Item 1. Reports to Stockholders

Fixed income mutual fund

Delaware Emerging Markets Debt Fund

July 31, 2018

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail. Visit delawarefunds.com/edelivery.

Experience Delaware Funds® by Macquarie

Macquarie Investment Management (MIM) is a global asset manager with offices throughout the United States, Europe, Asia, and Australia. We are active managers who prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for our clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 75 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Emerging Markets Debt Fund at delawarefunds.com/literature.

Manage your account online

| ● | | Check your account balance and transactions |

| ● | | View statements and tax forms |

| ● | | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. Macquarie Investment Management (MIM) is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following registered investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Capital Investment Management LLC.

The Fund is distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Fund is governed by US laws and regulations.

Unless otherwise noted, views expressed herein are current as of July 31, 2018, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2018 Macquarie Management Holdings, Inc.

| | |

| Portfolio management review | | |

| Delaware Emerging Markets Debt Fund | | August 7, 2018 |

| | | | | | | | |

Performance preview (for the year ended July 31, 2018) | | | | | | | | |

Delaware Emerging Markets Debt Fund (Institutional Class shares) | | | 1-year return | | | | +0.16 | % |

Delaware Emerging Markets Debt Fund (Class A shares) | | | 1-year return | | | | -0.10 | % |

J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified (benchmark) | | | 1-year return | | | | +0.51 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Emerging Markets Debt Fund, please see the table on page 5. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Please see page 8 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

For the first six months of the fiscal year ended July 31, 2018, emerging market economies continued to benefit from the favorable macro conditions that had characterized the previous 12 months. Fiscal expansion in the United States, a slow but steady rebound in the euro zone, and continued growth in China’s economy were all contributing factors to a generally favorable period that investors characterized as globally coordinated growth.

Beginning in January 2018 and continuing through the end of the fiscal period, however, many of these macro fundamentals slowed down and then reversed. First, and foremost, beginning with the US Federal Reserve and subsequently echoed somewhat by the Bank of Japan and the European Central Bank, there was a shift in developed-market central banks from a fairly easy monetary stance to a tighter one. As interest rates on an absolute, risk-free basis began to rise, the US dollar gained strength, casting a pall on emerging market economies.

Secondarily, China’s economy, upon which many emerging markets depend, began to slow during this period. As the largest consumer of many of the commodities exported by emerging market countries, China’s economic health is a crucial factor in emerging market performance (source: Bloomberg). When the fiscal year began in August 2017, we believe the Chinese growth

While there may be some truth to the

saying that a rising tide lifts all boats, it

seems that when the tide goes out, a lot

depends on the precise location of each

boat. In the case of emerging markets,

virtually all countries benefited from the

benign macro environment that

persisted through the end of 2017, and

we believe investors tended to look no

further for an explanation of their

positive performance. However, the

broadly tightening conditions that took

hold early in 2018 heightened

sensitivities to idiosyncratic factors

within emerging markets, driving greater

country performance dispersion.

| | |

| Portfolio management review | | |

| Delaware Emerging Markets Debt Fund | | |

was pumped up somewhat artificially in support of President Xi Jinping’s political agenda, which included the elimination of term limits. However, starting in January 2018, we began to see a return to economic reality in China.

Equally, if not more important, was the relative strength of the US dollar. Throughout the last six months of 2017, the dollar had been relatively weak, which, in our view, is advantageous for emerging market countries that issue bonds denominated in dollars. A weak dollar effectively lowers the cost of servicing the interest on the bonds that they have issued. When the dollar rises, the cost of servicing those bonds increases commensurately. It also supports benign inflation dynamics and strong commodity pricing. From the beginning of the fiscal year through mid-February 2018, the US Dollar Index declined 4.6%, creating a favorable backdrop for emerging market debt. From that point on, however, and continuing through the end of the fiscal year, the US Dollar Index gained 6.7%, which created significant pressure on that debt.

The looming threat and, ultimately, the imposition of US tariffs on trade were another factor that adversely affected emerging market economies during the fiscal year. As the fiscal period began and for much of the period, investors generally considered the Trump administration’s rhetoric as little more than posturing for a better deal. When the threats came closer to fruition, however, markets repriced accordingly. In the past, investors found what was good for the US was also good for emerging markets. If the US economy grew at a certain rate, investors could expect an even higher factor of growth for its emerging market trading partners. With the imposition of tariffs, however, that factor appears to be decreasing. In essence, advancing a protectionist trade agenda weakened global growth forecasts during the latter half of the fiscal year.

While there may be some truth to the saying that a rising tide lifts all boats, it seems that when the tide goes out, a lot depends on the precise location of each boat. In the case of emerging markets, virtually all countries benefited from the benign macro environment that persisted through the end of 2017, and we believe investors tended to look no further for an explanation of their positive performance. However, the broadly tightening conditions that took hold early in 2018 heightened sensitivities to idiosyncratic factors within emerging markets, driving greater country performance dispersion.

Two countries represented in the Fund’s portfolio — Argentina and Turkey — experienced dramatic declines in their currencies. Over the course of the fiscal year, the Argentine peso declined nearly 36% versus the dollar while the Turkish lira depreciated more than 28%. In both cases, political uncertainty played a significant role. Although Mexico’s currency also depreciated during the fiscal period, it stood in stark contrast as the Mexican peso gained strength in the latter half of the fiscal year as political uncertainty concerning its presidential election stabilized following the victory of Andres Manuel Lopez Obrador in early July 2018.

Within the Fund

For the fiscal year ended July 31, 2018, Delaware Emerging Markets Debt Fund underperformed its benchmark, the J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified. The Fund’s Institutional Class shares returned +0.16%. The Fund’s Class A shares declined -0.10% at net asset value and -4.59% at maximum offer price. These figures reflect all distributions reinvested. For the same period, the Fund’s benchmark returned +0.51%. For complete annualized performance for Delaware Emerging Markets Debt Fund, please see the table on page 5.

The Fund’s underperformance relative to the benchmark was partially the result of the sharp change in the economic environment that occurred early in 2018. As the Fund’s fiscal year progressed, attempting to take advantage of the then favorable financing conditions balanced by interest rate concerns, the Fund decreased duration (a measure of a bond’s price sensitivity to changes in interest rates) and increased its exposure to high yield relative to high grade securities, raising high yield exposure from 55% to 58% of the portfolio, with a corresponding decrease in high grade exposure from 45% to 42%. Since January 2018, however, given ongoing concern about higher interest rates and tightening financing conditions, the Fund shortened duration further and reduced its high yield exposure to 52% while increasing its high grade position to 48%. These dynamic changes in portfolio positioning acted to reduce underperformance relative to the benchmark, but were insufficient in overcoming the sharp downturns that took place in several countries.

Argentina was the most significant detractor from the Fund’s performance during the fiscal year, affected by both country and credit selection. We carried an overweight position in Argentina into the beginning of the fiscal year, based on our belief that Mauricio Macri — elected president in 2015 and a former J.P. Morgan banker who spoke the language of the markets — could execute a financial turnaround and get Argentina re-engaged with the markets. However, in our opinion, Macri and the government acted too slowly and failed to enact a credible fiscal program. Even though Argentina has now secured a $50 billion program from the International Monetary Fund (IMF), investors remain skeptical. We owned bonds linked to the peso that were issued by YPF S.A., the Argentine national oil company. Even though the company has decent leverage metrics versus its peers and a fairly compelling growth opportunity, it declined sharply given investors’

broad Argentinian risk-off sentiment and currency depreciation. We maintained the Fund’s position in the bonds based on solid fundamentals and a belief that IMF support could ultimately stabilize Argentine assets.

Turkey was another significant detractor during fiscal period. We transitioned the Fund from an underweight position relative to the benchmark to an overweight just prior to the election held on June 24, 2018. Typically, markets settle down after an election, as the pre-election rhetoric cools off. Unfortunately, this was not one of those times. Once viewed as a market savior, Turkish president Recep Tayyip Erdogan increasingly seems driven purely by politics, in our view. Shedding his prior hands-off approach, he now openly criticizes central bank policy and independence, creating a two-pronged problem as the market struggles with both currency depreciation and inflation. Further, his policy shift on Syria, in defiance of Turkey’s North Atlantic Treaty Organization (NATO) allies, seems to have further alienated investors. Among the Fund’s Turkish holdings, we were heavily skewed toward banks, given that corporates were trading tight relative to sovereign bonds. We held subordinated bonds of two banks, Akbank Turk AS and Turkiye Is Bankasi AS. Despite the strength of these Turkish banks, they were punished inordinately as investors fled the country. We maintained the Fund’s positions in both banks as they have solid capital buffers to absorb some of the volatility; however, we are constantly assessing relative value and may dispose of these positions going forward.

Mexico also detracted from performance, as we took the Fund from a neutral position relative to the benchmark to an underweight and then back to neutral following the presidential election in early July 2018. In our view, the Fund underperformed moderately based on credit selection. Although the election is over, uncertainty continues to hang over the market. President-elect Lopez Obrador will not take office

| | |

| Portfolio management review | | |

| Delaware Emerging Markets Debt Fund | | |

until Dec. 1, though he has already made some policy pronouncements. Additionally, Mexico and the US continued to trade barbs over the renegotiation of the North American Free Trade Agreement (NAFTA).

Angola was the leading contributor to the Fund’s performance during the fiscal year, as its sovereign bonds performed well. A new government proved more market friendly, engaging the IMF for policy supervision. That seemed to help improve investors’ view as it regained access to capital markets. Higher oil prices also contributed.

The Fund’s investments in Israel also performed well, benefiting from both its sector and credit selection. Absent a position in Teva Pharmaceutical Finance, both a poor performer and a large position in the benchmark, the Fund was significantly underweight for much of the fiscal period. We renewed the Fund’s position in Teva Pharmaceutical after new management and a turnaround plan were put in place.

Elsewhere, Chile performed well, benefiting from strong credit selection. Egypt, an overweight position in the Fund, benefited from strong fiscal performance under an IMF program. Additionally, Kazakhstan benefited from higher commodity prices and a low level of political malaise.

A note about derivatives

During the fiscal year, Delaware Emerging Markets Debt Fund invested in currency hedges in forward foreign exchange contracts, options, and credit default swaps. These positions did not have a material effect on the Fund’s performance, contributing 0.15 percentage points for the fiscal year. The total outstanding notional exposure at the end of the fiscal year was -10.35% (notional value is the face amount of a security that is used to calculate the payout on a derivative contract of that underlying security at settlement).

| | |

| Performance summary | | |

| Delaware Emerging Markets Debt Fund | | July 31, 2018 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| | | | | | | | |

| Fund and benchmark performance1, 2, 3 | | Average annual total returns through July 31, 2018 |

| | | | |

| | | 1 year | | 3 years | | 5 years | | Lifetime |

Class A (Est. Sept. 30, 2013) | | | | | | | | |

Excluding sales charge | | -0.10% | | +5.12% | | +3.95% | | +5.73% |

Including sales charge | | -4.59% | | +3.52% | | +3.00% | | +5.11% |

Class C (Est. Sept. 30, 2013) | | | | | | | | |

Excluding sales charge | | -0.84% | | +4.72% | | +3.59% | | +5.22% |

Including sales charge | | -1.78% | | +4.72% | | +3.59% | | +5.22% |

Class R (Est. Sept. 30, 2013) | | | | | | | | |

Excluding sales charge | | +0.16% | | +5.20% | | +3.97% | | +5.65% |

Including sales charge | | +0.16% | | +5.20% | | +3.97% | | +5.65% |

Institutional Class (Est. Sept. 30, 2013) | | | | | | | | |

Excluding sales charge | | +0.16% | | +5.24% | | +4.10% | | +5.92% |

Including sales charge | | +0.16% | | +5.24% | | +4.10% | | +5.92% |

J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified | | +0.51% | | +4.46% | | +4.86% | | +4.97%* |

*The benchmark lifetime return is for Class A share comparison only and is calculated using the last business day in the month of the Fund’s Class A inception date.

1 A privately offered fund managed by the Fund’s portfolio manager was reorganized into the Fund and the Fund commenced operations on Sept. 30, 2013. This privately offered fund commenced operations on Nov. 3, 2010 and had an investment objective and strategies that were, in all material respects, the same as those of the Fund, and was managed in a manner that, in all material respects, complied with the investment guidelines and restrictions of the Fund. However, the privately offered fund was not registered as an investment under the Investment Company Act of 1940 (1940 Act). As a result, the privately offered fund was not subject to certain investment limitations, diversification requirements, liquidity requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of

1986, as amended, which, if applicable, may have adversely affected its performance.

The Fund’s performance for the periods prior to its commencement of operations on Sept. 30, 2013 is that of the privately offered fund. Because the privately offered fund was a master fund that did not charge any management or other asset-based fees, the privately offered fund’s performance shown above has been restated, on a one-time basis, to reflect the fees, expenses, and waivers and reimbursements for each class of the Fund at the commencement of the Fund’s operations. If the performance of the privately offered fund had not been restated, the performance for such classes may have been higher than the performance shown in the average annual total returns table above.

| | |

| Performance summary | | |

| Delaware Emerging Markets Debt Fund | | |

2 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 7. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual distribution and service fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of 0.50% of average daily net assets.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Fund to obtain precise valuations of the high yield securities in its portfolio.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

Diversification may not protect against market risk.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

Leverage risk is the risk associated with securities or practices (for example, borrowing and the use of certain derivatives) and investment in certain types of derivatives that multiply small index or market movements into larger changes in value. Use of derivative instruments may involve leverage. Leverage magnifies the potential for gain and the risk of loss. As a result, a relatively small

decline in the value of the underlying investments could result in a relatively large loss. Although the Fund will seek to manage the Fund’s risk from the leverage associated with derivative investments by closely monitoring the volatility of such investments, the Fund may not be successful in this respect.

3 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.79% of the Fund’s average daily net assets during the period from April 1, 2018 to July 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| | | | | | | | |

| | | | |

| Fund expense ratios | | Class A | | Class C | | Class R | | Institutional Class |

Total annual operating expenses (without fee waivers) | | 1.91% | | 2.66% | | 2.16% | | 1.66% |

Net expenses (including fee waivers, if any) | | 1.04% | | 1.79% | | 1.29% | | 0.79% |

| Type of waiver | | Contractual | | Contractual | | Contractual

(Investment

manager

waiver);

Voluntary

(12b-1 fee

waiver) | | Contractual |

*For the period Aug. 1, 2017 to Nov. 27, 2017, the waiver was set at 1.00% of the Fund’s average daily net assets and for the period Nov. 28, 2017 to March 31, 2018, the waiver was set at 0.95% of the Fund’s average daily net assets. The aggregate contractual waiver period covering this report is from Nov. 28, 2016 through April 1, 2019.

| | |

| Performance summary | | |

| Delaware Emerging Markets Debt Fund | | |

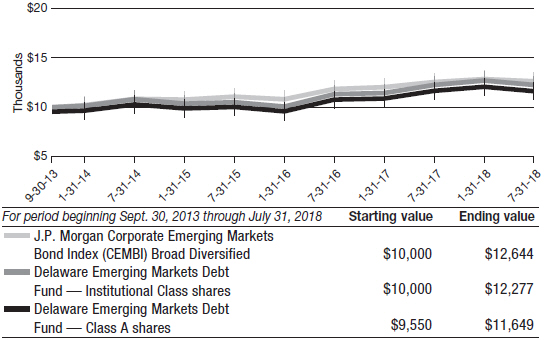

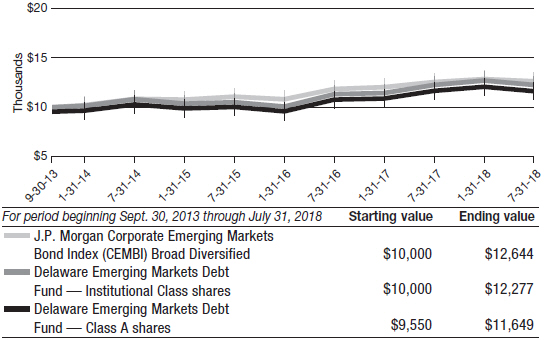

Performance of a $10,000 investment1

Average annual total returns from Sept. 30, 2013 (Fund’s inception) through July 31, 2018

1 The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on Sept. 30, 2013, and includes the effect of a 4.50% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 7. Please note additional details on pages 5 through 9.

