UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: December 31

Date of reporting period: June 30, 2015

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | June 30, 2015 |

| | |

| | | | Tax-Advantaged Equity Funds |

| | | | U.S. Equity Dividend and Premium |

| | | | International Equity Dividend and Premium |

| | | | U.S. Tax-Managed Equity |

| | | | International Tax-Managed Equity |

Goldman Sachs Tax-Advantaged

Equity Funds

| n | | U.S. EQUITY DIVIDEND AND PREMIUM |

| n | | INTERNATIONAL EQUITY DIVIDEND AND PREMIUM |

| n | | U.S. TAX-MANAGED EQUITY |

| n | | INTERNATIONAL TAX-MANAGED EQUITY |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Market Review | | | 3 | |

| |

Investment Process — Equity Dividend and Premium Funds | | | 6 | |

| |

Portfolio Management Discussions and Performance Summaries — Equity Dividend and Premium Funds | | | 7 | |

| |

Investment Process — Global Tax-Managed Funds | | | 17 | |

| |

Portfolio Management Discussions and Performance Summaries — Global

Tax-Managed Funds | | | 18 | |

| |

Schedules of Investments | | | 29 | |

| |

Financial Statements | | | 52 | |

| |

Financial Highlights | | | 56 | |

| |

Notes to the Financial Statements | | | 64 | |

| |

Other Information | | | 81 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS STRUCTURED TAX-ADVANTAGED EQUITY FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectus.

The Goldman Sachs U.S. Equity Dividend and Premium Fund invests primarily in dividend-paying equity investments in large-capitalization U.S. equity issuers, including foreign issuers that are traded in the United States. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The Fund is also subject to the risks associated with writing (selling) call options, which limits the opportunity to profit from an increase in the market value of stocks in exchange for up-front cash at the time of selling the call option. In a rising market, the Fund could significantly underperform the market, and the Fund’s options strategies may not fully protect it against declines in the value of the market. The Investment Adviser’s use of quantitative models to execute the Fund’s investment strategy may fail to produce the intended result. Different investment styles (e.g., “quantitative”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes. The Fund is also subject to the risk that the pre-tax performance of the Fund may be lower than the performance of a similar fund that is not tax-managed. No assurance can be offered that the Fund’s tax-managed strategies will reduce the amount of taxable income and capital gains distributed by the Fund to shareholders.

The Goldman Sachs International Equity Dividend and Premium Fund invests primarily in dividend-paying equity investments in companies that are organized outside the United States or whose securities are principally traded outside the United States. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. The Fund is also subject to the risks associated with writing (selling) call options, which limits the opportunity to profit from an increase in the market value of stocks in exchange for up-front cash at the time of selling the call option. In a rising market, the Fund could significantly underperform the market, and the Fund’s options strategies may not fully protect it against declines in the value of the market. The Investment Adviser’s use of quantitative models to execute the Fund’s investment strategy may fail to produce the intended result. Different investment styles (e.g., “quantitative”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes. The Fund is also subject to the risk that the pre-tax performance of the Fund may be lower than the performance of a similar fund that is not tax-managed. No assurance can be offered that the Fund’s tax managed strategies will reduce the amount of taxable income and capital gains distributed by the Fund to shareholders.

The Goldman Sachs U.S. Tax-Managed Equity Fund invests in equity investments in U.S. issuers, including foreign issuers that are traded in the United States. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The Investment Adviser’s use of quantitative models to execute the Fund’s investment strategy may fail to produce the intended result. Different investment styles (e.g., “quantitative”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes. Foreign and emerging markets investments may be more volatile and less liquid than U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. The Fund is also subject to the risk that the pre-tax performance of the Fund may be lower than the performance of a similar fund that is not tax-managed. No assurance can be offered that the Fund’s tax-managed strategies will reduce the amount of taxable income and capital gains distributed by the Fund to shareholders. The Fund is not suitable for IRAs or other tax-exempt or tax-deferred accounts.

1

GOLDMAN SACHS STRUCTURED TAX-ADVANTAGED EQUITY FUNDS

The Goldman Sachs International Tax-Managed Equity Fund invests primarily in equity investments in companies that are organized outside the United States or whose securities are principally traded outside the United States. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. The Investment Adviser’s use of quantitative models to execute the Fund’s investment strategy may fail to produce the intended result. Different investment styles (e.g., “quantitative”) tend to shift in and out of favor, and at times the Fund may underperform other funds that invest in similar asset classes. The Fund is also subject to the risk that the pre-tax performance of the Fund may be lower than the performance of a similar fund that is not tax-managed. No assurance can be offered that the Fund’s tax-managed strategies will reduce the amount of taxable income and capital gains distributed by the Fund to shareholders. The Fund is not suitable for IRAs or other tax-exempt or tax-deferred accounts.

2

MARKET REVIEW

Goldman Sachs U.S. Tax-Advantaged

Equity Funds

Market Review

During the six months ended June 30, 2015 (the “Reporting Period”), U.S. and international equities generated positive returns.

U.S. Equities

In the U.S., economic data generally improved during the Reporting Period. First quarter 2015 U.S. Gross Domestic Product (“GDP”) came in weaker than expected, though many of the contributing factors were deemed temporary, such as severe winter weather and a port strike on the west coast. Importantly, unemployment continued to steadily fall, reaching a low of 5.4%, and the housing market continued to improve. Consumer spending was slightly softer than expected early in the Reporting Period, but progressively bettered, with strong retail sales growth and robust auto sales in May 2015.

Throughout the Reporting Period, markets focused on the timing of the first interest rate increase by the U.S. Federal Reserve (the “Fed”) since 2006. Given the unexpectedly weak economy in the first quarter of 2015, many market participants extended their forecasts for an initial rate hike, or “lift-off”, from September 2015 to December 2015.

The West Texas Intermediate (“WTI”) crude oil benchmark price fell from a high of $107 per barrel in June 2014 to a low of $43 per barrel in March 2015 before rebounding to almost $60 per barrel by the end of April 2015 and remaining around that level for the rest of the Reporting Period. Market participants perceived the combination of lower energy prices, better employment prospects and an improving housing market as beneficial for consumers. Thus, stocks of many consumer companies rose in anticipation of increasing consumption. Health care stocks generally performed well, as many companies have been meeting or beating earnings estimates, and merger and acquisition activity remained robust.

U.S. equities, as represented by the S&P 500® Index, gained 1.23% during the Reporting Period. Five of the ten sectors within the S&P 500® Index were up, with the health care (+9.51%) and consumer discretionary (+6.82%) sectors posting the largest gains in absolute terms. The health care sector was the largest contributor on the basis of impact, which takes both weightings and total returns into account.

While returns overall were muted, most segments of the U.S. equity market advanced during the Reporting Period, with small-cap stocks, as measured by the Russell 2000® Index, gaining most, followed by mid-cap stocks and then large-cap stocks, as measured by the Russell Midcap® Index and Russell 1000® Index, respectively. From a style perspective, growth-oriented stocks significantly outpaced value-oriented stocks across the capitalization spectrum. (All as measured by the Russell Investments indices.)

