UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-05002

Deutsche Variable Series II

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and Address of Agent for Service)

| Date of fiscal year end: | 12/31 |

| | |

| Date of reporting period: | 12/31/2015 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

December 31, 2015

Annual Report

Deutsche Variable Series II

Deutsche Alternative Asset Allocation VIP

Contents

3 Performance Summary 4 Management Summary 5 Portfolio Summary 6 Investment Portfolio 7 Statement of Assets and Liabilities 8 Statement of Operations 8 Statement of Changes in Net Assets 10 Financial Highlights 11 Notes to Financial Statements 15 Report of Independent Registered Public Accounting Firm 16 Information About Your Fund's Expenses 17 Tax Information 17 Proxy Voting 18 Advisory Agreement Board Considerations and Fee Evaluation 20 Board Members and Officers |

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Although allocation among different asset categories generally limits risk, portfolio management may favor an asset category that underperforms other assets or markets as a whole. The Fund expects to invest in underlying funds that emphasize alternatives or non-traditional asset categories or investment strategies, and as a result, it is subject to the risk factors of those underlying funds. Some of those risks include: stock market risk; the political, general economic, liquidity and currency risks of foreign investments, which may be particularly significant for emerging markets; credit and interest rate risk; floating rate loan risk; volatility in commodity prices, infrastructure and high-yield debt securities; market direction risk (market advances when short, market declines when long); and short sales risk. Because Exchange Traded Funds (ETFs) trade on a securities exchange, their shares may trade at a premium or discount to their net asset value. ETFs also incur fees and expenses so they may not fully match the performance of the indexes they are designed to track. The Fund may use derivatives, including as part of its currency and interest-rate strategies. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. The success of the Fund’s currency and interest-rate strategies are dependent, in part, on the effectiveness and implementation of portfolio management’s proprietary models. As part of these strategies, the Fund’s exposure to foreign currencies could cause lower returns or even losses because foreign currency rates may fluctuate significantly over short periods of time for a number of reasons. The risk of loss is heightened during periods of rapid rises in interest rates. In addition, the notional amount of the Fund’s aggregate currency and interest-rate exposure resulting from these strategies may significantly exceed the net assets of the Fund. See the prospectus for additional risks and specific details regarding the Fund's risk profile.

Deutsche Asset Management represents the asset management activities conducted by Deutsche Bank AG or any of its subsidiaries.

DeAWM Distributors, Inc., 222 South Riverside Plaza, Chicago, IL 60606, (800) 621-1148

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary December 31, 2015 (Unaudited)

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund's most recent month-end performance. Performance doesn't reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns. While all share classes have the same underlying portfolio, their performance will differ.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated May 1, 2015 are 1.73% and 2.03% for Class A and Class B shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. These expense ratios include net expenses of the underlying funds in which the Fund invests.

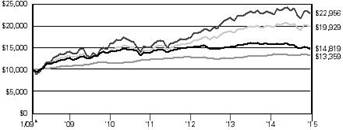

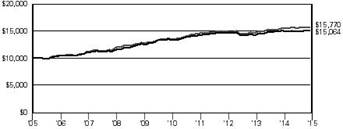

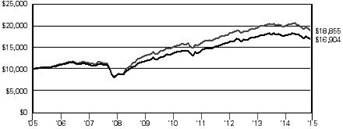

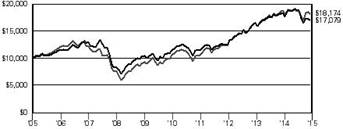

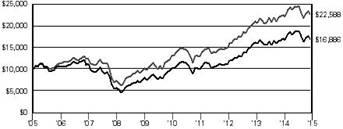

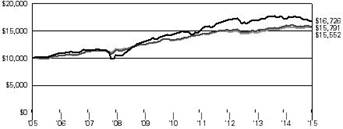

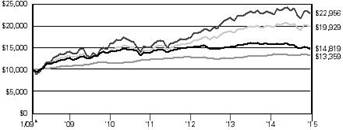

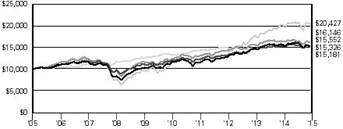

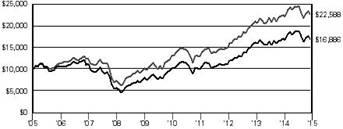

| Growth of an Assumed $10,000 Investment in Deutsche Alternative Asset Allocation VIP from 2/2/09 to12/31/15 |

■ Deutsche Alternative Asset Allocation VIP — Class A ■ MSCI World Index ■ Barclays U.S. Aggregate Bond Index ■ Blended Index | | The Morgan Stanley Capital International (MSCI) World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The index consists of 23 developed market country indices. The index is calculated using closing local market prices and translates into U.S. dollars using the London close foreign exchange rates. The Barclays U.S. Aggregate Bond Index is an unmanaged index representing domestic taxable investment-grade bonds, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities with an average maturity of one year or more. The Blended Index is calculated using the performance of two unmanaged indices, representative of stocks (the MSCI World Index (70%)) and bonds (the Barclays U.S. Aggregate Bond Index (30%)). These results are summed to produce the aggregate benchmark. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| |

| Yearly periods ended December 31 | |

| Comparative Results |

| Deutsche Alternative Asset Allocation VIP | 1-Year | 3-Year | 5-Year | Life of Fund* |

| Class A | Growth of $10,000 | $9,371 | $9,789 | $10,433 | $14,819 |

| Average annual total return | –6.29% | –0.71% | 0.85% | 5.85% |

| MSCI World Index | Growth of $10,000 | $9,913 | $13,177 | $14,417 | $22,956 |

| Average annual total return | –0.87% | 9.63% | 7.59% | 12.77% |

| Barclays U.S. Aggregate Bond Index | Growth of $10,000 | $10,055 | $10,439 | $11,732 | $13,359 |

| Average annual total return | 0.55% | 1.44% | 3.25% | 4.28% |

| Blended Index | Growth of $10,000 | $9,976 | $12,336 | $13,715 | $19,929 |

| Average annual total return | –0.24% | 7.25% | 6.52% | 10.48% |

The growth of $10,000 is cumulative.

* The Fund commenced offering Class A shares on February 2, 2009. The performance shown for each index is for the time period of January 31, 2009 through December 31, 2015, which is based on the performance period of the life of the Fund.

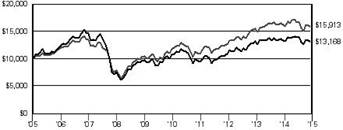

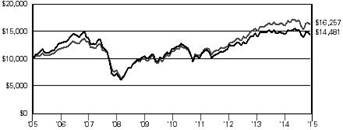

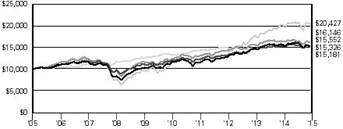

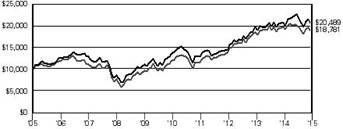

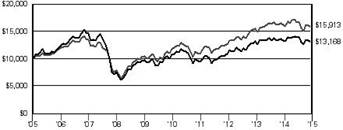

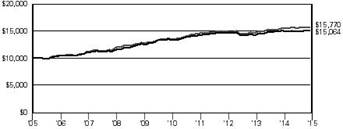

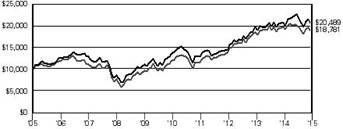

| Comparative Results |

| Deutsche Alternative Asset Allocation VIP | 1-Year | 3-Year | 5-Year | Life of Class** |

| Class B | Growth of $10,000 | $9,346 | $9,721 | $10,300 | $13,400 |

| Average annual total return | –6.54% | –0.94% | 0.59% | 4.52% |

| MSCI World Index | Growth of $10,000 | $9,913 | $13,177 | $14,417 | $19,606 |

| Average annual total return | –0.87% | 9.63% | 7.59% | 10.77% |

| Barclays U.S. Aggregate Bond Index | Growth of $10,000 | $10,055 | $10,439 | $11,732 | $13,068 |

| Average annual total return | 0.55% | 1.44% | 3.25% | 4.15% |

| Blended Index | Growth of $10,000 | $9,976 | $12,336 | $13,715 | $17,668 |

| Average annual total return | –0.24% | 7.25% | 6.52% | 9.03% |

The growth of $10,000 is cumulative.

