UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-04257

Deutsche Variable Series I

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and Address of Agent for Service)

| Date of fiscal year end: | 12/31 |

| | |

| Date of reporting period: | 12/31/2015 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

December 31, 2015

Annual Report

Deutsche Variable Series I

Deutsche Bond VIP

Contents

3 Performance Summary 4 Management Summary 5 Portfolio Summary 6 Investment Portfolio 16 Statement of Assets and Liabilities 17 Statement of Operations 18 Statement of Changes in Net Assets 19 Financial Highlights 20 Notes to Financial Statements 29 Report of Independent Registered Public Accounting Firm 30 Information About Your Fund's Expenses 31 Tax Information 31 Proxy Voting 32 Advisory Agreement Board Considerations and Fee Evaluation 34 Board Members and Officers |

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Bond investments are subject to interest-rate, credit, liquidity and market risks to varying degrees. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investments in lower-quality ("junk bonds") and non-rated securities present greater risk of loss than investments in higher-quality securities. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Emerging markets tend to be more volatile than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. See the prospectus for details.

Deutsche Asset Management represents the asset management activities conducted by Deutsche Bank AG or any of its subsidiaries.

DeAWM Distributors, Inc., 222 South Riverside Plaza, Chicago, IL 60606, (800) 621-1148

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary December 31, 2015 (Unaudited)

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund's most recent month-end performance. Performance doesn't reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns.

The gross expense ratio of the Fund, as stated in the fee table of the prospectus dated May 1, 2015 is 0.69% for Class A shares and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

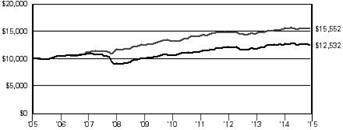

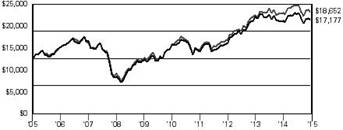

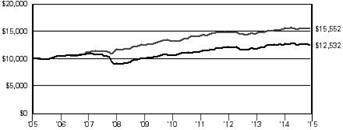

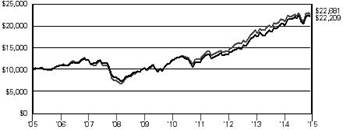

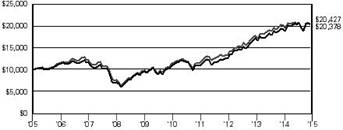

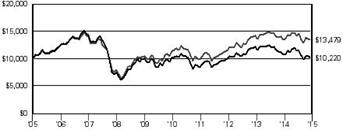

| Growth of an Assumed $10,000 Investment |

■ Deutsche Bond VIP — Class A ■ Barclays U.S. Aggregate Bond Index | The Barclays U.S. Aggregate Bond Index is an unmanaged index representing domestic taxable investment-grade bonds, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities with an average maturity of one year or more. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| |

| Yearly periods ended December 31 | | |

| Comparative Results |

| Deutsche Bond VIP | 1-Year | 3-Year | 5-Year | 10-Year |

| Class A | Growth of $10,000 | $9,971 | $10,310 | $11,743 | $12,532 |

| Average annual total return | –0.29% | 1.02% | 3.27% | 2.28% |

| Barclays U.S. Aggregate Bond Index | Growth of $10,000 | $10,055 | $10,439 | $11,732 | $15,552 |

| Average annual total return | 0.55% | 1.44% | 3.25% | 4.51% |

The growth of $10,000 is cumulative.

Management Summary December 31, 2015 (Unaudited)

During the 12-month period ended December 31, 2015, the Fund provided a total return of –0.29% (Class A shares, unadjusted for contract charges), compared with the 0.55% return of its benchmark, the Barclays U.S. Aggregate Bond Index.1

As the period opened, there was ongoing speculation over when the U.S. Federal Reserve Board (the Fed) would initiate a cycle of hikes in its benchmark short-term lending rate, after several years of maintaining a zero interest rate policy. The Fed would remain in a data-dependent "wait and see" mode until December, despite the overall modest upward progress of the U.S. economy. The Fed's patient stance was supported by a strong dollar and the absence of upward pressures on U.S. inflation and wages, against a global backdrop of heightened macroeconomic and geopolitical uncertainty. A more than halving of the price of oil, along with weakness in commodities overall and the strong U.S. dollar, put a number of emerging-markets economies under severe stress throughout the period. In early 2015, the European Central Bank began a program of sovereign bond purchases in an effort to avert deflation. The next several months in Europe were dominated by the threat of a Greek default and exit from the common currency. The Greece crisis would be displaced in global economic headlines by heightened concerns over slowing growth in China, which has for some time been the primary source of incremental demand for the global economy. U.S. Treasury yields were volatile over the 12-month period as investors responded to the news flow and mixed data, but ended somewhat higher on all maturities as investors positioned themselves for the Fed's hiking cycle late in the period.

The Fund's performance relative to the benchmark for the period was principally aided by positioning along the yield curve. In particular, we were positioned for the curve to flatten via more significant interest rate increases on shorter maturities. Throughout the period, the managers used interest rate derivatives as part of implementing the Fund’s yield curve exposures. The Fund's performance also benefited from our positioning within investment-grade corporates, which outweighed the impact of the sector's underperformance as credit spreads widened overall. While the underweight to mortgage-backed securities was a modest detractor, the Fund's focus on higher-coupon mortgage pools and other instruments that are sensitive to prepayment expectations worked well as market rates rose over the period. The Fund's modest holdings of emerging-markets and high-yield corporate debt were a drag on returns, largely due to energy-related positions. There continues to be substantial uncertainty around events which could act as a pivot point for credit sentiment globally. Against this backdrop, we have continued to broadly lower the Fund’s risk profile. We are continuing to look for opportunities to diversify risks in the portfolio and for relative valuation opportunities created by heightened volatility.

William Chepolis, CFA

John D. Ryan

Gary Russell, CFA

Portfolio Managers

Effective February 1, 2016, the portfolio management team is as follows:

Gary Russell, CFA

John D. Ryan

Thomas M. Farina, CFA

Gregory M. Staples, CFA

Portfolio Managers

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

1 The Barclays U.S. Aggregate Bond Index is an unmanaged index representing domestic taxable investment-grade bonds, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities with an average maturity of one year or more. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Portfolio Summary (Unaudited)

| Asset Allocation (As a % of Total Net Assets) | 12/31/15 | 12/31/14 |

| | | |

| Government & Agency Obligations | 41% | 30% |

| Mortgage-Backed Securities Pass-Throughs | 23% | 18% |

| Corporate Bonds | 22% | 31% |

| Collateralized Mortgage Obligations | 8% | 6% |

| Commercial Mortgage-Backed Securities | 4% | 4% |

| Asset-Backed | 2% | 2% |

| Municipal Bonds and Notes | 1% | 4% |

| Short-Term U.S. Treasury Obligations | 1% | 1% |

| Cash Equivalents, Securities Lending Collateral and other Assets and Liabilities, net | –2% | 4% |

| | 100% | 100% |

| Quality (Excludes Cash Equivalents and Securities Lending Collateral) | 12/31/15 | 12/31/14 |

| | | |

| AAA | 65% | 53% |

| AA | 3% | 7% |

| A | 4% | 5% |

| BBB | 15% | 17% |

| BB or Below | 9% | 17% |

| Not Rated | 4% | 1% |

| | 100% | 100% |

| Interest Rate Sensitivity | 12/31/15 | 12/31/14 |

| | | |

| Effective Maturity | 7.4 years | 6.7 years |

| Effective Duration | 7.1 years | 4.7 years |

The quality ratings represent the higher of Moody's Investors Service, Inc. ("Moody's"), Fitch Ratings, Inc. ("Fitch") or Standard & Poor's Corporation ("S&P") credit ratings. The ratings of Moody's, Fitch and S&P represent their opinions as to the quality of the securities they rate. Credit quality measures a bond issuer's ability to repay interest and principal in a timely manner. Ratings are relative and subjective and are not absolute standards of quality. Credit quality does not remove market risk and is subject to change.

Effective maturity is the weighted average of the maturity date of bonds held by the Fund taking into consideration any available maturity shortening features.

Effective duration is an approximate measure of the Fund's sensitivity to interest rate changes taking into consideration any maturity shortening features.

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund's investment portfolio, see page 6.

Following the Fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC's Web site at sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. The Fund's portfolio holdings are also posted on deutschefunds.com from time to time. Please see the Fund's current prospectus for more information.

Investment Portfolio December 31, 2015 (Unaudited)

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Corporate Bonds 21.7% |

| Consumer Discretionary 1.7% |

| AMC Entertainment, Inc., 5.875%, 2/15/2022 | | 15,000 | 15,225 |

| AmeriGas Finance LLC: |

| | 6.75%, 5/20/2020 | | 15,000 | 14,588 |

| | 7.0%, 5/20/2022 | | 10,000 | 9,675 |

| APX Group, Inc., 6.375%, 12/1/2019 | 15,000 | 14,363 |

| Asbury Automotive Group, Inc., 144A, 6.0%, 12/15/2024 | 5,000 | 5,163 |

| Ashton Woods U.S.A. LLC, 144A, 6.875%, 2/15/2021 | | 25,000 | 21,250 |

| Avis Budget Car Rental LLC, 5.5%, 4/1/2023 (b) | | 15,000 | 15,037 |

| Bed Bath & Beyond, Inc.: |

| | 4.915%, 8/1/2034 | | 130,000 | 115,981 |

| | 5.165%, 8/1/2044 | | 150,000 | 127,052 |

| CCO Safari II LLC: |

| | 144A, 4.908%, 7/23/2025 | | 40,000 | 39,961 |

| | 144A, 6.484%, 10/23/2045 | | 30,000 | 30,049 |

| Cequel Communications Holdings I LLC: | | |

| | 144A, 5.125%, 12/15/2021 | | 5,000 | 4,500 |

| | 144A, 6.375%, 9/15/2020 | | 55,000 | 53,762 |

| Churchill Downs, Inc., 144A, 5.375%, 12/15/2021 | | 8,690 | 8,712 |

| Clear Channel Worldwide Holdings, Inc.: | | |

| | Series A, 6.5%, 11/15/2022 | 15,000 | 14,475 |

| | Series B, 6.5%, 11/15/2022 | 25,000 | 24,375 |

| | Series B, 7.625%, 3/15/2020 | 75,000 | 69,281 |

| CVS Health Corp., 5.125%, 7/20/2045 | 60,000 | 63,206 |

| Delphi Corp., 5.0%, 2/15/2023 | 20,000 | 21,160 |

| Discovery Communications LLC, 4.875%, 4/1/2043 | | 25,000 | 20,578 |

| DISH DBS Corp.: |

| | 4.25%, 4/1/2018 | | 15,000 | 15,037 |

| | 5.0%, 3/15/2023 | | 20,000 | 17,350 |

| | 7.875%, 9/1/2019 | | 90,000 | 97,875 |

| General Motors Financial Co., Inc., 3.2%, 7/13/2020 | | 75,000 | 73,845 |

| Group 1 Automotive, Inc., 144A, 5.25%, 12/15/2023 | 20,000 | 19,800 |

| Hot Topic, Inc., 144A, 9.25%, 6/15/2021 | | 10,000 | 8,850 |

| Live Nation Entertainment, Inc., 144A, 7.0%, 9/1/2020 | | 20,000 | 20,700 |

| MDC Partners, Inc., 144A, 6.75%, 4/1/2020 | | 20,000 | 20,600 |

| Mediacom Broadband LLC: |

| | 5.5%, 4/15/2021 | | 5,000 | 4,813 |

| | 6.375%, 4/1/2023 | | 10,000 | 9,775 |

| MGM Resorts International: |

| | 6.625%, 12/15/2021 | | 40,000 | 40,950 |

| | 6.75%, 10/1/2020 | | 42,000 | 43,155 |

| Numericable-SFR, 144A, 4.875%, 5/15/2019 | | 30,000 | 29,737 |

| Pinnacle Entertainment, Inc., 6.375%, 8/1/2021 | | 10,000 | 10,513 |

| Quebecor Media, Inc., 5.75%, 1/15/2023 | | 15,000 | 15,112 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Sirius XM Radio, Inc., 144A, 5.875%, 10/1/2020 (b) | | 10,000 | 10,475 |

| Springs Industries, Inc., 6.25%, 6/1/2021 | | 10,000 | 9,900 |

| Starz LLC, 5.0%, 9/15/2019 | | 10,000 | 10,125 |

| Time Warner Cable, Inc., 7.3%, 7/1/2038 | | 165,000 | 178,886 |

| Viking Cruises Ltd., 144A, 8.5%, 10/15/2022 | | 15,000 | 14,213 |

| | 1,340,104 |

| Consumer Staples 0.3% |

| Aramark Services, Inc., 144A, 5.125%, 1/15/2024 (b) | | 10,000 | 10,187 |

| Chiquita Brands International, Inc., 7.875%, 2/1/2021 | 7,000 | 7,332 |

| Constellation Brands, Inc., 4.75%, 12/1/2025 | | 5,000 | 5,094 |

| JBS Investments GmbH, 144A, 7.25%, 4/3/2024 | 30,000 | 27,225 |

| JBS U.S.A. LLC: |

| | 144A, 7.25%, 6/1/2021 | | 30,000 | 29,775 |

| | 144A, 8.25%, 2/1/2020 (b) | | 115,000 | 115,000 |

| Post Holdings, Inc., 144A, 6.75%, 12/1/2021 | | 5,000 | 5,100 |

| Reynolds American, Inc.: |

| | 4.45%, 6/12/2025 | | 30,000 | 31,375 |

| | 5.85%, 8/15/2045 | | 20,000 | 22,235 |

| Smithfield Foods, Inc., 6.625%, 8/15/2022 | | 20,000 | 20,750 |

| | 274,073 |

| Energy 2.8% |

| Antero Resources Corp., 5.375%, 11/1/2021 | | 5,000 | 4,000 |

| DCP Midstream LLC, 144A, 9.75%, 3/15/2019 | | 760,000 | 773,869 |

| Delek & Avner Tamar Bond Ltd., 144A, 5.082%, 12/30/2023 | 250,000 | 251,563 |

| Endeavor Energy Resources LP, 144A, 7.0%, 8/15/2021 | 16,000 | 14,240 |

| Kinder Morgan, Inc.: |

| | 3.05%, 12/1/2019 | | 220,000 | 203,613 |

| | 5.55%, 6/1/2045 | | 160,000 | 124,901 |

| MEG Energy Corp., 144A, 7.0%, 3/31/2024 | | 15,000 | 10,650 |

| Murphy Oil U.S.A., Inc., 6.0%, 8/15/2023 | | 20,000 | 21,000 |

| Noble Holding International Ltd., 4.0%, 3/16/2018 | 20,000 | 18,110 |

| ONEOK Partners LP, 4.9%, 3/15/2025 (b) | | 80,000 | 67,379 |

| Rosneft Finance SA, 144A, 6.625%, 3/20/2017 | | 100,000 | 102,350 |

| Transocean, Inc., 4.3%, 10/15/2022 | 555,000 | 294,150 |

| Transportadora de Gas Internacional SA ESP, 144A, 5.7%, 3/20/2022 | 250,000 | 250,625 |

| Williams Partners LP, 4.0%, 9/15/2025 (b) | | 100,000 | 74,876 |

| | 2,211,326 |

| Financials 7.8% |

| Banco Continental SAECA, 144A, 8.875%, 10/15/2017 | 200,000 | 203,500 |

| Barclays Bank PLC, 7.625%, 11/21/2022 | | 890,000 | 1,013,487 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| BBVA Bancomer SA, 144A, 6.75%, 9/30/2022 | | 150,000 | 165,000 |

| CBL & Associates LP, (REIT), 4.6%, 10/15/2024 | | 410,000 | 386,450 |

| CIT Group, Inc., 3.875%, 2/19/2019 | 65,000 | 64,675 |

| Corp. Financiera de Desarrollo SA, 144A, 4.75%, 2/8/2022 | 250,000 | 253,750 |

| Credit Agricole SA, 144A, 7.875%, 1/29/2049 (b) | | 200,000 | 204,500 |

| Equinix, Inc.: |

| | (REIT), 5.375%, 4/1/2023 | | 45,000 | 45,900 |

| | (REIT), 5.875%, 1/15/2026 | | 5,000 | 5,150 |

| Everest Reinsurance Holdings, Inc., 4.868%, 6/1/2044 | 170,000 | 160,272 |

| Hospitality Properties Trust, (REIT), 5.0%, 8/15/2022 | | 380,000 | 390,336 |

| HSBC Holdings PLC: |

| | 5.625%, 12/29/2049 (b) | | 410,000 | 410,513 |

| | 6.375%, 12/29/2049 | | 660,000 | 654,000 |

| International Lease Finance Corp., 6.25%, 5/15/2019 | | 5,000 | 5,356 |

| Legg Mason, Inc., 5.625%, 1/15/2044 | | 110,000 | 109,264 |

| Macquarie Group Ltd., 144A, 6.0%, 1/14/2020 | | 825,000 | 910,543 |

| Massachusetts Mutual Life Insurance Co., 144A, 4.5%, 4/15/2065 | | 30,000 | 26,831 |

| Morgan Stanley, Series H, 5.45%, 7/29/2049 | | 10,000 | 9,763 |

| Nationwide Financial Services, Inc., 144A, 5.3%, 11/18/2044 | 220,000 | 220,238 |

| Neuberger Berman Group LLC, 144A, 5.875%, 3/15/2022 | 155,000 | 161,200 |

| Omega Healthcare Investors, Inc., (REIT), 4.95%, 4/1/2024 | 505,000 | 510,013 |

