UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-08748

Wanger Advisors Trust

(Exact name of registrant as specified in charter)

227 W. Monroe Street

Suite 3000

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Ryan C. Larrenaga

c/o Columbia Management

Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

Alan Berkshire

Columbia Acorn Trust

227 West Monroe Street, Suite 3000

Chicago, Illinois 60606

Mary C. Moynihan

Perkins Coie LLP

700 13th Street, NW

Suite 600

Washington, DC 20005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 634-9200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

December 31, 2018

Wanger USA

Managed by Columbia Wanger Asset Management, LLC

Please remember that you may not buy (nor will you own) shares of the Fund directly. The Fund is available through variable annuity contracts and variable life insurance policies offered by the separate accounts of participating insurance companies as well as qualified pension and retirement plans. Please contact your financial advisor or insurance representative for more information.

Not FDIC Insured • No bank guarantee • May lose value

Wanger USA | Annual Report 2018

Investment objective

Wanger USA (the Fund) seeks long-term capital appreciation.

Portfolio management

Matthew A. Litfin, CFA

Lead Portfolio Manager since 2016

Service with the Fund since 2015

Richard Watson, CFA

Co-Portfolio Manager since 2017

Service with the Fund since 2006

| Average annual total returns (%) (for the period ended December 31, 2018) |

| | | Inception | 1 Year | 5 Years | 10 Years | Life |

| Wanger USA | 05/03/95 | -1.46 | 6.89 | 14.26 | 11.25 |

| Russell 2000 Growth Index | | -9.31 | 5.13 | 13.52 | - |

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data shown. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment manager and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results would have been lower. For most recent month-end performance updates, please visit columbiathreadneedleus.com/investor/.

Performance numbers reflect all Fund expenses but do not include any fees and expenses imposed under your variable annuity contract or life insurance policy or qualified pension or retirement plan. If performance numbers included the effect of these additional charges, they would be lower.

The Fund’s annual operating expense ratio of 1.04% is stated as of the Fund’s prospectus dated May 1, 2018, and differences in expense ratios disclosed elsewhere in this report may result from the reflection of fee waivers and/or expense reimbursements as well as different time periods used in calculating the ratios.

All results shown assume reinvestment of distributions.

The Russell 2000 Growth Index, an unmanaged index, measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

Wanger USA | Annual Report 2018

| 3 |

Fund at a Glance (continued)

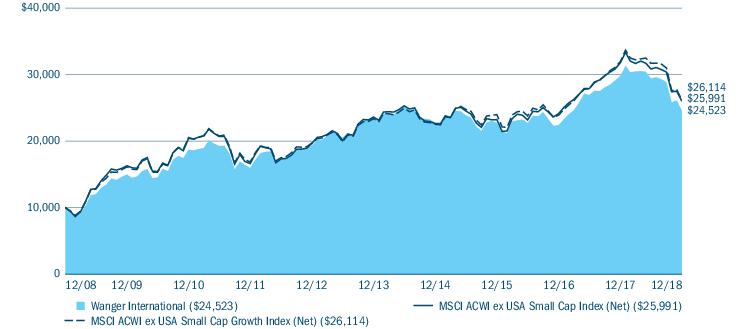

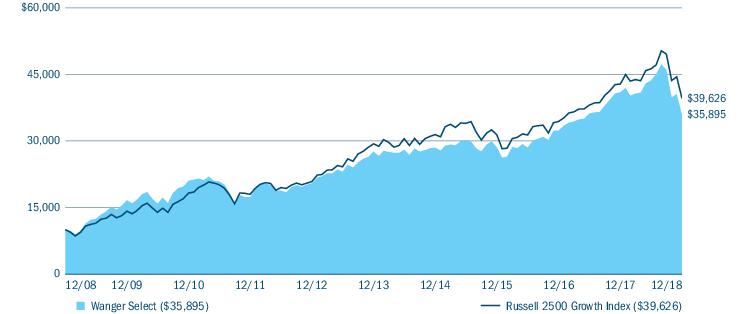

Performance of a hypothetical $10,000 investment (December 31, 2008 — December 31, 2018)

This graph compares the results of $10,000 invested in Wanger USA on December 31, 2008 through December 31, 2018 to the Russell 2000 Growth Index, with dividends and capital gains reinvested. Although the index is provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in an index. Performance numbers reflect all Fund expenses but do not include any fees and expenses imposed under your variable annuity contract or life insurance policy or qualified pension or retirement plan. If performance numbers included the effect of these additional charges, they would be lower.

| Top ten holdings (%) (at December 31, 2018) |

Unifirst Corp.

Workplace uniforms and protective clothing | 1.9 |

CyberArk Software Ltd.

IT security solutions | 1.8 |

Houlihan Lokey, Inc.

Investment bank | 1.7 |

Inter Parfums, Inc.

Fragrances and related products | 1.7 |

Chemed Corp.

Hospice and palliative care services | 1.6 |

Cedar Fair LP

Owns and operates amusement parks | 1.6 |

Dave & Buster’s Entertainment, Inc.

Venues that combine dining and entertainment for adults and families | 1.6 |

Central Garden & Pet Co.

Lawn, garden & pet supply products | 1.5 |

Dorman Products, Inc.

Automotive products and home hardware | 1.5 |

Alteryx, Inc., Class A

Data storage, retrieval, management, reporting, and analytics solutions | 1.5 |

Percentages indicated are based upon total investments (excluding Money Market Funds, Derivatives and Securities Lending Collateral, if any).

For further detail about these holdings, please refer to the section entitled “Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Portfolio breakdown (%) (at December 31, 2018) |

| Common Stocks | 91.8 |

| Limited Partnerships | 1.5 |

| Money Market Funds | 4.5 |

| Securities Lending Collateral | 2.2 |

| Total | 100.0 |

Percentages indicated are based upon total investments and exclude investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at December 31, 2018) |

| Communication Services | 0.8 |

| Consumer Discretionary | 19.7 |

| Consumer Staples | 6.3 |

| Energy | 1.1 |

| Financials | 13.2 |

| Health Care | 20.0 |

| Industrials | 11.1 |

| Information Technology | 21.3 |

| Materials | 2.6 |

| Real Estate | 3.9 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments and exclude investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| 4 | Wanger USA | Annual Report 2018 |

Manager Discussion of Fund Performance

Matthew A. Litfin, CFA

Lead Portfolio Manager

Richard Watson, CFA

Co-Portfolio Manager

Wanger USA returned -1.46% for the calendar year ended December 31, 2018. In a very difficult year for stocks, the Fund held up better than its benchmark, the Russell 2000 Growth Index, which returned -9.31% for the year. Stock selection generally accounted for the Fund’s relative performance advantage over the benchmark in this down year, with especially good results from health care and information technology holdings.

Investors kicked off 2018 with soaring optimism, buoyed by positive global economic conditions, fiscal stimulus in the form of broad corporate tax cuts and moves to reduce regulation in a number of industries. The pace of economic growth in the United States averaged more than 3.0% as the labor markets added an average of 220,000 jobs per month, wages increased on the order of 3.0% and manufacturing activity remained solid. Unemployment rose modestly in December 2018, but even that figure was positive for the economy, as it reflected an increase in the number of Americans seeking employment.

