UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-07064 |

| |

| Exact name of registrant as specified in charter: | | The Target Portfolio Trust |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2010 |

| |

| Date of reporting period: | | 10/31/2010 |

Item 1 – Reports to Stockholders

| | |

| OCTOBER 31, 2010 | | ANNUAL REPORT |

The TARGET Portfolio Trust®

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Trust portfolios’ securities are for the period covered by this report and are subject to change thereafter.

TARGET Funds, TARGET Portfolio Trust, Prudential, Prudential Financial, and the Rock Prudential logo are registered service marks of The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

December 15, 2010

Dear TARGET Shareholder:

We hope you find the annual report for The TARGET Portfolio Trust informative and useful. Today many investors are asking where they can find new growth opportunities. Whether you are looking for capital growth, current income, or a combination of both, the TARGET portfolios feature a wide range of strategies to suit a variety of investment needs.

TARGET is founded upon the belief that investment management talent is dispersed across a variety of firms and can be systematically identified through research. The managers for each portfolio are carefully chosen from among the leading institutional money managers and are monitored by your team of experienced investment management analysts. Of course, the future performance of the TARGET portfolios cannot be guaranteed.

Your selections among the TARGET portfolios can evolve as your needs change. Your financial professional can help you stay informed of important developments and assist you in determining whether you need to modify your investments.

Thank you for your continued confidence.

Sincerely,

Judy A. Rice, President

The TARGET Portfolio Trust

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 1 | |

Equity Portfolios’ Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudential.com or by calling (800) 225-1852.

Large Capitalization Growth Portfolio:

Gross operating expenses: Class R, 1.58%; Class T, 0.83%. Net operating expenses: Class R, 1.33%; Class T, 0.83%, after contractual reduction through 2/29/2012.

Large Capitalization Value Portfolio:

Gross operating expenses: Class R, 1.56%; Class T, 0.81%. Net operating expenses: Class R, 1.31%; Class T, 0.81%, after contractual reduction through 2/29/2012.

Small Capitalization Growth Portfolio:

Gross operating expenses: Class R, 1.71%; Class T, 0.96%. Net operating expenses: Class R, 1.46%; Class T, 0.96%, after contractual reduction through 2/29/2012.

Small Capitalization Value Portfolio:

Gross operating expenses: Class R, 1.51%; Class T, 0.76%. Net operating expenses: Class R, 1.26%; Class T, 0.76%, after contractual reduction through 2/29/2012.

International Equity Portfolio:

Gross operating expenses: Class R, 1.79%; Class T, 1.04%. Net operating expenses: Class R, 1.54%; Class T, 1.04%, after contractual reduction through 2/29/2012.

| | | | | | | | | | | | | | |

| Equity Portfolios |

| | | Cumulative Total Returns

as of 10/31/10 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Large Capitalization Growth Portfolio (Class R) | | | 17.99 | % | | | N/A | | | | N/A | | | –1.36% (8/22/06) |

Large Capitalization Growth Portfolio (Class T) | | | 18.55 | | | | 5.39 | % | | | –38.02 | % | | — |

S&P 500 Index | | | 16.54 | | | | 8.99 | | | | –0.14 | | | — |

Russell 1000 Growth Index | | | 19.65 | | | | 17.14 | | | | –22.51 | | | — |

Lipper Large-Cap Growth Funds Avg. | | | 17.70 | | | | 11.45 | | | | –15.43 | | | — |

| | |

| 2 | | THE TARGET PORTFOLIO TRUST |

| | | | | | | | | | | | | | |

| | | Average Annual Total Returns

as of 9/30/10 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Large Capitalization Growth Portfolio (Class R) | | | 9.29 | % | | | N/A | | | | N/A | | | –1.67% (8/22/06) |

Large Capitalization Growth Portfolio (Class T) | | | 9.78 | | | | –0.44 | % | | | –5.78 | % | | — |

S&P 500 Index | | | 10.18 | | | | 0.64 | | | | –0.43 | | | — |

Russell 1000 Growth Index | | | 12.65 | | | | 2.06 | | | | –3.44 | | | — |

Lipper Large-Cap Growth Funds Avg. | | | 10.19 | | | | 0.88 | | | | –2.93 | | | — |

| |

| | | Average Annual Total Returns

as of 10/31/10 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Large Capitalization Growth Portfolio (Class R) | | | 17.99 | % | | | N/A | | | | N/A | | | –0.32% (8/22/06) |

Large Capitalization Growth Portfolio (Class T) | | | 18.55 | | | | 1.05 | % | | | –4.67 | % | | — |

| |

| | | Cumulative Total Returns

as of 10/31/10 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Large Capitalization Value Portfolio (Class R) | | | 12.45 | % | | | N/A | | | | N/A | | | –19.57% (8/22/06) |

Large Capitalization Value Portfolio (Class T) | | | 13.00 | | | | –7.91 | % | | | 36.98 | % | | — |

S&P 500 Index | | | 16.54 | | | | 8.99 | | | | –0.14 | | | — |

Russell 1000 Value Index | | | 15.71 | | | | 3.15 | | | | 29.83 | | | — |

Lipper Large-Cap Value Funds Avg. | | | 12.79 | | | | 1.46 | | | | 24.23 | | | — |

| |

| | | Average Annual Total Returns

as of 9/30/10 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Large Capitalization Value Portfolio (Class R) | | | 7.86 | % | | | N/A | | | | N/A | | | –5.81% (8/22/06) |

Large Capitalization Value Portfolio (Class T) | | | 8.29 | | | | –2.78 | % | | | 3.31 | % | | — |

S&P 500 Index | | | 10.18 | | | | 0.64 | | | | –0.43 | | | — |

Russell 1000 Value Index | | | 8.90 | | | | –0.48 | | | | 2.59 | | | — |

Lipper Large-Cap Value Funds Avg. | | | 7.05 | | | | –0.74 | | | | 2.08 | | | — |

| |

| | | Average Annual Total Returns

as of 10/31/10 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Large Capitalization Value Portfolio (Class R) | | | 12.45 | % | | | N/A | | | | N/A | | | -5.06% (8/22/06) |

Large Capitalization Value Portfolio (Class T) | | | 13.00 | | | | –1.63 | % | | | 3.20 | % | | — |

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 3 | |

Equity Portfolios’ Performance (continued)

| | | | | | | | | | | | | | |

| | | Cumulative Total Returns

as of 10/31/10 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Small Capitalization Growth Portfolio (Class R) | | | 25.29 | % | | | N/A | | | | N/A | | | –12.50% (8/22/06) |

Small Capitalization Growth Portfolio (Class T) | | | 25.83 | | | | –8.89 | % | | | –32.03 | % | | — |

Russell 2000 Index | | | 26.58 | | | | 16.31 | | | | 61.21 | | | — |

Russell 2000 Growth Index | | | 28.67 | | | | 21.63 | | | | 12.09 | | | — |

Lipper Small-Cap Growth Funds Avg. | | | 27.71 | | | | 16.62 | | | | 21.22 | | | — |

| |

| | | Average Annual Total Returns

as of 9/30/10 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Small Capitalization Growth Portfolio (Class R) | | | 13.50 | % | | | N/A | | | | N/A | | | –4.21% (8/22/06) |

Small Capitalization Growth Portfolio (Class T) | | | 14.04 | | | | –3.21 | % | | | –4.46 | % | | — |

Russell 2000 Index | | | 13.35 | | | | 1.60 | | | | 4.00 | | | — |

Russell 2000 Growth Index | | | 14.79 | | | | 2.35 | | | | –0.13 | | | — |

Lipper Small-Cap Growth Funds Avg. | | | 14.86 | | | | 1.36 | | | | 0.27 | | | — |

| |

| | | Average Annual Total Returns

as of 10/31/10 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Small Capitalization Growth Portfolio (Class R) | | | 25.29 | % | | | N/A | | | | N/A | | | –3.13% (8/22/06) |

Small Capitalization Growth Portfolio (Class T) | | | 25.83 | | | | –1.84 | % | | | –3.79 | % | | — |

| |

| | | Cumulative Total Returns

as of 10/31/10 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Small Capitalization Value Portfolio (Class R) | | | 22.93 | % | | | N/A | | | | N/A | | | 11.82% (8/22/06) |

Small Capitalization Value Portfolio (Class T) | | | 23.58 | | | | 26.33 | % | | | 181.12 | % | | — |

Russell 2000 Index | | | 26.58 | | | | 16.31 | | | | 61.21 | | | — |

Russell 2000 Value Index | | | 24.43 | | | | 10.52 | | | | 119.21 | | | — |

Lipper Small-Cap Core Funds Avg. | | | 24.55 | | | | 15.27 | | | | 90.42 | | | — |

| | |

| 4 | | THE TARGET PORTFOLIO TRUST |

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns

as of 9/30/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Small Capitalization Value Portfolio (Class R) | | | 14.01 | % | | | N/A | | | | N/A | | | | 1.91% (8/22/06) | |

Small Capitalization Value Portfolio (Class T) | | | 14.60 | | | | 3.41 | % | | | 10.64 | % | | | — | |

Russell 2000 Index | | | 13.35 | | | | 1.60 | | | | 4.00 | | | | — | |

Russell 2000 Value Index | | | 11.84 | | | | 0.73 | | | | 7.72 | | | | — | |

Lipper Small-Cap Core Funds Avg. | | | 13.19 | | | | 1.33 | | | | 5.68 | | | | — | |

| |

| | | Average Annual Total Returns

as of 10/31/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Small Capitalization Value Portfolio (Class R) | | | 22.93 | % | | | N/A | | | | N/A | | | | 2.70% (8/22/06) | |

Small Capitalization Value Portfolio (Class T) | | | 23.58 | | | | 4.79 | % | | | 10.89 | % | | | — | |

| |

| | | Cumulative Total Returns

as of 10/31/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

International Equity Portfolio (Class R) | | | 10.93 | % | | | N/A | | | | N/A | | | | 1.04% (8/22/06) | |

International Equity Portfolio (Class T) | | | 11.45 | | | | 27.49 | % | | | 39.04 | % | | | — | |

MSCI EAFE ND Index | | | 8.36 | | | | 17.66 | | | | 36.66 | | | | — | |

Lipper International Large-Cap Core Funds Avg. | | | 10.34 | | | | 16.07 | | | | 30.60 | | | | — | |

| |

| | | Average Annual Total Returns

as of 9/30/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

International Equity Portfolio (Class R) | | | 4.69 | % | | | N/A | | | | N/A | | | | –0.75% (8/22/06) | |

International Equity Portfolio (Class T) | | | 5.21 | | | | 3.55 | % | | | 2.78 | % | | | — | |

MSCI EAFE ND Index | | | 3.27 | | | | 1.97 | | | | 2.56 | | | | — | |

Lipper International Large-Cap Core Funds Avg. | | | 3.88 | | | | 1.66 | | | | 1.77 | | | | — | |

| |

| | | Average Annual Total Returns

as of 10/31/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

International Equity Portfolio (Class R) | | | 10.93 | % | | | N/A | | | | N/A | | | | 0.25% (8/22/06) | |

International Equity Portfolio (Class T) | | | 11.45 | | | | 4.98 | % | | | 3.35 | % | | | — | |

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 5 | |

Equity Portfolios’ Performance (continued)

Growth of a $10,000 Investment

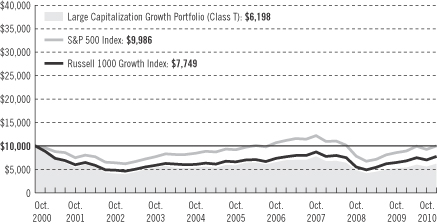

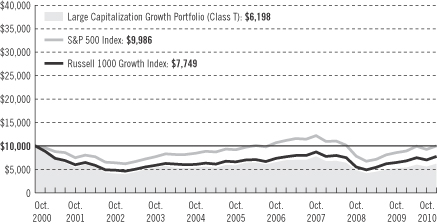

Large Capitalization Growth Portfolio

The graph compares a $10,000 investment in the TARGET Large Capitalization Growth Portfolio (Class T) with a similar investment in the S&P 500 Index and the Russell 1000 Growth Index by portraying the initial account values at the beginning of the 10-year period (October 31, 2000) and the account values at the end of the current fiscal year (October 31, 2010), as measured on a quarterly basis. The average annual total returns in the table and the returns on investment in the graph do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares.

| | |

| 6 | | THE TARGET PORTFOLIO TRUST |

Growth of a $10,000 Investment

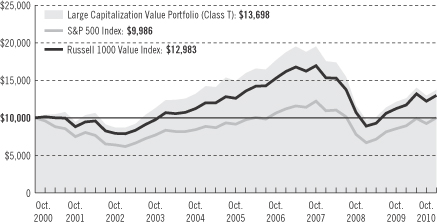

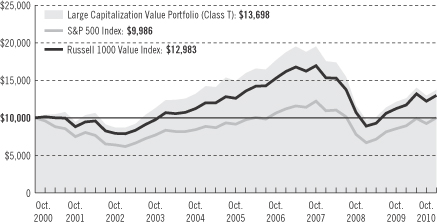

Large Capitalization Value Portfolio

The graph compares a $10,000 investment in the TARGET Large Capitalization Value Portfolio (Class T) with a similar investment in the S&P 500 Index and the Russell 1000 Value Index by portraying the initial account values at the beginning of the 10-year period (October 31, 2000) and the account values at the end of the current fiscal year (October 31, 2010), as measured on a quarterly basis. The average annual total returns in the table and the returns on investment in the graph do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 7 | |

Equity Portfolios’ Performance (continued)

Growth of a $10,000 Investment

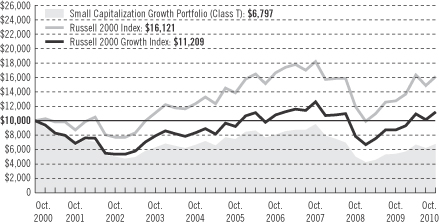

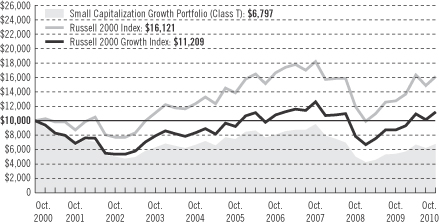

Small Capitalization Growth Portfolio

The graph compares a $10,000 investment in the TARGET Small Capitalization Growth Portfolio (Class T) with a similar investment in the Russell 2000 Index and the Russell 2000 Growth Index by portraying the initial account values at the beginning of the 10-year period (October 31, 2000) and the account values at the end of the current fiscal year (October 31, 2010), as measured on a quarterly basis. The average annual total returns in the table and the returns on investment in the graph do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares.

| | |

| 8 | | THE TARGET PORTFOLIO TRUST |

Growth of a $10,000 Investment

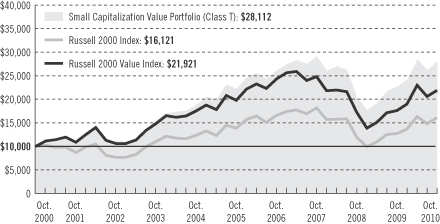

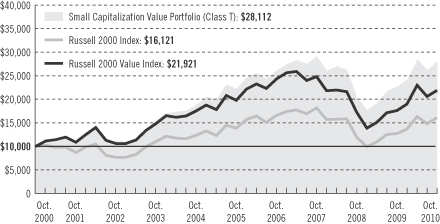

Small Capitalization Value Portfolio

The graph compares a $10,000 investment in the TARGET Small Capitalization Value Portfolio (Class T) with a similar investment in the Russell 2000 Index and the Russell 2000 Value Index by portraying the initial account values at the beginning of the 10-year period (October 31, 2000) and the account values at the end of the current fiscal year (October 31, 2010), as measured on a quarterly basis. The average annual total returns in the table and the returns on investment in the graph do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 9 | |

Equity Portfolios’ Performance (continued)

Growth of a $10,000 Investment

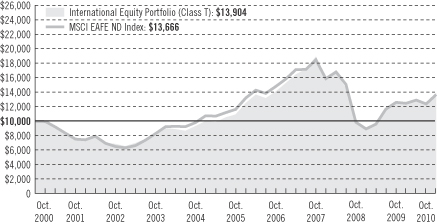

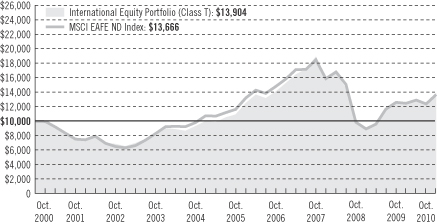

International Equity Portfolio

The graph compares a $10,000 investment in the TARGET International Equity Portfolio (Class T) with a similar investment in the Morgan Stanley Capital International Europe, Australasia, Far East Net Dividend Index (MSCI EAFE ND Index) by portraying the initial account values at the beginning of the 10-year period (October 31, 2000) and the account values at the end of the current fiscal year (October 31, 2010), as measured on a quarterly basis. The average annual total returns in the table and the returns on investment in the graph do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares.

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

Total returns assume the reinvestment of all dividends and distributions, and take into account all charges and expenses applicable to an investment in each portfolio. Class R shares are subject to an annual distribution and service (12b-1) fee of up to 0.75%. Returns in the table do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or following the redemption of portfolio shares.

Inception returns are provided for any share class with less than 10 calendar years of returns.

Benchmark Definitions

Lipper International Large Cap Core Funds Average

Lipper International Large Cap Core funds invest at least 75% of their equity assets in companies strictly outside of the U.S. with market capitalizations (on a three-year weighted basis) above Lipper’s international large-cap floor. International large-cap core funds typically have an average price-to-cash flow ratio, price-to-book ratio, and three-year sales-per-share growth value compared to their large-cap-specific subset of the S&P/Citigroup World ex-U.S. BMI.

Lipper Large-Cap Growth Funds Average

Lipper Large-Cap Growth funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s USDE large-cap floor. Large-cap growth funds have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the S&P 500 Index.

| | |

| 10 | | THE TARGET PORTFOLIO TRUST |

Lipper Large-Cap Value Funds Average

Lipper Large-Cap Value funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s USDE large-cap floor. Large-cap value funds typically have a below-average price-to-earnings ratio and three-year sales-per-share growth value compared with the S&P 500 Index.

Lipper Small-Cap Growth Funds Average

Lipper Small-Cap Growth funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 250% of the dollar-weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Small-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the S&P SmallCap 600 Index.

Lipper Small-Cap Core Funds Average

Lipper Small-Cap Core funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s USDE small-cap ceiling. Small-cap core funds typically have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P SmallCap 600 Index.

Morgan Stanley Capital International Europe, Australasia, and Far East Net Dividend Index

The Morgan Stanley Capital International Europe, Australasia, and Far East Index (MSCI EAFE ND Index) is an unmanaged, weighted index that reflects stock price movements in Europe, Australasia, and the Far East. It gives an indication of how foreign stocks have performed.

Russell 1000 Growth Index

The Russell 1000 Growth Index is an unmanaged index which contains those securities in the Russell 1000 Index with an above-average growth orientation. Companies in this index tend to exhibit higher price-to-book and price-to-earnings ratios, lower dividend yields, and higher forecasted growth rates.

Russell 1000 Value Index

The Russell 1000 Value Index is an unmanaged index which contains those securities in the Russell 1000 Index with a below-average growth orientation. Companies in this index generally have low price-to-book and price-to-earnings ratios, higher dividend yields, and lower forecasted growth values.

Russell 2000 Index

The Russell 2000 Index is an unmanaged index of the stocks of the 2,000 smallest U.S. companies included in the Russell 3000 Index. It gives an indication of how the stock prices of smaller companies have performed.

Russell 2000 Growth Index

The Russell 2000 Growth Index is an unmanaged index which contains those securities in the Russell 2000 Index with an above-average growth orientation. Companies in this index generally have higher price-to-book and price-to-earnings ratios.

Russell 2000 Value Index

The Russell 2000 Value Index is an unmanaged index which contains those securities in the Russell 2000 Index with a below-average growth orientation. Companies in this index generally have low price-to-earnings ratios, higher dividend yields, and lower forecasted growth values.

S&P 500 Index

The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of 500 stocks of large U.S. companies. It gives a broad look at how stock prices have performed.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 11 | |

Equity Portfolios’ Performance (continued)

Benchmark Inception Returns

Large Capitalization Growth Portfolio—S&P 500 Index Closest Month-End to Inception cumulative total return as of 10/31/10 is –0.77% for Class R. S&P 500 Index Closest Month-End to Inception average annual total return as of 9/30/10 is –1.10% for Class R. Russell 1000 Growth Index Closest Month-End to Inception cumulative total return as of 10/31/10 is 12.40% for Class R. Russell 1000 Growth Index Closest Month-End to Inception average annual total return as of 9/30/10 is 1.74% for Class R. Lipper Average Closest Month-End to Inception cumulative total return as of 10/31/10 is 8.61% for Class R. Lipper Average Closest Month-End to Inception average annual total return as of 9/30/10 is 0.69% for Class R.

Large Capitalization Value Portfolio—S&P 500 Index Closest Month-End to Inception cumulative total return as of 10/31/10 is –0.77% for Class R. S&P 500 Index Closest Month-End to Inception average annual total return as of 9/30/10 is –1.10% for Class R. Russell 1000 Value Index Closest Month-End to Inception cumulative total return as of 10/31/10 is –10.54% for Class R. Russell 1000 Value Index Closest Month-End to Inception average annual total return as of 9/30/10 is –3.39% for Class R. Lipper Average Closest Month-End to Inception cumulative total return as of 10/31/10 is –9.34% for Class R. Lipper Average Closest Month-End to Inception average annual total return as of 9/30/10 is –3.09% for Class R.

Small Capitalization Growth Portfolio—Russell 2000 Index Closest Month-End to Inception cumulative total return as of 10/31/10 is 3.38% for Class R. Russell 2000 Index Closest Month-End to Inception average annual total return as of 9/30/10 is

–0.17% for Class R. Russell 2000 Growth Index Closest Month-End to Inception cumulative total return as of 10/31/10 is 11.38% for Class R. Russell 2000 Growth Index Closest Month-End to Inception average annual total return as of 9/30/10 is 1.62% for Class R. Lipper Average Closest Month-End to Inception cumulative total return as of 10/31/10 is 9.02% for Class R. Lipper Average Closest Month-End to Inception average annual total return as of 9/30/10 is 0.87% for Class R.

Small Capitalization Value Portfolio—Russell 2000 Index Closest Month-End to Inception cumulative total return as of 10/31/10 is

3.38% for Class R. Russell 2000 Index Closest Month-End to Inception average annual total return as of 9/30/10 is –0.17% for Class R. Russell 2000 Value Index Closest Month-End to Inception cumulative total return as of 10/31/10 is –4.57% for Class R. Russell 2000 Value Index Closest Month-End to Inception average annual total return as of 9/30/10 is –2.06% for Class R. Lipper Average Closest Month-End to Inception cumulative total return as of 10/31/10 is 4.54% for Class R. Lipper Average Closest Month-End to Inception average annual total return as of 9/30/10 is 0.02% for Class R.

International Equity Portfolio—MSCI EAFE ND Index Closest Month-End to Inception cumulative total return as of 10/31/10 is –4.00% for Class R. MSCI EAFE ND Index Closest Month-End to Inception average annual total return as of 9/30/10 is –1.85% for Class R. Lipper Average Closest Month-End to Inception cumulative total return as of 10/31/10 is –5.02% for Class R. Lipper Average Closest Month-End to Inception average annual total return as of 9/30/10 is –2.20% for Class R.

Investors cannot invest directly in an index or average. The returns for the benchmark indexes would be lower if they reflected deductions for portfolio operating expenses, sales charges, or taxes.

The Lipper averages represent returns based on an average of all funds in the respective Lipper categories for the periods noted. The returns for the Lipper averages would be lower if they reflected deductions for portfolio operating expenses, sales charges, or taxes.

| | |

| 12 | | THE TARGET PORTFOLIO TRUST |

Fixed Income Portfolios’ Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudential.com or by calling (800) 225-1852.

Total Return Bond Portfolio:

Gross operating expenses: Class R, 1.42%; Class T, 0.67%. Net operating expenses: Class R, 1.17%; Class T, 0.67%, after contractual reduction through 2/29/2012.

Intermediate-Term Bond Portfolio:

Gross operating expenses: Class T, 0.66%. Net operating expenses: Class T, 0.66%.

Mortgage Backed Securities Portfolio:

Gross operating expenses: Class T, 0.88%. Net operating expenses: Class T, 0.88%.

| | | | | | | | | | | | | | | | |

| | | Cumulative Total Returns

as of 10/31/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Total Return Bond Portfolio (Class R) | | | 9.33 | % | | | N/A | | | | N/A | | | | 42.29% (8/22/06) | |

Total Return Bond Portfolio (Class T) | | | 9.82 | | | | 51.18 | % | | | 109.29 | % | | | — | |

Barclays Capital U.S. Aggregate Bond Index | | | 8.01 | | | | 36.66 | | | | 85.60 | | | | — | |

Lipper Corporate Debt BBB-Rated Funds Avg. | | | 12.74 | | | | 35.00 | | | | 94.86 | | | | — | |

| |

| | | Average Annual Total Returns

as of 9/30/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Total Return Bond Portfolio (Class R) | | | 9.59 | % | | | N/A | | | | N/A | | | | 8.86% (8/22/06) | |

Total Return Bond Portfolio (Class T) | | | 10.08 | | | | 8.31 | % | | | 7.67 | % | | | — | |

Barclays Capital U.S. Aggregate Bond Index | | | 8.16 | | | | 6.20 | | | | 6.41 | | | | — | |

Lipper Corporate Debt BBB-Rated Funds Avg. | | | 13.16 | | | | 5.78 | | | | 6.65 | | | | — | |

| |

| | | Average Annual Total Returns

as of 10/31/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Total Return Bond Portfolio (Class R) | | | 9.33 | % | | | N/A | | | | N/A | | | | 8.77% (8/22/06) | |

Total Return Bond Portfolio (Class T) | | | 9.82 | | | | 8.62 | % | | | 7.67 | % | | | — | |

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 13 | |

Fixed Income Portfolios’ Performance (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Cumulative Total Returns

as of 10/31/10 | | | Average Annual Total Returns

as of 9/30/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | One Year | | | Five Years | | | Ten Years | |

Intermediate-Term Bond Portfolio (Class T) | | | 9.07 | % | | | 48.47 | % | | | 94.93 | % | | | 9.36 | % | | | 7.97 | % | | | 6.89 | % |

Barclays Capital Int. Govt./Credit Bond Index | | | 7.81 | | | | 34.86 | | | | 79.98 | | | | 7.77 | | | | 5.95 | | | | 6.05 | |

Lipper Int. Inv.-Grade Debt Funds Avg. | | | 9.63 | | | | 32.77 | | | | 77.66 | | | | 9.98 | | | | 5.47 | | | | 5.85 | |

| | | | |

| | | | | | | | | | | | Average Annual Total Returns

as of 10/31/10 | |

| | | | | | | | | | | | One Year | | | Five Years | | | Ten Years | |

Intermediate-Term Bond Portfolio (Class T) | | | | | | | | | | | | | | | 9.07 | % | | | 8.22 | % | | | 6.90 | % |

| | |

| | | Cumulative Total Returns

as of 10/31/10 | | | Average Annual Total Returns

as of 9/30/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | One Year | | | Five Years | | | Ten Years | |

Mortgage Backed Securities Portfolio (Class T) | | | 12.02 | % | | | 41.60 | % | | | 82.24 | % | | | 13.00 | % | | | 6.87 | % | | | 6.13 | % |

Barclays Capital Mortgage-Backed Securities Index | | | 5.99 | | | | 38.76 | | | | 84.10 | | | | 5.71 | | | | 6.41 | | | | 6.27 | |

Citigroup Mortgage-Backed Securities Index | | | 6.13 | | | | 39.08 | | | | 84.96 | | | | 5.81 | | | | 6.48 | | | | 6.32 | |

Lipper U.S. Mortgage Funds Avg. | | | 7.51 | | | | 28.99 | | | | 67.04 | | | | 7.58 | | | | 4.77 | | | | 5.14 | |

| | | | |

| | | | | | | | | | | | Average Annual Total Returns

as of 10/31/10 | |

| | | | | | | | | | | | One Year | | | Five Years | | | Ten Years | |

Mortgage Backed Securities Portfolio (Class T) | | | | | | | | | | | | | | | 12.02 | % | | | 7.20 | % | | | 6.19 | % |

| | |

| 14 | | THE TARGET PORTFOLIO TRUST |

Growth of a $10,000 Investment

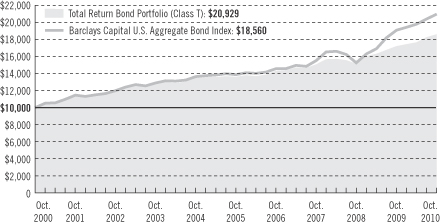

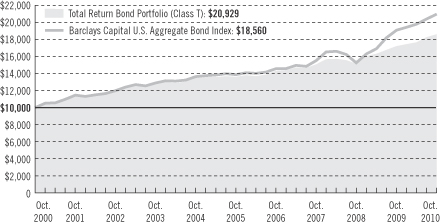

Total Return Bond Portfolio

The graph compares a $10,000 investment in the TARGET Total Return Bond Portfolio (Class T) with a similar investment in the Barclays Capital U.S. Aggregate Bond Index by portraying the initial account values at the beginning of the 10-year period (October 31, 2000) and the account values at the end of the current fiscal year (October 31, 2010), as measured on a quarterly basis. The average annual total returns in the table and the returns on investment in the graph do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 15 | |

Fixed Income Portfolios’ Performance (continued)

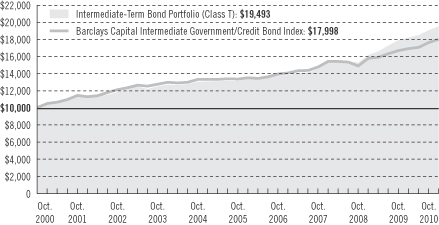

Growth of a $10,000 Investment

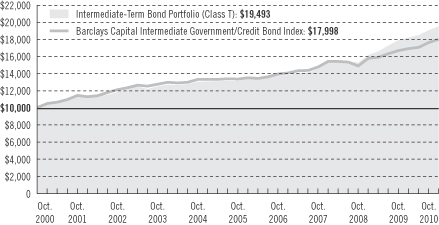

Intermediate-Term Bond Portfolio

The graph compares a $10,000 investment in the TARGET Intermediate-Term Bond Portfolio (Class T) with a similar investment in the Barclays Capital Intermediate Government/Credit Bond Index by portraying the initial account values at the beginning of the 10-year period (October 31, 2000) and the account values at the end of the current fiscal year (October 31, 2010), as measured on a quarterly basis. The average annual total returns in the table and the returns on investment in the graph do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares.

| | |

| 16 | | THE TARGET PORTFOLIO TRUST |

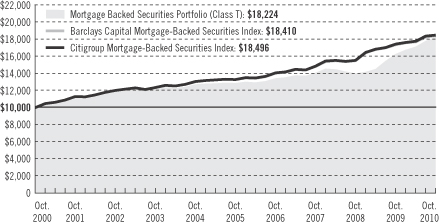

Growth of a $10,000 Investment

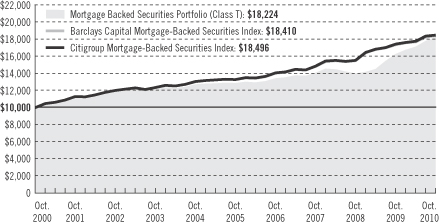

Mortgage Backed Securities Portfolio

The graph compares a $10,000 investment in the TARGET Mortgage Backed Securities Portfolio (Class T) with a similar investment in the Barclays Capital Mortgage-Backed Securities Index and the Citigroup Mortgage-Backed Securities Index by portraying the initial account values at the beginning of the 10-year period (October 31, 2000) and the account values at the end of the current fiscal year (October 31, 2010), as measured on a quarterly basis. The average annual total returns in the table and the returns on investment in the graph do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares.

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

Total returns assume the reinvestment of all dividends and distributions, and take into account all charges and expenses applicable to an investment in each portfolio. Class R shares are subject to an annual distribution and service (12b-1) fee of up to 0.75%. Returns in the table do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or following the redemption of portfolio shares.

Inception returns are provided for any share class with less than 10 calendar years of returns.

Investors cannot invest directly in an index. The returns for the benchmark indexes would be lower if they reflected deductions for portfolio operating expenses, sales charges, or taxes.

Benchmark Definitions

Barclays Capital Intermediate Government/Credit Bond Index

The Barclays Capital Intermediate Government/Credit Bond Index is an unmanaged index of publicly traded U.S. government bonds and investment-grade corporate bonds with maturities of up to 10 years. It gives a broad indication of how intermediate-term bonds have performed.

Barclays Capital Mortgage-Backed Securities Index

The Barclays Capital Mortgage-Backed Securities Index is an unmanaged, market capitalization-weighted index of 15- and 30-year fixed-rate securities backed by GNMA, FNMA, and FHLMC mortgage pools, and balloon mortgages with fixed-rate coupons.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 17 | |

Fixed Income Portfolios’ Performance (continued)

Barclays Capital U.S. Aggregate Bond Index

The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of investment-grade securities issued by the U.S. government and its agencies and by corporations with between one and 10 years remaining to maturity. It gives a broad indication of how bond prices of short- and intermediate-term bonds have performed.

Citigroup Mortgage-Backed Securities Index

The Citigroup Mortgage-Backed Securities Index is an unmanaged index of 15- and 30-year mortgage-related securities issued by U.S. government agencies. Each of them gives a broad indication of how mortgage-backed securities have performed.

Lipper Corporate Debt BBB-Rated

Lipper Corporate Debt BBB-Rated funds invest primarily in corporate and government debt issues rated in the top four grades.

Lipper Intermediate Investment-Grade Debt

Lipper Intermediate Investment-Grade Debt funds invest primarily in investment-grade debt issues (rated in the top four grades) with dollar-weighted average maturities of five to 10 years.

Lipper U.S. Mortgage

Lipper U.S. Mortgage funds invest primarily in mortgages/securities issued or guaranteed as to principal and interest by the U.S. government and certain federal agencies.

Benchmark Inception Returns

Total Return Bond Portfolio—Barclays Capital U.S. Aggregate Bond Index Closest Month-End to Inception cumulative total return as of 10/31/10 is 31.92% for Class R. Barclays Capital U.S. Aggregate Bond Index Closest Month-End to Inception average annual total return as of 9/30/10 is 6.93% for Class R. Lipper Average Closest Month-End to Inception cumulative total return as of 10/31/10 is 30.78% for Class R. Lipper Average Closest Month-End to Inception average annual total return as of 9/30/10 is 6.62% for Class R.

The Lipper Averages represent returns based on an average of all funds in the respective Lipper categories for the periods noted. The returns for the Lipper averages would be lower if they reflected deductions for portfolio operating expenses, sales charges, or taxes.

| | |

| 18 | | THE TARGET PORTFOLIO TRUST |

Money Market Portfolio Performance

Yields will fluctuate from time to time, and past performance does not guarantee future results. Current performance may be lower or higher than the past performance data quoted. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost. For the most recent month-end performance update, call (800) 225-1852.

U.S. Government Money Market Portfolio:

Gross operating expenses: Class T, 0.65%. Net operating expenses: Class T, 0.23%, after a voluntary waiver of management fees.

| | | | | | |

| Money Market Portfolio as of 10/31/10 | | | | |

| | | Cumulative

Total Returns

12 Months | | Net Asset Value

(NAV) | | 7-Day Current

Yield |

U.S. Government Money Market Portfolio (Class T) | | 0.04% | | $1.00 | | 0.01% |

Lipper U.S. Government Money Market Funds Avg. | | 0.02 | | N/A | | N/A |

iMoneyNet, Inc. All Taxable Money Market Funds Avg. | | N/A | | N/A | | 0.03 |

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

Total returns assume the reinvestment of all dividends and distributions, and take into account all charges and expenses applicable to an investment in each portfolio. The returns in the table do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or following the redemption of portfolio shares.

Benchmark Definitions

iMoneyNet, Inc. All Taxable Money Market Funds Average

iMoneyNet, Inc. regularly reports a 7-day current yield on Tuesdays for taxable money market funds. This is the data of all funds in the iMoneyNet, Inc. All Taxable Money Market Funds Average category as of 10/26/10, the closest date to the end of our reporting period.

Lipper U.S. Government Money Market Funds Average

Lipper U.S. Government Money Market funds invest principally in financial instruments issued or guaranteed by the U.S. government, its agencies, or instrumentalities with dollar-weighted average maturities of less than 90 days. These funds intend to keep a constant net asset value.

The Lipper average represents returns based on an average of all funds in the respective Lipper categories for the periods noted. The return for the Lipper average would be lower if it reflected deductions for sales charges or taxes.

An investment in the U.S. Government Money Market Portfolio (the Portfolio) is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Portfolio seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the Portfolio.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 19 | |

Strategy and Performance Overview

Large Capitalization Growth Portfolio

The Large Cap Growth Portfolio’s Class T shares returned 18.55% for the 12-month period ended October 31, 2010, which trailed the 19.65% return of its benchmark, the Russell 1000® Growth Index (the Index). The Portfolio’s Class T shares, however, outperformed the 17.70% return of the Lipper Large Cap Growth Funds Average.

The Large Cap Growth Portfolio uses a multi-manager approach, seeking to maximize returns by diversifying Portfolio performance across firms and by combining complementary approaches. Marsico Capital Management, LLC (Marsico), a traditional large-cap growth manager, constructs a relatively concentrated portfolio using an active top-down, bottom-up approach to investing. MFS Investment Management (MFS) follows a more diversified strategy that takes a traditional approach to identifying under-priced growth opportunities.

During the reporting period, the Portfolio’s performance relative to the Index weakened due to some key sector and investment style factors. The Portfolio had a large overall overexposure to the financial sector, which produced moderately low gains relative to other sectors for the year. The Portfolio was also underexposed to consumer non-cyclicals, a sector in the Index that broadly outperformed during the fiscal year. However, overweights in the consumer services and transport sectors helped performance.

Style factors such as growth and value along with capitalization levels modestly detracted from relative performance. Relative to the Index, the Portfolio’s overweight in stocks with large market capitalizations and those with levels of above-market stock-price-volatility were primary detractors. The Portfolio’s underweight in stocks paying high dividends also detracted from performance. However, stocks experiencing recent price strength contributed to relative performance.

The Portfolio’s security selection was another positive during the reporting period. Holdings in the consumer services and technology sectors significantly contributed to relative performance. Individual companies among the top contributors were in the technology sector and included Baidu Inc., Apple, Priceline, and Microsoft Corporation. Also during the reporting period, the Portfolio held a derivative, in the form of a call option, on a very limited basis, and it did not have a material impact on the Portfolio’s performance.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 20 | | THE TARGET PORTFOLIO TRUST |

Large Capitalization Value Portfolio

The Large Cap Value Portfolio’s Class T shares returned 13.00% for the 12-month reporting period ended October 31, 2010, trailing the 15.71% return of its benchmark, the Russell 1000® Value Index (the Index). However, the Portfolio’s Class T shares outperformed the 12.79% return of the Lipper Large-Cap Value Funds Average.

The Portfolio is managed by NFJ, Eaton Vance, and Hotchkis and Wiley Capital Management, LLC (Hotchkis and Wiley). NFJ follows a disciplined deep value investment strategy based on research that has shown that portfolios of low price-to-earnings (P/E) stocks have substantially outperformed market indexes throughout all capitalization levels over extended periods. The manager uses an elaborate screening process to identify the lowest valued stocks within their industry based on their P/E ratio.

In contrast, Eaton Vance’s portion of the overall portfolio follows a relative value or “growthier” investment style. The manager evaluates traditional measures of value, overall business health, and changes in business momentum to capture market inefficiencies in the universe of large capitalization companies. Eaton Vance focuses on companies that exhibit strong business franchises with attractive earnings-per-share (EPS) ratios and dividend growth potential.

Hotchkis and Wiley uses a value-oriented investment style and a bottom-up approach to security selection. It primarily invests in above-market yielding securities. The investment team seeks to identify companies with strong cash flow, improving profit margins, sustainability of projected growth, and competitive/strategic positioning within their industries.

During the reporting period, the Portfolio’s overweight stance in large-cap companies hurt results, as stocks of smaller companies outperformed their larger counterparts. All three portions of the Portfolio were overweight in highly capitalized stocks with Eaton Vance’s large-cap bias the primary detractor from the Portfolio’s performance.

The Portfolio’s stock selection negatively affected its performance relative to the Index. Stocks of companies in the energy and technology sectors such as Hewlett Packard, Diamond Offshore Drilling, and Anadarko Petroleum hurt relative performance. Moreover, stock selection in all three portions of the Portfolio detracted from performance during the reporting period, with NFJ’s portion being the primary detractor.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 21 | |

Strategy and Performance Overview (continued)

Cash holdings in the Portfolio dragged down performance. Most notably, Eaton Vance’s cash holdings in November 2009 hurt performance as the market rallied that month.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 22 | | THE TARGET PORTFOLIO TRUST |

Small Capitalization Growth Portfolio

The Small Cap Growth Portfolio’s Class T shares rose 25.83% for the 12-month reporting period ended October 31, 2010, which trailed the 28.67% gain of the Russell 2000® Growth Index (the Index). The Portfolio’s Class T shares also underperformed the 27.71% return of the Lipper Small-Cap Growth Funds Average.

Eagle Asset Management (Eagle) and Ashfield Capital Partners (Ashfield) manage the Portfolio because of their complementary investment styles. The primary goal of this co-management strategy is to help limit risk in particular economic sectors or market scenarios with a portfolio that provides prospective opportunities in most equity markets.

Eagle describes its traditional growth investment process as “Rapid Growth at a Reasonable Price.” The manager seeks companies with accelerating and sustainable earnings growth, a positive catalyst, a high or expanding return on equity, and a credible and competent management team.

Ashfield’s investment philosophy is based upon the belief that the price of a stock will be directly related to the underlying growth potential of the business. To some extent, each manager tends to have contrasting views toward certain sectors, but they share similar perspectives on portfolio risk and style factors.

Eagle’s portion outperformed the Index, while Ashfield’s hurt the Portfolio’s overall results. Ashfield’s stock selection in certain medical services, electronic equipment, and computer software industries were the main detractors.

Conversely, Eagle’s stock selection, specifically in the chemicals, energy reserves, specialty retail, restaurants, and computer hardware and software industries, added to the Portfolio’s returns. Additionally, the manager’s decision not to hold certain companies in the Index helped during the quarter. For example, avoiding or being underweight relative to the benchmark in biotech companies proved beneficial.

In aggregate, the Portfolio’s underweight position in the healthcare sector was the single largest detractor during the reporting period. Specifically, the Portfolio’s underweight stance in the pharmaceuticals industry and its overweight stance in the medical services industries had the largest negative impact during the period. However, stock selection against the Index in the consumer cyclical and technology

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 23 | |

Strategy and Performance Overview (continued)

sectors, particularly in computer software, made a positive contribution to performance. But since both managers of the Portfolio deploy bottom-up stock selection as their strategy, the Portfolio’s sector allocations generally have little or no effect on overall Portfolio performance over longer periods.

However, an overweight allocation against the Index in the consumer cyclical and technology sectors, particularly in computer software, made a positive contribution to performance. But since both managers of the Portfolio deploy bottom-up stock selection as their strategy, the Portfolio’s sector allocations generally have little or no effect on overall Portfolio performance over longer periods.

Overall, the Portfolio’s stance toward riskier assets contributed positively to Portfolio performance. To a lesser extent, a modest exposure to stocks exhibiting price momentum characteristics enhanced returns toward the end of the reporting period.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 24 | | THE TARGET PORTFOLIO TRUST |

Small Capitalization Value Portfolio

The Small Cap Value Portfolio’s Class T shares gained 23.58% for the 12-month reporting period ended October 31, 2010, which slightly underperformed the 24.43% return of its benchmark, the Russell 2000® Value Index (the Index). The Portfolio’s Class T shares also underperformed the 24.55% return of the Lipper Small-Cap Core Funds Average.

Small companies and firms may respond to economic trends differently. For example, some may occupy specific niches in which they are immune to economic cycles. Also, some inexpensive stocks may be not followed closely by analysts. Accordingly, small-cap managers can benefit from informational inefficiencies in the market. Research is critical and the Portfolio’s managers are chosen based on their experience and capabilities. The asset managers themselves may reach position-size limits in the amount they can hold in small firms. Consequently, the Portfolio uses several managers. As managers reach their capacity limits, new asset managers may be added to the Portfolio. EARNEST Partners, LLC; Lee Munder Capital Group; J.P. Morgan Investment Management, Inc.; NFJ Investment Group L.P.; and Vaughan Nelson Investment Management, L.P. are the current managers of the Portfolio.

Sector positioning had a positive effect on the Portfolio’s performance. Specifically, an underweight in the financial sector and an overweight in the basic materials sector generated positive results. On the negative side, an overweight in healthcare detracted from performance.

The Portfolio’s underexposure to stocks with particular style attributes proved beneficial. Specifically, the Portfolio was underexposed to stocks with higher volatility, as measured by the movements of a stock’s price, and was also underexposed to stocks with a high degree of earnings variability (stocks more closely tied to movements in the business cycle). On the negative side, the Portfolio was overexposed to stocks with the largest capitalization levels in the Index, which detracted from relative performance.

The Portfolio tends to be less sensitive to movements in the broad market than the Index. Accordingly, this defensive positioning tends to detract from relative performance during broad market gains, which was generally the case during the reporting period.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 25 | |

Strategy and Performance Overview (continued)

Stock selection had little impact on overall performance. Stocks within the chemicals and oil services industries, however, were a source of positive returns. Conversely, assets held within the specialty retail industry were a drag on results.

The JP Morgan Small Cap Value portion held a small derivative position in small-cap futures to hedge cash, which helped to manage flows and general market exposure. Over the last year, this exposure had a positive impact on Portfolio results due to the positive returns of the small-cap market relative to cash. It is important to note, however, the sole purpose for using futures in this portion of the Portfolio is to maintain full market exposure and not to leverage the Portfolio or make a market call.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 26 | | THE TARGET PORTFOLIO TRUST |

International Equity Portfolio

The International Equity Portfolio’s Class T shares posted a 11.45% return for the 12-month reporting period ended October 31, 2010, outperforming the 8.36% return of the Morgan Stanley Capital International Europe, Australasia, and Far East Net Dividend Index (the Index), and also outperforming the 10.34% return of the Lipper International Large-Cap Core Funds Average.

LSV Asset Management (LSV) and Thornburg Investment Management, Inc. (Thornburg) are co-managers of the Portfolio, which combines the distinct investment approaches of LSV International Value (deep value) and Thornburg International (relative value/core).

LSV’s active quantitative investment strategy is based on the firm’s research into value investing and behavioral finance. They believe that superior investment performance can be achieved by exploiting behavioral biases exhibited by other investors, including the tendency to extrapolate the past too far into the future, wrongly equating a good company with a good investment irrespective of price, ignoring statistical evidence and developing a “mindset” about a company. While they do not conduct traditional security analysis, the objective of LSV’s purely quantitative modeling approach is to pick undervalued stocks with near-term appreciation potential.

Thornburg’s value-based investment approach seeks promising companies trading at a discount to what the investment manager believes is a company’s intrinsic value. The strategy looks to reduce portfolio total risk by exposing the portfolio to traditional, relative, and/or deep value stocks. The investment process utilizes quantitative screens to identify attractively valued stocks (using metrics such as price/earnings, price/forward earnings, and price to cash flow) poised for fundamental improvement, such as earnings surprises or earnings revisions, relative to peers. Management then performs fundamental research (including visits with company management, peers, competitors, and suppliers) on companies deemed attractive by the screening process. However, Thornburg does reserve the right to circumvent the screening process, and often does, in their search for value. The result of their fundamental analysis is an estimate of a company’s intrinsic value, which is compared to current valuations to identify attractive opportunities.

In the beginning of the reporting period, the rally in riskier assets from the third quarter of 2009 stalled as stocks entered into a correction. The LSV portion struggled

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 27 | |

Strategy and Performance Overview (continued)

out of the gate, underperformed for the first two months of the period, and then outperformed for the remainder of the period.

Moreover, growth stocks outperformed value stocks in international markets. Underperformance by companies with low price-to-book valuation multiples, particularly in the financial sector, pulled down value stocks. LSV was overweight in financial stocks, and concentrated in those with the most attractive valuations, which further detracted from relative performance early in the period.

During the rest of the period, beginning in January 2010, LSV outperformed the Index, as equity markets vacillated between risk-friendly rallies and risk-averse corrections. However, LSV’s deep value strategy could not compensate for its slow start, and this muted its overall performance for the reporting period.

The Thornburg portion of the Portfolio displayed consistent outperformance during the entire period. As a relative value/core strategy, Thornburg benefited from the tailwinds of higher value stocks outperforming lower value stocks and also from growth-style stocks outperforming value stocks in markets outside of the U.S. Overall, Thornburg handily outperformed the Index for the period. Allocations to countries not in the Index significantly boosted performance. Holdings in companies in Canada, Mexico, and South Korea helped performance, as these markets individually outperformed the return of the Index. Additionally, stock selection in the United Kingdom (UK) and Germany further enhanced relative performance as Thornburg made good stock selections in the UK consumer discretionary sector and also among stocks of German automakers.

From time to time, Thornburg uses derivatives in the form of currency forwards as a hedging tool for risk management purposes. Thornburg does not expect a significant portion of the performance to come from currency hedging strategies. For the period ending October 31, 2010, currency hedging detracted slightly from results as the Portfolio hedged on the Euro, British Pound, Brazilian Real and Mexican Peso. The main hedge was earlier in the period, as the Portfolio’s hedge against the Mexican Peso detracted from results.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 28 | | THE TARGET PORTFOLIO TRUST |

Total Return Bond Portfolio

The Total Return Bond Portfolio’s Class T shares gained 9.82% for the 12-month reporting period ended October 31, 2010, outperforming the 8.01% gain of the Barclays Capital U.S. Aggregate Bond Index (the Index). However, the Portfolio’s Class T shares lagged the 12.74% gain of the Lipper Corporate Debt BBB-Rated Funds Average. Pacific Investment Management Company LLC (PIMCO) manages the Portfolio.

A low interest-rate environment prevailed in the U.S. fixed income markets as the Federal Reserve (the Fed) left its target for the overnight bank lending rate near zero throughout the reporting period. The rock-bottom borrowing costs were intended to help encourage commerce, as economic growth slowed in the United States and the unemployment rate remained high. The Fed also tried to aid the economy by completing a round of quantitative easing in which it bought federal agency debt securities and mortgage-backed securities of federal agencies to support mortgage lending and the housing markets.

Later in the reporting period, the Fed kept its holdings of debt securities constant by reinvesting principal payments from its mortgage-backed securities and federal agency debt securities back into U.S. Treasury securities, concentrating on notes maturing in two to 10 years. This helped boost prices of Treasury securities and pushed down their yields, as bond prices move inversely to yields. In September 2010, the Fed also said it was prepared to provide more help to the economy if needed. This led to renewed anticipation that the Fed would soon begin another round of quantitative easing in which it would buy additional Treasury securities to exert further downward pressure on longer-term rates.

For most of the reporting period, the Portfolio had a longer duration in the U.S. fixed income market than the Index. (Duration measures a portfolio’s sensitivity to changes in the level of interest rates.) The Portfolio also had duration exposure in core European bond markets. This strategy worked well as bond yields declined in these markets and pushed bond prices higher.

The Portfolio was also positioned to benefit from an anticipated flattening in the slope of the yield curve, a single-line graph that shows the relationship between yields of bonds of the same credit quality. This strategy detracted from performance because the slope of the yield curve became steeper. However, the negative impact from the Portfolio’s yield curve strategy was more than offset by its exposure to Eurodollar

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 29 | |

Strategy and Performance Overview (continued)

futures contracts whose prices rallied (Eurodollars are U.S. dollars deposited in commercial banks outside the United States.) Prices of Eurodollar futures contracts gained on the expectation that short-term rates will remain low for an extended period of time.

Some aspects of PIMCO’s bond market allocation strategy worked well. The Portfolio had a larger exposure than the Index to investment-grade bonds of financial companies, which outperformed the broader investment-grade corporate bond market. Also, the Portfolio benefited from having a modest exposure to high yield corporate “junk” bonds, which are not in the Index as they are rated below investment grade. High yield bonds outperformed Treasury securities with similar maturities. In the low-rate environment, investors took advantage of the more attractive yields on debt securities such as corporate bonds, which carry greater credit risk than ultra-safe Treasury securities.

The Portfolio also benefited from having a modest exposure to emerging market bonds denominated in local currencies, particularly debt securities of issuers in Brazil. The Portfolio gained this exposure by using a type of derivative instrument called zero coupon interest rate swaps instead of spending large amounts of money to buy the bonds outright. Under the swap agreement, the Portfolio makes periodic floating-rate payments based on the CDI (the interbank lending rate of Brazil) and will receive a lump-sum fixed-rate payment from the other party involved in the agreement when the swap matures. As the CDI declined during the calendar year, the swap gained in value, aiding the Portfolio’s performance.

Other aspects of PIMCO’s bond market allocation strategy hindered performance. For example, the Portfolio had a smaller exposure to commercial mortgage-backed securities (CMBS) than the Index. However, CMBS, which are made from bundled mortgages on properties such as hotels and office buildings, outperformed Treasury securities with similar maturities. Some of the negative impact from this strategy was offset by an emphasis on senior, high-quality CMBS, which added incremental yield to the Portfolio.

The Portfolio also had a smaller exposure than the Index to mortgage-backed securities of federal agencies, which detracted from its performance as these securities also outperformed Treasury securities with similar maturities. However, some of the negative impact from this strategy was offset by favorable security selection among mortgage-backed securities of federal agencies and exposure to high-quality “private label” mortgage-backed securities, which do not have any government backing.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 30 | | THE TARGET PORTFOLIO TRUST |

Intermediate-Term Bond Portfolio

The Intermediate-Term Bond Portfolio’s Class T shares gained 9.07% for the 12-month reporting period ended October 31, 2010, outperforming the 7.81% gain of the Barclays Capital Intermediate Government/Credit Index (the Index). However, the Portfolio’s Class T shares lagged the 9.63% gain of the Lipper Intermediate Investment-Grade Debt Funds Average. Pacific Investment Management Company LLC (PIMCO) manages the Portfolio.

A low interest-rate environment prevailed in the U.S. fixed income markets as the Federal Reserve (the Fed) left its target for the overnight bank lending rate near zero throughout the reporting period. The rock-bottom borrowing costs were intended to help encourage commerce, as economic growth slowed in the United States and the unemployment rate remained high. The Fed also tried to aid the economy by completing a round of quantitative easing in which it bought federal agency debt securities and mortgage-backed securities of federal agencies to support mortgage lending and the housing markets.

Later in the reporting period, the Fed kept its holdings of debt securities constant by reinvesting principal payments from its mortgage-backed securities and federal agency debt securities back into U.S. Treasury securities, concentrating on notes maturing in two to 10 years. This helped boost prices of Treasury securities and pushed down their yields, as bond prices move inversely to yields. In September 2010, the Fed also said it was prepared to provide more help to the economy if needed. This led to renewed anticipation that the Fed would soon begin another round of quantitative easing in which it would buy additional Treasury securities to exert further downward pressure on longer-term rates.

For most of the reporting period, the Portfolio had a longer duration in the U.S. fixed income market than the Index. (Duration measures a portfolio’s sensitivity to changes in the level of interest rates.) The Portfolio also had duration exposure in core European bond markets. This strategy worked well as bond yields declined in these markets and pushed bond prices higher.

Some aspects of PIMCO’s bond market allocation strategy worked well. The Portfolio had a larger exposure than the Index to investment-grade corporate bonds, particularly bonds of financial companies, which outperformed the broader investment-grade corporate bond market. In the low-rate environment, investors took

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 31 | |

Strategy and Performance Overview (continued)

advantage of the more attractive yields on debt securities such as corporate bonds, which carry greater credit risk than ultra-safe Treasury securities.

The Portfolio also benefited from having a modest exposure to emerging market bonds denominated in local currencies, particularly debt securities of issuers in Brazil. The Portfolio gained this exposure by using a type of derivative instrument called zero coupon interest rate swaps instead of spending large amounts of money to buy the bonds outright. Under the swap agreement, the Portfolio makes periodic floating-rate payments based on the CDI (the interbank lending rate of Brazil) and will receive a lump-sum fixed-rate payment from the other party involved in the agreement when the swap matures. As the CDI declined during the calendar year, the swap gained in value, aiding the Portfolio’s performance.

Another positive for the Portfolio was its modest exposure to mortgage-backed securities of federal agencies and senior, high-quality “private label” mortgage-backed securities, which do not have any government backing. Both types of bonds outperformed Treasury securities with similar maturities.

Other aspects of the Portfolio’s investment strategy hindered its performance. For most of the reporting period, the Portfolio was positioned to benefit as the slope of the yield curve became steeper. (The yield curve is a single-line graph that shows the relationship between yields on bonds of the same credit quality from the shortest to the longest maturities.) However, the positive impact from this strategy was more than offset as the Portfolio was repositioned in the third quarter of 2010 in anticipation that the yield curve would flatten. As it turned out, the slope of the yield curve did not flatten and the change in strategy subtracted from the Portfolio’s performance.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 32 | | THE TARGET PORTFOLIO TRUST |

Mortgage Backed Securities Portfolio

The Mortgage Backed Securities Portfolio’s Class T shares gained 12.02% for the 12-month reporting period ended October 31, 2010, widely outperforming the 5.99% gain of the Barclays Capital U.S. Mortgage Backed Securities Index (the Index) and the 7.51% gain of the Lipper U.S. Mortgage Funds Average. Wellington Management Company, LLP (Wellington Management) manages the Portfolio.

A low interest-rate environment prevailed in the U.S. fixed income markets as the Federal Reserve (the Fed) left its target for the overnight bank lending rate near zero during the reporting period that began November 1, 2009. The rock-bottom borrowing costs were intended to help encourage commerce, as economic growth slowed in the United States and the unemployment rate remained high. The Fed also tried to aid the economy by completing a round of quantitative easing in which it bought federal agency debt securities and mortgage-backed securities of federal agencies to support mortgage lending and the housing markets.

The primary reason the Portfolio gained more than the Index was that it had a smaller exposure than the Index to mortgage-backed securities of federal agencies, and it held other types of debt securities that performed well. Because of the Fed’s mortgage-backed securities purchase program, the amount of extra yield (spread) that mortgage-backed securities of federal agencies provided over Treasury securities with similar maturities declined sharply. As a result, the Portfolio took advantage of more attractive investment opportunities in other sectors not included in the Index, all of which helped it outperform the Index for the reporting period.

One such sector was “private label” mortgage-backed securities, which do not have any government backing. The Portfolio focused on debt securities in that sector that Wellington Management believed were undervalued. Strong technical factors and an improvement in mortgage payment data, including higher voluntary prepayments, helped drive performance during the reporting period.

The Portfolio also owned commercial mortgage-backed securities (CMBS), which are made from bundles of mortgage on properties such as hotels or office buildings. CMBS outperformed the Index for the reporting period as a limited supply of securities met with strong investor demand.

The Portfolio held inverse interest only (IIO) bonds, which, as the name implies, do not receive principal payments from the underlying mortgages. Wellington

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 33 | |

Strategy and Performance Overview (continued)

Management believed volatility would remain low and prepayment speeds would be slower than market expectations, despite historically low mortgage rates. As it turned out, strict underwriting standards and declining availability of mortgage credit kept prepayment speeds low. The stable prepayment environment in which borrowers continued to face challenges in refinancing benefited valuations of IIO bonds, and the Portfolio’s allocation to them enhanced its performance.

Another positive for the Portfolio was its favorable security selection among mortgage pass-through securities of federal agencies. In particular, the Portfolio benefited from its emphasis on mortgage pass-through securities with higher coupon rates. Wellington Management liked these debt securities based on its expectation that their prepayment speeds would continue to slow. As previously mentioned, refinancing options available to consumers were limited despite historically low mortgage rates, and this helped prepayments remain low. The Portfolio also benefited from positive security selection among mortgage pass-through securities backed by 15- and 20-year conventional home loans.

During the reporting period, the Portfolio used derivative instruments including interest rate swaps, interest rate futures, and bond futures to tactically manage interest rate risk, which is the risk that securities could lose value because of changes in interest rates. The Portfolio’s exposure to derivatives did not have a material impact on its performance.

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 34 | | THE TARGET PORTFOLIO TRUST |

U.S. Government Money Market Portfolio

The U.S. Government Money Market Portfolio’s* Class T shares returned 0.04% for the 12-month period ended October 31, 2010, which outperformed the 0.01% return of the Lipper U.S. Government Money Market Funds Average. Wellington Management Company, LLP (Wellington Management) manages the Portfolio.

During the reporting period that began November 1, 2009, a low interest-rate environment prevailed in the U.S. fixed income markets as the Federal Reserve (the Fed) left its target for the overnight bank lending rate near zero. The rock-bottom borrowing costs were intended to help encourage commerce, as economic growth slowed in the United States and the unemployment rate remained high.

Rates also remained near zero on repurchase agreements, in which one party sells U.S. Treasury securities to another party and then agrees to buy them back on a certain date and at an agreed-upon higher price. Repurchase agreements are essentially short-term collateralized loans. (The difference between the sale price and purchase price is the interest paid on the loan.) The volumes of repurchase agreements remained low throughout the year as the market demanded that banks unwind debt. Meanwhile, the slope of the money market yield curve flattened, as rates on three-month Treasury bills increased slightly and yields on one-year Treasury notes decreased.

The Portfolio opportunistically took advantage of increases in the yields of government securities, while maintaining liquidity and increasing exposure to high-quality discount notes of federal agencies.

The Securities and Exchange Commission (SEC) published a number of rule changes that affect money market funds governed by SEC Rule 2a-7 under the Investment Company Act of 1940. The changes were a direct result of concerns that arose during the financial crisis when the net asset value of a particular money market fund fell below $1.00 in September 2008. Most of the rule changes affect the quality, maturity limits, and liquidity of the investments held by money market funds.

| * | On December 1, 2010, the Board of Trustees of the Trust, of which the U.S. Government Money Market Portfolio (the “Portfolio”) is a series, determined that it was in the best interests of the Portfolio’s shareholders for the Portfolio to cease operations. Accordingly, the Board approved a proposal to redeem all the outstanding shares of the Portfolio at the net asset value on or about February 15, 2011. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| THE TARGET PORTFOLIO TRUST | | | 35 | |

Fees and Expenses (Unaudited)

As a shareholder of the Trust, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, and other Trust expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Trust and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on May 1, 2010, at the beginning of the period, and held through the six-month period ended October 31, 2010. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Trust’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential Investments funds, including the Trust, that you own. You should consider the additional fees that were charged to your Trust account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following pages provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

| | |

| 36 | | THE TARGET PORTFOLIO TRUST |

Hypothetical Example for Comparison Purposes

The second line for each share class in the table below and on the following pages provides information about hypothetical account values and hypothetical expenses based on the Trust’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Trust’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Trust and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

Large

Capitalization

Growth Portfolio | | Beginning Account

Value

May 1, 2010 | | | Ending Account

Value October 31, 2010 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid