UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Catherine Kennedy

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: June 30

Registrant is making a filing for 13 of its series:

Wells Fargo Alternative Risk Premia Fund, Wells Fargo California Limited-Term Tax-Free Fund, Wells Fargo California Tax-Free Fund, Wells Fargo High Yield Municipal Bond Fund, Wells Fargo Intermediate Tax/AMT-Free Fund, Wells Fargo Minnesota Tax-Free Fund, Wells Fargo Municipal Bond Fund, Wells Fargo Municipal Sustainability Fund, Wells Fargo Pennsylvania Tax-Free Fund, Wells Fargo Short-Term Municipal Bond Fund, Wells Fargo Strategic Municipal Bond Fund, Wells Fargo Ultra Short-Term Municipal Income Fund, and Wells Fargo Wisconsin Tax-Free Fund.

Date of reporting period: December 31, 2020

ITEM 1. REPORT TO STOCKHOLDERS

Semi-Annual Report

December 31, 2020

Wells Fargo

California Limited-Term Tax-Free Fund

Reduce clutter.

Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/ advantagedelivery

The views expressed and any forward-looking statements are as of December 31, 2020, unless otherwise noted, and are those of the Fund's portfolio managers and/or Wells Fargo Asset Management. Discussions of individual securities or the markets generally are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Asset Management and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

INVESTMENT PRODUCTS: NOT FDIC INSURED ■ NO BANK GUARANTEE ■ MAY LOSE VALUE

Wells Fargo California Limited-Term Tax-Free Fund | 1

Letter to shareholders (unaudited)

Andrew Owen

President

Wells Fargo Funds

Dear Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo California Limited-Term Tax-Free Fund for the six-month period that ended December 31, 2020. Despite a deeply challenging year, dominated by the spread of COVID-19 cases and a sharp drop in economic output throughout much of the world, global stocks performed extremely well, benefiting from ongoing central bank support and rising optimism over the development and distribution of effective COVID-19 vaccines. Bonds also had positive returns, led by global bonds and high-yield bonds.

For the six-month period, U.S. stocks, based on the S&P 500 Index,1 gained 22.16%. International stocks, as measured by the MSCI ACWI ex USA Index (Net),2 returned 24.33%, while the MSCI EM Index (Net),3 had even stronger performance, with a 31.14% gain. Among bond indexes, the Bloomberg Barclays U.S. Aggregate Bond Index,4 returned 1.29%, the Bloomberg Barclays Global Aggregate ex-USD Index (unhedged),5 gained 9.44%, and the Bloomberg Barclays Municipal Bond Index,6 returned 3.07% while the ICE BofA U.S. High Yield Index,7 gained a hefty 11.49%.

The stock market rally continued in July.

After a volatile first half of the year, an existing stock market rally continued in July with strong results for equities and fixed income. However, economic data and a resurgence of COVID-19 cases underscored the urgent need to regain control of the pandemic. Second-quarter gross domestic product (GDP) shrank from the previous quarter by 9.5% and 12.1% in the U.S. and the eurozone, respectively. In contrast, China’s second-quarter GDP grew 3.2% year over year. The U.S. economy added 1.8 million jobs in July, but a double-digit jobless rate persisted.

The stock market continued to rally in August despite concerns over rising numbers of U.S. and European COVID-19 cases as well as the expiration of the $600 weekly bonus unemployment benefit in July. Relatively strong second-quarter earnings boosted investor sentiment along with the U.S. Federal Reserve’s announcement of a monetary policy shift expected to support longer-term low interest rates. U.S. manufacturing and services activity indexes beat expectations, while the U.S. housing market maintained strength. In Europe, retail sales expanded and consumer confidence was steady. China’s economy continued to expand.

“After a volatile first half of the year, an existing stock market rally continued in July with strong results for equities and fixed income.”

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2021. ICE Data Indices, LLC. All rights reserved. |

2 | Wells Fargo California Limited-Term Tax-Free Fund

Letter to shareholders (unaudited)

Stocks grew more volatile in September on mixed economic data. U.S. economic activity continued to grow. However, U.S. unemployment remained elevated at 7.9% in September. With U.S. Congress delaying further fiscal relief and uncertainties surrounding a possible vaccine, doubts crept back into the financial markets. In the U.K., a lack of progress in Brexit talks weighed on markets. China’s economy picked up steam, fueled by increased global demand.

In October, capital markets stepped back from their six-month rally. Market volatility rose in advance of the U.S. election and amid a global increase in COVID-19 infections. Europe introduced tighter restrictions affecting economic activity. U.S. markets looked favorably at the prospect of Democratic control of the federal purse strings, which could lead to additional fiscal stimulus and a boost to economic activity. Meanwhile, China reported 4.9% third-quarter GDP growth.

Global stocks rallied in November, propelled by optimism over three promising COVID-19 vaccines. Reversing recent trends, value stocks outperformed growth stocks and cyclical stocks outpaced technology stocks. However, U.S. unemployment remained elevated, with a net job loss of 10 million since February. The eurozone services Purchasing Managers’ Index, a monthly survey of purchasing managers, contracted sharply while the region’s manufacturing activity grew. The U.S. election results added to the upbeat mood as investors anticipated more consistent policies in the new administration.

Financial markets ended the year with strength on high expectations for a rapid rollout of the COVID-19 vaccines, the successful passage of a $900 billion stimulus package, and rising expectations of additional economic support from a Democratic-led Congress. U.S. economic data were mixed with still-elevated unemployment and weak retail sales but growth in manufacturing output. In contrast, China’s economic expansion continued in both manufacturing and nonmanufacturing. U.S. COVID-19 infection rates continued to rise even as new state and local lockdown measures were implemented.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

“Global stocks rallied in November, propelled by optimism over three promising COVID-19 vaccines.”

For further information about your Fund, contact your investment professional, visit our website at wfam.com, or call us directly at 1-800-222-8222.

Wells Fargo California Limited-Term Tax-Free Fund | 3

Letter to shareholders (unaudited)

Preparing for LIBOR Transition

The global financial industry is preparing to transition away from the London Interbank Offered Rate (LIBOR), a key benchmark interest rate, to new alternative rates. LIBOR underpins more than $350 trillion of financial contracts. It is the benchmark rate for a wide spectrum of products ranging from residential mortgages to corporate bonds to derivatives. Regulators have called for a market-wide transition away from LIBOR to successor reference rates by the end of 2021 (expected to be extended through June 30, 2023 for most tenors of the U.S. dollar LIBOR), which requires proactive steps be taken by issuers, counterparties, and asset managers to identify impacted products and adopt new reference rates.

The Fund holds at least one security that uses LIBOR as a floating reference rate and has a maturity date after 12-31-2021.

Although the transition process away from LIBOR has become increasingly well-defined in advance of the anticipated discontinuation date, there remains uncertainty regarding the nature of successor reference rates, and any potential effects of the transition away from LIBOR on investment instruments that use it as a benchmark rate. The transition process may result in, among other things, increased volatility or illiquidity in markets for instruments that currently rely on LIBOR and could negatively impact the value of certain instruments held by the Fund.

Wells Fargo Asset Management is monitoring LIBOR exposure closely and has put resources and controls in place to manage this transition effectively. The Fund’s portfolio management team is evaluating LIBOR holdings to understand what happens to those securities when LIBOR ceases to exist, including examining security documentation to identify the presence or absence of fallback language identifying a replacement rate to LIBOR.

While the pace of transition away from LIBOR will differ by asset class and investment strategy, the portfolio management team will monitor market conditions for those holdings to identify and mitigate deterioration or volatility in pricing and liquidity and ensure appropriate actions are taken in a timely manner.

Further information regarding the potential risks associated with the discontinuation of LIBOR can be found in the Fund’s Statement of Additional Information.

4 | Wells Fargo California Limited-Term Tax-Free Fund

This page is intentionally left blank.

Performance highlights (unaudited)

Investment objective

The Fund seeks current income exempt from federal income tax and California individual income tax, consistent with capital preservation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Terry J. Goode

Kim Nakahara*

Brandon Pae

Adrian Van Poppel

Average annual total returns (%) as of December 31, 2020

| | | Including sales charge | | Excluding sales charge | | Expense ratios1 (%) |

| | Inception date | 1 year | 5 year | 10 year | | 1 year | 5 year | 10 year | | Gross | Net 2 |

| Class A (SFCIX) | 11-18-1992 | -0.11 | 1.13 | 1.99 | | 1.93 | 1.53 | 2.19 | | 0.85 | 0.80 |

| Class C (SFCCX) | 8-30-2002 | 0.17 | 0.78 | 1.43 | | 1.17 | 0.78 | 1.43 | | 1.60 | 1.55 |

| Administrator Class (SCTIX) | 9-6-1996 | – | – | – | | 2.04 | 1.73 | 2.39 | | 0.79 | 0.60 |

| Institutional Class (SFCNX)3 | 10-31-2014 | – | – | – | | 2.24 | 1.84 | 2.45 | | 0.52 | 0.50 |

| Bloomberg Barclays Municipal 1-5 Year Blend Index4 | – | – | – | – | | 3.15 | 2.16 | 2.12 | | – | – |

| Bloomberg Barclays California Municipal 1-5 Year Blend Index5 | – | – | – | – | | 2.93 | 1.93 | 2.07 | | – | – |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 2.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. shares are sold without a front-end sales charge or contingent deferred sales charge.

Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest rate changes and their impact on the fund and its share price can be sudden and unpredictable. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to California municipal securities risk and high-yield securities risk. Consult the Fund’s prospectus for additional information on these and other risks. A portion of the Fund’s income may be subject to federal, state, and/or local income taxes or the Alternative Minimum Tax (AMT). Any capital gains distributions may be taxable.

