UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-05075

Thrivent Mutual Funds

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

Michael W. Kremenak

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-4198

Date of fiscal year end: October 31

Date of reporting period: October 31, 2013

Item 1. Report to Stockholders

Table of Contents

Dear Shareholder:

The stock market soared in the fiscal year ending October 31, 2013, as the U.S. economy continued its slow but persistent expansion and Europe showed signs of emerging from a recession. Fixed-income markets mostly fell as investors worried that the improving economic picture might prompt the Federal Reserve to begin tempering its accommodative monetary policy.

Economic Review

After a slow start, the U.S. economy picked up steam as the 12-month reporting period progressed. By the third quarter of 2013, the nation’s gross domestic product (GDP) was expanding at an annual rate of 2.8%, according to the advance estimate of the Bureau of Economic Analysis. The economy has now grown in 16 of the past 17 quarters.

The private sector expanded at an even faster rate during the reporting period, at an estimated 3.4% pace in the third quarter. Reduced spending by the federal government kept the final GDP number below that level.

Among the sectors contributing to the economy’s improved performance were consumer spending and commercial and residential construction. Housing starts rose in August to a seasonally adjusted annual rate of 891,000 units, up 19% from a year earlier.

Despite the favorable economic news, the recovery from the 2008–2009 recession has been sluggish by historical standards, with GDP growth averaging about 2% annually over the last three years. That is only about half what we would expect in a more normal recovery, and it has translated into sluggish improvement in the job market, too. On average, the economy created nearly 200,000 nonfarm payrolls a month during the 12-month reporting period, yet the country still has roughly 1.5 million fewer jobs today than it did prior to the recession.

With the economy begrudgingly adding jobs, the unemployment rate continued to inch lower during the reporting period, falling from 7.9% in October 2012 to 7.2% in September 2013. It ticked up to 7.3% in October 2013 after the federal government closed for 16 days, temporarily adding hundreds of thousands of federal workers to the ranks of the unemployed. The shutdown was triggered when Congress failed to reach agreement on a federal spending plan for the U.S. fiscal year that began October 1.

Economic conditions also improved in Europe and China, which are important to the U.S. economy and its financial markets. After a year and a half of economic contraction, GDP for the 17-country eurozone grew 0.3% in the second quarter according to Eurostat, the statistical office of the European Union. China, after watching its economic growth slow for much of the past three years, saw its GDP rise 7.5% year-over-year in the second quarter, then jump 7.8% in the third.

Market Review

The stock market rose steadily during the reporting period. It received an early boost on New Year’s Day when Congress voted to permanently extend most of the temporary income tax cuts enacted by former President George W. Bush, a move viewed as bullish for the economy. Prices then continued to rise as the economic recovery gained speed, the Federal Reserve stuck to its campaign of stimulating economic growth by keeping interest rates low, and overseas economies showed early signs of a rebound.

In late March, the S&P 500 Index of large-company stocks set its first record high since October 2007. It finished the reporting period with a total return of 27.2%. Small-company stocks did even better, with the Russell 2000® Index earning 36.3%.

Stocks in developed markets overseas also posted stellar returns as the economy in Europe appeared to stabilize and fears about the sustainability of the euro faded. Investors also were encouraged by Japan’s shift to fiscal and monetary policies aimed at promoting economic growth in that country. The MSCI EAFE Index, which tracks developed markets in Europe, Australasia and Far East, posted a total return of 26.9%.

Emerging market stocks largely sat out the party, with the MSCI Emerging Markets Index posting a total return of 6.9%. The index slumped during the second quarter as investors worried about slowing economic growth in China, India and Brazil, and about lower commodities prices, which adversely impact the many natural resources companies located in emerging economies. Prices reversed course in October when China’s economy began showing new signs of strength.

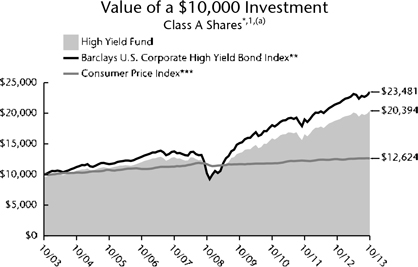

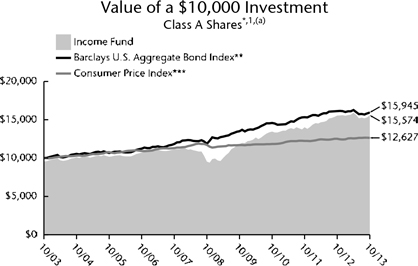

Fixed-income markets were mostly higher in the first half of the reporting period, but tumbled in the second as investors speculated that the Federal Reserve might begin backing away from its easy monetary policy as soon as September. In particular, they worried that the Fed might begin to wind down its latest quantitative easing program in which it has been buying $85 billion of bonds each month to help keep long-term interest rates low. By the end of the reporting period, that still hadn’t happened. Nonetheless, the yield on the benchmark 10-year Treasury bond had risen nearly a percentage point to just under 2.6%. When interest rates rise, bond prices go down. With most sectors of the bond market taking their lead from Treasuries, the broad Barclays U.S. Aggregate Bond Index finished the reporting period with a loss of 1.1%. Treasuries did much worse, with the Barclays 20+ Treasury Bond Index losing 10.5%. High-yield corporate bonds, which often trade in sympathy with stocks, were among the few sectors to escape the downturn. The Barclays U.S. Corporate High Yield Bond Index posted a positive return of 8.8%.

Our Outlook

Five years into an economic recovery, we have enjoyed extraordinary gains in the financial markets, particularly in equities. Valuations are now relatively high, tempering our expectations for the future.

Our forecasting models suggest the economic recovery will persevere through the year ahead, albeit at about the same plodding rate we have experienced for the past three years. The political stalemate in Washington that led to the government shutdown is likely to continue as well, although we do not anticipate that Congress will allow another

2

shutdown any time soon given the public backlash that followed the last one. On the other hand, there also is little likelihood of a tax-and-spending “grand bargain” that would have a meaningful impact on the nation’s growing long-term debt. That debt could become a bigger threat to the economy as time passes.

Against that backdrop, the unemployment rate should continue to inch down at a modest rate. The Fed will eventually conclude that the economy is healthy enough to pull back from its easy monetary policy, but the impact on the financial markets should be modest given that it is already on the radar screen of most investors. Leading indicators suggest that China and Europe should enjoy moderate economic growth as well.

The bulk of the stock market’s gains in the reporting period were attributable not to growth in corporate profits, which was good but not extraordinary, but rather to an expansion of price-to-earnings multiples. That suggests investors were expecting an even better economic environment—and higher corporate profits—ahead. If their enthusiasm is rewarded, U.S. stocks could add to last year’s gains in 2014, although it is hard to envision a scenario in which they match last year’s performance. We see more attractive stock valuations in Europe, particularly in shares of large European companies that generate their profits globally.

Fixed-income markets will continue to battle two big headwinds: Congress’ inability to agree on a long-term debt-reduction plan, and the impending shift in Fed monetary policy. We would not be surprised to see another modest loss in the Treasury sector, although the high-yield bond and leveraged loan sectors could notch moderate gains as fixed-income investors continue their search for yield in a low-interest-rate environment.

If you are uncertain about how your portfolio is positioned to weather the months ahead, we encourage you to meet with your Thrivent Financial representative. He or she can make sure your portfolio remains aligned with your financial goals and tolerance for risk.

As always, thank you for the trust you have placed in our entire team of professionals at Thrivent Asset Management.

Sincerely,

Russell W. Swansen

President and Chief Investment Officer

Thrivent Mutual Funds

3

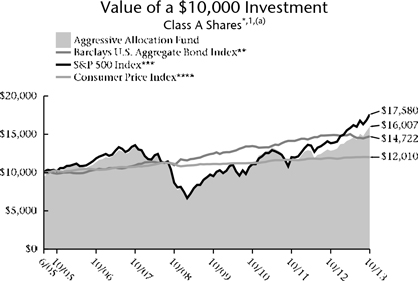

Thrivent Aggressive Allocation Fund

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

The Fund seeks long-term capital growth.

