Kirk Mining Consultants Pty Ltd

The Company’s business operations are subject to operational risks and hazards inherent in the mining industry.

Mineral resource and mineral reserve estimates may be inaccurate

Actual exploration, development or other costs and economic returns may differ significantly from those the Company has anticipated and there are no assurances that any future development activities will result in profitable mining operations.

Increased competition could adversely affect the Company’s ability to attract necessary capital funding.

The Company’s insurance coverage does not cover all of its potential losses, liabilities and damage related to its business and certain risks are uninsured or uninsurable.

The Company’s activities are subject to environmental laws and regulations that may increase the cost of doing business or restrict operations.

The Company requires numerous permits in order to conduct exploration, development or mining activities and delays in obtaining, or a failure to obtain, such permits or failure to comply with the terms of any such permits that have been obtained could have a material adverse impact on the Company.

The Company may experience difficulty in attracting and retaining qualified and experienced personnel.

Title to the Company’s mineral properties cannot be guaranteed and may be subject to prior unregistered agreements, transfers or claims or defects.

The Company’s business is subject to potential political, social and economic instability.

Changes in taxation legislation or regulations could have a material adverse effect on the Company’s business and financial condition.

Currency exchange rate fluctuations may affect the cost of the Company’s operations and exploration and development activities.

| |

| La Arena Project, Peru | Page: 32 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

The project can be accessed via a 165 km national roadway from the coastal city of Trujillo directly east towards Huamachuco, passing through Chiran, Shorey/Quiruvilca and the Lagunas Norte project (Barrick Gold Corporation). The road is paved from Trujillo to Otuzco (70 km) and Lagunas Norte to site (38 km) with the balance of 57 km between Otuzco and Lagunas Norte currently being paved with an expected completion date of first half of 2013. An air strip is also present at Huamachuco, a town of approximately 22,000 people located 21 km from La Arena that accommodates small airplanes.

| |

| 5.2 | Physiography and Climate |

The topography in the project area is relatively smooth with undulating hills. Elevations vary between 3,000 and 3,600 meters above sea level. In general, the slopes are stable with grades varying between 16º and 27º, and the land is covered with vegetation typical of the area.

On the northern and southern flanks of the deposit localized unstable areas exist where landslides have occurred during previous rainy seasons.

Average annual temperature data recorded from the La Arena meteorological station is 12ºC. The maximum recorded temperature is 18.5°C and the minimum is 1.6ºC.

Total annual rainfall varies between 750 and 850 mm/a and the average total annual evaporation rate ranges between 950 and 1,000 mm/a. The average relative humidity varies monthly between 55 and 77%.

Maximum precipitation usually occurs during the months of January through March while the months of June to August are the driest. The maximum daily precipitation recorded to date at the La Arena site is 34.6 mm and occurred in March of 1999 while minimum precipitation was recorded in July 1998 with a total of 1.2 mm.

The following information is from the Social Baseline Study developed by Tinkuy (2011):

In the area of study there are 1899 inhabitants residing in five communities: Agua Blanca, La Arena, La Ramada, Peña Colorada and Raumate. The community with the smallest number of inhabitants is Agua Blanca (15%) while the most populated one is La Arena (35%). A little more than a half of the total population (52%) is female.

| |

| La Arena Project, Peru | Page: 33 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

For 2011, more than half of the population (52%) is aged 20 years or younger and 43% of the population is between 20 and 65 years old. These results show a predominantly young population which follows the demographic pattern of the country’s rural population. The average number of members in a household is 5 persons, represented by 22% of households.

The young population moves temporarily or permanently in search for educational services (45%) and a job (28%), mainly to Huamachuco (43%) followed by the city of Trujillo (33%). The majority of emigrants are women (55%).

Immigration to the local area is lower than that of emigration. The majority of those who now live in the local area come from surrounding rural communities.

As the Project currently stands it is estimated that approximately 2,800 ha of surface lands will be required in total for both the gold oxide and copper-gold sulphide projects, out of which 867 ha have been acquired. The gold oxide project requires approximately 700 ha which has all been acquired.

About 90% of the area to acquire is composed of individual titles registered in the Public Registry (SUNARP), allowing direct negotiation with the owner. However the company estimates that only 70% of the individual titles are registered in the Public Registry (SUNARP). Currently, the company is updating the cadastral information.

The purchase program of surface land is continuing.

| |

| 5.5 | Local Infrastructure and Services |

All existing and current facilities are designed and constructed to support the gold oxide mining and extraction activities. All working areas of the mine are accessible by well-maintained dual lane gravel roads. The ongoing brownfields drilling and copper sulphide feasibility study work are supported by these facilities.

The dump leach gold oxide project and associated ADR processing plant with capacity for 24,000 tpd ore mining has been has been commissioned and is operational. The carbon regeneration circuit will be completed in January 2012. Pumping facilities for barren solution and pregnant solution currently have a capacity for 18,000 m3 solution per day. The pumping facility will be at full capacity by end of February 2012.

An independent analytical and assay laboratory is operational on site and a metallurgical laboratory (column leach testing) is currently under construction.

| |

| La Arena Project, Peru | Page: 34 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

An industrial water purification plant is also under construction. When fully operational by end of March 2012, this plant will have the capacity to process 220 m3 per hour.

Other associated facilities constructed in the processing plant are a reagent warehouse, a workshop and offices.

Camp and offices have been constructed on site with facilities to house 212 people and accommodation for 112 more people is under construction. Currently all La Arena staff and workers that do not live locally are domiciled in this camp. Principal contractor workers that do not live locally will also be brought to the camp once the additional accommodation is complete.

By the end of April 2012, construction of a mine equipment workshop, warehouse and core shed that are all under construction will be completed.

The offices all have phone and data connection via satellite link with a total available bandwidth of 2 \ Mb/sec. A backup capacity of 512 kb/sec is also available and both services are expandable. A cellular phone service has been installed under contract with a major Peruvian service provider. This cell phone service is also available to the general public as a community service provided by La Arena S.A.

Water supply for the processing plant, camp, workshop and other facilities is installed and fully connected. Water is sourced from an 80 m deep bore located approximately 1 km from the site offices. The bore has a nominal continuous flow capacity of 5 l/s. Sewage and wastewater management facilities are installed and operating with processed grey water being used for dust suppression on the mine haul roads.

Power for the ADR processing plant and leach pad pumps are supplied by locally positioned generator sets. Smaller locally positioned generators supply power to the camp, kitchen and laundry. Generator power is also used at the workshop and warehouse area.

A site 22.9 kV power grid is being installed. The processing plant and leach pad pond pumps will be powered on this grid by end of February 2012. This grid will be extended to the offices, camp and work shop by April 2012. Three large 2 MW generators in the main site powerhouse will power the 22.9 kV grid via a central substation. This substation has also been designed to connect to the national grid which is expected to supply all site power, at a significant reduction in energy costs, from early 2014.

| |

| La Arena Project, Peru | Page: 35 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

A high tension 220 kVA power line passes approximately 3 km west of the La Arena Project. This is a principal feeder of the national grid of Peru. Enquires indicate that this line carries and can provide sufficient energy for all of La Arena’s energy requirements. A second alternative would be to connect to the SEIN (National Interconnected Electrical System) through Barrick’s 138 kV Trujillo Norte – Lagunas Norte.

All future mining, processing and support activities will take place at the Project site with the exception of a small office which will be located in Salaverry on the coast to supervise concentrate shipments and offer a procurement service for the operation.

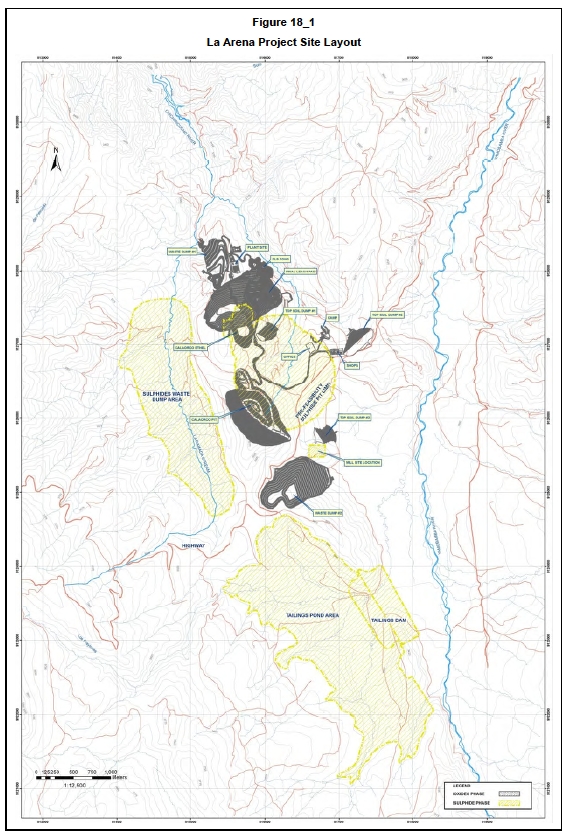

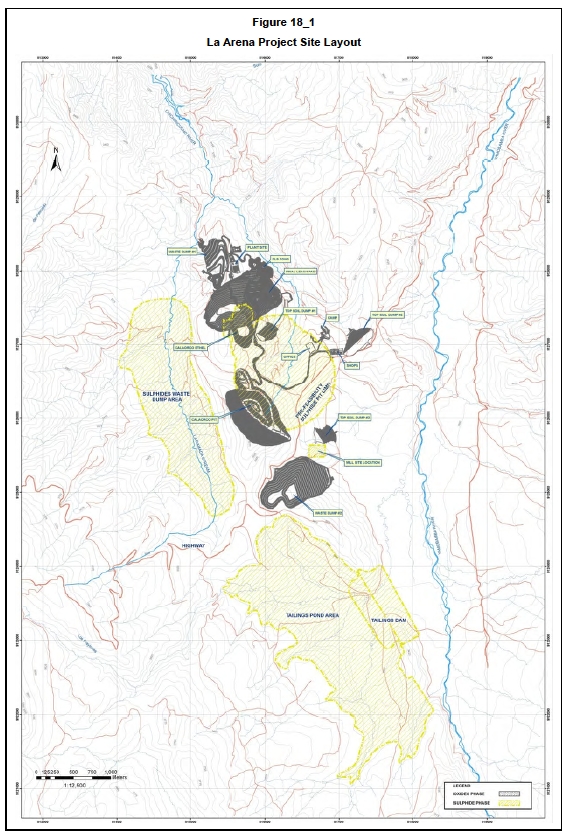

The locations and areas for waste dumps, tailings storage, dump leach pads, processing plant and other infrastructure are discussed further in Section 18 and this entire infrastructure lies well within the boundaries of La Arena S.A.’s mining properties.

| |

| La Arena Project, Peru | Page: 36 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| 6 | HISTORY |

| |

| 6.1 | Ownership History |

The deposit was first discovered by Cambior geologists in December 1994. Cambior staked a claim for mining concessions of 1,800 ha over the deposit in January 1995. A further 70,000 ha of mining concessions were claimed in 1996, most of which have been allowed to lapse or have been sold. The mining concessions making up the La Arena Project passed to Iamgold following its acquisition of Cambior.

Rio Alto entered into an option and earn-in agreement with Iamgold Quebec Management Inc. in June 2009 which provided it with an option to acquire 100% of La Arena S.A., the Peruvian company that owns La Arena Project, upon payment of $47.6 million cash, subject to certain adjustments and the completion of expenditure commitments.

On February 9 2011 Rio Alto announced that it had exercised its option and acquired 100% of La Arena gold-copper project upon payment of the exercise price of $49 million cash.

| |

| 6.2 | Exploration History by Previous Owners |

The geological exploration work completed at La Arena includes:

First half 1996 – detailed surface geochemistry and 1,502 m of diamond drilling in 6 holes.

Second half 1996 – 2,240 m of diamond drilling in 10 holes.

1997 – 4,958 m of diamond drilling in 32 holes.

1998 – 10,900 m of diamond drilling in 58 holes.

Between 1999 and 2003 – following a pre-feasibility study, unfavourable project economics meant the project did not progress.

Between 2003 and 2006 – five drilling campaigns were completed for 33,705 m of diamond drilling in 213 holes and 1,186 m of RC drilling in 11 holes.

2007 – 5,500 m of diamond drilling in 21 holes.

The accumulated drilling over the La Arena deposit area to end of December 2007 reached 59,991 m in 351 holes and 4,120m dug in 60 trenches completed in 2004.

The results of the drilling campaigns have been incorporated in a number of resource estimates as detailed below.

| |

| La Arena Project, Peru | Page: 37 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| 6.3 | Previous Mineral Resources |

Previous Mineral Resource estimates by Cambior and Iamgold from October 1997 up to February 2007 are discussed in the July 31, 2010 Technical Report.

