PARNASSUS INCOME FUNDS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06673

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2008

| Item 1: | Report to Shareholders |

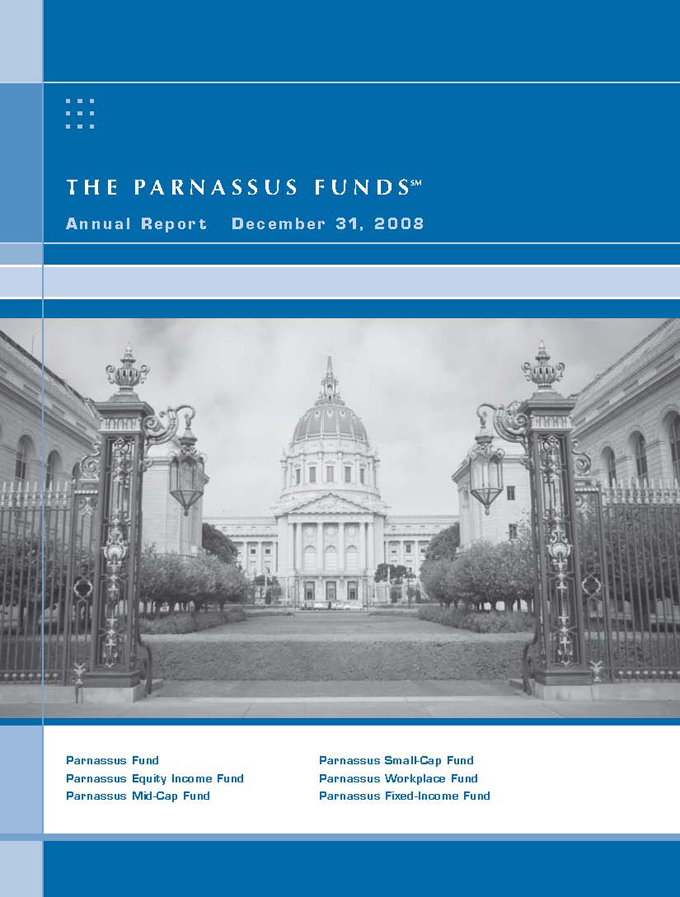

THE PARNASSUS FUNDSSM

Annual Report December 31, 2008

Parnassus Fund Parnassus Small-Cap Fund

Parnassus Equity Income Fund Parnassus Workplace Fund

Parnassus Mid-Cap Fund Parnassus Fixed-Income Fund

| | | |

Parnassus Fund | | (PARNX | ) |

Parnassus Equity Income Fund–Investor Shares | | (PRBLX | ) |

Parnassus Equity Income Fund–Institutional Shares | | (PRILX | ) |

Parnassus Mid-Cap Fund | | (PARMX | ) |

Parnassus Small-Cap Fund | | (PARSX | ) |

Parnassus Workplace Fund | | (PARWX | ) |

Parnassus Fixed-Income Fund | | (PRFIX | ) |

TABLE OF CONTENTS

THE PARNASSUS FUNDSSM

February 9, 2009

DEAR SHAREHOLDER:

The worst financial crisis of my career took place in 2008. In my lifetime, I have never seen anything like it. Major financial institutions have disappeared, and we have seen the end of investment banking as a separate industry. Morgan Stanley and Goldman Sachs, the two most famous investment banks, have become commercial banks and will now have much heavier regulation that will certainly put a damper on their swashbuckling ways. The other large investment banks, Lehman Brothers, Bear Stearns and Merrill Lynch, have completely disappeared either into bankruptcy or into the inner workings of huge financial conglomerates. Large commercial banks have also disappeared, including Washington Mutual and Wachovia. Fannie Mae and Freddie Mac, the two enormous financial institutions that hold half the country’s mortgages, have seen their shareholders wiped out and have been effectively nationalized. In the meantime, home prices have dropped almost 30% on a nationwide basis and last year, the stock market lost more than a third of its value. The economy is now in a deep recession.

Although the country finds itself in dire economic circumstances, both the U.S. Treasury and the Federal Reserve have taken strong action to pull us out of the slump. The thing that makes me most hopeful, though, is the new President and his economic team. So far, his economic appointments have been flawless. President Obama has the right temperament, the right vision and the leadership qualities that will help the nation recover.

Although all five of our equity funds have sustained significant losses, I am happy to report that all of them have outperformed both their Lipper peer groups and their stock market benchmarks. Most impressive has been portfolio manager Todd Ahlsten, whose Parnassus Equity Income Fund beat the S&P 500 Index by 14 percentage points in 2008. As you’ll see in this report, the Parnassus Equity Income Fund is far ahead of all its benchmarks for the three-, five- and ten-year periods as well.

Parnassus Investments Celebrates 25 Years

Parnassus Investments will be celebrating its 25th year anniversary in 2009. It was in 1984 that we launched our first fund, and there remain some very long-term shareholders who have been with us since the beginning. In November we hope to host an event to recognize all our shareholders, and once the date is set I encourage you to plan a trip to San Francisco to celebrate with us in person. We are proud to have earned your trust and confidence and are looking forward to serving you for many years to come.

New Intern

I’m pleased to announce that we have a very highly-qualified individual joining us as an intern. Vikram Gupta is an economics graduate of the University of California at Berkeley. He worked as an investment banking analyst in the Leveraged Finance Group of Credit Suisse First Boston in New York, then served as an associate and later as a principal with the JPMorgan Partners, the private equity/venture capital arm of JPMorgan. In his spare time, Vik enjoys running, hiking, skiing and traveling.

Thank you for investing in the Parnassus Funds.

Yours truly,

Jerome L. Dodson, President

Parnassus Investments

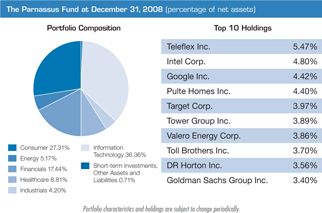

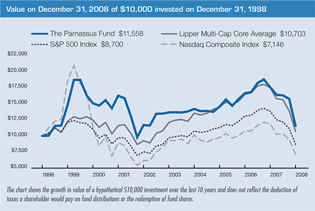

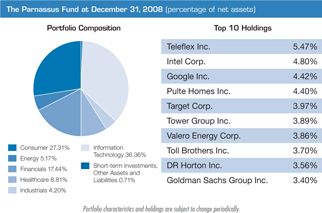

THE PARNASSUS FUND

As of December 31, 2008, the net asset value per share (“NAV”) of the Parnassus Fund was $23.59, so after taking dividends into account, the total return for the quarter was a loss of 26.57%. This compares to a loss of 21.94% for the S&P 500 Index (“S&P 500”), a loss of 22.94% for the average multi-cap core fund followed by Lipper Inc. (“Lipper average”) and a loss of 24.37% for the NASDAQ Composite Index (“NASDAQ”). For the quarter, we lagged all three indices, but we did finish well ahead of the benchmarks for the year. For 2008, the Fund’s total return was a loss of 34.12%, compared to a loss of 37.00% for the S&P 500, a loss of 38.79% for the Lipper average and a loss of 39.98% for the NASDAQ.

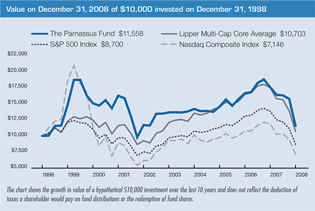

Below are a table and a graph comparing the Parnassus Fund with the S&P 500, the NASDAQ and the Lipper Multi-Cap Core Average over the past one-, three-, five- and ten-year periods. You will notice that we are ahead of all the benchmarks for the three-year period. For the five-year period, we beat the NASDAQ, but we’re behind the S&P 500 and the Lipper average. For the longer-term period of ten-years, we’re ahead of all the indices.

Average Annual Total Returns

for periods ended December 31, 2008

| | | | | | | | | | | | | | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

THE PARNASSUS FUND | | (34.12 | %) | | (7.39 | %) | | (3.28 | %) | | 1.46 | % | | 1.00 | % | | 0.99 | % |

S&P 500 Index | | (37.00 | %) | | (8.36 | %) | | (2.19 | %) | | (1.38 | %) | | NA | | | NA | |

Lipper Multi-Cap Core Average | | (38.79 | %) | | (9.66 | %) | | (2.61 | %) | | 0.82 | % | | NA | | | NA | |

Nasdaq Composite Index | | (39.98 | %) | | (9.81 | %) | | (3.95 | %) | | (2.71 | %) | | NA | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 Index and the NASDAQ Composite Index are unmanaged indices of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Prior to May 1, 2004, the Parnassus Fund charged a sales load (maximum of 3.5%), which is not reflected in the total return calculations. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus, which contains this and other information. The prospectus is available on the Parnassus website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2008, Parnassus Investments has contractually agreed to limit the total operating expenses to 0.99% of net assets, exclusive of acquired fund fees, until May 1, 2009. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

Company Analysis

Our normal practice is to describe which companies had the most impact on the Fund during the year, then briefly explain what caused them to move up or down. It’s difficult to do that this year, since stocks traded on fear, and good companies saw their stock prices crash just as mediocre companies did. In any case, here are six companies that had the most negative impact, each one causing the NAV to drop by 60¢ or more.

