UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06279 |

|

Harris Associates Investment Trust |

(Exact name of registrant as specified in charter) |

|

Two North La Salle Street, Suite 500 | | |

Chicago, Illinois | | 60602-3790 |

(Address of principal executive offices) | | (Zip code) |

|

John R. Raitt | Paulita A. Pike |

Harris Associates L.P. | K&L Gates LLP |

Two North La Salle Street, #500 | Three First National Plaza, #3100 |

Chicago, Illinois 60602 | Chicago, Illinois 60602 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 621-0600 | |

|

Date of fiscal year end: | 9/30/09 | |

|

Date of reporting period: | 3/31/09 | |

| | | | | | | | | |

Item 1. Reports to Shareholders.

SEMI-ANNUAL REPORT

MARCH 31, 2009

Advised by Harris Associates L.P.

THE OAKMARK FUNDS

2009 Semi-Annual Report

| President's Letter | | | 1 | | |

|

| Summary Information | | | 2 | | |

|

| Fund Expenses | | | 4 | | |

|

| Commentary on Oakmark and Oakmark Select Funds | | | 6 | | |

|

| Oakmark Fund | |

|

| Letter from the Portfolio Managers | | | 8 | | |

|

| Schedule of Investments | | | 9 | | |

|

| Oakmark Select Fund | |

|

| Letter from the Portfolio Managers | | | 13 | | |

|

| Schedule of Investments | | | 14 | | |

|

| Oakmark Equity and Income Fund | |

|

| Letter from the Portfolio Managers | | | 16 | | |

|

| Schedule of Investments | | | 19 | | |

|

| Oakmark Global Fund | |

|

| Letter from the Portfolio Managers | | | 25 | | |

|

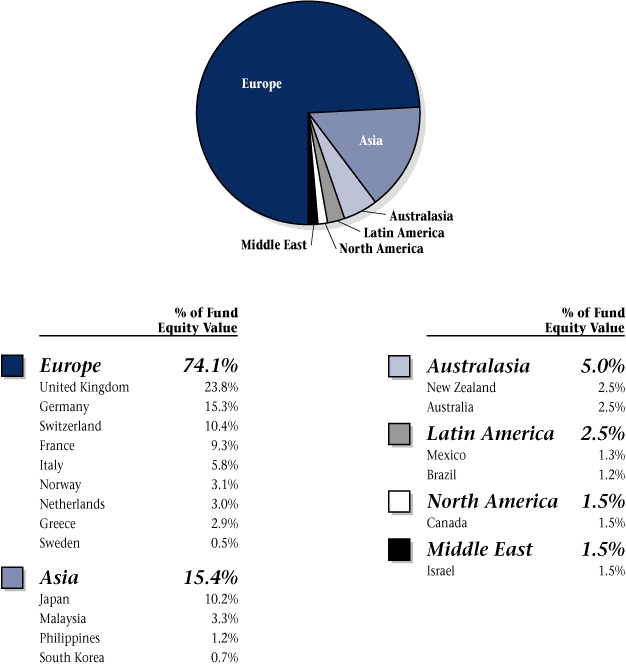

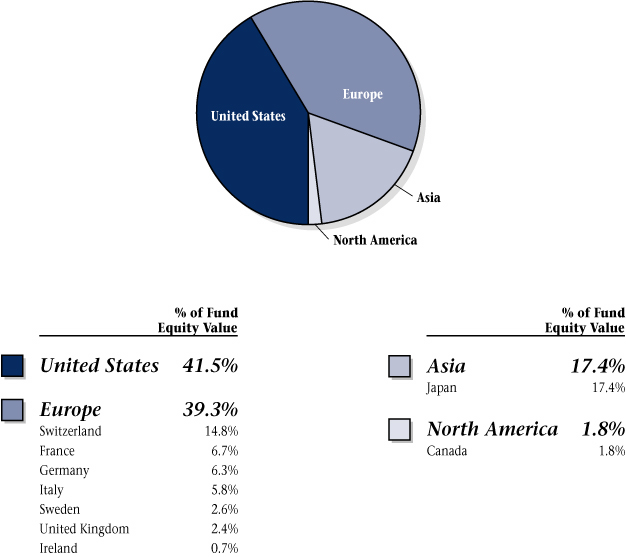

| Global Diversification Chart | | | 28 | | |

|

| Schedule of Investments | | | 29 | | |

|

| Oakmark Global Select Fund | |

|

| Letter from the Portfolio Managers | | | 33 | | |

|

| Global Diversification Chart | | | 35 | | |

|

| Schedule of Investments | | | 36 | | |

|

| Commentary on International and International Small Cap Funds | | | 39 | | |

|

| Oakmark International Fund | |

|

| Letter from the Portfolio Managers | | | 40 | | |

|

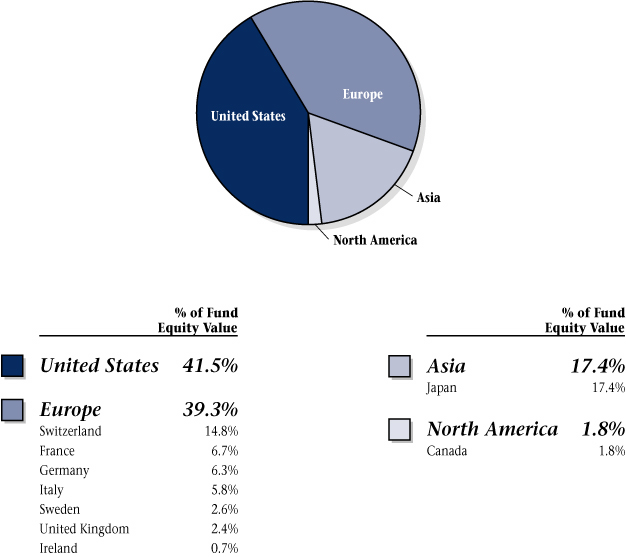

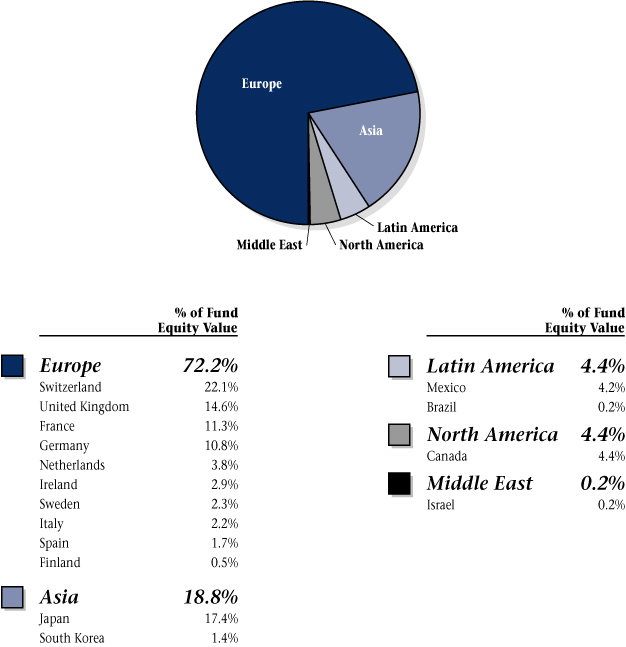

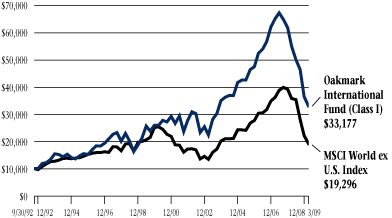

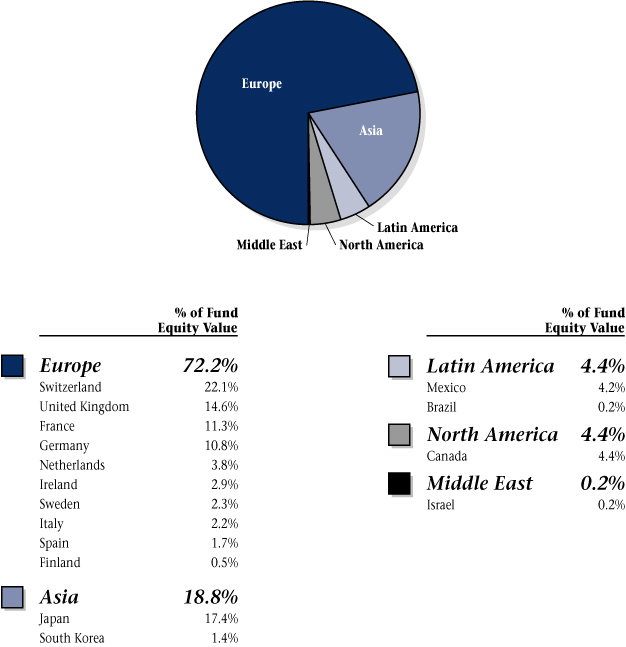

| Global Diversification Chart | | | 42 | | |

|

| Schedule of Investments | | | 43 | | |

|

| Oakmark International Small Cap Fund | |

|

| Letter from the Portfolio Managers | | | 48 | | |

|

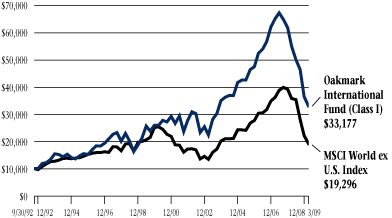

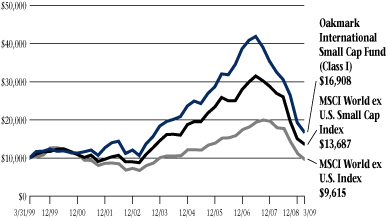

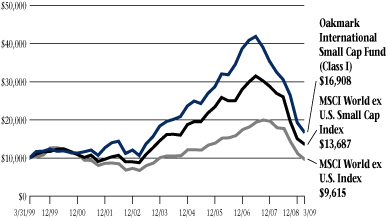

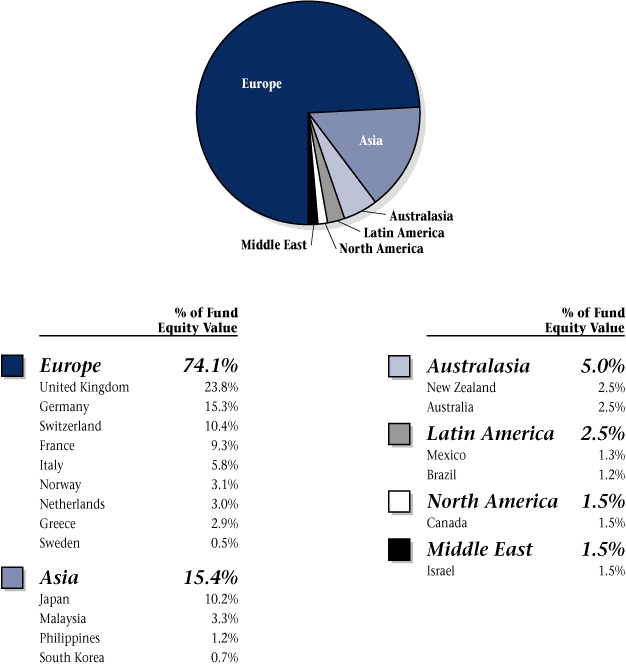

| Global Diversification Chart | | | 50 | | |

|

| Schedule of Investments | | | 51 | | |

|

| Financial Statements | |

|

| Statements of Assets and Liabilities | | | 58 | | |

|

| Statements of Operations | | | 60 | | |

|

| Statements of Changes in Net Assets | | | 62 | | |

|

| Notes to Financial Statements | | | 69 | | |

|

| Disclosure Regarding Investment Advisory Contract Approval | | | 86 | | |

|

| Oakmark Glossary | | | 92 | | |

|

| Trustees and Officers | | | 93 | | |

|

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe", "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

President's Letter

Dear Fellow Shareholders,

Continued economic weakness and financial system stress weighed heavily on world markets again in the first quarter. The broad U.S. and international market indexes have now fallen well over 45% from their peak in 2007. Even though most of our Funds declined significantly less than the market averages this quarter, we are still disappointed to be reporting another quarter of losses.

