UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21580

(Exact name of registrant as specified in charter)

| 825 N. Jefferson St., Suite 400, Milwaukee, WI 53202 | |

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code

Lori Hoch

825 N. Jefferson St., Suite 400

(Name and address of agent for service)

Date of fiscal year end: June 30

Date of reporting period: July 1, 2015 - December 31, 2015

Item 1. Reports to Stockholders.

The following is a copy of the report to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

| Cortina Small Cap Growth Fund | |

| Shareholder Letter | 1 |

| Portfolio Information | 3 |

| Cortina Small Cap Value Fund | |

| Shareholder Letter | 4 |

| Portfolio Information | 5 |

| Disclosure of Fund Expenses | 6 |

| Schedule of Investments | |

| Cortina Small Cap Growth Fund | 7 |

| Cortina Small Cap Value Fund | 10 |

| Statements of Assets and Liabilities | 12 |

| Statements of Operations | 13 |

| Statements of Changes in Net Assets | 14 |

| Financial Highlights | |

| Cortina Small Cap Growth Fund | 15 |

| Cortina Small Cap Value Fund - Institutional | 16 |

| Cortina Small Cap Value Fund - Investor | 17 |

| Notes to Financial Statements | 18 |

| Additional Information | 22 |

The equity market started to buckle in the second half of 2015 following its midyear peak. Our benchmark, the Russell 2000 Growth Index declined over 9%, which bested the Cortina Small Cap Growth Fund by a small amount. Under the covers the market had disconcerting nuances which kept us concerned. Chief among them was how equity returns grew increasingly narrow. The evidence of a very narrow market is clear when the data is analyzed at year’s end. In the broader Russell 3000® Index, 2/3 of all stocks closed the year off in excess of 15% from their 52-week highs. Yet the Index at large closed the year off just 6.8% from its June high. It was the elevated levels of just a handful of stocks that drove performance, which on its surface looked much healthier than what the average security has faced. Narrow markets are unsustainable as eventually whatever is holding them up fails, crumbles, or fades. The market in aggregate is the sum of its parts, and it needs many parts to thrive. It is equivalent to a golfer who leads a tournament early while missing fairway after fairway because he is putting like a wizard. This performance may get him in the clubhouse with a solid score after a round or maybe even two, but eventually the other parts of his game must contribute if he expects to win over the long run. Narrow markets are often difficult for stock pickers such as us since the market tends to narrow around crowded, high-momentum stocks. These types of stocks typically come with the unrealistic expectations and excessive valuations our process avoids.

While all sectors, save Consumer Staples and Telecom Services, were in negative territory for the second half of the year, no sector was pummeled as hard as the Energy sector. The price of oil has been in decline since its June 2014 peak, but the free fall resumed in the second half of 2015 after the second quarter commodity price boost. It is our belief, and we have data to support it, that unlike the collapse in other commodities and materials, the plunge in the price of oil has little to do with changes in demand and much to do with an increase in supply. Of course, the supply curve shifted to the right when drilling technologies enabled the United States to drastically increase its levels of production. Coupled with increased supply coming from Saudi Arabia, Iran, and Libya, the price continues to fall. The market has gotten so oversupplied (and global supply has gotten so geographically diverse) that the classic trump card of geopolitical instability has done nothing to support oil prices.

The decline in oil is raising investors’ concerns over the strength of the economy. The gravest fear is that the decline in oil prices is a symptom of a global recession which the market cannot yet see. Of course, a slowing Chinese economy would be the head of this snake. Our analysis is a little more targeted and tangible. We see the oil price decline as more of the cause of a slowdown in certain segments of the economy, rather than the effect of a macro crisis. The impact to the industrial economy (and all things supporting it) resulting from the massive decline in oil-related revenues and domestic drilling activity is relevant. Slashes to drilling / production and lower oil receipts impact hot-rolled steel mills in Indiana, restaurants in North Dakota, truckers in Oklahoma, and real estate agents in Houston. This is a wide net and to appreciate its significance, one must only recall the rhetoric from the many politicians and economists alike who claimed that credit for the economy’s recovery lied first and foremost from the domestic shale energy renaissance. Companies of all varieties in this food chain (due either to the nature of their business or their geographic concentration) should expect to see increasing headwinds.

Our exposure in the Energy sector has proven to be early. Acknowledging that oil price woes are driven by oversupply, we anticipate an ultimate return to rational behavior by producers which will diminish supply and allow prices to rise. In addition, the Consumer Discretionary sector has been a challenge for the fund in the second half of the year as well. Unable to benefit from lower gasoline prices, the sector performed just as weakly as both the Materials and Industrials sectors. The fund’s performance highlights were the Information Technology and Health Care sectors. Several of our long-term investment themes in technology have started to really become recognized by the market following strong financial performance, and our relative fortunes in Health Care have improved as the euphoria surrounding Biotech stocks (an area we traditionally avoid) has been fading.

OUTLOOK AND POSITIONING

Despite the fall in global oil prices, most of the domestic economy is on solid ground. Signs of increased wage pressures are fast approaching, however, as the labor market tightens. What this means for us, and why it is congruent with the types of portfolios we tend to build is that revenue growth is going to be key to delivering outsized earnings growth. A run-of-the-mill company will most likely not have pricing power, but they will face wage pressure. This should place a premium on companies that can drive substantial top line growsth because they should have a better chance to deliver margin/earnings expansion. And, in our view, earnings growth will be crucial because it seems like valuations are being compressed across the board. In the public markets, valuations are down a little from where they were a year ago and remain on the upper threshold of their long-term averages. In the private market, valuations appear to be compressing much faster as the stories pile up for “down funding rounds” being experienced by private companies.

We enter the year with the Information Technology sector as our single biggest exposure. Revenue growth rates remain very high and market weakness is providing opportunities for us to invest in some high growth companies, which in the recent past have exceeded our valuation limits. The Industrials sector is getting painted with a wide brush as many companies do supply, either directly or tangentially, the oil and gas complex. While it still seems early to get too enthused about energy infrastructure, we have added several new Industrial positions, mostly around building and infrastructure cycles. Some industries appear completely washed out, such as Transports, and we admit to being early to them. We are increasingly interested, however, in taking advantage of the fact that everything in the industry is down very significantly. If the consumer remains healthy and increases their spending, the fortunes of these companies should improve. We also remain constructive on the Airlines.

| Semi-Annual Report | December 31, 2015 | 1 |

| Cortina Small Cap Growth Fund | December 31, 2015 (Unaudited) |

Holdings in the Cortina Fund may change as we divest companies that reveal increased challenges to succeed in what may become a more difficult environment. Across-the-board weakness has historically presented the best opportunities for investors who are willing to differentiate companies, resisting the temptation to paint them all with the same myopic brush out of fear, uncertainty, and doubt.

Thank you for your continued investment and interest in the Cortina Small Cap Growth Fund.

Investing involves risks, including loss of principal.

The Russell 3000® Index measures the performance of the stocks of the 3,000 largest publicly traded U.S. companies, based on market capitalization. The index measures the performance of about 98% of the total market capitalization of the publicly traded U.S. equity market.

| 2 | 1-855-612-3936 | www.cortinafunds.com |

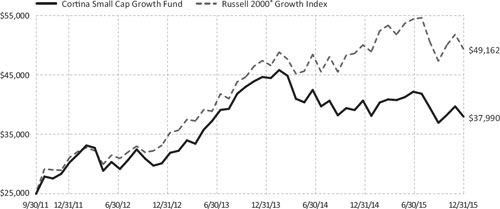

Growth of $25,000 Investment (Unaudited)

For the period from September 30, 2011 (Inception) to December 31, 2015.

This graph assumes an initial $25,000 investment at September 30, 2011 (Inception Date). The Cortina Small Cap Growth Fund (the “Fund”) will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. This graph depicts the performance of the Fund versus the Russell 2000® Growth Index. It is important to note the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only.

This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance Returns for the period ended December 31, 2015

| | 6 Months | 1 Year | 3 Years | Since Inception* | Gross

Expense Ratio** |

| Cortina Small Cap Growth Fund | -9.93% | -6.59% | 8.04% | 10.34% | 1.58% |

Russell 2000® Growth Index | -9.31% | -1.38% | 14.28% | 17.24% | |

| * | The Fund’s inception date is September 30, 2011. |

| ** | Cortina Asset Management, LLC (the “Adviser”) has contractually agreed to waive management fees and/or reimburse the Fund’s operating expenses in order to limit the Fund’s total annual fund operating expenses (excluding taxes, leverage, interest, brokerage commissions, dividends or interest expenses on short positions, acquired fund fees and expenses and extraordinary expenses) to 1.10% of average daily net assets of the Fund. The agreement will continue in effect at least through October 31, 2016, subject thereafter to annual re-approval of the agreement by the Fund's Board of Directors. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor's shares, when redeemed may be worth more or less than their original cost. To obtain performance information current to the most recent month end, call 1-855-612-3936.

Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-value ratios and higher forecasted growth values. All indices are unmanaged. It is not possible to invest directly in an index.

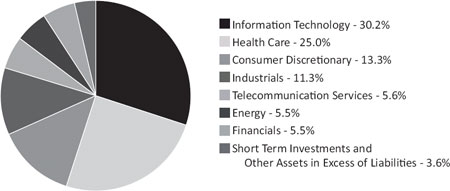

Sector Allocations***

| *** | Percentages are based on Net Assets as of December 31, 2015. Holdings are subject to change. |

| Semi-Annual Report | December 31, 2015 | 3 |

DEAR FELLOW SHAREHOLDERS:

After delivering decent outperformance in the first half of 2015, the Cortina Small Cap Value Fund posted a lackluster second half, particularly in the September quarter. This resulted in a full-year decline inline with the benchmark Russell 2000 Value Index. Underperformance against the benchmark in the second half was primarily driven by sector allocation, though stock selection was a slight negative as well. Despite some very large positive returns in several positions, 2015 was quite simply not a great year to be a value investor. However, we believe the large decline in the market during 3Q15 began to build a better opportunity set in 2016.

It is not particularly surprising that given the downtrend in the market, the top contributors to the portfolio in the back half were consumer and health care companies. Notable is a business services company that has been owned since January of 2012; although it had performed well over the first years of ownership, this year it really delivered with a 50%+ gain. What might be a bit surprising is that in a market in which transports as a whole was a terrible sector, an airline was one of the top contributors.

Top detractors were anything remotely related to energy. Despite a consistent underweight to the sector, its damage was wide ranging. The largest in the second half of 2015 was a sports equipment company. While nominal sales and profits were solid, we underestimated the financial impact the oil-related weakening of the Canadian dollar would have on the reported earnings of the enterprise. In addition, a steel company with a once profitable business serving the energy sector now has a break-even operation at best, which forced a corresponding decline in its equity valuation beyond any downside scenarios we had modeled.

2015 was a year of extremes that netted out to remarkably average results. Winners we owned were up by large percentages, while losers were down by large percentages. Patience was most assuredly not a virtue with companies that had the slightest disappointments, and sometimes the logic of the moves both up and down were not clear to us as observers and participants in the market. Although the beginning of 2016 feels terrible due to the very rapid decline during the first weeks of trading, we believe this is the beginning of a phase where value equities can begin to close the performance gap with growth equities. This would be a very important shift that would create a powerful tailwind for the investing style of the Cortina Small Cap Value Fund.

OUTLOOK & PORTFOLIO POSITIONING

Sitting at the opening of 2016, the largest challenge is that even companies undergoing positive internal change are subject to the diminished vigor of a slower economy and a skittish market. In such markets, we notice that company fundamentals have mattered a lot less than equity technicals. Lower prices beget lower prices - and this will likely continue for a while making for some uncomfortable days.

Our expectation for the coming months is for a difficult market. There will probably be some very large earnings misses and resets of expectations. August was the first blush of these events in a while and provided a great opportunity for nimble investors. Yet we think the risk is greater in the equities that have had significant moves upward, where valuations are stretched, and the earnings prospects may have peaked, versus companies in which we have focused. For the most part, the companies we are most excited about today have undergone some fairly significant setbacks, expectations are low, and valuations are well below those of the averages, those of the recent past, and those of certain peers.

We prefer companies where managements and strategies have been changed, costs cut, and sales efforts refocused. We have most of those opportunities in Industrials, Technology and Health Care companies today, all sectors in which the portfolio is overweight. Energy remains a significant underweight and a tiny portion of the portfolio, but there will be a time when we will move aggressively to increase that weighting - although that time keeps getting pushed farther away. Consumer remains an overweight, but that weighting has diminished as other opportunities beckon with greater potential. Financials, while underweight relative to the benchmark, remain the largest portion of the portfolio and a sector we expect to present increasing opportunities given the paradigm shift in the rate environment. We expect 2016 to be an interesting year. With the very significant turnover in the portfolio, we believe it is well-positioned for a swing towards value equities, and whether that swing comes in a week or a year, so long as history repeats, it will come.

Investing involves risks, including loss of principal.

| 4 | 1-855-612-3936 | www.cortinafunds.com |

| Cortina Small Cap Value Fund | December 31, 2015 (Unaudited) |

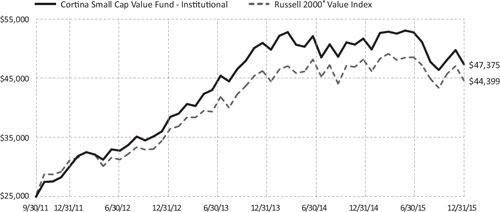

Growth of $25,000 Investment (Unaudited)

For the period from September 30, 2011 (Inception) to December 31, 2015.

This graph assumes an initial $25,000 investment at September 30, 2011 (Inception Date). The Cortina Small Cap Value Fund Institutional share class (the “Fund”) will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. This graph depicts the performance of the Fund versus the Russell 2000® Value Index. It is important to note the Fund is a professionally managed mutual fund, while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. Performance will vary from class to class based on differences in class-specific expenses.

This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance Returns for the period ended December 31, 2015

| | 6 Months | 1 Year | 3 Years* | Since Inception* | Gross

Expense Ratio** |

| Cortina Small Cap Value Fund - Institutional | -10.21% | -8.37% | 9.55% | 16.22% | 1.64% |

| Cortina Small Cap Value Fund - Investor | -10.34% | -8.61% | 9.28% | 15.93% | 1.89% |

Russell 2000® Value Index | -8.17% | -7.47% | 9.06% | 14.46%*** | |

| * | The Fund’s Institutional shares inception date is September 30, 2011, Investor shares inception date is April 30, 2014. The performance shown for Investor shares for periods pre-dating the commencement of operations of that class reflects the performance of the Fund’s Institutional shares, the initial share class, calculated using the fees and expenses of Investor shares. If Investor shares of the Fund had been available during periods prior to April 30, 2014, the performance shown may have been different. |

| ** | Cortina Asset Management, LLC (the “Adviser”) has contractually agreed to waive management fees and/or reimburse the Fund’s operating expenses in order to limit the Fund’s total annual fund operating expenses (excluding 12b-1 fees, taxes, leverage, interest, brokerage commissions, dividends or interest expenses on short positions, acquired fund fees and expenses and extraordinary expenses) to 1.10% of average daily net assets of the Fund. The agreement will continue in effect at least through October 31, 2016, subject thereafter to annual re-approval of the agreement by the Fund's Board of Directors. |

| *** | Represents the period from September 30, 2011 (date of original public offering of the Institutional shares) through December 31, 2015. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor's shares, when redeemed may be worth more or less than their original cost. To obtain performance information current to the most recent month end, call 1-855-612-3936.

Russell 2000® Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. All indices are unmanaged. It is not possible to invest directly in an index.

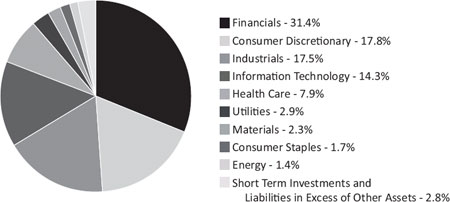

Sector Allocations****

| **** | Percentages are based on Net Assets as of December 31, 2015. Holdings are subject to change. |

| Semi-Annual Report | December 31, 2015 | 5 |

As a shareholder of the Fund(s), you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, as indicated below.