Ciena Corporation, a maker of optical network products for telecommunications, hurt our performance the most. It knocked down the price of each Parnassus share by $1.22, as its price sank 80.4% from $34.11 at the beginning of the year to $6.70 by the end. Phone companies, like all businesses, are trying to conserve cash, so they have reduced their capital spending, impacting the sale of Ciena products. I plan to retain Ciena, because demand should increase by the end of 2009, as phone companies have to start adding to their networks.

Refiner Valero Energy cut a very substantial $1.17 off the NAV, as its stock fell from $70.03 at the start of the year to $21.64 by year’s end for a drop of 69.1%. Demand for gasoline dropped as fuel prices increased early in the year, and this caused the company to cut back production. Demand did not pick up much as prices fell later in the year. Valero’s margins also suffered when the “crack spread” (the difference between the cost of crude oil and the price of refined products like gasoline) decreased because gasoline prices dropped faster than the price of crude oil. We’ll continue to hold the stock, since we expect margins to recover in 2009.

Fannie Mae cost the Fund 84¢ on the NAV, as it sank from our cost of $11.31 to $0.95, where we sold it after the announcement that the federal government was taking over the company. Before the government takeover, both Fannie Mae and the federal regulator said that the company had enough capital to weather the storm, so we decided to hold onto the stock. As it turned out, this was not the right decision.

Intel dropped 45.0% during the year, falling from $26.66 to $14.66, thereby slicing 82¢ off each fund share. The recession has reduced demand for electronic products, so semiconductor sales have been disappointing. We’ll continue to hold Intel’s stock, since it’s a solid company that should make a strong comeback once the recovery starts.

American Express cost the Fund 69¢, sinking 52.9% from $39.36 where we bought it during the year until it hit $18.55 by end of the period. At the time we invested, I thought the stock was a bargain, since it had been as high as $65.89 in July of 2007 and traded around $52 at the beginning of the year. American Express was affected because it relies on the credit markets to fund its card business, and investors are concerned that its customers might not be able to pay back what they owe. We’re holding onto the stock, since we think it will move much higher once the recovery gets started.

Powerwave Technologies, a manufacturer and distributor of products for wireless telephone networks, saw its stock fall 87.6% from $4.03 to $0.50, costing the Fund 63¢ per share. Wireless phone companies are hanging onto their cash because of all the economic uncertainty, so they’re not investing much in their networks.

Believe it or not, we had six companies that contributed 20¢ or more to the NAV for the year. In some cases, these companies made a positive contribution to the NAV based on special circumstances.

Valeant Pharmaceuticals added 39¢ to each Parnassus share, as its stock soared 51.6% from $11.97 at the start of 2008 to $18.15 where we sold it late in the year. The company brought out new products, and the CEO restructured what had been an unwieldy organization into a more efficient and rational operation with lower costs. We sold the stock because we thought it had reached its intrinsic value.

Wells Fargo added 36¢ to the NAV, even though its stock dropped 2.4% during the year from $30.19 to $29.48. Your first thought may be that I worked some magic on this stock, or that I might be trying to pull a fast one. In fact, the explanation is pretty straightforward. We didn’t buy any stock at $30 early in the year, but waited until it dropped well below that figure, accumulating most of our shares after it dropped into the mid-20s. In late September and early October when the stock climbed above $37, we sold half of our shares. At that point, Wells Fargo was one of the few banks that looked financially strong, so its stock climbed above $37 a share before it came back to earth. We’re still holding onto half our shares.

A similar thing happened with Qualcomm, the San Diego-based company that makes software and semiconductors that power wireless telecommunications equipment, including cell phones. The stock started the year at $39.35 and ended at $35.83 for a decline of 8.9%. However, we sold most of our Qualcomm stock in August, when the price had risen to about $54 a share.

Even more remarkable is the case of W&T Offshore, a company that explores for and produces petroleum. The shares started the year at $29.96 and ended at $14.32 for a frightening drop of 52.2%. Yet, the stock contributed 29¢ to the NAV. What happened was that we sold most of our shares in the late spring and early summer at prices well over $50, as the price of oil moved up to $140 a barrel. Now that the price of oil is below $50 a barrel, we’ve bought more shares.

Mentor Graphics, the Oregon-based maker of software used to design semiconductors, added 20¢ to each Parnassus share, even though the stock plunged 52.0% from $10.78 to $5.17 at the end of the year. We sold all our shares in June around $15.40 when Cadence Design made a hostile takeover offer at $16 a share.

BEA Systems, a provider of business enterprise software, contributed 20¢ to the NAV as it rose 22.8% from $15.78 to $19.38 on a buyout by Oracle.

Outlook and Strategy

Right now, stocks are trading not on fundamentals but fear. Valuations are as low as I can remember, reflecting the dismal state of the economy. If the economy continues this way, then the valuations are accurate. However, if the economy starts to recover sometime this year, the stock market should move much higher. Since the stock market is a discounting mechanism, it should come back before the economy does. We don’t know when the recovery will occur, and stocks seem to have hit bottom, so we’re staying fully invested in good companies now trading at bargain prices.

Jerome L. Dodson, President

Parnassus Investments

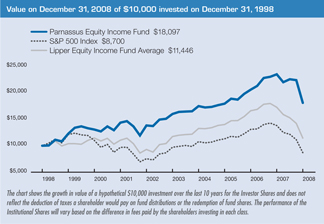

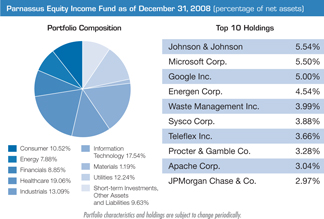

THE PARNASSUS EQUITY INCOME FUND

As of December 31, 2008, the net asset value per share (“NAV”) of the Parnassus Equity Income Fund – Investor Shares was $19.29. After taking dividends into account, the total return for the year was a loss of 22.95%. This compares to a decline of 37.00% for the S&P 500 Index (“S&P 500”) and a loss of 33.77% for the average equity income fund followed by Lipper Inc. (“Lipper average”). For the fourth quarter, the Fund was down 19.16% versus a decline of 21.94% for the S&P 500 and drop of 19.53% for the Lipper average. While I hate to lose money, the Fund fell far less than its peer group during 2008’s “once in a generation” stock market decline. We were able to cushion the loss, outperforming the S&P 500 by such a wide margin because the Fund owned few financial stocks. In contrast, the Fund’s performance was boosted by our quality holdings in the healthcare, technology and industrial sectors.

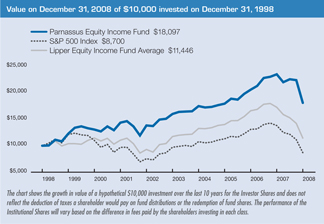

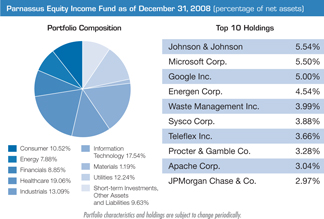

Our strategy of buying good, undervalued businesses has generated superb long-term results. I am especially proud that the Fund has positive investment returns for the trailing three-, five- and ten-year periods versus losses for S&P 500. The Fund’s average annual return over the past 10 years has been 6.11% versus a loss of 1.38% for the S&P 500 in each of those periods. Our objective is to continue building long-term wealth for shareholders. While I am the portfolio manager of the Fund, I am also a substantial shareholder, and the majority of my liquid net worth is invested in the Fund.

Below is a table that compares the performance of the Fund with that of the S&P 500 and the average equity income fund followed by Lipper. Average annual total returns are for the one-, three-, five- and ten-year periods.

