UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer 5228 Ameriprise Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | May 31 | |

|

Date of reporting period: | May 31, 2012 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

May 31, 2012

Columbia Dividend Income Fund

Not FDIC insured • No bank guarantee • May lose value

Columbia Dividend Income Fund

President's Message

Dear Shareholders,

Dear Shareholders,

A stock market rally that commenced in the fourth quarter of 2011 continued into 2012 in the United States and around the world, as all major market regions generated double-digit returns for the three-month period ended March 31, 2012. Volatility declined sharply as European debt fears quieted somewhat and sentiment improved. Returns in developed countries were buoyed by strong results in Germany, Belgium, Austria and the Nordic markets of Denmark, Finland, Norway and Sweden. Under the cloud of its own mounting debt problem, Spain was the only eurozone country to deliver a negative return during the three-month period. Solid economic growth and accommodative monetary policy helped boost gains in emerging markets. The rally in U.S. equities was largely driven by an expansion in "multiples" — an increase in stock prices relative to their earnings. By the end of the first quarter of 2012, stocks no longer appeared as cheap as they were late in 2011. Bonds lagged stocks during the first quarter as investors responded to signs of an improved environment with a greater appetite for risk.

Concerns around the health of the global economy were centered in news headlines focusing on Washington D.C., Europe, China and the Middle East. In the United States, economic indicators remained mixed but generally indicated support for slow, sustainable economic growth. European policymakers have made progress in containing the eurozone debt crisis, though they still have not solved the issue of long-term solvency. The European Central Bank has lowered interest rates and flooded the financial system with liquidity that may provide breathing space for a restructuring of fiscal balance sheets. These massive infusions of liquidity may whet the appetite for risk from investors around the world. However, they have delayed a true reckoning with the European financial situation, as concerns about Greece, Spain and Portugal continue to cloud the outlook. The structural challenges that persist in the developed world, and slower growth in emerging market economies, leave the global economy in a fragile state. Domestic demand, combined with slowing inflationary trends, has also helped to shore up emerging market economies. Joblessness remains relatively low and monetary conditions remain easy.

Despite the challenges and surprises of 2011, we see pockets of strength — and as a result, attractive opportunities — both here and abroad for 2012. We hope to help you capitalize on these opportunities with various articles in our 2012 Perspectives, which is available via the Market Insights tab at columbiamanagement.com. This publication showcases the strong research capabilities and experienced investment teams of Columbia Management and offers a diverse array of investment ideas based on our five key themes for 2012.

Other information and resources available at columbiamanagement.com include:

> detailed up-to-date fund performance and portfolio information

> economic analysis and market commentary

> quarterly fund commentaries

> Columbia Management Investor, our award-winning quarterly newsletter for shareholders

Thank you for your continued support of the Columbia Funds. We look forward to serving your investment needs for many years to come.

Best Regards,

J. Kevin Connaughton

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2012 Columbia Management Investment Advisers, LLC. All rights reserved.

Annual Report 2012

Columbia Dividend Income Fund

Table of Contents

| Performance Overview | | | 2 | | |

|

| Manager Discussion of Fund Performance | | | 4 | | |

|

| Understanding Your Fund's Expenses | | | 6 | | |

|

| Portfolio of Investments | | | 7 | | |

|

| Statement of Assets and Liabilities | | | 16 | | |

|

| Statement of Operations | | | 18 | | |

|

| Statement of Changes in Net Assets | | | 19 | | |

|

| Financial Highlights | | | 22 | | |

|

| Notes to Financial Statements | | | 30 | | |

|

Report of Independent Registered

Public Accounting Firm | | | 38 | | |

|

| Federal Income Tax Information | | | 39 | | |

|

| Board Members and Officers | | | 40 | | |

|

| Important Information About This Report | | | 45 | | |

|

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit columbiamanagement.com or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 8 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

Annual Report 2012

Columbia Dividend Income Fund

Performance Overview

Performance Summary

> For the eight-month period that ended May 31, 2012, Columbia Dividend Income Fund (the fund) Class A shares returned 16.26% excluding sales charge.

> The fund's benchmark, the Russell 1000 Index, returned 17.83% for the same period.

> The fund reaped more than 90% of the market gains in a strong rally. Lack of exposure to two of the benchmark's strongest performers generally accounted for its modest underperformance.

Average Annual Total Returns (%) (for period ended May 31, 2012)

| | | Inception | | 8 Months

cumulative | | 1 Year | | 5 Years | | 10 Years | |

| Class A* | | 11/25/02 | | | | | | | | | | | | | | | | | |

| Excluding sales charges | | | | | | | 16.26 | | | | 2.39 | | | | 0.61 | | | | 4.89 | | |

| Including sales charges | | | | | | | 9.59 | | | | -3.49 | | | | -0.57 | | | | 4.27 | | |

| Class B* | | 11/25/02 | | | | | | | | | | | | | | | | | |

| Excluding sales charges | | | | | | | 15.69 | | | | 1.65 | | | | -0.14 | | | | 4.12 | | |

| Including sales charges | | | | | | | 10.69 | | | | -3.35 | | | | -0.51 | | | | 4.12 | | |

| Class C* | | 11/25/02 | | | | | | | | | | | | | | | | | |

| Excluding sales charges | | | | | | | 15.71 | | | | 1.66 | | | | -0.14 | | | | 4.11 | | |

| Including sales charges | | | | | | | 14.71 | | | | 0.66 | | | | -0.14 | | | | 4.11 | | |

| Class I* | | 09/27/10 | | | 16.53 | | | | 2.77 | | | | 0.93 | | | | 5.21 | | |

| Class R* | | 03/28/08 | | | 16.03 | | | | 2.13 | | | | 0.38 | | | | 4.66 | | |

| Class T | | 03/04/98 | | | | | | | | | | | | | | | | | |

| Excluding sales charges | | | | | | | 16.14 | | | | 2.34 | | | | 0.56 | | | | 4.82 | | |

| Including sales charges | | | | | | | 9.48 | | | | -3.54 | | | | -0.62 | | | | 4.20 | | |

| Class W* | | 09/27/10 | | | 16.27 | | | | 2.40 | | | | 0.66 | | | | 4.96 | | |

| Class Z | | 03/04/98 | | | 16.39 | | | | 2.65 | | | | 0.87 | | | | 5.18 | | |

| Russell 1000 Index | | | | | | | 17.83 | | | | -1.23 | | | | -0.75 | | | | 4.52 | | |

Returns for Class A and Class T are shown with and without the maximum initial sales charge of 5.75%. Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter. Returns for Class C are shown with and without the 1.00% CDSC for the first year only. The fund's other classes are not subject to sales charges and have limited eligibility. Please see the fund's prospectuses for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. Performance results reflect the effect of any fee waivers or reimbursements of fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiamanagement.com or calling 800.345.6611.

*The returns shown for periods prior to the share class inception date (including returns since inception if shown, which are since fund inception) include the returns of the fund's oldest share class. Since the fund launched more than one share class at its inception, Class Z shares were used. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiamanagement.com/mutual-funds/appended-performance for more information.

The Russell 1000 Index, an unmanaged index, measures the performance of 1,000 of the largest U.S. companies, based on market capitalization.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Annual Report 2012

2

Columbia Dividend Income Fund

Performance Overview (continued)

