UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| | |

| 222 West Adams Street, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Michelle R. Seitz

William Blair Funds

222 West Adams Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: December 31, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

| Item 1. | December 31, 2010 Annual Reports transmitted to shareholders. |

ANNUAL REPORT

DECEMBER 31, 2010

Table of Contents

The views expressed in the commentary for each Fund reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The portfolio management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Statements involving predictions, assessments, analyses, or outlook for individual securities, industries, market sectors, and/or markets involve risks and uncertainties, and there is no guarantee they will come to pass.

This report is submitted for the general information of the shareholders of the William Blair Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a prospectus of the William Blair Funds. Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

December 31, 2010 | William Blair Funds 1 |

PERFORMANCE AS OF DECEMBER 31, 2010—CLASS N SHARES (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Yr. | | | 3 Yr. | | | 5 Yr. | | | 10 Yr

(or since

inception) | | | Inception

Date | | | Overall

Morningstar

Rating | |

Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 14.05 | | | | (0.38 | ) | | | 4.69 | | | | 1.62 | | | | 3/20/1946 | | |

| ««««

Among 1,504 Large Growth Funds |

|

Morningstar Large Growth | | | 15.53 | | | | (2.34 | ) | | | 2.77 | | | | 0.30 | | | | | | |

Russell 3000® Growth | | | 17.64 | | | | (0.26 | ) | | | 3.88 | | | | 0.30 | | | | | | |

Standard & Poor’s 500 | | | 15.06 | | | | (2.86 | ) | | | 2.29 | | | | 1.41 | | | | | | | | | |

| | | | | | |

Large Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 15.91 | | | | (1.71 | ) | | | 1.99 | | | | (1.67 | ) | | | 12/27/1999 | | |

| «««

Among 1,504 Large Growth Funds |

|

Morningstar Large Growth | | | 15.53 | | | | (2.34 | ) | | | 2.77 | | | | 0.30 | | | | | | |

Russell 1000® Growth | | | 16.71 | | | | (0.47 | ) | | | 3.75 | | | | 0.02 | | | | | | |

| | | | | | |

Small Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 16.16 | | | | 1.53 | | | | 3.17 | | | | 9.77 | | | | 12/27/1999 | | |

| «««

Among 670 Small Growth Funds |

|

Morningstar Small Growth | | | 26.98 | | | | 0.47 | | | | 4.24 | | | | 3.88 | | | | | | |

Russell 2000® Growth | | | 29.09 | | | | 2.18 | | | | 5.30 | | | | 3.78 | | | | | | |

Russell 2000® | | | 26.85 | | | | 2.22 | | | | 4.47 | | | | 6.33 | | | | | | | | | |

| | | | | | |

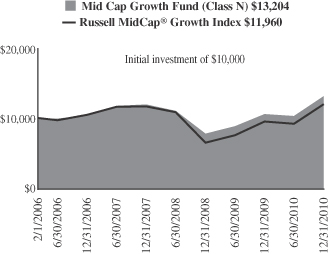

Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 24.01 | | | | 3.27 | | | | — | | | | 5.82 | | | | 2/1/2006 | | |

| ««««

Among 677 Mid-Cap Growth Funds |

|

Morningstar Mid-Cap Growth | | | 24.61 | | | | (0.48 | ) | | | — | | | | — | | | | | | |

Russell MidCap® Growth | | | 26.38 | | | | 0.97 | | | | — | | | | 3.70 | | | | | | |

| | | | | | |

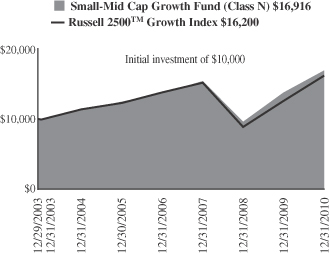

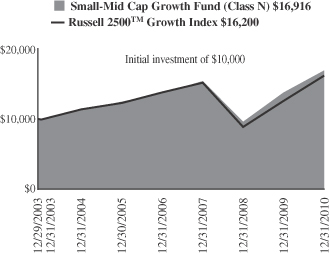

Small-Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 22.76 | | | | 3.21 | | | | 6.26 | | | | 7.79 | | | | 12/29/2003 | | |

| ««««

Among 677 Mid-Cap Growth Funds |

|

Morningstar Mid-Cap Growth | | | 24.61 | | | | (0.48 | ) | | | 4.58 | | | | — | | | | | | |

Russell 2500™ Growth | | | 28.86 | | | | 2.21 | | | | 5.63 | | | | 7.10 | | | | | | |

| | | | | | |

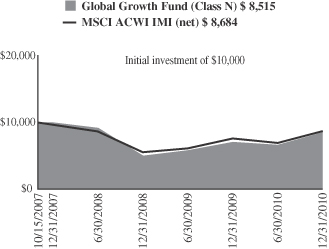

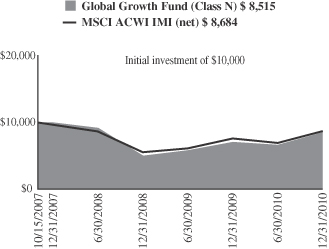

Global Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 20.52 | | | | (5.09 | ) | | | — | | | | (5.09 | ) | | | 10/15/2007 | | |

| ««

Among 628 World Stock Funds |

|

Morningstar World Stock | | | 13.74 | | | | (3.94 | ) | | | — | | | | — | | | | | | |

MSCI All Country World IMI (net) | | | 14.35 | | | | (3.48 | ) | | | — | | | | (4.59 | ) | | | | | |

| | | | | | |

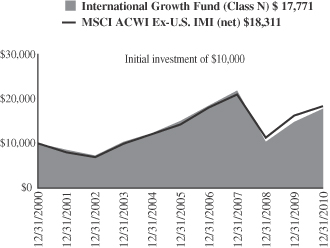

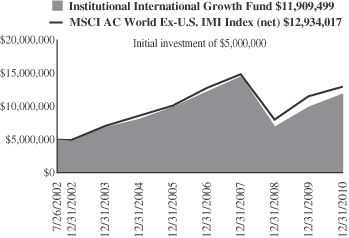

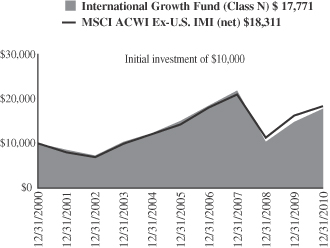

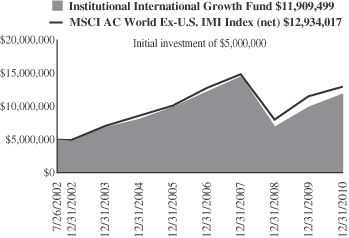

International Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 20.09 | | | | (6.61 | ) | | | 3.44 | | | | 5.92 | | | | 10/1/1992 | | |

| ««««

Among 209 Foreign Large Growth Funds |

|

Morningstar Foreign Large Growth | | | 14.78 | | | | (5.38 | ) | | | 4.14 | | | | 4.05 | | | | | | |

MSCI All Country World Ex-U.S. IMI (net) | | | 12.73 | | | | (4.38 | ) | | | 5.14 | | | | 6.24 | | | | | | |

| | | | | | |

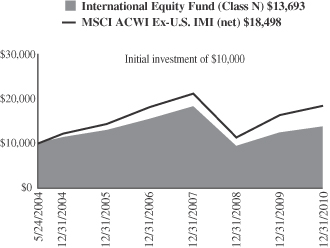

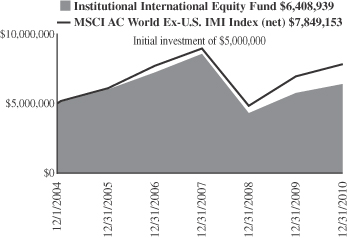

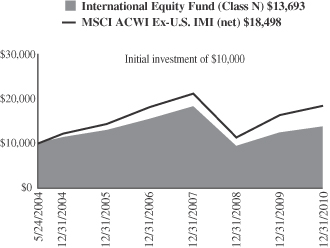

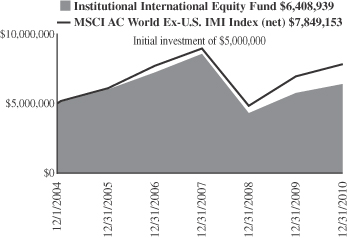

International Equity Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 10.92 | | | | (8.97 | ) | | | 1.26 | | | | 4.87 | | | | 5/24/2004 | | |

| ««

Among 209 Foreign Large Growth Funds |

|

Morningstar Foreign Large Growth | | | 14.78 | | | | (5.38 | ) | | | 4.14 | | | | — | | | | | | |

MSCI All Country World Ex-U.S. IMI (net) | | | 12.73 | | | | (4.38 | ) | | | 5.14 | | | | 9.72 | | | | | | |

| | | | | | |

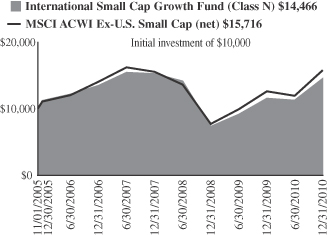

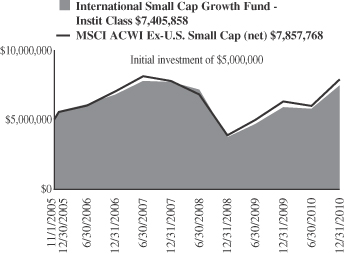

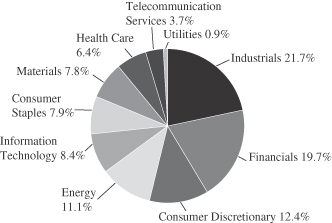

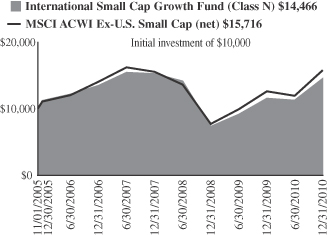

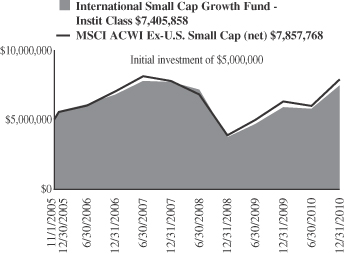

International Small Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 25.88 | | | | (1.60 | ) | | | 5.33 | | | | 7.41 | | | | 11/1/2005 | | |

| «««

Among 118 Foreign Small/Mid Growth Funds |

|

Morningstar Foreign Small/Mid Growth | | | 23.04 | | | | (2.88 | ) | | | 5.60 | | | | — | | | | | | |