Investor Psychology and the Economic Recovery

Over the past quarter, we have had many questions and heard much speculation about when or even if the world economic recovery will begin. Indeed, amidst the relentless waves of bad economic news, it is easy to become overwhelmed by the magnitude of the economy's problems and the seeming inevitability of further economic decline. Cognitive psychologists remind us of the difficulty of keeping perspective amidst a crisis and how "recency bias"—the fact that recent events and information can take on greater importance than more distant events—can distort economic decisions. We believe that an awareness of this effect is an important component of a disciplined investment process.

If we step back from the heat of events and objectively view the current recession in the longer term context of past cycles, we believe that its continuation appears a lot less inevitable. Although we face major problems that need to be fixed, the U.S. economic machine is still fundamentally sound and powerful. Furthermore, government actions and the self-correcting nature of markets are helping heal the economy. Factors contributing to this include: 1) the Fed has now been easing monetary policy for 20 months and has provided massive stimulus for more than six months, 2) short-term global interest rates have fallen more than two points, 3) mortgage rates have fallen more than one point, and housing affordability has actually reached its highest level since the early '70s, 4) energy prices are down and 5) the fiscal stimulus packages are starting to kick in. All of these factors will likely take time to have a positive impact on the economy , but careful observers will actually note some positive signs amidst the drumbeat of negative news—flattening consumer spending, a slight uptick in March auto sales, and increasing sales of existing homes.

We know that the recovery from this downturn will be difficult, but we believe that the seeds of a recovery are planted.... and are growing.

Maintaining Exposure to Equities:

The Critical Decision

In addition to questions about the economy, we are also frequently asked, "Has the market bottomed yet?" Many apprehensive investors have moved from stocks to U.S. government bonds and cash, hoping to avoid further losses and then re-enter the market when it hits bottom. We humbly recognize that the vast majority of investors, ourselves included, have no ability to accurately predict short-term movements in the stock market. Instead, we focus on analyzing individual stocks and factors that we can control: business quality, company management and valuation at the time of purchase. Bill Nygren eloquently argues in his quarterly commentary that equities are unusually attractive at current valuation levels. Although it is impossible to predict precisely when the credit squeeze, the recession and investor panic will end, we are confident that, in time, the economy will recover and that stocks will reflect more normal valuations. From the current extremes of undervaluation, we believe that stocks offer returns over a three- to five-year time frame that are well above historical averages.

With this in mind, we believe that the most important decision is not one of timing, but a decision to build and/or maintain a significant long-term exposure to equities, staying focused on the outsized returns that history—and our analysis—suggests that they offer.

We appreciate the trust and confidence that you have placed in us, particularly during these difficult times. We thank you for your continued patience and support. We welcome your comments and questions. You can reach us via e-mail at ContactOakmark@oakmark.com.

John R. Raitt

President and CEO of The Oakmark Funds

President and CEO of Harris Associates L.P.

March 31, 2009

1

THE OAKMARK FUNDS

Summary Information

Performance for Periods

Ended March 31, 20091 | | Oakmark

Fund—Class I

(OAKMX) | | Oakmark

Select Fund—Class I

(OAKLX) | | Oakmark

Equity and Income

Fund—Class I

(OAKBX) | | Oakmark

Global Fund—Class I

(OAKGX) | |

| 3 Months* | | | -9.59 | % | | | -6.26 | % | | | -6.03 | % | | | -13.70 | % | |

| 1 Year | | | -34.23 | % | | | -35.28 | % | | | -21.99 | % | | | -42.31 | % | |

Average Annual Total

Return for: | |

| 3 Year | | | -12.55 | % | | | -17.11 | % | | | -1.41 | % | | | -12.98 | % | |

| 5 Year | | | -5.47 | % | | | -8.10 | % | | | 2.37 | % | | | -2.36 | % | |

| 10 Year | | | -0.23 | % | | | 2.21 | % | | | 7.99 | % | | | N/A | | |

| Since inception | | | 10.09%

(8/5/91) | | | | 8.75%

(11/1/96) | | | | 10.07%

(11/1/95) | | | | 6.67%3

(8/4/99) | | |

Top Five Equity

Holdings as of

March 31, 20092

Company and % of Total

Net Assets | | | Best Buy Co., Inc. 3.4%

Liberty Media Corp.

-Entertainment 3.0%

Walgreen Co. 2.7%

Intel Corp. 2.7%

Schering-Plough

Corp. 2.6% | | | | Discovery

Communications, Inc.

Class C 8.7%

Liberty Media Corp.

-Entertainment 7.5%

H&R Block, Inc. 7.3%

Schering-Plough

Corp. 6.3%

Best Buy Co., Inc. 5.1% | | | | XTO Energy, Inc. 3.6%

EnCana Corp. 2.7%

Nestle SA 2.7%

General Dynamics

Corp. 2.6%

ConAgra Foods, Inc. 2.5% | | | | Credit Suisse

Group 4.7%

Oracle Corp. 4.7%

Daiwa Securities

Group Inc. 4.6%

Laboratory Corp. of

America Holdings 4.5%

Snap-on, Inc. 4.0% | | |

Sector

Allocation as of

March 31, 2009

Sector and % of

Market Value | | | Consumer

Discretionary 37.8%

Information

Technology 20.8%

Financials 12.4%

Consumer Staples 10.4%

Health Care 10.1%

Industrials 7.4%

Energy 1.1% | | | | Consumer

Discretionary 46.8%

Information

Technology 24.4%

Health Care 16.1%

Financials 9.0%

Energy 3.7% | | | | U.S. Government

Securities 44.8%

Consumer Staples 14.9%

Energy 10.8%

Health Care 9.1%

Industrials 8.4%

Consumer

Discretionary 6.4%

Financials 1.9%

Information

Technology 1.5%

Foreign Government

Securities 1.2%

Materials 1.0% | | | | Information

Technology 25.5%

Consumer

Discretionary 24.1%

Financials 16.8%

Industrials 13.2%

Health Care 13.1%

Energy 5.8%

Consumer Staples 1.5% | | |

The performance data quoted represents past performance. The above performance information for the Funds does not reflect the imposition of a 2% redemption fee on shares of all Funds, other than Oakmark Equity & Income Fund, redeemed within 90 days. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain current month end performance data, visit oakmark.com.

* Not annualized

THE OAKMARK FUNDS

2

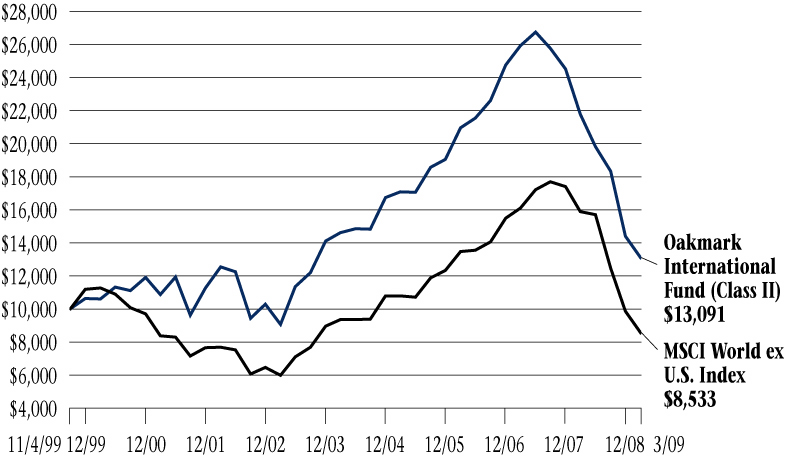

Performance for Periods

Ended March 31, 20091 | | Oakmark

Global Select

Fund—Class I

(OAKWX) | | Oakmark

International

Fund—Class I

(OAKIX) | | Oakmark

International

Small Cap Fund—Class I

(OAKEX) | |

| 3 Months* | | | -4.29 | % | | | -9.31 | % | | | -12.36 | % | |

| 1 Year | | | -27.41 | % | | | -39.93 | % | | | -48.24 | % | |

Average Annual Total

Return for: | |

| 3 Year | | | N/A | | | | -14.26 | % | | | -19.28 | % | |

| 5 Year | | | N/A | | | | -1.85 | % | | | -2.89 | % | |

| 10 Year | | | N/A | | | | 4.55 | % | | | 5.39 | % | |

| Since inception | | | -13.87%

(10/2/06) | | | | 7.54%

(9/30/92) | | | | 6.12%

(11/1/95) | | |

Top Five Equity

Holdings as of

March 31, 20092

Company and % of Total

Net Assets | | | Best Buy Co., Inc. 7.2%

Liberty Media Corp.

-Entertainment 6.9%

Credit Suisse

Group 6.6%

Societe Television

Francaise 1 6.3%

Daiwa Securities

Group, Inc. 5.2% | | | | Credit Suisse

Group 3.9%

Daiwa Securities

Group, Inc. 3.7%

Signet Jewelers, Ltd. 3.4%

OMRON Corp. 3.3%

BNP Paribas SA 3.2% | | | | LSL Property

Services PLC 4.2%

Julius Baer Holding,

Ltd. 3.7%

Rheinmetall AG 3.6%

Media Prima Berhad

Berhad 3.1%

Atea ASA 3.0% | | |

Sector

Allocation as of

March 31, 2009

Sector and % of

Market Value | | | Consumer

Discretionary 40.3%

Information

Technology 24.2%

Financials 20.0%

Health Care 10.2%

Industrials 5.3% | | | | Consumer

Discretionary 35.9%

Financials 20.5%

Industrials 15.8%

Information

Technology 15.1%

Consumer Staples 4.2%

Materials 3.6%

Health Care 3.3%

Energy 1.6% | | | | Industrials 35.2%

Consumer

Discretionary 26.1%

Financials 13.8%

Information

Technology 12.2%

Materials 6.7%

Consumer Staples 4.4%

Health Care 1.6% | | |

As of 9/30/08, the expense ratio for Class I shares was 1.10% for Oakmark Fund, 1.08% for Oakmark Select Fund, 0.81% for Oakmark Equity and Income Fund, 1.16% for Oakmark Global Fund, 1.35% for Oakmark Global Select Fund, 1.10% for Oakmark International Fund and 1.41% for Oakmark International Small Cap Fund.

THE OAKMARK FUNDS

3

FUND EXPENSES

A shareholder of each Fund incurs two types of costs: (1) transaction costs, such as redemption fees, and (2) ongoing costs, including investment advisory fees, transfer agent fees, and other fund expenses. The examples below are intended to help shareholders understand the ongoing cost (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses

The following table provides information about actual account values and actual fund expenses for Class I of each Fund. The table shows the expenses a Class I shareholder would have paid on a $1,000 investment in each Fund from October 1, 2008 to March 31, 2009, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual fund returns and expenses. A Class I shareholder can estimate expenses incurred for the period by dividing the account value at March 31, 2009, by $1,000 and multiplying the result by the number in the Expenses Paid During Period row as shown below.

Shares of all Funds, other than Oakmark Equity and Income Fund, invested for 90 days or less may be charged a 2% redemption fee. Please consult the Funds' prospectus at oakmark.com for more information.

| | | Oakmark Fund | | Oakmark Select Fund | | Oakmark Equity and Income Fund | | Oakmark Global Fund | | Oakmark Global Select Fund | | Oakmark International Fund | | Oakmark International Small Cap Fund | |

Beginning

Account

Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending

Account

Value | | $ | 696.60 | | | $ | 748.30 | | | $ | 828.00 | | | $ | 655.30 | | | $ | 800.90 | | | $ | 712.80 | | | $ | 637.50 | | |

Expenses

Paid

During

Period* | | $ | 5.50 | | | $ | 5.54 | | | $ | 3.97 | | | $ | 5.36 | | | $ | 7.23 | | | $ | 5.34 | | | $ | 6.82 | | |

Annualized

Expense

Ratio | | | 1.30 | % | | | 1.27 | % | | | 0.87 | % | | | 1.30 | % | | | 1.61 | % | | | 1.25 | % | | | 1.67 | % | |

* Expenses are equal to each Fund's annualized expense ratio for Class I, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 365 (to reflect the one-half year period).