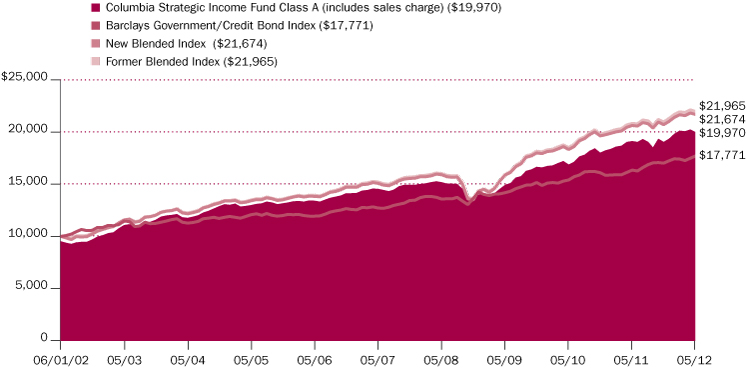

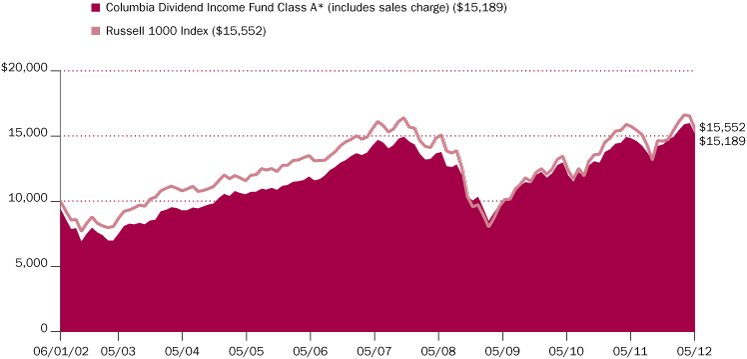

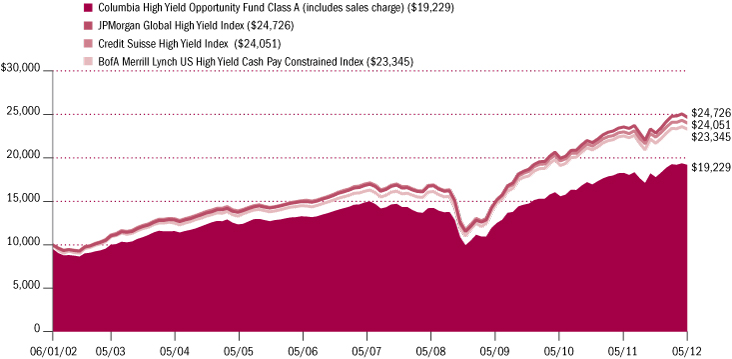

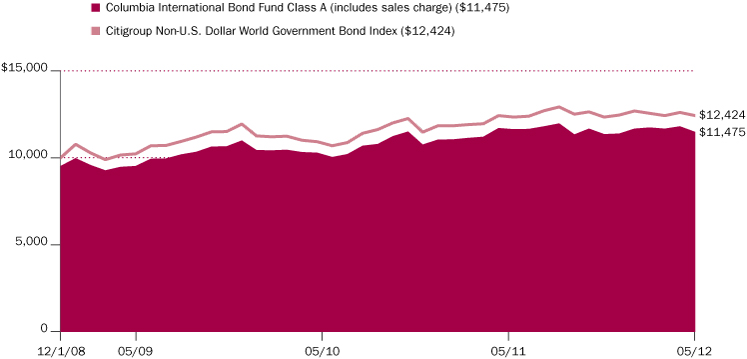

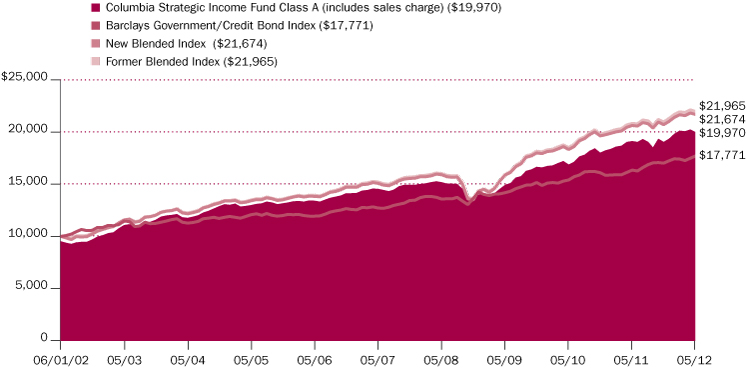

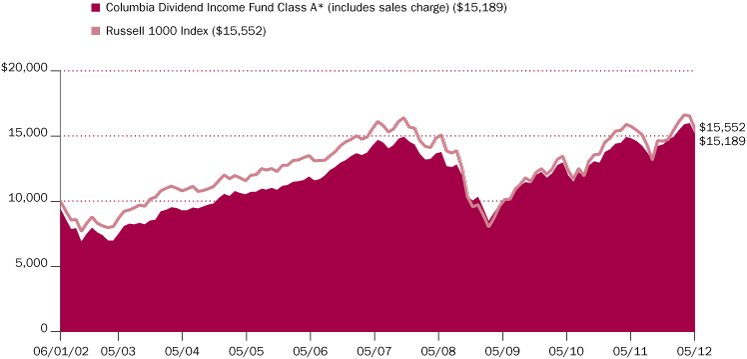

Performance of a Hypothetical $10,000 Investment (June 1, 2002 – May 31, 2012)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Dividend Income Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Annual Report 2012

3

Columbia Dividend Income Fund

Manager Discussion of Fund Performance

The Board of Trustees for Columbia Dividend Income Fund has approved the change of the fund's fiscal year end from September 30 to May 31. As a result, this report covers the 8-month period since the last annual report. The next report you receive will be for the six-month period from June 1, 2012 through November 30, 2012.

For the eight-month period that ended May 31, 2012, the fund's Class A shares returned 16.26% without sales charge. The fund's benchmark, the Russell 1000 Index, returned 17.83% for the same period. The fund reaped more than 90% of the market's gains in a strong rally, despite its conservative positioning and emphasis on dividend-paying stocks. Lack of exposure to two of the benchmark's strongest performers generally accounted for the modest underperformance.

Economic Growth Loses Momentum

Although Europe's debt problems and political stalemate in Washington on the federal budget and the national debt clouded the economic outlook, U.S. economic news was generally upbeat in the first six months of the period. The combination of the announcement of Long Term Refinancing Operation and stronger job data led a robust rally in stocks in the first quarter of 2012. However, debt problems flared up again in Europe and the domestic economic news turned disappointing in April, as the pace of job growth slowed markedly. Economic growth, as measured by gross domestic product, slipped to 1.9% in the first quarter, and expectations for second quarter growth are no higher. Manufacturing activity continued to expand — the one consistent bright spot throughout this recovery. And the housing market showed a glimmer of improvement, as year-over-year sales improved, inventories tightened and prices stabilized somewhat.

Investors Favored Financially Strong Companies

The fund maintained a consistent strategic stance throughout the period, focusing on companies considered to be stable, financially healthy and able to generate substantial free cash flow and shared their wealth with investors through stock dividends. While these companies are viewed as generally conservative, the fund's investments nevertheless captured most of the gains in a strong market rally. The fund's positions in the consumer staples and materials sectors contributed most to relative performance. One consumer staples holding, Philip Morris International, the tobacco products company marketing outside the United States, was the fund's top individual contributor. Another notable performer among staples investments was Diageo, the London-based international marketer of a variety of spirits, wines and beer brands. The top-performing position in materials was paint company Sherwin-Williams. It benefited from improving trends in home repair and remodeling that helped propel another solid performer, retailer Home Depot. Other leading performers that supported the fund's relative results included AT&T, the telecommunications services provider, diversified pharmaceutical company Pfizer and retailer Wal-Mart.

Portfolio Management

Richard E. Dahlberg, CFA

Scott L. Davis

David L. King, CFA

Michael Barclay, CFA

Morningstar Style BoxTM

The Morningstar Style BoxTM is based on the fund's portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2012 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Annual Report 2012

4

Columbia Dividend Income Fund

Manager Discussion of Fund Performance (continued)

Lack of Exposure to Top Performers Hurt Relative Results

The fund did not own two of the benchmark's leading performers, which detracted from results. One was a technology company that did not, until recently, pay a dividend to shareholders. Out of benchmark positions in Transocean and Canon also hampered relative returns somewhat. Transocean, an offshore oil and gas drilling company, was sold during the period. Japanese camera company Canon was hurt when the yen appreciated against the U.S. dollar. Another disappointment was National Fuel Gas, whose operations include natural gas production and pipeline services as well as gas utilities. Its results were affected by the decline in natural gas prices.

Looking Ahead

We remain confident in our long-term strategy. We believe our emphasis on quality companies with strong balance sheets and the ability to pay generous dividends gives the fund excellent potential to perform well through full market cycles. In the near term, we think market volatility is likely to continue as long as political leaders in the United States and Europe are unable to agree on solutions to their long-term fiscal problems. We are concerned about the amount of debt owed by countries, families and some corporations, and we believe this worldwide leverage problem will contribute to a prolonged period of slow growth in the global economy. Given this view, we think it makes even more sense to focus on the stocks of individual companies that have limited debt burdens. We intend to continue to emphasize those corporations that we believe are able to self-finance their operations and that can generate strong and sustainable free cash flow to pay healthy and increasing dividends to shareholders.

Top Ten Holdings (%)

(at May 31, 2012) | |

| Philip Morris International, Inc. | | | 3.5 | | |

| Verizon Communications, Inc. | | | 3.4 | | |

International Business

Machines Corp. | | | 3.1 | | |

| Microsoft Corp. | | | 3.0 | | |

| Intel Corp. | | | 2.9 | | |

| AT&T, Inc. | | | 2.9 | | |

| Exxon Mobil Corp. | | | 2.8 | | |

| Pfizer, Inc. | | | 2.6 | | |

| Bristol-Myers Squibb Co. | | | 2.5 | | |

| Merck & Co., Inc. | | | 2.3 | | |

Percentages indicated are based upon total investments (excluding Investments of Cash Collateral Received for Securities on Loan and money market funds).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Portfolio Breakdown (%)

(at May 31, 2012) | |

| Consumer Discretionary | | | 8.5 | | |

| Consumer Staples | | | 12.0 | | |

| Energy | | | 10.2 | | |

| Financials | | | 14.0 | | |

| Health Care | | | 13.7 | | |

| Industrials | | | 7.9 | | |

| Information Technology | | | 12.1 | | |

| Materials | | | 5.2 | | |

| Telecommunication Services | | | 6.3 | | |

| Utilities | | | 5.0 | | |

| Exchange-Traded Funds | | | 1.6 | | |

| Other(a) | | | 3.5 | | |

Sectors can be comprised of several industries. Please refer to the section entitled "Portfolio of Investments" for a complete listing.

Percentages indicated are based upon total investments (excluding Investments of Cash Collateral Received for Securities on Loan). The Fund's composition is subject to change.

(a) Includes investments in money market funds.

