UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| | |

| 222 West Adams Street, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Michelle R. Seitz

William Blair Funds

222 West Adams Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: December 31, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

| Item 1. | December 31, 2008 Annual Reports transmitted to shareholders. |

Table of Contents

This report is submitted for the general information of the shareholders of the William Blair Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a prospectus of the William Blair Funds. Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

December 31, 2008 | William Blair Funds 1 |

PERFORMANCE AS OF DECEMBER 31, 2008—CLASS N SHARES (unaudited)

| | | | | | | | | | | | | | | | |

| | | 1 Yr. | | | 3 Yr. | | | 5 Yr. | | | 10 Yr

(or since

inception) | | | Inception

Date | | Overall

Morningstar

Rating |

Growth Fund | | | | | | | | | | | | | | 3/20/1946 | | ««««

Among 1,507 large growth Funds |

Class N | | (37.61 | ) | | (7.41 | ) | | (1.34 | ) | | (1.93 | ) | | | |

Morningstar Large Growth | | (40.67 | ) | | (10.28 | ) | | (3.37 | ) | | (2.46 | ) | | | |

Russell 3000® Growth | | (38.44 | ) | | (9.12 | ) | | (3.33 | ) | | (4.01 | ) | | | | |

Standard & Poor’s 500 | | (37.00 | ) | | (8.36 | ) | | (2.19 | ) | | (1.38 | ) | | | | |

| | | | | | |

Tax-Managed Growth Fund | | | | | | | | | | | | | | | | ««««

Among 1,507 large growth Funds |

Class N Return before Taxes | | (39.57 | ) | | (10.41 | ) | | (2.87 | ) | | (3.46 | ) | | 12/27/1999 | |

After Taxes on Distributions | | (39.57 | ) | | (10.41 | ) | | (2.87 | ) | | (3.46 | ) | | | |

After Taxes on distributions and Sale of Fund Shares | | (25.72 | ) | | (8.69 | ) | | (2.42 | ) | | (2.89 | ) | | | | |

Morningstar Large Growth | | (40.67 | ) | | (10.28 | ) | | (3.37 | ) | | — | | | | | |

Russell 3000® Growth | | (38.44 | ) | | (9.12 | ) | | (3.33 | ) | | (7.38 | ) | | | | |

| | | | | | |

Large Cap Growth Fund | | | | | | | | | | | | | | 12/27/1999 | | «««

Among 1,507 large growth Funds |

Class N | | (37.76 | ) | | (10.23 | ) | | (4.62 | ) | | (8.05 | ) | | | |

Morningstar Large Growth | | (40.67 | ) | | (10.28 | ) | | (3.37 | ) | | — | | | | |

Russell 1000® Growth | | (38.44 | ) | | (9.11 | ) | | (3.42 | ) | | (7.63 | ) | | | | |

| | | | | | |

Small Cap Growth Fund | | | | | | | | | | | | | | 12/27/1999 | | ««

Among 704 small growth Funds |

Class N | | (46.85 | ) | | (15.96 | ) | | (5.24 | ) | | 6.42 | | | | |

Morningstar Small Growth | | (41.55 | ) | | (11.35 | ) | | (3.52 | ) | | — | | | | |

Russell 2000® Growth | | (38.54 | ) | | (9.32 | ) | | (2.35 | ) | | (4.15 | ) | | | | |

Russell 2000® | | (33.79 | ) | | (8.29 | ) | | (0.93 | ) | | 1.64 | | | | | |

| The Small Cap Growth Fund’s Performance during 2000 was primarily attributable to investments in initial public offerings (IPOs) during a rising market. Since then, IPOs have had an insignificant effect on the Fund’s performance. | | | | | | | | |

| | | | | | |

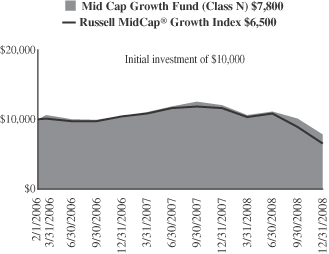

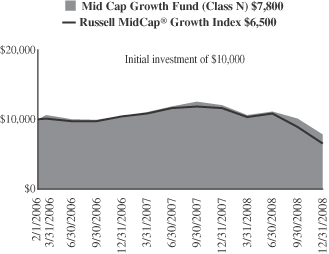

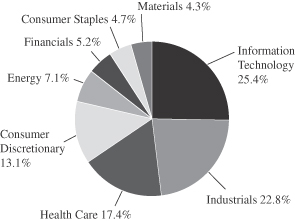

Mid Cap Growth Fund | | | | | | | | | | | | | | 2/1/2006 | | Not rated. |

Class N | | (34.71 | ) | | — | | | — | | | (8.04 | ) | | | | |

Morningstar Mid-Cap Growth | | (43.77 | ) | | — | | | — | | | — | | | | | |

Russell MidCap® Growth | | (44.32 | ) | | — | | | — | | | (13.84 | ) | | | | |

| | | | | | |

Small-Mid Cap Growth Fund | | | | | | | | | | | | | | 12/29/2003 | | ««««

Among 821 mid-cap growth funds |

Class N | | (37.71 | ) | | (8.44 | ) | | (0.72 | ) | | (0.84 | ) | | | |

Morningstar Mid-Cap Growth | | (43.77 | ) | | (10.92 | ) | | (2.44 | ) | | — | | | | |

Russell 2500™ Growth | | (41.50 | ) | | (10.36 | ) | | (2.24 | ) | | (2.35 | ) | | | | |

| | | | | | |

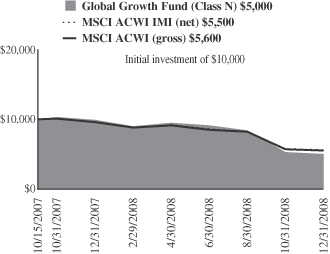

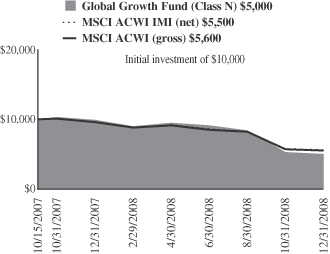

Global Growth Fund | | | | | | | | | | | | | | 10/15/2007 | | Not rated. |

Class N | | (49.52 | ) | | — | | | — | | | (43.43 | ) | | | | |

Morningstar World Stock | | (41.91 | ) | | — | | | — | | | — | | | | | |

MSCI All Country World IMI (net) | | (42.34 | ) | | — | | | — | | | (38.67 | ) | | | | |

MSCI All Country World (gross) | | (41.85 | ) | | — | | | — | | | (38.06 | ) | | | | |

| | | | | | |

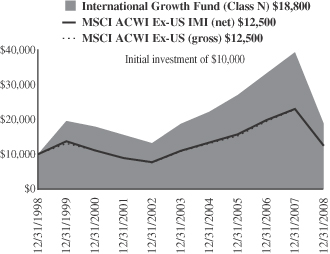

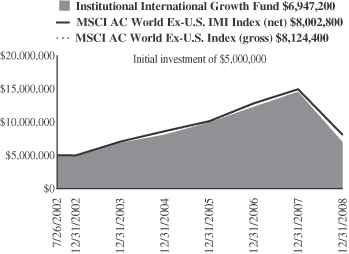

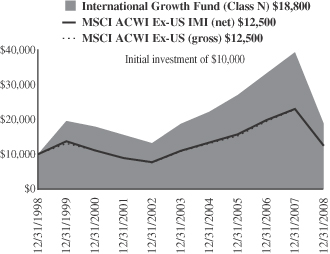

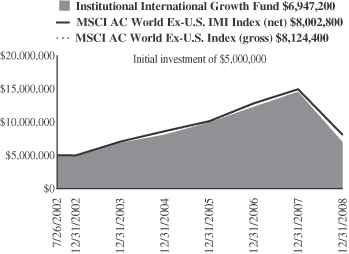

International Growth Fund | | | | | | | | | | | | | | 10/1/1992 | | ««««

Among 209 foreign large growth funds |

Class N | | (52.33 | ) | | (11.51 | ) | | (0.02 | ) | | 6.49 | | | | |

Morningstar Foreign Large Growth | | (46.56 | ) | | (8.21 | ) | | 0.61 | | | 0.66 | | | | |

MSCI All Country World Ex-U.S. IMI (net) | | (45.99 | ) | | (7.44 | ) | | 2.61 | | | 2.26 | | | | | |

MSCI All Country World Ex-U.S. (gross) | | (45.24 | ) | | (6.57 | ) | | 3.00 | | | 2.27 | | | | | |

| | | | | | |

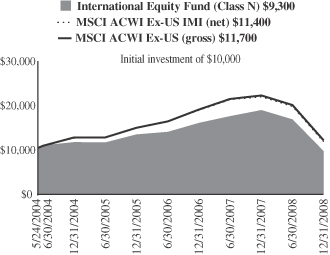

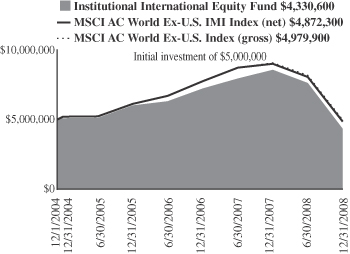

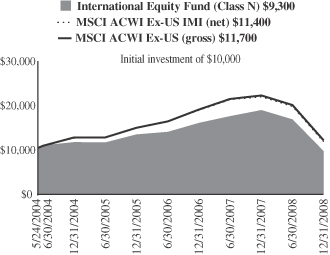

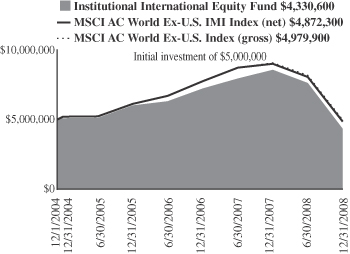

International Equity Fund | | | | | | | | | | | | | | 5/24/2004 | | «««

Among 209 foreign large growth funds |

Class N | | (48.75 | ) | | (10.23 | ) | | — | | | (1.55 | ) | | | |

Morningstar Foreign Large Growth | | (46.56 | ) | | (8.21 | ) | | — | | | — | | | | |

MSCI All Country World Ex-U.S. IMI (net) | | (45.99 | ) | | (7.44 | ) | | — | | | 2.91 | | | | | |

MSCI All Country World Ex-U.S. (gross) | | (45.24 | ) | | (6.57 | ) | | — | | | 3.42 | | | | | |

Please see the next page for important disclosure information.

2 Annual Report | December 31, 2008 |

PERFORMANCE AS OF DECEMBER 31, 2008—CLASS N SHARES—CONTINUED (unaudited)

| | | | | | | | | | | | | | | | |

| | | 1 Yr. | | | 3 Yr. | | | 5 Yr. | | | 10 Yr

(or since

inception) | | | Inception

Date | | Overall

Morningstar

Rating |

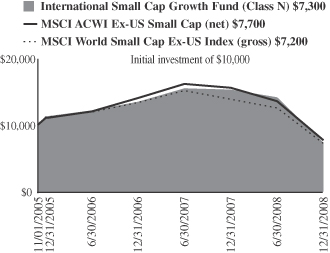

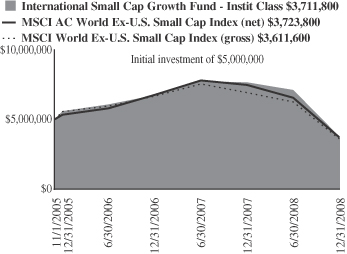

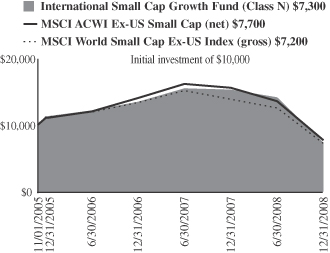

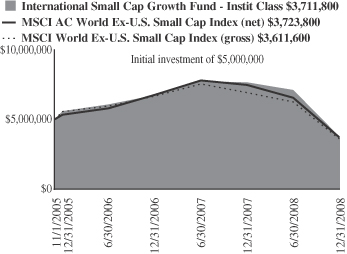

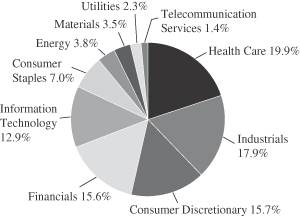

International Small Cap Growth Fund | | | | | | | | | | | | | | 11/1/2005 | | ««

Among 103 foreign small/mid growth funds |

Class N | | (51.82 | ) | | (13.13 | ) | | — | | | (9.37 | ) | | | |

Morningstar Foreign Small/Mid Growth | | (49.02 | ) | | (10.51 | ) | | — | | | — | | | | |

MSCI All Country World Small Cap Ex-U.S. (net) | | (50.23 | ) | | (11.29 | ) | | — | | | (7.91 | ) | | | |

MSCI World Small Cap Ex-U.S. (gross) | | (47.79 | ) | | (13.45 | ) | | — | | | (9.92 | ) | | | | |

| | | | | | |

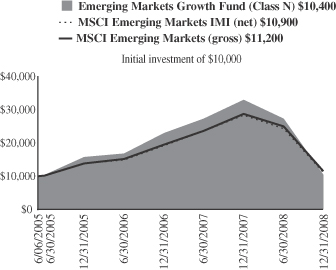

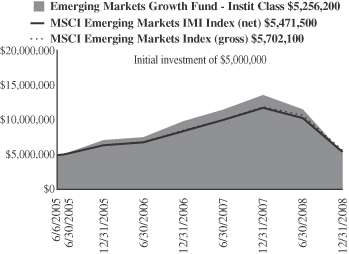

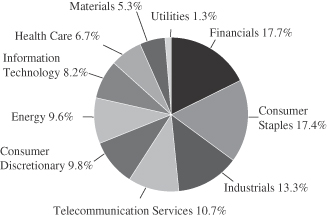

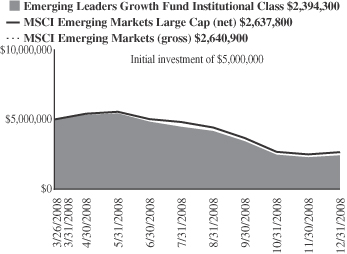

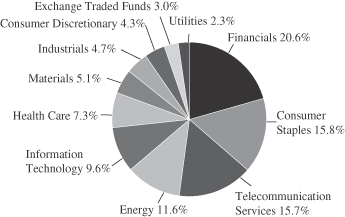

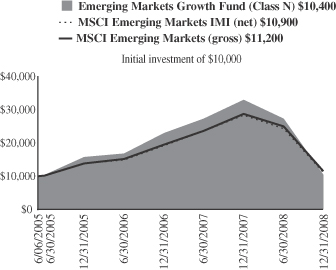

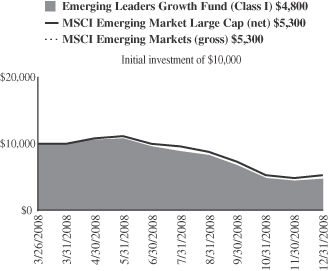

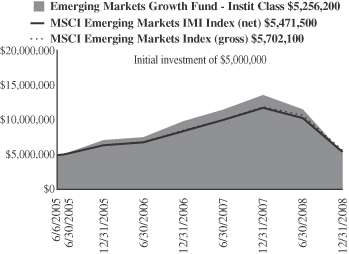

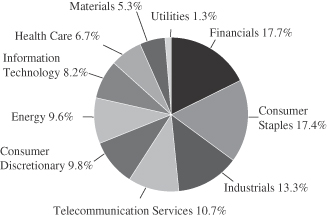

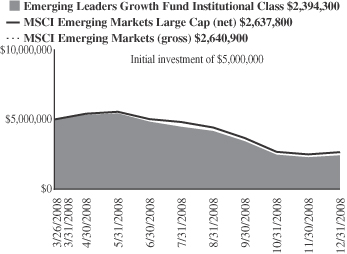

Emerging Markets Growth Fund | | | | | | | | | | | | | | 6/6/2005 | | «

Among 233 diversified emerging

market funds |

Class N | | (61.71 | ) | | (10.06 | ) | | — | | | 1.01 | | | | |

Morningstar Diversified Emerging Markets | | (54.44 | ) | | (6.38 | ) | | — | | | — | | | | |

MSCI Emerging Markets IMI (net) | | (53.78 | ) | | (5.22 | ) | | — | | | 2.54 | | | | |

MSCI Emerging Markets (gross) | | (53.18 | ) | | (4.62 | ) | | — | | | 3.25 | | | | | |

| | | | | | | | |

| | | | | | |

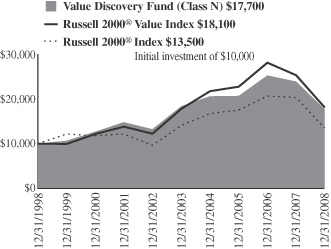

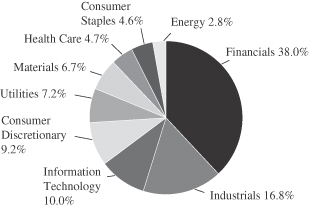

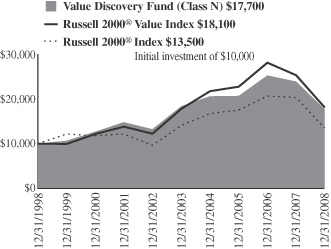

Value Discovery Fund | | | | | | | | | | | | | | 12/23/1996 | | «««

Among 341 small value funds |

Class N | | (25.85 | ) | | (5.16 | ) | | (0.80 | ) | | 5.87 | | | | |

Morningstar Small Value | | (32.24 | ) | | (9.63 | ) | | (0.97 | ) | | 5.51 | | | | |

Russell 2000® Value | | (28.92 | ) | | (7.49 | ) | | 0.27 | | | 6.11 | | | | | |

Russell 2000® | | (33.79 | ) | | (8.29 | ) | | (0.93 | ) | | 3.02 | | | | | |

| | | | | | |

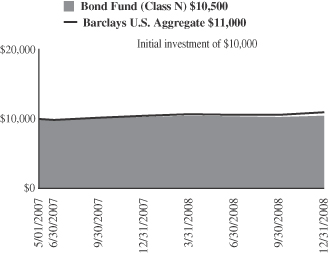

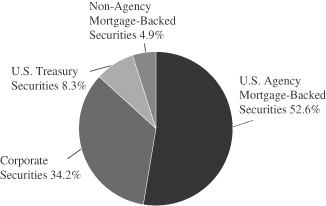

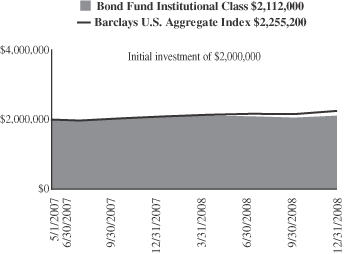

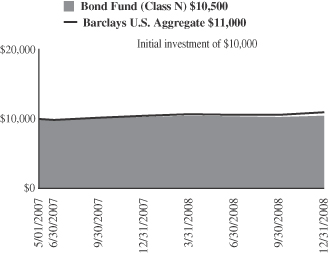

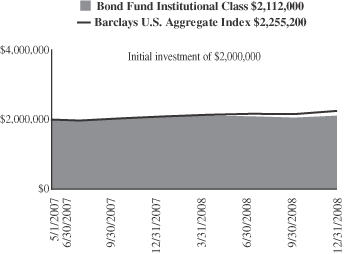

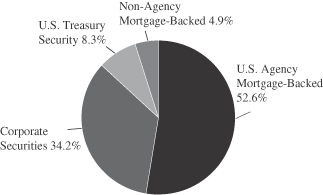

Bond Fund | | | | | | | | | | | | | | 5/1/2007 | | Not rated. |

Class N | | 1.64 | | | — | | | — | | | 3.00 | | | | | |

Morningstar Intermediate-Term Bond | | (4.70 | ) | | — | | | — | | | — | | | | | |

Barclays Capital U.S. Aggregate Bond Index | | 5.24 | | | — | | | — | | | 6.06 | | | | | |

| | | | | | |

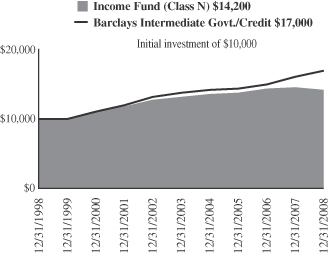

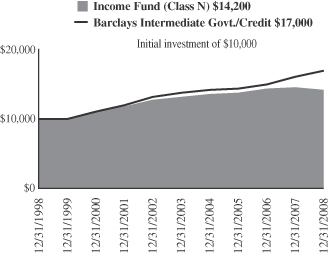

Income Fund | | | | | | | | | | | | | | 10/1/1990 | | «««

Among 375 short-term bond funds |

Class N | | (2.46 | ) | | 0.92 | | | 1.41 | | | 3.57 | | | | |

Morningstar Short-term Bond | | (4.23 | ) | | 0.96 | | | 1.23 | | | 3.38 | | | | |

Barclays Capital Intermediate Govt./Credit

Bond Index | | 5.08 | | | 5.50 | | | 4.21 | | | 5.42 | | | | | |

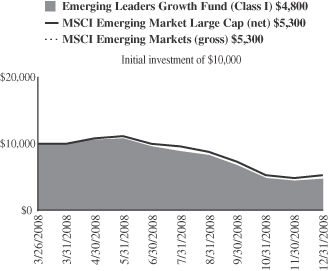

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or a loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. International and emerging markets investing involves special risk considerations, including currency fluctuations, lower liquidity, economic and political risk. As interest rates rise, bond prices will fall and bond funds become more volatile. Class N shares are available to the general public without a sales load. Emerging Leaders Growth Fund does not offer Class N shares.