| QBE Insurance Group Ltd., 144A, 2.4%, 5/1/2018 | 260,000 | 260,233 |

| Societe Generale SA, 144A, 7.875%, 12/29/2049 | | 20,000 | 19,926 |

| The Goldman Sachs Group, Inc., Series L, 5.7%, 12/29/2049 | 15,000 | 14,906 |

| | 6,205,806 |

| Health Care 1.2% |

| AbbVie, Inc., 3.6%, 5/14/2025 | 90,000 | 88,824 |

| Actavis Funding SCS, 4.75%, 3/15/2045 | | 2,000 | 1,950 |

| Community Health Systems, Inc.: |

| | 5.125%, 8/1/2021 | | 5,000 | 4,975 |

| | 6.875%, 2/1/2022 (b) | | 10,000 | 9,488 |

| | 7.125%, 7/15/2020 (b) | | 125,000 | 124,531 |

| Endo Finance LLC, 144A, 5.75%, 1/15/2022 (b) | | 15,000 | 14,550 |

| HCA, Inc.: |

| | 5.875%, 2/15/2026 | | 15,000 | 15,056 |

| | 6.5%, 2/15/2020 | | 235,000 | 256,032 |

| | 7.5%, 2/15/2022 | | 190,000 | 210,425 |

| IMS Health, Inc., 144A, 6.0%, 11/1/2020 | | 15,000 | 15,450 |

| LifePoint Health, Inc.: |

| | 5.5%, 12/1/2021 | | 15,000 | 15,263 |

| | 5.875%, 12/1/2023 | | 10,000 | 10,150 |

| Mallinckrodt International Finance SA, 4.75%, 4/15/2023 | 110,000 | 97,350 |

| Tenet Healthcare Corp., 6.25%, 11/1/2018 | | 60,000 | 63,150 |

| | 927,194 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Industrials 0.7% |

| ADT Corp.: |

| | 4.125%, 4/15/2019 | | 5,000 | 5,144 |

| | 6.25%, 10/15/2021 (b) | | 20,000 | 20,891 |

| Aerojet Rocketdyne Holdings, Inc., 7.125%, 3/15/2021 | | 35,000 | 36,400 |

| Artesyn Embedded Technologies, Inc., 144A, 9.75%, 10/15/2020 | | 15,000 | 13,313 |

| Belden, Inc., 144A, 5.5%, 9/1/2022 | 25,000 | 24,062 |

| Bombardier, Inc.: |

| | 144A, 5.75%, 3/15/2022 | | 90,000 | 62,775 |

| | 144A, 6.0%, 10/15/2022 | | 15,000 | 10,515 |

| Covanta Holding Corp., 5.875%, 3/1/2024 | | 10,000 | 9,050 |

| CTP Transportation Products LLC, 144A, 8.25%, 12/15/2019 | 15,000 | 15,638 |

| DigitalGlobe, Inc., 144A, 5.25%, 2/1/2021 | | 10,000 | 8,400 |

| FTI Consulting, Inc., 6.0%, 11/15/2022 | 15,000 | 15,712 |

| Garda World Security Corp., 144A, 7.25%, 11/15/2021 | 15,000 | 12,900 |

| Grupo KUO SAB De CV, 144A, 6.25%, 12/4/2022 | 200,000 | 185,500 |

| Meritor, Inc.: |

| | 6.25%, 2/15/2024 | | 10,000 | 8,550 |

| | 6.75%, 6/15/2021 | | 15,000 | 13,800 |

| Oshkosh Corp., 5.375%, 3/1/2022 | 8,000 | 8,000 |

| SBA Communications Corp., 5.625%, 10/1/2019 | | 15,000 | 15,638 |

| Spirit AeroSystems, Inc., 5.25%, 3/15/2022 | | 15,000 | 15,309 |

| Titan International, Inc., 6.875%, 10/1/2020 (b) | | 8,000 | 5,960 |

| United Rentals North America, Inc.: |

| | 6.125%, 6/15/2023 (b) | | 5,000 | 5,113 |

| | 7.625%, 4/15/2022 | | 85,000 | 90,839 |

| | 583,509 |

| Information Technology 1.0% |

| ACI Worldwide, Inc., 144A, 6.375%, 8/15/2020 | | 5,000 | 5,150 |

| Activision Blizzard, Inc., 144A, 5.625%, 9/15/2021 | 50,000 | 52,375 |

| Audatex North America, Inc., 144A, 6.0%, 6/15/2021 | 10,000 | 10,075 |

| Entegris, Inc., 144A, 6.0%, 4/1/2022 | 10,000 | 10,125 |

| Fidelity National Information Services, Inc., 3.625%, 10/15/2020 | 80,000 | 81,042 |

| First Data Corp., 144A, 8.75%, 1/15/2022 | | 22,000 | 22,987 |

| Freescale Semiconductor, Inc., 144A, 6.0%, 1/15/2022 | 15,000 | 15,713 |

| Hewlett Packard Enterprise Co.: |

| | 144A, 4.9%, 10/15/2025 | | 85,000 | 83,352 |

| | 144A, 6.35%, 10/15/2045 | | 45,000 | 42,720 |

| KLA-Tencor Corp., 4.65%, 11/1/2024 | 260,000 | 261,600 |

| NCR Corp.: |

| | 5.875%, 12/15/2021 | | 5,000 | 4,925 |

| | 6.375%, 12/15/2023 | | 10,000 | 9,850 |

| Seagate HDD Cayman, 144A, 5.75%, 12/1/2034 | | 340,000 | 237,923 |

| | 837,837 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Materials 3.1% |

| Anglo American Capital PLC: |

| | 144A, 4.125%, 4/15/2021 (b) | 350,000 | 239,750 |

| | 144A, 4.125%, 9/27/2022 | | 555,000 | 361,444 |

| ArcelorMittal, 6.125%, 6/1/2018 | 500,000 | 457,500 |

| Ball Corp., 4.375%, 12/15/2020 | 5,000 | 5,078 |

| Berry Plastics Corp., 5.5%, 5/15/2022 | | 25,000 | 24,906 |

| Corp. Nacional del Cobre de Chile, 144A, 4.5%, 9/16/2025 (b) | 200,000 | 188,337 |

| First Quantum Minerals Ltd., 144A, 7.0%, 2/15/2021 | 31,000 | 19,453 |

| Glencore Funding LLC, 144A, 4.125%, 5/30/2023 | | 50,000 | 36,876 |

| Gold Fields Orogen Holdings BVI Ltd., 144A, 4.875%, 10/7/2020 | 200,000 | 149,000 |

| Hexion, Inc., 6.625%, 4/15/2020 | 90,000 | 69,975 |

| Novelis, Inc., 8.75%, 12/15/2020 | 265,000 | 243,137 |

| Plastipak Holdings, Inc., 144A, 6.5%, 10/1/2021 | 15,000 | 14,475 |

| Reynolds Group Issuer, Inc., 5.75%, 10/15/2020 | | 325,000 | 330,587 |

| Yamana Gold, Inc., 4.95%, 7/15/2024 | 405,000 | 343,433 |

| | 2,483,951 |

| Telecommunication Services 2.8% |

| America Movil SAB de CV, 7.125%, 12/9/2024 | MXN | 2,000,000 | 112,565 |

| AT&T, Inc.: |

| | 2.45%, 6/30/2020 | | 75,000 | 73,862 |

| | 3.4%, 5/15/2025 | | 110,000 | 105,720 |

| B Communications Ltd., 144A, 7.375%, 2/15/2021 | | 15,000 | 16,155 |

| Bharti Airtel International Netherlands BV, 144A, 5.125%, 3/11/2023 | | 400,000 | 414,072 |

| CenturyLink, Inc.: |

| | Series V, 5.625%, 4/1/2020 | 5,000 | 4,944 |

| | Series T, 5.8%, 3/15/2022 | | 20,000 | 18,330 |

| | Series W, 6.75%, 12/1/2023 (b) | 10,000 | 9,375 |

| CyrusOne LP, 6.375%, 11/15/2022 | 5,000 | 5,150 |

| Digicel Group Ltd., 144A, 8.25%, 9/30/2020 | | 42,000 | 34,650 |

| Frontier Communications Corp.: |

| | 7.125%, 1/15/2023 | | 110,000 | 94,875 |

| | 8.5%, 4/15/2020 | | 55,000 | 55,137 |

| Hughes Satellite Systems Corp., 7.625%, 6/15/2021 | 50,000 | 53,000 |

| Intelsat Jackson Holdings SA, 5.5%, 8/1/2023 | | 30,000 | 23,550 |

| Level 3 Financing, Inc.: |

| | 6.125%, 1/15/2021 | | 10,000 | 10,350 |

| | 7.0%, 6/1/2020 | | 100,000 | 104,500 |

| Millicom International Cellular SA, 144A, 6.0%, 3/15/2025 (b) | 200,000 | 170,000 |

| MTN Mauritius Investments Ltd., 144A, 4.755%, 11/11/2024 | 250,000 | 217,500 |

| Sprint Communications, Inc., 6.0%, 11/15/2022 (b) | | 25,000 | 17,625 |

| Sprint Corp., 7.125%, 6/15/2024 | 15,000 | 10,819 |

| T-Mobile U.S.A., Inc.: |

| | 6.125%, 1/15/2022 | | 5,000 | 5,137 |

| | 6.625%, 11/15/2020 | | 175,000 | 181,911 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Turk Telekomunikasyon AS, 144A, 3.75%, 6/19/2019 | 250,000 | 247,825 |

| Windstream Services LLC, 7.75%, 10/15/2020 (b) | | 325,000 | 273,812 |

| | 2,260,864 |

| Utilities 0.3% |

| Empresa Electrica Angamos SA, 144A, 4.875%, 5/25/2029 | 200,000 | 178,417 |

| NRG Energy, Inc., 6.25%, 5/1/2024 (b) | 45,000 | 37,809 |

| | 216,226 |

| Total Corporate Bonds (Cost $18,693,280) | 17,340,890 |

| |

| Mortgage-Backed Securities Pass-Throughs 22.9% |

| Federal Home Loan Mortgage Corp.: |

| | 3.5%, 5/1/2043 (c) | | 4,000,000 | 4,117,539 |

| | 4.0%, 8/1/2039 | | 601,732 | 640,201 |

| | 5.5%, with various maturities from 10/1/2023 until 6/1/2035 | 1,230,622 | 1,367,401 |

| | 6.5%, 3/1/2026 | | 187,829 | 213,911 |

| Federal National Mortgage Association: | |

| | 2.5%*, 9/1/2038 | | 46,304 | 48,590 |

| | 4.0%, 8/1/2042 (c) | | 3,000,000 | 3,174,516 |

| | 5.0%, with various maturities from 10/1/2033 until 8/1/2040 | 1,193,192 | 1,317,719 |

| | 5.5%, with various maturities from 12/1/2032 until 8/1/2037 | 1,260,921 | 1,413,793 |

| | 6.0%, with various maturities from 4/1/2024 until 3/1/2025 | 362,371 | 408,924 |

| | 6.5%, with various maturities from 3/1/2017 until 12/1/2037 | 374,397 | 425,156 |

| Government National Mortgage Association, 4.0% , with various maturities from 2/15/2041 until 4/15/2041 | 4,828,853 | 5,126,065 |

| Total Mortgage-Backed Securities Pass-Throughs (Cost $17,982,592) | 18,253,815 |

| |

| Asset-Backed 2.2% |

| Automobile Receivables 0.6% |

| Avis Budget Rental Car Funding AESOP LLC, "C", Series 2015-1A, 144A, 3.96%, 7/20/2021 | 500,000 | 503,544 |

| Miscellaneous 1.6% |

| Hilton Grand Vacations Trust, "B", Series 2014-AA, 144A, 2.07%, 11/25/2026 | 268,587 | 262,118 |

| PennyMac LLC, "A1", Series 2015-NPL1, 144A, 4.0%, 3/25/2055 | | 552,166 | 549,266 |

| Voya CLO Ltd., "C", Series 2015-1A, 144A, 3.675%*, 4/18/2027 | | 500,000 | 452,908 |

| | 1,264,292 |

| Total Asset-Backed (Cost $1,800,051) | 1,767,836 |

| |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Commercial Mortgage-Backed Securities 3.8% |

| Del Coronado Trust, "M", Series 2013-HDMZ, 144A, 5.331%*, 3/15/2018 | 125,000 | 124,775 |

| FHLMC Multifamily Structured Pass-Through Certificates, "X1", Series K043, Interest Only, 0.549%*, 12/25/2024 | 4,989,855 | 206,419 |

| JPMBB Commercial Mortgage Securities Trust, "A3", Series 2014-C19, 3.669%, 4/15/2047 | 150,000 | 153,871 |

| JPMorgan Chase Commercial Mortgage Securities Corp., "A4", Series 2007-C1, 5.716%, 2/15/2051 | 944,381 | 986,358 |

| LB-UBS Commercial Mortgage Trust, "A4", Series 2007-C6, 5.858%, 7/15/2040 | 1,029,005 | 1,058,651 |

| Merrill Lynch Mortgage Trust, "ASB", Series 2007-C1, 5.836%*, 6/12/2050 | 462,966 | 470,503 |

| Total Commercial Mortgage-Backed Securities (Cost $3,084,280) | 3,000,577 |

| |

| Collateralized Mortgage Obligations 8.2% |

| Countrywide Home Loans, "A2", Series 2006-1, 6.0%, 3/25/2036 | 291,252 | 265,369 |

| CS First Boston Mortgage Securities Corp., "10A3", Series 2005-10, 6.0%, 11/25/2035 | 104,615 | 68,850 |

| Fannie Mae Connecticut Avenue Securities, "1M2", Series 2015-C01, 4.521%*, 2/25/2025 | | 1,000,000 | 969,319 |

| Federal Home Loan Mortgage Corp.: |

| | "PI", Series 4485, Interest Only, 3.5%, 6/15/2045 | | 2,897,030 | 417,188 |

| | "PI", Series 3940, Interest Only, 4.0%, 2/15/2041 | | 468,673 | 79,238 |

| | "SP", Series 4047, Interest Only, 6.32%**, 12/15/2037 | 501,566 | 71,962 |

| | "JS", Series 3572, Interest Only, 6.47%**, 9/15/2039 | 468,083 | 66,112 |

| Federal National Mortgage Association: | |

| | "PZ", Series 2010-129, 4.5%, 11/25/2040 | | 929,142 | 981,980 |

| | "SI", Series 2007-23, Interest Only, 6.348%**, 3/25/2037 | 207,179 | 34,977 |

| Freddie Mac Structured Agency Credit Risk Debt Notes: | |

| | "M3", Series 2014-DN2, 3.821%*, 4/25/2024 | | 500,000 | 466,210 |

| | "M3", Series 2014-DN4, 4.771%*, 10/25/2024 | | 240,000 | 238,090 |

| Government National Mortgage Association: | |

| | "PL", Series 2013-19, 2.5%, 2/20/2043 | 684,500 | 620,546 |

| | "HX", Series 2012-91, 3.0%, 9/20/2040 | 346,880 | 354,988 |

| | "GC", Series 2010-101, 4.0%, 8/20/2040 | 500,000 | 538,988 |

| | "ME", Series 2014-4, 4.0%, 1/16/2044 | 500,000 | 535,992 |

| | "PI", Series 2015-40, Interest Only, 4.0%, 4/20/2044 | 639,357 | 82,242 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| | "PI", Series 2014-108, Interest Only, 4.5%, 12/20/2039 | 430,068 | 71,168 |

| | "EI", Series 2011-162, Interest Only, 4.5%, 5/20/2040 | 903,949 | 58,936 |

| | "DI", Series 2011-40, Interest Only, 4.5%, 12/20/2040 | 1,699,229 | 71,763 |

| | "PZ", Series 2010-106, 4.75%, 8/20/2040 | 383,484 | 415,320 |

| | "IN", Series 2009-69, Interest Only, 5.5%, 8/20/2039 | 121,959 | 21,831 |

| | "IV", Series 2009-69, Interest Only, 5.5%, 8/20/2039 | 239,021 | 44,221 |

| | "IJ", Series 2009-75, Interest Only, 6.0%, 8/16/2039 | 104,604 | 17,868 |

| | "AI", Series 2007-38, Interest Only, 6.116%**, 6/16/2037 | 63,330 | 9,698 |

| MASTR Alternative Loans Trust: |

| | "5A1", Series 2005-1, 5.5%, 1/25/2020 | | 68,503 | 70,933 |

| | "8A1", Series 2004-3, 7.0%, 4/25/2034 | | 8,017 | 8,242 |

| Total Collateralized Mortgage Obligations (Cost $6,910,927) | 6,582,031 |

| |

| Government & Agency Obligations 40.5% |

| Other Government Related (d) 0.5% |

| Perusahaan Penerbit SBSN, 144A, 4.325%, 5/28/2025 | | 200,000 | 190,760 |

| Sberbank of Russia, Series 7, REG S, 5.717%, 6/16/2021 | | 200,000 | 197,238 |

| | 387,998 |

| Sovereign Bonds 5.7% |

| Dominican Republic, 144A, 5.5%, 1/27/2025 | | 100,000 | 96,250 |

| Government of Indonesia, Series FR56, 8.375%, 9/15/2026 | IDR | 2,680,000,000 | 189,381 |

| Government of Romania, 144A, 2.75%, 10/29/2025 | EUR | 1,000,000 | 1,101,692 |

| Republic of El Salvador: |

| | 144A, 6.375%, 1/18/2027 | | 100,000 | 84,500 |

| | 144A, 7.65%, 6/15/2035 | | 100,000 | 85,250 |

| | REG S, 8.25%, 4/10/2032 | | 40,000 | 37,300 |

| Republic of Hungary: |

| | 4.0%, 3/25/2019 | | 200,000 | 208,400 |

| | Series 19/A, 6.5%, 6/24/2019 | HUF | 11,600,000 | 45,284 |

| Republic of Namibia, 144A, 5.25%, 10/29/2025 | | 500,000 | 465,000 |

| Republic of Slovenia, 144A, 5.5%, 10/26/2022 | | 200,000 | 223,237 |

| Republic of South Africa: |

| | Series R204, 8.0%, 12/21/2018 | ZAR | 2,200,000 | 138,869 |

| | Series R186, 10.5%, 12/21/2026 | ZAR | 7,800,000 | 532,609 |

| Republic of Sri Lanka: |

| | 144A, 5.125%, 4/11/2019 | | 200,000 | 189,940 |

| | 144A, 6.85%, 11/3/2025 | | 280,000 | 263,753 |

| Republic of Turkey, 5.625%, 3/30/2021 | | 250,000 | 264,351 |

| Republic of Uruguay, 5.1%, 6/18/2050 | | 50,000 | 43,125 |

| United Mexican States, 4.6%, 1/23/2046 | | 600,000 | 531,000 |

| | 4,499,941 |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| U.S. Sponsored Agency 1.4% |

| Tennessee Valley Authority, 4.25%, 9/15/2065 | | 1,167,000 | 1,140,120 |

| U.S. Treasury Obligations 32.9% |

| U.S. Treasury Bonds: |

| | 3.0%, 5/15/2045 | | 11,000 | 10,950 |

| | 3.125%, 8/15/2044 | | 255,000 | 260,608 |

| U.S. Treasury Inflation-Indexed Note, 0.375%, 7/15/2025 | 1,805,292 | 1,747,842 |

| U.S. Treasury Notes: |

| | 1.0%, 8/31/2016 (f) (g) | | 9,248,000 | 9,266,783 |

| | 1.0%, 9/30/2016 | | 1,000,000 | 1,001,992 |

| | 1.0%, 8/15/2018 | | 4,670,100 | 4,639,819 |

| | 1.25%, 1/31/2020 | | 30,000 | 29,538 |

| | 1.625%, 4/30/2019 | | 6,640,000 | 6,678,645 |

| | 2.0%, 8/15/2025 | | 185,000 | 180,382 |

| | 2.25%, 11/15/2024 | | 1,201,000 | 1,200,390 |

| | 2.5%, 5/15/2024 | | 1,238,000 | 1,265,033 |

| | 26,281,982 |

| Total Government & Agency Obligations (Cost $32,844,984) | 32,310,041 |

| |

| Short-Term U.S. Treasury Obligations 1.0% |

| U.S. Treasury Bills: | | | |

| | 0.215% ***, 2/11/2016 (e) | | 623,000 | 622,913 |

| | 0.42%***, 6/2/2016 (e) | | 181,000 | 180,674 |

| Total Short-Term U.S. Treasury Obligations (Cost $803,524) | 803,587 |

| |

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Municipal Bonds and Notes 1.2% |

| Kentucky, Asset/Liability Commission, General Fund Revenue, 3.165%, 4/1/2018 (Cost $960,470) | 960,470 | 977,048 |

| |

Shares | Value ($) |

| | | | |

| Securities Lending Collateral 1.9% |

| Daily Assets Fund, 0.36% (h) (i) (Cost $1,522,504) | 1,522,504 | 1,522,504 |

| |

| Cash Equivalents 5.8% |

| Central Cash Management Fund, 0.25% (h) (Cost $4,617,939) | 4,617,939 | 4,617,939 |

| | | | |

| | % of Net Assets | Value ($) |

| | |

| Total Investment Portfolio (Cost $89,220,551)† | 109.2 | 87,176,268 |

| Other Assets and Liabilities, Net | (9.2) | (7,376,458) |

| Net Assets | 100.0 | 79,799,810 |

* Floating rate securities' yields vary with a designated market index or market rate, such as the coupon-equivalent of the U.S. Treasury Bill rate. These securities are shown at their current rate as of December 31, 2015.

** These securities are shown at their current rate as of December 31, 2015.

*** Annualized yield at time of purchase; not a coupon rate.

† The cost for federal income tax purposes was $89,224,053. At December 31, 2015, net unrealized depreciation for all securities based on tax cost was $2,047,785. This consisted of aggregate gross unrealized depreciation for all securities in which there was an excess of value over tax cost of $718,108 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $2,765,893.

(a) Principal amount stated in U.S. dollars unless otherwise noted.

(b) All or a portion of these securities were on loan. In addition, "Other Assets and Liabilities, Net" may include pending sales that are also on loan. The value of securities loaned at December 31, 2015 amounted to $1,460,838, which is 1.8% of net assets.

(c) When-issued or delayed delivery security included.

(d) Government-backed debt issued by financial companies or government sponsored enterprises.

(e) At December 31, 2015, this security has been pledged, in whole or in part, to cover initial margin requirements for open futures contracts.

(f) At December 31, 2015, this security has been pledged, in whole or in part, as collateral for open centrally cleared swap contracts.

(g) At December 31, 2015, this security has been pledged, in whole or in part, as collateral for open over-the-counter derivatives.

(h) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

(i) Represents collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates.

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

CLO: Collateralized Loan Obligation

Interest Only: Interest Only (IO) bonds represent the "interest only" portion of payments on a pool of underlying mortgages or mortgage-backed securities. IO securities are subject to prepayment risk of the pool of underlying mortgages.

REG S: Securities sold under Regulation S may not be offered, sold or delivered within the United States or to, or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933.

REIT: Real Estate Investment Trust

SBSN: Surat Berharga Syariah Negara (Islamic Based Government Securities)

Included in the portfolio are investments in mortgage- or asset-backed securities, which are interests in separate pools of mortgages or assets. Effective maturities of these investments may be shorter than stated maturities due to prepayments. Some separate investments in the Federal Home Loan Mortgage Corp., Federal National Mortgage Association and Government National Mortgage Association issues which have similar coupon rates have been aggregated for presentation purposes in this investment portfolio.

At December 31, 2015, open futures contracts purchased were as follows:

| Futures | Expiration Date | Contracts | Notional Value ($) | Unrealized Depreciation ($) |

| 10 Year U.S. Treasury Note | 3/21/2016 | 164 | 20,648,625 | (93,225) |

At December 31, 2015, open futures contracts sold were as follows:

| Futures | Expiration Date | Contracts | Notional Value ($) | Unrealized Depreciation ($) |

| Ultra Long U.S. Treasury Bond | 3/21/2016 | 33 | 5,236,688 | (32,791) |

At December 31, 2015, open written options contracts were as follows:

| Options on Interest Rate Swap Contracts |

| | Swap Effective/

Expiration Date | Contract Amount | Option Expiration Date | Premiums Received ($) | Value ($) (j) |

Call Options Receive Fixed — 4.48% – Pay Floating — 3-Month LIBOR | 5/9/2016

5/11/2026 | 2,000,0001 | 5/5/2016 | 22,450 | (2) |

Put Options Pay Fixed — 2.0% – Receive Floating — 3-Month LIBOR | 8/15/2016

8/15/2046 | 2,900,0001 | 8/11/2016 | 55,680 | (25,633) |

| Pay Fixed — 2.22% – Receive Floating — 3-Month LIBOR | 7/13/2016

7/13/2046 | 2,900,0002 | 7/11/2016 | 54,520 | (39,785) |

| Pay Fixed — 2.48% – Receive Floating — 3-Month LIBOR | 5/9/2016

5/11/2026 | 2,000,0001 | 5/5/2016 | 22,450 | (54,791) |

| Total Put Options | 132,650 | (120,209) |

| Total | 155,100 | (120,211) |

(j) Unrealized appreciation on written options on interest rate swap contracts at December 31, 2015 was $34,889.

At December 31, 2015, open credit default swap contracts purchased were as follows:

| Centrally Cleared Swap |

Effective/

Expiration Dates | Notional Amount ($) | Fixed Cash Flows Paid | Underlying Reference Obligation | Value ($) | Unrealized Depreciation ($) |

3/20/2015

6/20/2020 | 1,188,000 | 5.0% | Markit CDX North America High Yield Index | (44,574) | (2,180) |

At December 31, 2015, open interest rate swap contracts were as follows:

| Centrally Cleared Swaps |

Effective/

Expiration Dates | Notional Amount ($) | Cash Flows Paid by the Fund | Cash Flows Received by the Fund | Value ($) | Unrealized Appreciation/

(Depreciation) ($) |

12/16/2015

9/18/2045 | 3,600,000 | Floating — 3-Month LIBOR | Fixed — 2.998% | 306,831 | 185,624 |

12/16/2015

9/16/2025 | 500,000 | Floating — 3-Month LIBOR | Fixed — 2.64% | 21,823 | 18,656 |

12/16/2015

9/16/2020 | 8,900,000 | Floating — 3-Month LIBOR | Fixed — 2.214% | 223,142 | 227,052 |

12/16/2015

9/17/2035 | 9,700,000 | Floating — 3-Month LIBOR | Fixed — 2.938% | 665,342 | 453,541 |

12/4/2015

12/4/2045 | 2,000,000 | Fixed — 2.615% | Floating — 3-Month LIBOR | (4,736) | 38,664 |

2/3/2015

2/3/2045 | 1,800,000 | Fixed — 3.035% | Floating — 3-Month LIBOR | (186,496) | (164,940) |

1/28/2015

1/28/2045 | 2,000,000 | Fixed — 3.088% | Floating — 3-Month LIBOR | (231,073) | (210,992) |

12/16/2015

9/18/2017 | 13,600,000 | Fixed — 1.557% | Floating — 3-Month LIBOR | (117,111) | (127,616) |

9/16/2015

9/16/2045 | 1,800,000 | Fixed — 3.0% | Floating — 3-Month LIBOR | (167,879) | (125,436) |

12/16/2015

12/16/2045 | 1,400,000 | Fixed — 2.75% | Floating — 3-Month LIBOR | (43,490) | (57,298) |

9/30/2015

9/30/2045 | 2,000,000 | Fixed — 2.88% | Floating — 3-Month LIBOR | (131,650) | (89,804) |

9/16/2015

9/16/2045 | 8,995,000 | Floating — 3-Month LIBOR | Fixed — 3.0% | 838,928 | 345,563 |

| Total net unrealized appreciation | 493,014 |

Counterparties:

1 Nomura International PLC

2 Citigroup, Inc.

LIBOR: London Interbank Offered Rate; 3-Month LIBOR rate at December 31, 2015 is 0.61%.

At December 31, 2015, the Fund had the following open forward foreign currency exchange contracts:

| Contracts to Deliver | | In Exchange For | | Settlement Date | | Unrealized Appreciation ($) | Counterparty |

| BRL | 4,800,000 | | USD | 1,230,815 | | 1/5/2016 | | 17,545 | Macquarie Bank Ltd. |

| USD | 200,000 | | BRL | 800,000 | | 1/11/2016 | | 1,799 | Macquarie Bank Ltd. |

| BRL | 800,000 | | USD | 205,392 | | 1/11/2016 | | 3,593 | Macquarie Bank Ltd. |

| BRL | 1,600,000 | | USD | 411,311 | | 1/11/2016 | | 7,714 | Nomura International PLC |

| BRL | 1,600,000 | | USD | 412,219 | | 1/11/2016 | | 8,622 | BNP Paribas |

| BRL | 1,600,000 | | USD | 418,301 | | 1/11/2016 | | 14,704 | Morgan Stanley |

| EUR | 6,972,222 | | USD | 8,003,902 | | 1/19/2016 | | 423,155 | JPMorgan Chase Securities, Inc. |

| EUR | 991,830 | | USD | 1,126,438 | | 1/19/2016 | | 48,187 | Morgan Stanley |

| USD | 1,560,639 | | NZD | 2,383,000 | | 1/19/2016 | | 67,068 | Citigroup, Inc. |

| USD | 1,526,165 | | EUR | 1,436,000 | | 1/19/2016 | | 35,167 | JPMorgan Chase Securities, Inc. |

| USD | 930,818 | | MXN | 16,200,000 | | 1/20/2016 | | 8,132 | BNP Paribas |

| ZAR | 16,200,000 | | USD | 1,059,769 | | 1/20/2016 | | 15,043 | JPMorgan Chase Securities, Inc. |

| ZAR | 32,400,000 | | USD | 2,175,636 | | 1/20/2016 | | 86,185 | BNP Paribas |

| ZAR | 10,600,000 | | USD | 694,166 | | 1/28/2016 | | 11,589 | JPMorgan Chase Securities, Inc. |

| MXN | 2,042,900 | | USD | 118,619 | | 1/28/2016 | | 281 | JPMorgan Chase Securities, Inc. |

| CNY | 6,000,000 | | USD | 911,197 | | 2/25/2016 | | 4,787 | Australia & New Zealand Banking Group Ltd. |

| Total unrealized appreciation | | | | 753,571 | |

| Contracts to Deliver | | In Exchange For | | Settlement Date | | Unrealized Depreciation ($) | Counterparty |

| USD | 1,219,504 | | BRL | 4,800,000 | | 1/5/2016 | | (6,234) | Macquarie Bank Ltd. |

| MXN | 19,214,561 | | ZAR | 16,200,000 | | 1/11/2016 | | (67,943) | Nomura International PLC |

| USD | 411,576 | | BRL | 1,600,000 | | 1/11/2016 | | (7,979) | Nomura International PLC |

| USD | 1,150,765 | | MXN | 19,214,560 | | 1/11/2016 | | (36,372) | JPMorgan Chase Securities, Inc. |

| NZD | 2,383,000 | | USD | 1,603,225 | | 1/19/2016 | | (24,482) | BNP Paribas |

| USD | 6,063,437 | | EUR | 5,536,222 | | 1/19/2016 | | (44,022) | Citigroup, Inc. |

| USD | 2,124,347 | | ZAR | 32,400,000 | | 1/20/2016 | | (34,896) | BNP Paribas |

| USD | 466,838 | | COP | 1,450,000,000 | | 1/20/2016 | | (10,768) | Morgan Stanley |

| USD | 468,195 | | COP | 1,450,000,000 | | 1/20/2016 | | (12,125) | BNP Paribas |

| USD | 981,818 | | INR | 64,800,000 | | 1/29/2016 | | (6,141) | Morgan Stanley |

| USD | 934,143 | | CNY | 6,000,000 | | 2/25/2016 | | (27,734) | Australia & New Zealand Banking Group Ltd. |

| Total unrealized depreciation | | | | (278,696) | |

| Currency Abbreviations |

BRL Brazilian Dollar CNY Chinese Yuan COP Colombian Peso EUR Euro HUF Hungarian Forint IDR Indonesian Rupiah INR Indian Rupee MXN Mexican Peso NZD New Zealand Dollar USD United States Dollar ZAR South African Rand |

For information on the Fund's policy and additional disclosures regarding futures contracts, written options, credit default swap contracts, interest rate swap contracts and forward foreign currency exchange contracts, please refer to Note B in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of December 31, 2015 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | Level 1 | Level 2 | Level 3 | Total |

| |

| Fixed Income Investments (k) |

| | Corporate Bonds | $ — | $ 17,340,890 | $ — | $ 17,340,890 |

| | Mortgage-Backed Securities Pass-Throughs | — | 18,253,815 | — | 18,253,815 |

| | Asset-Backed | — | 1,767,836 | — | 1,767,836 |

| | Commercial Mortgage-Backed Securities | — | 3,000,577 | — | 3,000,577 |

| | Collateralized Mortgage Obligations | — | 6,582,031 | — | 6,582,031 |

| | Government & Agency Obligations | — | 32,310,041 | — | 32,310,041 |

| | Short-Term U.S. Treasury Obligations | — | 803,587 | — | 803,587 |

| | Municipal Bonds and Notes | — | 977,048 | — | 977,048 |

| Short-Term Investments (k) | 6,140,443 | — | — | 6,140,443 |

| Derivatives (l) |

| | Interest Rate Swap Contracts | — | 1,269,100 | — | 1,269,100 |

| | Forward Foreign Currency Exchange Contracts | — | 753,571 | — | 753,571 |

| Total | $ 6,140,443 | $ 83,058,496 | $ — | $ 89,198,939 |

| Liabilities | Level 1 | Level 2 | Level 3 | Total |

| |

| Derivatives (l) |

| | Futures Contracts | $ (126,016) | $ — | $ — | $ (126,016) |

| | Written Options | — | (120,211) | — | (120,211) |

| | Credit Default Swap Contracts | — | (2,180) | — | (2,180) |

| | Interest Rate Swap Contracts | — | (776,086) | — | (776,086) |

| | Forward Foreign Currency Exchange Contracts | — | (278,696) | — | (278,696) |

| Total | $ (126,016) | $ (1,177,173) | $ — | $ (1,303,189) |

There have been no transfers between fair value measurement levels during the year ended December 31, 2015.

(k) See Investment Portfolio for additional detailed categorizations.