Please see footnotes on page 7.

6 | Wells Fargo California Limited-Term Tax-Free Fund

Performance highlights (unaudited)

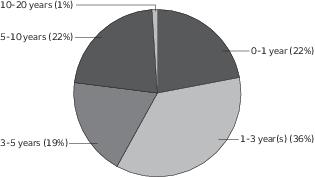

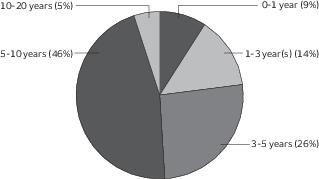

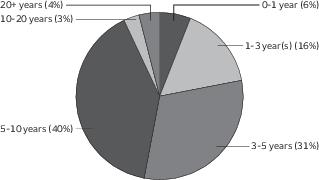

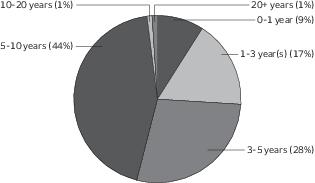

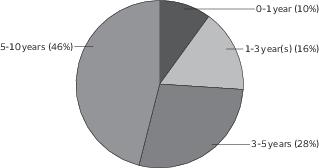

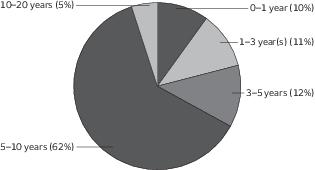

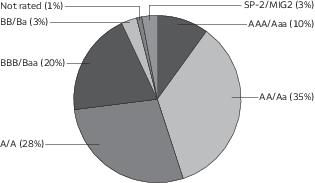

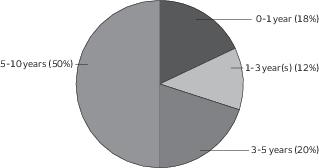

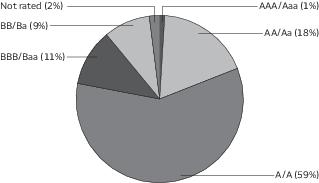

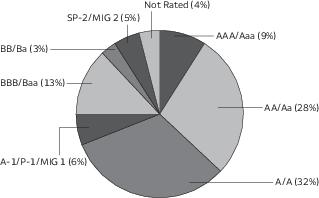

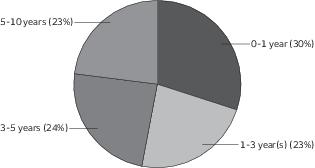

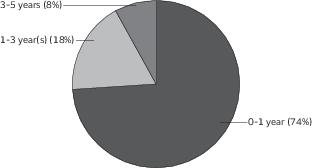

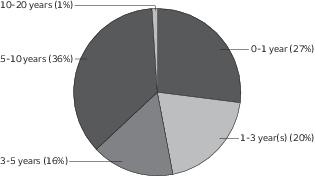

| Effective maturity distribution as of December 31, 20206 |

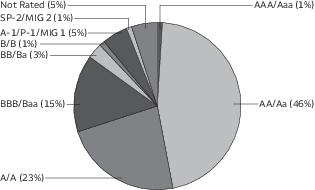

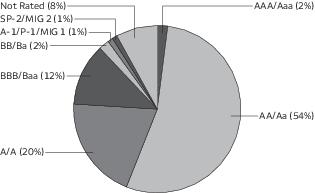

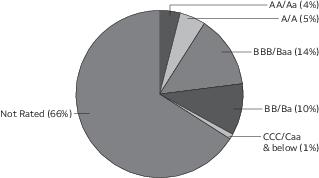

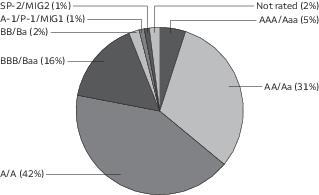

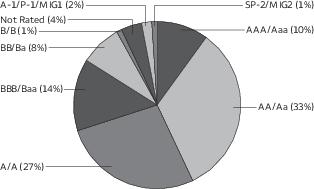

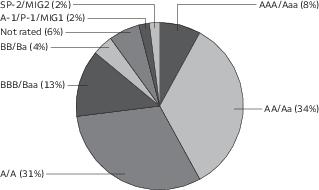

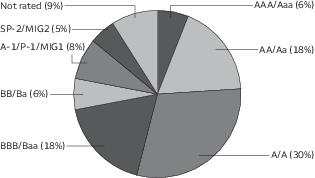

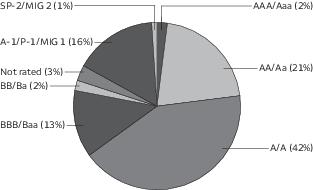

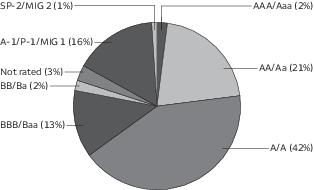

| Credit quality as of December 31, 20207 |

| * | Ms. Nakahara became a portfolio manager of the Fund on September 1, 2020. |

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through October 31, 2021, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.80% for Class A, 1.55% for Class C, 0.60% for Administrator Class, and 0.50% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Administrator Class shares, and is not adjusted to reflect the Institutional Class share expenses. If these expenses had been included, returns for the Institutional Class shares would be higher. |

| 4 | The Bloomberg Barclays Municipal 1–5 Year Blend Index is the 1–5 Year component of the Bloomberg Barclays Municipal Bond Index. The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays California Municipal 1-5 Year Blend Index is the 1-5 Year component of the Bloomberg Barclays California Municipal Bond Index. You cannot invest directly in an index. |

| 6 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

| 7 | The credit quality distribution of portfolio holdings reflected in the chart is based on ratings from Standard & Poor’s, Moody’s Investors Service, and/ or Fitch Ratings Ltd. Credit quality ratings apply to the underlying holdings of the Fund and not to the Fund itself. The percentages of the Fund’s portfolio with the ratings depicted in the chart are calculated based on the total market value of fixed income securities held by the Fund. If a security was rated by all three rating agencies, the middle rating was utilized. If rated by two of three rating agencies, the lower rating was utilized, and if rated by one of the rating agencies, that rating was utilized. Standard & Poor’s rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the rating categories. Standard & Poor’s rates the creditworthiness of short-term notes from SP-1 (highest) to SP-3 (lowest). Moody’s rates the creditworthiness of bonds, ranging from Aaa (highest) to C (lowest). Ratings Aa to B may be modified by the addition of a number 1 (highest) to 3 (lowest) to show relative standing within the ratings categories. Moody’s rates the creditworthiness of short-term U.S. tax-exempt municipal securities from MIG 1/VMIG 1 (highest) to SG (lowest). Fitch rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Credit quality distribution is subject to change and may have changed since the date specified. |

Wells Fargo California Limited-Term Tax-Free Fund | 7

Fund expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from July 1, 2020 to December 31, 2020.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

account value

7-1-2020 | Ending

account value

12-31-2020 | Expenses

paid during

the period1 | Annualized net

expense ratio |

| Class A | | | | |

| Actual | $1,000.00 | $1,015.95 | $4.07 | 0.80% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.17 | $4.08 | 0.80% |

| Class C | | | | |

| Actual | $1,000.00 | $1,012.12 | $7.86 | 1.55% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.39 | $7.88 | 1.55% |

| Administrator Class | | | | |

| Actual | $1,000.00 | $1,016.14 | $3.05 | 0.60% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.18 | $3.06 | 0.60% |

| Institutional Class | | | | |

| Actual | $1,000.00 | $1,017.62 | $2.54 | 0.50% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | $2.55 | 0.50% |

1 Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period).

8 | Wells Fargo California Limited-Term Tax-Free Fund

Portfolio of investments—December 31, 2020 (unaudited)

| | | | | Principal | Value |

| Closed end municipal bond fund obligations: 0.18% | | | | | |

| California: 0.18% | | | | | |

| Nuveen California AMT-Free Quality Municipal Income Fund MuniFund Preferred Shares Series A (10 shares) 0.51% 144Aø | | | | $ 1,000,000 | $ 1,000,000 |

| Total Closed end municipal bond fund obligations (Cost $1,000,000) | | | | | 1,000,000 |

| | | Interest

rate | Maturity

date | | |

| Municipal obligations: 99.40% | | | | | |

| California: 93.72% | | | | | |

| Airport revenue: 11.24% | | | | | |

| California Municipal Finance Authority Revenue Senior Lien Linxs APM Project Series A | | 5.00% | 12-31-2023 | $ 1,100,000 | $ 1,228,898 |

| California Municipal Finance Authority Revenue Senior Lien Linxs APM Project Series A | | 5.00 | 6-30-2024 | 955,000 | 1,084,317 |

| California Municipal Finance Authority Revenue Senior Lien Linxs APM Project Series A | | 5.00 | 12-31-2024 | 750,000 | 865,755 |

| Los Angeles CA Department Airports Airport Revenue Refunding Bond Senior Los Angeles International Airport | | 5.00 | 5-15-2032 | 10,000,000 | 13,618,300 |

| Los Angeles CA Department of Airports AMT Series B | | 5.00 | 5-15-2024 | 5,000,000 | 5,753,700 |

| Los Angeles CA Department of Airports AMT Series B | | 5.00 | 5-15-2025 | 6,000,000 | 7,155,660 |

| Los Angeles CA Department of Airports AMT Series B | | 5.00 | 5-15-2026 | 2,500,000 | 3,076,550 |

| Los Angeles CA Department of Airports AMT Subordinate Bond Series C | | 5.00 | 5-15-2024 | 4,315,000 | 4,971,700 |

| Palm Springs CA Airport Passenger Facility Charge Revenue Palm Springs International Airport (BAM Insured) | | 5.00 | 6-1-2027 | 1,205,000 | 1,401,608 |

| Port of Oakland Revenue Refunding Bond AMT Senior Lien Series P | | 5.00 | 5-1-2026 | 1,000,000 | 1,061,970 |

| Port of Oakland Revenue Refunding Bond Intermediate Lien Series E | | 5.00 | 11-1-2023 | 200,000 | 225,632 |