Average Annual Total Returns

for periods ended December 31, 2008

| | | | | | | | | | | | | | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

PARNASSUS EQUITY INCOME FUND | | | | | | | | | | | | | | | | | | |

Investor Shares | | (22.95 | %) | | 0.29 | % | | 2.50 | % | | 6.11 | % | | 1.04 | % | | 1.00 | % |

Institutional Shares | | (22.73 | %) | | NA | | | NA | | | NA | | | 0.83 | % | | 0.79 | % |

S&P 500 Index | | (37.00 | %) | | (8.36 | %) | | (2.19 | %) | | (1.38 | %) | | NA | | | NA | |

Lipper Equity Income | | | | | | | | | | | | | | | | | | |

Fund Average | | (33.77 | %) | | (6.69 | %) | | (0.73 | %) | | 1.08 | % | | NA | | | NA | |

The total return for the Parnassus Equity Income Fund-Institutional Shares from commencement (April 28, 2006) was (1.92%). The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the Classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information up to the most recent month-end is on the Parnassus Investments website (www.parnassus.com). Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Standard and Poor’s 500 Composite Stock Index, also known as the S&P 500, is an unmanaged index of common stocks, and it is not possible to invest directly in an index. An index does not take any expenses, fees or taxes into account, but mutual fund returns do. On March 31, 1998, the Fund changed its investment objective from a balanced portfolio to an equity income portfolio. Before investing, an investor should carefully consider the investment objectives, risk, charges and expenses of the Fund and should carefully read the prospectus, which contains this and other information. The prospectus is on the Parnassus Investments website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated, May 1, 2008, Parnassus Investments has contractually agreed to limit the total operating expenses to 0.99% and 0.78% of net assets, exclusive of acquired fund fees, through May 1, 2009 for the Investor Shares and Institutional Shares, respectively. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

2008 Analysis

While the stock market suffered its worst annual result in decades, I am pleased that the Fund reduced potential shareholder losses by beating the S&P 500 by 14 percentage points. Overall, picking the right stocks within sectors added 10% to our return versus the S&P 500, while overweighting and underweighting sectors boosted our results by 4%.

The year’s investment highlight was the decision to underweight the financial services sector. Furthermore, our ability to select the best relative performers within this sector significantly enhanced performance. These decisions shielded investors to a certain extent from the financial market meltdown, adding 4.27% to our return versus the S&P 500. I owe a big thank you to Parnassus Investment analyst Minh Bui as his forewarning regarding this economic crisis proved invaluable. His research, along with input from the rest of the investment team, convinced me to focus investments in this sector only on leading, healthy companies that could emerge stronger from the credit crisis. Wells Fargo, one of the Fund’s largest financial sector investments, actually rose 5.3% from our average cost during the year, as CEO John Stumpf successfully steered the company away from the worst of the financial crisis.

Strong stock-picking in industrials and technology added 2.75% and 2.27% of our S&P 500 lead, respectively. Analysts Ben Allen and Lori Keith were especially helpful to me in these areas. Propelled by the takeover offer of chemical-maker Rohm & Haas, our materials sector exposure added 1.76% to our outperformance versus the S&P 500. A balance of an over weight position with good stock selection within healthcare boosted our outperformance by 1.46%. Within healthcare, analyst Pearle Lee did a fantastic job recommending biotechnology and pharmaceutical companies, while Matthew Gershuny added value with solid healthcare and business service investment ideas. Overall, the portfolio’s results in 2008 proved the importance of owning great companies at undervalued prices within each sector of our investment universe.

Company Analysis

Considering the market’s performance, we were fortunate that only four stocks reduced the NAV by more than 40¢ per share over the course of the year. Microsoft saw its stock decline 45.4%, from $35.60 to $19.44, which lowered our NAV by 71¢ per share. In early 2008, Microsoft took a hit when the company bid $47.5 billion to buy Yahoo!. This offer was much too high, and Microsoft’s stock dropped 10% when the news hit. Fortunately, Yahoo! rejected Microsoft’s offer.

While I was disappointed that Microsoft was willing to pay such a large price for Yahoo!, I held onto our large investment because the company has a phenomenal software business. Unfortunately, the stock market began its rapid slide just as the Yahoo! distraction was fading, so the stock never recovered. Despite strong reported profits from Microsoft during 2008, investors are concerned about a slowdown in 2009. We continue to like Microsoft because of its dominant market position, significant recurring revenue stream, $24 billion cash position and attractive dividend.

Google, another of our large holdings, fell 55.5% for the year from $691 to $308 per share, lowering the price of our fund shares by 61¢. However, this price decline over-states our true loss, as the Fund owned far fewer shares at the beginning of the year and bought more shares as it fell to bargain levels. Our average cost for Google is $384.53 per share, so the loss on our investment for the year is a less daunting 21.7%.

Like Microsoft, Google’s profits held up well during 2008 based on growing demand for its online advertising services. The stock fell because of fears that Google’s customers would cut advertising budgets as consumers pull back on spending in a slowing economy. Our view is that Google is a terrific business with long-term competitive advantages. In addition, while its competitors struggle to catch up, Google has over $14 billion in cash and continues to add great people and products to enhance its competitive moat.

ProLogis, the real estate investment trust, reduced the Fund’s NAV by 51¢ in 2008, losing 78.1% of its value and closing the year at $13.89 per share. Most of this damage was done after Lehman Brothers declared bankruptcy in September. This bankruptcy crippled the credit markets, impairing the value of companies like ProLogis that rely on credit to fund their business activities.

Colleague Ben Allen and I spent a great deal of time during the last quarter determining if this impairment of value is “permanent.” Our belief is that ProLogis should survive this credit crisis, but that it could be a while until the stock returns to our cost basis of $31.46 per share.

Energen, an energy company that operates Alabama Gas and is a top-20 U.S. owner of natural gas and oil reserves, declined 54.3% from $64.23 to $29.33, costing the Fund 45¢ during the year. While we trimmed some energy investments as oil prices entered bubble territory in mid-2008, we held our Energen position. The reason is that the company has hedged a large portion of its 2009 and 2010 production at high prices and has very little debt on its balance sheet. In addition, the company’s oil and gas comes from long-lived wells, which helps Energen predict production levels. Unfortunately, Energen’s stock fell in-line with its peers, disproving my investment thesis in the short-term.

After sitting down with Energen management during the fourth quarter, I am confident that the team is top notch, and that they will use this downturn to buy valuable assets with an eye toward long-term growth. As a result, I added considerably to our position during the most recent quarter.

In a year when the S&P 500 fell 37%, any stock that rose at all could be considered a winner. I am pleased to say the Fund had 16 stocks that contributed a positive gain in 2008, and two of these added over 10¢ to the NAV. Rohm & Haas, a socially responsible chemical company, climbed 32.4% from $53.07 to our average selling price of $70.24, adding 19¢ to our NAV. Dow Chemical, recognizing Rohm & Haas’ strong secular growth prospects, offered to pay $78 per share for the company in July.

On the heels of this offer, we sold our entire position about $8 below the proposed offering price. We did this because of our concern that the deal could fall apart due to the credit crisis and weakening economy. As of this writing, Rohm & Haas’ stock is back down to $61 per share as one of Dow Chemical’s backers, the Kuwaiti government, pulled $7 billion of proposed financing for the deal, proving that our concerns were well founded.

EOG Resources, an oil and gas producer based in Houston, Texas, added 11¢ to the NAV during 2008. EOG has a good environmental record, and the company has a large portfolio of long-lived, low-cost energy reserves. The stock began the year at $89.25 and jumped to over $120 per share in the first quarter of 2008 as oil prices rose, and the company discovered large reserves in North Dakota.

We sold our position at an average cost of $112 per share by March when EOG’s stock hit what I considered its fair value. This transaction generated the majority of our gain in EOG for 2008. After oil and natural gas prices plunged in late 2008, we bought EOG shares back at an average price of $63.44. The stock ended the year up slightly from this level, which contributed to some of the 11¢ NAV gain.

Outlook and Strategy

We are in extraordinary times. As of this writing, the U.S. economy is in a significant recession, and almost all economic data are looking negative and getting worse. The newsstands are filled with varied explanations of how our economy got to this point, and even more predictions about what the coming years will bring. While we have written extensively about housing market risks for almost two years, and our defensive posture helped the Fund’s performance in 2008, the economy is in much worse shape than I originally anticipated. Unfortunately, a near-term recovery is unlikely.

After the S&P 500’s 37% drop in 2008, many investors are fatigued and emotional, jarred by the flood of negative economic, political and social news both here and abroad. While I read the same reports as everyone else, as a portfolio manager, it’s my job to step away from the frenzy, filter out the nonsense, and focus on long-term trends that will reveal sustainable investment themes and ideas.

While it seems highly probable that the economy will get worse before it gets better, massive government stimulus and record-low interest rates should serve as stabilizing factors. This tug of war between despair and optimism is causing immense volatility as winners and losers switch places almost daily. During my two-day trip to New York in early December, the S&P 500 had an amazing 18% swing over two days! That type of volatility used to be measured in years, not days!

