UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08748

Wanger Advisors Trust

(Exact name of registrant as specified in charter)

227 W. Monroe Street

Suite 3000

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Mary C. Moynihan

Perkins Coie LLP

700 13th Street, NW

Suite 600

Washington, DC 20005

Paul B. Goucher, Esq.

Columbia Management Investment Advisers, LLC

100 Park Avenue

New York, New York 10017

P. Zachary Egan

Columbia Acorn Trust

227 West Monroe Street, Suite 3000

Chicago, Illinois 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 634-9200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

December 31, 2016

WANGER USA

Managed by Columbia Wanger Asset Management, LLC

Not FDIC Insured • No bank guarantee • May lose value

WANGER USA | Annual Report 2016

Investment objective

Wanger USA (the Fund) seeks long-term capital appreciation.

Portfolio management

Matthew A. Litfin

Lead Portfolio Manager

William J. Doyle

Co-Portfolio Manager

| Average annual total returns (%) (for the period ended December 31, 2016) |

| | | Inception | 1 Year | 5 Years | 10 Years | Life |

| Wanger USA | 05/03/95 | 13.69 | 13.71 | 7.42 | 11.51 |

| Russell 2000 Index | | 21.31 | 14.46 | 7.07 | 9.27 |

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data shown. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment manager and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results would have been lower. For most recent month-end performance updates, please visit investor.columbiathreadneedleus.com.

Performance numbers reflect all Fund expenses but do not include any fees and expenses imposed under your variable annuity contract or life insurance policy or qualified pension or retirement plan. If performance numbers included the effect of these additional charges, they would be lower.

The Fund’s annual operating expense ratio of 1.01% is stated as of the Fund’s prospectus dated May 1, 2016, and differences in expense ratios disclosed elsewhere in this report may result from the reflection of fee waivers and/or expense reimbursements as well as different time periods used in calculating the ratios.

All results shown assume reinvestment of distributions.

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index.

Indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

Wanger USA | Annual Report 2016

| 3 |

Fund at a Glance (continued)

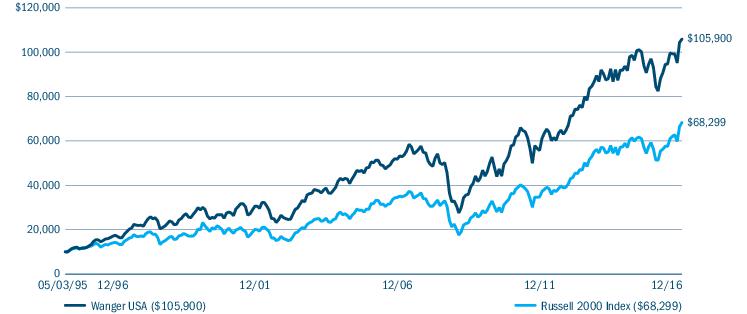

Performance of a hypothetical $10,000 investment (May 3, 1995 — December 31, 2016)

This graph compares the results of $10,000 invested in Wanger USA on May 3, 1995 (the date the Fund began operations) through December 31, 2016 to the Russell 2000 Index, with dividends and capital gains reinvested. Although the index is provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in the index.

| Top ten holdings (%) (at December 31, 2016) |

Toro Co. (The)

Turf Maintenance Equipment | 2.2 |

LCI Industries

RV & Manufactured Home Components | 2.1 |

Camping World Holdings, Inc., Class A

RV-centric Retail Stores & Services | 2.1 |

LegacyTexas Financial Group, Inc.

Texas Thrift | 1.9 |

Dorman Products, Inc.

Aftermarket Auto Parts Distributor | 1.9 |

j2 Global, Inc.

Communication Technology & Digital Media | 1.9 |

Papa John’s International, Inc.

Franchisor of Pizza Restaurants | 1.8 |

AMN Healthcare Services, Inc.

Temporary Healthcare Staffing | 1.8 |

Lakeland Financial Corp.

Indiana Bank | 1.7 |

ANSYS, Inc.

Simulation Software for Engineers & Designers | 1.7 |

Percentages indicated are based upon total investments (excluding Money Market Funds and Securities Lending Collateral).

For further detail about these holdings, please refer to the section entitled “Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Portfolio breakdown (%) (at December 31, 2016) |

| Common Stocks | 94.8 |

| Money Market Funds | 2.8 |

| Securities Lending Collateral | 2.4 |

| Total | 100.0 |

Percentages indicated are based upon total investments. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at December 31, 2016) |

| Consumer Discretionary | 19.5 |

| Consumer Staples | 1.4 |

| Energy | 2.5 |

| Financials | 15.3 |

| Health Care | 25.1 |

| Industrials | 15.9 |

| Information Technology | 18.0 |

| Real Estate | 2.3 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| 4 | Wanger USA | Annual Report 2016 |

Manager Discussion of Fund Performance

Matthew A. Litfin

Lead Portfolio Manager

William J. Doyle

Co-Portfolio Manager

Wanger USA gained 13.69% in 2016, a strong absolute return but short of the 21.31% gain of the Fund’s primary benchmark, the Russell 2000 Index. The difference was largely due to the benchmark’s exposure to value stocks, which led market performance for much of the year but aren’t a focus of the Fund’s small-cap growth strategy. Comparing to the Fund’s growth-oriented Morningstar US Insurance Small Growth peer group, Wanger USA surpassed the category average return of 11.12% for the year.

Health care names were prominent among the Fund’s detractors. Celldex Therapeutics, a biotech developing cancer drugs, was sold in the first quarter but ranked as the Fund’s worst detractor for the year, falling 78% in the Fund. The company’s brain cancer drug failed a Phase III trial early in the year and the stock declined on the news. Orphan drug developer Ultragenyx Pharmaceutical and Akorn, a developer, manufacturer and distributor of specialty generic drugs, both ended the year down roughly 40%. Political uncertainty following the election brought down the sector, as did increased concerns regarding drug pricing pressures. The Fund’s stock selection in health care was strong relative to the benchmark, but its large overweight in a down year was a negative.

The top-contributing sector to Fund performance for the year was consumer discretionary. The Fund’s overweight position in the sector gained 24%, nearly doubling the benchmark’s 13% return in the sector. LCI Industries (formerly Drew Industries), a provider of recreational vehicles (RVs) and manufactured home components, gained 78% as the company continued to benefit from market-share gains amid robust RV end-market demand, combined with its efficient manufacturing processes. Within the same industry, we participated in the October initial public offering of Camping World, a chain of RV-centric retail stores and related services provider. The stock got off to a strong start, ending the year up 41%. The RV market is one of the bright spots in the consumer discretionary space and has not shown signs of slowing yet. We believe Camping World has solid prospects for sales growth and margin expansion. Papa John’s International, a franchisor of pizza restaurants, was also a leader for the year in the sector, gaining 54% as the company took share in the pizza industry with its effective digital platform and marketing strategy, which drove strong earnings.

Over the past year, we made significant changes to Wanger USA. We added over 60 new ideas to the Fund, focusing on companies that have high and steady returns on invested capital. We also reduced the weighted average market cap of the Fund by focusing our additions to the portfolio on small-cap growth names. Overall, the Fund increased its exposure to the health care and consumer discretionary sectors in 2016 and reduced its exposure to industrials, as we gravitated to companies that we believe are less cyclical, have sustainable growth outlooks and have the ability to control their own destinies. While health care struggled late in the year, we are finding compelling valuations and investment opportunities in the sector in areas that we believe are unlikely to be greatly impacted by changes proposed by the new administration.

Going into 2017, it appears that there is significant economic momentum. U.S. gross domestic product growth looks encouraging, though it was down somewhat in the fourth quarter of 2016. Consumer spending has been strong, and the market is beginning to price in apparent optimism around potential regulatory changes. In our opinion, a more business-friendly environment should be beneficial to the high-quality, small-cap growth companies held in Wanger USA, as should a transition in equity markets from being interest-rate driven to being earnings driven.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Investments in small and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector.

Wanger USA | Annual Report 2016

| 5 |

Understanding Your Fund’s Expenses

As a shareholder, you incur three types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees and other expenses for Wanger USA (the Fund). Lastly, there may be additional fees or charges imposed by the insurance company that sponsors your variable annuity and/or variable life insurance product. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in the Fund during the period. The actual and hypothetical information in the table below is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing cost of investing in a fund only and do not reflect any transaction costs, such as sales charges, redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| July 1, 2016 — December 31, 2016 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Wanger USA | 1,000.00 | 1,000.00 | 1,117.50 | 1,020.05 | 5.24 | 5.00 | 0.99 |

Expenses paid during the period are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the Fund’s most recent fiscal half-year and divided by 366.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the Fund. Expenses paid during the period do not include any insurance charges imposed by your insurance company’s separate account. The hypothetical example provided is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds whose shareholders may incur transaction costs.

| 6 | Wanger USA | Annual Report 2016 |

Portfolio of Investments

December 31, 2016

| Common Stocks 97.8% |

| Issuer | Shares | Value ($) |

| Consumer Discretionary 19.0% |

| Auto Components 4.8% |

Dorman Products, Inc.(a)

Aftermarket Auto Parts Distributor | 170,554 | 12,460,675 |

Gentex Corp.

Manufacturer of Auto Parts | 287,392 | 5,658,749 |

LCI Industries

RV & Manufactured Home Components | 129,308 | 13,932,937 |

| Total | | 32,052,361 |

| Distributors 0.9% |

Pool Corp.

Swimming Pool Supplies & Equipment Distributor | 58,527 | 6,106,707 |

| Diversified Consumer Services 1.6% |

Bright Horizons Family Solutions, Inc.(a)

Child Care/Preschool Services | 97,884 | 6,853,838 |

ServiceMaster Global Holdings, Inc.(a)

Pest & Termite Control, Home Warranty & Other Home Services | 99,675 | 3,754,757 |

| Total | | 10,608,595 |

| Hotels, Restaurants & Leisure 4.4% |

Papa John’s International, Inc.

Franchisor of Pizza Restaurants | 138,112 | 11,819,625 |

Texas Roadhouse, Inc.

Rural-focused Full Service Steakhouse | 204,154 | 9,848,389 |

Vail Resorts, Inc.

Ski Resort Operator & Developer | 21,236 | 3,425,579 |

Zoe’s Kitchen, Inc.(a),(b)

Fast, Casual Mediterranean Food | 168,746 | 4,048,217 |

| Total | | 29,141,810 |

| Household Durables 2.6% |

Cavco Industries, Inc.(a)

Manufactured Homes | 88,486 | 8,835,327 |

iRobot Corp.(a)

Home Robots (Vacuums, Pool Cleaners) & Battlefield Reconnaissance Robots | 139,396 | 8,147,696 |

| Total | | 16,983,023 |

| Leisure Products 1.5% |

Brunswick Corp.

Boats, Boat Engines, Exercise & Bowling Equipment | 188,043 | 10,255,865 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Specialty Retail 3.2% |

Camping World Holdings, Inc., Class A

RV-centric Retail Stores & Services | 412,498 | 13,443,310 |

Five Below, Inc.(a)

Low-price Specialty Retailer Targeting Pre-Teens, Teens & Parents | 106,908 | 4,272,044 |

Monro Muffler Brake, Inc.

Automotive Services | 63,662 | 3,641,466 |

| Total | | 21,356,820 |

| Total Consumer Discretionary | 126,505,181 |

| Consumer Staples 1.4% |

| Household Products 1.4% |

WD-40 Co.

Manufacturer of Industrial Lubrications | 78,157 | 9,136,553 |

| Total Consumer Staples | 9,136,553 |

| Energy 2.5% |

| Energy Equipment & Services 1.3% |

Core Laboratories NV

Oil & Gas Reservoir Consulting | 43,178 | 5,183,087 |

Frank’s International NV(b)

Global Provider of Casing Running Services Post Drilling of Wells | 287,113 | 3,534,361 |

| Total | | 8,717,448 |

| Oil, Gas & Consumable Fuels 1.2% |

Carrizo Oil & Gas, Inc.(a)

Oil & Gas Producer | 95,787 | 3,577,645 |

PDC Energy, Inc.(a)

Oil & Gas Producer in the United States | 54,785 | 3,976,295 |

| Total | | 7,553,940 |

| Total Energy | 16,271,388 |

| Financials 14.9% |

| Banks 11.7% |

Associated Banc-Corp.

Midwest Bank | 328,176 | 8,105,947 |

First Busey Corp.

Illinois Bank | 335,458 | 10,325,397 |

Great Southern Bancorp, Inc.

Heartland Bank | 93,635 | 5,117,153 |

Lakeland Financial Corp.

Indiana Bank | 240,070 | 11,369,715 |

LegacyTexas Financial Group, Inc.

Texas Thrift | 291,787 | 12,564,348 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Wanger USA | Annual Report 2016

| 7 |

Portfolio of Investments (continued)

December 31, 2016

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

MB Financial, Inc.

Chicago Bank | 198,433 | 9,371,991 |

Sandy Spring Bancorp, Inc.

Baltimore & Washington, D.C. Bank | 175,120 | 7,003,049 |

SVB Financial Group(a)

Bank to Venture Capitalists | 56,463 | 9,692,439 |

Trico Bancshares

California Central Valley Bank | 122,157 | 4,175,326 |

| Total | | 77,725,365 |

| Capital Markets 2.7% |

MarketAxess Holdings, Inc.

Bond Exchange | 21,187 | 3,112,794 |

OM Asset Management PLC

Asset Manager Holding Company | 671,153 | 9,731,719 |

SEI Investments Co.

Mutual Fund Administration & Investment Management | 109,429 | 5,401,415 |

| Total | | 18,245,928 |

| Insurance 0.5% |

Allied World Assurance Co. Holdings AG

Commercial Lines Insurance/Reinsurance | 61,337 | 3,294,410 |

| Total Financials | 99,265,703 |

| Health Care 24.6% |

| Biotechnology 4.6% |

Agios Pharmaceuticals, Inc.(a),(b)

Biotech Focused on Cancer & Orphan Diseases | 94,140 | 3,928,462 |

Clovis Oncology, Inc.(a),(b)

Pre-commercial Biotech Company | 81,891 | 3,637,598 |

Exact Sciences Corp.(a),(b)

Molecular Diagnostics | 373,827 | 4,994,329 |

Genomic Health, Inc.(a)

Cancer Diagnostics | 138,767 | 4,078,362 |

Ligand Pharmaceuticals, Inc.(a)

Royalties from Licensing Drug Delivery Technology | 38,426 | 3,904,466 |

Repligen Corp.(a)

Supplier to Biopharma Industry | 128,384 | 3,956,795 |

Seattle Genetics, Inc.(a)

Antibody-based Therapies for Cancer | 53,606 | 2,828,788 |

Ultragenyx Pharmaceutical, Inc.(a)

Biotech Focused on "Ultra-Orphan" Drugs | 45,480 | 3,197,699 |

| Total | | 30,526,499 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Health Care Equipment & Supplies 7.5% |

ABIOMED, Inc.(a)

Medical Devices for Cardiac Conditions | 29,362 | 3,308,510 |

Endologix, Inc.(a)

Minimally Invasive Treatment of Abdominal Aortic Aneurysm | 660,630 | 3,778,804 |

iRhythm Technologies, Inc.(a)

Cardiac Arrhythmia Monitoring Devices & Services | 238,034 | 7,141,020 |

LeMaitre Vascular, Inc.

Medical Devices for Peripheral Vascular Disease | 383,293 | 9,712,645 |

Masimo Corp.(a)

Pulse Oximetry Monitors (Blood Oxygen Levels) | 100,543 | 6,776,598 |

Natus Medical, Inc.(a)

Neuro-diagnostic & Newborn Care Products | 254,144 | 8,844,211 |

West Pharmaceutical Services, Inc.

Components & Systems for Injectable Drug Delivery | 68,349 | 5,798,046 |

Zeltiq Aesthetics, Inc.(a)

Systems & Consumables for Aesthetics | 107,124 | 4,662,036 |

| Total | | 50,021,870 |

| Health Care Providers & Services 6.7% |

AMN Healthcare Services, Inc.(a)

Temporary Healthcare Staffing | 304,163 | 11,695,067 |

HealthSouth Corp.

Inpatient Rehabilitation Facilities & Home Health Care | 192,634 | 7,944,226 |

Mednax, Inc.(a)

Physician Management for Pediatric & Anesthesia Practices | 151,538 | 10,101,523 |

Team Health Holdings, Inc.(a)

Healthcare Professionals Outsourcing | 163,632 | 7,109,811 |

VCA, Inc.(a)

Animal Hospitals & Laboratory Services | 112,079 | 7,694,223 |

| Total | | 44,544,850 |

| Health Care Technology 2.1% |

Computer Programs & Systems, Inc.(b)

IT Systems & Services for Health Care Providers | 216,377 | 5,106,497 |

Evolent Health, Inc., Class A(a)

IT & Services Vendor for Hospitals | 198,658 | 2,940,138 |

Medidata Solutions, Inc.(a)

Cloud-based Software for Drug Studies | 112,104 | 5,568,206 |

| Total | | 13,614,841 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 8 | Wanger USA | Annual Report 2016 |

Portfolio of Investments (continued)

December 31, 2016

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Life Sciences Tools & Services 3.0% |

Bio-Techne Corp.

Maker of Consumables & Systems for the Life Science Market | 97,609 | 10,037,134 |

Cambrex Corp.(a)

Active Pharmaceutical Ingredients for Small Molecule Drugs | 116,759 | 6,299,148 |

VWR Corp.(a)

Distributor of Lab Supplies | 133,837 | 3,349,940 |

| Total | | 19,686,222 |

| Pharmaceuticals 0.7% |

Akorn, Inc.(a)

Developer, Manufacturer & Distributor of Specialty Generic Drugs | 216,967 | 4,736,390 |

| Total Health Care | 163,130,672 |

| Industrials 15.6% |

| Aerospace & Defense 2.8% |

Astronics Corp.(a)

Designer & Manufacturer of Aircraft Electrical Components & Testing Equipment | 126,858 | 4,292,875 |

Astronics Corp., Class B(a)

Designer & Manufacturer of Aircraft Electrical Components & Testing Equipment | 19,028 | 641,243 |

HEICO Corp., Class A

FAA-Approved Aircraft Replacement Parts | 105,800 | 7,183,820 |

Taser International, Inc.(a)

Manufacturer of Electrical Weapons & Body Cameras | 263,326 | 6,383,022 |

| Total | | 18,500,960 |

| Commercial Services & Supplies 4.8% |

Copart, Inc.(a)

Auto Salvage Services | 103,414 | 5,730,170 |

Healthcare Services Group, Inc.

Outsourced Services to Long-term Care Industry | 87,487 | 3,426,866 |

Knoll, Inc.

Office & Residential Furniture | 262,702 | 7,337,267 |

Ritchie Bros. Auctioneers, Inc.

Heavy Equipment Auctioneer | 151,423 | 5,148,382 |

Unifirst Corp.

Uniform Rental | 72,993 | 10,485,444 |

| Total | | 32,128,129 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Machinery 4.9% |

ESCO Technologies, Inc.

Industrial Filtration & Advanced Measurement Equipment | 61,760 | 3,498,704 |

Middleby Corp. (The)(a)

Manufacturer of Cooking Equipment | 34,778 | 4,479,754 |

Nordson Corp.

Dispensing Systems for Adhesives & Coatings | 55,659 | 6,236,591 |

Oshkosh Corp.

Specialty Truck Manufacturer | 58,696 | 3,792,349 |

Toro Co. (The)

Turf Maintenance Equipment | 255,118 | 14,273,852 |

| Total | | 32,281,250 |

| Professional Services 2.2% |

ICF International, Inc.(a)

Professional Service Company | 73,767 | 4,071,938 |

Wageworks, Inc.(a)

Healthcare Consumer Directed Benefits & Commuter Account Management | 144,995 | 10,512,138 |

| Total | | 14,584,076 |

| Trading Companies & Distributors 0.9% |

Watsco, Inc.

HVAC Distribution | 42,031 | 6,225,632 |

| Total Industrials | 103,720,047 |

| Information Technology 17.6% |

| Electronic Equipment, Instruments & Components 1.0% |

IPG Photonics Corp.(a)

Fiber Lasers | 65,168 | 6,432,733 |

| Internet Software & Services 6.9% |

CoStar Group, Inc.(a)

Commercial Real Estate Data Aggregator & Web Marketing for Retail Landlords | 56,419 | 10,634,417 |

j2 Global, Inc.

Communication Technology & Digital Media | 147,349 | 12,053,148 |

Mimecast Ltd.(a)

Cyber Security, Continuity & Archiving Software | 276,722 | 4,953,324 |

NIC, Inc.

Government Web Portal Development & Management Outsourcing | 289,260 | 6,913,314 |

Nutanix, Inc., Class A(a),(b)

Software Company Selling Hyper-converged Infrastructure Appliances | 120,000 | 3,187,200 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Wanger USA | Annual Report 2016

| 9 |

Portfolio of Investments (continued)

December 31, 2016

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

Q2 Holdings, Inc.(a)

Online & Mobile Banking Software | 126,637 | 3,653,478 |

SPS Commerce, Inc.(a)

Supply Chain Management Software Delivered via the Web | 63,646 | 4,448,219 |

| Total | | 45,843,100 |

| IT Services 3.0% |

CoreLogic, Inc.(a)

Data Processing Services for Real Estate, Insurance & Mortgages | 85,048 | 3,132,318 |

ExlService Holdings, Inc.(a)

Business Process Outsourcing | 65,532 | 3,305,434 |

MAXIMUS, Inc.

Outsourcer for Government Program Administration | 157,928 | 8,810,803 |

WNS Holdings Ltd., ADR(a)

Offshore Business Process Outsourcing Services | 183,040 | 5,042,752 |

| Total | | 20,291,307 |

| Semiconductors & Semiconductor Equipment 1.2% |

Monolithic Power Systems, Inc.

High Performance Analog & Mixed Signal Integrated Circuits | 97,373 | 7,977,770 |

| Software 5.5% |

ANSYS, Inc.(a)

Simulation Software for Engineers & Designers | 120,020 | 11,100,650 |

Apptio, Inc., Class A(a)

Software for Managing IT Spending | 171,584 | 3,179,452 |

Blackline, Inc.(a)

Accounting Software | 112,789 | 3,116,360 |

Guidewire Software, Inc.(a)

Software for Global Property & Casualty Insurance Carriers | 65,907 | 3,251,192 |

Manhattan Associates, Inc.(a)

Supply Chain Management Software & Services | 117,592 | 6,235,904 |

Qualys, Inc.(a)

Security Software Delivered Via the Cloud | 204,090 | 6,459,448 |

Tyler Technologies, Inc.(a)

Financial, Tax, Court & Document Management Systems for Local Governments | 22,417 | 3,200,475 |

| Total | | 36,543,481 |

| Total Information Technology | 117,088,391 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Real Estate 2.2% |

| Equity Real Estate Investment Trusts (REITS) 0.8% |

UMH Properties, Inc.

Owner & Operator of Manufactured Home Parks | 357,422 | 5,379,201 |

| Real Estate Management & Development 1.4% |

Colliers International Group, Inc.

Real Estate Services | 124,397 | 4,571,590 |

FirstService Corp.

Residential Property Management & Housing Related Services | 102,106 | 4,847,993 |

| Total | | 9,419,583 |

| Total Real Estate | 14,798,784 |

Total Common Stocks

(Cost: $469,962,479) | 649,916,719 |

|

| Securities Lending Collateral 2.4% |

| | Shares | Value ($) |

Dreyfus Government Cash Management Fund, Institutional Shares, (7 day yield of 0.450%)(c)

| 16,178,846 | 16,178,846 |

Total Securities Lending Collateral

(Cost: $16,178,846) | 16,178,846 |

|

| Money Market Funds 3.0% |

| | |

| JPMorgan U.S. Government Money Market Fund, Agency Shares, (7 day yield of 0.345%) | 19,564,974 | 19,564,974 |

Total Money Market Funds

(Cost: $19,564,974) | 19,564,974 |

Total Investments

(Cost $505,706,299) | 685,660,539 |

| Obligation to Return Collateral for Securities Loaned | | (16,178,846) |

| Other Assets & Liabilities, Net | | (5,245,976) |

| Net Assets | $664,235,717 |

Notes to portfolio of investments

| (a) | Non-income producing security. |

| (b) | All or a portion of this security was on loan at December 31, 2016. The total market value of securities on loan at December 31, 2016 was $15,694,712. |

| (c) | Investment made with cash collateral received from securities lending activity. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 10 | Wanger USA | Annual Report 2016 |

Portfolio of Investments (continued)

December 31, 2016

Abbreviation Legend

| ADR | American Depositary Receipt |

Fair value measurements

Various inputs are used in determining the value of the Fund’s investments, following the input prioritization hierarchy established by accounting principles generally accepted in the United States of America (GAAP). These inputs are summarized in the three broad levels listed below:

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others) |

| • | Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management’s own assumptions about the factors market participants would use in pricing an investment) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Examples of the types of securities in which the Fund would typically invest and how they are classified within this hierarchy are as follows. Typical Level 1 securities include exchange traded domestic equities, mutual funds whose net asset values are published each day and exchange traded foreign equities that are not statistically fair valued. Typical Level 2 securities include exchange traded foreign equities that are statistically fair valued and short-term investments valued at amortized cost. Additionally, securities fair valued by Columbia Wanger Asset Management’s Valuation Committee (the Committee) that rely on significant observable inputs are also included in Level 2. Typical Level 3 securities include any security fair valued by the Committee that relies on significant unobservable inputs.

The Committee is responsible for applying the Wanger Advisors Trust’s Portfolio Pricing Policy and the Columbia Wanger Asset Management pricing procedures (the Policies), which are approved by and subject to the oversight of the Board of Trustees.

The Committee meets as necessary, and no less frequently than quarterly, to determine fair values for securities for which market quotations are not readily available or for which Columbia Wanger Asset Management believes that available market quotations are unreliable. The Committee also reviews the continuing appropriateness of the Policies. In circumstances where a security has been fair valued, the Committee will also review the continuing appropriateness of the current value of the security. The Policies address, among other things: circumstances under which market quotations will be deemed readily available; selection of third party pricing vendors; appropriate pricing methodologies; events that require fair valuation and fair value techniques; circumstances under which securities will be deemed to pose a potential for stale pricing, including when securities are illiquid, restricted, or in default; and certain delegations of authority to determine fair values to the Fund’s investment manager. The Committee may also meet to discuss additional valuation matters, which may include review of back-testing results, review of time-sensitive information or approval of other valuation related actions, and to review the appropriateness of the Policies.

For investments categorized as Level 3, the significant unobservable inputs used in the fair value measurement of the Fund’s securities may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. Significant changes in any of these factors could result in lower or higher fair value measurements. Various factors impact the frequency of monitoring (which may occur as often as daily), however the Committee may determine that changes to inputs, assumptions and models are not required with the same frequency.

The following table is a summary of the inputs used to value the Fund’s investments at December 31, 2016:

| | Level 1

quoted prices

in active

markets for

identical

assets ($) | Level 2

other

significant

observable

inputs ($) | Level 3

significant

unobservable

inputs ($) | Investments

measured at

net asset

value ($) | Total ($) |

| Investments | | | | | |

| Common Stocks | | | | | |

| Consumer Discretionary | 126,505,181 | — | — | — | 126,505,181 |

| Consumer Staples | 9,136,553 | — | — | — | 9,136,553 |

| Energy | 16,271,388 | — | — | — | 16,271,388 |

| Financials | 99,265,703 | — | — | — | 99,265,703 |

| Health Care | 163,130,672 | — | — | — | 163,130,672 |

| Industrials | 103,720,047 | — | — | — | 103,720,047 |

| Information Technology | 117,088,391 | — | — | — | 117,088,391 |

| Real Estate | 14,798,784 | — | — | — | 14,798,784 |

| Total Common Stocks | 649,916,719 | — | — | — | 649,916,719 |

| Securities Lending Collateral | 16,178,846 | — | — | — | 16,178,846 |

| Money Market Funds | 19,564,974 | — | — | — | 19,564,974 |

| Total Investments | 685,660,539 | — | — | — | 685,660,539 |

There were no transfers of financial assets between levels during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Wanger USA | Annual Report 2016

| 11 |

Statement of Assets and Liabilities

December 31, 2016

| Assets | |

| Investments, at cost | |

| Unaffiliated issuers, at cost | $505,706,299 |

| Total investments, at cost | 505,706,299 |

| Investments, at value | |

| Unaffiliated issuers, at value (including securities on loan: $15,694,712) | 685,660,539 |

| Total investments, at value | 685,660,539 |

| Receivable for: | |

| Investments sold | 15,156,752 |

| Capital shares sold | 131,331 |

| Dividends | 225,876 |

| Securities lending income | 60,580 |

| Foreign tax reclaims | 1,836 |

| Prepaid expenses | 13,803 |

| Trustees’ deferred compensation plan | 187,169 |

| Total assets | 701,437,886 |

| Liabilities | |

| Due upon return of securities on loan | 16,178,846 |

| Payable for: | |

| Investments purchased | 19,742,841 |

| Capital shares purchased | 984,775 |

| Investment advisory fee | 15,789 |

| Transfer agent fees | 2 |

| Administration fees | 911 |

| Trustees’ fees | 1,651 |

| Chief compliance officer expenses | 930 |

| Other expenses | 89,255 |

| Trustees’ deferred compensation plan | 187,169 |

| Total liabilities | 37,202,169 |

| Net assets applicable to outstanding capital stock | $664,235,717 |

| Represented by | |

| Paid in capital | 379,976,837 |

| Excess of distributions over net investment income | (168,676) |

| Accumulated net realized gain | 104,473,316 |

| Unrealized appreciation (depreciation) on: | |

| Investments - unaffiliated issuers | 179,954,240 |

| Total - representing net assets applicable to outstanding capital stock | $664,235,717 |

| Shares outstanding | 25,035,093 |

| Net asset value per share | 26.53 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 12 | Wanger USA | Annual Report 2016 |

Statement of Operations

Year Ended December 31, 2016

| Net investment income | |

| Income: | |

| Dividends — unaffiliated issuers | $5,118,923 |

| Income from securities lending — net | 262,646 |

| Foreign taxes withheld | (42,836) |

| Total income | 5,338,733 |

| Expenses: | |

| Investment advisory fee | 5,542,406 |

| Transfer agent fees | 587 |

| Administration fees | 319,517 |

| Trustees’ fees | 51,091 |

| Custodian fees | 21,882 |

| Printing and postage fees | 198,942 |

| Audit fees | 37,725 |

| Legal fees | 104,969 |

| Chief compliance officer expenses | 65,953 |

| Other | 18,749 |

| Total expenses | 6,361,821 |

| Net investment loss | (1,023,088) |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Investments — unaffiliated issuers | 107,626,627 |

| Net realized gain | 107,626,627 |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments — unaffiliated issuers | (26,013,693) |

| Net change in unrealized appreciation (depreciation) | (26,013,693) |

| Net realized and unrealized gain | 81,612,934 |

| Net increase in net assets resulting from operations | $80,589,846 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Wanger USA | Annual Report 2016

| 13 |

Statement of Changes in Net Assets

| | Year Ended

December 31, 2016 | Year Ended

December 31, 2015 |

| Operations | | |

| Net investment loss | $(1,023,088) | $(2,618,992) |

| Net realized gain | 107,626,627 | 176,459,137 |

| Net change in unrealized appreciation (depreciation) | (26,013,693) | (175,148,605) |

| Net increase (decrease) in net assets resulting from operations | 80,589,846 | (1,308,460) |

| Distributions to shareholders | | |

| Net realized gains | (177,478,615) | (125,247,249) |

| Total distributions to shareholders | (177,478,615) | (125,247,249) |

| Increase in net assets from capital stock activity | 68,519,737 | 18,227,675 |

| Total decrease in net assets | (28,369,032) | (108,328,034) |

| Net assets at beginning of year | 692,604,749 | 800,932,783 |

| Net assets at end of year | $664,235,717 | $692,604,749 |

| Excess of distributions over net investment income | $(168,676) | $(140,539) |

| | Year Ended | Year Ended |

| | December 31, 2016 | December 31, 2015 |

| | Shares | Dollars ($) | Shares | Dollars ($) |

| Subscriptions | 358,725 | 9,663,627 | 393,619 | 13,842,692 |

| Distributions reinvested | 7,321,725 | 177,478,615 | 3,591,834 | 125,247,249 |

| Redemptions | (4,460,294) | (118,622,505) | (3,411,642) | (120,862,266) |

| Total net increase | 3,220,156 | 68,519,737 | 573,811 | 18,227,675 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 14 | Wanger USA | Annual Report 2016 |

The following table is intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of the expenses that apply to the variable accounts or contract charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund’s portfolio turnover rate may be higher.

| | Year Ended December 31, |

| | 2016 | 2015 | 2014 | 2013 | 2012 |

| Per share data | | | | | |

| Net asset value, beginning of period | $31.75 | $37.71 | $41.13 | $33.84 | $29.80 |

| Income from investment operations: | | | | | |

| Net investment income (loss) | (0.04) | (0.12) | (0.06) | (0.05) | 0.15 |

| Net realized and unrealized gain | 3.56 | 0.45 | 1.70 | 10.79 | 5.63 |

| Total from investment operations | 3.52 | 0.33 | 1.64 | 10.74 | 5.78 |

| Less distributions to shareholders from: | | | | | |

| Net investment income | — | — | — | (0.06) | (0.11) |

| Net realized gains | (8.74) | (6.29) | (5.06) | (3.39) | (1.63) |

| Total distributions to shareholders | (8.74) | (6.29) | (5.06) | (3.45) | (1.74) |

| Net asset value, end of period | $26.53 | $31.75 | $37.71 | $41.13 | $33.84 |

| Total Return | 13.69% | (0.61)% | 4.78% | 33.75% | 20.02% (a) |

| Ratios to average net assets | | | | | |

| Total gross expenses(b) | 1.00% | 1.01% | 0.96% | 0.96% | 0.96% |

| Total net expenses(b) | 1.00% | 1.01% | 0.96% | 0.96% | 0.96% (c) |

| Net investment income (loss) | (0.16)% | (0.34)% | (0.15)% | (0.12)% | 0.45% |

| Supplemental data | | | | | |

| Portfolio turnover | 118% | 45% | 14% | 15% | 12% |

| Net assets, end of period (in thousands) | $664,236 | $692,605 | $800,933 | $912,143 | $782,222 |

| Notes to Financial Highlights |

| (a) | Had the Investment Manager and/or its affiliates not waived a portion of expenses, total return would have been reduced. |

| (b) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (c) | The benefits derived from custody fees paid indirectly had an impact of less than 0.01%. |

The accompanying Notes to Financial Statements are an integral part of this statement.

Wanger USA | Annual Report 2016

| 15 |

Notes to Financial Statements

December 31, 2016

Note 1. Organization

Wanger USA (the Fund), a series of Wanger Advisors Trust (the Trust), is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The investment objective of the Fund is to seek long-term capital appreciation. The Fund is available only for allocation to certain life insurance company separate accounts established for the purpose of funding participating variable annuity contracts and variable life insurance policies and may also be offered directly to certain qualified pension and retirement plans.

Note 2. Summary of significant accounting policies

Basis of preparation

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services - Investment Companies (ASC 946). The financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security valuation

Securities of the Fund are valued at market value or, if a market quotation for a security is not readily available or is deemed not to be reliable because of events or circumstances that have occurred between the market quotation and the time as of which the security is to be valued, the security is valued at its fair value determined in good faith under consistently applied procedures established by the Board of Trustees. A security traded on a securities exchange or in an over-the-counter market in which transaction prices are reported is valued at the last sales price at the time of valuation. A security traded principally on NASDAQ is valued at the NASDAQ official closing price. Exchange-traded funds are valued at their closing net asset value as reported on the applicable exchange. A security for which there is no reported sale on the valuation date is valued by comparison of the mean of the latest bid and ask quotations.

Foreign equity securities are generally valued based on the closing price on the foreign exchange in which such securities are primarily traded. If any foreign equity security closing prices are not readily available, the securities are valued at the mean of the latest quoted bid and ask prices on such exchanges or markets. Foreign currency exchange rates are generally determined at 4:00 p.m. Eastern (U.S.) time. Many securities markets and exchanges outside the U.S. close prior to the close of the New York Stock Exchange; therefore, the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the New York Stock Exchange. In situations where foreign markets are closed, where a significant event has occurred after the foreign exchange closes but before the time at which the Fund’s share price is calculated, and in the event of significant movement in the trigger index for the statistical fair valuation process established by the Board of Trustees, foreign securities will be fair valued pursuant to a policy adopted by the Board of Trustees. The Trust has retained an independent statistical fair value pricing service that employs a systematic methodology to assist in the fair valuation process for securities principally traded in a foreign market in order to adjust for possible changes in value that may occur between the close of the foreign market and the time as of which the securities are to be valued. If a security is valued at a fair value, that value may be different from the last quoted market price for the security.

Short-term investments maturing in 60 days or less are valued at amortized cost, which approximates market value.

| 16 | Wanger USA | Annual Report 2016 |

Notes to Financial Statements (continued)

December 31, 2016

Fund share valuation

Fund shares are sold and redeemed on a continuing basis at net asset value. Net asset value per share is determined daily as of the close of trading on the New York Stock Exchange on each day the New York Stock Exchange is open for trading by dividing the total value of the Fund’s investments and other assets, less liabilities, by the number of Fund shares outstanding.

GAAP requires disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category. This information is disclosed following the Fund’s Portfolio of Investments.

Securities lending

The Fund may lend securities up to one-third of the value of its total assets to certain approved brokers, dealers and other financial institutions to earn additional income. The Fund retains the benefits of owning the securities, including the economic equivalent of dividends or interest generated by the security. The Fund also receives a fee for the loan. The Fund has the ability to recall the loans at any time and could do so in order to vote proxies or to sell the loaned securities. Each loan is collateralized by cash that exceeded the value of the securities on loan. The market value of the loaned securities is determined daily at the close of business of the Fund and any additional required collateral is delivered to each Fund on the next business day. The Fund has elected to invest the cash collateral in the Dreyfus Government Cash Management Fund. The income earned from the securities lending program is paid to the Fund, net of any fees remitted to Goldman Sachs Agency Lending, the Fund’s lending agent, and borrower rebates. The Fund’s investment manager, Columbia Wanger Asset Management, LLC (the Investment Manager or CWAM), does not retain any fees earned by the lending program. Generally, in the event of borrower default, the Fund has the right to use the collateral to offset any losses incurred. In the event the Fund is delayed or prevented from exercising its right to dispose of the collateral, there may be a potential loss to the Fund. Some of these losses may be indemnified by the lending agent. The Fund bears the risk of loss with respect to the investment of collateral. The net lending income earned by the Fund as of December 31, 2016, is included in the Statement of Operations.

The following table indicates the total amount of securities loaned by type, reconciled to gross liability payable upon return of the securities loaned by the Fund as of December 31, 2016:

| | Overnight and

continuous | Up to

30 days | 30-90

days | Greater than

90 days | Total |

| Wanger USA | | | | | |

| Securities lending transactions | | | | | |

| Equity securities | $15,694,712 | $— | $— | $— | $15,694,712 |

| Gross amount of recognized liabilities for securities lending (collateral received) | | | | | 16,178,846 |

| Amounts due to counterparty | | | | | $484,134 |

Offsetting of assets and liabilities

The following table presents the Fund’s gross and net amount of assets and liabilities available for offset under netting arrangements as well as any related collateral received or pledged by the Fund as of December 31, 2016:

| | Goldman Sachs ($) | | | | | | |

| Liabilities | | | | | | | |

| Collateral on Securities loaned | 16,178,846 | | | | | | |

| Total Liabilities | 16,178,846 | | | | | | |

| Total Financial and Derivative Net Assets | (16,178,846) | | | | | | |

| Financial Instruments | 15,694,712 | | | | | | |

| Net Amount (a) | (484,134) | | | | | | |

| (a) | Represents the net amount due from/(to) counterparties in the event of default. |

Wanger USA | Annual Report 2016

| 17 |

Notes to Financial Statements (continued)

December 31, 2016

Security transactions and investment income

Security transactions are accounted for on the trade date (date the order to buy or sell is executed) and dividend income is recorded on the ex-dividend date, except that certain dividends from foreign securities are recorded as soon as the information is available to the Fund. Interest income is recorded on the accrual basis and includes amortization of discounts on debt obligations when required for federal income tax purposes. Realized gains and losses from security transactions are recorded on an identified cost basis.

Income recognition

Corporate actions and dividend income are generally recorded net of any non-reclaimable tax withholdings, on the ex-dividend date or upon receipt of ex-dividend notification in the case of certain foreign securities.

The Fund may receive distributions from holdings in equity securities, exchange traded funds, other regulated investment companies (RICs), and real estate investment trusts (REITs), which report information on the tax character of their distributions annually. These distributions are allocated to dividend income, capital gain and return of capital based on actual information reported. Return of capital is recorded as a reduction of the cost basis of securities held. If the Fund no longer owns the applicable securities, return of capital is recorded as a realized gain. With respect to REITs, to the extent actual information has not yet been reported, estimates for return of capital may be made by the Fund’s management. Management’s estimates are subsequently adjusted when the actual character of the distributions is disclosed by the REITs, which could result in a proportionate change in return of capital to shareholders.

Awards, if any, from class action litigation related to securities owned may be recorded as a reduction of cost of those securities. If the applicable securities are no longer owned, the proceeds are recorded as realized gains.

Expenses

General expenses of the Trust are allocated to the Fund and the other series of the Trust based upon relative net assets or other expense allocation methodologies determined by the nature of the expense. Expenses directly attributable to the Fund are charged to the Fund.

Federal income tax status

The Fund intends to comply with the provisions of the Internal Revenue Code available to regulated investment companies and, in the manner provided therein, intends to distribute substantially all its taxable income, as well as any net realized gain on sales of investments and foreign currency transactions reportable for federal income tax purposes. Accordingly, the Fund paid no federal income taxes and no federal income tax provision was required. The Fund meets the exception under Internal Revenue Code Section 4982(f) and the Fund expects not to be subject to federal excise tax.

Foreign taxes

Gains in certain countries may be subject to foreign taxes at the fund level. The Fund accrues for such foreign taxes on realized and unrealized gains at the appropriate rate for each jurisdiction. The amount, if any, is disclosed as a liability on the Statement of Assets and Liabilities.

Distributions to shareholders

Distributions to shareholders are recorded on the ex-dividend date.

Guarantees and indemnification

In the normal course of business, the Trust on behalf of the Fund enters into contracts that contain a variety of representations and warranties and that provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims against the Fund. Also under the Trust’s organizational documents, the trustees and officers of the Trust are indemnified against certain liabilities that may arise out of their duties to the Trust. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

| 18 | Wanger USA | Annual Report 2016 |

Notes to Financial Statements (continued)

December 31, 2016

Investment company reporting modernization

In October 2016, the U.S. Securities and Exchange Commission adopted new rules and forms, and amendments to certain current rules and forms, to modernize reporting and disclosure of information by registered investment companies. The amendments to Regulation S-X will require standardized, enhanced disclosure about derivatives in investment company financial statements, and will also change the rules governing the form and content of such financial statements. The amendments to Regulation S-X take effect on August 1, 2017. At this time, management is assessing the anticipated impact of these regulatory developments.

Note 3. Fees and other transactions with affiliates

Management services fees

CWAM is a wholly owned subsidiary of Columbia Management Investment Advisers, LLC (Columbia Management), which in turn is a wholly owned subsidiary of Ameriprise Financial, Inc. (Ameriprise Financial). CWAM furnishes continuing investment supervision to the Fund and is responsible for the overall management of the Fund’s business affairs.

CWAM receives a monthly advisory fee based on the Fund’s average daily net assets at the following annual rates:

| Average daily net assets | Annual

fee rate |

| Up to $100 million | 0.940% |

| $100 million to $250 million | 0.890% |

| $250 million to $2 billion | 0.840% |

| $2 billion and over | 0.800% |

For the year ended December 31, 2016, the effective investment advisory fee rate was 0.867% of the Fund’s average daily net assets.

Administration fees

CWAM provides administrative services and receives an administration fee from the Fund at the following annual rates:

| Aggregate average daily net assets of the Trust | Annual

fee rate |

| Up to $4 billion | 0.050% |

| $4 billion to $6 billion | 0.040% |

| $6 billion to $8 billion | 0.030% |

| $8 billion and over | 0.020% |

For the year ended December 31, 2016, the effective administration fee rate was 0.050% of the Fund’s average daily net assets. CWAM has delegated to Columbia Management responsibility to provide certain sub-administrative services to the Fund.

Compensation of board members

Certain officers and trustees of the Trust are also officers of CWAM or Columbia Management. The Trust makes no direct payments to its officers and trustees who are affiliated with CWAM or Columbia Management. The Trust offers a deferred compensation plan for its independent trustees. Under that plan, a trustee may elect to defer all or a portion of his or her compensation. Amounts deferred are retained by the Trust and may represent an unfunded obligation of the Trust. The value of amounts deferred is determined by reference to the change in value of Class Z shares of one or more series of Columbia Acorn Trust or a money market fund as specified by the trustee. Benefits under the deferred compensation plan are payable in accordance with the plan.

Wanger USA | Annual Report 2016

| 19 |

Notes to Financial Statements (continued)

December 31, 2016

Compensation of Chief Compliance Officer

The Board has appointed a Chief Compliance Officer of the Trust in accordance with federal securities regulations. The Fund, along with other affiliated funds, pays its pro-rata share of certain of the expenses associated with the office of the Chief Compliance Officer.

Transactions with affiliates

For the year ended December 31, 2016, the Fund engaged in purchase and sales transactions with funds that have a common investment manager (or affiliated investment managers), common directors/trustees, and/or common officers. Those purchase and sale transactions complied with provisions of Rule 17a-7 under the 1940 Act and were $0 and $17,603,965, respectively. The sale transactions resulted in a net realized gain of $3,999,285.

Transfer agency fees

Columbia Management Investment Services Corp. (CMIS), a wholly owned subsidiary of Ameriprise Financial, is the transfer agent to the Fund. For its services, the Fund pays CMIS a monthly fee at the annual rate of $21.00 per open account. CMIS also receives reimbursement from the Fund for certain out-of-pocket expenses.

Distributor

Columbia Management Investment Distributors, Inc. (CMID), a wholly owned subsidiary of Ameriprise Financial, serves as the Fund’s distributor and principal underwriter.

Note 4. Federal tax information

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP because of temporary or permanent book to tax differences.

At December 31, 2016, these differences are primarily due to differing treatment for deferral/reversal of wash sale losses, re-characterization of distributions for investments, trustees’ deferred compensation and net operating loss reclassification. To the extent these differences are permanent, reclassifications are made among the components of the Fund’s net assets in the Statement of Assets and Liabilities. Temporary differences do not require reclassifications.

In the Statement of Assets and Liabilities the following reclassifications were made:

Excess of distributions

over net investment

income ($) | Accumulated

net realized

gain ($) | Paid in

capital ($) |

| 994,951 | 10,425 | (1,005,376) |

Net investment income (loss) and net realized gains (losses), as disclosed in the Statement of Operations, and net assets were not affected by this reclassification.

The tax character of distributions paid during the years indicated was as follows:

| December 31, 2016 | December 31, 2015 |

Ordinary

income ($) | Long-term

capital gains ($) | Total ($) | Ordinary

income (S) | Long-term

capital gains ($) | Total ($) |

| — | 177,478,615 | 177,478,615 | 210,772 | 125,036,477 | 125,247,249 |

Short-term capital gain distributions, if any, are considered ordinary income distributions for tax purposes.

At December 31, 2016, the components of distributable earnings on a tax basis were as follows:

Undistributed

ordinary income ($) | Undistributed

long-term

capital gains ($) | Capital loss

carryforwards ($) | Net unrealized

appreciation ($) |

| — | 107,909,281 | — | 176,518,275 |

| 20 | Wanger USA | Annual Report 2016 |

Notes to Financial Statements (continued)

December 31, 2016

At December 31, 2016, the cost of investments for federal income tax purposes along with the aggregate gross unrealized appreciation and depreciation based on that cost was:

Federal

tax cost ($) | Gross unrealized

appreciation ($) | Gross unrealized

(depreciation) ($) | Net unrealized

appreciation ($) |

| 509,142,264 | 186,067,896 | (9,549,621) | 176,518,275 |

Management is required to determine whether a tax position of the Fund is more likely than not to be sustained upon examination by the applicable taxing authority, including resolution of any related appeals or litigation processes, based on the technical merits of the position. The tax benefit to be recognized by the Fund is measured as the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement. Management is not aware of any tax positions in the Fund for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. However, management’s conclusions may be subject to review and adjustment at a later date based on factors including, but not limited to, new tax laws, regulations, and administrative interpretations (including relevant court decisions). The Fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

Note 5. Portfolio information

The aggregate cost of purchases and proceeds from sales other than short-term obligations for the year ended December 31, 2016, were $732,243,564 and $814,410,441, respectively. The amount of purchase and sales activity impacts the portfolio turnover rate reported in the Financial Highlights.

Note 6. Line of credit

During the period January 1, 2016 through April 28, 2016, the Trust participated in a revolving credit facility in the amount of $400 million with a syndicate of banks led by JPMorgan Chase Bank, N.A., along with Columbia Acorn Trust, another trust managed by CWAM. Effective April 28, 2016, the credit facility was renewed in the amount of $200 million with a syndicate of banks led by JPMorgan Chase Bank, N.A. Under each facility, interest is charged to each participating Fund based on its borrowings at a rate per annum equal to the Federal Funds Rate plus 1.00%. In addition, a commitment fee of 0.08% (before April 28, 2016) and 0.15% (after April 28, 2016) per annum of the unutilized line of credit is accrued and apportioned among the participating Funds based on their relative net assets. The commitment fee is disclosed as a part of other expenses in the Statement of Operations. The Trust expects to renew this line of credit for one year durations each April at then current market rates and terms.

No amounts were borrowed for the benefit of the Fund under the line of credit during the year ended December 31, 2016.

Note 7. Significant risks

Health care sector risk

The Fund may be more susceptible to the particular risks that may affect companies in the health care sector than if it were invested in a wider variety of companies in unrelated sectors. Companies in the health care sector are subject to certain risks, including restrictions on government reimbursement for medical expenses, government approval of medical products and services, competitive pricing pressures, and the rising cost of medical products and services (especially for companies dependent upon a relatively limited number of products or services). Performance of such companies may be affected by factors including, government regulation, obtaining and protecting patents (or the failure to do so), product liability and other similar litigation as well as product obsolescence.

Shareholder concentration risk

At December 31, 2016, two unaffiliated shareholders of record owned 32.9% of the outstanding shares of the Fund in one or more accounts. The Fund has no knowledge about whether any portion of those shares was owned beneficially. Affiliated shareholders of record owned 60.3% of the outstanding shares of the Fund in one or more accounts. Subscription and redemption activity by concentrated accounts may have a significant effect on the operations of the Fund. In the case of a large redemption, the Fund may be forced to sell investments at inopportune times, including its liquid or more liquid

Wanger USA | Annual Report 2016

| 21 |

Notes to Financial Statements (continued)

December 31, 2016

positions, resulting in Fund losses and the Fund holding a higher percentage of less liquid or illiquid securities. Large redemptions could result in decreased economies of scale and increased operating expenses for non-redeeming Fund shareholders.

Note 8. Subsequent events

Management has evaluated the events and transactions that have occurred through the date the financial statements were issued and noted no items requiring adjustment of the financial statements or additional disclosure.

Note 9. Information regarding pending and settled legal proceedings

Ameriprise Financial and certain of its affiliates have historically been involved in a number of legal, arbitration and regulatory proceedings, including routine litigation, class actions, and governmental actions, concerning matters arising in connection with the conduct of their business activities. Ameriprise Financial believes that the Funds are not currently the subject of, and that neither Ameriprise Financial nor any of its affiliates are the subject of, any pending legal, arbitration or regulatory proceedings that are likely to have a material adverse effect on the Funds or the ability of Ameriprise Financial or its affiliates to perform under their contracts with the Funds. Ameriprise Financial is required to make quarterly (10-Q), annual (10-K) and, as necessary, 8-K filings with the Securities and Exchange Commission (SEC) on legal and regulatory matters that relate to Ameriprise Financial and its affiliates. Copies of these filings may be obtained by accessing the SEC website at www.sec.gov.

There can be no assurance that these matters, or the adverse publicity associated with them, will not result in increased fund redemptions, reduced sale of fund shares or other adverse consequences to the Funds. Further, although we believe proceedings are not likely to have a material adverse effect on the Funds or the ability of Ameriprise Financial or its affiliates to perform under their contracts with the Funds, these proceedings are subject to uncertainties and, as such, we are unable to estimate the possible loss or range of loss that may result. An adverse outcome in one or more of these proceedings could result in adverse judgments, settlements, fines, penalties or other relief that could have a material adverse effect on the consolidated financial condition or results of operations of Ameriprise Financial.

| 22 | Wanger USA | Annual Report 2016 |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Wanger Advisors Trust and Shareholders of Wanger USA

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Wanger USA (a series of the Wanger Advisors Trust, hereinafter referred to as the "Fund") as of December 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities as of December 31, 2016 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Chicago, IL

February 17, 2017

Wanger USA | Annual Report 2016

| 23 |

Federal Income Tax Information

(Unaudited)

The Fund hereby designates the following tax attributes in the fiscal year ended December 31, 2016.

| Capital gain dividend | |

| $113,409,835 | |

Capital Gain Dividend. The Fund designates as a capital gain dividend the amount reflected above, or if subsequently determined to be different, the net capital gain of such fiscal period.

| 24 | Wanger USA | Annual Report 2016 |

Board of Trustees and Management of Wanger Advisors Trust

Each trustee may serve a term of unlimited duration. The Trust’s Bylaws generally require that a trustee retire at the end of the calendar year in which the trustee attains the age of 75 years. The trustees appoint their own successors, provided that at least two-thirds of the trustees, after such appointment, have been elected by shareholders. Shareholders may remove a trustee, with or without cause, upon the vote of two-thirds of the Trust’s outstanding shares at any meeting called for that purpose. A trustee may be removed, with or without cause, upon the vote of a majority of the trustees. The names of the trustees and officers of the Trust, the date each was first elected or appointed to office and the principal business occupations of each during at least the last five years, and for the trustees, the number of portfolios in the fund complex they oversee and other directorships they hold, are shown below. Each trustee and officer serves in such capacity for each of the eight series of Columbia Acorn Trust and for each of the three series of Wanger Advisors Trust.

The address for the trustees and officers of the Trust is Columbia Wanger Asset Management, LLC, 227 West Monroe Street, Suite 3000, Chicago, Illinois 60606. The Funds’ Statement of Additional Information includes additional information about the Funds’ trustees and officers. You may obtain a free copy of the Statement of Additional Information by writing or calling toll-free:

Columbia Wanger Asset Management, LLC

Shareholder Services Group

227 W. Monroe, Suite 3000

800.922.6769

Independent trustees

Name and age at

December 31, 2016 | Year first appointed or elected to a Board in the Columbia Funds Complex | Principal occupation(s)

during the past five years | Number of

Funds in the

Columbia

Funds

Complex

overseen (1) | Other directorships

held by the Trustee

during the past five years

in addition to

Columbia Acorn Trust and

Wanger Advisors Trust |

Laura M. Born, 51,

Chair | 2007 | Adjunct Associate Professor of Finance, University of Chicago Booth School of Business since 2007; Director, Carlson Inc. (private global hospitalities and travel company) since 2015; Managing Director – Investment Banking, JP Morgan Chase & Co. (broker-dealer) 2002-2007. | 11 | None. |

| Maureen M. Culhane, 68 | 2007 | Retired. Formerly, Vice President, Goldman Sachs Asset Management, L.P. (investment adviser), 2005-2007; Vice President (Consultant) – Strategic Relationship Management, Goldman, Sachs & Co., 1999-2005. | 11 | None. |

| Margaret M. Eisen, 63 | 2002 | Trustee, Smith College since 2012; Chief Investment Officer, EAM International LLC (corporate finance and asset management), 2003-2013; Managing Director, CFA Institute, 2005-2008. | 11 | RMB Investors Trust (formerly Burnham Investors Trust) (3 series). |

| Thomas M. Goldstein, 57 | 2014 | Retired. Formerly, Chief Financial Officer, Allstate Protection Division, 2011-2014; Founding Partner, The GRG Group LLC, 2009-2011; Managing Director and Chief Financial Officer, Madison Dearborn Partners, 2007-2009. | 11 | Federal Home Loan Bank – Chicago;

Federal Home Loan Mortgage

Corporation. |

| John C. Heaton, 57 | 2010 | Deputy Dean for Faculty, University of Chicago Booth School of Business; Joseph L. Gidwitz Professor of Finance, University of Chicago Booth School of Business since July 2000. | 11 | None. |

Wanger USA | Annual Report 2016

| 25 |

Board of Trustees and Management of Wanger Advisors Trust (continued)

Independent trustees (continued)

Name and age at

December 31, 2016 | Year first appointed or elected to a Board in the Columbia Funds Complex | Principal occupation(s)

during the past five years | Number of

Funds in the

Columbia

Funds

Complex

overseen (1) | Other directorships

held by the Trustee

during the past five years

in addition to

Columbia Acorn Trust and

Wanger Advisors Trust |

| Charles R. Phillips, 60 | 2015 | Retired. Director, University of North Carolina School of Law Foundation since 2010. Formerly, Vice Chairman, J.P. Morgan Private Bank, 2011-2014; Managing Director, J.P. Morgan Private Bank, 2001-2011. | 11 | None. |

David J. Rudis, 63,

Vice Chair | 2010 | Retired. Formerly, National Checking and Debit Executive, and Illinois President, Bank of America, 2007-2009; President, Consumer Banking Group, LaSalle National Bank, 2004-2007. | 11 | None. |

Interested trustee affiliated with Investment Manager

Name and age at

December 31, 2016 | Year first

appointed or

elected to a

Board in the

Columbia

Funds

Complex | Principal occupation(s)

during the past five years | Number of

Funds in the

Columbia

Funds

Complex

overseen (1) | Other directorships

held by the Trustee

during the past five years

in addition to

Columbia Acorn Trust and

Wanger Advisors Trust |

| P. Zachary Egan, 48 (2) | 2015 | President, CWAM and President, Columbia Acorn Trust and Wanger Advisors Trust since April 2014; Global Chief Investment Officer, CWAM since October 2015; International Chief Investment Officer, CWAM, April 2014-September 2015; Director of International Research, CWAM, December 2004-March 2014; Vice President of Columbia Acorn Trust, 2003-2014, and Wanger Advisors Trust, 2007-2014; portfolio manager and analyst, CWAM or its predecessors, since 1999. | 11 | None. |

| Ralph Wanger, 82 (3) | 1970 (4) | Founder, CWAM. Formerly, President, Chief Investment Officer and portfolio manager, CWAM or its predecessors, July 1992-September 2003; Director, Wanger Investment Company PLC; Consultant to CWAM or its predecessors, September 2003-September 2005. | 11 | None. |

| (1) | The Trustees oversee the series of Wanger Advisors Trust and Columbia Acorn Trust. |