UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06135

Templeton Institutional Funds

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: (954) 527-7500_

Date of fiscal year end: _12/31__

Date of reporting period: 12/31/15_

Item 1. Reports to Stockholders.

Annual Report

December 31, 2015

Templeton Institutional Funds

Emerging Markets Series

Foreign Equity Series

Foreign Smaller Companies Series

Global Equity Series

Franklin Templeton Investments

| |

| Contents | |

| Annual Report | |

| Economic and Market Overview | 2 |

| Emerging Markets Series | 3 |

| Foreign Equity Series | 9 |

| Foreign Smaller Companies Series | 17 |

| Global Equity Series | 23 |

| Financial Highlights and Statements of Investments | 30 |

| Financial Statements | 51 |

| Notes to Financial Statements | 57 |

| Report of Independent Registered Public Accounting Firm | 69 |

| Tax Information | 70 |

| Board Members and Officers | 72 |

| Shareholder Information | 77 |

ftinstitutional.com Not part of the annual report 1

Annual Report

Economic and Market Overview

The global economy expanded moderately during the 12 months under review. As measured by the MSCI World Index, stocks in global developed markets overall were nearly unchanged for the year amid some positive developments. Weighing on global stocks at times were worries about China’s slowing economy and tumbling stock market, declining commodity prices, geopolitical tensions between Russia and Turkey, and ongoing uncertainty over the U.S. Federal Reserve’s (Fed’s) timing for raising interest rates. Toward period-end, equity markets recovered somewhat as the Fed increased its federal funds target range for the first time in nine years, alleviating some uncertainty about a change in U.S. monetary policy. During the year, oil prices declined sharply largely due to increased global supply that exceeded demand. Gold and other commodity prices also fell. The U.S. dollar appreciated against most currencies during the period, which reduced returns of many foreign assets in U.S. dollar terms.

U.S. economic growth slowed in 2015’s first quarter but strengthened in 2015’s second quarter amid healthy consumer spending. The third and fourth quarters were less robust as exports slowed and state and local governments reduced their spending. At its December meeting, the Fed increased its target range for the federal funds rate to 0.25%–0.50%, as policymakers cited the labor market’s considerable improvement and were reasonably confident that inflation would move back to the Fed’s 2% medium-term objective. Furthermore, the Fed raised its forecast for 2016 U.S. economic growth and lowered its unemployment projections.

In Europe, U.K. economic growth gained momentum from the services sector, but the economy slowed in 2015 compared with 2014. The eurozone grew moderately and generally benefited during the period from lower oil prices, a weaker euro that supported exports, the European Central Bank’s (ECB’s) accommodative policy and expectations of further ECB stimulus. Although the eurozone’s annual inflation rate declined early in the period, it rose slightly during the rest of the period. The ECB maintained its benchmark interest rates although it reduced its bank deposit rate in December, seeking to boost the region’s slowing growth.

Japan’s economy continued to grow in 2015’s first quarter. After a decline in the second quarter of 2015, it expanded in the third quarter as capital expenditures improved. The Bank of Japan took several actions during the reporting period, including maintaining its monetary policy, lowering its economic growth and inflation forecasts, and reorganizing its stimulus program to increase exposure to long-term government bonds and exchange-traded funds.

In emerging markets, economic growth generally moderated. China’s economy grew at a less robust pace in 2015 than in 2014, but domestic demand continued to account for a greater portion of gross domestic product (GDP). In the third quarter, Brazil’s and Russia’s quarterly GDPs continued to contract but at slower rates compared with the second quarter. Despite moderating growth in some emerging market countries, India, the Czech Republic and Mexico showed signs of improvement. In China, the government’s intervention to cool domestic stock market speculation and the central bank’s effective currency devaluation led to a severe slump in emerging market stocks from June through August. China’s additional monetary and fiscal stimulus measures to support economic growth aided emerging market stocks in October, but weak commodity prices and terrorist attacks in Beirut and Paris hindered stocks toward period-end. Markets recovered somewhat after the Fed increased its federal funds target rate in December, alleviating some uncertainty about the direction of U.S. monetary policy. Central bank actions varied across emerging markets during the 12 months under review, as some banks raised interest rates in response to rising inflation and weakening currencies, while others lowered interest rates to promote economic growth. In the recent global environment, emerging market stocks overall, as measured by the MSCI Emerging Markets Index, fell for the 12-month period.

The foregoing information reflects our analysis and opinions as of December 31, 2015. The information is not a complete analysis of every aspect of any market, country, industry or fund. Statements of fact are from sources considered reliable.

2 Annual Report ftinstitutional.com

Emerging Markets Series

This annual report for Emerging Markets Series (Fund) covers the fiscal year ended December 31, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital growth. Under normal market conditions, the Fund invests at least 80% of its net assets in securities issued by “emerging market companies,” as defined in the Fund’s prospectus.

Investment Strategy

Our investment strategy employs a fundamental research, value-oriented, long-term approach. We focus on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential.

We also consider a company’s profit and loss outlook, balance sheet strength, cash flow trends and asset value in relation to the current price. Our analysis considers the company’s corporate governance behavior as well as its position in its sector, the economic framework and political environment.

Performance Overview

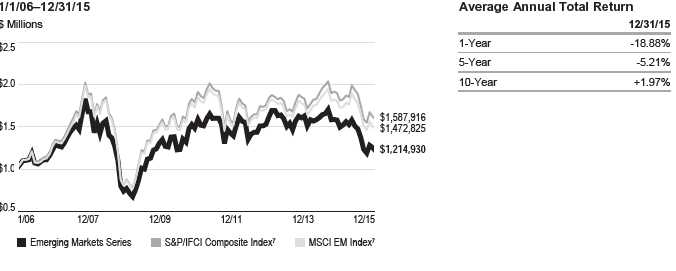

The Fund had a -18.88% cumulative total return for the 12 months under review. In comparison, the Standard & Poor’s®/International Finance Corporation Investable (S&P®/IFCI) Composite Index had a -12.38% total return, and the MSCI Emerging Markets (EM) Index had a -14.60% total return during the same period.1 The indexes measure global emerging market stock performance. Please note index performance information is provided for reference and we do not attempt to track an index but rather undertake investments on the basis of fundamental research. The Fund’s return reflects the effect of fees and expenses for professional management, while an index does not have such costs. In addition, an index is not subject to investment flows while the Fund is subject to purchases and redemptions that could impact performance. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 6.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to ftinstitutional.com or call a Franklin Templeton Institutional Services representative at (800) 321-8563.

Manager’s Discussion

During the year under review, the Fund remained diversified among different emerging market countries. Consistent with our long-term investment strategy, we viewed market corrections in China and other emerging markets in the context of a long-term uptrend. We continued to monitor global economic and market developments while seeking to minimize risk and to establish long-term positions in quality companies at share prices we considered more attractive.

Key detractors from the Fund’s absolute performance during the 12-month reporting period included positions in Itau Unibanco Holding, MTN Group and MGM China Holdings.

