UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-4367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

One Financial Center, Boston, Massachusetts | | 02111 |

(Address of principal executive offices) | | (Zip code) |

|

James R. Bordewick, Jr., Esq.

Columbia Management Advisors, LLC

One Financial Center

Boston, MA 02111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-617-426-3750 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | October 31, 2008 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Management®

Annual Report

October 31, 2008

Columbia California Tax-Exempt Fund

| NOT FDIC INSURED | | May Lose Value | |

|

| NOT BANK ISSUED | | No Bank Guarantee | |

|

Table of Contents

| Fund Profile | | | 1 | | |

|

| Economic Update | | | 2 | | |

|

| Performance Information | | | 3 | | |

|

| Understanding Your Expenses | | | 4 | | |

|

| Portfolio Manager's Report | | | 5 | | |

|

| Investment Portfolio | | | 7 | | |

|

Statement of Assets and

Liabilities | | | 18 | | |

|

| Statement of Operations | | | 19 | | |

|

Statement of Changes in

Net Assets | | | 20 | | |

|

| Financial Highlights | | | 22 | | |

|

| Notes to Financial Statements | | | 26 | | |

|

Report of Independent Registered

Public Accounting Firm | | | 34 | | |

|

| Federal Income Tax Information | | | 35 | | |

|

| Fund Governance | | | 36 | | |

|

Board Consideration and

Approval of Advisory

Agreements | | | 40 | | |

|

Summary of Management Fee

Evaluation by Independent

Fee Consultant | | | 43 | | |

|

Important Information About

This Report | | | 49 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholder:

We are pleased to provide this shareholder report for your Columbia Fund and hope you will find the portfolio management details, discussions and performance information helpful in monitoring your investments. As we've seen this past year, the financial markets can be quite volatile, with significant short-term price fluctuations. It's important to keep these ups and downs in perspective, particularly in light of your long-term investment strategy.

Staying the course with your long-term strategy typically involves riding out short-term price fluctuations, though we recognize that at times this can be tough. To support your efforts and give you the information you need to make prudent decisions, Columbia Management offers several valuable online resources. We encourage you to visit www.columbiamanagement.com/investor, where you can receive the most up-to-date information, including:

g Daily pricing and performance. View pricing and performance from a link in Fund Tracker on the homepage. This listing of funds is updated nightly with the current net asset value and the amount and percentage change from the prior day.

g News & Commentary. This tab provides links to quarterly fund commentaries and information from our investment strategies group, including trends in the economy and market impact.

If you would like more details on individual funds, select a fund from the dropdown menu on the top right side of the homepage for access to:

g Monthly and quarterly performance information.

g Portfolio holdings. Full holdings are updated monthly for money market funds, except for Columbia Cash Reserves, Columbia Government Plus Reserves, Columbia Government Reserves, Columbia Treasury Reserves and Columbia Money Market Reserves which are updated weekly, monthly for equity funds and quarterly for most other funds.

g Quarterly fact sheets. Accessible from the Literature tab in each fund page.

By registering on the site, you'll receive secured, 24-hour access to*:

g Mutual fund account details with balances, dividend and transaction information.

g Fund Tracker to customize your homepage with current net asset values for the funds that interest you.

g On-line transactions including purchases, exchanges and redemptions.

g Account maintenance for updating your address and dividend payment options.

g Electronic delivery of prospectuses and shareholder reports.

I encourage you to visit our website for access to the product information and tools described above. These valuable online resources can help you monitor your investments and provide direct access to your account. All of these tools, and more, can be found on www.columbiamanagement.com/investor.

While your financial advisor is a great resource for investment guidance, you can also access our website or call our service representatives at 800.345.6611 for additional assistance. We thank you for investing with Columbia Management and look forward to helping with your ongoing investment needs.

Sincerely,

Christopher L. Wilson

President, Columbia Funds

*Some restrictions apply. Shareholders who purchase shares through certain third-party organizations may not have the ability to register for online access.

Fund Profile – Columbia California Tax-Exempt Fund

Summary

g For the 12-month period that ended October 31, 2008, the fund's Class A shares returned negative 6.80% without sales charge.

g The fund trailed its benchmark, the Barclays Capital Municipal Bond Index1, but performed better than its peer group average, the Lipper California Municipal Debt Funds Classification.2

g Bonds in the mid-to-lower quality tiers held back performance compared to the benchmark. We believe that our focus on bonds in the 10-25 year maturity range and our comparatively smaller exposure to weaker performing sectors aided performance relative to the fund's peer group.

Portfolio Management

Gary Swayze has managed the fund since October 1997 and has been associated with the advisor or its predecessors or affiliate organizations since 1997.

1The Barclays Capital Municipal Bond Index (formerly the Lehman Brothers Municipal Bond Index) is considered representative of the broad market for investment-grade, tax exempt bonds with maturities of at least one year. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

2Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

1-year return as of 10/31/08

| | –6.80 | % | |

|

Class A Shares Class A Shares

(without sales charge) | |

|

| | –3.30 | % | |

|

Barclays Capital Barclays Capital

Municipal Bond Index | |

|

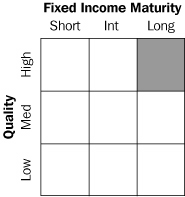

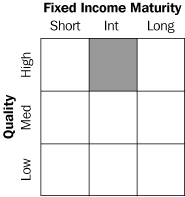

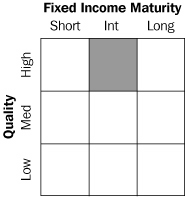

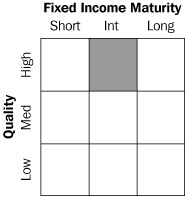

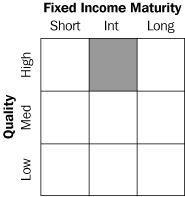

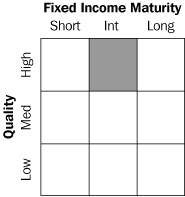

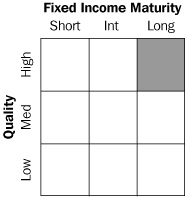

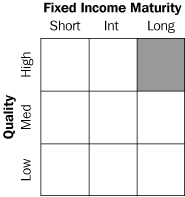

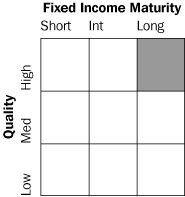

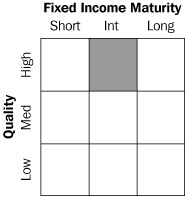

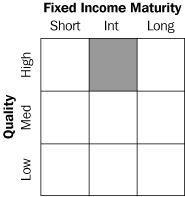

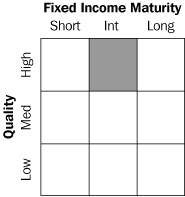

Morningstar Style Box

The Morningstar Style Box reveals a fund's investment strategy. For fixed-income funds the vertical axis shows the average credit quality of the bonds owned, and the horizontal axis shows interest rate sensitivity as measured by a bond's duration (short, intermediate or long). All of these numbers are drawn from the data most recently provided by the fund and entered into Morningstar's database as of quarter-end. Although the data is gathered from reliable sources, Morningstar cannot guarantee its completeness and accuracy. Information shown is as of 06/30/08.

1

Economic Update – Columbia California Tax-Exempt Fund

Summary

For the 12-month period that ended October 31, 2008

g Despite volatility in many segments of the bond market, the Barclays Capital U.S. Aggregate Bond Index delivered a modest gain. High-yield bonds lost significant ground, as measured by the Merrill Lynch U.S. High Yield, Cash Pay Index.

Barclays

Index | | Merrill

Lynch Index | |

|

| |  | |

|

g The broad U.S. stock market, as measured by the S&P 500 Index, returned negative 36.10%. Developed stock markets outside the United States returned negative 46.62%, as measured (in U.S. dollars) by the MSCI EAFE Index.

| S&P Index | | MSCI Index | |

|

| |  | |

|

The Barclays Capital U.S. Aggregate Bond Index (formerly the Lehman Brothers U.S. Aggregate Bond Index) is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

The Merrill Lynch U.S. High Yield, Cash Pay Index tracks the performance of non-investment-grade corporate bonds.

The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization US stocks.

The Morgan Stanley Capital International (MSCI) Europe, Australasia, Far East (EAFE) Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the US and Canada.

Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

The pace of economic growth ground to a halt during the 12-month period that began November 1, 2007 and ended October 31, 2008. Although the economic growth was modestly positive at the beginning of the period, the economy slipped into recession in 2008, with little relief in sight. A host of factors weighed on consumers and businesses alike.

The most severe housing downturn in decades showed no sign of abating as inventories of homes for sale rose, home prices declined and tighter credit standards, a result of continued turmoil in the subprime mortgage market, made it more difficult for homebuyers to qualify for loans.

The labor market contracted for ten consecutive months, driving the unemployment rate to 6.5%, the highest rate since the early 1990s. Nearly 1.2 million jobs have been lost since the beginning of 2008, with announced layoffs likely to drive that number even higher in the months ahead. Manufacturing activity slowed and consumer spending declined, dimming hopes for the holiday season.

A weakening economy and turmoil in the financial markets took a toll on consumer confidence, which plummeted to the lowest point ever in the 40-year history of the Conference Board's monthly survey.

