UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer 5228 Ameriprise Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | April 30 | |

|

Date of reporting period: | April 30, 2012 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Bond Fund

Annual Report for the Period Ended April 30, 2012

Not FDIC insured • No bank guarantee • May lose value

Table of Contents

| Fund Profile | | | 1 | | |

|

| Performance Information | | | 2 | | |

|

| Understanding Your Expenses | | | 3 | | |

|

| Portfolio Managers' Report | | | 4 | | |

|

| Portfolio of Investments | | | 6 | | |

|

Statement of Assets and

Liabilities | | | 20 | | |

|

| Statement of Operations | | | 22 | | |

|

Statement of Changes in

Net Assets | | | 23 | | |

|

| Financial Highlights | | | 25 | | |

|

| Notes to Financial Statements | | | 34 | | |

|

Report of Independent Registered

Public Accounting Firm | | | 48 | | |

|

| Federal Income Tax Information | | | 49 | | |

|

| Fund Governance | | | 50 | | |

|

Important Information About

This Report | | | 57 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholders,

A stock market rally that commenced in the fourth quarter of 2011 continued into 2012 in the United States and around the world, as all major market regions generated double-digit returns for the three-month period ended March 31, 2012. Volatility declined sharply as European debt fears quieted somewhat and sentiment improved. Returns in developed countries were buoyed by strong results in Germany, Belgium, Austria and the Nordic markets of Denmark, Finland, Norway and Sweden. Under the cloud of its own mounting debt problem, Spain was the only eurozone country to deliver a negative return during the three-month period. Solid economic growth and accommodative monetary policy helped boost gains in emerging markets. The rally in U.S. equities was largely driven by an expansion in "multiples"—an increase in stock prices relative to their earnings. By the end of the first quarter of 2012, stocks no longer appeared as cheap as they were late in 2011. Bonds lagged stocks during the first quarter as investors responded to signs of an improved environment with a greater appetite for risk.

Concerns around the health of the global economy were centered in news headlines focusing on Washington D.C., Europe, China and the Middle East. In the United States, economic indicators remained mixed but generally indicated support for slow, sustainable economic growth. European policymakers have made progress in containing the eurozone debt crisis, though they still have not solved the issue of long-term solvency. The European Central Bank has lowered interest rates and flooded the financial system with liquidity that may provide breathing space for companies to restructure their balance sheets. These massive infusions of liquidity may whet the appetite for risk from investors around the world. However, it has delayed a true reckoning with the European financial situation, as concerns about Spain and Portugal continue to cloud the outlook. These structural challenges that persist in the developed world, and slowing growth in emerging market economies, leave the global economy in a fragile state. Domestic demand, combined with slowing inflationary trends, has also helped to shore up emerging market economies. Joblessness remains low and monetary conditions remain easy.

Despite the challenges and surprises of 2011, we see pockets of strength—and as a result, attractive opportunities—both here and abroad for 2012. We hope to help you capitalize on these opportunities with various articles in our 2012 Perspectives, which is available via the Market Insights tab at columbiamanagement.com. This publication showcases the strong research capabilities and experienced investment teams of Columbia Management and offers a diverse array of investment ideas based on our five key themes for 2012.

Other information and resources available at columbiamanagement.com include:

> detailed up-to-date fund performance and portfolio information

> economic analysis and market commentary

> quarterly fund commentaries

> Columbia Management Investor, our award-winning quarterly newsletter for shareholders

Thank you for your continued support of the Columbia Funds. We look forward to serving your investment needs for many years to come.

Best Regards,

J. Kevin Connaughton

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2012 Columbia Management Investment Advisers, LLC. All rights reserved.

Fund Profile – Columbia Bond Fund

Summary

g For the 13-month period that ended April 30, 2012, the fund's Class A shares returned 8.51% without sales charge.

g The fund underperformed its benchmark, the Barclays Aggregate Bond Index1, which returned 8.91%.

g The fund's asset allocations were largely favorable, but a shorter-than-average maturity profile created a modest performance disadvantage compared to the index.

Portfolio Management

Alexander D. Powers, lead manager, has co-managed the fund since or the predecessor fund since 1997. From 1996 until joining Columbia Management Advisers, LLC (the Investment Manager) in May 2010, Mr. Powers was associated with the fund's previous investment adviser as an investment professional.

Carl Pappo has co-managed the fund or the predecessor fund since 2010. From 1993 until joining the Investment Manager in May 2010, Mr. Pappo was associated with the fund's previous investment adviser as an investment professional.

Michael Zazzarino has co-managed the fund or the predecessor fund since 2005. From 2005 until joining the Investment Manager in May 2010, Mr. Zazzarino was associated with the fund's previous investment adviser as an investment professional.

1The Barclays Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs, and total return performance of fixed-rate, publicly placed, dollar-denominated, and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Summary

13-month (cumulative) return as of 04/30/12

| | +8.51% | |

|

|  | | | Class A shares

(without sales charge) | |

|

| | +8.91% | |

|

|  | | | Barclays Aggregate Bond Index | |

|

1

Performance Information – Columbia Bond Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

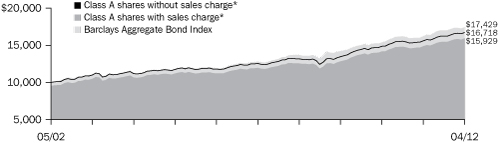

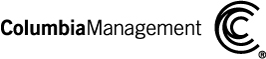

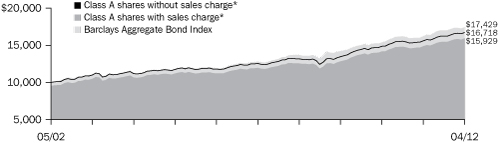

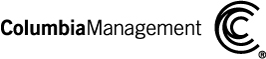

Performance of a $10,000 investment 05/01/02 – 04/30/12

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Bond Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Performance of a $10,000 investment 05/01/02 – 04/30/12 ($)

| Sales charge | | without | | with | |

| Class A* | | | 16,718 | | | | 15,929 | | |

| Class B* | | | 15.527 | | | | 15,527 | | |

| Class C* | | | 15,583 | | | | 15,583 | | |

| Class I* | | | 17,167 | | | | n/a | | |

| Class R* | | | 16,048 | | | | n/a | | |

| Class T* | | | 16,901 | | | | 16,104 | | |

| Class W* | | | 16,735 | | | | n/a | | |

| Class Y* | | | 17,184 | | | | n/a | | |

| Class Z | | | 17,154 | | | | n/a | | |

Average annual total return as of 04/30/12 (%)

| Share class | | A* | | B* | | C* | | I* | | R* | | T* | | W* | | Y* | | Z | |

| Inception | | 3/31/08 | | 03/07/11 | | 03/31/08 | | 09/27/10 | | 11/16/11 | | 03/07/11 | | 09/27/10 | | 07/15/09 | | 01/09/86 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | without | | without | | with | | without | | without | | without | |

1-month

(cumulative) | | | 1.08 | | | | –3.68 | | | | 1.02 | | | | –3.98 | | | | 1.03 | | | | 0.03 | | | | 1.21 | | | | 1.06 | | | | 1.20 | | | | –3.58 | | | | 1.09 | | | | 1.11 | | | | 1.10 | | |

| 1-year | | | 7.15 | | | | 2.01 | | | | 6.34 | | | | 1.34 | | | | 6.50 | | | | 5.50 | | | | 7.46 | | | | 6.81 | | | | 7.27 | | | | 2.22 | | | | 7.03 | | | | 7.35 | | | | 7.42 | | |

| 5-year | | | 5.91 | | | | 4.88 | | | | 5.14 | | | | 4.81 | | | | 5.17 | | | | 5.17 | | | | 6.21 | | | | 5.50 | | | | 6.03 | | | | 5.00 | | | | 5.93 | | | | 6.23 | | | | 6.19 | | |

| 10-year | | | 5.27 | | | | 4.77 | | | | 4.50 | | | | 4.50 | | | | 4.54 | | | | 4.54 | | | | 5.55 | | | | 4.84 | | | | 5.39 | | | | 4.88 | | | | 5.28 | | | | 5.56 | | | | 5.54 | | |

The "with sales charge" returns include the maximum initial sales charge of 4.75% for Class A shares and the applicable contingent deferred sales charge of 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class I, Y and Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class W shares are sold at net asset value with a distribution (12b-1) fee. Class I, W, Y and Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectuses for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

*The returns shown for periods prior to the share class inception date (including returns since inception) include the returns of the fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiamanagement.com/mutual-funds/appended-performance for more information.

