UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-05075

Thrivent Mutual Funds

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

Rebecca A. Paulzine

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-5168

Date of fiscal year end: October 31

Date of reporting period: October 31, 2012

Item 1. Report to Stockholders

Table of Contents

The fiscal year ended October 31, 2012, was productive for investors, with virtually every major asset class generating positive returns. Markets performed well despite continued sluggish economic growth and some growing worries about federal tax and spending policies.

Economic Review

The U.S. economy continued to grow at a slow pace during the 12-month reporting period, backstopped by a Federal Reserve that kept interest rates at extraordinarily low levels to lower borrowing costs and stimulate spending. The economy advanced enough to encourage optimists, but never achieved the momentum that would be needed to put the 2007-2009 recession finally and fully in the rearview mirror.

U.S. gross domestic product—the total of all goods and services produced—grew at an estimated 2.7% annual rate in the third quarter of 2012, according to the Bureau of Labor Statistics, driven largely by personal consumption. That was about in line with the average rate of growth for the 12-month period ending that quarter, and marked the 13th consecutive quarter that the U.S. economy expanded. Still, 2.7% is less than the 4% rate that would be needed to close, over a three-year period, the gap between what the economy is producing today and what it could be producing if the recession had not occurred.

Economic growth has proved insufficient to replace all the jobs lost during the recession. The U.S. has created more than 3 million net new jobs since the downturn ended, and more than 4.5 million since March 2010, when the numbers first started turning positive again. But even that bigger number is only about half the number of jobs lost from 2008 through early 2010. Accordingly, unemployment remains high. It stood at 7.9% in October 2012, down from a peak of 10.1% in October 2009, but still well above its historical average. Persistent high unemployment is the reason many people continue to say they feel like the country remains in an economic downturn even though it is not.

One factor keeping unemployment high is the continued reluctance on the part of businesses to invest in their operations. Domestic investment, largely by businesses, is usually one of the main drivers of economic growth during a recovery, along with personal consumption. But domestic investment stagnated over the course of the reporting period. Business leaders blamed uncertainty about the direction of federal taxing and spending policies and about whether the health care mandates required by the Patient Protection and Affordable Care Act would actually be implemented. Governor Mitt Romney, the Republican candidate for president in 2012, had campaigned, in part, on a vow to repeal the health care law. On November 6, he lost the election to President Obama, the law’s architect.

Uncertainty in the business community was exacerbated by worries about the impending fiscal cliff—the $1.2 trillion in automatic spending cuts over the next decade that are scheduled to take effect beginning on January 1, 2013, along with a series of automatic tax increases. That uncertainty extended from CEOs of Fortune 500 companies to entrepreneurs running small businesses. An October survey of the latter by the National Federation of Independent Business found that only 7% considered it a good time to be expanding their operations.

Europe and China also are important to the U.S. economy, with the companies in the S&P 500 stock index generating about 40% of their profits internationally. Europe accounts for the largest share and Asia, mainly in the form of China, the next biggest share. Much of Europe slipped into a recession during the reporting period as several of its southernmost members continued to wrestle with crushing debt woes. China grew strongly by international standards—its gross domestic product expanded at a 7.4% rate in the third quarter—but slowly in comparison to the 10% gains it averaged over most of the past three decades.

Market Review

Stock and bond markets both performed well during the 12-month reporting period, bolstered by relatively strong corporate profits and the Federal Reserve’s continued accommodative monetary stance.

The S&P 500, an index of large-company stocks, posted a total return of 15.2%. The Russell 2000 index, which tracks small-company shares, generated a total return of 12.08%. Value stocks—those perceived to be trading below their intrinsic worth based on sales, profits, dividends and other fundamental factors—broadly outperformed growth stocks. Investors worried about the economy and the corporate-profit outlook apparently concluded that value stocks would be better-positioned to weather any coming storm.

International stocks lagged their U.S. counterparts, reflecting the weak economic environment in Europe and the slowing growth in China. The MSCI All Country World Index, excluding the U.S., generated a total return of 4.48%.

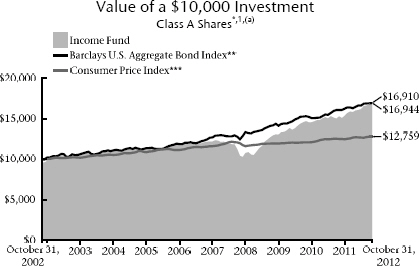

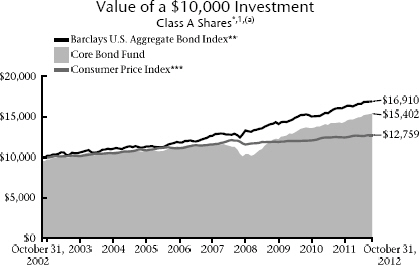

In the fixed-income markets, the Fed’s accommodative monetary policy was favorable for bonds across the credit spectrum. High-yield bonds were the standout performers, as strong corporate profits depressed default risk and emboldened investors attracted to the higher yields available on those securities relative to investment-grade bonds. While the broad-based Barclays U.S. Aggregate Bond Index generated a total return of 5.25%, the Barclays U.S. Corporate High Yield Bond Index posted a total return of 13.61%.

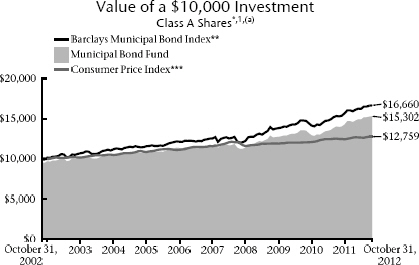

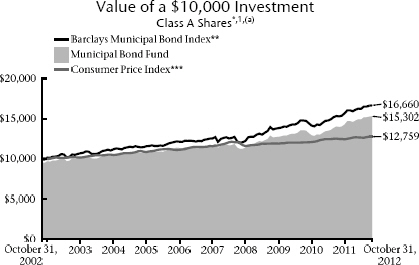

2

Municipal bonds also performed well as prior concerns about potential defaults in that sector eased against the backdrop of slow but steady economic growth. The Barclays Municipal Bond Index generated a total return of 9.03%.

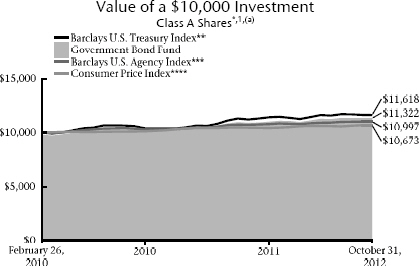

Treasury bonds remained a safe haven for the most-cautious investors, but high valuations at the start of the reporting period left them with little room for additional price appreciation. The Barclays U.S. Treasury Index posted a total return of 3.66%.

Our Outlook

The U.S. economy may no longer be in a recession, but it remains in the shadow of one, and we expect that to present a challenge to financial markets heading into the new year—especially if, as is widely expected, corporate profits begin to soften.

While stock prices have recovered much of what they lost during the 2007-2009 downturn, they remain below their pre-crash peak and continue to exhibit high levels of volatility. Their performance in the year ahead—and to some extent the performance of the bond market—will depend to a large degree on how much success Congress and the president have in their efforts to reach agreement on new tax and spending policies.

Businesses and investors had been hoping the election would bring new accord to Washington and greater clarity on fiscal policy, but the outcome produced little change, at least on the surface. Democrats retained control of the White House and the Senate, while Republicans retained control of the House of Representatives.

In the weeks immediately following the election, policymakers on both sides of the political aisle were looking for agreement on policy that could keep the country from edging over the fiscal cliff, which government economists have warned would plunge the U.S. back into a recession.

It was not unreasonable to think policymakers might agree on a short-term plan to defer some, if not most, of the automatic spending cuts and tax increases, and then spend much of 2013 trying to come up with more permanent reforms.

Potentially complicating their efforts—or perhaps adding to their incentive to get something done—the federal government was scheduled to bump up against its debt ceiling around the end of 2012. The government would need approval from Congress to raise that ceiling and continue to meet its debt obligations. Credit-rating agencies had already warned that failure on either front—the deficit or the debt ceiling—could lead to another downgrade of the federal government’s debt rating, a rare event that happened for the first time in 2011 when Congress last wrangled over the debt ceiling.