MSCI All Country World Ex-U.S. Small Cap (net) | | | 25.21 | | | | 0.50 | | | | 7.36 | | | | 9.11 | | | | | | |

| | | | | | |

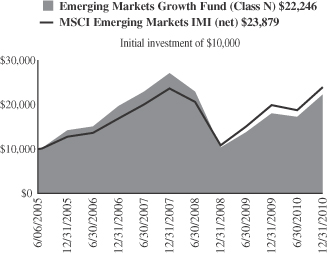

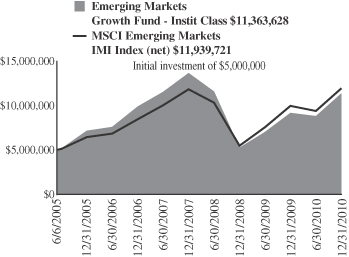

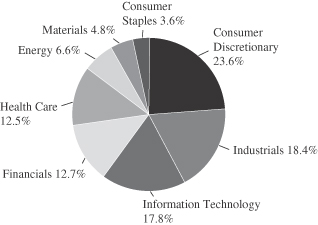

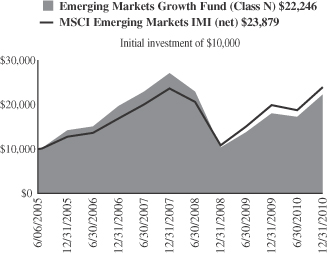

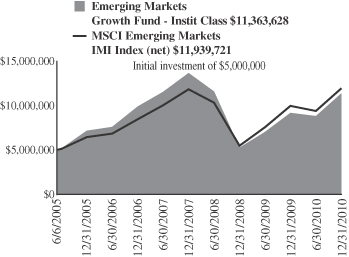

Emerging Markets Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 23.44 | | | | (6.33 | ) | | | 9.31 | | | | 15.43 | | | | 6/6/2005 | | |

| ««

Among 273 Diversified Emerging Markets Funds |

|

Morningstar Diversified Emerging Markets | | | 19.26 | | | | (2.11 | ) | | | 11.01 | | | | — | | | | | | |

MSCI Emerging Markets IMI (net) | | | 19.90 | | | | 0.35 | | | | 13.23 | | | | 16.84 | | | | | | |

Please see the next page for important disclosure information.

2 Annual Report | December 31, 2010 |

PERFORMANCE AS OF DECEMBER 31, 2010—CLASS N SHARES—CONTINUED (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Yr. | | | 3 Yr. | | | 5 Yr. | | | 10 Yr

(or since

inception) | | | Inception

Date | | | Overall

Morningstar

Rating | |

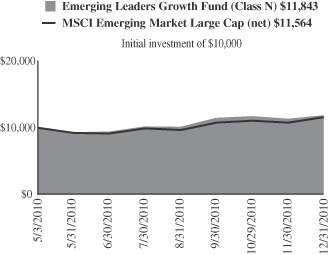

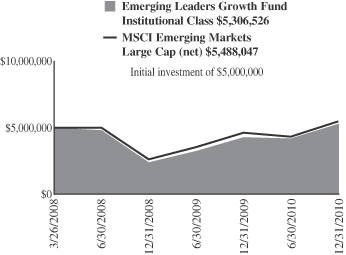

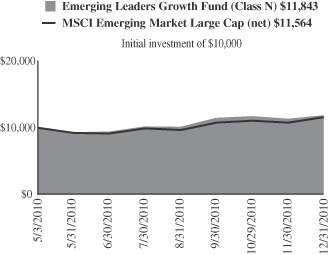

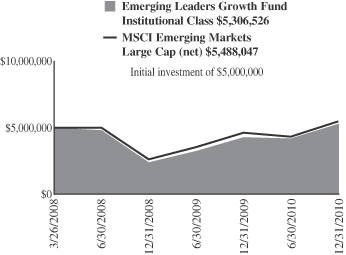

Emerging Leaders Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | — | | | | — | | | | — | | | | 18.43 | | | | 5/3/2010 | | | | Not rated. | |

MSCI Emerging Markets Large Cap Index (net) | | | — | | | | — | | | | — | | | | 15.64 | | | | | | |

| | | | | | |

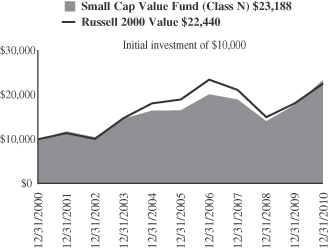

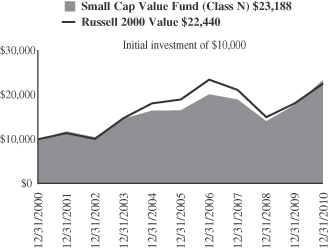

Small Cap Value Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 30.94 | | | | 7.02 | | | | 7.11 | | | | 8.77 | | | | 12/23/1996 | | |

| ««««

Among 307 Small Value Funds |

|

Morningstar Small Value | | | 26.17 | | | | 3.92 | | | | 4.22 | | | | 9.40 | | | | | | |

Russell 2000® Value | | | 24.50 | | | | 2.19 | | | | 3.52 | | | | 8.42 | | | | | | |

| | | | | | |

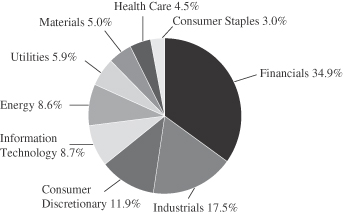

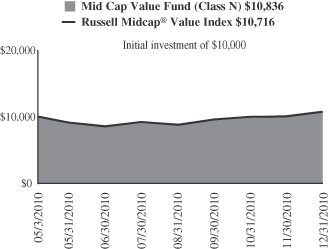

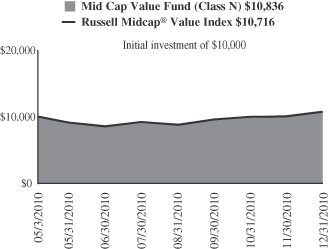

Mid Cap Value Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | — | | | | — | | | | — | | | | 8.36 | | | | 5/3/2010 | | | | Not rated. | |

Russell Midcap® Value | | | — | | | | — | | | | — | | | | 7.16 | | | | | | |

| | | | | | |

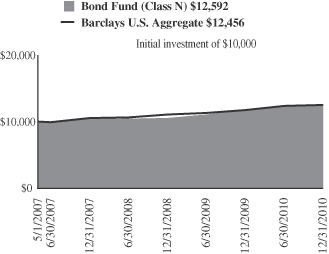

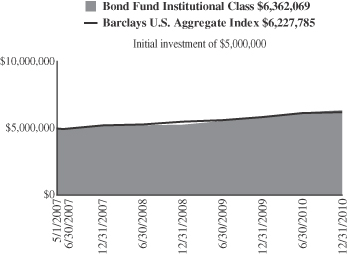

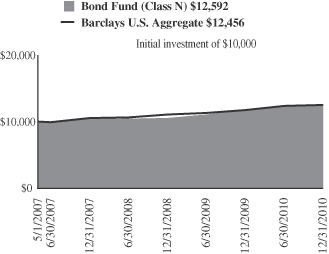

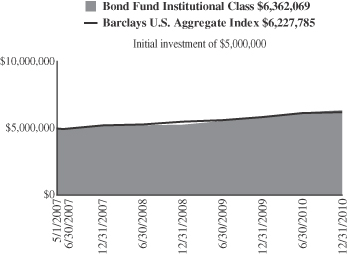

Bond Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 7.86 | | | | 6.80 | | | | — | | | | 6.48 | | | | 5/1/2007 | | |

| ««««

Among 1,026 Intermediate-Term Bond Funds |

|

Morningstar Intermediate-Term Bond | | | 7.72 | | | | 5.49 | | | | — | | | | — | | | | | | |

Barclays Capital U.S. Aggregate Bond Index | | | 6.54 | | | | 5.90 | | | | — | | | | 6.14 | | | | | | |

| | | | | | |

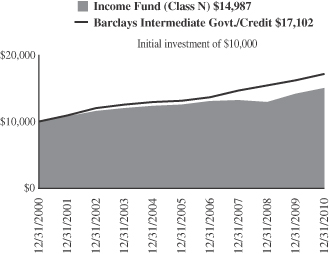

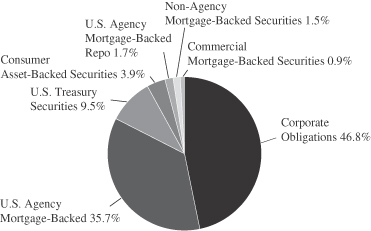

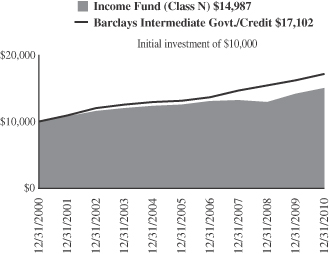

Income Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 6.04 | | | | 4.36 | | | | 3.67 | | | | 4.13 | | | | 10/1/1990 | | |

| ««

Among 1,026 Intermediate-Term Bond Funds |

|

Morningstar Short-term Bond | | | 7.72 | | | | 5.49 | | | | 5.15 | | | | 5.37 | | | | | | |

Barclays Capital Intermediate Govt./Credit

Bond Index | | | 5.89 | | | | 5.40 | | | | 5.53 | | | | 5.51 | | | | | | |

| | | | | | |

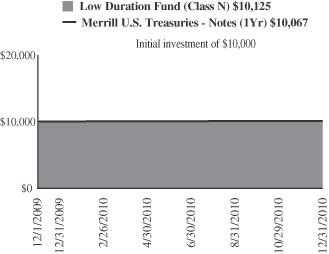

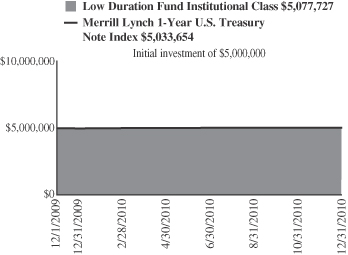

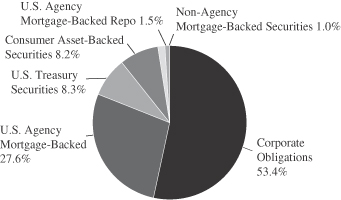

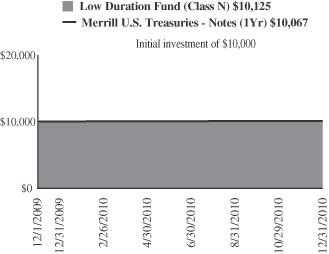

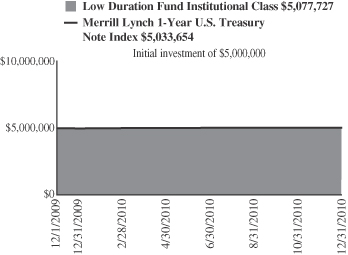

Low Duration Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class N | | | 1.86 | | | | — | | | | — | | | | 1.15 | | | | 12/1/2009 | | | | Not rated. | |

Morningstar Short-term Bond | | | 4.11 | | | | — | | | | — | | | | — | | | | | | | | | |

Merrill Lynch 1-Year U.S. Treasury Note Index | | | 0.83 | | | | — | | | | — | | | | 0.62 | | | | | | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or a loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, William Blair & Co. (the “Advisor”) may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. International and emerging markets investing involves special risk considerations, including currency fluctuations, lower liquidity, economic and political risk. As interest rates rise, bond prices will fall and bond funds may become more volatile. Class N shares are available to the general public without a sales load.