** The Fund commenced offering Class B shares on May 18, 2009. The performance shown for each index is for the time period of May 31, 2009 through December 31, 2015, which is based on the performance period of the life of Class B.

Management Summary December 31, 2015 (Unaudited)

The Fund returned –6.29% (Class A shares, unadjusted for contract charges) during 2015, which compares to a return of –0.24% for its blended benchmark.1

The annual period proved to be a challenging time for the global financial markets. Even though developed-market equities finished with a slight gain, the positive returns were largely concentrated in a relatively narrow group of growth stocks. In contrast, commodities performed poorly and bonds finished with tepid returns. Given the fund's diversified approach and emphasis on alternative asset classes, this environment provided a headwind to both absolute and relative performance in 2015.

The Fund’s position in commodity-related investments — which is achieved through a position in Deutsche Enhanced Commodity Strategy Fund — detracted from its 12-month results, as commodity prices fell sharply due to the unfavorable combination of falling demand and rising supply. This trend contributed to negative absolute returns for Deutsche Enhanced Commodity Strategy Fund, although the fund outperformed its benchmark on the strength of its active approach to risk management.

The Fund’s positions in fixed-income investments also contributed to its shortfall, although not to the extent of its commodities exposure. The Fund held positions in funds linked to short-term high-yield bonds, emerging-markets debt and domestic floating-rate securities, all of which finished in the red amid the broader weakness in credit-sensitive segments of the bond market. The Fund's position in Deutsche Global Inflation Fund, which invests in inflation-protected securities, also closed with a loss due to the dramatic decline in investors’ inflation expectations. The Fund's position in convertible securities, which we established through an investment in SPDR Barclays Convertible Securities ETF, finished the year with a slightly negative return as well.2 We continue to believe convertibles offer a way to generate yield with a lower degree of interest-rate sensitivity than typical fixed-income investments.

The Fund's investment in market-neutral strategies and an ETF linked to the performance of convertible bonds also modestly detracted from performance. Finally, the Fund's allocation to global infrastructure stocks lagged due to both the broader weakness in equities and the persistent uncertainty regarding U.S. Federal Reserve Board (the Fed) policy. On the plus side, the Fund's investment in real-estate investment trusts bucked the broader trends in the global financial markets to generate positive performance for the year.

Alternative assets performed poorly in the past year, but we believe this has made valuations more attractive in many segments of our investment universe. The importance of diversification is easy to overlook when returns are concentrated in very narrow segments of the financial markets, as was the case in 2015. However, we believe there has been a significant benefit to maintaining diversification and emphasizing undervalued investments over the long term. Notably, we think inflation-sensitive asset classes — such as Treasury Inflation Protected Securities, commodities, and infrastructure stocks — have become more interesting following their weak showing in the past year. We encourage investors to maintain a longer-term perspective, rather than focusing on short-term results.

Pankaj Bhatnagar, PhD

Darwei Kung

Portfolio Managers

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

1 The Blended Index is calculated using the performance of two unmanaged indices, representative of stocks (the Morgan Stanley Capital International (MSCI) World Index (70%) and bonds (the Barclays U.S. Aggregate Bond Index (30%). These results are summed to produce the aggregate benchmark. Index returns do not reflect fees or expenses and it is not possible to invest directly into an index.

2 An ETF is a security that tracks an index, a commodity or a basket of assets like an index fund, but trades like a stock on an exchange.

Portfolio Summary (Unaudited)

| Asset Allocation* (As a % of Investment Portfolio excluding Cash Equivalents) | 12/31/15 | 12/31/14 |

| |

| Commodity | 12% | 10% |

| Deutsche Enhanced Commodity Strategy Fund | 12% | 10% |

| Real Return | 39% | 35% |

| Deutsche Global Infrastructure Fund | 18% | 19% |

| Deutsche Global Inflation Fund | 10% | 7% |

| Deutsche Real Estate Securities Fund | 7% | 5% |

| Deutsche Global Real Estate Securities Fund | 3% | 3% |

| Deutsche Real Estate Securities Income Fund | 1% | 1% |

| Hedge Strategy | 14% | 11% |

| Deutsche Diversified Market Neutral Fund | 13% | 10% |

| Deutsche Strategic Equity Long/Short Fund | 1% | 1% |

| Currency | 13% | 15% |

| Deutsche Enhanced Emerging Markets Fixed Income Fund | 13% | 15% |

| Opportunistic | 22% | 29% |

| Deutsche Floating Rate Fund | 13% | 13% |

| SPDR Barclays Convertible Securities ETF | 9% | 13% |

| SPDR Barclays Short Term High Yield Bond Fund ETF | — | 3% |

| | 100% | 100% |

* Investment strategies will fall into the following categories: Commodities, Real-Return, Hedge Strategy, Currency and Opportunistic. Commodities investments seek to provide exposure to hard assets. Real-Return investments seek to provide a measure of inflation protection. Hedge Strategy investments seek to generate returns independent of the broader markets. Currency investments seek to offer exposure to foreign investments, many of which are not denominated in U.S. dollars. Opportunistic investments seek to offer exposure to categories generally not included in investors' allocations.

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund's investment portfolio, see page 6.

Following the Fund's fiscal first and third quarter-end, a complete portfolio holdings listing is filed with the SEC on Form N-Q. The form will be available on the SEC's Web site at sec.gov, and it also may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the SEC's Public Reference Room may be obtained by calling (800) SEC-0330. The Fund's portfolio holdings are also posted on deutschefunds.com from time to time. Please see the Fund's current prospectus for more information.

Investment Portfolio December 31, 2015

| |

Shares | Value ($) |

| | | |

| Mutual Funds 88.0% |

| Deutsche Diversified Market Neutral Fund "Institutional"* (a) | 1,535,052 | 13,155,393 |

| Deutsche Enhanced Commodity Strategy Fund "Institutional" (a) | 1,107,369 | 12,646,150 |

| Deutsche Enhanced Emerging Markets Fixed Income Fund "Institutional" (a) | 1,519,546 | 13,296,026 |

| Deutsche Floating Rate Fund "Institutional" (a) | 1,659,602 | 14,073,424 |

| Deutsche Global Inflation Fund "Institutional" (a) | 1,136,889 | 10,993,719 |

| Deutsche Global Infrastructure Fund "Institutional" (a) | 1,477,279 | 18,584,170 |

| Deutsche Global Real Estate Securities Fund "Institutional" (a) | 385,751 | 3,340,604 |

| Deutsche Real Estate Securities Fund "Institutional" (a) | 363,592 | 7,700,878 |

| Deutsche Real Estate Securities Income Fund "Institutional" (a) | 64,161 | 581,940 |

| Deutsche Strategic Equity Long/Short Fund "Institutional" (a) | 149,407 | 1,362,596 |

| Total Mutual Funds (Cost $104,097,012) | 95,734,900 |

| |

Shares | Value ($) |

| | | |

| Exchange-Traded Fund 8.2% |

| SPDR Barclays Convertible Securities (Cost $8,829,507) | 205,952 | 8,913,603 |

| |

| Cash Equivalents 3.5% |

| Central Cash Management Fund, 0.25% (a) (b) (Cost $3,850,877) | 3,850,877 | 3,850,877 |

| | % of Net Assets | Value ($) |

| | |

| Total Investment Portfolio (Cost $116,777,396)† | 99.7 | 108,499,380 |

| Other Assets and Liabilities, Net | 0.3 | 360,251 |

| Net Assets | 100.0 | 108,859,631 |

* Non-income producing security.

