UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-07064 |

| |

| Exact name of registrant as specified in charter: | | The Target |

| | Portfolio Trust |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2007 |

| | (Registrant changed its fiscal year end from December 31) |

| |

| Date of reporting period: | | 10/31/2007 |

Item 1 – Reports to Stockholders

| | |

| OCTOBER 31, 2007 | | ANNUAL REPORT |

The TARGET Portfolio Trust®

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Trust portfolios’ securities are for the period covered by this report and are subject to change thereafter.

TARGET Funds, TARGET Portfolio Trust, Prudential, Prudential Financial, and the Rock Prudential logo are registered service marks of The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

December 14, 2007

Dear TARGET Shareholder:

We hope you find the annual report for The TARGET Portfolio Trust informative and useful. Today many investors may be asking where they can find new growth opportunities. We believe that as a TARGET shareholder, you are uniquely positioned for domestic and global growth opportunities because you already have a strategic investment plan in place.

A structured and professional approach to investing can help you “tune out” the noise of current market developments and allows you to concentrate on what’s really important—your long-term goals. It starts with a personal plan that you and your financial professional construct based on your reasons for investing, the time you have to reach your goals, and the level of risk you are willing to assume. Your financial professional can work closely with you to develop an appropriate asset allocation and select the corresponding TARGET portfolio for each asset class in your investment plan. The managers for each portfolio are carefully chosen, are monitored by our team of experienced investment management analysts, and are among the leading institutional money managers available.

The TARGET portfolios’ fiscal year has changed from a reporting period that ends December 31 to one that ends October 31. This change should have no impact on the way the portfolios are managed. Shareholders will receive future annual and semiannual reports on the new fiscal year-end schedule.

Your selections among the TARGET portfolios can evolve as your needs change. Your financial professional can help you track your plan’s progress, stay informed of important developments, and assist you in determining whether you need to modify your portfolio. In these ways and more, the TARGET portfolios can help make your investment goals a reality.

Thank you for your continued confidence.

Sincerely,

Judy A. Rice, President

The TARGET Portfolio Trust

| | |

| THE TARGET PORTFOLIO TRUST | | 1 |

Equity Portfolios’ Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudential.com or by calling (800) 225-1852. The maximum TARGET program fee for retail investors is 1.50%.

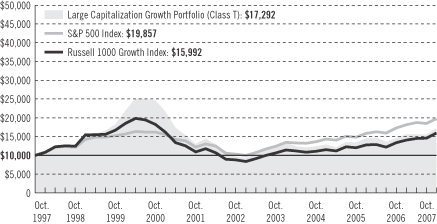

Large Capitalization Growth Portfolio:

Gross operating expenses: Class R, 1.43%; Class T, 0.68%. Net operating expenses apply to: Class R, 1.18%; Class T, 0.68%, after contractual reduction through 2/28/2009.

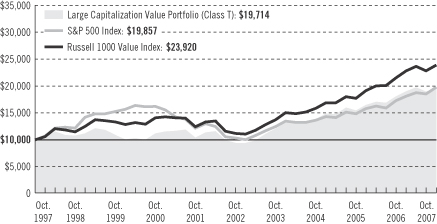

Large Capitalization Value Portfolio:

Gross operating expenses: Class R, 1.44%; Class T, 0.69%. Net operating expenses apply to: Class R, 1.19%; Class T, 0.69%, after contractual reduction through 2/28/2009.

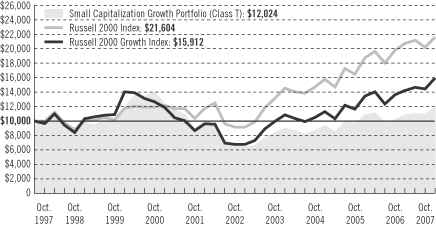

Small Capitalization Growth Portfolio:

Gross operating expenses: Class R, 1.53%; Class T, 0.78%. Net operating expenses apply to: Class R, 1.28%; Class T, 0.78%, after contractual reduction through 2/28/2009.

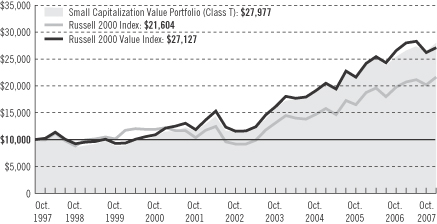

Small Capitalization Value Portfolio:

Gross operating expenses: Class R, 1.48%; Class T, 0.73%. Net operating expenses apply to: Class R, 1.23%; Class T, 0.73%, after contractual reduction through 2/28/2009.

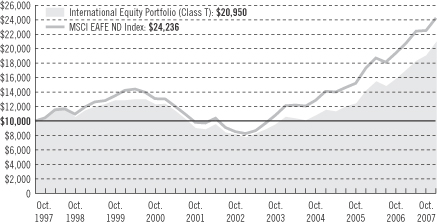

International Equity Portfolio:

Gross operating expenses: Class R, 1.58%; Class T, 0.83%. Net operating expenses apply to: Class R, 1.33%; Class T, 0.83%, after contractual reduction through 2/28/2009.

| | | | | | | | | | | |

| Equity Portfolios |

| | | Cumulative Total Returns1

as of 10/31/07 (Without TARGET Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

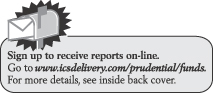

Large Capitalization Growth Portfolio (Class R) | | 18.96 | % | | N/A | | | N/A | | | 25.69% (8/22/06) |

Large Capitalization Growth Portfolio (Class T) | | 19.56 | | | 91.74 | % | | 100.98 | % | | — |

S&P 500 Index3 | | 14.55 | | | 91.45 | | | 98.57 | | | *** |

Russell 1000 Growth Index3 | | 19.23 | | | 81.09 | | | 59.92 | | | **** |

Lipper Large-Cap Core Funds Avg.4 | | 14.56 | | | 81.47 | | | 84.27 | | | ***** |

| | |

| 2 | | THE TARGET PORTFOLIO TRUST |

| | | | | | | | | | | |

| | | Average Annual Total Returns1

as of 9/30/07 (With TARGET Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

Large Capitalization Growth Portfolio (Class R) | | 17.85 | % | | N/A | | | N/A | | | 18.44% (8/22/06) |

Large Capitalization Growth Portfolio (Class T) | | 16.86 | | | 13.52 | % | | 4.30 | % | | — |

S&P 500 Index3 | | 16.42 | | | 15.44 | | | 6.57 | | | *** |

Russell 1000 Growth Index3 | | 19.35 | | | 13.84 | | | 4.06 | | | **** |

Lipper Large-Cap Core Funds Avg.4 | | 15.96 | | | 13.91 | | | 5.54 | | | ***** |

| |

| | | Cumulative Total Returns1

as of 10/31/07 (Without TARGET Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

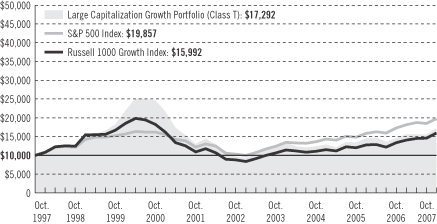

Large Capitalization Value Portfolio (Class R) | | 9.75 | % | | N/A | | | N/A | | | 16.23% (8/22/06) |

Large Capitalization Value Portfolio (Class T) | | 10.28 | | | 124.79 | % | | 129.11 | % | | — |

S&P 500 Index3 | | 14.55 | | | 91.45 | | | 98.57 | | | *** |

Russell 1000 Value Index3 | | 10.83 | | | 113.63 | | | 139.20 | | | **** |

Lipper Multi-Cap Value Funds Avg.4 | | 10.94 | | | 107.41 | | | 129.00 | | | ***** |

| |

| | | Average Annual Total Returns1

as of 9/30/07

(With TARGET Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

Large Capitalization Value Portfolio (Class R) | | 13.17 | % | | N/A | | | N/A | | | 14.27% (8/22/06) |

Large Capitalization Value Portfolio (Class T) | | 12.02 | | | 17.08 | % | | 6.58 | % | | — |

