UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08200

Bridgeway Funds, Inc.

(Exact name of registrant as specified in charter)

20 Greenway Plaza, Suite 450

Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Michael D. Mulcahy, President

Bridgeway Funds, Inc.

20 Greenway Plaza, Suite 450

Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 661-3500

Date of fiscal year end: June 30

Date of reporting period: July 1, 2013 through December 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| | | | | | |

| |

| | A no-load mutual fund family of domestic funds |

| | | |

| | Semi-Annual Report | | | | |

| | | |

| | December 31, 2013 (Unaudited) | | | | |

| | | |

| | AGGRESSIVE INVESTORS 1 | | BRAGX | | |

| | | |

| | ULTRA-SMALL COMPANY | | BRUSX | | |

| | (Open to Existing Investors — Direct Only) | | | | |

| | | |

| | ULTRA-SMALL COMPANY MARKET | | BRSIX | | |

| | | |

| | SMALL-CAP MOMENTUM | | BRSMX | | |

| | | |

| | SMALL-CAP GROWTH | | BRSGX | | |

| | | |

| | SMALL-CAP VALUE | | BRSVX | | |

| | | |

| | LARGE-CAP GROWTH | | BRLGX | | |

| | | |

| | BLUE CHIP 35 INDEX | | BRLIX | | |

| | | |

| | MANAGED VOLATILITY | | BRBPX | | |

| | | |

| | | | | | |

| | | |

| | www.bridgeway.com | | | | |

| | | |

| | | | | | |

| | |

| TABLE OF CONTENTS | |  |

Bridgeway Funds Standardized Returns as of December 31, 2013* (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Annualized | | | | | | | | | | |

| Fund | | Quarter | | | Six Months | | | 1 Year | | | 5 Years | | | 10 Years | | | Inception to Date | | | Inception Date | | | Gross Expense Ratio2 | | | Net Expense Ratio2 | |

Aggressive Investors 1 | | | 11.68% | | | | 20.65% | | | | 42.21% | | | | 17.76% | | | | 5.61% | | | | 13.90% | | | | 8/5/1994 | | | | 0.74% | | | | 0.74% | |

Ultra-Small Company | | | 9.30% | | | | 20.08% | | | | 55.77% | | | | 24.95% | | | | 9.41% | | | | 16.72% | | | | 8/5/1994 | | | | 1.33% | | | | 1.33% | |

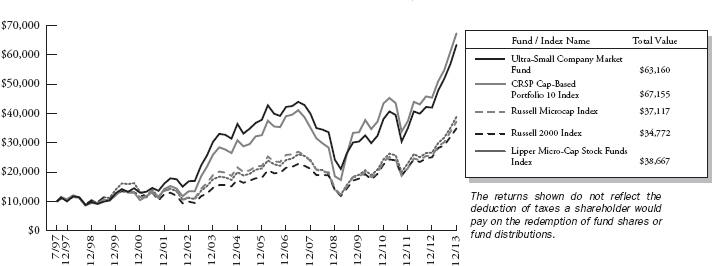

Ultra-Small Co Market | | | 11.29% | | | | 22.17% | | | | 50.91% | | | | 21.25% | | | | 7.65% | | | | 11.88% | | | | 7/31/1997 | | | | 0.90% | 1 | | | 0.86% | 1 |

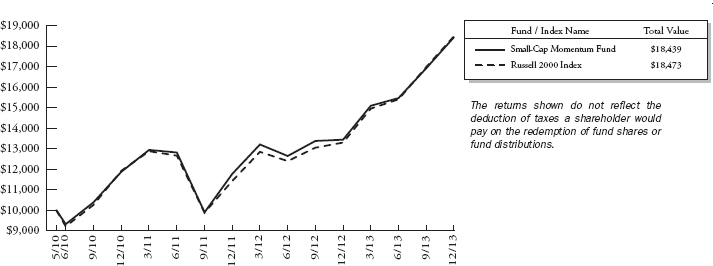

Small-Cap Momentum | | | 8.91% | | | | 19.19% | | | | 37.07% | | | | NA | | | | NA | | | | 18.56% | | | | 5/28/2010 | | | | 5.58% | 1 | | | 1.06% | 1 |

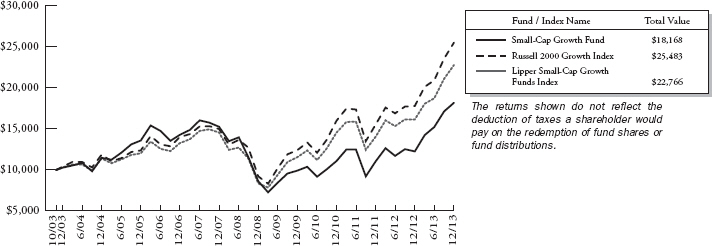

Small-Cap Growth | | | 6.11% | | | | 19.52% | | | | 48.52% | | | | 16.08% | | | | 5.87% | | | | 6.05% | | | | 10/31/2003 | | | | 1.13% | 1 | | | 0.94% | 1 |

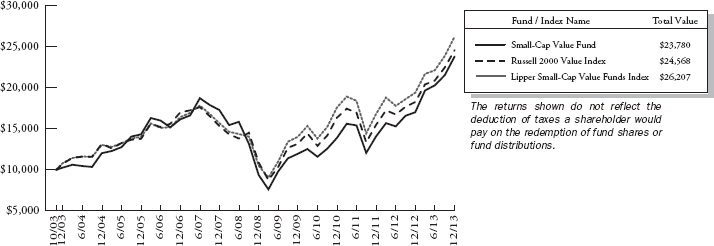

Small-Cap Value | | | 10.39% | | | | 17.17% | | | | 39.72% | | | | 20.38% | | | | 8.76% | | | | 8.89% | | | | 10/31/2003 | | | | 1.03% | | | | 1.03% | |

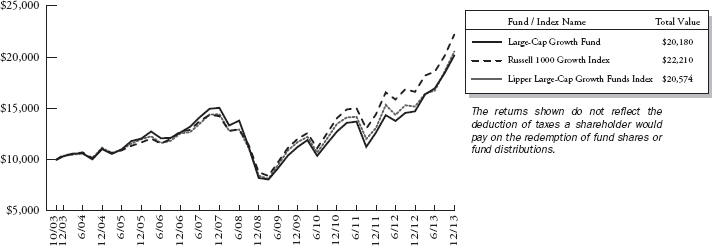

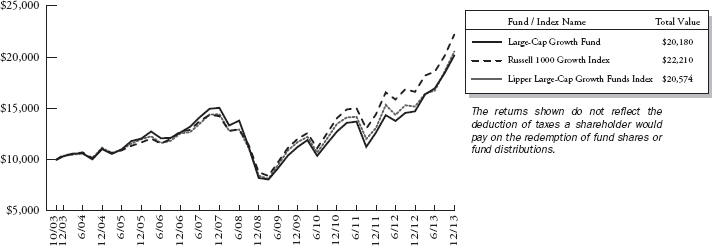

Large-Cap Growth | | | 9.36% | | | | 18.96% | | | | 37.19% | | | | 19.65% | | | | 6.92% | | | | 7.15% | | | | 10/31/2003 | | | | 0.90% | 1 | | | 0.84% | 1 |

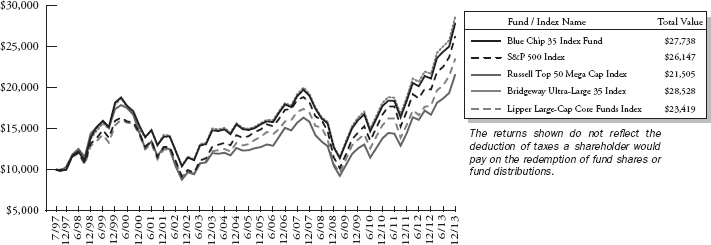

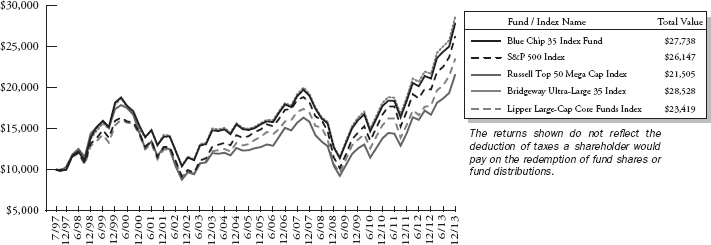

Blue Chip 35 Index | | | 11.19% | | | | 14.09% | | | | 31.67% | | | | 16.99% | | | | 6.49% | | | | 6.41% | | | | 7/31/1997 | | | | 0.27% | 1 | | | 0.15% | 1 |

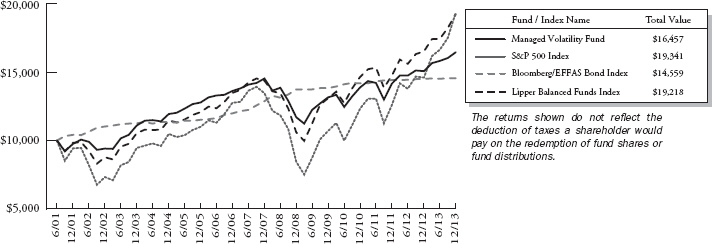

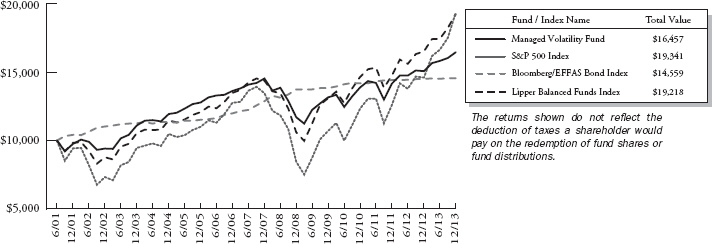

Managed Volatility | | | 2.74% | | | | 4.11% | | | | 9.25% | | | | 7.03% | | | | 4.01% | | | | 4.06% | | | | 6/30/2001 | | | | 1.36% | 1 | | | 0.95% | 1 |

Bridgeway Funds Returns for Calendar Years 2000 through 2013* (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 |

Aggressive Investors 1 | | 13.58% | | -11.20% | | -18.01% | | 53.97% | | 12.21% | | 14.93% | | 7.11% | | 25.80% | | -56.16% | | 23.98% | | 17.82% | | -10.31% | | 21.58% | | 42.21% |

Ultra-Small Company | | 4.75% | | 34.00% | | 3.98% | | 88.57% | | 23.33% | | 2.99% | | 21.55% | | -2.77% | | -46.24% | | 48.93% | | 23.55% | | -14.64% | | 24.49% | | 55.77% |

Ultra-Small Co Market | | 0.67% | | 23.98% | | 4.90% | | 79.43% | | 20.12% | | 4.08% | | 11.48% | | -5.40% | | -39.49% | | 25.95% | | 24.86% | | -7.86% | | 19.83% | | 50.91% |

Small-Cap Momentum | | | | | | | | | | | | | | | | | | | | | | | | -0.92% | | 14.18% | | 37.07% |

Small-Cap Growth | | | | | | | | | | 11.59% | | 18.24% | | 5.31% | | 6.87% | | -43.48% | | 15.04% | | 11.77% | | -0.63% | | 11.05% | | 48.52% |

Small-Cap Value | | | | | | | | | | 17.33% | | 18.92% | | 12.77% | | 6.93% | | -45.57% | | 26.98% | | 16.55% | | 1.05% | | 20.99% | | 39.72% |

Large-Cap Growth | | | | | | | | | | 6.77% | | 9.33% | | 4.99% | | 19.01% | | -45.42% | | 36.66% | | 13.34% | | -0.71% | | 16.21% | | 37.19% |

Blue Chip 35 Index | | -15.12% | | -9.06% | | -18.02% | | 28.87% | | 4.79% | | 0.05% | | 15.42% | | 6.07% | | -33.30% | | 26.61% | | 10.60% | | 3.17% | | 15.20% | | 31.67% |

Managed Volatility | | | | | | -3.51% | | 17.82% | | 7.61% | | 6.96% | | 6.65% | | 6.58% | | -19.38% | | 12.39% | | 5.41% | | 1.94% | | 6.46% | | 9.25% |

Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than original cost. To obtain performance current to the most recent month-end, please visit www.bridgeway.com or call 1-800-661-3550. Total return figures include the reinvestment of dividends and capital gains.