Itau Unibanco, one of Brazil’s largest financial conglomerates, continued to produce solid operating performance despite the country’s difficult economic environment. However, investor concerns about the potential for deteriorating asset quality and higher loan-loss provisions weighed on share price performance. The Brazilian financial market as a whole came under pressure during the reporting period, further hurting Itau Unibanco’s shares. Falling prices for energy and other commodities coincided with an economic recession, rising unemployment and political uncertainty, leading to equity weakness and currency depreciation. Standard & Poor’s downgrade of the country’s long-term foreign currency sovereign credit rating to below investment grade in September heightened market anxiety.

1. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 31.

ftinstitutional.com Annual Report 3

| | | |

| EMERGING MARKETS | SERIES | | |

| |

| |

| Top 10 Countries | | | |

| 12/31/15 | | | |

| | | % of Total | |

| | | Net Assets | |

| China | | 21.6 | % |

| India | | 11.6 | % |

| South Africa | | 10.2 | % |

| South Korea | | 9.5 | % |

| Taiwan | | 9.3 | % |

| U.K. | | 6.3 | % |

| Brazil | | 5.7 | % |

| Thailand | | 4.8 | % |

| Hong Kong | | 3.9 | % |

| Belgium | | 3.4 | % |

MTN Group is Africa’s largest cellular network in subscriber terms. The South Africa-based company’s share price declined following an announcement that the Nigerian Communications Commission imposed a US$5.2 billion fine, which was subsequently reduced to US$3.4 billion. MTN allegedly failed to meet a deadline for disconnecting subscribers identified as unregistered. Disappointing first-half 2015 earnings results amid a weak regional economic backdrop and depreciation of regional currencies also hurt share price performance. Although third-quarter corporate results showed some improvement in the company’s operations in South Africa, issues in the Nigerian market continued to weigh on overall operations. The resignation of the company’s chief executive officer and concerns about potential challenges in the company’s cash repatriation from Nigeria further pressured investor sentiment.

MGM China Holdings is a Hong Kong-listed casino gaming and entertainment business based in Macau. Shares of casino gaming companies, including MGM China’s, fell during the reporting period due to investor concerns about declining numbers of high-spending customers, a result of China’s anti-corruption campaign. Reduced dividend distributions also hurt overall sentiment in the casino gaming sector. However, despite weak revenue trends, MGM China reported slightly better-than-expected second- and third-quarter earnings results as the company achieved greater operating efficiencies.

Amid a challenging market environment, several Fund holdings performed well. Key contributors to absolute performance

during the reporting period included NetEase, Tencent Holdings and Anheuser-Busch InBev.

China’s Internet sector has been growing rapidly and could benefit further from the government’s “Internet Plus” strategy, which is designed to integrate the Internet with traditional businesses to support the country’s economic growth. NetEase is one of the largest companies in China’s online gaming market. It also has presence in online advertising, email and e-commerce. The company’s strong corporate results in 2015, driven by its mobile gaming operations, and plans to release new games in 2016 boosted the company’s share price to a record high in December.

Tencent is one of the world’s largest and most widely used Inter-net service portals. Founded in 1998 to provide instant messenger services, the company rapidly grew into a provider of mass media, entertainment, and Internet and mobile phone value-added services in China and internationally. Tencent reported solid earnings in 2015, supported by strong mobile gaming and advertising revenues.

Anheuser-Busch InBev is the world’s largest brewer by volume, with operations in 25 countries globally. The Belgium-listed company produces, markets, distributes and sells over 200 beer and other malt beverage brands, as well as produces and distributes soft drinks, notably in Latin America. In November, Anheuser-Busch InBev reached an agreement to acquire SABMiller, the second-largest global brewer, which would substantially extend the group’s global footprint. The transaction is expected to be completed in 2016’s second half and was positively received by the market, bolstering the company’s share price.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the 12 months ended December 31, 2015, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s investment predominantly in securities with non-U.S. currency exposure.

4 Annual Report

ftinstitutional.com

EMERGING MARKETS SERIES

| | |

| Top 10 Holdings | | |

| 12/31/15 | | |

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| Unilever PLC | 6.3 | % |

| Personal Products, U.K. | | |

| Naspers Ltd., N | 6.1 | % |

| Media, South Africa | | |

| TSMC (Taiwan Semiconductor Manufacturing Co.) Ltd. | 5.5 | % |

| Semiconductors & Semiconductor Equipment, Taiwan | | |

| Brilliance China Automotive Holdings Ltd. | 4.3 | % |

| Automobiles, China | | |

| Tencent Holdings Ltd. | 4.2 | % |

| Internet Software & Services, China | | |

| Anheuser-Busch InBev NV | 3.4 | % |

| Beverages, Belgium | | |

| Tata Consultancy Services Ltd. | 3.2 | % |

| IT Services, India | | |

| Baidu Inc., ADR | 2.9 | % |

| Internet Software & Services, China | | |

| China Mobile Ltd. | 2.6 | % |

| Wireless Telecommunication Services, China | | |

| Samsung Electronics Co. Ltd. | 2.6 | % |

| Technology Hardware, Storage & Peripherals, | | |

| South Korea | | |

In the past 12 months, we increased the Fund’s holdings in South Korea, Taiwan and Hong Kong as we sought to invest in opportunities we considered attractive. Additionally, we initiated investments in certain countries, notably Russia, Mexico and Cambodia. In sector terms, we increased investments largely in information technology, consumer discretionary and health care.2 Key purchases included new positions in Baidu, China’s leading Internet search engine; Hon Hai Precision Industry, a leading Taiwanese electronics manufacturing services provider; and SK Hynix, one of the world’s largest DRAM (dynamic random access memory) makers.

Conversely, we reduced the Fund’s investments in Thailand, South Africa and China primarily through China H shares to focus on companies we considered to be more attractively valued within our investment universe and to raise funds for share redemptions.3 We also made some sales in India and eliminated exposures to certain countries, notably Turkey. In sector terms, we reduced holdings largely in financials, energy, materials and industrials.4 Key sales included trimming the Fund’s positions in Siam Commercial Bank, a Thai bank; Remgro, a South African conglomerate with interests in finance, health care, food and industrials; and Tata Motors, an Indian automobile manufacturer.

