Exhibit 99.(a)(5)(viii)

Transperfect City of New York, State of New York, county of New York I, Livia Cheung, hereby certify that the following is to the best of my knowledge and belief, a true and accurate translation, of the document “KPN00026061” from Dutch .into English. Livia Cheung Sworn to before me this October 26, 2009 Signature, Notary Public Anne K Shreiner Notary Public, State of New York No. 01SH6181400 Qualified in NEW YORK County Commission Expires Jan 28, 2012. Stamp, Notary Public JX 240a

From: Renwarin, M. E. M. (Magnolia) (W&O STO Products & Services)

Sent: Tuesday, April 07, 2009 3:39:55 AM

To: Rodenburg, J.J. (Jan) (KPNCC M&A Management)

Subject: FW:

Attachments: valuation ibasis 6-4.xls; Valuation basic 250309 basis E&Y sensetivity 2.xls; Valuation basic 250309 basis E&Y sensetivity 3.xls;

Valuation basic 250309 basis E&Y sensetivity 3.1.xls; Valuation basic 250309 basis E&Y sensetivity 3.2.xls; Valuation basic 250309 basis E&Y

sensetivity 3.3.xls; Valuation basic 250309 basis E&Y sensetivity 4.xls; Valuation basic 250309 basis E&Y sensetivity 5.xls; image001.gif

Kind regards,

Magnolia Renwarin

Management assistant STO Product & Services

Wholesale & Operations

Regulusweg 1

2516 AC AC The Hague

HV4 BC 1st floor

(070) 44 66765

06 - 20 24 80 04

magnolia.renwarin@kpn.com

---

From: Johannes van Dijk [mailto:johannesvandijk@planet.nl]

Sent: Monday, April 6, 2009 11:03 PM

To: Dijk, van, J.A. (Johannes) (W&O Finance BC Carrier Services)

Re:

Kind regards,

Johannes A. van Dijk

52 02' 24 N

04 22' 41 E

Hegemanwater 27

2497 ZP The Hague

tel: 070-3629666 email: Hyperlink mailto:"johannesvandijk@planet.nl"johannesvandijk@planet.nl website: Hyperlink "http://www/ned3018c.nl/www.ned3018c.nl" | JX 240 |

| | |

| Confidential | KPN00026061 |

From: Renwarin, M.E.M. (Magnolia) (W&O STO Products & Services)

Sent: Tuesday, April 07, 2009 3:39:55 AM

To: Rodenburg, J.J. (Jan) (KPNCC M&A Management)

Subject: FW:

Attachments: valuation ibasis 6-4.xls; Valuation basic 250309 basis E&Y sensetivity 2.xls; Valuation basic 250309 basis E&Y sensetivity 3.xls; Valuation basic 250309 basis E&Y sensetivity 3.1.xls; Valuation basic 250309 basis E&Y sensetivity 3.2.xls; Valuation basic 250309 basis E&Y sensetivity 3.3.xls; Valuation basic 250309 basis E&Y sensetivity 4.xls; Valuation basic 250309 basis E&Y sensetivity 5.xls; image001.gif

Met vriendelijke groet,

Magnolia Renwarin

Management assistente STO Product & Services

Wholesale & Operations

Regulusweg 1

2516 AC Den Haag

HV4 BC 1e etage

(070) 44 66765

06 - - 20 24 80 04

magnolia.renwarin@kpn.corn

Van: Johannes van Dijk Emailto:[johannesvandijk@planet.nl]

Verzonden: maandag 6 april 2009 23:03

Aan: Dijk, van, J.A. (Johannes) (W&O Financiën BC Carrier Services)

Onderwerp:

Met vriendelijke groeten,

Johannes A. van Dijk

52 02’ 24 N

04 22’ 41 E

Hegemanwater 27

2497 ZP Den Haag

tel: 070-3629666 email: Hyperlink mailto:"johannesvandijk@planet.nl"johannesvandijk@planet.nl website: Hyperlink "http://www/ned3018c.nl/www.ned3018c.nl" | JX 240 |

| | |

| Confidential | KPN00026061 |

KPN Confidential KPN00026063

[kpn logo]

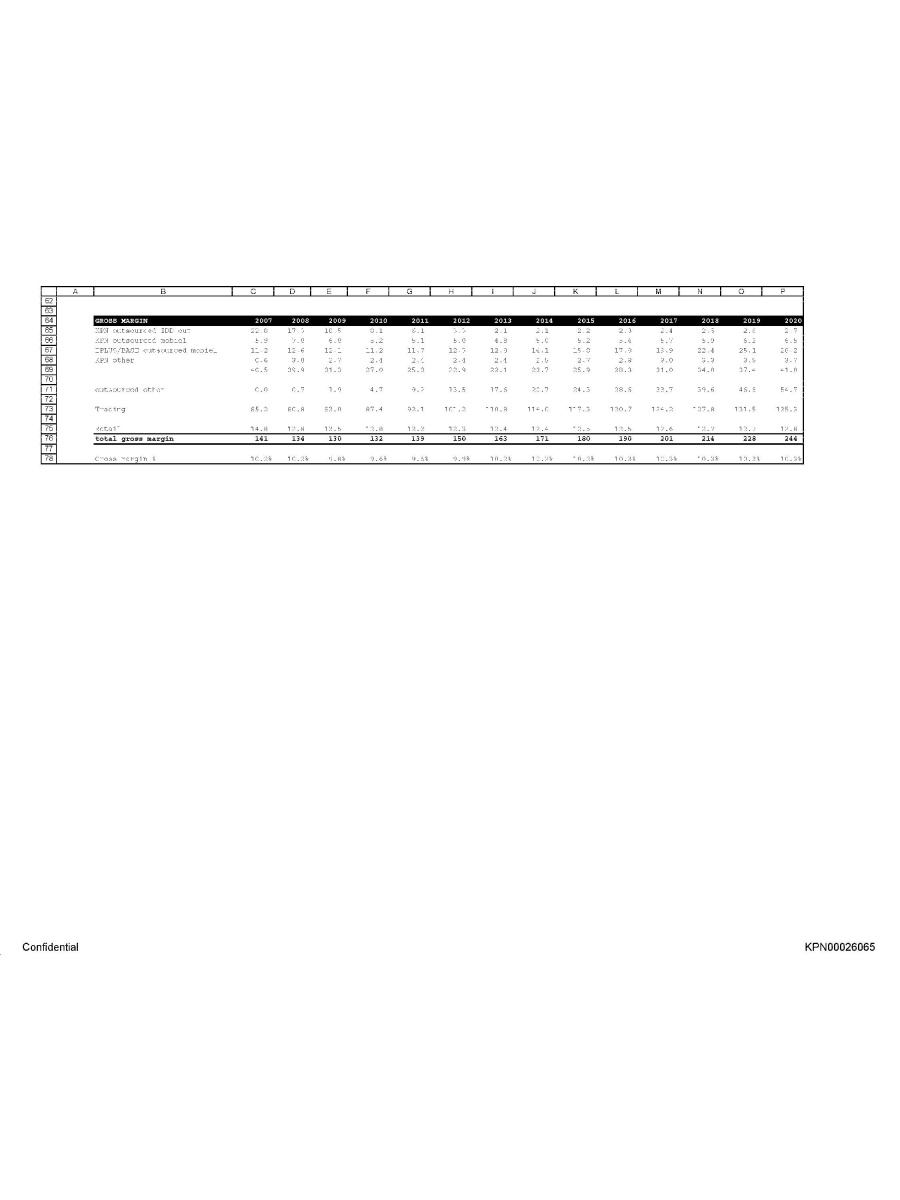

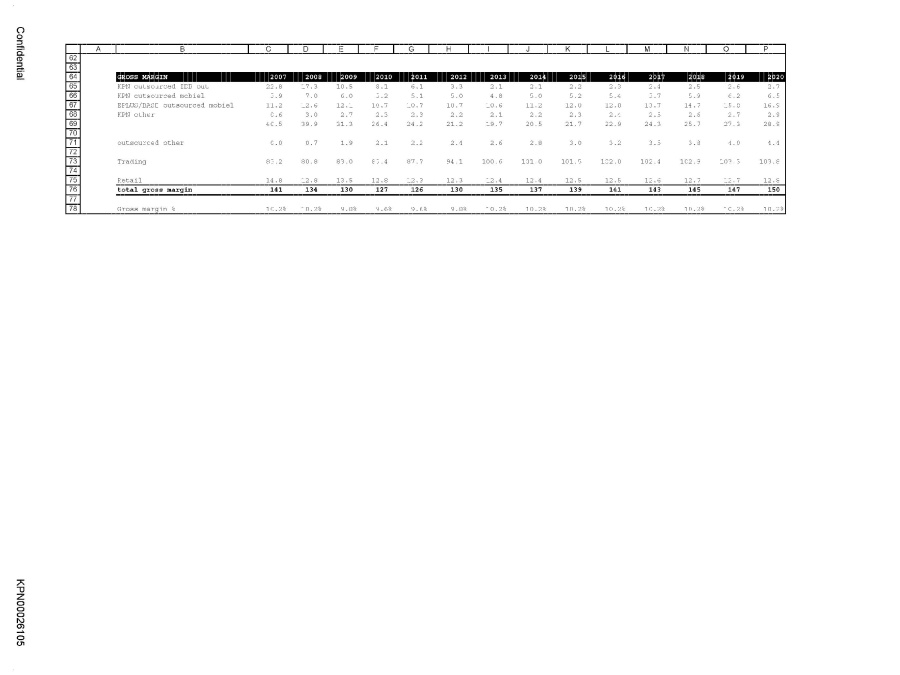

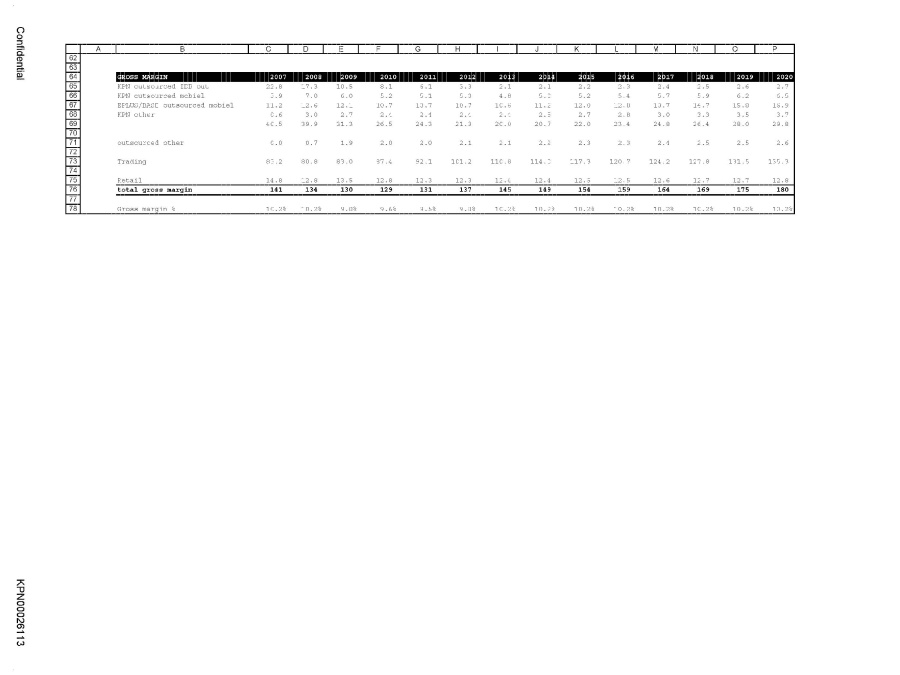

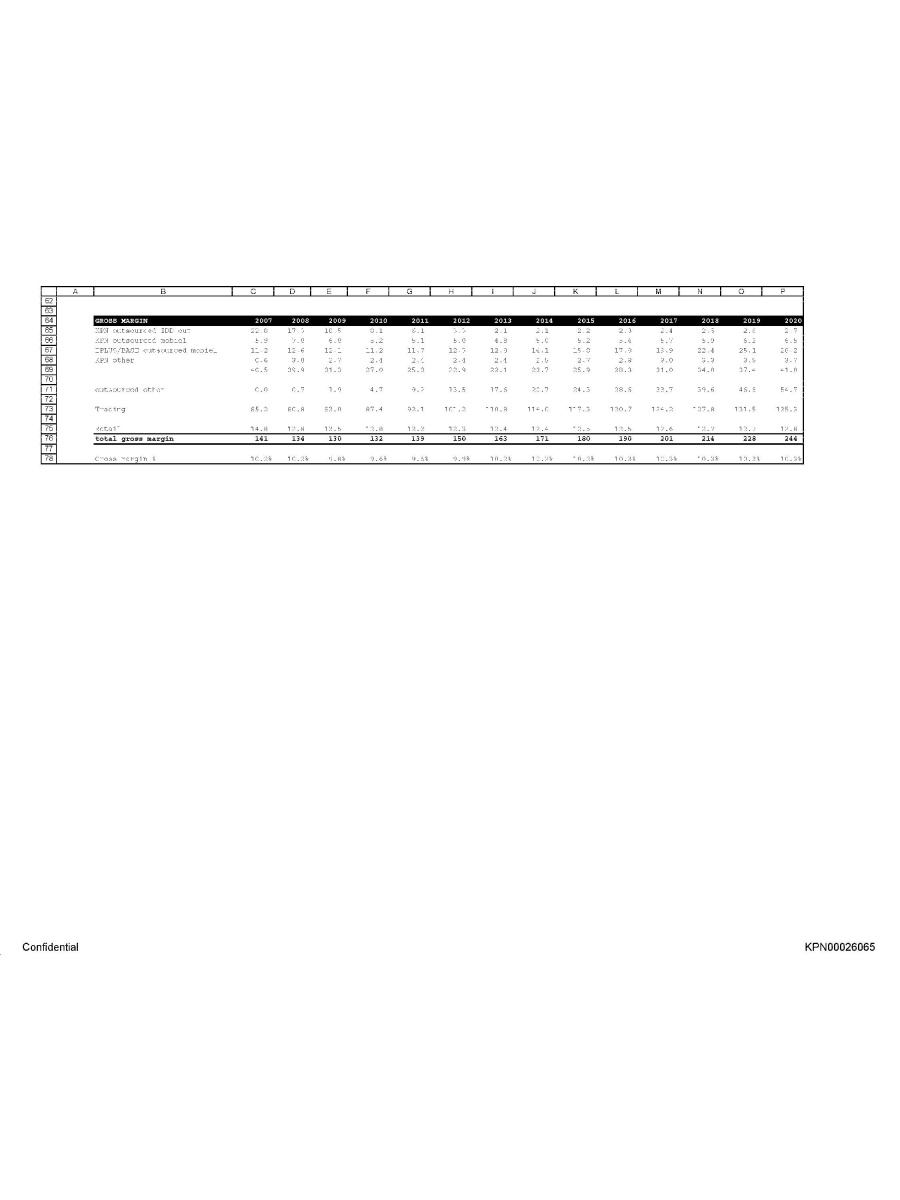

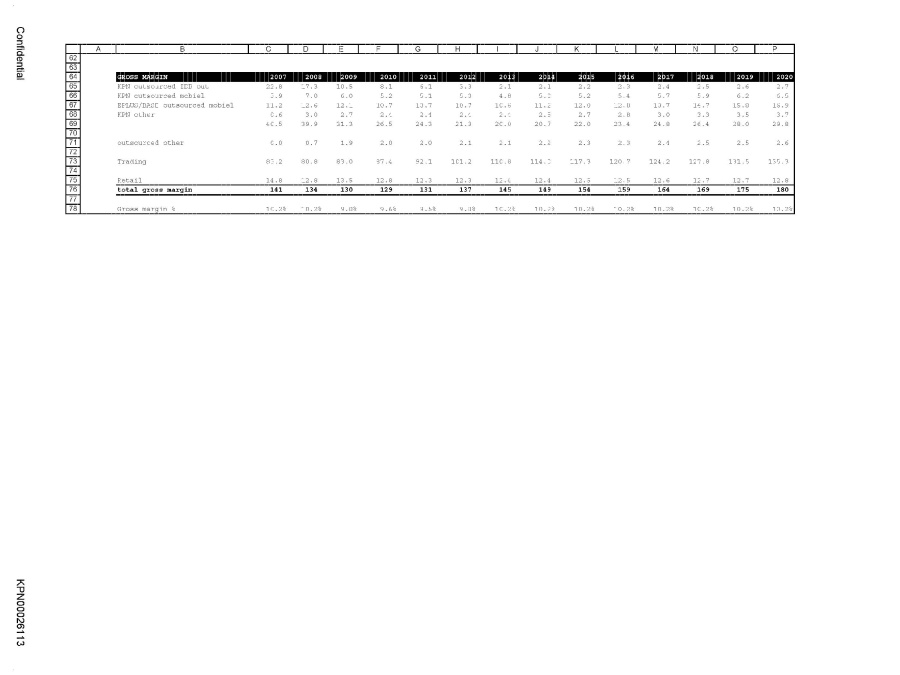

Gross Margin 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total gross margin Gross margin% Confidential KPN 00026065

Gross Margin 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total gross margin Gross margin% Confidential KPN 00026065

Gross Margin 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total gross margin Gross margin% Confidential KPN 00026065