If Congress and the White House can agree on a new tax-and-spend policy—one that begins to whittle away at the country’s debt—they could erase much of the uncertainty that has been constraining business investment. That could lead to a surge in stock prices. The challenge for investors will be to ride out the uncertainty and market volatility that is likely to persist until and if such a resolution materializes.

If you are uncertain about how your portfolio is positioned to weather the months ahead, we encourage you to meet with your Thrivent Financial representative. He or she can help you set an asset allocation policy and choose investments that are appropriate for your goals and your tolerance for risk.

As always, thank you for the trust you have placed with our entire team of Thrivent Financial investment professionals.

Sincerely,

Russell W. Swansen

President and Chief Investment Officer

Thrivent Mutual Funds

3

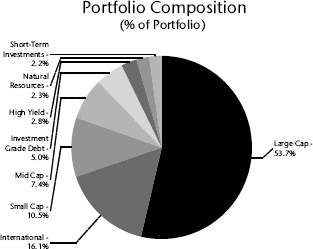

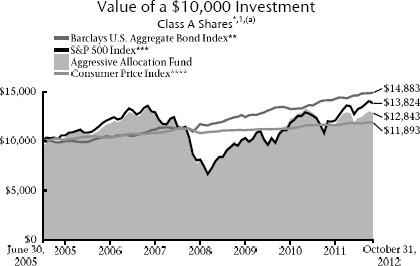

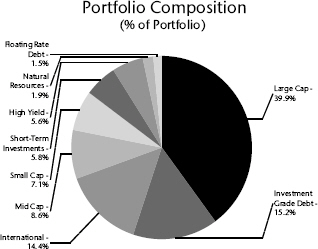

Thrivent Aggressive Allocation Fund

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

The Fund seeks long-term capital growth.

The Fund’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. Another risk of investing in the Fund is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Fund is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Fund’s prospectus. Views expressed in this discussion of fund performance are the views of this particular Fund’s portfolio management team.

How did the Fund perform during the 12-month period ended October 31, 2012?

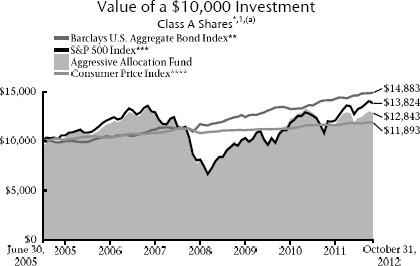

Thrivent Aggressive Allocation Fund earned a return of 8.42%, compared with the median return of its peer group, the Lipper Multi-Cap Core Funds category, of 10.98%. The Fund’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 15.21% and 5.25%, respectively.

What factors affected the Fund’s performance?

Performance in the Fund was limited by a combination of asset allocation decisions as well as security selection impacts in some of the equity portfolios. Fixed-income results were either in line with or ahead of their respective performance benchmarks.

A key factor in the relative performance versus our peers and the S&P 500 Index was our exposure to the international markets as reflected in our specific holdings of the Thrivent Partner Worldwide Allocation Fund. While that Fund outperformed both its benchmark and its peers, the category underperformed domestic indexes by a significant margin owing to particular weakness in the euro area and emerging markets.

Additionally, our small- and mid-cap stock managers generally did not perform in-line with their benchmarks, and their categories did not perform as well as the S&P 500 Index. Early in the period, we were underweighted in our target equity exposure as we were concerned that a lack of progress on fiscal and policy issues both in Europe and domestically would impair the recovery and negatively impact risk assets. While those uncertainties remain, monetary authorities have taken steps that, at least in the short term, have supported risk asset prices at levels that were unlikely to have been achieved otherwise.

A final factor is our exposure to fixed income, which averaged around 9% over the period. We are rated in an equity-only category, and while our fixed-income managers and assets performed well relative to their categories, the asset class did not keep pace with domestic equity markets.

What is your outlook?

Fiscal and policy risks remain high, but monetary authorities have expressed and interest or acted in unconventional ways to support the economic expansion and asset prices. In the absence of a severe policy mistake, risk asset prices are likely to see further advances but at reduced levels versus early in the recovery.

For domestic stocks, we believe that earnings will continue to be the key driver. Profit margins seem unusually high and further expansion is unlikely to be a driver of above-average earnings growth going forward. While equity valuations are not high, they are full and require continued progress in resolving fiscal issues both domestically and abroad without impairing what most would agree is a below-average recovery.

| | | | |

| Top 10 Holdings | |

| (% of Net Assets) | |

Thrivent Partner Worldwide Allocation Fund | | | 15.4 | % |

Thrivent Partner Small Cap Growth Fund | | | 8.0 | % |

Thrivent Large Cap Growth Fund | | | 6.8 | % |

Thrivent Mid Cap Growth Fund | | | 6.0 | % |

Thrivent Large Cap Value Fund | | | 5.8 | % |

Thrivent Mid Cap Stock Fund | | | 5.3 | % |

Thrivent Partner Mid Cap Value Fund | | | 3.6 | % |

Thrivent Large Cap Stock Fund | | | 3.4 | % |

Thrivent High Yield Fund | | | 2.8 | % |

Thrivent Small Cap Stock Fund | | | 2.8 | % |

These securities represent 59.9% of the total net assets of the Fund.

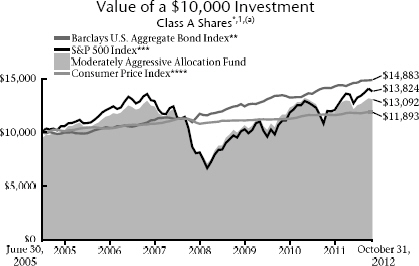

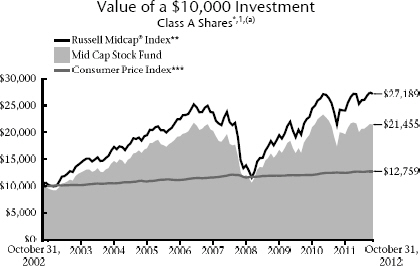

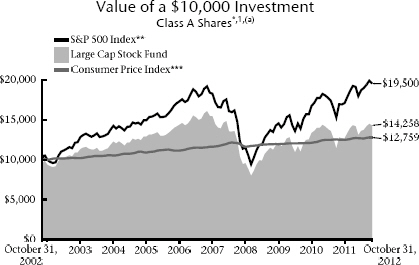

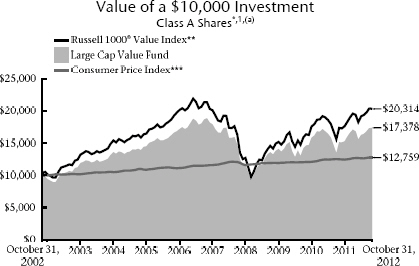

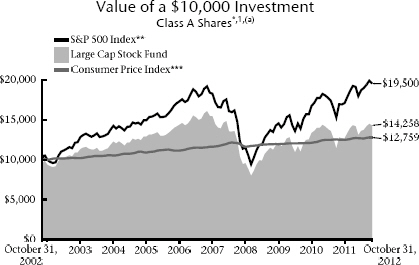

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

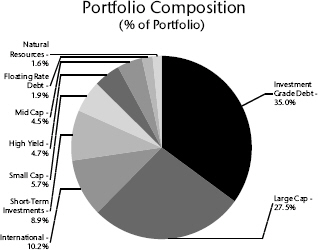

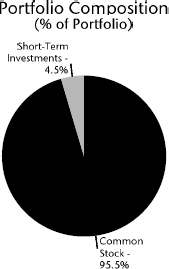

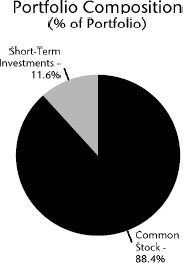

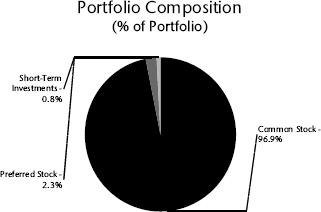

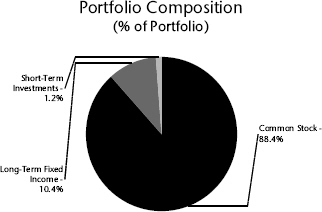

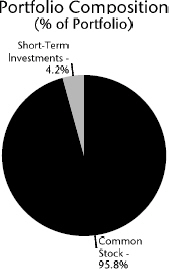

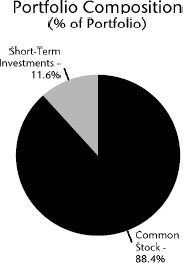

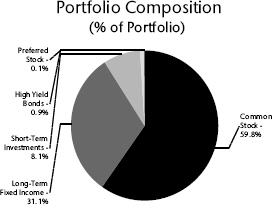

Portfolio Composition illustrates market exposure of all asset classes, including derivatives.