Tax-Managed Growth Fund’s after-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class N and the after-tax returns for Class N shares will vary.

Morningstar Ratings TM are as of 12/31/2008 and are subject to change every month. The ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The 3/5/10 year Morningstar ratings were as follows: Growth Fund ««««/« «««/«««, Tax-Managed Growth Fund «««/«««« /NA, and Large Cap Growth Fund «««/««« /NA, out of 1,507/1,243/608 large growth funds; Small Cap Growth Fund ««/««/NA out of 704/574/NA small growth funds; Small-Mid Cap Growth Fund ««««/««««/NA out of 821/674/NA mid cap growth funds; Value Discovery Fund ««««/«««/««« out of 341/269/121 small value funds; International Growth Fund ««/««/«««««and International Equity Fund «««/NA/NA out of 209/164/80 foreign large growth funds; International Small Cap Growth Fund ««/NA/NA out of 103/NA/NA foreign small/mid growth funds; Emerging Markets Growth Fund «/NA/NA out of 233/NA/NA diversified emerging markets growth funds; Income Fund «««/«««/««« out of 375/318/164 short-term bond funds.

Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

December 31, 2008 | William Blair Funds 3 |

David C. Fording

John F. Jostrand

GROWTH FUND

The Growth Fund invests primarily in common stocks of domestic growth companies that the Advisor expects to have sustainable, above-average growth from one business cycle to the next.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the last year? How did the Fund’s performance compare to its benchmark and peers?

Under very difficult market conditions, the Growth Fund decreased (37.61)% on a total return basis (Class N Shares) for the 12 months ended December 31, 2008. The Fund held up better than its benchmark and Morningstar peer group for 2008. By comparison, the Fund’s benchmark, the Russell 3000 Growth® Index, declined (38.44)%, while the average return for funds in the Morningstar Large Growth peer funds dropped (40.67)%.

What were the most significant factors impacting Fund performance over the course of the year? What factors were behind the Fund’s performance versus the benchmark?

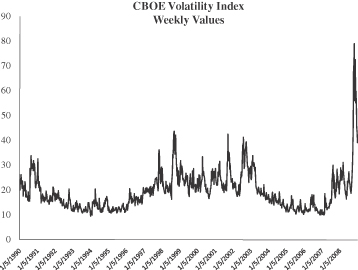

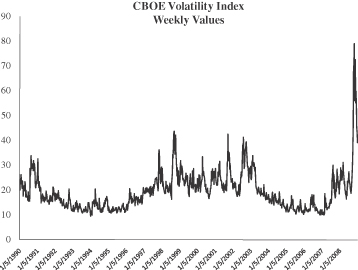

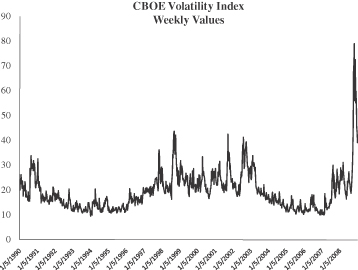

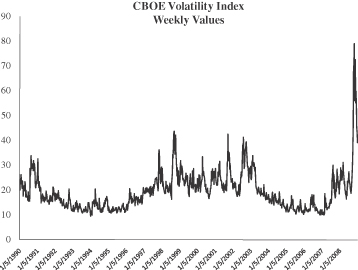

Looking back at 2008, it was an extremely challenging period with severe declines in equity markets and all time high levels of volatility. The Russell 3000® Growth Index had the worst annual decline since its inception in 1979. The broad U.S. market had its third worst annual return in its history—only superseded by two years in the 1930’s. A good portion of the significant retrenchment occurred in the fourth quarter, mostly in October, as the global financial crisis deepened after the demise of Lehman Brothers, investors priced in the prospect of a severe global growth slowdown, and uncertainty continued. The Russell 3000® Growth Index ended the fourth quarter down (23.15)%.

The financial system weakness continued to be focused on deleveraging and very tight credit markets, which caused significant duress for long standing financial institutions, corporations, and consumers. The weakness further manifested in domestic and global economic data with substantial declines in GDP, manufacturing, and industrial production. Corporate earnings have deteriorated too with significant revisions due to the global recession. The consumer also weakened further: unemployment reached 7.20%, credit card defaults rose, home prices dropped, and confidence fell to all time lows. In response, governments worldwide coordinated efforts to stimulate the global economy by reducing interest rates, and providing liquidity. In the U.S., the $700 billion Troubled Asset Relief Program (TARP) plan was passed, and the Federal Funds rate was lowered aggressively from 4.75% to 0.00-0.25%. With continued deterioration in economic data globally, there has been much debate over whether these stimulus initiatives have been enough to keep a significant slowdown at bay, or are focused on the right areas. While these discussions have caused near term confusion on the stimulus plan, there have been some modest signs of improvement with credit markets beginning to thaw as illustrated by lower high yield and Treasuries over Eurodollars (“TED”) spreads. Another positive in the overall global economy has been the decline in commodity prices, for example, oil dropped from all time highs of $145 to less than $40 per barrel. These declines have given a boost to consumers and corporations while also keeping inflation at bay.

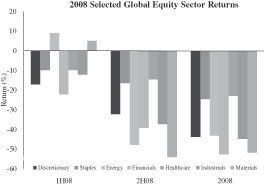

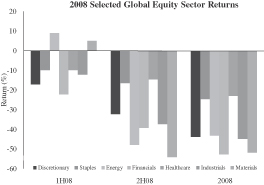

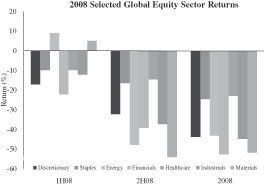

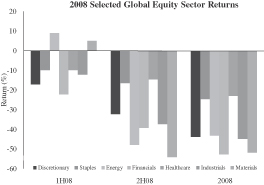

As equity markets fell during the year, risk aversion increased with investors flocking to more defensive groups universally. While all sectors were down in the Russell 3000® Growth Index, Consumer Staples and Health Care sectors held up best. Financial stocks were the worst performers as the credit crisis worsened around the globe. Also, investors shunned more cyclical sectors like Energy and Materials as global growth slowed. On a market capitalization basis within the growth segment, investors sought the stability of mega- and large-caps, which

4 Annual Report | December 31, 2008 |

held up relatively well. Small-cap stocks also held up well in comparison to the mid-cap group which fell further. Similarly, developed markets outperformed emerging markets. Lastly, growth modestly lagged value due to its energy exposure and higher technology weight.

What were among the best performing sectors for the Fund? Are there any specific investments you would like to highlight?

In general, the fund was assisted by our quality growth focus which typically does better when earnings growth becomes rare and clean balance sheets are rewarded a premium. More specifically for the year, our stock selection and overweighted positions in Health Care and Materials sectors helped. Within Health Care, our biotechnology exposure performed particularly well. Gilead Sciences, Inc., the leading provider of drugs to treat HIV, rose more than 10% on strong quarterly earnings reports. We believe that the drivers of HIV growth will continue with increased diagnosis, earlier treatment, and switches from a competitor drug due to safety issues. Another strong relative portfolio performer was Genentech, Inc., which gained greater than 20% due to a takeover bid by Roche for the remaining 44% of the firm’s shares that Roche doesn’t currently own, solid quarterly earnings reports, and the approval of Avastin in the treatment of metastatic breast cancer.

In the Materials sector, our exposure was concentrated in the chemicals industry. The best relative performer was Praxair, Inc., a producer and distributor of industrial gases, which held up well against other materials stocks as a result of attractive earnings reports during the year. More recently, this stock has come under pressure as the market has priced-in slowing global growth. While we continue to favor Praxair due to its robust project pipeline and high bid activity, it will likely be negatively impacted by macro events and we have modestly cut back the position. Secondarily, Ecolab, Inc., a recent addition to the portfolio, was also a contributor. It is a leading global manufacturer and marketer of premium cleaning, sanitizing, and pest elimination products and services for the hospitality, food service, healthcare and industrial markets. They have the leading market share position (12)% and should benefit from favorable secular growth drivers, for example, heightened environmental awareness and increasing government regulation, which increase demand for their products and services. Going forward, Ecolab stands to gain market share from competitors weakened by the financial crisis.

What were among the weakest performing sectors or groups for the Fund (or specific names that were disappointments)?

Although the Consumer Staples sector had the best relative returns in the benchmark as investors sought safety, it was the largest detractor from portfolio performance due to our substantial underweight. In our view, we believe there are better opportunities for earnings growth in other groups. As you might expect, we do not tactically hide in slow growers that the market favors in the short term, but rather seek intermediate to long term growers. While in the near term we have surrendered some performance, our long term results should benefit from our focus on quality companies that have above-market long term growth rates. We held three positions in consumer staples during the year: Wal-Mart de Mexico, Pepsi—which was sold in the first quarter on valuation and commodity cost concerns, and Smart Balance, Inc.—which was added in the fourth quarter.

In the Financial Sector, our stock selection was also a detractor. Our exposure to this group was in-line with the benchmark and primarily included exchanges and asset managers. We did not hold significant positions in those that were credit or interest rate sensitive. The weakest performer was Affiliated Managers Group, Inc., which declined on near term challenges such as heightened redemption activity and market depreciation, both of which lowers assets under management, revenues and earnings. We believe this stock has been oversold and that it continues to offer strong long term value. With a sustained market recovery, it is well positioned to gain inflows globally due to its attractive long-term investment performance and

December 31, 2008 | William Blair Funds 5 |

well diversified equity array. Additionally, IntercontinentalExchange, Inc. came under pressure over slowing volume growth and an increased competitive environment, especially from a potential CME/NYMEX merger. This stock was eliminated on these concerns.

Lastly, market cap exposure had a material impact on the portfolio. As you may recall from previous discussions, we have traditionally been underweighted in slower growing mega cap stocks, while more highly committed to mid- and small-cap stocks, which have more attractive growth profiles in our view. Since mega cap did relatively better than other groups, our underweight hurt results.

What is your current strategy? How is the Fund positioned?

Going forward, the global equity market outlook remains uncertain. Economic conditions are likely to deteriorate further with additional weakness in bellwether metrics such as GDP, unemployment, housing, and consumer confidence. The global policy response to this financial crisis has been aggressive and is at unprecedented levels, which is a bright spot. We would expect these proactive global monetary and fiscal actions to gradually begin to stem and then eventually help reverse the global economic slowdown. The U.S. should see improvement ahead of other developed and emerging countries since we began the stimulus program much earlier, for example, the first Federal Funds rate cut occurred 16 months ago in September 2007. In 2009, we anticipate continued contraction in U.S. economic growth in the first half followed by a slow growing second half based on the stimulus applied. We also expect the consumer to continue to repair their balance sheet and build up savings.

