Exhibit 99.(a)(5)(v)

KPN Business Plan iBasis 2009 KPN view November 2009 JX162 Highly Confidential KPN00202523

Contents Outlook from acquisition case Actuals 2008 Compensation Scenario’s KPN: Project Celtic iBasis financing Outlook Business Plan 2009 Next steps 5 Highly Confidential KPN00202524

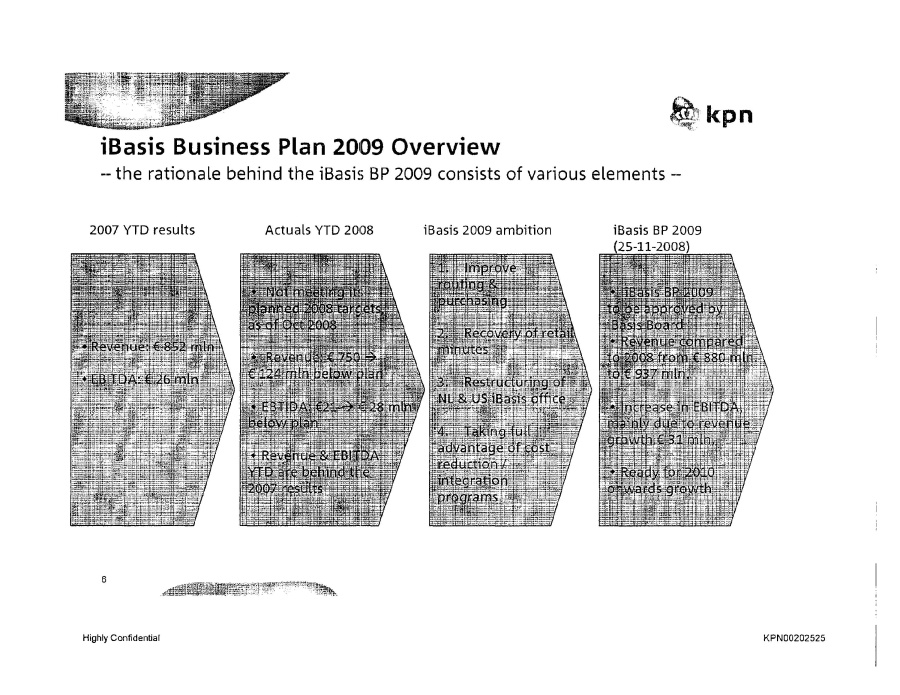

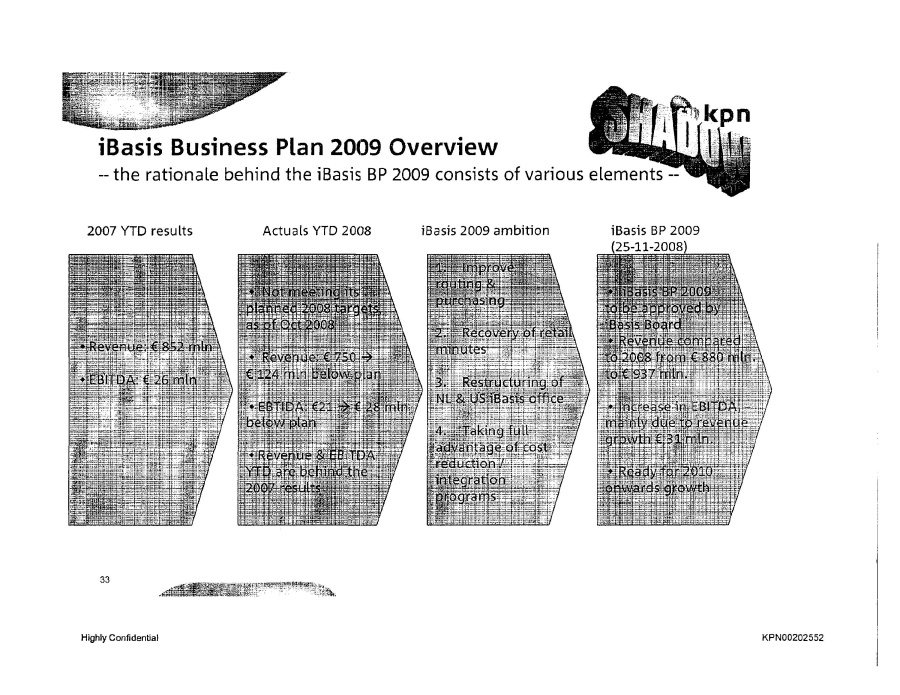

iBasis Business Plan 2009 Overview the rationale behind the iBasis BP 2009 consists of various elements 2007 YTD results Revenue €852 mln. EBITDA €26 mln. Actuals YTD 2008 Not meeting its planned 2008 targets as of Oct 2008 Revenue €750 - €124 mln below EBTIDA €2 - €28 mlns below plan Revenue & EBITDA YTD are behind the 2007 results iBasis 2009 ambition 1. Improve routing & purchasing 2. Recovery of retail 3. Restructuring of NL & US iBasis office 4. Taking full advantage of cost reduction/integration programs iBasis BP 2009 (25-11-2008) iBasis BP 2009 to be approved by Basis Board Revenue compared to 2008 from €880 mln. to €937 mln. Increase in EBITDA mainly due to revenue growth €31 mln. Ready to 2010 onwards growth 6 Highly Confidential KPN00202525

Contents Summary Outlook from acquisition case Actuals 2008 Compensation Scenario’s KPN: Project Celtic iBasis financing Outlook Business Plan 2009 Next steps 7 Highly Confidential KPN00202526

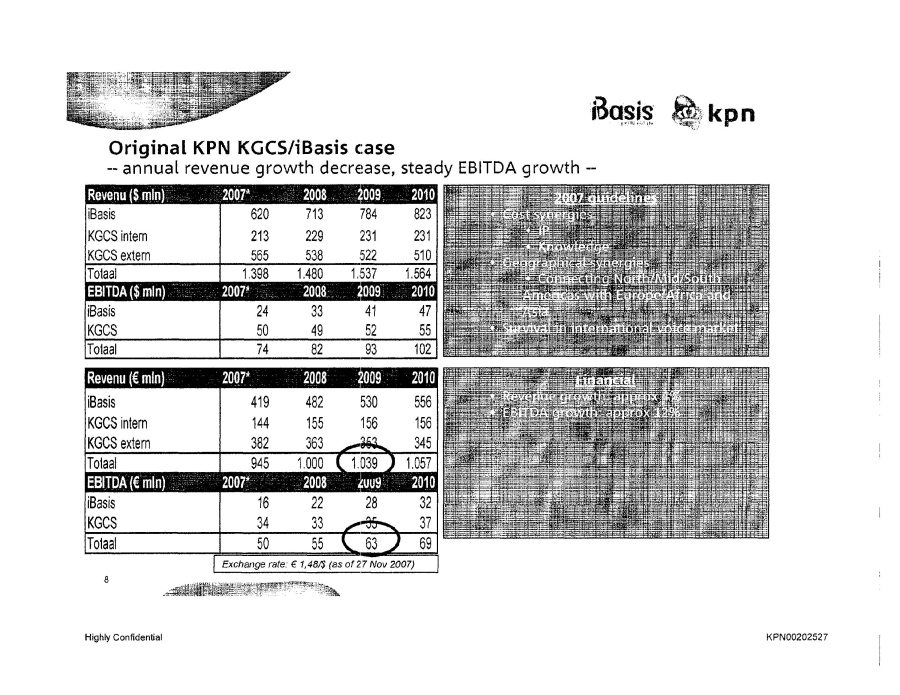

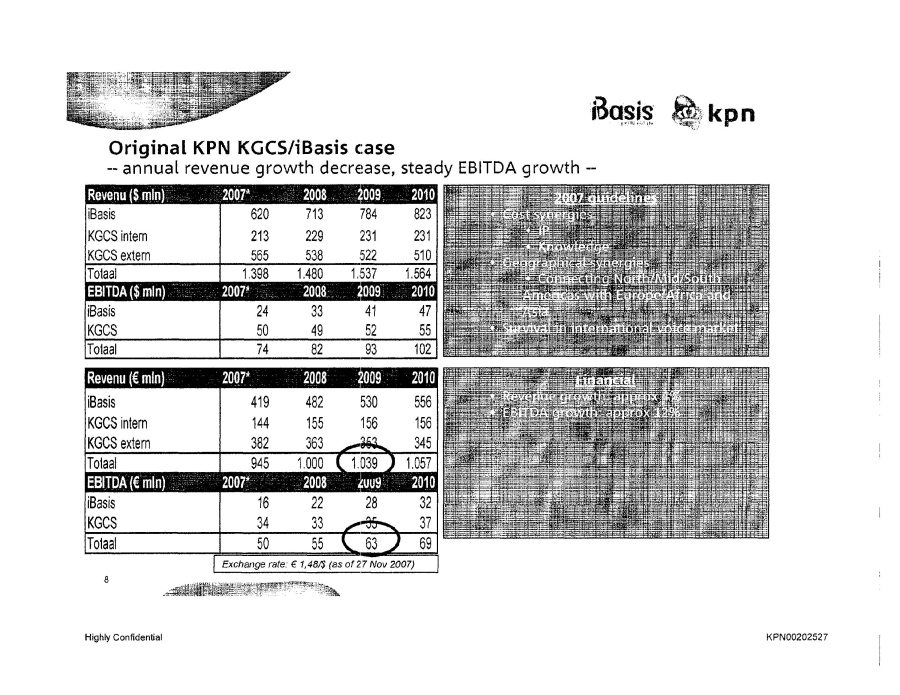

iBasis KPN Original KPN KGCS/iBasis case annual revenue growth decrease, steady EBITDA growth Revenu ($ min) 2007* 2008 2009 2010 iBasis 620 713 784 823 KGCS intern 213 229 231 231 KGCS extern 565 538 522 510 Totaal 1,398 1,480 1,537 1,564 EBITDA ($min) 2007* 2008 2009 2010 iBasis 24 33 41 47 KGCS 50 49 52 55 Totaal 74 82 93 102 Revenu (€ min) 2007* 2008 2009 2010 iBasis 419 482 530 556 KGCS intern 144 155 156 156 KGCS extern 382 363 353 345 Totaal 945 1,000 1,039 1,057 EBITDA (€ min) 2007* 2008 2009 2010 iBasis 16 22 28 32 KGCS 34 33 35 37 Totaal 50 55 63 69

Exchange rate: €1,48/$ (as of 27 Nov 2007) 2007 guidelines Cost synergies IP Knowledge Geographical synergies Connecting North/Mid/South Americas with Europe/Africa and Asia Survival in international voice market Financial Revenue growth approx 4% EBITDA growth approx 12% 8 Highly Confidential KPN00202527

Contents Summary Outlook from acquisition case Actuals 2008 Compensation Scenario’s KPN: Project Celtic iBasis financing Outlook Business Plan 2009 Next steps 9 Highly Confidential KPN00202528