The Fund invests in other Thrivent mutual funds and in directly held equity and debt instruments. The Fund is subject to its own operating expenses and the operating expenses of the other funds in which it invests, and is subject to all of the risks of the other funds in which it invests. The value of the Fund is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Fund may incur losses due to incorrect assessments of investments by its investment adviser. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. The use of equity index futures involves transaction costs and the loss from investing in them can exceed the initial investment.

How did the Fund perform during the 12-month period ended October 31, 2013?

Thrivent Aggressive Allocation Fund earned a return of 24.64%, compared with the median return of its peer group, the Lipper Multi-Cap Core Funds category, of 29.31%. The Fund’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 27.18% and -1.08%, respectively.

What factors affected the Fund’s performance?

Most major equity markets meaningfully outperformed fixed-income markets in the period. Across equity markets, small and mid-cap domestic stocks outperformed large caps in both domestic and foreign developed markets. Emerging market equities, while positive, provided dramatically lower returns versus most other stock groups.

In fixed income, Treasury and agency securities underperformed both investment-grade corporate and high-yield bonds. The Fund’s return in its fixed-income segment bested the bond index because our portfolio had limited exposure to the underperforming sectors.

The Fund’s return was aided by its significant exposure to equities across most major market segments. We were overweighted in large-cap stocks within our equity portfolio, which partially limited our advance because large-cap stocks did not keep pace with small and mid caps, although returns to all categories were quite attractive on an absolute basis.

Over the period, the Fund had an average exposure to fixed-income securities of 6%. Our holdings performed well versus the fixed-income benchmark, but even the best segment of bonds did not keep pace with the strong advance in U.S. stocks. Performance across the actively managed equity segments of the Fund was mixed. The large-cap growth and value segments outperformed while the mid-cap growth and small-cap core portfolios underperformed, each measured versus their respective benchmarks. However, absolute returns for all of the domestic equity segments of the Fund were quite good.

Within our international section, we had exposure to emerging markets debt and equity, and both of those segments—while performing well against their respective indexes—did not keep pace with the broader market advance. In total, results were close to management expectations given the asset mix of the portfolio.

What is your outlook?

As the period drew to a close, we became modestly more conservative in our portfolio positioning. Within fixed income, in the absence of an unexpected decline in the economy, we believe U.S. Treasury and agency securities are overvalued due to an aggressive purchase program that the Federal Reserve Bank has undertaken. As a result, we are overweighted in corporate bonds, and underweighted in Treasury and agency securities.

In equities, we have taken steps to modestly reduce our equity exposure. With the significant advance in global stock markets, it is difficult to represent that stocks are undervalued. At best, we would suggest equities are fairly valued. That does not mean any decline is imminent; in our process, however, it suggests it is appropriate to modestly adjust allocations.

While the rally certainly could continue to advance, we feel it would likely be at a more moderate pace. We do think that within equities, small and mid-cap domestic stocks are richly priced versus large caps, and that within large caps, non-U.S. stocks provide better opportunities. Thus, we have tilted the portfolio positions to take advantage of those opportunities.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

4

| | | | |

| Portfolio Composition | |

| (% of Portfolio) | |

Large Cap | | | 49.5 | % |

International | | | 21.9 | % |

Small Cap | | | 9.9 | % |

Mid Cap | | | 7.6 | % |

Short-Term Investments | | | 5.9 | % |

Natural Resources | | | 2.1 | % |

Investment Grade Debt | | | 1.9 | % |

High Yield | | | 1.2 | % |

| | | | |

Total | | | 100.0 | % |

| | | | |

| Top 10 Holdings | |

| (% of Net Assets) | |

Thrivent Partner Worldwide Allocation Fund | | | 15.1 | % |

Thrivent Partner Small Cap Growth Fund | | | 8.3 | % |

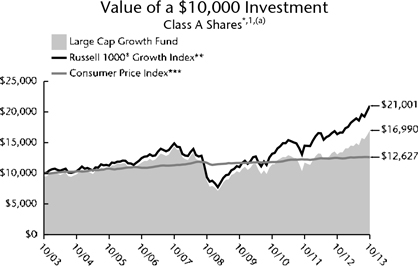

Thrivent Large Cap Growth Fund | | | 7.0 | % |

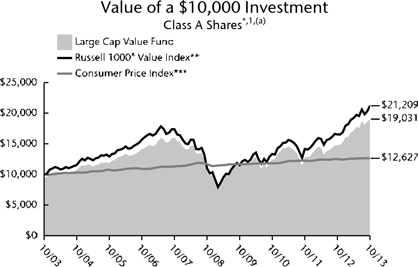

Thrivent Large Cap Value Fund | | | 6.2 | % |

Thrivent Mid Cap Stock Fund | | | 5.7 | % |

Thrivent Mid Cap Growth Fund | | | 5.0 | % |

Thrivent Partner Mid Cap Value Fund | | | 3.5 | % |

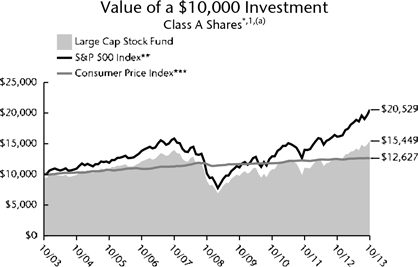

Thrivent Large Cap Stock Fund | | | 3.5 | % |

Thrivent Small Cap Stock Fund | | | 3.0 | % |

Thrivent Natural Resources Fund | | | 2.2 | % |

These securities represent 59.5% of the total net assets of the Fund.

Portfolio Composition illustrates market exposure of all asset classes, including derivatives.

The list of Top 10 Holdings excludes short-term investments.

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

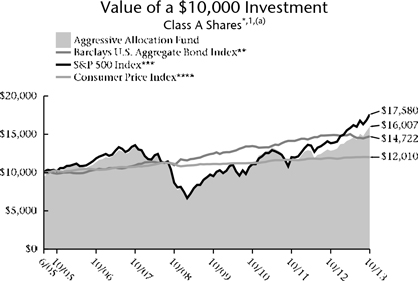

Average Annual Total Returns1

As of October 31, 2013

| | | | | | | | | | | | |

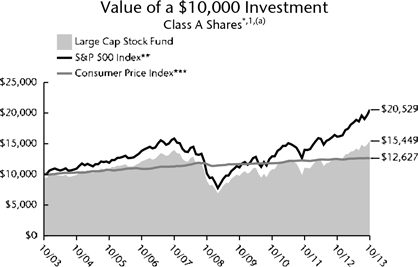

Class A2 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

without sales charge | | | 24.64 | % | | | 13.74 | % | | | 6.52 | % |

with sales charge | | | 17.80 | % | | | 12.46 | % | | | 5.80 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

Net Asset Value | | | 25.11 | % | | | 14.18 | % | | | 6.92 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

