UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Ryan Larrenaga

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 345-6611 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2015 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

December 31, 2015

COLUMBIA REAL ESTATE EQUITY FUND

ABOUT COLUMBIA THREADNEEDLE INVESTMENTS

Columbia Threadneedle Investments is a leading global asset management group that provides a broad range of actively managed investment strategies and solutions for individual, institutional and corporate clients around the world.

With more than 2,000 people, including over 450 investment professionals based in North America, Europe and Asia, we manage $471 billion* of assets across developed and emerging market equities, fixed income, asset allocation solutions and alternatives. We are the 13th largest manager of long-term mutual fund assets in the U.S.** and the 4th largest manager of retail funds in the U.K.***

Our priority is the investment success of our clients. We aim to deliver the investment outcomes they expect through an investment approach that is team-based, performance-driven and risk-aware. Our culture is dynamic and interactive. By sharing our insights across asset classes and geographies, we generate richer perspectives on global, regional and local investment landscapes. The ability to exchange and debate investment ideas in a collaborative environment enriches our teams' investment processes. More importantly, it results in better informed investment decisions for our clients.

Columbia funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

* In U.S. dollars as of September 30, 2015. Source: Ameriprise Q3 Earnings Release. Includes all assets managed by entities in the Columbia and Threadneedle groups of companies. Contact us for more current data.

** Source: ICI as of September 30, 2015 for Columbia Management Investment Advisers, LLC.

*** Source: Investment Association as of September 2015 for Threadneedle Asset Management Limited.

© 2015 Columbia Management Investment Advisers, LLC. All rights reserved.

Not part of the shareholder report

Investment strategies to help meet investor needs

We are committed to helping investors navigate financial challenges to reach their desired outcomes. The possibilities are endless.

Your success is our priority.

Retire comfortably

Retire comfortably

Fund college or higher education

Fund college or higher education

Leave a legacy

Leave a legacy

Generate an appropriate stream of income in retirement

Traditional approaches to income may no longer be adequate — and they may no longer provide the diversification benefits they once did. Investors need to rethink how they generate retirement income.

Worried about running out of income? You are not alone.

Navigate a changing interest rate environment

Even in today's challenging interest rate environment, it's still possible to navigate markets and achieve your goals.

Make investment choices designed specifically for this market environment.

Maximize after-tax returns

In an environment where what you keep is more important than what you earn, municipal bonds can help mitigate higher taxes while providing attractive yields compared to other investment options.

You've worked too hard building your wealth to lose it to taxes.

Grow assets to achieve financial goals

Finding growth opportunities in today's complex market environment requires strong research capabilities, creative thinking and a disciplined approach.

Do your investments deliver the portfolio growth you need?

Ease the impact of volatile markets

With increasing concerns about market volatility, investors should consider diversifying their portfolios with non-traditional holdings.

Interested in turning volatility into opportunity?

To find out more, contact your financial professional, call 800.426.3750 or visit columbiathreadneedle.com/us

Not part of the shareholder report

Get the market insight you need from our investment experts and subscribe to our latest publications

Stay informed with Columbia Threadneedle Investments

Investor insight

Find economic and market commentary, investment videos, white papers, mutual fund commentary and more at columbiathreadneedle.com/us.

Subscribe to the latest information from Columbia Threadneedle. Register your information online at columbiathreadneedle.com/us/subscribe and select the publications you would like to receive, including:

n Columbia Threadneedle Investor Newsletter, highlighting the latest macro- and micro-economic trends, investment themes, products, service changes and other items of interest to our investors

n Investment Strategy Outlook, showcasing the Columbia Threadneedle Asset Allocation Team's perspective on global economic investment conditions and markets

n MarketTrack, featuring straightforward insight on current investment opportunities

n White papers that delve deep into a variety of investment topics

n Quarterly portfolio manager commentary and fund fact sheets

Update your subscriptions at any time by accessing the email subscription center.

Social media

We offer you multiple ways to access our market commentary and investment insights.

n Perspectives blog at columbiathreadneedle.com/us

Read timely posts by our investment team, including our chief investment officer, chief economist and portfolio managers.

n Twitter.com/CTinvest_US

Follow us on Twitter for quick, up-to-the-minute comments on market news and more.

n Youtube.com/CTInvestUS

View our commentaries on the economy, markets and current investment opportunities.

n Linkedin.com/company/Columbia-Threadneedle-Investments-US

Connect with us on LinkedIn for updates from our thought leaders.

Not part of the shareholder report

Dear Shareholder,

Dear Shareholder,

Today's investors are typically focused on outcomes, like living a certain retirement lifestyle, paying for college education or building a legacy. But in today's complex global investment landscape, even simple goals are not easily achieved.

At Columbia Threadneedle Investments, we aspire to help satisfy five core needs of today's investors:

n Generate an appropriate stream of income in retirement

Traditional approaches to generating income may not provide the diversification benefits they once did, and they may actually introduce unwanted risk in today's market. To seek to improve your potential to live comfortably long term, we endeavor to pursue investments that explore less traveled paths to income.

n Navigate a changing interest rate environment

Today's uncertain market environment includes the prospect of a rise in interest rates. Blending traditional investments with non-traditional or alternative products may help protect your wealth during periods of volatility. We can attempt to help strengthen your portfolio with agile products designed to take on the market's ups and downs.

n Maximize after-tax returns

In an environment where what you keep may be more important than what you earn, municipal bonds can help mitigate high tax burdens while providing potentially attractive yields. Our state and federal tax-exempt products are aimed at helping investors manage risk, minimize the fluctuation of capital and grow wealth on a more tax-efficient basis.

n Grow assets to achieve financial goals

We believe that finding and protecting growth comes from a disciplined security selection process designed to create excess return. Our goal is to provide investment solutions built to help you face today's market challenges and grow your assets at each crossroad of your journey.

n Ease the impact of volatile markets

Despite a bull market run that has benefited many investors over the past several years, it's important to remember the lessons of 2008 and the value that a well-diversified portfolio may provide through times of market volatility. We are here to help you hold onto the savings you have worked tirelessly to amass, and to provide you the best opportunity to maintain your standard of living regardless of market conditions.

Find out today how we can help you confidently invest to realize your dreams. Please visit us at blog.columbiathreadneedleus.com/our-best-ideas to learn more about our unique investment solutions.

The world is constantly changing, but our priority remains the same: to help you secure your finances, meet your goals and achieve success. Thank you for your continued investment with us.

Sincerely,

Christopher O. Petersen

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus and summary prospectus, which contains this and other important information about a fund, visit columbiathreadneedle.com/us. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2016 Columbia Management Investment Advisers, LLC. All rights reserved.

COLUMBIA REAL ESTATE EQUITY FUND

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit columbiathreadneedle.com/us or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

Performance Overview | | | 3 | | |

Manager Discussion of Fund Performance | | | 5 | | |

Understanding Your Fund's Expenses | | | 8 | | |

Portfolio of Investments | | | 9 | | |

Statement of Assets and Liabilities | | | 12 | | |

Statement of Operations | | | 14 | | |

Statement of Changes in Net Assets | | | 15 | | |

Financial Highlights | | | 18 | | |

Notes to Financial Statements | | | 28 | | |

Report of Independent Registered Public Accounting Firm | | | 36 | | |

Federal Income Tax Information | | | 37 | | |

Trustees and Officers | | | 38 | | |

Important Information About This Report | | | 43 | | |

Annual Report 2015

COLUMBIA REAL ESTATE EQUITY FUND

Performance Summary

n Columbia Real Estate Equity Fund (the Fund) Class A shares returned 4.32% excluding sales charges for the 12-month period that ended December 31, 2015.

n The Fund outperformed its benchmark, the FTSE NAREIT Equity REITs Index, which returned 3.20% for the same period.

n Allocation decisions overall contributed most favorably to the Fund's performance during the annual period, though stock selection as a whole also added value.

Average Annual Total Returns (%) (for period ended December 31, 2015)

| | | Inception | | 1 Year | | 5 Years | | 10 Years | |

Class A | | 11/01/02 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 4.32 | | | | 10.83 | | | | 6.72 | | |

Including sales charges | | | | | | | -1.66 | | | | 9.52 | | | | 6.09 | | |

Class B | | 11/01/02 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 3.52 | | | | 10.00 | | | | 5.93 | | |

Including sales charges | | | | | | | -1.28 | | | | 9.72 | | | | 5.93 | | |

Class C | | 10/13/03 | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 3.53 | | | | 10.00 | | | | 5.93 | | |

Including sales charges | | | | | | | 2.57 | | | | 10.00 | | | | 5.93 | | |

Class I* | | 09/27/10 | | | 4.78 | | | | 11.37 | | | | 7.12 | | |

Class K* | | 03/07/11 | | | 4.46 | | | | 10.99 | | | | 6.88 | | |

Class R* | | 09/27/10 | | | 4.06 | | | | 10.56 | | | | 6.34 | | |

Class R4* | | 11/08/12 | | | 4.56 | | | | 11.08 | | | | 6.98 | | |

Class R5* | | 03/07/11 | | | 4.74 | | | | 11.23 | | | | 7.06 | | |

Class W* | | 09/27/10 | | | 4.32 | | | | 10.83 | | | | 6.76 | | |

Class Z | | 04/01/94 | | | 4.57 | | | | 11.10 | | | | 6.99 | | |

FTSE NAREIT Equity REITs Index | | | | | | | 3.20 | | | | 11.96 | | | | 7.41 | | |

Returns for Class A are shown with and without the maximum initial sales charge of 5.75%. Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter. Returns for Class C are shown with and without the 1.00% contingent deferred sales charge for the first year only. The Fund's other classes are not subject to sales charges and have limited eligibility. Please see the Fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedle.com/us or calling 800.345.6611.

*The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedle.com/us/investment-products/mutual-funds/appended-performance for more information.

The FTSE NAREIT Equity REITs Index reflects performance of all publicly traded equity real estate investment trusts (REITs), other than those designated as timber REITs.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Annual Report 2015

3

COLUMBIA REAL ESTATE EQUITY FUND

PERFORMANCE OVERVIEW (continued)

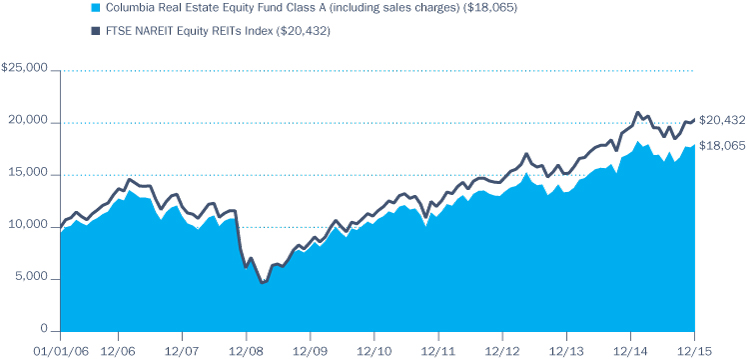

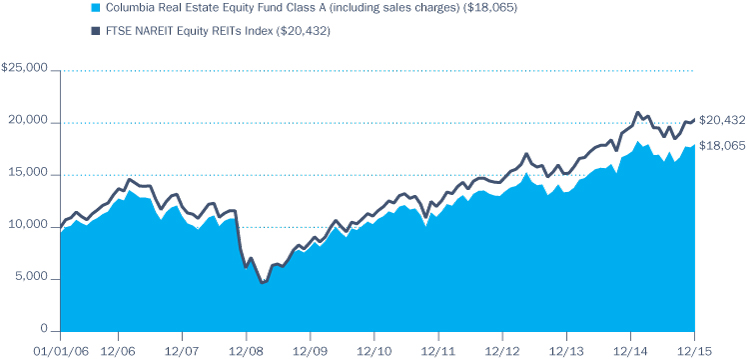

Performance of a Hypothetical $10,000 Investment (January 1, 2006 – December 31, 2015)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Real Estate Equity Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Annual Report 2015

4

COLUMBIA REAL ESTATE EQUITY FUND

MANAGER DISCUSSION OF FUND PERFORMANCE

For the 12-month period that ended December 31, 2015, the Fund's Class A shares returned 4.32% excluding sales charges. The Fund outperformed its benchmark, the FTSE NAREIT Equity REITs Index, which returned 3.20% for the same period. Allocation decisions overall contributed most favorably to the Fund's performance during the annual period, though stock selection as a whole also added value.

Real Estate Market Outpaced Broad U.S. Equity Market

The U.S. real estate market, as measured by the benchmark, notably outpaced the broad U.S. equity market, as measured by the S&P 500 Index, during the annual period. However, such performance masks what was significant volatility in the U.S. real estate market. Also, it should be noted that the positive return came primarily from dividends. On a price only basis, real estate investment trusts (REITs) actually declined slightly.

Maintaining momentum from 2014, REITs started the year with strong share price performance, up almost 10% in January 2015, even as the U.S. economy demonstrated signs of slower growth, largely attributable to harsh winter weather conditions and a strengthening U.S. dollar. However, the prospect of higher interest rates and the fear of the real estate cycle being in the later stages started to weigh on shares. In contrast to the first calendar quarter, the U.S. real estate equity market experienced a sharp and broad-based sell-off during the second quarter. An interest rate-sensitive industry, REITs struggled as interest rates rose on encouraging news about both the U.S. and European economies and in anticipation of the Federal Reserve's (the Fed) initial rate hike some time in the fall of 2015. During the third quarter, REITs were not immune to the volatility in the broader U.S. equity market, and thus, by September 2015, the benchmark was down almost 10%. Growing uncertainty around the timing of the Fed's next move and the direction of longer term interest rates also created volatility in REITs. REITs subsequently enjoyed a particularly strong rally during the fourth quarter, with its reversal in performance from the prior quarter attributable in part to the continuing strong fundamentals of the group. Also, the Fed acting on the highly anticipated first rate increase, and its indication that future hikes would likely be measured, removed some uncertainty from the interest rate-sensitive industry. Still, the outlook for higher rates remained on investors' minds, and thus we believe the property types that contributed most to the rally were those real estate owners with the best growth prospects and the lowest exposure to rising interest rates.

Importantly, amid such volatility, the fundamentals of the group remained strong and even gained momentum in some cases. Occupancies were near all-time highs in many property sub-sectors; market rents moved higher; and supply remained low by historical measures relative to demand. Many REITs took advantage of this supply/demand scenario to generate attractive internal growth. Many others were able to make accretive acquisitions and source development opportunities to generate competitive overall growth.

Portfolio Management

Arthur Hurley, CFA

Morningstar Style BoxTM

The Morningstar Style BoxTM is based on a fund's portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2016 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Top Ten Holdings (%)

(at December 31, 2015) | |

Simon Property Group, Inc. | | | 12.2 | | |

Public Storage | | | 8.6 | | |

Equity Residential | | | 5.1 | | |

AvalonBay Communities, Inc. | | | 5.1 | | |

Equity LifeStyle Properties, Inc. | | | 4.9 | | |

General Growth Properties, Inc. | | | 4.4 | | |

SL Green Realty Corp. | | | 4.2 | | |

Duke Realty Corp. | | | 4.1 | | |

Ventas, Inc. | | | 3.9 | | |

Alexandria Real Estate

Equities, Inc. | | | 3.9 | | |

Percentages indicated are based upon total investments (excluding Money Market Funds).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Annual Report 2015

5

COLUMBIA REAL ESTATE EQUITY FUND

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

Portfolio Breakdown (%)

(at December 31, 2015) | |

Common Stocks | | | 99.6 | | |

Money Market Funds | | | 0.4 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total investments. The Fund's portfolio composition is subject to change.

Equity Sector Breakdown (%)

(at December 31, 2015) | |

Consumer Discretionary | | | 1.8 | | |

Financials | | | 98.2 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total equity investments. The Fund's portfolio composition is subject to change.

Investment Risks

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Like real estate, real estate investment trusts (REITs) are subject to illiquidity, valuation and financing complexities, taxes, default, bankruptcy and other economic, political, or regulatory occurrences. As a non-diversified fund, fewer investments could have a greater effect on performance. See the Fund's prospectus for more information on these and other risks.

Overweight Allocation To Self-Storage Sub-Sector Aided Results Most

From a REIT industry exposure perspective, the Fund's results were helped most by having an overweight allocation to self-storage, which was the strongest sub-sector in the benchmark by a wide margin during the annual period. Having an overweight allocation to manufactured homes, which was the second-strongest performing sub-sector in the benchmark during the annual period, and an underweight allocation to the health care sub-sector, which was the second-weakest in the benchmark, also helped. Effective stock selection in the diversified sub-sector added significant value as well.

Among individual holdings, Equity LifeStyle Properties and Public Storage were standout performers. Equity LifeStyle Properties is a manufactured home and recreational vehicle community site REIT, which demonstrated attractive organic growth through higher occupancies and increased rents. The REIT also benefited from the shortage of affordable housing in the U.S. amid strong demand. Public Storage, a self-storage REIT, gained ground as the self-storage sub-sector broadly benefited from a tailwind of strong demand amidst the pre-dominance of renters and the declining trend of home ownership in the U.S. Additionally, Public Storage is the largest owner of self-storage facilities in the nation, taking advantage of its scale and gaining market share via accretive acquisitions it has made. Another strong performer for the Fund was Duke Realty in the diversified sub-sector. Duke Realty benefited both from simplifying its story and strengthening its balance sheet by selling many of its suburban office properties and reinvesting the proceeds into its core industrial property portfolio, which performed well during the annual period.

Positioning In Lodging/Resorts Sub-Sector Hurt Fund Results

Both stock selection in and having an overweight allocation to the lodging/resorts sub-sector, which was the weakest in the benchmark during the annual period, hurt the Fund's relative results most. Stock selection in the office, shopping centers and apartments sub-sectors also detracted. Having an underweight allocation to the apartments sub-sector, which outpaced the benchmark during the annual period, further dampened the Fund's performance.

Among individual holdings, the biggest disappointments were primarily in the lodging/resorts sub-sector, including RLJ Lodging Trust, Hilton Worldwide Holdings, Host Hotels & Resorts and Sunstone Hotel Investors. While there were no company-specific factors impacting these holdings during the annual period, each was hurt by the broad brush of concerns within the lodging/resorts industry, including fears of global economic sluggishness leading to a slowdown in global business and leisure travel and thus lower occupancy rates. Another weak performer during the annual period was Cousins Properties in the office sub-sector, which has its greatest exposure in the U.S. southeast and in Houston. Weakness in the energy sector, including the significant slide in crude oil prices, drove concerns about energy-related tenants being forced into vacating before

Annual Report 2015

6

COLUMBIA REAL ESTATE EQUITY FUND

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

leases expired. While such fears did not actually materialize, perceptions about the Houston real estate market were enough to create an overhang for Cousins Properties' stock.

Shifting Market Conditions Drove Portfolio Changes

During the annual period, we reduced the Fund's exposure to the lodging/resorts sub-sector, primarily through the sale of its position in Host Hotels & Resorts, and to the Houston market, largely via the elimination of the Fund's position in Cousins Properties. Also, while maintaining the Fund's overweight allocation to the self-storage sub-sector, we sold the Fund's position in Sovran Self Storage, taking profits, as the stock had performed well. We correspondingly increased the Fund's exposure to residential and data center properties, adding to a basket of names already in the portfolio.

Annual Report 2015

7

COLUMBIA REAL ESTATE EQUITY FUND

UNDERSTANDING YOUR FUND'S EXPENSES

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the "Actual" column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

July 1, 2015 – December 31, 2015

| | | Account Value at the Beginning

of the Period ($) | | Account Value at the End of the

Period ($) | | Expenses Paid During the

Period ($) | | Fund's Annualized

Expense Ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,108.90 | | | | 1,018.90 | | | | 6.64 | | | | 6.36 | | | | 1.25 | | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,104.30 | | | | 1,015.12 | | | | 10.61 | | | | 10.16 | | | | 2.00 | | |

Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,104.60 | | | | 1,015.12 | | | | 10.61 | | | | 10.16 | | | | 2.00 | | |

Class I | | | 1,000.00 | | | | 1,000.00 | | | | 1,111.70 | | | | 1,021.17 | | | | 4.26 | | | | 4.08 | | | | 0.80 | | |

Class K | | | 1,000.00 | | | | 1,000.00 | | | | 1,109.40 | | | | 1,019.66 | | | | 5.85 | | | | 5.60 | | | | 1.10 | | |

Class R | | | 1,000.00 | | | | 1,000.00 | | | | 1,107.50 | | | | 1,017.64 | | | | 7.97 | | | | 7.63 | | | | 1.50 | | |

Class R4 | | | 1,000.00 | | | | 1,000.00 | | | | 1,109.80 | | | | 1,020.11 | | | | 5.37 | | | | 5.14 | | | | 1.01 | | |

Class R5 | | | 1,000.00 | | | | 1,000.00 | | | | 1,111.30 | | | | 1,020.87 | | | | 4.58 | | | | 4.38 | | | | 0.86 | | |

Class W | | | 1,000.00 | | | | 1,000.00 | | | | 1,108.80 | | | | 1,018.90 | | | | 6.64 | | | | 6.36 | | | | 1.25 | | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,110.10 | | | | 1,020.16 | | | | 5.32 | | | | 5.09 | | | | 1.00 | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Annual Report 2015

8

COLUMBIA REAL ESTATE EQUITY FUND

PORTFOLIO OF INVESTMENTS

December 31, 2015

(Percentages represent value of investments compared to net assets)

Common Stocks 99.1%

Issuer | | Shares | | Value ($) | |

CONSUMER DISCRETIONARY 1.8% | |

Hotels, Restaurants & Leisure 1.3% | |

Hilton Worldwide Holdings, Inc. | | | 309,100 | | | | 6,614,740 | | |

Multiline Retail 0.5% | |

Hudson's Bay Co. | | | 206,800 | | | | 2,705,124 | | |

Total Consumer Discretionary | | | | | 9,319,864 | | |

FINANCIALS 97.3% | |

Real Estate Investment Trusts (REITs) 97.3% | |

Diversified REITs 4.0% | |

Duke Realty Corp. | | | 981,700 | | | | 20,635,334 | | |

Health Care REITs 7.4% | |

Healthcare Trust of America, Inc., Class A | | | 410,150 | | | | 11,061,745 | | |

Omega Healthcare Investors, Inc. | | | 192,300 | | | | 6,726,654 | | |

Ventas, Inc. | | | 351,474 | | | | 19,833,678 | | |

Total | | | | | 37,622,077 | | |

Hotel & Resort REITs 3.5% | |

Pebblebrook Hotel Trust | | | 78,100 | | | | 2,188,362 | | |

RLJ Lodging Trust | | | 452,900 | | | | 9,796,227 | | |

Sunstone Hotel Investors, Inc. | | | 458,078 | | | | 5,721,394 | | |

Total | | | | | 17,705,983 | | |

Industrial REITs 5.5% | |

First Industrial Realty Trust, Inc. | | | 807,500 | | | | 17,869,975 | | |

ProLogis, Inc. | | | 239,969 | | | | 10,299,469 | | |

Total | | | | | 28,169,444 | | |

Office REITs 16.0% | |

Alexandria Real Estate Equities, Inc. | | | 217,300 | | | | 19,635,228 | | |

Boston Properties, Inc. | | | 74,900 | | | | 9,552,746 | | |

Highwoods Properties, Inc. | | | 301,400 | | | | 13,141,040 | | |

Kilroy Realty Corp. | | | 66,000 | | | | 4,176,480 | | |

Mack-Cali Realty Corp. | | | 135,800 | | | | 3,170,930 | | |

SL Green Realty Corp. | | | 188,400 | | | | 21,285,432 | | |

Vornado Realty Trust | | | 108,100 | | | | 10,805,676 | | |

Total | | | | | 81,767,532 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Residentials REITs 21.3% | |

AvalonBay Communities, Inc. | | | 139,879 | | | | 25,755,920 | | |

Equity LifeStyle Properties, Inc. | | | 374,000 | | | | 24,934,580 | | |

Equity Residential | | | 315,700 | | | | 25,757,963 | | |

Essex Property Trust, Inc. | | | 80,000 | | | | 19,152,800 | | |

Sun Communities, Inc. | | | 197,500 | | | | 13,534,675 | | |

Total | | | | | 109,135,938 | | |

Retail REITs 20.3% | |

Brixmor Property Group, Inc. | | | 237,400 | | | | 6,129,668 | | |

General Growth Properties, Inc. | | | 825,500 | | | | 22,461,855 | | |

Ramco-Gershenson Properties Trust | | | 294,800 | | | | 4,896,628 | | |

Retail Properties of America, Inc., Class A | | | 422,000 | | | | 6,232,940 | | |

Simon Property Group, Inc. | | | 318,054 | | | | 61,842,420 | | |

Taubman Centers, Inc. | | | 34,100 | | | | 2,616,152 | | |

Total | | | | | 104,179,663 | | |

Specialized REITs 19.3% | |

American Tower Corp. | | | 82,300 | | | | 7,978,985 | | |

Coresite Realty Corp. | | | 97,600 | | | | 5,535,872 | | |

CubeSmart | | | 277,170 | | | | 8,486,946 | | |

Digital Realty Trust, Inc. | | | 210,100 | | | | 15,887,762 | | |

Equinix, Inc. | | | 17,255 | | | | 5,217,912 | | |

Extra Space Storage, Inc. | | | 136,600 | | | | 12,049,486 | | |

Public Storage | | | 176,759 | | | | 43,783,205 | | |

Total | | | | | 98,940,168 | | |

Total Real Estate Investment Trusts

(REITs) | | | | | 498,156,139 | | |

Total Financials | | | | | 498,156,139 | | |

Total Common Stocks

(Cost: $354,463,697) | | | | | 507,476,003 | | |

Money Market Funds 0.4%

| | | Shares | | Value ($) | |

Columbia Short-Term Cash Fund,

0.284%(a)(b) | | | 2,193,080 | | | | 2,193,080 | | |

Total Money Market Funds

(Cost: $2,193,080) | | | | | 2,193,080 | | |

Total Investments

(Cost: $356,656,777) | | | 509,669,083 | | |

Other Assets & Liabilities, Net | | | 2,444,711 | | |

Net Assets | | | 512,113,794 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

9

COLUMBIA REAL ESTATE EQUITY FUND

PORTFOLIO OF INVESTMENTS (continued)

December 31, 2015

Notes to Portfolio of Investments

(a) The rate shown is the seven-day current annualized yield at December 31, 2015.

(b) As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company's outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2015 are as follows:

Issuer | | Beginning

Cost ($) | | Purchase

Cost ($) | | Proceeds

From Sales ($) | | Ending

Cost ($) | | Dividends —

Affiliated

Issuers ($) | | Value ($) | |

Columbia Short-Term Cash Fund | | | 15,052,887 | | | | 116,173,394 | | | | (129,033,201 | ) | | | 2,193,080 | | | | 7,593 | | | | 2,193,080 | | |

Fair Value Measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset's or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

> Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

> Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

> Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund's Board of Trustees (the Board), the Investment Manager's Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager's organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

10

COLUMBIA REAL ESTATE EQUITY FUND

PORTFOLIO OF INVESTMENTS (continued)

December 31, 2015

Fair Value Measurements (continued)

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The following table is a summary of the inputs used to value the Fund's investments at December 31, 2015:

| | | Level 1

Quoted Prices in Active

Markets for Identical

Assets ($) | | Level 2

Other Significant

Observable Inputs ($) | | Level 3

Significant

Unobservable Inputs ($) | | Total ($) | |

Investments | |

Common Stocks | |

Consumer Discretionary | | | 9,319,864 | | | | — | | | | — | | | | 9,319,864 | | |

Financials | | | 498,156,139 | | | | — | | | | — | | | | 498,156,139 | | |

Total Common Stocks | | | 507,476,003 | | | | — | | | | — | | | | 507,476,003 | | |

Money Market Funds | | | — | | | | 2,193,080 | | | | — | | | | 2,193,080 | | |

Total Investments | | | 507,476,003 | | | | 2,193,080 | | | | — | | | | 509,669,083 | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund's assets assigned to the Level 2 input category are valued based upon utilizing observable market inputs, in which a security's value is determined through reference to prices and information from market transactions for similar or identical assets and/or fund per share market values which are not considered publicly available.

Financial assets were transferred from Level 1 to Level 2 as the market for these assets is not considered publicly available. Fund per share market values were obtained using observable market inputs.

The following table shows transfers between Level 1 and Level 2 of the fair value hierarchy:

Transfers In | | Transfers Out | |

| Level 1 ($) | | Level 2 ($) | | Level 1 ($) | | Level 2 ($) | |

| | — | | | | 15,052,887 | | | | 15,052,887 | | | | — | | |

Transfers between Level 1 and Level 2 are determined based on the fair value at the beginning of the period for security positions held throughout the period.

There were no transfers of financial assets between Levels 2 and 3 during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

11

COLUMBIA REAL ESTATE EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2015

Assets | |

Investments, at value | |

Unaffiliated issuers (identified cost $354,463,697) | | $ | 507,476,003 | | |

Affiliated issuers (identified cost $2,193,080) | | | 2,193,080 | | |

Total investments (identified cost $356,656,777) | | | 509,669,083 | | |

Receivable for: | |

Capital shares sold | | | 141,068 | | |

Dividends | | | 2,808,068 | | |

Foreign tax reclaims | | | 839 | | |

Prepaid expenses | | | 3,179 | | |

Trustees' deferred compensation plan | | | 54,677 | | |

Total assets | | | 512,676,914 | | |

Liabilities | |

Payable for: | |

Capital shares purchased | | | 355,348 | | |

Investment management fees | | | 9,759 | | |

Distribution and/or service fees | | | 1,524 | | |

Transfer agent fees | | | 78,155 | | |

Administration fees | | | 846 | | |

Plan administration fees | | | 22 | | |

Compensation of board members | | | 463 | | |

Chief compliance officer expenses | | | 63 | | |

Other expenses | | | 62,263 | | |

Trustees' deferred compensation plan | | | 54,677 | | |

Total liabilities | | | 563,120 | | |

Net assets applicable to outstanding capital stock | | $ | 512,113,794 | | |

Represented by | |

Paid-in capital | | $ | 369,451,291 | | |

Excess of distributions over net investment income | | | (50,860 | ) | |

Accumulated net realized loss | | | (10,298,913 | ) | |

Unrealized appreciation (depreciation) on: | |

Investments | | | 153,012,306 | | |

Foreign currency translations | | | (30 | ) | |

Total — representing net assets applicable to outstanding capital stock | | $ | 512,113,794 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

12

COLUMBIA REAL ESTATE EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES (continued)

December 31, 2015

Class A | |

Net assets | | $ | 123,136,257 | | |

Shares outstanding | | | 8,048,924 | | |

Net asset value per share | | $ | 15.30 | | |

Maximum offering price per share(a) | | $ | 16.23 | | |

Class B | |

Net assets | | $ | 1,227,245 | | |

Shares outstanding | | | 80,014 | | |

Net asset value per share | | $ | 15.34 | | |

Class C | |

Net assets | | $ | 18,522,702 | | |

Shares outstanding | | | 1,210,865 | | |

Net asset value per share | | $ | 15.30 | | |

Class I | |

Net assets | | $ | 33,308,378 | | |

Shares outstanding | | | 2,169,096 | | |

Net asset value per share | | $ | 15.36 | | |

Class K | |

Net assets | | $ | 51,817 | | |

Shares outstanding | | | 3,378 | | |

Net asset value per share | | $ | 15.34 | | |

Class R | |

Net assets | | $ | 9,139,949 | | |

Shares outstanding | | | 597,936 | | |

Net asset value per share | | $ | 15.29 | | |

Class R4 | |

Net assets | | $ | 362,805 | | |

Shares outstanding | | | 23,310 | | |

Net asset value per share | | $ | 15.56 | | |

Class R5 | |

Net assets | | $ | 7,101,800 | | |

Shares outstanding | | | 464,588 | | |

Net asset value per share | | $ | 15.29 | | |

Class W | |

Net assets | | $ | 26,243 | | |

Shares outstanding | | | 1,714 | | |

Net asset value per share | | $ | 15.31 | | |

Class Z | |

Net assets | | $ | 319,236,598 | | |

Shares outstanding | | | 20,831,095 | | |

Net asset value per share | | $ | 15.33 | | |

(a) The maximum offering price per share is calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge of 5.75%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

13

COLUMBIA REAL ESTATE EQUITY FUND

STATEMENT OF OPERATIONS

Year Ended December 31, 2015

Net investment income | |

Income: | |

Dividends — unaffiliated issuers | | $ | 14,062,594 | | |

Dividends — affiliated issuers | | | 7,593 | | |

Foreign taxes withheld | | | (4,874 | ) | |

Total income | | | 14,065,313 | | |

Expenses: | |

Investment management fees | | | 3,776,529 | | |

Distribution and/or service fees | |

Class A | | | 314,149 | | |

Class B | | | 19,012 | | |

Class C | | | 198,509 | | |

Class R | | | 45,295 | | |

Class W | | | 72 | | |

Transfer agent fees | |

Class A | | | 247,420 | | |

Class B | | | 3,759 | | |

Class C | | | 39,141 | | |

Class K | | | 27 | | |

Class R | | | 17,835 | | |

Class R4 | | | 399 | | |

Class R5 | | | 1,879 | | |

Class W | | | 57 | | |

Class Z | | | 667,627 | | |

Administration fees | | | 325,962 | | |

Plan administration fees | |

Class K | | | 136 | | |

Compensation of board members | | | 25,500 | | |

Custodian fees | | | 7,844 | | |

Printing and postage fees | | | 62,350 | | |

Registration fees | | | 118,009 | | |

Audit fees | | | 29,799 | | |

Legal fees | | | 19,785 | | |

Chief compliance officer expenses | | | 266 | | |

Other | | | 20,560 | | |

Total expenses | | | 5,941,921 | | |

Expense reductions | | | (1,460 | ) | |

Total net expenses | | | 5,940,461 | | |

Net investment income | | | 8,124,852 | | |

Realized and unrealized gain (loss) — net | |

Net realized gain (loss) on: | |

Investments | | | 31,477,499 | | |

Foreign currency translations | | | 2,095 | | |

Net realized gain | | | 31,479,594 | | |

Net change in unrealized appreciation (depreciation) on: | |

Investments | | | (20,119,139 | ) | |

Foreign currency translations | | | (17 | ) | |

Net change in unrealized depreciation | | | (20,119,156 | ) | |

Net realized and unrealized gain | | | 11,360,438 | | |

Net increase in net assets resulting from operations | | $ | 19,485,290 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

14

COLUMBIA REAL ESTATE EQUITY FUND

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended

December 31,

2015 | | Year Ended

December 31,

2014 | |

Operations | |

Net investment income | | $ | 8,124,852 | | | $ | 8,357,156 | | |

Net realized gain | | | 31,479,594 | | | | 42,164,258 | | |

Net change in unrealized appreciation (depreciation) | | | (20,119,156 | ) | | | 86,963,771 | | |

Net increase in net assets resulting from operations | | | 19,485,290 | | | | 137,485,185 | | |

Distributions to shareholders | |

Net investment income | |

Class A | | | (1,669,155 | ) | | | (1,647,804 | ) | |

Class B | | | (10,850 | ) | | | (18,925 | ) | |

Class C | | | (117,094 | ) | | | (120,327 | ) | |

Class I | | | (890,858 | ) | | | (1,133,368 | ) | |

Class K | | | (806 | ) | | | (893 | ) | |

Class R | | | (97,045 | ) | | | (101,779 | ) | |

Class R4 | | | (3,252 | ) | | | (8,696 | ) | |

Class R5 | | | (68,180 | ) | | | (1,314 | ) | |

Class W | | | (384 | ) | | | (514 | ) | |

Class Z | | | (5,349,955 | ) | | | (5,329,166 | ) | |

Net realized gains | |

Class A | | | (8,356,753 | ) | | | (4,493,133 | ) | |

Class B | | | (106,320 | ) | | | (101,322 | ) | |

Class C | | | (1,308,105 | ) | | | (721,091 | ) | |

Class I | | | (3,531,878 | ) | | | (1,416,585 | ) | |

Class K | | | (3,677 | ) | | | (2,021 | ) | |

Class R | | | (604,663 | ) | | | (349,373 | ) | |

Class R4 | | | (14,965 | ) | | | (3,159 | ) | |

Class R5 | | | (321,652 | ) | | | (4,923 | ) | |

Class W | | | (1,872 | ) | | | (1,237 | ) | |

Class Z | | | (22,345,300 | ) | | | (12,469,029 | ) | |

Total distributions to shareholders | | | (44,802,764 | ) | | | (27,924,659 | ) | |

Decrease in net assets from capital stock activity | | | (32,984,402 | ) | | | (12,127,923 | ) | |

Total increase (decrease) in net assets | | | (58,301,876 | ) | | | 97,432,603 | | |

Net assets at beginning of year | | | 570,415,670 | | | | 472,983,067 | | |

Net assets at end of year | | $ | 512,113,794 | | | $ | 570,415,670 | | |

Excess of distributions over net investment income | | $ | (50,860 | ) | | $ | (51,560 | ) | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

15

COLUMBIA REAL ESTATE EQUITY FUND

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Year Ended December 31, 2015 | | Year Ended December 31, 2014 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

Capital stock activity | |

Class A shares | |

Subscriptions(a) | | | 1,938,354 | | | | 30,884,153 | | | | 2,158,461 | | | | 31,755,236 | | |

Distributions reinvested | | | 642,018 | | | | 9,604,337 | | | | 376,325 | | | | 5,807,434 | | |

Redemptions | | | (2,753,240 | ) | | | (43,265,889 | ) | | | (2,476,738 | ) | | | (36,464,049 | ) | |

Net increase (decrease) | | | (172,868 | ) | | | (2,777,399 | ) | | | 58,048 | | | | 1,098,621 | | |

Class B shares | |

Subscriptions | | | 5,058 | | | | 84,107 | | | | 11,896 | | | | 176,159 | | |

Distributions reinvested | | | 7,505 | | | | 112,718 | | | | 7,500 | | | | 116,565 | | |

Redemptions(a) | | | (103,427 | ) | | | (1,627,949 | ) | | | (121,990 | ) | | | (1,779,959 | ) | |

Net decrease | | | (90,864 | ) | | | (1,431,124 | ) | | | (102,594 | ) | | | (1,487,235 | ) | |

Class C shares | |

Subscriptions | | | 192,691 | | | | 3,072,955 | | | | 258,917 | | | | 3,838,340 | | |

Distributions reinvested | | | 80,896 | | | | 1,208,348 | | | | 42,976 | | | | 667,642 | | |

Redemptions | | | (389,187 | ) | | | (6,036,446 | ) | | | (365,356 | ) | | | (5,298,498 | ) | |

Net decrease | | | (115,600 | ) | | | (1,755,143 | ) | | | (63,463 | ) | | | (792,516 | ) | |

Class I shares | |

Subscriptions | | | 1,764,169 | | | | 28,623,042 | | | | 4,905,757 | | | | 71,414,732 | | |

Distributions reinvested | | | 292,825 | | | | 4,422,270 | | | | 167,509 | | | | 2,549,596 | | |

Redemptions | | | (2,749,864 | ) | | | (40,834,758 | ) | | | (5,785,793 | ) | | | (87,606,989 | ) | |

Net decrease | | | (692,870 | ) | | | (7,789,446 | ) | | | (712,527 | ) | | | (13,642,661 | ) | |

Class K shares | |

Distributions reinvested | | | 268 | | | | 4,028 | | | | 168 | | | | 2,587 | | |

Redemptions | | | (514 | ) | | | (7,678 | ) | | | (2,042 | ) | | | (29,775 | ) | |

Net decrease | | | (246 | ) | | | (3,650 | ) | | | (1,874 | ) | | | (27,188 | ) | |

Class R shares | |

Subscriptions | | | 208,107 | | | | 3,224,684 | | | | 220,547 | | | | 3,230,740 | | |

Distributions reinvested | | | 34,084 | | | | 509,482 | | | | 20,712 | | | | 320,292 | | |

Redemptions | | | (266,803 | ) | | | (4,171,948 | ) | | | (196,072 | ) | | | (2,916,998 | ) | |

Net increase (decrease) | | | (24,612 | ) | | | (437,782 | ) | | | 45,187 | | | | 634,034 | | |

Class R4 shares | |

Subscriptions | | | 17,503 | | | | 281,908 | | | | 230,796 | | | | 3,213,349 | | |

Distributions reinvested | | | 1,183 | | | | 17,969 | | | | 797 | | | | 11,705 | | |

Redemptions | | | (1,225 | ) | | | (18,880 | ) | | | (227,030 | ) | | | (3,422,966 | ) | |

Net increase | | | 17,461 | | | | 280,997 | | | | 4,563 | | | | (197,912 | ) | |

Class R5 shares | |

Subscriptions | | | 480,246 | | | | 7,227,583 | | | | 8,221 | | | | 126,580 | | |

Distributions reinvested | | | 26,341 | | | | 389,569 | | | | 390 | | | | 6,074 | | |

Redemptions | | | (51,864 | ) | | | (783,633 | ) | | | (132,767 | ) | | | (1,895,973 | ) | |

Net increase (decrease) | | | 454,723 | | | | 6,833,519 | | | | (124,156 | ) | | | (1,763,319 | ) | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

16

COLUMBIA REAL ESTATE EQUITY FUND

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Year Ended December 31, 2015 | | Year Ended December 31, 2014 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

Capital stock activity (continued) | |

Class W shares | |

Subscriptions | | | — | | | | — | | | | 139 | | | | 1,833 | | |

Distributions reinvested | | | 132 | | | | 1,980 | | | | 103 | | | | 1,579 | | |

Redemptions | | | (516 | ) | | | (8,338 | ) | | | (2,524 | ) | | | (35,644 | ) | |

Net decrease | | | (384 | ) | | | (6,358 | ) | | | (2,282 | ) | | | (32,232 | ) | |

Class Z shares | |

Subscriptions | | | 2,111,165 | | | | 33,215,842 | | | | 4,314,381 | | | | 63,795,199 | | |

Distributions reinvested | | | 1,024,347 | | | | 15,368,216 | | | | 649,225 | | | | 10,015,546 | | |

Redemptions | | | (4,793,164 | ) | | | (74,482,074 | ) | | | (4,734,810 | ) | | | (69,728,260 | ) | |

Net increase (decrease) | | | (1,657,652 | ) | | | (25,898,016 | ) | | | 228,796 | | | | 4,082,485 | | |

Total net decrease | | | (2,282,912 | ) | | | (32,984,402 | ) | | | (670,302 | ) | | | (12,127,923 | ) | |

(a) Includes conversions of Class B shares to Class A shares, if any.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

17

COLUMBIA REAL ESTATE EQUITY FUND

The following tables are intended to help you understand the Fund's financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund's portfolio turnover rate may be higher.

| | | Year Ended December 31, | |

Class A | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 15.95 | | | $ | 12.98 | | | $ | 14.35 | | | $ | 12.69 | | | $ | 12.41 | | |

Income from investment operations: | |

Net investment income | | | 0.21 | | | | 0.20 | | | | 0.16 | | | | 0.21 | | | | 0.18 | | |

Net realized and unrealized gain (loss) | | | 0.42 | | | | 3.54 | | | | (0.20 | ) | | | 1.92 | | | | 0.59 | | |

Total from investment operations | | | 0.63 | | | | 3.74 | | | | (0.04 | ) | | | 2.13 | | | | 0.77 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.21 | ) | | | (0.20 | ) | | | (0.17 | ) | | | (0.21 | ) | | | (0.19 | ) | |

Net realized gains | | | (1.07 | ) | | | (0.57 | ) | | | (1.16 | ) | | | (0.26 | ) | | | (0.32 | ) | |

Total distributions to shareholders | | | (1.28 | ) | | | (0.77 | ) | | | (1.33 | ) | | | (0.47 | ) | | | (0.51 | ) | |

Redemption fees: | |

Redemption fees added to paid-in capital | | | — | | | | — | | | | — | | | | 0.00 | (a) | | | 0.02 | | |

Net asset value, end of period | | $ | 15.30 | | | $ | 15.95 | | | $ | 12.98 | | | $ | 14.35 | | | $ | 12.69 | | |

Total return | | | 4.32 | % | | | 29.08 | % | | | (0.37 | %) | | | 16.92 | % | | | 6.59 | % | |

Ratios to average net assets(b) | |

Total gross expenses | | | 1.25 | % | | | 1.24 | % | | | 1.28 | % | | | 1.31 | %(c) | | | 1.26 | % | |

Total net expenses(d) | | | 1.25 | %(e) | | | 1.24 | %(e) | | | 1.28 | %(e) | | | 1.30 | %(c)(e) | | | 1.24 | %(e) | |

Net investment income | | | 1.33 | % | | | 1.38 | % | | | 1.07 | % | | | 1.49 | % | | | 1.44 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 123,136 | | | $ | 131,148 | | | $ | 105,995 | | | $ | 112,410 | | | $ | 99,335 | | |

Portfolio turnover | | | 32 | % | | | 35 | % | | | 80 | % | | | 65 | % | | | 72 | % | |

Notes to Financial Highlights

(a) Rounds to zero.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Ratios include line of credit interest expense which is less than 0.01%.

(d) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(e) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

18

COLUMBIA REAL ESTATE EQUITY FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended December 31, | |

Class B | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 15.99 | | | $ | 13.01 | | | $ | 14.38 | | | $ | 12.71 | | | $ | 12.43 | | |

Income from investment operations: | |

Net investment income | | | 0.06 | | | | 0.08 | | | | 0.04 | | | | 0.10 | | | | 0.08 | | |

Net realized and unrealized gain (loss) | | | 0.45 | | | | 3.56 | | | | (0.19 | ) | | | 1.94 | | | | 0.58 | | |

Total from investment operations | | | 0.51 | | | | 3.64 | | | | (0.15 | ) | | | 2.04 | | | | 0.66 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.09 | ) | | | (0.09 | ) | | | (0.06 | ) | | | (0.11 | ) | | | (0.09 | ) | |

Net realized gains | | | (1.07 | ) | | | (0.57 | ) | | | (1.16 | ) | | | (0.26 | ) | | | (0.32 | ) | |

Total distributions to shareholders | | | (1.16 | ) | | | (0.66 | ) | | | (1.22 | ) | | | (0.37 | ) | | | (0.41 | ) | |

Redemption fees: | |

Redemption fees added to paid-in capital | | | — | | | | — | | | | — | | | | 0.00 | (a) | | | 0.03 | | |

Net asset value, end of period | | $ | 15.34 | | | $ | 15.99 | | | $ | 13.01 | | | $ | 14.38 | | | $ | 12.71 | | |

Total return | | | 3.52 | % | | | 28.14 | % | | | (1.13 | %) | | | 16.10 | % | | | 5.76 | % | |

Ratios to average net assets(b) | |

Total gross expenses | | | 2.00 | % | | | 1.99 | % | | | 2.03 | % | | | 2.05 | %(c) | | | 2.02 | % | |

Total net expenses(d) | | | 2.00 | %(e) | | | 1.99 | %(e) | | | 2.03 | %(e) | | | 2.05 | %(c)(e) | | | 2.01 | %(e) | |

Net investment income | | | 0.38 | % | | | 0.53 | % | | | 0.26 | % | | | 0.68 | % | | | 0.61 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 1,227 | | | $ | 2,732 | | | $ | 3,559 | | | $ | 5,341 | | | $ | 7,274 | | |

Portfolio turnover | | | 32 | % | | | 35 | % | | | 80 | % | | | 65 | % | | | 72 | % | |

Notes to Financial Highlights

(a) Rounds to zero.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Ratios include line of credit interest expense which is less than 0.01%.

(d) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(e) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

19

COLUMBIA REAL ESTATE EQUITY FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended December 31, | |

Class C | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 15.95 | | | $ | 12.98 | | | $ | 14.34 | | | $ | 12.68 | | | $ | 12.40 | | |

Income from investment operations: | |

Net investment income | | | 0.09 | | | | 0.09 | | | | 0.04 | | | | 0.10 | | | | 0.08 | | |

Net realized and unrealized gain (loss) | | | 0.42 | | | | 3.54 | | | | (0.18 | ) | | | 1.93 | | | | 0.59 | | |

Total from investment operations | | | 0.51 | | | | 3.63 | | | | (0.14 | ) | | | 2.03 | | | | 0.67 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.09 | ) | | | (0.09 | ) | | | (0.06 | ) | | | (0.11 | ) | | | (0.09 | ) | |

Net realized gains | | | (1.07 | ) | | | (0.57 | ) | | | (1.16 | ) | | | (0.26 | ) | | | (0.32 | ) | |

Total distributions to shareholders | | | (1.16 | ) | | | (0.66 | ) | | | (1.22 | ) | | | (0.37 | ) | | | (0.41 | ) | |

Redemption fees: | |

Redemption fees added to paid-in capital | | | — | | | | — | | | | — | | | | 0.00 | (a) | | | 0.02 | | |

Net asset value, end of period | | $ | 15.30 | | | $ | 15.95 | | | $ | 12.98 | | | $ | 14.34 | | | $ | 12.68 | | |

Total return | | | 3.53 | % | | | 28.13 | % | | | (1.08 | %) | | | 16.06 | % | | | 5.77 | % | |

Ratios to average net assets(b) | |

Total gross expenses | | | 2.00 | % | | | 1.99 | % | | | 2.03 | % | | | 2.06 | %(c) | | | 2.01 | % | |

Total net expenses(d) | | | 2.00 | %(e) | | | 1.99 | %(e) | | | 2.03 | %(e) | | | 2.05 | %(c)(e) | | | 2.00 | %(e) | |

Net investment income | | | 0.56 | % | | | 0.62 | % | | | 0.30 | % | | | 0.72 | % | | | 0.67 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 18,523 | | | $ | 21,155 | | | $ | 18,045 | | | $ | 21,001 | | | $ | 19,802 | | |

Portfolio turnover | | | 32 | % | | | 35 | % | | | 80 | % | | | 65 | % | | | 72 | % | |

Notes to Financial Highlights

(a) Rounds to zero.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Ratios include line of credit interest expense which is less than 0.01%.

(d) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(e) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

20

COLUMBIA REAL ESTATE EQUITY FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended December 31, | |

Class I | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 16.01 | | | $ | 13.03 | | | $ | 14.39 | | | $ | 12.72 | | | $ | 12.42 | | |

Income from investment operations: | |

Net investment income | | | 0.28 | | | | 0.25 | | | | 0.22 | | | | 0.27 | | | | 0.21 | | |

Net realized and unrealized gain (loss) | | | 0.42 | | | | 3.56 | | | | (0.18 | ) | | | 1.93 | | | | 0.62 | | |

Total from investment operations | | | 0.70 | | | | 3.81 | | | | 0.04 | | | | 2.20 | | | | 0.83 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.28 | ) | | | (0.26 | ) | | | (0.24 | ) | | | (0.27 | ) | | | (0.24 | ) | |

Net realized gains | | | (1.07 | ) | | | (0.57 | ) | | | (1.16 | ) | | | (0.26 | ) | | | (0.32 | ) | |

Total distributions to shareholders | | | (1.35 | ) | | | (0.83 | ) | | | (1.40 | ) | | | (0.53 | ) | | | (0.56 | ) | |

Redemption fees: | |

Redemption fees added to paid-in capital | | | — | | | | — | | | | — | | | | 0.00 | (a) | | | 0.03 | | |

Net asset value, end of period | | $ | 15.36 | | | $ | 16.01 | | | $ | 13.03 | | | $ | 14.39 | | | $ | 12.72 | | |

Total return | | | 4.78 | % | | | 29.61 | % | | | 0.21 | % | | | 17.48 | % | | | 7.19 | % | |

Ratios to average net assets(b) | |

Total gross expenses | | | 0.80 | % | | | 0.80 | % | | | 0.80 | % | | | 0.84 | %(c) | | | 0.80 | % | |

Total net expenses(d) | | | 0.80 | % | | | 0.80 | % | | | 0.80 | % | | | 0.84 | %(c) | | | 0.80 | %(e) | |

Net investment income | | | 1.79 | % | | | 1.70 | % | | | 1.47 | % | | | 1.95 | % | | | 1.65 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 33,308 | | | $ | 45,809 | | | $ | 46,560 | | | $ | 70,213 | | | $ | 68,508 | | |

Portfolio turnover | | | 32 | % | | | 35 | % | | | 80 | % | | | 65 | % | | | 72 | % | |

Notes to Financial Highlights

(a) Rounds to zero.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Ratios include line of credit interest expense which is less than 0.01%.

(d) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(e) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

21

COLUMBIA REAL ESTATE EQUITY FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended December 31, | |

Class K | | 2015 | | 2014 | | 2013 | | 2012 | | 2011(a) | |

Per share data | |

Net asset value, beginning of period | | $ | 15.99 | | | $ | 13.02 | | | $ | 14.38 | | | $ | 12.72 | | | $ | 12.73 | | |

Income from investment operations: | |

Net investment income | | | 0.23 | | | | 0.22 | | | | 0.19 | | | | 0.23 | | | | 0.18 | | |

Net realized and unrealized gain (loss) | | | 0.42 | | | | 3.54 | | | | (0.19 | ) | | | 1.93 | | | | 0.31 | | |

Total from investment operations | | | 0.65 | | | | 3.76 | | | | — | | | | 2.16 | | | | 0.49 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.23 | ) | | | (0.22 | ) | | | (0.20 | ) | | | (0.24 | ) | | | (0.20 | ) | |

Net realized gains | | | (1.07 | ) | | | (0.57 | ) | | | (1.16 | ) | | | (0.26 | ) | | | (0.32 | ) | |

Total distributions to shareholders | | | (1.30 | ) | | | (0.79 | ) | | | (1.36 | ) | | | (0.50 | ) | | | (0.52 | ) | |

Redemption fees: | |

Redemption fees added to paid-in capital | | | — | | | | — | | | | — | | | | 0.00 | (b) | | | 0.02 | | |

Net asset value, end of period | | $ | 15.34 | | | $ | 15.99 | | | $ | 13.02 | | | $ | 14.38 | | | $ | 12.72 | | |

Total return | | | 4.46 | % | | | 29.17 | % | | | (0.10 | %) | | | 17.09 | % | | | 4.24 | % | |

Ratios to average net assets(c) | |

Total gross expenses | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.13 | %(d) | | | 1.12 | %(e) | |

Total net expenses(f) | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.13 | %(d) | | | 1.12 | %(e)(g) | |

Net investment income | | | 1.48 | % | | | 1.50 | % | | | 1.26 | % | | | 1.64 | % | | | 1.66 | %(e) | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 52 | | | $ | 58 | | | $ | 72 | | | $ | 74 | | | $ | 75 | | |

Portfolio turnover | | | 32 | % | | | 35 | % | | | 80 | % | | | 65 | % | | | 72 | % | |

Notes to Financial Highlights

(a) Based on operations from March 7, 2011 (commencement of operations) through the stated period end.

(b) Rounds to zero.

(c) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(d) Ratios include line of credit interest expense which is less than 0.01%.

(e) Annualized.

(f) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(g) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2015

22

COLUMBIA REAL ESTATE EQUITY FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended December 31, | |

Class R | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 15.94 | | | $ | 12.97 | | | $ | 14.34 | | | $ | 12.67 | | | $ | 12.40 | | |

Income from investment operations: | |

Net investment income | | | 0.17 | | | | 0.17 | | | | 0.13 | | | | 0.17 | | | | 0.16 | | |

Net realized and unrealized gain (loss) | | | 0.42 | | | | 3.53 | | | | (0.21 | ) | | | 1.94 | | | | 0.56 | | |

Total from investment operations | | | 0.59 | | | | 3.70 | | | | (0.08 | ) | | | 2.11 | | | | 0.72 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.17 | ) | | | (0.16 | ) | | | (0.13 | ) | | | (0.18 | ) | | | (0.16 | ) | |

Net realized gains | | | (1.07 | ) | | | (0.57 | ) | | | (1.16 | ) | | | (0.26 | ) | | | (0.32 | ) | |

Total distributions to shareholders | | | (1.24 | ) | | | (0.73 | ) | | | (1.29 | ) | | | (0.44 | ) | | | (0.48 | ) | |

Redemption fees: | |

Redemption fees added to paid-in capital | | | — | | | | — | | | | — | | | | 0.00 | (a) | | | 0.03 | | |

Net asset value, end of period | | $ | 15.29 | | | $ | 15.94 | | | $ | 12.97 | | | $ | 14.34 | | | $ | 12.67 | | |

Total return | | | 4.06 | % | | | 28.78 | % | | | (0.62 | %) | | | 16.74 | % | | | 6.25 | % | |

Ratios to average net assets(b) | |

Total gross expenses | | | 1.50 | % | | | 1.49 | % | | | 1.53 | % | | | 1.55 | %(c) | | | 1.51 | % | |

Total net expenses(d) | | | 1.50 | %(e) | | | 1.49 | %(e) | | | 1.53 | %(e) | | | 1.55 | %(c)(e) | | | 1.49 | %(e) | |

Net investment income | | | 1.09 | % | | | 1.15 | % | | | 0.87 | % | | | 1.20 | % | | | 1.29 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 9,140 | | | $ | 9,922 | | | $ | 7,491 | | | $ | 6,131 | | | $ | 6,004 | | |

Portfolio turnover | | | 32 | % | | | 35 | % | | | 80 | % | | | 65 | % | | | 72 | % | |

Notes to Financial Highlights

(a) Rounds to zero.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Ratios include line of credit interest expense which is less than 0.01%.

(d) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(e) The benefits derived from expense reductions had an impact of less than 0.01%.