Annual Report 2012

5

Columbia Dividend Income Fund

Understanding Your Fund's Expenses

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and service (Rule 12b-1) fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

December 1, 2011 – May 31, 2012

| | | Account Value at the Beginning

of the Period ($) | | Account Value at the End of the

Period ($) | | Expenses Paid During the

Period ($) | | Fund's Annualized

Expense Ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,057.40 | | | | 1,020.00 | | | | 5.14 | | | | 5.05 | | | | 1.00 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,053.30 | | | | 1,016.25 | | | | 8.98 | | | | 8.82 | | | | 1.75 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,053.30 | | | | 1,016.25 | | | | 8.98 | | | | 8.82 | | | | 1.75 | | |

| Class I | | | 1,000.00 | | | | 1,000.00 | | | | 1,060.00 | | | | 1,021.85 | | | | 3.24 | | | | 3.18 | | | | 0.63 | | |

| Class R | | | 1,000.00 | | | | 1,000.00 | | | | 1,056.10 | | | | 1,018.75 | | | | 6.43 | | | | 6.31 | | | | 1.25 | | |

| Class T | | | 1,000.00 | | | | 1,000.00 | | | | 1,057.10 | | | | 1,019.75 | | | | 5.40 | | | | 5.30 | | | | 1.05 | | |

| Class W | | | 1,000.00 | | | | 1,000.00 | | | | 1,057.50 | | | | 1,020.00 | | | | 5.14 | | | | 5.05 | | | | 1.00 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,058.70 | | | | 1,021.25 | | | | 3.86 | | | | 3.79 | | | | 0.75 | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 366.

Expenses do not include fees and expenses incurred indirectly by the Fund from the underlying funds in which the Fund may invest (also referred to as "acquired funds"), including affiliated and non-affiliated pooled investment vehicles (including mutual funds and exchange traded funds).

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Annual Report 2012

6

Columbia Dividend Income Fund

Portfolio of Investments

May 31, 2012

(Percentages represent value of investments compared to net assets)

Common Stocks 94.1%

| Issuer | | Shares | | Value ($) | |

| Consumer Discretionary 8.5% | |

| Hotels, Restaurants & Leisure 1.7% | |

| McDonald's Corp. | | | 1,100,000 | | | | 98,274,000 | | |

| Leisure Equipment & Products 0.6% | |

| Mattel, Inc.(a) | | | 1,154,400 | | | | 35,936,472 | | |

| Media 2.1% | |

| McGraw-Hill Companies, Inc. (The) | | | 760,150 | | | | 32,975,307 | | |

| Meredith Corp.(a) | | | 971,575 | | | | 28,748,904 | | |

| Regal Entertainment Group, Class A | | | 70,000 | | | | 962,500 | | |

| Time Warner, Inc.(a) | | | 1,714,550 | | | | 59,100,539 | | |

| Total | | | | | 121,787,250 | | |

| Multiline Retail 1.0% | |

| Macy's, Inc. | | | 752,550 | | | | 28,634,528 | | |

| Nordstrom, Inc. | | | 689,350 | | | | 32,654,509 | | |

| Total | | | | | 61,289,037 | | |

| Specialty Retail 3.1% | |

| Home Depot, Inc. (The)(a) | | | 2,076,950 | | | | 102,476,713 | | |

| Limited Brands, Inc.(a) | | | 789,825 | | | | 35,036,637 | | |

| TJX Companies, Inc. | | | 965,700 | | | | 41,003,622 | | |

| Total | | | | | 178,516,972 | | |

| Total Consumer Discretionary | | | | | 495,803,731 | | |

| Consumer Staples 12.0% | |

| Beverages 2.1% | |

| Coca-Cola Co. (The)(a) | | | 760,150 | | | | 56,806,010 | | |

| Diageo PLC, ADR | | | 695,383 | | | | 66,297,815 | | |

| Total | | | | | 123,103,825 | | |

| Food & Staples Retailing 1.0% | |

| Wal-Mart Stores, Inc.(a) | | | 855,025 | | | | 56,277,746 | | |

| Food Products 1.9% | |

| General Mills, Inc. | | | 965,900 | | | | 36,974,652 | | |

| HJ Heinz Co.(a) | | | 1,423,100 | | | | 75,538,148 | | |

| Total | | | | | 112,512,800 | | |

| Household Products 2.3% | |

| Kimberly-Clark Corp. | | | 752,500 | | | | 59,710,875 | | |

| Procter & Gamble Co. (The) | | | 1,245,900 | | | | 77,607,111 | | |

| Total | | | | | 137,317,986 | | |

Common Stocks (continued)

| Issuer | | Shares | | Value ($) | |

| Tobacco 4.7% | |

| Altria Group, Inc. | | | 2,342,300 | | | | 75,398,637 | | |

| Philip Morris International, Inc. | | | 2,331,750 | | | | 197,056,192 | | |

| Total | | | | | 272,454,829 | | |

| Total Consumer Staples | | | | | 701,667,186 | | |

| Energy 10.1% | |

| Energy Equipment & Services 0.5% | |

| Schlumberger Ltd. | | | 512,050 | | | | 32,387,162 | | |

| Oil, Gas & Consumable Fuels 9.6% | |

| Chevron Corp. | | | 1,174,750 | | | | 115,489,673 | | |

| ConocoPhillips | | | 765,825 | | | | 39,945,432 | | |

| Exxon Mobil Corp. | | | 1,999,400 | | | | 157,212,822 | | |

| Kinder Morgan, Inc. | | | 1,840,175 | | | | 62,915,583 | | |

| Occidental Petroleum Corp. | | | 787,775 | | | | 62,446,924 | | |

| Penn West Petroleum Ltd. | | | 1,005,825 | | | | 13,377,473 | | |

| Phillips 66(b) | | | 382,887 | | | | 11,498,097 | | |

| Royal Dutch Shell PLC, ADR(a) | | | 1,549,130 | | | | 96,324,903 | | |

| Total | | | | | 559,210,907 | | |

| Total Energy | | | | | 591,598,069 | | |

| Financials 13.5% | |

| Capital Markets 2.1% | |

| BlackRock, Inc. | | | 345,450 | | | | 59,002,860 | | |

| Northern Trust Corp. | | | 859,600 | | | | 37,117,528 | | |

| T Rowe Price Group, Inc.(a) | | | 492,150 | | | | 28,342,918 | | |

| Total | | | | | 124,463,306 | | |

| Commercial Banks 3.4% | |

| PNC Financial Services Group, Inc. | | | 851,575 | | | | 52,303,736 | | |

| U.S. Bancorp(a) | | | 1,977,025 | | | | 61,505,248 | | |

| Wells Fargo & Co. | | | 2,613,075 | | | | 83,749,054 | | |

| Total | | | | | 197,558,038 | | |

| Consumer Finance 1.1% | |

| American Express Co. | | | 1,152,125 | | | | 64,323,139 | | |

| Diversified Financial Services 2.3% | |

| CME Group, Inc.(a) | | | 151,575 | | | | 39,041,173 | | |

| JPMorgan Chase & Co. | | | 2,832,900 | | | | 93,910,635 | | |

| Total | | | | | 132,951,808 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

7

Columbia Dividend Income Fund

Portfolio of Investments (continued)

May 31, 2012

Common Stocks (continued)

| Issuer | | Shares | | Value ($) | |

| Insurance 2.9% | |

| Arthur J Gallagher & Co.(a) | | | 1,294,375 | | | | 44,966,587 | | |

| Chubb Corp. (The) | | | 569,825 | | | | 41,067,288 | | |

| MetLife, Inc. | | | 771,225 | | | | 22,527,482 | | |

| Old Republic International Corp. | | | 55,000 | | | | 542,850 | | |

| Progressive Corp. (The)(a) | | | 974,950 | | | | 21,185,664 | | |

| RenaissanceRe Holdings Ltd.(a) | | | 192,900 | | | | 14,866,803 | | |

| Unum Group | | | 1,274,450 | | | | 25,425,277 | | |

| Total | | | | | 170,581,951 | | |

| Real Estate Investment Trusts (REITs) 1.3% | |

| Digital Realty Trust, Inc.(a) | | | 540,425 | | | | 38,245,877 | | |

| Public Storage | | | 273,000 | | | | 36,437,310 | | |

| Total | | | | | 74,683,187 | | |

| Thrifts & Mortgage Finance 0.4% | |

| People's United Financial, Inc.(a) | | | 2,240,925 | | | | 26,061,958 | | |

| Total Financials | | | | | 790,623,387 | | |

| Health Care 13.6% | |

| Biotechnology 1.0% | |

| Amgen, Inc.(a) | | | 856,975 | | | | 59,576,902 | | |

| Pharmaceuticals 12.6% | |

| Abbott Laboratories(a) | | | 1,771,675 | | | | 109,471,798 | | |

| Bristol-Myers Squibb Co. | | | 4,304,950 | | | | 143,527,033 | | |

| GlaxoSmithKline PLC, ADR(a) | | | 2,630,100 | | | | 116,013,711 | | |

| Johnson & Johnson(a) | | | 1,520,175 | | | | 94,904,525 | | |

| Merck & Co., Inc. | | | 3,428,975 | | | | 128,860,881 | | |

| Pfizer, Inc. | | | 6,658,025 | | | | 145,611,007 | | |

| Total | | | | | 738,388,955 | | |

| Total Health Care | | | | | 797,965,857 | | |

| Industrials 7.9% | |

| Aerospace & Defense 3.9% | |

| Boeing Co. (The) | | | 384,100 | | | | 26,737,201 | | |

| Honeywell International, Inc. | | | 1,328,275 | | | | 73,931,786 | | |

| Raytheon Co.(a) | | | 954,425 | | | | 48,026,666 | | |

| United Technologies Corp. | | | 1,110,375 | | | | 82,289,891 | | |

| Total | | | | | 230,985,544 | | |

| Commercial Services & Supplies 0.6% | |

| Waste Management, Inc.(a) | | | 1,088,700 | | | | 35,317,428 | | |

Common Stocks (continued)

