UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-07064 |

| |

| Exact name of registrant as specified in charter: | | The Target Portfolio Trust |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 7/31/2014 |

| | (Registrant changed its fiscal year end from October 31) |

| |

| Date of reporting period: | | 7/31/2014 |

| | | | |

| Item 1 | | – | | Reports to Stockholders |

PRUDENTIAL INVESTMENTS»MUTUAL FUNDS

THE TARGET PORTFOLIO TRUST®

ANNUAL REPORT · JULY 31, 2014

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about each Portfolio’s securities are for the period covered by this report and are subject to change thereafter.

Target Funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company and member SIPC. © 2014 Prudential Financial, Inc. and its related entities. Prudential Investments LLC, Prudential, the Prudential logo, the Rock symbol, Bring Your Challenges, Target Funds, and Target Portfolio Trust are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

September 16, 2014

Dear Target Shareholder:

We hope you find the annual report for Target informative and useful. The report covers performance for the 12-month period that ended July 31, 2014. Please note Target has changed its fiscal year-end from October 31 to July 31. Going forward, Target’s annual and semi-annual reports will be based on the new fiscal year-end cycle. The change in fiscal year-end will not affect the management or operation of the portfolios.

Since market conditions change over time, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Whether you are looking for capital growth, current income, or a combination of both, the Target portfolios feature a wide range of strategies to suit a variety of investment needs.

Target is founded upon the belief that investment management talent is dispersed across a variety of firms and can be systematically identified through research. The managers for each portfolio are carefully chosen from among the leading institutional money managers and are monitored by our team of experienced investment management analysts. Of course, the future performance of the Target portfolios cannot be guaranteed.

Your selections among the Target portfolios can evolve as your needs change. Your financial professional can help you stay informed of important developments and assist you in determining whether you need to modify your investments.

Thank you for your continued confidence.

Sincerely,

Stuart S. Parker, President

The Target Portfolio Trust

| | | | |

| The TARGET Portfolio Trust | | | 1 | |

Target Large Capitalization Growth Portfolio

Performance (Unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | | | | | | | |

| | | Cumulative Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 15.15 | % | | | 98.08 | % | | | N/A | | | | 57.98% (8/22/06) | |

Class T | | | 15.73 | | | | 103.16 | | | | 94.16 | % | | | — | |

Russell 1000® Growth Index | | | 18.69 | | | | 121.61 | | | | 129.44 | | | | — | |

S&P 500 Index | | | 16.92 | | | | 117.17 | | | | 115.70 | | | | — | |

Lipper Large-Cap Growth Funds Average | | | 18.20 | | | | 106.16 | | | | 117.73 | | | | — | |

| |

| | | Average Annual Total Returns as of 6/30/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 21.80 | % | | | 16.44 | % | | | N/A | | | | 6.11% (8/22/06) | |

Class T | | | 22.48 | | | | 17.05 | | | | 6.17 | % | | | — | |

Russell 1000 Growth Index | | | 26.92 | | | | 19.24 | | | | 8.20 | | | | — | |

S&P 500 Index | | | 24.58 | | | | 18.82 | | | | 7.78 | | | | — | |

Lipper Large-Cap Growth Funds Average | | | 26.61 | | | | 17.40 | | | | 7.51 | | | | — | |

| |

| | | Average Annual Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 15.15 | % | | | 14.65 | % | | | N/A | | | | 5.93% (8/22/06) | |

Class T | | | 15.73 | | | | 15.23 | | | | 6.86 | % | | | — | |

| | |

| 2 | | The TARGET Portfolio Trust |

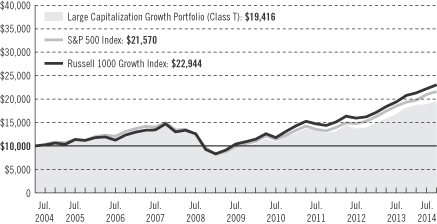

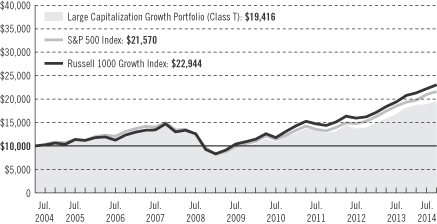

Growth of a $10,000 Investment

Large Capitalization Growth Portfolio

The graph compares a $10,000 investment in the Target Large Capitalization Growth Portfolio (Class T) with a similar investment in the S&P 500 Index and the Russell 1000 Growth Index by portraying the initial account values at the beginning of the 10-year period (July 31, 2004) and the account values at the end of the current fiscal period (July 31, 2014), as measured on a quarterly basis.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Portfolio’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Portfolio or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

Inception returns are provided for any share class with less than 10 calendar years of returns.

| | | | |

| The TARGET Portfolio Trust | | | 3 | |

Target Large Capitalization Growth Portfolio

Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | |

| | | Class R | | Class T |

Maximum initial sales charge | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or sale proceeds) | | None | | None |

Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | .75% (.50% currently) | | None |

Benchmark Definitions

Russell 1000 Growth Index

The Russell 1000 Growth Index is an unmanaged index which contains those securities in the Russell 1000 Index with an above-average growth orientation. Companies in this index tend to exhibit higher price-to-book and price-to-earnings ratios, lower dividend yields, and higher forecasted growth rates.

S&P 500 Index

The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of 500 stocks of large U.S. companies. It gives a broad look at how stock prices have performed.

Lipper Large-Cap Growth Funds Average

Lipper Large-Cap Growth funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s U.S. Diversified Equity (USDE) large-cap floor. Large-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the S&P 500 Index.

Benchmark Inception Returns

Large Capitalization Growth Portfolio—Russell 1000 Growth Index Closest Month-End to Inception cumulative total return as of 7/31/14 is 98.32% for Class R. Russell 1000 Growth Index Closest Month-End to Inception average annual total return as of 6/30/14 is 9.35% for Class R. S&P 500 Index Closest Month-End to Inception cumulative total return as of 7/31/14 is 75.33% for Class R. S&P 500 Index Closest Month-End to Inception average annual total return as of 6/30/14 is 7.62% for Class R. Lipper Average Closest Month-End to Inception cumulative total return as of 7/31/14 is 86.11% for Class R. Lipper Average Closest Month-End to Inception average annual total return as of 6/30/14 is 8.33% for Class R.

Investors cannot invest directly in an index or average. The returns for the benchmark indexes would be lower if they reflected deduction for portfolio operating expenses, sales charges, or taxes.

The Lipper Average represents returns based on an average of all funds in the respective Lipper category for the periods noted. The returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | |

| 4 | | The TARGET Portfolio Trust |

Strategy and Performance Overview

How did the Portfolio perform?

The Large Capitalization Growth Portfolio’s Class T shares returned 15.73% for the 12-month period ended July 31, 2014. This compares to the 18.69% return of its benchmark, the Russell 1000® Growth Index (the Index) and the 18.20% return of the Lipper Large Cap Growth Funds Average during the 12-month period ended July 31, 2014.

The Portfolio was sub-advised during this reporting period by Brown Advisory, LLC (Brown) and Massachusetts Financial Services Company (MFS).

What were market conditions?

U.S. large-cap equities generated strong returns for the reporting period, posting their eighth consecutive quarter of gains during the second quarter of 2014. Investors were buoyed by improving employment figures, housing data, and automobile sales, as well as the Federal Reserve’s (Fed) continued commitment to low interest rates. These factors outweighed the contraction in first-quarter U.S. economic growth, anxiety about the crisis in Ukraine, and mixed news about China’s growth prospects. For the period overall, large-cap stocks outperformed small-cap stocks by a wide margin, and micro-cap stocks registered losses during the second quarter.