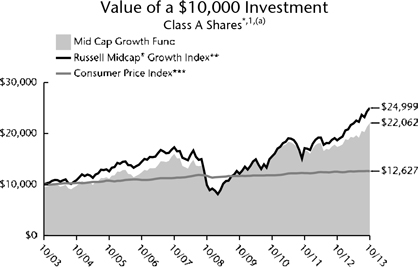

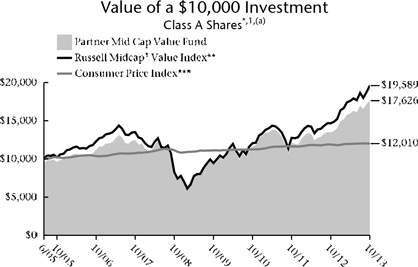

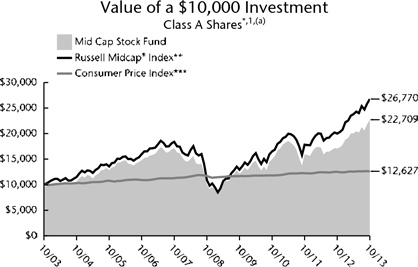

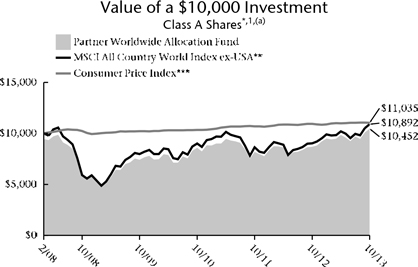

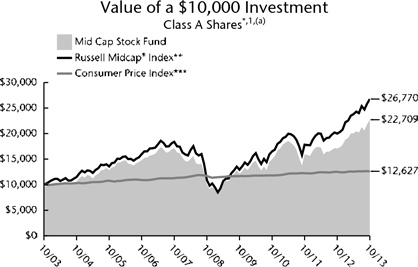

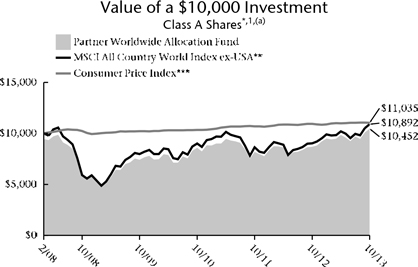

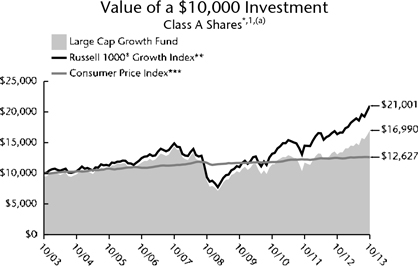

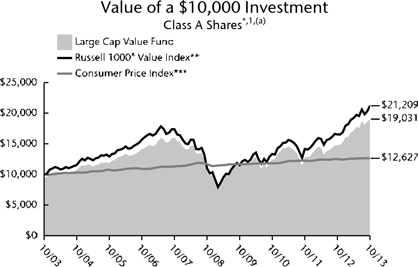

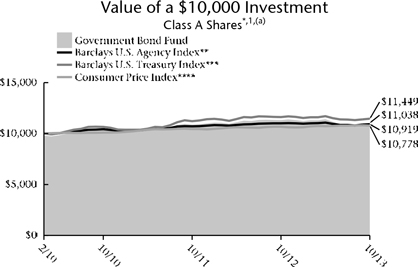

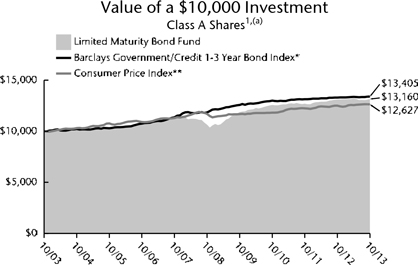

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in those Indexes, any charges you would pay would reduce your total return as well. |

** | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

**** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

5

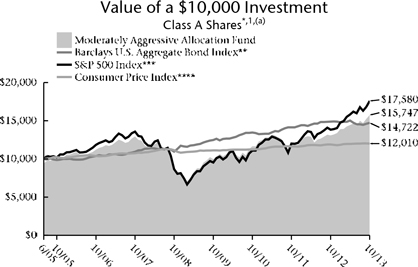

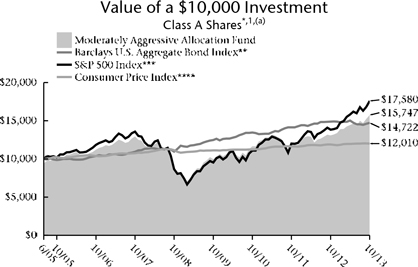

Thrivent Moderately Aggressive Allocation Fund

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

The Fund seeks long-term capital growth.

The Fund invests in other Thrivent mutual funds and in directly held equity and debt instruments. The Fund is subject to its own operating expenses and the operating expenses of the other funds in which it invests, and is subject to all of the risks of the other funds in which it invests. The value of the Fund is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Fund may incur losses due to incorrect assessments of investments by its investment adviser. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. The use of equity index futures involves transaction costs and the loss from investing in them can exceed the initial investment.

How did the Fund perform during the 12-month period ended October 31, 2013?

Thrivent Moderately Aggressive Allocation Fund earned a return of 20.28%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Growth Funds category, of 17.94%. The Fund’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 27.18% and -1.08%, respectively.

What factors affected the Fund’s performance?

Most major equity markets meaningfully outperformed fixed-income markets in the period. Across equity markets, small and mid-cap domestic stocks outperformed large caps—both domestic as well as foreign. Emerging market equities, while positive, provided dramatically lower returns versus most other stock groups.

In fixed income, Treasury and agency securities underperformed both investment-grade corporate and high-yield bonds. The Fund’s return in its fixed-income segment bested the bond index because our portfolio had limited exposure to the underperforming sectors.

The Fund’s return was aided by its significant exposure to equities across most major market segments. We were overweighted in large-cap stocks within our equity portfolio, which partially limited our advance because large-cap stocks did not keep pace with small and mid caps, but returns to all categories were quite attractive on an absolute basis.

Over the period, the Fund had an average exposure to fixed-income securities of 23%. Our holdings performed well versus the fixed-income benchmark, but even the best segment of bonds did not keep pace with the strong advance in U.S. stocks. Performance across the actively managed equity segments of the Fund were mixed. The large-cap growth and value segments outperformed while the mid-cap growth and small-cap core portfolios underperformed, each measured versus their respective benchmarks. However, absolute returns for all of the domestic equity segments of the Fund were quite good.

Within our international section, we had exposure to emerging markets debt and equity, and both of those segments—while performing well against their respective indexes—did not keep pace with the broader market advance. In total, results were close to management expectations given the asset mix of the portfolio.

What is your outlook?

As the period drew to a close, we became modestly more conservative in our portfolio positioning. Within fixed income, in the absence of an unexpected decline in the economy, we believe U.S. Treasury and agency securities are overvalued due to an aggressive purchase program that the Federal Reserve Bank has undertaken. As a result, we are overweighted in corporate bonds, and underweighted in Treasury and agency securities.

In equities, we have taken steps to modestly reduce our equity exposure. With the significant advance in global stock markets, it is difficult to represent that stocks are undervalued. At best, we would suggest equities are fairly valued. That does not mean any decline is imminent; in our process, however, it suggests it is appropriate to modestly adjust allocations.

While the rally certainly could continue to advance, we feel it would likely be at a more moderate pace. We do think that within equities, small and mid-cap domestic stocks are richly priced versus large caps, and that within large caps, non-U.S. stocks provide better opportunities. Thus, we have tilted the portfolio positions to take advantage of those opportunities.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

6

| | | | |

| Portfolio Composition | |

| (% of Portfolio) | |

Large Cap | | | 39.3 | % |

International | | | 18.1 | % |

Investment Grade Debt | | | 9.6 | % |

Mid Cap | | | 8.6 | % |

Short-Term Investments | | | 7.0 | % |

Small Cap | | | 6.9 | % |

High Yield | | | 4.1 | % |

Floating Rate Debt | | | 3.7 | % |

Natural Resources | | | 1.8 | % |

Municipals | | | 0.9 | % |

Total | | | 100.0 | % |

| | | | |

| Top 10 Holdings | |

| (% of Net Assets) | |

Thrivent Partner Worldwide Allocation Fund | | | 12.4 | % |

Thrivent Large Cap Value Fund | | | 8.5 | % |

Thrivent Large Cap Growth Fund | | | 6.6 | % |

Thrivent Mid Cap Stock Fund | | | 5.3 | % |

Thrivent Large Cap Stock Fund | | | 5.3 | % |

Thrivent Income Fund | | | 4.3 | % |

Thrivent High Yield Fund | | | 3.4 | % |

Thrivent Partner Small Cap Growth Fund | | | 3.2 | % |

Thrivent Partner Mid Cap Value Fund | | | 3.1 | % |

Thrivent Mid Cap Growth Fund | | | 2.8 | % |

These securities represent 54.9% of the total net assets of the Fund.