| Issuer | | Shares | | Value ($) | |

| Electrical Equipment 0.5% | |

| Emerson Electric Co. | | | 627,275 | | | | 29,337,652 | | |

| Machinery 2.3% | |

| Deere & Co.(a) | | | 374,600 | | | | 27,671,702 | | |

| Dover Corp. | | | 714,200 | | | | 40,395,152 | | |

| Illinois Tool Works, Inc. | | | 467,525 | | | | 26,251,529 | | |

| Parker Hannifin Corp.(a) | | | 493,900 | | | | 40,371,386 | | |

| Total | | | | | 134,689,769 | | |

| Road & Rail 0.6% | |

| Norfolk Southern Corp. | | | 495,425 | | | | 32,460,246 | | |

| Total Industrials | | | | | 462,790,639 | | |

| Information Technology 12.0% | |

| IT Services 5.3% | |

| Accenture PLC, Class A | | | 1,452,800 | | | | 82,954,880 | | |

| Automatic Data Processing, Inc. | | | 989,100 | | | | 51,581,565 | | |

International Business

Machines Corp.(a) | | | 899,925 | | | | 173,595,533 | | |

| Total | | | | | 308,131,978 | | |

| Office Electronics 0.4% | |

| Canon, Inc., ADR | | | 640,100 | | | | 25,559,193 | | |

| Semiconductors & Semiconductor Equipment 3.4% | |

| Intel Corp. | | | 6,290,950 | | | | 162,558,148 | | |

| Texas Instruments, Inc.(a) | | | 1,338,950 | | | | 38,133,296 | | |

| Total | | | | | 200,691,444 | | |

| Software 2.9% | |

| Microsoft Corp. | | | 5,779,775 | | | | 168,711,632 | | |

| Total Information Technology | | | | | 703,094,247 | | |

| Materials 5.2% | |

| Chemicals 3.8% | |

| EI du Pont de Nemours & Co.(a) | | | 1,352,800 | | | | 65,286,128 | | |

| RPM International, Inc.(a) | | | 1,141,065 | | | | 30,078,474 | | |

| Sherwin-Williams Co. (The) | | | 959,600 | | | | 124,402,544 | | |

| Total | | | | | 219,767,146 | | |

| Containers & Packaging 0.5% | |

| Sonoco Products Co.(a) | | | 943,425 | | | | 29,029,187 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

8

Columbia Dividend Income Fund

Portfolio of Investments (continued)

May 31, 2012

Common Stocks (continued)

| Issuer | | Shares | | Value ($) | |

| Metals & Mining 0.9% | |

| BHP Billiton Ltd., ADR | | | 346,275 | | | | 21,306,301 | | |

| Nucor Corp.(a) | | | 913,340 | | | | 32,661,038 | | |

| Total | | | | | 53,967,339 | | |

| Total Materials | | | | | 302,763,672 | | |

| Telecommunication Services 6.3% | |

| Diversified Telecommunication Services 6.3% | |

| AT&T, Inc.(a) | | | 4,750,850 | | | | 162,336,544 | | |

| CenturyLink, Inc. | | | 100,000 | | | | 3,922,000 | | |

| Verizon Communications, Inc.(a) | | | 4,581,150 | | | | 190,759,086 | | |

| Windstream Corp.(a) | | | 960,100 | | | | 8,986,536 | | |

| Total | | | | | 366,004,166 | | |

| Total Telecommunication Services | | | | | 366,004,166 | | |

| Utilities 5.0% | |

| Electric Utilities 2.1% | |

| American Electric Power Co., Inc. | | | 1,015,150 | | | | 39,093,426 | | |

| NextEra Energy, Inc. | | | 430,000 | | | | 28,096,200 | | |

| Northeast Utilities | | | 860,000 | | | | 30,968,600 | | |

| NV Energy, Inc. | | | 75,000 | | | | 1,297,500 | | |

| Westar Energy, Inc. | | | 868,498 | | | | 24,856,413 | | |

| Total | | | | | 124,312,139 | | |

| Gas Utilities 0.4% | |

| National Fuel Gas Co.(a) | | | 570,325 | | | | 24,655,150 | | |

| Multi-Utilities 2.5% | |

| CMS Energy Corp.(a) | | | 1,316,950 | | | | 30,684,935 | | |

| Dominion Resources, Inc.(a) | | | 580,000 | | | | 30,194,800 | | |

| Public Service Enterprise Group, Inc.(a) | | | 197,327 | | | | 6,154,629 | | |

| Sempra Energy | | | 691,500 | | | | 44,954,415 | | |

| Wisconsin Energy Corp.(a) | | | 828,075 | | | | 31,334,358 | | |

| Total | | | | | 143,323,137 | | |

| Total Utilities | | | | | 292,290,426 | | |

Total Common Stocks

(Cost: $4,837,646,906) | | | | | 5,504,601,380 | | |

Convertible Preferred Stocks 0.6%

| Issuer | | Shares | | Value ($) | |

| Energy 0.1% | |

| Oil, Gas & Consumable Fuels 0.1% | |

| Apache Corp., 6.000%(a) | | | 109,725 | | | | 5,259,942 | | |

| Total Energy | | | | | 5,259,942 | | |

| Financials 0.5% | |

| Commercial Banks 0.5% | |

| Fifth Third Bancorp, 8.500%(a) | | | 200,000 | | | | 27,225,000 | | |

| Total Financials | | | | | 27,225,000 | | |

Total Convertible Preferred Stocks

(Cost: $36,022,370) | | | | | 32,484,942 | | |

| Exchange-Traded Funds 1.6% | |

| SPDR S&P 500 ETF Trust(a) | | | 725,000 | | | | 95,330,250 | | |

Total Exchange-Traded Funds

(Cost: $99,837,441) | | | | | 95,330,250 | | |

| Money Market Funds 3.4% | |

| | Shares | | Value ($) | |

Columbia Short-Term Cash

Fund, 0.161%(c)(d) | | | 201,123,460 | | | | 201,123,460 | | |

Total Money Market Funds

(Cost: $201,123,460) | | | | | 201,123,460 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

9

Columbia Dividend Income Fund

Portfolio of Investments (continued)

May 31, 2012

Investments of Cash Collateral Received for Securities on Loan 14.9%

| Issuer | | Effective

Yield | | Par ($)/

Principal ($)/

Shares | | Value ($) | |

| Asset-Backed Commercial Paper 1.1% | |

Atlantis One

08/01/12 | | | 0.662 | % | | | 11,959,960 | | | | 11,959,960 | | |

| 09/10/12 | | | 0.592 | % | | | 5,982,300 | | | | 5,982,300 | | |

| 10/11/12 | | | 0.541 | % | | | 4,986,275 | | | | 4,986,275 | | |

Gemini Securitization Corporation (FKA Twin Towers)

08/31/12 | | | 0.501 | % | | | 4,992,014 | | | | 4,992,014 | | |

Kells Funding LLC

06/04/12 | | | 0.501 | % | | | 1,997,361 | | | | 1,997,361 | | |

| 07/02/12 | | | 0.601 | % | | | 4,989,250 | | | | 4,989,250 | | |

| 10/12/12 | | | 0.612 | % | | | 9,969,161 | | | | 9,969,161 | | |

Rheingold Securitization

06/25/12 | | | 0.550 | % | | | 7,996,700 | | | | 7,996,700 | | |

Royal Park Investments

Funding Corp.

06/21/12 | | | 0.720 | % | | | 9,994,000 | | | | 9,994,000 | | |

| Total | | | | | | | 62,867,021 | | |

| Certificates of Deposit 6.5% | |

ABM AMRO Bank N.V.

06/21/12 | | | 0.400 | % | | | 9,989,788 | | | | 9,989,788 | | |

| 08/07/12 | | | 0.450 | % | | | 6,992,134 | | | | 6,992,134 | | |

| 08/08/12 | | | 0.460 | % | | | 11,985,910 | | | | 11,985,910 | | |

Barclays Bank PLC

07/18/12 | | | 0.280 | % | | | 10,000,000 | | | | 10,000,000 | | |

Credit Suisse

08/30/12 | | | 0.300 | % | | | 10,000,000 | | | | 10,000,000 | | |

| 11/08/12 | | | 0.399 | % | | | 15,000,000 | | | | 15,000,000 | | |

DZ Bank AG

07/27/12 | | | 0.320 | % | | | 10,000,000 | | | | 10,000,000 | | |

Deutsche Bank AG

07/27/12 | | | 0.340 | % | | | 10,000,000 | | | | 10,000,000 | | |

| 10/09/12 | | | 0.750 | % | | | 10,000,000 | | | | 10,000,000 | | |

| 11/02/12 | | | 0.729 | % | | | 10,000,000 | | | | 10,000,000 | | |

DnB NOR ASA

09/14/12 | | | 0.530 | % | | | 5,000,000 | | | | 5,000,000 | | |

FMS Wertmanagement Anstalt Des Oeffentlichen Rechts

06/29/12 | | | 0.240 | % | | | 15,000,000 | | | | 15,000,000 | | |

Hong Kong Shanghai Bank Corp., Ltd.

