Bear Stearns 17th Annual Technology Conference

New York – June 13, 2006

Craig DeYoung – VP Investor Relations

Exhibit 99.9

Safe Harbor

“Safe Harbor” Statement under the U.S. Private Securities

Litigation Reform Act of 1995: the matters discussed in this

presentation may include forward-looking statements that are

subject to risks and uncertainties including, but not limited to:

economic conditions, product demand and semiconductor

equipment industry capacity, worldwide demand and

manufacturing capacity utilization for semiconductors (the

principal product of our customer base), competitive products

and pricing, manufacturing efficiencies, new product

development, ability to enforce patents, the outcome of

intellectual property litigation, availability of raw materials and

critical manufacturing equipment, trade environment, and

other risks indicated in the risk factors included in ASML’s

Annual Report on Form 20-F and other filings with the U.S.

Securities and Exchange Commission.

/ Slide 2

ASML Investment Thesis

Integrated circuit imaging advancements (shrink) drives

the semiconductor industry (Moore’s law)

ASML is the leading Lithography equipment supplier to

semiconductor industry

There are multiple drivers for ASML’s growth - industry

growth, market share growth and ASP growth

ASML has a sustainable competitive advantage through

technology and scale

ASML will demonstrate strong financial performance in

the years to come

/ Slide 3

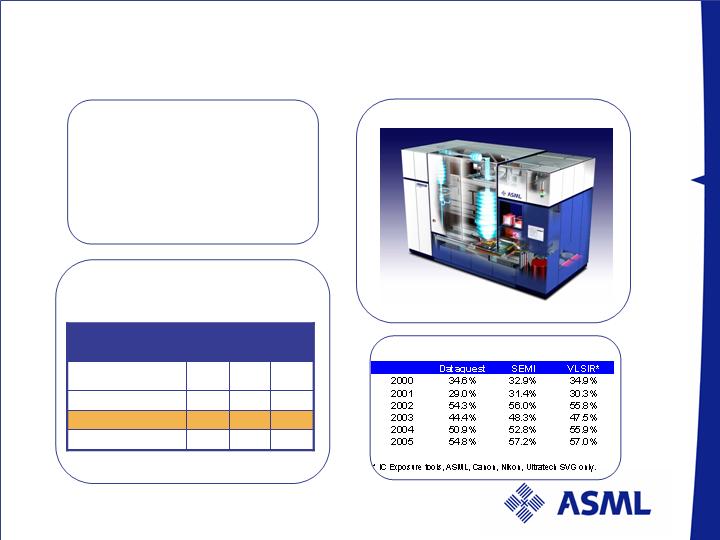

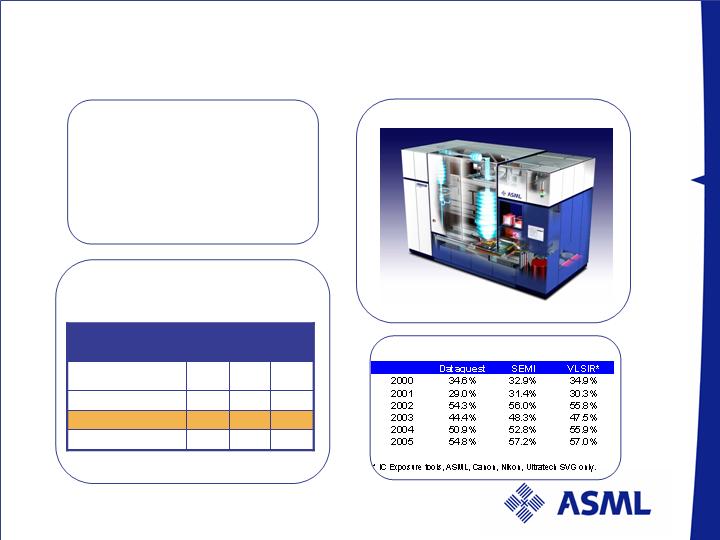

ASML overview

-7.1%

23396.8

25191.0

Total Market

+2.7%

2786.9

2712.4

ASML

-6.3%

3480.9

3714.0

Tokyo Electron Ltd.