Morningstar RatingsTM are as of 12/31/2010 and are subject to change every month. The ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The 3/5/10 year Morningstar ratings were as follows: Growth Fund ««««/««««/««««, and Large Cap Growth Fund «««/«««/««, out of 1,504/1,286/787 large growth funds; Small Cap Growth Fund «««/««/««««, out of 670/563/341 small growth funds; Mid Cap Growth Fund ««««/NA/NA and Small-Mid Cap Growth Fund ««««/««««/NA out of 677/594/NA mid cap growth funds; Small Cap Value Fund ««««/««««/««« out of 307/241/135 small value funds; International Growth Fund ««««/«««/«««« and International Equity Fund ««/««/NA out of 209/162/89 foreign large growth funds; International Small Cap Growth Fund «««/«««/NA out of 118/97/NA foreign small/mid growth funds; Emerging Markets Growth Fund ««/««/NA out of 273/207/NA diversified emerging markets growth funds; Income Fund ««/««/« and Bond Fund ««««/NA/NA out of 1,026/878/560 intermediate-term bond funds; Global Growth Fund ««/NA/NA out of 628/NA/NA world stocks.

Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

December 31, 2010 | William Blair Funds 3 |

David C. Fording

John F. Jostrand

GROWTH FUND

The Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

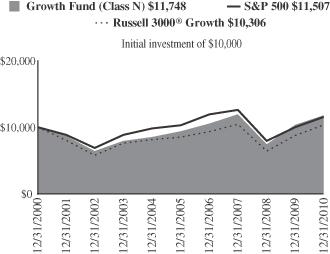

The Growth Fund increased 14.05% on a total return basis (Class N Shares) for the 12 months ended December 31, 2010. By comparison, the Fund’s benchmark, the Russell 3000® Growth Index, gained 17.64%.

While the Fund’s absolute return was strong, it lagged its benchmark, the Russell 3000® Growth Index, which returned 17.64%. While we are disappointed with these near-term results, the Fund has a strong performance record over the long-term; for the past five years, it returned 4.69% in comparison to the benchmark at 3.88%.

Several factors impacted the Fund’s performance in 2010. First, from a market perspective, macroeconomic forces dominated the psychology of the stock market throughout the year, leading to high stock correlations, making it more challenging for active managers. The pronounced shifts in sentiment, from macroeconomic forces, resulted in relatively high volatility, especially in the first half. More specifically through April, the equity market responded positively to continued signs of a U.S. economic recovery and stronger than expected corporate earnings reports on improved sales growth rather than expense control alone, which had been a big driver of 2009 earnings surprises. Beginning in late April, this trend reversed as equity markets sharply corrected given concerns over the sustainability of economic growth, European sovereign debt, and the possibility of a “double dip” recession. Since summer, while volatility has continued, the market’s direction was up on better-than-expected company earnings, positive economic reports, another round of quantitative easing, and extension of the Bush-era tax cuts. As a general theme, investors sought high confidence stocks with clear earnings visibility, and bid up past winners; this phenomenon was clearly displayed with select mid-cap Technology stocks, which had a powerful move. However, as we have discussed in the past, the Fund’s returns are primarily generated by stock selection. While there were headwinds due to macroeconomic drivers, volatility and momentum stocks, our main challenge was stock selection and cash drag (on average we held 3.0% cash).

The Fund’s weakest single stock was Baxter International Inc., a leading global diversified manufacturer of hospital supplies and medical equipment. We had a sizable position in this more defensive company, and it declined unexpectedly in the second quarter on a competitive pricing issue. As a result, it was sold from the portfolio. Also, in Health Care, CareFusion Corporation, a medical technology company, was challenged due to the unexpected departure announcements of senior executives as well a lower than expected revenues predominantly due to weakness in their respiratory franchise. We eliminated the stock due to management turnover which may cause a potential change in the strategy of the company. Lastly, our Consumer Discretionary positioning was a detractor. Strong results from Johnson Controls, Inc., P.F. Chang’s China Bistro, Inc., and Dick’s Sporting Goods, Inc. could not overcome losses from our positions in for-profit education stocks, DeVry, Inc. and Capella Education Co. These stocks did well in the first quarter, and we cut back our positions in the first half of the year. However, in the third quarter, there were unanticipated regulatory and legislative announcements; that caused uncertainty around future growth rates and profitability, causing both stocks to decline significantly. Heading into the fourth quarter, we believed that these issues were reflected in the stock prices. However, Capella Education’s stock price dropped further on lower enrollment growth that resulted from increased competition for its master’s programs, and some new pressure on education degrees given job prospects for teachers. As a result, we sold the stock in November. We continue to own DeVry, which we believe has attractive academic programs, provides a good value to students, and addresses significant education and training needs in the U.S. workforce. There should be clarity on the regulatory and legislative issues in the coming quarters.

4 Annual Report | December 31, 2010 |

The highest contributor to relative returns for the year was IHS, Inc., the leading global provider of critical technical information primarily to the energy industry; this Industrial firm benefited from accelerating subscription-based organic growth. In our view, the company should continue to see attractive earnings due to further cost rationalization, improved infrastructure with a common technology platform, as well as strategic acquisitions. Another strong performer in Industrials was TransDigm Group, Inc.—an aerospace and defense company. Its business benefited from the improving economy and increased airline miles flown; we expect this trend to continue. In Information Technology, we also had several stocks that stood out. McAfee, Inc., a provider of security software, rallied after it announced its acquisition by Intel. As a result of the acquisition, we sold this stock from the portfolio. Ultimate Software Group, Inc., the leading provider of on-demand payroll and human resources solutions, gained ground on continued momentum in both its Enterprise and Workplace divisions with new customer subscriptions, and add-on products. We expect this firm to continue to see attractive growth, high customer retention, and market share gains. Notably, we were underweight Information Technology for a good portion of the year due to rich earnings multiples, and high expectations for many stocks. Over the past several months, we have found several new opportunities in this sector. In order to fund these positions, in general, our Industrials exposure has come down; it remains an over-weighted sector as it has been all year, but to a lesser degree relative to the benchmark. We have reduced existing positions that have done well and eliminated others with less attractive risk/rewards, in our view.

Looking into 2011, we believe the U.S. economy will likely experience healthy growth as a result of a stabilized and improving macroeconomic environment. The Federal Reserve remains very accommodative with interest rates at all time lows and additional quantitative easing. This stance should assist asset prices, businesses, and ultimately, wages. Also, there is more certainty on high profile government-related issues; for example, the election results are complete with “balanced government” returning to Washington, tax cuts have been extended, and the health care and financial reform bills passed. All of these factors combined should give investors greater comfort with the sustainability of the U.S. economic recovery and the potential for continued economic expansion in 2011.

Despite the positive outlook for 2011, many risks to economic growth remain. The U.S. and other developed countries have significant (and growing) debt levels, European sovereign debt issues could resurface especially in Portugal, Ireland, Greece and Spain, and any plans for fiscal austerity may temper growth. Also, the U.S. consumer, while showing signs of life via increased spending in the second half of 2010, is likely to remain susceptible to swings in confidence until job growth returns in earnest or housing prices stabilize. With the potential for a large volume of foreclosed homes coming back onto the market in the first half of 2011, house prices in the U.S. could face further downward pressure. Any of these issues may flare up from time-to-time in 2011, and have the potential to create volatility, increase stock correlations (macroeconomic effects) in equity markets, and impact economic growth. However, as economic stability persists and the risks are better understood, the impact of any one issue should be less pronounced.

As we have discussed in the past, one of the bright spots remains the growth of emerging market countries especially China. Despite the effects of interest rate tightening to stem inflation, we believe China’s economic growth should continue to be attractive and a driving force along with other emerging countries behind the global economy. We will seek to take advantage of this growth through our investments in large, multinational companies in the portfolio. Another area of strength is U.S. corporations where strong, cash rich balance sheets remain. Capital spending cutbacks in recent years are unsustainable going forward in our view. We believe companies will increase their capital investments, dividend payouts, stock buybacks, and/or pursue acquisitions in 2011. We have begun to see corporations become more active recently (increasing employees and capital expenditures) due to improvements in order backlogs, increased consumer spending, and more clarity on the aforementioned legislative and regulatory issues.

December 31, 2010 | William Blair Funds 5 |

Going forward, given the broadening recovery, we believe macroeconomic influences will subside at the margin though inflation and rising interest rates are clear wildcards. This possibility, in combination with our expectations for a more stable growth backdrop, should favor stock pickers and our quality growth philosophy. As always, our focus will be on deep fundamental investment research in order to identify durable business franchises that can leverage their competitive advantages to sustain growth leadership in their respective industries. We feel confident the Fund is well positioned in quality firms that, in our view, can deliver on earnings growth expectations in any market environment.

6 Annual Report | December 31, 2010 |

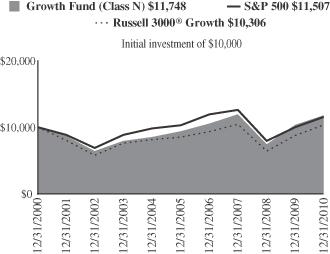

Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 12/31/2010

| | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | | 14.05 | % | | | (0.38 | )% | | | 4.69 | % | | | 1.62 | % |

Class I | | | 14.36 | | | | (0.05 | ) | | | 5.02 | | | | 1.91 | |

Russell 3000® Growth Index | | | 17.64 | | | | (0.26 | ) | | | 3.88 | | | | 0.30 | |

S&P 500 Index | | | 15.06 | | | | (2.86 | ) | | | 2.29 | | | | 1.41 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company L.L.C. without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on December 31, 2010. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

