Credit Suisse Semiconductor and

Semiconductor Capital Equipment Conference

Craig DeYoung

VP Investor Relations

May 3, 2006

New York

Exhibit 99.6

Safe Harbor

“Safe Harbor” Statement under the U.S. Private Securities

Litigation Reform Act of 1995: the matters discussed in this

document may include forward-looking statements that are

subject to risks and uncertainties including, but not limited to:

economic conditions, product demand and semiconductor

equipment industry capacity, worldwide demand and

manufacturing capacity utilization for semiconductors (the

principal product of our customer base), competitive products

and pricing, manufacturing efficiencies, new product

development, ability to enforce patents, the outcome of

intellectual property litigation, availability of raw materials and

critical manufacturing equipment, trade environment, and

other risks indicated in the risk factors included in ASML’s

Annual Report on Form 20-F and other filings with the U.S.

Securities and Exchange Commission.

/ Slide 2

Agenda

Recent accomplishments

Recent financial summary

Q2 outlook

Company focus 2006

/ Slide 3

Accomplishments

/ Slide 4

ASML out performs equipment industry growth

in 2005

Source: VLSI Research, April 2006

-7.1%

23396.8

25191.0

Total Market

+2.7%

2786.9

2712.4

ASML

-6.3%

3480.9

3714.0

Tokyo Electron Ltd.

-22.9%

4444.7

5768.1

Applied Materials

2005/2004

2005

2004

IC Fabrication Equipment

/ Slide 5

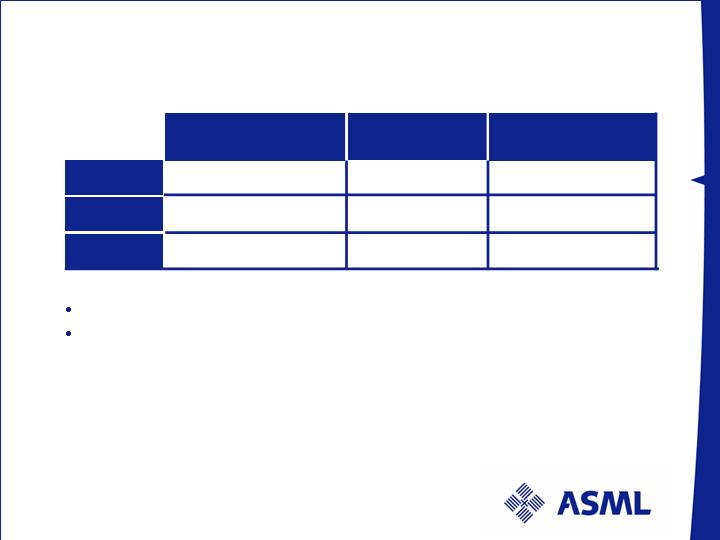

ASML improves its market share by revenue in 2005

VLSIR

Gartner

SEMI

TIN

Semiconductor new systems

x

x

x

x

Semiconductor used systems

x

x

x

ASML Share

57.0%

54.8%

-

53.3%

Non Semiconductor (TFH, MEMS)

-

-

x

-

ASML Share

-

-

57.2%

-

/ Slide 6

Accomplishments Q1 2006

Solid execution

Gross margin increased to 40.0% from 37.3% in Q4 ‘05

Operating margin grew to 18.2% from 13.6% in Q4 ‘05

Improved our market position

Gained 7th customer in Japan – will use ASML immersion tools

Net bookings of 62 systems (47 new) with a value of € 710 million

Immersion

Backlog increased to 18 immersion systems with 5 pending orders for shipment

in 2006

First 1.2NA TWINSCAN XT:1700i shipped early April to Asian customer

42 nm resolution half pitch images produced on the TWINSCAN XT:1700i

Customers demonstrate low defect immersion processes

/ Slide 7

Financial accomplishments Q1 2006

Robust financial performance

Revenue of € 629 million, 15% increase over Q4 ‘05

Shipped 51 systems (39 new systems) vs. 47 in Q4 ‘05

ASP new systems is € 13.5 million vs. € 12.5 in Q4 ‘05

Net profit of € 80 million (12.7% of sales) vs. € 52 (9.4%

of sales)

