UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| | |

| 222 West Adams Street, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Michelle R. Seitz

William Blair Funds

222 West Adams Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: December 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

| Item 1. | December 31, 2007 Annual Reports transmitted to shareholders. |

Table of Contents

This report is submitted for the general information of the shareholders of the William Blair Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a prospectus of the William Blair Funds. Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

December 31, 2007 | William Blair Funds 1 |

PERFORMANCE AS OF DECEMBER 31, 2007—CLASS N SHARES (unaudited)

| | | | | | | | | | | | | | |

| | | 1 Yr. | | | 3 Yr. | | 5 Yr. | | 10 Yr.

(or since

inception) | | | Inception

Date | | Overall

Morningstar

Rating |

Growth Fund | | 13.17 | | | 11.77 | | 13.14 | | 5.31 | | | 3/20/1946 | | ««« |

Morningstar Large Growth | | 13.35 | | | 9.11 | | 12.75 | | 5.28 | | | | | Among 1,449 |

Russell 3000® Growth | | 11.40 | | | 8.64 | | 12.42 | | 3.83 | | | | | large growth Funds |

Standard & Poor’s 500 | | 5.49 | | | 8.62 | | 12.83 | | 5.91 | | | | | |

| | | | | | |

Tax-Managed Growth Fund | | | | | | | | | | | | | | ««« |

Return before Taxes | | 9.96 | | | 10.20 | | 11.89 | | 2.33 | | | 12/27/1999 | | Among 1,449 |

After Taxes on Distributions | | 9.96 | | | 10.20 | | 11.89 | | 2.33 | | | | | large growth Funds |

After Taxes on distributions and Sale of Fund Shares | | 5.55 | | | 8.79 | | 10.41 | | 2.01 | | | | | |

Morningstar Large Growth | | 13.35 | | | 9.11 | | 12.75 | | — | | | | | |

Russell 3000® Growth | | 11.40 | | | 8.64 | | 12.42 | | (2.55 | ) | | | | |

Standard & Poor’s 500 | | 5.49 | | | 8.62 | | 12.83 | | 1.76 | | | | | |

| | | | | | |

Large Cap Growth Fund | | 9.30 | | | 6.42 | | 9.39 | | (3.48 | ) | | 12/27/1999 | | «« |

Morningstar Large Growth | | 13.35 | | | 9.11 | | 12.75 | | — | | | | | Among 1,449 |

Russell 1000® Growth | | 11.81 | | | 8.68 | | 12.11 | | (2.86 | ) | | | | large growth Funds |

| | | | | | |

Small Cap Growth Fund | | (2.15 | ) | | 4.15 | | 18.40 | | 16.03 | | | 12/27/1999 | | ««« |

Morningstar Small Growth | | 7.59 | | | 7.94 | | 15.63 | | — | | | | | Among 671 |

Russell 2000® Growth | | 7.05 | | | 8.11 | | 16.50 | | 1.29 | | | | | small growth Funds |

Russell 2000® | | (1.57 | ) | | 6.80 | | 16.25 | | 7.20 | | | | | |

| The Small Cap Growth Fund’s Performance during 2000 was primarily attributable to investments in initial public offerings (IPOs) during a rising market. Since then, IPOs have had an insignificant effect on the Fund’s performance. | | |

| | | | | | |

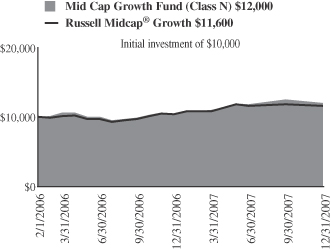

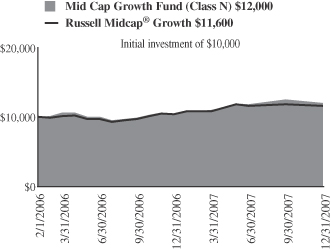

Mid Cap Growth Fund | | 14.62 | | | — | | — | | 9.93 | | | 2/1/2006 | | Not rated. |

Morningstar Mid-Cap Growth | | 15.09 | | | — | | — | | — | | | | | |

Russell Mid Cap® Growth | | 11.43 | | | — | | — | | 8.15 | | | | | |

| | | | | | |

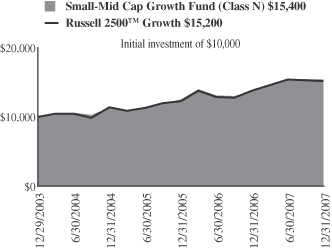

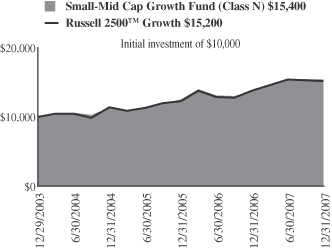

Small-Mid Cap Growth Fund | | 12.34 | | | 10.91 | | — | | 11.32 | | | 12/29/2003 | | ««« |

Morningstar Mid-Cap Growth | | 15.09 | | | 11.23 | | — | | — | | | | | Among 811 |

Russell 2500™ Growth | | 9.69 | | | 10.03 | | — | | 10.93 | | | | | mid-cap growth funds |

| | | | | | |

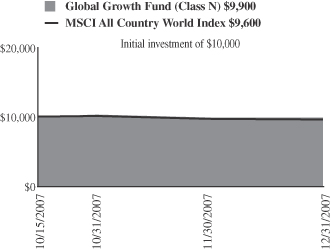

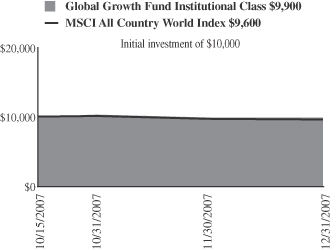

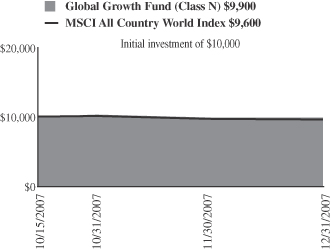

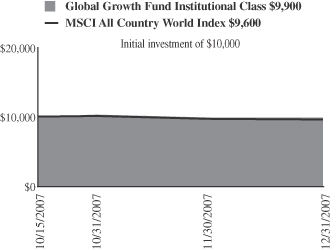

Global Growth Fund | | — | | | — | | — | | (1.10 | ) | | 10/15/2007 | | Not rated. |

MSCI All Country World | | — | | | — | | — | | (4.10 | ) | | | | |

| | | | | | |

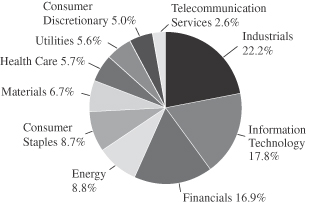

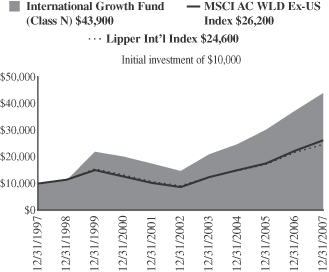

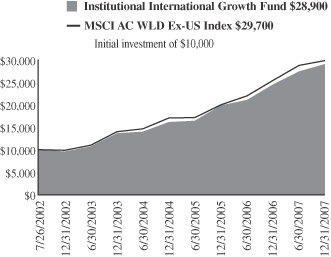

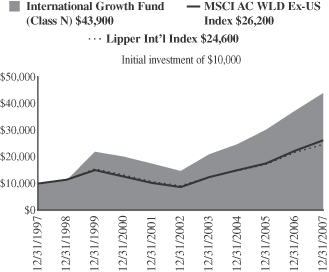

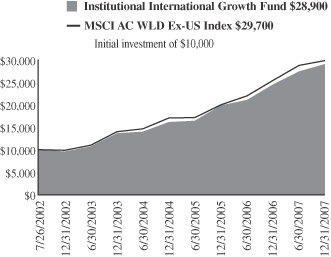

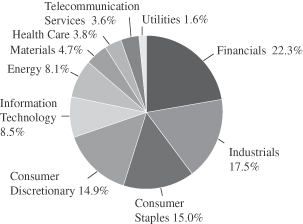

International Growth Fund | | 18.13 | | | 20.93 | | 24.40 | | 15.93 | | | 10/1/1992 | | ««««« |

Morningstar Foreign Large Growth | | 16.26 | | | 18.25 | | 20.90 | | 8.41 | | | | | Among 173 |

MSCI All Country World Ex-US | | 17.12 | | | 20.37 | | 24.52 | | 10.09 | | | | | foreign large growth funds |

| | | | | | |

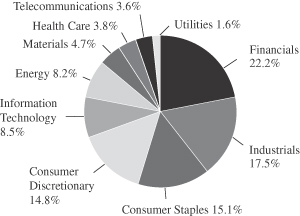

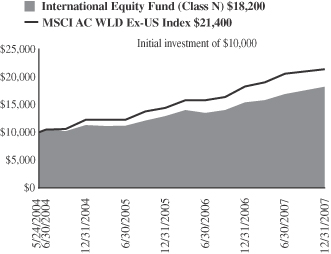

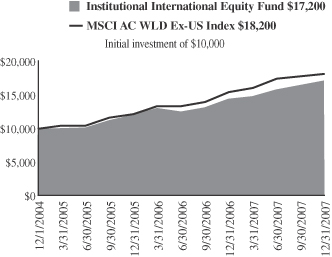

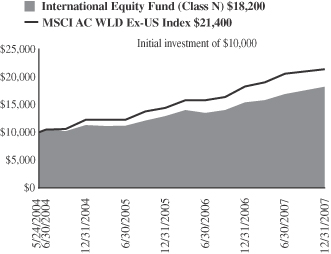

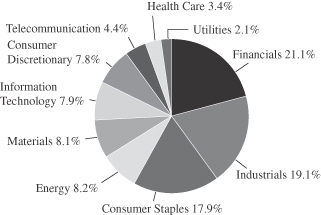

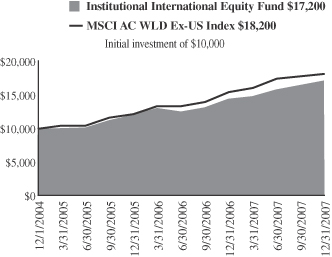

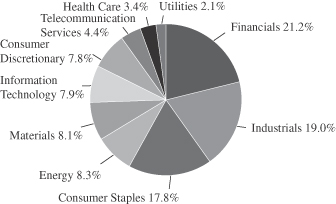

International Equity Fund | | 17.68 | | | 17.02 | | — | | 17.93 | | | 5/24/2004 | | ««« |

Morningstar Foreign Large Growth | | 16.26 | | | 18.25 | | — | | — | | | | | Among 173 |

MSCI All Country World Ex-US | | 17.12 | | | 20.37 | | — | | 23.31 | | | | | foreign large growth funds |

Please see the next page for important disclosure information.

