UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

50606 Ameriprise Financial Center, Minneapolis, Minnesota | | 55474 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer 5228 Ameriprise Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | May 31 | |

|

Date of reporting period: | May 31, 2010 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Strategic Income Fund

Annual Report for the Period Ended May 31, 2010

Not FDIC insured • No bank guarantee • May lose value

Table of Contents

| Fund Profile | | | 1 | | |

|

| Economic Update | | | 2 | | |

|

| Performance Information | | | 4 | | |

|

| Understanding Your Expenses | | | 5 | | |

|

| Portfolio Managers' Report | | | 6 | | |

|

| Financial Statements | | | | | |

|

| Investment Portfolio | | | 8 | | |

|

Statement of Assets and

Liabilities | | | 27 | | |

|

| Statement of Operations | | | 29 | | |

|

Statement of Changes in

Net Assets | | | 30 | | |

|

| Financial Highlights | | | 32 | | |

|

| Notes to Financial Statements | | | 36 | | |

|

Report of Independent Registered

Public Accounting Firm | | | 47 | | |

|

| Fund Governance | | | 48 | | |

|

Board Consideration and

Approval of Advisory Agreements | | | 53 | | |

|

Summary of Management Fee

Evaluation by Independent Fee

Consultant (RiverSource

Investments, LLC) | | | 57 | | |

|

| Shareholder Meeting Results | | | 59 | | |

|

Important Information About

This Report | | | 61 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholder:

On May 3, 2010, Ameriprise Financial, Inc. announced that it had completed the acquisition of the long-term asset management business of Columbia Management Group, LLC from Bank of America. This includes the business of managing its equity and fixed-income mutual funds. Ameriprise Financial has combined its current U.S. asset management business, RiverSource Investments, LLC, with Columbia Management. This transaction puts together two leading asset management firms to create one entity that ranks as one of the largest managers of long-term mutual fund assets in the United States. This combined business will operate under the well-regarded Columbia Management brand, where we will build on the strengths of our combined investment capabilities and talent, our broad and diversified product lineup and exceptional service.

Our combined business has a new breadth and depth of investment choices. William "Ted" Truscott, CEO, U.S. asset management and president of annuities for Ameriprise Financial, leads the combined U.S. asset management business. Michael Jones serves as president, U.S. asset management.1 Colin Moore continues to serve as chief investment officer.1 I am also continuing in my role as head of mutual funds, responsible for the delivery of mutual fund products and services to investors. The Columbia funds' advisers, distributor and transfer agent are now subsidiaries of our parent company, Ameriprise Financial but operate under the Columbia Management name. You will begin to see these names used in communications and statements going forward.

| | | Service provider name | |

| Advisers | | Columbia Management Investment Advisers, LLC

Columbia Wanger Asset Management, LLC | |

|

| Distributor | | Columbia Management Investment Distributors, Inc. | |

|

| Transfer Agent | | Columbia Management Investment Services Corp. | |

|

As a valued investor in Columbia funds, please know that our goal is to ensure a smooth transition and provide the highest quality products and services. Transition teams across the organization continue their efforts to build on best practices from both legacy organizations with integration efforts including rebranding, vendor and system consolidations and client communications. Additionally, we want to assure you that the funds' portfolio managers also continue to focus on providing uninterrupted service to all fund shareholders.

Although we have a lot of work ahead of us in 2010, Columbia Management and Ameriprise Financial are excited about the opportunities for our combined organization. I share this optimism and believe it positions us as a best-in-class asset management business with the ability to deliver more for our clients than ever before.

Sincerely,

J. Kevin Connaughton

President, Columbia Funds

1Associate joined Columbia Management Investment Advisers, LLC as part of its 2010 acquisition of the long-term asset management business of Columbia Management Group, LLC from Bank of America.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit www.columbiamanagement.com. Read the prospectus carefully before investing.

Securities products offered through Columbia Management Investment Distributors, Inc. (formerly known as RiverSource Fund Distributors, Inc.), member FINRA. Advisory services provided by Columbia Management Investment Advisers, LLC (formerly known as RiverSource Investments, LLC).

© 2010 Columbia Management Investment Advisers, LLC. All rights reserved.

Fund Profile – Columbia Strategic Income Fund

Summary

g For the 12-month period that ended May 31, 2010, the fund's Class A shares returned 13.14% without sales charge.

g The fund outperformed its primary benchmark, the Barclays Capital Government/Credit Bond Index1, but trailed its blended benchmark, which consists of 35% Barclays Capital Aggregate Bond Index, 35% JPMorgan Global High Yield Index, 15% Citigroup Non-U.S. World Government Bond Index—Unhedged and 15% JPMorgan EMBI Global Diversified Index.2 The fund also lagged its peer group, the Lipper Multi-Sector Income Funds Classification.3

g Allocations to high-yield and emerging market debt aided performance relative to the fund's former benchmark, while an underweight in riskier assets hurt performance relative to the new blended benchmark and the average return of competing funds.

Portfolio Management

Laura A. Ostrander, lead manager of the fund, has managed or co-managed the fund since 2000 and has been associated with the advisor since May 2010. Prior to joining the advisor, Ms. Ostrander was associated with the fund's previous advisor or its predecessors since 1996.

Brian Lavin, CFA has co-managed the fund since 2010 and has been associated with the advisor since 1994.

Colin J. Lundgren, CFA has co-managed the fund since 2010 and has been associated with the advisor since 1986.

Gene R. Tannuzzo, CFA has co-managed the fund since 2010 and has been associated with the advisor since 2003.

Effective July 16, 2010, Laura A. Ostrander will no longer co-manage the fund.

1The Barclays Capital Government/Credit Bond Index is an index that tracks the performance of U.S. government and corporate bonds rated investment grade or better, with maturities of at least one year.

2The Barclays Capital Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity. The JPMorgan Global High Yield Index is designed to mirror the investable universe of the U.S. dollar global high yield corporate debt market, including domestic and international issues. The Citigroup Non-U.S. World Government Bond Index—Unhedged is calculated on a market-weighted basis and includes all fixed-rate bonds with a remaining maturity of one year or longer and with amounts outstanding of at least the equivalent of U.S. $25 million. The index excludes floating or variable rate bonds, securities aimed principally at non-institutional investors and private placem ent-type securities. The JPMorgan Emerging Markets Bond Index Global Diversified Index ("EMBI Global") tracks total returns for traded external debt instruments in the emerging markets and is an expanded version of the JPMorgan Emerging Markets Bond Index Plus ("EMBI+"). As with EMBI+, the EMBI Global includes U.S. dollar-denominated Brady bonds, loans and Eurobonds with an outstanding face value of at least $500 million. It covers more of the eligible instruments than the EMBI+ by relaxing somewhat the strict EMBI+ limits on secondary market trading liquidity.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

3Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustments for the effect of sales loads.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

1-year return as of 05/31/10

| | +13.14% | |

|

| |  | | | Class A shares

(without sales charge) | |

|

| | +8.64% | |

|

| |  | | | Barclays Capital

Government/Credit Bond Index | |

|

| | +16.19% | |

|

| |  | | | Blended Benchmark | |

|

1

Economic Update – Columbia Strategic Income Fund

Summary

For the 12-month period that ended May 31, 2010

g Solid economic growth and relatively low interest rates boosted bond market returns. The Barclays Capital Aggregate Bond Index delivered solid results. High-yield bonds outperformed stocks, as measured by the Credit Suisse High Yield Index.

Barclays

Aggregate Index | | Credit Suisse

Index | |

|

| |  | |

|

g The U.S. stock market delivered solid returns, despite a correction in the final weeks of the period. Emerging market stocks, as measured by the MSCI Emerging Markets Index, outperformed U.S. stocks as well as stock markets in developed foreign markets.

| S&P Index | | MSCI Index | |

|

| |  | |

|

Although it has been nearly a year since U.S. economic growth turned positive, the economy continues to send mixed signals about the sustainability of this recovery. Consumer spending on items such as cars, clothing and other goods, for example, was solid throughout most of the year. However, in May 2010, spending fell 1.2%. By contrast, consumer confidence gained ground near the end of the period as consumers surveyed indicated they were increasingly optimistic about business conditions and job prospects.

The housing market showed some signs of stabilizing. However, a full recovery remained out of reach. Home sales moved generally higher, as mortgage rates remained low and new homebuyers took advantage of a federal tax credit, which was extended through June of 2010—the second such extension in the past six months. Distressed properties continued to pressure prices and a huge backlog of foreclosed homes is likely to continue to keep a lid on prices for some time. Yet, housing prices were higher at the end of May 2010 than they were one year ago.

News on the job front was mostly positive. Approximately 290,000 new jobs were added to the economy in April 2010—the second consecutive month of significant job gains in 2010. Yet, a good portion of those jobs are government sponsored and temporary.

Reports from the business side of the economy were generally positive. A key measure of the nation's manufacturing situation—the Institute for Supply Management's Index—rose for nine consecutive months before a slight downtick in May and industrial production moved higher. Perhaps the best news was about corporate profits. Of the S&P 500 companies announcing first-quarter results, 77% exceeded Wall Street earnings forecasts.