/ Slide 8

Financial summary Q1 ‘06

/ Slide 9

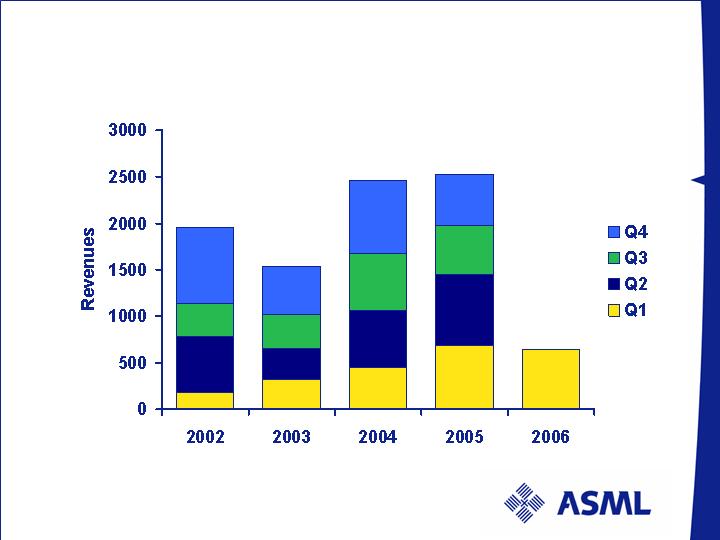

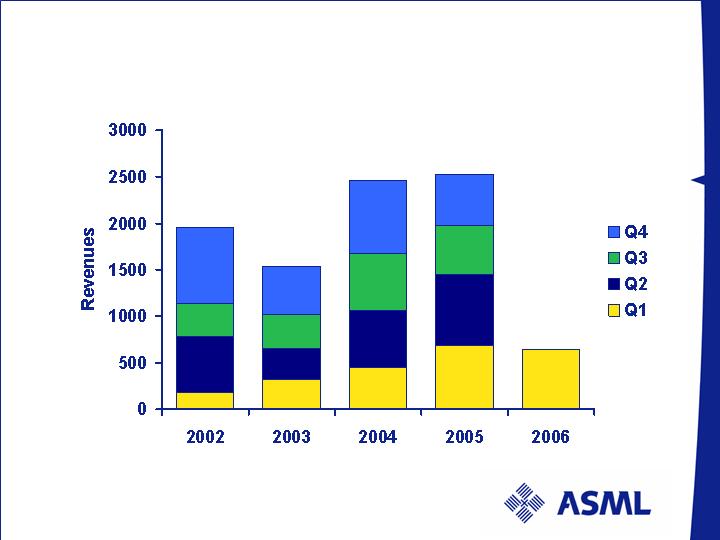

Total revenues M€

179

609

351

820

526

370

329

318

785

611

616

453

548

533

763

685

629

1959

1543

2465

2529

Peak revenue year 2000 at € 2.673B

/ Slide 10

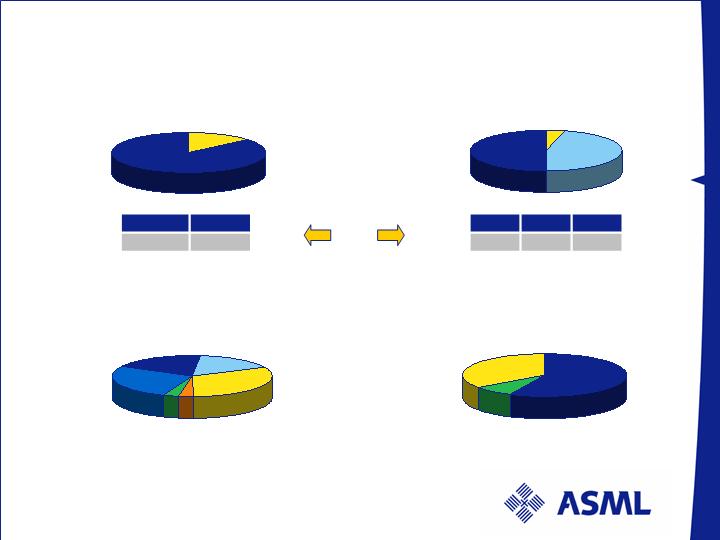

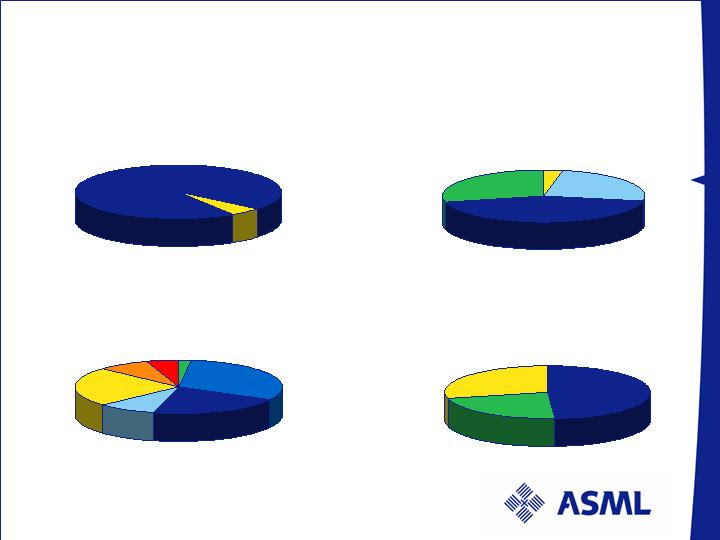

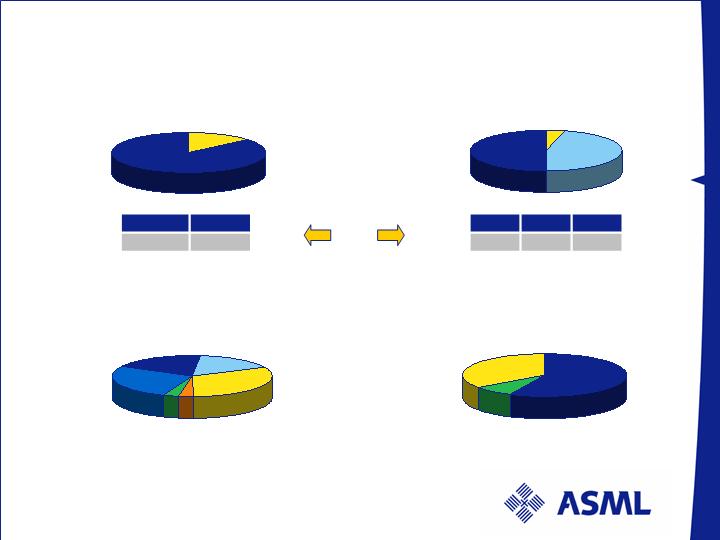

Revenue breakdown: Q1 2006

Value per type

TWINSCAN

86%

Others

14%

Value per end-use

Foundry

8%

Memory

57%

IDM

35%

Value per technology

KrF

46%

ArF

50%

i-line

4%

Value per region

U.S.