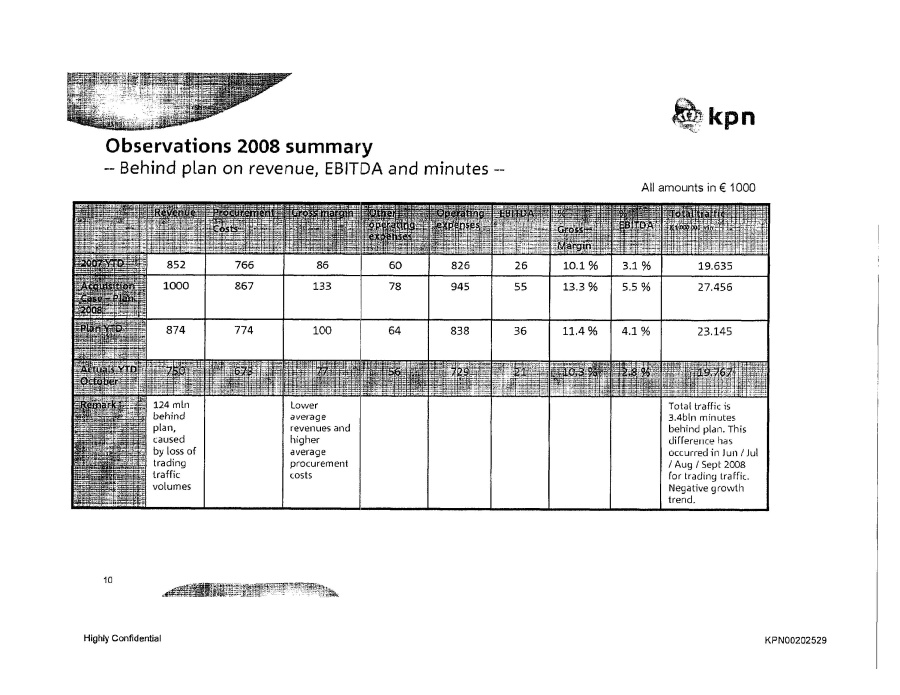

Observations 2008 summary Behind plan on revenue, EBITDA and minutes All amounts in € 1000 Revenue Procurement Costs Gross Margin Other Operating Expenses Operating Expenses EBITDA GrossMargin EBITDA Total Traffic 2007 YTD 852 766 86 60 826 26 10.1% 3.1% 19,635 Acquisition Case Plan 2008 1000 867 133 78 945 55 13.3% 5.5% 27.456 Plan YTD 874 774 100 64 838 36 11.4% 4.1% 23.145 Actuals YTD October 750 673 77 56 729 21 10.3% 2.8% 19.767 Remark 124 mln behind plan, caused by loss of trading traffic volumes Lower average revenues and higher average procurement costs Total traffic is 3.4bln minutes behind plan. This difference has occurred in Jun/Jul/Aug/Sept 2008 for trading traffic. Negative growth trend. 10 Highly Confidential KPN00202529

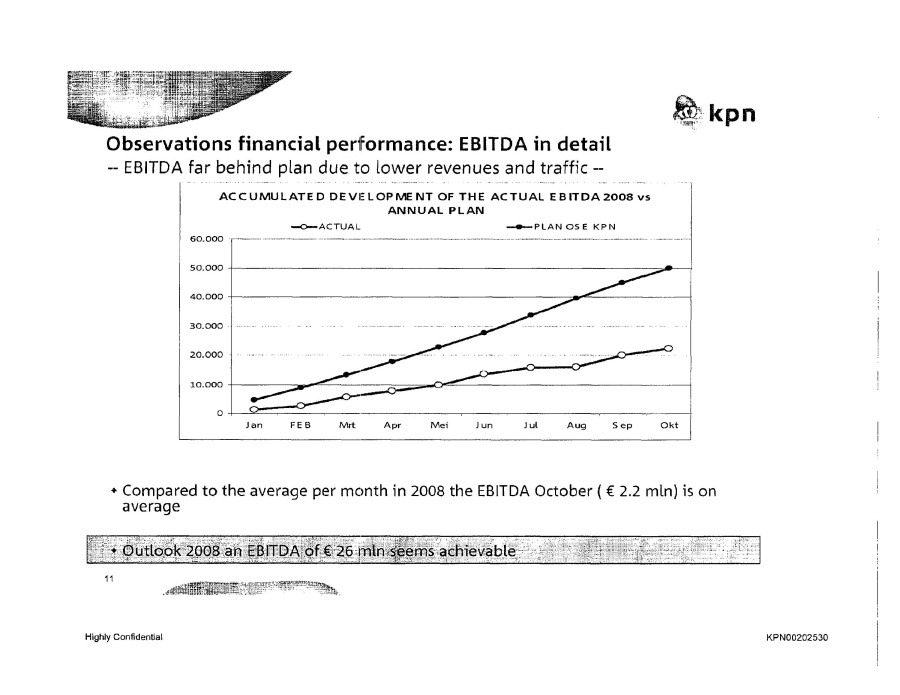

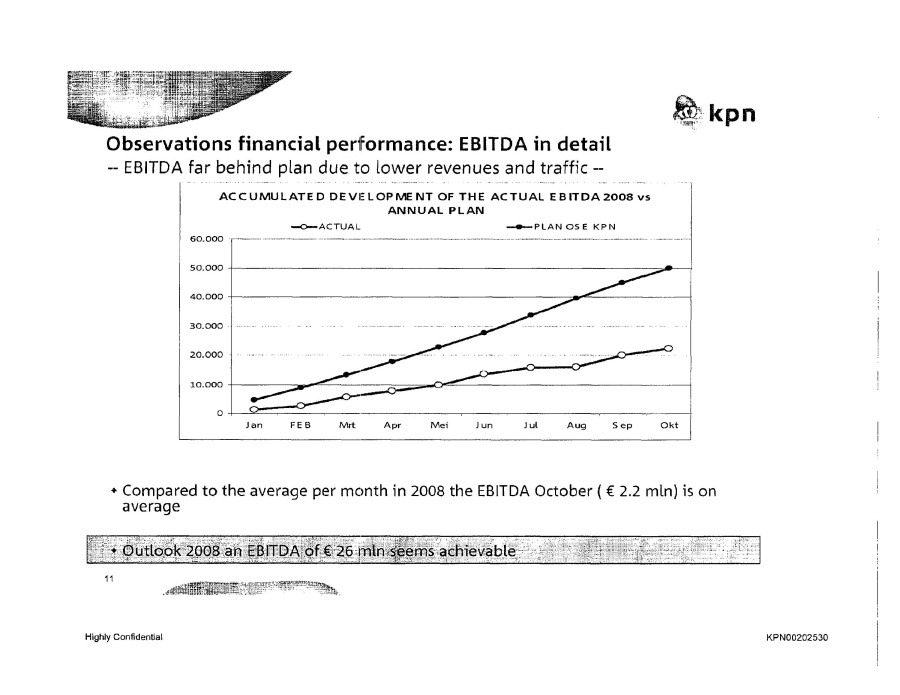

Observations financial performance: EBITDA in detail EBITDA far behind plan due to lower revenues and traffic ACCUMULATED DEVELOPMENT OF THE ACTUAL EBITDA 2008vs ANNUAL PLAN ACTUAL PLAN OS E KPN 60.000 50.000 40.000 30,000 20,000 10,000 0 Jan FEB Mrt Apr Mai Jun Jul Aug Sep Okt Compared to the average per month in 2008 the EBITDA October (€ 2.2 mln) is on average Outlook 2008 an EBITDA of €26 mln seems achievable 11 Highly Confidential KPN00202530

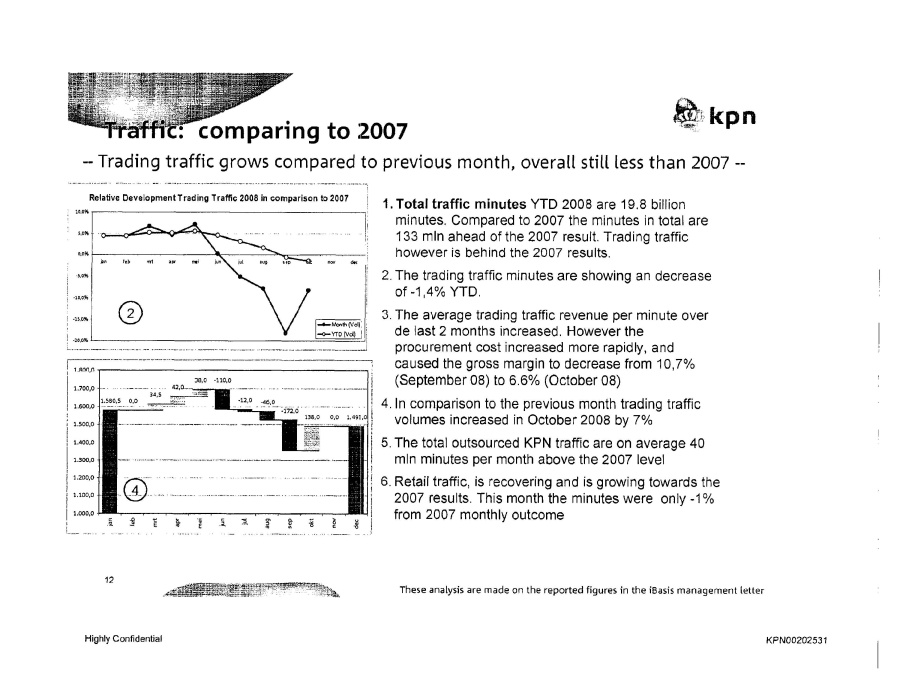

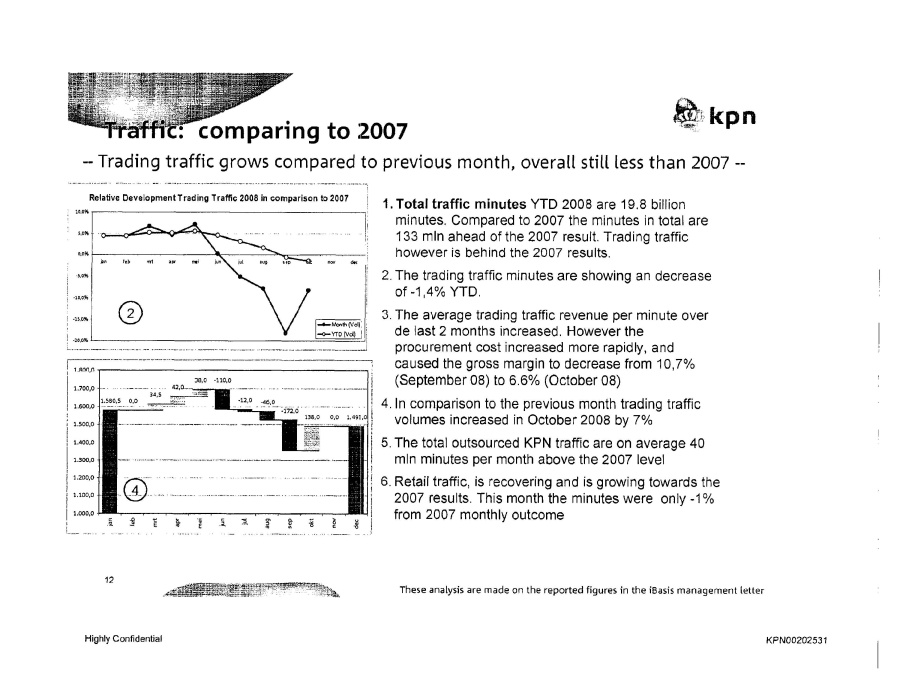

Traffic: comparing to 2007 Trading traffic grows compared to previous month, overall still less than 2007 1. Total traffic minutes YTD 2008 are 19.8 billion minutes. Compared to 2007 the minutes in total are 133 mln ahead of the 2007 result. Trading traffic however is behind the 2007 results. 2. The trading traffic minutes are showing an decrease of -1,4% YTD. 3. The average trading traffic revenue per minute over de last 2 months increased. However the procurement cost increased more rapidly, and caused the gross margin to decrease from 10,7% (September 08) to 6.6% (October 08) 4. ln comparison to the previous month trading traffic volumes increased in October 2008 by 7% 5. The total outsourced KPN traffic are on average 40 mln minutes per month above the 2007 level 6. Retail traffic, is recovering and is growing towards the 2007 results. This month the minutes were only -1 % from 2007 monthly outcome CHART 1 Relative Development Trading Traffic 2008 in comparison to 2007 jan feb mrt apr mai jun jul aug sep okt nov dec 10,0% 5.0% 0,0% -5,0% -10,0% -15,0% -20,0% 2 Mon (Vol) YTD (Vol) CHART 2 1.800,0 1.700,0 1.600,0 1.500,0 1.400,0 1.300,0 1.200,0 1.100,0 1.000,0 1.580,5 0.0 34,5 42,0 38,0 -110,0 -12,0 -46,0 -172,0 138,0 0,0 1.491,0 4 jan feb mrt apr mai jun jul aug sep okt nov dec These analysis are made on the reported figures in the iBasis management letter 12 Highly Confidential KPN00202531