Actual Expenses – The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6) then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds by comparing these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| | Beginning

Account Value

July 1, 2015 | Ending

Account Value

December 31, 2015 | Expenses Paid

During Period(a) | Net

Expense

Ratios(b) |

| Cortina Small Cap Growth Fund - Institutional | | | | |

| Actual Fund Return | $1,000.00 | $900.70 | $5.26 | 1.10% |

| Hypothetical Fund Return (assuming a 5% return before expenses) | $1,000.00 | $1,019.61 | $5.58 | 1.10% |

| Cortina Small Cap Value Fund - Institutional | | | | |

| Actual Fund Return | $1,000.00 | $897.90 | $5.25 | 1.10% |

| Hypothetical Fund Return (assuming a 5% return before expenses) | $1,000.00 | $1,019.61 | $5.58 | 1.10% |

| Cortina Small Cap Value Fund - Investor | | | | |

| Actual Fund Return | $1,000.00 | $896.60 | $6.44 | 1.35% |

| Hypothetical Fund Return (assuming a 5% return before expenses) | $1,000.00 | $1,018.35 | $6.85 | 1.35% |

(a) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), divided by 366. |

(b) | Annualized, based on the Fund's most recent half-year expenses. |

| 6 | 1-855-612-3936 | www.cortinafunds.com |

| Schedule of Investments |

| Cortina Small Cap Growth Fund | December 31, 2015 (Unaudited) |

| | | Shares | | | Value | |

| COMMON STOCKS (96.4%) | | | | |

| Consumer Discretionary (13.3%) | | | | |

| Build-A-Bear Workshop, Inc.(a) | | | 21,538 | | | $ | 263,625 | |

| Dave & Buster's Entertainment, Inc.(a) | | | 12,074 | | | | 503,969 | |

| Fiesta Restaurant Group, Inc.(a) | | | 12,747 | | | | 428,299 | |

| Five Below, Inc.(a) | | | 11,385 | | | | 365,459 | |

| Gentherm, Inc.(a) | | | 2,405 | | | | 113,997 | |

| IMAX Corp.(a) | | | 15,505 | | | | 551,048 | |

| Kirkland's, Inc. | | | 22,983 | | | | 333,254 | |

| Kona Grill, Inc.(a) | | | 16,408 | | | | 260,231 | |

| Malibu Boats, Inc., Class A(a) | | | 23,869 | | | | 390,736 | |

| Motorcar Parts of America, Inc.(a) | | | 14,011 | | | | 473,712 | |

| Nautilus, Inc.(a) | | | 6,720 | | | | 112,358 | |

| Performance Sports Group, Ltd.(a) | | | 27,415 | | | | 264,006 | |

| Restoration Hardware Holdings, Inc.(a) | | | 3,480 | | | | 276,486 | |

| Tumi Holdings, Inc.(a) | | | 21,275 | | | | 353,803 | |

| Universal Electronics, Inc.(a) | | | 9,144 | | | | 469,544 | |

| | | | | | | | 5,160,527 | |

| Energy (5.5%) | | | | | |

| Aegean Marine Petroleum Network, Inc. | | | 30,657 | | | | 256,292 | |

| Aspen Aerogels, Inc.(a) | | | 46,794 | | | | 284,040 | |

| Carrizo Oil & Gas, Inc.(a) | | | 8,085 | | | | 239,154 | |

| Oasis Petroleum, Inc.(a) | | | 31,544 | | | | 232,479 | |

| Parsley Energy, Inc., Class A(a) | | | 15,513 | | | | 286,215 | |

| RigNet, Inc.(a) | | | 10,301 | | | | 213,128 | |

| Ring Energy, Inc.(a) | | | 24,222 | | | | 170,765 | |

| Sanchez Energy Corp.(a) | | | 53,590 | | | | 230,973 | |

| Synergy Resources Corp.(a) | | | 27,448 | | | | 233,857 | |

| | | | | | | | 2,146,903 | |

| Financials (5.5%) | | | | | |

| Allegiance Bancshares, Inc.(a) | | | 4,876 | | | | 115,317 | |

| BofI Holding, Inc.(a) | | | 20,848 | | | | 438,850 | |

| Encore Capital Group, Inc.(a) | | | 5,549 | | | | 161,365 | |

| Health Insurance Innovations, Inc., Class A(a) | | | 40,329 | | | | 270,204 | |

| LendingTree, Inc.(a) | | | 5,759 | | | | 514,164 | |

| Pinnacle Financial Partners, Inc. | | | 8,528 | | | | 437,998 | |

| PRA Group, Inc.(a) | | | 4,876 | | | | 169,149 | |

| | | | | | | | 2,107,047 | |

| Health Care (25.0%) | | | | | |

| ABIOMED, Inc.(a) | | | 3,817 | | | | 344,599 | |

| AMN Healthcare Services, Inc.(a) | | | 13,609 | | | | 422,559 | |

| AtriCure, Inc.(a) | | | 35,352 | | | | 793,299 | |

| AxoGen, Inc.(a) | | | 14,809 | | | | 74,045 | |

| BioTelemetry, Inc.(a) | | | 41,057 | | | | 479,546 | |

| Cepheid(a) | | | 8,093 | | | | 295,637 | |

| Cerus Corp.(a) | | | 70,901 | | | | 448,094 | |

| Cross Country Healthcare, Inc.(a) | | | 25,289 | | | | 414,487 | |

| Genomic Health, Inc.(a) | | | 1,097 | | | | 38,614 | |

| HealthEquity, Inc.(a) | | | 13,330 | | | | 334,183 | |

| HealthStream, Inc.(a) | | | 16,326 | | | | 359,172 | |

| HMS Holdings Corp.(a) | | | 38,660 | | | | 477,064 | |

| K2M Group Holdings, Inc.(a) | | | 30,140 | | | | 594,964 | |

| Myriad Genetics, Inc.(a) | | | 10,547 | | | | 455,209 | |

| NanoString Technologies, Inc.(a) | | | 7,733 | | | | 113,752 | |

| Neogen Corp.(a) | | | 7,363 | | | | 416,157 | |

| NeoGenomics, Inc.(a) | | | 62,956 | | | | 495,464 | |

| Novadaq Tech Inc(a) | | | 28,318 | | | | 360,771 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | December 31, 2015 | 7 |

| Schedule of Investments |

| Cortina Small Cap Growth Fund | December 31, 2015 (Unaudited) |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | | | | |

| Health Care (continued) | | | | |

| NxStage Medical, Inc.(a) | | | 43,421 | | | $ | 951,354 | |

| OraSure Technologies, Inc.(a) | | | 52,047 | | | | 335,183 | |

| Oxford Immunotec Global PLC(a) | | | 36,165 | | | | 415,898 | |

| The Spectranetics Corp.(a) | | | 23,541 | | | | 354,528 | |

| Streamline Health Solutions, Inc.(a) | | | 52,318 | | | | 73,768 | |

| TearLab Corp.(a) | | | 74,743 | | | | 103,893 | |

| Vocera Communications, Inc.(a) | | | 43,527 | | | | 531,029 | |

| | | | | | | | 9,683,269 | |

| Industrials (11.3%) | | | | | |

| Albany International Corp., Class A | | | 7,084 | | | | 258,920 | |

| Allegiant Travel Co. | | | 1,748 | | | | 293,367 | |

| Astec Industries, Inc. | | | 7,568 | | | | 308,018 | |

| Controladora Vuela Cia de Aviacion SAB de CV, ADR(a) | | | 27,325 | | | | 468,897 | |

| Forward Air Corp. | | | 10,638 | | | | 457,540 | |

| Heritage Crystal Clean, Inc.(a) | | | 21,595 | | | | 228,907 | |

| Hub Group, Inc., Class A(a) | | | 7,281 | | | | 239,909 | |

| Insteel Industries, Inc. | | | 18,772 | | | | 392,710 | |

| On Assignment, Inc.(a) | | | 10,629 | | | | 477,774 | |

| Primoris Services Corp.(a) | | | 13,688 | | | | 301,547 | |

| Radiant Logistics, Inc.(a) | | | 43,856 | | | | 150,426 | |

| Spirit Airlines, Inc.(a) | | | 10,350 | | | | 412,447 | |

| Team, Inc.(a) | | | 11,893 | | | | 380,100 | |

| | | | | | | | 4,370,562 | |

| Information Technology (30.2%) | | | | | |

| Actua Corp.(a) | | | 21,916 | | | | 250,938 | |

| BroadSoft, Inc.(a) | | | 16,794 | | | | 593,836 | |

| CEVA, Inc.(a) | | | 10,416 | | | | 243,318 | |

| ChannelAdvisor Corp.(a) | | | 41,352 | | | | 572,725 | |

| Cirrus Logic, Inc.(a) | | | 5,721 | | | | 168,941 | |

| Entegris Inc.(a) | | | 22,285 | | | | 295,722 | |

| Everyday Health, Inc.(a) | | | 45,998 | | | | 276,908 | |

| Five9, Inc.(a) | | | 33,431 | | | | 290,850 | |

| Imperva, Inc.(a) | | | 10,605 | | | | 671,403 | |

| Infinera Corporation(a) | | | 18,427 | | | | 333,897 | |

| Infoblox, Inc.(a) | | | 30,608 | | | | 562,881 | |

| Inphi Corp.(a) | | | 13,757 | | | | 371,714 | |

| Internap Corp.(a) | | | 32,340 | | | | 206,976 | |

| Intralinks Holdings, Inc.(a) | | | 48,815 | | | | 442,752 | |

| M/A-COM Technology Solutions Holdings, Inc.(a) | | | 16,104 | | | | 658,493 | |