Port of Oakland Revenue Refunding Bond Intermediate Lien

Series H %% | | 5.00 | 11-1-2029 | 1,875,000 | 2,452,875 |

| Sacramento County CA Airport System Subordinate Refunding Bond AMT Series F ## | | 5.00 | 7-1-2021 | 2,585,000 | 2,639,544 |

| Sacramento County CA Airport System Subordinate Refunding Bond AMT Series F | | 5.00 | 7-1-2022 | 2,590,000 | 2,755,061 |

| Sacramento County CA Airport System Subordinate Refunding Bond AMT Series F | | 5.00 | 7-1-2023 | 2,585,000 | 2,860,897 |

| Sacramento County CA Airport System Subordinate Refunding Bond AMT Series F | | 5.00 | 7-1-2024 | 1,760,000 | 2,018,738 |

| San Diego County CA Regional Airport Authority Airport Revenue Refunding Bond AMT Subordinated Series C | | 5.00 | 7-1-2027 | 750,000 | 940,980 |

| San Diego County CA Regional Airport Authority Airport Revenue Refunding Bond AMT Subordinated Series C | | 5.00 | 7-1-2028 | 1,000,000 | 1,279,550 |

| San Diego County CA Regional Airport Authority Airport Revenue Refunding Bond AMT Subordinated Series C | | 5.00 | 7-1-2029 | 1,000,000 | 1,301,850 |

| San Francisco CA City and Refunding Bond AMT Second Series A | | 5.00 | 5-1-2025 | 740,000 | 786,583 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo California Limited-Term Tax-Free Fund | 9

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Airport revenue (continued) | | | | | |

| San Francisco CA City and Refunding Bond AMT Second Series A | | 5.00% | 5-1-2030 | $ 3,850,000 | $ 4,064,869 |

| San Francisco CA City and Refunding Bond AMT Second Series A | | 5.50 | 5-1-2028 | 250,000 | 279,038 |

| | | | | | 61,824,075 |

| Education revenue: 7.25% | | | | | |

| California Municipal Finance Authority Revenue Anticipation Notes River Springs 144A | | 4.00 | 6-15-2021 | 2,250,000 | 2,261,003 |

| California Educational Facilities Authority Revenue Loma Linda University Series A | | 5.00 | 4-1-2024 | 550,000 | 621,203 |

| California Educational Facilities Authority Revenue Loma Linda University Series A | | 5.00 | 4-1-2026 | 325,000 | 390,709 |

| California Municipal Finance Authority California Baptist University Series A 144A | | 4.00 | 11-1-2021 | 195,000 | 198,401 |

| California Municipal Finance Authority Charter School Albert Einstein Academies Project Series A | | 6.00 | 8-1-2023 | 445,000 | 475,620 |

| California Municipal Finance Authority Charter School Revenue Palmdale Aerospace Academy Project Series A 144A | | 3.88 | 7-1-2028 | 1,750,000 | 1,851,465 |

| California Municipal Finance Authority Revenue Anticipation Notes Highlands Community 144A | | 4.00 | 11-15-2021 | 1,650,000 | 1,658,415 |

| California Municipal Finance Authority Revenue Refunding Bond Biola University | | 5.00 | 10-1-2027 | 790,000 | 972,111 |

| California Municipal Finance Authority Revenue Refunding Bond California Lutheran University | | 5.00 | 10-1-2021 | 250,000 | 256,530 |

| California Municipal Finance Authority Revenue Refunding Bond California Lutheran University | | 5.00 | 10-1-2022 | 250,000 | 265,003 |

| California Municipal Finance Authority Revenue Refunding Bond California Lutheran University | | 5.00 | 10-1-2023 | 225,000 | 249,224 |

| California Municipal Finance Authority Revenue Refunding Bond California Lutheran University | | 5.00 | 10-1-2024 | 275,000 | 314,529 |

| California Municipal Finance Authority Revenue Refunding Bond California Lutheran University | | 5.00 | 10-1-2025 | 275,000 | 324,060 |

| California Municipal Finance Authority Revenue Refunding Bond California Lutheran University | | 5.00 | 10-1-2026 | 300,000 | 362,634 |

| California Municipal Finance Authority Revenue Refunding Bond University of the Pacific Series A %% | | 5.00 | 11-1-2024 | 600,000 | 679,128 |

| California Municipal Finance Authority Revenue Refunding Bond University of the Pacific Series A %% | | 5.00 | 11-1-2025 | 600,000 | 702,078 |

| California Municipal Finance Authority Revenue Refunding Bond University of the Pacific Series A %% | | 5.00 | 11-1-2026 | 625,000 | 752,381 |

| California Municipal Finance Authority Revenue Refunding Bond University of the Pacific Series A %% | | 5.00 | 11-1-2027 | 650,000 | 799,838 |

| California Municipal Finance Authority Revenue Refunding Bond University of the Pacific Series A %% | | 5.00 | 11-1-2028 | 700,000 | 878,255 |

| California Municipal Finance Authority Revenue Refunding Bond University of the Pacific Series A %% | | 5.00 | 11-1-2029 | 470,000 | 601,031 |

| California Municipal Finance Authority Revenue Refunding Bond University of the Pacific Series A %% | | 5.00 | 11-1-2030 | 500,000 | 649,820 |

| California School Finance Authority Bright Star School Obligation Group 144A | | 5.00 | 6-1-2027 | 1,705,000 | 1,845,986 |

| California School Finance Authority Classical Academies Project Series A 144A | | 3.25 | 10-1-2022 | 1,320,000 | 1,341,833 |

| California School Finance Authority Coastal Academy Project Series A 144A | | 5.00 | 10-1-2022 | 140,000 | 146,038 |

The accompanying notes are an integral part of these financial statements.

10 | Wells Fargo California Limited-Term Tax-Free Fund

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Education revenue (continued) | | | | | |

| California School Finance Authority Rocket Ship Education Series A 144A | | 5.00% | 6-1-2021 | $ 205,000 | $ 207,306 |

| California School Finance Authority Rocketship Education Series A 144A | | 5.00 | 6-1-2026 | 500,000 | 545,570 |

| California Statewide CDA California Baptist University Series A | | 5.13 | 11-1-2023 | 440,000 | 465,780 |

| California Statewide CDA Refunding Bond California Baptist University Series A 144A | | 3.00 | 11-1-2022 | 895,000 | 906,680 |

| California Statewide CDA School Facilities | | 5.88 | 7-1-2022 | 645,000 | 662,912 |

| University of California Series AK | | 5.00 | 5-15-2048 | 10,000,000 | 11,123,600 |

| University of California Series AR | | 5.00 | 5-15-2032 | 6,000,000 | 7,351,740 |

| | | | | | 39,860,883 |

| GO revenue: 23.12% | | | | | |

| Bassett CA Unified School District Refunding Bond Series B (BAM Insured) | | 5.00 | 8-1-2021 | 550,000 | 565,378 |

| Bassett CA Unified School District Refunding Bond Series B (BAM Insured) | | 5.00 | 8-1-2023 | 725,000 | 809,847 |

| California | | 5.00 | 10-1-2021 | 6,795,000 | 7,040,843 |

| California | | 5.00 | 11-1-2022 | 2,500,000 | 2,721,025 |

| California | | 5.00 | 10-1-2023 | 8,400,000 | 9,499,644 |

| California | | 5.25 | 10-1-2022 | 2,750,000 | 2,993,980 |

| California Refunding Bond Various Purpose Bidding Group C (BAM Insured) | | 5.00 | 9-1-2027 | 8,500,000 | 10,666,820 |

| California Series B | | 5.00 | 9-1-2023 | 10,730,000 | 12,092,603 |

| California Statewide Refunding Bond Various Purpose | | 5.00 | 8-1-2025 | 3,500,000 | 4,255,265 |

| California Statewide Series B (1 Month LIBOR+0.76%)± | | 0.87 | 12-1-2031 | 2,500,000 | 2,502,725 |

| California Statewide Series E (SIFMA Municipal Swap+0.43%)± | | 0.52 | 12-1-2029 | 3,050,000 | 3,050,458 |

| Central California Unified School District Refunding Bond (AGM Insured) | | 5.00 | 7-1-2021 | 400,000 | 409,516 |

| Central California Unified School District Refunding Bond (AGM Insured) | | 5.00 | 7-1-2022 | 750,000 | 801,743 |

| Coachella Valley CA Unified School District (BAM Insured) | | 4.00 | 8-1-2021 | 2,230,000 | 2,277,521 |

| Coachella Valley CA Unified School District (BAM Insured) | | 4.00 | 8-1-2022 | 1,000,000 | 1,058,150 |

| Dixon CA Unified School District (AGM Insured) | | 5.00 | 8-1-2021 | 1,210,000 | 1,243,832 |

| Dixon CA Unified School District (AGM Insured) | | 5.00 | 8-1-2022 | 1,285,000 | 1,383,251 |

| El Cerrito CA Tax and Revenue Anticipation Notes | | 3.00 | 7-1-2021 | 1,000,000 | 1,010,230 |

| El Monte CA City School District CAB BAN ¤ | | 0.00 | 4-1-2023 | 2,000,000 | 1,978,960 |

| El Monte CA Union High School Refunding Bond | | 5.00 | 6-1-2021 | 1,315,000 | 1,340,406 |

| Hayward CA Unified School District Certificate of Participation (AGM Insured) | | 5.00 | 8-1-2022 | 500,000 | 537,325 |

| Hayward CA Unified School District Certificate of Participation (AGM Insured) | | 5.00 | 8-1-2023 | 805,000 | 902,075 |

| Huntington Beach CA City School District Election of 2002 | | 4.00 | 8-1-2021 | 505,000 | 516,236 |

| Inglewood CA Unified School District Election of 2012 Series B (BAM Insured) | | 4.00 | 8-1-2021 | 320,000 | 326,893 |

| Inglewood CA Unified School District Election of 2012 Series B (BAM Insured) | | 4.00 | 8-1-2022 | 200,000 | 211,794 |

| Inglewood CA Unified School District Election of 2012 Series B (BAM Insured) | | 5.00 | 8-1-2023 | 195,000 | 218,408 |

| Inglewood CA Unified School District Election of 2012 Series B (BAM Insured) | | 5.00 | 8-1-2024 | 150,000 | 174,705 |

| Inglewood CA Unified School District Election of 2012 Series B (BAM Insured) | | 5.00 | 8-1-2025 | 170,000 | 205,306 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo California Limited-Term Tax-Free Fund | 11