-22.9%

4444.7

5768.1

Applied Materials

2004/

2005

2005

2004

IC Fabrication

Equipment

Key facts:

Headquarters: Veldhoven,

the Netherlands

Revenue 2005 ~ €2.5 B

Market cap ~ €7.75 B

Employees 5100

Leaders in Innovation

ASML TWINSCAN

The world’s leading supplier of Lithography equipment

ASML outperforms in 2005

VLSI Research

Growing market share (revs)

/ Slide 4

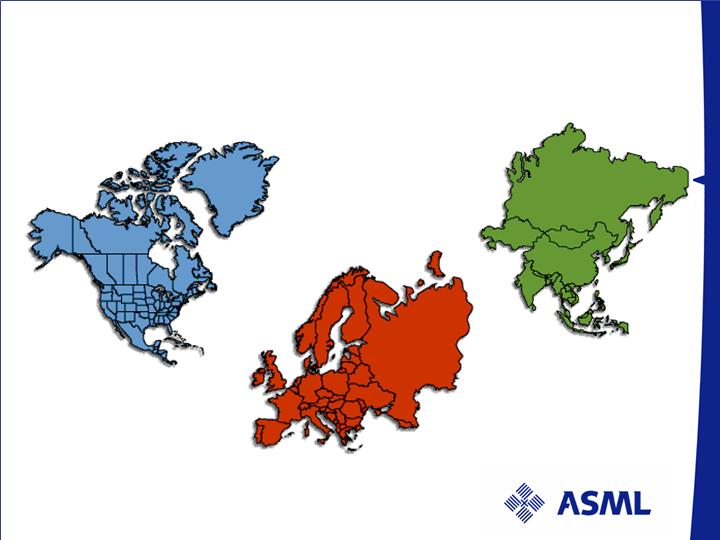

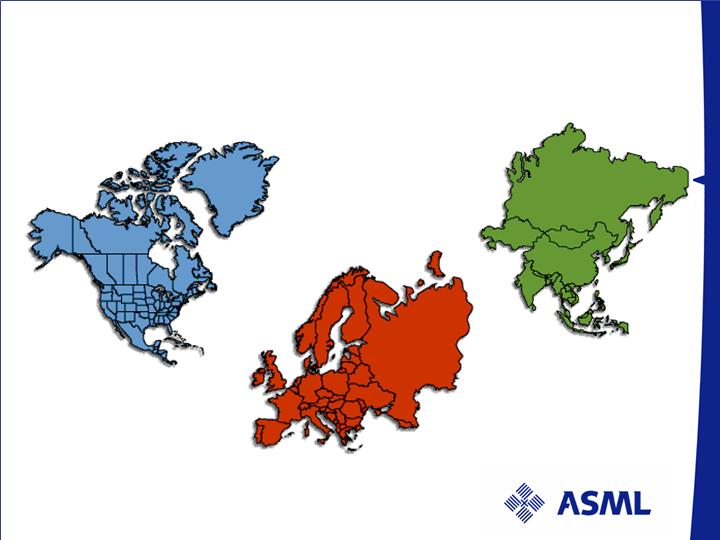

ASML market share per region in ($)

WW market share 57% in 2005

Europe

48%

North America

62%

Asia w/o Japan

77%

Japan

8%

Source: ASML – market shares are

value based in 2005

/ Slide 5

Resolution: 130nm

Throughput: 134wph

Superior CoO in 300mm KrF

XT:400

Resolution: 350nm

Throughput: 129wph

Lowest CoO in 300mm i-line

TWINSCAN™ creating value in non and mid

critical applications

Source: ASML – market shares are

value based in 2005

ASML i-line

market share

29%

ASML KrF

market share

51%

/ Slide 6

TWINSCAN XT:1700i Enabling 45nm production

Imaging

Resolution 45-nm

Overlay

System 7-nm

Throughput

125 shots 122 wph

In-line

Catadioptric

lens design

4th generation

immersion

technology

High

Efficiency

Polarized

Illuminator

42nm

1.2 NA with

26x33mm2 field

/ Slide 7

TWINSCAN XT:1700i Enabling 45nm production

ASML wet + dry ArF

market share

68%

Source: ASML – market shares are

value based in 2005

/ Slide 8

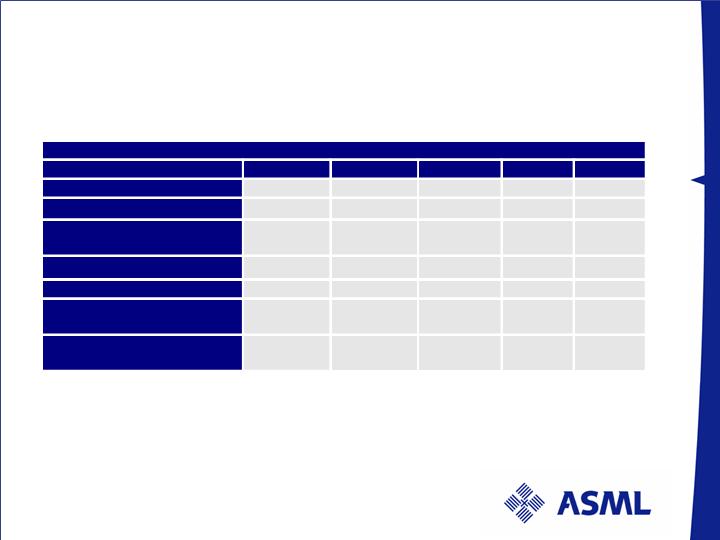

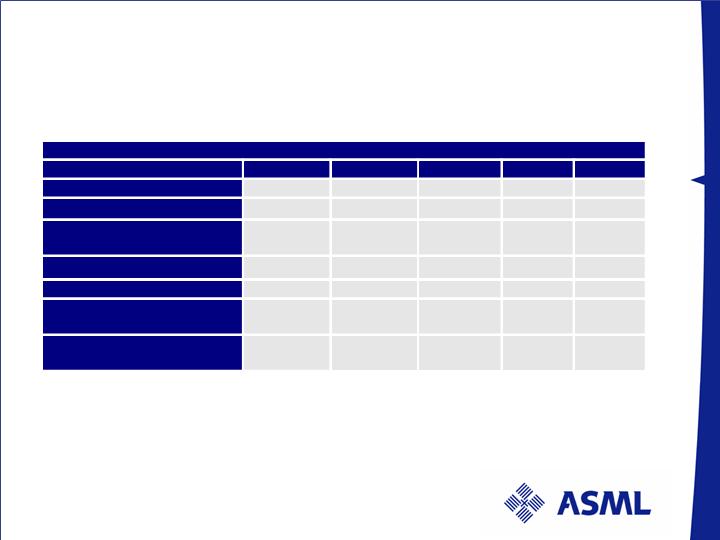

Key financial trends 2005 - 2006

Numbers have been rounded for readers’ convenience

Profit & Loss Statement

M€

Q1 0

5

Q2 0

5

Q3 0

5

Q4 0

5

Q1

0

6

Units

59

51

39

47

51

Sales

685

763

533

548

62

9

Gross margin

Gross margin %

274

40.0

%

299

39.1

%

197

37.0

%

204

37.3

%

251

40.0

%

R&D

79

82

80

82

87

SG&A

51

55

48

47

50

O

perating income

Operating

income %

144

21.0

%

162

21.2

%

69

12.9

%

75

13.6

%

114

18.2

%

Net income

Net income %

100

14.6

%

112

14.6

%

48

9.0

%

52

9.4

%

80

12.7

%

/ Slide 9

Mid-Term Market Update

Market Status Summary

2006 IC Unit growth forecast at 10+% growth y-o-y

Inventory at appropriate levels for continuous FAB

capacity build up - under scrutiny

Utilization rates remain high with a wide range of

customers at capacity limits

Industry shows sign of maturing as swings appear

smaller in amplitude and length

/ Slide 11

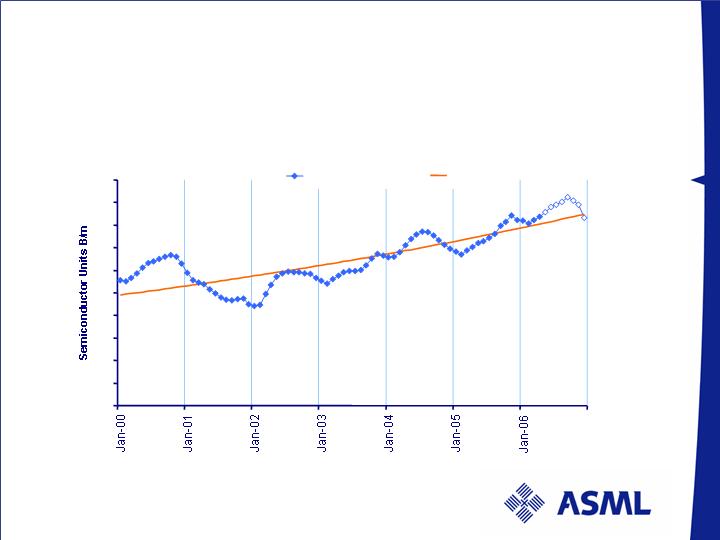

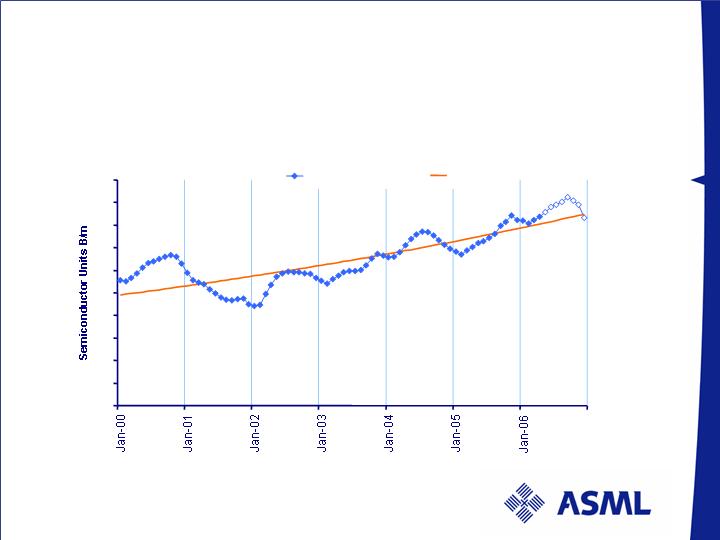

Source: ASML MCC

25% -21% 14% 9% 18% 4% 14%

Semiconductor Units history and forecast

2006 Semiconductor consensus growth forecast up to 14%

Semiconductor unit Forecast

0

5

10

15

20

25

30

35

40

45

50

Semiconductor Units

Unit Trend

/ Slide 12

IC unit sales and inventory

Steady demand - inventory under scrutiny

Source: WSTS, VLSIResearch, ASML

Last data point: April 2006

IC unit sales and inventory

0

10

20

30

40

50

60

70

80

-

10

20

30

40

50

60

70

80

IC inventory

3mma IC unit Sales

3mma IC unit sales corrected for Inventory

/ Slide 13

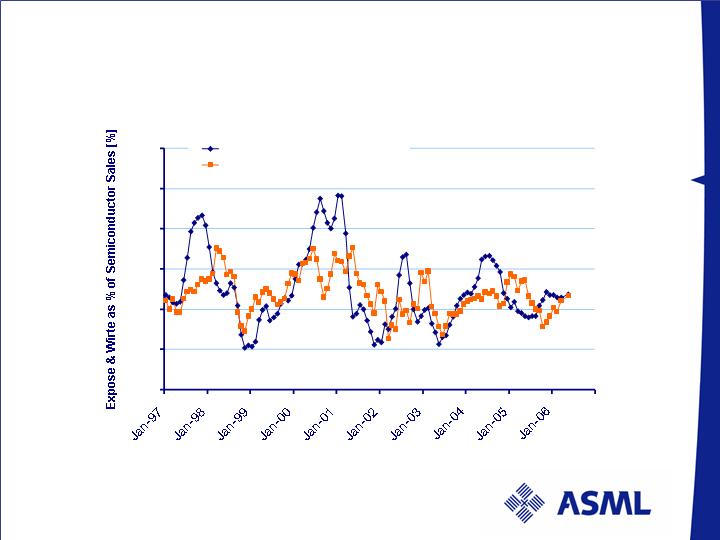

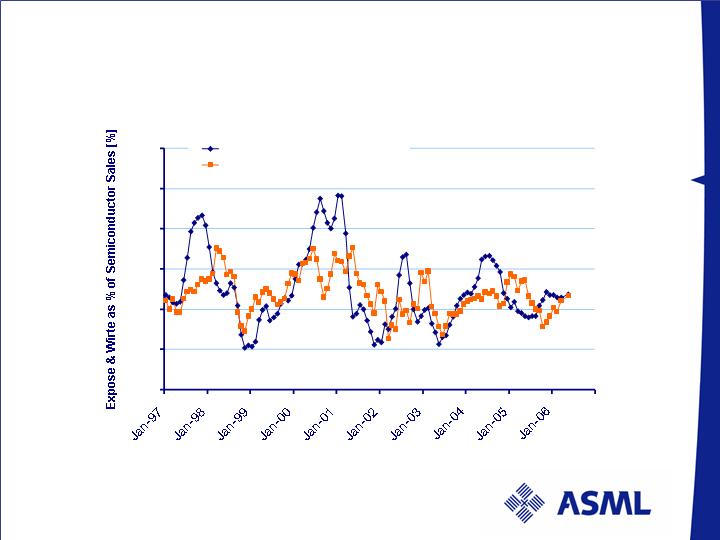

Source: SEMI, WSTS, ASML

Last data point: April 2006

Litho Bookings and Billings as % of Semiconductor Revenue

Relative Litho spending in range of control

Expose & Write Bookings and Billings as % of Semiconductor

sales

0%

1%

2%

3%

4%

5%

6%

E&W bookings as % of Semi $Sadj 3MMA

E&W billings as % of Semi $ Sadj 3MMA

/ Slide 14

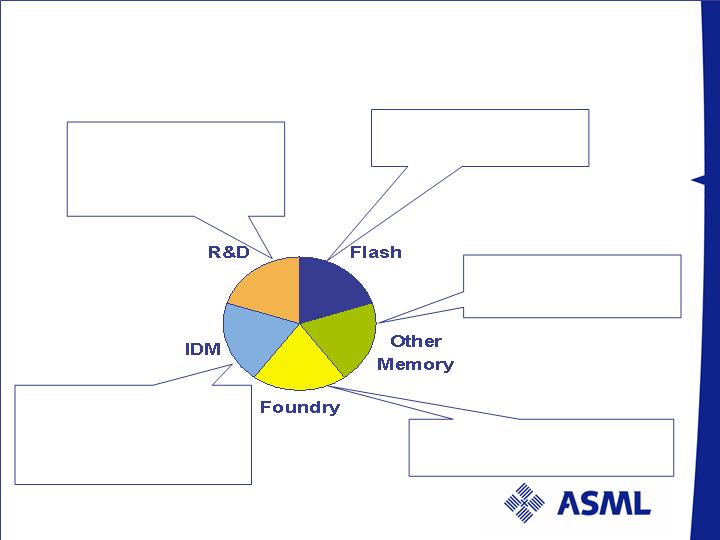

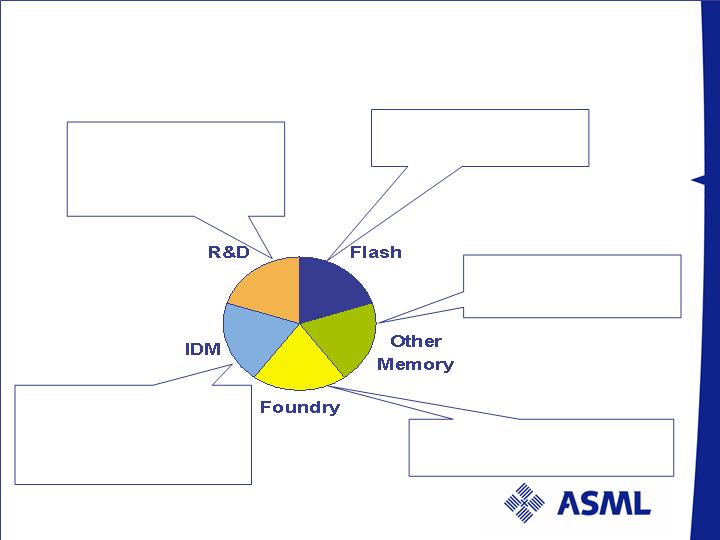

Growth from Multiple independent Segments

Each Segment with its own investment cycle

Flash shrink - 12 to 15

month investment cycle

DRAM – closely follows

Flash investment cycle

Foundries represent classic

supply/demand cycle

Moore’s law, 18 to 24

months - invest for new

product development -

volume to Foundry

Shrink for new

functionality and cost per

function - 12 to 24 month

investment cycle

/ Slide 15

Further Growth engines:

26 new fab projects under construction:

9 Flash fabs

6 other Memory fabs

11 Foundry or IDM fabs

Immersion enabling 55 nm/45 nm next generation

node for early 2007 production ramp:

Flash next generation

High integration/complexity Logic designs

STRONG BOOKINGS OUTLOOK IN Q2 2006

FOR DELIVERIES IN Q3 06, Q4 06, Q1 07

NO SHORT TERM OVERHEATING FORESEEN

/ Slide 16

Long-Term Trajectory

Company focus

Execution on Technology – Cost – Lead time

Execute on Leadership:

Volume production ramp of the TWINSCAN XT:1700i,

hyper NA tool for 45 nm node: 20 - 25 tools to ship in 2006

2 EUV alpha tools mid 2006

R&D investment increased to sustain an accelerated

roadmap of 1 node/year

Execute on cost of goods reduction:

Redesigns for cost - for performance/availability/throughput

Internal target of 15% cost of ownership reduction

Execute on lead time reduction:

Lead time reduction of 30%

Capacity increase: 50% +

/ Slide 18

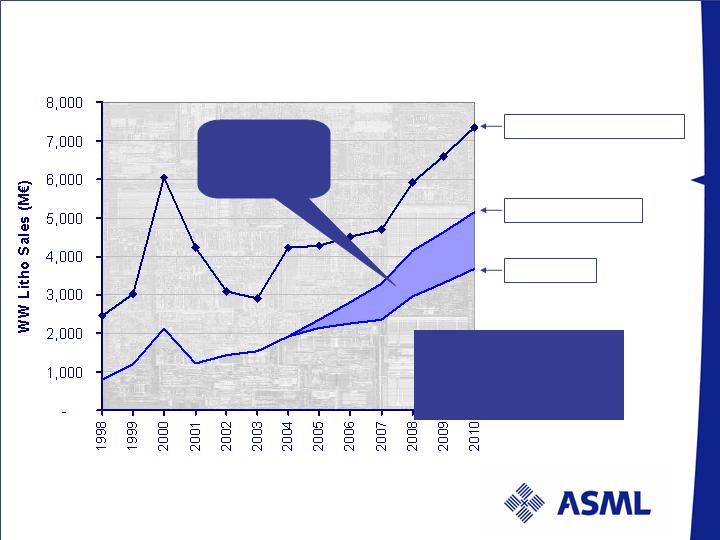

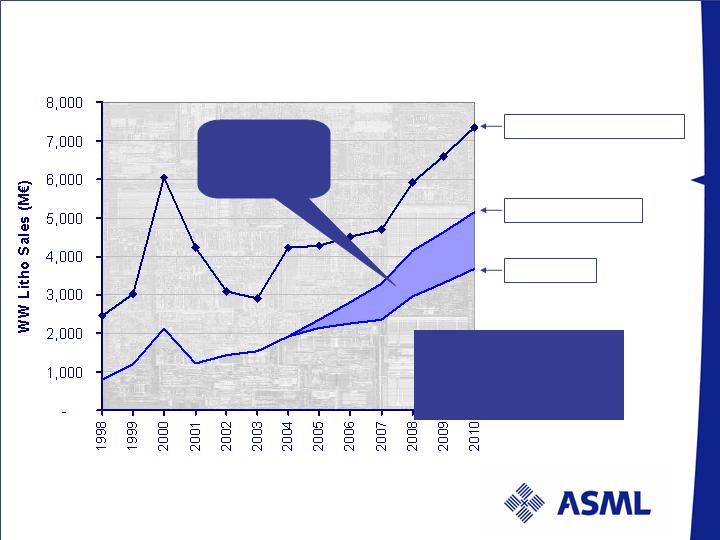

ASML Secular Growth model

Source: Average of Dataquest, VLSI Research and ASML fab based simultion model – NOT A FORECAST

Average WW litho sales

ASML’s potential

Status quo

Natural growth

potential towards

4-5 B€ range

ASML’s

opportunity

window

Assumption: 9% IC unit Growth/year

/ Slide 19

ASML is well positioned for value generation

Growth

Target of 70% market share

Potential to double top line in 5 years (reference 2005)

Profitability

Track record of last 8 quarters - average 17.1% EBIT

margin

Improvement through scaling

Liquidity

Average M €79 cash generation from operations in last 8

quarters

/ Slide 20

/ Slide 21