The last Mineral Resource estimate by Iamgold was completed in August 2007 and reviewed and validated by Coffey Mining in 2008. Resources were confined within a pit shell based on $550/oz Au, $1.50/lb Cu, $10/lb Mo and $10/oz Ag. Coffey Mining did not support the Measured classification of the 2007 resource and reclassified the Measured category to Indicated. The Iamgold August 2007 Mineral Resource is summarised in Table 6.3_1.

| | | | | | | | | | |

| Table 6.3_1 |

| Updated In-Pit Mineral Resource by Iamgold (August 31 st 2007) |

| | Tonnes

(Mt) | Au

Grade

(g/t) | Cu

Grade

(%) | Ag

Grade

(g/t) | Mo

Grade

(ppm) | Au

(‘000oz) | Cu

(‘000lbs) | Ag

(‘000oz) | Mo

(‘000

lbs) |

| | “measured”

”indicated” | 25.5

123.0 | 0.51

0.41 | 0.17

0.40 | 0.31

0.20 | 26.3

42.3 | 414

1,636 | 97,962

1,078,760 | 250

781 | 1,477

11,472 |

| “measured” +

“indicated” |

148.5 |

0.43 |

0.36 |

0.22 |

39.6 |

2,050 |

1,176,722 |

1,031 |

12,949 |

| “inferred” | 10.7 | 0.26 | 0.34 | 0.17 | 53.4 | 91 | 80,835 | 58 | 1,265 |

Using the same resources block model the Mineral Resource was revised by Coffey Mining in 2010 based on updated metal prices and pit optimization parameters. The Coffey Mining 2010 Mineral Resource is given in Table 6.3_2. Resources were confined within an optimum undiscounted cashflow pit shell based on $1.050/oz Au and $12/oz Ag for copper-poor mineralization largely in oxide sandstone (Cu < 300ppm) and a shell based on $3.00/lb Cu and $1,050/oz Au for copper-rich mineralization largely in primary and secondary porphyry.

| | | | | | | | | | |

| Table 6.3_2

Coffey Mining Mineral Resource (July 31st 2010) |

| Material | Cuttoff | Category | Tonnes

(Mt) | Au

Grade

(g/t) | Cu

Grade

(%) | Ag

Grade

(g/t) | Au

(‘000oz) | Cu

(‘Mlb) | Ag

(‘000oz) |

| Oxide | 0.11g/t

Au | Indicated

Inferred | 79.6

9.2 | 0.41

0.19 | 0.01

0.01 | 0.08

0.29 | 1,050

57 | | 172

66 |

| Secondary

& Primary | 0.1% Cu | Indicated

Inferred | 225

178 | 0.27

0.21 | 0.35

0.30 | | 1,932

1,216 | 1,722

1,171 | |

The average molybdenum grade was of the order of 40 ppm. Although not included in the resources, recovery of Mo did present an economic opportunity of interest.

| |

| La Arena Project, Peru | Page: 38 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| 6.4 | Previous Mineral Reserves |

The first Technical Report on the La Arena Project filed by Rio Alto, with an effective date of March 31, 2008, described the Iamgold 2006 Mineral Reserve estimate and the Coffey Mining 2008 Mineral Reserve estimate, as summarised in Tables 6.4_3 and 6.4_4.

For the Iamgold 2006 PFS pit optimisation, mine design and mine production scheduling was based on processing 12,000 tpd of gold oxide ore by heap leach along with 24,000 tpd of gold-copper ore to be floated into a concentrate.

Pit design, scheduling and fleet sizing was done by Independent Mining Consultants (IMC) of Tucson, Arizona based on preliminary geomechanical characterization. Engineering and cost estimates were done by Cambior personnel based on owner mining and their experience and knowledge of comparable operations.

A net value cutoff based on a positive NSR value (after discounting for processing and general & administrative (G&A) costs) was used to categorize the mill ore. Additionally, all mill feed with a copper equivalent cutoff below 0.30% was classified as waste. Economic cutoff for heap leach ore was based on a marginal cost (i.e. processing and G & A) of $2.82/t and a metallurgical recovery of 80%.

All heap leach feed with copper grade greater than 0.03% Cu was considered unsuitable to leaching because of its potentially preg-robbing characteristics.

The optimization was done using the parameters as presented in Table 6.4_1.

| | | | |

| Table 6.4_1

Iamgold Pit Optimisation Parameters 2006 |

| Parameter | Dump Leach | Mill |

| Market Price | $550 per ounce Au / $1.50 per lb Cu |

| Mining cost

($/t mined) | Sediment

Porphyry | $1.30

$1.16 | $1.30

$1.16 |

|

| Processing Cost ($/t Ore)

G & A Cost | $1.78

$0.84 | $2.97

$1.03 |

|

| Mill Recovery | Au

Cu | 80%

0% | 40%

87% |

|

| Slope Angles

Royalty | 35º - 50º

0% |

|

| Internal Cutoff Grades | 0.19g Au/t | 0.30% Cu equivalent |

The mining cost was increased by 1% for every bench mined below elevation 3300 mRL.

The Mineral Reserve from the Iamgold 2006 PFS is as per Table 6.4_3. This reserve was not made public or signed off by a “qualified person” as at that time La Arena was not seen as a material project to Cambior.

| |

| La Arena Project, Peru | Page: 39 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

All Iamgold key inputs were reviewed by Coffey Mining in 2008 and a pit optimisation using these updated parameters undertaken using Whittle software by Coffey Mining. The processing rate was assumed to be 24,000tpd of gold oxide ore to be processed by run-of-mine ore dump leach and 24,000tpd of gold-copper ore to be floated into a concentrate and the key optimisation input parameters used are shown in Table 6.4_2.

No new work was done on mine design since the November 2006 PFS although the Whittle optimisation work carried out by Coffey Mining generally supported the Iamgold PFS pit design. Contract mining was now assumed and costed based on first principles estimates.

The mineral reserves were estimated using the following cut-off grades:

For oxide ore with Cu<300ppm (dump leach feed) 0.2Aug/t

For oxides with Cu>300ppm, secondary and primary sediments and porphyry (mill feed) 0.1%Cu.

| | | | |

| Table 6.4_2

Coffey Mining Pit Optimisation Parameters 2008 |

| Parameter | Dump Leach | Mill |

| Market Price | $750 per ounce Au / $1.95 per lb Cu |

| Mining cost

($/t mined) | Sediment

Porphyry | $1.49 ore, $1.12 waste

$1.49 ore, $1.12 waste | $1.49 ore, $1.12 waste

$1.49 ore, $1.12 waste* |

| Processing Cost ($/t Ore)

G & A Cost | $2.22

$0.60** | $3.73

$0.95 |

| Mill Recovery | Au

Cu | 65%

0% | 40%

88% |

| Slope Angles

Royalty | 45º for all

1.7% |

| Calculated Cutoff Grades | 0.18g Au/t*** | 0.10% Cu only |

| * | Note that the mining cost was increased by $0.03/t for every 12m bench mined below elevation 3328mRL. |

| ** | Note the G&A cost assumed an ore processing rate of 13Mtpa when Whittle work was done. |

| *** | Note for calculation and reporting of mineral reserves a cut-off of 0.2g/t for dump leach oxide gold was used. |

The Coffey Mining 2008 Mineral Reserve is summarised in Table 6.4_4.

| |

| La Arena Project, Peru | Page: 40 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| | | | | | | | | | | | | | | |

| Table 6.4_3

Iamgold Mineral Reserve 2006 |

| Ore Type | Oxide Ore | Secondary Ore | Primary Ore | All Ore |

| Mt | g Au/t | %Cu | Mt | g Au/t | %Cu | Mt | g Au/t | %Cu | Mt | g Au/t | Oz Au | %Cu | 000’s lbs

Cu |

| All Sectors |

| Sediments

Porphyry | 29.9

5.2 | 0.65

0.41 | 0.10

0.10 | -

10.7 | -

0.43 | -

0.53 | 0.7

81.7 | 1.09

0.36 | 0.10

0.46 | 30.5

97.6 | 0.66

0.37 | 644,500

1,167,800 | 0.01

0.45 | 8,800

960,200 |

| Total | 35.1 | 0.61 | 0.10 | 10.7 | 0.43 | 0.53 | 82.4 | 0.37 | 0.46 | 128.1 | 0.44 | 1,812,300 | 0.34 | 968,900 |

*Rounded numbers may not sum exactly.

| | | | | | | | | | | | | | | |

| Table 6.4_4

Coffey Mining Mineral Reserve 2008 |

| Ore Type | Oxide Ore | Secondary Ore | Primary Ore | All Ore |

| Mt | g Au/t | %Cu | Mt | g Au/t | %Cu | Mt | g Au/t | %Cu | Mt | g Au/t | Oz Au | %Cu | 000’s lbs

Cu |

| All Sectors |

| Sediments

Porphyry | 29.5

4.3 | 0.62

0.49 | 0.01

0.16 | 0.1

13.0 | 0.34

0.36 | 0.32

0.52 | 0.1

127.4 | 0.45

0.30 | 0.18

0.40 | 29.7

144.8 | 0.62

0.30 | 586,886

1,414,689 | 0.01

0.40 | 1,032

1,273,861 |

| Total | 33.9 | 0.61 | 0.03 | 13.1 | 0.36 | 0.52 | 127.5 | 0.30 | 0.40 | 174.4 | 0.36 | 2,001,575 | 0.33 | 1,274,910 |

*Rounded numbers may not sum exactly.

| | |

| Note: | The oxide ore includes 30.2Mt suitable for a gold dump leach operation plus 3.7Mt suitable for recovering copper in the copper plant. The lbs of copper in the mineral reserve for sediments is only that associated with this 3.7Mt of ore. Only a small amount of silver is contained in the oxide mineral reserve and is not reported as it is not material. |

| |

| La Arena Project, Peru | Page: 41 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

Mineral Reserves were updated by Coffey Mining in 2010 and is detailed in the July 31, 2010 Technical Report.

All key inputs for both the then recent Rio Alto gold oxide feasibility study work and the previous Iamgold PFS work were reviewed by Coffey Mining and a pit optimisation using updated parameters undertaken using Whittle software by Coffey Mining.

Rio Alto planned to proceed with a staged approach to the project, commencing mining and processing for the gold ore dump leach and once this is operational expand the project by mining and processing the copper ore. The processing rate was again assumed to be 24,000 tpd of gold oxide ore by run-of-mine ore dump leach and 24,000 tpd of gold-copper ore to be floated into a concentrate and the key optimisation input parameters used are shown in Table 6.4_5.

| | | | |

| Table 6.4_5

Coffey Mining Pit Optimisation Parameters 2010 |

| Parameter | Dump Leach | Mill |

| Market Price | $950 per ounce Au / $2.30 per lb Cu |

| Mining cost

($/t mined) | Sediment

Porphyry | $1.74 ore and waste

$1.82 ore and waste | $1.74 ore and waste

$1.82 ore and waste* |

| Processing Cost ($/t Ore)

G & A Cost | $1.55

$0.72** | $4.77

$0.95 |

| Mill Recovery | Au

Cu | 80%

0% | 40%

88% |

| Slope Angles

Royalty | 38º and 45º

1.7% |

| * | Note that the mining cost was increased by $0.03/t for every 12m bench mined below elevation 3328mRL. |

| ** | Note the G&A cost assumed an ore processing rate of 8.6Mtpa when Whittle work was done. |

The mineral reserves have been estimated using the following cutoff grades:

For oxide ore with Cu<300ppm (dump leach feed) 0.11 Au g/t.

For oxides with Cu>300ppm, secondary and primary sediments and porphyry (mill feed) 0.13% Cu.

The Mineral Reserve from 2010 has not yet been updated and hence is still current, refer Section 15.

There has been no production from the La Arena property by previous owners.

Rio Alto developed the gold oxide dump leach project in 2011 with commencement of mining and first ore placed on the dump leach pad in March 2011. The first gold pour was on May 6 2011 (1,115 oz).

| |

| La Arena Project, Peru | Page: 42 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

The mining rate has built up to the nameplate level of 10,000 tonnes per day of ore to the leach pad up to the Effective Date of September 30, 2011 during the preproduction phase. By the end of September 2011 some 1.7 Mt of ore had been placed on the leach pad and an additional 127,000 t of low grade ore had been stockpiled off the pad. Gold sold to the end of September has been 19,369 oz.

Further details of production to date are included in Sections 16 and 17.

| |

| La Arena Project, Peru | Page: 43 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| 7 | GEOLOGICAL SETTING AND MINERALIZATION |

| |

| 7.1 | Regional Geology |

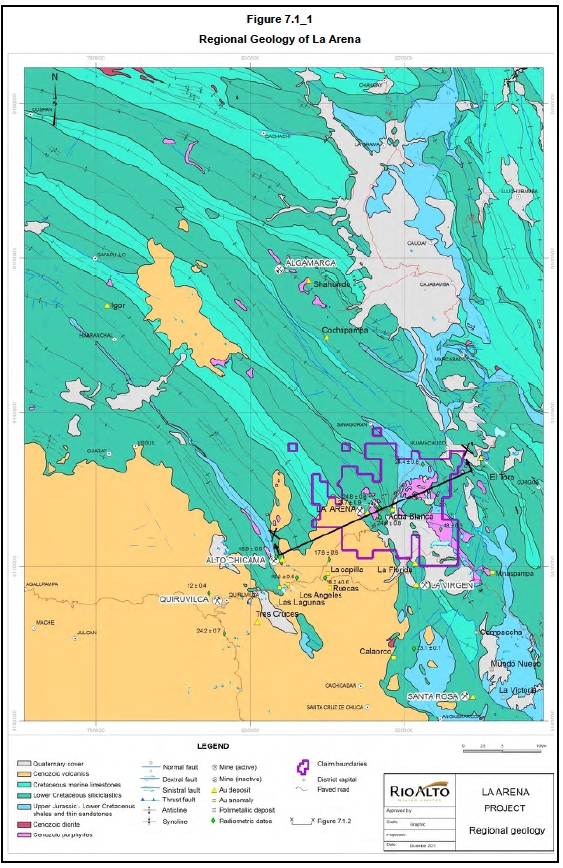

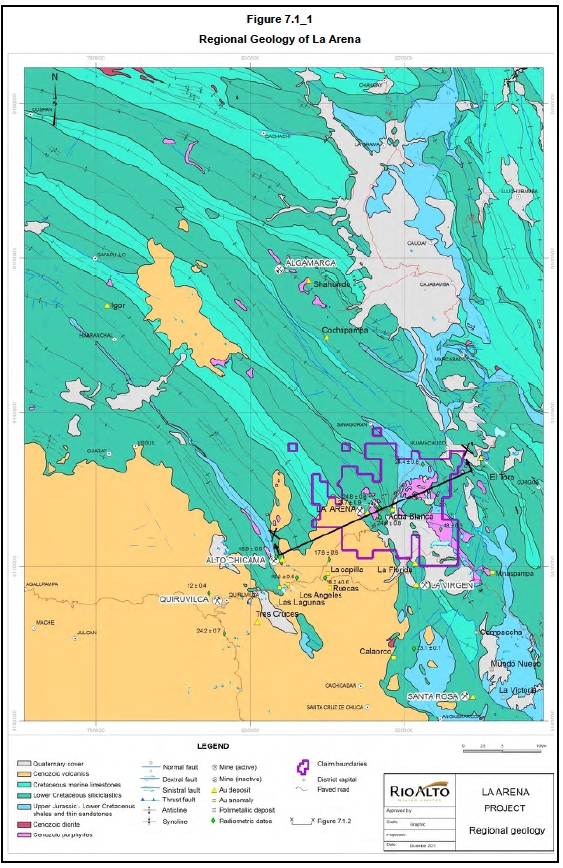

The La Arena Deposit is located on the eastern flank of the Andean Western Cordillera in northern Peru. The area is underlain by sediments of the Mesozoic West Peruvian Basin which were folded and faulted during the Cenozoic deformation.

The regional stratigraphy (Figure 7.1_1 and Table 7.1_1) is dominated at outcrop by the folded Upper Jurassic (Chicama Formation) to the Lower Cretaceous (Goyllarisquizga Group), which are mainly siliciclastic sediments, with lesser amounts of younger Lower-to-Upper-Cretaceous carbonate sediments occupying the cores of synclines. West of La Arena, the Cretaceous sediments are unconformably overlain by the Cenozoic volcanics of the Calipuy Group. The regional stratigraphical column is summarised in Table 7.1_1 and a plan of the regional geology is shown in Figure 7.1_1.

| | | | | | | | |

| Table 7.1_1

Regional Stratigraphic Column of La Arena and Surrounding Areas |

| Erathem | System | Series | Group | Formation | Extrusive

Lithology | Intrusive

Lithology

Abbreviation | Gold

Mineralisation |

| Cenozoic | Quaternary | Recent | | Alluvial, Fluvial | Q-al/Q-fl | | |

| Pleistocene | | Glacial,

Lacustrine | Q-gl/Q-la | | |

| Neogene | | Calipuy | | Pn-ca | P-da | AC |

| Paleogene | P-and |

| Mesozoic | Cretaceous | Upper | | Yumagual | Ks-yu | | |

| Lower | | Pariatambo | Ki-pa | | |

| Chulec | Ki-chu | | |

| Inca | Ki-In | | |

| Goyllarisquizga | Farrat | Ki-fa | | |

| Carhuaz | Ki-ca | | S |

| Santa | Ki-sa | | |

| Chimu | Ki-chi | | AC, ET, LA,

LV, SR |

| Oyón | Ki-o | | |

| Jurassic | Upper | | Chicama | Js-ch | | |

| after Reyes R. L, 1980 and Navarro et. al. 2010).

Gold mineralization: AC: Lagunas Norte, ET: El Toro, LA: La Arena, LV: La Virgen, S: Shahuindo, SR: Santa Rosa |

| |

| La Arena Project, Peru | Page: 44 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| La Arena Project, Peru | Page: 45 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

From oldest to youngest, the regional stratigraphy is described as follows:

Palaeozoic (and Precambrian): Constitute basement rocks to the east of La Arena along the River Marañon and the Eastern Cordillera. They are not exposed at La Arena, nor in the immediately surrounding area.

Mesozoic: The oldest outcropping rocks in the region belong to the Upper Jurassic Chicama Formation and consist of soft, laminated marine black shales with thin sandstone intercalations.

These pass upwards into the Lower Cretaceous shallow marine siliciclastic Goyllarisquizga Group, the lowest unit of which, the Oyon Formation, consists of fine-to-medium-grained sandstone and thinly-bedded shale, with some coal seams. Overlying the Oyon Formation are thickly-bedded, medium grained quartzitic sandstones of the Chimu Formation which constitutes the principal host rock for gold mineralization at Lagunas Norte, El Toro, La Arena, La Virgin and Santa Rosa. The remainder of the Goyllarisquisga Group (Santa, Carhuaz and Farrat formations) consists of generally finer grained siliciclastic units with interbedded minor carbonates. The Carhuaz Formation provides the host for gold mineralization at Shahuindo.

Overlying the Goyllarisquisga Group sediments are Lower-Cretaceous shallow marine carbonates of the Inca, Chulec, Pariatambo formations and the Upper Cretaceous Yumagual Formation.

The Mesozoic sediments were folded and faulted towards the end of the Cretaceous by the early stages of the developing Andean Orogeny.

Cenozoic: Calipuy Group, cordilleran arc volcanics unconformably overlie the folded and faulted Mesozoic strata south and west of La Arena. These sub-aerial volcanics are associated with Upper Miocene sub-volcanic intrusive bodies of andesitic to dacitic composition. The Calipuy volcanics are mainly tuffs with agglomerate horizons at the base, and inter-bedded with andesitic lavas. They constitute the host rock for high sulphidation, low sulphidation and polymetallic mineralization at Lagunas Norte, Tres Cruces and Quiruvilca respectively.

To the west of the area shown in Figure 7.1.1, the Coastal Batholith is emplaced in volcano-sedimentary strata of the Mesozoic Western Peruvian Trough, time equivalents of the rocks described above.

| |

| La Arena Project, Peru | Page: 46 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

Cenozoic intrusive rocks, including granodiorites, diorites and quartz–feldspar porphyries, are intruded as isolated stocks into both the Mesozoic sedimentary sequence and the overlying Calipuy volcanics. The age of those intrusions vary from c.a. 23 to 25 M.y. One of these intrusions hosts the porphyry-style mineralization at La Arena.

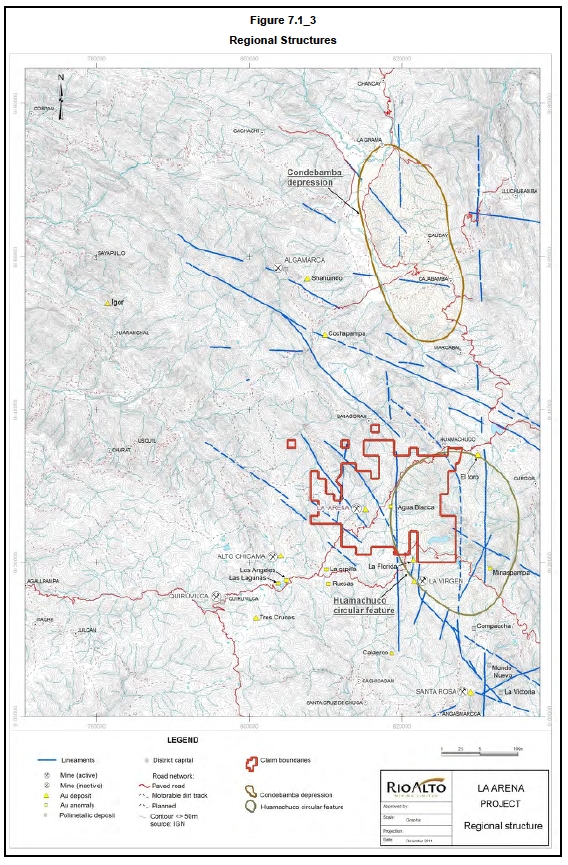

Structure: The main structural features of the region are associated with the Jurassic-Cretaceous sedimentary sequence and consist of a series of folds, reverse faults and over-thrusts trending generally NW-SE (see Figures 7.1_1.and 7.1_2). Individual folds range up to 80km in length and 5km in width, and display various forms depending on the relative competency of the various stratigraphic levels. The highly competent sections of the Chimu Formation for example form structurally complex cores to the main anticlines, where they have resisted erosion better than the enclosing strata.

The fold belt which passes through La Arena has a WNW-ESE trend around Sayapullo to the west, swinging to a NW-SE trend immediately west of La Arena and locally N-S in the La Arena Mine area before swinging back to a more southeasterly trend in an easterly direction. This deflection in the orientation of fold axes is observed 90 km to the north of La Arena between Cachachi and Lluchubamba (Figure 7.1_1). An idealized regional section passing through La Arena is shown in Figure 7.1_2.

Much of the southeastern corner of the La Arena property is covered by Quaternary morainic/alluvial/colluvial deposits (Figure 7.1_1), implying the presence of a geomorphological depression which may have been influenced by structure.

| |

| La Arena Project, Peru | Page: 47 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

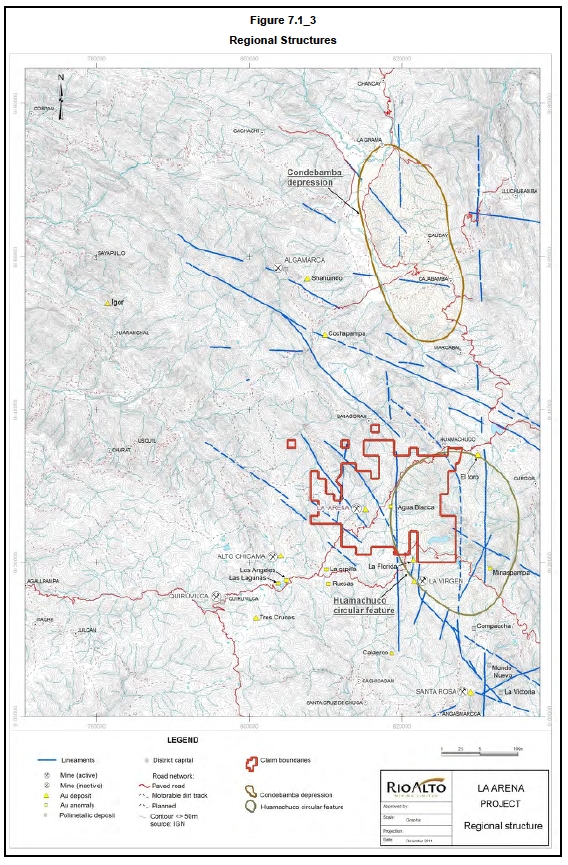

Figure 7.1_3 shows the position of lineaments taken from Landsat satellite imagery. A north-trending corridor bounded by two N-S lineaments, 10 km apart, appears to coincide with the N-S deflection of the overall NW-SE fold trend and appears also to control the position of two geomorphological landforms, the Condebamba Depression and the Huamachuco Circular Feature. The latter also lies between two N120ºE-trending lineaments which may mark the position of transverse basement faults. It is perhaps the intersection of these two trends, due N and N120ºE, which produced a local pull-apart structure which, in turn, permitted the rise of an intrusive stock and subsequent mineralization. It may not be coincidence that the La Virgin and La Arena gold mines, the El Toro and La Florida gold deposits and the Agua Blanca gold anomaly lie on, or close to, the margins of the Huamachuco Circular Feature.

The region is particularly well-endowed with mines and mineral occurrences varying from low-to-high sulfidation systems and from porphyry through polymetallic to epithermal deposits. Currently operating mines other than La Arena, include Quiruvilca (polymetallic Cu/Zn/Pb/Ag) and Lagunas Norte (Lagunas Norte), La Virgen and Santa Rosa (all epithermal Au).

| |

| La Arena Project, Peru | Page: 48 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| La Arena Project, Peru | Page: 49 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

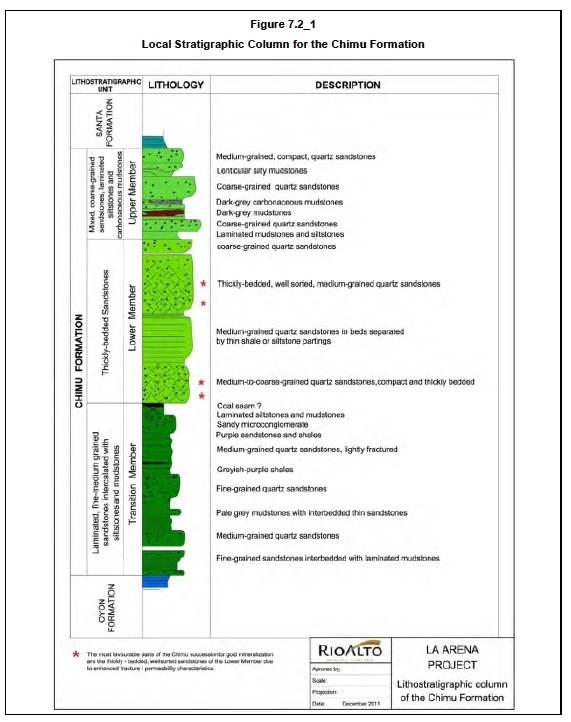

The La Arena Project is located within a regional fold and thrust belt of predominantly Mesozoic sedimentary rocks. The sediments consist of a lower, shallow-marine-to-deltaic, siliciclastic sequence followed by an upper, carbonate-dominated succession, all of Lower Cretaceous age. The oldest rocks exposed in the cores of anticlines are thinly bedded and laminated mudstones, minor siltstones and fine grained sandstones with occasional coal seams which make up the upper Jurassic Chicama Formation and the basal, Lower Cretaceous Oyon Formation.

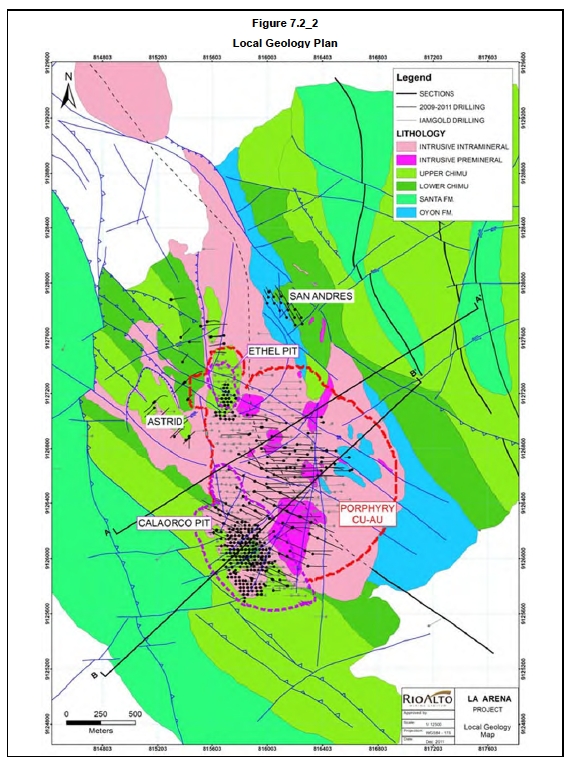

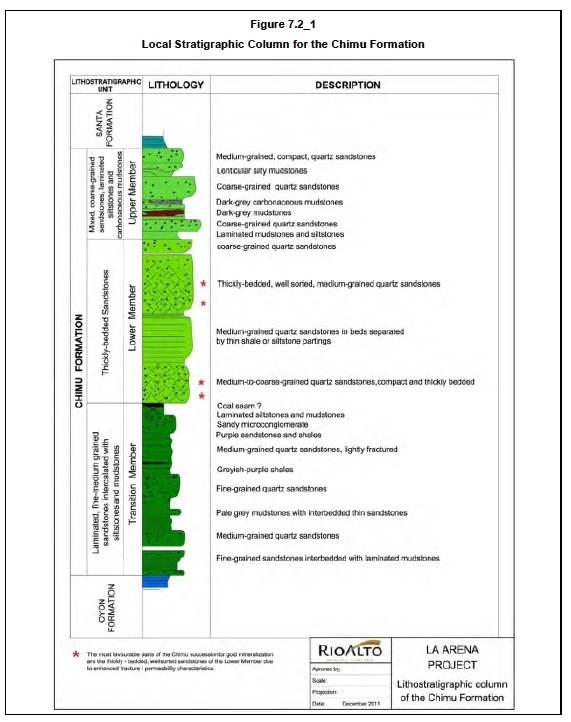

Overlying the Oyon Formation is the mainly arenaceous Chimu Formation. The Chimu Formation, the principal host rock for epithermal gold at La Arena (and elsewhere in the region) has been sub-divided into the three mapable members shown in Figure 7.2_1 and described below (from oldest to youngest):

The Transition Member (130 m) consists of laminated fine-to-medium grained sandstones intercalated with siltstones and mudstones, and is a transitional facies between the more shaly Oyon Formation and the more sandy Lower Member of the Chimu Formation.