We are using this volatility to our advantage, buying great businesses that meet our rigorous research criteria when pricing opportunities arise. While the economy faces serious challenges, and it is extremely hard to know when the recovery will hit, I am confident that “the strong will get stronger” as we move through this economic cycle. In each industry, we are looking to buy the undervalued companies with significant competitive advantages, attractive secular growth opportunities, great management teams and the healthiest balance sheets. These companies, unlike their peers, will be able to invest during the downturn and thrive when the economy rebounds.

We are overweighted relative to our index in the healthcare, technology and energy sectors, as we believe several leaders in these industries are undervalued, can remain profitable in this downturn and will do well in a normalized economic environment. In healthcare, our largest holding is Johnson & Johnson. This company has increased dividends fo 46 years in a row and has a tremendous portfolio of products with sturdy demand. In technology, our two biggest holdings are Microsoft and Google. As discussed earlier, these companies have about $40 billion of combined cash, dominant products, great people and secular growth opportunities. Our two largest energy investments, Energen and Apache Corporation, boast strong track records and low-cost reserves.

The Fund remains underweighted relative to our index in financial and consumer stocks. Companies in these areas have benefited more than most from the excessive leverage of the past few years, so as debt levels return to normal, we believe most stocks in these sectors will continue to under-perform. In the finance arena, our portfolio companies have superb management teams and significant competitive advantages. We are avoiding consumer discretionary businesses and instead are focusing on companies that sell basic goods for everyday life. Foodservice company Sysco is our largest consumer-related holding—despite the downturn, people still need to eat. Procter & Gamble, another important consumer holding, boasts over 20 brands, like Tide detergent, which generates over $1 billion in annual sales. Finally, we are a top ten shareholder in WD-40, which is run by the talented Australian Garry Ridge. I am confident that doors and cabinets will squeak even through recessions!

Even though our financial markets are strained and the national mood is sour, it’s important to remember that the underlying structural advantages of our nation are intact. In previous recessions and bear markets, our country and its leading businesses have emerged stronger from their challenges. I am confident that a similar consequence will emerge after this downturn. This bolsters my conviction that over the long-term, our high-quality portfolio companies should increase in value. It’s also why I still have the bulk of my liquid net worth in the Parnassus Equity Income Fund. To echo what my colleague Ben Allen likes to say, “When it comes to long-term investing, don’t bet against America!”

Yours truly,

Todd C. Ahlsten

Chief Investment Officer

THE PARNASSUS MID - CAP FUND

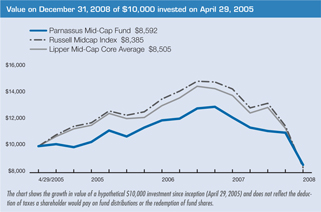

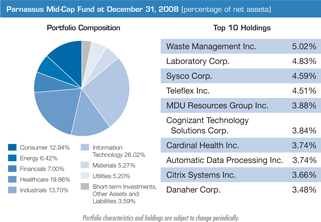

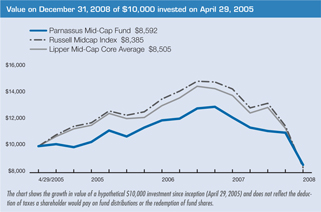

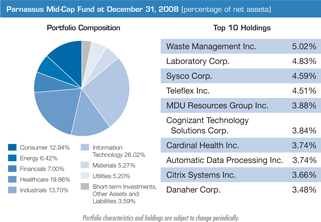

As of December 31, 2008, the net asset value per share (“NAV”) of the Parnassus Mid-Cap Fund was $12.00. After taking dividends into account, the total return for 2008 was a loss of 29.38%. This compares to a loss of 41.46% for the Russell Midcap Index (the “Russell”) and a loss of 38.53% for the average mid-cap core fund followed by Lipper Inc. (“Lipper average”). Although we had a large loss for the year, we substantially outperformed both our benchmarks, beating the Russell Index by 12 percentage points and the Lipper average by nine percentage points.

Below is a table comparing the Parnassus Mid-Cap Fund with the Russell Index and the Lipper average for the one- and three-year periods, for the period since September 30, 2005 when we first had most of the Fund’s assets invested in stock and for the period since inception on April 29, 2005. We’re proud to report that the Fund’s returns are better than all the benchmarks for all time periods.

Average Annual Total Returns

for periods ended December 31, 2008

| | | | | | | | | | | | | | | | | | |

| | | One

Year | | | Three

Years | | | Since

September 30,

2005 | | | Since

Inception

April 29, 2005 | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

PARNASSUS MID-CAP FUND | | (29.38 | %) | | (5.93 | %) | | (4.35 | %) | | (4.05 | %) | | 2.05 | % | | 1.41 | % |

Russell Midcap Index | | (41.46 | %) | | (10.68 | %) | | (9.26 | %) | | (4.91 | %) | | NA | | | NA | |

Lipper Mid-Cap Core Average | | (38.53 | %) | | (9.61 | %) | | (8.25 | %) | | (4.15 | %) | | NA | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information up to the most recent month-end is on the Parnassus Investments website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. During the most recent quarter, Lipper changed our benchmark from Mid-Cap Value to Mid-Cap Core. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus, which contains this and other information. The prospectus is available on the Parnassus Investments website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2008, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.40% of net assets, exclusive of acquired fund fees, until May 1, 2009. For the year ending December 31, 2008, Parnassus Investments has agreed to further reduce the total operating expenses to 1.20% of net assets exclusive of acquired fund fees. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

2008 Analysis

This past year was very difficult for stock investors, culminating in a volatile and demoralizing fourth quarter. The most recent quarter saw all major stock indices plummet, and the Mid-Cap Fund was not immune. It was not an easy time for a new portfolio management team to take over the Fund, but the silver lining is that we outperformed our Russell benchmark by over 5 percentage points, a substantial margin in a short amount of time. For the year as a whole, the Fund’s outperformance was even larger at 12 percentage points. This was almost entirely due to individual stock selection as opposed to sector weights relative to the benchmark. Jerome Dodson did a terrific job running this Fund from inception until September 30, 2008, and we will work hard to build upon his record.

Since taking over the Fund, we have exited a relatively large number of positions and added some new ones. While every portfolio manager at Parnassus Investments shares research resources and follows the same investment process, we do have slight differences in how we construct our respective portfolios. In light of these changes, we will limit our company analysis to six significant winners and losers that the Fund owned after the portfolio management transition.

Company Analysis

Our basic investment philosophy focuses on owning high-quality businesses that stand to benefit from positive, long-term secular trends. We believe the three winners discussed below represent our adherence to this philosophy. These companies also have strong management teams, sound balance sheets and are trading at reasonable valuations relative to their long-term potential.

Amazon.com closed the year at $51.28, 19.5% higher than our cost of $42.92, adding 9¢ to the Fund’s NAV. We think the on-line retailer will benefit from market share growth, helping them offset the negative impacts of the recession. The company generates a large amount of cash flow, which is used for reinvestment in the business and to bolster the balance sheet.

McAfee was up 21.8% to $34.57 from our cost of $28.39, adding another 9¢ to the NAV. We think security software is in the midst of a long, positive upswing, and that McAfee is positioned well relative to its competitors. The company has no debt on its balance sheet and a solid track record of high cash flow generation.

Automatic Data Processing (ADP), a company best known for its payroll processing service, rose 10.6% to $39.34 from our cost of $35.57, adding 7¢ to the NAV. ADP should benefit from a continued move to outsourcing non-core business functions like payroll and benefit administration and potential consolidation in its industry. Regarding its financial position, the company is one of only a handful of AAA-rated companies in the United States.

The most significant loser this year was ProLogis, which cost the Fund 48¢ in NAV, as its shares dropped 78.1% to $13.89 over the course of the year. This real estate investment trust relies on credit to fund its business, and it was negatively affected by the Lehman Brothers’ bankruptcy in September. During the fourth quarter, ProLogis installed a new CEO, Walt Rakowich, who has begun an aggressive restructuring to position the company for a prolonged economic downturn.

Nordstrom, the high-end specialty department store, lopped 30¢ off the NAV, as its stock sank 63.8%, dropping from $36.73 to $13.31. Like most retailers, Nordstrom has been hurt by the recession. We still hold the shares because we think Nordstrom is a best-in-class operator and should emerge from this economic downturn in relatively strong shape.

Software provider Citrix’s shares declined 38.0% from $38.01 to $23.57 during the year, reducing the NAV by 21¢. The stock has suffered from investor concerns about possible information technology budget cuts in 2009, which would hurt sales for Citrix’s web and desktop virtualization software products. The company has also seen their margins contract due to investments in new products. We’re heartened by the fact that the company continues to maintain a leading market share position in its core products, and that its investments should improve sales and margins in 2009.