What affected the Portfolio’s performance?

| | • | | Stock selection was the primary contributor to the Portfolio’s underperformance relative to the Index, particularly holdings in the information technology and industrials sectors. Although the Portfolio benefited from good stock selection in the consumer discretionary and financials sectors, these results were not enough to offset the weak performance of holdings in other sectors. |

| | • | | Style factors slightly detracted from relative performance, particularly the Portfolio’s underweight compared with the Index in stocks with high dividend yields and low valuations. Stocks with lower price-to-earnings ratios and higher yields outperformed their higher growth, lower-yielding counterparts during the reporting period. Both Brown and MFS seek to buy companies with high earnings per share growth rates, but these companies tend to be more expensive and do not pay dividends. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| The TARGET Portfolio Trust | | | 5 | |

Target Large Capitalization Value Portfolio

Performance (Unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | | | | | | | |

| | | Cumulative Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 15.66 | % | | | 102.50 | % | | | N/A | | | | 35.77% (8/22/06) | |

Class T | | | 16.26 | | | | 107.45 | | | | 87.34 | % | | | — | |

Russell 1000® Value Index | | | 15.47 | | | | 118.92 | | | | 115.76 | | | | — | |

S&P 500 Index | | | 16.92 | | | | 117.17 | | | | 115.70 | | | | — | |

Lipper Large-Cap Value Funds Average | | | 14.72 | | | | 102.46 | | | | 100.97 | | | | — | |

| |

| | | Average Annual Total Returns

as of 6/30/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 24.25 | % | | | 17.07 | % | | | N/A | | | | 4.15% (8/22/06) | |

Class T | | | 24.95 | | | | 17.66 | | | | 6.40 | % | | | — | |

Russell 1000 Value Index | | | 23.81 | | | | 19.23 | | | | 8.03 | | | | — | |

S&P 500 Index | | | 24.58 | | | | 18.82 | | | | 7.78 | | | | — | |

Lipper Large-Cap Value Funds Average | | | 22.72 | | | | 17.24 | | | | 7.08 | | | | — | |

| |

| | | Average Annual Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 15.66 | % | | | 15.16 | % | | | N/A | | | | 3.93% (8/22/06) | |

Class T | | | 16.26 | | | | 15.71 | | | | 6.48 | % | | | — | |

| | |

| 6 | | The TARGET Portfolio Trust |

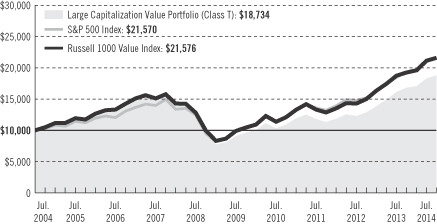

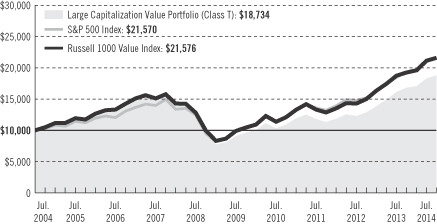

Growth of a $10,000 Investment

Large Capitalization Value Portfolio

The graph compares a $10,000 investment in the Target Large Capitalization Value Portfolio (Class T) with a similar investment in the S&P 500 Index and the Russell 1000 Value Index by portraying the initial account values at the beginning of the 10-year period (July 31, 2004) and the account values at the end of the current fiscal period (July 31, 2014), as measured on a quarterly basis.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Portfolio’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Portfolio or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

Inception returns are provided for any share class with less than 10 calendar years of returns.

| | | | |

| The TARGET Portfolio Trust | | | 7 | |

Target Large Capitalization Value Portfolio

Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | |

| | | Class R | | Class T |

Maximum initial sales charge | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or sale proceeds) | | None | | None |

Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | .75% (.50% currently) | | None |

Benchmark Definitions

Russell 1000 Value Index

The Russell 1000 Value Index is an unmanaged index which contains those securities in the Russell 1000 Index with a below-average growth orientation. Companies in this index generally have lower price-to-book and price-to-earnings ratios, higher dividend yields, and lower forecasted growth values.

S&P 500 Index

The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of 500 stocks of large U.S. companies. It gives a broad look at how stock prices have performed.

Lipper Large-Cap Value Funds Average

Lipper Large-Cap Value funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s U.S. Diversified Equity (USDE) large-cap floor. Large-cap value funds typically have a below-average price-to-earnings ratio and three-year sales-per-share growth value compared with the S&P 500 Index.

Benchmark Inception Returns

Large Capitalization Value Portfolio—Russell 1000 Value Index Closest Month-End to Inception cumulative total return as of 7/31/14 is 59.75% for Class R. Russell 1000 Value Index Closest Month-End to Inception average annual total return as of 6/30/14 is 6.40% for Class R. S&P 500 Index Closest Month-End to Inception cumulative total return as of 7/31/14 is 75.33% for Class R. S&P 500 Index Closest Month-End to Inception average annual total return as of 6/30/14 is 7.62% for Class R. Lipper Average Closest Month-End to Inception cumulative total return as of 7/31/14 is 55.41% for Class R. Lipper Average Closest Month-End to Inception average annual total return as of 6/30/14 is 5.93% for Class R.

Investors cannot invest directly in an index or average. The returns for the benchmark indexes would be lower if they reflected deduction for portfolio operating expenses, sales charges, or taxes.

The Lipper Average represents returns based on an average of all funds in the respective Lipper category for the periods noted. The returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | |

| 8 | | The TARGET Portfolio Trust |

Strategy and Performance Overview

How did the Portfolio perform?

The Large Capitalization Value Portfolio’s Class T shares returned 16.26% for the 12-month period ended July 31, 2014. This compares to the 15.47% return of its benchmark, the Russell 1000® Value Index (the Index), and the 14.72% return of the Lipper Large-Cap Value Funds Average for the 12-month period ended July 31, 2014.

The Portfolio was sub-advised during this reporting period by NFJ Investment Group LLC (NFJ); Hotchkis and Wiley Capital Management, LLC (H&W); and Epoch Investment Partners, Inc. (Epoch).

What were market conditions?

U.S. large-cap equities generated strong returns for the reporting period, posting their eighth consecutive quarter of gains during the second quarter of 2014. Investors were buoyed by improving employment figures, housing data, and automobile sales, as well as the U.S. Federal Reserve’s (Fed) continued commitment to low interest rates. These factors outweighed the contraction in first-quarter U.S. economic growth, anxiety about the crisis in Ukraine, and mixed news about China’s growth prospects. For the period overall, large-cap stocks outperformed small-cap stocks by a wide margin, and micro-cap stocks registered losses during the second quarter.