Improvement in several key areas will be critical to the market stabilization and recovery. Credit spreads need to narrow further indicating that investors are more comfortable with risk taking and governmental policy actions. As the credit markets loosen, volatility will likely recede and more normal market activity should return. Another area of concern is the U.S. housing market where a reversal in both the decline in prices and the rise in inventory is required to support consumers, and to help stave off the possibility of deeper losses in the banking sector. As discussed above, emerging countries have started to slow, but it will be vital to global economic growth to have the slowdown in emerging economies be short in duration. Additionally, positive trends in leading economic indicators should show the first signs of progress. We have yet to see these, but we are hopeful for some improvement later in the year.

Entering 2009 with continued uncertainty on the direction of the U.S. equity markets, we must take great care in portfolio positioning to strike a balance in light of possible mixed economic signals and potential earnings disappointments. Investors will be weighing the market levels relative to incremental economic data points and looking for news reports to be relatively less negative as a sign of economic improvement. With that said, there remains a risk of further market declines as investors potentially face more negative economic reports in the near term. In the long term, we do feel comfortable that the fiscal and monetary stimulus will ultimately help and that the U.S. should recover earlier in comparison to other countries. Earnings forecasts for the U.S. market have begun to come down aggressively, and may yet fall further in the coming months, but we believe a substantial portion of the bad news has been priced-in. In our view, valuations are generally attractive and with intra-sector valuation spreads at multi-year highs, this should provide a tremendous opportunity for stock pickers going forward.

As always, we continue to rely on our quality growth philosophy, process and discipline to see us through these difficult market times. We thank you for your patience and perseverance during this challenging market environment.

6 Annual Report | December 31, 2008 |

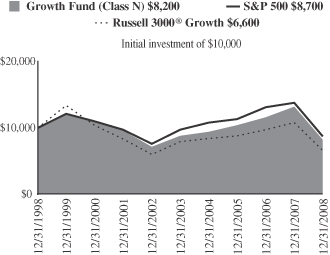

Growth Fund

Performance Highlights (unaudited)

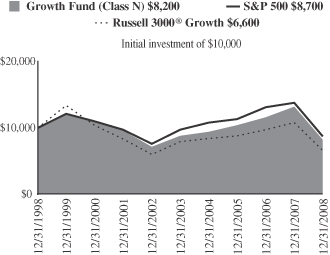

Average Annual Total Return at 12/31/2008

| | | | | | | | | | | | | | | |

| | | 1 Year | | | 3

Year | | | 5

Year | | | 10

Year | | | Since Inception | |

Growth Fund Class N | | (37.61 | )% | | (7.41 | )% | | (1.34 | )% | | (1.93 | )% | | — | % |

Growth Fund Class I | | (37.35 | ) | | (7.10 | ) | | (1.04 | ) | | — | | | (1.87 | )(a) |

Russell 3000® Growth Index | | (38.44 | ) | | (9.12 | ) | | (3.33 | ) | | (4.01 | ) | | (4.96 | )(a) |

S&P 500 Index | | (37.00 | ) | | (8.36 | ) | | (2.19 | ) | | (1.38 | ) | | (2.04 | )(a) |

| | (a) | | For the period from October 1, 1999 to December 31, 2008. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company L.L.C. without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on December 31, 2008. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

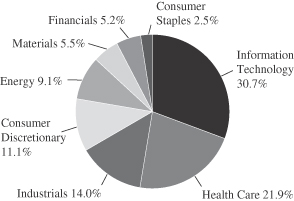

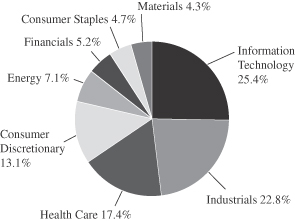

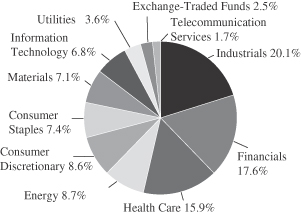

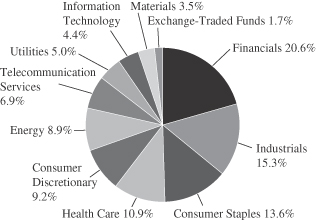

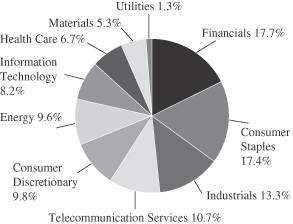

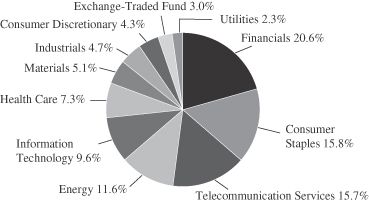

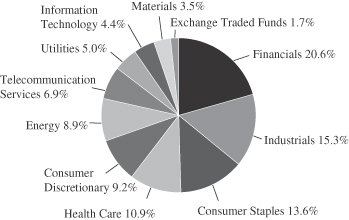

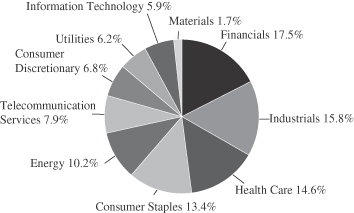

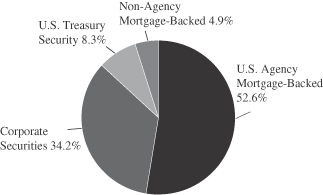

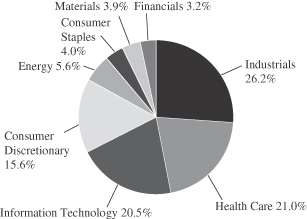

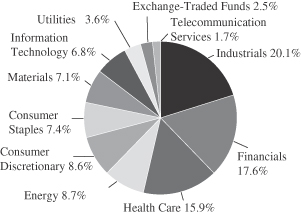

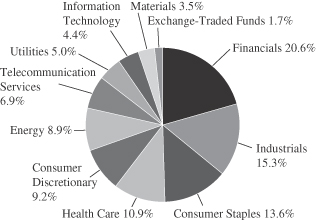

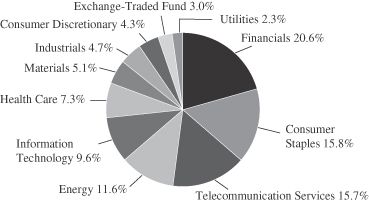

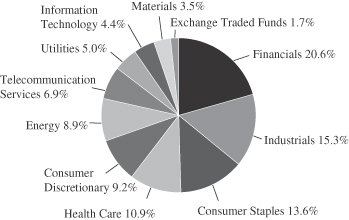

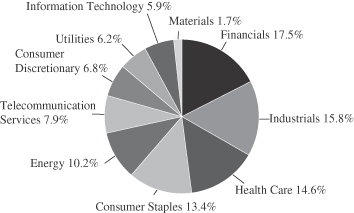

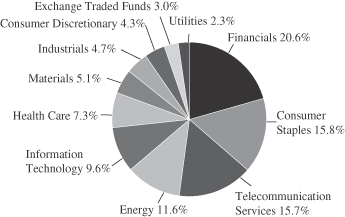

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

December 31, 2008 | William Blair Funds 7 |

Growth Fund

Portfolio of Investments, December 31, 2008 (all dollar amounts in thousands)

| | | | | |

Issuer | | Shares | | Value |

| | |

Common Stocks | | | | | |

Information Technology—30.1% | | | | | |

*Activision Blizzard, Inc. | | 341,870 | | $ | 2,954 |

*Adobe Systems Incorporated | | 197,149 | | | 4,197 |

Amphenol Corporation | | 141,680 | | | 3,398 |

*Apple, Inc. | | 47,980 | | | 4,095 |

*Cisco Systems, Inc. | | 673,050 | | | 10,971 |

*Cognizant Technology Solutions Corporation | | 241,090 | | | 4,354 |

*FLIR Systems, Inc. | | 186,960 | | | 5,736 |

*Google, Inc. | | 23,205 | | | 7,139 |

Qualcomm Incorporated | | 295,740 | | | 10,596 |

*Salesforce.com, Inc. | | 97,890 | | | 3,133 |

*Silicon Laboratories, Inc. | | 180,875 | | | 4,482 |

*The Ultimate Software Group, Inc. | | 135,950 | | | 1,985 |

Visa, Inc. | | 92,373 | | | 4,845 |

*VistaPrint Limited† | | 140,713 | | | 2,619 |

*WNS Holdings Limited—ADR | | 271,900 | | | 1,427 |

| | | | | |

| | | | | 71,931 |

| | | | | |

Health Care—21.4% | | | | | |

Allergan, Inc. | | 130,000 | | | 5,242 |

*CardioNet, Inc. | | 143,200 | | | 3,530 |

*Celgene Corporation | | 115,980 | | | 6,411 |

*Genentech, Inc. | | 86,210 | | | 7,148 |

*Gilead Sciences, Inc. | | 156,885 | | | 8,023 |

*IDEXX Laboratories, Inc. | | 181,330 | | | 6,542 |

Pharmaceutical Product Development, Inc. | | 176,810 | | | 5,129 |

*Qiagen N.V.† | | 295,620 | | | 5,191 |

*St. Jude Medical, Inc. | | 118,950 | | | 3,921 |

| | | | | |

| | | | | 51,137 |

| | | | | |

Industrials & Services—13.7% | | | | | |

Danaher Corporation | | 124,881 | | | 7,070 |

Expeditors International of Washington, Inc. | | 125,630 | | | 4,180 |

Fastenal Company | | 236,629 | | | 8,247 |

*InnerWorkings, Inc. | | 366,410 | | | 2,400 |

Knight Transportation, Inc. | | 295,130 | | | 4,758 |

Roper Industries, Inc. | | 138,570 | | | 6,015 |

| | | | | |

| | | | | 32,670 |

| | | | | |

Consumer Discretionary—10.9% | | | | | |

*Bed Bath & Beyond, Inc. | | 115,400 | | | 2,933 |

*Capella Education Company | | 49,928 | | | 2,934 |

DeVry, Inc. | | 93,645 | | | 5,376 |

*K12, Inc. | | 196,766 | | | 3,752 |

Omnicom Group, Inc. | | 326,670 | | | 8,794 |

Phillips-Van Heusen Corporation | | 107,385 | | | 2,162 |

| | | | | |

| | | | | 25,951 |

| | | | | |

*Non-income producing securities

† = U.S. listed foreign security

ADR = American Depository Receipt

**Fair valued pursuant to Valuation Procedures adopted by Board of Trustees. This holding represents 1.24% of the Fund’s net assets at December 31, 2008.

| | | | | | |

Issuer | | Shares or

Principal | | Value |

| | |

Common Stocks—(continued) | | | | | | |

Energy—8.9% | | | | | | |

Apache Corporation | | | 110,565 | | $ | 8,240 |

*IHS, Inc. | | | 124,215 | | | 4,648 |

Schlumberger Limited† | | | 51,890 | | | 2,197 |

Smith International, Inc. | | | 140,240 | | | 3,210 |

XTO Energy | | | 83,900 | | | 2,959 |

| | | | | | |

| | | | | | 21,254 |

| | | | | | |

Materials—5.4% | | | | | | |

Ecolab, Inc. | | | 101,620 | | | 3,572 |

Monsanto Company | | | 66,130 | | | 4,652 |

Praxair, Inc. | | | 76,565 | | | 4,545 |

| | | | | | |

| | | | | | 12,769 |

| | | | | | |

Financials—5.2% | | | | | | |

*Affiliated Managers Group, Inc. | | | 81,285 | | | 3,407 |

Charles Schwab & Co., Inc. | | | 296,275 | | | 4,791 |

Wells Fargo & Company | | | 139,150 | | | 4,102 |

| | | | | | |

| | | | | | 12,300 |

| | | | | | |

Consumer Staples—2.5% | | | | | | |

*Smart Balance, Inc. | | | 439,500 | | | 2,989 |

Wal Mart de Mexico—ADR** | | | 110,430 | | | 2,950 |

| | | | | | |

| | | | | | 5,939 |

| | | | | | |

Total Common Stock—98.1%

(cost $286,793) | | | 233,951 |

| | | | | | |

| | |

Investment in Affiliate | | | | | | |

William Blair Ready Reserves Fund | | | 3,060,445 | | | 3,060 |

| | | | | | |

Total Investment in Affiliate—1.3%

(cost $3,060) | | | 3,060 |

| | | | | | |

Repurchase Agreement | | | | | | |

Fixed Income Clearing Corporation, 0.010% dated 12/31/08 due 1/2/09, repurchase price $970, collateralized by FHLMC, 5.625%, due 11/23/35 | | $ | 970 | | | 970 |

| | | | | | |

Total Repurchase Agreement—0.4%

(cost $970) | | | 970 |

| | | | | | |

Total Investments—99.8%

(cost $290,823) | | | 237,981 |

Cash and other assets, less liabilities—0.2% | | | 605 |

| | | | | | |

Net assets—100.0% | | $ | 238,586 |

| | | | | | |

See accompanying Notes to Financial Statements.

8 Annual Report | December 31, 2008 |

Mark A. Fuller III

Gregory J. Pusinelli

TAX-MANAGED GROWTH FUND

The Tax-Managed Growth Fund invests primarily in common stocks of large, medium and small domestic growth companies that the Advisor expects will have sustainable, above-average growth from one business cycle to the next.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform during the past year? How did the Fund’s performance compare to its benchmark?

The Tax-Managed Growth Fund posted a (39.57)% decrease on a total return basis (Class N Shares) for the 12 months ended December 31, 2008. By comparison, the Fund’s benchmark, the Russell 3000® Growth Index, declined (38.44)% while the Standard & Poor’s 500 Stock Index dropped (37.00)%.

What were the most significant market factors impacting Fund performance?

The past year was the worst one for the equity markets since 1931. The Fund’s one-year performance was the worst year in the Fund’s nine-year history.

The equity markets were roiled during the first half of the year by a series of failures by major financial institutions, and the markets entered a state of upheaval during the third quarter. Declines in the financial markets worldwide continued into the fourth quarter and occurred in spite of moves by central banks to restore investor confidence by injecting massive amounts of capital into the financial system. Within the fixed-income markets especially, a “flight-to-liquidity” ensued and investors sought the safe haven of U.S. Treasury securities.

Among the ignominious milestones reached during the fourth quarter was the official declaration that the economy was in recession by the National Bureau of Economic Research, and news that the economy had experienced job losses not seen since the very severe recession of 1974.

The Federal Reserve Board also entered a new era as it set its benchmark overnight federal funds interest rate to a range of 0.00%—0.25%, in a move to signal it still had tools in its arsenal with which to stimulate the economy.

What factors were behind the Fund’s performance versus the benchmark?

The Fund underperformed its Russell 3000® Growth Index benchmark largely because of poor performance from its holdings in the Consumer Staples and Consumer Discretionary sectors.

The Fund’s performance was hampered by its underweight position in Consumer Discretionary and Consumer Staples stocks relative to its benchmark, but even had the Fund had an equal weighting, its holdings were poor performers. The Consumer Staples sector was one of the best performing sectors in the Russell 3000® Growth Index.

What were the weakest performing sectors and investments for the Fund?

Although the weakest performing sectors for the Fund during the quarter compared to the benchmark were Consumer Staples and Consumer Discretionary, two of the Funds weakest performing stocks were International Game Technologies, down (70.97)%, and Suncor Energy, Inc. down (63.99)%. These were held in the Consumer Discretionary and Energy sectors respectively.

December 31, 2008 | William Blair Funds 9 |

International Game Technology designs and manufactures computerized gaming equipment, network systems, and licensing and services for the casino gaming industry. With the downturn in the economy, casinos are deferring the replacement of older equipment, pushing out the “replacement cycle,” for machines. The company is the first to offer server-based gaming—meaning games on machines can be reprogrammed from a central hub. This means that multiple choices can be offered throughout the gaming process, and games can be changed to those that are most popular without having to actually physically install new equipment. However, the company continues to push out the launch date for this new technology. We sold this stock in the fourth quarter.

Suncor Energy’s performance reflected the sharp decline in oil prices and investor concerns that the company would not be nimble enough to be able to quickly adapt its business model to the new realities of lower energy prices.

What were the best performing sectors and investments for the Fund?

On a relative basis the best-performing sectors were Materials and Energy. The Fund’s Energy holdings are long-standing names in the portfolio that we believe are quality, industry-leading companies that have very strong fundamentals and solid prospects. However, we should note that the rapidity with which the commodity bubble burst during the second half of the year—a decline in the price of a barrel of oil from $145 to $40—left many energy companies scrambling to cut costs, and ramp down production in areas that were less profitable. These companies were caught up in investor nervousness about whether they could execute quickly enough with their businesses to respond to the drop in oil prices and whether or not the price of oil would eventually rebound.

The Fund’s two best performing investments were Health Care sector holding Gilead Sciences, Inc. and Consumer Discretionary holding Tractor Supply.

Gilead was up 12.08% for the fourth quarter. Gilead develops and produces drugs for life-threatening infectious diseases. The company currently has four products—Viread, Emtriva, combination pill Truvada, and triple combination Atripla—that are used for HIV treatment regimens and which represent a sizable percentage of the company’s sales. The company also has two promising products undergoing FDA review. Gilead maintained earnings guidance during the quarter when most of its peers did not.

Tractor Supply, a retailer which supplies farm-maintenance and related products, was up 25.90% for the year. However, during the second quarter, Tractor Supply lowered earnings guidance based on the larger macroeconomic outlook as well as weather-related issues. We subsequently sold this stock during the third quarter.

What is your current strategy? How is the Fund positioned?

Notable new additions to the Fund in the fourth quarter include The Kroger Co., in the Consumer Staples sector, and Apollo Group, Inc. in the Consumer Discretionary sector.

Kroger is the largest retail grocery chain in the United States, and uses sophisticated data-mining techniques to successfully target promotions and mailings tailored to specific households in a geographic area.

Apollo Group is the largest for-profit education company, with more than 380,000 students. Its core school is the University of Phoenix, which offers online courses. Apollo Group has an excellent student retention rate and attractive and economical pricing for its programs. The company is expected to benefit as those seeking new employment or advancement in their careers seek to expand their education during this economic downturn.

10 Annual Report | December 31, 2008 |

Consensus forecasts are for the economy to begin to show improvement during the middle of this year, and while the market is often viewed as a “discounting” mechanism, earnings results will provide a sobering reality check for investors that conditions could become worse before they ultimately get better.

By owning quality companies which still have solid fundamentals—such as strong balance sheets and durable business franchises—our hope is that the companies in the Fund’s portfolio will be able to weather the rough economic conditions ahead, yet still be poised to capture significant upside potential when the economy eventually improves.

We expect the Fund to experience a higher turnover rate in 2009, partly owing to the increased volatility we expect in the market. However, we believe this turnover could work to the Fund’s tax-efficient advantage, as it will allow us to offset any net short-term capital gains in the Fund with the historical tax-loss carry forward that the Fund has available from prior years. We believe this benefit may have more relevance in the coming year than it has had for some time.

December 31, 2008 | William Blair Funds 11 |

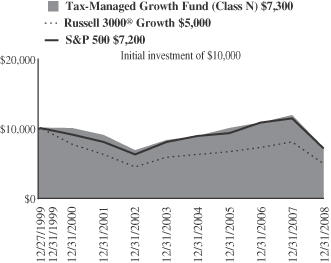

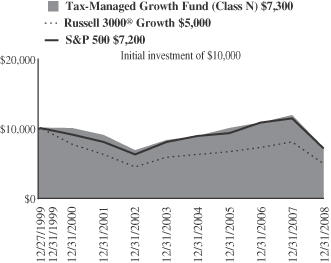

Tax-Managed Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 12/31/2008

| | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | Since

Inception(a) | |

Tax-Managed Growth Fund

Class N | | (39.57 | )% | | (10.41 | )% | | (2.87 | )% | | (3.46 | )% |

Tax-Managed Growth Fund

Class I | | (39.50 | ) | | (10.20 | ) | | (2.64 | ) | | (3.22 | ) |

Russell 3000®

Growth Index | | (38.44 | ) | | (9.12 | ) | | (3.33 | ) | | (7.38 | ) |

S&P 500 Index | | (37.00 | ) | | (8.36 | ) | | (2.19 | ) | | (3.49 | ) |

| | (a) | | For the period from December 27, 1999 to December 31, 2008. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small-capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on December 31, 2008. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