The Lower Member (125 m) consists of thickly bedded and compact medium-to-coarse grained sandstones which, due to their brittle nature, are fractured and often brecciated, and constitute the principal sedimentary host rock at La Arena. In addition to hosting the La Arena high-sulphidation Au mineralization, the Chimu Formation also hosts similar mineralization at Lagunas Norte, El Toro, La Virgin and Santa Rosa.

The Upper Member (150 m) consists of a mixed sequence of coarse-grained sandstones, laminated siltstones and carbonaceous mudstones.

| |

| La Arena Project, Peru | Page: 50 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| La Arena Project, Peru | Page: 51 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

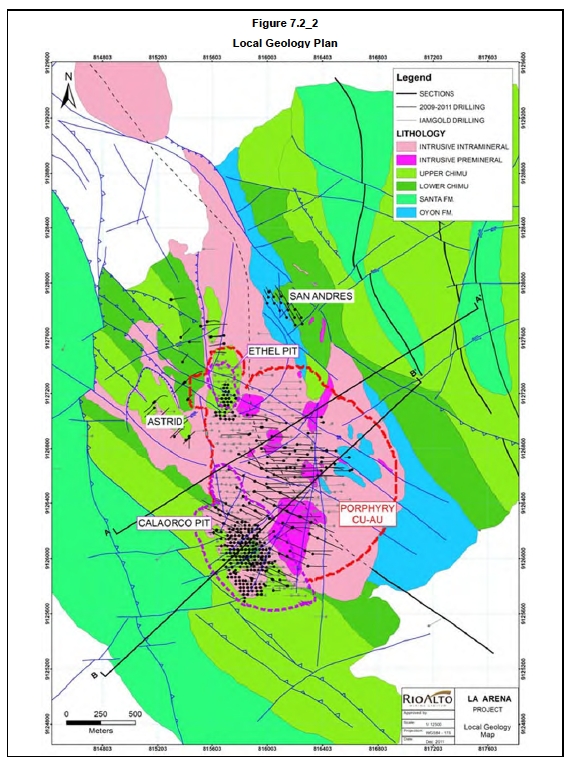

Sedimentary rocks in the project area have been intruded by intermediate-to-felsic porphyritic stocks which tend to occupy the cores of anticlinal structures as displayed in Figure 7.2_2.

| |

| La Arena Project, Peru | Page: 52 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

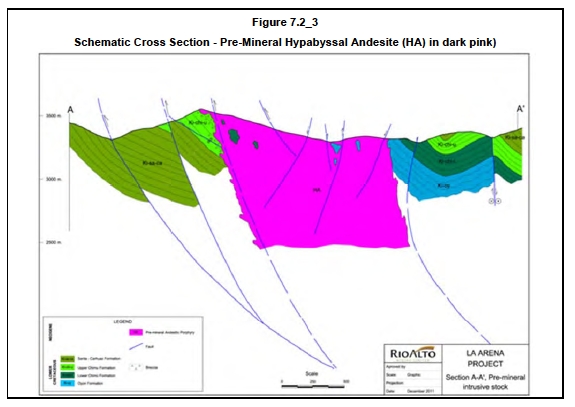

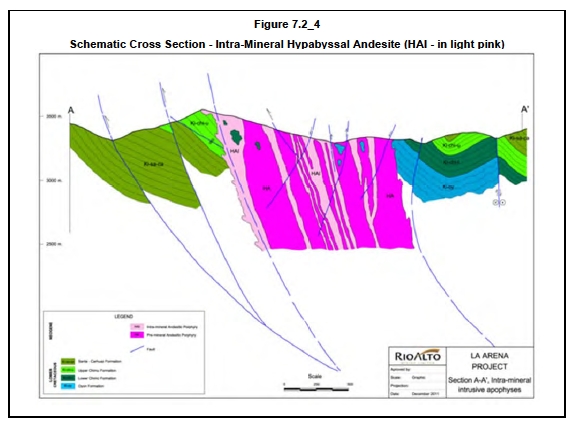

The following three main intrusive phases have been identified at La Arena:

| | |

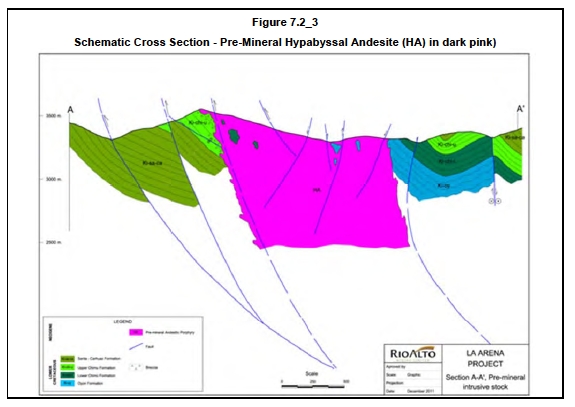

| ● | Pre-mineral Hypabyssal Andesite (HA): A medium-to-coarse grained porphyritic intrusive, hydrothermally altered with plagioclase crystals mainly converted to sericite and kaolinite. The mainly phyllic (quartz/sericite) alteration is variable, accompanied by stockwork quartz veining and is related to Cu/Au/Mo mineralization as displayed in Figure 7.2_3. |

| | | |

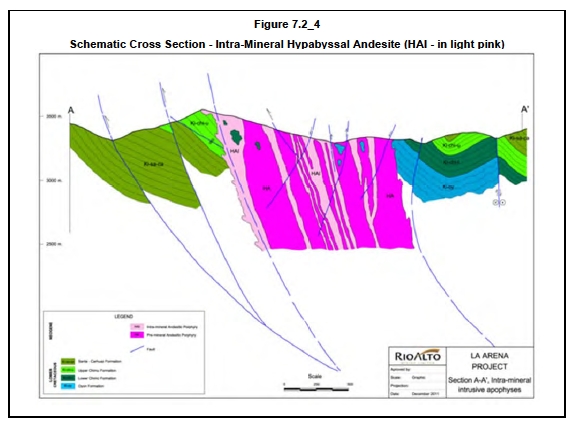

| ● | Intra-mineral Hypabyssal Andesite (HAI): A lesser-altered, medium-to-coarse-grained porphyritic intrusive facies cross-cutting the HA. Alteration varies from argillic near surface to weak phyllic at depth. Plagioclase crystals altered to illite

or sericite are also replaced by fine pyrite as displayed in Figure 7.2_4. |

| | | |

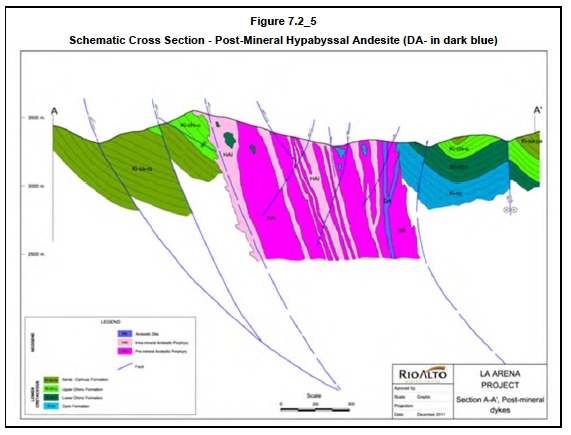

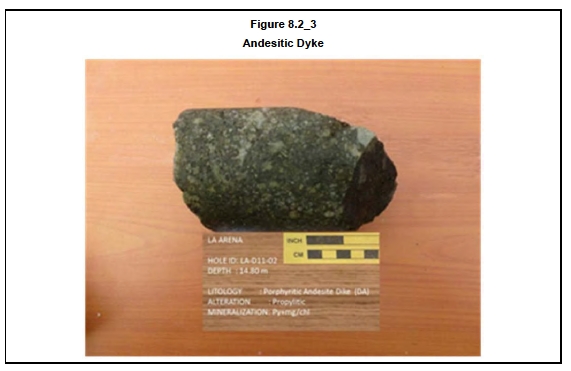

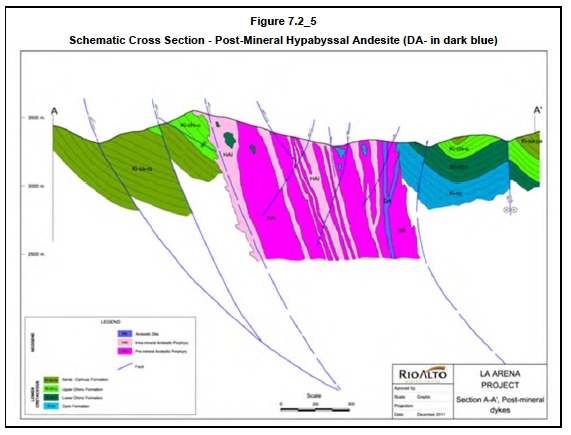

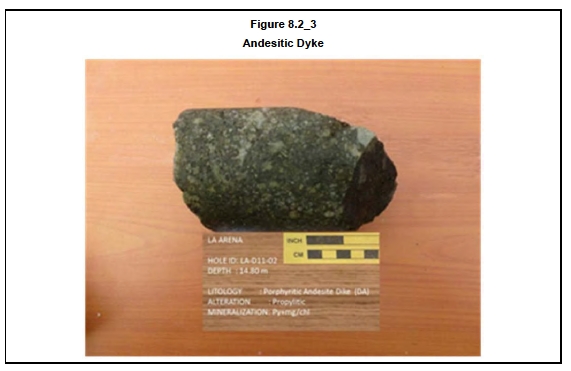

| ● | Post-mineral Andesitic Dykes (DA): Late intrusive dykes cross-cutting earlier facies (described above) forming narrow, tabular bodies. Textures vary from porphyritic to phaneritic, the rocks consisting largely of plagioclases and amphiboles which have been subjected to prophyllitic (chlorite/epidote/magnetite) alteration as displayed in Figure 7.2_5. |

| |

| La Arena Project, Peru | Page: 53 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| La Arena Project, Peru | Page: 54 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

The La Arena open pit currently in progress lies at the western margin of a HA-facies intrusion, where the latter forms a laccolith-like structure overlying an argillically-altered heterolithic breccia. The breccia is altered up to advanced argillic (quartz/alunite) facies, with an oxidized, porous matrix dominated by hematite, limonite and quartz. Remnant sulphides are also present.

One of the principal structural features of the project area is the La Arena Anticline, the core of which hosts the mineralization-related porphyry intrusion. The strike of the anticlinal axis undergoes a deflection in the area immediately to the north of the current open pit (see Figure 7.2.2). Regionally, fold axes trend generally NW-SE, but the La Arena Anticline swings N-S for around 1,000 m, presumably influenced by the north-trending structures referred to previously and shown in Figure 7.1.2. This deflection, the porphyry intrusions and the mineralization are all considered to be inter-related.

Major faults within the Project area have strikes varying from northwest-southeast to N-S, mimicking the orientation of the fold axes and probably following the same controls. They are mainly reverse faults, probably syn-folding. Other mapped faults strike NE-SW to E-W, parallel to the main fold-related stresses, and these faults tend to be lesser structures displaying dilationary and tear movements.

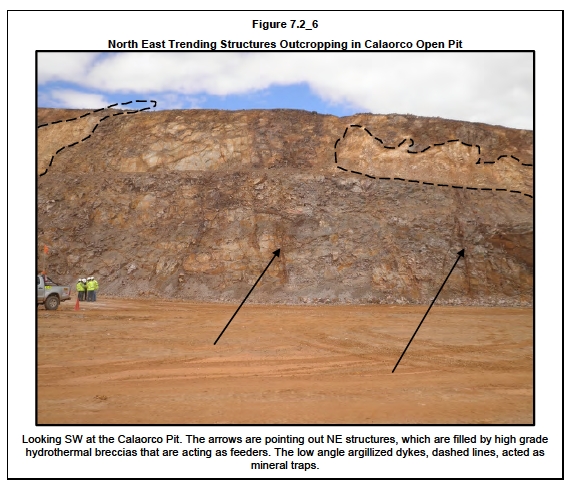

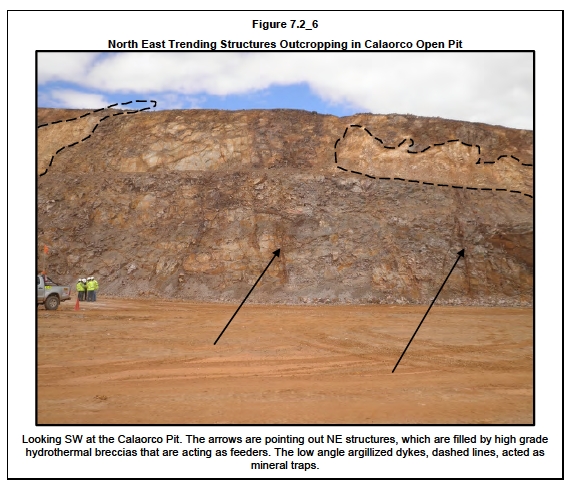

In the current open pit the mineralization appears to be controlled by the interaction of three fault trends. The first corresponds broadly to the Andean Trend, NW-SE, with dips varying 50º to 70º to the NE. The second trend is N10ºE, dips sub-vertical and relative movement mainly dextral tear, and the third trend N40ºE, dips 70º to 80º to both SW and NE and has a sinistral component. The N40ºE fault trend cuts all the others, and appears to have acted as the principal feeder channels for mineralizing fluids, refer to the pit photo in Figure 7.2_6.

| |

| La Arena Project, Peru | Page: 55 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

The La Arena project area contains epithermal style gold mineralization in sandstone-hosted oxidized fractures and breccia, and porphyry Cu-Au (Mo) mineralization. Both styles of mineralization are probably linked because they likely emanate from the same source, namely residual magmatic activity related to intrusives of intermediate composition.

The mineralization extends over a length of 2.2 km south-to-north, a width of 1.1 km west-to-east and a 1,000 m vertical range. Continuity of the mineralization is generally excellent, and improves with lower-grade cutoffs, which is a characteristic of this type of deposit.

Further detail on mineralization is included in Section 8.

| |

| La Arena Project, Peru | Page: 56 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

The region is well endowed with mineral deposits in a variety of settings such as:

Porphyry (La Arena),

Polymetallic Au/Ag/Cu/Pb/Zn vein deposits such as Quiruvilca and Veca

Epithermal gold, including both low and high sulfidation types, such as Lagunas Norte Mine at Lagunas Norte, Santa Rosa Mine, La Virgen Mine, La Arena Mine and the Shahuindo and Tres Cruces projects.

| |

| 8.2 | Porphyry Copper Deposits |

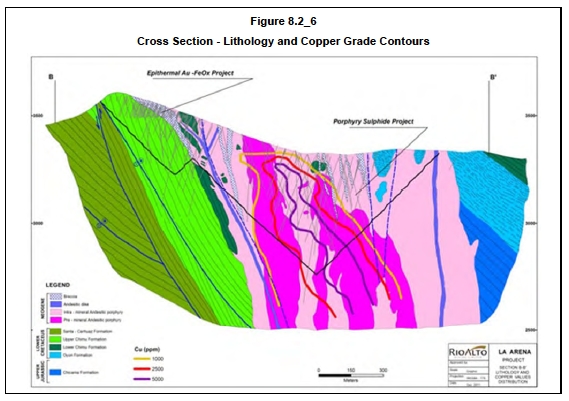

The Cu-Au-(Mo) porphyry at La Arena comprises an elongated ore body 2000 m long (NW-SE) by 1000 m wide, associated with a stockwork hosted in a porphyritic andesite intrusion. Mineralization extends down over 800 m depth. The styles of mineralization are displayed in the photographs presented in Figures 8.2_1 to 8.2_4.

The mineralization occurs as disseminations along hairline fractures as well as within larger veinlets. The mineralization typically contains between 0.4-1.0 % copper, with smaller amounts of other metals such as gold, molybdenum, and silver.

The primary sulfide mineralization is hosted in the central zone of the andesitic porphyry stock, which contains Cu/Au mineralization associated with phyllic (quartz/sericite) on top and potassic alteration at depth. The stockwork, which facilitated the alteration, contains pyrite, chalcopyrite, smaller amounts of bornite, and some molybdenite in the primary mineralization zone, and covellite and chalcocite in the secondary mineralization zone on top. Microscopic native gold has been observed (in the 50-70 micron range, Williams, 1996-b).

Mineral zoning from surface downwards is typically no more than 40-50 m for the zone of secondary enrichment (chalcocite + covellite +/- copper oxides) and 10-40 m for the mixed zone (chalcocite + chalcopyrite +/- covellite). The primary zone (chalcopyrite +/- bornite +/- molybdenum), which predominates at La Arena, is normally located more than 100 m below the natural surface.

| |

| La Arena Project, Peru | Page: 57 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| La Arena Project, Peru | Page: 58 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

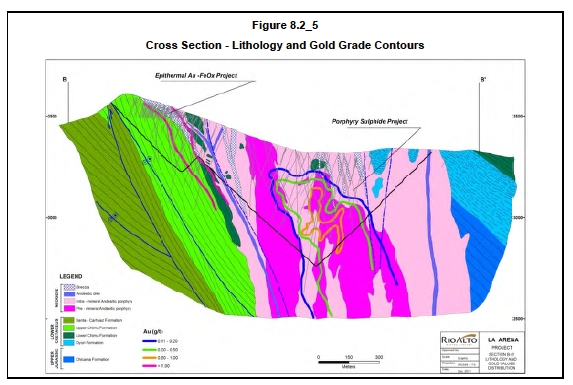

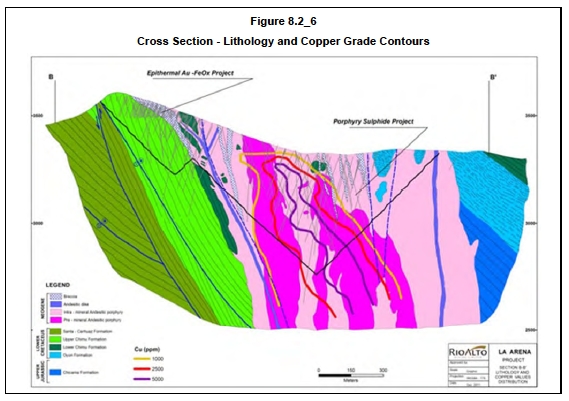

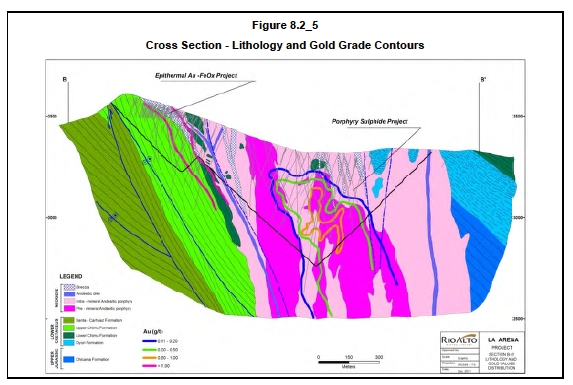

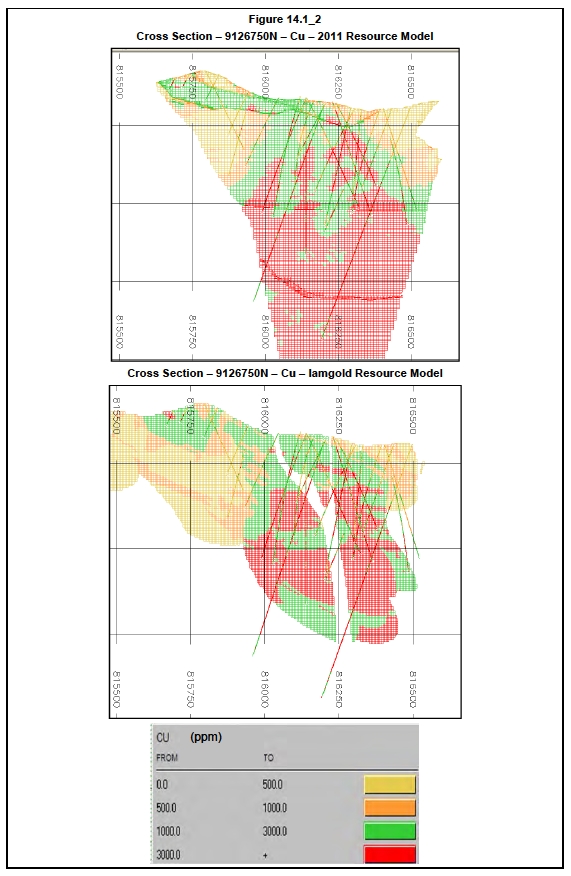

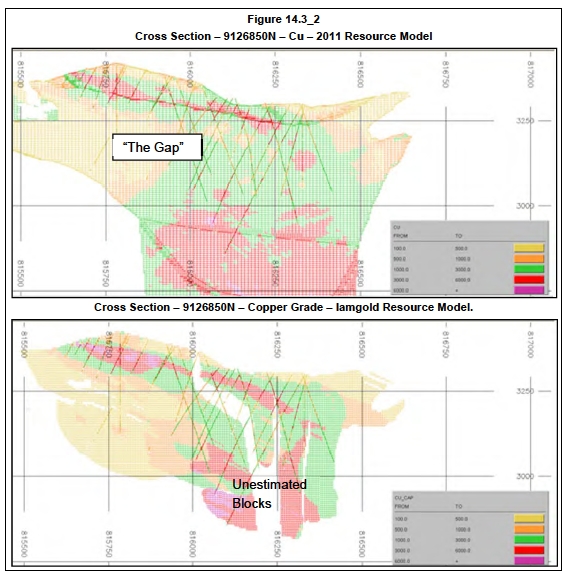

Figures 8.2_5 to 8.2_8 are cross sections that show the distribution of gold and copper values associated with the lithology and alteration. The plan view location of these cross sections is displayed in Figure 7.2_2.

| |

| La Arena Project, Peru | Page: 59 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| La Arena Project, Peru | Page: 60 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| La Arena Project, Peru | Page: 61 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| 8.3 | Epithermal Gold Deposits |

Four separate zones of breccias containing anomalous gold have been recognized around the western and northern margins of the La Arena Porphyry. They are known as Calaorco, Ethel, Astrid and San Andrés (see Figure 7.2.2).

Epithermal gold mineralization currently being mined in the Calaorco Open Pit occurs partly in the Calaorco Breccia (located at the contact between well-fractured Chimu quartz sandstones and the overlying intrusive), partly within the un-brecciated but still well fractured sandstones, and partly within the intrusive along the contact. It appears that the low-angled intrusive contact may have acted as a trap for mineralizing fluids rising along sub-vertical NE-trending feeder channels. The breccia, and the fractured sandstones which host it, dip moderately to the east and contain the best gold values.

Located to the north of the Calaorco Breccia and open pit, the Ethel Breccia is a similar but smaller oxidized epithermal gold deposit.

Two phases of epithermal gold mineralization have been recognized at La Arena. The first phase was associated with the first stage of porphyry emplacement. It is of low sulfidation type and occurs as narrow veinlets filled by a box-work of cubic pyrite, drusy quartz, and native gold. The second phase which overprints the first phase was associated with a later intrusion stage. It is of high sulfidation type and occurs as enargite-pyrite-Au associated with an alunite-dickite mineral assemblage. Each phase added gold to the system, and supergene oxidation has liberated the gold, improved permeability and contributes to a high gold recovery during processing.

| |

| La Arena Project, Peru | Page: 62 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

Serious exploration started in 1994, first by Cambior and then by Iamgold. Accumulated drilling over the La Arena deposit between 1994 and 2007 totalled 59,991 m in 351 holes refer to Section 6.2. Trenching totalled 4,120 m in 60 trenches, and a further 2,900 m of RC drilling was completed for sterilization purposes.

In addition to the La Arena development project, the property includes several prospects that have been defined by a combination of soil geochemistry and exploration diamond drilling. These are Cerro Colorado, El Alizar Porphyry, Agua Blanca epithermal and porphyry occurrences, Pena Colorado and La Florida as shown in Figure 9.1_1.

There was a fallow period from 2007 until 2010 on the Project when no exploration was conducted during the sale and acquisition of the Project by Rio Alto Mining Ltd.

During 2010 and 2011 Rio Alto carried out the following exploration works:

Detailed geological mapping at La Arena and surrounding areas (3,000 ha at 1:2,000), and regional geological mapping (23,000 ha at 1:25,000 scale).

Prior to mine development, 7,296 m of RC holes were drilled at 93 platforms to sterilize areas for the location of future mine facilities.

The San Andres Project was initiated to the northeast of the Calaorco Open Pit (near the initial leach pad, refer Figures 9.1_1 and 9.1_2). This mineralized zone was discovered by surface mapping and sampling (149 samples). The gold mineralization is hosted in a highly-oxidized sandstone breccia zone, and 3,050 m of RC drilling from 15 platforms provided an inferred Mineral Resource of 10.7 Mt @ 0.21 g/t Au (73,600 oz), which is not included in this La Arena project resource update.

The Astrid Project is located 1.0 km NW of the Calaorco Open Pit. Work to date included detailed geological mapping (1:1,000 scale), 840 rock samples (200 of which reported values of more than 100 ppb Au), 14 km of IP and ground- magnetic geophysical lines, and 3,856 m of diamond drilling in 16 holes. Gold mineralization was encountered close to surface, hosted in an oxidized sandstone breccia near its contact with an intrusive stock. The gold mineralization is similar to that in the Calaorco deposit, and exploration is ongoing.

The Calaorco and Ethel Projects were intensively explored by Cambior and Iamgold and on the basis of these studies a Mineral Reserve of 820,000 oz of Au was reported (NI 43-101, July 2010). Subsequently, Rio Alto carried out two drilling campaign. The first drilling program undertaken at the end of 2010

| |

| La Arena Project, Peru | Page: 63 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

involved 8,938 m of RC drilling at a 25 m x 25 m spacing from 194 locations. The second program, completed during the first semester of 2011, involved 13,674 m of diamond drilling in a total of 50 holes. The updated resource of this Au/FeOx mineralization in this Report includes the data from these two drilling programs.

The 2011/2012 drilling program still in progress is planned for 32,000 m of core drilling and 34,000 m of RC drilling. It is focused on the areas displayed in Figure 9.1_2. The 2011 resource estimation update utilised some new data from this program, consisting of 3,879 m of DC holes from 5 locations and 21,904 m of RC holes from 67 locations. The average hole depth from surface was 775 m and 350 m for DC and RC drilling respectively. It is important to mention that the mineralization in the deep drilling holes is open at depth. The resource of sulphide mineralization in this Report is based on initial results from this drilling program and the historical data.

| |

| La Arena Project, Peru | Page: 64 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| La Arena Project, Peru | Page: 65 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

The principal methods used for exploration drilling at La Arena have been diamond core drilling (DC) and reverse circulation drilling (RC).

The deposit was relatively well drilled, with approximately 60,000 m of drilling, on a nominal spacing of 50 m in the sandstone and 65 m in the porphyry, from discovery in 1994 to 2007 with predominantly HQ and to a lesser degree NQ core. Diamond drilling accounted for 98 % of the metres drilled at this stage. Drilling recommenced in September 2010 and has focussed on three programs:

Infill RC grade control drilling, totalling 8,938 m, on a 25 m x 25 m grid to assist with grade control models and preliminary mine scheduling. This has been included in the updated Resource Model. This drilling was conducted between September 2010 and January 2011.

Infill RC resource drilling, totalling 12,966 m to close off gaps within the Resource to a more rigorous 50 m x 50 m pattern in the sandstone, and to close off a major geographical gap between the sandstone and the porphyry. This drilling commenced in January 2011 and is ongoing.

Depth and strike extensions to the porphyry. These are all DC. There are 5 new holes drilled to date totalling 3,879 m. This drilling commenced in January 2011 and is ongoing. All core is HQ diameter to a depth of 450-500 m depending upon ground conditions, and then NQ diameter thereafter.

Up until 30th November 2011, the deposit has had 86,652 m of drilling, as summarised in Table 10.1_1.

| | | | | |

| Table 10.1_1 |

| Summary Drilling Statistics |

| Year | DC (m) | RC (m) | RC Grade Control | Total (m) |

| (m) |

| 1996 | 3,745 | | | 3,745 |

| 1997 | 7,048 | | | 7,048 |

| 1998 | 7,219 | | | 7,219 |

| 1999 | 476 | | | 476 |

| 2003 | 3,107 | | | 3,107 |

| 2004 | 851 | | | 851 |

| 2005 | 19,705 | 1,186 | | 20,891 |

| 2006 | 13,170 | | | 13,170 |

| 2007 | 4,362 | | | 4,362 |

| 2010 | | | 8,702 | 8,702 |

| 2011 | 3,879 | 12,966 | 236 | 17,081 |

| Total | 63,562 | 14,152 | 8,938 | 86,652 |

| |

| La Arena Project, Peru | Page: 66 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

Up until 2007, DC holes were drilled by Sociedad Minera Cambior Peru S.A (SMCP) and RC holes were drilled by AK drilling. Most DC holes were drilled with HQ diameter until 1999 and about 40% of the holes were drilled NQ diameter from 1999 to 2005. The historical database does not clearly record core size. DC recoveries, in general, are very good, except where there are heavily oxidised zones. It is clear that in these areas there are wash outs and loss of fines from the core. RC drilling recoveries were noted as poor in general due to bad ground conditions and abundant underground water. There were 11 RC holes.

The recent drilling programs commencing in 2010 were by AK drilling (RC) and Explomin del Peru (DC). DC recovery is high, and RC sample recovery has increased markedly, in general, probably as a result of better drilling technology.

Drilling prior to 2008 was generally drilled to the west at between 60 to 70 degrees dip. Holes were targeted to perpendicularly intersect the expected main trend of global mineralization.

Recent mapping in 2010 has determined that a primary orientation of 040o has not been systematically tested for both gold and copper mineralisation. The majority of the drilling in 2011 has been orientated orthogonal to this trend, and this has probably contributed to an elevated Au and Cu grade returned in assays. This has not yet been analysed in any detail.

| |

| 10.4.1 | Accuracy of Drillhole Collar Locations |

Historical drillhole collars were surveyed by Eagle Mapping Ltd. using total station and differential GPS. Survey accuracy is reported as +/-0.5 m. Recent drillhole collars have been surveyed using a Total Station GPS.

| |

| 10.4.2 | Down-hole Surveying Procedures |

Prior to the 2005 drilling campaign, holes were down-hole surveyed using acid test every 50 m. This method uses acid, in a glass test tube, with the acid etching the tube and indicating the inclination or dip of the hole. It is carried out by lowering the tube down the hole to the desired depth, for each reading. Magnetic azimuth readings are not obtained by this method.

| |

| La Arena Project, Peru | Page: 67 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

Also tropari survey measurements are noted in the drillhole logs. A tropari is a directional surveying instrument that gives inclination and magnetic azimuth and can be used in open holes or through rods 36 mm (1.40 inches) or larger. Accuracy to +/-0.5 degrees is claimed by the manufacturer.

After hole 172, down-hole surveys were collected with a SingleSmart Flexit tool with a reported accuracy of +/-0.2 degrees, recording both dip and azimuth. Real-time recording tools were used from 2007 onwards.

Accuracy of the down-hole survey measurements meets acceptable industry standards. Post acid test holes were found to deviate in azimuth by an average 3.2º and have a tendency to steepen in dip by an average 2.9º.

All except 5 RC holes drilled in 2010/2011 have not yet been down hole surveyed in 2011 due to magnetic interference. A non-magnetic downhole Gyro tool has subsequently been purchased for down-hole surveys for RC holes.

Ian Dreyer considers the locations of the total data set of DC and RC holes have sufficient accuracy to make no material impact on the quality of the resource estimation.

| |

| 10.5 | Sterilisation Drilling |

A total of 48 RC holes were drilled between September and November 2009 to ensure planned gold oxide Project infrastructure would not be placed in areas of potential economic mineralization. The holes were drilled to the south, east and north of the expected sulphide project pit limits to assess a planned waste dump to the south, planned gold oxide project infrastructure to the east and the planned gold oxide dump leach pad and ADR plant to the north.

There has been no further sterilisation drilling.

| |

| La Arena Project, Peru | Page: 68 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| 11 | SAMPLE PREPARATION, ANALYSES AND SECURITY |

| |

| 11.1 | Sampling Method and Approach |

| |

| 11.1.1 | Diamond Core Sampling |

Core mark-up and sampling has been conventional and appropriate. Samples are generally 2 m long, except on geological contacts. Core has not been orientated for structural measurements.

During earlier exploration programs the core was chiselled in half. It has been noted previously that when the core had been split using the chisel method, the remaining half core was completely fractured, and that silicified core was not well split using this technique.

More recently the core has been cut lengthways with a diamond saw and half-core is sent for assay.

Diamond core samples are numbered and collected in individual plastic bags with sample tags inserted inside. Each sample batch is made up of approximately 73 samples, including 3 quality control blanks, 3 standards and 3 field duplicates. Each work order consisted of a rice bag with samples along with an order list of which one copy was sent to the laboratory in Lima and another copy retained on site. Bags were closed with tie-wraps.

| |

| 11.1.2 | Reverse Circulation Sampling |

RC samples were collected at 2 m intervals and quartered in riffle splitters. Sub-samples weigh approximately 6 kg and are collected in cloth-lined sample bags. The quality control insertion rate is identical to the DC procedure.

| |

| 11.1.3 | Surface Trench Sampling |

The surface trench sampling is now of little use to this Project and has not been utilised in any interpretation or grade estimation.

Diamond core is logged in detail for geological, structural and geotechnical information, including RQD and core recovery. Whole core is routinely photographed.

Diamond core and RC chip logging is conventional and appropriate.

Core recovery has been recorded for all drillholes at 2 m intervals. Core recovery is generally 90-95% or higher and infrequently 70-80% or less. The lower recoveries occur mainly in the more weathered, upper parts of the deposit.

| |

| La Arena Project, Peru | Page: 69 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

There has been a major review of the previous core logging approach by Rio Alto geologists, although this review was not complete at the time of the compilation of this resource, however sufficient data has been collected to assist in refining the interpretation and estimation approach to the resource.

The emphasis has been on improving the alteration codes and to check if the numerous styles of intrusive, over and above those mentioned in Section 8.2 are appropriate. The consensus opinion is that more detail and system is required on logging of alteration and less internal division of porphyry’s is warranted.

Reference material is retained and stored on site, including half-core and photographs generated by diamond drilling, and duplicate pulps and residues of all submitted samples. All pulps are stored at the La Arena exploration camp.

| |

| 11.3 | Sample Preparation and Analysis |

The sample preparation methods for the samples submitted prior to 2003 are not documented. Since 2003 the sample preparation methods have been constant as outlined below.

The flow sheet for drill core sample preparation and analysis is included as Figure 11.3_1. Samples were digitally weighed, dried to a maximum of 120ºC (for wet samples), crushed to 70% < 2 mm (10 mesh), riffle split to 250 g, and pulverized to 85 % < 75 µm (200 mesh). 50 g pulps were submitted for chemical analysis. These procedures have been in place since 2003.

Chemical analysis at the primary laboratory (ALS Chemex since 2005) and the secondary laboratory (CIMM Peru) consisted of fire assay (FA) with atomic absorption spectrometry (AAS) finish, using 50 g sub-samples. Those samples that analysed ≥ 5 g/t Au were analysed using gravimetric methods.

For Cu and Ag (and Mo, Pb, Zn, As, Sb and Bi) multi-acid (four) digestion AAS was used. Hg was analysed using cold vapour AAS. Until the end of 2004 the core samples from drillholes 1 to 125 were processed by CIMM Peru as the primary laboratory. The assay methods for the samples submitted prior to 2005 are not documented.

The primary laboratory has now switched back to CIMM Peru since 2010 with the secondary laboratory being ALS Chemex.

| |

| La Arena Project, Peru | Page: 70 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| La Arena Project, Peru | Page: 71 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

There was little or no routine QAQC conducted prior to 2004 on the drillhole assays for this project.

QAQC since 2004 has been much more rigorous and this intensity has continued on with the Rio Alto ownership since 2007. In general, the QAQC in the field and in the laboratory is very rigorous.

There have been minor improvements made on bulk density determinations since the previous Resource model was constructed. However there is insufficient new data to make any changes to bulk densities with any confidence and therefore the values from the previous resource estimate have been retained.

The drillhole database has been reviewed and there are some minor issues with old data, particularly for Ag and Mo, that have been taken into account in this estimate. These issues need to also be remediated in the primary drillhole database.

| |

| 12.2 | Analytical Quality Control |

There has been three phases of analytical quality control and quality assurance on the La Arena deposit. They are time bounded and are defined by:

Pre 2004

2004 to 2007.

2010 onwards.

The emphasis of this Report is to briefly summarise all previous work that has been documented in the July 2010 Technical Report and to present the new data in detail.

| |

| 12.2.1 | Pre 2004 Quality Control |

There was little or no routine QAQC conducted prior to 2004 on the drillhole assays for this project. This represents 125 drillholes out of a database of 726 holes or 17% of the entire database by holes and 18% by metres drilled. The holes with little or no QAQC are all diamond drillholes and are drilled to varying depths through both sandstone and intrusive lithologies and in both oxidised and fresh rock domains.

The hole numbers of these holes are from 001 to 125, having a variety of prefixes, generally pertaining to the year that the hole was drilled. These holes are relatively evenly spread throughout the deposit with 100 holes less than 250 m long and only 4 holes are greater than 400 m long.

| |

| La Arena Project, Peru | Page: 72 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| 12.2.2 | 2004 to 2007 Quality Control |

In June 2004 a rigorous QAQC program was implemented and consisted of:

Standards and blanks inserted at a rate of 1:30.

Field duplicates inserted at a rate of 1:30.

Coarse (crushed) rejects submitted to the primary laboratory at a rate of 1:20.

Pulp rejects submitted to the primary laboratory at a rate of 1:30.

Pulp duplicates submitted to the primary laboratory at a rate of 1:15.

Pulp duplicates submitted to secondary laboratory at a rate of 1:20.

Internal quality control by the laboratory consisted of 2 standards, 2 blanks, 2 duplicates from sample rejects, and 2 laboratory duplicates. ALS Chemex is an international company that has an ISO 9001:2000 certification at all their laboratories.

The results obtained for standards, blanks, rejects and duplicates display adequate accuracy and precision to be considered as reliable data sets.

These results are as presented in the graphs in the Appendix to the La Arena Pre-feasibility Study (November 2006) (PFS) and they have not been replicated in this Report.

There was no resource drilling completed between 2007 and September 2010.

| |

| 12.2.3 | 2010 and Onwards Quality Control |

The quality control results since the ownership of the project by Rio Alto are of high quality on field duplicates, blanks and standards.

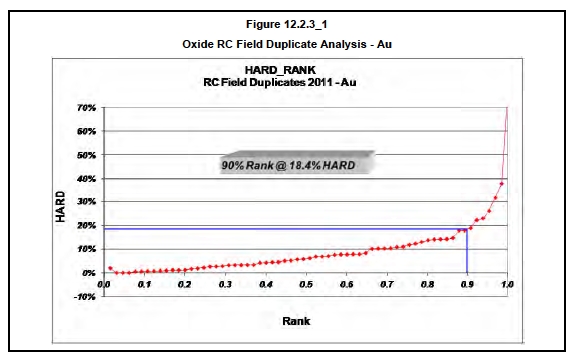

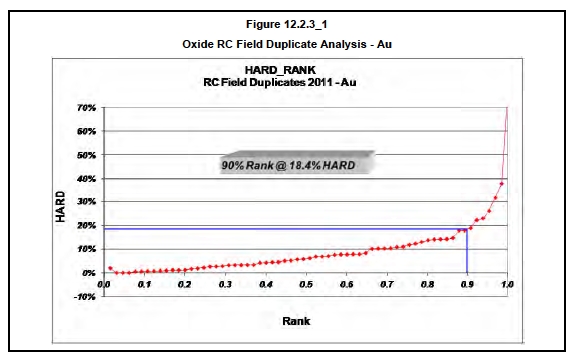

RC and DC field duplicates, which are taken at a frequency of 1:20, show very good reproducibility, with 90% of the data having a precision within 10-20% as displayed in Figure 12.2.3_1 and this is indicative of the excellent quality of sampling practices observed during the site visit by Ian Dreyer, particularly on the RC sampling.