The list of Top 10 Holdings excludes short-term investments.

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

4

The challenge for the markets will be to continue to perform well in an environment characterized by unusually active policy choices and uneven growth. We are modestly optimistic that will be the case but remain alert for changes in the environment.

Portfolio Facts

As of October 31, 2012

| | | | | | | | |

| | | Class A | | | Institutional Class | |

Ticker | | | TAAAX | | | | TAAIX | |

Transfer Agent ID | | | 038 | | | | 468 | |

Net Assets | | | $494,277,313 | | | | $81,205,588 | |

NAV | | | $11.54 | | | | $11.64 | |

NAV - High† | | | 9/14/2012 - $11.98 | | | | 9/14/2012 - $12.07 | |

NAV - Low† | | | 11/25/2011 - $9.84 | | | | 11/25/2011 - $9.91 | |

Number of Holdings: 249 | | | | | | | | |

† | For the year ended October 31, 2012 |

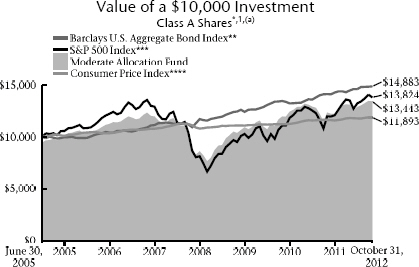

Average Annual Total Returns1

As of October 31, 2012

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

without sales charge | | | 8.42 | % | | | -0.90 | % | | | 4.27 | % |

with sales charge | | | 2.48 | % | | | -2.02 | % | | | 3.47 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

Net Asset Value | | | 8.94 | % | | | -0.54 | % | | | 4.66 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

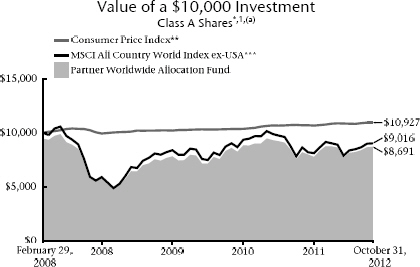

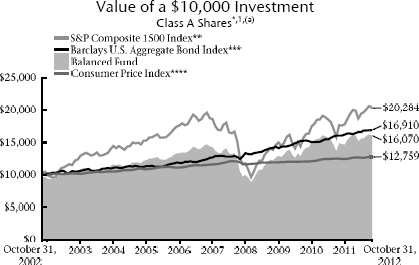

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in those Indexes, any charges you would pay would reduce your total return as well. |

** | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

**** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

5

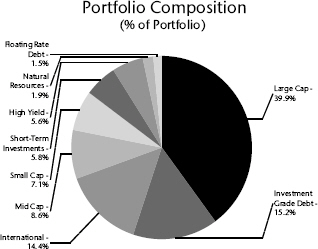

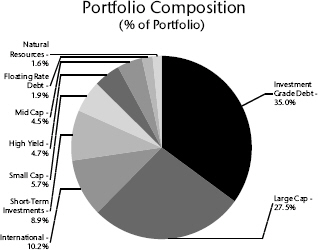

Thrivent Moderately Aggressive Allocation Fund

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

The Fund seeks long-term capital growth.

The Fund’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. Another risk of investing in the Fund is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Fund is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Fund’s prospectus. Views expressed in this discussion of fund performance are the views of this particular Fund’s portfolio management team.

How did the Fund perform during the 12-month period ended October 31, 2012?

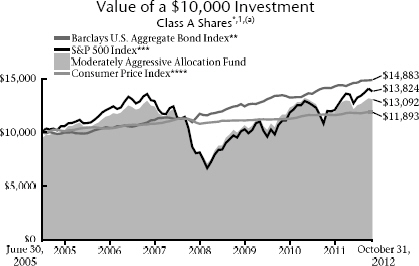

Thrivent Moderately Aggressive Allocation Fund earned a return of 8.92%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Growth Funds category, of 9.67%. The Fund’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 15.21% and 5.25%, respectively.

What factors affected the Fund’s performance?

Performance in the Fund was limited by a combination of asset allocation decisions as well as security selection impacts in some of the equity portfolios. Fixed-income results were either in-line with or ahead of their respective performance benchmarks.

Our small- and mid-cap stock managers generally did not perform in-line with their benchmarks, and their categories did not perform as well as the S&P 500 Index. The former factor limited our returns while the latter was less of a factor owing to our reduction in exposure to mid and small caps in favor of more exposure to large-capitalization companies.

Another factor was that, early in the period, we were underweighted in our target equity exposure as we were concerned that a lack of progress on fiscal and policy issues both in Europe and domestically would impair the recovery and negatively impact risk assets. While those uncertainties remain, monetary authorities have taken steps that, at least in the short term, have supported risk asset prices at levels that were unlikely to have been achieved otherwise.

Our exposure to fixed income, which averaged around 24% over the period, was additive to results as our fixed-income managers and assets performed well relative to their categories. That said, the fixed-income asset class, while generally providing positive returns, did not keep pace with the returns seen in large-cap domestic equity markets.

What is your outlook?

Fiscal and policy risks remain high, but monetary authorities have expressed an interest or acted in unconventional ways to support the economic expansion and asset prices. In the absence of a severe policy mistake, risk asset prices are likely to see further advances but at reduced levels versus early in the recovery.

For domestic stocks, earnings will continue to be the key driver. We feel that profit margins seem unusually high and further expansion is unlikely to be a driver of above-average earnings growth going forward. While equity valuations are not high, they are full and require continued progress in resolving fiscal issues both domestically and abroad without impairing what most would agree is a below-average recovery. Emerging market growth has slowed to more sustainable levels as well.

| | | | |

| Top 10 Holdings | |

| (% of Net Assets) | |

Thrivent Partner Worldwide Allocation Fund | | | 12.6 | % |

Thrivent Large Cap Value Fund | | | 8.1 | % |

Thrivent Income Fund | | | 6.5 | % |

Thrivent Large Cap Growth Fund | | | 6.2 | % |

Thrivent Large Cap Stock Fund | | | 5.8 | % |

Thrivent Mid Cap Stock Fund | | | 4.9 | % |

Thrivent High Yield Fund | | | 4.0 | % |

Thrivent Partner Mid Cap Value Fund | | | 3.4 | % |

Thrivent Partner Small Cap Growth Fund | | | 3.0 | % |

Thrivent Mid Cap Growth Fund | | | 2.7 | % |

These securities represent 57.2% of the total net assets of the Fund.