Bond returns ranged from solid to strong

As the economy strengthened, bonds delivered solid returns. The Barclays Capital Aggregate Bond Index1 returned 8.42%. Municipal bonds gained slightly more than taxable investment-grade bonds even without factoring in potential tax advantages to investors in higher income-tax brackets. The Barclays Capital Municipal Bond Index2 returned 8.52%. The high-yield bond market outpaced stocks during the period. For the 12 months covered by this report, the Credit Suisse High Yield Index3 returned 29.96%. Even the Treasury market was positive as the yield on the 10-year U.S. Treasury, a common bellwether for the bond market, fell from 3.5% to 3.3% during the 12-month period. Despite the pickup in economic activity, the Federal Reserve Board kept a key short-term interest rate—the federal funds rate—close to zero.

1The Barclays Capital Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

2The Barclays Capital Municipal Bond Index is considered representative of the broad market for investment-grade, tax-exempt bonds with a maturity of at least one year.

3The Credit Suisse High Yield Index is a broad-based index that tracks the performance of high-yield bonds.

2

Economic Update (continued) – Columbia Strategic Income Fund

Stocks staged a solid comeback

Against a strengthening economic backdrop, a stock market rally that began in mid-March 2009 continued into April 2010, when a debt crisis brewing in Europe spilled over and undermined investor confidence in the United States. The S&P 500 Index lost on the order of 10% in the final six weeks of the period. Yet, the U.S. stock market returned 20.99% for the 12-month period, as measured by the S&P 500 Index.4

Outside the United States, stock market returns were also strong. The MSCI EAFE Index,5 a broad gauge of stock market performance in foreign developed markets, returned 6.38% (net of dividends, in U.S. dollars) for the period, as concerns about the impact of a bailout for weak eurozone economies weighed on the markets. Emerging stock markets were more resilient. The MSCI Emerging Markets Index6 returned 22.39% (net of dividends, in U.S. dollars) for the 12-month period.

Past performance is no guarantee of future results.

4The S&P 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

5The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index is a capitalization-weighted index that tracks the total return of common stocks in 21 developed-market countries within Europe, Australasia and the Far East.

6The Morgan Stanley Capital International Emerging Markets Index (MSCI EMI) is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. As of June 2009, the MSCI Emerging Markets Index consisted of the following 22 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

3

Performance Information – Columbia Strategic Income Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Annual operating expense ratio (%)*

| Class A | | | 0.98 | | |

| Class B | | | 1.73 | | |

| Class C | | | 1.73 | | |

| Class Z | | | 0.73 | | |

* The annual operating expense ratio is as stated in the fund's prospectus that is current as of the date of this report. Differences in expense ratios disclosed elsewhere in this report may result from the inclusion of fee waivers and expense reimbursements as well as the use of different time periods to calculate the ratios.

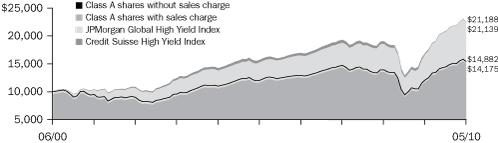

Performance of a $10,000 investment 06/01/00 – 05/31/10

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Strategic Income Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Performance of a $10,000 investment 06/01/00 – 05/31/10 ($)

| Sales charge | | without | | with | |

| Class A | | | 19,136 | | | | 18,227 | | |

| Class B | | | 17,761 | | | | 17,761 | | |

| Class C | | | 18,019 | | | | 18,019 | | |

| Class Z | | | 19,499 | | | | n/a | | |

Average annual total return as of 05/31/10 (%)

| Share class | | A | | B | | C | | Z | |

| Inception | | 04/21/77 | | 05/15/92 | | 07/01/97 | | 01/29/99 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | 13.14 | | | | 7.76 | | | | 12.30 | | | | 7.30 | | | | 12.26 | | | | 11.26 | | | | 13.36 | | |

| 5-year | | | 5.41 | | | | 4.38 | | | | 4.62 | | | | 4.30 | | | | 4.77 | | | | 4.77 | | | | 5.68 | | |

| 10-year | | | 6.71 | | | | 6.19 | | | | 5.91 | | | | 5.91 | | | | 6.07 | | | | 6.07 | | | | 6.91 | | |

Average annual total return as of 06/30/10 (%)

| Share class | | A | | B | | C | | Z | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | 13.34 | | | | 7.95 | | | | 12.50 | | | | 7.50 | | | | 12.66 | | | | 11.66 | | | | 13.77 | | |

| 5-year | | | 5.48 | | | | 4.46 | | | | 4.73 | | | | 4.41 | | | | 4.85 | | | | 4.85 | | | | 5.76 | | |

| 10-year | | | 6.64 | | | | 6.12 | | | | 5.84 | | | | 5.84 | | | | 6.00 | | | | 6.00 | | | | 6.84 | | |

The "with sales charge" returns include the maximum initial sales charge of 4.75% for Class A shares and the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

4

Understanding Your Expenses – Columbia Strategic Income Fund

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Investment Services Corp., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account may be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

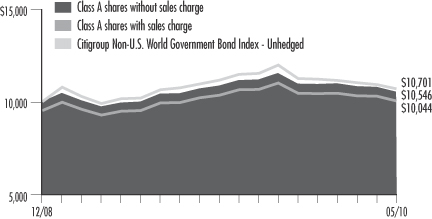

12/01/09 – 05/31/10

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,014.60 | | | | 1,019.85 | | | | 5.12 | | | | 5.14 | | | | 1.02 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,010.90 | | | | 1,016.11 | | | | 8.87 | | | | 8.90 | | | | 1.77 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,011.60 | | | | 1,016.85 | | | | 8.12 | | | | 8.15 | | | | 1.62 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,016.10 | | | | 1,021.09 | | | | 3.87 | | | | 3.88 | | | | 0.77 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the investment advisor and/or any of its affiliates not waived fees or reimbursed a portion of expenses for Class C shares, account value at the end of the period for Class C shares would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

5

Portfolio Managers' Report – Columbia Strategic Income Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Net asset value per share

as of 05/31/10 ($)

| Class A | | | 5.84 | | |

| Class B | | | 5.84 | | |

| Class C | | | 5.84 | | |

| Class Z | | | 5.78 | | |

Distributions declared per share

06/01/09 – 05/31/10 ($)

| Class A | | | 0.26 | | |

| Class B | | | 0.22 | | |

| Class C | | | 0.23 | | |

| Class Z | | | 0.27 | | |

For the 12-month period that ended May 31, 2010, the fund's Class A shares returned 13.14% without sales charge. The fund's return was higher than the 8.64% return of its primary benchmark, the Barclays Capital Government/Credit Bond Index but lower than the 16.19% return of its blended benchmark, which consists of 35% Barclays Capital Aggregate Bond Index, 35% JPMorgan Global High Yield Index, 15% Citigroup Non-U.S. World Government Bond Index—Unhedged and 15% JPMorgan EMBI Global Diversified Index. The fund also trailed the 19.48% average return of its peer group, the Lipper Multi-Sector Income Funds Classification. High-yield bond and emerging market debt allocations helped the fund outperform its former benchmark. An underweight in high-yield bonds early on in the period and an underweight in investment-grade corporate bonds throughout the period hampered returns relative to the blended benchmark. Underperformance from high-yield and emerging market bond investments also detracted from relative return. We believe the fund underperformed the average fund in its peer group because it had less exposure to risk within the high-yield, investment grade corporate and emerging market bond sectors.

Investors favored riskier assets for higher yields

As the global economy improved and interest rates stayed near historical lows, investors moved into higher-risk, higher-yielding assets. Demand was strong for high-yield and emerging market debt and for low-quality investment grade corporate bonds. Late in the period, however, the European sovereign debt crisis escalated, and the euro weakened significantly versus the U.S. dollar and other major currencies. Concerns about fiscal problems in Greece and other smaller European Union countries quickly dampened investors' risk appetite, sparking a flight into higher-quality assets.

Biggest contribution from high-yield bonds

For the 12-month period, the high-yield bond sector generated returns of over 30%, benefiting from strong investor demand as an improving economy lowered the risk of default. The best performers were the lowest-quality (CCC-rated) issues, with returns that were more than double those of the overall sector. The fund benefited from having more than 30% of its assets, on average, in high-yield bonds, but was hurt by an underweight in the sector, especially early in the period, as well as an underweight versus the peer group in CCC-rated issues. As the economic outlook improved, we increased the fund's stake in both CCC- and B-rated securities. A decision to trim exposure to defensive industries, such as utilities and health care, and add to more economically-sensitive areas, including financials and housing, also aided performance.

Mixed results from foreign government bonds

Roughly one-third of the fund's assets were in foreign government bonds, split approximately equally between emerging and developed markets. Emerging market bonds posted much stronger gains than developed market government bonds. The fund's underweights in riskier emerging market countries and in emerging market currency exposure, however, hindered results. As the global economic outlook

6

Portfolio Managers' Report (continued) – Columbia Strategic Income Fund

improved, we added to emerging market debt, focusing on markets that we thought would be among the first to benefit from a global economic recovery.

An overweight in foreign developed market government bonds relative to the fund's new blended benchmark further hindered results, as did an overweight versus the peer group in euro currency exposure. Underweights in the hardest hit European markets, such as Greece, and overweights in more stable markets, such as Germany and France, however, were helpful, as was our decision to reduce foreign developed market exposure. A 20% stake in U.S. government bonds, which outperformed foreign developed market government issues, also added modestly to returns. An underweight in investment grade corporate bonds relative to the peer group, however, hampered results, as the sector posted strong gains.