Standards are inserted at a frequency of 1:20. Au oxide standards display little bias and a high level of precision, as shown in Figure 12.2.3_2. Cu sulphide standards display a slight to moderate negative bias in all grade ranges as displayed in Figures 12.2.3_3. This is very consistent and should be followed up by Rio Alto. Au sulphide standards display little bias and a high level of precision, as shown in Figures 12.2.3_4. Ian Dreyer is satisfied that standards falling significantly outside the tolerance limits are incorrectly labelled samples.

| |

| La Arena Project, Peru | Page: 73 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

Blanks for Au show no signs of contamination. Minor contamination is noted in the Cu sulphide blanks, as displayed in Figure 12.2.3_5, however this has no material effect on the veracity of the remaining data. Rio Alto should attempt to make up a lower grade Cu blank.

| |

| La Arena Project, Peru | Page: 74 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| La Arena Project, Peru | Page: 75 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

The comparative testwork between data sets has not been reviewed in any more detail than the Technical Report of July 31, 2010 which is restated here for completeness.

Gold in the oxide resource at La Arena is preferentially situated within numerous fractures within the sandstone, quartzite and brecciated material that host the oxide resource. During the diamond drilling and core cutting process water is utilized to cool and lubricate the diamond bits and this water can potentially wash the fine friable material out of the fractures in the rock. Given the gold mineralization is located within these fractures the resulting core used for analysis can underestimate the total gold content. This sampling issue with diamond drilling has been identified in a number of other projects in Peru.

Rio Alto completed a channel and bulk sampling program over a 3 month period at the start of 2009. 10 pits were excavated to a maximum depth of 10 m. The pits were located to provide a representative distribution of the oxide resource and were excavated on the existing HQ diamond holes utilized in the current La Arena oxide resource estimate.

| |

| La Arena Project, Peru | Page: 76 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

Channel samples weighing approximately 10 kg each were taken 20 cm parallel to the existing drillhole on two metre intervals (equivalent to the diamond drill sample length and spacial position). Bulk samples were also taken (1.5 m by 1 m shaft by 2 m intervals) then dried, homogenized and a total of 10 representative 10 kg samples were taken for analysis from each bulk sample.

The results of the sampling and the original diamond drillhole grades are outlined in Table 12.3_1.

The results from this comparative study, although representative of only 39 samples in the La Arena oxide resource, demonstrates that in the case of both the bulk sample and the channel samples taken, the gold grade, in the majority of cases, tends to be significantly higher than the grades achieved by diamond drilling.

The reverse circulation drillhole twinning program recommended by Coffey Mining has not yet been undertaken due to time constraints.

Bulk densities assigned to the resource estimates were derived by Iamgold from four different sources:

Nearby projects, for Quaternary alluvium.

Water-immersion (wax) measurements during 2005, for sandstone, fractured sandstone, brecciated sandstone, siltstone and intrusive breccia.

Water-immersion (wax) measurements during 2006, for the various porphyry types.

Published theoretical values, for dykes, shale-limestone and diorite.

The variety of rock types have been amalgamated in this resource, to some degree, as described in Section 14. The previous bulk densities have been averaged in this case.

Recent bulk density measurements have been ongoing on site, but there are insufficient to make any material changes to bulk density in this resource estimate.

| |

| 12.5 | Verification Sampling |

Independent verification sampling has not been carried out as this Project is now an operating mine.

| |

| La Arena Project, Peru | Page: 77 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| | | | | | | | | |

| Table 12.3_1

Summary of Channel and Bulk Sampling Compared to Diamond Drilling |

| Hole | From | To | Recovery in

DDH (%) | ORI_DDHppb | Channel_ppb | Bulk_ppb | Channel

vs DDH | Pit

vs DDH |

| | 96D-LA-045 | 2 | 4 | no data | 33 | 25 | 13 | -24% | -60% |

| 96D-LA-045 | 4 | 6 | no data | 25 | 1,506 | 1,023 | 5924% | 3991% |

| 96D-LA-045 | 6 | 8 | no data | 1,180 | 881 | 4,523 | -25% | 283% |

| 96D-LA-045 | 8 | 10 | no data | 460 | 2,197 | 989 | 378% | 115% |

| 98D-LA-058 | 0 | 2 | 57.5 | 1,000 | 1,424 | 2,032 | 42% | 103% |

| 98D-LA-058 | 2 | 4 | 60 | 360 | 1,021 | 550 | 184% | 53% |

| 98D-LA-058 | 4 | 6 | 70 | 180 | 196 | 253 | 9% | 41% |

| 98D-LA-068 | 0 | 2 | 75 | 510 | 2,157 | 851 | 323% | 67% |

| 98D-LA-068 | 2 | 4 | 85 | 770 | 2,754 | 912 | 258% | 18% |

| 98D-LA-068 | 4 | 6 | 100 | 930 | 3,687 | 1,629 | 296% | 75% |

| 98D-LA-068 | 6 | 8 | 100 | 2,700 | 5,643 | 2,343 | 109% | -13% |

| 98D-LA-068 | 8 | 10 | 100 | 3,770 | 6,394 | 3,541 | 70% | -6% |

| 98D-LA-075 | 0 | 2 | 89 | 570 | 883 | 649 | 55% | 14% |

| 98D-LA-075 | 2 | 4 | 80 | 440 | 1,273 | 515 | 189% | 17% |

| 98D-LA-075 | 4 | 6 | 78 | 42 | 274 | 369 | 552% | 780% |

| 98D-LA-075 | 6 | 8 | 75 | 350 | 108 | 413 | -69% | 18% |

| 98D-LA-077 | 0 | 2 | 80 | 270 | 156 | 72 | -42% | -73% |

| 98D-LA-077 | 2 | 4 | 82.5 | 92 | 1,565 | 1,442 | 1601% | 1468% |

| 98D-LA-077 | 4 | 6 | 84 | 2,010 | 2,138 | 3,798 | 6% | 89% |

| 98D-LA-077 | 6 | 8 | 98 | 6,940 | 2,614 | 3,394 | -62% | -51% |

| 98D-LA-087 | 0 | 2 | 55 | 1,240 | 789 | 1,260 | -36% | 2% |

| 98D-LA-087 | 2 | 4 | 67.5 | 1,380 | 4,340 | 1,529 | 214% | 11% |

| 98D-LA-087 | 4 | 6 | 55 | 11,100 | 21,160 | 5,073 | 91% | -54% |

| 98D-LA-087 | 6 | 8 | 57.5 | 1,640 | 4,634 | 4,212 | 183% | 157% |

| 98D-LA-087 | 8 | 10 | 60 | 1,680 | 5,092 | 7,259 | 203% | 332% |

| 98D-LA-123 | 0 | 2 | 99 | 239 | 296 | 190 | 24% | -20% |

| 98D-LA-123 | 2 | 4 | 97.5 | 517 | 575 | 458 | 11% | -12% |

| 98D-LA-123 | 4 | 6 | 95 | 659 | 2,791 | 1,959 | 324% | 197% |

| 98D-LA-123 | 6 | 8 | 92.5 | 2,079 | 1,917 | 1,275 | -8% | -39% |

| 98D-LA-123 | 8 | 10 | 95 | 89 | 2,119 | 622 | 2281% | 599% |

| 05D-LA-146 | 0 | 2 | 80 | 1,105 | 5,355 | 6,685 | 385% | 505% |

| DDH-LA-245 | 0 | 2 | 91.5 | 1,000 | 2,127 | 1,351 | 113% | 35% |

| DDH-LA-245 | 2 | 4 | 97.5 | 534 | 3,472 | 1,065 | 550% | 99% |

| DDH-LA-245 | 4 | 6 | 97.5 | 1,475 | 1,815 | 1,071 | 23% | -27% |

| DDH-LA-253 | 0 | 2 | 32.5 | 1,155 | 2,363 | 999 | 105% | -13% |

| DDH-LA-253 | 2 | 4 | 28.5 | 254 | 851 | 1,160 | 235% | 356% |

| DDH-LA-253 | 4 | 6 | 37.5 | 526 | 809 | 1,541 | 54% | 193% |

| DDH-LA-253 | 6 | 8 | 50 | 388 | 1,384 | 3,308 | 257% | 752% |

| DDH-LA-253 | 8 | 10 | 95 | 2,320 | 3,142 | 2,645 | 35% | 14% |

| Average | | | | 1,334 | 2,614 | 1,871 | 96% | 40% |

| |

| La Arena Project, Peru | Page: 78 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

The drillhole database is now housed in a commercial quality Acquire database.

The Iamgold database has been reviewed in 2010 and 2011 and the following changes have been made to the data in conjunction with a major re-logging exercise

The creation of simplified lithological codes by amalgamation of numerous styles of porphyry into one intrusive unit, and these are coded separately as such in the database.

The amalgamation and rationalisation of numerous alteration codes.

Hard copies of original paper drill logs, daily drill reports, core photos, assay results, and various ancillary logging features are stored on site at La Arena.

The historical data, prior to 2004, has a lack of documented quality control. The new data presented is robust and there are sufficient controls in place to ensure that the data collection is reliable and adequate for this resource estimate.

| |

| La Arena Project, Peru | Page: 79 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| 13 | MINERAL PROCESSING AND METALLURGICAL TESTING |

The La Arena Project comprises an oxide portion containing gold mineralization, and a sulphide fraction containing both primary and secondary copper mineralization. The gold bearing oxide material is currently being processed via a dump leach. Sulphide material is planned to be treated via a conventional grinding and flotation circuit.

Extensive metallurgical testwork has been undertaken on the gold oxide material as part of the gold oxide feasibility study for the dump leach project.

Metallurgical testwork has also been undertaken to assess the mineralogical, comminution and flotation characteristics of the sulphide mineralization types. This testwork focused on copper recovery and enabled key process design parameters to be established. Results to date indicate the copper concentrate can be regarded as clean without any major penalty elements.

No new metallurgical testwork has been completed since the July 31, 2010 Technical Report was completed however the gold oxide dump leach project has since been constructed and is in pre-production phase, with a total of 19,369 oz of gold having been produced up to 30 September 2011.

A metallurgical testwork program to further investigate the metallurgical response of sulphide material is planned. To this end drill core intercepts have been identified in order to prepare composite samples and quotations from metallurgical testing laboratories have been obtained. Preparation of testwork composites is currently in progress.

This Section summarises the more detailed metallurgical testing information contained in the July 31, 2010 Technical Report and highlights the differences from the testwork to the preliminary operational results obtained to date for the gold oxide dump leach Project. Further details of the dump leach operation are included in Section 17.

| |

| 13.1 | Mineralogy |

| | |

| 13.1.1 | Oxide |

The oxide mineralization consists mainly of sandstone, quartzite and dacite material types, with minor amounts of brecciated sulphide porphyry and siltstone also observed. The gold mineralization in the sandstone/quartzite samples was found to consist of relatively large, liberated grains with sizes averaging 100 µm. Some electrum was seen, both free and associated with gangue and sulphide minerals.

| |

| La Arena Project, Peru | Page: 80 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

Several other oxide samples containing an amount of clay material showed completely different gold mineralization, in that no coarse gold particles were observed. The microscopic examination of the concentrate produced by heavy liquid separation indicated that most of the gold grains were associated with limonite, un-liberated quartz and the lighter gangue fractions. Evaluation of the average gold grain size had to rely on a very limited number of observations and is therefore not considered reliable. All gold particles detected exhibited a size below 1 micron.

The third type of oxide mineralization was observed in samples taken closer to the adjacent copper sulphide deposit, and contained a larger portion of the brecciated sulphide porphyry material. The heavy media concentrate (sink fraction) produced for this material consisted largely of quartz and pyrite grains in almost equal proportions. Traces of chalcopyrite were also found, as well as chalcocite. Native gold was rarely seen, being present mainly in association with pyrite. Significant amounts of copper and other deleterious elements such as lead, iron and arsenic were also observed, which would be detrimental to cyanide leaching, however this material is expected to represent only a small portion of the total oxide material.

The copper sulphide mineralization has previously been categorized into three types, Primary High Grade, Primary Average Grade and Secondary ore for the purposes of metallurgical testing.

Pyrite is the most dominant sulphide mineral present in all cases, while quartz, phyllosilicates and feldspars account for most of the non-sulphide minerals in each of the ore types. Copper is present almost entirely as chalcopyrite and less bornite in the primary ore types with little to no secondary copper minerals present. The secondary ore type however includes significant amounts of secondary copper mineralization including covellite and chalcocite, although chalcopyrite is still the dominant copper-bearing mineral.

Trace quantities of molybdenum as molybdenite were also observed in all three samples. A study of the grain size distribution indicated the copper bearing and molybdenum minerals to be relatively fine grained in comparison to the larger pyrite and non-sulphide gangue materials.

The gold association was determined by heavy liquid separation. Analysis of the float and sink products indicated that the gold is evenly distributed between the pyrite/sulphide (49%) sinks, and quartz/silicate gangue (47%) float fractions. Subsequent super-panning and concentration of the sinks fractions revealed the presence of only a small amount of coarse gold, with liberated particles accounting for 4% of total gold, with the rest being fine grain inclusions in pyrite and quartz gangue material.

| |

| La Arena Project, Peru | Page: 81 |

| Technical Report – 30 September 2011 | |

Kirk Mining Consultants Pty Ltd

| |

| 13.2 | Metallurgical Sampling and Testwork Programs |

Details of all metallurgical sampling and testwork programs undertaken to date are described in the July 31, 2010 Technical Report.

It is also planned to erect test columns at La Arena to carry out testwork on the high copper (>300 ppm Cu) gold oxide material.

| |

| 13.3 | Heap and Dump Leach Testwork Results |

Results from all gold oxide project metallurgical testwork is described in the July 31, 2010 Technical Report. From this work the cyanide consumption was very low, averaging 0.15 kg/t for all samples. Lime consumption is medium to high averaging 1.0 kg/t and is very similar to previous testwork. Based on the test results the use of dump leaching rather than heap leaching (where the ore is crushed), and from experience at comparable operations close to La Arena it was concluded that a gold recovery of 80% and a cyanide consumption of 0.20 kg/t was reasonable.