† The cost for federal income tax purposes was $118,758,485. At December 31, 2015, net unrealized depreciation for all securities based on tax cost was $10,259,105. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $1,768,709 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $12,027,814.

(a) Affiliated fund managed by Deutsche Investment Management Americas Inc.

(b) The rate shown is the annualized seven-day yield at period end.

SPDR: Standard & Poor's Depositary Receipt

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of December 31, 2015 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | Level 1 | Level 2 | Level 3 | Total |

| |

| Mutual Funds | $ 95,734,900 | $ — | $ — | $ 95,734,900 |

| Exchange-Traded Fund | 8,913,603 | — | — | 8,913,603 |

| Short-Term Investment | 3,850,877 | — | — | 3,850,877 |

| Total | $ 108,499,380 | $ — | $ — | $ 108,499,380 |

There have been no transfers between fair value measurement levels during the year ended December 31, 2015.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities

| as of December 31, 2015 |

| Assets |

Investments: Investments in affiliated Underlying Funds, at value (cost $107,947,889) | $ 99,585,777 |

| Investments in non-affiliated Underlying Funds, at value (cost $8,829,507) | 8,913,603 |

| Total investments in securities, at value (cost $116,777,396) | 108,499,380 |

| Receivable for Fund shares sold | 77,003 |

| Dividends receivable | 462,274 |

| Interest receivable | 566 |

| Other assets | 1,934 |

| Total assets | 109,041,157 |

| Liabilities |

| Payable for Fund shares redeemed | 64,351 |

| Accrued management fee | 2,216 |

| Accrued Trustees' fees | 2,072 |

| Other accrued expenses and payables | 112,887 |

| Total liabilities | 181,526 |

| Net assets, at value | $ 108,859,631 |

| Net Assets Consist of |

| Undistributed net investment income | 2,181,836 |

| Net unrealized appreciation (depreciation) on investments | (8,278,016) |

| Accumulated net realized gain (loss) | (1,981,369) |

| Paid-in capital | 116,937,180 |

| Net assets, at value | $ 108,859,631 |

Class A Net Asset Value, offering and redemption price per share ($21,004,353 ÷ 1,666,853 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | $ 12.60 |

Class B Net Asset Value, offering and redemption price per share ($87,855,278 ÷ 6,979,222 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | $ 12.59 |

The accompanying notes are an integral part of the financial statements.

Statement of Operations

| for the year ended December 31, 2015 |

| Investment Income |

Income: Income distributions from affiliated Underlying Funds | $ 2,223,894 |

| Dividends | 567,604 |

| Total income | 2,791,498 |

Expenses: Management fee | 351,994 |

| Administration fee | 113,173 |

| Record keeping fees (Class B) | 47,885 |

| Services to shareholders | 2,870 |

| Distribution service fee (Class B) | 231,793 |

| Custodian fee | 10,110 |

| Professional fees | 66,227 |

| Reports to shareholders | 42,191 |

| Registration fees | 40 |

| Trustees' fees and expenses | 6,719 |

| Other | 3,510 |

| Total expenses before expense reductions | 876,512 |

| Expense reductions | (238,161) |

| Total expenses after expense reductions | 638,351 |

| Net investment income (loss) | 2,153,147 |

| Realized and Unrealized Gain (Loss) |

Net realized gain (loss) from: Sale of affiliated Underlying Funds | (1,079,498) |

| Sale of non-affiliated Underlying Funds | (173,358) |

| Capital gain distributions from affiliated Underlying Funds | 887,783 |

| Capital gain distributions from non-affiliated Underlying Funds | 230,977 |

| | (134,096) |

| Change in net unrealized appreciation (depreciation) on investments | (9,619,966) |

| Net gain (loss) | (9,754,062) |

| Net increase (decrease) in net assets resulting from operations | $ (7,600,915) |

The accompanying notes are an integral part of the financial statements.

Statement of Changes in Net Assets

| Increase (Decrease) in Net Assets | Years Ended December 31, |

| 2015 | 2014 |

Operations: Net investment income | $ 2,153,147 | $ 2,410,031 |

| Net realized gain (loss) | (134,096) | 367,010 |

| Change in net unrealized appreciation (depreciation) | (9,619,966) | 335,372 |

| Net increase (decrease) in net assets resulting from operations | (7,600,915) | 3,112,413 |

Distributions to shareholders from: Net investment income: Class A | (610,326) | (310,914) |

| Class B | (2,547,011) | (1,375,733) |

Net realized gains: Class A | (44,846) | (99,727) |

| Class B | (205,010) | (510,421) |

| Total distributions | (3,407,193) | (2,296,795) |

Fund share transactions: Class A Proceeds from shares sold | 4,707,272 | 5,912,399 |

| Reinvestment of distributions | 655,172 | 410,641 |

| Payments for shares redeemed | (2,020,383) | (1,499,503) |

| Net increase (decrease) in net assets from Class A share transactions | 3,342,061 | 4,823,537 |

Class B Proceeds from shares sold | 12,671,502 | 15,772,435 |

| Reinvestment of distributions | 2,752,021 | 1,886,154 |

| Payments for shares redeemed | (12,115,711) | (8,841,659) |

| Net increase (decrease) in net assets from Class B share transactions | 3,307,812 | 8,816,930 |

| Increase (decrease) in net assets | (4,358,235) | 14,456,085 |

| Net assets at beginning of period | 113,217,866 | 98,761,781 |

| Net assets at end of period (including undistributed net investment income of $2,181,836 and $3,120,563, respectively) | $ 108,859,631 | $ 113,217,866 |

| Other Information |

Class A Shares outstanding at beginning of period | 1,416,911 | 1,072,115 |

| Shares sold | 354,455 | 422,091 |

| Shares issued to shareholders in reinvestment of distributions | 47,893 | 29,692 |

| Shares redeemed | (152,406) | (106,987) |

| Net increase (decrease) in Class A shares | 249,942 | 344,796 |

| Shares outstanding at end of period | 1,666,853 | 1,416,911 |

Class B Shares outstanding at beginning of period | 6,744,084 | 6,114,865 |

| Shares sold | 947,455 | 1,125,357 |

| Shares issued to shareholders in reinvestment of distributions | 201,024 | 136,283 |

| Shares redeemed | (913,341) | (632,421) |

| Net increase (decrease) in Class B shares | 235,138 | 629,219 |

| Shares outstanding at end of period | 6,979,222 | 6,744,084 |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

| Class A | |

Years Ended December 31, |

| 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per Share Data |

| Net asset value, beginning of period | $ 13.88 | $ 13.75 | $ 13.90 | $ 13.24 | $ 13.85 |

