UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| |

| Investment Company Act file number: | 811-04627 |

Name of Registrant: | Vanguard Convertible Securities Fund |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Heidi Stam, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: | (610) 669-1000 |

Date of fiscal year end: November 30 |

Date of reporting period: December 1, 2014 – November 30, 2015 |

Item 1: Reports to Shareholders |

Annual Report | November 30, 2015

Vanguard Convertible Securities Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 7 |

| Fund Profile. | 10 |

| Performance Summary. | 12 |

| Financial Statements. | 14 |

| Your Fund’s After-Tax Returns. | 29 |

| About Your Fund’s Expenses. | 30 |

| Glossary. | 32 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Pictured is a sailing block on the Brilliant, a 1932 schooner docked in Mystic, Connecticut. A type of pulley, the

sailing block helps coordinate the setting of the sails. At Vanguard, the intricate coordination of technology and people allows

us to help millions of clients around the world reach their financial goals.

Your Fund’s Total Returns

| |

| Fiscal Year Ended November 30, 2015 | |

| |

| | Total |

| | Returns |

| Vanguard Convertible Securities Fund | 0.55% |

| Convertibles Composite Index | 1.27 |

| Convertible Securities Funds Average | -2.23 |

| For a benchmark description, see the Glossary. |

| Convertible Securities Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| November 30, 2014, Through November 30, 2015 | | | | |

| |

| | | | Distributions Per Share |

| | Starting | Ending | | |

| | Share | Share | Income | Capital |

| | Price | Price | Dividends | Gains |

| Vanguard Convertible Securities Fund | $13.85 | $12.67 | $0.241 | $1.010 |

1

Chairman’s Letter

Dear Shareholder,

For the 12 months ended November 30, 2015, Vanguard Convertible Securities Fund returned 0.55%. The fund’s result trailed the 1.27% return of its benchmark, the Convertibles Composite Index, but surpassed the –2.23% average return of its peers.

Convertible securities are corporate bonds and preferred stocks that may be exchanged for common stocks at a predetermined price. Convertibles combine the features of bonds and stocks; they offer steady income along with the potential to benefit if the value of their underlying stocks increases.

The fund leans away from riskier convertible securities that lack downside protection. Therefore, as in some prior fiscal years, the fund did not benefit from the market’s recent preference for higher-risk convertibles, which helped the benchmark’s return.

The broad U.S. stock market produced modest returns

U.S. stocks traveled a rocky route on their way to returns that approached 3% for the period. Most of the turmoil came in late summer; markets tumbled in August and September amid fears about the ripple effects of China’s slowing economic growth.

Stocks recovered markedly in October and held firm in November. Central banks in Europe and Asia discussed or enacted more stimulus measures to combat weak growth and low inflation.

2

International stocks returned about –6% as the dollar’s strength hurt results. Returns for emerging markets, which were especially affected by the concerns about China, trailed those of the developed markets of the Pacific region and Europe.

Bonds managed slight gains as investors waited for the Fed

Bond returns were muted over the fiscal year as markets digested the Federal Reserve’s latest statements about the timing of a potential rise in short-term interest rates. (In mid-December, after the close of the reporting period, the Fed raised its target for short-term rates to 0.25%–0.5%.) Investors seemed to alternately seek and shun safe-haven assets, depending on stock market volatility at the time.

The broad U.S. taxable bond market returned 0.97%, with income providing the gain. The yield of the 10-year Treasury note ended November at 2.22%, down from 2.25% a year earlier.

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned –8.29%, hindered by the dollar’s strength against many foreign currencies. Without this currency effect, results were positive.

The Fed’s 0%–0.25% target for short-term rates continued to limit returns for money market funds and savings accounts.

| | | |

| Market Barometer | | | |

| |

| | | Average Annual Total Returns |

| | | Periods Ended November 30, 2015 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 2.53% | 16.10% | 14.32% |

| Russell 2000 Index (Small-caps) | 3.51 | 14.92 | 12.02 |

| Russell 3000 Index (Broad U.S. market) | 2.58 | 16.00 | 14.13 |

| FTSE All-World ex US Index (International) | -6.43 | 3.85 | 3.41 |

| |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 0.97% | 1.50% | 3.09% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 3.10 | 2.49 | 4.79 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.02 | 0.02 | 0.04 |

| |

| CPI | | | |

| Consumer Price Index | 0.50% | 1.02% | 1.64% |

3

Convertibles’ returns reflected small gains for stocks and bonds

The Convertible Securities Fund allows investors to benefit from some of the characteristics of both stocks and bonds. As U.S. stocks and bonds posted small gains for the fiscal year, the convertible market did the same.

Convertible securities tend to be issued by small or midsized firms that often have difficulty securing other sources of financing. They are an attractive funding method because they typically require lower interest payments than bonds. The issuance of convertibles during the period started at a healthy pace but slowed as stock and bond market volatility rose. Persistent low interest rates also made

regular bonds a more attractive way to raise money than convertibles, which can potentially dilute the value of the issuer’s equity shares.

The fund’s relative performance was hindered modestly by its tilt toward convertible securities that have a balanced degree of equity sensitivity. Convertibles with greater sensitivity to stock market movements did well for the period, helping the benchmark modestly outdistance the fund.

During the 12 months, the fund reached its goal of holding about 30% of assets in non-U.S. securities. The year-ago figure was about 25%. The fund’s greater diversification is expected to

| | |

| Expense Ratios | | |

| Your Fund Compared With Its Peer Group | | |

| |

| �� | | Peer Group |

| | Fund | Average |

| Convertible Securities Fund | 0.41% | 1.24% |

The fund expense ratio shown is from the prospectus dated March 25, 2015, and represents estimated costs for the current fiscal year. For

the fiscal year ended November 30, 2015, the fund’s expense ratio was 0.38%. This decrease from the estimated expense ratio reflects a

performance-based investment advisory fee adjustment. When the performance adjustment is positive, the fund’s expenses increase; when it

is negative, expenses decrease. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and

captures information through year-end 2014.

Peer group: Convertible Securities Funds.

4

help the advisor manage risk and gain exposure to opportunities not available in the United States.

Returns from convertibles denominated in non-U.S. currencies were hurt as the value of many such currencies fell against the U.S. dollar. The dollar strengthened noticeably against most major currencies, including the euro, Japanese yen, British pound, Australian and Canadian dollars, and Swiss franc. The fund, though, uses currency hedging to take away the effects of currency fluctuations, whether positive or negative. As a result, the fund’s international holdings returned more than 6%, helping it to outperform peer funds.

Performance was restrained by the fund’s exposure to oil and gas companies in the energy sector, still battered by falling oil prices. The price of U.S.-produced oil fell 37% over the 12 months. However, energy-related convertibles made up just about 6% of the fund’s holdings, down from 16% two years ago. Information technology was the dominant sector; that helped results because IT stocks were among the market’s better performers during the period. The semiconductor industry did particularly well for the fund.

For more information on the fund’s positioning and performance during the year, please see the Advisor’s Report that follows this letter.

| |

| Total Returns | |

| Ten Years Ended November 30, 2015 | |

| | Average |

| | Annual Return |

| Convertible Securities Fund | 7.12% |

| Convertibles Composite Index | 6.65 |

| Convertible Securities Funds Average | 5.84 |

For a benchmark description, see the Glossary.

Convertible Securities Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be

lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our

website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so

an investor’s shares, when sold, could be worth more or less than their original cost.

5

The fund’s long-term record continued to beat its yardsticks

The Convertible Securities Fund delivered an average annual return of 7.12% over the ten years ended November 30, 2015, besting both the Convertibles Composite Index (+6.65%) and the average return of peers (+5.84%).