In contrast to the acceleration in the U.S. economy, the global economy lost momentum and showed mixed performance among regions during the year. In December 2018, global manufacturing slowed to the lowest level in eleven months impacted by escalating threats of a trade war between the United States and its largest trading partners as well as a maturing economic cycle. The U.S. Dollar Index (a widely-used benchmark for the international value of the U.S. dollar) gained 4.9% in the second quarter, also weighing on overseas markets. While the global economy remained on solid footing, the divergences in economic and market performance were a departure from the synchronized global growth that helped support equities in 2017.

In December 2018, the U.S. Federal Reserve (Fed) rattled investors when it raised the target on its key short-term interest rate, the federal funds rate, to a range from 2.25% to 2.50%. It was the fourth increase for the year and the ninth increase since the Fed began raising rates from close to 0.00% three years ago. As uncertainties rose, investors backed away from riskier assets. Technology stocks, which had been global market leaders, stumbled in the third quarter and triggered a broader market sell-off of stocks and high-yield bonds in the fourth quarter. By year end, both U.S. and overseas equities had given back earlier gains and ended in negative territory.

Also late in 2018, the Fed announced that it had reduced the number of anticipated 2019 rate increases from three to two, and would continue to monitor global economic and financial developments and to assess their implications for the economic outlook.

The Fund’s relative performance advantage over its benchmark in this down year was generally the result of stock selection. Alteryx, Amedisys and Reata Pharaceuticals were the top contributors to Fund results. Investors responded favorably to computer software company Alteryx after a slew of earnings and revenue announcements that exceeded expectations. Amedisys, a major provider of home health care and hospice services, enjoyed substantial earnings growth in 2018. Shares of Reata Pharmaceuticals, which focuses on oral antioxidative and anti-inflammatory drugs, rose in value after the company reported encouraging mid-stage trial results for a drug for rare forms of chronic kidney disease.

Stock selection in the consumer discretionary sector partially offset some of these good results. Within the consumer discretionary sector, Cooper-Standard Holdings and LCI Industries were top detractors. Cooper-Standard Holdings, a global supplier of systems and components to the auto industry, slumped after the company fell short of third quarter earnings estimates. Slowing revenue growth, declining margins and falling RV shipments weighed on LCI Industries, which supplies engineered components to manufacturers in the recreational and industrial products market. OptiNose, a specialty pharmaceutical company focused on creating and bringing to market innovative products for patients with diseases treated by ear, nose, throat and allergy physicians, was another major detractor.

Wanger USA | Annual Report 2018

| 5 |

Manager Discussion of Fund Performance (continued)

OptiNose shares dropped sharply despite reasonably good news on revenues. Metrics showed a downtrend in market penetration by the company’s Xhance nasal spray, and the company lowered earnings guidance for the year.

We noted the significant divergences between the global and U.S. economies and equity markets. Historically, the United States has been able to maintain business cycles that occur independent of the rest of the world. However, there is also precedent for international events triggering U.S. stock market reactions. Thus, weakness abroad can create vulnerabilities for domestic equities. A weaker U.S. dollar could help stabilize key markets.

We believe that the stock market’s recent record of relatively high volatility and number of economic and market divergences have the potential to create good opportunities for stock pickers. As a result, we are confident that our investment philosophy, which favors higher quality and structural growth (growth derived from structural shifts or changes in the economy) as measured across metrics such as return on invested capital, revenue and earnings growth, and superior debt ratios, has the potential to be particularly advantageous in the environment that prevailed at the end of the year.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Investments insmall and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. The Fund may invest significantly in issuers within a particularsector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Wanger Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Wanger Fund. References to specific securities should not be construed as a recommendation or investment advice.

| 6 | Wanger USA | Annual Report 2018 |

Understanding Your Fund’s Expenses

(Unaudited)

As a shareholder, you incur three types of costs. There are shareholder transaction costs, which may include redemption fees. There are also ongoing fund costs, which generally include investment advisory fees and other expenses for Wanger USA (the Fund). Lastly, there may be additional fees or charges imposed by the insurance company that sponsors your variable annuity and/or variable life insurance product. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in the Fund during the period. The actual and hypothetical information in the table below is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing cost of investing in a fund only and do not reflect any transaction costs, such as redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| July 1, 2018 — December 31, 2018 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Wanger USA | 1,000.00 | 1,000.00 | 852.40 | 1,020.22 | 4.74 | 5.17 | 1.01 |

Expenses paid during the period are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the Fund’s most recent fiscal half-year and divided by 365.

Had the investment manager and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced. See Note 3 to the Financial Statements.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the Fund. Expenses paid during the period do not include any insurance charges imposed by your insurance company’s separate account. The hypothetical example provided is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds whose shareholders may incur transaction costs.

Wanger USA | Annual Report 2018

| 7 |

Portfolio of Investments

December 31, 2018

(Percentages represent value of investments compared to net assets)

Investments in securities

| Common Stocks 93.8% |

| Issuer | Shares | Value ($) |

| Communication Services 0.8% |

| Interactive Media & Services 0.8% |

Care.com, Inc.(a)

Child, adult, senior, pet and home care services | 234,573 | 4,529,605 |

| Total Communication Services | 4,529,605 |

| Consumer Discretionary 17.2% |

| Auto Components 3.4% |

Cooper-Standard Holding, Inc.(a)

Sealing, fuel and brake delivery, fluid transfer systems, anti-vibration systems components, subsystems, and modules | 55,749 | 3,463,128 |

Dorman Products, Inc.(a)

Automotive products and home hardware | 92,235 | 8,302,995 |

LCI Industries

Recreational vehicles and equipment | 84,103 | 5,618,080 |

Visteon Corp.(a)

Automotive systems, modules and components | 39,113 | 2,357,732 |

| Total | | 19,741,935 |

| Distributors 0.9% |

Pool Corp.

Swimming pool supplies, equipment and leisure products | 32,628 | 4,850,152 |

| Diversified Consumer Services 0.8% |

Adtalem Global Education, Inc.(a)

Higher education institutions | 102,094 | 4,831,088 |

| Hotels, Restaurants & Leisure 7.5% |

Choice Hotels International, Inc.

Vacation rental properties, travel tips and other services | 55,111 | 3,944,845 |

Churchill Downs, Inc.

Horse racing company, home of the Kentucky Derby | 25,572 | 6,238,034 |

Dave & Buster’s Entertainment, Inc.

Venues that combine dining and entertainment for adults and families | 198,094 | 8,827,069 |

Extended Stay America, Inc.

Hotels and motels | 510,899 | 7,918,935 |

Red Rock Resorts, Inc., Class A

Casino & entertainment properties | 290,882 | 5,907,814 |

Six Flags Entertainment Corp.

Theme parks across North America | 53,137 | 2,956,011 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

Texas Roadhouse, Inc.

Moderately priced, full service restaurant chain | 68,829 | 4,109,091 |

Wingstop, Inc.

Cooked-to-order chicken wings | 56,949 | 3,655,556 |

| Total | | 43,557,355 |

| Household Durables 2.3% |

Cavco Industries, Inc.(a)

Designs and manufactures systems-built structures | 24,935 | 3,251,025 |

Helen of Troy Ltd.(a)

Brand-name hair and comfort products | 26,967 | 3,537,531 |

iRobot Corp.(a),(b)

Manufactures robots for cleaning | 51,580 | 4,319,309 |

Skyline Champion Corp.

Factory-built housing | 167,475 | 2,460,208 |

| Total | | 13,568,073 |

| Leisure Products 1.7% |

Brunswick Corp.