In an effort to inspire confidence in the capital markets, loosen the reins on credit and shore up economic growth, the Federal Reserve Board (the Fed) brought a key short-term rate—the federal funds rate—down from 4.50% to 1.0% during the 12-month period. Despite earlier concerns about inflation, a weak economic outlook has kept the Fed focused on stimulating economic growth through lowering borrowing rates. In fact, the one bright spot during this period of uncertainty has been lower energy and commodity prices. With oil trading near $60 per barrel at the end of the period, gasoline prices are forecasted to come down below $2 per gallon after peaking above $4 per gallon during the summer months.

Bonds eke out a small, positive return

The U.S. bond market seesawed during the 12-month period but managed to eke out a small gain as investors sought the relative safety of the highest quality sectors. After a weak start, bond prices in several sectors rose and yields declined as economic growth slowed and stock market volatility increased. The benchmark 10-year U.S. Treasury yield ended the period at just under 4.0%, nearly one-half percentage point lower than where it stood one year ago. In this environment, the Barclays Capital U.S. Aggregate Bond Index returned 0.30%. High-yield bonds disappointed as economic prospects weakened and default fears rose. The Merrill Lynch U.S. High Yield, Cash Pay Index returned negative 26.43%.

Stocks retreat as economic outlook darkens

Against a shifting economic backdrop, the U.S. stock market lost 36.10% for the 12-month period, as measured by the S&P 500 Index. Losses extended across all market caps and both growth and value, although value stocks held up somewhat better than growth stocks, as measured by their respective Russell indices.1 Stock markets outside the U.S. suffered even greater losses. The MSCI EAFE Index, a broad gauge of stock market performance in foreign developed markets, lost 46.62% (in U.S. dollars) for the period. Emerging stock markets, which have had a strong run over the past several years, were also caught in the downdraft. As investors backed away from risk, emerging markets suffered most of all. The MSCI Emerging Markets Index returned negative 56.22% (in U.S. dollars).2

Past performance is no guarantee of future results.

1The Russell 1000 Index measures the performance of 1,000 of the largest US companies, based on market capitalization. The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, as ranked by total market capitalization. The Russell 2000 Index measures the performance of the 2,000 smallest of the 3,000 largest US companies based on market capitalization.

2The Morgan Stanley Capital International (MSCI) Emerging Markets Index is a widely accepted index composed of a sample of companies from 25 countries representing the global emerging stock markets.

Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

2

Performance Information – Columbia California Tax-Exempt Fund

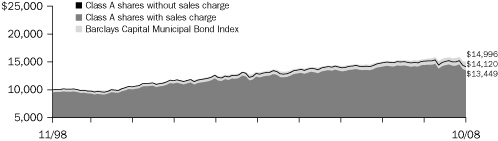

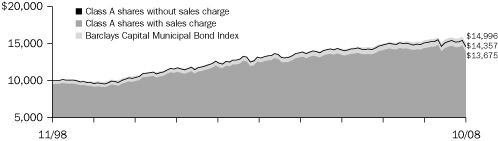

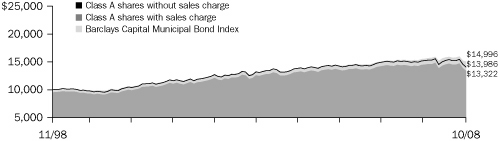

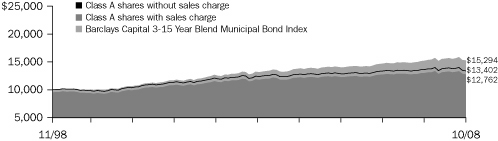

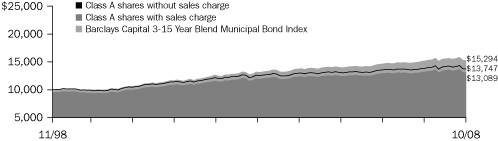

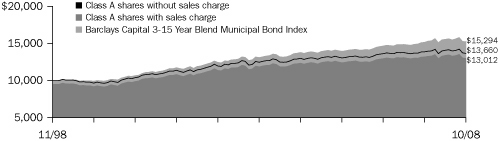

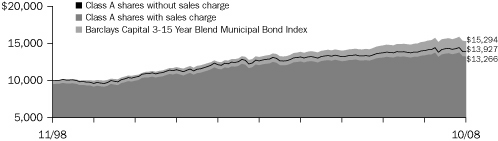

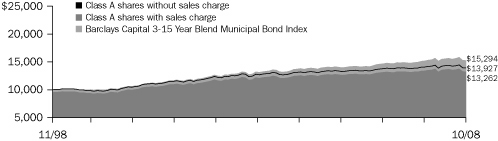

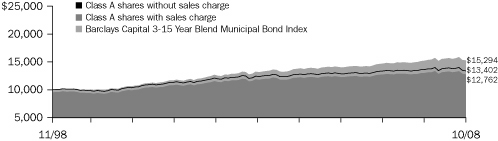

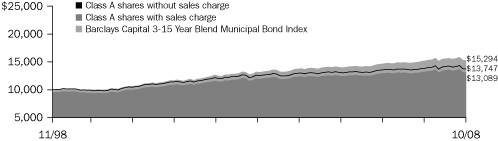

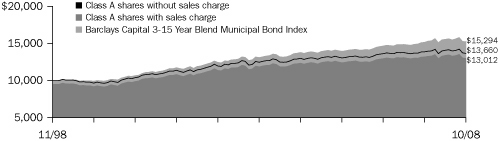

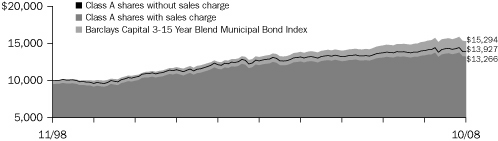

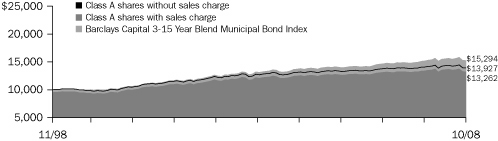

Growth of a $10,000 Investment 11/01/98 – 10/31/08

The chart above shows the growth in value of a hypothetical $10,000 investment in Class A shares of Columbia California Tax-Exempt Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. The Barclays Capital Municipal Bond Index is considered representative of the broad market for investment-grade, tax exempt bonds with maturities of at least one year. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

Performance of a $10,000 Investment 11/01/98 – 10/31/08 ($)

| Sales charge | | without | | with | |

| Class A | | | 14,120 | | | | 13,449 | | |

| Class B | | | 13,107 | | | | 13,107 | | |

| Class C | | | 13,501 | | | | 13,501 | | |

| Class Z | | | 14,223 | | | | n/a | | |

Average annual total return as of 10/31/08 (%)

| Share class | | A | | B | | C | | Z | |

| Inception | | 06/16/86 | | 08/04/92 | | 08/01/97 | | 09/19/05 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | –6.80 | | | | –11.22 | | | | –7.49 | | | | –11.93 | | | | –7.22 | | | | –8.11 | | | | –6.57 | | |

| 5-year | | | 1.98 | | | | 0.99 | | | | 1.22 | | | | 0.89 | | | | 1.52 | | | | 1.52 | | | | 2.13 | | |

| 10-year | | | 3.51 | | | | 3.01 | | | | 2.74 | | | | 2.74 | | | | 3.05 | | | | 3.05 | | | | 3.59 | | |

Average annual total return as of 09/30/08 (%)

| Share class | | A | | B | | C | | Z | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | –4.35 | | | | –8.89 | | | | –5.06 | | | | –9.62 | | | | –4.78 | | | | –5.70 | | | | –4.11 | | |

| 5-year | | | 2.22 | | | | 1.23 | | | | 1.46 | | | | 1.12 | | | | 1.76 | | | | 1.76 | | | | 2.37 | | |

| 10-year | | | 3.66 | | | | 3.16 | | | | 2.90 | | | | 2.90 | | | | 3.20 | | | | 3.20 | | | | 3.74 | | |

The "with sales charge" returns include the maximum initial sales charge of 4.75% for Class A shares, the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year, and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and the fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Class Z share (newer class shares) performance information includes returns of the fund's Class A shares (the oldest existing fund class) for periods prior to the inception of Class Z shares. These returns have not been restated to reflect any differences in expenses such as distribution and service (Rule 12b-1) fees between Class A shares and Class Z shares. The Class A share returns have been adjusted to take into account the fact that Class Z shares are sold without sales charges. If differences in expenses had been reflected, the returns shown for periods prior to the inception of Class Z shares would have been higher, to the extent that Class Z shares are not subject to any distribution and service (Rule 12b-1) fees. Class A shares were initially offered on June 16, 1986, Class B shares were initially offered on August 4, 1992, Class C shares were initially offered on August 1, 1997, and Class Z shares were initially offere d on September 19, 2005.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Annual operating expense ratio (%)*

| Class A | | | 0.86 | | |

| Class B | | | 1.61 | | |

| Class C | | | 1.61 | | |

| Class Z | | | 0.63 | | |

* The annual operating expense ratio is as stated in the fund's prospectus that is current as of the date of this report. Differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and expense reimbursements as well as different time periods used in calculating the ratios.