What affected the Portfolio’s performance?

| | • | | Sector allocation helped relative results as the Portfolio had an overweight position to the technology sector, which was the best performing sector within the Index during the reporting period. The Portfolio’s cash holdings was a modest drag on relative results, which is not unexpected given the sound gains of the Index and the fact that cash earned little. |

| | • | | Stock selection was a modest plus for the Portfolio as gains within the pharmaceutical and oil and gas industries offset weakness among consumer discretionary and semiconductor companies. |

| | • | | While Epoch and Hotchkis and Wiley outperformed the Index for the reporting period, NFJ trailed, although modestly. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| The TARGET Portfolio Trust | | | 9 | |

Target Small Capitalization Growth Portfolio

Performance (Unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | | | | | | | |

| | | Cumulative Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 2.57 | % | | | 98.95 | % | | | N/A | | | | 37.14% (8/22/06) | |

Class T | | | 3.01 | | | | 103.89 | | | | 74.60 | % | | | — | |

Russell 2000® Growth Index | | | 8.93 | | | | 121.46 | | | | 145.26 | | | | — | |

Russell 2000® Index | | | 8.56 | | | | 115.11 | | | | 132.02 | | | | — | |

Lipper Small-Cap Growth Funds Average | | | 7.92 | | | | 119.60 | | | | 133.80 | | | | — | |

| |

| | | Average Annual Total Returns

as of 6/30/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 17.54 | % | | | 18.03 | % | | | N/A | | | | 5.02% (8/22/06) | |

Class T | | | 18.11 | | | | 18.61 | | | | 5.54 | % | | | — | |

Russell 2000 Growth Index | | | 24.73 | | | | 20.50 | | | | 9.04 | | | | — | |

Russell 2000 Index | | | 23.64 | | | | 20.21 | | | | 8.70 | | | | — | |

Lipper Small-Cap Growth Funds Average | | | 22.44 | | | | 20.00 | | | | 8.50 | | | | — | |

| |

| | | Average Annual Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 2.57 | % | | | 14.75 | % | | | N/A | | | | 4.06% (8/22/06) | |

Class T | | | 3.01 | | | | 15.31 | | | | 5.73 | % | | | — | |

| | |

| 10 | | The TARGET Portfolio Trust |

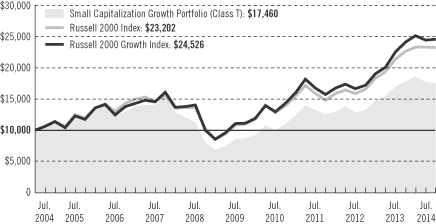

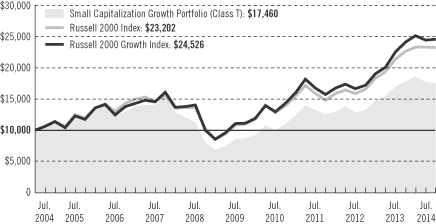

Growth of a $10,000 Investment

Small Capitalization Growth Portfolio

The graph compares a $10,000 investment in the Target Small Capitalization Growth Portfolio (Class T) with a similar investment in the Russell 2000 Index and the Russell 2000 Growth Index by portraying the initial account values at the beginning of the 10-year period (July 31, 2004) and the account values at the end of the current fiscal period (July 31, 2014), as measured on a quarterly basis.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Portfolio’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Portfolio or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

Inception returns are provided for any share class with less than 10 calendar years of returns.

| | | | |

| The TARGET Portfolio Trust | | | 11 | |

Target Small Capitalization Growth Portfolio

Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | |

| | | Class R | | Class T |

Maximum initial sales charge | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or sale proceeds) | | None | | None |

Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | .75% (.50% currently) | | None |

Benchmark Definitions

Russell 2000 Growth Index

The Russell 2000 Growth Index is an unmanaged index which contains those securities in the Russell 2000 Index with an above-average growth orientation. Companies in this index generally have higher price-to-book and price-to-earnings ratios.

Russell 2000 Index

The Russell 2000 Index is an unmanaged index of the stocks of the 2,000 smallest U.S. companies included in the Russell 3000 Index. It gives an indication of how the stock prices of smaller companies have performed.

Lipper Small-Cap Growth Funds Average

Lipper Small-Cap Growth funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s U.S. Diversified Equity (USDE) small-cap ceiling. Small-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share-growth value compared with the S&P SmallCap 600 Index.

Benchmark Inception Returns

Small Capitalization Growth Portfolio—Russell 2000 Growth Index Closest Month-End to Inception cumulative total return as of 7/31/14 is 91.45% for Class R. Russell 2000 Growth Index Closest Month-End to Inception average annual total return as of 6/30/14 is 9.51% for Class R. Russell 2000 Index Closest Month-End to Inception cumulative total return as of 7/31/14 is 73.24% for Class R. Russell 2000 Index Closest Month-End to Inception average annual total return as of 6/30/14 is 8.13% for Class R. Lipper Average Closest Month-End to Inception cumulative total return as of 7/31/14 is 84.22% for Class R. Lipper Average Closest Month-End to Inception average annual total return as of 6/30/14 is 8.82% for Class R.

Investors cannot invest directly in an index or average. The returns for the benchmark indexes would be lower if they reflected deduction for portfolio operating expenses, sales charges, or taxes.

The Lipper Average represents returns based on an average of all funds in the respective Lipper category for the periods noted. The returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | |

| 12 | | The TARGET Portfolio Trust |

Strategy and Performance Overview

How did the Portfolio perform?

The Small Capitalization Growth Portfolio’s Class T shares rose 3.01% for the 12-month period ended July 31, 2014. This compares to the 8.93% return of the Russell 2000® Growth Index (the Index) and the 7.92% return of the Lipper Small-Cap Growth Funds Average.

The Portfolio was sub-advised during the reporting period by Eagle Asset Management, Inc. (Eagle) and Emerald Mutual Fund Advisers Trust (Emerald).

What were market conditions?

During the reporting period, the overall stock market advanced, reflecting sustained improvement in the U.S. economic outlook. Corporate profits remained strong, housing and employment indicators improved, and consumer confidence rose to post-recession highs. The Federal Reserve (Fed) began incrementally tapering its quantitative easing program in December 2013, signaling confidence in U.S. economic activity and labor market conditions. U.S. GDP contracted in the first quarter of 2014, largely because of severe winter weather, but rebounded in the second quarter.

Small-cap stocks with the highest forecast long-term growth were the best performers in January and February, followed by inexpensive stocks in March. During the first and second quarters of 2014, small-capitalization stocks were the worst performers of all capitalization ranges. Investors then began to favor value-style stocks. Healthcare was one of the best performing sectors led by continued strength from the biotechnology industry, while financial services and consumer discretionary lagged other sectors.

What affected the Portfolio’s performance?

| | • | | The Portfolio trailed the Index, largely because of its holdings in the information technology, healthcare, and energy sectors. In particular, investments in the Internet software and services and biotechnology industries hampered results. |

| | • | | Most of the Portfolio’s relative underperformance can be attributed to Eagle’s and Emerald’s positions in Internet software and services companies that fell short of earnings growth expectations during the second quarter of 2014. |

| | • | | In addition, Eagle did not own many of the high-priced, high-growth biotechnology companies that outperformed during the reporting period. Conversely, Emerald’s biotechnology holdings performed well in November and December 2013. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| The TARGET Portfolio Trust | | | 13 | |

Strategy and Performance Overview (continued)

| | • | | Although sector allocation does not generally play a role in managing the Portfolio, a slight underweight relative to the Index in the information technology sector hurt performance. |

| | • | | The Portfolio’s exposure to larger market-cap securities and to those more actively traded companies had a positive impact. An underexposure to less leveraged and less risky companies were a slight drag on performance. |

| | • | | On the positive side, the Portfolio’s marginal overweight in the energy sector added to relative returns. Its exposure to larger-cap stocks also enhanced performance. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 14 | | The TARGET Portfolio Trust |

Target Small Capitalization Value Portfolio

Performance (Unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | | | | | | | |

| | | Cumulative Total Returns as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | N/A | | | | N/A | | | | N/A | | | | 1.68% (2/14/14) | |

Class R | | | 10.57 | % | | | 112.27 | % | | | N/A | | | | 84.92 (8/22/06) | |

Class T | | | 11.18 | | | | 117.69 | | | | 169.78 | % | | | — | |

Russell 2000® Value Index | | | 8.18 | | | | 108.48 | | | | 117.31 | | | | — | |

Russell 2000 Index | | | 8.56 | | | | 115.11 | | | | 132.02 | | | | — | |

Lipper Small-Cap Value Funds Average | | | 10.18 | | | | 115.84 | | | | 130.11 | | | | — | |