Opportunities ahead

We believe that high-yield bond valuations are attractive, especially given their late-period decline and the likelihood, in our opinion, of fewer defaults going forward. Prospects for emerging market debt also look strong, as faster growing economies can remove stimulus policies more quickly than major industrialized economies faced with tepid growth. In the near term, however, sustainability of the global economic recovery remains uncertain and could result in more market volatility. We plan to take advantage of buying opportunities created by further volatility, using our disciplined approach to credit selection to add to high-yield and emerging market debt exposure.

Portfolio characteristics and holdings are subject to change and may not be representative of current characteristics and holdings. The outlook for the fund may differ from that presented for other Columbia Funds.

Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yield and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa.

Investments in high-yield bonds (sometimes referred to as "junk" bonds) offer the potential for high current income and attractive total return, but involve certain risks. Changes in economic conditions or other circumstances may adversely affect a high-yield bond issuer's ability to make principal and interest payments.

International investing involves special risks, including foreign taxation, currency fluctuations, risks associated with possible differences in financial standards and other risks associated with future political and economic developments.

Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility.

30-day SEC yields

as of 05/31/10 (%)

| Class A | | | 4.42 | | |

| Class B | | | 3.90 | | |

| Class C | | | 4.02 | | |

| Class Z | | | 4.89 | | |

The 30-day SEC yields reflect the fund's earning power net of expenses, expressed as an annualized percentage of the public offering price per share at the end of the period. Had the investment advisor not waived fees or reimbursed a portion of expenses, the 30-day SEC yields would have been lower.

Maturity breakdown

as of 05/31/10 (%)

| 0–1 year | | | 4.0 | | |

| 1–3 years | | | 9.1 | | |

| 3–5 years | | | 18.9 | | |

| 5–7 years | | | 23.4 | | |

| 7–10 years | | | 17.1 | | |

| 10–15 years | | | 5.0 | | |

| 15–20 years | | | 4.0 | | |

| 20–30 years | | | 11.8 | | |

| 30 years and over | | | 1.9 | | |

| Other | | | 4.8 | | |

Portfolio structure

as of 05/31/10 (%)

Corporate fixed-income

bonds & notes | | | 46.4 | | |

Foreign government

obligations | | | 26.2 | | |

| U.S. government obligations | | | 13.5 | | |

| Mortgage-backed securities | | | 4.8 | | |

Commercial mortgage-backed

securities | | | 2.2 | | |

| Municipal bonds | | | 0.2 | | |

| U.S. government agencies | | | 0.2 | | |

| Asset-backed securities | | | 0.1 | | |

| Warrants | | | 0.0 | * | |

| Preferred stock | | | 0.0 | * | |

| Others | | | 6.4 | | |

*Rounds to less than 0.1%

Quality breakdown

as of 05/31/10 (%)

| AAA | | | 35.0 | | |

| AA | | | 3.1 | | |

| A | | | 4.7 | | |

| BBB | | | 13.5 | | |

| BB | | | 15.3 | | |

| B | | | 20.2 | | |

| CCC | | | 6.6 | | |

| CC | | | 0.9 | | |

| D | | | 0.1 | | |

| Not Rated | | | 0.6 | | |

The fund is actively managed and the composition of its portfolio will change over time. Maturity breakdown, portfolio structure and quality breakdown are calculated as a percentage of total investments excluding securities lending collateral. Ratings shown in the quality breakdown are assigned to individual bonds by taking the lower of the ratings available from one of the following nationally recognized rating agencies: Standard & Poor's or Moody's Investor Services. If a security is rated by only one of the two agencies, that rating is used. If a security is not rated by either of the two agencies, it is designated as Non-Rated. Ratings are relative and subjective and are not absolute standards of quality. The fund's credit quality does not remove market risk.

7

Investment Portfolio – Columbia Strategic Income Fund

May 31, 2010

| Corporate Fixed-Income Bonds & Notes – 47.4% | |

| | | Par (a) | | Value ($) | |

| Basic Materials – 4.0% | |

| Chemicals – 1.3% | |

| Chemicals-Diversified – 1.0% | |

| Dow Chemical Co. | |

| 5.900% 02/15/15 | | | 3,400,000 | | | | 3,663,497 | | |

| 8.550% 05/15/19 | | | 790,000 | | | | 936,946 | | |

| 9.400% 05/15/39 | | | 395,000 | | | | 516,780 | | |

| INEOS Finance PLC | |

| 9.000% 05/15/15 (b) | | | 1,200,000 | | | | 1,194,000 | | |

| INEOS Group Holdings PLC | |

| 8.500% 02/15/16 (b) | | | 4,530,000 | | | | 3,431,475 | | |

| INVISTA | |

| 9.250% 05/01/12 (b) | | | 4,525,000 | | | | 4,599,300 | | |

| Nova Chemicals Corp. | |

| 8.375% 11/01/16 | | | 1,095,000 | | | | 1,100,475 | | |

| 8.625% 11/01/19 | | | 1,870,000 | | | | 1,879,350 | | |

| Solutia, Inc. | |

| 8.750% 11/01/17 | | | 2,425,000 | | | | 2,485,625 | | |

| | | | 19,807,448 | | |

| Chemicals-Plastics – 0.3% | |

| Hexion Finance Escrow LLC/Hexion Escrow Corp. | |

| 8.875% 02/01/18 (b) | | | 5,860,000 | | | | 5,420,500 | | |

| | | | 5,420,500 | | |

| Chemicals Total | | | 25,227,948 | | |

| Forest Products & Paper – 1.0% | |

| Paper & Related Products – 1.0% | |

| Cascades, Inc. | |

| 7.750% 12/15/17 (b) | | | 2,700,000 | | | | 2,605,500 | | |

| Clearwater Paper Corp. | |

| 10.625% 06/15/16 (b) | | | 1,080,000 | | | | 1,185,300 | | |

| Domtar Corp. | |

| 10.750% 06/01/17 | | | 2,110,000 | | | | 2,468,700 | | |

| Georgia-Pacific LLC | |

| 8.000% 01/15/24 | | | 6,315,000 | | | | 6,583,387 | | |

| NewPage Corp. | |

| 10.000% 05/01/12 | | | 3,290,000 | | | | 1,912,313 | | |

| 11.375% 12/31/14 | | | 2,670,000 | | | | 2,496,450 | | |

| PE Paper Escrow GmbH | |

| 12.000% 08/01/14 (b) | | | 3,305,000 | | | | 3,618,975 | | |

| | | | 20,870,625 | | |

| Forest Products & Paper Total | | | 20,870,625 | | |

| Iron/Steel – 0.4% | |

| Steel-Producers – 0.4% | |

| ArcelorMittal | |

| 7.000% 10/15/39 | | | 185,000 | | | | 178,257 | | |

| Nucor Corp. | |

| 5.000% 06/01/13 | | | 140,000 | | | | 151,691 | | |

| | | Par (a) | | Value ($) | |

| Russel Metals, Inc. | |

| 6.375% 03/01/14 | | | 2,275,000 | | | | 2,178,312 | | |

| Steel Dynamics, Inc. | |

| 7.750% 04/15/16 | | | 3,890,000 | | | | 3,870,550 | | |

| United States Steel Corp. | |

| 7.000% 02/01/18 | | | 1,885,000 | | | | 1,861,438 | | |

| | | | 8,240,248 | | |

| Iron/Steel Total | | | 8,240,248 | | |

| Metals & Mining – 1.3% | |

| Diversified Minerals – 0.3% | |

| Teck Resources Ltd. | |

| 10.750% 05/15/19 | | | 3,895,000 | | | | 4,693,475 | | |

| Vale Overseas Ltd. | |

| 6.875% 11/21/36 | | | 1,115,000 | | | | 1,111,322 | | |

| | | | 5,804,797 | | |

| Metal-Diversified – 0.3% | |

| Freeport-McMoRan Copper & Gold, Inc. | |

| 8.375% 04/01/17 | | | 1,215,000 | | | | 1,321,312 | | |

| Vedanta Resources PLC | |

| 9.500% 07/18/18 (b) | | | 4,415,000 | | | | 4,503,300 | | |

| | | | 5,824,612 | | |

| Mining Services – 0.1% | |

| Noranda Aluminium Holding Corp. | |

PIK,

7.123% 11/15/14

(11/15/10) (c)(d) | | | 2,536,893 | | | | 2,532,033 | | |

| | | | 2,532,033 | | |

| Non-Ferrous Metals – 0.6% | |

| Codelco, Inc. | |

| 5.500% 10/15/13 | | | 3,000,000 | | | | 3,237,450 | | |

| 7.500% 01/15/19 (b) | | | 7,500,000 | | | | 8,837,610 | | |

| | | | 12,075,060 | | |

| Metals & Mining Total | | | 26,236,502 | | |

| Basic Materials Total | | | 80,575,323 | | |

| Communications – 9.1% | |

| Advertising – 0.1% | |

| Advertising Agencies – 0.1% | |

| Interpublic Group of Companies, Inc. | |

| 6.250% 11/15/14 | | | 780,000 | | | | 772,200 | | |

| | | | 772,200 | | |

| Advertising Total | | | 772,200 | | |

See Accompanying Notes to Financial Statements.

