Exhibit 99(a)(5)(xix)

kpn WORK IN PROGRESS Project Celtic Board of Management The Hague, 4 June 2009 Strictly private & confidential JX 105 Q1 2008 1 Highly Confidential KPN00183853

Mergers & Acquisitions WORK IN PROGRESS kpn Agenda Summary Situation overview Options going forward Valuation Process Recommendation Q1 2008 2 Highly Confidential KPN00183854

Mergers & Acquisitions WORK IN PROGRESS kpn Summary Celtic performance to date is behind expectations Integration KGCS / TCC finalized, financial and shareholding performance lacking initial expectations Strategy partly executed, strategic flexibility restricted by current listing, governance structure and share price Value KPN stake diminished from -$ 298 mnti (€ 214 mn12)) to -S 54 mni'l (€ 38 mn(21) in the period 2007 to 2009 Redacted for Business Strategy Immunity Buying remaining stake and delisting is considered an attractive option Enables implementation of optimal governance structure Creates room for strategic flexibility through delisting and full ownership Improves ability to capture potential upside Redacted for Business Strategy Immunity We ask the Management Board to authorize Preparation for a possible buy-out of the remaining outstanding shares in Celtic Notice to Supervisory Board regarding the possible buy-out Note: any request for authority to proceed with a buy-out to be made at a later stage Value 2007 based on share price 9 October 2007 of $7.82 times 51% of 74.8 mm shares outstanding: value 2008 based on share price 1 June 2008 01 $1.34 tines 58% of 71.2 shares outstanding USD – EUR exchange rate of 0:71.as of Juen 2009 Q1 2008 3 Highly Confidential KPN00183855

Mergers & Acquisitions WORK IN PROGRESS kpn Agenda Summary Situation overview Options going forward Valuation Process Recommendation Q1 2008 4 Highly Confidential KPN00183856

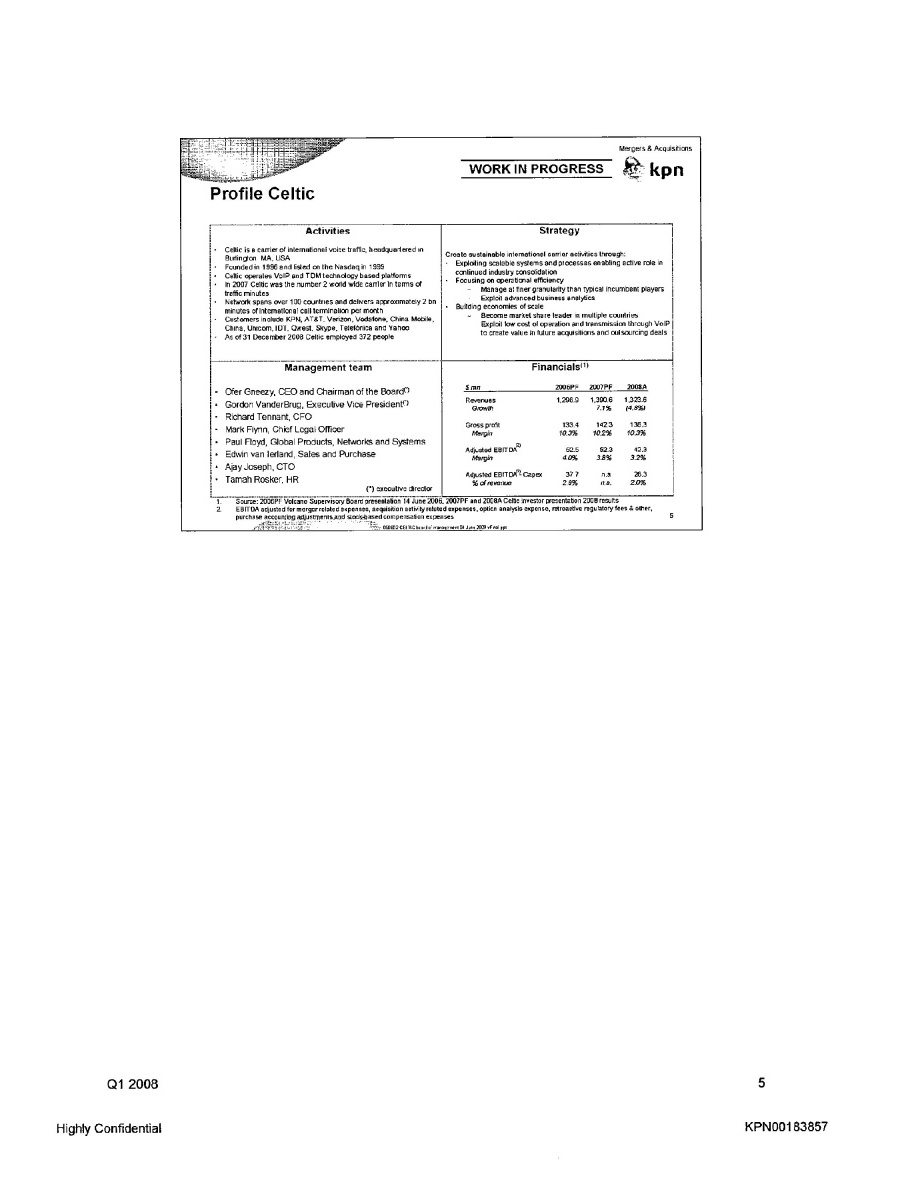

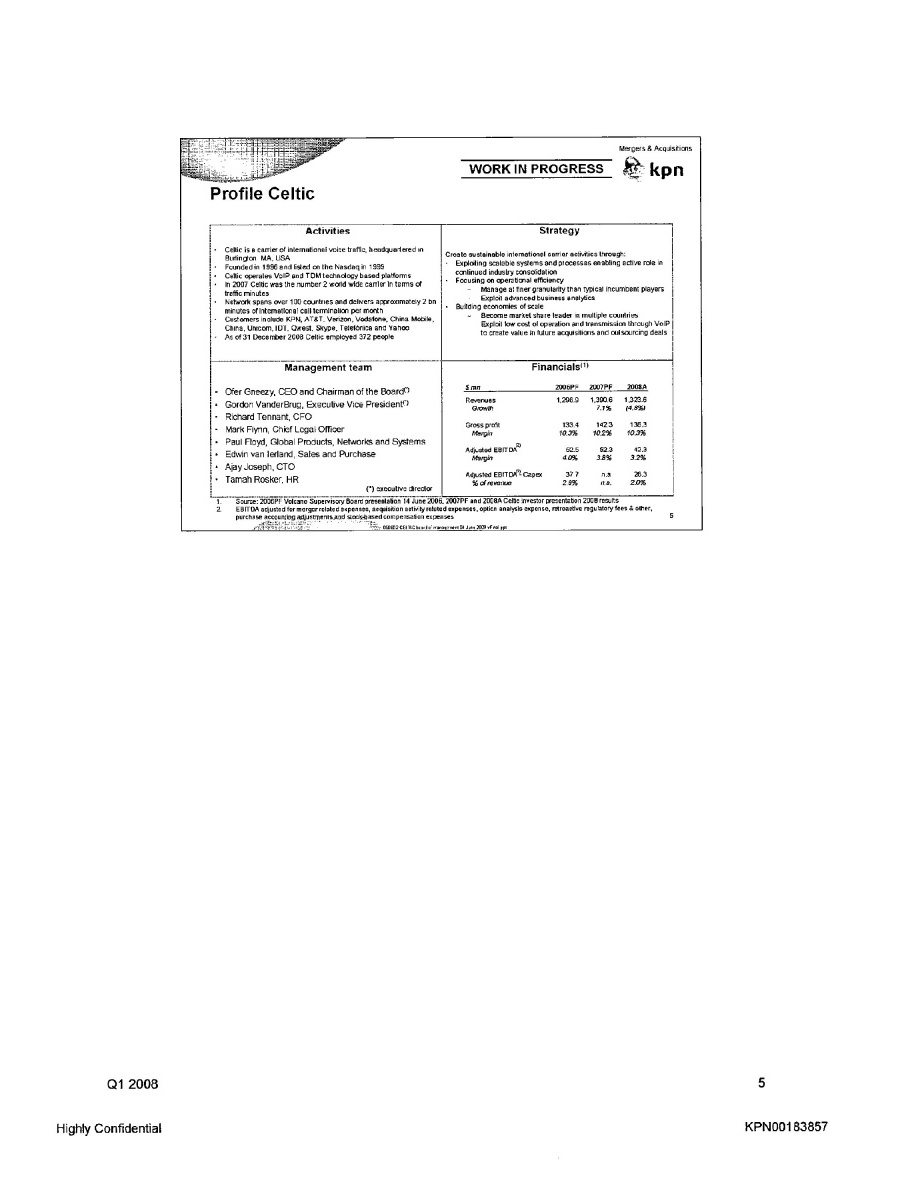

Mergers & Acquisitions WORK IN PROGRESS kpn Profile Celtic Activities Celtic is a carrier of international voice traffic, headquartered in Burlington MA. USA Founded in 1996 and listed on the Nasdaq in 1999 Celtic operates VolP and TDM technology based platforms In 2007 Celtic was the number 2 world wide carrier in terms of traffic minutes Network spans over 100 countries and delivers approximately 2bn minutes of International Call termination per month Customers include KPN, AT&T. Verizon, Vodafone, China Mobile, China, Unicorn, IDT. Qwest. Skype. Telelonica and Yahoo As of 31 December 2008 Celtic employed 372 people Strategy Create sustainable international carrier activities through: Exploding scalable systems and processes enabling active role in continued industry consolidation Focusing on operational efficiency Manage at finer granularity than typical incumbent players Exploit advanced business analytics Building economies of scale Become market share leader in multiple countries Exploit low cost of operation and transmission through VolP to create value in future acquisitions and outsourcing deals Management team Ofer Sneezy, CEO and Chairman of the Board(*) Gordon VanderBrug, Executive Vice President(*) Richard Tennant, CFO Mark Flynn: Chief Legal Officer Paul Floyd, Global Products, Networks and Systems Edwin van lerland, Sales and Purchase Ajay Joseph, CTO Tomah Rosker, HR (*) executive director Financials Revenues Growth Gross profit Margin Adjusted EBITDA(*) Margin Adjusted EBITD(*) Capex %d revenue 1. Source: 2006PF Volcano Supervisory Board presentation 14 June 2006. 2007PF and 2008A Celtic investor presentation 2006 results 2. EBFTDA adjusted for merger related expenses, acquisition activity related expenses, option analysis expense, retroactive regulatory fees & other, purchase accounting adjustments and stock-based compensation expenses Q1 2008 5 KPN00183857

