Merrill Lynch TMT Conference

London – June 6, 2006

Eric Meurice – CEO

Exhibit 99.8

Safe Harbor

“Safe Harbor” Statement under the U.S. Private Securities

Litigation Reform Act of 1995: the matters discussed in this

presentation may include forward-looking statements that are

subject to risks and uncertainties including, but not limited to:

economic conditions, product demand and semiconductor

equipment industry capacity, worldwide demand and

manufacturing capacity utilization for semiconductors (the

principal product of our customer base), competitive products

and pricing, manufacturing efficiencies, new product

development, ability to enforce patents, the outcome of

intellectual property litigation, availability of raw materials and

critical manufacturing equipment, trade environment, and

other risks indicated in the risk factors included in ASML’s

Annual Report on Form 20-F and other filings with the U.S.

Securities and Exchange Commission.

/ Slide 2

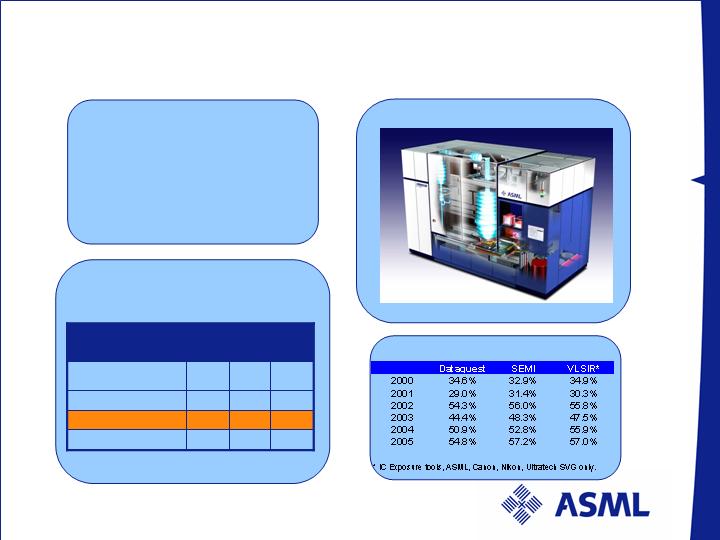

ASML overview

-7.1%

23396.8

25191.0

Total Market

+2.7%

2786.9

2712.4

ASML

-6.3%

3480.9

3714.0

Tokyo Electron Ltd.

-22.9%

4444.7

5768.1

Applied Materials

2004/

2005

2005

2004

IC Fabrication

Equipment

Key facts:

Headquarters: Veldhoven,

the Netherlands

Revenue 2005 ~ €2.5 B

Market cap ~ €7.75 B

Employees 5100

Technology Leader/Innovator

ASML TWINSCAN

The world’s leading supplier of Lithography equipment

ASML outperforms in 2005

VLSI Research

Growing market share (revs)

/ Slide 3

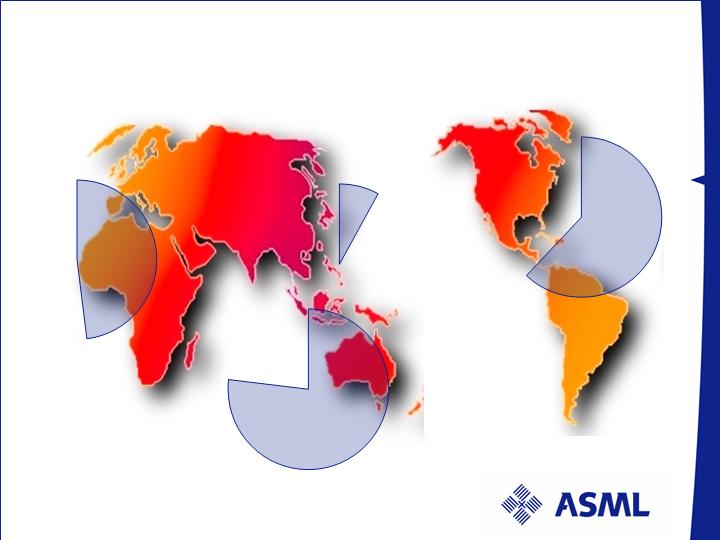

ASML market share per region in ($)