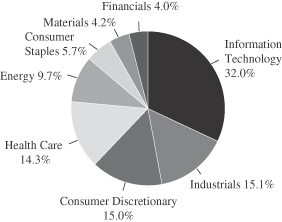

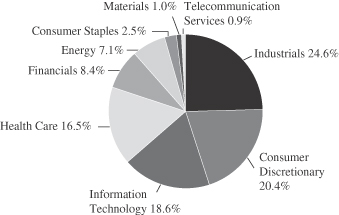

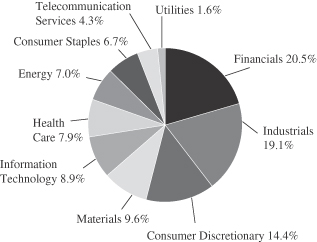

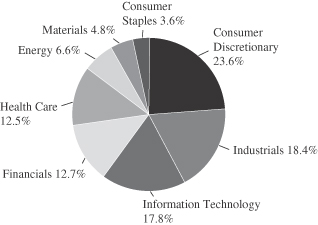

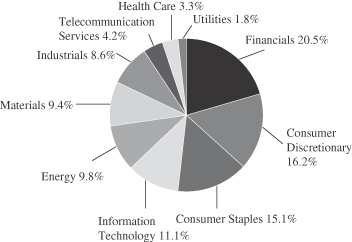

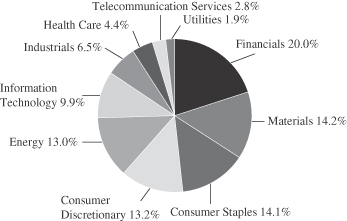

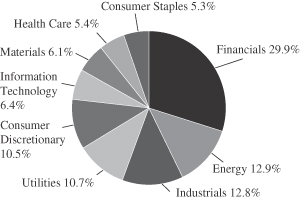

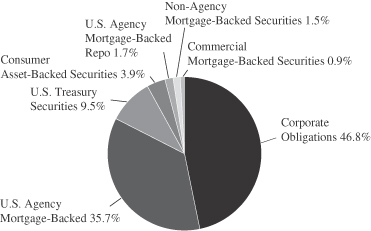

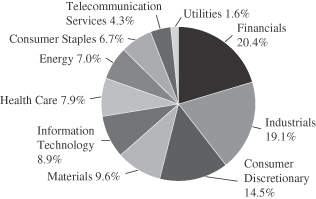

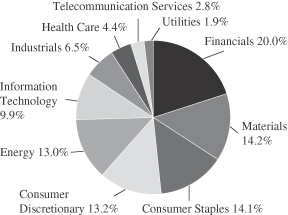

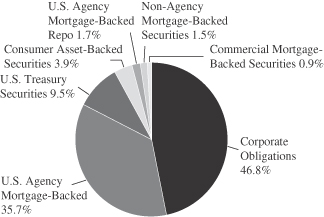

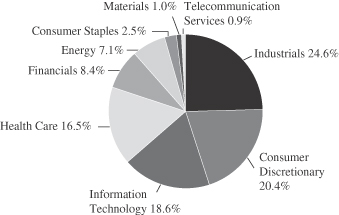

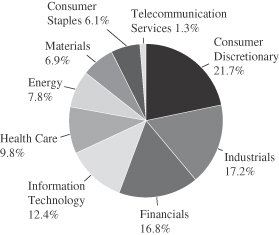

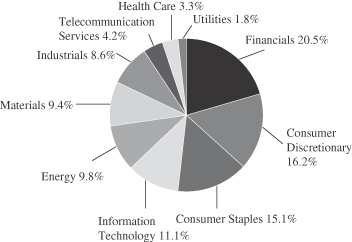

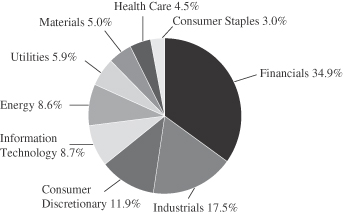

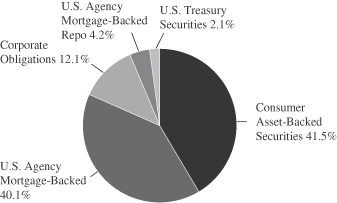

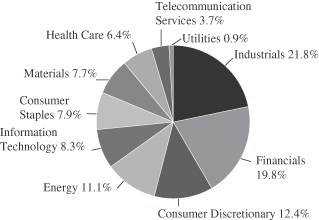

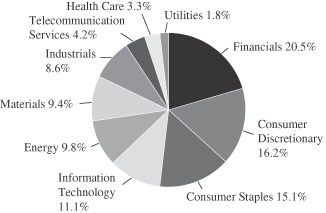

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

December 31, 2010 | William Blair Funds 7 |

Growth Fund

Portfolio of Investments, December 31, 2010 (all dollar amounts in thousands)

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

Information Technology—28.7% | | | | | | | | |

*Apple, Inc. | | | 77,685 | | | $ | 25,058 | |

*Atheros Communications, Inc. | | | 225,000 | | | | 8,082 | |

*Citrix Systems, Inc. | | | 41,800 | | | | 2,860 | |

*Dolby Laboratories, Inc. Class “A” | | | 78,800 | | �� | | 5,256 | |

*FLIR Systems, Inc. | | | 426,353 | | | | 12,684 | |

*Genpact, Ltd.† | | | 346,600 | | | | 5,268 | |

*Google, Inc. Class “A” | | | 29,405 | | | | 17,466 | |

Microsoft Corporation | | | 799,900 | | | | 22,333 | |

*Monolithic Power Systems, Inc. | | | 406,400 | | | | 6,714 | |

QUALCOMM, Inc. | | | 228,640 | | | | 11,315 | |

*Silicon Laboratories, Inc. | | | 278,640 | | | | 12,823 | |

Solera Holdings, Inc. | | | 136,000 | | | | 6,979 | |

*Trimble Navigation, Ltd. | | | 258,300 | | | | 10,314 | |

*Ultimate Software Group, Inc. | | | 191,650 | | | | 9,320 | |

VeriSign, Inc. | | | 268,900 | | | | 8,785 | |

| | | | | | | | |

| | | | | | | 165,257 | |

| | | | | | | | |

Industrials—13.6% | | | | | | | | |

Fastenal Co. | | | 144,929 | | | | 8,683 | |

Flowserve Corporation | | | 57,700 | | | | 6,879 | |

Goodrich Corporation | | | 82,900 | | | | 7,301 | |

*IHS, Inc. Class “A” | | | 132,420 | | | | 10,645 | |

*Jacobs Engineering Group, Inc. | | | 258,400 | | | | 11,847 | |

Manpower, Inc. | | | 140,000 | | | | 8,786 | |

The Corporate Executive Board Co. | | | 280,639 | | | | 10,538 | |

*TransDigm Group, Inc. | | | 127,980 | | | | 9,216 | |

*Trimas Corporation | | | 207,709 | | | | 4,250 | |

| | | | | | | | |

| | | | | | | 78,145 | |

| | | | | | | | |

Consumer Discretionary—13.4% | | | | | | | | |

DeVry, Inc. | | | 141,048 | | | | 6,768 | |

*Dick’s Sporting Goods, Inc. | | | 206,400 | | | | 7,740 | |

Johnson Controls, Inc. | | | 290,000 | | | | 11,078 | |

*K12, Inc. | | | 202,388 | | | | 5,801 | |

McDonald’s Corporation | | | 266,964 | | | | 20,492 | |

*Tempur-Pedic International, Inc. | | | 222,800 | | | | 8,925 | |

*Urban Outfitters, Inc. | | | 123,700 | | | | 4,430 | |

*Valassis Communications, Inc. | | | 375,500 | | | | 12,148 | |

| | | | | | | | |

| | | | | | | 77,382 | |

| | | | | | | | |

Health Care—12.9% | | | | | | | | |

*Align Technology, Inc. | | | 236,800 | | | | 4,627 | |

Allergan, Inc. | | | 135,100 | | | | 9,277 | |

*Celgene Corporation | | | 190,180 | | | | 11,247 | |

*Cerner Corporation | | | 71,500 | | | | 6,774 | |

*Gilead Sciences, Inc. | | | 185,335 | | | | 6,717 | |

*Haemonetics Corporation | | | 102,300 | | | | 6,463 | |

*IDEXX Laboratories, Inc. | | | 113,330 | | | | 7,845 | |

*Illumina, Inc. | | | 129,600 | | | | 8,209 | |

*MedAssets, Inc. | | | 348,682 | | | | 7,040 | |

*NxStage Medical, Inc. | | | 236,172 | | | | 5,876 | |

| | | | | | | | |

| | | | | | | 74,075 | |

| | | | | | | | |

* = Non-income producing securities

† = U.S. listed foreign security

| | | | | | | | |

Issuer | | Shares or

Principal

Amount | | | Value | |

| | |

Common Stocks—(continued) | | | | | | | | |

Energy—8.7% | | | | | | | | |

Apache Corporation | | | 93,665 | | | $ | 11,168 | |

*Cameron International Corporation | | | 163,547 | | | | 8,297 | |

Occidental Petroleum Corporation | | | 117,900 | | | | 11,566 | |

Schlumberger, Ltd.† | | | 144,900 | | | | 12,099 | |

*Weatherford International, Ltd.† | | | 298,700 | | | | 6,810 | |

| | | | | | | | |

| | | | | | | 49,940 | |

| | | | | | | | |

Consumer Staples—5.1% | | | | | | | | |

*Green Mountain Coffee Roasters, Inc. | | | 218,700 | | | | 7,187 | |

PepsiCo, Inc. | | | 340,400 | | | | 22,238 | |

| | | | | | | | |

| | | | | | | 29,425 | |

| | | | | | | | |

Materials—3.8% | | | | | | | | |

Ecolab, Inc. | | | 222,820 | | | | 11,234 | |

Praxair, Inc. | | | 74,365 | | | | 7,100 | |

*Stillwater Mining Co. | | | 170,200 | | | | 3,634 | |

| | | | | | | | |

| | | | | | | 21,968 | |

| | | | | | | | |

Financials—3.6% | | | | | | | | |

Greenhill & Co., Inc. | | | 91,600 | | | | 7,482 | |

*IntercontinentalExchange, Inc. | | | 69,400 | | | | 8,269 | |

The Charles Schwab Corporation | | | 292,175 | | | | 4,999 | |

| | | | | | | | |

| | | | | | | 20,750 | |

| | | | | | | | |

Total Common Stocks—89.8%

(cost $415,427) | | | | 516,942 | |

| | | | | | | | |

| | |

Repurchase Agreement | | | | | | | | |

Fixed Income Clearing Corporation, 0.150% dated 12/31/10, due 1/3/10, repurchase price $6,302, collateralized by FNMA, 1.050%, due 10/22/13 | | $ | 6,302 | | | | 6,302 | |

| | | | | | | | |

Total Repurchase Agreement—1.1%

(cost $6,302) | | | | 6,302 | |

| | | | | | | | |

Total Investments—90.9%

(cost $421,729) | | | | 523,244 | |

Cash and other assets, less liabilities—9.1% | | | | 52,369 | |

| | | | | | | | |

Net assets—100.0% | | | $ | 575,613 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

8 Annual Report | December 31, 2010 |

James S. Golan

Tracy McCormick

LARGE CAP GROWTH FUND

The Large Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

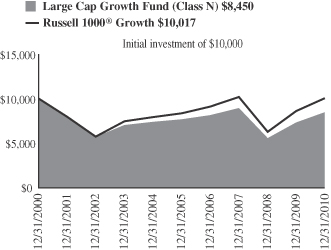

The Large Cap Growth Fund increased 15.91% on a total return basis (Class N Shares) for the year ended December 31, 2010. By comparison, the Fund’s benchmark, the Russell 1000® Growth Index, increased 16.71%.

Our quality growth portfolio of stocks kept up well, but trailed the robust performing market.

Several headwinds impacted the Fund’s performance in 2010. First, from a market perspective, macroeconomic forces dominated the psychology of the stock market throughout the year, leading to high stock correlations, making it more challenging for active managers. The pronounced shifts in sentiment resulted in relatively high volatility, especially in the first half. More specifically through April, the equity market responded positively to continued signs of a U.S. economic recovery and stronger than expected corporate earnings reports on improved sales growth rather than expense control alone, which had been a big driver of 2009 earnings surprises. Beginning in late April, this trend reversed as equity markets sharply corrected given concerns over the sustainability of economic growth, European sovereign debt, and the possibility of a “double dip” recession. Since summer, while volatility has continued, the market’s direction was up on better-than-expected company earnings, positive economic reports, another round of quantitative easing, and extension of the Bush-era tax cuts. As a result of uncertainty throughout the year and as a general theme, investors sought high confidence stocks with clear earnings visibility, and bid up past winners; this phenomenon was clearly displayed with select mid-cap Technology stocks, which had a powerful move. Furthermore, smaller-cap stocks continued their dominance in 2010 much like the previous year; small-cap stocks rose 29.09% while mid-cap stocks gained 26.38% as measured by the Russell 2000® Growth Index and Russell Mid Cap® Growth Index, respectively. Importantly, stock correlations subsided in the fourth quarter, which assisted stock pickers as company fundamentals mattered more than macro events. As a result, the Fund had a powerful fourth quarter return, and many of the stocks we held throughout the year were rewarded. However, these results could not overcome the relative weakness from earlier in the year. The Fund’s fourth quarter results were 13.88%; the Russell 1000® Growth returned 11.83%.

Our weakest single stock was Baxter International, Inc., where we had a sizable position in this more defensive company. It declined unexpectedly in the second quarter on a competitive pricing issue; we sold the position in May. Sectors that lagged for the year were Financials and Materials. Our Financial stock selection was weak due to CME Group, Inc., the largest futures exchange group in the U.S., as well as Invesco, Ltd., an investment manager. CME Group’s stock declined due to lower trading volumes in their interest rate futures business; we believe they should benefit from a pick-up in interest rate volatility and trading volume gains in other areas such as agriculture and energy. Invesco was sold from the portfolio in June on concerns about the Van Kampen acquisition and a weak net flow environment. In Materials, we had little exposure to more cyclical stocks such as those in Metals & Mining, which rallied in the second half of the year.

Our Industrials holdings were standouts in 2010. Our best overall portfolio contributor was Rockwell Automation, a leading global provider of industrial solutions. It benefited from a recovering economy and the original equipment manufacturers looking to reduce costs and enhance productivity. Another solid performer was W.W. Grainger, Inc., the largest wholesale supplier of facilities maintenance supplies and information in North America. It gained ground on strong revenues and operating margins. In our view, the company continues

December 31, 2010 | William Blair Funds 9 |

to execute well and should benefit from further economic recovery, expansion of products offered and efficiency programs. In general, our Industrial exposure was overweight relative to the benchmark for the year, which assisted results as it was one of the better performing sectors. Secondarily, our exposure to select Information Technology stocks was helpful as well. McAfee, Inc., a provider of security software, rallied after it announced its acquisition by Intel Corporation. As a result of the acquisition, this stock was sold from the portfolio. Broadcom Corporation also positively impacted results. Its stock price climbed on continued strength in its mobile and wireless segment as well as modest growth in the broadband and networking segments. We believe its earnings growth should be driven by continued market share gains and fiscal discipline. Notably, during the year, we reduced Information Technology names to below benchmark weight taking profits in stocks that had done well and exiting those where we felt there were better opportunities elsewhere. More recently, we have added several new companies with strong business models and sustainable earnings growth in our view. A few examples are Citrix Systems, Inc., Dolby Laboratories, Inc., and Trimble Navigation, Ltd.

Looking into 2011, we believe the U.S. economy will likely experience healthy growth as a result of a stabilized and improving macroeconomic environment. The Federal Reserve remains very accommodative with interest rates at all time lows and additional quantitative easing. This stance should assist asset prices, businesses, and ultimately, wages. Also, there is more certainty on high profile government-related issues; for example, the election results are complete with “balanced government” returning to Washington, tax cuts have been extended, and the health care and financial reform bills passed. All of these factors combined should give investors greater comfort with the sustainability of the U.S. economic recovery and the potential for continued economic expansion in 2011.

Despite the positive outlook for 2011, many risks to economic growth remain. The U.S. and other developed countries have significant (and growing) debt levels, European sovereign debt issues could resurface especially in Portugal, Ireland, Greece and Spain, and any plans for fiscal austerity may temper growth. Also, the U.S. consumer, while showing signs of life via increased spending in the second half of 2010, is likely to remain susceptible to swings in confidence until job growth returns in earnest or housing prices stabilize. With the potential for a large volume of foreclosed homes coming back onto the market in the first half of 2011, house prices in the U.S. could face further downward pressure. Any of these issues may flare up from time-to-time in 2011, and have the potential to create volatility, increase stock correlations (macroeconomic effects) in equity markets, and impact economic growth. However, as economic stability persists and the risks are better understood, the impact of any one issue should be less pronounced.

As we have discussed in the past, one of the bright spots in the global economy remains the growth of emerging market countries especially China. Despite the effects of interest rate tightening to stem inflation, we believe China’s economic growth should continue to be attractive and a driving force along with other emerging countries behind the global economy. We will seek to take advantage of this growth through our investments in large, multinational companies in the portfolio. Another area of strength is U.S. corporations where strong, cash rich balance sheets remain. Capital spending cutbacks in recent years are unsustainable going forward in our view. We believe companies will increase their capital investments, dividend payouts, stock buybacks, and/or pursue acquisitions in 2011. We have begun to see corporations become more active recently (increasing employees and capital expenditures) due to improvements in order backlogs, increased consumer spending, and more clarity on legislative and regulatory issues.

Going forward, given the broadening recovery, we believe macroeconomic influences will subside at the margin though inflation and rising interest rates are clear wildcards. This possibility, in combination with our expectations for a more stable growth backdrop, should favor stock pickers and our quality growth philosophy. As always, our focus will be on deep fundamental investment research in order to identify durable business franchises that can leverage their competitive advantages to sustain growth leadership in their respective industries. We feel confident the Fund is well positioned in quality firms that, in our view, can deliver on earnings growth expectations in any market environment.

10 Annual Report | December 31, 2010 |

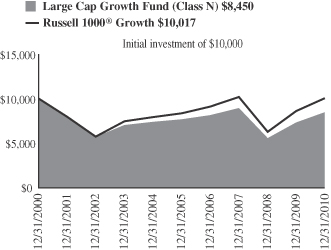

Large Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 12/31/2010

| | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | | 15.91 | % | | | (1.71 | )% | | | 1.99 | % | | | (1.67 | )% |

Class I | | | 16.03 | | | | (1.44 | ) | | | 2.21 | | | | (1.45 | ) |

Russell 1000® Growth Index | | | 16.71 | | | | (0.47 | ) | | | 3.75 | | | | 0.02 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large capitalization companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2010. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

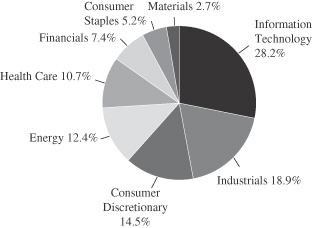

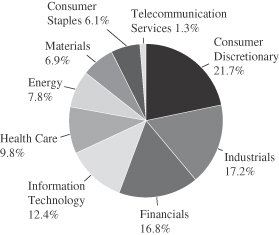

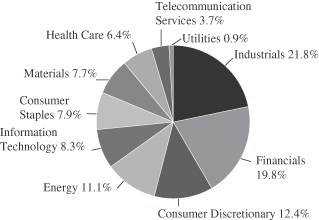

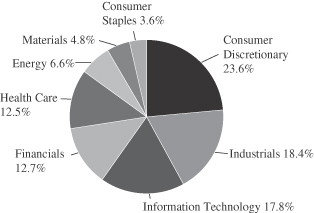

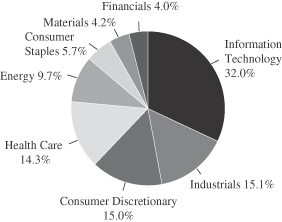

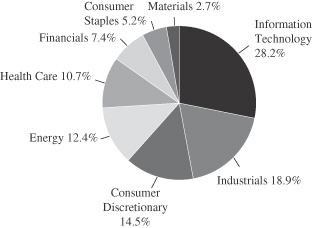

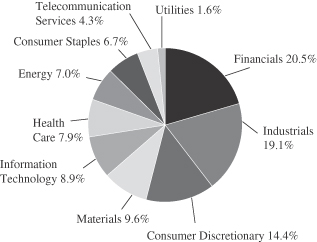

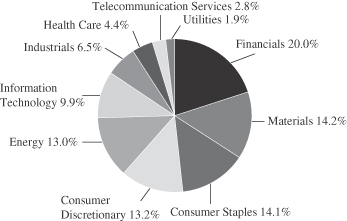

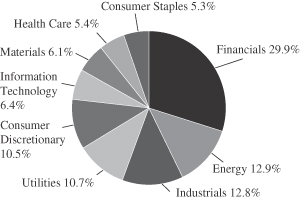

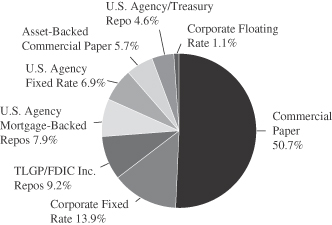

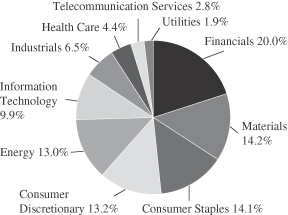

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

December 31, 2010 | William Blair Funds 11 |

Large Cap Growth Fund

Portfolio of Investments, December 31, 2010 (all dollar amounts in thousands)

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

Information Technology—27.7% | | | | | | | | |

*Apple, Inc. | | | 5,295 | | | $ | 1,708 | |

Broadcom Corporation Class “A” | | | 12,550 | | | | 547 | |

*Citrix Systems, Inc. | | | 8,850 | | | | 606 | |

*Dolby Laboratories, Inc. Class “A” | | | 5,750 | | | | 384 | |

*eBay, Inc. | | | 34,750 | | | | 967 | |

*EMC Corporation | | | 23,500 | | | | 538 | |

*Google, Inc. Class “A” | | | 2,238 | | | | 1,329 | |

Microsoft Corporation | | | 46,935 | | | | 1,310 | |

QUALCOMM, Inc. | | | 21,115 | | | | 1,045 | |

*Trimble Navigation, Ltd. | | | 11,450 | | | | 457 | |

| | | | | | | | |

| | | | | | | 8,891 | |

| | | | | | | | |

Industrials—18.6% | | | | | | | | |

CH Robinson Worldwide, Inc. | | | 4,400 | | | | 353 | |

Danaher Corporation | | | 12,744 | | | | 601 | |

Goodrich Corporation | | | 7,400 | | | | 652 | |

*Jacobs Engineering Group, Inc. | | | 7,400 | | | | 339 | |

Manpower, Inc. | | | 9,900 | | | | 621 | |

Rockwell Automation, Inc. | | | 11,050 | | | | 792 | |

Roper Industries, Inc. | | | 4,500 | | | | 344 | |

*Stericycle, Inc. | | | 8,100 | | | | 656 | |

United Parcel Service, Inc. Class “B” | | | 12,470 | | | | 905 | |

W.W. Grainger, Inc. | | | 4,980 | | | | 688 | |

| | | | | | | | |

| | | | | | | 5,951 | |

| | | | | | | | |

Consumer Discretionary—14.3% | | | | | | | | |

*Discovery Communications, Inc. | | | 15,500 | | | | 647 | |

Johnson Controls, Inc. | | | 23,700 | | | | 905 | |

McDonald’s Corporation | | | 8,335 | | | | 640 | |

NIKE, Inc. Class “B” | | | 7,250 | | | | 619 | |

*O’Reilly Automotive, Inc. | | | 8,980 | | | | 543 | |

Scripps Networks Interactive, Inc. Class “A” | | | 9,085 | | | | 470 | |

Yum! Brands, Inc. | | | 15,500 | | | | 760 | |

| | | | | | | | |

| | | | | | | 4,584 | |

| | | | | | | | |

Energy—12.2% | | | | | | | | |

Apache Corporation | | | 6,215 | | | | 741 | |

National Oilwell Varco, Inc. | | | 10,150 | | | | 683 | |

Occidental Petroleum Corporation | | | 10,850 | | | | 1,064 | |

Schlumberger, Ltd.† | | | 16,930 | | | | 1,414 | |

| | | | | | | | |

| | | | | | | 3,902 | |

| | | | | | | | |

Health Care—10.6% | | | | | | | | |

*Agilent Technologies, Inc. | | | 27,000 | | | | 1,119 | |

Allergan, Inc. | | | 6,865 | | | | 471 | |

*Celgene Corporation | | | 11,240 | | | | 665 | |

Covidien plc† | | | 12,250 | | | | 559 | |

*Illumina, Inc. | | | 9,000 | | | | 570 | |

| | | | | | | | |

| | | | | | | 3,384 | |

| | | | | | | | |

Financials—7.2% | | | | | | | | |

American Express Co. | | | 18,300 | | | | 785 | |

Ameriprise Financial, Inc. | | | 13,250 | | | | 763 | |

* = Non-income producing securities

† = U.S. listed foreign security

| | | | | | | | |

Issuer | | Shares or

Principal

Amount | | | Value | |

| | |

Common Stocks—(continued) | | | | | | | | |

Financials—(continued) | | | | | | | | |

CME Group, Inc. | | | 2,400 | | | $ | 772 | |

| | | | | | | | |

| | | | | | | 2,320 | |

| | | | | | | | |

Consumer Staples—5.1% | | | | | | | | |

Mead Johnson Nutrition Co. | | | 11,700 | | | | 728 | |

PepsiCo, Inc. | | | 13,750 | | | | 898 | |

| | | | | | | | |

| | | | | | | 1,626 | |

| | | | | | | | |

Materials—2.6% | | | | | | | | |

Praxair, Inc. | | | 8,725 | | | | 833 | |

| | | | | | | | |

Total Common Stocks—98.3%

(cost $23,564) | | | | 31,491 | |

| | | | | | | | |

| | |

Repurchase Agreement | | | | | | | | |

State Street Bank and Trust Company, 0.150% dated 12/31/10, due 1/3/11, repurchase price $375, collateralized by FHLMC, 0.172%, due 6/20/11 | | $ | 375 | | | | 375 | |

| | | | | | | | |

Total Repurchase Agreement—1.2%

(cost $375) | | | | 375 | |

| | | | | | | | |

Total Investments—99.5%

(cost $23,939) | | | | 31,866 | |

Cash and other assets, less liabilities—0.5% | | | | 169 | |

| | | | | | | | |

Net assets—100.0% | | | $ | 32,035 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

12 Annual Report | December 31, 2010 |

Michael P. Balkin

Karl W. Brewer

SMALL CAP GROWTH FUND

The Small Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

The Small Cap Growth Fund increased 16.16% on a total return basis (Class N shares) for the year ended December 31, 2010. By comparison the Fund’s benchmark, the Russell 2000® Growth Index, gained 29.09%.

The year started off as a continuation of 2009 with better-than-expected corporate earnings propelling stocks higher. Then, during the second quarter, European sovereign debt concerns and fears of a double-dip recession in the U.S. caused a steep mid-year correction. The selloff was short lived, however, as in late August the Federal Reserve signaled a second round of quantitative easing to help keep interest rates low and promote a more sustainable economic recovery. Improved investor sentiment was supported in part by stronger-than-expected retail sales that persisted into the holiday shopping season, U.S. industrial production data that proved better than many had expected at mid-year, and a more pro-business environment in Washington D.C. that emerged after the November elections. Strong growth in the emerging markets economies also boosted confidence in the reality of a global economic recovery.

From a sector perspective within the Russell 2000® Growth Index, Energy (+43.91%) and Information Technology (+36.54%) were the best performing sectors, with Consumer Discretionary (+32.22%), Industrials (+29.73%) and Materials (+33.47%) turning in impressive results for the year as well. Financials (+22.18%) and Consumer Staples (+23.50%) underperformed the broader small cap market, while Health Care (+16.78%) was the weakest sector during the year.

The Fund’s underperformance for 2010 was driven by style headwinds, industry factors and primarily stock selection. Although the Fund performed well in the first few months of the year and it stabilized in the last two months of the year, the five-month period from June through October witnessed dramatic underperformance. First of all, style headwinds—specifically both our contrarian bias and our smaller market cap bias—were most pronounced during this five-month period. The market favored momentum-oriented stocks and larger cap stocks during this period and our typical biases against these factors contributed to the underperformance. Second, although individual stock picks dictate our sector and industry weights, the Fund’s exposure to certain industries during 2010 detracted from performance. Real Estate Management & Development within Financials and Health Care Equipment & Supplies within Health Care were two such examples. Finally, negative stock selection was the primary contributor to the underperformance in 2010. The largest detractors from relative return came from the Consumer Discretionary and Information Technology sectors, while Telecommunication stock selection was a modest contributor.

During the fourth quarter specifically, the Fund’s underperformance can be explained by stock selection and industry factors. All of the quarter’s underperformance took place in October, with an improvement in November and December. Overweights to Health Care Equipment & Supplies and Diversified Consumer Services detracted during the quarter. From a stock selection perspective, certain holdings in Consumer Discretionary pulled down relative results while stock selection in Industrials, Information Technology and Materials partially offset the negative dynamics.

Detractors from return

Cenveo, Inc. (CVO) is a diversified printing company. The company’s portfolio of products include forms and labels manufacturing, packaging and publisher offerings, envelope

December 31, 2010 | William Blair Funds 13 |

production and commercial printing. Reason for underperformance: Irrational pricing by a weakened competitor in the envelopes business greatly impacted industry pricing, thereby reducing Cenveo’s revenues and earnings in the intermediate term. In addition, despite more recent signs of a recovery in the commercial printing industry, the industry has been weaker than expected coming out of the recession. Action: We maintain our position in the stock for a few reasons. First, the company announced an acquisition of MeadWestvaco’s envelopes business which should strengthen Cenveo’s leadership position in the industry. Second, the company announced an acquisition of a higher growth, niche, specialty packaging company which should complement Cenveo’s other higher growth, niche, specialty printing businesses. Third, new ownership of the weakened competitor discussed above has instituted more rational pricing and is reducing industry capacity aggressively. Finally, the valuation on the stock remains unjustifiably low.

Healthways, Inc. (HWAY) is a healthcare services firm that provides disease management solutions. The company’s services are implemented by managed care companies, governments, employers and hospitals in order to reduce both short- and long-term healthcare costs within their patient populations. Reason for underperformance: Lackluster employment data hurt investor sentiment as Healthways’ business model benefits as the employed base increases. In addition, new business decisions at prospective corporate clients have been lengthened given the uncertain economic environment. Finally, the healthcare reform bill has instilled further uncertainty given its potential impact on managed care, Healthways’ primary customer base. Action: We sold our position given these multiple headwinds and the lack of visibility into the company’s earnings over the intermediate term.

Princeton Review, Inc. (REVU) provides test preparation courses, tutoring services and various career-focused degree and vocational programs. Reason for underperformance: The sluggish economy reduced demand for the company’s core test preparation business. In general, some consumers decided not to take a test preparation course while others traded down from a longer (and more expensive) course to a shorter, more affordable one. In addition, the company expanded its balance sheet in 2009 to make an acquisition. This additional debt combined with slowing business dynamics caused a reduction in earnings throughout the year. Action: We continue to own a position in the stock as we believe Princeton Review is a leader in test preparation and tutoring services and earnings growth will reaccelerate once the macroeconomic backdrop improves. As well, we believe there is a good growth opportunity in its nascent career education partnerships with the National Labor College and several community colleges.

SurModics, Inc. (SRDX) provides surface modification and drug delivery technologies to the healthcare industry. The company develops relationships with many of the large medical device and pharmaceutical companies in order to create additional uses for its proprietary technologies. Reason for underperformance: Lackluster revenues and earnings which exacerbated ongoing investor concern that the company has not signed up another major partner to utilize its intellectual property. Action: We liquidated our position given the deterioration in fundamentals and lack of catalysts for meaningful reacceleration in its businesses.

VistaPrint N.V. (VPRT) is a worldwide provider of marketing and printing services to small business and home office customers via the internet. The company’s products include business cards, brochures, invitations, websites, and various types of marketing material. Reason for underperformance: Disappointing revenues announced in July raised concern among investors regarding long-term growth opportunities, especially given sub-par results from a then-recent television advertising campaign. Action: We sold our position given the uncertainty around customer acquisition costs and therefore the volatility of the company’s return on marketing investments.

Contributors to return

Air Methods Corporation (AIRM) is a leader in medical air transport. The company contracts with both hospitals and communities for emergency and non-emergency transport. Reason for

14 Annual Report | December 31, 2010 |

outperformance: Company fundamentals accelerated throughout 2010 in part due to growth in flight volumes, strong pricing and lower maintenance expense for its aircraft. Management also announced multiple price increases during the year with plans to continue regular increases in 2011. Action: We have trimmed our position on strength over the second half of 2010. However, we continue to own the stock as we believe the company’s pricing power is underappreciated and that future outsourcing of medical air transport by hospitals will increase in part due to implications of the health care reform bill.

MDC Partners, Inc. (MDCA), through its subsidiaries, provides marketing communications and consulting services primarily in the U.S., Canada, and Europe. Reason for outperformance: The company has strong business momentum from existing clients and new business wins alike, in part due to a general rebound in the advertising environment. In addition, investors have cheered the company’s investments in two growth-oriented areas of the advertising industry, social media and analytics. Action: We maintain a position as we believe this diversified marketing services firm is well-positioned for growth and that its stock is trading at an attractive valuation.

National Financial Partners Corporation (NFP) is a financial services firm that offers high net worth individuals and corporations a variety of financial services such as life insurance and wealth transfer, corporate and executive benefits, and investment advisory. Reason for outperformance: As a financial services company, the stock benefitted from improved investor sentiment and the rebound in capital markets. Also, company fundamentals improved during 2010, and the company strengthened its balance sheet and sold certain underperforming partner firms. Action: We maintain a position in the stock as we believe growth will continue to improve and the stock remains attractively valued.

Trinity Biotech plc (TRIB) develops, acquires, manufactures and markets medical diagnostic products for the clinical laboratory and point-of-care segments of the diagnostic market. Reason for outperformance: The company divested a slower growth business during the year which allowed it to strengthen its balance sheet and focus on the higher growth areas of its business. In addition, investors are anticipating a strong product pipeline over the next couple of years. Action: We added to our position early in the year but maintained our position on the rally during the second half of the year.