3

Understanding Your Expenses – Columbia California Tax-Exempt Fund

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account generally will be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing costs of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

05/01/08 – 10/31/08

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 932.68 | | | | 1,020.91 | | | | 4.08 | | | | 4.27 | | | | 0.84 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 929.22 | | | | 1,017.14 | | | | 7.71 | | | | 8.06 | | | | 1.59 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 930.62 | | | | 1,018.65 | | | | 6.26 | | | | 6.55 | | | | 1.29 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 933.79 | | | | 1,022.12 | | | | 2.92 | | | | 3.05 | | | | 0.60 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 366.

Had the investment advisor and/or any of its affiliates not waived fees or reimbursed a portion of expenses, account value at the end of the period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

4

Portfolio Manager's Report – Columbia California Tax-Exempt Fund

For the 12-month period that ended October 31, 2008, the fund's Class A shares returned negative 6.80% without sales charge. The fund's benchmark, the Barclays Capital Municipal Bond Index returned negative 3.30%.1 The average return of the fund's peer group, the Lipper California Municipal Debt Funds Classification, was negative 9.24%2. The fund's shortfall to its benchmark was the result of two factors: the index is national in scope and it has less exposure than the fund to longer-term (20 to 30 years) and mid-to-lower quality sectors, which were underperformers during the period. We believe that the fund outperformed its peer group average because it had a greater focus on bonds in the 10-25 year maturity range and comparatively less exposure to weaker performing sectors.

Economic slowdown has sharp impact

A year ago, we anticipated an economic slowdown and an easing of inflationary pressures fed by high commodity prices and worldwide growth. But the intensity of the slowdown has been unexpectedly sharp. In hopes of reviving the economy, the Federal Reserve Board (the Fed) cut short-term interest rates aggressively while Congress passed a stimulus package to aid middle-class households.

Fallout from a widespread credit crisis caused municipal bonds to underperform Treasuries over this period. Sinking home values and waves of foreclosures began to shrink tax revenues and swell deficits for state and local governments. In addition, downgrades of municipal bond insurers dramatically reduced the number of AAA-rated3 municipal bonds. As a result, investors demanded higher yields for insured issues, which represent over half of the new issue market. Meanwhile, volatile markets forced some institutions to sell off their municipal bond holdings, especially hedge funds.

Amid this economic stress, the yield difference between higher and lower quality municipal bonds widened. The period's worst performance came in lower quality, long-maturity sectors where yields rose substantially. Skittish investors preferred to confine their commitments to better quality issues with maturities of five years or less, causing yields to decline and raising prices modestly for these bonds.

Lower and medium quality fund holdings and those with long maturities hurt results. We achieved better returns among intermediate-term prerefunded bonds, which are backed by escrowed government securities.

1The Barclays Capital Municipal Bond Index is considered representative of the broad market for investment-grade, tax-exempt bonds with maturities of at least one year. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

2Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

3The credit quality ratings represent those of Moody's Investors Service, Inc. ("Moody's"), Standard & Poor's Corporation ("S&P") or Fitch Ratings ("Fitch") credit ratings. The ratings represent their opinions as to the quality of the securities they rate. Ratings are relative and subjective and are not absolute standards of quality. The security's credit quality does not eliminate risk.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Net asset value per share

as of 10/31/08 ($)

| Class A | | | 6.71 | | |

| Class B | | | 6.71 | | |

| Class C | | | 6.71 | | |

| Class Z | | | 6.71 | | |

Distributions declared per share

11/01/07 – 10/31/08 ($)

| Class A | | | 0.35 | | |

| Class B | | | 0.29 | | |

| Class C | | | 0.31 | | |

| Class Z | | | 0.36 | | |

A portion of the fund's income may be subject to the alternative minimum tax. The fund may at times purchase tax-exempt securities at a discount. Some, or all, of this discount may be included in the fund's ordinary income, and is taxable when distributed. Distributions include $0.04 per share of taxable realized gains.

30-day SEC yields

as of 10/31/08 (%)

| Class A | | | 4.35 | | |

| Class B | | | 3.80 | | |

| Class C | | | 4.10 | | |

| Class Z | | | 4.82 | | |

The 30-day SEC yields reflect the fund's earning power, net of expenses, expressed as an annualized percentage of the public offering price per share at the end of the period.

Taxable equivalent SEC yields

as of 10/31/08 (%)

| Class A | | | 7.38 | | |

| Class B | | | 6.45 | | |

| Class C | | | 6.95 | | |

| Class Z | | | 8.18 | | |

Taxable-equivalent SEC yields are based on the combined maximum effective 35.0% federal income tax rate and the applicable state income tax rate. This tax rate does not reflect the phase out of exemptions or the reduction of the otherwise allowable deductions that occur when adjusted gross income exceeds certain levels.

5

Portfolio Manager's Report (continued) – Columbia California Tax-Exempt Fund

Top 5 sectors

as of 10/31/08 (%)

| Refunded/Escrowed | | | 16.7 | | |

| Local General Obligations | | | 16.5 | | |

| Special Property Tax | | | 11.4 | | |

| Water & Sewer | | | 8.7 | | |

| Local Appropriated | | | 7.8 | | |

Quality breakdown

as of 10/31/08 (%)

| AAA | | | 21.2 | | |

| AA | | | 52.3 | | |

| A | | | 10.4 | | |

| BBB | | | 11.9 | | |

| BB | | | 0.2 | | |

| Non-rated | | | 2.9 | | |

| Cash & Equivalents | | | 1.1 | | |

Maturity breakdown

as of 10/31/08 (%)

| 1-3 years | | | 1.1 | | |

| 3-5 years | | | 6.7 | | |

| 5-7 years | | | 15.0 | | |

| 7-10 years | | | 16.9 | | |

| 10-15 years | | | 23.7 | | |

| 15-20 years | | | 13.5 | | |

| 20-25 years | | | 8.3 | | |

| 25 years and over | | | 13.6 | | |

| Cash & Equivalents | | | 1.1 | | |

Ratings shown in the quality breakdown represent the rating assigned to a particular bond by one of the following nationally-recognized rating agencies: Standard and Poor's, Moody's Investors Service, Inc. or Fitch Ratings Ltd. Ratings are relative and subjective and are not absolute standards of quality. The fund's credit quality does not remove market risk.

The fund is actively managed and the composition of its portfolio will change over time. Information provided is calculated as a percentage of net assets.

Housing and budget concerns pressured California's economy

Falling home prices and mortgage foreclosures were the triggers for California's latest recession. Stressed homeowners have slashed spending, eroding tax revenues at a time of severe shortfalls in the state's budget. Cutbacks in government construction projects added to California's unemployment rate, already among the nation's highest. With the 2009 budget gap unresolved well into the fiscal year, steep reductions were anticipated in state payrolls and programs; a boost in the sales tax was also possible. Depending on the outcome of these and other factors there may be rating downgrades by the rating agencies. Longer term, once the current slowdown ends and the budget stabilizes, we believe that California's strengths in technology, agriculture and higher education, plus global tourism and international trade, may set the state's economy back on course.

A cautious, deliberate approach

A widening difference in yield between higher and lower quality securities of comparable maturities offers potential opportunities in bonds in the mid and lower quality tiers. However, we are being selective in our choice of securities because we do not believe that the challenges facing municipal issuers will dissipate quickly in light of the current economic slowdown. In this environment, we believe that short-term interest rates are likely to remain low and further stimulus moves are possible. Eventually, we believe that taxes may rise, making municipal bonds more attractive. However, we believe that continued stimulus programs could also trigger inflation over the longer-term, a potential negative for bond investors.

Portfolio holdings and characteristics are subject to change periodically and may not be representative of current holdings and characteristics. The outlook for the fund may differ from that presented for other Columbia Funds.

Tax-exempt investing offers current tax-exempt income, but it also involves special risks. The value of the fund will be affected by interest rate changes and the creditworthiness of issues held in the fund. When interest rates go up, bond prices generally drop and vice versa.

Interest income from certain tax-exempt bonds may be subject to certain state and local taxes and, if applicable, the alternative minimum tax. Capital gains are not exempt from income taxes.

Single-state municipal bond funds pose additional risks due to limited geographical diversification.

6

Investment Portfolio – Columbia California Tax-Exempt Fund

October 31, 2008

| Municipal Bonds – 95.6% | |

| | | Par ($) | | Value ($) | |

| Education – 3.2% | |

| Education – 2.8% | |

| CA Educational Facilities Authority | |

California College of Arts,

Series 2005:

5.000% 06/01/26 | | | 1,000,000 | | | | 717,120 | | |

| 5.000% 06/01/35 | | | 1,500,000 | | | | 980,175 | | |

| California Lutheran University, | |

Series 2008,

5.750% 10/01/38 | | | 3,000,000 | | | | 2,350,800 | | |

| Loyola Marymount University, | |

Series 2001,

Insured: MBIA

(a) 10/01/15 | | | 1,265,000 | | | | 903,956 | | |

| University of Redlands, | |

Series 2008 A,

5.125% 08/01/38 | | | 1,750,000 | | | | 1,499,942 | | |

| University of Southern California, | |

Series 2007 A,

4.500% 10/01/33 | | | 2,500,000 | | | | 2,051,900 | | |

| Woodbury University, | |

Series 2006,

5.000% 01/01/25 | | | 1,830,000 | | | | 1,339,286 | | |

CA Statewide Communities Development

Authority | |

San Francisco Art Institute,

Series 2002,

7.375% 04/01/32 | | | 2,000,000 | | | | 1,641,560 | | |

| Education Total | | | 11,484,739 | | |

| Prep School – 0.4% | |

CA Statewide Communities Development

Authority | |

Crossroads School for Arts & Sciences,

Series 1998,

6.000% 08/01/28 (b) | | | 1,690,000 | | | | 1,458,690 | | |

| Prep School Total | | | 1,458,690 | | |

| Education Total | | | 12,943,429 | | |

| Health Care – 8.3% | |

| Continuing Care Retirement – 0.8% | |

CA ABAG Finance Authority for

Nonprofit Corps. | |

Channing House,

Series 1999,

5.375% 02/15/19 | | | 1,700,000 | | | | 1,525,512 | | |

| | | Par ($) | | Value ($) | |

CA Riverside County Public

Financing Authority | |

Air Force Village West, Inc.,

Series 1999,

5.750% 05/15/19 | | | 2,000,000 | | | | 1,822,000 | | |

| Continuing Care Retirement Total | | | 3,347,512 | | |

| Hospitals – 7.5% | |

CA ABAG Finance Authority for

Nonprofit Corps. | |

San Diego Hospital Association,

Series 2003 C,

5.375% 03/01/21 | | | 1,000,000 | | | | 897,620 | | |

| CA Health Facilities Financing Authority | |

Catholic Healthcare West,

Series 2004 I,

4.950% 07/01/26 | | | 1,000,000 | | | | 966,380 | | |

Cedars-Sinai Medical Center,

Series 2005:

5.000% 11/15/27 | | | 1,500,000 | | | | 1,263,435 | | |

| 5.000% 11/15/34 | | | 2,500,000 | | | | 1,977,075 | | |

Kaiser Permanante,

Series 2006, | | | |

| 5.250% 04/01/39 | | | 2,000,000 | | | | 1,636,400 | | |

Stanford Hospital & Clinics,

Series 2003 A, | | | |

| 5.000% 11/15/12 | | | 500,000 | | | | 501,310 | | |

Sutter Health,

Series 2042 A, | | | |

| 5.000% 11/15/42 | | | 2,000,000 | | | | 1,602,140 | | |

CA Infrastructure & Economic

Development Bank | |

Kaiser Assistance Corp.,

Series 2001 A,

5.550% 08/01/31 | | | 2,500,000 | | | | 2,170,600 | | |

| CA Kaweah Delta Health Care District | |

| Series 2006, | |

| 4.500% 06/01/34 | | | 3,500,000 | | | | 2,353,785 | | |

| CA Loma Linda Hospital | |

Loma Linda University Medical Center,

Series 2005,

5.000% 12/01/22 | | | 6,155,000 | | | | 5,068,212 | | |

| CA Municipal Finance Authority | |

Community Hospital Center,

Series 2007,

5.250% 02/01/37 | | | 2,500,000 | | | | 1,761,425 | | |

See Accompanying Notes to Financial Statements.

7

Columbia California Tax-Exempt Fund

October 31, 2008

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

CA Rancho Mirage Joint Powers

Financing Authority | |

Eisenhower Medical Center,

Series 2007 A,

5.000% 07/01/47 | | | 2,500,000 | | | | 1,843,375 | | |

| CA Sierra View Local Health Care District | |

| Series 2007, | |

| 5.250% 07/01/37 | | | 1,500,000 | | | | 1,144,140 | | |

CA Statewide Communities

Development Authority | |

Kaiser Permanente,

Series 2007 A,

4.750% 04/01/33 | | | 2,000,000 | | | | 1,534,260 | | |

| CA Turlock Health Facility | |

Emanuel Medical Center, Inc.:

Series 2004:

5.000% 10/15/13 | | | 940,000 | | | | 899,721 | | |

| 5.375% 10/15/34 | | | 800,000 | | | | 598,824 | | |

| Series 2007 A, | |

| 5.000% 10/15/22 | | | 2,780,000 | | | | 2,234,397 | | |

| Series 2007 B, | |

| 5.125% 10/15/37 | | | 2,500,000 | | | | 1,740,350 | | |

| Hospitals Total | | | 30,193,449 | | |

| Health Care Total | | | 33,540,961 | | |

| Housing – 1.0% | |

| Multi-Family – 0.4% | |

CA Statewide Communities

Development Authority | |

Oracle Communities Corp.,

Series 2002 E-1,

5.375% 07/01/32 | | | 2,000,000 | | | | 1,459,340 | | |

| Multi-Family Total | | | 1,459,340 | | |

| Single-Family – 0.6% | |

| CA Housing Finance Agency | |

Series 1997 B-3 Class I, AMT,

Insured: FHA

5.400% 08/01/28 | | | 485,000 | | | | 474,417 | | |

Series 2006 K, AMT,

4.625% 08/01/26 | | | 2,500,000 | | | | 1,889,150 | | |

| CA Rural Home Mortgage Finance Authority | |

Series 1997 A-2, AMT,

Guarantor: GNMA

7.000% 09/01/29 | | | 40,000 | | | | 40,420 | | |

Series 1998 B-5, AMT,

Guarantor: FNMA

6.350% 12/01/29 | | | 55,000 | | | | 55,929 | | |

| | | Par ($) | | Value ($) | |

Series 2000 B, AMT,

Guarantor: FNMA

7.300% 06/01/31 | | | 40,000 | | | | 40,983 | | |

Series 2000 D, AMT,

Guarantor: GNMA

7.100% 06/01/31 | | | 40,000 | | | | 40,481 | | |

| Single-Family Total | | | 2,541,380 | | |

| Housing Total | | | 4,000,720 | | |

| Industrials – 0.5% | |

| Oil & Gas – 0.5% | |

CA Southern California Public

Power Authority | |

| Series 2007, | |

| 5.000% 11/01/33 | | | 3,385,000 | | | | 2,111,902 | | |

| Oil & Gas Total | | | 2,111,902 | | |

| Industrials Total | | | 2,111,902 | | |

| Other – 18.7% | |

| Other – 0.7% | |

CA Infrastructure & Economic

Development Bank | |

Walt Disney Family Museum,

Series 2008,

5.250% 02/01/38 | | | 3,050,000 | | | | 2,694,217 | | |

| Other Total | | | 2,694,217 | | |

| Pool/Bond Bank – 0.1% | |

| CA Educational Facilities Authority | |

| Series 1999 B, | |

| 5.250% 04/01/24 | | | 725,000 | | | | 558,627 | | |

| Pool/Bond Bank Total | | | 558,627 | | |

| Refunded/Escrowed (c) – 16.7% | |

| CA Central Unified School District | |

Series 1993,

Escrowed to Maturity,

Insured: AMBAC

(a) 03/01/18 | | | 20,065,000 | | | | 12,749,903 | | |

CA Daly City Housing Development

Finance Agency | |

Linc Franciscan LP,

Series 2002 A,

Pre-refunded 12/15/13,

5.850% 12/15/32 | | | 2,000,000 | | | | 2,277,920 | | |

See Accompanying Notes to Financial Statements.

8

Columbia California Tax-Exempt Fund

October 31, 2008

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

| CA East Whittier City School District | |

Series 1997 A,

Escrowed to Maturity,

Insured: FGIC

5.750% 08/01/17 | | | 1,675,000 | | | | 1,835,415 | | |

| CA Educational Facilities Authority | |

Series 1999 B,

Pre-refunded 04/01/09,

5.250% 04/01/24 | | | 275,000 | | | | 281,831 | | |

Series 2000 B,

Pre-refunded 06/01/10,

6.625% 06/01/20 | | | 170,000 | | | | 182,493 | | |

| CA Health Facilities Financing Authority | |

Kaiser Permanente,

Series 1998 A,

Escrowed to Maturity,

Insured: FSA

5.000% 06/01/24 | | | 3,000,000 | | | | 2,993,430 | | |

CA Infrastructure & Economic Development

Bank Revenue | |

Series 2003 A,

Pre-refunded 07/01/26,

Insured: AMBAC

5.125% 07/01/37 | | | 4,275,000 | | | | 4,402,865 | | |

CA Inland Empire Solid Waste

Financing Authority | |

Series 1996 B, AMT,

Escrowed to Maturity,

Insured: FSA

6.250% 08/01/11 | | | 1,270,000 | | | | 1,328,966 | | |

| CA Lompoc Unified School District | |

Election of 2002,

Series 2003 A,

Pre-refunded 08/01/13,

Insured: FGIC

5.000% 08/01/27 | | | 2,065,000 | | | | 2,235,342 | | |

CA Metropolitan Water District of

Southern California | |

| Series 1993 A, | |

Escrowed to Maturity,

5.750% 07/01/21 | | | 2,865,000 | | | | 3,103,569 | | |

| CA Morgan Hill Unified School District | |

Series 2002,

Escrowed to Maturity,

Insured: FGIC

(a) 08/01/21 | | | 2,010,000 | | | | 1,026,567 | | |

| | | Par ($) | | Value ($) | |

CA Pleasanton-Suisun City Home

Financing Authority | |

Series 1984 A,

Escrowed to Maturity,

Insured: MBIA

(a) 10/01/16 | | | 5,270,000 | | | | 3,674,350 | | |

| CA Pomona | |

Single Family Mortgage Revenue,

Series 1990 B,

Escrowed to Maturity,

Guarantor: GNMA

7.500% 08/01/23 | | | 1,000,000 | | | | 1,206,320 | | |

| CA Redding Electric Systems Revenue | |

Series 1992 A, IFRN,

Escrowed to Maturity,

Insured: MBIA

6.223% 07/01/22 (d) | | | 580,000 | | | | 735,649 | | |

| CA Riverside County | |

Series 1989 A, AMT,

Escrowed to Maturity,

Guarantor: GNMA

7.800% 05/01/21 | | | 2,500,000 | | | | 3,100,375 | | |

CA San Joaquin Hills Transportation

Corridor Agency | |

Series 1993,

Escrowed to Maturity,

(a) 01/01/20 | | | 15,400,000 | | | | 8,662,038 | | |

| CA San Jose Redevelopment Agency | |

Series 1993,

Escrowed to Maturity,

Insured: MBIA

6.000% 08/01/15 | | | 1,405,000 | | | | 1,611,914 | | |

| CA Santa Margarita Water District | |

Community Facilities District No. 99-1,

Series 2003,

Pre-refunded 09/01/13,

6.000% 09/01/30 | | | 1,000,000 | | | | 1,108,120 | | |

CA Southern California Public

Power Authority | |

Series 2003 A-1,

Pre-refunded 07/01/13,

Insured: AMBAC

5.000% 07/01/25 | | | 1,000,000 | | | | 1,082,820 | | |

| CA State Department of Water Resources | |

Series 2001,

Escrowed to Maturity,

Insured: FSA

5.500% 12/01/14 | | | 10,000 | | | | 11,164 | | |

See Accompanying Notes to Financial Statements.

9

Columbia California Tax-Exempt Fund

October 31, 2008

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

CA Statewide Communities

Development Authority | |

Eskaton Village - Grass Valley,

Series 2000,

Pre-refunded 11/15/10,

8.250% 11/15/31 | | | 2,395,000 | | | | 2,666,928 | | |

| CA State | |

Series 2000:

Pre-refunded 05/01/10,

5.625% 05/01/26 | | | 60,000 | | | | 63,655 | | |

| Pre-refunded 09/01/10, | |

| Insured: FGIC | |

| 5.250% 09/01/30 | | | 155,000 | | | | 163,375 | | |

| Series 2004: | |

| Pre-refunded 02/01/14, | |

| 5.000% 02/01/33 | | | 1,000,000 | | | | 1,079,630 | | |

| Pre-refunded 04/01/14, | |

| 5.250% 04/01/34 | | | 1,500,000 | | | | 1,640,850 | | |

| CA Whisman School District | |

Series 1996 A,

Escrowed to Maturity,

Insured: FGIC

(a) 08/01/16 | | | 1,645,000 | | | | 1,166,124 | | |

PR Commonwealth of Puerto Rico

Aqueduct & Sewer Authority | |

Series 1995,

Escrowed to Maturity,

Insured: MBIA

6.250% 07/01/13 | | | 2,750,000 | | | | 3,109,508 | | |

PR Commonwealth of Puerto Rico

Electric Power Authority | |

| Series 1989 O, | |

Pre-refunded to various dates

beginning 07/01/15,

(a) 07/01/17 | | | 2,490,000 | | | | 1,611,528 | | |

PR Commonwealth of Puerto Rico

Infrastructure Financing Authority | |

| Series 2000 A, | |

Economically Defeased to Maturity,

5.500% 10/01/32 | | | 1,500,000 | | | | 1,501,125 | | |

PR Commonwealth of Puerto Rico

Public Finance Corp. | |

| Series 2002 E, | |

Pre-refunded 02/01/12,

5.500% 08/01/29 | | | 480,000 | | | | 511,502 | | |

| Refunded/Escrowed Total | | | 67,125,276 | | |

| | | Par ($) | | Value ($) | |

| Tobacco – 1.2% | |

| CA Golden State Tobacco Securitization Corp. | |

| Series 2007 A-1, | |

| 5.000% 06/01/33 | | | 7,500,000 | | | | 4,650,675 | | |

| Tobacco Total | | | 4,650,675 | | |

| Other Total | | | 75,028,795 | | |

| Resource Recovery – 0.8% | |

| Disposal – 0.8% | |

| CA Pollution Control Financing Authority | |

Waste Management,

Series 2002 A,

5.000% 01/01/22 | | | 2,000,000 | | | | 1,465,500 | | |

CA Statewide Communities Development

Authority | |

| Series 2003 A, AMT, | |

| 4.950% 12/01/12 | | | 2,000,000 | | | | 1,749,760 | | |

| Disposal Total | | | 3,215,260 | | |

| Resource Recovery Total | | | 3,215,260 | | |

| Tax-Backed – 46.0% | |

| Local Appropriated – 7.8% | |

| CA Alameda County | |

| Series 1989, | |

| Insured: MBIA | |

| (a) 06/15/14 | | | 2,185,000 | | | | 1,672,071 | | |

| CA Anaheim Public Financing Authority | |

| Series 1997 C, | |

| Insured: FSA | |

| 6.000% 09/01/14 | | | 3,500,000 | | | | 3,868,445 | | |

| Series 2007 A-1, | |

| Insured: FGIC | |

| 4.250% 09/01/35 | | | 3,500,000 | | | | 2,533,440 | | |

| CA Antelope Valley East-Kern Water Agency | |

Certificates of Participation,

Series 2007 A-1,

Insured: FGIC

4.375% 06/01/37 | | | 2,500,000 | | | | 1,882,525 | | |

| CA Bodega Bay Fire Protection District | |

Certificates of Participation,

Series 1996,

6.450% 10/01/31 | | | 1,185,000 | | | | 975,267 | | |

See Accompanying Notes to Financial Statements.

10

Columbia California Tax-Exempt Fund

October 31, 2008

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

| CA Los Angeles County Schools | |

Regionalized Business Services Corp.,

Series 1999 A,

Insured: AMBAC:

(a) 08/01/16 | | | 1,945,000 | | | | 1,307,662 | | |

| (a) 08/01/17 | | | 1,980,000 | | | | 1,246,529 | | |

| CA Modesto | |

Certificates of Participation,

Series 1993 A,

Insured: AMBAC

5.000% 11/01/23 | | | 2,235,000 | | | | 1,989,552 | | |

CA Oakland Joint Powers Financing

Authority | |

| Series 2008 B, | |

| 5.000% 08/01/22 | | | 3,000,000 | | | | 2,892,810 | | |

| CA Sacramento City Financing Authority | |

| Series 1993 A, | |

| Insured: AMBAC | |

| 5.375% 11/01/14 | | | 1,100,000 | | | | 1,134,111 | | |

| CA San Joaquin County | |

Certificates of Participation,

Series 1993,

Insured: MBIA

5.500% 11/15/13 | | | 1,750,000 | | | | 1,820,893 | | |

| CA Santa Ana Financing Authority | |

| Series 1994 A, | |

| Insured: MBIA | |

| 6.250% 07/01/18 | | | 6,035,000 | | | | 6,449,665 | | |

| CA Victor Elementary School District | |

| Series 1996, | |

| Insured: MBIA | |

| 6.450% 05/01/18 | | | 3,345,000 | | | | 3,641,534 | | |

| Local Appropriated Total | | | 31,414,504 | | |

| Local General Obligations – 16.5% | |

| CA Cabrillo Unified School District | |

| Series 1996 A, | |

| Insured: AMBAC | |

| (a) 08/01/15 | | | 3,000,000 | | | | 2,149,710 | | |

CA Central Valley School District

Financing Authority | |

| Series 1998 A, | |

| Insured: MBIA | |

| 6.450% 02/01/18 | | | 1,000,000 | | | | 1,087,140 | | |

| | | Par ($) | | Value ($) | |

| CA Clovis Unified School District | |

| Series 2001 A, | |

| Insured: FGIC | |

| (a) 08/01/16 | | | 3,000,000 | | | | 2,053,890 | | |

| CA Coast Community College District | |

| Series 2005, | |

| Insured: MBIA | |

| (a) 08/01/22 | | | 4,000,000 | | | | 1,856,800 | | |

| CA Corona-Norco Unified School District | |

| Series 2001 C, | |

| Insured: FGIC | |

| (a) 09/01/17 | | | 1,000,000 | | | | 626,570 | | |

CA Culver City School Facilities

Financing Authority | |

| Series 2005, | |

| Insured: FSA: | |

| 5.500% 08/01/25 | | | 655,000 | | | | 675,253 | | |

| 5.500% 08/01/26 | | | 1,750,000 | | | | 1,804,057 | | |

CA East Side Union High School

District Santa Clara County | |

| Series 2003 B, | |

| Insured: MBIA | |

| 5.250% 08/01/26 | | | 2,010,000 | | | | 1,838,326 | | |

| CA Fillmore Unified School District | |

| Series 1997 A, | |

| Insured: FGIC | |

| (a) 07/01/17 | | | 650,000 | | | | 411,158 | | |

| CA Fresno Unified School District | |

| Series 2002 A, | |

| Insured: MBIA | |

| 6.000% 02/01/19 | | | 2,480,000 | | | | 2,594,526 | | |

| CA Golden West Schools Financing Authority | |

Beverly Hills Unified School District,

Series 2005,

Insured: FGIC

5.250% 08/01/18 | | | 1,000,000 | | | | 1,042,630 | | |

Placentia Yorba Linda Unified,

Series 2006,

Insured: AMBAC

5.500% 08/01/24 | | | 1,825,000 | | | | 1,877,268 | | |

| CA Grossmont Union High School District | |

| Series 2006, | |

| Insured: MBIA | |

| (a) 08/01/28 | | | 5,000,000 | | | | 1,517,300 | | |

See Accompanying Notes to Financial Statements.

11

Columbia California Tax-Exempt Fund

October 31, 2008

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

CA Hacienda La Puente Unified

School District | |

| Series 2005, | |

| Insured: FGIC | |

| 5.000% 08/01/19 | | | 2,050,000 | | | | 2,026,199 | | |

| CA Jefferson Union High School District | |

| Series 2000 A, | |

| Insured: MBIA | |

| 6.450% 08/01/25 | | | 1,000,000 | | | | 1,040,770 | | |

| CA Lafayette | |

| Series 2002, | |

| 5.125% 07/15/25 | | | 1,995,000 | | | | 1,965,155 | | |

| CA Las Virgenes Unified School District | |

| Series 1997 C, | |

| Insured: FGIC | |

| (a) 11/01/20 | | | 1,205,000 | | | | 615,526 | | |

| CA Los Angeles Unified School District | |

| Series 2002 E, | |

| Insured: MBIA | |

| 5.750% 07/01/16 | | | 2,500,000 | | | | 2,742,150 | | |

| CA Manteca Unified School District | |

| Series 2006, | |

| Insured: MBIA | |

| (a) 08/01/32 | | | 5,440,000 | | | | 1,191,578 | | |

| CA Modesto High School District | |

| Series 2002 A, | |

| Insured: FGIC | |

| (a) 08/01/16 | | | 1,500,000 | | | | 1,008,480 | | |

| CA New Haven Unified School District | |

| Series 2002, | |

| Insured: FSA | |

| 12.000% 08/01/17 | | | 1,565,000 | | | | 2,423,089 | | |

| CA Oak Park Unified School District | |

| Series 2000, | |

| Insured: FSA | |

| (a) 05/01/14 | | | 2,095,000 | | | | 1,660,853 | | |

| CA Oxnard Union High School District | |

| Series 2001 A, | |

| Insured: MBIA | |

| 5.650% 02/01/17 | | | 960,000 | | | | 1,001,222 | | |

| CA Pajaro Valley Unified School District | |

| Series 2005, | |

| Insured: FSA | |

| 5.250% 08/01/18 | | | 1,000,000 | | | | 1,033,760 | | |

| | | Par ($) | | Value ($) | |

| CA Pomona Unified School District | |

| Series 2001 A, | |

| Insured: MBIA | |

| 5.900% 02/01/16 | | | 845,000 | | | | 898,565 | | |

| CA Redwood City Elementary School District | |

| Series 1997, | |

| Insured: FGIC | |

| (a) 08/01/18 | | | 2,385,000 | | | | 1,389,429 | | |

| CA Rocklin Unified School District | |

| Series 1995 C, | |

| Insured: MBIA | |

| (a) 07/01/20 | | | 6,920,000 | | | | 3,679,295 | | |

| Series 2003, | |

| Insured: FGIC | |

| (a) 08/01/17 | | | 2,000,000 | | | | 1,259,120 | | |

| CA San Juan Unified School District | |

| Series 2001, | |

| Insured: FSA | |

| (a) 08/01/15 | | | 2,760,000 | | | | 2,001,304 | | |

| CA San Marino Unified School District | |

| Series 1998 B, | |

| 5.000% 06/01/23 | | | 1,000,000 | | | | 994,840 | | |

| CA San Mateo County Community College | |

| Series 2006 C, | |

| Insured: MBIA | |

| (a) 09/01/26 | | | 1,925,000 | | | | 662,335 | | |

| CA San Mateo Union High School District | |

| Series 2000 B, | |

| Insured: FGIC | |

| (a) 09/01/26 | | | 4,005,000 | | | | 1,385,890 | | |

| CA Sanger Unified School District | |

| Series 1999, | |

| Insured: MBIA | |

| 5.350% 08/01/15 | | | 1,500,000 | | | | 1,522,395 | | |

| CA Santa Margarita - Dana Point Authority | |

| Series 1994 B, | |

| Insured: MBIA | |

| 7.250% 08/01/13 | | | 2,000,000 | | | | 2,294,320 | | |

| CA Saratoga | |

| Series 2001, | |

| Insured: MBIA | |

| 5.250% 08/01/31 | | | 2,000,000 | | | | 1,930,340 | | |

| CA Simi Valley Unified School District | |

| Series 1997, | |

| Insured: AMBAC | |

| 5.250% 08/01/22 | | | 925,000 | | | | 875,485 | | |

See Accompanying Notes to Financial Statements.

12

Columbia California Tax-Exempt Fund

October 31, 2008

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

| CA South San Francisco Unified School District | |

| Series 2006, | |

| Insured: MBIA | |

| 5.250% 09/15/22 | | | 1,500,000 | | | | 1,548,180 | | |

| CA Tahoe-Truckee Unified School District | |

| No. 1-A, | |

| Series 1999, | |

| Insured: FGIC | |

| (a) 08/01/23 | | | 3,780,000 | | | | 1,533,697 | | |

| No. 2-A, | |

| Series 1999, | |

| Insured: FGIC | |

| (a) 08/01/24 | | | 2,965,000 | | | | 1,121,333 | | |

| CA Union Elementary School District | |

| Series 1999 A, | |

| Insured: FGIC | |

| (a) 09/01/19 | | | 1,750,000 | | | | 970,882 | | |

| CA Upland Unified School District | |

| Series 2001, | |

| Insured: FSA | |

| 5.125% 08/01/25 | | | 750,000 | | | | 733,043 | | |

| CA West Contra Costa Unified School District | |

| Series 2001 A, | |

| Insured: MBIA | |

| 5.600% 02/01/20 | | | 1,610,000 | | | | 1,568,591 | | |

| Series 2005 D, | |

| Insured: FGIC | |

| (a) 08/01/22 | | | 5,000,000 | | | | 2,100,450 | | |

| CA West Covina Unified School District | |

| Series 2002 A, | |

| Insured: MBIA | |

| 5.250% 02/01/19 | | | 725,000 | | | | 718,374 | | |

| CA Yuba City Unified School District | |

| Series 2000, | |

| Insured: FGIC | |

| (a) 09/01/20 | | | 2,385,000 | | | | 1,174,994 | | |

| Local General Obligations Total | | | 66,606,272 | | |

| Special Non-Property Tax – 3.2% | |

| CA San Diego Redevelopment Agency | |

| Series 2001, | |

| Insured: FSA | |

| (a) 09/01/20 | | | 3,630,000 | | | | 1,817,323 | | |

CA San Francisco Bay Area Rapid Transit

Financing Authority | |

| Series 2001, | |

| Insured: AMBAC | |

| 5.000% 07/01/26 | | | 525,000 | | | | 501,816 | | |

| | | Par ($) | | Value ($) | |

| Series 2005 A, | |

| Insured: MBIA | |

| 4.250% 07/01/25 | | | 2,000,000 | | | | 1,711,520 | | |

| PR Commonwealth of Puerto Rico Highway & Transportation Authority | |

| Series 1996 Y, | |

| Insured: MBIA | |

| 6.250% 07/01/12 | | | 3,000,000 | | | | 3,142,380 | | |

| Series 1998 A, | |

| Insured: MBIA | |

| 4.750% 07/01/38 | | | 2,250,000 | | | | 1,706,288 | | |

| Series 2002 E, | |

| Insured: FSA | |

| 5.500% 07/01/14 | | | 2,000,000 | | | | 2,091,800 | | |

| Series 2006 BB, | |

| Insured: FSA | |

| 5.250% 07/01/22 | | | 2,000,000 | | | | 1,932,680 | | |

| Special Non-Property Tax Total | | | 12,903,807 | | |

| Special Property Tax – 11.4% | |

| CA Carson Improvement Bond Act 1915 | |

| Series 1992, | |

| 7.375% 09/02/22 | | | 125,000 | | | | 118,813 | | |

| CA Cerritos Public Financing Authority | |

Los Coyotes Redevelopment,

Series 1993 A,

Insured: AMBAC

6.500% 11/01/23 | | | 2,000,000 | | | | 2,112,220 | | |

| CA Elk Grove Unified School District | |

Community Facilities District No. 1,

Series 1995 A,

Insured: AMBAC:

(a) 12/01/18 | | | 2,720,000 | | | | 1,518,386 | | |

| 6.500% 12/01/24 | | | 4,055,000 | | | | 4,046,687 | | |

| CA Inglewood Redevelopment Agency | |

| Series 1998 A, | |

| Insured: AMBAC | |

| 5.250% 05/01/23 | | | 1,000,000 | | | | 977,670 | | |

| CA Lancaster Financing Authority | |

| Series 2003, | |

| Insured: MBIA | |

| 5.125% 02/01/17 | | | 1,270,000 | | | | 1,287,640 | | |

| CA Long Beach Bond Finance Authority | |

| Series 2006 C, | |

| Insured: AMBAC | |

| 5.500% 08/01/31 | | | 3,250,000 | | | | 2,937,610 | | |

See Accompanying Notes to Financial Statements.