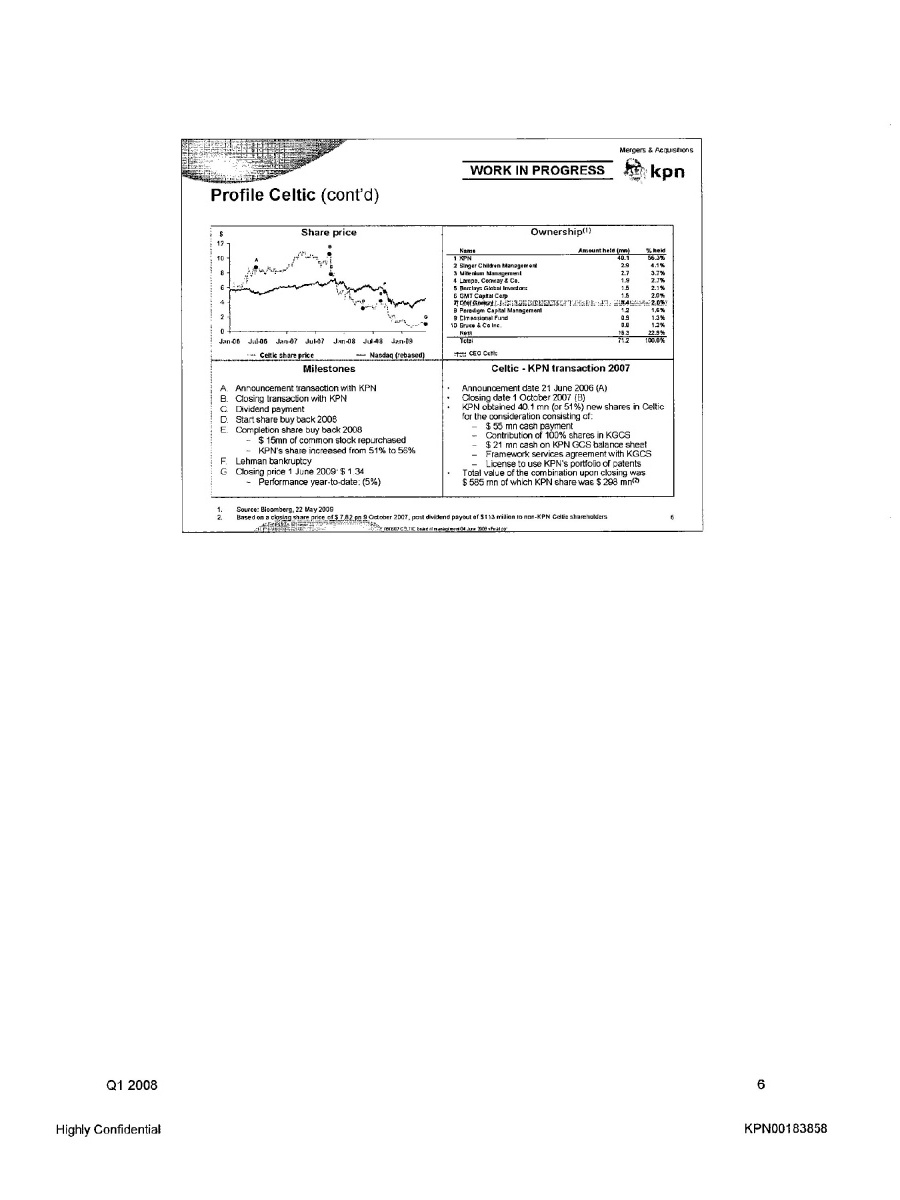

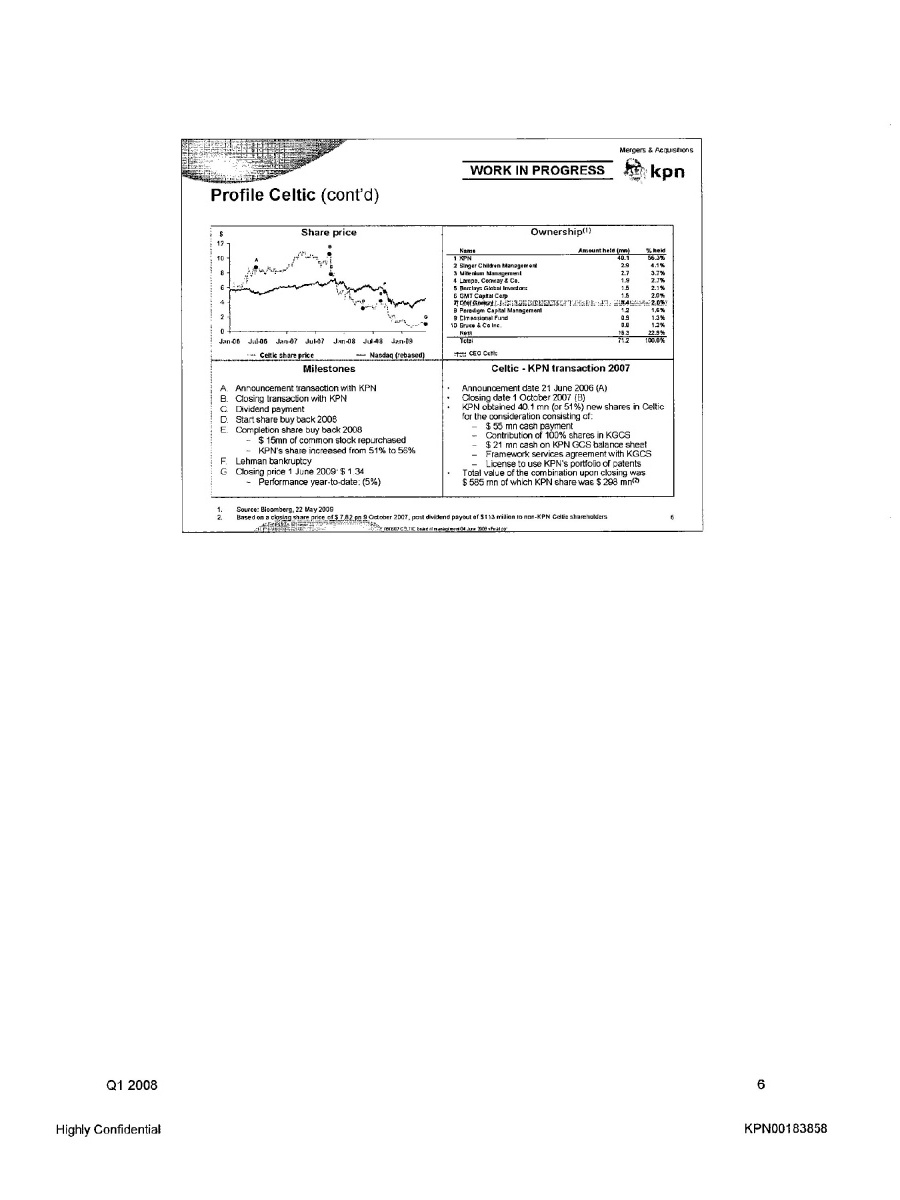

Mergers & Acquisitions WORK IN PROGRESS Profile Celtic (cont'd) Celtic Share price Nasdaq (rebased) Ownership(l) Name Amount held (mn) %held 1 KPN 2 Singer Children Management 3 Millenium Management 4 Lampe. Conway & Co. 5. Barclays Global Investors 6 GMT Capital Corp 7. Gneezy 9 Dimensional Fund 10 Bruce & Co Inc Rest 163 229% Total Milestones A. Announcement transaction with KPNB. B. Closing transaction with KPNC. Dividend payment D. Start share buy back 2008 E. Completion share buy back 2008 $ 15mn of common stock repurchased KPN's share increased from 51% to 56% F. Lehman bankruptcy G. Closing price 1 June 2009: $ 1.34 Performance year-to-date: (5%) Celtic - KPN transaction 2007 Announcement date 21 June 2006 (A) Closing date 1 October 2007 (B) KPN obtained 40.1 mn (or 51%) new shares in Celtic for the consideration consisting of: $ 55 mn cash payment Contribution of 100% shares in KGCS $ 21 mn cash on KPN GCS balance sheet Framework services agreement with KGCS License to use KPN's portfolio of patents Total value of the combination upon closing was $585 mn of which KPN share was $ 298 m(2) 1. Source: Bloomberg, 22 May 2009 2. Based on a closing share price of $ 7.82 on 9 October 2007, post dividend payout of $113 million to non-KPN Celtic shareholders Q1 2008 KPN00183858

Mergers & Acquisitions WORK IN PROGRESS kpn Market developments Traffic volumes increasing and shifting to VolP, traffic prices declining CAGR Traffic trends Modest growth in traditional minutes VolP share of global traffic is increasing Price trends Steady price erosion of 5 - 10% per annum due to price competition annum due to price competition Current conditions Economic slowdown results in lower traffic volumes due to less long distance calls Outlook International voice traffic is expected to grow in long-term with lower mid-term growth Price erosion expected to continue Revenue development not fully clear Q1 2008 7 Highly Confidential KPN00183859

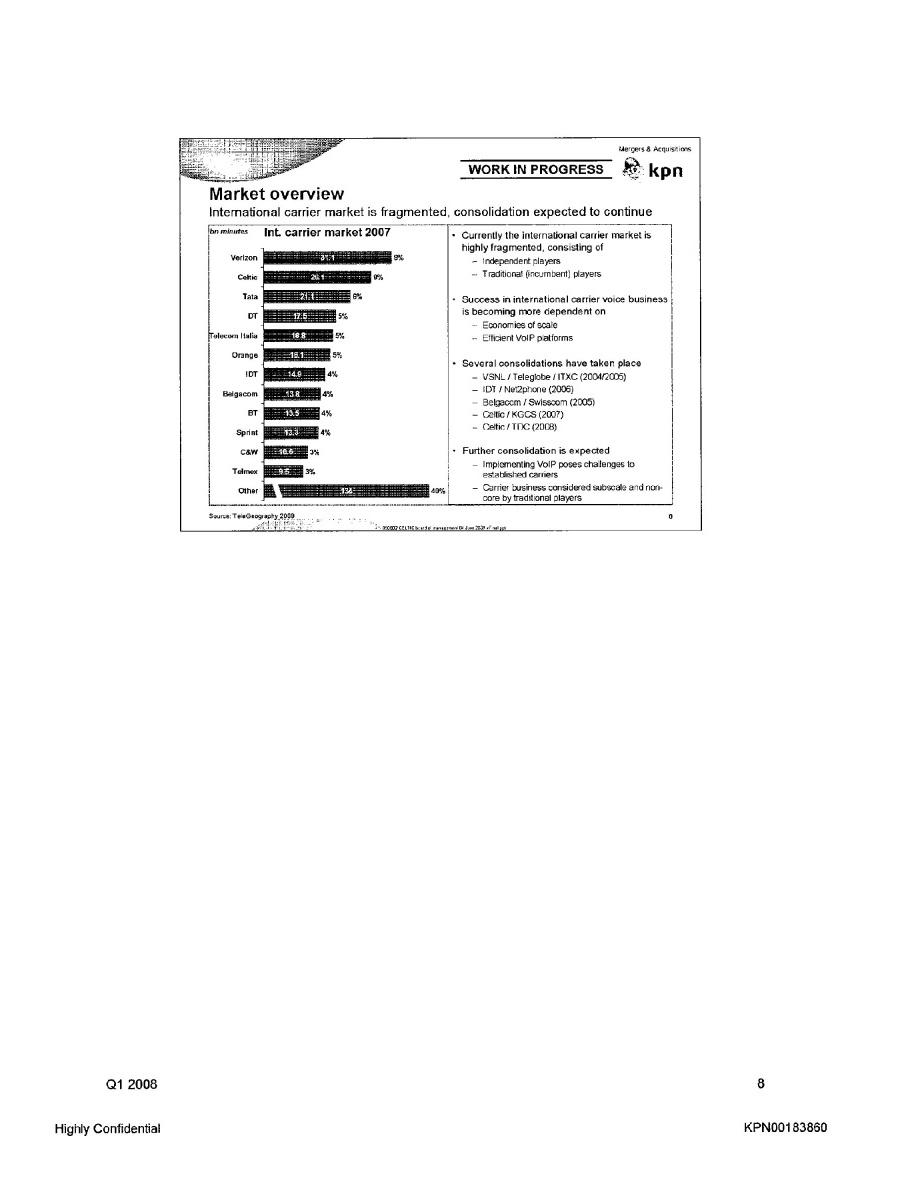

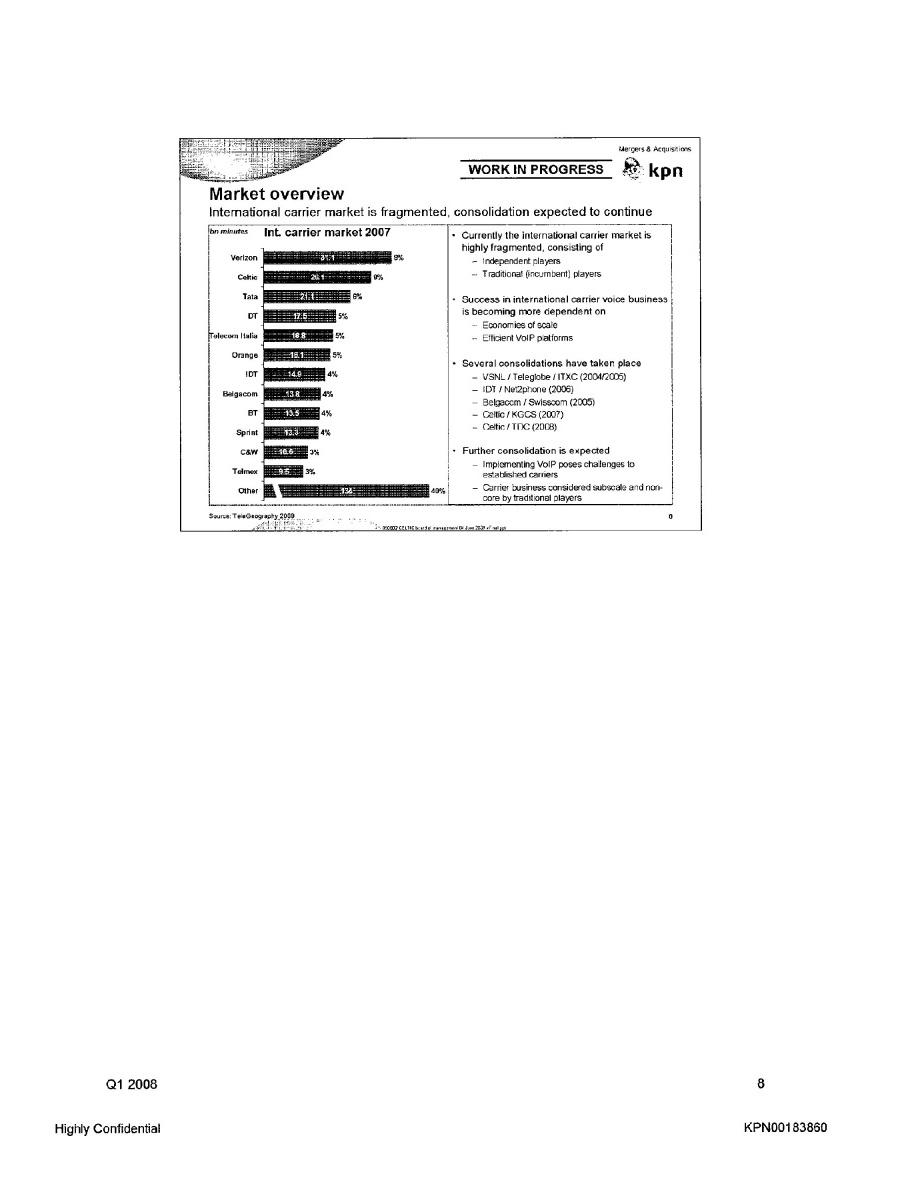

WORK IN PROGRESS kpn Market overview International carrier market is fragmented, consolidation expected to continue On minutes Int. carrier market 2007 Verizon Celtic Tala DT Telecom Italia Orange IDT Belgacom BT Sprint C&W Telmex Other Currently the international carrier market is highly fragmented, consisting of Independent players Traditional (incumbent) players Success in international carrier voice business is becoming more dependent on Economies of scale Efficient VolP platforms Several consolidations have taken place VSNL / Teleglobe I ITXC (2004/2005) IDT / Net2phone (2006) Belgacom / Swisscom (2005 Celtic / KGCS (2007) Celtic / TDC (2008) Further consolidation is expected Implementing VoIP poses challenges to established carriers Carrier business considered subscale and non-core by traditional players Source TeleGeography2009 01 2008 8 Highly Confidential KPN00183860

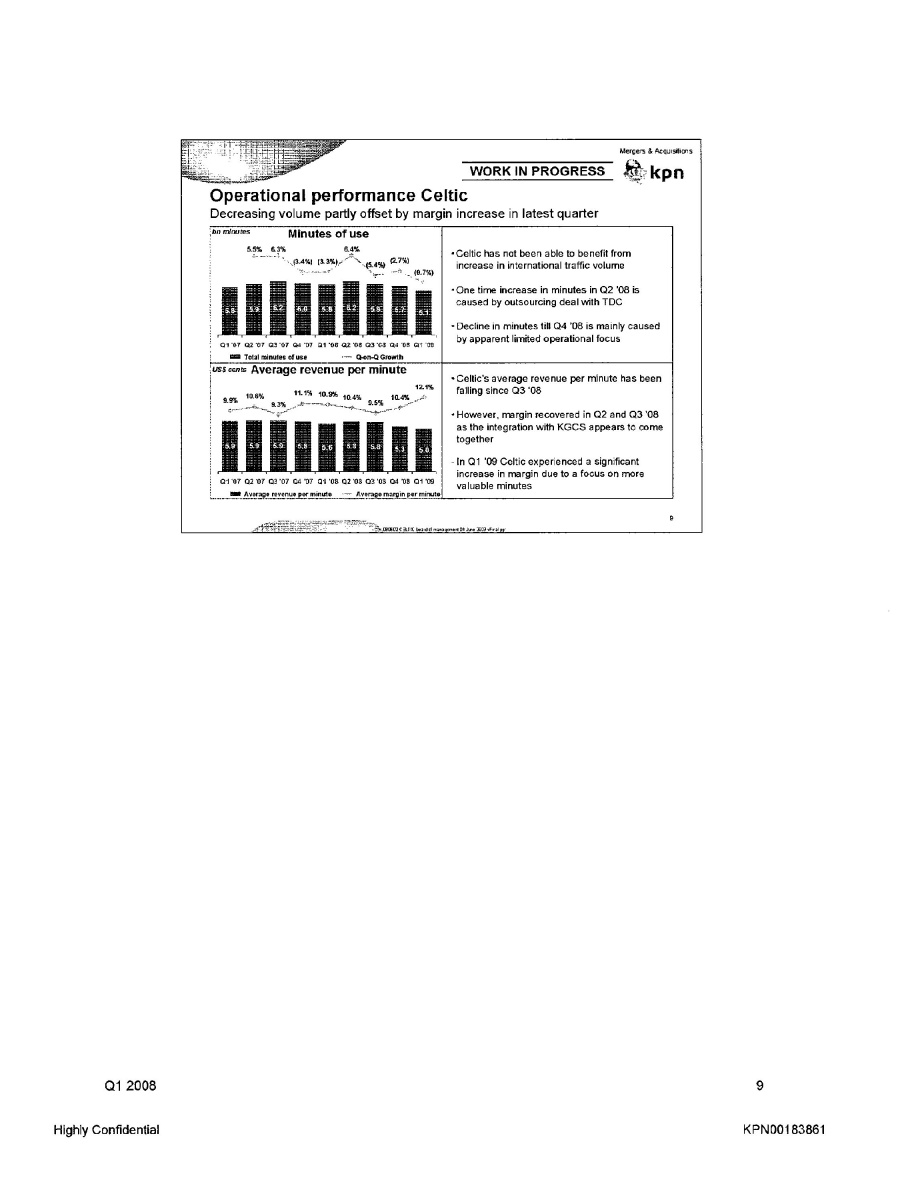

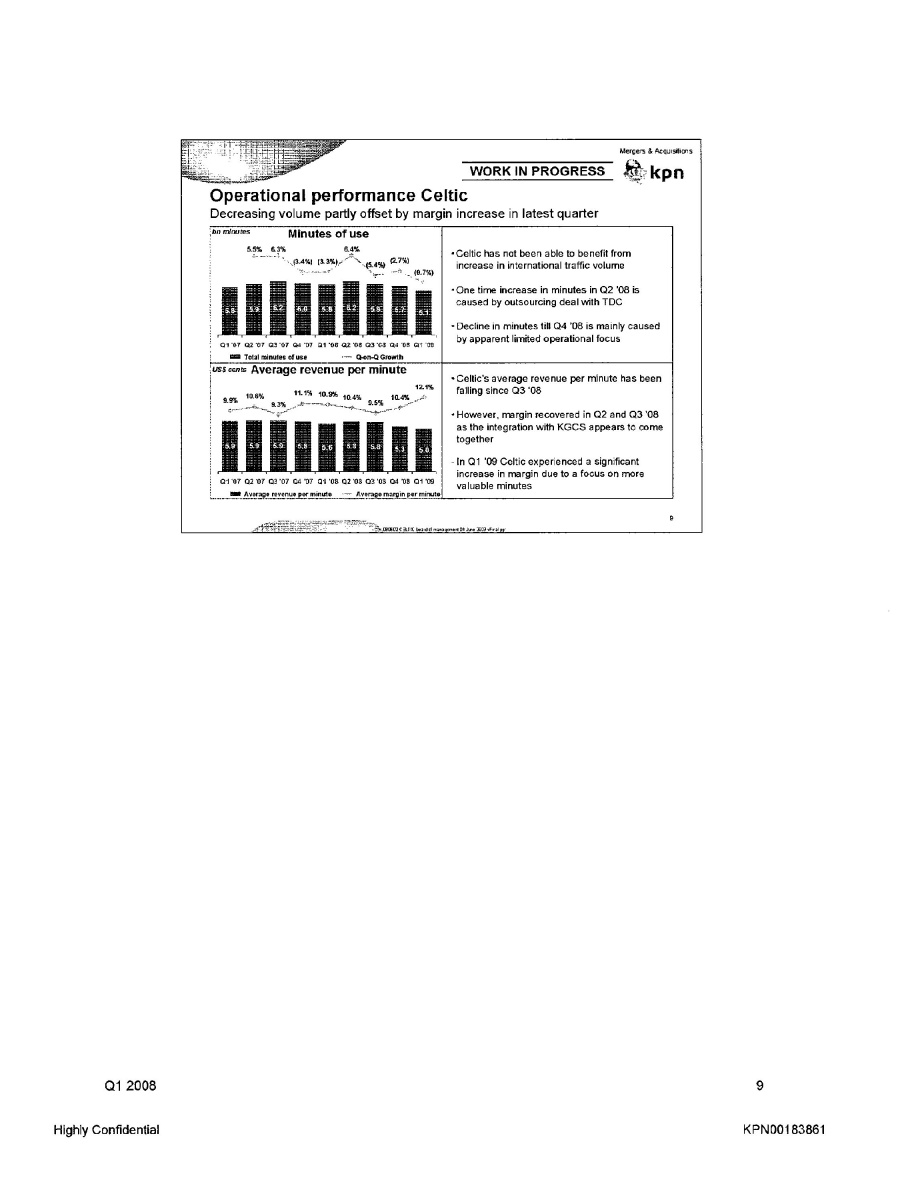

WORK IN PROGRESS kpn Operational performance Celtic Decreasing volume partly offset by margin increase in latest quarter On minutes Minutes of use Average revenue per minute Celtic has not been able to benefit from increase in international traffic volume One time increase in minutes in Q2 '08 is caused by outsourcing deal with TDC Decline in minutes till Q4 '08 is mainly caused by apparent limited operational focus Celtic's average revenue per minute has been falling since Q3 ‘08 However, margin recovered in Q2 and Q3 '08 as the integration with KGCS appears to come together In Q1 '09 Celtic experienced a significant increase in margin due to a focus on more valuable minutes Average revenue per minute Average margin per minute 9 Q1 2008 9 Highly Confidential KPN00183861

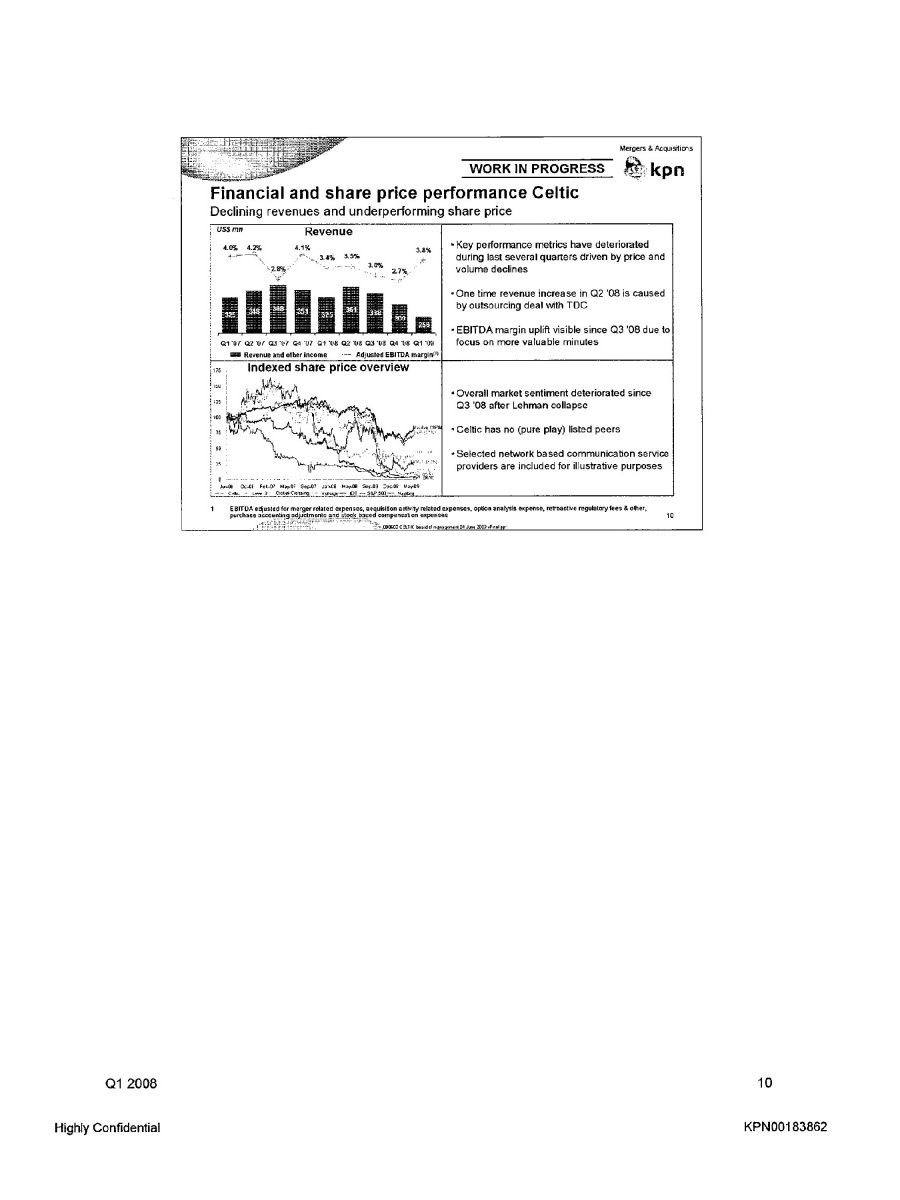

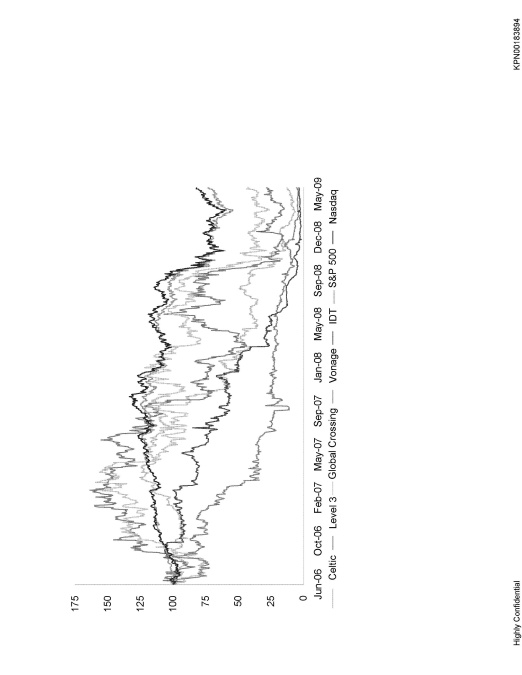

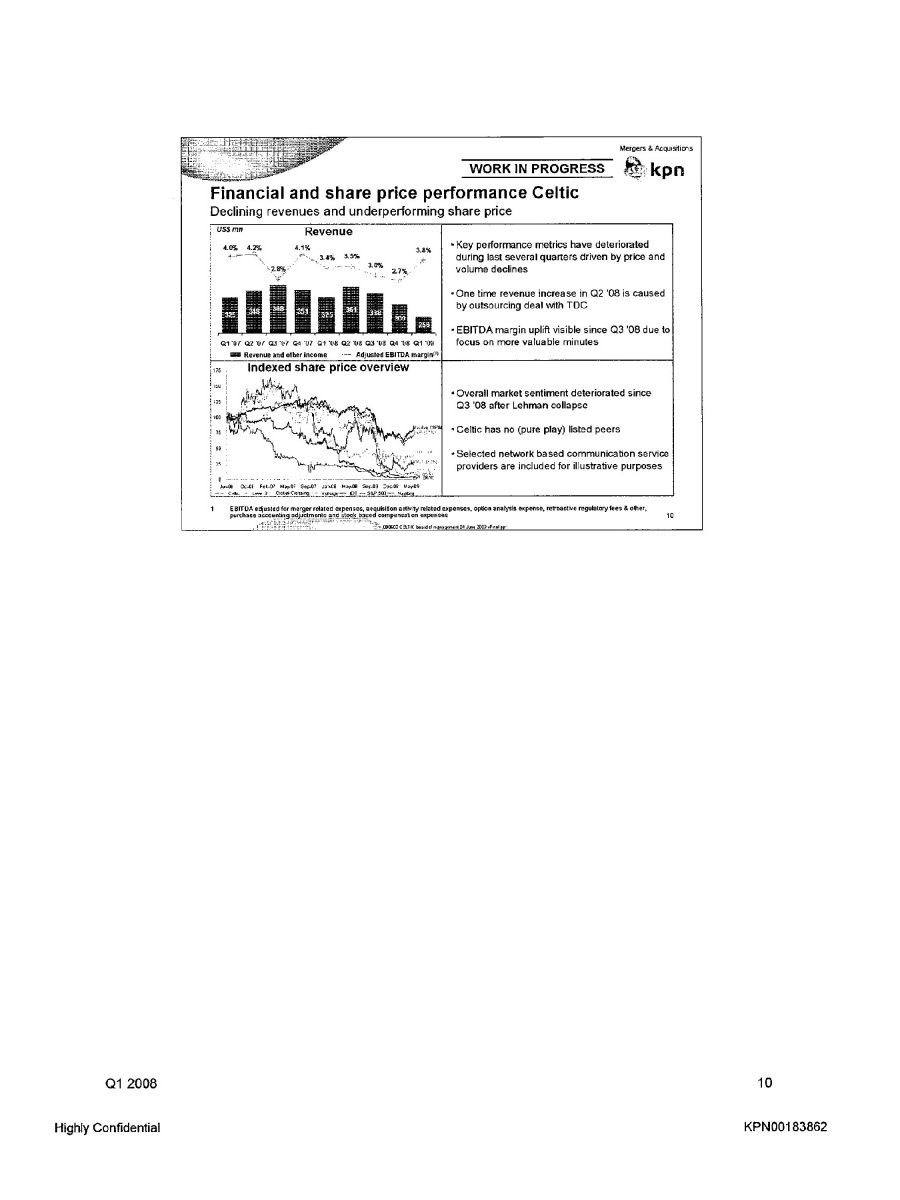

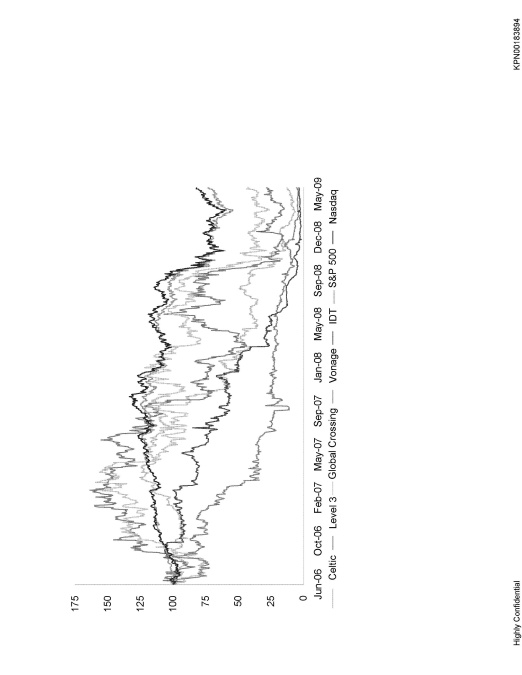

Mergers & Acquisitions WORK IN PROGRESS kpn Financial and share price performance Celtic Declining revenues and underperforming share price USS mn Revenue Revenue and other income Adjusted EBITDA margin(1) Key performance metrics have deteriorated during last several quarters driven by price and volume declines One time revenue increase in Q2 '08 is caused by outsourcing deal with TDC EBITDA margin uplift visible since Q3'08 due to focus on more valuable minutes Indexed share price overview Overall market sentiment deteriorated since after Lehman collapse Celtic has no (pure play) listed peers Selected network based communication service providers are included for illustrative purposes EBITDA adjusted for merger related expenses, acquisition activity related expenses, option analysis expense, retroactive regulatory fees & otter, purchase accounting adjustments and stock-based compensation expenses Q1 2008 10 Highly Confidential KPN00183862

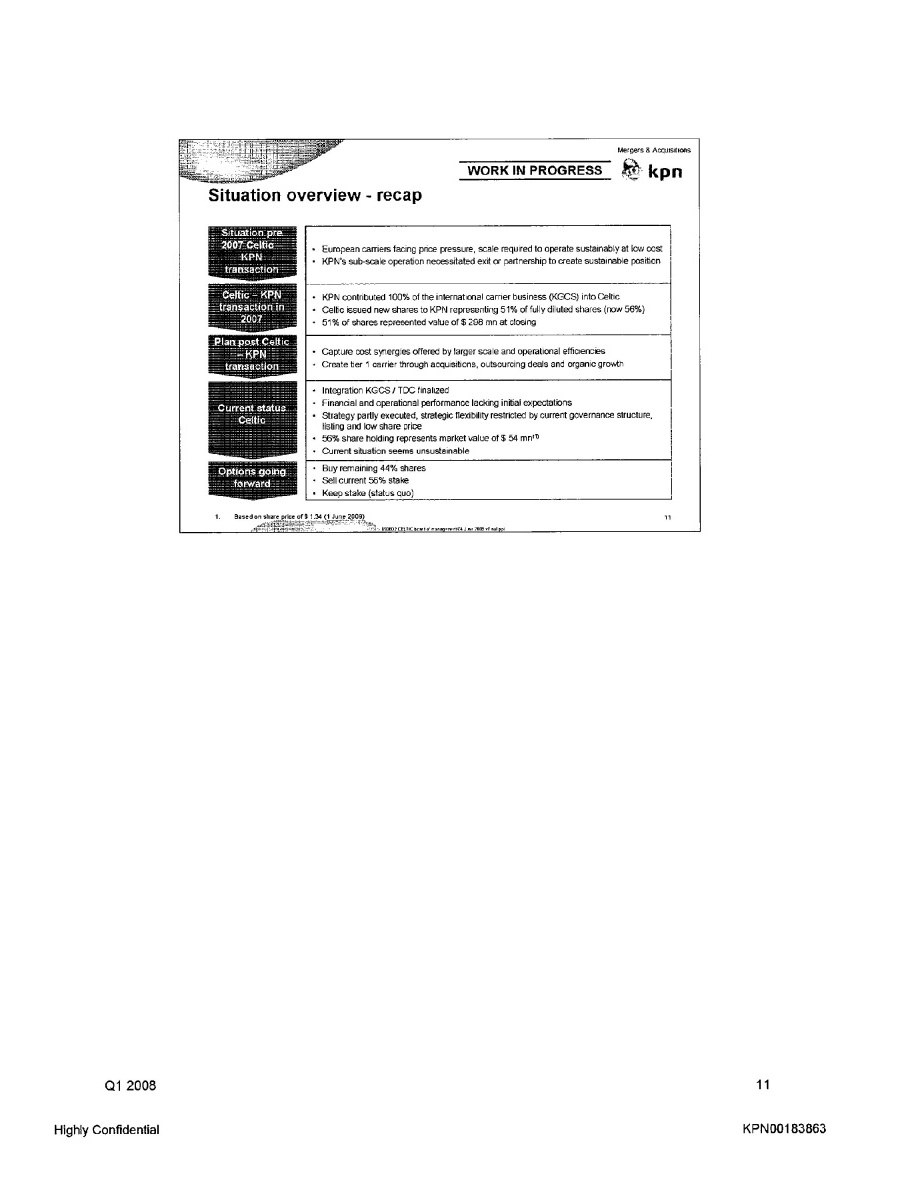

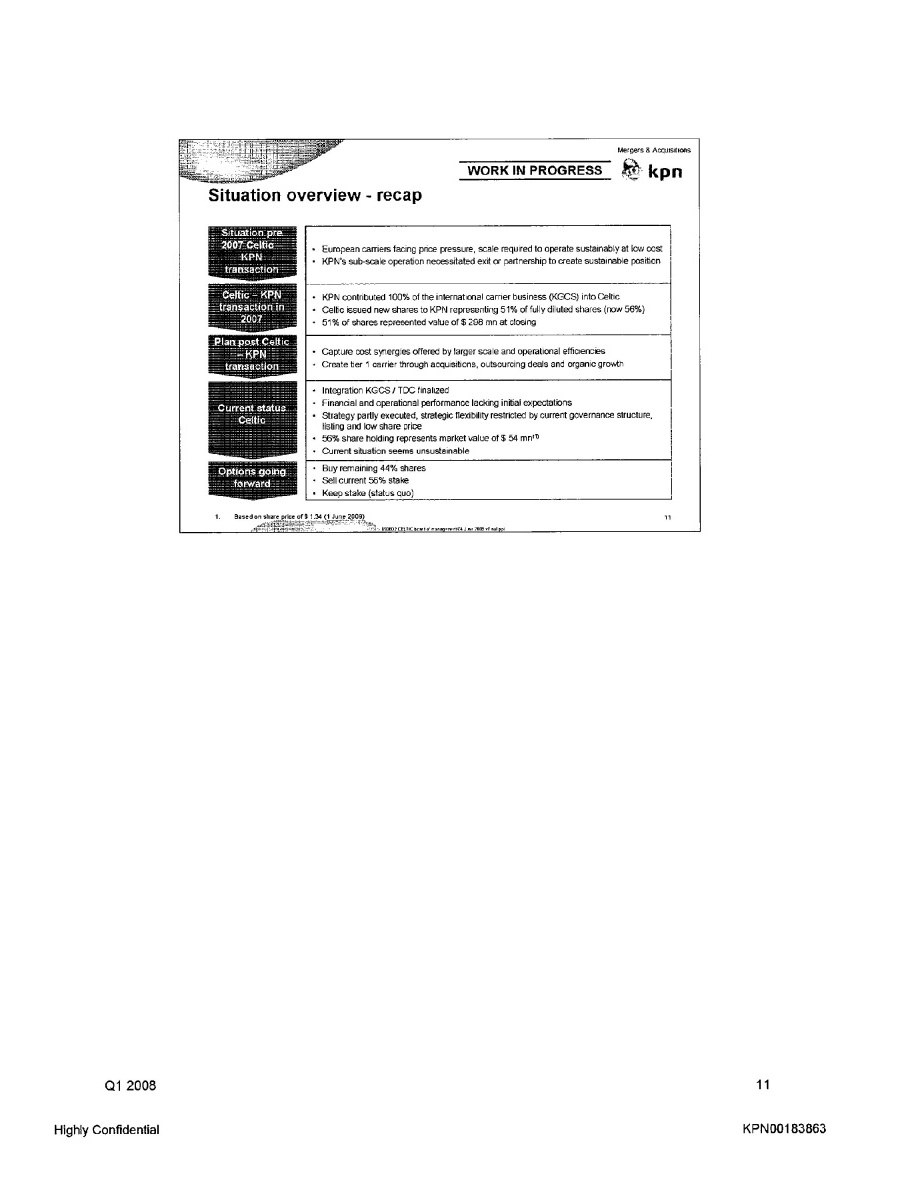

Mergers & Acquisitions WORK IN PROGRESS kpn Situation overview - recap European carriers facing price pressure, scale required to operate sustainably at low cost KPN's sub-scale operation necessitated exit or partnership to create sustainable position KPN contributed 100% of the international carrier business (KGCS) into Celtic Celtic issued new shares to KPN representing 51% of fully diluted shares (now 56%) 51% of shares represented value of $ 298 inn at closing Capture cost synergies offered by larger scale and operational efficiencies Create tier 1 carrier through acquisitions, outsourcing deals and organic growth Integration KGCS / TDC finalized Financial and operational performance lacking initial expectations Strategy partly executed, strategic flexibility restricted by current governance structure, listing and low share price 56% share holding represents market value of $ 54 mn(1) Current situation seems unsustainable Buy remaining 44% shares Sell current 56% stake Keep stake (status quo) 1. Based on share price of $ 1.34 (1 June 2009) Q1 2008 11 Highly Confidential KPN00183863

Mergers A. Acquisitions WORK IN PROGRESSk kpn Agenda Summary Situation overview Options going forward Valuation Process Recommendation Q1 2008 12 Highly Confidential KPN00183864

Mergers & Acquisitions WORK IN PROGRESS kpn Options going forward Buying remaining stake and delisting considered attractive option Strategic flexibility through full ownership and delisting Optimal governance structure and changes to management can be implemented No management focus required for managing / governing Celtic (commercial and operational relationship remains) No further investment needed to acquire remaining stake Likely requires paying minority shareholders premium to current market price Additional investment required Time and effort for delisting process Relatively high transaction costs vs. anticipated deal size Possible damage to reputation If sell for cash, lose opportunity to capture market price potential upside Loss of revenue (6.3% of total FY 2008) and EBITDA contribution Potential value loss through multiple difference between Celtic and KPN Limited flexibility to improve business performance Continued management focus required Limited ability to capture potential upside Q1 2008 13 Highly Confidential KPN00183865

Redacted for Business Strategy Immunity Q1 2008 14 Highly Confidential KPN00183866

Mergers & Acquisttions WORK IN PROGRESS Redacted for Business Strategy Immunity Q1 2008 15 Highly Confidential KPN00183867

Mergers & Acquisitions WORK IN PROGRESS kpn Agenda Summary Situation overview Options going forward Valuation Process Recommendation Q1 2008 16 Highly Confidential KPN00183868

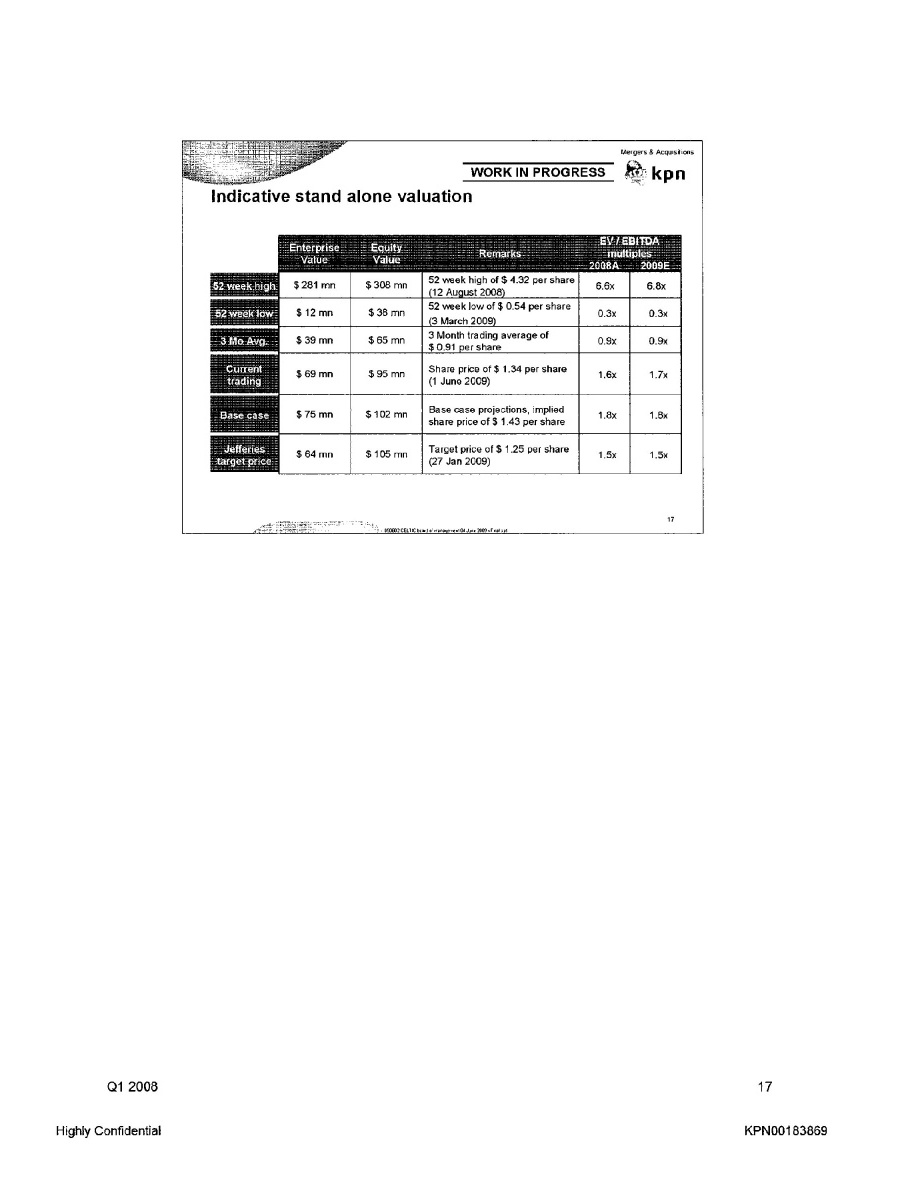

Mergers & Acquisitions WORK IN PROGRESS kpn Indicative stand alone valuation Enterprise Value Equity Value Remarks EV / EBITDA Multiples 2008a 2009E 5 week high 52 week low 3 Mo Avg. Current trading Base Case Q1 2008 17 Highly Confidential KPN00183869

Redacted for Business Strategy Immunity Q1 2008 18 Highly Confidential KPN00183870

Redacted for Business Strategy Immunity Q1 2008 19 Highly Confidential KPN00183871

Mergers & Acquisbons WORK IN PROGRESS kpn Agenda Summary Situation overview Options going forward Valuation Process Recommendation Q1 2008 20 Highly Confidential KPN00183872

Mergers & Acquisitions Work in Progress kpn Redacted for Business Strategy Immunity Q1 2008 21 Highly Confidential KPN00183873

Mergers & Acquisitions Work in Progress kpn Redacted for Business Strategy Immunity Q1 2008 22 Highly Confidential KPN00183874

Mergers & Acquisitions WORK IN PROGRESS kpn Agenda Summary Situation overview Options going forward Valuation Process Recommendation Q1 2008 23 Highly Confidential KPN00183875

Mergers & Acquisitions WORK IN PROGRESS kpn Recommendation and next steps We recommend giving serious consideration to the buy option Next steps Start preparation for possible tender offer and announcement of tender offer Notice to Supervisory Board regarding the possible buy-out We ask the Management Board to authorize Preparation for a possible buy-out for the remaining outstanding shares in Celtic Notice to Supervisory Board regarding the possible buy-out Note: any request for authority to proceed with a buy-out to be made at a later stage 1 2008 24 Highly Confidential KPN00183876