The graph also assumes $10,000 invested in the J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified as of Sept. 30, 2013. The J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified tracks US dollar–denominated

emerging market corporate bonds, limiting the weights of countries with larger corporate debt stocks by including only a specified portion of those countries’ eligible current face amounts of debt outstanding.

The US Dollar Index, mentioned on page 2, measures the weighted mean value of the US dollar relative to a basket of six foreign currencies: the euro, Japanese yen, British pound sterling, Canadian dollar, Swedish krona, and Swiss franc. The index goes up when the US dollar gains strength, or value, compared to other currencies.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | | | | | |

| | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | DEDAX | | 246094841 | | |

Class C | | DEDCX | | 246094833 | | |

Class R | | DEDRX | | 246094825 | | |

Institutional Class | | DEDIX | | 246094817 | | |

| | |

| Disclosure of Fund expenses | | |

| For the six-month period February 1, 2018 to July 31, 2018 (Unaudited) | | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from Feb. 1, 2018 to July 31, 2018.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect. The expenses shown in the table assume reinvestment of all dividends and distributions.

Delaware Emerging Markets Debt Fund

Expense analysis of an investment of $1,000

| | | | | | | | | | | | | | | | |

| | | Beginning | | | Ending | | | | | | Expenses | |

| | | Account Value | | | Account Value | | | Annualized | | | Paid During Period | |

| | | 2/1/18 | | | 7/31/18 | | | Expense Ratio | | | 2/1/18 to 7/31/18* | |

| | | | |

Actual Fund return† | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $964.00 | | | | 1.09% | | | | $5.31 | |

Class C | | | 1,000.00 | | | | 960.40 | | | | 1.84% | | | | 8.94 | |

Class R | | | 1,000.00 | | | | 965.10 | | | | 0.84% | | | | 4.09 | |

Institutional Class | | | 1,000.00 | | | | 965.20 | | | | 0.84% | | | | 4.09 | |

| | | | |

Hypothetical 5% return (5% return before expenses) | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,019.39 | | | | 1.09% | | | | $5.46 | |

Class C | | | 1,000.00 | | | | 1,015.67 | | | | 1.84% | | | | 9.20 | |

Class R | | | 1,000.00 | | | | 1,020.63 | | | | 0.84% | | | | 4.21 | |

Institutional Class | | | 1,000.00 | | | | 1,020.63 | | | | 0.84% | | | | 4.21 | |

| * | “Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| † | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

11

Security type / country and sector allocation

| | |

| Delaware Emerging Markets Debt Fund | | As of July 31, 2018 (Unaudited) |

Sector designations may be different than the sector designations presented in other fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| | | | |

Security type / country | | | Percentage of net assets | |

Corporate Bonds by Country | | | 70.53% | |

Argentina | | | 4.02% | |

Australia | | | 1.42% | |

Brazil | | | 11.75% | |

Chile | | | 4.62% | |

China | | | 3.72% | |

Colombia | | | 1.78% | |

Dominican Republic | | | 0.96% | |

Georgia | | | 0.92% | |

Ghana | | | 1.09% | |

Guatemala | | | 0.95% | |

Hong Kong | | | 1.20% | |

India | | | 1.72% | |

Indonesia | | | 1.82% | |

Israel | | | 3.02% | |

Jamaica | | | 0.59% | |

Kazakhstan | | | 1.84% | |

Kuwait | | | 1.13% | |

Mexico | | | 5.28% | |

Morocco | | | 1.35% | |

Netherlands | | | 1.00% | |

Peru | | | 0.87% | |

Republic of Korea | | | 0.91% | |

Russia | | | 3.98% | |

Singapore | | | 1.13% | |

South Africa | | | 2.75% | |

Spain | | | 0.82% | |

Turkey | | | 3.41% | |

Ukraine | | | 2.86% | |

United Arab Emirates | | | 1.77% | |

Zambia | | | 1.85% | |

Loan Agreement | | | 1.50% | |

Regional Bonds | | | 1.20% | |

Sovereign Bonds by Country | | | 18.94% | |

Angola | | | 0.97% | |

Argentina | | | 1.87% | |

Azerbaijan | | | 0.63% | |

Bermuda | | | 0.87% | |

Brazil | | | 0.34% | |

12

| | | | |

Security type / country | | | Percentage of net assets | |

Dominican Republic | | | 1.51% | |

Egypt | | | 1.82% | |

Ivory Coast | | | 0.85% | |

Jordan | | | 1.12% | |

Mexico | | | 0.07% | |

Mongolia | | | 0.90% | |

Nigeria | | | 0.95% | |

Qatar | | | 0.95% | |

Senegal | | | 1.04% | |

South Africa | | | 2.44% | |

Turkey | | | 0.89% | |

Ukraine | | | 1.72% | |

Supranational Banks | | | 2.37% | |

Options Purchased | | | 0.25% | |

Short-Term Investments | | | 2.12% | |

Total Value of Securities | | | 96.91% | |

Receivables and Other Assets Net of Liabilities | | | 3.09% | |

Total Net Assets | | | 100.00% | |

| |

Corporate bonds by sector | | | Percentage of net assets | |

Banking | | | 12.75% | |

Basic Industry | | | 16.39% | |

Capital Goods | | | 0.90% | |

Communications | | | 4.29% | |

Consumer Cyclical | | | 1.87% | |

Consumer Non-Cyclical | | | 9.28% | |

Electric | | | 6.82% | |

Energy | | | 16.46% | |

Transportation | | | 0.88% | |

Utilities | | | 0.89% | |

Total | | | 70.53% | |

13

| | |

| Schedule of investments | | |

| Delaware Emerging Markets Debt Fund | | July 31, 2018 |

| | | | | | | | | | | | |

| | | | | | Principal amount° | | | Value (US $) | |

Corporate Bonds – 70.53%D | | | | | | | | | | | | |

| | |

Argentina – 4.02% | | | | | | | | | | | | |

Rio Energy 144A 6.875% 2/1/25 # | | | | | | | 225,000 | | | $ | 187,650 | |

Tecpetrol 144A 4.875% 12/12/22 # | | | | | | | 335,000 | | | | 316,156 | |

Transportadora de Gas del Sur 144A 6.75% 5/2/25 # | | | | | | | 170,000 | | | | 160,599 | |

YPF | | | | | | | | | | | | |

144A 7.00% 12/15/47 # | | | | | | | 150,000 | | | | 121,031 | |

144A 36.75% (BADLARPP + 4.00%) 7/7/20 #• | | | | | | | 170,000 | | | | 92,521 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 877,957 | |

| | | | | | | | | | | | |

Australia – 1.42% | | | | | | | | | | | | |

Adani Abbot Point Terminal 144A 4.45% 12/15/22 # | | | | | | | 340,000 | | | | 310,301 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 310,301 | |

| | | | | | | | | | | | |

Brazil – 11.75% | | | | | | | | | | | | |

Aegea Finance 144A 5.75% 10/10/24 # | | | | | | | 200,000 | | | | 193,300 | |

Banco do Brasil 144A 4.875% 4/19/23 # | | | | | | | 315,000 | | | | 310,181 | |

Braskem Netherlands Finance 144A 4.50% 1/10/28 # | | | | | | | 315,000 | | | | 303,077 | |

Cemig Geracao e Transmissao 144A 9.25% 12/5/24 # | | | | | | | 270,000 | | | | 282,461 | |

CSN Resources 144A 7.625% 2/13/23 # | | | | | | | 205,000 | | | | 194,240 | |

ESAL 144A 6.25% 2/5/23 # | | | | | | | 200,000 | | | | 195,060 | |

JBS USA LUX 144A 6.75% 2/15/28 # | | | | | | | 120,000 | | | | 113,550 | |

Marfrig Holdings Europe 144A 8.00% 6/8/23 # | | | | | | | 200,000 | | | | 205,250 | |

Petrobras Global Finance | | | | | | | | | | | | |

7.25% 3/17/44 | | | | | | | 105,000 | | | | 103,556 | |

7.375% 1/17/27 | | | | | | | 130,000 | | | | 135,330 | |

Rede D’or Finance 144A 4.95% 1/17/28 # | | | | | | | 200,000 | | | | 183,375 | |

Suzano Austria 144A 7.00% 3/16/47 # | | | | | | | 200,000 | | | | 214,500 | |

Swiss Insured Brazil Power Finance 144A 9.85% 7/16/32 # | | | BRL | | | | 500,000 | | | | 129,553 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,563,433 | |

| | | | | | | | | | | | |

Chile – 4.62% | | | | | | | | | | | | |

AES Gener 144A 8.375% 12/18/73 #µ | | | | | | | 200,000 | | | | 208,000 | |

Banco de Credito e Inversiones 144A 3.50% 10/12/27 # | | | | | | | 200,000 | | | | 185,125 | |

Enel Chile 4.875% 6/12/28 | | | | | | | 205,000 | | | | 210,029 | |

Geopark 144A 6.50% 9/21/24 # | | | | | | | 200,000 | | | | 198,084 | |

VTR Finance 144A 6.875% 1/15/24 # | | | | | | | 200,000 | | | | 207,480 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,008,718 | |

| | | | | | | | | | | | |

China – 3.72% | | | | | | | | | | | | |

Baidu 4.375% 3/29/28 | | | | | | | 215,000 | | | | 213,410 | |

Bank of China 144A 5.00% 11/13/24 # | | | | | | | 205,000 | | | | 211,106 | |

BOC Aviation 144A 2.375% 9/15/21 # | | | | | | | 200,000 | | | | 191,193 | |

JD.com 3.125% 4/29/21 | | | | | | | 200,000 | | | | 195,116 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 810,825 | |

| | | | | | | | | | | | |

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

Corporate BondsD (continued) | | | | | | | | |

| |

Colombia – 1.78% | | | | | | | | |

Ecopetrol | | | | | | | | |

5.875% 9/18/23 | | | 50,000 | | | $ | 53,700 | |

7.375% 9/18/43 | | | 110,000 | | | | 126,087 | |

Frontera Energy 144A 9.70% 6/25/23 # | | | 200,000 | | | | 209,250 | |

| | | | | | | | |

| | | | | | | 389,037 | |

| | | | | | | | |

Dominican Republic – 0.96% | | | | | | | | |

AES Andres 144A 7.95% 5/11/26 # | | | 200,000 | | | | 209,000 | |

| | | | | | | | |

| | | | | | | 209,000 | |

| | | | | | | | |

Georgia – 0.92% | | | | | | | | |

Bank of Georgia 144A 6.00% 7/26/23 # | | | 200,000 | | | | 200,013 | |

| | | | | | | | |

| | | | | | | 200,013 | |

| | | | | | | | |

Ghana – 1.09% | | | | | | | | |

Tullow Oil 144A 7.00% 3/1/25 # | | | 245,000 | | | | 238,875 | |

| | | | | | | | |

| | | | | | | 238,875 | |

| | | | | | | | |

Guatemala – 0.95% | | | | | | | | |

Comunicaciones Celulares via Comcel Trust 144A 6.875% 2/6/24 # | | | 200,000 | | | | 208,097 | |

| | | | | | | | |

| | | | | | | 208,097 | |

| | | | | | | | |

Hong Kong – 1.20% | | | | | | | | |

CK Hutchison International 17 144A 2.875% 4/5/22 # | | | 270,000 | | | | 262,045 | |

| | | | | | | | |

| | | | | | | 262,045 | |

| | | | | | | | |

India – 1.72% | | | | | | | | |

ICICI Bank 144A 4.00% 3/18/26 # | | | 200,000 | | | | 188,440 | |

Vedanta Resources 144A 6.125% 8/9/24 # | | | 200,000 | | | | 186,748 | |

| | | | | | | | |

| | | | | | | 375,188 | |

| | | | | | | | |

Indonesia – 1.82% | | | | | | | | |

Perusahaan Gas Negara Persero 144A 5.125% 5/16/24 # | | | 200,000 | | | | 201,852 | |

Perusahaan Listrik Negara 144A 5.25% 5/15/47 # | | | 200,000 | | | | 194,495 | |

| | | | | | | | |

| | | | | | | 396,347 | |

| | | | | | | | |

Israel – 3.02% | | | | | | | | |

Israel Chemicals 144A 6.375% 5/31/38 # | | | 250,000 | | | | 250,156 | |

Israel Electric 144A 4.25% 8/14/28 # | | | 200,000 | | | | 195,957 | |

Teva Pharmaceutical Finance Netherlands III 6.75% 3/1/28 | | | 200,000 | | | | 213,816 | |

| | | | | | | | |

| | | | | | | 659,929 | |

| | | | | | | | |

Jamaica – 0.59% | | | | | | | | |

Digicel Group 144A 7.125% 4/1/22 # | | | 200,000 | | | | 128,250 | |

| | | | | | | | |

| | | | | | | 128,250 | |

| | | | | | | | |

15

Schedule of investments

Delaware Emerging Markets Debt Fund

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

Corporate BondsD (continued) | | | | | | | | |

| |

Kazakhstan – 1.84% | | | | | | | | |

KazMunayGas National JSC 144A 6.375% 10/24/48 # | | | 200,000 | | | $ | 209,690 | |

KazTransGas JSC 144A 4.375% 9/26/27 # | | | 200,000 | | | | 192,772 | |

| | | | | | | | |

| | | | | | | 402,462 | |

| | | | | | | | |

Kuwait – 1.13% | | | | | | | | |

Equate Petrochemical 144A 3.00% 3/3/22 # | | | 255,000 | | | | 246,019 | |

| | | | | | | | |

| | | | | | | 246,019 | |

| | | | | | | | |

Mexico – 5.28% | | | | | | | | |

Banco Santander Mexico 144A 4.125% 11/9/22 # | | | 150,000 | | | | 150,660 | |

Cydsa 144A 6.25% 10/4/27 # | | | 200,000 | | | | 193,500 | |

Grupo Cementos de Chihuahua 144A 5.25% 6/23/24 # | | | 200,000 | | | | 197,000 | |

Infraestructura Energetica Nova 144A 4.875% 1/14/48 # | | | 240,000 | | | | 210,000 | |

Mexichem 144A 5.50% 1/15/48 # | | | 220,000 | | | | 206,778 | |

Petroleos Mexicanos 6.75% 9/21/47 | | | 210,000 | | | | 194,250 | |

| | | | | | | | |

| | | | | | | 1,152,188 | |

| | | | | | | | |

Morocco – 1.35% | | | | | | | | |

OCP 144A 4.50% 10/22/25 # | | | 300,000 | | | | 294,599 | |

| | | | | | | | |

| | | | | | | 294,599 | |

| | | | | | | | |

Netherlands – 1.00% | | | | | | | | |

Syngenta Finance 144A 5.182% 4/24/28 # | | | 225,000 | | | | 218,749 | |

| | | | | | | | |

| | | | | | | 218,749 | |

| | | | | | | | |

Peru – 0.87% | | | | | | | | |

Kallpa Generacion 144A 4.125% 8/16/27 # | | | 200,000 | | | | 188,750 | |

| | | | | | | | |

| | | | | | | 188,750 | |

| | | | | | | | |

Republic of Korea – 0.91% | | | | | | | | |

Woori Bank 144A 4.75% 4/30/24 # | | | 200,000 | | | | 198,658 | |

| | | | | | | | |

| | | | | | | 198,658 | |

| | | | | | | | |

Russia – 3.98% | | | | | | | | |

Gazprom OAO via Gaz Capital 144A 4.95% 3/23/27 # | | | 260,000 | | | | 253,330 | |