06/25/12 | | | 0.240 | % | | | 15,000,000 | | | | 15,000,000 | | |

Mitsubishi UFJ Trust and Banking Corp.

10/12/12 | | | 0.530 | % | | | 5,000,000 | | | | 5,000,000 | | |

Mizuho Corporate Bank Ltd.

06/01/12 | | | 0.370 | % | | | 20,000,000 | | | | 20,000,000 | | |

| 08/14/12 | | | 0.400 | % | | | 10,000,000 | | | | 10,000,000 | | |

N.V. Bank Nederlandse

Gemeenten

06/29/12 | | | 0.260 | % | | | 10,000,000 | | | | 10,000,000 | | |

Investments of Cash Collateral Received for Securities on Loan (continued)

| Issuer | | Effective

Yield | | Par ($)/

Principal ($)/

Shares | | Value ($) | |

National Australia Bank

08/16/12 | | | 0.339 | % | | | 10,000,000 | | | | 10,000,000 | | |

| 10/29/12 | | | 0.298 | % | | | 9,999,600 | | | | 9,999,600 | | |

National Bank of Canada

11/09/12 | | | 0.299 | % | | | 10,000,000 | | | | 10,000,000 | | |

Nordea Bank AB

08/23/12 | | | 0.290 | % | | | 20,000,000 | | | | 20,000,000 | | |

Norinchukin Bank

08/21/12 | | | 0.390 | % | | | 10,000,000 | | | | 10,000,000 | | |

| 08/22/12 | | | 0.390 | % | | | 10,000,000 | | | | 10,000,000 | | |

| 10/31/12 | | | 0.560 | % | | | 10,000,000 | | | | 10,000,000 | | |

| 11/09/12 | | | 0.519 | % | | | 10,000,000 | | | | 10,000,000 | | |

Rabobank

10/26/12 | | | 0.515 | % | | | 10,000,000 | | | | 10,000,000 | | |

Standard Chartered Bank PLC

10/05/12 | | | 0.630 | % | | | 13,955,308 | | | | 13,955,308 | | |

Sumitomo Mitsui Banking Corp.

06/04/12 | | | 0.375 | % | | | 10,000,000 | | | | 10,000,000 | | |

| 10/11/12 | | | 0.500 | % | | | 10,000,000 | | | | 10,000,000 | | |

| 11/02/12 | | | 0.479 | % | | | 5,000,000 | | | | 5,000,000 | | |

Sumitomo Trust & Banking Co., Ltd.

08/29/12 | | | 0.350 | % | | | 20,000,000 | | | | 20,000,000 | | |

| 11/01/12 | | | 0.479 | % | | | 12,000,000 | | | | 12,000,000 | | |

Svenska Handelsbanken

08/27/12 | | | 0.270 | % | | | 10,000,130 | | | | 10,000,130 | | |

| 08/30/12 | | | 0.580 | % | | | 10,000,000 | | | | 10,000,000 | | |

| 09/13/12 | | | 0.490 | % | | | 5,000,000 | | | | 5,000,000 | | |

| Total | | | | | | | 379,922,870 | | |

| Commercial Paper 3.2% | |

BTM Capital

06/08/12 | | | 0.340 | % | | | 9,997,733 | | | | 9,997,733 | | |

Caisse d'Amortissement de la Dette Sociale

07/19/12 | | | 0.471 | % | | | 4,992,167 | | | | 4,992,167 | | |

Caisse des Depots

08/31/12 | | | 0.360 | % | | | 9,990,800 | | | | 9,990,800 | | |

| 10/05/12 | | | 0.562 | % | | | 2,991,460 | | | | 2,991,460 | | |

Development Bank of Singapore Ltd.

08/02/12 | | | 0.551 | % | | | 9,973,417 | | | | 9,973,417 | | |

DnB NOR

08/30/12 | | | 0.489 | % | | | 3,000,000 | | | | 3,000,000 | | |

| 10/10/12 | | | 0.511 | % | | | 9,974,075 | | | | 9,974,075 | | |

Erste Abwicklungsanstalt

08/22/12 | | | 0.390 | % | | | 19,980,067 | | | | 19,980,067 | | |

| 08/27/12 | | | 0.380 | % | | | 9,989,972 | | | | 9,989,972 | | |

Mitsubishi UFJ Trust and Banking Corp.

09/04/12 | | | 0.441 | % | | | 9,984,967 | | | | 9,984,967 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

10

Columbia Dividend Income Fund

Portfolio of Investments (continued)

May 31, 2012

Investments of Cash Collateral Received for Securities on Loan (continued)

| Issuer | | Effective

Yield | | Par ($)/

Principal ($)/

Shares | | Value ($) | |

Nordea Bank AB

07/24/12 | | | 0.627 | % | | | 6,977,882 | | | | 6,977,882 | | |

| 08/14/12 | | | 0.592 | % | | | 4,985,168 | | | | 4,985,168 | | |

Skandinaviska Enskilda Banken AB

06/15/12 | | | 0.330 | % | | | 9,994,500 | | | | 9,994,500 | | |

| 07/03/12 | | | 0.315 | % | | | 9,994,662 | | | | 9,994,662 | | |

| 07/17/12 | | | 0.300 | % | | | 9,994,667 | | | | 9,994,667 | | |

Suncorp Metway Ltd.

06/04/12 | | | 0.450 | % | | | 4,996,062 | | | | 4,996,062 | | |

| 06/05/12 | | | 0.460 | % | | | 3,996,882 | | | | 3,996,882 | | |

| 06/12/12 | | | 0.460 | % | | | 9,991,950 | | | | 9,991,950 | | |

| 06/13/12 | | | 0.450 | % | | | 4,996,063 | | | | 4,996,063 | | |

| 07/23/12 | | | 0.460 | % | | | 14,987,925 | | | | 14,987,925 | | |

The Commonwealth Bank of Australia

08/16/12 | | | 0.299 | % | | | 10,000,000 | | | | 10,000,000 | | |

Westpac Securities NZ Ltd.

08/27/12 | | | 0.491 | % | | | 6,984,279 | | | | 6,984,279 | | |

| Total | | | | | | | 188,774,698 | | |

| Repurchase Agreements 4.1% | |

Citigroup Global Markets, Inc.

dated 05/31/12,

matures 06/01/12,

repurchase price

$5,000,031(e) | | | 0.220 | % | | | 5,000,000 | | | | 5,000,000 | | |

Deutsche Bank AG

dated 05/29/12,

matures 06/05/12,

repurchase price

$25,000,875(e) | | | 0.180 | % | | | 25,000,000 | | | | 25,000,000 | | |

Goldman Sachs & Co.

dated 05/31/12,

matures 06/01/12,

repurchase price

$10,000,058(e) | | | 0.210 | % | | | 10,000,000 | | | | 10,000,000 | | |

Mizuho Securities USA, Inc.

dated 05/31/12,

matures 06/01/12,

repurchase price

$23,400,163(e) | | | 0.250 | % | | | 23,400,000 | | | | 23,400,000 | | |

Natixis Financial

Products, Inc.

dated 05/31/12,

matures 06/01/12,

repurchase price

$86,000,573(e) | | | 0.240 | % | | | 86,000,000 | | | | 86,000,000 | | |

Nomura Securities

dated 05/31/12,

matures 06/01/12,

repurchase price

$63,000,140(e) | | | 0.230 | % | | | 62,999,738 | | | | 62,999,738 | | |

Investments of Cash Collateral Received for Securities on Loan (continued)

| Issuer | | Effective

Yield | | Par ($)/

Principal ($)/

Shares | | Value ($) | |

Societe Generale

dated 05/31/12,

matures 06/01/12,

repurchase price

$25,000,146(e) | | | 0.210 | % | | | 25,000,000 | | | | 25,000,000 | | |

UBS Securities LLC

dated 05/31/12,

matures 06/01/12,

repurchase price

$2,675,335(e) | | | 0.210 | % | | | 2,675,319 | | | | 2,675,319 | | |

| Total | | | | | | | 240,075,057 | | |

Total Investments of Cash Collateral Received for Securities on Loan

(Cost: $871,639,646) | | | | | | | 871,639,646 | | |

Total Investments

(Cost: $6,046,269,823) | | | | | | | 6,705,179,678 | | |

| Other Assets & Liabilities, Net | | | | | | | (856,338,388 | ) | |

| Net Assets | | | | | | | 5,848,841,290 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

11

Columbia Dividend Income Fund

Portfolio of Investments (continued)

May 31, 2012

Notes to Portfolio of Investments

(a) At May 31, 2012, security was partially or fully on loan.

(b) Non-income producing.

(c) The rate shown is the seven-day current annualized yield at May 31, 2012.