| Marchex, Inc., Class B | | | 80,849 | | | | 314,503 | |

| Marketo, Inc.(a) | | | 15,965 | | | | 458,355 | |

| MaxLinear, Inc., Class A(a) | | | 40,408 | | | | 595,210 | |

| Nanometrics, Inc.(a) | | | 20,660 | | | | 312,792 | |

| Orbotech, Ltd.(a) | | | 16,227 | | | | 359,103 | |

| Planet Payment, Inc.(a) | | | 99,334 | | | | 302,969 | |

| Q2 Holdings, Inc.(a) | | | 25,018 | | | | 659,725 | |

| Qlik Technologies, Inc.(a) | | | 12,238 | | | | 387,455 | |

| RADWARE, Ltd.(a) | | | 30,731 | | | | 471,414 | |

| RingCentral, Inc., Class A(a) | | | 27,554 | | | | 649,723 | |

| SPS Commerce, Inc.(a) | | | 5,368 | | | | 376,887 | |

| Super Micro Computer, Inc.(a) | | | 12,402 | | | | 303,973 | |

| TechTarget, Inc.(a) | | | 23,483 | | | | 188,568 | |

| Varonis Systems, Inc.(a) | | | 18,107 | | | | 340,412 | |

| | | | | | | | 11,662,443 | |

| See Notes to Financial Statements. | |

| 8 | 1-855-612-3936 | www.cortinafunds.com |

| Schedule of Investments |

| Cortina Small Cap Growth Fund | December 31, 2015 (Unaudited) |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | | | | |

| Telecommunication Services (5.6%) | | | | |

| 8x8, Inc.(a) | | | 44,135 | | | $ | 505,346 | |

| Boingo Wireless, Inc.(a) | | | 65,229 | | | | 431,816 | |

| Cogent Communications Holdings, Inc. | | | 9,948 | | | | 345,096 | |

| inContact, Inc.(a) | | | 69,046 | | | | 658,699 | |

| Vonage Holdings Corp.(a) | | | 37,109 | | | | 213,005 | |

| | | | | | | | 2,153,962 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS (COST $34,290,997) | | | | 37,284,713 | |

| | | | | | | | | |

| SHORT TERM INVESTMENT (2.8%) | | | | | |

| Fidelity® Institutional Money Market Government Portfolio - Class I, 7 Day Yield 0.117% | | | 1,081,360 | | | | 1,081,360 | |

| | | | | | | | | |

| TOTAL SHORT TERM INVESTMENT (COST $1,081,360) | | | | 1,081,360 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (99.2%) (COST $35,372,357) | | | | | | | 38,366,073 | |

| | | | | | | | | |

| TOTAL ASSETS IN EXCESS OF OTHER LIABILITIES (0.8%) | | | | | | | 309,865 | |

| | | | | | | | | |

| NET ASSETS 100.0% | | | | | | $ | 38,675,938 | |

(a) | Non Income Producing Security. |

Common Abbreviations:

ADR -American Depositary Receipt.

Ltd. - Limited.

PLC - Public Limited Company.

SAB de CV - A variable rate company.

| See Notes to Financial Statements. | |

| Semi-Annual Report | December 31, 2015 | 9 |

| Schedule of Investments |

| Cortina Small Cap Value Fund | December 31, 2015 (Unaudited) |

| | | Shares | | | Value | |

| COMMON STOCKS (97.2%) | | | | |

| Consumer Discretionary (17.8%) | | | | |

| Caleres, Inc. | | | 31,660 | | | $ | 849,121 | |

| ClubCorp Holdings, Inc. | | | 85,005 | | | | 1,553,041 | |

| Cooper-Standard Holding, Inc.(a) | | | 22,401 | | | | 1,738,094 | |

| Fox Factory Holding Corp.(a) | | | 57,673 | | | | 953,335 | |

| Guess? Inc | | | 57,144 | | | | 1,078,879 | |

| Helen of Troy, Ltd.(a) | | | 19,347 | | | | 1,823,455 | |

| La Quinta Holdings, Inc.(a) | | | 44,991 | | | | 612,327 | |

| Performance Sports Group, Ltd.(a) | | | 102,333 | | | | 985,467 | |

| SeaWorld Entertainment, Inc. | | | 44,156 | | | | 869,432 | |

| Tile Shop Holdings, Inc.(a) | | | 69,185 | | | | 1,134,634 | |

| Travelport Worldwide, Ltd. | | | 98,867 | | | | 1,275,384 | |

| | | | | | | | 12,873,169 | |

| Consumer Staples (1.7%) | | | | | |

| Diamond Foods, Inc.(a) | | | 31,752 | | | | 1,224,040 | |

| | | | | | | | | |

| Energy (1.4%) | | | | | |

| Bristow Group, Inc. | | | 18,290 | | | | 473,711 | |

| Matador Resources Co.(a) | | | 27,286 | | | | 539,444 | |

| | | | | | | | 1,013,155 | |

| Financials (31.4%) | | | | | |

| The Bancorp, Inc.(a) | | | 85,440 | | | | 544,253 | |

| BofI Holding, Inc.(a) | | | 38,098 | | | | 801,963 | |

| Boston Private Financial Holdings, Inc. | | | 62,669 | | | | 710,666 | |

| Capitol Federal Financial, Inc. | | | 65,077 | | | | 817,367 | |

| Enterprise Financial Services Corp. | | | 26,048 | | | | 738,461 | |

| Gramercy Property Trust, Inc., REIT | | | 145,574 | | | | 1,123,834 | |

| Hannon Armstrong Sustainable Infrastructure Capital, Inc., REIT | | | 78,405 | | | | 1,483,423 | |

| iStar Financial, Inc., REIT(a) | | | 88,497 | | | | 1,038,070 | |

| James River Group Holdings Ltd. | | | 44,372 | | | | 1,488,237 | |

| Kennedy-Wilson Holdings, Inc. | | | 55,265 | | | | 1,330,781 | |

| Maiden Holdings, Ltd. | | | 91,459 | | | | 1,363,654 | |

| MB Financial, Inc. | | | 30,640 | | | | 991,817 | |

| Meridian Bancorp, Inc. | | | 102,752 | | | | 1,448,803 | |

| National General Holdings Corp. | | | 110,622 | | | | 2,418,197 | |

| PacWest Bancorp | | | 20,920 | | | | 901,652 | |

| State National Cos, Inc. | | | 105,995 | | | | 1,039,811 | |

| Texas Capital Bancshares, Inc.(a) | | | 21,201 | | | | 1,047,753 | |

| Virtu Financial, Inc., Class A | | | 51,561 | | | | 1,167,341 | |

| Waterstone Financial, Inc. | | | 88,497 | | | | 1,247,808 | |

| Yadkin Financial Corp.(a) | | | 42,468 | | | | 1,068,919 | |

| | | | | | | | 22,772,810 | |

| Health Care (7.9%) | | | | | |

| Allscripts Healthcare Solutions, Inc.(a) | | | 94,240 | | | | 1,449,411 | |

| AngioDynamics, Inc.(a) | | | 79,797 | | | | 968,735 | |

| Healthways, Inc.(a) | | | 86,924 | | | | 1,118,712 | |

| Magellan Health, Inc.(a) | | | 21,582 | | | | 1,330,746 | |

| Prestige Brands Holdings, Inc.(a) | | | 15,920 | | | | 819,562 | |

| | | | | | | | 5,687,166 | |

| Industrials (17.5%) | | | | | |

| Actuant Corp., Class A | | | 51,841 | | | | 1,242,111 | |

| Barnes Group, Inc. | | | 23,513 | | | | 832,125 | |

| Beacon Roofing Supply, Inc.(a) | | | 23,751 | | | | 978,066 | |

| Celadon Group, Inc. | | | 50,357 | | | | 498,031 | |

| Federal Signal Corp. | | | 78,405 | | | | 1,242,719 | |

| Forward Air Corp. | | | 21,928 | | | | 943,123 | |

| See Notes to Financial Statements. | |

| 10 | 1-855-612-3936 | www.cortinafunds.com |

| Schedule of Investments |

| Cortina Small Cap Value Fund | December 31, 2015 (Unaudited) |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | | | | |

| Industrials (continued) | | | | |

| FTI Consulting, Inc.(a) | | | 30,079 | | | $ | 1,042,538 | |

| Genesee & Wyoming, Inc., Class A(a) | | | 19,286 | | | | 1,035,465 | |

| Hawaiian Holdings, Inc.(a) | | | 29,809 | | | | 1,053,152 | |

| MasTec, Inc.(a) | | | 49,853 | | | | 866,445 | |

| Matson, Inc. | | | 26,659 | | | | 1,136,473 | |

| Tutor Perini Corp.(a) | | | 62,392 | | | | 1,044,442 | |

| YRC Worldwide, Inc.(a) | | | 52,030 | | | | 737,786 | |

| | | | | | | | 12,652,476 | |

| Information Technology (14.3%) | | | | | |

| Advanced Energy Industries, Inc.(a) | | | 50,938 | | | | 1,437,980 | |

| Barracuda Networks, Inc.(a) | | | 51,657 | | | | 964,953 | |

| Blackhawk Network Holdings, Inc.(a) | | | 28,205 | | | | 1,246,943 | |

| CommVault Systems, Inc.(a) | | | 23,282 | | | | 916,147 | |

| Eastman Kodak Co.(a) | | | 66,835 | | | | 838,111 | |

| ExlService Holdings, Inc.(a) | | | 24,367 | | | | 1,094,809 | |

| FARO Technologies, Inc.(a) | | | 31,194 | | | | 920,847 | |

| Power Integrations, Inc. | | | 19,717 | | | | 958,838 | |

| Rogers Corp.(a) | | | 20,270 | | | | 1,045,324 | |

| Tower Semiconductor, Ltd.(a) | | | 67,508 | | | | 949,162 | |

| | | | | | | | 10,373,114 | |

| Materials (2.3%) | | | | | |

| Carpenter Technology Corp. | | | 23,790 | | | | 720,123 | |

| Ferro Corp.(a) | | | 85,163 | | | | 947,013 | |

| | | | | | | | 1,667,136 | |

| Utilities (2.9%) | | | | | |

| Chesapeake Utilities Corp. | | | 19,901 | | | | 1,129,382 | |

| Ormat Technologies, Inc. | | | 27,248 | | | | 993,734 | |

| | | | | | | | 2,123,116 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS (COST $69,198,728) | | | | 70,386,182 | |

| | | | | | | | | |

| SHORT TERM INVESTMENT (5.4%) | | | | | |

| Fidelity® Institutional Money Market Government Portfolio - Class I, 7 Day Yield 0.117% | | | 3,894,901 | | | | 3,894,901 | |

| | | | | | | | | |

| TOTAL SHORT TERM INVESTMENT (COST $3,894,901) | | | | 3,894,901 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (102.6%) (COST $73,093,629) | | | | | | | 74,281,083 | |

| | | | | | | | | |

| TOTAL LIABILITIES IN EXCESS OF OTHER ASSETS (-2.6%) | | | | | | | (1,794,718 | ) |

| | | | | | | | | |

| NET ASSETS 100.0% | | | | | | $ | 72,486,365 | |

(a) | Non Income Producing Security. |

Common Abbreviations:

Ltd. - Limited.

REIT - Real Estate Investment Trust.

| See Notes to Financial Statements. | |

| Semi-Annual Report | December 31, 2015 | 11 |

| Statements of Assets and Liabilities |

December 31, 2015 (Unaudited)

| | | Cortina Small Cap Growth Fund | | | Cortina Small Cap Value Fund | |

| ASSETS: | | | | | | |

| Investments, at value (Cost - see below) | | $ | 38,366,073 | | | $ | 74,281,083 | |

| Receivable for investments sold | | | 318,779 | | | | 182,416 | |

| Receivable for fund shares subscribed | | | 19,068 | | | | 135,985 | |

| Dividends receivable | | | 23,860 | | | | 69,328 | |

| Prepaid expenses and other assets | | | 15,390 | | | | 22,574 | |

| Total Assets | | | 38,743,170 | | | | 74,691,386 | |

| |

| LIABILITIES: | |

| Payable for investments purchased | | | – | | | | 1,895,453 | |

| Payable for fund shares redeemed | | | 14,988 | | | | 237,655 | |

| Payable for director fees | | | 1,674 | | | | 1,674 | |

| Payable for advisory fees | | | 24,557 | | | | 38,952 | |

| Payable for fund accounting and administration fees | | | 10,021 | | | | 13,211 | |

| Payable for distribution and service fees | | | – | | | | 71 | |

| Payable for audit and legal fees | | | 7,154 | | | | 6,933 | |

| Other accrued liabilities and expenses | | | 8,838 | | | | 11,072 | |

| Total Liabilities | | | 67,232 | | | | 2,205,021 | |

| Net Assets | | $ | 38,675,938 | | | $ | 72,486,365 | |

| | | | | | | | | |

| NET ASSETS CONSISTS OF: | |

| Paid-in capital | | $ | 38,900,298 | | | $ | 74,755,631 | |

| Accumulated net investment income/(loss) | | | (399,575 | ) | | | 46,463 | |

| Accumulated undistributed net realized loss on investments | | | (2,818,501 | ) | | | (3,503,183 | ) |

| Net unrealized appreciation on investments | | | 2,993,716 | | | | 1,187,454 | |

| Net Assets | | $ | 38,675,938 | | | $ | 72,486,365 | |

| | | | | | | | | |

| Cost of Investments | | $ | 35,372,357 | | | $ | 73,093,629 | |

| | | | | | | | | |

| PRICING OF SHARES: | | | | | | | | |

| Institutional | | | | | | | | |

| Net Assets | | $ | 38,675,938 | | | $ | 72,158,053 | |

| Shares Outstanding ($0.01 par value, unlimited number of shares authorized) | | | 2,786,860 | | | | 4,340,300 | |

| Net Asset Value, offering and redemption price per share | | $ | 13.88 | | | $ | 16.63 | |

| Investor | | | | | | | | |

| Net Assets | | $ | – | | | $ | 328,312 | |

| Shares Outstanding ($0.01 par value, unlimited number of shares authorized) | | | – | | | | 19,826 | |

| Net Asset Value, offering and redemption price per share | | $ | – | | | $ | 16.56 | |

See Notes to Financial Statements.

| 12 | 1-855-612-3936 | www.cortinafunds.com |

For the Six Months Ended December 31, 2015 (Unaudited)

| | | Cortina Small Cap Growth Fund | | | Cortina Small Cap Value Fund | |

| INVESTMENT INCOME: | | | | | | |

| Dividends | | $ | 43,589 | | | $ | 394,617 | |

| Total Investment Income | | | 43,589 | | | | 394,617 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Advisory fees (Note 3) | | | 209,065 | | | | 299,693 | |

| Transfer agent fees | | | 15,111 | | | | 22,333 | |

| Fund accounting and administration fees and expenses | | | 43,832 | | | | 59,560 | |

| Distribution and service fees | | | | | | | | |

| Investor | | | – | | | | 419 | |

| Legal fees | | | 7,741 | | | | 9,408 | |

| Printing fees | | | 1,952 | | | | 4,263 | |

| Registration fees | | | 10,925 | | | | 17,762 | |

| Audit and tax fees | | | 7,290 | | | | 7,711 | |

| Custodian fees | | | 3,740 | | | | 3,456 | |

| Insurance | | | 4,019 | | | | 4,629 | |

| Director fees and expenses | | | 6,174 | | | | 6,174 | |

| Other | | | 2,931 | | | | 3,388 | |

| Total Expenses Before Waivers | | | 312,780 | | | | 438,796 | |

| Less fees waived by Adviser (Note 3) | | | (82,809 | ) | | | (108,714 | ) |

| Total Net Expenses | | | 229,971 | | | | 330,082 | |

| Net Investment Income/(Loss) | | | (186,382 | ) | | | 64,535 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | | | | | |

| Net realized gain/(loss) on investments | | | 511,535 | | | | (2,898,951 | ) |

| Net change in unrealized depreciation on investments | | | (4,766,941 | ) | | | (3,517,646 | ) |

| Net Realized and Unrealized Loss on Investments | | | (4,255,406 | ) | | | (6,416,597 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (4,441,788 | ) | | $ | (6,352,062 | ) |