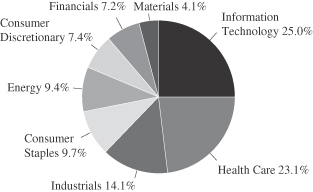

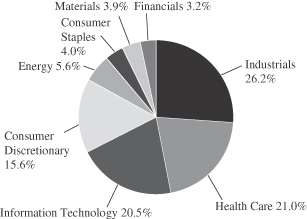

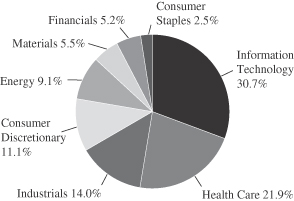

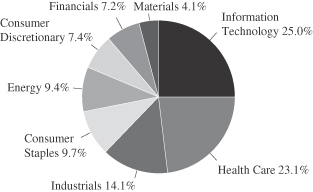

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

12 Annual Report | December 31, 2008 |

Tax-Managed Growth Fund

Portfolio of Investments, December 31, 2008 (all dollar amounts in thousands)

| | | | | |

Issuer | | Shares | | Value |

| | |

Common Stocks | | | | | |

Information Technology—24.1% | | | | | |

*Activision Blizzard, Inc. | | 10,766 | | $ | 93 |

*Adobe Systems Incorporated | | 5,620 | | | 120 |

*Apple, Inc. | | 790 | | | 67 |

*Citrix Systems, Inc. | | 3,430 | | | 81 |

*Dolby Laboratories, Inc., Class “A” | | 3,590 | | | 118 |

*Electronic Arts, Inc. | | 2,720 | | | 44 |

*Euronet Worldwide, Inc. | | 6,680 | | | 78 |

*FLIR Systems, Inc. | | 3,280 | | | 101 |

*Google, Inc. | | 285 | | | 88 |

Microsoft Corporation | | 4,730 | | | 92 |

*Nuance Communications, Inc. | | 4,060 | | | 42 |

Qualcomm Incorporated | | 5,100 | | | 183 |

*Salesforce.com, Inc. | | 3,380 | | | 108 |

*Silicon Laboratories, Inc. | | 3,000 | | | 74 |

*The Ultimate Software Group, Inc. | | 5,910 | | | 86 |

| | | | | |

| | | | | 1,375 |

| | | | | |

Health Care—22.4% | | | | | |

Abbott Laboratories | | 3,440 | | | 184 |

Allergan, Inc. | | 2,510 | | | 101 |

C.R. Bard, Inc. | | 1,580 | | | 133 |

*Celgene Corporation | | 2,310 | | | 128 |

*Gilead Sciences, Inc. | | 3,780 | | | 193 |

*Healthways, Inc. | | 5,190 | | | 60 |

*Illumina, Inc. | | 2,730 | | | 71 |

*Medco Health Solutions, Inc. | | 4,320 | | | 181 |

Pharmaceutical Product Development, Inc. | | 3,370 | | | 98 |

*Psychiatric Solutions, Inc. | | 4,440 | | | 124 |

| | | | | |

| | | | | 1,273 |

| | | | | |

Industrials—13.6% | | | | | |

*Corrections Corporation of America | | 8,420 | | | 138 |

Danaher Corporation | | 2,430 | | | 138 |

Expeditors International of Washington, Inc. | | 3,130 | | | 104 |

Fastenal Company | | 1,710 | | | 60 |

J. B. Hunt Transport Services, Inc. | | 3,020 | | | 79 |

Precision Castparts Corp. | | 1,330 | | | 79 |

Roper Industries, Inc. | | 2,260 | | | 98 |

*Stericycle, Inc. | | 1,480 | | | 77 |

| | | | | |

| | | | | 773 |

| | | | | |

Consumer Staples—9.3% | | | | | |

Campbell Soup Company | | 4,770 | | | 143 |

Colgate-Palmolive Company | | 2,780 | | | 190 |

CVS Caremark Corporation | | 3,474 | | | 100 |

The Kroger Co. | | 3,720 | | | 98 |

| | | | | |

| | | | | 531 |

| | | | | |

* Non-income producing securities

† = U.S. listed foreign security

| | | | | | | |

Issuer | | Shares or

Principal

Amount | | Value | |

| | | | | | | | |

| | |

Common Stocks—(continued) | | | | | | | |

Energy—9.0% | | | | | | | |

Apache Corporation | | | 1,590 | | $ | 118 | |

EnCana Corporation† | | | 2,120 | | | 98 | |

*IHS, Inc. | | | 2,750 | | | 103 | |

Schlumberger Limited† | | | 1,360 | | | 58 | |

Smith International, Inc. | | | 2,050 | | | 47 | |

Suncor Energy, Inc.† | | | 4,610 | | | 90 | |

| | | | | | | |

| | | | | | 514 | |

| | | | | | | |

Consumer Discretionary—7.2% | | | | | | | |

*Apollo Group, Inc. | | | 1,400 | | | 107 | |

*GameStop Corp. | | | 4,370 | | | 95 | |

*K12, Inc. | | | 3,230 | | | 62 | |

McDonald's Corporation | | | 1,440 | | | 89 | |

*Scientific Games Corporation | | | 3,260 | | | 57 | |

| | | | | | | |

| | | | | | 410 | |

| | | | | | | |

Financials—7.0% | | | | | | | |

*Affiliated Managers Group, Inc. | | | 2,300 | | | 96 | |

Charles Schwab & Co., Inc. | | | 9,050 | | | 146 | |

CME Group, Inc. | | | 290 | | | 60 | |

T. Rowe Price Group, Inc. | | | 2,690 | | | 95 | |

| | | | | | | |

| | | | | | 397 | |

| | | | | | | |

Materials—3.9% | | | | | | | |

Monsanto Company | | | 780 | | | 55 | |

Praxair, Inc. | | | 2,830 | | | 168 | |

| | | | | | | |

| | | | | | 223 | |

| | | | | | | |

Total Common Stock—96.5%

(cost $6,968) | | | 5,496 | |

| | | | | | | |

| | |

Investment in Affiliate | | | | | | | |

William Blair Ready Reserves Fund | | | 13,711 | | | 14 | |

| | | | | | | |

Total Investment in Affiliate—0.3%

(cost $14) | | | 14 | |

| | | | | | | |

Repurchase Agreement | | | | | | | |

Fixed Income Clearing Corporation, 0.010% dated 12/31/08 due 1/2/09, repurchase price $202, collateralized by FHLMC, 5.625%, due 11/23/35 | | $ | 202 | | | 202 | |

| | | | | | | |

Total Repurchase Agreement—3.5%

(cost $202) | | | 202 | |

| | | | | | | |

Total Investments—100.3%

(cost $7,184) | | | 5,712 | |

Liabilities, plus cash and other assets—(0.3)% | | | (16 | ) |

| | | | | | | |

Net assets—100.0% | | $ | 5,696 | |

| | | | | | | |

See accompanying Notes to Financial Statements.

December 31, 2008 | William Blair Funds 13 |

James S. Golan

John F. Jostrand

Tracy McCormick

LARGE CAP GROWTH FUND

The Large Cap Growth Fund invests primarily in common stocks of quality large domestic growth companies that the Advisor believes have demonstrated sustained growth over a long period of time.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the last year? How did the Fund’s performance compare to its benchmark and peers?

Under very difficult market conditions, the Large Cap Growth Fund decreased (37.76)% on a total return basis (Class N Shares) for the 12 months ended December 31, 2008. The Fund held up better than its benchmark and Morningstar peer group for 2008. By comparison, the Fund’s benchmark, the Russell 1000® Growth Index, declined (38.44)%, while the average return for funds in the Morningstar Large Growth category dropped (40.67)%.

What were the most significant factors impacting Fund performance over the course of the year? What factors were behind the Fund’s performance versus the benchmark?

Looking back at 2008, it was an extremely challenging period with severe declines in equity markets and all time high levels of volatility. The Russell 1000 Growth® Index had the worst annual decline since its inception in 1979. The broad U.S. market had its third worst annual return in its history—only superseded by two years in the 1930’s. A good portion of the significant retrenchment occurred in the fourth quarter, mostly in October, as the global financial crisis deepened after the demise of Lehman Brothers, investors priced in the prospect of a severe global growth slowdown, and uncertainty continued. The Russell 1000® Growth Index ended the fourth quarter down (22.79)%.

The financial system weakness continued to be focused on deleveraging and very tight credit markets, which caused significant duress for long standing financial institutions, corporations, and consumers. The weakness further manifested in domestic and global economic data with substantial declines in GDP, manufacturing, and industrial production. Corporate earnings have deteriorated too with significant revisions due to the global recession. The consumer also weakened further: unemployment reached 7.20%, credit card defaults rose, home prices dropped, and confidence fell to all time lows. In response, worldwide governments coordinated efforts to stimulate the global economy by reducing interest rates, and providing liquidity. In the U.S., the $700 billion Troubled Asset Relief Program (TARP) plan was passed, and the Federal Funds rate was lowered aggressively from 4.75% to 0.00-0.25%. With continued deterioration in economic data globally, there has been much debate over whether these stimulus initiatives have been enough to keep a significant slowdown at bay, or are focused on the right areas. While these discussions have caused near term confusion on the stimulus plan, there have been some modest signs of improvement with credit markets beginning to thaw as illustrated by lower high yield and Treasuries over Eurodollars (TED) spreads. Another positive in the overall global economy has been the decline in commodity prices, for example, oil dropped from all time highs of $145 to less than $40 per barrel. These declines have given a boost to consumers and corporations while also keeping inflation at bay.

As equity markets fell during the year, risk aversion increased with investors flocking to more defensive groups universally. While all sectors were down in the Russell 1000® Growth Index, Consumer Staples and Health Care sectors held up best. Financial stocks were the worst performers as the credit crisis worsened around the globe. Also, investors shunned more cyclical sectors like Energy and Materials as global growth slowed. On a market capitalization

14 Annual Report | December 31, 2008 |

basis within the growth segment, investors sought the stability of mega- and large-caps, which held up relatively well. Small-cap stocks also held up well in comparison to the mid-cap group which fell further. Similarly, developed markets outperformed emerging markets. Lastly, growth modestly lagged value due to its energy exposure and higher technology weight.

What were among the best performing sectors for the Fund? Are there any specific investments you would like to highlight?

In general, the portfolio was assisted by our quality growth focus which typically does better when earnings growth becomes rare and clean balance sheets are rewarded a premium. More specifically for the year, our stock selection and overweight in the Health Care sector helped. Our biotechnology exposure performed particularly well. Gilead Sciences, Inc., the leading provider of drugs to treat HIV, rose more than 10% on strong quarterly earnings reports. We believe that the drivers of HIV growth will continue with increased diagnosis, earlier treatment, and switches from a competitor drug due to safety issues. Another strong relative portfolio performer was Genentech, Inc., which gained greater than 20% due to a takeover bid by Roche for the remaining 44% of the firm’s shares that Roche doesn’t currently own, solid quarterly earnings reports, and the approval of Avastin in the treatment of metastatic breast cancer.

Our Consumer Discretionary stock selection also contributed on a relative basis. Apollo Group, Inc., a for profit education company specializing in on-line courses, a relatively new portfolio addition, had positive returns on a better than expected fiscal fourth quarter earnings report as a result of strong enrollments and improved operating efficiencies. Kohl’s Corporation was also a good relative performer due to their strong value positioning within a weak consumer spending environment, tight expense control, and strong inventory management. Going forward, we believe they will benefit from their exclusive private label brands, and increased market share as competitors fail, particularly Mervyn’s and Linens’N Things.