Thank you for your continued participation in Emerging Markets Series. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | |

| 2. The information technology sector comprises electronic equipment, instruments and components; Internet software and services; IT services; semiconductors and semi- | |

| conductor equipment; software; and technology hardware, storage and peripherals in the SOI. The consumer discretionary sector comprises auto components; automobiles; |

| distributors; hotels, restaurants and leisure; Internet and catalog retail; media; and textiles, apparel and luxury goods in the SOI. The health care sector comprises bio- | |

| technology and pharmaceuticals in the SOI. | | |

| 3. “China H” denotes shares of China-incorporated, Hong Kong Stock Exchange-listed companies with most businesses in China. | | |

| 4. The financials sector comprises banks, capital markets, diversified financial services, insurance, and real estate management and development in the SOI. The energy | |

| sector comprises oil, gas and consumable fuels in the SOI. The materials sector comprises chemicals and construction materials in the SOI. The industrials sector comprises |

| construction and engineering, trading companies and distributors, and transportation infrastructure in the SOI. | | |

| See www.franklintempletondatasources.com for additional data provider information. | | |

| |

| ftinstitutional.com | Annual Report | 5 |

EMERGING MARKETS SERIES

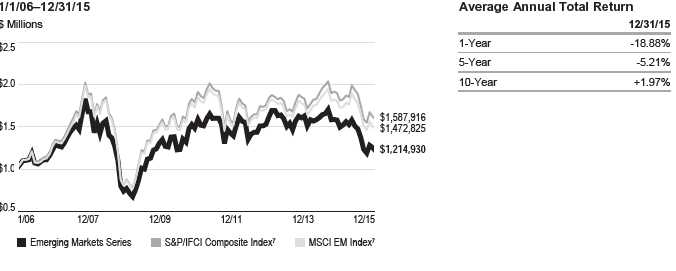

Performance Summary as of December 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | | | |

| Share Price | | | | | | | | | | |

| |

| Symbol: TEEMX | | | | 12/31/15 | | | 12/31/14 | | Change | |

| Net Asset Value (NAV) | | | $ | 3.65 | | $ | 4.59 | -$ | 0.94 | |

| |

| |

| Distributions1 (1/1/15–12/31/15) | | | | | | | | | |

| | | | | Dividend | | | Long-Term | | | |

| | | | | Income | | | Capital Gain | | Total | |

| | | | $ | 0.0553 | | $ | 0.0179 | $ | 0.0732 | |

| |

| |

| Performance2 | | | | | | | | | | |

| | | | | | | | | | Total Annual | |

| | Cumulative | | | Average Annual | | | Value of $1,000,000 | | Operating | |

| | Total Return3 | | | Total Return4 | | | Investment5 | | Expenses6 | |

| | | | | | | | | | 1.32 | % |

| 1-Year | -18.88 | % | | -18.88 | % | $ | 811,157 | | | |

| 5-Year | -23.45 | % | | -5.21 | % | $ | 765,492 | | | |

| 10-Year | +21.48 | % | + | 1.97 | % | $ | 1,214,930 | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, visit ftinstitutional.com or call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 7 for Performance Summary footnotes.

6 Annual Report

ftinstitutional.com

EMERGING MARKETS SERIES

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $1,000,000 Investment2

Total return represents the change in value of an investment over the periods shown. It includes any Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic

instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same

factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks

to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased

potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier mar-

kets. The Fund’s ability to invest in smaller company securities that may have limited liquidity involves additional risks, such as relatively small revenues, limited

product lines and small market share. Historically, these stocks have exhibited greater price volatility than larger company stocks, especially over the short term.

The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also

includes a description of the main investment risks.

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income and

capital gain.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end. Fund

investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not

been annualized.

5. These figures represent the value of a hypothetical $1,000,000 investment in the Fund over the periods indicated.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

7. Source: Morningstar. The S&P/IFCI Composite Index is a free float-adjusted, market capitalization-weighted index designed to measure equity performance of global emerg-

ing markets. The MSCI EM Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance of global emerging markets.

See www.franklintempletondatasources.com for additional data provider information.

ftinstitutional.com

Annual Report 7

EMERGING MARKETS SERIES

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases, if applicable; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) of the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period, by following these steps. Of course, your account value and expenses will differ from those in this illustration:

1. Divide your account value by $1,000.

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

2. Multiply the result by the number under the heading “Expenses Paid During Period.”

If Expenses Paid During Period were $7.50, then 8.6 × $7.50 = $64.50.

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the Fund’s actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges, if applicable. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| | | Value 7/1/15 | | Value 12/31/15 | | Period* 7/1/15–12/31/15 |

| Actual | $ | 1,000 | $ | 823.70 | $ | 6.02 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.60 | $ | 6.67 |

| |

| *Expenses are calculated using the most recent six-month annualized expense ratio, net of expense waivers, of 1.31%, multiplied by the aver- |

| age account value over the period, multiplied by 184/365 to reflect the one-half year period. | | |

8 Annual Report ftinstitutional.com

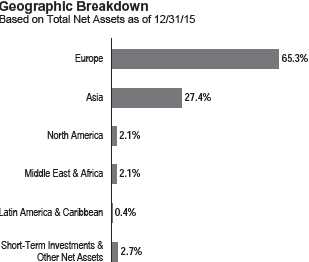

Foreign Equity Series

This annual report for Foreign Equity Series (Fund) covers the fiscal year ended December 31, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital growth. Under normal market conditions, the Fund invests at least 80% of its net assets in foreign (non-U.S.) equity securities.