Consumer products serving the outdoor and indoor active recreation markets | 88,562 | 4,113,705 |

MasterCraft Boat Holdings, Inc.(a)

Recreational powerboats | 318,318 | 5,952,546 |

| Total | | 10,066,251 |

| Specialty Retail 0.6% |

Boot Barn Holdings, Inc.(a)

Western and work gear | 215,000 | 3,661,450 |

| Total Consumer Discretionary | 100,276,304 |

| Consumer Staples 6.0% |

| Beverages 0.9% |

MGP Ingredients, Inc.

Distillery ingredients and products | 84,922 | 4,844,800 |

| Food & Staples Retailing 0.9% |

BJ’s Wholesale Club Holdings, Inc.(a)

Warehouse club | 237,289 | 5,258,324 |

| Household Products 2.6% |

Central Garden & Pet Co.(a)

Lawn, garden & pet supply products | 243,823 | 8,399,703 |

WD-40 Co.

Multi-purpose lubricant products and heavy-duty hand cleaners | 37,331 | 6,841,279 |

| Total | | 15,240,982 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 8 | Wanger USA | Annual Report 2018 |

Portfolio of Investments (continued)

December 31, 2018

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Personal Products 1.6% |

Inter Parfums, Inc.

Fragrances and related products | 142,423 | 9,338,676 |

| Total Consumer Staples | 34,682,782 |

| Energy 1.0% |

| Energy Equipment & Services 0.4% |

Core Laboratories NV

Reservoir description, production enhancement, and reservoir management services | 42,779 | 2,552,195 |

| Oil, Gas & Consumable Fuels 0.6% |

Callon Petroleum Co.(a)

Independent energy company | 515,000 | 3,342,350 |

| Total Energy | 5,894,545 |

| Financials 12.6% |

| Banks 5.7% |

First Busey Corp.

Multi-bank holding company | 260,419 | 6,390,682 |

Great Southern Bancorp, Inc.

Real estate, commercial real estate, commercial business, consumer, and construction loans | 107,537 | 4,949,928 |

Lakeland Financial Corp.

Bank holding company | 161,369 | 6,480,579 |

OFG Bancorp

Holding company for Oriental Bank | 344,942 | 5,677,745 |

Sandy Spring Bancorp, Inc.

Holding company for Sandy Spring Bank | 163,328 | 5,118,700 |

Trico Bancshares

Holding company for Tri Counties Bank | 130,375 | 4,405,371 |

| Total | | 33,023,005 |

| Capital Markets 3.7% |

Ares Management Corp., Class A

Asset management firm | 262,569 | 4,668,477 |

Hamilton Lane, Inc., Class A

Private market investment solutions | 82,788 | 3,063,156 |

Houlihan Lokey, Inc.

Investment bank | 258,109 | 9,498,411 |

OM Asset Management Plc

Asset management company | 404,287 | 4,317,785 |

| Total | | 21,547,829 |

| Consumer Finance 0.7% |

FirstCash, Inc.

Owns and operates pawn stores | 57,271 | 4,143,557 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Thrifts & Mortgage Finance 2.5% |

Merchants Bancorp

Bank holding company | 200,652 | 4,005,014 |

OceanFirst Financial Corp.

New Jersey banks | 241,335 | 5,432,451 |

Walker & Dunlop, Inc.

Commercial real estate financial services | 114,104 | 4,934,998 |

| Total | | 14,372,463 |

| Total Financials | 73,086,854 |

| Health Care 19.1% |

| Biotechnology 6.8% |

Agios Pharmaceuticals, Inc.(a)

Therapeutics in the field of cancer metabolism | 93,776 | 4,324,011 |

Amicus Therapeutics, Inc.(a)

Orally-administered, small molecule drugs to treat human genetic diseases | 526,360 | 5,042,529 |

Enanta Pharmaceuticals, Inc.(a)

Pharmaceutical products | 62,816 | 4,449,257 |

Kiniksa Pharmaceuticals Ltd., Class A(a),(b)

Clinical-stage biopharmaceutical company | 165,834 | 4,658,277 |

Ligand Pharmaceuticals, Inc.(a)

Drugs that regulate hormone activated intracellular receptors | 39,140 | 5,311,298 |

Loxo Oncology, Inc.(a)

Researches and develops cancer drugs | 35,564 | 4,981,450 |

MacroGenics, Inc.(a)

Treatments for autoimmune disorders, cancer and infectious diseases | 342,006 | 4,343,476 |

Repligen Corp.(a)

Supplier to Biopharma Industry | 61,329 | 3,234,492 |

Ultragenyx Pharmaceutical, Inc.(a)

Therapeutics and sialic acid for treating metabolic, body myopathy, glucuronidase, and rare genetic diseases | 77,723 | 3,379,396 |

| Total | | 39,724,186 |

| Health Care Equipment & Supplies 6.6% |

Atrion Corp.

Medical products and components | 9,303 | 6,894,267 |

AxoGen, Inc.(a)

Technologies for peripheral nerve reconstruction and regeneration | 272,223 | 5,561,516 |

Cerus Corp.(a)

Systems to enhance the safety of blood transfusions | 593,000 | 3,006,510 |

iRhythm Technologies, Inc.(a)

Medical instruments | 66,434 | 4,615,834 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Wanger USA | Annual Report 2018

| 9 |

Portfolio of Investments (continued)

December 31, 2018

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

Orthofix Medical, Inc.(a)

Spine fixation, biological, and other orthopedic and spine solutions | 83,843 | 4,400,919 |

Sientra, Inc.(a)

Plastic surgery implantable devices | 214,737 | 2,729,307 |

Tactile Systems Technology, Inc.(a)

Technology for treating lymphedema, chronic swelling & venous ulcers | 114,258 | 5,204,452 |

Tandem Diabetes Care, Inc.(a)

Produces medical devices | 153,406 | 5,824,826 |

| Total | | 38,237,631 |

| Health Care Providers & Services 3.7% |

AMN Healthcare Services, Inc.(a)

Temporary healthcare staffing | 82,571 | 4,678,473 |

Chemed Corp.

Hospice and palliative care services | 32,255 | 9,137,197 |

HealthEquity, Inc.(a)

Technology-enabled services platforms for consumers to make healthcare saving and spending decisions | 66,856 | 3,987,960 |

Tivity Health, Inc.(a)

Health fitness solutions | 137,458 | 3,410,333 |

| Total | | 21,213,963 |

| Pharmaceuticals 2.0% |

GW Pharmaceuticals PLC, ADR(a)

Cannabinoid prescription medicines | 40,341 | 3,928,810 |

Optinose, Inc.(a),(b)

Health care services | 558,460 | 3,462,452 |

Reata Pharmaceuticals, Inc., Class A(a)

Biopharmaceutical company | 79,070 | 4,435,827 |

| Total | | 11,827,089 |

| Total Health Care | 111,002,869 |

| Industrials 10.6% |

| Aerospace & Defense 0.8% |

BWX Technologies, Inc.

Nuclear components and fuel | 115,831 | 4,428,219 |

| Commercial Services & Supplies 3.1% |

Brink’s Co. (The)

Provides security services globally | 50,180 | 3,244,137 |

Healthcare Services Group, Inc.(b)

Housekeeping, laundry, linen, facility maintenance, and food services | 117,422 | 4,718,016 |

Unifirst Corp.

Workplace uniforms and protective clothing | 72,631 | 10,391,317 |

| Total | | 18,353,470 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Machinery 2.4% |

ITT, Inc.

Engineered components & customized technology solutions | 108,601 | 5,242,170 |

Toro Co. (The)

Turf equipment | 63,070 | 3,524,352 |

Woodward, Inc.