Novolipetsk Steel via Steel Funding DAC 144A 4.00% 9/21/24 # | | | 200,000 | | | | 188,825 | |

Phosagro OAO via Phosagro Bond Funding DAC 144A 3.95% 11/3/21 # | | | 240,000 | | | | 234,908 | |

VEON Holdings 144A 4.95% 6/16/24 # | | | 200,000 | | | | 191,924 | |

| | | | | | | | |

| | | | | | | 868,987 | |

| | | | | | | | |

Singapore – 1.13% | | | | | | | | |

DBS Group Holdings 144A 4.52% 12/11/28 #µ | | | 245,000 | | | | 247,249 | |

| | | | | | | | |

| | | | | | | 247,249 | |

| | | | | | | | |

South Africa – 2.75% | | | | | | | | |

Growthpoint Properties International 144A 5.872% 5/2/23 # | | | 200,000 | | | | 207,064 | |

Myriad International Holdings 144A 4.85% 7/6/27 # | | | 200,000 | | | | 199,873 | |

16

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

Corporate BondsD (continued) | | | | | | | | |

| |

South Africa (continued) | | | | | | | | |

Transnet SOC 144A 4.00% 7/26/22 # | | | 200,000 | | | $ | 192,839 | |

| | | | | | | | |

| | | | | | | 599,776 | |

| | | | | | | | |

Spain – 0.82% | | | | | | | | |

Atento Luxco 1 144A 6.125% 8/10/22 # | | | 180,000 | | | | 177,885 | |

| | | | | | | | |

| | | | | | | 177,885 | |

| | | | | | | | |

Turkey – 3.41% | | | | | | | | |

Akbank Turk 144A 7.20% 3/16/27 #µ | | | 205,000 | | | | 170,298 | |

Petkim Petrokimya Holding 144A 5.875% 1/26/23 # | | | 200,000 | | | | 179,910 | |

Turkiye Garanti Bankasi 144A 6.25% 4/20/21 # | | | 210,000 | | | | 207,442 | |

Turkiye Is Bankasi 144A 7.00% 6/29/28 #µ | | | 240,000 | | | | 185,872 | |

| | | | | | | | |

| | | | | | | 743,522 | |

| | | | | | | | |

Ukraine – 2.86% | | | | | | | | |

Kernel Holding 144A 8.75% 1/31/22 # | | | 220,000 | | | | 226,184 | |

MHP | | | | | | | | |

144A 6.95% 4/3/26 # | | | 200,000 | | | | 193,243 | |

144A 7.75% 5/10/24 # | | | 200,000 | | | | 205,790 | |

| | | | | | | | |

| | | | | | | 625,217 | |

| | | | | | | | |

United Arab Emirates – 1.77% | | | | | | | | |

Abu Dhabi Crude Oil Pipeline | | | | | | | | |

144A 3.65% 11/2/29 # | | | 200,000 | | | | 191,965 | |

144A 4.60% 11/2/47 # | | | 200,000 | | | | 194,380 | |

| | | | | | | | |

| | | | | | | 386,345 | |

| | | | | | | | |

Zambia – 1.85% | | | | | | | | |

First Quantum Minerals | | | | | | | | |

144A 7.25% 4/1/23 # | | | 200,000 | | | | 201,750 | |

144A 7.50% 4/1/25 # | | | 200,000 | | | | 202,000 | |

| | | | | | | | |

| | | | | | | 403,750 | |

| | | | | | | | |

Total Corporate Bonds (cost $15,868,171) | | | | | | | 15,392,171 | |

| | | | | | | | |

|

| |

Loan Agreement – 1.50% | | | | | | | | |

| |

Republic of Angola 8.747% (LIBOR06M + 6.25%) 12/16/23 =• | | | 350,625 | | | | 328,571 | |

| | | | | | | | |

Total Loan Agreement (cost $350,625) | | | | | | | 328,571 | |

| | | | | | | | |

|

| |

Regional Bonds – 1.20%D | | | | | | | | |

| |

Argentina – 1.20% | | | | | | | | |

Provincia de Cordoba | | | | | | | | |

144A 7.125% 8/1/27 # | | | 155,000 | | | | 127,295 | |

144A 7.45% 9/1/24 # | | | 150,000 | | | | 134,064 | |

| | | | | | | | |

Total Regional Bonds (cost $315,807) | | | | | | | 261,359 | |

| | | | | | | | |

17

Schedule of investments

Delaware Emerging Markets Debt Fund

| | | | | | | | | | | | |

| | | | | | Principal amount° | | | Value (US $) | |

Sovereign Bonds – 18.94%D | | | | | | | | | | | | |

| |

Angola – 0.97% | | | | | | | | | | | | |

Angolan Government International Bond 144A 9.375% 5/8/48 # | | | | | | | 200,000 | | | $ | 212,461 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 212,461 | |

| | | | | | | | | | | | |

Argentina – 1.87% | | | | | | | | | | | | |

Argentine Bonos del Tesoro | | | | | | | | | | | | |

16.00% 10/17/23 | | | ARS | | | | 467,000 | | | | 15,863 | |

21.20% 9/19/18 | | | ARS | | | | 315,000 | | | | 12,145 | |

Argentine Republic Government International Bond | | | | | | | | | | | | |

5.625% 1/26/22 | | | | | | | 125,000 | | | | 119,000 | |

6.875% 1/11/48 | | | | | | | 330,000 | | | | 260,043 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 407,051 | |

| | | | | | | | | | | | |

Azerbaijan – 0.63% | | | | | | | | | | | | |

Republic of Azerbaijan International Bond 144A 3.50% 9/1/32 # | | | | | | | 160,000 | | | | 136,868 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 136,868 | |

| | | | | | | | | | | | |

Bermuda – 0.87% | | | | | | | | | | | | |

Bermuda Government International Bond 144A 3.717% 1/25/27 # | | | | | | | 200,000 | | | | 190,228 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 190,228 | |

| | | | | | | | | | | | |

Brazil – 0.34% | | | | | | | | | | | | |

Brazil Notas do Tesouro Nacional Series F 10.00% 1/1/23 | | | BRL | | | | 280,000 | | | | 74,282 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 74,282 | |

| | | | | | | | | | | | |

Dominican Republic – 1.51% | | | | | | | | | | | | |

Dominican Republic International Bond 144A 6.00% 7/19/28 # | | | | | | | 325,000 | | | | 329,063 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 329,063 | |

| | | | | | | | | | | | |

Egypt – 1.82% | | | | | | | | | | | | |

Egypt Government International Bond | | | | | | | | | | | | |

144A 5.577% 2/21/23 # | | | | | | | 200,000 | | | | 198,837 | |

144A 7.903% 2/21/48 # | | | | | | | 200,000 | | | | 199,202 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 398,039 | |

| | | | | | | | | | | | |

Ivory Coast – 0.85% | | | | | | | | | | | | |

Ivory Coast Government International Bond 144A 6.125% 6/15/33 # | | | | | | | 200,000 | | | | 184,237 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 184,237 | |

| | | | | | | | | | | | |

Jordan – 1.12% | | | | | | | | | | | | |

Jordan Government International Bond 144A 5.75% 1/31/27 # | | | | | | | 255,000 | | | | 244,637 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 244,637 | |

| | | | | | | | | | | | |

18

| | | | | | | | | | | | |

| | | | | | Principal amount° | | | Value (US $) | |

Sovereign BondsD (continued) | | | | | | | | | | | | |

| |

Mexico – 0.07% | | | | | | | | | | | | |

Mexican Bonos 6.50% 6/9/22 | | | MXN | | | | 297,000 | | | $ | 15,258 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 15,258 | |

| | | | | | | | | | | | |

Mongolia – 0.90% | | | | | | | | | | | | |

Mongolia Government International Bond 144A 5.625% 5/1/23 # | | | | | | | 200,000 | | | | 195,921 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 195,921 | |

| | | | | | | | | | | | |

Nigeria – 0.95% | | | | | | | | | | | | |

Nigeria Government International Bond 144A 7.875% 2/16/32 # | | | | | | | 200,000 | | | | 207,161 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 207,161 | |

| | | | | | | | | | | | |

Qatar – 0.95% | | | | | | | | | | | | |

Qatar Government International Bond 144A 3.875% 4/23/23 # | | | | | | | 206,000 | | | | 207,078 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 207,078 | |

| | | | | | | | | | | | |

Senegal – 1.04% | | | | | | | | | | | | |

Senegal Government International Bond 144A 6.75% 3/13/48 # | | | | | | | 250,000 | | | | 227,475 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 227,475 | |

| | | | | | | | | | | | |

South Africa – 2.44% | | | | | | | | | | | | |

Republic of South Africa Government Bond 8.75% 1/31/44 | | | ZAR | | | | 4,659,000 | | | | 329,557 | |