3

MARKET REVIEW

International Equities

Central bank policy, currency trends and sharp oil price declines were major themes affecting international equities during the Reporting Period. Both the European Central Bank (“ECB”) and the Bank of Japan (“BoJ”) employed easy monetary policy in an effort to stimulate economic growth. With interest rates near zero in both regions, the euro and yen fell against the U.S. dollar, which helped increase exports, an important source of revenue to companies in Europe and Japan. The euro sank to a 12-year low against the U.S. dollar in March 2015 before rebounding slightly through the remainder of the Reporting Period. The impact of the weaker euro was already noticeable in European corporate earnings reports during the Reporting Period, many of which were better than expected. Similarly, Japanese companies began to benefit from the weak yen. In our view, strong equity markets in Europe and Japan reflected the positive impact of weak currencies on corporate earnings growth as well as optimism that monetary stimulus would stave off deflation and promote economic growth.

Toward the end of the Reporting Period, the uncertainty and rising intensity of Greece’s negotiations with European Union (“EU”) leaders weighed on global financial markets, particularly European equities. The Greek government took the unusual step of calling a referendum on whether Greece should accept the deal offered by its creditors. The ECB voted against providing any additional emergency liquidity assistance to Greek banks in the meantime, forcing Greece to close its banks until after the referendum.

The sharp drop in oil prices also impacted international equity markets during the Reporting Period. The international Brent crude oil benchmark price fell from a high of $115 per barrel in June 2014 to a low of $47 per barrel in January 2015 before rebounding to just more than $65 per barrel at the beginning of May 2015 and settling in a range of approximately $60 to $65 per barrel through the end of June 2015. The low crude oil price forced many energy companies to lower earnings.

Market participants perceived the combination of lower energy prices, aggressive monetary stimulus and improving economies as beneficial for consumers in Europe and Japan as well as for sales of European and Japanese consumer products in the U.S. In turn, stocks of many consumer companies rose in anticipation of increasing consumption. Health care stocks generally performed well, as many companies have been meeting or beating earnings estimates, and merger and acquisition activity remained robust.

International equities, as measured by the MSCI EAFE Index, returned 5.52% in U.S. dollar terms during the Reporting Period. Sixteen of the 21 countries in the MSCI EAFE Index were up for the Reporting Period, with Denmark (+19.10%), Japan (+12.82%) and Ireland (+12.42%) posting the largest gains in absolute terms. Japan was also the largest positive contributor on the basis of impact, which takes both weightings and total returns into account.

Eight of the 10 sectors in the MSCI EAFE Index were up, with health care (+8.40%) and consumer discretionary (+7.78%) contributing most positively to returns. The financials (+6.44%) sector was the largest positive contributor on the basis of impact, which takes both weightings and total returns into account.

4

MARKET REVIEW

Looking Ahead

In the months ahead, we expect less expensive stocks to outpace more expensive stocks. We also believe that stocks with good momentum may outperform those with poor momentum. Our plan is to seek profitable companies with positive fundamentals, sustainable earnings and a track record of using capital to enhance shareholder value. To that end, we anticipate remaining fully invested, with long-term performance likely to be the result of stock selection rather than sector or capitalization allocations.

We stand behind our investment philosophy that sound economic investment principles, coupled with a disciplined quantitative approach, can provide potentially strong, uncorrelated returns over the long term. Our research agenda is robust, and we continue to enhance our existing models, add new proprietary forecasting signals and improve our trading execution as we seek to provide the most value to our shareholders.

All sector and country returns quoted herein are based on cumulative total returns.

5

INVESTMENT PROCESS

What Differentiates the Goldman Sachs

U.S. Equity Dividend and Premium and

Goldman Sachs International Equity Dividend

and Premium Funds’ Investment Process?

The Goldman Sachs U.S. Equity Dividend and Premium Fund seeks to maximize income and total return. The Goldman Sachs International Equity Dividend and Premium Fund seeks to maximize total return with an emphasis on income. Their portfolios consist primarily of large-cap, dividend-paying stocks.1 By investing in these securities, and through the use of option call writing, the Funds seek to generate an attractive after-tax cash flow.

A diversified portfolio:

| n | | Create a diversified large-cap equity portfolio that participates in all industries and sectors. |

| n | | Emphasize higher dividend-paying stocks within each industry and sector. |

Written call options:

| n | | The Funds utilize index call writing to seek to enhance their cash flow. |

| n | | We use proprietary quantitative techniques, including optimization tools, a risk model and a transactions cost model, in identifying a portfolio of stocks that we believe may enhance expected dividend yield while limiting deviations when compared to the S&P 500 Index or MSCI EAFE Index, as applicable. |

| n | | A fully invested, style-consistent portfolio. |

| n | | The Funds seek attractive after-tax cash flow from qualified dividends, long-term capital gains and option call writing. |

| n | | The Funds seek to enhance after-tax returns by generating distributions primarily from qualified dividends and long-term capital gains. |

| 1 | | Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. |

| | | There is no guarantee that these objectives will be met. |

| | | Diversification does not protect an investor from market risk and does not ensure a profit |

6

PORTFOLIO RESULTS

U.S. Equity Dividend and Premium Fund

Investment Objective

The Fund seeks to maximize income and total return.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Goldman Sachs U.S. Equity Dividend and Premium Fund’s (the “Fund”) performance and positioning for the six-month period ended June 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of 2.59%, 2.22%, 2.80% and 2.72%, respectively. These returns compare to the 1.23% cumulative total return of the Fund’s primary benchmark, the Standard & Poor’s 500® Index (with dividends reinvested) (the “S&P 500® Index”), during the same period. The Barclays U.S. Aggregate Bond Index, the secondary benchmark, returned -0.10%. Although the Fund does not invest in fixed income securities, maximizing income is part of the Fund’s investment objective, and therefore we believe that a comparison of the Fund’s performance to that of the Barclays U.S. Aggregate Bond Index is useful to investors. |

| Q | | What key factors were most responsible for the Fund’s performance during the Reporting Period? |

| A | | The sale of call options on the S&P 500® Index contributed positively to the Fund’s total return during the Reporting Period. (A call option is an option that gives the holder the right to buy a certain quantity of an underlying security at an agreed-upon price at any time up to an agreed-upon date.) |

| | Security selection also added to the Fund’s relative performance. More specifically, the Fund benefited from its holdings in the financials, industrials and materials sectors. The Fund was overweight relative to the S&P 500® Index in the financials and materials sectors and underweight in the industrials sector. Conversely, the Fund was hurt by stock picks in the telecommunication services, consumer discretionary and health care sectors. The Fund was overweight compared to the S&P 500® Index in the telecommunication services and consumer discretionary sectors and was underweight in the health care sector. |

| Q | | How did the Fund’s call writing affect its performance? |

| A | | Consistent with our investment approach, we wrote index call options on a portion of the stock portfolio’s market value. When the Fund sells an index call option, it retains the premium it receives from the sale. However, if the purchaser exercises the option, the Fund is obligated to pay the purchaser the difference between the price of the index and the exercise price of the option. Although the Fund retains the premium it receives from the sale of the option, the premium may not exceed the difference in the value of the index as call options are exercised. This is what happened during the Reporting Period for certain of the Fund’s options positions, however, our call writing overall contributed positively to performance. |

| | Overall, call option writing tends to reduce Fund volatility. Since its inception, the realized daily volatility of the Fund has been 18.86% compared to the realized volatility of the S&P 500® Index of 20.43%. During the Reporting Period, the realized daily volatility of the Fund was 10.42% compared to the realized volatility of the S&P 500® Index of 12.02%. |

| Q | | What was the Fund’s dividend yield during the Reporting Period? |

| A | | While maintaining industry and sector weights consistent with the S&P 500® Index, we favor stocks with higher dividend yields. The dividend yield of the Fund during the Reporting Period was 2.79% compared to 2.10% for the S&P 500® Index (Dividend yield is a ratio that shows how much a company pays out in dividends in a year divided by its share price). The Fund’s dividend yield served to enhance its quarterly net income distributions. For the Reporting Period, the Standardized 30-Day Subsidized Yield was 1.93% and the Standardized 30-Day Unsubsidized Yield was 1.89%. |

7

PORTFOLIO RESULTS

| Q | | Among individual holdings, which stocks contributed most to the Fund’s results? |

| | Relative to the S&P 500® Index, the Fund benefited from overweight positions in Kraft Foods Group, a packaged food maker; New York Community Bancorp, the fourth-largest U.S. thrift; and Eli Lilly, a pharmaceutical company. The Fund held all three stocks largely because of their attractive dividend yields. |

| Q | | Which individual stock holdings detracted significantly from relative performance during the Reporting Period? |

| A | | Relative to the S&P 500® Index, the Fund was hurt by overweight positions in CenturyLink, a telecommunication services company; Duke Energy, an electric and gas utility; and Wynn Resorts, a developer and operator of high end hotels and casinos. The Fund held all three stocks largely due to their attractive dividend yields. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we used equity index futures, on an opportunistic basis, to equitize the Fund’s excess cash holdings. In other words, we put the Fund’s excess cash holdings to work by using them as collateral for the purchase of equity index futures. Consistent with our investment approach, we also wrote equity index options on a portion of the portfolio’s market value in an effort to generate premiums. |

| Q | | What changes or enhancements did you make to your quantitative model during the Reporting Period? |

| A | | We made no changes to our quantitative model during the Reporting Period. |

8

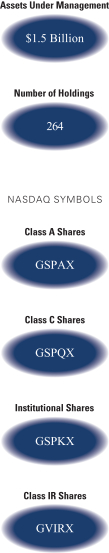

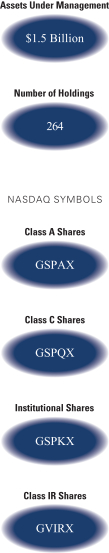

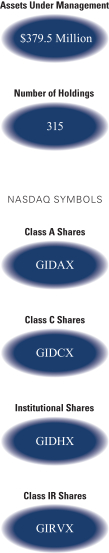

FUND BASICS

U.S. Equity Dividend and Premium Fund

as of June 30, 2015

| | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2015– June 30, 2015 | | Fund Total Return

(based on NAV)1 | | | S&P 500® Index2 | | | Barclays U.S. Aggregate

Bond Index3 | |

| | Class A | | | 2.59 | % | | | 1.23 | % | | | -0.10 | % |

| | Class C | | | 2.22 | | | | 1.23 | | | | -0.10 | |

| | Institutional | | | 2.80 | | | | 1.23 | | | | -0.10 | |

| | | Class IR | | | 2.72 | | | | 1.23 | | | | -0.10 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The S&P 500® Index is an unmanaged composite index of 500 common stock prices. The Index figures do not include any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The Barclays U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS4 | |

| | | For the period ended 6/30/15 | | One Year | | | Five Years | | | Since Inception | | | Inception Date | |

| | Class A | | | 1.21 | % | | | 13.20 | % | | | 6.10 | % | | | 8/31/05 | |

| | Class C | | | 5.40 | | | | 13.63 | | | | 5.91 | | | | 8/31/05 | |

| | Institutional | | | 7.58 | | | | 14.95 | | | | 7.13 | | | | 8/31/05 | |

| | | Class IR | | | 7.51 | | | | N/A | | | | 14.71 | | | | 8/31/10 | |

| | 4 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS5 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.19 | % | | | 1.20 | % |

| | Class C | | | 1.94 | | | | 1.95 | |

| | Institutional | | | 0.79 | | | | 0.80 | |

| | | Class IR | | | 0.94 | | | | 0.95 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least April 30, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | | | | | |

| | STANDARDIZED AFTER-TAX PERFORMANCE AS OF 6/30/156 | |

| | | Class A Shares | | One Year | | | Five Years | | | Since Inception (8/31/05) | |

| | Returns before taxes* | | | 1.21 | % | | | 13.20 | % | | | 6.10 | % |

| | Returns after taxes on distributions** | | | -0.26 | | | | 12.01 | | | | 5.21 | |

| | | Returns after taxes on distributions***

and sale of Fund shares | | | 1.56 | | | | 10.51 | | | | 4.88 | |

| | 6 | | The after-tax returns are calculated using the historically highest individual federal marginal income tax rates at the time of distributions (currently 23.8% for qualifying ordinary income dividends and long-term capital gain distributions and 43.4% for non-qualifying ordinary income dividends) and do not reflect state and local taxes. Actual after-tax returns will be calculated at calendar year-end and depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Under certain circumstances, the addition of the tax benefits from capital losses resulting from redemptions may cause the Returns After Taxes on Distributions and Sale of Fund Shares to be greater than the Returns After Taxes on Distributions or even Returns Before Taxes. Standardized after-tax returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.5% for Class A Shares. |

| | * | | Returns Before Taxes do not reflect taxes on distributions on the Fund’s Class A Shares nor do they show how performance can be impacted by taxes when shares are redeemed. |

| | ** | | Returns After Taxes on Distributions assume that taxes are paid on distributions on the Fund’s Class A Shares (i.e., dividends and capital gains) but do not reflect taxes that may be incurred upon redemption of the Class A Shares at the end of the performance period. |

| *** | | Returns After Taxes on Distributions and Sale of Fund Shares reflect taxes paid on distributions on the Fund’s Class A Shares and taxes applicable when the shares are redeemed. |

10

FUND BASICS

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 6/30/157 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Apple, Inc. | | | 4.0 | % | | Technology Hardware & Equipment |

| | Microsoft Corp. | | | 2.3 | | | Software & Services |

| | General Electric Co. | | | 2.2 | | | Capital Goods |

| | Wells Fargo & Co. | | | 2.0 | | | Banks |

| | Johnson & Johnson | | | 1.9 | | | Pharmaceuticals, Biotechnology & Life

Sciences |

| | JPMorgan Chase & Co. | | | 1.9 | | | Banks |

| | Pfizer, Inc. | | | 1.6 | | | Pharmaceuticals, Biotechnology & Life

Sciences |

| | Exxon Mobil Corp. | | | 1.6 | | | Energy |

| | AT&T, Inc. | | | 1.6 | | | Telecommunication Services |

| | | The Procter & Gamble Co. | | | 1.5 | | | Household & Personal Products |

| | 7 | | The top 10 holdings may not be representative of the Fund’s future investments. |

| | | | |

| | FUND VS. BENCHMARK SECTOR ALLOCATIONS8 |

| | | As of June 30, 2015 | | |

| | 8 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

11

PORTFOLIO RESULTS

International Equity Dividend and Premium Fund

Investment Objective

The Fund seeks to maximize total return with an emphasis on income.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Goldman Sachs International Equity Dividend and Premium Fund’s (the “Fund”) performance and positioning for the six-month period ended June 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of 2.20%, 1.78%, 2.31% and 2.23%, respectively. These returns compare to the 5.52% cumulative total return of the Fund’s primary benchmark, the MSCI EAFE Index (net, USD, unhedged). The Barclays Global Aggregate Bond Index, the secondary benchmark, returned -3.08%. Although the Fund does not invest in fixed income securities, maximizing income is part of the Fund’s investment objective, and therefore we believe that a comparison of the Fund’s performance to that of the Barclays Global Aggregate Bond Index is useful to investors. |

| Q | | What key factors were most responsible for the Fund’s performance during the Reporting Period? |

| A | | The sale of index call options detracted from the Fund’s total return during the Reporting Period. (A call option is an option that gives the holder the right to buy a certain quantity of an underlying security at an agreed-upon price at any time up to an agreed-upon date.) |

| | Security selection also hampered the Fund’s relative performance. More specifically, the Fund was hurt by its holdings in the financials, industrials and utilities sectors. The Fund was overweight relative to the MSCI EAFE Index in all three sectors. On the positive side, the Fund benefited from stock choices in the consumer discretionary, materials and information technology sectors. Compared to the MSCI EAFE Index, the Fund was overweight in the consumer discretionary sector, underweight in the materials sector and relatively neutral in the information technology sector during the Reporting Period. |

| Q | | How did the Fund’s call writing affect its performance? |

| A | | Consistent with our investment approach, we wrote index call options on a portion of the stock portfolio’s market value, primarily on the Japanese, United Kingdom and European indices. When the Fund sells an index call option, it retains the premium it receives from the sale. However, if the purchaser exercises the option, the Fund is obligated to pay the purchaser the difference between the price of the index and the exercise price of the option. Although the Fund retains the premium it receives from the sale of the option, the premium may not exceed the difference in the value of the index as call options are exercised. This is what happened during the Reporting Period when the MSCI EAFE Index appreciated, and thus the Fund’s call writing detracted from performance. |

| | Overall, call option writing tends to reduce Fund volatility. However, since its inception, the realized daily volatility of the Fund has been 22.96% compared to the realized volatility of the MSCI EAFE Index of 20.96%. During the Reporting Period, realized daily volatility of the Fund was 12.44% compared to the realized volatility of the MSCI EAFE Index of 12.31%.1 |

| Q | | What was the Fund’s dividend yield during the Reporting Period? |

| A | | While maintaining industry and sector weights consistent with the MSCI EAFE Index, we favor stocks with higher dividend yields. The dividend yield of the Fund at the end of the Reporting Period was 3.87% compared to 3.17% for the MSCI EAFE Index (Dividend yield is a ratio that shows how much a company pays out in dividends in a year divided by its share price). The Fund’s dividend yield served to enhance its quarterly net income distributions. For the Reporting Period, |

| 1 | | The realized daily volatility of the Fund quoted herein is gross of fees. |

12

PORTFOLIO RESULTS

| | the Standardized 30-Day Subsidized Yield was 2.70% and the Standardized 30-Day Unsubsidized Yield was 2.70%. |

| Q | | Which individual stock holdings detracted significantly from relative performance during the Reporting Period? |

| A | | The Fund was hurt by its overweight positions in Engie, a French electric utility; Banco Santander, a Spanish banking group; and Insurance Australia Group, an insurance company. The Fund held all three stocks largely due to their attractive dividend yields. |

| Q | | Among individual holdings, which stocks contributed most to the Fund’s results? |

| A | | The Fund benefited from its overweight positions in Persimmon, a British housebuilding company; Takeda Pharmaceutical, a Japan-based pharmaceutical company; and Nokian Renkaat, a Finland-headquartered tire manufacturer. The Fund held these stocks largely because of their attractive dividend yields and/or risk metrics. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we used equity index futures, on an opportunistic basis, to equitize the Fund’s excess cash holdings. In other words, we put the Fund’s excess cash holdings to work by using them as collateral for the purchase of equity index futures. Consistent with our investment approach, we also wrote equity index options on a portion of the portfolio’s market value in an effort to generate premiums. |

| Q | | What changes or enhancements did you make to your quantitative model during the Reporting Period? |

| A | | We made no changes to our quantitative model during the Reporting Period. |

13

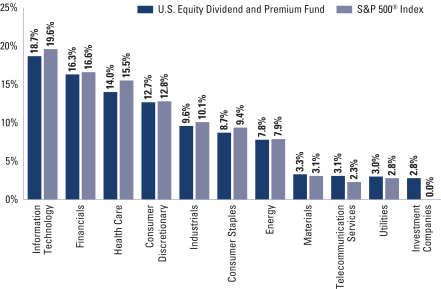

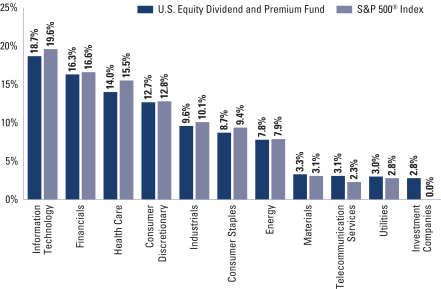

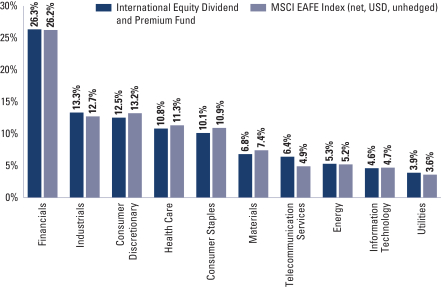

FUND BASICS

International Equity Dividend and Premium Fund

as of June 30, 2015

| | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2015– June 30, 2015 | | Fund Total Return

(based on NAV)1 | | | MSCI EAFE Index (net, USD, unhedged)2 | | | Barclays Global Aggregate

Bond Index3 | |

| | Class A | | | 2.20 | % | | | 5.52 | % | | | -3.08 | % |

| | Class C | | | 1.78 | | | | 5.52 | | | | -3.08 | |

| | Institutional | | | 2.31 | | | | 5.52 | | | | -3.08 | |

| | | Class IR | | | 2.23 | | | | 5.52 | | | | -3.08 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI EAFE Index (net, USD, unhedged) is an unmanaged market capitalization-weighted composite of securities in 21 developed markets. The Index figures do not include any deduction for fees or expenses. It is not possible to invest directly in an index. |

| | 3 | | The Barclays Global Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS4 | |

| | | For the period ended 6/30/15 | | One Year | | | Five Years | | | Since Inception | | | Inception Date | |

| | Class A | | | -14.07 | | | | 5.59 | | | | -0.81 | % | | | 1/31/08 | |

| | Class C | | | -10.69 | | | | 6.02 | | | | -0.97 | | | | 1/31/08 | |

| | Institutional | | | -8.86 | | | | 7.25 | | | | 0.16 | | | | 1/31/08 | |

| | | Class IR | | | -9.03 | | | | N/A | | | | 5.86 | | | | 8/31/10 | |

| | 4 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

14

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS5 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.35 | % | | | 1.35 | % |

| | Class C | | | 2.10 | | | | 2.10 | |

| | Institutional | | | 0.95 | | | | 0.95 | |

| | | Class IR | | | 1.09 | | | | 1.09 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations), are as set forth above according to the most recent publicly available Prospectus. For the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. |

| | | | | | | | | | | | | | |

| | STANDARDIZED AFTER-TAX PERFORMANCE AS OF 6/30/156 | |

| | | Class A Shares | | One Year | | | Five Years | | | Since Inception (1/31/08) | |

| | Returns before taxes* | | | -14.07 | % | | | 5.59 | % | | | -0.81 | % |

| | Returns after taxes on distributions** | | | -15.18 | | | | 4.67 | | | | -1.45 | |

| | | Returns after taxes on distributions***

and sale of Fund shares | | | -7.16 | | | | 4.66 | | | | -0.33 | |

| | 6 | | The after-tax returns are calculated using the historically highest individual federal marginal income tax rates at the time of distributions (currently 23.8% for qualifying ordinary income dividends and long-term capital gain distributions and 43.4% for non-qualifying ordinary income dividends) and do not reflect state and local taxes. Actual after-tax returns will be calculated at calendar year-end and depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Under certain circumstances, the addition of the tax benefits from capital losses resulting from redemptions may cause the Returns After Taxes on Distributions and Sale of Fund Shares to be greater than the Returns After Taxes on Distributions or even Returns Before Taxes. Standardized after-tax returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.5% for Class A Shares. |

| | * | | Returns Before Taxes do not reflect taxes on distributions on the Fund’s Class A Shares nor do they show how performance can be impacted by taxes when shares are redeemed. |

| | ** | | Returns After Taxes on Distributions assume that taxes are paid on distributions on the Fund’s Class A Shares (i.e., dividends and capital gains) but do not reflect taxes that may be incurred upon redemption of the Class A Shares at the end of the performance period. |

| *** | | Returns After Taxes on Distributions and Sale of Fund Shares reflect taxes paid on distributions on the Fund’s Class A Shares and taxes applicable when the shares are redeemed. |

15

FUND BASICS

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 6/30/157 |

| | | Company | | % of Net Assets | | | Line of Business |

| | HSBC Holdings PLC | | | 2.6 | % | | Banks |

| | GlaxoSmithKline PLC ADR | | | 2.0 | | | Pharmaceuticals, Biotechnology &

Life Sciences |

| | Roche Holding AG | | | 1.7 | | | Pharmaceuticals, Biotechnology &

Life Sciences |

| | Novartis AG (Registered) | | | 1.6 | | | Pharmaceuticals, Biotechnology &

Life Sciences |

| | Daimler AG (Registered) | | | 1.6 | | | Automobiles & Components |

| | Telefonica SA | | | 1.4 | | | Telecommunication Services |

| | Anheuser-Busch InBev NV | | | 1.4 | | | Food, Beverage & Tobacco |

| | Vodafone Group PLC ADR | | | 1.4 | | | Telecommunication Services |

| | Banco Santander SA | | | 1.3 | | | Banks |

| | | Unilever NV | | | 1.3 | | | Food, Beverage & Tobacco |

| | 7 | | The top 10 holdings may not be representative of the Fund’s future investments. |

| | | | |

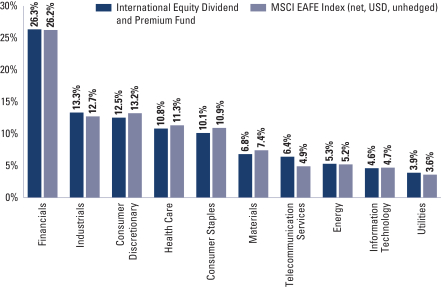

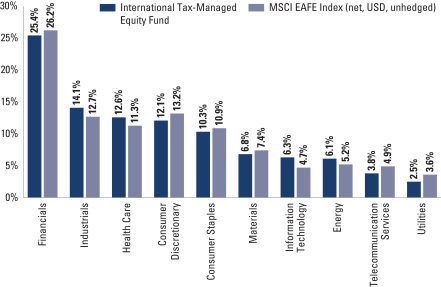

| | FUND VS. BENCHMARK SECTOR ALLOCATIONS8 |

| | | As of June 30, 2015 | | |

| | 8 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

16

INVESTMENT PROCESS

What Differentiates the Goldman Sachs Global Tax-Management Investment Process?

In managing money for many of the world’s wealthiest taxable investors, Goldman Sachs often constructs a diversified investment portfolio around a tax-managed core. With the Goldman Sachs Tax-Managed Equity Fund and International Tax-Managed Equity Fund, investors can access Goldman Sachs’ tax-smart investment expertise while capitalizing on this same strategic approach to portfolio construction.

Goldman Sachs Global Tax-Management Investment Process

The Goldman Sachs Global Tax-Management investment process is a disciplined quantitative approach that has been consistently applied since 1989. With the Goldman Sachs Tax-Managed Equity Fund and the Goldman Sachs International Tax-Managed Equity Fund, the investment process is enhanced with an additional layer that seeks to maximize after-tax returns.

Advantage: Daily analysis of approximately 3,000 U.S. and international equity securities using a proprietary model.

| n | | Sector and size neutral |

Tax optimization is an additional layer that is built into the existing Structured investment process — a distinct advantage. While other managers may simply seek to minimize taxable distributions through a low turnover strategy, this extension of the Structured investment process seeks to maximize after-tax returns — the true objective of every taxable investor.

Advantage: Value added through stock selection — not market timing, industry rotation or style bias.

| n | | A fully invested, style-consistent portfolio |

| n | | Broad access to the total U.S. and international equity markets |

| n | | A consistent goal of seeking to maximize after-tax risk-adjusted returns |

17

PORTFOLIO RESULTS

U.S. Tax-Managed Equity Fund

Investment Objective

The Fund seeks to provide long-term after-tax growth of capital through tax-sensitive participation in a broadly diversified portfolio of U.S. equity securities.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Goldman Sachs U.S. Tax-Managed Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended June 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, Service and IR Shares generated cumulative total returns, without sales charges, of 0.06%, -0.30%, 0.28%, 0.06% and 0.23%, respectively. These returns compare to the 1.94% cumulative total return of the Fund’s benchmark, the Russell 3000® Index (the “Index”), over the same time period. |

| Q | | What key factors were most responsible for the Fund’s performance during the Reporting Period? |

| A | | Security selection detracted from relative performance during the Reporting Period. Two of the six themes within our quantitative model dampened relative returns. |

| Q | | What impact did the Fund’s investment themes have on performance during the Reporting Period? |

| A | | In keeping with our investment approach, we use our quantitative model and its six investment themes to take a long-term view of market patterns and look for inefficiencies, selecting stocks for the Fund and overweighting or underweighting the ones chosen by the model. Over time and by design, the performance of any one of the model’s investment themes tends to have a low correlation with the model’s other themes, demonstrating the diversification benefit of the Fund’s theme-driven quantitative model. The variance in performance supports our research indicating that the diversification provided by the Fund’s different investment themes is a significant investment advantage over the long term, even though the Fund may experience underperformance in the short term. Of course, diversification does not protect an investor from market risk nor does it ensure a profit. |

| | During the Reporting Period, two of our investment themes — Valuation and Quality — detracted from Fund performance. The Valuation theme attempts to capture potential mispricings of securities, typically by comparing a measure of the company’s intrinsic value to its market value. The Quality theme seeks to assess both firm and management quality. |

| | Sentiment and Momentum added to the Fund’s relative returns. The Sentiment theme reflects selected investment views and decisions of individuals and financial intermediaries. The Momentum theme seeks to predict drifts in stock prices caused by delayed investor reaction to company-specific information and information about related companies. |

| | Our Management and Profitability themes had a relatively neutral impact on the Fund’s relative results during the Reporting Period. The Management theme assesses the characteristics, policies and strategic decisions of company management. The Profitability theme assesses whether a company is earning more than its cost of capital. |

| Q | | How did the Fund sector and industry allocations affect relative performance? |

| A | | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making sector or industry bets. Consequently, the Fund is similar to the Index in terms of its sector and industry allocations and its style. Changes in its sector or industry weights generally do not have a meaningful impact on relative performance. |

18

PORTFOLIO RESULTS

| Q | | How successful was your stock selection during the Reporting Period? |

| A | | The Fund seeks to provide investors with a tax-efficient means for maintaining broadly diversified exposure to the entire U.S. equity market, ranging from large- to small-cap stocks. During the Reporting Period, our stock selection hurt the Fund’s relative performance. |

| Q | | Which individual stock holdings detracted significantly from relative performance during the Reporting Period? |

| A | | Security selection in the information technology, consumer staples and consumer discretionary sectors detracted most from relative returns. The Fund was hampered by overweight positions in Micron Technology, a semiconductor maker; Hewlett-Packard, a provider of hardware, software and technology services; and American Airlines Group. We chose to overweight Micron Technology because of our positive views on Valuation and Sentiment. The Fund was overweight Hewlett-Packard as a result of our positive views on Sentiment and Quality. The overweight in American Airlines Group was based on our positive views of Valuation. |

| Q | | Among individual holdings, which stocks contributed most to the Fund’s results? |

| A | | Stock picks in the energy, financials and industrials sectors added most to the Fund’s relative performance during the Reporting Period. The Fund benefited from overweight positions in Valero Energy and Pharmacyclics as well as from an underweight in Bank of America. We adopted the overweight in petroleum refiner Valero Energy due to our positive views on Sentiment and Momentum. The Fund was overweight biotechnology company Pharmacyclics because of our positive views on Quality and Momentum. The underweight in Bank of America was assumed as a result of our negative views of Momentum and Quality. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives as part of an active management strategy to add value to the Fund’s results. However, we used equity index futures, on an opportunistic basis, to equitize the Fund’s excess cash holdings. In other words, we put the Fund’s excess cash holdings to work by using them as collateral for the purchase of equity index futures. |

| Q | | What changes or enhancements did you make to your quantitative model during the Reporting Period? |

| A | | We made no changes to our quantitative model during the first quarter of 2015. In the second calendar quarter, we introduced an enhancement within our Sentiment theme that uses the credit default swap spread of a company as an early indicator of potential stock price swings. To arrive at our views, we use data on single-name credit default swap spreads for more than 300 companies on a daily basis. (Credit default swap spread is the annual cost of protecting against default.) Also within our Sentiment theme, we introduced an enhancement that uses stock options data of a company as a potential indicator of stock mispricing. Because options markets have fewer restrictions on leverage and short selling, we believe they typically incorporate information more efficiently than equity markets. We are able to use this enhancement, employing broadly available options data on U.S. equities, to form views on the majority of stocks in our investment universe. In addition, during the second calendar quarter, we added an enhancement to our Profitability theme that analyzes web traffic data of companies to provide an insight into future revenues. We analyze this information for more than 1,700 U.S. stocks across various sectors. |

| Q | | How was the Fund positioned relative to the Index at the end of the Reporting Period? |

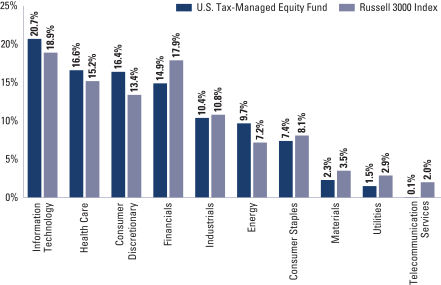

| A | | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making industry or sector bets. Consequently, the Fund is similar to the Index in terms of its sector allocation and style. That said, at the end of the Reporting Period, the Fund was overweight relative to the Index in the consumer discretionary, energy, information technology and health care sectors. It was underweight compared to the Index in the financials, telecommunication services, utilities and materials sectors. The Fund was relatively neutral in the consumer staples and industrials sectors at the end of the Reporting Period. |

19

FUND BASICS

U.S. Tax-Managed Equity Fund

as of June 30, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2015–June 30, 2015 | | Fund Total Return

(based on NAV)1 | | | Russell 3000® Index2 | |

| | Class A | | | 0.06 | % | | | 1.94 | % |

| | Class C | | | -0.30 | | | | 1.94 | |

| | Institutional | | | 0.28 | | | | 1.94 | |

| | Service | | | 0.06 | | | | 1.94 | |

| | | Class IR | | | 0.23 | | | | 1.94 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Russell 3000® Index is an unmanaged index that measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 6/30/15 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | -0.75 | % | | | 16.64 | % | | | 6.52 | % | | | 3.97 | % | | 4/3/00 |

| | Class C | | | 3.27 | | | | 17.10 | | | | 6.32 | | | | 3.57 | | | 4/3/00 |

| | Institutional | | | 5.42 | | | | 18.43 | | | | 7.56 | | | | 4.78 | | | 4/3/00 |

| | Service | | | 4.97 | | | | 17.86 | | | | 7.01 | | | | 4.26 | | | 4/3/00 |

| | | Class IR | | | 5.30 | | | | N/A | | | | N/A | | | | 18.90 | | | 8/31/10 |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

20

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.18 | % | | | 1.19 | % |

| | Class C | | | 1.93 | | | | 1.94 | |

| | Institutional | | | 0.78 | | | | 0.79 | |

| | Service | | | 1.28 | | | | 1.29 | |

| | | Class IR | | | 0.93 | | | | 0.94 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least April 30, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | | | | | | | | | |

| | STANDARDIZED AFTER-TAX PERFORMANCE AS OF 6/30/155 | |

| | | Class A Shares | | One Year | | | Five Years | | | Ten Years | | | Since Inception (4/3/00) | |

| | Returns before taxes* | | | -0.75 | % | | | 16.64 | % | | | 6.52 | % | | | 3.97 | % |

| | Returns after taxes on distributions** | | | -0.84 | | | | 16.42 | | | | 6.37 | | | | 3.86 | |

| | Returns after taxes on distributions***

and sale of Fund shares | | | -0.35 | | | | 13.48 | | | | 5.26 | | | | 3.19 | |

| | | | | | | | | | | | | | | | | | |

| | 5 | | The after-tax returns are calculated using the historically highest individual federal marginal income tax rates at the time of distributions (currently 23.8% for qualifying ordinary income dividends and long-term capital gain distributions and 43.4% for non-qualifying ordinary income dividends) and do not reflect state and local taxes. Actual after-tax returns will be calculated at calendar year-end and depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Under certain circumstances, the addition of the tax benefits from capital losses resulting from redemptions may cause the Returns After Taxes on Distributions and Sale of Fund Shares to be greater than the Returns After Taxes on Distributions or even Returns Before Taxes. Standardized after-tax returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.5% for Class A Shares. |

| | * | | Returns Before Taxes do not reflect taxes on distributions on the Fund’s Class A Shares nor do they show how performance can be impacted by taxes when shares are redeemed. |

| | ** | | Returns After Taxes on Distributions assume that taxes are paid on distributions on the Fund’s Class A Shares (i.e., dividends and capital gains) but do not reflect taxes that may be incurred upon redemption of the Class A Shares at the end of the performance period. |

| *** | | Returns After Taxes on Distributions and Sale of Fund Shares reflect taxes paid on distributions on the Fund’s Class A Shares and taxes applicable when the shares are redeemed. |

21

FUND BASICS

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 6/30/156 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Apple, Inc. | | | 3.3 | % | | Technology Hardware & Equipment |

| | Pfizer, Inc. | | | 1.9 | | | Pharmaceuticals, Biotechnology &

Life Sciences |

| | Gilead Sciences, Inc. | | | 1.8 | | | Pharmaceuticals, Biotechnology &

Life Sciences |

| | Microsoft Corp. | | | 1.8 | | | Software & Services |

| | Comcast Corp. Class A | | | 1.7 | | | Media |

| | JPMorgan Chase & Co. | | | 1.7 | | | Banks |

| | Cisco Systems, Inc. | | | 1.6 | | | Technology Hardware & Equipment |

| | General Electric Co. | | | 1.6 | | | Capital Goods |

| | CVS Health Corp. | | | 1.5 | | | Food & Staples Retailing |

| | | Bank of America Corp. | | | 1.5 | | | Banks |

| | 6 | | The top 10 holdings may not be representative of the Fund’s future investments. |

| | | | |

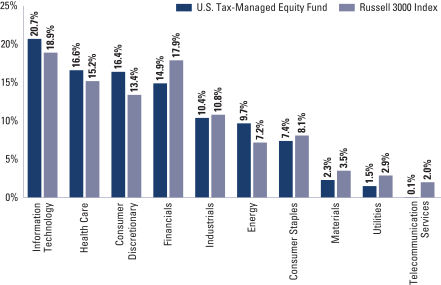

| | FUND VS. BENCHMARK SECTOR ALLOCATIONS7 |

| | | As of June 30, 2015 | | |

| | 7 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from percentages contained in the graph above. The graph categorizes investments using Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investments in the securities lending reinvestment vehicle, if any). Investments in the securities lending reinvestment vehicle represented 2.6% of the Fund’s net assets at June 30, 2015. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

22

PORTFOLIO RESULTS

International Tax-Managed Equity Fund

Investment Objective

The Fund seeks to provide long-term after-tax growth of capital through tax-sensitive participation in a broadly diversified portfolio of international equity securities.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Goldman Sachs International Tax-Managed Equity Fund’s (the “Fund”) performance and positioning for the six-month period ended June 30, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional and IR Shares generated cumulative total returns, without sales charges, of 7.93%, 7.50%, 8.13% and 8.07%, respectively. These returns compare to the 5.52% cumulative total return of the Fund’s benchmark, the MSCI EAFE Index (net, USD, unhedged) (the “Index”), during the same time period. |

| Q | | What key factors were most responsible for the Fund’s performance during the Reporting Period? |

| A | | Security selection added to relative returns during the Reporting Period. Four of the six investment themes within our quantitative model contributed positively to Fund performance. |

| Q | | What impact did the Fund’s investment themes have on performance during the Reporting Period? |

| A | | In keeping with our investment approach, we use our quantitative model and its six investment themes to take a long-term view of market patterns and look for inefficiencies, selecting stocks for the Fund and overweighting or underweighting the ones chosen by the model. Over time and by design, the performance of any one of the model’s investment themes tends to have a low correlation with the model’s other themes, demonstrating the diversification benefit of the Fund’s theme-driven quantitative model. The variance in performance supports our research indicating that the diversification provided by the Fund’s different investment themes is a significant investment advantage over the long term, even though the Fund may experience underperformance in the short term. Of course, diversification does not protect an investor from market risk nor does it ensure a profit. |

| | During the Reporting Period, four of our six investment themes — Sentiment, Valuation, Momentum and Quality — bolstered the Fund’s relative results. The Sentiment theme reflects selected investment views and decisions of individuals and financial intermediaries. The Valuation theme attempts to capture potential mispricings of securities, typically by comparing a measure of the company’s intrinsic value to its market value. The Momentum theme seeks to predict drifts in stock prices caused by delayed investor reaction to company-specific information and information about related companies. The Quality theme seeks to assess both firm and management quality. |

| | Our Profitability theme, which assesses whether a company is earning more than its cost of capital, detracted from relative performance. Management had a relatively neutral impact on the Fund’s relative returns during the Reporting Period. The Management theme assesses the characteristics, policies and strategic decisions of company management. |

| Q | | How did the Fund sector and industry allocations affect relative performance? |

| A | | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making sector or industry bets. Consequently, the Fund is similar to the Index in terms of its sector and industry allocations and its style. Changes in its sector or industry weights generally do not have a meaningful impact on relative performance. |

| Q | | How successful was your stock selection during the Reporting Period? |

| A | | The Fund seeks to provide investors with a tax-efficient means for maintaining broadly diversified exposure to the |

23

PORTFOLIO RESULTS

| | entire Europe, Australasia and Far East (EAFE) equity market. During the Reporting Period, security selection added to the Fund’s relative returns. |

| Q | | Among individual holdings, which stocks contributed most to the Fund’s results? |

| A | | Stock picks in the financials, consumer discretionary and health care sectors contributed positively to the Fund’s relative returns. The Fund benefited from overweight positions in Sompo Japan Nipponkoa Holdings, a Japanese insurance holdings company; Renault, a France-based carmaker; and Dialog Semiconductor, a U.K.-based manufacturer of semiconductor systems. We assumed the overweights in Sompo Japan Nipponkoa Holdings and Renault because of our positive views on Momentum and Valuation. The overweight in Dialog Semiconductor was based on our positive views on Momentum and Sentiment. |

| Q | | Which individual stock holdings detracted significantly from relative performance during the Reporting Period? |

| A | | Investments in the consumer staples, energy and information technology sectors detracted from relative results. Fund performance was hampered by an underweight position in Novo Nordisk and by overweight positions in Noble Group and Norsk Hydro. We chose to underweight Danish pharmaceutical company Novo Nordisk as a result of our negative views on Valuation. The Fund was overweight Noble Group, a Hong Kong-based investment holding company, because of our positive views on Valuation and Quality. The overweight in Norsk Hydro, a Norwegian aluminum supplier, was due to our positive views on Sentiment and Momentum. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, we did not use derivatives as part of an active management strategy to add value to the Fund’s results. However, we used equity index futures, on an opportunistic basis, to equitize the Fund’s excess cash holdings. In other words, we put the Fund’s excess cash holdings to work by using them as collateral for the purchase of equity index futures. |

| Q | | What changes or enhancements did you make to your quantitative model during the Reporting Period? |

| A | | We made no changes to our quantitative model during the first quarter of 2015. In the second calendar quarter, we introduced an enhancement within our Sentiment theme within Europe and Japan that uses the credit default swap spread of a company as an early indicator of potential stock price swings. To arrive at our views, we use data on single-name credit default swap spreads for more than 300 companies on a daily basis. (Credit default swap spread is the annual cost of protecting against default.) Additionally, we extended to South Korea our ability, through our global linkages theme, to examine the relationship between the separate companies that belong to a single conglomerate as well as between public sector companies that belong to the same state owned industry sub-group. In addition, we extended to Europe our ability, also through our global linkages theme, to look at economic linkages. We analyze more than 3.5 million patents globally to establish the economic linkages between companies in various industries. We believe these linkages help predict price movements across similar companies more accurately. |

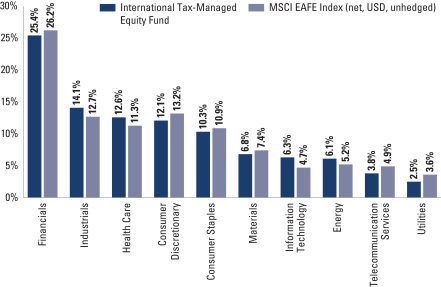

| Q | | How was the Fund positioned relative to the Index at the end of the Reporting Period? |

| A | | In constructing the Fund’s portfolio, we focus on picking stocks rather than on country weightings. Consequently, the Fund is similar to the Index in terms of its sector and country allocations. That said, at the end of the Reporting Period, the Fund was overweight the information technology, industrials, health care and energy sectors relative to the Index. It was underweight the utilities, telecommunication services and consumer discretionary sectors. The Fund was relatively neutrally weighted compared to the Index in the materials, consumer staples and financials sectors at the end of the Reporting Period. |

| | At the end of the Reporting Period, the Fund was overweight relative to the Index in Japan, Norway, France and Spain. Compared to the Index, it was underweight Australia, Sweden and the U.K. The Fund was relatively neutrally weighted compared to the Index in Germany, Finland, Italy, Switzerland, Belgium, Israel, the Netherlands, Denmark, Hong Kong, Singapore, Portugal, New Zealand, Austria and Ireland at the end of the Reporting Period. |

24

FUND BASICS

International Tax-Managed Equity Fund

as of June 30, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | January 1, 2015–June 30, 2015 | | Fund Total Return

(based on NAV)1 | | | MSCI EAFE Index (net, USD, unhedged)2 | |

| | Class A | | | 7.93 | % | | | 5.52 | % |

| | Class C | | | 7.50 | | | | 5.52 | |

| | Institutional | | | 8.13 | | | | 5.52 | |

| | | Class IR | | | 8.07 | | | | 5.52 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The unmanaged MSCI EAFE Index (net, USD, unhedged) is a market capitalization-weighted composite of securities in 21 developed markets. The Index figures do not include any deduction for fees or expenses. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 | |

| | | For the period ended 6/30/15 | | One Year | | | Five Years | | | Since Inception | | | Inception Date | |

| | Class A | | | -8.31 | % | | | 8.58 | % | | | 0.06 | % | | | 1/31/08 | |

| | Class C | | | -4.66 | | | | 8.98 | | | | 0.07 | | | | 1/31/08 | |

| | Institutional | | | -2.61 | | | | 10.24 | | | | 1.22 | | | | 1/31/08 | |

| | | Class IR | | | -2.75 | | | | N/A | | | | 8.89 | | | | 8/31/10 | |

| | 3 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional and Class IR Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

25

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 1.38 | % | | | 1.42 | % |

| | Class C | | | 2.13 | | | | 2.17 | |

| | Institutional | | | 0.98 | | | | 1.02 | |

| | | Class IR | | | 1.13 | | | | 1.17 | |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least April 30, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | | | | | | | |

| | STANDARDIZED AFTER-TAX PERFORMANCE AS OF 6/30/155 | |

| | | Class A Shares | | One Year | | | Five Years | | | Since Inception

(1/31/08) | |

| | Returns before taxes* | | | -8.31 | % | | | 8.58 | % | | | 0.06 | % |

| | Returns after taxes on distributions** | | | -8.80 | | | | 8.22 | | | | -0.23 | |

| | | Returns after taxes on distributions***

and sale of Fund shares | | | -4.31 | | | | 6.88 | | | | 0.13 | |

| | 5 | | The after-tax returns are calculated using the historically highest individual federal marginal income tax rates at the time of distributions (currently 23.8% for qualifying ordinary income dividends and long-term capital gain distributions and 43.4% for non-qualifying ordinary income dividends) and do not reflect state and local taxes. Actual after-tax returns will be calculated at calendar year-end and depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Under certain circumstances, the addition of the tax benefits from capital losses resulting from redemptions may cause the Returns After Taxes on Distributions and Sale of Fund Shares to be greater than the Returns After Taxes on Distributions or even Returns Before Taxes. Standardized after-tax returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.5% for Class A Shares. |