(l) Derivatives include unrealized appreciation (depreciation) on open futures contracts, credit default swap contracts, interest rate swap contracts, forward foreign currency exchange contracts and written options, at value.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities

| as of December 31, 2015 |

| Assets |

Investments: Investments in non-affiliated securities, at value (cost $83,080,108) — including $1,460,838 of securities loaned | $ 81,035,825 |

| Investment in Daily Assets Fund (cost $1,522,504)* | 1,522,504 |

| Investment in Central Cash Management Fund (cost $4,617,939) | 4,617,939 |

| Total investments in securities, at value (cost $89,220,551) | 87,176,268 |

| Cash | 17,166 |

| Foreign currency, at value (cost $335,168) | 306,943 |

| Deposit with broker for futures contracts | 15,707 |

| Receivable for Fund shares sold | 129,176 |

| Interest receivable | 525,741 |

| Receivable for variation margin on centrally cleared swaps | 268,511 |

| Unrealized appreciation on forward foreign currency exchange contracts | 753,571 |

| Foreign taxes recoverable | 1,498 |

| Other assets | 3,214 |

| Total assets | 89,197,795 |

| Liabilities |

| Payable upon return of securities loaned | 1,522,504 |

| Payable for investment purchased — delayed delivery securities | 7,315,620 |

| Payable for Fund shares redeemed | 6,715 |

| Options written, at value (premiums received $155,100) | 120,211 |

| Unrealized depreciation on forward foreign currency exchange contracts | 278,696 |

| Accrued management fee | 22,417 |

| Accrued Trustees' fees | 1,428 |

| Other accrued expenses and payables | 130,394 |

| Total liabilities | 9,397,985 |

| Net assets, at value | $ 79,799,810 |

| Net Assets Consist of |

| Undistributed net investment income | 3,494,238 |

Net unrealized appreciation (depreciation) on: Investments | (2,044,283) |

| Swap contracts | 490,834 |

| Futures | (126,016) |

| Foreign currency | 446,291 |

| Written options | 34,889 |

| Accumulated net realized gain (loss) | (18,517,172) |

| Paid-in capital | 96,021,029 |

| Net assets, at value | $ 79,799,810 |

Class A Net Asset Value, offering and redemption price per share ($79,799,810 ÷ 14,528,974 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | $ 5.49 |

* Represents collateral on securities loaned.

The accompanying notes are an integral part of the financial statements.

Statement of Operations

| for the year ended December 31, 2015 |

| Investment Income |

Income: Interest (net of foreign taxes withheld of $1,703) | $ 3,046,609 |

| Income distributions — Central Cash Management Fund | 9,168 |

| Securities lending income, including income from Daily Assets Fund, net of borrower rebates | 8,843 |

| Total income | 3,064,620 |

Expenses: Management fee | 376,262 |

| Administration fee | 96,477 |

| Services to shareholders | 1,625 |

| Custodian fee | 54,192 |

| Professional fees | 90,201 |

| Reports to shareholders | 30,956 |

| Trustees' fees and expenses | 5,629 |

| Other | 11,594 |

| Total expenses before expense reductions | 666,936 |

| Expense reductions | (50,533) |

| Total expenses after expense reductions | 616,403 |

| Net investment income | 2,448,217 |

| Realized and Unrealized Gain (Loss) |

Net realized gain (loss) from: Investments | (3,142,875) |

| Swap contracts | (831,307) |

| Futures | (848,103) |

| Written options | 36,090 |

| Foreign currency | 1,465,217 |

| | (3,320,978) |

Change in net unrealized appreciation (depreciation) on: Investments | (736,463) |

| Swap contracts | 489,661 |

| Futures | (124,388) |

| Written options | 626,631 |

| Foreign currency | 527,557 |

| | 782,998 |

| Net gain (loss) | (2,537,980) |

| Net increase (decrease) in net assets resulting from operations | $ (89,763) |

The accompanying notes are an integral part of the financial statements.

Statement of Changes in Net Assets

| Increase (Decrease) in Net Assets | Years Ended December 31, |

| 2015 | 2014 |

Operations: Net investment income | $ 2,448,217 | $ 3,111,445 |

| Net realized gain (loss) | (3,320,978) | 3,604,392 |

| Change in net unrealized appreciation (depreciation) | 782,998 | (20,085) |

| Net increase (decrease) in net assets resulting from operations | (89,763) | 6,695,752 |

Distributions to shareholders from: Net investment income: Class A | (2,926,472) | (3,659,417) |

Fund share transactions: Class A Proceeds from shares sold | 11,060,840 | 11,004,710 |

| Reinvestment of distributions | 2,926,472 | 3,659,417 |

| Payments for shares redeemed | (32,571,389) | (21,178,745) |

| Net increase (decrease) in net assets from Class A share transactions | (18,584,077) | (6,514,618) |

| Increase (decrease) in net assets | (21,600,312) | (3,478,283) |

| Net assets at beginning of period | 101,400,122 | 104,878,405 |

| Net assets at end of period (including undistributed net investment income of $3,494,238 and $2,890,836, respectively) | $ 79,799,810 | $ 101,400,122 |

| Other Information |

Class A Shares outstanding at beginning of period | 17,886,425 | 19,030,134 |

| Shares sold | 1,969,516 | 1,948,624 |

| Shares issued to shareholders in reinvestment of distributions | 520,725 | 662,938 |

| Shares redeemed | (5,847,692) | (3,755,271) |

| Net increase (decrease) in Class A shares | (3,357,451) | (1,143,709) |

| Shares outstanding at end of period | 14,528,974 | 17,886,425 |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

| Class A | |

Years Ended December 31, |

| 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per Share Data |

| Net asset value, beginning of period | $ 5.67 | $ 5.51 | $ 5.89 | $ 5.72 | $ 5.66 |

Income (loss) from investment operations: Net investment incomea | .14 | .17 | .16 | .16 | .22 |

| Net realized and unrealized gain (loss) | (.15) | .19 | (.33) | .27 | .09 |

| Total from investment operations | (.01) | .36 | (.17) | .43 | .31 |

Less distributions from: Net investment income | (.17) | (.20) | (.21) | (.26) | (.25) |

| Net asset value, end of period | $ 5.49 | $ 5.67 | $ 5.51 | $ 5.89 | $ 5.72 |

| Total Return (%) | (.29)b | 6.63b | (3.03)b | 7.77 | 5.68 |

| Ratios to Average Net Assets and Supplemental Data |

| Net assets, end of period ($ millions) | 80 | 101 | 105 | 190 | 112 |

| Ratio of expenses before expense reductions (%) | .69 | .69 | .65 | .58 | .62 |

| Ratio of expenses after expense reductions (%) | .64 | .61 | .56 | .58 | .62 |

| Ratio of net investment income (%) | 2.54 | 2.99 | 2.88 | 2.81 | 3.86 |

| Portfolio turnover rate (%) | 197 | 273 | 418 | 115 | 219 |

a Based on average shares outstanding during the period. b Total return would have been lower had certain expenses not been reduced. |

Notes to Financial Statements

A. Organization and Significant Accounting Policies

Deutsche Variable Series I (the "Trust") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end, registered management investment company organized as a Massachusetts business trust. The Trust consists of five diversified funds: Deutsche Bond VIP, Deutsche Capital Growth VIP, Deutsche Core Equity VIP, Deutsche CROCI® International VIP (formerly Deutsche International VIP) and Deutsche Global Small Cap VIP (individually or collectively hereinafter referred to as a "Fund" or the "Funds"). These financial statements report on Deutsche Bond VIP. The Trust is intended to be the underlying investment vehicle for variable annuity contracts and variable life insurance policies to be offered by the separate accounts of certain life insurance companies ("Participating Insurance Companies").

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Debt securities are valued at prices supplied by independent pricing services approved by the Trustees of the Series. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, prepayment speeds and other data, as well as broker quotes. If the pricing services are unable to provide valuations, debt securities are valued at the average of the most recent reliable bid quotations or evaluated prices, as applicable, obtained from broker-dealers. These securities are generally categorized as Level 2.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Futures contracts are generally valued at the settlement prices established each day on the exchange on which they are traded and are categorized as Level 1.

Swap contracts are valued daily based upon prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer. Swap contracts are generally categorized as Level 2.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and are categorized as Level 2.

Exchange-traded options are valued at the last sale price or, in the absence of a sale, the mean between the closing bid and asked prices or at the most recent asked price (bid for purchased options) if no bid or asked price are available. Exchange-traded options are generally categorized as Level 1. Over-the-counter written or purchased options are valued at prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer with which the option was traded. Over-the-counter written or purchased options are generally categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Trustees and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors considered in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund's Investment Portfolio.