8

Columbia Strategic Income Fund

May 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par (a) | | Value ($) | |

| Media – 2.7% | |

| Broadcast Services/Programs – 0.5% | |

| Clear Channel Worldwide Holdings, Inc. | |

| 9.250% 12/15/17 (b) | | | 6,590,000 | | | | 6,705,325 | | |

| Liberty Media LLC | |

| 8.250% 02/01/30 | | | 3,170,000 | | | | 2,932,250 | | |

| | | | 9,637,575 | | |

| Cable TV – 1.4% | |

| CCH II LLC/CCH II Capital Corp. | |

| 13.500% 11/30/16 | | | 3,246,188 | | | | 3,720,943 | | |

| Cequel Communications Holdings I LLC & Cequel Capital Corp. | |

| 8.625% 11/15/17 (b) | | | 2,455,000 | | | | 2,369,075 | | |

| Comcast Corp. | |

| 6.950% 08/15/37 | | | 3,430,000 | | | | 3,823,143 | | |

| CSC Holdings LLC | |

| 8.500% 04/15/14 (b) | | | 3,515,000 | | | | 3,655,600 | | |

| 8.500% 06/15/15 (b) | | | 1,795,000 | | | | 1,857,825 | | |

| DirecTV Holdings LLC | |

| 6.375% 06/15/15 | | | 335,000 | | | | 345,469 | | |

| DISH DBS Corp. | |

| 6.625% 10/01/14 | | | 4,545,000 | | | | 4,476,825 | | |

| 7.875% 09/01/19 | | | 1,825,000 | | | | 1,843,250 | | |

| Mediacom LLC/Mediacom Capital Corp. | |

| 9.125% 08/15/19 (b) | | | 1,525,000 | | | | 1,509,750 | | |

| Time Warner Cable, Inc. | |

| 3.500% 02/01/15 | | | 1,505,000 | | | | 1,520,067 | | |

| 5.000% 02/01/20 | | | 650,000 | | | | 648,823 | | |

| 5.850% 05/01/17 | | | 405,000 | | | | 440,079 | | |

| 7.300% 07/01/38 | | | 1,585,000 | | | | 1,810,339 | | |

| | | | 28,021,188 | | |

| Multimedia – 0.0% | |

| News America, Inc. | |

| 6.400% 12/15/35 | | | 150,000 | | | | 157,291 | | |

| 6.550% 03/15/33 | | | 620,000 | | | | 650,082 | | |

| | | | 807,373 | | |

| Publishing-Books – 0.3% | |

| TL Acquisitions, Inc. | |

| 10.500% 01/15/15 (b) | | | 6,760,000 | | | | 6,134,700 | | |

| | | | 6,134,700 | | |

| Radio – 0.3% | |

| CMP Susquehanna Corp. | |

3.430% 05/15/14

(08/12/10) (c)(d)(e) | | | 175,000 | | | | 103,250 | | |

| Salem Communications Corp. | |

| 9.625% 12/15/16 | | | 2,570,000 | | | | 2,602,125 | | |

| Sirius XM Radio, Inc. | |

| 9.750% 09/01/15 (b) | | | 4,230,000 | | | | 4,483,800 | | |

| | | | 7,189,175 | | |

| | | Par (a) | | Value ($) | |

| Television – 0.2% | |

| Sinclair Television Group, Inc. | |

| 9.250% 11/01/17 (b) | | | 3,300,000 | | | | 3,267,000 | | |

| | | | 3,267,000 | | |

| Media Total | | | 55,057,011 | | |

| Telecommunication Services – 6.3% | |

| Cellular Telecommunications – 1.7% | |

| Cellco Partnership/Verizon Wireless Capital LLC | |

| 5.550% 02/01/14 | | | 1,050,000 | | | | 1,160,718 | | |

| 8.500% 11/15/18 | | | 570,000 | | | | 712,677 | | |

| Cricket Communications, Inc. | |

| 9.375% 11/01/14 | | | 4,965,000 | | | | 5,002,238 | | |

| Digicel Group Ltd. | |

| 8.875% 01/15/15 (b) | | | 7,360,000 | | | | 7,120,800 | | |

| MetroPCS Wireless, Inc. | |

| 9.250% 11/01/14 | | | 5,620,000 | | | | 5,788,600 | | |

| Nextel Communications, Inc. | |

| 7.375% 08/01/15 | | | 5,975,000 | | | | 5,631,438 | | |

| NII Capital Corp. | |

| 10.000% 08/15/16 | | | 1,585,000 | | | | 1,695,950 | | |

| Wind Acquisition Finance SA | |

| 11.750% 07/15/17 (b) | | | 7,102,000 | | | | 7,244,040 | | |

| | | | 34,356,461 | | |

| Media – 0.5% | |

| Nielsen Finance LLC/Nielsen Finance Co. | |

| 11.500% 05/01/16 | | | 4,375,000 | | | | 4,637,500 | | |

| Quebecor Media, Inc. | |

| 7.750% 03/15/16 | | | 6,125,000 | | | | 5,895,312 | | |

| | | | 10,532,812 | | |

| Satellite Telecommunications – 0.6% | |

| Intelsat Bermuda SA | |

| 11.250% 02/04/17 | | | 6,155,000 | | | | 6,062,675 | | |

| Intelsat Jackson Holdings SA | |

| 11.250% 06/15/16 | | | 5,845,000 | | | | 6,166,475 | | |

| | | | 12,229,150 | | |

| Telecommunication Equipment – 0.3% | |

| Lucent Technologies, Inc. | |

| 6.450% 03/15/29 | | | 7,325,000 | | | | 4,981,000 | | |

| WireCo WorldGroup | |

| 9.500% 05/15/17 (b) | | | 1,490,000 | | | | 1,454,612 | | |

| | | | 6,435,612 | | |

| Telecommunication Services – 1.0% | |

| Clearwire Communications LLC/Clearwire Finance, Inc. | |

| 12.000% 12/01/15 (b) | | | 3,220,000 | | | | 3,128,775 | | |

| Global Crossing Ltd. | |

| 12.000% 09/15/15 (b) | | | 3,660,000 | | | | 3,989,400 | | |

See Accompanying Notes to Financial Statements.

9

Columbia Strategic Income Fund

May 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par (a) | | Value ($) | |

