | 150,000 | 156,028 |

| JPMorgan Chase Commercial Mortgage Securities Corp., "A4", Series 2007-C1, 5.716%, 2/15/2051 | 714,723 | 730,723 |

| LB-UBS Commercial Mortgage Trust, "A4", Series 2007-C6, 5.858%, 7/15/2040 | 612,833 | 617,061 |

| Total Commercial Mortgage-Backed Securities (Cost $1,926,173) | 1,842,411 |

| |

| Collateralized Mortgage Obligations 3.0% |

| Countrywide Home Loans, "A2", Series 2006-1, 6.0%, 3/25/2036 | 245,001 | 207,720 |

| CS First Boston Mortgage Securities Corp., "10A3", Series 2005-10, 6.0%, 11/25/2035 | 95,399 | 53,230 |

| Federal Home Loan Mortgage Corp.: | |

| | "PI", Series 4485, Interest Only, 3.5%, 6/15/2045 | 2,174,280 | 352,705 |

| | "PI", Series 3940, Interest Only, 4.0%, 2/15/2041 | 356,840 | 52,648 |

| | "C31", Series 303, Interest Only, 4.5%, 12/15/2042 | 1,636,449 | 325,455 |

| | "JS", Series 3572, Interest Only, 6.096%**, 9/15/2039 | 350,891 | 49,897 |

| Federal National Mortgage Association, "SI", Series 2007-23, Interest Only, 6.014%**, 3/25/2037 | 170,282 | 25,803 |

| Government National Mortgage Association: | |

| | "PL", Series 2013-19, 2.5%, 2/20/2043 | | 684,500 | 627,948 |

| | "HX", Series 2012-91, 3.0%, 9/20/2040 | | 324,778 | 330,711 |

| | "PI", Series 2015-40, Interest Only, 4.0%, 4/20/2044 | 430,636 | 64,739 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| | "PI", Series 2014-108, Interest Only, 4.5%, 12/20/2039 | 313,859 | 52,347 |

| | "EI", Series 2011-162, Interest Only, 4.5%, 5/20/2040 | 555,318 | 32,418 |

| | "DI", Series 2011-40, Interest Only, 4.5%, 12/20/2040 | 768,771 | 17,615 |

| | "IN", Series 2009-69, Interest Only, 5.5%, 8/20/2039 | 91,185 | 16,351 |

| | "IV", Series 2009-69, Interest Only, 5.5%, 8/20/2039 | 175,475 | 34,740 |

| | "AI", Series 2007-38, Interest Only, 5.753%**, 6/16/2037 | 50,144 | 7,255 |

| | "IJ", Series 2009-75, Interest Only, 6.0%, 8/16/2039 | 78,676 | 13,546 |

| MASTR Alternative Loans Trust: |

| | "5A1", Series 2005-1, 5.5%, 1/25/2020 | | 46,002 | 47,057 |

| | "8A1", Series 2004-3, 7.0%, 4/25/2034 | | 7,123 | 7,585 |

| Total Collateralized Mortgage Obligations (Cost $2,653,440) | 2,319,770 |

| |

| Government & Agency Obligations 22.9% |

| Other Government Related (d) 1.6% |

| Novatek OAO, 144A, 6.604%, 2/3/2021 | | 300,000 | 325,500 |

| Province of New Brunswick Canada, 3.8%, 8/14/2045 | CAD | 1,000,000 | 776,807 |

| Vnesheconombank, 144A, 6.902%, 7/9/2020 (b) | | 150,000 | 162,045 |

| | 1,264,352 |

| Sovereign Bonds 2.1% |

| Japan Bank for International Cooperation, 1.5%, 7/21/2021 | 700,000 | 671,145 |

| KazAgro National Management Holding JSC, 144A, 4.625%, 5/24/2023 | 250,000 | 234,230 |