Securities Lending. Deutsche Bank AG, as lending agent, lends securities of the Fund to certain financial institutions under the terms of the Security Lending Agreement. The Fund retains the benefits of owning the securities it has loaned and continues to receive interest and dividends generated by the securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at least equal to the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the security lending agreement. The Fund may invest the cash collateral into a joint trading account in an affiliated money market fund pursuant to Exemptive Orders issued by the SEC. During the year ended December 31, 2015, the Fund invested the cash collateral in Daily Assets Fund, an affiliated money market fund managed by Deutsche Investment Management Americas Inc. Deutsche Investment Management Americas Inc. receives a management/administration fee (0.08% annualized effective rate as of December 31, 2015) on the cash collateral invested in Daily Assets Fund. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. If the Fund is not able to recover securities lent, the Fund may sell the collateral and purchase a replacement investment in the market, incurring the risk that the value of the replacement security is greater than the value of the collateral. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

As of December 31, 2015, the Fund had securities on loan. The value of the related collateral exceeded the value of the securities loaned at period end.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

When-Issued/Delayed Delivery Securities. The Fund may purchase or sell securities with delivery or payment to occur at a later date beyond the normal settlement period. At the time the Fund enters into a commitment to purchase or sell a security, the transaction is recorded and the value of the transaction is reflected in the net asset value. The price of such security and the date when the security will be delivered and paid for are fixed at the time the transaction is negotiated. The value of the security may vary with market fluctuations. At the time the Fund enters into a purchase transaction it is required to segregate cash or other liquid assets at least equal to the amount of the commitment. Additionally, the Fund may be required to post securities and/or cash collateral in accordance with the terms of the commitment.

Certain risks may arise upon entering into when-issued or delayed delivery transactions from the potential inability of counterparties to meet the terms of their contracts or if the issuer does not issue the securities due to political, economic, or other factors. Additionally, losses may arise due to changes in the value of the underlying securities.

Taxes. The Fund is treated as a separate taxpayer as provided for in the Internal Revenue Code, as amended. It is the Fund's policy to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to the separate accounts of the Participating Insurance Companies which hold its shares.

Additionally, the Fund may be subject to taxes imposed by the governments of countries in which it invests and are generally based on income and/or capital gains earned or repatriated. Estimated tax liabilities on certain foreign securities are recorded on an accrual basis and are reflected as components of interest income or net change in unrealized gain/loss on investments. Tax liabilities realized as a result of security sales are reflected as a component of net realized gain/loss on investments.

Under the Regulated Investment Company Modernization Act of 2010, net capital losses incurred post-enactment may be carried forward indefinitely, and their character is retained as short-term and/or long-term. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

At December 31, 2015, the Fund had a net tax basis capital loss carryforward of approximately $14,056,000 of pre-enactment losses, which may be applied against any realized net taxable capital gains of each succeeding year until fully utilized or until December 31, 2017, the expiration date, whichever occurs first; and approximately $4,561,000 of post-enactment losses, which may be applied against realized net taxable capital gains indefinitely, including short-term losses ($1,170,000) and long-term losses ($3,391,000).

The Fund has reviewed the tax positions for the open tax years as of December 31, 2015 and has determined that no provision for income tax and/or uncertain tax provisions is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund, if any, are declared and distributed to shareholders annually. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to investments in foreign denominated investments, investments in forward foreign currency exchange contracts, futures contracts, swap contracts and certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

At December 31, 2015, the Fund's components of distributable earnings (accumulated losses) on a tax basis are as follows:

| Undistributed ordinary income* | $ 3,977,470 |

| Capital loss carryforwards | $ (18,617,000) |

| Net unrealized appreciation (depreciation) on investments | $ (2,047,785) |

In addition, the tax character of distributions paid to shareholders by the Fund is summarized as follows:

| | Years Ended December 31, |

| | 2015 | 2014 |

| Distributions from ordinary income* | $ 2,926,472 | $ 3,659,417 |

* For tax purposes, short-term capital gain distributions are considered ordinary income distributions.

Expenses. Expenses of the Trust arising in connection with a specific Fund are allocated to that Fund. Other Trust expenses which cannot be directly attributed to a Fund are apportioned among the Funds in the Trust based upon the relative net assets or other appropriate measures.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis net of foreign withholding taxes. Realized gains and losses from investment transactions are recorded on an identified cost basis. Proceeds from litigation payments, if any, are included in net realized gain (loss) from investments. All discounts and premiums are accreted/amortized for both tax and financial reporting purposes.

B. Derivative Instruments

Futures Contracts. A futures contract is an agreement between a buyer or seller and an established futures exchange or its clearinghouse in which the buyer or seller agrees to take or make a delivery of a specific amount of a financial instrument at a specified price on a specific date (settlement date). For the year ended December 31, 2015, the Fund invested in interest rate futures to gain exposure to different parts of the yield curve while managing the overall duration. The Fund also entered into interest rate futures contracts for non-hedging purposes to seek to enhance potential gains.

Upon entering into a futures contract, the Fund is required to deposit with a financial intermediary cash or securities ("initial margin") in an amount equal to a certain percentage of the face value indicated in the futures contract. Subsequent payments ("variation margin") are made or received by the Fund dependent upon the daily fluctuations in the value and are recorded for financial reporting purposes as unrealized gains or losses by the Fund. Gains or losses are realized when the contract expires or is closed. Since all futures contracts are exchange traded, counterparty risk is minimized as the exchange's clearinghouse acts as the counterparty, and guarantees the futures against default.

Certain risks may arise upon entering into futures contracts, including the risk that an illiquid market will limit the Fund's ability to close out a futures contract prior to the settlement date and the risk that the futures contract is not well correlated with the security, index or currency to which it relates. Risk of loss may exceed amounts disclosed in the Statement of Assets and Liabilities.

A summary of the open futures contracts as of December 31, 2015, is included in a table following the Fund's Investment Portfolio. For the year ended December 31, 2015, the investment in futures contracts purchased had a total notional value generally indicative of a range from approximately $5,369,000 to $20,649,000, and the investment in futures contracts sold had a total notional value generally indicative of a range from approximately $3,895,000 to $38,428,000.

Options. An option contract is a contract in which the writer (seller) of the option grants the buyer of the option, upon payment of a premium, the right to purchase from (call option), or sell to (put option), the writer a designated instrument at a specified price within a specified period of time. The Fund may write or purchase interest rate swaption agreements which are options to enter into a pre-defined swap agreement. The interest rate swaption agreement will specify whether the buyer of the swaption will be a fixed-rate receiver or a fixed-rate payer upon exercise. Certain options, including options on indices, will require cash settlement by the Fund if exercised. For the year ended December 31, 2015, the Fund entered into options interest rate swaps in order to hedge against potential adverse interest rate movements of portfolio assets.

If the Fund writes a covered call option, the Fund foregoes, in exchange for the premium, the opportunity to profit during the option period from an increase in the market value of the underlying security above the exercise price. If the Fund writes a put option it accepts the risk of a decline in the value of the underlying security below the exercise price. Over-the-counter options have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund's maximum exposure to purchased options is limited to the premium initially paid. In addition, certain risks may arise upon entering into option contracts including the risk that an illiquid secondary market will limit the Fund's ability to close out an option contract prior to the expiration date and that a change in the value of the option contract may not correlate exactly with changes in the value of the securities or currencies hedged.

There are no open purchased option contracts as of December 31, 2015. A summary of open written option contracts is included in the table following the Fund's Investment Portfolio. For the year ended December 31, 2015, the investment in written options contracts had a total value generally indicative of a range from approximately $120,000 to $923,000.

Swaps. A swap is a contract between two parties to exchange future cash flows at periodic intervals based on the notional amount of the swap. A bilateral swap is a transaction between the fund and a counterparty where cash flows are exchanged between the two parties. A centrally cleared swap is a transaction executed between the fund and a counterparty, then cleared by a clearing member through a central clearinghouse. The central clearinghouse serves as the counterparty, with whom the fund exchanges cash flows.

The value of a swap is adjusted daily, and the change in value, if any, is recorded as unrealized appreciation or depreciation in the Statement of Assets and Liabilities. Gains or losses are realized when the swap expires or is closed. Certain risks may arise when entering into swap transactions including counterparty default; liquidity; or unfavorable changes in interest rates or the value of the underlying reference security, commodity or index. In connection with bilateral swaps, securities and/or cash may be identified as collateral in accordance with the terms of the swap agreement to provide assets of value and recourse in the event of default. The maximum counterparty credit risk is the net present value of the cash flows to be received from or paid to the counterparty over the term of the swap, to the extent that this amount is beneficial to the Fund, in addition to any related collateral posted to the counterparty by the Fund. This risk may be partially reduced by a master netting arrangement between the Fund and the counterparty. Upon entering into a centrally cleared swap, the Fund is required to deposit with a financial intermediary cash or securities ("initial margin") in an amount equal to a certain percentage of the notional amount of the swap. Subsequent payments ("variation margin") are made or received by the Fund dependent upon the daily fluctuations in the value of the swap. In a cleared swap transaction, counterparty risk is minimized as the central clearinghouse acts as the counterparty.

An upfront payment, if any, made by the Fund is recorded as an asset in the Statement of Assets and Liabilities. An upfront payment, if any, received by the Fund is recorded as a liability in the Statement of Assets and Liabilities. Payments received or made at the end of the measurement period are recorded as realized gain or loss in the Statement of Operations.