Lipper Small-Cap Core Funds Average | | | 9.78 | | | | 113.85 | | | | 134.73 | | | | — | |

| |

| | | Average Annual Total Returns as of 6/30/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | N/A | | | | N/A | | | | N/A | | | | N/A (2/14/14) | |

Class R | | | 23.01 | % | | | 19.49 | % | | | N/A | | | | 8.85% (8/22/06) | |

Class T | | | 23.64 | | | | 20.09 | | | | 10.59 | % | | | — | |

Russell 2000 Value Index | | | 22.54 | | | | 19.88 | | | | 8.24 | | | | — | |

Russell 2000 Index | | | 23.64 | | | | 20.21 | | | | 8.70 | | | | — | |

Lipper Small-Cap Value Funds Average | | | 23.67 | | | | 20.28 | | | | 8.71 | | | | — | |

Lipper Small-Cap Core Funds Average | | | 23.73 | | | | 19.79 | | | | 8.88 | | | | — | |

| |

| | | Average Annual Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | N/A | | | | N/A | | | | N/A | | | | N/A (2/14/14) | |

Class R | | | 10.57 | % | | | 16.25 | % | | | N/A | | | | 8.05% (8/22/06) | |

Class T | | | 11.18 | | | | 16.83 | | | | 10.43 | % | | | — | |

| | | | |

| The TARGET Portfolio Trust | | | 15 | |

Target Small Capitalization Value Portfolio

Performance (continued)

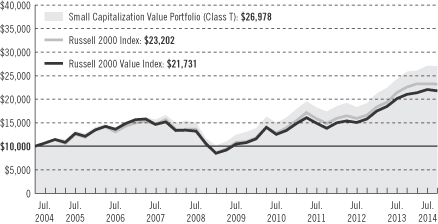

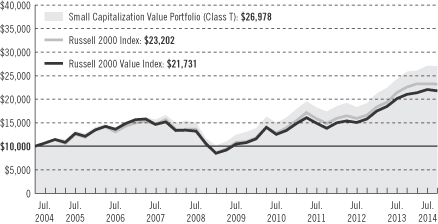

Growth of a $10,000 Investment

Small Capitalization Value Portfolio

The graph compares a $10,000 investment in the Target Small Capitalization Value Portfolio (Class T) with a similar investment in the Russell 2000 Index and the Russell 2000 Value Index by portraying the initial account values at the beginning of the 10-year period (July 31, 2004) and the account values at the end of the current fiscal period (July 31, 2014), as measured on a quarterly basis.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Portfolio’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Portfolio or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

Inception returns are provided for any share class with less than 10 calendar years of returns.

| | |

| 16 | | The TARGET Portfolio Trust |

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | |

| | | Class A | | Class R | | Class T |

Maximum initial sales charge | | 5.50% of the public Offering price | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or sale proceeds) | | 1% on sales of $1 million or more made within 12 months of purchase | | None | | None |

Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | .30% (.25% currently) | | .75% (.50% currently) | | None |

Benchmark Definitions

Russell 2000 Value Index

The Russell 2000 Value Index is an unmanaged index which contains those securities in the Russell 2000 Index with a below-average growth orientation. Companies in this index generally have lower price-to-earnings ratios, higher dividend yields, and lower forecasted growth values.

Russell 2000 Index

The Russell 2000 Index is an unmanaged index of the stocks of the 2,000 smallest U.S. companies included in the Russell 3000 Index. It gives an indication of how the stock prices of smaller companies have performed.

Lipper Small-Cap Value Funds Average

Lipper Small-Cap Value funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s USDE small-cap ceiling. Small-cap value funds typically have a below-average price-to-earnings ratio, price-to-book ratio, and a three-year sales-per-share growth value, compared to the S&P SmallCap 600 Index. Although Lipper classifies the Portfolio in the Lipper Small-Cap Core Funds Performance Universe, returns for the Lipper Small-Cap Value Funds Performance Universe are also shown because the Portfolio’s manager believes that the funds included in the Lipper Small-Cap Value Funds Performance Universe provide a more appropriate basis for Portfolio performance comparisons.

Lipper Small-Cap Core Funds Average

Lipper Small-Cap Core funds invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s U.S. Diversified Equity (USDE) small-cap ceiling. Small-cap core funds typically have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share-growth value, compared to the S&P SmallCap 600 Index.

| | | | |

| The TARGET Portfolio Trust | | | 17 | |

Target Small Capitalization Value Portfolio

Performance (continued)

Benchmark Inception Returns

Small Capitalization Value Portfolio—Russell 2000 Value Index Closest Month-End to Inception cumulative total returns as of 7/31/14 are 1.84% for Class A and 55.71% for Class R. Russell 2000 Value Index Month-End to Inception average annual total return as of 6/30/14 is 6.66% for Class R. Russell 2000 Index Closest Month-End to Inception cumulative total returns as of 7/31/14 are –0.30% for Class A and 73.24% for Class R. Russell 2000 Index Closest Month-End to Inception average annual total return as of 6/30/14 is 8.13% for Class R. Lipper Small-Cap Value Funds Average Closest Month-End to Inception cumulative total returns as of 7/31/14 are 2.84% for Class A and 72.12% for Class R. Lipper Small-Cap Value Funds Average Closest Month-End to Inception average annual total return as of 6/30/14 is 7.83% for Class R. Lipper Small-Cap Core Funds Average Closest Month-End to Inception cumulative total returns as of 7/31/14 are 1.81% for Class A and 76.16% for Class R. Lipper Small-Cap Core Funds Average Closest Month-End to Inception average annual total return as of 6/30/14 is 8.20% for Class R. Class A shares have been in existence for less than one year and have no average annual total return performance information available.

Investors cannot invest directly in an index or average. The returns for the benchmark indexes would be lower if they reflected deduction for portfolio operating expenses, sales charges, or taxes.

The Lipper Averages represent returns based on an average of all funds in the respective Lipper categories for the periods noted. The returns for the Lipper averages reflect the deduction of operating expenses, but not sales charges or taxes.

| | |

| 18 | | The TARGET Portfolio Trust |

Strategy and Performance Overview

How did the Portfolio perform?

The Small Capitalization Value Portfolio’s Class T shares returned 11.18% for the 12-month period ended July 31, 2014. This compares to the 8.18% return of its benchmark, the Russell 2000® Value Index (the Index), the 9.78% return of the Lipper Small-Cap Core Funds Average, and the 10.18% return of the Lipper Small Cap Value Funds Average.

The Portfolio was sub-advised during this reporting period by EARNEST Partners, LLC; Lee Munder Capital Group, LLC (Lee Munder); J.P. Morgan Investment Management, Inc. (J.P. Morgan); NFJ Investment Group LLC (NFJ); Vaughan Nelson Investment Management, L.P. (Vaughan Nelson); and Sterling Capital Management LLC (Sterling was added as a subadviser in January 2014).

What were market conditions?

During the reporting period, the overall stock market advanced, reflecting sustained improvement in the U.S. economic outlook. Corporate profits remained strong, housing and employment indicators improved, and consumer confidence rose to post-recession highs. The Federal Reserve (Fed) began incrementally tapering its quantitative easing program in December 2013, signaling confidence in U.S. economic activity and labor market conditions. U.S. GDP contracted in the first quarter of 2014, largely because of severe winter weather, but rebounded in the second quarter.

Small cap stocks underperformed mid-cap and large-cap stocks, while growth-oriented stocks outperformed value-oriented stocks. Nine of the 10 sectors in the Index generated positive returns, with healthcare, energy, and materials posting double-digit gains. The telecommunication services sector recorded a double-digit decline.