1 Some of the Funds’ fees were waived or expenses reimbursed; otherwise, returns would have been lower. The Adviser has contractually agreed to waive fees and/or reimburse expenses. Any material change to this Fund policy would require a vote by shareholders.

2 Expense ratios are as stated in the current prospectus. Please see financial highlights for expense ratios as of December 31, 2013.

* Numbers highlighted in green indicate periods when the Fund outperformed its primary benchmark.

This report is submitted for the general information of the shareholders of each Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding a Fund’s risks, objectives, fees and expenses, experience of its management, and other information. Investors should read the prospectus carefully before investing in a Fund. For questions or other Fund information, call 1-800-661-3550 or visit the Funds’ website at www.bridgeway.com. Funds are available for purchase by residents of the United States, Puerto Rico, U.S. Virgin Islands and Guam only. Foreside Fund Services, LLC, Distributor.

The views expressed here are exclusively those of Fund management. These views, including those relating to the market, sectors, or individual stocks, are not meant as investment advice and should not be considered predictive in nature.

| | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM | |

|

December 31, 2013

Dear Fellow Shareholders,

Hooray!

Well, not exactly. Time to both check our emotions and hit the “reset button” on expectations.

“Hooray!” might seem like an appropriate response to 2013 calendar year returns. Six of our eleven Bridgeway Funds appreciated more than 40% in calendar year 2013. While we understand that positive feels better than negative and more feels better than less, we think it’s more complicated than that. The question we ask to evaluate our Funds is, “Did we perform in accordance with the Fund’s investment objective and design parameters?” Let’s take a quick example: Ultra-Small Company Market Fund. It wasn’t our best performer, but a 50.91% annual return in 2013 commands attention and helps demonstrate our point. The design of the Fund? According to our prospectus, it’s capital appreciation. . . we seek to provide a long-term total return on capital, primarily through capital appreciation, by approximating the total return of our primary benchmark of ultra-small companies over longer time periods. In 2013, the primary market benchmark [more on page 23] was up 48.45%. Four important points: first, over the long term, since 1925, this highly volatile, risky index has returned 13.48% per year (a few percentage points per year better than the S&P 500 Index of large stocks). That’s in the ballpark of what we might anticipate over the very long term — nothing like 50%. Second, to achieve a long term annual return in the low double digits with some years above 50% means that quite a few negative annual returns will be included in the mix. As a matter of fact, 35.2% of all years have been negative index years since 1925. In 2008, the return was down 47.40%. Since we don’t know what any future year will look like and since we don’t believe in market timing, when we have a year like 2013, one way we think of it is “we just banked a cushion against the next downturn.” Third, back to design: due to the difference in turnover between the index and the Fund, we won’t hit the exact index return number in any year — in fact, in any one year we may under- or outperform it substantially. The bottom line: we performed in line with our Fund’s design in 2013. Good job. We’d say the same thing if our index were down 30% and we underperformed slightly. It’s important to understand the investment objective and design of any fund. Ultra-Small Company Market Fund is a high octane, volatile, but nice diversifier of other funds for the right investor. Fourth, let’s pause and hit the reset button.

All corners of the domestic equity markets performed very positively during the latest quarter and last twelve months ended December 31, 2013. The Bridgeway Funds performed within design expectations, guided by our statistically driven, evidence-based investment approach. Please see the enclosed letters for a detailed explanation of each Fund’s performance during the quarter and calendar year. We hope you find them helpful.

Our newest Bridgeway Partner, Dr. Andrew Berkin, is a published expert on tax efficiency. He points out on page 2 that we just passed a very notable milestone in the economic history of our nation: 100 years of tax code. Andy commemorates this event for Bridgeway shareholders by noting five techniques to improve tax efficiency.

Our Chief Investment Officer and founder, John Montgomery, recently attended a course in behavioral finance at Harvard University. His section on page 4 starts, “Wouldn’t it be great if you knew when the market was going to go up or down?”

Bridgeway Partner, Monika Henderson, took part in an event for community transformational change with her children and other Partners at Bridgeway’s annual corporate retreat. See Monika’s insights on page 6.

As always, we appreciate your feedback. We take your comments very seriously and regularly discuss them internally to help in managing our Funds. Please keep your ideas coming — both favorable and critical. They provide us with a vital tool, helping us to serve you better.

Sincerely,

Your Investment Management Team

| | | | | | | | |

| | | |  | | | |  |

| John Montgomery | | | | Christine L. Wang | | | | Michael Whipple |

| | | |  | | | | |

| Elena Khoziaeva | | | | Dick Cancelmo | | | | |

| | |

1 | | Semi-Annual Report | December 31, 2013 (Unaudited) |

| | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

Market Review

The Short Version: Domestic equity markets rose in the fourth quarter of 2013, capping one of the best years for stocks since 1995. The quarter ended with the S&P 500 Index up 10.5% and the Dow up 10.2%. For the year, the S&P 500 Index and Dow were up 32.4% and 29.7%, respectively.

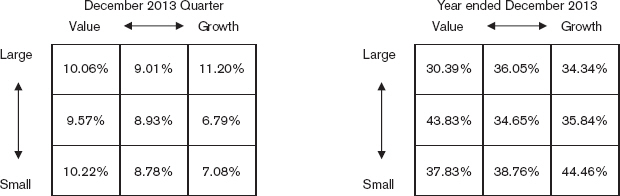

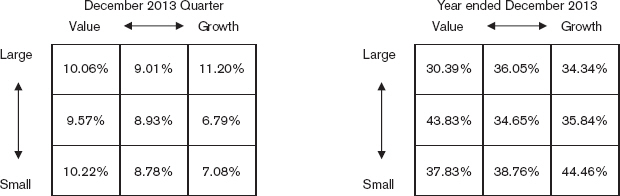

Returns across U.S. equity style boxes, as defined by Morningstar, were strong across all styles for the quarter. Large-cap growth stocks led the way, up 11.20%, while mid-cap growth stocks were the laggard, up 6.79%. During the quarter, value slightly outperformed growth, and large-cap stocks were favored over small-cap stocks.

Sector performance for the S&P 500 Index was strong in the fourth quarter. Six out of ten sectors ended the quarter with double-digit returns. Industrials led the way, gaining approximately 13.5%, followed closely by Information Technology, up over 13%, and Consumer Discretionary, up almost 11%. Consumer Staples (up 9%), Energy (up 8%), Telecommunication Services (up 5%), and Utilities (up 3%) were the laggards and the only four sectors not posting double-digit returns.

Following are the stock market “style box” returns from Morningstar for the quarter and year:

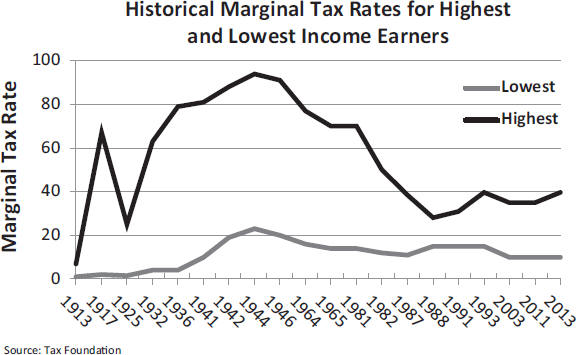

100 Years of Tax Efficiency

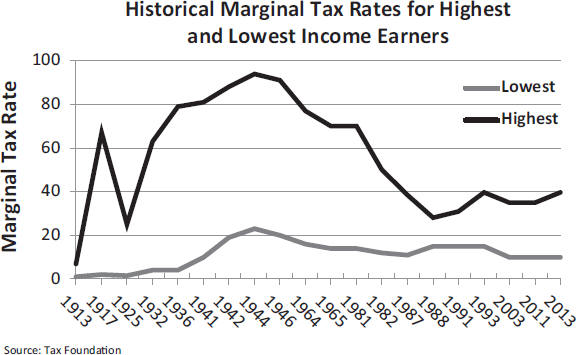

As 2013 draws to a close, those of us who care about tax efficiency (and that should be about everyone with a taxable account) should note an important anniversary. This year marks the 100th anniversary of the ratification of the Sixteenth Amendment, and with it the inauguration of regular income tax in the United States. This year also most assuredly marks the 100th anniversary of investors seeking greater tax efficiency.

The top tax rate in 1913 was 7% - low by today’s standards but obviously a shock to those used to paying nothing. Before getting too nostalgic, however, that top tax rate rose to 77% in 1917 to help pay for World War I. As the chart below shows, top tax rates have fluctuated widely over the past 100 years from the initial low of 7% to a high of 94% in 1944-5. By historical standards, today’s tax rates are rather moderate.

| | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

Whether rates are high or low, people have always sought to reduce their taxes. While some methods have been dubious or illegal, perfectly standard, well-established techniques exist to reduce tax payments. Judge Learned Hand, widely regarded as the most quoted judicial philosopher of the 20th century, once noted that “...there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible...” Indeed, one could argue that many of the provisions of the tax code are there to encourage people to make beneficial decisions. These include incentives to save for retirement, health care and education and thus lessen poverty and reliance on the government, to own a home and create social stability, and to be a long-term investor and help grow business and the economy.