Income (loss) from investment operations: Net investment incomea | .29 | .36 | .26 | .33 | .64 |

| Net realized and unrealized gain (loss) | (1.13) | .13 | (.13) | .93 | (1.02) |

| Total from investment operations | (.84) | .49 | .13 | 1.26 | (.38) |

Less distributions from: Net investment income | (.41) | (.27) | (.28) | (.49) | (.19) |

| Net realized gains | (.03) | (.09) | — | (.11) | (.04) |

| Total distributions | (.44) | (.36) | (.28) | (.60) | (.23) |

| Net asset value, end of period | $ 12.60 | $ 13.88 | $ 13.75 | $ 13.90 | $ 13.24 |

| Total Return (%)b,c | (6.29) | 3.50 | .93 | 9.72 | (2.87) |

| Ratios to Average Net Assets and Supplemental Data |

| Net assets, end of period ($ millions) | 21 | 20 | 15 | 10 | 7 |

| Ratio of expenses before expense reductions (%)d | .53 | .56 | .64 | .63 | .61 |

| Ratio of expenses after expense reductions (%)d | .33 | .32 | .27 | .30 | .30 |

| Ratio of net investment income (%) | 2.19 | 2.54 | 1.86 | 2.46 | 4.72 |

| Portfolio turnover rate (%) | 21 | 28 | 40 | 22 | 39 |

a Based on average shares outstanding during the period. b Total return would have been lower had certain expenses not been reduced. c Total return would have been lower if the Advisor had not reduced some Underlying Deutsche Funds' expenses. d The Fund invests in other Funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. This ratio does not include these indirect fees and expenses. |

| Class B | |

Years Ended December 31, |

| 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per Share Data |

| Net asset value, beginning of period | $ 13.87 | $ 13.74 | $ 13.88 | $ 13.23 | $ 13.84 |

Income (loss) from investment operations: Net investment incomea | .25 | .31 | .22 | .30 | .61 |

| Net realized and unrealized gain (loss) | (1.12) | .14 | (.11) | .91 | (1.03) |

| Total from investment operations | (.87) | .45 | .11 | 1.21 | (.42) |

Less distributions from: Net investment income | (.38) | (.23) | (.25) | (.45) | (.15) |

| Net realized gains | (.03) | (.09) | — | (.11) | (.04) |

| Total distributions | (.41) | (.32) | (.25) | (.56) | (.19) |

| Net asset value, end of period | $ 12.59 | $ 13.87 | $ 13.74 | $ 13.88 | $ 13.23 |

| Total Return (%)b,c | (6.54) | 3.24 | .75 | 9.36 | (3.12) |

| Ratios to Average Net Assets and Supplemental Data |

| Net assets, end of period ($ millions) | 88 | 94 | 84 | 62 | 41 |

| Ratio of expenses before expense reductions (%)d | .83 | .86 | .93 | .88 | .86 |

| Ratio of expenses after expense reductions (%)d | .62 | .57 | .52 | .55 | .55 |

| Ratio of net investment income (%) | 1.84 | 2.22 | 1.57 | 2.25 | 4.47 |

| Portfolio turnover rate (%) | 21 | 28 | 40 | 22 | 39 |

a Based on average shares outstanding during the period. b Total return would have been lower had certain expenses not been reduced. c Total return would have been lower if the Advisor had not reduced some Underlying Deutsche Funds' expenses. d The Fund invests in other Funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. This ratio does not include these indirect fees and expenses. |

Notes to Financial Statements

A. Organization and Significant Accounting Policies

Deutsche Alternative Asset Allocation VIP (the "Fund") is a diversified series of Deutsche Variable Series II (the "Trust"), which is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company organized as a Massachusetts business trust. The Fund mainly invests in other affiliated Deutsche funds (i.e., mutual funds, exchange-traded funds and other pooled investment vehicles managed by Deutsche Investment Management Americas Inc. or one of its affiliates, together the "Underlying Deutsche Funds"), non-affiliated exchange-traded funds ("Non-affiliated ETFs") and derivative investments. Non-affiliated ETFs and Underlying Deutsche Funds are collectively referred to as "Underlying Funds." During the year ended December 31, 2015, the Fund primarily invested in underlying Deutsche Funds and non-affiliated ETFs. Each Underlying Deutsche Fund's accounting policies and investment holdings are outlined in the Underlying Deutsche Funds' financial statements and are available upon request.

Multiple Classes of Shares of Beneficial Interest. The Fund offers two classes of shares (Class A shares and Class B shares). Sales of Class B shares are subject to recordkeeping fees up to 0.15% and Rule 12b-1 fees under the 1940 Act equal to an annual rate of 0.25% of the average daily net assets of the Class B shares of the Fund. Class A shares are not subject to such fees.

Investment income, realized and unrealized gains and losses, and certain fund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares except that each class bears certain expenses unique to that class (including the applicable Rule 12b-1 fee). Differences in class-level expenses may result in payment of different per share dividends by class. All shares have equal rights with respect to voting subject to class-specific arrangements.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Investments in mutual funds are valued at the net asset value per share of each class of the Underlying Deutsche Funds and are categorized as Level 1.

ETFs are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. ETFs for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. ETF securities are generally categorized as Level 1.

Disclosure about the classification of fair value measurements is included in a table following the Fund's Investment Portfolio.

Federal Income Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies and to distribute all of its taxable income to its shareholders.

At December 31, 2015, the Fund had approximately $280 of short-term tax basis capital loss carryforwards, which may be applied against realized net taxable capital gains indefinitely.

The Fund has reviewed the tax positions for the open tax years as of December 31, 2015 and has determined that no provision for income tax and/or uncertain tax provisions is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund, if any, are declared and distributed to shareholders annually. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to certain securities sold at a loss and capital gain distributions from Underlying Funds. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

At December 31, 2015, the Fund's components of distributable earnings on a tax basis were as follows:

| Undistributed ordinary income* | $ 2,181,836 |

| Capital loss carryforward | $ (280) |

| Unrealized appreciation (depreciation) on investments | $ (10,259,105) |

In addition, the tax character of distributions paid by the Fund is summarized as follows:

| | Years Ended December 31, |

| 2015 | 2014 |

| Distributions from ordinary income* | $ 3,164,682 | $ 1,686,647 |

| Distributions from long-term capital gains | $ 242,511 | $ 610,148 |

* For tax purposes, short-term capital gain distributions are considered ordinary income distributions.

Expenses. Expenses of the Trust arising in connection with a specific fund are allocated to that fund. Other Trust expenses which cannot be directly attributed to a fund are apportioned among the funds in the Trust based upon the relative net assets or other appropriate measures.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend Income is recorded on the ex-dividend date. Distributions of income and capital gains from the Underlying Funds are recorded on the ex-dividend date. Realized gains and losses from investment transactions are recorded on an identified cost basis.

B. Purchases and Sales of Securities

During the year ended December 31, 2015, purchases and sales of affiliated Underlying Funds (excluding money market funds) aggregated $25,944,475 and $12,071,000, respectively. Purchases and sales of Non-affiliated ETFs aggregated $3,834,688 and $11,366,659, respectively.

C. Related Parties

Management Agreement. Under the Investment Management Agreement with Deutsche Investment Management Americas Inc. ("DIMA" or the "Advisor"), an indirect, wholly owned subsidiary of Deutsche Bank AG, the Advisor directs the investments of the Fund in accordance with its investment objectives, policies and restrictions. The Advisor determines the securities, instruments and other contracts relating to investments in Underlying Funds to be purchased, sold or entered into by the Fund or delegates such responsibility to the Fund's subadvisors.

RREEF America L.L.C. ("RREEF"), an indirect wholly owned subsidiary of Deutsche Bank AG, acts as an investment subadvisor to the Fund. As an investment subadvisor to the Fund, RREEF provides investment management services to the portions of the Fund's portfolio allocated to direct investments in global real estate and global infrastructure securities. RREEF is paid by the Advisor for the services RREEF provides to the Fund. As of the date of this report, the Fund obtained its exposure to global real estate and global infrastructure securities indirectly through investments in other Underlying Deutsche Funds.

The Fund does not invest in the Underlying Deutsche Funds for the purpose of exercising management or control; however, investments within the set limits may represent 5% or more of an Underlying Deutsche Fund's outstanding shares. At December 31, 2015, the Fund held approximately 13% of Deutsche Diversified Market Neutral Fund.

Pursuant to the Investment Management Agreement with the Advisor, the Fund pays a monthly management fee based on the Fund's average daily net assets, computed and accrued daily and payable monthly, at the following annual rates:

| On assets invested in other Deutsche Funds | .20% |

| On assets invested in all other assets not considered Deutsche Funds | 1.20% |

Accordingly, for the year ended December 31, 2015, the fee pursuant to the Investment Management Agreement was equivalent to an annual rate (exclusive of any applicable waivers/reimbursements) of 0.31% of the Fund's average daily net assets.

In addition, the Advisor will receive management fees from managing the Underlying Deutsche Funds in which the Fund invests.

For the period from January 1, 2015 through April 30, 2015, the Advisor had contractually agreed to waive its fee and/or reimburse certain operating expenses to the extent necessary to maintain the total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest expense and Underlying Funds) of each class as follows:

Effective May 1, 2015 through September 30, 2015, the Advisor had contractually agreed to waive its fee and/or reimburse certain operating expenses to the extent necessary to maintain the total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest expense and Underlying Funds) of each class as follows:

Effective October 1, 2015 through September 30, 2016, the Advisor has contractually agreed to waive its fee and/or reimburse certain operating expenses to the extent necessary to maintain the total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest expense and Underlying Funds) of each class as follows:

For the year ended December 31, 2015, the Advisor agreed to waive 0.15% of the monthly management fee based on average daily net assets for the Fund.

For the year ended December 31, 2015, fees waived and/or expenses reimbursed for each class are as follows:

| Class A | $ 40,351 |

| Class B | 197,810 |

| | $ 238,161 |

The Fund indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which it is invested.

Administration Fee. Pursuant to an Administrative Services Agreement, DIMA provides most administrative services to the Fund. For all services provided under the Administrative Services Agreement, the Fund pays DIMA an annual fee ("Administration Fee") of 0.10% of the Fund's average daily net assets, computed and accrued daily and payable monthly. For the year ended December 31, 2015, the Administration Fee was $113,173, of which $9,222 is unpaid.

Service Provider Fees. DeAWM Service Company ("DSC"), an affiliate of the Advisor, is the transfer agent, dividend-paying agent and shareholder service agent for the Fund. Pursuant to a sub-transfer agency agreement between DSC and DST Systems, Inc. ("DST"), DSC has delegated certain transfer agent, dividend-paying agent and shareholder service agent functions to DST. DSC compensates DST out of the shareholder servicing fee it receives from the Fund. For the year ended December 31, 2015, the amounts charged to the Fund by DSC were as follows:

| Services to Shareholders | Total Aggregated | Unpaid at December 31, 2015 |

| Class A | $ 114 | $ 23 |

| Class B | 221 | 43 |

| | $ 335 | $ 66 |

Distribution Service Agreement. Under the Fund's Class B 12b-1 plans, DeAWM Distributors, Inc. ("DDI") received a fee ("Distribution Service Fee") of 0.25% of average daily net assets of Class B shares. For the year ended December 31, 2015, the Distribution Service Fee aggregated $231,793, of which $18,653 is unpaid.

Typesetting and Filing Service Fees. Under an agreement with DIMA, DIMA is compensated for providing typesetting and certain regulatory filing services to the Fund. For the year ended December 31, 2015, the amount charged to the Fund by DIMA included in the Statement of Operations under "Reports to shareholders" aggregated $7,682, of which $3,935 is unpaid.

Trustees' Fees and Expenses. The Fund paid retainer fees to each Trustee not affiliated with the Advisor, plus specified amounts to the Board Chairperson and Vice Chairperson and to each committee Chairperson.

Affiliated Cash Management Vehicles. The Fund may invest uninvested cash balances in Central Cash Management Fund and Deutsche Variable NAV Money Fund, affiliated money market funds which are managed by the Advisor. Each affiliated money market fund seeks to provide a high level of current income consistent with liquidity and the preservation of capital. Each affiliated money market fund is managed in accordance with Rule 2a-7 under the 1940 Act, which governs the quality, maturity, diversity and liquidity of instruments in which a money market fund may invest. Central Cash Management Fund seeks to maintain a stable net asset value, and Deutsche Variable NAV Money Fund maintains a floating net asset value. The Fund indirectly bears its proportionate share of the expenses of each affiliated money market fund in which it invests. Central Cash Management Fund does not pay the Advisor an investment management fee. To the extent that Deutsche Variable NAV Money Fund pays an investment management fee to the Advisor, the Advisor will waive an amount of the investment management fee payable to the Advisor by the Fund equal to the amount of the investment management fee payable on the Fund's assets invested in Deutsche Variable NAV Money Fund.

D. Ownership of the Fund

At December 31, 2015, one participating insurance company was the owner of record of 10% or more of the total outstanding Class A shares of the Fund, owning 97%. Two participating insurance companies were the owner of record of 10% or more of the total outstanding Class B shares of the Fund, owning 64% and 28%, respectively.

E. Transactions with Affiliates

The Fund mainly invests in Underlying Deutsche Funds and Non-affiliated ETFs. The Underlying Deutsche Funds in which the Fund invests are considered to be affiliated investments. A summary of the Fund's transactions with affiliated Underlying Deutsche Funds during the year ended December 31, 2015 is as follows:

| Affiliate | Value ($) at 12/31/2014 | Purchases Cost ($) | Sales

Cost ($) | Realized Gain/

(Loss) ($) | Income Distributions ($) | Capital Gain Distributions ($) | Value ($) at 12/31/2015 |

| Deutsche Diversified Market Neutral Fund | 11,773,693 | 1,527,000 | 147,000 | (18,310) | — | — | 13,155,393 |

| Deutsche Enhanced Commodity Strategy Fund | 11,309,510 | 3,937,291 | 33,000 | (9,553) | 49,291 | — | 12,646,150 |

| Deutsche Enhanced Emerging Markets Fixed Income Fund | 16,310,878 | 2,738,074 | 3,903,000 | (644,447) | 775,074 | — | 13,296,026 |

| Deutsche Floating Rate Fund | 14,486,144 | 2,842,449 | 2,293,000 | (89,943) | 642,449 | — | 14,073,424 |

| Deutsche Global Inflation Fund | 7,965,785 | 3,586,292 | 264,000 | (6,494) | 137,292 | — | 10,993,719 |

| Deutsche Global Infrastructure Fund | 20,612,292 | 3,349,557 | 2,123,000 | (62,753) | 292,981 | 30,576 | 18,584,170 |

| Deutsche Global Real Estate Securities Fund | 3,383,883 | 2,734,696 | 2,426,000 | (242,233) | 160,696 | — | 3,340,604 |

| Deutsche Real Estate Securities Fund | 4,870,451 | 4,363,605 | 825,000 | (4,669) | 122,921 | 830,684 | 7,700,878 |

| Deutsche Real Estate Securities Income Fund | 465,079 | 195,822 | 4,000 | (420) | 23,299 | 26,523 | 581,940 |

| Deutsche Strategic Equity Long/Short Fund | 836,561 | 669,689 | 53,000 | (676) | 16,689 | — | 1,362,596 |

| Central Cash Management Fund | 3,316,670 | 22,847,669 | 22,313,462 | — | 3,202 | — | 3,850,877 |

| | 95,330,946 | 48,792,144 | 34,384,462 | (1,079,498) | 2,223,894 | 887,783 | 99,585,777 |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Deutsche Variable Series II and Shareholders of Deutsche Alternative Asset Allocation VIP:

We have audited the accompanying statement of assets and liabilities, including the investment portfolio, of Deutsche Alternative Asset Allocation VIP (one of the funds constituting Deutsche Variable Series II) (the "Fund"), as of December 31, 2015, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2015, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Deutsche Alternative Asset Allocation VIP (one of the funds constituting Deutsche Variable Series II) at December 31, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

| | |  |

Boston, Massachusetts

February 12, 2016 | | |

Information About Your Fund's Expenses (Unaudited)

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include contract charges, which are not shown in this section. The following tables are intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. In addition to the ongoing expenses which the Fund bears directly, the Fund's shareholders indirectly bear the expense of the Underlying Funds in which the Fund invests. These expenses are not included in the Fund's annualized expense ratios used to calculate the expense estimate in the tables. In the most recent six-month period, the Fund limited the ongoing expenses the Fund bears directly; had it not done so, expenses would have been higher. The examples in the table are based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (July 1, 2015 to December 31, 2015).

The tables illustrate your Fund's expenses in two ways:

— Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses (but not transaction costs) paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

— Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses (but not transaction costs) with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical Fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expense of owning different funds. If these transaction costs had been included, your costs would have been higher.

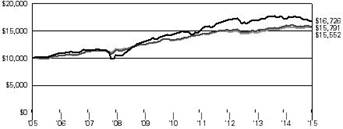

| Expenses and Value of a $1,000 Investment for the six months ended December 31, 2015 |

| Actual Fund Return | | Class A | | Class B | |

| Beginning Account Value 7/1/15 | | $ 1,000.00 | | $ 1,000.00 | |

| Ending Account Value 12/31/15 | | $ 950.90 | | $ 949.50 | |

| Expenses Paid per $1,000* | | $ 1.57 | | $ 3.05 | |

| Hypothetical 5% Fund Return | | Class A | | Class B | |

| Beginning Account Value 7/1/15 | | $ 1,000.00 | | $ 1,000.00 | |

| Ending Account Value 12/31/15 | | $ 1,023.59 | | $ 1,022.08 | |

| Expenses Paid per $1,000* | | $ 1.63 | | $ 3.16 | |

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by 184 (the number of days in the most recent six-month period), then divided by 365.

| Annualized Expense Ratios** | | Class A | | Class B | |

| Deutsche Variable Series II — Deutsche Alternative Asset Allocation VIP | | .32% | | .62% | |

** The Fund invests in other funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. These ratios do not include these indirect fees and expenses.

For more information, please refer to the Fund's prospectus.

These tables do not reflect charges and fees ("contract charges") associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option.

For an analysis of the fees associated with an investment in the fund or similar funds, please refer to the current and hypothetical expense calculators for Variable Insurance Products which can be found at deutschefunds.com/EN/resources/calculators.jsp.

Tax Information (Unaudited)

The Fund paid distributions of $0.03 per share from net long-term capital gains during its year ended December 31, 2015.

For corporate shareholders, 7% of income dividends paid during the Fund's fiscal year ended December 31, 2015 qualified for the dividends received deduction.

Please consult a tax advisor if you have questions about federal or state income tax laws, or on how to prepare your tax returns. If you have specific questions about your account, please contact your insurance provider.

Proxy Voting

The Trust's policies and procedures for voting proxies for portfolio securities and information about how the Trust voted proxies related to its portfolio securities during the 12-month period ended June 30 are available on our Web site — deutschefunds.com (click on "proxy voting" at the bottom of the page) — or on the SEC's Web site — sec.gov. To obtain a written copy of the Trust's policies and procedures without charge, upon request, call us toll free at (800) 728-3337.

Advisory Agreement Board Considerations and Fee Evaluation

The Board of Trustees approved the renewal of Deutsche Alternative Asset Allocation VIP’s investment management agreement (the "Agreement") with Deutsche Investment Management Americas Inc. ("DIMA") and sub-advisory agreement (the "Sub-Advisory Agreement" and together with the Agreement, the "Agreements") between DIMA and RREEF America L.L.C. ("RREEF"), an affiliate of DIMA, in September 2015.

In terms of the process that the Board followed prior to approving the Agreements, shareholders should know that:

— In September 2015, all of the Fund’s Trustees were independent of DIMA and its affiliates.

— The Trustees met frequently during the past year to discuss fund matters and dedicated a substantial amount of time to contract review matters. Over the course of several months, the Board’s Contract Committee reviewed comprehensive materials received from DIMA, independent third parties and independent counsel. These materials included an analysis of the Fund’s performance, fees and expenses, and profitability from a fee consultant retained by the Fund’s Independent Trustees (the "Fee Consultant"). The Board also received extensive information throughout the year regarding performance of the Fund.

— The Independent Trustees regularly meet privately with counsel to discuss contract review and other matters. In addition, the Independent Trustees were advised by the Fee Consultant in the course of their review of the Fund’s contractual arrangements and considered a comprehensive report prepared by the Fee Consultant in connection with their deliberations.

— In connection with reviewing the Agreements, the Board also reviewed the terms of the Fund’s Rule 12b-1 plan, distribution agreement, administrative services agreement, transfer agency agreement and other material service agreements.

— Based on its evaluation of the information provided, the Contract Committee presented its findings and recommendations to the Board. The Board then reviewed the Contract Committee’s findings and recommendations.

In connection with the contract review process, the Contract Committee and the Board considered the factors discussed below, among others. The Board also considered that DIMA has managed the Fund since its inception, and the Board believes that a long-term relationship with a capable, conscientious advisor is in the best interests of the Fund. The Board considered, generally, that shareholders chose to invest or remain invested in the Fund knowing that DIMA managed the Fund. DIMA and RREEF are part of Deutsche Bank AG’s ("Deutsche Bank") Asset and Wealth Management ("Deutsche AWM") division. Deutsche AWM is a global asset management business that offers a wide range of investing expertise and resources, including research capabilities in many countries throughout the world. Deutsche Bank has advised the Independent Trustees that the U.S. asset management business continues to be a critical and integral part of Deutsche Bank, and that Deutsche Bank will continue to make significant investments in Deutsche AWM, including ongoing enhancements to Deutsche AWM’s investment platform. Deutsche Bank also has confirmed its commitment to maintaining strong legal and compliance groups within the Deutsche AWM division.

As part of the contract review process, the Board carefully considered the fees and expenses of each Deutsche fund overseen by the Board in light of the fund’s performance. In many cases, this led to the negotiation and implementation of expense caps. As part of these negotiations, the Board indicated that it would consider relaxing these caps in future years following sustained improvements in performance, among other considerations.

While shareholders may focus primarily on fund performance and fees, the Fund’s Board considers these and many other factors, including the quality and integrity of DIMA’s and RREEF’s personnel and such other issues as back-office operations, fund valuations, and compliance policies and procedures.

Nature, Quality and Extent of Services. The Board considered the terms of the Agreements, including the scope of advisory services provided under the Agreements. The Board noted that, under the Agreements, DIMA and RREEF provide portfolio management services to the Fund and that, pursuant to a separate administrative services agreement, DIMA provides administrative services to the Fund. The Board considered the experience and skills of senior management and investment personnel, the resources made available to such personnel, the ability of DIMA to attract and retain high-quality personnel, and the organizational depth and stability of DIMA. The Board also requested and received information regarding DIMA’s oversight of Fund sub-advisers, including RREEF. The Board reviewed the Fund’s performance over short-term and long-term periods and compared those returns to various agreed-upon performance measures, including market index(es) and a peer universe compiled using information supplied by Morningstar Direct ("Morningstar"), an independent fund data service. The Board also noted that it has put into place a process of identifying "Focus Funds" (e.g., funds performing poorly relative to a peer universe), and receives additional reporting from DIMA regarding such funds and, where appropriate, DIMA’s plans to address underperformance. The Board believes this process is an effective manner of identifying and addressing underperforming funds. Based on the information provided, the Board noted that for the one-, three- and five-year periods ended December 31, 2014, the Fund’s performance (Class A shares) was in the 1st quartile of the applicable Morningstar universe (the 1st quartile being the best performers and the 4th quartile being the worst performers). The Board also observed that the Fund has underperformed its benchmark in the one-, three- and five-year periods ended December 31, 2014.

Fees and Expenses. The Board considered the Fund’s investment management fee schedule, sub-advisory fee schedule, operating expenses and total expense ratios, and comparative information provided by Lipper Inc. ("Lipper") and the Fee Consultant regarding investment management fee rates paid to other investment advisors by similar funds (1st quartile being the most favorable and 4th quartile being the least favorable). With respect to management fees paid to other investment advisors by similar funds, the Board noted that the contractual fee rates paid by the Fund, which include a 0.10% fee paid to DIMA under the Fund’s administrative services agreement, were higher than the median (4th quartile) of the applicable Lipper peer group (based on Lipper data provided as of December 31, 2014). With respect to the sub-advisory fee paid to RREEF, the Board noted that the fee is paid by DIMA out of its fee and not directly by the Fund. The Board noted that the Fund’s Class A shares total (net) operating expenses were expected to be higher than the median (3rd quartile) of the applicable Lipper expense universe (based on Lipper data provided as of December 31, 2014, and analyzing Lipper expense universe Class A (net) expenses less any applicable 12b-1 fees) ("Lipper Universe Expenses"). The Board also reviewed data comparing each share class’s total (net) operating expenses to the applicable Lipper Universe Expenses. The Board noted that the expense limitations agreed to by DIMA were expected to help the Fund’s total (net) operating expenses remain competitive. The Board considered the Fund’s management fee rate as compared to fees charged by DIMA to comparable Deutsche U.S. registered funds ("Deutsche Funds") and considered differences between the Fund and the comparable Deutsche Funds. The information requested by the Board as part of its review of fees and expenses also included information about institutional accounts (including any sub-advised funds and accounts) and funds offered primarily to European investors ("Deutsche Europe funds") managed by Deutsche AWM. The Board noted that DIMA indicated that Deutsche AWM does not manage any institutional accounts or Deutsche Europe funds comparable to the Fund.

On the basis of the information provided, the Board concluded that management fees were reasonable and appropriate in light of the nature, quality and extent of services provided by DIMA and RREEF.

Profitability. The Board reviewed detailed information regarding revenues received by DIMA from advising the Deutsche Funds along with the estimated costs and pre-tax profits realized by DIMA from advising the Deutsche Funds. The Board also received information regarding the estimated enterprise-wide profitability of DIMA and its affiliates with respect to all fund services in totality. The Board did not receive profitability information with respect to the Fund, but did receive such information with respect to the funds in which the Fund invests. The Board also reviewed certain publicly available information regarding the profitability of certain similar investment management firms. The Board noted that while information regarding the profitability of such firms is limited (and in some cases is not necessarily prepared on a comparable basis), DIMA and its affiliates’ overall profitability with respect to the Deutsche Funds (after taking into account distribution and other services provided to the funds by DIMA and its affiliates) was lower than the overall profitability levels of most comparable firms for which such data was available.

Economies of Scale. The Board considered whether there are economies of scale with respect to the management of the Fund and whether the Fund benefits from any economies of scale. In this regard, the Board observed that while the Fund’s current investment management fee schedule does not include breakpoints, the Fund’s fee schedule represents an appropriate sharing between the Fund and DIMA of such economies of scale as may exist in the management of the Fund at current asset levels.

Other Benefits to DIMA and Its Affiliates. The Board also considered the character and amount of other incidental benefits received by DIMA and its affiliates, including any fees received by DIMA for administrative services provided to the Fund and any fees received by an affiliate of DIMA for distribution services. The Board also considered benefits to DIMA related to brokerage and soft-dollar allocations, including allocating brokerage to pay for research generated by parties other than the executing broker dealers, which pertain primarily to funds investing in equity securities, along with the incidental public relations benefits to DIMA related to Deutsche Funds advertising and cross-selling opportunities among DIMA products and services. The Board considered these benefits in reaching its conclusion that the Fund’s management fees were reasonable.

Compliance. The Board considered the significant attention and resources dedicated by DIMA to documenting and enhancing its compliance processes in recent years. The Board noted in particular (i) the experience and seniority of the individual serving as DIMA’s and the Fund’s chief compliance officer; (ii) the large number of DIMA compliance personnel; and (iii) the substantial commitment of resources by DIMA and its affiliates to compliance matters.

Based on all of the information considered and the conclusions reached, the Board unanimously determined that the continuation of the Agreements is in the best interests of the Fund. In making this determination, the Board did not give particular weight to any single factor identified above. The Board considered these factors over the course of numerous meetings, certain of which were in executive session with only the Independent Trustees and counsel present. It is possible that individual Trustees may have weighed these factors differently in reaching their individual decisions to approve the continuation of the Agreements.

Board Members and Officers

The following table presents certain information regarding the Board Members and Officers of the fund. Each Board Member's year of birth is set forth in parentheses after his or her name. Unless otherwise noted, (i) each Board Member has engaged in the principal occupation(s) noted in the table for at least the most recent five years, although not necessarily in the same capacity; and (ii) the address of each Independent Board Member is c/o Kenneth C. Froewiss, Chairman, Deutsche Mutual Funds, P.O. Box 390601, Cambridge, MA 02139. Except as otherwise noted below, the term of office for each Board Member is until the election and qualification of a successor, or until such Board Member sooner dies, resigns, is removed or as otherwise provided in the governing documents of the fund. Because the fund does not hold an annual meeting of shareholders, each Board Member will hold office for an indeterminate period. The Board Members may also serve in similar capacities with other funds in the fund complex.

| Independent Board Members |

| Name, Year of Birth, Position with the Fund and Length of Time Served1 | Business Experience and Directorships During the Past Five Years | Number of Funds in Deutsche Fund Complex Overseen | Other Directorships Held by Board Member |

Kenneth C. Froewiss (1945) Chairperson since 2013, and Board Member since 2001 | Retired Clinical Professor of Finance, NYU Stern School of Business (1997–2014); Member, Finance Committee, Association for Asian Studies (2002–present); Director, Mitsui Sumitomo Insurance Group (US) (2004–present); prior thereto, Managing Director, J.P. Morgan (investment banking firm) (until 1996) | 106 | — |

William McClayton (1944) Vice Chairperson since 2013, and Board Member since 2004 | Private equity investor (since October 2009); previously, Managing Director, Diamond Management & Technology Consultants, Inc. (global consulting firm) (2001–2009); Directorship: Board of Managers, YMCA of Metropolitan Chicago; formerly: Senior Partner, Arthur Andersen LLP (accounting) (1966–2001); Trustee, Ravinia Festival | 106 | — |

John W. Ballantine (1946) Board Member since 1999 | Retired; formerly, Executive Vice President and Chief Risk Management Officer, First Chicago NBD Corporation/The First National Bank of Chicago (1996–1998); Executive Vice President and Head of International Banking (1995–1996); former Directorships: Director and former Chairman of the Board, Healthways, Inc.2 (provider of disease and care management services) (2003–2014); Stockwell Capital Investments PLC (private equity); First Oak Brook Bancshares, Inc. and Oak Brook Bank; Prisma Energy International | 106 | Portland General Electric2 (utility company) (2003– present) |

Henry P. Becton, Jr. (1943) Board Member since 1990 | Vice Chair and former President, WGBH Educational Foundation. Directorships: Public Radio International; Public Radio Exchange (PRX); former Directorships: Belo Corporation2 (media company); The PBS Foundation; Association of Public Television Stations; Boston Museum of Science; American Public Television; Concord Academy; New England Aquarium; Mass. Corporation for Educational Telecommunications; Committee for Economic Development; Public Broadcasting Service; Connecticut College; North Bennett Street School (Boston) | 106 | Director, Becton Dickinson and Company2 (medical technology company) |

Dawn-Marie Driscoll (1946) Board Member since 1987 | Emeritus Executive Fellow, Center for Business Ethics, Bentley University; formerly: President, Driscoll Associates (consulting firm); Partner, Palmer & Dodge (law firm) (1988–1990); Vice President of Corporate Affairs and General Counsel, Filene's (retail) (1978–1988). Directorships: Director of ICI Mutual Insurance Company (since 2007); Advisory Board, Center for Business Ethics, Bentley University; Trustee and former Chairman of the Board, Southwest Florida Community Foundation (charitable organization); former Directorships: Sun Capital Advisers Trust (mutual funds) (2007–2012), Investment Company Institute (audit, executive, nominating committees) and Independent Directors Council (governance, executive committees) | 106 | — |

Keith R. Fox, CFA (1954) Board Member since 1996 | Managing General Partner, Exeter Capital Partners (a series of private investment funds) (since 1986). Directorships: Progressive International Corporation (kitchen goods importer and distributor); The Kennel Shop (retailer); former Chairman, National Association of Small Business Investment Companies; former Directorships: BoxTop Media Inc. (advertising); Sun Capital Advisers Trust (mutual funds) (2011–2012) | 106 | — |

Paul K. Freeman (1950) Board Member since 1993 | Consultant, World Bank/Inter-American Development Bank; Chair, Independent Directors Council; Investment Company Institute (executive and nominating committees); formerly, Chairman of Education Committee of Independent Directors Council; Project Leader, International Institute for Applied Systems Analysis (1998–2001); Chief Executive Officer, The Eric Group, Inc. (environmental insurance) (1986–1998); Directorships: Denver Zoo Foundation (December 2012–present); former Directorships: Prisma Energy International | 106 | — |

Richard J. Herring (1946) Board Member since 1990 | Jacob Safra Professor of International Banking and Professor, Finance Department, The Wharton School, University of Pennsylvania (since July 1972); Co-Director, Wharton Financial Institutions Center; Co-Chair, U.S. Shadow Financial Regulatory Committee; Executive Director, Financial Economists Roundtable; formerly: Vice Dean and Director, Wharton Undergraduate Division (July 1995–June 2000); Director, Lauder Institute of International Management Studies (July 2000–June 2006) | 106 | Director, Aberdeen Singapore and Japan Funds (since 2007); Independent Director of Barclays Bank Delaware (since September 2010) |

Rebecca W. Rimel (1951) Board Member since 1995 | President and Chief Executive Officer, The Pew Charitable Trusts (charitable organization) (1994 to present); formerly: Executive Vice President, The Glenmede Trust Company (investment trust and wealth management) (1983–2004); Board Member, Investor Education (charitable organization) (2004–2005); Trustee, Executive Committee, Philadelphia Chamber of Commerce (2001–2007); Director, Viasys Health Care2 (January 2007–June 2007); Trustee, Thomas Jefferson Foundation (charitable organization) (1994–2012) | 106 | Director, Becton Dickinson and Company2 (medical technology company) (2012– present); Director, BioTelemetry Inc.2 (health care) (2009– present) |

William N. Searcy, Jr. (1946) Board Member since 1993 | Private investor since October 2003; formerly: Pension & Savings Trust Officer, Sprint Corporation2 (telecommunications) (November 1989–September 2003); Trustee, Sun Capital Advisers Trust (mutual funds) (1998–2012) | 106 | — |

Jean Gleason Stromberg (1943) Board Member since 1997 | Retired. Formerly, Consultant (1997–2001); Director, Financial Markets U.S. Government Accountability Office (1996–1997); Partner, Norton Rose Fulbright, L.L.P. (law firm) (1978–1996). Directorships: The William and Flora Hewlett Foundation (charitable organization); former Directorships: Service Source, Inc. (nonprofit), Mutual Fund Directors Forum (2002–2004), American Bar Retirement Association (funding vehicle for retirement plans) (1987–1990 and 1994–1996) | 106 | — |

| Officers4 |

| Name, Year of Birth, Position with the Fund and Length of Time Served5 | Business Experience and Directorships During the Past Five Years |

Brian E. Binder8 (1972) President and Chief Executive Officer, 2013–present | Managing Director3 and Head of Fund Administration, Deutsche Asset Management (2013–present); formerly: Head of Business Management and Consulting at Invesco, Ltd. (2010–2012) |

John Millette7 (1962) Vice President and Secretary, 1999–present | Director,3 Deutsche Asset Management; Chief Legal Officer and Secretary, Deutsche Investment Management Americas Inc. (since 2015); and Director and Vice President, DeAWM Trust Company (since 2016) |

Melinda Morrow6 (1970) Vice President, 2012–present | Director,3 Deutsche Asset Management |

Paul H. Schubert6 (1963) Chief Financial Officer, 2004–present Treasurer, 2005–present | Managing Director,3 Deutsche Asset Management; and Chairman, Director and President, DeAWM Trust Company (since 2013); formerly, Director, DeAWM Trust Company (2004–2013) |

Caroline Pearson7 (1962) Chief Legal Officer, 2010–present | Managing Director,3 Deutsche Asset Management; Secretary, DeAWM Distributors, Inc; and Secretary, DeAWM Service Company |

Robert Kloby6 (1962) Chief Compliance Officer, 2006–present | Managing Director,3 Deutsche Asset Management |

Wayne Salit6 (1967) Anti-Money Laundering Compliance Officer, 2014–present | Director,3 Deutsche Asset Management; formerly: Managing Director, AML Compliance Officer at BNY Mellon (2011–2014); and Director, AML Compliance Officer at Deutsche Bank (2004–2011) |

Hepsen Uzcan6 (1974) Assistant Secretary, 2013–present | Director,3 Deutsche Asset Management |

Paul Antosca7 (1957) Assistant Treasurer, 2007–present | Director,3 Deutsche Asset Management |

Jack Clark7 (1967) Assistant Treasurer, 2007–present | Director,3 Deutsche Asset Management |

Diane Kenneally7 (1966) Assistant Treasurer, 2007–present | Director,3 Deutsche Asset Management |

1 The length of time served represents the year in which the Board Member joined the board of one or more Deutsche funds currently overseen by the Board.

2 A publicly held company with securities registered pursuant to Section 12 of the Securities Exchange Act of 1934.

3 Executive title, not a board directorship.

4 As a result of their respective positions held with the Advisor, these individuals are considered "interested persons" of the Advisor within the meaning of the 1940 Act. Interested persons receive no compensation from the fund.

5 The length of time served represents the year in which the officer was first elected in such capacity for one or more Deutsche funds.

6 Address: 60 Wall Street, New York, NY 10005.

7 Address: One Beacon Street, Boston, MA 02108.

8 Address: 222 South Riverside Plaza, Chicago, IL 60606.

The fund's Statement of Additional Information ("SAI") includes additional information about the Board Members. The SAI is available, without charge, upon request. If you would like to request a copy of the SAI, you may do so by calling the following toll-free number: (800) 728-3337.

VS2AAA-2 (R-025824-5 2/16)

December 31, 2015

Annual Report

Deutsche Variable Series II

Deutsche Global Equity VIP

Contents

3 Performance Summary 4 Management Summary 5 Portfolio Summary 6 Investment Portfolio 9 Statement of Assets and Liabilities 10 Statement of Operations 10 Statement of Changes in Net Assets 12 Financial Highlights 13 Notes to Financial Statements 17 Report of Independent Registered Public Accounting Firm 18 Information About Your Fund's Expenses 19 Tax Information 19 Proxy Voting 20 Advisory Agreement Board Considerations and Fee Evaluation 22 Board Members and Officers |

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800) 728-3337 or your financial representative. We advise you to consider the Fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Stocks may decline in value. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Emerging markets tend to be more volatile than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. The Fund may lend securities to approved institutions. See the prospectus for details.