| Province of British Columbia Canada, 2.25%, 6/2/2026 | | 500,000 | 475,630 |

| Republic of Indonesia, 144A, 3.7%, 1/8/2022 | | 265,000 | 265,596 |

| | 1,646,601 |

| U.S. Government Sponsored Agency 0.9% |

| Federal Home Loan Mortgage Corp., 6.25%, 7/15/2032 | 500,000 | 688,070 |

| U.S. Treasury Obligations 18.3% |

| U.S. Treasury Bond, 2.25%, 8/15/2046 (b) | 1,530,000 | 1,286,455 |

| U.S. Treasury Notes: |

| | 0.75%, 10/31/2017 (e) | | 4,000,000 | 3,996,408 |

| | 1.375%, 5/31/2021 | | 1,260,000 | 1,234,947 |

| | 1.75%, 11/30/2021 | | 650,000 | 645,150 |

| | 2.0%, 11/15/2026 (b) | | 7,169,800 | 6,898,409 |

| | 14,061,369 |

| Total Government & Agency Obligations (Cost $17,719,334) | 17,660,392 |

| |

| Short-Term U.S. Treasury Obligations 1.0% |

| U.S. Treasury Obligations |

| U.S. Treasury Bills: |

| | 0.4%***, 2/9/2017 (f) | | 623,000 | 622,713 |

| | 0.56%***, 6/1/2017 (f) | | 181,000 | 180,533 |

| Total Short-Term U.S. Treasury Obligations (Cost $803,217) | 803,246 |

| |

Shares | Value ($) |

| | | | | |

| Securities Lending Collateral 10.9% |

| Government & Agency Securities Portfolio "Deutsche Government Cash Institutional Shares", 0.42% (g) (h) (Cost $8,355,835) | 8,355,835 | 8,355,835 |

| |

| Cash Equivalents 3.9% |

| Deutsche Central Cash Management Government Fund, 0.49% (g) (Cost $2,994,873) | 2,994,873 | 2,994,873 |

| | | | | |

| | % of Net Assets | Value ($) |

| | |

| Total Investment Portfolio (Cost $90,410,570)† | 116.9 | 89,988,013 |

| Other Assets and Liabilities, Net | (16.9) | (13,017,235) |

| Net Assets | 100.0 | 76,970,778 |

* Floating rate securities' yields vary with a designated market index or market rate, such as the coupon-equivalent of the U.S. Treasury Bill rate. These securities are shown at their current rate as of December 31, 2016.

** These securities are shown at their current rate as of December 31, 2016.

*** Annualized yield at time of purchase; not a coupon rate.

† The cost for federal income tax purposes was $90,492,875. At December 31, 2016, net unrealized depreciation for all securities based on tax cost was $504,862. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $882,168 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $1,387,030.

(a) Principal amount stated in U.S. dollars unless otherwise noted.

(b) All or a portion of these securities were on loan. In addition, "Other Assets and Liabilities, Net" may include pending sales that are also on loan. The value of securities loaned at December 31, 2016 amounted to $8,191,983, which is 10.6% of net assets.

(c) When-issued or delayed delivery security included.

(d) Government-backed debt issued by financial companies or government sponsored enterprises.

(e) At December 31, 2016, this security has been pledged, in whole or in part, to cover initial margin requirements for open centrally cleared swap contracts.

(f) At December 31, 2016, this security has been pledged, in whole or in part, to cover initial margin requirements for open futures contracts.

(g) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

(h) Represents collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates.

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

CLO: Collateralized Loan Obligation

Interest Only: Interest Only (IO) bonds represent the "interest only" portion of payments on a pool of underlying mortgages or mortgage-backed securities. IO securities are subject to prepayment risk of the pool of underlying mortgages.

JSC: Joint Stock Company

REIT: Real Estate Investment Trust

Included in the portfolio are investments in mortgage- or asset-backed securities, which are interests in separate pools of mortgages or assets. Effective maturities of these investments may be shorter than stated maturities due to prepayments. Some separate investments in the Federal Home Loan Mortgage Corp., Federal National Mortgage Association and Government National Mortgage Association issues which have similar coupon rates have been aggregated for presentation purposes in this investment portfolio.

At December 31, 2016, open futures contracts purchased were as follows:

| Futures | Currency | Expiration Date | Contracts | Notional Value ($) | Unrealized Depreciation ($) |

| 10 Year U.S. Treasury Note | USD | 3/22/2017 | 11 | 1,367,094 | (8,617) |

At December 31, 2016, open futures contracts sold were as follows:

| Futures | Currency | Expiration Date | Contracts | Notional Value ($) | Unrealized Appreciation/ (Depreciation) ($) |

| Federal Republic of Germany Euro-Bund | EUR | 3/8/2017 | 25 | 4,319,814 | (45,825) |

| Ultra 10 Year U.S. Treasury Note | USD | 3/22/2017 | 10 | 1,340,625 | 10,040 |

| Ultra Long U.S. Treasury Bond | USD | 3/22/2017 | 49 | 7,852,250 | 113,226 |

| Total net unrealized appreciation | 77,441 |

At December 31, 2016, open interest rate swap contracts were as follows:

| Centrally Cleared Swaps |

Effective/

Expiration Dates | Notional Amount | Currency | Cash Flows Paid by the Fund | Cash Flows Received by the Fund | Value ($) | Unrealized Appreciation/ (Depreciation) ($) |

9/16/2015

9/16/2045 | 7,195,000 | USD | Floating — 3-Month LIBOR | Fixed — 3.0% | 650,217 | 214,545 |

12/16/2015

9/16/2025 | 500,000 | USD | Floating — 3-Month LIBOR | Fixed — 2.64% | 18,078 | 15,238 |

12/16/2015

9/17/2035 | 9,700,000 | USD | Floating — 3-Month LIBOR | Fixed — 2.938% | 623,796 | 422,763 |

12/16/2015

9/18/2045 | 3,600,000 | USD | Floating — 3-Month LIBOR | Fixed — 2.998% | 323,584 | 206,464 |

9/30/2015

9/30/2045 | 2,000,000 | USD | Fixed — 2.88% | Floating — 3-Month LIBOR | (144,018) | (103,925) |

2/3/2015

2/3/2045 | 1,800,000 | USD | Fixed — 3.035% | Floating — 3-Month LIBOR | (197,172) | (176,358) |

12/14/2016

12/14/2046 | 800,000 | CAD | Fixed — 2.386% | Floating — 3-Month CDOR | (6,243) | (6,243) |

12/23/2016

12/23/2026 | 15,200,000 | SEK | Fixed — 1.175% | Floating — 3-Month STIBOR | (14,680) | (14,680) |

1/28/2015

1/28/2045 | 2,000,000 | USD | Fixed — 3.088% | Floating — 3-Month LIBOR | (242,271) | (222,882) |

12/16/2015

9/18/2017 | 13,600,000 | USD | Fixed — 1.557% | Floating — 3-Month LIBOR | (99,765) | (104,128) |

12/4/2015

12/4/2045 | 2,000,000 | USD | Fixed — 2.615% | Floating — 3-Month LIBOR | (22,816) | 19,024 |

| Total net unrealized appreciation | 249,818 |

CDOR: Canadian Dollar Offered Rate; 3-Month CDOR rate at December 31, 2016 is 0.945%.

LIBOR: London Interbank Offered Rate; 3-Month LIBOR rate at December 31, 2016 is 1.00%.

STIBOR: Stockholm Interbank Offered Rates; 3-Month STIBOR rate at December 31, 2016 is –0.59%.

At December 31, 2016, the Fund had the following open forward foreign currency exchange contracts:

| Contracts to Deliver | | In Exchange For | | Settlement Date | | Unrealized Depreciation ($) | Counterparty |

| CAD | 1,068,445 | | USD | 795,519 | | 2/17/2017 | | (704) | Bank of America |

| | | | | | | | | | |

| Currency Abbreviations |

CAD Canadian Dollar EUR Euro SEK Swedish Krona USD United States Dollar |

For information on the Fund's policy and additional disclosures regarding futures contracts, interest rate swap contracts and forward foreign currency exchange contracts, please refer to Note B in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of December 31, 2016 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | Level 1 | Level 2 | Level 3 | Total |

| |

| Fixed Income Investments (i) |

| | Corporate Bonds | $ — | $37,603,006 | $ — | $37,603,006 |

| | Mortgage-Backed Securities Pass-Throughs | — | 14,716,008 | — | 14,716,008 |

| | Asset-Backed | — | 3,692,472 | — | 3,692,472 |

| | Commercial Mortgage-Backed Securities | — | 1,842,411 | — | 1,842,411 |

| | Collateralized Mortgage Obligations | — | 2,319,770 | — | 2,319,770 |

| | Government & Agency Obligations | — | 17,660,392 | — | 17,660,392 |

| | Short-Term U.S. Treasury Obligations | — | 803,246 | — | 803,246 |

| Short-Term Investments (i) | 11,350,708 | — | — | 11,350,708 |

| Derivatives (j) |

| | Futures Contracts | 123,266 | — | — | 123,266 |

| | Interest Rate Swap Contracts | — | 878,034 | — | 878,034 |

| Total | $11,473,974 | $79,515,339 | $ — | $90,989,313 |

| Liabilities | Level 1 | Level 2 | Level 3 | Total |

| |

| Derivatives (j) |

| | Futures Contracts | $ (54,442) | $ — | $ — | $ (54,442) |

| | Interest Rate Swap Contracts | — | (628,216) | — | (628,216) |

| | Forward Foreign Currency Exchange Contracts | — | (704) | — | (704) |

| Total | $ (54,442) | $ (628,920) | $ — | $ (683,362) |

There have been no transfers between fair value measurement levels during the year ended December 31, 2016.

(i) See Investment Portfolio for additional detailed categorizations.