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| GO revenue (continued) | | | | | |

| Inglewood CA Unified School District Election of 2012 Series B (BAM Insured) | | 5.00% | 8-1-2026 | $ 235,000 | $ 292,704 |

| Kern CA Community College District CAB Anticipation Notes Facilities ¤ | | 0.00 | 8-1-2023 | 2,000,000 | 1,972,420 |

| La Habra CA School District Refunding Bond | | 5.00 | 8-1-2021 | 805,000 | 827,371 |

| Long Beach CA Harbor Revenue AMT Series C | | 5.00 | 5-15-2027 | 500,000 | 588,390 |

| Los Angeles CA Unified School District Measure Q Series C | | 4.00 | 7-1-2032 | 1,000,000 | 1,263,540 |

| Los Angeles CA Unified School District Refunding Bond Series D | | 5.00 | 7-1-2023 | 6,180,000 | 6,913,010 |

| Mount San Antonio Community College District CAB ¤ | | 0.00 | 4-1-2022 | 10,000,000 | 9,972,800 |

| Oak Valley CA Hospital District Refunding Bond Los Angeles County CA RDA | | 5.00 | 7-1-2021 | 950,000 | 971,983 |

| Oak Valley CA Hospital District Refunding Bond Los Angeles County CA RDA | | 5.00 | 7-1-2022 | 750,000 | 796,298 |

| Oak Valley CA Hospital District Refunding Bond Los Angeles County CA RDA | | 5.00 | 7-1-2023 | 755,000 | 837,959 |

| Oakland CA Unified School District Alameda County Election of 2012 Series A | | 5.00 | 8-1-2022 | 750,000 | 800,333 |

| Oakland CA Unified School District Alameda County Election of 2012 Series A | | 5.00 | 8-1-2024 | 600,000 | 692,796 |

| Oakland CA Unified School District Refunding Bond | | 5.00 | 8-1-2025 | 1,540,000 | 1,842,810 |

| Oakland CA Unified School District Refunding Bond Measure B Series B | | 5.00 | 8-1-2026 | 500,000 | 615,970 |

| Oakland CA Unified School District Refunding Bond Measure J Series C | | 5.00 | 8-1-2025 | 795,000 | 951,321 |

| Palomar Pomerado Health CA CAB Electric Series A (National Insured)¤ | | 0.00 | 8-1-2025 | 1,000,000 | 949,770 |

| Redondo Beach CA Unified School Election of 2008 Series B | | 6.38 | 8-1-2034 | 670,000 | 871,335 |

| Sacramento CA City Unified School Election of 2012 Measure Q Series E | | 5.00 | 8-1-2029 | 1,500,000 | 1,837,830 |

| Sacramento CA City Unified School Refunding Bond | | 5.00 | 7-1-2022 | 485,000 | 514,566 |

| Sacramento CA City Unified School Refunding Bond | | 5.00 | 7-1-2026 | 2,430,000 | 2,476,632 |

| San Bernardino CA City Unified School District Refunding Bond Series A (AGM Insured) | | 1.25 | 8-1-2029 | 435,000 | 429,019 |

| San Bernardino CA City Unified School District Refunding Bond Series A (AGM Insured) | | 1.63 | 8-1-2031 | 850,000 | 847,773 |

| San Bernardino CA City Unified School District Refunding Bond Series A (AGM Insured) | | 4.00 | 8-1-2029 | 1,000,000 | 1,234,690 |

| San Bernardino CA City Unified School District Refunding Bond Series A (AGM Insured) | | 4.00 | 8-1-2031 | 875,000 | 1,082,366 |

| San Gorgonio CA Memorial Healthcare Refunding Bond | | 4.00 | 8-1-2027 | 1,090,000 | 1,243,505 |

| San Gorgonio CA Memorial Healthcare Refunding Bond | | 4.00 | 8-1-2030 | 580,000 | 671,895 |

| San Gorgonio CA Memorial Healthcare Refunding Bond | | 5.00 | 8-1-2021 | 275,000 | 281,595 |

| San Gorgonio CA Memorial Healthcare Refunding Bond | | 5.00 | 8-1-2022 | 500,000 | 531,880 |

| San Gorgonio CA Memorial Healthcare Refunding Bond | | 5.00 | 8-1-2023 | 1,000,000 | 1,098,080 |

| Sierra Kings CA Health Care Refunding Bond | | 4.00 | 8-1-2021 | 345,000 | 350,489 |

| Sierra Kings CA Health Care Refunding Bond | | 4.00 | 8-1-2022 | 425,000 | 443,233 |

| Sierra Kings CA Health Care Refunding Bond | | 4.00 | 8-1-2023 | 405,000 | 432,990 |

| Sierra Kings CA Health Care Refunding Bond | | 4.00 | 8-1-2024 | 420,000 | 459,824 |

| Soledad CA Unified School District BAN ¤ | | 0.00 | 8-1-2021 | 3,000,000 | 2,991,960 |

| SouthWestern Community College District Refunding Bond | | 5.00 | 8-1-2021 | 2,710,000 | 2,785,772 |

| Sweetwater CA Union High School District PFA Refunding Bond (BAM Insured) | | 5.00 | 8-1-2021 | 620,000 | 636,356 |

The accompanying notes are an integral part of these financial statements.

12 | Wells Fargo California Limited-Term Tax-Free Fund

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| GO revenue (continued) | | | | | |

| Vacaville CA Unified School District Series C (BAM Insured) | | 5.00% | 8-1-2022 | $ 675,000 | $ 726,611 |

| Vallejo City CA Unified School District Refunding Bond Series A (National Insured) | | 5.90 | 2-1-2022 | 3,905,000 | 4,114,464 |

| | | | | | 127,147,279 |

| Health revenue: 9.96% | | | | | |

| California HFFA Catholic Healthcare West Series A | | 5.25 | 3-1-2023 | 4,000,000 | 4,031,640 |

| California HFFA El Camino Hospital | | 5.00 | 2-1-2025 | 1,000,000 | 1,181,100 |

| California HFFA Memorial Health Services Series A | | 5.00 | 10-1-2023 | 2,475,000 | 2,679,559 |

| California HFFA Revenue Common Spirit Health Series A | | 5.00 | 4-1-2032 | 1,500,000 | 1,984,665 |

| California HFFA Revenue Health Series A | | 5.00 | 6-1-2031 | 3,990,000 | 5,292,456 |

| California HFFA Revenue On Lok Senior Health Services Social | | 3.00 | 8-1-2022 | 325,000 | 336,564 |

| California HFFA Revenue On Lok Senior Health Services Social | | 3.00 | 8-1-2025 | 475,000 | 516,021 |

| California HFFA Revenue On Lok Senior Health Services Social | | 3.00 | 8-1-2028 | 400,000 | 444,004 |

| California HFFA Revenue On Lok Senior Health Services Social | | 3.00 | 8-1-2030 | 210,000 | 234,217 |

| California HFFA Sutter Health Series A | | 5.00 | 11-15-2023 | 2,500,000 | 2,830,850 |

| California Municipal Finance Authority Community Medical Centers Series A | | 5.00 | 2-1-2023 | 735,000 | 800,871 |

| California Municipal Finance Authority Community Medical Centers Series A | | 5.00 | 2-1-2024 | 500,000 | 564,235 |

| California Municipal Finance Authority Revenue Community Medical Centers Series A | | 5.00 | 2-1-2025 | 1,000,000 | 1,167,000 |

| California Municipal Finance Authority Revenue Health Right 360 Series A 144A | | 5.00 | 11-1-2029 | 1,170,000 | 1,375,288 |

| California Municipal Finance Authority Revenue Insured Channing House Project Series A | | 5.00 | 5-15-2023 | 925,000 | 1,026,602 |

| California Municipal Finance Authority Revenue Insured Paradise Valley Estates Project Series B1 | | 2.25 | 7-1-2025 | 2,200,000 | 2,201,650 |

| California Municipal Finance Authority Revenue Insured Paradise Valley Estates Project Series B2 | | 2.00 | 7-1-2024 | 2,500,000 | 2,501,675 |

| California Municipal Finance Authority Revenue Refunding Bond Community Medical Centers Series A | | 5.00 | 2-1-2022 | 1,000,000 | 1,048,280 |

| California Municipal Finance Authority Revenue Refunding Bond Eisenhower Medical Center Series A | | 5.00 | 7-1-2027 | 1,650,000 | 2,024,699 |