THE OAKMARK FUNDS

4

Hypothetical Example for Comparison Purposes

The following table provides information about hypothetical account values and hypothetical expenses for Class I of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the third line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, the total costs would have been higher.

| | | Oakmark Fund | | Oakmark Select Fund | | Oakmark Equity and Income Fund | | Oakmark Global Fund | | Oakmark Global Select Fund | | Oakmark International Fund | | Oakmark International Small Cap Fund | |

Beginning

Account

Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending

Account

Value | | $ | 1,018.45 | | | $ | 1,018.60 | | | $ | 1,020.59 | | | $ | 1,018.45 | | | $ | 1,016.90 | | | $ | 1,018.70 | | | $ | 1,016.60 | | |

Expenses

Paid

During

Period* | | $ | 6.54 | | | $ | 6.39 | | | $ | 4.38 | | | $ | 6.54 | | | $ | 8.10 | | | $ | 6.29 | | | $ | 8.40 | | |

Annualized

Expense

Ratio | | | 1.30 | % | | | 1.27 | % | | | 0.87 | % | | | 1.30 | % | | | 1.61 | % | | | 1.25 | % | | | 1.67 | % | |

* Expenses are equal to each Fund's annualized expense ratio for Class I, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 365 (to reflect the one-half year period).

THE OAKMARK FUNDS

5

OAKMARK AND OAKMARK SELECT FUNDS

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

"How many times does the end of the world as we know it need to arrive before we realize that it's not the end of the world as we know it?"

"How many times does the end of the world as we know it need to arrive before we realize that it's not the end of the world as we know it?"

Michael Lewis, author

The New York Times is full of stories of lost fortunes. Their search for culprits unearthed commercial bankers, short-sellers, and even the previous Republican administration. They report that the stock market "no longer appraises by its movement actual events and values, but merely reflects a state of mind and then makes that state of mind worse by reflecting it." The Times further states that the consensus view of the stock market is that "if general insolvency is ahead of us, existing prices cannot be too low...they ought to be even lower."4 Time Magazine reflects the negative attitude, reporting: "indicators of the U.S. economy flashed some of their gloomiest signals ever last week,"5 "depression in the housing industry,"6 "doubt among investors about the Administration's ability to control the economy has sent the stock market into a frightening slump,"7 and "the high cost of borrowing a nd the impossibility of selling new stock issues in a collapsing market make it difficult for companies to raise the money needed to expand or in some cases even to stay alive, thus intensifying the threat of recession—or worse."8

Clearly, the U.S. and global economies are going through a tough time, and it is tempting to conclude that we're in uncharted waters. But before we join the camp that says we're entering a post-capitalism era, it might be useful to consider some of the difficulties that our relatively young economy has recovered from. Spring break reading for me included Michael Lewis's latest book, PANIC: The Story of Modern Financial Insanity. In this book Lewis examines panics since 1987 by presenting articles written in the midst of each of those panics. The common thread that soon became obvious is that during each panic the problems appeared intractable, the solutions illusory. Lewis states: "Black Monday (the crash of 1987) was the first of a breed: a crash that suggested disastrous economic and social consequences but in the end had no serious effects at all. The bursting of the Internet bubble, the Asian currency crisis, the Russian government bond default that triggered the failure of the hedge fund Long-Term Capital Management—all of these extreme events have been compressed into a fantastically short space of financial history. And all seemed, in the heat of the moment, to have the power to change the world as we know it. None of them, it turned out, was that big a deal for the U.S. economy or for ordinary citizens."9

But one might say that the panics of the past twenty or so years were really just mini-panics and that what we're facing now is of much larger magnitude, more like the early 1970s or, even worse, the Great Depression. Let's take a step back. Investors are always faced with the choice of investing for safety or of assuming risk in exchange for the higher returns that typically come from owning businesses. Over the past eighty years, owners of stocks have been well rewarded for taking that risk. The annualized return from owning the S&P 50010 has averaged 9% since 1928, compared to only 4% from owning short-term government bonds. And that return advantage has come despite three periods during which stocks drastically underperformed risk-free assets. In the Great Depression, from 1929 to 1932 stocks fell by 86%; from 1973 to 1974 they fell by 48%; and from March 24, 2000 to March 9, 2009, stocks fell 56%. (And, yes, I know the S&P in 2007 slightly surpassed the 2000 peak, but because stocks underperformed T-Bills for those seven years, I think of the peak as having occurred in 2000.) With the pain of the past nine years so fresh in our minds, it's easy to overlook the seventy years of history that preceded it. But it is that very record of stocks outperforming other asset classes that has made stocks the asset of choice for long-term investors.

As investors try to decide what to do now, I think it is useful to contrast two options. Let's assume investors are making their decisions for a five-year time horizon. Were the time horizon any shorter, we would say stocks shouldn't even be considered because short-term results can be too random. One option for an investor is to say "no" to any risk, and invest in a five-year government bond. Many investors, stinging from recent losses, are making that very choice. The annual yield for that bond today is 1.8%. So, at the end of five years, that investor could be certain to have a 9% return (not considering either taxes or inflation). The other choice is to buy equities, anticipating a higher return in exchange for accepting uncertainty. Can history give us any guide as to what that return might be? One approach would be to assume that returns would simply match the historical average of 9% per year, or 54% compounded over a five-year period . That answer, however, ignores the effect of the starting price. I think the following is more useful.

First, the dividend yield of the S&P 500 is now about 3%, so over five years the equity investor should receive a 15%

OAKMARK AND OAKMARK SELECT FUNDS

6

return plus or minus price change. We can estimate the S&P price five years from now by estimating both its earnings level and its P/E11 ratio. Over the past 80 years the median P/E ratio for the S&P 500 has been 15 times. I could argue that today's very low rates on government bonds suggest future P/Es should be higher, but let's not bother with that complexity. Earnings are trickier to forecast. Operating earnings for the S&P 500 peaked at $88 in 2006 but the consensus forecasts a trough at about $62 this year.12 Extrapolating either peak or trough earnings is not likely to be productive. Instead, let's look back over the p ast thirty years. A regression analysis of the past thirty years shows that trend earnings for 2009 are about $84, or 5% below the peak achieved three years earlier. Further, that same regression analysis calculates that earnings growth has averaged between 6 and 7% per year. Extrapolating based on those numbers puts trend line earnings for 2014 at about $115. Multiplying $115 in earnings by a P/E of 15 produces a 2014 expected price for the S&P 500 of 1725, 116% higher than today's price of 798. Were that to happen, the annualized return for the next five years would be about 20%, a little more than twice the historical average, and more than ten times the bond return.

What about the downside? By 2014, the S&P could fall to about 750 and still match the return on a five-year bond because the current dividend yield exceeds the bond's interest rate. If the historical average P/E is attained, that means the S&P earnings would have to be more than 50% below trend for the stock investor to underperform the bond investor. Alternatively, if the earnings trend line proves accurate, the P/E would have to be below 7 times for the stock investor to underperform. While those outcomes are certainly possible, they would be extreme historical outliers. The possibility of historically high returns, combined with what we believe to be a low probability of loss, makes me excited about investing in stocks today. And that's why I significantly added again to my personal Oakmark investment last quarter.

The commentary in my opening paragraph sounds like it was taken from recent publications. However, the summary of stock market reporting from the New York Times is from 1932, just weeks before the Great Depression bear market ended. The quotes from Time Magazine are from fall 1974, just days before that bear market bottom was reached. The Time Magazine archive on their website provides links to "related articles." For the 1974 piece referring to the housing depression they suggest also reading an article titled: "Will President Obama's New Housing Plan Work?" Even a computer program concluded that the current panic looks a lot like earlier panics.

As Michael Lewis showed, in the midst of a panic, the light at the end of the tunnel is not visible, but that doesn't mean the end isn't near. At a recent client meeting, one of our managers was explaining why we so strongly believe that this is a time to be adding to equity exposure. The client asked, almost belittling, if it bothered us that we were their only bullish investment manager. Our manager said, "Please write that down: in the first quarter of 2009, Harris Associates was your most bullish manager." At a time when others are waffling on their positions, I would likewise say to you, "Please write this down: at the end of the first quarter of 2009, the managers of Oakmark and Oakmark Select were your most bullish managers."

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com

oaklx@oakmark.com

March 31, 2009

OAKMARK AND OAKMARK SELECT FUNDS

7

OAKMARK FUND

Report from Bill Nygren and Kevin Grant, Portfolio Managers

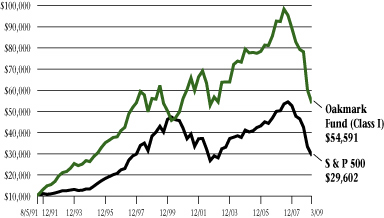

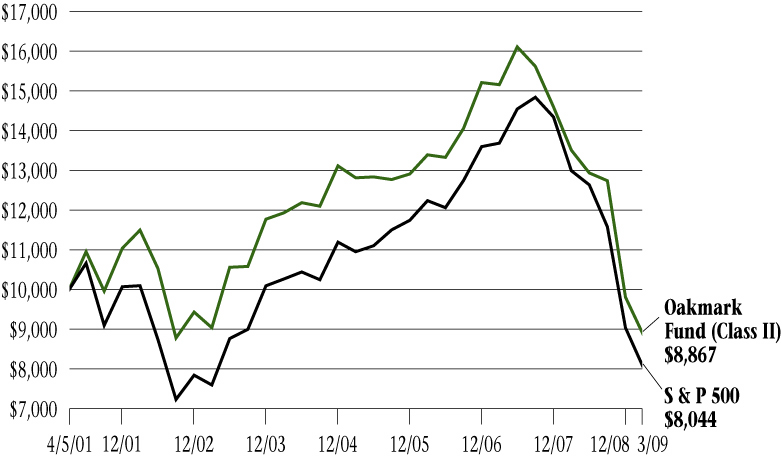

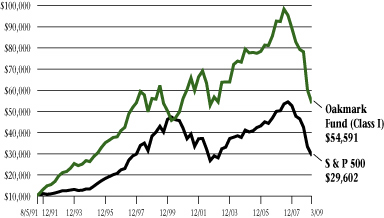

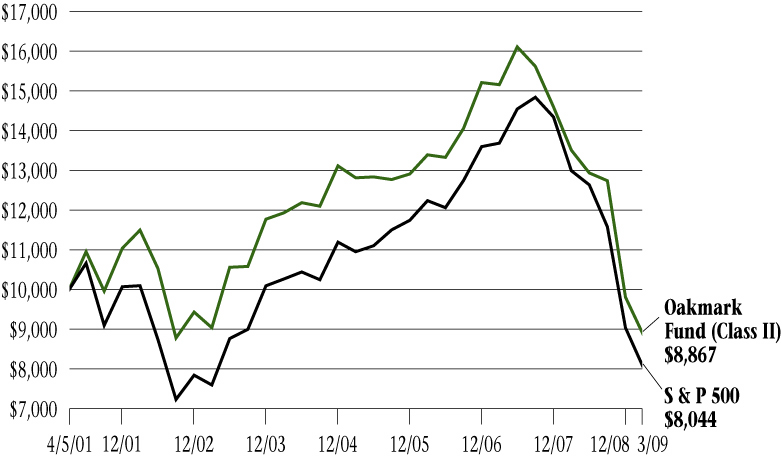

THE VALUE OF A $10,000 INVESTMENT IN OAKMARK FUND FROM ITS INCEPTION (8/5/91) TO PRESENT (3/31/09) AS COMPARED TO THE STANDARD & POOR'S 500 INDEX10 (UNAUDITED)

| | | | | Average Annual Total Returns

(as of 3/31/09) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | 10-year | | Since

Inception

(8/5/91) | |

| Oakmark Fund (Class I) | | | -9.59 | % | | | -34.23 | % | | | -5.47 | % | | | -0.23 | % | | | 10.09 | % | |

| S&P 500 | | | -11.01 | % | | | -38.09 | % | | | -4.76 | % | | | -3.00 | % | | | 6.34 | % | |

| Dow Jones Average13 | | | -12.48 | % | | | -35.94 | % | | | -3.64 | % | | | -0.36 | % | | | 7.86 | % | |

Lipper Large Cap

Value Index14 | | | -11.75 | % | | | -38.54 | % | | | -4.78 | % | | | -1.83 | % | | | 6.07 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The expense ratio for Class I shares as of 9/30/08 was 1.10%.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares redeemed within 90 days. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit oakmark.com.