Energy control systems and components for aircraft, industrial engines and turbines | 72,088 | 5,355,417 |

| Total | | 14,121,939 |

| Professional Services 1.8% |

Exponent, Inc.

Science and engineering consulting firm | 119,253 | 6,047,320 |

ICF International, Inc.

Management, technology, policy consulting, and implementation services | 65,401 | 4,236,677 |

| Total | | 10,283,997 |

| Road & Rail 1.6% |

Landstar System, Inc.

Truckload carrier | 40,451 | 3,869,947 |

Saia, Inc.(a)

Trucking transportation | 101,808 | 5,682,923 |

| Total | | 9,552,870 |

| Trading Companies & Distributors 0.9% |

SiteOne Landscape Supply, Inc.(a)

Landscape supplies | 90,941 | 5,026,309 |

| Total Industrials | 61,766,804 |

| Information Technology 20.3% |

| Electronic Equipment, Instruments & Components 1.7% |

ePlus, Inc.(a)

Provides IT hardware, software and services | 83,447 | 5,938,923 |

Novanta, Inc.(a)

Precision photonics and motion control components and subsystems | 58,877 | 3,709,251 |

| Total | | 9,648,174 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 10 | Wanger USA | Annual Report 2018 |

Portfolio of Investments (continued)

December 31, 2018

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| IT Services 2.2% |

CoreLogic, Inc.(a)

Consumer, financial and property information, analytics and services to business and government | 73,787 | 2,465,962 |

Endava PLC, ADR(a)

IT services | 151,838 | 3,680,553 |

Hackett Group

Business consulting and technology implementation | 218,842 | 3,503,661 |

Science Applications International Corp.

Scientific, Engineering and technology consulting services | 49,932 | 3,180,668 |

| Total | | 12,830,844 |

| Semiconductors & Semiconductor Equipment 3.4% |

Advanced Energy Industries, Inc.(a)

Engineered precision power conversion, measurement and control solutions | 101,849 | 4,372,377 |

Entegris, Inc.

Microelectronics materials management | 130,556 | 3,641,860 |

Inphi Corp.(a)

Analog semiconductor solutions | 132,972 | 4,275,050 |

MKS Instruments, Inc.

Instruments and components used to control and analyze gases in semiconductor manufacturing | 52,864 | 3,415,543 |

Semtech Corp.(a)

Analog and mixed-signal semiconductors | 94,620 | 4,340,219 |

| Total | | 20,045,049 |

| Software 13.0% |

Alteryx, Inc., Class A(a)

Data storage, retrieval, management, reporting, and analytics solutions | 138,776 | 8,253,009 |

Anaplan, Inc.(a),(b)

Cloud platform for business applications | 143,249 | 3,801,828 |

Blackline, Inc.(a)

Develops and markets enterprise software | 142,222 | 5,823,991 |

CyberArk Software Ltd.(a)

IT security solutions | 133,456 | 9,894,428 |

j2 Global, Inc.

Cloud-based communications and storage messaging services | 72,400 | 5,023,112 |

Manhattan Associates, Inc.(a)

Information technology solutions for distribution centers | 137,227 | 5,814,308 |

Mimecast Ltd.(a)

Cloud security and risk management services for corporate information and email | 199,399 | 6,705,788 |

MINDBODY, Inc., Class A(a)

Business management software | 198,173 | 7,213,497 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

Q2 Holdings, Inc.(a)

Secure, cloud-based virtual banking solutions | 77,724 | 3,851,224 |

Qualys, Inc.(a)

Information technology security risk and compliance management solutions | 106,501 | 7,959,885 |

Zscaler, Inc.(a)

Cloud-based internet security platform | 150,857 | 5,915,103 |

Zuora, Inc., Class A(a)

Develops cloud based software | 308,311 | 5,592,762 |

| Total | | 75,848,935 |

| Total Information Technology | 118,373,002 |

| Materials 2.5% |

| Chemicals 2.5% |

Orion Engineered Carbons SA

Global supplier of Carbon Black | 255,495 | 6,458,913 |

PolyOne Corp.

International polymer services company | 133,247 | 3,810,864 |

Quaker Chemical Corp.

Custom-formulated chemical specialty products | 24,763 | 4,400,633 |

| Total | | 14,670,410 |

| Total Materials | 14,670,410 |

| Real Estate 3.7% |

| Equity Real Estate Investment Trusts (REITS) 2.1% |

Coresite Realty Corp.

Develops, owns & operates data centers | 70,553 | 6,154,338 |

UMH Properties, Inc.

Real estate investment trust | 508,782 | 6,023,979 |

| Total | | 12,178,317 |

| Real Estate Management & Development 1.6% |

Colliers International Group, Inc.

Commercial real estate, residential property management and property services | 82,145 | 4,521,261 |

FirstService Corp.

Real estate services | 70,500 | 4,827,840 |

| Total | | 9,349,101 |

| Total Real Estate | 21,527,418 |

Total Common Stocks

(Cost: $520,022,313) | 545,810,593 |

|

The accompanying Notes to Financial Statements are an integral part of this statement.

Wanger USA | Annual Report 2018

| 11 |

Portfolio of Investments (continued)

December 31, 2018

| Limited Partnerships 1.5% |

| Issuer | Shares | Value ($) |

| Consumer Discretionary 1.5% |

| Hotels, Restaurants & Leisure 1.5% |

Cedar Fair LP

Owns and operates amusement parks | 187,034 | 8,846,708 |

| Total Consumer Discretionary | 8,846,708 |

Total Limited Partnerships

(Cost: $10,466,812) | 8,846,708 |

|

| Securities Lending Collateral 2.2% |

| | Shares | Value ($) |

Dreyfus Government Cash Management Fund, Institutional Shares, 2.372%(c),(d)

| 13,137,290 | 13,137,290 |

Total Securities Lending Collateral

(Cost: $13,137,290) | 13,137,290 |

|

| Money Market Funds 4.6% |

| | Shares | Value ($) |

| Columbia Short-Term Cash Fund, 2.459%(c),(e) | 26,682,465 | 26,679,797 |

Total Money Market Funds

(Cost: $26,679,797) | 26,679,797 |

Total Investments in Securities

(Cost $570,306,212) | 594,474,388 |

| Obligation to Return Collateral for Securities Loaned | | (13,137,290) |

| Other Assets & Liabilities, Net | | 653,464 |

| Net Assets | $581,990,562 |

Notes to Portfolio of Investments

| (a) | Non-income producing security. |

| (b) | All or a portion of this security was on loan at December 31, 2018. The total market value of securities on loan at December 31, 2018 was $13,684,905. |

| (c) | The rate shown is the seven-day current annualized yield at December 31, 2018. |

| (d) | Investment made with cash collateral received from securities lending activity. |

| (e) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2018 are as follows: |

| Issuer | Beginning

shares | Shares

purchased | Shares

sold | Ending

shares | Realized gain

(loss) —

affiliated

issuers ($) | Net change in

unrealized

appreciation

(depreciation) —

affiliated

issuers ($) | Dividend —

affiliated issuers

($) | Value —

affiliated

issuers

at end of

period ($) |

| Columbia Short-Term Cash Fund, 2.459% |

| | — | 179,942,424 | (153,259,959) | 26,682,465 | — | — | 167,066 | 26,679,797 |

Abbreviation Legend

| ADR | American Depositary Receipt |

Fair value measurements

Various inputs are used in determining the value of the Fund’s investments, following the input prioritization hierarchy established by accounting principles generally accepted in the United States of America (GAAP). These inputs are summarized in the three broad levels listed below:

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others) |

| ■ | Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management’s own assumptions about the factors market participants would use in pricing an investment) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Examples of the types of securities in which the Fund would typically invest and how they are classified within this hierarchy are as follows. Typical Level 1 securities include exchange traded domestic equities, mutual funds whose net asset values are published each day and exchange traded foreign equities that are not typically statistically fair valued. Typical Level 2 securities include exchange traded foreign equities that are traded in the European region or Asia Pacific region time zones which are typically statistically fair valued, forward

The accompanying Notes to Financial Statements are an integral part of this statement.

| 12 | Wanger USA | Annual Report 2018 |

Portfolio of Investments (continued)

December 31, 2018

Fair value measurements (continued)

foreign currency exchange contracts and short-term investments valued at amortized cost. Additionally, securities fair valued by Columbia Wanger Asset Management’s Valuation Committee (the Committee) that rely on significant observable inputs are also included in Level 2. Typical Level 3 securities include any security fair valued by the Committee that relies on significant unobservable inputs.