What affected the Portfolio’s performance?

| | • | | The Portfolio’s outperformance was driven mostly by positive, broad-based stock selection, but sector allocation helped, too. In particular, the Portfolio benefited from an overweight to the healthcare sector (which was the Index’s best performing area) and an underweight to financials (which was an area of weakness). The Portfolio’s cash holdings was a modest drag on relative results, which is not unexpected given the benchmark’s sound gains and the fact that cash earned little over the reporting period. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| The TARGET Portfolio Trust | | | 19 | |

Strategy and Performance Overview (continued)

| | • | | Of the investment subadvisers that comprise the Portfolio, all but Lee Munder posted results that exceed the Index. Lee Munder’s performance modestly trailed the Index. Please note that in January 2014, Sterling Capital was added to the Portfolio. As a result, their performance does not reflect an entire year. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 20 | | The TARGET Portfolio Trust |

Target International Equity Portfolio

Performance (Unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | | | | | | | |

| | | Cumulative Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class Q | | | 10.53 | % | | | N/A | | | | N/A | | | | 17.92% (3/1/11) | |

Class R | | | 9.84 | | | | 45.54 | % | | | N/A | | | | 24.94 (8/22/06) | |

Class T | | | 10.42 | | | | 49.20 | | | | 101.62 | % | | | — | |

MSCI EAFE ND Index | | | 15.07 | | | | 56.67 | | | | 98.08 | | | | — | |

Lipper Customized Blend Funds Average | | | 12.64 | | | | 53.57 | | | | 93.64 | | | | — | |

Lipper International Multi-Cap Core Funds Average | | | 12.52 | | | | 54.80 | | | | 91.00 | | | | — | |

| |

| | | Average Annual Total Returns

as of 6/30/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class Q | | | 20.37 | % | | | N/A | | | | N/A | | | | 5.93% (3/1/11) | |

Class R | | | 19.67 | | | | 10.49 | % | | | N/A | | | | 3.23 (8/22/06) | |

Class T | | | 20.26 | | | | 11.03 | | | | 7.22 | % | | | — | |

MSCI EAFE ND Index | | | 23.57 | | | | 11.77 | | | | 6.93 | | | | — | |

Lipper Customized Blend Funds Average | | | 21.12 | | | | 11.49 | | | | 6.74 | | | | — | |

Lipper International Multi-Cap Core Funds Average | | | 21.02 | | | | 11.71 | | | | 6.66 | | | | — | |

| |

| | | Average Annual Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class Q | | | 10.53 | % | | | N/A | | | | N/A | | | | 4.94% (3/1/11) | |

Class R | | | 9.84 | | | | 7.80 | % | | | N/A | | | | 2.84 (8/22/06) | |

Class T | | | 10.42 | | | | 8.33 | | | | 7.26 | % | | | — | |

| | | | |

| The TARGET Portfolio Trust | | | 21 | |

Target International Equity Portfolio

Performance (continued)

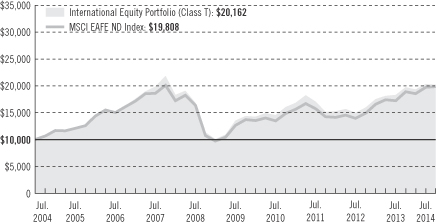

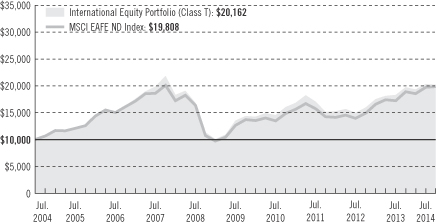

Growth of a $10,000 Investment

International Equity Portfolio

The graph compares a $10,000 investment in the Target International Equity Portfolio (Class T) with a similar investment in the Morgan Stanley Capital International Europe, Australasia, Far East Net Dividend Index (MSCI EAFE ND Index) by portraying the initial account values at the beginning of the 10-year period (July 31, 2004) and the account values at the end of the current fiscal period (July 31, 2014), as measured on a quarterly basis.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Portfolio’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Portfolio or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

Inception returns are provided for any share class with less than 10 calendar years of returns.

| | |

| 22 | | The TARGET Portfolio Trust |

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | |

| | | Class Q | | Class R | | Class T |

Maximum initial sales charge | | None | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or sale proceeds) | | None | | None | | None |

Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | None | | .75% (.50% currently) | | None |

Benchmark Definitions

Morgan Stanley Capital International Europe, Australasia, and Far East Net Dividend Index

The Morgan Stanley Capital International Europe, Australasia, and Far East Net Dividend Index (MSCI EAFE ND Index) is an unmanaged, weighted index that reflects stock price movements of developed country markets in Europe, Australasia, and the Far East. It gives an indication of how foreign stocks have performed. The MSCI EAFE Index reflects the impact of the maximum withholding taxes on reinvested dividends.

Lipper Customized Blend Funds Average

The Lipper Customized Blend Funds Average is a 50/50 blend of the Lipper International Multi-Cap Core Funds and Lipper International Large-Cap Core Funds Averages. Although Lipper classifies the Portfolio in the Lipper International Multi-Cap Core Funds Performance Universe, returns for the Lipper Customized Blend Funds Performance Universe are also shown because the Portfolio’s manager believes that the funds included in this custom blend universe provide a more appropriate basis for Portfolio performance comparisons.

Lipper International Multi-Cap Core Funds Average

Lipper International Multi-Cap Core funds invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. International multi-cap core funds typically have an average price-to-cash flow ratio, price-to-book ratio, and three-year sales-per-share growth value compared to the MSCI EAFE Index.

Benchmark Inception Returns

International Equity Portfolio—MSCI EAFE ND Index Closest Month-End to Inception cumulative total returns as of 7/31/14 are 22.94% for Class Q and 28.41% for Class R. MSCI EAFE ND Index Closest Month-End to Inception average annual total returns as of 6/30/14 are 7.03% for Class Q and 3.51% for Class R. Lipper Customized Blend Funds Average Closest Month-End to Inception cumulative total returns as of 7/31/14 are 20.25% for Class Q and 26.57% for Class R. Lipper Customized Blend Funds Average Closest Month-End to Inception average annual total returns as of 6/30/14 are 6.41% for Class Q and 3.28% for Class R. Lipper International Multi-Cap Core Funds Average Closest Month-End to Inception cumulative total returns as of 7/31/14 are 20.38% for Class Q and 25.96% for Class R. Lipper International Multi-Cap Core Funds Average Closest Month-End to Inception average annual total returns as of 6/30/14 are 6.58% for Class Q and 3.32% for Class R.

| | | | |

| The TARGET Portfolio Trust | | | 23 | |

Target International Equity Portfolio

Performance (continued)

Investors cannot invest directly in an index or average. The returns for the benchmark indexes would be lower if they reflected deductions for portfolio operating expenses, sales charges, or taxes.

The Lipper Averages represent returns based on an average of all funds in the respective Lipper categories for the periods noted. The returns for the Lipper averages reflect the deduction of operating expenses, but not sales charges or taxes.

| | |

| 24 | | The TARGET Portfolio Trust |

Strategy and Performance Overview

How did the Portfolio perform?

The International Equity Portfolio’s Class T shares returned 10.42% for the 12-month period ended July 31, 2014. This compares to the 15.07% return of the MSCI EAFE (Europe, Australasia, and Far East) Net Dividend Index (the Index), the 12.52% return of the Lipper International Multi-Cap Core Funds Average, and the 12.64% return of the Lipper Customized Blend Funds Average for the 12-month period ended July 31, 2014.

The Portfolio was sub-advised during the reporting period by LSV Asset Management (LSV) and Thornburg Investment Management, Inc. (Thornburg).

