| OMB APPROVAL |

OMB Number: 3235-0570 Expires: August 31, 2020 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-05685 | |

| Williamsburg Investment Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

John H. Chilton, Esq.

| Sullivan & Worcester LLP 1666 K Street NW Washington, D.C. 20006 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | March 31 | |

| | | |

| Date of reporting period: | March 31, 2020 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

March 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting the Funds at 1-800-281-3217 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at 1-800-281-3217. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

THE DAVENPORT FUNDS

LETTER TO SHAREHOLDERS | April 20, 2020 |

Dear Shareholders,

These are frightening and unusual times. Economies, financial markets, and people around the world are gripped with coronavirus fears. We’ve gone from a buoyant economy that was supported by a very healthy consumer to a full-blown crisis. The S&P 500® Index declined 19.60% in the fiscal fourth quarter and experienced the fastest move into bear market territory in history. The Russell 2000® Index declined 30.61% and the Dow Jones Industrial Average had its worst calendar first quarter ever. The market’s swoon has been nauseating and very few stocks have been defensive.

Suffice it to say, the world is a different place than it was at the time of our last quarterly update. There’s significant social change that accompanies change in financial markets. Much of America is closed. We are working from home, wearing masks to the grocery store, spraying packages with Lysol, doing puzzles, binging on Netflix, and developing a newfound appreciation for delicacies fromChef Boyardee. Meanwhile, our kids are being treated to “virtual learning.” Personal space has indeed taken on a completely new meaning. How long will this last, and what should we be doing as investors?

We don’t have a crystal ball, and the virus outcome involves wide extremes. However, it’s clear we are experiencing an unprecedented economic shock. Surely, there will be lasting effects, including heightened risk aversion in terms of both debt and germs. We will also see unrivaled monetary and fiscal stimulus to offset the virus’ impact. Already, the Federal Reserve has lowered interest rates to zero, and the government has passed the $2 trillion CARES Act meant to provide relief to businesses and individuals.

Different companies have varying degrees of exposure to the virus and its effects. Some may see business temporarily improve, some will see a muted impact, and some will see deep declines. Another camp, most notably travel & leisure companies with significant debt, will see their existence threatened if this pandemic persists. The situation could also accelerate the structural decline of challenged areas such as brick & mortar retail and old media, while furthering trends such as cloud computing and online retailing.

Generally, we’ve been trying to upgrade the durability of our Funds while also taking advantage of opportunities. Years from now, we think the current pricing of some very high-quality franchises will look quite attractive. Our mission is to have our best players on the field. There are cases where we can sell a depressed stock and buy an equally depressed name of superior quality. We don’t want to run too far from risk when fear is rampant, but we also want survivors and are paying keen attention to the balance sheet health of our holdings.

By definition, something horrible has to be happening for prices to be where they are. Such panics are typically caused by something new, different and totally unanticipated… this time is no exception. In fact, it feels worse and less controllable than other crises. While the situation does appear to entail extreme outcomes, we are placing a higher probability on a return to normalcy at some point in the not too distant future (albeit after a period of pain). Investors may ultimately be rewarded should that prove to be the case.

1

Davenport Core Fund

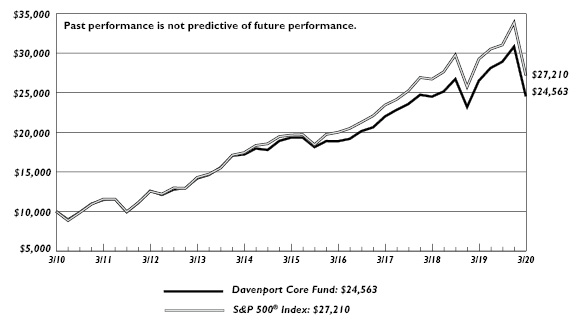

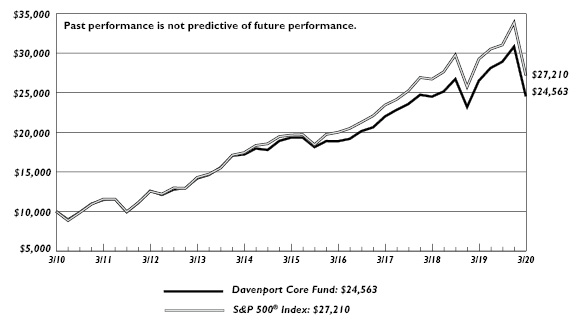

The following chart represents Davenport Core Fund’s (DAVPX) performance and the performance of the S&P 500 Index*, the Core Fund’s primary benchmark, for the periods ended March 31, 2020.

| Fiscal Q4

2019 | 1 Year | 3 Years** | 5 Years** | 10 Years** | Since

Inception

1/15/98** | Fiscal

Year 2020

Expense

Ratio |

Core Fund | -20.31% | -7.36% | 3.74% | 4.90% | 9.40% | 6.19% | 0.89% |

S&P 500 Index* | -19.60% | -6.98% | 5.10% | 6.73% | 10.53% | 6.61% | |

30-Day SEC Yield: 0.49%; Expense Ratio in current prospectus: 0.89%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

* | The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500 Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

** | Returns greater than one year are annualized. |

The Davenport Core Fund (DAVPX), along with the broader market, suffered a setback in the final quarter of fiscal 2020. The Fund fell 20.31%, relative to a 19.60% decline for the S&P 500® Index. For the fiscal year, the Fund declined 7.36% compared to the 6.98% decline for the Index. As mentioned in the above macro letter, the COVID-19 virus wreaked havoc across equity markets late in the fourth quarter, as precautions taken to slow the spread of the virus heavily disrupted economic activity.

Being underweight in the Information Technology hurt performance to end the year, as tech stocks held up better than the market. In addition, our Consumer Staples sector performance was dragged down by a sharp selloff in Anheuser-Busch Inbev (BUD), which we sold during the quarter. On the positive side, the Real Estate and Communication Services sectors helped us during the fiscal fourth quarter and full year, with strong relative performance from American Tower Corporation (AMT) and connectivity names such as T-Mobile US, Inc. (TMUS) and Liberty Broadband Corporation (LBRDK).

While we never like to see sharp declines, we take great comfort in the quality and durability of the companies we own in the Core Fund. When looked at as a whole, we believe these are large, well-capitalized companies that have survived and profitably grown for many decades.

Transaction activity was very modest in the first two months of the fiscal fourth quarter, but as the pandemic spread, we took the opportunity to make some changes, improving quality and reacting to this new world. We sold some economically sensitive names, such as FedEx Corporation (FDX) and Vulcan Materials Company (VMC). We also changed horses in the Financials sector by selling Wells Fargo & Company (WFC) to purchase Moody’s Corporation (MCO).

2

Moody’s is a leading provider of global credit ratings and has a strong data analysis business. The asset-light business model is excellent, leading to very high margins and free cash flow generation. Barriers-to-entry are high with Moody’s operating largely in a duopoly with Standard & Poor’s. In addition, Moody’s is not exposed to credit concerns and interest margin compression that traditional banks currently face. The stock had pulled back sharply alongside the market and we were able to purchase this high-quality business at an attractive valuation.

With some of the cyclical proceeds, we purchased shares in Abbott Laboratories (ABT). ABT, founded in 1888, is a global, diversified health care leader with operations in four operating divisions that include Nutritionals, Diagnostics, Established Pharmaceuticals, and Medical Devices. The 2017 acquisition of St. Jude Medical brought ABT an array of advanced cardiac products. The balance sheet has been de-levered from that deal, and ABT is benefiting from the late-stage R&D pipeline delivering next-generation Medtech products to market. As a result, we view ABT as well-positioned to sustain sector leading, high single-digit organic sales growth along with enhanced operating margins through supply chain and manufacturing efficiencies from its global network that drives double-digit EPS growth into 2023.

In addition, we added to our existing positions in Microsoft Corporation (MSFT), Amazon.com, Inc. (AMZN) and T-Mobile US, Inc. (TMUS). These businesses are very well insulated from the economic fallout of the virus. MSFT and AMZN are both benefiting from increased uptake of cloud computing in this virtual, work-from-home world. Secular trends in their favor are only accelerated by the pandemic, and they have outstanding balance sheets. TMUS has a great story in the wake of the recently-closed Sprint deal. TMUS should continue to take market share with its value offering and marketing prowess. The Sprint deal offers ample savings on marketing costs and allows TMUS to take advantage of Sprint’s fallow spectrum, providing a durable double-digit earnings growth outlook.

In sum, it was a tough close to the year for performance. We were quite active as the market volatility increased, working to both improve the Fund’s resilience if the COVID-driven economic weakness continues and also to further improve the Fund’s upside potential for when the pandemic wanes and the economy rebounds. We feel good about the changes made in the fourth quarter and will remain vigilant as volatility is likely to continue into the next fiscal year.

The following are transactions performed in the Core Fund for the quarter ended March 31, 2020.

Recent Purchases

Abbott Laboratories (ABT)We initiated a new position in ABT, a diversified health care leader with operations in four operating divisions that include Nutritionals, Diagnostics, Established Pharmaceuticals and Medical Devices. Although ABT has not adjusted its earnings guidance provided before coronavirus came on the scene, we note that revenues generated from product sales to China represent less than 8% of company totals, and the supply chain does not rely on sourcing from China – suggesting likely minimal initial impact to the 2020 outlook from this factor.

Microsoft Corporation (MSFT)We added to our position, believing that MSFT is well-positioned to be a key beneficiary of increasing cloud computing, due to its monopoly on operating systems and cross-selling opportunities. Additionally, MSFT has a net cash balance sheet, trades for a reasonable valuation, and should be relatively insulated from the economic fallout of COVID-19 given its digital focus.

3

Moody’s Corporation (MCO) We initiated a position in MCO on weakness, attracted to this leading provider of global credit ratings, research, and analysis. With ~$4.8 billion in 2019 revenue and strong mid-to-upper 40’s operating margins, we were pleased to add this name to our holdings.

Recent Sales

Anheuser-Busch Inbev S.A./N.V. (BUD)While BUD remains a market leader with best-in-class scale and operating margins, on premise sales (such as bars, restaurants, stadiums, etc.) will be impacted by the coronavirus, and we, therefore, elected to sell the shares in favor of other higher-quality businesses on sale.

Brookfield Asset Management, Inc. (BAM) Despite our decision to trim the position, we continue to regard BAM as one of the highest quality companies we own. While the stock looks more fairly valued, we still believe the company can compound value in the low-to-mid teens for years to come.

FedEx Corporation (FDX) FDX has been a struggle for quite some time, as numerous issues have cropped up. Although a great deal of damage has been done, the company remains in a highly cyclical industry and results could deteriorate further in a prolonged global slowdown. Given this uncertain outlook, we elected to sell the shares and move to a higher quality business with greater visibility.

Vulcan Materials Company (VMC) Despite being good businesses, the aggregates stocks have not been immune to the market turmoil as a recession represents the biggest risk the companies face. VMC has a good balance sheet and no liquidity concerns but was our smallest position in an already overweight Materials sector and we, therefore, elected to sell the shares.

Wells Fargo & Company (WFC) Shares of WFC and its banking peers have struggled in the declining interest rate environment. With the Fed Funds rate now near zero, and bank earnings expected to decline over the near-term due to net interest margin compression, we elected to sell the position in favor of a financial stock with a stronger growth outlook.

Davenport Value & Income Fund

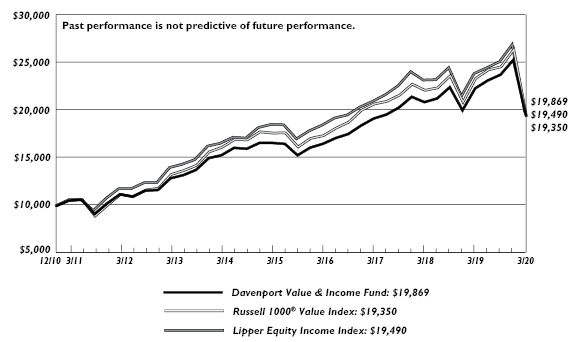

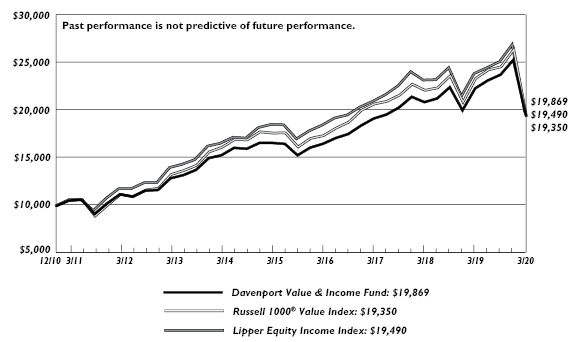

The following chart represents Davenport Value & Income Fund (DVIPX) performance and the performance of the Russell 1000 Value Index*, the Value & Income Fund’s primary benchmark, the S&P 500 and the Lipper Equity Income Index for the periods ended March 31, 2020.

| | Fiscal Q4

2019 | 1 Year | 3 Years** | 5 Years** | Since

Inception

12/31/10** | Fiscal

Year 2020

Expense

Ratio |

Value & Income Fund | -26.32% | -16.97% | -1.83% | 1.36% | 7.71% | 0.88% |

Russell 1000 Value Index | -26.73% | -17.17% | -2.18% | 1.90% | 7.40% | |

S&P 500 Index* | -19.60% | -6.98% | 5.10% | 6.73% | 10.38% | |

Lipper Equity Income Index* | -23.11% | -12.85% | 0.52% | 3.23% | 7.48% | |

30-Day SEC Yield: 2.46%; Expense Ratio in current prospectus: 0.89%

4

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

* | The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. London Stock Exchange Group PLC and its group undertakings (collectively, the “LSE Group”).© LSE Group 2020. FTSE Russell is a trading name of certain LSE Group companies. “Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote/sponsor/endorse the content of this communication. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500 Index. The Lipper Equity Income Index is an unmanaged index of the 30 largest Funds in the Lipper Equity Income Fund category. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

** | Returns greater than one year are annualized. |

The Davenport Value & Income Fund (DVIPX) declined 26.32% in the final quarter of the fiscal year. This was largely in line with the Fund’s primary benchmark, the Russell 1000 Value® Index, which decreased 26.73%. The S&P 500® Index decreased 19.60% in the quarter. For the fiscal year, the Fund declined 16.97% compared to declines of 17.17% and 6.98% for the Russell 1000 Value and S&P 500, respectively. The Fund started the final quarter on a positive note with the Russell 1000 Value Index hitting record highs in mid-February, before succumbing to the market volatility attributed to the coronavirus pandemic and declining precipitously in March. We are disappointed that the Fund did not prove more defensive during the drawdown, but in reality, there was nowhere to hide as all sectors registered sharp and significant declines. This included traditionally defensive areas such as Real Estate, Utilities, and Consumer Staples.

The key positive contributors to performance for both the quarter and fiscal year were the timely addition of Lowe’s Companies, Inc. (LOW) (more on this below) as well as our ownership of Microsoft Corporation (MSFT), which held up well thanks to its resilient cloud and enterprise software business. Our roughly 4% cash position also helped. On the negative side, the Fund’s overweight in Financials and Energy stocks were key detractors with names such as Fidelity National Financial, Inc. (FNF), Capital One Financial Corporation (COF), and Marathon Petroleum Corporation (MPC) declining over 40%. Additional detractors included some of our travel/leisure holdings, such as Delta Air Lines, Inc. (DAL) and Carnival Corporation (CCL).

Our Fund activity was higher than normal in the fourth quarter as we took the opportunity provided by significant market volatility to attempt to reduce risk to the downside while retaining the upside potential, with a focus on strong balance sheets and businesses that we think should perform well when the pandemic is over. This included adding to our positions in Berkshire Hathaway, Inc. (BRK’B), 3M Company (MMM), McDonald’s Corporation (MCD) and PepsiCo, Inc. (PEP).

5

Early in the quarter, we swapped our position in Intel Corporation (INTC) for International Business Machines Corporation (IBM). Intel was a solid holding as early actions under a new CEO were rewarded by the market and the stock’s valuation re-rated to a more normal range. IBM has struggled to grow for years while trying several different paths to success in the new digital world. We think the company may finally have gotten it right with the acquisition of Red Hat, Inc. in 2019 and a shifting focus to be the leading hybrid cloud provider. IBM has an investment-grade balance sheet, low beta, and less business risk due to the recurring nature of its service business. We felt investor sentiment was overdone to the downside, offering an attractive entry point, and in the meantime, get to enjoy the nearly 5% dividend yield.

Additionally, late in the quarter we initiated a new position in Lowe’s Companies, Inc. (LOW). LOW is the world’s second-largest home improvement retailer and is a retail self-help situation led by a management team with a proven track record of execution, trading at its lowest valuation in 20 years. Additionally, we view the home improvement retail landscape favorably given above-average household formation, strong housing turnover, and aging of the housing stock (75% of homes are >20 yrs old). We also think that LOW could be a near-term beneficiary in the work from home age as people stuck at home can catch up on house projects.

During the quarter we sold several of our more cyclical businesses and those with somewhat elevated balance sheet risk including Carnival Corporation (CCL), Dow, Inc. (DOW), Freeport-McMoRan, Inc. (FCX), Altria Group, Inc. (MO), and Citigroup, Inc. (C).

In summary, the final quarter was difficult for almost all equity funds and the Value & Income Fund was no exception. However, we are optimistic that recent changes should position the Fund to “survive and thrive” in this new world. We also think the Fund’s current yield of 2.46% is compelling in a low-interest rate environment.

The following are transactions performed in Value & Income Fund for the quarter ended March 31, 2020.

Recent Purchases

3M Company (MMM)We added to our position, believing that downward estimate revisions are nearing an end and the stock’s valuation more than prices in potential liabilities. While it may take some time to play out, we expect MMM to return to growth.

Berkshire Hathaway, Inc. (BRK’B) We added to our position as we continue to believe the shares offer significant value at current levels and should act defensively during more volatile and uncertain economic times.

Bunge Ltd. (BG)BG is one of the largest agribusinesses and grain processing companies in the world. With a new management team focused on cutting costs, shedding non-core assets and increasing the earnings power of the company, we elected to initiate a position in the name.

Chevron Corporation (CVX) With a AA-rated balance sheet, diversified asset base and disciplined management team, we elected to add to CVX during the quarter, as it remains one of the more solid ways to play the volatile energy sector.

Comcast Corporation (CMCSA)With the shares trading lower after recent earnings release, we elected to add to CMCSA believing the market is overlooking the bigger picture and the strategic moves the company is making.

6

Delta Air Lines, Inc. (DAL) We used proceeds from our sale of CCL and added to DAL, as flying is more essential than cruising and shares should rebound faster when concerns over the coronavirus begin to abate.

International Business Machines Corporation (IBM) We initiated a position in IBM, as it fits into our defensive category with a solid balance sheet, low beta, minimal business risk, and negative sentiment. After years of struggling to grow, we believe their shift in focus to the cloud and artificial intelligence may pay off in the time to come.

Lamar Advertising Company (LAMR)We added to the shares on weakness, as we remain attracted to the company’s free cash flow dynamics and structural tailwinds and believe LAMR should benefit from the upcoming political season.

McDonald’s Corporation (MCD)While MCD is not immune to COVID-19, we added to the shares given that approximately 75% of sales are “off-premise” (65% drive-thru), and results should hold up much better than many other stocks in the current environment.

Medtronic PLC (MDT)We added to MDT shares on weakness, as we remain impressed with the robust new product pipeline including recently launched leadless Micra AV pacer in the EU and pending roll-out of the next generation closed-loop diabetes monitor/pump.

Lowe’s Companies, Inc. (LOW) Trading at a 20-year low valuation, we initiated a position in the world’s 2nd largest home improvement retailer, given macro tailwinds and favorable view on management’s ability to execute amid COVID-19 concerns.

PepsiCo, Inc. (PEP)We added to the shares on weakness, as we remain attracted to the strong balance sheet and believe PEP represents one of the best combinations of defense and offense in the consumer staples sector.

Tyson Foods, Inc. (TSN)After our initial purchase of TSN during the quarter, we added again to the shares on weakness due to the coronavirus outbreak in China and continued operational issues in its chicken business. TSN is one of the world’s leading processors and marketers of chicken, beef and pork products and stands to benefit from long-term secular growth from higher global protein demand.

United Parccel Service, Inc. (UPS) We added to the shares as they approached a 5-year low due to recessionary fears. We believe this is a high-quality business with a solid balance sheet and are attracted to its more domestic orientation and solid long-term growth plan.

Recent Sales

Altria Group, Inc. (MO)While we believe the dividend is safe, trends in cigarette consumption appear to be on the decline. Alongside what appears to be a poor investment in Juul (and potentially Cronos), we elected to sell the position.

Allstate Corporation (ALL)While we remain attracted to ALL from a long-term perspective, we elected to sell the shares as the stock has appreciated significantly since our initial purchase and near-term potential risks outweigh the upside potential.

Bristol-Meyers Squibb Company (BMY)Given recent strength in the stock following the closing of the Celgene deal, we elected to sell some of our position but retain the bulk of the shares as the combined company still trades at an undemanding valuation, has a promising late-stage pipeline, and generates significant free cash flow.

7

Brookfield Asset Management, Inc (BAM) Despite our decision to trim the position on recent strength, we continue to regard BAM as one of the highest quality companies we own and believe the company can compound value for years to come.

Carnival Corporation (CCL)While CCL shares may ultimately recover, we opted to sell our position, believing our capital can be deployed into better risk/reward opportunities.

Citigroup, Inc. (C)C shares have struggled in the declining interest rate environment. Alongside risks associated with the company’s international exposure (broadest of the major money center banks), we decided to sell the position.

Dow, Inc. (DOW) With the stock struggling since our initial purchase in May 2019 we elected to sell the shares, believing it will be tough for the stock to work absent an acceleration in global growth, which looks increasingly unlikely given coronavirus concerns.

Fidelity National Financial, Inc. (FNF)While we remain attracted to FNF and management’s strong track record of increasing shareholder value, we elected to chip the position on recent strength in the shares.

Freeport-McMoRan, Inc. (FCX)Copper prices have fallen precipitously from their recent high due to the coronavirus and fears of a recession. Given we have other cyclical stocks that are likely to perform well should global growth improve, we elected to sell the position.

Intel Corporation (INTC) We sold our position on strength during the quarter, as early actions from the new CEO have been rewarded, shares have responded favorably and our thesis has played out sooner than anticipated.

Microsoft Corporation (MSFT) While we remain very positive on the outlook for MSFT, which has undergone a tremendous transformation in its business and culture and is gaining market share in the critical public cloud space, we opted to chip some of the position on recent strength in the stock.

Davenport Equity Opportunities Fund

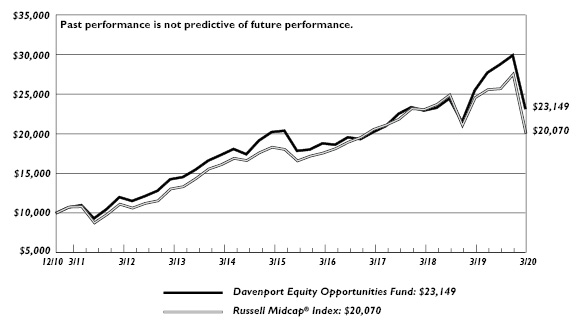

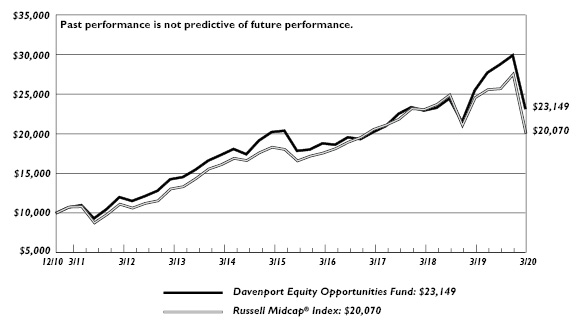

The following chart represents Davenport Equity Opportunities Fund (DEOPX) performance and the performance of the Russell Midcap Index*, the Fund’s primary benchmark, and the S&P 500 Index* for the periods ended March 31, 2020.

| | Fiscal Q4

2019 | 1 Year | 3 Years** | 5 Years** | Since

Inception

12/31/10** | Fiscal

Year 2020

Expense

Ratio |

Equity Opportunities Fund | -22.62% | -9.13% | 4.62% | 2.74% | 9.50% | 0.90% |

Russell Midcap Index | -27.07% | -18.31% | -0.81% | 1.85% | 7.82% | |

S&P 500 Index* | -19.60% | -6.98% | 5.10% | 6.73% | 10.38% | |

30-Day SEC Yield: -0.09%; Expense Ratio in current prospectus: 0.91%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

8

* | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000, which represent approximately 25% of the total market capitalization of the Russell 1000®. London Stock Exchange Group PLC and its group undertakings (collectively, the “LSE Group”).© LSE Group 2020. FTSE Russell is a trading name of certain LSE Group companies. “Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote/sponsor/endorse the content of this communication. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500 Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

** | Returns greater than one year are annualized. |

The Davenport Equity Opportunities Fund (DEOPX) endured a challenging fiscal fourth quarter, experiencing a 22.62% decline for the period and a 9.13% decline for the fiscal year. Though the drawdown for the strategy proved resilient relative to the 27.07% decline and 18.31% decline for the Russell Midcap® Index during the quarter and year respectively, it was painful nonetheless.

Simplistically, the fiscal fourth quarter can be thought of as two distinct periods: pre-crisis and post. In each period, we took several actions aimed at improving the risk-reward profile of the strategy; however, the new reality of the latter stages of the quarter made profit-taking exercises seem timely while rendering decisions to add to or introduce new positions “too early” at best.

Earlier in the quarter, we took profits in larger positions that had performed well such as Brookfield Asset Management, Inc. (BAM), CarMax, Inc. (KMX), and Martin Marietta Materials, Inc. (MLM). We also continued to reduce stakes in growth-oriented names such as Autodesk, Inc. (ADSK), Intuit, Inc. (INTU) and MercadoLibre, Inc. (MELI) as the tech sector continued its outperformance. With the funds, we added to positions in Fairfax Financial Holdings Ltd. (FRFHF) and Markel Corporation (MKL) given what appeared to be reasonable valuations in light of an improving industry backdrop and ongoing investment momentum. We also added to our position in auto parts retailer and quality compounder, O’Reilly Automotive, Inc. (ORLY). While we wish we had waited on each of these decisions as the stocks declined in the market’s swoon, we continue to believe in the long-term prospects of these franchises and take comfort in their solid liquidity and defensible businesses that should be able to weather the storm.

We also introduced two new names to the strategy earlier in the quarter in Altice USA, Inc. (ATUS) and Colfax Corporation (CFX). ATUS is the fourth-largest cable operator in the U.S. and appears well-positioned to benefit from increased data consumption over the long term. CFX is a name we have known for some time that, following recent business repositioning, had reduced the cyclicality of its operations and seemed well-positioned for cash generation, continuous improvement, and capital allocation. While we remain attracted to both of these businesses, they carry higher degrees of leverage, thereby making the near-term outlook a bit more nebulous. As such, amid the market drawdown, we elected to emphasize other names that we highlight below.

Two of our top-performing holdings during the quarter and full-year were American Tower Corporation (AMT) and Take-Two Interactive Software, Inc. (TTWO), with each becoming outsized positions due to their relatively sturdy performance amid the market’s drawdown. In the case of AMT, we continue to regard the company as one of the highest quality businesses we know of, with predictable revenue streams from secular growth in mobile connectivity.

9

However, with the position size approaching 9%, we felt it prudent to re-allocate funds to some more distressed ideas that exhibit more attractive risk/reward profiles. In the case of TTWO, the stock had received a flight to safety bid alongside other game publishers as investors viewed the business model as being resilient during this unprecedented period of self-quarantine and social distancing. While we agree with this notion and like the company’s strong balance sheet, astute management team and top-quality content, its weighting had also increased dramatically. With the funds from these two reductions, we elected to add to holdings in Live Nation Entertainment, Inc. (LYV), Fidelity National Financial, Inc. (FNF), CarMax, Inc. (KMX) and Liberty Broadband Corporation (LBRDK) at what have turned out to be attractive prices at the time of this writing.

In summary, we note that both entering the crisis and at year-end, our strategy has been anchored by quality businesses with strong balance sheets led by capable management teams. As we hope to have illustrated, we took opportunistic actions during the final quarter that we feel helped to bolster the quality while also not abandoning risk (or the opportunity for a bounce-back on the other side). We believe these characteristics along with actions taken during the latest period of volatility will not only help the strategy survive whatever comes next but thrive on the other end.

The following are transactions performed in the Equity Opportunities Fund for the quarter ended March 31, 2020.

Recent Purchases

Altice USA, Inc. (ATUS)We initiated a position in ATUS, the fourth-largest cable operator in the U.S. Later in Q1, we added to our position as we think there is potential for significant upside over the next 2-3 years and the risk/reward looks attractive.

CarMax, Inc. (KMX)We elected to add to our position in KMX late in the quarter. Like many consumer discretionary stocks, shares of KMX have plummeted in recent trading, but with its strong balance sheet and limited credit risk on its auto loan fund, we felt the shares were oversold.

Colfax Corporation (CFX)We initiated a new position in CFX after selling our position in October 2018. Since that time, the company has undergone a significant transformation that has resulted in a higher margin, less cyclical company with better cash flow.

Etsy, Inc. (ETSY)While we suspect that demand for items on ETSY’s marketplace will be negatively affected by the current economic contraction, we think this can be offset by a reduction in in-store shopping and could drive additional buyers to ETSY’s e-commerce marketplace. As such we remain confident in ETSY and elected to add to our position.

Fairfax Financial Holdings Ltd. (FRFHF)We added multiple times to FRFHF during the quarter, as the shares continue to trade at a discount to our estimation of year-end book value despite much-improved returns in the investment fund and continued momentum in the insurance business. We note that FRFHF enjoys a strong capital position and has an impressive track record of capital allocation.

Fidelity National Financial, Inc. (FNF)Still sporting a solid balance sheet and attractive dividend yield, we elected to add to FNF shares during the quarter as the stock sold off dramatically alongside the rest of the housing sector with bond spreads widening and mortgage rates ticking up in recent trading.

10

Liberty Broadband Corporation (LBRDK)As a reminder, LBRDK is a holding company that owns shares of cable concern Charter Communications (CHTR). We chose to add to these shares as the company’s business should prove very resilient during a market slowdown. The value of CHTR’s broadband/data service and “connectivity” in general should only increase as people stay home and watch Netflix and other content providers.

Markel Corporation (MKL)Although MKL has been an underperformer of late, we feel the shares represent a decent value given solid insurance pricing, strong investment results and ongoing momentum in MKL Ventures. We note that MKL enjoys a strong capital position and has an impressive track record of capital allocation. As such, we decided to add to our position.

O’Reilly Automotive, Inc. (ORLY) We added to our position as we are impressed by the company’s defensive business model evidenced by consistent growth during the last recession and should offer protection during more volatile economic times.

Live Nation Entertainment, Inc. (LYV) Due to the coronavirus, shares of LYV pulled back considerably during the quarter as investors were quick to fear that live events/concerts could be impacted. While logical, even a sharp reduction to this year’s earnings would not dramatically impact the long-term value of the company and as such, we elected to add multiple times to our position.

Recent Sales

American Tower Corporation (AMT)We chipped our position in AMT as it had become outsized due to its relatively sturdy performance amid the market’s drawdown. However, it remains one of our larger positions and is still one of the highest quality businesses we know.

AutoDesk, Inc. (ADSK)We continue to have strong long-term conviction in the name but felt it prudent to lock in some gains following the strong up move and reduce our exposure to the more volatile software industry.

Black Knight, Inc. (BKI)This stock has been a stellar performer for the strategy as investors have rewarded the company for superior business models, visible growth opportunities and strong execution. Whereas we continue to like the long-term prospects, we felt valuations left little margin for error and elected to take some profits.

Brookfield Asset Management, Inc. (BAM) BAM posted solid returns in 2019 and was a big contributor to the Fund’s relative outperformance last year. Given the strong run-up, we elected to take some profits with shares more accurately reflecting the company’s business momentum and long-term prospects.

CarMax, Inc. (KMX)With shares approaching all-time highs and rumors of strengthening same-store sales rippling through buy-side expectations, we elected to chip the position on strength early in the quarter, choosing to reduce the outsized position and move to more attractive risk/reward opportunities.

Dollar Tree, Inc. (DLTR)While DLTR generated decent returns since our purchase, the experience has been volatile and frustrating at times. Results have been inconsistent; the integration of Family Dollar has been tougher than originally expected, and we, therefore, opted to sell the remainder of our shares for higher conviction ideas.

Intuit, Inc. (INTU) While we appreciate INTU’s high return business model, strong cash generation and predictable double-digit growth, we elected to chip our position on recent strength, concerned that the significant re-rating in the shares is more the result of macro fund flows than anything fundamental or company-specific.

11

Martin Marietta Materials, Inc. (MLM)While MLM continues to exceed quarterly expectations and provides a favorable 2020 outlook, after the strong run in 2019, we felt it prudent to chip our position and reduce our exposure to housing and infrastructure.

MercadoLibre, Inc. (MELI) We continue to like the long-term opportunity for MELI’s marketplace and payments businesses in South America. However, after the stock’s recent and impressive run, the shares more accurately reflect the opportunity, and we, therefore, elected to chip the position.

Take-Two Interactive Software, Inc. (TTWO)We elected to chip the position as it had become outsized due to its relatively sturdy performance amid the market’s drawdown and investors’ attraction to game publishers in this period of self-quarantine and social distancing.

Zoetis, Inc. (ZTS) This stock has been a stellar performer for the strategy as investors have rewarded the company for superior business models, visible growth opportunities and strong execution. Whereas we continue to like the long-term prospects, we felt valuations left little margin for error and elected to take some profits.

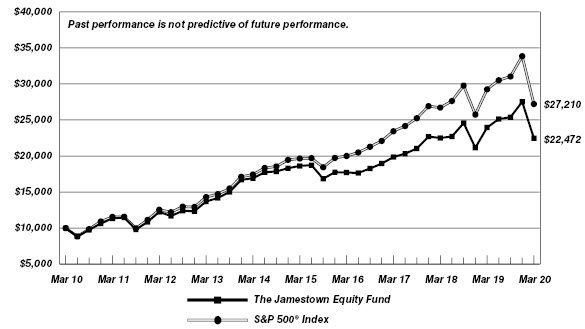

Davenport Small Cap Focus Fund

The following chart represents performance of the Davenport Small Cap Focus Fund (DSCPX) and the performance of the Fund’s primary benchmark, the Russell 2000 Index*, for the periods ended March 31, 2020.

| | Fiscal Q4

2019 | 1 Year | 3 Years** | 5 Years** | Since

Inception

12/31/14** | Fiscal

Year 2020

Expense

Ratio |

Small Cap Focus Fund | -28.04% | -14.08% | -0.52% | 2.80% | 3.46% | 0.95% |

Russell 2000 Index* | -30.61% | -23.99% | -4.64% | -0.25% | 0.57% | |

30-Day SEC Yield: 0.73%; Expense Ratio in current prospectus: 0.98%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

* | The Russell 2000 Index measures the performance of the 2000 smallest companies in the Russell 3000® Index. Frank Russell Company (“Russell”) is the source and owner of the registered trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. An investor cannot invest in an index and index returns are not indicative of the performance of any specific investment. London Stock Exchange Group PLC and its group undertakings (collectively, the “LSE Group”).© LSE Group 2020. FTSE Russell is a trading name of certain LSE Group companies. “Russell®” is a trade-mark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote/sponsor/endorse the content of this communication. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

** | Returns greater than one year are annualized. |

12

The Davenport Small Cap Focus Fund (DSCPX) saw its strong momentum from the beginning of fiscal 2020 reverse sharply in the final quarter as small cap stocks were hit particularly hard during the market’s swoon. The Russell 2000® Index declined 30.61% during the period, faring much worse than the S&P 500® Index with its 19.60% drop. Whereas the Fund’s 28.04% decline bested the Russell 2000, the drawdown was painful and unsettling. For the fiscal year, the Fund declined 14.08%, compared to the 23.99% and 6.98% declines for the Russell 2000 and S&P 500, respectively. Despite the turbulent close to the year, we feel this period of pain has unearthed buying opportunities in names we know well. Ultimately, we view the strategy (and the asset class) to be quite timely at the moment.

Starting with the positives: we were fortunate to have a position in one of the only beneficiaries of this crisis in telehealth leader Teladoc Health, Inc. (TDOC). The company saw its share price soar over 85% during the fiscal fourth quarter as key impediments to the adoption of telehealth were removed in light of the important role telemedicine will play in helping to diagnose and contain the outbreak. While we trimmed the position modestly, we have held on to a meaningful position given our belief that the value creation timeline has been pulled forward. Shenandoah Telecommunications Company (SHEN) was also a meaningful contributor to results as the approval of the Sprint/T-Mobile merger provided a positive catalyst. Cable provider Cable One, Inc. (CABO) was another resilient performer during the quarter. The stock’s contribution to results was augmented by our ability to purchase the shares cheaply during a period of volatility.

Unfortunately, there were more negatives than positives in the quarter. The rapidly intensifying impact of the virus (and the effort to combat it) has upended the global economy, disrupted business models and presented new realities that no one could have anticipated. The world is simply different now and, as a result, we were forced to make some tough decisions regarding businesses that in a pre-COVID-19 world were otherwise resilient and sturdy. Amid the chaos, we elected to exit or dramatically reduce holdings in businesses we once held in high regard that now are seeing their existence threatened. Key examples of this are in travel and leisure facing companies such as Eldorado Resorts, Inc. (ERI), a regional casino operator in the midst of a major acquisition, and OneSpaWorld Holdings Ltd. (OSW), the leading operator of wellness facilities on cruise ships. In the case of the former, deal leverage threatens to dramatically impair the company assuming the complete shutdown of its operations persists. In terms of the latter, the company has some time on its debt maturities, but we are worried that the cruise industry may be one of the last to make a recovery. In each case, the set of potential outcomes has become extreme.

We directed money towards more clear-cut survivors that can also do well on the other side. In that vein, we added to our position in Monarch Casino & Resort, Inc. (MCRI) at depressed levels. With minimal debt, ample cash on the balance sheet and access to a credit facility, MCRI can survive its two casinos being closed for a long time. It could also be one of few companies positioned to opportunistically make an acquisition if others in the industry become distressed sellers. Furthermore, the stock looks cheap even if one assumes cash flow is down 30-40% for a while upon re-opening. This is a case where we could make a lot of money if the world returns to normal and the risk seems manageable in the meantime.

In closing, we are disappointed by the magnitude of the Fund’s drawdown to end the fiscal year. However, we are confident in the Fund’s positioning and feel efforts to take advantage of recent volatility have improved the risk/reward profile of the Fund. We also note that we continue to carry an above average cash balance that should allow us to take advantage of future volatility.

13

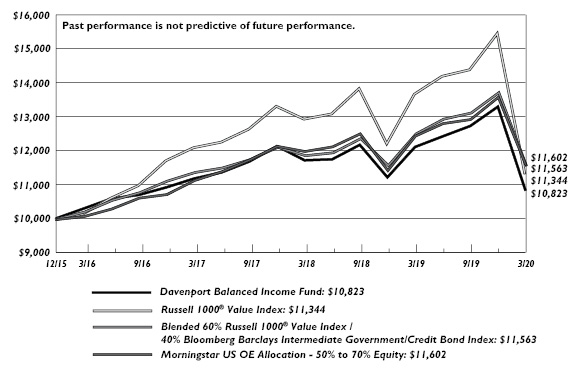

Davenport Balanced Income Fund

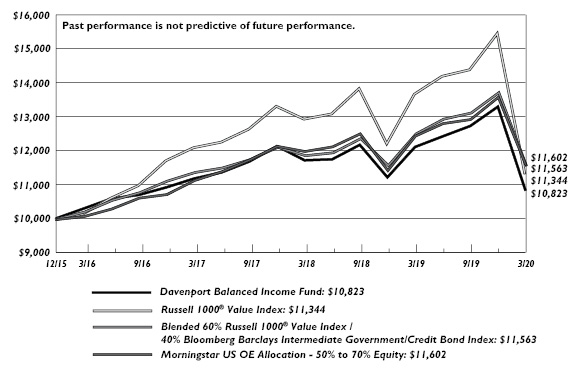

The following chart represents Davenport Balanced Income Fund (DBALX) performance, and performance of the Fund’s primary benchmark, the Russell 1000® Value Index, along with the Morningstar Allocation 50-70% Equity Index, and the blended 60% Russell 1000® Value Index / 40% Bloomberg Barclays Intermediate Government/Credit Bond (BBIGC) Index for the period ended March 31, 2020.

| | Fiscal Q4

2019 | 1 Year | 3 Years** | Since

Inception

12/31/15** | Fiscal

Year 2020

Expense

Ratio |

Balanced Income Fund | -18.57% | -10.59% | -1.06% | 1.88% | 0.95% |

Russell 1000® Value* | -26.73% | -17.17% | -2.18% | 3.01% | |

Morningstar Allocation 50-70% Equity* | -14.71% | -6.89% | 1.33% | 3.56% | |

60% Russell 1000® Value/40% BBIGC | -15.74% | -7.56% | 0.56% | 3.48% | |

30-Day SEC Yield: 2.42%; Expense Ratio in current prospectus: 0.96%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

* | The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. London Stock Exchange Group PLC and its group undertakings (collectively, the “LSE Group”).© LSE Group 2020. FTSE Russell is a trading name of certain LSE Group companies. “Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote/sponsor/endorse the content of this communication. The Morningstar US OE Allocation 50-70% Equity Index is composed of funds which seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds, and cash. These portfolios are dominated by domestic holdings and have equity exposure between 50% and 70%. The blended 60% Russell 1000 Value/40% Bloomberg Barclay’s Intermediate Government/Credit (BBIGC) Index is included as an additional comparative index because it is representative of a balanced portfolio consisting of 60% equity and 40% fixed income securities. The BBIGC measures the non-securitized component of the U.S. Aggregate Index. It includes investment grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate rate securities. Intermediate maturity bonds include bonds with maturities of 1 to 9.999 years. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

** | Returns greater than one year are annualized. |

The Davenport Balanced Income Fund (DBALX) declined 18.57% during the final quarter of the year compared to a 15.74% decline for the blended 60% Russell 1000® Value Index and 40% Bloomberg Barclays Intermediate Government/Credit Index. For the fiscal year, the fund declined 10.59% compared to the 7.56% decline for the blended benchmark. Following three quarters of outsized performance to start the fiscal year, the year ended on a sour note as financial markets were turned upside down as the novel coronavirus spread globally, causing unprecedented economic shock.

14

To close the fiscal year, equity indices tumbled into bear market territory at a record pace with seemingly no industries or stocks acting defensive. During this pullback, we’ve taken steps to upgrade the durability of the equity portion of the Fund and have taken advantage of buying opportunities in names we feel are oversold. One example of this is Lowe’s Companies, Inc. (LOW), the world’s second-largest home retailer. We view the home improvement retail landscape favorably given above-average household formations, strong housing turnover, and aging of the housing stock. Moreover, Lowe’s is led by a management team with a proven track record of execution and maintains a healthy balance sheet while generating significant cash, some of which the company returns to shareholders via dividends and buybacks. Lowe’s is a dividend aristocrat (3.2% yield at time of purchase) and has increased its dividend for 56 years. While there may be near term impacts from the coronavirus, we felt this was reflected in the stock price and valuation and argue homeowners may use their increased time at home to catch up on house projects.

The world is clearly a different landscape than at the end of the fiscal third quarter and there will be lasting effects from the virus both in the short-term and well into the future. Each industry and company will experience varying degrees of impacts from the virus, and some businesses we’ve previously been bullish on now have less enthusiastic outlooks. Carnival Corporation (CCL) is one name that falls in this camp, and we elected to sell the position during the quarter. At the time of our initial purchase, we believed the cruise industry outlook was bright with demand-driven primarily by gaining baby boomers, a rising middle class in emerging markets, and rising incomes and economic growth globally. The current economic conditions have altered our thesis and we’ve become increasingly concerned that a rebound in the business is likely to take longer than originally expected, as evidenced by dramatic declines in future bookings. Ultimately, we believe the industry will bounce back, but we felt our capital could be deployed in better risk/reward opportunities such as Lowe’s.

The bond market in fiscal Q4 2020 experienced quite a shock as central banks provided unprecedented accommodations to markets due to the coronavirus. Between the COVID-19 global health pandemic and the escalation of an international oil price war, Treasuries and cash were the true safe haven as corporate credit came under pressure. As former Fed governor Kevin Warsh said, “If you’ve seen one financial crisis, you’ve seen one financial crisis.” Along those lines, this isn’t 2008 2.0; we have already seen dramatically different fiscal and monetary actions to buffer the economy and capital markets.

The bond allocation of the Balanced Income Fund consists of 30 high-quality bonds across eight sectors with the top allocations to Consumer Discretionary at 23.99%, U.S. Treasuries at 23.87%, and Energy at 17.05%. The credit quality of the Fund is at A+/A1 with an effective maturity of 4.21 years and a duration of 3.63 years.

During the quarter, we increased our Deere & Company (DE), General Dynamics Corporation (GD), and MPLX LP (MPLX) fixed-income holdings and initiated a position in Amgen, Inc. (AMGN) 2.2% notes due in 2027. In January we exited our Boeing Company (BA) 2027 2.7% notes, luckily unscathed, as the direction of the company became too unclear on many fronts. Our exposure to floating rate notes remains around 18%. We were pleased to see 3-month LIBOR rebound almost back to pre-virus levels even with all of the rate cuts by the Federal Reserve. Going forward, we will be looking to opportunistically increase our corporate exposure, as spreads become more attractive.

15

In closing, with a turbulent end to fiscal 2020, we believe this is a good reminder of the value in a balanced investing approach. Our allocation to dividend-paying, value-oriented equities with strong balance sheets that can weather economic uncertainty and defensive positioning in fixed income should continue to provide a volatility buffer in the near term as well as current income and long-term capital appreciation.

During the last two months of the quarter, there was no shortage of volatility and fear in the market which was an abrupt reversal from the preceding ten months. The drop in stock prices was fast and unprecedented and while questions remain about the strength of the economy, we have confidence in the companies we own. We have always sought durable companies, with solid management teams that we believe will navigate difficult environments and emerge on the other side stronger. We will continue to look for opportunities to upgrade the portfolio and own the best companies we can while maintaining a careful eye on risk. We thank you for your continued trust and confidence in this difficult market. Please stay safe.

Sincerely,

George L. Smith, III

Vice President, The Davenport Funds

16

DAVENPORT CORE FUND

PERFORMANCE INFORMATION (Unaudited)

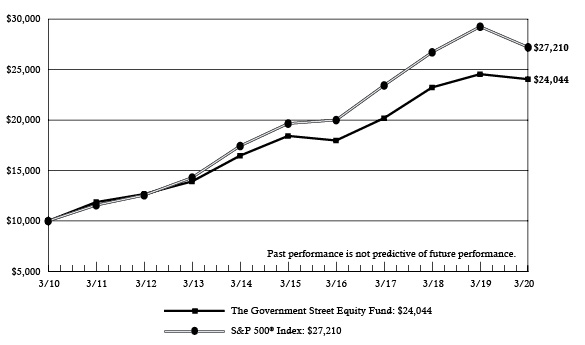

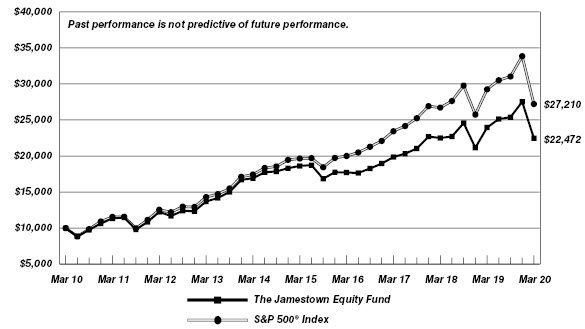

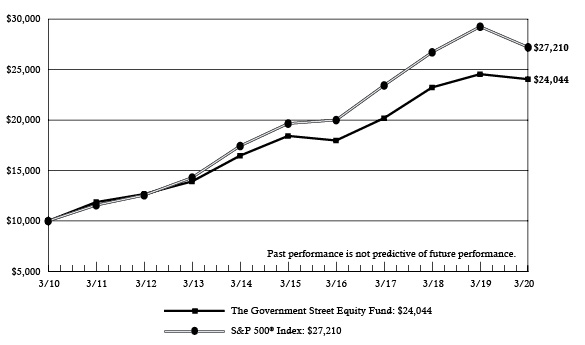

Comparison of the Change in Value of a $10,000 Investment in

Davenport Core Fund and the S&P 500® Index

| | Average Annual Total Returns

(for periods ended March 31, 2020) | |

| | 1 Year | 5 Years | 10 Years | |

Davenport Core Fund(a) | (7.36%) | 4.90% | 9.40% | |

S&P 500® Index | (6.98%) | 6.73% | 10.53% | |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

17

DAVENPORT VALUE & INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Value & Income Fund, the Russell 1000® Value Index

and the Lipper Equity Income Index

| | Average Annual Total Returns

(for periods ended March 31, 2020) | |

| | 1 Year | 5 Years | Since

Inception(b) | |

Davenport Value & Income Fund(a) | (16.97%) | 1.36% | 7.71% | |

Russell 1000® Value Index | (17.17%) | 1.90% | 7.40% | |

Lipper Equity Income Index | (12.85%) | 3.23% | 7.48% | |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2010. |

18

DAVENPORT EQUITY OPPORTUNITIES FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Equity Opportunities Fund and the Russell Midcap® Index

| | Average Annual Total Returns

(for periods ended March 31, 2020) | |

| | 1 Year | 5 Years | Since

Inception(b) | |

Davenport Equity Opportunities Fund(a) | (9.13%) | 2.74% | 9.50% | |

Russell Midcap® Index | (18.31%) | 1.85% | 7.82% | |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2010. |

19

DAVENPORT SMALL CAP FOCUS FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Davenport Small Cap Focus Fund and the Russell 2000® Index

| | Average Annual Total Returns

(for periods ended March 31, 2020) | |

| | 1 Year | 5 Years | Since

Inception(b) | |

Davenport Small Cap Focus Fund(a) | (14.08%) | 2.80% | 3.46% | |

Russell 2000® Index | (23.99%) | (0.25%) | 0.57% | |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2014. |

20

DAVENPORT BALANCED INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in Davenport Balanced

Income Fund, the Russell 1000® Value Index, a Blended 60% Russell 1000® Value

Index / 40% Bloomberg Barclays Intermediate Government/Credit Bond Index

and the Morningstar US OE Allocation — 50% to 70% Equity

| | Average Annual Total Returns

(for periods ended March 31, 2020) | |

| | 1 Year | 3 Years | Since

Inception(b) | |

Davenport Balanced Income Fund(a) | (10.59%) | (1.06%) | 1.88% | |

Russell 1000® Value Index | (17.17%) | (2.18%) | 3.01% | |

Blended 60% Russell 1000® ValueIndex / 40% Bloomberg Barclays Intermediate Government/Credit Bond Index | (7.56%) | 0.56% | 3.48% | |

Morningstar US OE Allocation - 50% to 70% Equity | (6.89%) | 1.33% | 3.56% | |

(a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Commencement of operations was December 31, 2015. |

21

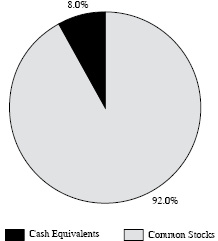

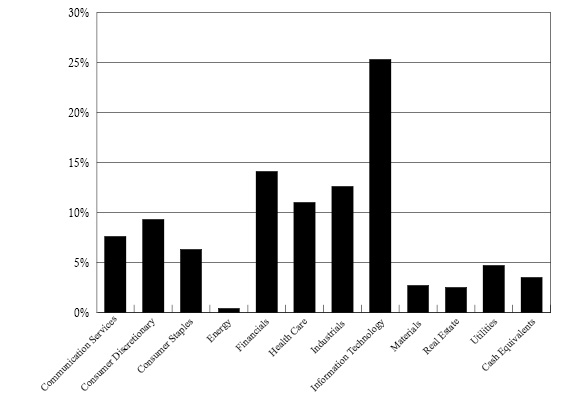

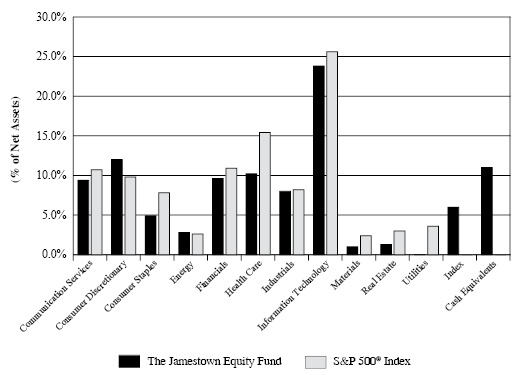

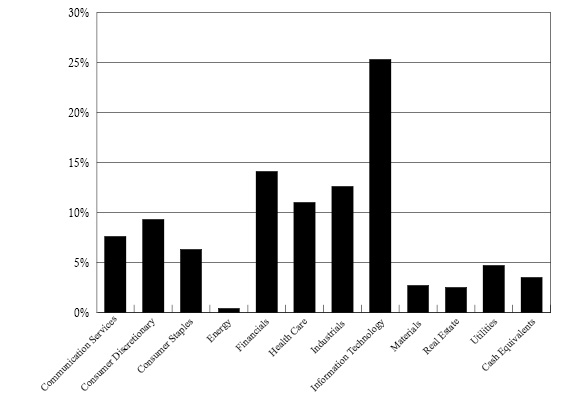

DAVENPORT CORE FUND

PORTFOLIO INFORMATION

March 31, 2020 (Unaudited)

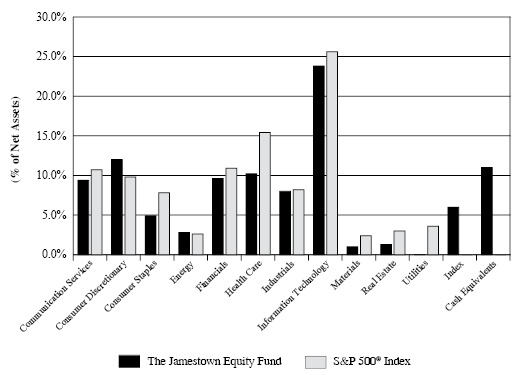

Sector Allocation vs. the S&P 500® Index

Top Ten Equity Holdings

Security Description | % of Net Assets |

American Tower Corporation | 4.7% |

Adobe, Inc. | 4.1% |

Danaher Corporation | 3.9% |

Microsoft Corporation | 3.5% |

Accenture plc - Class A | 3.1% |

Berkshire Hathaway, Inc. - Class B | 3.1% |

Visa, Inc. - Class A | 3.1% |

Markel Corporation | 2.9% |

Brookfield Asset Management, Inc. - Class A | 2.9% |

Mastercard, Inc. - Class A | 2.9% |

22

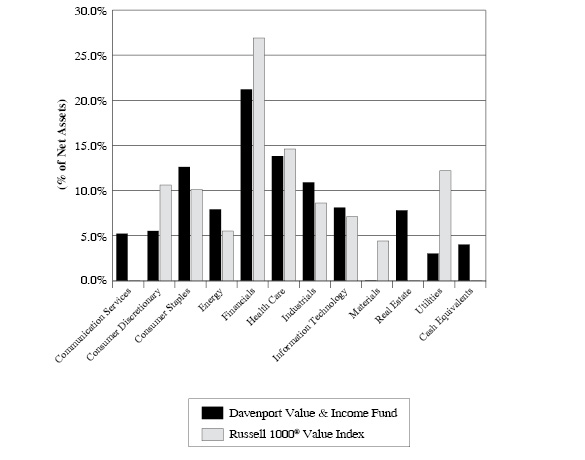

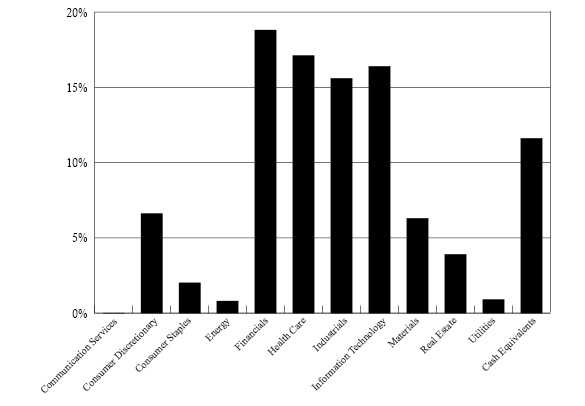

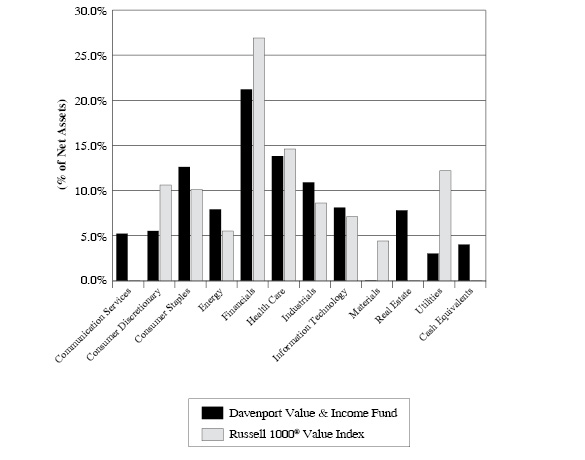

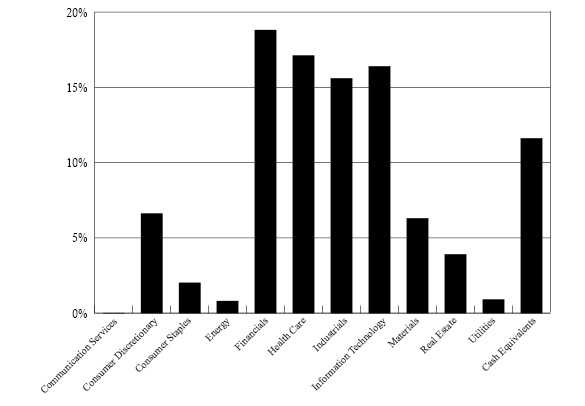

DAVENPORT VALUE & INCOME FUND

PORTFOLIO INFORMATION

March 31, 2020 (Unaudited)

Sector Allocation vs. the Russell 1000® Value Index

Top Ten Equity Holdings

Security Description | % of Net Assets |

Johnson & Johnson | 3.8% |

Comcast Corporation - Class A | 3.3% |

Brookfield Asset Management, Inc. - Class A | 3.3% |

Watsco, Inc. | 3.2% |

JPMorgan Chase & Company | 3.1% |

Dominion Energy, Inc. | 3.0% |

Markel Corporation | 3.0% |

Berkshire Hathaway, Inc. - Class B | 2.9% |

Medtronic plc | 2,8% |

PepsiCo, Inc. | 2.7% |

23

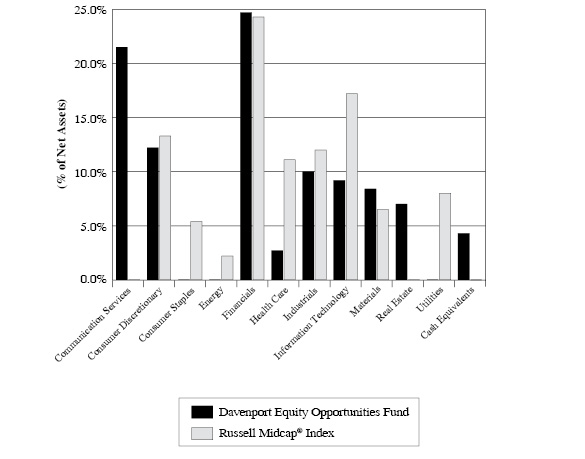

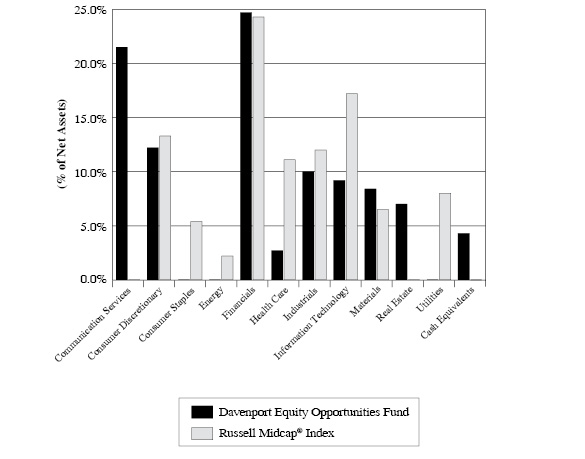

DAVENPORT EQUITY OPPORTUNITIES FUND

PORTFOLIO INFORMATION

March 31, 2020 (Unaudited)

Sector Allocation vs. the Russell Midcap® Index

Top Ten Equity Holdings

Security Description | % of Net Assets |

American Tower Corporation | 7.0% |

Markel Corporation | 6.0% |

Liberty Broadband Corporation - Series C | 5.5% |

Fairfax Financial Holdings Ltd. | 5.4% |

Live Nation Entertainment, Inc. | 5.2% |

Brookfield Asset Management, Inc. - Class A | 4.9% |

Sherwin-Williams Company (The) | 4.9% |

Watsco, Inc. | 4.4% |

Take-Two Interactive Software, Inc. | 4.0% |

Xylem, Inc. | 3.8% |

24

DAVENPORT SMALL CAP FOCUS FUND

PORTFOLIO INFORMATION

March 31, 2020 (Unaudited)

Sector Allocation vs. the Russell 2000® Index

Top Ten Equity Holdings

Security Description | % of Net Assets |

Monarch Casino & Resort, Inc. | 9.3% |

Cannae Holdings, Inc. | 7.8% |

Seaboard Corporation | 4.5% |

Shenandoah Telecommunications Company | 4.4% |

Diamond Hill Investment Group, Inc. | 4.0% |

Watsco, Inc. | 3.8% |

Etsy, Inc. | 3.7% |

NewMarket Corporation | 3.7% |

Switch, Inc. - Class A | 3.6% |

Hanesbrands, Inc. | 3.4% |

25

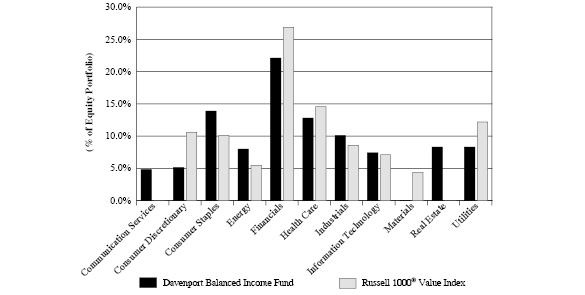

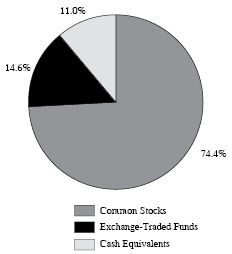

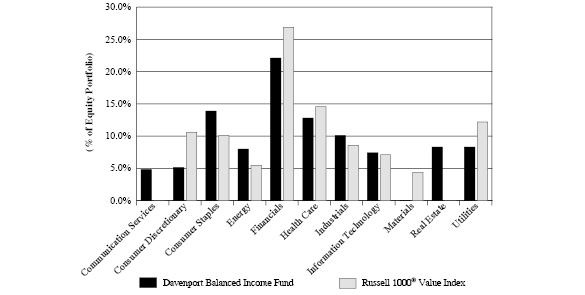

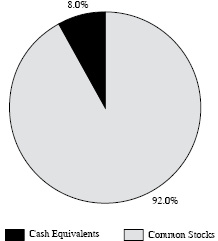

DAVENPORT BALANCED INCOME FUND

PORTFOLIO INFORMATION

March 31, 2020 (Unaudited)

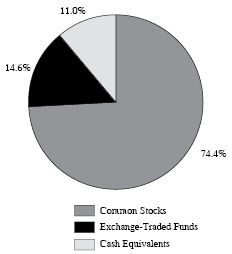

Asset Allocation (% of Net Assets) | | Ten Largest Equity Holdings | % of Net Assets |

| | Johnson & Johnson | 1.9% |

Brookfield Asset Management, Inc. - Class A | 1.6% |

Comcast Corporation - Class A | 1.6% |

Watsco, Inc. | 1.6% |

JPMorgan Chase & Company | 1.5% |

Dominion Energy, Inc. | 1.5% |

Markel Corporation | 1.5% |

Brookfield Renewable Partners, L.P. | 1.4% |

Berkshire Hathaway, Inc. - Class B | 1.4% |

Medtronic plc | 1.4% |

| |

Equity Sector Concentration vs. the Russell 1000 Value Index (53.8% of Net Assets) |

Bond Portfolio (42.6% of Net Assets) | | Credit Quality | Composite Quality |

Number of Fixed-Income Securities | 30 | | AAA | 22.6% |

Average Quality | A+/A1 | | AA | 3.5% |

Effective Maturity | 4.2 yrs. | | A | 43.0% |

Average Effective Duration | 3.6 yrs. | | BBB | 30.9% |

Sector Breakdown | % of

Bond Portfolio |

Communication Services | 1.5% |

Consumer Staples | 11.7% |

Energy | 14.8% |

Financials | 19.5% |

Health Care | 9.6% |

Industrials | 8.7% |

Information Technology | 6.2% |

Materials | 5.3% |

U.S. Treasury | 22.7% |

26

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS

March 31, 2020 |

| COMMON STOCKS — 95.9% | | Shares | | | Value | |

| Communication Services — 9.1% | | | | | | |

Alphabet, Inc. - Class A(a) | | | 7,961 | | | $ | 9,250,284 | |

Alphabet, Inc. - Class C(a) | | | 6,941 | | | | 8,071,064 | |

Liberty Broadband Corporation - Series C(a) | | | 103,475 | | | | 11,456,752 | |

T-Mobile USA, Inc.(a) | | | 104,414 | | | | 8,760,335 | |

| Walt Disney Company (The) | | | 69,634 | | | | 6,726,644 | |

| | | | | | | | 44,265,079 | |

| Consumer Discretionary — 10.3% | | | | | | | | |

Amazon.com, Inc.(a) | | | 6,395 | | | | 12,468,459 | |

CarMax, Inc.(a) | | | 181,587 | | | | 9,774,828 | |

| Home Depot, Inc. (The) | | | 56,232 | | | | 10,499,077 | |

| NIKE, Inc. - Class B | | | 94,083 | | | | 7,784,428 | |

| TJX Companies, Inc. (The) | | | 201,130 | | | | 9,616,025 | |

| | | | | | | | 50,142,817 | |

| Consumer Staples — 5.7% | | | | | | | | |

| Mondelēz International, Inc. - Class A | | | 154,758 | | | | 7,750,281 | |

| Nestlé S.A. - ADR | | | 121,554 | | | | 12,518,846 | |

| PepsiCo, Inc. | | | 62,225 | | | | 7,473,223 | |

| | | | | | | | 27,742,350 | |

| Energy — 2.7% | | | | | | | | |

| Chevron Corporation | | | 67,744 | | | | 4,908,730 | |

| EOG Resources, Inc. | | | 95,470 | | | | 3,429,282 | |

| Marathon Petroleum Corporation | | | 204,933 | | | | 4,840,518 | |

| | | | | | | | 13,178,530 | |

| Financials — 17.5% | | | | | | | | |

Berkshire Hathaway, Inc. - Class B(a) | | | 82,053 | | | | 15,001,750 | |

| Brookfield Asset Management, Inc. - Class A | | | 320,514 | | | | 14,182,744 | |

| Capital One Financial Corporation | | | 150,286 | | | | 7,577,420 | |

| Charles Schwab Corporation (The) | | | 207,471 | | | | 6,975,175 | |

| CME Group, Inc. | | | 52,565 | | | | 9,089,014 | |

| JPMorgan Chase & Company | | | 116,788 | | | | 10,514,424 | |

Markel Corporation(a) | | | 15,355 | | | | 14,247,751 | |

| Moody’s Corporation | | | 36,170 | | | | 7,649,955 | |

| | | | | | | | 85,238,233 | |

| Health Care — 13.8% | | | | | | | | |

| Abbott Laboratories | | | 103,075 | | | | 8,133,648 | |

| Becton, Dickinson and Company | | | 43,084 | | | | 9,899,411 | |

| CVS Health Corporation | | | 130,146 | | | | 7,721,562 | |

| Danaher Corporation | | | 135,736 | | | | 18,787,220 | |

| Johnson & Johnson | | | 97,740 | | | | 12,816,646 | |

| Merck & Company, Inc. | | | 130,354 | | | | 10,029,437 | |

| | | | | | | | 67,387,924 | |

27

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.9% (Continued) | | Shares | | | Value | |

Industrials — 4.8% | | | | | | | | |

General Dynamics Corporation | | | 41,578 | | | $ | 5,501,185 | |

Honeywell International, Inc. | | | 63,353 | | | | 8,475,998 | |

Union Pacific Corporation | | | 65,235 | | | | 9,200,745 | |

| | | | | | | | 23,177,928 | |

Information Technology — 20.4% | | | | | | | | |

Accenture plc - Class A | | | 93,234 | | | | 15,221,383 | |

Adobe, Inc.(a) | | | 62,835 | | | | 19,996,610 | |

Apple, Inc. | | | 43,769 | | | | 11,130,019 | |

Broadcom, Inc. | | | 29,532 | | | | 7,002,037 | |

Mastercard, Inc. - Class A | | | 58,230 | | | | 14,066,039 | |

Microsoft Corporation | | | 107,581 | | | | 16,966,600 | |

Visa, Inc. - Class A | | | 92,686 | | | | 14,933,568 | |

| | | | | | | | 99,316,256 | |

Materials — 6.9% | | | | | | | | |

Air Products & Chemicals, Inc. | | | 37,095 | | | | 7,404,533 | |

Ecolab, Inc. | | | 42,886 | | | | 6,682,925 | |

Martin Marietta Materials, Inc. | | | 40,356 | | | | 7,636,566 | |

Sherwin-Williams Company (The) | | | 25,365 | | | | 11,655,725 | |

| | | | | | | | 33,379,749 | |

Real Estate — 4.7% | | | | | | | | |

American Tower Corporation | | | 105,272 | | | | 22,922,978 | |

| | | | | | | | | |

Total Common Stocks (Cost $323,445,806) | | | | | | $ | 466,751,844 | |

|

MONEY MARKET FUNDS — 1.4% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.28%(b) (Cost $6,917,059) | | | 6,917,059 | | | $ | 6,917,059 | |

| | | | | | | | | |

Total Investments at Value — 97.3%(Cost $330,362,865) | | | | | | $ | 473,668,903 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 2.7% | | | | | | | 12,899,605 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 486,568,508 | |

ADR - American Depositary Receipt.

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of March 31, 2020. |

See accompanying notes to financial statements.

28

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS

March 31, 2020 |

| COMMON STOCKS — 96.0% | | Shares | | | Value | |

| Communication Services — 5.2% | | | | | | |

| Comcast Corporation - Class A | | | 532,184 | | | $ | 18,296,486 | |

| Verizon Communications, Inc. | | | 191,041 | | | | 10,264,633 | |

| | | | | | | | 28,561,119 | |

| Consumer Discretionary — 5.5% | | | | | | | | |

| Las Vegas Sands Corporation | | | 182,121 | | | | 7,734,679 | |

| Lowe’s Companies, Inc. | | | 114,621 | | | | 9,863,137 | |

| McDonald’s Corporation | | | 77,366 | | | | 12,792,468 | |

| | | | | | | | 30,390,284 | |

| Consumer Staples — 12.6% | | | | | | | | |

| Anheuser-Busch InBev S.A./N.V. - ADR | | | 251,853 | | | | 11,111,754 | |

| Bunge Ltd. | | | 212,790 | | | | 8,730,774 | |

| Diageo plc - ADR | | | 91,794 | | | | 11,668,853 | |

| PepsiCo, Inc. | | | 125,110 | | | | 15,025,711 | |

| Philip Morris International, Inc. | | | 160,926 | | | | 11,741,161 | |

| Tyson Foods, Inc. - Class A | | | 186,312 | | | | 10,781,876 | |

| | | | | | | | 69,060,129 | |

| Energy — 7.9% | | | | | | | | |

| Chevron Corporation | | | 126,117 | | | | 9,138,438 | |

| Enbridge, Inc. | | | 312,446 | | | | 9,089,054 | |

| Exxon Mobil Corporation | | | 197,166 | | | | 7,486,393 | |

| Marathon Petroleum Corporation | | | 288,265 | | | | 6,808,819 | |

| Royal Dutch Shell plc - Class B - ADR | | | 322,917 | | | | 10,546,469 | |

| | | | | | | | 43,069,173 | |

| Financials — 21.2% | | | | | | | | |

| Bank of America Corporation | | | 358,777 | | | | 7,616,836 | |

Berkshire Hathaway, Inc. - Class B(a) | | | 86,816 | | | | 15,872,569 | |

| Brookfield Asset Management, Inc. - Class A | | | 413,202 | | | | 18,284,189 | |

| Capital One Financial Corporation | | | 187,291 | | | | 9,443,212 | |

| Fairfax Financial Holdings Ltd. | | | 43,231 | | | | 13,270,188 | |

| Fidelity National Financial, Inc. | | | 482,804 | | | | 12,012,164 | |

| JPMorgan Chase & Company | | | 191,015 | | | | 17,197,080 | |

Markel Corporation(a) | | | 17,671 | | | | 16,396,744 | |

| Wells Fargo & Company | | | 219,359 | | | | 6,295,603 | |

| | | | | | | | 116,388,585 | |

| Health Care — 13.8% | | | | | | | | |

| Bristol-Myers Squibb Company | | | 241,264 | | | | 13,448,055 | |

| CVS Health Corporation | | | 239,641 | | | | 14,217,900 | |

| Johnson & Johnson | | | 159,565 | | | | 20,923,758 | |

| Medtronic plc | | | 168,420 | | | | 15,188,116 | |

| Merck & Company, Inc. | | | 158,157 | | | | 12,168,600 | |

| | | | | | | | 75,946,429 | |

29

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 96.0% (Continued) | | Shares | | | Value | |

Industrials — 10.9% | | | | | | | | |

3M Company | | | 92,075 | | | $ | 12,569,158 | |

Delta Air Lines, Inc. | | | 327,058 | | | | 9,330,965 | |

Norfolk Southern Corporation | | | 55,813 | | | | 8,148,698 | |

United Parcel Service, Inc. - Class B | | | 132,420 | | | | 12,370,677 | |

Watsco, Inc. | | | 110,372 | | | | 17,442,087 | |

| | | | | | | | 59,861,585 | |

Information Technology — 8.1% | | | | | | | | |

Cisco Systems, Inc. | | | 315,038 | | | | 12,384,144 | |

International Business Machines Corporation | | | 83,584 | | | | 9,271,973 | |

Microsoft Corporation | | | 85,360 | | | | 13,462,126 | |

TE Connectivity Ltd. | | | 147,598 | | | | 9,295,722 | |

| | | | | | | | 44,413,965 | |

Real Estate — 7.8% | | | | | | | | |

Crown Castle International Corporation | | | 96,688 | | | | 13,961,747 | |

Gaming and Leisure Properties, Inc. | | | 292,729 | | | | 8,111,521 | |

Lamar Advertising Company - Class A | | | 241,630 | | | | 12,390,786 | |

W.P. Carey, Inc. | | | 141,244 | | | | 8,203,452 | |

| | | | | | | | 42,667,506 | |

Utilities — 3.0% | | | | | | | | |

Dominion Energy, Inc. | | | 228,989 | | | | 16,530,716 | |

| | | | | | | | | |

Total Common Stocks(Cost $576,281,358) | | | | | | $ | 526,889,491 | |

|

MONEY MARKET FUNDS — 4.1% | | Shares | | | Value | |

First American Treasury Obligations Fund - Class Z, 0.28%(b) (Cost $22,669,201) | | | 22,669,201 | | | $ | 22,669,201 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $598,950,559) | | | | | | $ | 549,558,692 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (447,133 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 549,111,559 | |

ADR - American Depositary Receipt.

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of March 31, 2020. |

See accompanying notes to financial statements.

30

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

March 31, 2020 |

| COMMON STOCKS — 95.7% | | Shares | | | Value | |

| Communication Services — 21.5% | | | | | | |

Altice USA, Inc. - Class A(a) | | | 555,409 | | | $ | 12,380,067 | |

DISH Network Corporation - Class A(a) | | | 672,416 | | | | 13,441,596 | |

Liberty Broadband Corporation - Series C(a) | | | 192,940 | | | | 21,362,317 | |

Live Nation Entertainment, Inc.(a) | | | 444,212 | | | | 20,193,877 | |

Take-Two Interactive Software, Inc.(a) | | | 129,558 | | | | 15,366,874 | |

| | | | | | | | 82,744,731 | |

| Consumer Discretionary — 12.2% | | | | | | | | |

CarMax, Inc.(a) | | | 271,488 | | | | 14,614,199 | |

Etsy, Inc.(a) | | | 302,891 | | | | 11,643,130 | |

MercadoLibre, Inc.(a) | | | 13,071 | | | | 6,386,229 | |

O’Reilly Automotive, Inc.(a) | | | 47,551 | | | | 14,315,229 | |

| | | | | | | | 46,958,787 | |

| Financials — 24.7% | | | | | | | | |

| Brookfield Asset Management, Inc. - Class A | | | 430,812 | | | | 19,063,431 | |

| Capital One Financial Corporation | | | 185,970 | | | | 9,376,607 | |

| Cboe Global Markets, Inc. | | | 110,758 | | | | 9,885,151 | |

| Fairfax Financial Holdings Ltd. | | | 67,386 | | | | 20,684,807 | |

| Fidelity National Financial, Inc. | | | 526,841 | | | | 13,107,804 | |

Markel Corporation(a) | | | 24,847 | | | | 23,055,283 | |

| | | | | | | | 95,173,083 | |

| Health Care — 2.7% | | | | | | | | |

| Zoetis, Inc. | | | 87,976 | | | | 10,353,895 | |

| | | | | | | | | |

| Industrials — 10.0% | | | | | | | | |

Colfax Corporation(a) | | | 355,844 | | | | 7,045,711 | |

| Watsco, Inc. | | | 107,276 | | | | 16,952,827 | |

| Xylem, Inc. | | | 224,492 | | | | 14,621,164 | |

| | | | | | | | 38,619,702 | |

| Information Technology — 9.2% | | | | | | | | |

Autodesk, Inc.(a) | | | 80,623 | | | | 12,585,250 | |

Black Knight, Inc.(a) | | | 182,917 | | | | 10,620,161 | |

| Intuit, Inc. | | | 52,899 | | | | 12,166,770 | |

| | | | | | | | 35,372,181 | |

| Materials — 8.4% | | | | | | | | |

| Martin Marietta Materials, Inc. | | | 71,088 | | | | 13,451,982 | |

| Sherwin-Williams Company (The) | | | 41,395 | | | | 19,021,831 | |

| | | | | | | | 32,473,813 | |

| Real Estate — 7.0% | | | | | | | | |

| American Tower Corporation | | | 123,333 | | | | 26,855,761 | |

| | | | | | | | | |