Performance Overview

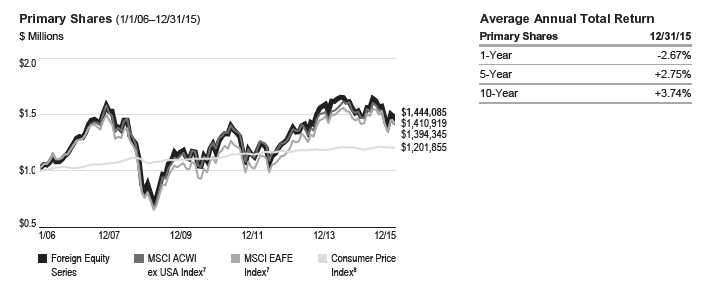

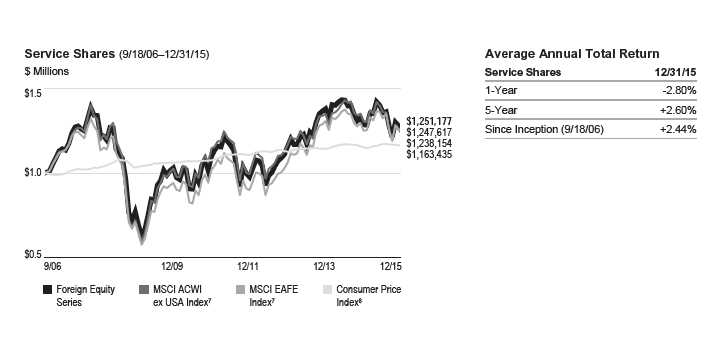

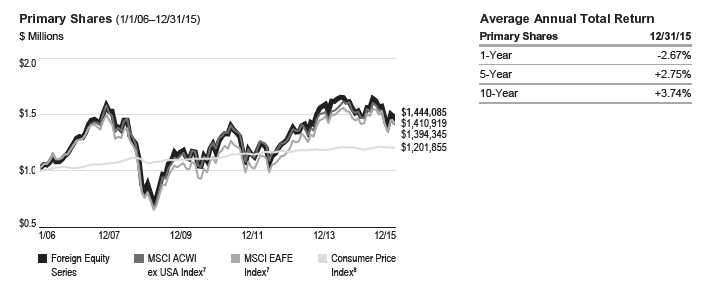

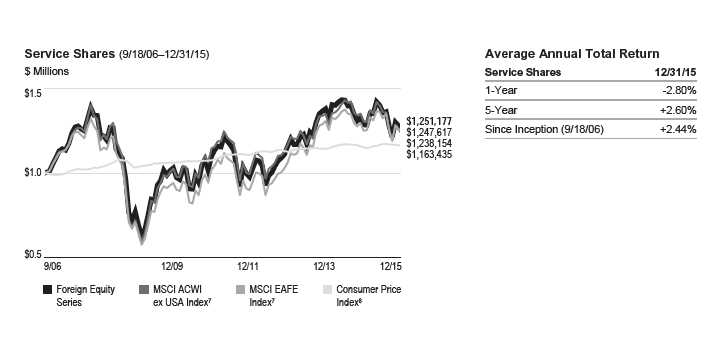

For the 12 months under review, the Fund’s Primary shares had a -2.67% total return. For comparison, the Fund’s benchmark, the MSCI All Country World Index (ACWI) ex USA Index, which measures stock market performance in global developed and emerging markets excluding the U.S, had a -5.25% total return for the period under review.1 The Fund’s other benchmark, the MSCI Europe, Australasia, Far East (EAFE) Index, which measures stock market performance in global developed markets excluding the U.S. and Canada, produced a -0.39% total return.1 Please note index performance information is provided for reference and we do not attempt to track an index but rather undertake investments on the basis of fundamental research. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 13.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For the most recent month-end performance, go to ftinstitutional.com or call a Franklin Templeton Institutional Services representative at (800) 321-8563.

Investment Strategy

We employ a bottom-up, value-oriented, long-term investment strategy. We focus on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. We also consider a company’s price/earnings ratio, profit margins and liquidation value.

Manager’s Discussion

During the tumultuous past year, international stocks initially appreciated before succumbing in the third quarter to fears about U.S. Federal Reserve (Fed) tightening, emerging market instability, China’s economic weakness and a deepening commodity decline. International stocks staged a patchy and partial recovery throughout the final months of 2015 but ultimately ended the year lower, with a narrow group of high-growth, high-quality, low-risk issues outperforming value-oriented and economically cyclical stocks.

In this difficult environment, the Fund performed better than its benchmark, the MSCI ACWI ex USA Index, supported by stock selection. In particular, our bottom-up stock selection helped relative gains in financials, a major contributor to performance versus the benchmark during the year.2 SwissRe, the world’s second-largest reinsurer, was one of the portfolio’s top performers, rallying to the highest levels in more than a decade following a benign year for natural weather events and successful operational and financial management. German financial market operator Deutsche Boerse also contributed as heightened financial market volatility boosted revenues and new management announced a restructuring plan focused on product

1. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

2. The financials sector comprises banks, capital markets, diversified financial services, insurance, real estate management and development, and thrifts and mortgage

finance in the SOI.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 36.

ftinstitutional.com

Annual Report

9

FOREIGN EQUITY SERIES

innovation and new growth markets. Deutsche Boerse has been a successful investment, having nearly doubled since we initially identified it as a bargain in early 2013. The stock at period-end was approaching what we considered fair value and we continued to monitor the investment for potential attractive exit opportunities. More broadly, the financials sector represented attractive value, in our analysis, particularly in Europe. We believe falling provisions, easing regulatory pressures and eventual turns in the business and interest-rate cycles should support book value and earnings recoveries in the restructured sector.

Stock selection and an underweighting in materials also contributed to relative performance.3 For example, Irish building materials firm CRH delivered strong absolute gains as firmer demand in key markets like the U.S. and Europe improved the company’s earnings outlook. Restructuring and cost-saving initiatives have been well executed thus far, in our opinion, and CRH stands to benefit from the acquisition of assets divested as a regulatory requirement of a merger between competitors. Within the materials sector more broadly, we continued to find what we considered only select values. In general, construction materials firms are highly sensitive to wider economic trends, and we believe valuations have begun to reflect expected earnings improvements as major western property markets recover. Elsewhere, chemicals stocks looked generally expensive to us with margins near cyclical peaks and new capacity negatively impacting industry pricing. The mining industry also suffered from significant excess capacity following the unprecedented investment boom in China. Although the sector began to look more interesting to us following extreme weakness, bottom-up bargains remained highly selective, in our analysis.

Although stock selection in health care detracted from relative performance, an overweighting in the strong sector led to an overall positive relative result.4 A major contributor was an off-benchmark position in Israeli generic pharmaceuticals firm Teva Pharmaceutical Industries. Teva shares gained after the firm announced a strategic partnership with Japanese drug maker Takeda Pharmaceuticals and the sale of equity to fund the purchase of Allergan’s generic drug business. We remained positive on the latter acquisition, which we believed would bolster Teva’s position as the world’s largest generic drug maker and give it greater negotiating power with governments and health insurers. We viewed this deal as more favorable than Teva’s recently abandoned takeover attempt of U.S. generic

| | |

| Portfolio Breakdown | | |

| 12/31/15 | | |

| | % of Total | |

| Sector/Industry | Net Assets | |

| Banks | 13.5 | % |

| Pharmaceuticals | 11.8 | % |

| Insurance | 9.1 | % |

| Oil, Gas & Consumable Fuels | 8.2 | % |

| Diversified Telecommunication Services | 4.8 | % |

| Automobiles | 3.7 | % |

| Auto Components | 3.1 | % |

| Wireless Telecommunication Services | 3.1 | % |

| Technology Hardware, Storage & Peripherals | 3.1 | % |

| Construction Materials | 3.1 | % |

| Industrial Conglomerates | 3.0 | % |

| Energy Equipment & Services | 2.8 | % |

| Semiconductors & Semiconductor Equipment | 2.3 | % |

| Other | 25.6 | % |

| Short-Term Investments & Other Net Assets | 2.8 | % |

drug firm Mylan. By comparison, we believe the Allergan deal avoids the uncertainty of a hostile takeover, ensures a quicker closing, represents a better asset acquisition and should be easier to integrate given management synergies. More broadly in health care, major pharmaceuticals firms have been rallying and the industry has been trading at a slight premium to the broader market. Biotechnology stocks have also become broadly more expensive, though we continued to find select opportunities among firms where we believe growth and innovation were still being underestimated.

The positive effects of stock selection overcame an unfavorable overweighting in energy and a detractive underweighting in consumer discretionary.5 Although the timing for recovery in the broader energy sector remained uncertain, at year-end oil traded near the cash cost of production, a very depressed level reached only a few times in the past 25 years. In our opinion, these types of prices should continue to accelerate the supply adjustment, ultimately restoring balance at a level that encourages continued investment in the production necessary to meet global demand over the long term. We found fewer bargains in consumer discretionary, where we began to selectively reduce exposure following a strong rally amid consumer-led recoveries

3. The materials sector comprises chemicals, construction materials, and containers and packaging in the SOI.

4. The health care sector comprises health care equipment and supplies, health care providers and services, life sciences tools and services, and pharmaceuticals in the SOI.