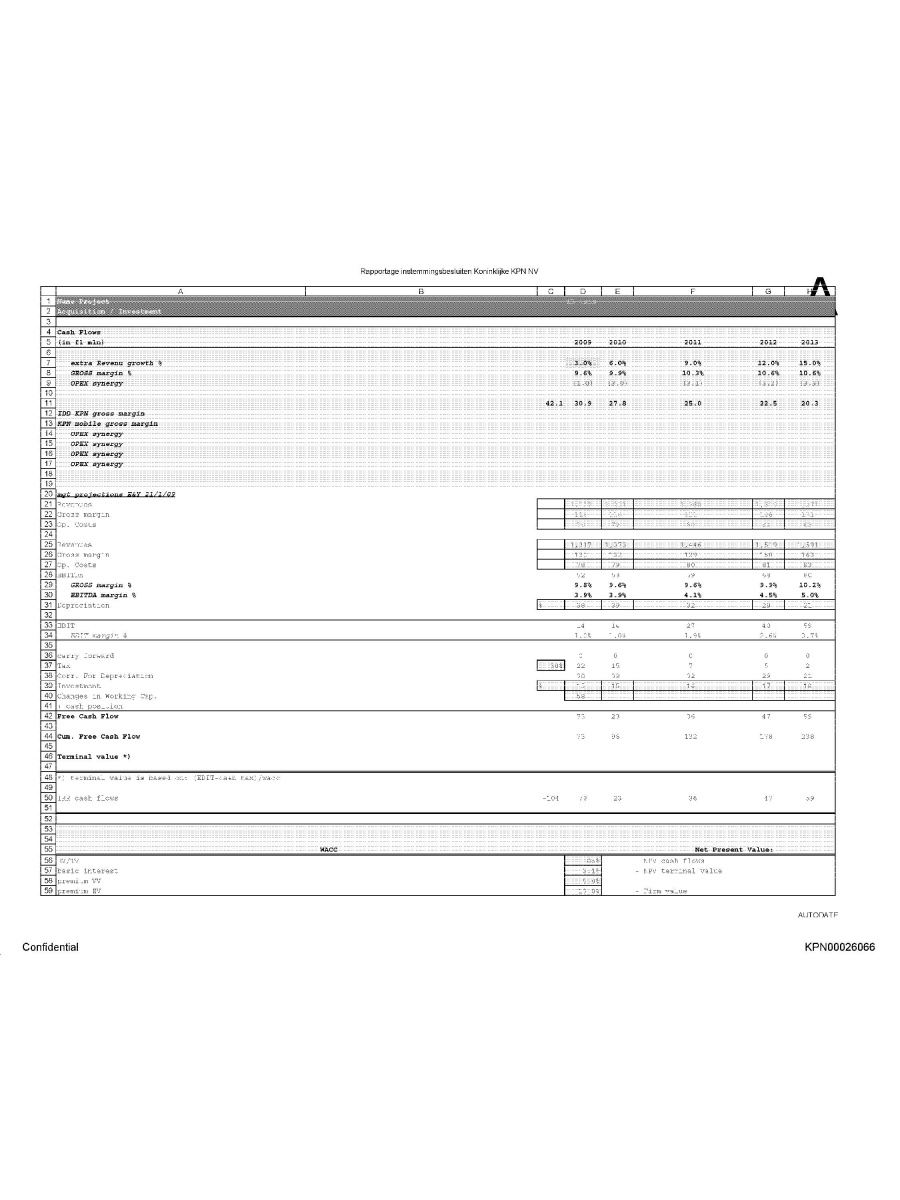

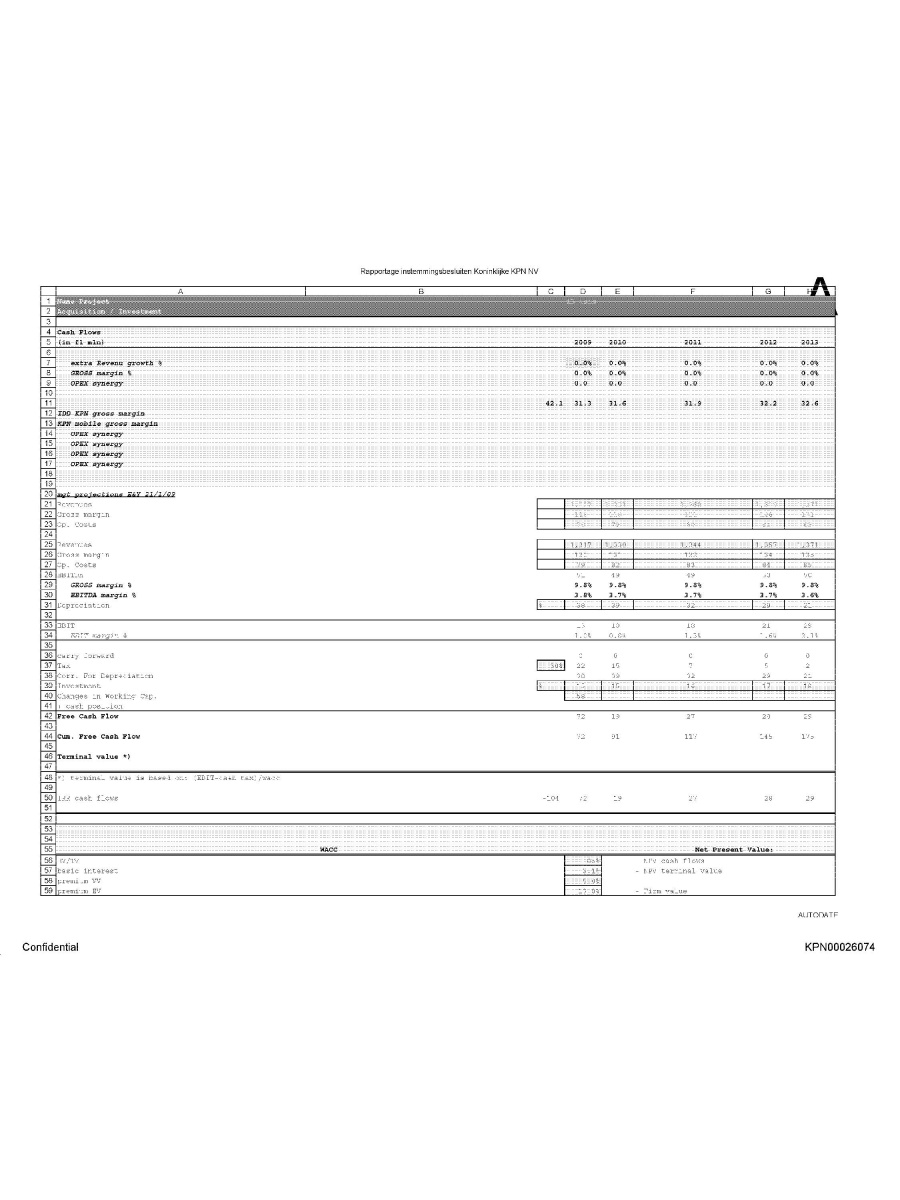

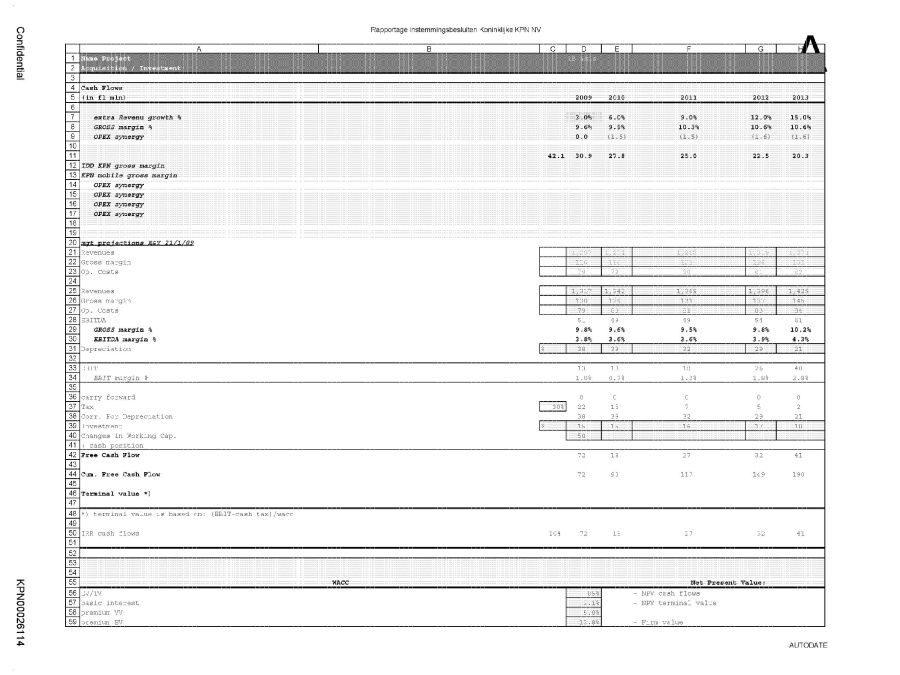

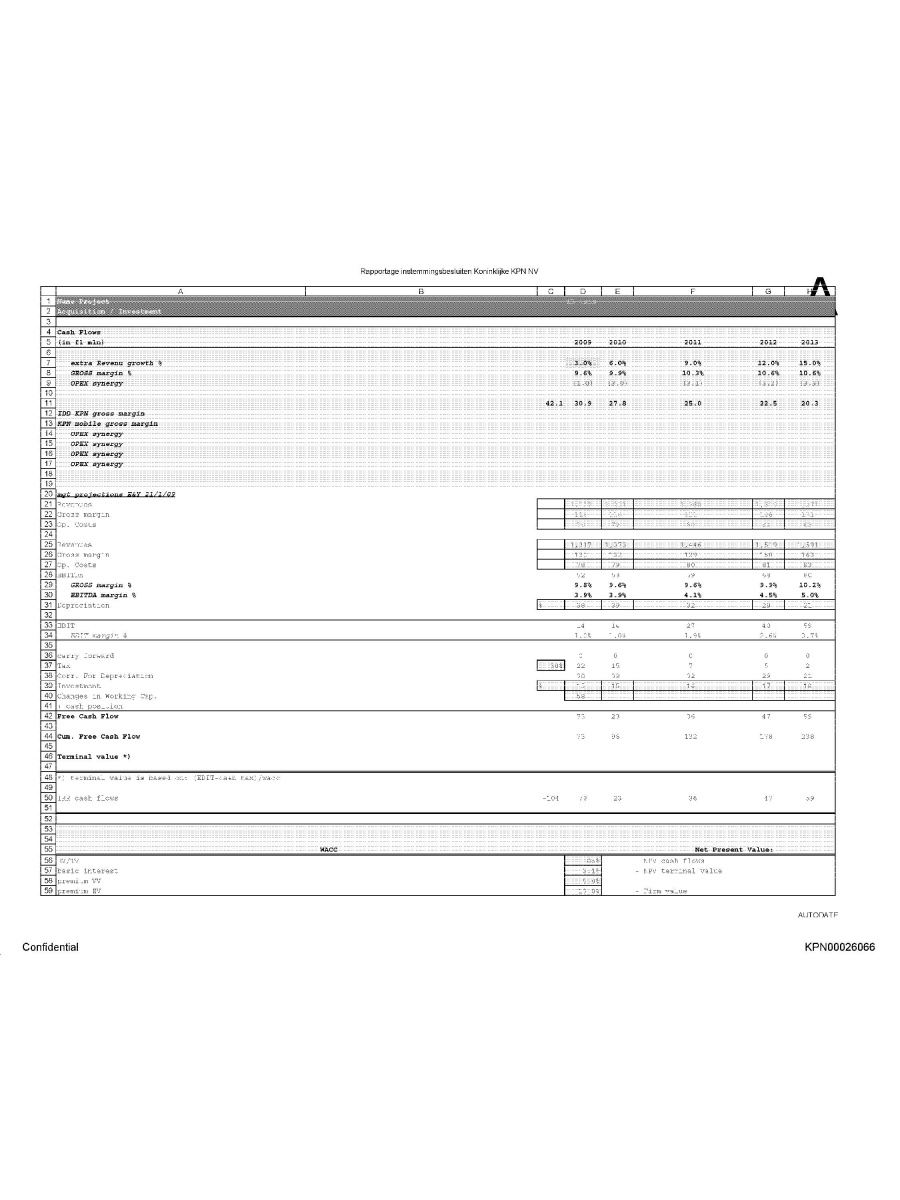

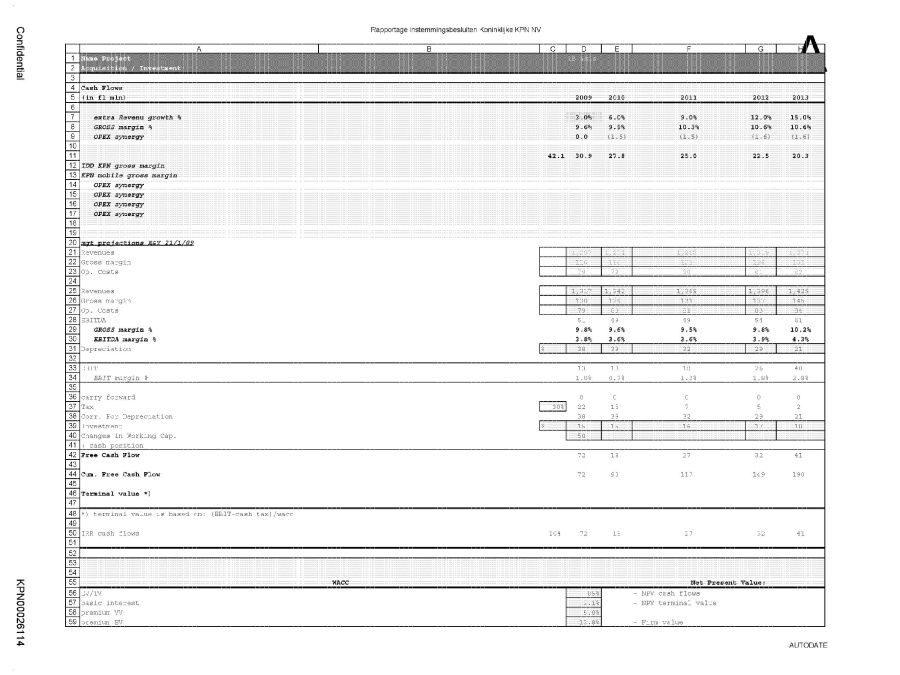

Rapportage instemmingsbesluiten Koninklijke KPN NV Name Project Acquisition / Investment Cash Flow (in fl. mln) 2009 2010 2011 2012 2013 extra Revenu growth % GROSS margin % OPEX synergy IDD KPN gross margin KPN mobile gross margin OPEX synergy OPEX synergy OPEX synergy OPEX synergy mgt projections E&Y 21/1/09 Revenues Gross margin Op. Costs Revenues Gross margin Op. Costs EBITDA GROSS margin % EBITDA margin % Depreciation EBIT EBIT margin % carry forward Tax Corr. For Depreciation Investment Changes in Working Cap. + cash position Free Cash Flow Cum. Free Cash Flow Terminal value *) *) terminal value is based on: (EBIT-cash tax)/wacc IRR cash flows WACC Net Present Value EV/TV NPV cash flows basic interest NPV terminal value premium VV premium EV Firm Value Confidential KPN00026066

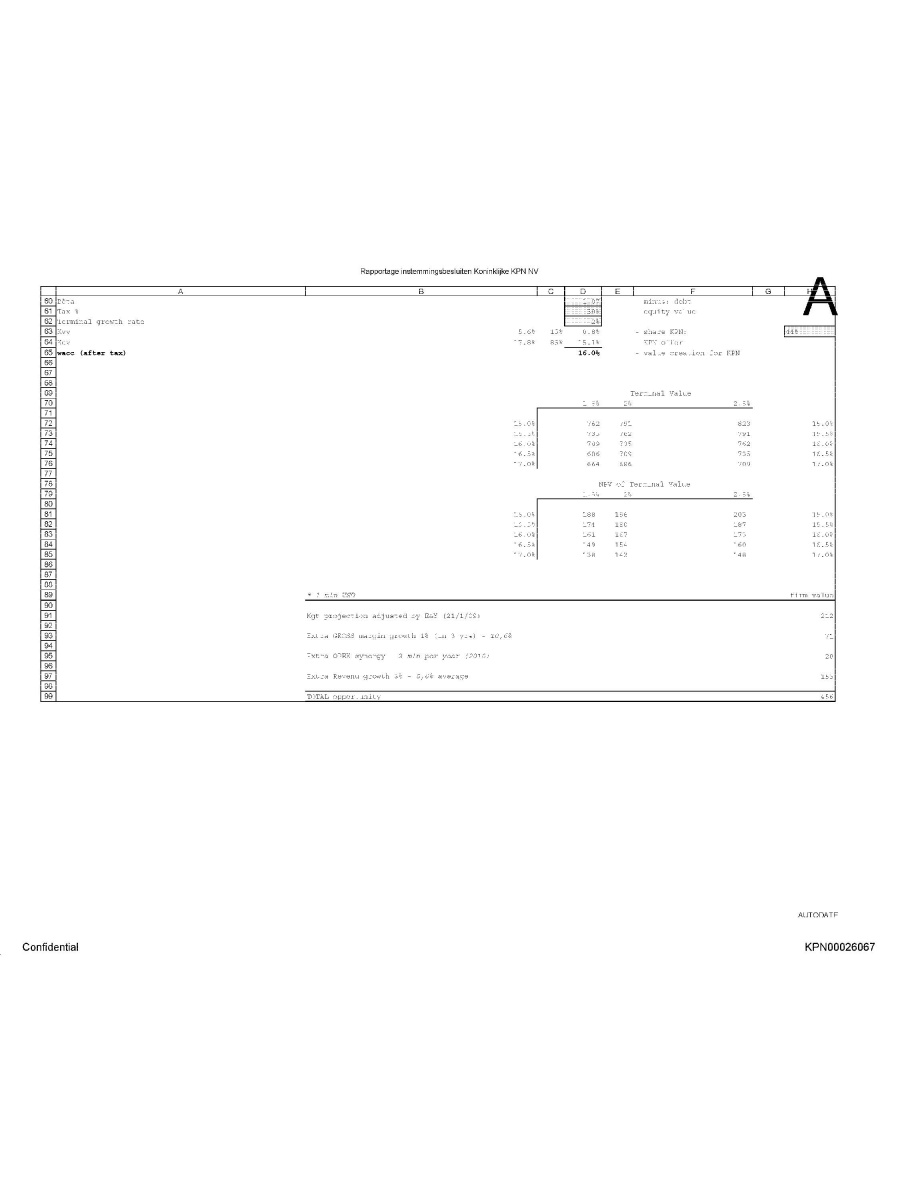

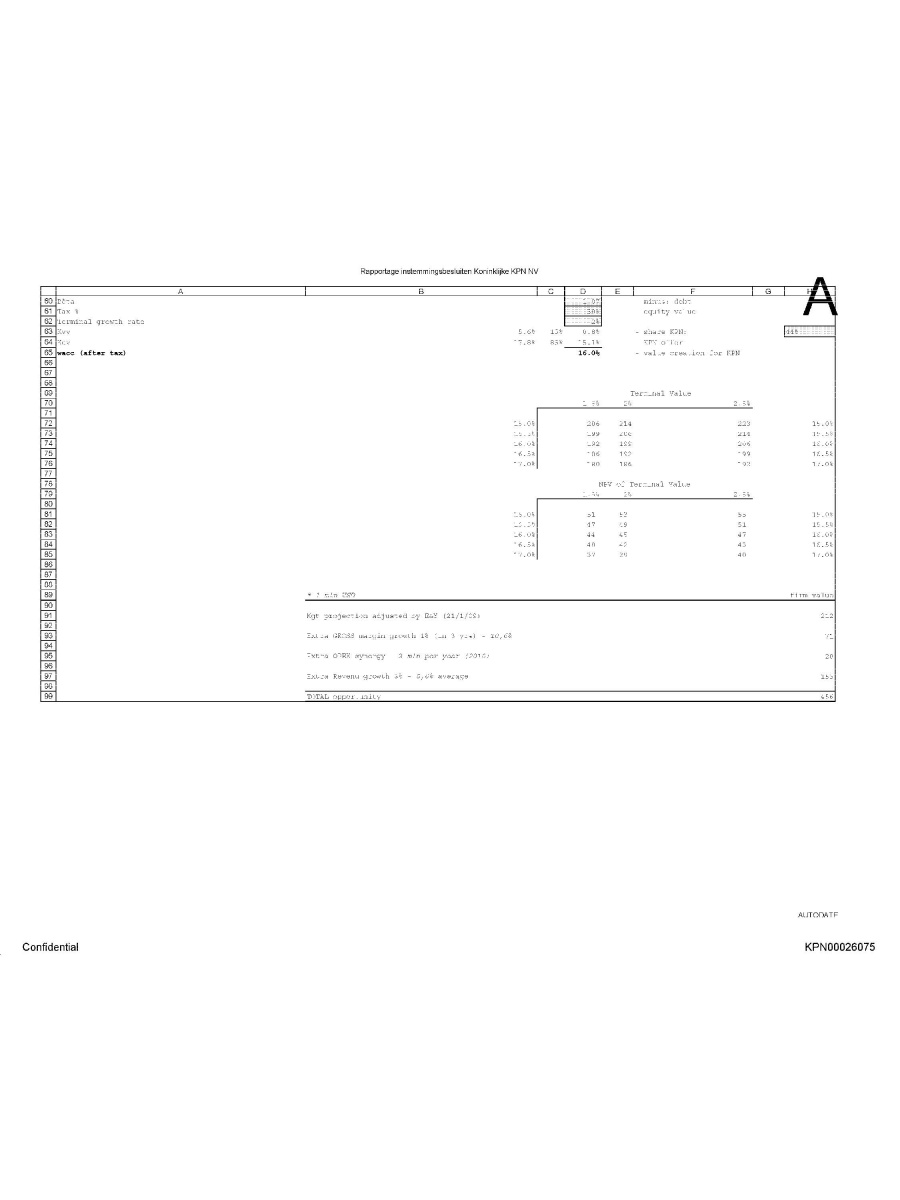

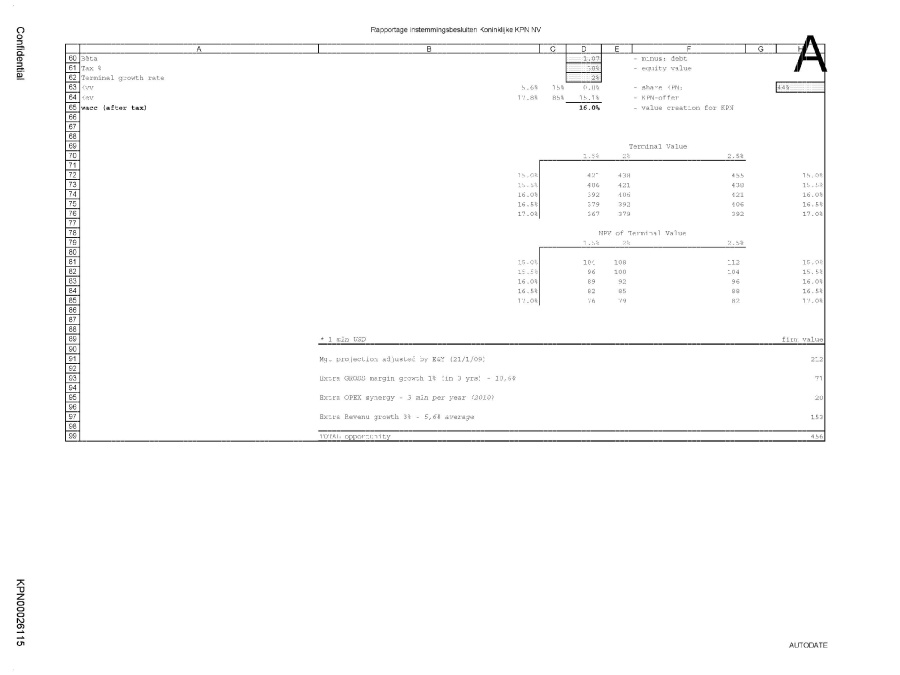

Rapportage instemmingsbesluiten Koninklijke KPN NV Beta minus debt Tax % Terminal growth rate equity value Kvv share KPN Kev KPN-ovver wacc (after tax) value creation for KPN Terminal Value NPV of Terminal Value * 1 mln USD Mgt projection adjusted by E&Y (21/1/09) Extra GROSS margin growth 1% (in 3 yrs) - 10,6% Extra OPEX synergy - 3 mln per year (2010) Extra Revenu growth 3% - 5,6% average TOTAL opportunity Confidential KPN00026067

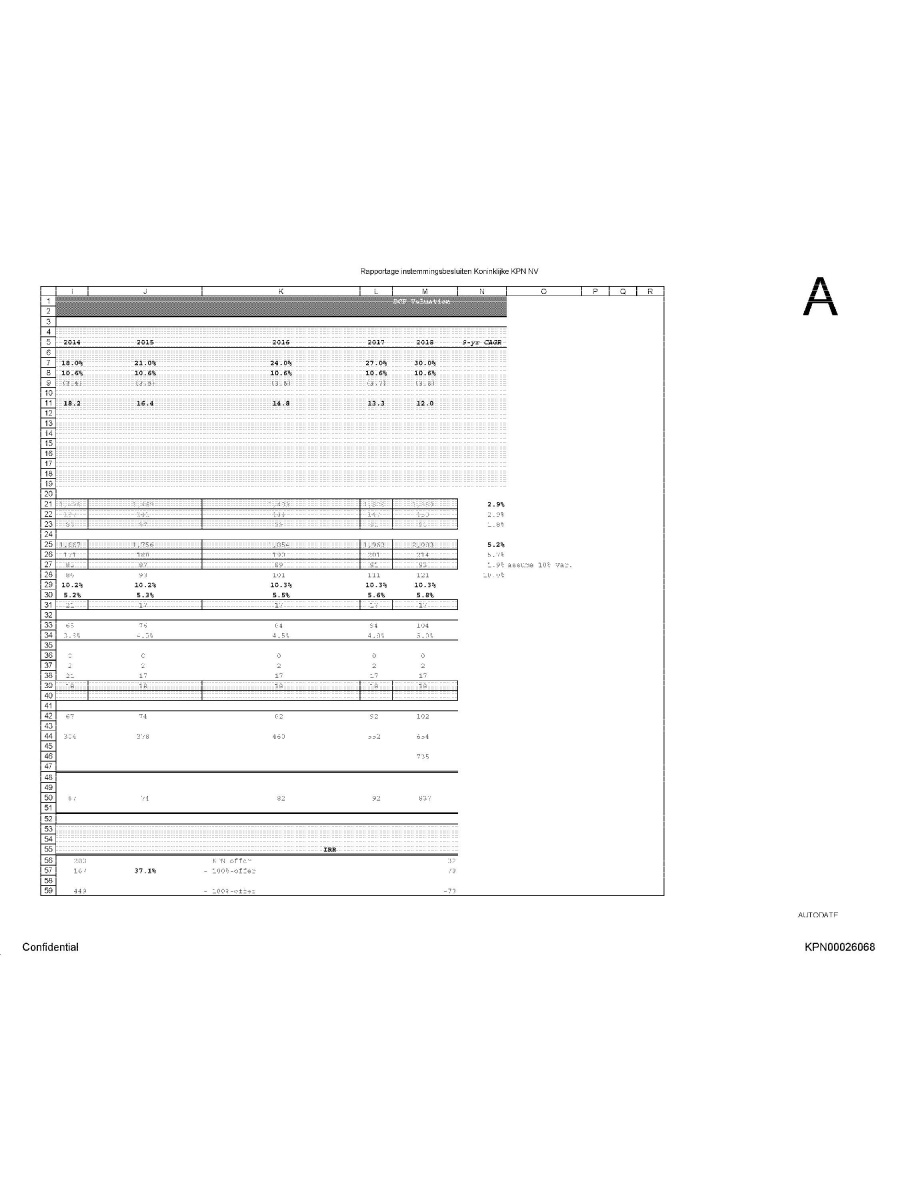

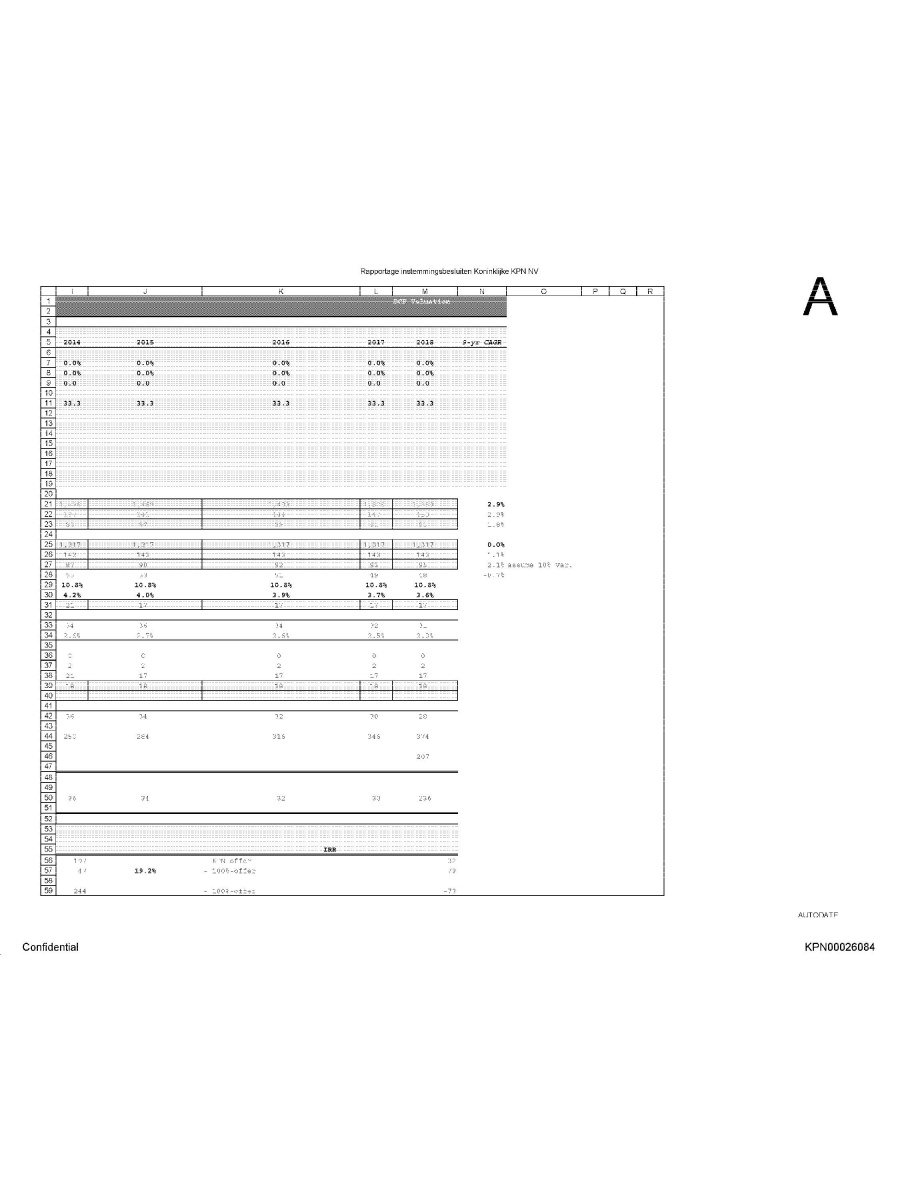

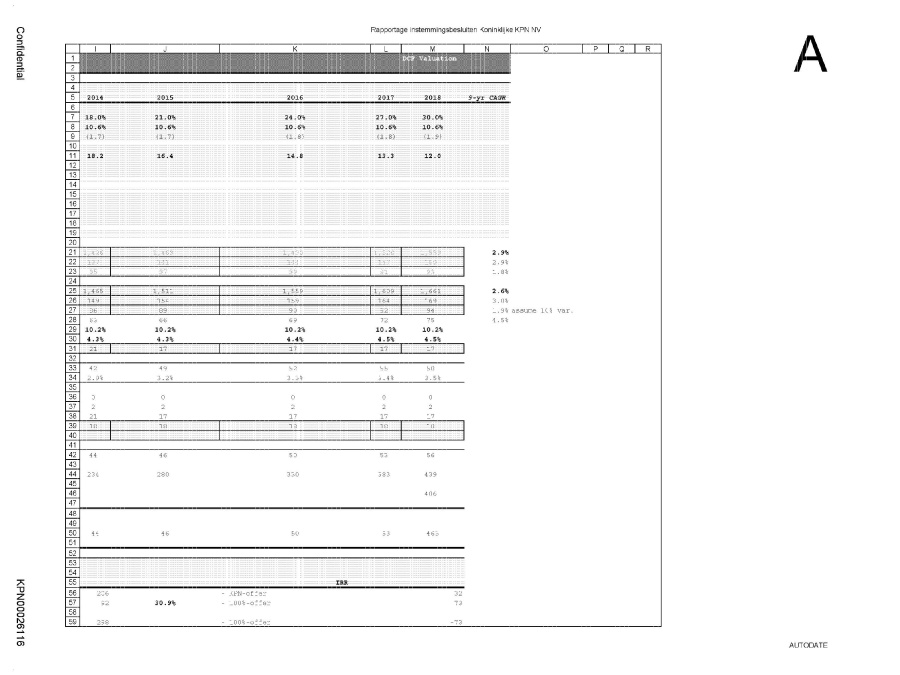

Rapportage instemmingsbesluiten Koninklijke KPN NV DCF Valuation 2014 2015 2016 2017 2018 9-yr CAGR IRR KPN-offer 100%-offer 100%-offer Confidential KPN00026068

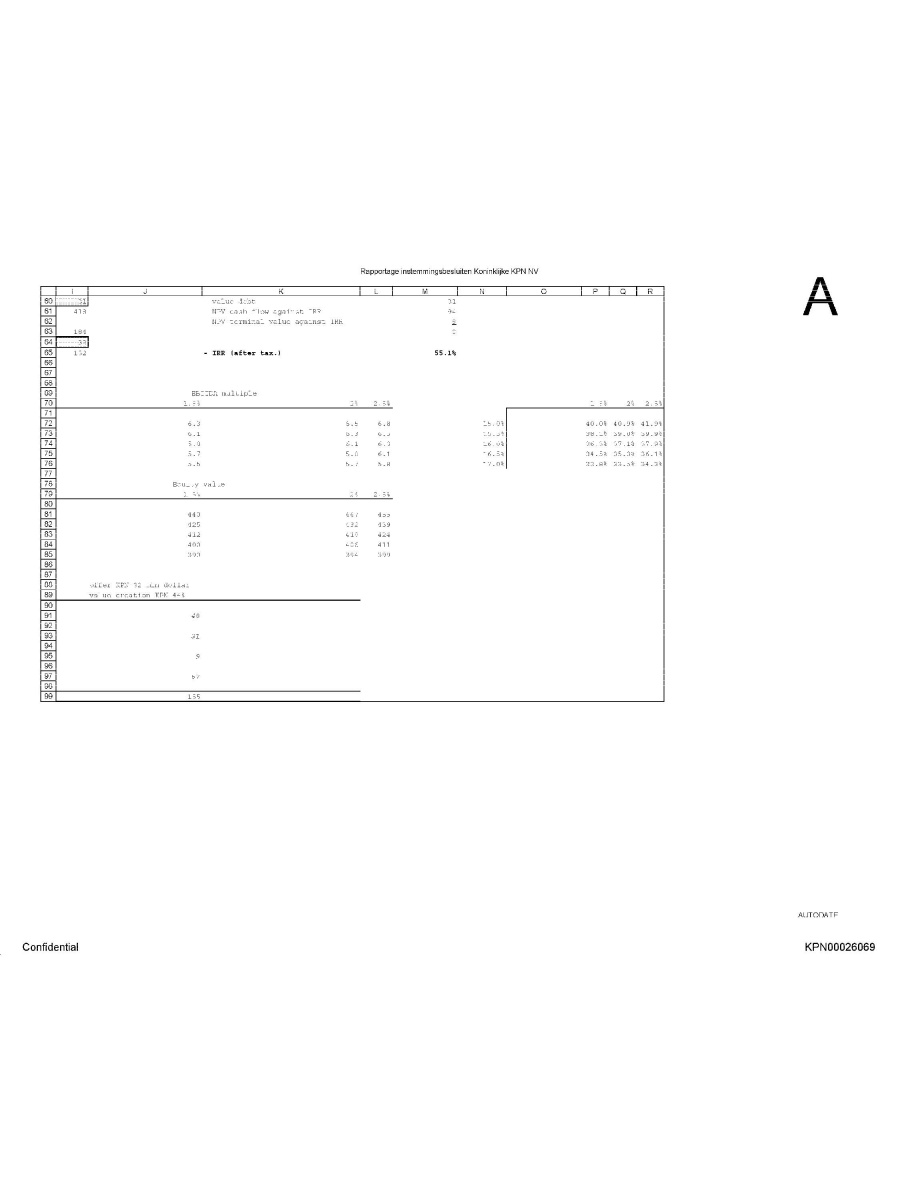

Rapportage instemmingsbesluiten Koninklijke KPN NV value debt NPV cash flow against IRR NPV terminal value against IRR IRR (after tax.) EBITA multiple Equity value offer KPN 32 mln dollar value creation KPN 44% Confidential KPN00026069