See accompanying Notes to Financial Statements.

2 Annual Report | December 31, 2007 |

PERFORMANCE AS OF DECEMBER 31, 2007—CLASS N SHARES—CONTINUED (unaudited)

| | | | | | | | | | | | | |

| | | 1 Yr. | | | 3 Yr. | | 5 Yr. | | 10 Yr.

(or since

inception) | | Inception

Date | | Overall

Morningstar

Rating |

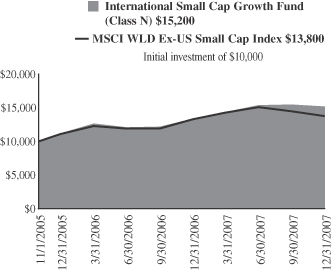

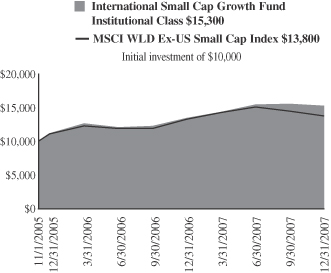

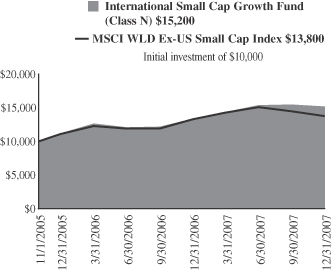

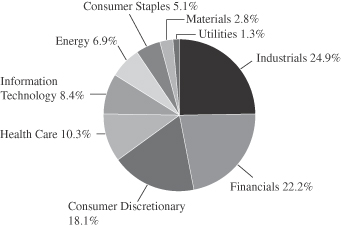

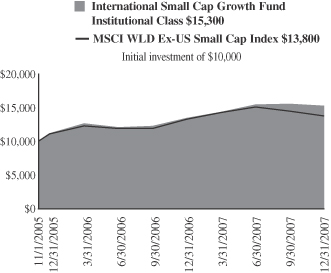

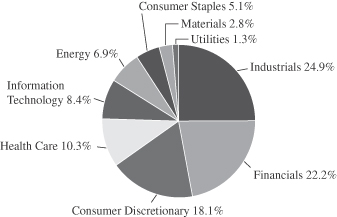

International Small Cap Growth Fund | | 13.06 | | | — | | — | | 21.22 | | 11/1/2005 | | Not rated. |

Morningstar Foreign Small/Mid Growth | | 12.03 | | | — | | — | | — | | | | |

MSCI World Ex-US Small Cap | | 3.64 | | | — | | — | | 15.79 | | | | |

| | | | | | |

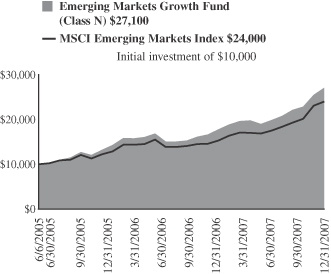

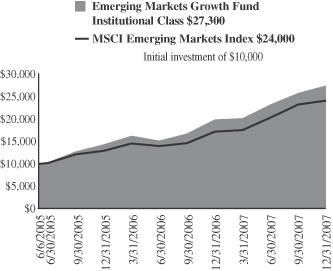

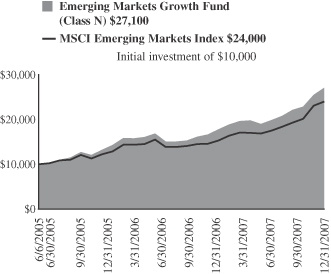

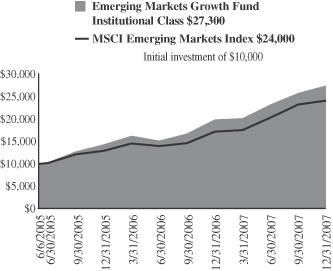

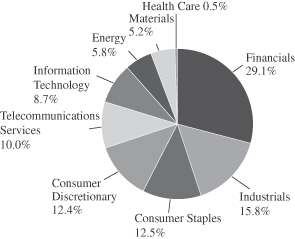

Emerging Markets Growth Fund | | 37.75 | | | — | | — | | 47.18 | | 6/6/2005 | | Not rated. |

Morningstar Diversified Emerging Markets | | 36.68 | | | — | | — | | — | | | | |

MSCI Emerging Markets | | 39.78 | | | — | | — | | 40.36 | | | | |

| A portion of the Emerging Markets Growth Fund’s performance since inception is attributable to an investment in an initial public offering. (IPO) | | |

| | | | | | |

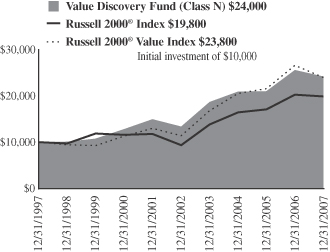

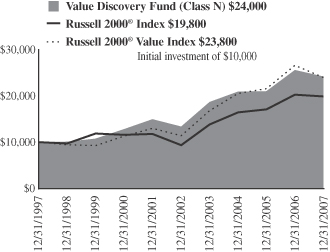

Value Discovery Fund | | (5.54 | ) | | 4.95 | | 12.53 | | 9.16 | | 12/23/1996 | | ««« |

Morningstar Small Value | | (6.08 | ) | | 5.02 | | 14.58 | | 8.88 | | | | Among 329 |

Russell 2000® | | (1.57 | ) | | 6.80 | | 16.25 | | 7.08 | | | | small value funds |

Russell 2000® Value | | (9.78 | ) | | 5.27 | | 15.80 | | 9.06 | | | | |

| | | | | | |

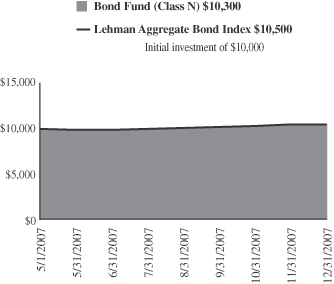

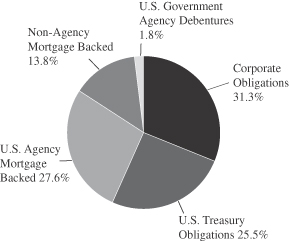

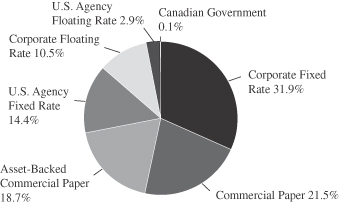

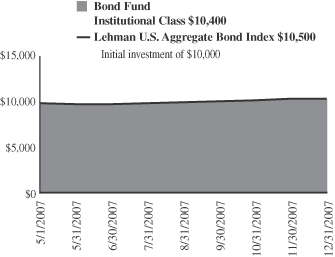

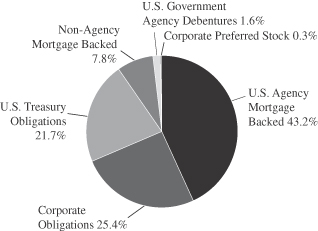

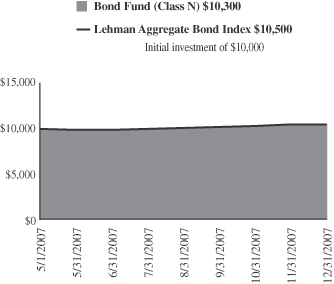

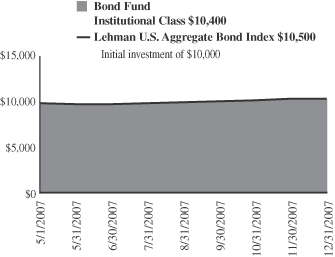

Bond Fund | | — | | | — | | — | | 3.38 | | 5/1/2007 | | Not rated. |

Lehman Aggregate Bond Index | | — | | | — | | — | | 4.87 | | | | |

| | | | | | |

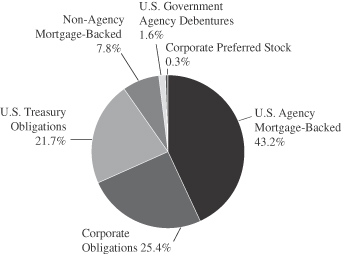

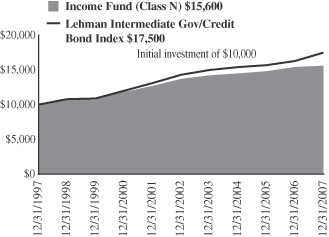

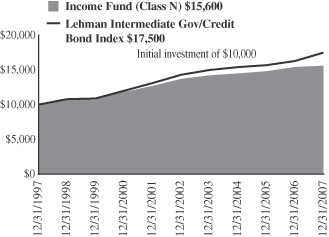

Income Fund | | 1.08 | | | 2.34 | | 2.66 | | 4.54 | | 10/1/1990 | | ««« |

Morningstar Short-term Bond | | 4.29 | | | 3.25 | | 2.88 | | 4.41 | | | | Among 374 |

Lehman Intermediate Govt./Credit Bond Index | | 7.39 | | | 4.32 | | 4.06 | | 5.75 | | | | short-term bond funds |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Returns shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or a loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. International and emerging markets investing involves special risk considerations, including currency fluctuations, lower liquidity, economic and political risk. As interest rates rise, bond prices will fall and bond funds become more volatile. From time to time, the investment advisor may waive fees or reimburse expenses for certain Funds. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load.

Tax-Managed Growth Fund’s after-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class N and the after-tax returns for Class N shares will vary.

Morningstar RatingsTM are as of 12/31/2007 and are subject to change every month. The ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The 3/5/10 year Morningstar ratings were as follows: Growth Fund ««««/«««/«««, Tax-Managed Growth Fund ««««/«««/NA, and Large Cap Growth Fund ««/««/NA, out of 1,449/1,215/554 large growth funds; Small Cap Growth Fund ««/««««/NA out of 671/556/NA small growth funds; Small-Mid Cap Growth Fund «««/NA/NA out of 811/NA/NA mid cap growth funds; Value Discovery Fund ««/«/««« out of 329/258/92 small value funds; International Growth Fund ««««/««««/««««« and International Equity Fund «««/NA/NA out of 173/155/67 foreign large growth funds; Income Fund ««/««/««« out of 374/282/159 short-term bond funds.

Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

See accompanying Notes to Financial Statements.

December 31, 2007 | William Blair Funds 3 |

David C. Fording

John F. Jostrand

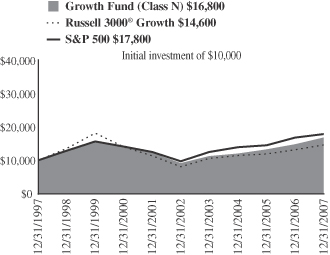

GROWTH FUND

The Growth Fund invests primarily in common stocks of domestic growth companies that the Advisor expects to have sustainable, above-average growth from one business cycle to the next.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the last year? How did the Fund’s performance compare to its benchmark?