(j) Derivatives include unrealized appreciation (depreciation) on open futures contracts, interest rate swap contracts and forward foreign currency exchange contracts.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities

| as of December 31, 2016 |

| Assets |

Investments: Investments in non-affiliated securities, at value (cost $79,059,862) — including $8,191,983 of securities loaned | $ 78,637,305 |

| Investment in Government & Agency Securities Portfolio (cost $8,355,835)* | 8,355,835 |

| Investment in Deutsche Central Cash Management Government Fund (cost $2,994,873) | 2,994,873 |

| Total investments in securities, at value (cost $90,410,570) | 89,988,013 |

| Cash | 1,119,563 |

| Foreign currency, at value (cost $115,505) | 51,243 |

| Receivable for Fund shares sold | 28,981 |

| Interest receivable | 584,844 |

| Receivable for variation margin on centrally cleared swaps | 104,209 |

| Foreign taxes recoverable | 1,742 |

| Other assets | 1,944 |

| Total assets | 91,880,539 |

| Liabilities |

| Payable upon return of securities loaned | 8,355,835 |

| Payable for investments purchased | 1,106,309 |

| Payable for investments purchased — when-issued/delayed delivery securities | 5,175,679 |

| Payable for Fund shares redeemed | 61,370 |

| Payable for variation margin on futures contracts | 52,305 |

| Unrealized depreciation on forward foreign currency exchange contracts | 704 |

| Accrued management fee | 17,084 |

| Accrued Trustees' fees | 1,324 |

| Other accrued expenses and payables | 139,151 |

| Total liabilities | 14,909,761 |

| Net assets, at value | $ 76,970,778 |

| Net Assets Consist of |

| Undistributed net investment income | 1,699,560 |

Net unrealized appreciation (depreciation) on: Investments | (422,557) |

| Swap contracts | 249,818 |

| Futures | 68,824 |

| Foreign currency | (65,381) |

| Accumulated net realized gain (loss) | (17,253,292) |

| Paid-in capital | 92,693,806 |

| Net assets, at value | $ 76,970,778 |

Class A Net Asset Value, offering and redemption price per share ($76,970,778 ÷ 13,944,103 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | $ 5.52 |

* Represents collateral on securities loaned.

The accompanying notes are an integral part of the financial statements.

Statement of Operations

| for the year ended December 31, 2016 |

| Investment Income |

Income: Interest (net of foreign taxes withheld of $399) | $ 2,536,470 |

| Dividends | 74,159 |

| Income distributions — Deutsche Central Cash Management Government Fund | 8,583 |

| Securities lending income, net of borrower rebates | 16,545 |

| Other income | 37,784 |

| Total income | 2,673,541 |

Expenses: Management fee | 313,410 |

| Administration fee | 80,362 |

| Services to shareholders | 1,853 |

| Custodian fee | 19,448 |

| Professional fees | 92,445 |

| Reports to shareholders | 35,037 |

| Trustees' fees and expenses | 5,295 |

| Other | 81,337 |

| Total expenses before expense reductions | 629,187 |

| Expense reductions | (112,296) |

| Total expenses after expense reductions | 516,891 |

| Net investment income | 2,156,650 |

| Realized and Unrealized Gain (Loss) |

Net realized gain (loss) from: Investments | (183,678) |

| Swap contracts | 41,729 |

| Futures | 1,303,448 |

| Written options | (12,713) |

| Foreign currency | 153,949 |

| Disposal of investments in violation of restrictions | 47,138 |

| | 1,349,873 |

Change in net unrealized appreciation (depreciation) on: Investments | 1,621,726 |

| Swap contracts | (241,016) |

| Futures | 194,840 |

| Written options | (34,889) |

| Foreign currency | (511,672) |

| | 1,028,989 |

| Net gain (loss) | 2,378,862 |

| Net increase (decrease) in net assets resulting from operations | $ 4,535,512 |

The accompanying notes are an integral part of the financial statements.

Statements of Changes in Net Assets

| Increase (Decrease) in Net Assets | Years Ended December 31, |

| 2016 | 2015 |

Operations: Net investment income | $ 2,156,650 | $ 2,448,217 |

| Net realized gain (loss) | 1,349,873 | (3,320,978) |

| Change in net unrealized appreciation (depreciation) | 1,028,989 | 782,998 |

| Net increase (decrease) in net assets resulting from operations | 4,535,512 | (89,763) |

Distributions to shareholders from: Net investment income: Class A | (4,037,321) | (2,926,472) |

Fund share transactions: Class A Proceeds from shares sold | 10,928,699 | 11,060,840 |

| Reinvestment of distributions | 4,037,321 | 2,926,472 |

| Payments for shares redeemed | (18,293,243) | (32,571,389) |

| Net increase (decrease) in net assets from Class A share transactions | (3,327,223) | (18,584,077) |

| Increase (decrease) in net assets | (2,829,032) | (21,600,312) |

| Net assets at beginning of period | 79,799,810 | 101,400,122 |

| Net assets at end of period (including undistributed net investment income of $1,699,560 and $3,494,238, respectively) | $ 76,970,778 | $ 79,799,810 |

| Other Information |

Class A Shares outstanding at beginning of period | 14,528,974 | 17,886,425 |

| Shares sold | 1,951,337 | 1,969,516 |

| Shares issued to shareholders in reinvestment of distributions | 739,436 | 520,725 |

| Shares redeemed | (3,275,644) | (5,847,692) |

| Net increase (decrease) in Class A shares | (584,871) | (3,357,451) |

| Shares outstanding at end of period | 13,944,103 | 14,528,974 |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

| Class A | |

Years Ended December 31, |

| 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per Share Data |

| Net asset value, beginning of period | $ 5.49 | $ 5.67 | $ 5.51 | $ 5.89 | $ 5.72 |

Income (loss) from investment operations: Net investment incomea | .15 | .14 | .17 | .16 | .16 |

| Net realized and unrealized gain (loss) | .17 | (.15) | .19 | (.33) | .27 |

| Total from investment operations | .32 | (.01) | .36 | (.17) | .43 |

Less distributions from: Net investment income | (.29) | (.17) | (.20) | (.21) | (.26) |

| Net asset value, end of period | $ 5.52 | $ 5.49 | $ 5.67 | $ 5.51 | $ 5.89 |

| Total Return (%) | 5.93b | (.29)b | 6.63b | (3.03)b | 7.77 |

| Ratios to Average Net Assets and Supplemental Data |

| Net assets, end of period ($ millions) | 77 | 80 | 101 | 105 | 190 |

| Ratio of expenses before expense reductions (%) | .78 | .69 | .69 | .65 | .58 |

| Ratio of expenses after expense reductions (%) | .64 | .64 | .61 | .56 | .58 |

| Ratio of net investment income (%) | 2.68 | 2.54 | 2.99 | 2.88 | 2.81 |

| Portfolio turnover rate (%) | 236 | 197 | 273 | 418 | 115 |

a Based on average shares outstanding during the period. b Total return would have been lower had certain expenses not been reduced. |

Notes to Financial Statements

A. Organization and Significant Accounting Policies

Deutsche Variable Series I (the "Trust") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end, registered management investment company organized as a Massachusetts business trust. The Trust consists of five diversified funds: Deutsche Bond VIP, Deutsche Capital Growth VIP, Deutsche Core Equity VIP, Deutsche CROCI® International VIP and Deutsche Global Small Cap VIP (individually or collectively hereinafter referred to as a "Fund" or the "Funds"). These financial statements report on Deutsche Bond VIP. The Trust is intended to be the underlying investment vehicle for variable annuity contracts and variable life insurance policies to be offered by the separate accounts of certain life insurance companies ("Participating Insurance Companies").

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Debt securities are valued at prices supplied by independent pricing services approved by the Trustees of the Series. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, prepayment speeds and other data, as well as broker quotes. If the pricing services are unable to provide valuations, debt securities are valued at the average of the most recent reliable bid quotations or evaluated prices, as applicable, obtained from broker-dealers. These securities are generally categorized as Level 2.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Futures contracts are generally valued at the settlement prices established each day on the exchange on which they are traded and are categorized as Level 1.

Swap contracts are valued daily based upon prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer. Swap contracts are generally categorized as Level 2.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and are categorized as Level 2.

Exchange-traded options are valued at the last sale price or, in the absence of a sale, the mean between the closing bid and asked prices or at the most recent asked price (bid for purchased options) if no bid or asked price are available. Exchange-traded options are generally categorized as Level 1. Over-the-counter written or purchased options are valued at prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer with which the option was traded. Over-the-counter written or purchased options are generally categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Trustees and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors considered in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund's Investment Portfolio.

