UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Ryan Larrenaga

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 345-6611 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | October 31, 2015 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

October 31, 2015

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

Dear Shareholder,

Dear Shareholder,

Today's investors are typically focused on outcomes, like living a certain retirement lifestyle, paying for college education or building a legacy. But in today's complex global investment landscape, even simple goals are not easily achieved.

At Columbia Threadneedle Investments, we aspire to help satisfy five core needs of today's investors:

n Generate an appropriate stream of income in retirement

Traditional approaches to generating income may not provide the diversification benefits they once did, and they may actually introduce unwanted risk in today's market. To seek to improve your potential to live comfortably long term, we endeavor to pursue investments that explore less traveled paths to income.

n Navigate a changing interest rate environment

Today's uncertain market environment includes the prospect of a rise in interest rates. Blending traditional investments with non-traditional or alternative products may help protect your wealth during periods of volatility. We can attempt to help strengthen your portfolio with agile products designed to take on the market's ups and downs.

n Maximize after-tax returns

In an environment where what you keep may be more important than what you earn, municipal bonds can help mitigate high tax burdens while providing potentially attractive yields. Our state and federal tax-exempt products are aimed at helping investors manage risk, minimize the fluctuation of capital and grow wealth on a more tax-efficient basis.

n Grow assets to achieve financial goals

We believe that finding and protecting growth comes from a disciplined security selection process designed to create excess return. Our goal is to provide investment solutions built to help you face today's market challenges and grow your assets at each crossroad of your journey.

n Ease the impact of volatile markets

Despite a bull market run that has benefited many investors over the past several years, it's important to remember the lessons of 2008 and the value that a well-diversified portfolio may provide through times of market volatility. We are here to help you hold onto the savings you have worked tirelessly to amass, and to provide you the best opportunity to maintain your standard of living regardless of market conditions.

Find out today how we can help you confidently invest to realize your dreams. Please visit us at blog.columbiathreadneedleus.com/our-best-ideas to learn more about our unique investment solutions.

The world is constantly changing, but our priority remains the same: to help you secure your finances, meet your goals and achieve success. Thank you for your continued investment with us.

Sincerely,

Christopher O. Petersen

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus and summary prospectus, which contains this and other important information about a fund, visit columbiathreadneedle.com/us. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2015 Columbia Management Investment Advisers, LLC. All rights reserved.

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

Performance Overview | | | 2 | | |

Manager Discussion of Fund Performance | | | 4 | | |

Understanding Your Fund's Expenses | | | 6 | | |

Portfolio of Investments | | | 7 | | |

Statement of Assets and Liabilities | | | 12 | | |

Statement of Operations | | | 14 | | |

Statement of Changes in Net Assets | | | 15 | | |

Financial Highlights | | | 17 | | |

Notes to Financial Statements | | | 23 | | |

Report of Independent Registered Public Accounting Firm | | | 30 | | |

Federal Income Tax Information | | | 31 | | |

Trustees and Officers | | | 32 | | |

Board Consideration and Approval of Advisory Agreement | | | 36 | | |

Important Information About This Report | | | 41 | | |

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit columbiathreadneedle.com/us or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

Performance Summary

n Columbia AMT-Free Connecticut Intermediate Muni Bond Fund (the Fund) Class A shares returned 1.60% excluding sales charges for the 12-month period that ended October 31, 2015. Class Z shares of the Fund returned 1.85%.

n The Fund's benchmark, the Barclays 3-15 Year Blend Municipal Bond Index, which is national in scope, returned 2.64% for the same time period.

n The Fund's positions in local general obligation, electric revenue and hospital bonds aided performance during the period, but the positive impact was offset by its duration positioning.

Average Annual Total Returns (%) (for period ended October 31, 2015)

| | | Inception | | 1 Year | | 5 Years | | 10 Years | |

Class A | | 11/18/02 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 1.60 | | | | 2.82 | | | | 3.40 | | |

Including sales charges | | | | | -1.43 | | | | 2.20 | | | | 3.09 | | |

Class B | | 11/18/02 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 0.84 | | | | 2.05 | | | | 2.63 | | |

Including sales charges | | | | | | | -2.12 | | | | 2.05 | | | | 2.63 | | |

Class C | | 11/18/02 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 1.14 | | | | 2.39 | | | | 2.99 | | |

Including sales charges | | | | | | | 0.16 | | | | 2.39 | | | | 2.99 | | |

Class R4* | | 03/19/13 | | | 1.86 | | | | 3.08 | | | | 3.67 | | |

Class T | | 06/26/00 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 1.72 | | | | 2.92 | | | | 3.51 | | |

Including sales charges | | | | | | | -3.10 | | | | 1.92 | | | | 3.01 | | |

Class Z | | 08/01/94 | | | 1.85 | | | | 3.08 | | | | 3.66 | | |

Barclays 3-15 Year Blend Municipal Bond Index | | | | | | | 2.64 | | | | 3.91 | | | | 4.70 | | |

Returns for Class A are shown with and without the maximum initial sales charge of 3.00%. The maximum applicable sales charge was reduced from 3.25% to 3.00% on Class A share purchases made on or after February 19, 2015. Class A returns (including sales charges) for all periods reflect the current maximum applicable sales charge of 3.00%. Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 3.00% in the first year, declining to 1.00% in the fourth year and eliminated thereafter. Returns for Class C are shown with and without the 1.00% CDSC for the first year only. Returns for Class T are shown with and without the maximum sales charge of 4.75%. The Fund's other classes are not subject to sales charges and have limited eligibility. Please see the Fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedle.com/us or calling 800.345.6611.

*The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedle.com/us/investment-products/mutual-funds/appended-performance for more information.

The Barclays 3-15 Year Blend Municipal Bond Index is an unmanaged index that tracks the performance of municipal bonds issued after December 31, 1990, with remaining maturities between 2 and 17 years and at least $7 million in principal amount outstanding.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Annual Report 2015

2

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

PERFORMANCE OVERVIEW (continued)

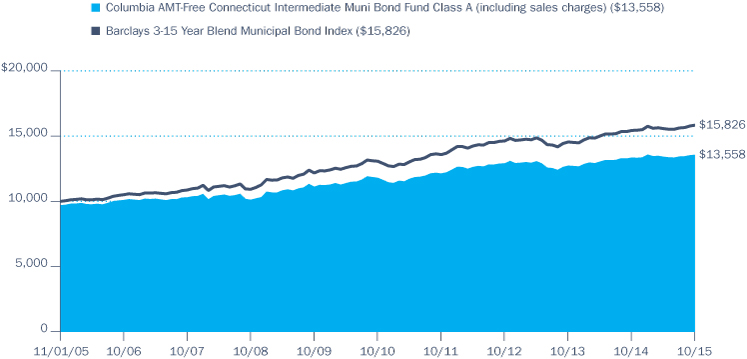

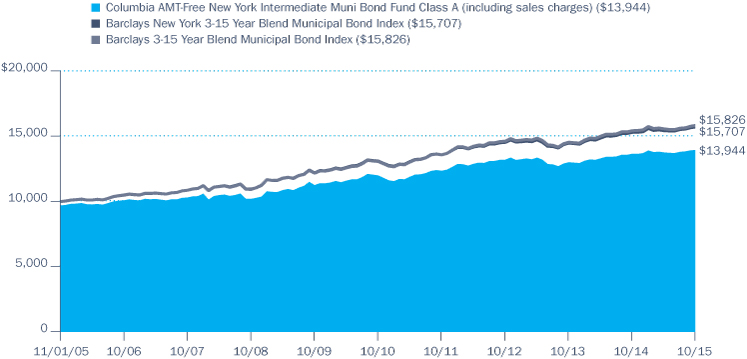

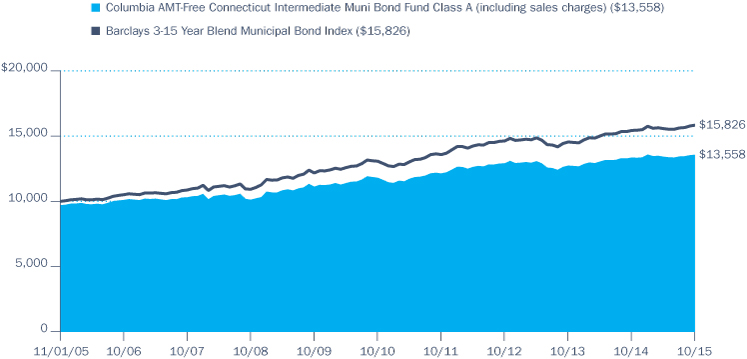

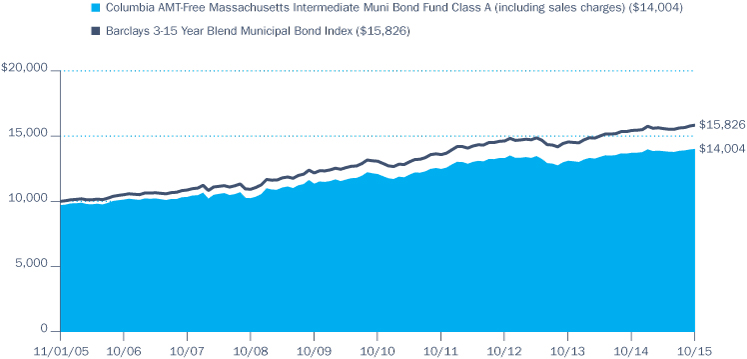

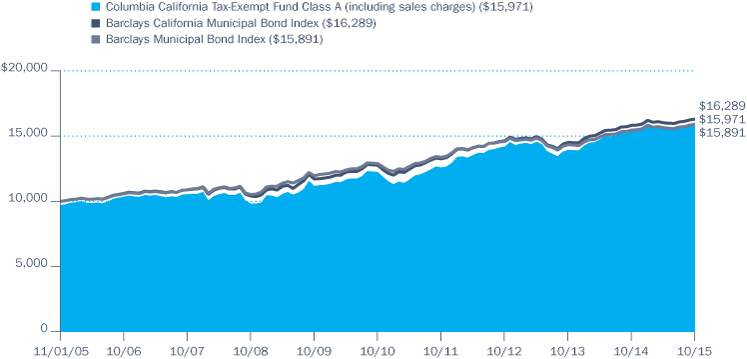

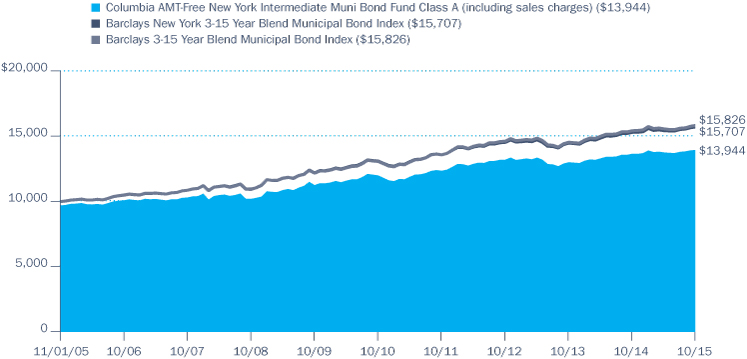

Performance of a Hypothetical $10,000 Investment (November 1, 2005 – October 31, 2015)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia AMT-Free Connecticut Intermediate Muni Bond Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares

Annual Report 2015

3

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

MANAGER DISCUSSION OF FUND PERFORMANCE

Portfolio Management

Brian McGreevy

Quality Breakdown (%)

(at October 31, 2015) | |

AAA rating | | | 8.0 | | |

AA rating | | | 38.3 | | |

A rating | | | 45.0 | | |

BBB rating | | | 2.7 | | |

Not rated | | | 6.0 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total fixed income investments (excluding Money Market Funds).

Bond ratings apply to the underlying holdings of the Fund and not the Fund itself and are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody's, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as "Not rated." Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. The ratings assigned by credit rating agencies are but one of the considerations that the Investment Manager and/or Fund's subadviser incorporates into its credit analysis process, along with such other issuer-specific factors as cash flows, capital structure and leverage ratios, ability to de-leverage (repay) through free cash flow, quality of management, market positioning and access to capital, as well as such security-specific factors as the terms of the security (e.g., interest rate and time to maturity) and the amount and type of any collateral.

The Fund's Class A shares returned 1.60% excluding sales charges during the 12-month period that ended October 31, 2015. Class Z shares of the Fund returned 1.85%. By comparison, the Fund's benchmark, the Barclays 3-15 Year Blend Municipal Bond Index — which is national in scope — returned 2.64% for the same time period. The Fund's positions in local general obligation, electric revenue and hospital bonds aided performance during the period, but the positive impact was offset by its duration positioning.

Market Overview

As the return of the benchmark would indicate, intermediate-term municipal bonds generated muted returns during the past 12 months. After a small rally in the first three months of the period, yields subsequently rose (as prices fell) in tandem with U.S. Treasuries through the first half of 2015. During this time, the municipal market was pressured by the impact that heavy new-issue supply had on prices. Refunding activity accounted for a large portion of the elevated supply, as issuers capitalized on the environment of low interest rates to refund higher-rated debt. The supply-and-demand equation improved in June, however, leading to a better tone in the market. Further, weaker economic data indicated that the U.S. Federal Reserve (Fed) could delay its first interest-rate increase, fueling a rally in both Treasuries and municipal bonds.

Connecticut's Economy Strengthened, but Pension Issues Weighed on its Bond Market

Connecticut continued to exhibit signs of improved economic performance during the period, but this did not translate to corresponding strength in its municipal bond market. The primary issue weighing on performance was the underfunding of the state's pension system, a topic that gained greater attention from investors during the period due to similar challenges in Illinois and New Jersey. As a result, Connecticut state general obligation bonds experienced widening yield spreads and underperformance relative to the national market. While there were no rating changes for Connecticut during the year, Standard & Poor's placed a negative outlook on the state's debt early in the year.

These developments obscured the continued economic improvement in the state. Connecticut has been experiencing a recovery on the strength of continued growth in the manufacturing and financial services sectors, which has contributed to falling unemployment and gains in wage growth. In fact, Moody's reported that financial services employment in the state has been growing at the fastest rate in ten years. In turn, these factors have fueled healthy increases in consumer spending. The state's housing market has also performed very well, leading to an increase in residential construction and an associated increase in employment within the homebuilding industry. While positive, these factors were not enough to offset the impact of concerns about pension obligations.

Annual Report 2015

4

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

New-issue supply was dominated by a few issuers during the past 12 months, including the state. Several hospitals and colleges came to market as well. There were many local general obligation issues, but a large portion of the issuance encompassed smaller-sized deals with structures that we did not feel offered much value to the Fund.

Contributors and Detractors

The Fund lagged the broader-market benchmark during the period, as would be expected given its concentration in the underperforming Connecticut market.

The Fund had slightly shorter duration than the benchmark; i.e., a lower sensitivity to interest-rate movements. Given that yields fell during the period as prices rose, this aspect of the Fund's positioning detracted from performance. The Fund's overweight in A rated bonds was a positive for performance, but its investments in the AA tier lagged due to its exposure to state general obligation bonds. Local general obligation debt, which currently comprises about 20% of the portfolio, produced results in line with the benchmark. On a sector basis, both electric revenue and hospital bonds produced above-average results. Some of the best performing bonds in the Fund for the year were its positions in longer maturity hospital issues. However, the Fund's holdings in the education sector underperformed their shorter average duration vs. the corresponding benchmark components. The unrated bonds of Stamford's Harbor Point Infrastructure Improvement District performed well as the project continued to build out.

Fund Positioning

In managing the Fund, we continue to emphasize bottom-up, issue-by-issue credit research and maintaining a competitive dividend yield for shareholders. As always, we intend to analyze what effects new purchases have on the portfolio, while seeking to manage capital gains in order to minimize tax consequences. We intend to monitor the ongoing budget and pensions issues in Connecticut, particularly as it regards some of the local general obligation issuers with pension shortfalls. We believe pension issues have the potential to lead to increased yield spreads if the rating agencies decide to enact downgrades.

Investment Risks

Fixed-income securities present issuer default risk. The fund invests substantially in municipal securities and will be affected by tax, legislative, regulatory, demographic or political changes, as well as changes impacting a state's financial, economic or other conditions. A relatively small number of tax-exempt issuers may necessitate the Fund investing more heavily in a single issuer and, therefore, be more exposed to the risk of loss than a fund that invests more broadly. The value of the Fund's portfolio may be more volatile than a more geographically diversified fund. Prepayment and extension risk exists as a loan, bond or other investment may be called, prepaid or redeemed before maturity and that similar yielding investments may not be available for purchase. A rise in interest rates may result in a price decline of fixed-income instruments held by the fund, negatively impacting its performance and NAV. Falling rates may result in the Fund investing in lower yielding debt instruments, lowering the Fund's income and yield. These risks may be heightened for longer maturity and duration securities. Non-investment-grade (high-yield or junk) securities present greater price volatility and more risk to principal and income than higher rated securities. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Federal and state tax rules apply to capital gain distributions and any gains or losses on sales. Income may be subject to state or local taxes. Liquidity risk is associated with the difficulty of selling underlying investments at a desirable time or price. See the Fund's prospectus for information on these and other risks.

Annual Report 2015

5

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

UNDERSTANDING YOUR FUND'S EXPENSES

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the "Actual" column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

May 1, 2015 – October 31, 2015

| | | Account Value at the Beginning

of the Period ($) | | Account Value at the End of the

Period ($) | | Expenses Paid During the

Period ($) | | Fund's Annualized

Expense Ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,011.20 | | | | 1,021.01 | | | | 4.08 | | | | 4.10 | | | | 0.81 | | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,007.40 | | | | 1,017.25 | | | | 7.85 | | | | 7.89 | | | | 1.56 | | |

Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,008.90 | | | | 1,018.75 | | | | 6.35 | | | | 6.38 | | | | 1.26 | | |

Class R4 | | | 1,000.00 | | | | 1,000.00 | | | | 1,012.40 | | | | 1,022.26 | | | | 2.83 | | | | 2.84 | | | | 0.56 | | |

Class T | | | 1,000.00 | | | | 1,000.00 | | | | 1,011.70 | | | | 1,021.51 | | | | 3.58 | | | | 3.60 | | | | 0.71 | | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,012.40 | | | | 1,022.26 | | | | 2.83 | | | | 2.84 | | | | 0.56 | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Annual Report 2015

6

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

PORTFOLIO OF INVESTMENTS

October 31, 2015

(Percentages represent value of investments compared to net assets)

Municipal Bonds 95.3%

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

DISPOSAL 1.1% | |

New Haven Solid Waste Authority

Revenue Bonds

Series 2008

06/01/23 | | | 5.125 | % | | | 1,520,000 | | | | 1,641,828 | | |

HIGHER EDUCATION 11.8% | |

Connecticut State Health & Educational Facility Authority

Refunding Revenue Bonds

Connecticut State University

Series 2014O

11/01/25 | | | 4.000 | % | | | 2,000,000 | | | | 2,278,820 | | |

Sacred Heart University

Series 2012H (AGM)

07/01/19 | | | 5.000 | % | | | 2,350,000 | | | | 2,667,790 | | |

Revenue Bonds

Fairfield University

Series 2008N

07/01/18 | | | 5.000 | % | | | 1,500,000 | | | | 1,648,035 | | |

07/01/22 | | | 5.000 | % | | | 2,500,000 | | | | 2,744,050 | | |

Quinnipiac University Health & Education

Series 2007 (NPFGC)

07/01/28 | | | 5.000 | % | | | 2,000,000 | | | | 2,181,700 | | |

Sacred Heart University

Series 2011G

07/01/20 | | | 5.000 | % | | | 1,190,000 | | | | 1,332,027 | | |

Trinity College

Series 1998F (NPFGC)

07/01/21 | | | 5.500 | % | | | 500,000 | | | | 563,150 | | |

Yale University

Series 1997T-1

07/01/29 | | | 4.700 | % | | | 4,800,000 | | | | 5,080,608 | | |

Total | | | | | | | 18,496,180 | | |

HOSPITAL 14.7% | |

Connecticut State Health & Educational Facility Authority

Revenue Bonds

Bridgeport Hospital

Series 2012D

07/01/22 | | | 5.000 | % | | | 1,400,000 | | | | 1,674,050 | | |

Hartford Healthcare

Series 2014E

07/01/34 | | | 5.000 | % | | | 2,360,000 | | | | 2,607,776 | | |

Health System Catholic East

Series 2010

11/15/29 | | | 4.750 | % | | | 3,420,000 | | | | 3,718,087 | | |

Hospital for Special Care

Series 2007C (AGM)

07/01/17 | | | 5.250 | % | | | 500,000 | | | | 536,560 | | |

07/01/20 | | | 5.250 | % | | | 1,235,000 | | | | 1,317,091 | | |

07/01/27 | | | 5.250 | % | | | 750,000 | | | | 791,138 | | |

Lawrence & Memorial Hospital

Series 2011S

07/01/31 | | | 5.000 | % | | | 2,000,000 | | | | 2,178,720 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

Middlesex Hospital

Series 2006M (AGM)

07/01/27 | | | 4.875 | % | | | 500,000 | | | | 526,360 | | |

Series 2011N

07/01/20 | | | 5.000 | % | | | 1,365,000 | | | | 1,566,365 | | |

07/01/21 | | | 5.000 | % | | | 1,000,000 | | | | 1,159,460 | | |

Western Connecticut Health Network

Series 2011

07/01/19 | | | 5.000 | % | | | 1,760,000 | | | | 1,959,742 | | |

07/01/20 | | | 5.000 | % | | | 1,630,000 | | | | 1,836,847 | | |

Yale-New Haven Health

Series 2014A

07/01/31 | | | 5.000 | % | | | 2,500,000 | | | | 2,854,500 | | |

Yale-New Haven Hospital

Series 2013N

07/01/25 | | | 5.000 | % | | | 300,000 | | | | 353,649 | | |

Total | | | | | | | 23,080,345 | | |

INVESTOR OWNED 3.5% | |

Connecticut State Development Authority

Refunding Revenue Bonds

Connecticut Light & Power Co. Project

Series 2011

09/01/28 | | | 4.375 | % | | | 5,000,000 | | | | 5,509,800 | | |

JOINT POWER AUTHORITY 0.7% | |

Connecticut Municipal Electric Energy Cooperative

Revenue Bonds

Series 2012A

01/01/27 | | | 5.000 | % | | | 1,000,000 | | | | 1,131,690 | | |

LOCAL GENERAL OBLIGATION 21.8% | |

City of Bridgeport

Unlimited General Obligation Bonds

Series 2014A (AGM)

07/01/31 | | | 5.000 | % | | | 1,350,000 | | | | 1,539,229 | | |

Unlimited General Obligation Refunding Bonds

Series 2004C (NPFGC)

08/15/17 | | | 5.250 | % | | | 1,500,000 | | | | 1,614,090 | | |

08/15/21 | | | 5.500 | % | | | 1,125,000 | | | | 1,338,233 | | |

City of Hartford

Unlimited General Obligation Bonds

Series 2011A

04/01/22 | | | 5.250 | % | | | 1,325,000 | | | | 1,547,176 | | |

04/01/23 | | | 5.250 | % | | | 1,325,000 | | | | 1,529,673 | | |

04/01/24 | | | 5.250 | % | | | 1,325,000 | | | | 1,528,546 | | |

Unlimited General Obligation Refunding Bonds

Series 2005C (NPFGC)

09/01/19 | | | 5.000 | % | | | 2,085,000 | | | | 2,361,513 | | |

Series 2013A

04/01/26 | | | 5.000 | % | | | 1,810,000 | | | | 2,086,876 | | |

City of Middletown

Unlimited General Obligation Bonds

Series 2015

04/01/26 | | | 5.000 | % | | | 2,000,000 | | | | 2,485,720 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

7

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2015

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

City of New Haven

Unlimited General Obligation Bonds

Series 2011 (AGM)

08/01/18 | | | 5.000 | % | | | 820,000 | | | | 906,576 | | |

Series 2015 (AGM)

09/01/27 | | | 5.000 | % | | | 1,200,000 | | | | 1,385,364 | | |

Unlimited General Obligation Refunding Bonds

Series 2008 (AGM)

11/01/18 | | | 5.000 | % | | | 4,410,000 | | | | 4,911,020 | | |

City of Stamford

Unlimited General Obligation Refunding Bonds

Series 2003B

08/15/17 | | | 5.250 | % | | | 1,125,000 | | | | 1,220,513 | | |

Town of Brookfield

Unlimited General Obligation Refunding Bonds

Series 2014

08/01/25 | | | 5.000 | % | | | 325,000 | | | | 408,291 | | |

Town of Fairfield

Unlimited General Obligation Refunding Bonds

Series 2008

01/01/20 | | | 5.000 | % | | | 1,000,000 | | | | 1,161,160 | | |

01/01/22 | | | 5.000 | % | | | 500,000 | | | | 602,415 | | |

Town of Hamden

Unlimited General Obligation Bonds

Series 2014A (BAM)

08/15/23 | | | 5.000 | % | | | 320,000 | | | | 376,464 | | |

Town of North Haven

Unlimited General Obligation Bonds

Series 2007

07/15/24 | | | 4.750 | % | | | 1,150,000 | | | | 1,383,082 | | |

07/15/25 | | | 4.750 | % | | | 1,150,000 | | | | 1,389,602 | | |

Town of Ridgefield

Unlimited General Obligation Refunding Bonds

Series 2009

09/15/20 | | | 5.000 | % | | | 2,130,000 | | | | 2,502,622 | | |

Town of Stratford

Unlimited General Obligation Refunding Bonds

Series 2014

12/15/32 | | | 5.000 | % | | | 600,000 | | | | 678,912 | | |

Town of Trumbull

Unlimited General Obligation Refunding Bonds

Series 2009

09/15/20 | | | 4.000 | % | | | 575,000 | | | | 633,903 | | |

09/15/21 | | | 4.000 | % | | | 600,000 | | | | 657,006 | | |

Total | | | | | | | 34,247,986 | | |

MULTI-FAMILY 1.4% | |

Bridgeport Housing Authority

Revenue Bonds

Custodial Receipts Energy Performance

Series 2009

06/01/22 | | | 5.000 | % | | | 1,035,000 | | | | 1,061,620 | | |

06/01/23 | | | 5.000 | % | | | 1,085,000 | | | | 1,109,955 | | |

Total | | | | | | | 2,171,575 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

MUNICIPAL POWER 0.2% | |

Guam Power Authority

Refunding Revenue Bonds

Series 2012A (AGM)(a)

10/01/24 | | | 5.000 | % | | | 315,000 | | | | 373,987 | | |

NURSING HOME 0.6% | |

Connecticut State Development Authority

Revenue Bonds

Alzheimers Resource Center, Inc. Project

Series 2007

08/15/17 | | | 5.200 | % | | | 455,000 | | | | 473,623 | | |

08/15/21 | | | 5.400 | % | | | 500,000 | | | | 517,935 | | |

Total | | | | | | | 991,558 | | |

PREP SCHOOL 3.4% | |

Connecticut State Health & Educational Facility Authority

Revenue Bonds

Greenwich Academy

Series 2007E (AGM)

03/01/26 | | | 5.250 | % | | | 2,770,000 | | | | 3,247,964 | | |

Loomis Chaffe School

Series 2005F (AMBAC)

07/01/27 | | | 5.250 | % | | | 1,670,000 | | | | 2,095,716 | | |

Total | | | | | | | 5,343,680 | | |

REFUNDED / ESCROWED 5.3% | |

City of Hartford

Unlimited General Obligation Bonds

Series 2009A Escrowed to Maturity (AGM)

08/15/17 | | | 5.000 | % | | | 695,000 | | | | 749,641 | | |

Connecticut Municipal Electric Energy Cooperative

Prerefunded 01/01/17 Revenue Bonds

Series 2006A (AMBAC)

01/01/22 | | | 5.000 | % | | | 2,000,000 | | | | 2,105,520 | | |

Revenue Bonds

Series 2009A Escrowed to Maturity (AGM)

01/01/17 | | | 5.000 | % | | | 1,525,000 | | | | 1,607,121 | | |

Connecticut State Health & Educational Facility Authority

Prerefunded 07/01/16 Revenue Bonds

Miss Porters School Issue

Series 2006B (AMBAC)

07/01/29 | | | 4.500 | % | | | 600,000 | | | | 616,674 | | |

Prerefunded 07/01/17 Revenue Bonds

Quinnipiac University

Series 2007I (NPFGC)

07/01/22 | | | 5.000 | % | | | 2,000,000 | | | | 2,146,980 | | |

Puerto Rico Highways & Transportation Authority

Refunding Revenue Bonds

Series 2005BB Escrowed to Maturity (AGM)(a)

07/01/22 | | | 5.250 | % | | | 895,000 | | | | 1,093,278 | | |

Total | | | | | | | 8,319,214 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

8

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2015

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

SINGLE FAMILY 1.7% | |

Connecticut Housing Finance Authority

Revenue Bonds

Subordinated Series 2008B-1

11/15/23 | | | 4.750 | % | | | 2,500,000 | | | | 2,638,750 | | |

SPECIAL NON PROPERTY TAX 8.9% | |

State of Connecticut Special Tax

Revenue Bonds

Transportation Infrastructure

Series 2009A

12/01/19 | | | 4.500 | % | | | 3,765,000 | | | | 4,265,067 | | |

Series 2014A

09/01/25 | | | 5.000 | % | | | 2,500,000 | | | | 3,024,275 | | |

State of Connecticut

Refunding Special Tax Bonds

2nd Lien Transportation Infrastructure

Series 2009-1

02/01/19 | | | 5.000 | % | | | 3,450,000 | | | | 3,894,015 | | |

Territory of Guam

Revenue Bonds

Series 2011A(a)

01/01/31 | | | 5.000 | % | | | 550,000 | | | | 603,389 | | |

Virgin Islands Public Finance Authority

Revenue Bonds

Matching Fund Loan Notes-Senior Lien

Series 2010A(a)

10/01/25 | | | 5.000 | % | | | 2,020,000 | | | | 2,254,340 | | |

Total | | | | | | | 14,041,086 | | |

SPECIAL PROPERTY TAX 1.8% | |

Harbor Point Infrastructure Improvement District

Tax Allocation Bonds

Harbor Point Project

Series 2010A

04/01/22 | | | 7.000 | % | | | 2,496,000 | | | | 2,882,356 | | |

STATE APPROPRIATED 4.3% | |

University of Connecticut

Revenue Bonds

Series 2007A

04/01/24 | | | 4.000 | % | | | 2,100,000 | | | | 2,186,205 | | |

Series 2009A

02/15/23 | | | 5.000 | % | | | 2,000,000 | | | | 2,237,140 | | |

Series 2015A

02/15/29 | | | 5.000 | % | | | 2,000,000 | | | | 2,343,420 | | |

Total | | | | | | | 6,766,765 | | |

Municipal Bonds (continued)

Issue

Description | | Coupon

Rate | | Principal

Amount ($) | |

Value ($) | |

STATE GENERAL OBLIGATION 8.1% | |

Connecticut Housing Finance Authority

Revenue Bonds

State Supported Special Obligation

Series 2009-10

06/15/18 | | | 5.000 | % | | | 1,755,000 | | | | 1,934,905 | | |

06/15/19 | | | 5.000 | % | | | 1,840,000 | | | | 2,087,130 | | |

State of Connecticut

Unlimited General Obligation Bonds

Series 2008B

04/15/22 | | | 5.000 | % | | | 5,415,000 | | | | 5,943,504 | | |

Unlimited General Obligation Refunding Bonds

Series 2005B (AMBAC)

06/01/20 | | | 5.250 | % | | | 600,000 | | | | 702,768 | | |

Series 2006E

12/15/20 | | | 5.000 | % | | | 2,000,000 | | | | 2,104,400 | | |

Total | | | | | | | 12,772,707 | | |

WATER & SEWER 6.0% | |

Greater New Haven Water Pollution Control Authority

Refunding Revenue Bonds

Series 2014B

08/15/31 | | | 5.000 | % | | | 1,000,000 | | | | 1,146,020 | | |

Metropolitan District (The)

Revenue Bonds

Clean Water Project

Series 2014A

11/01/27 | | | 5.000 | % | | | 1,000,000 | | | | 1,191,240 | | |

South Central Connecticut Regional Water Authority

Refunding Revenue Bonds

20th Series 2007A (NPFGC)

08/01/22 | | | 5.250 | % | | | 1,370,000 | | | | 1,653,837 | | |

08/01/23 | | | 5.250 | % | | | 500,000 | | | | 609,265 | | |

27th Series 2012

08/01/29 | | | 5.000 | % | | | 2,945,000 | | | | 3,333,239 | | |

29th Series 2014

08/01/25 | | | 5.000 | % | | | 500,000 | | | | 593,460 | | |

Revenue Bonds

18th Series 2003B (NPFGC)

08/01/29 | | | 5.250 | % | | | 750,000 | | | | 815,595 | | |

Total | | | | | | | 9,342,656 | | |

Total Municipal Bonds

(Cost: $139,982,888) | | | | | | | 149,752,163 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

9

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2015

Money Market Funds 1.7%

| | | Shares | | Value ($) | |

Dreyfus Tax-Exempt Cash

Management Fund,

Institutional Shares, 0.000%(b) | | | 2,600,070 | | | | 2,600,070 | | |

Total Money Market Funds

(Cost: $2,600,070) | | | | | 2,600,070 | | |

Total Investments

(Cost: $142,582,958) | | | | | 152,352,233 | | |

Other Assets & Liabilities, Net | | | | | 4,674,761 | | |

Net Assets | | | | | 157,026,994 | | |

Notes to Portfolio of Investments

(a) Municipal obligations include debt obligations issued by or on behalf of territories, possessions, or sovereign nations within the territorial boundaries of the United States. At October 31, 2015, the value of these securities amounted to $4,324,994 or 2.75% of net assets.

(b) The rate shown is the seven-day current annualized yield at October 31, 2015.

Abbreviation Legend

AGM Assured Guaranty Municipal Corporation

AMBAC Ambac Assurance Corporation

BAM Build America Mutual Assurance Co.

NPFGC National Public Finance Guarantee Corporation

Fair Value Measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset's or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

> Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

> Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

> Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

10

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

PORTFOLIO OF INVESTMENTS (continued)

October 31, 2015

Fair Value Measurements (continued)

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund's Board of Trustees (the Board), the Investment Manager's Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager's organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The following table is a summary of the inputs used to value the Fund's investments at October 31, 2015:

Description | | Level 1

Quoted Prices in Active

Markets for Identical

Assets ($) | | Level 2

Other Significant

Observable Inputs ($) | | Level 3

Significant

Unobservable Inputs ($) | | Total ($) | |

Investments | |

Municipal Bonds | | | — | | | | 149,752,163 | | | | — | | | | 149,752,163 | | |

Money Market Funds | | | 2,600,070 | | | | — | | | | — | | | | 2,600,070 | | |

Total Investments | | | 2,600,070 | | | | 149,752,163 | | | | — | | | | 152,352,233 | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund's assets assigned to the Level 2 input category are valued based upon utilizing observable market inputs, in which a security's value is determined through reference to prices and information from market transactions for similar or identical assets and/or fund per share market values which are not considered publicly available.

There were no transfers of financial assets between levels during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

11

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2015

Assets | |

Investments, at value | |

(identified cost $142,582,958) | | $ | 152,352,233 | | |

Cash | | | 3,230,988 | | |

Receivable for: | |

Capital shares sold | | | 94,253 | | |

Interest | | | 1,810,730 | | |

Expense reimbursement due from Investment Manager | | | 668 | | |

Prepaid expenses | | | 1,205 | | |

Trustees' deferred compensation plan | | | 34,222 | | |

Total assets | | | 157,524,299 | | |

Liabilities | |

Payable for: | |

Capital shares purchased | | | 18,874 | | |

Dividend distributions to shareholders | | | 388,209 | | |

Investment management fees | | | 1,720 | | |

Distribution and/or service fees | | | 234 | | |

Transfer agent fees | | | 24,267 | | |

Administration fees | | | 301 | | |

Chief compliance officer expenses | | | 6 | | |

Other expenses | | | 29,472 | | |

Trustees' deferred compensation plan | | | 34,222 | | |

Total liabilities | | | 497,305 | | |

Net assets applicable to outstanding capital stock | | $ | 157,026,994 | | |

Represented by | |

Paid-in capital | | $ | 146,832,911 | | |

Undistributed net investment income | | | 135,036 | | |

Accumulated net realized gain | | | 289,772 | | |

Unrealized appreciation (depreciation) on: | | | |

Investments | | | 9,769,275 | | |

Total — representing net assets applicable to outstanding capital stock | | $ | 157,026,994 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

12

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

STATEMENT OF ASSETS AND LIABILITIES (continued)

October 31, 2015

Class A | |

Net assets | | $ | 8,089,535 | | |

Shares outstanding | | | 741,378 | | |

Net asset value per share | | $ | 10.91 | | |

Maximum offering price per share(a) | | $ | 11.25 | | |

Class B | |

Net assets | | $ | 154,615 | | |

Shares outstanding | | | 14,169 | | |

Net asset value per share | | $ | 10.91 | | |

Class C | |

Net assets | | $ | 6,573,670 | | |

Shares outstanding | | | 602,449 | | |

Net asset value per share | | $ | 10.91 | | |

Class R4 | |

Net assets | | $ | 1,278,579 | | |

Shares outstanding | | | 117,341 | | |

Net asset value per share | | $ | 10.90 | | |

Class T | |

Net assets | | $ | 11,823,418 | | |

Shares outstanding | | | 1,084,727 | | |

Net asset value per share | | $ | 10.90 | | |

Maximum offering price per share(a) | | $ | 11.44 | | |

Class Z | |

Net assets | | $ | 129,107,177 | | |

Shares outstanding | | | 11,832,190 | | |

Net asset value per share | | $ | 10.91 | | |

(a) The maximum offering price per share is calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge of 3.00% for Class A and 4.75% for Class T.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

13

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

STATEMENT OF OPERATIONS

Year Ended October 31, 2015

Net investment income | |

Income: | |

Dividends | | $ | 63 | | |

Interest | | | 5,677,994 | | |

Total income | | | 5,678,057 | | |

Expenses: | |

Investment management fees | | | 634,771 | | |

Distribution and/or service fees | |

Class A | | | 18,037 | | |

Class B | | | 1,503 | | |

Class C | | | 62,280 | | |

Class T | | | 18,070 | | |

Transfer agent fees | |

Class A | | | 14,592 | | |

Class B | | | 304 | | |

Class C | | | 12,595 | | |

Class R4 | | | 1,650 | | |

Class T | | | 24,378 | | |

Class Z | | | 267,605 | | |

Administration fees | | | 111,085 | | |

Compensation of board members | | | 18,738 | | |

Custodian fees | | | 2,220 | | |

Printing and postage fees | | | 20,394 | | |

Registration fees | | | 31,071 | | |

Audit fees | | | 24,780 | | |

Legal fees | | | 5,145 | | |

Chief compliance officer expenses | | | 76 | | |

Other | | | 8,317 | | |

Total expenses | | | 1,277,611 | | |

Fees waived or expenses reimbursed by Investment Manager and its affiliates | | | (288,981 | ) | |

Fees waived by Distributor — Class C | | | (18,684 | ) | |

Expense reductions | | | (60 | ) | |

Total net expenses | | | 969,886 | | |

Net investment income | | | 4,708,171 | | |

Realized and unrealized gain (loss) — net | |

Net realized gain (loss) on: | |

Investments | | | 307,334 | | |

Net realized gain | | | 307,334 | | |

Net change in unrealized appreciation (depreciation) on: | |

Investments | | | (2,199,413 | ) | |

Net change in unrealized depreciation | | | (2,199,413 | ) | |

Net realized and unrealized loss | | | (1,892,079 | ) | |

Net increase in net assets resulting from operations | | $ | 2,816,092 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

14

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

STATEMENT OF CHANGES IN NET ASSETS

| | Year ended

October 31,

2015 | | Year ended

October 31,

2014 | |

Operations | |

Net investment income | | $ | 4,708,171 | | | $ | 5,184,083 | | |

Net realized gain | | | 307,334 | | | | 813,241 | | |

Net change in unrealized appreciation (depreciation) | | | (2,199,413 | ) | | | 2,345,718 | | |

Net increase in net assets resulting from operations | | | 2,816,092 | | | | 8,343,042 | | |

Distributions to shareholders | |

Net investment income | |

Class A | | | (199,743 | ) | | | (248,236 | ) | |

Class B | | | (3,036 | ) | | | (2,982 | ) | |

Class C | | | (144,467 | ) | | | (156,889 | ) | |

Class R4 | | | (24,930 | ) | | | (12,860 | ) | |

Class T | | | (348,467 | ) | | | (379,822 | ) | |

Class Z | | | (3,996,071 | ) | | | (4,374,518 | ) | |

Net realized gains | |

Class A | | | (15,020 | ) | | | — | | |

Class B | | | (286 | ) | | | — | | |

Class C | | | (12,022 | ) | | | — | | |

Class R4 | | | (959 | ) | | | — | | |

Class T | | | (23,917 | ) | | | — | | |

Class Z | | | (265,330 | ) | | | — | | |

Total distributions to shareholders | | | (5,034,248 | ) | | | (5,175,307 | ) | |

Decrease in net assets from capital stock activity | | | (5,557,652 | ) | | | (20,333,069 | ) | |

Total decrease in net assets | | | (7,775,808 | ) | | | (17,165,334 | ) | |

Net assets at beginning of year | | | 164,802,802 | | | | 181,968,136 | | |

Net assets at end of year | | $ | 157,026,994 | | | $ | 164,802,802 | | |

Undistributed net investment income | | $ | 135,036 | | | $ | 143,579 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

15

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Year Ended October 31, 2015 | | Year Ended October 31, 2014 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

Capital stock activity | |

Class A shares | |

Subscriptions(a) | | | 256,472 | | | | 2,794,955 | | | | 318,442 | | | | 3,480,852 | | |

Distributions reinvested | | | 16,539 | | | | 181,226 | | | | 19,947 | | | | 218,400 | | |

Redemptions | | | (228,753 | ) | | | (2,515,171 | ) | | | (471,961 | ) | | | (5,170,674 | ) | |

Net increase (decrease) | | | 44,258 | | | | 461,010 | | | | (133,572 | ) | | | (1,471,422 | ) | |

Class B shares | |

Subscriptions | | | 988 | | | | 10,750 | | | | 62 | | | | 682 | | |

Distributions reinvested | | | 230 | | | | 2,517 | | | | 210 | | | | 2,300 | | |

Redemptions(a) | | | (479 | ) | | | (5,190 | ) | | | (9 | ) | | | (107 | ) | |

Net increase | | | 739 | | | | 8,077 | | | | 263 | | | | 2,875 | | |

Class C shares | |

Subscriptions | | | 103,504 | | | | 1,133,128 | | | | 106,476 | | | | 1,167,330 | | |

Distributions reinvested | | | 11,083 | | | | 121,430 | | | | 10,084 | | | | 110,446 | | |

Redemptions | | | (78,459 | ) | | | (861,174 | ) | | | (193,145 | ) | | | (2,114,703 | ) | |

Net increase (decrease) | | | 36,128 | | | | 393,384 | | | | (76,585 | ) | | | (836,927 | ) | |

Class R4 shares | |

Subscriptions | | | 90,181 | | | | 984,888 | | | | 51,517 | | | | 556,485 | | |

Distributions reinvested | | | 2,339 | | | | 25,564 | | | | 1,153 | | | | 12,641 | | |

Redemptions | | | (12,875 | ) | | | (140,503 | ) | | | (15,198 | ) | | | (167,050 | ) | |

Net increase | | | 79,645 | | | | 869,949 | | | | 37,472 | | | | 402,076 | | |

Class T shares | |

Subscriptions | | | 4,488 | | | | 49,143 | | | | 5,935 | | | | 64,807 | | |

Distributions reinvested | | | 18,541 | | | | 202,987 | | | | 18,739 | | | | 205,099 | | |

Redemptions | | | (63,145 | ) | | | (690,184 | ) | | | (124,182 | ) | | | (1,354,178 | ) | |

Net decrease | | | (40,116 | ) | | | (438,054 | ) | | | (99,508 | ) | | | (1,084,272 | ) | |

Class Z shares | |

Subscriptions | | | 1,400,503 | | | | 15,375,739 | | | | 1,341,677 | | | | 14,691,260 | | |

Distributions reinvested | | | 19,480 | | | | 213,423 | | | | 20,249 | | | | 221,724 | | |

Redemptions | | | (2,049,162 | ) | | | (22,441,180 | ) | | | (2,956,945 | ) | | | (32,258,383 | ) | |

Net decrease | | | (629,179 | ) | | | (6,852,018 | ) | | | (1,595,019 | ) | | | (17,345,399 | ) | |

Total net decrease | | | (508,525 | ) | | | (5,557,652 | ) | | | (1,866,949 | ) | | | (20,333,069 | ) | |

(a) Includes conversions of Class B shares to Class A shares, if any.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

16

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

The following tables are intended to help you understand the Fund's financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund's portfolio turnover rate may be higher.

| | | Year Ended October 31, | |

Class A | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 11.06 | | | $ | 10.85 | | | $ | 11.34 | | | $ | 10.97 | | | $ | 11.00 | | |

Income from investment operations: | |

Net investment income | | | 0.30 | | | | 0.31 | | | | 0.29 | | | | 0.31 | | | | 0.33 | | |

Net realized and unrealized gain (loss) | | | (0.13 | ) | | | 0.21 | | | | (0.44 | ) | | | 0.38 | | | | (0.03 | ) | |

Total from investment operations | | | 0.17 | | | | 0.52 | | | | (0.15 | ) | | | 0.69 | | | | 0.30 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.30 | ) | | | (0.31 | ) | | | (0.29 | ) | | | (0.31 | ) | | | (0.33 | ) | |

Net realized gains | | | (0.02 | ) | | | — | | | | (0.05 | ) | | | (0.01 | ) | | | — | | |

Total distributions to shareholders | | | (0.32 | ) | | | (0.31 | ) | | | (0.34 | ) | | | (0.32 | ) | | | (0.33 | ) | |

Net asset value, end of period | | $ | 10.91 | | | $ | 11.06 | | | $ | 10.85 | | | $ | 11.34 | | | $ | 10.97 | | |

Total return | | | 1.60 | % | | | 4.83 | % | | | (1.34 | %) | | | 6.36 | % | | | 2.83 | % | |

Ratios to average net assets(a) | |

Total gross expenses | | | 0.99 | % | | | 0.99 | % | | | 0.97 | % | | | 1.00 | % | | | 1.03 | % | |

Total net expenses(b) | | | 0.81 | %(c) | | | 0.81 | %(c) | | | 0.80 | %(c) | | | 0.79 | %(c) | | | 0.79 | %(c) | |

Net investment income | | | 2.76 | % | | | 2.81 | % | | | 2.67 | % | | | 2.79 | % | | | 3.09 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 8,090 | | | $ | 7,711 | | | $ | 9,016 | | | $ | 8,937 | | | $ | 9,108 | | |

Portfolio turnover | | | 6 | % | | | 12 | % | | | 9 | % | | | 19 | % | | | 6 | % | |

Notes to Financial Highlights

(a) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(b) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(c) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

17

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended October 31, | |

Class B | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 11.06 | | | $ | 10.85 | | | $ | 11.34 | | | $ | 10.97 | | | $ | 11.00 | | |

Income from investment operations: | |

Net investment income | | | 0.22 | | | | 0.23 | | | | 0.21 | | | | 0.23 | | | | 0.25 | | |

Net realized and unrealized gain (loss) | | | (0.13 | ) | | | 0.20 | | | | (0.44 | ) | | | 0.38 | | | | (0.03 | ) | |

Total from investment operations | | | 0.09 | | | | 0.43 | | | | (0.23 | ) | | | 0.61 | | | | 0.22 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.22 | ) | | | (0.22 | ) | | | (0.21 | ) | | | (0.23 | ) | | | (0.25 | ) | |

Net realized gains | | | (0.02 | ) | | | — | | | | (0.05 | ) | | | (0.01 | ) | | | — | | |

Total distributions to shareholders | | | (0.24 | ) | | | (0.22 | ) | | | (0.26 | ) | | | (0.24 | ) | | | (0.25 | ) | |

Net asset value, end of period | | $ | 10.91 | | | $ | 11.06 | | | $ | 10.85 | | | $ | 11.34 | | | $ | 10.97 | | |

Total return | | | 0.84 | % | | | 4.04 | % | | | (2.08 | %) | | | 5.56 | % | | | 2.05 | % | |

Ratios to average net assets(a) | |

Total gross expenses | | | 1.74 | % | | | 1.73 | % | | | 1.72 | % | | | 1.84 | % | | | 1.83 | % | |

Total net expenses(b) | | | 1.56 | %(c) | | | 1.56 | %(c) | | | 1.55 | %(c) | | | 1.54 | %(c) | | | 1.55 | %(c) | |

Net investment income | | | 2.02 | % | | | 2.06 | % | | | 1.91 | % | | | 2.06 | % | | | 2.35 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 155 | | | $ | 149 | | | $ | 143 | | | $ | 197 | | | $ | 265 | | |

Portfolio turnover | | | 6 | % | | | 12 | % | | | 9 | % | | | 19 | % | | | 6 | % | |

Notes to Financial Highlights

(a) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(b) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(c) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

18

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended October 31, | |

Class C | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 11.06 | | | $ | 10.85 | | | $ | 11.34 | | | $ | 10.97 | | | $ | 11.00 | | |

Income from investment operations: | |

Net investment income | | | 0.25 | | | | 0.26 | | | | 0.25 | | | | 0.27 | | | | 0.29 | | |

Net realized and unrealized gain (loss) | | | (0.13 | ) | | | 0.21 | | | | (0.44 | ) | | | 0.38 | | | | (0.03 | ) | |

Total from investment operations | | | 0.12 | | | | 0.47 | | | | (0.19 | ) | | | 0.65 | | | | 0.26 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.25 | ) | | | (0.26 | ) | | | (0.25 | ) | | | (0.27 | ) | | | (0.29 | ) | |

Net realized gains | | | (0.02 | ) | | | — | | | | (0.05 | ) | | | (0.01 | ) | | | — | | |

Total distributions to shareholders | | | (0.27 | ) | | | (0.26 | ) | | | (0.30 | ) | | | (0.28 | ) | | | (0.29 | ) | |

Net asset value, end of period | | $ | 10.91 | | | $ | 11.06 | | | $ | 10.85 | | | $ | 11.34 | | | $ | 10.97 | | |

Total return | | | 1.14 | % | | | 4.37 | % | | | (1.74 | %) | | | 5.94 | % | | | 2.41 | % | |

Ratios to average net assets(a) | |

Total gross expenses | | | 1.74 | % | | | 1.74 | % | | | 1.72 | % | | | 1.74 | % | | | 1.79 | % | |

Total net expenses(b) | | | 1.26 | %(c) | | | 1.24 | %(c) | | | 1.20 | %(c) | | | 1.19 | %(c) | | | 1.19 | %(c) | |

Net investment income | | | 2.32 | % | | | 2.38 | % | | | 2.26 | % | | | 2.39 | % | | | 2.68 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 6,574 | | | $ | 6,264 | | | $ | 6,977 | | | $ | 7,520 | | | $ | 7,172 | | |

Portfolio turnover | | | 6 | % | | | 12 | % | | | 9 | % | | | 19 | % | | | 6 | % | |

Notes to Financial Highlights

(a) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(b) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(c) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

19

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended October 31, | |

Class R4 | | 2015 | | 2014 | | 2013(a) | |

Per share data | |

Net asset value, beginning of period | | $ | 11.05 | | | $ | 10.84 | | | $ | 11.19 | | |

Income from investment operations: | |

Net investment income | | | 0.33 | | | | 0.34 | | | | 0.20 | | |

Net realized and unrealized gain (loss) | | | (0.13 | ) | | | 0.21 | | | | (0.35 | ) | |

Total from investment operations | | | 0.20 | | | | 0.55 | | | | (0.15 | ) | |

Less distributions to shareholders: | |

Net investment income | | | (0.33 | ) | | | (0.34 | ) | | | (0.20 | ) | |

Net realized gains | | | (0.02 | ) | | | — | | | | — | | |

Total distributions to shareholders | | | (0.35 | ) | | | (0.34 | ) | | | (0.20 | ) | |

Net asset value, end of period | | $ | 10.90 | | | $ | 11.05 | | | $ | 10.84 | | |

Total return | | | 1.86 | % | | | 5.13 | % | | | (1.36 | %) | |

Ratios to average net assets(b) | |

Total gross expenses | | | 0.74 | % | | | 0.74 | % | | | 0.62 | %(c) | |

Total net expenses(d) | | | 0.56 | %(e) | | | 0.56 | %(e) | | | 0.56 | %(c)(e) | |

Net investment income | | | 3.04 | % | | | 3.08 | % | | | 2.92 | %(c) | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 1,279 | | | $ | 416 | | | $ | 2 | | |

Portfolio turnover | | | 6 | % | | | 12 | % | | | 9 | % | |

Notes to Financial Highlights

(a) Based on operations from March 19, 2013 (commencement of operations) through the stated period end.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Annualized.

(d) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(e) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

20

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended October 31, | |

Class T | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 11.05 | | | $ | 10.85 | | | $ | 11.34 | | | $ | 10.97 | | | $ | 11.00 | | |

Income from investment operations: | |

Net investment income | | | 0.31 | | | | 0.32 | | | | 0.31 | | | | 0.32 | | | | 0.34 | | |

Net realized and unrealized gain (loss) | | | (0.12 | ) | | | 0.21 | | | | (0.45 | ) | | | 0.38 | | | | (0.03 | ) | |

Total from investment operations | | | 0.19 | | | | 0.53 | | | | (0.14 | ) | | | 0.70 | | | | 0.31 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.32 | ) | | | (0.33 | ) | | | (0.30 | ) | | | (0.32 | ) | | | (0.34 | ) | |

Net realized gains | | | (0.02 | ) | | | — | | | | (0.05 | ) | | | (0.01 | ) | | | — | | |

Total distributions to shareholders | | | (0.34 | ) | | | (0.33 | ) | | | (0.35 | ) | | | (0.33 | ) | | | (0.34 | ) | |

Net asset value, end of period | | $ | 10.90 | | | $ | 11.05 | | | $ | 10.85 | | | $ | 11.34 | | | $ | 10.97 | | |

Total return | | | 1.72 | % | | | 4.93 | % | | | (1.25 | %) | | | 6.47 | % | | | 2.93 | % | |

Ratios to average net assets(a) | |

Total gross expenses | | | 0.89 | % | | | 0.89 | % | | | 0.87 | % | | | 0.89 | % | | | 0.94 | % | |

Total net expenses(b) | | | 0.71 | %(c) | | | 0.71 | %(c) | | | 0.70 | %(c) | | | 0.69 | %(c) | | | 0.69 | %(c) | |

Net investment income | | | 2.87 | % | | | 2.91 | % | | | 2.76 | % | | | 2.89 | % | | | 3.18 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 11,823 | | | $ | 12,431 | | | $ | 13,287 | | | $ | 14,903 | | | $ | 15,110 | | |

Portfolio turnover | | | 6 | % | | | 12 | % | | | 9 | % | | | 19 | % | | | 6 | % | |

Notes to Financial Highlights

(a) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(b) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(c) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

21

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended October 31, | |

Class Z | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 11.06 | | | $ | 10.85 | | | $ | 11.34 | | | $ | 10.97 | | | $ | 11.00 | | |

Income from investment operations: | |

Net investment income | | | 0.33 | | | | 0.33 | | | | 0.32 | | | | 0.34 | | | | 0.36 | | |

Net realized and unrealized gain (loss) | | | (0.13 | ) | | | 0.21 | | | | (0.44 | ) | | | 0.38 | | | | (0.03 | ) | |

Total from investment operations | | | 0.20 | | | | 0.54 | | | | (0.12 | ) | | | 0.72 | | | | 0.33 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.33 | ) | | | (0.33 | ) | | | (0.32 | ) | | | (0.34 | ) | | | (0.36 | ) | |

Net realized gains | | | (0.02 | ) | | | — | | | | (0.05 | ) | | | (0.01 | ) | | | — | | |

Total distributions to shareholders | | | (0.35 | ) | | | (0.33 | ) | | | (0.37 | ) | | | (0.35 | ) | | | (0.36 | ) | |

Net asset value, end of period | | $ | 10.91 | | | $ | 11.06 | | | $ | 10.85 | | | $ | 11.34 | | | $ | 10.97 | | |

Total return | | | 1.85 | % | | | 5.09 | % | | | (1.10 | %) | | | 6.63 | % | | | 3.08 | % | |

Ratios to average net assets(a) | |

Total gross expenses | | | 0.74 | % | | | 0.74 | % | | | 0.72 | % | | | 0.74 | % | | | 0.79 | % | |

Total net expenses(b) | | | 0.56 | %(c) | | | 0.56 | %(c) | | | 0.55 | %(c) | | | 0.54 | %(c) | | | 0.54 | %(c) | |

Net investment income | | | 3.02 | % | | | 3.06 | % | | | 2.91 | % | | | 3.04 | % | | | 3.33 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 129,107 | | | $ | 137,832 | | | $ | 152,543 | | | $ | 182,533 | | | $ | 182,400 | | |

Portfolio turnover | | | 6 | % | | | 12 | % | | | 9 | % | | | 19 | % | | | 6 | % | |

Notes to Financial Highlights

(a) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(b) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(c) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

22

COLUMBIA AMT-FREE CONNECTICUT INTERMEDIATE MUNI BOND FUND

NOTES TO FINANCIAL STATEMENTS

October 31, 2015

Note 1. Organization

Columbia AMT-Free Connecticut Intermediate Muni Bond Fund (the Fund), a series of Columbia Funds Series Trust I (the Trust), is a non-diversified fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

Fund Shares

The Trust may issue an unlimited number of shares (without par value). The Fund offers Class A, Class B, Class C, Class R4, Class T and Class Z shares. Although all share classes generally have identical voting, dividend and liquidation rights, each share class votes separately when required by the Trust's organizational documents or by law. Different share classes pay different distribution amounts to the extent the expenses of such share classes differ, and distributions in liquidation will be proportional to the net asset value of each share class. Each share class has its own expense and sales charge structure.

Class A shares are subject to a maximum front-end sales charge of 3.00% based on the initial investment amount. In addition, Class A shares purchased on or after February 19, 2015 are subject to a contingent deferred sales charge (CDSC) of 0.75% on certain investments of $500,000 or more if redeemed within 12 months after purchase. Redemptions of Class A shares purchased prior to February 19, 2015, without an initial sales charge in accounts aggregating $1 million to $50 million at the time of purchase, are subject to a CDSC of 1.00% if redeemed within 12 months after purchase, and 0.50% if redeemed more than 12, but less than 18, months after purchase.

Class B shares may be subject to a maximum CDSC of 3.00% based upon the holding period after purchase. Class B shares will generally convert to Class A shares eight years after purchase. The Fund no longer accepts investments by new or existing investors in the Fund's Class B shares, except in connection with the reinvestment of any dividend and/or capital gain distributions in Class B shares of the Fund and exchanges by existing Class B shareholders of certain other funds within the Columbia Family of Funds.

Class C shares are subject to a 1.00% CDSC on shares redeemed within 12 months after purchase.

Class R4 shares are not subject to sales charges and are generally available only to omnibus retirement plans

and certain investors as described in the Fund's prospectus.

Class T shares are subject to a maximum front-end sales charge of 4.75% based on the investment amount. Class T shares purchased without an initial sales charge in accounts aggregating $1 million to $50 million at the time of purchase are subject to a CDSC if the shares are sold within 18 months after purchase, charged as follows: 1.00% CDSC if redeemed within 12 months after purchase, and 0.50% CDSC if redeemed more than 12, but less than 18, months after purchase. Class T shares are available only to investors who received (and who have continuously held) Class T shares in connection with previous fund reorganizations.

Class Z shares are not subject to sales charges and are available only to eligible investors, which are subject to different investment minimums as described in the Fund's prospectus.