Exhibit 99.(a)(5)(ix)

From: Dijk, van, J.A. (Johannes) (W&O Financin BC Carrier Services)

Sent: Tuesday, April 07, 2009 12:14 PM

To: Rodenburg, J.J. (Jan) (KPNCC M&A Management); Uematsu, K. (Kenji) (KPNCC M&A Management); Costermans, H.J. (Huib) (W&O Financin Manager); Braat, D. (Daniel) (KPNCC M&A Management) Subject: 090407 Celtic Valuation v2.xls

Attachments:

All,

This scenario looks in my opion as going concern.

I will thank Jan en Kenij for the misstake in the model. The wrong opex amount was in the model. Hereby changed. The value decreased to approx. 170 mln instead of 212 mln.

With regards,

Johannes JX192

Confidential <?xml:namespace prefix = st1 ns = "urn:schemas-microsoft-com:office:smarttags" />KPN00026124

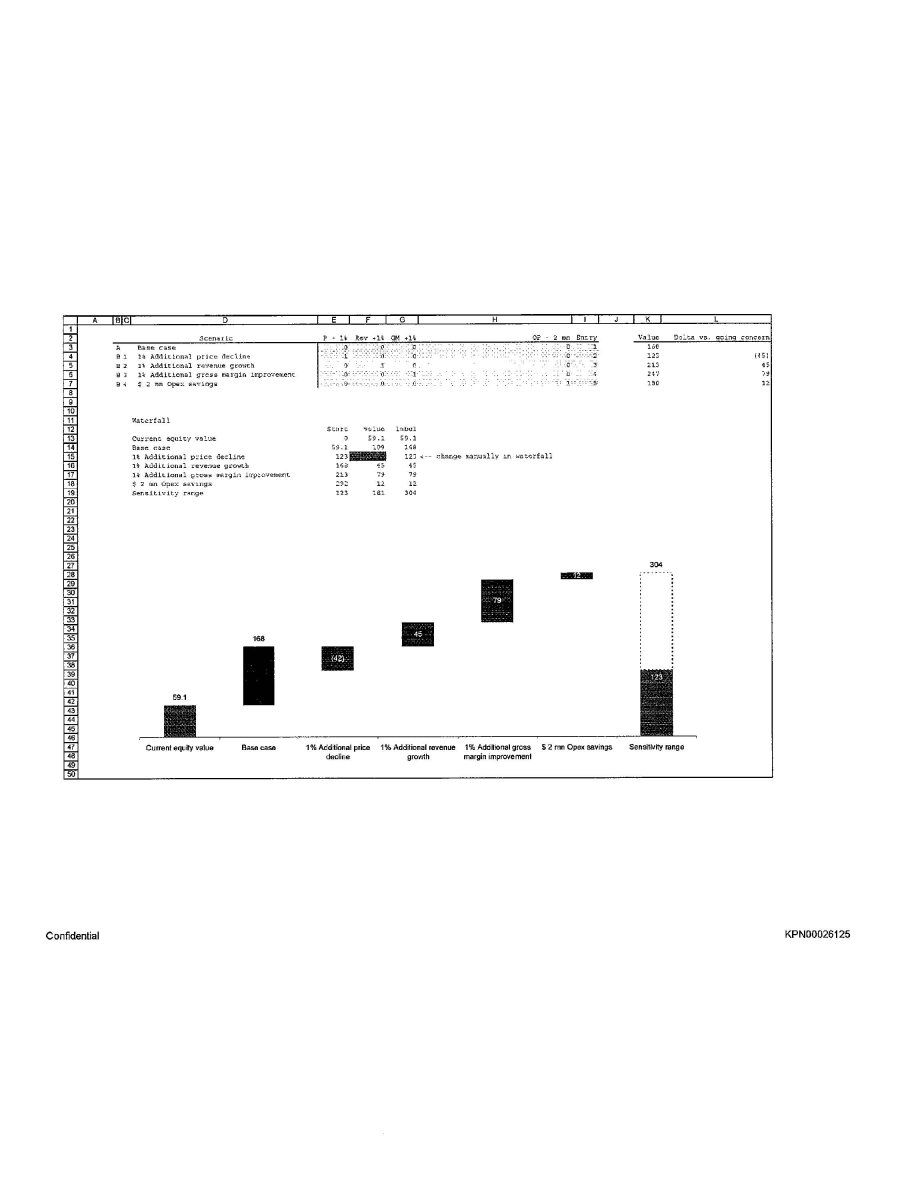

Scenario P - 1% Rev +1% OP - 2 mn Entry Value Delta vs. going concern Base case 1% Additional price decline 1% Additional revenue growth 1% Additional gross margin improvement $ 2 mn Opex savings Waterfall Start value label Current equity value Base case 1% Additional price decline - change manually in waterfall 1% Additional revenue growth 1% Additional gross margin improvement $ 2 mn Opex savings Sensitivity range Current equity value Base case 1% Additional price decline 1% Additional revenue growth 1% Additional gross margin improvement $ 2 mn Opex savings Sensitivity range Confidential KPN00026125<?xml:namespace prefix = o ns = "urn:schemas-microsoft-com:office:office" />

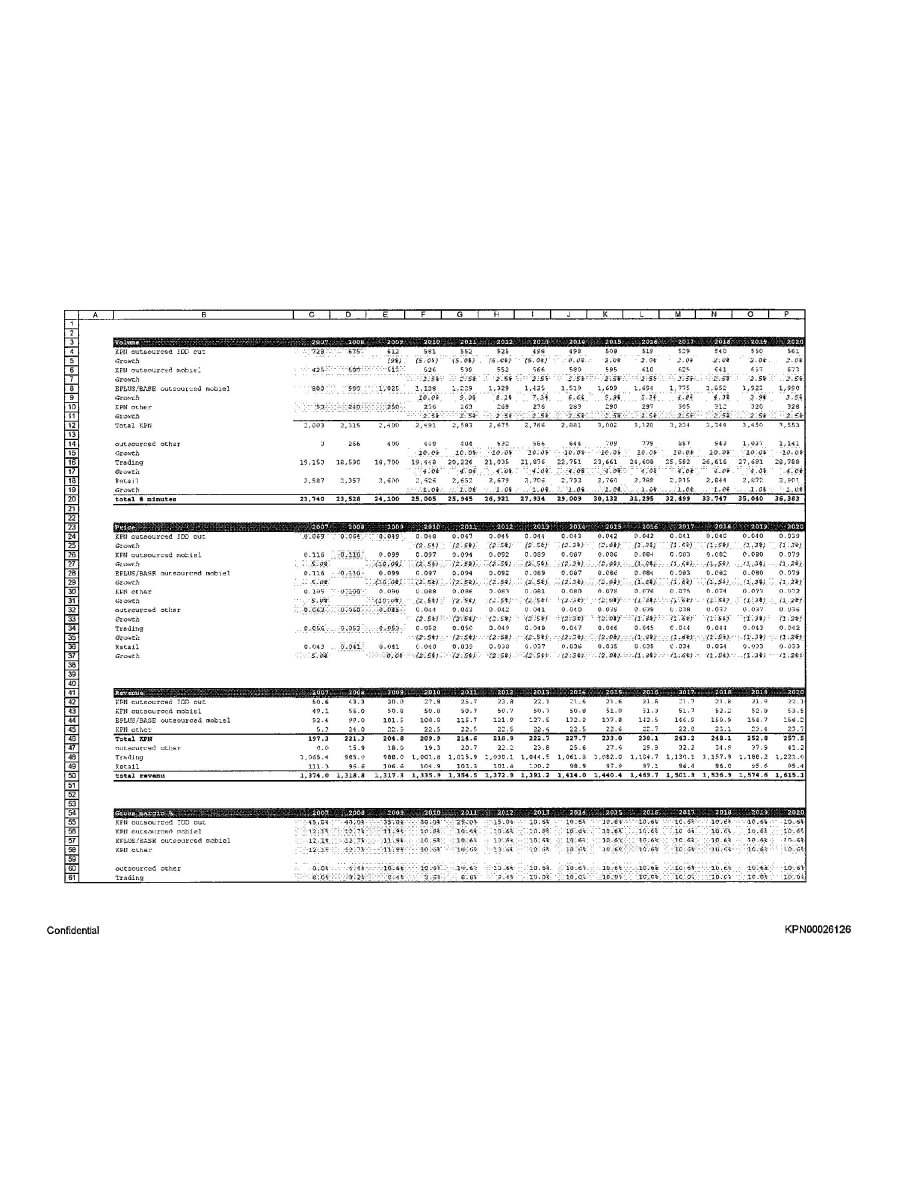

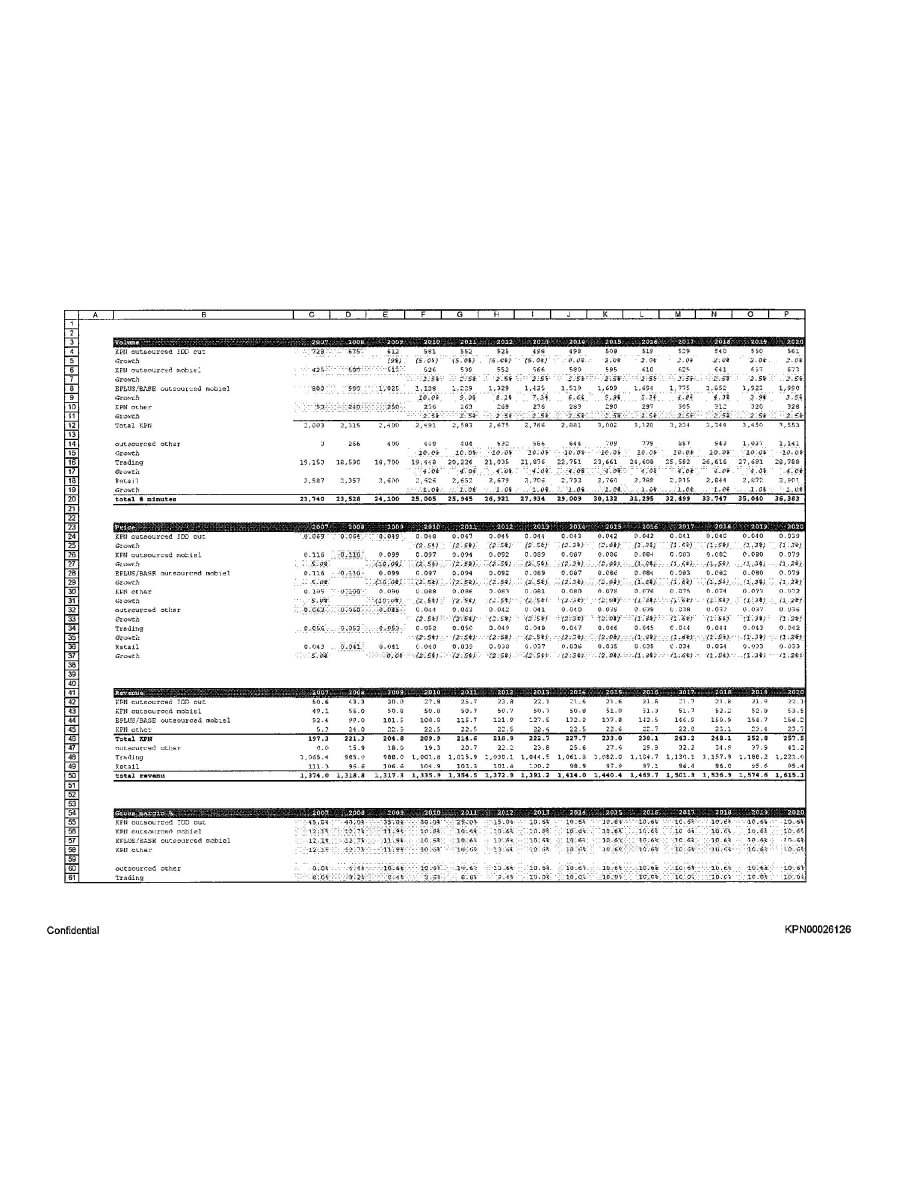

Volume 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out Growth KPN outsourced mobiel Growth EPLUS/BASE outsourced mobiel Growth KPN other Growth Total KPN outsourced other Growth Trading Growth Retail Growth total minutes Price 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out Growth KPN outsourced mobiel Growth EPLUS/BASE outsourced mobiel Growth KPN other Growth outsourced other Growth Trading Growth Retail Growth Revenue 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other Total KPN outsourced other Trading Retail total revenu Gross margin % 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Confidential KPN00026126

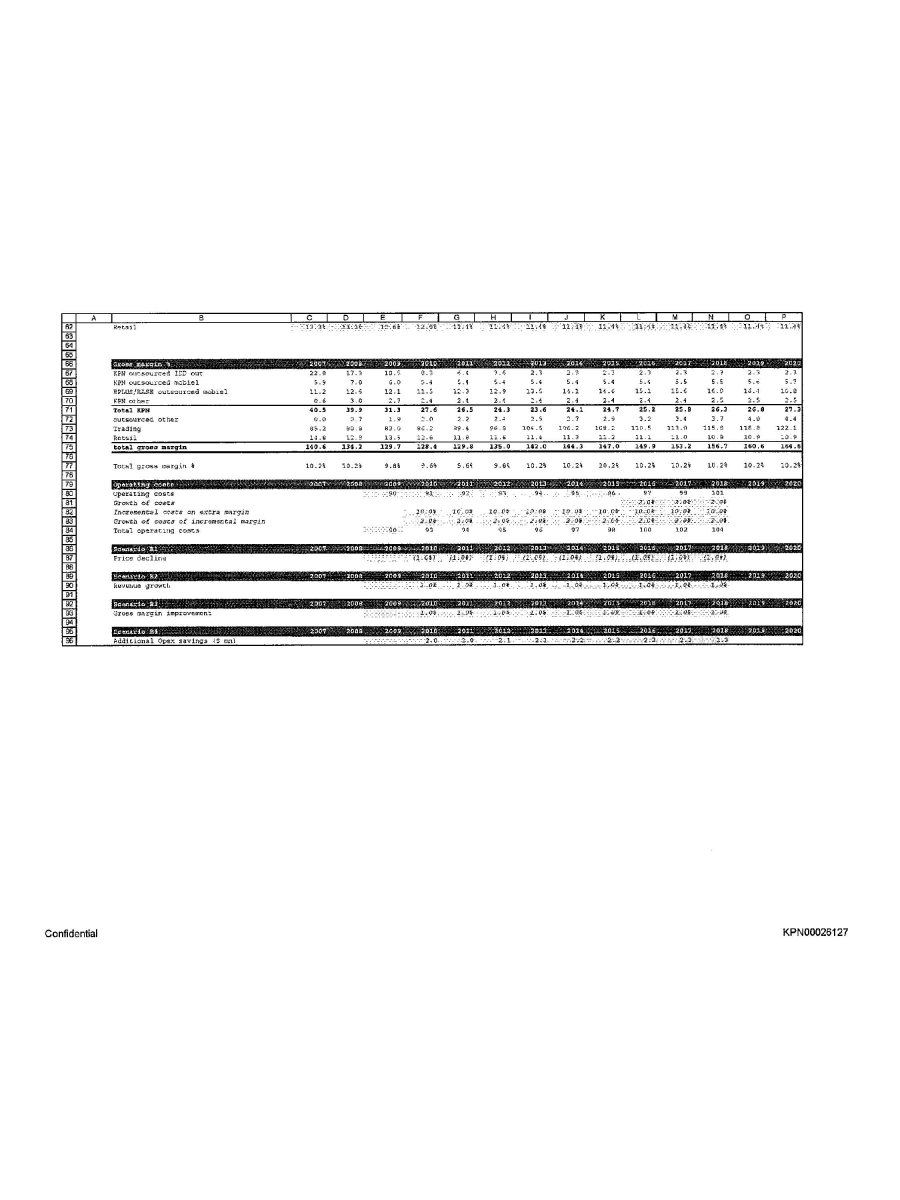

Gross margin % 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other Total KPN outsourced other Trading Retail total gross margin Total gross margin % Operating costs Operating costs Growth of costs Incremental costs on extra margin Growth of costs of incremental margin Total operating costs Scenario B1 Price decline Scenario B2 Revenue growth Scenario B3 Gross margin improvement Scenario B4 Additional Opex savings (5 mn) Confidential KPN00026127

Cell: E5

Comment: Jan Rodenburg: Is equal to (600*1.02)

Confidential KPN00026128

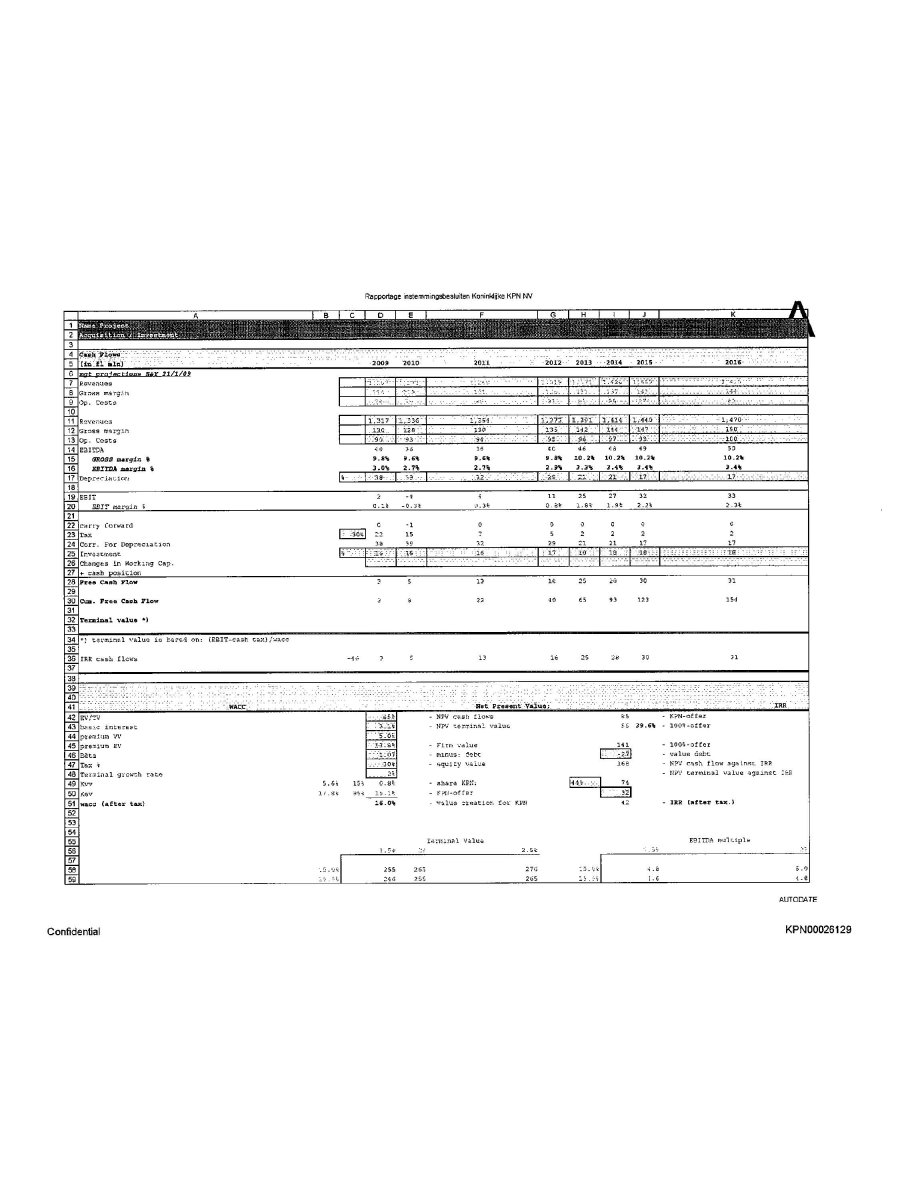

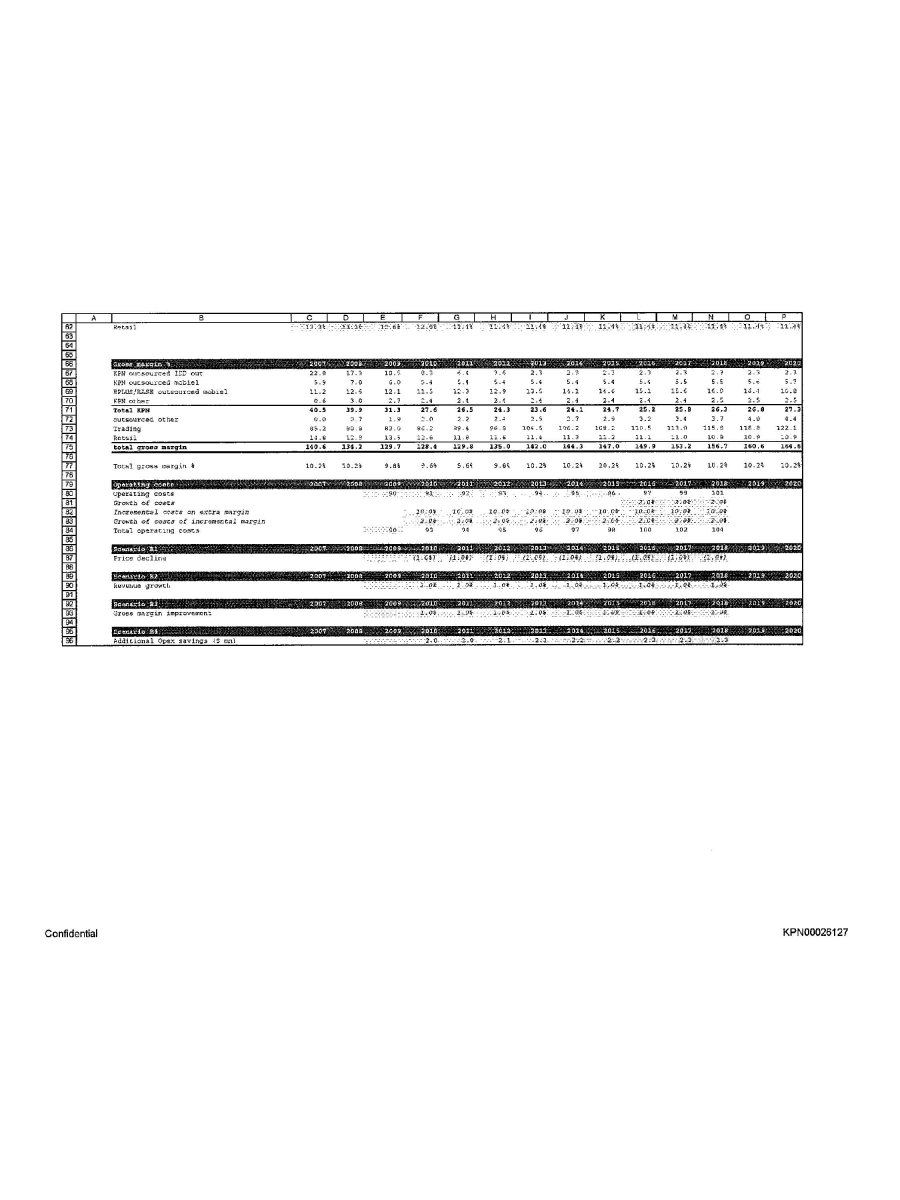

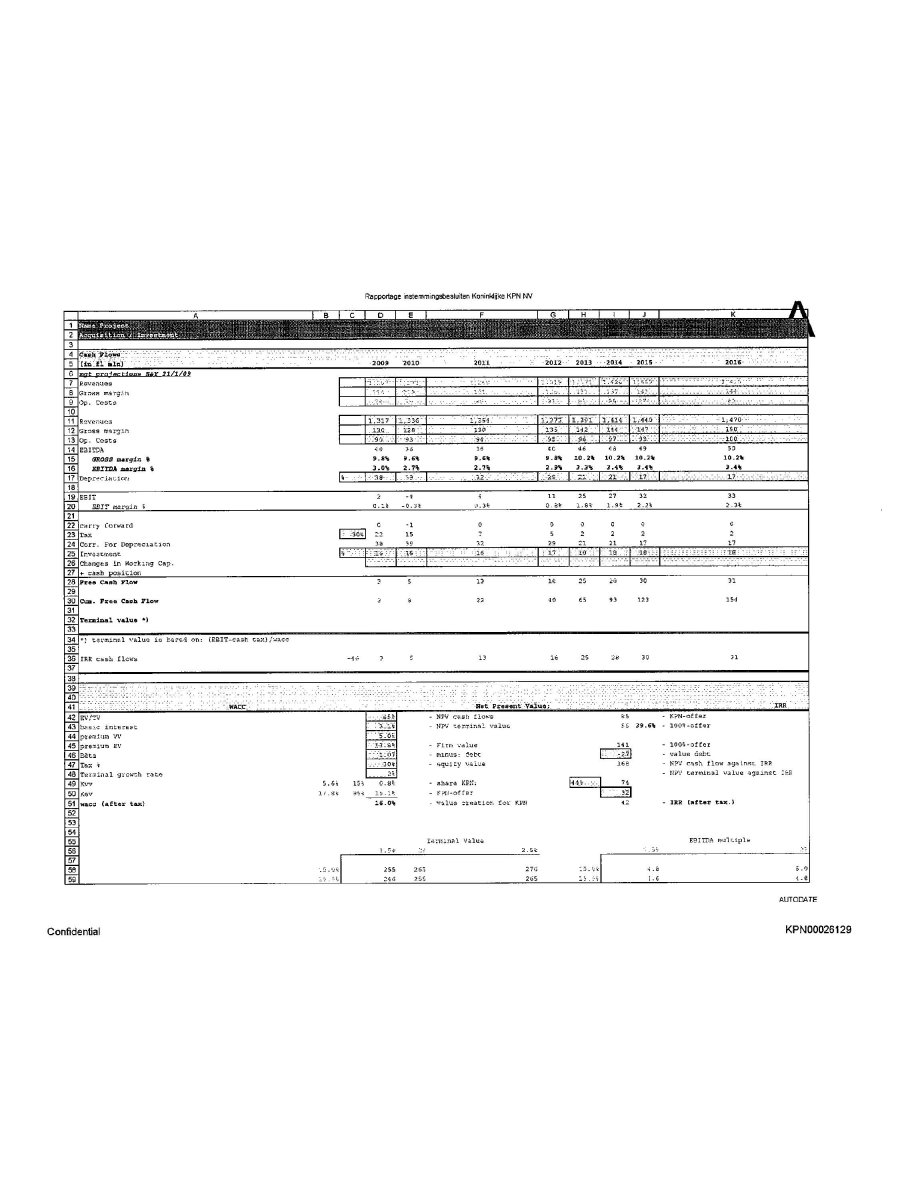

Rapportage instemmingsbesluiten Koninklijke KPN NV Name Project Acquisition/Investment Cash Flows (in fl min) 2009 2010 2011 2012 2013 2014 2015 2016 mgt projects E&Y 21/1/09 Revenues Gross margin Op. Costs Revenues Gross margin Op. Costs EBITDA GROSS margin % EBITDA margin % Depreciation EBIT EBIT margin 1 carry forward Tax Corr. For Depreciation Investment Changes in Working Cap. + cash position Free Cash Flow Cum. Free Cash Flow Terminal value *) *) terminal value is based on: EBIT-cash tax)/wacc IRR cash flows WACC Net Present Value: IRR EV/TV - NPV cash flows - KPN-offer basic interest - NPV terminal value - 100%-offer premium VV premium BV - Firm value - 100%-offer Beta - minus: debt - value debt Tax % - equity value NPV cash flow against IRR Terminal growth rate - NPV terminal value against IRR Kvv - share KPN: Kev - KPN-offer wacc (after tax) - value creation for KPN - IRR (after tax.) Terminal Value EBITDA multiple AUTODATE Confidential KPN00026129

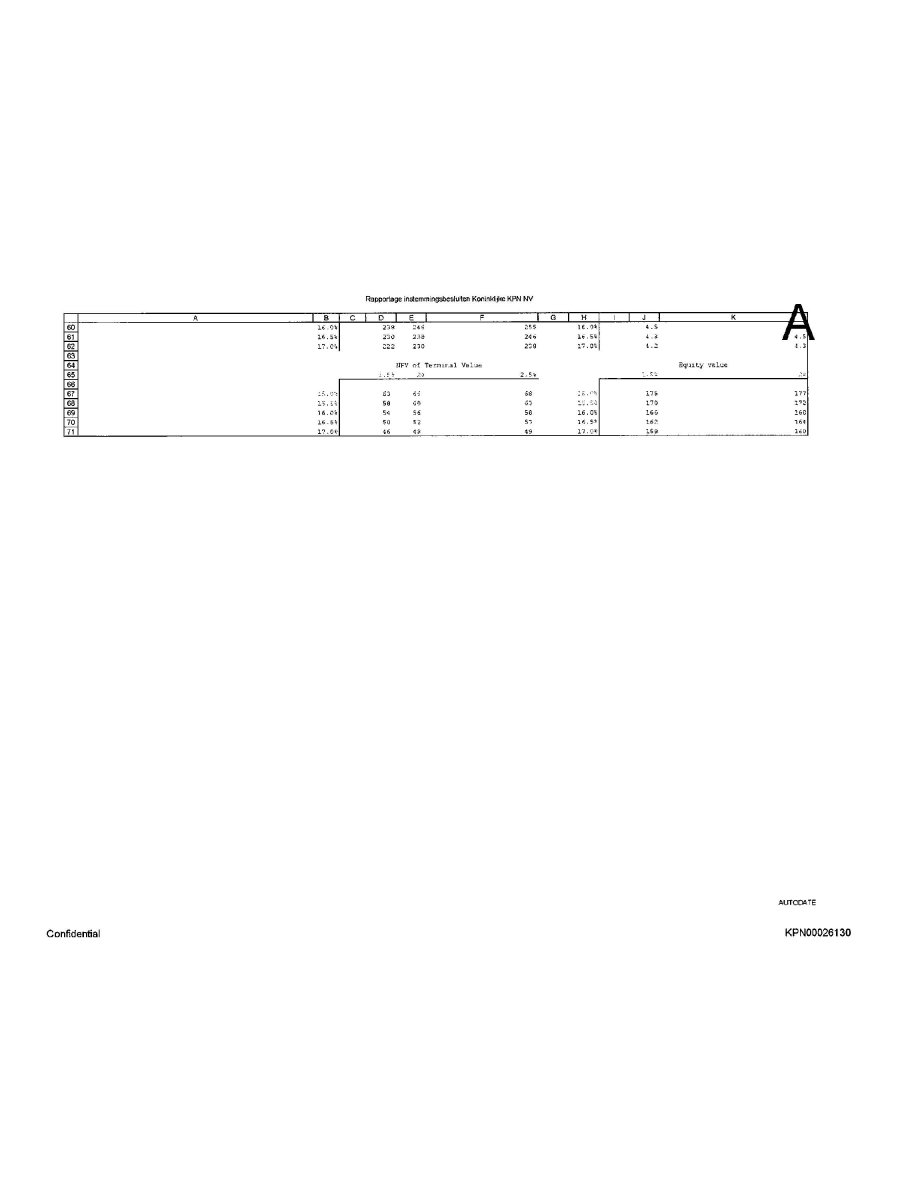

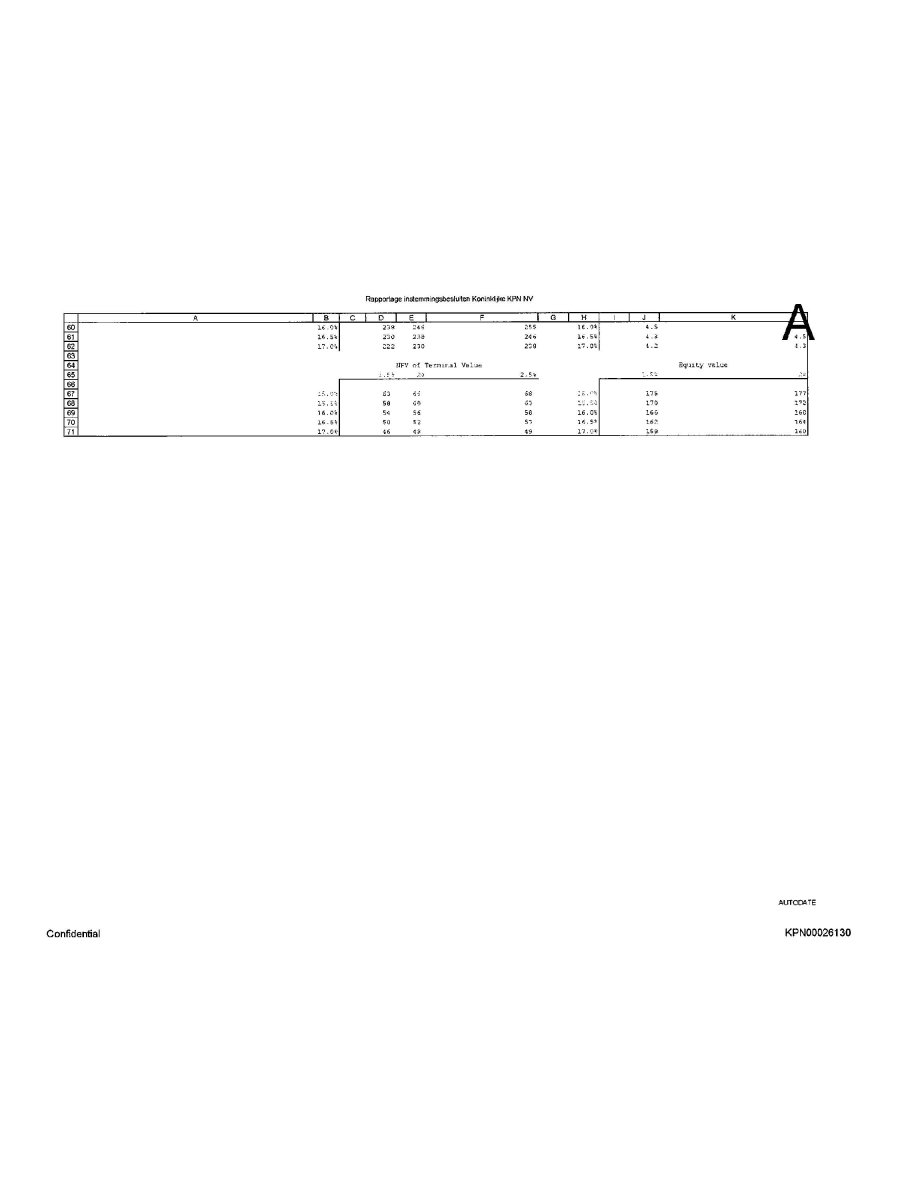

Rapportage instemmingsbesluiten Koninklijke KPN NV NPV of Terminal Value Equity value AUTODATE Confidential KPN00026130

Rapportage instemmingsbesluiten Koninklijke KPN NV DCF Valuation 2017 2018 9-yr CAGR assume 10% var. AUTODATE Confidential KPN00026131

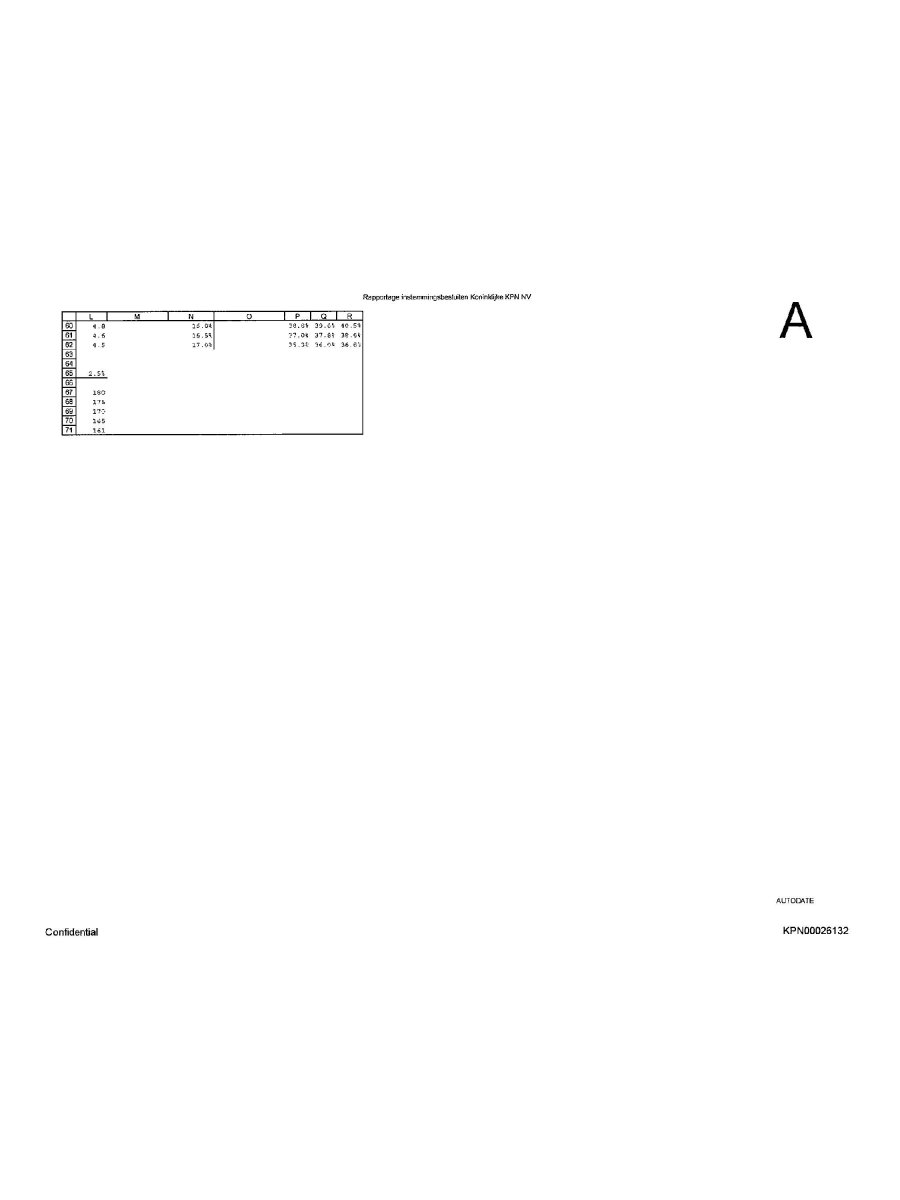

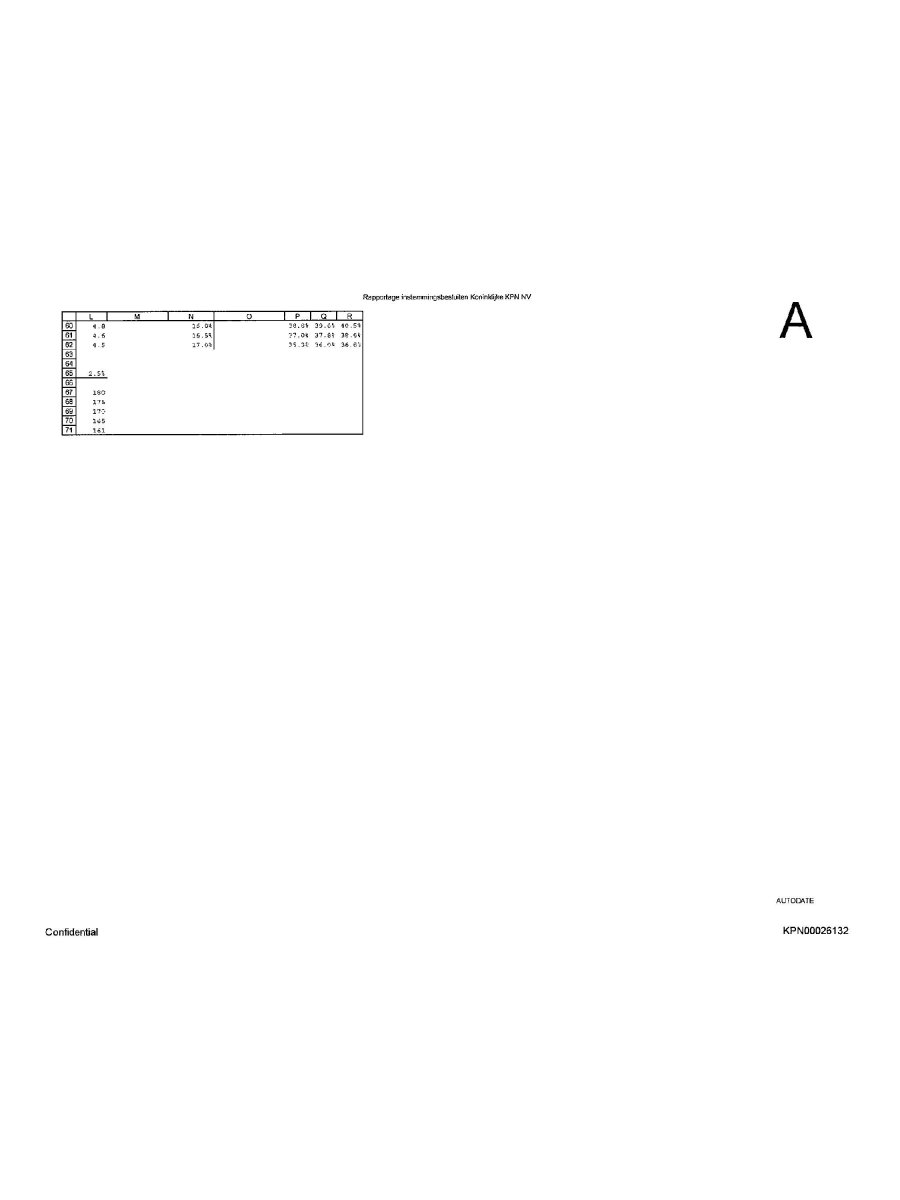

Rapportage instemmingsbesluiten Koninklijke KPN NV AUTODATE KPN00026132

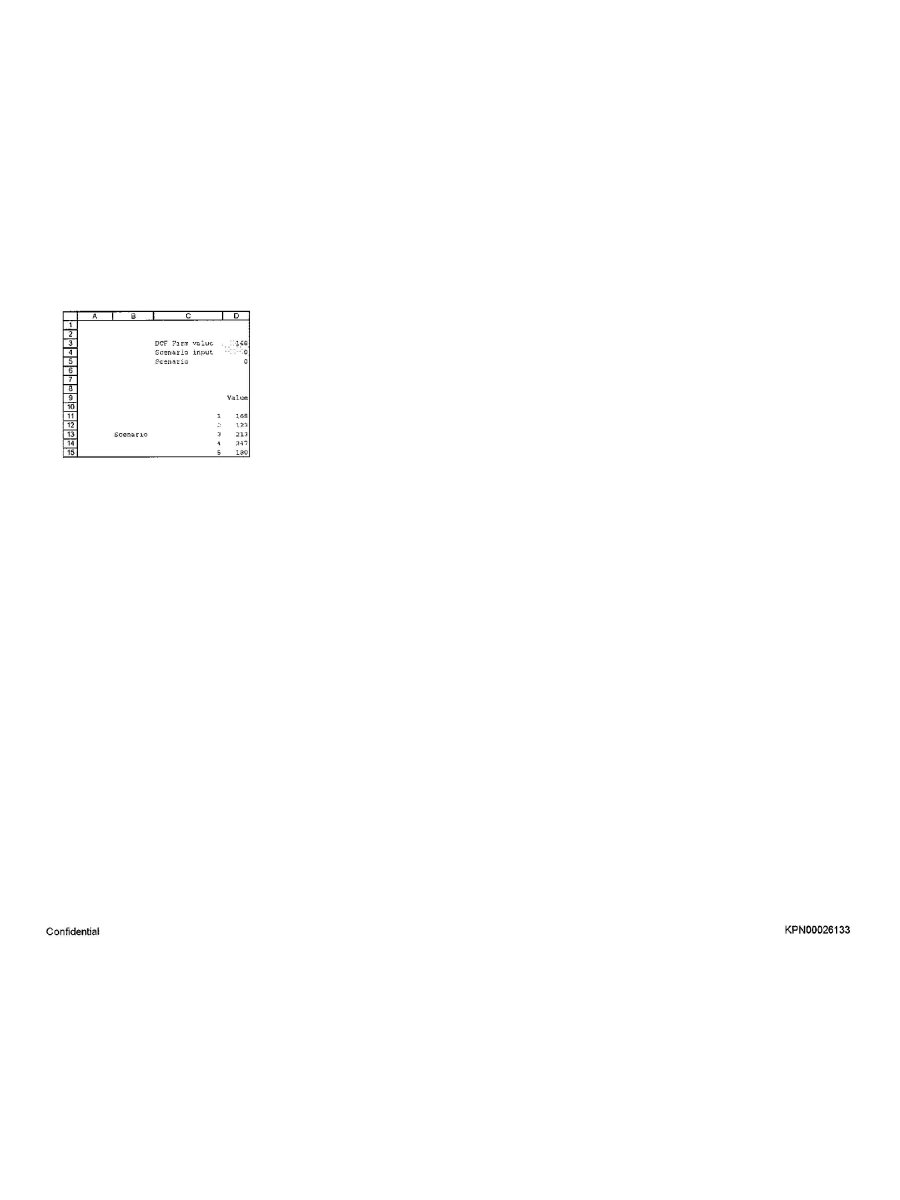

DCF Firm value Scenario input Scenario Value Scenario Confidential KPN00026133

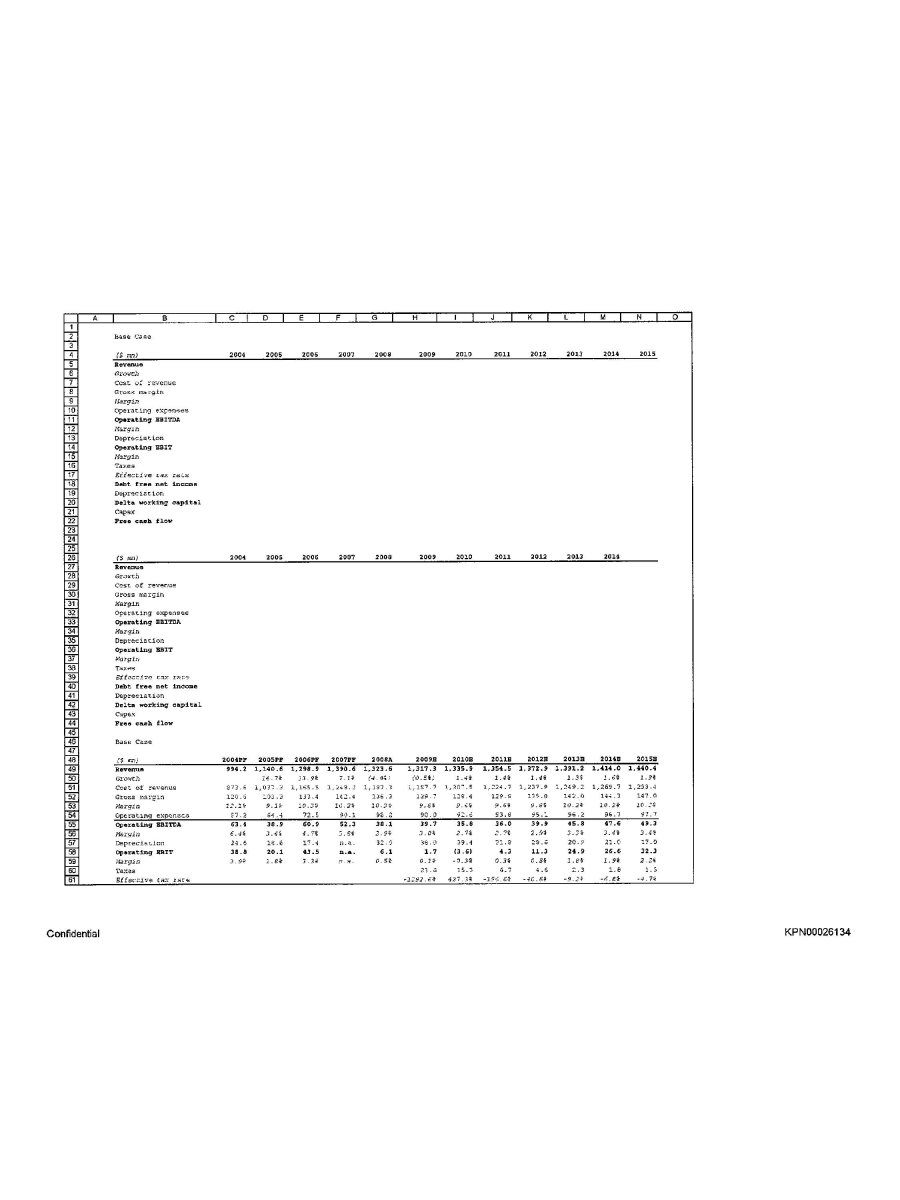

Base Case ($ mn) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Revenue Growth Cost of revenue Gross margin Margin Operating expenses Operating EBITDA Margin Depreciation Operating EBIT Margin Taxes Effective tax rate Debt free net income Depreciation Delta working capital Capex Free cash flow ($ mn) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Revenue Growth Cost of revenue Gross margin Margin Operating expenses Operating EBITDA Margin Depreciation Operating EBIT Margin Taxes Effective tax rate Debt free net income Depreciation Delta working capital Capex Free cash flow Base Case ($ mn) 2004PF 2005PF 2006PF 2007PF 2008A 2009E 2010E 2011E 2012E 2013E 2014E 2015E Revenue Growth Cost of revenue Gross margin Margin Operating expenses Operating EBITDA Margin Depreciation Operating EBIT Margin Taxes Effective tax rate Confidential KPN00026134

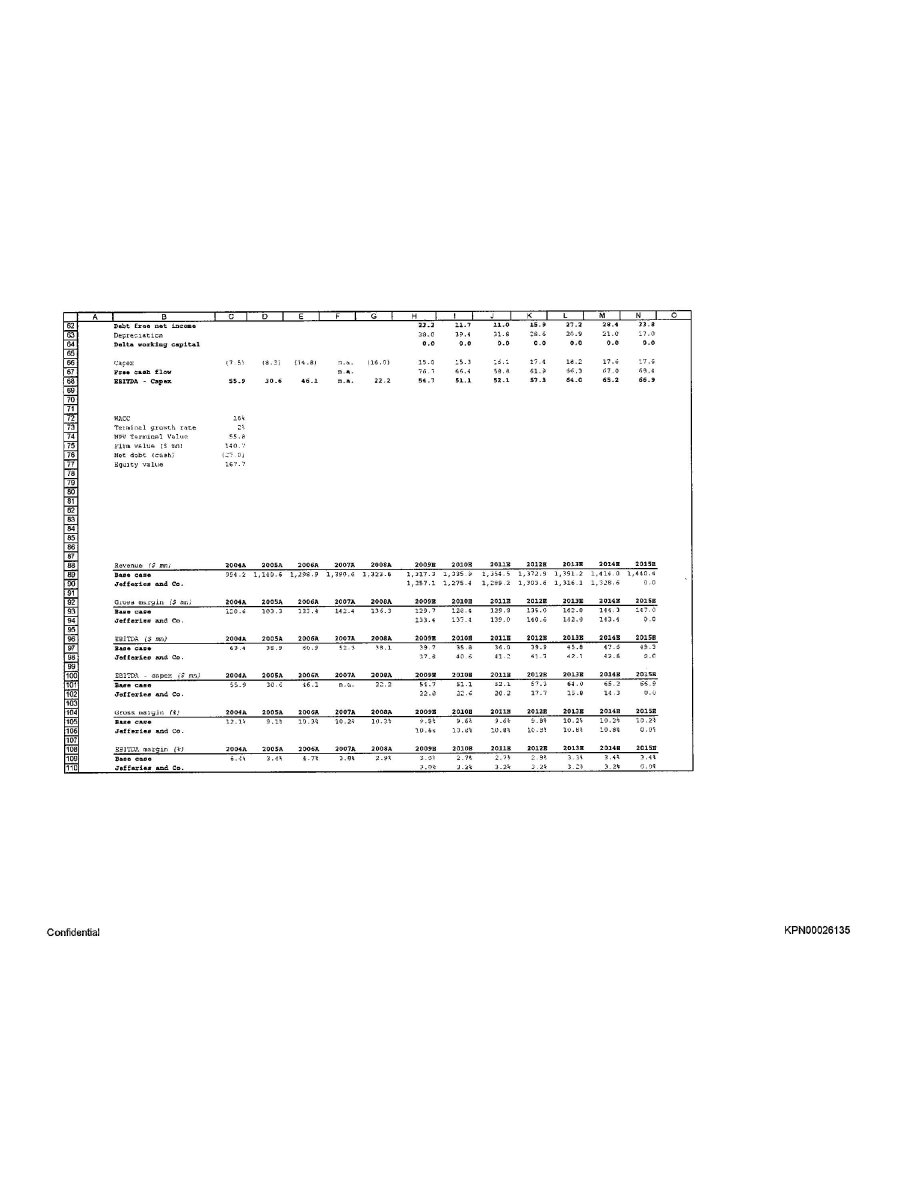

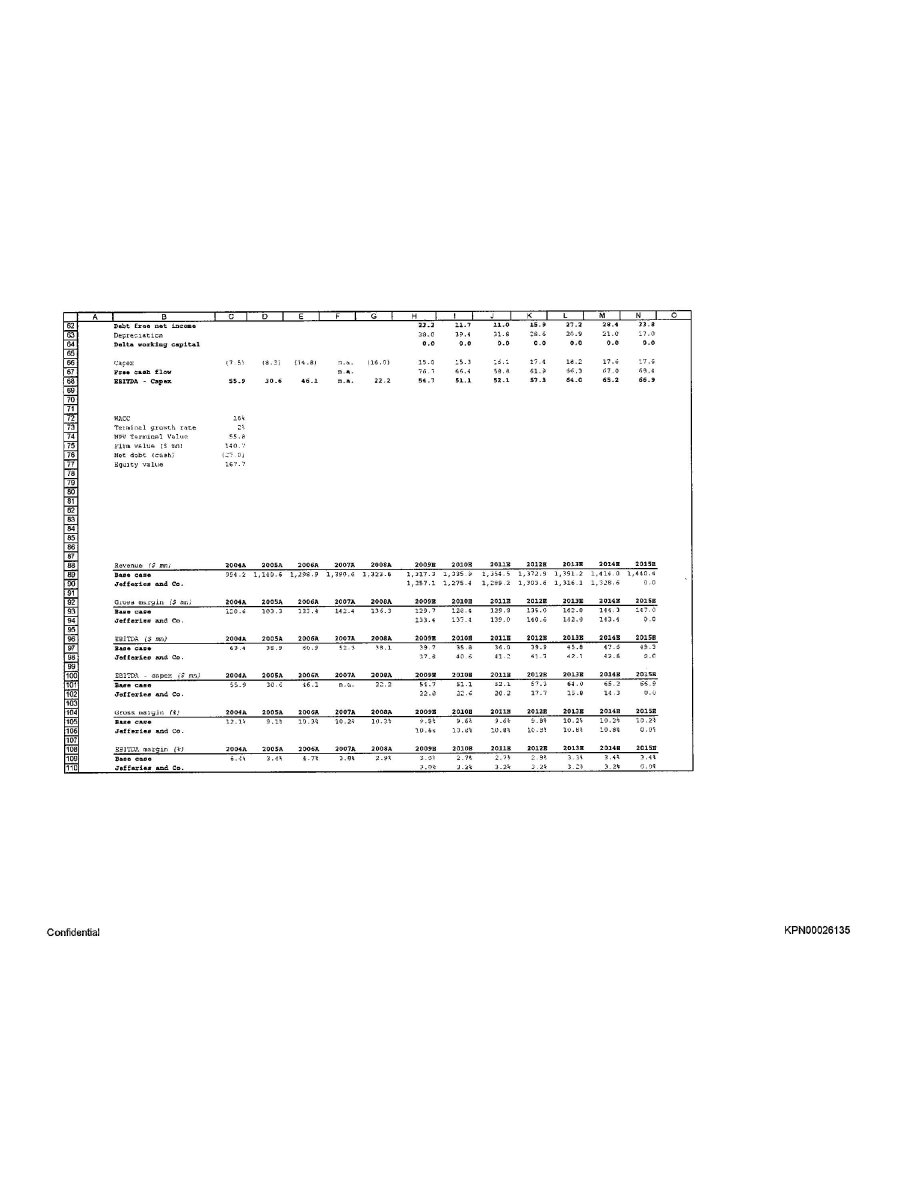

Debt free net income Depreciation Delta working capital Capex Free cash flow EBITDA - Capex WACC Terminal growth rate NPV Terminal Value Firm Value ($mn) Net debt (cash) Equity value Revenue ($mn) 2004A 2005A 2006A 2007A 2008A 2009E 2010E 2011E 2012E 2013E 2014E 2015E Base Case Jefferies and Co. Gross margin ($mn) 2004A 2005A 2006A 2007A 2008A 2009E 2010E 2011E 2012E 2013E 2014E 2015E Base Case Jefferies and Co. EBITDA ($mn) 2004A 2005A 2006A 2007A 2008A 2009E 2010E 2011E 2012E 2013E 2014E 2015E Base Case Jefferies and Co. EBITDA - capex ($mn) 2004A 2005A 2006A 2007A 2008A 2009E 2010E 2011E 2012E 2013E 2014E 2015E Base Case Jefferies and Co. Gross margin (%) 2004A 2005A 2006A 2007A 2008A 2009E 2010E 2011E 2012E 2013E 2014E 2015E Base Case Jefferies and Co. Revenue (%) 2004A 2005A 2006A 2007A 2008A 2009E 2010E 2011E 2012E 2013E 2014E 2015E Base Case Jefferies and Co. Confidential KPN00026135

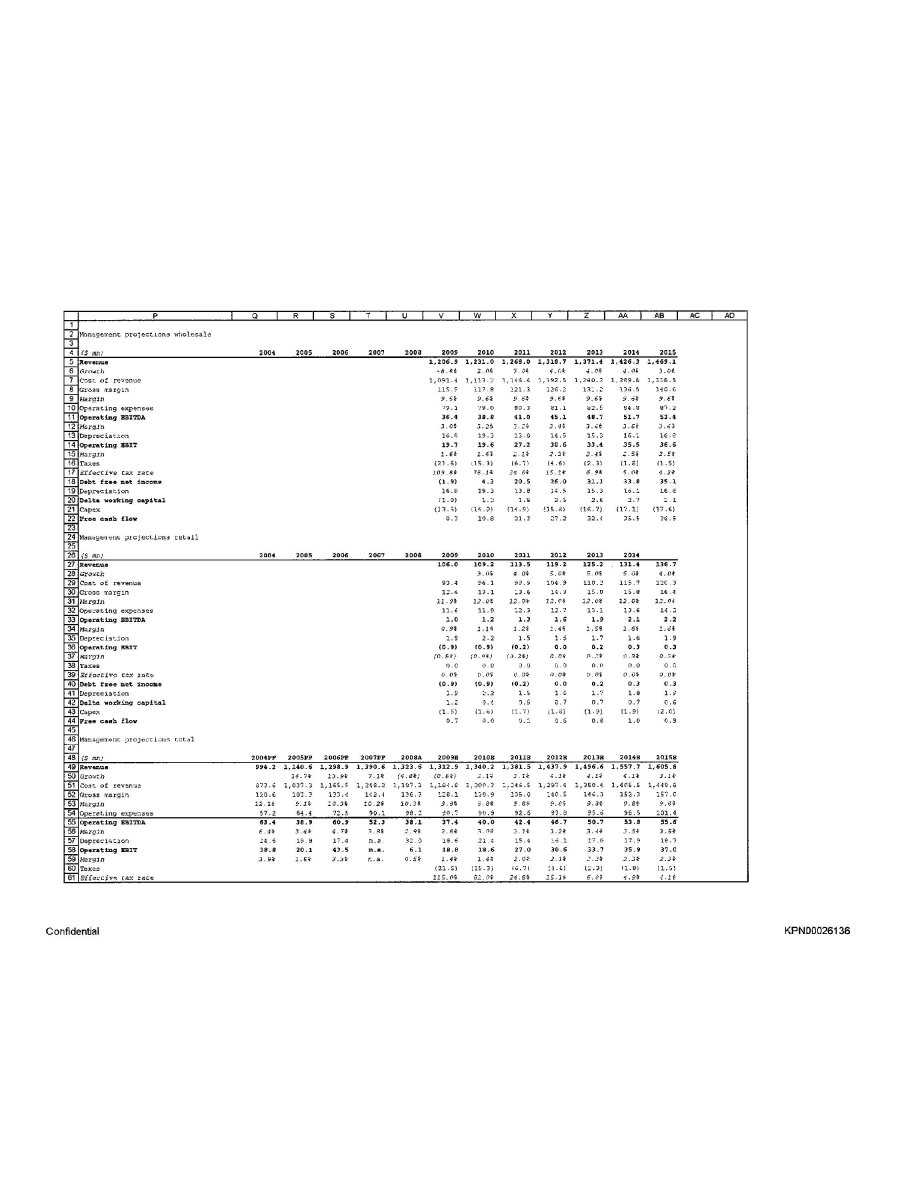

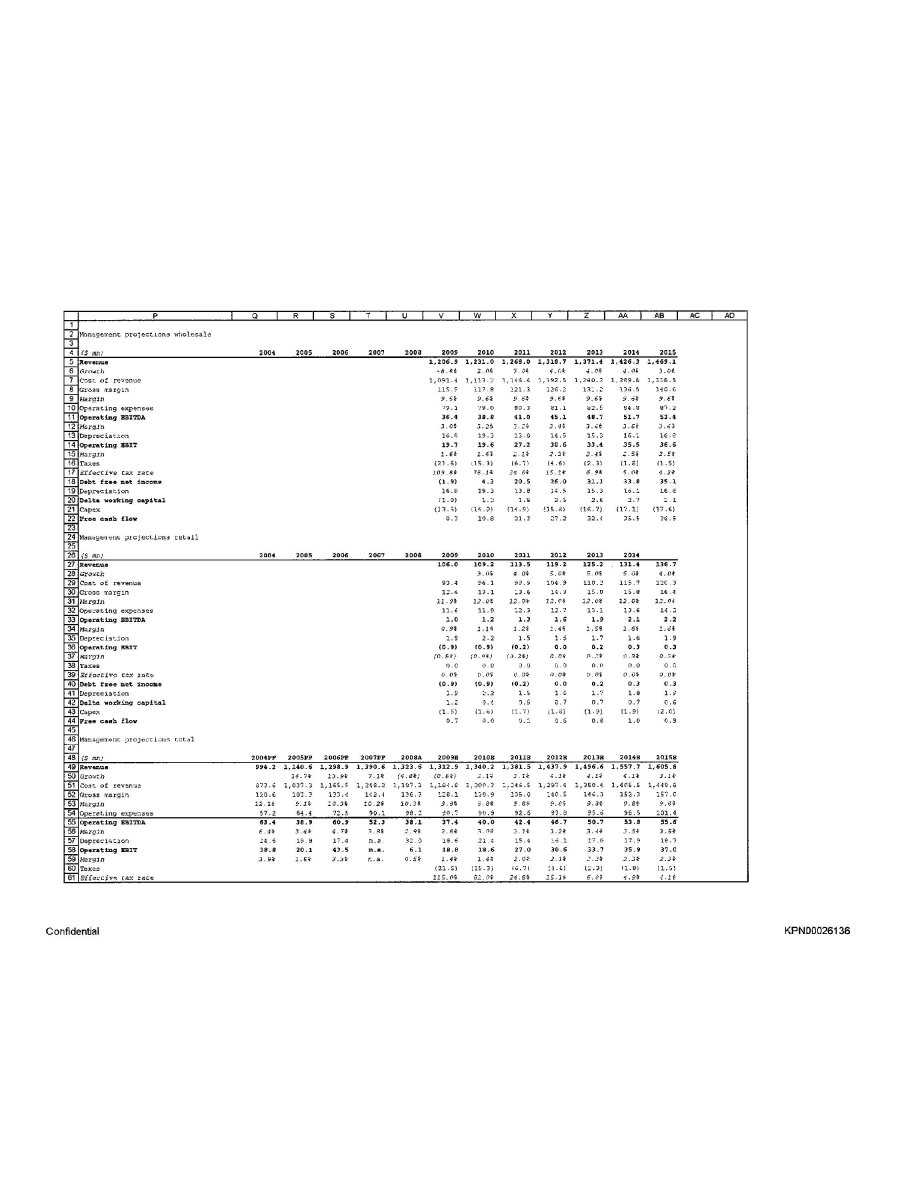

Management projections wholesale ($ mn) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Revenue Growth Cost of revenue Gross margin Margin Operating expenses Operating EBITDA Margin Depreciation Operating EBIT Margin Taxes Effective tax rate Debt free net income Depreciation Delta working capital Capex Free cash flow Management projections retail ($ mn) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Revenue Growth Cost of revenue Gross margin Margin Operating expenses Operating EBITDA Margin Depreciation Operating EBIT Margin Taxes Effective tax rate Debt free net income Depreciation Delta working capital Capex Free cash flow Management projection total ($ mn) 2004PF 2005PF 2006PF 2007PF 2008A 2009E 2010E 2011E 2012E 2013E 2014E 2015E Revenue Growth Cost of revenue Gross margin Margin Operating expenses Operating EBITDA Margin Depreciation Operating EBIT Margin Taxes Effective tax rate Confidential <?xml:namespace prefix = st1 ns = "urn:schemas-microsoft-com:office:smarttags" />KPN00026136

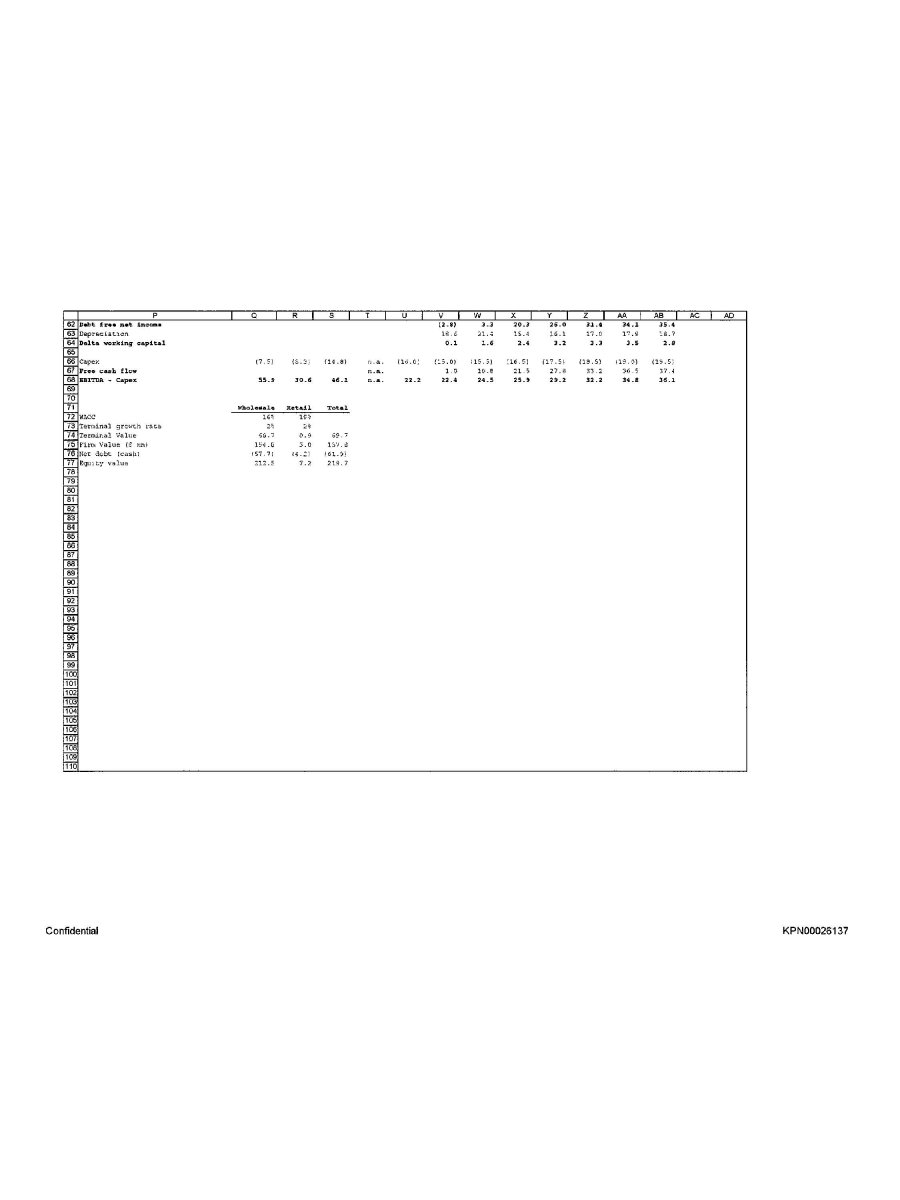

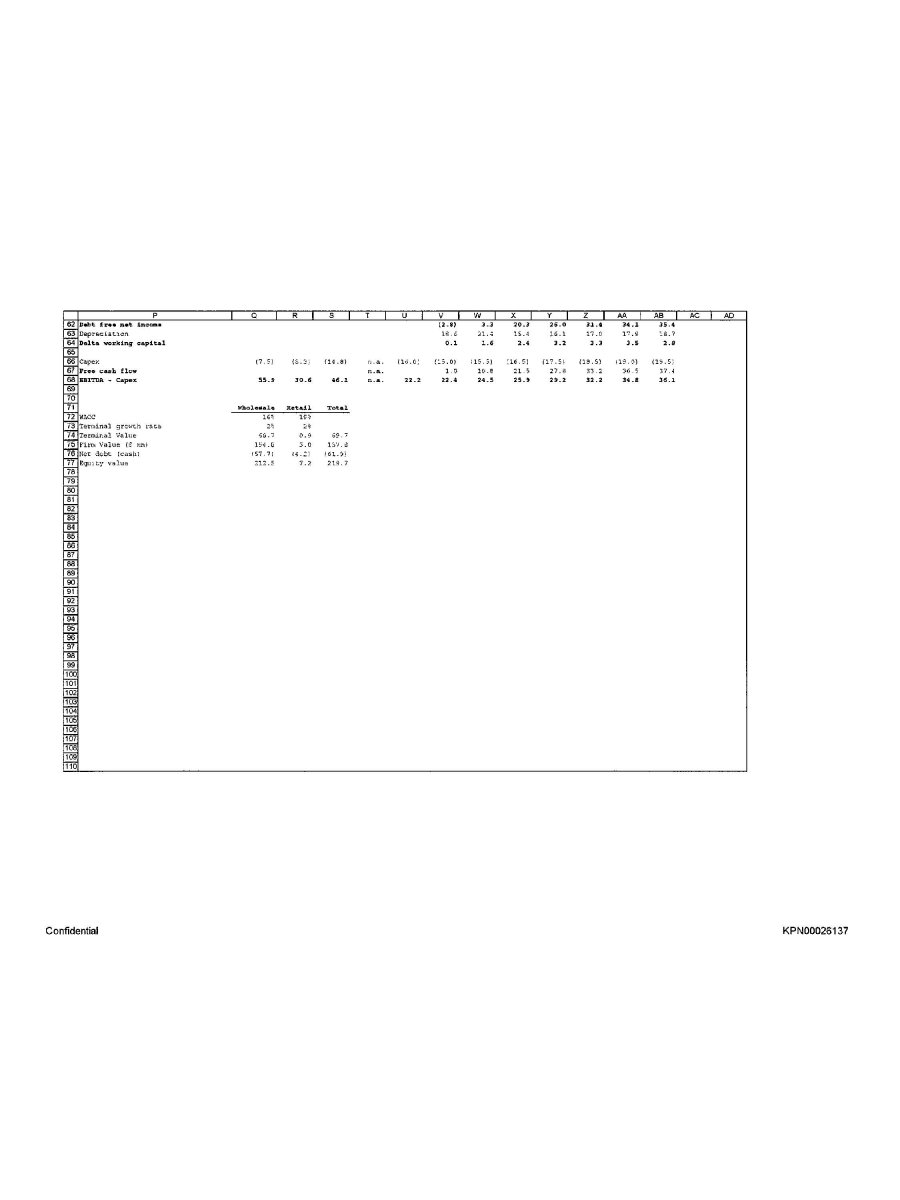

Debt free net income Depreciation Delta working capital Capex Free cash flow EBITDA - Capex Wholesale Retail Total WACC Terminal growth rate Terminal Value Firm Value ($ mn) Net debt (cash) Equity value Confidential KPN00026137

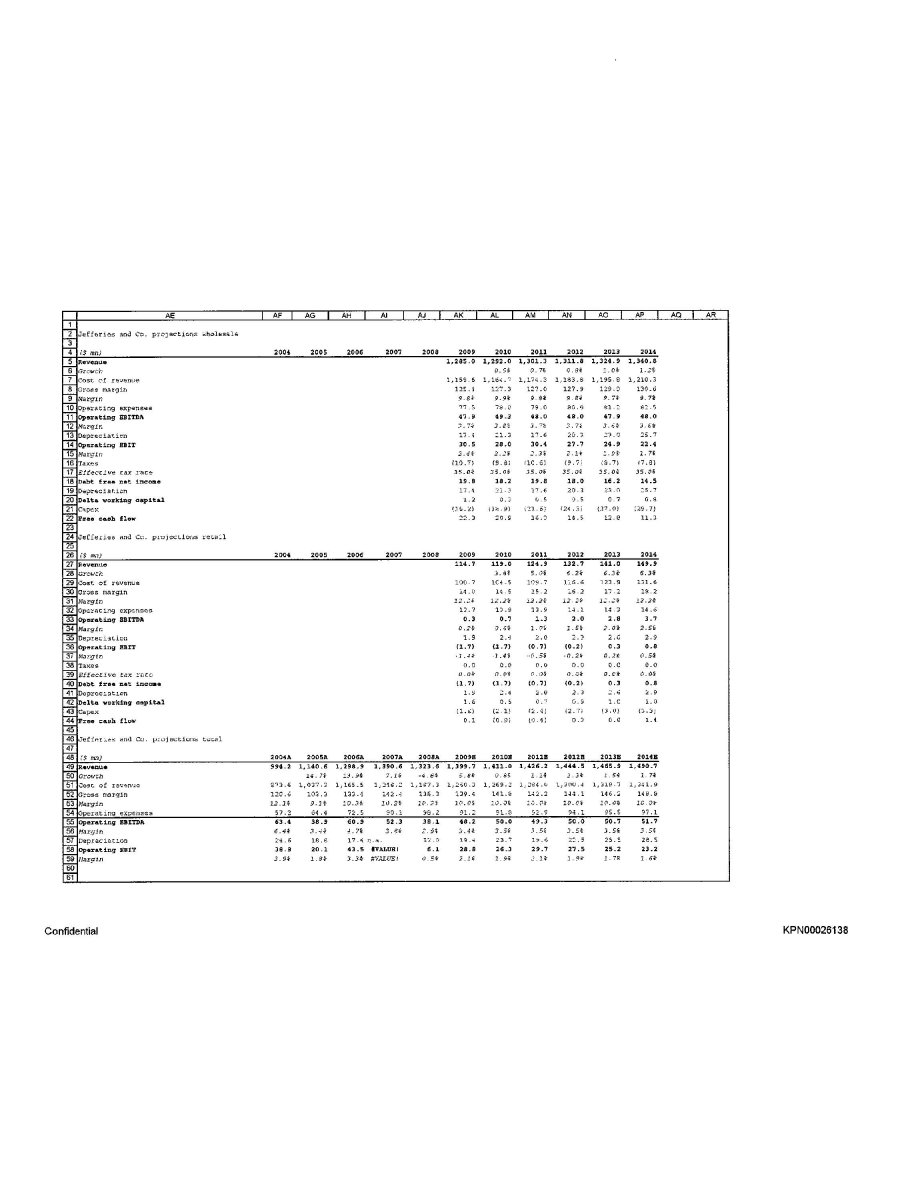

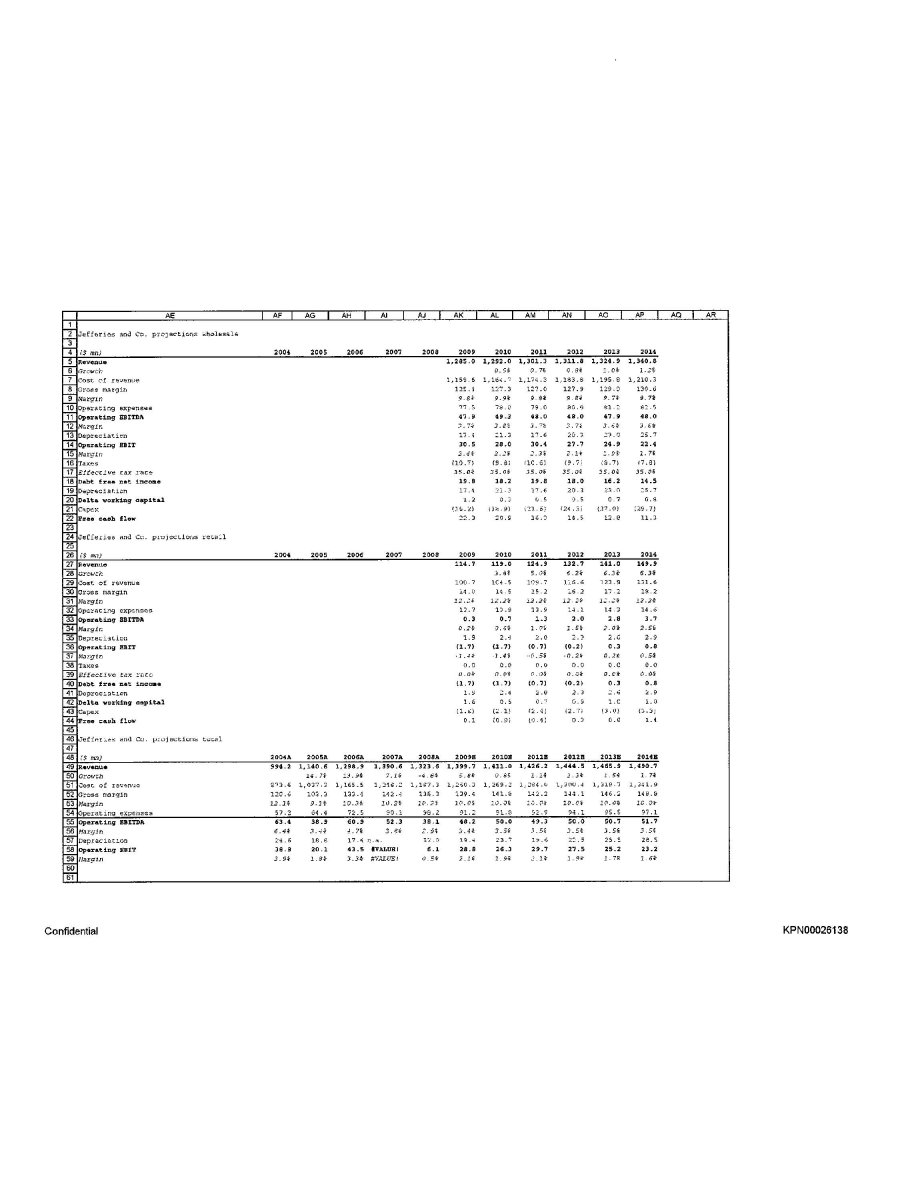

Jefferies and Co. projections wholesale ($ mn) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Revenue Growth Cost of revenue Gross margin Margin Operating expenses Operating EBITDA Margin Depreciation Operating EBIT Margin Taxes Effective tax rate Debt free net income Depreciation Delta working capital Capex Free cash flow Jefferies and Co. projections retail ($ mn) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Revenue Growth Cost of revenue Gross margin Margin Operating expenses Operating EBITDA Margin Depreciation Operating EBIT Margin Taxes Effective tax rate Debt free net income Depreciation Delta working capital Capex Free cash flow Jefferies and Co. projections total ($ mn) 2004A 2005A 2006A 2007A 2008A 2009E 2010E 2011E 2012E 2013E 2014E Revenue Growth Cost of revenue Gross margin Margin Operating expenses Operating EBITDA Margin Depreciation Operating EBIT Margin Confidential KPN00026138

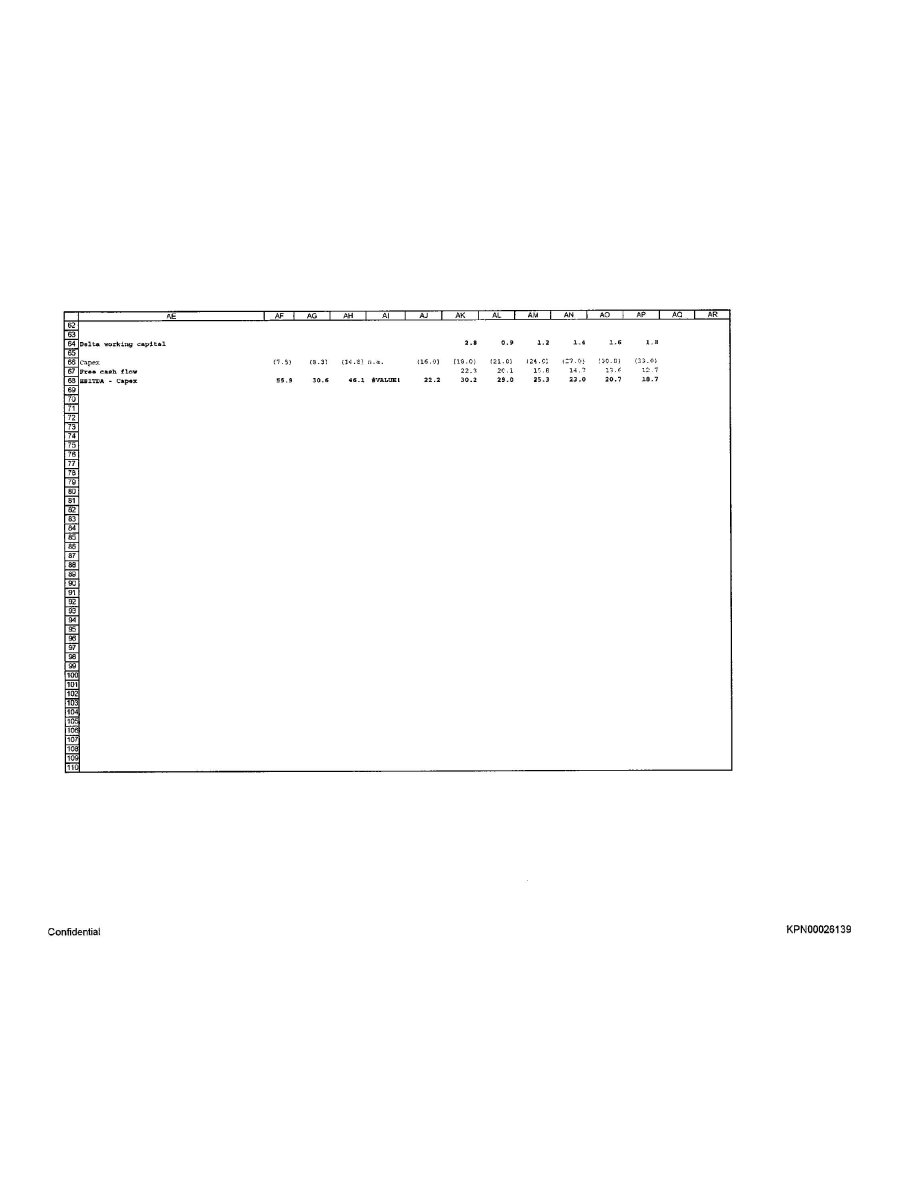

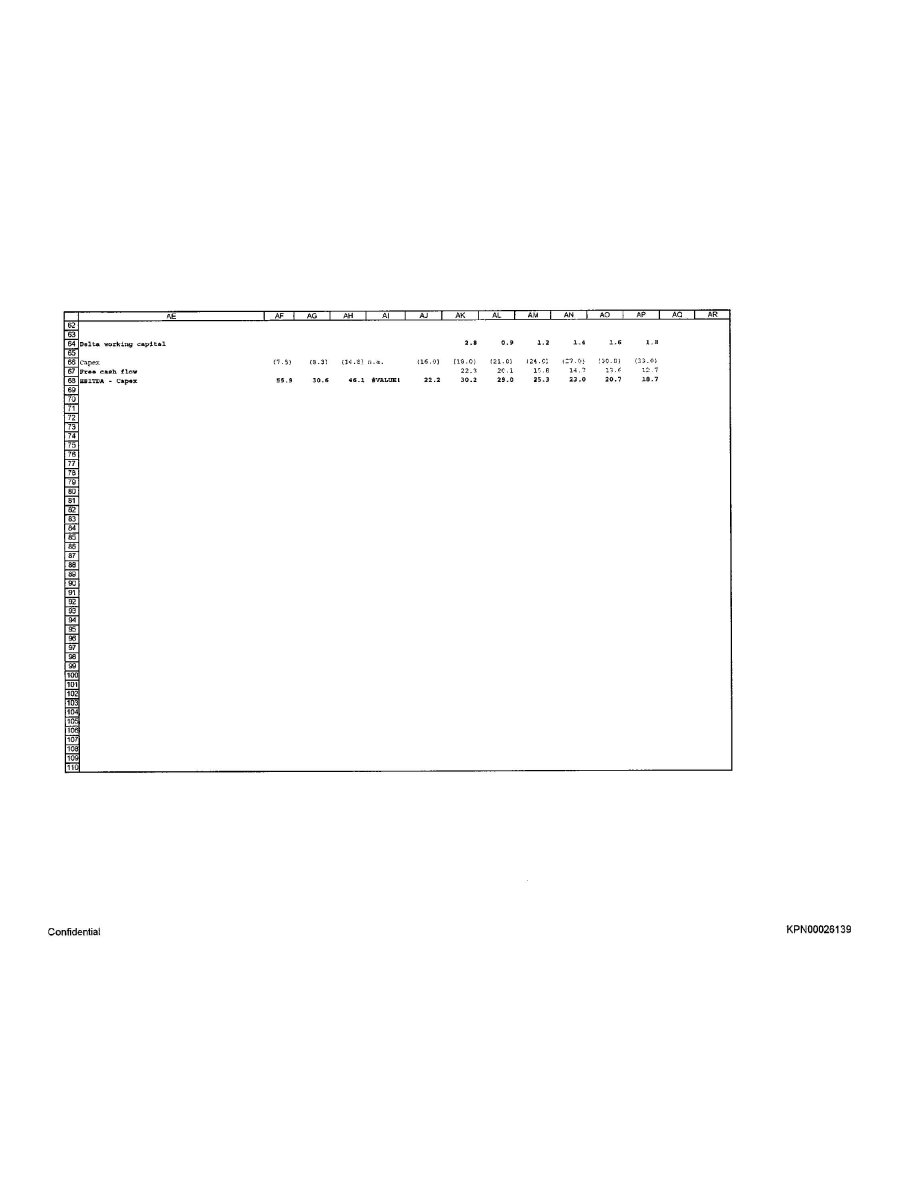

Delta working capital Capex Free cash flow EBITDA - Capex Confidential KPN00026139

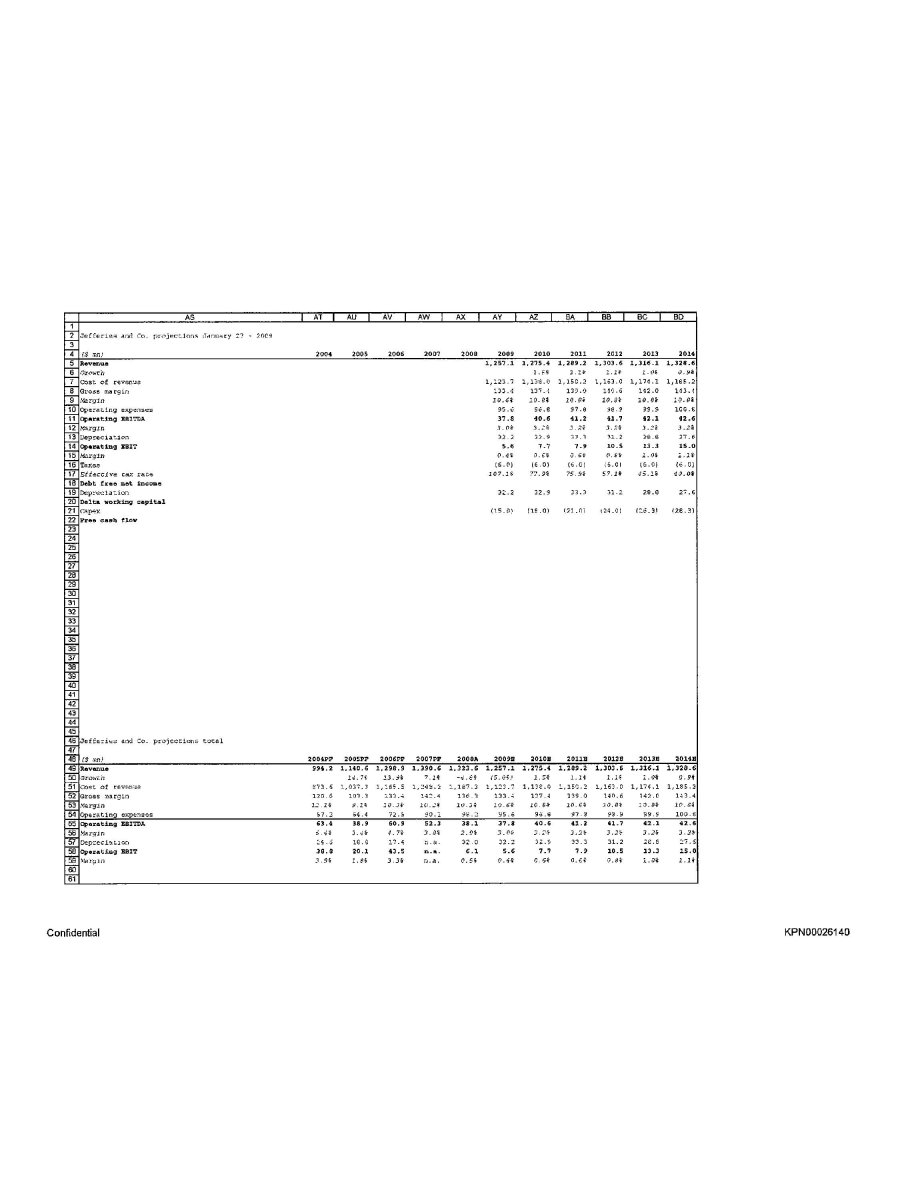

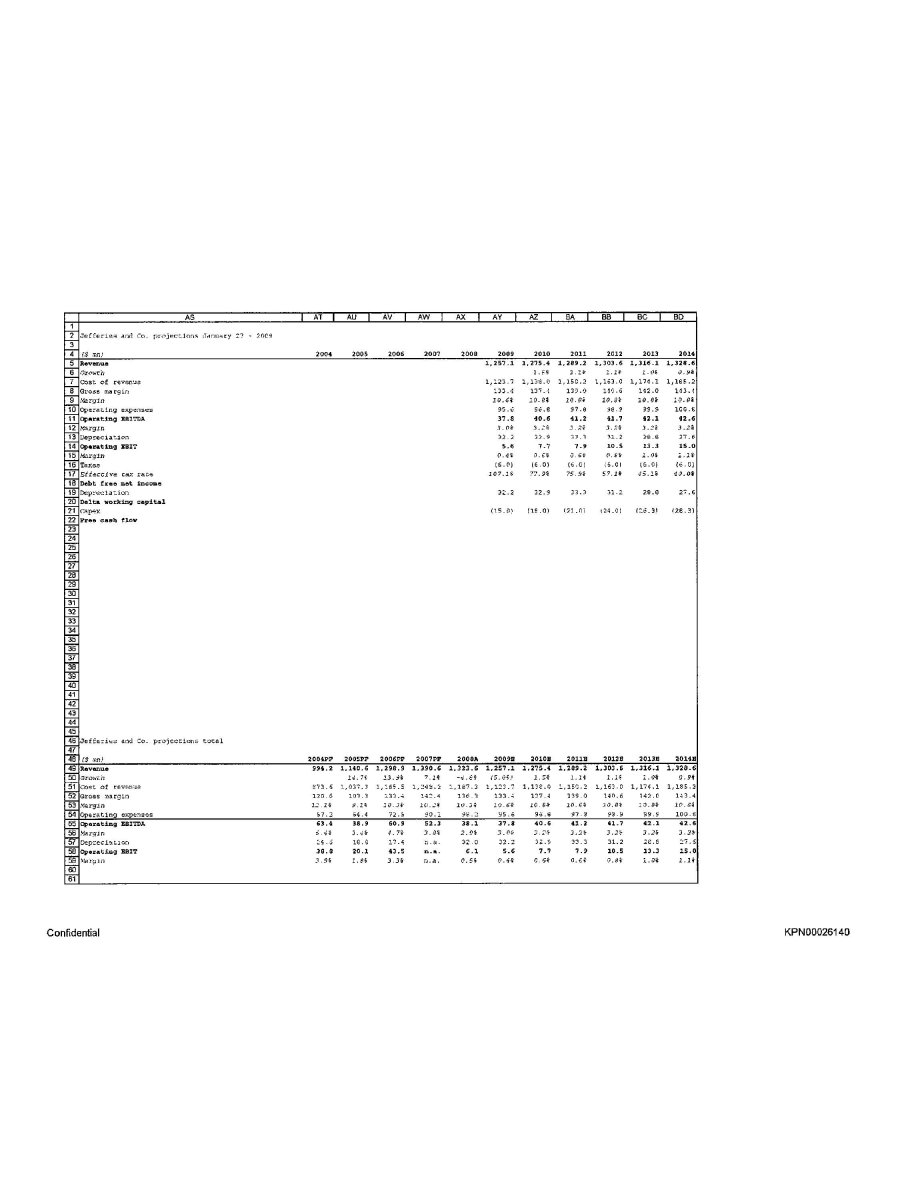

Jefferies and Co. projections January 27 - 2009 ($ mn) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Revenue Growth Cost of revenue Gross margin Margin Operating expenses Operating EBITDA Margin Depreciation Operating EBIT Margin Taxes Effective tax rate Debt free net income Depreciation Delta working capital Capex Free cash flow Jefferies and Co. projections total ($ mn) 2004PF 2005PF 2006PF 2007PF 2008A 2009E 2010E 2011E 2012E 2013E 2014E 2015E Revenue Growth Cost of revenue Gross margin Margin Operating expenses Operating EBITDA Margin Confidential KPN00026140

Delta working capital Capex Free cash flow EBITDA - Capex WACC Terminal growth rate Terminal Value Firm Value ($ mn) Net debt (cash) Equity value Confidential KPN00026141

Cell:C47

Comment: Jan Rodenburg:

Source: Volcano SvB presentation

Cell: D47

Comment: Jan Rodenburg:

Source: Volcano SvB presentation

Cell: E47

Comment: Jan Rodenburg:

Source: Volcano SvB presentation

Cell: F47

Comment: Jan Rodenburg

Source: jeffries report Q4 08

Cell: 047

Comment: Jan Rodenburg:

Source: Volcano SvB presentation

Cell: R47

Comment: Jan Rodenburg:

Source: Volcano SvB presentation

Cell: S47

Comment: Jan Rodenburg:

Source: Volcano SvB presentation

Cell: T47

Comment: Jan Rodenburg

Source: jeffries report Q4 08

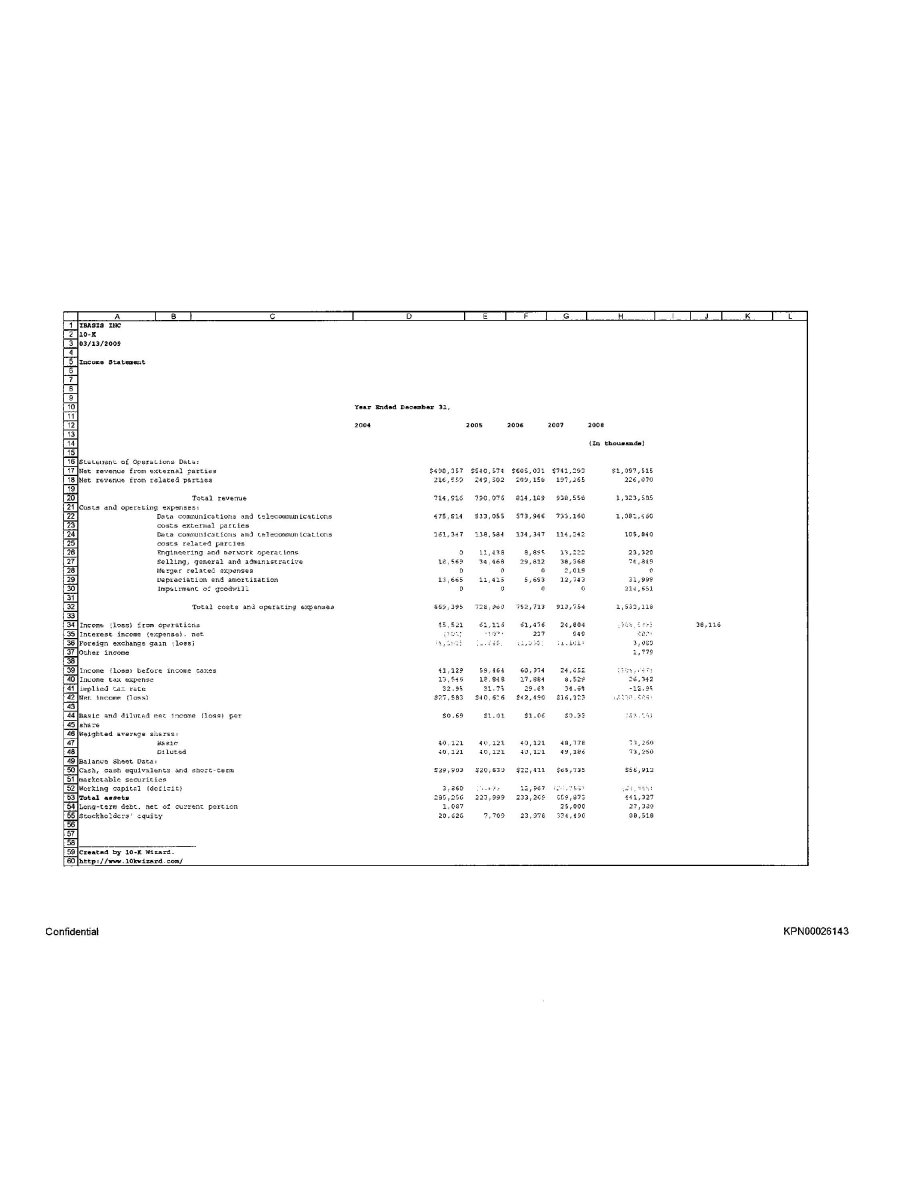

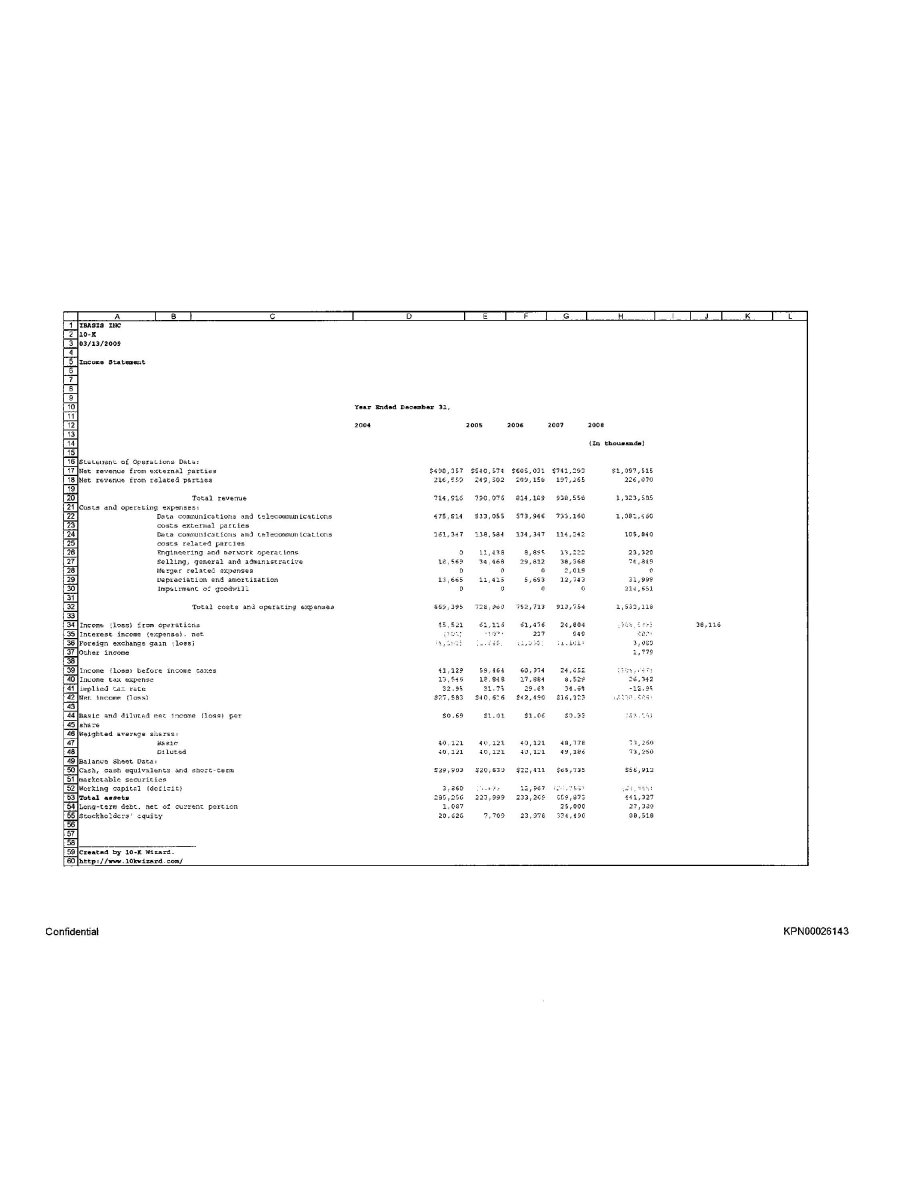

IBASIS INC 10-K 03/13/2009 Income Statement Year Ended December 31, 2004 2005 2006 2007 2008 (In thousands) Statement of Operations Data: Net revenue from external parties Net revenue from related parties Total revenue Costs and operating expenses: Data communications and telecommunications costs external parties Data communications and telecommunications costs related parties Engineering and network operations Selling, general and administrative Merger related expenses Depreciation and amortization Impairment of goodwill Total costs and operating expenses Income (loss) from operations Interest Income (expense), net Foreign exchange gain (loss) Other income Income (loss) before income taxes Income tax expense Implied tax rate Net income (loss) Basic and diluted net income (loss) per share Weighted average shares: Basic Diluted Balance Sheet Data: Cash, cash equivalents and short-term marketable securities Working capital (deficit) Total assets Long-term debt. net of current portion Stockholders’ equity Created by 10-K Wizard. http://www.10kwizard.com/ Confidential KPN00026143

| | M | N | O | P | Q | R |

| 1 | | | | | | |

| 2 | | | | | | |

| 3 | | | | | | |

| 4 | | | | | | |

| 5 | | | | | | |

| 6 | | | | | | |

| 7 | | | | | | |

| 8 | | | | | | |

| 9 | | | | | | |

| 10 | | | | | | |

| 11 | | | | | | |

| 12 | | | | | | |

| 13 | | | | | | |

| 14 | | | | | | |

| 15 | | | | | | |

| 16 | | | | | | |

| 17 | | | | | | |

| 18 | | | | | | |

| 19 | | | | | | |

| 20 | | | | | | |

| 21 | | | | | | |

| 22 | | | | | | |

| 23 | | | | | | |

| 24 | | | | | | |

| 25 | | | | | | |

| 26 | | | | | | |

| 27 | | | | | | |

| 28 | | | | | | |

| 29 | | | | | | |

| 30 | | | | | | |

| 31 | | | | | | |

| 32 | | | | | | |

| 33 | | | | | | |

| 34 | | | | | | |

| 35 | | | | | | |

| 36 | | | | | | |

| 37 | | | | | | |

| 38 | | | | | | |

| 39 | | | | | | |

| 40 | | | | | | |

| 41 | | | | | | |

| 42 | | | | | | |

| 43 | | | | | | |

| 44 | | | | | | |

| 45 | | | | | | |

| 46 | | | | | | |

| 47 | | | | | | |

| 48 | | | | | | |

| 49 | | | | | | |

| 50 | | | | | | |

| 51 | | | | | | |

| 52 | | | | | | |

| 53 | | | | | | |

| 54 | | | | | | |

| 55 | | | | | | |

| 56 | | | | | | |

| 57 | | | | | | |

| 58 | | | | | | |

| 59 | | | | | | |

| 60 | | | | | | |

Confidential KPN00026144

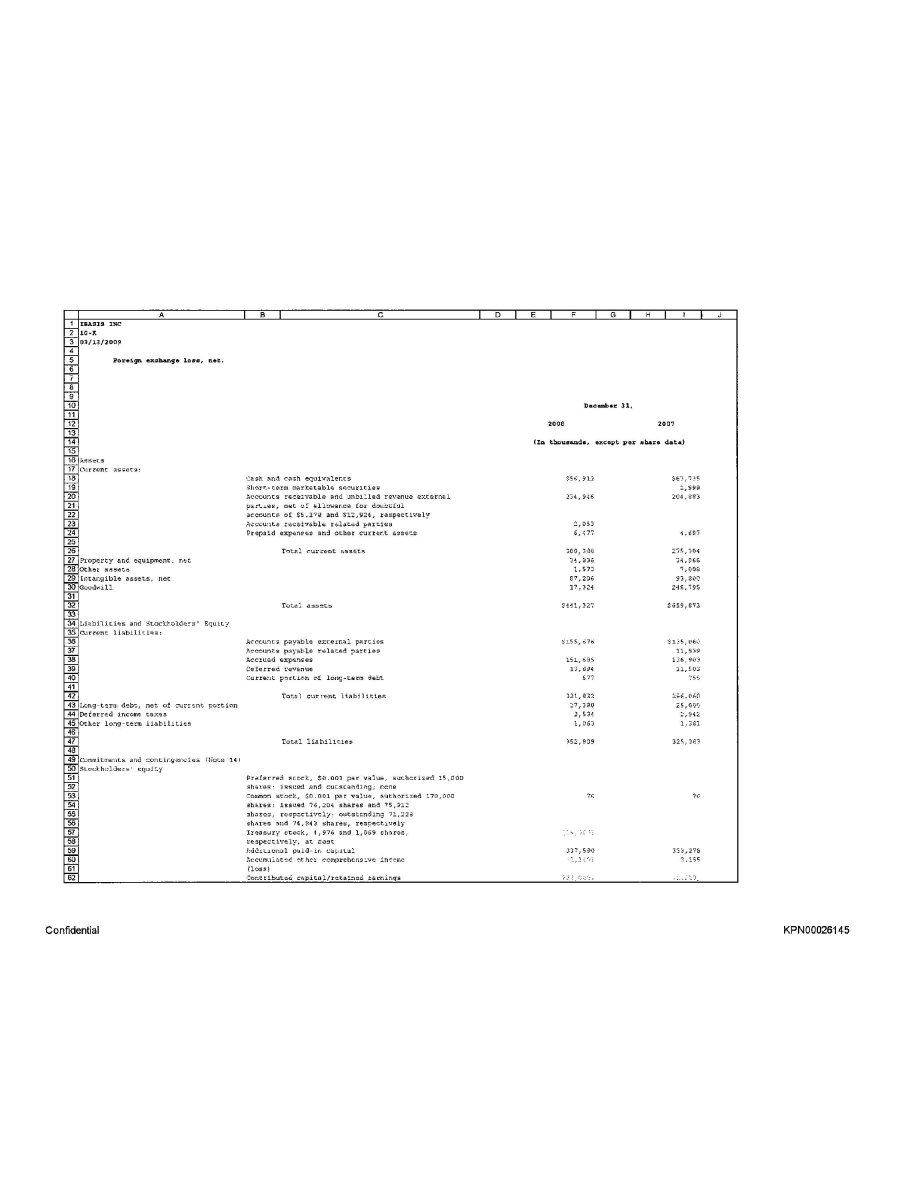

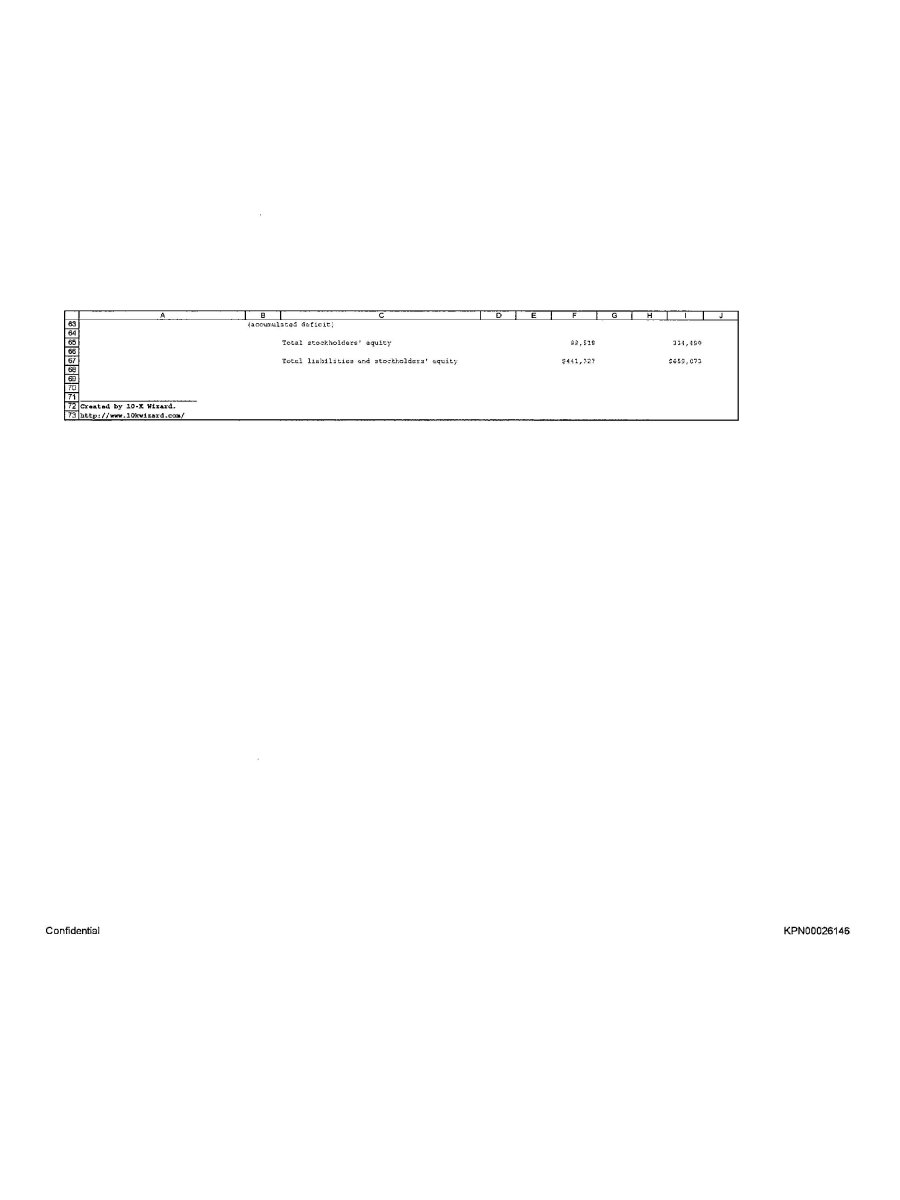

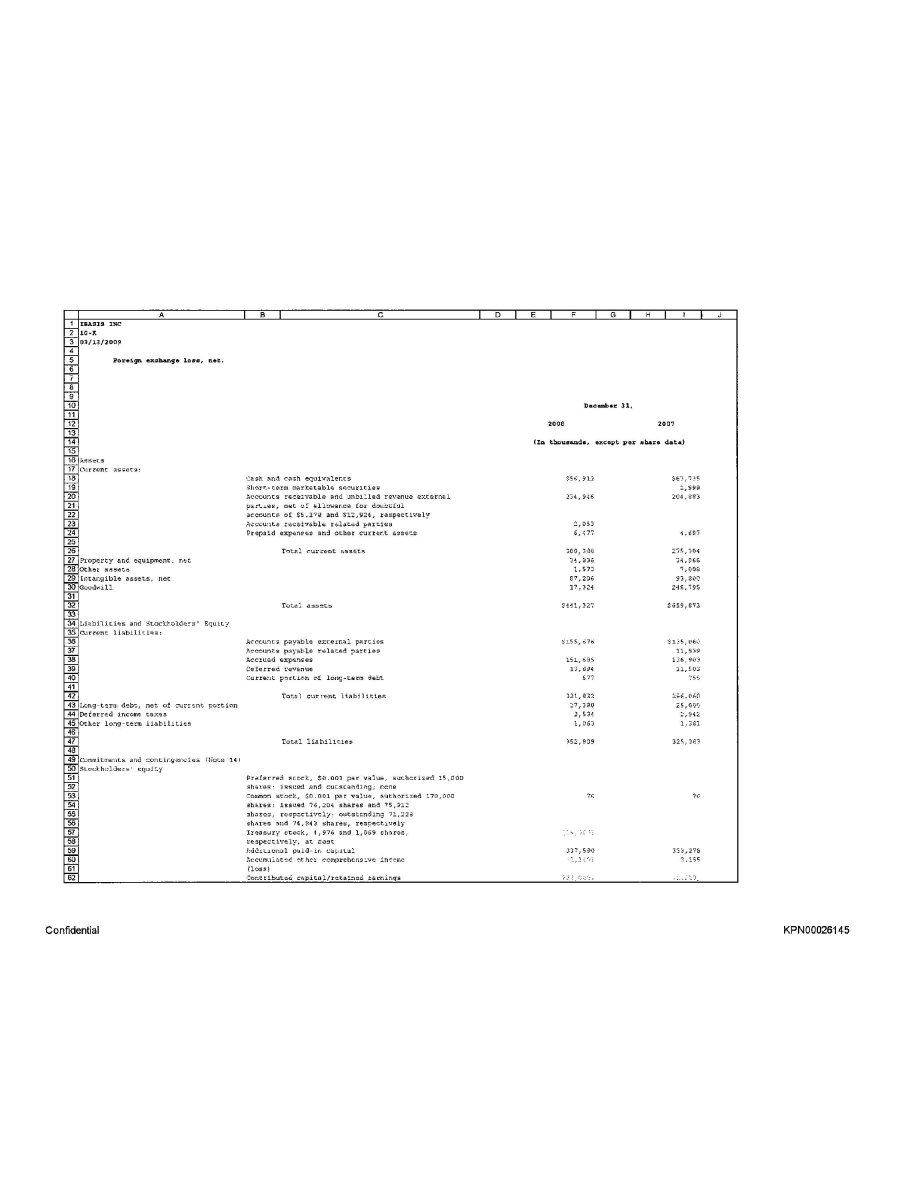

IBASIS INC 10-K 03/13/2009 Foreign exchange loss, net. December 31, 2008 2007 (In thousands, except per share data) Assets Current assets: Cash and cash equivalents Short-term marketable securities Accounts receivable and unbilled revenue external parties, net of allowance (or doubtful accounts of $5,178 and $12,924, respectively Accounts receivable related parties Prepaid expenses and other current assets Total current assets Property and equipment, net Other assets Intangible assets, net Goodwill Total assets Liabilities and Stockholders’ Equity Current liabilities: Accounts payable external parties Accounts payable related parties Accrued expenses Deferred revenue Current portion of long-term debt Total current liabilities Long-term debt, net of current portion Deferred income taxes Other long-term liabilities Total liabilities Commitments and contingencies (Note 14) Stockholders’ equity Preferred stock, $0.001 par value, authorized 15,000 shares: issued and outstanding: none Common stock, $0.001 par value, authorized 170,000 shares: issued 76,204 shares and 75,912 shares, respectively: outstanding 71,228 shares and 74,843 shares, respectively Treasury stock, 4,976 and 1,069 shares, respectively, at cost Additional paid-in capital Accumulated other comprehensive income (loss) Contributed capital/retained earnings Confidential KPN00026145

(accumulated deficit) Total stockholders’ equity Total liabilities and stockholders’ equity Created by 10-K Wizard. http://www.10kwizard.com/ Confidential KPN00026146

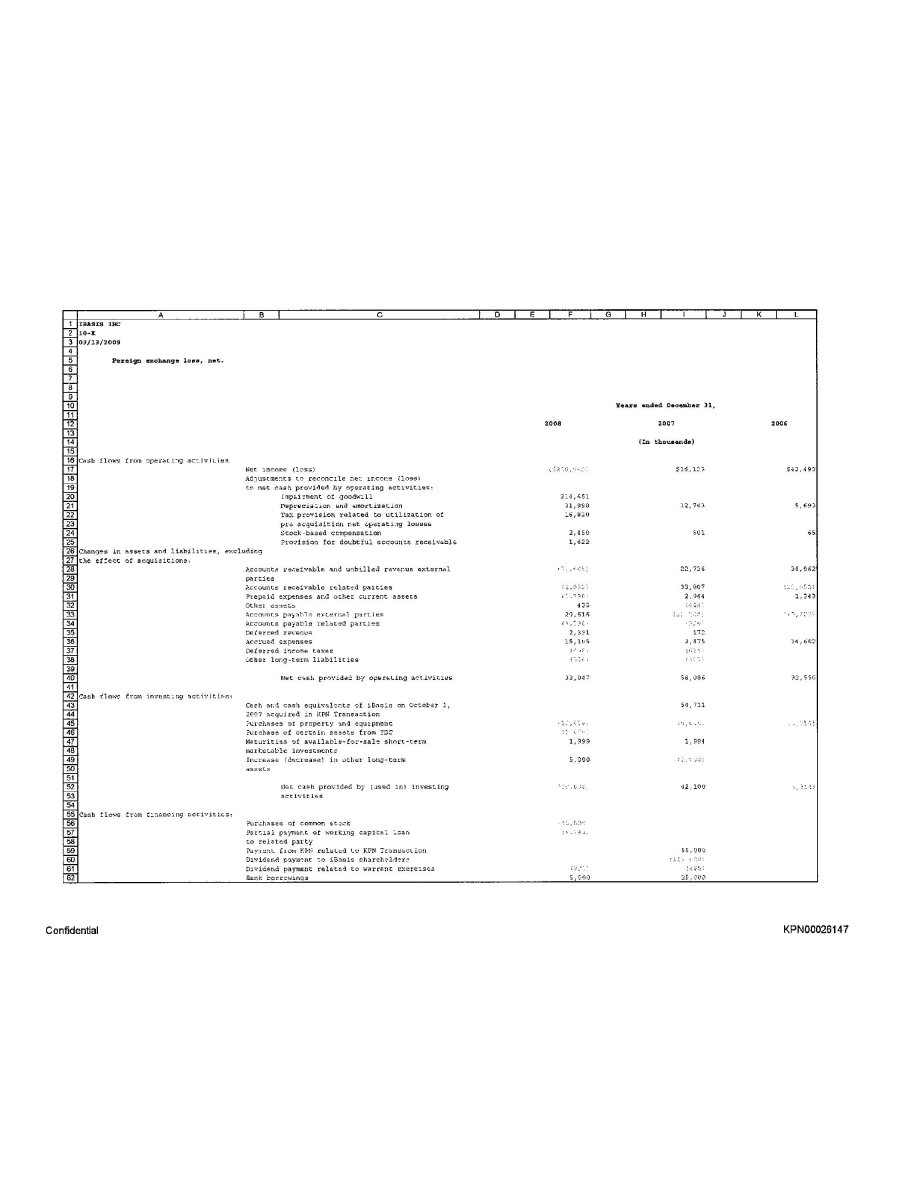

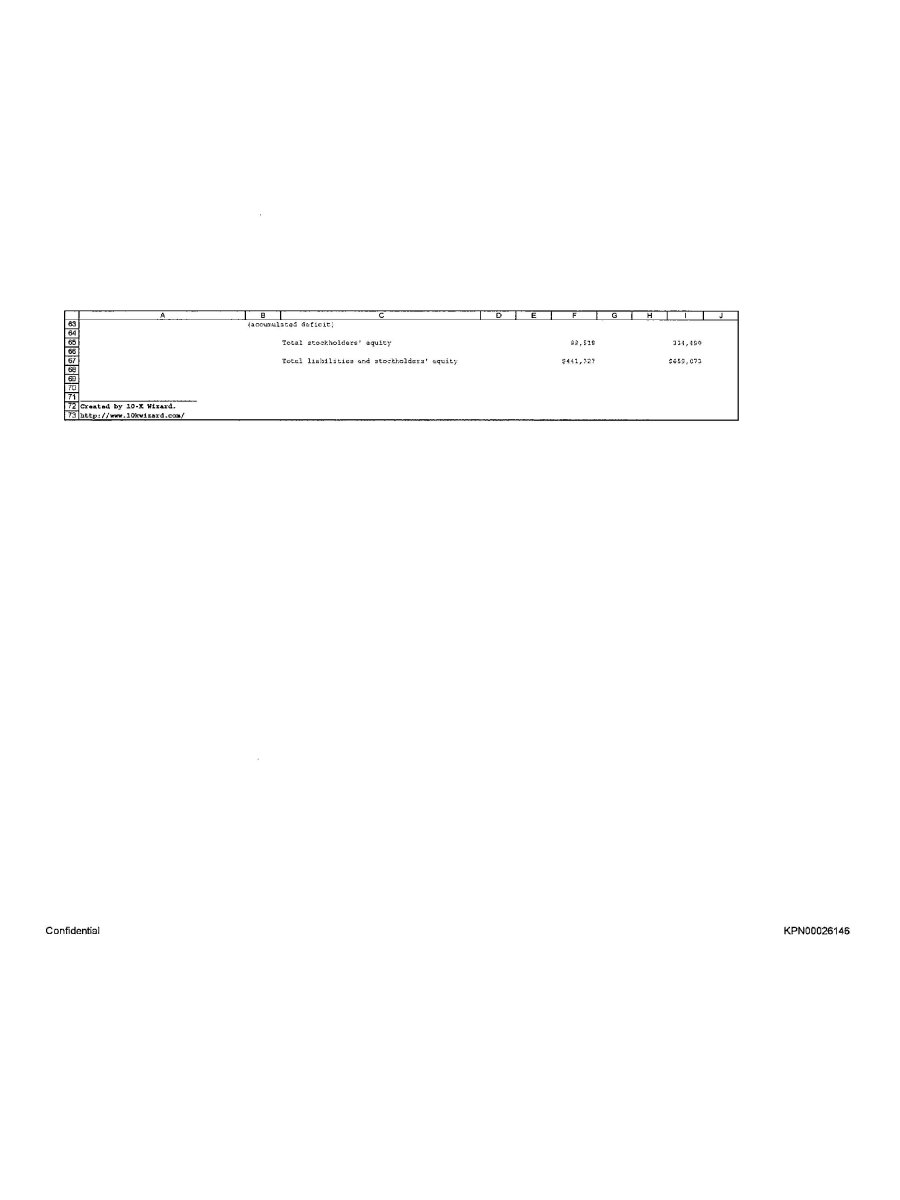

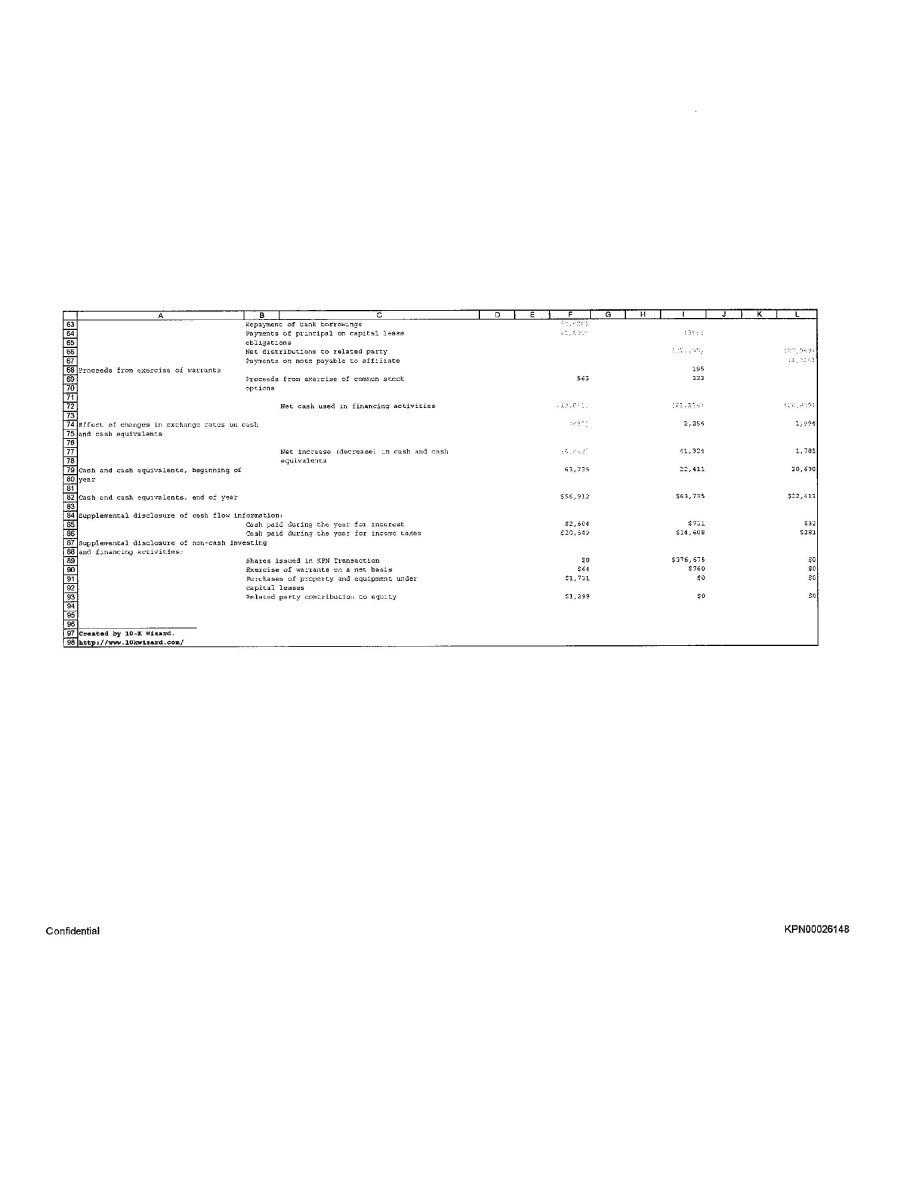

IBASIS INC 10-K 03/13/2009 Foreign exchange loss, net. Years ended December 31, 2008 2007 2006 (In thousands) Cash flows from operating activities Net income (loss) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Impairment of goodwill Depreciation and amortization Tax provision related to utilization of pre acquisition net operating losses Stock-based compensation Provision for doubtful accounts receivable Changes in assets and liabilities, excluding the effect of acquisitions: Accounts receivable and unbilled revenue external parties Accounts receivable related parties Prepaid expenses and other current assets Other assets Accounts payable external parties Accounts payable related parties Deferred revenue Accrued expenses Deferred income taxes Other long-term liabilities Net cash provided by operating activities Cash flows from investing activities: Cash and cash equivalents of iBasis on October 1, 2007 acquired in KPN Transaction Purchases of property and equipment Purchase of certain assets from TDC Maturities of available-for-sale short-term marketable investments Increase (decrease) in other long-term assets Net cash provided by (used in) investing activities Cash flows from financing activities: Purchases of common stock Partial payment of working capital loan to related party Payment from KPN related to KPN Transaction Dividend payment to iBasis shareholder Dividend payment related to warrant exercises Bank borrowings Confidential KPN00026147

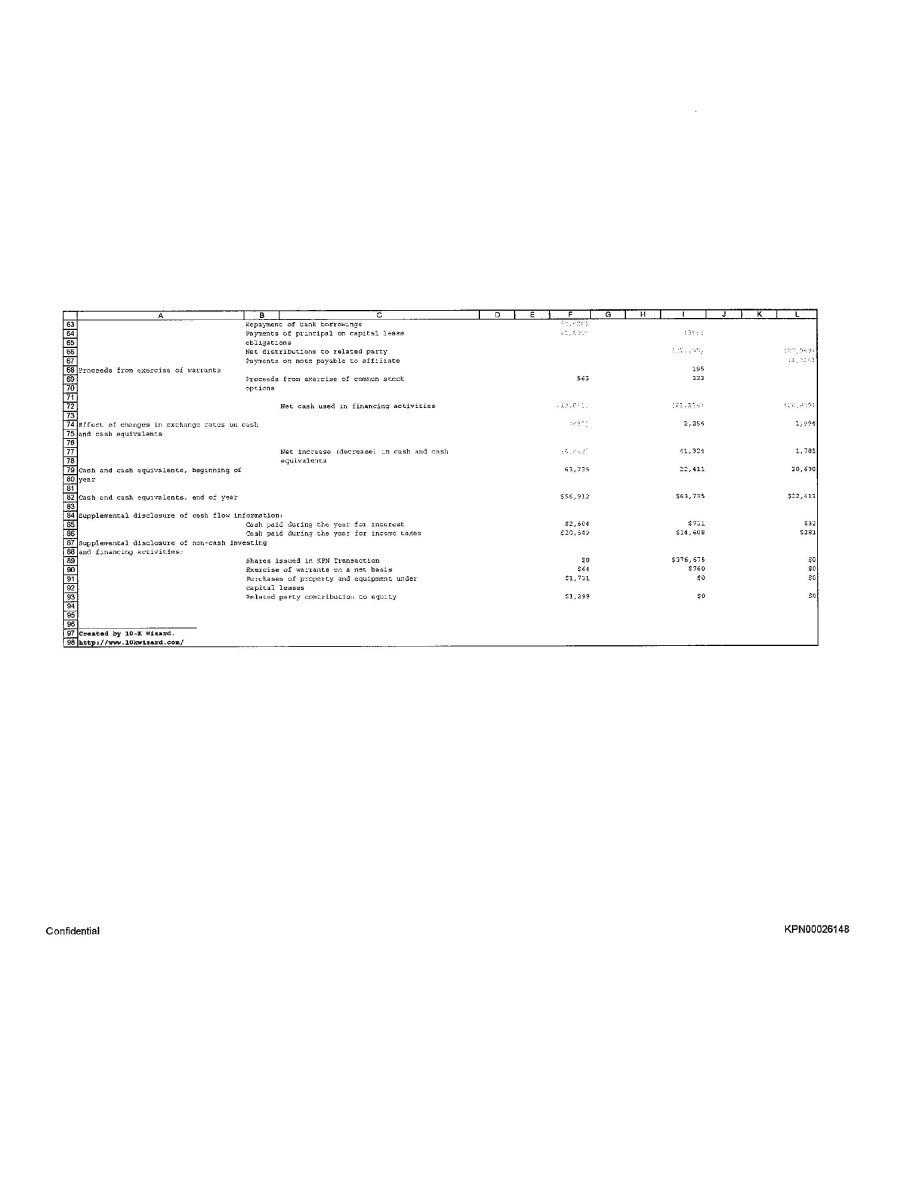

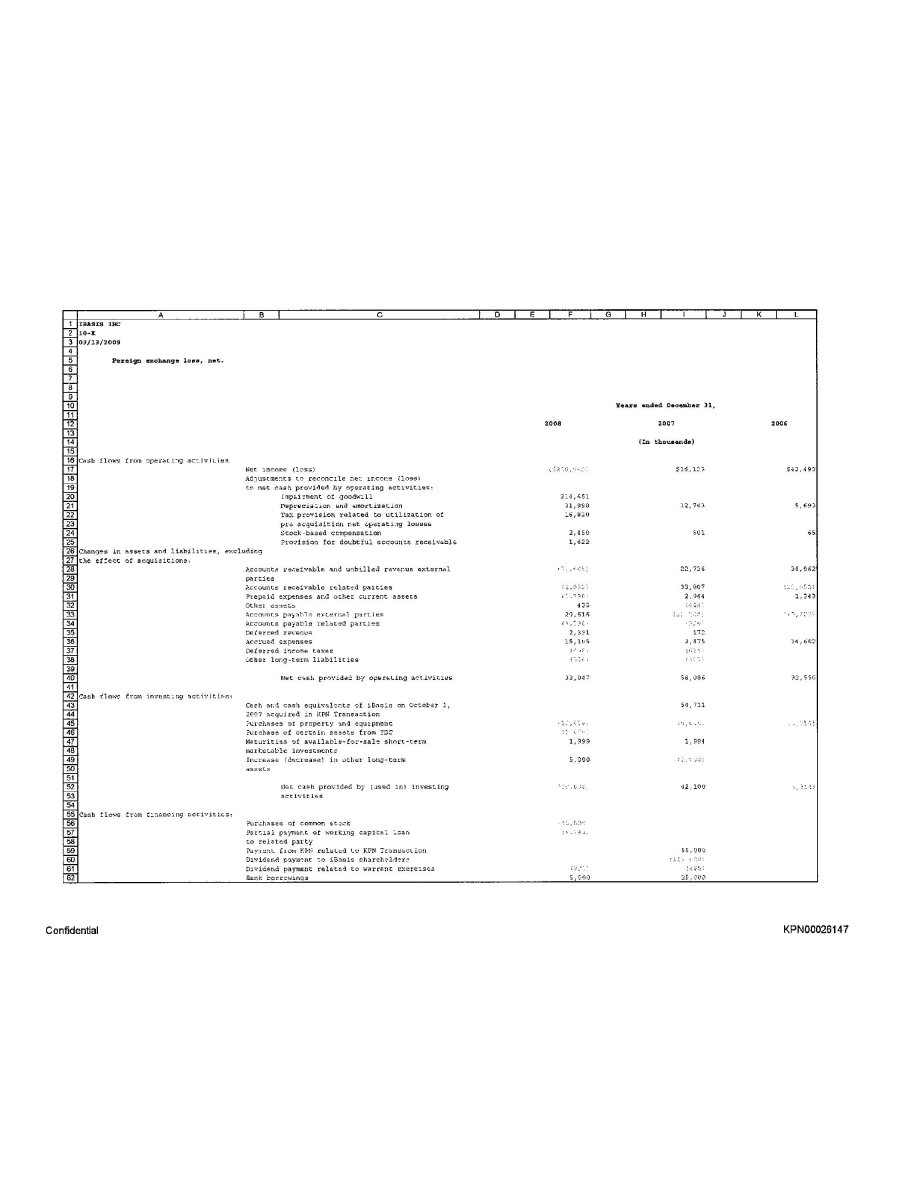

Repayment of bank borrowings Payments of principal on capital lease obligations Net distributions to related party Payments on note payable to affiliate Proceeds from exercise of warrants Proceeds from exercise of common stock options Net cash used in financing activities Effect of changes in exchange rates on cash and cash equivalents Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Supplemental disclosure of cash flow information: Cash paid during the year for interest Cash paid during the year for income taxes Supplemental disclosure of non-cash Investing and financing activities: Shares issued in KPN Transaction Exercise of warrants on a net basis Purchases of property and equipment under capital leases Related party contribution to equity Created by 10-K Wizard. http://www.10kwizard.com/Confidential KPN00026148

| | M | | | | | |

| 1 | | | | | | |

| 2 | | | | | | |

| 3 | | | | | | |

| 4 | | | | | | |

| 5 | | | | | | |

| 6 | | | | | | |

| 7 | | | | | | |

| 8 | | | | | | |

| 9 | | | | | | |

| 10 | | | | | | |

| 11 | | | | | | |

| 12 | | | | | | |

| 13 | | | | | | |

| 14 | | | | | | |

| 15 | | | | | | |

| 16 | | | | | | |

| 17 | | | | | | |

| 18 | | �� | | | | |

| 19 | | | | | | |

| 20 | | | | | | |

| 21 | | | | | | |

| 22 | | | | | | |

| 23 | | | | | | |

| 24 | | | | | | |

| 25 | | | | | | |

| 26 | | | | | | |

| 27 | | | | | | |

| 28 | | | | | | |

| 29 | | | | | | |

| 30 | | | | | | |

| 31 | | | | | | |

| 32 | | | | | | |

| 33 | | | | | | |

| 34 | | | | | | |

| 35 | | | | | | |

| 36 | | | | | | |

| 37 | | | | | | |

| 38 | | | | | | |

| 39 | | | | | | |

| 40 | | | | | | |

| 41 | | | | | | |

| 42 | | | | | | |

| 43 | | | | | | |

| 44 | | | | | | |

| 45 | | | | | | |

| 46 | | | | | | |

| 47 | | | | | | |

| 48 | | | | | | |

| 49 | | | | | | |

| 50 | | | | | | |

| 51 | | | | | | |

| 52 | | | | | | |

| 53 | | | | | | |

| 54 | | | | | | |

| 55 | | | | | | |

| 56 | | | | | | |

| 57 | | | | | | |

| 58 | | | | | | |

| 59 | | | | | | |

| 60 | | | | | | |

| 61 | | | | | | |

| 62 | | | | | | |

Confidential KPN00026149

| | M | | | | | |

| 63 | | | | | | |

| 64 | | | | | | |

| 65 | | | | | | |

| 66 | | | | | | |

| 67 | | | | | | |

| 68 | | | | | | |

| 69 | | | | | | |

| 70 | | | | | | |

| 71 | | | | | | |

| 72 | | | | | | |

| 73 | | | | | | |

| 74 | | | | | | |

| 75 | | | | | | |

| 76 | | | | | | |

| 77 | | | | | | |

| 78 | | | | | | |

| 79 | | | | | | |

| 80 | | | | | | |

| 81 | | | | | | |

| 82 | | | | | | |

| 83 | | | | | | |

| 84 | | | | | | |

| 85 | | | | | | |

| 86 | | | | | | |

| 87 | | | | | | |

| 88 | | | | | | |

| 89 | | | | | | |

| 90 | | | | | | |

| 91 | | | | | | |

| 92 | | | | | | |

| 93 | | | | | | |

| 94 | | | | | | |

| 95 | | | | | | |

| 96 | | | | | | |

| 97 | | | | | | |

| 98 | | | | | | |

Confidential KPN00026150

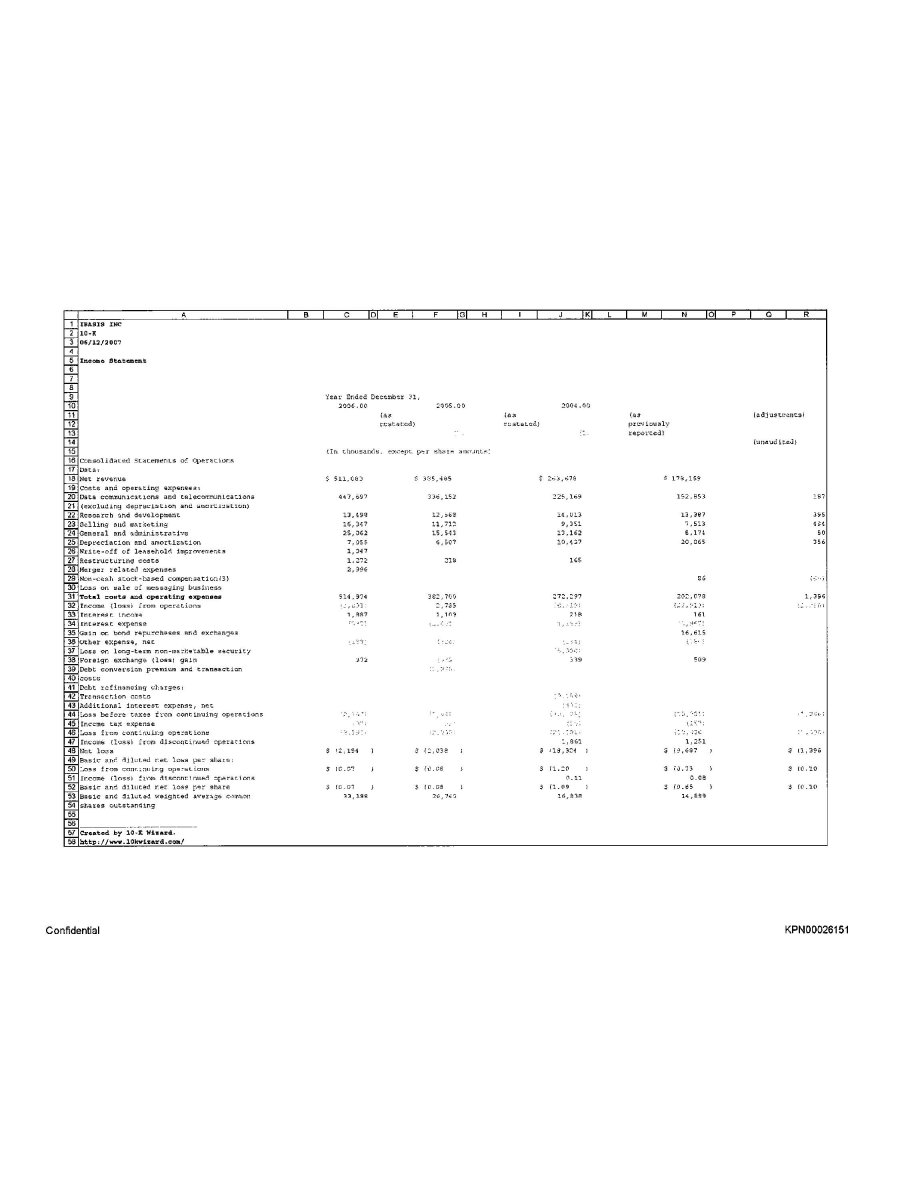

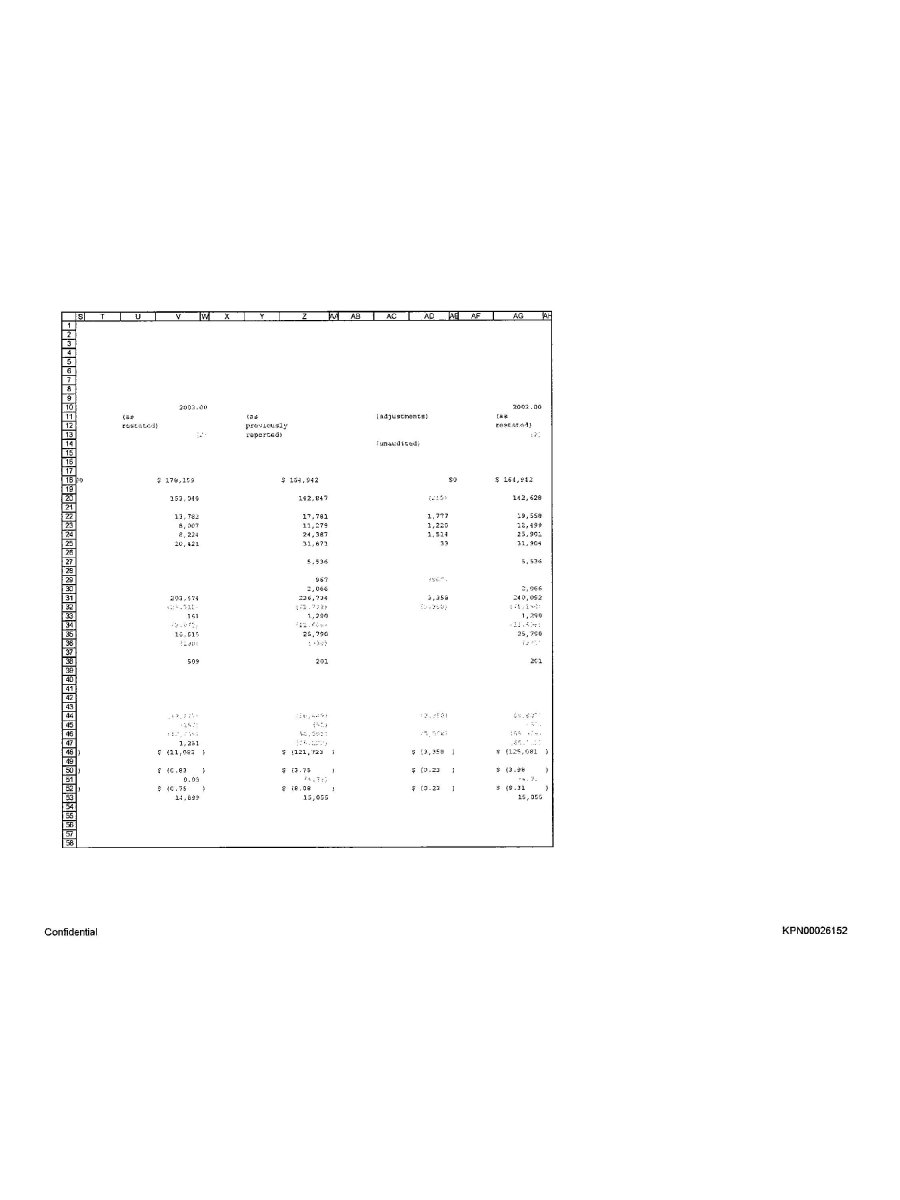

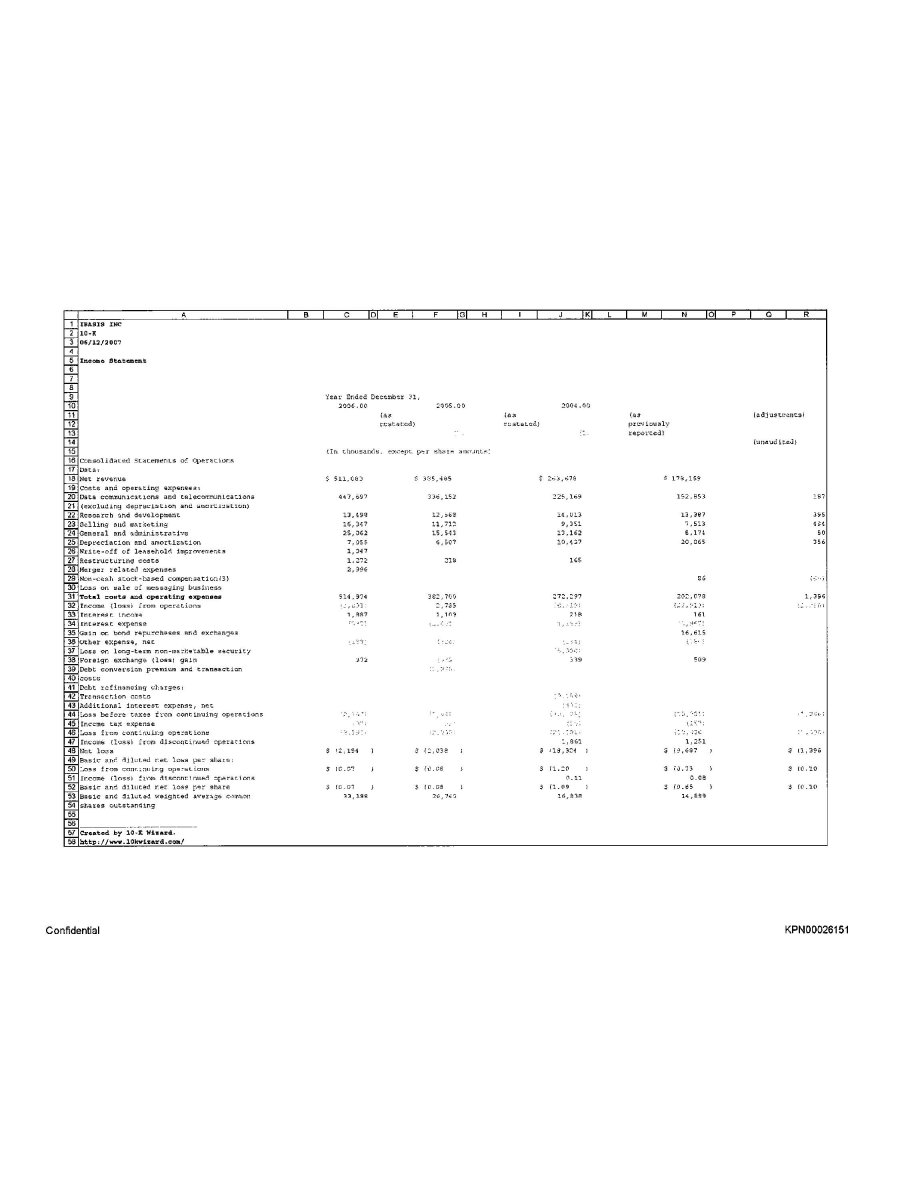

IBASIS INC 10-K 06/12/2007 Income Statement Year Ended December 31, 2006.00 (as restated) 2005.00 (as restated) 2004.00 (as previously reported) (adjustments) (unaudited) (In thousands, except per share amounts) Consolidated Statements of Operations Data: Net revenue Costs and operating expenses: Data communications and telecommunications (excluding depreciation and amortization) Research and development Selling and marketing General and administrative Depreciation and amortization Write-off of leasehold improvements Restructuring costs Merger related expenses Non-cash stock-based compensation(3) Loss on sale of messaging business Total costs and operating expenses Income (loss) from operations Interest income Interest expenses Gain on bond repurchases and exchanges Other expense, net Loss on long-term non-marketable security Foreign exchange (loss) gain Debt conversion premium and transaction costs Debt refinancing charges: Transaction costs Additional interest expense, net Loss before taxes from continuing operations Income tax expense Loss from continuing operations Income (loss) from discontinued operations Net loss Basic and diluted net loss per share: Loss from continuing operations income (loss) from discontinued operations Basic and diluted net loss per share Basic and diluted weighted average common shares outstanding Created by 10-K Wizard. http://www.10kwizard.com/ Confidential KPN00026151

2003.00 2002.00 (as restated) (as previously reported) (adjustments) (as restated) (unaudited) Confidential KPN00026152

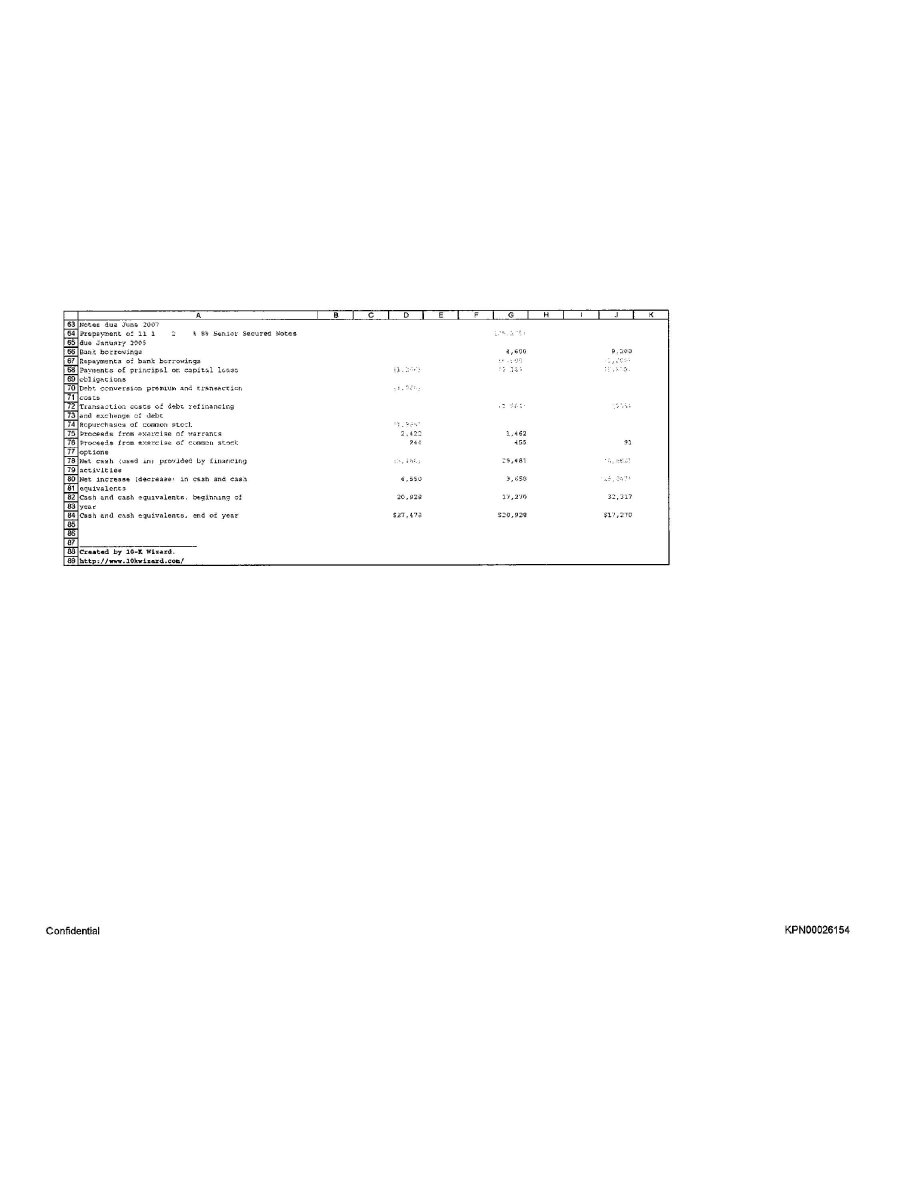

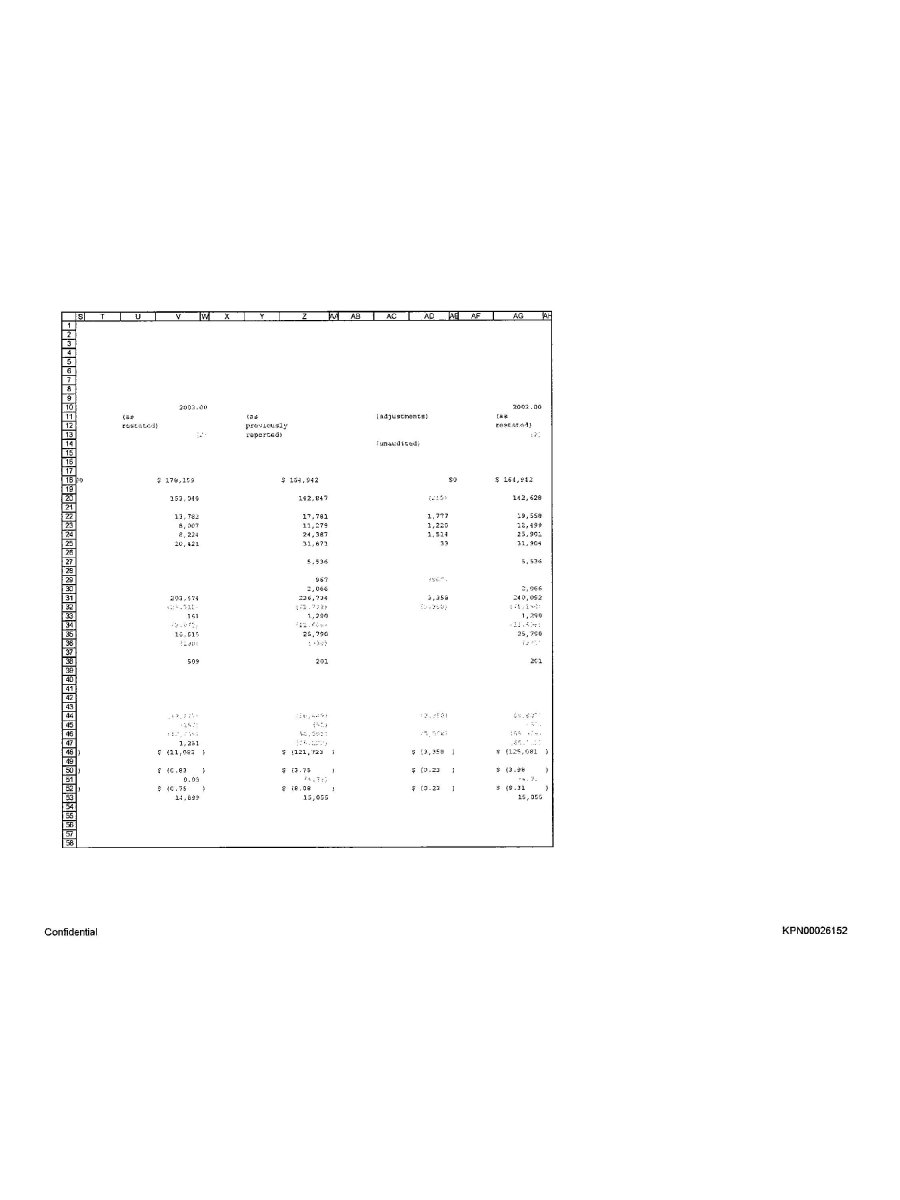

IBASIS INC 10-K 03/16/2006 Consolidated Statements of Cash Flow Years ended December 31, 2005.00 2004.00 2003.00 (In thousands) Cash flows from operating activities Net loss Income from discontinued operations Loss from continuing operations Adjustments to reconcile loss from continuing operations to net cash used in operating activities: Gain on bond repurchases and exchanges Restructuring costs Depreciation and amortization Amortization of deferred debt financing costs Amortization of discount on short-term marketable securities Non-cash debt conversion premium Amortization of deferred compensation Loss on long-term non-marketable security Fair value of warrant issued in debt refinancing Allowance for doubtful accounts Recovery of previously reserved receivable balance Changes in current assets and liabilities: Accounts receivable, net Prepaid expenses and other current assets Other assets Accounts payable Deferred revenue Accrued expenses Other long-term liabilities Net cash provided by (used in) continuing operating activities Cash flows from investing activities: Purchases of property and equipment Purchases of available-for-sale short-term marketable investments Maturities of available-for-sale short-term marketable investments Proceeds from sale of Speech Solutions business Proceeds from earn-out relating to sale of Speech Solutions business Payment associated with the sale of Speech Solutions businesses Payment associated with the sale of Speech Solutions businesses Net cash used in investing activities Cash flows from financing activities: Redemption of 5 % Convertible Subordinated Notes Proceeds from sale of common stock in private placement Transaction costs of private placement Proceeds from issuance of 8% Secured Convertible Confidential KPN00026153

<?xml:namespace prefix = o ns = "urn:schemas-microsoft-com:office:office" />

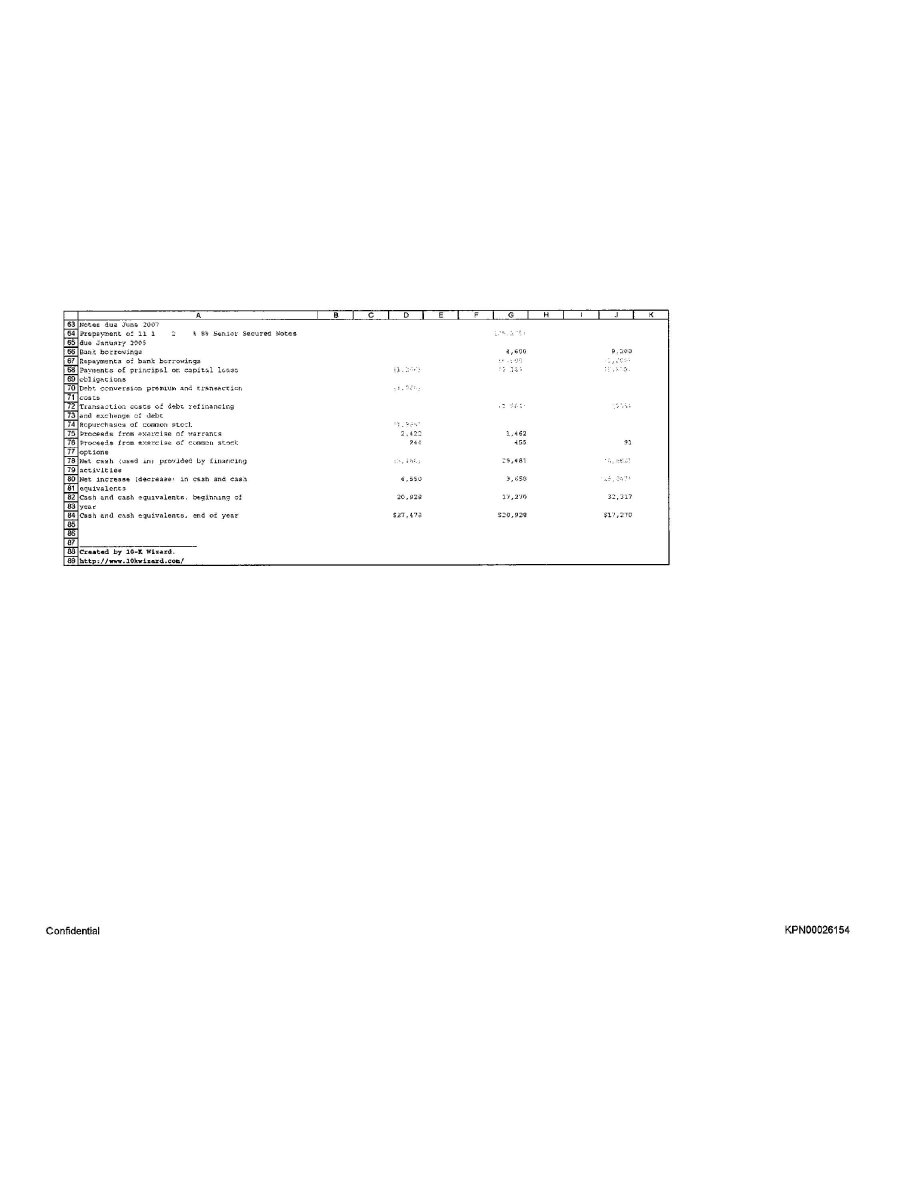

Notes due June 2007 Prepayment of 11 1 2 % 8% Senior Secured Notes due January 2005 Bank borrowings Repayments of bank borrowings Payments of principal on capital lease obligations Debt conversion premium and transaction costs Transaction costs of debt refinancing and exchange of debt Repurchase of common stock Proceeds from exercise of warrants Proceeds from exercise of common stock options Net cash (used in) provided by financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Confidential KPN00026154

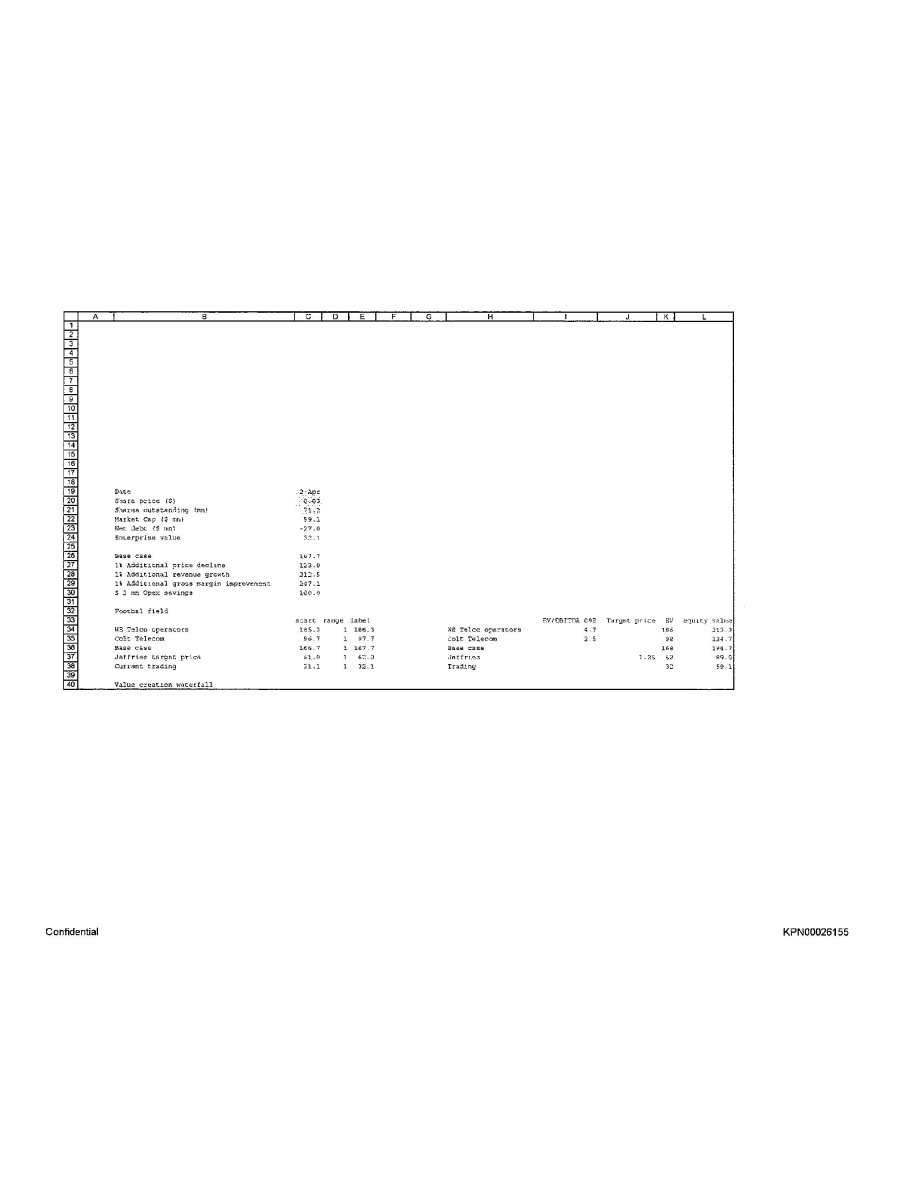

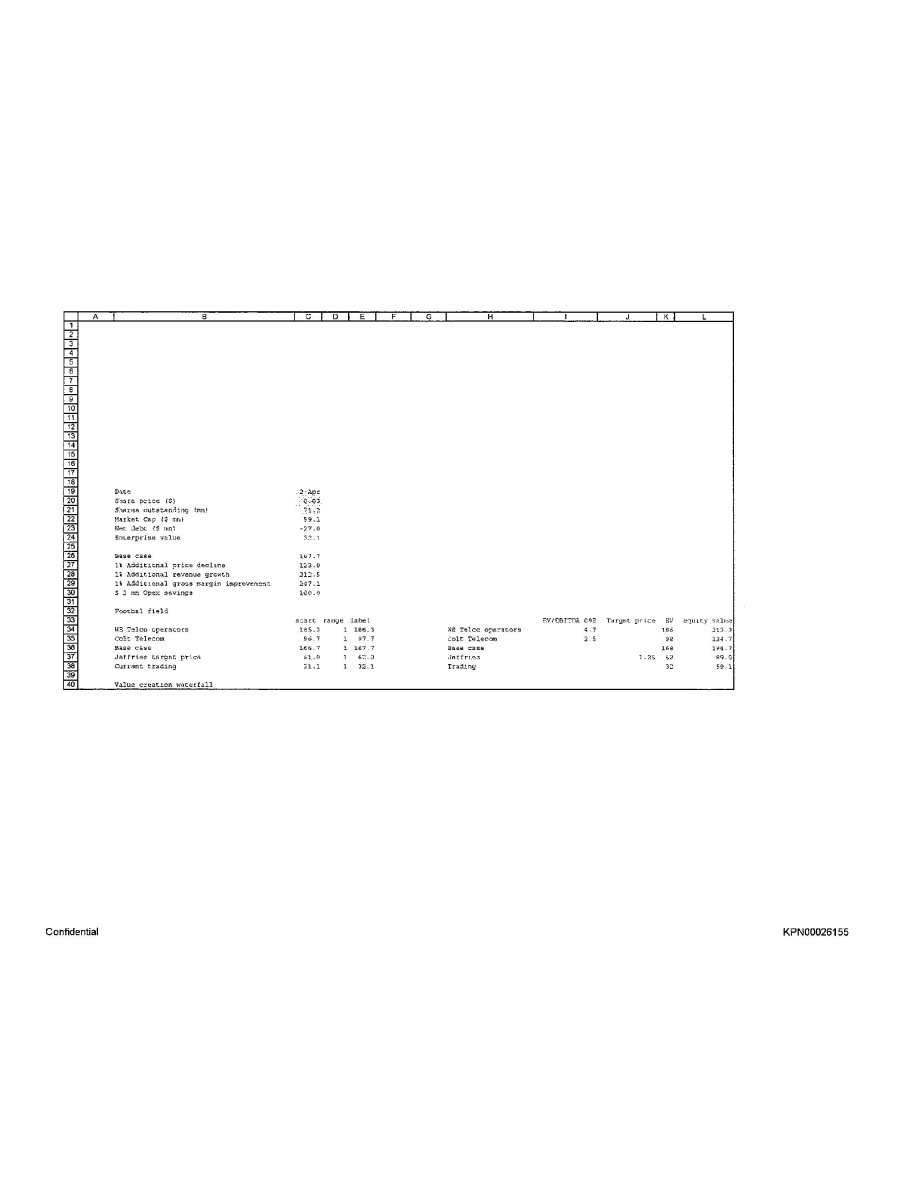

Date Share price ($) Shares outstanding (mn) Market Cap ($ mn) Net debt ($ mn) Enterprise value Base case 1% Additional price decline 1% Additional revenue growth 1% Additional gross margin improvement $ 2 mn Opex savings Footbal field start range label EV/EBITDA 09E Target price BV equity value WB Telco operators WB Telco operators Colt Telecom Colt Telecom Base case Base case Jeffries target price Jeffries Current trading Trading Value creation waterfall Confidential KPN00026155

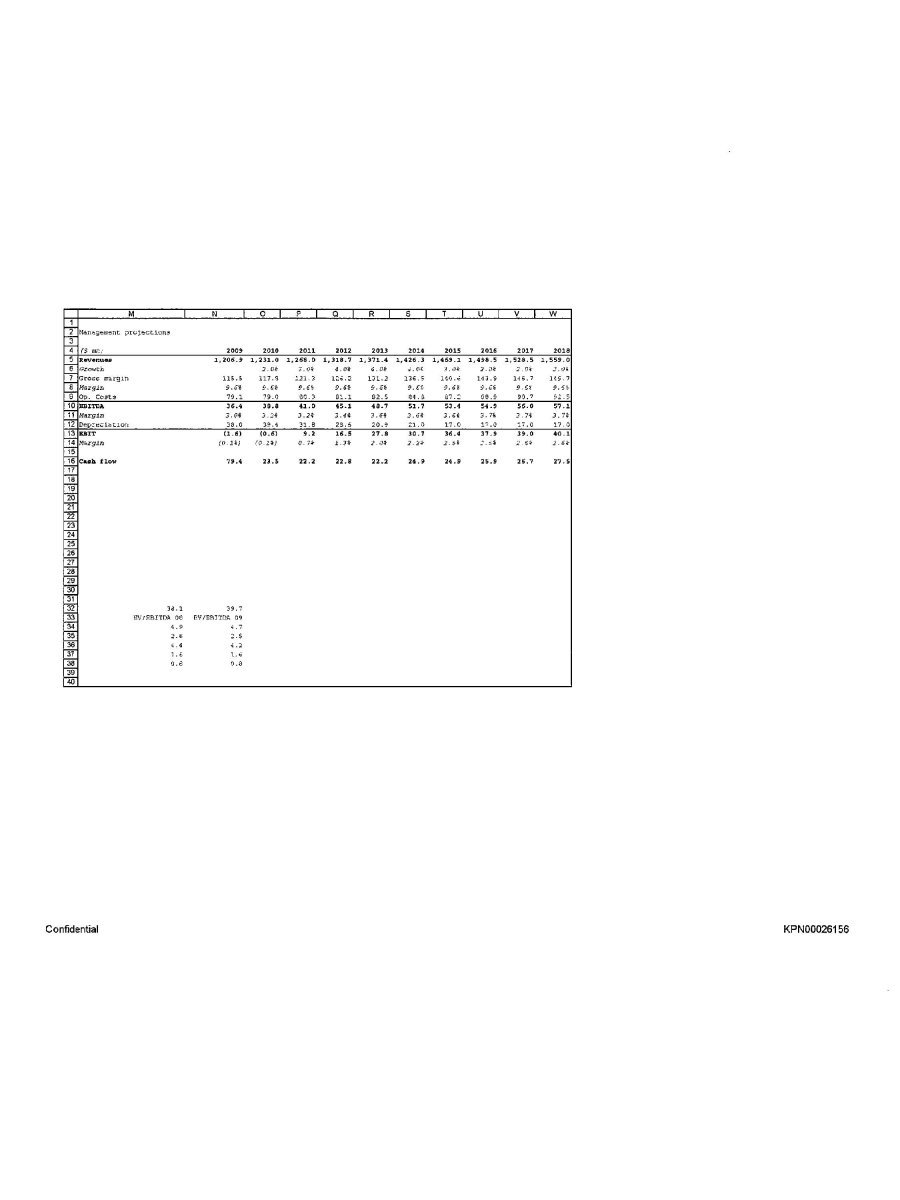

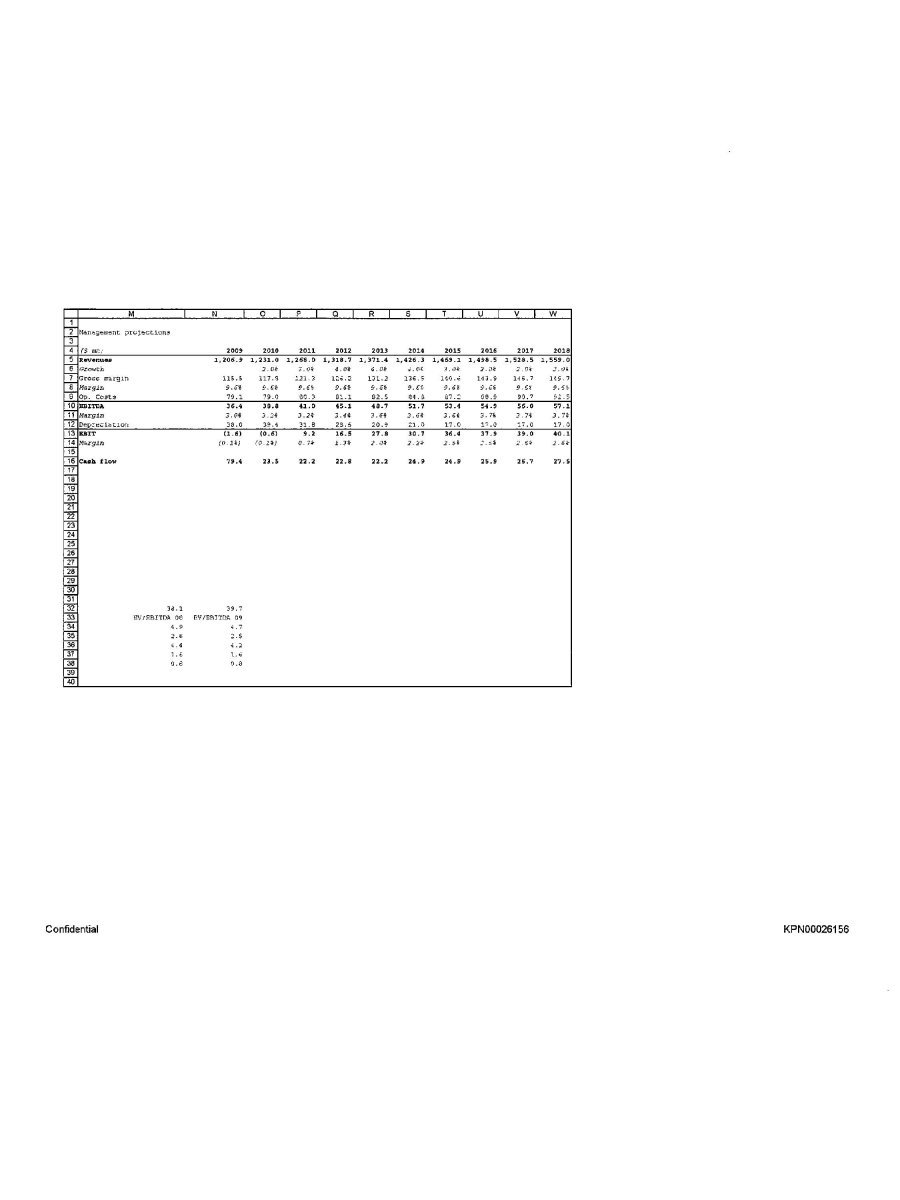

Management projections ($ mn) 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Revenues Growth Gross margin Margin Op. Costs EBITDA Margin Depreciation EBIT Margin Cash flow EV/EBITDA 08 EV/EBITDA 09 Confidential KPN00026156