Results to date, as discussed in Section 17, generally support these conclusions.

| |

| 13.4 | Copper Sulphide Testwork |

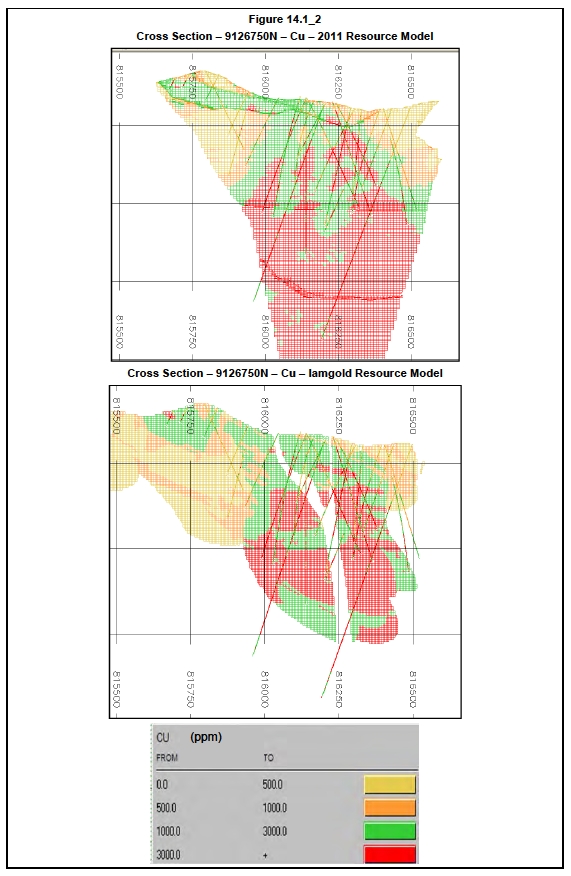

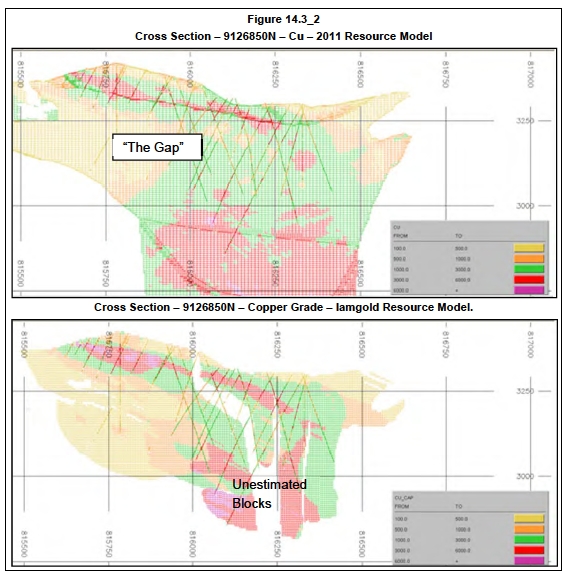

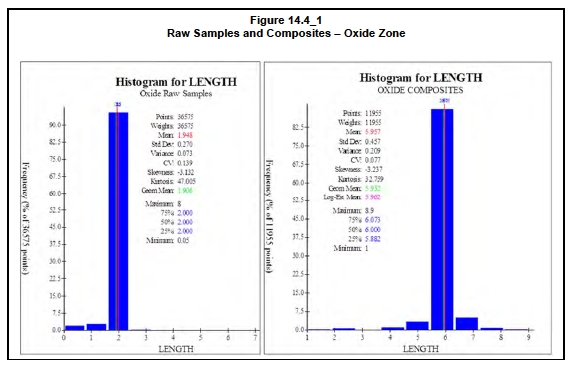

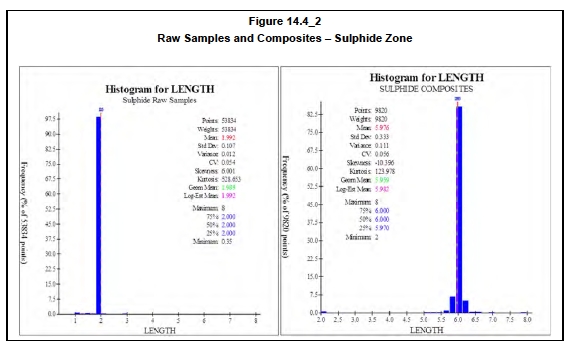

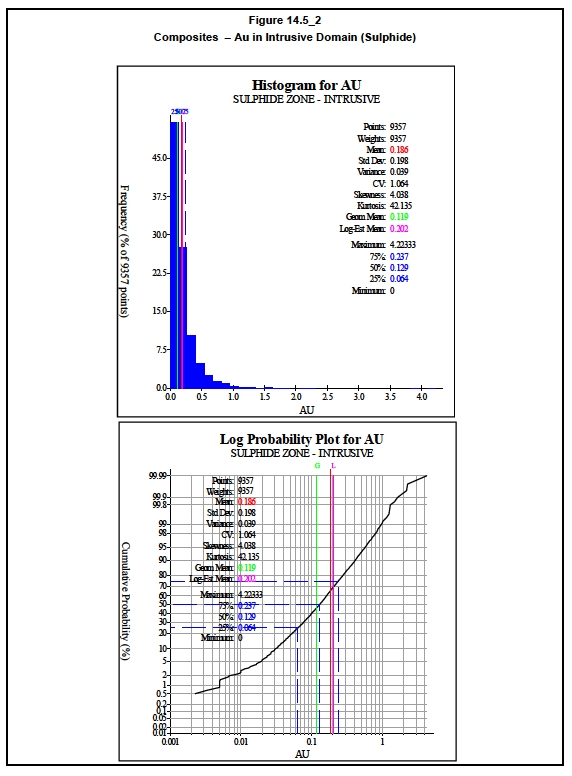

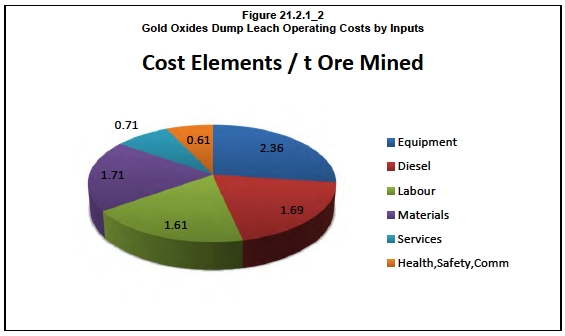

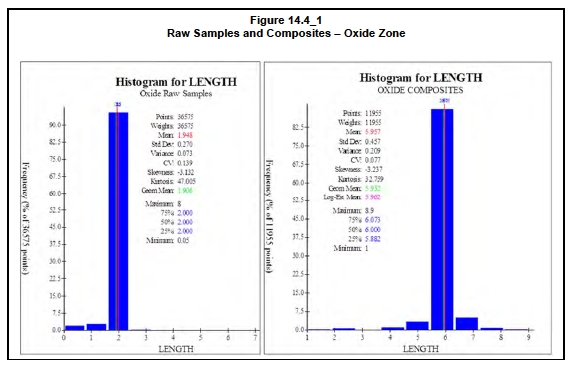

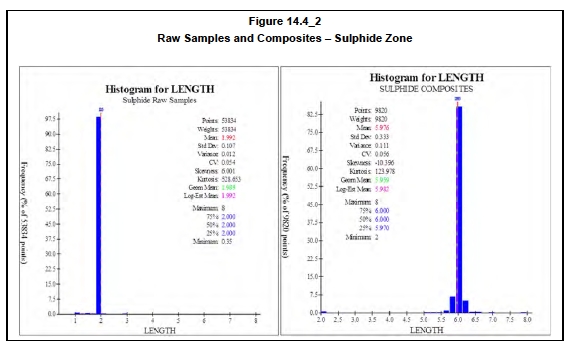

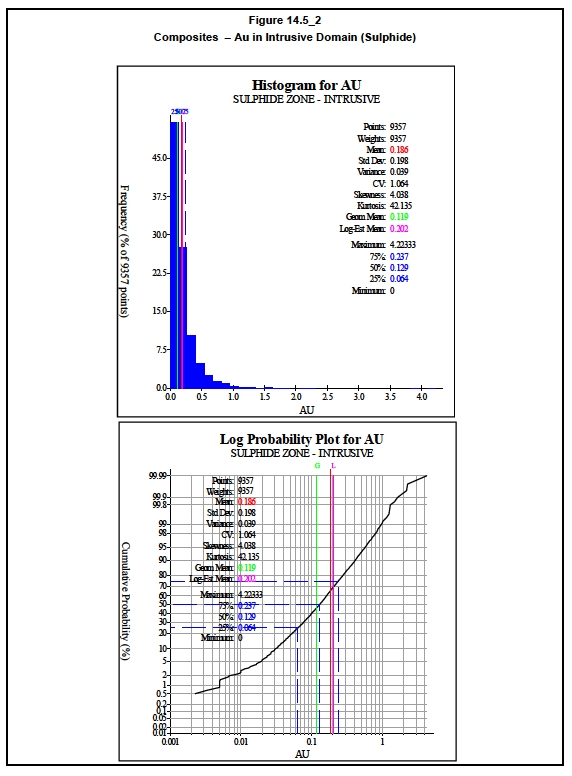

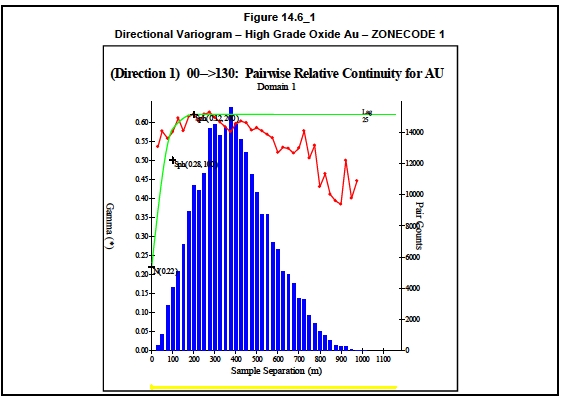

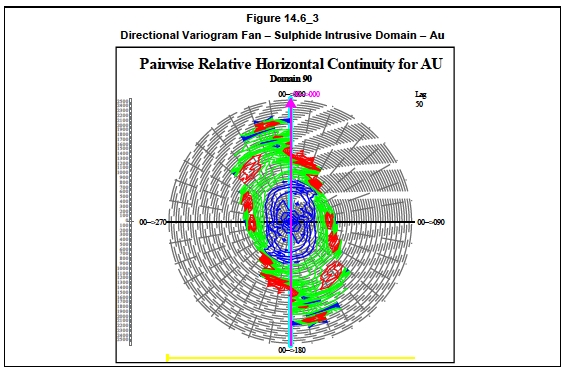

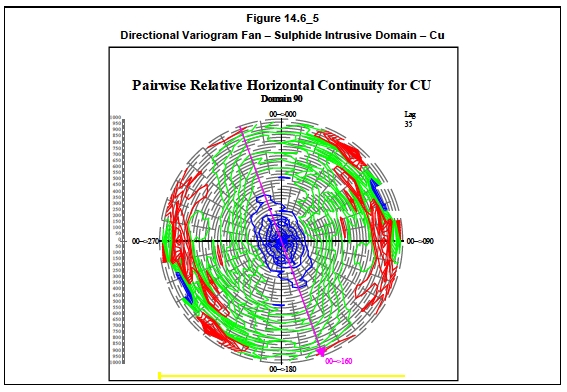

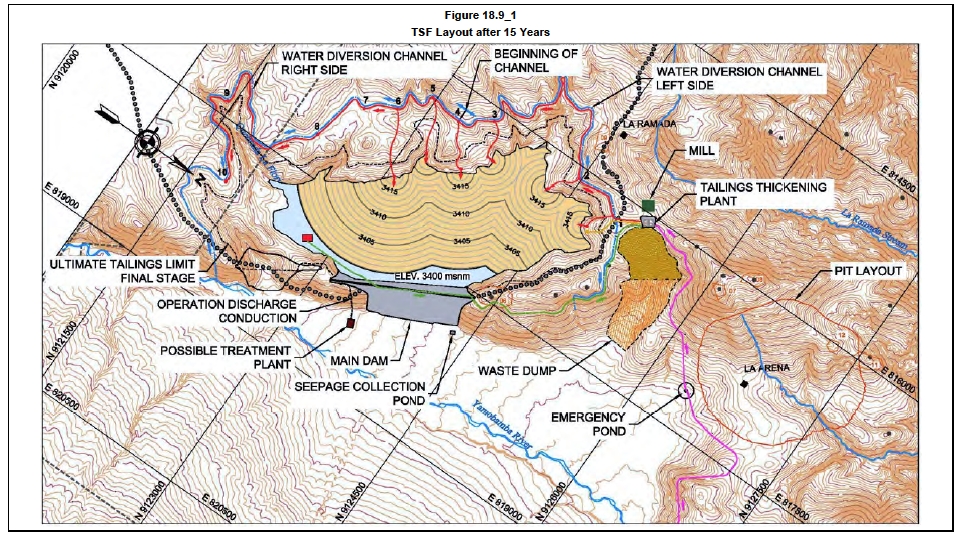

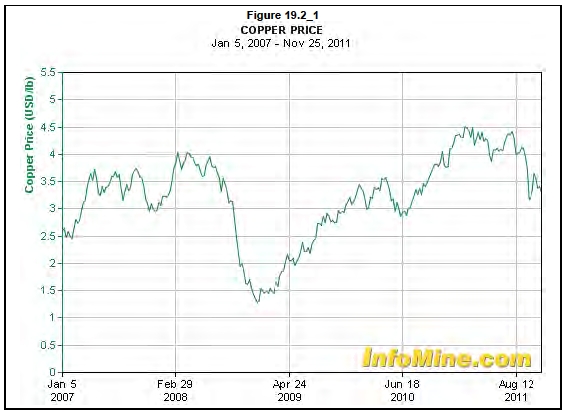

A comprehensive testwork programme was initiated as part of the Iamgold PFS, as is described in detail in the July 31, 2010 Technical Report. This includes: