UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-04840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 West 57th Street, 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt

The Tocqueville Trust

40 West 57th Street, 19th Floor

New York, NY 10019

(Name and address of agent for service)

(212)698-0800

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2019

Date of reporting period: April 30, 2019

| Item 1. | Reports to Stockholders. |

The Tocqueville Trust

Mutual Funds

Semi-Annual Report

April 30, 2019

The Tocqueville Fund

The Tocqueville Opportunity Fund

The Tocqueville Gold Fund

The Tocqueville Phoenix Fund

The Tocqueville Select Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (http://tocquevillefunds.com/mutual-funds/download-information-literature-center), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or a bank) or, if you are a direct investor, by calling1-800-697-3863, or by enrolling at www.tocquevillefunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call1-800-697-3863 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all Funds held with the Fund complex if you invest directly with the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust. Please call1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @www.tocquevillefunds.com

Chairman’s Letter

Dear Fellow Shareholder,

As of this writing, equity markets continue to focus on international trade issues and their possible impact on global growth. The interest rate panic that was behind the calendar 2018 fourth quartersell-off has subsided, with rates falling to three-year lows, and a chastened FED vowing not to raise short-term rates any further, any time soon. The good news on rates triggered a powerful rally in equities in the first calendar quarter of 2019, but growing pessimism on trade, particularly with China, the world’s second largest economy, has brought equities down to earth more recently. Still, equities have generated solid returns in the first half of our fiscal year, as the strong U.S. economy has more than offset the trade concerns as well as the ongoing political shenanigans in our nation’s capital.

Gold prices, always a good barometer of investor confidence in government, have remained depressed, signaling greater optimism in political developments than, perhaps, our national media suggests. Record low unemployment, productivity gains, and rising wage rates, along with respectable earnings reports, are, no doubt, instrumental in this brighter outlook, and certainly of greater importance to investors than the political drama unleashed by the recent elections and the warring factions in Washington. Of course, should the latter get much worse, or the former no better, this could change over the course of the next six months, but our crystal ball is too cloudy to make that call. Rather, we think that the volatility in the markets that shows up in response to temporal issues gives our analysts and our managers an opportunity to find attractive long-term investments at attractive prices, so we welcome it. The equity markets continue, in our view, to be the preferred place to invest for the long term and the best place to preserve capital against the rapaciousness of taxes and the ongoing depreciation of currencies.

Asco-investors with all of our shareholders, the portfolio managers of all our funds and I thank you for your continued support.

Sincerely,

Robert W. Kleinschmidt

Chairman

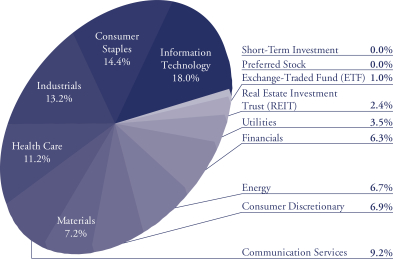

The Tocqueville Fund

Dear Fellow Shareholder,

Thesix-month period ended April 30, 2019 was a positive one for equity markets overall bookended by periods of volatility. Investors initially fled equity markets toward the end of calendar 2018 as concerns over the Federal Reserve’s interest rate policy, in particular, coupled with the Trump Administration’s aggressive trade policies, began to upset global commercial activity and exacerbated some signs of weakness that had been percolating since the prior spring, caused markets to doubt the growth narrative. When, in December, the Fed signaled that it might be more data dependent (and therefore dovish) in its interest rate posture and the Trump Administration reinforced the notion that trade negotiations were progressing, markets rallied strongly. Prior concerns returned to the forefront at the end of the period when it became more apparent, through heated rhetoric and additional tariffs, that, trade talks were still stuck on the crucial issues of intellectual property, technology transfers and the restructuring of the Chinese economy. Still, the more enlightened Fed policy, as well as better than feared earnings data was enough for the S&P to gain 9.76% for the period.

During the same period, the Fund returned 11.50%. All sectors were positive contributors, but the strongest sectors for the Fund were Information Technology, Consumer Staples and Industrials while the weakest were Real Estate, Energy and Utilities. The top performing individual names were Microsoft, Procter & Gamble, Applied Materials, Noble Energy and Amazon while the laggards were Apple, Haliburton, Biogen, Pioneer Natural Resources and Pfizer.

Over the past six months, we added a few new names to the portfolio. One of these was Nvidia, a manufacturer of graphics processing units (GPUs) typically used in video games but increasingly in other applications requiring rapid calculations like machine learning or autonomous vehicles. Nvidia’s shares had fallen out of favor because of concerns about a slowdown in demand for gaming equipment due to new game formats, an inventory overhang from cryptocurrencies where GPUs had been used for “mining”, and the overall China trade fears. Our view is that this slowdown is a temporary blip, that inventories will be cleared over time and that the secular trends are likely to continue indefinitely. Hence, we believed that the shares were trading at a significant discount to intrinsic value.

Another new purchase was Raytheon, the defense contractor. Raytheon’s shares had been under pressure because of concerns that defense spending would not be as favorable as expected with the Democrats winning in themid-term elections, as well as the Trump administration proposing a budget that was less than expected. Policies of military disengagement also contributed to weakness in Defense names. Our view is that the world remains a dangerous place, that Raytheon is less vulnerable than the other large defense contractors to budget pressures and it is well positioned for the sorts of spending that is likely to be a priority for the military in the future, namely cyber security and missile technology. The business has a strong balance sheet, generates consistent returns on capital and was trading at an attractive valuation considering the overall quality of the company.

We also added United Technologies, a multi-industry conglomerate with traditionally attractive returns on capital that has seen its valuation compress because of concerns over

China and recent performance issues at its Pratt and Whitney aerospace division. Our view is that the pending separation into three distinct companies focused on aerospace, HVAC equipment and elevators, with a high service component brought on by investor activism, will be value enhancing as the individual businesses receive higher ratings over time.

Other positions that were added or increased include Biogen, Capital One, Constellation Brands, FedEx, Nektar Therapeutics, Noble Energy, Parker Hannifin, Schlumberger, Vulcan Materials, Walt Disney and Weyerhaeuser.

A variety of positions were reduced or eliminated during the period as they approached our valuation targets, in order to make room for an idea with a better risk reward profile, in response to a change in circumstances or to investors’ desire for liquidity. Of those sold or reduced for fundamental reasons, Goldcorp was sold following its announced merger with Newmont Mining and Boeing was reduced following the crash of two of its 737 Max jets that called into question the prospects of the 737 Max jets platform and potential related liabilities. Other sales included Apple, Automated Data Processing, Bank of New York, Brighthouse Financial, Facebook, Fluor, Halliburton, Ionis Pharmaceuticals, Johnson & Johnson, JPMorgan Chase, McDonald’s, Merck, Nektar Therapeutics, Nextera Energy and Pioneer Natural Resources.

Our view is that in spite of markets still being near their highs, equities represent the more attractive asset class relative to fixed income. The trade disputes have definitely raised questions about sustainability of global growth, but domestic corporate earnings have generally been better than expected even in the face of supply chain challenges, rising labor costs and the recovery in energy prices. If the trade situation resolves itself eventually, which we suspect it will, it will likely be a positive for equity markets, certainly for those sectors exposed to China such as technology, industrials, and agriculture, and likely bring back concerns of rates moving up to the detriment of bonds. Conversely, if the trade dispute drags on and begins more materially to impact the domestic economy, the Fed has some, but not much room to maneuver. The Fed could cut rates again, but that might give rise to concerns about credit quality and a looming recession that could weigh on both equity and fixed income investors. With rates as low as they are, rate reductions may have a limited effect, forcing the Fed to other,non-traditional, measures to prevent a recession. On balance, however, we think that is an unlikely scenario. In the meantime, while we await a resolution to these macro and geopolitical factors, we will continue to focus our efforts on looking for opportunities where quality companies get oversold and fall out of favor due to these or other temporary concerns. As long-term, value-oriented investors, it is precisely concerns such as these that give us the chance to own good companies at great prices.

Sincerely,

| | |

| |  |

Robert W. Kleinschmidt Portfolio Manager | | Peter Shawn Director of Research |

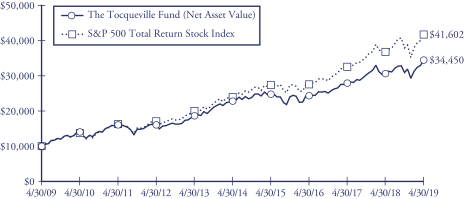

The Tocqueville Fund

(Unaudited)

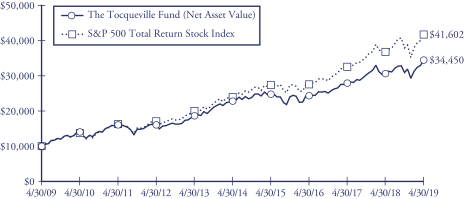

This chart assumes an initial gross investment of $10,000 made on 4/30/09. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED APRIL 30, 2019

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Fund | | | 12.63% | | | | 12.50% | | | | 8.66% | | | | 13.17% | |

Standard & Poor’s 500 Total Return Stock Index | | | 13.49% | | | | 14.87% | | | | 11.63% | | | | 15.32% | |

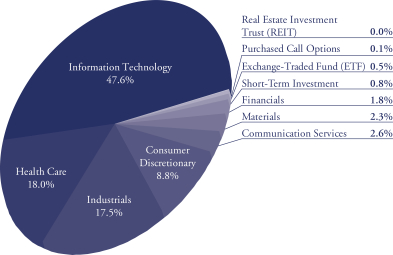

The Tocqueville Opportunity Fund

Dear Fellow Shareholder,

We are pleased to provide this investment overview for the firstsix-month period of the fiscal year 2019 for the Tocqueville Opportunity Fund. The end of this fiscal year (October 2019) will mark the ninth consecutive year of management of the Fund as a growth fund. During thesix-month period ended April 30, 2019, the Fund appreciated 18.11%, and outperformed the SMID cap growth benchmark, the Russell 2500® Growth Total Return Index, which gained 11.86%.

Investors will recall that the passage of the Tax Cuts and Jobs Act of 2017 at the end of 2017 set the stage for a strong start for 2018 financial markets. But early on in 2018, the Administration adopted a serious new trade policy with regard to U.S. trading partners, with a particular focus on Chinese trade. Against a background of targeted, first round tariffs, Fed tightening, and increased evidence of slowing housing and capital investment, the broad market struggled throughout most of 2018 to recover its peak level in January, only to be done in late in the year by interest rate fears. Although the early months of 2019 have been characterized with ongoing trade concerns and the recent imposition of another round of significant tariff increases, markets have acted more sanguinely due to evidence of sustained growth in the U.S., low inflation, and a 10 year Treasury yield which closed at 2.50% on April 30, 2019, versus a peak in November 2018 at nearly 3.25%.

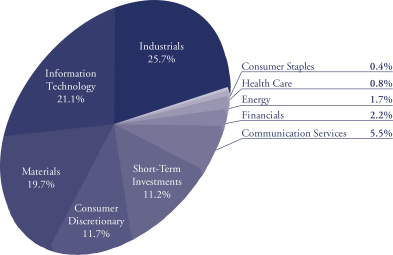

Over the past six months, investments in Technology, Communication Services, and Industrials provided the leading contributions to the Fund’s absolute and relative (versus the Fund’s benchmark) performances. Relative to the benchmark, Healthcare investments detracted the most; investments in Utilities, Materials, and Real Estate also provided negative attributed returns—the Fund held no investments in Real Estate or Utilities over the six months and consequently surrendered an insignificant 0.10% of relative performance—it lost 0.02% on the relative Materials investments. On the positive side, the Fund gained 8.98% of relative gains on investments in Technology, Communication Services and Industrials. The Fund had no Energy investments during the six months, adding to relative performance. On a relative basis, the top ten performers included eight Technology issues, one Internet issue and one Healthcare investment (SAGE Therapeutics); the largest detractors included Nvidia, Sarepta Therapeutics, and STAAR Surgical. Investments in Shopify, ServiceNow and Workday were the leading drivers of absolute and relative performance respectively for the Fund during the period. With a high concentration of investment in the top 100 names at nearly 87%, the Fund benefitted significantly from the fact that 21 issues gained 50% or more in price during the period; only two issues fell 50% or more—Roku(-51.8%) and Inogen(-53.95%)—insignificant at less than 0.15% of investments.

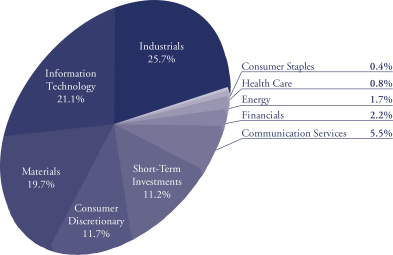

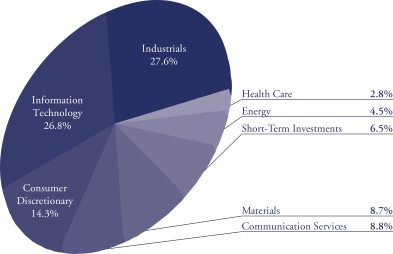

At the close of the first six months of fiscal year 2019, the Fund had maintained its largest commitments in Technology holdings. The overall allocation to Technology

investments was relatively unchanged from the start of the fiscal year on October 31, 2018. We continue to believe that certain Technology investments are benefitting from the secular shift of spending fromon-premise hardware and software capital spending to hybrid- cloud, edge, and public cloud business models—enabling increased productivity, competitiveness and lower total cost of ownership. Current and future drivers of this massive, digital transformation of business models include: Artificial Intelligence, Machine Learning, 5G applications (Autonomous Driving), Natural Language Processing, etc. The Fund increased its exposure to the Industrials sector to a slightly overweight exposure from a significant underweight position when the fiscal period commenced. The Industrial sector was heavily oversold in late 2018, investments have been targeted with low/no China exposure and include holdings in: aerospace and defense, business services, distribution, and equipment. Funding for the increase in Industrials was provided by reducing Healthcare holdings—now moved to an underweight position. Investments have been tilted to Biotechnology companies with approved products, and toward Services and Specialty Medical investments. During the last election cycle (2015-2016), Healthcare investments significantly underperformed the broad markets and did not regain their beginning of election cycle price levels for two years.

The Fund benefitted from seven takeovers during the past six months after a dry spell frommid-2018—the total number of takeovers in the Fund is nearly 110 since late 2010. The current period takeovers included: Esterline, Apptio, Loxo Oncology, Ultimate Software, Spark Therapeutics, Worldpay, WellCare Health Plans, and Ingersoll-Rand. Often, Fund holdings are buyers of other existing holdings—Transdigm and Fidelity National were acquirers. The SMID capitalization andMid-capitalization segments continue to provide the most attractive opportunities for takeovers and consolidation; a steady economy and good industrial and tax policy should encourage continued activity.

The Top 10 and Top 25 positions comprised approximately 32% and 45% of the Fund’s holdings at the end of the period. Approximately 87% of the Fund’s holdings were invested in the Top 100 positions. Smaller positions continue to serve a critical role in the Fund’s outperformance of its benchmark—providing a foothold in new, rapid expanding opportunities and minimizing risk in more binary outcome situations.

The Fund’s investments are well placed in competitively advantaged companies—many, like the Top 3 holdings—Shopify, ServiceNow and Workday—are long-term investments made years ago which have continued to execute at the highest level and drive significant excess returns. We believe that these companies are led by smart, vested, and visionary managements competing in very large and expanding markets. Substitution, innovation, obsolescence, and digital transformation represent a major threat to many legacy business models and disruption is an ever-present risk to many mature companies. We continue to seek to identify the leading, strategic opportunities while avoiding the value traps of fading companies. As always, we appreciate your continued confidence in our efforts.

Sincerely,

Thomas R. Vandeventer

Portfolio Manager

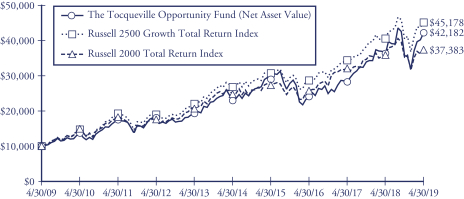

The Tocqueville Opportunity Fund

(Unaudited)

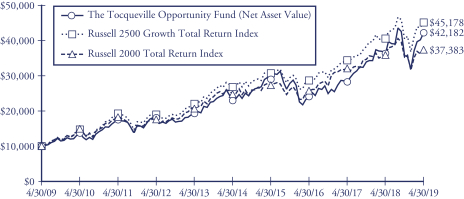

This chart assumes an initial gross investment of $10,000 made on 4/30/09. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The chart and table reflect The Opportunity Fund’s performance achieved prior to the changes effected in 2010 to its investment strategy.

The Russell 2500 Growth Total Return Index is an unmanaged index that measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Returns assume the reinvestment of all dividends

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED APRIL 30, 2019

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Opportunity Fund | | | 16.53% | | | | 20.84% | | | | 12.99% | | | | 15.48% | |

Russell 2500 Growth Total Return Index | | | 12.02% | | | | 16.56% | | | | 11.27% | | | | 16.28% | |

Russell 2000 Total Return Index | | | 4.61% | | | | 13.60% | | | | 8.63% | | | | 14.10% | |

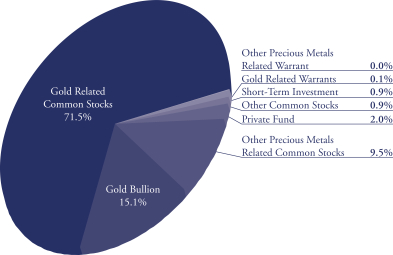

The Tocqueville Gold Fund

Dear Fellow Shareholder,

During the first half of the Fund’s 2019 fiscal year—November 1st through April 30th—gold markets recovered from their mid-summer and autumn correction especially as the U.S. Federal Reserve’s posture on interest rates caused broader markets to swoon at the end of 2018. The government shutdown and ongoing China-U.S. trade war rhetoric also provided support for gold in early 2019 even as the U.S. dollar rose, and as U.S. equity markets rebounded to record levels. For the period, the Tocqueville Gold Fund rose 5.31%, while the Philadelphia Stock Exchange Gold and Silver Index increased 11.46%.

In our quarterly investment letters, we have expanded on the investment case for precious metal exposure. The main thesis being that government sponsored currencies will ultimately become debased when debt and credit become so massive that economic growth cannot effectively pay for the interest on those liabilities or even pay back the obligations that fed that growth. Because gold has been considered a standard of value throughout millennia it is a form of insurance and a hedge to the destruction of financial assets that would get swamped by enormous debt loads.

The Fund invests not only in gold bullion but also in precious metal mining companies that create value in ways that are not solely dependent on rising metal prices. We are constantly monitoring activities and developments in the global precious metals sector for underappreciated value creation opportunities. Those investment opportunities present themselves through the potential for geologic discovery, as well as in mine development and/or through improved efficiencies brought on by production enhancement projects. Corporate strategies can also create compelling investment situations whether it is through financial structuring or mergers, acquisitions and joint ventures. Exposure to various stages of resource development and mining activity allows the Fund to diversify risk while also capturing different elements of value enhancement.

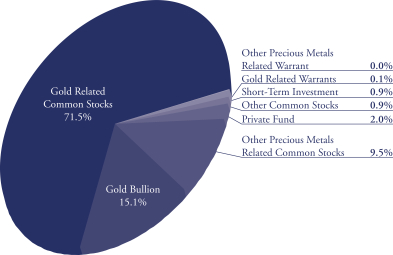

Approximately 72% of the Fund’s assets are gold mining equities focused on gold discovery, mine project development or production, while approximately 13% of the Fund is exposed to silver mining stocks. Silver has numerous industrial applications but is also considered a monetary metal similar to gold. Often the metals appear together, and mining companies will mine both to improve margins, but companies where the majority of the revenues come from silver production are considered silver mining companies. Generally, silver mining companies have greater leverage to the movement in metal prices.

The largest single position in the Fund is the 97,849 ounces of gold bullion that makes up about 15% of the Fund’s assets. That gold is stored outside the financial system in a secure vault that is monitored and audited on a regular basis. The Fund’s direct ownership and exposure to physical gold helped reduce the Fund’s volatility during the period. In order to maintain the 15% exposure on gold bullion, approximately

21,000 ounces were sold during the reporting period. The Fund’s gold bullion position was the largest contributor to positive performance during the first half of the year.

The precious metal stocks that contributed the most to performance during the period included Mag Silver Corp., Wheaton Precious Metals Corp., Detour Gold Corporation, and Franco-Nevada Corporation. After some delays, Mag Silver received the go ahead for its mine development project with joint venture partner, Fresnillo, which was well received by the market. Wheaton Precious Metals received a favorable court decision regarding its tax status in Canada that had been overhanging the stock for an extended period. Detour Gold Corporation was re-rated by the broader market as it restructured its board of directors in response to investor activism. Franco-Nevada Corporation benefitted from the royalty model it has applied to the oil and gas sector.

Corvus Gold Inc., Pan American Silver Corp., Jaguar Mining Inc., IAMGOLD Corporation, and Gold Standard Ventures Corp. corrected during the period, which dampened the Fund’s performance. In the case of Corvus Gold, Pan American and Gold Standard Ventures, those three stocks corrected from a period of outperformance during calendar 2018. Jaguar Mining and IAMGOLD experienced mining challenges at their underground mines which delayed some mining activity and will result in less gold production this year than what was originally expected.

Several positions were eliminated because they were either fully valued or presented limited value creation opportunities, such as Barrick Gold which became fully valued after it closed its merger with Randgold. The GoGold position was eliminated because of its limited options for value creation. GoldCorp was also sold during the period as its stock fully reflected the value of the Newmont bid for the company.

New names added during the period included Wesdome Gold Mines Ltd. and AngloGold Ashanti Limited. Wesdome has identified gold ore zones at its operating Eagle River mine which should extend the mine-life of that operation and which will also provide the capital from its operating cash flow to restart Wesdome’s idled Kiena mine complex where high-grade ore zones are also being discovered. AngloGold Ashanti had been undervalued by the market, but new management has been successfully restructuring the company to improve its geographic and operating risk exposure.

Currently, precious metals and related mining stocks have consolidated into a relatively narrow trading range and appear poised to breakout to higher levels as they await direction from the broader markets. For the remainder of 2019, we expect the U.S. Federal Reserve to keep interest rates low with a bias to lowering them while market volatility is likely to intensify along with the trade war. Low interest rates and continued volatility should be constructive for precious metal markets.

Over the past ten years, the spring and early summer months have tended to be favorable periods to increase exposure to precious metals and the related mining stocks. With the recent consolidation of the gold price below $1,300 per ounce and the ultra-cheap valuations in the gold mining sector, the coming months should present a similar opportunity.

Sincerely,

| | | | |

| |  | |  |

| John C. Hathaway | | Douglas B. Groh | | Ryan McIntyre |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

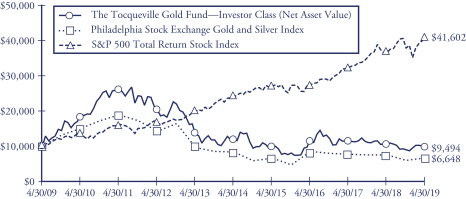

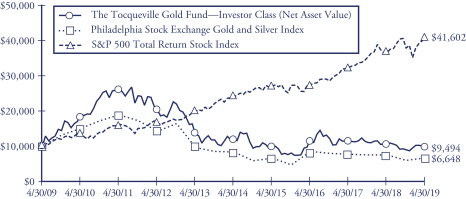

The Tocqueville Gold Fund—Investor Class

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/09. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2009, 2010, and 2016 the performance of The Tocqueville Gold Fund—Investor Class was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED APRIL 30, 2019

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Gold Fund—Investor Class | | | -12.34% | | | | -8.55% | | | | -4.94% | | | | -0.52% | |

Philadelphia Stock Exchange Gold and Silver Index | | | -11.41% | | | | -7.81% | | | | -4.25% | | | | -4.00% | |

Standard & Poor’s 500 Total Return Stock Index | | | 13.49% | | | | 14.87% | | | | 11.63% | | | | 15.32% | |

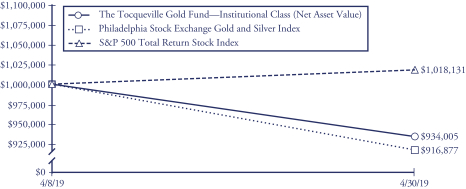

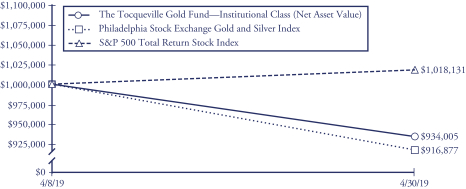

The Tocqueville Gold Fund—Institutional Class

(Unaudited)

This chart assumes an initial gross investment of $1,000,000 made on 4/8/19 (commencement of operations for Institutional Class). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

TOTAL RETURN (%)

FOR PERIOD ENDED APRIL 30, 2019

| | | | |

| | | Since Inception

(April 8, 2019) | |

The Tocqueville Gold Fund—Institutional Class | | | -6.60% | |

Philadelphia Stock Exchange Gold and Silver Index | | | -8.31% | |

Standard & Poor’s 500 Total Return Stock Index | | | 1.81% | |

The Tocqueville Phoenix Fund

Dear Fellow Shareholder,

For the six months ended April 30, 2019, the Fund’s net asset value increased 11.00% versus an increase of 6.06% for the Russell 2000 Index (“Russell 2000”) and an increase of 9.76% for the Standard & Poor’s 500 Index (“S&P 500”), each on a total return basis. Owing to the smaller average market capitalization of companies in the Russell 2000, we view it as the more appropriately comparative index to the Fund. The Fund’s net asset value as of April 30, 2019 was $20.89 per share. The net asset value amounted to $208,763,744 of which 89.4% was invested in equities, and the balance in cash and equivalents.

Domestic equities posted solid returns for thesix-month period, but the path toward realizing those returns was not without its challenges, particularly during the first couple of months of the period. While indices eked out gains in November 2018 thanks to a late month rally, trading for the bulk of the month was bearish, in particular among theso-called FAANG stocks, which entered bear market territory. And then came December 2018, when a convergence of negative news drove market declines of historic proportions and the return of hyper-volatility. During the month of December, the Russell 2000 dropped 11.9% and was down 10.5% through the two months ended December 31, 2018. U.S. stocks then rebounded meaningfully in the first calendar quarter of 2019. President Trump delayed an anticipated increase in tariffs on Chinese imports and markets rallied on hopes that a resolution to the U.S./China trade war may be more likely. A deceleration in the rate of growth of the U.S. economy prompted the Federal Reserve Board to delay any incremental rate hikes for the time being, further encouraging investors. Lastly, fourth quarter earnings reports were generallyin-line or slightly better than expected, which also seemed to embolden market bulls despite the more cautious forward outlook issued by a number of companies.

Despite continued headwinds from the market’s predilection for growth and scale, we outperformed for thesix-month period. As we mentioned in the 2018 Annual Report, when markets are in opposition to our investment approach, stock picking is critical to success, and our stock selection contributed favorably to our relative performance for thissix-month period. As we have also written in the past, sector allocation is aby-product of ourbottom-up investment process. Nonetheless, our inadvertent sector weightings also added to our relative return for the period, as we were overweight (and outperformed) the strongest sector within the Russell 2000, Information Technology, which contributed about 540 basis points to our absolute return and 230 basis points to our performance relative to the Russell 2000. We also had relatively little exposure to both Energy and Healthcare, both of which were particularly weak during the period, which also benefited our relative performance.

For the entiresix-month period, our top contributor was US Concrete Inc., which rose steadily off its lows on an improved outlook for 2019, as well as hopes for an expanded infrastructure budget out of the Washington D.C. Flex Ltd., Fabrinet, Tegna Inc. and Lumentum Holdings, were also among our top performing holdings, with each adding about 100 basis points to performance.

In contrast, Cars.com, PolyOne Corporation and Greenbrier Companies Inc. were the largest detractors to our performance. Cars surprised investors to the downside with mediocre guidance for 2019 and while their strategic review remains ongoing, the protracted process has likely dampened some enthusiasm that a takeout is likely. PolyOne’s shares traded off after the company reported earnings that were in line with expectations but warned of a slowdown in their end markets and cautioned on the potential impact of tariffs to their business. Greenbrier, which we ultimately exited during the period, weakened as investors became more concerned about its ability to meet expectations for 2019, as its guidance relies on an exceptionally strong second half of the year.

We opportunistically put capital to work following December’s correction, and we added a number of new positions to the portfolio during thesix-month period, the largest of which included Loews Corporation, Louisiana Pacific Corporation, Stanley Black & Decker Inc, and Tile Shop Holdings Inc. The largest portfolio deletions included Ducommun Incorporated, Electronics for Imaging Inc. (which announced it was being acquired), Hanesbrands Inc, and Minerals Technologies.

Sincerely,

| | | | |

| |  | |  |

| J. Dennis Delafield | | Joshua Kaufthal | | James Maxwell |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

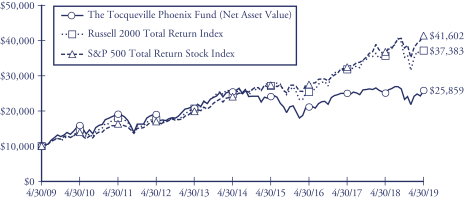

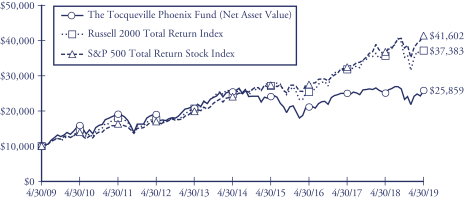

The Tocqueville Phoenix Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/09. On February 15, 2019, The Delafield Fund’s name changed to The Tocqueville Phoenix Fund. Since the Tocqueville Phoenix Fund did not commence operations until 9/28/09, returns prior to that date are those of the Predecessor Fund. The Tocqueville Phoenix Fund assumed the net asset value and performance history of the Predecessor Fund (See Footnote 1 to the Financial Statements). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 10% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Total Return Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED APRIL 30, 2019

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Phoenix Fund* | | | 3.23% | | | | 7.05% | | | | 0.43% | | | | 9.97% | |

Russell 2000 Total Return Index | | | 4.61% | | | | 13.60% | | | | 8.63% | | | | 14.10% | |

Standard & Poor’s 500 Total Return Stock Index | | | 13.49% | | | | 14.87% | | | | 11.63% | | | | 15.32% | |

| * | Prior to February 15, 2019, the Fund’s name was The Delafield Fund. |

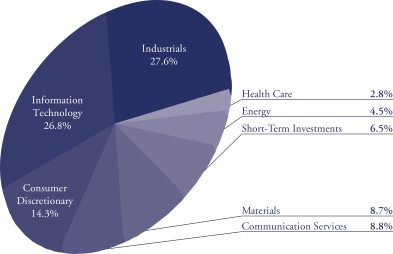

The Tocqueville Select Fund

Dear Fellow Shareholder,

For the six months ended April 30, 2019, the Fund’s net asset value increased 11.19% versus increases of 8.76% for the Russell 2500 Index (“Russell 2500”) and 6.06% for the Russell 2000 Index (“Russell 2000”), each on a total return basis. The Fund’s net asset value as of April 30, 2019 was $12.12 per share. The net asset value amounted to $40,313,535 of which 93.6% was invested in equities, and the balance in cash and equivalents.

Domestic equities managed to put up solid returns for thesix-month period, but not without a good bit of volatility intra-period. While indices eked out gains in November 2018 thanks to a late month rally, trading for the bulk of the month was bearish, in particular among theso-called FAANG stocks, which entered bear market territory. And then came December 2018, when a convergence of negative news drove market declines of historic proportions and the return of hyper-volatility. During the month of December, the Russell 2500 dropped nearly 11% and was down roughly 9.3% through the two months ended December 31, 2018. U.S. stocks then rebounded meaningfully in the first calendar quarter of 2019. President Trump delayed an anticipated increase in tariffs on Chinese imports and markets rallied on hopes that a resolution to the U.S./China trade war may be more likely. A deceleration in the rate of growth in the U.S. economy prompted the Federal Reserve Board to delay any incremental rate hikes for the time being, further encouraging investors. Lastly, fourth quarter earnings reports were generallyin-line or slightly better than expected, which also seemed to embolden market bulls despite the more cautious forward outlook issued by a number of companies.

As we have discussed in the past, stock picking is critical to our success, in particular during times such as these, when our value strategy is in opposition to the market’s preference. Stock selection did contribute favorably to our relative performance for thissix-month period, with the selection effect representing roughly one third of our relative outperformance for the period. Sector allocation also added to our relative return for the period, although inadvertently, as sector weighting has always been aby-product of ourbottom-up investment process. During the period we were overweight (and outperformed) the strongest sector within the Russell 2500, Information Technology, which contributed about 800 basis points to our absolute return. Our relative lack of exposure to Energy also benefited our relative performance, as it was the weakest sector in the Russell 2500.

Not surprisingly given our aforementioned strength in Information Technology during the period, three of our top four contributors came from within that sector, including Epam Systems Inc., Fabrinet and Flex Lt. In contrast, Tile Shop Holdings, Harsco and Cars.com were the largest detractors to our performance.

We added a number of new positions to the portfolio during the period, including Cross Country Healthcare Inc, PVH Corp and Solaris Oilfield Infrastructure Inc. We also exited four investments, Apogee Enterprises Inc, Gentex Corp., Minerals Technologies Inc, and Trueblue Inc.

Sincerely,

| | |

| |  |

| J. Dennis Delafield | | Joshua Kaufthal |

| Portfolio Manager | | Portfolio Manager |

| | |

| |  |

| Donald Wang | | James Maxwell |

| Portfolio Manager | | Portfolio Manager |

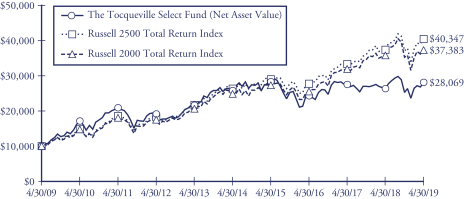

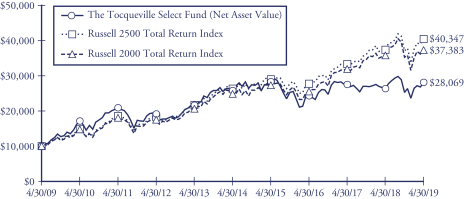

The Tocqueville Select Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/09. Since The Tocqueville Select Fund did not commence operations until 9/28/09, returns from the period from September 29, 2008 to September 27, 2009 are those of the Class Y Shares of the Predecessor Fund (See Footnote 1 to the Financial Statements). Prior to that period, returns shown are those of a limited partnership managed by the adviser. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

In 2013 the performance of The Tocqueville Select Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Russell 2500 Total Return Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR YEARS ENDED APRIL 30, 2019

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Select Fund | | | 6.32% | | | | 4.83% | | | | 1.78% | | | | 10.87% | |

Russell 2500 Total Return Index | | | 7.89% | | | | 13.31% | | | | 9.04% | | | | 14.97% | |

Russell 2000 Total Return Index | | | 4.61% | | | | 13.60% | | | | 8.63% | | | | 14.10% | |

Expense Example—April 30, 2019 (Unaudited)

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (November 1, 2018-April 30, 2019). For The Toqueville Gold Fund—Institutional Class, the example is based on an investment of $1,000 invested on April 8, 2019, the commencement of operations and held through April 30, 2019.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables (Unaudited)

The Tocqueville Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

November 1, 2018 | | | Ending

Account Value

April 30,

2019 | | | Expenses Paid

During Period*

November 1, 2018 -

April 30, 2019 | |

Actual | | $ | 1,000.00 | | | $ | 1,115.00 | | | $ | 6.56 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.60 | | | | 6.26 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.25% for The Tocqueville Fund, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

The Tocqueville Opportunity Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

November 1, 2018 | | | Ending

Account Value

April 30,

2019 | | | Expenses Paid

During Period*

November 1, 2018 -

April 30, 2019 | |

Actual | | $ | 1,000.00 | | | $ | 1,181.10 | | | $ | 6.81 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.55 | | | | 6.31 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.26% for The Tocqueville Opportunity Fund, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

The Tocqueville Gold Fund—Investor Class

| | | | | | | | | | | | |

| | | Beginning

Account Value

November 1, 2018 | | | Ending

Account Value

April 30,

2019 | | | Expenses Paid

During Period*

November 1, 2018 -

April 30, 2019 | |

Actual | | $ | 1,000.00 | | | $ | | | | $ | | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | | | | | | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense) of 1.49% for The Tocqueville Gold Fund Investor Class, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

The Tocqueville Gold Fund—Institutional Class

| | | | | | | | | | | | |

| | | Beginning

Account Value

April 8, 2019 | | | Ending

Account Value

April 30,

2019 | | | Expenses Paid

During Period*

April 8, 2019 -

April 30, 2019 | |

Actual | | $ | 1,000.00 | | | $ | 934.00 | | | $ | 0.78 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.20 | | | | 6.66 | |

| * | Actual expenses are equal to the Fund’s annualized six-month expense ratio of 1.33% for The Tocqueville Gold Fund Institutional Class multiplied by the average value over the period, multiplied by 22/365 to reflect the period. Hypothetical expenses are equal to the Fund’s annualized six-month expense ratio of 1.33% for The Tocqueville Gold Fund Institutional Class multiplied by the average value over the period, multiplied by 181/365 for comparison purposes. |

The Tocqueville Phoenix Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

November 1, 2018 | | | Ending

Account Value

April 30,

2019 | | | Expenses Paid

During Period*

November 1, 2018 -

April 30, 2019 | |

Actual | | $ | 1,000.00 | | | $ | 1,110.00 | | | $ | 6.54 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.60 | | | | 6.26 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.25% for The Tocqueville Phoenix Fund, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

The Tocqueville Select Fund

| | | | | | | | | | | | |

| | | Beginning

Account Value

November 1, 2018 | | | Ending

Account Value

April 30,

2019 | | | Expenses Paid

During Period*

November 1, 2018 -

April 30, 2019 | |

Actual | | $ | 1,000.00 | | | $ | 1,111.90 | | | $ | 6.55 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.60 | | | | 6.26 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.25% for The Tocqueville Select Fund, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2019 | | | Years Ended October 31, | |

| | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 35.84 | | | $ | 38.60 | | | $ | 33.72 | | | $ | 32.91 | | | $ | 34.18 | | | $ | 30.67 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.22 | | | | 0.35 | | | | 0.37 | | | | 0.42 | | | | 0.37 | | | | 0.28 | |

Net realized and unrealized gain (loss) | | | 3.55 | | | | 0.45 | | | | 6.40 | | | | 1.07 | | | | (0.19 | ) | | | 3.78 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 3.77 | | | | 0.80 | | | | 6.77 | | | | 1.49 | | | | 0.18 | | | | 4.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.34 | ) | | | (0.33 | ) | | | (0.39 | ) | | | (0.35 | ) | | | (0.25 | ) | | | (0.30 | ) |

Distributions from net realized gains | | | (2.59 | ) | | | (3.23 | ) | | | (1.50 | ) | | | (0.33 | ) | | | (1.20 | ) | | | (0.25 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (2.93 | ) | | | (3.56 | ) | | | (1.89 | ) | | | (0.68 | ) | | | (1.45 | ) | | | (0.55 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 0.84 | | | | (2.76 | ) | | | 4.88 | | | | 0.81 | | | | (1.27 | ) | | | 3.51 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 36.68 | | | $ | 35.84 | | | $ | 38.60 | | | $ | 33.72 | | | $ | 32.91 | | | $ | 34.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 11.5 | % | | | 2.0 | % | | | 20.9 | % | | | 4.6 | % | | | 0.5 | % | | | 13.4 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 281,790 | | | $ | 272,043 | | | $ | 293,637 | | | $ | 283,126 | | | $ | 309,267 | | | $ | 380,561 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.29 | % | | | 1.26 | % | | | 1.27 | % | | | 1.27 | % | | | 1.29 | % | | | 1.25 | % |

Expenses after waiver/reimbursement | | | 1.25 | % | | | 1.25 | % | | | 1.26 | %(3) | | | 1.24 | %(3) | | | 1.25 | % | | | 1.24 | % |

Net investment income before waiver/reimbursement | | | 1.19 | % | | | 0.91 | % | | | 0.97 | % | | | 1.18 | % | | | 0.91 | % | | | 0.84 | % |

Net investment income after waiver/reimbursement | | | 1.23 | % | | | 0.92 | % | | | 0.98 | % | | | 1.21 | % | | | 0.95 | % | | | 0.85 | % |

Portfolio turnover rate | | | 9 | % | | | 19 | % | | | 10 | % | | | 12 | % | | | 15 | % | | | 19 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanentbook-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Includes 0.01% of interest expense which is not included in the Fund’s operating expense cap. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Opportunity Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2019 | | | Years Ended October 31, | |

| | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 26.60 | | | $ | 26.12 | | | $ | 19.14 | | | $ | 21.41 | | | $ | 22.78 | | | $ | 21.29 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.11 | ) | | | (0.29 | ) | | | (0.37 | ) | | | (0.29 | ) | | | (0.15 | ) | | | (0.22 | ) |

Net realized and unrealized gain (loss) | | | 4.39 | | | | 1.63 | | | | 7.35 | | | | (1.98 | ) | | | 1.98 | | | | 2.80 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 4.28 | | | | 1.34 | | | | 6.98 | | | | (2.27 | ) | | | 1.83 | | | | 2.58 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | (2.49 | ) | | | (0.86 | ) | | | — | | | | — | | | | (3.20 | ) | | | (1.09 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (2.49 | ) | | | (0.86 | ) | | | — | | | | — | | | | (3.20 | ) | | | (1.09 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 1.79 | | | | 0.48 | | | | 6.98 | | | | (2.27 | ) | | | (1.37 | ) | | | 1.49 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 28.39 | | | $ | 26.60 | | | $ | 26.12 | | | $ | 19.14 | | | $ | 21.41 | | | $ | 22.78 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 18.1 | % | | | 5.3 | % | | | 36.5 | % | | | -10.6 | % | | | 9.1 | % | | | 12.6 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 93,986 | | | $ | 82,106 | | | $ | 77,773 | | | $ | 92,958 | | | $ | 153,456 | | | $ | 80,324 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.40 | % | | | 1.33 | % | | | 1.38 | % | | | 1.38 | % | | | 1.31 | % | | | 1.30 | % |

Expenses after waiver/reimbursement | | | 1.26 | %(3) | | | 1.26 | %(3) | | | 1.30 | %(3)(4) | | | 1.38 | % | | | 1.31 | % | | | 1.30 | % |

Net investment income before waiver/reimbursement | | | (1.18 | )% | | | (1.13 | )% | | | (1.05 | )% | | | (0.94 | )% | | | (0.95 | )% | | | (0.90 | )% |

Net investment income after waiver/reimbursement | | | (1.04 | )% | | | (1.06 | )% | | | (0.97 | )%(4) | | | (0.94 | )% | | | (0.95 | )% | | | (0.90 | )% |

Portfolio turnover rate | | | 93 | % | | | 151 | % | | | 133 | % | | | 108 | % | | | 101 | % | | | 92 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanentbook-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Includes interest expense of 0.01% for the six months ended April 30, 2019, 0.01% for the year ended October 31, 2018 and 0.05% for the year ended October 31, 2017. Interest expense is not included in the Fund’s operating expense cap. |

| (4) | Expense waiver of 1.25% was implemented on November 1, 2016. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Gold Fund—Investor Class

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2019 | | | Years Ended October 31, | |

| | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 29.01 | | | $ | 35.64 | | | $ | 39.32 | | | $ | 26.04 | | | $ | 30.38 | | | $ | 38.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.16 | ) | | | (0.38 | ) | | | (0.39 | ) | | | (0.33 | ) | | | (0.27 | ) | | | (0.08 | ) |

Net realized and unrealized gain (loss) | | | 1.70 | | | | (6.25 | ) | | | (3.29 | ) | | | 13.61 | | | | (4.07 | ) | | | (7.55 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 1.54 | | | | (6.63 | ) | | | (3.68 | ) | | | 13.28 | | | | (4.34 | ) | | | (7.63 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 1.54 | | | | (6.63 | ) | | | (3.68 | ) | | | 13.28 | | | | (4.34 | ) | | | (7.63 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 30.55 | | | $ | 29.01 | | | $ | 35.64 | | | $ | 39.32 | | | $ | 26.04 | | | $ | 30.38 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | 0.01 | | | | 0.00 | (2) | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.02 | |

Total Return | | | 5.3 | % | | | -18.6 | % | | | -9.4 | % | | | 51.0 | % | | | -14.3 | % | | | -20.1 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 835,981 | | | $ | 859,394 | | | $ | 1,153,287 | | | $ | 1,365,282 | | | $ | 947,367 | | | $ | 1,138,557 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.49 | % | | | 1.42 | % | | | 1.38 | % | | | 1.39 | % | | | 1.43 | % | | | 1.36 | % |

Net investment loss | | | (0.73 | )% | | | (0.88 | )% | | | (0.95 | )% | | | (0.91 | )% | | | (0.84 | )% | | | (0.78 | )% |

Portfolio turnover rate | | | 9 | % | | | 9 | % | | | 14 | % | | | 15 | % | | | 11 | % | | | 10 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanentbook-to-tax differences. |

| (2) | Represents less than $0.01. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Gold Fund—Institutional Class

Financial Highlights

| | | | |

Per share operating performance

(For a share outstanding throughout the period) | | April 8, 2019(1)

through

April 30, 2019 | |

|

| | | (Unaudited) | |

Net asset value, beginning of period (1) | | $ | 32.73 | |

| | | | |

Operations: | | | | |

Net investment income (2) | | | 0.00 | (3) |

Net realized and unrealized loss | | | (2.16 | ) |

| | | | |

Total from investment operations * | | | (2.16 | ) |

| | | | |

Distributions to shareholders: | | | | |

Dividends from net investment income | | | — | |

Distributions from net realized gains | | | — | |

| | | | |

Total distributions | | | — | |

| | | | |

Change in net asset value for the period | | | (2.16 | ) |

| | | | |

Net asset value, end of period | | $ | 30.57 | |

| | | | |

* Includes redemption fees per share of | | | | |

Total Return | | | -6.6 | % |

Ratios/supplemental data | | | | |

Net assets, end of period (000) | | $ | 20 | |

Ratio to average net assets: | | | | |

Expense | | | 1.33 | % |

Net investment loss | | | 0.90 | % |

Portfolio turnover rate | | | 9 | % |

| (1) | Institutional Class shares commenced operations on April 8, 2019. |

| (2) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanentbook-to-tax differences. |

| (3) | Represents less than $0.01. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Phoenix Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2019 | | | Years Ended October 31, | |

| | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 20.20 | | | $ | 26.40 | | | $ | 26.47 | | | $ | 28.64 | | | $ | 36.40 | | | $ | 37.13 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.01 | ) | | | (0.14 | ) | | | (0.15 | ) | | | (0.15 | ) | | | (0.14 | ) | | | (0.10 | ) |

Net realized and unrealized gain (loss) | | | 2.05 | | | | (2.27 | ) | | | 4.91 | | | | 0.78 | | | | (3.99 | ) | | | 0.70 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 2.04 | | | | (2.41 | ) | | | 4.76 | | | | 0.63 | | | | (4.13 | ) | | | 0.60 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | 0.00 | (2) | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | (1.35 | ) | | | (3.79 | ) | | | (4.83 | ) | | | (2.80 | ) | | | (3.63 | ) | | | (1.33 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.35 | ) | | | (3.79 | ) | | | (4.83 | ) | | | (2.80 | ) | | | (3.63 | ) | | | (1.33 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 0.69 | | | | (6.20 | ) | | | (0.07 | ) | | | (2.17 | ) | | | (7.76 | ) | | | (0.73 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 20.89 | | | $ | 20.20 | | | $ | 26.40 | | | $ | 26.47 | | | $ | 28.64 | | | $ | 36.40 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 11.0 | % | | | (10.6 | )% | | | 19.0 | % | | | 3.3 | % | | | (12.3 | )% | | | 1.6 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 208,764 | | | $ | 237,119 | | | $ | 373,353 | | | $ | 400,827 | | | $ | 674,525 | | | $ | 1,475,139 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.40 | % | | | 1.32 | % | | | 1.31 | % | | | 1.29 | % | | | 1.25 | % | | | 1.21 | % |

Expenses after waiver/reimbursement | | | 1.25 | % | | | 1.25 | % | | | 1.25 | %(3) | | | 1.29 | % | | | 1.25 | % | | | 1.21 | % |

Net investment income before waiver/reimbursement | | | (0.23 | )% | | | (0.55 | )% | | | (0.55 | )% | | | (0.33 | )% | | | (0.15 | )% | | | (0.24 | )% |

Net investment income after waiver/reimbursement | | | (0.08 | )% | | | (0.48 | )% | | | (0.49 | )%(3) | | | (0.33 | )% | | | (0.15 | )% | | | (0.24 | )% |

Portfolio turnover rate | | | 23 | % | | | 40 | % | | | 36 | % | | | 39 | % | | | 19 | % | | | 34 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanentbook-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Expense waiver of 1.25% was implemented on November 1, 2016. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Select Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2019 | | | Years Ended October 31, | |

| | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 10.90 | | | $ | 11.87 | | | $ | 11.43 | | | $ | 12.08 | | | $ | 14.90 | | | $ | 15.57 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.01 | ) | | | (0.05 | ) | | | (0.06 | ) | | | (0.07 | ) | | | (0.08 | ) | | | (0.07 | ) |

Net realized and unrealized gain (loss) | | | 1.23 | | | | (0.70 | ) | | | 1.12 | | | | (0.18 | ) | | | (1.00 | ) | | | 0.94 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 1.22 | | | | (0.75 | ) | | | 1.06 | | | | (0.25 | ) | | | (1.08 | ) | | | 0.87 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | — | | | | (0.22 | ) | | | (0.62 | ) | | | (0.40 | ) | | | (1.74 | ) | | | (1.54 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | (0.22 | ) | | | (0.62 | ) | | | (0.40 | ) | | | (1.74 | ) | | | (1.54 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 1.22 | | | | (0.97 | ) | | | 0.44 | | | | (0.65 | ) | | | (2.82 | ) | | | (0.67 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 12.12 | | | $ | 10.90 | | | $ | 11.87 | | | $ | 11.43 | | | $ | 12.08 | | | $ | 14.90 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 11.2 | % | | | (6.4 | )% | | | 8.9 | % | | | (1.9 | )% | | | (8.0 | )% | | | 6.1 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 40,314 | | | $ | 39,225 | | | $ | 49,453 | | | $ | 63,812 | | | $ | 81,813 | | | $ | 108,060 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver/reimbursement | | | 1.44 | % | | | 1.37 | % | | | 1.37 | % | | | 1.37 | % | | | 1.36 | % | | | 1.32 | % |

Expenses after waiver/reimbursement | | | 1.25 | % | | | 1.25 | % | | | 1.25 | %(3) | | | 1.37 | % | | | 1.36 | % | | | 1.32 | % |

Net investment income before waiver/reimbursement | | | (0.34 | )% | | | (0.50 | )% | | | (0.47 | )% | | | (0.45 | )% | | | (0.52 | )% | | | (0.50 | )% |

Net investment income after waiver/reimbursement | | | (0.15 | )% | | | (0.38 | )% | | | (0.35 | )%(3) | | | (0.45 | )% | | | (0.52 | )% | | | (0.50 | )% |

Portfolio turnover rate | | | 15 | % | | | 27 | % | | | 24 | % | | | 32 | % | | | 43 | % | | | 32 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanentbook-to-tax differences. |

| (2) | Represents less than $0.01. |

| (3) | Expense waiver of 1.25% was implemented on November 1, 2016. |

The Accompanying Notes are an Integral Part of these Financial Statements.

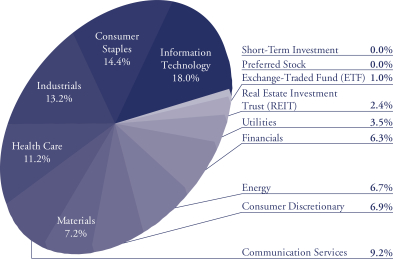

The Tocqueville Fund

Schedule of Investments as of April 30, 2019

(Unaudited)

| | | | | | | | |

| Common Stocks—96.2% | | Shares | | | Value | |

Automobiles & Components—1.3% | |

Ford Motor Co. | | | 350,000 | | | $ | 3,657,500 | |

Banks—1.1% | | | | | | | | |

Bank of America Corp. | | | 100,000 | | | | 3,058,000 | |

Capital Goods—8.5% | | | | | | | | |

Arconic, Inc. | | | 175,000 | | | | 3,759,000 | |

Caterpillar, Inc. | | | 25,000 | | | | 3,485,500 | |

Illinois Tool Works, Inc. | | | 40,000 | | | | 6,225,200 | |

Parker-Hannifin Corp. | | | 15,000 | | | | 2,716,200 | |

Raytheon Co. | | | 10,000 | | | | 1,775,900 | |

The Boeing Co. | | | 10,000 | | | | 3,776,900 | |

United Technologies Corp. | | | 15,000 | | | | 2,139,150 | |

| | | | | | | | 23,877,850 | |

Commercial & Professional Services—1.2% | |

Steelcase, Inc.—Class A | | | 200,000 | | | | 3,458,000 | |

Consumer Services—2.1% | |

McDonald’s Corp. | | | 30,000 | | | | 5,927,100 | |

Diversified Financials—2.6% | |

Capital One Financial Corp. | | | 25,000 | | | | 2,320,750 | |

The Bank of New York Mellon Corp. | | | 100,000 | | | | 4,966,000 | |

| | | | | | | | 7,286,750 | |

Energy—6.7% | | | | | | | | |

Exxon Mobil Corp. | | | 100,000 | | | | 8,028,000 | |

Noble Energy, Inc. | | | 200,000 | | | | 5,412,000 | |

Schlumberger Ltd.(a) | | | 125,000 | | | | 5,335,000 | |

| | | | | | | | 18,775,000 | |

Food & Staples Retailing—3.3% | |

Walmart, Inc. | | | 90,000 | | | | 9,255,600 | |

Food, Beverage & Tobacco—4.7% | |

Campbell Soup Co. | | | 100,000 | | | | 3,869,000 | |

Constellation Brands, Inc.—Class A | | | 10,000 | | | | 2,116,700 | |

The Coca-Cola Co. | | | 150,000 | | | | 7,359,000 | |

| | | | | | | | 13,344,700 | |

Health Care Equipment & Services—1.4% | |

Abbott Laboratories | | | 50,000 | | | | 3,978,000 | |

Household & Personal Products—6.4% | |

Colgate-Palmolive Co. | | | 100,000 | | | | 7,279,000 | |

The Procter & Gamble Co. | | | 100,000 | | | $ | 10,648,000 | |

| | | | | | | | 17,927,000 | |

Insurance—2.6% | | | | | | | | |

Aflac, Inc. | | | 100,000 | | | | 5,038,000 | |

MetLife, Inc. | | | 50,000 | | | | 2,306,500 | |

| | | | | | | | 7,344,500 | |

Materials—7.2% | | | | | | | | |

BHP Group Ltd.—ADR(a) | | | 50,000 | | | | 2,647,500 | |

Dow, Inc.(b) | | | 33,333 | | | | 1,890,981 | |

DowDuPont, Inc. | | | 100,000 | | | | 3,845,000 | |

Nutrien Ltd.(a) | | | 40,000 | | | | 2,167,200 | |

Sonoco Products Co. | | | 75,000 | | | | 4,729,500 | |

Vulcan Materials Co. | | | 40,000 | | | | 5,044,400 | |

| | | | | | | | 20,324,581 | |

Media & Entertainment—7.1% | |

Alphabet, Inc.—Class A(b) | | | 7,000 | | | | 8,392,720 | |

Facebook, Inc.—Class A(b) | | | 25,000 | | | | 4,835,000 | |

The Walt Disney Co. | | | 50,000 | | | | 6,848,500 | |

| | | | | | | | 20,076,220 | |

Pharmaceuticals, Biotechnology & Life Sciences—9.8% | |

Biogen, Inc.(b) | | | 12,500 | | | | 2,865,500 | |

Ionis Pharmaceuticals, Inc.(b) | | | 40,000 | | | | 2,973,200 | |

Johnson & Johnson | | | 40,000 | | | | 5,648,000 | |

Merck & Co., Inc. | | | 100,000 | | | | 7,871,000 | |

Pfizer, Inc. | | | 200,000 | | | | 8,122,000 | |

| | | | | | | | 27,479,700 | |

Retailing—3.4% | | | | | | | | |

Amazon.com, Inc.(b) | | | 5,000 | | | | 9,632,600 | |

Semiconductors & Semiconductor Equipment—7.6% | |

Applied Materials, Inc. | | | 150,000 | | | | 6,610,500 | |

Intel Corp. | | | 150,000 | | | | 7,656,000 | |

NVIDIA Corp. | | | 15,000 | | | | 2,715,000 | |

QUALCOMM, Inc. | | | 50,000 | | | | 4,306,500 | |

| | | | | | | | 21,288,000 | |

Software & Services—7.6% | |

Automatic Data Processing, Inc. | | | 50,000 | | | | 8,219,500 | |

The Accompanying Footnotes are an Integral Part of these Financial Statements.

The Tocqueville Fund

Schedule of Investments as of April 30, 2019

(Unaudited)

| | | | | | | | |

| Common Stocks—96.2% | | Shares | | | Value | |

Microsoft Corp. | | | 100,000 | | | $ | 13,060,000 | |

| | | | | | | | 21,279,500 | |

Technology Hardware & Equipment—2.8% | |

Apple, Inc. | | | 40,000 | | | | 8,026,800 | |

Bio-key International, Inc.(b)(c)(d)

(Originally acquired 09/16/05, Cost $0) | | | 1,963 | | | | — | |

| | | | | | | | 8,026,800 | |

Telecommunication Services—2.0% | |

Verizon Communications, Inc. | | | 100,000 | | | | 5,719,000 | |

Transportation—3.4% | |

Delta Air Lines, Inc. | | | 100,000 | | | | 5,829,000 | |

FedEx Corp. | | | 10,000 | | | | 1,894,600 | |

Kansas City Southern | | | 15,000 | | | | 1,847,100 | |

| | | | | | | | 9,570,700 | |

Utilities—3.4% | |

NextEra Energy, Inc. | | | 50,000 | | | | 9,722,000 | |

Total Common Stocks

(Cost $133,055,425) | | | | | | | 271,009,101 | |

Preferred Stock—0.0% | |

Health Care Equipment & Supplies—0.0% | |

Velico Medical, Inc.(b)(c)(d)

(Originally acquired 10/13/16, Cost $0) | | | 400,000 | | | | 1,600 | |

Total Preferred Stock

(Cost $0) | | | | | | | 1,600 | |

Real Estate Investment Trust (REIT)—2.4% | |

Real Estate—2.4% | | | | | | | | |

Weyerhaeuser Co. | | | 250,000 | | | | 6,700,000 | |

Total Real Estate Investment Trust

(Cost $4,725,263) | | | | 6,700,000 | |

Exchange-Traded Fund (ETF)—1.0% | |

Metals and Mining—1.0% | | | | | | | | |

SPDR S&P Metals & Mining ETF | | | 100,000 | | | | 2,883,000 | |

Total Exchange-Traded Fund

(Cost $1,495,845) | | | | 2,883,000 | |

| Short-Term Investment—0.0% | | Shares | | | Value | |

Money Market Fund—0.0% | |

STIT-Treasury

Portfolio—Institutional Class, 2.319%(e) | | | 472 | | | $ | 472 | |

Total Short-Term Investment

(Cost $472) | | | | 472 | |

Total Investments

(Cost $139,277,005)—99.6% | | | | 280,594,173 | |

Other Assets in Excess of Liabilities—0.4% | | | | 1,196,093 | |

Total Net Assets—100.0% | | | | | | $ | 281,790,266 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

ADR American Depository Receipt

| (a) | Foreign issued Security. Foreign Concentration (including ADR’s) was as follows: Australia 0.9%; Canada 0.8%; Curacao 1.9%. |

| (b) | Non-income producing security. |

| (c) | Denotes a security that is either fully or partially restricted to resale. The aggregate value of restricted securities as of April 30, 2019 was $1,600 which represented 0.0% of net assets. |

| (d) | Security is fair valued using procedures approved by the Board of Trustees which includes significant unobservable inputs and is deemed a Level 3 security. See Footnote 2. The aggregate value of fair value securities as of April 30, 2019 was $1,600 which represented 0.0% of net assets. |

| (e) | Rate listed is the7-day effective yield. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The Accompanying Footnotes are an Integral Part of these Financial Statements.

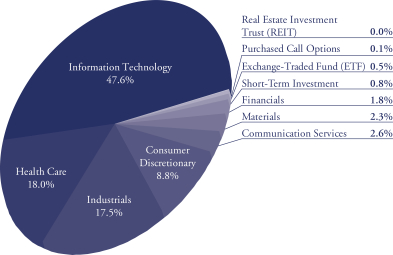

The Tocqueville Opportunity Fund

Schedule of Investments as of April 30, 2019

(Unaudited)

| | | | | | | | |

| Common Stocks—99.1% | | Shares | | | Value | |

Automobiles & Components—0.0% | |

Delphi Technologies PLC(a) | | | 1 | | | $ | 22 | |

Capital Goods—13.3% | |

Allison Transmission Holdings, Inc. | | | 1,000 | | | | 46,860 | |

AMETEK, Inc. | | | 4,000 | | | | 352,680 | |

AO Smith Corp. | | | 5,500 | | | | 289,135 | |

Cummins, Inc. | | | 1,400 | | | | 232,806 | |

Emerson Electric Co. | | | 4,000 | | | | 283,960 | |

Fastenal Co. | | | 6,000 | | | | 423,300 | |

Fortive Corp. | | | 7,500 | | | | 647,550 | |

Gardner Denver Holdings, Inc.(b) | | | 4,500 | | | | 151,875 | |

Graco, Inc. | | | 5,000 | | | | 256,250 | |

Harris Corp. | | | 4,500 | | | | 758,250 | |

HD Supply Holdings, Inc.(b) | | | 4,000 | | | | 182,760 | |