UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-05888

SMALLCAP World Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (213) 486-9200

Date of fiscal year end: September 30

Date of reporting period: September 30, 2015

Michael W. Stockton

SMALLCAP World Fund, Inc.

6455 Irvine Center Drive

Irvine, California 92618

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

25 years of small-cap

investing to help meet

your needs.

Special feature page 4

| SMALLCAP World Fund® Annual report

for the year ended

September 30, 2015 |

SMALLCAP World Fund seeks to provide you with long-term growth of capital.

This fund is one of more than 40 offered by one of the nation’s largest mutual fund families, American Funds, from Capital Group. For more than 80 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge (maximum 5.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. For current information and month-end results, visit americanfunds.com.

See page 3 for Class A share results with relevant sales charges deducted. For other share class results, visit americanfunds.com and americanfundsretirement.com.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Investing outside the United States may be subject to risks, such as currency fluctuations and political instability. These risks may be heightened in connection with investments in developing countries. Investing in small-capitalization stocks can involve greater risk than is customarily associated with investing in stocks of larger, more established companies. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Fellow investors:

Despite a difficult market environment in the closing months of SMALLCAP World Fund’s fiscal year, the fund produced a positive total return for the 12-month period ended September 30, 2015. The fund marked its 25th anniversary with a total return of 2.25% for the fiscal year. This included a one-time capital gain payment of $4.75 a share, paid December 26, 2014.

By way of comparison, the MSCI All Country World Small Cap Index* fell 3.28% for the period, while the Lipper Global Small-/Mid-Cap Funds Average, a measure of the fund’s peer group, declined 4.37%. As long-term investors, we would highlight that the fund has surpassed the returns of both the index and peer group over the past 5- and 10-year periods, and exceeded the peer group return over the 25-year life of the fund.

The year in review

Much of the fund’s fiscal year was marked by steady economic growth in the U.S. and strong equity markets around the globe. However, concerns about China’s lagging growth, along with a sharp drop in oil prices, triggered a market correction in the U.S. and in many equity markets worldwide. China and many emerging markets equities suffered particularly steep declines. In Europe, deflation due to the rigidity of the euro, along with intensifying political unpredictability, proved to be a headwind for equities there as well.

Despite this, the U.S. economy remains strong, and many innovative small-capitalization companies continue to thrive. The decline in oil prices prompted a sharp drop in energy and utilities shares, but may prove to be an overall boon to the economy longer term.

How the fund responded

SMALLCAP World Fund continues to leverage its global research network to find small-cap companies with the potential to provide shareholders with growth, and we continue to believe in the value and discipline of long-term investing. Rather than sell into the market decline, our primary goal was to find companies whose stock valuations became attractive, and determine whether they could be added to the fund’s holdings.

Results at a glance

For periods ended September 30, 2015, with all distributions reinvested

| | | Cumulative | | Average annual |

| | | total returns | | total returns |

| | | 1 year | | 5 years | | 10 years | | Lifetime

(since 4/30/90) |

| | | | | | | | | | |

| SMALLCAP World Fund (Class A shares) | | | 2.25 | % | | | | 8.49 | % | | | 7.16 | % | | | 9.41 | % |

| MSCI All Country World Small Cap Index* | | | –3.28 | | | | | 8.14 | | | | 6.52 | | | | n/a | |

| Lipper Global Small-/Mid-Cap Funds Average† | | | –4.37 | | | | | 6.90 | | | | 5.47 | | | | 8.95 | |

| * | The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. The market index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results of smaller capitalization companies in both developed and emerging markets. Results reflect dividends net of withholding taxes. This index was not in existence when the fund’s Class A shares were first sold; therefore, lifetime results are not available. |

| † | Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. |

Overall, health care equities were additive to the fund’s returns, with bluebird bio (up 138.4%) among our top five positive contributors. As mentioned earlier, utilities and energy shares weighed against returns, with Paramount Resources declining 87.1% for the period. Overall, the fund was weighted more toward sectors with generally positive returns, and the fund’s active management yielded better returns relative to the MSCI index.

In terms of geography, the fund’s U.S. holdings helped returns greatly compared to the index, while holdings domiciled in Hong Kong, Korea and the United Kingdom weighed against returns.

The road ahead

We continue to see the U.S. in the vanguard of innovation and small-cap companies worldwide, but new business models and new products and services from around the world remain remarkably disruptive. It can be chaotic at times, especially in the current market environment, but we are working hard to understand this disruption and try to find companies around the globe that may generate it or take advantage of it.

Geopolitics likely will continue to be a factor around the globe in the coming year. The immigrant crisis in Europe, continued conflict in the Middle East and the presidential election in the United States may all affect equity markets in the coming year.

25 years of SMALLCAP

This report marks the 25th anniversary of SMALLCAP World Fund’s inception. In 1990, the notion of a truly global small-cap fund on this scale was groundbreaking. Few fund managers could marshal the resources necessary to properly research so many up-and-coming companies on a global basis, and the fund began at a time when domestic large-cap stocks were deemed more favorable for investors.

We credit our success to the hard work of our investment analysts and portfolio managers who have served the fund over the course of its lifetime. The Capital SystemSM allows individual managers and analysts to invest according to their highest convictions, giving our shareholders a total portfolio of companies that represent our very best ideas. These investment professionals are some of the most experienced in the mutual fund industry, allowing us to look at potential future investments through the lens of our collective experience.

The trust you have placed in us, which we do not take for granted, has made SMALLCAP World Fund one of the largest global small-cap mutual funds in the world by assets. This size allows us to continue to aggressively invest in our research efforts, which in turn allows us to uncover potential investments that others may have overlooked.

This year’s special feature highlights three of the fund’s investment professionals who have been with SMALLCAP World Fund from the beginning, as well as three others who we believe represent the future of this fund.

We thank you for your continued investment in the fund, and we look forward to reporting to you again in six months – and for years to come.

Sincerely,

Jonathan Knowles

Vice Chairman of the Board

Gregory W. Wendt

President

November 11, 2015

For current information about the fund, visit americanfunds.com.

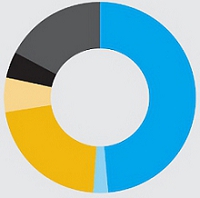

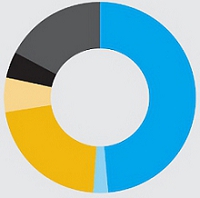

Where the fund’s assets are invested (by country of domicile)

| As of September 30, 2015 | Percent of net assets |

| ▀ | United States | | | 44.2 | % |

| ▀ | Asia & Pacific Basin | | | 21.2 | |

| ▀ | Europe | | | 20.1 | |

| ▀ | Other (including Canada & Latin America) | | | 4.3 | |

| ▀ | Short-term securities & other assets less liabilities | | | 10.2 | |

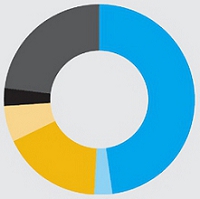

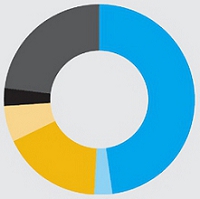

| | As of September 30, 2014 | Percent of

net assets |

| ▀ | United States | | | 46.0 | % |

| ▀ | Asia & Pacific Basin | | | 21.9 | |

| ▀ | Europe | | | 18.5 | |

| ▀ | Other (including Canada & Latin America) | | | 5.1 | |

| ▀ | Short-term securities & other assets less liabilities | | | 8.5 | |

| Largest equity holdings | | | |

| | | | |

| | | Percent of

net assets |

| Incyte | | | 1.7 | % |

| Domino’s Pizza | | | 1.3 | |

| Molina Healthcare | | | 1.0 | |

| Lions Gate Entertainment | | | 1.0 | |

| Myriad Genetics | | | .8 | |

| Kotak Mahindra Bank | | | .8 | |

| Hoshizaki Electric | | | .7 | |

| Endo International | | | .7 | |

| Qorvo | | | .7 | |

| Kakaku.com | | | .6 | |

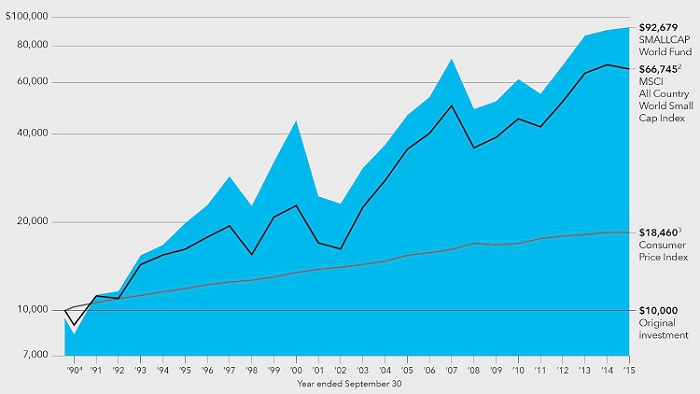

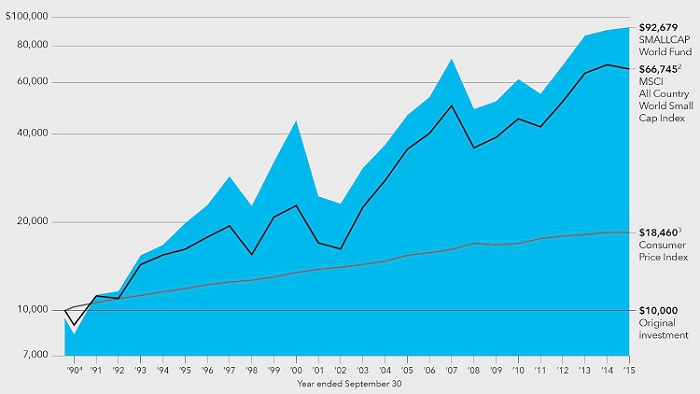

The value of a long-term perspective

This chart shows how a $10,000 investment in SMALLCAP World Fund’s Class A shares grew from April 30, 1990 – the fund’s inception – through September 30, 2015, the end of the fund’s latest fiscal year. As you can see, the $10,000 would have grown to $92,679 even after deducting the maximum 5.75% sales charge.