What were among the weakest performing sectors for the Fund (or specific names that were disappointments)?

Although the Consumer Staples sector had the best relative returns in the Fund’s benchmark as investors sought safety, it was the largest detractor from portfolio performance due to our underweight position and stock selection. Avon Products was the largest detractor and was eliminated from the portfolio due to a disappointing third quarter earnings report. U.S. sales came in weaker-than-expected highlighting the more discretionary nature of the firm’s non-beauty business; they also had issues in the execution of their cost control programs lowering their margin goal for the year. PepsiCo also detracted from results. The Portfolio owned this stock in the first half of the year, but sold it as we became concerned with rising input costs especially from corn and packaging, as well as a potential slow down in emerging market demand. However, as the market declined further, PepsiCo held up relatively well as investors looked for more defensive companies, which hurt results compared to the benchmark.

Another detractor was Information Technology stock selection especially in the software group. Electronic Arts declined and was eliminated on below expected results for the quarter and fiscal year 2009. They were challenged by the current consumer weakness, and also significantly adjusted their operating plan for fiscal year 2010, which has reduced our confidence in the management team. Secondarily, Autodesk fell on headwinds in the U.S. commercial construction market, and was eliminated in the first quarter.

What is your current strategy? How is the Fund positioned?

Going forward, the global equity market outlook remains uncertain. Economic conditions are likely to deteriorate further with additional weakness in bellwether metrics such as GDP, unemployment, housing, and consumer confidence. The global policy response to this

December 31, 2008 | William Blair Funds 15 |

financial crisis has been aggressive and is at unprecedented levels, which is a bright spot. We would expect these proactive global monetary and fiscal actions to gradually begin to stem and then eventually help reverse the global economic slowdown. The U.S. should see improvement ahead of other developed and emerging countries since we began the stimulus program much earlier, for example, the first Federal Funds rate cut occurred 16 months ago in September 2007. In 2009, we anticipate continued contraction in U.S. economic growth in the first half followed by a slow growing second half based on the stimulus applied. We also expect the consumer to continue to repair their balance sheet and build up savings.

Improvement in several key areas will be critical to market stabilization and recovery. Credit spreads need to narrow further indicating that investors are more comfortable with risk taking and governmental policy actions. As the credit markets loosen, volatility will likely recede and more normal market activity should return. Another area of concern is the U.S. housing market where a reversal in both the decline in prices and the rise in inventory is required to support consumers, and to help stave off the possibility of deeper losses in the banking sector. As discussed above, emerging countries have started to slow, but it will be vital to global economic growth to have the slowdown in emerging economies be short in duration. Additionally, positive trends in leading economic indicators should show the first signs of progress. We have yet to see these, but we are hopeful for some improvement later in the year.

Entering 2009 with continued uncertainty on the direction of the U.S. equity markets, we must take great care in portfolio positioning to strike a balance in light of possible mixed economic signals and potential earnings disappointments. Investors will be weighing the market levels relative to incremental economic data points and looking for news reports to be relatively less negative as a sign of economic improvement. With that said, there remains a risk of further market declines as investors potentially face more negative economic reports in the near term. In the long term, we do feel comfortable that the fiscal and monetary stimulus will ultimately help and that the U.S. should recover earlier in comparison to other countries. Earnings forecasts for the U.S. market have begun to come down aggressively, and may yet fall further in the coming months, but we believe a substantial portion of the bad news has been priced-in. In our view, valuations are generally attractive and with intra-sector valuation spreads at multi-year highs, this should provide a tremendous opportunity for stock pickers going forward.

As always, we continue to rely on our quality growth philosophy, process and discipline to see us through these difficult market times. We thank you for your patience and perseverance during this challenging market environment.

16 Annual Report | December 31, 2008 |

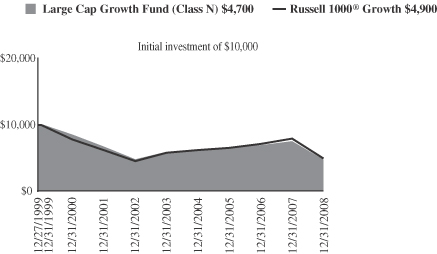

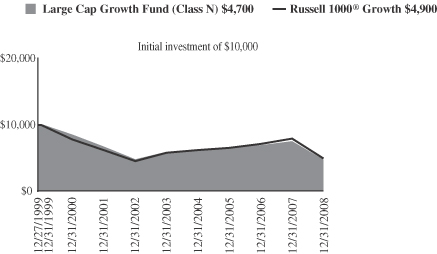

Large Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 12/31/2008

| | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | Since

Inception(a) | |

Large Cap Growth Fund Class N | | (37.76 | )% | | (10.23 | )% | | (4.62 | )% | | (8.05 | )% |

Large Cap Growth Fund Class I | | (37.56 | ) | | (10.06 | ) | | (4.44 | ) | | (7.85 | ) |

Russell 1000®

Growth Index | | (38.44 | ) | | (9.11 | ) | | (3.42 | ) | | (7.63 | ) |

| | (a) | | For the period from December 27, 1999 to December 31, 2008. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large capitalization companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2008. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

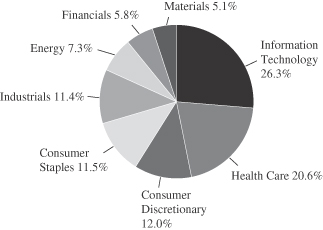

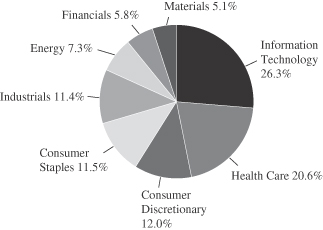

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

December 31, 2008 | William Blair Funds 17 |

Large Cap Growth Fund

Portfolio of Investments, December 31, 2008 (all dollar amounts in thousands)

| | | | | |

Issuer | | Shares | | Value |

| | |

Common Stocks | | | | | |

Information Technology—25.2% | | | | | |

*Adobe Systems Incorporated | | 10,805 | | $ | 230 |

*Apple, Inc. | | 8,570 | | | 731 |

*Cisco Systems, Inc. | | 58,564 | | | 955 |

*FLIR Systems, Inc. | | 13,150 | | | 403 |

*Google, Inc. | | 2,350 | | | 723 |

Microsoft Corporation | | 56,255 | | | 1,094 |

*NetApp, Inc. | | 16,650 | | | 233 |

Qualcomm Incorporated | | 32,155 | | | 1,152 |

*Salesforce.com, Inc. | | 11,000 | | | 352 |

| | | | | |

| | | | | 5,873 |

| | | | | |

Health Care—19.8% | | | | | |

Abbott Laboratories | | 22,520 | | | 1,202 |

Allergan, Inc. | | 9,545 | | | 385 |

*Celgene Corporation | | 15,240 | | | 843 |

*Genentech, Inc. | | 3,380 | | | 280 |

*Gilead Sciences, Inc. | | 16,935 | | | 866 |

*St. Jude Medical, Inc. | | 18,065 | | | 595 |

*Thermo Fisher Scientific, Inc. | | 12,885 | | | 439 |

| | | | | |

| | | | | 4,610 |

| | | | | |

Consumer Discretionary—11.5% | | | | | |

*Apollo Group, Inc. | | 5,350 | | | 410 |

*Kohl’s Corporation | | 14,896 | | | 539 |

Lowe’s Companies, Inc. | | 22,940 | | | 494 |

McDonald’s Corporation | | 12,575 | | | 782 |

Omnicom Group, Inc. | | 16,665 | | | 449 |

| | | | | |

| | | | | 2,674 |

| | | | | |

Consumer Staples—11.0% | | | | | |

Campbell Soup Company | | 13,990 | | | 420 |

CVS Caremark Corporation | | 14,290 | | | 411 |

The Kroger Co. | | 18,170 | | | 480 |

Wal-Mart Stores, Inc. | | 22,300 | | | 1,250 |

| | | | | |

| | | | | 2,561 |

| | | | | |

Industrials—11.0% | | | | | |

Danaher Corporation | | 10,652 | | | 603 |

Expeditors International of Washington, Inc. | | 8,315 | | | 277 |

Fastenal Company | | 15,300 | | | 533 |

J.B. Hunt Transport Services, Inc. | | 13,220 | | | 347 |

Precision Castparts Corp. | | 3,950 | | | 235 |

Roper Industries, Inc. | | 12,750 | | | 553 |

| | | | | |

| | | | | 2,548 |

| | | | | |

Energy—7.0% | | | | | |

Apache Corporation | | 10,995 | | | 819 |

EOG Resources, Inc. | | 5,410 | | | 360 |

Schlumberger Limited† | | 10,790 | | | 457 |

| | | | | |

| | | | | 1,636 |

| | | | | |

*Non-income producing securities

† = U.S. listed foreign security

ADR = American Depository Receipt

VRN = Variable Rate Note

| | | | | | | |

Issuer | | Shares or

Principal

Amount | | Value | |

| | |

Common Stocks—(continued) | | | | | | | |

Financials—5.6% | | | | | | | |

AXA—ADR | | | 10,700 | | $ | 240 | |

CME Group, Inc. | | | 1,965 | | | 409 | |

Charles Schwab & Co., Inc. | | | 26,885 | | | 435 | |

Wells Fargo & Company | | | 7,600 | | | 224 | |

| | | | | | | |

| | | | | | 1,308 | |

| | | | | | | |

Materials—4.9% | | | | | | | |

Ecolab, Inc. | | | 6,550 | | | 230 | |

Monsanto Company | | | 6,280 | | | 442 | |

Praxair, Inc. | | | 7,865 | | | 467 | |

| | | | | | | |

| | | | | | 1,139 | |

| | | | | | | |

Total Common Stock—96.0%

(cost $27,506) | | | 22,349 | |

| | | | | | | |

| | |

Investment in Affiliate | | | | | | | |

William Blair Ready Reserves Fund | | | 340,308 | | | 340 | |

| | | | | | | |

Total Investment in Affiliate—1.5%

(cost $340) | | | 340 | |

| | | | | | | |

| | |

Short-Term Investments | | | | | | | |

American Express Credit Corp. Demand Note, VRN 0.32125%, due 1/2/09 | | $ | 400 | | | 400 | |

| | | | | | | |

Total Short-Term Investments—1.7%

(cost $400) | | | 400 | |

| | | | | | | |

| | |

Repurchase Agreement | | | | | | | |

Fixed Income Clearing Corporation, 0.010% dated 12/31/08 due 1/2/09, repurchase price $231, collateralized by FHLMC, 5.625%, due 11/23/35 | | | 231 | | | 231 | |

| | | | | | | |

Total Repurchase Agreement—1.0%

(cost $231) | | | 231 | |

Total Investments—100.2%

(cost $28,477) | | | 23,320 | |

Liabilities, plus cash and other assets—(0.2)% | | | (41 | ) |

| | | | | | | |

Net assets—100.0% | | $ | 23,279 | |

| | | | | | | |

See accompanying Notes to Financial Statements.

