UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-07064 |

| |

| Exact name of registrant as specified in charter: | | The Target Portfolio Trust |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 7/31/2015 |

| |

| Date of reporting period: | | 7/31/2015 |

Item 1 – Reports to Stockholders

PRUDENTIAL INVESTMENTS»MUTUAL FUNDS

TARGET INTERNATIONAL EQUITY PORTFOLIO

ANNUAL REPORT · JULY 31, 2015

Objective

Capital appreciation

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Portfolio’s securities are for the period covered by this report and are subject to change thereafter.

Mutual Funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company and member SIPC. © 2015 Prudential Financial, Inc. and its related entities. Prudential Investments LLC, Prudential, the Prudential logo, the Rock symbol, Bring Your Challenges, and Target Portfolio Trust are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

September 15, 2015

Dear Shareholder:

We hope you find the annual report for the Target International Equity Portfolio informative and useful. The report covers performance for the 12-month period that ended July 31, 2015.

We recognize that ongoing market volatility may make it a difficult time to be an investor. We continue to believe a prudent response to uncertainty is to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals.

Your financial advisor can help you stay informed of important developments and assist you in creating a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. Keep in mind, however, that diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

Prudential Investments® is dedicated to helping you solve your toughest investment challenges—whether it’s capital growth, reliable income, or protection from market volatility and other risks.

Thank you for your continued confidence.

Sincerely,

Stuart S. Parker, President

Target International Equity Portfolio

| | | | |

| Target International Equity Portfolio | | | 1 | |

Your Portfolio’s Performance (Unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | | | | | |

Cumulative Total Returns as of 7/31/15 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Class Q | | | 2.52 | % | | | N/A | | | | N/A | | | 20.89% (3/1/11) |

Class R | | | 1.88 | | | | 38.63 | % | | | N/A | | | 27.29 (8/22/06) |

Class T | | | 2.41 | | | | 42.13 | | | | 70.47 | % | | — |

MSCI EAFE ND Index | | | –0.27 | | | | 47.03 | | | | 63.16 | | | |

Lipper Customized Blend Funds Average* | | | –0.39 | | | | 43.48 | | | | 62.95 | | | |

Lipper International Multi-Cap Core Funds Average* | | | –0.10 | | | | 44.86 | | | | 62.51 | | | |

| | | | | | | | | | | | | | |

Average Annual Total Returns as of 6/30/15 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Class Q | | | –1.53 | % | | | N/A | | | | N/A | | | 4.16% (3/1/11) |

Class R | | | –2.16 | | | | 8.43 | % | | | N/A | | | 2.61 (8/22/06) |

Class T | | | –1.64 | | | | 8.97 | | | | 5.78 | % | | — |

MSCI EAFE ND Index | | | –4.22 | | | | 9.54 | | | | 5.12 | | | |

Lipper Customized Blend Funds Average* | | | –3.37 | | | | 9.31 | | | | 5.22 | | | |

Lipper International Multi-Cap Core Funds Average* | | | –3.30 | | | | 9.36 | | | | 5.05 | | | |

| | | | | | | | | | | | | | |

Average Annual Total Returns as of 7/31/15 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Class Q | | | 2.52 | % | | | N/A | | | | N/A | | | 4.39% (3/1/11) |

Class R | | | 1.88 | | | | 6.75 | % | | | N/A | | | 2.74 (8/22/06) |

Class T | | | 2.41 | | | | 7.28 | | | | 5.48 | % | | — |

*The Portfolio is compared to the Lipper Customized Blend Funds Performance Universe, although Lipper classifies the portfolio in the Lipper International Multi-Cap Core Funds Performance Universe. The Lipper Customized Blend Funds Performance Universe is utilized because the Fund’s manager believes that the funds included in this universe provide a more appropriate basis for fund performance comparisons.

| | |

| 2 | | Visit our website at www.prudentialfunds.com |

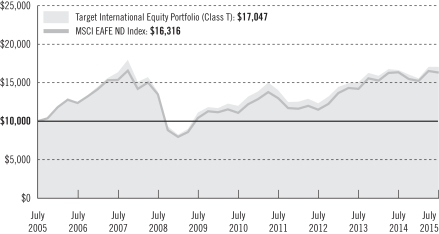

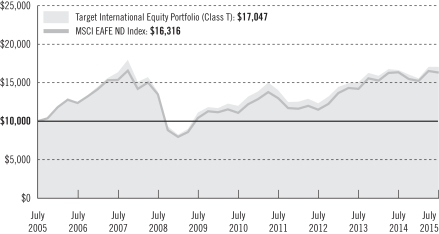

Growth of a $10,000 Investment

International Equity Portfolio

The graph compares a $10,000 investment in the Target International Equity Portfolio (Class T) with a similar investment in the Morgan Stanley Capital International Europe, Australasia, Far East Net Dividend Index (MSCI EAFE ND Index) by portraying the initial account values at the beginning of the 10-year period (July 31, 2005) and the account values at the end of the current fiscal year (July 31, 2015), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) the maximum applicable front-end sales charge was deducted from the initial $10,000 investment in Class T shares; (b) all recurring fees (including management fees) were deducted; and (c) all dividends and distributions were reinvested. The line graph provides information for Class T shares only. As indicated in the tables provided earlier, performance for Class Q and Class R shares will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Portfolio’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Portfolio or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

Inception returns are provided for any share class with less than 10 calendar years of returns.

| | | | |

| Target International Equity Portfolio | | | 3 | |

Your Portfolio’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or following the redemption of Portfolio shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | |

| | Class Q | | Class R | | Class T |

Maximum initial sales charge | | None | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or net asset value at redemption) | | None | | None | | None |

Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | None | | .75% (.50% currently) | | None |

Benchmark Definitions

Morgan Stanley Capital International Europe, Australasia, and Far East Net Dividend Index

The Morgan Stanley Capital International Europe, Australasia, and Far East Net Dividend Index (MSCI EAFE ND Index) is an unmanaged, weighted index that reflects stock price movements of developed country markets in Europe, Australasia, and the Far East. It gives an indication of how foreign stocks have performed. The MSCI EAFE Index reflects the impact of the maximum withholding taxes on reinvested dividends. The cumulative total returns for the MSCI EAFE ND Index measured from the month-end closest to the inception date for Class Q shares through 7/31/15 are 22.60% and 28.05% for Class R shares. The average annual total returns for the MSCI EAFE ND Index measured from the month-end closest to the inception date for Class Q shares through 6/30/15 are 4.32% and 2.60% for Class R shares.

Lipper Customized Blend Funds Average

The Lipper Customized Blend Funds Average is a 50/50 blend of the Lipper International Multi-Cap Core Funds and Lipper International Large-Cap Core Funds Averages. The cumulative total returns for the Lipper Customized Blend Funds Average measured from the month-end closest to the inception date for Class Q shares through 7/31/15 are 19.82% and 27.86% for Class R shares. The average annual total returns for the Lipper Customized Blend Funds Average measured from the month-end closest to the inception date for Class Q shares through 6/30/15 are 4.00% and 2.62% for Class R shares.

Lipper International Multi-Cap Core Funds Average

Lipper International Multi-Cap Core funds invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. International multi-cap core funds typically have an average price-to-cash flow ratio, price-to-book ratio, and three-year sales-per-share growth value compared to the MSCI EAFE Index. The cumulative total returns for the Lipper International Multi-Cap Core Funds Average measured from the month-end closest to the inception date for Class Q shares through 7/31/15 are 21.58% and 29.29% for Class R shares. The average annual total returns for the Lipper International Multi-Cap Core Funds Average measured from the month-end closest to the inception date for Class Q shares through 6/30/15 are 4.26% and 2.62% for Class R shares.

Investors cannot invest directly in an index or average. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Averages reflect the deduction of operating expenses, but not sales charges or taxes.

| | |

| 4 | | Visit our website at www.prudentialfunds.com |

Strategy and Performance Overview

How did the Portfolio perform?

The Target International Equity Portfolio’s Class T shares returned 2.41% for the 12 months ended July 31, 2015. This compares with the -0.27% return of the MSCI EAFE (ND) Index (the Index), the -0.10 % return of the Lipper International Multi-Cap Core Funds Average, and the -0.39% return of the Lipper Customized Blend Funds Average for the 12-month period ended July 31, 2015.