| Q1 2008 | 25 |

| Highly Confidential | KPN00183877 |

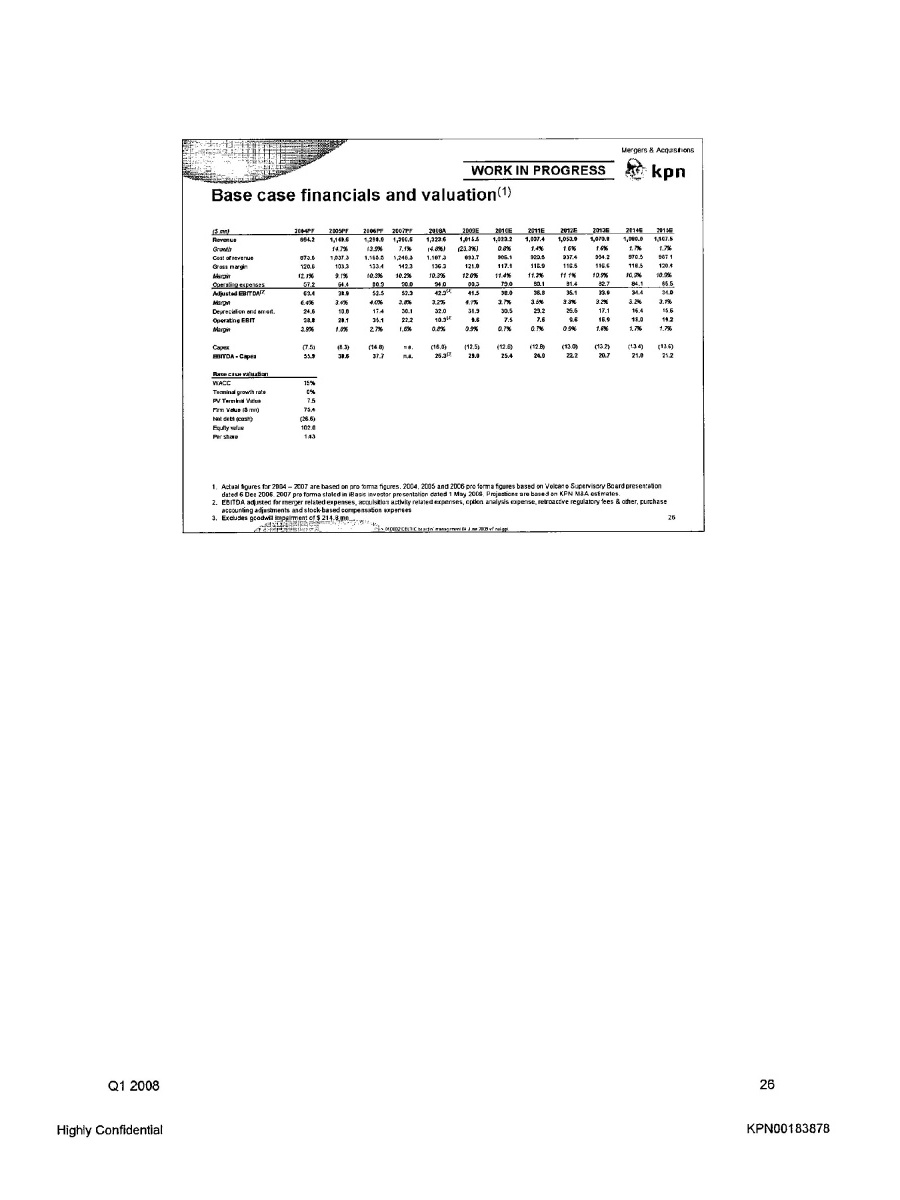

Mergers & Acquisitions WORK IN PROGRESS kpn Base case financials and valuation WACC Terminal growth rate PV Terminal Value Firm Value (% mn) Not Debt (cash) Equity value Per share 1. Actual figures for 2004-2007 are based on pro forma figures. 2004, 2005 and 2006 pro forma figures based on Volcano Supervisory Board presentation dated 6 Dec 2006. 2007 pro forma stated in iBasis investor presentation dated 1 May 2009. Projections are based on KPN M&A estimates. 2. EBITDA adjusted for merger related expenses, acquisition activity related expenses, option analysis expense, retroactive regulatory fees & other, purchase accounting adjustments and stock-based compensation expenses. 3. Excludes goodwill impairment of $214.8mn Q1 2008 26 Highly Confidential KPN00183878

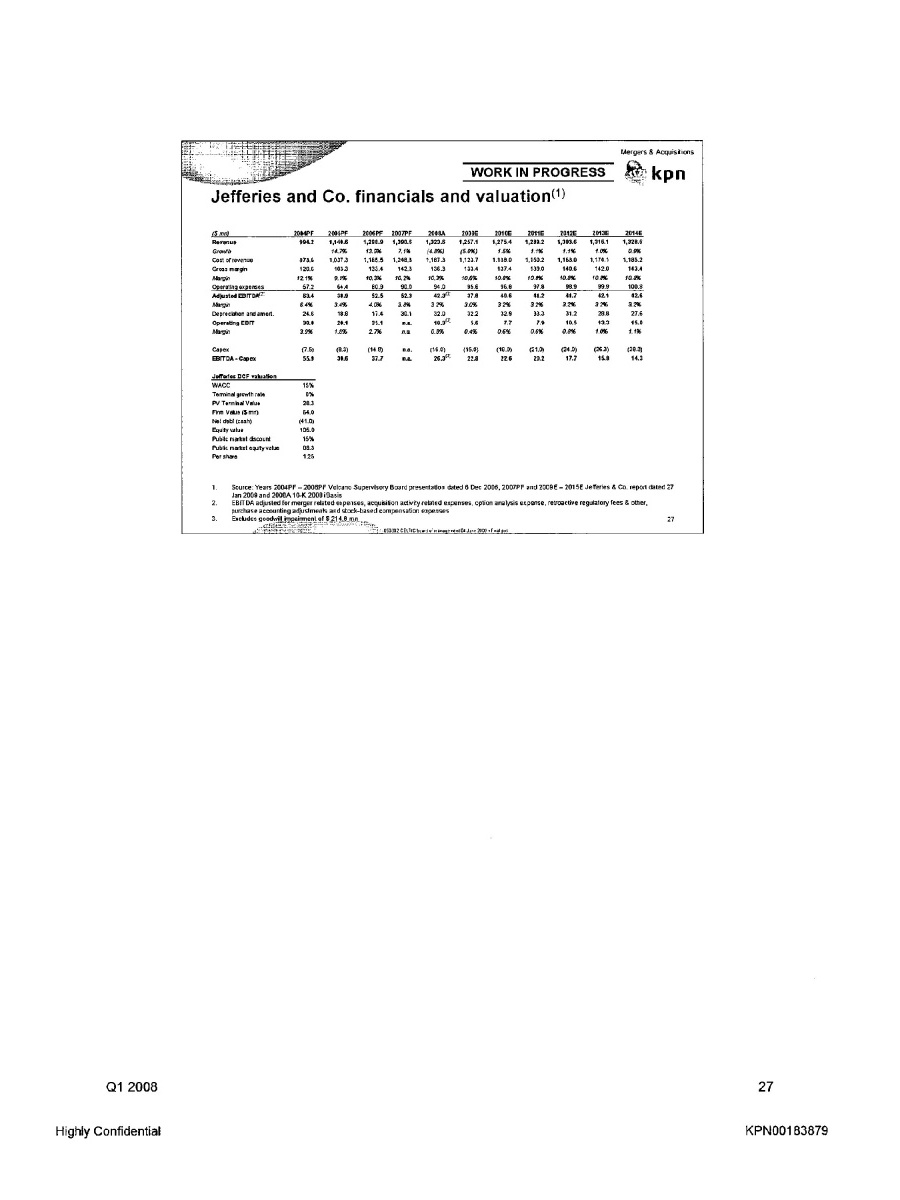

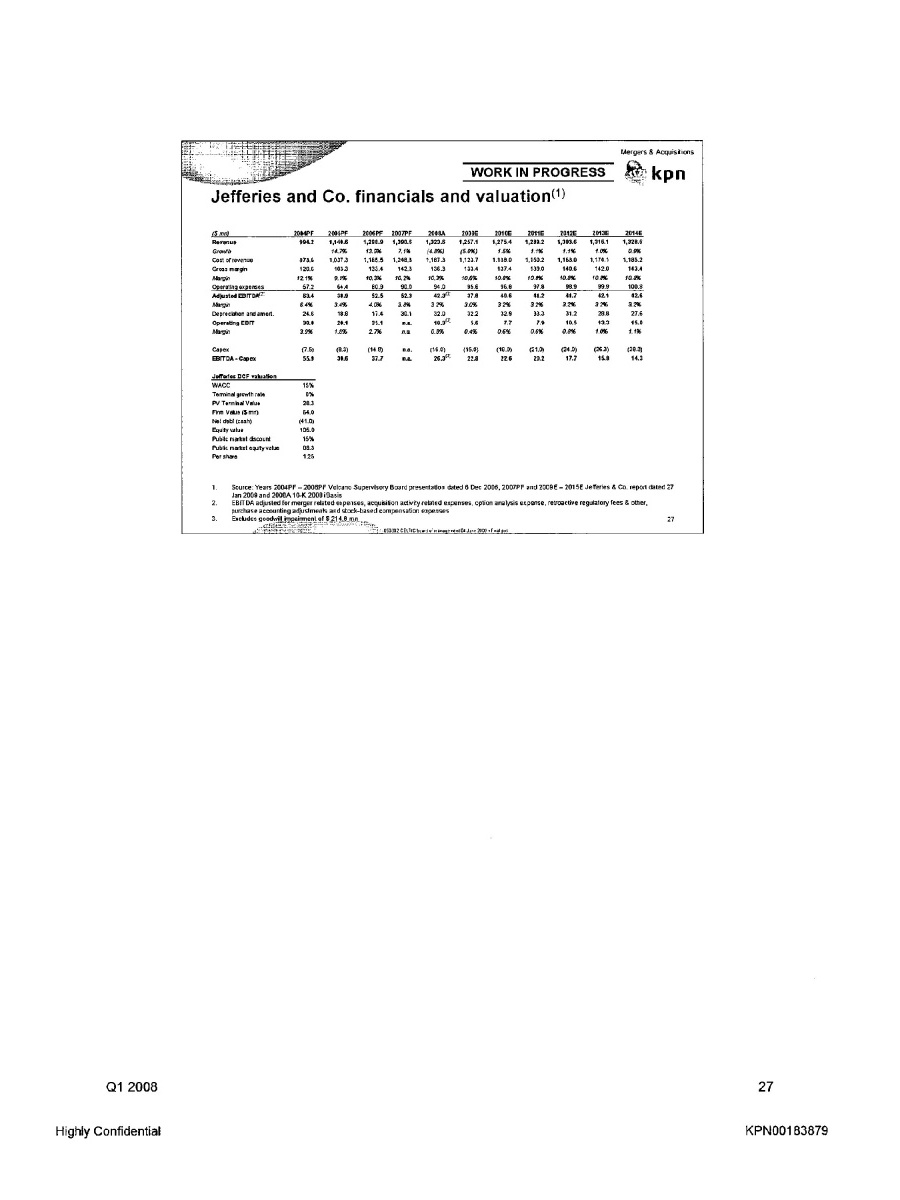

Mergers & Acquisitions WORK IN PROGRESS kpn Jefferies and Co. financials and valuation(1) ($ mn) 2004PF 2005PF 2006PF 2007PF 2008A 2009E 2010E 2011E 2012E 2013E 2014E 2015E Revenue Growth Cost of revenue Gross margin Margin Operating expenses Adjusted EBITDA(2) Margin Depreciation and amend. Operating EBIT Margin Capex EBITDA - Capex Jefferies DCF valuation WACC Terminal growth rate PV Terminal Value Firm value ($mn) Net debt (cash) Equity value Public market discount Public market equity value Per share 1. Source: Years 2004PF —2006PF Volcano Supervisory Board presentation dated 6 Dec 2006, 2007PF and 2009E — 201 SE Jefferies 8 Co. report dated 27 Jan 2000 and 2008A 10-K 2008 iBasis 2. EBfTDA adjusted for merger related expenses, acquisition activity related expenses, option analysis expense. retroactive regulatory fees 8 other, purchase accounting adjustments and stock-based compensation expenses 3. Excludes goodwill impairment of $214.8 mn Q1 2008 27 Highly Confidential KPN00183879

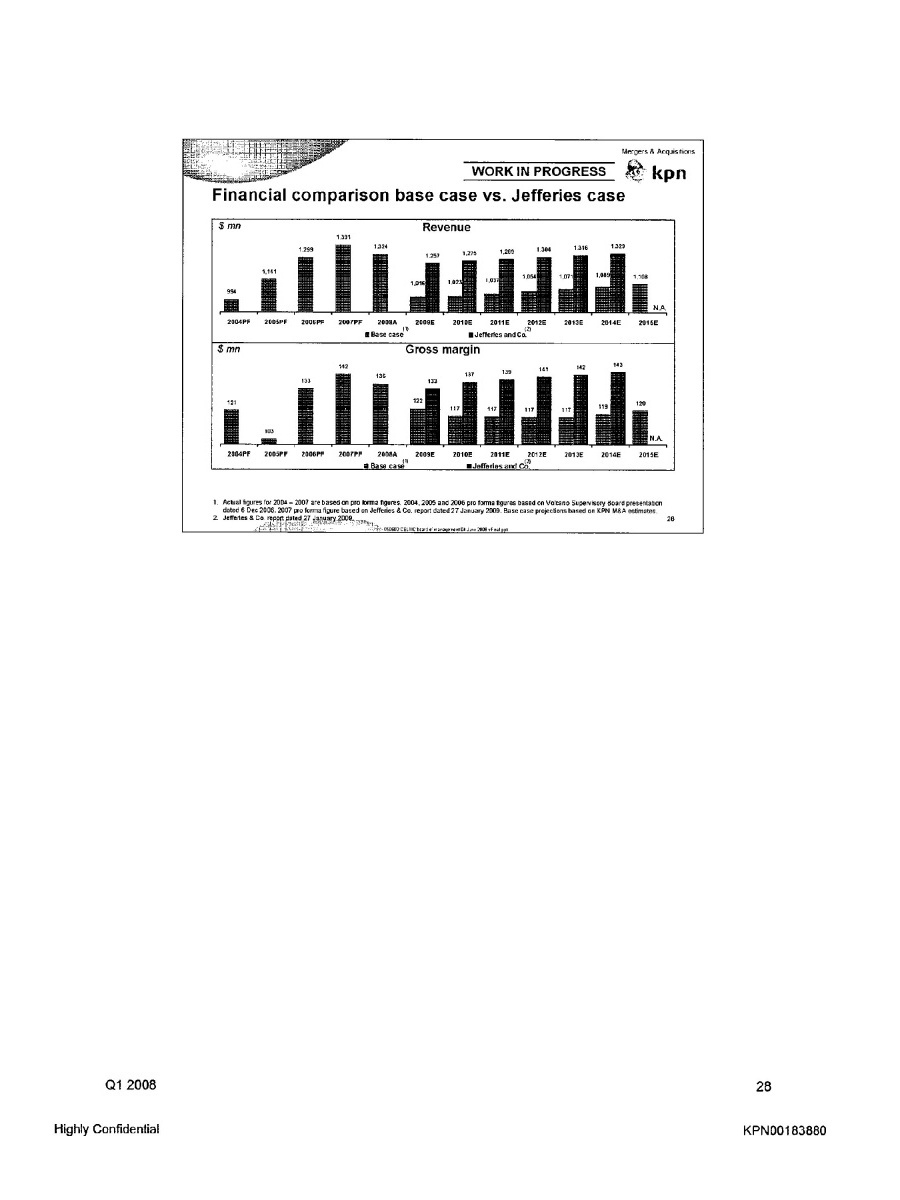

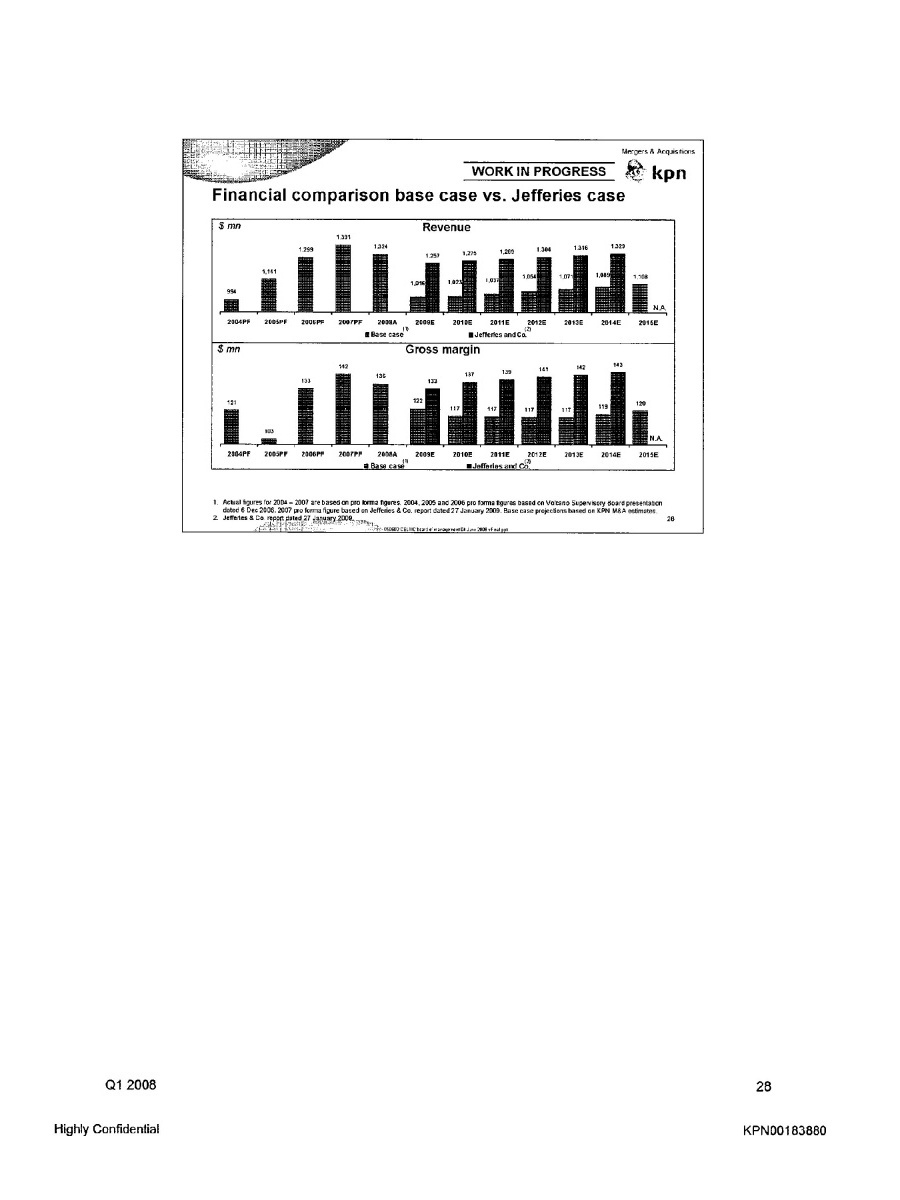

Mergers & Acquisitions WORK IN PROGRESS kpn Financial comparison base case vs. Jefferies case Revenue Gross margin 1. Actual figures for 2004 — 2007 are based on pro forma figures. 2004. 2005 and 2006 pro forma figures based on Volcano Supervisory Board presentation dated 6 Dec 2006. 2007 pro forma figure based on Jefferies & Co. report dated 27 January 2009. Base case projections based on KIM MBA estimates. 2. Jefferies 8, Co. report dated 27 January 2009 Q1 2008 28 Highly Confidential KPN00183880

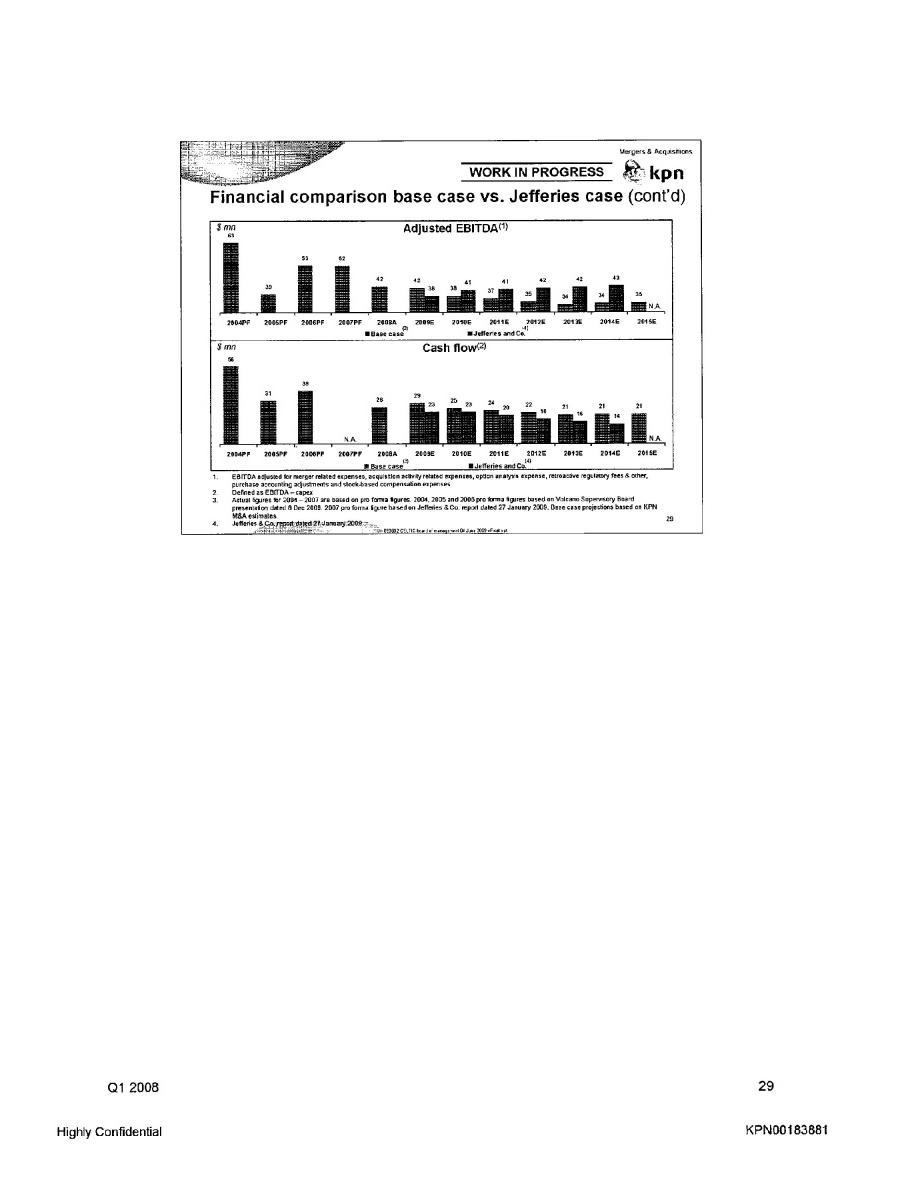

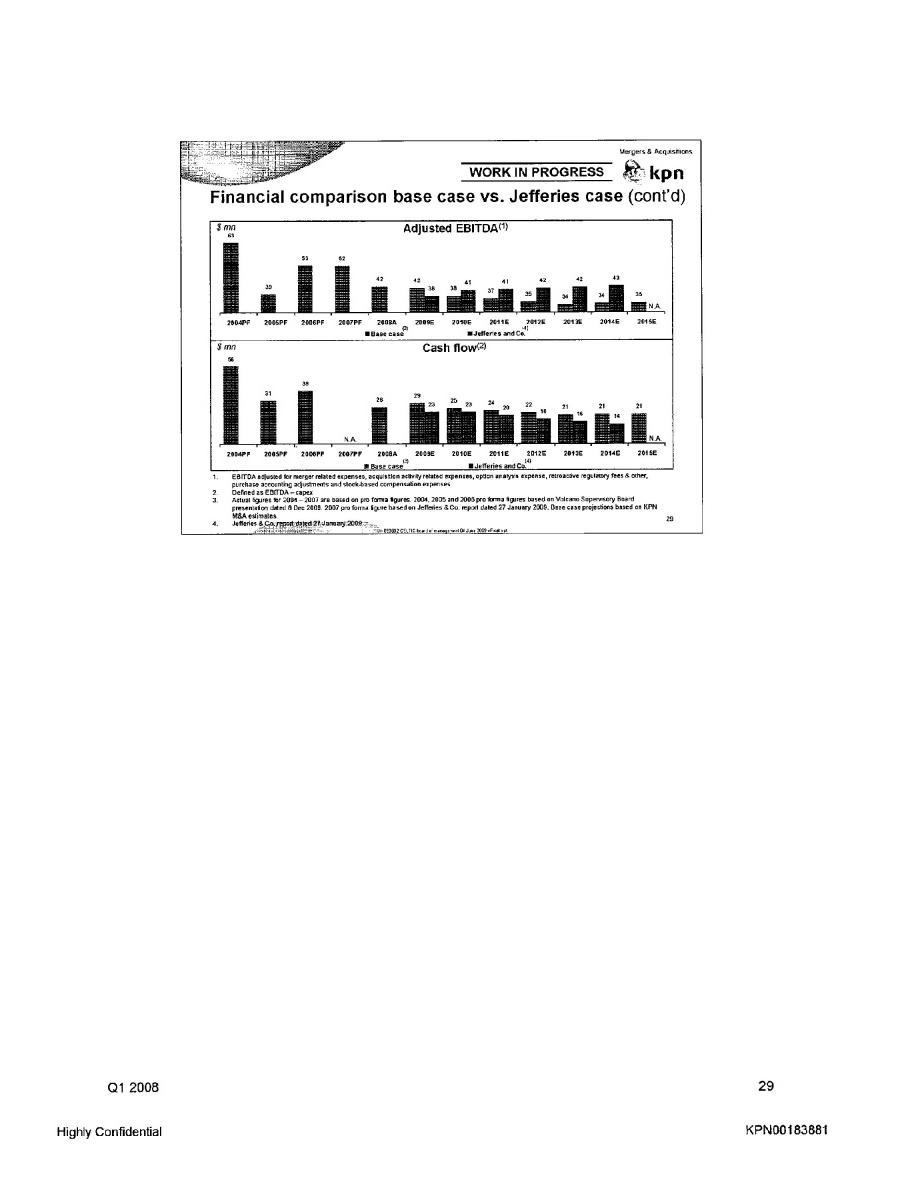

kpn WORK IN PROGRESS Financial comparison base case vs. Jefferies case (cont'd) Adjusted EBITDA Cash flow 1. ES FTDA adjusted for merger related expenses, acquisition activity related expenses, option analysis expense, retroactive regulatory fees & other, purchase accounting adjustments and stock-based compensation expenses 2. Defined as EBITDA — capex 3. Actual figures for 22004— 2007 are based on pro forma figures 2004. 2005 and 2006 pro forma figures based an Volcano Supervisory Board presentation dated 6 Dec 2006. 2007 pro forma figure based on Jefferies 8 Co. report dated 27 January 2009. Base case projections based on KPN M&A estimates 4. Jefferies & Co. report dated 27 January 2008 Q1 2008 29 Highly Confidential KPN00183881

Mergers & Acquisitions WORK IN PROGRESS kpn Financial comparison base case vs. Jefferies case (cont'd) Gross margin EBITDA margin(1) 1. EB1TDA adjusted for merger related expenses, acquisition activity related expenses option analysis expense, retroactive regulatory fees & other, purchase accounting adjustments and slack-based compensation expenses 2. Actual figures for 2004— 2007 are based on pro forma figures. 2004. 2005 and 2006 pro forma figures based on Volcano Supervisory Board presentation dated 6 Dec 2006. 2007 pro forma figure based on Jefferies & Co. report dated 27 January 2009. Base ease projections based on KPN MBA estimates 3. Jefferies & Co. report dated 27 January 2 Q1 2008 30 Highly Confidential KPN00183882

Redacted for Business Strategy Immunity Q1 2008 31 Highly Confidential KPN00183883

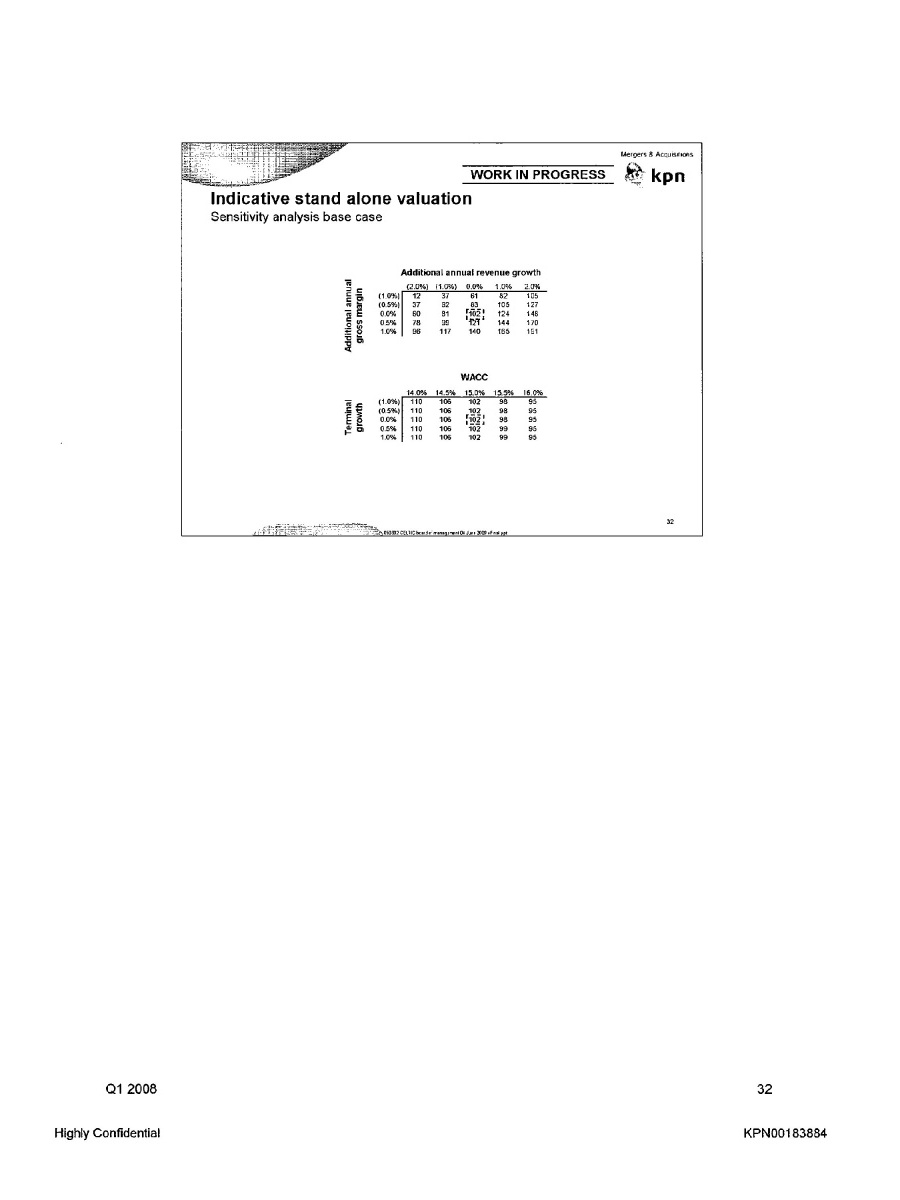

kpn WORK IN PROGRESS kpn Indicative stand alone valuation Sensitivity analysis base case Additional annual revenue growth Additional annual gross margin WACC Terminal growth Q1 2008 32 Highly Confidential KPN00183884

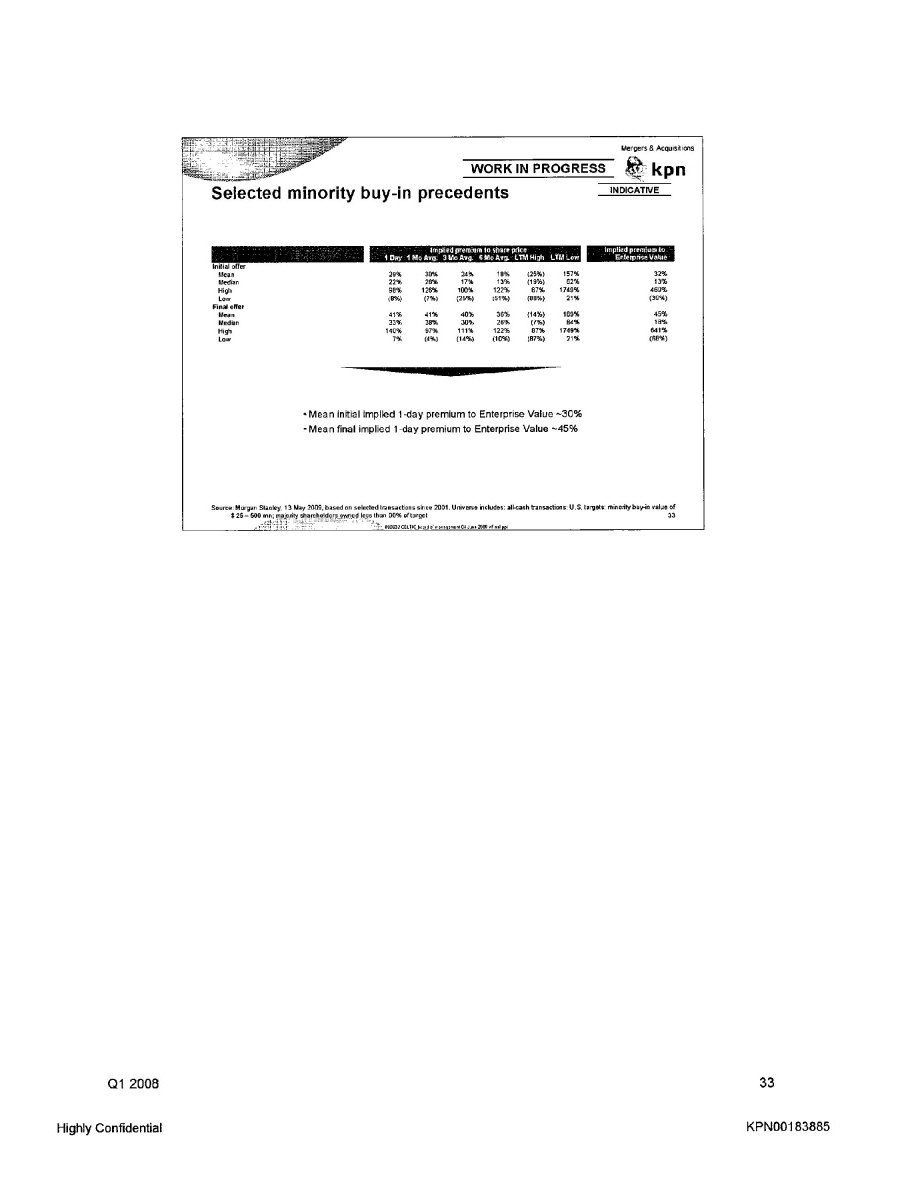

Mergers & Acquisitions WORK IN PROGRESS kpn Indicative Selected minority buy-in precedents Initial offer Mean Median High Low Final offer Mean Median High Low • Mean initial implied 1-day premium to Enterprise Value -30% Mean final implied 1-day premium to Enterprise Value -45% Source: Morgan Stanley. 13 May 2009, based on selected transactions since 2001. Universe includes: all-cash transactions: U.S. targets: minority buy-in value of 25— 500 mn; majority shareholders owned less than 90% of target Q1 2008 33 Highly Confidential KPN00183885

Mergers & Acquisitions WORK IN PROGRESS kpn Redacted for Business Strategy Immunity Q1 2008 34 Highly Confidential KPN00183886

1 This sheet contains Factset binary data for use with this workbook’s =FDS codes. Modyfying the worksheet’s contents may damage the workbook’s =FDS functionality. Highly Confidential KPN00183887

Cell: A1 Comment: Highly Confidential KPN00183888

Cell: B1 Comment: 151037 Cell: A2 Comment: Highly Confidential KPN00183889

Cell: A3 Comment: Highly Confidential KPN00183890

Cell: A4 Comment: Highly Confidential KPN00183891

Cell: A5 Comment: Highly Confidential KPN00183892

Highly Confidential KPN00183893

175 150 125 100 75 50 25 0 Jun-06 Oct-06 Feb 07 May-07 Sep-07 Jan-08 May-08 Sep-08 Dec-08 May-09 Celtic Level 3 Global Crossing Vonage IDT S&P 500 Nasdaq Highly Confidential KPN00183894

Celtic level 3 Global Crossing Vonage IDT S&P 500 Nasdaq Jun-2006 Jun-2006 Jun-2006 Jun-2006 Jun-2006 Jun-2006 Jun-2006 Jun-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Jul-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Aug-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Highly Confidential KPN00183895

Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Sep-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Oct-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Nov-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Highly Confidential KPN00183896

Dec-2006 Dec-2006 Dec-2006 Dec-2006 Dec-2006 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Jan-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Feb-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Mar-2007 Highly Confidential KPN00183897

Mar-2007 Mar-2007 Mar-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 Apr-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 May-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Jun-2007 Highly Confidential KPN00183898

Jun-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Jul-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Aug-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Sep-2007 Oct-2007 Highly Confidential KPN00183899

Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Oct-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Nov-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Dec-2007 Jan-2008 Jan-2008 Highly Confidential KPN00183900

Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Jan-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Feb-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Mar-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Highly Confidential KPN00183901

Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 Apr-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 May-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jun-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Highly Confidential KPN00183902

Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Jul-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Aug-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Sep-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Highly Confidential KPN00183903

904

Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Oct-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Nov-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Dec-2008 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Highly Confidential KPN00183904

Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Jan-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Feb-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Mar-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Highly Confidential KPN00183905

Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 Apr-2009 May-2009 May-2009 May-2009 May-2009 May-2009 May-2009 May-2009 Highly Confidential KPN00183906