(d) Investments in affiliates during the period ended May 31, 2012:

| Issuer | | Beginning

Cost ($) | | Purchase

Cost ($) | | Sales Cost/

Proceeds

From Sales ($) | | Realized

Gain/Loss ($) | | Ending

Cost ($) | | Dividends

or Interest

Income ($) | | Value ($) | |

Columbia Short-Term

Cash Fund | | | 123,514,676 | | | | 1,193,764,310 | | �� | | (1,116,155,526 | ) | | | — | | | | 201,123,460 | | | | 170,160 | | | | 201,123,460 | | |

(e) The table below represents securities received as collateral for repurchase agreements. This collateral is deposited with the Fund's custodian and, pursuant to the terms of the repurchase agreement, must have an aggregate market value greater than or equal to the repurchase price plus accrued interest at all times. The value of securities and/or cash held as collateral for repurchase agreements is monitored on a daily basis to ensure the proper level of collateral.

| Security Description | | Value ($) | |

| Citigroup Global Markets, Inc. (0.220%) | |

| Fannie Mae Benchmark REMIC | | | 25,133 | | |

| Fannie Mae REMICS | | | 1,979,305 | | |

| Fannie Mae-Aces | | | 41,059 | | |

| Freddie Mac Reference REMIC | | | 11,036 | | |

| Freddie Mac REMICS | | | 2,518,595 | | |

| Government National Mortgage Association | | | 524,872 | | |

| Total Market Value of Collateral Securities | | | 5,100,000 | | |

| Security Description | | Value ($) | |

| Deutsche Bank AG (0.180%) | |

| Fannie Mae REMICS | | | 4,136,938 | | |

| Government National Mortgage Association | | | 21,372,615 | | |

| Total Market Value of Collateral Securities | | | 25,509,553 | | |

| Security Description | | Value ($) | |

| Goldman Sachs & Co. (0.210%) | |

| Ginnie Mae I Pool | | | 8,107,002 | | |

| Ginnie Mae II Pool | | | 2,092,998 | | |

| Total Market Value of Collateral Securities | | | 10,200,000 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

12

Columbia Dividend Income Fund

Portfolio of Investments (continued)

May 31, 2012

Notes to Portfolio of Investments (continued)

| Security Description | | Value ($) | |

| Mizuho Securities USA, Inc. (0.250%) | |

| Fannie Mae Grantor Trust | | | 710,631 | | |

| Fannie Mae Pool | | | 54,909 | | |

| Fannie Mae REMICS | | | 12,028,491 | | |

| Fannie Mae Whole Loan | | | 829,593 | | |

| FHLMC Structured Pass Through Securities | | | 378,857 | | |

| Freddie Mac Non Gold Pool | | | 1,659,616 | | |

| Freddie Mac REMICS | | | 1,577,540 | | |

| Ginnie Mae II Pool | | | 6,628,363 | | |

| Total Market Value of Collateral Securities | | | 23,868,000 | | |

| Security Description | | Value ($) | |

| Natixis Financial Products, Inc. (0.240%) | |

| Fannie Mae Pool | | | 7,262,678 | | |

| Fannie Mae REMICS | | | 23,394,532 | | |

| Fannie Mae-Aces | | | 283,803 | | |

| Freddie Mac Gold Pool | | | 9,860,612 | | |

| Freddie Mac REMICS | | | 19,265,132 | | |

| Government National Mortgage Association | | | 19,195,098 | | |

| United States Treasury Note/Bond | | | 8,458,733 | | |

| Total Market Value of Collateral Securities | | | 87,720,588 | | |

| Security Description | | Value ($) | |

| Nomura Securities (0.230%) | |

| Fannie Mae Pool | | | 27,450,209 | | |

| Freddie Mac Gold Pool | | | 14,271,257 | | |

| Ginnie Mae II Pool | | | 22,538,266 | | |

| Total Market Value of Collateral Securities | | | 64,259,732 | | |

| Security Description | | Value ($) | |

| Societe Generale (0.210%) | |

| Fannie Mae Pool | | | 14,039,392 | | |

| Freddie Mac Gold Pool | | | 11,460,608 | | |

| Total Market Value of Collateral Securities | | | 25,500,000 | | |

| Security Description | | Value ($) | |

| UBS Securities LLC (0.210%) | |

| Ginnie Mae I Pool | | | 1,671,413 | | |

| Ginnie Mae II Pool | | | 1,057,413 | | |

| Total Market Value of Collateral Securities | | | 2,728,826 | | |

Abbreviation Legend

ADR American Depositary Receipt

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

13

Columbia Dividend Income Fund

Portfolio of Investments (continued)

May 31, 2012

Fair Value Measurements

Generally accepted accounting principles (GAAP) require disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category.

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

> Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

> Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

> Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

14

Columbia Dividend Income Fund

Portfolio of Investments (continued)

May 31, 2012

Fair Value Measurements (continued)

The following table is a summary of the inputs used to value the Fund's investments at May 31, 2012:

| Description | | Level 1

Quoted Prices in Active

Markets for Identical

Assets ($) | |

Level 2

Other Significant

Observable Inputs ($) | |

Level 3

Significant

Unobservable Inputs ($) | |

Total ($) | |

| Equity Securities | |

| Common Stocks | |

| Consumer Discretionary | | | 495,803,731 | | | | — | | | | — | | | | 495,803,731 | | |

| Consumer Staples | | | 701,667,186 | | | | — | | | | — | | | | 701,667,186 | | |

| Energy | | | 591,598,069 | | | | — | | | | — | | | | 591,598,069 | | |

| Financials | | | 790,623,387 | | | | — | | | | — | | | | 790,623,387 | | |

| Health Care | | | 797,965,857 | | | | — | | | | — | | | | 797,965,857 | | |

| Industrials | | | 462,790,639 | | | | — | | | | — | | | | 462,790,639 | | |

| Information Technology | | | 703,094,247 | | | | — | | | | — | | | | 703,094,247 | | |

| Materials | | | 302,763,672 | | | | — | | | | — | | | | 302,763,672 | | |

| Telecommunication Services | | | 366,004,166 | | | | — | | | | — | | | | 366,004,166 | | |

| Utilities | | | 292,290,426 | | | | — | | | | — | | | | 292,290,426 | | |

| Convertible Preferred Stocks | |

| Energy | | | 5,259,942 | | | | — | | | | — | | | | 5,259,942 | | |

| Financials | | | 27,225,000 | | | | — | | | | — | | | | 27,225,000 | | |

| Exchange-Traded Funds | | | 95,330,250 | | | | — | | | | — | | | | 95,330,250 | | |

| Total Equity Securities | | | 5,632,416,572 | | | | — | | | | — | | | | 5,632,416,572 | | |

| Other | |

| Money Market Funds | | | 201,123,460 | | | | — | | | | — | | | | 201,123,460 | | |

Investments of Cash Collateral

Received for Securities on Loan | | | — | | | | 871,639,646 | | | | — | | | | 871,639,646 | | |

| Total Other | | | 201,123,460 | | | | 871,639,646 | | | | — | | | | 1,072,763,106 | | |

| Total | | | 5,833,540,032 | | | | 871,639,646 | | | | — | | | | 6,705,179,678 | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund's assets assigned to the Level 2 input category are generally valued using the market approach, in which a security's value is determined through reference to prices and information from market transactions for similar or identical assets.

Financial assets were transferred from Level 2 to Level 1 as the market for these assets was deemed to be active during the period and fair values were consequently obtained using quoted prices for identical assets rather than being based upon other observable market inputs as of period end, May 31, 2012.

The following table shows transfers between Level 1 and Level 2 of the fair value hierarchy:

| Transfers In | | Transfers Out | |

| Level 1 | | Level 2 | | Level 1 | | Level 2 | |

| $ | 26,020,953 | | | $ | — | | | $ | — | | | $ | 26,020,953 | | |

Transfers between Level 1 and Level 2 are determined based on the fair value at the beginning of the period for security positions held throughout the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

15

Columbia Dividend Income Fund

Statement of Assets and Liabilities

May 31, 2012

| Assets | |

| Investments, at value* | |

| Unaffiliated issuers (identified cost $4,973,506,717) | | $ | 5,632,416,572 | | |

| Affiliated issuers (identified cost $201,123,460) | | | 201,123,460 | | |

| Investment of cash collateral received for securities on loan | |

| Short-term securities (identified cost $631,564,589) | | | 631,564,589 | | |

| Repurchase agreements (identified cost $240,075,057) | | | 240,075,057 | | |

| Total investments (identified cost $6,046,269,823) | | | 6,705,179,678 | | |

| Receivable for: | |

| Investments sold | | | 47,426,496 | | |

| Capital shares sold | | | 8,494,125 | | |

| Dividends | | | 20,128,790 | | |

| Interest | | | 1,571,819 | | |

| Expense reimbursement due from Investment Manager | | | 8,507 | | |

| Trustees' deferred compensation plan | | | 122,249 | | |

| Total assets | | | 6,782,931,664 | | |

| Liabilities | |

| Due upon return of securities on loan | | | 871,639,646 | | |

| Payable for: | |

| Investments purchased | | | 56,817,841 | | |

| Capital shares purchased | | | 4,408,240 | | |

| Investment management fees | | | 86,205 | | |

| Distribution and service fees | | | 21,227 | | |

| Transfer agent fees | | | 913,882 | | |

| Administration fees | | | 7,416 | | |

| Compensation of board members | | | 5,180 | | |

| Chief compliance officer expenses | | | 640 | | |

| Other expenses | | | 67,848 | | |

| Trustees' deferred compensation plan | | | 122,249 | | |

| Total liabilities | | | 934,090,374 | | |

| Net assets applicable to outstanding capital stock | | $ | 5,848,841,290 | | |

| Represented by | |

| Paid-in capital | | $ | 5,227,549,204 | | |

| Undistributed net investment income | | | 28,231,804 | | |

| Accumulated net realized loss | | | (65,849,573 | ) | |

| Unrealized appreciation (depreciation) on: | |

| Investments | | | 658,909,855 | | |

| Total — representing net assets applicable to outstanding capital stock | | $ | 5,848,841,290 | | |

| *Value of securities on loan | | $ | 850,240,144 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