Republic of South Africa Government International Bond 5.875% 6/22/30 | | | | | | | 200,000 | | | | 202,614 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 532,171 | |

| | | | | | | | | | | | |

Turkey – 0.89% | | | | | | | | | | | | |

Turkey Government Bond 8.00% 3/12/25 | | | TRY | | | | 1,542,000 | | | | 194,726 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 194,726 | |

| | | | | | | | | | | | |

Ukraine – 1.72% | | | | | | | | | | | | |

Ukraine Government International Bond | | | | | | | | | | | | |

144A 7.375% 9/25/32 # | | | | | | | 200,000 | | | | 182,059 | |

144A 7.75% 9/1/26 # | | | | | | | 200,000 | | | | 193,972 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 376,031 | |

| | | | | | | | | | | | |

Total Sovereign Bonds (cost $4,328,880) | | | | | | | | | | | 4,132,687 | |

| | | | | | | | | | | | |

|

| |

Supranational Banks – 2.37% | | | | | | | | | | | | |

| |

Banque Ouest Africaine de Developpement 144A 5.00% 7/27/27 # | | | | | | | 240,000 | | | | 233,183 | |

Inter-American Development Bank | | | | | | | | | | | | |

6.25% 6/15/21 | | | IDR | | | | 300,000,000 | | | | 19,891 | |

7.875% 3/14/23 | | | IDR | | | | 1,870,000,000 | | | | 130,966 | |

| | |

| Schedule of investments | | |

| Delaware Emerging Markets Debt Fund | | |

| | | | | | | | | | | | |

| | | | | | Principal amount° | | | Value (US $) | |

Supranational Banks (continued) | | | | | | | | | | | | |

International Finance 7.00% 7/20/27 | | | MXN | | | | 2,650,000 | | | $ | 133,810 | |

| | | | | | | | | | | | |

Total Supranational Banks (cost $535,561) | | | | | | | | | | | 517,850 | |

| | | | | | | | | | | | |

| | | |

| | | | | | Number of contracts | | | | |

Options Purchased – 0.25% | | | | | | | | | | | | |

| |

Currency Put Options – 0.25% | | | | | | | | | | | | |

USD vs CLP strike price CLP 630, expiration date 9/25/18, notional amount CLP 1,348,830,000 (CITI) | | | | | | | 2,141,000 | | | | 22,904 | |

USD vs INR strike price INR 67, expiration date 1/24/19, notional amount INR 501,294,000 (HSBC) | | | | | | | 7,482,000 | | | | 20,454 | |

USD vs JPY strike price JPY 108, expiration date 9/20/18, notional amount JPY 378,000,000 (BOA) | | | | | | | 3,500,000 | | | | 10,979 | |

USD vs TRY strike price TRY 4, expiration date 8/31/18, notional amount TRY 9,058,880 (BNP) | | | | | | | 2,264,720 | | | | 1 | |

| | | | | | | | | | | | |

Total Options Purchased (cost $55,113) | | | | | | | | | | | 54,338 | |

| | | | | | | | | | | | |

| | | |

| | | | | | Principal amount° | | | | |

Short-Term Investments – 2.12% | | | | | | | | | | | | |

| |

Repurchase Agreements – 2.12% | | | | | | | | | | | | |

Bank of America Merrill Lynch | | | | | | | | | | | | |

1.84%, dated 7/31/18, to be repurchased on 8/1/18, repurchase price $73,431 (collateralized by US government obligations 2.25% 11/15/27; market value $74,896) | | | | | | | 73,428 | | | | 73,428 | |

Bank of Montreal | | | | | | | | | | | | |

1.83%, dated 7/31/18, to be repurchased on 8/1/18, repurchase price $146,863 (collateralized by US government obligations 0.125%–2.875% 7/15/22–11/15/46; market value $149,792) | | | | | | | 146,855 | | | | 146,855 | |

BNP Paribas | | | | | | | | | | | | |

1.87%, dated 7/31/18, to be repurchased on 8/1/18, repurchase price $241,730 (collateralized by US government obligations 0.00%–4.75% 12/31/22–8/15/46; market value $246,552) | | | | | | | 241,717 | | | | 241,717 | |

| | | | | | | | | | | | |

Total Short-Term Investments (cost $462,000) | | | | | | | | | | | 462,000 | |

| | | | | | | | | | | | |

| | | |

Total Value of Securities – 96.91%

(cost $21,916,157) | | | | | | | | | | $ | 21,148,976 | |

| | | | | | | | | | | | |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At July 31, 2018, the aggregate value of Rule 144A securities was $17,350,618, which represents 79.50% of the Fund’s net assets. See Note 11 in “Notes to financial statements.” |

| = | The value of this security was determined using significant unobservable inputs and is reported as a Level 3 security in the disclosure table located in Note 3 in “Notes to financial statements.” |

° Principal amount shown is stated in US Dollars unless noted that the security is denominated in another currency.

| D | Securities have been classified by country of origin. Aggregate classification by business sector has been presented on page 13 in “Security type / country and sector allocations.” |

| µ | Fixed to variable rate investment. The rate shown reflects the fixed rate in effect at July 31, 2018. Rate will reset at a future date. |

| • | Variable rate investment. Rates reset periodically. Rate shown reflects the rate in effect at July 31, 2018. For securities based on a published reference rate and spread, the reference rate and spread are indicated in their description above. The reference rate descriptions (i.e. LIBOR03M, LIBOR06M, etc.) used in this report are identical for different securities, but the underlying reference rates may differ due to the timing of the reset period. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their description above. |

The following foreign currency exchange contracts and futures contracts were outstanding at July 31, 2018:1

Foreign Currency Exchange Contracts

| | | | | | | | | | | | | | | | |

Counterparty | | Contracts to Receive (Deliver) | | In Exchange For | | Settlement Date | | | Unrealized

Appreciation | | | Unrealized

Depreciation | |

BNP | | JPY (10,489,887) | | USD 96,090 | | | 8/10/18 | | | $ | 2,213 | | | $ | — | |

GS | | BRL 1,202,952 | | USD (322,637) | | | 8/10/18 | | | | — | | | | (2,510 | ) |

| | | | | | | | | | | | | | | | |

Total Foreign Currency Exchange Contracts | | | | | | | | $ | 2,213 | | | $ | (2,510 | ) |

| | | | | | | | | | | | | | | | |

Futures Contract

| | | | | | | | | | | | | | | | | | | | |

Contracts to Buy (Sell) | | Notional

Amount | | | Notional

Cost

(Proceeds) | | | Expiration

Date | | | Value/

Unrealized

Depreciation | | | Variation

Margin

Due from

(Due to)

Brokers | |

US Treasury | | | | | | | | | | | | | | | | | | | | |

(6) Long Bonds | | $ | (857,813 | ) | | $ | (855,732 | ) | | | 9/20/18 | | | $ | (2,081 | ) | | $ | (2,063 | ) |

The use of foreign currency exchange contracts and futures contracts involve elements of market risk and risks in excess of the amounts disclosed in these financial statements. The foreign currency exchange contracts and notional amounts presented above represent the Fund’s total exposure in such contracts, whereas only the net unrealized appreciation (depreciation) is reflected in the Fund’s net assets.

| 1See | Note 8 in “Notes to financial statements.” |

| | |

| Schedule of investments | | |

| Delaware Emerging Markets Debt Fund | | |

Summary of abbreviations:

ARS – Argentine Peso

BADLARPP – Argentina Term Deposit Rate

BNP – BNP Paribas

BOA – Bank of America

BRL – Brazilian Real

CITI – Citigroup Global Markets

CLP – Chilean Peso

DAC – Designated Activity Company

GS – Goldman Sachs

ICE – Intercontinental Exchange

IDR – Indonesian Rupiah

INR – Indian Rupee

JPY – Japanese Yen

JSC – Joint Stock Company

LIBOR – London Interbank Offered Rate

LIBOR06M – ICE LIBOR USD 6 Month

MXN – Mexican Peso

TRY – Turkish Lira

USD – US Dollar

ZAR – South African Rand

See accompanying notes, which are an integral part of the financial statements.

This page intentionally left blank.

| | |

| Statement of assets and liabilities | | |

| Delaware Emerging Markets Debt Fund | | July 31, 2018 |

| | | | |

Assets: | | | | |

Investments, at value1 | | $ | 21,094,638 | |

Options purchased, at value2 | | | 54,338 | |

Foreign currencies, at value3 | | | 399,375 | |

Interest receivable | | | 306,505 | |

Cash | | | 26,002 | |

Cash collateral due from broker | | | 16,000 | |

Receivable for securities sold | | | 4,248 | |

Unrealized appreciation on foreign currency exchange contracts | | | 2,213 | |

| | | | |

Total assets | | | 21,903,319 | |

| | | | |

Liabilities: | | | | |

Audit and tax fees payable | | | 48,112 | |

Other accrued expenses | | | 21,528 | |

Investment management fees payable to affiliates | | | 4,519 | |

Unrealized depreciation on foreign currency exchange contracts | | | 2,510 | |

Variation margin due to broker on futures contracts | | | 2,063 | |

Accounting and administration expenses payable to affiliates | | | 409 | |

Dividend disbursing and transfer agent fees and expenses payable to affiliates | | | 352 | |

Distribution fees payable to affiliates | | | 80 | |

Trustees’ fees and expenses payable | | | 62 | |

Legal fees payable to affiliates | | | 24 | |

Reports and statements to shareholders expenses payable to affiliates | | | 18 | |

| | | | |

Total liabilities | | | 79,677 | |

| | | | |

Total Net Assets | | $ | 21,823,642 | |

| | | | |

| |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 22,419,152 | |

Undistributed net investment income | | | 36,706 | |

Accumulated net realized gain | | | 140,295 | |

Net unrealized depreciation of investments | | | (766,406 | ) |

Net unrealized depreciation of foreign currencies | | | (2,952 | ) |

Net unrealized depreciation of foreign currency exchange contracts | | | (297 | ) |

Net unrealized depreciation of futures contracts | | | (2,081 | ) |

Net unrealized depreciation of options purchased | | | (775 | ) |

| | | | |

Total Net Assets | | $ | 21,823,642 | |

| | | | |

| | | | |

Class A: | | | | |

Net assets | | $ | 56,466 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 6,838 | |

Net asset value per share | | $ | 8.26 | |

Sales charge | | | 4.50 | % |

Offering price per share, equal to net asset value per share / (1 – sales charge) | | $ | 8.65 | |

| |

Class C: | | | | |

Net assets | | $ | 81,942 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 9,923 | |

Net asset value per share | | $ | 8.26 | |

| |

Class R: | | | | |

Net assets | | $ | 2,471 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 299 | |

Net asset value per share | | $ | 8.26 | |

| |

Institutional Class: | | | | |

Net assets | | $ | 21,682,763 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 2,622,764 | |

Net asset value per share | | $ | 8.27 | |

| |

1 Investments, at cost | | $ | 21,861,044 | |

2 Options purchased, at cost | | | 55,113 | |

3 Foreign currencies, at cost | | | 401,605 | |

See accompanying notes, which are an integral part of the financial statements.

| | |

| Statement of operations | | |

| Delaware Emerging Markets Debt Fund | | Year ended July 31, 2018 |

| | | | |

Investment Income: | | | | |

Interest | | $ | 1,262,247 | |

Foreign tax withheld | | | (81 | ) |

| | | | |

| | | 1,262,166 | |

| | | | |

Expenses: | | | | |

Management fees | | | 165,174 | |

Distribution expenses – Class A | | | 110 | |

Distribution expenses – Class C | | | 790 | |

Distribution expenses – Class R | | | 12 | |

Registration fees | | | 52,916 | |

Audit and tax fees | | | 50,719 | |

Accounting and administration expenses | | | 32,627 | |

Reports and statements to shareholders expenses | | | 21,603 | |

Legal fees | | | 13,477 | |

Dividend disbursing and transfer agent fees and expenses | | | 6,692 | |

Custodian fees | | | 5,601 | |

Trustees’ fees and expenses | | | 972 | |

Other | | | 14,627 | |

| | | | |

| | | 365,320 | |

Less expenses waived | | | (161,941 | ) |

Less waived distribution expenses – Class R | | | (12 | ) |

Less expense paid indirectly | | | (1,184 | ) |

| | | | |

Total operating expenses | | | 202,183 | |

| | | | |

Net Investment Income | | | 1,059,983 | |

| | | | |

| | | | |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain (loss) on: | | | | |

Investments | | $ | 356,842 | |

Foreign currencies | | | (25,028 | ) |

Foreign currency exchange contracts | | | 5,099 | |

Futures contracts | | | 34,765 | |

Options purchased | | | (11,806 | ) |

Swap contracts | | | (14,854 | ) |

| | | | |

Net realized gain | | | 345,018 | |

| | | | |

Net change in unrealized appreciation (depreciation) of: | | | | |

Investments1 | | | (1,406,107 | ) |

Foreign currencies | | | (3,082 | ) |

Foreign currency exchange contracts | | | (654 | ) |

Futures contracts | | | (2,081 | ) |

Options purchased | | | 28,255 | |

Swap contracts | | | 7,307 | |

| | | | |

Net change in unrealized appreciation (depreciation) | | | (1,376,362 | ) |

| | | | |

Net Realized and Unrealized Loss | | | (1,031,344 | ) |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 28,639 | |

| | | | |

| 1 | Includes decrease of $11 capital gains taxes accrued. |

See accompanying notes, which are an integral part of the financial statements.

| | |

| Statements of changes in net assets | | |

| Delaware Emerging Markets Debt Fund | | |

| | | | | | | | |

| | | Year ended | |

| | | 7/31/18 | | | 7/31/17 | |

Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 1,059,983 | | | $ | 925,769 | |

Net realized gain | | | 345,018 | | | | 786,912 | |

Net change in unrealized appreciation (depreciation) | | | (1,376,362 | ) | | | (80,487 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 28,639 | | | | 1,632,194 | |

| | | | | | | | |

| | |

Dividends and Distributions to Shareholders from: | | | | | | | | |

Net investment income: | | | | | | | | |

Class A | | | (1,956 | ) | | | (503 | ) |

Class C | | | (2,926 | ) | | | (338 | ) |

Class R | | | (118 | ) | | | (104 | ) |

Institutional Class | | | (1,027,398 | ) | | | (911,292 | ) |

| | |

Net realized gain: | | | | | | | | |

Class A | | | (455 | ) | | | — | |

Class C | | | (1,207 | ) | | | — | |

Class R | | | (36 | ) | | | — | |

Institutional Class | | | (317,542 | ) | | | — | |

| | | | | | | | |

| | | (1,351,638 | ) | | | (912,237 | ) |

| | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Proceeds from shares sold: | | | | | | | | |

Class A | | | 92,140 | | | | 48,538 | |

Class C | | | 58,822 | | | | 59,542 | |

Institutional Class | | | 126,314 | | | | — | |

| | |

Net asset value of shares issued upon reinvestment of dividends and distributions: | | | | | | | | |

Class A | | | 2,411 | | | | 502 | |

Class C | | | 4,133 | | | | 338 | |

Class R | | | 154 | | | | 104 | |

Institutional Class | | | 1,341,785 | | | | 911,292 | |

| | | | | | | | |

| | | 1,625,759 | | | | 1,020,316 | |

| | | | | | | | |

| | | | | | | | |

| | | Year ended | |

| | | 7/31/18 | | | 7/31/17 | |

Capital Share Transactions (continued): | | | | | | | | |

Cost of shares redeemed: | | | | | | | | |

Class A | | $ | (61,604 | ) | | $ | (25,345 | ) |

Class C | | | (38,549 | ) | | | — | |

Institutional Class | | | (30,869 | ) | | | — | |

| | | | | | | | |

| | | (131,022 | ) | | | (25,345 | ) |

| | | | | | | | |

Increase in net assets derived from capital share transactions | | | 1,494,737 | | | | 994,971 | |

| | | | | | | | |

Net Increase in Net Assets | | | 171,738 | | | | 1,714,928 | |

Net Assets: | | | | | | | | |

Beginning of year | | | 21,651,904 | | | | 19,936,976 | |

| | | | | | | | |

End of year | | $ | 21,823,642 | | | $ | 21,651,904 | |

| | | | | | | | |

Undistributed net investment income | | $ | 36,706 | | | $ | 56,892 | |

| | | | | | | | |

See accompanying notes, which are an integral part of the financial statements.