To commemorate 100 years of tax efficiency, some of these common techniques are discussed below. Many of these are well known to both financial advisors and their clients, but listing them provides a reminder of their existence and importance. Much of investing is filled with uncertainty, but taxes are one aspect where an investor has greater control. Utilizing tax-efficient techniques helps keep the overall cost of investing down and leaves more wealth from which to grow and benefit.

1. Utilize tax-advantaged accounts. As previously noted, the tax code provides for tax-advantaged accounts for purposes such as saving for retirement, health care and education. Some of these, such as 401(k) retirement plans, are funded with pre-tax dollars, and taxes are paid at withdrawal. Other plans are funded with after-tax dollars, but no tax is paid upon withdrawal. Generally, the investments grow tax-free.

2. Implement asset location. Investors will generally have money in different accounts, some taxable and others tax advantaged. Rather than holding the same allocation across accounts, locate assets in a tax efficient manner. This often means placing less tax-efficient investments — such as fixed income where the interest payments are taxed at ordinary income rates — in tax-advantaged accounts. More tax-efficient investments, such as low turnover equities, should be considered for taxable accounts. Tax rates now and in the future do matter. For example, placing those equities in a tax-deferred account — perhaps a regular IRA — can also mean they will be taxed at potentially higher income rates upon withdrawal, whereas they would be taxed at lower long-term capital gain rates if held in a taxable account.

3. Consider Roth conversions. The tax code now allows all investors to convert regular IRAs to Roth IRAs. Tax must be paid on the amount converted, but that money is then withdrawn tax-free in retirement. Such conversions may make sense for investors who expect to be in a higher income bracket in retirement. By paying those taxes with money from outside the IRA, the amount of money growing tax-free effectively increases. A big advantage can occur by doing the conversion at the beginning of the year and then waiting until taxes are filed to decide whether to keep the conversion or recharacterize it back to a regular IRA. Because taxes are due on the amount that was converted, if the account has appreciated notably,

| | |

3 | | Semi-Annual Report | December 31, 2013 (Unaudited) |

| | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

then taxes are being paid on a lower amount than the IRA is currently worth. If the IRA has declined in value or appreciated only modestly, then it can be recharacterized and the process repeated the following year.

4. Avoid realizing gains. One of the simplest ways to minimize taxes is to avoid realizing gains, as taxes aren’t triggered until a position is sold. By waiting at least a year, short-term capital gains become long-term and are taxed at a lower rate. But delaying gains even longer effectively acts as an interest-free loan from the government. The money not being paid in taxes continues to remain invested. If a portfolio is held until death, then taxes may be avoided altogether, as heirs receive a tax-free step-up in cost basis. Gifting appreciated positions to charity can avoid realizing gains as well. It is important not to let tax considerations overwhelm other decisions, such as desired asset allocation. When positions do need to be trimmed, use tax lot accounting to identify the most tax-efficient lots to be sold.

5. Actively harvest losses. While investors don’t want their holdings to go down, a well-diversified portfolio will typically include some positions that are at a loss. Realizing those losses by selling the positions enhances after-tax returns, as the losses can be offset against realized gains. Excess losses can even help reduce taxable income by up to $3,000 each year. Investors do need to be careful of wash sales, however, as repurchasing a substantially similar security within a 30-day window around the sale invalidates the loss. One study* found that loss harvesting leads to a median of 27% higher final portfolio value after 25 years. The benefits of loss harvesting work well in a wide variety of market conditions**. Opportunities for loss harvesting should be monitored year-round and not just at year end, and should be considered on a lot-by-lot basis.

The aforementioned techniques are common, but can contain some subtleties. Considerations such as the investor’s specific current and future tax rates, retirement plans and cash flows all matter. Tax-efficient investing is a critical part of an overall financial plan and needs to be considered in the context of the plan’s other elements. Investor circumstances, portfolio positioning and tax laws all can change and thus need to be monitored. By doing so, implementing tax-efficient solutions can be quite rewarding and should be an important element of every investment decision.

*Arnott, Robert D., Andrew L. Berkin, and Jia Ye. “Loss Harvesting: What’s It Worth to the Taxable Investor?” The Journal of Wealth Management 3, no. 4 (2001): 10-18.

**Berkin, Andrew L., and Jia Ye. “Tax Management, Loss Harvesting, and HIFO Accounting.” Financial Analysts Journal (2003): 91-102.

Valuing Markets with the CAPE Ratio

The Short Version: The financial media has given a lot of coverage to the concept of timing the market using Robert Shiller’s “CAPE ratio.” As a statistic, we think the CAPE ratio is interesting but it has a number of shortcomings. More importantly, we think the activity of market timing is fraught with severe risk.

Wouldn’t it be great if you knew when the market was going to go up or down?

One statistical measure of overall market valuation, the Shiller Cyclically Adjusted Price to Earnings ratio (“CAPE” ratio) is getting a lot of play in the financial press as “the single best forecaster of long-term future stock returns.” Nobel Prize-winning economist Robert Shiller first published information on the CAPE ratio in 1998 (Robert Shiller, “Valuation Ratios and the Long-Run Stock Market Outlook”). Based on backtesting this ratio to 1871, CAPE has an impressive record. The statistical nature of this forecasting tool has some appeal to statistically focused investment managers such as Bridgeway. So what does Bridgeway think about it?

Plus: Bridgeway’s investment management team likes the concept of valuation — buying stocks at a discount to some measure of a company’s actual worth. Price-to-earnings is among a handful of valuation metrics shown to statistically distinguish cheaper companies from more expensive companies based on long-term price appreciation. However, applying that concept to a whole asset class on an absolute basis rather than to a cross-section of many companies at one point in time may be a bit of a stretch.

| | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

Minus: While a proven and valid measure of valuation, earnings do have some disadvantages. First, they can be manipulated by management. Second, since accounting standards change over time, a dollar of earnings in 1880 may not mean the same thing as a dollar of earnings in 1990 or in 2014.

Plus: We like the fact that Shiller smoothes earnings across a decade and that the specific calculation takes inflation into consideration.

Minus: We agree with Jeremy Siegel’s critique (“The Shiller CAPE Ratio: A New Look,” presented at the Q Group, October 2013) that significant changes in U.S. accounting standards have resulted in inconsistent corporate earnings estimates over the last decade and a half. Siegel’s analysis doesn’t just stop with criticism, however; he proposes some adjustments and an alternative data set that we believe represent an improvement over the basic CAPE ratio. But . . . it introduces some new problems of its own.

Neutral: Robert Shiller was awarded the Nobel Prize in Economics in 2013. He is a very smart man. But the task of timing the market is a very difficult task. In a Wall Street Journal article (October 20, 2013) published immediately after learning he had received the Nobel Prize, Dr. Shiller said, “I’m just naturally skeptical of people who look impressive.” We think humility in research is extremely important and are even more impressed with Dr. Shiller for this reason. But we still remain skeptical of CAPE, even with his amazing credentials.

What the numbers are telling us: based on historical ranges of the last century and a half, as of December 31, 2013, the CAPE ratio indicates that the stock market is expensive. Using Siegel’s methodology, the stock market is in a “fairly valued” range. What is one to do?

The record of actual CAPE ratio: CAPE has been remarkably effective at predicting the 10-year forward pricing of the stock market from 1871 through today. But the only person we know who has been using the CAPE ratio in real time over the last decade and a half says, “you should think of the CAPE ratio as getting you within a year or two of the actual peak or bottom; don’t think you’ll be getting it right year to year.” The CAPE ratio was never intended to be a short-term indicator of market movements. Recently, however, it seems that people are using it this way. Then there’s the record of Dr. Shiller himself. The CAPE ratio first gained attention when the authors delivered a paper to the Federal Reserve Board of Governors on December 3, 1996, warning that stock prices were running well ahead of earnings, according to Jeremy Siegel. The “sell signal,” if you could call it that, was more than three years early. From December 3, 1996 through the market peak on September 1, 2000, the S&P 500 Index (with dividends reinvested) appreciated 114.71%. In spite of the market rout from 2000 through 2002, the S&P 500 Index has never again touched the December 1996 level, adjusting for dividends. More recently, on May 17, 2011, Shiller stated, “Equity returns will be disappointing over the next decade.” From that date through December 31, 2013, two and a half years later, the S&P 500 Index total return is up 47.3% (15.9% annualized). The decade is far from over yet, but the market will have to fall a long way before the decade he refers to is disappointing. We’ll see, but it causes one to pause.

The bottom line: we believe the basic CAPE ratio is fraught with significant problems. As Jeremy Siegel states, a significant one is with the consistency of data across time, especially due to changes in accounting standards. Even more problematic for us at Bridgeway is the concept of fishing in a bad pond. Bridgeway’s investment management team likes to ask the question, “Is the pond we are fishing in a good one based on history and one’s investment objective?” For example, small-value stocks have done well relative to the broader market over many decades, and may be appropriate for a portion of an investor’s total asset allocation plan. Thus, we would say small value stocks are “a good pond” for an investor with a high risk tolerance or an investor using small value stocks for diversification on the periphery of a well-diversified portfolio. At the other end of the spectrum, initial public offerings tend to underperform the broader market from the opening on the first day of trading. We would say, “the IPO pond is a bad one to fish in.” It doesn’t necessarily mean there aren’t some good fish in the pond, but it may be dangerous to fish there. We think the “market timing pond” is a very bad pond in which to go fishing. Does it mean market timing can’t be done? Not necessarily. But the overall results of many professionals who have tried to do so are abysmal. With this kind of risk, we have to ask, “Even with some promising statistics, is market timing of any kind worth the risk?”

What is that risk? The risk is that the market appreciates very substantially while you’re waiting on the sidelines in cash. Or even worse, that you get whipsawed and end up out of the market as it’s going up, only to reinvest just before it declines. Unlike market risk (historically, if the market goes down, it will bounce back if you are able to wait long enough), market-timing risk can be one-directional (when you lose money, you have a good probability of never getting it back). We believe this is a

| | |

5 | | Semi-Annual Report | December 31, 2013 (Unaudited) |

| | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

very serious risk. We think the statistics are saying, “The market is either somewhat expensive or it’s not.” But rest assured that that’s not the kind of thinking that drives any of the investment decisions we make at Bridgeway on behalf of fund shareholders.

Transformative Change

Houston Food Bank - authored by Monika Henderson

When you work at Bridgeway, you have many opportunities to better yourself and those around you. In addition to my primary role in Investment Operations, I have had many opportunities through the years to volunteer both locally and internationally. Throughout all of our service projects, I have had wonderful experiences and have met some amazing people. As a result, I know my life is richer, and I am so grateful for these opportunities.

Bridgeway’s last service project was with the Houston Food Bank. It was very special to me, as I had an opportunity to share the experience with my two children. The Houston Food Bank, from its 308,000 square-foot warehouse, feeds 137,000 people each week by delivering food to 600 hunger relief agencies in 18 Texas counties.

My daughter joined me and other Bridgeway Partners one very early Saturday morning, which is not easy for a typical teenager. After our orientation, we were taken to a giant factory-type room filled with hundreds of other volunteers. Our job was to sort different types of boxed foods as they haphazardly zoomed by on a conveyer belt. I felt like Lucy in the “I Love Lucy” episode when Lucy and Ethel were working in the chocolate factory. As I was sifting through all of the food, I looked to my right and saw my daughter with a big smile, moving at a speed I had never seen before. She enjoyed the experience so much that she convinced her younger brother and a friend to join us for the Food Bank’s Friday Family Night. This time our job was to pack “Backpack Buddy” weekend bags for children. Once again, I was pleasantly surprised to see my son packing the bags without any complaints in a speedy manner with such joy on his face.

The next morning, I offered my kids the choice of bagels, pancakes or an omelet. They both looked at me with sad eyes and my son said, “The kids we helped yesterday got only two small boxes of milk, a bag of cereal, two granola bars, two cans of peaches, one can of corn and one can of beef stew for the whole weekend, and they will have to share their food with their family. We are so fortunate to have all this food. We need to go back and do more for them.”

Bridgeway not only has created many opportunities for me to be a better person, but it’s also helping to create the next generation of givers and volunteers.

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (Unaudited) | |  |

December 31, 2013

Dear Fellow Aggressive Investors 1 Fund Shareholder,

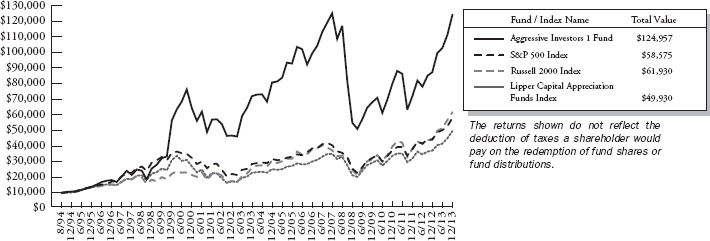

For the quarter ended December 31, 2013, our Fund appreciated 11.68%, outperforming our primary market benchmark, the S&P 500 Index (+10.51%), our peer benchmark, the Lipper Capital Appreciation Funds Index (+10.15%), and the Russell 2000 Index (+8.72%). It was a quarter without correlation spikes. Low to mid correlations in stocks are the historical norm, indicating that stock prices are moving based on individual company fundamentals. It is an environment that is favorable to our investment process, particularly to this Fund. We are pleased with the results.

For the six-month “semi-annual” period ending December 31, 2013, our Fund returned 20.65%, easily outpacing our primary market benchmark, the S&P 500 Index (+16.31%), our peer benchmark, the Lipper Capital Appreciation Funds Index (+19.67%), and the Russell 2000 Index (+19.82%). It was a solid six months of relatively low correlation markets, and we performed well on an absolute and relative basis.

For the calendar year, our Fund returned 42.21%, outperforming our primary market benchmark, the S&P 500 Index (+32.39%), our peer benchmark, the Lipper Capital Appreciation Funds Index (+34.05%), and the Russell 2000 Index (+38.82%). Thanks to an extraordinary year in 2013, we made up a lot of lost ground that was due to the unprecedented high correlation spikes of 2008, 2010, and 2011, as described in our previous shareholder letters. Looking forward, we would expect to experience more periods without high correlation spikes and to navigate spikes with less negative effects, since our model calibration period includes a number of these spikes.

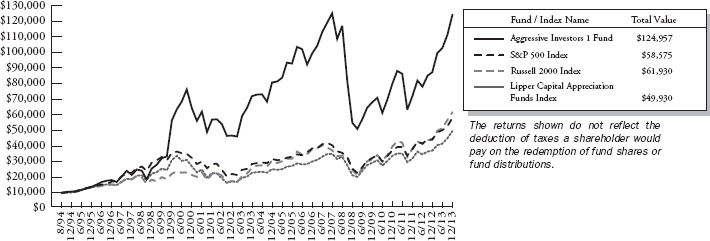

The table below presents our December quarter, six-month, one-year, five-year, ten-year, fifteen-year, and inception-to-date financial results. See the next page for a graph of performance since inception.

Standardized Returns as of December 31, 2013

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Annualized | |

| | | Quarter | | 6 Months | | 1 Year | | | 5 Years | | 10 Years | | 15 Years | | | Since Inception

(8/5/94) | |

| | | | | | | |

Aggressive Investors 1 Fund | | 11.68% | | 20.65% | | | 42.21% | | | 17.76% | | 5.61% | | | 11.10% | | | | 13.90% | |

S&P 500 Index | | 10.51% | | 16.31% | | | 32.39% | | | 17.94% | | 7.41% | | | 4.68% | | | | 9.52% | |

Russell 2000 Index | | 8.72% | | 19.82% | | | 38.82% | | | 20.08% | | 9.07% | | | 8.42% | | | | 9.85% | |

Lipper Capital Appreciation Funds Index | | 10.15% | | 19.67% | | | 34.05% | | | 18.42% | | 8.17% | | | 5.48% | | | | 8.63% | |

Performance figures quoted in the table above represent past performance and are no guarantee of future results. Total return figures in the table above include the reinvestment of dividends and capital gains. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions, based on the average of 500 widely held common stocks with dividends reinvested. The Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in the category of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of December 31, 2013, Aggressive Investors 1 Fund ranked 32nd of 262 capital appreciation funds for the twelve months ending December 31, 2013, 144th of 221 over the last five years, 134th of 156 over the last ten years, and 2nd of 49 since inception in August, 1994. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

| | |

7 | | Semi-Annual Report | December 31, 2013 (Unaudited) |

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |

|

Aggressive Investors 1 Fund vs. S&P 500 Index, Russell 2000 Index & Lipper Capital Appreciation Funds Index

from Inception 8/5/94 to 12/31/13

Detailed Explanation of Quarterly Performance

The Short Version: The low correlation market was favorable to a majority of our stock selection models, specifically our value category of models.

Stocks selected by our value category of models were the best performers in the quarter, returning approximately 21% on average. In fact, four of our value holdings returned more than 30%. Higher exposure to momentum stocks resulted in a modest contribution to performance as well.

The Fund was slightly overweighted in the best performing sectors for the quarter, Information Technology and Industrials. Despite underweighting in the Energy sector, holdings within the sector added to the Fund’s strong performance.

Detailed Explanation of Calendar Year Performance

The Short Version: For the calendar year, we outperformed our primary benchmark by 9.82%. Our current positioning, favoring smaller size and higher beta (market risk) companies, helped in the market environment of the calendar year.

Smaller market cap design accounted for about one third of outperformance for the calendar year. The Fund owned significantly more of the stronger performing, smaller cap names than the benchmark. Only one percent of assets were invested in the largest ten percent of names in the S&P 500 Index, which was the worst performing decile for the year. This was a “risk-on” year, which meant that higher beta stocks outperformed lower beta stocks. Our stronger weighting toward higher beta stocks helped. Stock selection in the Consumer Staples and Information Technology sectors also contributed to performance.

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |  |

Top Ten Holdings as of December 31, 2013

| | | | | | |

| Rank | | Description | | Industry | | % of Net Assets |

1 | | Lincoln National Corp. | | Insurance | | 2.3% |

2 | | Sealed Air Corp. | | Containers & Packaging | | 2.1% |

3 | | Southwest Airlines Co. | | Airlines | | 2.1% |

4 | | Micron Technology, Inc. | | Semiconductors & Semiconductor Equipment | | 2.0% |

5 | | Goodyear Tire & Rubber Co. (The ) | | Auto Components | | 1.6% |

6 | | Pilgrim’s Pride Corp. | | Food Products | | 1.6% |

7 | | Alliance Data Systems Corp. | | IT Services | | 1.5% |

8 | | Gap, Inc. (The) | | Specialty Retail | | 1.4% |

9 | | Delta Air Lines, Inc. | | Airlines | | 1.4% |

10 | | Delphi Automotive PLC | | Auto Components | | 1.4% |

| | Total | | | | 17.4% |

Industry Sector Representation as of December 31, 2013

| | | | | | | | | | | | |

| | | % of Net Assets | | | % of S&P 500 Index | | | Difference | |

Consumer Discretionary | | | 17.5% | | | | 12.5% | | | | 5.0% | |

Consumer Staples | | | 6.1% | | | | 9.8% | | | | -3.7% | |

Energy | | | 7.1% | | | | 10.3% | | | | -3.2% | |

Financials | | | 14.2% | | | | 16.2% | | | | -2.0% | |

Health Care | | | 10.2% | | | | 13.0% | | | | -2.8% | |

Industrials | | | 12.1% | | | | 10.9% | | | | 1.2% | |

Information Technology | | | 21.0% | | | | 18.6% | | | | 2.4% | |

Materials | | | 7.8% | | | | 3.5% | | | | 4.3% | |

Telecommunication Services | | | 3.3% | | | | 2.3% | | | | 1.0% | |

Utilities | | | 0.9% | | | | 2.9% | | | | -2.0% | |

Cash & Other Assets | | | -0.1% | | | | 0.0% | | | | -0.1% | |

Total | | | 100.0% | | | | 100.0% | | | | | |

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, December 31, 2013, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

Market volatility can significantly affect short-term performance. The Fund is not an appropriate investment for short-term investors. Investments in the small companies within this multi-cap fund generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of factors, including the relatively limited financial resources that are typically available to small companies and the fact that small companies often have comparatively limited product lines. In addition, the stock of small companies tends to be more volatile than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn. The Fund’s use of options, futures, and leverage can magnify the risk of loss in an unfavorable market, and the Fund’s use of short-sale positions can, in theory, expose shareholders to unlimited loss. Finally, the Fund exposes shareholders to “focus risk,” which may add to Fund volatility through the possibility that a single company could significantly affect total return. Shareholders of the Fund, therefore, are taking on more risk than they would if they invested in the stock market as a whole.

| | |

9 | | Semi-Annual Report | December 31, 2013 (Unaudited) |

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |

|

Conclusion

Thank you for your continued investment in Aggressive Investors 1 Fund. We encourage your feedback; your reactions and concerns are extremely important to us.