Portfolio Composition illustrates market exposure of all asset classes, including derivatives.

The list of Top 10 Holdings excludes short-term investments.

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

Average Annual Total Returns1

As of October 31, 2013

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | From Inception 6/30/2005 | |

without sales charge | | | 20.28 | % | | | 13.01 | % | | | 6.31 | % |

with sales charge | | | 13.64 | % | | | 11.73 | % | | | 5.60 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | From Inception 6/30/2005 | |

Net Asset Value | | | 20.66 | % | | | 13.42 | % | | | 6.69 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in those Indexes, any charges you would pay would reduce your total return as well. |

** | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

**** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

7

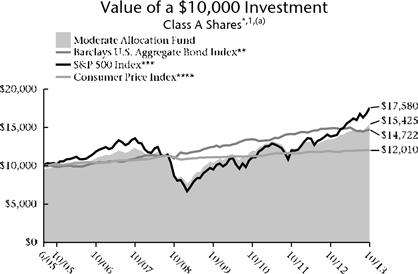

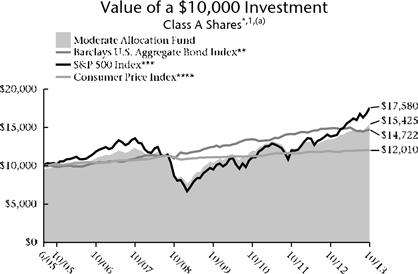

Thrivent Moderate Allocation Fund

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

The Fund seeks long-term capital growth while providing reasonable stability of principal.

The Fund invests in other Thrivent mutual funds and in directly held equity and debt instruments. The Fund is subject to its own operating expenses and the operating expenses of the other funds in which it invests, and is subject to all of the risks of the other funds in which it invests. The value of the Fund is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Fund may incur losses due to incorrect assessments of investments by its investment adviser. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. The use of equity index futures involves transaction costs and the loss from investing in them can exceed the initial investment.

How did the Fund perform during the 12-month period ended October 31, 2013?

Thrivent Moderate Allocation Fund earned a return of 14.74%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Moderate Funds category, of 13.83%. The Fund’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 27.18% and -1.08%, respectively.

What factors affected the Fund’s performance?

Most major equity markets meaningfully outperformed fixed-income markets in the period. Across equity markets, small and mid-cap domestic stocks outperformed large caps—both domestic as well as foreign. Emerging market equities, while positive, provided dramatically lower returns versus most other stock groups.

In fixed income, Treasury and agency securities underperformed both investment-grade corporate and high-yield bonds. The Fund’s return in its fixed-income segment bested the bond index because our portfolio had limited exposure to the underperforming sectors.

The Fund’s return was aided by its significant exposure to equities across most major market segments. We were overweighted in large-cap stocks within our equity portfolio, which partially limited our advance because large-cap stocks did not keep pace with small and mid caps, but returns to all categories were quite attractive on an absolute basis.

Over the period, the Fund had an average exposure to fixed-income securities of 42%. Our holdings performed well versus the fixed-income benchmark, but even the best segment of bonds did not keep pace with the strong advance in U.S. stocks. Performance across the actively managed equity segments of the Fund were mixed. The large-cap growth and value segments outperformed while the mid-cap growth and small-cap core portfolios underperformed, each measured versus their respective benchmarks. However, absolute returns for all of the domestic equity segments of the Fund were quite good.

Within our international section, we had exposure to emerging markets debt and equity, and both of those segments—while performing well against their respective indexes—did not keep pace with the broader market advance. In total, results were close to management expectations given the asset mix of the portfolio.

What is your outlook?

As the period drew to a close, we became modestly more conservative in our portfolio positioning. Within fixed income, in the absence of an unexpected decline in the economy, we believe U.S. Treasury and agency securities are overvalued due to an aggressive purchase program that the Federal Reserve Bank has undertaken. As a result, we are overweighted in corporate bonds, and underweighted in Treasury and agency securities.

In equities, we have taken steps to modestly reduce our equity exposure. With the significant advance in global stock markets, it is difficult to represent that stocks are undervalued. At best, we would suggest equities are fairly valued. That does not mean any decline is imminent; in our process, however, it suggests it is appropriate to modestly adjust allocations.

While the rally certainly could continue to advance, we feel it would likely be at a more moderate pace. We do think that within equities, small and mid-cap domestic stocks are richly priced versus large caps, and that within large caps, non-U.S. stocks provide better opportunities. Thus, we have tilted the portfolio positions to take advantage of those opportunities.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

8

| | | | |

| Portfolio Composition | |

| (% of Portfolio) | |

Large Cap | | | 28.6 | % |

Investment Grade Debt | | | 25.7 | % |

International | | | 14.0 | % |

Short-Term Investments | | | 7.8 | % |

Floating Rate Debt | | | 6.3 | % |

Small Cap | | | 5.9 | % |

Mid Cap | | | 4.7 | % |

High Yield | | | 3.6 | % |

Municipals | | | 1.7 | % |

Natural Resources | | | 1.7 | % |

| | | | |

Total | | | 100.0 | % |

| | | | |

| Top 10 Holdings | |

| (% of Net Assets) | |

Thrivent Income Fund | | | 10.4 | % |

Thrivent Partner Worldwide Allocation Fund | | | 9.7 | % |

Thrivent Large Cap Value Fund | | | 7.5 | % |

Thrivent Limited Maturity Bond Fund | | | 7.1 | % |

Thrivent Large Cap Growth Fund | | | 5.3 | % |

Thrivent Mid Cap Stock Fund | | | 3.6 | % |

Thrivent High Yield Fund | | | 3.0 | % |

Thrivent Partner Small Cap Growth Fund | | | 2.1 | % |

Thrivent Large Cap Stock Fund | | | 2.1 | % |

Thrivent Partner Mid Cap Value Fund | | | 2.1 | % |

These securities represent 52.9% of the total net assets of the Fund.

Portfolio Composition illustrates market exposure of all asset classes, including derivatives.

The list of Top 10 Holdings excludes short-term investments.

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

Average Annual Total Returns1

As of October 31, 2013

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

without sales charge | | | 14.74 | % | | | 11.66 | % | | | 6.05 | % |

with sales charge | | | 8.45 | % | | | 10.41 | % | | | 5.33 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

Net Asset Value | | | 15.18 | % | | | 12.06 | % | | | 6.40 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in those Indexes, any charges you would pay would reduce your total return as well. |

** | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

**** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

9

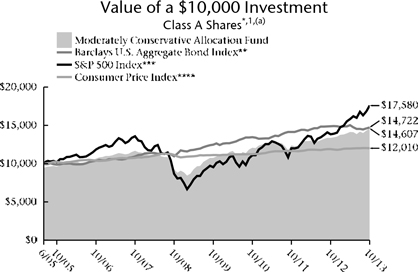

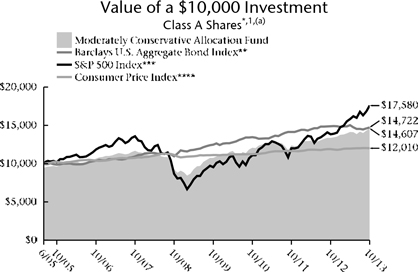

Thrivent Moderately Conservative Allocation Fund

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

The Fund seeks long-term capital growth while providing reasonable stability of principal.

The Fund invests in other Thrivent mutual funds and in directly held equity and debt instruments. The Fund is subject to its own operating expenses and the operating expenses of the other funds in which it invests, and is subject to all of the risks of the other funds in which it invests. The value of the Fund is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Fund may incur losses due to incorrect assessments of investments by its investment adviser. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. The use of equity index futures involves transaction costs and the loss from investing in them can exceed the initial investment.

How did the Fund perform during the 12-month period ended October 31, 2013?