5. The energy sector comprises energy equipment and services; and oil, gas and consumable fuels in the SOI. The consumer discretionary sector comprises auto compo-

nents, automobiles, household durables, multiline retail and specialty retail in the SOI.

10 Annual Report

ftinstitutional.com

FOREIGN EQUITY SERIES

in major western economies. Within this diverse sector, Japa-nese auto maker Nissan Motor finished among the Fund’s top contributors during the year after management raised full-year profit guidance following Japanese yen weakness and improving sales volumes in the U.S. Nissan remained lowly valued based on our analysis, and looked well positioned for continued earnings improvement given a favorable model cycle, attractive emerging market exposure and positive operating leverage as capacity utilization improves.

Turning to detractors, a significant underweighting in the resilient consumer staples sector notably detracted.6 We found few opportunities in the sector, which has become the most expensive in at least a decade on nearly all major metrics, including earnings, book value and cash flow multiples, while yielding the lowest dividend since the global financial crisis. Despite the sector’s stable earnings and balance sheet profile, our strategy does not favor richly valued companies in an ultra-competitive industry selling commoditized products at single-digit profit margins. The few bargains we did find in consumer staples were mostly in special situations or restructuring stories. Japanese beverage company Suntory Beverage & Food was a solid performer as it benefited from input cost declines and continued to redeploy capital to growth opportunities in Asia outside of Japan. U.K. retailer Tesco, a notable detractor during the year, was a potential restructuring example. The stock remained under pressure following difficult holiday trading. However, with sentiment at an all-time low, valuation extremely depressed, and progress evident under new management in the form of steadily improving transactions and volume, Tesco appeared to us positioned for a long-term recovery.

Stock selection in telecommunication services also detracted, pressured by Chinese mobile operator China Telecom and Spanish mobile company Telefonica.7 China’s third-largest mobile operator declined during a year when anti-corruption purges led to the resignation of the firm’s chairman. The Chi-nese telecommunications sector more broadly has come under pressure amid a top-down industry reorganization and increasing state intervention. Although Premier Li’s directive to “upgrade speeds and reduce tariffs” has scared some industry observers, we considered Chinese data pricing high, suggesting to us that prices can decline and revenues can still grow as customers begin to consume more data following the rollout of the 4G network. While China Telecom continued to work through

| | |

| Top 10 Holdings | | |

| 12/31/15 | | |

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| Samsung Electronics Co. Ltd. | 2.4 | % |

| Technology Hardware, Storage & Peripherals, | | |

| South Korea | | |

| Roche Holding AG | 2.3 | % |

| Pharmaceuticals, Switzerland | | |

| Teva Pharmaceutical Industries Ltd., ADR | 2.1 | % |

| Pharmaceuticals, Israel | | |

| ING Groep NV, IDR | 2.0 | % |

| Banks, Netherlands | | |

| Nissan Motor Co. Ltd. | 2.0 | % |

| Automobiles, Japan | | |

| CRH PLC | 1.9 | % |

| Construction Materials, Ireland | | |

| BNP Paribas SA | 1.8 | % |

| Banks, France | | |

| BP PLC | 1.8 | % |

| Oil, Gas & Consumable Fuels, U.K. | | |

| Bayer AG | 1.8 | % |

| Pharmaceuticals, Germany | | |

| GlaxoSmithKline PLC | 1.7 | % |

| Pharmaceuticals, U.K. | | |

numerous changes internally and in the broader industry, we believed the net effect of restructuring could be positive over the long term and we were encouraged by the company’s recent strong operating momentum. Telefonica declined primarily due to continued concerns about the company’s Latin American exposure. Despite recent economic and political difficulties, results during the year confirmed solid operational progress and an improving market position in the important region. Tele-fonica has taken major steps to streamline and focus its operations where it has the best growth opportunities, exiting ancillary European markets and using cash to reduce debt and improve its market position in Brazil, Spain and Germany. With Spain exiting recession and the commercial environment in Brazil likely to improve over our investment horizon, we believed Telefonica appeared well positioned for the long term.

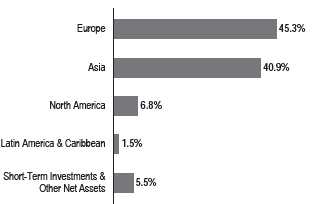

From a regional standpoint, stock selection and an overweighting in Europe contributed to relative performance, while stock selection and an underweighting in Asia detracted, pressured by an underweighting and stock selection in Japan, one of the world’s top performing major equity markets in 2015.

6. The consumer staples sector comprises beverages, and food and staples retailing in the SOI.

7. The telecommunication services sector comprises diversified telecommunication services and wireless telecommunication services in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

ftinstitutional.com Annual Report 11

FOREIGN EQUITY SERIES

It is also important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the 12 months ended December 31, 2015, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s investment predominantly in securities with non-U.S. currency exposure.

A critical insight we have gleaned through six decades of investing in global equity markets is that returns seem to accrue to value intermittently. Our style of investing has historically provided positive performance over a long-term investment horizon. But, it has rarely been a steady appreciation. At Templeton, we buy on pessimism, and the market can remain at odds with our portfolios for a considerable stretch. However, empirical evidence has shown that when the value cycle turns, it does so swiftly and abruptly. We believe being properly positioned for these turns is essential to capturing the long-term benefits of the value investment discipline. We have been witnessing historical extremes in the discount afforded to value relative to growth, quality and safety. Although this environment has been, and may remain, painful for some time, we believe the eventual normalization of these extremes represents the most compelling opportunity in equity markets today, and we have sought to position our portfolio accordingly.

Thank you for your continued participation in Foreign Equity Series. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

12 Annual Report ftinstitutional.com

FOREIGN EQUITY SERIES

Performance Summary as of December 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses on the sale of Fund shares.

| | | | | | | | | | |

| Net Asset Value | | | | | | | | | | |

| |

| Share Class (Symbol) | | | | 12/31/15 | | | 12/31/14 | | Change | |

| Primary (TFEQX) | | | $ | 19.05 | | $ | 20.05 | -$ | 1.00 | |

| Service (TFESX) | | | $ | 19.11 | | $ | 20.11 | -$ | 1.00 | |

| |

| |

| Distributions1 (1/1/15–12/31/15) | | | | | | | | | |

| |

| | | | | Dividend | | | | | | |

| Share Class | | | | Income | | | | | | |

| Primary | | | $ | 0.4679 | | | | | | |

| Service | | | $ | 0.4397 | | | | | | |

| |

| Performance2 | | | | | | | | | | |

| | | | | | | | | | Total Annual | |

| | Cumulative | | | Average Annual | | | Value of $1,000,000 | | Operating | |

| Share Class | Total Return3 | | | Total Return4 | | | Investment5 | | Expenses6 | |

| Primary | | | | | | | | | 0.78 | % |

| 1-Year | -2.67 | % | | -2.67 | % | $ | 973,268 | | | |

| 5-Year | +14.54 | % | + | 2.75 | % | $ | 1,145,362 | | | |

| 10-Year | +44.41 | % | + | 3.74 | % | $ | 1,444,085 | | | |

| Service | | | | | | | | | 0.93 | % |

| 1-Year | -2.80 | % | | -2.80 | % | $ | 971,958 | | | |

| 5-Year | +13.68 | % | + | 2.60 | % | $ | 1,136,797 | | | |

| Since Inception (9/18/06) | +25.12 | % | + | 2.44 | % | $ | 1,251,177 | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, visit ftinstitutional.com or call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 15 for Performance Summary footnotes.

ftinstitutional.com

Annual Report

13

FOREIGN EQUITY SERIES

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $1,000,000 Investment2

Total return represents the change in value of an investment over the periods shown. It includes any Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

See page 15 for Performance Summary footnotes.