Sincerely,

The Investment Management Team

| | |

Bridgeway Aggressive Investors 1 Fund SCHEDULE OF INVESTMENTS | |

|

| Showing percentage of net assets as of December 31, 2013 (Unaudited) | | |

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

COMMON STOCKS - 100.29% | | | | | |

Aerospace & Defense - 3.52% | | | | | | | | |

AAR Corp. | | | 109,800 | | | | $ 3,075,498 | |

Lockheed Martin Corp. | | | 18,000 | | | | 2,675,880 | |

Moog, Inc., Class A* | | | 43,500 | | | | 2,955,390 | |

| | | | | | | | |

| | | | | | | 8,706,768 | |

| | |

Airlines - 4.43% | | | | | | | | |

Delta Air Lines, Inc. | | | 125,800 | | | | 3,455,726 | |

SkyWest, Inc. | | | 159,700 | | | | 2,368,351 | |

Southwest Airlines Co. | | | 272,400 | | | | 5,132,016 | |

| | | | | | | | |

| | | | | | | 10,956,093 | |

| | |

Auto Components - 4.26% | | | | | | | | |

Delphi Automotive PLC | | | 57,100 | | | | 3,433,423 | |

Goodyear Tire & Rubber Co. (The) | | | 167,800 | | | | 4,002,030 | |

Lear Corp. | | | 38,200 | | | | 3,093,054 | |

| | | | | | | | |

| | | | | | | 10,528,507 | |

| | |

Automobiles - 0.99% | | | | | | | | |

Ford Motor Co. | | | 158,400 | | | | 2,444,112 | |

| | |

Chemicals - 3.08% | | | | | | | | |

CF Industries Holdings, Inc. | | | 9,778 | | | | 2,278,665 | |

Ferro Corp.* | | | 185,200 | | | | 2,376,116 | |

LyondellBasell Industries NV, Class A | | | 36,700 | | | | 2,946,276 | |

| | | | | | | | |

| | | | | | | 7,601,057 | |

| | |

Commercial Banks - 0.98% | | | | | | | | |

Wells Fargo & Co. | | | 53,400 | | | | 2,424,360 | |

| | |

Computers & Peripherals - 4.21% | | | | | | | | |

Apple, Inc. | | | 4,800 | | | | 2,693,328 | |

Hewlett-Packard Co. | | | 91,700 | | | | 2,565,766 | |

Seagate Technology PLC | | | 45,200 | | | | 2,538,432 | |

Western Digital Corp. | | | 31,100 | | | | 2,609,290 | |

| | | | | | | | |

| | | | | | | 10,406,816 | |

| | |

Consumer Finance - 2.10% | | | | | | | | |

Discover Financial Services | | | 47,700 | | | | 2,668,815 | |

SLM Corp. | | | 96,000 | | | | 2,522,880 | |

| | | | | | | | |

| | | | | | | 5,191,695 | |

| | |

Containers & Packaging - 4.20% | | | | | | | | |

Ball Corp. | | | 49,700 | | | | 2,567,502 | |

Packaging Corp. of America | | | 40,500 | | | | 2,562,840 | |

Sealed Air Corp. | | | 153,900 | | | | 5,240,295 | |

| | | | | | | | |

| | | | | | | 10,370,637 | |

| | |

Distributors - 1.01% | | | | | | | | |

LKQ Corp.* | | | 76,200 | | | | 2,506,980 | |

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

| | | | | |

Diversified Telecommunication Services - 2.46% | |

Cincinnati Bell, Inc.* | | | 342,500 | | | $ | 1,219,300 | |

Level 3 Communications, Inc.* | | | 79,600 | | | | 2,640,332 | |

Verizon Communications, Inc. | | | 45,200 | | | | 2,221,128 | |

| | | | | | | | |

| | | | | | | 6,080,760 | |

| | |

Electric Utilities - 0.89% | | | | | | | | |

Entergy Corp. | | | 34,600 | | | | 2,189,142 | |

| | |

Electrical Equipment - 1.25% | | | | | | | | |

Rockwell Automation, Inc. | | | 26,200 | | | | 3,095,792 | |

|

Electronic Equipment, Instruments & Components - 1.70% | |

Plexus Corp.* | | | 62,500 | | | | 2,705,625 | |

ScanSource, Inc.* | | | 35,000 | | | | 1,485,050 | |

| | | | | | | | |

| | | | | | | 4,190,675 | |

|

Energy Equipment & Services - 0.94% | |

Newpark Resources, Inc.* | | | 189,900 | | | | 2,333,871 | |

| | |

Food & Staples Retailing - 3.45% | | | | | | | | |

Kroger Co. (The) | | | 80,800 | | | | 3,194,024 | |

Rite Aid Corp.* | | | 471,600 | | | | 2,386,296 | |

Safeway, Inc. | | | 90,000 | | | | 2,931,300 | |

| | | | | | | | |

| | | | | | | 8,511,620 | |

| | |

Food Products - 1.60% | | | | | | | | |

Pilgrim’s Pride Corp.* | | | 243,900 | | | | 3,963,375 | |

|

Health Care Equipment & Supplies - 1.93% | |

Cooper Companies, Inc. (The) | | | 18,400 | | | | 2,278,656 | |

Medtronic, Inc. | | | 43,200 | | | | 2,479,248 | |

| | | | | | | | |

| | | | | | | 4,757,904 | |

|

Health Care Providers & Services - 5.18% | |

AmerisourceBergen Corp. | | | 40,700 | | | | 2,861,617 | |

Centene Corp.* | | | 42,400 | | | | 2,499,480 | |

DaVita HealthCare Partners, Inc.* | | | 42,000 | | | | 2,661,540 | |

HCA Holdings, Inc.* | | | 55,800 | | | | 2,662,218 | |

Tenet Healthcare Corp.* | | | 50,000 | | | | 2,106,000 | |

| | | | | | | | |

| | | | | | | 12,790,855 | |

|

Hotels, Restaurants & Leisure - 1.02% | |

Cracker Barrel Old Country Store, Inc. | | | 23,000 | | | | 2,531,610 | |

| | |

Household Durables - 0.81% | | | | | | | | |

Sony Corp. - Sponsored ADR | | | 115,100 | | | | 1,990,079 | |

| | |

11 | | Semi-Annual Report | December 31, 2013 (Unaudited) |

| | |

Bridgeway Aggressive Investors 1 Fund SCHEDULE OF INVESTMENTS (continued) | |

|

Showing percentage of net assets as of December 31, 2013 (Unaudited)

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

Common Stocks (continued) | | | | | |

Insurance - 7.70% | |

Arch Capital Group, Ltd.* | | | 49,900 | | | | $2,978,531 | |

Axis Capital Holdings, Ltd. | | | 59,200 | | | | 2,816,144 | |

Genworth Financial, Inc., Class A* | | | 220,700 | | | | 3,427,471 | |

Lincoln National Corp. | | | 108,100 | | | | 5,580,122 | |

Navigators Group, Inc. (The)* | | | 20,400 | | | | 1,288,464 | |

Prudential Financial, Inc. | | | 31,900 | | | | 2,941,818 | |

| | | | | | | | |

| | | | | | | 19,032,550 | |

| |

Internet & Catalog Retail - 0.30% | |

Orbitz Worldwide, Inc.* | | | 103,800 | | | | 745,284 | |

| |

Internet Software & Services - 0.71% | |

EarthLink, Inc. | | | 346,200 | | | | 1,755,234 | |

| |

IT Services - 4.62% | |

Alliance Data Systems Corp.* | | | 14,500 | | | | 3,812,485 | |

Computer Sciences Corp. | | | 46,000 | | | | 2,570,480 | |

Unisys Corp.* | | | 73,400 | | | | 2,464,038 | |

Western Union Co. (The) | | | 148,500 | | | | 2,561,625 | |

| | | | | | | | |

| | | | | | | 11,408,628 | |

| |

Life Sciences Tools & Services - 1.05% | |

Illumina, Inc.* | | | 23,500 | | | | 2,599,570 | |

| |

Machinery - 0.62% | |

CIRCOR International, Inc. | | | 19,000 | | | | 1,534,820 | |

| |

Media - 3.29% | |

Regal Entertainment Group, Class A+ | | | 120,900 | | | | 2,351,505 | |

Time Warner Cable, Inc. | | | 24,200 | | | | 3,279,100 | |

Twenty-First Century Fox, | | | | | | | | |

Inc., Class A | | | 71,000 | | | | 2,497,780 | |

| | | | | | | | |

| | | | | | | 8,128,385 | |

| |

Multiline Retail - 0.98% | |

Nordstrom, Inc. | | | 39,100 | | | | 2,416,380 | |

| |

Office Electronics - 1.12% | |

Xerox Corp. | | | 228,300 | | | | 2,778,411 | |

| |

Oil, Gas & Consumable Fuels - 6.15% | |

ConocoPhillips | | | 17,000 | | | | 1,201,050 | |

Crosstex Energy, Inc. | | | 77,000 | | | | 2,784,320 | |

Marathon Petroleum Corp. | | | 29,000 | | | | 2,660,170 | |

Pioneer Natural Resources Co. | | | 12,000 | | | | 2,208,840 | |

Tesoro Corp. | | | 56,300 | | | | 3,293,550 | |

Valero Energy Corp. | | | 60,500 | | | | 3,049,200 | |

| | | | | | | | |

| | | | | | | 15,197,130 | |

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

| | | | | | | | |

|

Paper & Forest Products - 0.51% | |

Clearwater Paper Corp.* | | | 24,100 | | | $ | 1,265,250 | |

| |

Personal Products - 1.04% | | | | | |

Herbalife, Ltd.+ | | | 32,500 | | | | 2,557,750 | |

| |

Pharmaceuticals - 2.04% | | | | | |

Actavis, PLC* | | | 15,100 | | | | 2,536,800 | |

Eli Lilly & Co. | | | 49,200 | | | | 2,509,200 | |

| | | | | | | | |

| | | | | | | 5,046,000 | |

|

Real Estate Investment Trusts (REITs) - 0.81% | |

Geo Group, Inc. (The) | | | 61,900 | | | | 1,994,418 | |

|

Real Estate Management & Development - 1.03% | |

Brookfield Asset Management, Class A | | | 65,400 | | | | 2,539,482 | |

|

Road & Rail - 1.03% | |

Arkansas Best Corp. | | | 37,400 | | | | 1,259,632 | |

Union Pacific Corp. | | | 7,600 | | | | 1,276,800 | |

| | | | | | | | |

| | | | | | | 2,536,432 | |

|

Semiconductors & Semiconductor Equipment - 5.79% | |

Amkor Technology, Inc.*+ | | | 427,800 | | | | 2,622,414 | |

Intel Corp. | | | 97,100 | | | | 2,520,716 | |

Magnachip Semiconductor Corp.* | | | 144,900 | | | | 2,825,550 | |

Micron Technology, Inc.* | | | 224,400 | | | | 4,882,944 | |

Spansion, Inc., Class A* | | | 105,000 | | | | 1,458,450 | |

| | | | | | | | |

| | | | | | | 14,310,074 | |

|

Software - 2.90% | |

Activision Blizzard, Inc. | | | 145,400 | | | | 2,592,482 | |

Electronic Arts, Inc.* | | | 82,900 | | | | 1,901,726 | |

Splunk, Inc.* | | | 39,000 | | | | 2,678,130 | |

| | | | | | | | |

| | | | | | | 7,172,338 | |

|

Specialty Retail - 2.47% | |

Best Buy Co., Inc. | | | 65,800 | | | | 2,624,104 | |

Gap, Inc. (The) | | | 89,000 | | | | 3,478,120 | |

| | | | | | | | |

| | | | | | | 6,102,224 | |

|

Textiles, Apparel & Luxury Goods - 2.42% | |

G-III Apparel Group, Ltd.* | | | 42,500 | | | | 3,136,075 | |

Wolverine World Wide, Inc. | | | 83,400 | | | | 2,832,264 | |

| | | | | | | | |

| | | | | | | 5,968,339 | |

|

Thrifts & Mortgage Finance - 1.61% | |

Flagstar Bancorp, Inc.* | | | 67,900 | | | | 1,332,198 | |

MGIC Investment Corp.* | | | 312,500 | | | | 2,637,500 | |

| | | | | | | | |

| | | | | | | 3,969,698 | |

| | |

Bridgeway Aggressive Investors 1 Fund SCHEDULE OF INVESTMENTS (continued) | |  |

Showing percentage of net assets as of December 31, 2013 (Unaudited)

| | | | | | | | |

| Industry Company | | | | Shares | | Value | |

Common Stocks (continued) | | | | |

Trading Companies & Distributors - 1.22% | |

United Rentals, Inc.* | | 38,700 | | | $ 3,016,665 | |

| |

Wireless Telecommunication Services - 0.87% | |

Cellcom Israel, Ltd.+ | | 155,000 | | | 2,157,600 | |

| | | | | | | | |

TOTAL COMMON STOCKS - 100.29% | | | 247,805,370 | |

| | | | | | | | |

(Cost $201,594,977) | |

| | | |

| | | Rate^ | | Shares | | Value | |

| | | |

MONEY MARKET FUND - 0.00% | | | | |

BlackRock FedFund | | 0.02% | | 605 | | | 605 | |

| | | | | | | | |

TOTAL MONEY MARKET FUND -0.00% | | | 605 | |

| | | | | | | | |

(Cost $605) | | | | |

| |

| INVESTMENTS PURCHASED WITH CASH PROCEEDS FROM SECURITIES LENDING - 1.48% | |

BNY Mellon Overnight Government Fund | | 0.01% | | 3,669,998 | | | 3,669,998 | |

| | | | | | | | |

TOTAL INVESTMENTS PURCHASED WITH CASH PROCEEDS FROM SECURITIES LENDING - 1.48% | | | 3,669,998 | |

| | | | | | | | |

(Cost $3,669,998) | | | | |

| |

TOTAL INVESTMENTS - 101.77% (Cost $205,265,580) | | | $251,475,973 | |

Liabilities in Excess of Other Assets - (1.77%) | | | (4,380,346 | ) |

| | | | | | | | |

NET ASSETS - 100.00% | | | $247,095,627 | |

| | | | | | | | |

* Non-income producing security. ^ Rate disclosed as of December 31, 2013. + This security or a portion of the security is out on loan as of December 31, 2013. Total loaned securities had a value of $3,588,226 at December 31, 2013. ADR - American Depositary Receipt PLC - Public Limited Company | |

| |

Summary of inputs used to value the Fund’s investments as of 12/31/2013 is as follows (See Note 2 in Notes to Financial Statements):

| | | | | | | | | | | | |

| | | Valuation Inputs |

| | | Investment in Securities (Value) |

| | | Level 1

Quoted

Prices | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total |

Common Stocks | | $247,805,370 | | $ | — | | | $ | — | | | $247,805,370 |

Money Market Fund | | — | | | 605 | | | | — | | | 605 |

Investments Purchased with Cash Proceeds From Securities Lending | | — | | | 3,669,998 | | | | — | | | 3,669,998 |

| | | | | | | | | | | | |

TOTAL | | $247,805,370 | | $ | 3,670,603 | | | $ | — | | | $251,475,973 |

| | | | | | | | | | | | |

See Notes to Financial Statements.

| | |

13 | | Semi-Annual Report | December 31, 2013 (Unaudited) |

| | |

Ultra-Small Company Fund MANAGER’S COMMENTARY (Unaudited) | |  |

(Unaudited)

December 31, 2013

Dear Fellow Ultra-Small Company Fund Shareholder,

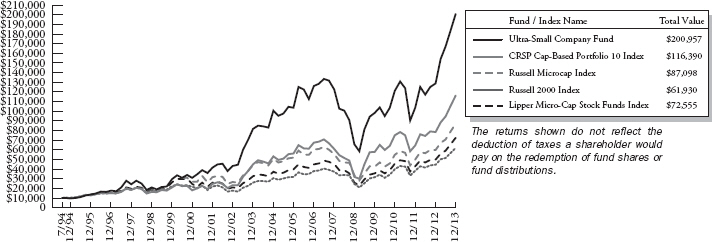

For the quarter ended December 31, 2013, our Fund appreciated 9.30%, underperforming our primary market benchmark, the CRSP Cap-Based Portfolio 10 Index (+9.97%), our peer benchmark, the Lipper Micro-Cap Stock Funds Index (+10.26%), and the Russell 2000 Index (+10.26%). Our Fund outperformed the Russell Microcap Index (+8.72%). It was a poor quarter on a relative basis.

For the six-month “semi-annual” period ending December 31, 2013, our Fund returned 20.08%, underperforming our primary benchmark, the CRSP Cap-Based Portfolio 10 Index (+23.02%), our peer benchmark, the Lipper Micro-Cap Stock Funds Index (+22.32%), and the Russell 2000 Index (+23.07%). Our Fund outperformed the Russell Microcap Index (+19.82%).

For the calendar year, our Fund was up 55.77%, outperforming all of our benchmarks. It feels good to have a clean sweep for the calendar year and since inception.

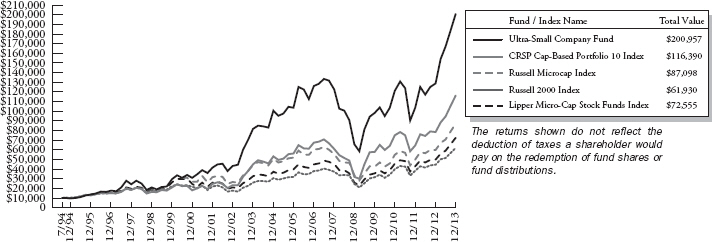

The table below presents our December quarter, six-month, one-year, five-year, ten-year, fifteen-year, and inception-to-date financial results. See the next page for a graph of performance since inception.

Standardized Returns as of December 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Annualized | |

| | | Quarter | | | 6 Months | | | 1 Year | | | 5 Years | | | 10 Years | | | 15 Years | | | Since Inception

(8/5/94) | |

| | | | | | | |

Ultra-Small Company Fund | | | 9.30% | | | | 20.08% | | | | 55.77% | | | | 24.95% | | | | 9.41% | | | | 16.19% | | | | 16.72% | |

CRSP Cap-Based Portfolio 10 Index | | | 9.97% | | | | 23.02% | | | | 48.45% | | | | 29.52% | | | | 10.02% | | | | 13.98% | | | | 13.47% | |

Russell Microcap Index | | | 8.72% | | | | 19.82% | | | | 38.82% | | | | 20.08% | | | | 9.07% | | | | 8.42% | | | | 9.85% | |

Russell 2000 Index | | | 10.26% | | | | 23.07% | | | | 45.62% | | | | 21.05% | | | | 6.99% | | | | N/A | | | | N/A | |

Lipper Micro-Cap Stock Funds Index | | | 10.26% | | | | 22.32% | | | | 45.79% | | | | 22.90% | | | | 8.29% | | | | 9.25% | | | | N/A | |

Performance figures quoted in the table above represent past performance and are no guarantee of future results. Total return figures in the table above include the reinvestment of dividends and capital gains. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The CRSP Cap-Based Portfolio 10 Index is an unmanaged index of 1,009 of the smallest publicly traded U.S. stocks (with dividends reinvested), as reported by the Center for Research on Security Prices. The Russell Microcap Index is an unmanaged, market value weighted index that measures performance of 1,000 of the smallest securities in the Russell 2000 Index. The Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Micro-Cap Stock Funds Index is an index of micro-cap funds compiled by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of December 31, 2013, Ultra-Small Company Fund ranked 10th of 68 micro-cap funds for the twelve months ending December 31, 2013, 7th of 50 over the last five years, 9th of 33 over the last ten years, and 1st of 8 since inception in August, 1994. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

| | |

Ultra-Small Company Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |  |

(Unaudited)

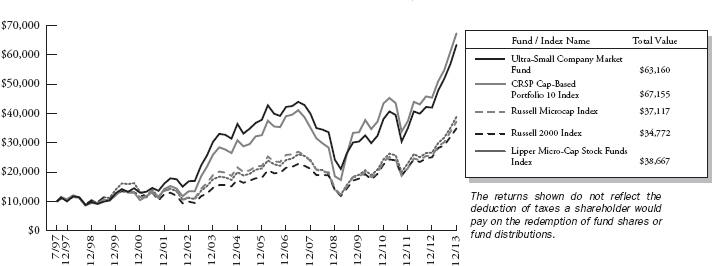

Ultra-Small Company Fund vs. CRSP Cap-Based Portfolio 10 Index, Russell Microcap Index**, Russell 2000 Index & Lipper Micro-Cap Stock Funds Index* from Inception 7/31/94 to 12/31/13

| * | The Lipper Micro-Cap Stock Funds Index began on 12/31/1995, and the line graph for the Index begins at the same value as the Fund on that date. |

| ** | The Russell Microcap Index began on 6/30/2000, and the line graph for the Index begins at the same value as the Fund on that date. |

Detailed Explanation of Quarterly Performance

The Short Version: The Fund’s current weighting of deeper value stocks hurt performance for the quarter.

Design features of the Fund, such as our overweighting of value stocks, hurt the Fund’s performance for the quarter. Additionally, holdings within the Health Care sector detracted from relative performance.

A primary determinant of our performance relative to most other Funds has to do with the size of the companies in which we invest. Our investment strategy is to approximate the long-term returns of the CRSP Cap-Based Portfolio 10 Index of ultra-small companies by investing in a representative sample of ultra-small stocks. As shown in the table on the next page, smaller companies (particularly those in the 9th and 10th decile) and the largest companies (those in the 1st decile) shined in a strong performing quarter.

| | |

15 | | Semi-Annual Report | December 31, 2013 (Unaudited) |

| | |

Ultra-Small Company Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |  |

| (Unaudited) | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| CRSP Decile1 | | Quarter | | | 6 Months | | | 1 Year | | | 5 Years | | | 10 Years | | | 88 Years | |

| 1 (ultra-large) | | | 11.04% | | | | 16.85% | | | | 32.66 | % | | | 16.86% | | | | 6.97% | | | | 9.30% | |

| 2 | | | 9.88% | | | | 17.47% | | | | 37.39 | % | | | 21.95% | | | | 10.15% | | | | 10.70% | |

| 3 | | | 7.81% | | | | 17.91% | | | | 36.89 | % | | | 22.93% | | | | 10.12% | | | | 11.01% | |

| 4 | | | 9.33% | | | | 19.32% | | | | 41.59 | % | | | 24.11% | | | | 11.06% | | | | 11.10% | |

| 5 | | | 9.10% | | | | 20.87% | | | | 41.03 | % | | | 24.67% | | | | 12.13% | | | | 11.71% | |

| 6 | | | 9.93% | | | | 19.90% | | | | 42.42 | % | | | 24.49% | | | | 10.49% | | | | 11.63% | |

| 7 | | | 8.89% | | | | 18.89% | | | | 41.95 | % | | | 24.66% | | | | 11.21% | | | | 11.71% | |

| 8 | | | 9.47% | | | | 21.70% | | | | 45.40 | % | | | 26.03% | | | | 11.62% | | | | 11.88% | |

| 9 | | | 11.04% | | | | 24.68% | | | | 50.04 | % | | | 25.33% | | | | 9.63% | | | | 11.73% | |

| 10 (ultra-small) | | | 9.97% | | | | 23.02% | | | | 48.45 | % | | | 29.52% | | | | 10.02% | | | | 13.48% | |

| 1 | Performance figures are as of the period ended December 31, 2013. The CRSP Cap-Based Portfolio Indexes are unmanaged indexes of the publicly traded U.S. stocks with dividends reinvested, grouped by market capitalization, as reported by the Center for Research in Security Prices. Past performance is no guarantee of future results. |

Detailed Explanation of Calendar Year Performance

The Short Version: Greater exposure to value stocks coupled with strong broad sector performance contributed to an exceptional year.

Strong relative performance, particularly in the Industrial and Energy sectors, played a large part in the Fund handily beating the CRSP Cap-Based Portfolio 10 Index for the calendar year. The Fund was underexposed to the relatively poor performing Financials sector, helping the Fund’s relative performance. Additionally, the Fund’s Financials sector holdings outperformed those of the primary market benchmark.

Top Ten Holdings as of December 31, 2013

| | | | | | | | | | |

| Rank | | Description | | Industry | | % of Net

Assets |

1 | | HCI Group, Inc. | | Insurance | | | 2.8 | % | | |

2 | | Universal Insurance Holdings, Inc. | | Insurance | | | 2.0 | % | | |

3 | | Christopher & Banks Corp. | | Specialty Retail | | | 2.0 | % | | |

4 | | Green Plains Renewable Energy, Inc. | | Oil, Gas & Consumable Fuels | | | 2.0 | % | | |

5 | | Quicksilver Resources, Inc. | | Oil, Gas & Consumable Fuels | | | 1.8 | % | | |

6 | | Addus Homecare Corp. | | Health Care Providers & Services | | | 1.8 | % | | |

7 | | Galena Biopharma, Inc. | | Biotechnology | | | 1.8 | % | | |

8 | | Barrett Business Services, Inc. | | Professional Services | | | 1.4 | % | | |

9 | | Tessco Technologies, Inc. | | Communications Equipment | | | 1.3 | % | | |

10 | | Fairpoint Communications, Inc. | | Diversified Telecommunication Services | | | 1.3 | % | | |

| | Total | | | | | 18.2 | % | | |

| | |

Ultra-Small Company Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |  |

| (Unaudited) | | |

Industry Sector Representation as of December 31, 2013

| | | | | | | | | | | | |

| | | % of Net Assets | | | % of CRSP 10 Index | | | Difference | |

Consumer Discretionary | | | 15.7% | | | | 14.1% | | | | 1.6% | |

Consumer Staples | | | 4.4% | | | | 3.7% | | | | 0.7% | |

Energy | | | 7.5% | | | | 7.5% | | | | 0.0% | |

Financials | | | 19.5% | | | | 27.3% | | | | -7.8% | |

Health Care | | | 13.0% | | | | 13.2% | | | | -0.2% | |

Industrials | | | 16.6% | | | | 11.8% | | | | 4.8% | |

Information Technology | | | 17.6% | | | | 16.3% | | | | 1.3% | |

Materials | | | 2.3% | | | | 3.5% | | | | -1.2% | |

Telecommunication Services | | | 2.3% | | | | 1.7% | | | | 0.6% | |

Utilities | | | 0.3% | | | | 1.0% | | | | -0.7% | |

Cash & Other Assets | | | 0.8% | | | | 0.0% | | | | 0.8% | |

Total | | | 100.0% | | | | 100.0% | | | | | |

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, December 31, 2013, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

The Fund is subject to very high, above market risk (volatility) and is not an appropriate investment for short-term investors. Investments in ultra-small companies generally carry greater risk than is customarily associated with larger companies and even “small companies” for various reasons, such as narrower markets (fewer investors), limited financial resources and greater trading difficulty.

Conclusion

Ultra-Small Company Fund remains closed to new investors. We encourage your feedback; your reactions and concerns are important to us.

Sincerely,

The Investment Management Team

| | |

17 | | Semi-Annual Report | December 31, 2013 (Unaudited) |

| | |

Bridgeway Ultra-Small Company Fund SCHEDULE OF INVESTMENTS | |  |

Showing percentage of net assets as of December 31, 2013 (Unaudited)

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

COMMON STOCKS - 99.23% | | | | | |

Air Freight & Logistics - 0.97% | | | | | |

Pacer International, Inc.* | | | 178,600 | | | | $1,475,236 | |

| |

Airlines - 1.02% | | | | | |

Republic Airways Holdings, Inc.* | | | 144,800 | | | | 1,547,912 | |

| |

Auto Components - 1.61% | |

Shiloh Industries, Inc.* | | | 33,400 | | | | 651,300 | |

Stoneridge, Inc.* | | | 51,700 | | | | 659,175 | |

Strattec Security Corp. | | | 8,900 | | | | 397,563 | |

Tower International, Inc.* | | | 34,600 | | | | 740,440 | |

| | | | | | | | |

| | | | | | | 2,448,478 | |

| |

Biotechnology - 4.64% | | | | | |

ARCA Biopharma, Inc.* | | | 120,000 | | | | 201,600 | |

AVEO Pharmaceuticals, Inc.* | | | 580,000 | | | | 1,067,200 | |

Coronado Biosciences, Inc.*+ | | | 332,500 | | | | 874,475 | |

Galena Biopharma, Inc.*+ | | | 538,100 | | | | 2,668,976 | |

OXiGENE, Inc.*+ | | | 78,600 | | | | 198,072 | |

QLT, Inc.+ | | | 85,400 | | | | 475,678 | |

Vanda Pharmaceuticals, Inc.*+ | | | 126,500 | | | | 1,569,865 | |

| | | | | | | | |

| | | | | | | 7,055,866 | |

| |

Building Products - 0.71% | | | | | |

China Ceramics Co., Ltd. | | | 29,500 | | | | 71,980 | |

PGT, Inc.* | | | 100,000 | | | | 1,012,000 | |

| | | | | | | | |

| | | | | | | 1,083,980 | |

| |

Capital Markets - 2.58% | | | | | |

FBR & Co.* | | | 51,300 | | | | 1,353,294 | |

Full Circle Capital Corp.+ | | | 80,000 | | | | 564,000 | |

Manning & Napier, Inc. | | | 50,800 | | | | 896,620 | |

Solar Senior Capital, Ltd. | | | 60,500 | | | | 1,102,310 | |

| | | | | | | | |

| | | | | | | 3,916,224 | |

| |

Chemicals - 1.89% | | | | | |

American Pacific Corp.* | | | 36,400 | | | | 1,356,264 | |

Chase Corp. | | | 17,400 | | | | 614,220 | |

GSE Holding, Inc.* | | | 216,000 | | | | 447,120 | |

Gulf Resources, Inc.* | | | 195,100 | | | | 458,485 | |

| | | | | | | | |

| | | | | | | 2,876,089 | |

| |

Commercial Banks - 5.70% | | | | | |

1st United Bancorp, Inc. | | | 37,200 | | | | 283,092 | |

C&F Financial Corp.+ | | | 6,700 | | | | 305,989 | |

Center Bancorp, Inc. | | | 18,300 | | | | 343,308 | |

Codorus Valley Bancorp, Inc. | | | 7,500 | | | | 149,250 | |

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

| | | | | | | | |

Commercial Banks (continued) | | | | | |

Farmers Capital Bank Corp.* | | | 20,000 | | | | $ 435,000 | |

Fidelity Southern Corp. | | | 22,334 | | | | 370,968 | |

First Business Financial Services, Inc. | | | 8,400 | | | | 316,092 | |

First Community Bancshares, Inc. | | | 35,500 | | | | 592,850 | |

Guaranty Bancorp | | | 17,700 | | | | 248,685 | |

Heritage Commerce Corp. | | | 29,000 | | | | 238,960 | |

Independent Bank Corp.* | | | 156,700 | | | | 1,880,400 | |

Intervest Bancshares Corp.* | | | 56,500 | | | | 424,315 | |

LCNB Corp.+ | | | 16,700 | | | | 298,429 | |

Metro Bancorp, Inc.* | | | 38,700 | | | | 833,598 | |

Monarch Financial Holdings, Inc. | | | 24,500 | | | | 301,595 | |

National Bankshares, Inc.+ | | | 1,600 | | | | 59,024 | |

Old Line Bancshares, Inc.+ | | | 10,200 | | | | 147,900 | |

Old Second Bancorp, Inc.*+ | | | 60,100 | | | | 277,061 | |

Pacific Continental Corp. | | | 3,102 | | | | 49,446 | |

Premier Financial Bancorp, Inc. | | | 10,500 | | | | 148,575 | |

Suffolk Bancorp* | | | 17,400 | | | | 361,920 | |

Trico Bancshares | | | 21,000 | | | | 595,770 | |

| | | | | | | | |

| | | | | | | 8,662,227 | |

| |

Commercial Services & Supplies - 3.84% | | | | | |

ARC Document Solutions, Inc.* | | | 200,000 | | | | 1,644,000 | |

Casella Waste Systems, Inc., Class A* | | | 159,000 | | | | 922,200 | |

Ceco Environmental Corp. | | | 35,700 | | | | 577,269 | |

Cenveo, Inc.*+ | | | 485,300 | | | | 1,669,432 | |

Costa, Inc.* | | | 17,600 | | | | 382,448 | |

Metalico, Inc.* | | | 311,300 | | | | 644,391 | |

| | | | | | | | |

| | | | | | | 5,839,740 | |

| |

Communications Equipment - 4.90% | | | | | |

Aviat Networks, Inc.* | | | 303,700 | | | | 686,362 | |

CalAmp Corp.* | | | 61,500 | | | | 1,720,155 | |

Clearfield, Inc.* | | | 83,000 | | | | 1,679,920 | |

KVH Industries, Inc.* | | | 31,000 | | | | 403,930 | |

Mitel Networks Corp.*+ | | | 34,800 | | | | 351,132 | |

Performance Technologies, Inc.* | | | 97,900 | | | | 365,656 | |

Tessco Technologies, Inc. | | | 49,100 | | | | 1,979,712 | |

UTStarcom Holdings Corp.* | | | 91,066 | | | | 252,253 | |

| | | | | | | | |

| | | | | | | 7,439,120 | |

| |

Computers & Peripherals - 3.83% | | | | | |

Concurrent Computer Corp. | | | 172,100 | | | | 1,406,057 | |

| | |

Bridgeway Ultra-Small Company Fund SCHEDULE OF INVESTMENTS (continued) | |  |

Showing percentage of net assets as of December 31, 2013 (Unaudited)