The Portfolio was subadvised during the reporting period by LSV Asset Management (LSV), Thornburg Investment Management, Inc. (Thornburg), and Lazard Asset Management LLC (Lazard). On October 28, 2014, Lazard replaced Thornburg as a subadviser.

What were market conditions?

The Greek negotiations, the drop in the Chinese stock market, and the likelihood of a Puerto Rico default brought no shortage of causes for concern during the reporting period. Fortunately, many of these events were contained and the overall markets sustained little damage. After heightened volatility in the latter half of 2014, crude oil prices eventually stabilized in the first quarter of 2015. Most developed economies continued to make gradual progress and the outlook for corporate earnings remained positive. However, concern over the impact of the strong dollar limited the Index’s progress somewhat, because of the variance between the US dollar and other currencies.

During the period, all international regions and a majority of sectors in the Index turned in small positive returns. Regarding sectors, the financials, consumer discretionary, health care, and industrials sectors were the strongest. From a regional perspective, nations in the Pacific Rim (led by Japan) delivered the biggest contribution within the Index. Emerging markets stocks were down; however, they posted gains later in the reporting period.

What affected the Portfolio’s performance?

| | • | | The Portfolio outperformed the Index during the reporting period, primarily due to stock selection. Sector allocation had a slightly positive effect on the Portfolio. An overweight position in energy, the worst-performing sector in the Index, detracted from relative performance. However, this was offset by an overweight to the consumer discretionary group, which was a strong performer. The Portfolio benefited from strong stock selection in the financials, health care, industrials, and technology sectors, which helped relative performance. On the downside, stock selection was weak in utilities. |

| | | | |

| Target International Equity Portfolio | | | 5 | |

Strategy and Performance Overview (continued)

| | • | | From a regional standpoint, the Portfolio’s holdings across the globe were beneficial. Stock selection in Western Europe, North America, and the Pacific Rim was quite strong. The UK, Japan, and the US contributed positively. |

| | • | | The LSV portion of the Portfolio outperformed the Index as a result of stock selection; sector allocation was negative. Returns were strongest in the financials, materials, and telecommunications services sectors. From a country perspective, LSV benefited most from its holdings in the UK and Japan. |

| | • | | The Lazard/Thornburg portion of the Portfolio outperformed due to both allocation and stock selection, which was positive in all but three sectors. The largest areas of strength were in the health care, industrials, financials, and information technology sectors. |

| | • | | Regarding allocation to sectors, an underweight position in two of the Index’s worst-performing groups, energy and materials, aided relative results. Additionally, an overweight to the Middle East (Israel) also contributed to relative returns. |

Did the Portfolio use derivatives and how did they affect performance?

| | • | | A former subadviser, Thornburg, used currency forwards (a form of a derivative instrument) as a tool to hedge some of the currency risk from investing in non-US stocks. This foreign exchange hedging had a slightly positive effect on the Portfolio. |

| | |

| 6 | | Visit our website at www.prudentialfunds.com |

Fees and Expenses (Unaudited)

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, and other Portfolio expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on February 1, 2015, at the beginning of the period, and held through the six-month period ended July 31, 2015. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following pages provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following pages provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Portfolio’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following pages. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential Investments funds, including the Portfolio, that

| | | | |

| Target International Equity Portfolio | | | 7 | |

Fees and Expenses (continued)

you own. You should consider the additional fees that were charged to your Portfolio account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Target International

Equity Portfolio | | Beginning Account

Value

February 1, 2015 | | | Ending Account

Value

July 31, 2015 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| | | | | | | | | | | | | | | | | | |

| Class Q | | Actual | | | $1,000.00 | | | | $1,094.10 | | | | 0.79 | % | | | $4.10 | |

| | | Hypothetical | | | $1,000.00 | | | | $1,020.88 | | | | 0.79 | % | | | $3.96 | |

| | | | | | | | | | | | | | | | | | |

| Class R | | Actual | | | $1,000.00 | | | | $1,091.10 | | | | 1.43 | % | | | $7.41 | |

| | | Hypothetical | | | $1,000.00 | | | | $1,017.70 | | | | 1.43 | % | | | $7.15 | |

| | | | | | | | | | | | | | | | | | |

| Class T | | Actual | | | $1,000.00 | | | | $1,093.30 | | | | 0.93 | % | | | $4.83 | |

| | | Hypothetical | | | $1,000.00 | | | | $1,020.18 | | | | 0.93 | % | | | $4.66 | |

*Portfolio expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 181 days in the six-month period ended July 31, 2015, and divided by the 365 days in the Portfolio’s fiscal year ended July 31, 2015 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Portfolio may invest.

The Portfolio’s annualized expense ratios for the 12-month period ended July 31, 2015, are as follows:

| | | | | | | | |

| Class | | Gross Operating Expenses | | | Net Operating Expenses | |

Q | | | 0.82 | % | | | 0.82 | % |

R | | | 1.70 | | | | 1.45 | |

T | | | 0.95 | | | | 0.95 | |

Net operating expenses shown above reflect any fee waivers and/or expense reimbursements. Additional information on Portfolio expenses and any fee waivers and/or expense reimbursements can be found in the “Financial Highlights” tables in this report and in the Notes to the Financial Statements in this report.

| | |

| 8 | | Visit our website at www.prudentialfunds.com |

Portfolio of Investments

as of July 31, 2015

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

LONG-TERM INVESTMENTS 96.7% | | | | | | | | |

| | |

COMMON STOCKS | | | | | | | | |

| | |

Australia 3.6% | | | | | | | | |

Ansell Ltd. | | | 98,662 | | | $ | 1,803,529 | |

Arrium Ltd. | | | 1,291,400 | | | | 113,121 | |

Ausdrill Ltd. | | | 166,700 | | | | 36,544 | |

Australia & New Zealand Banking Group Ltd. | | | 45,300 | | | | 1,080,337 | |

Bank of Queensland Ltd. | | | 165,969 | | | | 1,664,471 | |

Bendigo & Adelaide Bank Ltd. | | | 91,300 | | | | 875,878 | |

Bradken Ltd. | | | 227,100 | | | | 195,520 | |

Caltex Australia Ltd. | | | 131,987 | | | | 3,324,903 | |

Challenger Ltd. | | | 248,800 | | | | 1,301,652 | |

Downer EDI Ltd. | | | 288,000 | | | | 955,690 | |

Fortescue Metals Group Ltd.(a) | | | 355,100 | | | | 479,861 | |

Lend Lease Group | | | 178,100 | | | | 2,023,119 | |

Metcash Ltd.(a) | | | 637,800 | | | | 534,448 | |

Mineral Resources Ltd. | | | 75,100 | | | | 296,898 | |

National Australia Bank Ltd. | | | 58,968 | | | | 1,496,549 | |

Orica Ltd. | | | 66,800 | | | | 935,665 | |

Pacific Brands Ltd.* | | | 914,400 | | | | 279,852 | |

Primary Health Care Ltd.(a) | | | 260,000 | | | | 872,965 | |

Seven Group Holdings Ltd. | | | 171,300 | | | | 692,067 | |

Seven West Media Ltd. | | | 882,400 | | | | 582,507 | |

| | | | | | | | |

| | | | | | | 19,545,576 | |

| | |

Austria 0.7% | | | | | | | | |

OMV AG | | | 39,100 | | | | 1,039,094 | |

UNIQA Insurance Group AG | | | 147,640 | | | | 1,395,164 | |

Voestalpine AG | | | 29,800 | | | | 1,277,724 | |

| | | | | | | | |

| | | | | | | 3,711,982 | |

| | |

Belgium 2.0% | | | | | | | | |

AGFA-Gevaert NV* | | | 102,600 | | | | 308,406 | |

Anheuser-Busch InBev NV | | | 50,178 | | | | 5,995,349 | |

Delhaize Group | | | 25,400 | | | | 2,299,714 | |

KBC Groep NV | | | 33,920 | | | | 2,365,251 | |

| | | | | | | | |

| | | | | | | 10,968,720 | |

| | |

Brazil 0.2% | | | | | | | | |

BB Seguridade Participacoes SA | | | 136,400 | | | | 1,284,744 | |

See Notes to Financial Statements.

