UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05742

Name of Fund: BlackRock Funds

BlackRock Advantage Small Cap Growth Fund (formerly BlackRock Small Cap Growth Equity Portfolio)

BlackRock All-Cap Energy & Resources Portfolio

BlackRock Emerging Markets Dividend Fund

BlackRock Energy & Resources Portfolio

BlackRock Flexible Equity Fund

BlackRock Global Opportunities Portfolio

BlackRock Health Sciences Opportunities Portfolio

BlackRock International Opportunities Portfolio

BlackRock Mid-Cap Growth Equity Portfolio

BlackRock Science & Technology Opportunities Portfolio

BlackRock Tactical Opportunities Portfolio

BlackRock U.S. Opportunities Portfolio

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2017

Date of reporting period: 03/31/2017

Item 1 – Report to Stockholders

MARCH 31, 2017

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

▶ BlackRock All-Cap Energy & Resources Portfolio

▶ BlackRock Emerging Markets Dividend Fund

▶ BlackRock Energy & Resources Portfolio

| | |

| Not FDIC Insured § May Lose Value § No Bank Guarantee | | |

Dear Shareholder,

In the 12 months ended March 31, 2017, risk assets, such as stocks and high-yield bonds, delivered strong performance, while U.S. Treasuries and other higher-quality assets generated negative returns. Markets showed great resilience during a period with big surprises, including the United Kingdom’s vote to leave the European Union and the outcome of the U.S. presidential election, which brought only brief spikes in equity market volatility. The more rate-sensitive high-quality assets, however, struggled as rising energy prices, modest wage increases and steady U.S. job growth led to expectations of higher inflation and anticipation of interest rate increases by the U.S. Federal Reserve (the “Fed”).

The global reflationary theme — rising nominal growth, wages and inflation — was the dominant driver of asset returns during the period, outweighing significant political upheavals and uncertainty. Reflationary expectations accelerated after the U.S. election and continued into the beginning of 2017, stoked by expectations for an extra boost to U.S. growth via fiscal policy. The primary tension surfacing in markets in 2017 has been between reflationary expectations and the realities of fiscal and monetary policy. Markets have been turning their attention to the Fed’s outlook for additional interest rate hikes, while assessing the probability of Congress passing meaningful fiscal stimulus amid political division and a limited budget.

Although economic momentum is gaining traction, the capacity for rapid global growth is restrained by structural factors, including an aging population, low productivity growth and excess savings, as well as cyclical factors, like the Fed leaning toward higher interest rates and the length of the current expansion. Tempered economic growth and high valuations across most assets have set the stage for muted long-term investment returns going forward.

Equity markets still present opportunities, although the disparity between winners and losers is widening — a dynamic that increases the risk and return potential of active investing. Fixed income investors are also facing challenges as bond markets recalibrate for higher inflation expectations after eight years of deflationary concerns. And in a world where political risk and policy uncertainty abound, there is no lack of potential catalysts for higher volatility.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of March 31, 2017 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities

(S&P 500® Index)

| | | 10.12 | % | | | 17.17 | % |

U.S. small cap equities

(Russell 2000® Index)

| | | 11.52 | | | | 26.22 | |

International equities

(MSCI Europe, Australasia, Far East Index) | | | 6.48 | | | | 11.67 | |

Emerging market equities (MSCI Emerging Markets Index) | | | 6.80 | | | | 17.21 | |

3-month Treasury bills

(BofA Merrill Lynch 3-Month U.S. Treasury Bill Index) | | | 0.19 | | | | 0.36 | |

U.S. Treasury securities

(BofA Merrill Lynch 10-Year U.S. Treasury Index) | | | (6.08 | ) | | | (3.97 | ) |

U.S. investment grade bonds (Bloomberg Barclays U.S. Aggregate Bond Index) | | | (2.18 | ) | | | 0.44 | |

Tax-exempt municipal bonds (S&P Municipal Bond Index) | | | (1.93 | ) | | | 0.55 | |

U.S. high yield bonds (Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | | 4.50 | | | | 16.39 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| 2 | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | |

| | | | | | |

| | |

| | Shareholders can sign up for e-mail notifications of quarterly statements, annual and semi-annual shareholder reports and prospectuses by enrolling in the electronic delivery program. Electronic copies of shareholder reports and prospectuses are also available on BlackRock’s website. TO ENROLL IN ELECTRONIC DELIVERY: Shareholders Who Hold Accounts with Investment Advisors, Banks or Brokerages: Please contact your financial advisor. Please note that not all investment advisors, banks or brokerages may offer this service. Shareholders Who Hold Accounts Directly with BlackRock: 1. Access the BlackRock website at blackrock.com 2. Select “Access Your Account” 3. Next, select “eDelivery” in the “Related Resources” box and follow the sign-up instructions | | |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2017 | | 3 |

| | | | |

| Fund Summary as of March 31, 2017 | | | BlackRock All-Cap Energy & Resources Portfolio | |

BlackRock All-Cap Energy & Resources Portfolio’s (the “Fund”) investment objective is to provide long-term growth of capital.

|

| Portfolio Management Commentary |

How did the Fund perform?

| • | | For the six-month period ended March 31, 2017, the Fund underperformed its benchmark, the MSCI World Energy Index. |

What factors influenced performance?

| • | | The Fund’s overweight position in exploration & production (“E&P”) companies with natural gas exposure, including EQT Corp., came under pressure due to higher-than-predicted temperatures. |

| • | | A rising rig count in the United States in the latter part of the period increased investor concerns that growth in U.S. production would lead to higher oil supplies. The Fund’s overweights in the U.S. E&P companies Anadarko Petroleum Corp., Cimarex Energy Co. and Hess Corp. detracted from relative performance as a result. Hess was also negatively impacted by its announcement of a weaker-than-expected growth forecast for 2017. |

| • | | An overweight position in the pressure pumping and service provider Superior Energy Services, Inc. also detracted from relative performance. The stock lost ground following the announcement of a joint venture between Schlumberger Ltd. and Weatherford International Ltd. that will focus on pressure pumping and therefore potentially increase competition. |

| • | | The Fund’s overweight position in Baker Hughes Inc. was the leading contributor to relative performance. In late October 2016, General Electric Co. announced that it would merge its oil services business with Baker Hughes Inc. and would pay $7.4 billion to take a controlling stake in the combined company. Additionally, Baker Hughes announced stronger-than-expected results. |

| • | | An overweight in the E&P company ConocoPhillips was also a notable contributor. The market responded positively to the company’s plans to |

| | position itself for a lower oil price environment by reducing its break-even cost of production, divesting $5 to $8 billion in assets and beginning a $3 billion share repurchase program. The divestment plan began to show results when ConocoPhillips announced the sale of its higher-cost Canadian assets to Cenovus Energy, Inc. in March. |

Describe recent portfolio activity.

| • | | The investment adviser has positioned the portfolio for a positive oil price environment on the belief that the supply-and-demand backdrop will continue to improve. Accordingly, the investment adviser increased the Fund’s weighting in U.S. onshore oil-services companies by initiating a position in Superior Energy Services Inc. and adding to an existing position in Halliburton Co. These moves were funded by taking profits in certain E&P stocks that performed well in 2016, including Pioneer Natural Resources Co. and EOG Resources, Inc. Later in the period, the investment adviser used the pull-back in the energy sector to increase the portfolio’s beta (risk exposure) somewhat based on the positive fundamentals in the oil market. The investment adviser sought to accomplish this by adding to its favored oil services and E&P holdings and reducing exposure to integrated energy companies such as ExxonMobil Corp. and Chevron Corp. |

Describe portfolio positioning at period end.

| • | | Relative to the MSCI World Energy Index, the Fund closed the period with an overweight in E&Ps and an underweight in the integrated oil and gas sub-sector, based on the belief that the former is in a better position to benefit from rising oil prices. With that said, the investment adviser remains cognizant of near-term risks and is therefore maintaining a high-quality bias in the portfolio. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | |

| Ten Largest Holdings | | Percent of

Net Assets |

Royal Dutch Shell PLC, Class A | | | | 12 | % |

Exxon Mobil Corp. | | | | 10 | |

BP PLC | | | | 6 | |

ConocoPhillips | | | | 5 | |

EOG Resources, Inc. | | | | 5 | |

Chevron Corp. | | | | 5 | |

Anadarko Petroleum Corp. | | | | 4 | |

Pioneer Natural Resources Co. | | | | 4 | |

Baker Hughes, Inc. | | | | 4 | |

Schlumberger Ltd. | | | | 3 | |

| | | | | |

| Industry Allocation | | Percent of

Net Assets |

Oil, Gas & Consumable Fuels | | | | 87 | % |

Energy Equipment & Services | | | | 13 | |

For Fund compliance purposes, the Fund’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| 4 | | BLACKROCK FUNDS | | MARCH 31, 2017 | | |

| | |

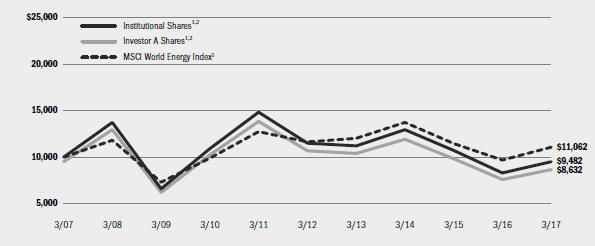

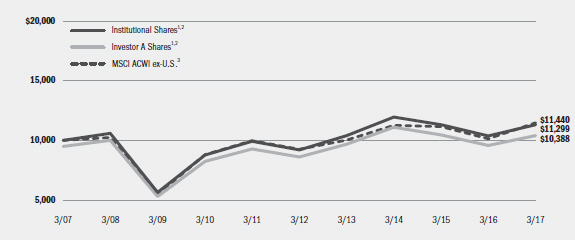

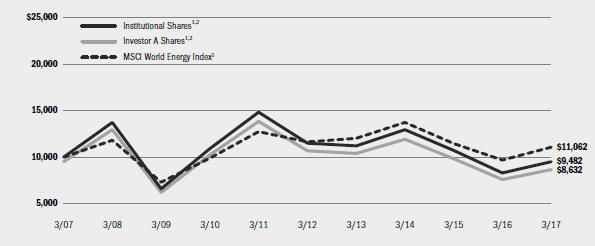

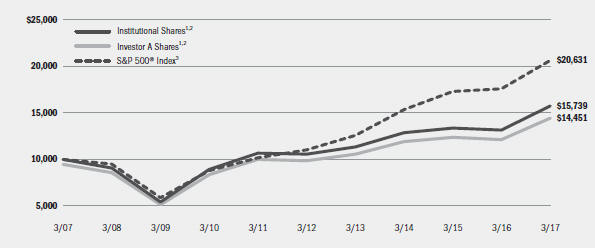

| | | BlackRock All-Cap Energy & Resources Portfolio |

|

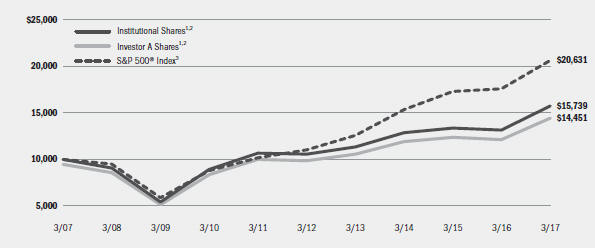

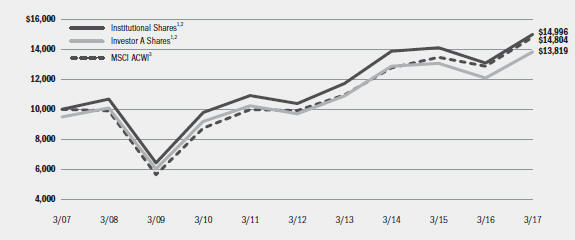

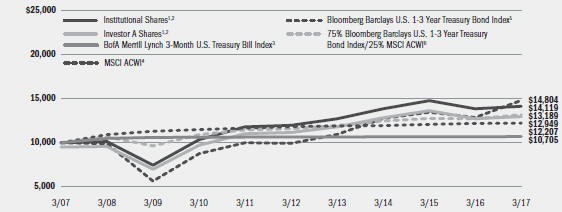

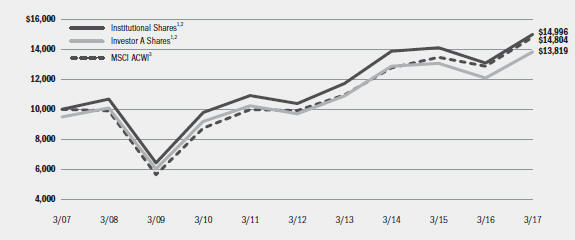

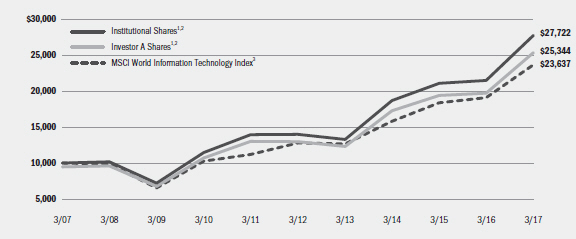

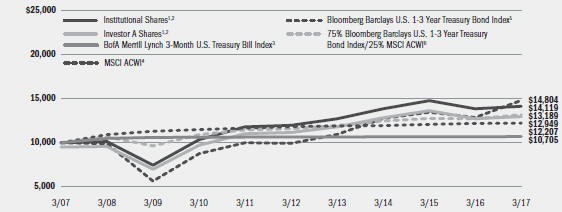

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | Under normal market conditions, the Fund invests at least 80% of its total assets in equity securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and telecommunications utilities). |

| | 3 | A free float-adjusted market capitalization index that represents the energy segment in global developed market equity performance. |

|

| Performance Summary for the Period Ended March 31, 2017 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns4 |

| | | | | 1 Year | | 5 Years | | 10 Years |

| | | 6-Month

Total Returns | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge |

Institutional | | | | 1.31 | % | | | | 14.34 | % | | | | N/A | | | | | (3.76 | )% | | | | N/A | | | | | (0.53 | )% | | | | N/A | |

Service | | | | 1.16 | | | | | 13.80 | | | | | N/A | | | | | (4.14 | ) | | | | N/A | | | | | (0.91 | ) | | | | N/A | |

Investor A | | | | 1.15 | | | | | 13.84 | | | | | 7.87 | % | | | | (4.15 | ) | | | | (5.18 | )% | | | | (0.93 | ) | | | | (1.46 | )% |

Investor B | | | | 0.77 | | | | | 13.02 | | | | | 8.52 | | | | | (4.85 | ) | | | | (5.23 | ) | | | | (1.52 | ) | | | | (1.52 | ) |

Investor C | | | | 0.85 | | | | | 13.13 | | | | | 12.13 | | | | | (4.83 | ) | | | | (4.83 | ) | | | | (1.64 | ) | | | | (1.64 | ) |

MSCI World Energy Index | | | | 2.06 | | | | | 14.44 | | | | | N/A | | | | | (0.96 | ) | | | | N/A | | | | | 1.01 | | | | | N/A | |

| | 4 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical6 | | |

| | | Beginning

Account Value

October 1, 2016 | | Ending

Account Value

March 31, 2017 | | Expenses Paid

During the Period5 | | Beginning

Account Value

October 1, 2016 | | Ending

Account Value

March 31, 2017 | | Expenses Paid

During the Period5 | | Annualized

Expense

Ratio |

Institutional | | | $ | 1,000.00 | | | | $ | 1,013.10 | | | | $ | 4.55 | | | | $ | 1,000.00 | | | | $ | 1,020.34 | | | | $ | 4.57 | | | | | 0.91 | % |

Service | | | $ | 1,000.00 | | | | $ | 1,011.60 | | | | $ | 6.65 | | | | $ | 1,000.00 | | | | $ | 1,018.25 | | | | $ | 6.67 | | | | | 1.33 | % |

Investor A | | | $ | 1,000.00 | | | | $ | 1,011.50 | | | | $ | 6.65 | | | | $ | 1,000.00 | | | | $ | 1,018.25 | | | | $ | 6.67 | | | | | 1.33 | % |

Investor B | | | $ | 1,000.00 | | | | $ | 1,007.70 | | | | $ | 10.23 | | | | $ | 1,000.00 | | | | $ | 1,014.67 | | | | $ | 10.27 | | | | | 2.05 | % |

Investor C | | | $ | 1,000.00 | | | | $ | 1,008.50 | | | | $ | 10.24 | | | | $ | 1,000.00 | | | | $ | 1,014.67 | | | | $ | 10.27 | | | | | 2.05 | % |

| | 5 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| | 6 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 11 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2017 | | 5 |

| | | | |

| Fund Summary as of March 31, 2017 | | | BlackRock Emerging Markets Dividend Fund | |

BlackRock Emerging Markets Dividend Fund’s (the “Fund”) investment objective is primarily to seek investment income; and, as a secondary objective, to seek capital appreciation.

|

| Portfolio Management Commentary |

How did the Fund perform?

| • | | For the six-month period ended March 31, 2017, the Fund outperformed its benchmark, the MSCI Emerging Markets Index. |

What factors influenced performance?

| • | | Stock selection in India made the largest contribution to the Fund’s positive relative performance. The country’s market produced a strong gain due to the combination of declining concerns about the government’s effort to remove paper money from the financial system and the announcement of a prudent budget for the 2018 fiscal year. More recently, state election wins from the Prime Minister’s party confirmed the support for more reforms. In this environment, the Indian stocks Indiabulls Housing Finance Ltd. and Sun TV Network Ltd. were among the top contributors to Fund performance. Shares of the latter surged after legal charges against its owners were dropped, removing a major overhang on the stock. The Brazilian bank Itau Unibanco Holding SA also performed well following guidance on lower loss-provision costs and an interest rate cut by the country’s central bank. Stock selection in Mexico was an additional contributor. |

| • | | Stock selection in South Korea detracted from results. The underperformance largely stemmed from the Fund’s investment in KT&G Corp. and its zero weighting in Samsung Electronics Co., Ltd. which performed well amid robust demand for memory chips and organic light emitting diodes. A zero weighting in the Brazilian miner Vale SA also weighed on returns as iron ore prices made robust gains. |

Describe recent portfolio activity.

| • | | The Fund increased its positions in the materials and health care sectors during the course of the period. |

| • | | At the country level, the investment adviser reduced the Fund’s weighting in Brazil by taking profits in Itau Unibanco SA and exiting a position in Ambev SA due to its weak earnings. Similarly, the Fund trimmed some of its allocation to China near the close of 2016, as companies had generally reported disappointing profits and growth rates seemed to be moderating going into 2017. The investment adviser later added back exposure by increasing the portfolio’s existing positions in certain financial and consumer stocks. |

Describe portfolio positioning at period end.

| • | | The Fund’s bottom-up positioning reflected the investment adviser’s positive view on the emerging markets, which was based on valuations that remain below the historical average and rising visibility regarding profit margins and earnings. The investment adviser continued to focus on identifying firms with high-quality balance sheets and strong cash flows. |

| • | | The Fund ended the period with its largest overweight positions in India and Thailand, while its most significant underweight was in South Korea. At the sector level, the Fund was overweight in health care and underweight in information technology. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | |

| Ten Largest Holdings | | Percent of

Net Assets |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | | 3 | % |

KT&G Corp. | | | | 3 | |

China Mobile Ltd. | | | | 3 | |

NovaTek PJSC - GDR | | | | 2 | |

Indiabulls Housing Finance Ltd. | | | | 2 | |

NTPC Ltd. | | | | 2 | |

Powszechny Zaklad Ubezpieczen SA | | | | 2 | |

Sun TV Network Ltd. | | | | 2 | |

Siam Commercial Bank PCL - NVDR | | | | 2 | |

EcoRodovias Infraestrutura e Logistica SA | | | | 2 | |

| | | | | |

| Geographic Allocation | | Percent of

Net Assets |

China | | | | 18 | % |

India | | | | 14 | |

Taiwan | | | | 12 | |

Brazil | | | | 9 | |

Russia | | | | 6 | |

South Korea | | | | 6 | |

Thailand | | | | 6 | |

Hong Kong | | | | 4 | |

South Africa | | | | 3 | |

Mexico | | | | 3 | |

Other1 | | | | 19 | |

| | 1 | | Includes holdings within countries that are 2% or less of long-term investments. Please refer to the Schedule of Investments for such countries. |

| | | | | | |

| 6 | | BLACKROCK FUNDS | | MARCH 31, 2017 | | |

| | | | |

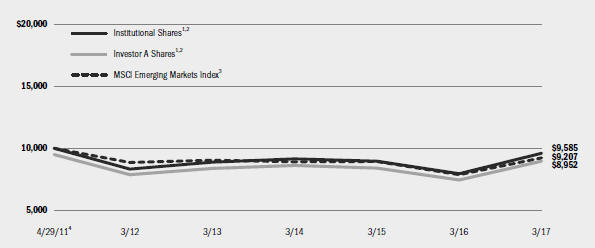

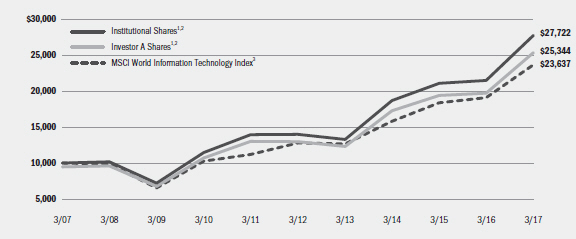

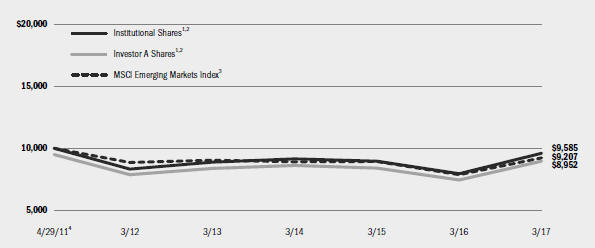

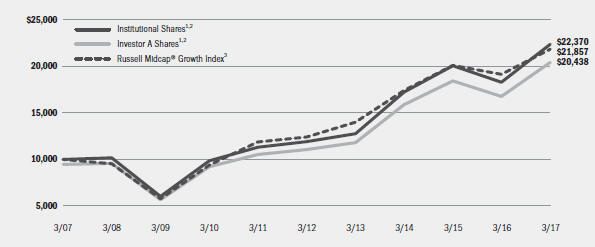

| | | | BlackRock Emerging Markets Dividend Fund | |

|

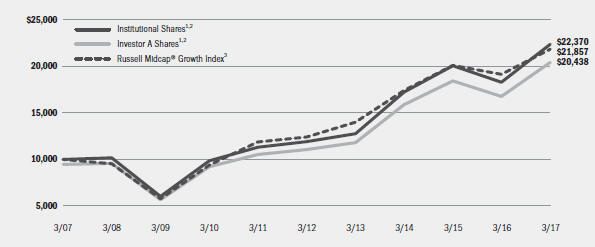

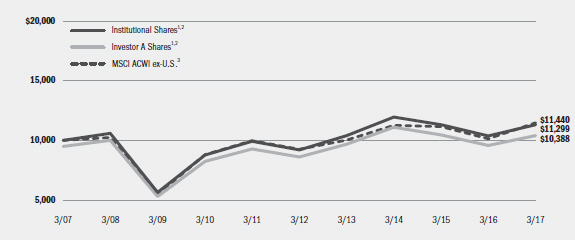

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | Under normal circumstances, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in dividend-paying equity securities of, or derivatives having economic characteristics similar to the dividend-paying equity securities of, companies domiciled in, or tied economically to, emerging market countries. The Fund’s total returns prior to August 16, 2013, are the returns of the Fund when it followed different investment strategies under the name BlackRock China Fund. |

| | 3 | A free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 23 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and the United Arab Emirates. |

| | 4 | Commencement of operations. |

| | | | | | | | | | | | | | |

| Performance Summary for the Period Ended March 31, 2017 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns2,5 |

| | | | | 1 Year | | 5 Years | | Since Inception6 |

| | | 6-Month

Total Returns | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge |

Institutional | | | | 8.64 | % | | | | 20.70 | % | | | | N/A | | | | | 2.92 | % | | | | N/A | | | | | (0.71 | )% | | | | N/A | |

Investor A | | | | 8.41 | | | | | 20.34 | | | | | 14.02 | % | | | | 2.66 | | | | | 1.56 | % | | | | (0.95 | ) | | | | (1.85 | )% |

Investor C | | | | 8.08 | | | | | 19.56 | | | | | 18.56 | | | | | 1.95 | | | | | 1.95 | | | | | (1.66 | ) | | | | (1.66 | ) |

MSCI Emerging Markets Index | | | | 6.80 | | | | | 17.21 | | | | | N/A | | | | | 0.81 | | | | | N/A | | | | | (1.39 | ) | | | | N/A | |

| | 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees. |

| | 6 | | The Fund commenced operations on April 29, 2011. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical8 | | |

| | | Beginning

Account Value

October 1, 2016 | | Ending

Account Value

March 31, 2017 | | Expenses Paid

During the Period7 | | Beginning

Account Value

October 1, 2016 | | Ending

Account Value

March 31, 2017 | | Expenses Paid

During the Period7 | | Annualized

Expense

Ratio |

Institutional | | | $ | 1,000.00 | | | | $ | 1,086.40 | | | | $ | 7.78 | | | | $ | 1,000.00 | | | | $ | 1,017.40 | | | | $ | 7.52 | | | | | 1.50 | % |

Investor A | | | $ | 1,000.00 | | | | $ | 1,084.10 | | | | $ | 9.07 | | | | $ | 1,000.00 | | | | $ | 1,016.16 | | | | $ | 8.77 | | | | | 1.75 | % |

Investor C | | | $ | 1,000.00 | | | | $ | 1,080.80 | | | | $ | 12.93 | | | | $ | 1,000.00 | | | | $ | 1,012.43 | | | | $ | 12.51 | | | | | 2.50 | % |

| | 7 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| | 8 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 11 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2017 | | 7 |

| | |

| Fund Summary as of March 31, 2017 | | BlackRock Energy & Resources Portfolio |

BlackRock Energy & Resources Portfolio’s (the “Fund”) investment objective is to provide long-term growth of capital.

|

| Portfolio Management Commentary |

How did the Fund perform?

| • | | For the six-month period ended March 31, 2017, the Fund underperformed the MSCI World Small and Mid-Cap Energy Index. |

What factors influenced performance?

| • | | The Fund’s overweight position in exploration & production (“E&P”) companies with natural gas exposure, including Gulfport Energy Corp., Carrizo Oil & Gas, Inc. and EQT Corp., came under pressure due to higher-than-predicted temperatures. |

| • | | An overweight position in the pressure pumping and service provider Superior Energy Services, Inc. also detracted from relative performance. The stock lost ground following the announcement of a joint venture between Schlumberger Ltd. and Weatherford International Ltd. that will focus on pressure pumping and therefore potentially increase competition. |

| • | | The Fund’s overweight position in Baker Hughes Inc. was the leading contributor to relative performance. In late October 2016, General Electric Co. announced that it would merge its oil services business with Baker Hughes Inc. and would pay $7.4 billion to take a controlling stake in the combined company. Additionally, Baker Hughes announced stronger-than-expected results. |

| • | | An overweight in the E&P company Ithaca Energy, Inc., which received a takeover bid from the Israeli energy producer The Delek Group, was also a notable contributor. |

Describe recent portfolio activity.

| • | | The investment adviser has positioned the portfolio for a positive oil price environment on the belief that the supply-and-demand backdrop will continue to improve. Accordingly, the investment adviser increased exposure to U.S. onshore oil-services companies by initiating a position in Precision Drilling Corp. These moves were funded by taking profits in certain E&P stocks that performed well in 2016, including Cimarex Energy and Oil Search Ltd. Later in the period, the Fund used the pull-back in the energy sector to increase the portfolio’s beta (risk exposure) somewhat based on the positive fundamentals in the oil market. |

Describe portfolio positioning at period end.

| • | | Relative to the MSCI World Small and Mid-Cap Energy Index, the Fund closed the period with an overweight in E&Ps and underweights in the refining & marketing and oil services sub-sectors, based on the belief that the former is better positioned to benefit from rising oil prices. With that said, the investment adviser remains cognizant of near-term risks and is therefore maintaining a high-quality bias in the portfolio. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | |

| Ten Largest Holdings | | Percent of

Net Assets |

Encana Corp. | | | | 7 | % |

Cimarex Energy Co. | | | | 6 | |

Marathon Oil Corp. | | | | 6 | |

EQT Corp. | | | | 5 | |

TransCanada Corp. | | | | 5 | |

Cabot Oil & Gas Corp. | | | | 5 | |

Baker Hughes, Inc. | | | | 4 | |

Concho Resources, Inc. | | | | 4 | |

Pioneer Natural Resources Co. | | | | 4 | |

Devon Energy Corp. | | | | 4 | |

| | | | | |

| Industry Allocation | | Percent of

Net Assets |

Oil, Gas & Consumable Fuels | | | | 88 | % |

Energy Equipment & Services | | | | 16 | |

Short-Term Securities | | | | 1 | |

Liabilities in Excess of Other Assets | | | | (5 | ) |

| | | For Fund compliance purposes, the Fund’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| | | | | | |

| 8 | | BLACKROCK FUNDS | | MARCH 31, 2017 | | |

| | |

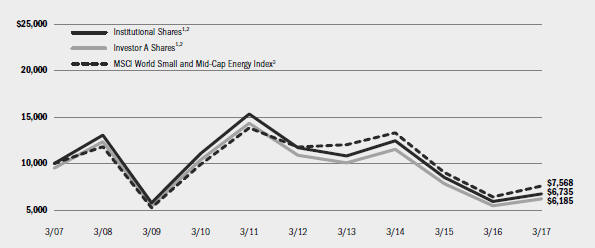

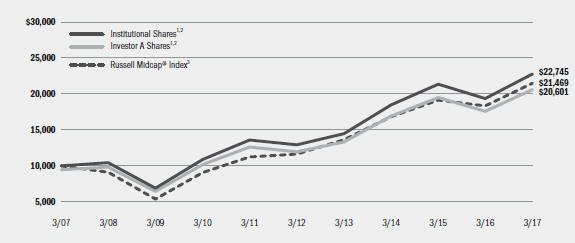

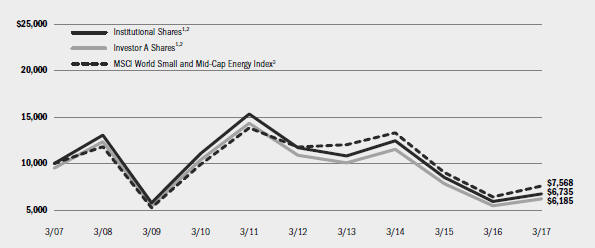

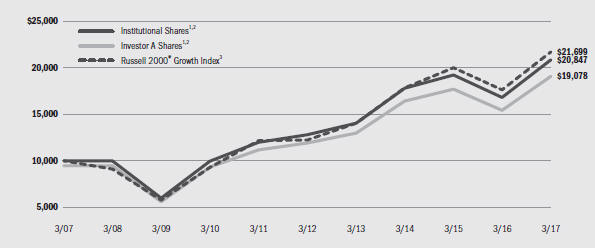

| | | BlackRock Energy & Resources Portfolio |

|

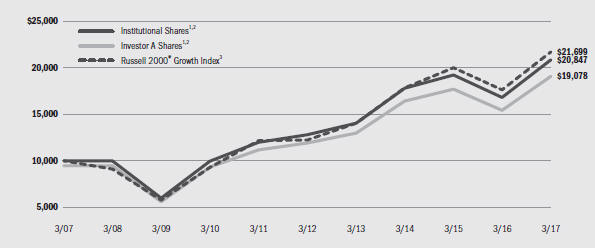

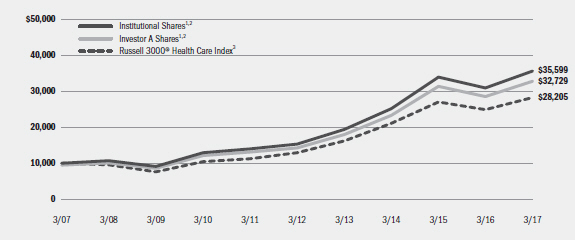

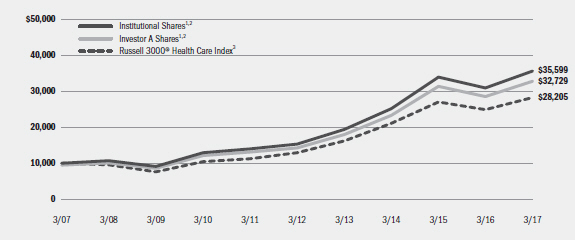

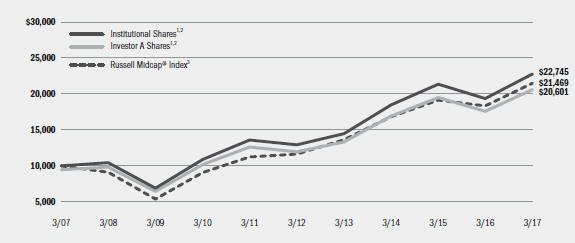

| Total Return Based on a $10,000 Investment |

| | 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees and administration fees, if any. Institutional Shares do not have a sales charge. |

| | 2 | Under normal conditions, the Fund invests at least 80% of its total assets in equity securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and telecommunications utilities). |

| | 3 | An index comprised of the energy sector constituents of the MSCI World SMID Index, a free float-adjusted market capitalization weighted index designed to measure the equity market performance of the mid and small cap developed market. |

|

| Performance Summary for the Period Ended March 31, 2017 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns4 |

| | | | | 1 Year | | 5 Years | | 10 Years |

| | | 6-Month

Total Returns | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge | | w/o sales

charge | | w/ sales

charge |

Institutional | | | | (3.16 | )% | | | | 14.10 | % | | | | N/A | | | | | (10.41 | )% | | | | N/A | | | | | (3.88 | )% | | | | N/A | |

Investor A | | | | (3.26 | ) | | | | 13.77 | | | | | 7.79 | % | | | | (10.68 | ) | | | | (11.63 | )% | | | | (4.18 | ) | | | | (4.69 | )% |

Investor B | | | | (3.67 | ) | | | | 12.92 | | | | | 8.42 | | | | | (11.35 | ) | | | | (11.70 | ) | | | | (4.76 | ) | | | | (4.76 | ) |

Investor C | | | | (3.63 | ) | | | | 12.95 | | | | | 11.95 | | | | | (11.34 | ) | | | | (11.34 | ) | | | | (4.88 | ) | �� | | | (4.88 | ) |

MSCI World Small and Mid-Cap Energy Index | | | | (0.75 | ) | | | | 17.94 | | | | | N/A | | | | | (8.43 | ) | | | | N/A | | | | | (2.75 | ) | | | | N/A | |

| | 4 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 10 for a detailed description of share classes, including any related sales charges and fees. |

| | | | N/A—Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results |

| | | | Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical6 | | |

| | | Beginning

Account Value

October 1, 2016 | | Ending

Account Value

March 31, 2017 | | Expenses Paid

During the Period5 | | Beginning

Account Value

October 1, 2016 | | Ending

Account Value

March 31, 2017 | | Expenses Paid

During the Period5 | | Annualized

Expense

Ratio |

Institutional | | | $ | 1,000.00 | | | | $ | 1,086.40 | | | | $ | 5.29 | | | | $ | 1,000.00 | | | | $ | 1,019.79 | | | | $ | 5.12 | | | | | 1.02 | % |

Investor A | | | $ | 1,000.00 | | | | $ | 1,087.90 | | | | $ | 6.90 | | | | $ | 1,000.00 | | | | $ | 1,018.25 | | | | $ | 6.67 | | | | | 1.33 | % |

Investor B | | | $ | 1,000.00 | | | | $ | 963.30 | | | | $ | 10.01 | | | | $ | 1,000.00 | | | | $ | 1,014.67 | | | | $ | 10.27 | | | | | 2.05 | % |

Investor C | | | $ | 1,000.00 | | | | $ | 1,080.80 | | | | $ | 10.61 | | | | $ | 1,000.00 | | | | $ | 1,014.67 | | | | $ | 10.27 | | | | | 2.05 | % |

| | 5 | | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| | 6 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 11 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2017 | | 9 |

| • | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| • | | Service Shares (available only in All-Cap Energy & Resources Portfolio) are not subject to any sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee) and are only available to certain eligible investors. |

| • | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. |

| • | | Investor B Shares (available only in All-Cap Energy & Resources Portfolio and Energy & Resources Portfolio) are subject to a maximum CDSC of 4.50%, declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares automatically convert to Investor A Shares after approximately eight years. (There is no initial sales charge for automatic share conversions.) All returns for periods greater than eight years reflect this conversion. These shares are only available through exchanges and dividend reinvestments by current holders and for purchase by certain employer-sponsored retirement plans. |

| • | | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures shown in the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), each Fund’s investment adviser, has contractually agreed to waive and/or reimburse a portion of the Funds’ expenses. Without such waiver and/or reimbursement, the Funds’ performance would have been lower. The Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See Note 6 of the Notes to Financial Statements for additional information on waivers and/or reimbursements.

The Manager has voluntarily waived and/or reimbursed a portion of the expenses of each fund. Without such waiver and/or reimbursement, each such Fund’s performance would have been lower. The Manager is under no obligation to waive and/or reimburse or to continue waiving and/or reimbursing its fees and such voluntary waiver may be reduced or discontinued at any time. See Note 6 of the Notes to Financial Statements for additional information on waivers and/or reimbursements.

| | | | | | |

| 10 | | BLACKROCK FUNDS | | MARCH 31, 2017 | | |

Shareholders of the Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on October 1, 2016 and held through March 31, 2017) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the headings entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

|

| Derivative Financial Instruments |

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market and/or other asset without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction

or illiquidity of the instrument. The Funds’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2017 | | 11 |

| | | | |

| Schedule of Investments March 31, 2017 (Unaudited) | | | BlackRock All-Cap Energy & Resources Portfolio | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Energy Equipment & Services — 12.6% | | | | | | | | |

Baker Hughes, Inc. | | | 63,866 | | | $ | 3,820,464 | |

Halliburton Co. | | | 74,500 | | | | 3,666,145 | |

Precision Drilling Corp. (a) | | | 178,460 | | | | 844,090 | |

Schlumberger Ltd. | | | 47,141 | | | | 3,681,712 | |

Superior Energy Services, Inc. (a) | | | 119,300 | | | | 1,701,218 | |

| | | | | | | | |

| | | | | | | | 13,713,629 | |

Oil, Gas & Consumable Fuels — 87.3% | | | | | | | | |

Anadarko Petroleum Corp. | | | 70,421 | | | | 4,366,102 | |

BP PLC | | | 1,198,198 | | | | 6,896,953 | |

Cabot Oil & Gas Corp. | | | 68,066 | | | | 1,627,458 | |

Cairn Energy PLC (a) | | | 416,978 | | | | 1,069,739 | |

Chevron Corp. | | | 48,797 | | | | 5,239,334 | |

Cimarex Energy Co. | | | 25,262 | | | | 3,018,556 | |

ConocoPhillips | | | 116,369 | | | | 5,803,322 | |

Devon Energy Corp. | | | 70,945 | | | | 2,959,825 | |

Enbridge, Inc. | | | 51,773 | | | | 2,168,872 | |

Encana Corp. | | | 239,892 | | | | 2,810,480 | |

Eni SpA | | | 142,496 | | | | 2,333,136 | |

EOG Resources, Inc. | | | 56,316 | | | | 5,493,626 | |

EQT Corp. | | | 27,617 | | | | 1,687,399 | |

Exxon Mobil Corp. | | | 129,852 | | | | 10,649,163 | |

Hess Corp. | | | 57,967 | | | | 2,794,589 | |

Kosmos Energy, Ltd. (a) | | | 180,417 | | | | 1,201,577 | |

Lundin Petroleum AB (a) | | | 32,167 | | | | 652,868 | |

Marathon Oil Corp. | | | 169,966 | | | | 2,685,463 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Oil, Gas & Consumable Fuels (continued) | | | | | | | | |

Noble Energy, Inc. | | | 69,502 | | | $ | 2,386,699 | |

Occidental Petroleum Corp. | | | 16,993 | | | | 1,076,676 | |

Oil Search Ltd. | | | 344,737 | | | | 1,900,692 | |

Phillips 66 | | | 13,495 | | | | 1,069,074 | |

Pioneer Natural Resources Co. | | | 21,314 | | | | 3,969,306 | |

Royal Dutch Shell PLC, Class A | | | 500,530 | | | | 13,193,078 | |

Tesoro Corp. | | | 19,598 | | | | 1,588,614 | |

TransCanada Corp. | | | 77,180 | | | | 3,561,707 | |

Valero Energy Corp. | | | 37,284 | | | | 2,471,556 | |

| | | | | | | | |

| | | | | | | | 94,675,864 | |

Total Long-Term Investments (Cost — $94,723,508) — 99.9% | | | | | | | 108,389,493 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, T-Fund,

Institutional Class, 0.60% (b)(c) | | | 443,067 | | | | 443,067 | |

Total Short-Term Securities (Cost — $443,067) — 0.4% | | | | 443,067 | |

Total Investments (Cost — $95,166,575) — 100.3% | | | | | | | 108,832,560 | |

Liabilities in Excess of Other Assets — (0.3)% | | | | | | | (332,793 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 108,499,767 | |

| | | | | | | | |

|

| Notes to Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | During the six months ended March 31, 2017, investments in issuers considered to be an affiliate of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Affiliate | | Shares

Held at

September 30,

2016 | | Net Activity | | Shares

Held at

March 31,

2017 | | Value at

March 31,

2017 | | Income | | Realized

Gain1 | | Chang in

Unrealized

Appreciation

(Depreciation) |

BlackRock Liquidity Funds, T-Fund, Institutional Class | | | | 154,227 | | | | | 288,840 | | | | | 443,067 | | | | | $443,067 | | | | $ | 1,456 | | | | | $7 | | | | | — | |

| | 1 | | Includes net capital gain distributions. |

| (c) | Current yield as of period end. |

| | | | | | | | |

| Portfolio Abbreviations | | | | |

| ADR | | American Depositary Receipts | | USD | | U.S. Dollar | | |

| GDR | | Global Depositary Receipts | | ZAR | | South African Rand | | |

| NVDR | | Non-Voting Depository Receipts | | | | | | |

See Notes to Financial Statements.

| | | | | | |

| 12 | | BLACKROCK FUNDS | | MARCH 31, 2017 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock All-Cap Energy & Resources Portfolio | |

| • | | For Fund compliance purposes, the Fund’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

|

| Fair Value Hierarchy as of Period End |

Various inputs are used in determining the fair value of investments. For information about the Fund’s policy regarding valuation of investments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Energy Equipment & Services | | $ | 13,713,629 | | | | — | | | | — | | | $ | 13,713,629 | |

Oil, Gas & Consumable Fuels | | | 68,629,398 | | | $ | 26,046,466 | | | | — | | | | 94,675,864 | |

Short-Term Securities. | | | 443,067 | | | | — | | | | — | | | | 443,067 | |

| | | | |

Total | | $ | 82,786,094 | | | $ | 26,046,466 | | | | — | | | $ | 108,832,560 | |

| | | | |

During the six months ended March 31, 2017, there were no transfers between levels.

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2017 | | 13 |

| | | | |

| Schedule of Investments March 31, 2017 (Unaudited) | | | BlackRock Emerging Markets Dividend Fund | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Brazil — 9.3% | | | | | | | | |

AES Tiete Energia SA | | | 7,523 | | | $ | 6,536 | |

AES Tiete Energia SA | | | 3,311 | | | | 14,479 | |

AES Tiete Energia SA, Preference | | | 30,152 | | | | 26,294 | |

BB Seguridade Participacoes SA | | | 10,411 | | | | 97,505 | |

EcoRodovias Infraestrutura e Logistica SA | | | 51,823 | | | | 149,149 | |

Hypermarcas SA | | | 15,693 | | | | 145,370 | |

Itau Unibanco Holding SA — ADR | | | 11,374 | | | | 137,284 | |

Kroton Educacional SA | | | 20,834 | | | | 88,311 | |

Qualicorp SA | | | 7,835 | | | | 49,704 | |

| | | | | | | | |

| | | | | | | | 714,632 | |

China — 13.8% | | | | | | | | |

Anhui Conch Cement Co. Ltd., H Shares | | | 25,500 | | | | 86,727 | |

ANTA Sports Products Ltd. | | | 48,000 | | | | 132,801 | |

China Construction Bank Corp., H Shares | | | 163,000 | | | | 131,330 | |

China Machinery Engineering Corp., H Shares | | | 108,000 | | | | 79,242 | |

China Mobile Ltd. | | | 18,000 | | | | 197,955 | |

CSPC Pharmaceutical Group Ltd. | | | 60,000 | | | | 78,607 | |

Industrial & Commercial Bank of China Ltd., H Shares | | | 141,000 | | | | 92,263 | |

Jiangsu Expressway Co. Ltd., H Shares | | | 74,000 | | | | 106,302 | |

NetEase, Inc. — ADR | | | 366 | | | | 103,944 | |

Silergy Corp. | | | 3,000 | | | | 55,358 | |

| | | | | | | | |

| | | | | | | | 1,064,529 | |

Hong Kong — 3.7% | | | | | | | | |

AIA Group Ltd. | | | 16,800 | | | | 106,041 | |

Sino Biopharmaceutical Ltd. | | | 101,000 | | | | 83,174 | |

Tongda Group Holdings Ltd. | | | 270,000 | | | | 95,312 | |

| | | | | | | | |

| | | | | | | | 284,527 | |

Hungary — 1.0% | | | | | | | | |

Richter Gedeon Nyrt | | | 3,282 | | | | 74,540 | |

India — 14.1% | | | | | | | | |

Ambuja Cements Ltd. | | | 31,363 | | | | 114,327 | |

Bharat Petroleum Corp. Ltd. | | | 10,424 | | | | 104,332 | |

Biocon Ltd. | | | 4,213 | | | | 73,469 | |

Housing Development Finance Corp. Ltd. | | | 4,976 | | | | 115,122 | |

Indiabulls Housing Finance Ltd. | | | 11,974 | | | | 183,977 | |

InterGlobe Aviation Ltd. (a) | | | 4,868 | | | | 78,829 | |

NTPC Ltd. | | | 71,861 | | | | 183,734 | |

Sun TV Network Ltd. | �� | | 12,873 | | | | 156,733 | |

Tata Consultancy Services Ltd. | | | 1,906 | | | | 71,378 | |

| | | | | | | | |

| | | | | | | | 1,081,901 | |

Indonesia — 2.0% | | | | | | | | |

Bank Negara Indonesia Persero Tbk PT | | | 202,000 | | | | 98,208 | |

Media Nusantara Citra Tbk PT | | | 403,324 | | | | 55,971 | |

| | | | | | | | |

| | | | | | | | 154,179 | |

Jersey — 1.4% | | | | | | | | |

Centamin PLC | | | 49,378 | | | | 106,818 | |

Luxembourg — 1.2% | | | | | | | | |

Ternium SA — ADR | | | 3,437 | | | | 89,774 | |

Mexico — 2.9% | | | | | | | | |

Grupo Aeroportuario del Pacifico SAB de CV, Class B | | | 8,868 | | | | 86,121 | |

Grupo Aeroportuario del Sureste SAB de CV — ADR | | | 790 | | | | 136,860 | |

| | | | | | | | |

| | | | | | | | 222,981 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Peru — 1.7% | | | | | | | | |

Credicorp Ltd. | | | 803 | | | $ | 131,130 | |

Poland — 2.2% | | | | | | | | |

Powszechny Zaklad Ubezpieczen SA | | | 19,518 | | | | 171,163 | |

Russia — 5.0% | | | | | | | | |

Inter RAO UES PJSC | | | 32,132 | | | | 2,291 | |

LUKOIL PJSC — ADR | | | 1,806 | | | | 95,736 | |

Mobile TeleSystems PJSC — ADR | | | 9,021 | | | | 99,502 | |

NovaTek PJSC — GDR | | | 1,476 | | | | 184,052 | |

| | | | | | | | |

| | | | | | | | 381,581 | |

Singapore — 1.3% | | | | | | | | |

Jardine Cycle & Carriage Ltd. | | | 3,300 | | | | 103,362 | |

South Africa — 3.1% | | | | | | | | |

Mr Price Group Ltd. | | | 6,674 | | | | 79,442 | |

Sanlam Ltd. | | | 17,172 | | | | 86,165 | |

SPAR Group Ltd. | | | 5,769 | | | | 74,845 | |

| | | | | | | | |

| | | | | | | | 240,452 | |

South Korea — 6.1% | | | | | | | | |

Hyundai Marine & Fire Insurance Co. Ltd. | | | 3,699 | | | | 115,776 | |

KT&G Corp. | | | 2,417 | | | | 210,728 | |

Samsung Life Insurance Co. Ltd. | | | 556 | | | | 53,936 | |

Shinhan Financial Group Co. Ltd. | | | 2,068 | | | | 86,168 | |

| | | | | | | | |

| | | | | | | | 466,608 | |

Taiwan — 11.9% | | | | | | | | |

Bizlink Holding, Inc. | | | 19,000 | | | | 108,005 | |

Far EasTone Telecommunications Co. Ltd. | | | 16,000 | | | | 39,284 | |

Lite-On Technology Corp. | | | 65,215 | | | | 112,408 | |

Mega Financial Holding Co. Ltd. | | | 85,000 | | | | 68,589 | |

Primax Electronics Ltd. | | | 68,000 | | | | 111,511 | |

Silicon Motion Technology Corp. — ADR | | | 1,982 | | | | 92,659 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 12,000 | | | | 75,248 | |

Taiwan Semiconductor Manufacturing Co. Ltd. — ADR | | | 8,165 | | | | 268,139 | |

TSRC Corp. | | | 31,000 | | | | 35,709 | |

| | | | | | | | |

| | | | | | | | 911,552 | |

Thailand — 5.9% | | | | | | | | |

Advanced Info Service PCL — NVDR | | | 25,900 | | | | 134,163 | |

Land & Houses PCL — NVDR | | | 272,000 | | | | 77,171 | |

PTT PCL — NVDR | | | 8,400 | | | | 94,600 | |

Siam Commercial Bank PCL — NVDR | | | 32,000 | | | | 151,805 | |

| | | | | | | | |

| | | | | | | | 457,739 | |

Turkey — 1.1% | | | | | | | | |

Tupras Turkiye Petrol Rafinerileri A/S | | | 3,293 | | | | 81,812 | |

United Arab Emirates — 1.0% | | | | | | | | |

DP World Ltd. | | | 3,573 | | | | 76,820 | |

United Kingdom — 1.0% | | | | | | | | |

Ferrexpo PLC | | | 35,546 | | | | 74,553 | |

Total Common Stocks — 89.7% | | | | | | | 6,890,653 | |

See Notes to Financial Statements.

| | | | | | |

| 14 | | BLACKROCK FUNDS | | MARCH 31, 2017 | | |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Emerging Markets Dividend Fund | |

| | | | | | | | |

Participation Notes (b) | | | Shares | | | | Value | |

China — 3.7% | | | | | | | | |

Deutsche Bank AG (Kweichow Moutai Co., Ltd., Class A),

due 5/22/26 | | | 1,491 | | | $ | 83,617 | |

UBS AG (Hangzhou Hikvision Digital Technology Co., Ltd.,

Class A), due 04/17/17 | | | 26,147 | | | | 121,058 | |

UBS AG (Weifu High-Technology Group Co., Ltd.,

Class A), due 12/22/17 | | | 24,297 | | | | 80,580 | |

Russia — 1.1% | | | | | | | | |

Deutsche Bank AG (Inter RAO UES PJSC), due 01/13/2027 | | | 1,216,364 | | | | 86,717 | |

Total Participation Notes — 4.8% | | | | | | | 371,972 | |

| | | | |

| | | | Value | |

Total Long-Term Investments (Cost — $6,275,292) — 94.5% | | $ | 7,262,625 | |

Total Investments (Cost — $6,275,292) — 94.5% | | | 7,262,625 | |

Other Assets Less Liabilities — 5.5% | | | 423,091 | |

| | | | |

Net Assets — 100.0% | | $ | 7,685,716 | |

| | | | |

|

| Notes to Schedule of Investments |

| (a) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (b) | Non-income producing security. |

During the six months ended March 31, 2017, investments in issuers considered to be an affiliate of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Affiliate | | Shares

Held at

September 30,

2016 | | Net Activity | | Shares

Held at

March 31,

2017 | | Value at

March 31,

2017 | | Income | | Realized

Gain | | Change in

Unrealized

Appreciation

(Depreciation) |

BlackRock Liquidity Funds, T-Fund, Institutional Class | | | | 54,357 | | | | | (54,357 | ) | | | | — | | | | | — | | | | $ | 31 | | | | | — | | | | | — | |

|

| Derivative Financial Instruments Outstanding as of Period End |

| | | | | | | | | | | | | | | | | | | | | | |

Forward Foreign Currency Exchange Contracts | | | | | | | | |

Currency Purchased | | | | | |

| Currency

Sold |

| | | | | | Counterparty | |

| Settlement

Date |

| |

| Unrealized

Appreciation (Depreciation) |

|

USD | | | 46,891 | | | | ZAR | | | | 697,500 | | | BNP Paribas S.A. | | | 5/11/17 | | | | $(4,729) | |

ZAR | | | 697,500 | | | | USD | | | | 48,853 | | | BNP Paribas S.A. | | | 5/11/17 | | | | 2,767 | |

Total | | | | | | | | | | | | | | | | | | | | | $(1,962) | |

|

| Derivative Financial Instruments Categorized by Risk Exposure |

As of period end, the fair values of derivative financial instruments located in the Statements of Assets and Liabilities were as follows:

| | | | | | | | | | | | | | | | |

| Assets — Derivative Financial Instruments | | Commodity

Contracts | | Credit

Contracts | | Equity

Contracts | | Foreign

Currency

Exchange

Contracts | | Interest

Rate

Contracts | | Other

Contracts | | Total |

Forward foreign currency exchange contracts | | Unrealized appreciation on

forward foreign currency exchange contracts | | — | | — | | — | | $2,767 | | — | | — | | $2,767 |

| | | | | | | | |

| Liabilities — Derivative Financial Instruments | | | | | | | | | | | | | | |

Forward foreign currency exchange contracts | | Unrealized depreciation on forward foreign currency exchange contracts | | — | | — | | — | | $4,729 | | — | | — | | $4,729 |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2017 | | 15 |

| | | | |

| Schedule of Investments (continued) | | | BlackRock Emerging Markets Dividend Fund | |

For the six months ended March 31, 2017, the effect of derivative financial instruments in the Statements of Operations was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Realized Gain (Loss) from: | | Commodity

Contracts | | Credit

Contracts | | Equity

Contracts | | Foreign

Currency

Exchange

Contracts | | Interest

Rate

Contracts | | Other

Contracts | | Total |

Forward foreign currency exchange contracts | | | | — | | | | | — | | | | | — | | | | $ | 3,964 | | | | | — | | | | | — | | | | $ | 3,964 | |

| | | | | | | |

Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Forward foreign currency exchange contracts | | | | — | | | | | — | | | | | — | | | | $ | (420 | ) | | | | — | | | | | — | | | | $ | (420 | ) |

|

| Average Quarterly Balances of Outstanding Derivative Financial Instruments |

| | | | |

Forward foreign currency exchange contracts: | | | | |

Average amounts purchased — in USD | | $ | 46,891 | |

Average amounts sold — in USD | | $ | 48,853 | |

For more information about the Fund’s investment risks regarding derivative financial instruments, refer to the Notes to Financial Statements.

|

| Derivative Financial Instruments — Offsetting as of Period End |

The Fund’s derivative assets and liabilities (by type) were as follows:

| | | | | | | | |

| | | Assets | | | Liabilities | |

Derivative Financial Instruments: | | | | | | | | |

Forward foreign currency exchange contracts | | | $2,767 | | | | $4,729 | |

| | | | |

Total derivative assets and liabilities in the Statements of Assets and Liabilities | | | $2,767 | | | | $4,729 | |

Derivatives not subject to a Master Netting Agreement or similar agreement (“MNA”) | | | — | | | | — | |

| | | | |

Total derivative assets and liabilities subject to an MNA | | | $2,767 | | | | $4,729 | |

| | | | |

The following tables present the Fund’s derivative assets and liabilities by counterparty net of amounts available for offset under an MNA and net of the related collateral pledged by Fund:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | | | Derivative Assets

Subject to an MNA by

Counterparty | | Derivatives Available

for Offset1 | | Non-cash

Collateral

Received | | Cash

Collateral

Received | | Net Amount of

Derivative Assets |

BNP Paribas S.A. | | | | | $ | 2,767 | | | | $ | (2,767 | ) | | | | — | | | | | — | | | | | — | |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | | | Derivative Liabilities

Subject to an MNA by

Counterparty | | Derivatives Available

for Offset | | Non-cash

Collateral

Pledged | | Cash

Collateral

Pledged | | Net Amount of

Derivative Liabilities2 |

BNP Paribas S.A. | | | | | $ | 4,729 | | | | $ | (2,767 | ) | | | | — | | | | | — | | | | $ | 1,962 | |

| | | |

| | 1 | | The amount of derivatives available for offset is limited to the amount of derivative assets and/or liabilities that are subject to an MNA. |

| | 2 | | Net amount represents the net amount payable due to the counterparty in the event of default. |

See Notes to Financial Statements.

| | | | | | |

| 16 | | BLACKROCK FUNDS | | MARCH 31, 2017 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock Emerging Markets Dividend Fund | |

|

| Fair Value Hierarchy as of Period End |

Various inputs are used in determining the fair value of investments and derivative financial instruments. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments, refer to the Notes to Financial Statements.

The following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Brazil | | $ | 714,632 | | | | — | | | | — | | | $ | 714,632 | |

China | | | 103,944 | | | $ | 960,585 | | | | — | | | | 1,064,529 | |

Hong Kong | | | — | | | | 284,527 | | | | — | | | | 284,527 | |

Hungary | | | — | | | | 74,540 | | | | — | | | | 74,540 | |

India | | | — | | | | 1,081,901 | | | | — | | | | 1,081,901 | |

Indonesia | | | — | | | | 154,179 | | | | — | | | | 154,179 | |

Jersey | | | — | | | | 106,818 | | | | — | | | | 106,818 | |

Luxembourg | | | 89,774 | | | | — | | | | — | | | | 89,774 | |

Mexico | | | 222,981 | | | | — | | | | — | | | | 222,981 | |

Peru | | | 131,130 | | | | — | | | | — | | | | 131,130 | |

Poland | | | — | | | | 171,163 | | | | — | | | | 171,163 | |

Russia | | | 99,502 | | | | 282,079 | | | | — | | | | 381,581 | |

Singapore | | | — | | | | 103,362 | | | | — | | | | 103,362 | |

South Africa | | | — | | | | 240,452 | | | | — | | | | 240,452 | |

South Korea | | | 210,728 | | | | 255,880 | | | | — | | | | 466,608 | |

Taiwan | | | 360,798 | | | | 550,754 | | | | — | | | | 911,552 | |

Thailand | | | — | | | | 457,739 | | | | — | | | | 457,739 | |

Turkey | | | — | | | | 81,812 | | | | — | | | | 81,812 | |

United Arab Emirates | | | 76,820 | | | | — | | | | — | | | | 76,820 | |

United Kingdom | | | — | | | | 74,553 | | | | — | | | | 74,553 | |

Participation Notes: | | | | | | | | | | | | | | | | |

China | | | 80,580 | | | | 204,675 | | | | — | | | | 285,255 | |

Russia | | | 86,717 | | | | — | | | | — | | | | 86,717 | |

| | | | |

Total | | $ | 2,177,606 | | | $ | 5,085,019 | | | | — | | | $ | 7,262,625 | |

| | | | |

| | | | | | | | | | | | | | | | |

Derivative Financial Instruments1 | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | |

Foreign currency exchange contracts | | | — | | | $ | 2,767 | | | | — | | | $ | 2,767 | |

Liabilities: | | | | | | | | | | | | | | | | |

Foreign currency exchange contracts | | | — | | | | (4,729 | ) | | | — | | | | (4,729 | ) |

| | | | |

Total | | | — | | | $ | (1,962 | ) | | | — | | | $ | (1,962 | ) |

| | | | |

| |

1 Derivative financial instruments are forward foreign currency exchange contracts. Forward foreign currency exchange contracts are valued at the unrealized appreciation (depreciation) on the instrument. | | | | | |

| | | | | | | | | | | | | | | | |

Transfers between Level 1 and Level 2 were as follows: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Transfers into

Level 11 | | | Transfers out

of Level 12 | | | Transfers into

Level 22 | | | Transfers out

of Level 21 | |

Assets: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

South Africa | | | — | | | $ | (56,185 | ) | | $ | 56,185 | | | | — | |

South Korea | | $ | 144,285 | | | | — | | | | — | | | $ | (144,285 | ) |

| | | | |

Total | | $ | 144,285 | | | $ | (56,185 | ) | | $ | 56,185 | | | $ | (144,285 | ) |

| | | | |

| | 1 | | Systematic Fair Value Prices were not utilized at period end for these investments. |

| | 2 | | External pricing service used to reflect any significant market movements between the time the Trust valued such foreign securities and the earlier closing of foreign markets. |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2017 | | 17 |

| | | | |

| Schedule of Investments March 31, 2017 (Unaudited) | | | BlackRock Energy & Resources Portfolio | |

| | | (Percentages shown are based on Net Assets) | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Energy Equipment & Services — 16.4% | | | | | | | | |

Baker Hughes, Inc. | | | 178,650 | | | $ | 10,686,843 | |

Helmerich & Payne, Inc. | | | 53,850 | | | | 3,584,794 | |

Nabors Industries, Ltd. | | | 322,700 | | | | 4,217,689 | |

Patterson-UTI Energy, Inc. | | | 179,050 | | | | 4,345,544 | |

Poseidon Concepts Corp. (a) | | | 35,081 | | | | 18 | |

Precision Drilling Corp. (a) | | | 889,465 | | | | 4,207,042 | |

Superior Energy Services, Inc. (a) | | | 473,507 | | | | 6,752,210 | |

Tenaris SA | | | 349,600 | | | | 6,045,429 | |

| | | | | | | | |

| | | | | | | | 39,839,569 | |

Oil, Gas & Consumable Fuels — 88.1% | | | | | | | | |

AltaGas Ltd. | | | 116,500 | | | | 2,698,199 | |

Cabot Oil & Gas Corp. | | | 466,280 | | | | 11,148,755 | |

Cairn Energy PLC (a) | | | 3,108,842 | | | | 7,975,599 | |

Carrizo Oil & Gas, Inc. (a) | | | 157,700 | | | | 4,519,682 | |

Cimarex Energy Co. | | | 130,410 | | | | 15,582,691 | |

Concho Resources, Inc. (a) | | | 81,500 | | | | 10,459,710 | |

Devon Energy Corp. | | | 203,890 | | | | 8,506,291 | |

Enbridge, Inc. | | | 166,800 | | | | 6,987,576 | |

Encana Corp. | | | 1,372,050 | | | | 16,074,399 | |

Energen Corp. (a) | | | 77,100 | | | | 4,197,324 | |

EQT Corp. | | | 206,694 | | | | 12,629,003 | |

Gulfport Energy Corp. (a) | | | 274,905 | | | | 4,725,617 | |

Hess Corp. | | | 172,800 | | | | 8,330,688 | |

HollyFrontier Corp. | | | 128,700 | | | | 3,647,358 | |

Ithaca Energy, Inc. (a) | | | 3,057,950 | | | | 4,437,977 | |

Kosmos Energy, Ltd. (a) | | | 990,838 | | | | 6,598,981 | |

Longview Energy Co. (a) | | | 85,400 | | | | 137,494 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Oil, Gas & Consumable Fuels (continued) | | | | | | | | |

Lundin Petroleum AB (a) | | | 231,203 | | | $ | 4,692,542 | |

Marathon Oil Corp. | | | 966,750 | | | | 15,274,650 | |

Murphy Oil Corp. | | | 122,850 | | | | 3,512,281 | |

Newfield Exploration Co. (a) | | | 83,850 | | | | 3,094,903 | |

Noble Energy, Inc. | | | 222,120 | | | | 7,627,601 | |

Oil Search Ltd. | | | 1,541,650 | | | | 8,499,816 | |

Painted Pony Petroleum Ltd. (a) | | | 464,100 | | | | 1,877,549 | |

Pioneer Natural Resources Co. | | | 55,127 | | | | 10,266,301 | |

RSP Permian, Inc. (a) | | | 167,462 | | | | 6,937,951 | |

Tesoro Corp. | | | 96,150 | | | | 7,793,919 | |

TransCanada Corp. | | | 245,100 | | | | 11,310,890 | |

Western Refining, Inc. | | | 99,750 | | | | 3,498,232 | |

| | | | | | | | |

| | | | | | | | 213,043,979 | |

Total Long-Term Investments (Cost — $251,665,053) — 104.5% | | | | | | | 252,883,548 | |

| | | | | | | | |

| Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, T-Fund, Institutional

Class, 0.60% (b)(c) | | | 1,108,790 | | | | 1,108,790 | |

Total Short-Term Securities (Cost — $1,108,790) — 0.5% | | | | 1,108,790 | |

Total Investments (Cost — $252,773,843) — 105.0% | | | | | | | 253,992,338 | |

Liabilities in Excess of Other Assets — (5.0)% | | | | | | | (12,102,068 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 241,890,270 | |

| | | | | | | | |

|

| Notes to Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | During the six months ended March 31, 2017, investments in issuers considered to be affiliates of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Affiliate | | Shares Held at

September 30,

2016 | | Net Activity | | Shares

Held at

March 31,

2017 | | Value at

March 31,

2017 | | Income | | Realized

Gain1 | | Change in

Unrealized

Appreciation

(Depreciation) |

BlackRock Liquidity Funds, T-Fund, Institutional Class | | | | 1,879,285 | | | | | (770,495 | ) | | | | 1,108,790 | | | | $ | 1,108,790 | | | | $ | 3,672 | | | | $ | 20 | | | | | — | |

SL Liquidity Series, LLC, Money Market Series | | | | — | | | | | — | | | | | — | | | | | — | | | | | 1,429 | 2 | | | | — | | | | | — | |

Total | | | | | | | | | | | | | | | | | | $ | 1,108,790 | | | | $ | 5,101 | | | | $ | 20 | | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | 1 | | Includes net capital gain distributions. |

| | 2 | | Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

| (c) | Current yield as of period end. |

See Notes to Financial Statements.

| | | | | | |

| 18 | | BLACKROCK FUNDS | | MARCH 31, 2017 | | |

| | | | |

| Schedule of Investments (concluded) | | | BlackRock Energy & Resources Portfolio | |

| • | | For Fund compliance purposes, the Fund’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

|

| Fair Value Hierarchy as of Period End |

Various inputs are used in determining the fair value of investments. For information about the Fund’s policy regarding valuation of investments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Energy Equipment & Services | | $ | 33,794,122 | | | $ | 6,045,447 | | | | — | | | $ | 39,839,569 | |

Oil, Gas & Consumable Fuels | | | 191,738,528 | | | | 21,167,957 | | | | 137,494 | | | | 213,043,979 | |

Short-Term Securities | | | 1,108,790 | | | | — | | | | — | | | | 1,108,790 | |

| | | | |

Total | | $ | 226,641,440 | | | $ | 27,213,404 | | | | 137,494 | | | $ | 253,992,338 | |

| | | | |

During the six months ended March 31, 2017, there were no transfers between levels.

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2017 | | 19 |

| | | | |

| Statements of Assets and Liabilities | | | | |

| | | | | | | | | | | | |

| March 31, 2017 (Unaudited) | | BlackRock All-Cap Energy &

Resources

Portfolio | | | BlackRock

Emerging

Markets

Dividend

Fund | | | BlackRock

Energy &

Resources

Portfolio | |

| | | | | | | | | | | | |

| Assets | | | | | | | | | | | | |

Investments at value — unaffiliated1 | | $ | 108,389,493 | | | $ | 7,262,625 | | | $ | 252,883,548 | |

Investments at value — affiliated2 | | | 443,067 | | | | — | | | | 1,108,790 | |

Cash | | | — | | | | 205,007 | | | | — | |

Foreign currency at value3 | | | 136,693 | | | | 4,558 | | | | 50,934 | |

Receivables: | | | | | | | | | | | | |

Investments sold | | | — | | | | 96,256 | | | | — | |

Capital shares sold | | | 133,500 | | | | 557,903 | | | | 342,326 | |

Dividends — affiliated | | | 144 | | | | — | | | | 416 | |

Dividends — unaffiliated | | | 83,080 | | | | 20,292 | | | | 128,947 | |

From the Manager | | | 10,239 | | | | 11,614 | | | | 13,433 | |

Unrealized appreciation on forward foreign currency exchange contracts | | | — | | | | 2,767 | | | | — | |

Prepaid expenses | | | 54,678 | | | | 39,183 | | | | 37,574 | |

| | | | |

Total assets | | | 109,250,894 | | | | 8,200,205 | | | | 254,565,968 | |

| | | | |

| | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

Payables: | | | | | | | | | | | | |

Investments purchased | | | — | | | | 330,024 | | | | — | |

Capital shares redeemed | | | 459,108 | | | | 3,090 | | | | 12,100,625 | |

Deferred foreign capital gain tax | | | — | | | | 18,163 | | | | — | |

Investment advisory fees | | | 57,304 | | | | — | | | | 175,199 | |

Officer’s and Trustees’ fees | | | 4,474 | | | | 3,279 | | | | 6,027 | |

Other accrued expenses | | | 42,076 | | | | 47,005 | | | | 51,554 | |

Other affiliates | | | 7,710 | | | | — | | | | 25,713 | |

Professional fees | | | 55,502 | | | | 103,401 | | | | 72,224 | |

Service and distribution fees | | | 38,380 | | | | 1,165 | | | | 61,985 | |

Transfer agent fees | | | 86,573 | | | | 3,633 | | | | 182,371 | |

Unrealized depreciation on forward foreign currency exchange contracts | | | — | | | | 4,729 | | | | — | |

| | | | |

Total liabilities | | | 751,127 | | | | 514,489 | | | | 12,675,698 | |

| | | | |

Net Assets | | $ | 108,499,767 | | | $ | 7,685,716 | | | $ | 241,890,270 | |

| | | | |

| | | | | | | | | | | | |

| Net Assets Consist of | | | | | | | | | | | | |

Paid-in capital | | $ | 183,818,062 | | | $ | 8,223,701 | | | $ | 463,630,836 | |

Undistributed (distributions in excess) net investment income (loss) | | | 366,790 | | | | 12,830 | | | | (381,285 | ) |

Accumulated net realized loss | | | (89,351,655 | ) | | | (1,518,271 | ) | | | (222,578,321 | ) |

Net unrealized appreciation (depreciation) | | | 13,666,570 | | | | 967,456 | | | | 1,219,040 | |

| | | | |

Net Assets | | $ | 108,499,767 | | | $ | 7,685,716 | | | $ | 241,890,270 | |

| | | | |

1 Investments at cost — unaffiliated | | $ | 94,723,508 | | | $ | 6,275,292 | | | $ | 251,665,053 | |

2 Investments at cost — affiliated | | $ | 443,067 | | | | — | | | $ | 1,108,790 | |

3 Foreign currency at cost | | $ | 136,127 | | | $ | 4,558 | | | $ | 51,029 | |

See Notes to Financial Statements.

| | | | | | |

| 20 | | BLACKROCK FUNDS | | MARCH 31, 2017 | | |

| | | | |

| Statements of Assets and Liabilities (concluded) | | | | |

| | | | | | | | | | | | |

| March 31, 2017 (Unaudited) | | BlackRock

All-Cap Energy &

Resources

Portfolio | | | BlackRock

Emerging

Markets

Dividend

Fund | | | BlackRock

Energy &

Resources

Portfolio | |

| | | | | | | | | | | | |

| Net Asset Value | | | | | | | | | | | | |

Institutional | | | | | | | | | | | | |

Net assets | | $ | 24,968,860 | | | $ | 3,771,624 | | | $ | 64,317,527 | |

| | | | |

Shares outstanding1 | | | 2,280,144 | | | | 440,669 | | | | 2,997,790 | |

| | | | |

Net asset value | | $ | 10.95 | | | $ | 8.56 | | | $ | 21.45 | |

| | | | |

Service | | | | | | | | | | | | |

Net assets | | $ | 680,937 | | | | — | | | | — | |

| | | | |

Shares outstanding1 | | | 63,462 | | | | — | | | | — | |

| | | | |

Net asset value | | $ | 10.73 | | | | — | | | | — | |

| | | | |

Investor A | | | | | | | | | | | | |

Net assets | | $ | 53,609,782 | | | $ | 3,247,556 | | | $ | 145,324,194 | |

| | | | |

Shares outstanding1 | | | 5,021,352 | | | | 380,951 | | | | 7,887,083 | |

| | | | |

Net asset value | | $ | 10.68 | | | $ | 8.52 | | | $ | 18.43 | |

| | | | |

Investor B | | | | | | | | | | | | |

Net assets | | $ | 213,263 | | | | — | | | $ | 121,269 | |

| | | | |

Shares outstanding1 | | | 20,474 | | | | — | | | | 9,250 | |

| | | | |

Net asset value | | $ | 10.42 | | | | — | | | $ | 13.11 | |

| | | | |

Investor C | | | | | | | | | | | | |

Net assets | | $ | 29,026,925 | | | $ | 666,536 | | | $ | 32,127,280 | |

| | | | |

Shares outstanding1 | | | 2,846,650 | | | | 79,077 | | | | 2,471,078 | |

| | | | |

Net asset value | | $ | 10.20 | | | $ | 8.43 | | | $ | 13.00 | |

| | | | |

| | 1 | | Unlimited number of shares authorized, $0.001 par value. |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2017 | | 21 |

| | | | | | | | | | | | |

| Six Months Ended March 31, 2017 (Unaudited) | | BlackRock

All-Cap Energy &

Resources

Portfolio | | | BlackRock

Emerging

Markets

Dividend

Fund | | | BlackRock

Energy &

Resources

Portfolio | |

| | | | | | | | | | | | |