27%

Taiwan

19%

Korea

32%

China

3%

Europe

16%

ROW

3%

Numbers have been rounded for readers’ convenience

units

Units

18

33

Others

TWINSCAN

12

25

14

i-line

KrF

ArF

/ Slide 11

Key financial trends 2005 - 2006

/ Slide 12

Numbers have been rounded for readers’ convenience

Profit & Loss Statement

M€

Q1 0

5

Q2 0

5

Q3 0

5

Q4 0

5

Q1

0

6

Units

59

51

39

47

51

Sales

685

763

533

548

62

9

Gross margin

Gross margin %

274

40.0

%

299

39.1

%

197

37.0

%

204

37.3

%

251

40.0

%

R&D

79

82

80

82

87

SG&A

51

55

48

47

50

O

perating income

Operating

income %

144

21.0

%

162

21.2

%

69

12.9

%

75

13.6

%

114

18.2

%

Net income

Net income %

100

14.6

%

112

14.6

%

48

9.0

%

52

9.4

%

80

12.7

%

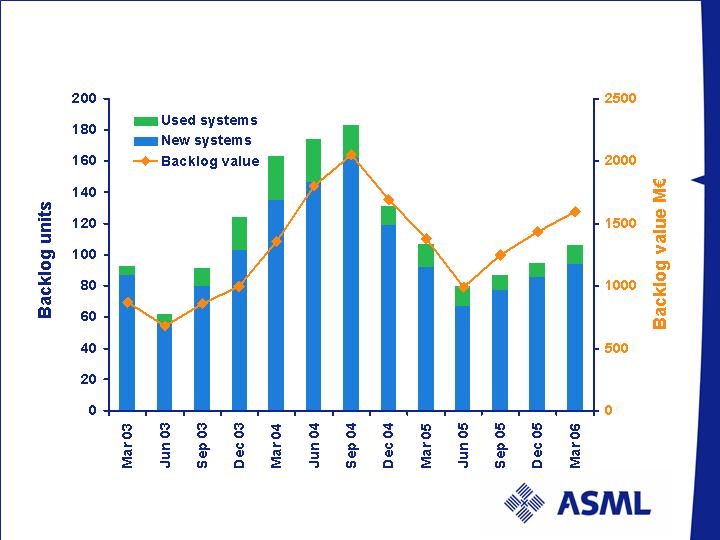

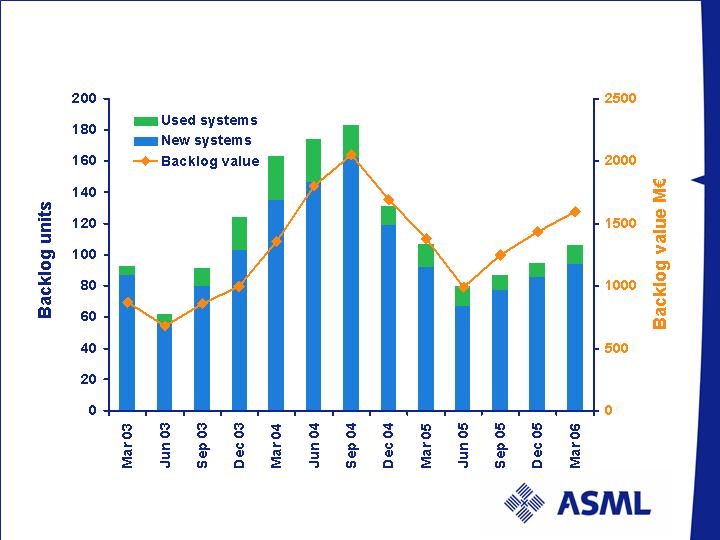

Backlog: litho units and value

/ Slide 13

Backlog as of April 2, 2006

85 % of unit backlog carry Q2 + Q3 2006 shipment dates

Q1 net bookings of 62 systems with a value M€ 710 including

47 new tools with an ASP of M€ 14.3

Note: Due to possible customer changes in delivery schedules and to cancellation of orders, our backlog at any

particular date is not necessarily indicative of actual sales for any succeeding period

Numbers have been rounded for readers’ convenience

New Systems

Used Systems

Total Backlog

M€ 1.560 (1.411)

M€ 36 (23)

M€ 1.596 (1.434)

M€ 16.6 (16.4)

M€ 3.0 (2.6)

M€ 15.1 (15.1)

Backlog

Backlog

94 (86)

12 (9)

106 (95)

Units

Value

ASP

( ) previous quarter data

/ Slide 14

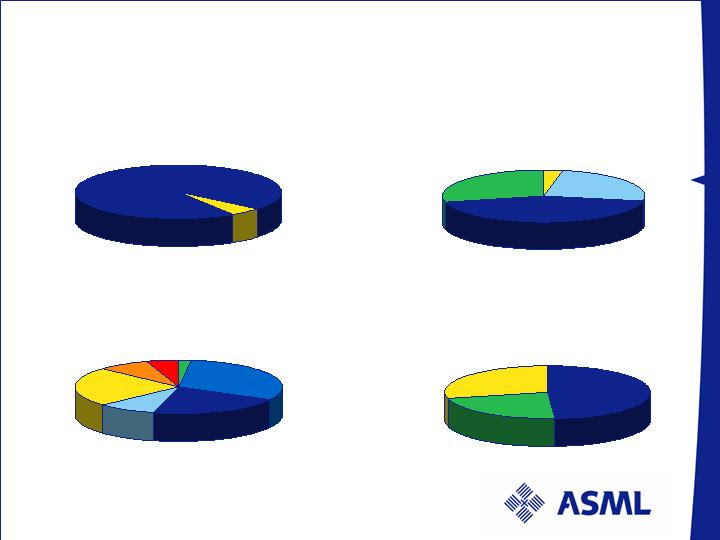

Backlog lithography per April 2, 2006

Total value M€ 1,596

Value per type

TWINSCAN

95%

Others

5%

Value per end-use

Foundry

22%

Memory

49%

IDM

29%

Value per technology

i-line

3%

ArF dry

43 %

KrF

25%

ArF immersion

29 %

Numbers have been rounded for readers’ convenience

Value per region

U.S.

31%

Taiwan

21%

Korea

24%

ROW

2%

Europe

9%

China

8%

Japan

5%

/ Slide 15

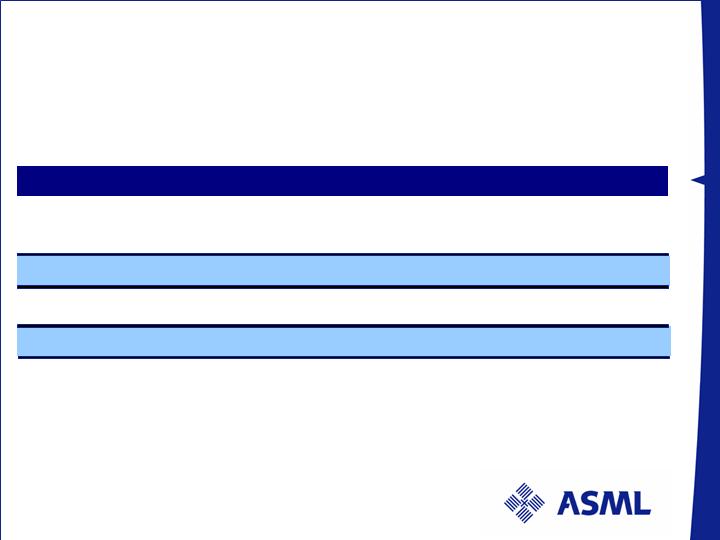

Q2 outlook

Shipment of 64 systems expected vs. 51 in Q1

ASP for new system shipments expected to be € 14.5 million for

new systems and € 12.3 million for new + refurbished systems

Gross margin expected at 39 – 40%

R&D and SG&A are expected to be € 87 million net of credit and

€ 51 million respectively

ASML expects a sustained level of unit bookings in Q2 similar to

that of Q1, with a Q2 order mix favoring capacity additions in KrF

and i-line systems and shorter order leadtimes

Planning to ship the first EUV Alpha demo tools by mid 2006

Reiterating shipment forecast of 20-25 immersion systems in

2006

/ Slide 16

Share Buyback Program

ASML confirms its intention to execute a share buyback

program in 2006

Company will repurchase up to the equivalent of € 400

million of its own shares over the next 12 months

Purpose of the program is to return excess cash to

shareholders through reduction of the number of issued

shares

/ Slide 17

Company focus 2006

Continue execution of 2005 focus points

Execute on volume production ramp of the TWINSCAN

XT:1700i, hyper NA tool for 45 nm node

Execute on cost of goods reduction

Execute on lead time reduction

Accelerate the technology leadership gap

Ship 2 EUV Alpha demo tools

Finalize development of the >1.3 NA immersion tool for

shipment in H1 2007

Develop alternative architectures for cost effective

lithography at 32 nm resolution and beyond

/ Slide 18

Commitment