Thrivent Moderately Conservative Allocation Fund earned a return of 9.32%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Conservative Funds category, of 7.20%. The Fund’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 27.18% and -1.08%, respectively.

What factors affected the Fund’s performance?

Most major equity markets meaningfully outperformed fixed-income markets in the period. Across equity markets, small and mid-cap domestic stocks outperformed large caps—both domestic as well as foreign. Emerging market equities, while positive, provided dramatically lower returns versus most other stock groups.

In fixed income, Treasury and agency securities underperformed both investment-grade corporate and high-yield bonds. The Fund’s return in its fixed-income segment bested the bond index because our portfolio had limited exposure to the underperforming sectors.

The Fund’s return was aided by its significant exposure to equities across most major market segments. We were overweighted in large-cap stocks within our equity portfolio, which partially limited our advance because large-cap stocks did not keep pace with small and mid caps, but returns to all categories were quite attractive on an absolute basis.

Over the period, the Fund had an average exposure to fixed-income securities of 62%. Our holdings performed well versus the fixed-income benchmark, but even the best segment of bonds did not keep pace with the strong advance in U.S. stocks. Performance across the actively managed equity segments of the Fund was mixed. The large-cap growth and value segments outperformed while the mid-cap growth and small-cap core portfolios underperformed, each measured versus their respective benchmarks. However, absolute returns for all of the domestic equity segments of the Fund were quite good.

Within our international section, we had exposure to emerging markets debt and equity, and both of those segments—while performing well against their respective indexes—did not keep pace with the broader market advance. In total, results were close to management expectations given the asset mix of the portfolio.

What is your outlook?

As the period drew to a close, we became modestly more conservative in our portfolio positioning. Within fixed income, in the absence of an unexpected decline in the economy, we believe U.S. Treasury and agency securities are overvalued due to an aggressive purchase program that the Federal Reserve Bank has undertaken. As a result, we are overweighted in corporate bonds, and underweighted in Treasury and agency securities.

In equities, we have taken steps to modestly reduce our equity exposure. With the significant advance in global stock markets, it is difficult to represent that stocks are undervalued. At best, we would suggest equities are fairly valued. That does not mean any decline is imminent; in our process, however, it suggests it is appropriate to modestly adjust allocations.

While the rally certainly could continue to advance, we feel it would likely be at a more moderate pace. We do think that within equities, small and mid-cap domestic stocks are richly priced versus large caps, and that within large caps, non-U.S. stocks provide better opportunities. Thus, we have tilted the portfolio positions to take advantage of those opportunities.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

10

| | | | |

| Portfolio Composition | |

| (% of Portfolio) | |

Investment Grade Debt | | | 36.9 | % |

Large Cap | | | 17.5 | % |

Short-Term Investments | | | 12.2 | % |

International | | | 9.7 | % |

Floating Rate Debt | | | 9.0 | % |

High Yield | | | 5.0 | % |

Small Cap | | | 2.9 | % |

Mid Cap | | | 2.7 | % |

Municipals | | | 2.6 | % |

Natural Resources | | | 1.5 | % |

| | | | |

Total | | | 100.0 | % |

Top 10 Holdings

(% of Net Assets)

| | | | |

Thrivent Limited Maturity Bond Fund | | | 12.3 | % |

Thrivent Income Fund | | | 9.0 | % |

Thrivent Partner Worldwide Allocation Fund | | | 6.4 | % |

Thrivent Large Cap Value Fund | | | 5.6 | % |

Thrivent High Yield Fund | | | 3.5 | % |

Thrivent Partner Mid Cap Value Fund | | | 2.5 | % |

Thrivent Large Cap Growth Fund | | | 2.4 | % |

Federal National Mortgage Association Conventional 30-Yr. Pass Through | | | 1.8 | % |

Federal National Mortgage Association Conventional 30-Yr. Pass Through | | | 1.8 | % |

Thrivent Natural Resources Fund | | | 1.7 | % |

These securities represent 47.0% of the total net assets ofthe Fund.

Portfolio Composition illustrates market exposure of all asset classes, including derivatives.

The list of Top 10 Holdings excludes short-term investments.

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

Average Annual Total Returns1

As of October 31, 2013

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

without sales charge | | | 9.32 | % | | | 9.49 | % | | | 5.36 | % |

with sales charge | | | 3.31 | % | | | 8.26 | % | | | 4.65 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | From

Inception

6/30/2005 | |

Net Asset Value | | | 9.62 | % | | | 9.81 | % | | | 5.66 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in those Indexes, any charges you would pay would reduce your total return as well. |

** | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

**** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

11

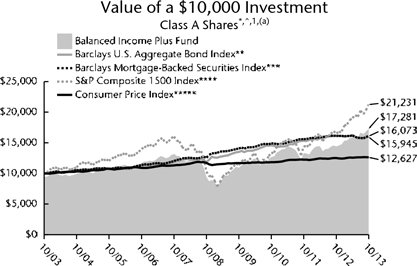

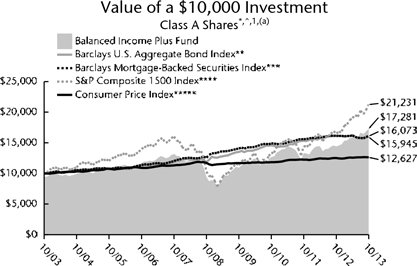

Thrivent Balanced Income Plus Fund

Darren M. Bagwell, CFA, Michael G. Landreville, CFA and CPA (inactive), and Stephen D. Lowe, CFA, Portfolio Co-Managers*

The Fund seeks long-term total return through a balance between income and the potential for long-term capital growth.

The Fund invests in equity securities and debt securities. The value of the Fund is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Fund may incur losses due to incorrect assessments of investments by its investment adviser. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. Leveraged loans, preferred securities, sovereign debt, and mortgage-related and other asset-backed securities are subject to additional risks. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards; these risks are magnified for investments in emerging markets. As of August 16, 2013, the Fund changed its name from Thrivent Balanced Fund to its current name.

* | Effective June 2013, Stephen D. Lowe became a Portfolio Co-Manager. |

How did the Fund perform during the 12-month period ended October 31, 2013?

Thrivent Balanced Income Plus Fund earned a return of 19.95%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Moderate Funds category, of 13.83%. The Fund’s market benchmarks, the S&P Composite 1500 Index, the Barclays U.S. High Yield Loan Index and the Barclays U.S. Mortgage-Backed Securities Index, earned returns of 28.09%, 5.65% and -0.36%, respectively.

What factors affected the Fund’s performance?

Effective August 16, 2013, Thrivent Balanced Fund was converted to Thrivent Balanced Income Plus Fund, which entailed significant changes to its principal investment strategies and benchmarks. We began transitioning the Fund’s holdings to reflect its new strategy and expect to be done by year-end. Therefore, the majority of the Fund’s performance during the fiscal year, particularly in fixed income, is reflective of a portfolio that was materially different from its new composition and benchmarks.

The Fund’s equity portfolio outperformed due to strong security selection. In particular, results were favorable among Internet-related holdings in technology, aerospace-related positions in industrials, and oil and gas producers within energy. However, the fixed-income portfolio returns fell short of the Barclays benchmarks because of our higher Treasury exposure, lower high-yield exposure and significantly longer duration, or interest-rate sensitivity, for most of the period.

How are you positioning the Fund?

The goals of the Fund’s new approach are to reduce interest rate risk while at the same time to enhance yield. We continue to make changes in the fixed-income portion of the Fund to accomplish these goals. These changes include eliminating longer-duration, lower-yielding U.S. Treasury securities, while increasing exposure to higher-yielding floating-rate leveraged bank loan securities, high-yield securities and emerging market debt securities.

The Fund will also continue to hold mortgage-backed securities and investment-grade corporate bonds. While these securities tend to have more yield and less interest rate risk than medium- to longer-term Treasury securities, they also have more credit risk than Treasuries.

Going forward, much of the fixed-income portfolio will be rated below investment grade in terms of credit quality, although most of these holdings will be at the higher end of the noninvestment-grade spectrum. In addition, the Fund will now target a 50/50 split between fixed-income and equity exposure.

While equity exposure was lowered from two-thirds to one-half of the overall Fund, we continued to use the same investment approach. We are focused on driving equity returns through individual security selection, while maintaining a generally sector-neutral portfolio.

What is your outlook?

We expect economic growth and capital spending to continue improving at a modest, but positive, pace while inflationary pressures will likely remain muted. This should allow the Fed to remain accommodative in its monetary policy. Fiscal policy will likely remain somewhat unpredictable in 2014, as it was in 2013 and earlier. We would not be surprised to see increased interest rate volatility over the course of the year. We expect to continue emphasizing more cyclical and discretionary holdings within the various equity market sectors.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

12

Portfolio Composition

(% of Portfolio)

| | | | |

Common Stock | | | 47.4 | % |

Long-Term Fixed Income | | | 27.7 | % |

Bank Loans | | | 14.4 | % |

Short-Term Investments | | | 10.4 | % |

Preferred Stock | | | 0.1 | % |

| | | | |

Total | | | 100.0 | % |

Major Market Sectors

(% of Net Assets)

| | | | |

Financials | | | 15.6 | % |

Consumer Discretionary | | | 11.5 | % |

Information Technology | | | 10.3 | % |

Consumer Staples | | | 9.7 | % |

Telecommunications Services | | | 7.8 | % |

Energy | | | 7.1 | % |

Industrials | | | 6.7 | % |

Mortgage-Backed Securities | | | 6.6 | % |

Health Care | | | 5.8 | % |

Materials | | | 5.1 | % |

Top 10 Holdings

(% of Net Assets)

| | | | |

Apple, Inc. | | | 2.2 | % |

Total SA ADR | | | 2.2 | % |

Comcast Corporation | | | 2.1 | % |

Federal National Mortgage Association Conventional 30-Yr. Pass Through | | | 1.9 | % |

Federal National Mortgage Association Conventional 30-Yr. Pass Through | | | 1.9 | % |

Las Vegas Sands Corporation | | | 1.9 | % |

U.S. Treasury Notes | | | 1.8 | % |

British American Tobacco plc ADR | | | 1.3 | % |

Honeywell International, Inc. | | | 1.3 | % |

Boeing Company | | | 1.3 | % |

These securities represent 17.9% of the total net assets of the Fund.

Quoted Major Market Sectors, Portfolio Composition and Top 10 Holdings are subject to change.

The lists of Major Market Sectors and Top 10 Holdings exclude short-term investments and collateral held for securities loaned.

The Portfolio Composition chart excludes collateral held for securities loaned.

Average Annual Total Returns1

As of October 31, 2013

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | 10 Years | |

without sales charge | | | 19.95 | % | | | 12.98 | % | | | 6.22 | % |

with sales charge | | | 13.31 | % | | | 11.71 | % | | | 5.62 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | 10 Years | |

Net Asset Value | | | 20.49 | % | | | 13.53 | % | | | 6.73 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | Effective August 2013, the Fund’s benchmark indices changed from the Barclays U.S. Aggregate Bond Index to the Barclays U.S. Mortgage-Backed Securities Index and the Barclays U.S. High Yield Loan Index. The Adviser made these benchmark changes because of changes to the Fund’s principal investment strategies. As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the benchmark indices do not reflect any such charges, deductions for fees, expenses or taxes. It is not possible to invest directly in the indices shown. If you were to purchase any of the above individual securities represented in those indices, any charges you would pay would reduce your total return as well. |

** | The Barclays U.S. Aggregate Bond Index measures the performance of U.S. investment grade bonds. |

*** | The Barclays U.S. Mortgage-Backed Securities Index (MBS) is formed by grouping the universe of over 600,000 individual fixed-rate U.S. government agency MBS pools into approximately 3,500 generic types of securities. |

**** | The S&P 500 Index represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

***** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. |

^ | The Barclays U.S. High Yield Loan Index is a benchmark index that incepted in January 2006. This index is not shown in the chart because it does not have 10 years of history and thus an accurate comparison of a $10,000 investment over 10 years cannot be shown. |

13

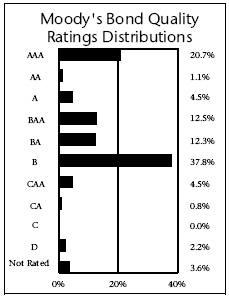

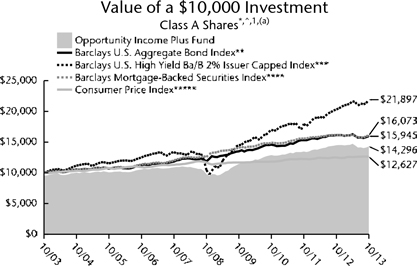

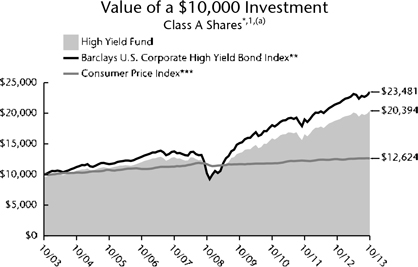

Thrivent Opportunity Income Plus Fund

Michael G. Landreville, CFA and CPA (inactive), Gregory R. Anderson, CFA, and Conrad Smith, CFA, Portfolio Co-Managers*

The Fund seeks a high level of current income consistent with capital preservation.

The Fund primarily invests in a broad range of debt securities. The value of the Fund is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Fund may incur losses due to incorrect assessments of investments by its investment adviser. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. Leveraged loans, sovereign debt, and mortgage-related and other asset-backed securities are subject to additional risks. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards; these risks are magnified for investments in emerging markets. The prices of futures contracts can be highly volatile and the loss from investing in them can exceed the initial investment. As of August 16, 2013, the Fund changed its name from Thrivent Core Bond Fund to its current name.

* | Effective June 2013, Conrad Smith became a Portfolio Co-Manager. |

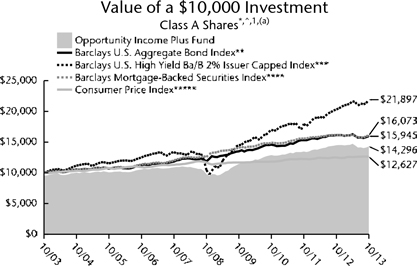

How did the Fund perform during the 12-month period ended October 31, 2013?

Thrivent Opportunity Income Plus Fund earned a return of -1.26%, compared with the median return of its peer group, the Lipper Multi-Sector Income Funds category, of 2.16%. The Fund’s market benchmarks, the Barclays U.S. High Yield Loan Index and the Barclays U.S. High Yield Ba/B 2% Issuer Cap Index, earned returns of 5.65% and 7.69%, respectively.

What factors affected the Fund’s performance?

Effective August 16, 2013, Thrivent Core Bond Fund was converted to Thrivent Opportunity Income Plus Fund, which entailed significant changes to its principal investment strategies and benchmarks. We began transitioning the Fund’s holdings to reflect its new strategy, and expect to be done by year-end. Therefore, the majority of the Fund’s performance during the fiscal year is reflective of a portfolio that was materially different from its new composition and benchmarks.

Fund returns fell short of the new Barclays benchmarks and the new Lipper peer group because of several factors. For the majority of the reporting period before the transition, the Fund had more than 20% of its net assets invested in Treasury securities. Treasuries underperformed other fixed-income asset classes as interest rates rose substantially over the period as a whole. The Fund also had a significantly longer duration stance, making it more interest-rate sensitive for the majority of the fiscal year. As rates rose, the yield curve steepened, meaning that yields went up (and prices went down) more for longer-maturity bonds than they did for shorter maturities. In addition, the new Barclays benchmarks are composed solely of high-yield securities, which strongly outperformed all other fixed-income sectors over the reporting period.