| California Municipal Finance Authority Revenue Refunding Bond Eisenhower Medical Center Series A | | 5.00 | 7-1-2029 | 400,000 | 483,440 |

| California Statewide CDA Adventist Health Systems West Series A | | 5.00 | 3-1-2024 | 800,000 | 914,952 |

| California Statewide CDA Health Facilities Catholic Series F (AGM Insured)€ | | 0.17 | 7-1-2040 | 1,000,000 | 1,000,000 |

| California Statewide CDA Henry Mayo Newhall Memorial Hospital Series A (AGM Insured) | | 5.00 | 10-1-2021 | 500,000 | 516,075 |

| California Statewide CDA Henry Mayo Newhall Memorial Hospital Series A (AGM Insured) | | 5.00 | 10-1-2022 | 395,000 | 424,657 |

| California Statewide CDA Henry Mayo Newhall Memorial Hospital Series A (AGM Insured) | | 5.00 | 10-1-2023 | 500,000 | 560,330 |

| California Statewide CDA Huntington Memorial Hospital | | 5.00 | 7-1-2025 | 500,000 | 592,925 |

| California Statewide CDA Huntington Memorial Hospital | | 5.00 | 7-1-2026 | 500,000 | 611,235 |

| California Statewide CDA Loma Linda University Medical Center Series A 144A | | 5.00 | 12-1-2026 | 250,000 | 295,238 |

| California Statewide CDA Loma Linda University Medical Center Series A 144A | | 5.00 | 12-1-2027 | 300,000 | 359,460 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo California Limited-Term Tax-Free Fund | 13

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Health revenue (continued) | | | | | |

| California Statewide CDA Loma Linda University Medical Center Series A 144A | | 5.00% | 12-1-2028 | $ 250,000 | $ 299,995 |

| California Statewide CDA Revenue Emanate Health Series A | | 5.00 | 4-1-2028 | 755,000 | 980,322 |

| California Statewide CDA Revenue Emanate Health Series A | | 5.00 | 4-1-2029 | 795,000 | 1,054,981 |

| California Statewide CDA Revenue Emanate Health Series A | | 5.00 | 4-1-2031 | 1,465,000 | 1,956,420 |

| California Statewide CDA Viamonte Senior Living Project Series B | | 3.00 | 7-1-2025 | 3,000,000 | 3,005,580 |

| Palomar Health California Certificate of Participation Health & Arch Health Partners Incorporated | | 5.00 | 11-1-2021 | 275,000 | 284,444 |

| Palomar Health California Certificate of Participation Health & Arch Health Partners Incorporated | | 5.00 | 11-1-2022 | 375,000 | 403,553 |

| Palomar Health California Certificate of Participation Health & Arch Health Partners Incorporated | | 5.00 | 11-1-2023 | 300,000 | 335,031 |

| Palomar Health California Certificate of Participation Health & Arch Health Partners Incorporated | | 5.00 | 11-1-2024 | 300,000 | 347,109 |

| Palomar Health California Certificate of Participation Health & Arch Health Partners Incorporated | | 5.00 | 11-1-2025 | 330,000 | 393,106 |

| San Buenaventura CA Community Mental Health System | | 6.50 | 12-1-2021 | 2,585,000 | 2,694,061 |

| Sierra View CA Local Health Care District Revenue Refunding Bond | | 4.00 | 7-1-2023 | 500,000 | 538,595 |

| Sierra View CA Local Health Care District Revenue Refunding Bond | | 4.00 | 7-1-2025 | 580,000 | 654,588 |

| Sierra View CA Local Health Care District Revenue Refunding Bond | | 5.00 | 7-1-2027 | 630,000 | 769,558 |

| Sierra View CA Local Health Care District Revenue Refunding Bond | | 5.00 | 7-1-2029 | 630,000 | 790,165 |

| Washington Township CA Health Care District Refunding Bond Series A | | 4.00 | 7-1-2033 | 275,000 | 322,842 |

| Washington Township CA Health Care District Refunding Bond Series A | | 5.00 | 7-1-2023 | 600,000 | 661,524 |

| Washington Township CA Health Care District Refunding Bond Series A | | 5.00 | 7-1-2029 | 350,000 | 447,542 |

| Washington Township CA Health Care District Refunding Bond Series A | | 5.00 | 7-1-2030 | 300,000 | 389,349 |

| Washington Township CA Health Care District Refunding Bond Series A | | 5.00 | 7-1-2031 | 325,000 | 419,055 |

| | | | | | 54,747,508 |

| Housing revenue: 6.23% | | | | | |

| California Department of Veterans Affairs Home Purchase Series A | | 3.50 | 12-1-2021 | 855,000 | 866,149 |

| California HFA Municipal Certificate of Participation Series 2 Class A | | 4.00 | 3-20-2033 | 5,152,463 | 5,806,722 |

| California Independent Cities Finance Authority Mobile Home Park Revenue Refunding Bond Union City Tropics | | 4.25 | 5-15-2024 | 745,000 | 827,337 |

| California Municipal Finance Authority Housing Revenue Dino Papavero Apartments Project | | 1.50 | 6-1-2022 | 10,000,000 | 10,047,400 |

| California Municipal Finance Authority Peppertree Senior Apartments Series A (FHLMC Insured, FHLMC LIQ) | | 2.80 | 6-1-2023 | 2,500,000 | 2,646,600 |

| California Municipal Finance Authority Student Housing Davis I LLC West Village Student Housing Project | | 5.00 | 5-15-2024 | 1,200,000 | 1,344,696 |

| California Municipal Finance Authority Student Housing Davis I LLC West Village Student Housing Project | | 5.00 | 5-15-2025 | 3,435,000 | 3,957,910 |

| California Municipal Finance Authority Village Grove Apartments Series A (FHLMC Insured, FHLMC LIQ) | | 3.10 | 12-1-2021 | 1,000,000 | 1,025,480 |

The accompanying notes are an integral part of these financial statements.

14 | Wells Fargo California Limited-Term Tax-Free Fund

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Housing revenue (continued) | | | | | |

| California Statewide CDA Lancer Educational Student Housing Project Series A 144A | | 3.00% | 6-1-2029 | $ 750,000 | $ 759,698 |

| California Statewide Enterprise Development Authority Student Housing Revenue Provident Group | | 5.00 | 8-1-2029 | 200,000 | 248,472 |

| California Statewide Enterprise Development Authority Student Housing Revenue Provident Group | | 5.00 | 8-1-2030 | 225,000 | 283,536 |

| FHLMC Multifamily Variable Rate Certificates Series M 057 Class A | | 2.40 | 10-15-2029 | 5,990,000 | 6,438,771 |

| | | | | | 34,252,771 |

| Industrial development revenue: 0.64% | | | | | |

| San Francisco CA City and County Airports Commission International Airport Revenue AMT Special Facilities Lease SFO Fuel Company Series 2019A | | 5.00 | 1-1-2025 | 3,000,000 | 3,494,970 |

| Miscellaneous revenue: 11.51% | | | | | |

| Alameda County CA Joint Powers Authority Multiple Capital Projects Series A | | 5.00 | 12-1-2021 | 1,000,000 | 1,044,226 |

| Brentwood CA Infrastructure Financing Authority Subordinate Bond Series B | | 4.00 | 9-2-2021 | 1,135,000 | 1,163,591 |

| California | | 5.00 | 9-1-2022 | 2,240,000 | 2,419,962 |

| California HFA Revenue Sanitary Francisco Supportive Housing | | 5.00 | 4-1-2031 | 730,000 | 995,625 |

| California HFA Revenue Sanitary Supportive Housing | | 5.00 | 4-1-2029 | 630,000 | 831,329 |

| California Infrastructure & Economic Development Bank Refunding Bond California Academy of Sciences Project Series C (1 Month LIBOR+0.38%)± | | 0.48 | 8-1-2047 | 4,000,000 | 3,999,600 |

| California Public Works Board Department of Corrections & Rehabilitation Series C | | 5.00 | 10-1-2022 | 1,500,000 | 1,625,460 |

| California Public Works Board Judicial Council Projects Series B | | 5.00 | 10-1-2022 | 500,000 | 541,820 |

| California Statewide CDA Refunding Bond (AGM Insured) | | 5.00 | 11-15-2021 | 200,000 | 208,166 |

| California Statewide CDA Refunding Bond (AGM Insured) | | 5.00 | 11-15-2022 | 200,000 | 217,510 |

| California Statewide Community Monterey County Savers Bond (BAM Insured) | | 5.00 | 8-1-2027 | 2,185,000 | 2,747,506 |

| Chula Vista CA Certificate of Participation Refunding Bond Police Facility Project | | 5.00 | 10-1-2021 | 720,000 | 745,286 |

| Compton CA PFA Lease 144A | | 4.00 | 9-1-2022 | 1,040,000 | 1,056,120 |

| Compton CA PFA Refunding Bond 144A | | 4.00 | 9-1-2027 | 2,000,000 | 2,068,000 |

| Desert Sands CA Unified School District Certificate of Participation (BAM Insured) | | 5.00 | 3-1-2024 | 1,500,000 | 1,719,615 |

| Golden Empire School California Financing Authority Refunding Bond Kern High School District | | 5.00 | 5-1-2021 | 1,000,000 | 1,015,250 |

| Inglewood CA Unified School District School Facilities Authority (AGM Insured) | | 5.25 | 10-15-2023 | 8,670,000 | 9,577,142 |

| Irvine CA Limited Obligation Improvement Bonds Reassessment District #15-2 | | 5.00 | 9-2-2023 | 800,000 | 894,208 |

| Irvine CA Limited Obligation Improvement Bonds Reassessment District #15-2 | | 5.00 | 9-2-2024 | 850,000 | 986,238 |

| Lodi CA PFA Electric Refunding Bond (AGM Insured) | | 5.00 | 9-1-2024 | 1,100,000 | 1,284,888 |

| Los Angeles CA Public Works Series D | | 5.00 | 12-1-2027 | 1,605,000 | 1,952,707 |

| Los Angeles CA Unified School District Certificate of Participation Headquarters Building Projects Series B | | 5.00 | 10-1-2025 | 1,875,000 | 2,019,750 |

| Mountain HFA California Utility System Revenue Refunding Bond Series A | | 5.00 | 12-1-2029 | 520,000 | 677,487 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo California Limited-Term Tax-Free Fund | 15

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Miscellaneous revenue (continued) | | | | | |

| Mountain HFA California Utility System Revenue Refunding Bond Series A | | 5.00% | 12-1-2030 | $ 710,000 | $ 917,164 |

| Mountain HFA California Utility System Revenue Refunding Bond Series A | | 5.00 | 12-1-2031 | 745,000 | 954,904 |

| Palo Alto CA Improvement Bond Act of 1915 University Area Off-Street Parking Assessment District | | 4.00 | 9-2-2021 | 450,000 | 461,394 |

| Sacramento CA City Financing Refunding Bond Master Lease Program Facilities (BAM Insured) | | 5.00 | 12-1-2022 | 800,000 | 873,640 |

| Sacramento CA City Schools Joint Powers Financing Authority Series A (BAM Insured) | | 5.00 | 3-1-2021 | 830,000 | 836,242 |

| Sacramento CA City Schools Joint Powers Financing Authority Series A (BAM Insured) | | 5.00 | 3-1-2022 | 775,000 | 818,191 |

| Sacramento CA City Schools Joint Powers Financing Authority Series A (BAM Insured) | | 5.00 | 3-1-2023 | 815,000 | 895,172 |

| San Joaquin CA Area Flood Control Agency Smith Canal Area Assessment District Assessment Revenue (AGM Insured) | | 5.00 | 10-1-2025 | 250,000 | 296,125 |

| San Joaquin CA Area Flood Control Agency Smith Canal Area Assessment District Assessment Revenue (AGM Insured) | | 5.00 | 10-1-2027 | 350,000 | 434,497 |

| San Joaquin CA Area Flood Control Agency Smith Canal Area Assessment District Assessment Revenue (AGM Insured) | | 5.00 | 10-1-2029 | 380,000 | 490,056 |

| Santa Clara County CA Financing Capital Projects Series A | | 4.00 | 2-1-2024 | 6,000,000 | 6,240,720 |

| Santa Cruz County CA Capital Financing Public Facilities Project (AGM Insured) | | 5.00 | 8-1-2021 | 125,000 | 128,334 |

| Santa Cruz County CA Capital Financing Public Facilities Project (AGM Insured) | | 5.00 | 8-1-2022 | 165,000 | 176,667 |

| Sutter Butte CA Flood Agency Assessment (BAM Insured) | | 5.00 | 10-1-2023 | 1,280,000 | 1,448,691 |

| Sutter Butte CA Flood Agency Assessment (BAM Insured) | | 5.00 | 10-1-2024 | 715,000 | 841,677 |

| Sutter Butte CA Flood Agency Assessment (BAM Insured) | | 5.00 | 10-1-2025 | 1,575,000 | 1,922,776 |

| Turlock CA PFA Water Revenue BAN | | 4.00 | 3-1-2027 | 5,000,000 | 5,119,100 |

| Visalia CA Certificate of Participation (AGM Insured) | | 4.00 | 12-1-2021 | 250,000 | 258,568 |

| Visalia CA Certificate of Participation (AGM Insured) | | 5.00 | 12-1-2022 | 335,000 | 362,751 |

| | | | | | 63,268,155 |

| Tax revenue: 18.00% | | | | | |

| California School Infrastructure Financing Agency Refunding Bond (AGM Insured) | | 5.00 | 9-1-2021 | 500,000 | 516,015 |

| California Statewide Community Facilities District #2015-01 | | 5.00 | 9-1-2027 | 450,000 | 513,576 |

| Carson CA RDA Project Area #1 Series A (AGM Insured) | | 5.00 | 10-1-2021 | 855,000 | 884,959 |

| Carson CA RDA Project Area #1 Series A (AGM Insured) | | 5.00 | 10-1-2022 | 600,000 | 647,778 |

| Cathedral City CA RDA Refunding Bond Merged Redevelopment Project Series A | | 5.00 | 8-1-2021 | 2,425,000 | 2,489,675 |

| Cathedral City CA RDA Refunding Bond Merged Redevelopment Project Series A | | 5.00 | 8-1-2022 | 2,550,000 | 2,725,721 |

| Cathedral City CA RDA Refunding Bond Merged Redevelopment Project Series A | | 5.00 | 8-1-2023 | 1,735,000 | 1,939,001 |

| Cathedral City CA RDA Refunding Bond Merged Redevelopment Project Series A (AGM Insured) | | 5.00 | 8-1-2024 | 1,770,000 | 2,056,032 |

| Chino CA PFA Local Agency Series A (AGM Insured) | | 5.00 | 9-1-2022 | 1,830,000 | 1,962,437 |

| Chino CA PFA Local Agency Series A (AGM Insured) | | 5.00 | 9-1-2024 | 660,000 | 761,812 |

| Commerce CA RDA CAB Project #1 ¤ | | 0.00 | 8-1-2021 | 290,000 | 289,487 |

| Commerce CA Successor Agency to the Community Development Commission Refunding Bond Series A (AGM Insured) | | 5.00 | 8-1-2023 | 600,000 | 670,218 |

The accompanying notes are an integral part of these financial statements.

16 | Wells Fargo California Limited-Term Tax-Free Fund

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Tax revenue (continued) | | | | | |

| Dinuba CA RDA Successor Agency to Merged City Project #2 (BAM Insured) | | 5.00% | 9-1-2021 | $ 250,000 | $ 257,975 |

| Dinuba CA RDA Successor Agency to Merged City Project #2 (BAM Insured) | | 5.00 | 9-1-2022 | 250,000 | 268,913 |

| Fairfield CA RDA Successor Agency Tax Allocation Refunding Bond | | 5.00 | 8-1-2021 | 3,170,000 | 3,258,094 |

| Fairfield CA RDA Successor Agency Tax Allocation Refunding Bond | | 5.00 | 8-1-2022 | 2,395,000 | 2,563,967 |

| Fairfield CA RDA Successor Agency Tax Allocation Refunding Bond | | 5.00 | 8-1-2023 | 1,025,000 | 1,144,956 |

| Fremont CA Community Facilities District | | 5.00 | 9-1-2024 | 1,000,000 | 1,146,450 |

| Garden Grove CA Agency Community Refunding Bond Garden Grove Community Project (BAM Insured) | | 4.00 | 10-1-2021 | 770,000 | 792,114 |

| Garden Grove CA Agency Community Refunding Bond Garden Grove Community Project (BAM Insured) | | 5.00 | 10-1-2022 | 3,015,000 | 3,255,084 |

| Hollister CA RDA Refunding Bond Hollister Community Development Project (BAM Insured) | | 5.00 | 10-1-2026 | 700,000 | 815,353 |

| Inglewood CA Redevelopment Refunding Bond Subordinate Lien Merged Redevelopment Project (BAM Insured) | | 5.00 | 5-1-2025 | 1,000,000 | 1,194,730 |

| Irwindale CA CDA City Industrial Development Project (AGM Insured) | | 5.00 | 7-15-2021 | 340,000 | 348,548 |

| Irwindale CA CDA City Industrial Development Project (AGM Insured) | | 5.00 | 7-15-2022 | 365,000 | 390,488 |

| Irwindale CA CDA City Industrial Development Project (AGM Insured) | | 5.00 | 7-15-2023 | 375,000 | 418,144 |

| La Quinta CA RDA Project Areas #1 & 2 Series A | | 5.00 | 9-1-2021 | 565,000 | 583,024 |

| La Quinta CA RDA Project Areas #1 & 2 Series A | | 5.00 | 9-1-2022 | 615,000 | 661,525 |

| Lancaster CA RDA Refunding Bond Combined Redevelopment Project Areas (AGM Insured) | | 5.00 | 8-1-2024 | 870,000 | 1,009,922 |

| Lancaster CA RDA Refunding Bond Combined Redevelopment Project Areas (AGM Insured) | | 5.00 | 8-1-2029 | 400,000 | 484,308 |

| Lincoln CA Special Tax Refunding Bond Community Facilities District #2003-1 Lincoln Crossing Project | | 4.00 | 9-1-2024 | 600,000 | 680,490 |

| Lincoln CA Special Tax Refunding Bond Community Facilities District #2003-1 Lincoln Crossing Project | | 5.00 | 9-1-2025 | 550,000 | 667,090 |

| Menifee CA Union School District Public Series A | | 4.00 | 9-1-2022 | 540,000 | 566,617 |

| Oakdale CA Successor Agency to Oakdale Community RDA Series A (AGM Insured) | | 5.00 | 6-1-2027 | 350,000 | 430,210 |

| Orange County CA Community Facilities #2015-1 Esencia Village Series A | | 5.00 | 8-15-2023 | 365,000 | 404,015 |

| Orange County CA Community Facilities #2015-1 Esencia Village Series A | | 5.00 | 8-15-2025 | 325,000 | 384,709 |

| Pittsburg CA Successor Agency of Los Medanos Community Development (AGM Insured) | | 5.00 | 8-1-2021 | 1,885,000 | 1,937,497 |

| Pittsburg CA Successor Agency of Los Medanos Community Development (AGM Insured) | | 5.00 | 8-1-2022 | 1,305,000 | 1,399,195 |

| Pittsburg CA Successor Agency of Los Medanos Community Development (AGM Insured) | | 5.00 | 8-1-2023 | 780,000 | 871,283 |

| Poway CA Unified School District PFA (BAM Insured) | | 4.00 | 10-1-2021 | 185,000 | 190,313 |

| Poway CA Unified School District PFA Series B (BAM Insured) | | 5.00 | 9-1-2024 | 1,115,000 | 1,299,310 |

| Poway CA Unified School District PFA Series B (BAM Insured) | | 5.00 | 9-1-2025 | 775,000 | 937,200 |

| Rialto CA RDA Successor Agency to Merged Project Area | | 5.00 | 9-1-2022 | 475,000 | 510,112 |

| Riverside CA PFA Local Measure Certificate of Participation Riverside Pavement Rehabilitation Project (AGM Insured) | | 5.00 | 6-1-2023 | 845,000 | 943,003 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo California Limited-Term Tax-Free Fund | 17

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Tax revenue (continued) | | | | | |

| Roseville CA Finance Authority Special Refunding Bond Series A | | 5.00% | 9-1-2023 | $ 400,000 | $ 451,136 |

| Roseville CA Finance Authority Special Refunding Bond Series A | | 5.00 | 9-1-2029 | 300,000 | 384,879 |

| Roseville CA Special Tax Refunding Bond Community Facilities District | | 5.00 | 9-1-2021 | 500,000 | 513,830 |

| Roseville CA Special Tax Refunding Bond Fiddyment Ranch Community | | 5.00 | 9-1-2024 | 1,905,000 | 2,188,445 |

| Roseville CA Special Tax Refunding Bond Fiddyment Ranch Community | | 5.00 | 9-1-2029 | 1,595,000 | 1,957,591 |

| Sacramento CA Transient Occupancy Tax Revenue Convention Center Complex Senior | | 5.00 | 6-1-2027 | 575,000 | 705,519 |

| Sacramento CA Transportation Authority Sales Tax Refunding Bond Series A (Sumitomo Mitsui Banking Corporation LOC)ø | | 0.05 | 10-1-2038 | 12,000,000 | 12,000,000 |

| San Francisco CA City & County RDA Successor Agency to Community Facilities District #6 Mission Bay South Series A | | 5.00 | 8-1-2025 | 1,600,000 | 1,708,944 |

| San Francisco CA City & County RDA Successor Agency to Mission Bay South Redevelopment Project Series A | | 5.00 | 8-1-2022 | 375,000 | 401,948 |

| San Francisco CA City & County RDA Successor Agency to Mission Bay South Redevelopment Project Subordinate Bond Series D 144A | | 3.00 | 8-1-2021 | 1,020,000 | 1,032,485 |

| San Jose CA Convention Center Expansion & Renovation Project | | 5.25 | 5-1-2023 | 1,465,000 | 1,480,558 |

| San Marcos CA Unified School District Community Facilities District #5 (BAM Insured) | | 5.00 | 9-1-2021 | 270,000 | 278,648 |

| San Marcos CA Unified School District Community Facilities District #5 (BAM Insured) | | 5.00 | 9-1-2022 | 250,000 | 270,128 |

| San Pablo CA RDA Series B (AGM Insured) | | 5.00 | 6-15-2021 | 1,775,000 | 1,810,571 |

| San Pablo CA RDA Series B (AGM Insured) | | 5.00 | 6-15-2022 | 1,865,000 | 1,984,509 |

| San Pablo CA RDA Series B (AGM Insured) | | 5.00 | 6-15-2023 | 1,945,000 | 2,158,503 |

| Stockton CA RDA Refunding Bond Series A (AGM Insured) | | 5.00 | 9-1-2025 | 1,675,000 | 2,025,561 |

| Successor Agency to the Morgan Hill CA RDA Series A | | 5.00 | 9-1-2021 | 1,055,000 | 1,088,581 |

| Successor Agency to the Richmond CA Community RDA Series A (BAM Insured) | | 4.50 | 9-1-2025 | 160,000 | 182,205 |

| Successor Agency to the Richmond CA Community RDA Series A (BAM Insured) | | 5.00 | 9-1-2021 | 310,000 | 319,805 |

| Successor Agency to the Richmond CA Community RDA Series A (BAM Insured) | | 5.00 | 9-1-2022 | 300,000 | 324,048 |

| Successor Agency to the Richmond CA Community RDA Series A (BAM Insured) | | 5.00 | 9-1-2023 | 265,000 | 298,652 |

| Successor Agency to the Richmond CA Community RDA Series A (BAM Insured) | | 5.00 | 9-1-2025 | 150,000 | 174,705 |

| Successor Agency to the Riverside County CA RDA Desert Communities Project Area Series D | | 5.00 | 10-1-2022 | 445,000 | 478,250 |

| Successor Agency to the Riverside County CA RDA Desert Communities Project Area Series D | | 5.00 | 10-1-2023 | 470,000 | 524,802 |

| Successor Agency to the Riverside County CA RDA Project Area #1 Series A | | 5.00 | 10-1-2022 | 240,000 | 257,933 |

| Successor Agency to the Riverside County CA RDA Project Area #1 Series A | | 5.00 | 10-1-2023 | 460,000 | 513,636 |

| Tracy CA Community Facilities District | | 4.00 | 9-1-2021 | 140,000 | 142,708 |

| Tracy CA Community Facilities District | | 4.00 | 9-1-2022 | 180,000 | 188,422 |

| Tracy CA Community Facilities District | | 4.00 | 9-1-2024 | 135,000 | 147,987 |

| Tracy CA Community Facilities District | | 4.00 | 9-1-2025 | 155,000 | 173,457 |

The accompanying notes are an integral part of these financial statements.

18 | Wells Fargo California Limited-Term Tax-Free Fund

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Tax revenue (continued) | | | | | |

| Tracy CA Community Facilities District | | 5.00% | 9-1-2028 | $ 425,000 | $ 502,945 |

| Transbay Joint Powers Authority Green Subordinated Bond Tax Allocation Bond Series B | | 2.40 | 10-1-2049 | 1,820,000 | 1,850,157 |

| Transbay Joint Powers Authority Green Tax Allocation Bond Senior Series A | | 5.00 | 10-1-2029 | 500,000 | 654,375 |

| Transbay Joint Powers Authority Green Tax Allocation Bond Senior Series A | | 5.00 | 10-1-2030 | 500,000 | 658,565 |

| Transbay Joint Powers Authority Green Tax Allocation Bond Senior Series A | | 5.00 | 10-1-2031 | 400,000 | 524,260 |

| Tustin CA Community Facilities District #6-1 Legacy Columbus Villages Series A | | 5.00 | 9-1-2025 | 1,000,000 | 1,210,830 |

| Upland CA Successor Agency to Merged Project Tax Allocation Bond (AGM Insured) | | 5.00 | 9-1-2023 | 1,000,000 | 1,120,740 |

| Vacaville CA RDA Tax Allocation Subordinate Refunding Bond Redevelopment Projects | | 5.00 | 9-1-2021 | 600,000 | 618,816 |

| Vacaville CA RDA Tax Allocation Subordinate Refunding Bond Redevelopment Projects | | 5.00 | 9-1-2022 | 1,050,000 | 1,126,346 |

| Val Verde CA Unified School District (BAM Insured) | | 4.00 | 10-1-2021 | 375,000 | 385,429 |

| Val Verde CA Unified School District (BAM Insured) | | 5.00 | 10-1-2022 | 665,000 | 717,954 |

| Western Placer CA Unified School District Special Tax BAN Community Facilities | | 2.00 | 6-1-2025 | 2,000,000 | 2,071,280 |

| Western Placer CA Unified School District Special Tax BAN Community Facilities | | 2.00 | 6-1-2025 | 5,000,000 | 5,158,700 |

| Yuba City CA RDA Refunding Bond (AGM Insured) | | 5.00 | 9-1-2025 | 750,000 | 906,968 |

| | | | | | 98,947,161 |

| Tobacco revenue: 1.47% | | | | | |

| California County CA Tobacco Securitization Agency Settlement Senior Refunding Bond Series A | | 5.00 | 6-1-2030 | 450,000 | 616,496 |

| California County CA Tobacco Securitization Agency Settlement Senior Refunding Bond Series A | | 5.00 | 6-1-2031 | 550,000 | 748,407 |

| California County CA Tobacco Securitization Agency Settlement Senior Refunding Bond Series A | | 5.00 | 6-1-2032 | 300,000 | 404,586 |

| California County CA Tobacco Securitization Agency Settlement Subordinate Refunding Bond Series B1 | | 1.75 | 6-1-2030 | 750,000 | 787,238 |

| California County CA Tobacco Securitization Agency Tabacco Settlement Revenue Sonoma County Securitization | | 5.00 | 6-1-2029 | 500,000 | 667,505 |

| California County CA Tobacco Securitization Agency Tabacco Settlement Revenue Sonoma County Securitization | | 5.00 | 6-1-2030 | 200,000 | 271,428 |

| California County CA Tobacco Securitization Agency Tabacco Settlement Revenue Sonoma County Securitization | | 5.00 | 6-1-2031 | 225,000 | 304,875 |

| California County CA Tobacco Securitization Agency Tabacco Settlement Revenue Sonoma County Securitization | | 5.00 | 6-1-2032 | 250,000 | 336,535 |

| Golden State Tobacco Securitization Corporation Tobacco Settlement Refunding Bond Series A1 | | 5.00 | 6-1-2026 | 3,000,000 | 3,663,480 |

| Tobacco Securitization Authority Tobacco Settlement Revenue Refunding Bond Asset Backed Senior Series B1 Class 2 | | 2.25 | 6-1-2029 | 290,000 | 292,868 |

| | | | | | 8,093,418 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo California Limited-Term Tax-Free Fund | 19

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Utilities revenue: 0.28% | | | | | |

| Southern California Public Power Authority Refunding Bond Canyon Power Project Series A | | 5.00% | 7-1-2027 | $ 1,000,000 | $ 1,023,740 |

| Walnut CA Energy Center Authority Refunding Bond Series A | | 5.00 | 1-1-2021 | 500,000 | 500,000 |

| | | | | | 1,523,740 |

| Water & sewer revenue: 4.02% | | | | | |

| Eastern California Municipal Water District Refunding Bond Series C (SIFMA Municipal Swap+0.25%)± | | 0.34 | 7-1-2046 | 3,000,000 | 3,000,900 |

| Florin CA Resource Conservation District Series A (National Insured) | | 5.00 | 9-1-2021 | 1,250,000 | 1,288,363 |

| Florin CA Resource Conservation District Series A (National Insured) | | 5.00 | 9-1-2022 | 1,250,000 | 1,346,300 |

| Lower Tule River Irrigation District California Revenue Refunding Bond Series A | | 5.00 | 8-1-2031 | 700,000 | 895,286 |

| Middle Fork CA Project Finance Authority Revenue Refunding Bond | | 5.00 | 4-1-2029 | 3,525,000 | 4,441,394 |

| Oxnard CA Financing Authority Refunding Bond (AGM Insured) | | 5.00 | 6-1-2021 | 735,000 | 749,509 |

| San Francisco City & County CA Public Utilities Commission Series C Green Bond | | 2.13 | 10-1-2048 | 10,000,000 | 10,394,800 |

| | | | | | 22,116,552 |

| | | | | | 515,276,512 |

| Guam: 1.00% | | | | | |

| Airport revenue: 0.26% | | | | | |

| Guam Port Authority AMT Series B | | 5.00 | 7-1-2023 | 540,000 | 583,675 |

| Guam Port Authority AMT Series B | | 5.00 | 7-1-2024 | 750,000 | 833,085 |

| | | | | | 1,416,760 |

| Miscellaneous revenue: 0.74% | | | | | |

| Guam Education Financing Foundation Certificate of Participation Refunding Bond Series A | | 5.00 | 10-1-2023 | 3,840,000 | 4,101,466 |

| | | | | | 5,518,226 |

| Illinois: 2.50% | | | | | |

| Miscellaneous revenue: 2.04% | | | | | |

| Illinois Refunding Bond | | 5.00 | 2-1-2025 | 10,000,000 | 11,239,800 |

| Tax revenue: 0.46% | | | | | |

| Metropolitan Pier & Exposition Authority McCormick Place Expansion Project Series B | | 5.00 | 12-15-2025 | 650,000 | 751,056 |

| Sales Tax Securitization Corporation Series 2017A | | 5.00 | 1-1-2026 | 1,500,000 | 1,782,585 |

| | | | | | 2,533,641 |

| | | | | | 13,773,441 |

| Louisiana: 0.18% | | | �� | | |

| Industrial development revenue: 0.18% | | | | | |

| St. James Parish LA Nucor Steel LLC Project Gulf Opportunity Zone Series A-1 ø | | 0.16 | 11-1-2040 | 1,000,000 | 1,000,000 |

The accompanying notes are an integral part of these financial statements.

20 | Wells Fargo California Limited-Term Tax-Free Fund

Portfolio of investments—December 31, 2020 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| New Jersey: 0.23% | | | | | |

| Tax revenue: 0.23% | | | | | |

| New Jersey Statewide Covid-19 Emergency Series A | | 5.00% | 6-1-2027 | $ 1,000,000 | $ 1,250,700 |

| New York: 1.19% | | | | | |

| Industrial development revenue: 1.19% | | | | | |

| New York Transportation Development Corporation Special Facilities Revenue Delta Air Lines Incorporated LaGuardia Airport Terminals C&D Redevelopment | | 5.00 | 1-1-2029 | 5,000,000 | 6,033,300 |

| New York Transportation Development Corporation Special Facilities Revenue Terminal 4 John F Kennedy International Airport | | 5.00 | 12-1-2032 | 400,000 | 508,704 |

| | | | | | 6,542,004 |

| Texas: 0.58% | | | | | |

| Industrial development revenue: 0.58% | | | | | |

| Houston TX Airport System AMT Revenue Refunding Bond United Airlines Incorporated Terminal E Project | | 5.00 | 7-1-2029 | 3,000,000 | 3,184,950 |

| Total Municipal obligations (Cost $525,168,863) | | | | | 546,545,833 |

| | | Yield | | Shares | |

| Short-term investments: 0.91% | | | | | |

| Investment companies: 0.91% | | | | | |

| Wells Fargo Municipal Cash Management Money Market Fund Institutional Class ♠∞## | | 0.01% | | 4,980,330 | $ 4,981,824 |

| Total Short-term investments (Cost $4,981,632) | | | | | 4,981,824 |

| Total investments in securities (Cost $531,150,495) | 100.49% | | | | 552,527,657 |

| Other assets and liabilities, net | (0.49) | | | | (2,705,783) |

| Total net assets | 100.00% | | | | $549,821,874 |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| ø | Variable rate demand notes are subject to a demand feature which reduces the effective maturity. The maturity date shown represents the final maturity date of the security. The interest rate is determined and reset by the issuer daily, weekly, or monthly depending upon the terms of the security. The rate shown is the rate in effect at period end. |

| ## | All or a portion of this security is segregated for when-issued securities. |

| ± | Variable rate investment. The rate shown is the rate in effect at period end. |

| ¤ | The security is issued in zero coupon form with no periodic interest payments. |

| € | The security is an auction-rate security which has an interest rate that resets at predetermined short-term intervals through a Dutch auction. The rate shown is the rate in effect at period end. |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

| %% | The security is purchased on a when-issued basis. |

The accompanying notes are an integral part of these financial statements.

Wells Fargo California Limited-Term Tax-Free Fund | 21

Portfolio of investments—December 31, 2020 (unaudited)

| Abbreviations: |

| AGM | Assured Guaranty Municipal |

| AMT | Alternative minimum tax |

| BAM | Build America Mutual Assurance Company |

| BAN | Bond anticipation notes |

| CAB | Capital appreciation bond |

| CDA | Community Development Authority |

| FHLMC | Federal Home Loan Mortgage Corporation |

| GO | General obligation |

| HFA | Housing Finance Authority |

| HFFA | Health Facilities Financing Authority |

| LIBOR | London Interbank Offered Rate |

| LIQ | Liquidity agreement |

| LOC | Letter of credit |

| National | National Public Finance Guarantee Corporation |

| PFA | Public Finance Authority |

| RDA | Redevelopment Authority |

| SIFMA | Securities Industry and Financial Markets Association |

Investments in affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were either affiliated persons of the Fund at the beginning of the period or the end of the period were as follows:

| | Value,

beginning of

period | Purchases | Sales

proceeds | Net

realized

gains

(losses) | Net

change in

unrealized

gains

(losses) | Value,

end of

period | % of

net

assets | Shares,

end

of period | Income

from

affiliated

securities |

| Short-term investments | | | | | | | | | |

| Investment companies | | | | | | | | | |

| Wells Fargo Municipal Cash Management Money Market Fund Institutional Class | $0 | $126,651,290 | $(121,671,321) | $1,663 | $192 | $4,981,824 | 0.91% | 4,980,330 | $838 |

The accompanying notes are an integral part of these financial statements.

22 | Wells Fargo California Limited-Term Tax-Free Fund

Statement of assets and liabilities—December 31, 2020 (unaudited)

| | |

| Assets | |

Investments in unaffiliated securities, at value (cost $526,168,863)

| $ 547,545,833 |

Investments in affiliated securites, at value (cost $4,981,632)

| 4,981,824 |

Receivable for interest

| 5,987,082 |

Receivable for Fund shares sold

| 284,072 |

Prepaid expenses and other assets

| 23,274 |

Total assets

| 558,822,085 |

| Liabilities | |

Payable for when-issued transactions

| 7,418,586 |

Payable for Fund shares redeemed

| 567,761 |

Payable for investments purchased

| 388,581 |

Dividends payable

| 321,440 |

Management fee payable

| 187,268 |

Administration fees payable

| 50,423 |

Distribution fee payable

| 4,910 |

Trustees’ fees and expenses payable

| 2,946 |

Accrued expenses and other liabilities

| 58,296 |

Total liabilities

| 9,000,211 |

Total net assets

| $549,821,874 |

| Net assets consist of | |

Paid-in capital

| $ 537,741,931 |

Total distributable earnings

| 12,079,943 |

Total net assets

| $549,821,874 |

| Computation of net asset value and offering price per share | |

Net assets – Class A

| $ 109,728,469 |

Shares outstanding – Class A1

| 10,161,756 |

Net asset value per share – Class A

| $10.80 |

Maximum offering price per share – Class A2

| $11.02 |

Net assets – Class C

| $ 6,830,330 |

Shares outstanding – Class C1

| 632,680 |

Net asset value per share – Class C

| $10.80 |

Net assets – Administrator Class

| $ 33,507,505 |

Shares outstanding – Administrator Class1

| 3,151,052 |

Net asset value per share – Administrator Class

| $10.63 |

Net assets – Institutional Class

| $ 399,755,570 |

Shares outstanding – Institutional Class1

| 37,615,780 |

Net asset value per share – Institutional Class

| $10.63 |

| 1 | The Fund has an unlimited number of authorized shares |

| 2 | Maximum offering price is computed as 100/98 of net asset value. On investments of $50,000 or more, the offering price is reduced. |