| | | | |

| Target International Equity Portfolio | | | 9 | |

Portfolio of Investments

as of July 31, 2015 continued

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Canada 0.9% | | | | | | | | |

Encana Corp. | | | 170,200 | | | $ | 1,293,564 | |

MacDonald, Dettwiler & Associates Ltd. | | | 34,500 | | | | 2,045,441 | |

National Bank of Canada | | | 47,700 | | | | 1,668,233 | |

| | | | | | | | |

| | | | | | | 5,007,238 | |

| | |

China 0.3% | | | | | | | | |

Poly Property Group Co. Ltd. | | | 794,000 | | | | 299,845 | |

Shougang Fushan Resources Group Ltd. | | | 1,824,000 | | | | 274,586 | |

TCL Communication Technology Holdings Ltd. | | | 1,365,000 | | | | 1,060,621 | |

| | | | | | | | |

| | | | | | | 1,635,052 | |

| | |

Denmark 1.0% | | | | | | | | |

A.P. Moeller - Maersk A/S (Class B Stock) | | | 700 | | | | 1,192,512 | |

Carlsberg A/S (Class B Stock) | | | 24,598 | | | | 2,143,113 | |

TDC A/S | | | 267,900 | | | | 2,020,971 | |

| | | | | | | | |

| | | | | | | 5,356,596 | |

| | |

Finland 1.3% | | | | | | | | |

Sampo Oyj (Class A Stock) | | | 79,793 | | | | 3,948,211 | |

Tieto Oyj | | | 41,200 | | | | 1,054,937 | |

UPM-Kymmene Oyj | | | 110,300 | | | | 2,037,433 | |

| | | | | | | | |

| | | | | | | 7,040,581 | |

| | |

France 8.6% | | | | | | | | |

Alstom SA* | | | 37,700 | | | | 1,107,223 | |

Arkema SA | | | 6,200 | | | | 483,134 | |

AXA SA | | | 74,000 | | | | 1,948,805 | |

BNP Paribas SA | | | 84,717 | | | | 5,510,606 | |

Cap Gemini SA | | | 43,924 | | | | 4,196,117 | |

Cie Generale des Etablissements Michelin | | | 22,600 | | | | 2,212,282 | |

CNP Assurances | | | 73,800 | | | | 1,240,335 | |

Credit Agricole SA | | | 124,000 | | | | 1,951,091 | |

Electricite de France | | | 101,200 | | | | 2,408,335 | |

Iliad SA | | | 4,059 | | | | 963,106 | |

Renault SA | | | 19,800 | | | | 1,822,741 | |

Sanofi | | | 47,800 | | | | 5,152,409 | |

SCOR SE | | | 42,800 | | | | 1,640,114 | |

Societe Generale SA | | | 31,700 | | | | 1,556,515 | |

Thales SA | | | 42,000 | | | | 2,838,258 | |

Total SA | | | 79,900 | | | | 3,942,498 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

France (cont’d.) | | | | | | | | |

Valeo SA | | | 37,435 | | | $ | 4,989,219 | |

Vinci SA | | | 52,109 | | | | 3,339,557 | |

| | | | | | | | |

| | | | | | | 47,302,345 | |

| | |

Germany 7.5% | | | | | | | | |

Allianz SE | | | 18,300 | | | | 2,997,768 | |

Aurubis AG | | | 3,600 | | | | 215,364 | |

BASF SE | | | 26,000 | | | | 2,246,778 | |

Bayer AG | | | 42,875 | | | | 6,331,627 | |

Bayerische Motoren Werke AG | | | 31,000 | | | | 3,108,543 | |

Continental AG | | | 8,661 | | | | 1,936,278 | |

Daimler AG | | | 50,600 | | | | 4,526,463 | |

Deutsche Bank AG | | | 67,000 | | | | 2,353,697 | |

Deutsche Lufthansa AG* | | | 60,200 | | | | 817,827 | |

E.ON SE | | | 54,400 | | | | 718,421 | |

Freenet AG | | | 48,100 | | | | 1,650,703 | |

Hannover Rueck SE | | | 19,500 | | | | 2,070,230 | |

Merck KGaA | | | 9,300 | | | | 946,406 | |

Muenchener Rueckversicherungs-Gesellschaft AG | | | 14,300 | | | | 2,628,030 | |

Rheinmetall AG | | | 18,900 | | | | 1,028,652 | |

RTL Group SA | | | 17,530 | | | | 1,593,111 | |

Siemens AG | | | 12,500 | | | | 1,339,324 | |

Stada Arzneimittel AG | | | 31,800 | | | | 1,224,060 | |

Volkswagen AG | | | 12,100 | | | | 2,447,409 | |

Wincor Nixdorf AG | | | 22,900 | | | | 972,975 | |

| | | | | | | | |

| | | | | | | 41,153,666 | |

| | |

Hong Kong 1.4% | | | | | | | | |

Cheung Kong Property Holdings Ltd.* | | | 97,000 | | | | 808,302 | |

China Resources Cement Holdings Ltd. | | | 2,098,000 | | | | 1,092,257 | |

CK Hutchison Holdings Ltd. | | | 97,000 | | | | 1,439,818 | |

Huabao International Holdings Ltd. | | | 1,087,000 | | | | 528,060 | |

Kingboard Chemical Holdings Ltd. | | | 292,680 | | | | 490,641 | |

Skyworth Digital Holdings Ltd. | | | 2,444,000 | | | | 1,866,625 | |

Yue Yuen Industrial Holdings Ltd. | | | 410,800 | | | | 1,335,366 | |

| | | | | | | | |

| | | | | | | 7,561,069 | |

| | |

Ireland 2.1% | | | | | | | | |

C&C Group PLC | | | 239,200 | | | | 932,064 | |

James Hardie Industries PLC | | | 156,367 | | | | 2,162,533 | |

See Notes to Financial Statements.

| | | | |

| Target International Equity Portfolio | | | 11 | |

Portfolio of Investments

as of July 31, 2015 continued

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Ireland (cont’d.) | | | | | | | | |

Permanent TSB Group Holdings PLC* | | | 486 | | | $ | 2,815 | |

Ryanair Holdings PLC, ADR | | | 23,585 | | | | 1,747,884 | |

Shire PLC | | | 45,673 | | | | 4,060,144 | |

Smurfit Kappa Group PLC | | | 82,300 | | | | 2,474,987 | |

| | | | | | | | |

| | | | | | | 11,380,427 | |

| | |

Israel 2.5% | | | | | | | | |

Bank Hapoalim BM | | | 182,600 | | | | 1,015,267 | |

Elbit Systems Ltd. | | | 16,000 | | | | 1,320,523 | |

Teva Pharmaceutical Industries Ltd. | | | 51,600 | | | | 3,540,278 | |

Teva Pharmaceutical Industries Ltd., ADR | | | 115,760 | | | | 7,989,755 | |

| | | | | | | | |

| | | | | | | 13,865,823 | |

| | |

Italy 1.6% | | | | | | | | |

A2A SpA | | | 1,000,700 | | | | 1,277,563 | |

Atlantia SpA | | | 74,353 | | | | 1,985,533 | |

Azimut Holding SpA | | | 88,801 | | | | 2,218,034 | |

Enel SpA | | | 361,000 | | | | 1,696,319 | |

Eni SpA | | | 104,300 | | | | 1,825,313 | |

| | | | | | | | |

| | | | | | | 9,002,762 | |

| | |

Japan 22.7% | | | | | | | | |

Alfresa Holdings Corp. | | | 44,100 | | | | 738,554 | |

Alpine Electronics, Inc. | | | 22,600 | | | | 372,342 | |

Aoyama Trading Co. Ltd. | | | 36,400 | | | | 1,446,082 | |

Aozora Bank Ltd. | | | 513,000 | | | | 1,968,471 | |

Asahi Kasei Corp. | | | 124,000 | | | | 941,941 | |

Bank of Yokohama Ltd. (The) | | | 156,000 | | | | 991,231 | |

Calsonic Kansei Corp. | | | 215,000 | | | | 1,568,275 | |

Daihatsu Motor Co. Ltd. | | | 101,200 | | | | 1,437,217 | |

Daikin Industries Ltd. | | | 40,900 | | | | 2,643,269 | |

Daiwa House Industry Co. Ltd. | | | 226,400 | | | | 5,631,067 | |

Don Quijote Holdings Co. Ltd. | | | 123,100 | | | | 5,247,825 | |

Enplas Corp. | | | 23,600 | | | | 950,810 | |

Fuji Oil Co. Ltd. | | | 105,300 | | | | 1,764,426 | |

Fujikura Ltd. | | | 223,000 | | | | 1,180,502 | |

Fuyo General Lease Co. Ltd. | | | 30,600 | | | | 1,282,287 | |

Heiwa Corp. | | | 71,500 | | | | 1,570,145 | |

Hogy Medical Co. Ltd. | | | 16,700 | | | | 811,816 | |

Isuzu Motors Ltd. | | | 249,400 | | | | 3,452,251 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Japan (cont’d.) | | | | | | | | |