What were market conditions?

Investors seemed optimistic during the reporting period in spite of global geopolitical turmoil, including tensions between Russia and the Ukraine and the sectarian uprising in Iraq. Positive sentiment was driven by continued assurances from the U.S. Federal Reserve (Fed) and the European Central Bank that interest rates would remain low, which lifted several global equity indexes toward multi-year highs and sent volatility to historic lows. The number of mergers and acquisitions contributed to investors’ positive mood, as more than $1 trillion in deals have recently taken place.

During the reporting period, all international regions and sectors in the Index turned in positive returns, led by strength in the healthcare, energy, and information technology sectors. From a regional perspective, Western Europe (led by the U.K.) delivered the best results within the Index. Emerging markets stocks also performed well, posting gains during the 2014 calendar year through July 31, 2014.

What affected the Portfolio’s performance?

| | • | | The Portfolio underperformed the Index during the reporting period, because of allocation effects and stock selection. An overweight position in consumer discretionary, the worst-performing sector in the Index, detracted from relative performance. In addition, the Portfolio’s holdings failed to keep up with Index returns. |

| | • | | The Portfolio experienced similar results in the consumer staples and information technology sectors, as it failed to keep pace with each sector’s Index returns. On a positive note, the Portfolio’s stock selection was very strong in the utilities sector, which added to relative performance. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| The TARGET Portfolio Trust | | | 25 | |

Strategy and Performance Overview (continued)

| | • | | From a regional standpoint, stock selection in Western Europe hurt results, while the Portfolio’s holdings in the Pacific Rim and North America had a neutral and positive impact, respectively, on performance versus the Index. |

| | • | | The LSV portion of the Portfolio outperformed the Index as a result of allocation and stock selection. Returns were strongest in the consumer discretionary, financials, and telecommunications services sectors. From a country perspective, LSV benefited most from its holdings in Japan, Switzerland, and Spain. |

| | • | | The Thornburg portion of the Portfolio underperformed, with security selection trailing the Index in nine out of 10 sectors. The largest areas of weakness were in the consumer discretionary, financials, and information technology sectors. In financials, what the Portfolio didn’t hold hurt performance the most. For example, Thornburg was underweight real estate securities, the best performing group within the financials sector. In country allocation, Thornburg’s underweight to Japan dampened relative returns, while its exposure to emerging markets such as Brazil and Mexico detracted significantly. |

Did the Portfolio use derivatives and how did they affect performance?

| | • | | Thornburg used currency forwards (a form of a derivative instrument) as a tool to hedge some of the currency risk from investing in non-U.S. stocks. During the reporting period, this foreign exchange hedging had a slightly positive effect on the Portfolio. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 26 | | The TARGET Portfolio Trust |

Target Total Return Bond Portfolio

Performance (Unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | | | | | | | |

| | | Cumulative Total Returns as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 2.80 | % | | | 25.23 | % | | | N/A | | | | 55.53% (8/22/06) | |

Class T | | | 3.39 | | | | 28.49 | | | | 76.43 | % | | | — | |

Barclays U.S. Aggregate Bond Index | | | 3.97 | | | | 24.42 | | | | 59.88 | | | | — | |

Lipper Core Bond Funds Average | | | 4.44 | | | | 29.24 | | | | 54.91 | | | | — | |

Lipper Corporate Debt BBB-Rated Funds Average | | | 6.93 | | | | 42.85 | | | | 75.35 | | | | — | |

| |

| | | Average Annual Total Returns as of 6/30/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 3.46 | % | | | 5.22 | % | | | N/A | | | | 5.85% (8/22/06) | |

Class T | | | 4.05 | | | | 5.76 | | | | 5.98 | % | | | — | |

Barclays U.S. Aggregate Bond Index | | | 4.37 | | | | 4.85 | | | | 4.93 | | | | — | |

Lipper Core Bond Funds Average | | | 4.93 | | | | 5.85 | | | | 4.56 | | | | — | |

Lipper Corporate Debt BBB-Rated Funds Average | | | 7.85 | | | | 8.21 | | | | 5.81 | | | | — | |

| |

| | | Average Annual Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class R | | | 2.80 | % | | | 4.60 | % | | | N/A | | | | 5.72% (8/22/06) | |

Class T | | | 3.39 | | | | 5.14 | | | | 5.84 | % | | | — | |

| | | | |

| The TARGET Portfolio Trust | | | 27 | |

Target Total Return Bond Portfolio

Performance (continued)

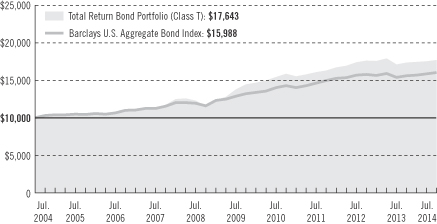

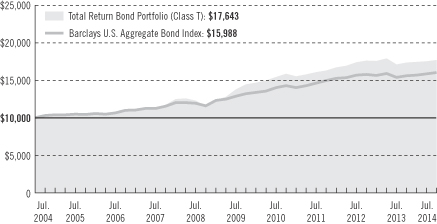

Growth of a $10,000 Investment

Total Return Bond Portfolio

The graph compares a $10,000 investment in the Target Total Return Bond Portfolio (Class T) with a similar investment in the Barclays U.S. Aggregate Bond Index by portraying the initial account values at the beginning of the 10-year period (July 31, 2004) and the account values at the end of the current fiscal period (July 31, 2014), as measured on a quarterly basis.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Portfolio’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Portfolio or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

Inception returns are provided for any share class with less than 10 calendar years of returns.

| | |

| 28 | | The TARGET Portfolio Trust |

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | |

| | | Class R | | Class T |

Maximum initial sales charge | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or sale proceeds) | | None | | None |

Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | .75% (.50% currently) | | None |

Benchmark Definitions

Barclays U.S. Aggregate Bond Index

The Barclays U.S. Aggregate Bond Index is an unmanaged index of investment-grade securities issued by the U.S. government and its agencies and by corporations with between one and 10 years remaining to maturity. It gives a broad indication of how bond prices of short- and intermediate-term bonds have performed.

Lipper Core Bond Funds Average

Lipper Core Bond funds invest at least 85% in domestic investment-grade debt issues (rated in the top four grades) with any remaining investment in non-benchmark sectors such as high yield, global and emerging market debt. These funds maintain dollar-weighted average maturities of five to ten years. Although Lipper classifies the Portfolio in the Lipper Corporate Debt BBB-Rated Funds Performance Universe, returns for the Lipper Core Bond Funds Performance Universe are also shown because the Portfolio’s manager believes that the funds included in the Lipper Core Bond Funds Performance Universe provide a more appropriate basis for Portfolio performance comparisons.

Lipper Corporate Debt BBB-Rated Funds Average

Lipper Corporate Debt BBB-Rated funds invest at least 65% of their assets in corporate and government debt issues rated in the top four grades.

Benchmark Inception Returns

Total Return Bond Portfolio—Barclays U.S. Aggregate Bond Index Closest Month-End to Inception cumulative total return as of 7/31/14 is 48.11% for Class R. Barclays U.S. Aggregate Bond Index Closest Month-End to Inception average annual total return as of 6/30/14 is 5.18% for Class R. Lipper Core Bond Funds Average Closest Month-End to Inception cumulative total return as of 7/31/14 is 44.90% for Class R. Lipper Core Bond Funds Average Closest Month-End to Inception average annual total return as of 6/30/14 is 4.84% for Class R. Lipper Corporate Debt BBB-Rated Funds Average Closest Month-End to Inception cumulative total return as of 7/31/14 is 61.88% for Class R. Lipper Corporate Debt BBB-Rated Funds Average Closest Month-End to Inception average annual total return as of 6/30/14 is 6.30% for Class R.

| | | | |

| The TARGET Portfolio Trust | | | 29 | |

Target Total Return Bond Portfolio

Performance (continued)

Investors cannot invest directly in an index or average. The returns for the benchmark indexes would be lower if they reflected deduction for portfolio operating expenses, sales charges, or taxes.