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2015 | 13 |

| Statements of Changes in Net Assets |

| | | Cortina Small Cap Growth Fund | | | Cortina Small Cap Value Fund | |

| | | Six Months Ended December 31, 2015 (Unaudited) | | | Year Ended June 30, 2015 | | | Six Months Ended December 31, 2015 (Unaudited) | | | Year Ended June 30, 2015 | |

| OPERATIONS: | |

| Net investment income/(loss) | | $ | (186,382 | ) | | $ | (393,131 | ) | | $ | 64,535 | | | $ | (55,182 | ) |

| Net realized gain/(loss) on investments | | | 511,535 | | | | (2,878,481 | ) | | | (2,898,951 | ) | | | 487,186 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (4,766,941 | ) | | | 3,991,897 | | | | (3,517,646 | ) | | | 370,290 | |

| Net increase/(decrease) in net assets resulting from operations | | | (4,441,788 | ) | | | 720,285 | | | | (6,352,062 | ) | | | 802,294 | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

| Institutional | | | | | | | | | | | | | | | | |

| From net realized gains on investments | | | – | | | | (1,833,184 | ) | | | – | | | | (816,791 | ) |

| Investor | | | | | | | | | | | | | | | | |

| From net realized gains on investments | | | – | | | | – | | | | – | | | | (5,280 | ) |

| Total distributions | | | – | | | | (1,833,184 | ) | | | – | | | | (822,071 | ) |

| | | | | | | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | |

| Institutional | | | | | | | | | | | | | | | | |

| Proceeds from sale of shares | | | 1,162,884 | | | | 29,015,536 | | | | 35,005,641 | | | | 18,510,674 | |

| Shares issued in reinvestment of distributions | | | – | | | | 1,817,180 | | | | – | | | | 786,261 | |

| Cost of shares redeemed | | | (4,330,097 | ) | | | (15,092,422 | ) | | | (7,785,548 | ) | | | (2,859,262 | ) |

| Redemption fees | | | – | | | | 57 | | | | 108 | | | | 19 | |

| Total | | | (3,167,213 | ) | | | 15,740,351 | | | | 27,220,201 | | | | 16,437,692 | |

| Investor | | | | | | | | | | | | | | | | |

| Proceeds from sale of shares | | | – | | | | – | | | | 34,407 | | | | 276,871 | |

| Shares issued in reinvestment of distributions | | | – | | | | – | | | | – | | | | 5,280 | |

| Cost of shares redeemed | | | – | | | | – | | | | (30,063 | ) | | | (31,077 | ) |

| Total | | | – | | | | – | | | | 4,344 | | | | 251,074 | |

| Net increase/(decrease) from capital shares transactions | | | (3,167,213 | ) | | | 15,740,351 | | | | 27,224,545 | | | | 16,688,766 | |

| | | | | | | | | | | | | | | | | |

| Net increase/(decrease) in net assets | | | (7,609,001 | ) | | | 14,627,452 | | | | 20,872,483 | | | | 16,668,989 | |

| | | | | | | | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | | | | | | | | |

| Beginning of period | | | 46,284,939 | | | | 31,657,487 | | | | 51,613,882 | | | | 34,944,893 | |

| End of period | | $ | 38,675,938 | | | $ | 46,284,939 | | | $ | 72,486,365 | | | $ | 51,613,882 | |

| Including accumulated net investment income/(loss) of: | | $ | (399,575 | ) | | $ | (213,193 | ) | | $ | 46,463 | | | $ | (18,072 | ) |

| | | | | | | | | | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | | | | | | | | | |

| Share Transactions: | | | | | | | | | | | | | | | | |

| Institutional | | | | | | | | | | | | | | | | |

| Beginning shares | | | 3,003,898 | | | | 1,936,011 | | | | 2,768,059 | | | | 1,865,870 | |

| Shares sold | | | 81,622 | | | | 1,942,260 | | | | 2,032,184 | | | | 1,016,113 | |

| Shares issued in reinvestment of dividends | | | – | | | | 124,465 | | | | – | | | | 43,632 | |

| Less shares redeemed | | | (298,660 | ) | | | (998,838 | ) | | | (459,943 | ) | | | (157,556 | ) |

| Ending shares | | | 2,786,860 | | | | 3,003,898 | | | | 4,340,300 | | | | 2,768,059 | |

| Investor | | | | | | | | | | | | | | | | |

| Beginning shares | | | – | | | | – | | | | 19,513 | | | | 5,510 | |

| Shares sold | | | – | | | | – | | | | 2,042 | | | | 15,384 | |

| Shares issued in reinvestment of dividends | | | – | | | | – | | | | – | | | | 293 | |

| Less shares redeemed | | | – | | | | – | | | | (1,729 | ) | | | (1,674 | ) |

| Ending shares | | | – | | | | – | | | | 19,826 | | | | 19,513 | |

See Notes to Financial Statements.

| 14 | 1-855-612-3936 | www.cortinafunds.com |

Cortina Small Cap Growth Fund | For a share outstanding throughout the periods presented. |

| | | Six Months Ended December 31, 2015 (Unaudited) | | | Year Ended June 30, 2015 | | | Year Ended June 30, 2014 | | | Year Ended June 30, 2013 | | | For the Period September 30, 2011 (Inception) to June 30, 2012 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 15.41 | | | $ | 16.35 | | | $ | 14.46 | | | $ | 11.87 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.06 | ) | | | (0.14 | ) | | | (0.17 | ) | | | (0.13 | ) | | | (0.09 | ) |

| Net realized and unrealized gain/(loss) on investments | | | (1.47 | ) | | | (0.02 | )(b) | | | 2.19 | | | | 2.81 | | | | 2.22 | |

| Total from Investment Operations | | | (1.53 | ) | | | (0.16 | ) | | | 2.02 | | | | 2.68 | | | | 2.13 | |

| | | | | | | | | | | | | | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | | | | | |

| From net realized gains on investments | | | – | | | | (0.78 | ) | | | (0.13 | ) | | | (0.09 | ) | | | (0.26 | ) |

| Total Dividends and Distributions to Shareholders | | | – | | | | (0.78 | ) | | | (0.13 | ) | | | (0.09 | ) | | | (0.26 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Paid-in Capital from Redemption Fees | | | – | | | | 0.00 | (c) | | | 0.00 | (c) | | | – | | | | 0.00 | (c) |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | (1.53 | ) | | | (0.94 | ) | | | 1.89 | | | | 2.59 | | | | 1.87 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, END OF PERIOD | | $ | 13.88 | | | $ | 15.41 | | | $ | 16.35 | | | $ | 14.46 | | | $ | 11.87 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | (9.93% | )(d) | | | (0.71 | %) | | | 13.99 | % | | | 22.79 | % | | | 21.40 | %(d) |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 38,676 | | | $ | 46,285 | | | $ | 31,657 | | | $ | 18,245 | | | $ | 1,410 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding waiver/reimbursement | | | 1.50 | %(e) | | | 1.57 | % | | | 1.86 | % | | | 3.85 | % | | | 21.70 | %(e) |

| Operating expenses including waiver/reimbursement | | | 1.10 | %(e) | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | %(e) |

| Net investment loss including waiver/reimbursement | | | (0.89 | )%(e) | | | (0.94 | )% | | | (1.02 | )% | | | (1.00 | )% | | | (0.99 | )%(e) |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 38 | %(d) | | | 95 | % | | | 81 | % | | | 73 | % | | | 144 | %(d) |

(a) | Calculated using average shares throughout the period. |

(b) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statements of Operations due to the share transactions for the period. |