Certain investments that have been measured at fair value using the net asset value (NAV) per share (or its equivalent) are not categorized in the fair value hierarchy. The fair value amounts presented in the table are intended to reconcile the fair value hierarchy to the amounts presented in the Portfolio of Investments. The Columbia Short-Term Cash Fund seeks to provide shareholders with maximum current income consistent with liquidity and stability of principal. Columbia Short-Term Cash Fund prices its shares with a floating NAV and no longer seeks to maintain a stable NAV.

The Committee is responsible for applying the Wanger Advisors Trust Portfolio Pricing Policy and the Columbia Wanger Asset Management pricing procedures (the Policies), which are approved by and subject to the oversight of the Board of Trustees.

The Committee meets as necessary, and no less frequently than quarterly, to determine fair values for securities for which market quotations are not readily available or for which Columbia Wanger Asset Management believes that available market quotations are unreliable. The Committee also reviews the continuing appropriateness of the Policies. In circumstances where a security has been fair valued, the Committee will also review the continuing appropriateness of the current value of the security. The Policies address, among other things: circumstances under which market quotations will be deemed readily available; selection of third party pricing vendors; appropriate pricing methodologies; events that require fair valuation and fair value techniques; circumstances under which securities will be deemed to pose a potential for stale pricing, including when securities are illiquid, restricted, or in default; and certain delegations of authority to determine fair values to the Fund’s investment manager. The Committee may also meet to discuss additional valuation matters, which may include review of back-testing results, review of time-sensitive information or approval of other valuation related actions, and to review the appropriateness of the Policies.

For investments categorized as Level 3, the significant unobservable inputs used in the fair value measurement of the Fund’s securities may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. Significant changes in any of these factors could result in lower or higher fair value measurements. Various factors impact the frequency of monitoring (which may occur as often as daily), however the Committee may determine that changes to inputs, assumptions and models are not required with the same frequency.

The following table is a summary of the inputs used to value the Fund’s investments at December 31, 2018:

| | Level 1

quoted prices

in active

markets for

identical

assets ($) | Level 2

other

significant

observable

inputs ($) | Level 3

significant

unobservable

inputs ($) | Investments

measured at

net asset

value ($) | Total ($) |

| Investments in Securities | | | | | |

| Common Stocks | | | | | |

| Communication Services | 4,529,605 | — | — | — | 4,529,605 |

| Consumer Discretionary | 100,276,304 | — | — | — | 100,276,304 |

| Consumer Staples | 34,682,782 | — | — | — | 34,682,782 |

| Energy | 5,894,545 | — | — | — | 5,894,545 |

| Financials | 73,086,854 | — | — | — | 73,086,854 |

| Health Care | 111,002,869 | — | — | — | 111,002,869 |

| Industrials | 61,766,804 | — | — | — | 61,766,804 |

| Information Technology | 118,373,002 | — | — | — | 118,373,002 |

| Materials | 14,670,410 | — | — | — | 14,670,410 |

| Real Estate | 21,527,418 | — | — | — | 21,527,418 |

| Total Common Stocks | 545,810,593 | — | — | — | 545,810,593 |

| Limited Partnerships | | | | | |

| Consumer Discretionary | 8,846,708 | — | — | — | 8,846,708 |

| Securities Lending Collateral | 13,137,290 | — | — | — | 13,137,290 |

| Money Market Funds | — | — | — | 26,679,797 | 26,679,797 |

| Total Investments in Securities | 567,794,591 | — | — | 26,679,797 | 594,474,388 |

There were no transfers of financial assets between levels during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Wanger USA | Annual Report 2018

| 13 |

Statement of Assets and Liabilities

December 31, 2018

| Assets | |

| Investments in securities, at value* | |

| Unaffiliated issuers (cost $543,626,415) | $567,794,591 |

| Affiliated issuers (cost $26,679,797) | 26,679,797 |

| Cash | 867,000 |

| Receivable for: | |

| Capital shares sold | 714,905 |

| Dividends | 452,619 |

| Securities lending income | 6,108 |

| Foreign tax reclaims | 1,362 |

| Prepaid expenses | 18,394 |

| Trustees’ deferred compensation plan | 204,204 |

| Total assets | 596,738,980 |

| Liabilities | |

| Due upon return of securities on loan | 14,004,290 |

| Payable for: | |

| Capital shares purchased | 334,642 |

| Investment advisory fee | 41,238 |

| Service fees | 60,689 |

| Administration fees | 2,369 |

| Compensation of chief compliance officer | 1,174 |

| Other expenses | 99,812 |

| Trustees’ deferred compensation plan | 204,204 |

| Total liabilities | 14,748,418 |

| Net assets applicable to outstanding capital stock | $581,990,562 |

| Represented by | |

| Paid in capital | 445,552,158 |

| Total distributable earnings (loss) (Note 2) | 136,438,404 |

| Total - representing net assets applicable to outstanding capital stock | $581,990,562 |

| Shares outstanding | 28,113,809 |

| Net asset value per share | 20.70 |

| * Includes the value of securities on loan | 13,684,905 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 14 | Wanger USA | Annual Report 2018 |

Statement of Operations

Year Ended December 31, 2018

| Net investment income | |

| Income: | |

| Dividends — unaffiliated issuers | $5,964,320 |

| Dividends — affiliated issuers | 167,066 |

| Income from securities lending — net | 333,212 |

| Foreign taxes withheld | (57,834) |

| Total income | 6,406,764 |

| Expenses: | |

| Investment advisory fee | 6,105,538 |

| Service fees | 554,135 |

| Administration fees | 352,951 |

| Trustees’ fees | 65,401 |

| Custodian fees | 11,634 |

| Printing and postage fees | 158,392 |

| Audit fees | 41,213 |

| Legal fees | 110,814 |

| Compensation of chief compliance officer | 2,299 |

| Other | 38,958 |

| Total expenses | 7,441,335 |

| Fees waived by transfer agent | (412,152) |

| Total net expenses | 7,029,183 |

| Net investment loss | (622,419) |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Investments — unaffiliated issuers | 115,134,937 |

| Net realized gain | 115,134,937 |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments — unaffiliated issuers | (113,466,197) |

| Net change in unrealized appreciation (depreciation) | (113,466,197) |

| Net realized and unrealized gain | 1,668,740 |

| Net increase in net assets resulting from operations | $1,046,321 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Wanger USA | Annual Report 2018

| 15 |

Statement of Changes in Net Assets

| | Year Ended

December 31, 2018 | Year Ended

December 31, 2017 |

| Operations | | |

| Net investment loss | $(622,419) | $(528,477) |

| Net realized gain | 115,134,937 | 163,958,845 |

| Net change in unrealized appreciation (depreciation) | (113,466,197) | (42,319,867) |

| Net increase in net assets resulting from operations | 1,046,321 | 121,110,501 |

| Distributions to shareholders | | |

| Net investment income and net realized gains | (161,967,932) | |

| Net realized gains | | (108,009,366) |

| Total distributions to shareholders (Note 2) | (161,967,932) | (108,009,366) |

| Increase in net assets from capital stock activity | 58,200,283 | 7,375,038 |

| Total increase (decrease) in net assets | (102,721,328) | 20,476,173 |

| Net assets at beginning of year | 684,711,890 | 664,235,717 |

| Net assets at end of year | $581,990,562 | $684,711,890 |

| Undistributed (excess of distributions over) net investment income | $102,427 | $(152,351) |

| | Year Ended | Year Ended |

| | December 31, 2018 | December 31, 2017 |

| | Shares | Dollars ($) | Shares | Dollars ($) |

| Capital stock activity |

| | | | | |

| Subscriptions | 912,955 | 23,287,444 | 368,297 | 9,709,107 |

| Distributions reinvested | 6,526,840 | 161,967,932 | 4,399,567 | 108,009,366 |

| Redemptions | (4,929,560) | (127,055,093) | (4,199,383) | (110,343,435) |

| Total net increase | 2,510,235 | 58,200,283 | 568,481 | 7,375,038 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 16 | Wanger USA | Annual Report 2018 |

The following table is intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of the expenses that apply to the variable accounts or contract charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund’s portfolio turnover rate may be higher.

| | Year Ended December 31, |

| 2018 | 2017 | 2016 | 2015 | 2014 |

| Per share data | | | | | |

| Net asset value, beginning of period | $26.74 | $26.53 | $31.75 | $37.71 | $41.13 |

| Income from investment operations: | | | | | |

| Net investment income (loss) | (0.02) | (0.02) | (0.04) | (0.12) | (0.06) |

| Net realized and unrealized gain | 0.75 | 4.81 | 3.56 | 0.45 | 1.70 |

| Total from investment operations | 0.73 | 4.79 | 3.52 | 0.33 | 1.64 |

| Less distributions to shareholders from: | | | | | |

| Net investment income | (0.03) | — | — | — | — |

| Net realized gains | (6.74) | (4.58) | (8.74) | (6.29) | (5.06) |

| Total distributions to shareholders | (6.77) | (4.58) | (8.74) | (6.29) | (5.06) |

| Net asset value, end of period | $20.70 | $26.74 | $26.53 | $31.75 | $37.71 |

| Total return | (1.46)%(a) | 19.58%(a) | 13.69% | (0.61)% | 4.78% |

| Ratios to average net assets | | | | | |

| Total gross expenses(b) | 1.05% | 1.03% | 1.00% | 1.01% | 0.96% |

| Total net expenses(b) | 1.00% | 0.99% | 1.00% | 1.01% | 0.96% |

| Net investment loss | (0.09)% | (0.08)% | (0.16)% | (0.34)% | (0.15)% |

| Supplemental data | | | | | |

| Portfolio turnover | 81% | 96% | 118% | 45% | 14% |

| Net assets, end of period (in thousands) | $581,991 | $684,712 | $664,236 | $692,605 | $800,933 |

| Notes to Financial Highlights |

| (a) | Had the Investment Manager and/or its affiliates not waived a portion of expenses, total return would have been reduced. |

| (b) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

The accompanying Notes to Financial Statements are an integral part of this statement.

Wanger USA | Annual Report 2018

| 17 |

Notes to Financial Statements

December 31, 2018

Note 1. Organization

Wanger USA (the Fund), a series of Wanger Advisors Trust (the Trust), is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The investment objective of the Fund is to seek long-term capital appreciation. The Fund is available only for allocation to certain life insurance company separate accounts established for the purpose of funding participating variable annuity contracts and variable life insurance policies and may also be offered directly to certain qualified pension and retirement plans.

Note 2. Summary of significant accounting policies

Basis of preparation

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946,Financial Services - Investment Companies (ASC 946). The financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security valuation

Securities of the Fund are valued at market value or, if a market quotation for a security is not readily available or is deemed not to be reliable because of events or circumstances that have occurred between the market quotation and the time as of which the security is to be valued, the security is valued at its fair value determined in good faith under consistently applied procedures established by the Board of Trustees. A security traded on a securities exchange or in an over-the-counter market in which transaction prices are reported is valued at the last sales price at the time of valuation. A security traded principally on NASDAQ is valued at the NASDAQ official closing price. Exchange-traded funds are valued at their official close net asset value as reported on the applicable exchange. A security for which there is no reported sale on the valuation date is valued by comparison of the mean of the latest bid and ask quotations.

Foreign equity securities are generally valued based on the closing price on the foreign exchange in which such securities are primarily traded. If any foreign equity security closing prices are not readily available, the securities are valued at the mean of the latest quoted bid and ask prices on such exchanges or markets. Foreign currency exchange rates are generally determined at 4:00 p.m. Eastern (U.S.) time. Many securities markets and exchanges outside the U.S. close prior to the close of the New York Stock Exchange; therefore, the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the New York Stock Exchange. In situations where foreign markets are closed, where a significant event has occurred after the foreign exchange closes but before the time at which the Fund’s share price is calculated, and in the event of significant movement in the trigger index for the statistical fair valuation process established by the Board of Trustees, foreign securities will be fair valued pursuant to a policy adopted by the Board of Trustees. The Trust has retained an independent statistical fair value pricing service that employs a systematic methodology to assist in the fair valuation process for securities principally traded in a foreign market in order to adjust for possible changes in value that may occur between the close of the foreign market and the time as of which the securities are to be valued. If a security is valued at a fair value, that value may be different from the last quoted market price for the security.

Short-term investments maturing in 60 days or less are valued at amortized cost, which approximates market value.

| 18 | Wanger USA | Annual Report 2018 |

Notes to Financial Statements (continued)

December 31, 2018

Fund share valuation

Fund shares are sold and redeemed on a continuing basis at net asset value. Net asset value per share is determined daily as of the close of trading on the New York Stock Exchange on each day the New York Stock Exchange is open for trading by dividing the total value of the Fund’s investments and other assets, less liabilities, by the number of Fund shares outstanding.

GAAP requires disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category. This information is disclosed following the Fund’s Portfolio of Investments.

Securities lending

The Fund may lend securities up to one-third of the value of its total assets to certain approved brokers, dealers and other financial institutions to earn additional income. The Fund retains the benefits of owning the securities, including the economic equivalent of dividends or interest generated by the security. The Fund also receives a fee for the loan. The Fund has the ability to recall the loans at any time and could do so in order to vote proxies or to sell the loaned securities. Each loan is collateralized by cash that exceeded the value of the securities on loan. The market value of the loaned securities is determined daily at the close of business of the Fund and any additional required collateral is delivered to each Fund on the next business day. The Fund typically invests the cash collateral in the Dreyfus Government Cash Management Fund. The income earned from the securities lending program is paid to the Fund, net of any fees remitted to Goldman Sachs Agency Lending, the Fund’s lending agent, and borrower rebates. The Fund’s investment manager, Columbia Wanger Asset Management, LLC (the Investment Manager or CWAM), does not retain any fees earned by the lending program. Generally, in the event of borrower default, the Fund has the right to use the collateral to offset any losses incurred. In the event the Fund is delayed or prevented from exercising its right to dispose of the collateral, there may be a potential loss to the Fund. Some of these losses may be indemnified by the lending agent. The Fund bears the risk of loss with respect to the investment of collateral. The net lending income earned by the Fund as of December 31, 2018, is included in the Statement of Operations.

The following table indicates the total amount of securities loaned by type, reconciled to gross liability payable upon return of the securities loaned by the Fund as of December 31, 2018:

| | Overnight and

continuous | Up to

30 days | 30-90

days | Greater than

90 days | Total |

| Wanger USA | | | | | |

| Securities lending transactions | | | | | |

| Equity securities | $13,684,905 | $— | $— | $— | $13,684,905 |

| Gross amount of recognized liabilities for securities lending (collateral received) | | | | | 14,004,290 |

| Amounts due to counterparty in the event of default | | | | | $319,385 |

Offsetting of assets and liabilities

The following table presents the Fund’s gross and net amount of assets and liabilities available for offset under netting arrangements as well as any related collateral received or pledged by the Fund as of December 31, 2018:

| | Goldman

Sachs ($) |

| Liabilities | |

| Collateral on Securities Loaned | 14,004,290 |

| Total Liabilities | 14,004,290 |

| Total Financial and Derivative Net Assets | (14,004,290) |

| Financial Instruments | 13,684,905 |

| Net Amount(a) | (319,385) |

| (a) | Represents the net amount due from/(to) counterparties in the event of default. |

Wanger USA | Annual Report 2018

| 19 |

Notes to Financial Statements (continued)

December 31, 2018

Security transactions and investment income

Security transactions are accounted for on the trade date (date the order to buy or sell is executed) and dividend income is recorded on the ex-dividend date, except that certain dividends from foreign securities are recorded as soon as the information is available to the Fund. Interest income is recorded on the accrual basis and includes amortization of discounts on debt obligations when required for federal income tax purposes. Realized gains and losses from security transactions are recorded on an identified cost basis.

Income recognition

Corporate actions and dividend income are generally recorded net of any non-reclaimable tax withholdings, on the ex-dividend date or upon receipt of ex-dividend notification in the case of certain foreign securities.

The Fund may receive distributions from holdings in equity securities, exchange traded funds (ETFs), limited partnerships (LPs), other regulated investment companies (RICs), and real estate investment trusts (REITs), which report information on the tax character of their distributions annually. These distributions are allocated to dividend income, capital gain and return of capital based on actual information reported. Return of capital is recorded as a reduction of the cost basis of securities held. If the Fund no longer owns the applicable securities, return of capital is recorded as a realized gain. With respect to REITs, to the extent actual information has not yet been reported, estimates for return of capital may be made by the Fund’s management. Management’s estimates are subsequently adjusted when the actual character of the distributions is disclosed by the REITs, which could result in a proportionate change in return of capital to shareholders.

Awards, if any, from class action litigation related to securities owned may be recorded as a reduction of cost of those securities. If the applicable securities are no longer owned, the proceeds are recorded as realized gains.

Expenses

General expenses of the Trust are allocated to the Fund and the other series of the Trust based upon relative net assets or other expense allocation methodologies determined by the nature of the expense. Expenses directly attributable to the Fund are charged to the Fund.

Federal income tax status

The Fund intends to comply with the provisions of the Internal Revenue Code available to regulated investment companies and, in the manner provided therein, intends to distribute substantially all its taxable income, as well as any net realized gain on sales of investments and foreign currency transactions reportable for federal income tax purposes. Accordingly, the Fund paid no federal income taxes and no federal income tax provision was required. The Fund meets the exception under Internal Revenue Code Section 4982(f) and the Fund expects not to be subject to federal excise tax.

Foreign taxes

Gains in certain countries may be subject to foreign taxes at the fund level. The Fund accrues for such foreign taxes on realized and unrealized gains at the appropriate rate for each jurisdiction. The amount, if any, is disclosed as a liability on the Statement of Assets and Liabilities.

Distributions to shareholders

Distributions to shareholders are recorded on the ex-dividend date.

Guarantees and indemnification

In the normal course of business, the Trust on behalf of the Fund enters into contracts that contain a variety of representations and warranties and that provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims against the Fund. Also under the Trust’s organizational documents, the trustees and officers of the Trust are indemnified against certain liabilities that may arise out of their duties to the Trust. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

| 20 | Wanger USA | Annual Report 2018 |

Notes to Financial Statements (continued)

December 31, 2018

Recent accounting pronouncements

Accounting Standards Update 2017-08 Premium Amortization on Purchased Callable Debt Securities

In March 2017, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2017-08 Premium Amortization on Purchased Callable Debt Securities. ASU No. 2017-08 updates the accounting standards to shorten the amortization period for certain purchased callable debt securities, held at a premium, to be amortized to the earliest call date. The update applies to securities with explicit, noncontingent call features that are callable at fixed prices and on preset dates. The standard is effective for annual periods beginning after December 15, 2018 and interim periods within those fiscal years. Management does not expect the implementation of this guidance to have a material impact on the financial statement amounts and footnote disclosures.

Accounting Standards Update 2018-13 Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement

In August 2018, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2018-13 Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement. ASU No. 2018-13, in addition to other modifications and additions, removes the requirement to disclose the amount and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy and the policy for the timing of transfers between levels. The standard is effective for annual periods beginning after December 15, 2019 and interim periods within those fiscal years. At this time, management is evaluating the implication of this guidance and the impact it will have on the financial statement disclosures, if any.

Disclosure Update and Simplification

In September 2018, the Securities and Exchange Commission (SEC) released Final Rule 33-10532, Disclosure Update and Simplification, which amends certain financial statement disclosure requirements that the SEC determined to be redundant, outdated, or superseded in light of other SEC disclosure requirements, GAAP, or changes in the information environment. As a result of the amendments, Management implemented disclosure changes which included removing the components of distributable earnings presented on the Statement of Assets and Liabilities and combining income and gain distributions paid to shareholders as presented on the Statement of Changes in Net Assets. Any values presented to meet prior year requirements were left unchanged. The amendments had no effect on the Funds’ net assets or results of operation.

Note 3. Fees and other transactions with affiliates

Management services fees

CWAM is a wholly owned subsidiary of Columbia Management Investment Advisers, LLC (Columbia Management), which in turn is a wholly owned subsidiary of Ameriprise Financial, Inc. (Ameriprise Financial). CWAM furnishes continuing investment supervision to the Fund and is responsible for the overall management of the Fund’s business affairs.

CWAM receives a monthly advisory fee based on the Fund’s daily net assets at the following annual rates:

| Average daily net assets | Annual

fee rate |

| Up to $100 million | 0.94% |

| $100 million to $250 million | 0.89% |

| $250 million to $2 billion | 0.84% |

| $2 billion and over | 0.80% |

For the year ended December 31, 2018, the effective investment advisory fee rate was 0.86% of the Fund’s average daily net assets.

Wanger USA | Annual Report 2018

| 21 |

Notes to Financial Statements (continued)

December 31, 2018

Administration fees

CWAM provides administrative services and receives an administration fee from the Fund at the following annual rates:

| Aggregate average daily net assets of the Trust | Annual

fee rate |

| Up to $4 billion | 0.05% |

| $4 billion to $6 billion | 0.04% |

| $6 billion to $8 billion | 0.03% |

| $8 billion and over | 0.02% |

For the year ended December 31, 2018, the effective administration fee rate was 0.05% of the Fund’s average daily net assets. CWAM has delegated to Columbia Management responsibility to provide certain sub-administrative services to the Fund.

Compensation of board members

Certain officers and trustees of the Trust are also officers of CWAM or Columbia Management. The Trust makes no direct payments to its officers and trustees who are affiliated with CWAM or Columbia Management. The Trust offers a Deferred Compensation Plan (the Deferred Plan) for its independent trustees. Under the Deferred Plan, a trustee may elect to defer all or a portion of his or her compensation. Amounts deferred are retained by the Trust and may represent an unfunded obligation of the Trust. The value of amounts deferred is determined by reference to the change in value of Institutional Class shares of one or more series of Columbia Acorn Trust or a money market fund as specified by the trustee. Benefits under the Deferred Plan are payable in accordance with the Deferred Plan.

Compensation of Chief Compliance Officer

The Board of Trustees has appointed a Chief Compliance Officer to the Fund in accordance with federal securities regulations. As disclosed in the Statement of Operations, a portion of the Chief Compliance Officer’s total compensation is allocated to the Fund, along with other allocations to affiliated funds governed by the Board of Trustees, based on relative net assets.

Service fees

Pursuant to the Transfer, Dividend Disbursing and Shareholder Servicing Agreement between the Fund and Columbia Management Investment Services Corp. (the Transfer Agent), an affiliate of the Investment Manager and a wholly-owned subsidiary of Ameriprise Financial, the Fund bears a service fee paid to the Transfer Agent to compensate it for amounts paid to Participating Insurance Companies and other financial intermediaries (together, Participating Organizations) for various sub-transfer agency and other shareholder services each Participating Organization provides to its clients, customers and participants that are invested directly or indirectly in the Fund, up to a cap approved by the Board of Trustees from time to time.

The Transfer Agent may retain as compensation for its services revenues from fees for wire, telephone and redemption orders, account transcripts due the Transfer Agent from Fund shareholders and interest (net of bank charges) earned with respect to balances in accounts the Transfer Agent maintains in connection with its services to the Fund.

Effective July 1, 2018 through June 30, 2019, the Transfer Agent has contractually agreed to waive a portion of the service fee payable by the Fund such that the annual service fee paid by the Fund does not exceed 0.04% of the Fund’s average daily net assets. This agreement may be terminated at the sole discretion of the Board of Trustees. Prior to July 1, 2018, the Transfer Agent had contractually agreed to waive a portion of the service fee payable by the Fund such that the annual service fee paid by the Fund did not exceed 0.00% of the Fund’s average daily net assets.

Distributor

Columbia Management Investment Distributors, Inc., a wholly owned subsidiary of Ameriprise Financial, serves as the Fund’s distributor and principal underwriter.

| 22 | Wanger USA | Annual Report 2018 |

Notes to Financial Statements (continued)

December 31, 2018

Note 4. Federal tax information

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP because of temporary or permanent book to tax differences.

At December 31, 2018, these differences were primarily due to differing treatment for deferral/reversal of wash sale losses, passive foreign investment company (PFIC) holdings, trustees’ deferred compensation and investments in partnerships. To the extent these differences were permanent, reclassifications were made among the components of the Fund’s net assets. Temporary differences do not require reclassifications.

The following reclassifications were made:

Undistributed net

investment

income ($) | Accumulated

net realized

gain ($) | Paid in

capital ($) |

| 1,523,184 | (1,523,184) | — |

Net investment income (loss) and net realized gains (losses), as disclosed in the Statement of Operations, and net assets were not affected by this reclassification.

The tax character of distributions paid during the years indicated was as follows:

| Year Ended December 31, 2018 | Year Ended December 31, 2017 |

Ordinary

income ($) | Long-term

capital gains ($) | Total ($) | Ordinary

income ($) | Long-term

capital gains ($) | Total ($) |

| 42,836,331 | 119,131,601 | 161,967,932 | — | 108,009,366 | 108,009,366 |

Short-term capital gain distributions, if any, are considered ordinary income distributions for tax purposes.

At December 31, 2018, the components of distributable earnings on a tax basis were as follows:

Undistributed

ordinary income ($) | Undistributed

long-term

capital gains ($) | Capital loss

carryforwards ($) | Net unrealized

appreciation ($) |

| 28,331,923 | 87,004,469 | — | 21,269,505 |

At December 31, 2018, the cost of all investments for federal income tax purposes along with the aggregate gross unrealized appreciation and depreciation based on that cost was:

Federal

tax cost ($) | Gross unrealized

appreciation ($) | Gross unrealized

(depreciation) ($) | Net unrealized

appreciation ($) |

| 573,204,883 | 95,378,946 | (74,109,441) | 21,269,505 |

Tax cost of investments and unrealized appreciation/(depreciation) may also include timing differences that do not constitute adjustments to tax basis.

Management is required to determine whether a tax position of the Fund is more likely than not to be sustained upon examination by the applicable taxing authority, including resolution of any related appeals or litigation processes, based on the technical merits of the position. The tax benefit to be recognized by the Fund is measured as the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement. Management is not aware of any tax positions in the Fund for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. However, management’s conclusions may be subject to review and adjustment at a later date based on factors including, but not limited to, new tax laws, regulations, and administrative interpretations (including relevant court decisions). The Fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

Wanger USA | Annual Report 2018

| 23 |

Notes to Financial Statements (continued)

December 31, 2018

Note 5. Portfolio information

The aggregate cost of purchases and proceeds from sales other than short-term obligations for the year ended December 31, 2018, were $546,948,095 and $671,432,152, respectively. The amount of purchase and sales activity impacts the portfolio turnover rate reported in the Financial Highlights.

Note 6. Line of credit

The Fund has access to a revolving credit facility with a syndicate of banks led by Citibank, N.A., HSBC Bank USA, N.A. and JPMorgan Chase Bank, N.A. whereby the Fund may borrow for the temporary funding of shareholder redemptions or for other temporary or emergency purposes. The credit facility, which is a collective agreement between the Fund and certain other funds managed by the Investment Manager or an affiliated investment manager, severally and not jointly, permits collective borrowings up to $1 billion. Interest is charged to each participating fund based on its borrowings at a rate equal to the higher of (i) the federal funds effective rate, (ii) the one-month LIBOR rate and (iii) the overnight bank funding rate, plus in each case, 1.00%. Each borrowing under the credit facility matures no later than 60 days after the date of borrowing. The Fund also pays a commitment fee equal to its pro rata share of the unused amount of the credit facility at a rate of 0.15% per annum. The commitment fee is included in other expenses in the Statement of Operations. This agreement expires annually in December unless extended or renewed.

The Fund had no borrowings during the year ended December 31, 2018.

Note 7. Significant risks

Shareholder concentration risk

At December 31, 2018, two unaffiliated shareholders of record owned 33.2% of the outstanding shares of the Fund in one or more accounts. The Fund has no knowledge about whether any portion of those shares was owned beneficially. Affiliated shareholders of record owned 60.2% of the outstanding shares of the Fund in one or more accounts. Subscription and redemption activity by concentrated accounts may have a significant effect on the operations of the Fund. In the case of a large redemption, the Fund may be forced to sell investments at inopportune times, including its liquid positions, which may result in Fund losses and the Fund holding a higher percentage of less liquid positions. Large redemptions could result in decreased economies of scale and increased operating expenses for non-redeeming Fund shareholders.

Technology and technology-related investment risk