UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer 5228 Ameriprise Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | July 31 | |

|

Date of reporting period: | July 31, 2012 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

July 31, 2012

CMG Ultra Short Term Bond Fund

Not FDIC insured • No bank guarantee • May lose value

CMG Ultra Short Term Bond Fund

President's Message

Dear Shareholders,

Dear Shareholders,

On the heels of solid gains for stocks during the first quarter, U.S. stock market averages fell in the second quarter as uncertainty mounted regarding the fate of the eurozone and other real concerns. On the last day of the quarter, an announcement that European leaders had agreed to relieve short-term funding pressure on Italy and Spain and to back a plan heading toward a banking union raised hopes that a longer term solution was achievable. The announcement lifted stocks around the world. However, it was a losing quarter for most stock markets as economic data disappointed in the United States and growth in Europe and emerging markets slowed. China, which has been a key driver of worldwide growth over the past decade, has experienced a significant slowdown, and its declining demand for raw materials has had a chilling effect on world commodity markets.

Against a backdrop of rising uncertainty and a declining stock market, bond investors turned cautious. U.S. Treasuries were the quarter's strongest performers. Total returns on long-dated Treasuries surged late last year, sank from mid-December to mid-March then soared through the end of the quarter. By contrast, European sovereign bonds lost value as interest rates rose and concerns about the eurozone's fiscal health mounted.

Despite these continued challenges, we see pockets of strength — and as a result, attractive opportunities — both here and abroad for 2012. We hope to help you capitalize on these opportunities with various articles in our 2012 Perspectives, which is available via the Market Insights tab at columbiamanagement.com. This publication showcases the strong research capabilities and experienced investment teams of Columbia Management and offers a diverse array of investment ideas based on our five key themes for 2012.

Other information and resources available at columbiamanagement.com include:

> detailed up-to-date fund performance and portfolio information

> economic analysis and market commentary

> quarterly fund commentaries

> Columbia Management Investor, our award-winning quarterly newsletter for shareholders

Thank you for your continued support of the Columbia Funds. We look forward to serving your investment needs for many years to come.

Best Regards,

J. Kevin Connaughton

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2012 Columbia Management Investment Advisers, LLC. All rights reserved.

Annual Report 2012

CMG Ultra Short Term Bond Fund

Table of Contents

| Performance Overview | | | 2 | | |

|

| Manager Discussion of Fund Performance | | | 4 | | |

|

| Understanding Your Fund's Expenses | | | 6 | | |

|

| Portfolio of Investments | | | 7 | | |

|

| Statement of Assets and Liabilities | | | 20 | | |

|

| Statement of Operations | | | 21 | | |

|

| Statement of Changes in Net Assets | | | 22 | | |

|

| Financial Highlights | | | 24 | | |

|

| Notes to Financial Statements | | | 25 | | |

|

Report of Independent Registered

Public Accounting Firm | | | 31 | | |

|

| Trustees and Officers | | | 32 | | |

|

Board Consideration and Approval of

Advisory Agreement | | | 35 | | |

|

| Important Information About This Report | | | 41 | | |

|

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit columbiamanagement.com or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 8 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

Annual Report 2012

CMG Ultra Short Term Bond Fund

Performance Overview

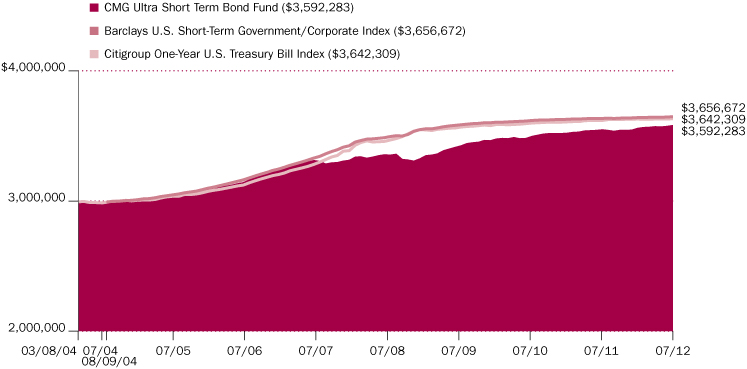

Performance Summary

> CMG Ultra Short Term Bond Fund (the Fund) returned 0.93% for the 12-month period that ended July 31, 2012.

> The Fund outperformed its benchmark, the Barclays U.S. Short-Term Government/Corporate Index, which returned 0.36% during the same period.

> The Fund also outperformed the Citigroup One-Year U.S. Treasury Bill Index, which returned 0.40% for the 12-month period.

> The Fund's relative performance was aided by its duration positioning as well as its diversification away from the U.S. Treasury market.

Average Annual Total Returns (%) (for period ended July 31, 2012)

| | | Inception | | 1 Year | | 5 Years | | Life | |

| CMG Ultra Short Term Bond Fund | | 03/08/04 | | | 0.93 | | | | 1.61 | | | | 2.17 | | |

| Barclays U.S. Short-Term Government/Corporate Index | | | | | 0.36 | | | | 1.76 | | | | 2.51 | * | |

| Citigroup One-Year U.S. Treasury Bill Index | | | | | 0.40 | | | | 1.96 | | | | 2.34 | | |

*From August 9, 2004

The Fund commenced operations on November 23, 2009. The returns shown for periods prior to November 23, 2009 are the returns of CMG Ultra Short Term Bond Fund, the predecessor to the Fund and a portfolio of Columbia Funds Institutional Trust. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower. All results shown assume reinvestment of distributions. The table does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of shares.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiamanagement.com or calling 800.345.6611.

On December 1, 2011 the Barclays U.S. Short-Term Government/Corporate Index, which is unavailable at the Fund's predecessor's inception in March 2004, replaced the Citigroup One-Year U.S. Treasury Bill Index as the Fund's benchmark. The Fund changed its benchmark because the Investment Manager believes it is more representative of the investment approach used to manage the Fund.

The Barclays U.S. Short-Term Government/Corporate Index tracks the performance of U.S. Government and corporate bonds rated investment grade or better, with maturities of less than one year.

The Citigroup One-Year U.S. Treasury Bill Index consists of a single one-year U.S. Treasury Bill whose return is tracked until its maturity.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Annual Report 2012

2

CMG Ultra Short Term Bond Fund

Performance Overview (continued)

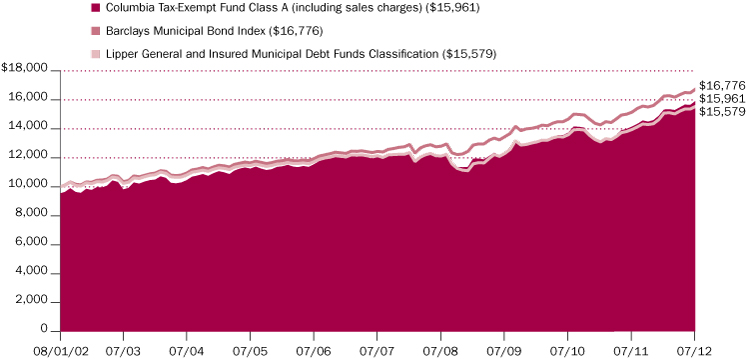

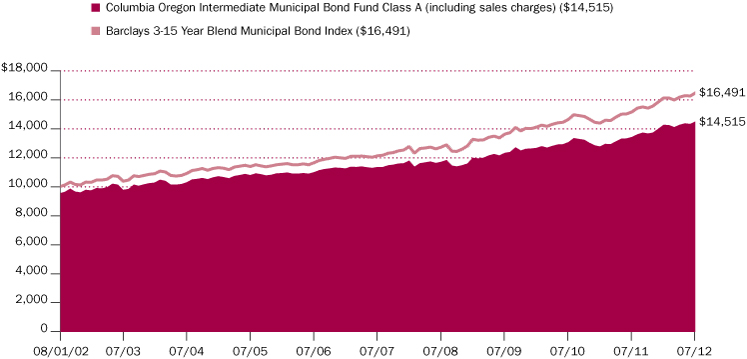

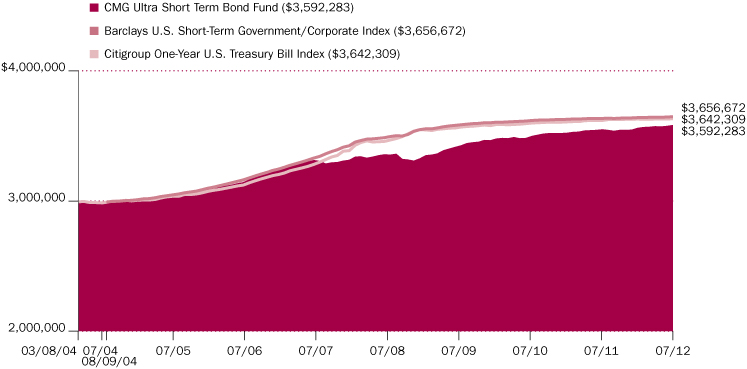

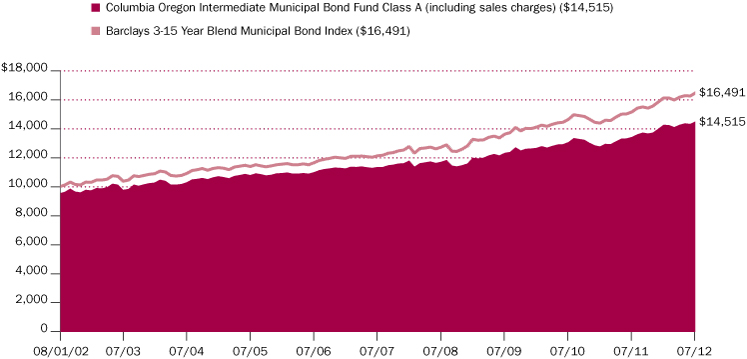

Performance of a Hypothetical $3,000,000 Investment (March 8, 2004 – July 31, 2012)

The chart above shows the change in value of a hypothetical $3,000,000 investment in CMG Ultra Short Term Bond Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

A $3,000,000 investment in the Fund since 03/08/04 was equal to $2,999,581 on 08/09/04, the inception date of the Barclays U.S. Short-Term Government/Corporate Index. For comparison with the Barclays U.S. Short-Term Government/Corporate Index, the chart shows the index at the same value as of 08/09/04.

Annual Report 2012

3

CMG Ultra Short Term Bond Fund

Manager Discussion of Fund Performance

For the 12-month period that ended July 31, 2012, CMG Ultra Short Term Bond Fund returned 0.93%. The Fund outperformed its benchmark, the Barclays U.S. Short-Term Government/Corporate Index, which returned 0.36%. Although returns from the short-term debt markets were low throughout the period, the Fund's relative performance was aided by its duration positioning as well as its diversification away from the U.S. Treasury market.

A sluggish economy

Early in the 12-month period, Europe's debt problems and an uncertain economic outlook dominated world headlines. In the United States, the pace of economic growth slowed to 2.0% in the first quarter of 2012, as measured by gross domestic product, and the preliminary estimate of second quarter growth was just 1.5%. Job growth picked up, raising hopes that better employment prospects would lift consumer spending. However, three months of disappointingly low figures weighed on confidence. The housing market showed a glimmer of improvement, as year-over-year sales improved, inventories tightened and prices stabilized somewhat. However, manufacturing activity — the one consistent bright spot throughout this recovery — slipped near the end of the period. The Federal Reserve (the Fed) responded to this economic sluggishness by extending its commitment to keep short-term interest rates low.

Seeking yield in a low rate environment

The challenge for the Fund has been to find ways to augment yields in a low-yield environment. To that end, we extended the maturities of Fund investments to capture incremental yield along the positive-sloping yield curve. We increased Fund exposure to corporate securities, mortgages, asset-backed securities and other non-Treasury issues. These strategies were responsible for most of the excess return the Fund enjoyed versus its benchmark. In addition, the Fund's asset allocation decisions worked out well: A shift from asset-backed securities to commercial mortgage-backed securites produced incrementally higher returns.

Detractors from performance were few during the period. New purchases of corporate bonds emphasized industrial issuers at the expense of the finance sector, and finance outperformed for the period. In an effort to reduce the price volatility of the Fund, we eliminated holdings in European financial companies during the period. The more conservative management style helped to decrease volatility but at the cost of reducing performance. Because the Fund's assets experienced significant growth during the period, there were times when the Fund owned higher-than-target levels of low-yielding commercial paper prior to putting these assets to work in higher-yielding securities. The impact of this inflow of new money was temporary.

Looking ahead

We expect the economy to continue to exhibit steady but constrained growth. Mindful of the slowdowns in Europe and Asia, as well as the domestic uncertainties posed by the presidential election and the year-end expiration of certain tax benefits and introduction of automatic federal spending cuts, popularly known as the "fiscal cliff," we will continue to position the portfolio in a conservative fashion. We expect to maintain investments in commercial mortgage-backed securities, but will avoid the residential mortgage market because of an unacceptably high prepayment risk. Although Fund assets have

Portfolio Management

Guy Holbrook, IV, CFA

Mary Werler, CFA

Effective September 3, 2012, Leonard Aplet, CFA, replaced Guy Holbrook as Lead Manager of the Fund.

Quality Breakdown (%)

(at July 31, 2012) | |

| AAA rating | | | 39.1 | | |

| AA rating | | | 12.7 | | |

| A rating | | | 25.3 | | |

| BBB rating | | | 22.0 | | |

| Not rated | | | 0.9 | | |

| Total | | | 100.0 | | |

Percentages indicated are based upon total fixed income securities (excluding Money Market Funds and Investments of Cash Collateral Received for Securities on Loan).

Bond ratings apply to the underlying holdings of the Fund and not the Fund itself and are divided into categories ranging from AAA (highest) to D (lowest), and are subject to change. The ratings shown are determined by using the middle rating of Moody's, S&P, and Fitch after dropping the highest and lowest available ratings. When a rating from only two agencies is available, the lower rating is used. When a rating from only one agency is available, that rating is used. When a bond is not rated by one of these agencies, it is designated as Not rated. Credit ratings are subjective opinions and not statements of fact.

Annual Report 2012

4

CMG Ultra Short Term Bond Fund

Manager Discussion of Fund Performance (continued)

slightly longer maturities than the benchmark, we are comfortable with this positioning in light of the Fed's repeated assurances that a near-term increase in rates is unlikely.

Portfolio Breakdown (%)

(at July 31, 2012) | |

| Corporate Bonds & Notes | | | 44.6 | | |

Residential Mortgage-Backed

Securities — Agency | | | 0.8 | | |

Residential Mortgage-Backed

Securities — Non-Agency | | | 0.7 | | |

| Commercial Mortgage-Backed Securities — Agency | | | 1.1 | | |

| Commercial Mortgage-Backed Securities — Non-Agency | | | 10.8 | | |

Asset-Backed

Securities — Non-Agency | | | 16.0 | | |

| U.S. Treasury Obligations | | | 4.5 | | |

| Municipal Bonds | | | 4.4 | | |

| Commercial Paper | | | 17.1 | | |

| Other(a) | | | 0.0 | (b) | |

Percentages indicated are based upon total investments (excluding Investments of Cash Collateral Received for Securities on Loan). The Fund's portfolio composition is subject to change.

(a) Includes investments in Money Market Funds.

(b) Rounds to less than 0.1%.

Annual Report 2012

5

CMG Ultra Short Term Bond Fund

Understanding Your Fund's Expenses

(Unaudited)

As an investor, you incur ongoing costs, which generally include management fees, distribution and service (Rule 12b-1) fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in shares of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

February 1, 2012 – July 31, 2012

Account Value at the Beginning

of the Period ($) | | Account Value at the End of the

Period ($) | | Expenses Paid During the

Period ($) | | Fund's Annualized

Expense Ratio (%) | |

| Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| | 1,000.00 | | | | 1,000.00 | | | | 1,005.80 | | | | 1,023.62 | | | | 1.25 | | | | 1.26 | | | | 0.25 | | |

Expenses paid during the period are equal to the annualized expense ratio of the Fund, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 366.

Expenses do not include fees and expenses incurred indirectly by the Fund from the underlying funds in which the Fund may invest (also referred to as "acquired funds"), including affiliated and non-affiliated pooled investment vehicles (including mutual funds and exchange traded funds).

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Annual Report 2012

6

CMG Ultra Short Term Bond Fund

Portfolio of Investments

July 31, 2012

(Percentages represent value of investments compared to net assets)

Corporate Bonds & Notes 45.3%

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

| Aerospace & Defense 0.4% | |

Boeing Co. (The)

Senior Unsecured

11/20/12 | | | 1.875 | % | | | 5,000,000 | | | | 5,022,935 | | |

| Automotive 3.1% | |

American Honda Finance Corp.(a)

Senior Unsecured

03/18/13 | | | 2.375 | % | | | 4,000,000 | | | | 4,046,784 | | |

American Honda Finance Corp.(a)(b)

Senior Unsecured

06/18/14 | | | 0.861 | % | | | 10,000,000 | | | | 9,992,790 | | |

PACCAR Financial Corp.

Senior Unsecured

12/17/12 | | | 1.950 | % | | | 4,100,000 | | | | 4,123,514 | | |

| 06/05/15 | | | 1.050 | % | | | 4,000,000 | | | | 4,023,508 | | |

Toyota Motor Credit Corp.

Senior Unsecured

07/17/15 | | | 0.875 | % | | | 10,000,000 | | | | 10,045,240 | | |

Volkswagen International Finance NV(a)

08/12/13 | | | 1.625 | % | | | 5,000,000 | | | | 5,045,500 | | |

Volkswagen International Finance NV(a)(b)

04/01/14 | | | 1.071 | % | | | 5,000,000 | | | | 5,003,875 | | |

| Total | | | | | | | 42,281,211 | | |

| Banking 10.2% | |

American Express Centurion Bank

Senior Unsecured

10/17/12 | | | 5.550 | % | | | 6,000,000 | | | | 6,063,516 | | |

American Express Co.

Senior Unsecured

07/15/13 | | | 4.875 | % | | | 3,870,000 | | | | 4,024,069 | | |

BB&T Corp.

Senior Unsecured

04/30/14 | | | 5.700 | % | | | 2,061,000 | | | | 2,233,079 | | |

BB&T Corp.(b)

Senior Unsecured

04/28/14 | | | 1.147 | % | | | 5,000,000 | | | | 5,024,675 | | |

Canadian Imperial Bank of Commerce

Senior Unsecured

09/13/13 | | | 1.450 | % | | | 11,000,000 | | | | 11,122,327 | | |

Capital One Financial Corp.

Senior Unsecured

07/15/14 | | | 2.125 | % | | | 2,000,000 | | | | 2,027,828 | | |

Capital One Financial Corp.(b)

Senior Unsecured

07/15/14 | | | 1.605 | % | | | 5,000,000 | | | | 4,968,355 | | |

Citigroup, Inc.

Senior Unsecured(b)(c)

04/01/14 | | | 1.391 | % | | | 7,500,000 | | | | 7,428,592 | | |

Corporate Bonds & Notes (continued)

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Commonwealth Bank of Australia

Senior Unsecured(a)(b)

03/19/13 | | | 1.018 | % | | | 10,000,000 | | | | 10,030,150 | | |

Fifth Third Bank

Senior Unsecured(b)

05/17/13 | | | 0.576 | % | | | 5,500,000 | | | | 5,480,613 | | |

Goldman Sachs Group, Inc. (The)

Senior Unsecured(c)

04/01/13 | | | 5.250 | % | | | 7,500,000 | | | | 7,696,072 | | |

JPMorgan Chase & Co.

Senior Unsecured

06/01/14 | | | 4.650 | % | | | 7,500,000 | | | | 7,970,647 | | |

JPMorgan Chase & Co.(b)

09/30/13 | | | 1.211 | % | | | 7,500,000 | | | | 7,541,595 | | |

KeyCorp

Senior Unsecured

05/14/13 | | | 6.500 | % | | | 8,000,000 | | | | 8,337,160 | | |

Morgan Stanley

Senior Unsecured(b)

01/09/14 | | | 0.760 | % | | | 6,500,000 | | | | 6,280,300 | | |

National Australia Bank Ltd.

Senior Unsecured(a)(b)(c)

04/11/14 | | | 1.178 | % | | | 5,000,000 | | | | 5,006,905 | | |

National Bank of Canada

Bank Guaranteed

06/26/15 | | | 1.500 | % | | | 5,000,000 | | | | 5,070,122 | | |

Royal Bank of Canada

03/15/13 | | | 2.250 | % | | | 3,000,000 | | | | 3,038,082 | | |

Toronto-Dominion Bank (The)(b)

Senior Unsecured

07/14/14 | | | 0.755 | % | | | 2,000,000 | | | | 2,005,040 | | |

Toronto-Dominion Bank (The)(c)

Senior Unsecured

07/14/14 | | | 1.375 | % | | | 5,000,000 | | | | 5,085,745 | | |

U.S. Bancorp

Senior Notes

07/27/15 | | | 2.450 | % | | | 5,000,000 | | | | 5,249,917 | | |

Senior Unsecured

09/13/13 | | | 1.375 | % | | | 5,000,000 | | | | 5,051,810 | | |

Wachovia Corp.

Subordinated Notes

08/01/14 | | | 5.250 | % | | | 5,000,000 | | | | 5,365,115 | | |

Wachovia Corp.(b)

Senior Unsecured

05/01/13 | | | 2.215 | % | | | 5,000,000 | | | | 5,065,740 | | |

Westpac Banking Corp.

Senior Unsecured

11/19/12 | | | 2.250 | % | | | 2,000,000 | | | | 2,011,194 | | |

| Total | | | | | | | 139,178,648 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

7

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Corporate Bonds & Notes (continued)

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

| Chemicals 0.4% | |

Dow Chemical Co. (The)

Senior Unsecured

05/15/14 | | | 7.600 | % | | | 5,000,000 | | | | 5,561,945 | | |

| Construction Machinery 0.9% | |

Caterpillar Financial Services Corp.

Senior Unsecured

04/01/14 | | | 1.650 | % | | | 5,000,000 | | | | 5,089,220 | | |

| 05/29/15 | | | 1.100 | % | | | 3,000,000 | | | | 3,041,064 | | |

John Deere Capital Corp.

Senior Unsecured

04/17/15 | | | 0.875 | % | | | 4,950,000 | | | | 4,978,482 | | |

| Total | | | | | | | 13,108,766 | | |

| Diversified Manufacturing 0.3% | |

United Technologies Corp.

Senior Unsecured(b)

06/01/15 | | | 0.967 | % | | | 3,810,000 | | | | 3,853,887 | | |

| Electric 4.3% | |

Consumers Energy Co.

1st Mortgage

02/15/14 | | | 6.000 | % | | | 3,000,000 | | | | 3,232,983 | | |

DTE Energy Co.

Senior Unsecured(b)

06/03/13 | | | 1.167 | % | | | 2,000,000 | | | | 2,005,723 | | |

Duke Energy Corp.

Senior Unsecured

02/01/14 | | | 6.300 | % | | | 6,675,000 | | | | 7,212,097 | | |

Exelon Generation Co. LLC

Senior Unsecured

01/15/14 | | | 5.350 | % | | | 7,500,000 | | | | 7,938,315 | | |

Georgia Power Co.

Senior Unsecured(b)

03/15/13 | | | 0.788 | % | | | 10,000,000 | | | | 10,000,760 | | |

Ohio Power Co.

Senior Unsecured

02/15/13 | | | 5.500 | % | | | 4,800,000 | | | | 4,921,954 | | |

PSEG Power LLC

04/15/13 | | | 2.500 | % | | | 10,000,000 | | | | 10,134,380 | | |

Peco Energy Co.

1st Mortgage

10/15/13 | | | 5.600 | % | | | 5,360,000 | | | | 5,685,325 | | |

Pennsylvania Electric Co.

Senior Unsecured

04/01/14 | | | 5.125 | % | | | 7,000,000 | | | | 7,448,147 | | |

| Total | | | | | | | 58,579,684 | | |

Corporate Bonds & Notes (continued)

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

| Food and Beverage 4.4% | |

Anheuser-Busch InBev Worldwide, Inc.

07/14/14 | | | 1.500 | % | | | 6,000,000 | | | | 6,108,012 | | |

Anheuser-Busch InBev Worldwide, Inc.(b)

03/26/13 | | | 1.192 | % | | | 2,000,000 | | | | 2,009,514 | | |

Bacardi Ltd.(a)

04/01/14 | | | 7.450 | % | | | 5,000,000 | | | | 5,509,045 | | |

Campbell Soup Co.

Senior Unsecured(b)(d)

08/01/14 | | | 0.743 | % | | | 5,000,000 | | | | 5,009,900 | | |

Dr. Pepper Snapple Group, Inc.

12/21/12 | | | 2.350 | % | | | 3,500,000 | | | | 3,524,850 | | |

| 05/01/13 | | | 6.120 | % | | | 2,474,000 | | | | 2,574,726 | | |

General Mills, Inc.

Senior Unsecured

05/16/14 | | | 1.550 | % | | | 4,000,000 | | | | 4,066,036 | | |

General Mills, Inc.(b)

Senior Unsecured

05/16/14 | | | 0.816 | % | | | 4,000,000 | | | | 4,010,552 | | |

Kellogg Co.

Senior Unsecured

05/15/15 | | | 1.125 | % | | | 6,500,000 | | | | 6,559,813 | | |

Kraft Foods Group, Inc.(a)

06/04/15 | | | 1.625 | % | | | 3,000,000 | | | | 3,050,598 | | |

Kraft Foods, Inc.

Senior Unsecured(b)

07/10/13 | | | 1.333 | % | | | 5,000,000 | | | | 5,028,065 | | |

PepsiCo, Inc.

Senior Unsecured(b)

05/10/13 | | | 0.546 | % | | | 5,000,000 | | | | 5,009,990 | | |

SABMiller Holdings, Inc.(a)

01/15/15 | | | 1.850 | % | | | 6,000,000 | | | | 6,140,892 | | |

SABMiller PLC

Senior Unsecured(a)

01/15/14 | | | 5.700 | % | | | 2,000,000 | | | | 2,135,300 | | |

| Total | | | | | | | 60,737,293 | | |

| Gas Distributors 0.4% | |

Sempra Energy

Senior Unsecured(b)

03/15/14 | | | 1.228 | % | | | 5,000,000 | | | | 5,000,955 | | |

| Gas Pipelines 1.2% | |

Enterprise Products Operating LLC

02/01/13 | | | 6.125 | % | | | 5,000,000 | | | | 5,122,315 | | |

NiSource Finance Corp.

03/01/13 | | | 6.150 | % | | | 8,000,000 | | | | 8,254,968 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

8

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Corporate Bonds & Notes (continued)

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

TransCanada PipeLines Ltd.

Senior Unsecured

03/02/15 | | | 0.875 | % | | | 3,650,000 | | | | 3,672,853 | | |

| Total | | | | | | | 17,050,136 | | |

| Health Care 0.6% | |

Express Scripts Holding Co.(a)

11/21/14 | | | 2.750 | % | | | 8,000,000 | | | | 8,247,376 | | |

| Independent Energy 0.7% | |

Canadian Natural Resources Ltd.

Senior Unsecured

10/01/12 | | | 5.450 | % | | | 4,000,000 | | | | 4,032,356 | | |

| 11/14/14 | | | 1.450 | % | | | 5,000,000 | | | | 5,071,528 | | |

| Total | | | | | | | 9,103,884 | | |

| Integrated Energy 0.6% | |

BP Capital Markets PLC

12/05/14 | | | 1.700 | % | | | 7,500,000 | | | | 7,652,730 | | |

| Life Insurance 2.6% | |

MetLife Institutional Funding II

Secured(a)(b)

04/04/14 | | | 1.361 | % | | | 7,500,000 | | | | 7,543,178 | | |

Metropolitan Life Global Funding I

Secured(a)

01/10/14 | | | 1.208 | % | | | 5,000,000 | | | | 5,016,470 | | |

New York Life Global Funding(a)(b)

06/18/14 | | | 0.588 | % | | | 8,000,000 | | | | 7,991,195 | | |

Principal Life Global Funding II(a)(b)

07/09/14 | | | 1.080 | % | | | 5,000,000 | | | | 4,999,629 | | |

Prudential Financial, Inc.

Senior Unsecured

09/17/12 | | | 3.625 | % | | | 2,400,000 | | | | 2,408,000 | | |

| 01/14/13 | | | 2.750 | % | | | 8,000,000 | | | | 8,074,384 | | |

| Total | | | | | | | 36,032,856 | | |

| Media Non-Cable 0.6% | |

Reed Elsevier Capital, Inc.

01/15/14 | | | 7.750 | % | | | 7,625,000 | | | | 8,315,306 | | |

| Metals 0.5% | |

Rio Tinto Finance USA PLC

03/20/15 | | | 1.125 | % | | | 7,000,000 | | | | 7,052,500 | | |

| Non-Captive Diversified 1.3% | |

General Electric Capital Corp.

Senior Unsecured

01/09/15 | | | 2.150 | % | | | 5,000,000 | | | | 5,126,915 | | |

Corporate Bonds & Notes (continued)

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

General Electric Capital Corp.(b)

Senior Unsecured

04/07/14 | | | 1.090 | % | | | 5,000,000 | | | | 5,003,640 | | |

| 07/02/15 | | | 1.491 | % | | | 7,500,000 | | | | 7,528,386 | | |

| Total | | | | | | | 17,658,941 | | |

| Other Financial Institutions 0.4% | |

Teva Pharmaceutical Finance Co. BV(b)

11/08/13 | | | 1.366 | % | | | 5,000,000 | | | | 5,037,705 | | |

| Pharmaceuticals 1.2% | |

Novartis Capital Corp.

04/24/13 | | | 1.900 | % | | | 5,300,000 | | | | 5,362,328 | | |

Sanofi

Senior Unsecured

09/30/14 | | | 1.200 | % | | | 5,000,000 | | | | 5,078,400 | | |

Sanofi(b)

Senior Unsecured

03/28/14 | | | 0.771 | % | | | 5,000,000 | | | | 5,026,535 | | |

Teva Pharmaceutical Finance IV LLC

11/10/14 | | | 1.700 | % | | | 1,000,000 | | | | 1,019,700 | | |

| Total | | | | | | | 16,486,963 | | |

| Property & Casualty 1.6% | |

Allstate Life Global Funding Trusts

Senior Secured

04/30/13 | | | 5.375 | % | | | 4,005,000 | | | | 4,153,021 | | |

Berkshire Hathaway Finance Corp.(b)

01/10/14 | | | 0.788 | % | | | 4,600,000 | | | | 4,617,935 | | |

Berkshire Hathaway, Inc.

Senior Unsecured

08/15/14 | | | 1.167 | % | | | 10,000,000 | | | | 10,131,470 | | |

Liberty Mutual Group, Inc.(a)

09/01/12 | | | 7.250 | % | | | 3,225,000 | | | | 3,240,034 | | |

| Total | | | | | | | 22,142,460 | | |

| Railroads 0.7% | |

Union Pacific Corp.

Senior Unsecured

01/31/13 | | | 5.450 | % | | | 10,000,000 | | | | 10,240,100 | | |

| Refining 0.7% | |

Valero Energy Corp.

06/15/13 | | | 4.750 | % | | | 8,800,000 | | | | 9,086,370 | | |

| Retailers 1.3% | |

Best Buy Co., Inc.

Senior Unsecured

07/15/13 | | | 6.750 | % | | | 5,000,000 | | | | 5,199,000 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

9

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Corporate Bonds & Notes (continued)

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

CVS Caremark Corp.

Senior Unsecured

09/15/14 | | | 4.875 | % | | | 8,000,000 | | | | 8,688,272 | | |

Target Corp.

Senior Unsecured

07/18/14 | | | 1.125 | % | | | 3,950,000 | | | | 3,996,578 | | |

| Total | | | | | | | 17,883,850 | | |

| Supermarkets 1.1% | |

Kroger Co. (The)

02/01/13 | | | 5.500 | % | | | 2,000,000 | | | | 2,047,310 | | |

| 04/15/13 | | | 5.000 | % | | | 5,000,000 | | | | 5,141,985 | | |

Safeway, Inc.

Senior Unsecured

03/15/14 | | | 6.250 | % | | | 6,974,000 | | | | 7,452,368 | | |

| Total | | | | | | | 14,641,663 | | |

| Technology 2.3% | |

Hewlett-Packard Co.

Senior Unsecured

05/30/14 | | | 1.550 | % | | | 3,000,000 | | | | 3,023,280 | | |

Hewlett-Packard Co.(b)

Senior Unsecured

09/19/14 | | | 2.018 | % | | | 5,000,000 | | | | 5,063,510 | | |

International Business Machines Corp.

Senior Unsecured

02/06/15 | | | 0.550 | % | | | 4,950,000 | | | | 4,954,930 | | |

International Business Machines Corp.(c)

Senior Unsecured

05/11/15 | | | 0.750 | % | | | 7,500,000 | | | | 7,545,338 | | |

Xerox Corp.

Senior Unsecured

09/13/13 | | | 1.868 | % | | | 7,950,000 | | | | 8,002,812 | | |

Xerox Corp.(b)

Senior Unsecured

05/16/14 | | | 1.286 | % | | | 3,000,000 | | | | 2,990,265 | | |

| Total | | | | | | | 31,580,135 | | |

| Transportation Services 0.5% | |

ERAC U.S.A. Finance LLC(a)

01/10/14 | | | 2.250 | % | | | 7,000,000 | | | | 7,072,387 | | |

| Wireless 0.6% | |

Cellco Partnership/Verizon Wireless Capital LLC

Senior Unsecured

02/01/14 | | | 5.550 | % | | | 7,500,000 | | | | 8,020,140 | | |

| Wirelines 2.4% | |

AT&T, Inc.

Senior Unsecured(c)

02/13/15 | | | 0.875 | % | | | 5,000,000 | | | | 5,040,735 | | |

Corporate Bonds & Notes (continued)

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

BellSouth Corp.

Senior Unsecured

09/15/14 | | | 5.200 | % | | | 3,000,000 | | | | 3,271,890 | | |

British Telecommunications PLC

Senior Unsecured(b)

12/20/13 | | | 1.593 | % | | | 10,000,000 | | | | 10,037,970 | | |

Telefonica Emisiones SAU(b)

02/04/13 | | | 0.772 | % | | | 10,000,000 | | | | 9,855,210 | | |

Verizon Communications, Inc.

Senior Unsecured

03/28/14 | | | 1.950 | % | | | 1,000,000 | | | | 1,023,517 | | |

Verizon Communications, Inc.(b)

Senior Unsecured

03/28/14 | | | 1.071 | % | | | 3,000,000 | | | | 3,025,530 | | |

| Total | | | | | | | 32,254,852 | | |

Total Corporate Bonds & Notes

(Cost: $615,795,212) | | | | | | | 618,885,678 | | |

Residential Mortgage-Backed Securities — Agency 0.8%

Federal Home Loan Mortgage Corp.(b)(e)

02/01/36 | | | 2.380 | % | | | 416,693 | | | | 444,123 | | |

Federal Home Loan Mortgage Corp.(e)

CMO Series 2534 Class EC

05/15/22 | | | 5.000 | % | | | 18,664 | | | | 18,658 | | |

CMO Series 2843 Class BA

01/15/18 | | | 5.000 | % | | | 883,266 | | | | 884,119 | | |

CMO Series 2958 Class QC

09/15/18 | | | 4.500 | % | | | 647,969 | | | | 651,517 | | |

CMO Series 3241 Class DC

07/15/34 | | | 4.500 | % | | | 1,420,865 | | | | 1,436,438 | | |

Federal National Mortgage Association(b)(e)

03/01/34 | | | 3.042 | % | | | 373,252 | | | | 398,032 | | |

Federal National Mortgage Association(e)

CMO Series 2008-68 Class AE

07/25/35 | | | 5.250 | % | | | 375,441 | | | | 376,220 | | |

CMO Series 2011-18 Class EM

06/25/37 | | | 4.000 | % | | | 6,220,927 | | | | 6,388,170 | | |

Total Residential Mortgage-Backed

Securities — Agency

(Cost: $10,677,116) | | | | | | | 10,597,277 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

10

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Residential Mortgage-Backed Securities — Non-Agency 0.7%

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Credit Suisse Mortgage Capital Certificates

CMO Series 2010-1R Class 21A1(a)(e)

01/27/36 | | | 2.587 | % | | | 1,142,831 | | | | 1,123,964 | | |

JPMorgan Reremic

CMO Series 2010-1 Class 1A1(a)(e)

02/26/37 | | | 6.000 | % | | | 2,301,087 | | | | 2,374,575 | | |

Morgan Stanley Reremic Trust

CMO Series 2010-R4 Class 1A(a)(b)(e)

01/26/36 | | | 0.576 | % | | | 971,123 | | | | 967,719 | | |

RBSSP Resecuritization Trust

CMO Series 2012-2 Class 1A5(a)(b)(e)

05/26/47 | | | 0.388 | % | | | 5,400,000 | | | | 5,312,251 | | |

Total Residential Mortgage-Backed

Securities — Non-Agency

(Cost: $9,749,266) | | | | | | | 9,778,509 | | |

Commercial Mortgage-Backed Securities — Agency 1.2%

Government National Mortgage Association(e)

CMO Series 2010-102 Class AB

07/16/32 | | | 1.852 | % | | | 5,397,872 | | | | 5,443,987 | | |

CMO Series 2010-13 Class A

08/16/22 | | | 2.461 | % | | | 4,813,992 | | | | 4,848,302 | | |

CMO Series 2010-83 Class A

10/16/50 | | | 2.021 | % | | | 5,300,511 | | | | 5,361,483 | | |

Total Commercial Mortgage-Backed

Securities — Agency

(Cost: $15,687,027) | | | | | | | 15,653,772 | | |

Commercial Mortgage-Backed Securities — Non-Agency 11.0%

Banc of America Commercial Mortgage, Inc.

Series 2004-3 Class A5(b)(e)

06/10/39 | | | 5.549 | % | | | 9,177,993 | | | | 9,822,711 | | |

Bear Stearns Commercial Mortgage Securities

Series 2003-T12 Class A4(e)

08/13/39 | | | 4.680 | % | | | 5,780,000 | | | | 5,951,192 | | |

Citigroup Commercial Mortgage Trust

Series 2005-C3 Class ASB(e)

05/15/43 | | | 4.755 | % | | | 2,858,965 | | | | 2,962,834 | | |

Commercial Mortgage Pass-Through Certificates

Series 2004-LB3A Class A5(e)

07/10/37 | | | 5.358 | % | | | 15,295,000 | | | | 16,412,560 | | |

Credit Suisse First Boston Mortgage Securities Corp.(b)(e)

Series 2003-C4 Class A4

08/15/36 | | | 5.137 | % | | | 9,301,355 | | | | 9,567,941 | | |

Commercial Mortgage-Backed Securities — Non-Agency (continued)

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Credit Suisse First Boston Mortgage Securities Corp.(e)

Series 2002-CP5 Class A2

12/15/35 | | | 4.940 | % | | | 2,688,339 | | | | 2,699,890 | | |

GS Mortgage Securities Corp. II

Series 2004-GG2 Class A6(e)

08/10/38 | | | 5.396 | % | | | 6,850,000 | | | | 7,314,642 | | |

Greenwich Capital Commercial Funding Corp.

Series 2004-GG1 Class A7(e)

06/10/36 | | | 5.317 | % | | | 10,233,000 | | | | 10,829,891 | | |

JPMorgan Chase Commercial Mortgage Securities Corp.(e)

Series 2003-CB6 Class A2

07/12/37 | | | 5.255 | % | | | 3,900,000 | | | | 4,025,986 | | |

Series 2003-ML1A Class A2

03/12/39 | | | 4.767 | % | | | 8,953,000 | | | | 9,072,919 | | |

LB-UBS Commercial Mortgage Trust(e)

Series 2002-C4 Class A5

09/15/31 | | | 4.853 | % | | | 121,956 | | | | 121,969 | | |

Series 2004-C6 Class A6

08/15/29 | | | 5.020 | % | | | 6,780,000 | | | | 7,238,247 | | |

Merrill Lynch Mortgage Trust(b)(e)

Series 2004-BPC1 Class A5

10/12/41 | | | 4.855 | % | | | 6,395,000 | | | | 6,860,332 | | |

Merrill Lynch Mortgage Trust(e)

Series 2003-KEY1 Class A4

11/12/35 | | | 5.236 | % | | | 9,370,000 | | | | 9,780,443 | | |

Morgan Stanley Capital I, Inc.(e)

Series 2003-T11 Class A4

06/13/41 | | | 5.150 | % | | | 11,445,304 | | | | 11,774,837 | | |

Series 2004-T13 Class A4

09/13/45 | | | 4.660 | % | | | 4,434,000 | | | | 4,615,195 | | |

Morgan Stanley Dean Witter Capital I

Series 2002-IQ3 Class A4(e)

09/15/37 | | | 5.080 | % | | | 3,376,129 | | | | 3,395,362 | | |

Wachovia Bank Commercial Mortgage Trust(b)(e)

Series 2004-C14 Class A4

08/15/41 | | | 5.088 | % | | | 7,500,000 | | | | 8,026,628 | | |

Wachovia Bank Commercial Mortgage Trust(e)

Series 2003-C3 Class A2

02/15/35 | | | 4.867 | % | | | 8,414,400 | | | | 8,499,167 | | |

Series 2004-C10 Class A4

02/15/41 | | | 4.748 | % | | | 10,363,721 | | | | 10,872,455 | | |

Total Commercial Mortgage-Backed

Securities — Non-Agency

(Cost: $151,413,716) | | | | | | | 149,845,201 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

11

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Asset-Backed Securities — Non-Agency 16.3%

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Ally Auto Receivables Trust

Series 2010-1 Class A3

05/15/14 | | | 1.450 | % | | | 1,064,367 | | | | 1,067,616 | | |

Series 2012-3 Class A2

01/15/15 | | | 0.700 | % | | | 9,900,000 | | | | 9,917,199 | | |

Ally Master Owner Trust

Series 2011-4 Class A2

09/15/16 | | | 1.540 | % | | | 5,110,000 | | | | 5,159,363 | | |

AmeriCredit Automobile Receivables Trust

Series 2012-1 Class A2

10/08/15 | | | 0.910 | % | | | 2,000,000 | | | | 2,005,836 | | |

BMW Vehicle Lease Trust

Series 2010-1 Class A3

04/15/13 | | | 0.820 | % | | | 754,492 | | | | 754,729 | | |

BMW Vehicle Owner Trust

Series 2011-A Class A3

08/25/15 | | | 0.760 | % | | | 3,964,000 | | | | 3,977,799 | | |

CIT Education Loan Trust

Series 2005-1 Class A2(b)

03/15/22 | | | 0.558 | % | | | 2,871,651 | | | | 2,863,085 | | |

CNH Equipment Trust

Series 2009-B Class A4

10/15/14 | | | 5.170 | % | | | 3,046,899 | | | | 3,062,735 | | |

Series 2011-B Class A3

08/15/16 | | | 0.910 | % | | | 2,487,000 | | | | 2,497,394 | | |

Series 2012-B Class A2

10/15/15 | | | 0.650 | % | | | 5,000,000 | | | | 5,002,409 | | |

Capital Auto Receivables Asset Trust

Series 2008-A Class B(a)

01/15/15 | | | 6.890 | % | | | 7,000,000 | | | | 7,208,446 | | |

Capital One Multi-Asset Execution Trust

Series 2007-A8 Class A8(b)

10/15/15 | | | 0.768 | % | | | 10,000,000 | | | | 10,007,260 | | |

Chesapeake Funding LLC(a)(b)

Series 2009-2A Class A

09/15/21 | | | 1.999 | % | | | 4,196,723 | | | | 4,230,297 | | |

Series 2012-1A Class A

11/07/23 | | | 0.996 | % | | | 5,000,000 | | | | 4,999,999 | | |

Conn Funding II LP

CMO Series 2012-AA Class A(a)