The Growth Fund posted a 13.17% increase on a total return basis (Class N Shares) for the 12 months ended December 31, 2007. By comparison, the Fund’s benchmark, the Russell 3000® Growth Index, gained 11.40% while the Standard & Poor’s 500 Stock Index rose 5.49%.

What were the most significant market factors impacting Fund performance?

For 2007, most US equity markets gained ground with the exception of those focused on value stocks and micro cap stocks. In a significant reversal since the beginning of the millennium, growth stocks surpassed value stocks with a 12% spread or more between Russell growth and value indices. From a market cap perspective, large caps outperformed small caps. The spread between Russell large and small indices for 2007 was more than 4.7%. Volatility remained high as investors responded to weakness in economic and employment data. Second and third quarter GDP was reported as solid but the fourth quarter GDP estimate was much lower. The unemployment rate rose to 5.0% by year end suggesting a weakening labor market. Additionally, the health of consumers and financial firms came under pressure during the period due to higher defaults on home loans and mortgage related investments as well as increasing losses on credit cards and other consumer loans. As a result of these strong market headwinds in December, many market observers have discussed the potential for a recession in the coming year.

On a positive note, US corporations have significant cash on their balance sheets and profit margins have remained elevated as a result of continued cost productivity. While the US economic growth seems to be slowing, foreign growth has continued to be healthy.

In terms of sector performance in the Russell 3000® Growth index, the best contributors to overall returns were technology and industrials. The technology group was up 18.3% for the year with many of the largest bellwether companies doing well in the flight to safety. Industrials gained 13.5% for the period benefiting from strong global demand. The weakest sector contributors were Consumer Discretionary and Financials. Consumer discretionary stocks declined 9.7% as investors were concerned over a possible recession that could impact future returns for the group while Financial stocks dropped 1.7% on the issues discussed above.

Which sectors enhanced the Fund’s return? What were among the best performing investments for the Fund?

In 2007, the Fund benefited from stock selection within the Financial, Energy and Health Care sectors. In fact, the Fund saw its strongest absolute returns come from energy which increased about 70% as well as materials which rose approximately 50% in the period. Our positioning within the Financials sector led to a nearly 30% absolute return during 2007 as the portfolio leaned towards companies that are beneficiaries of volatility (e.g., Intercontinental Exchange, which saw strong gains in 2007) and away from companies that are credit or

4 Annual Report | December 31, 2007 |

interest-rate sensitive. Charles Schwab was also a strong absolute and relative performer, as its attractive product and service offerings, combined with effective marketing, have resulted in on-going market share gains.

Within Energy, our exposure to both oil services and exploration and production stocks saw solid relative returns. The portfolio benefited from its holdings in Smith International, Apache Corp and Suncor Energy. The price of oil approached $100 per barrel during the fourth quarter, driving optimism about future earnings.

Stock selection within Health Care also had a positive impact on both absolute and relative performance. Kyphon, a small cap health care equipment and supplier, rose significantly during the period on news that the company would be acquired by Medtronic for $71 per share. This stock was sold from the portfolio at the end of July. Another strong performer was Gilead Sciences, the leading provider of drugs to treat HIV, which continued to deliver very solid earnings growth and was a strong stock for the full year.

Were there any investment strategies or themes that did not measure up to your expectations?

Poor stock selection in Technology was the principal drag on both absolute and relative performance of the Fund. While technology stocks, in general, outperformed the market, the Fund’s Technology sector returns lagged those of the benchmark. The benchmark’s Technology returns were led by a few large cap winners such as Apple and Google, each of which appreciated by more than 50% in 2007. The fact that we did not hold these names hurt our relative performance. Equally important, a number of our Technology positions did not perform well. Two of our mid-cap Technology stocks, Network Appliance and F5 Networks, underperformed. Network Appliance declined during the year on earnings weakness and was sold from the portfolio in the third quarter. F5 Networks fell as investors began to question whether spending, particularly within the financial services industry, would be sustained into 2008. We believe cyclical concerns have been priced into the F5 Networks and that its competitive position as well as the secular drivers of its growth rate remain strong, and remain committed to the stock.

Consumer Staple stocks also hurt the portfolio’s absolute and relative performance. Walgreen’s reported a very disappointing third quarter, as expense growth exceeded revenue growth, resulting in declining margins. We sold the stock, believing these issues will take several quarters to resolve and perceiving that the company’s growth rate may slow more rapidly than anticipated.

What is your current strategy? How is the Fund positioned?

The economy is slowing driven by subprime and credit issues. We believe that economic growth will be weak through the first-half of this year, but begin to strengthen as we move to the latter part of the year. Through continued strong export growth and actions by the Federal Reserve, the economy should continue to move forward. The factors that we will continue to watch include unemployment and inflation. A significant increase in the unemployment rate could have a detrimental impact on the economic outlook while a significant increase in inflation expectation could also limit the Federal Reserve’s response to slowing growth.

We have experienced an unprecedented period of corporate profitability growth. As the economy slows, the higher quality growth companies should continue to differentiate themselves relative to the average company. Regardless of the macro issues facing the market, we continue to find quality stocks that offer growth opportunities. We continue to find interesting opportunities in Technology, select Health Care, Industrials and Energy. We believe that as overall earnings growth decelerates, investors will pay more attention to earnings multiples, and reward stocks which exhibit longer, more sustainable earnings trends with higher P/E multiples.

December 31, 2007 | William Blair Funds 5 |

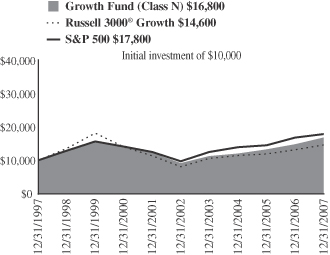

Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 12/31/2007

| | | | | | | | | | | | | | | |

| | | 1 Year | | | 3

Year | | | 5

Year | | | 10

Year | | | Since Inception | |

Growth Fund Class N | | 13.17 | % | | 11.77 | % | | 13.14 | % | | 5.31 | % | | — | % |

Growth Fund

Class I | | 13.59 | | | 12.10 | | | 13.46 | | | — | | | 3.60 | (a) |

Russell 3000® Growth Index | | 11.40 | | | 8.64 | | | 12.42 | | | 3.83 | | | 0.16 | (a) |

S&P 500 Index | | 5.49 | | | 8.62 | | | 12.83 | | | 5.91 | | | 3.32 | (a) |

| | (a) | | For the period from October 1, 1999 to December 31, 2007. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company L.L.C. without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on December 31, 2007. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

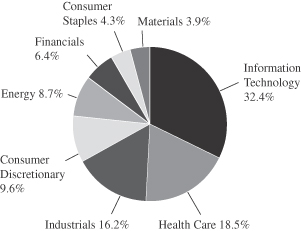

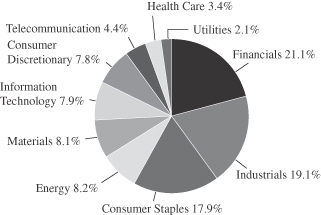

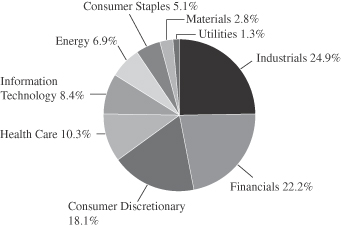

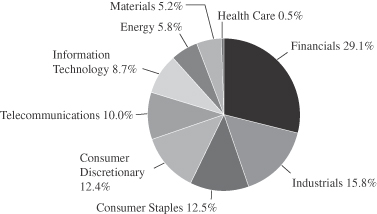

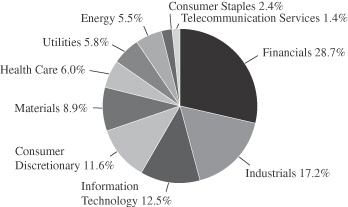

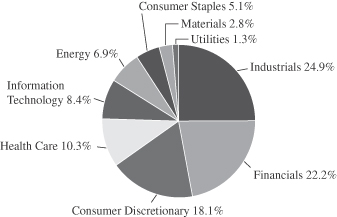

Sector Diversification (unaudited)

The sector diversification shown is based on the total investment portfolio.

6 Annual Report | December 31, 2007 |

Growth Fund

Portfolio of Investments, December 31, 2007 (all dollar amounts in thousands)

