| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: July 31, 2022 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-05685 | |

| Williamsburg Investment Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

John H. Chilton, Esq.

| Sullivan & Worcester LLP 1666 K Street NW Washington, D.C. 20006 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | March 31 | |

| | | |

| Date of reporting period: | March 31, 2022 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a)

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Davenport Core Fund (DAVPX) |

| | |

| | Davenport Value & Income Fund (DVIPX) |

| | |

| | Davenport Equity Opportunities Fund (DEOPX) |

| | |

| | Davenport Small Cap Focus Fund (DSCPX) |

| | |

| | Davenport Balanced Income Fund (DBALX) |

| | |

| | |

| | |

| | |

| ANNUAL REPORT |

| | |

| | |

| March 31, 2022 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| THE DAVENPORT FUNDS | |

| LETTER TO SHAREHOLDERS (Unaudited) | April 29, 2022 |

Dear Shareholders,

The fiscal fourth-quarter brought investors yet another curveball with Russia’s invasion of Ukraine. This sent shockwaves through global markets and added to already notable inflation pressures, while also casting a new light on international investing. Meanwhile, the Federal Reserve raised interest rates as policymakers began to reign in monetary stimulus. Markets ultimately proved more resilient than one might expect given these circumstances, with energy and commodity-related stocks leading the way. While the S&P 500® Index and Russell 2000® Index were down 12% and 14% at one point during the quarter, they finished down 4.60% and 7.53%, respectively. It’s worth noting, however, that the major indices belie underlying weakness in the market. Many stocks, especially in riskier corners of the market, have experienced steep declines.

War in Ukraine added a new layer of risk to equity markets. One major consequence of the situation has been a spike in oil prices and many other commodities (Russia is the world’s second-largest producer of oil). The S&P GSCI, an index of commodities, advanced 29% for its biggest gain in over 30 years. This is prompting a variety of pressures ranging from higher prices at the pump to higher input costs for companies. While good for commodity producers, higher prices could squeeze consumers’ pocketbooks, crimp corporate margins, and generally help promote an economic slowdown. Moreover, many corporations have shut down activities in Russia and we seem to be going through a process of de-globalization in the near term. This corporate warfare seems warranted, but could become a slippery slope. What if some companies decide to do less business with China (a huge source of demand for many companies) given ideological differences? Such a scenario seems far-fetched, but less so than it did just a few months ago.

Inflation is now even more of an issue. We were already dealing with significant inflation, given pandemic bounceback demand and associated supply chain challenges. To wit, the consumer price index advanced 7.9% in February, a 40-year high. The geopolitical situation has added fuel to the fire. In turn, the Federal Reserve (the “Fed”) is committed to tighter monetary policy to ensure inflation doesn’t spiral out of control. It just raised interest rates for the first time since 2018 and remains intent on 7 rate hikes this year. True, the emergency stimulus post-pandemic is no longer needed, and inflation does need to be constrained, but many fear excessive tightening could also prompt a slowdown or even a recession.

How likely is a recession? Many sources of inflation pressure could prove ephemeral and higher interest rates may only serve to quell economic activity. Or, we could see a period of stagflation, which is defined as elevated inflation alongside no/low economic growth. Economists continue to forecast decent GDP growth for this year and next, thereby implying that most do not anticipate Fed policy will trigger either scenario, but the risks have risen. On the positive side, the COVID recovery continues unabated. One only needs to look at the results of a casino, concert and/or theme park operator to see there is a thirst to spend, and rising inflation has had limited impact so far. To that end, consumer balance sheets are very healthy with debt relatively low by historical standards, and household disposable income very strong. Corporations are also flush with cash and have significant capacity to spend money.

Putting it all together, we think the risk/reward profile for stocks is relatively balanced. Valuations look more reasonable than they did at the start of the calendar year, but we still find ourselves expecting more moderate returns than in recent years. While a sudden outbreak of peace in Ukraine could prompt a relief rally, rising interest rates and tighter monetary/fiscal policy will remain a headwind and higher input costs could weigh on corporate profitability. Despite a more subdued market outlook, we continue to find exciting individual ideas for our portfolios and have added a number of new positions. Please refer to our portfolio letters for a discussion of recent actions and we look forward to reporting to you next quarter.

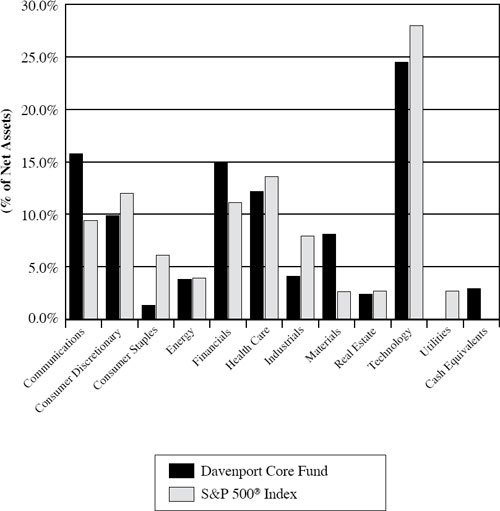

Davenport Core Fund

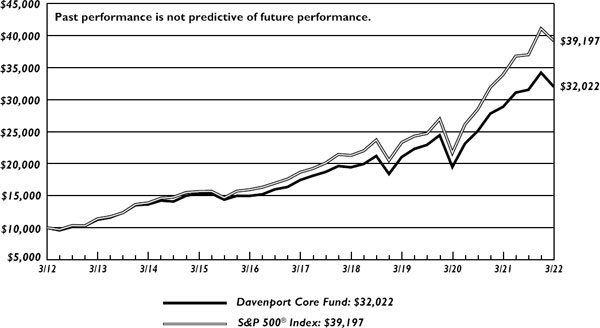

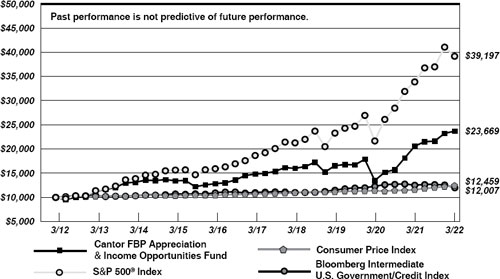

The following chart represents Davenport Core Fund’s (DAVPX) performance and the performance of the S&P 500® Index*, the Core Fund’s primary benchmark, for the periods ended March 31, 2022.

| | Fiscal Q4

2021 | 1 Year | 3 Years** | 5 Years** | 10 Years** | Since

Inception

1/15/98** | Fiscal

Year 2022

Expense

Ratio |

| Core Fund | -6.40% | 10.89% | 15.04% | 12.91% | 12.34% | 7.85 % | 0.86% |

| S&P 500® Index* | -4.60% | 15.65% | 18.92% | 15.99% | 14.64% | 8.67% | |

30-Day SEC Yield: 0.20%; Expense Ratio in current prospectus: 0.86%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

| * | The S&P 500® Index is comprised of 500 US stocks and is an indicator of the performance of the overall US stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500® Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

| ** | Returns greater than one year are annualized. |

After a strong start to the fiscal year, The Davenport Core Fund (DAVPX) and the broader market suffered a slight reversal in the final fiscal quarter of 2022. The Fund declined 6.40% while the S&P 500® Index fell 4.60% to start the year. For the fiscal year, the Fund gained 10.89% compared to the 15.65% gain for the index. While we are disappointed to end the year behind the benchmark, we are pleased to see the Fund hold up relatively well given the broader market volatility seen throughout the quarter as investors grappled with spiking inflation, Russia’s invasion of Ukraine, rising interest rates, and waning monetary stimulus.

Our top performer during the quarter and second best performer for the fiscal year was Pioneer Natural Resources Co (PXD), a leading US shale oil & gas producer and the largest producer in the prolific Permian Basin. The stock returned nearly 40%, nearly in lockstep with oil prices which reached multi-year highs following Russia’s invasion of Ukraine. Other top performers in fiscal Q4 included our insurance holdings Markel Corp (MKL) and Berkshire Hathaway Inc. (BRK.B), who saw improved insurance pricing and higher investment returns as a result of rising interest rates. The Consumer Discretionary sector was our biggest detractor to performance,

with Home Depot Inc. (HD), Sherwin-Williams Co (SHW), and CarMax Inc. (KMX) all seeing significant pullbacks after a very strong calendar 2021 as the companies face near-term headwinds from supply chain issues, rising rates, and inflation/elevated prices.

Transaction activity was fairly moderate during the final quarter, but focused on striking a balance between growth and value. Given our expectation for more moderate returns following years of outsized gains, we took advantage of the market volatility by taking profits in some of our big winners and redeploying the proceeds into both new and existing names with attractive risk/reward profiles. In early/mid-February we sold our position in Advanced Micro Devices Inc. (AMD), our top performer for the fiscal year. Under the leadership of CEO Dr. Lisa Su, the company has transitioned from a multi-year turnaround situation to an impressive secular growth story, with AMD taking sizable market share gains across its end-markets. While the story is impressive, we elected to sell the position for a nearly 55% gain since our purchase in 2021, as we felt the continued growth potential was fairly reflected in the stock price. Similarly, towards the end of the quarter we chipped our position in Apple Inc. (AAPL). The stock has had a tremendous run, increasing more than 260% over the last 3 years (nearly 4x the return of the S&P 500). We continue to be fans of Apple’s businesses and maintain a healthy position in the name, but felt valuation had become a bit stretched and elected to take some off the table. We added to our positions in Adobe Inc. (ADBE) and Sherwin Williams Co (SHW), two high-quality compounders that have been beaten up this year due to some of the macro headwinds mentioned at the onset of this letter. We continue to see long-term secular growth upside for both of these names, and elected to add to our positions on the near-term weakness. We also initiated a new position in Bank of America Corp (BAC).

A household name, Bank of America sold off in mid-February alongside US banks in general as the Russia/Ukraine conflict raised concerns of the possibility for fewer rate hikes than initially expected, as well as the potential for Russian sanctions to prompt credit losses at large-cap banks. While these concerns are valid, after the stock’s pullback we felt these uncertainties were more than priced in with the stock trading at the lowest valuation multiple since 2020. We elected to take advantage of the weakness and establish a position in one of the highest quality US banks that continues to invest in technology, expand into new markets, and return cash to shareholders.

In sum, after a fairly volatile end to the fiscal year that saw the market down more than 10% at one point, we continue to believe the risk/reward profile for stocks is relatively balanced. Valuations look far more reasonable than just a few months ago and certain areas of the market offer attractive opportunities. Additionally, we continue to believe that equities should provide an inflation hedge and we’re focused on maintaining a core style portfolio of high-quality companies with attractive long-term outlooks.

The following are transactions performed in the Core Fund for the quarter ended March 31, 2022.

Recent Purchases

Adobe Inc (ADBE) - We think company guidance could prove conservative and view the ~40% pullback in the stock and valuation reset back to pre-pandemic levels as an attractive entry point for this high quality, secular grower in the software industry. We elect to add 0.5%, taking the position to 3.3% of the Fund.

Bank of America Corp (BAC) - We feel that this purchase, alongside our additions to Adobe Inc and Sherwin Williams Co, should help to give the Fund a nice balance on the value/growth spectrum.

Caesars Entertainment Inc (CZR) - We purchased a position in CZR as we think recent weakness has presented an opportunity and view the company as a quality way to lean back into the “re-opening” trade.

Medtronic plc (MDT) - We added to our position in MDT as it maintains a well-positioned pipeline with a strong balance sheet that is set to support its commitment to maintaining a high level of Research and Development (R&D) spend and a stable dividend payout.

Meta Platforms Inc (FB) - Though we regret the timing of adding to FB, we believe the company has the capacity to navigate the current environment and feel the stock exhibits an attractive risk/ reward profile following the recent expectations reset (acknowledging it could spend some time in the penalty box).

Pioneer Natural Resources Co (PXD) - PXD aims to return 80% of free cash flow to shareholders in 2022, and with the new fixed-plus-variable dividend structure, the total 2022 yield should be over 10%-one of the highest yields in the S&P 500. Given our positive outlook for the company, we felt the risk/reward opportunity to be attractive and a good time to increase our energy exposure to the Fund.

Sherwin Williams Co (SHW) - Assuming raw material costs eventually plateau, we think SHW can earn >$12 in EPS in the next two years, which would drive a $300 target (23%+ upside) assuming the current multiple. As such, we elect to add 0.5% to this high-quality compounder, taking the position to 1.9% of the Fund.

T-Mobile US Inc (TMUS) - While the industry could see a deceleration in growth back to more normal levels, we believe that as the disruptor, TMUS will continue to take market share and offset some of the industry-wide deceleration. Analysts estimate that after adjusting for Sprint losses (the migration will complete this year), TMUS is actually winning nearly 50% of net additions this year (similar to 2020) and we believe this is sustainable going forward. All told, we see a path to double-digit earnings and free cash flow growth and elect to add to the position.

Recent Sales

Accenture PLC (ACN) - ACN has been an outstanding performer for the Fund, up 61% in 2021, and returning more than 45% annually over the last 3 years (almost double the S&P). While we continue to believe ACN is a high-quality business with solid outlooks going forward, valuations are now well above their averages and we felt it to be an opportune time to take some profits as part of our risk management process, and chip the position size down to more normal levels.

Advanced Micro Devices Inc (AMD) - Momentum is set to continue in 2022 with management forecasting another strong year of growth across all core business segments, and the market share expansion story is likely still in the early innings. However, we are becoming less confident in underlying demand trends for certain end-markets like PCs, which could add a layer of uncertainty to the company’s growth potential as the year progresses. With a more balanced risk/reward profile, in our opinion, we elect to sell our position in AMD and hope to redeploy capital into other compelling opportunities.

Apple Inc (AAPL) - While we continue to be fans of Apple’s products, services, and innovation, we believe the valuation has become a bit stretched given expectations for mid-to-high single-digit earnings growth, and it could be tough for the shares to generate further outperformance. We continue to maintain a healthy position, but felt it prudent to chip the position and take some profits given a more balanced risk/reward profile.

Mastercard Inc (MA) - The stocks’ multiple has recovered to more typical levels relative to the market and we believe it prudent to reduce our position to more normal levels given our outsized weighting to the payment networks and more balanced risk/reward outlook.

MercadoLibre Inc (MELI) - While we are attracted to the MELI’s strong growth profile in the long-term, we believe the current headwinds are likely to persist for the foreseeable future. While the stock’s recent underperformance reflects these concerns, we also think it is important to consider this action in the context of the fund’s exposure to broader risk factors impacting “growthier” names, and focus on names with more attractive risk/reward profiles.

Microsoft Corp (MSFT) - While we continue to believe MSFT is a high-quality business with solid outlooks going forward, valuations are now well above their averages and we felt it to be an opportune time to take some profits as part of our risk management process.

Visa Inc (V) - The stocks’ multiple has recovered to more typical levels relative to the market, and we believe it prudent to reduce our position to more normal levels given our outsized weighting to the payment networks. We continue to believe the company is a high-quality compounder, with strong runways, and great returns on capital.

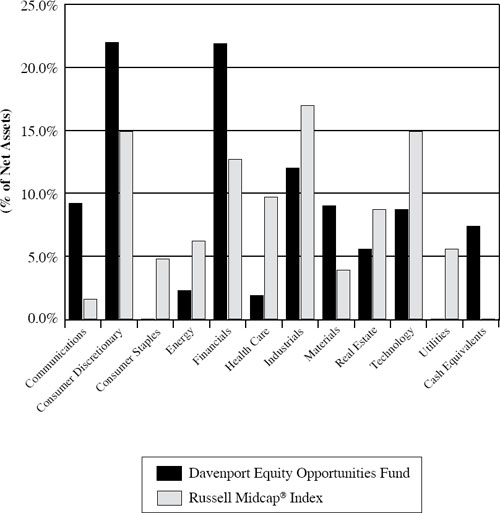

Davenport Equity Opportunities Fund

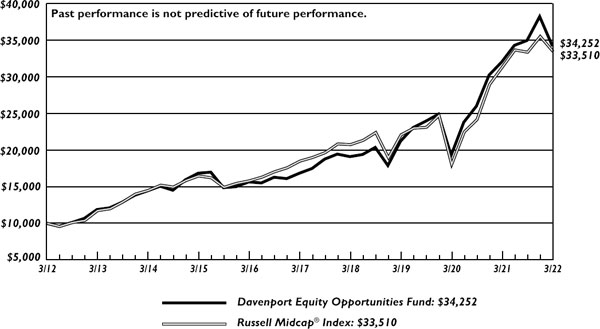

The following chart represents Davenport Equity Opportunities Fund (DEOPX) performance and the performance of the Russell Midcap® Index*, the Fund’s primary benchmark, and the S&P 500® Index* for the periods ended March 31, 2022.

| | Fiscal Q4

2021 | 1 Year | 3 Years** | 5 Years** | 10 Years** | Since

Inception

12/31/10** | Fiscal

Year 2022

Expense

Ratio |

| Equity Opportunities Fund | -10.46% | 6.89% | 17.31% | 15.26% | 13.10% | 13.40% | 0.87% |

| Russell Midcap® Index | -5.68% | 6.92% | 14.89% | 12.62% | 12.85% | 12.41% | |

| S&P 500® Index* | -4.60% | 15.65% | 18.92% | 15.99% | 14.64% | 14.32% | |

30-Day SEC Yield: -0.11%; Expense Ratio in current prospectus: 0.89%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

| * | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000, which represent approximately 25% of the total market capitalization of the Russell 1000®. London Stock Exchange Group PLC and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. FTSE Russell is a trading name of certain LSE Group companies. “Russell®” is a trademark of the relevant LSE Group companies and is used by any other |

LSE Group company under license. All rights in the FTSE Russell indexes or data vest in relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote/sponsor/endorse the content of this communication. The S&P 500® Index is comprised of 500 US stocks and is an indicator of the performance of the overall US stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500® Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment.

| ** | Returns greater than one year are annualized. |

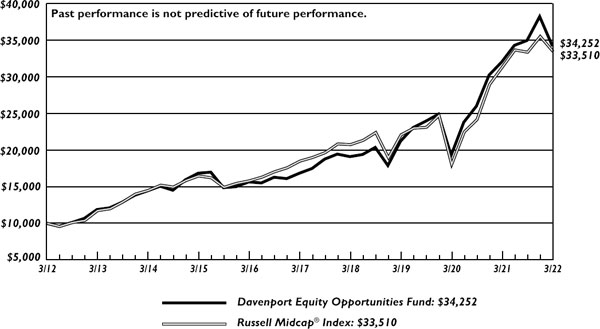

The Davenport Equity Opportunities Fund (DEOPX) experienced a 10.46% decline to end the fiscal year, lagging the 5.68% drawdown for the Russell Midcap® Index. For the fiscal year, the Fund increased 6.89% compared to the 6.92% increase for the index.

Despite the overall drawdown to end the fiscal year, the Fund enjoyed strong performance from holdings in the insurance sector, with Markel Corp (MKL) and Fairfax Financial Holdings Ltd (FRFHF) advancing of 19.5% and 12.9%, respectively. Both are top 5 holdings and we remain attracted to each given strong insurance pricing fundamentals, well-positioned investment portfolios and short duration bond portfolios that are poised to benefit from higher interest rates. Another standout performer during the final quarter was oil and gas producer Coterra Energy Inc. (CTRA), a new holding that we believe offers us a high-quality way to participate in what we perceive to be secular tailwinds for hydrocarbon prices (more on this below).

Heading into calendar 2022, we took several actions to de-risk the Fund, selling and/or chipping positions in outperformers that had seen significant valuation expansion and appeared vulnerable. Despite these actions, performance was negatively impacted by a significant drawdown in growthier/interest rate sensitive names such as Etsy Inc. (ETSY), Sherwin Williams Co (SHW), Align Technologies (ALGN) and Autodesk Inc. (ADSK). In some cases, the drawdown in these names has been so severe that they are starting to look attractive again. In fact, we elected to add to our position in ADSK near quarter-end at a price nearly 40% below the level where we trimmed the position last August. Additionally, our position in Cannae Holdings Inc. (CNNE) served as a detractor. Despite significant share repurchases and meaningful asset monetizations, the shares continue to decouple from their net asset value, with the discount now wider than it has ever been (now north of 40%). Though we are clearly frustrated with this name, we feel the risk/reward remains favorable.

We initiated a position in leading online sports betting company Draftkings Inc. (DKNG). The name should be familiar given our recent ownership from mid-2020 through mid-2021. Since our exit, the shares have been more than cut in half as the market shifted from “growth at any cost” to a heightened focus on profitability. While DKNG is not yet profitable, it’s important to remember that this industry is less than four years old and is still in the growth phase. The total addressable market has continued to increase, DKNG has cemented a leading position in most states that have legalized and the company’s playbook (2-3 year path to profitability) has been proven out in the early states. As such, we think current levels offer an attractive entry point.

As mentioned above, we initiated a position in Coterra Energy Inc. (CTRA). The company offers participation in two of the best domestic oil and gas basins (Permian basin oil and Marcellus natural gas), where it holds long-lived, low-cost reserves. We are constructive on the outlook for hydrocarbon prices for the next several years given by producer discipline, years of underinvestment, diversion of capital to renewables and regulatory constraints. With respect to

CTRA, we are attracted to the company’s high-quality assets, strong balance sheet and attractive capital return outlook. We expect total dividends to exceed $2 per share in calendar 2022 (HSD dividend yield) even if oil and natural gas prices retreat from current levels. Furthermore, the company expects to be nearly net debt-free by the end of 2022 and recently approved a $1.25bn buyback authorization, which represented roughly 7% of the market cap at the time. Putting it all together, we see a path to double-digit returns from capital return alone (with the added benefit of participation should oil and gas prices rise). As such, we used a recent pullback in the shares as an opportunity to add diversification and differentiation to the Fund at an attractive risk/reward.

In closing, we are disappointed with the end to the fiscal year; however, believe we have taken many steps to plant the seeds for future outperformance. As such, we feel the Fund carries an element of timeliness in addition to ample flexibility resulting from a slightly above average cash balance.

The following are transactions performed in the Equity Opportunities Fund for the quarter ended March 31, 2022.

Recent Purchases

Autodesk Inc (ADSK) - Despite the near-term headwinds, we feel the sell-off is overdone and the company should continue to see strong growth as the construction and manufacturing industries further embrace digitization and modern cloud tools. Even with FX headwinds, we believe FCF should grow nearly 50% this year and continue to grow at double-digit Compound Annual Growth Rate (CAGR) over the next few years and elect to add to our position.

Alight Inc (ALIT) - We elected to take advantage of recent weakness to build our position further and continue to view the risk/reward profile favorably.

Black Knight Inc (BKI) - We added to our position in BKI as we think the core business is performing extremely well and we struggle to find a business as high quality as Black Knight’s trading at such a reasonable valuation.

Caesars Entertainment Inc (CZR) - The stock has languished recently and is down 35% from its all-time high due to general market weakness, Omicron fears, concerns about difficult comparisons in regional markets (following tremendous results last year) and general negativity towards sports betting plays (a new part of CZR’s business). We think recent weakness has presented an opportunity, adding to our position and view the company as a quality way to lean back into the “re-opening” trade.

Caesars Entertainment Inc (CZR) - Shares of CZR have continued to languish since our initial purchase just over a week ago, and we elect to additionally add to our position on the weakness.

Colfax Corp (CFX) - As a reminder, CFX will split into two companies at the end of 1Q (ESAB - welding business / Enovis - medical device business). Using a conservative sum-of-the-parts valuation, we see upside into the $50+ range. As such, we decided to use market weakness to add to our position.

Coterra Energy Inc. (CTRA) - We purchased a position in CTRA. Though we have typically avoided companies in the commodity space due to historically unpredictable and insufficient returns, we are constructive on the outlook for hydrocarbon prices for the next several years

given by producer discipline, years of underinvestment, diversion of capital to renewables and regulatory constraints. With respect to CTRA, we are attracted to the company’s high-quality assets, strong balance sheet and attractive capital return outlook.

Coterra Energy Inc (CTRA) - With the stock price relatively unchanged, we elect to add to the name and make it a more meaningful position size within the Fund.

DraftKings Inc (DKNG) - We purchased a position in DKNG. Following a significant downward re-rating in the sports betting world, we believe the time is right to revisit the DKNG story. The name should be familiar given our recent ownership from mid-2020 through mid-2021. Since our exit, the shares have been more than cut in half as the market shifted from “growth at any cost” to a heightened focus on profitability. While DKNG is not yet profitable, it’s important to remember that this industry is less than four years old and is still in the growth phase. The Total Addressable Market (TAM) has continued to increase, DKNG has cemented a leading position in most states that have legalized and the company’s playbook (2-3 year path to profitability) has been proven out in the early states.

DraftKings Inc (DKNG) - With the broader market sell-off (and consumer stocks in particular), we decided to make the position a bit more meaningful, adding to the position at an attractive price. We continue to see DKNG as a long-term winner in the sports betting industry and believe risk/reward remains very attractive at current levels.

Recent Sales

American Tower Corp (AMT) - We continue to believe the company operates one of the more attractive business models we are aware of while offering a high-quality way to play the secular theme of connectivity and wireless infrastructure buildout. With this action, we reduce the position size to 3.0% of the Fund.

Hilton Worldwide Holdings Inc (HLT) - While we continue to appreciate the company’s capital light business model and leverage to a recovery in travel demand, we believe the risk/reward profile is balanced with both the share price and valuation hovering near all-time highs and elected to sell the position. Ultimately, we like the flexibility enabled by this degree of “dry powder,” and look forward to deploying funds into attractive opportunities as they arise.

MercadoLibre Inc (MELI) - We sold our position in MELI. While we are still attracted to the company’s strong growth profile and high return business model, we are concerned the shares may continue to struggle amid emerging market economic stress, increased competitive activity, and rising interest rates. While the stock’s recent underperformance reflects these concerns, we also think it is important to consider this action in the context of our Fund’s exposure to broader risk factors impacting “growthier” names, to which we continue to have ample exposure. Ultimately, we feel the strategy maintains a sense of balance and like the optionality that our now elevated cash balance provides.

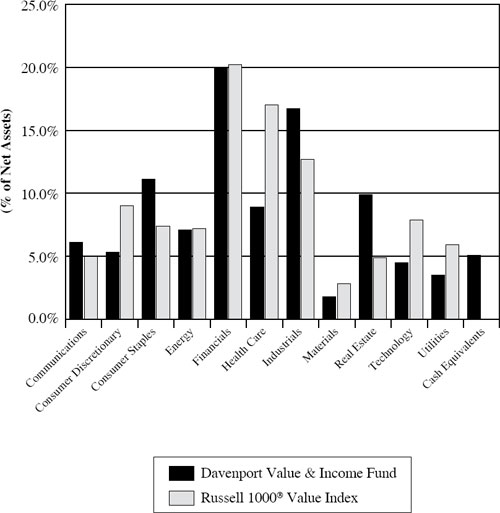

Davenport Value & Income Fund

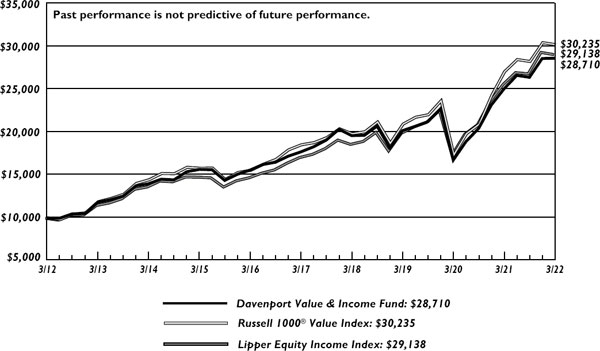

The following chart represents Davenport Value & Income Fund (DVIPX) performance and the performance of the Russell 1000® Value Index*, the Value & Income Fund’s primary benchmark, the S&P 500® and the Lipper Equity Income Index for the periods ended March 31, 2022.

| | Fiscal Q4

2021 | 1 Year | 3 Years** | 5 Years** | 10 Years** | Since

Inception

12/31/10** | Fiscal

Year 2022

Expense

Ratio |

| Value & Income Fund | 0.14% | 14.24% | 12.36% | 10.08% | 11.12% | 11.48% | 0.86% |

| Russell 1000® Value Index | -0.74% | 11.67% | 13.02% | 10.29% | 11.70% | 11.42% | |

| S&P 500® Index* | -4.60% | 15.65% | 18.92% | 15.99% | 14.64% | 14.32% | |

| Lipper Equity Income Index* | -0.86% | 13.76% | 13.49% | 11.24% | 11.29% | 11.77% | |

30-Day SEC Yield: 1.50%; Expense Ratio in current prospectus: 0.87%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

| * | The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. London Stock Exchange Group PLC and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. FTSE Russell is a trading name of certain LSE Group companies. “Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote/sponsor/endorse the content of this communication. The S&P 500® Index is comprised of 500 US stocks and is an indicator of the performance of the overall US stock market. The S&P 500® Index is comprised of 500 US stocks and is an indicator of the performance of the overall US stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500® Index. The Lipper Equity Income Index is an unmanaged index of the 30 largest Funds in the Lipper Equity Income Fund category. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

| ** | Returns greater than one year are annualized. |

The Davenport Value & Income Fund (DVIPX) increased 0.14% in the fiscal fourth quarter. This compares to the Fund’s primary benchmark, the Russell 1000 Value® Index, which declined 0.74% in the quarter as well as the S&P 500® Index, which decreased 4.60%. For the fiscal year, the Fund increased 14.24%, ahead of the Russell 1000 Value® Index’s 11.67% return. The S&P 500® Index gained 15.65% in fiscal 2022.

Value stocks continued to perform well compared to their growth counterparts during the fiscal fourth quarter and we were pleased that the Fund outperformed its benchmark. Energy and material stocks were the top performers as commodity prices reached multi-year highs following Russia’s invasion of Ukraine. Coterra Energy Inc. (CTRA) was our top performer, increasing nearly 45% in the first quarter, followed by a 40% gain in energy giant Chevron Corp (CVX). Agricultural processor Bunge Ltd (BG) was also a top contributor as high commodity prices and supply disruptions drove margins higher. Gold miner Newmont Corp (NEM) increased

nearly 30%. Our insurance holdings also performed well, with nearly 20% gains from Berkshire Hathaway Inc. (BRKB) and Markel Corp (MKL). This was due to improved insurance pricing and higher investment returns as a result of rising interest rates. On the other side, key detractors included Cannae Holdings Inc. (CNNE), Sony Group Corp (SONY), and TE Connectivity Ltd (TEL).

We continue to find good value in lower risk, higher-yielding names, which we think fit well in this Fund given our view of more muted returns ahead. You may recall that we bought Walmart Inc. (WMT) and added to Johnson & Johnson (JNJ) in fiscal Q3. This quarter we added to our position in McDonald’s Corp (MCD) and initiated a new position in Verizon Communications Inc. (VZ). MCD shares were down significantly on fears related to Russia/Ukraine as well as higher input costs. We viewed this as a buying opportunity as the company has proven time and again its ability to raise prices to offset inflation. Verizon continues to improve performance with its 5G initiatives. 5G mobility, nationwide broadband, edge computing, and B2B solutions are expected to improve revenue growth from ~2% to the mid-single-digit range over the next couple of years. Earnings have the potential to grow ahead of revenue given the benefit of improving margins. Additionally, with capital expenditure expected to peak next year, we see the potential for share buybacks in the near future. With the stock at less than 10x forward earnings, we think the valuation is attractive.

We also introduced a position in Sysco Corp (SYY). Sysco is the largest US food service distributor with an estimated 17% market share in a highly-fragmented industry. The company sells over 400K products to restaurants (66% of sales), healthcare (9%), education and government (8%), and several other. Over 80% of sales are from the US While the last two years have been incredibly difficult, we think the company is poised to emerge from the pandemic in a much stronger position and view SYY as a relatively safe way to play a return to normal. Significant investments in its technology, salesforce, and supply chain should allow SYY to grow at 1.5x the industry rate. The company is a dividend aristocrat with a 2.4% yield and trades at a discount to its average valuation.

In summary, despite the many market-moving events that occurred in the fiscal fourth quarter, we were pleased that our Fund held up well and finished slightly ahead of its benchmark. We continue to have a favorable view towards energy and material stocks given our view that commodity prices are likely to remain higher for longer, and we maintain a healthy weighting in several names that touch that theme. We are balancing that with more traditional defensive stocks that have lower risk and solid dividends. The Fund currently yields 2.3% and we note that many of our holdings are raising their dividends at a rate at least commensurate with inflation.

The following are transactions performed in Value & Income Fund for the quarter ended March 31, 2022.

Recent Purchases

Citigroup Inc (C) - With the stock trading at approximately 8.5x earnings-per-share (EPS), well below peers and its historical range, we find the current price offers an attractive entry point and elect to purchase a position.

Comcast Corp (CMCSA) - We added to our position in CMCSA and think it will generate modest subscriber growth over the next few years and also like the re-opening exposure provided via its theme park business. CMCSA trades at a 34% discount to the S&P 500, the widest gap in over a decade, offering tremendous relative value, in our view.

McDonald’s Corp (MCD) - Shares of MCD have declined significantly over the past few weeks on fears relating to Russia/Ukraine as well as higher input costs. We believe the sell-off is overdone as Russia/Ukraine represent <3% of operating income, and the company has proven time and again its ability to balance price with value. As such, we elect to take advantage of the weakness and attractive valuation to add to our position.

Perrigo Company PLC (PRGO) - PRGO shares have given back most of the recent gains generated when it settled many of its outstanding headwinds (i.e. Irish tax case) as supply chain issues, and weak cough/cold trends have been a drag on the Earnings Per Share (EPS) recovery story. With trends expected to normalize as the Omicron wave recedes, we elect to add to our position.

Sysco Corp (SYY) - We purchased a position in SYY. While the last two years have been incredibly difficult, we think the company is poised to emerge from the pandemic in a much stronger position and view SYY as a relatively safe way to play a return to normal. We are also attracted to Sysco’s capital return. The company is a Dividend Aristocrat with a 2.4% yield after raising its dividend by 4% in May. The company also recently restarted its share repurchase program. While near-term results could be choppy due to the impact from the Omicron wave and supply chain/inflation, we think SYY offers attractive risk-reward at current levels.

Verizon Communications Inc (VZ) - While unlikely to be a home run, we think the low-beta, 5% dividend yield, and improving growth profile make VZ an attractive investment. Earnings before interest, taxes, depreciation, and amortization, (EBITDA) has the potential to grow ahead of revenue given the benefit of improving operating leverage. Additionally, with capex expected to peak next year, we see the potential for share buybacks in the not-too-distant future. With the stock at less than 10x forward earnings, we think valuation is attractive.

Recent Sales

Bunge Ltd (BG) - BG has been a standout performer for us as the company’s turnaround took hold and coincided with a strengthening agricultural cycle. Additionally, the development of the renewable diesel industry has proven to be a strong catalyst for the shares. While we continue to be constructive on the stock, it had grown to be one of our biggest positions and, as such, we elect to take some profits.

BP PLC (BP) - Following the recent outperformance of the energy sector as well as the spike in oil prices as a result of the Russia/Ukraine events, we elect to take some profits in the sector. BP has been a good performer for the Fund, but is also the most global of our holdings, including exposure to Russia (which it announced this morning that it plans to divest). As such, it is the position we decided to exit. We continue to have significant exposure to the sector in the form of Chevron, Coterra, and Enbridge, all of which we think look more appealing given their significant capital return programs.

Fidelity National Financial Inc (FNF) - We continue to like the story and believe the stock is cheap, but after a nearly 50% increase over the past year and a half, we elected to take a bit off the table to fund our Sysco Corp (SYY) purchase, where we currently see more favorable risk/reward.

L3harris Technologies Inc (LHX) - L3 and other defense stocks are on a spike due to the tensions in Ukraine and what that might mean for future defense spending. While we continue to like the company and its exposure to high-growth DoD programs, we thought it prudent to take some profits as these stocks traditionally move significantly on headlines and then take some time to work as various government appropriations play out.

Microsoft Corp (MSFT) - While we continue to believe MSFT is one of the highest-quality businesses in the world with significant runway ahead, we no longer think it fits in the Value & Income Fund and thus decide to exit our position.

Truist Financial Corp (TFC) - TFC has had a nice move since our initial purchase in December 2020 as many of the BB&T/SunTrust merger synergies were realized and earnings results came in better than expected. As such, we elect to take some profits.

Truist Financial Corp (TFC) - We chipped our position a second time in TFC given the significant re-rating the stuck has experienced and now elect to sell our remaining stake to fund our purchase of Citi.

Davenport Small Cap Focus Fund

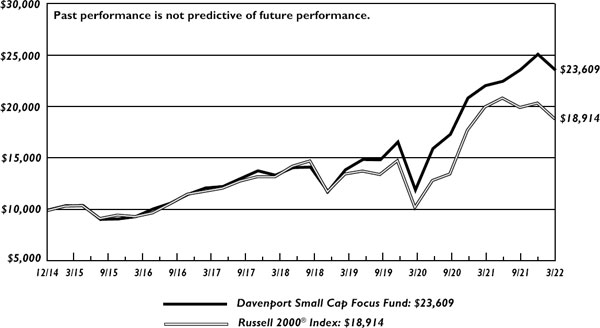

The following chart represents performance of the Davenport Small Cap Focus Fund (DSCPX) and the performance of the Fund’s primary benchmark, the Russell 2000® Index*, for the periods ended March 31, 2022.

| | Fiscal Q4

2021 | 1 Year | 3 Years** | 5 Years** | Since

Inception

12/31/14** | Fiscal

Year 2022

Expense

Ratio |

| Small Cap Focus Fund | -6.10% | 6.85% | 19.28% | 14.22% | 12.59% | 0.88% |

| Russell 2000® Index* | -7.53% | -5.79% | 11.74% | 9.74% | 9.19% | |

30-Day SEC Yield: -0.03%; Expense Ratio in current prospectus: 0.87%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

| * | The Russell 2000® Index measures the performance of the 2000 smallest companies in the Russell 3000® Index. Frank Russell Company (“Russell”) is the source and owner of the registered trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. An investor cannot invest in an index and index returns are not indicative of the performance of any specific investment. London Stock Exchange Group PLC and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. FTSE Russell is a trading name of certain LSE Group companies. “Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote/sponsor/endorse the content of this communication. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

| ** | Returns greater than one year are annualized. |

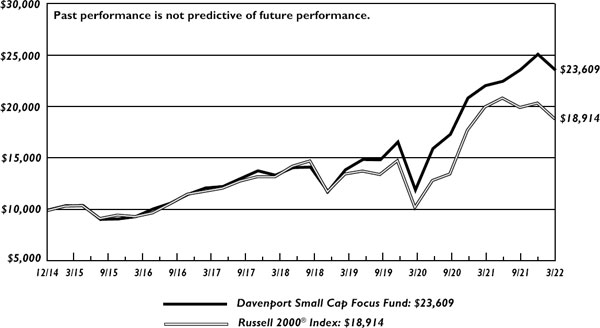

The Davenport Small Cap Focus Fund (DSCPX) declined 6.10% in the fiscal fourth quarter, outpacing the 7.53% decline for the Russell 2000® Index. Though the close to the fiscal year was unpleasant for risk assets, we were pleased to see the strategy prove a bit more resilient. For the fiscal year, the fun increased 6.85%, compared to the 5.79% decline for the index.

Speaking of resiliency, top holding Monarch Casino & Resort Inc. (MCRI) was the Fund’s biggest contributor for the fiscal fourth quarter, advancing nearly 18% alongside strong quarterly results. As a reminder, we were adding to the position throughout the second half of calendar 2021 and have been impressed with the significant momentum across the business, especially at the company’s recently renovated property in Black Hawk, CO. Elsewhere, we were pleased to see a few of the “quality reopening” plays we highlighted last quarter outperform. Manhattan commercial real estate REIT SL Green Realty Corp (SLG) and rental car tolling solution provider Verra Mobility Corp (VRRM) posted solid gains during the period as Omicron variant concerns subsided. Cannae Holdings Inc. (CNNE) was the strategy’s biggest detractor during the period. While several of the company’s portfolio investments declined in value alongside the market, shares of CNNE continued to decouple from the intrinsic value of its holdings and stood at a record discount (north of 40%) to net asset value at quarter-end. Despite our frustration and disappointment with this holding, we bolstered the position modestly and continue to exercise patience.

The strategy’s exposure to the renewable energy/energy transition space was a positive standout during the last quarter. The group saw a renewed wave of investor interest alongside strength in energy prices and Russia’s invasion of Ukraine, with the latter calling attention to the growing role of renewable/alternative energy sources. We have discussed our position in “picks and shovels” LNG (liquefied natural gas) and hydrogen equipment provider, Chart Industries Inc. (GTLS), in the past. We still view GTLS as a great way to play the intermediate (LNG) and longer term (hydrogen) themes within energy transition evolution. We have also been building a position in leading RNG (renewable natural gas) player, Archea Energy Inc. (LFG). Archea is the largest RNG operator in the country, with a primary focus on converting landfill methane gas into the chemical equivalent of natural gas. Due to the fact that methane is a much more potent greenhouse gas than carbon dioxide, the sequestration of the gas is highly incentivized by the government, resulting in very attractive economics for producers. Despite being a complicated/early-stage story, we think LFG is a great way to play RNG fundamentals given its strong management team, project backlog and marketing strategy, which locks in a substantial portion of future volumes at attractive prices.

We also added to our position in Colfax Corp (CFX) during the fiscal fourth quarter. Shares of CFX are down more than 20% from their recent highs amidst general market malaise, the Russia/ Ukraine conflict, and the Omicron wave. Early in the quarter, Omicron fears gave way to concerns regarding the potential for further delays in elective procedures in the Med Tech business. As these headwinds began to dissipate, geopolitical turmoil combined with concerns around the economic cycle started to weigh on the shares. While we think the near term could be choppy for the stock, we think CFX shares offer attractive value at current levels. As a reminder, CFX will split into two companies at the beginning of the calendar second quarter (ESAB - welding business / Enovis - medical device business). Using a conservative sum-of-the-parts valuation, we see upside into the $50+ range. As such, we decided to use recent weakness to add to our position.

In closing, we are pleased to have held up modestly better than the index in what was a rocky close to the year. Though we put some cash to work during the quarter in names we are excited about, we still carry meaningful cash balance (roughly 7.5%), which should provide us some flexibility should conditions remain volatile.

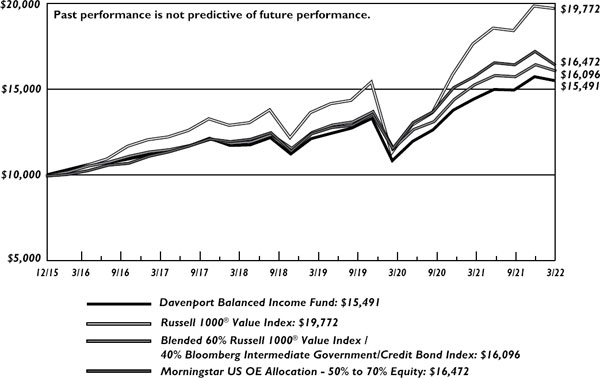

Davenport Balanced Income Fund

The following chart represents Davenport Balanced Income Fund (DBALX) performance, and performance of the Fund’s primary benchmark, the Russell 1000® Value Index, along with the Morningstar Allocation 50-70% Equity Index, and the blended 60% Russell 1000® Value Index / 40% Bloomberg Intermediate Government/Credit Bond (BIGC) Index for the periods ended March 31, 2022.

| | Fiscal Q4

2021 | 1 Year | 3 Years** | 5 Years** | Since

Inception

12/31/15** | Fiscal

Year 2022

Expense

Ratio |

| Balanced Income Fund | -1.46% | 7.50% | 8.57% | 6.75% | 7.25% | 0.92% |

| Russell 1000® Value* | -0.74% | 11.67% | 13.02% | 10.29% | 11.53% | |

| Morningstar Allocation 50-70% Equity* | -4.60% | 4.30% | 9.75% | 8.12% | 8.31% | |

| 60% Russell 1000® Value/40% BIGC | -2.23% | 5.25% | 8.77% | 7.19% | 7.91% | |

30-Day SEC Yield: 1.54%; Expense Ratio in current prospectus: 0.92%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

| * | The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. London Stock Exchange Group PLC and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. FTSE Russell is a trading name of certain LSE Group companies. “Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote/sponsor/endorse the content of this communication. The Morningstar US OE Allocation 50-70% Equity Index is composed of funds which seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds, and cash. These portfolios are dominated by domestic holdings and have equity exposure between 50% and 70%. The blended 60% Russell 1000® Value/40% Bloomberg Intermediate Government/Credit (BIGC) Index is included as an additional comparative index because it is representative of a balanced portfolio consisting of 60% equity and 40% fixed income securities. The BIGC measures the non-securitized component of the US Aggregate Bond Index. It includes investment grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate rate securities. Intermediate maturity bonds include bonds with maturities of 1 to 9.999 years. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

| ** | Returns greater than one year are annualized. |

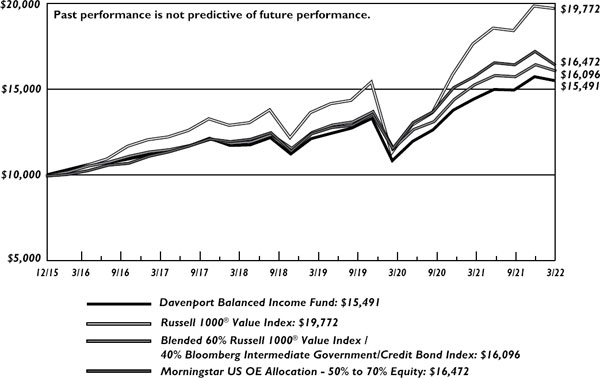

The Davenport Balanced Income Fund (DBALX) declined 1.46% during the fiscal fourth quarter of 2022, ahead of the 2.23% decline for the blended 60% Russell 1000® Value and 40% Bloomberg Intermediate Government/Credit Index. For the fiscal year, the fund increased 7.50% compared to the 5.25% increase for the blended benchmark.

After a strong first three quarters of fiscal 2022, the final quarter brought more volatility to the markets. Russia invaded Ukraine leading to spiking commodity prices, inflation soared to levels not seen in roughly 40 years, the Federal Reserve began raising interest rates, and stimulus continued to wane. While many pockets of the equity market saw large intra-quarter declines, value stocks held up fairly well with the Russell 1000® Value index dipping 6% in February compared to the 12% dip for the S&P 500® Index. The Russell ended the quarter down only 0.74% compared to the 4.60% decline for the S&P. Given the Fund’s value bias, we were pleased to see the equity portion of the Fund perform well to close the year.

Given the previously mentioned spike in commodity prices, our energy and materials stocks were our top contributors to equity performance, with our oil themed stocks Coterra Energy Inc. (CTRA) and Chevron Corp (CVX) increasing more than 40% each, and Devon Energy Corp (DVN) increasing nearly 35%. Gold miner Newmont Corp (NEM) also proved resilient, increasing nearly 30%. Our biggest detractors included Cannae Holdings Inc. (CNNE) and Stewart Information Services Corp (STC). Shares of Cannae have continued to decouple from the intrinsic value of its holdings, with the discount to net asset value now at a record 40% as of year-end. While frustrating, we continue to exercise patience as we believe the fundamentals of the underlying businesses are strong at the discount should narrow over time. As a title insurer, Stewart shares have underperformed as investors have grown concerned over rising mortgage rates impacting new home sales and home refinancing. While rising rates are certainly a headwind, we continue to have a favorable housing outlook as demand remains strong and supply remains sparse.

After years of outsized returns in equities, we expect more muted returns moving forward, especially given the macro headwinds outlined above. As such, transactions during the final quarter focused on seeking lower risk and higher yielding names. Shares of McDonald’s Corp (MCD) were down significantly on fears relating to the Russia/Ukraine conflict as well has higher input costs. We used this weakness to add to our position as the company has repeatedly proved its ability to pass through costs and offset inflation. Moreover, the company pays a handsome dividend which has grown at more than 7% annually over the last 10 years. We also purchased a position in Verizon Communications Inc. (VZ), a low volatility name with an improving growth profile and an attractive 5% dividend yield and valuation.

The bond allocation consists of 32 high quality bonds across ten sectors with the top allocation financials at 18.55%, consumer discretionary at 15.37%, US Treasuries at 15.01%, and energy at 12.50%. The credit quality of the fixed portion remains high investment grade with an effective maturity of 3.25 years and a duration of 2.89 years, down from 3.44 years at the beginning of calendar 2022.

Our allocation to floating rate notes within the fixed portion of the fund increased to 12.3% from 4.54% during the final quarter. With the Fed signaling to be more apt to raise rates at a faster clip to stave off inflation, floating rate notes should benefit in a rising rate environment. We initiated floating rate positions in Deere & Co (DE FRN 2025), Charles Schwab Corp (SCHW FRN 2024), and US Treasury 2024. More clarity on the Fed’s intentions to increase Fed Funds also forced the

front end of the yield curve to reprice. Two year Treasuries began the quarter at 0.734%, but sold off enough allowing us the opportunity to initiate a 2-year treasury position at 2.33%, increasing our credit quality.

We decided to exit two of our longer duration positions, Comcast Corp (CMCSA 3.15 2028) and Halliburton Co (HAL 3.8 2025), with the intent to shorten our duration. With the proceeds, we bought Brookfield Asset Management Inc. (BAMACN 4 2024) and DuPont de Nemours Inc. (DD 4.205 2023), both short-duration high coupon positions. So, our main focus is on adding floating rate notes, short-dated treasuries, short-duration high coupon bonds, and exiting longer-duration corporates.

In closing, after a turbulent end to the fiscal year, we think this is a good reminder of the value in a balanced investing approach. We believe our allocation to dividend-paying value-oriented equities should position the fund nicely for long-term capital appreciation. Additionally, our defensive fixed income positioning should continue to provide current income and a volatility buffer in the near-term.

As a fellow shareholder of the Davenport Funds, we would like to thank you for your support, trust and confidence. Together we have overcome numerous and unprecedented market challenges the last couple of years including: An economy that almost ground to a halt by covid restrictions, ghastly pictures of hospitals overrun by sick patients, and more recently images of Russia’s invasion of the Ukraine.

Investors will no doubt always face periods of extreme volatility, but that historically has rewarded patience. During market stress, it may help to remember that for many of our 400 plus employees their single largest investment is invested alongside the Davenport Funds. To say we have a lot of “eyes” overseeing our investment process and philosophy would be an understatement. Our investment team appreciates the fiduciary responsibility we have for our clients, co-workers, families and friends. Rest assured, our passion, motivation and enthusiasm for uncovering attractive investments remains high.

Our team is always willing to share with you our thoughts and strategy and we welcome your questions and comments. Thank you again for being a fellow shareholder of our Fund(s).

Sincerely,

John P. Ackerly IV, CFA

President, The Davenport Funds

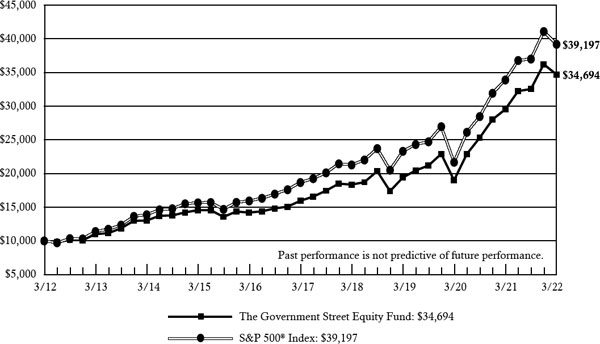

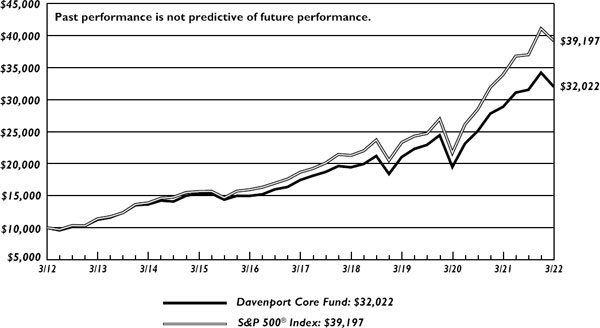

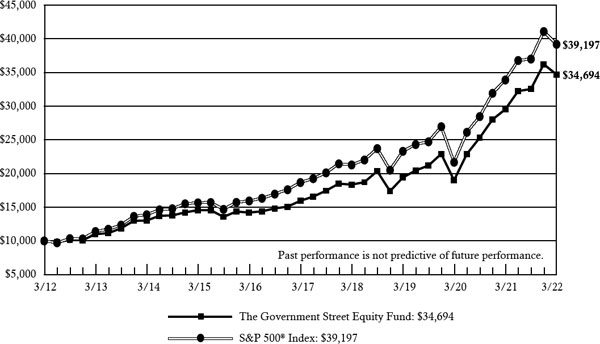

| DAVENPORT CORE FUND |

| PERFORMANCE INFORMATION (Unaudited) |

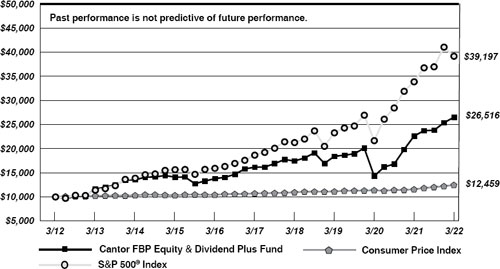

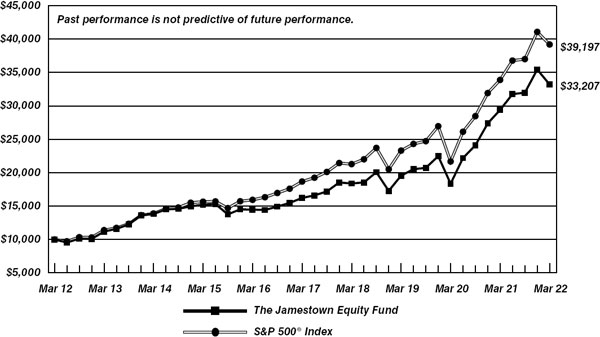

Comparison of the Change in Value of a $10,000 Investment in

Davenport Core Fund and the S&P 500® Index

| | | |

| | Average Annual Total Returns | |

| | (for periods ended March 31, 2022) | |

| | | |

| | 1 Year | | 5 Years | | 10 Years | |

| Davenport Core Fund (a) | 10.89% | | 12.91% | | 12.34% | |

| S&P 500® Index | 15.65% | | 15.99% | | 14.64% | |

| | | | | | | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

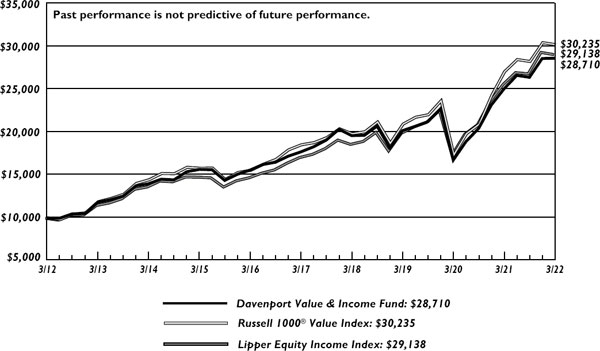

| DAVENPORT VALUE & INCOME FUND |

| PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in

Davenport Value & Income Fund, the Russell 1000® Value Index

and the Lipper Equity Income Index

| | | | | | | |

| | Average Annual Total Returns

(for periods ended March 31, 2022) | |

| | | | | | | |

| | 1 Year | | 5 Years | | 10 Years | |

| Davenport Value & Income Fund (a) | 14.24% | | 10.08% | | 11.12% | |

| Russell 1000® Value Index | 11.67% | | 10.29% | | 11.70% | |

| Lipper Equity Income Index | 13.76% | | 11.24% | | 11.29% | |

| | | | | | | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

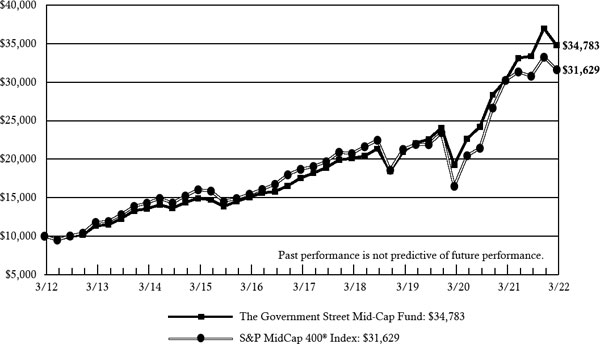

| DAVENPORT EQUITY OPPORTUNITIES FUND |

| PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in

Davenport Equity Opportunities Fund and the Russell Midcap® Index

| | | |

| | Average Annual Total Returns | |

| | (for periods ended March 31, 2022) | |

| | | |

| | 1 Year | | 5 Years | | 10 Years | |

| Davenport Equity Opportunities Fund (a) | 6.89% | | 15.26% | | 13.10% | |

| Russell Midcap® Index | 6.92% | | 12.62% | | 12.85% | |

| | | | | | | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

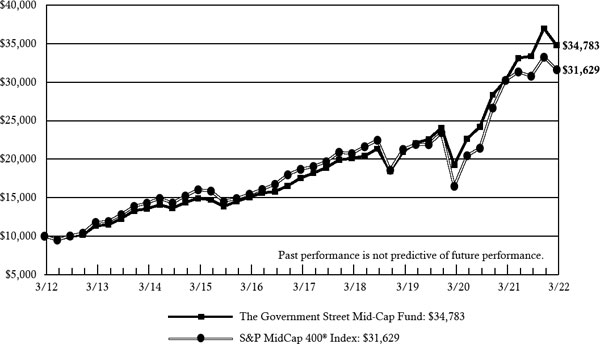

| DAVENPORT SMALL CAP FOCUS FUND |

| PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in

Davenport Small Cap Focus Fund and the Russell 2000® Index

| | | | | | | |

| | Average Annual Total Returns | |

| | (for periods ended March 31, 2022) | |

| | | |

| | | | | | Since | |

| | 1 Year | | 5 Years | | Inception(b) | |

| Davenport Small Cap Focus Fund (a) | 6.85% | | 14.22% | | 12.59% | |

| Russell 2000® Index | (5.79%) | | 9.74% | | 9.19% | |

| | | | | | | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Commencement of operations was December 31, 2014. |

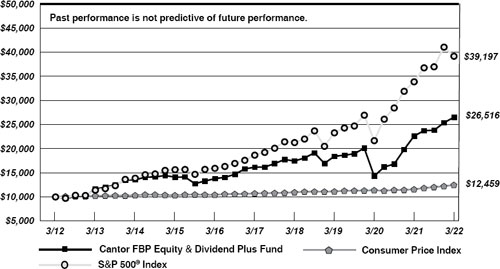

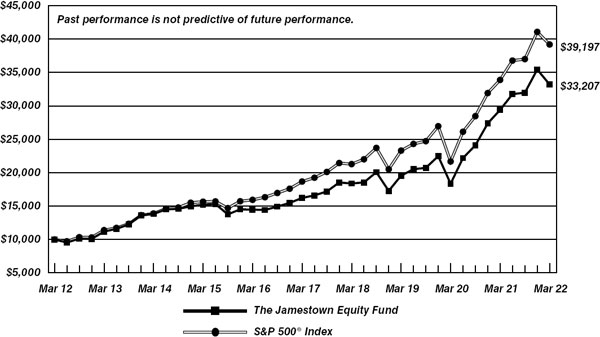

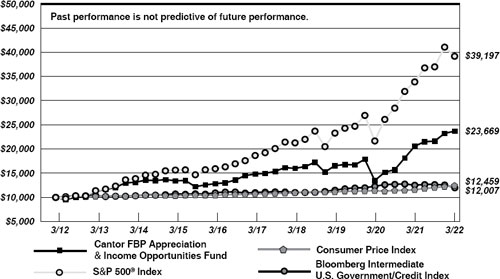

| DAVENPORT BALANCED INCOME FUND |

| PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in Davenport Balanced

Income Fund, the Russell 1000® Value Index, a Blended 60% Russell 1000® Value

Index / 40% Bloomberg Intermediate Government/Credit Bond Index

and the Morningstar US OE Allocation – 50% to 70% Equity

| | | |

| | Average Annual Total Returns | |

| | (for periods ended March 31, 2022) | |

| | | |

| | | | | | Since | |

| | 1 Year | | 5 Years | | Inception(b) | |

| Davenport Balanced Income Fund (a) | 7.50% | | 6.75% | | 7.25% | |

| Russell 1000® Value Index | 11.67% | | 10.29% | | 11.53% | |

| Blended 60% Russell 1000® Value Index / 40% Bloomberg Intermediate Government/Credit Bond Index | 5.25% | | 7.19% | | 7.91% | |

| Morningstar US OE Allocation - 50% to 70% Equity | 4.30% | | 8.12% | | 8.31% | |

| | | | | | | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Commencement of operations was December 31, 2015. |

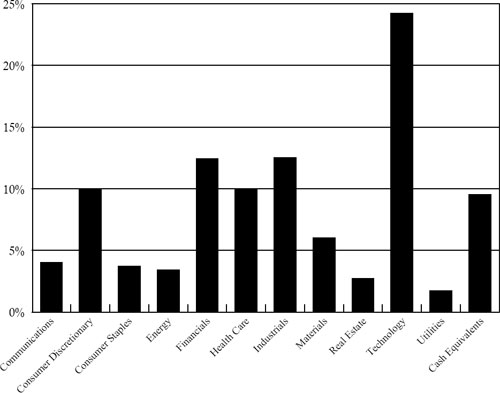

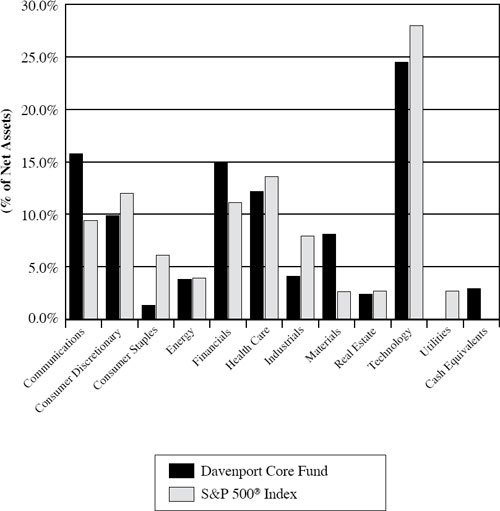

| DAVENPORT CORE FUND |

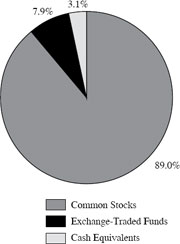

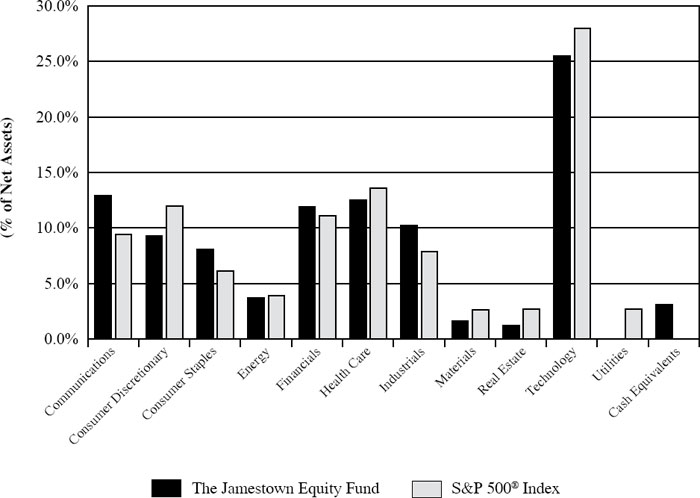

| PORTFOLIO INFORMATION |

| March 31, 2022 (Unaudited) |

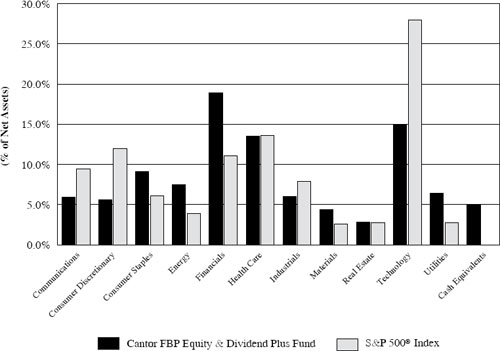

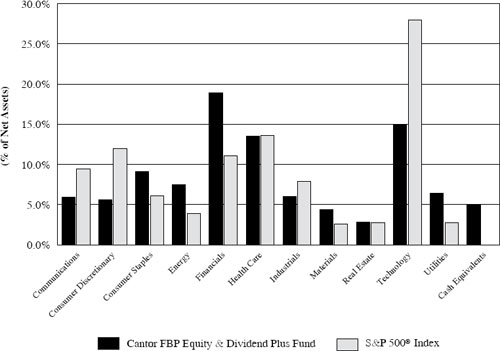

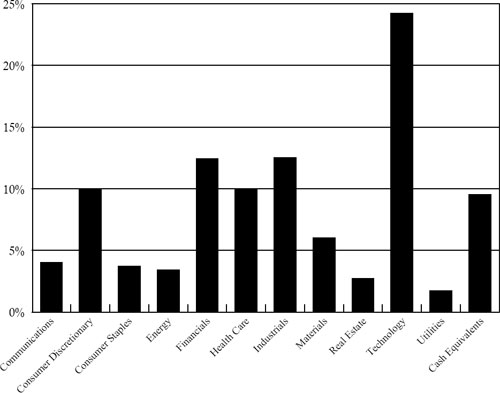

Sector Allocation vs. the S&P 500® Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Alphabet, Inc. - Classes A and C | 5.1% |

| Pioneer Natural Resources Company | 3.8% |

| Amazon.com, Inc. | 3.6% |

| Brookfield Asset Management, Inc. - Class A | 3.6% |

| Microsoft Corporation | 3.6% |

| Markel Corporation | 3.5% |

| Danaher Corporation | 3.5% |

| Adobe, Inc. | 3.3% |

| Apple, Inc. | 3.1% |

| T-Mobile US, Inc. | 3.1% |

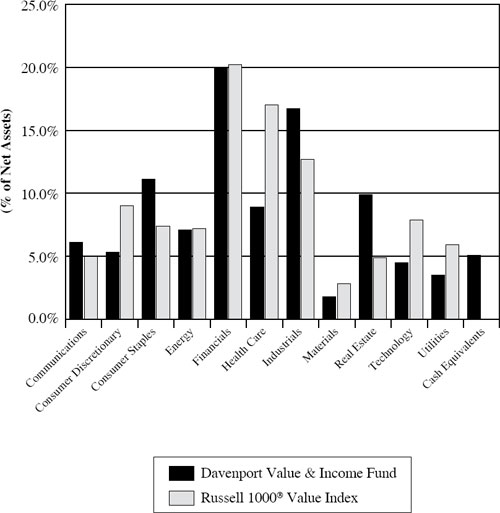

| DAVENPORT VALUE & INCOME FUND |

| PORTFOLIO INFORMATION |

| March 31, 2022 (Unaudited) |

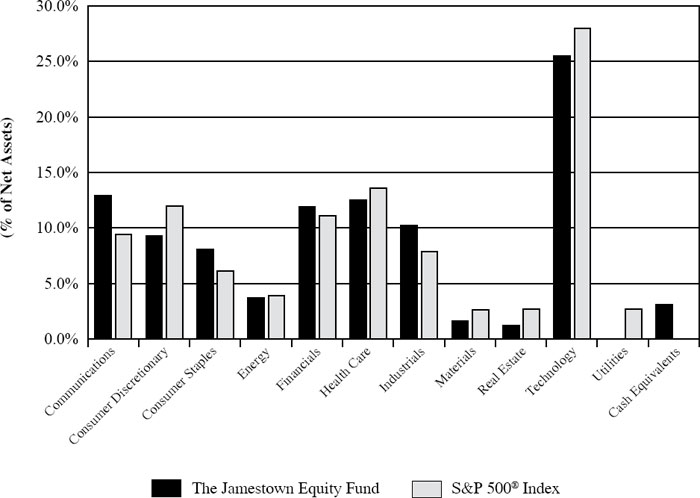

Sector Allocation vs. the Russell 1000® Value Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Brookfield Asset Management, Inc. - Class A | 3.8% |

| Johnson & Johnson | 3.4% |

| Berkshire Hathaway, Inc. - Class B | 3.2% |

| Watsco, Inc. | 3.1% |

| Fairfax Financial Holdings Ltd. | 3.0% |

| United Parcel Service, Inc. - Class B | 2.9% |

| Coterra Energy, Inc. | 2.8% |

| Markel Corporation | 2.7% |

| Comcast Corporation - Class A | 2.6% |

| McDonald’s Corporation | 2.6% |

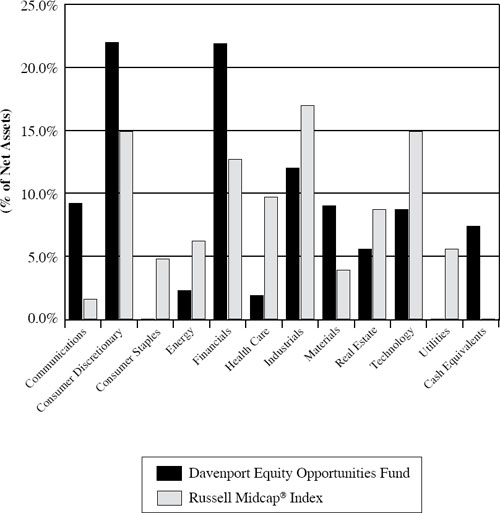

| DAVENPORT EQUITY OPPORTUNITIES FUND |

| PORTFOLIO INFORMATION |

| March 31, 2022 (Unaudited) |

Sector Allocation vs. the Russell Midcap® Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Markel Corporation | 6.3% |

| Brookfield Asset Management, Inc. - Class A | 6.3% |

| Fairfax Financial Holdings Ltd. | 5.9% |

| O’Reilly Automotive, Inc. | 5.1% |

| DISH Network Corporation - Class A | 5.0% |

| Take-Two Interactive Software, Inc. | 4.2% |

| Martin Marietta Materials, Inc. | 3.7% |

| Evoqua Water Technologies Corporation | 3.6% |

| Alight, Inc. - Class A | 3.5% |

| Fidelity National Financial, Inc. | 3.4% |

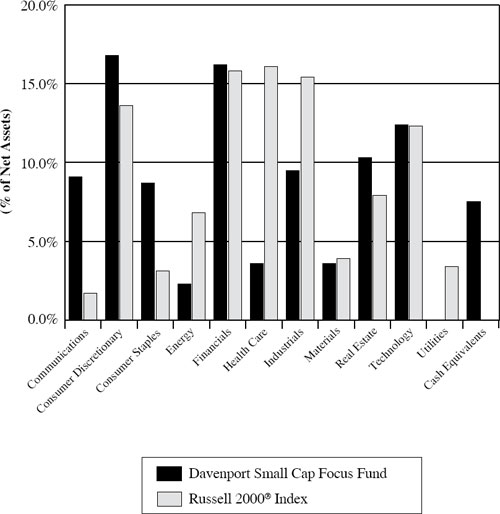

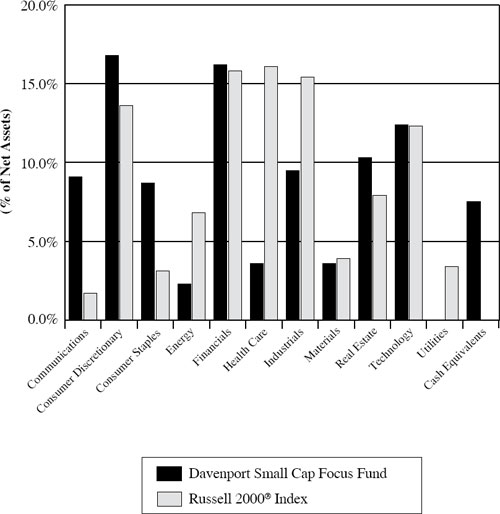

| DAVENPORT SMALL CAP FOCUS FUND |

| PORTFOLIO INFORMATION |

| March 31, 2022 (Unaudited) |

Sector Allocation vs. the Russell 2000® Index

Top Ten Equity Holdings

| Security Description | % of Net Assets |

| Monarch Casino & Resort, Inc. | 8.5% |

| Alight, Inc. - Class A | 5.9% |

| Cannae Holdings, Inc. | 4.0% |

| Kinsale Capital Group, Inc. | 3.8% |

| Verra Mobility Corporation | 3.8% |

| Perrigo Company plc | 3.6% |

| NewMarket Corporation | 3.6% |

| Evoqua Water Technologies Corporation | 3.5% |

| J & J Snack Foods Corporation | 3.3% |

| SL Green Realty Corporation | 3.2% |

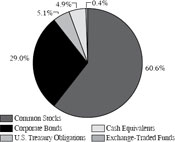

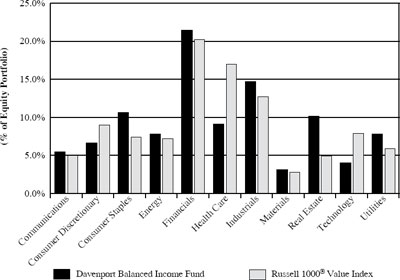

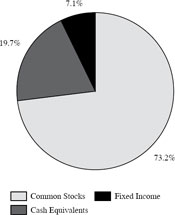

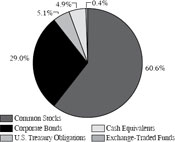

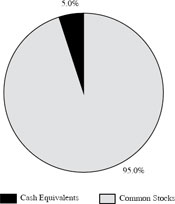

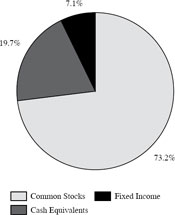

| DAVENPORT BALANCED INCOME FUND |

| PORTFOLIO INFORMATION |

| March 31, 2022 (Unaudited) |

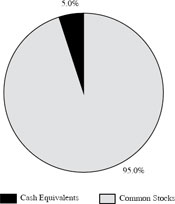

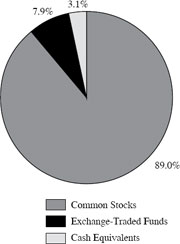

Asset Allocation (% of Net Assets)

| Ten Largest Equity Holdings | % of Net Assets |

| Brookfield Asset Management, Inc. - Class A | 2.0% |

| SL Green Realty Corporation | 1.9% |

| Johnson & Johnson | 1.8% |

| Berkshire Hathaway, Inc. - Class B | 1.7% |

| Watsco, Inc. | 1.7% |

| Perrigo Company plc | 1.7% |

| Fairfax Financial Holdings Ltd. | 1.7% |

| United Parcel Service, Inc. - Class B | 1.6% |

| Coterra Energy, Inc. | 1.5% |

| Markel Corporation | 1.5% |

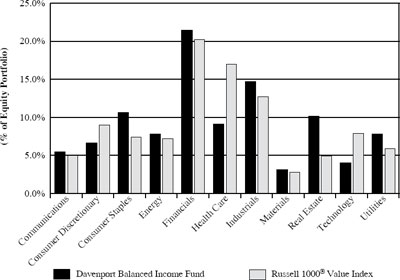

Equity Sector Concentration vs. the Russell 1000® Value Index (70.0% of Net Assets)

| Bond Portfolio (34.1% of Net Assets) | | Credit Quality | Composite Quality |

| Number of Fixed-Income Securities | 32 | | AAA | 15.0% |

| Average Quality | A- | | AA | 8.5% |

| Effective Maturity | 3.2 yrs. | | A | 29.6% |

| Average Effective Duration | 2.84 yrs. | | BBB | 46.9% |

| | | | Ba | 0.0% |

| | | | | |

| Sector Breakdown | % of Bond

Portfolio | | | |

| Communications | 6.4% | | | |

| Consumer Discretionary | 7.7% | | | |

| Consumer Staples | 3.3% | | | |

| Energy | 12.5% | | | |

| Financials | 11.1% | | | |

| Health Care | 12.4% | | | |

| Industrials | 9.6% | | | |

| Materials | 5.5% | | | |

| Real Estate | 7.5% | | | |

| Technology | 5.8% | | | |

| Utilities | 3.2% | | | |

| U.S. Treasury | 15.0% | | | |

| DAVENPORT CORE FUND |

| SCHEDULE OF INVESTMENTS |

| March 31, 2022 |

| COMMON STOCKS — 97.1% | | Shares | | | Value | |

| Communications — 15.8% | | | | | | |

| Alphabet, Inc. - Class A (a) | | | 8,290 | | | $ | 23,057,391 | |

| Alphabet, Inc. - Class C (a) | | | 7,036 | | | | 19,651,478 | |

| Booking Holdings, Inc. (a) | | | 5,669 | | | | 13,313,363 | |

| DISH Network Corporation - Class A (a) | | | 380,358 | | | | 12,038,331 | |

| Electronic Arts, Inc. | | | 100,594 | | | | 12,726,147 | |

| Meta Platforms, Inc. - Class A (a) | | | 53,477 | | | | 11,891,146 | |

| T-Mobile US, Inc. (a) | | | 201,856 | | | | 25,908,217 | |

| Walt Disney Company (The) (a) | | | 106,750 | | | | 14,641,830 | |

| | | | | | | | 133,227,903 | |

| Consumer Discretionary — 9.9% | | | | | | | | |

| Amazon.com, Inc. (a) | | | 9,449 | | | | 30,803,267 | |

| Caesars Entertainment, Inc. (a) | | | 99,877 | | | | 7,726,485 | |

| CarMax, Inc. (a) | | | 151,983 | | | | 14,663,320 | |

| Home Depot, Inc. (The) | | | 35,678 | | | | 10,679,496 | |

| TJX Companies, Inc. (The) | | | 330,596 | | | | 20,027,506 | |

| | | | | | | | 83,900,074 | |

| Consumer Staples — 1.3% | | | | | | | | |

| Constellation Brands, Inc. - Class A | | | 49,590 | | | | 11,421,569 | |

| | | | | | | | | |

| Energy — 3.8% | | | | | | | | |

| Pioneer Natural Resources Company | | | 127,162 | | | | 31,794,315 | |

| | | | | | | | | |

| Financials — 15.0% | | | | | | | | |

| Aon plc - Class A | | | 49,035 | | | | 15,967,267 | |

| Bank of America Corporation | | | 289,355 | | | | 11,927,213 | |

| Berkshire Hathaway, Inc. - Class B (a) | | | 68,270 | | | | 24,093,166 | |

| Brookfield Asset Management, Inc. - Class A | | | 542,090 | | | | 30,666,031 | |

| JPMorgan Chase & Company | | | 104,842 | | | | 14,292,061 | |

| Markel Corporation (a) | | | 20,348 | | | | 30,018,184 | |

| | | | | | | | 126,963,922 | |

| Health Care — 12.2% | | | | | | | | |

| Abbott Laboratories | | | 105,732 | | | | 12,514,440 | |

| Danaher Corporation | | | 101,875 | | | | 29,882,994 | |

| Illumina, Inc. (a) | | | 22,916 | | | | 8,006,850 | |

| Johnson & Johnson | | | 123,867 | | | | 21,952,948 | |

| Medtronic plc | | | 135,781 | | | | 15,064,902 | |

| UnitedHealth Group, Inc. | | | 30,261 | | | | 15,432,202 | |

| | | | | | | | 102,854,336 | |

| Industrials — 4.1% | | | | | | | | |

| Honeywell International, Inc. | | | 86,581 | | | | 16,846,931 | |

| Union Pacific Corporation | | | 65,908 | | | | 18,006,725 | |

| | | | | | | | 34,853,656 | |

| DAVENPORT CORE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 97.1% (Continued) | | Shares | | | Value | |

| Materials — 8.1% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 81,373 | | | $ | 20,335,926 | |

| Ball Corporation | | | 167,580 | | | | 15,082,200 | |

| Martin Marietta Materials, Inc. | | | 45,798 | | | | 17,627,192 | |

| Sherwin-Williams Company (The) | | | 62,711 | | | | 15,653,920 | |

| | | | | | | | 68,699,238 | |

| Real Estate — 2.4% | | | | | | | | |

| American Tower Corporation | | | 82,369 | | | | 20,692,740 | |

| | | | | | | | | |

| Technology — 24.5% | | | | | | | | |

| Accenture plc - Class A | | | 65,677 | | | | 22,148,255 | |

| Adobe, Inc. (a) | | | 60,470 | | | | 27,551,341 | |

| Apple, Inc. | | | 150,747 | | | | 26,321,934 | |

| Broadcom, Inc. | | | 28,113 | | | | 17,702,194 | |

| Mastercard, Inc. - Class A | | | 62,762 | | | | 22,429,883 | |

| Microsoft Corporation | | | 99,418 | | | | 30,651,564 | |

| Moody’s Corporation | | | 37,574 | | | | 12,677,843 | |

| ServiceNow, Inc. (a) | | | 23,684 | | | | 13,189,383 | |

| Sony Group Corporation - ADR | | | 157,462 | | | | 16,172,922 | |

| Visa, Inc. - Class A | | | 81,889 | | | | 18,160,523 | |

| | | | | | | | 207,005,842 | |

| | | | | | | | | |

| Total Common Stocks (Cost $478,105,253) | | | | | | $ | 821,413,595 | |

| MONEY MARKET FUNDS — 1.5% | | Shares | | | Value | |

| First American Treasury Obligations Fund - Class Z, 0.20% (b) (Cost $12,678,253) | | | 12,678,253 | | | $ | 12,678,253 | |

| | | | | | | | | |

| Total Investments at Value — 98.6% (Cost $490,783,506) | | | | | | $ | 834,091,848 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 1.4% | | | | | | | 11,557,955 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 845,649,803 | |

| ADR | - American Depositary Receipt. |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of March 31, 2022. |

See accompanying notes to financial statements.

| DAVENPORT VALUE & INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| March 31, 2022 |

| COMMON STOCKS — 94.9% | | Shares | | | Value | |

| Communications — 6.1% | | | | | | |

| Alphabet, Inc. - Class A (a) | | | 6,724 | | | $ | 18,701,797 | |

| Comcast Corporation - Class A | | | 515,430 | | | | 24,132,433 | |

| Verizon Communications, Inc. | | | 267,752 | | | | 13,639,287 | |

| | | | | | | | 56,473,517 | |

| Consumer Discretionary — 5.3% | | | | | | | | |

| Cannae Holdings, Inc. (a) | | | 489,230 | | | | 11,702,382 | |

| Lowe’s Companies, Inc. | | | 64,286 | | | | 12,997,986 | |

| McDonald’s Corporation | | | 96,337 | | | | 23,822,213 | |

| | | | | | | | 48,522,581 | |

| Consumer Staples — 11.1% | | | | | | | | |

| Bunge Ltd. | | | 210,394 | | | | 23,313,759 | |

| Coca-Cola Company (The) | | | 227,120 | | | | 14,081,440 | |

| Diageo plc - ADR | | | 89,607 | | | | 18,202,766 | |

| Philip Morris International, Inc. | | | 195,455 | | | | 18,361,043 | |

| Sysco Corporation | | | 174,369 | | | | 14,237,229 | |

| Walmart, Inc. | | | 92,162 | | | | 13,724,765 | |

| | | | | | | | 101,921,002 | |

| Energy — 7.1% | | | | | | | | |

| Chevron Corporation | | | 121,084 | | | | 19,716,108 | |

| Coterra Energy, Inc. | | | 971,916 | | | | 26,212,575 | |

| Enbridge, Inc. | | | 414,682 | | | | 19,112,693 | |

| | | | | | | | 65,041,376 | |

| Financials — 20.0% | | | | | | | | |

| Berkshire Hathaway, Inc. - Class B (a) | | | 82,663 | | | | 29,172,599 | |

| Brookfield Asset Management, Inc. - Class A | | | 616,582 | | | | 34,880,044 | |

| Capital One Financial Corporation | | | 123,371 | | | | 16,197,379 | |

| Citigroup, Inc. | | | 209,478 | | | | 11,186,125 | |

| Fairfax Financial Holdings Ltd. | | | 50,803 | | | | 27,673,918 | |

| Fidelity National Financial, Inc. | | | 446,969 | | | | 21,829,966 | |

| JPMorgan Chase & Company | | | 133,326 | | | | 18,175,000 | |

| Markel Corporation (a) | | | 17,063 | | | | 25,172,020 | |

| | | | | | | | 184,287,051 | |

| Health Care — 8.9% | | | | | | | | |

| Anthem, Inc. | | | 34,246 | | | | 16,822,320 | |

| Johnson & Johnson | | | 176,436 | | | | 31,269,752 | |

| Medtronic plc | | | 164,167 | | | | 18,214,329 | |

| Perrigo Company plc | | | 397,187 | | | | 15,263,897 | |

| | | | | | | | 81,570,298 | |

| Industrials — 16.7% | | | | | | | | |

| 3M Company | | | 109,379 | | | | 16,284,346 | |

| Boeing Company (The) (a) | | | 61,469 | | | | 11,771,313 | |

| Deere & Company | | | 37,216 | | | | 15,461,759 | |

| L3Harris Technologies, Inc. | | | 61,487 | | | | 15,277,675 | |

| DAVENPORT VALUE & INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 94.9% (Continued) | | Shares | | | Value | |

| Industrials — 16.7% (Continued) | | | | | | | | |

| Norfolk Southern Corporation | | | 70,618 | | | $ | 20,141,666 | |

| TE Connectivity Ltd. | | | 145,015 | | | | 18,994,065 | |

| United Parcel Service, Inc. - Class B | | | 124,506 | | | | 26,701,557 | |

| Watsco, Inc. | | | 93,891 | | | | 28,602,954 | |

| | | | | | | | 153,235,335 | |

| Materials — 1.8% | | | | | | | | |

| Newmont Corporation | | | 210,118 | | | | 16,693,875 | |

| | | | | | | | | |

| Real Estate — 9.9% | | | | | | | | |

| Crown Castle International Corporation | | | 92,736 | | | | 17,119,066 | |

| Digital Realty Trust, Inc. | | | 104,438 | | | | 14,809,308 | |

| Gaming and Leisure Properties, Inc. | | | 380,337 | | | | 17,849,215 | |

| Lamar Advertising Company - Class A | | | 192,816 | | | | 22,401,363 | |

| SL Green Realty Corporation | | | 237,885 | | | | 19,311,504 | |

| | | | | | | | 91,490,456 | |

| Technology — 4.5% | | | | | | | | |

| QUALCOMM, Inc. | | | 124,508 | | | | 19,027,313 | |

| Sony Group Corporation - ADR | | | 219,286 | | | | 22,522,865 | |

| | | | | | | | 41,550,178 | |

| Utilities — 3.5% | | | | | | | | |

| Dominion Energy, Inc. | | | 225,731 | | | | 19,180,363 | |

| NextEra Energy, Inc. | | | 152,862 | | | | 12,948,940 | |

| | | | | | | | 32,129,303 | |

| | | | | | | | | |

| Total Common Stocks (Cost $618,232,738) | | | | | | $ | 872,914,972 | |

| | | | | | | |

| MONEY MARKET FUNDS — 5.8% | | Shares | | | Value | |

| First American Treasury Obligations Fund - Class Z, 0.20% (b) (Cost $53,284,438) | | | 53,284,438 | | | $ | 53,284,438 | |

| | | | | | | | | |

| Total Investments at Value — 100.7% (Cost $671,517,176) | | | | | | $ | 926,199,410 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.7%) | | | | | | | (6,144,031 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 920,055,379 | |

| ADR | - American Depositary Receipt. |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of March 31, 2022. |

See accompanying notes to financial statements.

| DAVENPORT EQUITY OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS |

| March 31, 2022 |

| COMMON STOCKS — 92.6% | | Shares | | | Value | |

| Communications — 9.2% | | | | | | | | |

| DISH Network Corporation - Class A (a) | | | 1,175,074 | | | $ | 37,191,092 | |

| Take-Two Interactive Software, Inc. (a) | | | 202,893 | | | | 31,192,770 | |

| | | | | | | | 68,383,862 | |

| Consumer Discretionary — 22.0% | | | | | | | | |

| Builders FirstSource, Inc. (a) | | | 328,149 | | | | 21,178,736 | |

| Caesars Entertainment, Inc. (a) | | | 195,059 | | | | 15,089,764 | |

| Cannae Holdings, Inc. (a) | | | 1,018,253 | | | | 24,356,612 | |

| CarMax, Inc. (a) | | | 208,440 | | | | 20,110,291 | |

| DraftKings, Inc. - Class A (a) | | | 696,724 | | | | 13,565,216 | |

| Etsy, Inc. (a) | | | 95,321 | | | | 11,846,494 | |

| Live Nation Entertainment, Inc. (a) | | | 162,815 | | | | 19,153,557 | |

| O’Reilly Automotive, Inc. (a) | | | 55,633 | | | | 38,106,380 | |

| | | | | | | | 163,407,050 | |

| Energy — 2.3% | | | | | | | | |