Japan Airlines Co. Ltd. | | | 49,100 | | | $ | 1,852,497 | |

Japan Tobacco, Inc. | | | 77,400 | | | | 3,004,409 | |

JX Holdings, Inc. | | | 169,160 | | | | 721,091 | |

KDDI Corp. | | | 320,200 | | | | 8,128,620 | |

Keihin Corp. | | | 71,100 | | | | 1,009,757 | |

KYORIN Holdings, Inc. | | | 56,000 | | | | 1,090,896 | |

Kyowa Exeo Corp. | | | 78,200 | | | | 952,070 | |

Makita Corp. | | | 32,000 | | | | 1,766,630 | |

Marubeni Corp. | | | 247,900 | | | | 1,377,704 | |

Matsumotokiyoshi Holdings Co. Ltd. | | | 26,500 | | | | 1,278,950 | |

Medipal Holdings Corp. | | | 67,800 | | | | 1,207,176 | |

Megmilk Snow Brand Co. Ltd. | | | 27,100 | | | | 425,448 | |

Miraca Holdings, Inc. | | | 9,100 | | | | 418,848 | |

Mitsubishi Corp. | | | 58,300 | | | | 1,257,927 | |

Mitsubishi UFJ Financial Group, Inc. | | | 354,100 | | | | 2,576,817 | |

Mitsui & Co. Ltd. | | | 147,400 | | | | 1,912,544 | |

Mizuho Financial Group, Inc. | | | 977,800 | | | | 2,132,104 | |

Morinaga Milk Industry Co. Ltd. | | | 245,000 | | | | 1,001,742 | |

Nichi-iko Pharmaceutical Co. Ltd. | | | 44,700 | | | | 1,537,233 | |

Nichirei Corp. | | | 219,000 | | | | 1,428,796 | |

Nikkiso Co. Ltd. | | | 131,600 | | | | 1,274,413 | |

Nippon Telegraph & Telephone Corp. | | | 132,200 | | | | 5,091,384 | |

Nishi-Nippon City Bank Ltd. (The) | | | 254,300 | | | | 772,281 | |

Nissan Motor Co. Ltd. | | | 277,200 | | | | 2,637,428 | |

NTT DOCOMO, Inc. | | | 110,000 | | | | 2,322,687 | |

Otsuka Holdings Co. Ltd. | | | 30,100 | | | | 1,080,740 | |

Resona Holdings, Inc. | | | 483,700 | | | | 2,659,252 | |

Ricoh Co. Ltd. | | | 135,700 | | | | 1,338,782 | |

Sankyu, Inc. | | | 213,000 | | | | 1,208,864 | |

Seino Holdings Co. Ltd. | | | 82,000 | | | | 943,133 | |

Seven & I Holdings Co. Ltd. | | | 81,700 | | | | 3,769,751 | |

Shimachu Co. Ltd. | | | 36,500 | | | | 1,011,707 | |

Shizuoka Gas Co. Ltd. | | | 28,200 | | | | 202,079 | |

SKY Perfect JSAT Holdings, Inc. | | | 161,300 | | | | 809,690 | |

SoftBank Group Corp. | | | 56,200 | | | | 3,106,407 | |

Sony Corp. | | | 146,200 | | | | 4,144,247 | |

Sumitomo Corp. | | | 149,600 | | | | 1,698,307 | |

Sumitomo Metal Mining Co. Ltd. | | | 87,000 | | | | 1,169,736 | |

Sumitomo Mitsui Financial Group, Inc. | | | 169,000 | | | | 7,620,890 | |

Suzuken Co. Ltd. | | | 16,100 | | | | 569,668 | |

See Notes to Financial Statements.

| | | | |

| Target International Equity Portfolio | | | 13 | |

Portfolio of Investments

as of July 31, 2015 continued

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Japan (cont’d.) | | | | | | | | |

Toagosei Co. Ltd. | | | 101,700 | | | $ | 789,952 | |

Toho Holdings Co. Ltd. | | | 51,700 | | | | 1,285,931 | |

Tokai Rika Co. Ltd. | | | 88,400 | | | | 2,221,135 | |

Toppan Forms Co. Ltd. | | | 50,400 | | | | 683,630 | |

Toyo Tire & Rubber Co. Ltd. | | | 79,700 | | | | 1,746,745 | |

Toyoda Gosei Co. Ltd. | | | 56,200 | | | | 1,241,823 | |

Tsumura & Co. | | | 45,800 | | | | 960,228 | |

United Arrows Ltd. | | | 52,800 | | | | 2,105,106 | |

Yokohama Rubber Co. Ltd. (The) | | | 83,550 | | | | 1,652,379 | |

| | | | | | | | |

| | | | | | | 125,198,145 | |

| | |

Liechtenstein 0.1% | | | | | | | | |

VP Bank AG | | | 3,195 | | | | 277,740 | |

| | |

Netherlands 4.6% | | | | | | | | |

Aegon NV | | | 175,900 | | | | 1,352,976 | |

ING Groep NV, CVA* | | | 154,200 | | | | 2,622,500 | |

Koninklijke Ahold NV | | | 171,200 | | | | 3,407,181 | |

Koninklijke KPN NV | | | 829,332 | | | | 3,276,756 | |

NXP Semiconductors NV* | | | 20,721 | | | | 2,024,496 | |

Royal Dutch Shell PLC (Class A Stock) (AEX) | | | 4,300 | | | | 123,332 | |

Royal Dutch Shell PLC (Class A Stock) (XLON) | | | 96,238 | | | | 2,758,497 | |

Royal Dutch Shell PLC (Class B Stock) | | | 188,600 | | | | 5,460,910 | |

TKH Group NV | | | 21,500 | | | | 922,560 | |

Wolters Kluwer NV | | | 97,660 | | | | 3,232,410 | |

| | | | | | | | |

| | | | | | | 25,181,618 | |

| | |

New Zealand 0.3% | | | | | | | | |

Air New Zealand Ltd. | | | 825,600 | | | | 1,438,026 | |

| | |

Norway 1.6% | | | | | | | | |

DNB ASA | | | 94,500 | | | | 1,540,581 | |

Fred Olsen Energy ASA* | | | 11,700 | | | | 54,384 | |

Marine Harvest ASA | | | 116,300 | | | | 1,435,567 | |

Statoil ASA | | | 66,900 | | | | 1,127,844 | |

Telenor ASA | | | 136,528 | | | | 2,998,974 | |

Yara International ASA | | | 37,700 | | | | 1,875,733 | |

| | | | | | | | |

| | | | | | | 9,033,083 | |

| | |

Philippines 0.4% | | | | | | | | |

Alliance Global Group, Inc. | | | 4,579,300 | | | | 2,261,858 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Portugal 0.1% | | | | | | | | |