18 Annual Report | December 31, 2008 |

Michael P. Balkin

Karl W. Brewer

SMALL CAP GROWTH FUND

The Small Cap Growth Fund invests primarily in common stocks of small domestic growth companies that the Advisor expects to have solid growth in earnings.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform during the past year? How did the Fund’s performance compare to its benchmark?

The Small Cap Growth Fund decreased (46.85)% on a total return basis (Class N shares) for the 12 months ended December 31, 2008. By comparison the Fund’s benchmark, the Russell 2000® Growth Index, declined (38.54)%.

What were the most significant factors impacting Fund performance? What factors were behind the Fund’s performance versus the benchmark?

As we entered 2008, the debate simply was over whether the United States was already in or headed towards a recession. As we exit the year, we are clearly in a global recession and the debate is over the duration and magnitude of the slowdown. The events during the year produced one of the most volatile and challenging equity markets ever.

Housing and mortgage problems morphed into balance sheet issues for financial institutions, which in turn led to credit market and short term liquidity concerns. During the first part of the third quarter, there were fresh signs of growth slowing in emerging markets, and with them, came a sharp reduction in commodity prices. The third quarter also witnessed major bankruptcy filings, government takeovers and government-brokered acquisitions of major financial institutions.

As we look back, the Lehman Brothers failure in mid-September caused a ripple effect that sent global markets into a freefall during the fourth quarter. Lehman’s bankruptcy intensified concerns about counterparty risk and the basic solvency of many well-established financial institutions. Tighter credit conditions and falling equity prices created a vicious feedback loop as leveraged investors were forced to sell stocks to meet margin calls, in turn driving stock prices down further and forcing additional margin calls. Shaken confidence among investors, consumers and businesses manifested itself in ever-worsening economic data. Corporate and consumer cost-cutting took their toll on capital expenditures, employment trends and retail sales both in the U.S. and abroad. Concerns about global economic activity propelled a collapse of energy prices due, in part, to shrinking demand for crude oil.

Global policy responses to ailing economies and financial markets have been unprecedented in scale and coordination. These responses, along with attractive equity valuations and greater clarity on President-elect Obama’s cabinet picks, helped the stock market stage a late fourth quarter rally. This rally allowed equity investors to take back at least a fraction of the losses suffered during the first half of the fourth quarter.

Small cap growth stocks, as measured by the Russell 2000® Growth Index, posted a decline of (38.54)% during 2008. Energy was the notable laggard given the precipitous drop in energy prices after their peak around the July 4th holiday. The sector finished down (51.02)% for the year. Information Technology and the Consumer Discretionary sectors both trailed the market by roughly 5% or more. Consumer Staples turned in the best return at (17.4)%, while the Financial sector had the second best return in the index. Although it might sound counter-intuitive given the troubles of many large financial institutions, small cap financials actually

December 31, 2008 | William Blair Funds 19 |

performed relatively well, finishing down (27.8)%. Health Care also out-performed the market with a (30.4)% return. From a style perspective, the market was biased toward higher momentum, higher quality and more expensive stocks during the year as a whole.

From a relative perspective, the Small Cap Growth Fund underperformed during 2008, with the majority of the underperformance coming in the first seven months of the year. The Fund’s lower-than-benchmark market cap bias, valuation sensitivity and lower allocation to momentum stocks detracted during 2008 as a whole. As an aside, many of these headwinds that have affected the Fund since the beginning of the credit crunch in 2007 seemed to lose steam late in 2008. In addition to the style headwinds, stock selection was also a meaningful detractor from relative performance for the year. This was most pronounced in the Health Care sector as certain Fund holdings trailed their Health Care peers in the benchmark. Our underweight in the sector, especially biotechnology stocks, detracted as well. Some of our larger Information Technology holdings disappointed during the year but we continue to feel comfortable about the long-term prospects for these companies. Also, select stocks in Consumer Discretionary and Financials detracted from relative performance. The largest sources of positive relative performance were stock selection in both the Energy and Telecommunications services sectors.

What were among the weakest performing investments for the Fund?

Two of the worst performing stocks during the year were DG FastChannel, Inc. and Providence Service Corporation.

DG FastChannel enables the electronic distribution of advertisements from advertising agencies to traditional radio and TV broadcasters and other media outlets. The stock underperformed during the year as investors grew increasingly pessimistic on advertising sales. Big advertisers, especially automakers, have cut their advertising budgets in the current economic environment. Another concern that developed late in the year was the potential for a delay in the expected February 2009 transition to digital broadcasting. This transition is expected to speed up the shift to High Definition (HD) advertisements, where DG FastChannel makes a higher profit margin. However, we feel those fears are overblown. DG FastChannel continues to be a large holding as the company stands to benefit greatly from the trend to HD advertising going forward.

Providence Service Corporation provides and manages government-sponsored non-emergency transportation services and social services, such as counseling and foster care. The stock was a meaningful detractor during the year as the company’s business was impacted severely by various macro factors. Since the company receives a fixed fee from government agencies for its services, higher fuel costs and increased utilization rates by patients reduced profit margins. In addition, the weak economy has pressured state budgets, and in turn, pressuring reimbursement levels for vendors such as Providence. Although the company’s business had held up better in the last recession, these factors greatly impacted Providence’s bottom line.

What were among the best performing investments for the Fund?

Two of the best performing stocks during the year were Syniverse and Orthovita, Inc..

Syniverse is a telecommunications services firm whose technologies enable wireless carriers to properly charge each other for voice and data roaming on their respective networks. The stock was a large contributor during 2008. This business strength was primarily due to strong revenues from its data business. The secular trend of increasing data transmitted over mobile networks has clearly helped Syniverse’s business. After the solid move in the stock we decided to exit the position.

20 Annual Report | December 31, 2008 |

Orthovita is a leading manufacturer and distributor of synthetic-based biomaterial products used in spine surgery and for other bone fractures. The stock performed well during the year on the heels of good momentum in its core business but also in anticipation of FDA approval for a new product, Cortoss, which is a bone augmentation material that mimics the characteristics of human bone. Cortoss should be the next big driver of growth for the company. The product has been used in Europe for the last three years and has just finished clinical trials in the United States. If approved by the FDA, Cortoss has a market opportunity of well over $100 million in revenue. We maintain our positive bias on this name.

What is your current outlook?

Looking forward, we continue to scrutinize our companies’ earnings vulnerability in a depressed economic environment. The global economy, credit markets and financial institutions remain fragile. At the same time, while we believe that the economy will get worse before it gets better, the market has priced in a great deal of bad news. We believe the abundance of fiscal and monetary stimulus, lower gasoline prices, easier earnings comparisons later in 2009 and 2010, and meaningfully high investor cash balances all provide a positive bias to equity markets. We continue to seek out quality growth companies where we believe investor sentiment has pushed valuations down to attractive levels. As always, we remain focused on finding individual companies with superior management teams and defensible business models that should afford them relative success regardless of outside forces.

December 31, 2008 | William Blair Funds 21 |

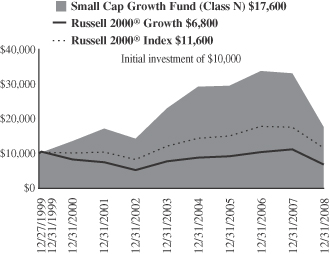

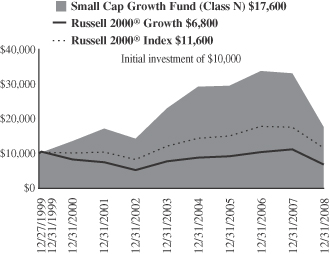

Small Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 12/31/2008

| | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | Since

Inception(a) | |

Small Cap Growth Fund Class N | | (46.85 | )% | | (15.96 | )% | | (5.24 | )% | | 6.42 | % |

Small Cap Growth Fund Class I | | (46.70 | ) | | (15.73 | ) | | (4.98 | ) | | 6.69 | |

Russell 2000® Growth Index | | (38.54 | ) | | (9.32 | ) | | (2.35 | ) | | (4.15 | ) |

Russell 2000® Index | | (33.79 | ) | | (8.29 | ) | | (0.93 | ) | | 1.64 | |

| | (a) | | For the period from December 27, 1999 to December 31, 2008. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2000® Growth Index consists of small-capitalization companies with above average price-to-book ratios and forecasted growth rates.

The Russell 2000® Index is an unmanaged composite of the smallest 2000 stocks of the Russell 3000® Index.

This report identifies the Fund’s investments on December 31, 2008. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

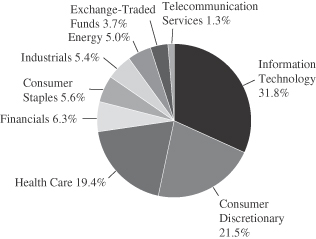

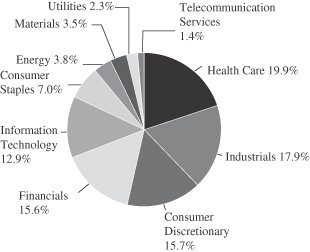

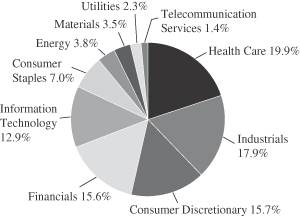

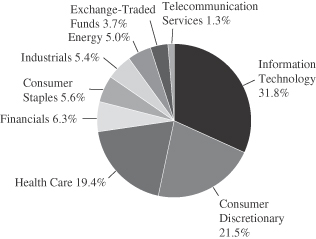

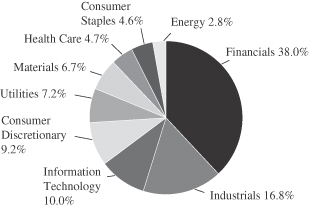

Sector Diversification (unaudited)

The sector diversification shown is based on the total long-term securities.

22 Annual Report | December 31, 2008 |

Small Cap Growth Fund

Portfolio of Investments, December 31, 2008 (all dollar amounts in thousands)

| | | | | |

Issuer | | Shares | | Value |

| | |

Common Stocks | | | | | |

Information Technology—31.3% | | | | | |

*Cavium Networks, Inc. | | 401,956 | | $ | 4,225 |

CryptoLogic, Ltd.† | | 357,996 | | | 820 |

*DG Fastchannel, Inc | | 1,013,551 | | | 12,649 |

*DTS, Inc. | | 244,431 | | | 4,485 |

*Euronet Worldwide, Inc. | | 907,234 | | | 10,533 |

*Exlservice Holdings, Inc. | | 628,613 | | | 5,387 |