WW market share 57% in 2005

Europe

Asia

without

Japan

USA

Source: ASML

48%

8%

77%

62%

Japan

/ Slide 4

TWINSCAN™ XT:400 and XT:760 creating value

in non and mid critical applications

XT:400E

Resolution: 350nm

Throughput: 129wph

Lowest CoO in 300mm I-line

XT:760F

Resolution: 130nm

Throughput: 134wph

Superior CoO in 300mm KrF

I-line

29%

KrF

51%

Source: ASML

/ Slide 5

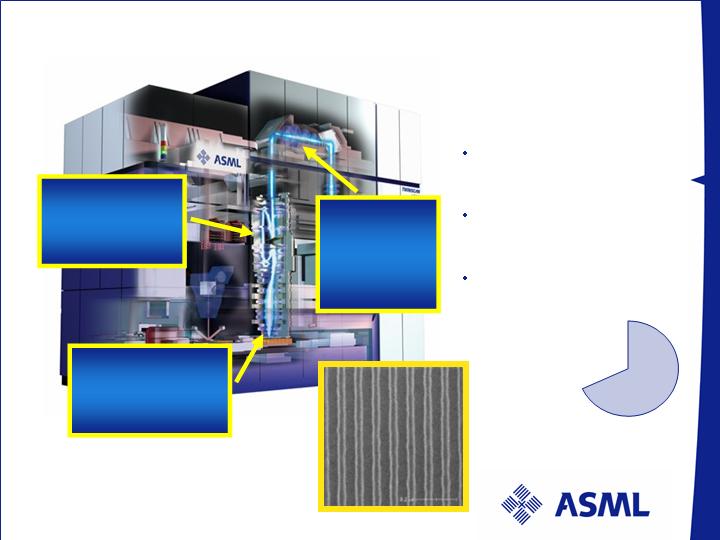

TWINSCAN XT:1700i 1.2 NA with 26x33mm2 field

Imaging

Resolution 45-nm

Overlay

System 7-nm

Throughput

125 shots 122 wph

In-line

Catadioptric

lens design

4th generation

immersion

technology

High

Efficiency

Polarized

Illuminator

42nm

Market share wet + dry

ArF 68%

Source: ASML

/ Slide 6

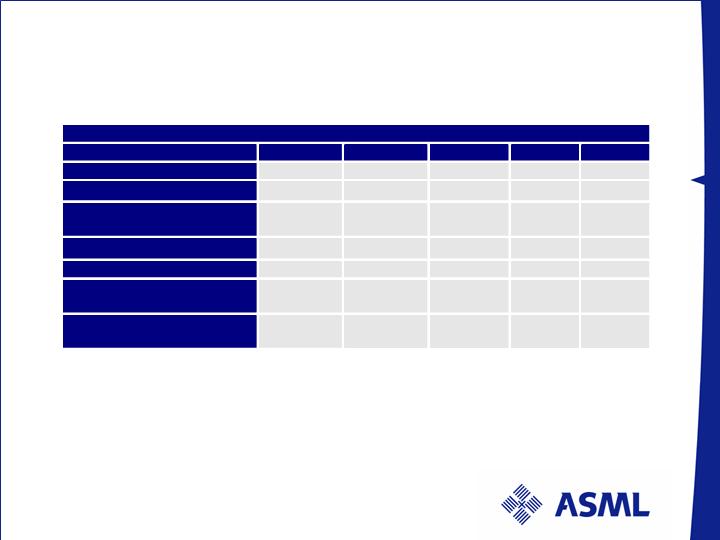

Key financial trends 2005 - 2006

/ Slide 7

Numbers have been rounded for readers’ convenience

Profit & Loss Statement

M€

Q1 0

5

Q2 0

5

Q3 0

5

Q4 0

5

Q1

0

6

Units

59

51

39

47

51

Sales

685

763

533

548

62

9

Gross margin

Gross margin %

274

40.0

%

299

39.1

%

197

37.0

%

204

37.3

%

251

40.0

%

R&D

79

82

80

82

87

SG&A

51

55

48

47

50

O

perating income

Operating

income %

144

21.0

%

162

21.2

%

69

12.9

%

75

13.6

%

114

18.2

%

Net income

Net income %

100

14.6

%

112

14.6

%

48

9.0

%

52

9.4

%

80

12.7

%

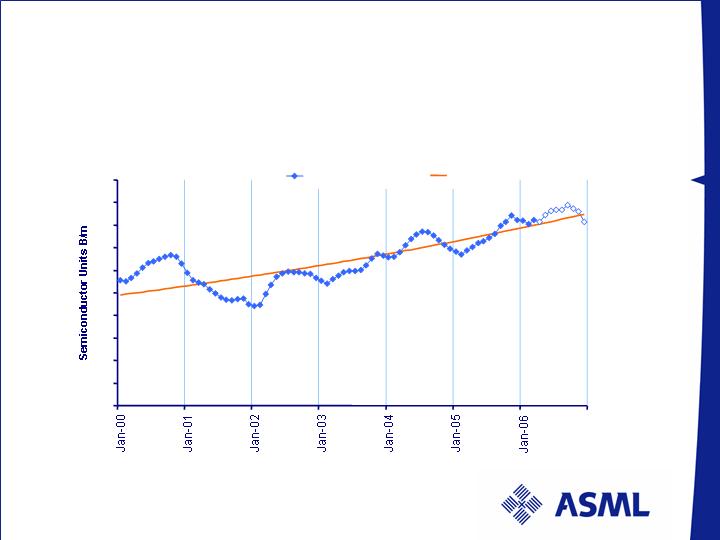

Mid-Term Market Update

Market Status Summary

2006 IC Unit growth forecast at about 10% / 11%

growth y-o-y

Inventory at appropriate levels for continuous FAB

capacity build up - under scrutiny

Utilization rates at approx. 92 % with wide range of

customers hitting capacity limits

Industry shows sign of maturing as swings are

smaller in amplitude and length

/ Slide 9

Source: ASML MCC

25% -21% 14% 9% 18% 4% 11%

Semiconductor Units history and forecast

2006 Semiconductor consensus growth forecast at +11%

Semiconductor unit Forecast

0

5

10

15

20

25

30

35

40

45

50

Semiconductor Units

Unit Trend

/ Slide 10

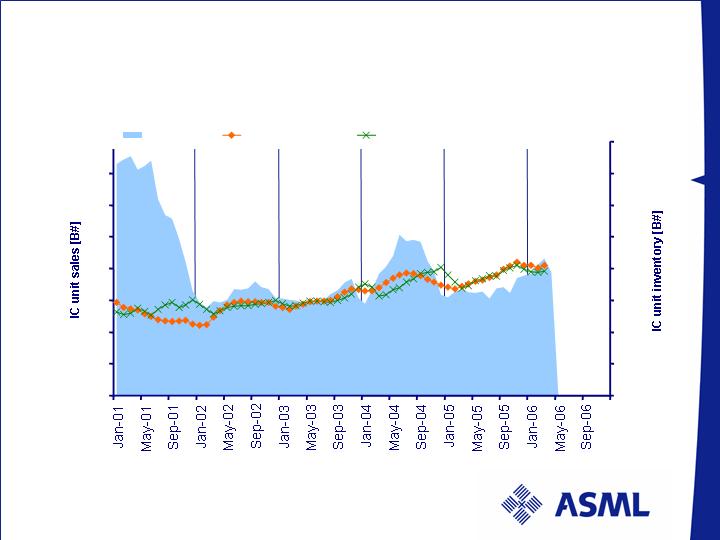

IC unit sales and inventory

Steady demand - inventory under control

Source: WSTS, VLSI Research, ASML

Last data point: March 2006

IC unit sales and inventory

0

10

20

30

40

50

60

70

80

-

10

20

30

40

50

60

70

80

IC inventory

3mma IC unit Sales

3mma IC unit sales corrected for Inventory

/ Slide 11

Source: SEMI, WSTS, ASML

Last data point: March 2006

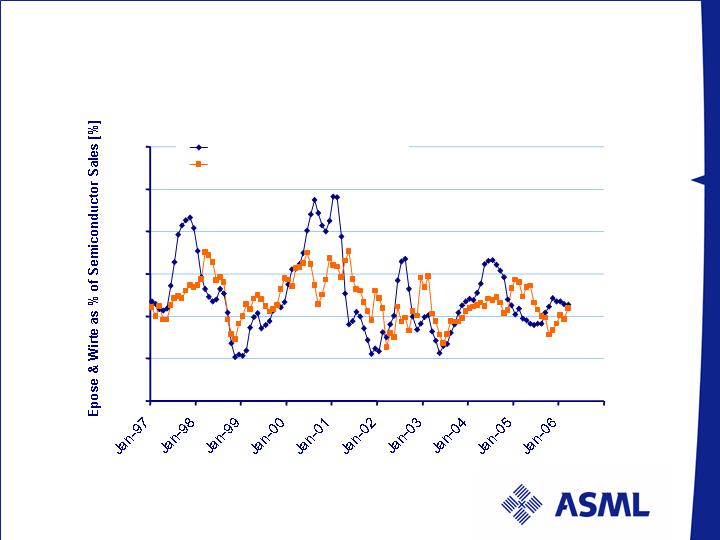

Litho Bookings and Billings as % of Semiconductor Revenue

Relative Litho spending in range of control

Expose & Write Bookings and Billings as % of Semiconductor

sales

0%

1%

2%

3%

4%

5%

6%

E&W bookings as % of Semi $Sadj 3MMA

E&W billings as % of Semi $ Sadj 3MMA

/ Slide 12

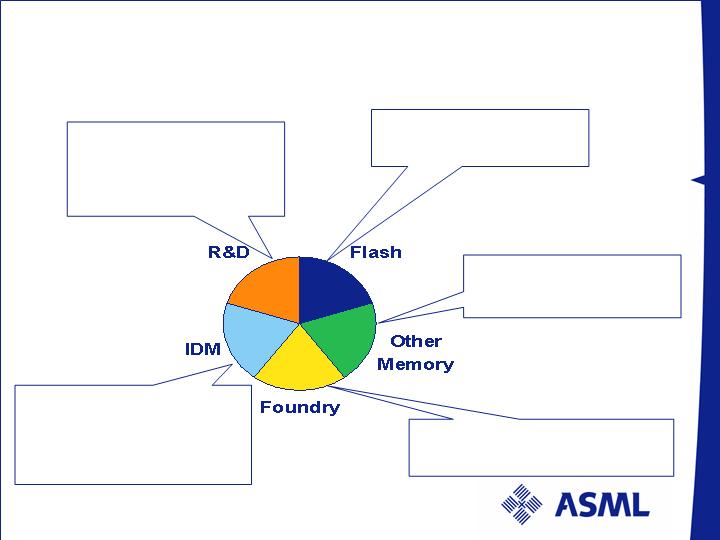

Growth from Multiple independent Segments

Each Segment with its own investment cycle

Flash shrink - 12 to 15

month investment cycle

DRAM – closely follows

Flash investment cycle

Foundries represent classic

supply/demand cycle

Moore’s law, 18 to 24

months - invest for new

product development -

volume to Foundry

Shrink for new

functionality and cost per

function - 12 to 24 month

investment cycle

/ Slide 13

Further Growth engines:

26 new fab projects under construction:

9 Flash fabs

6 other Memory fabs

11 Foundry or IDM fabs

Immersion enabling 55 nm/45 nm next generation

node for early 2007 production ramp:

Flash next generation

High integration/complexity Logic designs

STRONG BOOKINGS OUTLOOK IN Q2 2006

FOR DELIVERIES IN Q3 06, Q4 06, Q1 07

NO SHORT TERM OVERHEATING FORESEEN

/ Slide 14

Long-Term Trajectory

Company focus

Execution on Technology – Cost – Leadtime

Execute on Leadership:

Volume production ramp of the TWINSCAN XT:1700i,

hyper NA tool for 45 nm node: 20 - 25 tools to ship in 2006

2 EUV alpha tools mid 2006

R&D investment increased to sustain an accelerated

roadmap 1 node/year

Execute on cost of goods reduction:

Redesigns for cost - for performance/availability/throughput

Internal target of 15% cost of ownership reduction

Execute on lead time reduction

Leadtime reduction of 30%

Capacity increase: 50% +

/ Slide 16

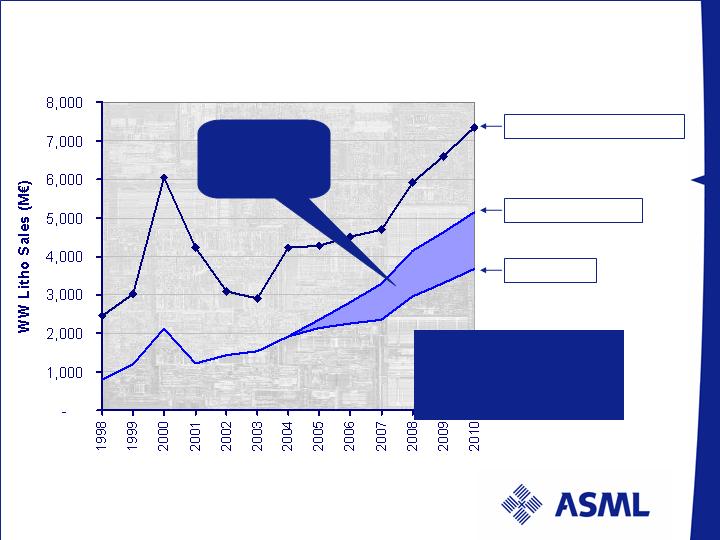

ASML Secular Growth model

Source: Average of Dataquest, VLSI Research and ASML fab based simultion model – NOT A FORECAST

Average WW litho sales

ASML’s potential

Status quo

Natural growth

potential towards

4-5 B€ range

ASML’s

opportunity

window

Assumption: 9% IC unit Growth/year

/ Slide 17

ASML is well positioned for value generation

Growth

Target of 70% market share

Potential to double top line in 5 years (reference 2005)

Profitability

Track record of last 8 quarters - average 17.1% EBIT

margin

Improvement through scaling

Liquidity

Average M €79 cash generation from operations in last

8 quarters

/ Slide 18

/ Slide 19