EDP-Energias de Portugal SA | | | 180,100 | | | $ | 666,145 | |

| | |

Singapore 0.8% | | | | | | | | |

DBS Group Holdings Ltd. | | | 168,000 | | | | 2,473,333 | |

United Overseas Bank Ltd. | | | 56,000 | | | | 906,560 | |

Wilmar International Ltd. | | | 399,800 | | | | 932,286 | |

| | | | | | | | |

| | | | | | | 4,312,179 | |

| | |

South Africa 0.3% | | | | | | | | |

Mondi PLC | | | 71,700 | | | | 1,721,168 | |

| | |

Spain 1.7% | | | | | | | | |

ACS Actividades de Construccion y Servicios SA | | | 22,600 | | | | 758,480 | |

Banco Santander SA | | | 211,617 | | | | 1,463,270 | |

Ebro Foods SA | | | 51,000 | | | | 1,017,226 | |

Gas Natural SDG SA | | | 28,800 | | | | 625,086 | |

Iberdrola SA | | | 361,300 | | | | 2,548,334 | |

Red Electrica Corporacion SA | | | 24,082 | | | | 1,922,942 | |

Repsol SA | | | 76,500 | | | | 1,285,689 | |

| | | | | | | | |

| | | | | | | 9,621,027 | |

| | |

Sweden 3.4% | | | | | | | | |

Assa Abloy AB (Class B Stock) | | | 199,884 | | | | 4,058,612 | |

Boliden AB | | | 87,100 | | | | 1,608,453 | |

Nordea Bank AB | | | 147,900 | | | | 1,841,478 | |

Securitas AB (Class B Stock) | | | 91,300 | | | | 1,310,598 | |

Swedbank AB (Class A Stock) | | | 231,959 | | | | 5,433,451 | |

Telefonaktiebolaget LM Ericsson (Class B Stock) | | | 203,600 | | | | 2,176,901 | |

TeliaSonera AB | | | 415,200 | | | | 2,523,264 | |

| | | | | | | | |

| | | | | | | 18,952,757 | |

| | |

Switzerland 6.7% | | | | | | | | |

Baloise Holding AG | | | 13,600 | | | | 1,732,756 | |

Bucher Industries AG | | | 5,600 | | | | 1,365,212 | |

Cembra Money Bank AG* | | | 23,400 | | | | 1,424,977 | |

Credit Suisse Group AG* | | | 262,234 | | | | 7,736,114 | |

Georg Fischer AG | | | 2,200 | | | | 1,467,071 | |

Glencore PLC* | | | 385,513 | | | | 1,249,102 | |

Helvetia Holding AG | | | 2,000 | | | | 1,097,476 | |

Novartis AG | | | 99,070 | | | | 10,279,921 | |

See Notes to Financial Statements.

| | | | |

| Target International Equity Portfolio | | | 15 | |

Portfolio of Investments

as of July 31, 2015 continued

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Switzerland (cont’d.) | | | | | | | | |

Oriflame Holding AG* | | | 17,400 | | | $ | 257,569 | |

Pargesa Holding SA | | | 18,200 | | | | 1,222,568 | |

Swiss Life Holding AG* | | | 10,100 | | | | 2,383,070 | |

Swiss Re AG | | | 40,700 | | | | 3,661,252 | |

UBS AG* | | | 2,600 | | | | 59,528 | |

Zurich Insurance Group AG* | | | 10,600 | | | | 3,227,802 | |

| | | | | | | | |

| | | | | | | 37,164,418 | |

| | |

Taiwan 0.6% | | | | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | | 150,300 | | | | 3,323,133 | |

| | |

Thailand 0.2% | | | | | | | | |

Krung Thai Bank PCL | | | 2,359,000 | | | | 1,171,301 | |

| | |

Turkey 0.4% | | | | | | | | |

Turkcell Iletisim Hizmetleri A/S | | | 479,793 | | | | 2,195,892 | |

| | |

United Kingdom 18.7% | | | | | | | | |

3i Group PLC | | | 209,500 | | | | 1,807,169 | |

Alent PLC | | | 54,000 | | | | 399,534 | |

Amec Foster Wheeler PLC | | | 45,400 | | | | 579,771 | |

Anglo American PLC | | | 180,019 | | | | 2,269,852 | |

AstraZeneca PLC | | | 23,500 | | | | 1,586,447 | |

Aviva PLC | | | 263,100 | | | | 2,139,307 | |

BAE Systems PLC | | | 459,800 | | | | 3,442,594 | |

Barclays PLC | | | 300,600 | | | | 1,355,594 | |

Barratt Developments PLC | | | 127,300 | | | | 1,259,828 | |

Beazley PLC | | | 313,989 | | | | 1,653,288 | |

Bellway PLC | | | 46,600 | | | | 1,751,067 | |

Berkeley Group Holdings PLC | | | 29,100 | | | | 1,528,208 | |

BG Group PLC | | | 144,437 | | | | 2,457,556 | |

Bovis Homes Group PLC | | | 75,100 | | | | 1,337,839 | |

BP PLC | | | 632,500 | | | | 3,896,021 | |

British American Tobacco PLC | | | 95,864 | | | | 5,692,010 | |

BT Group PLC | | | 272,500 | | | | 1,972,078 | |

Carillion PLC | | | 219,400 | | | | 1,184,236 | |

Centrica PLC | | | 349,500 | | | | 1,453,639 | |

Dairy Crest Group PLC | | | 80,900 | | | | 728,874 | |

Debenhams PLC | | | 507,900 | | | | 695,165 | |

Direct Line Insurance Group PLC | | | 297,326 | | | | 1,696,794 | |

DS Smith PLC | | | 156,000 | | | | 974,418 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

United Kingdom (cont’d.) | | | | | | | | |

GlaxoSmithKline PLC | | | 80,100 | | | $ | 1,740,967 | |

Go-Ahead Group PLC | | | 20,900 | | | | 831,196 | |

Home Retail Group PLC | | | 314,600 | | | | 802,283 | |

HSBC Holdings PLC | | | 306,500 | | | | 2,768,439 | |

Informa PLC | | | 328,216 | | | | 3,050,931 | |

Intermediate Capital Group PLC | | | 175,542 | | | | 1,595,619 | |

International Consolidated Airlines Group SA* | | | 229,297 | | | | 1,909,682 | |

J. Sainsbury PLC | | | 599,900 | | | | 2,478,039 | |

Lloyds Banking Group PLC | | | 6,127,516 | | | | 7,979,282 | |

Man Group PLC | | | 604,000 | | | | 1,531,564 | |

Marston’s PLC | | | 144,620 | | | | 352,544 | |

Old Mutual PLC | | | 524,912 | | | | 1,735,980 | |

Pace PLC | | | 166,100 | | | | 941,267 | |

Petrofac Ltd. | | | 52,900 | | | | 724,605 | |

Provident Financial PLC | | | 54,462 | | | | 2,522,463 | |

Prudential PLC | | | 248,965 | | | | 5,856,992 | |

Relex PLC | | | 200,041 | | | | 3,488,494 | |

Rexam PLC | | | 553,195 | | | | 4,801,545 | |

Rio Tinto Ltd. | | | 35,600 | | | | 1,367,656 | |

Tate & Lyle PLC | | | 167,200 | | | | 1,423,034 | |

Tullett Prebon PLC | | | 153,300 | | | | 968,956 | |

Unilever PLC | | | 61,601 | | | | 2,794,213 | |

Vesuvius PLC | | | 80,600 | | | | 514,078 | |

WH Smith PLC | | | 29,000 | | | | 715,118 | |

William Hill PLC | | | 449,939 | | | | 2,842,726 | |

WM Morrison Supermarkets PLC | | | 693,300 | | | | 1,972,929 | |

Wolseley PLC | | | 53,445 | | | | 3,548,528 | |

| | | | | | | | |

| | | | | | | 103,120,419 | |

| | |

United States 0.4% | | | | | | | | |

Aon PLC | | | 21,730 | | | | 2,189,732 | |

Boart Longyear Ltd.* | | | 93,300 | | | | 7,843 | |

| | | | | | | | |

| | | | | | | 2,197,575 | |

| | | | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $497,677,254) | | | | | | | 532,653,065 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Target International Equity Portfolio | | | 17 | |

Portfolio of Investments

as of July 31, 2015 continued

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

SHORT-TERM INVESTMENT 2.3% | | | | | | | | |

| | |

AFFILIATED MONEY MARKET MUTUAL FUND | | | | | | | | |

Prudential Investment Portfolios 2 - Prudential Core Taxable Money Market Fund

(cost $12,526,740; includes $1,336,010 of cash collateral for securities on loan) (Note 3)(b)(c) | | | 12,526,740 | | | $ | 12,526,740 | |

| | | | | | | | |

TOTAL INVESTMENTS 99.0%

(cost $510,203,994; Note 5) | | | | | | | 545,179,805 | |

Other assets in excess of liabilities 1.0% | | | | | | | 5,458,783 | |

| | | | | | | | |

NET ASSETS 100.0% | | | | | | $ | 550,638,588 | |

| | | | | | | | |

The following abbreviations are used in the portfolio descriptions:

ADR—American Depositary Receipt

AEX—Amsterdam Exchange

XLON—London Stock Exchange

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $1,180,408; cash collateral of $1,336,010 (included in liabilities) was received with which the Portfolio purchased highly liquid short-term investments. Securities on loan are subject to contractual netting arrangements. |

| (b) | Represents security, or a portion thereof, purchased with cash collateral received for securities on loan. |

| (c) | Prudential Investments LLC, the manager of the Portfolio, also serves as manager of the Prudential Investment Portfolios 2 - Prudential Core Taxable Money Market Fund. |

Various inputs are used in determining the value of the Portfolio’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

See Notes to Financial Statements.