| ITC Deltacom, Inc. | |

| 10.500% 04/01/16 (b) | | | 2,430,000 | | | | 2,332,800 | | |

| PAETEC Holding Corp. | |

| 8.875% 06/30/17 (b) | | | 1,445,000 | | | | 1,426,937 | | |

| SBA Telecommunications, Inc. | |

| 8.250% 08/15/19 (b) | | | 1,540,000 | | | | 1,605,450 | | |

| Syniverse Technologies, Inc. | |

| 7.750% 08/15/13 | | | 2,415,000 | | | | 2,366,700 | | |

| West Corp. | |

| 11.000% 10/15/16 | | | 4,870,000 | | | | 4,918,700 | | |

| | | | 19,768,762 | | |

| Telephone-Integrated – 2.1% | |

| BellSouth Corp. | |

| 5.200% 09/15/14 | | | 2,205,000 | | | | 2,423,101 | | |

| British Telecommunications PLC | |

| 5.950% 01/15/18 | | | 665,000 | | | | 687,421 | | |

| Cincinnati Bell, Inc. | |

| 8.250% 10/15/17 | | | 3,825,000 | | | | 3,605,062 | | |

| Frontier Communications Corp. | |

| 7.875% 01/15/27 | | | 6,114,000 | | | | 5,594,310 | | |

| Level 3 Financing, Inc. | |

| 8.750% 02/15/17 | | | 1,925,000 | | | | 1,636,250 | | |

| 9.250% 11/01/14 | | | 1,150,000 | | | | 1,046,500 | | |

| Qwest Communications International, Inc. | |

| 7.500% 02/15/14 | | | 5,090,000 | | | | 5,013,650 | | |

| Qwest Corp. | |

| 7.500% 10/01/14 | | | 2,455,000 | | | | 2,583,888 | | |

| 7.500% 06/15/23 | | | 5,245,000 | | | | 5,087,650 | | |

| Sprint Capital Corp. | |

| 6.875% 11/15/28 | | | 1,500,000 | | | | 1,246,875 | | |

| Telefonica Emisiones SAU | |

| 6.421% 06/20/16 | | | 1,425,000 | | | | 1,583,124 | | |

| Virgin Media Finance PLC | |

| 9.500% 08/15/16 | | | 5,210,000 | | | | 5,340,250 | | |

| Windstream Corp. | |

| 8.625% 08/01/16 | | | 6,245,000 | | | | 6,182,550 | | |

| | | | 42,030,631 | | |

| Wireless Equipment – 0.1% | |

| Crown Castle International Corp. | |

| 9.000% 01/15/15 | | | 2,235,000 | | | | 2,349,544 | | |

| | | | 2,349,544 | | |

| Telecommunication Services Total | | | 127,702,972 | | |

| Communications Total | | | 183,532,183 | | |

| | | Par (a) | | Value ($) | |

| Consumer Cyclical – 5.5% | |

| Auto Manufacturers – 0.1% | |

| Auto-Cars/Light Trucks – 0.1% | |

| General Motors Corp. | |

| 7.200% 01/15/11 (f) | | | 2,775,000 | | | | 860,250 | | |

| 8.375% 07/15/33 (f) | | | 2,785,000 | | | | 905,125 | | |

| | | | 1,765,375 | | |

| Auto Manufacturers Total | | | 1,765,375 | | |

| Auto Parts & Equipment – 0.5% | |

| Auto/Truck Parts & Equipment-Original – 0.3% | |

| American Axle & Manufacturing Holdings, Inc. | |

| 9.250% 01/15/17 (b) | | | 1,170,000 | | | | 1,228,500 | | |

| Lear Corp. | |

| 7.875% 03/15/18 | | | 900,000 | | | | 877,500 | | |

| 8.125% 03/15/20 | | | 325,000 | | | | 317,687 | | |

| TRW Automotive, Inc. | |

| 7.000% 03/15/14 (b) | | | 3,320,000 | | | | 3,261,900 | | |

| | | | 5,685,587 | | |

| Rubber-Tires – 0.2% | |

| Goodyear Tire & Rubber Co. | |

| 10.500% 05/15/16 | | | 4,430,000 | | | | 4,695,800 | | |

| | | | 4,695,800 | | |

| Auto Parts & Equipment Total | | | 10,381,387 | | |

| Distribution/Wholesale – 0.3% | |

| Distribution/Wholesale – 0.3% | |

| McJunkin Red Man Corp. | |

| 9.500% 12/15/16 (b) | | | 6,125,000 | | | | 5,941,250 | | |

| | | | 5,941,250 | | |

| Distribution/Wholesale Total | | | 5,941,250 | | |

| Entertainment – 0.7% | |

| Casino Services – 0.1% | |

| Tunica-Biloxi Gaming Authority | |

| 9.000% 11/15/15 (b) | | | 1,390,000 | | | | 1,251,000 | | |

| | | | 1,251,000 | | |

| Gambling (Non-Hotel) – 0.5% | |

| Boyd Gaming Corp. | |

| 6.750% 04/15/14 | | | 1,250,000 | | | | 1,125,000 | | |

| 7.125% 02/01/16 | | | 1,225,000 | | | | 1,047,375 | | |

| Jacobs Entertainment, Inc. | |

| 9.750% 06/15/14 | | | 2,640,000 | | | | 2,468,400 | | |

| Pinnacle Entertainment, Inc. | |

| 8.625% 08/01/17 (b) | | | 2,405,000 | | | | 2,429,050 | | |

| Shingle Springs Tribal Gaming Authority | |

| 9.375% 06/15/15 (b) | | | 3,205,000 | | | | 2,499,900 | | |

| | | | 9,569,725 | | |

See Accompanying Notes to Financial Statements.

10

Columbia Strategic Income Fund

May 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par (a) | | Value ($) | |

| Music – 0.1% | |

| WMG Acquisition Corp. | |

| 7.375% 04/15/14 | | | 1,330,000 | | | | 1,251,862 | | |

| WMG Holdings Corp. | |

| 9.500% 12/15/14 | | | 1,455,000 | | | | 1,425,900 | | |

| | | | 2,677,762 | | |

| Resorts/Theme Parks – 0.0% | |

| Six Flags, Inc. | |

| 9.625% 06/01/14 (e)(g) | | | 1,557,000 | | | | — | | |

| | | | — | | |

| Entertainment Total | | | 13,498,487 | | |

| Home Builders – 0.8% | |

| Building-Residential/Commercial – 0.8% | |

| Beazer Homes USA, Inc. | |

| 9.125% 06/15/18 | | | 3,075,000 | | | | 2,890,500 | | |

| D.R. Horton, Inc. | |

| 5.625% 09/15/14 | | | 2,785,000 | | | | 2,757,150 | | |

| 5.625% 01/15/16 | | | 1,483,000 | | | | 1,408,850 | | |

| KB Home | |

| 5.875% 01/15/15 | | | 4,970,000 | | | | 4,553,762 | | |

| Ryland Group, Inc. | |

| 8.400% 05/15/17 | | | 1,400,000 | | | | 1,470,000 | | |

| Standard Pacific Corp. | |

| 7.000% 08/15/15 | | | 2,685,000 | | | | 2,470,200 | | |

| | | | 15,550,462 | | |

| Home Builders Total | | | 15,550,462 | | |

| Home Furnishings – 0.1% | |

| Home Furnishings – 0.1% | |

| Norcraft Companies LP/Norcraft Finance Corp. | |

| 10.500% 12/15/15 (b) | | | 1,435,000 | | | | 1,506,750 | | |

| Simmons Co. | |

PIK,

7.351% 02/15/12

(08/16/10) (c)(d)(f)(h) | | | 2,601,458 | | | | 6,504 | | |

| | | | 1,513,254 | | |

| Home Furnishings Total | | | 1,513,254 | | |

| Housewares – 0.1% | |

| Housewares – 0.1% | |

| Libbey Glass, Inc. | |

| 10.000% 02/15/15 (b) | | | 3,000,000 | | | | 3,112,500 | | |

| | | | 3,112,500 | | |

| Housewares Total | | | 3,112,500 | | |

| | | Par (a) | | Value ($) | |

| Leisure Time – 0.2% | |

| Cruise Lines – 0.2% | |

| Royal Caribbean Cruises Ltd. | |

| 7.500% 10/15/27 | | | 4,450,000 | | | | 4,005,000 | | |

| | | | 4,005,000 | | |

| Leisure Time Total | | | 4,005,000 | | |

| Lodging – 1.4% | |

| Casino Hotels – 0.9% | |

| FireKeepers Development Authority | |

| 13.875% 05/01/15 (b) | | | 2,800,000 | | | | 3,206,000 | | |

| Harrah's Operating Co., Inc. | |

| 11.250% 06/01/17 | | | 3,840,000 | | | | 4,022,400 | | |

| MGM Mirage | |

| 6.750% 09/01/12 | | | 5,525,000 | | | | 5,096,812 | | |

| 11.375% 03/01/18 (b) | | | 1,085,000 | | | | 1,003,625 | | |

| Pokagon Gaming Authority | |

| 10.375% 06/15/14 (b) | | | 2,390,000 | | | | 2,473,650 | | |

| Snoqualmie Entertainment Authority | |

| 9.125% 02/01/15 (b) | | | 2,015,000 | | | | 1,692,600 | | |

| | | | 17,495,087 | | |

| Gambling (Non-Hotel) – 0.2% | |

| Mashantucket Western Pequot Tribe | |

| 8.500% 11/15/15 (b)(i) | | | 4,265,000 | | | | 938,300 | | |

| Seminole Indian Tribe of Florida | |

| 6.535% 10/01/20 (b) | | | 675,000 | | | | 602,269 | | |

| 7.804% 10/01/20 (b) | | | 3,055,000 | | | | 2,777,331 | | |

| | | | 4,317,900 | | |

| Hotels & Motels – 0.3% | |

| Host Hotels & Resorts LP | |

| 6.750% 06/01/16 | | | 3,270,000 | | | | 3,204,600 | | |

| Starwood Hotels & Resorts Worldwide, Inc. | |

| 6.750% 05/15/18 | | | 3,305,000 | | | | 3,263,688 | | |

| | | | 6,468,288 | | |

| Lodging Total | | | 28,281,275 | | |

| Retail – 1.2% | |

| Retail-Apparel/Shoe – 0.1% | |

| Limited Brands, Inc. | |

| 8.500% 06/15/19 | | | 3,140,000 | | | | 3,344,100 | | |

| | | | 3,344,100 | | |

| Retail-Drug Stores – 0.3% | |

| CVS Pass-Through Trust | |

| 8.353% 07/10/31 (b) | | | 1,863,844 | | | | 2,226,045 | | |

| Rite Aid Corp. | |

| 9.500% 06/15/17 | | | 4,525,000 | | | | 3,631,313 | | |

| | | | 5,857,358 | | |

See Accompanying Notes to Financial Statements.

11

Columbia Strategic Income Fund

May 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par (a) | | Value ($) | |