Financial highlights

Delaware Emerging Markets Debt Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income2 |

Net realized and unrealized gain (loss) |

| |

Total from investment operations |

| |

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

| |

Total dividends and distributions |

| |

|

Net asset value, end of period |

|

Total return3 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets excluding interest expense |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived4 |

Ratio of net investment income to average net assets excluding interest expense |

Ratio of net investment income to average net assets |

Ratio of net investment income to average net assets prior to fees waived4 |

Portfolio turnover |

| 1 | Date of commencement of operations; ratios have been annualized and total return and portfolio turnover have not been annualized. |

| 2 | The average shares outstanding method has been applied for per share information. |

| 3 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

| 4 | Expenses paid indirectly were not material and had no impact on the ratios disclosed. Expenses paid indirectly for the year ended July 31, 2018 are reflected on the “Statement of operations.” |

See accompanying notes, which are an integral part of the financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Year ended | | | | | | | | | | | | 9/30/131

to | |

| | | 7/31/18 | | | | | 7/31/17 | | | | | 7/31/16 | | | | | 7/31/15 | | | | | 7/31/14 | |

| | $ | 8.77 | | | | | $ | 8.48 | | | | | $ | 8.21 | | | | | $ | 8.84 | | | | | $ | 8.50 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 0.39 | | | | | | 0.37 | | | | | | 0.36 | | | | | | 0.37 | | | | | | 0.32 | |

| | | (0.39 | ) | | | | | 0.29 | | | | | | 0.24 | | | | | | (0.61 | ) | | | | | 0.34 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | — | | | | | | 0.66 | | | | | | 0.60 | | | | | | (0.24 | ) | | | | | 0.66 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | (0.38 | ) | | | | | (0.37 | ) | | | | | (0.33 | ) | | | | | (0.30 | ) | | | | | (0.32 | ) |

| | | (0.13 | ) | | | | | — | | | | | | — | | | | | | (0.09 | ) | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.51 | ) | | | | | (0.37 | ) | | | | | (0.33 | ) | | | | | (0.39 | ) | | | | | (0.32 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | $ | 8.26 | | | | | $ | 8.77 | | | | | $ | 8.48 | | | | | $ | 8.21 | | | | | $ | 8.84 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | (0.10% | ) | | | | | 8.03% | | | | | | 7.62% | | | | | | (2.65% | ) | | | | | 7.86% | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 57 | | | | | $ | 27 | | | | | $ | 3 | | | | | $ | 2 | | | | | $ | 2 | |

| | | 1.16% | | | | | | 1.22% | | | | | | 1.01% | | | | | | 1.08% | | | | | | 1.31% | |

| | | 1.16% | | | | | | 1.22% | | | | | | 1.03% | | | | | | 1.14% | | | | | | 1.50% | |

| | | 1.90% | | | | | | 1.91% | | | | | | 2.04% | | | | | | 2.03% | | | | | | 2.48% | |

| | | 4.57% | | | | | | 4.30% | | | | | | 4.44% | | | | | | 4.46% | | | | | | 4.66% | |

| | | 4.57% | | | | | | 4.30% | | | | | | 4.42% | | | | | | 4.40% | | | | | | 4.47% | |

| | | 3.83% | | | | | | 3.61% | | | | | | 3.41% | | | | | | 3.51% | | | | | | 3.49% | |

| | | 108% | | | | | | 154% | | | | | | 232% | | | | | | 288% | | | | | | 152% | |

Financial highlights

Delaware Emerging Markets Debt Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income2 |

Net realized and unrealized gain (loss) |

| |

Total from investment operations |

| |

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

Total dividends and distributions |

|

Net asset value, end of period |

|

Total return3 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets excluding interest expense |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived4 |

Ratio of net investment income to average net assets excluding interest expense |

Ratio of net investment income to average net assets |

Ratio of net investment income to average net assets prior to fees waived4 |

Portfolio turnover |

| 1 | Date of commencement of operations; ratios have been annualized and total return and portfolio turnover have not been annualized. |

| 2 | The average shares outstanding method has been applied for per share information. |

| 3 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

| 4 | Expenses paid indirectly were not material and had no impact on the ratios disclosed. Expenses paid indirectly for the year ended July 31, 2018 are reflected on the “Statement of operations.” |

See accompanying notes, which are an integral part of the financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended | | | | | 9/30/131 to | |

| | | 7/31/18 | | | | | 7/31/17 | | | | | 7/31/16 | | | | | 7/31/15 | | | | | 7/31/14 | |

| | $ | 8.77 | | | | | $ | 8.48 | | | | | $ | 8.22 | | | | | $ | 8.84 | | | | | $ | 8.50 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 0.33 | | | | | | 0.32 | | | | | | 0.36 | | | | | | 0.37 | | | | | | 0.27 | |

| | | (0.39 | ) | | | | | 0.32 | | | | | | 0.23 | | | | | | (0.60 | ) | | | | | 0.33 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.06 | ) | | | | | 0.64 | | | | | | 0.59 | | | | | | (0.23 | ) | | | | | 0.60 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.32 | ) | | | | | (0.35 | ) | | | | | (0.33 | ) | | | | | (0.30 | ) | | | | | (0.26 | ) |

| | | (0.13 | ) | | | | | — | | | | | | — | | | | | | (0.09 | ) | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.45 | ) | | | | | (0.35 | ) | | | | | (0.33 | ) | | | | | (0.39 | ) | | | | | (0.26 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | $ | 8.26 | | | | | $ | 8.77 | | | | | $ | 8.48 | | | | | $ | 8.22 | | | | | $ | 8.84 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | (0.84% | ) | | | | | 7.74% | | | | | | 7.49% | | | | | | (2.53% | ) | | | | | 7.22% | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 82 | | | | | $ | 63 | | | | | $ | 2 | | | | | $ | 2 | | | | | $ | 2 | |

| | | 1.91% | | | | | | 1.81% | | | | | | 1.01% | | | | | | 1.08% | | | | | | 2.03% | |

| | | 1.91% | | | | | | 1.81% | | | | | | 1.03% | | | | | | 1.14% | | | | | | 2.22% | |

| | | 2.65% | | | | | | 2.66% | | | | | | 2.79% | | | | | | 2.78% | | | | | | 3.20% | |

| | | 3.82% | | | | | | 3.71% | | | | | | 4.44% | | | | | | 4.46% | | | | | | 3.94% | |

| | | 3.82% | | | | | | 3.71% | | | | | | 4.42% | | | | | | 4.40% | | | | | | 3.75% | |

| | | 3.08% | | | | | | 2.86% | | | | | | 2.66% | | | | | | 2.76% | | | | | | 2.77% | |

| | | 108% | | | | | | 154% | | | | | | 232% | | | | | | 288% | | | | | | 152% | |

Financial highlights

Delaware Emerging Markets Debt Fund Class R

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income2 |

Net realized and unrealized gain (loss) |

Total from investment operations |

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

Total dividends and distributions |

|