14 Annual Report ftinstitutional.com

FOREIGN EQUITY SERIES

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic

instability and political developments; investments in emerging markets involve heightened risks related to the same factors. To the extent the Fund focuses on

particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such

areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. The Fund is actively managed but there is no

guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment

risks.

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end. Fund

investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not

been annualized.

5. These figures represent the value of a hypothetical $1,000,000 investment in the Fund over the periods indicated.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

7. Source: Morningstar. The MSCI ACWI ex USA Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance of global

developed and emerging markets, excluding the U.S. The MSCI EAFE Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market

performance of global developed markets excluding the U.S. and Canada.

8. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index is a commonly used measure of the inflation rate.

See www.franklintempletondatasources.com for additional data provider information.

ftinstitutional.com

Annual Report

15

FOREIGN EQUITY SERIES

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases, if applicable; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period, by following these steps. Of course, your account value and expenses will differ from those in this illustration:

1. Divide your account value by $1,000.

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

2. Multiply the result by the number under the heading “Expenses Paid During Period.”

If Expenses Paid During Period were $7.50, then 8.6 × $7.50 = $64.50.

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges, if applicable. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 7/1/15 | | Value 12/31/15 | | Period* 7/1/15–12/31/15 |

| Primary Shares | | | | | | |

| Actual | $ | 1,000 | $ | 920.50 | $ | 3.78 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.27 | $ | 3.97 |

| Service Shares | | | | | | |

| Actual | $ | 1,000 | $ | 918.80 | $ | 4.50 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.52 | $ | 4.74 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (Primary Shares: 0.78% and Service Shares: 0.93%), multiplied by the average account value over the period, multiplied by 184/365 for to reflect the one-half year period.

16 Annual Report

ftinstitutional.com

Foreign Smaller Companies Series

This annual report for Foreign Smaller Companies Series (Fund) covers the fiscal year ended December 31, 2015. Effective at the market close on December 10, 2013, the Fund closed to new investors. Existing shareholders may add to their accounts. We believe this closure can help us manage the inflow of assets and allow us to effectively manage our current level of assets.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital growth. Under normal market conditions, the Fund invests at least 80% of its net assets in investments of smaller companies located outside the U.S., including emerging markets.

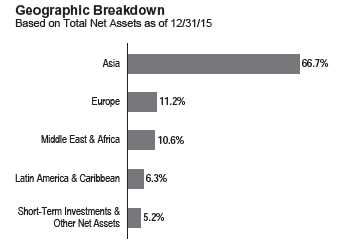

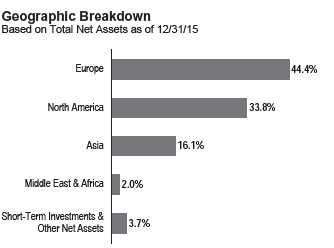

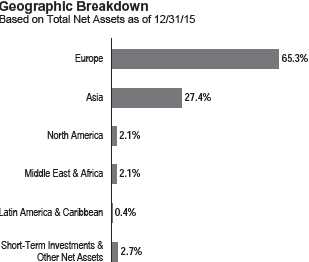

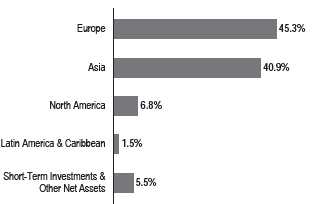

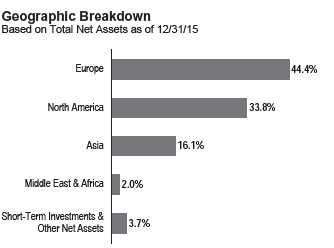

Geographic Breakdown

Based on Total Net Assets as of 12/31/15

Performance Overview

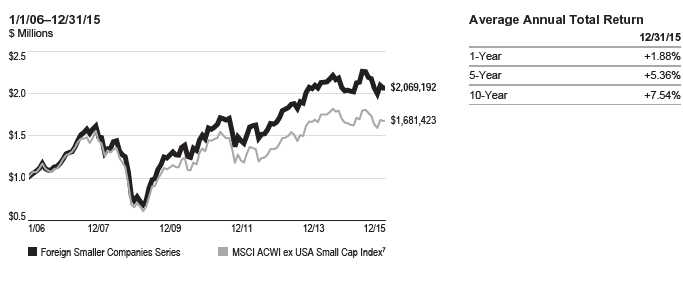

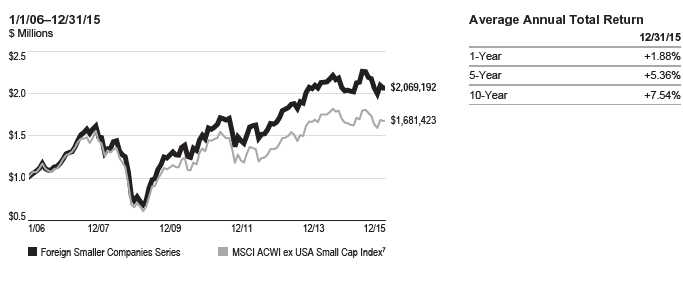

The Fund delivered a +1.88% cumulative total return for the 12-month period under review. In comparison, the MSCI All Country World Index (ACWI) ex USA Small Cap Index, which measures performance of global developed and emerging market small-cap equities, excluding the U.S., generated a +2.95% total return.1 Please note index performance information is provided for reference and we do not attempt to track the index but rather undertake investments on the basis of fundamental research. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 20.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to ftinstitutional.com or call a Franklin Templeton Institutional Services representative at (800) 321-8563.

Investment Strategy

When choosing equity investments, we apply a bottom-up, value-oriented, long-term approach, focusing on the market price of a company’s securities relative to our evaluation of the company’s long-term (typically five years) earnings, asset value and cash flow potential. We also consider a company’s price/earnings ratio, profit margins, liquidation value and other factors.

Portfolio Breakdown

12/31/15

| | |

| | % of Total | |

| | Net Assets | |

| Machinery | 9.3 | % |

| Electronic Equipment, Instruments & Components | 7.0 | % |

| Auto Components | 6.7 | % |

| Household Durables | 5.9 | % |

| Capital Markets | 5.6 | % |

| Leisure Products | 5.4 | % |

| Textiles, Apparel & Luxury Goods | 5.1 | % |

| Real Estate Management & Development | 3.8 | % |

| Personal Products | 3.1 | % |

| Energy Equipment & Services | 2.9 | % |

| Banks | 2.7 | % |

| Food & Staples Retailing | 2.6 | % |

| Technology Hardware, Storage & Peripherals | 2.5 | % |

| Pharmaceuticals | 2.3 | % |

| Food Products | 2.3 | % |

| Software | 2.3 | % |

| Professional Services | 2.2 | % |

| Specialty Retail | 2.2 | % |

| Commercial Services & Supplies | 2.1 | % |

| Life Sciences Tools & Services | 2.0 | % |

| Containers & Packaging | 2.0 | % |

| Other | 14.5 | % |

| Short-Term Investments & Other Net Assets | 5.5 | % |

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 41.

ftinstitutional.com

Annual Report

17

FOREIGN SMALLER COMPANIES SERIES

Manager’s Discussion

Several holdings performed well and contributed to the Fund’s absolute performance during the year under review. Greggs, a vertically integrated U.K. retail baker that owns and operates its supply chain and distribution network, is a leading player in the food-on-the-go sandwich and savories market. Greggs reported strong financial results during the period, attributable to new product offerings and renovated stores, indicating that its products are resonating with customers. We believe that as the U.K. economy improves, the company could benefit from customers who dine out but are open to exploring other dining options. We were pleased to see management executing well on its turnaround strategy and believed it could benefit Greggs’s revenue without significant increases in store count.

Amer Sports is a Finland-based sporting goods company with revenues diversified across several product areas, including winter sports equipment, apparel and footwear, ball sports and fitness equipment. During the period, Amer announced its acquisition of Louisville Slugger, a baseball goods brand. This acquisition does not add substantially to group sales, but it was Amer’s first meaningful acquisition since its acquisition of mountain sports apparel and equipment brand Salomon in 2005. Amer expected its acquisition of Louisville Slugger to have little effect on its fiscal-year 2015 margins but to potentially contribute to fiscal-year 2016 profitability.

Kobayashi Pharmaceutical manufactures and sells pharmaceuticals and other products in Japan and internationally, with half of its products commanding greater-than-50% market share in Japan. Its shares performed well following news that U.S. medical device firm C.R. Bard agreed to buy Kobayashi Pharmaceutical’s 50% stake in Medicon, which distributes medical device products in Japan. Additionally, Kobayashi’s sales benefited from the many Chinese tourists who visited Japan and bought the company’s products due to perceived quality, better packaging and product safety.

In contrast, several holdings detracted from the Fund’s absolute performance during the year. The share price of Canada-based HudBay Minerals, an integrated copper, zinc and gold producer with assets in North and Central America, declined due to commodity market weakness. However, domestic operations continued to progress, with production on new projects increasing and on track to contribute meaningfully to cash flow over the next few years. The company was also nearing an end to a heavy capital investment phase and was positioned to considerably increase its total output. We believe its value was not adequately reflected in the recent price.

| | |

| Top 10 Holdings | | |

| 12/31/15 | | |

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| Rational AG | 2.0 | % |

| Machinery, Germany | | |

| Techtronic Industries Co. Ltd. | 2.0 | % |

| Household Durables, Hong Kong | | |

| Kobayashi Pharmaceutical Co. Ltd. | 2.0 | % |

| Personal Products, Japan | | |

| Gerresheimer AG | 2.0 | % |

| Life Sciences Tools & Services, Germany | | |

| Huhtamaki OYJ | 2.0 | % |

| Containers & Packaging, Finland | | |

| Amer Sports OYJ | 2.0 | % |

| Leisure Products, Finland | | |

| Aalberts Industries NV | 2.0 | % |

| Machinery, Netherlands | | |

| Greggs PLC | 2.0 | % |

| Food & Staples Retailing, U.K. | | |

| Tsumura & Co. | 1.6 | % |

| Pharmaceuticals, Japan | | |

| MEITEC Corp. | 1.6 | % |

| Professional Services, Japan | | |

South Korea-based BNK Financial Group’s shares under-performed amid a tepid South Korean equity market whose performance was negatively affected by currency weakness during the year. Furthermore, the company’s decision to increase capital by issuing new shares hindered stock performance. However, BNK’s operating performance improved, and we believe the company’s focus away from growth and toward profitability and risk reduction is a positive development.

Hong Kong-based VTech Holdings, one of the world’s largest manufacturers and distributors of cordless phones and electronic learning products (ELPs), also detracted from the Fund’s absolute performance. In our long-term view, VTech’s scale and cost competitiveness make it well positioned to maintain its leading position in the U.S. and expand sales in Europe and Asia. We believe new ELP platform launches may potentially drive growth, as VTech can benefit from the “age compression” trend, whereby its preschool-focused products appeal to children at a younger age. In our analysis, the company’s high dividend payout, which management indicated would likely increase, combined with a high return on equity and an absence of debt, could support shares.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment

18 Annual Report

ftinstitutional.com

FOREIGN SMALLER COMPANIES SERIES

traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the 12 months ended December 31, 2015, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s investment predominantly in securities with non-U.S. currency exposure.

Thank you for your continued participation in Foreign Smaller Companies Series. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

ftinstitutional.com Annual Report 19

FOREIGN SMALLER COMPANIES SERIES

Performance Summary as of December 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating

expenses. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graph do

not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the

sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unreal-

ized gains or losses.

| | | | | | | | | | |

| Share Price | | | | | | | | | | |

| |

| Symbol: TFSCX | | | | 12/31/15 | | | 12/31/14 | | Change | |

| Net Asset Value | | | $ | 20.90 | | $ | 20.80 | + | 0.10 | |

| |

| |

| Distributions1 (1/1/15–12/31/15) | | | | | | | | | |

| | | | | Dividend | | | Long-Term | | | |

| | | | | Income | | | Capital Gain | | Total | |

| | | | $ | 0.2779 | | $ | 0.0213 | $ | 0.2992 | |

| |

| |

| Performance2 | | | | | | | | | | |

| | | | | | | | | | Total Annual | |

| | Cumulative | | | Average Annual | | | Value of $1,000,000 | | Operating | |

| | Total Return3 | | | Total Return4 | | | Investment5 | | Expenses6 | |

| | | | | | | | | | 0.98 | % |

| 1-Year | +1.88 | % | + | 1.88 | % | $ | 1,018,783 | | | |

| 5-Year | +29.83 | % | + | 5.36 | % | $ | 1,298,286 | | | |

| 10-Year | +106.92 | % | + | 7.54 | % | $ | 2,069,192 | | | |

Performance data represent past performance, which does not guarantee future results. Investment return

and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current per-

formance may differ from figures shown. For most recent month-end performance, visit ftinstitutional.com

or call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 21 for Performance Summary footnotes.

20 Annual Report

ftinstitutional.com

FOREIGN SMALLER COMPANIES SERIES

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $1,000,000 Investment2

Total return represents the change in value of an investment over the periods shown. It includes any Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

All investments involve risks, including possible loss of principal. The Fund invests in foreign securities, which can involve exposure to currency volatility and

political, economic and regulatory uncertainty. Emerging markets involve heightened risks related to the same factors, in addition to those associated with their

relatively small size and lesser liquidity. The Fund’s investments in smaller company stocks carry special risks as such stocks have historically exhibited greater

price volatility than large company stocks, particularly over the short term. Additionally, smaller companies often have relatively small revenues, limited product

lines and small market share. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results.

The Fund’s prospectus also includes a description of the main investment risks.

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income and

capital gain.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end. Fund

investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not

been annualized.

5. These figures represent the value of a hypothetical $1,000,000 investment in the Fund over the periods indicated.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

7. Source: Morningstar. The MSCI ACWI ex USA Small Cap Index is a free float-adjusted, market capitalization-weighted index that is designed to measure performance of

small cap equity securities of global developed and emerging markets, excluding the U.S.

See www.franklintempletondatasources.com for additional data provider information.

ftinstitutional.com

Annual Report

21

FOREIGN SMALLER COMPANIES SERIES

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases, if applicable; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) of the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period, by following these steps. Of course, your account value and expenses will differ from those in this illustration:

1. Divide your account value by $1,000.

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

2. Multiply the result by the number under the heading “Expenses Paid During Period.”

If Expenses Paid During Period were $7.50, then 8.6 × $7.50 = $64.50.

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the Fund’s actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges, if applicable. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| | | Value 7/1/15 | | Value 12/31/15 | | Period* 7/1/15–12/31/15 |

| Actual | $ | 1,000 | $ | 943.50 | $ | 4.80 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.27 | $ | 4.99 |

| *Expenses are calculated using the most recent six-month annualized expense ratio, net of expense waivers, of 0.98%, multiplied by the aver- |

| age account value over the period, multiplied by 184/365 to reflect the one-half year period. | | |

22 Annual Report ftinstitutional.com

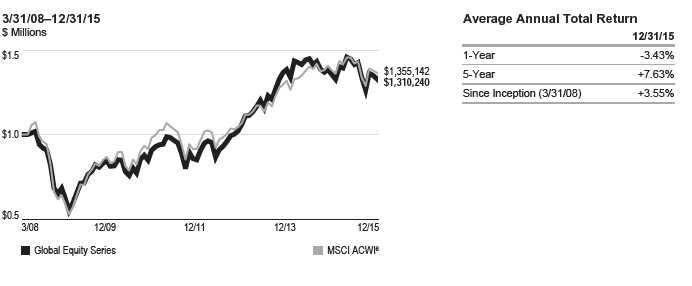

Global Equity Series

This annual report for Global Equity Series (Fund) covers the fiscal year ended December 31, 2015.

Your Fund’s Goal and Main Investments

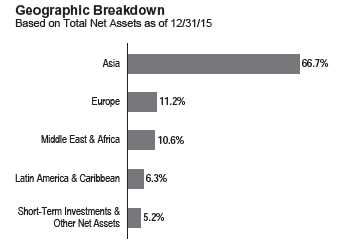

The Fund seeks long-term capital growth. Under normal market conditions, the Fund invests at least 80% of its net assets in equity securities of companies located anywhere in the world, including emerging markets.

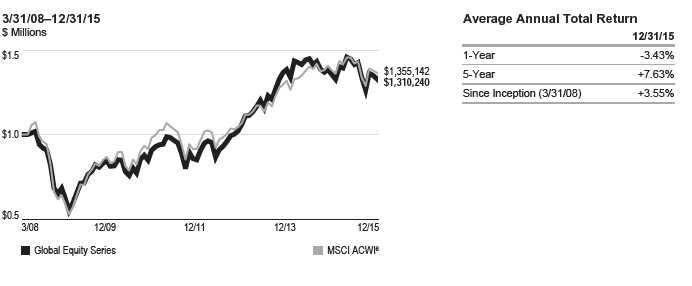

Performance Overview

For the 12 months under review, the Fund had a -3.43% cumulative total return. For comparison, the Fund’s benchmark, the MSCI All Country World Index (ACWI), which measures stock market performance in global developed and emerging markets, had a -1.84% total return.1 Please note index performance information is provided for reference and we do not attempt to track an index but rather undertake investments on the basis of fundamental research. You can find the Fund’s long-term performance data in the Performance Summary on page 27.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For the most recent month-end performance, go to ftinstitutional.com or call a Franklin Templeton Institutional Services representative at (800) 321-8563.

Investment Strategy

We employ a bottom-up, value-oriented, long-term investment strategy. Our in-depth fundamental research evaluates a company’s potential to grow earnings, asset value and/or cash flow. We also consider a company’s price/earnings ratio, profit margins and liquidation value.

Manager’s Discussion

During the tumultuous past year, global stocks hit record highs before succumbing in the third quarter to fears about U.S. Federal Reserve (Fed) tightening, emerging market instability and commodities weakness. Stocks staged a patchy and partial recovery throughout the final months of 2015 but ultimately ended the year modestly down, with a narrow group of

high-growth, high-quality, low-risk issues outperforming value-priced and economically cyclical stocks.

Consumer holdings negatively impacted performance during the year, pressured by an underweighting and stock selection in consumer staples and stock selection in consumer discretionary.2 From the former sector, shares of U.K. retailer Tesco fell following difficult holiday trading. However, with sentiment at an all-time low, valuations extremely depressed and progress evident under new management in the form of steadily improving transactions and volume, Tesco appeared to us positioned for a long-term recovery. The limited bargains we found in consumer staples tended to be among special situations or restructuring stories like Tesco. The sector more broadly has become the most expensive in at least a decade on nearly all major metrics, including earnings, book value and cash flow multiples, while yielding the lowest dividend since the global financial crisis. Despite the sector’s stable earnings and balance sheet profile, our strategy does not favor richly valued companies in an ultra-competitive industry selling commoditized products at single-digit profit margins.

We found more abundant bargains in consumer discretionary, where we believe the market underestimated the organic growth potential and the significant restructuring opportunities evident across the media, retail and automotive industries. U.S. fashion retailer Michael Kors Holdings (sold by period-end) and U.S. department store Macy’s came under pressure during the year. The former fell after posting a surprise sales decline in its primary North American market and issuing a disappointing forecast. Macy’s share price declined from record highs in the

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

2. The consumer staples sector comprises food and staples retailing in the SOI. The consumer discretionary sector comprises auto components, automobiles, household

durables, media, multiline retail and specialty retail in the SOI.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 47.

ftinstitutional.com

Annual Report

23

GLOBAL EQUITY SERIES