S&P 500 Index3 | | 16.42 | | | 15.44 | | | 6.57 | | | *** |

Russell 1000 Value Index3 | | 14.45 | | | 18.07 | �� | | 8.80 | | | **** |

Lipper Multi-Cap Value Funds Avg.4 | | 13.55 | | | 16.56 | | | 7.78 | | | ***** |

| | |

| THE TARGET PORTFOLIO TRUST | | 3 |

Equity Portfolios’ Performance (continued)

| | | | | | | | | | | |

| |

| | | Cumulative Total Returns1

as of 10/31/07 (Without TARGET Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

Small Capitalization Growth Portfolio (Class R) | | 17.85 | % | | N/A | | | N/A | | | 24.37% (8/22/06) |

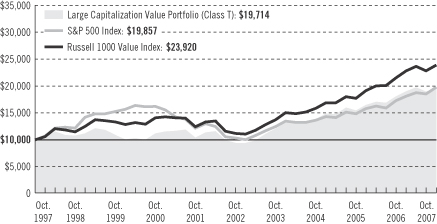

Small Capitalization Growth Portfolio (Class T) | | 18.52 | | | 90.62 | % | | 39.74 | % | | — |

Russell 2000 Index3 | | 9.27 | | | 135.37 | | | 116.04 | | | *** |

Russell 2000 Growth Index3 | | 16.73 | | | 134.40

|

| | 59.12 | | | **** |

Lipper Small-Cap Growth Funds Avg.4 | | 20.33 | | | 123.32

|

| | 129.71 | | | ***** |

| |

| | | Average Annual Total Returns1

as of 9/30/07

(With TARGET Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

Small Capitalization Growth Portfolio (Class R) | | 18.21 | % | | N/A | | | N/A | | | 18.37% (8/22/06) |

Small Capitalization Growth Portfolio (Class T) | | 16.95 | | | 11.94 | % | | 0.92 | % | | — |

Russell 2000 Index3 | | 12.34 | | | 18.75 | | | 7.22 | | | *** |

Russell 2000 Growth Index3 | | 18.94 | | | 18.70 | | | 3.65 | | | **** |

Lipper Small-Cap Growth Funds Avg.4 | | 21.55 | | | 17.34 | | | 7.04 | | | ***** |

| |

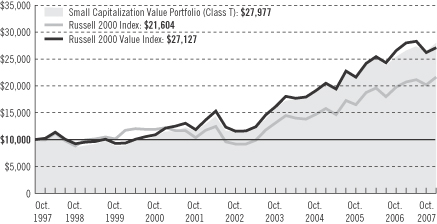

| | | Cumulative Total Returns1

as of 10/31/07 (Without TARGET Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

Small Capitalization Value Portfolio (Class R) | | 11.17 | % | | N/A | | | N/A | | | 17.71% (8/22/06) |

Small Capitalization Value Portfolio (Class T) | | 11.67 | | | 163.16 | % | | 225.16 | % | | — |

Russell 2000 Index3 | | 9.27 | | | 135.37 | | | 116.04 | | | *** |

Russell 2000 Value Index3 | | 2.05 | | | 134.66 | | | 171.27 | | | **** |

Lipper Small-Cap Core Funds Avg.4 | | 10.39 | | | 130.16 | | | 144.20 | | | ***** |

| | |

| 4 | | THE TARGET PORTFOLIO TRUST |

| | | | | | | | | | | |

| |

| | | Average Annual Total Returns1

as of 9/30/07

(With TARGET Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

Small Capitalization Value Portfolio (Class R) | | 13.79 | % | | N/A | | | N/A | | | 13.31% (8/22/06) |

Small Capitalization Value Portfolio (Class T) | | 12.65 | | | 19.64 | % | | 10.17 | % | | — |

Russell 2000 Index3 | | 12.34 | | | 18.75 | | | 7.22 | | | *** |

Russell 2000 Value Index3 | | 6.09 | | | 18.70 | | | 10.07 | | | **** |

Lipper Small-Cap Core Funds Avg.4 | | 13.40 | | | 18.00 | | | 8.26 | | | ***** |

| |

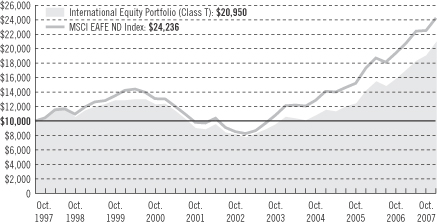

| | | Cumulative Total Returns1

as of 10/31/07 (Without TARGET Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

International Equity Portfolio (Class R) | | 33.23 | % | | N/A | | | N/A | | | 39.52% (8/22/06) |

International Equity Portfolio (Class T) | | 33.85 | | | 175.34 | % | | 143.50 | % | | — |

MSCI EAFE ND Index3 | | 24.91 | | | 183.98 | | | 142.36 | | | *** |

Lipper International Large-Cap Value Funds Avg.4 | | 25.18 | | | 188.54 | | | 157.86 | | | ***** |

| |

| | | Average Annual Total Returns1

as of 9/30/07

(With TARGET Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

International Equity Portfolio (Class R) | | 32.09 | % | | N/A | | | N/A | | | 29.61% (8/22/06) |

International Equity Portfolio (Class T) | | 30.69 | | | 21.07 | % | | 6.47 | % | | — |

MSCI EAFE ND Index3 | | 24.86 | | | 23.55 | | | 7.97 | | | *** |

Lipper International Large-Cap Value Funds Avg.4 | | 24.92 | | | 23.72 | | | 8.73 | | | ***** |

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

1Total returns assume the reinvestment of all dividends and distributions, and take into account all charges and expenses applicable to an investment in each portfolio. The average annual total returns for the TARGET portfolios assume the imposition of the maximum TARGET annual advisory fee of 1.50% for equity portfolios for retail investors. Class R shares are subject to an annual distribution and service (12b-1) fee of up to 0.75%. Returns in the table do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or following the redemption of portfolio shares.

2Inception date returns are provided for any share class with less than 10 calendar years of returns.

3Investors cannot invest directly in an index. The returns for the benchmark indexes would be lower if they reflected deductions for TARGET program fees, portfolio operating expenses, sales charges, or taxes. The Standard

| | |

| THE TARGET PORTFOLIO TRUST | | 5 |

Equity Portfolios’ Performance (continued)

& Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of 500 stocks of large U.S. companies. It gives a broad look at how stock prices have performed. The Russell 1000 Growth Index contains those securities in the Russell 1000 Index with an above-average growth orientation. Companies in this index tend to exhibit higher price-to-book and price-to-earnings ratios, lower dividend yields, and higher forecasted growth rates. The Russell 1000 Value Index contains those securities in the Russell 1000 Index with a below-average growth orientation. Companies in this index generally have low price-to-book and price-to-earnings ratios, higher dividend yields, and lower forecasted growth values. The Russell 2000 Index is an unmanaged index of the stocks of the 2,000 smallest U.S. companies included in the Russell 3000 Index. It gives an indication of how the stock prices of smaller companies have performed. The Russell 2000 Growth Index contains those securities in the Russell 2000 Index with an above-average growth orientation. Companies in this index generally have higher price-to-book and price-to-earnings ratios. The Russell 2000 Value Index contains those securities in the Russell 2000 Index with a below-average growth orientation. Companies in this index generally have low price-to-earnings ratios, higher dividend yields, and lower forecasted growth values. The Morgan Stanley Capital International Europe, Australasia, and Far East Index (MSCI EAFE ND Index) is an unmanaged, weighted index that reflects stock price movements in Europe, Australasia, and the Far East. It gives an indication of how foreign stocks have performed.

4The Lipper averages represent returns based on an average of all funds in the respective Lipper categories for the periods noted. The returns for the Lipper averages would be lower if they reflected deductions for TARGET program fees, portfolio operating expenses, sales charges, or taxes. Large-Cap Core funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Large-cap core funds have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the S&P 500 Index. Multi-Cap Value funds invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Multi-cap funds typically have between 25% and 75% of their assets invested in companies with market capitalizations (on a three-year weighted basis) above 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Multi-cap value funds typically have a below-average price-to-earnings ratio and three-year sales-per-share growth value compared with the S&P 500 Index. Small-Cap Growth funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 250% of the dollar-weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Small-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the S&P SmallCap 600 Index. Small-Cap Core funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 250% of the dollar-weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Small-cap core funds have more latitude in the companies in which they invest. These funds typically have an average price-to-earnings ratio and three-year sales-per-share growth value compared with the S&P SmallCap 600 Index. International funds invest their assets in securities with primary trading markets outside of the United States.

***Large Capitalization Growth Portfolio—S&P 500 Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 21.33% for Class R and 369.13% for Class T. S&P 500 Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 17.80% for Class R and 10.93% for Class T. Large Capitalization Value Portfolio—S&P 500 Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 21.33% for Class R and 369.13% for Class T. S&P 500 Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 17.80% for Class R and 10.93% for Class T. Small Capitalization Growth Portfolio—Russell 2000 Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 16.52% for Class R and 356.69% for Class T. Russell 2000 Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 10.63% for Class R and 12.19% for Class T. Small

| | |

| 6 | | THE TARGET PORTFOLIO TRUST |

Capitalization Value Portfolio—Russell 2000 Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 16.52% for Class R and 356.69% for Class T. Russell 2000 Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 12.19% for Class R and 10.63% for Class T. International Equity Portfolio—MSCI EAFE ND Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 29.97% for Class R and 316.27% for Class T. MSCI EAFE ND Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 22.93% for Class R and 9.86% for Class T.

****Large Capitalization Growth Portfolio—Russell 1000 Growth Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 26.81% for Class R and 252.97% for Class T. Russell 1000 Growth Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 20.72% for Class R and 8.68% for Class T. Large Capitalization Value Portfolio—Russell 1000 Value Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 16.74% for Class R and 486.06% for Class T. Russell 1000 Value Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 15.35% for Class R and 12.74% for Class T. Small Capitalization Growth Portfolio—Russell 2000 Growth Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 25.13% for Class R and 196.78% for Class T. Russell 2000 Growth Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 7.33% for Class R and 18.09% for Class T. Small Capitalization Value Portfolio—Russell 2000 Value Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 8.29% for Class R and 536.09% for Class T. Russell 2000 Value Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 6.56% for Class R and 13.28% for Class T.

*****Large Capitalization Growth Portfolio—Lipper Average Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 21.05% for Class R and 307.43% for Class T. Lipper Average Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 17.31% for Class R and 9.67% for Class T. Large Capitalization Value Portfolio—Lipper Average Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 16.99% for Class R and 394.49% for Class T. Lipper Average Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 14.62% for Class R and 11.18% for Class T. Small Capitalization Growth Portfolio—Lipper Average Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 27.78% for Class R and 361.73% for Class T. Lipper Average Closest Month-End to Inception average annual total returns as of 9/30/2007 are 20.93% for Class R and 10.01% for Class T. Small Capitalization Value Portfolio—Lipper Average Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 17.03% for Class R and 433.98% for Class T. Lipper Average Closest Month-End to Inception average annual total returns as of 9/30/2007 are 13.30% for Class R and 10.81% for Class T. International Equity Portfolio—Lipper Average Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 30.78% for Class R and 397.84% for Class T. Lipper Average Closest Month-End to Inception average annual total returns as of 9/30/2007 are 23.19% for Class R and 10.84% for Class T.

| | |

| THE TARGET PORTFOLIO TRUST | | 7 |

Fixed Income Portfolios’ Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudential.com or by calling (800) 225-1852. The maximum TARGET program fee for retail investors is 1.50%.

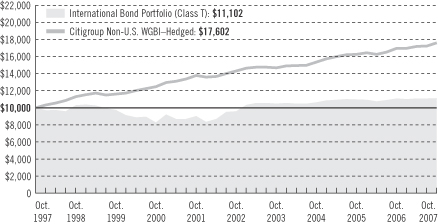

International Bond Portfolio:

Gross operating expenses: Class T, 1.08%. Net operating expenses apply to: Class T, 1.08%.

Total Return Bond Portfolio:

Gross operating expenses: Class R, 1.39%; Class T, 0.64%. Net operating expenses apply to: Class R, 1.14%; Class T, 0.64%, after contractual reduction through 2/28/2009.

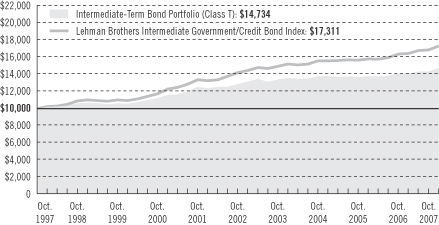

Intermediate-Term Bond Portfolio:

Gross operating expenses: Class T, 0.58%. Net operating expenses apply to: Class T, 0.58%.

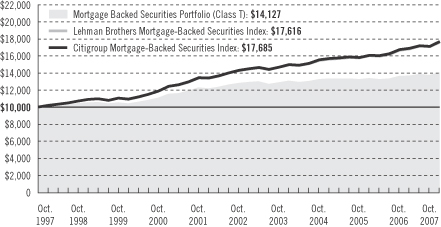

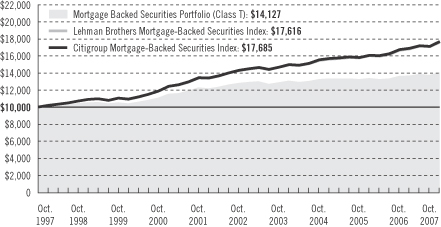

Mortgage Backed Securities Portfolio:

Gross operating expenses: Class T, 1.82%. Net operating expenses apply to: Class T, 1.82%.

| | | | | | | | | |

| Fixed Income Portfolios | |

| | | Cumulative Total Returns1

as of 10/31/07

(Without Target Program Fee) | |

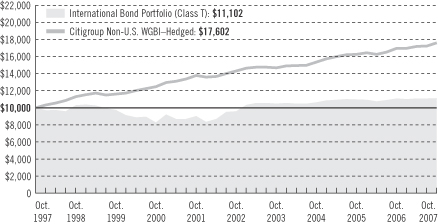

| | | One Year | | | Five Years | | | Ten Years | |

International Bond Portfolio (Class T) | | 1.59 | % | | 24.49 | % | | 29.03 | % |

Citigroup Non-U.S. WGBI–Hedged3 | | 3.94 | | | 23.10 | | | 76.02 | |

Lipper International Income Funds Avg.4 | | 8.23 | | | 42.99 | | | 71.61 | |

| | | | | | | | | |

| | | Average Annual Total Returns1

as of 9/30/07

(With TARGET Program Fee) | |

| | | One Year | | | Five Years | | | Ten Years | |

International Bond Portfolio (Class T) | | –0.04 | % | | 2.67 | % | | 1.16 | % |

Citigroup Non-U.S. WGBI–Hedged3 | | 3.57 | | | 4.06 | | | 5.81 | |

Lipper International Income Funds Avg.4 | | 7.52 | | | 6.92 | | | 5.35 | |

| | |

| 8 | | THE TARGET PORTFOLIO TRUST |

| | | | | | | | | | | |

| | | Cumulative Total Returns1

as of 10/31/07 (Without Target Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

Total Return Bond Portfolio (Class R) | | 5.85 | % | | N/A | | | N/A | | | 6.79% (8/22/06) |

Total Return Bond Portfolio (Class T) | | 6.34 | | | 29.37

| %

| | 81.44 | % | | —

|

Lehman Brothers U.S. Aggregate Bond Index3 | | 5.38 | | | 24.11 | | | 77.57 | | | *** |

Lipper Corporate Debt BBB-Rated Funds Avg.4 | | 4.69 | | | 35.47 | | | 71.63 | | | **** |

| | | | | | | | | | | |

| | | Average Annual Total Returns1

as of 9/30/07

(With TARGET Program Fee) |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

Total Return Bond Portfolio (Class R) | | 5.26 | % | | N/A | | | N/A | | | 5.60% (8/22/06) |

Total Return Bond Portfolio (Class T) | | 4.84 | | | 3.65 | % | | 4.61 | % | | — |

Lehman Brothers U.S. Aggregate Bond Index3 | | 5.14 | | | 4.13 | | | 5.97 | | | *** |

Lipper Corporate Debt BBB-Rated Funds Avg.4 | | 4.57 | | | 5.79 | | | 5.45 | | | **** |

| | | | | | | | | | | | | | | | | | |

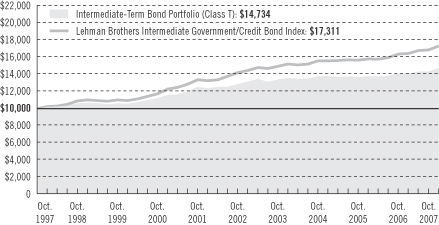

| | | Cumulative Total Returns1

as of 10/31/07

(Without TARGET Program Fee) | | | Average Annual Total Returns1

as of 9/30/07

(With TARGET Program Fee) | |

| | | One Year | | | Five Years | | | Ten Years | | | One Year | | | Five Years | | | Ten Years | |

Intermediate-Term Bond Portfolio (Class T) | | 5.48 | % | | 23.15 | % | | 71.23 | % | | 4.22 | % | | 2.66 | % | | 4.03 | % |

Lehman Brothers Int. Govt./Credit Bond Index3 | | 5.64 | | | 21.95 | | | 73.11 | | | 5.43 | | | 3.82 | | | 5.68 | |

Lipper Int. Inv.-Grade Debt Funds Avg.4 | | 4.08 | | | 22.47 | | | 65.57 | | | 4.14 | | | 3.87 | | | 5.20 | |

| | | | | | | | | | | | | | | | | | |

Mortgage Backed Securities Portfolio (Class T) | | 4.50 | % | | 18.09 | % | | 64.18 | % | | 2.92 | % | | 1.75 | % | | 3.57 | % |

Lehman Brothers Mortgage-Backed Securities Index3 | | 5.68 | | | 23.27 | | | 76.16 | | | 5.39 | | | 4.14 | | | 5.84 | |

Citigroup Mortgage-Backed Securities Index3 | | 5.64 | | | 23.48 | | | 76.85 | | | 5.40 | | | 4.18 | | | 5.88 | |

Lipper U.S. Mortgage Funds Avg.4 | | 4.09 | | | 18.37 | | | 62.93 | | | 4.07 | | | 3.33 | | | 5.05 | |

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

1Total returns assume the reinvestment of all dividends and distributions, and take into account all charges and expenses applicable to an investment in each portfolio. The average annual total returns for the TARGET portfolios assume the imposition of the maximum TARGET annual advisory fee of 1.50% for bond portfolios for retail investors. Class R shares are subject to an annual distribution and service (12b-1) fee of up to 0.75%. Returns in the table do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or following the redemption of portfolio shares.

| | |

| THE TARGET PORTFOLIO TRUST | | 9 |

Fixed Income Portfolios’ Performance (continued)

2Inception date returns are provided for any share class with less than 10 calendar years of returns.

3Investors cannot invest directly in an index. The returns for the benchmark indexes would be lower if they reflected deductions for TARGET program fees, portfolio operating expenses, sales charges, or taxes. The Citigroup Non-U.S. World Government Bond Index Hedged (WGBI–Hedged) is an unmanaged index of approximately 600 high-quality bonds with foreign currency exposure translated to the U.S. dollar. It gives a broad indication of how foreign bonds have performed. The Lehman Brothers U.S. Aggregate Bond Index is an unmanaged index of investment-grade securities issued by the U.S. government and its agencies and by corporations with between one and 10 years remaining to maturity. It gives a broad indication of how bond prices of short- and intermediate-term bonds have performed. The Lehman Brothers Intermediate Government/Credit Bond Index is an unmanaged index of publicly traded U.S. government bonds and investment-grade corporate bonds with maturities of up to 10 years. It gives a broad indication of how intermediate-term bonds have performed. The Lehman Brothers Mortgage-Backed Securities Index is a market capitalization-weighted index of 15- and 30-year fixed-rate securities backed by GNMA, FNMA, and FHLMC mortgage pools, and balloon mortgages with fixed-rate coupons. The Citigroup Mortgage-Backed Securities Index is an unmanaged index of 15- and 30-year mortgage-related securities issued by U.S. government agencies. Each of them gives a broad indication of how mortgage-backed securities have performed.

4The Lipper averages represent returns based on an average of all funds in the respective Lipper categories for the periods noted. The returns for the Lipper averages would be lower if they reflected deductions for TARGET program fees, portfolio operating expenses, sales charges, or taxes. International Income funds invest primarily in U.S. dollar and non-U.S. dollar debt securities of issuers located in at least three countries, excluding the United States, except in periods of market weakness. Corporate Debt BBB-Rated funds invest primarily in corporate and government debt issues rated in the top four grades. Intermediate Investment-Grade Debt funds invest primarily in investment-grade debt issues (rated in the top four grades) with dollar-weighted average maturities of five to 10 years. U.S. Mortgage funds invest primarily in mortgages/securities issued or guaranteed as to principal and interest by the U.S. government and certain federal agencies.

***Total Return Bond Portfolio—Lehman Brothers U.S. Aggregate Bond Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 7.01% for Class R and 151.01% for Class T. Lehman Brothers U.S. Aggregate Bond Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 5.58% for Class R and 6.37% for Class T.

****Total Return Bond Portfolio—Lipper Average Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 6.61% for Class R and 163.03% for Class T. Lipper Average Index Closest Month-End to Inception average annual total returns as of 9/30/2007 are 5.15% for Class R and 6.59% for Class T.

| | |

| 10 | | THE TARGET PORTFOLIO TRUST |

Money Market Portfolio Performance

Yields will fluctuate from time to time, and past performance does not guarantee future results. Current performance may be lower or higher than the past performance data quoted. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost. For the most recent month-end performance update, call (800) 225-1852.

U.S. Government Money Market Portfolio:

Gross operating expenses: Class T, 0.50%. Net operating expenses apply to: Class T, 0.50%.

| | | | | | | | | |

| Money Market Portfolio as of 10/31/07 | | | | | | |

| | | Cumulative

Total Returns1

(Without TARGET

Program Fee)

One Year | | | Net Asset Value

(NAV) | | 7-Day Current

Yield | |

U.S. Government Money Market Portfolio (Class T) | | 4.99 | % | | $ | 1.00 | | 4.22 | % |

Lipper U.S. Government Money Market Funds Avg.2 | | 4.54 | | | | N/A | | N/A | |

iMoneyNet, Inc. All Taxable Money Market Funds Avg.3 | | N/A | | | | N/A | | 4.42 | |

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

1Total returns assume the reinvestment of all dividends and distributions, and take into account all charges and expenses applicable to an investment in each portfolio. Returns would be lower if the fee were deducted. The returns in the table do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or following the redemption of portfolio shares.

2The Lipper average represents returns based on an average of all funds in the respective Lipper categories for the periods noted. The return for the Lipper average would be lower if it reflected deductions for TARGET program fees, portfolio operating expenses, sales charges, or taxes. U.S. Government Money Market funds invest principally in financial instruments issued or guaranteed by the U.S. government, its agencies, or instrumentalities with dollar-weighted average maturities of less than 90 days. These funds intend to keep a constant net asset value.

3iMoneyNet, Inc. regularly reports a 7-day current yield on Tuesdays for taxable money market funds. This is the data of all funds in the iMoneyNet, Inc. All Taxable Money Market Funds Average category as of 10/30/07, the closest date to the end of our reporting period.

An investment in the U.S. Government Money Market Portfolio (the Portfolio) is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Portfolio seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the Portfolio.

| | |

| THE TARGET PORTFOLIO TRUST | | 11 |

Strategy and Performance Overview

Large Capitalization Growth Portfolio

The Large Capitalization Growth Portfolio (Class T) posted a 15.41% total return for the 10-month reporting period ended October 31, 2007*, which trailed the 16.51% total return of the Russell 1000 Growth Index (the Index), but exceeded the 10.86% total return of the S&P 500 Index and the 11.00% total return of the Lipper Large-Cap Core Funds Average.

The Portfolio is co-managed by Marsico Capital Management and Goldman Sachs Asset Management, who play different roles in the Portfolio’s long-term performance. Goldman Sachs uses a quantitative approach with rigorously applied risk controls that aim to limit deviations from the return of the Russell 1000 Growth Index. Marsico Capital uses a more active strategy to select a smaller number of high-conviction growth stock positions. (High conviction investing involves holding fewer stocks and taking larger positions relative to the Index.)

The Goldman Sachs portion of the Portfolio underperformed its benchmark, the Russell 1000 Growth Index primarily, due to the quant downturn that was precipitated by a deleveraging of hedge funds as a result of the meltdown in subprime mortgages (home loans made to borrowers with poor credit histories). Goldman Sachs holdings in the consumer cyclicals, consumer services, healthcare, and technology sectors also detracted from the Portfolio’s relative returns. However, the Marsico portion, which continued to favor larger cap companies with better earnings growth relative to the Index, significantly outperformed particularly in the second half of the period, as the market began to shift from value toward growth investments. Marsico’s holdings in the hotel, chemicals, restaurants, and financial services industries helped to drive performance. Specifically, Marsico’s stock selection in a few hotel and casino operators, a credit card company, and a global chemical producer generated significant positive returns relative to the Index.

Overall, positions in the consumer cyclical, healthcare, financial, and energy stocks hampered the performance relative to the Index. Specifically, holdings in biotech, drug, specialty retail, and financial services companies detracted the most. Underweight holdings in technology and overweight positions in consumer services weakened performance, while underweight positions in consumer cyclicals benefited the Portfolio.

We expect the overall Portfolio’s performance profile to behave like a traditional growth strategy, and continue to benefit from the complementary strengths of each asset manager.

*Portfolio changed its fiscal year-end to October 31. Refer to the Portfolio’s previous annual report for performance information prior to January 1, 2007.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 12 | | THE TARGET PORTFOLIO TRUST |

Large Capitalization Value Portfolio

The Large Capitalization Value Portfolio (Class T) posted a 5.70% total return for the 10-month reporting period ended October 31, 2007*, which trailed the 5.98% total return of the Russell 1000 Value Index (the Index) and the 6.72% total return of the Lipper Multi-Cap Value Funds Average.

The Portfolio has three subadvisers. JP Morgan Asset Management is responsible for approximately half the Portfolio, and uses a value style that is sector-neutral to the Russell 1000 Value Index. NFJ Investment Group follows a disciplined deep value investment strategy, based on research that has shown that portfolios that hold low price-to-earnings (P/E) stocks have substantially outperformed market indexes throughout all capitalization levels over extended periods. Hotchkis and Wiley Capital Management employs a value-oriented investment style and a bottom-up approach, based on the philosophy that stocks derive their value from the contribution of dividends and the profitable reinvestment of retained earnings over time.

The Portfolio’s underperformance was mainly attributable to the subadvisers’ stock selections. A few holdings in the construction & real property, financial services, and property/casualty insurance industries had a negative impact on relative performance. This was evident in companies like Lennar Corporation, Countrywide Financial, Freddie Mac, and Ambac Financial Group. Some of these stocks in the Index included Exxon Mobil, JPMorgan Chase & Co., General Electric, Bristol Myers Squibb, Public Service Enterprise, Goldman Sachs, and Lyondell Chemical Company.

An underexposure to companies with growth attributes (stocks in the Index with above average sales and earnings growth) adversely affected results, as the market rewarded growth-oriented stocks over less expensive stocks with questionable earnings sustainability. An overexposure to companies with volatile stock prices also detracted from returns, as market participants placed a greater emphasis on predictability given the uncertainty around inflation, U.S. housing activity, and the credit crisis.

An underweight position in the financial sector, specifically in banking stocks, contributed positively to performance. An overweight position in the basic materials sector also helped returns. While the JPMorgan portion contributed to positive returns, the NFJ portion contributed most to the Portfolio’s gains.

We expect the overall Portfolio’s performance profile to behave like a traditional value strategy, but to benefit from the complementary strengths of each asset manager.

*Portfolio changed its fiscal year-end to October 31. Refer to the Portfolio’s previous annual report for performance information prior to January 1, 2007.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| THE TARGET PORTFOLIO TRUST | | 13 |

Strategy and Performance Overview (continued)

Small Capitalization Growth Portfolio

The Small Capitalization Growth Portfolio (Class T) posted a 13.84% total return for the 10-month reporting period ended October 31, 2007*, which trailed the 14.27% return of the Russell 2000 Growth Index (the Index) and the Lipper Small-Cap Growth Funds Average of 16.86%. It also exceeded the 6.12% return of the Russell 2000 Index.

Transamerica Investment Management and RS Investment Management subadvised the Portfolio. Transamerica uses a fundamental, research-driven approach to identify high-quality growth stocks. RS emphasizes the merits of individual stocks, but is more aggressive as a small-cap growth manager. Both managers use traditional growth investment styles, but they tend to look for stocks in different parts of the small-cap growth market.

For example, the Transamerica portion had a lower exposure to highly leveraged and highly volatile stocks, which helped, and was underweight to momentum stocks (stocks with near-term rapidly growing prices), which detracted from performance relative to the Index. The RS portion registered stronger performance through its higher exposure to momentum stocks and to stocks of companies poised for superior growth and profitability. But RS was overweight in micro-cap stocks, which hurt its performance.

With respect to the aggregate portfolio, industry factors had a positive impact on performance relative to the Index. Overweight positions to stocks in the Internet, oil services, and defense & aerospace industries had a positive effect on performance. An underweight position to clothing stores also helped. Factors regarding specific stocks also affected the portfolio’s performance. Holdings in the consumer cyclicals and the consumer services sectors detracted from performance, while the Portfolio benefited from stocks within the energy sector.

*Portfolio changed its fiscal year-end to October 31. Refer to the Portfolio’s previous annual report for performance information prior to January 1, 2007.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 14 | | THE TARGET PORTFOLIO TRUST |

Small Capitalization Value Portfolio

The Small Capitalization Value Portfolio (Class T) posted an 8.04% total return for the 10-month period ended October 31, 2007*, which outperformed the 1.64% decline of the Russell 2000 Value Index (the Index) and the 7.00% total return of the Lipper Small-Cap Core Funds Average.

Small companies and firms may respond to economic trends differently. For example, some may occupy specific niches in which they are immune to economic cycles. Small companies and firms may respond to economic trends differently. For example, some may occupy specific niches in which they are immune to economic cycles. Also, some inexpensive stocks may be not be followed closely by analysts. Accordingly, small-cap managers can benefit from informational inefficiencies in the market. Research is critical and the Fund’s managers are chosen based on their experience and capabilities. The asset managers themselves may reach position-size limits they can hold in small firms. Consequently, that is why the Portfolio uses several managers. As subadvisers reach their capacity limits, we may add new subadvisers. In 2007, the Portfolio was managed by EARNEST Partners, LLC; Lee Munder Investments; JP Morgan Asset Management; NFJ Investment Group; and Vaughan Nelson Investment Management.

Investment style factors that helped the Portfolio’s performance included underweight holdings versus the Index in stocks with low price-to-book ratios. The book value of a company is generally calculated by total assets minus intangible assets (patents, goodwill) and liabilities. The Portfolio was also underweight in stocks with high dividend yields, stocks with high price volatility, and stocks in highly leveraged companies (those with relatively high levels of debt). Overweight positions versus the Index in momentum stocks (stocks with near-term rapidly growing prices) also benefited the Portfolio.

A higher exposure to the energy, basic materials, and industrials sectors augmented performance. The Portfolio also benefited from underweight positions in the financial and technology sectors. Significantly, not one sector had any meaningful negative impact on performance relative to the benchmark. Holdings in the freight transportation, electronic equipment, and food & beverage industries also helped overall performance.

On the negative side, the Portfolio’s exposure to larger stocks (those with capitalization rates higher than stocks in the Index) detracted from results. Additionally, the Portfolio’s holdings within the energy reserves industry and the construction and real property industry had a negative impact.

*Portfolio changed its fiscal year-end to October 31. Refer to the Portfolio’s previous annual report for performance information prior to January 1, 2007.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| THE TARGET PORTFOLIO TRUST | | 15 |

Strategy and Performance Overview (continued)

International Equity Portfolio

The International Equity Portfolio (Class T) posted a 25.33% return for the 10-month reporting period ended October 31, 2007* that significantly outperformed the 17.60% return of the MSCI EAFE Index (the Index) and the 17.74% return of the Lipper International Large-Cap Value Funds Average.

The Portfolio was managed by LSV Asset Management and Thornburg Investment Management who were selected in part because of their complementary investment styles. LSV uses a quantitative deep value investment strategy and maintains a relatively large number of stocks in its portfolio. Thornburg uses traditional analysis of business fundamentals and a relative value strategy to select a portfolio with fewer and larger individual stock positions than LSV. Whereas LSV has no emerging market exposure, Thornburg may invest as much as 30% of its assets in that area. Emerging market stocks are not included in the Index.

The LSV segment posted a solid return but underperformed the Index. A turn in the market that favored firms with large market capitalizations began during the period and picked up steam from July through October, when a financial crisis tied to risky mortgages sent investors fleeing to shares of companies with consistent earnings growth. This posed a challenge for LSV. Its strategy typically creates a portfolio more heavily invested in companies with smaller market capitalizations whose shares have lower valuation multiples than those in the Index. These stocks fell out of favor. The LSV segment was also hurt by exposure to shares of U.K.-based companies mostly in the utilities, consumer staples, and financials sectors.

Thornburg’s strategy enabled its segment and the overall Portfolio to outperform the Index. It favored firms with higher valuations and higher earnings growth than those in the Index. These types of shares generally outperformed the broader stock market. In addition, the Thornburg segment benefited from its roughly 25% exposure to companies not included in the Index, of which about 18% were emerging market stocks. The segment benefited most from companies in Canada (excluded from the Index) and from an underweight exposure to firms in Japan (included in the Index). The Japanese stock market turned in a lackluster performance. However, some shares of Japanese firms held by the segment performed well, as did shares of companies in China and Hong Kong, both of which are not included in the Index.

*Portfolio changed its fiscal year-end to October 31. Refer to the Portfolio’s previous annual report for performance information prior to January 1, 2007.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 16 | | THE TARGET PORTFOLIO TRUST |

International Bond Portfolio

The International Bond Portfolio (Class T) posted a 1.34% total return for the 10-month reporting period ended October 31, 2007*, which trailed the 3.71% total return of the Citigroup Non-U.S. World Government Bond Index (Hedged) (the Index) and the 7.21% total return of the Lipper International Income Funds Average. Pacific Investment Management Company LLC (PIMCO) managed the Portfolio.

What began early in the reporting period as concern about rising delinquencies and foreclosures on subprime mortgages (home loans made to less creditworthy borrowers) grew into a financial crisis in the summer that spread abroad from the United States. Many mortgage lenders went out of business; investor demand for all sorts of risky bonds dried up; and credit rating agencies downgraded mortgage-related securities worth billions of dollars. Conditions in the global bond markets improved as the Federal Reserve cut short-term interest rates in the summer and fall, but signs of financial stress remained as institutions continued to report large losses from securities linked to risky mortgages.

Exposure to mortgage-backed securities and bank loans detracted from the Portfolio’s return as these and other investments that carry more credit risk than ultra safe U.S. Treasury securities came under pressure in the volatile market environment. Similarly, the Portfolio had exposure to certain swap transactions that were also pressured, subtracting from its returns.

When the Fed cut rates, yields on shorter-term bonds, which are more sensitive to changes in monetary policy, declined more than yields on longer-term bonds. This caused the slope of the yield curve—a single line graph that depicts yields on bonds of the same type and credit quality from the shortest to the longest maturities—to become steeper. The Portfolio’s emphasis on shorter-term bonds in the U.S. and U.K. markets worked well as they outperformed longer-term bonds when the yield curve in both markets steepened. Exposure to select currencies of emerging market nations was another positive for the Portfolio as they strengthened versus a U.S. dollar weakened by declining interest rates.

*Portfolio changed its fiscal year-end to October 31. Refer to the Portfolio’s previous annual report for performance information prior to January 1, 2007.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| THE TARGET PORTFOLIO TRUST | | 17 |

Strategy and Performance Overview (continued)

Total Return Bond Portfolio

The Total Return Bond Portfolio (Class T) posted a total return of 5.94% for the 10-month reporting period ended October 31, 2007*, which outperformed the 4.78% total return of the Lehman Brothers U.S. Aggregate Bond Index (the Index) and the 3.81% total return of the Lipper Corporate Debt BBB-Rated Funds Average. Pacific Investment Management Company LLC (PIMCO) manages the Portfolio.

The Portfolio’s performance was relatively stable, though conditions in the U.S. bond market turned volatile due to a crisis in bonds linked to subprime mortgages, home loans made to less creditworthy borrowers. In response to strains in the fixed income market in August, the Federal Reserve reduced the discount rate its charges banks to borrow from its discount window by a half point. In mid-September, it cut the discount rate and its target for the federal funds rate on overnight loans between banks by a half point. In late October, it lowered both rates by a quarter point.

The bond market turned in a mixed performance from January through July, but in the final three months of the period, bond prices generally rallied in response to the short-term rate cuts, as bonds prices move inversely to rates. The Portfolio was favorably positioned to benefit from the rally because it had a longer duration (a measure of sensitivity to changes in interest rates) than the Index. When the Fed cut rates, yields on shorter-term bonds, which are more sensitive to changes in monetary policy, declined more than yields on longer-term bonds. This caused the slope of the yield curve—a single line graph that depicts yields on bonds of the same type and credit quality from the shortest to the longest maturities—to become steeper. The Portfolio’s emphasis on shorter-term bonds in the U.S. market, and to a lesser extent in the U.K. market, worked well as they outperformed longer-term bonds.

In the U.S. market, investment-grade corporate bonds, high yield corporate “junk” bonds, and mortgage-backed securities underperformed comparable U.S. Treasury securities. Therefore, a smaller exposure than the Index to investment-grade corporate bonds helped the Portfolio, but a larger exposure than the Index to mortgage-backed securities hurt it, though this was partially offset by favorable security selection in the sector. Exposure to high yield bonds was another negative for the Portfolio.

In the foreign exchange markets, the Portfolio benefited from its currency exposure, particularly select currencies of emerging market nations. They strengthened versus a U.S. dollar weakened by the short-term rate cuts.

*Portfolio changed its fiscal year-end to October 31. Refer to the Portfolio’s previous annual report for performance information prior to January 1, 2007.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 18 | | THE TARGET PORTFOLIO TRUST |

Intermediate-Term Bond Portfolio

The Intermediate-Term Bond Portfolio (Class T) posted a total return of 5.13% for the 10-month period ended October 31, 2007*, which was in line with the 5.12% total return of the Lehman Brothers Intermediate Government/Credit Index (the Index) and exceeded the 3.42% total return of the Lipper Intermediate Investment-Grade Debt Funds Average. Pacific Investment Management Company LLC (PIMCO) manages the Portfolio.

The Portfolio’s performance was relatively stable, though conditions in the U.S. bond market turned volatile due to a crisis in bonds linked to subprime mortgages, home loans made to less creditworthy borrowers. In response to strains in the fixed income market in August, the Federal Reserve reduced the discount rate it charges banks to borrow from its discount window by a half point. In mid-September, it cut the discount rate and its target for the federal funds rate on overnight loans between banks by a half point. In late October, it lowered both rates by a quarter point.

The bond market turned in a mixed performance from January through July, but in the final three months of the period, bond prices generally rallied in response to the short-term rate cuts, as bond prices move inversely to rates. PIMCO’s efforts to adjust the Portfolio’s duration (a measure of sensitivity to changes in interest rates) relative to the duration of the Index did not work well in the volatile interest-rate environment. When the Fed cut rates, yields on shorter-term bonds, which are more sensitive to changes in monetary policy, declined more than yields on longer-term bonds. This caused the slope of the yield curve—a single line graph that depicts yields on bonds of the same type and credit quality from the shortest to the longest maturities—to become steeper. The Portfolio’s focus on shorter-term bonds in the U.S. market, and to a lesser extent in the U.K. market, worked well as they outperformed longer-term bonds.

In the U.S. market, investment-grade corporate bonds, high yield corporate “junk” bonds, and mortgage-backed securities underperformed comparable U.S. Treasury securities. Therefore, a smaller exposure than the Index to investment-grade corporate bonds helped the Portfolio, but exposures to mortgage-backed securities and high yield bonds hurt it.

In the foreign exchange markets, the Portfolio benefited from its exposure to the euro and select currencies of emerging market nations. They strengthened versus a U.S. dollar weakened by the short-term rate cuts.

*Portfolio changed its fiscal year-end to October 31. Refer to the Portfolio’s previous annual report for performance information prior to January 1, 2007.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| THE TARGET PORTFOLIO TRUST | | 19 |

Strategy and Performance Overview (continued)

Mortgage Backed Securities Portfolio

The Mortgage Backed Securities Portfolio (Class T) posted a 3.89% total return for the 10-month reporting period ended October 31, 2007*, which trailed the 4.77% total return of the Lehman Brothers Mortgage Backed Securities Index (the Index), but exceeded the 3.41% total return of the Lipper U.S. Mortgage Funds Average. Wellington Management, LLP, managed the Portfolio.

What began early in the reporting period as concern about rising delinquencies and foreclosures on subprime mortgages (home loans made to less creditworthy borrowers) grew into a financial crisis in the summer that spread abroad from the United States. Many mortgage lenders went out of business; investor demand for all sorts of risky bonds dried up; and credit rating agencies downgraded mortgage-related securities worth billions of dollars. Conditions in the bond markets improved as the Federal Reserve cut short-term interest rates in the summer and fall, but signs of financial stress remained as institutions continued to report large losses from securities linked to risky mortgages.

The Portfolio held a variety of mortgage-backed securities issued by a federal agency, or government-sponsored enterprises like the Federal National Mortgage Association, or so-called “private label” issuers such as units of investment banks. Losses on a credit default swap index, a type of derivative security comprised of 20 subprime mortgage-backed securities, was the primary reason the Portfolio underperformed the Index. It was also hurt by losses on adjustable-rate mortgage securities issued by a private entity, as higher quality securities were tainted by the subprime mortgage turmoil.

On a positive note, the largest contributor to the Portfolio’s return was its allocation to interest-only collateralized mortgage obligations, which give investors the right to interest cash flows of the underlying home loans. The Portfolio held these securities as Wellington Management correctly expected they would benefit from slower prepayments on mortgages. Wellington Management also helped the Portfolio by lengthening its duration, a measure of sensitivity to changes in interest rates. This enabled it to benefit more fully as bond prices generally rallied when rates fell in the last few months of the period. (Bond prices move inversely to rates.) A larger exposure to intermediate-term bonds than the Index also aided the Portfolio as the bonds performed well when the slope of the yield curve steepened. The yield curve is a single line graph that depicts yields on bonds of the same type and credit quality from the shortest to the longest maturities.

*Portfolio changed its fiscal year-end to October 31. Refer to the Portfolio’s previous annual report for performance information prior to January 1, 2007.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 20 | | THE TARGET PORTFOLIO TRUST |

U.S. Government Money Market Portfolio

The U.S. Government Money Market Portfolio returned 4.04%* for the 10-month period ended October 31, 2007, which outperformed the 3.75% return of the Lipper U.S. Government Money Market Portfolio Funds Average. The Portfolio was subadvised by Wellington Management Company, LLP.

Two competing views of the U.S. economy and monetary policy held sway in the financial markets as the reporting period began. One view held that the Federal Reserve (the Fed) would soon ease monetary policy to reinvigorate economic growth. The other view held that the economic expansion, though slowing, remained solid, and that a continued threat of higher inflation made it less likely that the Fed would soon cut short-term interest rates.

The direction of monetary policy became clear during the summer after a crisis in debt securities tied to U.S. subprime mortgages (home loans made to borrowers with poor credit histories) began to rattle financial markets. Signs of distress in the credit markets in early August led the Fed, along with certain other central banks, to inject massive amounts of cash into their banking systems. In mid-August, the Fed reduced the discount rate it charges banks to borrow from its discount window by a half point. In mid-September, it cut the discount rate and its target for the federal funds rate on overnight loans between banks by a half point. Finally, in late October, both short-term rates were reduced another quarter point, which lowered the discount rate to 5.0% and the target for the federal funds rate to 4.5%.

The short-term debt market was not immune to the stress in the broader financial markets. Wellington Management’s conservative strategy insulated the Portfolio from volatility associated with riskier types of short-term investments. The Portfolio was largely invested in repurchase agreements, in which parties sell U.S. government securities to the Portfolio and later buy them back at an agreed upon price and time, thereby generating a fixed return of short duration for the Portfolio. The focus on repurchase agreements boosted the Portfolio’s liquidity. The remainder of its assets were invested in short-term bonds of federal agencies.

*Portfolio changed its fiscal year-end to October 31. Refer to the Portfolio’s previous annual report for performance information prior to January 1, 2007.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| THE TARGET PORTFOLIO TRUST | | 21 |

Fees and Expenses (Unaudited)

As a shareholder of the Trust, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, TARGET program fees, and other Trust expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Trust and to compare these costs with the ongoing costs of investing in other mutual funds. This example does not reflect TARGET program fees. If TARGET program fees were included, the costs would be higher.

The example is based on an investment of $1,000 invested on May 1, 2007, at the beginning of the period, and held through the six-month period ended October 31, 2007. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Trust’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to Individual Retirement Accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of JennisonDryden Funds, including the Trust, that you own. You should consider the additional fees that were charged to your Trust account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

| | |

| 22 | | THE TARGET PORTFOLIO TRUST |

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Trust’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Trust’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Trust and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Large

Capitalization

Growth Portfolio | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value October 31, 2007 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| | | Class R | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,109.00 | | 1.14 | % | | $ | 6.06 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,019.46 | | 1.14 | % | | $ | 5.80 |

| | | Class T | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,111.30 | | 0.64 | % | | $ | 3.41 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,021.98 | | 0.64 | % | | $ | 3.26 |

| | | | | | | | | | | | | | |

Large

Capitalization

Value Portfolio | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value October 31, 2007 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| | | Class R | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 998.70 | | 1.17 | % | | $ | 5.89 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,019.31 | | 1.17 | % | | $ | 5.96 |

| | | Class T | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,001.10 | | 0.67 | % | | $ | 3.38 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,021.83 | | 0.67 | % | | $ | 3.41 |

| | |

| THE TARGET PORTFOLIO TRUST | | 23 |

Fees and Expenses (continued)

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Small

Capitalization

Growth Portfolio | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value October 31, 2007 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| | | Class R | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,088.80 | | 1.25 | % | | $ | 6.58 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,018.90 | | 1.25 | % | | $ | 6.36 |

| | | Class T | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,091.60 | | 0.75 | % | | $ | 3.95 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,021.42 | | 0.75 | % | | $ | 3.82 |

| | | | | | | | | | | | | | |

Small

Capitalization

Value Portfolio | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value October 31, 2007 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| | | Class R | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,025.90 | | 1.21 | % | | $ | 6.18 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,019.11 | | 1.21 | % | | $ | 6.16 |

| | | Class T | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,028.60 | | 0.71 | % | | $ | 3.63 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,021.63 | | 0.71 | % | | $ | 3.62 |

| | | | | | | | | | | | | | |

International

Equity Portfolio | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value October 31, 2007 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| | | Class R | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,147.30 | | 1.29 | % | | $ | 6.98 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,018.70 | | 1.29 | % | | $ | 6.56 |

| | | Class T | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,149.80 | | 0.79 | % | | $ | 4.28 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,021.22 | | 0.79 | % | | $ | 4.02 |

| | | | | | | | | | | | | | |

International

Bond Portfolio | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value

October 31, 2007 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| | | Class T | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,006.00 | | 1.09 | % | | $ | 5.51 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,019.71 | | 1.09 | % | | $ | 5.55 |

| | |

| 24 | | THE TARGET PORTFOLIO TRUST |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Total Return

Bond Portfolio | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value

October 31, 2007 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| | | Class R | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,035.20 | | 1.13 | % | | $ | 5.80 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,019.51 | | 1.13 | % | | $ | 5.75 |

| | | Class T | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,036.50 | | 0.63 | % | | $ | 3.23 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.03 | | 0.63 | % | | $ | 3.21 |

| | | | | | | | | | | | | | |

Intermediate-Term

Bond Portfolio | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value

October 31, 2007 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| | | Class T | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,034.60 | | 0.57 | % | | $ | 2.92 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.33 | | 0.57 | % | | $ | 2.91 |

| | | | | | | | | | | | | | |

Mortgage Backed

Securities Portfolio | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value

October 31, 2007 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| | | Class T | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,019.60 | | 1.79 | % | | $ | 9.11 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,016.18 | | 1.79 | % | | $ | 9.10 |

| | | | | | | | | | | | | | |

U.S. Government

Money Market

Portfolio | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value October 31, 2007 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| | | Class T | | | | | | | | | | | | |

| | | Actual | | $ | 1,000.00 | | $ | 1,024.10 | | 0.48 | % | | $ | 2.45 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.79 | | 0.48 | % | | $ | 2.45 |

* Portfolio expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2007, and divided by 365 days to reflect the six-month period. Expenses presented in the table include the expenses of any underlying portfolios in which the Trust may invest.

| | |

| THE TARGET PORTFOLIO TRUST | | 25 |

| | |

Portfolio of Investments

As of October 31, 2007 | | Large Capitalization Growth Portfolio |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

| | | | | |

| | LONG-TERM INVESTMENTS—99.4% | | | |

| | |

| | COMMON STOCKS | | | |

| | |

| | Aerospace & Defense—4.6% | | | |

| 23,105 | | Boeing Co. | | $ | 2,277,922 |

| 61,260 | | General Dynamics Corp. | | | 5,572,209 |

| 56,446 | | Lockheed Martin Corp. | | | 6,211,318 |

| 23,800 | | Northrop Grumman Corp. | | | 1,990,156 |

| | | | | |

| | | | | 16,051,605 |

| | | | | |

| | |

| | Agriculture/Heavy Equipment—2.2% | | | |

| 8,900 | | Altria Group, Inc. | | | 649,077 |

| 72,030 | | Monsanto Co. | | | 7,032,289 |

| | | | | |

| | | | | 7,681,366 |

| | | | | |

| | |

| | Auto Related | | | |

| 2,400 | | ArvinMeritor, Inc.(a) | | | 35,592 |

| | | | | |

| | |

| | Automobile Manufacturers—1.4% | | | |

| 8,200 | | Cummins, Inc.(a) | | | 983,672 |

| 32,230 | | Toyota Motor Corp., ADR (Japan) | | | 3,688,401 |

| | | | | |

| | | | | 4,672,073 |

| | | | | |

| | |

| | Automotive Parts | | | |

| 1,800 | | TRW Automotive Holdings Corp.* | | | 53,442 |

| | | | | |

| | |

| | Beverages—3.2% | | | |

| 58,890 | | Coca-Cola Co. (The) | | | 3,637,047 |

| 6,700 | | Hansen Natural Corp.* | | | 455,600 |

| 91,705 | | Heinekin NV, ADR (Netherlands) | | | 3,204,099 |

| 7,400 | | Molson Coors Brewing Co.(a) | | | 423,502 |

| 1,900 | | Pepsi Bottling Group, Inc. | | | 81,852 |

| 900 | | PepsiAmericas, Inc. | | | 32,148 |

| 42,300 | | PepsiCo, Inc. | | | 3,118,356 |

| | | | | |

| | | | | 10,952,604 |

| | | | | |

| | |

| | Biotechnology—2.1% | | | |

| 28,500 | | Amgen, Inc.* | | | 1,656,135 |

| 1,500 | | Applera Corp. - Applied Biosystems Group | | | 55,710 |

| 72,808 | | Genentech, Inc.* | | | 5,397,257 |

| | | | | |

| | | | | 7,109,102 |

| | | | | |

| | |

| | Business Services—2.3% | | | |

| 19,200 | | Manpower, Inc. | | | 1,435,008 |

| 34,201 | | MasterCard, Inc. | | | 6,482,800 |

| | | | | |

| | | | | 7,917,808 |

| | | | | |

See Notes to Financial Statements.

| | |

| THE TARGET PORTFOLIO TRUST | | 27 |

| | |

Large Capitalization Growth Portfolio (continued) | | Portfolio of Investments

As of October 31, 2007 |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

| | | | | |

| | COMMON STOCKS (continued) | | | |

| | |

| | Cable Television—0.2% | | | |

| 26,038 | | DIRECTV Group, Inc. (The)* | | $ | 689,486 |

| | | | | |

| | |

| | Chemicals—1.3% | | | |

| 9,833 | | Air Products & Chemicals, Inc. | | | 962,159 |

| 8,800 | | Celanese Corp. | | | 369,248 |

| 500 | | Minerals Technologies, Inc. | | | 35,110 |

| 37,625 | | Praxair, Inc. | | | 3,216,185 |

| 1,000 | | Terra Industries, Inc.*(a) | | | 36,890 |

| | | | | |

| | | | | 4,619,592 |

| | | | | |

| | |

| | Commercial Services—1.1% | | | |

| 35,000 | | Accenture Ltd. (Class A Stock) | | | 1,366,750 |

| 31,701 | | Expedia, Inc.*(a) | | | 1,035,355 |

| 35,300 | | Moody’s Corp.(a) | | | 1,543,316 |

| | | | | |

| | | | | 3,945,421 |

| | | | | |

| | |

| | Commercial Services & Supplies—0.2% | | | |

| 29,800 | | Avis Budget Group* | | | 621,926 |

| | | | | |

| | |

| | Communication Equipment—1.1% | | | |

| 100,817 | | Juniper Networks, Inc.* | | | 3,629,412 |

| | | | | |

| | |

| | Computer Hardware—5.8% | | | |

| 47,121 | | Apple Computer, Inc.* | | | 8,950,634 |

| 9,300 | | Cadence Design System, Inc.* | | | 182,280 |

| 102,800 | | Dell, Inc.* | | | 3,145,680 |

| 90,613 | | Hewlett-Packard Co. | | | 4,682,880 |

| 17,500 | | International Business Machines Corp.(a) | | | 2,032,100 |

| 39,900 | | Synopsys, Inc.* | | | 1,127,574 |

| | | | | |

| | | | | 20,121,148 |

| | | | | |

| | |

| | Computer Services & Software—3.4% | | | |

| 23,600 | | Amazon.com, Inc.*(a) | | | 2,103,940 |

| 2,000 | | Autodesk, Inc.* | | | 97,800 |

| 249,790 | | Microsoft Corp. | | | 9,194,770 |

| 7,500 | | Pitney Bowes, Inc. | | | 300,300 |

| 4,500 | | Riverbed Technology, Inc.* | | | 152,055 |

| | | | | |

| | | | | 11,848,865 |

| | | | | |

| | |

| | Computers—0.1% | | | |

| 10,300 | | Lexmark International, Inc. (Class A Stock)* | | | 432,497 |

| | | | | |

| | |

| | Computers & Peripherals—0.4% | | | |

| 44,700 | | EMC Corp.*(a) | | | 1,134,933 |

| 4,800 | | NCR Corp.* | | | 132,432 |

| | | | | |

| | | | | 1,267,365 |

| | | | | |

See Notes to Financial Statements.

| | |

| 28 | | THE TARGET PORTFOLIO TRUST |

| | | | | |

| SHARES | | DESCRIPTION | | VALUE (NOTE 1) |

| | | | | |

| | COMMON STOCKS (continued) | | | |

| | |

| | Consumer Products & Services—0.7% | | | |

| 16,600 | | American Greetings Corp. (Class A Stock)(a) | | $ | 437,244 |

| 4,845 | | Proctor & Gamble Co. | | | 336,824 |

| 27,900 | | UST, Inc.(a) | | | 1,487,628 |

| | | | | |

| | | | | 2,261,696 |

| | | | | |

| | |

| | Diversified—0.6% | | | |

| 25,600 | | 3M Co. | | | 2,210,816 |

| | | | | |

| | |

| | Diversified Financial Services—0.5% | | | |

| 23,880 | | Morgan Stanley Dean Witter & Co. | | | 1,606,169 |

| | | | | |

| | |

| | Diversified Machinery—0.1% | | | |

| 4,600 | | Ingersoll-Rand Co. Ltd. (Class A Stock) | | | 231,610 |

| | | | | |

| | |

| | Diversified Manufacturing—0.7% | | | |

| 41,100 | | Honeywell International, Inc. | | | 2,482,851 |

| | | | | |

| | |