04/15/16 | | | 4.133 | % | | | 4,044,164 | | | | 4,034,053 | | |

DT Auto Owner Trust(a)

Series 2011-2A Class C

02/16/16 | | | 3.050 | % | | | 3,000,000 | | | | 3,000,960 | | |

Series 2011-3A Class A

08/15/14 | | | 1.400 | % | | | 2,480,101 | | | | 2,488,504 | | |

Discover Card Master Trust

Series 2010-A1 Class A1(b)

09/15/15 | | | 0.899 | % | | | 8,500,000 | | | | 8,528,373 | | |

Enterprise Fleet Financing LLC

Series 2011-2 Class A2(a)

10/20/16 | | | 1.430 | % | | | 5,049,349 | | | | 5,065,343 | | |

Asset-Backed Securities — Non-Agency (continued)

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Ford Credit Auto Lease Trust

Series 2011-A Class A3

07/15/14 | | | 1.030 | % | | | 2,890,000 | | | | 2,901,661 | | |

Ford Credit Auto Lease Trust(a)

Series 2010-B Class A3

07/15/13 | | | 0.910 | % | | | 916,025 | | | | 916,280 | | |

Ford Credit Auto Owner Trust

Series 2012-C Class A2

04/15/15 | | | 0.470 | % | | | 4,000,000 | | | | 4,000,299 | | |

Ford Credit Floorplan Master Owner Trust

Series 2010-5 Class A1

09/15/15 | | | 1.500 | % | | | 8,175,000 | | | | 8,184,313 | | |

Ford Credit Floorplan Master Owner Trust(a)(b)

Series 2010-1 Class A

12/15/14 | | | 1.899 | % | | | 10,000,000 | | | | 10,053,212 | | |

GE Equipment Midticket LLC

Series 2011-1 Class A2

05/22/14 | | | 0.720 | % | | | 3,679,312 | | | | 3,679,058 | | |

GE Equipment Small Ticket LLC

Series 2012-1A Class A2(a)

11/21/14 | | | 0.850 | % | | | 6,000,000 | | | | 5,972,843 | | |

Great America Leasing Receivables

Series 2011-1 Class A2(a)

03/15/13 | | | 1.050 | % | | | 713,142 | | | | 713,257 | | |

Harley-Davidson Motorcycle Trust

Series 2012-1 Class A2

08/15/15 | | | 0.500 | % | | | 4,000,000 | | | | 4,000,553 | | |

Hyundai Auto Lease Securitization Trust

Series 2012-A Class A2(a)

01/15/15 | | | 0.680 | % | | | 4,500,000 | | | | 4,478,235 | | |

Hyundai Auto Receivables Trust

Series 2012-B Class A2

01/15/15 | | | 0.540 | % | | | 6,000,000 | | | | 6,000,718 | | |

Leaf II Receivables Funding LLC(a)

Series 2010-4 Class A

08/20/18 | | | 1.700 | % | | | 894,091 | | | | 891,408 | | |

Series 2011-1 Class A

12/20/18 | | | 1.700 | % | | | 2,204,737 | | | | 2,178,721 | | |

Louisiana Public Facilities Authority

Series 2011-A Class A1(b)

04/26/21 | | | 0.951 | % | | | 460,794 | | | | 461,043 | | |

Mercedes-Benz Auto Lease Trust

Series 2012-A Class A3

11/17/14 | | | 0.880 | % | | | 10,000,000 | | | | 10,043,238 | | |

Navistar Financial Dealer Note Master Trust

Series 2011-1 Class A(a)(b)

10/25/16 | | | 1.396 | % | | | 2,500,000 | | | | 2,518,568 | | |

New York City Tax Lien

Series 2011-AA Class A(a)

12/10/24 | | | 1.990 | % | | | 2,503,573 | | | | 2,503,956 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

12

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Asset-Backed Securities — Non-Agency (continued)

| Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Nissan Auto Receivables Owner Trust

Series 2012-B Class A2(d)

04/01/15 | | | 0.390 | % | | | 6,000,000 | | | | 5,999,554 | | |

Oncor Electric Delivery Transition Bond Co. LLC

Series 2004-1 Class A2

11/17/14 | | | 4.810 | % | | | 87,800 | | | | 88,902 | | |

Panhandle-Plains Higher Education Authority, Inc.

Series 2011-1 Class A1(b)

10/01/18 | | | 0.961 | % | | | 1,103,983 | | | | 1,105,418 | | |

SLM Student Loan Trust(a)(b)

Series 2011-A Class A1

10/15/24 | | | 1.249 | % | | | 1,946,672 | | | | 1,944,116 | | |

Series 2011-B Class A1

12/16/24 | | | 1.099 | % | | | 4,105,236 | | | | 4,088,515 | | |

Series 2012-B Class A1

12/15/21 | | | 1.349 | % | | | 1,776,103 | | | | 1,776,103 | | |

SMART Trust(a)

Series 2011-2USA Class A2A

11/14/13 | | | 1.220 | % | | | 3,463,200 | | | | 3,467,076 | | |

Series 2012-1USA Class A2A

09/14/14 | | | 1.040 | % | | | 4,000,000 | | | | 4,018,410 | | |

Santander Drive Auto Receivables Trust

Series 2010-2 Class A2

08/15/13 | | | 0.950 | % | | | 208,182 | | | | 208,234 | | |

Series 2012-1 Class A2

04/15/15 | | | 1.250 | % | | | 2,924,709 | | | | 2,936,201 | | |

Series 2012-2 Class A2

05/15/15 | | | 0.910 | % | | | 4,200,000 | | | | 4,210,049 | | |

Series 2012-3 Class A2

04/15/15 | | | 0.830 | % | | | 4,230,000 | | | | 4,236,101 | | |

Series 2012-4 Class A2

08/17/15 | | | 0.790 | % | | | 5,000,000 | | | | 4,978,776 | | |

Silverleaf Finance LLC

Series 2010-A Class A(a)

07/15/22 | | | 5.360 | % | | | 1,403,644 | | | | 1,421,300 | | |

Toyota Auto Receivables Owner Trust

Series 2012-A Class A2

10/15/14 | | | 0.570 | % | | | 7,500,000 | | | | 7,506,319 | | |

Utah State Board of Regents

Series 2011-1 Class A1(b)

05/01/23 | | | 0.945 | % | | | 8,441,175 | | | | 8,441,175 | | |

Volkswagen Auto Lease Trust

Series 2010-A Class A3

11/20/13 | | | 0.990 | % | | | 2,901,418 | | | | 2,906,745 | | |

Series 2012-A Class A2

11/20/14 | | | 0.660 | % | | | 8,000,000 | | | | 7,960,273 | | |

Total Asset-Backed Securities — Non-Agency

(Cost: $222,367,354) | | | | | | | 222,662,030 | | |

U.S. Treasury Obligations 4.5%

| Issue | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

U.S. Treasury

03/15/15 | | | 0.375 | % | | | 12,000,000 | | | | 12,034,692 | | |

U.S. Treasury(c)

01/31/14 | | | 0.250 | % | | | 20,000,000 | | | | 20,010,940 | | |

| 02/28/14 | | | 0.250 | % | | | 30,000,000 | | | | 30,017,580 | | |

Total U.S. Treasury Obligations

(Cost: $61,864,453) | | | | | | | 62,063,212 | | |

Municipal Bonds 4.5%

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Citizens Property Insurance Corp.(b)

Revenue Bonds

High Risk

Series 2010A3

06/01/13 | | | 1.890 | % | | | 5,000,000 | | | | 5,045,050 | | |

Personal & Commercial Lines

Series 2012

06/01/15 | | | 1.390 | % | | | 5,000,000 | | | | 5,001,200 | | |

City of Baton Rouge/Parish of East Baton Rouge

Refunding Revenue Bonds

Taxable

Series 2012

01/15/15 | | | 1.239 | % | | | 1,000,000 | | | | 1,006,360 | | |

County of Orange

Revenue Bonds

Series 2012A

08/01/12 | | | 0.750 | % | | | 3,500,000 | | | | 3,500,032 | | |

Florida Hurricane Catastrophe Fund Finance Corp.

Revenue Bonds

Series 2007A(b)

10/15/12 | | | 1.029 | % | | | 16,000,000 | | | | 16,000,160 | | |

Illinois Municipal Electric Agency

Taxable Revenue Bonds

Series 2009B

02/01/13 | | | 4.160 | % | | | 750,000 | | | | 757,905 | | |

Kentucky State Property & Building Commission

Revenue Bonds

Taxable Project No. 78

Series 2003 (NPFGC)

10/01/12 | | | 4.800 | % | | | 2,450,000 | | | | 2,466,880 | | |

New York State Energy Research & Development Authority

Revenue Bonds

Consolidated Edison Co., Inc. Project

Series 2010 AMT(f)

06/01/36 | | | 1.450 | % | | | 4,210,000 | | | | 4,220,567 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

13

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

State of Illinois

Unlimited General Obligation Bonds

Series 2004B

03/01/13 | | | 5.000 | % | | | 7,400,000 | | | | 7,595,952 | | |

Unlimited General Obligation Taxable Bonds

Series 2010

01/01/13 | | | 3.321 | % | | | 3,500,000 | | | | 3,538,220 | | |

State of New Jersey

Certificate of Participation

Equipment Lease Purchase

Series 2004A

06/15/14 | | | 5.000 | % | | | 5,000,000 | | | | 5,377,650 | | |

University of California

Revenue Bonds

Taxable

Series 2011Y-1(b)

07/01/41 | | | 0.826 | % | | | 5,000,000 | | | | 4,988,500 | | |

West Virginia Economic Development Authority

Revenue Bonds

Appalachian Power Co.-Amos Project

Series 2011A AMT(f)

01/01/41 | | | 2.250 | % | | | 2,000,000 | | | | 2,000,000 | | |

Total Municipal Bonds

(Cost: $61,269,798) | | | | | | | 61,498,476 | | |

Money Market Funds —%

| | | Shares | | Value ($) | |

Columbia Short-Term Cash Fund,

0.153%(g)(h) | | | 27,934 | | | | 27,934 | | |

Total Money Market Funds

(Cost: $27,934) | | | | | 27,934 | | |

Commercial Paper 17.4%

| Issuer | | Effective

Yield | | Principal

Amount ($) | | Value ($) | |

| Automotive 1.1% | |

Ford Motor Credit Co.(a)

08/29/12 | | | 1.150 | % | | | 15,000,000 | | | | 14,986,346 | | |

| Electric 6.0% | |

American Electric Power Co.(a)

08/08/12 | | | 0.390 | % | | | 15,000,000 | | | | 14,998,733 | | |

Duke Energy Corp.(a)

08/10/12 | | | 0.430 | % | | | 10,000,000 | | | | 9,998,834 | | |

| 08/15/12 | | | 0.490 | % | | | 19,100,000 | | | | 19,096,180 | | |

Commercial Paper (continued)

| Issuer | | Effective

Yield | | Principal

Amount ($) | | Value ($) | |

Pacific Gas & Electric Co.(a)

08/06/12 | | | 0.370 | % | | | 20,500,000 | | | | 20,498,770 | | |

| 08/07/12 | | | 0.470 | % | | | 10,000,000 | | | | 9,999,091 | | |

| 08/08/12 | | | 0.330 | % | | | 8,000,000 | | | | 7,999,413 | | |

| Total | | | | | | | 82,591,021 | | |

| Gas Distributors 2.8% | |

Michigan Consolidated Gas Co.

08/03/12 | | | 0.380 | % | | | 23,200,000 | | | | 23,199,285 | | |

| 08/06/12 | | | 0.390 | % | | | 4,300,000 | | | | 4,299,728 | | |

| 08/09/12 | | | 0.410 | % | | | 10,900,000 | | | | 10,898,910 | | |

| Total | | | | | | | 38,397,923 | | |

| Gas Pipelines 0.9% | |

Kinder Morgan Energy Partners LP(a)

08/02/12 | | | 0.350 | % | | | 12,700,000 | | | | 12,699,753 | | |

| Independent Energy 1.3% | |

Apache Corp.(a)

08/06/12 | | | 0.420 | % | | | 10,000,000 | | | | 9,999,317 | | |

Devon Energy Corp.(a)

08/13/12 | | | 0.340 | % | | | 7,100,000 | | | | 7,099,128 | | |

| Total | | | | | | | 17,098,445 | | |

| Integrated Energy 1.5% | |

Suncor Energy Inc.(a)

08/13/12 | | | 0.340 | % | | | 5,000,000 | | | | 4,999,386 | | |

| 08/16/12 | | | 0.330 | % | | | 15,000,000 | | | | 14,997,800 | | |

| Total | | | | | | | 19,997,186 | | |

| Media Non-Cable 1.6% | |

Reed Elsevier, Inc.(a)

08/02/12 | | | 0.430 | % | | | 15,000,000 | | | | 14,999,650 | | |

| 08/03/12 | | | 0.430 | % | | | 7,300,000 | | | | 7,299,745 | | |

| Total | | | | | | | 22,299,395 | | |

| Wirelines 2.2% | |

Verizon Communications, Inc.(a)

08/01/12 | | | 0.300 | % | | | 30,000,000 | | | | 29,999,750 | | |

Total Commercial Paper

(Cost: $238,072,843) | | | | | | | 238,069,819 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

14

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Investments of Cash Collateral Received for Securities on Loan 1.8%

| Issuer | | Effective

Yield | | Par ($)/

Principal ($)/

Shares | | Value ($) | |

| Repurchase Agreements 1.8% | |

Mizuho Securities USA, Inc.

dated 07/31/12,

matures 08/01/12,

repurchase price

$10,000,058(i) | | | 0.210 | % | | | 10,000,000 | | | | 10,000,000 | | |

Natixis Financial Products, Inc.

dated 07/31/12,

matures 08/01/12,

repurchase price

$1,000,006(i) | | | 0.200 | % | | | 1,000,000 | | | | 1,000,000 | | |

Nomura Securities

dated 07/31/12,

matures 08/01/12,

repurchase price

$5,000,028(i) | | | 0.200 | % | | | 5,000,000 | | | | 5,000,000 | | |

Royal Bank of Canada

dated 07/31/12,

matures 08/01/12,

repurchase price

$8,715,371(i) | | | 0.190 | % | | | 8,715,325 | | | | 8,715,325 | | |

| Total | | | | | | | 24,715,325 | | |

Total Investments of Cash Collateral

Received for Securities on Loan

(Cost: $24,715,325) | | | | | | | 24,715,325 | | |

Total Investments

(Cost: $1,411,640,044) | | | | | | | 1,413,797,233 | | |

| Other Assets & Liabilities, Net | | | | | | | (48,005,271 | ) | |

| Net Assets | | | | | | | 1,365,791,962 | | |

Notes to Portfolio of Investments

(a) Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At July 31, 2012, the value of these securities amounted to $387,492,115 or 28.37% of net assets.

(b) Variable rate security. The interest rate shown reflects the rate as of July 31, 2012.

(c) At July 31, 2012, security was partially or fully on loan.

(d) Represents a security purchased on a when-issued or delayed delivery basis.

(e) The maturity dates shown represent the original maturity of the underlying obligation. Actual maturity may vary based upon prepayment activity on these obligations. Unless otherwise noted, the coupon rates presented are fixed rates.

(f) Income from this security may be subject to alternative minimum tax.

(g) The rate shown is the seven-day current annualized yield at July 31, 2012.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

15

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Notes to Portfolio of Investments (continued)

(h) As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of its outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended July 31, 2012, are as follows:

| Issuer | | Beginning

Cost ($) | | Purchase

Cost ($) | | Sales Cost/

Proceeds

from Sales ($) | | Realized

Gain/Loss ($) | | Ending

Cost ($) | | Dividends

or Interest

Income ($) | | Value ($) | |

Columbia

Short-Term

Cash Fund | | | — | | | | 33,617,869 | | | | (33,589,935 | ) | | | — | | | | 27,934 | | | | 310 | | | | 27,934 | | |

(i) The table below represents securities received as collateral for repurchase agreements. This collateral is deposited with the Fund's custodian and, pursuant to the terms of the repurchase agreement, must have an aggregate value greater than or equal to the repurchase price plus accrued interest at all times. The value of securities and/or cash held as collateral for repurchase agreements is monitored on a daily basis to ensure the proper level of collateral.

| Security Description | | Value ($) | |

| Mizuho Securities USA, Inc. (0.210%) | |

| Fannie Mae Pool | | | 4,615,872 | | |

| Freddie Mac Gold Pool | | | 66,141 | | |

| Freddie Mac Non Gold Pool | | | 437,748 | | |

| Freddie Mac REMICS | | | 798,596 | | |

| Ginnie Mae I Pool | | | 249,413 | | |

| Ginnie Mae II Pool | | | 4,032,230 | | |

| Total Market Value of Collateral Securities | | | 10,200,000 | | |

| Security Description | | Value ($) | |

| Natixis Financial Products, Inc. (0.200%) | |

| Ginnie Mae | | | 6,836 | | |

| Fannie Mae Pool | | | 152,577 | | |

| Fannie Mae REMICS | | | 317,638 | | |

| Federal National Mortgage Association | | | 34,605 | | |

| Freddie Mac Gold Pool | | | 11,209 | | |

| Freddie Mac Non Gold Pool | | | 32,055 | | |

| Freddie Mac REMICS | | | 226,636 | | |

| Government National Mortgage Association | | | 238,450 | | |

| Total Market Value of Collateral Securities | | | 1,020,006 | | |

| Security Description | | Value ($) | |

| Nomura Securities (0.200%) | |

| Ginnie Mae I Pool | | | 3,449,839 | | |

| Ginnie Mae II Pool | | | 1,650,161 | | |

| Total Market Value of Collateral Securities | | | 5,100,000 | | |

| Security Description | | Value ($) | |

| Royal Bank of Canada (0.190%) | |

| Fannie Mae Pool | | | 8,889,632 | | |

| Total Market Value of Collateral Securities | | | 8,889,632 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

16

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Abbreviation Legend

AMT Alternative Minimum Tax

CMO Collateralized Mortgage Obligation

NPFGC National Public Finance Guarantee Corporation

Fair Value Measurements

Generally accepted accounting principles (GAAP) require disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category.

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

> Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

> Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

> Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund's Board of Trustees (the Board), the Investment Manager's Valuation Committee (the Committee) is responsible for carrying out the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager's organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third-party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

17

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Fair Value Measurements (continued)

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The following table is a summary of the inputs used to value the Fund's investments at July 31, 2012:

| Description | | Level 1

Quoted Prices in

Active Markets for

Identical Assets ($) | | Level 2

Other Significant

Observable

Inputs ($) | | Level 3

Significant

Unobservable

Inputs ($) | | Total ($) | |

| Bonds | |

| Corporate Bonds & Notes | | | — | | | | 618,885,678 | | | | — | | | | 618,885,678 | | |

Residential Mortgage-Backed

Securities — Agency | | | — | | | | 10,597,277 | | | | — | | | | 10,597,277 | | |

Residential Mortgage-Backed

Securities — Non-Agency | | | — | | | | 4,466,258 | | | | 5,312,251 | | | | 9,778,509 | | |

Commercial Mortgage-Backed

Securities — Agency | | | — | | | | 15,653,772 | | | | — | | | | 15,653,772 | | |

Commercial Mortgage-Backed

Securities — Non-Agency | | | — | | | | 149,845,201 | | | | — | | | | 149,845,201 | | |

| Asset-Backed Securities — Non-Agency | | | — | | | | 215,557,847 | | | | 7,104,183 | | | | 222,662,030 | | |

| U.S. Treasury Obligations | | | 62,063,212 | | | | — | | | | — | | | | 62,063,212 | | |

| Municipal Bonds | | | — | | | | 61,498,476 | | | | — | | | | 61,498,476 | | |

| Total Bonds | | | 62,063,212 | | | | 1,076,504,509 | | | | 12,416,434 | | | | 1,150,984,155 | | |

| Short-Term Securities | |

| Commercial Paper | | | — | | | | 238,069,819 | | | | — | | | | 238,069,819 | | |

| Total Short-Term Securities | | | — | | | | 238,069,819 | | | | — | | | | 238,069,819 | | |

| Other | |

| Money Market Funds | | | 27,934 | | | | — | | | | — | | | | 27,934 | | |

Investments of Cash Collateral

Received for Securities on Loan | | | — | | | | 24,715,325 | | | | — | | | | 24,715,325 | | |

| Total Other | | | 27,934 | | | | 24,715,325 | | | | — | | | | 24,743,259 | | |

| Total | | | 62,091,146 | | | | 1,339,289,653 | | | | 12,416,434 | | | | 1,413,797,233 | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund's assets assigned to the Level 2 input category are generally valued using the market approach, in which a security's value is determined through reference to prices and information from market transactions for similar or identical assets.

There were no transfers of financial assets between Levels 1 and 2 during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

18

CMG Ultra Short Term Bond Fund

Portfolio of Investments (continued)

July 31, 2012

Fair Value Measurements (continued)

The following table is a reconciliation of Level 3 assets for which significant observable and/or unobservable inputs were used to determine fair value.

| | | Residential

Mortgage-Backed

Securities —

Non-Agency ($) | | Asset-Backed

Securities —

Non-Agency ($) | | Total ($) | |

| Balance as of July 31, 2011 | | | — | | | | — | | | | — | | |

| Accrued discounts/premiums | | | — | | | | 192,833 | | | | 192,833 | | |

| Realized gain (loss) | | | 17,833 | | | | — | | | | 17,833 | | |

| Change in unrealized appreciation (depreciation)(a) | | | 20,250 | | | | (5,251 | ) | | | 14,999 | | |

| Sales | | | (891,629 | ) | | | (9,372,730 | ) | | | (10,264,359 | ) | |

| Purchases | | | 6,165,797 | | | | 4,034,053 | | | | 10,199,850 | | |

| Transfers into Level 3 | | | — | | | | 12,255,278 | | | | 12,255,278 | | |

| Transfers out of Level 3 | | | — | | | | — | | | | — | | |

| Balance as of July 31, 2012 | | | 5,312,251 | | | | 7,104,183 | | | | 12,416,434 | | |

(a) Change in unrealized appreciation (depreciation) relating to securities held at July 31, 2012 was $14,999.

The Fund does not hold any significant investments with unobservable inputs which are categorized as Level 3.

The Fund's assets assigned to the Level 3 category are valued utilizing the valuation technique deemed the most appropriate in the circumstances. Certain Residential Mortgage and Asset Backed Securities classified as Level 3 are valued using the market approach and utilize single market quotations from broker dealers which may have included, but not limited to, the distressed nature of the security and observable transactions for similar assets in the market. Significant increases (decreases) to any of these inputs would result in a significantly lower (higher) fair value measurement.

Financial Assets were transferred from Level 2 to Level 3 due to unavailable market inputs. As a result, as of period end, management determined to fair value the security under consistently applied procedures established by and under the general supervision of the Board of Trustees.

Transfers in and/or out of Level 3 are determined based on the fair value at the beginning of the period for security positions held throughout the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

19

CMG Ultra Short Term Bond Fund

Statement of Assets and Liabilities

July 31, 2012

| Assets | |

| Investments, at value* | |

| Unaffiliated issuers (identified cost $1,386,896,785) | | $ | 1,389,053,974 | | |

| Affiliated issuers (identified cost $27,934) | | | 27,934 | | |

| Investment of cash collateral received for securities on loan | |

| Repurchase agreements (identified cost $24,715,325) | | | 24,715,325 | | |

| Total investments (identified cost $1,411,640,044) | | | 1,413,797,233 | | |

| Receivable for: | |

| Investments sold | | | 1,182 | | |

| Capital shares sold | | | 1,863,965 | | |

| Dividends | | | 37 | | |

| Interest | | | 5,040,932 | | |

| Expense reimbursement due from Investment Manager | | | 693 | | |

| Trustees' deferred compensation plan | | | 27,781 | | |

| Total assets | | | 1,420,731,823 | | |

| Liabilities | |

| Disbursements in excess of cash | | | 208,370 | | |

| Due upon return of securities on loan | | | 24,715,325 | | |

| Payable for: | |

| Investments purchased | | | 14,227,034 | | |

| Investments purchased on a delayed delivery basis | | | 10,999,554 | | |

| Capital shares purchased | | | 3,568,256 | | |

| Dividend distributions to shareholders | | | 1,134,150 | | |

| Investment management fees | | | 9,347 | | |

| Compensation of board members | | | 1,072 | | |

| Other expenses | | | 48,972 | | |

| Trustees' deferred compensation plan | | | 27,781 | | |

| Total liabilities | | | 54,939,861 | | |

| Net assets applicable to outstanding capital stock | | $ | 1,365,791,962 | | |

| Represented by | |

| Paid-in capital | | $ | 1,393,033,805 | | |

| Excess of distributions over net investment income | | | (836,354 | ) | |

| Accumulated net realized loss | | | (28,562,678 | ) | |

| Unrealized appreciation (depreciation) on: | |

| Investments | | | 2,157,189 | | |

| Total — representing net assets applicable to outstanding capital stock | | $ | 1,365,791,962 | | |

| Shares outstanding | | | 151,547,812 | | |

| Net asset value per share | | $ | 9.01 | | |

| *Value of securities on loan | | $ | 73,788,378 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

20

CMG Ultra Short Term Bond Fund

Statement of Operations

Year Ended July 31, 2012

| Net investment income | |

| Income: | |

| Interest | | $ | 12,900,981 | | |

| Dividends from affiliates | | | 310 | | |

| Income from securities lending — net | | | 25,856 | | |

| Total income | | | 12,927,147 | | |

| Expenses: | |

| Investment management fees | | | 2,729,842 | | |

| Compensation of board members | | | 47,830 | | |

| Professional fees | | | 95,611 | | |

| Total expenses | | | 2,873,283 | | |

| Fees waived or expenses reimbursed by Investment Manager and its affiliates | | | (146,116 | ) | |

| Total net expenses | | | 2,727,167 | | |

| Net investment income | | | 10,199,980 | | |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Investments | | | (581,851 | ) | |

| Net realized loss | | | (581,851 | ) | |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments | | | 943,137 | | |

| Net change in unrealized appreciation | | | 943,137 | | |

| Net realized and unrealized gain | | | 361,286 | | |

| Net increase in net assets resulting from operations | | $ | 10,561,266 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2012

21

CMG Ultra Short Term Bond Fund

Statement of Changes in Net Assets

| | | Year Ended

July 31,