* Not annualized

The Oakmark Fund declined 10% last quarter compared to an 11% drop in the S&P 500. Stocks were extremely volatile. As of March 9, the S&P had fallen 25%; it then rose 18% from that date until the end of the quarter. The extreme volatility resulted from widely divergent economic views—one extreme believes we are entering a depression, the other believes low stock prices offer a once-in-a-generation buying opportunity. The letter that precedes this report makes it clear that we are in the latter camp.

The Fund's worst performers in the quarter, like the overall market, were some of our financial stocks. Capital One, Bank of America and Citigroup each lost over 50%. We sold our position in Citigroup and re-invested the proceeds in financial companies we believe are equally undervalued, but have less risk of capital inadequacy. The Fund's best performers were Liberty Media Capital and Morgan Stanley, which gained over 40%. Schering-Plough gained just short of 40%, but made the largest positive contribution to the Fund because it began the year as our third largest holding. Schering agreed to be acquired by Merck in a transaction that we believe will benefit both sets of shareholders. We took advantage of market volatility during the quarter by initiating new positions in Apple, State Street (both explained on our website) and EnCana.

EnCana (ECA – $41)

For the most part, we missed both the big moves up and down in oil stocks. We did not believe that $100-plus oil prices would balance supply and demand. Without considering its stock price, EnCana was a company we wanted to own. Its management acts like owners that are trying to maximize long-term per-share value. When the company's projected returns from share repurchase exceeded returns from exploration or acquisition, management repurchased shares. When the company believed that energy prices had reached unsustainably high levels, management used hedging to reduce exposure to oil and gas prices. Finally, the company has huge reserves in Canadian tar sands, which are of minor value today, but would become very valuable at higher oil prices. When EnCana stock reached $99 last year, it was far above our buy target, which was based on oil prices falling back below $50. Last quarter, we got the chance to buy EnCana for less than $40, and we di dn't let it slip by. With a 4% yield, a single-digit P/E,11 and a large discount to our estimated value, EnCana makes us pleased to again be invested in the energy sector—and especially pleased to be invested with this management team.

William C. Nygren, CFA

Portfolio Manager

oakmx@oakmark.com | | Kevin G. Grant, CFA

Portfolio Manager

oakmx@oakmark.com | |

|

March 31, 2009

OAKMARK FUND

8

OAKMARK FUND

Schedule of Investments—March 31, 2009 (Unaudited)

Name | |

Shares Held | |

Value | |

| Common Stocks—93.6% | |

| Advertising—1.1% | |

| Omnicom Group, Inc. | | | 1,000,000 | | | $ | 23,400,001 | | |

| Apparel Retail—1.2% | |

| Limited Brands | | | 3,014,647 | | | $ | 26,227,429 | | |

| Broadcasting—1.0% | |

| Discovery Communications, Inc. Class C (a) | | | 1,540,140 | | | $ | 22,563,051 | | |

| Cable & Satellite—5.3% | |

| Liberty Media Corp. - Entertainment (a) | | | 3,298,680 | | | $ | 65,808,666 | | |

| Comcast Corp., Class A | | | 3,800,000 | | | | 48,906,000 | | |

| | | | 114,714,666 | | |

| Catalog Retail—0.6% | |

| Liberty Media Holding Corp. - Interactive, Class A (a) | | | 4,199,850 | | | $ | 12,179,565 | | |

| Computer & Electronics Retail—3.3% | |

| Best Buy Co., Inc. | | | 1,919,400 | | | $ | 72,860,424 | | |

| Department Stores—2.5% | |

| Kohl's Corp. (a) | | | 1,276,900 | | | $ | 54,038,408 | | |

| Home Improvement Retail—2.5% | |

| The Home Depot, Inc. | | | 2,281,500 | | | $ | 53,752,140 | | |

| Household Appliances—2.0% | |

| The Black & Decker Corp. | | | 1,400,000 | | | $ | 44,184,000 | | |

| Housewares & Specialties—1.5% | |

| Fortune Brands, Inc. | | | 1,350,000 | | | $ | 33,142,500 | | |

| Motorcycle Manufacturers—1.5% | |

| Harley-Davidson, Inc. | | | 2,462,000 | | | $ | 32,966,180 | | |

| Movies & Entertainment—6.9% | |

| The Walt Disney Co. | | | 2,700,000 | | | $ | 49,032,000 | | |

| Viacom, Inc., Class B (a) | | | 2,339,745 | | | | 40,664,768 | | |

| Time Warner, Inc. | | | 1,982,566 | | | | 38,263,524 | | |

| Time Warner Cable, Inc. | | | 497,644 | | | | 12,341,571 | | |

| Liberty Media Holding Corp. - Capital, Class A (a) | | | 1,395,836 | | | | 9,742,935 | | |

| | | | 150,044,798 | | |

| Restaurants—3.6% | |

| Yum! Brands, Inc. | | | 1,664,000 | | | $ | 45,726,720 | | |

| McDonald's Corp. | | | 594,000 | | | | 32,414,580 | | |

| | | | 78,141,300 | | |

OAKMARK FUND

9

OAKMARK FUND

Schedule of Investments—March 31, 2009 (Unaudited) cont.

Name | |

Shares Held | |

Value | |

| Common Stocks—93.6% (cont.) | |

| Specialized Consumer Services—2.4% | |

| H&R Block, Inc. | | | 2,858,600 | | | $ | 51,997,934 | | |

| Brewers—0.8% | |

| Anheuser-Busch InBev NV (b) | | | 600,000 | | | $ | 16,537,084 | | |

| Anheuser-Busch InBev NV, Rights (a) (b) | | | 600,000 | | | | 2,391 | | |

| | | | 16,539,475 | | |

| Distillers & Vintners—2.1% | |

| Diageo PLC (c) | | | 1,021,000 | | | $ | 45,689,750 | | |

| Drug Retail—2.7% | |

| Walgreen Co. | | | 2,300,000 | | | $ | 59,708,000 | | |

| Hypermarkets & Super Centers—2.1% | |

| Wal-Mart Stores, Inc. | | | 900,000 | | | $ | 46,890,000 | | |

| Packaged Foods & Meats—2.0% | |

| H.J. Heinz Co. | | | 1,300,000 | | | $ | 42,978,000 | | |

| Oil & Gas Exploration & Production—1.0% | |

| EnCana Corp. | | | 550,000 | | | $ | 22,335,500 | | |

| Asset Management & Custody Banks—3.9% | |

| Bank of New York Mellon Corp. | | | 1,839,630 | | | $ | 51,969,548 | | |

| State Street Corp. | | | 1,050,000 | | | | 32,319,000 | | |

| | | | 84,288,548 | | |

| Consumer Finance—3.2% | |

| Capital One Financial Corp. | | | 3,414,800 | | | $ | 41,797,152 | | |

| American Express Co. | | | 2,100,000 | | | | 28,623,000 | | |

| | | | 70,420,152 | | |

| Investment Banking & Brokerage—1.3% | |

| Morgan Stanley | | | 1,200,000 | | | $ | 27,324,000 | | |

| Other Diversified Financial Services—3.2% | |

| JPMorgan Chase & Co. | | | 2,000,000 | | | $ | 53,160,000 | | |

| Bank of America Corp. | | | 2,500,000 | | | | 17,050,000 | | |

| | | | 70,210,000 | | |

| Health Care Equipment—2.3% | |

| Medtronic, Inc. | | | 1,650,000 | | | $ | 48,625,500 | | |

| Pharmaceuticals—7.2% | |

| Schering-Plough Corp. | | | 2,431,135 | | | $ | 57,253,229 | | |

| Bristol-Myers Squibb Co. | | | 2,300,000 | | | | 50,416,000 | | |

| GlaxoSmithKline PLC (c) | | | 1,600,000 | | | | 49,712,000 | | |

| | | | 157,381,229 | | |

OAKMARK FUND

10

OAKMARK FUND

Schedule of Investments—March 31, 2009 (Unaudited) cont.

Name | |

Shares Held | |

Value | |

| Common Stocks—93.6% (cont.) | |

| Aerospace & Defense—1.6% | |

| The Boeing Co. | | | 1,000,000 | | | $ | 35,580,000 | | |

| Air Freight & Logistics—2.1% | |

| FedEx Corp. | | | 1,050,000 | | | $ | 46,714,500 | | |

| Industrial Conglomerates—1.6% | |

| Tyco International, Ltd. (b) | | | 1,739,500 | | | $ | 34,024,620 | | |

| Industrial Machinery—1.6% | |

| Illinois Tool Works, Inc. | | | 1,100,000 | | | $ | 33,935,000 | | |

| Communications Equipment—1.9% | |

| Cisco Systems, Inc. (a) | | | 2,500,000 | | | $ | 41,925,000 | | |

| Computer Hardware—5.6% | |

| Hewlett-Packard Co. | | | 1,725,000 | | | $ | 55,303,500 | | |

| Dell, Inc. (a) | | | 3,900,000 | | | | 36,972,000 | | |

| Apple, Inc. (a) | | | 270,000 | | | | 28,382,400 | | |

| | | | 120,657,900 | | |

| Data Processing & Outsourced Services—1.6% | |

| Western Union Co. | | | 2,775,000 | | | $ | 34,881,750 | | |

| Electronic Manufacturing Services—1.4% | |

| Tyco Electronics, Ltd. | | | 2,839,500 | | | $ | 31,348,080 | | |

| Internet Software & Services—1.4% | |

| eBay, Inc. (a) | | | 2,400,000 | | | $ | 30,144,000 | | |

| Office Electronics—1.1% | |

| Xerox Corp. | | | 5,072,400 | | | $ | 23,079,420 | | |

| Semiconductors—5.1% | |

| Intel Corp. | | | 3,900,000 | | | $ | 58,695,000 | | |

| Texas Instruments, Inc. | | | 3,200,000 | | | | 52,832,000 | | |

| | | | 111,527,000 | | |

| Systems Software—1.4% | |

| Microsoft Corp. | | | 1,600,000 | | | $ | 29,392,000 | | |

| Total Common Stocks (Cost: $2,376,191,666) | | | | | | | 2,035,811,820 | | |

OAKMARK FUND

11

OAKMARK FUND

Schedule of Investments—March 31, 2009 (Unaudited) cont.

Name | |

Par Value | |

Value | |

| Short Term Investment—6.3% | |

| Repurchase Agreement—6.3% | |

Fixed Income Clearing Corp. Repurchase Agreement,

0.17% dated 3/31/2009 due 4/1/2009, repurchase

price $136,469,051, collateralized by a Federal Home

Loan Bank Note, with a rate of 1.620%, with a maturity

of 12/30/2009, and with a market value plus accrued

interest of $1,946,598, by a Federal Home Loan Mortgage

Corp. Bond, with a rate of 3.050%, with a maturity of

4/28/2010, and with a market value plus accrued interest of $33,454,400, and by a Federal National Mortgage

Association Note, with a rate of 4.750%, and a maturity

of 3/12/2010, and with a market value plus accrued

interest of $103,800,000 | | $ | 136,468,407 | | | $ | 136,468,407 | | |

| Total Repurchase Agreement (Cost: $136,468,407) | | | | | 136,468,407 | | |

| Total Short Term Investment (Cost: $136,468,407) | | | | | 136,468,407 | | |

| Total Investments (Cost: $2,512,660,073)—99.9% | | | | $ | 2,172,280,227 | | |

| Other Assets In Excess of Liabilities—0.1% | | | | | 2,931,218 | | |

| Total Net Assets—100% | | | | $ | 2,175,211,445 | | |

(a) Non income-producing security.

(b) Represents a foreign domiciled corporation.

(c) Represents an American Depositary Receipt.

See accompanying Notes to Financial Statements.

OAKMARK FUND

12

OAKMARK SELECT FUND

Report from Bill Nygren and Henry Berghoef, Portfolio Managers

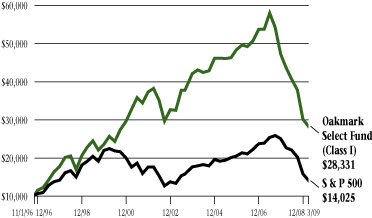

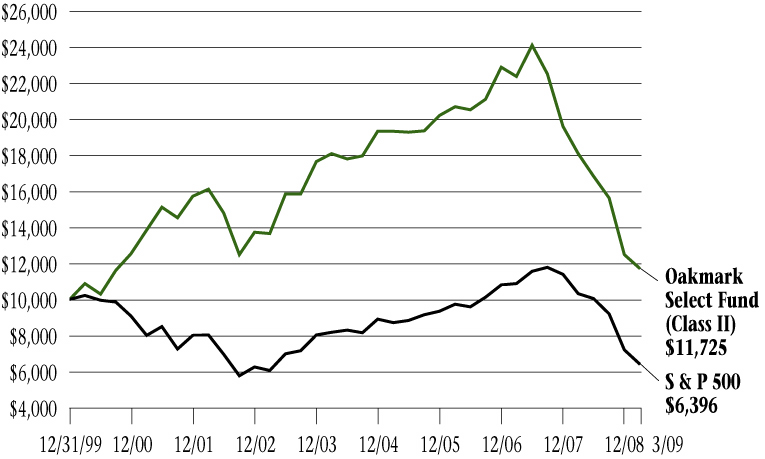

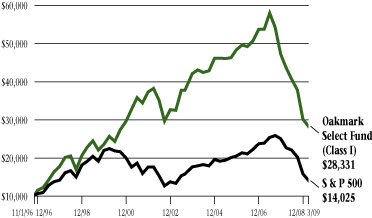

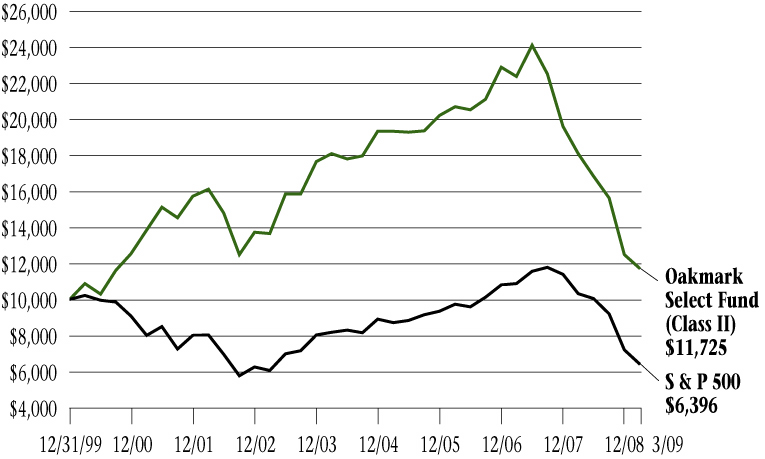

THE VALUE OF A $10,000 INVESTMENT IN OAKMARK SELECT FUND FROM ITS INCEPTION (11/1/96) TO PRESENT (3/31/09) AS COMPARED TO THE STANDARD & POOR'S 500 INDEX10 (UNAUDITED)

| | | | | Average Annual Total Returns

(as of 3/31/09) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | 10-year | | Since

Inception

(11/1/96) | |

Oakmark Select Fund

(Class I) | | | -6.26 | % | | | -35.28 | % | | | -8.10 | % | | | 2.21 | % | | | 8.75 | % | |

| S&P 500 | | | -11.01 | % | | | -38.09 | % | | | -4.76 | % | | | -3.00 | % | | | 2.76 | % | |

Lipper Multi-Cap

Value Index15 | | | -11.56 | % | | | -38.70 | % | | | -5.42 | % | | | -0.02 | % | | | 3.00 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The expense ratio for Class I shares as of 9/30/08 was 1.08%.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares redeemed within 90 days. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit oakmark.com.

* Not annualized

The Oakmark Select Fund declined 6% last quarter. Relative to the S&P 500's 11% loss, the Fund's loss was small. Relative to cash—and coming on top of losses during the past two years—it was painful. We compare our returns to the S&P 500 because we believe that over the long run, the S&P will deliver a better return than most other investments will. Effectively, we believe that simply investing in the S&P 500 would meet our goal for the Fund—achieving long-term growth of capital. If we can grow capital at a higher rate than the S&P grows—or match its growth with less risk—by investing in securities that meet our criteria, we would judge our results a success. Clearly the S&P has fallen far short of that goal over the past ten years, returning a negative 3% per year. However, as outlined in the Oakmark and Oakmark Select Funds letter, we believe that the decline over the past decade has positio ned the S&P for unusual gains in the upcoming decade. For that reason, we will continue to measure our short-term successes or failures by comparison to the S&P.

Two stocks that contributed the most to the Fund's relative outperformance last quarter were Schering-Plough and Best Buy. Schering agreed to be acquired by Merck, which resulted in the stock gaining 39%. We trimmed the position but continue to hold it because it sells at a 10% discount to the merger price, and we believe the transaction will be completed. Best Buy rose 36% as their consumer electronics sales fell less than had been anticipated. We trimmed that position as well, but want to maintain exposure to this category dominant retailer. Our worst performers, each losing over half their value, were Capital One and Bank of America. We continue to believe that both companies will survive this downturn and that they are extremely inexpensive relative to potential recovery earnings.

The only addition last quarter was Newfield Exploration, a mid-sized oil and gas company. After selling Burlington Resources in early 2006, the Fund had zero exposure to energy companies. For two years, as oil prices increased to $150, that lack of exposure hurt our relative results. Over the past few quarters, as oil prices fell back under $50, we also missed their decline. Newfield stock peaked at $70 last May and recently traded under $20. Assuming no rebound in energy prices, we believe that Newfield is now significantly undervalued and is a size that is attractive to acquirers.

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com | | Henry R. Berghoef, CFA

Portfolio Manager

oaklx@oakmark.com | |

|

March 31, 2009

OAKMARK SELECT FUND

13

OAKMARK SELECT FUND

Schedule of Investments—March 31, 2009 (Unaudited)

Name | |

Shares Held | |

Value | |

| Common Stocks—94.0% | |

| Broadcasting—8.6% | |

| Discovery Communications, Inc. Class C (a) | | | 9,509,500 | | | $ | 139,314,175 | | |

| Cable & Satellite—7.5% | |

| Liberty Media Corp. - Entertainment (a) | | | 6,017,029 | | | $ | 120,039,728 | | |

| Catalog Retail—1.7% | |

| Liberty Media Holding Corp. - Interactive, Class A (a) | | | 9,400,000 | | | $ | 27,260,000 | | |

| Computer & Electronics Retail—5.1% | |

| Best Buy Co., Inc. | | | 2,150,000 | | | $ | 81,614,000 | | |

| Movies & Entertainment—9.0% | |

| Viacom, Inc., Class B (a) | | | 4,325,000 | | | $ | 75,168,500 | | |

| Time Warner, Inc. | | | 3,610,666 | | | | 69,685,854 | | |

| | | | 144,854,354 | | |

| Restaurants—4.8% | |

| Yum! Brands, Inc. | | | 2,815,000 | | | $ | 77,356,200 | | |

| Specialized Consumer Services—7.3% | |

| H&R Block, Inc. | | | 6,469,600 | | | $ | 117,682,024 | | |

| Oil & Gas Exploration & Production—3.5% | |

| Newfield Exploration Co. (a) | | | 2,500,000 | | | $ | 56,750,000 | | |

| Consumer Finance—2.2% | |

| Capital One Financial Corp. | | | 2,910,600 | | | $ | 35,625,744 | | |

| Other Diversified Financial Services—6.2% | |

| JPMorgan Chase & Co. | | | 2,494,000 | | | $ | 66,290,520 | | |

| Bank of America Corp. | | | 4,900,000 | | | | 33,418,000 | | |

| | | | 99,708,520 | | |

| Health Care Equipment—4.2% | |

| Medtronic, Inc. | | | 2,300,000 | | | $ | 67,781,000 | | |

| Pharmaceuticals—10.9% | |

| Schering-Plough Corp. | | | 4,282,954 | | | $ | 100,863,567 | | |

| Bristol-Myers Squibb Co. | | | 3,410,200 | | | | 74,751,584 | | |

| | | | 175,615,151 | | |

| Computer Hardware—3.3% | |

| Dell, Inc. (a) | | | 5,613,000 | | | $ | 53,211,240 | | |

| Data Processing & Outsourced Services—4.0% | |

| Western Union Co. | | | 5,065,400 | | | $ | 63,672,078 | | |

| Electronic Manufacturing Services—3.2% | |

| Tyco Electronics, Ltd. | | | 4,667,838 | | | $ | 51,532,931 | | |

OAKMARK SELECT FUND

14

OAKMARK SELECT FUND

Schedule of Investments—March 31, 2009 (Unaudited) cont.

Name | | Shares Held/

Par Value | |

Value | |

| Common Stocks—94.0% (cont.) | |

| Internet Software & Services—3.3% | |

| eBay, Inc. (a) | | | 4,200,000 | | | $ | 52,752,000 | | |

| Semiconductors—9.2% | |

| Intel Corp. | | | 5,247,000 | | | $ | 78,967,350 | | |

| Texas Instruments, Inc. | | | 4,175,000 | | | | 68,929,250 | | |

| | | | 147,896,600 | | |

| Total Common Stocks (Cost: $1,811,096,306) | | | | | | | 1,512,665,745 | | |

| Short Term Investment—4.8% | |

| Repurchase Agreement—4.8% | |

Fixed Income Clearing Corp. Repurchase Agreement,

0.17% dated 3/31/2009 due 4/1/2009, repurchase

price $76,364,699, collateralized by Federal Home Loan

Mortgage Corp. Bonds, with rates from 3.000% - 3.050%,

with maturities from 4/28/2010 - 4/30/2010, and with an

aggregate market value plus accrued interest of $45,659,775,

and by a Federal National Mortgage Association Bond, with

a rate of 3.250%, with a maturity of 4/29/20 11, and with

a market value plus accrued interest of $32,235,450 | | $ | 76,364,338 | | | $ | 76,364,338 | | |

| Total Repurchase Agreement (Cost: $76,364,338) | | | | | | | 76,364,338 | | |

| Total Short Term Investment (Cost: $76,364,338) | | | | | | | 76,364,338 | | |

| Total Investments (Cost: $1,887,460,644)—98.8% | | | | | | $ | 1,589,030,083 | | |

| Other Assets In Excess of Liabilities—1.2% | | | | | | | 19,522,039 | | |

| Total Net Assets—100% | | | | | | $ | 1,608,552,122 | | |

(a) Non income-producing security.

See accompanying Notes to Financial Statements.

OAKMARK SELECT FUND

15

OAKMARK EQUITY AND INCOME FUND

Report from Clyde S. McGregor and Edward A. Studzinski, Portfolio Managers

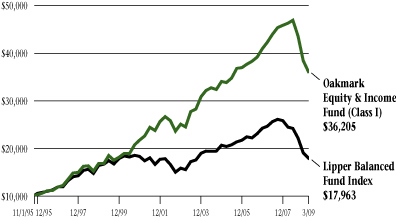

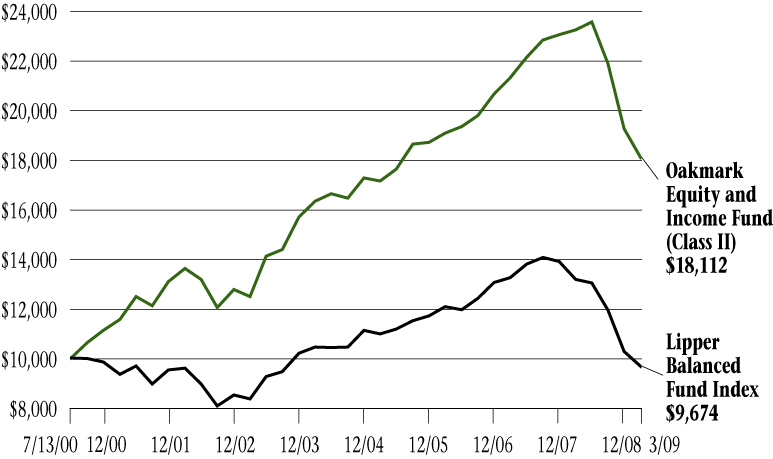

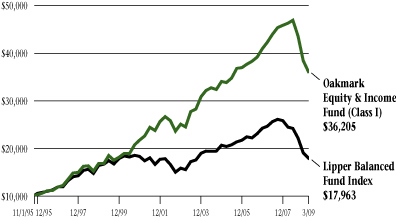

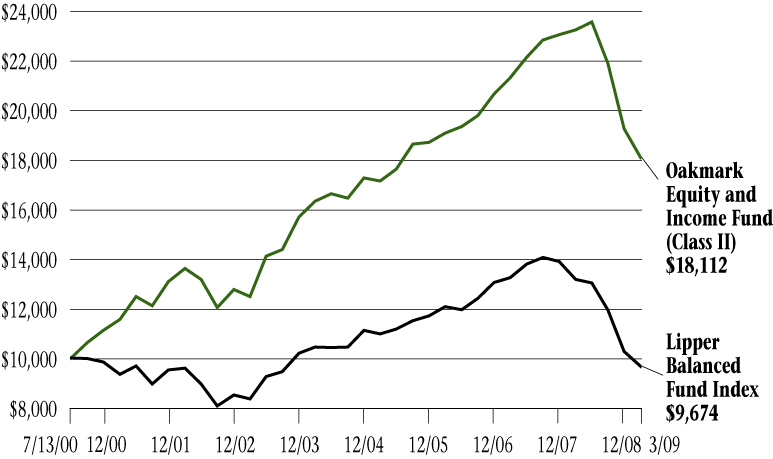

THE VALUE OF A $10,000 INVESTMENT IN OAKMARK EQUITY AND INCOME FUND FROM ITS INCEPTION (11/1/95) TO PRESENT (3/31/09) AS COMPARED TO THE LIPPER BALANCED FUND INDEX16 (UNAUDITED)

| | | | | Average Annual Total Returns

(as of 3/31/09) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | 10-year | | Since

Inception

(11/1/95) | |

Oakmark Equity &

Income Fund (Class I) | | | -6.03 | % | | | -21.99 | % | | | 2.37 | % | | | 7.99 | % | | | 10.07 | % | |

Lipper Balanced

Fund Index | | | -5.84 | % | | | -26.60 | % | | | -1.54 | % | | | 0.76 | % | | | 4.46 | % | |

| S&P 50010 | | | -11.01 | % | | | -38.09 | % | | | -4.76 | % | | | -3.00 | % | | | 4.17 | % | |

Barclays Capital

U.S. Govt./Credit17 | | | -1.28 | % | | | 1.78 | % | | | 3.74 | % | | | 5.64 | % | | | 5.96 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The expense ratio for Class I shares as of 9/30/08 was 0.81%.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit oakmark.com.

* Not annualized

Quarter Review

While the Fund's percentage loss for the March quarter was much reduced from the preceding period, to report any loss still disappoints us greatly. The Fund's 6% decline in value was virtually the same as the return for the Lipper Balanced Fund Index, our standard of comparison. Since inception, the Fund's annualized rate of return has been 10% compared to the 4% which the Lipper Index reported.

After a busy end of calendar 2008, portfolio activity returned to more typical levels during the past quarter. We initiated two new equity positions, both involved in medical and scientific instrumentation: PerkinElmer and Varian Medical Systems. Our research department has unearthed a wide variety of interesting names in this area, and we believe that these two companies offer intriguing prospects as well as compelling valuations. We eliminated two equity holdings, ITT and Medtronic, and the January takeover of UST removed that name from the portfolio as well.

Even in down quarters the Fund is blessed with some strong contributors. In the March quarter these included TJX, Hospira, and Walter Industries. TJX, parent company of T.J.Maxx, Marshall's, and other retail concepts, is a natural beneficiary of a difficult retail environment because the company sources its inventories so cheaply. Hospira announced a reorganization during the quarter that should boost the company's profitability. Significant detractors included Medtronic, Diageo, and General Dynamics. Shares of Medtronic and General Dynamics both reacted negatively to the Obama administration's budget, and General Dynamics also suffered delays and cancellations in its Gulfstream business jet unit. Diageo experienced the effects of consumers trading down to less expensive brands.

Equity Portfolio Characteristics

The bear market for stocks has many diverse effects. For example, declining market values have forced Standard & Poors more than once to adjust the minimum market capitalization requirement for companies eligible to be added to the S&P 500 Index. Standard & Poors has also been busy removing and adding names in response to drastic price movements. Even with all of this activity, at the end of February more than 20% of the Index's constituent companies were below the already reduced minimum market capitalization level for index inclusion.

Fortunately, this trend of companies becoming mid-cap or even small-cap is almost irrelevant to our management of the Fund. Oakmark Equity and Income has always been an all-cap fund. Both our new purchases in the March quarter had market capitalizations of less than $5 billion. In fact,

OAKMARK EQUITY AND INCOME FUND

16

using $1.5 billion to $5 billion as the range for mid cap companies and anything below $1.5 billion for small cap companies, as of March 31, 21% of the Fund's holdings are mid caps and 6% small caps. Size is never an important issue except insofar as it limits our ability to invest a material proportion of the Fund in a name. Value is always the determining factor, and in our management of the Fund we go wherever value takes us.

Dividend yield is another characteristic to which the financial press has devoted considerable attention this year. With share prices down dramatically, dividend yields perforce go up, but severe dividend reductions in the financial sector have diminished this effect, especially since financials had been the highest yielding sector. Thankfully, the Equity and Income Fund equity portfolio has enjoyed six dividend increases and no reductions so far this year. We like high dividend yields as much as anyone, but we consider yield to be only one factor in determining the true worth of a stock.

As we have often written, the Equity and Income Fund is intended to be a low volatility, total return oriented portfolio. To that end in this environment we have attempted to invest the Fund in businesses that provide products or services that are not discretionary but that have perpetual utility. Whether the product is food, natural gas, medical supplies, aggregates for road-building, or cable TV systems, we are confident that consumers will find a way to continue to purchase these items. We also believe that the world is not getting any safer, which means that defense companies' business should remain solid.

Finally, in our effort to control risk in this difficult time, we have oriented the holdings to companies that we believe have solid balance sheets and strong cash flows. Most important, we have avoided companies that appear to have the need to refinance debt maturities within the next few years. While we expect market conditions to improve and liquidity to recover before too long, this forecast is highly uncertain. What we do know is that price and value tend to converge over time. If we focus on identifying and owning businesses that are significantly underpriced, that have demonstrated the ability to grow their value per share, and that have managers that treat their shareholders as their partners, we believe we will position the portfolio for the eventual return of a more favorable environment.

Between Scylla and Charybdis

We have offered e-mail communication to our shareholders for many years. Often, shareholder correspondence is not directed to any particular investing theme or sector, but for the past few years one significant focus has been the Fund's fixed income holdings and strategy. This focus surprises us both because of the inherent conservatism of the fixed income strategy, but also because of the fact that the majority of the Fund's historic returns have originated on the equity side.

Now, however, we do understand our shareholders' focus on fixed income. The economic environment facing fixed income investors is described again and again as unprecedented, and justifiably so. Perhaps never before has the world seen so much government intervention and so many simultaneous efforts to stimulate economic activity. At the same time, economic activity continues to contract, resulting in excess inventories and declining prices.

In Greek mythology, Scylla and Charybdis were two sea monsters situated on opposite sides of the Strait of Messina. A ship would have to navigate perfectly in order to avoid both threats. For today's fixed income investor, the twin threats are deflation now and probable inflation in the future. Deflation is good for high-quality fixed coupon bonds and bad for high-yield or inflation-indexed securities. The opposite is true for an inflationary environment. Since we do not know when—or even if—the environment will evolve from deflation to inflation, we have sought to construct all-weather fixed income portfolios.

Fortunately, occasional market dislocations have produced opportunities to adapt the fixed income portfolio better to these twin threats. Throughout the quarter we had several opportunities to build out the commitment to inflation-indexed securities (often called TIPS) at unusually favorable prices. TIPS generally pay a low interest rate, but their principal value adjusts periodically to reflect inflation. The interest income is therefore "real return" i.e., the return after neutralizing inflation (or at least inflation as the government is able to measure it). Usually TIPS have an interest-only return below that of ordinary Treasury notes. During the past quarter, however, TIPS occasionally traded "through Treasurys," meaning that their nominal yield exceeded that of Treasurys of similar maturity. This anomalous occurrence was the result of investors' fears that deflation would persist. We took advantage of this opportunity and increased th e Fund's TIPS commitment to 12% of the portfolio. We also extended the average maturity of the TIPS position and reduced the level of built-in accretion (historic inflation adjustments), the latter an attempt to mitigate the impact of near-term deflation. The enhanced TIPS position has already positively affected the portfolio: on the day that the Federal Reserve announced that it would begin to purchase Treasurys, the Fund's TIPS gained over 4% in market value, a substantial move in bond market terms.

While increasing the TIPS position, we also reduced the Fund's commitment to ordinary Treasury notes from 26% to 22%. The Treasurys are still important for their income generation and their protection against deflation.

Other fixed income changes were more modest, although not for want of effort. We made a vigorous attempt to increase the portfolio's investment-grade corporate bond position, and in fact, we more than doubled this segment's size. However, it still aggregates to approximately 1% of the entire portfolio. We have always looked skeptically at investment-grade corporates because experience teaches us that far more are down-graded than up-graded. We prefer to invest our clients' funds where the probabilities are more favorable. We also do not like the bond market's typical focus on the yield spread of a corporate bond versus a Treasury issue of similar maturity. We much prefer to invest in corporate bonds when they appear to offer attractive absolute, rather than attractive relative, returns. We have

OAKMARK EQUITY AND INCOME FUND

17

found what we believe are several such opportunities during the quarter, but they could not absorb much capital. The corporate bond market continues to suffer from the effects of markets seizing up, and liquidity conditions remain variable. While we would have preferred to have built up a larger investment-grade corporate bond position, we could not do so on our terms.

We also continued to avoid the high yield sector. Mathematically oriented investors have calculated that current prices of high yield (or junk) debt in the aggregate effectively discount default outcomes that have never actually been realized. Such investors make the case for purchasing a wide array of junk issues, in essence betting that the outsized returns of the survivors will more than compensate for those that default. While this could work, investing in such a fashion is alien to the Equity and Income Fund. Although we do believe in diversification, we also insist that every security that enters the Fund should have definite merit and that we should be willing to own all of the issue at our purchase price. Neither knowing how bad the economy will become nor the moment when deflation will mutate over to inflation, we choose to focus on issues that are less economically vulnerable.

Once again, we thank you for being our shareholders and invite your questions and comments.

Clyde S. McGregor, CFA

Portfolio Manager

oakbx@oakmark.com | | Edward A. Studzinski, CFA

Portfolio Manager

oakbx@oakmark.com | |

|

March 31, 2009

OAKMARK EQUITY AND INCOME FUND

18

OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2009 (Unaudited)

Name | |

Shares Held | |

Value | |

| Equity and Equivalents—48.8% | |

| Common Stocks—48.8% | |

| Apparel Retail—2.4% | |

| The TJX Cos., Inc. | | | 9,215,100 | | | $ | 236,275,164 | | |

| Foot Locker, Inc. | | | 5,000,000 | | | | 52,400,000 | | |

| | | | 288,675,164 | | |

| Cable & Satellite—2.7% | |

| Comcast Corp., Class A | | | 13,750,000 | | | $ | 187,550,000 | | |

| Scripps Networks Interactive, Inc., Class A | | | 6,208,000 | | | | 139,742,080 | | |

| | | | 327,292,080 | | |

| Home Furnishings—0.4% | |

| Mohawk Industries, Inc. (a) | | | 1,000,000 | | | $ | 29,870,000 | | |

| Leggett & Platt, Inc. | | | 1,279,056 | | | | 16,614,937 | | |

| | | | 46,484,937 | | |

| Publishing—0.2% | |

| The Washington Post Co., Class B | | | 75,000 | | | $ | 26,782,500 | | |

| Distillers & Vintners—2.2% | |

| Diageo PLC (b) | | | 5,950,000 | | | $ | 266,262,500 | | |

| Drug Retail—2.3% | |

| CVS Caremark Corp. | | | 10,000,000 | | | $ | 274,900,000 | | |

| Packaged Foods & Meats—6.8% | |

| Nestle SA (b) (c) | | | 9,457,500 | | | $ | 319,710,787 | | |

| ConAgra Foods, Inc. | | | 17,500,000 | | | | 295,225,000 | | |

| Kraft Foods, Inc., Class A | | | 9,000,000 | | | | 200,610,000 | | |

| | | | 815,545,787 | | |

| Personal Products—2.4% | |

| Avon Products, Inc. | | | 15,000,000 | | | $ | 288,450,000 | | |

| Coal & Consumable Fuels—0.6% | |

| Walter Industries, Inc. (d) | | | 3,100,000 | | | $ | 70,897,000 | | |

| Oil & Gas Exploration & Production—8.5% | |

| XTO Energy, Inc. | | | 14,305,572 | | | $ | 438,036,615 | | |

| EnCana Corp. (e) | | | 8,100,000 | | | | 328,941,000 | | |

| Apache Corp. | | | 4,000,000 | | | | 256,360,000 | | |

| | | | 1,023,337,615 | | |

| Oil & Gas Storage & Transportation—0.8% | |

| The Williams Cos., Inc. | | | 9,000,000 | | | $ | 102,420,000 | | |

| Reinsurance—1.3% | |

| PartnerRe, Ltd. (e) | | | 2,600,000 | | | $ | 161,382,000 | | |

OAKMARK EQUITY AND INCOME FUND

19

OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2009 (Unaudited) cont.

Name | |

Shares Held | |

Value | |

| Equity and Equivalents—48.8% (cont.) | |

| Health Care Equipment—5.9% | |

| Hospira, Inc. (a) (d) | | | 8,000,000 | | | $ | 246,880,000 | | |

| Covidien, Ltd. | | | 7,000,000 | | | | 232,680,000 | | |

| Varian Medical Systems, Inc. (a) | | | 4,900,000 | | | | 149,156,000 | | |

| Steris Corp. | | | 2,250,000 | | | | 52,380,000 | | |

| Kinetic Concepts, Inc. (a) | | | 1,223,400 | | | | 25,838,208 | | |

| | | | 706,934,208 | | |

| Health Care Services—2.0% | |

| Laboratory Corp. of America Holdings (a) | | | 4,000,000 | | | $ | 233,960,000 | | |

| Life Sciences Tools & Services—0.5% | |

| Varian, Inc. (a) | | | 1,409,400 | | | $ | 33,459,156 | | |

| PerkinElmer, Inc. | | | 2,500,000 | | | | 31,925,000 | | |

| | | | 65,384,156 | | |

| Aerospace & Defense—6.3% | |

| General Dynamics Corp. | | | 7,500,000 | | | $ | 311,925,000 | | |

| Rockwell Collins, Inc. | | | 6,500,000 | | | | 212,160,000 | | |

| Goodrich Corp. | | | 4,000,000 | | | | 151,560,000 | | |

| Alliant Techsystems, Inc. (a) | | | 1,285,200 | | | | 86,082,696 | | |

| | | | 761,727,696 | | |

| Industrial Machinery—0.8% | |

| Pentair, Inc. | | | 4,000,000 | | | $ | 86,680,000 | | |

| Mueller Water Products, Inc., Class A (d) | | | 2,500,000 | | | | 8,250,000 | | |

| | | | 94,930,000 | | |

| Marine—0.6% | |

| Kirby Corp. (a) | | | 2,650,000 | | | $ | 70,596,000 | | |

| Application Software—0.1% | |

| Mentor Graphics Corp. (a) | | | 3,189,718 | | | $ | 14,162,348 | | |

| Communications Equipment—0.6% | |

| EchoStar Corp. (a) (d) | | | 4,900,000 | | | $ | 72,667,000 | | |

| Electronic Manufacturing Services—0.6% | |

| Tyco Electronics, Ltd. | | | 6,250,000 | | | $ | 69,000,000 | | |

| Construction Materials—0.8% | |

| Martin Marietta Materials, Inc. | | | 1,175,000 | | | $ | 93,177,500 | | |

| Total Common Stocks (Cost: $6,753,656,931) | | | | | | | 5,874,968,491 | | |

| Total Equity and Equivalents (Cost: $6,753,656,931) | | | | | | | 5,874,968,491 | | |

OAKMARK EQUITY AND INCOME FUND

20

OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2009 (Unaudited) cont.

Name | |

Par Value | |

Value | |

| Fixed Income—43.0% | |

| Corporate Bonds—0.8% | |

| Diversified Real Estate Activities—0.2% | |

| Brookfield Asset Management, Inc., 7.125%, due 6/15/2012 | | $ | 19,500,000 | | | $ | 16,185,000 | | |

| Brookfield Asset Management, Inc., 5.75%, due 3/1/2010 | | | 4,875,000 | | | | 4,710,713 | | |

| | | | 20,895,713 | | |

| Property & Casualty Insurance—0.1% | |

| Fund American Cos., Inc., 5.875%, due 5/15/2013 | | $ | 20,243,000 | | | $ | 15,541,300 | | |

| Insurance Brokers—0.0% | |

| Marsh & McLennan Cos., Inc., 6.25%, due 3/15/2012 | | $ | 975,000 | | | $ | 929,479 | | |

| Consumer Finance—0.1% | |

| Toyota Motor Credit Corp., 4.00%, due 6/25/2010 | | $ | 15,000,000 | | | $ | 14,762,250 | | |

| Leisure Facilities—0.1% | |

| Vail Resorts, Inc., 6.75%, due 2/15/2014 | | $ | 15,422,000 | | | $ | 13,262,920 | | |

| Paper Packaging—0.2% | |

| Sealed Air Corp., 144A, 5.625%, due 7/15/2013 (f) | | $ | 19,400,000 | | | $ | 16,690,945 | | |

| Semiconductors—0.1% | |

| ASML Holding NV, 5.75%, due 6/13/2017 | | EUR | 10,000,000 | | | $ | 8,104,460 | | |

| Oil & Gas Exploration & Production—0.0% | |

| Newfield Exploration Co., 7.625%, due 3/1/2011 | | $ | 2,300,000 | | | $ | 2,271,250 | | |

| Health Care Services—0.0% | |

| Quest Diagnostic, Inc. Senior Note, 5.125%, due 11/1/2010 | | $ | 1,680,000 | | | $ | 1,686,320 | | |

| Total Corporate Bonds (Cost: $97,294,535) | | | | | | | 94,144,637 | | |

| Government and Agency Securities—42.2% | |

| Canadian Government Bonds—1.1% | |

| Canadian Government Bond, 3.50%, due 6/1/2013 | | CAD | 100,000,000 | | | $ | 85,287,119 | | |

| Canadian Government Bond, 4.00%, due 6/1/2016 | | CAD | 50,000,000 | | | | 44,337,722 | | |

| | | | 129,624,841 | | |

| U.S. Government Agencies—7.5% | |

| Federal Farm Credit Bank, 3.50%, due 10/3/2011 | | $ | 100,000,000 | | | $ | 104,360,400 | | |

| Federal Farm Credit Bank, 0.413%, due 2/22/2012 (g) | | | 97,000,000 | | | | 95,360,603 | | |

| Federal Home Loan Bank, 3.25%, due 3/11/2011 | | | 80,000,000 | | | | 82,778,800 | | |

| Tennessee Valley Authority, 6.79%, due 5/23/2012 | | | 58,730,000 | | | | 66,889,418 | | |

| Tennessee Valley Authority, 5.50%, due 7/18/2017 | | | 58,500,000 | | | | 65,310,336 | | |

| Federal Farm Credit Bank, 2.75%, due 5/4/2010 | | | 50,000,000 | | | | 50,902,700 | | |

OAKMARK EQUITY AND INCOME FUND

21

OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2009 (Unaudited) cont.

Name | |

Par Value | |

Value | |

| Fixed Income—43.0% (cont.) | |

| U.S. Government Agencies—7.5% (cont.) | |

| Federal Farm Credit Bank, 2.25%, due 7/1/2010 | | $ | 50,000,000 | | | $ | 50,689,350 | | |

| Federal Farm Credit Bank, 3.875%, due 11/13/2012 | | | 40,000,000 | | | | 42,168,840 | | |

| Federal Home Loan Bank, 4.25%, due 11/20/2009 | | | 38,000,000 | | | | 38,786,448 | | |

| Federal Farm Credit Bank, 3.15%, due 5/19/2011 | | | 35,000,000 | | | | 36,172,955 | | |

| Private Export Funding Corp. Series Y, 3.55%, due 4/15/2013 | | | 25,000,000 | | | | 26,004,450 | | |

| Federal Farm Credit Bank, 4.92%, due 1/11/2010 | | | 19,400,000 | | | | 19,993,310 | | |

| Federal Farm Credit Bank, 4.50%, due 10/17/2012 | | | 15,750,000 | | | | 16,873,384 | | |

| Federal Farm Credit Bank, 5.125%, due 8/25/2016 | | | 14,625,000 | | | | 16,097,971 | | |

Private Export Funding Corp. Secured Note, Series 1, 7.20%,

due 1/15/2010 | | | 15,000,000 | | | | 15,717,480 | | |

| Federal Agricultural Mortgage Corp., 3.875%, due 8/19/2011 | | | 14,625,000 | | | | 15,374,385 | | |

| Federal Farm Credit Bank, 3.875%, due 8/25/2011 | | | 14,500,000 | | | | 15,245,228 | | |

| Federal Farm Credit Bank, 2.75%, due 11/20/2009 | | | 15,000,000 | | | | 15,174,510 | | |

| Tennessee Valley Authority, 4.375%, due 6/15/2015 | | | 10,000,000 | | | | 10,639,420 | | |

| Federal Farm Credit Bank, 5.15%, due 7/20/2009 | | | 10,216,000 | | | | 10,360,720 | | |

| Federal Farm Credit Bank, 5.25%, due 7/16/2010 | | | 9,700,000 | | | | 10,208,358 | | |

| Federal Home Loan Bank, 4.375%, due 10/22/2010 | | | 9,750,000 | | | | 10,206,271 | | |

| Federal Farm Credit Bank, 3.85%, due 2/11/2015 | | | 9,750,000 | | | | 10,169,289 | | |

| Tennessee Valley Authority, 5.625%, due 1/18/2011 | | | 8,721,000 | | | | 9,356,316 | | |

| Federal Home Loan Bank, 3.50%, due 12/10/2010 | | | 8,750,000 | | | | 9,062,375 | | |

| Federal Farm Credit Bank, 5.28%, due 8/16/2013 | | | 7,500,000 | | | | 8,315,415 | | |

| Federal Farm Credit Bank, 5.20%, due 11/28/2016 | | | 5,850,000 | | | | 6,485,135 | | |

| Federal Farm Credit Bank, 4.85%, due 12/16/2009 | | | 6,305,000 | | | | 6,475,077 | | |

| Federal Farm Credit Bank, 5.125%, due 6/6/2011 | | | 5,435,000 | | | | 5,847,343 | | |

| Federal Farm Credit Bank, 4.92%, due 8/26/2013 | | | 4,875,000 | | | | 5,334,147 | | |

| Federal Farm Credit Bank, 4.875%, due 12/16/2015 | | | 4,875,000 | | | | 5,296,434 | | |

| Federal Farm Credit Bank, 5.10%, due 8/9/2011 | | | 4,850,000 | | | | 5,233,911 | | |

| Federal Farm Credit Bank, 4.75%, due 5/7/2010 | | | 4,850,000 | | | | 5,043,835 | | |

| Federal Farm Credit Bank, 4.85%, due 3/9/2011 | | | 4,322,000 | | | | 4,602,083 | | |

| Federal Farm Credit Bank, 5.05%, due 5/25/2011 | | | 3,880,000 | | | | 4,165,595 | | |

| Tennessee Valley Authority, 4.875%, due 12/15/2016 | | | 3,750,000 | | | | 4,030,729 | | |

| Federal Farm Credit Bank, 4.50%, due 8/8/2011 | | | 2,910,000 | | | | 3,083,340 | | |

| Federal Farm Credit Bank, 4.82%, due 10/12/2012 | | | 2,425,000 | | | | 2,635,303 | | |

| | | | 910,451,664 | | |

| U.S. Government Notes—33.6% | |

| United States Treasury Notes, 4.875%, due 2/15/2012 | | $ | 485,000,000 | | | $ | 537,288,820 | | |

| United States Treasury Notes, 5.125%, due 6/30/2011 | | | 485,000,000 | | | | 531,756,910 | | |

| United States Treasury Notes, 2.875%, due 1/31/2013 | | | 500,000,000 | | | | 528,906,000 | | |

United States Treasury Notes, 1.375%, due 7/15/2018 ,

Inflation Indexed | | | 440,554,500 | | | | 436,974,995 | | |

United States Treasury Notes, 1.625%, due 1/15/2018,

Inflation Indexed | | | 403,088,000 | | | | 407,370,810 | | |

OAKMARK EQUITY AND INCOME FUND

22

OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2009 (Unaudited) cont.

Name | |

Par Value | |

Value | |

| Fixed Income—43.0% (cont.) | |

| U.S. Government Notes—33.6% (cont.) | |

United States Treasury Notes, 2.625%, due 7/15/2017,

Inflation Indexed | | $ | 254,652,500 | | | $ | 276,536,826 | | |

| United States Treasury Notes, 5.00%, due 8/15/2011 | | | 242,500,000 | | | | 266,522,535 | | |

| United States Treasury Notes, 2.75%, due 10/31/2013 | | | 250,000,000 | | | | 263,672,000 | | |

| United States Treasury Notes, 2.75%, due 2/28/2013 | | | 250,000,000 | | | | 263,437,500 | | |

United States Treasury Notes, 2.125%, due 1/15/2019,

Inflation Indexed | | | 196,660,000 | | | | 209,381,542 | | |

| United States Treasury Notes, 4.75%, due 3/31/2011 | | | 194,000,000 | | | | 209,338,028 | | |

United States Treasury Notes, 2.00%, due 1/15/2016,

Inflation Indexed | | | 106,366,000 | | | | 109,723,124 | | |

| | | | 4,040,909,090 | | |

| Total Government and Agency Securities (Cost: $4,775,531,575) | | | | | | | 5,080,985,595 | | |

| Total Fixed Income (Cost: $4,872,826,110) | | | | | | | 5,175,130,232 | | |

| Short Term Investments—8.7% | |

| Canadian Treasury Bills—1.3% | |

Canadian Treasury Bills, 0.53% - 2.65%,

due 8/6/2009 - 3/18/2010 | | CAD | 200,000,000 | | | $ | 158,061,746 | | |

| Total Canadian Treasury Bills (Cost: $168,148,137) | | | | | | | 158,061,746 | | |

| U.S. Government Agencies—0.3% | |

| Federal Home Loan Bank, 0.92%, due 9/14/2009 | | | 40,000,000 | | | $ | 39,942,840 | | |

| Total U.S. Government Agencies (Cost: $39,834,000) | | | | | | | 39,942,840 | | |

| U.S. Government Bills—2.5% | |

United States Treasury Bills, 2.11% - 2.18%,

due 7/2/2009 - 8/27/2009 | | | 300,000,000 | | | $ | 299,741,700 | | |

| Total U.S. Government Bills (Cost: $297,900,333) | | | | | | | 299,741,700 | | |

OAKMARK EQUITY AND INCOME FUND

23

OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2009 (Unaudited) cont.

Name | |

Par Value | |

Value | |

| Short Term Investments—8.7% (cont.) | |

| Repurchase Agreement—4.6% | |

Fixed Income Clearing Corp. Repurchase Agreement,

0.17% dated 3/31/2009 due 4/1/2009, repurchase price

$549,578,978, collateralized by Federal Home Loan Bank

Notes, with rates from 1.620% - 5.000%, with maturities

from 12/11/2009 - 12/30/2009, and with an aggregate

market value plus accrued interest of $383,008,690, and

by a Federal Home Loan Bank Discount Note, with a rate

of 0.000%, with a maturity of 7/31/2009, and with a

market value plus accrued interest of $99,875,000, and

by Freddie Mac Discount Notes, with rates of 0.000%,

with maturities from 6/30/2009 - 9/15/2009, and with

an aggregate market value plus accrued interest

of $77,688,618 | | $ | 549,576,382 | | | $ | 549,576,382 | | |

| Total Repurchase Agreement (Cost: $549,576,382) | | | | | 549,576,382 | | |

| Total Short Term Investments (Cost: $1,055,458,852) | | | | | 1,047,322,668 | | |

| Total Investments (Cost: $12,681,941,893)—100.5% | | | | $ | 12,097,421,391 | | |

| Liabilities In Excess of Other Assets—(0.5)% | | | | | (65,552,052 | ) | |

| Total Net Assets—100% | | | | $ | 12,031,869,339 | | |

(a) Non income-producing security.

(b) Represents an American Depositary Receipt.

(c) Market value is determined in good faith in accordance with procedures established by the Board of Trustees.

(d) See note number five in the Notes to the Financial Statements regarding investments in affiliated issuers.

(e) Represents a foreign domiciled corporation.

(f) Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

(g) Floating Rate Note. Rate shown is as of March 31, 2009.

Key to abbreviations:

CAD: Canadian Dollar

EUR: Euro Dollar

See accompanying Notes to Financial Statements.

OAKMARK EQUITY AND INCOME FUND

24

OAKMARK GLOBAL FUND

Report from Clyde S. McGregor and Robert A. Taylor, Portfolio Managers

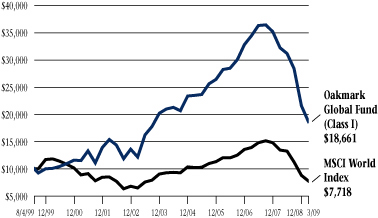

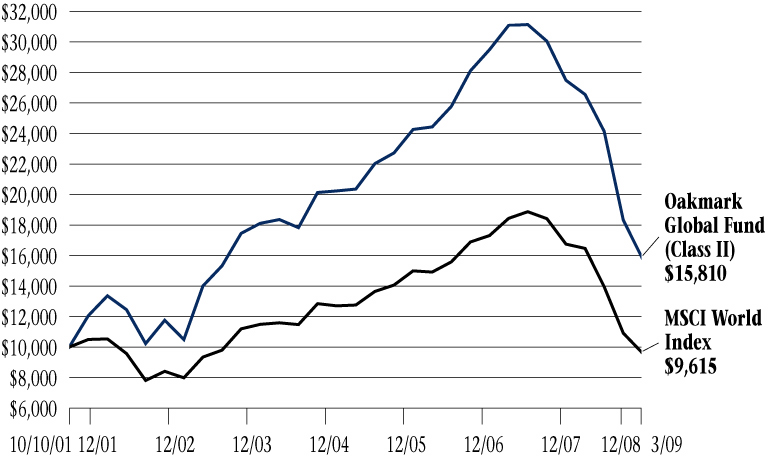

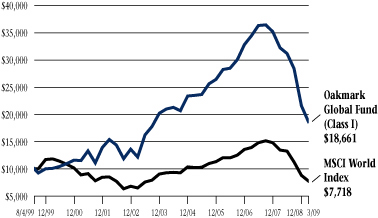

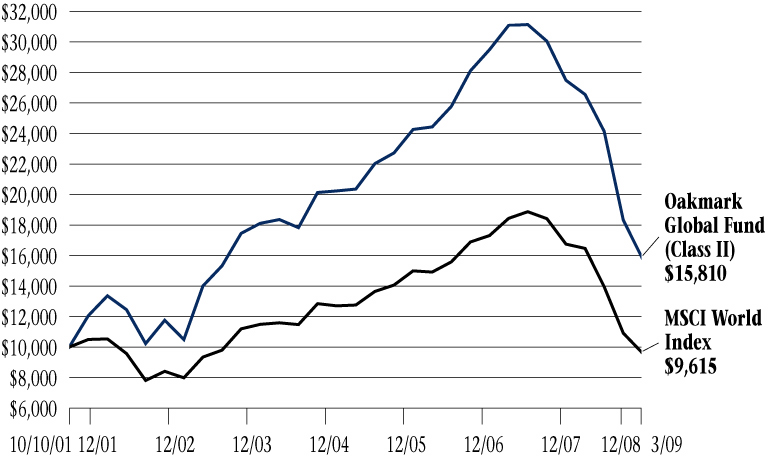

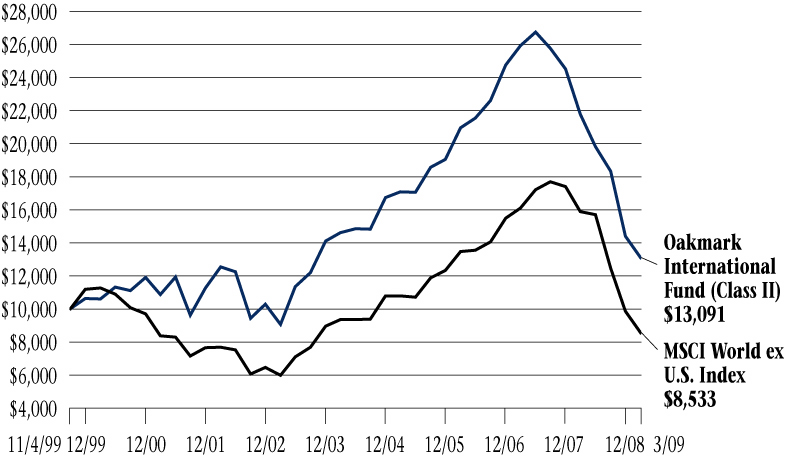

THE VALUE OF A $10,000 INVESTMENT IN OAKMARK GLOBAL FUND FROM ITS INCEPTION (8/4/99) TO PRESENT (3/31/09) AS COMPARED TO THE MSCI WORLD INDEX18 (UNAUDITED)

| | | | | Average Annual Total Returns

(as of 3/31/09) | |

| (Unaudited) | | Total Return

Last 3 Months* | | 1-year | | 5-year | | Since

Inception

(8/4/99) | |

| Oakmark Global Fund (Class I) | | | -13.70 | % | | | -42.31 | % | | | -2.36 | % | | | 6.67 | %3 | |

| MSCI World | | | -11.92 | % | | | -42.58 | % | | | -3.50 | % | | | -2.65 | % | |

| Lipper Global Fund Index19 | | | -9.75 | % | | | -39.64 | % | | | -2.35 | % | | | -0.65 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The expense ratio for Class I shares as of 9/30/08 was 1.16%.