| | | | | |

Issuer | |

Shares | | Value |

| | |

Common Stocks | | | | | |

Information Technology—32.1% | | | | | |

*Activision, Inc. | | 223,605 | | $ | 6,641 |

*Adobe Systems Incorporated | | 163,435 | | | 6,984 |

*Cisco Systems, Inc. | | 496,970 | | | 13,453 |

*Citrix Systems, Inc. | | 123,070 | | | 4,678 |

*Cognizant Technology Solutions Corporation | | 190,320 | | | 6,459 |

*EMC Corporation | | 384,635 | | | 7,127 |

*Euronet Worldwide, Inc. | | 141,655 | | | 4,250 |

*F5 Networks, Inc. | | 228,515 | | | 6,517 |

*FLIR Systems, Inc. | | 134,410 | | | 4,207 |

*j2 Global Communications, Inc. | | 234,870 | | | 4,972 |

*Nuance Communications, Inc. | | 230,780 | | | 4,311 |

Paychex, Inc. | | 174,750 | | | 6,330 |

Qualcomm Incorporated | | 173,815 | | | 6,840 |

*Silicon Laboratories Inc. | | 229,980 | | | 8,608 |

Taiwan Semiconductor Mfg. Co. Ltd.—ADR | | 1,124,411 | | | 11,199 |

*Verisign Inc. | | 123,780 | | | 4,655 |

*Vistaprint Limited† | | 182,513 | | | 7,821 |

*WNS (Holdings) Limited—ADR | | 210,290 | | | 3,438 |

| | | | | |

| | | | | 118,490 |

| | | | | |

Health Care—18.3% | | | | | |

Allergan, Inc. | | 124,310 | | | 7,986 |

C.R. Bard, Inc. | | 67,755 | | | 6,423 |

*Genentech, Inc. | | 113,790 | | | 7,632 |

*Gilead Sciences, Inc. | | 248,620 | | | 11,439 |

*Healthways, Inc. | | 136,595 | | | 7,982 |

*Hologic, Inc. | | 118,780 | | | 8,153 |

*Idexx Laboratories, Inc. | | 71,870 | | | 4,214 |

*Integra Lifesciences Holding Corporation | | 111,535 | | | 4,677 |

Pharmaceutical Product Development, Inc. | | 225,855 | | | 9,118 |

| | | | | |

| | | | | 67,624 |

| | | | | |

Industrials & Services—16.0% | | | | | |

ABB Ltd—ADR | | 310,370 | | | 8,939 |

Danaher Corporation | | 160,426 | | | 14,076 |

Expeditors International of Washington, Inc. | | 118,720 | | | 5,304 |

Fastenal Company | | 171,954 | | | 6,950 |

*IHS Inc. | | 99,440 | | | 6,022 |

*InnerWorkings, Inc. | | 234,465 | | | 4,047 |

Rockwell Automation, Inc. | | 73,595 | | | 5,075 |

Rockwell Collins, Inc. | | 121,775 | | | 8,764 |

| | | | | |

| | | | | 59,177 |

| | | | | |

Consumer Discretionary—9.4% | | | | | |

*Coach, Inc. | | 124,705 | | | 3,814 |

*Coinstar, Inc. | | 186,730 | | | 5,257 |

International Game Technology | | 139,480 | | | 6,127 |

Johnson Controls, Inc. | | 242,631 | | | 8,744 |

*Life Time Fitness, Inc. | | 75,860 | | | 3,769 |

*McCormick & Schmick’s Seafood Restaurants, Inc. | | 142,945 | | | 1,705 |

Omnicom Group Inc. | | 115,785 | | | 5,503 |

| | | | | |

| | | | | 34,919 |

| | | | | |

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

VRN = Variable Rate Note

| | | | | | | |

Issuer | | Shares or

Principal

Amount | | Value | |

| | |

Common Stocks—(continued) | | | | | | | |

Energy—8.6% | | | | | | | |

Apache Corporation | | | 93,700 | | $ | 10,076 | |

Smith International, Inc. | | | 176,085 | | | 13,004 | |

Suncor Energy, Inc.† | | | 80,125 | | | 8,712 | |

| | | | | | | |

| | | | | | 31,792 | |

| | | | | | | |

Financials—6.3% | | | | | | | |

Charles Schwab & Co., Inc. | | | 232,780 | | | 5,948 | |

CME Group Inc. | | | 9,050 | | | 6,208 | |

*IntercontinentalExchange Inc. | | | 30,080 | | | 5,790 | |

*MF Global Ltd.† | | | 175,680 | | | 5,529 | |

| | | | | | | |

| | | | | | 23,475 | |

| | | | | | | |

Consumer Staples—4.2% | | | | | | | |

PepsiCo, Inc. | | | 140,010 | | | 10,627 | |

Wal Mart De Mexico—ADR | | | 140,415 | | | 4,844 | |

| | | | | | | |

| | | | | | 15,471 | |

| | | | | | | |

Materials—3.9% | | | | | | | |

Praxair, Inc. | | | 161,840 | | | 14,357 | |

| | | | | | | |

Total Common Stock—98.8%

(cost $297,905) | | | 365,305 | |

| | | | | | | |

| | |

Investment in Affiliate | | | | | | | |

William Blair Ready Reserves Fund | | | 1,699,132 | | | 1,699 | |

| | | | | | | |

Total Investment in Affiliate—0.5%

(cost $1,699) | | | 1,699 | |

| | | | | | | |

| | |

Short-Term Investment | | | | | | | |

Prudential Funding Demand Note, VRN 4.430%, due 1/2/08 | | $ | 200,000 | | | 200 | |

| | | | | | | |

Total Short-Term Investment—0.0%

(cost $200) | | | 200 | |

| | | | | | | |

| | |

Repurchase Agreement | | | | | | | |

State Street Bank & Trust Company, 3.80% dated 12/31/07 due 1/2/08, repurchase price $3,309, collateralized by FNR 2002-76 | | | 3,307,874 | | | 3,308 | |

| | | | | | | |

Total Repurchase Agreement—0.9%

(cost $3,308) | | | 3,308 | |

| | | | | | | |

Total Investments—100.2%

(cost $303,112) | | | 370,512 | |

Liabilities, plus cash and other assets—(0.2)% | | | (868 | ) |

| | | | | | | |

Net assets—100.0% | | $ | 369,644 | |

| | | | | | | |

See accompanying Notes to Financial Statements.

December 31, 2007 | William Blair Funds 7 |

Mark A. Fuller III

Gregory J. Pusinelli

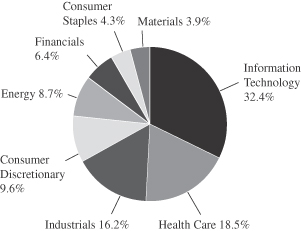

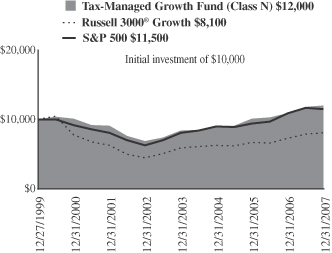

TAX-MANAGED GROWTH FUND

The Tax-Managed Growth Fund invests primarily in common stocks of large, medium and small domestic growth companies that the Advisor expects will have sustainable, above-average growth from one business cycle to the next.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform during the past year? How did the Fund’s performance compare to its benchmark?

The Tax-Managed Growth Fund posted a 9.96% gain on a total return basis (Class N Shares) for the 12 months ended December 31, 2007. By comparison, the Fund’s benchmark, the Russell 3000® Growth Index increased 11.40% while the Standard & Poor’s 500 Stock Index rose 5.49%.

What factors were behind the Fund’s performance versus the benchmark?

The Fund benefited from its stock selection in the Consumer Discretionary, Financials, Energy and Industrials sectors, while Information Technology and Consumer Staples proved to be a drag on performance relative to the Fund’s Russell 3000® Growth Index benchmark.

What were the most significant market factors impacting Fund performance?

Following a relatively flat first quarter, and in spite of some setbacks along the way, the stock market forged ahead in the second quarter to a strong mid-year finish. Facing strong headwinds from rising interest rates, a slump in housing prices and rising energy prices, the Standard & Poor’s 500 stock index still set a record high in late May. Boosting the market’s performance was a strong flow of private equity acquisitions, a pickup in manufacturing activity and signs that inflation had moderated.

However, turmoil in the home-loan market during the third quarter sparked concerns about tightening credit worldwide. This anxiety in turn gave way to worry over signs that the economy was slipping and uncertainty about the Federal Reserve Board’s response in dealing with the credit crisis. A series of interest rate cuts by the Fed beginning in August provided some support for stocks, but for equity investors the net effect was a series of gut-wrenching ups and downs.

The equity markets fell into a slump during November and December, as investors began to worry that the crisis in the credit markets might be gradually damaging the broader economy beyond housing. In fact, the Fed’s 0.25% reduction in the discount rate in the final month of the year only seemed to heighten investor anxiety about the overall health of the economy.

What were the best performing sectors and investments for the Fund?

The two best performing sectors for the Fund during 2007 were Consumer Discretionary and Financials. Our stock selection and underweight positions in both sectors contributed to the Fund’s performance relative to the benchmark In addition, Energy was a standout sector performance-wise for the Fund during the year, as the Fund’s holdings have benefited from higher demand and the strength in oil and natural gas prices.

The Funds two best-performing investments were Smith International and Kyphon.

8 Annual Report | December 31, 2007 |

Smith International, which supplies drill bits, fluids, and other products to the oil and gas industry, continued to benefit from strength in oil and natural gas prices, with offshore drilling projects as a major driver of revenue in recent quarters. Smith International was up 81.06% for the year for the Fund.

Health Care holding Kyphon, Inc. was up 75.67% for the year. Kyphon developed a minimally invasive procedure, kyphoplasty, to fix spinal compression fractures. Medtronic announced in July that it would be acquiring Kyphon.

Like Kyphon, a number of other companies that the Fund owns were also involved in acquisitions, which we believe lends credibility to our quality growth philosophy of investing in high quality companies with strong management and durable business franchises. These included MedImmune, which was acquired by European drug manufacturer AstraZeneca, Laureate Education, which was bought by a private equity firm, WebEx Communications, which was subsequently acquired by Cisco Systems, and Investors Financial Services Company, which was acquired by State Street.

What were the weakest performing sectors and investments for the Fund?

As mentioned, the Information Technology sector was the single largest detractor to Fund performance during 2007, followed by Consumer Staples.

The Fund’s worst overall performing investment was Santarus, which was down 70.63% for the Fund. Santarus is a pharmaceutical company that makes less expensive versions of drugs made by large cap drug companies to treat gastrointestinal diseases and disorders. The company’s products came under pricing pressure from managed care discounts for over-the-counter versions of its drugs as well as from other generics, and growth was not nearly what the company had anticipated. Following a succession of missed quarterly earnings estimates, we had begun to eliminate our position in this stock in the third quarter. The stock was no longer held in the Fund’s portfolio at your end.

The Fund also saw weak performance from the Information Technology name Jabil.

Jabil Circuit, a technology company which provides electronics manufacturing services for other firms, was the worst performing investment for the year, declining 37.0% for the Fund. Jabil reported a weak third quarter and attributed it to lower sales in their industrial segment due to slowing U.S. economic growth. The company also reduced earnings “guidance” for the following quarter that was well below Wall Street analysts’ expectations.

What is your current strategy? How is the Fund positioned?

We currently intend to be cautious investors towards the Consumer Discretionary sector. The slump in the housing sector and recent problems in the subprime lending market are negative factors overhanging the market, and have the potential to negatively impact consumer spending. We continue to monitor these issues and the potential impact they may have on the Fund’s holdings.

In the Financial sector, we have eliminated positions where we believe a company is overexposed to “headline” risk, based on the problems in the credit markets. During the fourth quarter we finished selling our position in Moody’s, swapping it for asset management firm T. Rowe Price, a company that does not have significant credit exposure and that is experiencing strong growth in its institutional and overseas businesses. Other Financial companies in the Fund’s portfolio that we consider core names have so far demonstrated an ability to withstand the recent turbulence.

December 31, 2007 | William Blair Funds 9 |

Within the Information Technology sector we will stick to our quality growth approach and attempt to mitigate potential losses by exiting names that we believe have a high degree of vulnerability to a slowdown in consumer spending. At the same time, we will seek to “trade up” to attractive quality growth names that that have traded down in price. And while we have not changed our philosophy or process with regard to the types of companies we seek, we intend to be more open minded with regard to stock valuation considerations within this sector, particularly if a company has a very unique franchise.

10 Annual Report | December 31, 2007 |

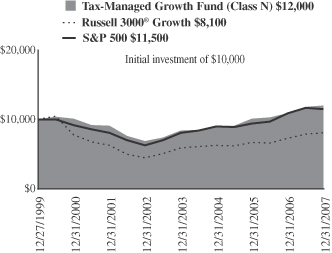

Tax-Managed Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 12/31/2007

| | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | Since

Inception(a) | |

Tax-Managed Growth Fund

Class N | | 9.96 | % | | 10.20 | % | | 11.89 | % | | 2.33 | % |

Tax-Managed Growth Fund

Class I | | 10.24 | | | 10.54 | | | 12.18 | | | 2.60 | |

Russell 3000®

Growth Index | | 11.40 | | | 8.64 | | | 12.42 | | | (2.55 | ) |

S&P 500 Index | | 5.49 | | | 8.62 | | | 12.83 | | | 1.76 | |

| | (a) | | For the period from December 27, 1999 to December 31, 2007. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small-capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500 Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on December 31, 2007. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

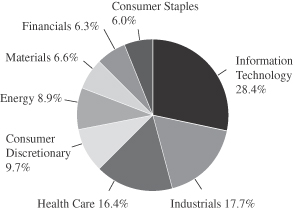

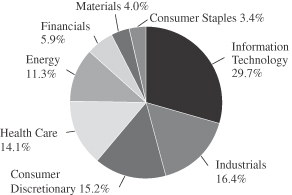

Sector Diversification (unaudited)

The sector diversification shown is based on the total investment portfolio.

December 31, 2007 | William Blair Funds 11 |

Tax-Managed Growth Fund

Portfolio of Investments, December 31, 2007 (all dollar amounts in thousands)

| | | | | |

Issuer | |

Shares | | Value |

| | |

Common Stocks | | | | | |

Information Technology—27.0% | | | | | |

*Activision, Inc. | | 8,453 | | $ | 251 |

*Adobe Systems Incorporated | | 6,160 | | | 263 |

Arm Holdings plc—ADR | | 11,960 | | | 89 |

*Cisco Systems, Inc. | | 7,180 | | | 194 |

*Cognizant Technology Solutions Corporation | | 5,350 | | | 182 |

*Electronic Arts Inc. | | 2,950 | | | 172 |

*EMC Corporation | | 14,140 | | | 262 |

*Euronet Worldwide, Inc. | | 3,770 | | | 113 |

*F5 Networks, Inc. | | 5,160 | | | 147 |

FactSet Research Systems Inc. | | 1,840 | | | 103 |

Jabil Circuit Inc. | | 15,770 | | | 241 |

Microchip Technology Incorporated | | 5,250 | | | 165 |

*Nuance Communications, Inc. | | 5,420 | | | 101 |

Paychex, Inc. | | 5,950 | | | 216 |

Qualcomm Incorporated | | 5,100 | | | 201 |

*Silicon Laboratories Inc. | | 3,300 | | | 124 |

Taiwan Semiconductor Mfg. Co. Ltd.—ADR | | 10,719 | | | 107 |

| | | | | |

| | | | | 2,931 |

| | | | | |

Industrials—16.9% | | | | | |

3M Company | | 2,430 | | | 205 |

*Corrections Corporation of America | | 6,210 | | | 183 |

Danaher Corporation | | 3,810 | | | 334 |

Expeditors International of Washington, Inc. | | 3,500 | | | 156 |

General Electric Company | | 6,985 | | | 259 |

*IHS Inc. | | 4,640 | | | 281 |

Knight Transportation, Inc. | | 7,832 | | | 116 |

Rockwell Collins, Inc. | | 4,110 | | | 296 |

| | | | | |

| | | | | 1,830 |

| | | | | |

Health Care—15.6% | | | | | |

Allergan Inc. | | 4,090 | | | 263 |

C.R.Bard, Inc. | | 1,710 | | | 162 |

*Gilead Sciences, Inc. | | 5,770 | | | 265 |

*Healthways, Inc. | | 5,710 | | | 334 |

Pharmaceutical Product Development, Inc. | | 5,970 | | | 241 |

*Psychiatric Solutions, Inc. | | 4,820 | | | 157 |

Stryker Corporation | | 3,600 | | | 269 |

| | | | | |

| | | | | 1,691 |

| | | | | |

Consumer Discretionary—9.2% | | | | | |

*CarMax, Inc. | | 6,840 | | | 135 |

*GameStop Corp. | | 2,810 | | | 175 |

International Game Technology | | 5,420 | | | 238 |

Johnson Controls, Inc. | | 5,670 | | | 204 |

*Scientific Games Corporation | | 3,590 | | | 119 |

*Tractor Supply Company | | 3,580 | | | 129 |

| | | | | |

| | | | | 1,000 |

| | | | | |

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

VRN = Variable Rate Note

| | | | | | | |

Issuer | | Shares or

Principal

Amount | | Value | |

| | |

Common Stocks—(continued) | | | | | | | |

Energy—8.4% | | | | | | | |

Apache Corporation | | | 1,780 | | $ | 191 | |

Encana Corporation† | | | 2,370 | | | 161 | |

Smith International, Inc. | | | 2,280 | | | 168 | |

Suncor Energy, Inc.† | | | 3,630 | | | 395 | |

| | | | | | | |

| | | | | | 915 | |

| | | | | | | |

Materials—6.2% | | | | | | | |

Airgas, Inc. | | | 4,870 | | | 254 | |

Praxair, Inc. | | | 4,750 | | | 421 | |

| | | | | | | |

| | | | | | 675 | |

| | | | | | | |

Financials—5.9% | | | | | | | |

*Affiliated Managers Group, Inc. | | | 1,040 | | | 122 | |

American International Group | | | 2,780 | | | 162 | |

*IntercontinentalExchange, Inc. | | | 930 | | | 179 | |

T. Rowe Price Group, Inc. | | | 2,990 | | | 182 | |

| | | | | | | |

| | | | | | 645 | |

| | | | | | | |

Consumer Staples—5.7% | | | | | | | |

Colgate-Palmolive Company | | | 3,020 | | | 235 | |

CVS/Caremark Corporation | | | 3,774 | | | 150 | |

PepsiCo, Inc. | | | 3,095 | | | 235 | |

| | | | | | | |

| | | | | | 620 | |

| | | | | | | |

Total Common Stock—94.9%

(cost $8,127) | | | 10,307 | |

| | | | | | | |

| | |

Investment in Affiliate | | | | | | | |

William Blair Ready Reserves Fund | | | 308,701 | | | 309 | |

| | | | | | | |

Total Investment in Affiliate—2.9%

(cost $309) | | | 309 | |

| | | | | | | |

| | |

Short-Term Investment | | | | | | | |

Prudential Funding Demand Note, VRN 4.430%, due 1/2/08 | | $ | 100,000 | | | 100 | |

| | | | | | | |

Total Short-Term Investment—0.9%

(cost $100) | | | 100 | |

| | | | | | | |

| | |

Repurchase Agreement | | | | | | | |

State Street Bank and Trust Company, 3.800% dated 12/31/07 due 1/2/08 repurchase price $154, collateralized by FN Pool #712321 | | | 154,120 | | | 154 | |

| | | | | | | |

Total Repurchase Agreement—1.4%

(cost $154) | | | 154 | |

| | | | | | | |

Total Investments—100.1%

(cost $8,690) | | | 10,870 | |

Liabilities, plus cash and other assets—( 0.1)% | | | (8 | ) |

| | | | | | | |

Net assets—100.0% | | $ | 10,862 | |

| | | | | | | |

See accompanying Notes to Financial Statements.

12 Annual Report | December 31, 2007 |

James S. Golan

John F. Jostrand

LARGE CAP GROWTH FUND

The Large Cap Growth Fund invests primarily in common stocks of quality large domestic growth companies that the Advisor believes have demonstrated sustained growth over a long period of time.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the last year? How did the Fund’s performance compare to its benchmark?

The Large Cap Growth Fund posted a 9.30% increase on a total return basis (Class N Shares) for the 12 months ended December 31, 2007. By comparison, the Fund’s benchmark, the Russell 1000® Growth Index, gained 11.81%.

What were the most significant market factors impacting Fund performance?

For 2007, most US equity markets gained ground with the exception of those focused on value and micro cap stocks. In a significant reversal since the beginning of the millennium, growth stocks surpassed value stocks with a 12% spread or more between Russell growth and value indices. From a market cap perspective, large caps outperformed small caps; the spread between Russell large and small indices for 2007 was more than 4.7%. Volatility remained high as investors responded to weakness in economic and employment data. Second and third quarter GDP was reported as solid but the fourth quarter GDP estimate was much lower. The unemployment rate rose to 5.0% by year end suggesting a weakening labor market. Additionally, the wealth and health of consumers and financial firms came under pressure during the period due to higher defaults on home loans and mortgage related investments as well as increasing losses on credit cards and other consumer loans. As a result of these strong market headwinds in December, many market observers have discussed the potential for a recession in the coming year.

On a positive note, US corporations have significant cash on their balance sheets and profit margins have remained elevated as a result of continued cost productivity. While the US economic growth seems to be slowing, foreign growth has continued to be healthy.

In terms of sector performance in the Russell 1000® Growth index, the best contributors to overall returns were technology and industrials. The technology group was up 19.1% for the year with many of the largest bell-whether companies doing well in the flight to safety. Industrials gained 14.0% for the period benefiting from strong global demand. The weakest sector contributors and the only ones with negative returns were consumer discretionary, telecommunications services and financials. Consumer discretionary stocks declined 10.5% as investors were concerned over a possible recession that could impact future returns for the group while financial stocks dropped 3.4% on the issues discussed above.

Were there any investment strategies or themes that did not measure up to your expectations?

Those sectors with the weakest relative portfolio performance for 2007 were Technology and Consumer Staples. For Technology, while we were overweighted in this solid performing group, a couple of factors drove the poor performance. First, our holdings in semiconductors detracted from results due to declines in Maxim Integrated Products and Taiwan Semiconductors. Maxim Integrated Products came under pressure relative to peers due to

December 31, 2007 | William Blair Funds 13 |

delayed restatement and share buyback issues. Taiwan Semiconductor was impacted by concerns over a slowing global economy as well as some emerging concerns over the competitive environment; however, this firm continues to be viewed as an industry leader and we believe that market concerns about the competitive environment for semiconductors were overdone. We added to this position during the fourth quarter on weakness and the stock has appreciated from third quarter lows. Secondly, there was a flight to safety during the last half of the year as investors worried over a slowing economy. Investors flocked to the very largest technology companies such as Microsoft and Intel, or those with strong product momentum like Apple. The fact that we didn’t own these stocks hurt our relative performance.

Although Consumer Staples had healthy returns in the benchmark, they were the second largest detractor from relative performance due to stock selection. While Pepsi was a good performer for us, Walgreens was a disappointment. The company reported very disappointing earnings in October causing a significant drop in the stock price. We exited the stock because we believed that the issues facing the company would take several quarters to be resolved.

Which sectors enhanced the Fund’s return? What were among the best performing investments for the Fund?

Stock selection in Financials, Energy and Industrials sectors assisted performance for the year. Financial stocks, which had a negative return in the benchmark, drove a significant part of the Fund’s performance. With positioning in select capital markets and diversified financial services companies, our financial stocks had positive results and we were able to avoid significant exposure to the sub prime and credit issues faced by the market during the year. Charles Schwab was a strong relative and absolute performer with solid quarterly earnings reports driven by continued strong asset growth.

Energy stocks were the best performing sector for the Fund versus the benchmark with a return of 41%. Our exploration and production stocks saw strong returns in the period. Appreciation was particularly pronounced for Apache and Suncor, as global demand for oil continued to rise and the price of oil reached near $100 per barrel. Schlumberger was also a strong performer as producers began a more aggressive push to find new energy reserves.

Our industrial stocks were also good performers for the Fund driven by strength in Danaher and ABB Ltd. Danaher continued to deliver the financial results investors have grown to expect over time while ABB continued to benefit from the strong global demand for its products used in the electrical power grid.

What is your current strategy? How is the Fund positioned?

The economy is slowing driven by sub prime and credit issues. We believe that economic growth will be weak through the first-half of this year, but begin to strengthen as we move to the latter part of the year. Through continued strong export growth and actions by the Federal Reserve, the economy should continue to move forward. The factors that we will continue to watch include unemployment and inflation. A significant increase in the unemployment rate could have a detrimental impact on the economic outlook while a significant increase in inflation expectation could also limit the Federal Reserve’s response to slowing growth.

We have experienced an unprecedented period of corporate profitability growth. As the economy slows, the higher quality growth companies should continue to differentiate themselves relative to the average company. Regardless of the macro issues facing the market, we continue to find quality stocks that offer growth opportunities. We continue to find interesting opportunities in Technology, select Health Care, Industrials and Energy. We believe that as overall earnings growth decelerates, investors will pay more attention to earnings multiples, and reward stocks which exhibit longer, more sustainable earnings trends with higher P/E multiples.

14 Annual Report | December 31, 2007 |

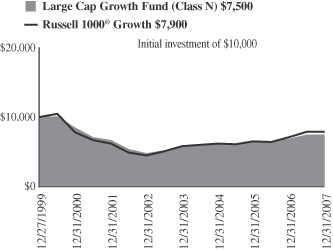

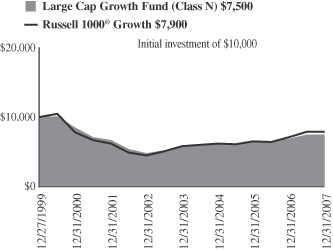

Large Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 12/31/2007

| | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | Since

Inception(a) | |

Large Cap Growth Fund Class N | | 9.30 | % | | 6.42 | % | | 9.39 | % | | (3.48 | )% |

Large Cap Growth Fund Class I | | 9.36 | | | 6.60 | | | 9.66 | | | (3.29 | ) |

Russell 1000®

Growth Index | | 11.81 | | | 8.68 | | | 12.11 | | | (2.86 | ) |

| | (a) | | For the period from December 27, 1999 to December 31, 2007. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large capitalization companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2007. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

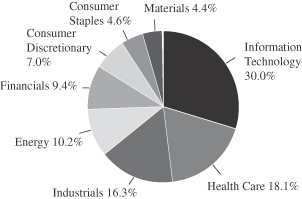

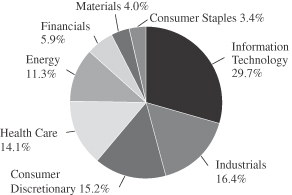

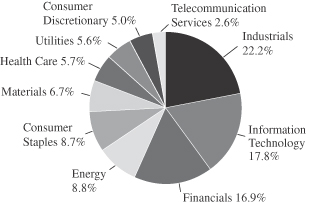

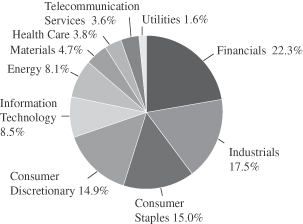

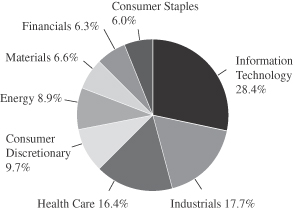

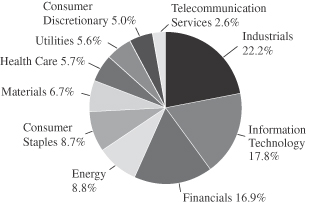

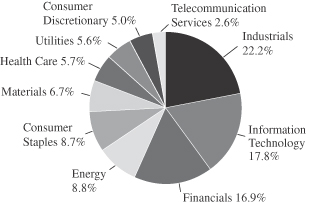

Sector Diversification (unaudited)

The sector diversification shown is based on the total investment portfolio.

December 31, 2007 | William Blair Funds 15 |

Large Cap Growth Fund

Portfolio of Investments, December 31, 2007 (all dollar amounts in thousands)

| | | | | |

Issuer | | Shares | | Value |

| | |

Common Stocks | | | | | |

Information Technology—29.3% | | | | | |

*Adobe Systems Incorporated | | 24,655 | | $ | 1,053 |

*Autodesk, Inc. | | 14,350 | | | 714 |

*Cisco Systems Inc. | | 68,954 | | | 1,867 |

Corning Incorporated | | 30,230 | | | 725 |

*EMC Corporation | | 55,945 | | | 1,037 |

*Fiserv, Inc. | | 9,850 | | | 547 |

*Google Inc. | | 630 | | | 436 |

Maxim Integrated Products, Inc. | | 19,340 | | | 512 |

Paychex, Inc. | | 20,035 | | | 726 |

Qualcomm Incorporated | | 16,695 | | | 657 |

Taiwan Semiconductor Mfg. Co. Ltd.—ADR | | 98,826 | | | 984 |

*Verisign, Inc. | | 16,390 | | | 616 |

| | | | | |

| | | | | 9,874 |

| | | | | |

Health Care—17.7% | | | | | |

Allergan, Inc. | | 15,520 | | | 997 |

C. R. Bard, Inc. | | 11,465 | | | 1,087 |

*Genentech, Inc. | | 11,975 | | | 803 |

*Gilead Sciences, Inc. | | 25,520 | | | 1,174 |

*Hologic, Inc. | | 10,410 | | | 715 |

Stryker Corporation | | 8,955 | | | 669 |

*Thermo Fisher Scientific Inc. | | 8,930 | | | 515 |

| | | | | |

| | | | | 5,960 |

| | | | | |

Industrials—16.0% | | | | | |

ABB Ltd.—ADR | | 32,250 | | | 929 |

Danaher Corporation | | 22,442 | | | 1,969 |

Expeditors International of Washington, Inc. | | 10,810 | | | 483 |

Rockwell Automation, Inc. | | 9,490 | | | 654 |

Rockwell Collins, Inc. | | 18,565 | | | 1,336 |

| | | | | |

| | | | | 5,371 |

| | | | | |

Energy—10.0% | | | | | |

Apache Corporation | | 11,720 | | | 1,260 |

Schlumberger Limited† | | 13,315 | | | 1,310 |

Suncor Energy, Inc.† | | 7,385 | | | 803 |

| | | | | |

| | | | | 3,373 |

| | | | | |

Financials—9.2% | | | | | |

Brookfield Asset Management Inc.† | | 8,730 | | | 312 |

Charles Schwab & Co, Inc. | | 42,655 | | | 1,090 |

CME Group Inc. | | 760 | | | 521 |

Franklin Resources, Inc. | | 5,705 | | | 653 |

*IntercontinentalExchange, Inc. | | 2,650 | | | 510 |

| | | | | |

| | | | | 3,086 |

| | | | | |

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

VRN = Variable Rate Note

| | | | | | | |

Issuer | | Shares or

Principal

Amount | | Value | |

| | |

Common Stocks—(continued) | | | | | | | |

Consumer Discretionary—6.9% | | | | | | | |

*Coach, Inc. | | | 11,690 | | $ | 358 | |

International Game Technology | | | 9,687 | | | 425 | |

Johnson Controls, Inc. | | | 29,895 | | | 1,077 | |

Omnicom Group Inc. | | | 9,550 | | | 454 | |

| | | | | | | |

| | | | | | 2,314 | |

| | | | | | | |

Consumer Staples—4.5% | | | | | | | |

PepsiCo, Inc. | | | 14,005 | | | 1,063 | |

Wal Mart De Mexico—ADR | | | 13,060 | | | 451 | |

| | | | | | | |

| | | | | | 1,514 | |

| | | | | | | |

Materials—4.3% | | | | | | | |

Praxair, Inc. | | | 16,345 | | | 1,450 | |

| | | | | | | |

Total Common Stock—97.9%

(cost $28,392) | | | 32,942 | |

| | | | | | | |

| | |

Investment in Affiliate | | | | | | | |

William Blair Ready Reserves Fund | | | 244,119 | | | 244 | |

| | | | | | | |

Total Investment in Affiliate—0.7%

(cost $244) | | | 244 | |

| | | | | | | |

| | |

Short-Term Investment | | | | | | | |

American Express Credit Corp. Demand Note, VRN 4.695%, due 1/2/08 | | $ | 407,000 | | | 407 | |

Prudential Funding Demand Note, VRN 4.430%, due 1/2/08 | | | 510,000 | | | 510 | |

| | | | | | | |

Total Short-Term Investment—2.7%

(cost $917) | | | 917 | |

| | | | | | | |

| | |

Repurchase Agreement | | | | | | | |

State Street Bank and Trust Company, 3.800% dated 12/31/07, due 1/2/08, repurchase price $600, collateralized by FN Pool #712321 | | | 599,500 | | | 600 | |

| | | | | | | |

Total Repurchase Agreement—1.8%

(cost $600) | | | 600 | |

| | | | | | | |

Total Investments—103.1%

(cost $30,153) | | | 34,703 | |

Liabilities, plus cash and other assets—(3.1)% | | | (1,036 | ) |

| | | | | | | |

Net assets—100.0% | | | | | $ | 33,667 | |

| | | | | | | |

See accompanying Notes to Financial Statements.

16 Annual Report | December 31, 2007 |

Karl W. Brewer

Colin J. Williams

SMALL CAP GROWTH FUND

The Small Cap Growth Fund invests primarily in common stocks of small domestic growth companies that the Advisor expects to have solid growth in earnings.

AN OVERVIEW FROM THE PORTFOLIO MANAGERS

How did the Fund perform over the last year? How did the Fund’s performance compare to its benchmark?

The Small Cap Growth Fund posted a 2.15% loss on a total return basis (Class N Shares) for the 12 months ended December 31, 2007. By comparison, the Funds benchmark, the Russell® Growth Index gained 7.05% while the Russell 2000® Index lost 1.57% for the year end December 31, 2007.

What were the most significant factors impacting Fund performance? What factors were behind the Fund’s performance versus the benchmark?

As we look back at 2007, we entered the year much differently than we exited the year. The first half of the year was characterized by positive prospects for economic growth and corporate profit growth to continue their strong trends. The immense merger and buyout activity continued through the first six months of the year and was a boost to stock valuations. The housing market had already begun to slow but there was little fallout to consumer spending at that point, and despite a brief scare in February 2007, mortgage-related issues had not been a material problem. With that, most equity indices turned in strong mid to high single digit performances through the end of June — with a slight bias towards growth over value and towards small and mid caps over large. However, in the second half of 2007, the breadth and depth of the mortgage-related problems came to the surface and the slumping housing industry began to take its toll on consumers and those companies with revenue exposure to residential real estate investment and sales activity. As we exited 2007, stock market volatility had increased dramatically. This was caused by the expanding housing market and credit issues and the uncertain severity of their effects on the consumer and overall economy. Accordingly, equity indices finished the second half of the year considerably weaker than the first six months of the year. As earnings growth became less broad-based, growth indices sharply outpaced their value counterparts in the second half of the year, and for 2007 as a whole. The flight to quality witnessed in the back half of the year drove investors up the cap spectrum. Because of this, large caps narrowly outpaced mid caps during 2007, while small caps were the notable laggards.

With the housing market slump and credit quality concerns of 2007, the Consumer Discretionary and Financials sectors were the weakest performers for the Russell 2000® Growth Index. With rising crude prices and commodity prices in general, along with strong global industrial activity, the Energy, Materials and Industrials sectors turned in the strongest performances. The defensive-natured Health Care sector also outperformed the broad market during 2007, as it was one of the best performing sectors in the second half of the year when risk aversion increased dramatically.

From a relative standpoint, the Fund underperformed the Russell 2000® Growth Index during the year. Negative stock selection contributed to the Fund’s underperformance, but market headwinds played a role as well.

| | 1. | First, our market cap bias disadvantaged us this year given that “bigger was better” along the market cap spectrum and our investment process seeks to find smaller, less-discovered companies. We were underweight the largest quintile of stocks in |

December 31, 2007 | William Blair Funds 17 |

| | the Russell 2000® Growth which was up 13.5% for the year, while we were overweight the smallest quintile which turned in only a 4.3% return. |

| | 2. | The second style bias that detracted from performance was our valuation sensitivity. We believe that we are more valuation sensitive than most growth investors. During 2007 and especially later in the year, the market was biased toward more expensive stocks, which made it a tougher environment for our style of investing. |

| | 3. | Similarly, the third style dynamic that disadvantaged the Fund was the fact the market rewarded momentum stocks and the Fund suffered because of our bias to avoid chasing stocks simply because of great recent performance. |

| | 4. | Finally, industry factors also detracted from relative performance during the year. Some of the traditional cyclical and commodity-driven industries such as Industrial Conglomerates, Chemicals, and Metals & Mining performed well. Our style of finding companies with more sustainable growth prospects, which are often less economically sensitive, biases us away from these types of industries. |

| | 5. | Our stock selection in the Fund was a detractor from relative performance during 2007 as well. When simply examining the Fund by sector, certain stocks in the Consumer Discretionary, Information Technology, Industrials and Health Care sectors were particularly weak relative to the benchmark. |

What were among the weakest performing investments for the Fund?

Two of the weakest performing stocks for the Fund were Santarus and WNS Holdings.

Santarus, a specialty pharmaceutical company, was a stock we owned because they had one of the fastest-acting drugs in the huge ($12 billion) acid reflux drug category. Our investment thesis was that Santarus would rapidly penetrate this large market with a superior product to the competition. However, throughout the course of the year, we were disappointed with data on sales force productivity, and more importantly, increasing generic and over-the-counter utilization and the corresponding pricing pressure within the acid reflux market. The latter made us question the ongoing market opportunity and earnings power for the company, and we therefore sold the stock.

WNS Holdings Limited operates in the business process outsourcing (BPO) industry. The company offers its corporate clients an outsourced solution for various business functions in areas such as finance and accounting, supply chain management, human resources and market research. During August, one of the company’s mortgage servicing clients informed the company that it would no longer be in business, and therefore, earnings expectations needed to come down. The stock was down in the days following the announcement, which we thought mostly reflected the loss in earnings derived from that client. However, despite having minimal exposure to other mortgage servicers and the balance of their business performing well, the stock continued to sell off through year end as the valuation compressed due to the stigma of having “mortgage-related” exposure. We continue to be optimistic about the future growth prospects for WNS.

What were among the best performing investments for the Fund?

Two of the best performing stocks during the year were Air Methods and SurModics.

Air Methods is a leader in medical air transport. The company contracts with both hospitals and communities for emergency and non-emergency transport. The stock performed very well in 2007 as the company surpassed earnings expectations throughout the year. This business strength was the result of strong medical transport trends, and in turn, high earnings contribution due to Air Methods’ largely fixed cost model.

18 Annual Report | December 31, 2007 |

SurModics, a medical technology and device company, was another top performer in the Portfolio during 2007. In June, the company announced that it was entering an agreement with Merck to develop and commercialize products using Merck’s drug compounds and Surmodics’ I-Vation drug delivery system to treat various retinal diseases in the ophthalmology market. SurModics also bought back shares, made two acquisitions and announced a partnership with a leading orthopedics company. All of these events translated into positive sentiment for the stock during 2007.

What is your current outlook?

The threat of a recession is the main overhang on the markets as we look out to 2008. The housing market shows little signs of stabilizing, employment data has softened recently, and the conventional wisdom of a global economy moderating any US slowdown is being tested as two major pieces of the world economy, Europe and Japan, show signs of moderation as well. From an earnings perspective, growth forecasts appear overly optimistic for 2008 so the market could be at further risk if expectations ease in the coming months. However, valuation multiples are at reasonable levels and the Federal Reserve seems willing to combat any signs of a recession. The dichotomy in the market during 2007, in which consumer related shares vastly underperformed those on the industrial side of the economy, may still present opportunities on a bottom-up basis, as certain consumer stocks may be more fully discounting an economic slowdown than are many industrial companies. Regardless, we will continue to look across all sectors for companies with more company-specific growth drivers that should enable them to exceed growth expectations despite the macro-economic environment.

Is there any other news with respect to the Fund?

With respect to illiquid securities in the Fund, there are five companies for which the fund holds illiquid securities or warrants. These securities amounted to roughly 1.2% of the Fund as of December 31, 2007. The Fund holds warrants of Motorcar Parts of America, Zila Inc and Think Partnership, Inc. The underlying warrants for the above mentioned securities are exercisable at various dates until 2011. The Fund also holds common shares of Kona Grill, a restaurant company, which were purchased in two private transactions during 2006. These shares are expected to become freely tradable during 2008. Likewise, the Fund owns shares of BancTec which provides automation solutions to the retail banking industry; these shares are also expected to become freely tradable during 2008. The Fund’s Pricing Committee and Valuation Committee are currently pricing BancTec common shares, Kona Grill common shares and all warrants at fair value.

December 31, 2007 | William Blair Funds 19 |

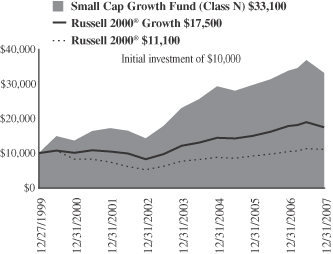

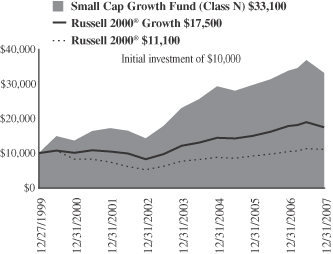

Small Cap Growth Fund

Performance Highlights (unaudited)

Average Annual Total Return at 12/31/2007

| | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | Since

Inception(a) | |

Small Cap Growth Fund Class N | | (2.15 | )% | | 4.15 | % | | 18.40 | % | | 16.03 | % |

Small Cap Growth Fund Class I | | (1.88 | ) | | 4.44 | | | 18.70 | | | 16.32 | |

Russell 2000®

Growth Index | | 7.05 | | | 8.11 | | | 16.50 | | | 1.29 | |

Russell 2000® Index | | (1.57 | ) | | 6.80 | | | 16.25 | | | 7.20 | |

| | (a) | | For the period from December 27, 1999 to December 31, 2007. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. From time to time, the investment advisor may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2000® Growth Index consists of small-capitalization companies with above average price-to-book ratios and forecasted growth rates.

The Russell 2000® Index is an unmanaged composite of the smallest 2000 stocks of the Russell 3000® Index.

This report identifies the Fund’s investments on December 31, 2007. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

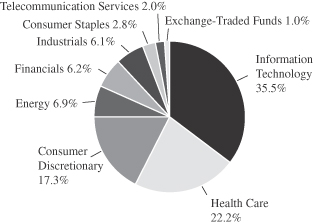

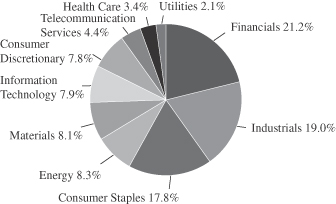

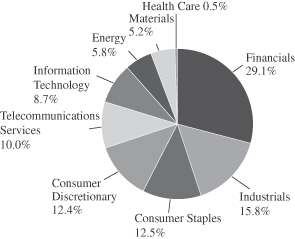

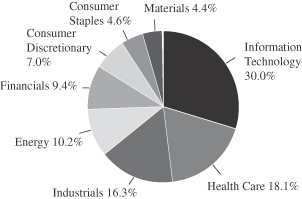

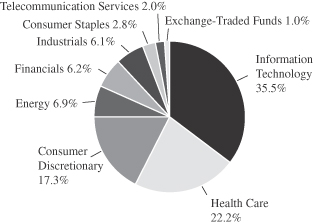

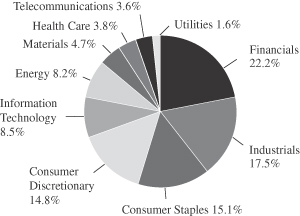

Sector Diversification (unaudited)

The sector diversification shown is based on the total investment portfolio.

20 Annual Report | December 31, 2007 |

Small Cap Growth Fund

Portfolio of Investments, December 31, 2007 (all dollar amounts in thousands)

| | | | | |

Issuer | | Shares | | Value |

| | |

Common Stocks | | | | | |

Information Technology—35.0% | | | | | |

*DTS, Inc. | | 827,500 | | $ | 21,159 |

*EarthLink, Inc. | | 2,401,291 | | | 16,977 |

*Euronet Worldwide, Inc. | | 1,107,282 | | | 33,218 |

*F5 Networks, Inc. | | 372,799 | | | 10,632 |

*GigaMedia Limited† | | 778,438 | | | 14,596 |

*j2 Global Communications, Inc. | | 784,347 | | | 16,605 |

*MathStar, Inc. | | 1,290,104 | | | 839 |

*Metavante Technologies, Inc. | | 455,806 | | | 10,629 |

*Miva, Inc. | | 3,027,199 | | | 5,782 |

*Monotype Imaging Holdings Inc. | | 185,745 | | | 2,818 |

*Nuance Communications, Inc. | | 994,644 | | | 18,580 |

*Optimal Group, Inc.† | | 2,164,208 | | | 8,981 |

*PDF Solutions, Inc. | | 1,889,930 | | | 17,028 |

*Silicon Laboratories, Inc. | | 546,303 | | | 20,448 |

*Skillsoft, plc—ADR | | 1,440,415 | | | 13,770 |

*Sonic Solutions | | 1,143,655 | | | 11,883 |

*SuccessFactors, Inc. | | 1,041,000 | | | 12,305 |

Syntel, Inc. | | 188,600 | | | 7,265 |

*Think Partnership, Inc. | | 4,626,270 | | | 7,032 |

*Ultimate Software Group, Inc. | | 462,285 | | | 14,548 |

United Online, Inc. | | 1,805,299 | | | 21,339 |

*Virtusa Corporation | | 708,131 | | | 12,272 |

*VistaPrint Limited† | | 668,112 | | | 28,629 |

*Volterra Semiconductor Corporation | | 752,727 | | | 8,303 |

*Website Pros, Inc. | | 1,922,561 | | | 22,321 |

*Wind River Systems, Inc. | | 989,375 | | | 8,835 |

*WNS Holdings Limited—ADR | | 1,003,909 | | | 16,414 |

| | | | | |

| | | | | 383,208 |

| | | | | |

Health Care—21.0% | | | | | |

*Air Methods Corporation | | 433,504 | | | 21,532 |

*Allscrpits Healthcare Solutions, Inc. | | 289,938 | | | 5,631 |

*Capital Senior Living Corporation | | 1,228,146 | | | 12,195 |

*Healthways, Inc. | | 408,893 | | | 23,896 |

*HMS Holdings Corp. | | 228,784 | | | 7,598 |

*Integra Lifesciences Holdings Corporation | | 377,872 | | | 15,844 |

*Iris International, Inc. | | 476,140 | | | 9,342 |

*Kensey Nash Corporation | | 310,869 | | | 9,301 |

*LifeCell Corporation | | 222,234 | | | 9,581 |

*Northstar Neuroscience, Inc. | | 577,926 | | | 5,375 |

*Omnicell, Inc. | | 128,300 | | | 3,455 |

*Providence Service Corporation | | 821,414 | | | 23,115 |

*Psychiatric Solutions, Inc. | | 411,054 | | | 13,359 |

*Sangamo Biosciences, Inc. | | 794,874 | | | 10,405 |

*Sciele Pharma, Inc. | | 441,098 | | | 9,020 |

*Surmodics, Inc. | | 415,453 | | | 22,547 |

*Trinity Biotech plc—ADR | | 1,010,654 | | | 6,893 |

*VistaCare, Inc. | | 1,907,915 | | | 13,832 |

*Zila, Inc. | | 7,237,388 | | | 7,020 |

| | | | | |

| | | | | 229,941 |

| | | | | |

Consumer Discretionary—15.1% | | | | | |

*Century Casinos, Inc. | | 1,289,233 | | | 8,303 |

*Coinstar, Inc. | | 529,804 | | | 14,914 |

*DG Fastchannel, Inc | | 1,046,244 | | | 26,826 |

*Duckwall-ALCO Stores, Inc. | | 322,738 | | | 10,302 |

*Granite City Food & Brewery, Ltd. | | 1,247,423 | | | 3,318 |

*Jarden Corporation | | 742,503 | | | 17,531 |

*Jos. A. Bank Clothiers, Inc. | | 334,222 | | | 9,509 |

*K12 Inc. | | 210,730 | | | 5,454 |

*Kona Grill, Inc.—144A | | 300,000 | | | 4,374 |

*Kona Grill, Inc.** (restricted) | | 135,134 | | | 1,701 |

| | | | | |

Issuer | | Shares | | Value |

| | |

Common Stocks—(continued) | | | | | |

Consumer Discretionary—(continued) | | | | | |

*Kona Grill, Inc. | | 210,695 | | $ | 3,072 |

*Lions Gate Entertainment Corporation† | | 1,092,832 | | | 10,294 |

*Motorcar Parts of America, Inc. | | 706,436 | | | 7,735 |

*Progressive Gaming International Corporation | | 5,331,944 | | | 13,222 |

*Shuffle Master, Inc. | | 761,512 | | | 9,131 |

Strayer Education, Inc. | | 100,706 | | | 17,178 |

*Ulta Salon, Cosmetics & Fragrance, Inc. | | 135,900 | | | 2,331 |

| | | | | |

| | | | | 165,195 |

| | | | | |

Energy—6.6% | | | | | |

*Concho Resources Inc. | | 742,883 | | | 15,311 |

*Dril-Quip, Inc. | | 213,588 | | | 11,888 |

*Oil States International, Inc. | | 319,025 | | | 10,885 |

*Petrohawk Energy Corporation | | 1,308,107 | | | 22,644 |

*W-H Energy Services, Inc. | | 196,730 | | | 11,058 |

| | | | | |

| | | | | 71,786 |

| | | | | |

Financials—5.8% | | | | | |

*Banctec, Inc.** | | 1,809,982 | | | 10,860 |

*Cash Systems, Inc. | | 1,131,365 | | | 5,001 |

*FirstService Corporation† | | 334,021 | | | 10,198 |

*Marlin Business Services Corporation | | 579,313 | | | 6,986 |

National Financial Partners Corporation | | 419,975 | | | 19,155 |

*Signature Bank New York | | 344,782 | | | 11,636 |

| | | | | |

| | | | | 63,836 |

| | | | | |

Industrials—5.8% | | | | | |

*GEO Group, Inc. | | 664,796 | | | 18,614 |

Heidrick & Struggles International, Inc. | | 314,631 | | | 11,676 |

*Hudson Highland Group, Inc. | | 617,358 | | | 5,192 |

*InnerWorkings, Inc. | | 1,382,752 | | | 23,866 |

*Kforce, Inc. | | 438,345 | | | 4,274 |

| | | | | |

| | | | | 63,622 |

| | | | | |

Consumer Staples—2.7% | | | | | |

*Overhill Farms, Inc. | | 1,903,720 | | | 5,406 |

*Physicians Formula Holdings, Inc. | | 1,335,045 | | | 15,860 |

*Smart Balance, Inc. | | 753,934 | | | 8,241 |

| | | | | |

| | | | | 29,507 |

| | | | | |

Telecommunication Services—1.9% | | | | | |

*Syniverse Holdings, Inc. | | 1,312,233 | | | 20,445 |

| | | | | |

Total Common Stock—93.9%

(Total Cost $964,213) | | | 1,027,540 |

| | | | | |

Exchange-Traded Funds—1.0% | | | | | |

iShares, Russell 2000 Growth | | 124,622 | | | 10,403 |

| | | | | |

Total Exchange-Traded Funds—1.0%

(cost $10,383) | | | 10,403 |

| | | | | |

| | |

Investment in Warrants | | | | | |

*Motorcar Parts of America, Inc.** | | 111,575 | | | — |

*Think Partnership, Inc., 2011, $2.50** | | 1,424,000 | | | — |

*Think Partnership, Inc., 2011, $3.05** | | 448,409 | | | — |

*Think Partnership, Inc., 2011, $4.00** | | 224,205 | | | — |

*Zila, Inc., 2011, $2.21** | | 2,271,528 | | | — |

| | | | | |

Total Investment in Warrants—0.0%

(cost $0) | | | — |

| | | | | |

See accompanying Notes to Financial Statements.

December 31, 2007 | William Blair Funds 21 |

Small Cap Growth Fund

Portfolio of Investments, December 31, 2007 (all dollar amounts in thousands)

| | | | | | |

Issuer | | Shares or

Principal

Amount | | Value |

| | |

Investment in Affiliate | | | | | | |

William Blair Ready Reserves Fund | | | 1,553,704 | | $ | 1,554 |

| | | | | | |

Total Investment in Affiliate—0.1%

(cost $1,554) | | | 1,554 |

| | | | | | |

| | |

Short-Term Investments | | | | | | |

American Express Credit Corp. Demand Note, VRN 4.695%, due 1/2/08 | | $ | 12,710,000 | | | 12,710 |

Prudential Funding Demand Note, VRN 4.430%, due 1/2/08 | | | 11,602,000 | | | 11,602 |

| | | | | | |

Total Short-Term Investments—2.2%

(cost $24,312) | | | 24,312 |

| | | | | | |

*Non-income producing securities

ADR = American Depository Receipt

† = U.S. listed foreign security

VRN = Variable Rate Note

** = Fair valued pursuant to Valuation Procedures adopted by the Board of Trustees. The holdings represents 1.15% of the Fund's net assets at December 31, 2007. These securities were also deemed illiquid pursuant to Liquidity Procedures approved by the Board of Trustees.

| | | | | | |

| | | |

Issuer | | Principal

Amount | | Value |

| | |

Repurchase Agreement | | | | | | |

State Street Bank and Trust Company, 3.800% dated 12/31/07, due 1/2/08, repurchase price $28,610, collateralized by

U.S. Treasury Bill, due 2/28/08 | | $ | 28,604,422 | | $ | 28,604 |

| | | | | | |

Total Repurchase Agreement—2.6%

(cost $28,604) | | | 28,604 |

| | | | | | |

Total Investments—99.8%

(cost $1,029,066) | | | 1,092,413 |

| | | | | | |

Cash and other assets, less liabilities—0.2% | | | 2,006 |

| | | | | | |

Net assets—100.0% | | $ | 1,094,419 |

| | | | | | |

If a Fund’s portfolio holding represents ownership of 5% or more of the voting securities of a company, the company is deemed to be an affiliate as defined in the Investment Company Act of 1940. The Small Cap Growth Fund had the following transactions during the year ended December 31, 2007 with affiliated companies:

| | | | | | | | | | | | | | |

| | | Share Activity | | Period Ended

December 31, 2007 |

| | | | | | | | | | | (in thousands) |

Security Name | | Balance

12/31/2006 | | Purchases | | Sales | | Balance

12/31/2007 | | Value | | Dividends

Included

in Income |

4 Kids Entertainment, Inc. | | 696,575 | | 23,800 | | 720,375 | | — | | $ | — | | $ | — |

Access Integrated Technologies, Inc. | | 1,530,387 | | 740,427 | | 2,270,814 | | — | | | — | | | — |

Cash Systems, Inc. | | — | | 1,146,065 | | 14,700 | | 1,131,365 | | | 5,001 | | | — |

Century Casinos, Inc. | | 1,546,133 | | 75,400 | | 332,300 | | 1,289,233 | | | 8,303 | | | — |