The Lipper Averages represent returns based on an average of all funds in the respective Lipper categories for the periods noted. The returns for the Lipper averages reflect the deduction of operating expenses, but not sales charges or taxes.

| | |

| 30 | | The TARGET Portfolio Trust |

Strategy and Performance Overview

How did the Portfolio perform?

The Total Return Bond Portfolio’s Class T shares returned 3.39% for the 12-month period ended July 31, 2014. This compares to the 3.97% return of the Barclays U.S. Aggregate Bond Index (the Index), the 4.44% return of the Lipper Core Bond Funds Average, and the 6.93% return of the Lipper Corporate Debt BBB-Rated Funds Average for the 12-month period ended July 31, 2014.

Pacific Investment Management Company LLC (PIMCO) managed the Portfolio during this reporting period.

What were market conditions?

The reporting period was dominated by news of global central bank policies, tighter spreads (yield differentials between bonds of comparable maturities), and rising geopolitical tensions.

| | • | | Global fixed income markets posted solid returns during the reporting period overall, benefiting from a decline in interest rates across most maturities and sentiment that the federal funds rate would remain low. |

| | • | | In January, the Federal Reserve (Fed) began to gradually exit its quantitative easing bond-buying program. The Fed reassured the markets that the federal funds rate would remain near zero until signs of sustainable economic growth were broadly evident. |

| | • | | Rising geopolitical tensions between Russia and the Ukraine led to increased volatility, particularly in the equity markets. |

| | • | | An uncharacteristically cold winter took a toll on the U.S. economy, leading to a contraction in first-quarter growth. Investors seemed to ignore the news, apparently trusting that a spring bounce-back was likely. |

| | • | | In the second quarter, improving global economic data, supportive central bank policy, and the easing of global political risks led to sizable equity market gains. Meanwhile, the strong momentum of the high yield market in the first half of 2014 reversed during July. After yields on high yield bonds reached all-time lows in June, investors appeared to focus on valuations despite continued strong fundamentals. |

| | • | | To spur business lending, the European Central Bank (ECB) announced new easing measures, including the introduction of a negative deposit rate and a cut in the key policy rate, as well as targeted long-term refinancing operations. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| The TARGET Portfolio Trust | | | 31 | |

Strategy and Performance Overview (continued)

What affected the Portfolio’s performance?

| | • | | The Portfolio’s yield curve positioning, specifically a focus on short-to-intermediate maturities coupled with an underweight to longer maturities, dampened performance as the yield curve flattened. |

| | • | | Interest rate exposures to non-U.S. economies contributed positively to returns. Among developed countries, the Portfolio’s exposures to Italy and Spain added to performance as rates declined on continuing support from the ECB. |

| | • | | The Portfolio’s mortgage exposure added to relative performance for the period. Although an underweight position in agency mortgage-backed securities (MBS) was negative, it was more than offset by the Portfolio’s allocation to non-agency MBS, which continued to benefit from limited supply and the housing sector recovery. |

| | • | | Other positive contributors to performance included the Portfolio’s exposure to Build America Bonds, as spreads tightened on investor demand for attractive yields. Holdings of Treasury inflation-protected securities (TIPS) also added to returns as breakeven inflation (the yield difference between nominal Treasury bonds and TIPS) rose over the period. |

| | • | | The Portfolio’s underweight position in the investment grade corporate sector detracted from returns as spreads generally narrowed; however, this was slightly offset by a focus on investment-grade credit and high yield financials, which outperformed the broader corporate sector during the period. |

| | • | | Modest currency exposure also contributed to returns for the period. In particular, the Portfolio benefited from its underweight position versus the euro starting in the second quarter of 2014, as the euro depreciated versus the U.S. dollar. |

Did the Portfolio use derivatives and how did they affect performance?

| | • | | Derivatives were used in the Portfolio and are instrumental in attaining specific exposures targeted to gain from anticipated market developments. The Portfolio’s U.S. duration positioning, which was negative for relative returns, was partly facilitated through the use of interest rate swaps. However, U.S. duration exposure gained through futures and swaptions contributed significantly to returns because of their positioning on the steepest portion of the yield curve. The Portfolio’s allocations to emerging markets local debt, which had a relatively neutral impact on performance, included exposure to local debt in Brazil and Mexico that was partially implemented through interest rate swaps. However, the Portfolio’s exposures to those two countries through sell protection credit default swaps was positive for performance, more than offsetting the negative contribution from interest rate swaps. Additionally, although the Portfolio’s corporate exposure was negative overall for performance, exposure gained through index credit default swaps was positive. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 32 | | The TARGET Portfolio Trust |

Target Intermediate-Term Bond Portfolio

Performance (Unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | | | |

| | | Cumulative Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | |

Class T | | | 1.80 | % | | | 24.98 | % | | | 69.15 | % |

Barclays Intermediate Govt./Credit Bond Index | | | 2.32 | | | | 20.28 | | | | 51.20 | |

Lipper Core Bond Funds Average | | | 4.44 | | | | 29.24 | | | | 54.91 | |

| |

| | | Average Annual Total Returns

as of 6/30/14 | |

| | | One Year | | | Five Years | | | Ten Years | |

Class T | | | 2.27 | % | | | 4.93 | % | | | 5.52 | % |

Barclays Intermediate Govt./Credit Bond Index | | | 2.86 | | | | 4.09 | | | | 4.33 | |

Lipper Core Bond Funds Average | | | 4.93 | | | | 5.85 | | | | 4.56 | |

| |

| | | Average Annual Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | |

Class T | | | 1.80 | % | | | 4.56 | % | | | 5.40 | % |

| | | | |

| The TARGET Portfolio Trust | | | 33 | |

Target Intermediate-Term Bond Portfolio

Performance (continued)

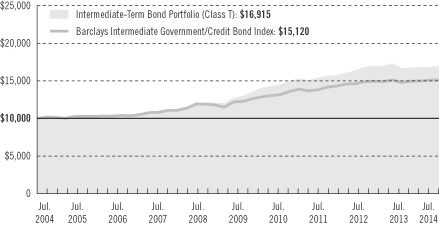

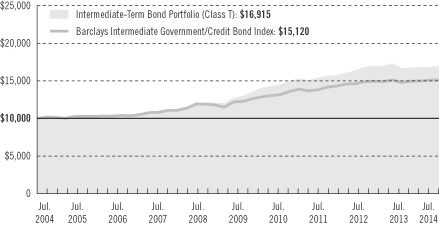

Growth of a $10,000 Investment

Intermediate-Term Bond Portfolio

The graph compares a $10,000 investment in the Target Intermediate-Term Bond Portfolio (Class T) with a similar investment in the Barclays Intermediate Government/Credit Bond Index by portraying the initial account values at the beginning of the 10-year period (July 31, 2004) and the account values at the end of the current fiscal period (July 31, 2014), as measured on a quarterly basis.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Portfolio’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Portfolio or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

Inception returns are provided for any share class with less than 10 calendar years of returns.

| | |

| 34 | | The TARGET Portfolio Trust |

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares. The average annual total returns take into account applicable sales charges, which are described in the table below.

| | |

| | | Class T |

Maximum initial sales charge | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or sale proceeds) | | None |

Annual distribution and service (12b-1) fees | | None |

Benchmark Definitions

Barclays Intermediate Government/Credit Bond Index

The Barclays Intermediate Government/Credit Bond Index is an unmanaged index of publicly traded U.S. government bonds and investment-grade corporate bonds with maturities of up to 10 years. It gives a broad indication of how intermediate-term bonds have performed.