Securities Lending. Deutsche Bank AG, as lending agent, lends securities of the Fund to certain financial institutions under the terms of its securities lending agreement. During the term of the loans, the Fund continues to receive interest and dividends generated by the securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at least equal to the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the securities lending agreement. As of period end, any securities on loan were collateralized by cash. During the year ended December 31, 2016, the Fund invested the cash collateral into a joint trading account in affiliated money market funds managed by Deutsche Investment Management Americas Inc. As of December 31, 2016, the Fund invested the cash collateral in Government & Agency Securities Portfolio. Deutsche Investment Management Americas Inc. receives a management/administration fee (0.09% annualized effective rate as of December 31, 2016) on the cash collateral invested in Government & Agency Securities Portfolio. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan at any time and the borrower, after notice, is required to return borrowed securities within a standard time period. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. If the Fund is not able to recover securities lent, the Fund may sell the collateral and purchase a replacement investment in the market, incurring the risk that the value of the replacement security is greater than the value of the collateral. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

As of December 31, 2016, the Fund had securities on loan, which were classified as corporate bonds, other government related and U.S. Treasury obligations in the Investment Portfolio. The value of the related collateral exceeded the value of the securities loaned at period end.

| Remaining Contractual Maturity of the Agreements as of December 31, 2016 |

| | Overnight and Continuous | <30 days | Between 30 & 90 days | >90 days | Total |

| Securities Lending Transactions |

| Corporate Bonds | $1,149,350 | $ — | $ — | $ — | $1,149,350 |

| Other Government Related | 56,750 | — | — | — | 56,750 |

| U.S. Treasury Obligations | 7,149,735 | — | — | — | 7,149,735 |

| Total Borrowings | $8,355,835 | $ — | $ — | $ — | $8,355,835 |

| Gross amount of recognized liabilities for securities lending transactions | $8,355,835 |

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

When-Issued/Delayed Delivery Securities. The Fund may purchase or sell securities with delivery or payment to occur at a later date beyond the normal settlement period. At the time the Fund enters into a commitment to purchase or sell a security, the transaction is recorded and the value of the transaction is reflected in the net asset value. The price of such security and the date when the security will be delivered and paid for are fixed at the time the transaction is negotiated. The value of the security may vary with market fluctuations. At the time the Fund enters into a purchase transaction it is required to segregate cash or other liquid assets at least equal to the amount of the commitment. Additionally, the Fund may be required to post securities and/or cash collateral in accordance with the terms of the commitment.

Certain risks may arise upon entering into when-issued or delayed delivery transactions from the potential inability of counterparties to meet the terms of their contracts or if the issuer does not issue the securities due to political, economic, or other factors. Additionally, losses may arise due to changes in the value of the underlying securities.

Taxes. The Fund is treated as a separate taxpayer as provided for in the Internal Revenue Code, as amended. It is the Fund's policy to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to the separate accounts of the Participating Insurance Companies which hold its shares.

Additionally, the Fund may be subject to taxes imposed by the governments of countries in which it invests and are generally based on income and/or capital gains earned or repatriated. Estimated tax liabilities on certain foreign securities are recorded on an accrual basis and are reflected as components of interest income or net change in unrealized gain/loss on investments. Tax liabilities realized as a result of security sales are reflected as a component of net realized gain/loss on investments.

Under the Regulated Investment Company Modernization Act of 2010, net capital losses incurred post-enactment may be carried forward indefinitely, and their character is retained as short-term and/or long-term. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

At December 31, 2016, the Fund had a net tax basis capital loss carryforward of approximately $14,056,000 of pre-enactment losses, which may be applied against any realized net taxable capital gains of each succeeding year until fully utilized or until December 31, 2017, the expiration date, whichever occurs first; and approximately $3,046,000 of post-enactment losses, which may be applied against realized net taxable capital gains indefinitely, including short-term losses ($190,000) and long-term losses ($2,856,000).

The Fund has reviewed the tax positions for the open tax years as of December 31, 2016 and has determined that no provision for income tax and/or uncertain tax provisions is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund, if any, are declared and distributed to shareholders annually. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to investments in foreign denominated investments, investments in forward foreign currency exchange contracts, futures contracts, swap contracts and certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

At December 31, 2016, the Fund's components of distributable earnings (accumulated losses) on a tax basis are as follows:

| Undistributed ordinary income* | $ 1,758,767 |

| Capital loss carryforwards | $(17,102,000) |

| Net unrealized appreciation (depreciation) on investments | $ (504,862) |

In addition, the tax character of distributions paid to shareholders by the Fund is summarized as follows:

| | Years Ended December 31, |

| | 2016 | 2015 |

| Distributions from ordinary income* | $ 4,037,321 | $ 2,926,472 |

* For tax purposes, short-term capital gain distributions are considered ordinary income distributions.

Expenses. Expenses of the Trust arising in connection with a specific Fund are allocated to that Fund. Other Trust expenses which cannot be directly attributed to a Fund are apportioned among the Funds in the Trust based upon the relative net assets or other appropriate measures.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis net of foreign withholding taxes. Realized gains and losses from investment transactions are recorded on an identified cost basis. Proceeds from litigation payments, if any, are included in net realized gain (loss) from investments. All discounts and premiums are accreted/amortized for both tax and financial reporting purposes.

B. Derivative Instruments

Futures Contracts. A futures contract is an agreement between a buyer or seller and an established futures exchange or its clearinghouse in which the buyer or seller agrees to take or make a delivery of a specific amount of a financial instrument at a specified price on a specific date (settlement date). For the year ended December 31, 2016, the Fund invested in interest rate futures to gain exposure to different parts of the yield curve while managing the overall duration. The Fund also entered into interest rate futures contracts for non-hedging purposes to seek to enhance potential gains.

Upon entering into a futures contract, the Fund is required to deposit with a financial intermediary cash or securities ("initial margin") in an amount equal to a certain percentage of the face value indicated in the futures contract. Subsequent payments ("variation margin") are made or received by the Fund dependent upon the daily fluctuations in the value and are recorded for financial reporting purposes as unrealized gains or losses by the Fund. Gains or losses are realized when the contract expires or is closed. Since all futures contracts are exchange traded, counterparty risk is minimized as the exchange's clearinghouse acts as the counterparty, and guarantees the futures against default.

Certain risks may arise upon entering into futures contracts, including the risk that an illiquid market will limit the Fund's ability to close out a futures contract prior to the settlement date and the risk that the futures contract is not well correlated with the security, index or currency to which it relates. Risk of loss may exceed amounts disclosed in the Statement of Assets and Liabilities.

A summary of the open futures contracts as of December 31, 2016, is included in a table following the Fund's Investment Portfolio. For the year ended December 31, 2016, the investment in futures contracts purchased had a total notional value generally indicative of a range from $0 to approximately $20,649,000, and the investment in futures contracts sold had a total notional value generally indicative of a range from approximately $5,237,000 to $13,513,000.

Options. An option contract is a contract in which the writer (seller) of the option grants the buyer of the option, upon payment of a premium, the right to purchase from (call option), or sell to (put option), the writer a designated instrument at a specified price within a specified period of time. The Fund may write or purchase interest rate swaption agreements which are options to enter into a pre-defined swap agreement. The interest rate swaption agreement will specify whether the buyer of the swaption will be a fixed-rate receiver or a fixed-rate payer upon exercise. Certain options, including options on indices, will require cash settlement by the Fund if exercised. For the year ended December 31, 2016, the Fund entered into options interest rate swaps in order to hedge against potential adverse interest rate movements of portfolio assets.

If the Fund writes a covered call option, the Fund foregoes, in exchange for the premium, the opportunity to profit during the option period from an increase in the market value of the underlying security above the exercise price. If the Fund writes a put option it accepts the risk of a decline in the value of the underlying security below the exercise price. Over-the-counter options have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund's maximum exposure to purchased options is limited to the premium initially paid. In addition, certain risks may arise upon entering into option contracts including the risk that an illiquid secondary market will limit the Fund's ability to close out an option contract prior to the expiration date and that a change in the value of the option contract may not correlate exactly with changes in the value of the securities or currencies hedged.

There are no open written options contracts as of December 31, 2016. For the year ended December 31, 2016, the investment in written options contracts had a total value generally indicative of a range from $0 to approximately $347,000.

Swaps. A swap is a contract between two parties to exchange future cash flows at periodic intervals based on the notional amount of the swap. A bilateral swap is a transaction between the fund and a counterparty where cash flows are exchanged between the two parties. A centrally cleared swap is a transaction executed between the fund and a counterparty, then cleared by a clearing member through a central clearinghouse. The central clearinghouse serves as the counterparty, with whom the fund exchanges cash flows.

The value of a swap is adjusted daily, and the change in value, if any, is recorded as unrealized appreciation or depreciation in the Statement of Assets and Liabilities. Gains or losses are realized when the swap expires or is closed. Certain risks may arise when entering into swap transactions including counterparty default; liquidity; or unfavorable changes in interest rates or the value of the underlying reference security, commodity or index. In connection with bilateral swaps, securities and/or cash may be identified as collateral in accordance with the terms of the swap agreement to provide assets of value and recourse in the event of default. The maximum counterparty credit risk is the net present value of the cash flows to be received from or paid to the counterparty over the term of the swap, to the extent that this amount is beneficial to the Fund, in addition to any related collateral posted to the counterparty by the Fund. This risk may be partially reduced by a master netting arrangement between the Fund and the counterparty. Upon entering into a centrally cleared swap, the Fund is required to deposit with a financial intermediary cash or securities ("initial margin") in an amount equal to a certain percentage of the notional amount of the swap. Subsequent payments ("variation margin") are made or received by the Fund dependent upon the daily fluctuations in the value of the swap. In a cleared swap transaction, counterparty risk is minimized as the central clearinghouse acts as the counterparty.

An upfront payment, if any, made by the Fund is recorded as an asset in the Statement of Assets and Liabilities. An upfront payment, if any, received by the Fund is recorded as a liability in the Statement of Assets and Liabilities. Payments received or made at the end of the measurement period are recorded as realized gain or loss in the Statement of Operations.

Credit Default Swaps. Credit default swaps are agreements between a buyer and a seller of protection against predefined credit events for the reference entity. The Fund may enter into credit default swaps to gain exposure to an underlying issuer's credit quality characteristics without directly investing in that issuer or to hedge against the risk of a credit event on debt securities. As a seller of a credit default swap, the Fund is required to pay the par (or other agreed-upon) value of the referenced entity to the counterparty with the occurrence of a credit event by a third party, such as a U.S. or foreign corporate issuer, on the reference entity, which would likely result in a loss to the Fund. In return, the Fund receives from the counterparty a periodic stream of payments over the term of the swap provided that no credit event has occurred. If no credit event occurs, the Fund keeps the stream of payments with no payment obligations. The Fund may also buy credit default swaps, in which case the Fund functions as the counterparty referenced above. This involves the risk that the swap may expire worthless. It also involves counterparty risk that the seller may fail to satisfy its payment obligations to the Fund with the occurrence of a credit event. When the Fund sells a credit default swap, it will cover its commitment. This may be achieved by, among other methods, maintaining cash or liquid assets equal to the aggregate notional value of the reference entities for all outstanding credit default swaps sold by the Fund. For the year ended December 31, 2016, the Fund entered into credit default swap agreements to gain exposure to the underlying issuer's credit quality characteristics or to hedge the risk of default or other specified credit events on portfolio assets.

Under the terms of a credit default swap, the Fund receives or makes periodic payments based on a specified interest rate on a fixed notional amount. These payments are recorded as a realized gain or loss in the Statement of Operations. Payments received or made as a result of a credit event or termination of the swap are recognized, net of a proportional amount of the upfront payment, as realized gains or losses in the Statement of Operations.

There are no open credit default swap contract as of December 31, 2016. For the year ended December 31, 2016, the investment in credit default swap contracts sold had a total notional value generally indicative of a range from $0 to $2,500,000.

Interest Rate Swaps. Interest rate swaps are agreements in which the Fund agrees to pay to the counterparty a fixed rate payment in exchange for the counterparty agreeing to pay to the Fund a variable rate payment, or the Fund agrees to receive from the counterparty a fixed rate payment in exchange for the counterparty agreeing to receive from the Fund a variable rate payment. The payment obligations are based on the notional amount of the swap. For the year ended December 31, 2016, the Fund entered into interest rate swap agreements to gain exposure to different parts of the yield curve while managing overall duration.

A summary of the open interest rate swap contracts as of December 31, 2016 is included in a table following the Fund's Investment Portfolio. For the year ended December 31, 2016, the investment in interest rate swap contracts had a total notional amount generally indicative of a range from $42,395,000 to $58,395,000.

Forward Foreign Currency Exchange Contracts. A forward foreign currency exchange contract ("forward currency contract") is a commitment to purchase or sell a foreign currency at the settlement date at a negotiated rate. The Fund is subject to foreign exchange rate risk in its securities denominated in foreign currencies. Changes in exchange rates between foreign currencies and the U.S. dollar may affect the U.S. dollar value of foreign securities or the income or gains received on these securities. To reduce the effect of currency fluctuations, the Fund may enter into forward currency contracts. For the year ended December 31, 2016, the Fund invested in forward currency contracts to hedge its exposure to changes in foreign currency exchange rates on its foreign currency denominated securities. In addition, the Fund also engaged in forward currency contracts for non-hedging purposes to seek to enhance potential gains.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and unrealized gain (loss) is recorded daily. On the settlement date of the forward currency contract, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value of the contract at the time it was closed. Certain risks may arise upon entering into forward currency contracts from the potential inability of counterparties to meet the terms of their contracts. The maximum counterparty credit risk to the Fund is measured by the unrealized gain on appreciated contracts. Additionally, when utilizing forward currency contracts to hedge, the Fund gives up the opportunity to profit from favorable exchange rate movements during the term of the contract.

A summary of the open forward currency contracts as of December 31, 2016, is included in a table following the Fund's Investment Portfolio. For the year ended December 31, 2016, the investment in forward currency contracts U.S. dollars purchased had a total contract value generally indicative of a range from $0 to approximately $18,371,000, and the investment in forward currency contracts U.S. dollars sold had a total contract value generally indicative of a range from $0 to approximately $18,038,000.