Exhibit 99(a)(5)(xxii)

Certificate of Translation State of New York ) ) SS: County of New York ) I, the undersigned, Shawn C. Haghighi, hereby certify that I am fluent in the English and Dutch languages; that I have translated, transcribed, reviewed and/or edited the following Dutch source file. Doc # KPN00204849 I certify that, to the best of my knowledge, ability and belief the same is a true and complete translation/transcription of the documents presented to me. SHAWN C. HAGHIGHI Sworn to before me on this 24th day of September, 2009 Notary Public JENNIFER CONTRERAS Notary Public, State of New York No. 01CO6196721 Qualified in New York County Commission Expires November 17, 2012 JX 115a

From: Schot, van der, P.J. (Paul) (W&O CS iBasis Office)

Sent: Friday, June 12, 2009 9:56:43 AM

To: Farwerck, J.F.E. (Joost) (W&O Executive Officer)

Subject: Mail for Ofer concerning scenarios

Attachments: Strategic scenario’s iBasis 2009 - 2012.ppt

Joost,

I wasn’t able to talk to you this afternoon.

Herewith [please find] the presentation for Ofer and my proposal for text of the accompanying email.

[I will] hear from you what you think of it.

Rgds Paul

[Original text below in English:]

===============================================================================================

=============

Dear Ofer,

KPN in general, and also W&O (including iBasis) is facing some concerns about the top line KPN revenu development. One of the drivers is that iBasis is YTD $110 mln revenu behind plan. Next Wednesday, I have a meeting with the board of directors to discuss this topic.

Therefore, I’d like to share some thoughts with you about the (long term) development of iBasis. To do so, I attached to this mail a paper which tries do some forward thinking in scenario’s. Namely, to me it looks a promising moment in time for the next step towards growth.

My suggestion is to have contact with you next Monday to discuss this paper.

With kind regards,

Joost

From: Schot, van der, P.J. (Paul) (W&O CS iBasis Office)

Sent: Friday, June 12, 2009 9:56:43 AM

To: Farwerck, J.F.E. (Joost) (W&O Directeur)

Subject: Mail voor Ofer over scenario’s

Attachments: Strategic scenario’s iBasis 2009 - 2012.ppt

Joost,

Het lukte me niet meer om je te spreken vanmiddag.

Hierbij de presentatie voor Ofer en mijn voorstel voor tekst in begeleidende mail.

Hoor het wel wat je er van vindt.

Gr Paul

===============================================================================================

=============

Dear Ofer,

KPN in general, and also W&O (including iBasis) is facing some concerns about the top line KPN revenu development. One of the drivers is that iBasis is YTD $110 mln revenu behind plan. Next Wednesday, I have a meeting with the board of directors to discuss this topic.

Therefore, I’d like to share some thoughts with you about the (long term) development of iBasis. To do so, I attached to this mail a paper which tries do some forward thinking in scenario’s. Namely, to me it looks a promising moment in time for the next step towards growth.

My suggestion is to have contact with you next Monday to discuss this paper.

With kind regards,

Joost

kpn Strategic scenario’s iBasis 2009 – 2012 12th June 2009 Confidential KPN00204850

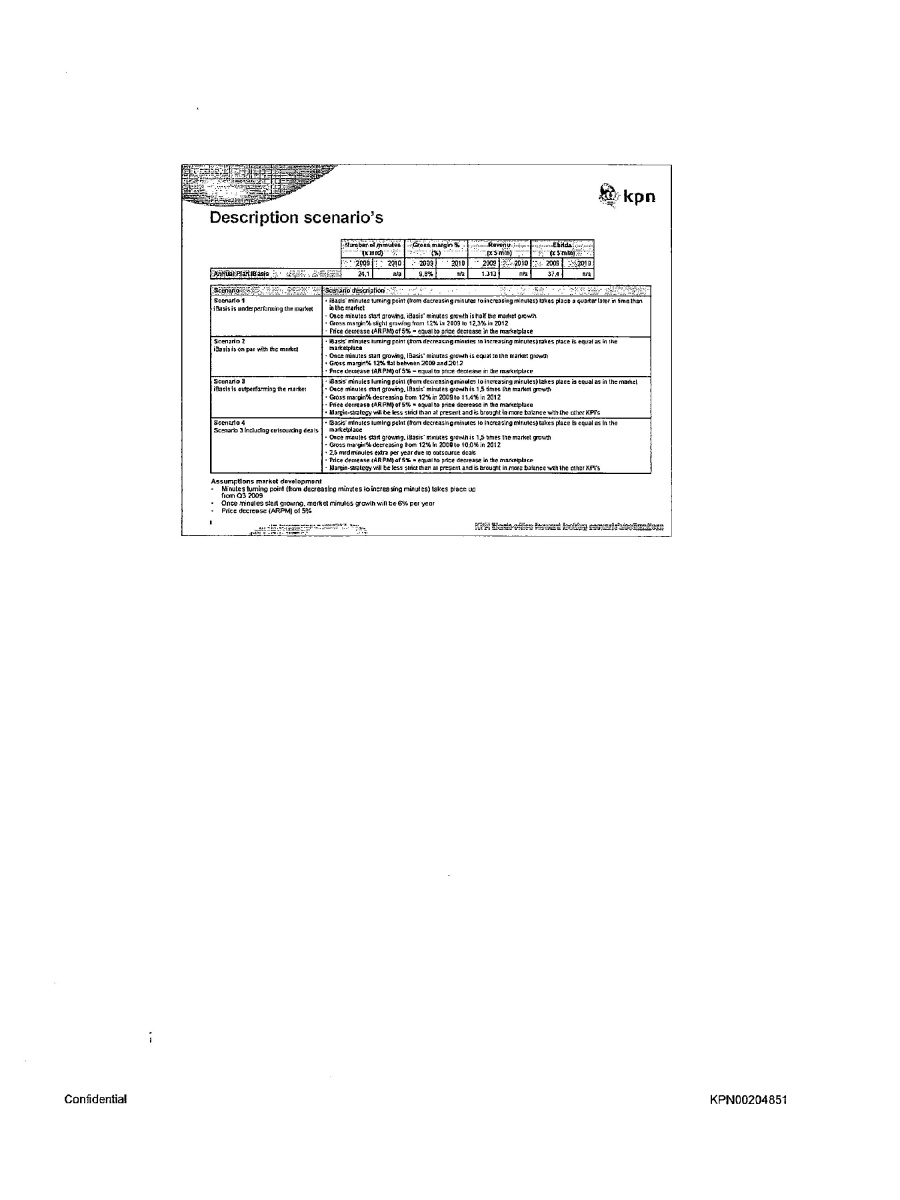

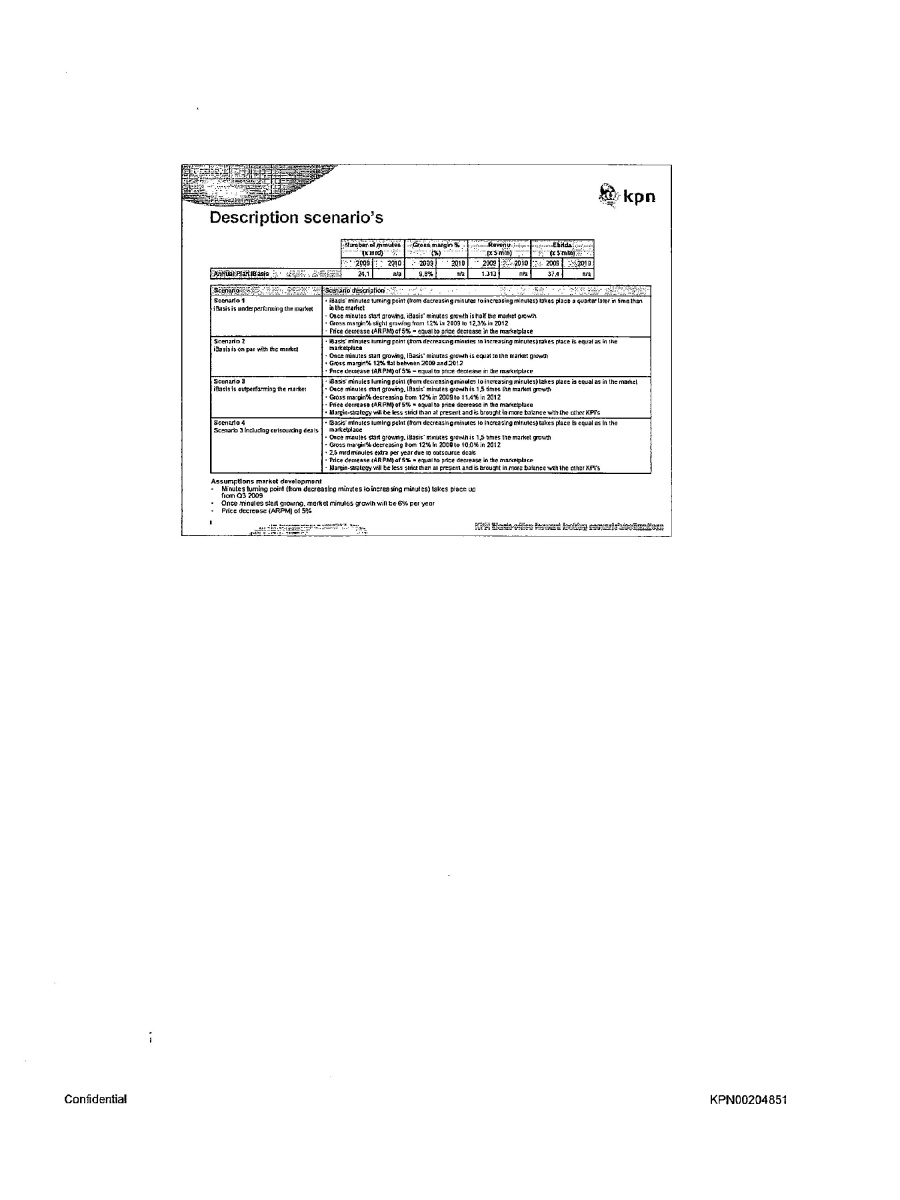

kpn Description scenario’s Number of minutes (x mrd) Gross margin% (%) Revenue (x $ min) Ebitda (x $ min) 2009 2010 2009 2010 2009 2010 2009 2010 Annual plan iBasis 24.1 n/a 9.8% n/a 1.313 n/a 37.4 n/a Scenario Scenario description Scenario 1 iBasis is underperforming the market iBasis’ minutes turning point (from decreasing minutes to increasing minutes) takes place a quarter later in time than in the market Once minutes start growing, iBasis’ minutes growth is half the market growth Gross margin % slight growing from 12% in 2009 to 12.3% in 2012 Price decrease (ARPM) of 5% = equal to price decrease in the marketplace Scenario 2 iBasis is on par with the market iBasis’ minutes running point (from decreasing minutes to increasing minutes) takes place is equal as in the marketplace Once minutes start growing, iBasis’ minutes growth is equal to the market growth Gross margin% 12% flat between 2009 and 2012 Price decrease (ARPM) of 5% = equal to price decrease in the marketplace Scenario 3 iBasis is outperforming the market iBasis’ minutes turning point (from decreasing minutes to increasing minutes) takes place is equal as in the market Once minutes start growing, iBasis’ minutes growth is 1.5 times the market growth Gross margin% decreasing from 12% in 2009 to 11.4% in 2012 Price decreases (ARPM) of 5% = equal to price decrease in the marketplace Margin strategy will be less strict than at present and is brought in more balance with the other KPI’s Scenario 4 Scenario 3 including outsourcing deals iBasis’ minutes turning point (from decreasing minutes to increasing minutes) takes place is equal as in the marketplace Once minutes start growing, iBasis’ minutes growth is 1.5 times the market growth Gross margin% decreasing from 12% in 2009 to 10.0% in 2012 2.5 mrd minutes extra per year due to outsource deals Price decrease (ARPM) of 6% = equal to price decrease in the marketplace Margin strategy will be less strict than at present and is brought in more balance with the other KPI’s Assumptions market development Minutes turning point (from decreasing minutes to increasing minutes) takes place up from Q3 2009 Once minutes start growing, market minutes growth will be 6% per year Price decrease (ARPM) of 5% Confidential KPN00204851

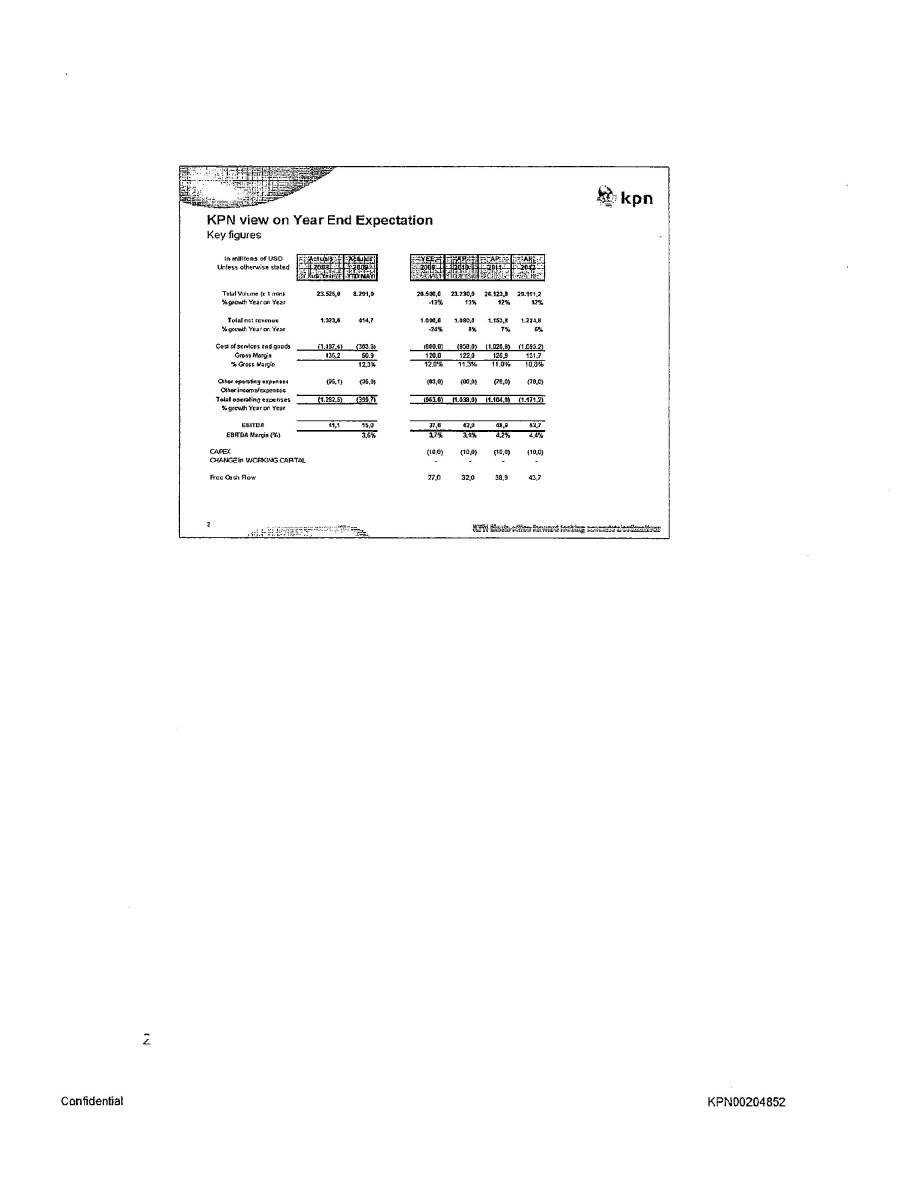

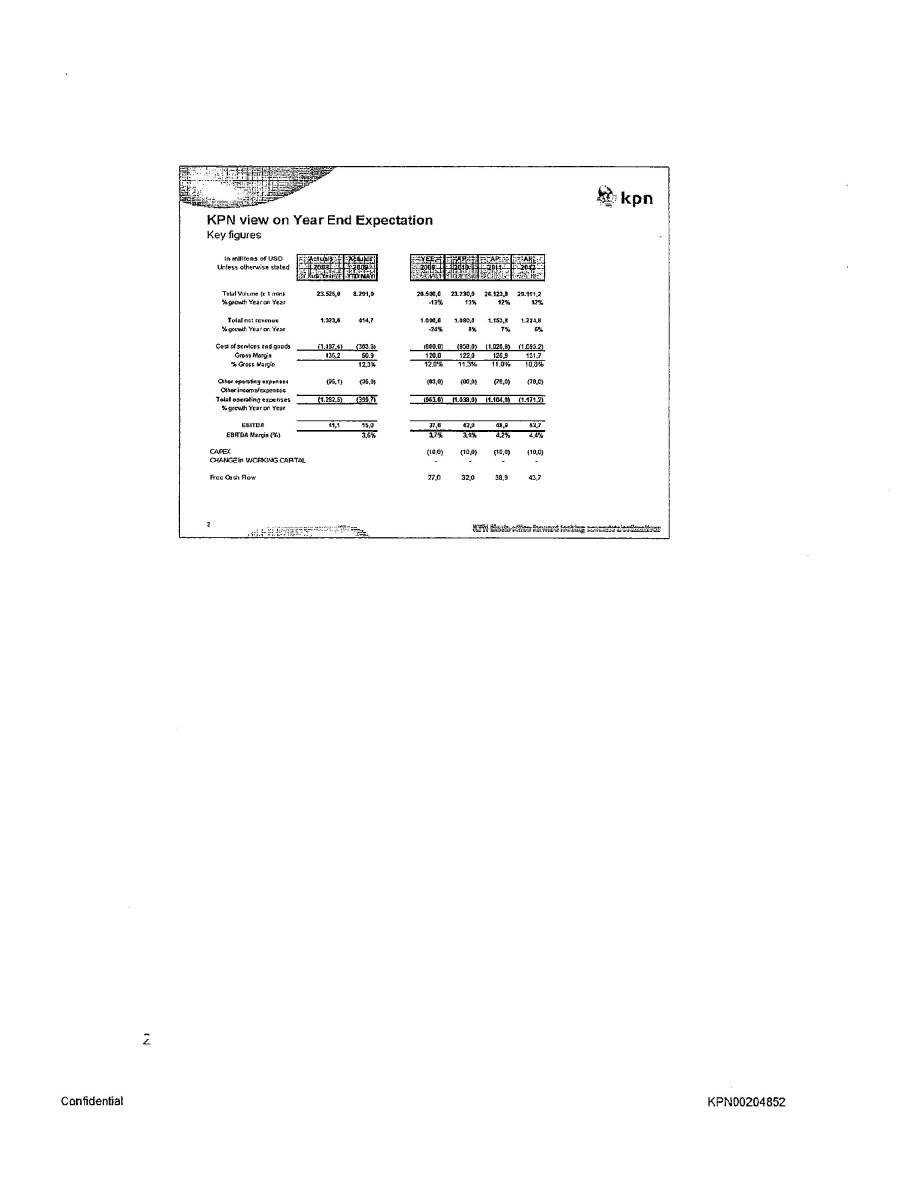

KPN view on Year End Expectation Key figures In millions of USD Unless otherwise stated Actuals 2008 Full Year Actuals 2009 YTD May YEE 2009 AP 2010, AP2011, AP 2012 Total Volume (x 1 min) 23,526.0 8,291.0 20,500.0 23,230.0 26,123.8 29,191.2 % growth Year on Year -13% 13% 12% 12% Total net revenue 1,323.6 414.7 1,000.0 1,080.0 1,153.8 1,224.8 % growth Year on Year -24% 8% 7% 6% Cost of services and goods (1.l87.4) (363.8) (880.0) (958.0) (1,026.9) (1.093.2) Gross Margin 136.2 50.9 120.0 122.0 126.9 131.7 % Gross Margin 12.3% 12.0% 11.3% 11.0% 10.8% Other operating expenses (95.1) (35.9) (83.0) (80.0) (79.0) (79.0) Other income/expenses Total operating expenses (1.282.5) (399.7) (963.0) (1,038.0) (1,104.8) (1,171.2) % growth Year on Year EBITDA 41.1 15.0 37.0 42.0 48.8 53.7 EBITDA Margin (%) 3.6% 3.7% 3.8%. 4.2% 4.4% CAPEX (10.00 (10.0) (10.0) (10.0) CHANGE in WORKING CAPITAL - - - - Free Cash Flow 27.0 32.0 38.9 43.7 Confidential KPN00204852

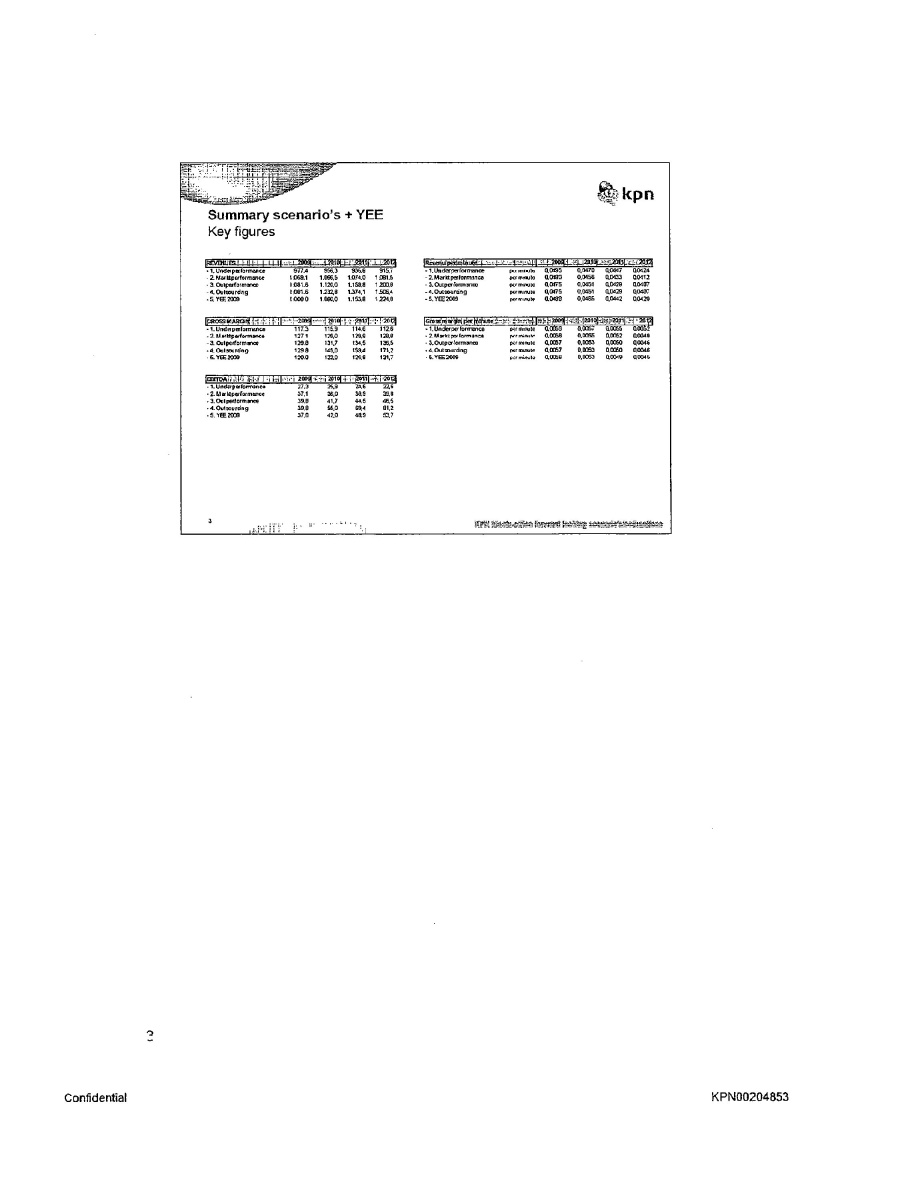

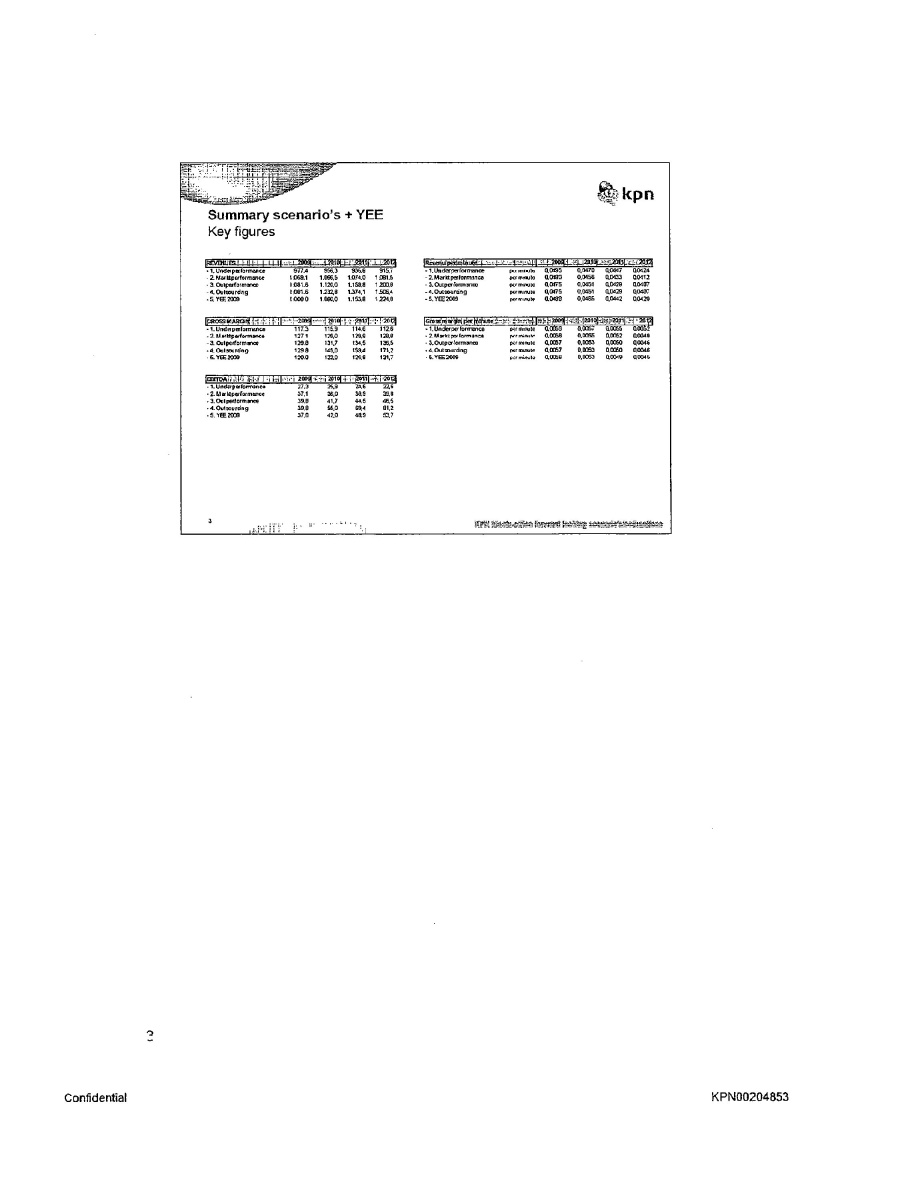

Kpn Summary scenario’s + YEE Key figures Revenues 2009 2010 2011 2012 1. Underperformance 977.4 956.3 935.6 915.7 2. Market performance 1,059.1 1,066.5 1.074.0 1,081.5 3.Outperformance 1,081.6 1,1200 1,158.8 1,.200.0 4. Outsourcing 1,081.6 1,232.8 1,374.1 1506.4 5. YEE 2009 1,000.0 1,080.0 1,153.8 1,224.8 Gross Margin 2009 2010 2011 2012 1. Underperformance 117.3 115.9 114.6 112.6 2. Market performance 127.1 128.0 128.9 129.8 3.Outperformance 129.8 131.7 134.5 135.5 4. Outsourcing 129.8 145.0 159.4 171.2 5. YEE 2009 120.0 122.0 126.8 131.7 EBITDA 2009 2010 2011 2012 1. Underperformance 27.3 25.9 24.6 22.6 2. Market performance 37.1 38.0 38.9 39.8 3.Outperformance 39.8 41.7 44.5 45.5 4. Outsourcing 39.8 55.0 69.4 81.2 5. YEE 2009 37.0 42.0 48.9 53.7 Revenue per minute 2009 2010 2011 2012 1. Underperformance per minute 0.0495 0.0470 0.0447 0.0424 2. Market performance per minute 0.0480 0.0456 0.0433 0.0412 3.Outperformance per minute 0.0475 0.0461 O.0429 0.0407 4. Outsourcing per minute 0.0475 0.0451 0.0429 0.0407 5. YEE 2009 per minute 0.0488 0.0465 0.0442 0.0420 Gross margin per minute 2009 2010 2011 2012 1. Underperformance per minute 0.0059 0.0057 0.0055 0.0052 2. Market performance per minute 0.0058 0.0055 0.0052 0.0049 3.Outperformance per minute 0.0057 0.0053 0.0050 0.0346 4. Outsourcing per minute 0.00J7 0.00J3 0.0060 0.0046 5. YEE 2009 per minute 0.0059 0.0053 0.0049 0.0045 Confidential KPN00204853

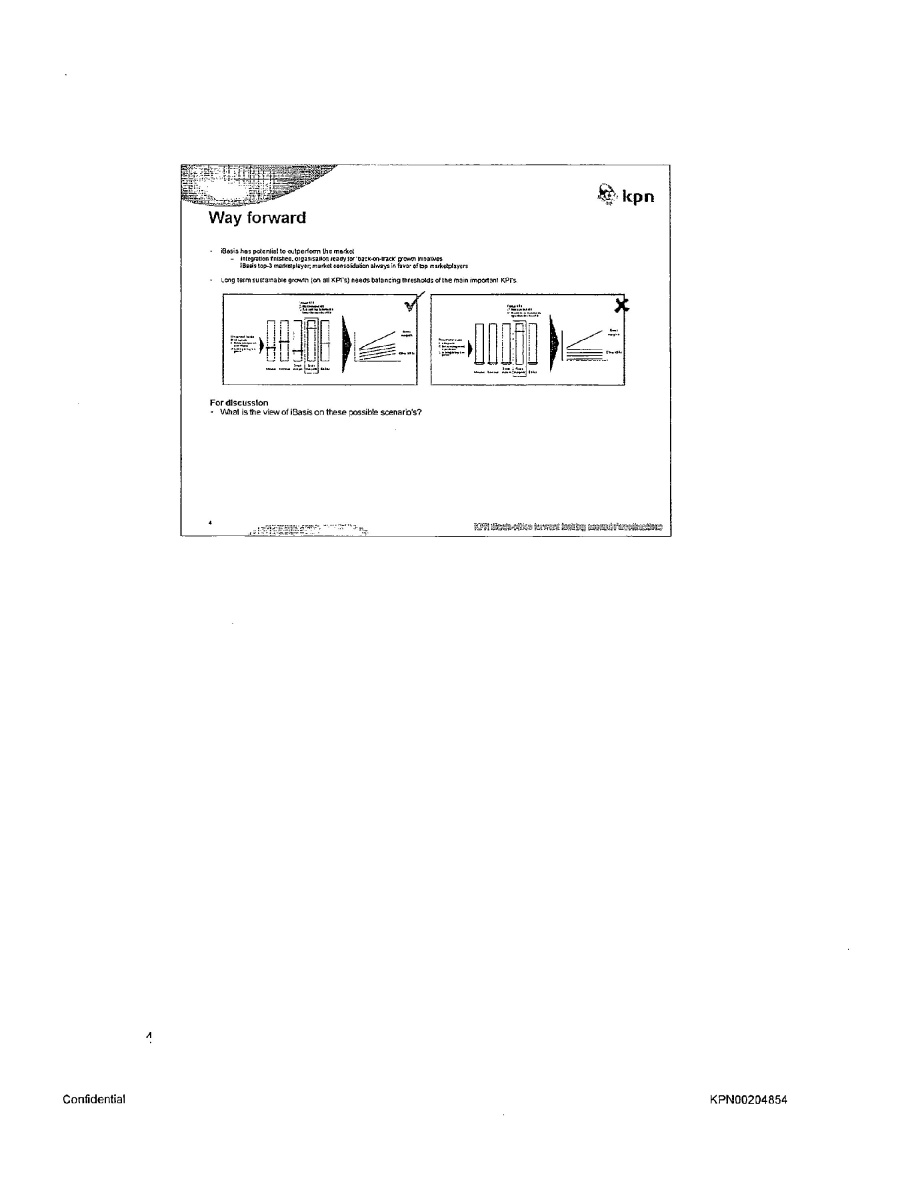

Kpn Way forward iBasis has potential to outperform the market Integration finished, organisation ready for “back-on-track” growth initiatives IBasis top-3 marketplayer; market consolidation always in favor of top marketplayers Long term sustainable growth (on all KPI’s) needs balancing thresholds of the main important KPI’s For discussion What is the view of iBasis on these possible scenario’s? Confidential KPN00204854