16

Columbia Dividend Income Fund

Statement of Assets and Liabilities (continued)

May 31, 2012

| Class A | |

| Net assets | | $ | 1,729,495,110 | | |

| Shares outstanding | | | 123,864,845 | | |

| Net asset value per share | | $ | 13.96 | | |

| Maximum offering price per share(a) | | $ | 14.81 | | |

| Class B | |

| Net assets | | $ | 15,095,292 | | |

| Shares outstanding | | | 1,107,598 | | |

| Net asset value per share | | $ | 13.63 | | |

| Class C | |

| Net assets | | $ | 279,092,932 | | |

| Shares outstanding | | | 20,491,359 | | |

| Net asset value per share | | $ | 13.62 | | |

| Class I | |

| Net assets | | $ | 271,693,881 | | |

| Shares outstanding | | | 19,426,368 | | |

| Net asset value per share | | $ | 13.99 | | |

| Class R | |

| Net assets | | $ | 32,182,998 | | |

| Shares outstanding | | | 2,304,697 | | |

| Net asset value per share | | $ | 13.96 | | |

| Class T | |

| Net assets | | $ | 77,344,325 | | |

| Shares outstanding | | | 5,539,104 | | |

| Net asset value per share | | $ | 13.96 | | |

| Maximum offering price per share(a) | | $ | 14.81 | | |

| Class W | |

| Net assets | | $ | 47,647,086 | | |

| Shares outstanding | | | 3,412,483 | | |

| Net asset value per share | | $ | 13.96 | | |

| Class Z | |

| Net assets | | $ | 3,396,289,666 | | |

| Shares outstanding | | | 243,045,184 | | |

| Net asset value per share | | $ | 13.97 | | |

(a) The maximum offering price per share is calculated by dividing the net asset value by 1.0 minus the maximum sales charge of 5.75%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

17

Columbia Dividend Income Fund

Statement of Operations

| | | Year Ended

May 31,

2012(a) | | Year Ended

September 30,

2011 | |

| Net investment income | |

| Income: | |

| Dividends | | $ | 120,060,174 | | | $ | 113,036,547 | | |

| Interest | | | — | | | | 51,726 | | |

| Dividends from affiliates | | | 170,160 | | | | 37,160 | | |

| Income from securities lending — net | | | 6,504,197 | | | | 77,258 | | |

| Foreign taxes withheld | | | (416,409 | ) | | | (712,700 | ) | |

| Total income | | | 126,318,122 | | | | 112,489,991 | | |

| Expenses: | |

| Investment management fees | | | 18,535,458 | | | | 20,026,109 | | |

| Distribution fees | |

| Class B | | | 81,704 | | | | 146,783 | | |

| Class C | | | 1,210,003 | | | | 1,164,658 | | |

| Class R | | | 76,739 | | | | 62,372 | | |

| Service fees | |

| Class A | | | 2,454,192 | | | | 2,530,486 | | |

| Class B | | | 27,234 | | | | 48,928 | | |

| Class C | | | 403,334 | | | | 388,219 | | |

| Class W | | | 80,221 | | | | 75,979 | | |

| Shareholder service fee — Class T | | | 158,657 | | | | 247,391 | | |

| Transfer agent fees | |

| Class A | | | 1,762,486 | | | | 1,717,159 | | |

| Class B | | | 20,531 | | | | 33,068 | | |

| Class C | | | 288,340 | | | | 261,871 | | |

| Class R | | | 26,997 | | | | 20,120 | | |

| Class T | | | 97,886 | | | | 138,140 | | |

| Class W | | | 56,999 | | | | 48,902 | | |

| Class Z | | | 3,496,086 | | | | 3,385,803 | | |

| Administration fees | | | 1,613,728 | | | | 2,133,693 | | |

| Compensation of board members | | | 86,606 | | | | 118,135 | | |

| Pricing and bookkeeping fees | | | — | | | | 108,964 | | |

| Custodian fees | | | 88,902 | | | | 90,644 | | |

| Printing and postage fees | | | 302,036 | | | | 300,001 | | |

| Registration fees | | | 470,674 | | | | 202,000 | | |

| Professional fees | | | 135,698 | | | | 179,437 | | |

| Chief compliance officer expenses | | | 1,066 | | | | 3,661 | | |

| Other | | | 115,787 | | | | 81,646 | | |

| Total expenses | | | 31,591,364 | | | | 33,514,169 | | |

| Fees waived or expenses reimbursed by Investment Manager and its affiliates | | | (1,781,743 | ) | | | (1,966,047 | ) | |

| Expense reductions | | | — | | | | (12,184 | ) | |

| Total net expenses | | | 29,809,621 | | | | 31,535,938 | | |

| Net investment income | | | 96,508,501 | | | | 80,954,053 | | |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Investments | | | 16,301,149 | | | | 16,568,991 | | |

| Foreign currency translations | | | 2,231 | | | | 1,298 | | |

| Net realized gain | | | 16,303,380 | | | | 16,570,289 | | |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments | | | 546,816,691 | | | | (125,200,605 | ) | |

| Foreign currency translations | | | 2,620 | | | | (2,620 | ) | |

| Net change in unrealized appreciation (depreciation) | | | 546,819,311 | | | | (125,203,225 | ) | |

| Net realized and unrealized gain (loss) | | | 563,122,691 | | | | (108,632,936 | ) | |

| Net change in net assets resulting from operations | | $ | 659,631,192 | | | $ | (27,678,883 | ) | |

(a) For the period from October 1, 2011 to May 31, 2012. During the period, the Fund's fiscal year end was changed from September 30 to May 31.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

18

Columbia Dividend Income Fund

Statement of Changes in Net Assets

| | | Year Ended

May 31,

2012(a) | | Year Ended

September 30,

2011 | | Year Ended

September 30,

2010(b) | |

| Operations | |

| Net investment income | | $ | 96,508,501 | | | $ | 80,954,053 | | | $ | 53,954,403 | | |

| Net realized gain | | | 16,303,380 | | | | 16,570,289 | | | | 43,830,633 | | |

| Net change in unrealized appreciation (depreciation) | | | 546,819,311 | | | | (125,203,225 | ) | | | 114,609,413 | | |

| Net increase (decrease) in net assets resulting from operations | | | 659,631,192 | | | | (27,678,883 | ) | | | 212,394,449 | | |

| Distributions to shareholders | |

| Net investment income | |

| Class A | | | (18,711,324 | ) | | | (22,582,632 | ) | | | (15,010,735 | ) | |

| Class B | | | (149,656 | ) | | | (274,525 | ) | | | (408,584 | ) | |

| Class C | | | (2,239,333 | ) | | | (2,356,214 | ) | | | (1,243,004 | ) | |

| Class I | | | (3,932,492 | ) | | | (3,517,020 | ) | | | — | | |

| Class R | | | (259,671 | ) | | | (247,636 | ) | | | (90,437 | ) | |

| Class T | | | (987,754 | ) | | | (1,721,136 | ) | | | (1,868,788 | ) | |

| Class W | | | (606,798 | ) | | | (740,376 | ) | | | — | | |

| Class Z | | | (41,629,351 | ) | | | (49,919,726 | ) | | | (36,042,620 | ) | |

| Total distributions to shareholders | | | (68,516,379 | ) | | | (81,359,265 | ) | | | (54,664,168 | ) | |

| Increase in net assets from share transactions | | | 1,350,220,709 | | | | 1,492,699,841 | | | | 671,056,299 | | |

| Total increase in net assets | | | 1,941,335,522 | | | | 1,383,661,693 | | | | 828,786,580 | | |

| Net assets at beginning of year | | | 3,907,505,768 | | | | 2,523,844,075 | | | | 1,695,057,495 | | |

| Net assets at end of year | | $ | 5,848,841,290 | | | $ | 3,907,505,768 | | | $ | 2,523,844,075 | | |

| Undistributed net investment income | | $ | 28,231,804 | | | $ | 244,845 | | | $ | 648,759 | | |

(a) For the period from October 1, 2011 to May 31, 2012. During the period, the Fund's fiscal year end was changed from September 30 to May 31.

(b) Class I and Class W shares are for the period from September 27, 2010 (commencement of operations) to September 30, 2010.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

19

Columbia Dividend Income Fund

Statement of Changes in Net Assets (continued)

| | | Year Ended May 31, 2012(a) | | Year Ended September 30, 2011(b) | | Year Ended September 30, 2010 | |

| | | Shares | | Dollars($) | | Shares | | Dollars($) | | Shares | | Dollars($) | |

| Capital stock activity | |

| Class A shares | |

| Subscriptions(c) | | | 48,546,597 | | | | 672,368,710 | | | | 48,175,528 | | | | 634,891,354 | | | | 27,619,891 | | | | 326,418,937 | | |

| Distributions reinvested | | | 1,151,653 | | | | 16,100,090 | | | | 1,446,142 | | | | 18,598,042 | | | | 1,091,127 | | | | 12,956,124 | | |

| Redemptions | | | (16,542,347 | ) | | | (228,949,914 | ) | | | (18,973,244 | ) | | | (248,181,551 | ) | | | (11,936,159 | ) | | | (140,954,594 | ) | |

| Net increase | | | 33,155,903 | | | | 459,518,886 | | | | 30,648,426 | | | | 405,307,845 | | | | 16,774,859 | | | | 198,420,467 | | |

| Class B shares | |

| Subscriptions | | | 193,082 | | | | 2,583,203 | | | | 342,782 | | | | 4,373,503 | | | | 287,214 | | | | 3,327,780 | | |

| Distributions reinvested | | | 8,376 | | | | 113,803 | | | | 15,508 | | | | 195,603 | | | | 28,145 | | | | 326,729 | | |

| Redemptions(c) | | | (410,573 | ) | | | (5,513,011 | ) | | | (823,282 | ) | | | (10,545,800 | ) | | | (1,094,271 | ) | | | (12,733,090 | ) | |

| Net decrease | | | (209,115 | ) | | | (2,816,005 | ) | | | (464,992 | ) | | | (5,976,694 | ) | | | (778,912 | ) | | | (9,078,581 | ) | |

| Class C shares | |

| Subscriptions | | | 6,603,537 | | | | 89,285,490 | | | | 9,101,453 | | | | 116,817,556 | | | | 4,345,783 | | | | 50,314,346 | | |

| Distributions reinvested | | | 126,063 | | | | 1,717,923 | | | | 132,150 | | | | 1,655,855 | | | | 78,265 | | | | 908,798 | | |

| Redemptions | | | (1,542,136 | ) | | | (20,780,156 | ) | | | (1,871,114 | ) | | | (23,806,169 | ) | | | (914,304 | ) | | | (10,483,246 | ) | |

| Net increase | | | 5,187,464 | | | | 70,223,257 | | | | 7,362,489 | | | | 94,667,242 | | | | 3,509,744 | | | | 40,739,898 | | |

| Class I shares | |

| Subscriptions | | | 5,520,881 | | | | 75,970,455 | | | | 24,078,342 | | | | 320,170,838 | | | | 206 | | | | 2,500 | | |

| Distributions reinvested | | | 282,493 | | | | 3,932,450 | | | | 276,223 | | | | 3,516,952 | | | | — | | | | — | | |

| Redemptions | | | (6,890,933 | ) | | | (93,486,923 | ) | | | (3,840,844 | ) | | | (50,294,066 | ) | | | — | | | | — | | |

| Net increase (decrease) | | | (1,087,559 | ) | | | (13,584,018 | ) | | | 20,513,721 | | | | 273,393,724 | | | | 206 | | | | 2,500 | | |

| Class R shares | |

| Subscriptions | | | 1,511,426 | | | | 21,095,800 | | | | 742,217 | | | | 9,640,024 | | | | 758,691 | | | | 9,240,343 | | |

| Distributions reinvested | | | 14,515 | | | | 203,218 | | | | 15,585 | | | | 200,423 | | | | 6,868 | | | | 81,266 | | |

| Redemptions | | | (297,634 | ) | | | (4,166,692 | ) | | | (388,469 | ) | | | (5,161,722 | ) | | | (117,253 | ) | | | (1,359,907 | ) | |

| Net increase | | | 1,228,307 | | | | 17,132,326 | | | | 369,333 | | | | 4,678,725 | | | | 648,306 | | | | 7,961,702 | | |

| Class T shares | |

| Subscriptions | | | 55,561 | | | | 761,410 | | | | 150,886 | | | | 1,961,263 | | | | 784,478 | | | | 9,235,572 | | |

| Distributions reinvested | | | 58,440 | | | | 812,871 | | | | 109,642 | | | | 1,414,376 | | | | 146,661 | | | | 1,740,293 | | |

| Redemptions | | | (527,656 | ) | | | (7,286,576 | ) | | | (938,084 | ) | | | (12,332,826 | ) | | | (898,540 | ) | | | (10,598,500 | ) | |

| Net increase (decrease) | | | (413,655 | ) | | | (5,712,295 | ) | | | (677,556 | ) | | | (8,957,187 | ) | | | 32,599 | | | | 377,365 | | |

| Class W shares | |

| Subscriptions | | | 746,557 | | | | 10,264,661 | | | | 4,878,494 | | | | 64,001,093 | | | | 206 | | | | 2,500 | | |

| Distributions reinvested | | | 43,651 | | | | 606,762 | | | | 58,168 | | | | 740,317 | | | | — | | | | — | | |

| Redemptions | | | (955,633 | ) | | | (13,161,521 | ) | | | (1,358,960 | ) | | | (17,428,109 | ) | | | — | | | | — | | |

| Net increase (decrease) | | | (165,425 | ) | | | (2,290,098 | ) | | | 3,577,702 | | | | 47,313,301 | | | | 206 | | | | 2,500 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

20

Columbia Dividend Income Fund

Statement of Changes in Net Assets (continued)

| | | Year Ended May 31, 2012(a) | | Year Ended September 30, 2011(b) | | Year Ended September 30, 2010 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

| Capital stock activity (continued) | |

| Class Z shares | |

| Subscriptions | | | 89,060,506 | | | | 1,229,645,133 | | | | 86,848,555 | | | | 1,140,726,956 | | | | 62,622,462 | | | | 742,481,198 | | |

| Distributions reinvested | | | 1,312,934 | | | | 18,342,883 | | | | 1,553,333 | | | | 19,960,237 | | | | 971,154 | | | | 11,539,013 | | |

| Redemptions | | | (30,405,107 | ) | | | (420,239,360 | ) | | | (36,526,580 | ) | | | (478,414,308 | ) | | | (27,195,653 | ) | | | (321,389,763 | ) | |

| Net increase | | | 59,968,333 | | | | 827,748,656 | | | | 51,875,308 | | | | 682,272,885 | | | | 36,397,963 | | | | 432,630,448 | | |

| Total net increase | | | 97,664,253 | | | | 1,350,220,709 | | | | 113,204,431 | | | | 1,492,699,841 | | | | 56,584,971 | | | | 671,056,299 | | |

(a) For the period from October 1, 2011 to May 31, 2012. During the period, the Fund's fiscal year end was changed from September 30 to May 31.

(b) Class I and Class W shares are for the period from September 27, 2010 (commencement of operations) to September 30, 2010.

(c) Includes conversions of Class B shares to Class A shares, if any.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

21

Columbia Dividend Income Fund

Financial Highlights

The following tables are intended to help you understand the Fund's financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total returns assume reinvestment of all dividends and distributions. Total returns do not reflect payment of sales charges, if any, and are not annualized for periods of less than one year.

| | | Year Ended

May 31, | |

Year Ended September 30, | |

| Class A | | 2012(a) | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| Per share data | |

| Net asset value, beginning of period | | $ | 12.16 | | | $ | 12.12 | | | $ | 11.18 | | | $ | 12.01 | | | $ | 15.35 | | | $ | 13.45 | | |

| Income from investment operations: | |

| Net investment income | | | 0.25 | | | | 0.29 | | | | 0.28 | | | | 0.29 | | | | 0.31 | | | | 0.28 | | |

| Net realized and unrealized gain (loss) | | | 1.73 | | | | 0.03 | (b) | | | 0.94 | | | | (0.86 | ) | | | (3.18 | ) | | | 2.02 | | |

| Total from investment operations | | | 1.98 | | | | 0.32 | | | | 1.22 | | | | (0.57 | ) | | | (2.87 | ) | | | 2.30 | | |

| Less distributions to shareholders: | |

| Net investment income | | | (0.18 | ) | | | (0.28 | ) | | | (0.28 | ) | | | (0.27 | ) | | | (0.31 | ) | | | (0.27 | ) | |

| Net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.16 | ) | | | (0.13 | ) | |

| Total distributions to shareholders | | | (0.18 | ) | | | (0.28 | ) | | | (0.28 | ) | | | (0.27 | ) | | | (0.47 | ) | | | (0.40 | ) | |

| Proceeds from regulatory settlements | | | — | | | | — | | | | — | | | | 0.01 | | | | — | | | | — | | |

| Net asset value, end of period | | $ | 13.96 | | | $ | 12.16 | | | $ | 12.12 | | | $ | 11.18 | | | $ | 12.01 | | | $ | 15.35 | | |

| Total return | | | 16.26 | % | | | 2.56 | % | | | 11.02 | % | | | (4.33 | %) | | | (19.06 | %) | | | 17.31 | % | |

| Ratios to average net assets(c) | |

Expenses prior to fees waived or expenses

reimbursed | | | 1.06 | %(d) | | | 1.09 | % | | | 1.07 | % | | | 1.11 | % | | | 1.11 | % | | | 1.12 | % | |

Net expenses after fees waived or expenses

reimbursed(e) | | | 1.00 | %(d) | | | 1.03 | %(f) | | | 1.05 | %(f) | | | 1.05 | %(f) | | | 1.05 | %(f) | | | 1.05 | %(f) | |

| Net investment income | | | 2.71 | %(d) | | | 2.23 | %(f) | | | 2.41 | %(f) | | | 2.88 | %(f) | | | 2.24 | %(f) | | | 1.90 | %(f) | |

| Supplemental data | |

| Net assets, end of period (in thousands) | | $ | 1,729,495 | | | $ | 1,103,389 | | | $ | 728,219 | | | $ | 483,916 | | | $ | 278,122 | | | $ | 370,358 | | |

| Portfolio turnover | | | 23 | % | | | 20 | % | | | 17 | % | | | 23 | % | | | 16 | % | | | 21 | % | |

Notes to Financial Highlights

(a) For the period from October 1, 2011 to May 31, 2012. During the period, the Fund's fiscal year end was changed from September 30 to May 31.