Outlook and Strategy

Since we joined Parnassus Investments as senior research analysts, all three of us have worked very closely with Jerome Dodson, the previous Parnassus Mid-Cap Fund portfolio manager, and Todd Ahlsten, our Chief Investment Officer. Because of this, we’re very well versed in the Parnassus investment philosophy and rigorous research process.

As Chief Investment Officer, Todd Ahlsten has been invaluable to us in ensuring a smooth transition to our portfolio management responsibilities. He’s been especially good at helping us crystallize an investment strategy that drives our individual stock selections and sector allocations. Practically speaking, this means that our investment strategy for 2009 is essentially the same as what Todd describes in his commentary on the Parnassus Equity Income Fund. The main differences in our portfolios are due to our mid-cap mandate, which means that we don’t own the large cap stocks found in Todd’s fund.

Our overarching investment strategy is to buy undervalued companies with strong balance sheets, competitive advantages, secular growth and great management. Given the strains in the economy and financial markets, we think this strategy should work especially well in 2009. As the recession deepens, we expect companies with poor competitive positions and fragile balance sheets to lag further behind industry leaders. Because of this, we’ve loaded the portfolio with leading companies in industries that should not only hold up in a recession, but also thrive when the economy eventually recovers.

Thank you for your investment with us.

Yours truly,

| | | | |

| |  | |  |

| | |

| Benjamin E. Allen | | Matthew D. Gershuny | | Lori A. Keith |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

THE PARNASSUS SMALL - CAP FUND

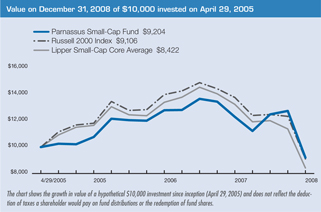

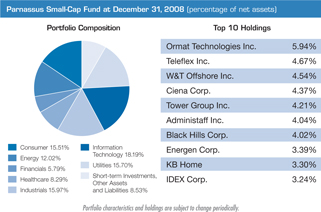

As of December 31, 2008, the net asset value per share (“NAV”) of the Parnassus Small-Cap Fund was $12.63, so after taking dividends into account, the total return for the quarter was a loss of 27.73%. This compares to a loss of 26.12% for the Russell 2000 Index (“the Russell”) and a loss of 25.95% for the average small-cap core fund followed by Lipper Inc. (“Lipper average”). For the quarter, we underperformed the indices, but for the year, we were way ahead of the benchmarks. The Parnassus Small-Cap Fund’s total return for the year was a loss of 25.08%, compared to a loss of 33.79% for the Russell Index and a loss of 36.21% for the Lipper average. Even though it was a terrible year, we finished more than 11 percentage points ahead of the average small-cap core fund followed by Lipper.

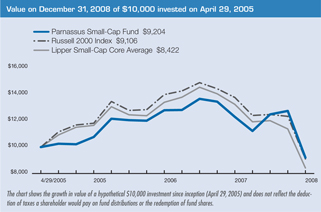

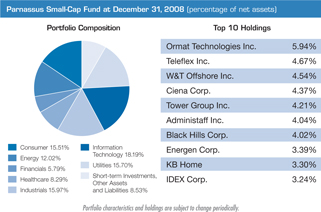

Below are a table and a graph that compare the performance of the Parnassus Small-Cap Fund with that of the Russell 2000 Index and the Lipper Small-Cap Core Average. You’ll notice that the Fund is substantially ahead of all benchmarks for all time periods. Besides the one- and three-year numbers, we’ve included the period since inception and the returns since September 30, 2005, since that is the approximate date when the Fund first had most of its assets invested in stock.

Average Annual Total Returns

for periods ended December 31, 2008

| | | | | | | | | | | | | | | | | | |

| | | One

Year | | | Three

Years | | | Since

September 30,

2005 | | | Since

Inception

April 29, 2005 | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

PARNASSUS SMALL-CAP FUND | | (25.08 | %) | | (5.09 | %) | | (3.15 | %) | | (2.24 | %) | | 2.08 | % | | 1.42 | % |

Russell 2000 Index | | (33.79 | %) | | (8.28 | %) | | (7.35 | %) | | (2.72 | %) | | NA | | | NA | |

Lipper Small-Cap Core Average | | (36.21 | %) | | (10.06 | %) | | (9.01 | %) | | (4.45 | %) | | NA | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 2000 Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Small-cap companies can be particularly sensitive to changing economic conditions and have fewer financial resources than large-cap companies. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus, which contains this and other information. The prospectus is on the Parnassus website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2008, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.40% of net assets, exclusive of acquired fund fees, until May 1, 2009. For the year ending December 31, 2008, Parnassus Investments has agreed to further reduce the total operating expenses to 1.20% of net assets exclusive of acquired fund fees. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

Company Analysis

Virtually all stocks went down this year, but five companies in the Parnassus Small-Cap Fund went down more than most and did significant damage to our portfolio. Each accounted for a loss of 70¢ or more on the NAV. The worst one was Ciena, which cost us a staggering $1.40 per fund share, dropping 80.4% from $34.11 to $6.70 by the end of the year. Ciena makes products for optical networks used in telecommunications. Phone companies have cut back on capital spending to build out their networks, and this cutback devastated Ciena’s stock. Had I known how much the shares would drop, I wouldn’t have owned the stock, but now that we own it, I’m hanging on. I expect Ciena to climb much higher when the recovery starts and phone companies increase capital spending to improve their communication networks.

W&T Offshore sliced 99¢ off the NAV, as its stock fell 52.2% from $29.96 at the start of the year to $14.32 by the end. The company has petroleum exploration and production facilities in the Gulf of Mexico, and after a run-up early in the year, the stock crashed as oil prices dropped below $40 a barrel.

Mitcham Industries was a victim of the same crash in oil prices as W&T Offshore: its stock sank 80.7% from $20.56 to $3.97, knocking 95¢ off each fund share. The company makes seismic equipment for use in exploring for oil, and sales of exploration equipment dropped sharply along with the price of oil.

Quicksilver Resources’ primary business is exploring for and producing natural gas; it also owns and operates natural gas pipelines. The stock subtracted 75¢ from the NAV, as it fell 62.5% from $14.85 where we bought it to $5.57. The sharp decline in energy prices affected Quicksilver just as it did W&T Offshore and Mitcham Industries.

Energen explores for, produces and sells natural gas, and demand has weakened during the recession, especially from industrial customers. The stock lost 36.3% of its value, as it dropped from $46.04, where we bought it in August and September, to $29.33 by the end of the year. This drop cost us 73¢ per fund share.

Amidst all the gloom, five companies made positive contributions to the Parnassus Small-Cap Fund’s NAV. Valeant Pharmaceuticals contributed 22¢ to each fund share, as its stock defied gravity by soaring 52.0% from $11.97 at the start of the year to $18.20, where we sold it, late in the year. The company brought out new products, and the new CEO restructured what had been an unwieldy organization into a more efficient and rational operation with lower costs. We sold the stock, because it had appreciated so much, and we thought it had reached its intrinsic value.

Insurer Tower Group added 19¢ to the NAV, even though its stock went from $33.40 to $28.21 during the year for a loss of 15.5%. The reason it made a positive contribution to the NAV is that we bought a lot of stock during the year in the $20 to $25 range and sold a lot of stock in the $29 to $32 range. We’re holding onto the shares we still own because we think Tower has an effective strategy of providing insurance to small businesses.

Computer Programs and Systems provides information technology to community hospitals in the United States, mostly in rural areas. Despite the recession, sales have been strong because of its quality products. The stock rose 17.9% during the year from $22.74 to $26.80 for a gain of 14¢ on the NAV.

Childcare-provider Bright Horizons Family Solutions added 12¢ to the NAV, as its stock went from $34.54 at the start of the year to $48.25 on a buyout. Shares of ViroPharma rose from $7.94 at the start of the year to $10.58 where we sold them in July when the stock hit our target price.

Jerome L. Dodson, President

Parnassus Investments

THE PARNASSUS WORKPLACE FUND

As of December 31, 2008, the net asset value per share (“NAV”) of the Parnassus Workplace Fund was $12.22, so after taking dividends into account, the total return for the quarter was a loss of 24.44%. This compares to a loss of 21.94% for the S&P 500 (“S&P 500”) Index and a loss of 22.94% for the average multi-cap core fund followed by Lipper Inc. (“Lipper average”). For the quarter, we underperformed the indices, but for the year, the Fund was substantially ahead of its benchmarks. The Workplace Fund’s total return for 2008 was a loss of 29.94%, compared to a loss of 37.00% for the S&P 500 and a loss of 38.79% for the Lipper average.

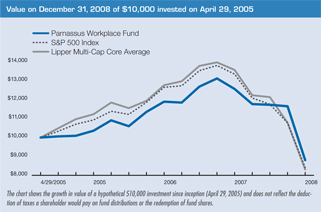

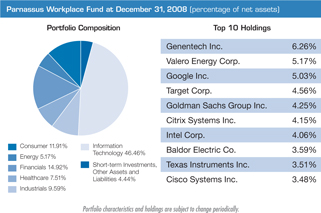

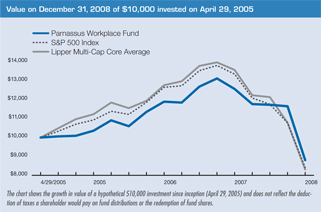

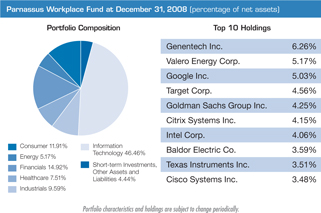

Below are a table and a graph that compare the performance of the Parnassus Workplace Fund with that of the S&P 500 Index and the Lipper Multi-Cap Core Average. You will notice that the Workplace Fund is ahead of both its benchmarks for all time periods. We’ve included results for not only the one- and three-year time periods, but also for the period since inception and the period since September 30, 2005, the approximate date when we first had most of the Fund’s assets invested in stock.

Average Annual Total Returns

for periods ended December 31, 2008

| | | | | | | | | | | | | | | | | | |

| | | One

Year | | | Three

Years | | | Since

September 30,

2005 | | | Since

Inception

April 29, 2005 | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

PARNASSUS WORKPLACE FUND | | (29.94 | %) | | (5.28 | %) | | (4.11 | %) | | (3.41 | %) | | 2.65 | % | | 1.21 | % |

S&P 500 Index | | (37.00 | %) | | (8.36 | %) | | (7.16 | %) | | (4.61 | %) | | NA | | | NA | |

Lipper Multi-Cap Core Average | | (38.79 | %) | | (9.66 | %) | | (8.31 | %) | | (5.01 | %) | | NA | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus, which contains this and other information. The prospectus is available on the Parnassus website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2008, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.20% of net assets, exclusive of acquired fund fees, until May 1, 2009. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

Company Analysis

Four companies did the most damage to the Workplace Fund during the year, with each one slicing 47¢ or more off the NAV. American Express cost the Fund 62¢ per fund share, with its stock price dropping 64.3% from $52.02 to $18.55. Investors are concerned because the company uses the credit markets to finance its card business, and there’s also concern that cardholders will not be able to pay back what they owe.

Oil-refiner Valero cut 60¢ off each fund share, as its stock sank 69.1% from $70.03 to $21.64. Earnings declined as margins contracted, and Americans drove less and bought less gasoline.

Corning’s most important product is glass used in liquid crystal displays for high-definition television sets and computer monitors; sales of these items have dropped substantially. The company’s stock fell 60.3% during the year from $23.99 to $9.53 for a decline of 48¢ in the NAV.

Google fell 55.5% during the year, sinking from $691 to $308 for a loss of 47¢ per fund share. Investors became concerned that Internet advertising would drop sharply due to the recession.

Four companies each made a positive contribution of 8¢ or more to the NAV. Bright Horizons Family Solutions contributed 18¢ to each fund share, as its stock rose 39.7% from $34.54 to $48.25 on a buyout by a private equity group.

Wells Fargo Bank added 15¢ to the NAV, even though its stock dropped 2.4% during the year from $30.19 to $29.48. We bought the stock in the range of $27 to $28 early in the year, then sold almost half our position at $36.95 in early October.

Qualcomm, the provider of software and semiconductors that power wireless communications equipment including cell phones, added 13¢ to each fund share, even though its stock dropped 8.9% during the year, going from $39.35 to $35.83. We sold all of our shares at an average price of $49.93, when the stock climbed higher in the August to early October time period.

Simpson Manufacturing contributed 8¢ to the NAV, as its stock went from $26.59 to $27.76 for a gain of 4.4%. The company makes fasteners and other construction materials, and sales held up better than expected during the year.

Jerome L. Dodson, President

Parnassus Investments

PARNASSUS FIXED - INCOME FUND

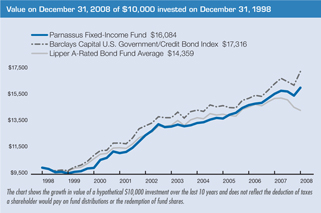

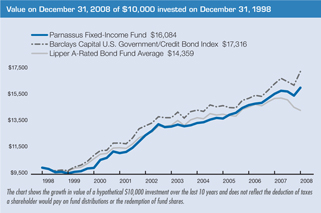

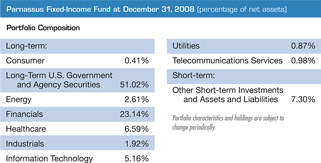

As of December 31, 2008, the net asset value per share (“NAV”) of the Parnassus Fixed-Income Fund was $16.19, producing a total return for the year of 2.98% (including dividends). This compares to a loss of 5.88% for the average A-rated bond fund followed by Lipper Inc. and a gain of 5.70% for the Barclays Capital U.S. Government/Credit Bond Index. For the fourth quarter, the Fund was up 3.89% versus a loss of 1.62% for the Lipper average and a gain of 6.42% for the Barclays Capital index. We’re very proud to report that our returns are better than the Lipper average for each of the one-, three-, five- and ten-year periods as of the end of the year.

Below is a table comparing the performance of the Fund with that of the Barclays Capital U.S. Government/Credit Bond Index and the average A-rated bond fund followed by Lipper. Average annual total returns are for the one-, three-, five- and ten-year periods. The 30-day SEC yield for the Fund for December 2008 was 2.64%.

Average Annual Total Returns

for periods ended December 31, 2008

| | | | | | | | | | | | | | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

PARNASSUS FIXED-INCOME FUND | | 2.98 | % | | 5.40 | % | | 4.15 | % | | 4.87 | % | | 0.88 | % | | 0.76 | % |

Lipper A-rated Bond Fund Average | | (5.88 | %) | | 0.52 | % | | 1.53 | % | | 3.70 | % | | NA | | | NA | |

Barclays Capital U.S. Government/Credit Bond Index | | 5.70 | % | | 5.56 | % | | 4.64 | % | | 5.64 | % | | NA | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information is on the Parnassus Investments website (www.parnassus.com). Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns shown in the table do not reflect the deduction of taxes a shareholder would pay in fund distributions or redemption of shares. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should read the prospectus, which contains this and other information. The prospectus is on the Parnassus Investments website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2008, Parnassus Investments has contractually agreed to limit the total operating expenses to 0.87% of net assets, exclusive of acquired fund fees, until May 1, 2009. The Barclays Capital U.S. Aggregate Bond Index and the Barclays Capital U.S. Government/ Credit Bond Index are unmanaged indexes of bonds, and it is not possible to invest directly in an index. An index does not take expenses into account, but mutual fund returns do. To provide better alignment with the overall investment objective of the Fund, the Barclays Capital U.S. Government/Credit Bond Index replaced the Barclays Capital U.S. Aggregate Bond Index as of December 31, 2008. The returns for the Barclays Capital U.S. Aggregate Bond Index for the one-, three-, five- and ten-year periods were 5.24%, 5.51%, 4.65% and 5.63%, respectively.

2008 Analysis

2008 was the year the impossible happened. From the collapse of Bear Stearns and the bankruptcy of Lehman Brothers to Bernard Madoff’s $50 billion Ponzi scheme, it seemed that everything and anything was possible. We also witnessed a commodities boom and crash with oil surging to $147 then collapsing to $32, the nationalization of Fannie Mae and Freddie Mac, a stock market meltdown, soaring corporate bond yields and record low yields in U.S. Treasury bonds. Nearly all asset classes lost value during the year, except for Treasuries and cash.

The U.S. Treasury market returned close to 14% in 2008 with yields across the entire curve at record low levels as the Federal Reserve reduced the federal funds target rate to a range of 0%–0.25% (bond prices move inversely to interest rates). At the front end, the yield on the 2-year declined from 3.05% at the end of 2007 to 0.76% at the end of 2008. Yields on longer-dated maturities followed the same pattern, with the 10-year yielding 2.21% at the end of 2008, compared to 4.02% in 2007, while the 30-year yield decreased to 2.68% from 4.45% during the same period.