ValueClick, Inc. (VCLK) is a leading online marketing services firm. Reason for outperformance: Growth appears to be reaccelerating in part due to a recovery in the advertising environment generally, and a new ValueClick product more specifically. Many of ValueClick’s business lines have seen growth reaccelerate. Action: We trimmed our position on strength late in the year, but continue to hold a position as we believe growth will continue accelerating and the stock remains attractively valued.

Outlook

Looking ahead, almost universally, market strategists believe 2011 will produce a solid, yet more modest, equity market return in the U.S. Broadly speaking, corporate cash flow generation and profit margins generally are attractive due to effective expense management by U.S. companies. If the past is any indication, these dynamics should eventually entice capital spending and increased hiring by corporations. This would help alleviate one of the main concerns with this recovery, unemployment.

Risks to a full economic recovery loom, yet are well documented. Government budgets at every level are stretched. The extension of the Bush-era federal income tax rates and new payroll tax break, along with the extension of unemployment benefits, help consumers and businesses in the short run, but the long-run impact is yet unknown. The same can be said for the Federal Reserve’s second round of quantitative easing and its impact on longer-term inflation. Rapid growth in emerging economies poses two distinct risks as well: higher commodity price inflation and potentially negative effects from emerging governments’ efforts to combat overheating of their economies.

December 31, 2010 | William Blair Funds 15 |

In the end, however, while we factor various economic scenarios into our stock picking, we focus our time on constructing the Fund from a bottom-up perspective. As mentioned above, corporate fundamentals remain attractive. In combination with valuations that are broadly in line with long-term averages, the market outlook remains balanced. While macroeconomic data largely drove correlated stock prices again in 2010, we expect individual company fundamentals to be the leading determinant of forward stock price returns. In an environment where earnings growth will be less about cost cutting and more about organic revenue growth, investors are likely to seek companies which possess more internal growth drivers. Our philosophy of finding solid quality growth companies, which “control their own destiny” to a greater degree and are less dependent on overall economic growth, should benefit in such an environment. While we are disappointed with performance in 2010, we remain confident in our ability to create alpha over the long term. We continue to find good ideas across sectors, and are confident the Fund consists of great companies with solid competitive positions whose stocks are at attractive valuations compared to the growth, consistency and sustainability of their earnings.

16 Annual Report | December 31, 2010 |

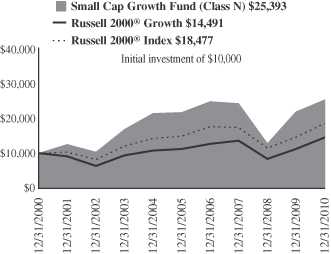

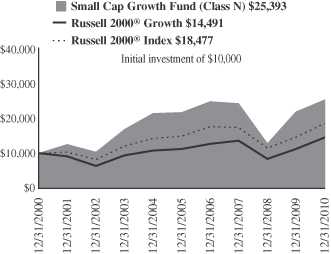

Small Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 12/31/2010

| | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | |

Class N | | | 16.16 | % | | | 1.53 | % | | | 3.17 | % | | | 9.77 | % |

Class I | | | 16.62 | | | | 1.86 | | | | 3.48 | | | | 10.07 | |

Russell 2000® Growth Index | | | 29.09 | | | | 2.18 | | | | 5.30 | | | | 3.78 | |

Russell 2000® Index | | | 26.85 | | | | 2.22 | | | | 4.47 | | | | 6.33 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. Smaller Capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2000® Growth Index consists of small-capitalization companies with above average price-to-book ratios and forecasted growth rates.

The Russell 2000® Index is an unmanaged composite of the smallest 2000 stocks of the Russell 3000® Index.

This report identifies the Fund’s investments on December 31, 2010. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

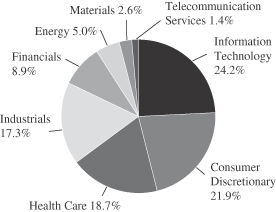

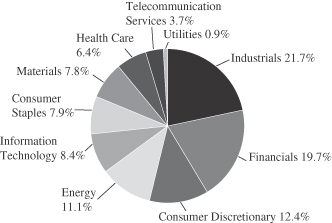

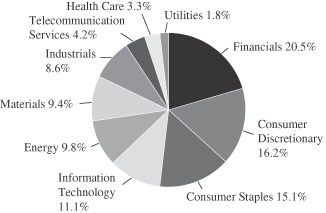

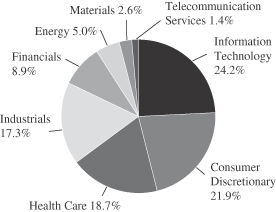

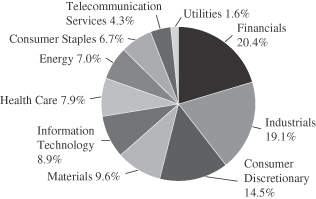

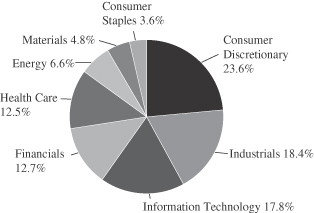

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

December 31, 2010 William Blair Funds 17 | |

Small Cap Growth Fund

Portfolio of Investments, December 31, 2010 (all dollar amounts in thousands)

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

Information Technology—23.3% | | | | | | | | |

*Atheros Communications, Inc. | | | 287,200 | | | $ | 10,316 | |

*Cavium Networks, Inc. | | | 266,200 | | | | 10,030 | |

iGate Corporation | | | 446,300 | | | | 8,797 | |

*Inuvo, Inc. | | | 861,747 | | | | 4,447 | |

*j2 Global Communications, Inc. | | | 717,948 | | | | 20,785 | |

*KIT Digital, Inc. | | | 664,700 | | | | 10,662 | |

*Lionbridge Technologies, Inc. | | | 1,123,516 | | | | 4,146 | |

*MaxLinear, Inc. Class “A” | | | 359,831 | | | | 3,872 | |

*Monolithic Power Systems, Inc. | | | 721,300 | | | | 11,916 | |

*RightNow Technologies, Inc. | | | 475,855 | | | | 11,263 | |

*Silicon Laboratories, Inc. | | | 468,577 | | | | 21,564 | |

Syntel, Inc. | | | 168,900 | | | | 8,072 | |

*TeleTech Holdings, Inc. | | | 880,500 | | | | 18,129 | |

*Ultimate Software Group, Inc. | | | 308,976 | | | | 15,025 | |

United Online, Inc. | | | 1,618,575 | | | | 10,683 | |

*ValueClick, Inc. | | | 1,559,040 | | | | 24,991 | |

*Vertro, Inc. | | | 847,343 | | | | 4,152 | |

*Volterra Semiconductor Corporation | | | 380,800 | | | | 8,819 | |

| | | | | | | | |

| | | | | | | 207,669 | |

| | | | | | | | |

Consumer Discretionary—21.1% | | | | | | | | |

*Amerigon, Inc. | | | 979,500 | | | | 10,657 | |

*Belo Corporation | | | 1,491,843 | | | | 10,562 | |

*Career Education Corporation | | | 862,926 | | | | 17,888 | |

*ChinaCast Education Corporation† | | | 1,425,139 | | | | 11,059 | |

*Dreams, Inc. | | | 3,285,457 | | | | 8,674 | |

*Duckwall-ALCO Stores, Inc. | | | 429,693 | | | | 5,414 | |

Gaiam, Inc. Class “A” | | | 1,050,272 | | | | 8,087 | |

*Grand Canyon Education, Inc. | | | 450,151 | | | | 8,818 | |

Jarden Corporation | | | 483,317 | | | | 14,920 | |

*Kona Grill, Inc. | | | 1,019,792 | | | | 4,181 | |

MDC Partners, Inc. Class “A”† | | | 858,030 | | | | 14,818 | |

*Office Depot, Inc. | | | 2,383,400 | | | | 12,870 | |

*Princeton Review, Inc. | | | 3,519,896 | | | | 4,154 | |

Strayer Education, Inc. | | | 85,095 | | | | 12,953 | |

*U.S. Auto Parts Network, Inc. | | | 1,448,391 | | | | 12,167 | |

*Valassis Communications, Inc. | | | 479,900 | | | | 15,525 | |

*Vitacost.com, Inc.§** | | | 554,359 | | | | 1,109 | |

*WMS Industries, Inc. | | | 317,200 | | | | 14,350 | |

| | | | | | | | |

| | | | | | | 188,206 | |

| | | | | | | | |

Health Care—18.0% | | | | | | | | |

*Air Methods Corporation | | | 318,723 | | | | 17,935 | |

*Align Technology, Inc. | | | 399,500 | | | | 7,806 | |

*American Medical Systems Holdings, Inc. | | | 112,164 | | | | 2,115 | |

*Brookdale Senior Living, Inc. | | | 570,700 | | | | 12,219 | |

*Haemonetics Corporation | | | 253,465 | | | | 16,014 | |

*Integra LifeSciences Holdings Corporation | | | 338,700 | | | | 16,021 | |

*Kensey Nash Corporation | | | 424,466 | | | | 11,813 | |

*MedAssets, Inc. | | | 594,621 | | | | 12,005 | |

*Natus Medical, Inc. | | | 726,900 | | | | 10,307 | |

*NxStage Medical, Inc. | | | 382,807 | | | | 9,524 | |

*Quidel Corporation | | | 856,346 | | | | 12,374 | |

*SXC Health Solutions Corporation† | | | 206,800 | | | | 8,864 | |

| | | | | | | | |

Issuer | | Shares | | | Value | |

| | |

Common Stocks—(continued) | | | | | | | | |

Health Care—(continued) | | | | | | | | |

*The Providence Service Corporation | | | 439,811 | | | $ | 7,068 | |

*Trinity Biotech plc—ADR | | | 1,903,563 | | | | 16,751 | |

| | | | | | | | |

| | | | | | | 160,816 | |

| | | | | | | | |

Industrials—16.7% | | | | | | | | |

*Cenveo, Inc. | | | 2,773,539 | | | | 14,811 | |

*Corrections Corporation of America | | | 261,527 | | | | 6,554 | |

*Dolan Media Co. | | | 1,199,958 | | | | 16,704 | |

*Franklin Covey Co. | | | 758,841 | | | | 6,518 | |

*GrafTech International, Ltd. | | | 826,600 | | | | 16,400 | |

Healthcare Services Group, Inc. | | | 498,720 | | | | 8,114 | |

*Huron Consulting Group, Inc. | | | 394,583 | | | | 10,437 | |

*ICF International, Inc. | | | 569,800 | | | | 14,655 | |

*On Assignment, Inc. | | | 2,248,382 | | | | 18,324 | |

*Polypore International, Inc. | | | 177,800 | | | | 7,242 | |

*TransDigm Group, Inc. | | | 184,414 | | | | 13,279 | |

*Trimas Corporation | | | 750,089 | | | | 15,347 | |

| | | | | | | | |

| | | | | | | 148,385 | |

| | | | | | | | |

Financials—7.7% | | | | | | | | |

*Cowen Group, Inc. | | | 1,814,117 | | | | 8,454 | |

*FirstService Corporation† | | | 570,071 | | | | 17,262 | |

*Grubb & Ellis Co. | | | 225,000 | | | | 286 | |

*Internet Capital Group, Inc. | | | 1,474,535 | | | | 20,968 | |

*Marlin Business Services Corporation | | | 718,870 | | | | 9,093 | |

*National Financial Partners Corporation | | | 906,856 | | | | 12,152 | |

*United Western Bancorp, Inc. | | | 2,290,015 | | | | 664 | |

| | | | | | | | |

| | | | | | | 68,879 | |

| | | | | | | | |

Energy—4.8% | | | | | | | | |

*Dresser-Rand Group, Inc. | | | 213,099 | | | | 9,076 | |

*Dril-Quip, Inc. | | | 111,300 | | | | 8,650 | |

*Goodrich Petroleum Corporation | | | 448,415 | | | | 7,910 | |

*Oil States International, Inc. | | | 263,400 | | | | 16,882 | |

| | | | | | | | |

| | | | | | | 42,518 | |

| | | | | | | | |

Materials—2.5% | | | | | | | | |

*Horsehead Holding Corporation | | | 1,026,860 | | | | 13,390 | |

*Stillwater Mining Co. | | | 423,800 | | | | 9,048 | |

| | | | | | | | |

| | | | | | | 22,438 | |

| | | | | | | | |

Telecommunication Services—1.3% | | | | | | | | |

*Cbeyond, Inc. | | | 760,831 | | | | 11,626 | |

| | | | | | | | |

Total Common Stocks—95.4%

(cost $718,251) | | | | 850,537 | |

| | | | | | | | |

| | |

Preferred Stock | | | | | | | | |

Grubb & Ellis Co.—144A, 12.00%§ | | | 83,121 | | | | 7,779 | |

| | | | | | | | |

Total Preferred Stock—0.9%

(cost $8,312) | | | | 7,779 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

18 Annual Report | December 31, 2010 |

Small Cap Growth Fund

Portfolio of Investments, December 31, 2010 (all dollar amounts in thousands)

| | | | | | | | |

Issuer | | Principal

Amount | | | Value | |

| | |

Repurchase Agreement | | | | | | | | |

State Street Bank and Trust Company, 0.150% dated 12/31/10, due 1/3/11, repurchase price $20,042, collateralized by FHLMC, 0.172%, due 6/20/11 and U.S. Treasury Notes, 2.500%-2.750%, due 4/30/15-12/31/17 | | $ | 20,042 | | | $ | 20,042 | |

| | | | | | | | |

Total Repurchase Agreement—2.2%

(cost $20,042) | | | | 20,042 | |

| | | | | | | | |

Total Investments—98.5%

(cost $746,605) | | | | 878,358 | |

Cash and other assets, less liabilities—1.5% | | | | 13,231 | |

| | | | | | | | |

Net assets—100.0% | | | $ | 891,589 | |

| | | | | | | | |

ADR = American Depository Receipt

* = Non-income producing securities

† = U.S. listed foreign security

§ = Deemed illiquid pursuant to Liquidity Procedures approved by the Board of Trustees. These holdings represent 1.00% of the net assets at December 31, 2010.

** = Fair valued pursuant to Valuation Procedures adopted by the Board of Trustees. This holding represents 0.12% of the net assets at December 31, 2010.

If the Fund’s portfolio holdings represent ownership of 5% or more of the voting securities of a company, the company is deemed to be an affiliate as defined in the Investment Company Act of 1940. The Small Cap Growth Fund had the following transactions during the period ended December 31, 2010 with companies deemed affiliated during the period or at December 31, 2010.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Share Activity | | | Year Ended

December 31, 2010 | |

| | | | | | | | | | | | | | | (in thousands) | |

Security Name | | Balance

12/31/2009 | | | Purchases | | | Sales | | | Balance

12/31/2010 | | | Value | | | Dividends

Included

in Income | |

CardioNet, Inc. | | | 1,344,381 | | | | 208,600 | | | | 1,552,981 | | | | — | | | $ | — | | | $ | — | |

DJSP Enterprises | | | — | | | | 788,419 | | | | 788,419 | | | | — | | | | — | | | | — | |

pDreams, Inc. | | | — | | | | 4,001,678 | | | | 716,221 | | | | 3,285,457 | | | | 8,674 | | | | — | |

pDuckwall-ALCO Stores, Inc. | | | 460,853 | | | | — | | | | 31,160 | | | | 429,693 | | | | 5,414 | | | | — | |

pGaiam, Inc. Class “A” | | | 1,511,007 | | | | 140,800 | | | | 601,535 | | | | 1,050,272 | | | | 8,087 | | | | 375 | |

pInuvo, Inc.* | | | 8,037,127 | | | | 776,634 | | | | 196,300 | | | | 861,747 | | | | 4,447 | | | | — | |

Kensey Nash Corporation | | | 422,340 | | | | 126,426 | | | | 124,300 | | | | 424,466 | | | | 11,813 | | | | — | |

pKona Grill, Inc. | | | 1,042,992 | | | | — | | | | 23,200 | | | | 1,019,792 | | | | 4,181 | | | | — | |

LCA-Vision Inc. | | | 948,955 | | | | 66,854 | | | | 1,015,809 | | | | — | | | | — | | | | — | |

Lionbridge Technologies, Inc. | | | 4,293,158 | | | | 553,800 | | | | 3,723,442 | | | | 1,123,516 | | | | 4,146 | | | | — | |

pMarlin Business Services Corporation | | | 988,701 | | | | — | | | | 269,831 | | | | 718,870 | | | | 9,093 | | | | — | |

pOn Assignment Inc. | | | 1,516,133 | | | | 1,293,264 | | | | 561,015 | | | | 2,248,382 | | | | 18,324 | | | | — | |

Overhill Farms, Inc. | | | 1,184,052 | | | | 53,900 | | | | 1,237,952 | | | | — | | | | — | | | | — | |

pPrinceton Review, Inc. | | | — | | | | 3,600,096 | | | | 80,200 | | | | 3,519,896 | | | | 4,154 | | | | — | |

pTrinity Biotech plc | | | 1,501,163 | | | | 486,500 | | | | 84,100 | | | | 1,903,563 | | | | 16,751 | | | | — | |

pUnited Western Bancorp, Inc. | | | 2,342,215 | | | | — | | | | 52,200 | | | | 2,290,015 | | | | 664 | | | | — | |

pVertro, Inc.** | | | 4,333,215 | | | | — | | | | 19,300 | | | | 847,343 | | | | 4,152 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 99,900 | | | $ | 375 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

*1 per 10 stock split on 12/13/2010.

**1 per 5 stock split on 8/18/2010.

p Affiliated company at December 31, 2010. The Small Cap Growth Fund’s total value in companies deemed to be affiliated at December 31, 2010 was $83,941 (thousands).

See accompanying Notes to Financial Statements.

December 31, 2010 William Blair Funds 19 | |

Robert C. Lanphier, IV

David P. Ricci

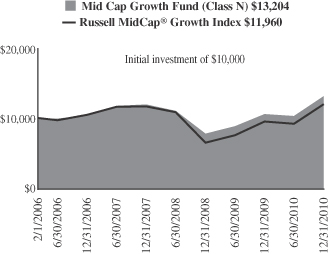

MID CAP GROWTH FUND

The Mid Cap Growth Fund seeks long-term capital appreciation.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

The Mid Cap Growth Fund posted a 24.01% increase on a total return basis (Class N Shares) for the year ended December 31, 2010. By comparison, the Fund’s benchmark, the Russell Midcap Growth® Index, gained 26.38% during the period.

The U.S. equity market produced its third best calendar year return in the last decade after staging an impressive four-month rally to close out 2010.

The year started off as a continuation of 2009 with better-than-expected corporate earnings propelling stocks higher. Then, during the second quarter, European sovereign debt concerns and fears of a double-dip recession in the U.S. caused a steep mid-year correction. The selloff was short lived, however, as in late August the Federal Reserve signaled a second round of quantitative easing to help keep interest rates low and promote a more sustainable economic recovery. Improved investor sentiment was supported in part by stronger-than-expected retail sales that persisted into the holiday shopping season, U.S. industrial production data that proved better than many had expected at mid-year and what appears to be a more pro-business environment in Washington D.C. after the November elections. Strong growth in the emerging economies also boosted confidence in the reality of a global economic recovery.

A resilient consumer propelled the Consumer Discretionary sector up 37.18%, leading all sectors during 2010. Industrials also performed well up 34.35% on the heels of positive industrial production data. While Energy was the best performing sector during the fourth quarter, it was a relative underperformer during 2010 as a whole, up only 16.04%. Health Care underperformed as well up 20.38%, as the sector lived up to its defensive-natured stereotype.

The Fund’s performance for 2010 was characterized by a headwind from its more conservative investment style (i.e. typical lower portfolio beta) being mostly offset by positive effects from its smaller-than-benchmark weighted average market capitalization, higher growth profile and stock selection. The effect of stock selection was somewhat mixed by sector as certain stocks in Industrials, Information Technology and Materials boosted relative performance while others in Health Care and Financials detracted from return.

Many of the same dynamics were at play during the fourth quarter’s narrow underperformance as well. The Fund’s typical lower beta was the main detractor given the quarter’s swift market rally. Consumer Discretionary, Information Technology and Industrials stock selection contributed positively to relative performance while certain stocks in Materials and Consumer Staples mitigated that benefit.

Detractors from return

American Medical Systems Holdings, Inc. (AMMD) designs and manufactures pelvic health solutions, including incontinence, and markets them to urologists, gynecologists and urogynecologists. Reason for underperformance: The stock was a large detractor for the year and the fourth quarter as surgical procedures across the healthcare industry continue to be depressed, especially for elective procedures such as many of American Medical Systems’ solutions. Action: We continue to hold the stock in the Fund as the long-term growth of these types of procedures is likely to be strong given an aging population. While some of the company’s solutions are elective, they are often critical to the patient’s way of life and are

20 Annual Report | December 31, 2010 |

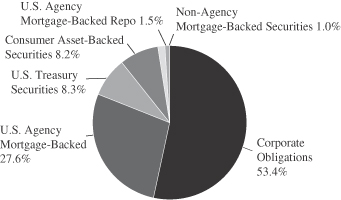

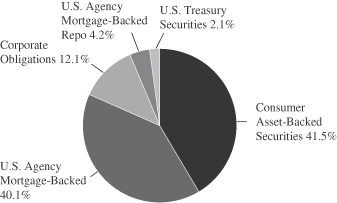

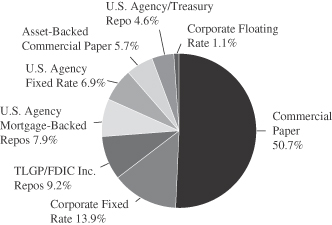

therefore usually just delayed rather than eliminated. In addition, the company increased its research and development spending over the past several years, contributing to an accelerated pace of new product introductions which should be most pronounced in 2011.