The fund’s superior long-term record is evidence of the skill and experience of Oaktree Capital Management. Oaktree—which oversees about $100 billion in high-yield and distressed debt, convertibles, and other alternative assets—successfully managed the fund during an unusually turbulent ten-year period, when the global financial crisis dramatically reduced new issuance of convertibles. Interest in convertibles rebounded, but periods of volatility amid historically low interest rates have created unique challenges.

Oaktree has admirably steered the fund through these unusual crosscurrents. Importantly, the fund’s low expense ratio—about one-third of the peer fund average—helps the advisor pass on more of the fund’s returns to you.

A dose of discipline is crucial when markets become volatile

The developments over the past few months remind us that nobody can control the direction of the markets or reliably predict where they’ll go in the short term. However, investors can control how they react to unstable and turbulent markets.

During periods of market adversity, it’s more important than ever to keep sight of one of Vanguard’s key principles: Maintain perspective and long-term discipline. Whether you’re investing for yourself or on behalf of clients, your success is affected greatly by how you respond—or don’t respond—during turbulent markets. (You can read Vanguard’s Principles for Investing Success at vanguard.com/research.)

As I’ve written in the past, the best course for long-term investors is generally to ignore daily market moves and not make decisions based on emotion. This is also a good time to evaluate your portfolio and make sure your asset allocation is aligned with your time horizon, goals, and risk tolerance.

The markets are unpredictable and often confounding. Keeping your long-term plans clearly in focus can help you weather these periodic storms.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

December 17, 2015

6

Advisor’s Report

The investment strategy of Vanguard Convertible Securities Fund is to create a highly diversified global portfolio of convertible securities. The fund emphasizes

investments in convertible bonds that have a relatively near-term maturity or put date. We focus on “balanced” convertibles with a reasonable yield, stable credit quality,

| |

| Major Portfolio Changes | |

| Fiscal Year Ended November 30, 2015 | |

| |

| Additions | Comments |

| Aroundtown Property Holdings | Balanced new issue offering an attractive yield on a company |

| (3.00% convertible note due 05/05/20) | with a good growth profile. |

| Cemex | Balanced convertible issue with attractive growth prospects. |

| (3.72% convertible note due 03/15/20) | |

| Ctrip.com International | Balanced convertible with strong equity catalysts. |

| (1.00% convertible note due 07/01/20) | |

| Dycom Industries | Balanced new issue with compelling growth characteristics. |

| (0.75% convertible note due 09/15/21) | |

| Euronet Worldwide | Balanced convertible issue with strong growth catalysts. |

| (1.50% convertible note due 10/01/44) | |

| LinkedIn | Balanced convertible with solid growth potential. |

| (0.50% convertible note due 11/01/19) | |

| Microchip Technology | Attractive new issue with above-average growth potential. |

| (1.625% convertible note due 02/15/25) | |

| |

| Reductions | Comments |

| BioMarin Pharmaceutical | Sold after substantial appreciation and bonds lacked significant |

| (0.75% convertible note due 10/15/18) | downside protection. |

| (1.50% convertible note due 10/15/20) | |

| Hologic | Sold after substantial appreciation and bonds lacked significant |

| (0.00% convertible note due 12/15/43) | downside protection. |

| (2.00% convertible note due 12/15/37) | |

| (2.00% convertible note due 03/01/42) | |

| Molina Healthcare | Sold after substantial appreciation and bonds lacked significant |

| (1.125% convertible note due 01/15/20) | downside protection. |

| (1.625% convertible note due 08/15/44) | |

| NVIDIA | Sold after substantial appreciation and bonds lacked significant |

| (1.00% convertible note due 12/01/18) | downside protection. |

| Omnicare | Sold after substantial appreciation with company being acquired by |

| (3.25% convertible note due 12/15/35) | CVS Health. |

| (3.50% convertible note due 02/15/44) | |

| Orpea | Sold after substantial appreciation and bonds developed significant |

| (1.75% convertible note due 01/01/20) | downside risk. |

| Shionogi & Company | Sold after substantial appreciation and bonds developed significant |

| (0.00% convertible note due 12/17/19) | downside risk. |

7

good call protection, and low to moderate conversion premiums. We believe these securities have a favorable balance of upside potential and downside risk. The fund underweights convertible preferred shares, which are riskier but may offer higher returns. We do, however, consider them part of our investable universe and make some use of them.

Importantly, the fund does not invest in common stocks or nonconvertible debt. We do not attempt market timing and therefore are fully invested, holding only a small amount of cash for potential investments. We believe that a portfolio of attractive, carefully selected convertible securities can produce equity-type returns with lower volatility and lower structural risk over long periods.

We are pleased to report that despite volatile market conditions, the fund posted a positive return, of 0.55%, for the 12 months ended November 30, 2015. Convertible securities benefited from the strength of underlying equities during market rallies while providing downside protection during times of volatility.

The investment environment

After a strong start to the period, convertible security valuations were affected by a combination of wider credit spreads and lower prices for the underlying equities. Several macroeconomic factors weighed heavily on the broad market from mid-June through the end of the period. Greece’s debt crisis, concerns over slowing growth in China, uncertainty about when the Federal Reserve would raise interest rates, and falling commodity prices led equity and credit markets to decline sharply. More narrowly focused markets, including convertible securities, also felt damaging effects. Despite these factors, global convertible bonds (on a U.S. dollar-hedged basis) remain a leading asset class for the calendar year to date.

The Convertible Securities portfolio remains highly sensitive to underlying equity performance as a result of convertibles’ historically low coupons in the current interest rate environment. The fund remains structurally conservative; 94% of its assets are in short- to intermediate-term bonds, defined as those with maturities or puts within seven years. Convertible preferred shares make up about 4% of the portfolio, a significant underweighting versus the benchmark index. We are comfortable with our current portfolio construction with its balance between equity and fixed income characteristics.

The new-issuance market over the period proved weaker than we anticipated. After a strong start to calendar year 2015, new issuance slowed considerably in the summer. It totaled $78.8 billion for the reporting period, with U.S. issuance of $38.8 billion slightly lagging non-U.S. issuance of $40 billion.

We believe there are three primary reasons for the lower issuance. First, volatility in the equity and credit markets dissuaded potential issuers. Second, uncertainty in the U.S. and global economies has made management teams hesitant to raise capital that may not be needed to fund internal growth

8

projects. Third, prolonged low interest rates have made nonconvertible debt issuance more attractive than a potentially dilutive convertible transaction. Until some of these obstacles are removed, we do not expect issuance to improve materially.

Our successes

The portfolio returns were broad-based. The top absolute individual contributors to performance were convertibles from Hologic, BioMarin Pharmaceutical, and Omnicare. Among industries, our security selection among semiconductor companies generated strong returns relative to the benchmark.

Our shortfalls

The fund had several winners and no meaningful detractors outside of oil and gas companies. Significant absolute individual detractors included SunEdison, Chesapeake Energy, and Iconix Brand Group. Among industries, our holdings in integrated oil, pharmaceutical, and communications equipment companies hurt relative performance.

The fund’s positioning

We remain fully invested in a highly diversified, well-balanced portfolio of convertible securities. At the end of the period, the fund held about one-third of its assets in securities issued outside the United States. The fund has an attractive current yield of 1.8% and an average credit quality of Ba3/BB–. The vast majority of the securities in the fund are performing well fundamentally and, importantly, are well-positioned from a credit perspective.

Our outlook remains positive. The convertible market remains technically sound. Demand is solid for most securities, especially for those issued by companies that have strong credit ratings. Fixed income investors find convertible securities attractive as they seek equity upside potential from fixed income assets and as equity investors seek to dampen stock market volatility. Convertibles will remain highly correlated with their underlying equities, but our emphasis on credit quality and intermediate-duration bonds will reduce that volatility.

Jean-Paul Nedelec, Managing Director

Abe Ofer, Managing Director

Stuart Spangler, CFA, Managing Director

Oaktree Capital Management, L.P.

December 18, 2015

9

Convertible Securities Fund

Fund Profile

As of November 30, 2015

| |

| Portfolio Characteristics | |

| Ticker Symbol | VCVSX |

| Number of Securities | 182 |

| 30-Day SEC Yield | 1.78% |

| Conversion Premium | 35.6% |

| Average Weighted Maturity | 4.6 years |

| Average Coupon | 1.9% |

| Average Duration | 4.3 years |

| Foreign Holdings | 33.3% |

| Turnover Rate | 95% |

| Expense Ratio1 | 0.41% |

| Short-Term Reserves | 2.6% |

| |

| Distribution by Maturity | |

| (% of fixed income portfolio) | |

| Under 1 Year | 1.9% |

| 1 - 5 Years | 63.7 |

| 5 - 10 Years | 32.4 |

| 10 - 20 Years | 1.2 |

| 20 - 30 Years | 0.8 |

| |

| Distribution by Credit Quality (% of fixed | |

| income portfolio) | |

| AAA | 0.0% |

| AA | 0.1 |

| A | 1.3 |

| BBB | 5.2 |

| BB | 15.0 |

| B | 9.0 |

| Below B | 1.7 |

| Not Rated | 67.7 |

Credit-quality ratings are obtained from S&P. "Not Rated" is used to classify securities for which a rating is not available. Not rated

securities include a fund's investment in Vanguard Market Liquidity Fund or Vanguard Municipal Cash Management Fund, each of

which invests in high-quality money market instruments and may serve as a cash management vehicle for the Vanguard funds,

trusts, and accounts. For more information about these ratings, see the Glossary entry for Credit Quality.

| | |

| Total Fund Volatility Measures | |

| | | DJ |

| | Convertibles | U.S. Total |

| | Composite | Market |

| | Index | FA Index |

| R-Squared | 0.89 | 0.71 |

| Beta | 0.95 | 0.55 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| | |

| Ten Largest Holdings (% of total net assets) |

| Citrix Systems Inc. | Software | 2.2% |

| Red Hat Inc. | Software | 2.1 |

| Jazz Investments I Ltd. | Pharmaceuticals | 2.0 |

| Priceline Group Inc. | Internet & Catalog | |

| | Retail | 1.9 |

| LinkedIn Corp. | Internet Software & | |

| | Services | 1.7 |

| Dycom Industries Inc. | Construction & | |

| | Engineering | 1.7 |

| NXP Semiconductors NV Semiconductors & | |

| | Semiconductor | |

| | Equipment | 1.7 |

| Ctrip.com International | Internet & Catalog | |

| Ltd. | Retail | 1.6 |

| Scorpio Tankers Inc. | Oil, Gas & | |

| | Consumable Fuels | 1.6 |

| j2 Global Inc. | Internet Software & | |

| | Services | 1.5 |

| Top Ten | | 18.0% |

The holdings listed exclude any temporary cash investments and equity index products.

1 The expense ratio shown is from the prospectus dated March 25, 2015, and represents estimated costs for the current fiscal year. For the

fiscal year ended November 30, 2015, the expense ratio was 0.38%.

10

Convertible Securities Fund

| |

| Sector Diversification (% of market exposure) |

| |

| Consumer Discretionary | 11.1% |

| Consumer Staples | 2.7 |

| Energy | 5.3 |

| Financials | 14.0 |

| Health Care | 18.0 |

| Industrials | 9.9 |

| Information Technology | 31.0 |

| Materials | 5.3 |

| Telecommunication Services | 0.9 |

| Utilities | 1.8 |

11

Convertible Securities Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

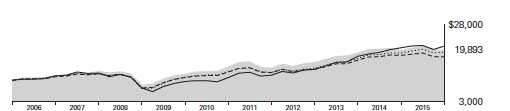

Cumulative Performance: November 30, 2005, Through November 30, 2015

Initial Investment of $10,000

| | | | | |

| | | Average Annual Total Returns | |

| | | Periods Ended November 30, 2015 | |

| | | | | | Final Value |

| | | One | Five | Ten | of a $10,000 |

| | | Year | Years | Years | Investment |

| | Convertible Securities Fund | 0.55% | 6.65% | 7.12% | $19,893 |

| •••••••• | Convertibles Composite Index | 1.27 | 8.19 | 6.65 | 19,030 |

| – – – – | Convertible Securities Funds Average | -2.23 | 6.86 | 5.84 | 17,640 |

| | Dow Jones U.S. Total Stock Market | | | | |

| | Float Adjusted Index | 2.50 | 14.10 | 7.71 | 21,016 |

| For a benchmark description, see the Glossary. |

| Convertible Securities Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

See Financial Highlights for dividend and capital gains information.

12

Convertible Securities Fund

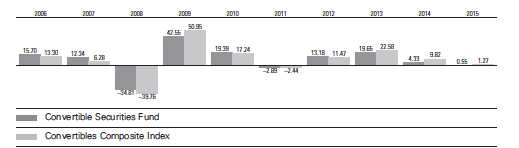

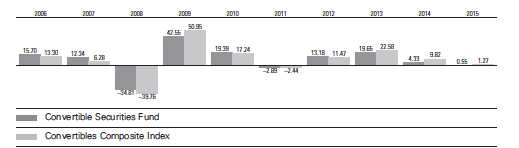

Fiscal-Year Total Returns (%): November 30, 2005, Through November 30, 2015

For a benchmark description, see the Glossary.

Average Annual Total Returns: Periods Ended September 30, 2015

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | Ten Years |

| | Inception Date | One Year | Five Years | Income | Capital | Total |

| Convertible Securities | | | | | | |

| Fund | 6/17/1986 | -2.07% | 6.90% | 3.53% | 3.51% | 7.04% |

13

Convertible Securities Fund

Financial Statements

Statement of Net Assets

As of November 30, 2015

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| Convertible Bonds (92.1%) | | | | | |

| Consumer Discretionary (10.7%) | | | | | |

| Cineplex Inc. Cvt. | 4.500% | 12/31/18 | CAD | 5,713 | 4,631 |

| 1 Ctrip.com International Ltd. Cvt. | 1.000% | 7/1/20 | USD | 18,725 | 22,306 |

| 1 Ctrip.com International Ltd. Cvt. | 1.990% | 7/1/25 | USD | 4,310 | 5,290 |

| FF Group Finance Luxembourg Cvt. | 1.750% | 7/3/19 | EUR | 8,000 | 7,089 |

| Iconix Brand Group Inc. Cvt. | 1.500% | 3/15/18 | USD | 16,027 | 10,588 |

| Iida Group Holdings Co. Ltd. Cvt. | 0.000% | 6/18/20 | JPY | 500,000 | 4,656 |

| Jarden Corp. Cvt. | 1.125% | 3/15/34 | USD | 20,449 | 23,210 |

| K’s Holdings Corp. Cvt. | 0.000% | 12/20/19 | JPY | 480,000 | 5,059 |

| Liberty Media Corp. Cvt. | 1.375% | 10/15/23 | USD | 24,325 | 24,857 |

| Lotte Shopping Co. Ltd. Cvt. | 0.000% | 1/24/18 | KRW | 4,200,000 | 3,572 |

| NH Hoteles SA Cvt. | 4.000% | 11/8/18 | EUR | 5,700 | 7,340 |

| NHK Spring Co. Ltd. Cvt. | 0.000% | 9/20/19 | USD | 1,650 | 1,764 |

| Priceline Group Inc. Cvt. | 0.350% | 6/15/20 | USD | 23,370 | 27,489 |

| Priceline Group Inc. Cvt. | 0.900% | 9/15/21 | USD | 6,165 | 6,177 |

| ResortTrust Inc. Cvt. | 0.000% | 12/1/21 | JPY | 560,000 | 5,453 |

| 1 Restoration Hardware Holdings Inc. Cvt. | 0.000% | 7/15/20 | USD | 8,045 | 7,643 |

| Sony Corp. Cvt. | 0.000% | 9/30/22 | JPY | 1,062,000 | 8,983 |

| Sumitomo Forestry Co. Ltd. Cvt. | 0.000% | 8/24/18 | JPY | 430,000 | 3,773 |

| Takashimaya Co. Ltd. Cvt. | 0.000% | 12/11/20 | JPY | 670,000 | 6,157 |

| | | | | | 186,037 |

| Consumer Staples (2.6%) | | | | | |

| Herbalife Ltd. Cvt. | 2.000% | 8/15/19 | USD | 19,335 | 17,172 |

| Marine Harvest ASA Cvt. | 0.125% | 11/5/20 | EUR | 4,400 | 4,823 |

| Marine Harvest ASA Cvt. | 0.875% | 5/6/19 | EUR | 2,200 | 3,117 |

| Olam International Ltd. Cvt. | 6.000% | 10/15/16 | USD | 5,000 | 5,100 |

| Sonae Investments BV Cvt. | 1.625% | 6/11/19 | EUR | 5,300 | 5,638 |

| Unicharm Corp. Cvt. | 0.000% | 9/25/20 | JPY | 90,000 | 907 |

| Vector Group Ltd. Cvt. | 1.750% | 4/15/20 | USD | 6,900 | 8,142 |

| | | | | | 44,899 |

| Energy (4.6%) | | | | | |

| BW Group Ltd. Cvt. | 1.750% | 9/10/19 | USD | 6,400 | 5,994 |

| Cheniere Energy Inc. Cvt. | 4.250% | 3/15/45 | USD | 10,765 | 6,392 |

| Cobalt International Energy Inc. Cvt. | 3.125% | 5/15/24 | USD | 13,015 | 8,492 |

| 1 Scorpio Tankers Inc. Cvt. | 2.375% | 7/1/19 | USD | 27,680 | 27,213 |

| SEACOR Holdings Inc. Cvt. | 2.500% | 12/15/27 | USD | 18,165 | 17,234 |

14

Convertible Securities Fund

| | | | | |

| | | �� | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date Currency | (000) | ($000) |

| Subsea 7 SA Cvt. | 1.000% | 10/5/17 | USD | 400 | 374 |

| TOTAL SA Cvt. | 0.500% | 12/2/22 | USD | 2,400 | 2,373 |

| 1 Whiting Petroleum Corp. Cvt. | 1.250% | 4/1/20 | USD | 13,075 | 11,506 |

| | | | | | 79,578 |

| Financials (11.6%) | | | | | |

| Aabar Investments PJSC Cvt. | 1.000% | 3/27/22 | EUR | 7,000 | 7,349 |

| AmTrust Financial Services Inc. Cvt. | 2.750% | 12/15/44 | USD | 13,070 | 12,245 |

| Aroundtown Property Holdings plc Cvt. | 3.000% | 5/5/20 | EUR | 8,300 | 10,962 |

| AYC Finance Ltd. Cvt. | 0.500% | 5/2/19 | USD | 2,886 | 3,084 |

| Azimut Holding SPA Cvt. | 2.125% | 11/25/20 | EUR | 10,300 | 13,753 |

| Baosteel Hong Kong Investment Co. Ltd. Cvt. | 0.000% | 12/1/18 | USD | 3,600 | 3,573 |

| Beni Stabili SpA SIIQ Cvt. | 0.875% | 1/31/21 | EUR | 7,500 | 8,192 |

| BNP Paribas SA Cvt. | 0.250% | 9/27/16 | EUR | 7,200 | 7,978 |

| British Land White 2015 Ltd. Cvt. | 0.000% | 6/9/20 | GBP | 2,100 | 3,194 |

| Caja de Ahorros y Pensiones de Barcelona Cvt. | 1.000% | 11/25/17 | EUR | 10,400 | 11,606 |

| CapitaCommercial Trust Cvt. | 2.500% | 9/12/17 | SGD | 6,000 | 4,392 |

| CapitaLand Ltd. Cvt. | 2.800% | 6/8/25 | SGD | 14,750 | 9,908 |

| Colony Financial Inc. Cvt. | 5.000% | 4/15/23 | USD | 9,594 | 9,426 |

| 1 Element Financial Corp. Cvt. | 4.250% | 6/30/20 | CAD | 7,385 | 5,800 |

| 1 Element Financial Corp. Cvt. | 5.125% | 6/30/19 | CAD | 14,279 | 12,938 |

| Encore Capital Group Inc. Cvt. | 3.000% | 7/1/20 | USD | 7,668 | 6,997 |

| 1 Extra Space Storage LP Cvt. | 3.125% | 10/1/35 | USD | 12,990 | 14,167 |

| Industrivarden AB Cvt. | 0.000% | 5/15/19 | SEK | 13,000 | 1,711 |

| INTU Jersey Ltd. Cvt. | 2.500% | 10/4/18 | GBP | 1,900 | 3,132 |

| National Bank of Abu Dhabi PJSC Cvt. | 1.000% | 3/12/18 | USD | 1,000 | 989 |

| Nexity SA Cvt. | 0.630% | 1/1/20 | EUR | 3,623 | 4,445 |

| Portfolio Recovery Associates Inc. Cvt. | 3.000% | 8/1/20 | USD | 12,908 | 11,657 |

| RWT Holdings Inc. Cvt. | 5.625% | 11/15/19 | USD | 7,800 | 7,410 |

| Spirit Realty Capital Inc. Cvt. | 3.750% | 5/15/21 | USD | 8,185 | 7,714 |

| St. Modwen Properties Securities Jersey | | | | | |

| Ltd. Cvt. | 2.875% | 3/6/19 | GBP | 4,800 | 7,455 |

| T&D Holdings Inc. Cvt. | 0.000% | 6/5/20 | JPY | 490,000 | 4,155 |

| Unite Jersey Issuer Ltd. Cvt. | 2.500% | 10/10/18 | GBP | 4,100 | 8,518 |

| | | | | | 202,750 |

| Health Care (15.5%) | | | | | |

| Acorda Therapeutics Inc. Cvt. | 1.750% | 6/15/21 | USD | 9,826 | 10,674 |

| Alere Inc. Cvt. | 3.000% | 5/15/16 | USD | 1,148 | 1,212 |

| Allscripts Healthcare Solutions Inc. Cvt. | 1.250% | 7/1/20 | USD | 10,095 | 10,846 |

| Brookdale Senior Living Inc. Cvt. | 2.750% | 6/15/18 | USD | 16,890 | 18,199 |

| Cepheid Inc. Cvt. | 1.250% | 2/1/21 | USD | 7,040 | 6,362 |

| Depomed Inc. Cvt. | 2.500% | 9/1/21 | USD | 8,040 | 9,728 |

| Emergent Biosolutions Inc. Cvt. | 2.875% | 1/15/21 | USD | 8,881 | 11,962 |

| Fresenius Medical Care AG & Co. KGaA Cvt. | 1.125% | 1/31/20 | EUR | 800 | 1,057 |

| HealthSouth Corp. Cvt. | 2.000% | 12/1/43 | USD | 12,336 | 13,446 |

| Healthways Inc. Cvt. | 1.500% | 7/1/18 | USD | 6,620 | 6,388 |

| 1 HeartWare International Inc. Cvt. | 1.750% | 12/15/21 | USD | 6,468 | 5,409 |

| Hologic Inc. Cvt. | 0.000% | 12/15/43 | USD | 12,880 | 16,631 |

| Hologic Inc. Cvt. | 2.000% | 3/1/42 | USD | 5,801 | 8,060 |

| 1 Horizon Pharma Investment Ltd. Cvt. | 2.500% | 3/15/22 | USD | 6,341 | 6,289 |

| Illumina Inc. Cvt. | 0.500% | 6/15/21 | USD | 10,495 | 12,148 |

| Insulet Corp. Cvt. | 2.000% | 6/15/19 | USD | 10,879 | 11,165 |

| 1 Ironwood Pharmaceuticals Inc. Cvt. | 2.250% | 6/15/22 | USD | 10,724 | 10,315 |

| Jazz Investments I Ltd. Cvt. | 1.875% | 8/15/21 | USD | 32,052 | 34,616 |

| 1 Medicines Co. Cvt. | 2.500% | 1/15/22 | USD | 7,655 | 10,707 |

15

Convertible Securities Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| Medidata Solutions Inc. Cvt. | 1.000% | 8/1/18 | USD | 14,805 | 15,860 |

| Molina Healthcare Inc. Cvt. | 1.625% | 8/15/44 | USD | 4,840 | 5,829 |

| NuVasive Inc. Cvt. | 2.750% | 7/1/17 | USD | 7,070 | 9,452 |

| Qiagen NV Cvt. | 0.375% | 3/19/19 | USD | 3,400 | 3,879 |

| Qiagen NV Cvt. | 0.875% | 3/19/21 | USD | 4,200 | 4,925 |

| Terumo Corp. Cvt. | 0.000% | 12/6/21 | JPY | 940,000 | 9,249 |

| 1 Wright Medical Group Inc. Cvt. | 2.000% | 2/15/20 | USD | 15,830 | 15,563 |

| | | | | | 269,971 |

| Industrials (9.6%) | | | | | |

| 51job Inc. Cvt. | 3.250% | 4/15/19 | USD | 6,240 | 6,267 |

| Aecon Group Inc. Cvt. | 5.500% | 12/31/18 | CAD | 4,503 | 3,526 |

| Brenntag Finance BV Cvt. | 1.875% | 12/2/22 | USD | 6,500 | 6,614 |

| Carillion Finance Jersey Ltd. Cvt. | 2.500% | 12/19/19 | GBP | 5,200 | 8,059 |

| DP World Ltd. Cvt. | 1.750% | 6/19/24 | USD | 7,400 | 7,918 |

| 1 Dycom Industries Inc. Cvt. | 0.750% | 9/15/21 | USD | 26,340 | 29,336 |

| Echo Global Logistics Inc. Cvt. | 2.500% | 5/1/20 | USD | 4,875 | 4,531 |

| GVM Debentures Lux 1 SA Cvt. | 5.750% | 2/14/18 | EUR | 6,200 | 5,624 |

| Huron Consulting Group Inc. Cvt. | 1.250% | 10/1/19 | USD | 12,015 | 12,068 |

| International Consolidated Airlines Group SA | | | | | |

| Cvt. | 0.625% | 11/17/22 | EUR | 4,900 | 5,121 |

| Johnson Electric Holdings Ltd. Cvt. | 1.000% | 4/2/21 | USD | 11,000 | 11,990 |

| Kawasaki Kisen Kaisha Ltd. Cvt. | 0.000% | 9/26/18 | JPY | 530,000 | 4,478 |

| KEYW Holding Corp. Cvt. | 2.500% | 7/15/19 | USD | 9,445 | 7,096 |

| Larsen & Toubro Ltd. Cvt. | 0.675% | 10/22/19 | USD | 6,325 | 6,180 |

| LIXIL Group Corp. Cvt. | 0.000% | 3/4/22 | JPY | 810,000 | 6,851 |

| MISUMI Group Inc. Cvt. | 0.000% | 10/22/18 | USD | 4,600 | 5,629 |

| Nagoya Railroad Co. Ltd. Cvt. | 0.000% | 12/11/24 | JPY | 750,000 | 6,687 |

| Park24 Co. Ltd. Cvt. | 0.000% | 4/26/18 | JPY | 270,000 | 2,404 |

| Prysmian SPA Cvt. | 1.250% | 3/8/18 | EUR | 3,300 | 3,945 |

| Sacyr SA Cvt. | 4.000% | 5/8/19 | EUR | 4,400 | 3,899 |

| Schindler Holding AG Cvt. | 0.375% | 6/5/17 | CHF | 3,300 | 3,368 |

| Shimizu Corp. Cvt. | 0.000% | 10/16/20 | JPY | 360,000 | 3,173 |

| Siemens Financieringsmaatschappij NV Cvt. | 1.650% | 8/16/19 | USD | 5,250 | 5,698 |

| Societa Iniziative Autostradali e Servizi SPA Cvt. | 2.625% | 6/30/17 | EUR | 1,195 | 1,391 |

| SolarCity Corp. Cvt. | 2.750% | 11/1/18 | USD | 5,595 | 4,458 |

| | | | | | 166,311 |

| Information Technology (29.8%) | | | | | |

| Advanced Semiconductor Engineering Inc. Cvt. | 0.000% | 3/27/18 | USD | 6,600 | 6,237 |

| ASM Pacific Technology Ltd. Cvt. | 2.000% | 3/28/19 | HKD | 18,000 | 2,368 |

| 1 BroadSoft Inc. Cvt. | 1.000% | 9/1/22 | USD | 9,700 | 11,440 |

| 1 Brocade Communications Systems Inc. Cvt. | 1.375% | 1/1/20 | USD | 15,555 | 15,079 |

| 1 CalAmp Corp. Cvt. | 1.625% | 5/15/20 | USD | 8,355 | 8,016 |

| Canadian Solar Inc. Cvt. | 4.250% | 2/15/19 | USD | 6,555 | 5,908 |

| Cardtronics Inc. Cvt. | 1.000% | 12/1/20 | USD | 13,885 | 13,659 |

| Citrix Systems Inc. Cvt. | 0.500% | 4/15/19 | USD | 34,305 | 37,886 |

| Cornerstone OnDemand Inc. Cvt. | 1.500% | 7/1/18 | USD | 13,795 | 14,079 |

| 1 DH Corp. Cvt. | 5.000% | 9/30/20 | CAD | 13,003 | 9,991 |

| Econocom Group Cvt. | 1.500% | 1/15/19 | EUR | 6,518 | 7,499 |

| Electronics For Imaging Inc. Cvt. | 0.750% | 9/1/19 | USD | 16,780 | 18,489 |

| Euronet Worldwide Inc. Cvt. | 1.500% | 10/1/44 | USD | 19,024 | 23,721 |

| 1 Integrated Device Technology Inc. Cvt. | 0.875% | 11/15/22 | USD | 14,750 | 15,893 |

| Intel Corp. Cvt. | 2.950% | 12/15/35 | USD | 4,810 | 6,214 |

| j2 Global Inc. Cvt. | 3.250% | 6/15/29 | USD | 19,796 | 25,698 |

| LinkedIn Corp. Cvt. | 0.500% | 11/1/19 | USD | 27,755 | 29,854 |

16

Convertible Securities Fund

| | | | | |

| | | | | Face | Market |

| | | Maturity | | Amount | Value• |

| | Coupon | Date | Currency | (000) | ($000) |

| 1 Microchip Technology Inc. Cvt. | 1.625% | 2/15/25 | USD | 21,935 | 22,634 |

| Micron Technology Inc. Cvt. | 3.000% | 11/15/43 | USD | 21,640 | 19,719 |

| Nuance Communications Inc. Cvt. | 1.500% | 11/1/35 | USD | 14,556 | 16,767 |

| 1 NXP Semiconductor NV Cvt. | 1.000% | 12/1/19 | USD | 24,886 | 28,743 |

| 1 ON Semiconductor Corp. Cvt. | 1.000% | 12/1/20 | USD | 9,805 | 9,499 |

| 1 Proofpoint Inc. Cvt. | 0.750% | 6/15/20 | USD | 12,430 | 14,061 |

| Red Hat Inc. Cvt. | 0.250% | 10/1/19 | USD | 28,000 | 36,295 |

| Salesforce.com Inc. Cvt. | 0.250% | 4/1/18 | USD | 9,695 | 12,646 |

| SanDisk Corp. Cvt. | 0.500% | 10/15/20 | USD | 15,785 | 16,308 |

| Semiconductor Manufacturing International | | | | | |

| Corp. Cvt. | 0.000% | 11/7/18 | USD | 4,000 | 4,580 |

| Siliconware Precision Industries Co. Ltd. Cvt. | 0.000% | 10/31/19 | USD | 4,000 | 4,300 |

| STMicroelectronics NV Cvt. | 0.000% | 7/3/19 | USD | 400 | 390 |

| STMicroelectronics NV Cvt. | 1.000% | 7/3/21 | USD | 4,800 | 4,731 |

| SunPower Corp. Cvt. | 0.875% | 6/1/21 | USD | 945 | 781 |

| Synchronoss Technologies Inc. Cvt. | 0.750% | 8/15/19 | USD | 12,410 | 12,992 |

| Trina Solar Ltd. Cvt. | 3.500% | 6/15/19 | USD | 2,975 | 2,731 |

| TTM Technologies Inc. Cvt. | 1.750% | 12/15/20 | USD | 13,523 | 13,481 |

| Verint Systems Inc. Cvt. | 1.500% | 6/1/21 | USD | 10,875 | 10,889 |

| Web.com Group Inc. Cvt. | 1.000% | 8/15/18 | USD | 13,795 | 13,752 |

| WebMD Health Corp. Cvt. | 1.500% | 12/1/20 | USD | 15,265 | 16,667 |

| WebMD Health Corp. Cvt. | 2.500% | 1/31/18 | USD | 3,025 | 3,091 |

| Yandex NV Cvt. | 1.125% | 12/15/18 | USD | 2,721 | 2,371 |

| | | | | | 519,459 |

| Materials (5.1%) | | | | | |

| APERAM Cvt. | 0.625% | 7/8/21 | USD | 7,400 | 8,159 |

| Buzzi Unicem SPA Cvt. | 1.375% | 7/17/19 | EUR | 3,700 | 4,931 |

| Cemex SAB de CV Cvt. | 3.720% | 3/15/20 | USD | 10,515 | 9,227 |

| Cemex SAB de CV Cvt. | 3.720% | 3/15/20 | USD | 18,740 | 16,444 |

| 1 Chemtrade Logistics Income Fund Cvt. | 5.250% | 6/30/21 | CAD | 5,331 | 4,022 |

| Chemtrade Logistics Income Fund Cvt. | 5.750% | 12/31/18 | CAD | 332 | 256 |

| NV Bekaert SA Cvt. | 0.750% | 6/18/18 | EUR | 5,200 | 5,381 |

| OCI Cvt. | 3.875% | 9/25/18 | EUR | 5,200 | 6,351 |

| Outokumpu OYJ Cvt. | 3.250% | 2/26/20 | EUR | 2,300 | 1,935 |

| RTI International Metals Inc. Cvt. | 1.625% | 10/15/19 | USD | 19,030 | 19,613 |

| Teijin Ltd. Cvt. | 0.000% | 12/12/18 | JPY | 140,000 | 1,365 |

| Teijin Ltd. Cvt. | 0.000% | 12/10/21 | JPY | 610,000 | 6,182 |

| Toray Industries Inc. Cvt. | 0.000% | 8/31/21 | JPY | 360,000 | 4,105 |

| | | | | | 87,971 |

| Telecommunication Services (0.9%) | | | | | |

| America Movil SAB de Cvt. | 0.000% | 5/28/20 | EUR | 7,600 | 8,287 |

| Telecom Italia SPA Cvt. | 1.125% | 3/26/22 | EUR | 5,800 | 6,903 |

| | | | | | 15,190 |

| Utilities (1.7%) | | | | | |

| Chugoku Electric Power Co. Inc. Cvt. | 0.000% | 3/25/20 | JPY | 300,000 | 2,571 |

| ENN Energy Holdings Ltd. Cvt. | 0.000% | 2/26/18 | USD | 5,500 | 5,940 |

| Northland Power Inc. Cvt. | 4.750% | 6/30/20 | CAD | 6,225 | 4,837 |

| Northland Power Inc. Cvt. | 5.000% | 6/30/19 | CAD | 2,661 | 2,067 |

| 1 Pattern Energy Group Inc. Cvt. | 4.000% | 7/15/20 | USD | 10,995 | 9,731 |

| Suez Environnement Co. Cvt. | 0.000% | 2/27/20 | EUR | 2,336 | 3,050 |

| Superior Plus Corp. Cvt. | 6.000% | 6/30/19 | CAD | 2,558 | 1,944 |

| | | | | | 30,140 |

| Total Convertible Bonds (Cost $1,603,100) | | | | | 1,602,306 |

17

Convertible Securities Fund

| | | |

| | | | Market |

| | | | Value |

| | Coupon | Shares | ($000) |

| Convertible Preferred Stocks (4.3%) | | | |

| Energy (0.6%) | | | |

| 1 Chesapeake Energy Corp. Pfd. | 5.750% | 12,470 | 3,003 |

| McDermott International Inc. Pfd. | 6.250% | 314,400 | 5,137 |

| Rex Energy Corp. Pfd. | 6.000% | 81,800 | 743 |

| Sanchez Energy Corp. Pfd. | 4.875% | 84,603 | 871 |

| | | | 9,754 |

| Financials (1.9%) | | | |

| American Tower Corp. Pfd. | 5.500% | 207,600 | 21,357 |

| Crown Castle International Corp. Pfd. | 4.500% | 104,700 | 11,164 |

| | | | 32,521 |

| Health Care (1.8%) | | | |

| Alere Inc. Pfd. | 3.000% | 39,776 | 11,903 |

| Allergan plc Pfd. | 5.500% | 19,600 | 20,482 |

| | | | 32,385 |

| Materials (0.0%) | | | |

| ArcelorMittal Pfd. | 6.000% | 78,500 | 619 |

| Total Convertible Preferred Stocks (Cost $93,862) | | | 75,279 |

| Temporary Cash Investment (2.3%) | | | |

| Money Market Fund (2.3%) | | | |

| 2 Vanguard Market Liquidity Fund (Cost $40,272) | 0.239% | 40,271,925 | 40,272 |

| Total Investments (98.7%) (Cost $1,737,234) | | | 1,717,857 |

| |

| | | | Amount |

| | | | ($000) |

| Other Assets and Liabilities (1.3%) | | | |

| Other Assets | | | |

| Investment in Vanguard | | | 153 |

| Receivables for Investment Securities Sold | | | 13,343 |

| Receivables for Accrued Income | | | 8,034 |

| Receivables for Capital Shares Issued | | | 773 |

| Other Assets | | | 21,907 |

| Total Other Assets | | | 44,210 |

| Liabilities | | | |

| Payables for Investment Securities Purchased | | | (15,344) |

| Payables to Investment Advisor | | | (672) |

| Payables for Capital Shares Redeemed | | | (1,690) |

| Payables to Vanguard | | | (3,285) |

| Other Liabilities | | | (161) |

| Total Liabilities | | | (21,152) |

| Net Assets (100%) | | | |

| Applicable to 137,402,821 outstanding $.001 par value shares of | | | |

| beneficial interest (unlimited authorization) | | | 1,740,915 |

| Net Asset Value Per Share | | | $12.67 |

18

Convertible Securities Fund

| |

| At November 30, 2015, net assets consisted of: | |

| | Amount |

| | ($000) |

| Paid-in Capital | 1,727,653 |

| Undistributed Net Investment Income | 13,980 |

| Accumulated Net Realized Gains | 1,966 |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | (19,377) |

| Forward Currency Contracts | 16,784 |

| Foreign Currencies | (91) |

| Net Assets | 1,740,915 |

• See Note A in Notes to Financial Statements.

1 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from

registration, normally to qualified institutional buyers. At November 30, 2015, the aggregate value of these securities was $336,594,000,

representing 19.3% of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the

7-day yield.

CAD—Canadian dollar.

CHF—Swiss franc.

EUR—Euro.

GBP—British pound.

HKD—Hong Kong dollar.

JPY—Japanese yen.

KRW—South Korean won.

SEK—Swedish krona.

SGD—Singapore dollar.

TWD—Taiwan dollar.

USD—U.S. dollar.

See accompanying Notes, which are an integral part of the Financial Statements.

19

Convertible Securities Fund

Statement of Operations

| |

| | Year Ended |

| | November 30, 2015 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends | 7,418 |

| Interest1,2 | 34,720 |

| Total Income | 42,138 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 6,348 |

| Performance Adjustment | (3,256) |

| The Vanguard Group—Note C | |

| Management and Administrative | 3,658 |

| Marketing and Distribution | 315 |

| Custodian Fees | 81 |

| Auditing Fees | 42 |

| Shareholders’ Reports | 21 |

| Trustees’ Fees and Expenses | 3 |

| Total Expenses | 7,212 |

| Net Investment Income | 34,926 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | (5,600) |

| Foreign Currencies and Forward Currency Contracts | 31,994 |

| Realized Net Gain (Loss) | 26,394 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | (54,242) |

| Foreign Currencies and Forward Currency Contracts | 5,351 |

| Change in Unrealized Appreciation (Depreciation) | (48,891) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 12,429 |

| 1 Interest income from an affiliated company of the fund was $58,000. |

| 2 Interest income is net of foreign withholding taxes of $15,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

20

Convertible Securities Fund

Statement of Changes in Net Assets

| | |

| | Year Ended November 30, |

| | 2015 | 2014 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 34,926 | 42,934 |

| Realized Net Gain (Loss) | 26,394 | 162,934 |

| Change in Unrealized Appreciation (Depreciation) | (48,891) | (118,068) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 12,429 | 87,800 |

| Distributions | | |

| Net Investment Income | (34,408) | (62,172) |

| Realized Capital Gain1 | (143,706) | (135,778) |

| Total Distributions | (178,114) | (197,950) |

| Capital Share Transactions | | |

| Issued | 141,337 | 266,327 |

| Issued in Lieu of Cash Distributions | 161,732 | 178,681 |

| Redeemed | (397,715) | (394,062) |

| Net Increase (Decrease) from Capital Share Transactions | (94,646) | 50,946 |

| Total Increase (Decrease) | (260,331) | (59,204) |

| Net Assets | | |

| Beginning of Period | 2,001,246 | 2,060,450 |

| End of Period2 | 1,740,915 | 2,001,246 |

1 Includes fiscal 2015 and 2014 short-term gain distributions totaling $40,124,000 and $40,382,000, respectively. Short-term gain distributions

are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $13,980,000 and $10,863,000.

See accompanying Notes, which are an integral part of the Financial Statements.

21

Convertible Securities Fund

Financial Highlights

| | | | | |

| For a Share Outstanding | Year Ended November 30, |

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 |

| Net Asset Value, Beginning of Period | $13.85 | $14.64 | $12.95 | $12.12 | $13.85 |

| Investment Operations | | | | | |

| Net Investment Income | . 251 | . 287 | .333 | .407 | .451 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | (.180) | .313 | 2.101 | 1.134 | (.752) |

| Total from Investment Operations | .071 | .600 | 2.434 | 1.541 | (.301) |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.241) | (.425) | (. 355) | (. 534) | (.474) |

| Distributions from Realized Capital Gains | (1.010) | (.965) | (.389) | (.177) | (.955) |

| Total Distributions | (1.251) | (1.390) | (.744) | (.711) | (1.429) |

| Net Asset Value, End of Period | $12.67 | $13.85 | $14.64 | $12.95 | $12.12 |

| |

| Total Return1 | 0.55% | 4.33% | 19.65% | 13.18% | -2.89% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $1,741 | $2,001 | $2,060 | $1,643 | $1,680 |

| Ratio of Total Expenses to Average Net Assets2 | 0.38% | 0.41% | 0.63% | 0.52% | 0.59% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 1.86% | 2.02% | 2.41% | 3.23% | 3.36% |

| Portfolio Turnover Rate | 95% | 85% | 101% | 82% | 90% |

1 Total returns do not include transaction or account service fees that may have applied in the periods shown. Fund prospectuses provide

information about any applicable transaction and account service fees.

2 Includes performance-based investment advisory fee increases (decreases) of (0.17%), (0.15%), 0.07%, (0.04%), and 0.03%.

See accompanying Notes, which are an integral part of the Financial Statements.

22

Convertible Securities Fund

Notes to Financial Statements

Vanguard Convertible Securities Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in securities of foreign issuers, which may subject it to investment risks not normally associated with investing in securities of U.S. corporations.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Bonds, and temporary cash investments acquired over 60 days to maturity, are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Other temporary cash investments are valued at amortized cost, which approximates market value. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Forward Currency Contracts: The fund enters into forward currency contracts to protect the value of securities and related receivables and payables against changes in future foreign exchange rates. The fund’s risks in using these contracts include movement in the values of the foreign currencies relative to the U.S. dollar and the ability of the counterparties to fulfill their obligations under the contracts. The fund mitigates its counterparty risk by entering into forward currency contracts only with a diverse group of prequalified counterparties, monitoring their financial strength, entering into master netting arrangements with its counterparties, and requiring its counterparties to transfer collateral as security for their performance. The master netting arrangements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate the forward currency contracts, determine the net amount owed by either party in accordance with its master netting arrangements, and sell or retain any collateral held up to the net amount owed to the fund under the master netting arrangements. The forward currency contracts contain provisions whereby a counterparty may terminate open contracts if the fund’s net assets decline below a certain level,

23

Convertible Securities Fund

triggering a payment by the fund if the fund is in a net liability position at the time of the termination. The payment amount would be reduced by any collateral the fund has pledged. Any assets pledged as collateral for open contracts are noted in the Statement of Net Assets. The value of collateral received or pledged is compared daily to the value of the forward currency contracts exposure with each counterparty, and any difference, if in excess of a specified minimum transfer amount, is adjusted and settled within two business days.

Forward currency contracts are valued at their quoted daily prices obtained from an independent third party, adjusted for currency risk based on the expiration date of each contract. The notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized forward currency contract gains (losses).

During the year ended November 30, 2015, the fund’s average investment in forward currency contracts represented 20% of net assets, based on the average of notional amounts at each quarter-end during the period.

4. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (November 30, 2012–2015), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

5. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

6. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.06% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate equal to the higher of the federal funds rate or LIBOR reference rate plus an agreed-upon spread.

The fund had no borrowings outstanding at November 30, 2015, or at any time during the period then ended.

7. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. Oaktree Capital Management, L.P. provides investment advisory services to the fund for a fee calculated at an annual percentage rate of average net assets. The basic fee is subject to quarterly adjustments based on the fund’s performance for the preceding three years relative to a composite index weighted 70% Bank of America Merrill Lynch All US Convertibles Index and 30% Bank of America Merrill Lynch Global 300 Convertibles ex-US Index (hedged). For the year ended

24

Convertible Securities Fund

November 30, 2015, the investment advisory fee represented an effective annual basic rate of 0.34% of the fund’s average net assets before a decrease of $3,256,000 (0.17%) based on performance.

C. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At November 30, 2015, the fund had contributed to Vanguard capital in the amount of $153,000, representing 0.01% of the fund’s net assets and 0.06% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the market value of the fund’s investments as of November 30, 2015, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Convertible Bonds | — | 1,591,323 | 10,983 |

| Convertible Preferred Stocks | — | 75,279 | — |

| Temporary Cash Investments | 40,272 | — | — |

| Forward Currency Contracts—Assets | — | 16,938 | — |

| Forward Currency Contracts—Liabilities | — | (154) | — |

| Total | 40,272 | 1,683,386 | 10,983 |

E. At November 30, 2015, the fund had open forward currency contracts to receive and deliver currencies as follows. Unrealized appreciation (depreciation) on open forward currency contracts, except for Hong Kong, Singapore, and Taiwan dollar currency contracts, is treated as realized gain (loss) for tax purposes.

25

Convertible Securities Fund

| | | | | | |

| | | | | | | Unrealized |

| | Contract | | | | | Appreciation |

| | Settlement | Contract Amount (000) | (Depreciation) |

| Counterparty | Date | | Receive | | Deliver | ($000) |

| UBS AG | 1/21/16 | EUR | 9,000 | USD | 9,522 | 3 |

| UBS AG | 1/21/16 | JPY | 749,700 | USD | 6,096 | 5 |

| UBS AG | 1/21/16 | EUR | 3,720 | USD | 4,039 | (102) |

| UBS AG | 1/21/16 | GBP | 1,694 | USD | 2,602 | (50) |

| UBS AG | 1/21/16 | GBP | 1,370 | USD | 2,061 | 2 |

| UBS AG | 1/21/16 | HKD | 5,030 | USD | 649 | — |

| UBS AG | 1/21/16 | USD | 177,712 | EUR | 156,830 | 11,734 |

| UBS AG | 1/21/16 | USD | 92,219 | JPY | 11,038,845 | 2,391 |

| UBS AG | 1/21/16 | USD | 52,783 | CAD | 68,585 | 1,426 |

| UBS AG | 1/21/16 | USD | 33,313 | GBP | 21,597 | 781 |

| UBS AG | 1/21/16 | USD | 14,564 | SGD | 20,325 | 182 |

| UBS AG | 1/21/16 | USD | 6,181 | TWD | 200,890 | 25 |

| UBS AG | 1/21/16 | USD | 3,608 | CHF | 3,440 | 252 |

| UBS AG | 1/21/16 | USD | 3,604 | KRW | 4,117,980 | 53 |

| UBS AG | 1/21/16 | USD | 3,522 | HKD | 27,295 | 1 |

| UBS AG | 1/21/16 | USD | 1,727 | GBP | 1,148 | (2) |

| UBS AG | 1/21/16 | USD | 1,724 | SEK | 14,285 | 83 |

| | | | | | | 16,784 |

| Refer to the Statement of Net Assets for currency abbreviations. |

At November 30, 2015, counterparties had deposited in segregated accounts securities and cash with a value of $14,885,000 in connection with open forward currency contracts.

F. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

During the year ended November 30, 2015, the fund realized net foreign currency losses of $9,457,000 (including the foreign currency component on sales of foreign currency denominated bonds), which decreased distributable net income for tax purposes; accordingly, such losses have been reclassified from accumulated net realized gains to undistributed net investment income.

Certain of the fund’s convertible preferred stock investments are treated as debt securities for tax purposes. During the year ended November 30, 2015, the fund realized gains of $25,000 from the sale of these securities, which are included in distributable net investment income for tax purposes; accordingly, such gains have been reclassified from accumulated net realized gains to undistributed net investment income.

26

Convertible Securities Fund

Certain of the fund’s convertible bond investments are in securities considered to be “contingent payment debt instruments,” for which any realized gains increase (and all or part of any realized losses decrease) income for tax purposes. During the year ended November 30, 2015, the fund realized net gains of $12,031,000 from the sale of these securities, which increased distributable net income for tax purposes; accordingly, such gains have been reclassified from accumulated net realized gains to undistributed net investment income.

The fund used a tax accounting practice to treat a portion of the price of capital shares redeemed during the year as distributions from realized capital gains. Accordingly, the fund has reclassified $10,591,000 from accumulated net realized gains to paid-in capital.

For tax purposes, at November 30, 2015, the fund had $17,006,000 of ordinary income and $18,615,000 of long-term capital gains available for distribution.

At November 30, 2015, the cost of investment securities for tax purposes was $1,737,234,000. Net unrealized depreciation of investment securities for tax purposes was $19,377,000, consisting of unrealized gains of $79,607,000 on securities that had risen in value since their purchase and $98,984,000 in unrealized losses on securities that had fallen in value since their purchase.

G. During the year ended November 30, 2015, the fund purchased $1,726,401,000 of investment securities and sold $1,930,452,000 of investment securities, other than temporary cash investments.

H. Capital shares issued and redeemed were:

| | |

| | Year Ended November 30, |

| | 2015 | 2014 |

| | Shares | Shares |

| | (000) | (000) |

| Issued | 10,764 | 18,911 |

| Issued in Lieu of Cash Distributions | 12,705 | 13,040 |

| Redeemed | (30,554) | (28,206) |

| Net Increase (Decrease) in Shares Outstanding | (7,085) | 3,745 |

I. Management has determined that no material events or transactions occurred subsequent to November 30, 2015, that would require recognition or disclosure in these financial statements.

27

Report of Independent Registered

Public Accounting Firm

To the Board of Trustees and Shareholders of Vanguard Convertible Securities Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Convertible Securities Fund (the “Fund”) at November 30, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at November 30, 2015 by correspondence with the custodian and brokers, by agreement to the underlying ownership records of the transfer agent and the application of alternative auditing procedures where securities purchased had not been received, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

January 13, 2016

Special 2015 tax information (unaudited) for Vanguard Convertible Securities Fund

This information for the fiscal year ended November 30, 2015, is included pursuant to provisions

of the Internal Revenue Code.

The fund distributed $114,172,000 as capital gain dividends (20% rate gain distributions) to

shareholders during the fiscal year.

For nonresident alien shareholders, 100% of short-term capital gain dividends distributed by the fund

are qualified short-term capital gains.

The fund distributed $2,914,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 14.9% of investment income (dividend income plus short-term gains,

if any) qualifies for the dividends-received deduction.

28

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2015. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

| | | |

| Average Annual Total Returns: Convertible Securities Fund | | | |

| Periods Ended November 30, 2015 | | | |

| | One | Five | Ten |

| | Year | Years | Years |

| Returns Before Taxes | 0.55% | 6.65% | 7.12% |

| Returns After Taxes on Distributions | -2.34 | 4.11 | 4.81 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 1.37 | 4.49 | 4.95 |

29

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

30

| | | |

| Six Months Ended November 30, 2015 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Convertible Securities Fund | 5/31/2015 | 11/30/2015 | Period |

| Based on Actual Fund Return | $1,000.00 | $942.43 | $1.90 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,023.11 | 1.98 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that

period is 0.39%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account

value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most

recent 12-month period (183/365).

31

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Average Coupon. The average interest rate paid on the fixed income securities held by a fund. It is expressed as a percentage of face value.

Average Duration. An estimate of how much the value of the bonds held by a fund will fluctuate in response to a change in interest rates. To see how the value could change, multiply the average duration by the change in rates. If interest rates rise by 1 percentage point, the value of the bonds in a fund with an average duration of five years would decline by about 5%. If rates decrease by a percentage point, the value would rise by 5%.

Average Weighted Maturity. The average length of time until fixed income securities held by a fund reach maturity and are repaid. The figure reflects the proportion of fund assets represented by each security.