As outlined in the strategy section of the last report, we positioned the portfolio to benefit from this lower interest rates environment. This decision paid off, as our investments in U.S. government bonds added 21¢ per share to the NAV. However, this gain was partially offset by a declining equity market, which hampered the performance of our convertible holdings, as well as wider corporate spreads that negatively impacted corporate bond prices. Overall, given the prevailing extraordinary market conditions, we are pleased that our focus on capital preservation and risk management has delivered value for our shareholders.

Outlook and Strategy

One can argue endlessly about the sustainability of an economic recovery based on reviving a credit cycle with low interest rates without reaching actionable investment conclusions. It seems more useful and practical to pay attention to policymakers’ efforts and resources deployed to achieve that goal. With economic data showing few signs of improvement, the Federal Reserve will have to keep interest rates as low as possible for as long as the economy remains weak. The Federal Reserve has not only lowered its federal funds target rate to an all-time low, but is also trying to influence yields by purchasing longer-term Treasury securities. In addition, it will buy agency debt and mortgage-backed securities in an effort to support the mortgage and housing markets.

The Fund’s investment strategy for 2009 assumes persistent weak economic activity in the U.S. and risk aversion remaining elevated throughout the year. Investors’ focus on capital preservation, rather than capital gain, will likely continue to support the Treasury market. At the same time, given the current record low-yield environment, we would expect a shift toward higher-yielding securities such as agency debts –which now have the explicit backing of the government – and high-quality corporate bonds.

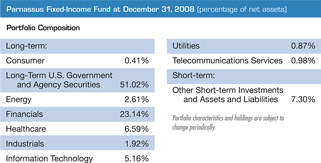

Accordingly, as of the end of 2008, about 60% of the Fund is invested in U.S. government securities, which include agency and Treasury bonds. The majority of this investment is in agency bonds, as they offer higher yields and price appreciation potential relative to Treasury bonds. Because risk management is central to our investment philosophy, the Fund is also positioned to benefit from a faster economic recovery. Therefore, the remainder of the Fund is invested in corporate bonds and convertible debts. As the financial system improves, increased liquidity and lower risk premium would benefit both corporate and convertible bond prices.

As always, we will continue to look for attractive opportunities and adjust our exposure accordingly in those three fixed-income markets to increase the returns of the Fund.

Thank you for investing in the Parnassus Fixed-Income Fund.

Yours truly,

| | |

| |  |

| |

| Todd C. Ahlsten | | Minh T. Bui |

| Portfolio Manager | | Portfolio Manager |

SOCIAL NOTES

By Milton Moskowitz

2008 was a brutal year on many fronts, and virtually all the companies in Parnassus portfolios were impacted, but perhaps the most crushing blow was the death, on November 18, of social investment pioneer Joan Bavaria after a two-and-one-half year battle with ovarian cancer. Joan was the example non-pareil of someone who lived by her principles, in both her personal and business lives. She founded Boston-based Franklin Research and Development in 1983 as an advisory firm for investors who wanted social responsibility to be reflected in their holdings. The firm’s name was later changed to Trillium Asset Management (she named it after a flower) and it grew to the point where it had more than $1 billion under management. She later founded two of the most important institutions in the social investment field, the Social Investment Forum and CERES, a coalition of investors and environmental and public interest organizations that became a catalyst for change in environmental policies. Joan was a Parnassus shareholder, a mentor to many people who became leaders in this movement and a strong ally of anyone dedicated to bending corporate power to social uses. She was only 65 years old. She will be sorely missed.

Whole Foods Market collected two major awards in 2008. It was selected as “America’s Healthiest Grocery Store” by Health magazine, and it was again named the nation’s number one retailer in seafood sustainability by Greenpeace, which cited its new quality standards for farmed seafood… First Horizon, the Tennessee-based bank holding company, moved to shore up its capital position by selling $866 million of preferred stock to the U.S. Treasury. The leading bank in Tennessee, First Horizon also sold all its mortgage banking operations outside the Volunteer State. And finally, it reduced its head count from 9,555 at the start of the year to 6,000 at the end…Otter Tail, an Upper Midwest electric utility with a number of side interests (plastics, food processing, health services, construction), has a stake in the alternative energy source of wind power through its subsidiary, DMI Industries, which was busy last year in supplying equipment for the expansion of wind farms in North Dakota and Oklahoma…Leading semiconductor maker Texas Instruments boasts a host of family-friendly benefits such as eight weeks maternity leave at full pay, 10 paid days for new fathers and adoptive parents and widely used concierge services and flexible work schedules. It’s no wonder then that TI made Working Mother magazine’s list of the 100 best companies for working mothers for the 13th consecutive year, nor is it surprising that 22% of employees have worked there for more than 20 years…Google, king of the search engine market, did not have to lay off any employees in the turbulence of 2008 — in fact it added people, although at a lower rate — and it maintained its position as the company with the richest benefits in America. For health insurance, employees have a zero premium if they join an HMO, plus they enjoy these privileges: 45 mental health visits a year, 20 acupuncture visits a year, $2,000 coverage for hearing assessments, $10,000 for gender reassignment surgery and 90% coverage up to $20,000 for infertility treatments…Daniel Vasella, CEO of the drug Swiss giant Novartis, joined 156 other CEOs in signing a statement reaffirming their support of the UN’s Universal Declaration of Human Rights, celebrating its 60th anniversary in 2008. The CEOs pledged to reiterate “our own commitment to respect and support human rights within our sphere.” Other signers included the heads of Coca-Cola, Unilever, Volvo, Axa, Diageo, Bacardi, Total, Lufthansa, Nestle and Credit Suisse…

2008 was a tough year for retailers, but the home improvement chain, Lowe’s Companies, did better than most. Same store sales were down but the company created jobs by opening more than 100 new stores. In the last month of the year, the Lowe’s name went up on new stores in Grove Village, Ohio, Belleville, Ontario, South Lebanon, Ohio, Derby, Connecticut and Kansas City. The company now has about 1,650 stores. Lowe’s offers unusual benefits for a retailer. In its 401(k) plan, employee contributions are matched dollar for dollar up to 3% of pay, then 50% from 4 to 5% of pay and finally, 25% on the next 1% up to 6% of pay. Wall Street has high regard for the company. As the year drew to a close, Lowe’s stock was down 25% from its high of $28.50 — and for 2008, that was a winning performance…Goldman Sachs survived the carnage on Wall Street by converting to a bank holding company. It laid off more than 3,000 employees across the globe, but thanks to new hires, it ended the year with about the same number of employees it had at the start of 2008. In 2009 it will celebrate its 140th anniversary by moving into a new 43-story building near the old World Trade Center site. The “green” building will house 11,000 Goldman employees.

FUND EXPENSES (UNAUDITED)

As a shareholder of the funds, you incur ongoing costs, which include portfolio management fees, administrative fees, shareholder reports, and other fund expenses. The funds do not charge transaction fees, so you do not incur transaction costs such as sales charges (loads) on purchase payments, reinvested dividends, or other distributions, redemption fees, and exchange fees. The information on this page is intended to help you understand your ongoing costs of investing in the funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the period of July 1, 2008 through December 31, 2008.

Actual Expenses

In the example below, the first line for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each fund provides information about hypothetical account values and hypothetical expenses based on the fund’s expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. You may compare the ongoing costs of investing in the fund with other mutual funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in the table are meant to highlight only your ongoing costs in these funds. Therefore, the second line of each fund is useful in comparing only ongoing costs and will not help you determine the relative total costs of owning other mutual funds, which may include transactional costs such as loads.