| Retail-Mail Order – 0.1% | |

| QVC, Inc. | |

| 7.500% 10/01/19 (b) | | | 1,365,000 | | | | 1,330,875 | | |

| | | | 1,330,875 | | |

| Retail-Propane Distributors – 0.4% | |

| AmeriGas Partners LP | |

| 7.125% 05/20/16 | | | 2,815,000 | | | | 2,800,925 | | |

| 7.250% 05/20/15 | | | 990,000 | | | | 990,000 | | |

| Inergy LP/Inergy Finance Corp. | |

| 8.250% 03/01/16 | | | 1,365,000 | | | | 1,378,650 | | |

| 8.750% 03/01/15 | | | 2,645,000 | | | | 2,697,900 | | |

| | | | 7,867,475 | | |

| Retail-Restaurants – 0.1% | |

| McDonald's Corp. | |

| 5.700% 02/01/39 | | | 1,050,000 | | | | 1,119,536 | | |

| | | | 1,119,536 | | |

| Retail-Toy Store – 0.2% | |

| Toys R US, Inc. | |

| 7.375% 10/15/18 | | | 5,440,000 | | | | 5,154,400 | | |

| | | | 5,154,400 | | |

| Retail-Vitamins/Nutritional Supplements – 0.0% | |

| General Nutrition Centers, Inc. | |

PIK,

5.750% 03/15/14

(09/15/10) (c)(d) | | | 980,000 | | | | 899,150 | | |

| | | | 899,150 | | |

| Retail Total | | | 25,572,894 | | |

| Storage/Warehousing – 0.1% | |

| Storage/Warehousing – 0.1% | |

Niska Gas Storage U.S. LLC/Niska Gas Storage

Canada ULC | |

| 8.875% 03/15/18 (b) | | | 1,760,000 | | | | 1,768,800 | | |

| | | | 1,768,800 | | |

| Storage/Warehousing Total | | | 1,768,800 | | |

| Consumer Cyclical Total | | | 111,390,684 | | |

| Consumer Non-Cyclical – 5.9% | |

| Beverages – 0.1% | |

| Brewery – 0.1% | |

| Anheuser-Busch InBev Worldwide, Inc. | |

| 7.750% 01/15/19 (b) | | | 420,000 | | | | 497,759 | | |

| 8.000% 11/15/39 (b) | | | 645,000 | | | | 820,123 | | |

| | | | 1,317,882 | | |

| Beverages Total | | | 1,317,882 | | |

| | | Par (a) | | Value ($) | |

| Commercial Services – 1.4% | |

| Commercial Services – 0.4% | |

| ARAMARK Corp. | |

| 8.500% 02/01/15 | | | 4,625,000 | | | | 4,613,437 | | |

| Iron Mountain, Inc. | |

| 8.000% 06/15/20 | | | 3,755,000 | | | | 3,726,838 | | |

| | | | 8,340,275 | | |

| Commercial Services-Finance – 0.1% | |

| Cardtronics, Inc. | |

| 9.250% 08/15/13 | | | 1,785,000 | | | | 1,785,000 | | |

| | | | 1,785,000 | | |

| Funeral Services & Related Items – 0.2% | |

| Service Corp. International | |

| 6.750% 04/01/16 | | | 1,980,000 | | | | 1,955,250 | | |

| 7.000% 06/15/17 | | | 1,930,000 | | | | 1,872,100 | | |

| | | | 3,827,350 | | |

| Private Corrections – 0.1% | |

| Corrections Corp. of America | |

| 6.250% 03/15/13 | | | 2,480,000 | | | | 2,483,100 | | |

| | | | 2,483,100 | | |

| Rental Auto/Equipment – 0.5% | |

| Ashtead Holdings PLC | |

| 8.625% 08/01/15 (b) | | | 3,149,000 | | | | 3,117,510 | | |

| Hertz Corp. | |

| 8.875% 01/01/14 | | | 2,000,000 | | | | 2,010,000 | | |

| Rental Service Corp. | |

| 9.500% 12/01/14 | | | 3,230,000 | | | | 3,068,500 | | |

| United Rentals North America, Inc. | |

| 10.875% 06/15/16 | | | 2,070,000 | | | | 2,204,550 | | |

| | | | 10,400,560 | | |

| Security Services – 0.1% | |

| Garda World Security Corp. | |

| 9.750% 03/15/17 (b) | | | 825,000 | | | | 847,688 | | |

| | | | 847,688 | | |

| Commercial Services Total | | | 27,683,973 | | |

| Cosmetics/Personal Care – 0.1% | |

| Cosmetics & Toiletries – 0.1% | |

| Revlon Consumer Products Corp. | |

| 9.750% 11/15/15 (b) | | | 2,225,000 | | | | 2,263,938 | | |

| | | | 2,263,938 | | |

| Cosmetics/Personal Care Total | | | 2,263,938 | | |

| Food – 0.8% | |

| Food-Meat Products – 0.2% | |

| JBS USA LLC/JBS USA Finance, Inc. | |

| 11.625% 05/01/14 | | | 1,765,000 | | | | 1,938,146 | | |

See Accompanying Notes to Financial Statements.

12

Columbia Strategic Income Fund

May 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par (a) | | Value ($) | |

| Smithfield Foods, Inc. | |

| 10.000% 07/15/14 (b) | | | 2,545,000 | | | | 2,724,741 | | |

| | | | 4,662,887 | | |

| Food-Miscellaneous/Diversified – 0.5% | |

| Campbell Soup Co. | |

| 4.500% 02/15/19 | | | 435,000 | | | | 460,664 | | |

| ConAgra Foods, Inc. | |

| 7.000% 10/01/28 | | | 855,000 | | | | 972,908 | | |

| Kraft Foods, Inc. | |

| 6.500% 02/09/40 | | | 3,715,000 | | | | 3,943,792 | | |

| Pinnacle Foods Finance LLC | |

| 9.250% 04/01/15 (b) | | | 1,095,000 | | | | 1,092,263 | | |

| 9.250% 04/01/15 | | | 3,315,000 | | | | 3,306,712 | | |

| | | | 9,776,339 | | |

| Retail-Hypermarkets – 0.1% | |

| New Albertsons, Inc. | |

| 8.000% 05/01/31 | | | 2,700,000 | | | | 2,349,000 | | |

| | | | 2,349,000 | | |

| Food Total | | | 16,788,226 | | |

| Healthcare Products – 0.5% | |

| Medical Products – 0.5% | |

| Biomet, Inc. | |

PIK,

10.375% 10/15/17 | | | 7,340,000 | | | | 7,807,925 | | |

| DJO Finance LLC/DJO Finance Corp. | |

| 10.875% 11/15/14 | | | 730,000 | | | | 759,200 | | |

| 10.875% 11/15/14 (b) | | | 1,365,000 | | | | 1,419,600 | | |

| | | | 9,986,725 | | |

| Healthcare Products Total | | | 9,986,725 | | |

| Healthcare Services – 2.0% | |

| Dialysis Centers – 0.1% | |

| DaVita, Inc. | |

| 7.250% 03/15/15 | | | 2,245,000 | | | | 2,233,775 | | |

| | | | 2,233,775 | | |

| Medical Labs & Testing Services – 0.1% | |

| Roche Holdings, Inc. | |

| 6.000% 03/01/19 (b) | | | 1,650,000 | | | | 1,865,363 | | |

| | | | 1,865,363 | | |

| Medical-HMO – 0.2% | |

| Health Net, Inc. | |

| 6.375% 06/01/17 | | | 3,440,000 | | | | 3,147,600 | | |

| WellPoint, Inc. | |

| 7.000% 02/15/19 | | | 960,000 | | | | 1,119,828 | | |

| | | | 4,267,428 | | |

| | | Par (a) | | Value ($) | |

| Medical-Hospitals – 1.1% | |

| Community Health Systems, Inc. | |

| 8.875% 07/15/15 | | | 5,810,000 | | | | 5,947,987 | | |

| HCA, Inc. | |

| 9.250% 11/15/16 | | | 2,655,000 | | | | 2,781,113 | | |

PIK,

9.625% 11/15/16 | | | 13,000,000 | | | | 13,682,500 | | |

| | | | 22,411,600 | | |

| Medical-Outpatient/Home Medical – 0.1% | |

| Select Medical Corp. | |

| 7.625% 02/01/15 | | | 1,900,000 | | | | 1,786,000 | | |

| | | | 1,786,000 | | |

| Physical Therapy/Rehab Centers – 0.2% | |

| Healthsouth Corp. | |

| 8.125% 02/15/20 | | | 1,475,000 | | | | 1,430,750 | | |

| 10.750% 06/15/16 | | | 2,190,000 | | | | 2,365,200 | | |

| | | | 3,795,950 | | |

| Physician Practice Management – 0.2% | |

| U.S. Oncology Holdings, Inc. | |

PIK,

6.643% 03/15/12

(09/15/10) (c)(d) | | | 2,769,000 | | | | 2,501,567 | | |

| U.S. Oncology, Inc. | |

| 9.125% 08/15/17 | | | 2,355,000 | | | | 2,375,606 | | |

| | | | 4,877,173 | | |

| Healthcare Services Total | | | 41,237,289 | | |

| Household Products/Wares – 0.3% | |

| Consumer Products-Miscellaneous – 0.3% | |

| American Greetings Corp. | |

| 7.375% 06/01/16 | | | 2,365,000 | | | | 2,388,650 | | |

| Central Garden & Pet Co. | |

| 8.250% 03/01/18 | | | 2,000,000 | | | | 1,980,000 | | |

| Jostens IH Corp. | |

| 7.625% 10/01/12 | | | 1,430,000 | | | | 1,429,821 | | |

| | | | 5,798,471 | | |

| Household Products/Wares Total | | | 5,798,471 | | |

| Pharmaceuticals – 0.7% | |

| Medical-Drugs – 0.5% | |

| Elan Finance PLC | |

4.436% 11/15/11

(08/15/10) (c)(d) | | | 975,000 | | | | 950,625 | | |

| 8.875% 12/01/13 | | | 1,505,000 | | | | 1,508,763 | | |

| Novartis Securities Investment Ltd. | |

| 5.125% 02/10/19 | | | 950,000 | | | | 1,043,585 | | |

| Patheon, Inc. | |

| 8.625% 04/15/17 (b) | | | 1,880,000 | | | | 1,880,000 | | |

See Accompanying Notes to Financial Statements.

13

Columbia Strategic Income Fund

May 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par (a) | | Value ($) | |

| Valeant Pharmaceuticals International | |

| 7.625% 03/15/20 (b) | | | 770,000 | | | | 752,675 | | |

| 8.375% 06/15/16 | | | 2,815,000 | | | | 2,878,337 | | |

| Wyeth | |

| 5.500% 02/15/16 | | | 800,000 | | | | 912,285 | | |

| | | | 9,926,270 | | |

| Medical-Generic Drugs – 0.1% | |

| Mylan, Inc./PA | |

| 7.875% 07/15/20 (b) | | | 1,410,000 | | | | 1,411,763 | | |

| | | | 1,411,763 | | |

| Pharmacy Services – 0.1% | |

| Omnicare, Inc. | |

| 6.875% 12/15/15 | | | 650,000 | | | | 641,875 | | |

| 7.750% 06/01/20 | | | 2,345,000 | | | | 2,350,862 | | |

| | | | 2,992,737 | | |

| Pharmaceuticals Total | | | 14,330,770 | | |

| Consumer Non-Cyclical Total | | | 119,407,274 | | |

| Diversified – 0.3% | |

| Diversified Holding Companies – 0.3% | |

| Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC | |

| 7.750% 10/15/16 (b) | | | 5,300,000 | | | | 5,247,000 | | |

| Diversified Holding Companies Total | | | 5,247,000 | | |

| Diversified Total | | | 5,247,000 | | |

| Energy – 7.3% | |

| Coal – 0.3% | |

| Coal – 0.3% | |

| Arch Western Finance LLC | |

| 6.750% 07/01/13 | | | 5,110,000 | | | | 5,046,125 | | |

| Consol Energy, Inc. | |

| 8.250% 04/01/20 (b) | | | 450,000 | | | | 459,563 | | |

| | | | 5,505,688 | | |

| Coal Total | | | 5,505,688 | | |

| Energy-Alternate Sources – 0.1% | |

| Energy-Alternate Sources – 0.1% | |

| Power Sector Assets & Liabilities Management Corp. | |

| 7.250% 05/27/19 (b) | | | 2,500,000 | | | | 2,731,250 | | |

| | | | 2,731,250 | | |

| Energy-Alternate Sources Total | | | 2,731,250 | | |

| Oil & Gas – 4.6% | |

| Oil Companies-Exploration & Production – 4.1% | |

| Anadarko Petroleum Corp. | |

| 6.200% 03/15/40 | | | 4,905,000 | | | | 4,530,665 | | |

| | | Par (a) | | Value ($) | |

| Antero Resources Finance Corp. | |

| 9.375% 12/01/17 (b) | | | 2,840,000 | | | | 2,783,200 | | |

| Berry Petroleum Co. | |

| 10.250% 06/01/14 | | | 535,000 | | | | 569,775 | | |

| Chesapeake Energy Corp. | |

| 6.375% 06/15/15 | | | 7,875,000 | | | | 7,855,312 | | |

| Cimarex Energy Co. | |

| 7.125% 05/01/17 | | | 3,989,000 | | | | 3,969,055 | | |

| Forest Oil Corp. | |

| 8.500% 02/15/14 | | | 4,445,000 | | | | 4,567,237 | | |

| Hilcorp Energy I LP/Hilcorp Finance Co. | |

| 7.750% 11/01/15 (b) | | | 2,815,000 | | | | 2,744,625 | | |

| KazMunaiGaz Finance Sub BV | |

| 9.125% 07/02/18 (b) | | | 3,500,000 | | | | 3,850,000 | | |

| NAK Naftogaz Ukraine | |

| 9.500% 09/30/14 | | | 5,625,000 | | | | 5,765,625 | | |

| Newfield Exploration Co. | |

| 6.625% 04/15/16 | | | 3,810,000 | | | | 3,790,950 | | |

| 6.875% 02/01/20 | | | 2,095,000 | | | | 2,021,675 | | |

| Nexen, Inc. | |

| 5.875% 03/10/35 | | | 960,000 | | | | 900,845 | | |

| 7.500% 07/30/39 | | | 1,080,000 | | | | 1,218,426 | | |

| Pemex Project Funding Master Trust | |

| 9.150% 11/15/18 | | | 2,485,000 | | | | 3,058,767 | | |

| 10.610% 08/15/17 | | | 1,650,000 | | | | 2,029,451 | | |

| Petrobras International Finance Co. | |

| 5.875% 03/01/18 | | | 4,150,000 | | | | 4,282,821 | | |

| 7.875% 03/15/19 | | | 3,200,000 | | | | 3,620,221 | | |

| PetroHawk Energy Corp. | |

| 7.875% 06/01/15 | | | 6,420,000 | | | | 6,219,375 | | |

| Pioneer Natural Resources Co. | |

| 7.500% 01/15/20 | | | 285,000 | | | | 284,983 | | |

| Quicksilver Resources, Inc. | |

| 7.125% 04/01/16 | | | 5,250,000 | | | | 4,738,125 | | |

| 8.250% 08/01/15 | | | 3,000,000 | | | | 2,925,000 | | |

| Range Resources Corp. | |

| 7.500% 05/15/16 | | | 1,590,000 | | | | 1,593,975 | | |

| Ras Laffan Liquefied Natural Gas Co., Ltd. III | |

| 5.500% 09/30/14 (b) | | | 1,000,000 | | | | 1,068,555 | | |

| 5.832% 09/30/16 (b) | | | 4,200,000 | | | | 4,435,200 | | |

| Southwestern Energy Co. | |

| 7.500% 02/01/18 | | | 1,595,000 | | | | 1,674,750 | | |

| Talisman Energy, Inc. | |

| 7.750% 06/01/19 | | | 1,094,000 | | | | 1,318,348 | | |

| XTO Energy, Inc. | |

| 7.500% 04/15/12 | | | 340,000 | | | | 378,090 | | |

| | | | 82,195,051 | | |

| Oil Company-Integrated – 0.1% | |

| Shell International Finance BV | |

| 5.500% 03/25/40 | | | 1,450,000 | | | | 1,455,809 | | |

| | | | 1,455,809 | | |

See Accompanying Notes to Financial Statements.

14

Columbia Strategic Income Fund

May 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par (a) | | Value ($) | |

| Oil Refining & Marketing – 0.2% | |

| Frontier Oil Corp. | |

| 8.500% 09/15/16 | | | 1,905,000 | | | | 1,943,100 | | |

| Tesoro Corp. | |

| 6.625% 11/01/15 | | | 3,225,000 | | | | 3,047,625 | | |

| | | | 4,990,725 | | |

| Oil-Field Services – 0.2% | |

| Gazprom International SA | |

| 7.201% 02/01/20 | | | 4,574,272 | | | | 4,668,502 | | |

| | | | 4,668,502 | | |

| Oil & Gas Total | | | 93,310,087 | | |

| Oil & Gas Services – 0.3% | |

| Oil-Field Services – 0.3% | |

| American Petroleum Tankers LLC/AP Tankers Co. | |

| 10.250% 05/01/15 (b) | | | 1,120,000 | | | | 1,108,800 | | |

| Expro Finance Luxembourg SCA | |

| 8.500% 12/15/16 (b) | | | 3,095,000 | | | | 3,002,150 | | |

| Halliburton Co. | |

| 5.900% 09/15/18 | | | 515,000 | | | | 556,957 | | |

| Smith International, Inc. | |

| 9.750% 03/15/19 | | | 470,000 | | | | 637,103 | | |

| Weatherford International Ltd. | |

| 5.150% 03/15/13 | | | 700,000 | | | | 739,005 | | |

| | | | 6,044,015 | | |

| Oil & Gas Services Total | | | 6,044,015 | | |

| Oil, Gas & Consumable Fuels – 0.6% | |

| Oil Company-Integrated – 0.6% | |

| Ecopetrol SA | |

| 7.625% 07/23/19 | | | 5,000,000 | | | | 5,562,500 | | |

| Petronas Capital Ltd. | |

| 5.250% 08/12/19 | | | 5,500,000 | | | | 5,616,270 | | |

| | | | 11,178,770 | | |

| Oil, Gas & Consumable Fuels Total | | | 11,178,770 | | |

| Pipelines – 1.4% | |

| Pipelines – 1.4% | |

| Atlas Pipeline Partners LP | |

| 8.125% 12/15/15 | | | 3,125,000 | | | | 2,953,125 | | |

| El Paso Corp. | |

| 6.875% 06/15/14 | | | 2,970,000 | | | | 2,977,740 | | |

| 7.250% 06/01/18 | | | 3,525,000 | | | | 3,452,265 | | |

| Kinder Morgan Energy Partners LP | |

| 6.500% 09/01/39 | | | 550,000 | | | | 535,212 | | |

| 6.950% 01/15/38 | | | 670,000 | | | | 685,759 | | |

| Kinder Morgan Finance Co. ULC | |

| 5.700% 01/05/16 | | | 2,445,000 | | | | 2,334,975 | | |

| | | Par (a) | | Value ($) | |

| MarkWest Energy Partners LP | |

| 6.875% 11/01/14 | | | 2,800,000 | | | | 2,674,000 | | |

| 8.500% 07/15/16 | | | 1,905,000 | | | | 1,914,525 | | |

| Plains All American Pipeline LP/PAA Finance Corp. | |

| 5.750% 01/15/20 | | | 140,000 | | | | 142,892 | | |

| 6.500% 05/01/18 | | | 1,360,000 | | | | 1,471,425 | | |

| 8.750% 05/01/19 | | | 2,715,000 | | | | 3,224,328 | | |

| Regency Energy Partners LP/Regency Energy Finance Corp. | |

| 8.375% 12/15/13 | | | 370,000 | | | | 381,100 | | |

| 9.375% 06/01/16 (b) | | | 1,740,000 | | | | 1,809,600 | | |

| Southern Natural Gas Co. | |

| 8.000% 03/01/32 | | | 755,000 | | | | 856,239 | | |

| Southern Star Central Corp. | |

| 6.750% 03/01/16 | | | 680,000 | | | | 680,000 | | |

| TransCanada Pipelines Ltd. | |

6.350% 05/15/67

(05/15/17) (c)(d) | | | 1,450,000 | | | | 1,315,409 | | |

| 7.625% 01/15/39 | | | 575,000 | | | | 683,894 | | |

| Williams Companies, Inc. | |

| 7.875% 09/01/21 | | | 763,000 | | | | 881,862 | | |

| | | | 28,974,350 | | |

| Pipelines Total | | | 28,974,350 | | |

| Energy Total | | | 147,744,160 | | |

| Financials – 7.8% | |

| Banks – 4.0% | |

| Commercial Banks-Central US – 0.2% | |

| Fifth Third Bank/Ohio | |

0.546% 05/17/13

(08/17/10) (c)(d) | | | 380,000 | | | | 356,069 | | |

| Northern Trust Co. | |

| 6.500% 08/15/18 | | | 2,920,000 | | | | 3,382,849 | | |

| | | | 3,738,918 | | |

| Commercial Banks-Eastern US – 0.1% | |

| Discover Bank/Greenwood DE | |

| 8.700% 11/18/19 | | | 2,385,000 | | | | 2,609,457 | | |

| | | | 2,609,457 | | |

| Commercial Banks-Non US – 0.8% | |

| Barclays Bank PLC | |

| 3.900% 04/07/15 | | | 935,000 | | | | 914,011 | | |

| 5.000% 09/22/16 | | | 760,000 | | | | 750,913 | | |

| 6.860% 09/29/49 (b)(d) | | | 365,000 | | | | 281,050 | | |

7.375% 06/29/49

(12/01/11) (b)(c)(d) | | | 275,000 | | | | 247,500 | | |

| 7.434% 09/29/49 (b)(d) | | | 1,055,000 | | | | 933,675 | | |

See Accompanying Notes to Financial Statements.

15

Columbia Strategic Income Fund

May 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par (a) | | Value ($) | |

| BES Investimento do Brasil SA | |

| 5.625% 03/25/15 (b) | | | 2,000,000 | | | | 1,867,722 | | |

| IKB Deutsche Industriebank AG | |

| 2.125% 09/10/12 | | EUR | 8,315,000 | | | | 10,386,097 | | |

| Lloyds TSB Group PLC | |

6.267% 11/29/49

(11/14/16) (b)(c)(d) | | | 300,000 | | | | 159,000 | | |

| | | | 15,539,968 | | |

| Commercial Banks-Southern US – 0.0% | |

| Regions Financial Corp. | |

| 7.000% 03/01/11 | | | 235,000 | | | | 238,201 | | |

| | | | 238,201 | | |

| Commercial Banks-Western U.S. – 1.1% | |

| Citibank NA | |

| 1.875% 05/07/12 | | | 20,000,000 | | | | 20,320,060 | | |

| Zions Bancorporation | |

| 7.750% 09/23/14 | | | 1,640,000 | | | | 1,650,635 | | |

| | | | 21,970,695 | | |

| Diversified Banking Institutional – 0.1% | |

| Citigroup, Inc. | |

| 6.010% 01/15/15 | | | 990,000 | | | | 1,030,042 | | |

| JPMorgan Chase & Co. | |

| 7.900% 04/29/49 (d) | | | 460,000 | | | | 467,935 | | |

| | | | 1,497,977 | | |

| Diversified Financial Services – 1.0% | |

| Capital One Capital IV | |

6.745% 02/17/37

(02/17/32) (c)(d) | | | 2,990,000 | | | | 2,466,750 | | |

| Capital One Capital V | |

| 10.250% 08/15/39 | | | 1,465,000 | | | | 1,574,875 | | |

| CIT Group, Inc. | |

| 7.000% 05/01/17 | | | 14,700,000 | | | | 13,266,750 | | |

| JPMorgan Chase Capital XVIII | |

| 6.950% 08/17/36 | | | 195,000 | | | | 192,157 | | |

| JPMorgan Chase Capital XX | |

| 6.550% 09/29/36 | | | 2,690,000 | | | | 2,522,959 | | |

| JPMorgan Chase Capital XXII | |

| 6.450% 02/02/37 | | | 150,000 | | | | 138,867 | | |

| �� | | | 20,162,358 | | |

| Fiduciary Banks – 0.1% | |

| Bank of New York Mellon Corp. | |

| 5.450% 05/15/19 | | | 1,520,000 | | | | 1,647,727 | | |

| Northern Trust Corp. | |

| 5.500% 08/15/13 | | | 535,000 | | | | 594,253 | | |

| | | | 2,241,980 | | |

| | | Par (a) | | Value ($) | |

| Finance-Investment Banker/Broker – 0.0% | |

| Merrill Lynch & Co., Inc. | |

| 5.700% 05/02/17 | | | 435,000 | | | | 430,517 | | |

| | | | 430,517 | | |

| Money Center Banks – 0.2% | |

| Comerica Bank | |

| 5.200% 08/22/17 | | | 500,000 | | | | 496,076 | | |

| Deutsche Bank AG/London | |

| 4.875% 05/20/13 | | | 2,280,000 | | | | 2,401,741 | | |

| Lloyds TSB Bank PLC | |

| 4.375% 01/12/15 (b) | | | 1,182,000 | | | | 1,129,566 | | |

| | | | 4,027,383 | | |

| Super-Regional Banks-US – 0.4% | |

| Capital One Financial Corp. | |

| 5.700% 09/15/11 | | | 1,920,000 | | | | 2,002,067 | | |

| Keycorp | |

| 6.500% 05/14/13 | | | 920,000 | | | | 996,081 | | |

| National City Corp. | |

| 4.900% 01/15/15 | | | 1,940,000 | | | | 2,072,007 | | |

| PNC Funding Corp. | |

| 3.625% 02/08/15 | | | 660,000 | | | | 673,321 | | |

| 5.125% 02/08/20 | | | 1,000,000 | | | | 1,015,027 | | |

| USB Capital IX | |

6.189% 10/29/49

(04/15/11) (c)(d) | | | 855,000 | | | | 666,900 | | |

| | | | 7,425,403 | | |

| Banks Total | | | 79,882,857 | | |

| Diversified Financial Services – 2.3% | |

| Diversified Financial Services – 0.2% | |

| General Electric Capital Corp. | |

| 5.500% 01/08/20 | | | 3,024,000 | | | | 3,102,131 | | |

| 6.000% 08/07/19 | | | 700,000 | | | | 741,566 | | |

| | | | 3,843,697 | | |

| Finance-Auto Loans – 1.1% | |

| Ally Financial, Inc. | |

| 6.875% 09/15/11 | | | 6,270,000 | | | | 6,270,000 | | |

| 8.000% 11/01/31 | | | 6,063,000 | | | | 5,517,330 | | |

| Ford Motor Credit Co., LLC | |

| 7.000% 04/15/15 | | | 1,160,000 | | | | 1,148,132 | | |

| 7.500% 08/01/12 | | | 380,000 | | | | 386,654 | | |

| 7.800% 06/01/12 | | | 3,700,000 | | | | 3,773,630 | | |

| 8.000% 12/15/16 | | | 5,025,000 | | | | 5,034,759 | | |

| | | | 22,130,505 | | |

| Finance-Consumer Loans – 0.4% | |

| American General Finance Corp. | |

| 4.875% 07/15/12 | | | 445,000 | | | | 400,500 | | |

| 6.900% 12/15/17 | | | 5,685,000 | | | | 4,519,575 | | |

See Accompanying Notes to Financial Statements.

16

Columbia Strategic Income Fund

May 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par (a) | | Value ($) | |

| SLM Corp. | |

| 8.000% 03/25/20 | | | 3,950,000 | | | | 3,513,517 | | |

| | | | 8,433,592 | | |

| Finance-Investment Banker/Broker – 0.2% | |

| Cemex Finance LLC | |

| 9.500% 12/14/16 (b) | | | 3,760,000 | | | | 3,431,000 | | |

| | | | 3,431,000 | | |

| Finance-Leasing Company – 0.1% | |

| International Lease Finance Corp. | |

| 4.875% 09/01/10 | | | 825,000 | | | | 820,875 | | |

| 5.625% 09/15/10 | | | 2,250,000 | | | | 2,233,125 | | |

| | | | 3,054,000 | | |

| Finance-Other Services – 0.3% | |

| Icahn Enterprises LP/Icahn Enterprises Finance Corp. | |

| 8.000% 01/15/18 (b) | | | 5,420,000 | | | | 5,094,800 | | |

| | | | 5,094,800 | | |

| Diversified Financial Services Total | | | 45,987,594 | | |

| Insurance – 1.3% | |

| Insurance Brokers – 0.1% | |

| HUB International Holdings, Inc. | |

| 10.250% 06/15/15 (b) | | | 1,160,000 | | | | 1,061,400 | | |

| | | | 1,061,400 | | |

| Life/Health Insurance – 0.4% | |

| Lincoln National Corp. | |

| 8.750% 07/01/19 | | | 1,720,000 | | | | 2,116,262 | | |

| Principal Life Income Funding Trusts | |

| 5.300% 04/24/13 | | | 960,000 | | | | 1,032,673 | | |

| Provident Companies, Inc. | |

| 7.000% 07/15/18 | | | 990,000 | | | | 1,036,422 | | |

| Prudential Financial, Inc. | |

| 7.375% 06/15/19 | | | 1,680,000 | | | | 1,923,365 | | |

8.875% 06/15/38

(06/15/18) (c)(d) | | | 1,730,000 | | | | 1,833,800 | | |

| Unum Group | |

| 7.125% 09/30/16 | | | 680,000 | | | | 760,747 | | |

| | | | 8,703,269 | | |

| Multi-Line Insurance – 0.3% | |

| CNA Financial Corp. | |