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

Common Stocks (continued) | | | | | | | | |

Computers & Peripherals (continued) | | | | | |

Dot Hill Systems Corp.* | | | 169,000 | | | | $ 569,530 | |

Hutchinson Technology, Inc.* | | | 428,000 | | | | 1,369,600 | |

Novatel Wireless, Inc.* | | | 153,900 | | | | 364,743 | |

Smart Technologies, Inc., | | | | | | | | |

Class A*+ | | | 194,300 | | | | 425,517 | |

Xyratex, Ltd. | | | 126,500 | | | | 1,681,185 | |

| | | | | | | | |

| | | | | | | 5,816,632 | |

| |

Construction & Engineering - 0.02% | | | | | |

UniTek Global Services, Inc.* | | | 15,700 | | | | 26,062 | |

| |

Construction Materials - 0.22% | | | | | |

U.S. Concrete, Inc.* | | | 15,000 | | | | 339,450 | |

| |

Diversified Consumer Services - 0.35% | | | | | |

Corinthian Colleges, Inc.* | | | 294,500 | | | | 524,210 | |

| |

Diversified Financial Services - 0.62% | | | | | |

Gain Capital Holdings, Inc.+ | | | 126,100 | | | | 947,011 | |

| |

Diversified Telecommunication Services - 2.30% | |

Alaska Communications | | | | | | | | |

Systems Group, Inc.* | | | 452,300 | | | | 958,876 | |

Fairpoint Communications, Inc.*+ | | | 175,000 | | | | 1,979,250 | |

HickoryTech Corp. | | | 24,900 | | | | 319,467 | |

PTGi Holding, Inc. | | | 83,500 | | | | 237,975 | |

| | | | | | | | |

| | | | | | | 3,495,568 | |

| |

Electrical Equipment - 1.55% | | | | | |

Broadwind Energy, Inc.* | | | 110,300 | | | | 1,041,232 | |

Highpower International, Inc.*+ | | | 142,000 | | | | 366,360 | |

Lihua International, Inc.*+ | | | 115,800 | | | | 662,376 | |

Orion Energy Systems, Inc.* | | | 42,000 | | | | 285,600 | |

| | | | | | | | |

| | | | | | | 2,355,568 | |

| |

Electronic Equipment, Instruments & Components - 2.76% | |

Agilysys, Inc.* | | | 41,800 | | | | 581,856 | |

NAPCO Security | | | | | | | | |

Technologies, Inc.* | | | 37,600 | | | | 236,128 | |

PCM, Inc.* | | | 33,700 | | | | 346,099 | |

Perceptron, Inc. | | | 111,700 | | | | 1,549,279 | |

Speed Commerce, Inc.* | | | 317,900 | | | | 1,484,593 | |

| | | | | | | | |

| | | | | | | 4,197,955 | |

| |

Energy Equipment & Services - 0.70% | | | | | |

Forbes Energy Services, Ltd.* | | | 47,900 | | | | 156,633 | |

Global Geophysical | | | | | | | | |

Services, Inc.* | | | 181,000 | | | | 291,410 | |

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

| | | | | | | | |

Energy Equipment & Services (continued) | |

North American Energy Partners, Inc.* | | | 105,100 | | | | $ 610,631 | |

| | | | | | | | |

| | | | | | | 1,058,674 | |

| |

Food & Staples Retailing - 0.99% | | | | | |

G. Willi-Food International, Ltd.*+ | | | 36,500 | | | | 299,300 | |

Pantry, Inc. (The)* | | | 71,400 | | | | 1,198,092 | |

| | | | | | | | |

| | | | | | | 1,497,392 | |

| |

Food Products - 1.64% | | | | | |

John B. Sanfilippo & Son, Inc. | | | 49,700 | | | | 1,226,596 | |

Omega Protein Corp.* | | | 93,600 | | | | 1,150,344 | |

SkyPeople Fruit Juice, Inc.* | | | 62,500 | | | | 109,375 | |

| | | | | | | | |

| | | | | | | 2,486,315 | |

| |

Gas Utilities - 0.32% | | | | | |

Gas Natural, Inc. | | | 60,600 | | | | 486,618 | |

| |

Health Care Equipment & Supplies - 0.98% | | | | | |

Digirad Corp. | | | 205,500 | | | | 760,350 | |

Kewaunee Scientific Corp. | | | 10,000 | | | | 156,200 | |

Medical Action Industries, Inc.* | | | 40,000 | | | | 342,400 | |

MGC Diagnostics Corp. | | | 18,200 | | | | 230,412 | |

| | | | | | | | |

| | | | | | | 1,489,362 | |

| |

Health Care Providers & Services - 5.95% | | | | | |

Addus HomeCare Corp.* | | | 122,900 | | | | 2,759,105 | |

Alliance HealthCare | | | | | | | | |

Services, Inc.* | | | 58,000 | | | | 1,434,920 | |

BioTelemetry, Inc.* | | | 176,600 | | | | 1,402,204 | |

Five Star Quality Care, Inc.* | | | 214,900 | | | | 1,179,801 | |

Providence Service Corp. (The)* | | | 62,700 | | | | 1,612,644 | |

RadNet, Inc.* | | | 77,300 | | | | 129,091 | |

Skilled Healthcare Group, Inc., Class A* | | | 109,300 | | | | 525,733 | |

| | | | | | | | |

| | | | | | | 9,043,498 | |

| |

Hotels, Restaurants & Leisure - 0.54% | | | | | |

Famous Dave’s of America, Inc.* | | | 25,200 | | | | 461,160 | |

Frisch’s Restaurants, Inc. | | | 6,400 | | | | 164,032 | |

MTR Gaming Group, Inc.* | | | 39,000 | | | | 201,240 | |

| | | | | | | | |

| | | | | | | 826,432 | |

| |

Household Durables - 0.98% | | | | | |

Bassett Furniture Industries, Inc. | | | 46,100 | | | | 704,408 | |

| | |

19 | | Semi-Annual Report | December 31, 2013 (Unaudited) |

| | |

Bridgeway Ultra-Small Company Fund SCHEDULE OF INVESTMENTS (continued) | |  |

Showing percentage of net assets as of December 31, 2013 (Unaudited)

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

| Common Stocks (continued) | | | | | | | | |

Household Durables (continued) | |

Dixie Group, Inc. (The)* | | | 59,400 | | | | $ 784,080 | |

| | | | | | | | |

| | | | | | | 1,488,488 | |

| |

Household Products - 1.04% | |

Orchids Paper Products Co. | | | 48,100 | | | | 1,579,604 | |

| |

Insurance - 6.64% | |

CNinsure, Inc. - ADR* | | | 72,400 | | | | 437,296 | |

Crawford & Co., Class B | | | 38,800 | | | | 358,512 | |

Eastern Insurance Holdings, Inc. | | | 18,700 | | | | 457,963 | |

Federated National Holding Co. | | | 35,000 | | | | 512,050 | |

Hallmark Financial Services, Inc.* | | | 32,900 | | | | 292,316 | |

HCI Group, Inc.+ | | | 78,200 | | | | 4,183,700 | |

Independence Holding Co. | | | 10,100 | | | | 136,249 | |

Investors Title Co. | | | 4,100 | | | | 332,018 | |

United Insurance Holdings Corp. | | | 22,500 | | | | 316,800 | |

Universal Insurance Holdings, Inc. | | | 211,700 | | | | 3,065,416 | |

| | | | | | | | |

| | | | | | | 10,092,320 | |

| |

Internet & Catalog Retail - 0.77% | |

1-800-Flowers.com, Inc., Class A* | | | 183,500 | | | | 992,735 | |

Vitacost.com, Inc.* | | | 31,700 | | | | 183,543 | |

| | | | | | | | |

| | | | | | | 1,176,278 | |

| |

Internet Software & Services - 0.89% | |

Autobytel, Inc.* | | | 25,600 | | | | 387,328 | |

BroadVision, Inc.*+ | | | 72,749 | | | | 705,665 | |

TheStreet, Inc.* | | | 113,700 | | | | 256,962 | |

| | | | | | | | |

| | | | | | | 1,349,955 | |

| |

IT Services - 2.23% | |

CSP, Inc. | | | 16,800 | | | | 135,576 | |

Edgewater Technology, Inc.* | | | 38,300 | | | | 267,717 | |

Hackett Group, Inc. (The) | | | 51,400 | | | | 319,194 | |

Information Services Group, Inc.* | | | 271,100 | | | | 1,149,464 | |

NCI, Inc., Class A* | | | 85,000 | | | | 562,700 | |

Pfsweb, Inc.* | | | 60,200 | | | | 546,014 | |

StarTek, Inc.* | | | 62,100 | | | | 403,029 | |

| | | | | | | | |

| | | | | | | 3,383,694 | |

| |

Leisure Equipment & Products - 0.13% | |

Escalade, Inc. | | | 16,600 | | | | 195,382 | |

| |

Life Sciences Tools & Services - 0.98% | |

Albany Molecular Research, Inc.* | | | 147,900 | | | | 1,490,832 | |

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

|

Machinery - 2.99% | |

Cleantech Solutions International, Inc.*+ | | | 47,900 | | | | $ 261,534 | |

Lydall, Inc.* | | | 39,600 | | | | 697,752 | |

Manitex International, Inc.* | | | 119,100 | | | | 1,891,308 | |

MFRI, Inc.* | | | 20,300 | | | | 291,305 | |

NN, Inc. | | | 69,700 | | | | 1,407,243 | |

| | | | | | | | |

| | | | | | | 4,549,142 | |

|

Media - 3.25% | |

Dex Media, Inc.*+ | | | 151,200 | | | | 1,025,136 | |

FAB Universal Corp.*D+ | | | 285,500 | | | | 528,175 | |

Lee Enterprises, Inc.*+ | | | 354,800 | | | | 1,231,156 | |