FUND EXPENSES (UNAUDITED) continued

| | | | | | | | | |

| | | Beginning

Account Value

July 1, 2008 | | Ending

Account Value

December 31, 2008 | | Expenses

Paid During

Period* |

| | | |

Parnassus Fund: Actual | | $ | 1,000.00 | | $ | 709.00 | | $ | 4.25 |

Hypothetical (5% before expenses) | | $ | 1,000.00 | | $ | 1,020.16 | | $ | 5.03 |

| | | |

Parnassus Equity Income Fund Investor Shares: Actual | | $ | 1,000.00 | | $ | 802.30 | | $ | 4.49 |

Hypothetical (5% before expenses) | | $ | 1,000.00 | | $ | 1,020.16 | | $ | 5.03 |

| | | |

Parnassus Equity Income Fund Institutional Shares: Actual | | $ | 1,000.00 | | $ | 803.50 | | $ | 3.54 |

Hypothetical (5% before expenses) | | $ | 1,000.00 | | $ | 1,021.22 | | $ | 3.96 |

| | | |

Parnassus Mid-Cap Fund: Actual | | $ | 1,000.00 | | $ | 770.90 | | $ | 5.34 |

Hypothetical (5% before expenses) | | $ | 1,000.00 | | $ | 1,019.10 | | $ | 6.09 |

| | | |

Parnassus Small-Cap Fund: Actual | | $ | 1,000.00 | | $ | 737.90 | | $ | 5.24 |

Hypothetical (5% before expenses) | | $ | 1,000.00 | | $ | 1,019.10 | | $ | 6.09 |

| | | |

Parnassus Workplace Fund: Actual | | $ | 1,000.00 | | $ | 750.50 | | $ | 5.28 |

Hypothetical (5% before expenses) | | $ | 1,000.00 | | $ | 1,019.10 | | $ | 6.09 |

| | | |

Parnassus Fixed-Income Fund: Actual | | $ | 1,000.00 | | $ | 1,018.20 | | $ | 4.41 |

Hypothetical (5% before expenses) | | $ | 1,000.00 | | $ | 1,020.76 | | $ | 4.42 |

| * | Expenses are equal to the fund’s annualized expense ratio of 0.99%, 0.99%, 0.78%, 1.20%, 1.20%, 1.20% and 0.87% for the Parnassus Fund, Equity Income Fund – Investor Shares, Equity Income Fund – Institutional Shares, Mid-Cap Fund, Small-Cap Fund, Workplace Fund and Fixed-Income Fund, respectively, multiplied by the average account value over the period, multiplied by the ratio of days in the period. The ratio of days in the period is 184/365 (to reflect the one-half year period). For the year ending December 31, 2008, Parnassus Investments has agreed to further reduce the total operating expenses from 1.40% to 1.20% of net assets, exclusive of acquired fund fees, for the Parnassus Mid-Cap and Parnassus Small-Cap Funds. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of the Parnassus Funds and the Parnassus Income Funds

San Francisco, California

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of the Parnassus Funds (comprised of Parnassus Fund, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund and Parnassus Workplace Fund) and the Parnassus Income Funds (comprised of Parnassus Equity Income Fund and Parnassus Fixed-Income Fund) (collectively, the “Trusts”) as of December 31, 2008, and the related statements of operations for the year then ended, and of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented. These financial statements and financial highlights are the responsibility of the Trusts’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Trusts are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trusts’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2008, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the funds constituting the Parnassus Funds and the Parnassus Income Funds as of December 31, 2008, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America.

San Francisco, California

January 30, 2009

THE PARNASSUS FUND

Portfolio of Investments as of

December 31, 2008

| | | | | | | | |

Shares | | Equities | | Percent of

Net Assets | | | Market Value |

| | Biotechnology | | | | | | |

| 70,000 | | Genentech Inc.1 | | 3.3 | % | | $ | 5,803,700 |

| | | | | | | | |

| | Computer Peripherals | | | | | | |

| 310,000 | | Seagate Technology | | 0.8 | % | | $ | 1,373,300 |

| | | | | | | | |

| | Consulting Services | | | | | | |

| 130,000 | | Cognizant Technology Solutions Corp.1 | | 1.3 | % | | $ | 2,347,800 |

| | | | | | | | |

| | Financial Services | | | | | | |

| 250,000 | | American Express Co. | | | | | $ | 4,637,500 |

| 435,000 | | First Horizon National Corp. | | | | | | 4,597,950 |

| 70,000 | | Goldman Sachs Group Inc. | | | | | | 5,907,300 |

| 25,000 | | Paychex Inc. | | | | | | 657,000 |

| 100,000 | | SLM Corp.1 | | | | | | 890,000 |

| 200,000 | | Wells Fargo & Co. | | | | | | 5,896,000 |

| | | | | | | | |

| | | | 13.0 | % | | $ | 22,585,750 |

| | | | | | | | |

| | Home Builders | | | | | | |

| 875,000 | | DR Horton Inc. | | | | | $ | 6,186,250 |

| 310,000 | | KB Home | | | | | | 4,222,200 |

| 700,000 | | Pulte Homes Inc. | | | | | | 7,651,000 |

| 300,000 | | Toll Brothers Inc.1 | | | | | | 6,429,000 |

| | | | | | | | |

| | | | 14.1 | % | | $ | 24,488,450 |

| | | | | | | | |

| | Home Products | | | | | | |

| 60,000 | | WD-40 Co. | | 1.0 | % | | $ | 1,697,400 |

| | | | | | | | |

| | Industrial Manufacturing | | | | | | |

| 80,000 | | Cooper Industries Ltd. | | | | | $ | 2,338,400 |

| 190,000 | | Teleflex Inc. | | | | | | 9,519,000 |

| | | | | | | | |

| | | | 6.8 | % | | $ | 11,857,400 |

| | | | | | | | |

| | Insurance | | | | | | |

| 240,000 | | Tower Group Inc. | | 3.9 | % | | $ | 6,770,400 |

| | | | | | | | |

| | Internet | | | | | | |

| 30,000 | | Amazon.com Inc.1 | | | | | $ | 1,538,400 |

| 40,000 | | eBay Inc.1 | | | | | | 558,400 |

| 25,000 | | Google Inc.1 | | | | | | 7,691,250 |

| | | | | | | | |

| | | | 5.6 | % | | $ | 9,788,050 |

| | | | | | | | |

| | Natural Gas | | | | | | |

| 75,000 | | Quicksilver Resources Inc.1 | | 0.2 | % | | $ | 417,750 |

| | | | | | | | |

| | Networking Products | | | | | | |

| 325,000 | | Cisco Systems Inc.1 | | 3.0 | % | | $ | 5,297,500 |

| | | | | | | | |

| | Oil & Gas | | | | | | |

| 310,000 | | Valero Energy Corp. | | | | | $ | 6,708,400 |

| 130,000 | | W&T Offshore Inc. | | | | | | 1,861,600 |

| | | | | | | | |

| | | | 4.9 | % | | $ | 8,570,000 |

| | | | | | | | |

| | Real Estate Investment Trusts | | | | | | |

| 120,000 | | ProLogis | | 1.0 | % | | $ | 1,666,800 |

| | | | | | | | |

| | Retail | | | | | | |

| 95,000 | | Best Buy Co., Inc. | | | | | $ | 2,670,450 |

| 270,000 | | Lowe’s Cos., Inc. | | | | | | 5,810,400 |

| 200,000 | | Target Corp. | | | | | | 6,906,000 |

| 130,000 | | Walgreen Co. | | | | | | 3,207,100 |

| 125,000 | | Whole Foods Market Inc.1 | | | | | | 1,180,000 |

| | | | | | | | |

| | | | 11.4 | % | | $ | 19,773,950 |

| | | | | | | | |

| | Semiconductor Capital Equipment | | | | | | |

| 460,000 | | Applied Materials Inc. | | | | | $ | 4,659,800 |

| 127,700 | | Cognex Corp. | | | | | | 1,889,960 |

| 100,000 | | Cymer Inc.1 | | | | | | 2,191,000 |

| 200,000 | | Lam Research Corp.1 | | | | | | 4,256,000 |

| | | | | | | | |

| | | | 7.5 | % | | $ | 12,996,760 |

| | | | | | | | |

| | Semiconductors | | | | | | |

| 310,000 | | Altera Corp. | | | | | $ | 5,180,100 |

| 570,000 | | Intel Corp. | | | | | | 8,356,200 |

| 350,000 | | Texas Instruments Inc. | | | | | | 5,432,000 |

| | | | | | | | |

| | | | 10.9 | % | | $ | 18,968,300 |

| | | | | | | | |

| | Software | | | | | | |

| 160,000 | | Autodesk Inc.1 | | | | | $ | 3,144,000 |

| 70,000 | | Citrix Systems Inc.1 | | | | | | 1,649,900 |

| | | | | | | | |

| | | | 2.8 | % | | $ | 4,793,900 |

| | | | | | | | |

| | Telecommunications Equipment | | | | | | |

| 610,000 | | Ciena Corp.1 | | | | | $ | 4,087,000 |

| 400,000 | | Corning Inc. | | | | | | 3,812,000 |

| 1,300,000 | | Powerwave Technologies Inc.1 | | | | | | 650,000 |

| | | | | | | | |

| | | | 4.9 | % | | $ | 8,549,000 |

| | | | | | | | |

| | Waste Management | | | | | | |

| 150,000 | | Waste Management Inc. | | 2.9 | % | | $ | 4,971,000 |

| | | | | | | | |

| | Total investment in equities | | | | | | |

| | (cost $249,323,346) | | 99.3 | % | | $ | 172,717,210 |

| | | | | | | | |

| | | | |

| 24 | | The accompanying notes are an integral part of these financial statements. | | |

Portfolio of Investments as of

December 31, 2008 continued

| | | | | | | | | |

Principal

Amount $ | | Short-Term Securities | | Percent of

Net Assets | | | Market Value | |