13

Columbia California Tax-Exempt Fund

October 31, 2008

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

CA Los Angeles Community

Redevelopment Agency | |

| Series 1998 C, | |

| Insured: MBIA | |

| 5.375% 07/01/18 | | | 1,665,000 | | | | 1,676,722 | | |

CA Los Angeles County Public Works

Financing Authority | |

| J.F. Shea Co., | |

| Series 1996 A, | |

| Insured: FSA | |

| 5.500% 10/01/18 | | | 2,695,000 | | | | 2,859,179 | | |

| Regional Park & Open Space, | |

| Series 2005, | |

| Insured: FSA | |

| 5.250% 10/01/18 | | | 2,000,000 | | | | 2,124,120 | | |

| CA Oakdale Public Financing Authority | |

Central City Redevelopment Project,

Series 2004,

5.375% 06/01/33 | | | 1,500,000 | | | | 1,134,960 | | |

| CA Oakland Redevelopment Agency | |

| Series 1992, | |

| Insured: AMBAC | |

| 5.500% 02/01/14 | | | 8,400,000 | | | | 8,844,360 | | |

| CA Oceanside Community Facilities | |

Ocean Ranch Corp.,

Series 2004,

5.875% 09/01/34 | | | 1,000,000 | | | | 803,130 | | |

CA Orange County Community

Facilities District | |

Ladera Ranch,

Series 2004 A,

5.625% 08/15/34 | | | 850,000 | | | | 679,787 | | |

CA Rancho Cucamonga

Redevelopment Agency | |

| Series 2007 A, | |

| Insured: MBIA | |

| 5.000% 09/01/34 | | | 1,000,000 | | | | 854,320 | | |

CA Redwood City Community Facilities

District No. 1 | |

| Series 2003 B, | |

| 5.950% 09/01/28 | | | 750,000 | | | | 628,507 | | |

CA Riverside County Public

Financing Authority | |

| Series 1991 A, | |

| 8.000% 02/01/18 | | | 20,000 | | | | 20,061 | | |

| | | Par ($) | | Value ($) | |

CA San Bernardino Joint Powers

Financing Authority | |

| Series 1998 A, | |

| Insured: AMBAC | |

| 5.750% 07/01/14 | | | 985,000 | | | | 1,041,874 | | |

| Series 2005 A, | |

| Insured: FSA | |

| 5.750% 10/01/24 | | | 2,420,000 | | | | 2,557,383 | | |

| CA San Jose Redevelopment Agency | |

| Series 1993, | |

| Insured: MBIA | |

| 6.000% 08/01/15 | | | 2,790,000 | | | | 3,004,663 | | |

| CA Sulphur Springs Unified School District | |

| Series 2002-1-A, | |

| 6.000% 09/01/33 | | | 1,500,000 | | | | 1,162,935 | | |

| CA West Covina Redevelopment Agency | |

| Series 1996, | |

| 6.000% 09/01/17 | | | 5,000,000 | | | | 5,346,100 | | |

| Special Property Tax Total | | | 45,737,127 | | |

| State Appropriated – 2.5% | |

| CA Public Works Board | |

Department of Mental Health,

Coalinga State Hospital,

Series 2004 A,

5.500% 06/01/19 | | | 1,500,000 | | | | 1,526,790 | | |

Various State Prisons Projects,

Series 1993 A,

Insured: AMBAC:

5.000% 12/01/19 | | | 6,000,000 | | | | 5,789,520 | | |

| 5.250% 12/01/13 | | | 2,500,000 | | | | 2,553,300 | | |

| State Appropriated Total | | | 9,869,610 | | |

| State General Obligations – 4.6% | |

| CA State | |

| Series 1995, | |

| 5.750% 03/01/09 | | | 65,000 | | | | 65,709 | | |

| Series 2000, | |

| 5.625% 05/01/26 | | | 160,000 | | | | 160,387 | | |

| Series 2003, | |

| 5.250% 02/01/20 | | | 1,250,000 | | | | 1,259,088 | | |

| Series 2007, | |

| 4.500% 08/01/26 | | | 2,500,000 | | | | 2,142,050 | | |

| Series 2008, | |

| 5.000% 08/01/34 | | | 2,500,000 | | | | 2,231,925 | | |

PR Commonwealth of Puerto Rico Public

Buildings Authority | |

| Series 2002 C, | |

| 5.500% 07/01/14 | | | 500,000 | | | | 507,485 | | |

See Accompanying Notes to Financial Statements.

14

Columbia California Tax-Exempt Fund

October 31, 2008

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

| PR Commonwealth of Puerto Rico | |

| Series 1995, | |

| Insured: MBIA | |

| 5.650% 07/01/15 | | | 1,000,000 | | | | 1,019,920 | | |

| Series 1996, | |

| Insured: MBIA | |

| 6.500% 07/01/14 | | | 2,000,000 | | | | 2,119,980 | | |

| Series 2004 A: | |

| 5.250% 07/01/21 | | | 2,000,000 | | | | 1,841,380 | | |

| 5.250% 07/01/22 | | | 2,000,000 | | | | 1,833,300 | | |

| Series 2007 A, | |

| 5.500% 07/01/21 | | | 2,500,000 | | | | 2,356,125 | | |

| PR Public Buildings Authority | |

| Series 2007, | |

| 6.250% 07/01/23 | | | 3,000,000 | | | | 3,011,130 | | |

| State General Obligations Total | | | 18,548,479 | | |

| Tax-Backed Total | | | 185,079,799 | | |

| Transportation – 2.4% | |

| Airports – 0.7% | |

| CA County of Sacramento | |

| Series 2008 B, AMT, | |

| Insured: FSA | |

| 5.250% 07/01/39 | | | 1,000,000 | | | | 757,550 | | |

CA San Diego County Regional

Airport Authority | |

| Series 2005, AMT, | |

| Insured: AMBAC | |

| 5.250% 07/01/20 | | | 750,000 | | | | 666,195 | | |

CA San Francisco City & County

Airports Commission | |

| Series 2008 34E, AMT, | |

| 5.750% 05/01/25 | | | 1,500,000 | | | | 1,327,590 | | |

| Airports Total | | | 2,751,335 | | |

| Toll Facilities – 1.7% | |

| CA Bay Area Toll Authority | |

| Series 2008 F-1, | |

| 5.125% 04/01/47 | | | 2,500,000 | | | | 2,219,700 | | |

CA Foothill Eastern Transportation

Corridor Agency | |

| Series 1995 A, | |

| Insured: MBIA | |

| 5.000% 01/01/35 | | | 2,000,000 | | | | 1,646,480 | | |

| | | Par ($) | | Value ($) | |

| Series 1999, | |

| 5.750% 01/15/40 | | | 4,000,000 | | | | 3,113,000 | | |

| Toll Facilities Total | | | 6,979,180 | | |

| Transportation Total | | | 9,730,515 | | |

| Utilities – 14.7% | |

| Investor Owned – 1.8% | |

CA Chula Vista Industrial Development

Authority | |

San Diego Gas & Electric Co.,

Series 1996 B, AMT,

5.500% 12/01/21 | | | 2,000,000 | | | | 1,772,640 | | |

San Diego Gas D,

Series 2005, AMT,

5.000% 12/01/27 | | | 3,500,000 | | | | 2,747,185 | | |

| CA Pollution Control Financing Authority | |

San Diego Gas & Electric Co.,

Series 1996 A,

Insured: AMBAC

5.900% 06/01/14 | | | 2,650,000 | | | | 2,858,237 | | |

| Investor Owned Total | | | 7,378,062 | | |

| Joint Power Authority – 1.1% | |

CA Southern California Public

Power Authority | |

| Series 1989, | |

| 6.750% 07/01/13 | | | 4,000,000 | | | | 4,512,760 | | |

| Joint Power Authority Total | | | 4,512,760 | | |

| Municipal Electric – 3.1% | |

| CA Modesto Irrigation District | |

Certificates of Participation,

Series 2004 B,

5.500% 07/01/35 | | | 2,000,000 | | | | 1,832,900 | | |

| CA Sacramento Municipal Utility District | |

| Series 1993 G, | |

| Insured: MBIA | |

| 6.500% 09/01/13 | | | 1,500,000 | | | | 1,605,705 | | |

| Series 1997 K, | |

| Insured: AMBAC: | |

| 5.250% 07/01/24 | | | 2,220,000 | | | | 2,182,615 | | |

| 5.700% 07/01/17 | | | 1,900,000 | | | | 2,053,501 | | |

| Series 2001 N, | |

| Insured: MBIA | |

| 5.000% 08/15/28 | | | 2,000,000 | | | | 1,815,140 | | |

See Accompanying Notes to Financial Statements.

15

Columbia California Tax-Exempt Fund

October 31, 2008

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

PR Commonwealth of Puerto Rico

Electric Power Authority | |

| Series 2007 VV, | |

| Insured: MBIA | |

| 5.250% 07/01/29 | | | 2,000,000 | | | | 1,756,900 | | |

| Series 2008 WW, | |

| 5.000% 07/01/28 | | | 1,500,000 | | | | 1,286,265 | | |

| Municipal Electric Total | | | 12,533,026 | | |

| Water & Sewer – 8.7% | |

| CA Big Bear Lake | |

| Series 1996, | |

| Insured: MBIA | |

| 6.000% 04/01/15 | | | 1,350,000 | | | | 1,440,018 | | |

| CA Chino Basin Regional Financing Authority | |

| Inland Empire Utilities Agency, | |

| Series 2008 A, | |

| Insured: AMBAC | |

| 5.000% 11/01/38 | | | 2,000,000 | | | | 1,718,320 | | |

| CA Contra Costa Water District | |

| Series 2002 L, | |

| Insured: FSA | |

| 5.000% 10/01/24 | | | 1,920,000 | | | | 1,882,752 | | |

| CA Eastern Municipal Water District | |

| Certificates of Participation, | |

| Series 1991, | |

| Insured: FGIC | |

| 6.750% 07/01/12 | | | 1,000,000 | | | | 1,062,740 | | |

| CA Elsinore Valley Municipal Water District | |

| Certificates of Participation, | |

| Series 1992 A, | |

| Insured: FGIC | |

| 6.000% 07/01/12 | | | 2,500,000 | | | | 2,572,500 | | |

| CA Fresno | |

| Series 1993 A-1, | |

| Insured: AMBAC | |

| 6.250% 09/01/14 | | | 5,000,000 | | | | 5,305,300 | | |

| CA Lodi Wastewater Systems Revenue | |

| Series 2007 A, | |

| Insured: FSA | |

| 5.000% 10/01/37 | | | 1,250,000 | | | | 1,110,525 | | |

CA Los Angeles Department of

Water & Power | |

| Series 2001 A: | |

| 5.125% 07/01/41 | | | 3,000,000 | | | | 2,684,490 | | |

| Insured: FGIC | |

| 5.125% 07/01/41 | | | 3,000,000 | | | | 2,676,540 | | |

| | | Par ($) | | Value ($) | |

| CA Manteca Financing Authority | |

| Series 2003 B, | |

| Insured: MBIA | |

| 5.000% 12/01/33 | | | 665,000 | | | | 668,644 | | |

CA Metropolitan Water District of

Southern California | |

| Series 1993 A, | |

| 5.750% 07/01/21 | | | 3,635,000 | | | | 3,860,188 | | |

| CA Pico Rivera Water Authority | |

| Series 1999 A, | |

| Insured: MBIA | |

| 5.500% 05/01/29 | | | 2,000,000 | | | | 1,936,880 | | |

| CA Sacramento County Sanitation District | |

| Series 2001, | |

| Insured: AMBAC | |

| 5.500% 12/01/18 | | | 2,000,000 | | | | 2,134,520 | | |

| CA Santa Clara Valley Water District | |

| Series 2006, | |

| Insured: FSA | |

| 4.250% 06/01/30 | | | 2,500,000 | | | | 1,992,275 | | |

| CA Santa Maria Water & Wastewater | |

| Series 1997 A, | |

| Insured: AMBAC | |

| (a) 08/01/14 | | | 2,000,000 | | | | 1,520,620 | | |

| CA State Department of Water Resources | |

| Series 2001, | |

| Insured: FSA | |

| 5.500% 12/01/14 | | | 1,990,000 | | | | 2,182,891 | | |

| Water & Sewer Total | | | 34,749,203 | | |

| Utilities Total | | | 59,173,051 | | |

Total Municipal Bonds

(cost of $406,286,166) | | | 384,824,432 | | |

| Municipal Preferred Stock – 0.5% | |

| | | Shares | | | |

| Housing – 0.5% | |

| Multi-Family – 0.5% | |

| Munimae TE Bond Subsidiary LLC | |

| Series 2004 A-2, | |

| 4.900% 06/30/49 (e) | | | 2,000,000 | | | | 1,740,180 | | |

| Multi-Family Total | | | 1,740,180 | | |

| Housing Total | | | 1,740,180 | | |

Total Municipal Preferred Stock

(cost of $2,000,000) | | | 1,740,180 | | |

See Accompanying Notes to Financial Statements.

16

Columbia California Tax-Exempt Fund

October 31, 2008

| Investment Company – 0.4% | |

| | | Shares | | Value ($) | |

| Dreyfus Municipal Cash | |

Management Plus

(7 day yield of 2.260%) | | | 1,637,554 | | | | 1,637,554 | | |

Total Investment Company

(cost of $1,637,554) | | | 1,637,554 | | |

| Other – 0.0% | |

| Transportation – 0.0% | |

CA Statewide Communities Development

Authority | |

United Airlines, Inc.,

Series 2001,

07/01/39 (f)(g) | | | 2,000,000 | | | | 80,000 | | |

| Transportation Total | | | 80,000 | | |

Total Other

(cost of $—) | | | 80,000 | | |

| Short-Term Obligation – 0.0% | |

| | | Par ($) | | | |

| Variable Rate Demand Note (h) – 0.0% | |

| CA Department of Water Resources | |

Power Supply Revenue,

Series 2005 F-2,

LOC: JPMorgan Chase Bank,

LOC: Societe Generale

0.900% 05/01/20 | | | 100,000 | | | | 100,000 | | |

| Variable Rate Demand Note Total | | | 100,000 | | |

Total Short-Term Obligation

(cost of $100,000) | | | 100,000 | | |

Total Investments – 96.5%

(cost of $410,023,720) (i) | | | 388,382,166 | | |

| Other Assets & Liabilities, Net – 3.5% | | | 14,067,224 | | |

| Net Assets – 100.0% | | | 402,449,390 | | |

Notes to Investment Portfolio:

(a) Zero coupon bond.

(b) Denotes a restricted security, which is subject to restrictions on resale under federal securities laws or in transactions exempt from registration. At October 31, 2008, the value of this security amounted to $1,458,690 which represents 0.4% of net assets. Additional information on this restricted security is as follows:

| Security | | Acquisition

Date | | Acquisition

Cost | |

CA Statewide Communities Development

Authority; Crossroads School for Arts &

Sciences, Series 1998, 6.000% 08/01/28 | | | 08/21/98 | | | $ | 1,750,000 | | |

(c) The Fund has been informed that each issuer has placed direct obligations of the U.S. Government in an irrevocable trust, solely for the payment of principal and interest.

(d) The interest rate shown on floating rate or variable rate securities reflects the rate at October 31, 2008.

(e) Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2008, the value of this security, which is not illiquid, represents 0.5% of net assets.

(f) Non-income producing.

(g) Position reflects anticipated residual bankruptcy claims. Income is not being accrued.

(h) This security is payable upon demand and secured by letters of credit or other credit support agreements from banks. The interest rate changes periodically and the interest rate shown reflect the rate at October 31, 2008.

(i) Cost for federal income tax purposes is $409,883,637.

At October 31, 2008, the composition of the Fund by revenue source is as follows:

| Holdings By Revenue Source (Unaudited) | | % of

Net Assets | |

| Tax-Backed | | | 46.0 | | |

| Refunded/Escrowed | | | 16.7 | | |

| Utilities | | | 14.7 | | |

| Health Care | | | 8.3 | | |

| Education | | | 3.2 | | |

| Transportation | | | 2.4 | | |

| Other | | | 2.0 | | |

| Housing | | | 1.0 | | |

| Resource Recovery | | | 0.8 | | |

| Industrials | | | 0.5 | | |

| | | | 95.6 | | |

| Municipal Preferred Stock | | | 0.5 | | |

| Investment Company | | | 0.4 | | |

| Other | | | 0.0 | * | |

| Short-Term Obligation | | | 0.0 | * | |

| Other Assets & Liabilities, Net | | | 3.5 | | |

| | | | 100.0 | | |

* Represented less than 0.1%.

| Acronym | | Name | |

| AMBAC | | Ambac Assurance Corp. | |

|

| AMT | | Alternative Minimum Tax | |

|

| FGIC | | Financial Guaranty Insurance Co. | |

|

| FHA | | Federal Housing Administration | |

|

| FNMA | | Federal National Mortgage Association | |

|

| FSA | | Financial Security Assurance, Inc. | |

|

| GNMA | | Government National Mortgage Association | |

|

| IFRN | | Inverse Floating Rate Note | |

|

| LOC | | Letter of Credit | |

|

| MBIA | | MBIA Insurance Corp. | |

|

See Accompanying Notes to Financial Statements.

17

Statement of Assets and Liabilities – Columbia California Tax-Exempt Fund

October 31, 2008

| Assets | | Investments, at cost | | $ | 410,023,720 | | |

| | | Investments, at value | | $ | 388,382,166 | | |

| | | Cash | | | 2,629,050 | | |

| | | Receivable for: | | | | | |

| | | Investments sold | | | 4,704,390 | | |

| | | Fund shares sold | | | 2,561,551 | | |

| | | Interest | | | 5,587,653 | | |

| | | Trustees' deferred compensation plan | | | 33,550 | | |

| | | Other assets | | | 919 | | |

| | | Total Assets | | | 403,899,279 | | |

| Liabilities | | Expense reimbursement due to investment advisor | | | 17,238 | | |