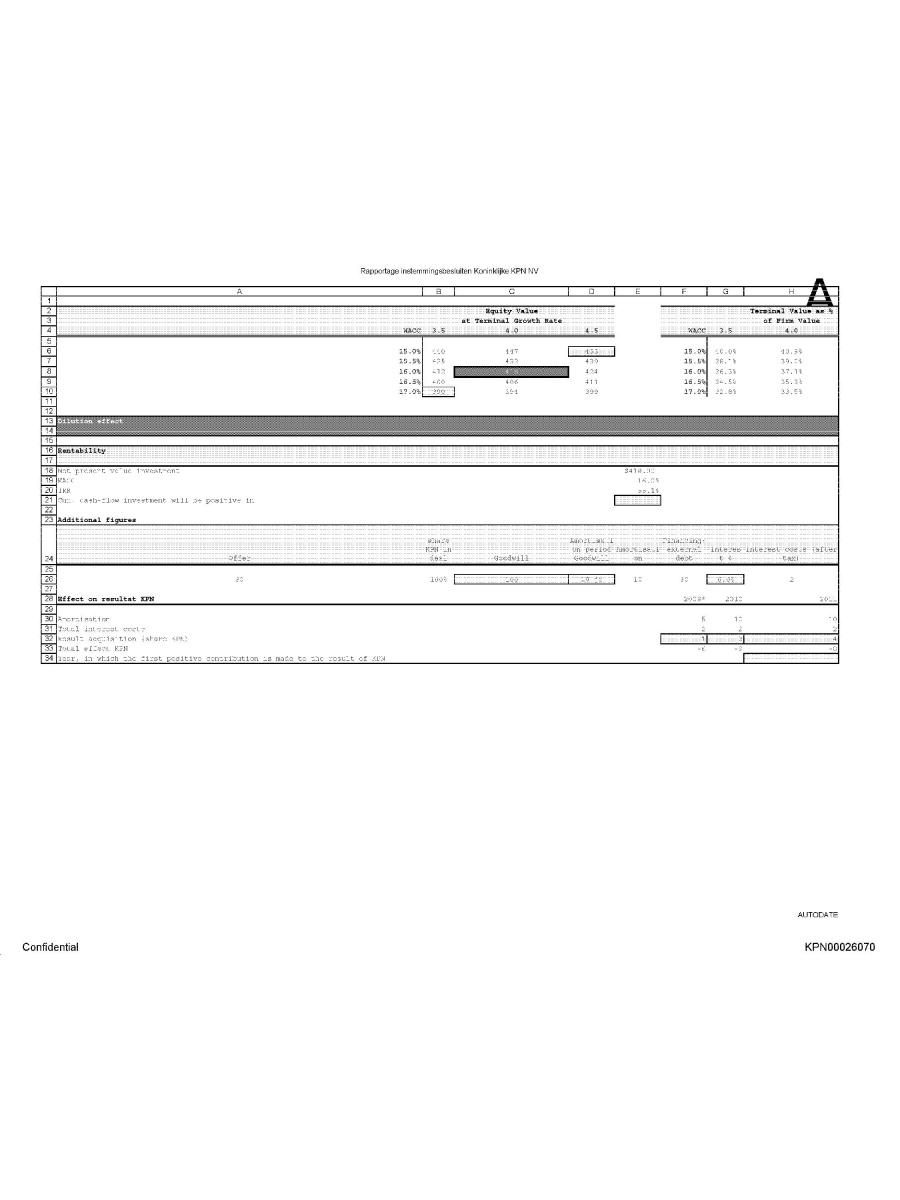

Rapportage instemmingsbesluiten Koninklijke KPN NV Equity Value at Terminal Growth Rate Terminal Value as % of Firm Value Dilution Effect Rentability Net present value investment WACC IRR Cum. cash-flow investment will be positive in Additional figures offer share KPN in deal Goodwill Amortisation period Goodwill Amortisation Financing external debt interest % interest costs (after tax) Effect on resultat KPN Amortisation Total interest costs Result acquisition (share KPN) total effect KPN Year, in which the first positive contribution is made to the result of KPN Confidential KPN00026070

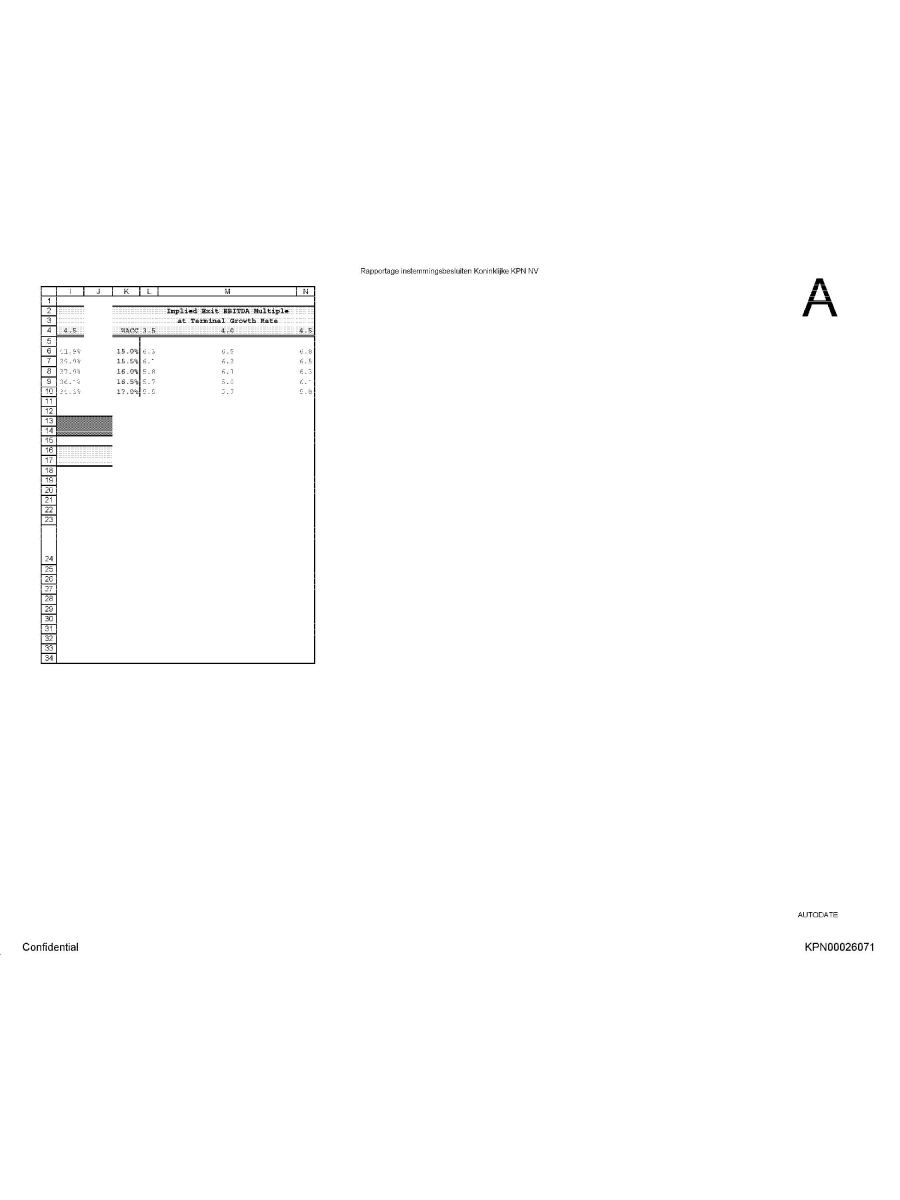

Rapportage Instemmingsbesluiten Koninklijke KPN NV Implied Exit EBITDA Multiple at Terminal Growth Rate Confidential KPN00026071

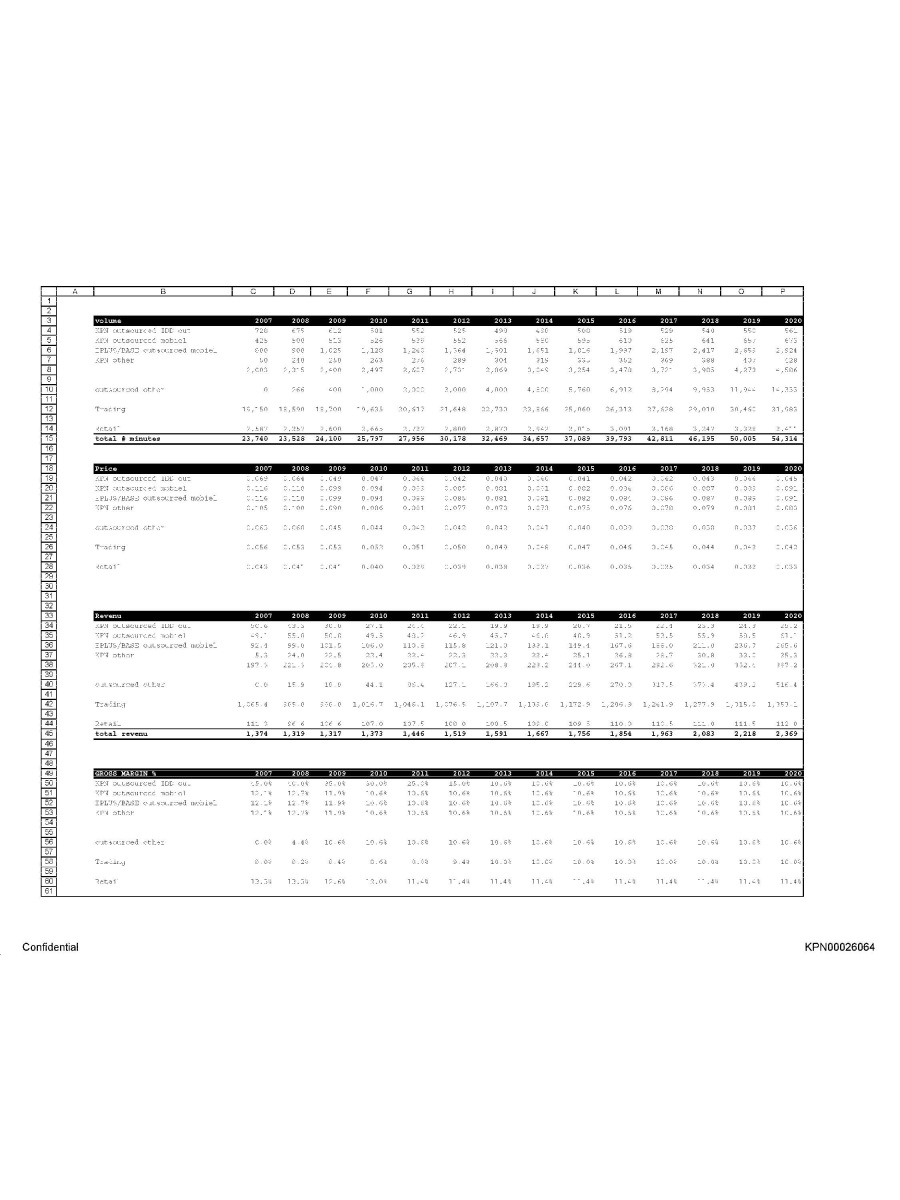

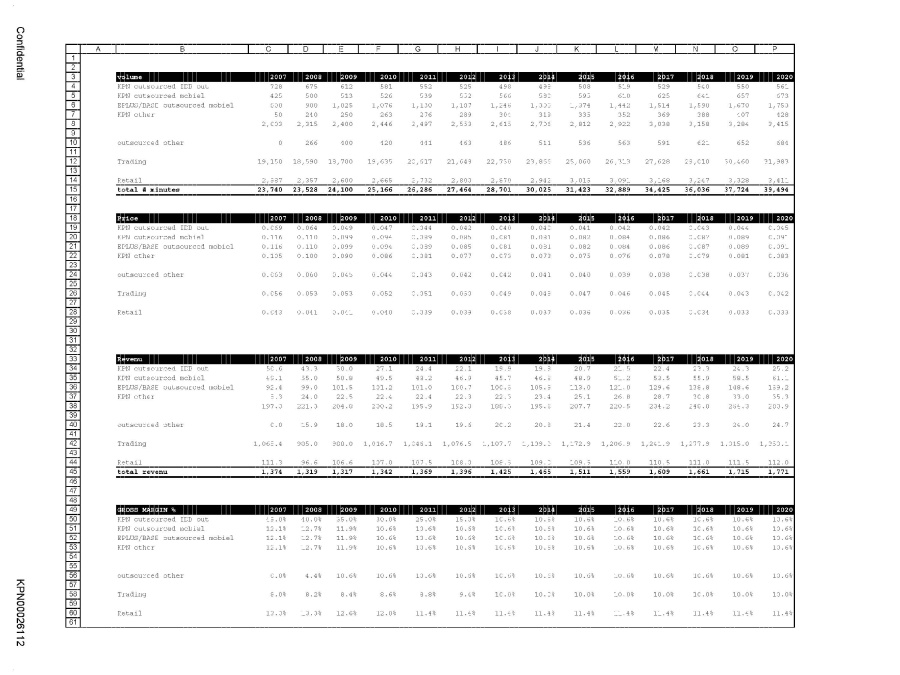

Volume 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total # minutes Price 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Revenu 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total revenu Gross Margin % 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Confidential KPN 00026072

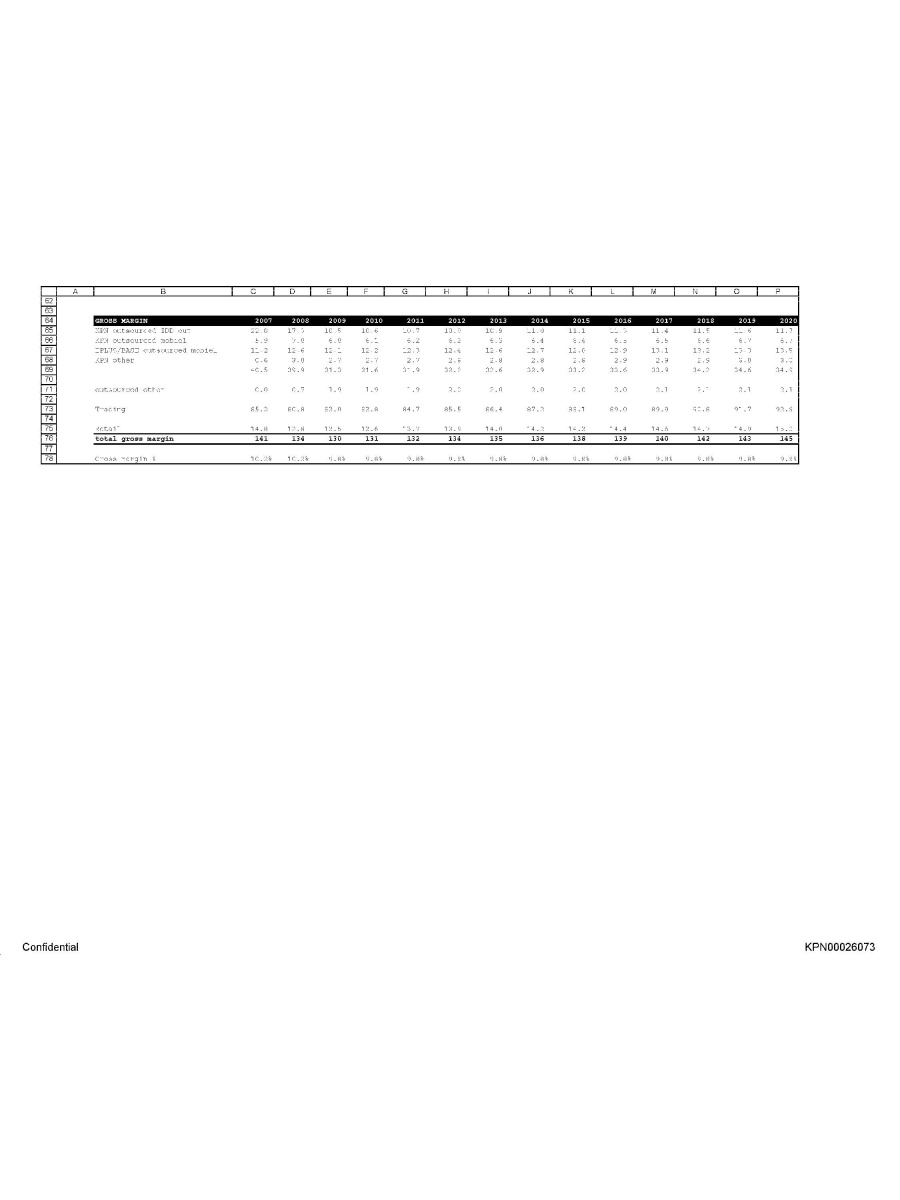

Gross Margin KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other trading Retail total gross margin Gross margin % Confidential KPN00026073

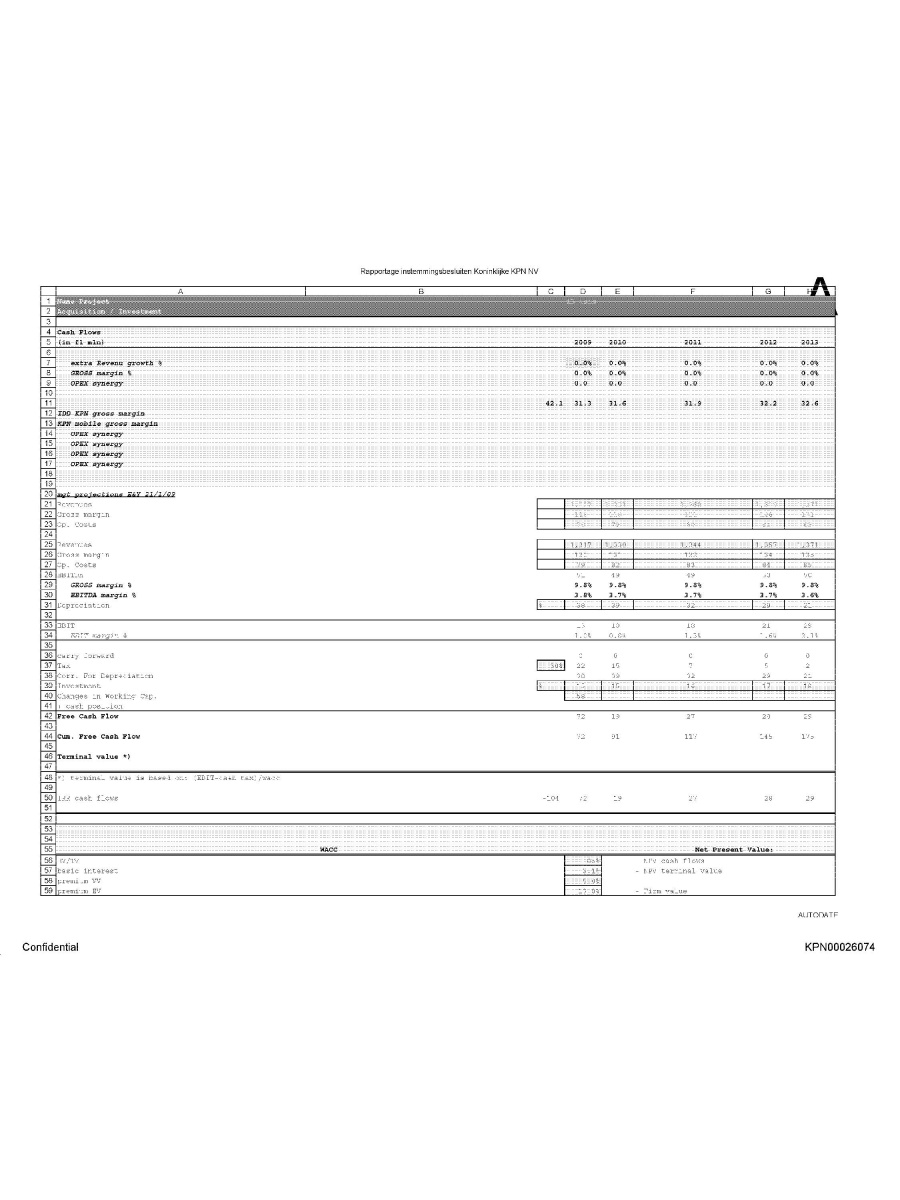

Rapportage instemmingsbesluiten Koninklijke KPN NV Name Project Acquisition / Investment Cash Flow (in fl. mln) 2009 2010 2011 2012 2013 extra Revenu growth % GROSS margin % OPEX synergy IDD KPN gross margin KPN mobile gross margin OPEX synergy OPEX synergy OPEX synergy OPEX synergy mgt projections E&Y 21/1/09 Revenues Gross margin Op. Costs Revenues Gross margin Op. Costs EBITDA GROSS margin % EBITDA margin % Depreciation EBIT EBIT margin % carry forward Tax Corr. For Depreciation Investment Changes in Working Cap. + cash position Free Cash Flow Cum. Free Cash Flow Terminal value *) *) terminal value is based on: (EBIT-cash tax)/wacc IRR cash flows WACC Net Present Value EV/TV NPV cash flows basic interest NPV terminal value premium VV premium EV Firm Value Confidential KPN00026074

Rapportage instemmingsbesluiten Koninklijke KPN NV Beta Tax % Terminal growth rate Kvv Kev wacc (after tax) minus: debt equity value share KPN KPN-offer value creation for KPN Terminal Value NPV of Terminal Value * 1 mln USD firm value Mgt projection adjusted by E&Y (21/1/09) Extra GROSS margin growth 1% (in 3 yrs) - 10,6% Extra OPEX synergy - 3 mln per year (2010) Extra Revenu growth 3% - 5,6% average TOTAL opportunity Confidential KPN00026075

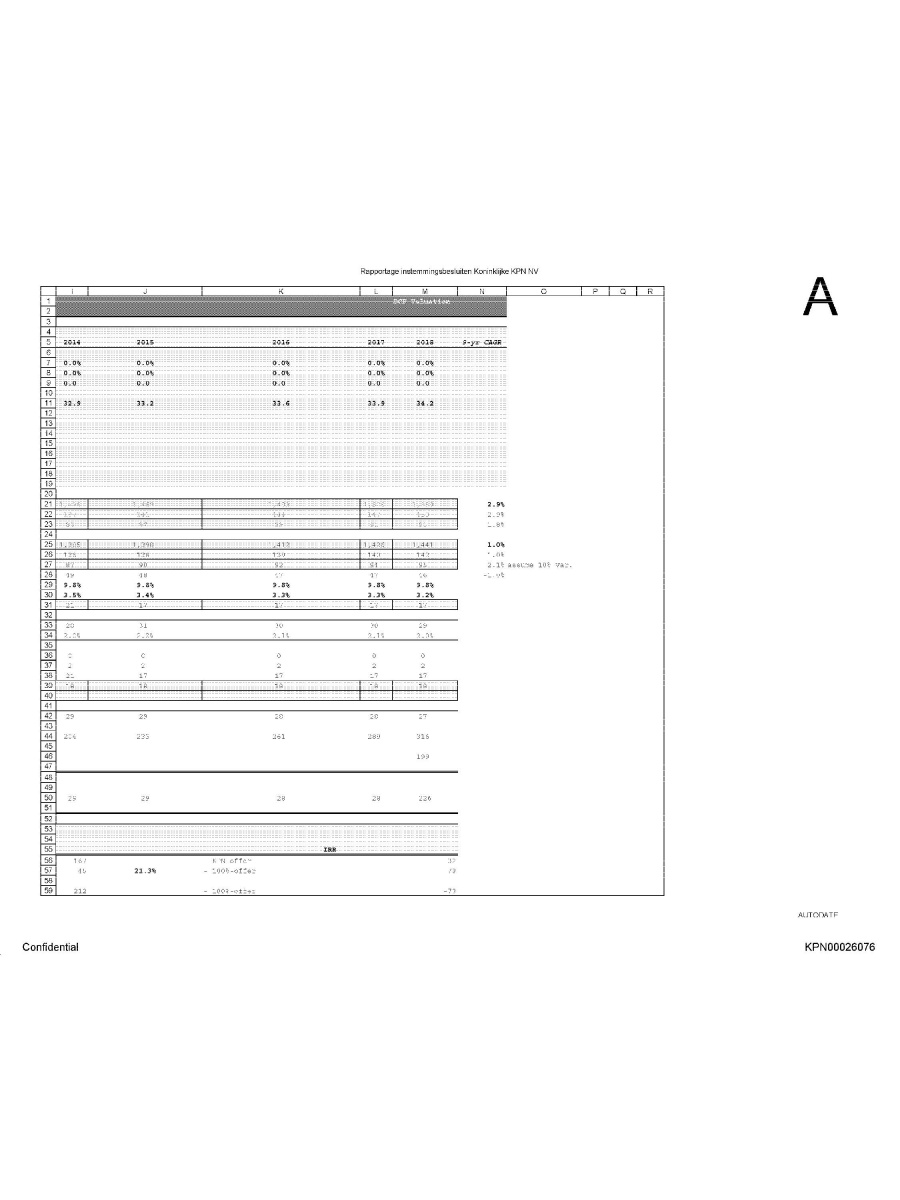

DCF Valuation 2014 2015 2016 2017 2018 9-yr CAGR assume 10% var. KPN-offer 100%-offer 100% offer Confidential KPN00026076

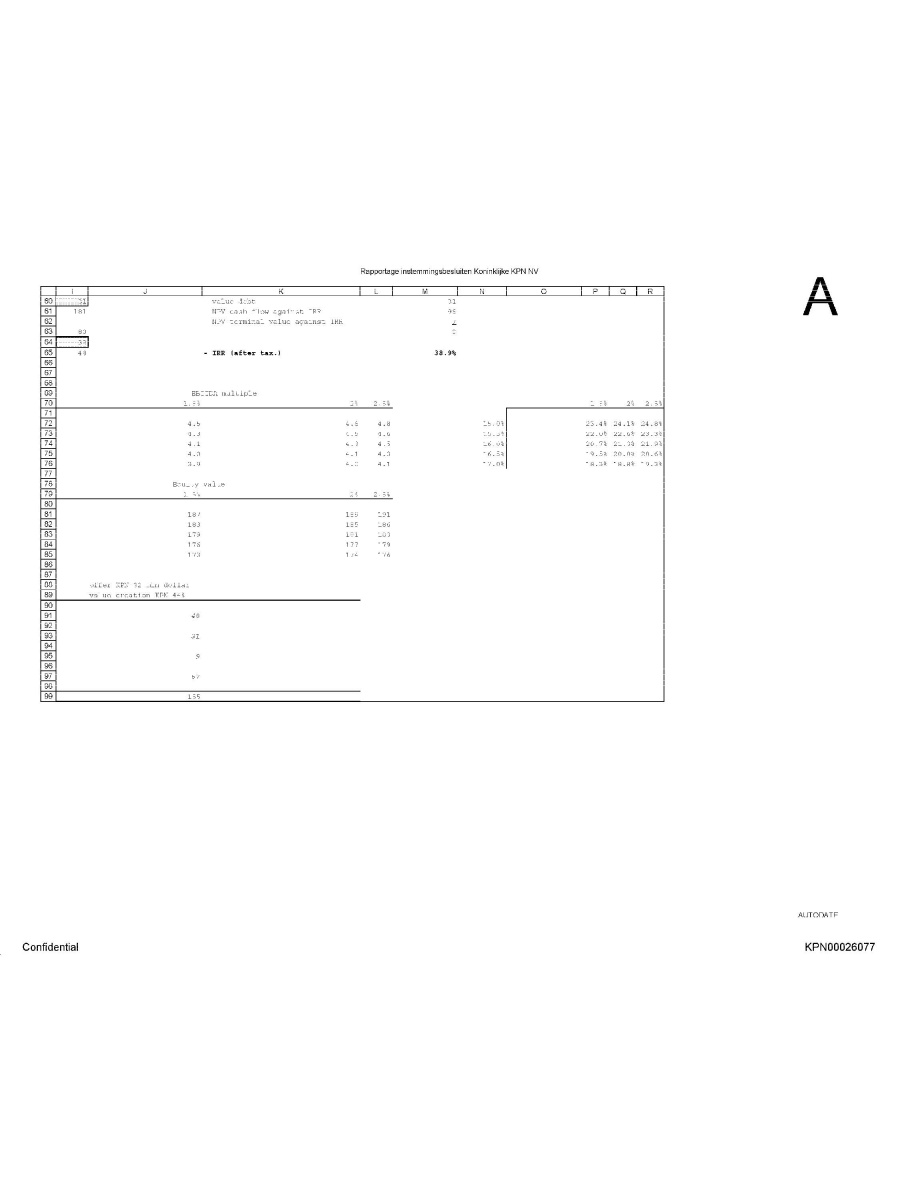

Rapportage instemmingsbesluiten koninklijke KPN NV value debt NPV cash flow against IRR NPV terminal value against IRR IRR (after tax.) EBITDA multiple Equity value offer KPN 32 mln dollar value creation KPN 44% Confidential KPN00026077

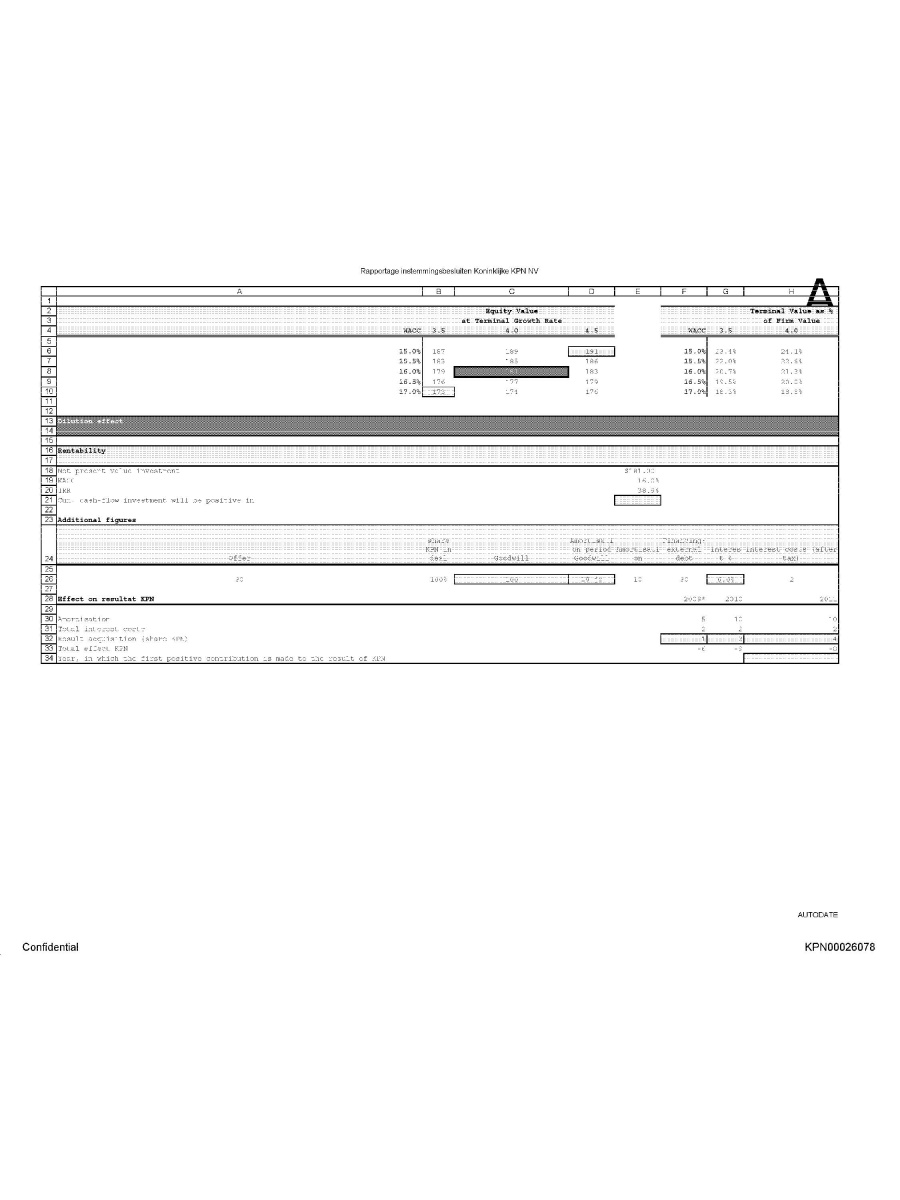

Rapportage instemmingsbesluiten Koninklijke KPN NV Equity Value at Terminal Growth Rate Terminal Value as % of Firm Value Dilution effect Rentability Net present value investment WACC IRR Cum. cash-flow investment will be positive in Additional figures Offer share KPN in deal Goodwill Amortisation period Goodwill Amortisation Financing: external debt interest % interest costs (after tax) Effect on resultat KPN Amortisation Total interest costs Result acquisition (share KPN) Total effect KPN year, in which the first positive contribution is made to the result of KPN Confidential KPN00026078

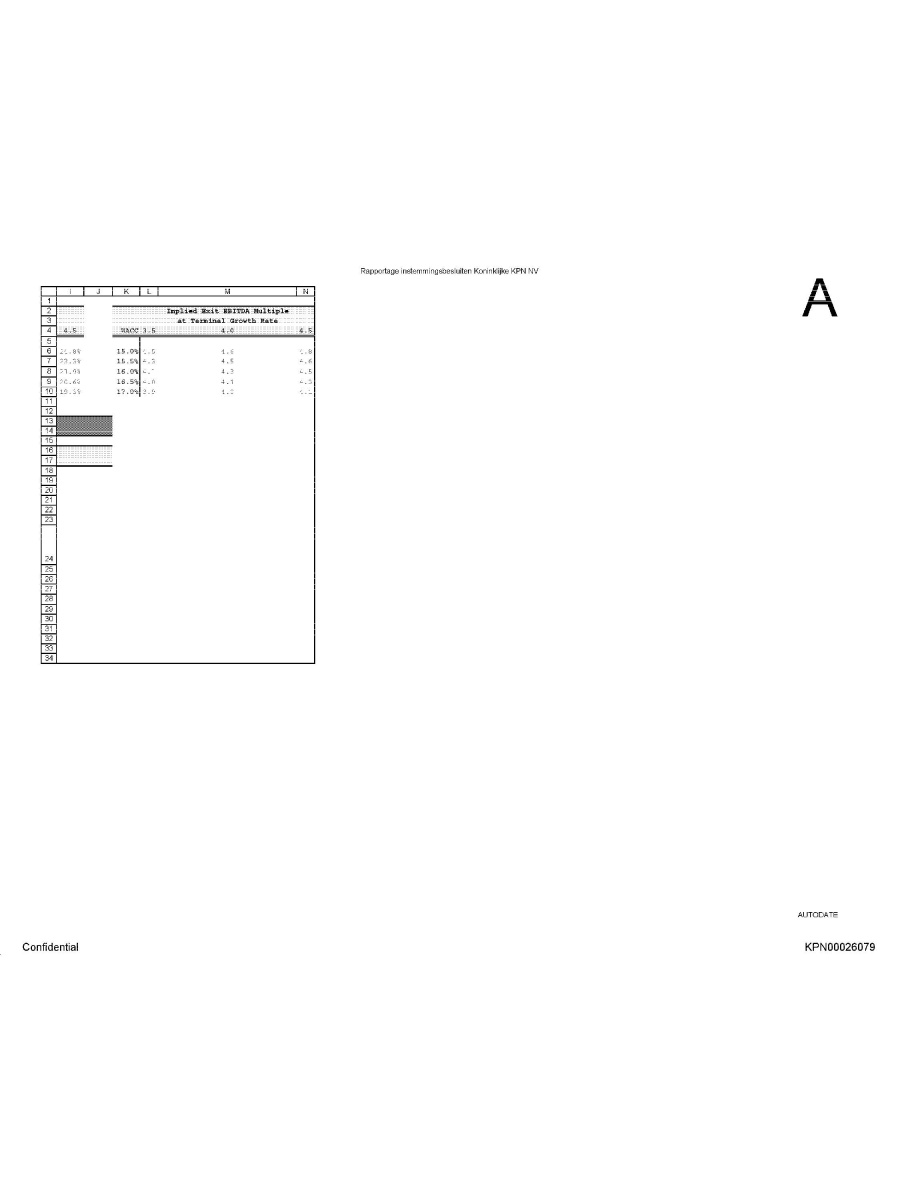

Rapportage instemmingsbesluiten Koninklijke KPN NV Implied Exit EBITDA Multiple at Terminal Growth Rate Confidential KPN00026079

Volume 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total # minutes Price 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Revenu 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total revenu Gross Margin % 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Confidential KPN 00026080

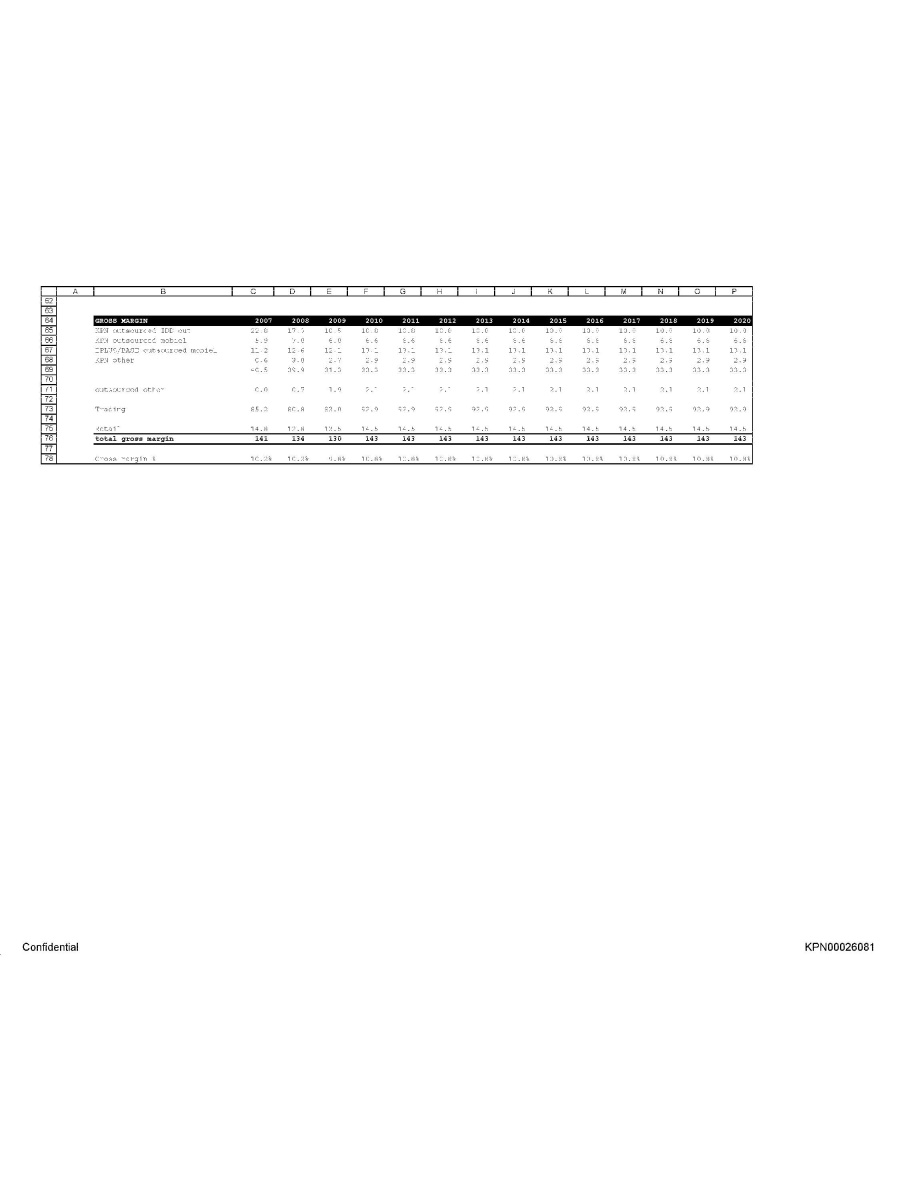

Gross Margin KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other trading Retail total gross margin Gross margin % Confidential KPN00026081

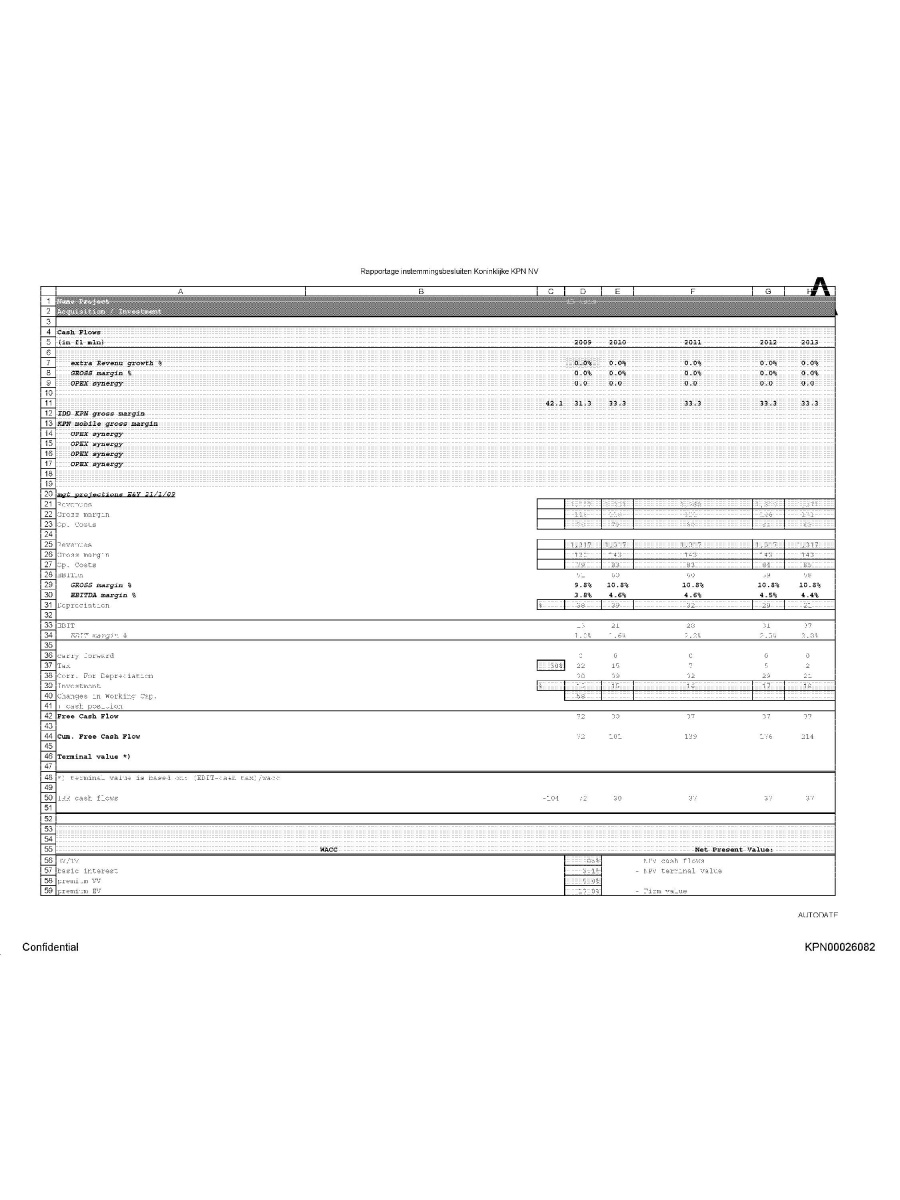

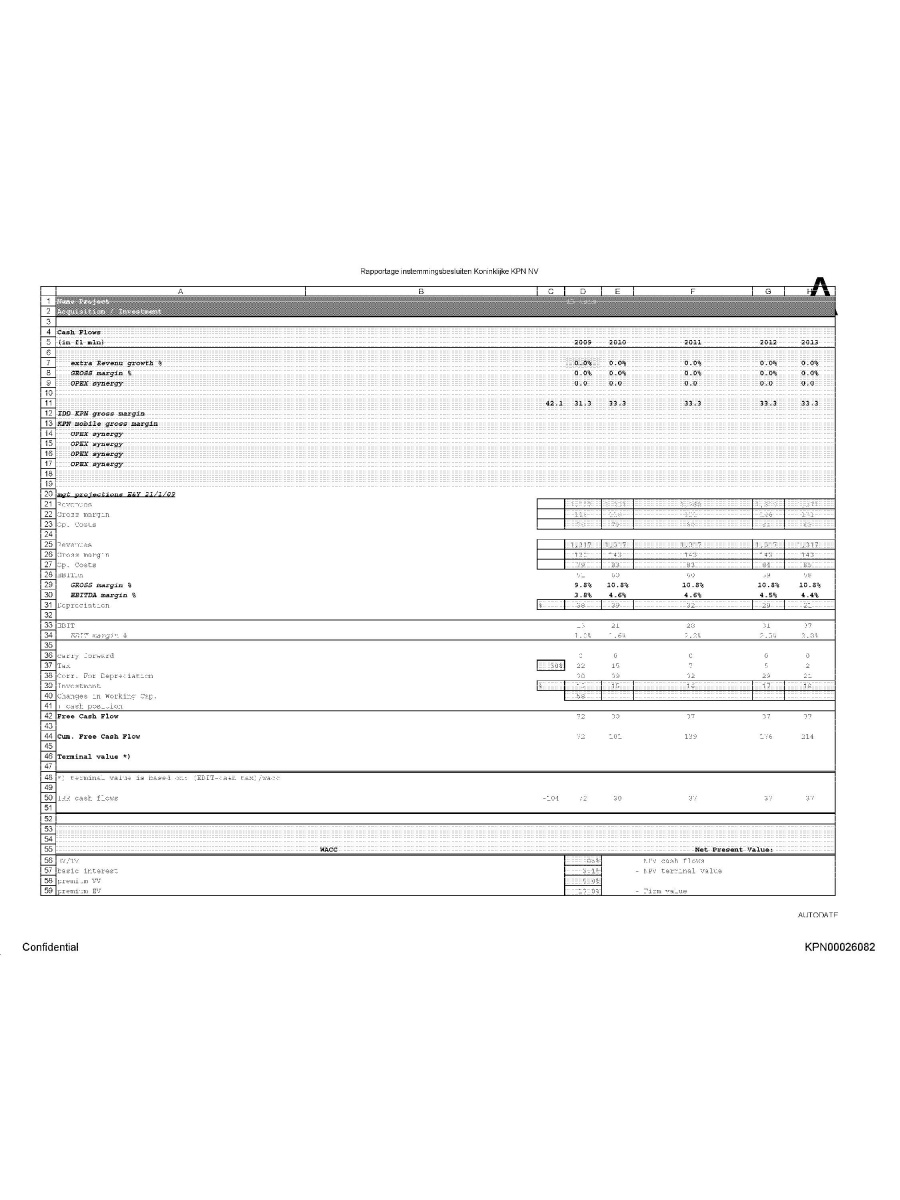

Rapportage instemmingsbesluiten Koninklijke KPN NV Name Project Acquisition / Investment Cash Flow (in fl. mln) 2009 2010 2011 2012 2013 extra Revenu growth % GROSS margin % OPEX synergy IDD KPN gross margin KPN mobile gross margin OPEX synergy OPEX synergy OPEX synergy OPEX synergy mgt projections E&Y 21/1/09 Revenues Gross margin Op. Costs Revenues Gross margin Op. Costs EBITDA GROSS margin % EBITDA margin % Depreciation EBIT EBIT margin % carry forward Tax Corr. For Depreciation Investment Changes in Working Cap. + cash position Free Cash Flow Cum. Free Cash Flow Terminal value *) *) terminal value is based on: (EBIT-cash tax)/wacc IRR cash flows WACC Net Present Value EV/TV NPV cash flows basic interest NPV terminal value premium VV premium EV Firm Value Confidential KPN00026082

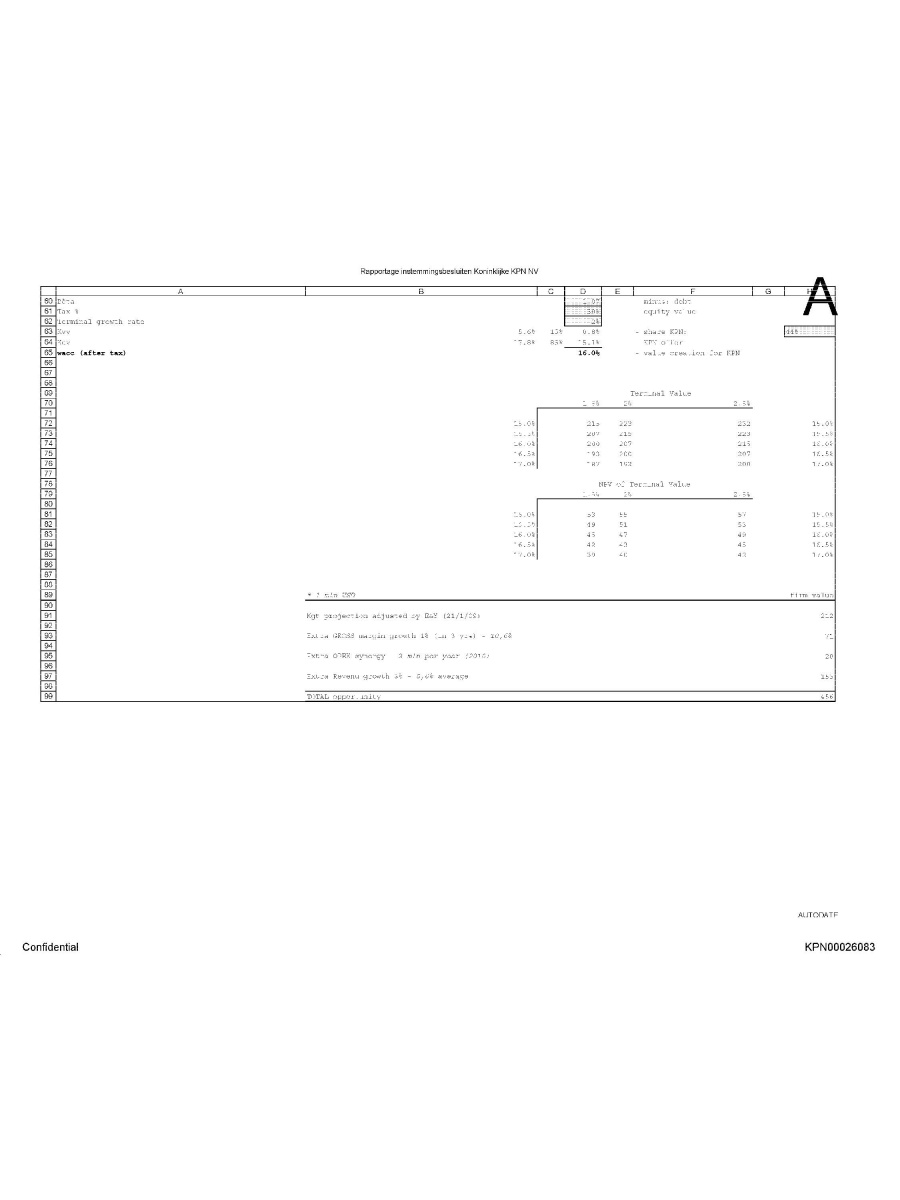

Rapportage instemmingsbesluiten Koninklijke KPN NV Beta minus debt Tax % Terminal growth rate equity value Kvv share KPN Kev KPN-ovver wacc (after tax) value creation for KPN Terminal Value NPV of Terminal Value * 1 mln USD Mgt projection adjusted by E&Y (21/1/09) Extra GROSS margin growth 1% (in 3 yrs) - 10,6% Extra OPEX synergy - 3 mln per year (2010) Extra Revenu growth 3% - 5,6% average TOTAL opportunity Confidential KPN00026083

DCF Valuation 2014 2015 2016 2017 2018 9-yr CAGR IRR KPN-offer 100%-offer 100%-offer Confidential KPN00026084

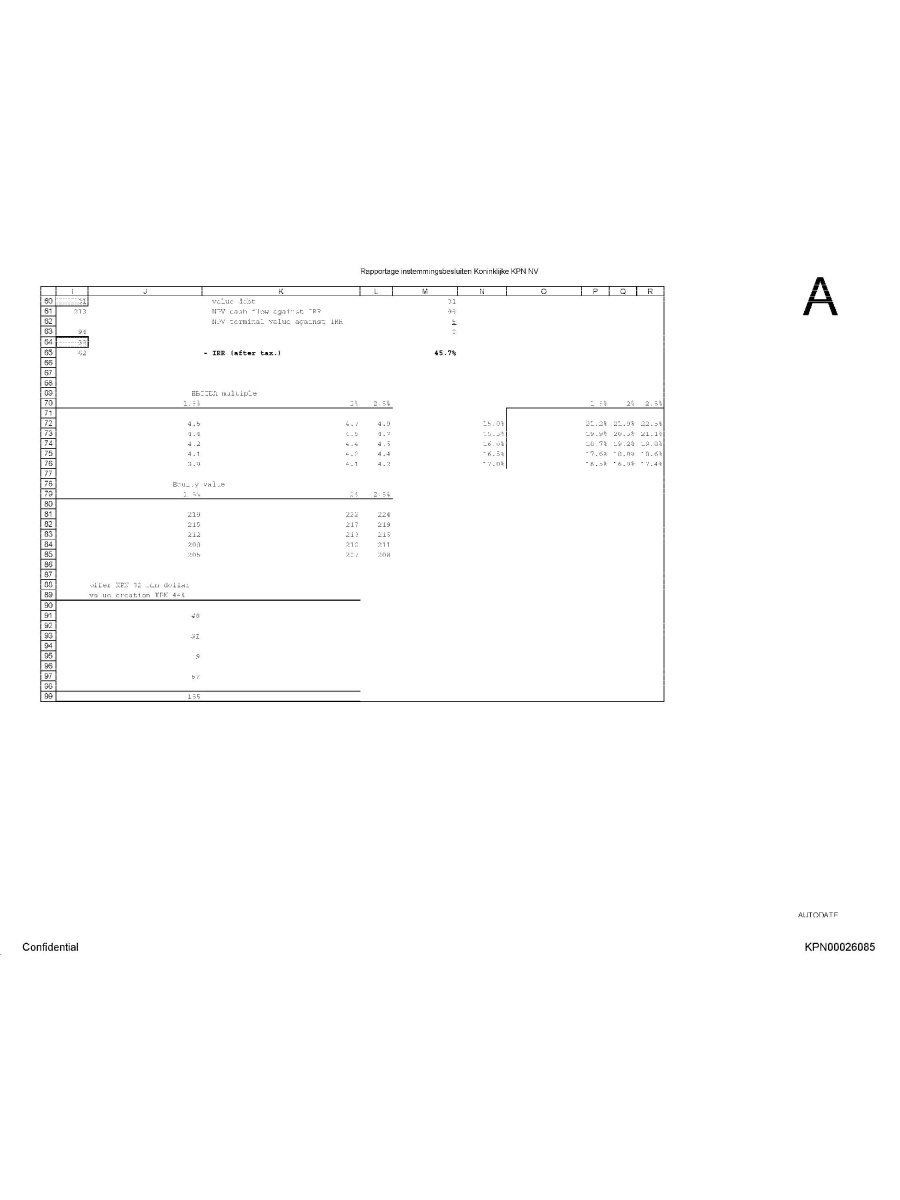

Rapportage instemmingsbesluiten Koninklijke KPN NV value debt NPV cash flow against IRR NPV terminal value against IRR IRR 9 (after tax.) EBITA multiple Equity value offer KPN 32 mln dollar value creation KPN 44% Confidential KPN00026085

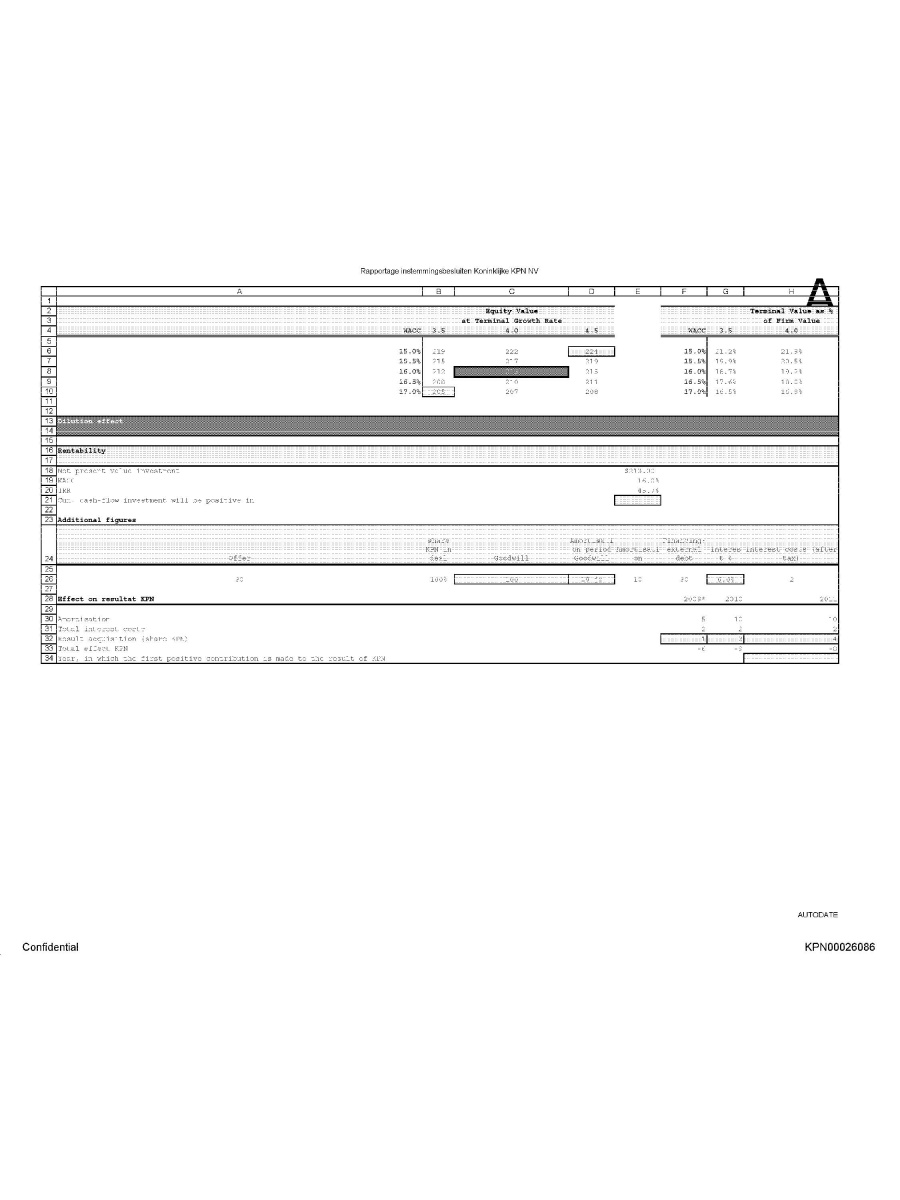

Rapportage instemmingsbesluiten Koninklijke KPN NV Equity Value at Terminal Growth Rate Terminal Value as % of Firm Value Dilution Effect Rentability Net present value investment WACC IRR Cum. cash-flow investment will be positive in Additional figures offer shares KPN in deal Goodwill Amortisation period Goodwill Amortisation Financing external debt interest % interest costs (after tax) Effect on resultat KPN Amortisation Total interest costs Result acquisition (share KPN) total effect KPN Year, in which the first positive contribution is made to the result of KPN Confidential KPN00026086

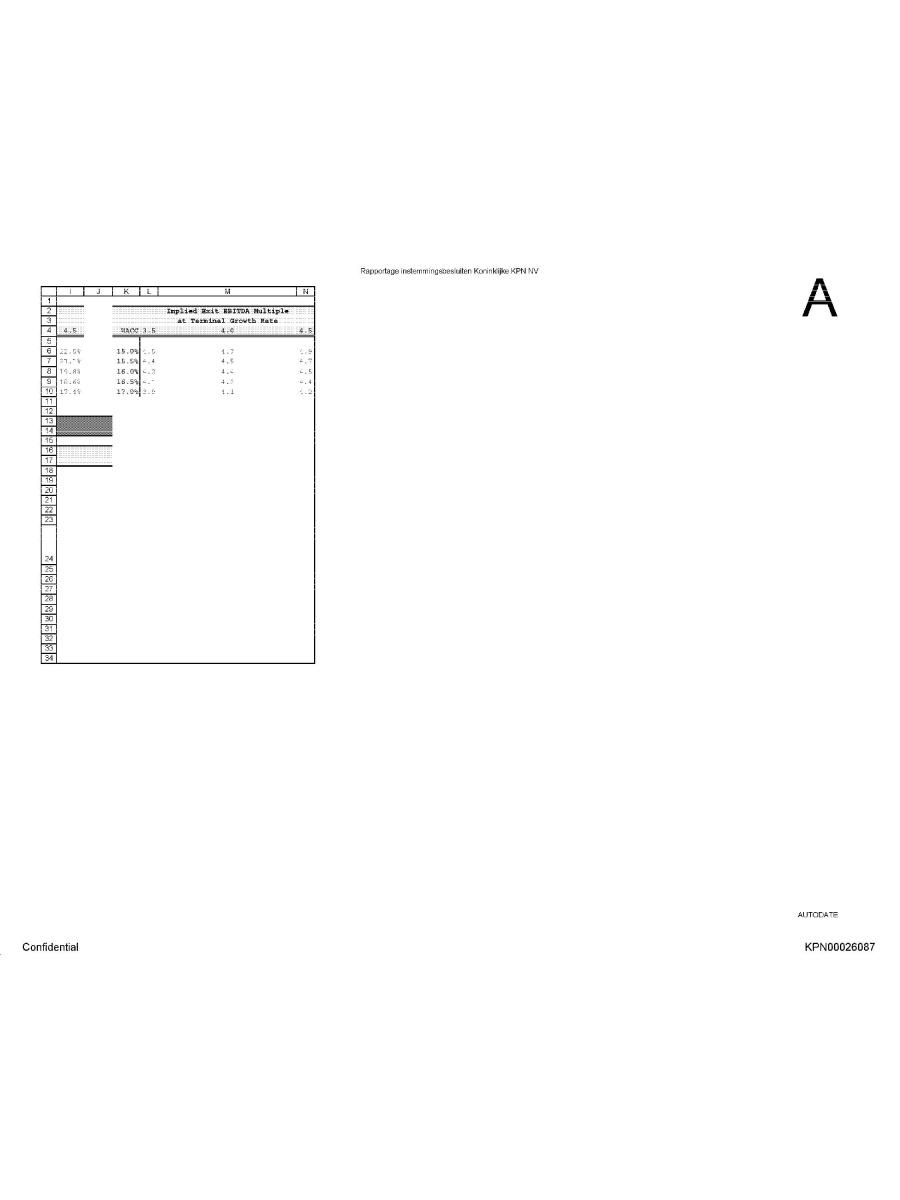

Implied Exit EBITDA Multiple at Terminal Growth Rate Confidential KPN00026087

Volume 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total # minutes Price 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Revenu 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total revenu Gross Margin % 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Confidential KPN 00026088

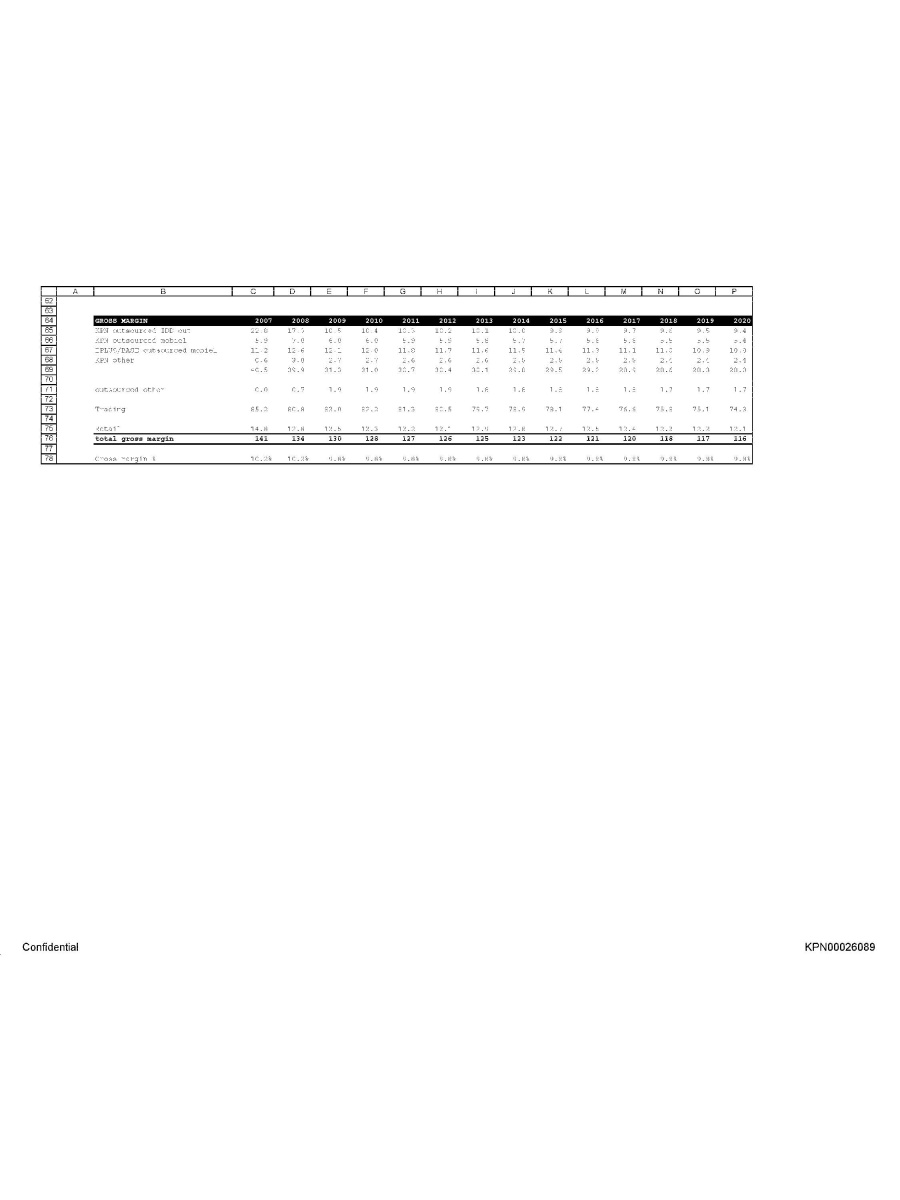

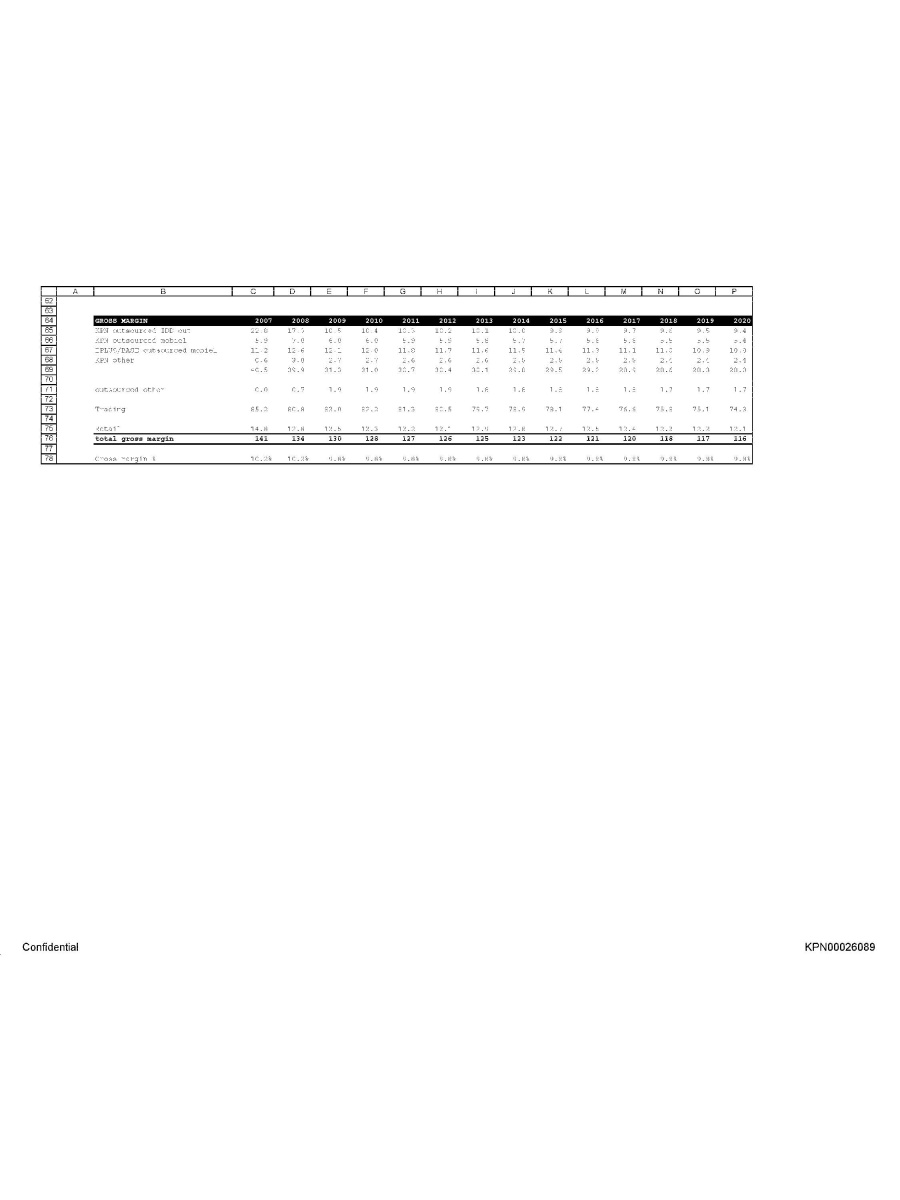

Gross Margin 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total gross margin Gross margin% Confidential KPN 00026089

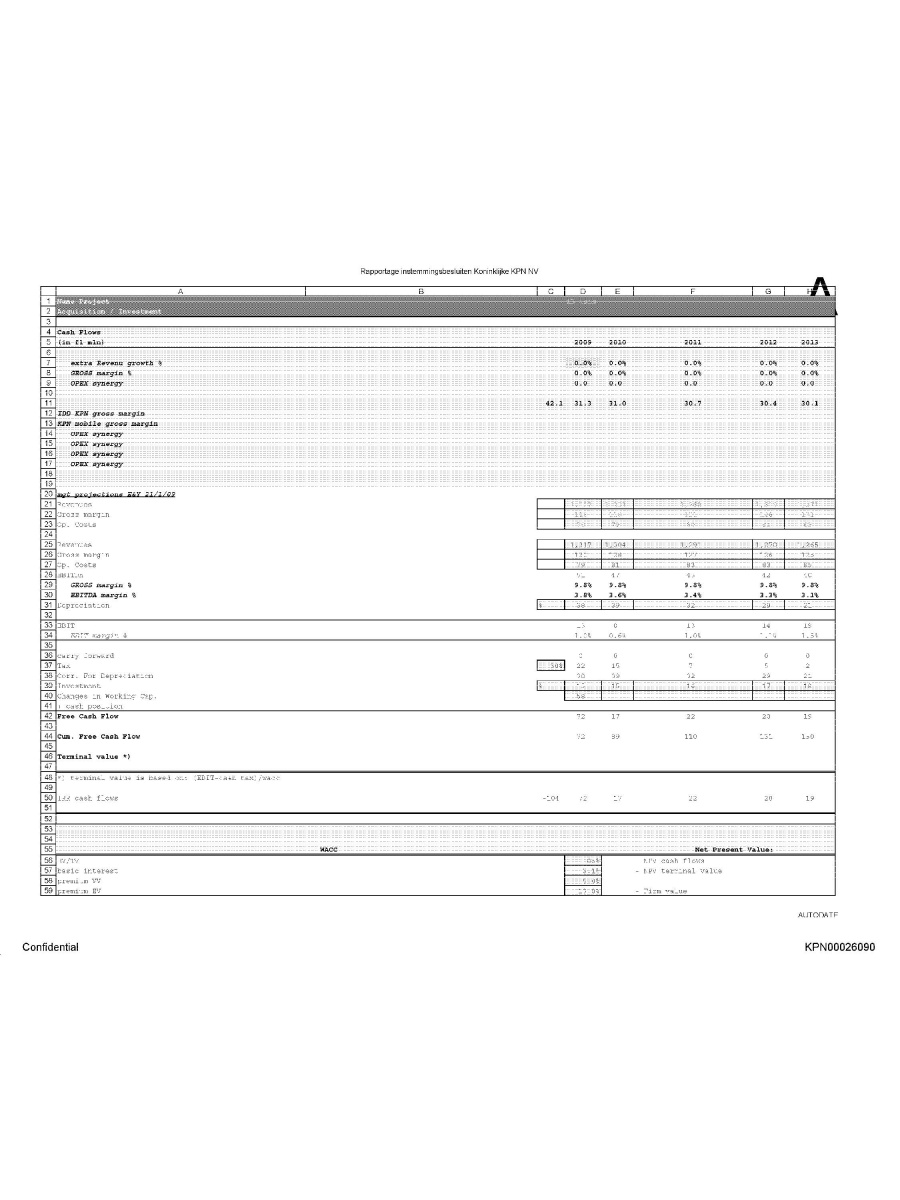

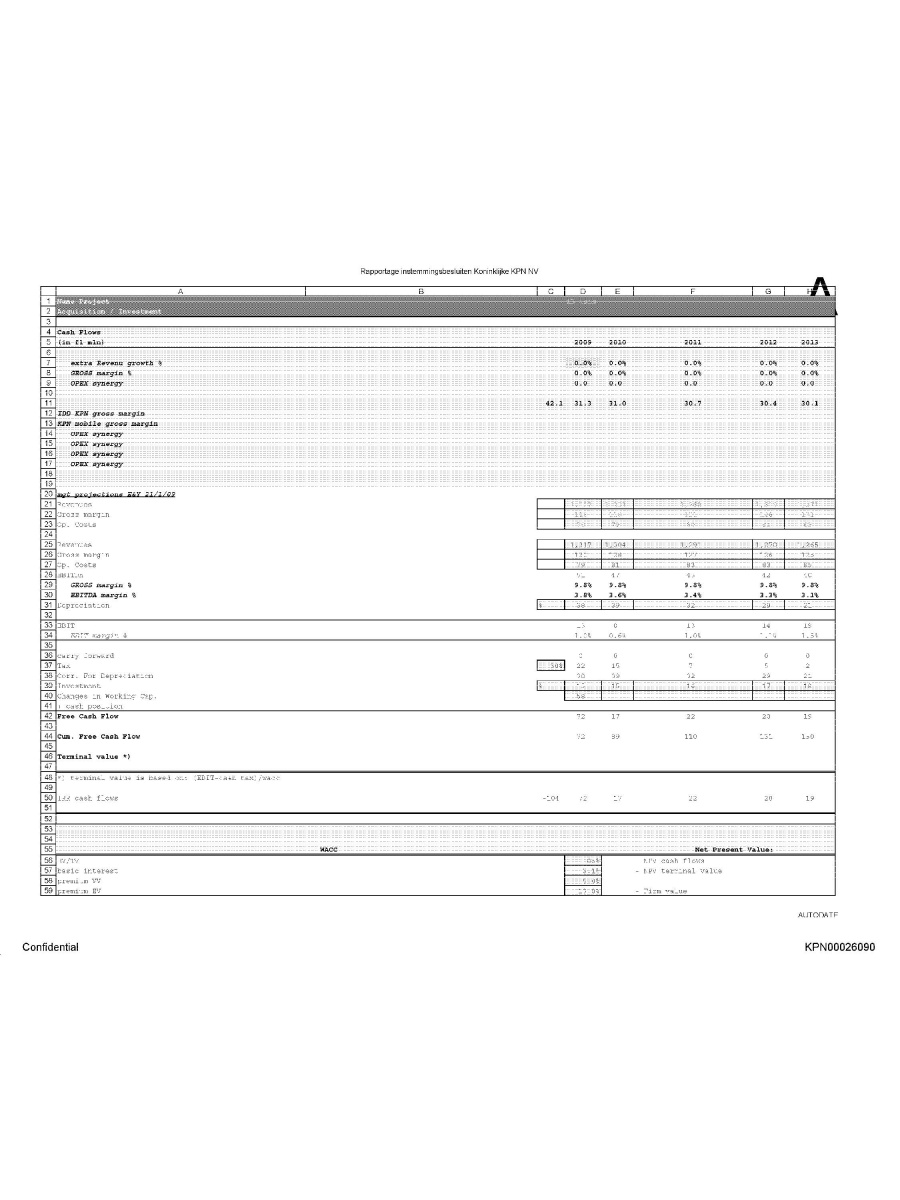

Rapportage instemmingsbesluiten Koninklijke KPN NV Name Project Acquisition / Investment Cash Flow (in fl. mln) 2009 2010 2011 2012 2013 extra Revenu growth % GROSS margin % OPEX synergy IDD KPN gross margin KPN mobile gross margin OPEX synergy OPEX synergy OPEX synergy OPEX synergy mgt projections E&Y 21/1/09 Revenues Gross margin Op. Costs Revenues Gross margin Op. Costs EBITDA GROSS margin % EBITDA margin % Depreciation EBIT EBIT margin % carry forward Tax Corr. For Depreciation Investment Changes in Working Cap. + cash position Free Cash Flow Cum. Free Cash Flow Terminal value *) *) terminal value is based on: (EBIT-cash tax)/wacc IRR cash flows WACC Net Present Value EV/TV NPV cash flows basic interest NPV terminal value premium VV premium EV Firm Value Confidential KPN00026090

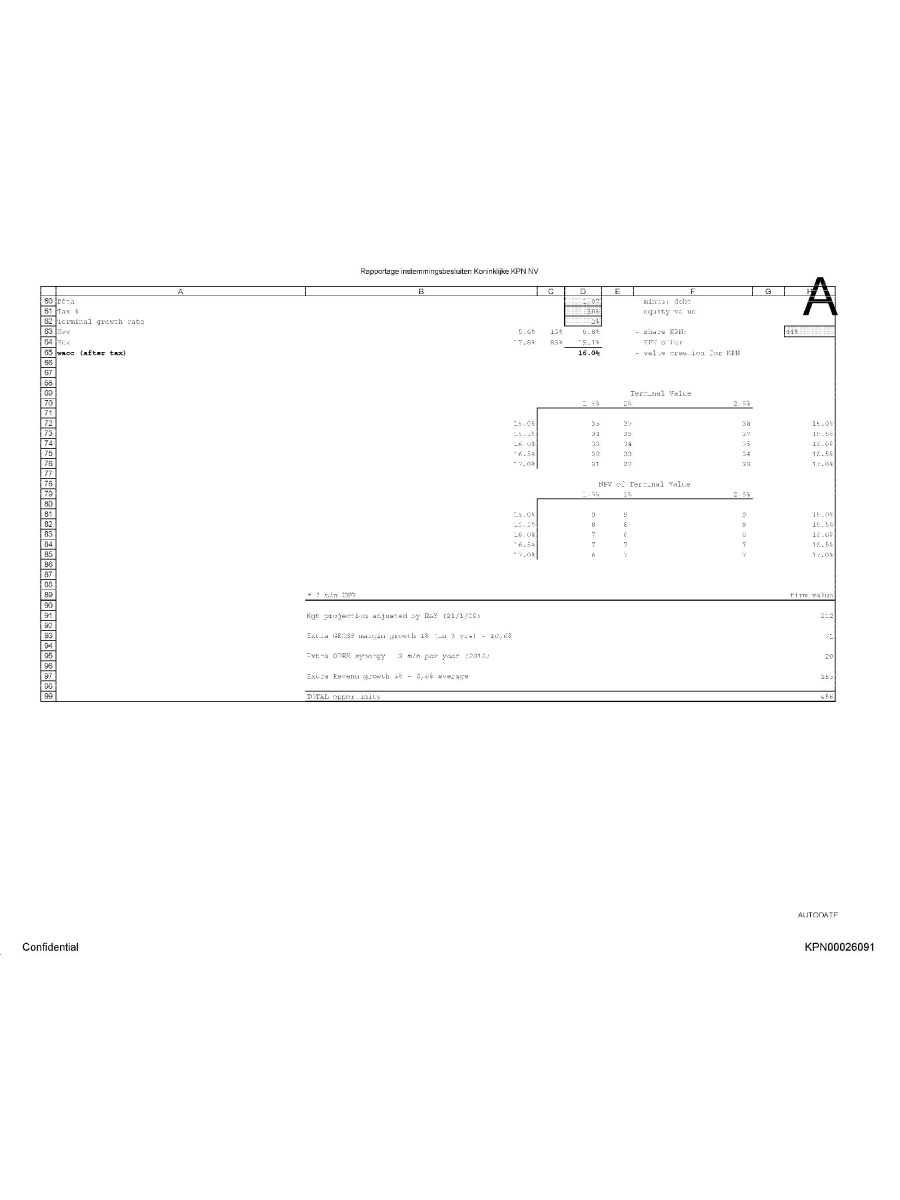

Rapportage instemmingsbesluiten Koninklijke KPN NV Beta minus debt Tax % Terminal growth rate equity value Kvv share KPN Kev KPN-ovver wacc (after tax) value creation for KPN Terminal Value NPV of Terminal Value * 1 mln USD Mgt projection adjusted by E&Y (21/1/09) Extra GROSS margin growth 1% (in 3 yrs) - 10,6% Extra OPEX synergy - 3 mln per year (2010) Extra Revenu growth 3% - 5,6% average TOTAL opportunity Confidential KPN00026091

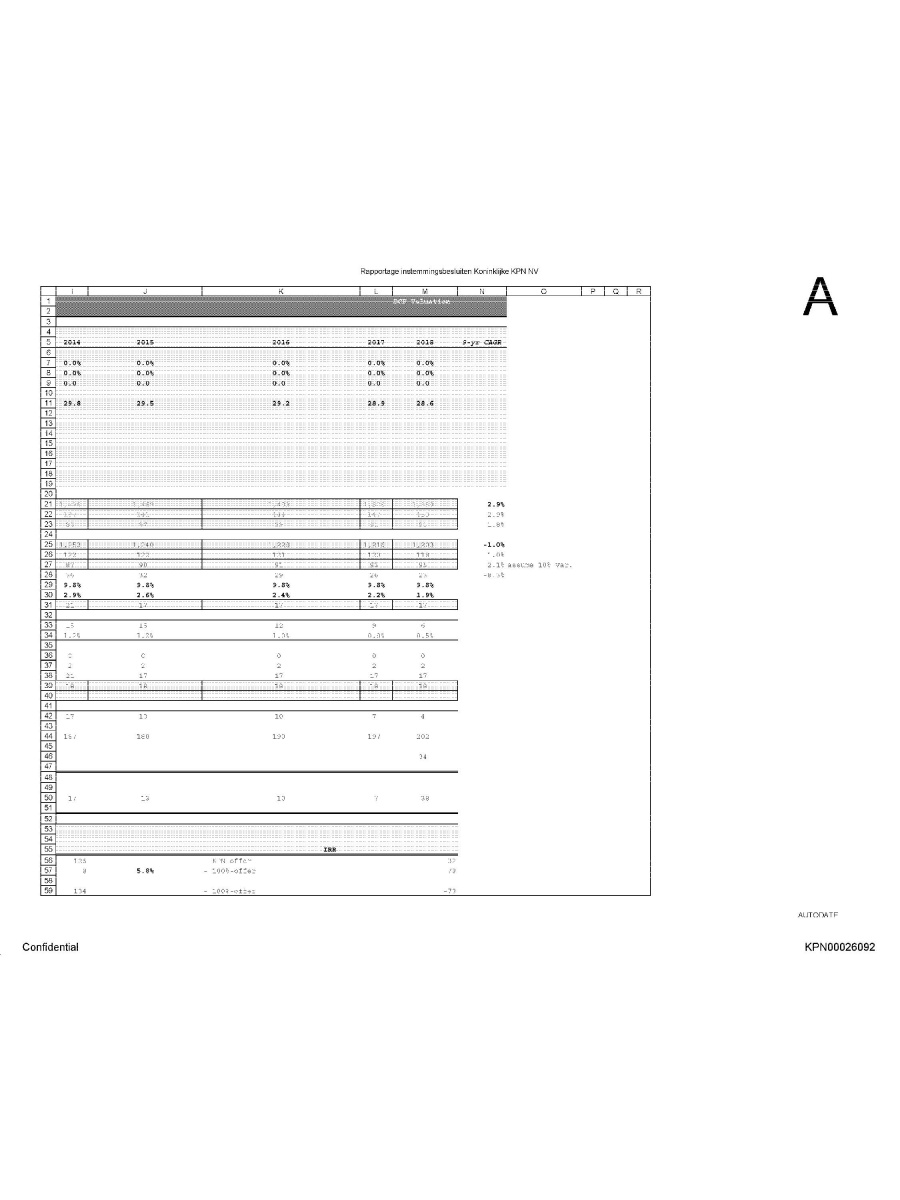

Rapportage instemmingsbesluiten Koninklijke KPN NV DCF Valuation 2014 2015 2016 2017 2018 9-yr CAGR IRR KPN-offer 100%-offer 100%-offer Confidential KPN00026092

Rapportage instemmingsbesluiten Koninklijke KPN NV value debt NPV cash flow against IRR NPV terminal value against IRR IRR (after tax.) EBITA multiple Equity value offer KPN 32 mln dollar value creation KPN 44% Confidential KPN00026093

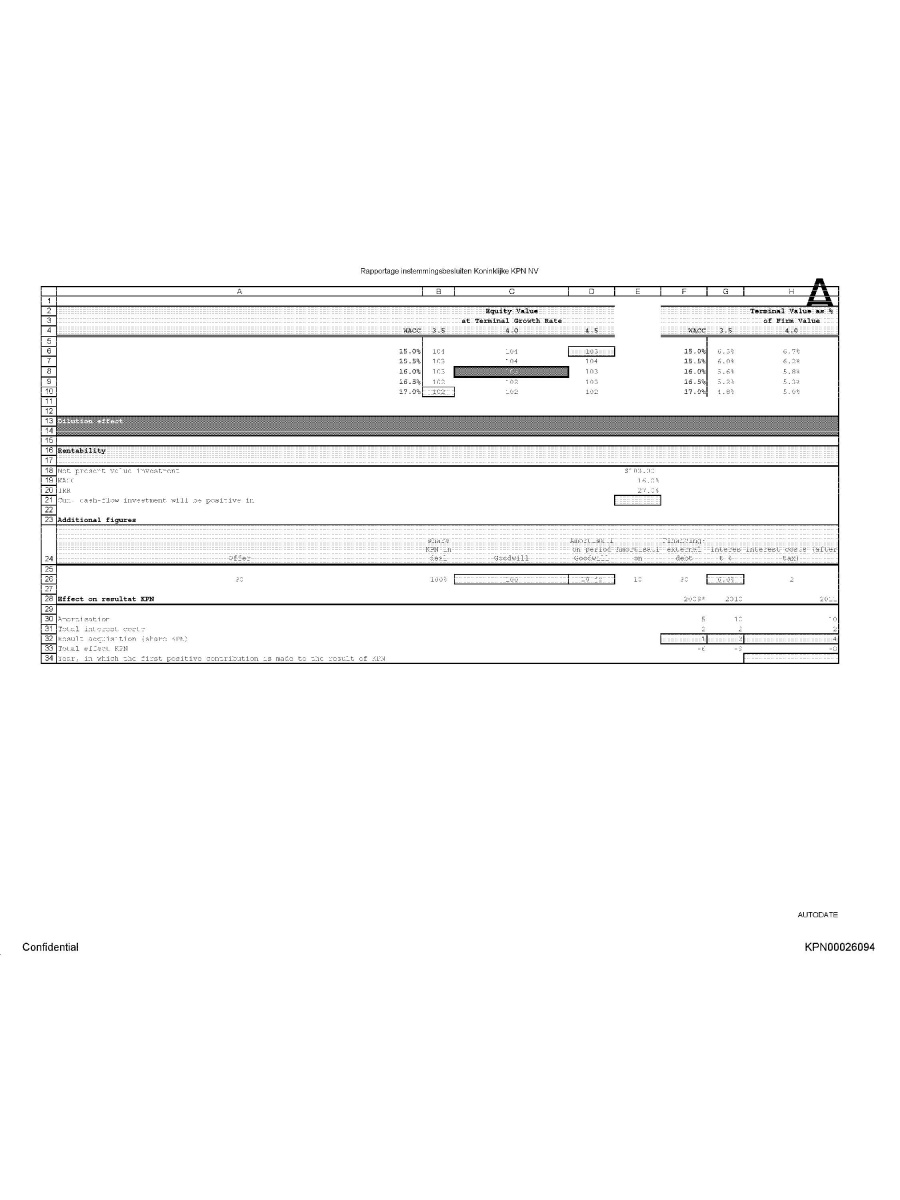

Rapportage instemmingsbesluiten Koninklijke KPN NV Equity Value at Terminal Growth Rate Terminal Value as % of Firm Value Dilution Effect Rentability Net present value investment WACC IRR Cum. cash-flow investment will be positive in Additional figures offer shares KPN in deal Goodwill Amortisation period Goodwill Amortisation Financing external debt interest % interest costs (after tax) Effect on resultat KPN Amortisation Total interest costs Result acquisition (share KPN) total effect KPN Year, in which the first positive contribution is made to the result of KPN Confidential KPN00026094

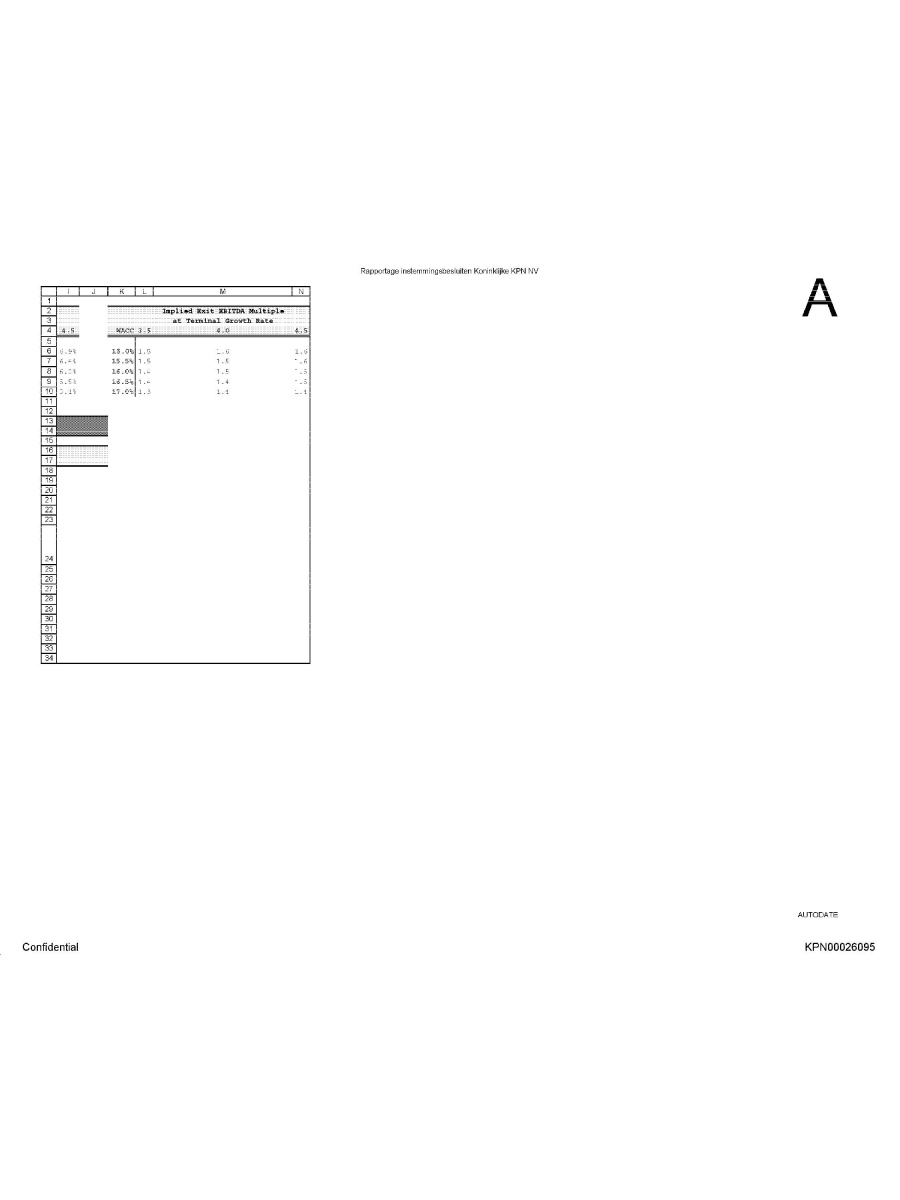

Implied Exit EBITDA Multiple at Terminal Growth Rate Confidential KPN00026095

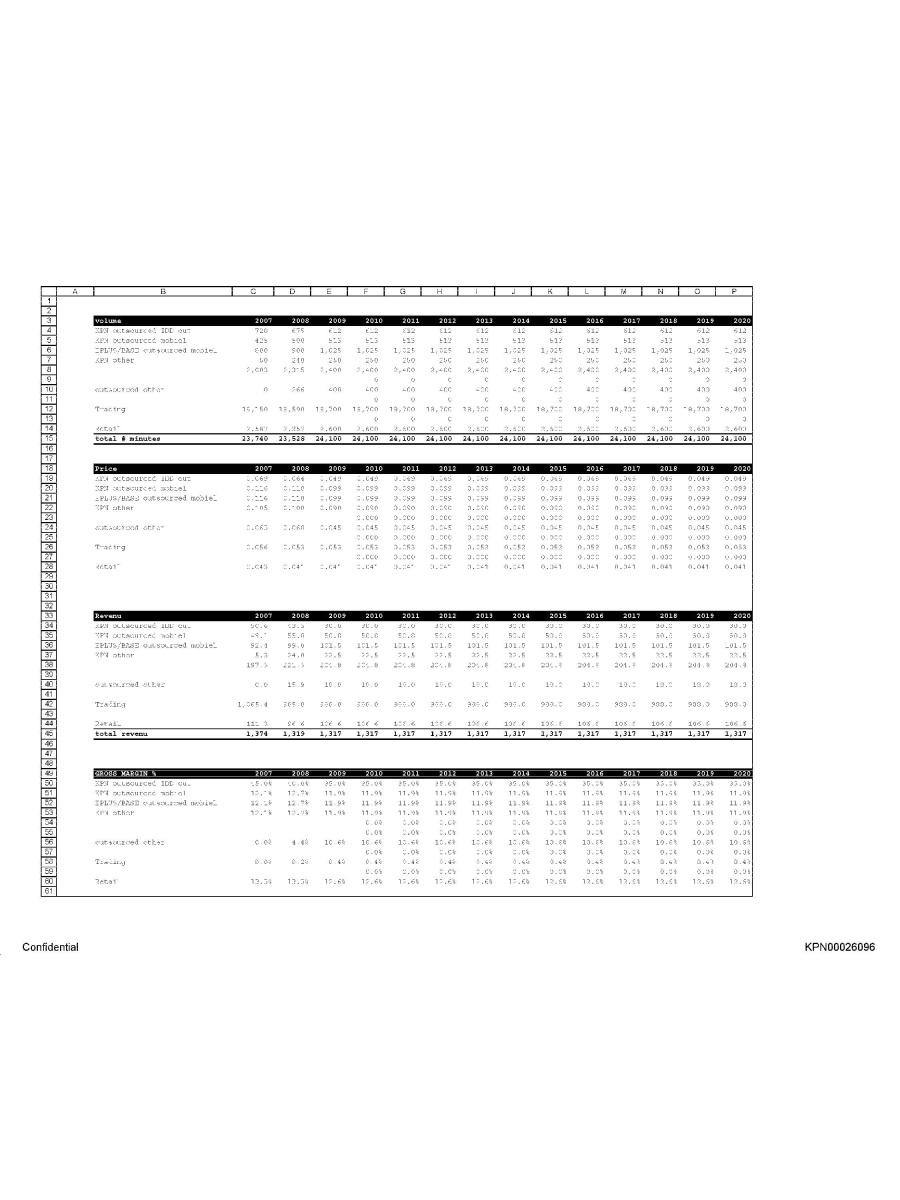

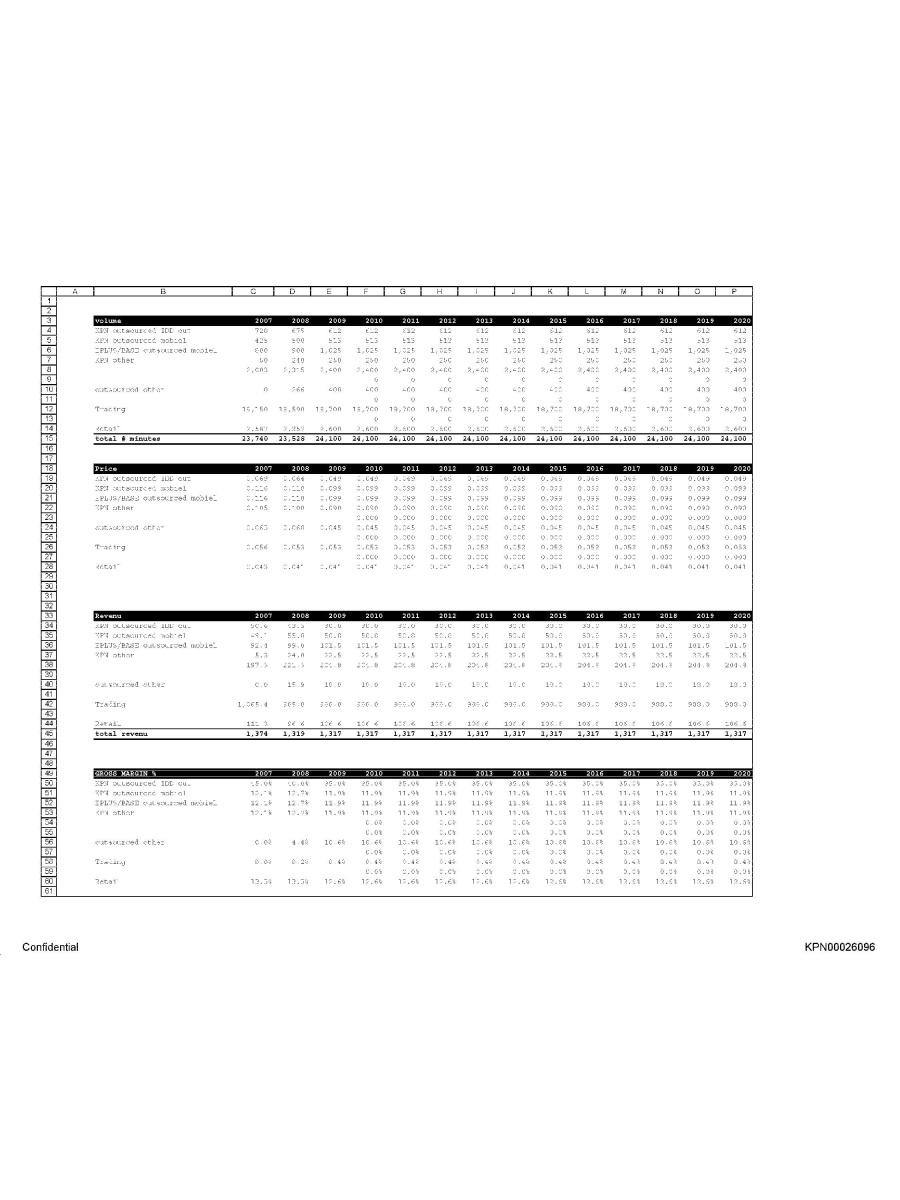

Volume 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total # minutes Price 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Revenu 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total revenu Gross Margin % 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Confidential KPN 00026096

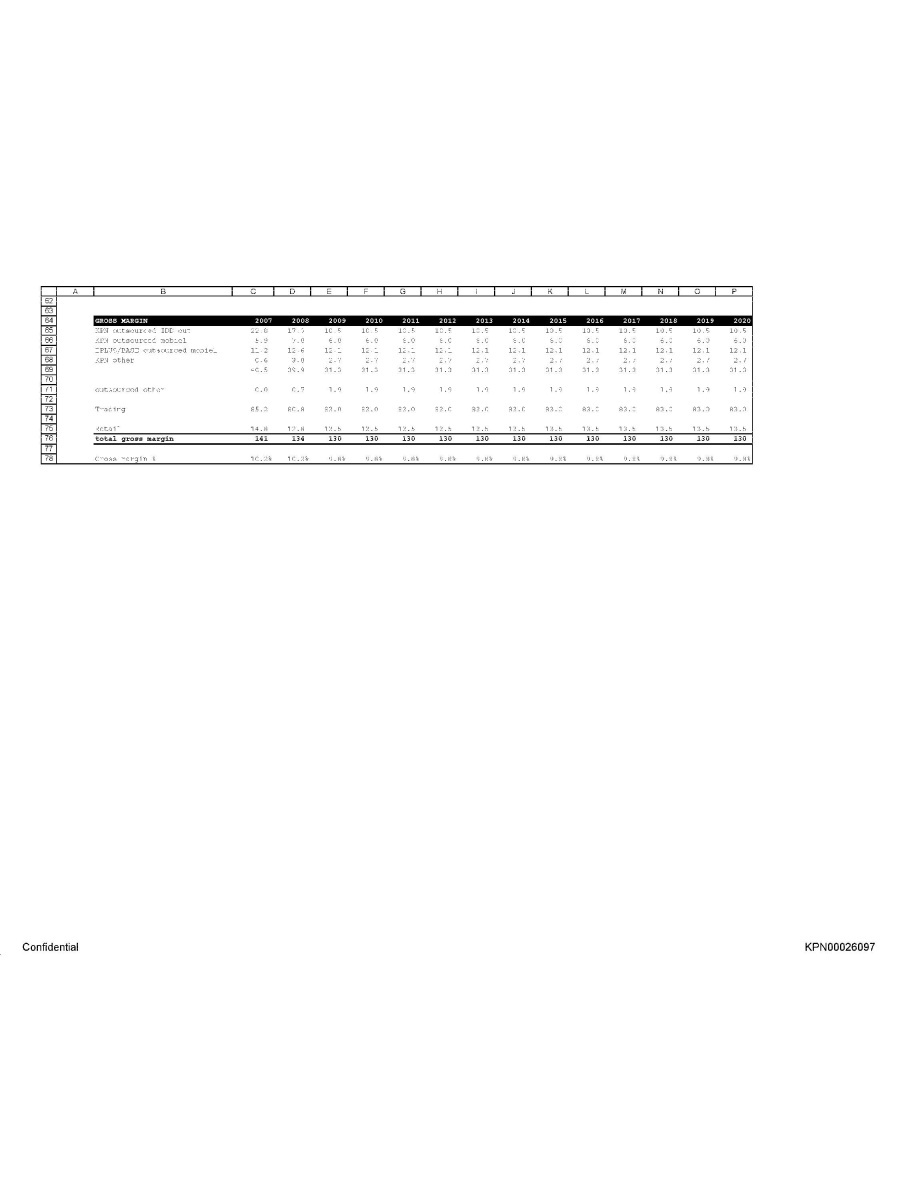

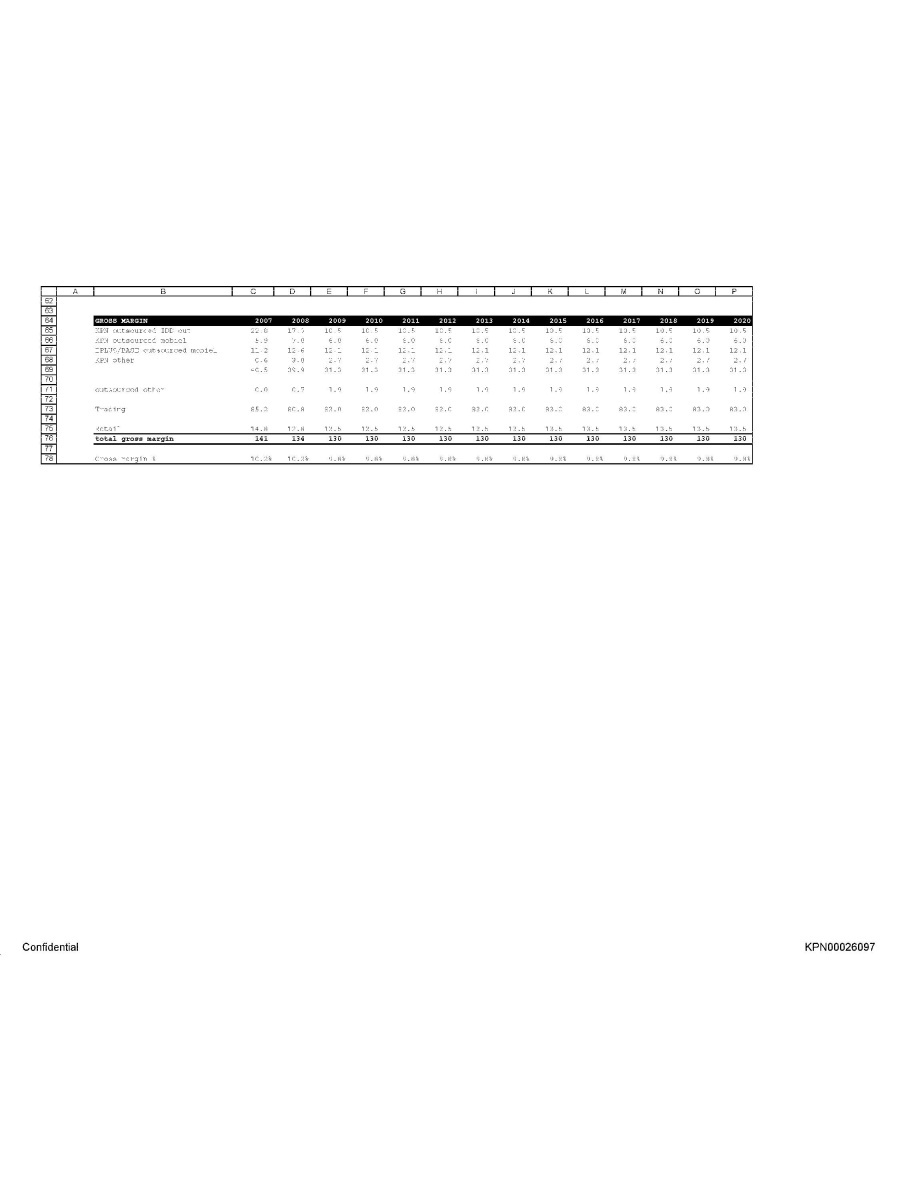

Gross Margin 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total gross margin Gross margin% Confidential KPN 00026097

Rapportage instemmingsbesluiten Koninklijke KPN NV Name Project Acquisition / Investment Cash Flow (in fl. mln) 2009 2010 2011 2012 2013 extra Revenu growth % GROSS margin % OPEX synergy IDD KPN gross margin KPN mobile gross margin OPEX synergy OPEX synergy OPEX synergy OPEX synergy mgt projections E&Y 21/1/09 Revenues Gross margin Op. Costs Revenues Gross margin Op. Costs EBITDA GROSS margin % EBITDA margin % Depreciation EBIT EBIT margin % carry forward Tax Corr. For Depreciation Investment Changes in Working Cap. + cash position Free Cash Flow Cum. Free Cash Flow Terminal value *) *) terminal value is based on: (EBIT-cash tax)/wacc IRR cash flows WACC Net Present Value EV/TV NPV cash flows basic interest NPV terminal value premium VV premium EV Firm Value Confidential KPN00026098

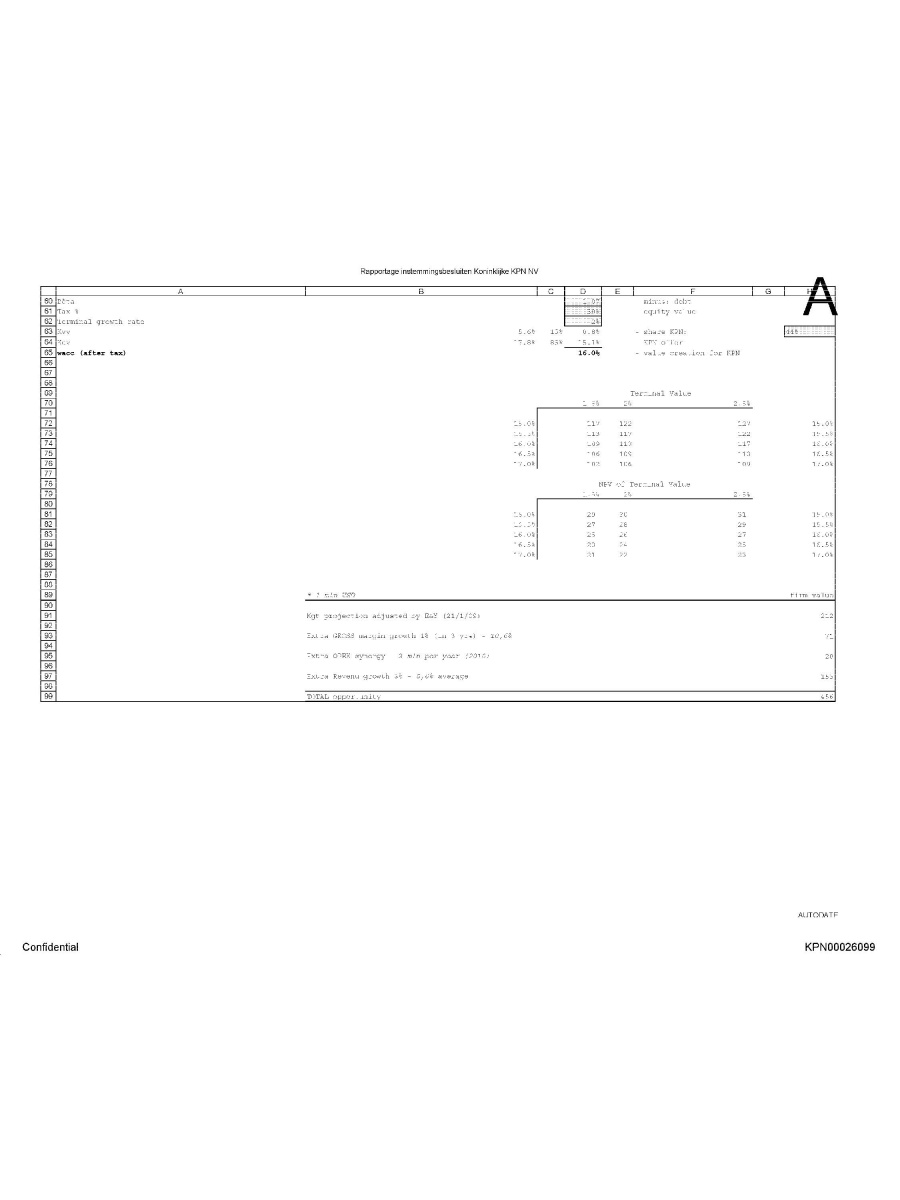

Rapportage instemmingsbesluiten Koninklijke KPN NV Beta Tax % Terminal growth rate Kvv Kev wacc (after tax) minus: debt equity value share KPN KPN-offer value creation for KPN Terminal Value NPV of Terminal Value * 1 mln USD firm value Mgt projection adjusted by E&Y (21/1/09) Extra GROSS margin growth 1% (in 3 yrs) - 10,6% Extra OPEX synergy - 3 mln per year (2010) Extra Revenu growth 3% - 5,6% average TOTAL opportunity Confidential KPN00026099

DCF Valuation 2014 2015 2016 2017 2018 9-yr CAGR IRR KPN-offer 100%-offer 100%-offer Confidential KPN0002100

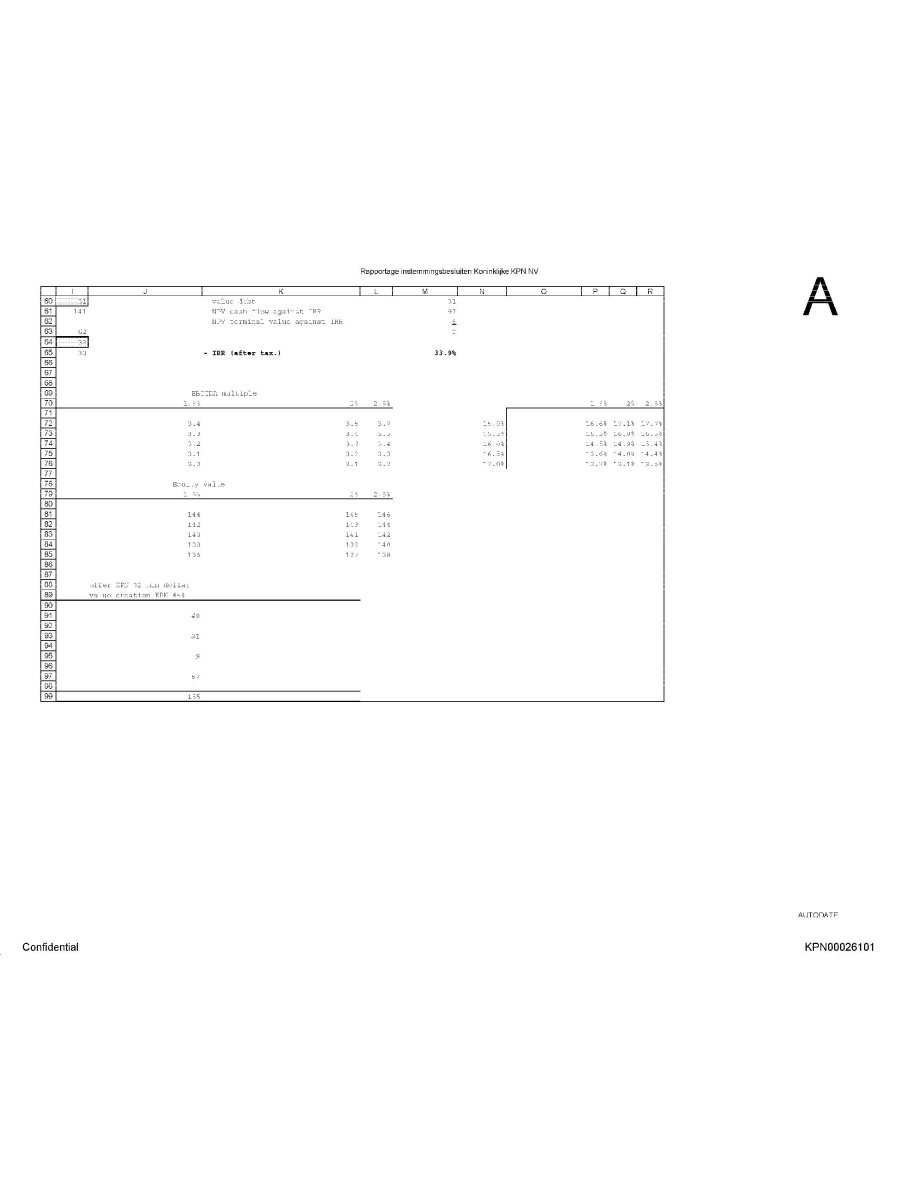

Rapportage instemmingsbesluiten Koninklijke KPN NV value debt NPV cash flow against IRR NPV terminal value against IRR IRR (after tax.) EBITA multiple Equity value offer KPN 32 mln dollar value creation KPN 44% Confidential KPN00026101

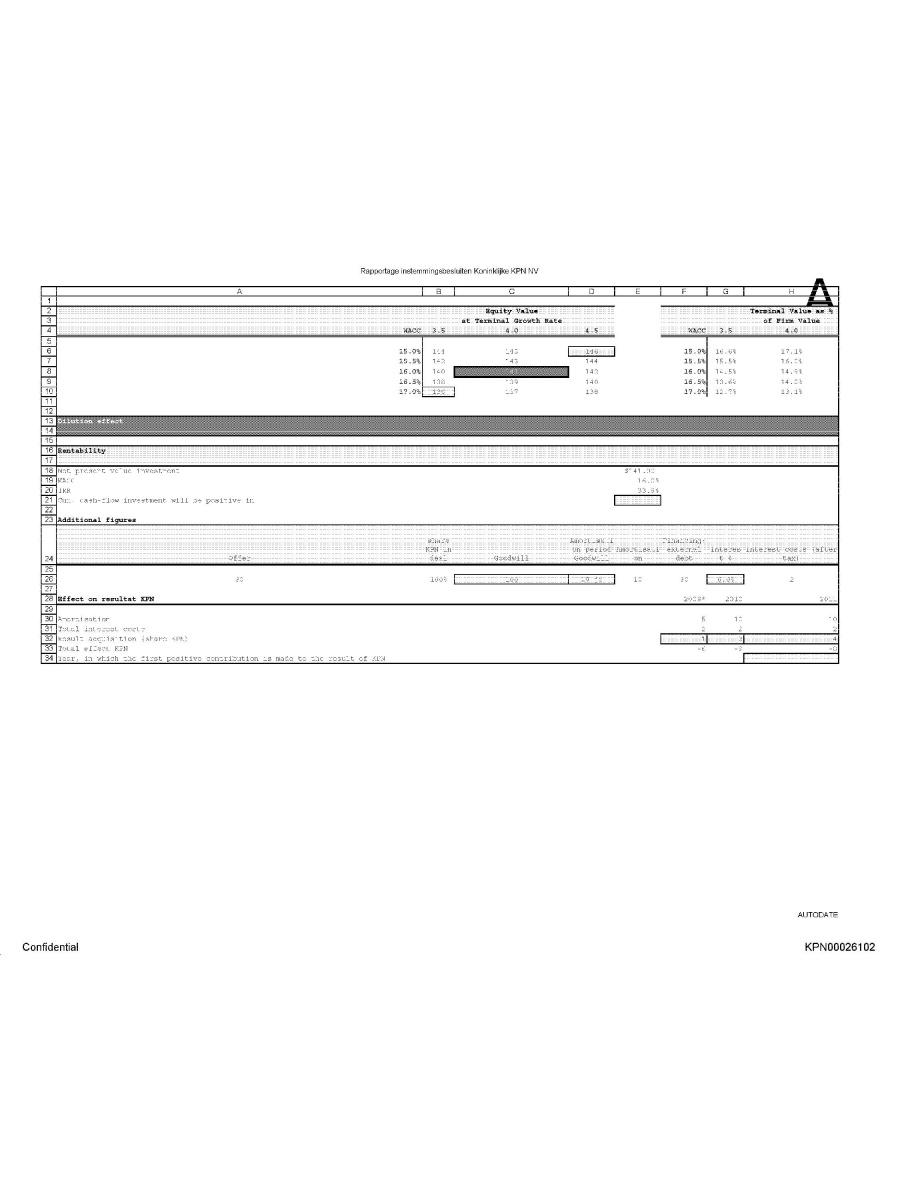

Rapportage instemmingsbesluiten Koninklijke KPN NV Equity Value at Terminal Growth Rate Terminal Value as % of Firm Value Dilution Effect Rentability Net present value investment WACC IRR Cum. cash-flow investment will be positive in Additional figures offer share KPN in deal Goodwill Amortisation period Goodwill Amortisation Financing external debt interest % interest costs (after tax) Effect on resultat KPN Amortisation Total interest costs Result acquisition (share KPN) total effect KPN Year, in which the first positive contribution is made to the result of KPN Confidential KPN00026102

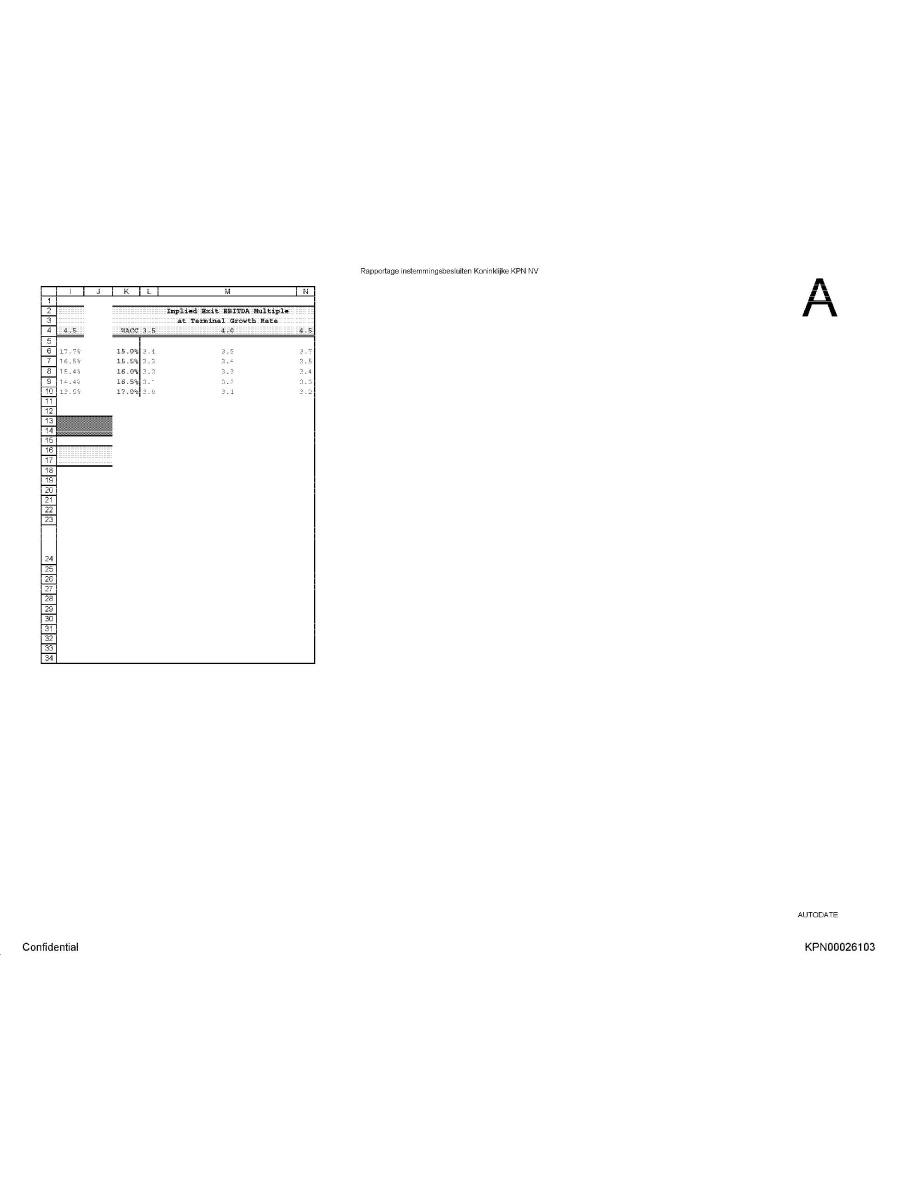

Implied Exit EBITDA Multiple at Terminal Growth Rate Confidential KPN00026103

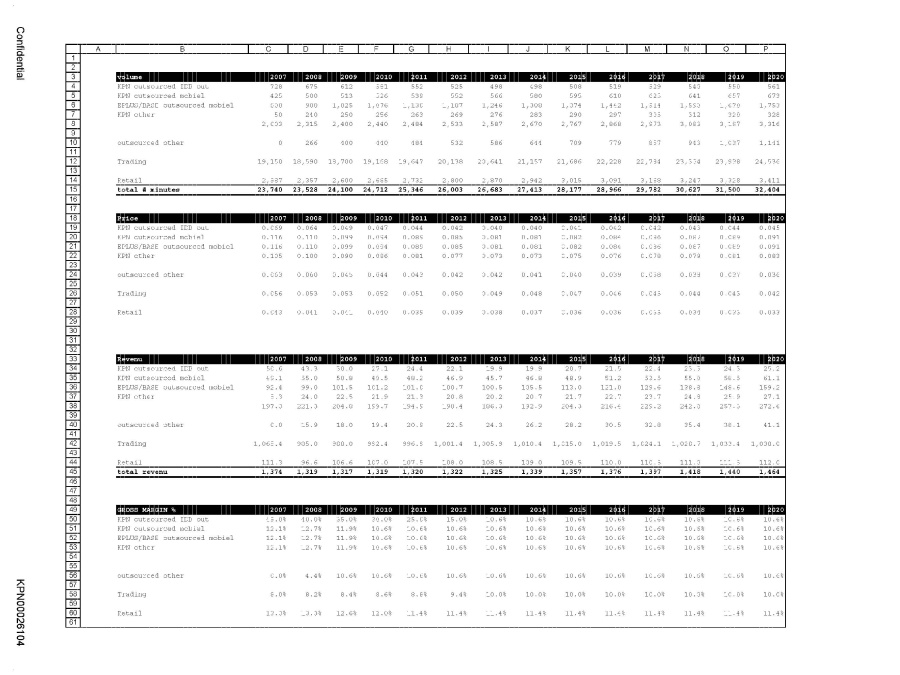

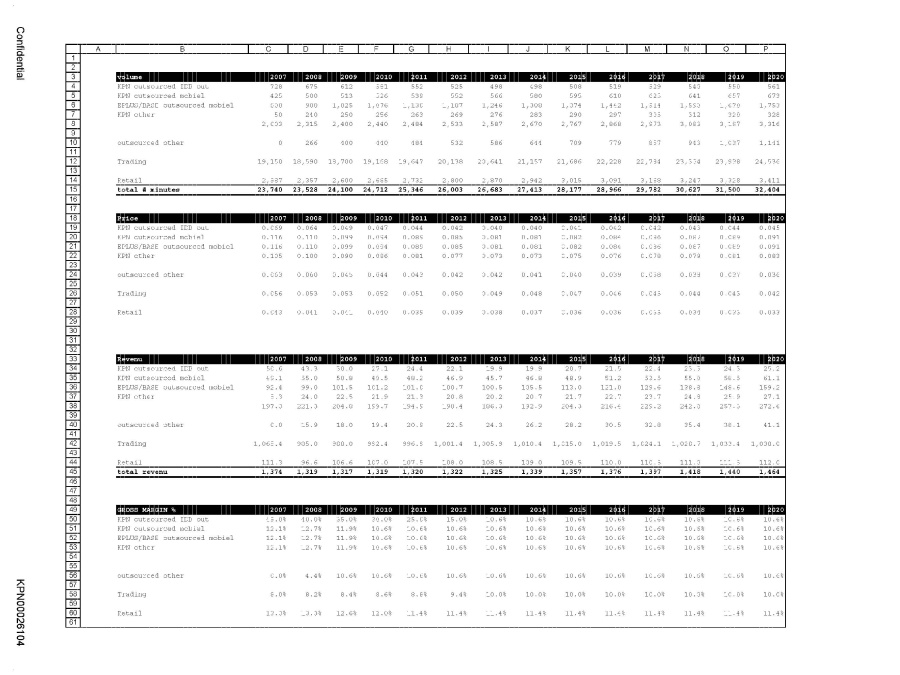

Volume 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total # minutes Price 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Revenu 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total revenu Gross Margin % 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Confidential KPN 00026104

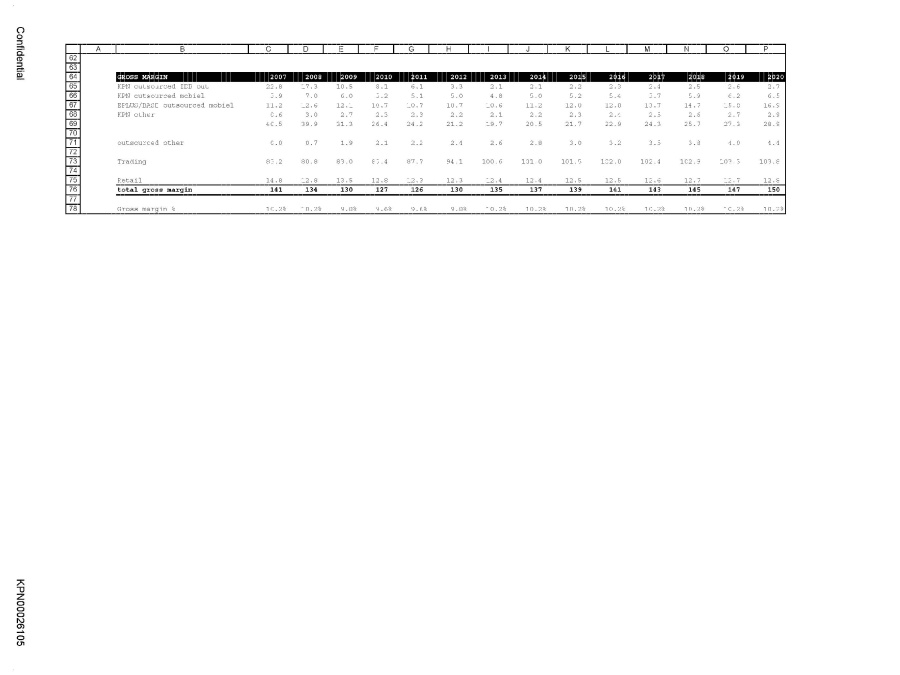

Gross Margin 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total gross margin Gross margin% Confidential KPN 00026105

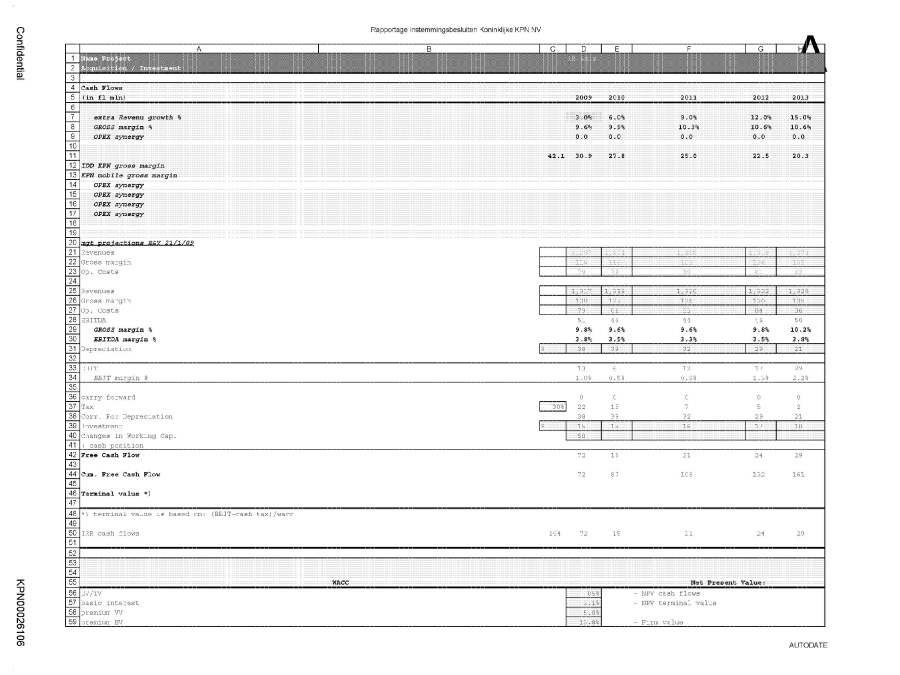

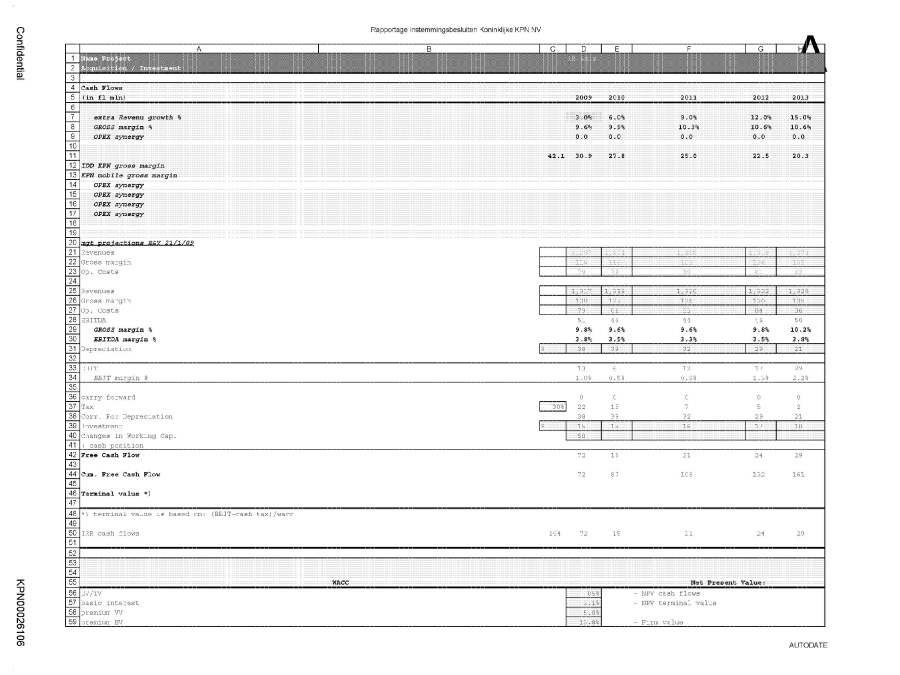

Rapportage instemmingsbesluiten Koninklijke KPN NV Name Project Acquisition / Investment Cash Flow (in fl. mln) 2009 2010 2011 2012 2013 extra Revenu growth % GROSS margin % OPEX synergy IDD KPN gross margin KPN mobile gross margin OPEX synergy OPEX synergy OPEX synergy OPEX synergy mgt projections E&Y 21/1/09 Revenues Gross margin Op. Costs Revenues Gross margin Op. Costs EBITDA GROSS margin % EBITDA margin % Depreciation EBIT EBIT margin % carry forward Tax Corr. For Depreciation Investment Changes in Working Cap. + cash position Free Cash Flow Cum. Free Cash Flow Terminal value *) *) terminal value is based on: (EBIT-cash tax)/wacc IRR cash flows WACC Net Present Value EV/TV NPV cash flows basic interest NPV terminal value premium VV premium EV Firm Value Confidential KPN00026106

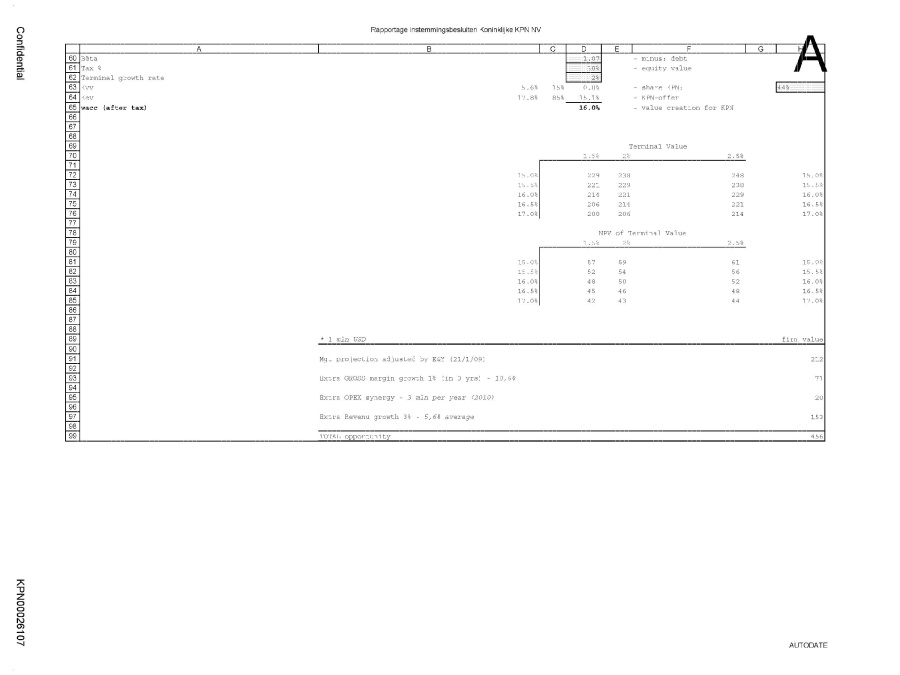

Rapportage instemmingsbesluiten Koninklijke KPN NV Beta minus debt Tax % Terminal growth rate equity value Kvv share KPN Kev KPN-ovver wacc (after tax) value creation for KPN Terminal Value NPV of Terminal Value * 1 mln USD Mgt projection adjusted by E&Y (21/1/09) Extra GROSS margin growth 1% (in 3 yrs) - 10,6% Extra OPEX synergy - 3 mln per year (2010) Extra Revenu growth 3% - 5,6% average TOTAL opportunity Confidential KPN00026107

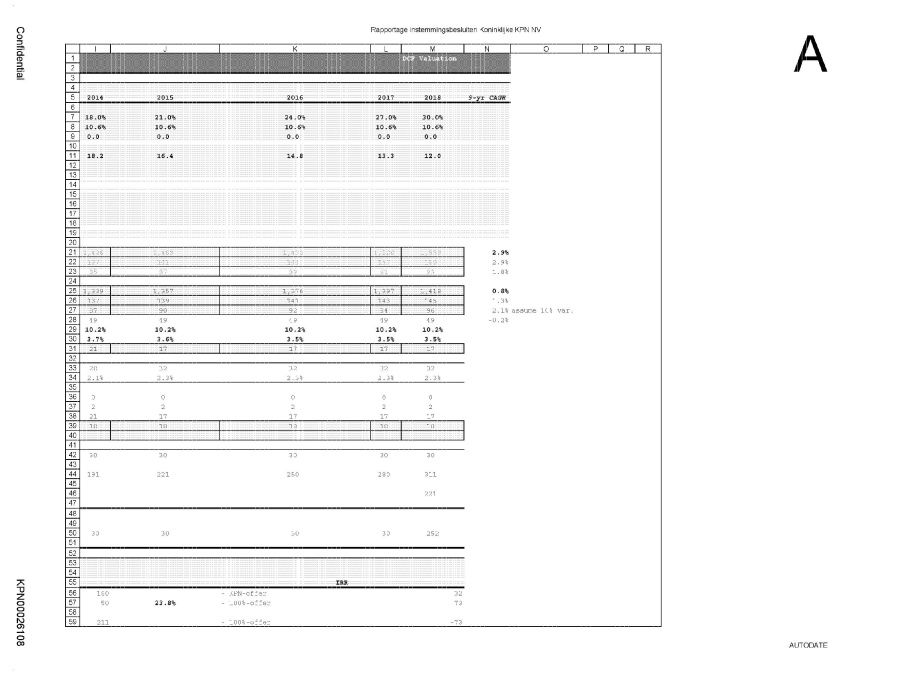

DCF Valuation 2014 2015 2016 2017 2018 9-yr CAGR IRR KPN-offer 100%-offer 100%-offer Confidential KPN00026108

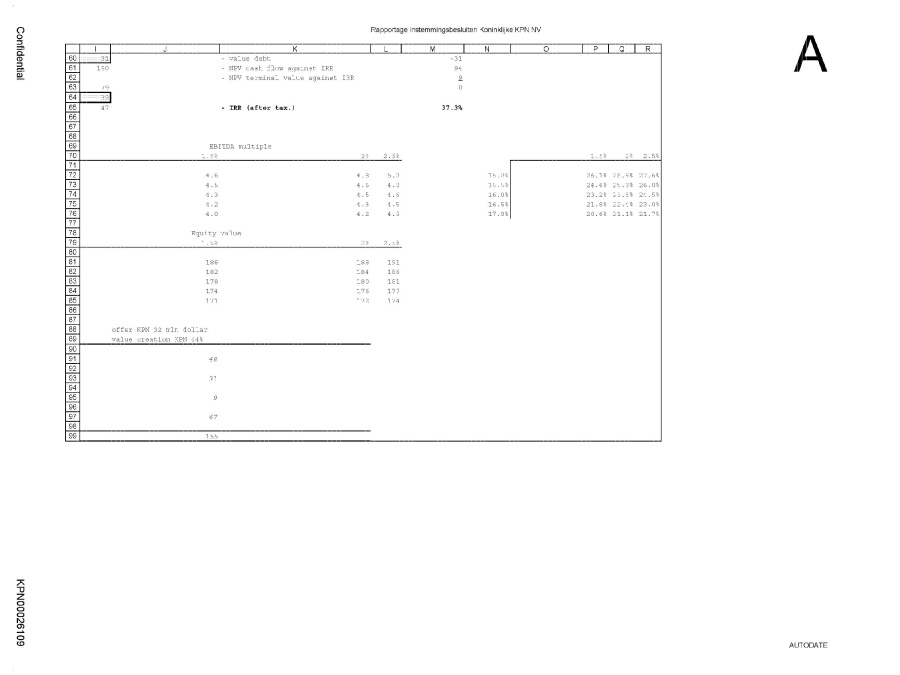

Rapportage instemmingsbesluiten Koninklijke KPN NV value debt NPV cash flow against IRR NPV terminal value against IRR IRR (after tax.) EBITA multiple Equity value offer KPN 32 mln dollar value creation KPN 44% Confidential KPN00026109

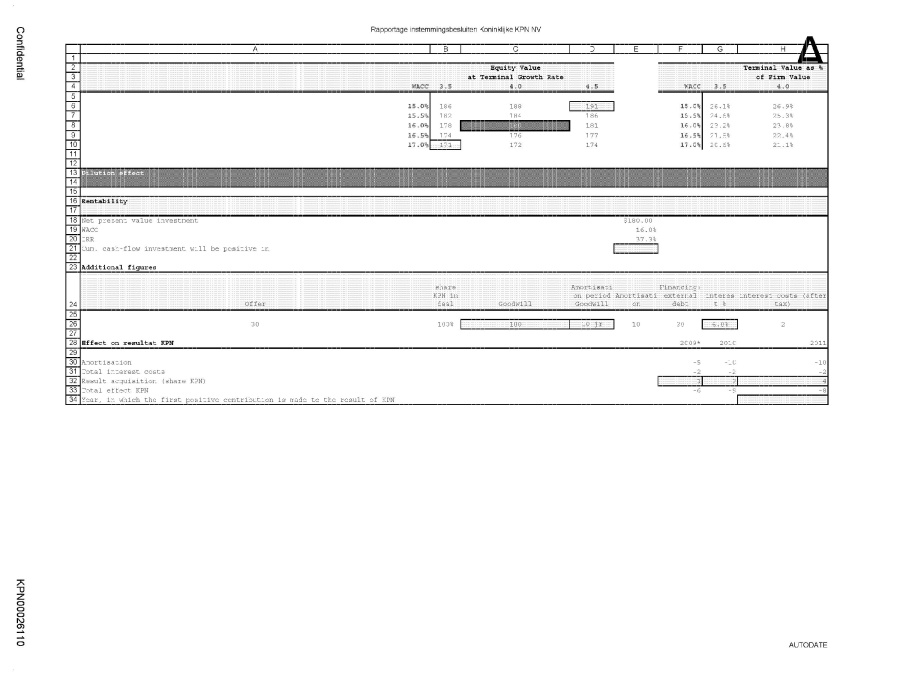

Rapportage instemmingsbesluiten Koninklijke KPN NV Equity Value at Terminal Growth Rate Terminal Value as % of Firm Value Dilution Effect Rentability Net present value investment WACC IRR Cum. cash-flow investment will be positive in Additional figures offer share KPN in deal Goodwill Amortisation period Goodwill Amortisation Financing external debt interest % interest costs (after tax) Effect on resultat KPN Amortisation Total interest costs Result acquisition (share KPN) total effect KPN Year, in which the first positive contribution is made to the result of KPN Confidential KPN00026110

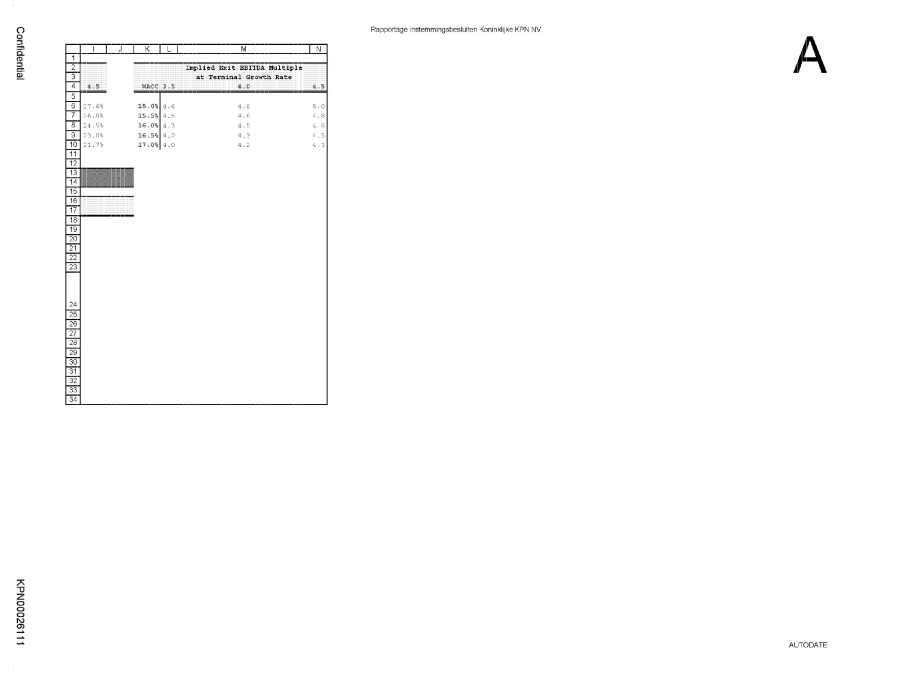

Implied Exit EBITDA Multiple at Terminal Growth Rate Confidential KPN00026111

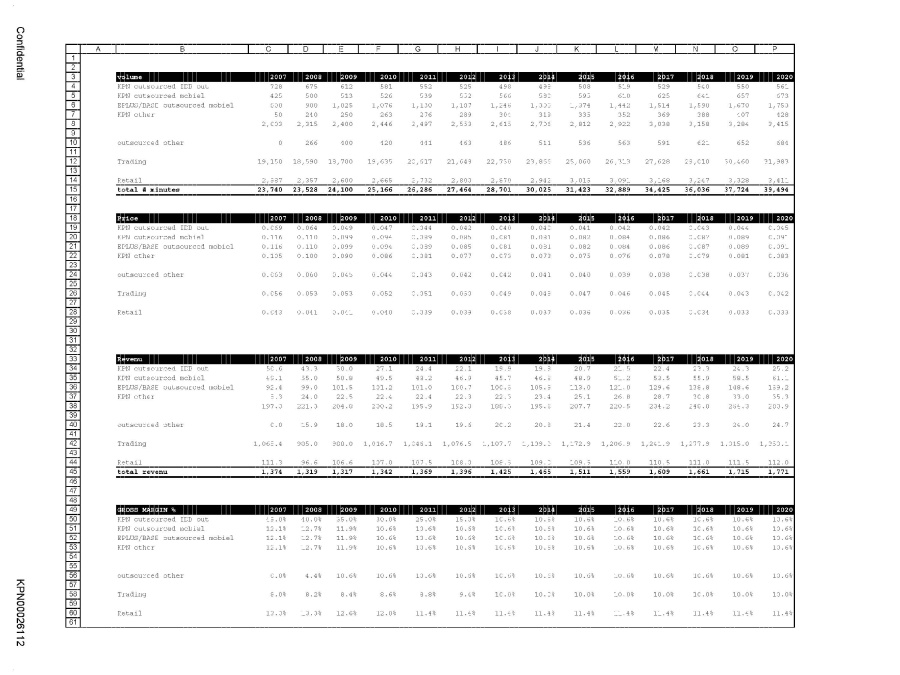

Volume 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total # minutes Price 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Revenu 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total revenu Gross Margin % 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail Confidential KPN 00026112

Gross Margin 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 KPN outsourced IDD out KPN outsourced mobiel EPLUS/BASE outsourced mobiel KPN other outsourced other Trading Retail total gross margin Gross margin% Confidential KPN 00026113

Rapportage instemmingsbesluiten Koninklijke KPN NV Name Project Acquisition / Investment Cash Flow (in fl. mln) 2009 2010 2011 2012 2013 extra Revenu growth % GROSS margin % OPEX synergy IDD KPN gross margin KPN mobile gross margin OPEX synergy OPEX synergy OPEX synergy OPEX synergy mgt projections E&Y 21/1/09 Revenues Gross margin Op. Costs Revenues Gross margin Op. Costs EBITDA GROSS margin % EBITDA margin % Depreciation EBIT EBIT margin % carry forward Tax Corr. For Depreciation Investment Changes in Working Cap. + cash position Free Cash Flow Cum. Free Cash Flow Terminal value *) *) terminal value is based on: (EBIT-cash tax)/wacc IRR cash flows WACC Net Present Value EV/TV NPV cash flows basic interest NPV terminal value premium VV premium EV Firm Value Confidential KPN00026114

Rapportage instemmingsbesluiten Koninklijke KPN NV Beta minus debt Tax % Terminal growth rate equity value Kvv share KPN Kev KPN-ovver wacc (after tax) value creation for KPN Terminal Value NPV of Terminal Value * 1 mln USD Mgt projection adjusted by E&Y (21/1/09) Extra GROSS margin growth 1% (in 3 yrs) - 10,6% Extra OPEX synergy - 3 mln per year (2010) Extra Revenu growth 3% - 5,6% average TOTAL opportunity Confidential KPN00026115

Rapportage instemmingsbesluiten Koninklijke KPN NV DCF Valuation 2014 2015 2016 2017 2018 9-yr CAGR IRR KPN-offer 100%-offer 100%-offer Confidential KPN00026116

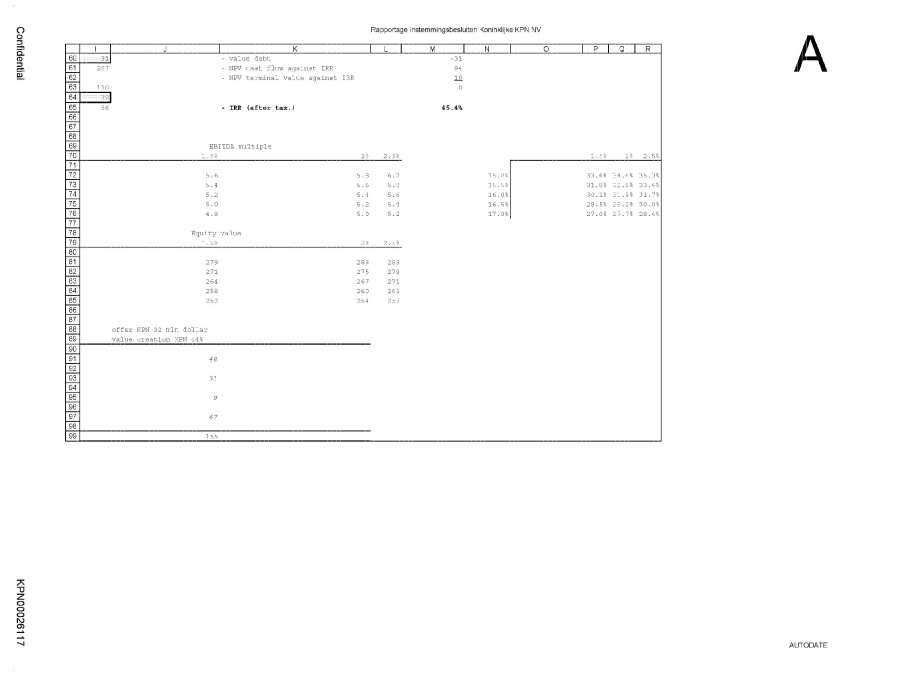

Rapportage instemmingsbesluiten Koninklijke KPN NV value debt NPV cash flow against IRR NPV terminal value against IRR IRR (after tax.) EBITA multiple Equity value offer KPN 32 mln dollar value creation KPN 44% Confidential KPN00026117

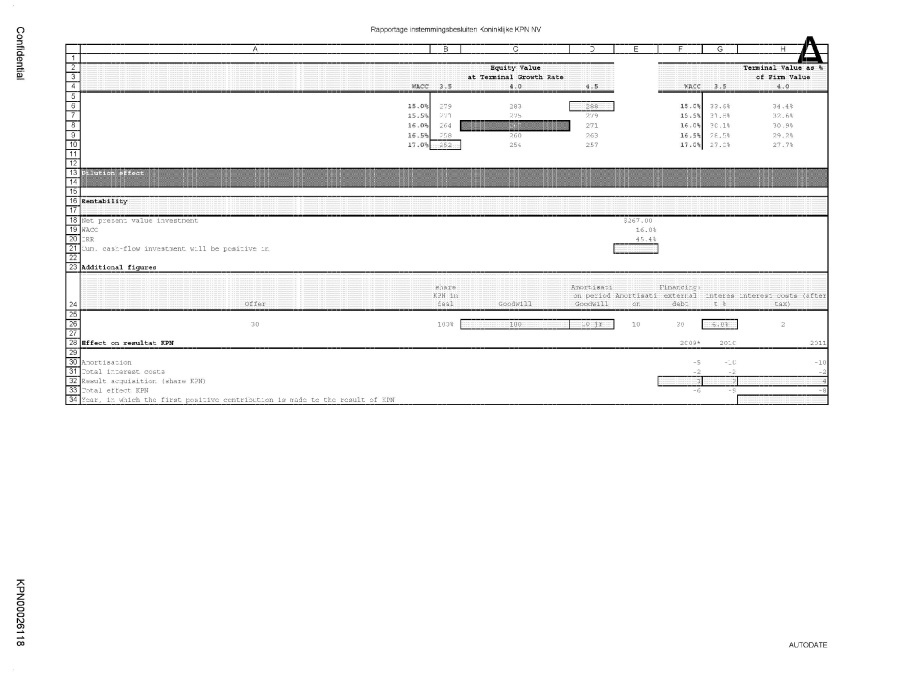

Rapportage instemmingsbesluiten Koninklijke KPN NV Equity Value at Terminal Growth Rate Terminal Value as % of Firm Value Dilution Effect Rentability Net present value investment WACC IRR Cum. cash-flow investment will be positive in Additional figures offer share KPN in deal Goodwill Amortisation period Goodwill Amortisation Financing external debt interest % interest costs (after tax) Effect on resultat KPN Amortisation Total interest costs Result acquisition (share KPN) total effect KPN Year, in which the first positive contribution is made to the result of KPN Confidential KPN00026118

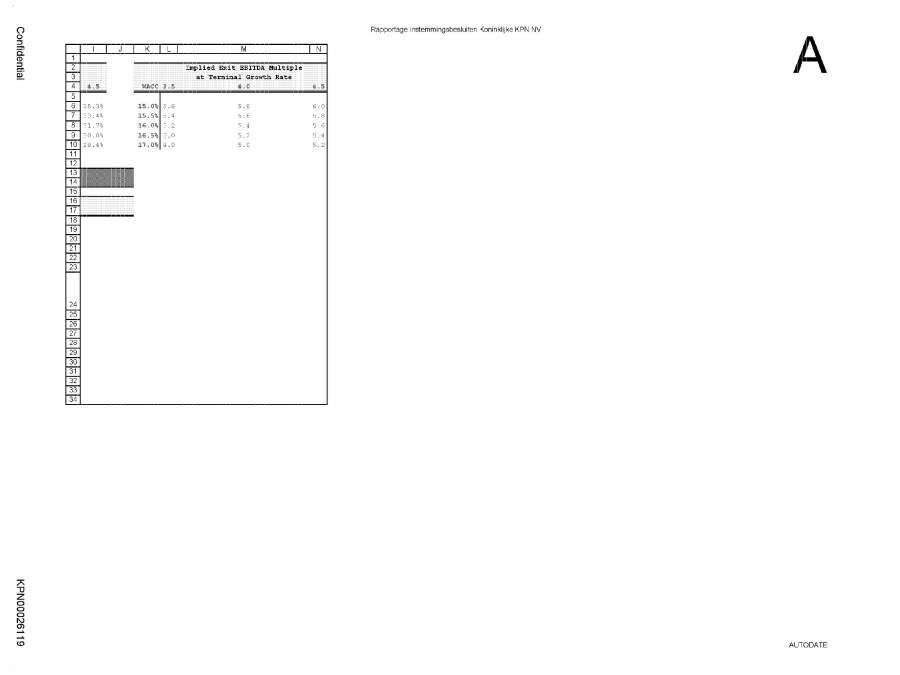

Implied Exit EBITDA Multiple at Terminal Growth Rate Confidential KPN00026119

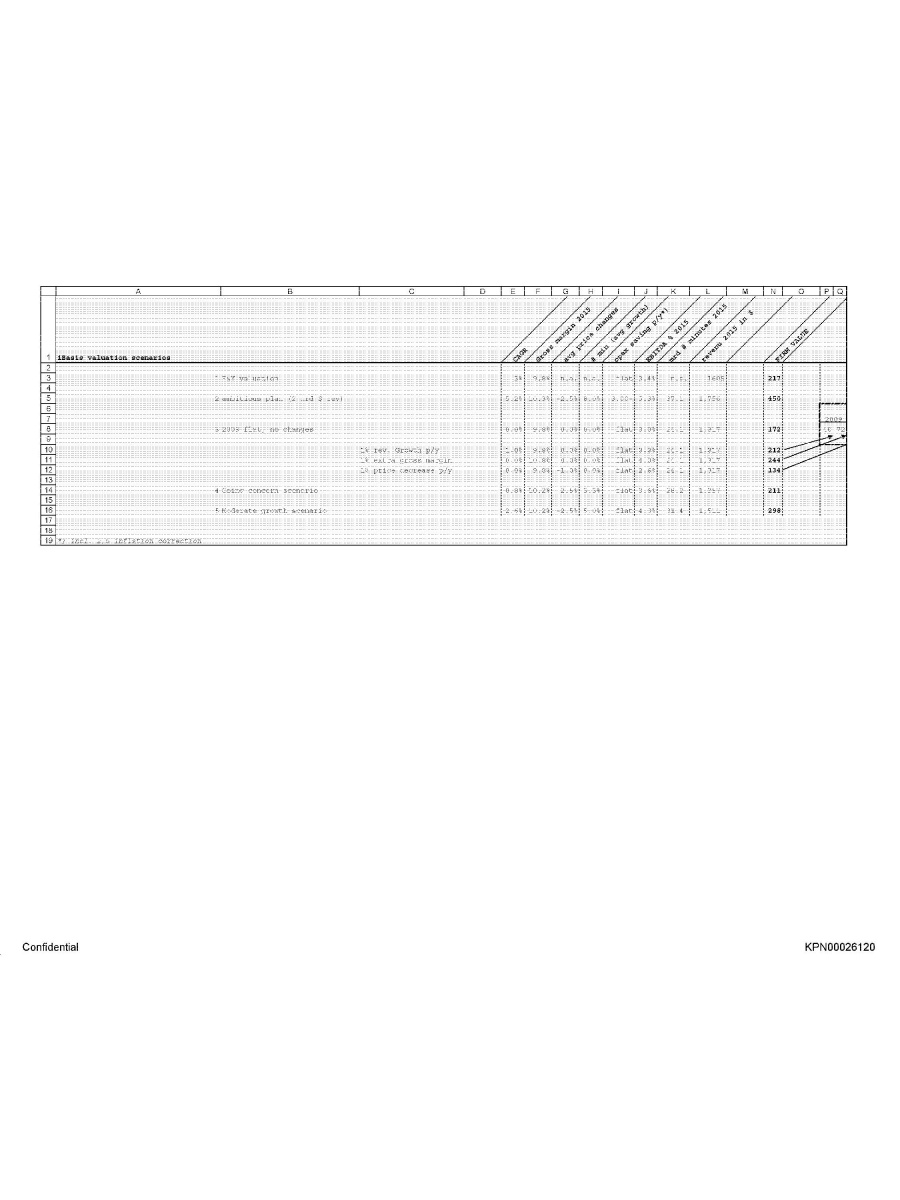

iBasis valuation scenarios CAGR Gross margin 2015 avg price changes # min (avg growth) opex saving p/y*) EBITDA % 2015 mrd # minutes 2015 revenue 2015 in $ Firm Value E&Y valuation ambitious plan (2 mrd $ rev) 2009 flat, no changes 1% rev. Growth p/y 1% extra gross margin 1% price decrease p/y going concern scenario Moderate growth scenario *) incl. 1,5 inflation correction Confidential KPN00026120

flat -38 Confidential KPN00026121