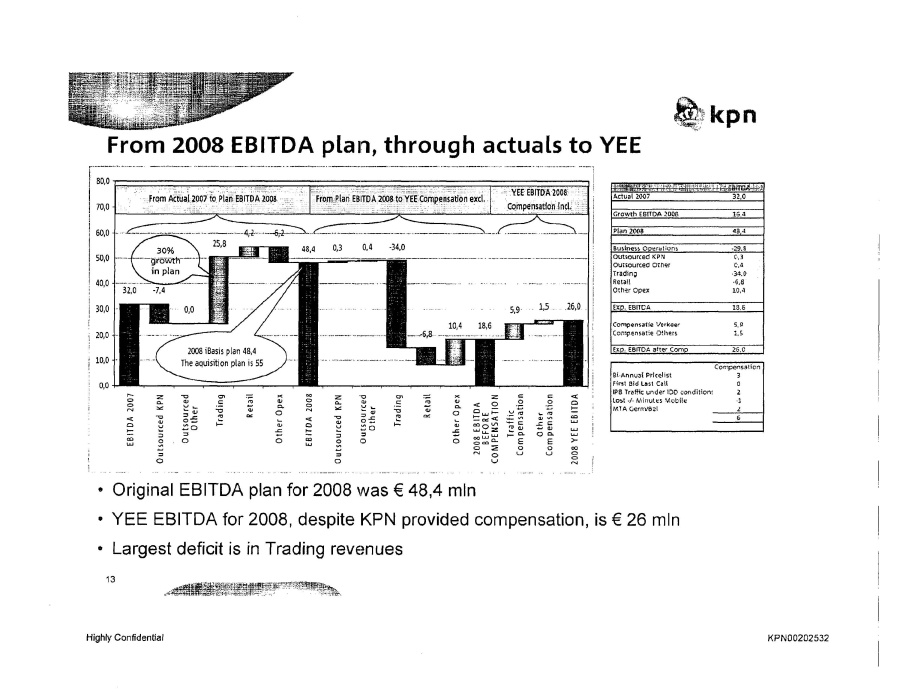

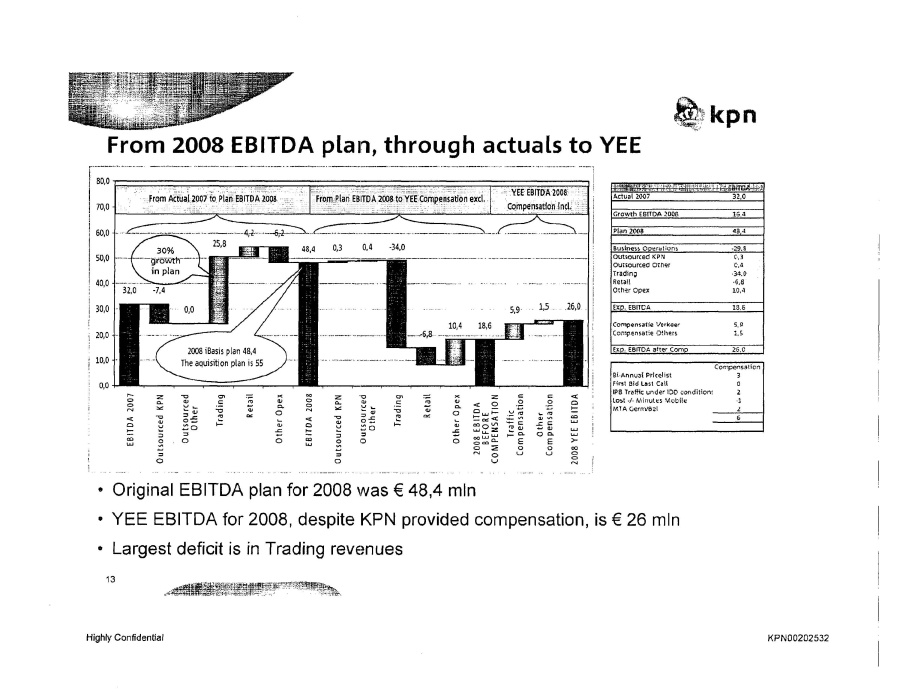

From 2008 EBITDA plan, through actuals to YEE CHART 1 80,0 70,0 60,0 50,0 40,0 30,0 20,0 10,0 0,0 From Actual 2007 to Plan EBITDA 2008 From Plan EBITDA 2008 to YEE Compensation excl. YEE EBITDA 2008 Compensation Incl. 30% growth in plan 2008 iBasis plan 48,4 The acquisition plan is 55 32,0 -7,4 0,0 25,8 4,2 5,2 48,4 0,3 0,4 -34,0 6,8 10,4 18,6 5,9 1,5 26,0 EBITDA 2007 Outsourced KPN Outsourced Other Trading Retail Other Opex EBITDA 2008 Outsourced KPN Outsourced Other Trading Retail Other Opex 2008 BEFORE COMPENSATION Traffic Compensation Other Compensation 2008 YEE EBITDA Original EBITDA plan for 2008 was € 48,4 mln YEE EBITDA for 2008, despite KPN provided compensation, is € 26 mln Largest deficit is in Trading revenues CHART 2 Actual 2007 32,0 Growth EBITDA 2008 16,4 Plan 2008 48,4 Business Operations -29.8 Outsourced KPN 0,3 Outsourced Other 0,4 Trading -34,0 Retail -6,8 Other Opex 10,4 Exp. EBITDA 18,6 Compensatie Verkeer 5,9 Compensatie Others 1,5 Exp. EBITDA after Comp 26,0 Compensation Bi-Annual Pricelist 3 First Bid Last Call 0 IPB Traffic under IDD condition: 2 Lost -/- Minute Mobile -1 MTA Gernvazl 2 6 13 Highly Confidential KPN00202532

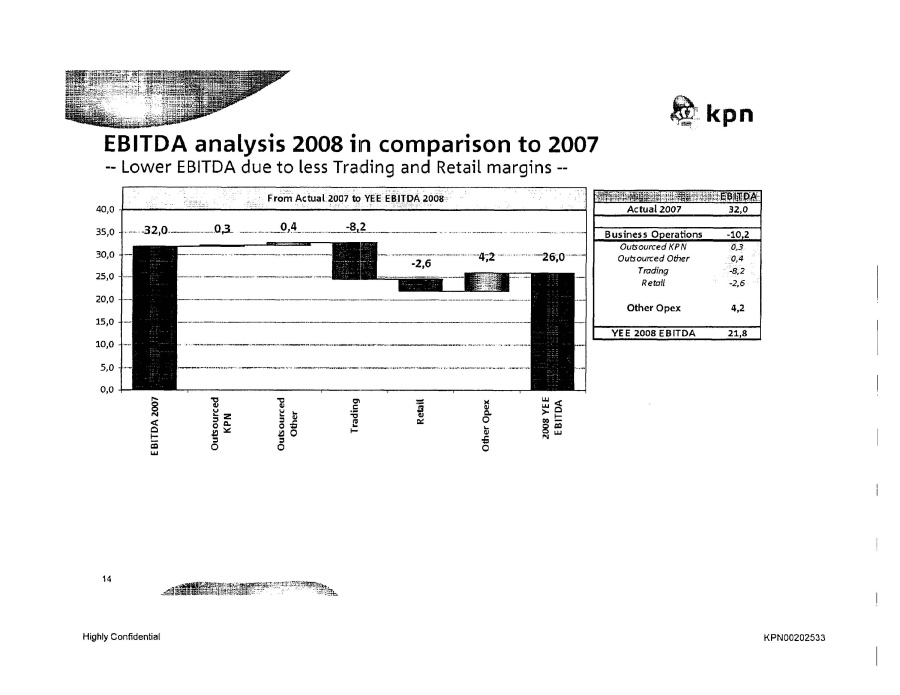

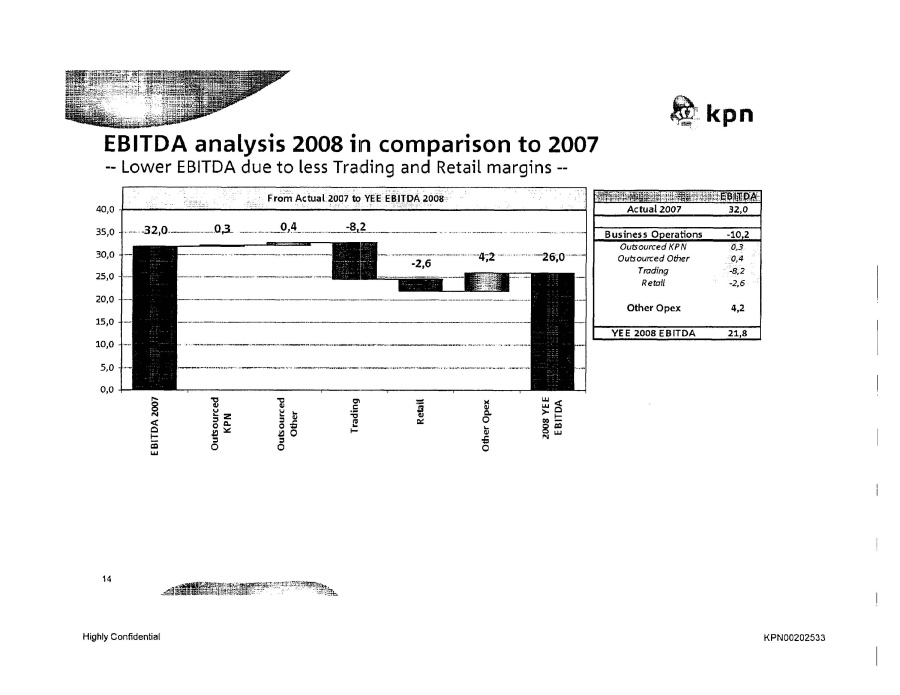

EBITDA analysis 2008 iln comparison to 2007 Lower EBITDA due to less Trading and Retail margins CHART 1 EBITDA From Actual 2007 to Plan EBITDA 2008 40,0 35,0 30,0 25,0 20,0 15,0 10,0 5,0 0,0 32,0 0,3 0,4 -8,2 -2,6 4,2 26,0 EBITDA 2007 Outsourced KPN Outsourced Other Trading Retail Other Opex 2008 YEE EBITDA CHART 2 EBITDA Actual 2007 32,0 Business Operations -10,2 Outsourced KPN 0,3 Outsourced Other 0,4 Trading -8,2 Retail -2,6 Other Opex 4,2 2008 YEE EBITDA 21,8 14 Highly Confidential KPN00202533

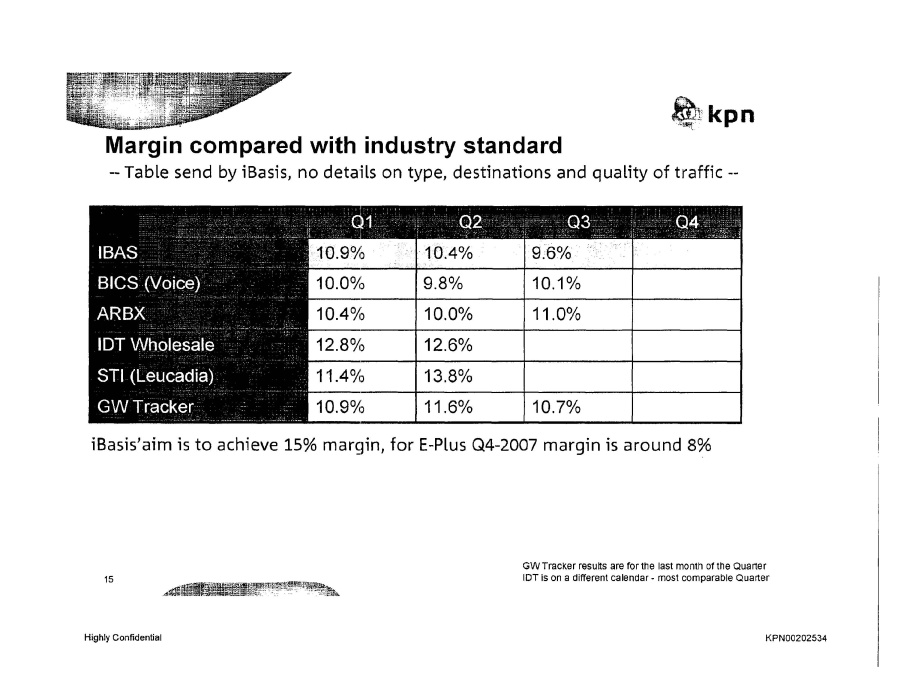

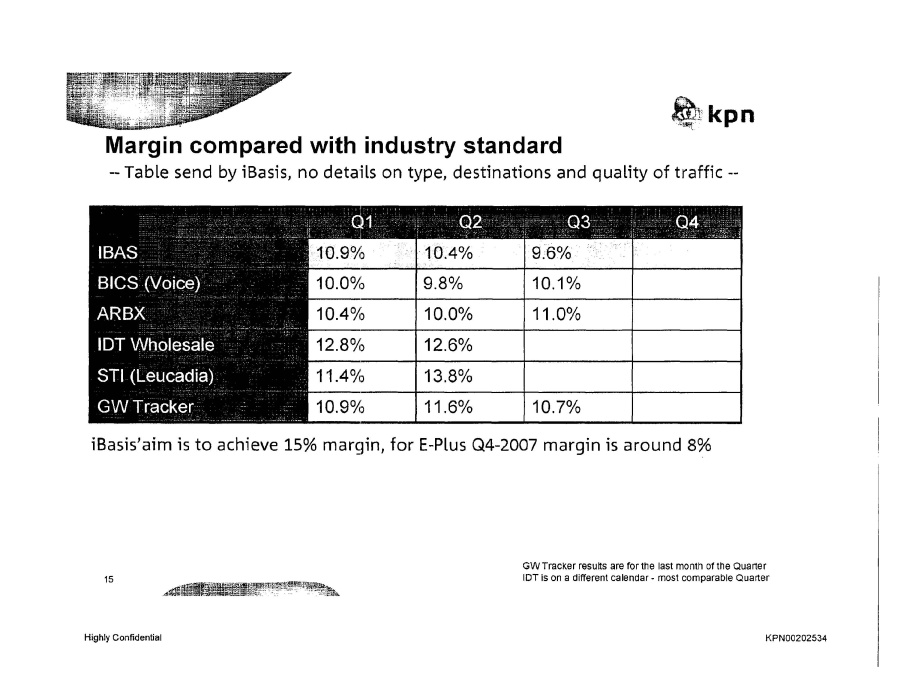

Margin compared with industry standard Table send by iBasis, no detaHs on type, destinations and quality of traffic Q1 Q2 Q3 Q4 IBAS 10.9% 10.4% 9.6% BICS (voice) 10.0% 9.8% 10.1% ARBX 10.4% 10.0% 11.0% IDT Wholesale 12.8% 12.6% STI (Leucadio) 11.4% 13.8% GW Tracker 10.9% 11.6% 10.7% iBasis’ aim is to achieve 15% margin, for E-Plus Q4-2007 margin is around 8% GW TracKer results are for the last month of the Quarter IDT is on a different calendar - most comparable Quarter 15 Highly Confidential KPN00202534

Contents Summary Outlook from acquisition case Actuals 2008 Compensation Scenario’s KPN: Project Celtic iBasis financing Outlook Business Plan 2009 Next steps 16 Highly Confidential KPN00202535

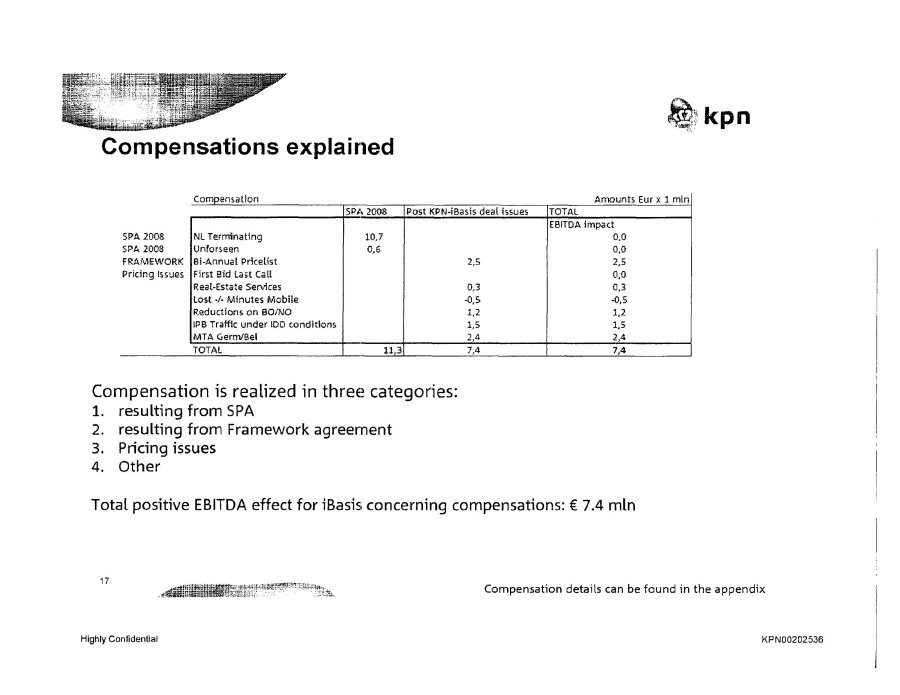

Compensations explained SPA 2008 SPA 2008 FRAMEWORK Pricing Issues Compensation NL Terminating Unforseen Bi-Annual Pricelist First Bid Last Call Real-Estate Services Lost -/- Minutes Mobile Reductions on BO/NO IPB Traffic under IDD conditions MTA Germ/Bel TOTAL SPA 2008 10,7 0,6 11,3 Post KPN-iBasis deal issues 2,5 0,3 -0,5 1,2 1,5 2,4 7,4 Amounts Eur x 1 mln TOTAL EBITDA impact 0,0 0,0 2,5 0,0 0,3 -0,5 1,2 1,5 2,4 7,4 Compensations is realized in three categories: 1. resulting from SPA 2. resulting from Framework agreement 3. Pricing issues 4. Other Total positive EBITDA effect for iBasis concerning compensations: € 7.4 mln 17 Highly Confidential KPN00202536

Contents Summary Outlook from acquisition case Actuals 2008 Compensation Scenario’s KPN Project Celtic iBasis financing Outlook Business Plan 2009 Next steps 18 Highly Confidential KPN00202537

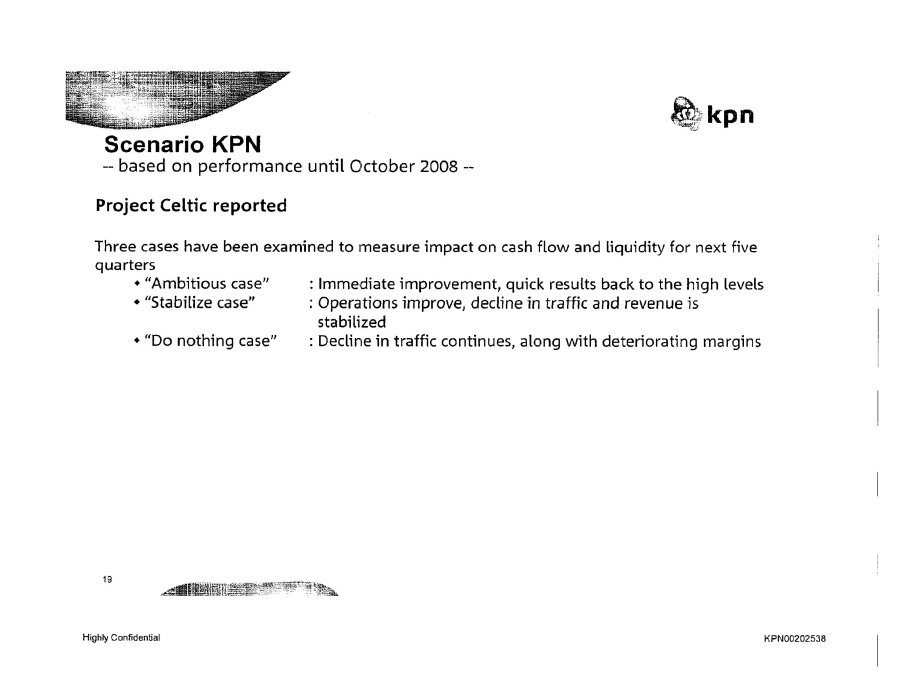

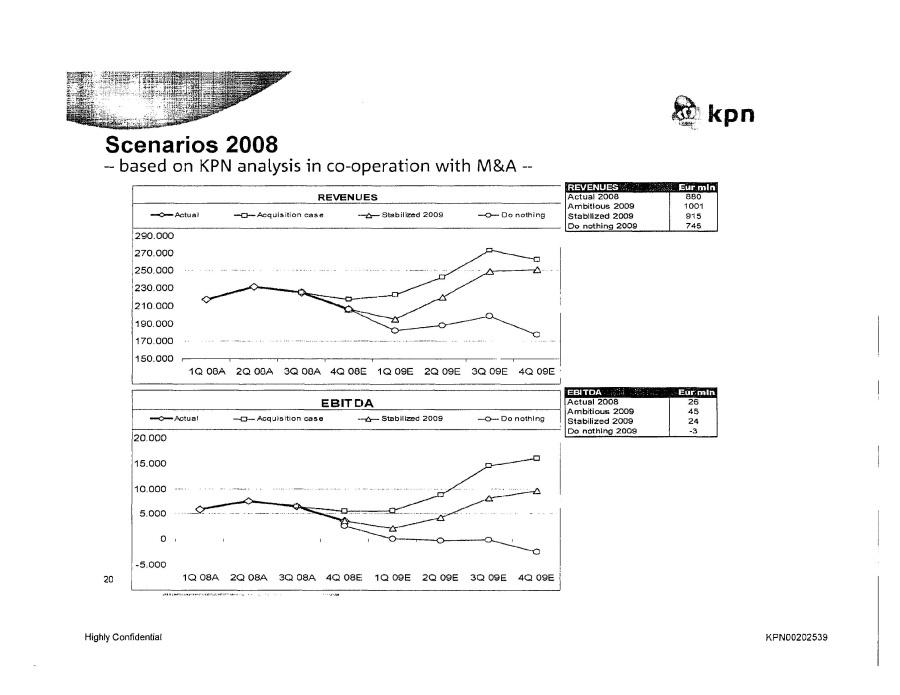

Scenario KPN based on performance until October 2008 Project Celtic reported Three cases have been examined to measure impact on cash flow and liquidity for next five quarters “Ambitious case” : Immediate improvement, quick results back to the high levels “Stabilize case” : Operations improve, decline in traffic and revenue is stabilized “Do nothing case” : Decline in traffic continues, along with deteriorating margins 19 Highly Confidential KPN00202538

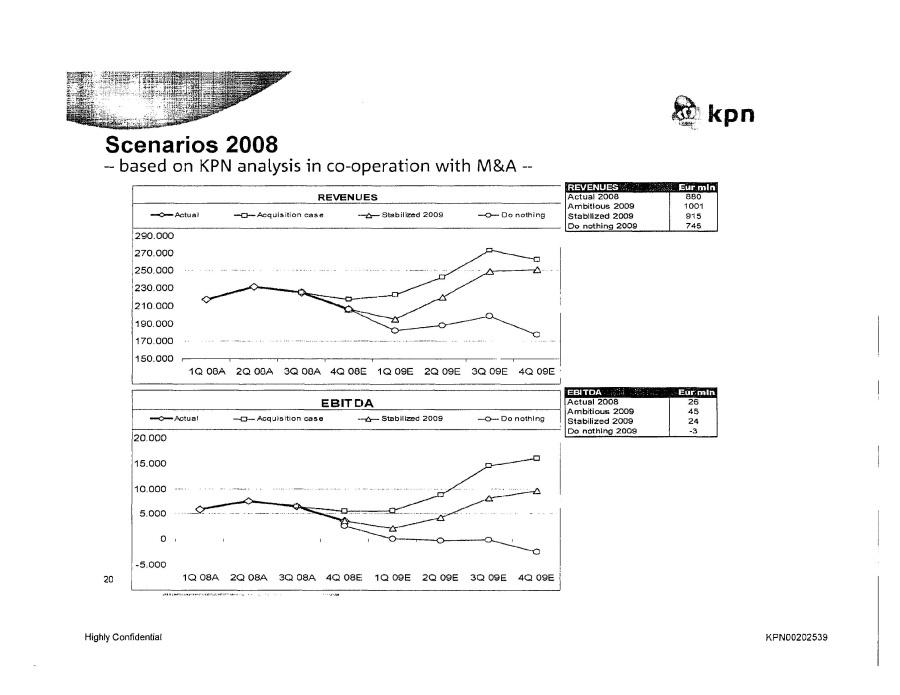

Scenarios 2008 based on KPN analysis in co-operation with M&A CHART 1 REVENUES Actual 2008 Ambitious 2009 Stabilized 2009 Do nothing 2009 290.000 270.000 250.000 230.000 210.000 190.000 170.000 150.000 1Q 08A 2Q 08A 3Q 08A 4Q 08E 1Q 09E 2Q 09E 3Q 09E 4Q 09E CHART 2 REVENUES Eur Mln Actual 2008 880 Ambitious 2009 1001 Stabilized 2009 915 Do nothing 2009 745 CHART 3 EBITDA Actual Acquisiton case Stabilized 2009 Do nothing 20.000 15.000 10.000 -5.000 1Q 08A 2Q 08A 3Q 08A 4Q 08E 1Q 09E 2Q 09E 3Q 09E 4Q 09E CHART 4 EBITDA Eur Mln Actual 2008 26 Ambitious 2009 45 Stabilized 2009 24 Do nothing 2009 -3 20 Highly Confidential KPN00202539

Contents Summary Outlook from acquisition case Actuals 2008 Compensation Scenario’s KPN: Project Celtic iBasis financing Outlook Business Plan 2009 Next steps 21 Highly Confidential KPN00202540

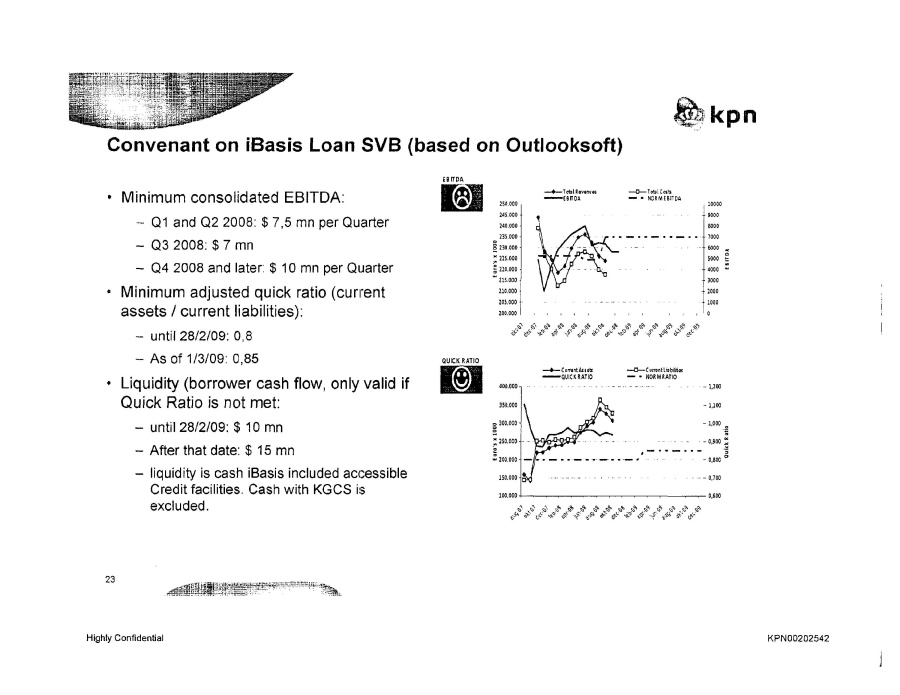

Financing iBasis Covenant on credit facility unlikely to be met iBasis has USD 50 mln Credit facilities granted by Silicon Valley Bank (SVB) iBasis has a draft of USD 30 mln on this facility There are 3 restrictions on this credit facility: 1. EBITDA 04 2008: USD 10 mln or higher (based on actual October USD 10 mln will not be met, expected Q4 Ebitda USO 8 mln) 2. Quick Ratio (current Assets divided by current liabilities >=0.8 until 28-02-2009) YTO October CR = 0.93) 3. Liquidity (targetted on iBasis Cash 7.0 mln until 28-02-2009 If these restrictions are not met SVB can demand immediate payment on the loan This also holds a risk for outstanding KPN loans Internal KPN LOAN to iBasis USD 11 mln 22 Highly Confidential KPN00202541

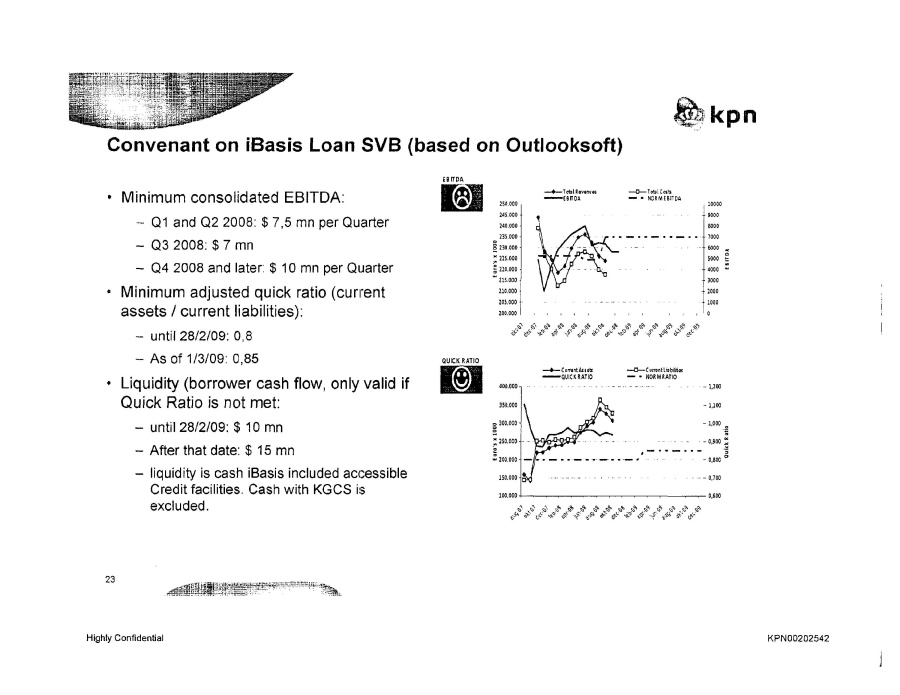

Covenant on iBasis Loan SVB (based on Outlooksoft) Minimum consolidated EBITDA: Q1 and Q2 2008: $ 7,5 mn per Quarter Q3 2008: $ 7 mn Q4 2008 and later: $ 10 mn per Quarter Minimum adjusted quick ratio (current assets/current liabilities): until 28/2/09: 0,8 As of 1/3109: 0,85 Liquidity (borrower cash flow, only valid if Quick Ratio is not met: until 28/2/09: $ 10 mn After that date: $ 15 mn liquidity is cash iBasis included accessible Credit facilities. Cash with KGCS is excluded. CHART 1 EBITDA Total Revenue Total Costs EBITDA NORM EBITDA Euros x 1000 250.000 245.000 240.000 235.000 230.000 225.000 220.000 215.000 210.000 205.000 200.000 EBITDA 10000 9000 8000 7000 6000 5000 4000 3000 2000 1000 CHART 2 QUICK RATIO Current Assets Current Liabilities QUICK RATIO NORM RATIO Euros x 1000 400,000 350,000 300,000 250,000 200,000 150,000 100,000 1,200 1,100 1,000 0,900 0,800 0,700 0,600 aug 07 okt 07 dec 07 sept -8 apr 08 jun 08 aug 08 okt 08 dec 08 feb 09 apr 09 jun 09 aug 09 okt 09 dec 09 23 Highly Confidential KPN00202542

Contents Summary Outlook from acquisition case Actuals 2008 Compensation Scenario’s KPN: Project Celtic iBasis financing Outlook Business Plan 2009 iBasis 21-11-2008 Next steps 24 Highly Confidential KPN00202543

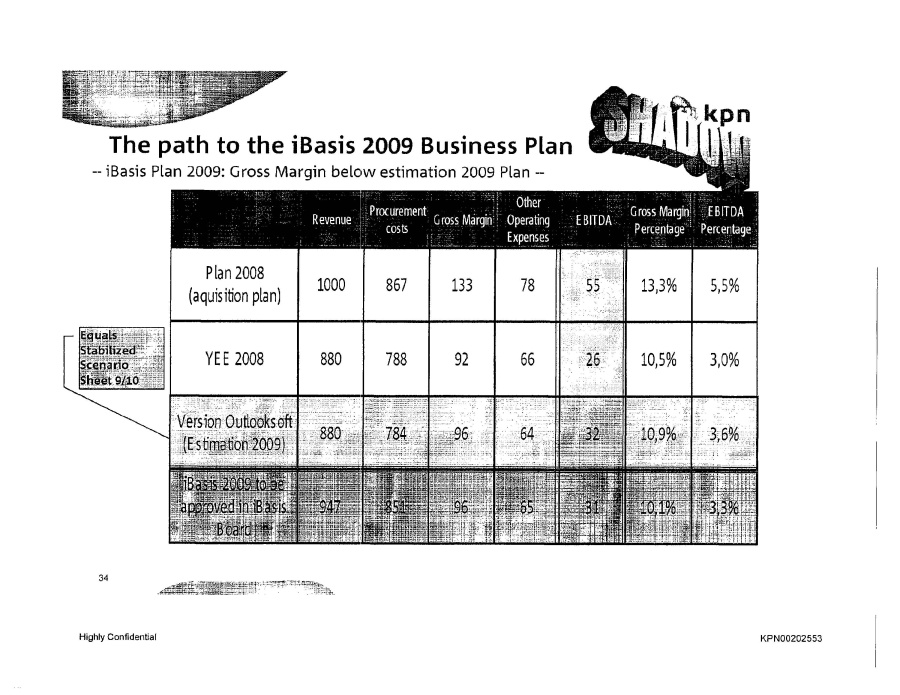

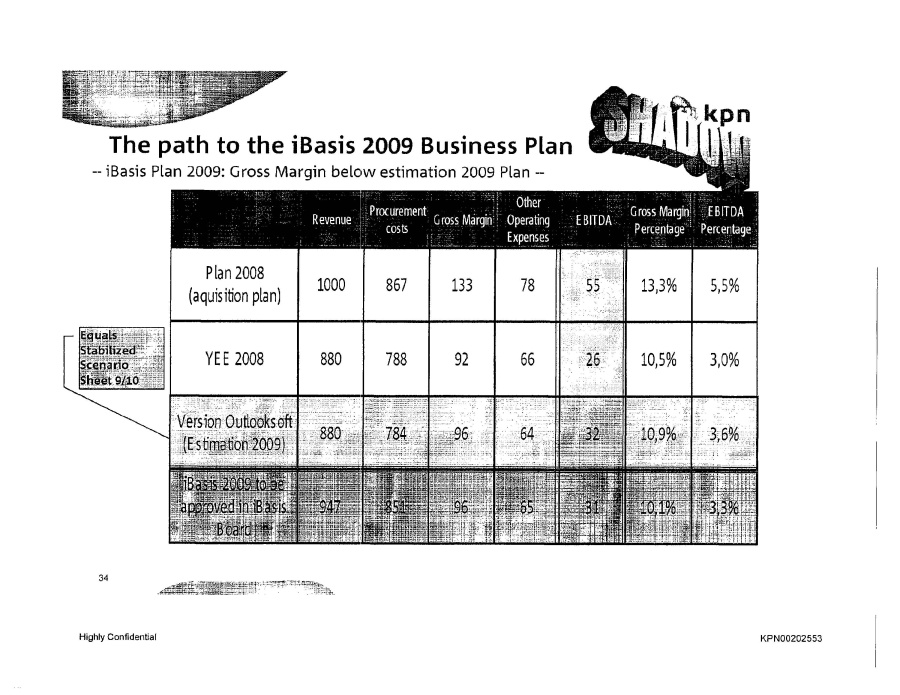

The path to the iBasis 2009 Business Plan iBasis Plan 2009: Gross Margin below estimation 2009 Plan Revenue Procurement costs Gross Margin Other Operating Expenses EBITDA Gross Margin Percentage EBITDA Percentage Plan 2008 (acquisiton plan) 1000 867 133 78 55 13,3% 5,5% YEE 2008 880 788 92 66 26 10,5%3,0% Version Outlooksoft (Estimation 2009) 880 784 96 64 32 10,9% 3,6% Equals Stabilized Scenario Sheet 9/10 Basis 2009 to be approved in iBasis Board 947 854 96 65 31 10,1% 3,3% 25 Highly Confidential KPN00202544

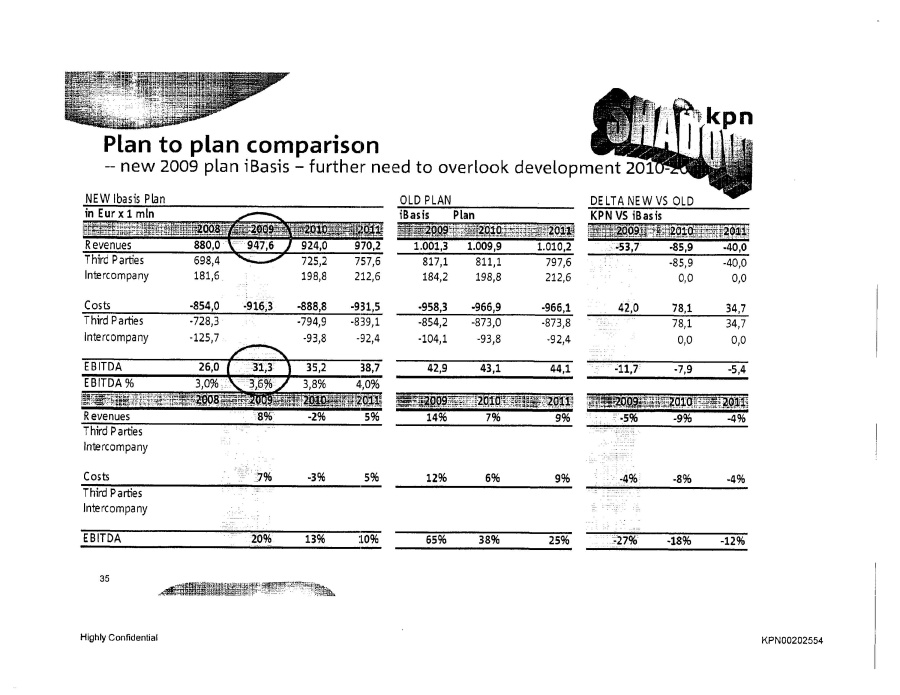

Plan to plan comparison realistic revenue and EBITDA targets, ready for 2010 onwards growth NEW In Eur x 1 min 2008 2009 2010 2011 Revenues 880,0 880,0 924,0 970,2 Third Parties 698,4695,8 725,2 757,6 Intercompany 181,6 184,2 198,8 212,6 Costs -854,0 -848,0 -888,8 -931,5 Third Parties -728,3 -743,9 -794,9 -839,1 Intercompany -125,7 1-104,1 -93,8 -92,4 EBITDA 26,0 32,0 35,2 38,7 EBITDA % 3,0% 3,6% 3,8% 4,0% 2008 2009 2010 2011 Revenus 0% 5% 5% Third Parties 0% 4% 4% Intercompany 1% 8% 7% Costs - -1% 5% 5% Third Parties 2% 7% 6% Intercompany -17% -10% -2% EBITDA 23% 10% 10% OLD PLAN iBasis Plan 2009 2010 2011 1.001,3 1.009,9 1.010,2 817,1 811,1 797,6 184,2 198,8 212,6 -958,3 -966,9 -966,1 -854,2 -873,0-873,8 -104,1 -93,8 -92,4 42,9 43,1 44,1 2009 2010 2011 -20% 1%0% - -18% -1% -2% -29% 8% 7% -22% 1% 0% -18% 2% 0% -42% -10% -2% 65% 0% 2% DELTA OUTLOOK PLAN KPN VS iBasis 2009 2010 2011 -121,3 -85,9 -40,0 -121,3 -85,9 -40,0 0,0 0,0 0,0 110,3 78,1 34,7 110,3 78,1 34,7 0,0 0,0 0,0 -10,9 -7,9 -5,4 2009 2010 2011 -12% -9% -4% -15% -11% -5% 0% 0% 0% -12% -8% -4% -13% -9% -4% 0% 0% 0% - -25% -18% -12% 26 Highly Confidential KPN00202545

Contents Summary Outlook from acquisition case Actuals 2008 Compensation Scenario’s KPN: Project Celtic iBasis financing Outlook Business Plan 2009 Next steps 27 Highly Confidential KPN00202546

Summary of analysis &findings Time for action The 2009 iBasis focus areas should be on Reduce expenses through benefitting from integration & cost reduction programs Recovery of minutes Restructuring the iBasis NL office Improve routing and purchasing management …to be completed by Vincent Dijk Results from project Celtic Regardless of case, EBITDA covenant on credit facility unlikely to be met for this quarter and next quarter $10mln EBITDA requirement vs. ~ $ 7 mln expected for fourth quarter Another amendment to credit facility probably required Implications on current KPN loan need to be considered ($ 10.7 mln still to be repaid over first two quarters of 2009) Senior management positions to be reviewed “Deep dive” into Celtic organization, financials, and credit (facilities) is imminently necessary 28 Highly Confidential KPN00202547

Appendix

29

| Highly Confidential | KPN00202548 |

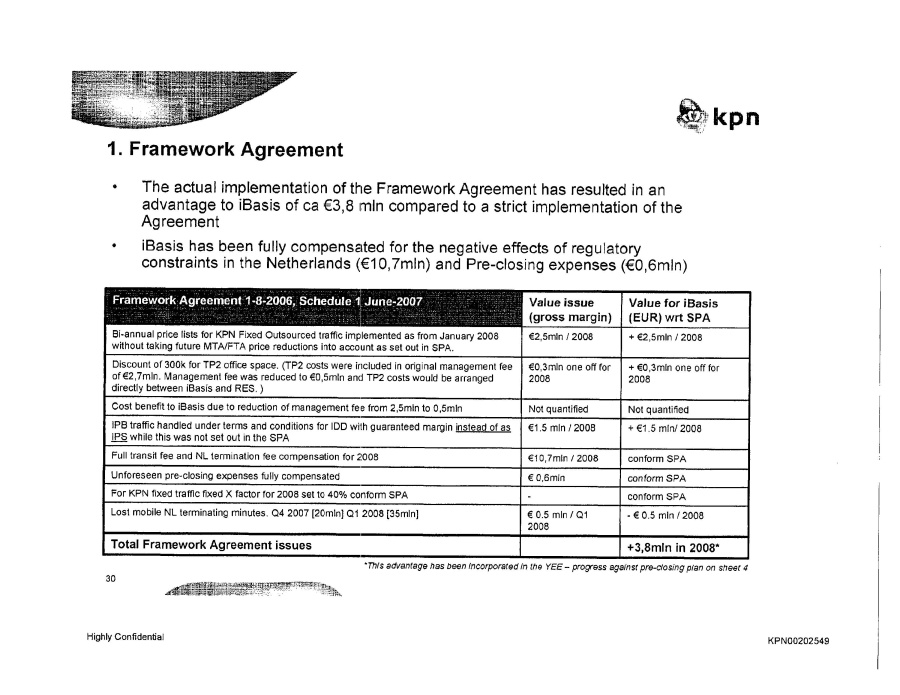

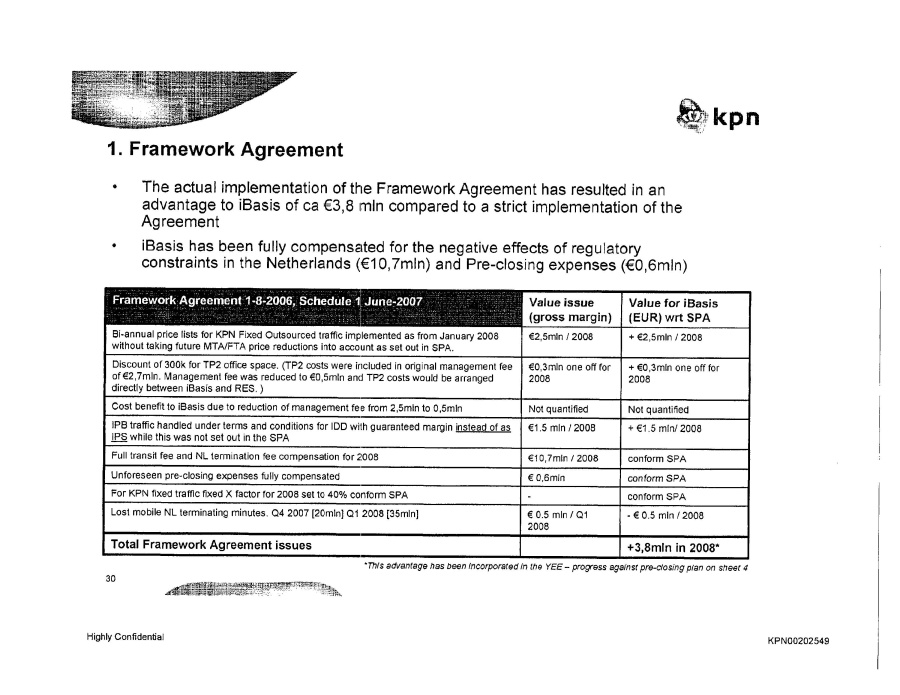

1.Framework Agreement The actual implementation of the Framework Agreement has resulted in an advantage to iBasis of ca €3,8 mln compared to a strict implementation of the Agreement iBasis has been fully compensated for the negative effects of regulatory constraints in the Netherlands (€1 0, 7mln) and Pre-closing expenses (€0,6mln) Framework Agreement 1-8-2006, Schedule 1 June-2007 Value issue (gross margin) Value for iBasis (EUR) wrt SPA Bi-annual price lists for KPN Fixed Outsourced traffic implemented as from January 2008 without taking future MTA/FTA price reductions into account as set out in SPA. €2,5 min/2008 +€2,5 min/2008 Discount of 300k for TP2 office space. (TP2 costs were included in original management fee of €2.7 min. Management fee was reduced to €0,5 min and TP2 costs would be arranged directly between iBasis and RES.) €0,3 min one off for 2008 +€0,3 min one off for 2008 Cost benefit to iBasis due to reduction of management fee from 2,5min to 0,5min Not quantified Not quantified IPB traffic handled under terms and conditions for IDD with guaranteed margin instead of as IPS while this was not set out in the SPA €1.5 min/2008 +€1.5 min/2008 Full transit fee and NL termination fee compensation for 2008 €10,7 min/2008 conform SPA Unforeseen pre-closing expenses fully compensated €0,6 min conform SPA For KPN fixed traffic fixed X factor for 2008 set to 40% conform SPA - conform SPA Lost mobile NL terminating minutes. Q4 2007 (20min) Q1 2008 (35min) €0.5 min/Q1 2008 -€0.5 min/2008 Total Framework Agreement issues +3,8min in 2008* *This advantage has been incorporated in the YEE - progress against pre-closing plan on sheet 4 30 Highly Confidential KPN00202549

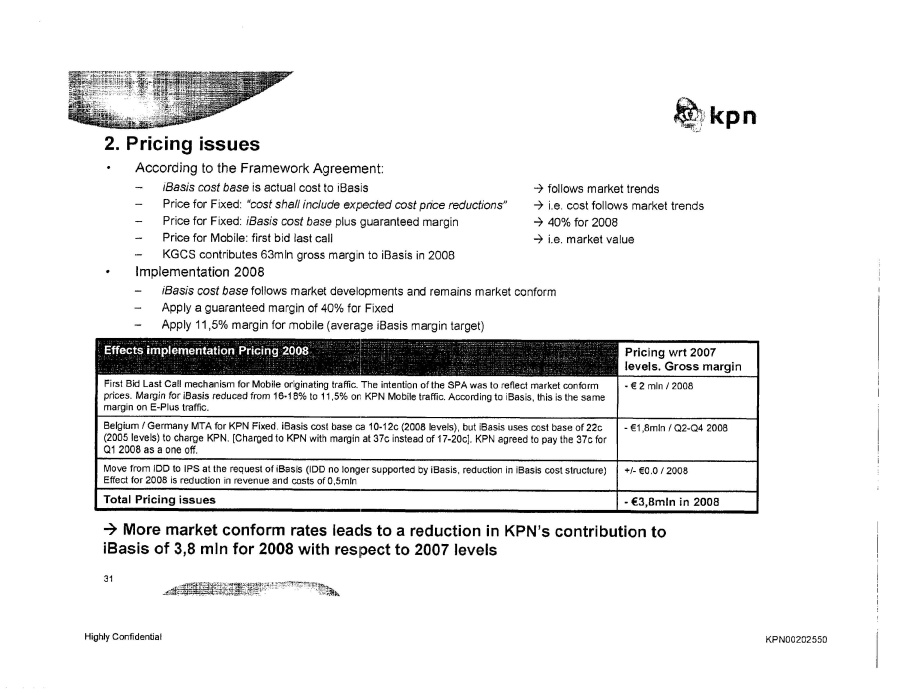

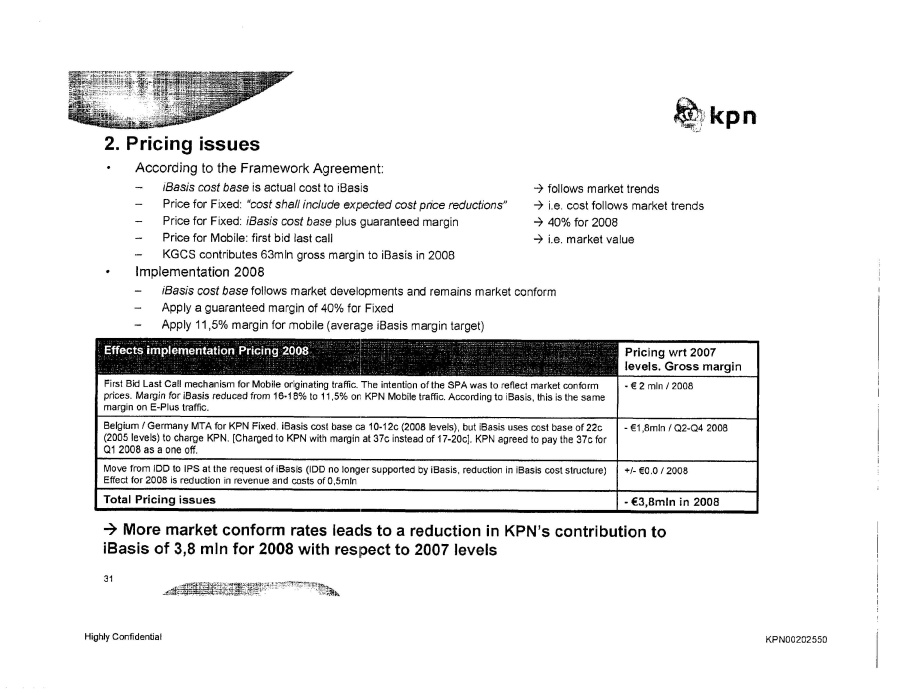

2. Pricing issues According to the Framework Agreement: iBasis cost base is actual cost to iBasis Price for Fixed: “cost shall include expected cost price reductions” Price for Fixed: iBasis cost base plus -guaranteed margin Price for Mobile: first bid last call KGCS contributes 63mln gross margin to iBasis in 2008 Implementation 2008 iBasis cost base follows market developments and remains market conform Apply a guaranteed margin of 40% for Fixed Apply 11,5% margin for mobile (average iBasis margin target) Effects implementation Pricing 2008 Pricing wrt 2007 levels. Gross margin First Bid Last Call mechanism for Mobile originating traffic. The intention of the SPA was to reflect market conform prices. Margin for iBasis reduced from 16-18% to 11.5% on KPN Mobile traffic. According to iBasis, this is the same margin on E-Plus traffic. - € 2 mln / 2008

Belgium / Germany MTA for KPN Fixed. iBasis cost base C8 10-12c (2008 levels), but iBasis uses cost base of 22c (2005 levels) to charge KPN. [Charged to KPN with margin at 37c instead of 17-20c]. KPN agreed to pay the 37c for Q1 2008 as a one off. - €1 ,8mln I Q2-Q4 2008 Move from IDD to IPS at the request of iBasis (IDD no longer supported by iBasis, reduction in iBasis cost structure) +- € 0.0 / 2008 Total Pricing issues - € 3.8mln in 2008 More market conform rates leads to a reduction in KPN’s contribution to iBasis of 3,8 mln for 2008 with respect to 2007 levels 31 Highly Confidential KPN00202550

Shadow plan iBasis 2009 (dd 25-11-08)

32

| Highly Confidential | KPN00202551 |

iBasis Business Plan 2009 Overview the rationale behind the iBasis BP 2009 consists of various elements

2007 YTD results Actuals YTO 2008 iBasis 2009 ambition iBasis BP 2009 (25-11-2008) Revenue €852 mln. Not meeting its planned 2008 targets as of Oct 2008 1. Improve routing & purchasing iBasis BP 2009 (25-11-2008) EBITDA €26 mln. Revenue €750 - €124 mln below 2. Recovery of retail iBasis BP 2009 to be approved by Basis Board EBTIDA €2 - €28 mlns below plan 3. Restructuring of NL & US iBasis office Revenue compared to 2008 from €880 mln. to €937 mln. Revenue & EBITDA YTD are behind the 2007 results 4. Taking full advantage of cost reduction/integration programs Increase in EBITDA mainly due to revenue growth €31 mln.Ready to 2010 onwards growth 33 Highly Confidential KPN00202552

The path to the iBasis 2009 Business Plan iBasis Plan 2009: Gross Margin below estimation 2009 Plan Plan 2008 (acquisition plan) 1000 867 133 78 55 13,3% 5,5%

YEE2008 880 788 92 66 10,5% 3,0% Version Outlooksoft (Estimation 2009) [Equals Stabilized Scenario Sheet 9/10] 880 784 96 64 32 10,9% 3,6% iBasis 2009 to be approved in iBasis Board 947 85 96 65 31 10,1% 3,3% 34 Highly Confidential KPN00202553

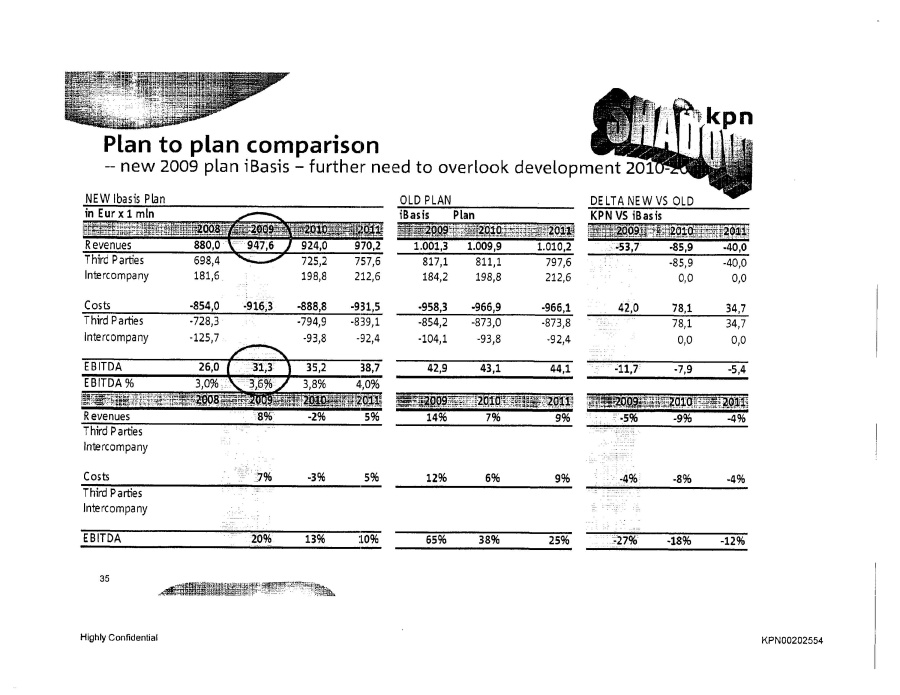

Plan to plan comparison new 2009 plan iBasis - further need to overlook development 2010-20 NEW ibasis Plan In Eur x 1 min 2008 2009 2010 2011 Revenues 880,0 947,6 924,0 970,2 Third Parties 698,4 725,2 757,6 Intercompany 181,6 198,8 212,6 Costs -854,0 -916,3 -888,8 -931,5 Third Parties -728,3 -794,9 -839,1 Intercompany -125,7 -93,8 - -92,4 EBITDA 26,0 31,3 35,2 38,7 EBITDA % 3,0% 3,6%3,8% 4,0% 2008 2009 2010 2011 Revenus 8% -2% 5% Third Parties Intercompany Costs 7% -3% 5% Third Parties Intercompany EBITDA 20%13% 10% OLD PLAN iBasis Plan 2009 2010 2011 1.001,3 1.009,9 1.010,2 817,1 811,1 797,6 184,2 198,8 212,6 -958,3-966,9-966,1 -854,2-873,0-873,8 -104,1 -93,8 -92,4 42,9 43,1 44,1 2009 2010 2011 14%7% 9% 12% 6% 9% 65% 38% 25% DELTA NEW VS OLD KPN VS iBasis 2009 20102011 -53,7 -85,9 - -40,0 -85,9 -40,0 0,0 0,0 42,0 78,1 34,7 78,134,7 0,0 0,0 -11,7 -7,9-5,4 2009 2010 2011 -5% -9% -4% -4%-8% -4% -27%-18% -12% 35 Highly Confidential KPN00202554

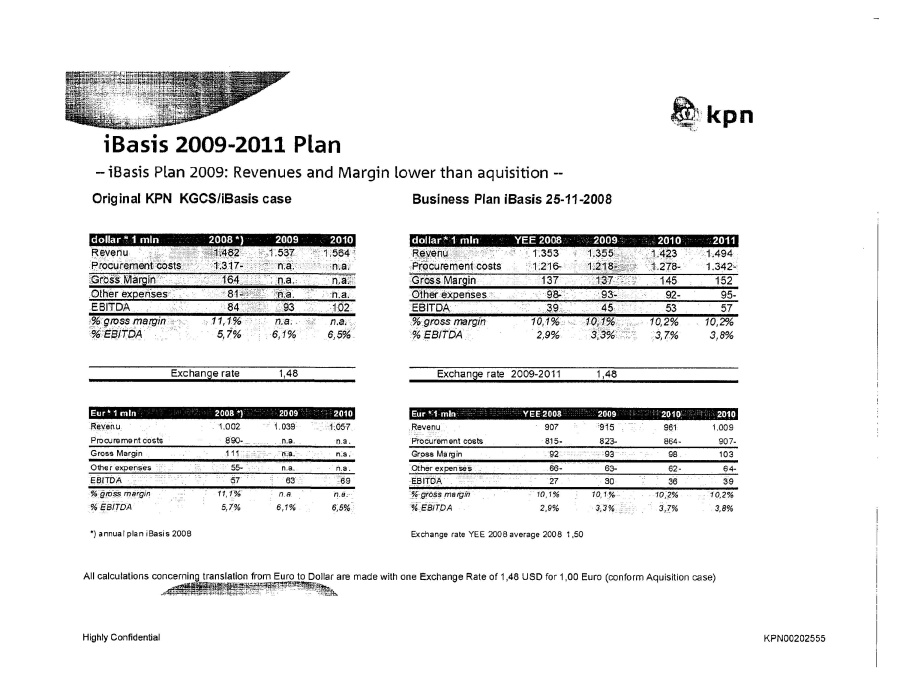

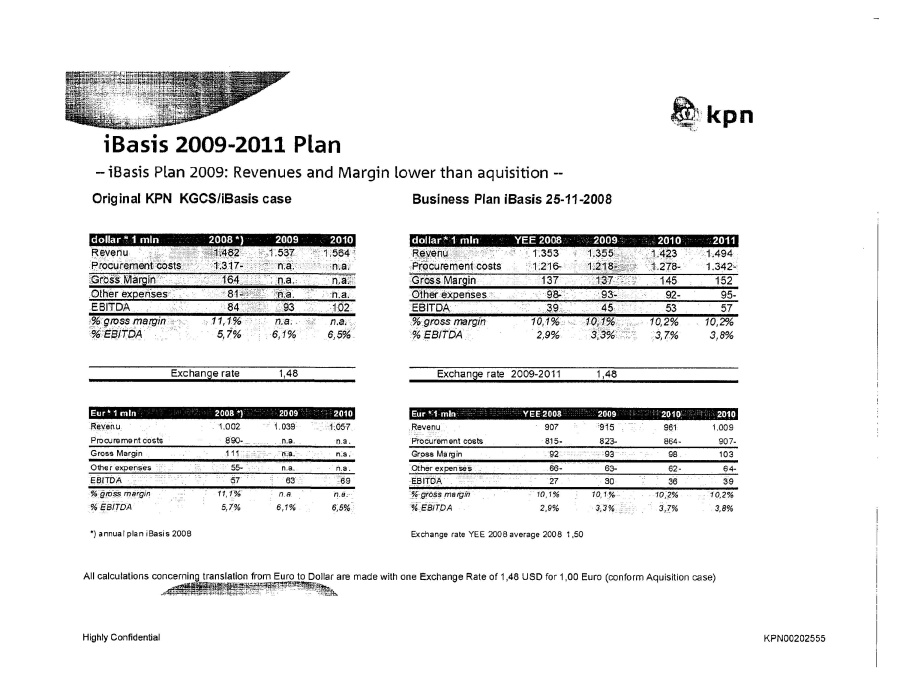

iBasis 2009-2011 Plan iBasis Plan 2009: Revenues and Margin lower than aquisition Original KPN KGCS/iBasis case dollar* 1 min 2008*) 2009 2010 Revenu 1,482 1,537 1,564 Procurement costs 1,317- n.a. n.a. Gross Margin 164 n.a. n.a. Other expenses 81 n.a. n.a. EBITDA 84 93 102 % gross margin 11,1% n.a. n.a. % EBITDA 5,7% 6,1% 6,5% Exchange rate 1,48 Eur*1 min 2008*) 2009 2010 Revenu 1,002 1,039 1,057 Procurement costs 890- n.a. n.a. Gross Margin 111 n.a. n.a. Other expenses 55- n.a. n.a. EBITDA 57 63 69 % gross margin 11,1% n.a. n.a. % EBITDA 5,7% 6,1% 6,5% *) annual plan iBasis 2008 Business Plan iBasis 25-11-2008 dollar* 1 min YEE2008 2009 2010 2011 Revenu 1,353 1,355 1,423 1,494 Procurement costs 1,216- 1,218- 1,278-1,342- Gross Margin 137 137 145 152 Other expenses 98- 93- 92- 95- EBITDA 39 45 53 57 % gross margin 10,1% 10,1% 10,2% 10,2% % EBITDA 2,9%` 3,3% 3,7% 3,8% Exchange rate 2009-2011 1,48 Eur* 1 min YEE2008 2009 2010 2010 Revenu 907 915 961 1,009 Procurement costs 815- 823- 864- 907- Gross Margin 92 93 98 103 Other expenses 66- 63- 62- 64- EBITDA 27 30 36 39 % gross margin 10,1% 10,1% 10,2% 10,2% % EBITDA 2,9% 3,3% 3,7% 3,8% Exchange rate YEE 2008 average 1008 1,50 All calculations concerning translation from Euro to Dollar are made with one Exchange Rate of 1,48 USD for 1,00 Euro (conform Aquisition case) Highly Confidential KPN00202555

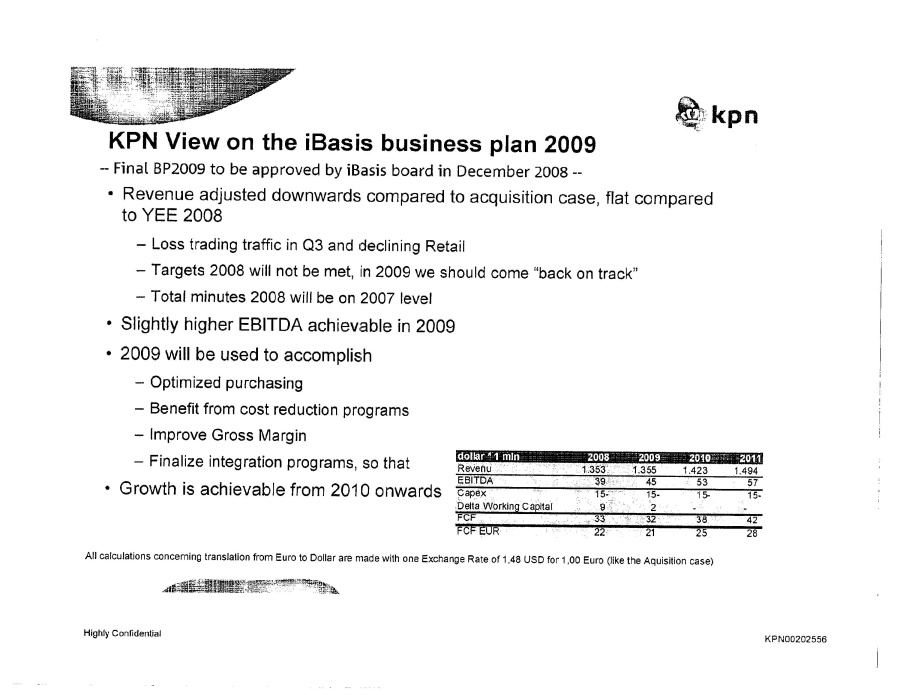

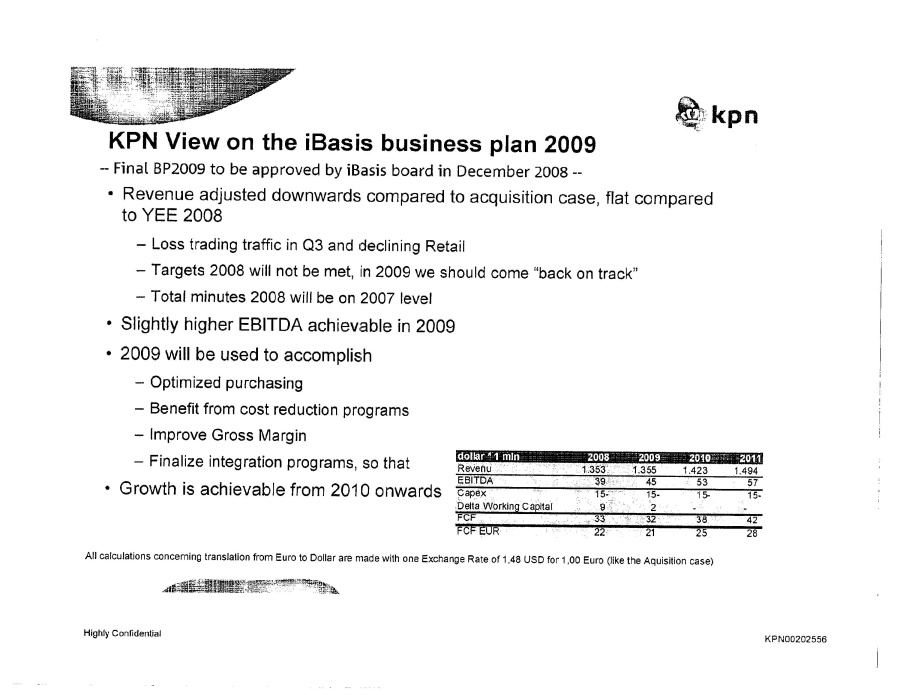

KPN View on the iBasis business plan 2009 Final BP2009 to be approved by iBasis board in December 2008 Revenue adjusted downwards compared to acquisition case, flat compared to YEE 2008 Loss trading traffic in Q3 and declining Retail Targets 2008 will not be met, lin 2009 we should come l'back on track" Total minutes 2008 will be on 2007 level Slightly higher EBITDA achievable in 2009 2009 will be used to accomplish Optimized purchasing Benefit from cost reduction programs Improve Gross Margin Finalize integration programs, so that Growth is achievable from 2010 onwards dollar *1mln 2008 2009 2010 2011 Revenue 1.353 1.355 1.423 1.494 EBITDA 39 45 53 57 Capex 15- 15- 15- 15- Delta Working Capital 9 2 FCF 33 32 38 42 FCB EUR 22 21 25 28 All calculations concerning translation from Euro to Dollar are made with one Exchange Rate of 1,48 USD for 1,00 Euro (like the Aquisition case) Highly Confidential KPN00202556