The following is a summary of the inputs used as of July 31, 2015 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Australia | | $ | — | | | $ | 19,545,576 | | | $ | — | |

Austria | | | — | | | | 3,711,982 | | | | — | |

Belgium | | | 308,406 | | | | 10,660,314 | | | | — | |

Brazil | | | 1,284,744 | | | | — | | | | — | |

Canada | | | 5,007,238 | | | | — | | | | — | |

China | | | — | | | | 1,635,052 | | | | — | |

Denmark | | | — | | | | 5,356,596 | | | | — | |

Finland | | | — | | | | 7,040,581 | | | | — | |

France | | | 963,106 | | | | 46,339,239 | | | | — | |

Germany | | | — | | | | 41,153,666 | | | | — | |

Hong Kong | | | 2,143,668 | | | | 5,417,401 | | | | — | |

Ireland | | | 2,682,763 | | | | 8,697,664 | | | | — | |

Israel | | | 9,310,278 | | | | 4,555,545 | | | | — | |

Italy | | | — | | | | 9,002,762 | | | | — | |

Japan | | | — | | | | 125,198,145 | | | | — | |

Liechtenstein | | | 277,740 | | | | — | | | | — | |

Netherlands | | | — | | | | 25,181,618 | | | | — | |

New Zealand | | | — | | | | 1,438,026 | | | | — | |

Norway | | | — | | | | 9,033,083 | | | | — | |

Philippines | | | — | | | | 2,261,858 | | | | — | |

Portugal | | | — | | | | 666,145 | | | | — | |

Singapore | | | — | | | | 4,312,179 | | | | — | |

South Africa | | | — | | | | 1,721,168 | | | | — | |

Spain | | | — | | | | 9,621,027 | | | | — | |

Sweden | | | — | | | | 18,952,757 | | | | — | |

Switzerland | | | 257,569 | | | | 36,906,849 | | | | — | |

Taiwan | | | 3,323,133 | | | | — | | | | — | |

Thailand | | | 1,171,301 | | | | — | | | | — | |

Turkey | | | — | | | | 2,195,892 | | | | — | |

United Kingdom | | | 2,577,861 | | | | 100,542,558 | | | | — | |

United States | | | 2,197,575 | | | | — | | | | — | |

Affiliated Money Market Mutual Fund | | | 12,526,740 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 44,032,122 | | | $ | 501,147,683 | | | $ | — | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Target International Equity Portfolio | | | 19 | |

Portfolio of Investments

as of July 31, 2015 continued

The industry classification of investments and other assets in excess of liabilities shown as a percentage of net assets as of July 31, 2015 were as follows (Unaudited):

| | | | |

Banks | | | 12.5 | % |

Insurance | | | 8.7 | |

Pharmaceuticals | | | 8.7 | |

Oil, Gas & Consumable Fuels | | | 5.1 | |

Automobiles | | | 3.5 | |

Diversified Telecommunication Services | | | 3.5 | |

Auto Components | | | 3.4 | |

Capital Markets | | | 3.4 | |

Wireless Telecommunication Services | | | 3.2 | |

Food & Staples Retailing | | | 2.9 | |

Food Products | | | 2.5 | |

Media | | | 2.3 | |

Affiliated Money Market Mutual Fund (including 0.2% of collateral for securities on loan) | | | 2.3 | |

Household Durables | | | 2.2 | |

Trading Companies & Distributors | | | 1.8 | |

Aerospace & Defense | | | 1.7 | |

Beverages | | | 1.7 | |

Real Estate Management & Development | | | 1.7 | |

Metals & Mining | | | 1.6 | |

Electric Utilities | | | 1.6 | |

Containers & Packaging | | | 1.6 | |

Tobacco | | | 1.5 | |

Chemicals | | | 1.5 | |

Airlines | | | 1.4 | |

Building Products | | | 1.2 | |

Construction & Engineering | | | 1.1 | |

Multiline Retail | | | 1.1 | |

Semiconductors & Semiconductor Equipment | | | 1.0 | |

Specialty Retail | | | 1.0 | |

IT Services | | | 1.0 | |

Machinery | | | 0.9 | % |

Health Care Providers & Services | | | 0.8 | |

Industrial Conglomerates | | | 0.8 | |

Consumer Finance | | | 0.8 | |

Paper & Forest Products | | | 0.7 | |

Health Care Equipment & Supplies | | | 0.6 | |

Diversified Financial Services | | | 0.6 | |

Multi-Utilities | | | 0.6 | |

Technology Hardware, Storage & Peripherals | | | 0.6 | |

Construction Materials | | | 0.6 | |

Commercial Services & Supplies | | | 0.6 | |

Electrical Equipment | | | 0.6 | |

Hotels, Restaurants & Leisure | | | 0.6 | |

Communications Equipment | | | 0.6 | |

Road & Rail | | | 0.6 | |

Transportation Infrastructure | | | 0.4 | |

Leisure Products | | | 0.3 | |

Electronic Equipment, Instruments & Components | | | 0.3 | |

Real Estate—Developers | | | 0.3 | |

Energy Equipment & Services | | | 0.2 | |

Textiles, Apparel & Luxury Goods | | | 0.2 | |

Marine | | | 0.2 | |

Gas Utilities | | | 0.1 | |

Internet & Catalog Retail | | | 0.1 | |

Health Care Technology | | | 0.1 | |

Distributors | | | 0.1 | |

| | | | |

| | | 99.0 | |

Other assets in excess of liabilities | | | 1.0 | |

| | | | |

| | | 100.0 | % |

| | | | |

The Portfolio invested in derivative instruments during the reporting period. The primary types of risk associated with these derivative instruments are foreign exchange risk and equity risk.

The effect of such derivative instruments on the Portfolio’s financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

See Notes to Financial Statements.

The Portfolio did not hold any derivative instruments as of July 31, 2015, accordingly, no derivative positions were presented in the Statements of Assets and Liabilities.

The effects of derivative instruments on the Statement of Operations for the year ended July 31, 2015 are as follows:

| | | | | | | | | | | | |

Amount of Realized Gain or (Loss) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging

instruments, carried at fair value | | Rights(1) | | | Forward

Currency

Contracts(2) | | | Total | |

Foreign exchange contracts | | $ | — | | | $ | 1,138,613 | | | $ | 1,138,613 | |

Equity contracts | | | 22,980 | | | | — | | | | 22,980 | |

| | | | | | | | | | | | |

Total | | $ | 22,980 | | | $ | 1,138,613 | | | $ | 1,161,593 | |

| | | | | | | | | | | | |

| | | | |

Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging

instruments, carried at fair value | | Forward

Currency

Contracts(3) | |

Foreign exchange contracts | | $ | (598,106 | ) |

| | | | |

| (1) | Included in net realized gain (loss) on investment transactions in the Statement of Operations. |

| (2) | Included in net realized gain (loss) on foreign currency transactions in the Statement of Operations. |

| (3) | Included in net change in unrealized appreciation (depreciation) on foreign currencies in the Statement of Operations. |

See Notes to Financial Statements.

| | | | |

| Target International Equity Portfolio | | | 21 | |

Statement of Assets & Liabilities

as of July 31, 2015

| | | | |

Assets | | | | |

Investments at value, including securities on loan of $1,180,408: | | | | |

Unaffiliated investments (cost $497,677,254) | | $ | 532,653,065 | |

Affiliated investments (cost $12,526,740) | | | 12,526,740 | |

Foreign currency, at value (cost $5,294,080) | | | 5,187,184 | |

Tax reclaim receivable | | | 1,287,519 | |

Receivable for Trust shares sold | | | 828,553 | |

Receivable for investments sold | | | 474,972 | |

Dividends receivable | | | 188,478 | |

| | | | |

Total assets | | | 553,146,511 | |

| | | | |

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan | | | 1,336,010 | |

Payable for investments purchased | | | 349,200 | |

Management fee payable | | | 322,912 | |

Payable for Trust shares reacquired | | | 192,597 | |

Distribution fee payable | | | 123,642 | |

Accrued expenses and other liabilities | | | 116,900 | |

Affiliated transfer agent fee payable | | | 63,927 | |

Deferred trustees’ fees | | | 2,387 | |

Loan interest payable (Note 7) | | | 348 | |

| | | | |

Total liabilities | | | 2,507,923 | |

| | | | |

| |

Net Assets | | $ | 550,638,588 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Shares of beneficial interest, at par | | $ | 40,228 | |

Paid-in capital in excess of par | | | 503,408,931 | |

| | | | |

| | | 503,449,159 | |

Undistributed net investment income | | | 4,940,746 | |

Accumulated net realized gain on investment and foreign currencies transactions | | | 7,502,022 | |

Net unrealized appreciation on investments and foreign currencies | | | 34,746,661 | |

| | | | |

Net assets, July 31, 2015 | | $ | 550,638,588 | |

| | | | |

See Notes to Financial Statements.

| | | | |

| |

Class Q | | | | |

Net asset value, offering price and redemption price per share,

($198,409,549 ÷ 14,458,384 shares of beneficial interest issued and outstanding) | | $ | 13.72 | |

| | | | |

| |

Class R | | | | |

Net asset value, offering price and redemption price per share,

($295,375,773 ÷ 21,623,387 shares of beneficial interest issued and outstanding) | | $ | 13.66 | |

| | | | |

| |

Class T | | | | |

Net asset value and redemption price per share,

($56,853,266 ÷ 4,146,604 shares of beneficial interest issued and outstanding) | | $ | 13.71 | |

| | | | |

See Notes to Financial Statements.

| | | | |

| Target International Equity Portfolio | | | 23 | |

Statement of Operations

Year Ended July 31, 2015

| | | | |

Net Investment Income | | | | |

Income | | | | |

Unaffiliated dividend income (net of foreign withholding taxes of $1,411,246) | | $ | 15,685,753 | |

Affiliated income from securities lending, net | | | 28,076 | |

Affiliated dividend income | | | 23,149 | |

| | | | |

Total income | | | 15,736,978 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 3,598,555 | |

Distribution fee—Class R | | | 2,050,529 | |

Transfer agent’s fees and expenses (including affiliated expense of $352,900) | | | 420,000 | |

Custodian and accounting fees | | | 328,000 | |

Shareholders’ reports | | | 94,000 | |

Registration fees | | | 44,000 | |

Audit fee | | | 34,000 | |

Legal fees and expenses | | | 23,000 | |

Trustees’ fees | | | 19,000 | |

Insurance expenses | | | 6,000 | |

Interest expense | | | 621 | |

Miscellaneous | | | 60,951 | |

| | | | |

Total expenses | | | 6,678,656 | |

Less: Distribution fee waiver—Class R | | | (683,510 | ) |

| | | | |

Net expenses | | | 5,995,146 | |

| | | | |

Net investment income | | | 9,741,832 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investment And Foreign Currencies | | | | |

Net realized gain on: | | | | |

Investment transactions | | | 29,570,218 | |

Foreign currency transactions | | | 1,663,408 | |

| | | | |

| | | 31,233,626 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | (26,550,509 | ) |

Foreign currencies | | | (782,829 | ) |

| | | | |

| | | (27,333,338 | ) |

| | | | |

Net gain on investments and foreign currencies | | | 3,900,288 | |

| | | | |

Net Increase In Net Assets Resulting From Operations | | $ | 13,642,120 | |

| | | | |

See Notes to Financial Statements.

Statement of Changes in Net Assets

| | | | | | | | | | | | |

| | | Year

Ended

July 31, 2015 | | | Nine Months

Ended

July 31, 2014 | | | Year

Ended

October 31, 2013 | |

Increase (Decrease) in Net Assets | | | | | | | | | | | | |

Operations | | | | | | | | | | | | |

Net investment income | | $ | 9,741,832 | | | $ | 7,750,595 | | | $ | 6,984,177 | |

Net realized gain on investment and foreign currency transactions | | | 31,233,626 | | | | 8,291,004 | | | | 12,174,474 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | (27,333,338 | ) | | | (6,894,405 | ) | | | 60,817,098 | |

| | | | | | | | | | | | |

Net increase in net assets resulting from operations | | | 13,642,120 | | | | 9,147,194 | | | | 79,975,749 | |

| | | | | | | | | | | | |

| | | |

Dividends and Distributions (Note 1) | | | | | | | | | | | | |

Dividends from net investment income: | | | | | | | | | | | | |

Class Q | | | (4,507,741 | ) | | | (2,853,716 | ) | | | (3,065,660 | ) |

Class R | | | (5,243,745 | ) | | | (2,935,682 | ) | | | (3,008,506 | ) |

Class T | | | (1,510,544 | ) | | | (1,203,254 | ) | | | (1,535,049 | ) |

| | | | | | | | | | | | |

| | | (11,262,030 | ) | | | (6,992,652 | ) | | | (7,609,215 | ) |

| | | | | | | | | | | | |

Distributions from net realized gains: | | | | | | | | | | | | |

Class Q | | | (758,360 | ) | | | — | | | | — | |

Class R | | | (1,154,406 | ) | | | — | | | | — | |

Class T | | | (265,245 | ) | | | — | | | | — | |

| | | | | | | | | | | | |

| | | (2,178,011 | ) | | | — | | | | — | |

| | | | | | | | | | | | |

| | | |

Trust share transactions (Note 6) | | | | | | | | | | | | |

Net proceeds from shares sold | | | 146,883,144 | | | | 92,099,433 | | | | 102,407,412 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 13,425,919 | | | | 6,979,844 | | | | 7,582,919 | |

Cost of shares reacquired | | | (94,364,257 | ) | | | (49,641,561 | ) | | | (84,338,457 | ) |

| | | | | | | | | | | | |

Net increase in net assets from Trust share transactions | | | 65,944,806 | | | | 49,437,716 | | | | 25,651,874 | |

| | | | | | | | | | | | |

Total increase | | | 66,146,885 | | | | 51,592,258 | | | | 98,018,408 | |

| | | |

Net Assets: | | | | | | | | | | | | |

Beginning of period | | | 484,491,703 | | | | 432,899,445 | | | | 334,881,037 | |

| | | | | | | | | | | | |

End of period(a) | | $ | 550,638,588 | | | $ | 484,491,703 | | | $ | 432,899,445 | |

| | | | | | | | | | | | |

(a) Includes undistributed net investment income of: | | $ | 4,940,746 | | | $ | 6,460,944 | | | $ | 5,703,001 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Target International Equity Portfolio | | | 25 | |

Notes to Financial Statements

The Target Portfolio Trust (the “Trust”) is an open-end management investment company, registered under the Investment Company Act of 1940, as amended, (“1940 Act”). The Trust currently consists of four series: Prudential Corporate Bond Fund (formerly known as the Target Mortgage Backed Portfolio), Prudential Core Bond Fund (formerly known as Target Intermediate Bond Portfolio), Target International Equity Portfolio (the “Portfolio”) and Prudential Small-Cap Value Fund (formerly known as Target Small Capitalization Portfolio). These financial statements relate to Target International Equity Portfolio. The financial statements of the other series are not presented herein.

The investment objective for the Portfolio is capital appreciation.

Note 1. Accounting Policies

The Portfolio follows investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services—Investment Companies. The following accounting policies conform to U.S. generally accepted accounting principles. The Portfolio consistently follow such policies in the preparation of their financial statements.

Securities Valuation: The Portfolio holds securities and other assets that are fair valued at the close of each day the New York Stock Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Board of Trustees (the “Board”) has adopted Valuation Procedures for security valuation under which fair valuation responsibilities have been delegated to Prudential Investments LLC (“PI” or “Manager”). Under the current Valuation Procedures, the established Valuation Committee is responsible for supervising the valuation of portfolio securities and other assets. The Valuation Procedures permit the Portfolio to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. A record of the Valuation Committee’s actions is subject to the Board’s review, approval, and ratification at its next regularly-scheduled quarterly meeting.

Various inputs determine how the Portfolio’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the tables following each Portfolio of Investments.

Common and preferred stocks, exchange-traded funds, and derivative instruments such as futures or options that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable exchange where the security principally trades. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy.

In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and ask prices, or at the last bid price in the absence of an ask price. These securities are classified as Level 2 in the fair value hierarchy.

Common and preferred stocks traded on foreign securities exchanges are valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy. Such securities are valued using model prices to the extent that the valuation meets the established confidence level for each security. If the confidence level is not met or the vendor does not provide a model price, securities are valued in accordance with exchange-traded common and preferred stocks discussed above.

Participatory Notes (“P-notes”) are generally valued based upon the value of a related underlying security that trades actively in the market and are classified as Level 2 in the fair value hierarchy.

Investments in open-end, non-exchange-traded mutual funds are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

Fixed income securities traded in the over-the-counter (“OTC”) market are generally valued at prices provided by approved independent pricing vendors. The pricing vendors provide these prices after evaluating observable inputs including, but not limited to yield curves, yield spreads, credit ratings, deal terms, tranche level attributes, default rates, cash flows, prepayment speeds, broker/dealer quotations, and

| | | | |

| Target International Equity Portfolio | | | 27 | |

Notes to Financial Statements

continued

reported trades. Securities valued using such vendor prices are classified as Level 2 in the fair value hierarchy.

OTC derivative instruments are generally valued using pricing vendor services, which derive the valuation based on inputs such as underlying asset prices, indices, spreads, interest rates, and exchange rates. These instruments are categorized as Level 2 in the fair value hierarchy.

Centrally cleared swaps listed or traded on a multilateral or trade facility platform, such as a registered exchange, are generally valued at the daily settlement price determined by the respective exchange. These securities are classified as Level 2 in the fair value hierarchy, as the daily settlement price is not public.

Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

Foreign Currency Translation: The books and records of the Portfolio are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities—at the current daily rates of exchange;

(ii) purchases and sales of investment securities, income and expenses—at the rates of exchange prevailing on the respective dates of such transactions.

The Portfolio does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term securities held at period end. Similarly, the Portfolio does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the period. Accordingly, realized foreign currency gains or losses are included in the reported net realized gains or losses on investment transactions.

Net realized gains or losses on foreign currency transactions represent net foreign exchange gains or losses from holdings of foreign currencies and forward currency contracts, disposition of foreign currencies, currency gains or losses realized between the trade date and settlement date on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Portfolio’ books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities (other than investments) at period-end exchange rates are reflected as a component of net unrealized appreciation (depreciation) on foreign currencies.

Concentration of Risk: Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin as a result of, among other factors, the possibility of political and economic instability or the level of governmental supervision and regulation of foreign securities markets.

Forward Foreign Currency Contracts: A forward foreign currency contract is a commitment to purchase or sell a foreign currency at a future date at a negotiated forward rate. The Portfolio may enter into forward foreign currency contracts in order to hedge their exposure to changes in foreign currency exchange rates on their foreign portfolio holdings or on specific receivables and payables denominated in a foreign currency and to gain exposure to certain currencies. The contracts are valued daily at current forward exchange rates and any unrealized gain or loss is included in net unrealized appreciation or depreciation on foreign currency transactions. Gains or losses are realized on the settlement date of the contract equal to the difference between the settlement value of the original and negotiated forward contracts. This gain or loss, if any, is included in net realized gain or loss on foreign currency transactions. Risks may arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts. Forward currency contracts involve risks from currency exchange rate and credit risk in excess of the amounts reflected on the Statement of Assets and Liabilities. The Portfolio’s maximum risk of loss from counterparty credit risk is the net value of the cash flows to be received from the counterparty at the end of the contract’s life.

| | | | |

| Target International Equity Portfolio | | | 29 | |

Notes to Financial Statements

continued

Master Netting Arrangements: The Portfolio is subject to various Master Agreements, or netting arrangements, with select counterparties. These are agreements which a sub-adviser may have negotiated and entered into on behalf of the Portfolio. For a multi-sleeve Portfolio, different sub-advisers who manage their respective sleeve, may enter into such agreements with the same counterparty and are disclosed separately for each sleeve when presenting information about offsetting and related netting arrangements for OTC derivatives under the FASB Accounting Standards Update (“ASU”) 2013-01 disclosure. A master netting arrangement between the Portfolio and the counterparty permits the Portfolio to offset amounts payable by the Portfolio to the same counterparty against amounts to be received; and by the receipt of collateral from the counterparty by the Portfolio to cover the Portfolio’s exposure to the counterparty. However, there is no assurance that such mitigating factors are easily enforceable. The right to set-off exists when all the conditions are met such that each of the parties owes the other determinable amounts, the reporting party has the right to set-off the amount owed with the amount owed by the other party, the reporting party intends to set-off and the right of set-off is enforceable by law. During the reporting period, there were no instances where the right of set-off existed and management has not elected to offset.

Warrants and Rights: The Portfolio may hold warrants and rights acquired either through a direct purchase, included as part of a private placement, or pursuant to corporate actions. Warrants and rights entitle the holder to buy a proportionate amount of common stock at a specific price and time through the expiration dates. Such warrants and rights are held as long positions by the Portfolio until exercised, sold or expired. Warrants and rights are valued at fair value in accordance with the Board of Trustees’ approved fair valuation procedures.

Securities Lending: The Portfolio may lend its portfolio securities to banks and broker-dealers. The loans are secured by collateral at least equal to the market value of the securities loaned. Collateral pledged by each borrower is invested in a highly liquid short-term money market fund and is marked to market daily, based on the previous day’s market value, such that the value of the collateral exceeds the value of the loaned securities. Loans are subject to termination at the option of the borrower or the Portfolio. Upon termination of the loan, the borrower will return to the lender securities identical to the loaned securities. Should the borrower of the securities fail financially, the Portfolio has the right to repurchase the securities using the collateral in the open market. The Portfolio recognizes income, net of any rebate and securities

lending agent fees, for lending its securities, and any interest on the investment of any cash received as collateral. The Portfolio also continues to receive interest and dividends or amounts equivalent thereto on the securities loaned and recognizes any unrealized gain or loss in the market price of the securities loaned that may occur during the term of the loan.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized and unrealized gains and losses from investment and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date. Interest income, including amortization of premium and accretion of discount of debt securities, as required, is recorded on the accrual basis. Expenses are recorded on an accrual basis, which may require the use of certain estimates by management, that may differ from actual. The Trust’s expenses are allocated to the respective Portfolio on the basis of relative net assets except for expenses that are charged directly at the Portfolio or class level.

Net investment income or loss (other than distribution fees which are charged directly to the respective class and transfer agency fees specific to Class Q shares which are charged to that share class), and unrealized and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of adjusted net assets of each class at the beginning of the day.

Dividends and Distributions: The Portfolio declares and pays a dividend from net investment income, if any, at least annually. The Portfolio declares and pays its net realized capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on ex-dividend date. Permanent book/ tax differences relating to income and gains are reclassified amongst undistributed net investment income, accumulated net realized gain or loss and paid-in capital, in excess of par, as appropriate.

Taxes: It is the Portfolio’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required. Withholding taxes on foreign interest and dividends are recorded net of reclaimable amounts, at the time the related income is earned.

The Portfolio has a tax year end of October 31st.

| | | | |

| Target International Equity Portfolio | | | 31 | |

Notes to Financial Statements

continued

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Portfolio’s manager is Prudential Investments LLC (“PI”). PI manages the investment operations of the Portfolio, administers the Portfolio’s affairs and is responsible for the selection, subject to review and approval of the Trustees, of the sub-advisers. PI supervises the sub-advisers’ performance of advisory services and makes recommendations to the Trustees as to whether the sub-advisers’ contracts should be renewed, modified or terminated. PI pays for the costs pursuant to the advisory agreements, the cost of compensation of officers of the Portfolio, occupancy and certain clerical and accounting costs of the Portfolio. The Portfolio bears all other costs and expenses.