How are you positioning the Fund?

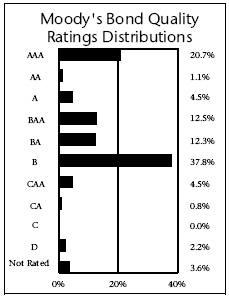

The goals of the Fund’s new approach are to reduce interest rate risk while at the same time to enhance yield. We continue to make changes to the Fund’s portfolio to accomplish these goals. These changes include eliminating longer-duration, lower-yielding U.S. Treasury securities, while increasing exposure to higher-yielding floating-rate leveraged bank loan securities, high-yield securities and emerging-market debt securities. The Fund will also continue to hold mortgage-backed securities and investment-grade corporate bonds. While, on balance, these securities have more yield and less interest-rate risk than medium- to longer-term Treasury securities, they also have more credit-quality risk than Treasuries. Going forward, much of the Fund’s portfolio will be rated below investment-grade in terms of credit quality, although most of these holdings will be at the higher end of the noninvestment-grade spectrum.

What is your outlook?

We expect economic growth and capital spending to continue to improve at a modest, but positive, pace while inflationary pressures will likely remain muted. This should allow the Fed to remain accommodative in its monetary policy. Fiscal policy will likely remain somewhat unpredictable in 2014, as it was in 2013 and earlier. We would not be surprised to see increased interest rate volatility over the course of the year. We remain focused on completing the Fund’s transition to its new approach before the start of 2014.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

14

Major Market Sectors

(% of Net Assets)

| | | | |

Communications Services | | | 18.6 | % |

Financials | | | 13.3 | % |

Mortgage-Backed Securities | | | 12.9 | % |

Consumer Cyclical | | | 7.9 | % |

Consumer Non-Cyclical | | | 7.6 | % |

Collateralized Mortgage Obligations | | | 4.5 | % |

Transportation | | | 4.5 | % |

Technology | | | 4.5 | % |

Capital Goods | | | 4.4 | % |

Asset-Backed Securities | | | 4.1 | % |

Top 10 Holdings

(% of Net Assets)

| | | | |

Federal National Mortgage Association Conventional 30-Yr. Pass Through | | | 3.4 | % |

Federal National Mortgage Association Conventional 30-Yr. Pass Through | | | 3.1 | % |

Federal Home Loan Mortgage Corporation Gold 30-Yr. Pass Through | | | 2.7 | % |

U.S. Treasury Notes | | | 2.5 | % |

iShares J.P. Morgan USD Emerging Markets Bond ETF | | | 1.8 | % |

American Airlines, Inc., Term Loan | | | 1.8 | % |

Federal Home Loan Mortgage Corporation Gold 15-Yr. Pass Through | | | 1.6 | % |

Federal National Mortgage Association Conventional 15-Yr. Pass Through | | | 1.5 | % |

Albertsons, LLC, Term Loan | | | 1.0 | % |

Supervalu, Inc., Term Loan | | | 0.9 | % |

These securities represent 20.3% of the total net assets of the Fund.

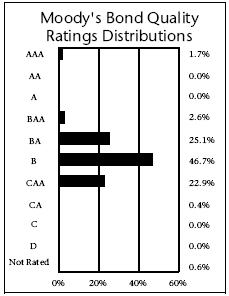

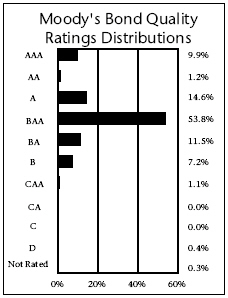

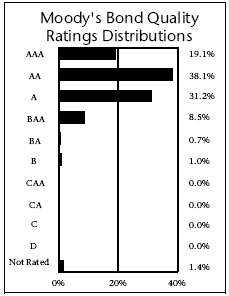

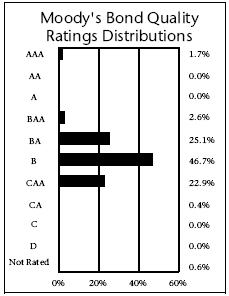

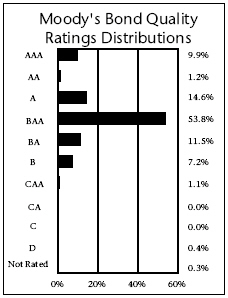

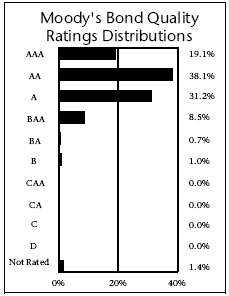

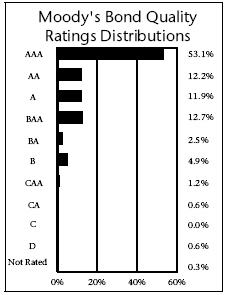

Quoted Major Market Sectors, Moody’s Bond Quality Ratings Distributions and Top 10 Holdings are subject to change.

The lists of Major Market Sectors and Top 10 Holdings exclude short-term investments and collateral held for securities loaned.

Average Annual Total Returns1

As of October 31, 2013

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | 10 Years | |

without sales charge | | | -1.26 | % | | | 7.89 | % | | | 4.12 | % |

with sales charge | | | -5.67 | % | | | 6.91 | % | | | 3.64 | % |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | 10 Years | |

Net Asset Value | | | -1.04 | % | | | 8.25 | % | | | 4.49 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 4.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | Effective August 2013, the Fund’s benchmark indices changed from the Barclays U.S. Aggregate Bond Index to the Barclays U.S. Mortgage-Backed Securities Index, the Barclays U.S. High Yield Ba/B 2% Issuer Cap Index and the Barclays U.S. High Yield Loan Index. The Adviser made these benchmark changes because of changes to the Fund’s principal investment strategies. As you compare performance, please note that the Fund’s performance reflects the maximum 4.5% sales charge, while the benchmark indices do not reflect any such charges, deductions for fees, expenses or taxes. It is not possible to invest directly in the indices shown. If you were to purchase any of the above individual securities represented in those indices, any charges you would pay would reduce your total return as well. |

** | The Barclays U.S. Aggregate Bond Index measures the performance of U.S. investment grade bonds. |

*** | The Barclays U.S. High-Yield Ba/B 2% Issuer Capped Index covers the USD denominated, non-investment grade, Ba or B rated, fixed-rate, taxable corporate bond market. The Index limits issuer exposures to a maximum 2%, redistributing excess market value index-wide on a pro-rata basis. |

**** | The Barclays U.S. Mortgage-Backed Securities Index (MBS) is formed by grouping the universe of over 600,000 individual fixed-rate U.S. government agency MBS pools into approximately 3,500 generic types of securities. |

***** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. |

^ | The Barclays U.S. High Yield Loan Index is a benchmark index that incepted in January 2006. This index is not shown in the chart because it does not have 10 years of history and thus an accurate comparison of a $10,000 investment over 10 years cannot be shown. |

15

Thrivent Partner Emerging Markets Equity Fund

| | |

| | Subadvised by DuPont Capital Management Corporation |

The Fund seeks long-term capital growth.

The Fund primarily invests in emerging markets equities. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards; these risks are magnified for investments in emerging markets. The value of the Fund is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Fund may incur losses due to incorrect assessments of investments by its investment advisers. Small and medium-sized companies often have greater price volatility and less liquidity than larger companies. Large cap companies may be unable to respond quickly to new competitive challenges and may not be able to attain a high growth rate.

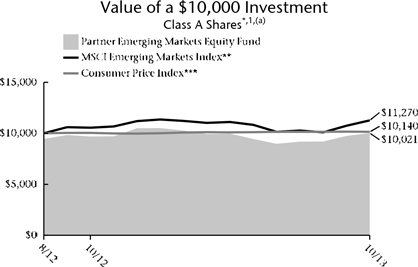

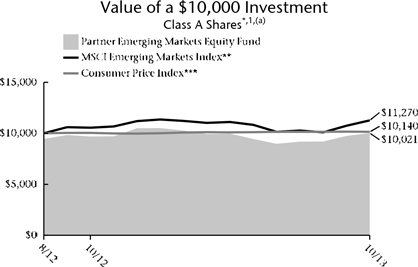

How did the Fund perform during the 12-month period ended October 31, 2013?

Thrivent Partner Emerging Markets Equity Fund earned a return of 3.26%, compared with the median return of its peer group, the Lipper Emerging Markets Funds category, of 6.90%. The Fund’s market benchmark, the MSCI Emerging Markets Index, earned a return of 6.90%.

What factors affected the Fund’s performance?

Over the past year, unfavorable relative performance was mostly derived from stock selection in Asia. Specifically, stock selection in China, Taiwan, Indonesia and Thailand detracted from relative performance. Stock selection was also unfavorable in South Africa.

Offsetting some of the underperformance in Asia was positive stock selection in Korea and India. Other countries with favorable stock selection included the Czech Republic, Panama, Poland and Mexico.

From a country allocation perspective, the overallocation to Korea and Poland benefited performance, while an underallocation to Taiwan detracted from results.

From a sector perspective, two sectors with stock selection that detracted from performance were energy and technology. In regards to sector allocation, an underallocation to technology and an overallocation to energy unfavorably impacted performance.

Stock selection within the financial sector was the strongest positive contributor to performance. This was mostly due to three Eastern European banks that performed well. In addition, an underallocation to banks in countries with high current account deficits helped performance within this sector.

Other sectors with positive stock selection were industrials and consumer discretionary.

What is your outlook?

We have a positive outlook for emerging markets equities as valuations appear attractive and the long-term drivers of growth remain in place. The MSCI Emerging Markets Index is currently valued at approximately 1.6 times book value and 10.6 times forward earnings expectations, and both measures look reasonable on a long-term basis. Given our long-term expected earnings growth rate of 7.5% and a current dividend yield of 2.6% for companies in the emerging markets index, the long-term expected return for emerging markets appears favorable.

Short-term market returns will likely be influenced by the outlook for global growth and the process in which developed market central banks, particularly the U.S. Federal Reserve, remove the extraordinary monetary stimulus measures taken since the onset of the global financial crisis.

In the near term, we expect global economies will continue to grow at a moderate pace and monetary stimulus will be cautiously withdrawn. If the environment shifts toward slower growth, our underallocation to the financial sector should help our relative performance.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

16

| | | | |

| Portfolio Composition | |

| (% of Portfolio) | |

Common Stock | | | 96.3 | % |

Preferred Stock | | | 2.0 | % |

Short-Term Investments | | | 1.7 | % |

| | | | |

Total | | | 100.0 | % |

| | | | |

| Major Market Sectors | |

| (% of Net Assets) | |

Financials | | | 26.5 | % |

Consumer Discretionary | | | 16.2 | % |

Materials | | | 16.0 | % |

Industrials | | | 12.5 | % |

Telecommunications Services | | | 10.8 | % |

Energy | | | 10.6 | % |

Information Technology | | | 3.9 | % |

Utilities | | | 1.5 | % |

Health Care | | | 0.4 | % |

| | | | |

| Top 10 Countries | |

| (% of Net Assets) | |

South Korea | | | 23.4 | % |

China | | | 8.3 | % |

South Africa | | | 6.7 | % |

Russia | | | 6.5 | % |

Hong Kong | | | 6.2 | % |

Poland | | | 6.1 | % |

Brazil | | | 5.5 | % |

Taiwan | | | 4.9 | % |

Indonesia | | | 4.3 | % |

United States | | | 4.1 | % |

Investments in securities in these countries represent 76.0% of the total net assets of the Fund.

Quoted Portfolio Composition, Major Market Sectors and Top 10 Countries are subject to change.

Portfolio Composition excludes collateral held for securities loaned.

The lists of Major Market Sectors and Top 10 Countries exclude short-term investments and collateral held for securities loaned.

Average Annual Total Returns1

As of October 31, 2013

| | | | | | | | |

Class A2 | | 1-Year | | | From

Inception

8/31/2012 | |

without sales charge | | | 3.26 | % | | | 5.16 | % |

with sales charge | | | -2.35 | % | | | 0.20 | % |

| | |

Institutional Class3 | | 1-Year | | | From

Inception

8/31/2012 | |

Net Asset Value | | | 3.65 | % | | | 5.50 | % |

1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end. |

2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

3 | Institutional Class shares have no sales load and are for institutional shareholders only. |

(a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

* | As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Barclays U.S. Aggregate Bond Index and the Consumer Price Index do not reflect any such charges. If you were to purchase any of the above individual securities represented in the Index, any charges you would pay would reduce your total return as well. |

** | The MSCI Emerging Markets Index is a modified capitalization-weighted index of selected emerging economies from around the world. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

*** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

17

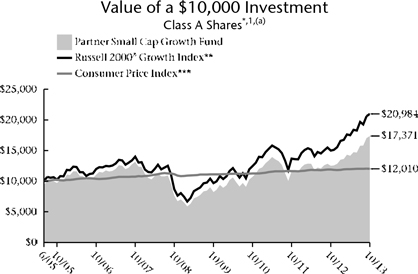

Thrivent Partner Small Cap Growth Fund

| | |

| | Subadvised by Turner Investments, L.P. The Fund seeks long-term growth of capital. The Fund primarily invests in securities of small companies. Smaller, less seasoned companies often have greater price volatility, lower trading volume, and less liquidity than larger, more established companies. The value of the Fund is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Fund may incur losses due to incorrect assessments of investments by its investment advisers. |

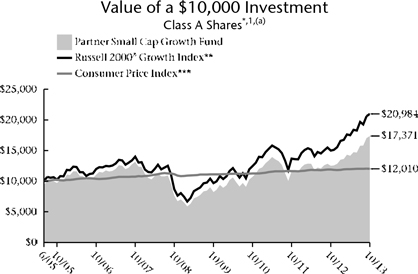

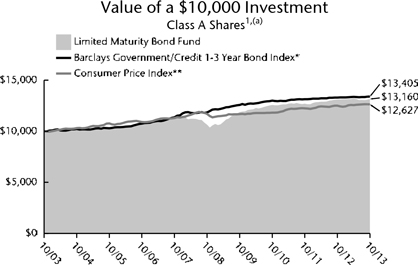

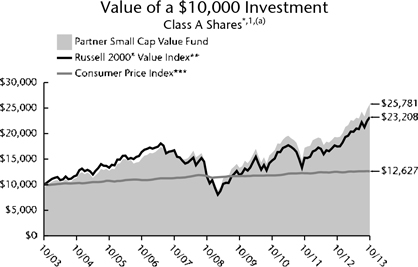

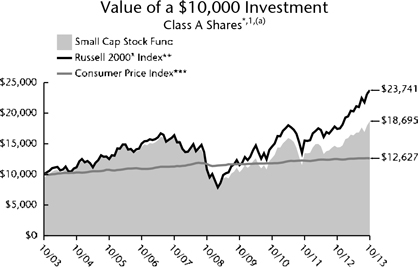

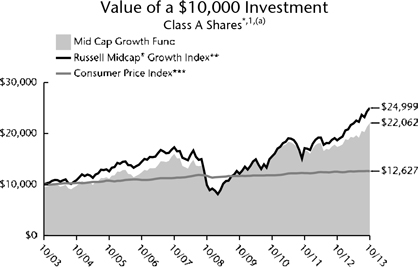

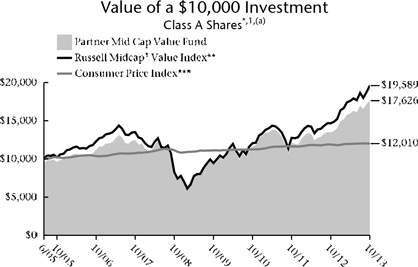

How did the Fund perform during the 12-month period ended October 31, 2013?