Fund results shown reflect deduction of the maximum sales charge of 5.75% on the $10,000 investment.1 Thus, the net amount invested was $9,425.

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $25,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The MSCI All Country World Small Cap Index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Results reflect dividends net of withholding taxes. Because the index was not in existence when the fund’s Class A shares were first sold, cumulative returns through May 31, 1994, reflect the returns of the S&P Developed <$1.2 Billion Index. |

| 3 | Computed from data supplied by the U.S. Department of Labor, Bureau of Labor Statistics. |

| 4 | For the period April 30, 1990, commencement of operations, through September 30, 1990. |

Past results are not predictive of results for future periods. The results shown are before taxes on fund distributions and sale of fund shares.

| Average annual total returns based on a $1,000 investment (for periods ended September 30, 2015)* |

| |

| | 1 year | | 5 years | | 10 years | |

| | | | | | | |

| Class A shares | –3.63% | | 7.21% | | 6.53% | |

| * | Assumes reinvestment of all distributions and payment of the maximum 5.75% sales charge. |

| | |

| | The total annual fund operating expense ratio is 1.07% for Class A shares as of the prospectus dated December 1, 2015 (unaudited). |

| | |

| | Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information. |

25 years of small-cap investing

SMALLCAP World Fund has

invested in thousands of

up-and-coming companies in

its 25-year history, and while

the marketplace has changed,

the fund’s commitment to

fundamental research and long-

term investing remains constant.

1990

The cover of the first SMALLCAP

World Fund annual report.

See how the covers evolved over the

past 25 years on the following pages.

“What this fund represented was an opportunity to really focus on those great small companies around the world with the potential to grow.”

– Claudia Huntington

Twenty-five years ago, American Funds introduced a unique fund – SMALLCAP World Fund. With a global mandate to find small-capitalization companies with the potential to grow, the fund’s investment professionals leveraged a growing research capability to bring shareholders a fund featuring some of the world’s newest innovators.

Today the fund is managed by investment professionals who have been with the fund since it began, as well as a new generation of analysts and managers who have brought new perspectives to the fund. We talked to people from both groups to find out more about how far the fund has come – and where it might go next.

Portfolio managers Mark Denning, Claudia Huntington and Greg Wendt have worked on the fund since its inception, having started as investment analysts before becoming portfolio managers. They recently shared some of their insights into how the fund has evolved – and the consistent process and culture that has led to its results on behalf of shareholders.

Tell us a little bit about the genesis of the fund and the challenges of launching a truly global small-cap mutual fund back in 1990.

Greg: A bunch of us were talking about it and pushing for it for a while before we finally got the go-ahead. We felt we had an opportunity to leverage this great team of global investment analysts to delve into the opportunities in global small-cap investing. And at the time, we were seeing a real emphasis at Capital (Capital Research and Management Company, the fund’s investment adviser) on global investing. It made sense.

Mark: We already had built out some of the capability. We launched New Perspective Fund in 1973, which had a strong international component, and we had a large base of emerging markets assets under management for institutional clients as well. We were already thinking globally, which was something rather unique back then.

Claudia: And many of us among the investment analysts were already looking at small companies as part of our coverage. Small-cap companies were, and still are, held in other American Funds. What this fund represented was an opportunity to really focus on those great small companies around the world with the potential to grow.

“Part of the glue of this fund is the longevity of the folks who’ve been a part of it.”

– Greg Wendt

How has that research effort evolved since then?

Greg: Originally, the analysts simply added more small-cap research to what they were already doing. Then we started looking at the potential of having small-cap generalists – I was one of the first ones, in fact. That was tough, though, because going from a bank to a retailer to a software company didn’t make sense. They were too different. Soon after, that role evolved into a kind of small-cap sector generalist, where the analyst would stick to one sector, like banking, and that’s worked really well for us.

Claudia: The research effort – and the number of portfolio managers, for that matter – has grown quite a bit over the years. We’ve added a lot of analysts and we’ve been able to tackle more of the world over the years. But really, the culture we have here hasn’t changed, and I think that’s the most important part of the success of the fund.

Is the culture the key to the fund’s longevity?

Mark: Well, first off, anytime we launch a fund, whether today or 25 years ago, we want to ensure that it will be relevant. I think SMALLCAP is as relevant today as it was 25 years ago, if not more so, because we thought it through and understood it could help meet a real need for investors – the need to have exposure to small companies that had the potential to do big things around the world. And once you’ve launched it, you have to have the system in place to hand off the baton to the next generation, which I think is what The Capital SystemSM is all about.

Claudia: At other mutual funds, especially large funds like this one, you maybe have one or two people trying to manage hundreds of holdings. How does one person have high conviction about so many different stocks? I think we’re better investors when we invest with our colleagues. We have every incentive to help each other make better decisions. We have richer dialogue and a more thorough understanding. It’s that process, The Capital System, which allows each of us to have really high conviction in the investments we make.

Greg: It’s part collaboration, and it’s part institutional knowledge, too. The three of us have been here since the beginning, and we talk about the mistakes we’ve made – and sure, we make mistakes. But that knowledge resides here and gets passed down. Part of the glue of this fund is the longevity of the folks who’ve been a part of it.

“It takes a lot more work to be a small-cap investor, but you can really add value that way.”

– Mark Denning

Tell us more about what you’ve learned over the years.

Mark: Humility and hard work. We’ve learned our lessons, particularly in the 2000–2001 era. We learned to be wary when the market becomes hyperextended. We’ve also learned the value of hard work. It takes a lot more work to be a small-cap investor, but you can really add value that way.

Claudia: For me, I started out primarily as an analyst in U.S.-based companies, spending time really learning about other economies, countries, companies, cultures, and management styles. That’s been really additive to me as an investor. I’ve become a better investor for having gone global.

Greg: When I look back, I think the quality of small-cap companies has gotten better over the years, at least for some of them. You’ll have small-cap companies that will always be small-cap companies because that’s what they’re destined to be –because of management, opportunity or industry. The stock price never really changes. What I’ve tried to do is find those small-cap companies that are exciting and, yes, they have some risk, but if they execute right and catch a break, they have the potential to become very big companies. And if you have to pick one element that’s the big difference, it’s the management teams, because great management can make all the difference.

If you had all of your “next generation” colleagues here, what advice would you give them?

Claudia: When it comes to making investment decisions, it’s keeping in mind that we’re really looking for growth companies. One of the best ways to approach a company, to me, is trying to figure out where they’re going, not where they are now. You do have to think about how they got to where they are now, but also if that’s enough to get them where you hope they’ll be down the road. The market environment is very short-term oriented, and our challenge is to look ahead and stay long-term oriented.

Mark: What’s struck me over the years is just how cyclical the market can be. When I first started, Germany was considered the place to be as an investor. Then it was all about Japan – how it was killing the U.S. semiconductor industry and how efficient the Japanese were. Then there was the rise of China. If you look at it now, I think the U.S. reigns supreme when it comes to innovation and small-cap companies with great growth potential. So it’s keeping in mind how cyclical these things are, and thinking about where the cycle will take you next.

|  |  |

| Andraz Razen | Roz Hongsaranagon | Julian Abdey |

Three of the fund’s newer investment professionals — Julian Abdey, Andraz Razen and Roz Hongsaranagon — represent the next generation of stewardship for the fund. They recently discussed their own experiences and what they’ve learned as they take on greater responsibility for the future of SMALLCAP.

What drew you to small-cap investing and working on behalf of SMALLCAP?

Roz: Finding that small company with the potential to go big is pretty exciting — that’s what we all want to do. With SMALLCAP, you’re really given the freedom and resources to do that, and with The Capital System, you get to work with experienced managers who have been there before. It’s pretty unique.

Julian: One of the great things about working here is you really get to do proper research. I traveled all around the U.S., including some very small towns, visiting small banks. I think there are very few analysts out there with the deep industry experience and relationships that we have.

Andraz: That kind of work is very time-consuming, to really dig down and understand all the permutations of your industry as it’s evolving over time. But it’s the biggest possible investment universe you can have — there are thousands of small-cap companies out there. Even we can’t visit them all, but because of our size and our capabilities, we can look at a lot more of them than maybe others could.

And yes, it’s finding the one that nobody’s really looked at yet and finding potential there. It’s rewarding.

What is it like working alongside the people who helped create this fund?

Andraz: Given that small-caps can be volatile sometimes, they’re really a nice, calm bunch of people. They have such a steady hand. When things are moving up and down and all over the place, their experience gives them a really good perspective. That’s such an incredible part of the culture of the fund that I don’t think you get anywhere else.

Roz: When things aren’t going right, you can just walk into their office and talk it through with them. They’ve probably seen it before, and it’s up to us to leverage that experience and learn from it. And they’re very good at making me feel empowered. I remember making my first investment, for $4 million — I stayed up that night figuring out how many cars that would buy, how many kids could go to college on the money I just invested for our shareholders. But while I was nervous and counting money, the people here were supportive and encouraging.

Julian: I remember very clearly when I started, we had a couple very tough years post-bubble (2001–02), and I remember one of the portfolio managers reading a letter from a shareholder who lost money in the fund. After reading it, he made it very clear we were going to turn the fund around and make our shareholders money again. All of the fund’s founders have never lost sight of who our shareholders are, and the importance of their investments in the fund. This fund is in college and retirement accounts, and it’s a key part of why we do what we do.

What have you learned from working on behalf of SMALLCAP?

Julian: Investing in small-cap companies is a vital tool to understanding large-cap companies as well, and vice versa. Small-cap companies are often the innovators, often the companies that can cause problems for the large caps. It’s their interaction that’s the space in which you see the excesses and the problems. That was a great bit of learning for me, to look at not just the small-cap competitors of given companies, but the larger ones as well.

Roz: I remember in 2008 when it was all falling apart, we were told that the biggest mistake we could make was to just freeze up and do nothing. We were encouraged to start our analysis, figure out different scenarios, which of our companies would survive and which wouldn’t. And that led to some insights that really let us identify what we called the “fallen angels” — companies that were beaten down for no good reason, or that had the potential to come back strong. I learned then to keep at it, to adjust and adapt and figure it out — not to freeze up.

Andraz: Personally, I like to invest when I’m alone in my opinion, which is usually scary. But I’ve learned — and I’ve been encouraged — to trust my analysis, to think for myself, to grow with and learn from the market. I’ve learned that it’s OK to be out there. I’ve stayed true to my style of investing — and that’s encouraged here.

What does the future hold for SMALLCAP?

Roz: There are new small-cap companies being listed every day. There are so many great innovators out there, and you’re seeing companies that can do more than ever before. They’re small and nimble and can be disruptive to any number of industries. And you have more coming out of emerging markets than ever before. It’s almost limitless.

Andraz: I think because we have such a steady hand, we’re able to continue to do what we do so well. It’s the culture and it’s handed down from one generation to the next. It teaches you to think for yourself, to become a good investor, but also to collaborate with others and work together. I think that’s going to keep us successful down the road.

Julian: We have an amazing team. What we don’t lack for is ideas. We generate a lot of great ideas, here and globally. It’s the wonderful problem of being a portfolio manager — too many good ideas. But that’s why I think we’re going to continue to be successful. We’re managing a global small-cap fund with one of the biggest small-cap research efforts there is at any firm, I believe. And every generation of analysts seems to get better than the one before. We have superb people coming through who are going to be amazing investors. It’s quite exciting to be part of that. n

The New Geography of Investing®

Where a company does business can be more important than where it’s located. Here’s a look at SMALLCAP World Fund’s portfolio in terms of where its equity holdings earn their revenue. The charts below show the countries and regions in which the fund’s equity investments are located, and where the revenue comes from.

Equity portion breakdown by domicile (%)

| | Region | | Fund | | Index |

| ▀ | United States | | | 49 | % | | | 53 | % |

| ▀ | Canada | | | 3 | | | | 3 | |

| ▀ | Europe | | | 21 | | | | 20 | |

| ▀ | Japan | | | 6 | | | | 10 | |

| ▀ | Asia-Pacific ex. Japan | | | 4 | | | | 4 | |

| ▀ | Emerging markets | | | 17 | | | | 10 | |

| | Total | | | 100 | % | | | 100 | % |

Equity portion breakdown by revenue (%)

| | Region | | Fund | | Index |

| ▀ | United States | | | 48 | % | | | 46 | % |

| ▀ | Canada | | | 3 | | | | 3 | |

| ▀ | Europe | | | 17 | | | | 19 | |

| ▀ | Japan | | | 6 | | | | 9 | |

| ▀ | Asia-Pacific ex. Japan | | | 3 | | | | 3 | |

| ▀ | Emerging markets | | | 23 | | | | 20 | |

| | Total | | | 100 | % | | | 100 | % |

Compared with the MSCI ACWI Small Cap Index as a percent of net assets. All figures include convertible securities.

Source: Capital Group (as of September 30, 2015).

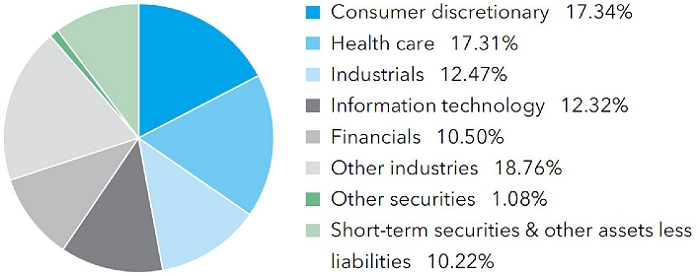

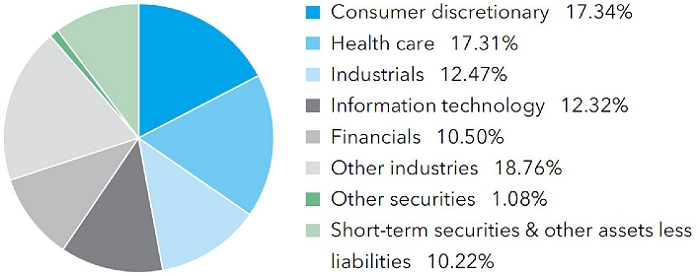

Summary investment portfolio September 30, 2015

| Industry sector diversification | Percent of net assets |

| Country diversification by domicile | | Percent of

net assets |

| United States | | | 44.18 | % |

| United Kingdom | | | 9.40 | |

| Euro zone* | | | 6.45 | |

| Japan | | | 5.17 | |

| India | | | 4.92 | |

| China | | | 2.64 | |

| Canada | | | 2.35 | |

| Hong Kong | | | 2.32 | |

| Taiwan | | | 1.72 | |

| Other countries | | | 10.63 | |

| Short-term securities & other assets less liabilities | | | 10.22 | |

| * | Countries using the euro as a common currency; those represented in the fund’s portfolio are Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Slovenia and Spain. |

| Common stocks 88.70% | | Shares | | | Value

(000) | |

| Consumer discretionary 17.34% | | | | | | | | |

| Domino’s Pizza, Inc.1 | | | 3,125,769 | | | $ | 337,302 | |

| Lions Gate Entertainment Corp. | | | 6,877,000 | | | | 253,074 | |

| Ted Baker PLC1,2 | | | 3,167,993 | | | | 153,870 | |

| Dollarama Inc. | | | 2,078,000 | | | | 140,345 | |

| BCA Marketplace PLC1,2,3 | | | 42,870,000 | | | | 110,886 | |

| Paddy Power PLC2 | | | 886,051 | | | | 101,967 | |

| YOOX SpA2,3 | | | 2,998,469 | | | | 90,485 | |

| Other securities | | | | | | | 3,356,448 | |

| | | | | | | | 4,544,377 | |

| | | | | | | | | |

| Health care 17.31% | | | | | | | | |

| Incyte Corp.3 | | | 4,054,883 | | | | 447,375 | |

| Molina Healthcare, Inc.1,3 | | | 3,898,100 | | | | 268,384 | |

| Myriad Genetics, Inc.1,3 | | | 5,766,556 | | | | 216,131 | |

| Endo International PLC3 | | | 2,672,381 | | | | 185,143 | |

| Hikma Pharmaceuticals PLC2 | | | 4,794,253 | | | | 165,645 | |

| GW Pharmaceuticals PLC (ADR)1,3 | | | 1,652,700 | | | | 151,007 | |

| bluebird bio, Inc.3 | | | 1,588,565 | | | | 135,902 | |

| athenahealth, Inc.3 | | | 929,371 | | | | 123,932 | |

| EXACT Sciences Corp.1,3 | | | 6,801,000 | | | | 122,350 | |

| Spire Healthcare Group PLC1,2 | | | 22,412,000 | | | | 122,321 | |

| Ultragenyx Pharmaceutical Inc.3 | | | 1,175,906 | | | | 113,252 | |

| Centene Corp.3 | | | 1,959,439 | | | | 106,260 | |

| Kite Pharma, Inc.3 | | | 1,855,562 | | | | 103,318 | |

| CONMED Corp.1 | | | 2,141,654 | | | | 102,243 | |

| Zeltiq Aesthetics, Inc.1,3 | | | 3,002,044 | | | | 96,155 | |

| BioMarin Pharmaceutical Inc.3 | | | 883,852 | | | | 93,087 | |

| Sysmex Corp.2 | | | 1,698,000 | | | | 89,788 | |

| Juno Therapeutics, Inc.3 | | | 2,107,501 | | | | 85,754 | |

| Other securities | | | | | | | 1,807,046 | |

| | | | | | | | 4,535,093 | |

| | | | | | | | | |

| Industrials 12.47% | | | | | | | | |

| Hoshizaki Electric Co., Ltd.2 | | | 2,780,700 | | | | 195,044 | |

| Moog Inc., Class A3 | | | 2,572,800 | | | | 139,111 | |

| ITT Corp. | | | 3,508,121 | | | | 117,276 | |

| AA PLC2,3 | | | 24,237,138 | | | | 104,128 | |

| King Slide Works Co., Ltd.1,2 | | | 6,683,000 | | | | 91,490 | |

| Loomis AB, Class B2 | | | 3,363,042 | | | | 88,199 | |

| Other securities | | | | | | | 2,531,009 | |

| | | | | | | | 3,266,257 | |

| Common stocks (continued) | | Shares | | | Value

(000) | |

| Information technology 12.32% | | | | | | | | |

| Qorvo, Inc.3 | | | 3,884,370 | | | $ | 174,991 | |

| Kakaku.com, Inc.2 | | | 10,380,000 | | | | 168,763 | |

| AAC Technologies Holdings Inc.2 | | | 26,351,500 | | | | 164,832 | |

| Zynga Inc., Class A3 | | | 61,055,000 | | | | 139,205 | |

| Demandware, Inc.1,3 | | | 2,529,356 | | | | 130,717 | |

| Palo Alto Networks, Inc.3 | | | 558,050 | | | | 95,985 | |

| Halma PLC2 | | | 8,477,237 | | | | 92,733 | |

| Other securities | | | | | | | 2,262,178 | |

| | | | | | | | 3,229,404 | |

| | | | | | | | | |

| Financials 10.50% | | | | | | | | |

| Kotak Mahindra Bank Ltd.2 | | | 20,057,040 | | | | 199,063 | |

| SVB Financial Group3 | | | 1,305,700 | | | | 150,861 | |

| Validus Holdings, Ltd. | | | 2,813,000 | | | | 126,782 | |

| Umpqua Holdings Corp. | | | 7,004,541 | | | | 114,174 | |

| VZ Holding AG2 | | | 310,100 | | | | 96,486 | |

| GT Capital Holdings, Inc.2 | | | 3,485,200 | | | | 94,624 | |

| Indiabulls Housing Finance Ltd.2 | | | 7,725,000 | | | | 94,437 | |

| Other securities | | | | | | | 1,875,155 | |

| | | | | | | | 2,751,582 | |

| | | | | | | | | |

| Consumer staples 5.75% | | | | | | | | |

| Emami Ltd.2 | | | 7,665,000 | | | | 134,870 | |

| Emmi AG1,2 | | | 290,775 | | | | 121,550 | |

| Sprouts Farmers Market, Inc.3 | | | 5,543,000 | | | | 116,957 | |

| Pinnacle Foods Inc. | | | 2,389,050 | | | | 100,053 | |

| Raia Drogasil SA, ordinary nominative | | | 9,627,374 | | | | 94,950 | |

| Other securities | | | | | | | 937,391 | |

| | | | | | | | 1,505,771 | |

| | | | | | | | | |

| Materials 3.92% | | | | | | | | |

| Chr. Hansen Holding A/S2 | | | 2,593,200 | | | | 145,221 | |

| James Hardie Industries PLC (CDI)2 | | | 7,355,000 | | | | 88,770 | |

| Other securities | | | | | | | 793,826 | |

| | | | | | | | 1,027,817 | |

| | | | | | | | | |

| Utilities 0.97% | | | | | | | | |

| ENN Energy Holdings Ltd.2 | | | 19,994,000 | | | | 96,472 | |

| Other securities | | | | | | | 157,375 | |

| | | | | | | | 253,847 | |

| | | | | | | | | |

| Other 3.16% | | | | | | | | |

| Other securities | | | | | | | 828,423 | |

| | | | | | | | | |

| Miscellaneous 4.96% | | | | | | | | |

| Other common stocks in initial period of acquisition | | | | | | | 1,299,397 | |

| | | | | | | | | |

| Total common stocks (cost: $19,011,776,000) | | | | | | | 23,241,968 | |

| | | | | | | | | |

| Preferred securities 0.00% | | | | | | | | |

| Other 0.00% | | | | | | | | |

| Other securities | | | | | | | 1,255 | |

| | | | | | | | | |

| Total preferred securities (cost: $731,000) | | | | | | | 1,255 | |

| | | | | | | | | |

| Rights & warrants 0.06% | | | | | | | | |

| Other 0.06% | | | | | | | | |

| Other securities | | | | | | | 16,184 | |

| | | | | | | | | |

| Total rights & warrants (cost: $927,000) | | | | | | | 16,184 | |

| | | | | | | | | |

| Convertible stocks 0.66% | | | | | | | | |

| Other 0.66% | | | | | | | | |

| Other securities | | | | | | | 173,464 | |

| | | | | | | | | |

| Total convertible stocks (cost: $145,162,000) | | | | | | | 173,464 | |

| Bonds, notes & other debt instruments 0.36% | | Principal amount

(000) | | | Value

(000) | |

| Other 0.36% | | | | | | | | |

| Other securities | | | | | | $ | 94,173 | |

| | | | | | | | | |

| Total bonds, notes & other debt instruments (cost: $94,336,000) | | | | | | | 94,173 | |

| | | | | | | | | |

| Short-term securities 9.55% | | | | | | | | |

| American Honda Finance Corp. 0.17% due 10/22/2015–10/23/2015 | | $ | 90,000 | | | | 89,993 | |

| Bank of Tokyo-Mitsubishi UFJ, Ltd. 0.24% due 11/17/2015 | | | 50,000 | | | | 49,986 | |

| Federal Home Loan Bank 0.10%–0.22% due 10/19/2015–2/8/2016 | | | 576,300 | | | | 576,276 | |

| Freddie Mac 0.11%–0.25% due 11/2/2015–1/27/2016 | | | 352,900 | | | | 352,877 | |

| KfW 0.21%–0.23% due 10/23/2015–11/9/20154 | | | 147,200 | | | | 147,189 | |

| Mitsubishi UFJ Trust and Banking Corp. 0.22% due 10/14/20154 | | | 50,000 | | | | 49,997 | |

| Mizuho Bank, Ltd. 0.28%–0.30% due 10/23/2015–11/5/20154 | | | 118,500 | | | | 118,483 | |

| Nordea Bank AB 0.27%–0.32% due 11/10/2015–12/14/20154 | | | 90,000 | | | | 89,973 | |

| Old Line Funding, LLC 0.28% due 10/5/20154 | | | 35,000 | | | | 34,999 | |

| Province of Ontario 0.13%–0.15% due 10/15/2015–10/21/2015 | | | 88,500 | | | | 88,495 | |

| Svenska Handelsbanken Inc. 0.26%–0.30% due 10/23/2015–12/1/20154 | | | 124,800 | | | | 124,764 | |

| Thunder Bay Funding, LLC 0.28%–0.31% due 11/6/2015–11/10/20154 | | | 75,000 | | | | 74,981 | |

| Victory Receivables Corp. 0.19% due 10/28/20154 | | | 22,700 | | | | 22,696 | |

| Other securities | | | | | | | 681,368 | |

| | | | | | | | | |

| Total short-term securities (cost: $2,501,688,000) | | | | | | | 2,502,077 | |

| Total investment securities 99.33% (cost: $21,754,620,000) | | | | | | | 26,029,121 | |

| Other assets less liabilities 0.67% | | | | | | | 175,051 | |

| | | | | | | | | |

| Net assets 100.00% | | | | | | $ | 26,204,172 | |

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

As permitted by U.S. Securities and Exchange Commission regulations, “Miscellaneous” securities include holdings in their first year of acquisition that have not previously been publicly disclosed.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio, including a portion of a security which was pledged as collateral. The total value of pledged collateral was $252,000, which represented less than .01% of the net assets of the fund.

Forward currency contracts

The fund has entered into forward currency contracts as shown in the following table. The average month-end notional amount of open forward currency contracts while held was $340,312,000.

| | | | | | | | | | | Unrealized | |

| | | | | | | | | | | appreciation | |

| | | | | | | Contract amount | | (depreciation) | |

| | | | | | | Receive | | Deliver | | at 9/30/2015 | |

| | | Settlement date | | Counterparty | | (000) | | (000) | | (000) | |

| Sales: | | | | | | | | | | | | |

| Australian dollars | | 10/19/2015 | | HSBC Bank | | $23,959 | | A$ 33,400 | | | $541 | |

| Australian dollars | | 10/26/2015 | | Barclays Bank PLC | | $1,061 | | A$ 1,450 | | | 45 | |

| Australian dollars | | 11/25/2015 | | UBS AG | | $1,397 | | A$ 2,000 | | | (2 | ) |

| British pounds | | 10/5/2015 | | JPMorgan Chase | | $42,196 | | £27,548 | | | 524 | |

| British pounds | | 10/9/2015 | | Citibank | | $54,060 | | £34,459 | | | 1,934 | |

| British pounds | | 10/9/2015 | | Barclays Bank PLC | | $22,184 | | £14,140 | | | 795 | |

| British pounds | | 10/14/2015 | | Bank of America, N.A. | | $72,798 | | £46,673 | | | 2,200 | |

| British pounds | | 10/14/2015 | | Barclays Bank PLC | | $6,430 | | £4,122 | | | 194 | |

| British pounds | | 10/19/2015 | | UBS AG | | $61,260 | | £39,721 | | | 1,177 | |

| British pounds | | 11/10/2015 | | Citibank | | $75,824 | | £49,322 | | | 1,227 | |

| Canadian dollars | | 10/7/2015 | | UBS AG | | $26,855 | | C$ 34,000 | | | 1,379 | |

| Euros | | 10/15/2015 | | Citibank | | $10,441 | | €9,200 | | | 159 | |

| Euros | | 10/20/2015 | | HSBC Bank | | $13,442 | | €11,884 | | | 159 | |

| Japanese yen | | 10/9/2015 | | JPMorgan Chase | | $14,093 | | ¥1,680,000 | | | 87 | |

| Japanese yen | | 10/9/2015 | | JPMorgan Chase | | $7,557 | | ¥900,000 | | | 54 | |

| Japanese yen | | 10/9/2015 | | Bank of America, N.A. | | $28,338 | | ¥3,395,000 | | | 35 | |

| Japanese yen | | 10/15/2015 | | Citibank | | $3,019 | | ¥364,000 | | | (16 | ) |

| Japanese yen | | 10/16/2015 | | UBS AG | | $7,061 | | ¥875,000 | | | (234 | ) |

| Japanese yen | | 10/21/2015 | | HSBC Bank | | $9,957 | | ¥1,200,000 | | | (48 | ) |

| Japanese yen | | 10/23/2015 | | UBS AG | | $5,601 | | ¥669,165 | | | 21 | |

| Japanese yen | | 10/23/2015 | | JPMorgan Chase | | $9,372 | | ¥1,125,000 | | | (9 | ) |

| Japanese yen | | 11/10/2015 | | Bank of America, N.A. | | $49,613 | | ¥5,940,000 | | | 73 | |

| Japanese yen | | 11/19/2015 | | Bank of New York Mellon | | $5,033 | | ¥625,000 | | | (180 | ) |

| Singapore dollars | | 11/24/2015 | | Barclays Bank PLC | | $19,168 | | S$ 26,880 | | | | 315 | |

| | | | | | | | | | | | | $10,430 | |

Investments in affiliates

A company is an affiliate of the fund under the Investment Company Act of 1940 if the fund’s holdings in that company represent 5% or more of the outstanding voting shares. The value of the fund’s affiliated-company holdings is either shown in the summary investment portfolio or included in the value of “Other securities” under the respective industry sectors. Further details on such holdings and related transactions during the year ended September 30, 2015, appear below.

| | | | | | | | | | | | | | | | | | Value of | |

| | | | | | | | | | | | | | | Dividend | | | affiliates at | |

| | | Beginning | | | | | | | | | Ending | | | income | | | 9/30/2015 | |

| | | shares | | | Additions | | | Reductions | | | shares | | | (000) | | | (000) | |

| Domino’s Pizza, Inc. | | | 3,218,769 | | | | — | | | | 93,000 | | | | 3,125,769 | | | $ | 3,712 | | | $ | 337,302 | |

| Molina Healthcare, Inc.3 | | | 3,488,100 | | | | 410,000 | | | | — | | | | 3,898,100 | | | | — | | | | 268,384 | |

| Myriad Genetics, Inc.3 | | | 5,725,556 | | | | 120,000 | | | | 79,000 | | | | 5,766,556 | | | | — | | | | 216,131 | |

| Ted Baker PLC2 | | | 3,154,993 | | | | 13,000 | | | | — | | | | 3,167,993 | | | | 1,997 | | | | 153,870 | |

| GW Pharmaceuticals PLC (ADR)3 | | | 1,215,600 | | | | 437,100 | | | | — | | | | 1,652,700 | | | | — | | | | 151,007 | |

| Demandware, Inc.3 | | | 1,803,000 | | | | 726,356 | | | | — | | | | 2,529,356 | | | | — | | | | 130,717 | |

| EXACT Sciences Corp.3,5 | | | 3,001,000 | | | | 3,800,000 | | | | — | | | | 6,801,000 | | | | — | | | | 122,350 | |

| Spire Healthcare Group PLC2 | | | 11,664,000 | | | | 10,748,000 | | | | — | | | | 22,412,000 | | | | 501 | | | | 122,321 | |

| Emmi AG2 | | | 240,600 | | | | 50,175 | | | | — | | | | 290,775 | | | | 1,139 | | | | 121,550 | |

| BCA Marketplace PLC2,3 | | | — | | | | 42,870,000 | | | | — | | | | 42,870,000 | | | | — | | | | 110,886 | |

| CONMED Corp. | | | 710,000 | | | | 1,431,654 | | | | — | | | | 2,141,654 | | | | 1,187 | | | | 102,243 | |

| Zeltiq Aesthetics, Inc.3 | | | 3,002,044 | | | | — | | | | — | | | | 3,002,044 | | | | — | | | | 96,155 | |

| King Slide Works Co., Ltd.2 | | | 4,913,000 | | | | 1,770,000 | | | | — | | | | 6,683,000 | | | | 1,481 | | | | 91,490 | |

| Globant SA3 | | | — | | | | 2,467,480 | | | | — | | | | 2,467,480 | | | | — | | | | 75,480 | |

| Zoopla Property Group PLC2,5 | | | 8,823,800 | | | | 14,597,300 | | | | — | | | | 23,421,100 | | | | 659 | | | | 74,125 | |

| HKBN Ltd.2 | | | — | | | | 60,888,000 | | | | — | | | | 60,888,000 | | | | — | | | | 70,449 | |

| Poundland Group PLC2,5 | | | 1,654,006 | | | | 14,244,500 | | | | — | | | | 15,898,506 | | | | 756 | | | | 67,464 | |

| zooplus AG, non-registered shares2,3 | | | 148,400 | | | | 379,378 | | | | — | | | | 527,778 | | | | — | | | | 66,561 | |

| | | | | | | | | | | | | | | | | | Value of | |

| | | | | | | | | | | | | | | Dividend | | | affiliates at | |

| | | Beginning | | | | | | | | | Ending | | | income | | | 9/30/2015 | |

| | | shares | | | Additions | | | Reductions | | | shares | | | (000) | | | (000) | |

| Takeuchi Mfg. Co., Ltd.2 | | | 1,232,300 | | | | 2,587,600 | | | | 49,500 | | | | 3,770,400 | | | $ | 267 | | | $ | 66,275 | |

| Continental Building Products, Inc.3 | | | 2,705,000 | | | | 330,700 | | | | — | | | | 3,035,700 | | | | — | | | | 62,353 | |

| eMemory Technology Inc.2 | | | — | | | | 6,146,000 | | | | — | | | | 6,146,000 | | | | 994 | | | | 61,208 | |

| WHA Corp. PCL, foreign registered2,3 | | | — | | | | 777,355,900 | | | | 100,214,700 | | | | 677,141,200 | | | | — | | | | 59,069 | |

| WHA Corp. PCL, warrants, expire 20203 | | | — | | | | 6,909,830 | | | | — | | | | 6,909,830 | | | | — | | | | 2,113 | |

| Finisar Corp.3 | | | 4,833,000 | | | | 553,000 | | | | — | | | | 5,386,000 | | | | — | | | | 59,946 | |

| Inphi Corp.3 | | | 1,785,699 | | | | 651,500 | | | | — | | | | 2,437,199 | | | | — | | | | 58,590 | |

| Entertainment One Ltd.2 | | | 13,659,782 | | | | 2,594,300 | | | | 1,000,000 | | | | 15,254,082 | | | | 160 | | | | 57,373 | |

| Talmer Bancorp, Inc., Class A | | | 3,068,056 | | | | 365,972 | | | | — | | | | 3,434,028 | | | | 130 | | | | 57,177 | |

| POYA International Co., Ltd.2 | | | 4,712,660 | | | | 875,556 | | | | — | | | | 5,588,216 | | | | 1,030 | | | | 55,967 | |

| NCC Group PLC2,5 | | | 5,665,000 | | | | 7,685,000 | | | | — | | | | 13,350,000 | | | | 680 | | | | 55,375 | |

| Adaptimmune Therapeutics PLC2,3,4 | | | — | | | | 16,938,900 | | | | — | | | | 16,938,900 | | | | — | | | | 30,752 | |

| Adaptimmune Therapeutics PLC (ADR)3 | | | — | | | | 1,713,918 | | | | — | | | | 1,713,918 | | | | — | | | | 20,516 | |

| Adaptimmune Therapeutics Ltd., Series A, convertible preferred2,6 | | | — | | | | 16,938,900 | | | | 16,938,900 | | | | — | | | | — | | | | — | |

| TechnoPro Holdings, Inc.2 | | | — | | | | 1,845,000 | | | | — | | | | 1,845,000 | | | | 1,353 | | | | 49,093 | |

| Northgate PLC2 | | | 10,626,805 | | | | — | | | | 3,718,406 | | | | 6,908,399 | | | | 1,853 | | | | 47,513 | |

| Lands’ End, Inc.3 | | | 1,300,000 | | | | 404,000 | | | | — | | | | 1,704,000 | | | | — | | | | 46,025 | |

| Sirius Minerals Plc2,3 | | | 139,533,460 | | | | 32,404,300 | | | | 18,860,000 | | | | 153,077,760 | | | | — | | | | 43,967 | |

| Sirius Minerals Plc, warrants, expire 20152,3 | | | 40,000,000 | | | | — | | | | 13,400,000 | | | | 26,600,000 | | | | — | | | | 1,066 | |

| Coupons.com Inc.3 | | | 4,587,996 | | | | 293,617 | | | | — | | | | 4,881,613 | | | | — | | | | 43,935 | |

| Stock Spirits Group PLC2 | | | 16,000,000 | | | | — | | | | 525,257 | | | | 15,474,743 | | | | 671 | | | | 43,308 | |

| Installed Building Products, Inc.3 | | | 2,068,345 | | | | 240,000 | | | | 604,306 | | | | 1,704,039 | | | | — | | | | 43,078 | |

| RIB Software AG2 | | | 2,476,356 | | | | — | | | | — | | | | 2,476,356 | | | | 385 | | | | 38,915 | |

| Tele Columbus AG2,3 | | | — | | | | 2,976,000 | | | | — | | | | 2,976,000 | | | | — | | | | 37,275 | |

| Mothercare PLC2,3 | | | 4,450,000 | | | | 6,360,000 | | | | — | | | | 10,810,000 | | | | — | | | | 36,195 | |

| Iridium Communications Inc.3 | | | 4,889,615 | | | | — | | | | — | | | | 4,889,615 | | | | — | | | | 30,071 | |

| Iridium Communications Inc., Series A, convertible preferred4 | | | 60,000 | | | | — | | | | — | | | | 60,000 | | | | — | | | | 5,009 | |

| Century Communities, Inc.3 | | | — | | | | 1,716,000 | | | | — | | | | 1,716,000 | | | | — | | | | 34,063 | |

| Cox & Kings Ltd.2 | | | 9,592,000 | | | | 1,425,346 | | | | 886,521 | | | | 10,130,825 | | | | 153 | | | | 31,825 | |

| Cox & Kings Ltd. (GDR)2 | | | 330,000 | | | | — | | | | — | | | | 330,000 | | | | 5 | | | | 1,037 | |

| Novadaq Technologies Inc.3 | | | 2,505,948 | | | | 579,000 | | | | — | | | | 3,084,948 | | | | — | | | | 32,176 | |

| Super Group Ltd.2 | | | 89,194,000 | | | | — | | | | 30,194,000 | | | | 59,000,000 | | | | 1,819 | | | | 32,043 | |

| Actua Corp3 | | | 2,094,000 | | | | 508,000 | | | | — | | | | 2,602,000 | | | | — | | | | 30,600 | |

| Twelve, Inc., Series C, convertible preferred2,7 | | | — | | | | 3,475,770 | | | | — | | | | 3,475,770 | | | | — | | | | 28,953 | |

| Zegona Communications PLC2,3 | | | — | | | | 12,305,654 | | | | — | | | | 12,305,654 | | | | — | | | | 28,841 | |

| Ocular Therapeutix, Inc.3,5 | | | 735,000 | | | | 1,220,700 | | | | — | | | | 1,955,700 | | | | — | | | | 27,497 | |

| CCL Products (India) Ltd.2 | | | — | | | | 7,278,328 | | | | — | | | | 7,278,328 | | | | 111 | | | | 26,235 | |

| Flexion Therapeutics, Inc.3 | | | 979,252 | | | | 723,942 | | | | — | | | | 1,703,194 | | | | — | | | | 25,309 | |

| Domo, Inc., Series D-2, convertible preferred2,7 | | | — | | | | 2,965,036 | | | | — | | | | 2,965,036 | | | | — | | | | 25,000 | |

| Acerta Pharma BV, Series B, convertible preferred2,7 | | | — | | | | 2,173,914 | | | | — | | | | 2,173,914 | | | | — | | | | 24,786 | |

| Neovasc Inc. (CAD denominated)2,3 | | | 4,277,000 | | | | — | | | | 30,100 | | | | 4,246,900 | | | | — | | | | 22,277 | |

| Neovasc Inc.3 | | | — | | | | 503,836 | | | | — | | | | 503,836 | | | | — | | | | 2,489 | |

| ARC Document Solutions, Inc.3 | | | 3,734,755 | | | | 856,372 | | | | 830,804 | | | | 3,760,323 | | | | — | | | | 22,374 | |

| J. Kumar Infraprojects Ltd.2 | | | 1,780,000 | | | | — | | | | — | | | | 1,780,000 | | | | 107 | | | | 21,484 | |

| ChemoCentryx, Inc.3 | | | 3,426,800 | | | | 40,440 | | | | — | | | | 3,467,240 | | | | — | | | | 20,977 | |

| TravelCenters of America LLC3 | | | 2,023,750 | | | | — | | | | — | | | | 2,023,750 | | | | — | | | | 20,905 | |

| Beauty Community PCL, foreign registered2 | | | — | | | | 150,000,000 | | | | — | | | | 150,000,000 | | | | 453 | | | | 18,791 | |

| Papa Murphy’s Holdings, Inc.3 | | | 1,102,000 | | | | 100,000 | | | | — | | | | 1,202,000 | | | | — | | | | 17,645 | |

| KEYW Holding Corp.3 | | | 2,836,400 | | | | — | | | | — | | | | 2,836,400 | | | | — | | | | 17,444 | |

| Sonus Networks, Inc.3,5 | | | 500,000 | | | | 3,638,000 | | | | 1,200,000 | | | | 2,938,000 | | | | — | | | | 16,805 | |

| Suprema Inc.2 | | | 868,200 | | | | — | | | | — | | | | 868,200 | | | | — | | | | 16,574 | |

| Trupanion, Inc.3 | | | — | | | | 2,155,668 | | | | — | | | | 2,155,668 | | | | — | | | | 16,275 | |

| Mahindra Lifespace Developers Ltd.2 | | | 2,157,380 | | | | — | | | | — | | | | 2,157,380 | | | | 204 | | | | 15,548 | |

| MagnaChip Semiconductor Corp.3 | | | 1,200,000 | | | | 1,155,000 | | | | — | | | | 2,355,000 | | | | — | | | | 15,519 | |

| Sinmag Equipment Corp.2,5 | | | 75,000 | | | | 3,802,020 | | | | — | | | | 3,877,020 | | | | 828 | | | | 14,066 | |

| Venture Global LNG, Inc., Class C2,3,7 | | | — | | | | 4,240 | | | | — | | | | 4,240 | | | | — | | | | 12,720 | |

| Tidewater Midstream and Infrastructure Ltd.2,4 | | | — | | | | 12,444,000 | | | | — | | | | 12,444,000 | | | | 79 | | | | 12,575 | |

| Greenko Group PLC2,3 | | | 9,748,155 | | | | — | | | | — | | | | 9,748,155 | | | | — | | | | 10,768 | |

| EVINE Live Inc., Class A3 | | | 3,987,540 | | | | — | | | | — | | | | 3,987,540 | | | | — | | | | 10,447 | |

| Mytrah Energy Ltd.2,3 | | | 10,418,000 | | | | — | | | | — | | | | 10,418,000 | | | | — | | | | 9,937 | |

| Talwalkars Better Value Fitness Ltd.2 | | | 1,694,000 | | | | 695,000 | | | | — | | | | 2,389,000 | | | | 54 | | | | 8,565 | |

| Xenon Pharmaceuticals Inc.3 | | | — | | | | 1,030,000 | | | | — | | | | 1,030,000 | | | | — | | | | 8,508 | |

| Tribhovandas Bhimji Zaveri Ltd.2 | | | 4,335,732 | | | | — | | | | — | | | | 4,335,732 | | | | 65 | | | | 7,648 | |

| | | | | | | | | | | | | | | | | | Value of | |

| | | | | | | | | | | | | | | Dividend | | | affiliates at | |

| | | Beginning | | | | | | | | | Ending | | | income | | | 9/30/2015 | |

| | | shares | | | Additions | | | Reductions | | | shares | | | (000) | | | (000) | |

| ITT Educational Services, Inc.3 | | | 1,519,000 | | | | 350,000 | | | | — | | | | 1,869,000 | | | $ | — | | | $ | 6,411 | |

| RMP Energy Inc.3 | | | — | | | | 6,670,300 | | | | — | | | | 6,670,300 | | | | — | | | | 6,348 | |

| Lekoil Ltd. (CDI)2,3 | | | 14,070,000 | | | | 5,360,400 | | | | — | | | | 19,430,400 | | | | — | | | | 6,242 | |

| Lekoil Ltd. (CDI)3,4,6 | | | 5,360,400 | | | | — | | | | 5,360,400 | | | | — | | | | — | | | | — | |

| Delphi Energy Corp.3,5 | | | 6,713,685 | | | | 5,721,315 | | | | 2,256,500 | | | | 10,178,500 | | | | — | | | | 5,263 | |

| Savannah Petroleum PLC2,3 | | | 7,844,000 | | | | 3,000,000 | | | | — | | | | 10,844,000 | | | | — | | | | 5,086 | |

| BNK Petroleum Inc.3 | | | 12,804,914 | | | | — | | | | — | | | | 12,804,914 | | | | — | | | | 3,646 | |

| San Leon Energy PLC2,3 | | | 155,300,000 | | | | 2,450,000 | | | | 153,747,000 | | | | 4,003,000 | | | | — | | | | 3,605 | |

| Altisource Asset Management Corp.3 | | | 56,153 | | | | 82,607 | | | | 21,834 | | | | 116,926 | | | | — | | | | 2,800 | |

| 7-Eleven Malaysia Holdings Bhd.2,6 | | | 76,209,600 | | | | — | | | | 76,209,600 | | | | — | | | | 601 | | | | — | |

| AA PLC2,3,6 | | | 44,319,669 | | | | 4,154,968 | | | | 24,237,499 | | | | 24,237,138 | | | | — | | | | — | |

| Achillion Pharmaceuticals, Inc.3,6 | | | 4,930,000 | | | | 185,000 | | | | 5,115,000 | | | | — | | | | — | | | | — | |

| bluebird bio, Inc.3,6 | | | 2,287,565 | | | | — | | | | 699,000 | | | | 1,588,565 | | | | — | | | | — | |

| Boer Power Holdings Ltd.2,6 | | | 39,202,000 | | | | — | | | | 8,364,000 | | | | 30,838,000 | | | | 1,681 | | | | — | |

| Cape Lambert Resources Ltd.3,6 | | | 47,330,825 | | | | — | | | | 47,330,825 | | | | — | | | | — | | | | — | |

| China High Precision Automation Group Ltd.2,3,6 | | | 53,032,000 | | | | — | | | | 53,032,000 | | | | — | | | | — | | | | — | |

| Duluth Metals Ltd.3,6 | | | 7,024,000 | | | | — | | | | 7,024,000 | | | | — | | | | — | | | | — | |

| Five Below, Inc.3,6 | | | 2,530,694 | | | | 513,000 | | | | 2,133,694 | | | | 910,000 | | | | — | | | | — | |

| Frigoglass SAIC2,3,6 | | | 3,052,380 | | | | — | | | | 3,052,380 | | | | — | | | | — | | | | — | |

| Galapagos NV2,3,6 | | | 2,422,427 | | | | — | | | | 969,892 | | | | 1,452,535 | | | | — | | | | — | |

| Gem Diamonds Ltd.2,3,6 | | | 7,625,000 | | | | — | | | | 7,625,000 | | | | — | | | | — | | | | — | |

| GI Dynamics, Inc. (CDI)2,6 | | | 30,320,000 | | | | — | | | | 30,320,000 | | | | — | | | | — | | | | — | |

| Houston Wire & Cable Co.6 | | | 1,150,000 | | | | — | | | | 1,150,000 | | | | — | | | | 276 | | | | — | |

| iEnergizer Ltd.2,3,6 | | | 7,650,500 | | | | — | | | | — | | | | 7,650,500 | | | | — | | | | — | |

| Intrepid Potash, Inc.3,6 | | | 4,895,000 | | | | 745,352 | | | | 5,640,352 | | | | — | | | | — | | | | — | |

| Kaveri Seed Co. Ltd.2,6 | | | 3,470,177 | | | | 660,793 | | | | 1,040,970 | | | | 3,090,000 | | | | 593 | | | | — | |

| Lions Gate Entertainment Corp.6 | | | 7,146,000 | | | | — | | | | 269,000 | | | | 6,877,000 | | | | 1,774 | | | | — | |

| Manappuram Finance Ltd.2,6 | | | 54,930,986 | | | | — | | | | 27,000,000 | | | | 27,930,986 | | | | 1,504 | | | | — | |

| Mistras Group, Inc.3,6 | | | 1,460,000 | | | | — | | | | 1,460,000 | | | | — | | | | — | | | | — | |

| Mood Media Corp. (CDI)6 | | | 3,710,000 | | | | — | | | | 3,710,000 | | | | — | | | | — | | | | — | |

| Mood Media Corp.3,6 | | | 6,375,000 | | | | 3,710,000 | | | | 10,085,000 | | | | — | | | | — | | | | — | |

| OM Group, Inc.3,6 | | | 1,560,000 | | | | — | | | | 1,560,000 | | | | — | | | | 246 | | | | — | |

| Phorm Corp. Ltd.2,3,6 | | | 15,890,000 | | | | 27,500,000 | | | | — | | | | 43,390,000 | | | | — | | | | — | |

| Powerland AG, non-registered shares2,6 | | | 1,200,000 | | | | — | | | | 1,200,000 | | | | — | | | | — | | | | — | |

| Repco Home Finance Ltd.2,6 | | | 4,040,440 | | | | — | | | | 2,868,440 | | | | 1,172,000 | | | | — | | | | — | |

| Stock Building Supply Holdings, Inc.3,6 | | | 1,785,000 | | | | — | | | | 1,205,778 | | | | 579,222 | | | | — | | | | — | |

| Synageva BioPharma Corp.3,6 | | | 2,190,074 | | | | 35,000 | | | | 2,225,074 | | | | — | | | | — | | | | — | |

| Tethys Petroleum Ltd.3,6 | | | 12,161,000 | | | | 4,647,487 | | | | — | | | | 16,808,487 | | | | — | | | | — | |

| Tethys Petroleum Ltd. (GBP denominated)3,6 | | | 4,647,487 | | | | — | | | | 4,647,487 | | | | — | | | | — | | | | — | |

| Tilaknager Industries Ltd.6 | | | 8,270,086 | | | | — | | | | 8,270,086 | | | | — | | | | — | | | | — | |

| TriQuint Semiconductor, Inc.3,6 | | | 9,012,000 | | | | — | | | | 9,012,000 | | | | — | | | | — | | | | — | |

| Ultragenyx Pharmaceutical Inc.3,6 | | | 1,628,457 | | | | 33,743 | | | | 486,294 | | | | 1,175,906 | | | | — | | | | — | |

| VST Industries Ltd.2,6 | | | 1,003,400 | | | | — | | | | 338,400 | | | | 665,000 | | | | 942 | | | | — | |

| Wizz Air Holdings PLC2,3,6 | | | — | | | | 3,498,684 | | | | 1,932,699 | | | | 1,565,985 | | | | — | | | | — | |

| XenoPort, Inc.3,6 | | | 4,769,000 | | | | — | | | | 4,065,334 | | | | 703,666 | | | | — | | | | — | |

| Xoom Corp.3,6 | | | 3,035,570 | | | | 40,235 | | | | 3,075,805 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | $ | 30,450 | | | $ | 4,218,756 | |

The following footnotes apply to either the individual securities noted or one or more of the securities aggregated and listed as a single line item.

| 1 | Represents an affiliated company as defined under the Investment Company Act of 1940. |

| 2 | Valued under fair value procedures adopted by authority of the board of directors. The total value of all such securities, including those in “Miscellaneous” and “Other securities,” was $10,869,522,000, which represented 41.48% of the net assets of the fund. This amount includes $10,552,479,000 related to certain securities trading outside the U.S. whose values were adjusted as a result of significant market movements following the close of local trading. |

| 3 | Security did not produce income during the last 12 months. |

| 4 | Acquired in a transaction exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities, including those in “Other securities,” was $1,112,791,000, which represented 4.25% of the net assets of the fund. |

| 5 | This security was an unaffiliated issuer in its initial period of acquisition at 9/30/2014; it was not publicly disclosed. |

| 6 | Unaffiliated issuer at 9/30/2015. |

| 7 | Acquired through a private placement transaction exempt from registration under the Securities Act of 1933. May be subject to legal or contractual restrictions on resale. Further details on these holdings appear below. |

| | |

| | | | | | | | | | | Percent | |

| | | Acquisition | | Cost | | | Value | | | of net | |

| Private placement securities | | date(s) | | (000) | | | (000) | | | assets | |

| Twelve, Inc., Series C, convertible preferred | | 4/16/2015 | | $ | 7,890 | | | $ | 28,953 | | | | .11 | % |

| Domo, Inc., Series D-2, convertible preferred | | 3/31/2015 | | | 25,000 | | | | 25,000 | | | | .10 | |

| Acerta Pharma BV, Series B, convertible preferred | | 5/7/2015 | | | 25,000 | | | | 24,786 | | | | .09 | |

| Venture Global LNG, Inc., Class C | | 5/1/2015 | | | 12,720 | | | | 12,720 | | | | .05 | |

| Other private placement securities | | 8/27/2012-7/23/2014 | | | 102,008 | | | | 107,094 | | | | .41 | |

| Total private placement securities | | | | $ | 172,618 | | | $ | 198,553 | | | | .76 | % |

Key to abbreviations and symbols

ADR = American Depositary Receipts

CDI = CREST Depository Interest

A$ = Australian dollars

CAD/C$ = Canadian dollars

€ = Euros

GBP/£ = British pounds

¥ = Japanese yen

S$ = Singapore dollars

See Notes to Financial Statements

Financial statements

Statement of assets and liabilities

at September 30, 2015 | | | (dollars in thousands) | |

| | | | | | | | | |

| Assets: | | | | | | | | |

| Investment securities, at value: | | | | | | | | |

| Unaffiliated issuers (cost: $18,140,200) | | $ | 21,810,365 | | | | | |

| Affiliated issuers (cost: $3,614,420) | | | 4,218,756 | | | $ | 26,029,121 | |

| Cash denominated in currencies other than U.S. dollars (cost: $10,589) | | | | | | | 10,589 | |

| Cash | | | | | | | 7,142 | |

| Unrealized appreciation on open forward currency contracts | | | | | | | 10,919 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | | 254,810 | | | | | |

| Sales of fund’s shares | | | 35,284 | | | | | |

| Dividends and interest | | | 25,007 | | | | | |

| Other | | | 903 | | | | 316,004 | |

| | | | | | | | 26,373,775 | |

| Liabilities: | | | | | | | | |

| Unrealized depreciation on open forward currency contracts | | | | | | | 489 | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 92,721 | | | | | |

| Repurchases of fund’s shares | | | 37,769 | | | | | |

| Closed forward currency contracts | | | 109 | | | | | |

| Investment advisory services | | | 14,002 | | | | | |

| Services provided by related parties | | | 6,679 | | | | | |

| Directors’ deferred compensation | | | 3,323 | | | | | |

| Other | | | 14,511 | | | | 169,114 | |

| | | | | | | $ | 26,204,172 | |

| Net assets at September 30, 2015 | | | | | | | | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of capital stock | | | | | | $ | 20,296,206 | |

| Accumulated net investment loss | | | | | | | (181,544 | ) |

| Undistributed net realized gain | | | | | | | 1,817,640 | |

| Net unrealized appreciation | | | | | | | 4,271,870 | |

| Net assets at September 30, 2015 | | | | | | $ | 26,204,172 | |

(dollars and shares in thousands, except per-share amounts)

Total authorized capital stock — 1,000,000 shares,

$.01 par value (585,671 total shares outstanding)

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share | |

| Class A | | $ | 16,881,688 | | | | 374,793 | | | $ | 45.04 | |

| Class B | | | 64,642 | | | | 1,565 | | | | 41.32 | |

| Class C | | | 847,000 | | | | 20,796 | | | | 40.73 | |

| Class F-1 | | | 661,601 | | | | 14,834 | | | | 44.60 | |

| Class F-2 | | | 1,487,410 | | | | 32,746 | | | | 45.42 | |

| Class 529-A | | | 943,128 | | | | 21,134 | | | | 44.63 | |

| Class 529-B | | | 9,692 | | | | 233 | | | | 41.70 | |

| Class 529-C | | | 274,572 | | | | 6,625 | | | | 41.45 | |

| Class 529-E | | | 49,351 | | | | 1,131 | | | | 43.63 | |

| Class 529-F-1 | | | 82,735 | | | | 1,840 | | | | 44.98 | |

| Class R-1 | | | 35,871 | | | | 857 | | | | 41.85 | |

| Class R-2 | | | 631,788 | | | | 15,096 | | | | 41.85 | |

| Class R-2E | | | 66 | | | | 1 | | | | 45.04 | |

| Class R-3 | | | 775,990 | | | | 17,815 | | | | 43.56 | |

| Class R-4 | | | 714,802 | | | | 15,986 | | | | 44.71 | |

| Class R-5 | | | 474,251 | | | | 10,324 | | | | 45.94 | |

| Class R-6 | | | 2,269,585 | | | | 49,895 | | | | 45.49 | |

See Notes to Financial Statements

Statement of operations

for the year ended September 30, 2015 | | | (dollars in thousands) | |

| | | | | |

| Investment income: | | | | | | | | |

| Income: | | | | | | | | |

| Dividends (net of non-U.S. taxes of $11,016; also includes $30,450 from affiliates) | | $ | 308,672 | | | | | |

| Interest (net of non-U.S. taxes of $70) | | | 4,335 | | | $ | 313,007 | |

| Fees and expenses*: | | | | | | | | |

| Investment advisory services | | | 170,815 | | | | | |

| Distribution services | | | 70,479 | | | | | |

| Transfer agent services | | | 41,123 | | | | | |

| Administrative services | | | 6,451 | | | | | |

| Reports to shareholders | | | 1,560 | | | | | |

| Registration statement and prospectus | | | 1,006 | | | | | |

| Directors’ compensation | | | 430 | | | | | |

| Auditing and legal | | | 468 | | | | | |

| Custodian | | | 3,816 | | | | | |

| State and local taxes | | | 4 | | | | | |

| Other | | | 1,410 | | | | 297,562 | |

| Net investment income | | | | | | | 15,445 | |

| | | | | | | | | |

| Net realized gain and unrealized depreciation: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments (net of non-U.S. taxes of $2,637; also includes $280,714 net gain from affiliates) | | | 1,892,044 | | | | | |

| Forward currency contracts | | | 22,436 | | | | | |

| Currency transactions | | | (2,240 | ) | | | 1,912,240 | |

| Net unrealized (depreciation) appreciation on: | | | | | | | | |

| Investments (net of non-U.S. taxes of $13,377) | | | (1,441,236 | ) | | | | |

| Forward currency contracts | | | 5,153 | | | | | |

| Currency translations | | | 776 | | | | (1,435,307 | ) |

| Net realized gain and unrealized depreciation | | | | | | | 476,933 | |

| | | | | | | | | |

| Net increase in net assets resulting from operations | | | | | | $ | 492,378 | |

| * | Additional information related to class-specific fees and expenses is included in the Notes to Financial Statements. |

| Statements of changes in net assets | |

| | (dollars in thousands) |

| | | | Year ended September 30 | |

| | | | 2015 | | | | 2014 | |

| Operations: | | | | | | | | |

| Net investment income (loss) | | $ | 15,445 | | | $ | (6,006 | ) |

| Net realized gain | | | 1,912,240 | | | | 2,602,946 | |

| Net unrealized depreciation | | | (1,435,307 | ) | | | (1,519,670 | ) |

| Net increase in net assets resulting from operations | | | 492,378 | | | | 1,077,270 | |

| | | | | | | | | |

| Distributions paid to shareholders from net realized gain on investments | | | (2,489,781 | ) | | | (1,231,152 | ) |

| | | | | | | | | |

| Net capital share transactions | | | 2,563,419 | | | | 1,351,365 | |

| | | | | | | | | |

| Total increase in net assets | | | 566,016 | | | | 1,197,483 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 25,638,156 | | | 24,440,673 | |

End of year (including accumulated net investment loss:

$(181,544) and $(147,181), respectively) | | $ | 26,204,172 | | | $ | 25,638,156 | |

See Notes to Financial Statements

Notes to financial statements

1. Organization

SMALLCAP World Fund, Inc. (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The fund seeks to provide long-term growth of capital. Shareholders approved a proposal to reorganize the fund from a Maryland corporation to a Delaware statutory trust. The reorganization may be completed in the next year; however, the fund reserves the right to delay the implementation.

The fund has 17 share classes consisting of five retail share classes (Classes A, B and C, as well as two F share classes, F-1 and F-2), five 529 college savings plan share classes (Classes 529-A, 529-B, 529-C, 529-E and 529-F-1) and seven retirement plan share classes (Classes R-1, R-2, R-2E, R-3, R-4, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are described further in the following table:

| Share class | | Initial sales charge | | Contingent deferred sales

charge upon redemption | | Conversion feature |

| Classes A and 529-A | | Up to 5.75% | | None (except 1% for certain redemptions within one year of purchase without an initial sales charge) | | None |

| Classes B and 529-B* | | None | | Declines from 5% to 0% for redemptions within six years of purchase | | Classes B and 529-B convert to Classes A and 529-A, respectively, after eight years |

| Class C | | None | | 1% for redemptions within one year of purchase | | Class C converts to Class F-1 after 10 years |

| Class 529-C | | None | | 1% for redemptions within one year of purchase | | None |

| Class 529-E | | None | | None | | None |

| Classes F-1, F-2 and 529-F-1 | | None | | None | | None |

| Classes R-1, R-2, R-2E, R-3, R-4, R-5 and R-6 | | None | | None | | None |

| * | Class B and 529-B shares of the fund are not available for purchase. |

Holders of all share classes have equal pro rata rights to the assets, dividends and liquidation proceeds of the fund. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, transfer agent and administrative services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

2. Significant accounting policies

The fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP“). These principles require the fund’s investment adviser to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. Subsequent events, if any, have been evaluated through the date of issuance in the preparation of the financial statements. The fund follows the significant accounting policies described in this section, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, transfer agent and administrative services, are charged directly to the respective share class.

Dividends and distributions to shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by U.S. GAAP. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | | Examples of standard inputs |

| All | | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

| Corporate bonds & notes; convertible securities | | Standard inputs and underlying equity of the issuer |

| Bonds & notes of governments & government agencies | | Standard inputs and interest rate volatilities |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or deemed to be not representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described for either equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of directors as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events

that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of directors has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of directors with supplemental information to support the changes. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.