(c) | Less than $0.005 per share. |

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2015 | 15 |

Cortina Small Cap Value Fund – Institutional | For a share outstanding throughout the periods presented. |

| | | Six Months Ended December 31, 2015 (Unaudited) | | | Year Ended June 30, 2015 | | | Year Ended June 30, 2014 | | | Year Ended June 30, 2013 | | | For the Period September 30, 2011 (Inception) to June 30, 2012 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 18.52 | | | $ | 18.67 | | | $ | 15.62 | | | $ | 12.54 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss)(a) | | | 0.02 | | | | (0.02 | ) | | | (0.01 | ) | | | 0.01 | | | | (0.03 | ) |

| Net realized and unrealized gain/(loss) on investments | | | (1.91 | ) | | | 0.24 | | | | 3.30 | | | | 3.68 | | | | 3.14 | |

| Total from Investment Operations | | | (1.89 | ) | | | 0.22 | | | | 3.29 | | | | 3.69 | | | | 3.11 | |

| | | | | | | | | | | | | | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | – | | | | (0.01 | ) | | | (0.07 | ) | | | – | |

| From net realized gains on investments | | | – | | | | (0.37 | ) | | | (0.23 | ) | | | (0.54 | ) | | | (0.57 | ) |

| Total Dividends and Distributions to Shareholders | | | – | | | | (0.37 | ) | | | (0.24 | ) | | | (0.61 | ) | | | (0.57 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Paid-in Capital from Redemption Fees | | | 0.00 | (b) | | | 0.00 | (b) | | | – | | | | – | | | | 0.00 | (b) |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | (1.89 | ) | | | (0.15 | ) | | | 3.05 | | | | 3.08 | | | | 2.54 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, END OF PERIOD | | $ | 16.63 | | | $ | 18.52 | | | $ | 18.67 | | | $ | 15.62 | | | $ | 12.54 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | (10.21% | )(c) | | | 1.21 | % | | | 21.14 | % | | | 30.41 | % | | | 31.99 | %(c) |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 72,158 | | | $ | 51,254 | | | $ | 34,842 | | | $ | 4,344 | | | $ | 1,942 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding waiver/reimbursement | | | 1.46 | %(d) | | | 1.63 | % | | | 1.92 | % | | | 5.55 | % | | | 22.37 | %(d) |

| Operating expenses including waiver/reimbursement | | | 1.10 | %(d) | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | %(d) |

| Net investment income/(loss) including waiver/reimbursement | | | 0.22 | %(d) | | | (0.13 | )% | | | (0.09 | )% | | | 0.10 | % | | | (0.32 | )%(d) |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 47 | %(c) | | | 102 | % | | | 78 | % | | | 81 | % | | | 146 | % |

(a) | Calculated using average shares throughout the period. |

(b) | Less than $0.005 per share. |

See Notes to Financial Statements.

| 16 | 1-855-612-3936 | www.cortinafunds.com |

Cortina Small Cap Value Fund – Investor | For a share outstanding throughout the periods presented. |

| | | Six Months Ended December 31, 2015 (Unaudited) | | | Year Ended June 30, 2015 | | | For the Period April 30, 2014 (Inception) to June 30, 2014 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 18.47 | | | $ | 18.67 | | | $ | 18.15 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.01 | ) | | | (0.06 | ) | | | (0.01 | ) |

| Net realized and unrealized gain/(loss) on investments | | | (1.90 | ) | | | 0.23 | | | | 0.53 | |

| Total from Investment Operations | | | (1.91 | ) | | | 0.17 | | | | 0.52 | |

| | | | | | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | |

| From net realized gains on investments | | | – | | | | (0.37 | ) | | | – | |

| Total Dividends and Distributions to Shareholders | | | – | | | | (0.37 | ) | | | – | |

| | | | | | | | | | | | | |

| Paid-in Capital from Redemption Fees | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | (1.91 | ) | | | (0.20 | ) | | | 0.52 | |

| | | | | | | | | | | | | |

| NET ASSET VALUE, END OF PERIOD | | $ | 16.56 | | | $ | 18.47 | | | $ | 18.67 | |

| | | | | | | | | | | | | |

| TOTAL RETURN | | | (10.34% | )(b) | | | 0.94 | % | | | 2.87 | %(b) |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 328 | | | $ | 360 | | | $ | 103 | |

| | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | |

| Operating expenses excluding waiver/reimbursement | | | 1.71 | %(c) | | | 1.86 | % | | | 2.14 | %(c) |

| Operating expenses including waiver/reimbursement | | | 1.35 | %(c) | | | 1.35 | % | | | 1.35 | %(c) |

| Net investment loss including waiver/reimbursement | | | (0.09 | )%(c) | | | (0.35 | )% | | | (0.20 | )%(c) |

| | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 47 | %(b) | | | 102 | % | | | 78 | %(d) |

(a) | Calculated using average shares throughout the period. |

(d) | Portfolio turnover is calculated at the Fund level and represents the year ended June 30, 2014. |

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2015 | 17 |

| Notes to Financial Statements |

December 31, 2015 (Unaudited)

1. ORGANIZATION

Cortina Funds, Inc. (the “Corporation”) is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Corporation was organized on April 27, 2004 as a Wisconsin corporation. The Corporation currently offers shares of common stock (“shares”) of the Cortina Small Cap Growth Fund and the Cortina Small Cap Value Fund (each a “Fund” and collectively, the “Funds”).

The Cortina Small Cap Growth Fund, which commenced operations with the sale of Institutional Class Shares on September 30, 2011, is a diversified portfolio with an investment objective to seek growth of capital. The Cortina Small Cap Value Fund, which commenced operations with the sale of Institutional Class Shares on September 30, 2011 and the sale of Investor Class Shares on April 30, 2014, is a diversified portfolio with an investment objective to seek long-term capital appreciation.

Shares of each Fund are designated as Institutional Shares or Investor Shares with an indefinite number of shares authorized at $0.01 par value. The Articles of Incorporation, as amended and restated, permit the Corporation’s Board of Directors (the “Board”) to create additional funds and share classes.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Funds. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The Funds are considered investment companies for financial reporting purposes under GAAP.

Use of Estimates — The accompanying financial statements were prepared in accordance with GAAP, which require the use of estimates and assumptions made by management. These may affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Investment Valuation — Investment securities are valued at the last sale price at the close of the principal exchange on which they trade, except for securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”) exchange, which are valued at the NASDAQ official closing price. Unlisted securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges or over-the-counter markets. Investments for which market quotations are not readily available are valued at fair value as determined in good faith under consistently applied procedures approved by and under the general supervision of the Funds’ Board. Securities with maturities of sixty (60) days or less are valued at amortized cost as Level 1 or 2 within the hierarchy. Money market funds, representing short-term investments, are valued at their daily net asset value.

Investment Transactions — Investment security transactions are accounted for on trade date. Gains and losses on securities sold are determined on a specific identification basis.

Investment Income — Interest income is accrued and recorded on a daily basis including amortization of premiums, accretions of discounts and income earned from money market funds. Interest is not accrued on securities that are in default. Dividend income is recorded on the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Fair Value Measurements — A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Funds disclose fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

Various inputs are used in determining the value of each Fund’s investments as of the reporting period end. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 | — | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; |

| | | |

| Level 2 | — | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

18 | 1-855-612-3936 | www.cortinafunds.com |

| Notes to Financial Statements |

December 31, 2015 (Unaudited)

| Level 3 | — | Significant unobservable prices or inputs (including a Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Funds to measure fair value during the six months ended December 31, 2015 maximized the use of observable inputs and minimized the use of unobservable inputs.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the inputs used in valuing the Funds’ investments as of December 31, 2015:

Cortina Small Cap Growth Fund

| | | Valuation Inputs | | | | |

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks* | | $ | 37,284,713 | | | $ | – | | | $ | – | | | $ | 37,284,713 | |

Short Term Investment | | | 1,081,360 | | | | – | | | | – | | | | 1,081,360 | |

| Total | | $ | 38,366,073 | | | $ | – | | | $ | – | | | $ | 38,366,073 | |

Cortina Small Cap Value Fund

| | | Valuation Inputs | | | | |

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks* | | $ | 70,386,182 | | | $ | – | | | $ | – | | | $ | 70,386,182 | |

Short Term Investment | | | 3,894,901 | | | | – | | | | – | | | | 3,894,901 | |

| Total | | $ | 74,281,083 | | | $ | – | | | $ | – | | | $ | 74,281,083 | |

| * | See Schedule of Investments for sector classification. |

For the six months ended December 31, 2015, there have been no significant changes to the Funds’ fair value methodologies. Additionally, there were no transfers into or out of Levels 1 and 2 during the six months ended December 31, 2015. It is the Funds’ policy to recognize transfers at the end of the reporting period.

For the six months ended December 31, 2015, the Funds did not have investments with significant unobservable inputs (Level 3) used in determining fair value.

Affiliated Companies — An affiliated company is a company that can have direct or indirect common ownership. The Funds did not hold any investments in affiliated companies as of and during the six months ended December 31, 2015.

Expenses — The Funds bear expenses incurred specifically on each Fund’s respective behalf as well as a portion of general Corporation expenses, which may be allocated on the basis of relative net assets or the nature of the services performed relative to applicability to each Fund.

Expenses that are specific to a class of shares of the Funds are charged directly to the share class. The Funds’ realized and unrealized gains and losses, net investment income, and expenses other than class specific expenses, are allocated daily to each class in proportion to its average daily net assets.