2

Understanding Your Expenses – Columbia Bond Fund

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and service (Rule 12b-1) fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare with other funds" below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

November 1, 2011 – April 30, 2012

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,030.30 | | | | 1,020.89 | | | | 4.04 | | | | 4.02 | | | | 0.80 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,026.50 | | | | 1,017.16 | | | | 7.81 | | | | 7.77 | | | | 1.55 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,026.10 | | | | 1,017.80 | | | | 7.15 | | | | 7.12 | | | | 1.42 | | |

| Class I | | | 1,000.00 | | | | 1,000.00 | | | | 1,030.70 | | | | 1,022.33 | | | | 2.57 | | | | 2.56 | | | | 0.51 | | |

| Class R | | | 1,000.00 | | | | 1,000.00 | | | | 1,028.30 | * | | | 1,019.69 | | | | 4.75 | * | | | 5.22 | | | | 1.04 | * | |

| Class T | | | 1,000.00 | | | | 1,000.00 | | | | 1,030.80 | | | | 1,021.38 | | | | 3.53 | | | | 3.52 | | | | 0.70 | | |

| Class W | | | 1,000.00 | | | | 1,000.00 | | | | 1,029.10 | | | | 1,020.93 | | | | 3.99 | | | | 3.97 | | | | 0.79 | | |

| Class Y | | | 1,000.00 | | | | 1,000.00 | | | | 1,030.70 | | | | 1,022.33 | | | | 2.57 | | | | 2.56 | | | | 0.51 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,030.50 | | | | 1,022.13 | | | | 2.78 | | | | 2.77 | | | | 0.55 | | |

*For the period November 16, 2011 through April 30, 2012. Class R shares commenced operations on November 16, 2011.

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 366.

Expenses do not include fees and expenses incurred indirectly by the Fund from the underlying funds in which the Fund may invest (also referred to as "acquired funds"), including affiliated and non-affiliated pooled investments vehicles (including mutual funds and exchange traded funds).

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

3

Portfolio Managers' Report – Columbia Bond Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Portfolio breakdown1

(at April 30, 2012) (%)

| Corporate Bonds & Notes | | | 25.8 | | |

Residential Mortgage-Backed

Securities—Agency | | | 35.8 | | |

Residential Mortgage-Backed

Securities—Non-Agency | | | 0.4 | | |

Commercial Mortgage-Backed

Securities—Agency | | | 2.0 | | |

Commercial Mortgage-Backed

Securities—Non-Agency | | | 15.1 | | |

Asset-Backed Securities—

Non-Agency | | | 1.9 | | |

| U.S. Treasury Obligations | | | 9.7 | | |

U.S. Government & Agency

Obligations | | | 2.3 | | |

| Foreign Government Obligations | | | 0.9 | | |

| Municipal Bonds | | | 1.1 | | |

| Common Stocks | | | 0.0 | * | |

| Preferred Debt | | | 0.5 | | |

| Treasury Note Short-Term | | | 4.1 | | |

| Other2 | | | 0.4 | | |

*Rounds to less than 0.1%.

1Percentages indicated are based upon total investments (excluding Investments of Cash Collateral Received for Securities on Loan). The Fund's portfolio composition is subject to change.

2Includes investments in money market funds.

Quality breakdown1

(at April 30, 2012) (%)

| AAA rating | | | 67.4 | | |

| AA rating | | | 4.1 | | |

| A rating | | | 11.2 | | |

| BBB rating | | | 16.3 | | |

| Non-investment grade | | | 0.8 | | |

| Not rated | | | 0.2 | | |

1Percentages indicated are based upon total fixed income securities (excluding Investments of Cash Collateral Received for Securities on Loan and money market funds).

Bond ratings apply to the underlying holdings of the Fund and not the Fund itself and are divided into categories ranging from AAA (highest) to D (lowest), and are subject to change. The ratings shown are determined by using the middle rating of Moody's, S&P, and Fitch after dropping the highest and lowest available ratings. When a rating from only two agencies is available, the lower rating is used. When a rating from only one agency is available, that rating is used. When a bond is not rated by one of these agencies, it is designated as Not rated. Credit ratings are subjective to opinions and not statements of fact.

The Board of Trustees for Columbia Bond Fund has approved the change of the fund's fiscal year end from March 31 to April 30. As a result, this report covers the 13-month period since the last annual report. The next report you receive will be for the six-month period from May 1, 2012 through October 31, 2012.

For the 13-month period that ended April 30, 2012, the fund's Class A shares returned 8.51% without sales charge. The fund's benchmark, the Barclays Aggregate Bond Index, returned 8.91% for the same period. This performance shortfall can be accounted for by the fund's relatively short maturity profile during the period. Holding longer-term securities was rewarded as interest rates declined.

A shifting economic environment

During this period, the fixed-income markets behaved largely in accordance with investors' changing views about the strength of the economic recovery. Early in the period, when investors were optimistic that the U.S. economy had turned a corner, corporate bonds and other riskier fixed-income assets tended to outperform Treasury securities. This trend reversed itself sharply in August 2011, when the European sovereign crisis erupted and financial markets experienced a global selloff. Riskier assets enjoyed a recovery in the fourth quarter of 2011, but the dual threats of unemployment at home and structural risks in Europe have kept a lid on investor optimism.

Corporate and commercial mortgage-backed overweight added performance

Against this backdrop, the fund maintained an overweight position in corporate bonds and commercial mortgage-backed securities. While this overweight, on balance, aided the portfolio, the fund elected to reduce holdings somewhat in these sectors during the summer of 2011, preferring to increase exposure to low-coupon agency mortgages when the Federal Reserve Board (the Fed) indicated a commitment to support that segment of the market. In addition, the yield advantage of corporate bonds versus Treasury securities had declined to the point where we felt that upside potential had been reduced, especially given the economic uncertainties created by the deteriorating situation in Europe. This move toward risk aversion made a positive contribution to the fund's relative performance.

Toward the end of 2011, the fund began to buy back corporates and other riskier assets, given their interim price declines, as well as an apparent improvement in European financials. The new corporate bond purchases emphasized the financial sector, which we felt came out of the market decline with a more attractive risk-reward profile than industrial bonds and other alternative sectors.

The portfolio maintained roughly this same asset allocation for the remainder of the period, with the total amount devoted to higher-risk assets not substantially different from where we began, but with a different composition. The fund's maturity profile was increased in the first quarter of 2012 after having been shorter than the index throughout the period. Given the trend toward lower rates (for example, yields on the 10-year bond dropped from 3.29% to 1.92% during the period), these short maturities hurt the fund's relative performance.

4

Portfolio Manager's Report (continued) – Columbia Bond Fund

Looking ahead

We plan to continue to monitor the fixed-income initiatives of the Fed in an effort to achieve the ideal asset mix. As the economic recovery continues to languish, we consider it increasingly likely that the central bank will initiate another round of quantitative easing—a program designed to increase the money supply at a time when the discount rate and other standard interest rate benchmarks are already close to zero. We would not be surprised to see such an effort emerge during the summer of 2012, when other forms of Fed stimulus will have reached their stated cutoff points. We also acknowledge the possibility that interest rates will go up, given the slight but measurable increase in inflation over the past year. Corporations have been reluctant to pass on higher costs to consumers during these difficult economic times, but at some point the cumulative effect of even a small amount of inflation could limit the Fed's ability to keep interest rates at historically low levels.

Portfolio characteristics and holdings are subject to change periodically and may not be representative of current characteristics and holdings. The outlook for the fund may differ from that presented for other Columbia Funds.

Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa.

5

Portfolio of Investments – Columbia Bond Fund

April 30, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes 26.9% | |

| Aerospace & Defense 0.3% | |

| L-3 Communications Corp. | |

| 02/15/21 | | | 4.950 | % | | $ | 2,995,000 | | | $ | 3,204,952 | | |

Raytheon Co.

Senior Unsecured | |

| 08/15/27 | | | 7.200 | % | | | 1,600,000 | | | | 2,131,821 | | |

| Total | | | 5,336,773 | | |

| Airlines —% | |

| Continental Airlines 1997-1 Class A Pass-Through Trust | |

| 04/01/15 | | | 7.461 | % | | | 158,942 | | | | 160,730 | | |

| Banking 6.0% | |

Bank of America Corp.

Senior Unsecured | |

| 01/24/22 | | | 5.700 | % | | | 9,965,000 | | | | 10,460,958 | | |

| 02/07/42 | | | 5.875 | % | | | 2,635,000 | | | | 2,604,044 | | |

Barclays Bank PLC

Senior Unsecured | |

| 09/22/16 | | | 5.000 | % | | | 4,465,000 | | | | 4,817,681 | | |

| Capital One/IV(a) | |

| 02/17/37 | | | 6.745 | % | | | 3,705,000 | | | | 3,705,000 | | |

| Capital One/V | |

| 08/15/39 | | | 10.250 | % | | | 3,960,000 | | | | 4,128,300 | | |

Citigroup, Inc.

Senior Unsecured | |

| 01/10/17 | | | 4.450 | % | | | 2,900,000 | | | | 3,029,349 | | |

| 01/30/42 | | | 5.875 | % | | | 2,765,000 | | | | 2,941,424 | | |

Comerica Bank

Subordinated Notes | |

| 08/22/17 | | | 5.200 | % | | | 1,940,000 | | | | 2,164,741 | | |

Discover Bank

Subordinated Notes | |

| 11/18/19 | | | 8.700 | % | | | 3,735,000 | | | | 4,710,974 | | |

Fifth Third Bancorp

Senior Unsecured | |

| 01/25/16 | | | 3.625 | % | | | 3,190,000 | | | | 3,383,397 | | |

HSBC Holdings PLC

Senior Unsecured | |

| 01/14/22 | | | 4.875 | % | | | 530,000 | | | | 571,555 | | |

HSBC USA, Inc.

Subordinated Notes | |

| 09/27/20 | | | 5.000 | % | | | 4,125,000 | | | | 4,177,020 | | |

ING Bank NV

Senior Unsecured(b) | |

| 03/15/16 | | | 4.000 | % | | | 2,960,000 | | | | 3,003,243 | | |

| JPMorgan Chase & Co.(a) | |

| 04/29/49 | | | 7.900 | % | | | 1,205,000 | | | | 1,320,246 | | |

| JPMorgan Chase Capital XVIII | |

| 08/17/36 | | | 6.950 | % | | | 380,000 | | | | 380,950 | | |

| JPMorgan Chase Capital XX | |

| 09/29/36 | | | 6.550 | % | | | 5,753,000 | | | | 5,774,574 | | |

| JPMorgan Chase Capital XXII | |

| 02/02/37 | | | 6.450 | % | | | 5,646,000 | | | | 5,646,000 | | |

| JPMorgan Chase Capital XXIII(a) | |

| 05/15/47 | | | 1.503 | % | | | 805,000 | | | | 595,717 | | |

KeyCorp

Senior Unsecured | |

| 03/24/21 | | | 5.100 | % | | | 5,390,000 | | | | 6,059,239 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Banking (cont.) | |

Lloyds TSB Bank PLC

Bank Guaranteed(b) | |

| 01/12/15 | | | 4.375 | % | | $ | 3,890,000 | | | $ | 3,978,750 | | |

Merrill Lynch & Co., Inc.

Senior Unsecured | |

| 02/03/14 | | | 5.000 | % | | | 3,085,000 | | | | 3,185,975 | | |

| Subordinated Notes | |

| 05/02/17 | | | 5.700 | % | | | 1,465,000 | | | | 1,502,632 | | |

| National City Preferred Capital Trust I(a)(c) | |

| 12/31/49 | | | 12.000 | % | | | 1,658,000 | | | | 1,764,775 | | |

| PNC Financial Services Group, Inc.(a) | |

| 07/29/49 | | | 6.750 | % | | | 2,560,000 | | | | 2,683,315 | | |

Scotland International Finance No. 2 BV

Bank Guaranteed(b) | |

| 05/23/13 | | | 4.250 | % | | | 1,700,000 | | | | 1,699,820 | | |

| State Street Corp. | |

| 03/15/18 | | | 4.956 | % | | | 3,640,000 | | | | 3,857,097 | | |

State Street Corp.(c)

Senior Unsecured | |

| 03/07/16 | | | 2.875 | % | | | 1,785,000 | | | | 1,879,005 | | |

| USB Capital XIII Trust | |

| 12/15/39 | | | 6.625 | % | | | 2,170,000 | | | | 2,212,814 | | |

Wells Fargo & Co.

Senior Unsecured(a) | |

| 06/15/16 | | | 3.676 | % | | | 11,160,000 | | | | 11,972,928 | | |

Westpac Banking Corp.

Senior Unsecured(c) | |

| 12/09/15 | | | 3.000 | % | | | 1,100,000 | | | | 1,141,005 | | |

| Total | | | 105,352,528 | | |

| Brokerage 0.1% | |

Eaton Vance Corp.

Senior Unsecured | |

| 10/02/17 | | | 6.500 | % | | | 1,255,000 | | | | 1,435,118 | | |

| Chemicals 0.7% | |

Dow Chemical Co. (The)

Senior Unsecured | |

| 05/15/18 | | | 5.700 | % | | | 2,125,000 | | | | 2,469,883 | | |

| 05/15/19 | | | 8.550 | % | | | 2,750,000 | | | | 3,646,519 | | |

| 05/15/39 | | | 9.400 | % | | | 150,000 | | | | 234,522 | | |

Dow Chemical Co. (The)(c)

Senior Unsecured | |

| 11/15/20 | | | 4.250 | % | | | 2,335,000 | | | | 2,478,250 | | |

| Lubrizol Corp. | |

| 02/01/19 | | | 8.875 | % | | | 2,305,000 | | | | 3,155,737 | | |

| Total | | | 11,984,911 | | |

| Diversified Manufacturing 0.2% | |

| Tyco International Ltd./Finance SA | |

| 01/15/21 | | | 6.875 | % | | | 2,460,000 | | | | 3,114,901 | | |

| Electric 2.5% | |

Alabama Power Co.

Senior Unsecured | |

| 03/15/41 | | | 5.500 | % | | | 1,635,000 | | | | 2,017,320 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

6

Columbia Bond Fund

April 30, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Electric (cont.) | |

Commonwealth Edison Co.

1st Mortgage | |

| 08/15/16 | | | 5.950 | % | | $ | 2,360,000 | | | $ | 2,792,864 | | |

| 09/15/17 | | | 6.150 | % | | | 1,690,000 | | | | 2,053,710 | | |

| 08/01/20 | | | 4.000 | % | | | 3,415,000 | | | | 3,763,624 | | |

| 03/15/36 | | | 5.900 | % | | | 640,000 | | | | 801,939 | | |

| Senior Unsecured | |

| 07/15/18 | | | 6.950 | % | | | 1,280,000 | | | | 1,551,045 | | |

Consolidated Edison Co. of New York, Inc.

Senior Unsecured | |

| 04/01/38 | | | 6.750 | % | | | 155,000 | | | | 215,841 | | |

Detroit Edison Co. (The)

1st Mortgage | |

| 10/01/20 | | | 3.450 | % | | | 3,860,000 | | | | 4,101,879 | | |

Dominion Resources, Inc.

Senior Unsecured | |

| 08/15/19 | | | 5.200 | % | | | 335,000 | | | | 392,077 | | |

Duke Energy Carolinas LLC

1st Mortgage | |

| 10/01/15 | | | 5.300 | % | | | 305,000 | | | | 349,115 | | |

Exelon Generation Co. LLC

Senior Unsecured | |

| 10/01/17 | | | 6.200 | % | | | 790,000 | | | | 928,268 | | |

FPL Energy National Wind LLC

Senior Secured(b) | |

| 03/10/24 | | | 5.608 | % | | | 556,010 | | | | 575,459 | | |

Georgia Power Co.

Senior Unsecured | |

| 06/01/17 | | | 5.700 | % | | | 1,015,000 | | | | 1,219,306 | | |

| 09/01/40 | | | 4.750 | % | | | 3,640,000 | | | | 3,963,887 | | |

MidAmerican Energy Holdings Co.

Senior Unsecured | |

| 10/01/12 | | | 5.875 | % | | | 1,415,000 | | | | 1,445,655 | | |

| Nevada Power Co.(c) | |

| 09/15/40 | | | 5.375 | % | | | 5,350,000 | | | | 6,279,375 | | |

Niagara Mohawk Power Corp.

Senior Unsecured(b) | |

| 08/15/19 | | | 4.881 | % | | | 1,830,000 | | | | 2,041,583 | | |

Pacific Gas & Electric Co.

Senior Unsecured | |

| 01/15/40 | | | 5.400 | % | | | 1,675,000 | | | | 1,938,878 | | |

Peco Energy Co.

1st Mortgage | |

| 03/01/18 | | | 5.350 | % | | | 1,860,000 | | | | 2,211,131 | | |

Southern California Edison Co.

1st Mortgage | |

| 01/15/16 | | | 5.000 | % | | | 2,500,000 | | | | 2,841,690 | | |

| 09/01/40 | | | 4.500 | % | | | 1,085,000 | | | | 1,172,735 | | |

Xcel Energy, Inc.

Senior Unsecured | |

| 05/15/20 | | | 4.700 | % | | | 1,715,000 | | | | 1,959,211 | | |

| Total | | | 44,616,592 | | |

| Entertainment 0.2% | |

| Time Warner, Inc. | |

| 11/15/36 | | | 6.500 | % | | | 2,780,000 | | | | 3,278,107 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Food and Beverage 1.2% | |

| Anheuser-Busch InBev Worldwide, Inc. | |

| 01/15/19 | | | 7.750 | % | | $ | 1,865,000 | | | $ | 2,467,497 | | |

ConAgra Foods, Inc.

Senior Unsecured | |

| 10/01/28 | | | 7.000 | % | | | 2,775,000 | | | | 3,370,548 | | |

General Mills, Inc.

Senior Unsecured | |

| 12/15/21 | | | 3.150 | % | | | 7,280,000 | | | | 7,401,365 | | |

Kraft Foods, Inc.

Senior Unsecured | |

| 02/09/16 | | | 4.125 | % | | | 4,995,000 | | | | 5,461,628 | | |

PepsiCo, Inc.

Senior Unsecured | |

| 01/15/20 | | | 4.500 | % | | | 1,705,000 | | | | 1,945,649 | | |

| Total | | | 20,646,687 | | |

| Gas Distributors 0.5% | |

Atmos Energy Corp.

Senior Unsecured | |

| 06/15/17 | | | 6.350 | % | | | 2,415,000 | | | | 2,846,049 | | |

| 03/15/19 | | | 8.500 | % | | | 2,360,000 | | | | 3,126,306 | | |

Sempra Energy

Senior Unsecured | |

| 06/01/16 | | | 6.500 | % | | | 2,045,000 | | | | 2,433,570 | | |

| Total | | | 8,405,925 | | |

| Gas Pipelines 1.6% | |

| El Paso Pipeline Partners Operating Co. LLC | |

| 10/01/21 | | | 5.000 | % | | | 3,738,000 | | | | 3,949,003 | | |

Energy Transfer Partners LP

Senior Unsecured | |

| 02/01/42 | | | 6.500 | % | | | 2,190,000 | | | | 2,321,231 | | |

Kinder Morgan Energy Partners LP

Senior Unsecured | |

| 01/15/38 | | | 6.950 | % | | | 1,585,000 | | | | 1,869,890 | | |

| 09/01/39 | | | 6.500 | % | | | 330,000 | | | | 371,831 | | |

| NiSource Finance Corp. | |

| 09/15/17 | | | 5.250 | % | | | 685,000 | | | | 767,664 | | |

| Plains All American Pipeline LP/Finance Corp. | |

| 05/01/18 | | | 6.500 | % | | | 1,215,000 | | | | 1,473,369 | | |

| 05/01/19 | | | 8.750 | % | | | 2,410,000 | | | | 3,179,303 | | |

| 01/15/20 | | | 5.750 | % | | | 545,000 | | | | 632,496 | | |

Southern Natural Gas Co. LLC

Senior Unsecured | |

| 03/01/32 | | | 8.000 | % | | | 2,325,000 | | | | 3,001,419 | | |

| TransCanada PipeLines Ltd.(a) | |

| 05/15/67 | | | 6.350 | % | | | 7,640,000 | | | | 7,975,335 | | |

Williams Partners LP

Senior Unsecured | |

| 04/15/40 | | | 6.300 | % | | | 1,715,000 | | | | 2,037,321 | | |

| Total | | | 27,578,862 | | |

| Health Care 0.7% | |

| Express Scripts Holding Co.(b) | |

| 02/15/17 | | | 2.650 | % | | | 5,349,000 | | | | 5,445,159 | | |

| 02/15/22 | | | 3.900 | % | | | 6,350,000 | | | | 6,534,683 | | |

| Total | | | 11,979,842 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

7

Columbia Bond Fund

April 30, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Healthcare Insurance 0.1% | |

UnitedHealth Group, Inc.

Senior Unsecured | |

| 02/15/18 | | | 6.000 | % | | $ | 1,935,000 | | | $ | 2,360,270 | | |

| Home Construction —% | |

| D.R. Horton, Inc. | |

| 09/15/14 | | | 5.625 | % | | | 365,000 | | | | 385,075 | | |

| Independent Energy 0.5% | |

Canadian Natural Resources Ltd.

Senior Unsecured | |

| 03/15/38 | | | 6.250 | % | | | 2,840,000 | | | | 3,544,843 | | |

Devon Energy Corp.

Senior Unsecured | |

| 01/15/19 | | | 6.300 | % | | | 1,290,000 | | | | 1,593,756 | | |

Nexen, Inc.

Senior Unsecured | |

| 03/10/35 | | | 5.875 | % | | | 1,080,000 | | | | 1,130,938 | | |

| 07/30/39 | | | 7.500 | % | | | 1,610,000 | | | | 1,972,287 | | |

| Total | | | 8,241,824 | | |

| Integrated Energy 0.4% | |

Hess Corp.

Senior Unsecured | |

| 08/15/31 | | | 7.300 | % | | | 1,966,000 | | | | 2,530,114 | | |

| 02/15/41 | | | 5.600 | % | | | 1,509,000 | | | | 1,632,198 | | |

| Shell International Finance BV | |

| 03/25/40 | | | 5.500 | % | | | 2,950,000 | | | | 3,684,432 | | |

| Total | | | 7,846,744 | | |

| Life Insurance 1.6% | |

Lincoln National Corp.

Senior Unsecured | |

| 07/01/19 | | | 8.750 | % | | | 2,870,000 | | | | 3,671,163 | | |

| Lincoln National Corp.(a) | |

| 04/20/67 | | | 6.050 | % | | | 8,302,000 | | | | 7,720,860 | | |

| MetLife Capital Trust X(b) | |

| 04/08/38 | | | 9.250 | % | | | 2,815,000 | | | | 3,434,300 | | |

| MetLife, Inc. | |

| 08/01/39 | | | 10.750 | % | | | 2,690,000 | | | | 3,739,100 | | |

Prudential Financial, Inc.

Senior Unsecured | |

| 06/15/19 | | | 7.375 | % | | | 3,040,000 | | | | 3,783,848 | | |

| Prudential Financial, Inc.(a) | |

| 06/15/38 | | | 8.875 | % | | | 5,290,000 | | | | 6,275,263 | | |

| Total | | | 28,624,534 | | |

| Media Cable 0.8% | |

| Comcast Corp. | |

| 11/15/15 | | | 5.850 | % | | | 4,250,000 | | | | 4,895,290 | | |

| 03/01/20 | | | 5.150 | % | | | 925,000 | | | | 1,079,290 | | |

| DIRECTV Holdings LLC/DIRECTV Financing Co., Inc.(b) | |

| 03/15/17 | | | 2.400 | % | | | 3,636,000 | | | | 3,644,083 | | |

| DIRECTV Holdings LLC/Financing Co., Inc. | |

| 02/15/16 | | | 3.125 | % | | | 2,445,000 | | | | 2,544,610 | | |

| Time Warner Cable, Inc. | |

| 05/01/17 | | | 5.850 | % | | | 1,905,000 | | | | 2,231,092 | | |

| Total | | | 14,394,365 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Media Non-Cable 0.8% | |

NBCUniversal Media LLC

Senior Unsecured | |

| 04/01/16 | | | 2.875 | % | | $ | 7,625,000 | | | $ | 7,974,065 | | |

| News America, Inc. | |

| 12/15/35 | | | 6.400 | % | | | 2,715,000 | | | | 3,106,859 | | |

| 02/15/41 | | | 6.150 | % | | | 2,639,000 | | | | 3,028,664 | | |

| Total | | | 14,109,588 | | |

| Metals 0.6% | |

ArcelorMittal

Senior Unsecured | |

| 10/15/39 | | | 7.000 | % | | | 3,660,000 | | | | 3,568,873 | | |

| 03/01/41 | | | 6.750 | % | | | 1,125,000 | | | | 1,063,817 | | |

Nucor Corp.

Senior Unsecured | |

| 06/01/18 | | | 5.850 | % | | | 2,765,000 | | | | 3,342,979 | | |

| Vale Overseas Ltd. | |

| 11/21/36 | | | 6.875 | % | | | 2,300,000 | | | | 2,737,479 | | |

| Total | | | 10,713,148 | | |

| Non-Captive Consumer 0.1% | |

| Discover Financial Services(b) | |

| 04/27/22 | | | 5.200 | % | | | 1,275,000 | | | | 1,322,952 | | |

| Non-Captive Diversified 0.6% | |

General Electric Capital Corp.

Senior Unsecured | |

| 01/07/21 | | | 4.625 | % | | | 9,110,000 | | | | 9,881,544 | | |

| Oil Field Services 0.1% | |

Halliburton Co.

Senior Unsecured | |

| 09/15/18 | | | 5.900 | % | | | 1,280,000 | | | | 1,570,040 | | |

| Weatherford International Ltd. | |

| 03/15/38 | | | 7.000 | % | | | 885,000 | | | | 1,009,508 | | |

| Total | | | 2,579,548 | | |

| Other Industry 0.3% | |

President and Fellows of Harvard College

Senior Notes | |

| 10/15/40 | | | 4.875 | % | | | 2,690,000 | | | | 3,159,184 | | |

| President and Fellows of Harvard College(b) | |

| 01/15/39 | | | 6.500 | % | | | 1,460,000 | | | | 2,133,512 | | |

| Total | | | 5,292,696 | | |

| Pharmaceuticals 0.3% | |

Johnson & Johnson

Senior Unsecured | |

| 05/15/41 | | | 4.850 | % | | | 3,002,000 | | | | 3,542,174 | | |

| Wyeth LLC | |

| 02/15/16 | | | 5.500 | % | | | 1,500,000 | | | | 1,746,258 | | |

| Total | | | 5,288,432 | | |

| Property & Casualty 0.6% | |

CNA Financial Corp.

Senior Unsecured | |

| 12/15/14 | | | 5.850 | % | | | 975,000 | | | | 1,050,722 | | |

| 11/15/19 | | | 7.350 | % | | | 2,405,000 | | | | 2,853,148 | | |

| 08/15/21 | | | 5.750 | % | | | 780,000 | | | | 853,572 | | |

| Liberty Mutual Group, Inc.(a)(b) | |

| 06/15/58 | | | 10.750 | % | | | 780,000 | | | | 1,060,800 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

8

Columbia Bond Fund

April 30, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Property & Casualty (cont.) | |

Transatlantic Holdings, Inc.

Senior Unsecured | |

| 11/30/39 | | | 8.000 | % | | $ | 3,710,000 | | | $ | 4,230,732 | | |

| Total | | | 10,048,974 | | |

| Railroads 0.8% | |

| BNSF Funding Trust I(a) | |

| 12/15/55 | | | 6.613 | % | | | 3,115,000 | | | | 3,243,494 | | |

Burlington Northern Santa Fe LLC

Senior Unsecured | |

| 08/15/30 | | | 7.950 | % | | | 1,025,000 | | | | 1,413,556 | | |

CSX Corp.

Senior Unsecured | |

| 06/01/21 | | | 4.250 | % | | | 4,585,000 | | | | 4,989,670 | | |

| 05/30/42 | | | 4.750 | % | | | 2,390,000 | | | | 2,397,832 | | |

Union Pacific Corp.

Senior Unsecured | |

| 08/15/18 | | | 5.700 | % | | | 1,140,000 | | | | 1,373,580 | | |

| Total | | | 13,418,132 | | |

| REITs 0.5% | |

| Brandywine Operating Partnership LP | |

| 05/15/15 | | | 7.500 | % | | | 2,860,000 | | | | 3,196,259 | | |

Duke Realty LP

Senior Unsecured | |

| 08/15/19 | | | 8.250 | % | | | 4,004,600 | | | | 4,994,301 | | |

Highwoods Realty LP

Senior Unsecured | |

| 03/15/17 | | | 5.850 | % | | | 810,000 | | | | 875,220 | | |

| Total | | | 9,065,780 | | |

| Restaurants 0.7% | |

McDonald's Corp.

Senior Unsecured | |

| 05/20/21 | | | 3.625 | % | | | 7,800,000 | | | | 8,576,162 | | |

| 02/01/39 | | | 5.700 | % | | | 1,375,000 | | | | 1,733,130 | | |

McDonald's Corp.(c)

Senior Unsecured | |

| 07/15/40 | | | 4.875 | % | | | 1,800,000 | | | | 2,058,451 | | |

| Total | | | 12,367,743 | | |

| Retailers 0.5% | |

Best Buy Co., Inc.

Senior Unsecured(c) | |

| 03/15/21 | | | 5.500 | % | | | 2,105,000 | | | | 1,969,347 | | |

CVS Pass-Through Trust(b)

Pass-Through Certificates | |

| 01/11/27 | | | 5.298 | % | | | 519,982 | | | | 543,310 | | |

| 07/10/31 | | | 8.353 | % | | | 2,799,046 | | | | 3,662,441 | | |

| Macy's Retail Holdings, Inc. | |

| 01/15/42 | | | 5.125 | % | | | 3,380,000 | | | | 3,413,574 | | |

| Total | | | 9,588,672 | | |

| Supermarkets 0.5% | |

| Kroger Co. (The) | |

| 10/01/15 | | | 3.900 | % | | | 5,825,000 | | | | 6,341,305 | | |

| 12/15/18 | | | 6.800 | % | | | 2,665,000 | | | | 3,299,043 | | |

| Total | | | 9,640,348 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Supranational 0.2% | |

European Investment Bank

Senior Unsecured | |

| 05/30/17 | | | 5.125 | % | | $ | 2,305,000 | | | $ | 2,692,708 | | |

| Technology 0.9% | |

Corning, Inc.

Senior Unsecured | |

| 03/15/42 | | | 4.750 | % | | | 3,640,000 | | | | 3,634,409 | | |

Hewlett-Packard Co.

Senior Unsecured | |

| 06/01/21 | | | 4.300 | % | | | 1,500,000 | | | | 1,542,569 | | |

| 09/15/21 | | | 4.375 | % | | | 2,505,000 | | | | 2,598,509 | | |

| 12/09/21 | | | 4.650 | % | | | 1,995,000 | | | | 2,108,059 | | |

| 09/15/41 | | | 6.000 | % | | | 4,745,000 | | | | 5,244,800 | | |

| Total | | | 15,128,346 | | |

| Transportation Services 0.2% | |

| ERAC U.S.A. Finance LLC(b) | |

| 10/01/20 | | | 5.250 | % | | | 3,305,000 | | | | 3,648,269 | | |

| Wireless 0.1% | |

Cellco Partnership/Verizon Wireless Capital LLC

Senior Unsecured | |

| 11/15/18 | | | 8.500 | % | | | 1,800,000 | | | | 2,478,508 | | |

| Wirelines 1.7% | |

AT&T, Inc.

Senior Unsecured | |

| 06/15/16 | | | 5.625 | % | | | 1,945,000 | | | | 2,267,403 | | |

| 02/15/39 | | | 6.550 | % | | | 3,030,000 | | | | 3,755,730 | | |

CenturyLink, Inc.

Senior Unsecured | |

| 06/15/21 | | | 6.450 | % | | | 3,175,000 | | | | 3,304,457 | | |

Embarq Corp.

Senior Unsecured | |

| 06/01/36 | | | 7.995 | % | | | 2,785,000 | | | | 2,795,388 | | |

| Telecom Italia Capital SA | |

| 07/18/36 | | | 7.200 | % | | | 3,690,000 | | | | 3,380,963 | | |

| Telefonica Emisiones SAU | |

| 06/20/16 | | | 6.421 | % | | | 3,120,000 | | | | 3,211,762 | | |

| 07/03/17 | | | 6.221 | % | | | 945,000 | | | | 964,097 | | |

| 04/27/20 | | | 5.134 | % | | | 3,185,000 | | | | 2,951,912 | | |

Verizon Communications, Inc.

Senior Unsecured | |

| 04/01/16 | | | 3.000 | % | | | 5,350,000 | | | | 5,703,924 | | |

| 04/01/21 | | | 4.600 | % | | | 975,000 | | | | 1,103,908 | | |

| Total | | | 29,439,544 | | |

Total Corporate Bonds & Notes

(Cost: $431,216,041) | | $ | 472,448,720 | | |

| Residential Mortgage-Backed Securities – Agency 37.3% | |

| Federal Home Loan Mortgage Corp.(d) | |

| 12/01/40 | | | 4.000 | % | | $ | 90,866,134 | | | $ | 96,670,624 | | |

| 05/01/41-06/01/41 | | | 4.500 | % | | | 31,350,414 | | | | 34,075,819 | | |

| 03/01/21-05/01/41 | | | 5.000 | % | | | 2,749,747 | | | | 3,032,461 | | |

| 12/01/14-12/01/35 | | | 7.000 | % | | | 737,161 | | | | 861,766 | | |

| 09/01/25-10/01/29 | | | 7.500 | % | | | 66,306 | | | | 80,621 | | |

| 06/01/26 | | | 8.000 | % | | | 1,186 | | | | 1,441 | | |

| 09/01/16 | | | 9.500 | % | | | 375 | | | | 423 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

9

Columbia Bond Fund

April 30, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Residential Mortgage-Backed Securities – Agency (continued) | |

| Federal National Mortgage Association(a)(d) | |

| 08/01/36 | | | 2.324 | % | | $ | 114,345 | | | $ | 115,686 | | |

| Federal National Mortgage Association(d) | |

| 12/01/40-12/01/41 | | | 4.000 | % | | | 76,927,583 | | | | 82,138,277 | | |

| 04/01/40-07/01/41 | | | 4.500 | % | | | 130,854,133 | | | | 142,739,411 | | |

| 07/01/40-09/01/40 | | | 5.000 | % | | | 71,452,602 | | | | 78,287,111 | | |

| 08/01/37-01/01/40 | | | 5.500 | % | | | 24,888,748 | | | | 27,331,844 | | |

| 07/01/38 | | | 6.000 | % | | | 16,925,607 | | | | 18,766,928 | | |

| 02/01/13 | | | 6.500 | % | | | 8,475 | | | | 8,630 | | |

| 06/01/32 | | | 7.000 | % | | | 11,870 | | | | 13,990 | | |

| 10/01/15-01/01/30 | | | 7.500 | % | | | 54,043 | | | | 62,966 | | |

| 12/01/29-05/01/30 | | | 8.000 | % | | | 228,126 | | | | 268,686 | | |

| 08/01/17 | | | 8.500 | % | | | 543 | | | | 552 | | |

| 10/01/20-12/01/20 | | | 10.000 | % | | | 137,437 | | | | 159,104 | | |

| Federal National Mortgage Association(d)(e) | |

| 05/01/42 | | | 3.500 | % | | | 55,000,000 | | | | 57,105,466 | | |

| Federal National Mortgage Association(d)(f) | |

| 02/01/41 | | | 4.000 | % | | | 21,830,648 | | | | 23,321,697 | | |

| Government National Mortgage Association(a)(d) | |

| 07/20/22 | | | 1.625 | % | | | 36,411 | | | | 37,699 | | |

| 07/20/21 | | | 2.000 | % | | | 27,888 | | | | 28,892 | | |

| 04/20/22-06/20/28 | | | 2.375 | % | | | 218,475 | | | | 226,611 | | |

| Government National Mortgage Association(d) | |

| 02/15/41 | | | 4.000 | % | | | 19,397,652 | | | | 21,029,782 | | |

| 06/15/39-03/15/41 | | | 4.500 | % | | | 43,247,634 | | | | 47,381,670 | | |

| 03/20/28 | | | 6.000 | % | | | 110,041 | | | | 124,712 | | |

| 05/15/23-12/15/31 | | | 6.500 | % | | | 148,740 | | | | 173,593 | | |

| 09/15/13-05/15/32 | | | 7.000 | % | | | 404,387 | | | | 476,571 | | |

| 04/15/26-03/15/30 | | | 7.500 | % | | | 365,336 | | | | 417,332 | | |

| 05/15/23-01/15/30 | | | 8.000 | % | | | 203,854 | | | | 235,222 | | |

| 01/15/17-12/15/17 | | | 8.500 | % | | | 367,120 | | | | 413,879 | | |

| 11/15/17-06/15/30 | | | 9.000 | % | | | 244,068 | | | | 273,622 | | |

| 11/15/17-08/15/20 | | | 9.500 | % | | | 203,118 | | | | 232,922 | | |

| 05/15/16-07/15/17 | | | 10.000 | % | | | 12,546 | | | | 12,924 | | |

| 06/15/13 | | | 11.500 | % | | | 4,787 | | | | 4,811 | | |

| Government National Mortgage Association(d)(e) | |

| 05/01/42 | | | 3.500 | % | | | 18,000,000 | | | | 18,959,062 | | |

Vendee Mortgage Trust(a)(d)(g)

CMO IO Series 1998-1 Class 2IO | |

| 03/15/28 | | | 0.412 | % | | | 4,115,639 | | | | 37,412 | | |

| CMO IO Series 1998-3 Class IO | |

| 03/15/29 | | | 0.264 | % | | | 5,383,325 | | | | 28,208 | | |

Total Residential Mortgage-Backed Securities – Agency

(Cost: $630,494,354) | | $ | 655,138,427 | | |

| Residential Mortgage-Backed Securities – Non-Agency 0.4% | |

American Mortgage Trust

Series 2093-3 Class 3A(d)(h)(i) | |

| 07/27/23 | | | 8.188 | % | | $ | 9,843 | | | $ | 5,968 | | |

BNPP Mortgage Securities LLC

CMO Series 2009-1 Class A1(b)(d) | |

| 08/27/37 | | | 6.000 | % | | | 880,427 | | | | 926,344 | | |

Credit Suisse Mortgage Capital Certificates(a)(b)(d)

CMO Series 2011-16R Class 7A3 | |

| 12/27/36 | | | 3.500 | % | | | 1,865,144 | | | | 1,837,074 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Residential Mortgage-Backed Securities – Non-Agency (continued) | |

| CMO Series 2011-17R Class 2A1 | |

| 12/27/37 | | | 3.400 | % | | $ | 1,965,033 | | | $ | 2,016,616 | | |

Springleaf Mortgage Loan Trust

CMO Series 2012-1A Class A(a)(b)(d) | |

| 09/25/57 | | | 2.667 | % | | | 1,760,000 | | | | 1,760,000 | | |

Total Residential Mortgage-Backed Securities – Non-Agency

(Cost: $6,512,235) | | $ | 6,546,002 | | |

| Commercial Mortgage-Backed Securities – Agency 2.1% | |

Federal Home Loan Mortgage Corp.

Multifamily Structured Pass-Through Certificates

CMO Series K706 Class A2(d) | |

| 10/25/18 | | | 2.323 | % | | $ | 10,757,000 | | | $ | 11,011,580 | | |

| Federal National Mortgage Association(d) | |

| 12/01/12 | | | 4.680 | % | | | 1,152,752 | | | | 1,155,839 | | |

| 09/01/19 | | | 4.760 | % | | | 5,761,739 | | | | 6,541,713 | | |

| 06/01/19 | | | 4.770 | % | | | 5,875,553 | | | | 6,657,765 | | |

| 01/01/19 | | | 2.600 | % | | | 10,000,000 | | | | 10,371,102 | | |

| 02/01/19 | | | 7.785 | % | | | 1,355,187 | | | | 1,493,245 | | |

Total Commercial Mortgage-Backed Securities – Agency

(Cost: $35,345,181) | | $ | 37,231,244 | | |

| Commercial Mortgage-Backed Securities – Non-Agency 15.7% | |

Banc of America Merrill Lynch Commercial Mortgage, Inc.

Series 2005-4 Class A5A(d) | |

| 07/10/45 | | | 4.933 | % | | $ | 17,198,000 | | | $ | 18,835,043 | | |

Bear Stearns Commercial Mortgage Securities(a)(d)

Series 2004-T14 Class A4 | |

| 01/12/41 | | | 5.200 | % | | | 11,705,000 | | | | 12,375,650 | | |

Bear Stearns Commercial Mortgage Securities(d)

Series 2002-TOP8 Class A2 | |

| 08/15/38 | | | 4.830 | % | | | 2,086,044 | | | | 2,101,902 | | |

| Series 2003-T10 Class A2 | |

| 03/13/40 | | | 4.740 | % | | | 15,330,824 | | | | 15,609,676 | | |

| Series 2006-PW14 Class A4 | |

| 12/11/38 | | | 5.201 | % | | | 3,310,000 | | | | 3,720,255 | | |

| Series 2006-T24 Class A4 | |

| 10/12/41 | | | 5.537 | % | | | 7,328,000 | | | | 8,352,323 | | |

| Series 2007-PW18 Class A4 | |

| 06/11/50 | | | 5.700 | % | | | 8,455,000 | | | | 9,715,091 | | |

Citigroup/Deutsche Bank Commercial Mortgage Trust(a)(d)

Series 2007-CD5 Class A4 | |

| 11/15/44 | | | 5.886 | % | | | 4,450,000 | | | | 5,138,023 | | |

Citigroup/Deutsche Bank Commercial Mortgage Trust(d)

Series 2007-CD4 Class A4 | |

| 12/11/49 | | | 5.322 | % | | | 8,830,000 | | | | 9,795,040 | | |

Commercial Mortgage Asset Trust(a)(d)

Series 1999-C1 Class B | |

| 01/17/32 | | | 7.230 | % | | | 2,000,000 | | | | 2,118,062 | | |

| Series 1999-C2 Class C | |

| 11/17/32 | | | 7.800 | % | | | 3,556,000 | | | | 3,803,341 | | |

Credit Suisse First Boston Mortgage Securities Corp.

Series 2003-CK2 Class A4(d) | |

| 03/15/36 | | | 4.801 | % | | | 3,490,000 | | | | 3,555,668 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

10

Columbia Bond Fund

April 30, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Commercial Mortgage-Backed Securities – Non-Agency (continued) | |

Credit Suisse Mortgage Capital Certificates

Series 2006-C3 Class A3(a)(d) | |

| 06/15/38 | | | 6.008 | % | | $ | 9,060,000 | | | $ | 10,303,911 | | |

GMAC Commercial Mortgage Securities, Inc.(a)(d)

CMO Series 2003-C2 Class A2 | |

| 05/10/40 | | | 5.636 | % | | | 1,060,000 | | | | 1,109,824 | | |

GMAC Commercial Mortgage Securities, Inc.(d)

Series 2003-C3 Class A4 | |

| 04/10/40 | | | 5.023 | % | | | 1,650,000 | | | | 1,723,582 | | |

GS Mortgage Securities Corp. II

Series 2005-GG4 Class A4A(d) | |

| 07/10/39 | | | 4.751 | % | | | 4,575,000 | | | | 4,971,762 | | |

Greenwich Capital Commercial Funding Corp.

Series 2005-GG3 Class A4(a)(d) | |

| 08/10/42 | | | 4.799 | % | | | 5,755,000 | | | | 6,202,900 | | |

JPMorgan Chase Commercial Mortgage Securities Corp.(a)(d)

Series 2003-CB6 Class A2 | |

| 07/12/37 | | | 5.255 | % | | | 3,875,000 | | | | 4,026,013 | | |

| Series 2003-CB7 Class A4 | |

| 01/12/38 | | | 4.879 | % | | | 3,847,697 | | | | 4,015,633 | | |

| Series 2005-LDP4 Class A4 | |

| 10/15/42 | | | 4.918 | % | | | 9,640,000 | | | | 10,457,241 | | |

| Series 2006-CB15 Class ASB | |

| 06/12/43 | | | 5.790 | % | | | 1,988,830 | | | | 2,125,841 | | |

JPMorgan Chase Commercial Mortgage Securities Corp.(d)

Series 2002-CIB4 Class A3 | |

| 05/12/34 | | | 6.162 | % | | | 72,461 | | | | 72,435 | | |

| Series 2003-C1 Class A2 | |

| 01/12/37 | | | 4.985 | % | | | 1,765,000 | | | | 1,797,693 | | |

| Series 2006-CB16 Class A4 | |

| 05/12/45 | | | 5.552 | % | | | 7,600,000 | | | | 8,554,689 | | |

| Series 2007-CB18 Class A4 | |

| 06/12/47 | | | 5.440 | % | | | 8,120,000 | | | | 9,099,548 | | |

LB-UBS Commercial Mortgage Trust(a)(d)

Series 2003-C8 Class A4 | |

| 11/15/32 | | | 5.124 | % | | | 6,865,000 | | | | 7,205,243 | | |

| Series 2004-C6 Class A6 | |

| 08/15/29 | | | 5.020 | % | | | 3,135,000 | | | | 3,356,670 | | |

LB-UBS Commercial Mortgage Trust(d)

Series 2003-C3 ClassA4 | |

| 05/15/32 | | | 4.166 | % | | | 3,525,000 | | | | 3,614,690 | | |

| Series 2005-C3 Class A5 | |

| 07/15/30 | | | 4.739 | % | | | 4,395,000 | | | | 4,801,529 | | |

| Series 2007-C2 Class A3 | |

| 02/15/40 | | | 5.430 | % | | | 8,930,000 | | | | 9,864,141 | | |

Merrill Lynch Mortgage Investors, Inc.

CMO IO Series 1998-C3 Class IO(a)(d)(g) | |

| 12/15/30 | | | 0.500 | % | | | 2,455,174 | | | | 24,662 | | |

Merrill Lynch Mortgage Trust

Series 2005-MCP1 Class A4(a)(d) | |

| 06/12/43 | | | 4.747 | % | | | 10,000,000 | | | | 10,859,140 | | |

Morgan Stanley Capital I(d)

Series 2003-IQ6 Class A4 | |

| 12/15/41 | | | 4.970 | % | | | 12,337,000 | | | | 12,969,666 | | |

| Series 2003-T11 Class A4 | |

| 06/13/41 | | | 5.150 | % | | | 16,419,517 | | | | 17,028,550 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Commercial Mortgage-Backed Securities – Non-Agency (continued) | |

| Series 2004-T13 Class A4 | |

| 09/13/45 | | | 4.660 | % | | $ | 6,224,000 | | | $ | 6,524,594 | | |

Morgan Stanley Dean Witter Capital I(d)

Series 2001-TOP3 Class A4 | |

| 07/15/33 | | | 6.390 | % | | | 32,020 | | | | 32,001 | | |

| Series 2003-HQ2 Class A2 | |

| 03/12/35 | | | 4.920 | % | | | 7,000,000 | | | | 7,153,363 | | |

| Series 2003-TOP9 Class A2 | |

| 11/13/36 | | | 4.740 | % | | | 4,003,829 | | | | 4,059,810 | | |

Morgan Stanley Reremic Trust

Series 2010-GG10 Class A4A(a)(b)(d) | |

| 08/15/45 | | | 5.980 | % | | | 5,731,000 | | | | 6,468,442 | | |

Nomura Asset Securities Corp.

Series 1998-D6 Class A4(a)(d) | |

| 03/15/30 | | | 7.899 | % | | | 4,025,000 | | | | 4,198,731 | | |

WF-RBS Commercial Mortgage Trust

Series 2012-C6 Class A2(d) | |

| 04/15/45 | | | 2.191 | % | | | 6,818,000 | | | | 6,930,299 | | |

Wachovia Bank Commercial Mortgage Trust(a)(d)

Series 2004-C12 Class A3 | |

| 07/15/41 | | | 5.230 | % | | | 4,029,786 | | | | 4,046,610 | | |

| Series 2005-C22 Class A4 | |

| 12/15/44 | | | 5.443 | % | | | 6,910,000 | | | | 7,717,724 | | |

Total Commercial Mortgage-Backed Securities – Non-Agency

(Cost: $262,664,850) | | $ | 276,437,011 | | |

| Asset-Backed Securities – Non-Agency 2.0% | |

Ally Auto Receivables Trust

Series 2011-5 Class A3 | |

| 11/15/15 | | | 0.990 | % | | $ | 2,485,000 | | | $ | 2,488,393 | | |

BMW Vehicle Owner Trust

Series 2011-A Class A3 | |

| 08/25/15 | | | 0.760 | % | | | 2,390,000 | | | | 2,393,291 | | |

Bombardier Capital Mortgage Securitization Corp.

Series 1998-A Class A3 | |

| 04/15/28 | | | 6.230 | % | | | 1,200 | | | | 1,188 | | |

CNH Equipment Trust

Series 2010-C Class A3 | |

| 05/15/15 | | | 1.170 | % | | | 4,297,760 | | | | 4,312,720 | | |

| Series 2011-B Class A3 | |

| 08/15/16 | | | 0.910 | % | | | 995,000 | | | | 997,001 | | |

Citibank Credit Card Issuance Trust

Series 2008-C6 Class C6 | |

| 06/20/14 | | | 6.300 | % | | | 455,000 | | | | 458,417 | | |

Citigroup Mortgage Loan Trust, Inc.(a)

Series 2005-WF2 Class MF1 | |

| 08/25/35 | | | 5.517 | % | | | 2,800,000 | | | | 224,280 | | |

| Series 2005-WF2 Class MF2 | |

| 08/25/35 | | | 5.666 | % | | | 820,034 | | | | 14,073 | | |

Conseco Financial Corp.

Series 1996-5 Class A7(a) | |

| 07/15/27 | | | 8.250 | % | | | 149,154 | | | | 152,595 | | |

Equity One ABS, Inc.

Series 2004-3 Class AV2(a) | |

| 07/25/34 | | | 0.579 | % | | | 356,903 | | | | 244,610 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

11

Columbia Bond Fund

April 30, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Asset-Backed Securities – Non-Agency (continued) | |

Franklin Auto Trust

Series 2008-A Class C(b) | |

| 05/20/16 | | | 7.160 | % | | $ | 2,812,221 | | | $ | 2,850,827 | | |

Harley-Davidson Motorcycle Trust

Series 2007-2 Class B | |

| 03/15/14 | | | 5.230 | % | | | 1,500,000 | | | | 1,502,638 | | |

Mercedes-Benz Auto Lease Trust

Series 2011-B Class A3(b) | |

| 08/15/14 | | | 1.070 | % | | | 4,000,000 | | | | 4,017,923 | | |

Nissan Auto Lease Trust

Series 2011-B Class A3 | |

| 02/16/15 | | | 0.920 | % | | | 3,000,000 | | | | 3,008,198 | | |

Nissan Auto Receivables Owner Trust

Series 2011-B Class A3 | |

| 02/16/16 | | | 0.959 | % | | | 2,145,000 | | | | 2,154,011 | | |

Porsche Innovative Lease Owner Trust

Series 2011-1 Class A3(b) | |

| 09/22/14 | | | 1.090 | % | | | 2,500,000 | | | | 2,504,136 | | |

SMART Trust

Series 2012-1USA Class A4A(b) | |

| 12/14/17 | | | 2.010 | % | | | 1,725,000 | | | | 1,723,535 | | |

Toyota Auto Receivables Owner Trust

Series 2011-B Class A3 | |

| 06/15/15 | | | 0.680 | % | | | 2,000,000 | | | | 2,000,399 | | |

Volkswagen Auto Lease Trust

Series 2011-A Class A3 | |

| 10/20/14 | | | 1.200 | % | | | 4,500,000 | | | | 4,535,572 | | |

Total Asset-Backed Securities – Non-Agency

(Cost: $39,148,596) | | $ | 35,583,807 | | |

| U.S. Treasury Obligations 10.1% | |

| U.S. Treasury | |

| 02/15/42 | | | 3.125 | % | | $ | 190,000 | | | $ | 190,535 | | |

| U.S. Treasury(c) | |

| 01/31/17 | | | 0.875 | % | | | 15,100,000 | | | | 15,180,211 | | |

| 02/28/17 | | | 0.875 | % | | | 48,980,000 | | | | 49,217,259 | | |

| 03/31/17 | | | 1.000 | % | | | 13,115,000 | | | | 13,246,150 | | |

| 02/15/22 | | | 2.000 | % | | | 14,320,000 | | | | 14,427,400 | | |

| 11/15/41 | | | 3.125 | % | | | 21,680,000 | | | | 21,747,750 | | |

| U.S. Treasury(j) | |

| STRIPS | |

| 02/15/22 | | | 0.000 | % | | | 48,715,000 | | | | 39,788,366 | | |

| 02/15/40 | | | 0.000 | % | | | 58,500,000 | | | | 23,542,155 | | |

Total U.S. Treasury Obligations

(Cost: $164,382,979) | | $ | 177,339,826 | | |

| U.S. Government & Agency Obligations 2.4% | |

| Residual Funding Corp.(j) | |

| STRIPS | |

| 10/15/20 | | | 0.000 | % | | $ | 14,620,000 | | | $ | 12,184,381 | | |

| 01/15/21 | | | 0.000 | % | | | 26,765,000 | | | | 21,997,591 | | |

| 01/15/30 | | | 0.000 | % | | | 14,000,000 | | | | 7,889,210 | | |

Total U.S. Government & Agency Obligations

(Cost: $33,478,394) | | $ | 42,071,182 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Foreign Government Obligations 0.9% | |

| CANADA 0.4% | |

| Hydro Quebec | |

| 12/01/29 | | | 8.500 | % | | $ | 1,020,000 | | | $ | 1,636,835 | | |

Province of Quebec

Senior Unsecured(c) | |

| 05/14/18 | | | 4.625 | % | | | 5,190,000 | | | | 6,046,568 | | |

| Total | | | 7,683,403 | | |

| MEXICO 0.2% | |

| Pemex Project Funding Master Trust | |

| 03/01/18 | | | 5.750 | % | | | 3,000,000 | | | | 3,420,000 | | |

| QATAR 0.3% | |

Nakilat, Inc.

Senior Secured(b) | |

| 12/31/33 | | | 6.067 | % | | | 3,140,000 | | | | 3,406,900 | | |

Ras Laffan Liquefied Natural Gas Co., Ltd. III

Senior Secured(b) | |

| 09/30/16 | | | 5.832 | % | | | 1,159,093 | | | | 1,246,025 | | |

| Total | | | 4,652,925 | | |

| SOUTH KOREA —% | |

Export-Import Bank of Korea

Senior Unsecured | |

| 10/17/12 | | | 5.500 | % | | | 600,000 | | | | 610,539 | | |

Total Foreign Government Obligations

(Cost: $13,851,698) | | $ | 16,366,867 | | |

Issue

Description | | Coupon

Rate | | Principal

Amount | | Value | |

| Municipal Bonds 1.1% | |

City of Chicago Waterworks

Revenue Bonds

Build America Bonds

Series 2010 | |

| 11/01/40 | | | 6.742 | % | | $ | 865,000 | | | $ | 1,116,334 | | |

Commonwealth of Massachusetts

Revenue Bonds

Build America Bonds-Recovery

Series 2010Z | |

| 06/01/30 | | | 5.631 | % | | | 2,820,000 | | | | 3,565,975 | | |

| 06/01/40 | | | 5.731 | % | | | 3,065,000 | | | | 3,942,847 | | |

Kentucky Asset Liability Commission

Revenue Bonds

Taxable

Series 2010 | |

| 04/01/18 | | | 3.165 | % | | | 3,560,000 | | | | 3,731,058 | | |

Los Angeles Unified School District

Unlimited General Obligation Bonds

Build America Bonds

Series 2009 | |

| 07/01/34 | | | 5.750 | % | | | 2,550,000 | | | | 2,990,206 | | |

State of California

Unlimited General Obligaion Taxable Bonds

Various Purpose

Series 2009-3 | |

| 04/01/14 | | | 5.250 | % | | | 260,000 | | | | 280,540 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

12

Columbia Bond Fund

April 30, 2012

(Percentages represent value of investments compared to net assets)

Issue

Description | | Coupon

Rate | | Principal

Amount | | Value | |

| Municipal Bonds (continued) | |

Unlimited General Obligation Bonds

Taxable

Series 2010 | |

| 11/01/15 | | | 3.950 | % | | $ | 835,000 | | | $ | 903,662 | | |

Taxable Build America Bonds

Series 2009 | |

| 04/01/39 | | | 7.550 | % | | | 2,390,000 | | | | 3,160,488 | | |

Total Municipal Bonds

(Cost: $16,228,000) | | $ | 19,691,110 | | |

| Preferred Debt 0.5% | |

| Banking 0.5% | |

Citigroup Capital XIII(a)

10/30/40 | | | 7.875 | % | | | 145,190 | | | $ | 3,866,410 | | |

U.S. Bancorp(a)

01/15/22 | | | 6.500 | % | | | 180,000 | | | | 4,870,800 | | |

| Total | | | 8,737,210 | | |

Total Preferred Debt

(Cost: $8,582,886) | | $ | 8,737,210 | | |

| Issuer | | | | Shares | | Value | |

| Common Stocks —% | |

| FINANCIALS —% | |

| Diversified Financial Services —% | |

| Leucadia National Corp. | | | | | 39 | | | $ | 969 | | |

| TOTAL FINANCIALS | | | 969 | | |

Total Common Stocks

(Cost: $—) | | $ | 969 | | |

| | | | | Shares | | Value | |

| Money Market Funds 0.4% | |

| Columbia Short-Term Cash Fund, | |

| | 0.144 | %(k)(l) | | | | | 7,416,654 | | | $ | 7,416,654 | | |

Total Money Market Funds

(Cost: $7,416,654) | | $ | 7,416,654 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Treasury Note Short-Term 4.3% | |

| U.S. Treasury Bills 0.060% | | | | $ | 75,550,000 | | | $ | 75,548,674 | | |

Total Treasury Note Short-Term

(Cost: $75,548,548) | | $ | 75,548,674 | | |

| Issuer | | Effective

Yield | | Par/

Principal/

Shares | | Value | |

Investments of Cash Collateral Received for

Securities on Loan 1.3% | |

| Repurchase Agreements 1.3% | |

Mizuho Securities USA, Inc.

dated 04/30/12, matures 05/01/12,

repurchase price $5,000,033(m)

| | | 0.240 | % | | | 5,000,000 | | | $ | 5,000,000 | | |

RBS Securities, Inc.

dated 04/30/12, matures 05/01/12,

repurchase price $10,000,058(m)

| | | 0.210 | % | | | 10,000,000 | | | | 10,000,000 | | |

Societe Generale

dated 04/30/12, matures 05/01/12,

repurchase price $7,266,255(m)

| | | 0.210 | % | | | 7,266,213 | | | | 7,266,213 | | |

| Total | | | 22,266,213 | | |

Total Investments of Cash Collateral Received for Securities

on Loan

(Cost: $22,266,213) | | $ | 22,266,213 | | |

Total Investments

(Cost: $1,747,136,629) | | | | | | | | | | $ | 1,852,823,916 | | |

| Other Assets & Liabilities, Net | | | | | | | | | | | (94,176,737 | ) | |

| Net Assets | | $ | 1,758,647,179 | | |

| Investment in Derivatives | |

Futures Contracts Outstanding at April 30, 2012

| Contract Description | | Number of

Contracts

Long (Short) | | Notional

Market Value | | Expiration

Date | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| U.S. Treasury Note, 5-year | | | (4 | ) | | $ | (495,188 | ) | | June 2012 | | $ | — | | | $ | (508 | ) | |

| U.S. Treasury Note, 10-year | | | 82 | | | | 10,847,063 | | | June 2012 | | | 192,411 | | | | — | | |

| U.S. Treasury Long Bond, 20-year | | | (142 | ) | | | (20,288,250 | ) | | June 2012 | | | — | | | | (311,727 | ) | |

| U.S. Treasury Ultra Bond, 30-year | | | (297 | ) | | | (46,870,313 | ) | | June 2012 | | | — | | | | (1,807,103 | ) | |

| Total | | | | | | | | $ | 192,411 | | | $ | (2,119,338 | ) | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

13

Columbia Bond Fund

April 30, 2012

| Notes to Portfolio of Investments | |

(a) Variable rate security. The interest rate shown reflects the rate as of April 30, 2012.

(b) Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At April 30, 2012, the value of these securities amounted to $71,486,186 or 4.06% of net assets.

(c) At April 30, 2012, security was partially or fully on loan.

(d) The maturity dates shown represent the original maturity of the underlying obligation. Actual maturity may vary based upon prepayment activity on these obligations. Unless otherwise noted, the coupon rates presented are fixed rates.

(e) Represents a security purchased on a when-issued or delayed delivery basis.

(f) At April 30, 2012, investments in securities included securities valued at $1,851,601 that were partially pledged as collateral to cover initial margin deposits on open interest rate futures contracts.

(g) Interest Only (IO) security. The actual effective yield of this security is different than the stated coupon rate.

(h) Identifies issues considered to be illiquid as to their marketability. The aggregate value of such securities at April 30, 2012 was $5,968, representing less than 0.01% of net assets. Information concerning such security holdings at April 30, 2012 was as follows:

| Security Description | | Acquisition

Dates | | Cost | |

American Mortgage Trust

Series 2093-3 Class 3A

07/27/23 8.188% | | 10/22/10-10/12/11 | | $ | 6,081 | | |

(i) Represents fair value as determined in good faith under procedures approved by the Board of Trustees. At April 30, 2012, the value of these securities amounted to $5,968, which represents less than 0.01% of net assets.

(j) Zero coupon bond.

(k) The rate shown is the seven-day current annualized yield at April 30, 2012.

(l) Investments in affiliates during the period ended April 30, 2012:

| Issuer | | Beginning

Cost | | Purchase

Cost | | Sales Cost/

Proceeds

from Sales | | Realized

Gain/Loss | | Ending

Cost | | Dividends

or Interest

Income | | Value | |

Columbia Short-Term

Cash Fund | | $ | 8,534,025 | | | $ | 54,745,664 | | | $ | (55,863,035 | ) | | $ | — | | | $ | 7,416,654 | | | $ | 1,351 | | | $ | 7,416,654 | | |

Investments in affiliates during the year ended March 31, 2012:

| Issuer | | Beginning

Cost | | Purchase

Cost | | Sales Cost/

Proceeds

from Sales | | Realized

Gain/Loss | | Ending

Cost | | Dividends

or Interest

Income | | Value | |

Columbia Short-Term

Cash Fund | | $ | — | | | $ | 876,229,321 | | | $ | (867,695,296 | ) | | $ | — | | | $ | 8,534,025 | | | $ | 85,100 | | | $ | 8,534,025 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

14

Columbia Bond Fund

April 30, 2012

| Notes to Portfolio of Investments (continued) | |

(m) The table below represents securities received as collateral for repurchase agreements. This collateral is deposited with the Fund's custodian and, pursuant to the terms of the repurchase agreement, must have an aggregate market value greater than or equal to the repurchase price plus accrued interest at all times. The value of securities and/or cash held as collateral for repurchase agreements is monitored on a daily basis to ensure the proper level of collateral.

Mizuho Securities USA, Inc. (0.240%)

| Security Description | | Value | |

| Fannie Mae REMICS | | $ | 2,530,245 | | |

| Freddie Mac REMICS | | | 2,569,755 | | |

| Total Market Value of Collateral Securities | | $ | 5,100,000 | | |

RBS Securities, Inc. (0.210%)

| Security Description | | Value | |

| United States Treasury Note/Bond | | $ | 10,200,050 | | |

| Total Market Value of Collateral Securities | | $ | 10,200,050 | | |

Societe Generale (0.210%)

| Security Description | | Value | |

| Fannie Mae Pool | | $ | 5,050,000 | | |

| Freddie Mac Gold Pool | | | 2,361,537 | | |

| Total Market Value of Collateral Securities | | $ | 7,411,537 | | |

| Abbreviation Legend | |

CMO Collateralized Mortgage Obligation

STRIPS Separate Trading of Registered Interest and Principal Securities

Generally accepted accounting principles (GAAP) require disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category.

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

• Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

• Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

• Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).