JP Morgan 34th Annual Technology Conference

San Francisco – May 23, 2006

Eric Meurice, CEO

Exhibit 99.7

Safe Harbor

“Safe Harbor” Statement under the U.S. Private Securities

Litigation Reform Act of 1995: the matters discussed in this

presentation may include forward-looking statements that are

subject to risks and uncertainties including, but not limited to:

economic conditions, product demand and semiconductor

equipment industry capacity, worldwide demand and

manufacturing capacity utilization for semiconductors (the

principal product of our customer base), competitive products

and pricing, manufacturing efficiencies, new product

development, ability to enforce patents, the outcome of

intellectual property litigation, availability of raw materials and

critical manufacturing equipment, trade environment, and

other risks indicated in the risk factors included in ASML’s

Annual Report on Form 20-F and other filings with the U.S.

Securities and Exchange Commission.

/ Slide 2

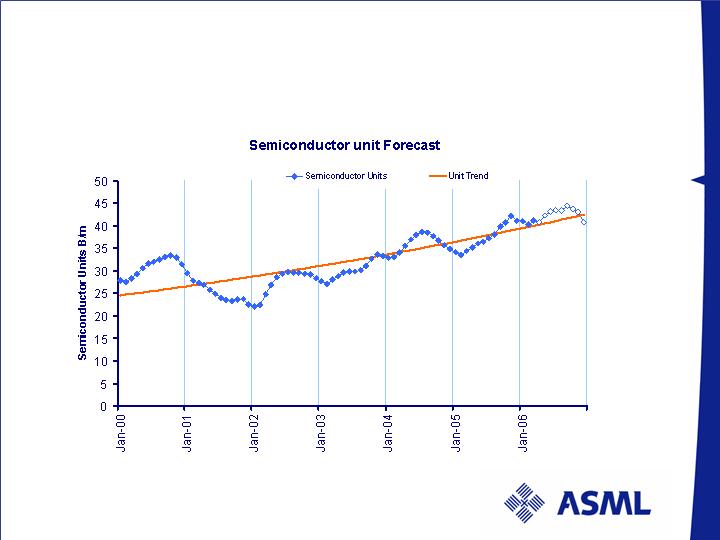

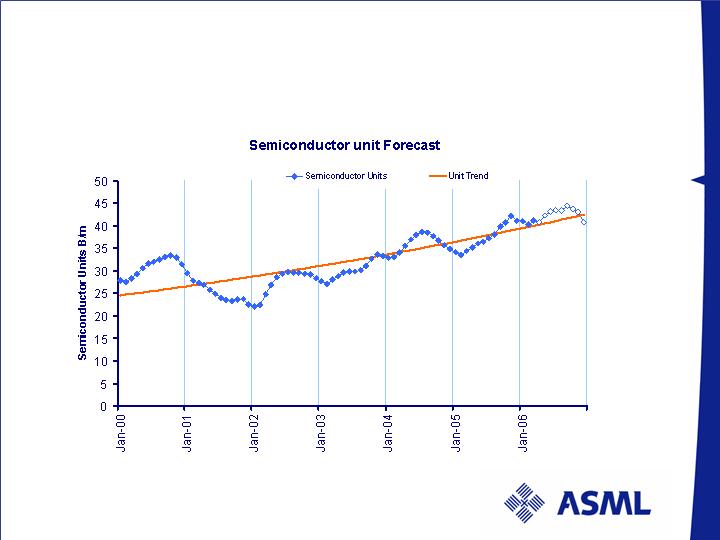

Mid-Term Market Update

Semiconductor Units history and forecast

2006 Semiconductor consensus growth forecast at +11%

25% -21% 14% 9% 18% 4% 11%

Source: ASML MCC

/ Slide 4

IC unit sales and inventory

Steady demand - inventory under control

Source: WSTS, VLSI Research, ASML

Last data point: March 2006

/ Slide 5

Litho Bookings and Billings as % of Semiconductor Revenue

Relative spending on Litho increasing

Source: SEMI, WSTS, ASML

Last data point: March 2006

/ Slide 6

Growth from Multiple independent Segments

Each Segment with its own investment cycle

Flash shrink - 12 to 15

month investment cycle

DRAM – closely follows

Flash investment cycle

Foundries represent classic

supply/demand cycle

Moore’s law, 18 to 24

months - invest for new

product development -

volume to Foundry

Shrink for new

functionality and cost per

function - 12 to 24 month

investment cycle

/ Slide 7

Market Status Summary

Market players remain cautious:

Inventory/Utilization under evaluation

Industry shows sign of maturing as swings are smaller in

amplitude and length

Wide range of customers are hitting capacity limits

Ordering production capacity tools including used

Utilization rates at approx. 92 %

/ Slide 8

Market Status Summary (Cont.)

26 new fab projects under construction:

9 Flash fabs

6 other Memory fabs

11 Foundry or IDM fabs

Immersion enabling 55 nm/45 nm next generation

node for early 2007 production ramp:

Flash next generation

High integration/complexity Logic designs

LEADING TO A STRONG BOOKINGS OUTLOOK IN Q2 2006

FOR DELIVERIES IN Q3 06, Q4 06, Q1 07

/ Slide 9

Long-Term Trajectory

Company focus

Execution on Technology – Cost – Leadtime

Execute on Leadership:

Volume production ramp of the TWINSCAN XT:1700i, hyper NA

tool for 45 nm node: 20 - 25 tools to ship in 2006

2 EUV alpha tools mid 2006

R&D investment increased to sustain 1 node/year

Execute on cost of goods reduction:

Internal target of 15% cost of ownership reduction

Redesigns for cost - for performance/availability/throughput

Execute on lead time reduction

Leadtime reduction of 30%

Capacity increase: 50% +

/ Slide 11

ASML Secular Growth model

Source: Average of Dataquest, VLSI Research and ASML fab based model

Average WW litho sales

ASML’s potential

Status quo

Natural growth

potential towards

4-5 B€ range

ASML’s

opportunity

window

/ Slide 12

ASML is well positioned for value generation

Growth

Target of 70% market share

Potential to double top line in 5 years (reference 2005)

Profitability

Track record of last 8 quarters - average 17.1% EBIT

margin

Liquidity

Average M €79 cash generation from operations in last

8 quarters

/ Slide 13

Commitment