Lipper Core Bond Funds Average

Lipper Core Bond funds invest at least 85% in domestic investment-grade debt issues (rated in the top four grades) with any remaining investment in non-benchmark sectors such as high yield, global and emerging market debt. These funds maintain dollar-weighted average maturities of five to ten years.

Investors cannot invest directly in an index or average. The returns for the benchmark indexes would be lower if they reflected deduction for portfolio operating expenses, sales charges, or taxes.

The Lipper Average represents returns based on an average of all funds in the respective Lipper category for the periods noted. The returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | | |

| The TARGET Portfolio Trust | | | 35 | |

Strategy and Performance Overview

How did the Portfolio perform?

The Intermediate-Term Bond Portfolio’s Class T shares returned 1.80% for the 12-month period ended July 31, 2014. This compares to the 2.32% return of the Barclays Intermediate Government/Credit Index (the Index) and the 4.44% return of the Lipper Core Bond Funds Average for the 12-month period ended July 31, 2014.

Pacific Investment Management Company LLC (PIMCO) managed the Portfolio during this reporting period.

What were market conditions?

The reporting period was dominated by news of global central bank policies, tighter spreads (yield differentials between bonds of comparable maturities), and rising geopolitical tensions.

| | • | | Global fixed income markets posted solid returns during the reporting period overall, benefiting from a decline in interest rates across most maturities and sentiment that the federal funds rate would remain low. |

| | • | | In January, the Federal Reserve (Fed) began to gradually exit its quantitative easing bond-buying program. The Fed reassured the markets that the federal funds rate would remain near zero until signs of sustainable economic growth were broadly evident. |

| | • | | Rising geopolitical tensions between Russia and the Ukraine led to increased volatility, particularly in the equity markets. |

| | • | | An uncharacteristically cold winter took a toll on the U.S. economy, leading to a contraction in first-quarter growth. Investors seemed to ignore the news, apparently trusting that a spring bounce-back was likely. |

| | • | | In the second quarter, improving global economic data, supportive central bank policy, and the easing of global political risks led to sizable equity market gains. Meanwhile, the strong momentum of the high yield market in the first half of 2014 reversed during July. After yields on high yield bonds reached all-time lows in June, investors appeared to focus on valuations despite continued strong fundamentals. |

| | • | | To spur business lending, the European Central Bank announced new easing measures, including the introduction of a negative deposit rate and a cut in the key policy rate, as well as targeted long-term refinancing operations. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | |

| 36 | | The TARGET Portfolio Trust |

What affected the Portfolio’s performance?

| | • | | The Portfolio’s U.S. interest rate strategies were neutral for performance. While yield curve positioning detracted from relative returns during the reporting period, positioning on the steepest part of the yield curve benefited from roll-down strategies. |

| | • | | The Portfolio was hurt by its defensive position in core eurozone interest rates, which declined during the period. This performance was partially offset by the Portfolio’s exposure to Australian interest rates as yields rallied. |

| | • | | Although an allocation to Brazilian interest rates slightly detracted from returns, select exposure to emerging markets external debt offset this impact as spreads narrowed. |

| | • | | An overall underweight to the broader corporate sector, as well as defensive positioning within high yield credit, hampered performance; however, this was partially offset by a focus on financials, which outperformed the broader corporate sector during the period. |

| | • | | The Portfolio’s mortgage exposure added to relative performance. More specifically, positioning and security selection within agency mortgage-backed securities (MBS) was modestly positive for performance, while the Portfolio’s allocation to non-agency MBS contributed substantially as these issues continued to rally amid limited supply and the ongoing housing recovery. A modest allocation to European residential mortgage-backed securities also enhanced results. |

| | • | | Other positive contributors to performance included the Portfolio’s exposure to Build America Bonds, as spreads tightened on investor demand for attractive yields. Exposure to the Brazilian real, which appreciated versus the U.S. dollar during the period, also added to results. |

Did the Portfolio use derivatives and how did they affect performance?

| | • | | Derivatives were used in the Portfolio and are instrumental in attaining specific exposures targeted to gain from anticipated market developments. The Portfolio’s U.S. interest rate positioning, which was neutral for relative returns, was partly facilitated through the use of interest rate swaps. However, U.S. duration exposure gained through swaptions contributed to returns because of their positioning on the steepest portion of the yield curve. The Portfolio’s exposure to core euro-zone interest rates, implemented through interest rate swaps, was negative for performance. Additionally, exposure to high yield corporate bonds gained through the use of index credit default swaps was negative for returns. |

The Portfolio of Investments following this report shows the size of the Portfolio’s positions at period-end.

| | | | |

| The TARGET Portfolio Trust | | | 37 | |

Target Mortgage-Backed Securities Portfolio

Performance (Unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | | | |

| | | Cumulative Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | |

Class T | | | 4.62 | % | | | 31.95 | % | | | 64.13 | % |

Barclays Mortgage-Backed Securities Index | | | 4.14 | | | | 19.49 | | | | 59.66 | |

Citigroup Mortgage-Backed Securities Index | | | 4.05 | | | | 19.81 | | | | 60.43 | |

Lipper U.S. Mortgage Funds Average | | | 3.93 | | | | 24.09 | | | | 51.06 | |

| |

| | | Average Annual Total Returns

as of 6/30/14 | |

| | | One Year | | | Five Years | | | Ten Years | |

Class T | | | 4.94 | % | | | 6.29 | % | | | 5.22 | % |

Barclays Mortgage-Backed Securities Index | | | 4.66 | | | | 3.92 | | | | 4.95 | |

Citigroup Mortgage-Backed Securities Index | | | 4.59 | | | | 3.97 | | | | 5.00 | |

Lipper U.S. Mortgage Funds Average | | | 4.10 | | | | 4.73 | | | | 4.27 | |

| |

| | | Average Annual Total Returns

as of 7/31/14 | |

| | | One Year | | | Five Years | | | Ten Years | |

Class T | | | 4.62 | % | | | 5.70 | % | | | 5.08 | % |

| | |

| 38 | | The TARGET Portfolio Trust |

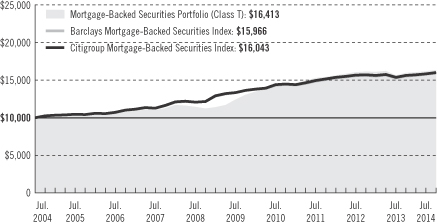

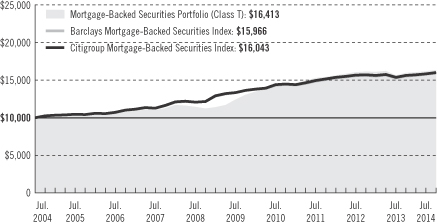

Growth of a $10,000 Investment

Mortgage Backed Securities Portfolio

The graph compares a $10,000 investment in the Target Mortgage-Backed Securities Portfolio (Class T) with a similar investment in the Barclays Mortgage-Backed Securities Index and the Citigroup Mortgage-Backed Securities Index by portraying the initial account values at the beginning of the 10-year period (July 31, 2004) and the account values at the end of the current fiscal period (July 31, 2014), as measured on a quarterly basis.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Portfolio’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Portfolio or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

Inception returns are provided for any share class with less than 10 calendar years of returns.

| | | | |

| The TARGET Portfolio Trust | | | 39 | |

Target Mortgage-Backed Securities Portfolio

Performance (continued)