Distributions to Shareholders — Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gains distributions are determined in accordance with income tax regulations, which may differ from GAAP. Distributions to shareholders are recorded on the ex-dividend date.

Fees on Redemptions — The Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. The redemption fee is not a fee to finance sales or sales promotion expenses, but is paid to the Funds to defray the costs of liquidating an investor and discouraging short-term trading of the Funds’ shares. No redemption fee will be imposed on redemptions initiated by the Funds.

| Semi-Annual Report | December 31, 2015 | 19 |

| Notes to Financial Statements |

December 31, 2015 (Unaudited)

Federal Income Taxes — As of and during the six months ended December 31, 2015, the Funds did not have a liability for any unrecognized tax benefits. The Funds file U.S. federal, state, and local tax returns as required. The Funds’ tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes. The Funds intend to distribute to shareholders all taxable investment income and realized gains, and otherwise comply with Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies.

3. ADVISORY FEES, FUND ACCOUNTING, ADMINISTRATION FEES, AND OTHER AGREEMENTS

Investment Advisor

Cortina Asset Management, LLC, is the Funds’ investment adviser (the “Adviser”). The Adviser is subject to the general supervision of the Board and is responsible for the overall management of the Funds’ business affairs. The Adviser invests the assets of the Funds based on the Funds’ investment objectives and policies. The Adviser is entitled to an investment advisory fee, computed daily and payable monthly, of 1.00% of the average daily net assets for each Fund.

The Adviser has contractually agreed to waive fees with respect to each of the Funds so that the net annual operating expenses (excluding 12b-1 fee, taxes, leverage, interest, brokerage commissions, dividends or interest expenses on short positions, acquired fund fees and expenses, and extraordinary expenses) of the Funds’ shares will not exceed 1.10% of average daily net assets of each Fund. The Adviser may request a reimbursement from the Funds to recapture any reduced management fees or reimbursed Fund expenses within three years following the fee reduction or expense reimbursement, but only to the extent the Funds’ total annual fund operating expenses including offering costs, plus any requested reimbursement amount, are less than the above limit at the time of the request. Any such reimbursement is subject to review by the Board.

As of December 31, 2015, reimbursements (including offering costs) that may potentially be made by the Fund to the Adviser total $684,091 for the Cortina Small Cap Growth Fund and $556,820 for the Cortina Small Cap Value Fund and expire as follows:

| Cortina Small Cap Growth Fund | | | |

| June 30, 2016 | | $ | 268,118 | |

| June 30, 2017 | | | 217,565 | |

| June 30, 2018 | | | 198,408 | |

| | | $ | 684,091 | |

| Cortina Small Cap Value Fund | | | | |

| June 30, 2016 | | $ | 140,394 | |

| June 30, 2017 | | | 194,315 | |

| June 30, 2018 | | | 222,111 | |

| | | $ | 556,820 | |

Fund Accounting Fees and Expenses

ALPS Fund Services, Inc. (“ALPS” or the “Administrator”) provides administrative, fund accounting and other services to the Funds for a monthly administration fee based on the Funds’ average daily net assets.

The Administrator is also reimbursed by the Funds for certain out-of-pocket expenses.

Transfer Agent

ALPS serves as transfer, dividend paying and shareholder servicing agent for the Funds (the “Transfer Agent”).

Compliance Services

ALPS provides services that assist the Corporation’s Chief Compliance Officer in monitoring and testing the policies and procedures of the Corporation in conjunction with requirements under Rule 38a-1 under the 1940 Act. ALPS is compensated under the Administration Agreement.

Distributor

The Funds have entered into a Distribution Agreement with ALPS Distributors, Inc (“the Distributor”) to provide distribution services to the Funds. The Distributor serves as underwriter/distributor of shares of the Funds.

Distribution Plan

The Small Cap Value Fund has adopted a Distribution Plan in accordance with Rule 12b-1 (“Distribution Plan”) under the 1940 Act. The Distribution Plan provides that the Small Cap Value Fund may compensate or reimburse the Distributor for services rendered and expenses borne in connection with activities primarily intended to result in the sale of the Small Cap Value Fund’s shares. Sales charges may be paid to broker-dealers, banks and any other financial intermediary eligible to receive such fees for sales of Investor Shares of the Small Cap Value Fund and for services provided to shareholders.

20 | 1-855-612-3936 | www.cortinafunds.com |

| Notes to Financial Statements |

December 31, 2015 (Unaudited)

The Small Cap Value Fund charges 12b-1 fees for Investor Shares. Pursuant to the Distribution Plan, the Small Cap Value Fund may annually pay the Distributor up to 0.25% of the average daily net assets of the Small Cap Value Fund’s Investor Shares. The expenses of the Distribution Plan are reflected in the Statements of Operations.

Certain Directors and Officers of the Funds are also officers of the Adviser.

4. PURCHASES AND SALES OF INVESTMENT SECURITIES

The aggregate cost of purchases and proceeds from sales of investment securities, excluding short-term securities, are shown below for the six months ended December 31, 2015. Purchases and proceeds from sales of U.S. Government obligations are included in the totals of Purchases of Securities and Proceeds from Sales of Securities below and also broken out separately for your convenience:

| Fund Name | | Purchases | | | Sales | |

Cortina Small Cap Growth Fund | | $ | 15,456,875 | | | $ | 19,274,033 | |

Cortina Small Cap Value Fund | | | 54,775,414 | | | | 27,152,504 | |

There were no purchases of long-term U.S. Government Obligations for either Fund during the period ended December 31, 2015.

5. TAX BASIS INFORMATION

Income and long-term capital gain distributions are determined in accordance with Federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes.

The tax character of distributions paid during the year ended June 30, 2015, were as follows:

| Fund | | Ordinary Income | | | Long-Term Capital Gain | |

Cortina Small Cap Growth Fund | | $ | 218,066 | | | $ | 1,615,118 | |

Cortina Small Cap Value Fund | | | – | | | | 822,071 | |

As of December 31, 2015, the aggregate cost of investments, gross unrealized appreciation/(depreciation) and net unrealized appreciation/(depreciation) for Federal tax purposes was as follows:

| Fund | | Cost of Investments for Income Tax Purposes | | | Gross Appreciation (excess of value over tax cost) | | | Gross Depreciation (excess of tax cost over value) | | | Net Unrealized Appreciation | |

Cortina Small Cap Growth Fund | | $ | 36,281,067 | | | $ | 5,950,610 | | | $ | (3,865,604 | ) | | $ | 2,085,006 | |

Cortina Small Cap Value Fund | | | 74,000,684 | | | | 4,950,163 | | | | (4,669,764 | ) | | | 280,399 | |

The difference between book basis and tax basis net unrealized appreciation is attributable to the deferral of losses from wash sales and passive foreign investment companies.

6. COMMITMENTS AND CONTINGENCIES

Under the Corporation’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Funds. In addition, in the normal course of business, the Corporation entered into contracts with its service providers, on behalf of the Funds, and others that provide for general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds. The Funds expect risk of loss to be remote.

| Semi-Annual Report | December 31, 2015 | 21 |

December 31, 2015 (Unaudited)

1. PROXY VOTING POLICIES AND VOTING RECORD

A description of the policies and procedures that the Funds use to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-855-612-3936, or on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent fiscal year end June 30, 2015 is available without charge upon request by calling toll-free 1-855-612-3936, or on the SEC’s website at http://www.sec.gov.

2. QUARTERLY PORTFOLIO HOLDINGS

The Corporation files a complete listing of portfolio holdings for the Funds with the SEC as of the first and third quarters of each fiscal year on Form N-Q. The filings are available upon request by calling 1-855-612-3936. Furthermore, you may obtain a copy of the filing on the SEC’s website at http://www.sec.gov. The Funds’ Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

22 | 1-855-612-3936 | www.cortinafunds.com |

This page intentionally left blank.

Material must be accompanied or preceded by the prospectus.

The Cortina Funds are distributed by ALPS Distributors, Inc.

Item 2. Code of Ethics.

Not applicable to this report.

Item 3. Audit Committee Financial Expert.

Not applicable to this report.

Item 4. Principal Accountant Fees and Services.

Not applicable to this report.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrant.

Item 6. Investments.

| (a) | The schedule of investments is included as part of the Reports to Stockholders filed under Item 1 of this report. |

| (b) | Not applicable to the registrant. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to registrant.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to registrant.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to registrant.

Item 10. Submission of Matters to Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

| (a) | The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) are effective based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report. |