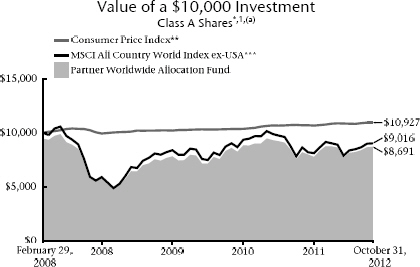

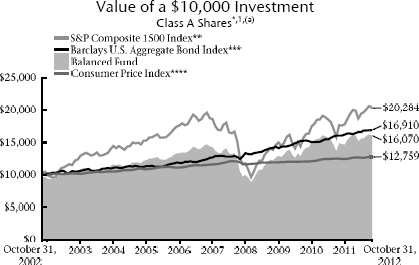

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

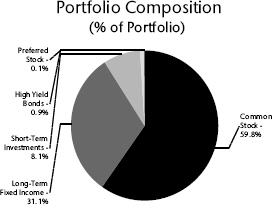

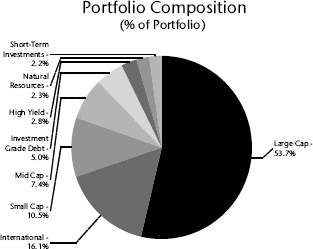

Portfolio Composition illustrates market exposure of all asset classes, including derivatives.

The list of Top 10 Holdings excludes short-term investments.

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

6

The challenge for the markets will be to continue to perform well in an environment characterized by unusually active policy choices and uneven growth. We are modestly optimistic that will be the case but remain alert for changes in the environment.

Portfolio Facts

As of October 31, 2012

| | | | | | | | |

| | | Class A | | | Institutional Class | |

Ticker | | | TMAAX | | | | TMAFX | |

Transfer Agent ID | | | 037 | | | | 467 | |

Net Assets | | | $1,268,160,769 | | | | $90,168,810 | |

NAV | | | $11.64 | | | | $11.73 | |

NAV - High† | | | 9/14/2012 - $11.95 | | | | 9/14/2012 - $12.03 | |

NAV - Low† | | | 11/25/2011 - $10.06 | | | | 11/25/2011 - $10.14 | |

Number of Holdings: 609 | | | | | | | | |

† | For the year ended October 31, 2012 |

Average Annual Total Returns1

As of October 31, 2012

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

without sales charge | | | 8.92 | % | | | 0.23 | % | | | 4.54 | % |

with sales charge | | | 2.94 | % | | | -0.90 | % | | | 3.74 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

Net Asset Value | | | 9.29 | % | | | 0.58 | % | | | 4.91 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in those Indexes, any charges you would pay would reduce your total return as well. |

** | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

**** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

7

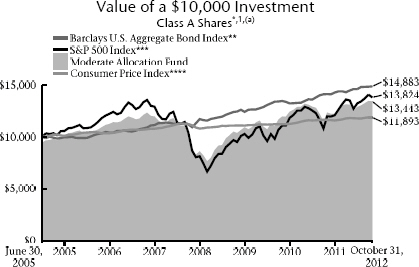

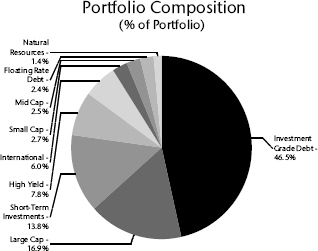

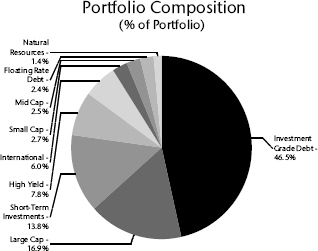

Thrivent Moderate Allocation Fund

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

The Fund seeks long-term capital growth while providing reasonable stability of principal.

The Fund’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. Another risk of investing in the Fund is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Fund is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Fund’s prospectus. Views expressed in this discussion of fund performance are the views of this particular Fund’s portfolio management team.

How did the Fund perform during the 12-month period ended October 31, 2012?

Thrivent Moderate Allocation Fund earned a return of 8.68%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Moderate Funds category, of 8.78%. The Fund’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 15.21% and 5.25%, respectively.

What factors affected the Fund’s performance?

Performance in the Fund was limited by a combination of asset allocation decisions as well as security selection impacts in some of the equity portfolios. Fixed-income results were either in-line with or ahead of their respective performance benchmarks.

Our small- and mid-cap stock managers generally did not perform in-line with their benchmarks, and their categories did not perform as well as the S&P 500 Index. The former factor limited our returns while the latter was less of a factor owing to our reduction in exposure to mid and small caps in favor of more exposure to large-capitalization companies.

Another factor was that, early in the period, we were underweighted in our target equity exposure as we were concerned that a lack of progress on fiscal and policy issues both in Europe and domestically would impair the recovery and negatively impact risk assets. While those uncertainties remain, monetary authorities have taken steps that, at least in the short term, have supported risk asset prices at levels that were unlikely to have been achieved otherwise.

Our exposure to fixed income, which averaged around 45% over the period, was additive to results as our fixed-income managers and assets performed well relative to their categories. That said, the fixed-income asset class, while generally providing positive returns, did not keep pace with the returns seen in large-cap domestic equity markets.

What is your outlook?

Fiscal and policy risks remain high, but monetary authorities have expressed an interest or acted in unconventional ways to support the economic expansion and asset prices. In the absence of a severe policy mistake, risk asset prices are likely to see further advances but at reduced levels versus early in the recovery.

For domestic stocks, earnings will continue to be the key driver. We believe that profit margins seem unusually high and further expansion is unlikely to be a driver of above-average earnings growth going forward. While equity valuations are not high, they are full and require continued progress in resolving fiscal issues both domestically and abroad without impairing what most would agree is a below-average recovery. Emerging market growth has slowed to more sustainable levels as well.

Top 10 Holdings

(% of Net Assets)

| | | | |

Thrivent Income Fund | | | 13.9 | % |

Thrivent Partner Worldwide Allocation Fund | | | 9.8 | % |

Thrivent Limited Maturity Bond Fund | | | 9.6 | % |

Thrivent Large Cap Value Fund | | | 7.2 | % |

Thrivent Large Cap Growth Fund | | | 4.8 | % |

Thrivent High Yield Fund | | | 3.3 | % |

Thrivent Mid Cap Stock Fund | | | 3.1 | % |

Thrivent Large Cap Stock Fund | | | 2.5 | % |

Thrivent Partner Mid Cap Value Fund | | | 2.0 | % |

Thrivent Partner Small Cap Growth Fund | | | 2.0 | % |

These securities represent 58.2% of the total net assets of the Fund.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

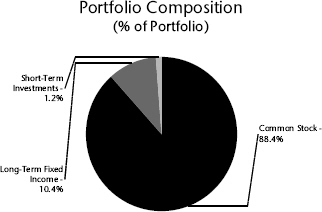

Portfolio Composition illustrates market exposure of all asset classes, including derivatives.

The list of Top 10 Holdings excludes short-term investments.

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

8

The challenge for the markets will be to continue to perform well in an environment characterized by unusually active policy choices and uneven growth. We are modestly optimistic that will be the case but remain alert for changes in the environment.

Portfolio Facts

As of October 31, 2012

| | | | | | | | |

| | | Class A | | | Institutional Class | |

Ticker | | | THMAX | | | | TMAIX | |

Transfer Agent ID | | | 036 | | | | 466 | |

Net Assets | | | $1,316,468,921 | | | | $66,027,019 | |

NAV | | | $11.55 | | | | $11.57 | |

NAV - High† | | | 9/14/2012 - $11.76 | | | | 9/14/2012 - $11.79 | |

NAV - Low† | | | 11/25/2011 - $10.18 | | | | 11/25/2011 - $10.21 | |

Number of Holdings: 605 | | | | | | | | |

† | For the year ended October 31, 2012 |

Average Annual Total Returns1

As of October 31, 2012

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

without sales charge | | | 8.68 | % | | | 1.71 | % | | | 4.92 | % |

with sales charge | | | 2.69 | % | | | 0.56 | % | | | 4.11 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

Net Asset Value | | | 9.05 | % | | | 2.04 | % | | | 5.26 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in those Indexes, any charges you would pay would reduce your total return as well. |

** | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

**** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

9

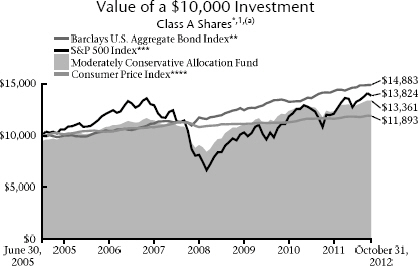

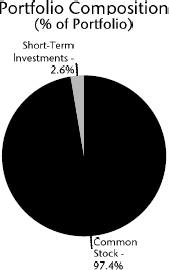

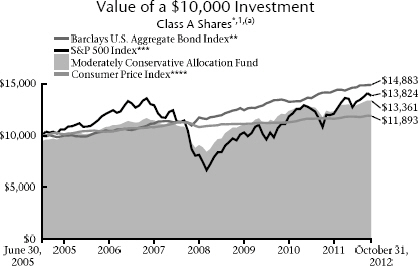

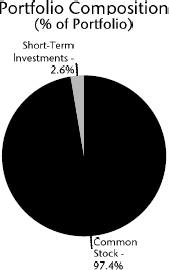

Thrivent Moderately Conservative Allocation Fund

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

The Fund seeks long-term capital growth while providing reasonable stability of principal.

The Fund’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. Another risk of investing in the Fund is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Fund is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Fund’s prospectus. Views expressed in this discussion of fund performance are the views of this particular Fund’s portfolio management team.

How did the Fund perform during the 12-month period ended October 31, 2012?

Thrivent Moderately Conservative Allocation Fund earned a return of 7.92%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Conservative Funds category, of 7.87%. The Fund’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 15.21% and 5.25%, respectively.

What factors affected the Fund’s performance?

Performance in the Fund was limited by a combination of asset allocation decisions as well as security selection impacts in some of the equity portfolios. Fixed-income results were either in-line with or ahead of their respective performance benchmarks.

Our small- and mid-cap stock managers generally did not perform in-line with their benchmarks, and their categories did not perform as well as the S&P 500 Index. The former factor limited our returns while the latter was less of a factor owing to our reduction in exposure to mid and small caps in favor of more exposure to large-capitalization companies.

Another factor was that, early in the period, we were underweighted in our target equity exposure as we were concerned that a lack of progress on fiscal and policy issues both in Europe and domestically would impair the recovery and negatively impact risk assets. While those uncertainties remain, monetary authorities have taken steps that, at least in the short term, have supported risk asset prices at levels that were unlikely to have been achieved otherwise.

Our exposure to fixed income, which averaged around 65% over the period, was additive to results as our fixed-income managers and assets performed well relative to their categories. That said, the fixed-income asset class, while generally providing positive returns, did not keep pace with the returns seen in large-cap domestic equity markets.

What is your outlook?

Fiscal and policy risks remain high, but monetary authorities have expressed an interest or acted in unconventional ways to support the economic expansion and asset prices. In the absence of a severe policy mistake, risk asset prices are likely to see further advances but at reduced levels versus early in the recovery.

For domestic stocks, earnings will continue to be the key driver. We believe that profit margins are unusually high and further expansion is unlikely to be a driver of above- average earnings growth going forward. While equity valuations are not high, they are full and require continued progress in resolving fiscal issues both domestically and abroad without impairing what most would agree is a below-average recovery. Emerging market growth has slowed to more sustainable levels as well.

Top 10 Holdings

(% of Net Assets)

| | | | |

Thrivent Limited Maturity Bond Fund | | | 16.9 | % |

Thrivent Income Fund | | | 11.7 | % |

Thrivent Partner Worldwide Allocation Fund | | | 5.8 | % |

Thrivent Large Cap Value Fund | | | 5.3 | % |

Thrivent High Yield Fund | | | 3.8 | % |

Federal National Mortgage Association Conventional 30-Yr. Pass Through | | | 2.8 | % |

Federal National Mortgage Association Conventional 30-Yr. Pass Through | | | 2.3 | % |

Thrivent Large Cap Growth Fund | | | 2.2 | % |

Thrivent Partner Mid Cap Value Fund | | | 2.1 | % |

Thrivent Government Bond Fund | | | 1.9 | % |

These securities represent 54.8% of the total net assets of the Fund.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

Portfolio Composition illustrates market exposure of all asset classes, including derivatives.

The list of Top 10 Holdings excludes short-term investments.

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

10

The challenge for the markets will be to continue to perform well in an environment characterized by unusually active policy choices and uneven growth. We are modestly optimistic that will be the case but remain alert for changes in the environment.

Portfolio Facts

As of October 31, 2012

| | | | | | | | |

| | | Class A | | | Institutional Class | |

Ticker | | | TCAAX | | | | TCAIX | |

Transfer Agent ID | | | 035 | | | | 465 | |

Net Assets | | | $632,934,529 | | | | $28,009,989 | |

NAV | | | $11.34 | | | | $11.37 | |

NAV - High† | | | 9/14/2012 - $11.46 | | | | 9/14/2012 - $11.49 | |

NAV - Low† | | | 11/25/2011 - $10.33 | | | | 11/25/2011 - $10.36 | |

Number of Holdings: 608 | | | | | | | | |

† | For the year ended October 31, 2012 |

Average Annual Total Returns1

As of October 31, 2012

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

without sales charge | | | 7.92 | % | | | 2.73 | % | | | 4.83 | % |

with sales charge | | | 1.95 | % | | | 1.57 | % | | | 4.03 | % |

Institutional Class3 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

Net Asset Value | | | 8.26 | % | | | 3.02 | % | | | 5.13 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in those Indexes, any charges you would pay would reduce your total return as well. |

** | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

**** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

11

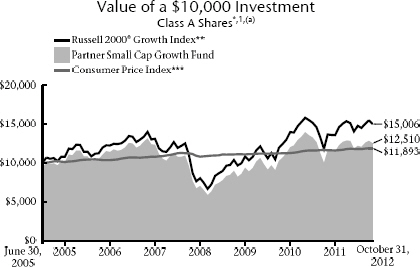

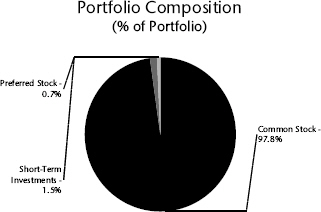

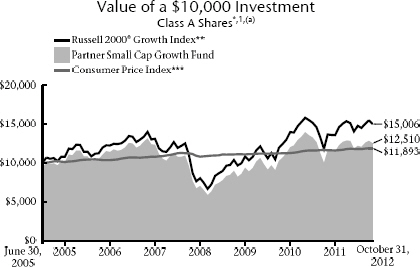

Thrivent Partner Small Cap Growth Fund

| | |

| | Subadvised by Turner Investments, L.P. The Fund seeks long-term growth of capital. The Fund is exposed to the risks of investing in equity securities of smaller companies, which may include, but are not limited to, lower trading volumes and less liquidity than larger, more established companies. Small company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Fund’s prospectus. Views expressed in this discussion of fund performance are the views of this particular Fund’s portfolio management team. |

How did the Fund perform during the 12-month period ended October 31, 2012?

Thrivent Partner Small Cap Growth Fund earned a return of 7.85%, compared with the median return of its peer group, the Lipper Small Cap Growth Funds category, of 9.40%. The Fund’s market benchmark, the Russell 2000® Growth Index, earned a return of 9.70%.

What factors affected the Fund’s performance?

During the period, five of the Fund’s nine sectors beat their corresponding index sectors on a relative basis. The consumer discretionary sector detracted the most from results, while holdings in the consumer staples sector contributed the most.

The consumer discretionary sector was an area of underperformance for the Fund. Shares of Brightpoint Education, a for-profit provider of post-secondary education services, traded lower after it failed to obtain a widely expected accreditation from a key academic governing body. Premium denim maker True Religion Apparel also disappointed as the company reported lower sales for the third quarter and reduced its full-year guidance due to lackluster results within its spring and summer clothing lines.

The consumer staples sector was an area of strength for the Fund. Organic and natural food company Hain Celestial has been a direct beneficiary of the trends in the natural and organic food industry as sales at mainstream supermarkets have climbed due to healthier consumer lifestyles and exposure to the high-end consumer. Natural Foods, a distributor of more than 60,000 natural and organic food products found in specialty and grocery stores, also rode the wave of increased demand for organic food offerings. During the period, the company reported a 15.6% increase in year-over-year net sales for the fiscal year 2012.

What is your outlook?

As we see it, the market still has upward potential as we head into the final quarter of the year. In the U.S., the presidential election and the so-called “fiscal cliff” of tax increases and spending cuts could be nonissues for the market. We’ve come to expect displays of brinkmanship, but neither political party wants to slam the brakes on the economy, so a solution to the fiscal cliff is likely to materialize now that the election is over. Once the fiscal cliff and its associated uncertainty are resolved, investors still holding their money on the sidelines could enter the market, pushing stocks higher.

| | | | |

| Major Market Sectors | |

| (% of Net Assets) | |

Information Technology | | | 22.7 | % |

Consumer Discretionary | | | 17.5 | % |

Health Care | | | 17.1 | % |

Industrials | | | 16.0 | % |

Financials | | | 8.1 | % |

Energy | | | 5.7 | % |

Materials | | | 4.9 | % |

Consumer Staples | | | 4.0 | % |

Telecommunications Services | | | 0.7 | % |

Utilities | | | 0.1 | % |

Top 10 Holdings

(% of Net Assets)

| | | | |

Vitamin Shoppe, Inc. | | | 1.4 | % |

United Natural Foods, Inc. | | | 1.3 | % |

OSI Systems, Inc. | | | 1.2 | % |

Teleflex, Inc. | | | 1.2 | % |

Cirrus Logic, Inc. | | | 1.2 | % |

Copa Holdings SA | | | 1.1 | % |

Chart Industries, Inc. | | | 1.1 | % |

Integra LifeSciences Holdings Corporation | | | 1.1 | % |

MAXIMUS, Inc. | | | 1.1 | % |

Hexcel Corporation | | | 1.1 | % |

These securities represent 11.8% of the total net assets of the Fund.

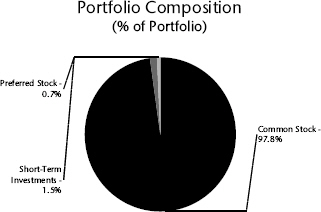

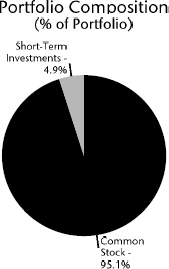

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

Quoted Major Market Sectors, Portfolio Composition and Top 10 Holdings are subject to change.

The lists of Major Market Sectors and Top 10 Holdings exclude short-term investments and collateral held for securities loaned.

The Portfolio Composition chart excludes collateral held for securities loaned.

12

Additionally, valuations for stocks remain reasonable. Despite the almost 30% move higher in the last year, the current price-to-forward earnings multiple for the S&P 500 Index is well below the 20-year average.

Portfolio Facts

As of October 31, 2012

| | | | | | | | |

| | | Class A | | | Institutional Class | |

Ticker | | | TPSAX | | | | TPGIX | |

Transfer Agent ID | | | 063 | | | | 463 | |

Net Assets | | | $17,247,327 | | | | $115,025,825 | |

NAV | | | $12.64 | | | | $12.98 | |

NAV - High† | | | 9/14/2012 - $13.52 | | | | 9/14/2012 - $13.87 | |

NAV - Low† | | | 11/25/2011 - $10.56 | | | | 11/25/2011 - $10.81 | |

Number of Holdings: 175 | | | | | | | | |

† | For the year ended October 31, 2012 |

Average Annual Total Returns1

As of October 31, 2012

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

without sales charge | | | 7.85 | % | | | -1.01 | % | | | 3.89 | % |

with sales charge | | | 1.94 | % | | | -2.13 | % | | | 3.10 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

Net Asset Value | | | 8.26 | % | | | -0.59 | % | | | 4.29 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

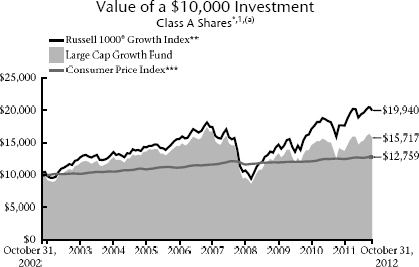

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index and the Russell 2000® Growth Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in the Index, any charges you would pay would reduce your total return as well. |

** | The Russell 2000® Growth Index is an index comprised of companies with a greater-than-average growth orientation. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

13

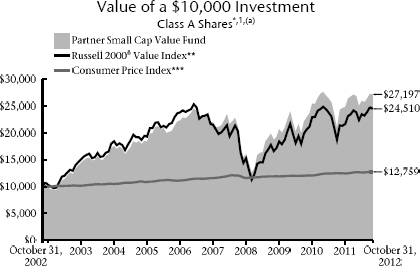

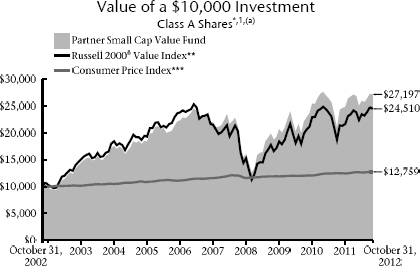

Thrivent Partner Small Cap Value Fund

| | |

| | Subadvised by T. Rowe Price Associates, Inc. The Fund seeks long-term capital appreciation. The Fund is exposed to the risks of investing in equity securities of smaller companies, which may include, but are not limited to, lower trading volumes and less liquidity than larger, more established companies. Small company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Fund’s prospectus. Views expressed in this discussion of fund performance are the views of this particular Fund’s portfolio management team. |

How did the Fund perform during the 12-month period ended October 31, 2012?

Thrivent Partner Small Cap Value Fund earned a return of 11.87%, compared with the median return of its peer group, the Lipper Small Cap Value Funds category, of 11.85%. The Fund’s market benchmark, the Russell 2000® Value Index, earned a return of 14.47%.

What factors affected the Fund’s performance?

Broadly speaking, negative sector allocation detracted from relative performance in the portfolio. Fundamentals are improving within the financials sector, and its returns were among the highest within the benchmark. Both our significant underweighting and stock selection weighed on relative results for the trailing one-year period.

Financials has been a tumultuous sector over the past several years, but recent performance has improved. Stock selection in energy also weighed on relative returns, driven by companies exposed to both falling crude oil and natural gas prices. Firms exposed to natural gas were punished during the period as prices for the commodity stayed within a range at historic lows before bouncing back more recently.

On the positive side, stock selection in consumer discretionary was extremely beneficial toward relative performance, particularly among auto components and household durables companies.

What is your outlook?

The market’s strong performance in the third quarter of 2012 came as a pleasant surprise to many investors. Stocks managed to climb an imposing wall of worry composed of domestic fiscal concerns, fears about the ongoing financial crisis in Europe, unease over the slowdown in China, and other uncertainties. We think the question now is whether the wall will come tumbling down around us in the coming months.

We are particularly worried about fiscal issues, given the possibility that taxes will rise and weigh on markets. As we have noted before, for example, a future rise in capital gains rates might encourage investors to act preemptively and sell now in order to avoid them. The outcome of the recent election should provide some clarity on the direction of fiscal policy, but for this reason alone we are more cautious than we have been in a number of months.

For most, monetary policy has been a reason to celebrate over recent months. The Federal Reserve’s stimulus announcements, including its latest quantitative easing program (QE3) of open-ended mortgage bond purchases, have been followed by solid rallies. We share the concerns of others, however, that the massive liquidity the Fed has inserted into the economy brings with it the risk of a spike in inflation over the longer term.

Major Market Sectors

(% of Net Assets)

| | | | |

Industrials | | | 25.6 | % |

Financials | | | 25.2 | % |

Consumer Discretionary | | | 15.4 | % |

Materials | | | 9.2 | % |

Information Technology | | | 8.5 | % |

Utilities | | | 5.4 | % |

Health Care | | | 4.3 | % |

Energy | | | 4.0 | % |

Consumer Staples | | | 0.5 | % |

Telecommunications Services | | | 0.3 | % |

Top 10 Holdings

(% of Net Assets)

| | | | |

Aaron’s, Inc. | | | 2.4 | % |

ProAssurance Corporation | | | 2.3 | % |

Genesee & Wyoming, Inc. | | | 2.2 | % |

Beacon Roofing Supply, Inc. | | | 1.8 | % |

Kirby Corporation | | | 1.7 | % |

Cleco Corporation | | | 1.6 | % |

CBL & Associates Properties, Inc. | | | 1.6 | % |

Meritage Homes Corporation | | | 1.4 | % |

A.O. Smith Corporation | | | 1.4 | % |

AptarGroup, Inc. | | | 1.4 | % |

These securities represent 17.8% of the total net assets of the Fund.

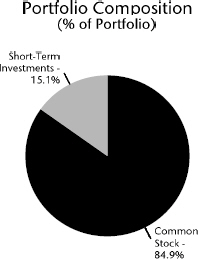

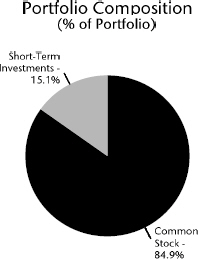

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

Quoted Major Market Sectors, Portfolio Composition and Top 10 Holdings are subject to change.

The lists of Major Market Sectors and Top 10 Holdings exclude short-term investments and collateral held for securities loaned.

The Portfolio Composition chart excludes collateral held for securities loaned.

14

Fortunately, we believe we have some tools to help protect the portfolio from such an outcome. In particular, we have been investing in energy, materials, and precious metals firms that we believe stand to benefit from rising prices. More generally, with stocks still priced reasonably overall and especially attractive relative to bonds, the prospect of inflation is a good argument for us to remain fully invested in equities—even if outright bargains are harder to come by than in recent years.

Portfolio Facts

As of October 31, 2012

| | | | | | | | |

| | | Class A | | | Institutional Class | |

Ticker | | | AALVX | | | | TPSIX | |

Transfer Agent ID | | | 032 | | | | 099 | |

Net Assets | | | $71,986,174 | | | | $148,934,419 | |

NAV | | | $15.99 | | | | $16.80 | |

NAV - High† | | | 9/14/2012 - $16.55 | | | | 9/14/2012 - $17.36 | |

NAV - Low† | | | 11/25/2011 - $13.17 | | | | 11/25/2011 - $13.84 | |

Number of Holdings: 156 | | | | | | | | |

† | For the year ended October 31, 2012 |

Average Annual Total Returns1

As of October 31, 2012

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | 10 Years | |

without sales charge | | | 11.87 | % | | | 3.01 | % | | | 11.15 | % |

with sales charge | | | 5.73 | % | | | 1.84 | % | | | 10.53 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | 10 Years | |

Net Asset Value | | | 12.51 | % | | | 3.64 | % | | | 11.90 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Russell 2000® Value Index and the Consumer Price Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in the Index, any charges you would pay would reduce your total return as well. |

** | The Russell 2000® Value Index measures the performance of small cap value stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

15

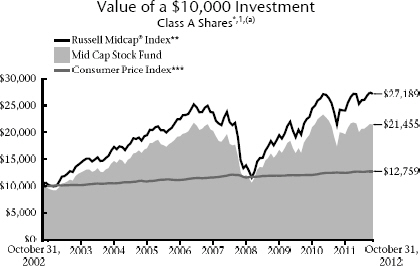

Thrivent Small Cap Stock Fund

Darren M. Bagwell, CFA, Portfolio Manager

The Fund seeks long-term capital growth.

The Fund is exposed to the risks of investing in equity securities of smaller companies, which may include, but are not limited to, lower trading volumes and less liquidity than larger, more established companies. Small company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Fund’s prospectus. Views expressed in this discussion of fund performance are the views of this particular Fund’s portfolio management team.

How did the Fund perform during the 12-month period ended October 31, 2012?

Thrivent Small Cap Stock Fund earned a return of 6.97%, compared with the median return of its peer group, the Lipper Small Cap Core Funds category, of 10.50%. The Fund’s market benchmark, the Russell 2000® Index, earned a return of 12.08%.

What factors affected the Fund’s performance?

The pro-cyclical positioning of the Fund was out of step with the anemic global growth environment and resulting low-risk bias in equity markets. While sector-neutral by design, our intra-sector exposures to coal (within the energy sector), as well as networking and semiconductors (within IT), were mitigating. Along with poor security selection in health care, this offset solid performance from financial and industrial exposures.

Despite eliminating coal-leveraged investments in Arch Coal, Patriot Coal and Walter Energy early in 2012, we were slow to realize the magnitude of the pricing impact of slowing Chinese demand and growing domestic stockpiles. The negative effect of these investments overwhelmed the positive performance of our oil and gas holdings in Petroleum Geo and Oil States International. We similarly misread the strength of domestic enterprise demand for networking equipment, which slowed as economic uncertainty grew. Cautious spending by businesses hurt videoconferencing gear maker Polycom, while slower consumer and industrial demand negatively impacted chipmaker Atmel.

In health care, we simply did not anticipate adverse developments. Drug developer VIVUS suffered from delayed European approval of its obesity drug and worries about the pace of the domestic roll-out, while the earnings outlook of managed care provider Health Net was impacted by negative legislative and economic developments in its key markets.

Holdings in financials and industrials were significant sources of relative performance. Most notable was mortgage servicer Ocwen, which benefited from banks’ accelerated disposition of servicing operations and the availability of significant portfolios. Also noteworthy was our emphasis on construction and engineering, where Shaw Group was acquired and EMCOR reported strong operating and demand trends.

What is your outlook?

We remain cautious, believing domestic growth will not exceed 2% in real terms—in part due to fiscal and regulatory headwinds, recessionary conditions in Europe, and slower consumer spending. Exports to emerging markets and domestic housing are wildcards that could provide economic tailwinds, and prove our expectations too pessimistic. That said, we worry that demand and profitability expectations are too high for 2013, and that negative outlook adjustments will mute performance.

Major Market Sectors

(% of Net Assets)

| | | | |

Financials | | | 24.1 | % |

Industrials | | | 14.8 | % |

Information Technology | | | 12.2 | % |

Consumer Discretionary | | | 10.9 | % |

Health Care | | | 5.3 | % |

Materials | | | 5.0 | % |

Utilities | | | 4.8 | % |

Consumer Staples | | | 4.0 | % |

Energy | | | 3.9 | % |

Top 10 Holdings

(% of Net Assets)

| | | | |

EMCOR Group, Inc. | | | 3.1 | % |

Ingredion, Inc. | | | 3.1 | % |

Actuant Corporation | | | 2.7 | % |

Petroleum Geo-Services ASA | | | 2.7 | % |

GATX Corporation | | | 2.6 | % |

Teradyne, Inc. | | | 2.6 | % |

Southwest Gas Corporation | | | 2.5 | % |

Foot Locker, Inc. | | | 2.5 | % |

Plantronics, Inc. | | | 2.3 | % |

PNM Resources, Inc. | | | 2.3 | % |

These securities represent 26.4% of the total net assets of the Fund.

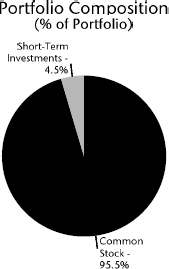

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

Quoted Major Market Sectors, Portfolio Composition and Top 10 Holdings are subject to change.

The lists of Major Market Sectors and Top 10 Holdings exclude short-term investments and collateral held for securities loaned.

The Portfolio Composition chart excludes collateral held for securities loaned.

16

Given our general trepidation regarding economic growth in 2013, our exposures are emphasizing companies with strong new product cycles, productivity-enhancing value propositions and superior demand visibility.

Portfolio Facts

As of October 31, 2012

| | | | | | | | |

| | | Class A | | | Institutional Class | |

Ticker | | | AASMX | | | | TSCSX | |

Transfer Agent ID | | | 024 | | | | 094 | |

Net Assets | | | $216,595,123 | | | | $63,434,982 | |

NAV | | | $14.28 | | | | $16.09 | |

NAV - High† | | | 9/14/2012 - $15.18 | | | | 9/14/2012 - $17.09 | |

NAV - Low† | | | 11/25/2011 - $12.06 | | | | 11/25/2011 - $13.51 | |

Number of Holdings: 68 | | | | | | | | |

† | For the year ended October 31, 2012 |

Average Annual Total Returns1

As of October 31, 2012

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | 10 Years | |

without sales charge | | | 6.97 | % | | | -2.78 | % | | | 7.38 | % |

with sales charge | | | 1.06 | % | | | -3.87 | % | | | 6.77 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | 10 Years | |

Net Asset Value | | | 7.55 | % | | | -2.14 | % | | | 8.06 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Russell 2000® Index and the Consumer Price Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in the Index, any charges you would pay would reduce your total return as well. |

** | The Russell 2000® Index measures the performance of small cap stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

17

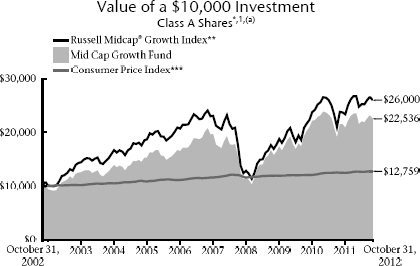

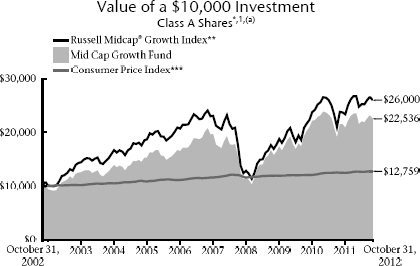

Thrivent Mid Cap Growth Fund

Andrea J. Thomas, CFA, Portfolio Manager

The Fund seeks long-term growth of capital.

Mid-cap stocks offer the potential for long-term gains but can be subject to short-term price movements. Mid-sized company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Fund’s prospectus. Views expressed in this discussion of fund performance are the views of this particular Fund’s portfolio management team.

How did the Fund perform during the 12-month period ended October 31, 2012?

Thrivent Mid Cap Growth Fund earned a return of 4.72%, compared with the median return of its peer group, the Lipper Mid Cap Growth Funds category, of 7.03%. The Fund’s market benchmark, the Russell Midcap® Growth Index, earned a return of 9.09%.

What factors affected the Fund’s performance?

The Fund lagged its competitors and the benchmark over the period. Most of this underperformance occurred in the first six months of the fiscal period as we did not own enough high-multiple consumer names over the period that did very well. Investors continued to rush into these names and were willing to pay enormous premiums for them. Many of these companies have seen their values subsequently decline, and we have picked up relative ground in the second part of the fiscal period.

Our energy stock picks did not fare well over the period, particularly our coal stocks. The substantial expansion of domestic natural gas supply over the last few years has caused prices to decline significantly. While a positive for the overall economy, this trend has resulted in a dramatic shift from coal to natural gas for domestic electricity production. Additionally, coal exports declined due to reduced demand from China. In the technology sector, our holdings in Atmel Corporation and Marvell Technologies also did not perform well over the period.

In the financial sector, good results were achieved from our holdings in Discover Financial Services and Affiliated Managers Group. Catamaran Corporation in the health care providers industry also performed extremely well.

What is your outlook?

The U.S. economy remains in a state of subpar growth due primarily to the lackluster job market and uncertainty about government policies going forward. Continued turmoil in the European markets also remains a significant risk to the U.S. and world economies. A bright spot in the economy is the U.S. housing market, which is showing signs of stabilization.

We believe market volatility will increase over the near term as Congress debates a solution to the fiscal cliff, and the European Union continues to be disrupted over finding a solution to its banking and debt problems. These issues will moderate U.S. economic growth in the coming months.

The Fed announced its decision in September to extend its quantitative easing program. The value of the U.S. dollar continues to be at risk due to this policy because of the chance that inflation will increase as more liquidity is forced into the system.

| | | | |

| Major Market Sectors | |

| (% of Net Assets) | |

Information Technology | | | 21.1 | % |

Consumer Discretionary | | | 16.9 | % |

Industrials | | | 15.8 | % |

Health Care | | | 14.1 | % |

Energy | | | 10.6 | % |

Financials | | | 5.5 | % |

Materials | | | 4.9 | % |

Consumer Staples | | | 3.3 | % |

Telecommunications Services | | | 2.9 | % |

| | | | |

| Top 10 Holdings | |

| (% of Net Assets) | |

Discover Financial Services | | | 2.5 | % |

Discovery Communications, Inc. | | | 2.4 | % |

Watson Pharmaceuticals, Inc. | | | 2.3 | % |

Whole Foods Market, Inc. | | | 2.3 | % |

Affiliated Managers Group, Inc. | | | 2.2 | % |

F5 Networks, Inc. | | | 2.1 | % |

Dollar Tree, Inc. | | | 2.1 | % |

Tractor Supply Company | | | 2.0 | % |

ANSYS, Inc. | | | 2.0 | % |

JB Hunt Transport Services, Inc. | | | 2.0 | % |

These securities represent 21.9% of the total net assets of the Fund.

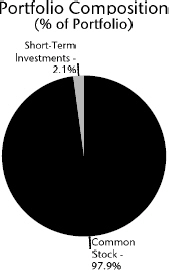

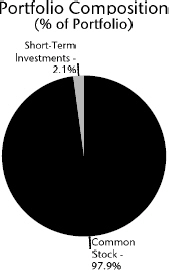

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

Quoted Major Market Sectors, Portfolio Composition and Top 10 Holdings are subject to change.

The lists of Major Market Sectors and Top 10 Holdings exclude short-term investments and collateral held for securities loaned.

The Portfolio Composition chart excludes collateral held for securities loaned.

18

In this environment, we remain invested in companies that have definable product cycles that should grow despite economic cyclicality. We also remain invested in companies that have hard assets that may benefit from commodity inflation. Due to the mixed outlook for growth going forward, we will continue to follow a disciplined process and remain wary of the multiples we are willing to pay for stocks.

| | | | | | | | |

| Portfolio Facts | |

| As of October 31, 2012 | |

| | | Class A | | | Institutional Class | |

Ticker | | | LBMGX | | | | LBMIX | |

Transfer Agent ID | | | 058 | | | | 458 | |

Net Assets | | | $228,980,567 | | | | $150,728,838 | |

NAV | | | $18.34 | | | | $20.68 | |

NAV - High† | | | 4/27/2012 - $19.35 | | | | 4/27/2012 - $21.77 | |

NAV - Low† | | | 11/25/2011 - $16.30 | | | | 11/25/2011 - $18.27 | |

Number of Holdings: 83 | | | | | | | | |

† | For the year ended October 31, 2012 |

Average Annual Total Returns1

As of October 31, 2012

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | 10 Years | |

without sales charge | | | 4.72 | % | | | 1.65 | % | | | 9.08 | % |

with sales charge | | | -1.04 | % | | | 0.51 | % | | | 8.47 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | 10 Years | |

Net Asset Value | | | 5.23 | % | | | 2.32 | % | | | 9.90 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

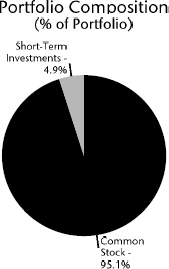

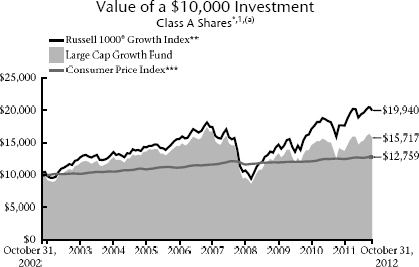

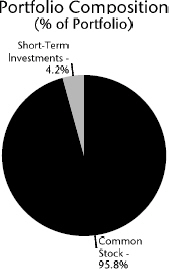

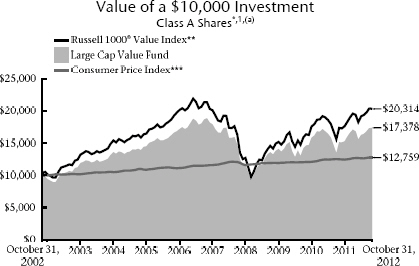

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |