Exhibit 99.26

ANNUAL GENERAL AND SPECIAL

MEETING OF SHAREHOLDERS

TO BE HELD ON THURSDAY, MAY 10, 2012

NOTICE OF MEETING AND

MANAGEMENT PROXY AND INFORMATION CIRCULAR

THIS NOTICE OF MEETING AND MANAGEMENT INFORMATION CIRCULAR IS FURNISHED IN CONNECTION WITH THE SOLICITATION BY THE MANAGEMENT OF RIO ALTO MINING LIMITED OF PROXIES TO BE VOTED AT THE ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS OF RIO ALTO MINING LIMITED TO BE HELD ON THURSDAY, MAY 10, 2012.

TO BE HELD AT:

Hyatt Regency Toronto on King

370 King Street West

Toronto, ON

At 11:00 a.m.

Dated: April 11, 2012

RIO ALTO MINING LIMITED

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS TO BE

HELD ON THURSDAY, MAY 10, 2012

NOTICE IS HEREBY GIVEN THAT AN ANNUAL GENERAL AND SPECIAL MEETING (the “Meeting”) of holders of common shares of Rio Alto Mining Limited (the “Corporation”) will be held at the Hyatt Regency Toronto on King, 370 King Street West, Toronto, ON at 11:00 a.m. on Thursday, May 10, 2012 for the following purposes:

| 1. | to receive and consider the audited financial statements of the Corporation for the seven-month financial year ended December 31, 2011, and the report of the auditor thereon; |

| |

| 2. | to fix the number of directors of the Corporation to be elected at the Meeting at eight (8); |

| |

| 3. | to elect the Board of Directors of the Corporation for the ensuing year; |

| |

| 4. | to appoint the auditor of the Corporation for the ensuing year and to authorize the Board of Directors to fix the auditor’s remuneration; |

| |

| 5. | to consider and, if thought appropriate, to pass, with or without variation, an ordinary resolution approving the amendments to the By-laws of the Corporation, as more particularly set forth in the management information circular; and |

| |

| 6. | to transact such other business as may be properly brought before the meeting or any adjournment thereof. |

DATED this 11th day of April, 2012.

BY ORDER OF THE BOARD OF DIRECTORS

Signed “Alexander Black”

Alexander Black

President and Chief Executive Officer

IMPORTANT

It is desirable that as many shares as possible be represented at the Meeting. If you do not expect to attend and would like your shares represented, please complete the enclosed instrument of proxy and return it as soon as possible in the envelope provided for that purpose or fax to 1-866-249-7775. All proxies, to be valid, must be received by Computershare Investor Services, 100 University Ave., 9th Floor, North Tower Toronto, Ontario M5J 2Y1, at least forty-eight (48) hours, excluding Saturdays, Sundays and holidays, before the Meeting or any adjournment thereof. Late proxies may be accepted or rejected by the Chairman of the Meeting in his discretion, and the Chairman is under no obligation to accept or reject any particular late proxy.

RIO ALTO MINING LIMITED

MANAGEMENT INFORMATION CIRCULAR

SOLICITATION OF PROXIES

THIS MANAGEMENT INFORMATION CIRCULAR (“CIRCULAR”) IS PROVIDED IN CONNECTION WITH THE SOLICITATION BY MANAGEMENT OF RIO ALTO MINING LIMITED (THE “CORPORATION”) of proxies from the holders of common shares (the “Common Shares”) for the annual general and special meeting of the shareholders of the Corporation (the “Meeting”) to be held on Thursday, May 10, 2012 at 11:00 a.m. at the Hyatt Regency Toronto on King, 370 King Street West, Toronto, or at any adjournment thereof for the purposes set out in the accompanying notice of meeting (“Notice of Meeting”).

Although it is expected that the solicitation of proxies will be primarily by mail, proxies may also be solicited personally or by telephone, facsimile or other proxy solicitation services. In accordance with National Instrument 54-101, arrangements have been made with brokerage houses and other intermediaries, clearing agencies, custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the Common Shares held of record by such persons and the Corporation may reimburse such persons for reasonable fees and disbursements incurred by them in doing so. The costs thereof will be borne by the Corporation.

APPOINTMENT AND REVOCATION OF PROXIES

The persons named (the “Management Designees”) in the enclosed instrument of proxy (“Instrument of Proxy”) have been selected by the directors of the Corporation and have indicated their willingness to represent as proxy the shareholder who appoints them. A shareholder has the right to designate a person (who need not be a shareholder) other than the Management Designees to represent him or her at the Meeting. Such right may be exercised by inserting in the space provided for that purpose on the Instrument of Proxy the name of the person to be designated and by deleting therefrom the names of the Management Designees, or by completing another proper form of proxy and delivering the same to the transfer agent of the Corporation. Such shareholder should notify the nominee of the appointment, obtain the nominee’s consent to act as proxy and should provide instructions on how the shareholder’s shares are to be voted. The nominee should bring personal identification with him to the Meeting. In any case, the form of proxy should be dated and executed by the shareholder or an attorney authorized in writing, with proof of such authorization attached (where an attorney executed the proxy form). In addition, a proxy may be revoked by a shareholder personally attending at the Meeting and voting his shares.

A form of proxy will not be valid for the Meeting or any adjournment thereof unless it is completed and delivered to the Corporation’s transfer agent by mail to Computershare Investor Services, 100 University Ave., 9th Floor, North Tower Toronto, Ontario M5J 2Y1, or via fax to 1-866-249-7775 at least forty-eight (48) hours, excluding Saturdays, Sundays and holidays, before the Meeting or any adjournment thereof. Late proxies may be accepted or rejected by the Chairman of the Meeting in his discretion, and the Chairman is under no obligation to accept or reject any particular late proxy.

A shareholder who has given a proxy may revoke it as to any matter upon which a vote has not already been cast pursuant to the authority conferred by the proxy. In addition to revocation in any other manner permitted by law, a proxy may be revoked by depositing an instrument in writing executed by the shareholder or by his authorized attorney in writing, or, if the shareholder is a corporation, under its

2

corporate seal by an officer or attorney thereof duly authorized, either at the registered office of the Corporation or with Computershare Investor Services, 100 University Ave., 9th Floor, North Tower Toronto, Ontario M5J 2Y1, at any time up to and including the last business day preceding the date of the Meeting, or any adjournment thereof at which the proxy is to be used, or by depositing the instrument in writing with the Chairman of such Meeting on the day of the Meeting, or any adjournment thereof. In addition, a proxy may be revoked by the shareholder personally attending the Meeting and voting his shares.

ADVICE TO BENEFICIAL SHAREHOLDERS

The information set forth in this section is of significant importance to many shareholders, as a substantial number of shareholders do not hold Common Shares in their own name. Shareholders who hold their Common Shares through their brokers, intermediaries, trustees or other persons, or who otherwise do not hold their Common Shares in their own name (referred to in this Circular as “Beneficial Shareholders”) should note that only proxies deposited by shareholders who appear on the records maintained by the Corporation’s registrar and transfer agent as registered holders of Common Shares will be recognized and acted upon at the Meeting. If Common Shares are listed in an account statement provided to a Beneficial Shareholder by a broker, those Common Shares will, in all likelihood, not be registered in the shareholder’s name. Such Common Shares will more likely be registered under the name of the shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms). Common Shares held by brokers (or their agents or nominees) on behalf of a broker’s client can only be voted (for or against resolutions) at the direction of the Beneficial Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the broker’s clients. Therefore, each Beneficial Shareholder should ensure that voting instructions are communicated to the appropriate person well in advance of the Meeting.

Existing regulatory policy requires brokers and other intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. The various brokers and other intermediaries have their own mailing procedures and provide their own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their Common Shares are voted at the Meeting. The form of proxy supplied to a Beneficial Shareholder by its broker (or the agent of the broker) is substantially similar to the Instrument of Proxy provided directly to registered shareholders by the Corporation. However, its purpose is limited to instructing the registered shareholder (i.e., the broker or agent of the broker) how to vote on behalf of the Beneficial Shareholder. The vast majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions Inc. (“Broadridge”) in Canada. Broadridge typically prepares a machine-readable voting instruction form, mails those forms to Beneficial Shareholders and asks Beneficial Shareholders to return the forms to Broadridge, or otherwise communicate voting instructions to Broadridge (by way of the Internet or telephone, for example). Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting. A Beneficial Shareholder who receives a Broadridge voting instruction form cannot use that form to vote Common Shares directly at the Meeting. The voting instruction forms must be returned to Broadridge (or instructions respecting the voting of Common Shares must otherwise be communicated to Broadridge) well in advance of the Meeting in order to have the Common Shares voted. If you have any questions respecting the voting of Common Shares held through a broker or other intermediary, please contact that broker or other intermediary for assistance.

3

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of his broker, a Beneficial Shareholder may attend the Meeting as proxyholder for the registered shareholder and vote the Common Shares in that capacity. Beneficial Shareholders who wish to attend the Meeting and indirectly vote their Common Shares as proxyholder for the registered shareholder, should enter their own names in the blank space on the form of proxy provided to them and return the same to their broker (or the broker’s agent) in accordance with the instructions provided by such broker.

All references to shareholders in this Circular and the accompanying Instrument of Proxy and Notice of Meeting are to registered shareholders unless specifically stated otherwise.

VOTING OF PROXIES

Each shareholder may instruct his proxy how to vote his Common Shares by completing the blanks on the Instrument of Proxy. All Common Shares represented at the Meeting by properly executed proxies will be voted or withheld from voting (including the voting on any ballot), and where a choice with respect to any matter to be acted upon has been specified in the Instrument of Proxy, the Common Shares represented by the proxy will be voted in accordance with such specification. In the absence of any such specification as to voting on the Instrument of Proxy, the Management Designees, if named as proxy, will vote in favour of the matters set out therein. In the absence of any specification as to voting on any other form of proxy, the Common Shares represented by such form of proxy will be voted in favour of the matters set out therein.

The enclosed Instrument of Proxy confers discretionary authority upon the Management Designees, or other persons named as proxy, with respect to amendments to or variations of matters identified in the Notice of Meeting and any other matters which may properly come before the Meeting. As of the date hereof, the Corporation is not aware of any amendments to, variations of or other matters that may come before the Meeting. In the event that other matters come before the Meeting, then the Management Designees intend to vote in accordance with the judgment of management of the Corporation.

QUORUM

The by-laws of the Corporation provide that a quorum of shareholders is present at a meeting of shareholders of the Corporation if at least two persons are present at the meeting, holding or representing by proxy not less than five (5%) percent of the outstanding shares of the Corporation entitled to vote at the Meeting.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Corporation is authorized to issue an unlimited number of Common Shares and an unlimited number of Preferred Shares. There are no other shares authorized, issued or outstanding of any class. As at the effective date of this Circular (the “Effective Date”), which is April 11th, 2012 the Corporation has 171,380,725 Common Shares without nominal or par value outstanding. There are no other shares authorized, issued or outstanding of any class. The Common Shares are the only shares entitled to be voted at the Meeting, and holders of Common Shares are entitled to one vote for each Common Share held.

Holders of Common Shares of record at the close of business on April 5, 2012 (the “Record Date”) are entitled to vote such Common Shares at the Meeting on the basis of one vote for each Common Share held

4

except to the extent that, (a) the holder has transferred the ownership of any of his Common Shares after the Record Date, and (b) the transferee of those Common Shares produces properly endorsed share certificates, or otherwise establishes that he owns the Common Shares, and demands not later than ten (10) days before the day of the Meeting that his name be included in the list of persons entitled to vote at the Meeting, in which case the transferee will be entitled to vote his Common Shares at the Meeting.

As of the Effective Date, to the knowledge of the directors and senior officers of the Corporation, the only person who beneficially owned, directly or indirectly, or exercised control or direction over Common Shares carrying more than 10% of the voting rights of the Corporation was Sentry Investments Inc. Based on the information filed by them on April 9, 2012, Sentry Investments Inc. has control and direction over 25,949,700 Common Shares representing approximately 15% of the voting rights attached to the Corporation’s voting securities.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This discussion describes the Corporation’s executive compensation program for each person who acted in the capacity as Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and the three most highly compensated executive officers (or three most highly compensated individuals acting in a similar capacity), other than the CEO and the CFO, whose compensation was more than $150,000 during the seven-month financial year ended December 31, 2011 (each a “Named Executive Officer” or “NEO” and collectively the “Named Executive Officers” or “NEOs”). This section will address the Corporation’s executive compensation philosophy and objectives and provide a review of the process the Corporate Governance and Compensation Committee (“CGC Committee”) and the Board undertakes in deciding how to compensate the Corporation’s Named Executive Officers. The compensation of the NEOs is subject to full Board review. This section will also provide discussion and analysis of the specific decisions about the compensation of the Named Executive Officers for the seven-month financial year ended December 31, 2011.

The compensation program of the Corporation is designed to attract, motivate, reward and retain knowledgeable and skilled executives required to achieve the Corporation’s corporate objectives and increase shareholder value. The main objective of the compensation program is to recognize the contribution of the executive officers to the overall success and strategic growth of the Corporation. The compensation program is designed to reward management performance by aligning a component of the compensation with the Corporation’s operating and financial performance and share value. The philosophy of the Corporation is to pay the management a total compensation amount that is competitive with other junior mineral exploration and development companies and is consistent with the experience and responsibility level of the management. The purpose of executive compensation is to incent and reward the executives for their contributions to the achievements of the Corporation on both an annual and long term basis. The compensation program of the Corporation provides incentive to the Corporation executives to achieve both short and long term objectives. The short term incentives include salary and bonus payments based on the operating and financial performance of the Corporation. The long term incentives include stock options.

In particular, the Corporation’s objective for the past three financial years has been the successful development of La Arena Gold Oxide Mine in Peru. This objective was met with commercial production being reached in 2012. The Corporation’s objective has now shifted to successful operations and the expansion of production at La Arena Gold Oxide Mine as well as the completion of the feasibility study of La Arena Sulphide Deposit. The Corporation’s compensation program is designed to incent management

5

to achieve these objectives and the CGC Committee will be considering these objectives when conducting this year’s review of the compensation of the Named Executive Officers.

The Board of Directors is satisfied that there were not any identified risks arising from the Corporation’s compensation plans or policies that would have had any negative or material impact on the Corporation. The Corporation does not have any policy in place to permit an executive officer or director to purchase financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the executive officer or director.

The CGC Committee has adopted a compensation program that covers three key elements: (i) a base amount of salary and benefits; (ii) a performance based cash bonus; and (iii) stock options.

Base Salary

The objective of base salary compensation and benefits is to retain and reward Named Executive Officers on a short term basis. The program is designed to reward Named Executive Officers for maximizing shareholder value in a volatile commodity based business in a safe, environmentally responsible, regulatory compliant and ethical manner. In setting base compensation levels, consideration is given to such factors as level of responsibility, experience, expertise and the amount of time devoted to the affairs of the Corporation. Subjective factors such as leadership, commitment and attitude are also considered. The Corporation has reviewed the public disclosure available for other junior mineral exploration and development companies to assist in determining the competitiveness of base salary, bonuses, benefits and stock options paid to each of the executive officers of the Corporation. The Corporation has historically tried to pay base salary to its Named Executive Officers in the range of that paid to the Named Executive Officers of its competitors.

Bonus Plan

The objective of performance based bonuses is to incent the maximization of shareholder value by the Named Executive Officers, taking into consideration the operating performance of the Corporation. Operational accomplishments of the Corporation will result in bonuses being paid to the Named Executive Officers. Bonuses were paid to the Named Executive Officers upon 10,000 ounces of gold being produced from La Arena Gold Oxide Mine and upon production from La Arena Gold Oxide Mine of 24,000 tonnes per day being achieved. Future performance goals for the payment of bonuses to the Named Executive Officers remain under consideration by the CGC Committee. Although the Board maintains the discretion to award bonuses absent the attainment of performance goals, such discretion was not exercised in the seven month financial year ended December 31, 2012.

Stock Options

The Corporation has in place a stock option plan (the “Plan) under which awards have been made to executive officers in amounts relative to positions, performance, and what is considered competitive in the industry. The Plan was last approved by shareholders at the annual general and special meeting of the Corporation held on September 29, 2011.

The objectives of the Plan are to incent the maximization of shareholder value on a long term basis and to retain executive officers on a long term basis. The stock option program is designed to reward executive officers for maximizing shareholder value in a volatile commodity based business in a safe, environmentally responsible, regulatory compliant and ethical manner. Increasing the value of the Common

6

Shares increases the value of the stock options, thereby better aligning the interests of the executive officers with those of the shareholders and encourages long-term value creation for shareholders.

The Corporation has reviewed the public disclosure available for other junior mining companies to assist in determining the competitiveness of stock option awards. The CGC Committee assesses such information and then makes recommendations to the Board who ratify the recommendations. In general, stock options are granted to executive officers upon their commencement of service. Outstanding options and previous grants are reviewed by the CGC Committee on an annual basis and again when considering option grants for new directors, officers and employees, however, the CGC Committee has not adopted pre-existing performance criteria or objectives for the grant of stock options. Additional grants are made periodically to recognize the exemplary performance of or the special contribution by eligible individuals.

Compensation Governance

The Corporation's Compensation Committee is comprised of Roger Norwich (Chair), Klaus Zeitler and Sidney Robinson, all of whom are independent directors within the meaning set out in National Instrument 52-110 – Audit Committees. All three of the members of the CGC Committee are experienced participants in the business world who have sat on the board of directors of other companies, charities or business associations, in addition to the Board of Directors of the Corporation. The CGC Committee has the responsibility of recommending stock option grants and bonus awards to the Board in addition to negotiating the NEOs' annual salaries or consulting fees. The CGC Committee is able to retain consultants to assist them in the determination of executive compensation decisions if they deem necessary.

The responsibilities of the CGC Committee in respect of compensation matters include reviewing and recommending to the Board of Directors the compensation policies and guidelines for supervisory management and personnel, corporate benefits, bonuses and other incentives, reviewing and approving corporate goals and objectives relevant to Chief Executive Officer compensation; non-CEO officer and director compensation; the review of executive compensation disclosure; succession plans for officers and for key employees; and material changes and trends in human resources policy, procedure, compensation and benefits. See “SCHEDULE “B” - CORPORATE GOVERNANCE DISCLOSURE - Other Board Committees” for additional information regarding the responsibilities of the CGC Committee”.

The CGC Committee has unrestricted access to the Corporation’s personnel and documents and is provided with the resources necessary, including, as required, the engagement and compensation of outside advisors, to carry out its responsibilities.

Performance Graph

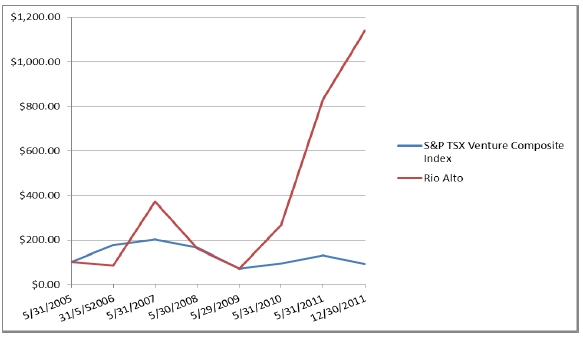

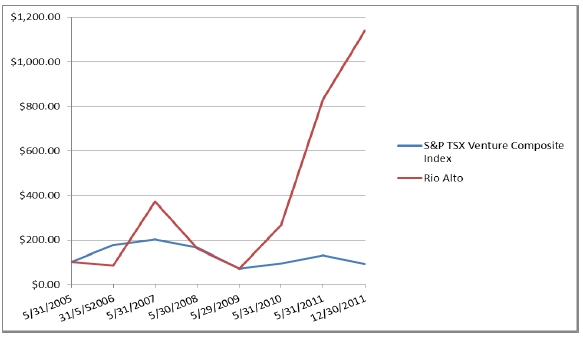

The following graph compares the total cumulative shareholder return as at fiscal/period year end, since May 31, 2006, for $100 invested in Common Shares of the Corporation with the cumulative total return (assuming dividends are reinvested) of the S&P TSX Venture Composite Index over the seven-month financial year ended December 31, 2011.

7

| | | |

| | S&P TSX Venture | Market Price per Common |

| Date | Composite Index | Share |

| June 1, 2006(1) | 2,827.68 | $0.235 |

| May 31, 2007(2) | 3,241.69 | $1.04 |

| May 30, 2008 | 2,657.00 | $0.45 |

| May 29, 2009 | 1,124.08 | $0.20 |

| May 31, 2010 | 1,514.07 | $0.75 |

| May 31, 2011 | 2,094.47 | $2.33 |

| December 31, 2011(3) | 1,484,66 | $3.19 |

Notes:

| (1) | No trading activities were reported from December 31, 2005 to June 1, 2006. For the purposes of this graph, the trading price on June 1, 2006 was used. |

| (2) | The Corporation’s Common Shares started trading on the TSXV on May 14, 2007, upon the completion of a reverse take-over and graduation from the NEX board of the TSXV. |

| (3) | In November 2011, the Company changed its fiscal year end from May 31 to December 31 |

| (4) | The Corporation’s shares commenced trading on the TSX on February 22, 2012. |

Summary Compensation Table

The following table sets forth all annual and long term compensation for the seven month financial year ended December 31, 2011 and the financial years ended May 31, 2011 and 2010, respectively, for services in all capacities to the Corporation and its subsidiaries, if any, in respect of Named Executive Officers. All amounts are in United States Dollars.

8

| | | | | | | | | | |

| SUMMARY COMPENSATION TABLE |

Name and

Principal

Position | | Salary

($) | Share-

Based

Awards

($)(1) | Option-

Based

Awards

($)(2) | Non-Equity

Incentive Plan

Compensation

($) | Pensio

n Value

($) | All Other

Compensation

($) | Total

Compensation

($) |

| Year Ended | Annual

Incentive

Plans(3) | Long-

Term

Incentiv

e Plans |

Alexander

Black(4)

President and

Chief Executive

Officer | Dec 31, 2011

May 31, 2011

May 31, 2010 | 141,316

230,000

180,000 | Nil

Nil

Nil | 427,707(5)

218,714

47,408 | 220,000

100,000

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

45,000 | 789,023

548,714

272,408 |

Anthony

Hawkshaw(6)

Chief Financial

Officer | Dec 31, 2011

May 31, 2011

May 31, 2010 | 140,501

230,000

180,000 | Nil

Nil

Nil | 427,707

218,714

111,553 | 220,000

100,000

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

45,000 | 788,208

548,714

336,553 |

Jaime Soldi(7)

Vice President

Peru Corporate

Affairs | Dec 31, 2011

May 31, 2011

May 31, 2010 | 113,558

213,232

174,556 | Nil

Nil

Nil | 269,006

136,696

25,099 | 92,144

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | 474,708

349,928

199,655 |

Andrew Cox(8)

Mining Manager | Dec 31, 2011

May 31, 2011

May 31, 2010 | 132,712

18,785

Nil | Nil

Nil

Nil | 269,006

Nil

Nil | 88,475

3,131

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | 490,193

21,916

Nil |

Timothy

Williams(9)

Vice President

Operations | Dec 31, 2011

May 31, 2011

May 31, 2010 | 157,342

44,453

Nil | Nil

Nil

Nil | 269,006

378,666

Nil | 104,895

8,166

Nil | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | 531,243

431,285

Nil |

Notes:

| (1) | “Share-Based Award” means an award under an equity incentive plan of equity-based instruments that do not have option- like features, including, for greater certainty, common shares, restricted shares, restricted share units, deferred share units, phantom shares, phantom share units, common share equivalent units and stock. |

| (2) | “Option-Based Award” means an award under an equity incentive plan of options, including, for greater certainty, share options, share appreciation rights and similar instruments that have option-like features. Value based on the fair market value of the stock options granted having a value of approximately $1,662,432 based on the Black-Scholes pricing model using weighted average assumptions of: risk-free interest rate – 1.47%; expected volatility – 110%; dividend yield – 0%; and expected life of each option granted – 5 years. |

| (3) | In November 2011, a discretionary bonus of US$100,000 was paid to each of Messrs. Black and Hawkshaw. |

| (4) | Mr. Black was appointed Chief Executive Officer of the Company on January 23, 2012, President of the Company on June 2, 2010 and Chief Operating Officer on June 25, 2009. |

| (5) | These options were granted to Auscan Assets Limited (“Auscan”), a company in which Alex Black has a beneficial interest. |

| (6) | Mr. Hawkshaw was appointed Chief Financial Officer of the Corporation on June 25, 2009. |

| (7) | Mr. Soldi was appointed Vice President Peru Corporate Affairs on March 31, 2011. Prior to this he was the General Manager of Rio Alto S.A.C., appointed to this position on September 1, 2009. |

| (8) | Mr. Cox was appointed Mining Manager of La Arena S.A., a subsidiary of the Company, on November 1, 2011. Prior to this he was a consultant acting in the same capacity. |

| (9) | Mr. Williams was appointed Vice President Operations of the Company on November 5, 2010. |

9

Alexander Black was paid a monthly consulting fee of approximately US$20,000 a month from June 1, 2011 to December 31, 2011 by the Corporation. In addition, a bonus of US$220,000 was paid to Alexander Black in November 2011.

Anthony Hawkshaw was a paid monthly salary of approximately US$20,000 from June 1, 2011 to December 31, 2011 by the Corporation. In addition, a bonus of US$220,000 was paid to Anthony Hawkshaw in November 2011.

Jaime Soldi was a paid a monthly salary of approximately US$16,200 for the seven month financial year ended December 31, 2011.

Andrew Cox was paid a monthly consulting fee/salary of approximately US$19,000 for the seven month financial year ended December 31, 2011.

Timothy Williams was paid a monthly salary of approximately US$22,500 for the seven-month financial year ended December 31, 2011.

Incentive Plan Awards

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth details of all awards outstanding for each Named Executive Officer of the Corporation as of the most recent financial year end, including awards granted before the most recently completed financial year.

| | | | |

Name and

Principal Position | Option-Based Awards |

Number of

Securities

Underlying

Unexercised

Options

(#) | Option

Exercise Price

($) | Option Expiration Date | Value of Unexercised

in-the-money Option(1)(2)

($) |

Alexander Black

President and Chief

Executive Officer | 340,000

200,000

200,000 | 0.30

1.80

3.22 | July 24, 2014

September 20, 2015

November 16, 2016 | 982,600

278,000

N/A |

Anthony Hawkshaw

Chief Financial

Officer | 800,000

200,000

200,000 | 0.30

1.80

3.22 | July 24, 2014

September 20, 2015

November 16, 2016 | 2,312,000

278,000

N/A |

Jaime Soldi

VP Peru Corporate

Affairs | 180,000

125,000

125,000 | 0.30

1.80

3.08 | July 24, 2014

September 20, 2015

November 16, 2016 | 520,200

173,750

13,750 |

Andrew Cox

Mining Manager | 125,000 | 3.08 | November 16, 2016 | 13,750 |

Timothy Williams

Vice President

Operations | 250,000

125,000 | 1.90

3.08 | November 5, 2015

November 16, 2016 | 322,500

13,750 |

Notes:

| (1) | Unexercised “in-the-money” options refer to the options in respect of which the market value of the underlying securities as at the financial year end, exceeds the exercise or base price of the option. |

10

| (2) | The aggregate of the difference between the market value of the Common Shares as at December 31, 2011, being $3.19 per Common Share, and the exercise price of the options. |

The Corporation does not have any share-based awards.

None of the awards disclosed in the table above have been transferred at other than fair market value.

Incentive Plan Awards - Value Vested or Earned During the Year

The following table sets forth the value of option-based awards and share-based awards which vested or were earned during the most recently completed financial year for each Named Executive Officer.

| | | |

Name and Principal

Position | Option-Based Awards -

Value vested during the year

($)(1) | Share-Based Awards -

Value vested during the year

($) | Non-Equity Incentive Plan

Compensation -

Value earned during the

year

($) |

Alexander Black

President and Chief

Operating Officer | 134,962 | N/A | N/A |

Anthony Hawkshaw

Chief Financial Officer | 134,962 | N/A | N/A |

Jaime Soldi

VP Peru Corporate

Affairs | 87,180 | N/A | N/A |

Andrew Cox

Mining Manager | 81,747 | N/A | N/A |

Timothy Williams

Vice President Operations | 105,112 | N/A | N/A |

Note:

| (1) | Value based on the fair market value of the stock options granted having a value of approximately $1,662,432 based on the Black-Scholes pricing model using weighted average assumptions of: risk-free interest rate –1.47%; expected volatility –110%; dividend yield – 0%; and expected life of each option granted – 5 years. |

Pension Plan Benefits

The Corporation does not have in place any pension plan or deferred compensation plan that provides for payments or benefits at, following or in connection with the retirement of the Named Executive Officers.

Termination and Change of Control Benefits

The Board of Directors resolved that a payment of two year’s salary and unpaid bonuses, if any, would be made to a Named Executive Officer at, following or in connection with any termination (whether voluntary, involuntary or constructive), resignation, retirement, a change in control of the Corporation, its subsidiaries or affiliates or a change in a Named Executive Officer’s responsibilities. No termination or change of control benefits were paid during the seven-month financial year ended December 31, 2011.

DIRECTOR COMPENSATION

During the seven-month year ended December 31, 2011, the Corporation had ten (10) directors, three (3) of whom were also Named Executive Officers. For a description of the compensation paid to the Named Executive Officers of the Corporation who also act as directors of the Corporation, see “EXECUTIVE COMPENSATION” above.

11

Director Compensation Table

The following table sets forth all compensation provided to directors who are not also Named Executive Officers (“Outside Directors”) of the Corporation for the seven-month financial year ended December 31, 2011. All amounts are in United States Dollars.

| | | | | | | |

| Name | Fees

Earned | Share-

Based

Awards

($)(1) | Option-

Based

Awards

($)(2) | Non-Equity

Incentive Plan

Compensation

($) | Pension

Value

($) | All Other

Compensation

($) | Total

($) |

| Victor Gobitz(3) | 18,500 | Nil | 213,853 | Nil | Nil | Nil | 232,353 |

| Daniel Kenney(4) | 10,000 | Nil | 0 | Nil | Nil | Nil | 10,000 |

| Drago Kisic | 18,500 | Nil | 213,853 | Nil | Nil | Nil | 232,353 |

| Roger Norwich | 18,500 | Nil | 213,853 | Nil | Nil | Nil | 232,353 |

| Ram Ramachandran | 18,500 | Nil | 213,853 | Nil | Nil | Nil | 232,353 |

| Sidney Robinson | 18,500 | Nil | 213,853 | Nil | Nil | Nil | 232,353 |

| Klaus Zeitler | 42,000 | Nil | 320,780 | Nil | Nil | 13,600 | 376,380 |

Notes:

| (1) | “Share-Based Award” means an award under an equity incentive plan of equity-based instruments that do not have option- like features, including, for greater certainty, common shares, restricted shares, restricted share units, deferred share units, phantom shares, phantom share units, common share equivalent units and stock. |

| (2) | “Option-Based Award” means an award under an equity incentive plan of options, including, for greater certainty, share options, share appreciation rights and similar instruments that have option-like features. Value based on the fair market value of the stock options granted having a value of approximately $1,390,045 based on the Black-Scholes pricing model using weighted average assumptions of: risk-free interest rate – 1.47%; expected volatility – 110%; dividend yield – 0%; and expected life of each option granted – 5 years. |

| (3) | Mr. Gobitz was appointed as the Corporation’s Chief Operating Officer effective February 1, 2012. He continues to also serve as a director of the Corporation. |

| (4) | Mr. Kenney did not stand for re-election, and thereby his term of director ended on September 29, 2011. All amounts disclosed relate to the period in which Mr. Kenney was a director. |

From June 2011 to November 2011, all Outside Directors are paid a monthly fee of US$2,500 with the exception of Mr. Zeitler, who acts as chairman of the Board. In December 2011, all Directors, with the exception of Mr. Zeitler, received a fee increase of US$1,000, for a monthly fee of US$3,500. For his role as chairman of the Board, the Corporation has agreed to fee an additional fee of US$3,500 a month and an accommodation allowance of US$1,800 per month from June 2011 to November 2011, and an accommodation allowance of US $2,800 per month from December 2011 going forward, to a private company controlled by Mr. Zeitler. Mr. Zeitler is also entitled to a one year severance payment if a change of control of the Corporation occurs and Mr. Zeitler resigns as chairman of the Board as a result of certain specified reasons or the agreement with Mr. Zeitler is terminated by the Corporation.

12

Incentive Plan Awards

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth details of all awards outstanding for each Outside Director of the Corporation as of the most recent financial year end, including awards granted before the most recently completed financial year.

| | | | |

| Name | Option-Based Awards |

Number of

Securities

Underlying

Unexercised

Options

(#) | Option Exercise Price

($) | Option Expiration Date | Value of Unexercised in-

the-money Option(1)(2)

($) |

| Victor Gobitz | 180,000

100,000

200,000 | 2.39

3.22

3.75 | March 11, 2016

November 16, 2016

January 23, 2017 | 144,000

3,000

N/A |

| Drago Kisic | 180,000

100,000

100,000 | 0.70

1.80

3.22 | March 15, 2015

September 20, 2015

November 16, 2016 | 235,800

21,000

N/A |

| Roger Norwich | 100,000

100,000 | 1.80

3.22 | September 20, 2015

November 16, 2016 | 21,000

N/A |

| Ram Ramachandran | 120,000

100,000 | 2.15

3.22 | March 11, 2016

November 16, 2016 | 124,800

3,000 |

| Sidney Robinson | 180,000

100,000 | 2.39

3.22 | March 11, 2016

November 16, 2016 | 144,000

3,000 |

| Klaus Zeitler | 180,000

150,000

150,000 | 0.30

1.80

3.22 | July 24, 2014

September 20, 2015

November 16, 2016 | 520,200

208,500

N/A |

Notes:

| (1) | Unexercised “in-the-money” options refer to the options in respect of which the market value of the underlying securities as at the financial year end exceeds the exercise or base price of the option. |

| (2) | The aggregate of the difference between the market value of the Common Shares as at December 31, 2011, being $3.19 per Common Share, and the exercise price of the options. |

The Corporation does not have any share-based awards.

Incentive Plan Awards - Value Vested or Earned During the Year

The following table sets forth the value of option-based awards and share-based awards which vested or were earned during the most recently completed financial year for each Outside Director.

13

| | | |

| Name and Title | Option-Based Awards -

Value vested during the

year

($)(1) | Share-Based Awards -

Value vested during the

year

($) | Non-Equity Incentive Plan

Compensation -

Value earned during the

year

($) |

| Victor Gobitz | 64,987 | N/A | N/A |

| Daniel Kenney(2) | 2,494 | N/A | N/A |

| Drago Kisic | 67,481 | N/A | N/A |

| Roger Norwich | 67,481 | N/A | N/A |

| Sidney Robinson | 64,987 | N/A | N/A |

| Ram Ramachandran | 64,987 | N/A | N/A |

| Klaus Zeitler | 101,221 | N/A | N/A |

Notes:

| (1) | Based on the difference between the fair market price of the options on the date of grant using the Black-Scholes pricing model and the exercise price. |

| (2) | Mr. Kenney served as a director until September 29, 2011, and did not stand for re-election. Only options vested up to and including September 29, 2011 are disclosed above. |

Pension Plan Benefits

The Corporation does not have in place any deferred compensation plan or pension plan that provides for payments or benefits at, following or in connection with retirement.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets forth securities of the Corporation that were authorized for issuance under equity compensation plans as at the end of the Corporation’s most recently completed financial year.

| | | |

| Plan Category | Number of Securities to be

issued upon exercise of

outstanding options,

warrants and rights | Weighted average

exercise price of

outstanding options,

warrants

and rights | Number of securities

remaining available for

issuance under equity

compensation plans

(excluding outstanding

securities reflected in

Column 1)(1) |

Equity compensation plans

approved by securityholders | 10,510,000 | $1.91 | 6,464,635 |

Equity compensation plans not

approved by securityholders | N/A | N/A | N/A |

| Total | 10,510,000 | $1.91 | 6,464,635 |

Note:

| (3) | The aggregate number of Common Shares that may be reserved for issuance under the Plan shall not exceed 10% of the issued and outstanding Common Shares. Based on the number of Common Shares issued and outstanding at December 31, 2011 in which the Corporation had 169,746,352 Common Shares issued and outstanding. As of the Effective Date there are 171,380,725 Common Shares issued and outstanding. |

14

MANAGEMENT CONTRACTS

During the most recently completed financial year, no management functions of the Corporation were to any substantial degree performed by a person or company other than the directors or executive officers (or private companies controlled by them, either directly or indirectly) of the Corporation.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

Aggregate Indebtedness

The following table sets forth the aggregate indebtedness outstanding as at the Effective Date of all executive officers, directors, employees and former executive officers, directors, employees of the Corporation and its subsidiaries. All amounts are in United States Dollars.

| | |

| AGGREGATE INDEBTEDNESS ($) |

| Purpose | To the Corporation or its

Subsidiaries | To Another Entity |

| Share purchases | Nil | Nil |

| Other | $380,000(1) | N/A |

Indebtedness of Directors and Executive Officers under Securities Purchase and Other Programs

The following table sets forth information regarding the indebtedness outstanding as at the Effective Date and during the seven month financial year ended December 31, 2011 of all executive officers, directors, employees and former executive officers, directors, employees of the Corporation and its subsidiaries. All amounts are in United States Dollars.

15

| | | | | | |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS UNDER (1) SECURITIES PURCHASE AND (2) OTHER

PROGRAMS |

Name and Principal

Position | Involvement of

Company or

Subsidiary | Largest Amount

Outstanding

During

Financial Year

Ended Dec. 31,

2011

($) | Amount

Outstanding as

at March 11,

2012

($) | Financially

Assisted Securities

Purchases During

Financial Year

Ended Dec. 31,

2011

(#) | Security for

Indebtedness | Amount

Forgiven

During

Financial Year

Ended Dec. 31,

2011

($) |

Jaime Soldi (1)

VP Peru Corporate

Affairs | VP Peru

Corporate Affairs | 380,000 | 380,000 | NIL | 450,000 Common

Shares | NIL |

Note:

| (1) | A housing loan was granted to Jaime Soldi in December 2011. This housing loan is secured by 450,000 Common Shares of the Corporation, and bears interest at 1.5% per annum. The repayment term of the loan is one year. |

Except for the aforementioned housing loan, no director, executive officer, employee or former director, executive officer or employee of the Corporation or its subsidiaries nor any of their associates or affiliates, is, or has been at any time since the beginning of the financial year ended December 31, 2011, indebted to the Corporation or its subsidiaries nor has any such person been indebted to any other entity where such indebtedness is the subject of a guarantee, support agreement, letter of credit or similar arrangement or understanding, provided by the Corporation.

INTERESTS OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

The Corporation is not aware of any material interests, direct or indirect, by way of beneficial ownership of securities or otherwise, of any director or executive officer, proposed nominee for election as a director or any shareholder holding more than 10% of the voting rights attached to the Common Shares or any associate or affiliate of any of the foregoing in any transaction in the seven-month financial year ending December 31, 2011 or any proposed or ongoing transaction of the Corporation which has or will materially affect the Corporation.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as otherwise set out herein, no director or executive officer of the Corporation or any proposed nominee of management of the Corporation for election as a director of the Corporation, nor any associate or affiliate of the foregoing persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in matters to be acted upon at the Meeting.

DISCLOSURE OF CORPORATE GOVERNANCE PRACTICES

The Corporation’s disclosure with respect to Corporate Governance Practices is set forth in Schedule “B” hereto.

16

PARTICULARS OF MATTERS TO BE ACTED UPON

To the knowledge of the Board of the Corporation, the only matters to be brought before the meeting are those matters set forth in the accompanying Notice of Meeting.

| |

| 1. | Report and Financial Statements |

The Board of the Corporation has approved all of the information in the audited financial statements of the Corporation for the seven-month financial year ended December 31, 2011, and the report of the auditor thereon.

| |

| 2. | Fix Number of Directors to be Elected at the Meeting |

Shareholders of the Corporation will be asked to consider and, if thought appropriate, to approve and adopt an ordinary resolution fixing the number of directors to be elected at the Meeting. In order to be effective, an ordinary resolution requires the approval of a majority of the votes cast by shareholders who vote in respect of the resolution.

At the Meeting, it will be proposed that eight (8) directors be elected to hold office until the next annual general and special meeting or until their successors are elected or appointed. Unless otherwise directed, it is the intention of the Management Designees, if named as proxy, to vote in favour of the ordinary resolution fixing the number of directors to be elected at the Meeting at eight (8).

The Corporation currently has eight directors and all eight of these directors are being nominated for re-election. The following table sets forth the name of each of the persons proposed to be nominated for election as a director, all positions and offices in the Corporation presently held by such nominee, the nominee’s municipality of residence, principal occupation at the present and during the preceding five years, the period during which the nominee has served as a director, and the number and percentage of Common Shares of the Corporation that the nominee has advised are beneficially owned by the nominee, directly or indirectly, or over which control or direction is exercised, as of the Effective Date.

Unless otherwise directed, it is the intention of the Management Designees, if named as proxy, to vote for the election of the persons named in the following table to the Board. Management does not contemplate that any of such nominees will be unable to serve as directors; however, if for any reason any of the proposed nominees do not stand for election or are unable to serve as such, proxies held by Management Designees will be voted for another nominee in their discretion unless the shareholder has specified in his form of proxy that his Common Shares are to be withheld from voting in the election of directors. Each director elected will hold office until the next annual general and special meeting of shareholders or until his successor is duly elected, unless his office is earlier vacated in accordance with the by-laws of the Corporation or the provisions of the Business Corporations Act to which the Corporation is subject.

17

| | |

Name, Municipality of

Residence, Office and Date

Became a Director | Present Occupation and Positions Held During the Last Five

Years | Number and

Percentage of

Common Shares

Held or Controlled

as at the Effective

Date(1)(2) |

Klaus Zeitler(4)

West Vancouver, BC, Canada Chairman and a Director since

June 25, 2009 | Dr. Zeitler received his professional education at Karlsruhe University from 1959 to 1966 and obtained a Ph.D in economic planning. Dr. Zeitler is a member of the Canadian Institute of Mining and Metallurgy and the Prospectors and Developers Association. Dr. Zeitler financed, built and managed base metal and gold mines throughout the world (Europe, Africa, North America, South America, and Pacific Region) with a total investment value of $4 billion. Dr. Zeitler was a managing director of Metallgeschaft AG, a German metals conglomerate and in 1986 founded and was a director and CEO of Metall Mining Ltd., later Inmet Inc., a Toronto Stock Exchange listed company with assets of over $1 billion and base metal and gold mines in different parts of the world. After having been a director of Teck Cominco for many years, Dr. Zeitler joined Teck Cominco in 1997 as Senior Vice President and had responsibilities for the exploration and development of mines in Peru, Mexico and the USA. Since his retirement from Teck Cominco in 2002, and in addition to being President and a director of Amerigo Resources Ltd., Dr. Zeitler has been actively involved as a director in various junior base and precious metal companies. |

750,000(7)

0.44% |

Alexander Black (5)

San Isidro, Lima, Peru Director since June 25, 2009,

President since Jun 2, 2010 and

Chief Executive Officer since

January 23, 2012 | Mr. Black lives in Lima, Peru and has 30 years’ experience in the mining industry. Mr. Black holds a BSc in Mining Engineering from the University of South Australia and is a member of the Australasian Institute of Mining and Metallurgy. Prior to moving to Peru in 2000, Mr. Black was the founder and Managing Director of international mining consulting services group Global Mining Services from 1994 to 2000. In 1996, Mr. Black also founded and

was Chairman of OFEX listed AGR Limited with exploration projects in Ghana and Mongolia. In 2002, Mr. Black took control of Chariot Resources Limited as a listed TSXV shell and played a key role in the acquisition of the Marcona Copper Project and formation of the Korean joint venture with Chariot Resources. Upon his resignation as Chairman & Executive VP of Chariot Resources in 2006, Mr. Black returned to Peru and founded the Peruvian registered Rio Alto S.A.C. Mr. Black was the Chief Executive Officer, President and a director of Rio Alto prior to the acquisition of the company by Mexican Silver Mines (since renamed Rio Alto Mining Limited). |

6,169,651(6)

3.59% |

Anthony Hawkshaw

Vancouver, BC, Canada Chief Financial Officer and a

Director since June 25, 2009 | Mr. Hawkshaw was a Chartered Accountant for 29 years and holds a Bachelor Degree in Business Management from the Ryerson University. Since 2007 to present, Mr. Hawkshaw was a director of Rio Alto Mining S.A.C. From 2005 to 2007, Mr. Hawkshaw was the CFO of Grove Energy Limited, a London and Toronto listed oil and gas development company. In 2004, Mr. Hawkshaw was the CFO of Chariot Resources Limited for a period of 12 months. Prior to Chariot, Mr. Hawkshaw was CFO of Pan American Silver Corp. from 1995 to 2003. With more than 25 years’ experience in the mining industry in countries including Canada, the United States, Mexico, Russia and Peru, Mr. Hawkshaw has extensive experience in the marketing of metals in refined and concentrate form and in metals trading. He has arranged numerous debt, equity and convertible debt financings with institutional investors, commercial banks and multilateral lending agencieshas been a director of Caza Gold Corp. since June 3, 2009. |

1,000,000

0.58% |

18

| | |

Name, Municipality of

Residence, Office and Date

Became a Director | Present Occupation and Positions Held During the Last Five

Years | Number and

Percentage of

Common Shares

Held or Controlled

as at the Effective

Date(1)(2) |

Victor Gobitz (5)

Lima, Peru Director since March 8, 2011 and

Chief Operating Officer since

January 23, 2012 | Mr. Gobitz is a Mining Engineer who received his professional education at the Pontificia Universidad Católica del Perú from 1981 to 1986 and obtained a Masters degree in Business Administration (MBA) from Escuela de Administración de Negocios – ESAN in 1998. Mr. Gobitz sits on the Board of Directors of another public mining company listed on Bolsa de Valores de Lima, Castrovirreyna Compañía Minera. Mr. Gobitz has been Director of Volcan Compañía Minera and Sociedad Nacional de Minería, Energía y Petróleo (SNMPE) and has extensive experience in the startup and expansion of mining projects and currently is Director of the Peruvian Mining Safety Institute (ISEM) and Member of the Board of the Peruvian Corps of Engineers – Chapter of Mining Engineers (CIP). |

Nil Nil% |

Drago Kisic(3)(5)

Lima, Peru Director since March 15, 2010 | Mr. Kisic specializes in investment banking, finance and macroeconomics. He holds a B.S. from Pontificia Universidad Católica del Perú and a Master’s degree (B-Phil) from Oxford University. As a founding partner and current Director of MACROCONSULT and MACROINVEST, Mr. Kisic advised the Government of Peru during the privatization of Centromin, Minero- Peru, Hierro-Peru and Peru’s telephone and telecommunications companies CPT and ENTEL-Peru. Mr. Kisic is a member of the board of CEMENTOS LIMA (a cement company); Mapfre and Mapfre Peru Vida (insurance companies); Haug (a steel contractor); Corporación Rey and Teditex (textile related companies); and Banco Financiero (a commercial bank). Currently, he is President of Bodega San Nicolás and is a member and former President of the Peruvian Center for International Studies (CEPEI) and the Peruvian Institute of Business Management (IPAE). He was advisor to the Executive Director of the World Bank, and was President of CONASEV (the Peruvian securities and companies’ regulatory authority) and Vice-president of the Lima Stock Exchange (BVL). |

NilNil% |

Roger Norwich(3)(4)

St. Magloire, Sark, Channel

Islands Director since May 2007 | Dr. Norwich has a BA in Geology and Archaeology (1974) from Manchester University England. He also holds MB Bachelor of Medicine and ChB Bachelor of Surgery degrees from Manchester University. From 1990 to July 2006 he was Managing Director of Medicolegal Consultancy initially a private company then a Public Company trading on the OFEX (now Plus Market Group plc) trading platform in London England. Having served as Chairman of a London AIM listed oil and gas exploration company he was a founding Director of Mexican Silver Mines (MSM-V) from May 7,

2007 to July 24, 2009 and to date remains a non-executive Director of Rio Alto Mining (RIO TSX-V) since the merger of Mexican Silver Mines Ltd with Rio Alto Mining Ltd on July 24, 2009. Dr. Norwich is Chairman of the CGC Committee. Dr. Norwich is non- executive Chairman of Grupo Minero Panuco a private mining company based in Monterrey Mexico which is involved in the production of Copper Gold and Molybdenum and also sits on the board of Inkron Limited, a Hong Kong based private company focused on nanometal production. |

4,734,1952.67% |

19

| | |

Name, Municipality of

Residence, Office and Date

Became a Director | Present Occupation and Positions Held During the Last Five

Years | Number and

Percentage of

Common Shares

Held or Controlled

as at the Effective

Date(1)(2) |

Ram Ramachandran(3)

Toronto, Ont., Canada Director since May 11, 2011 | Mr. Ramachandran is the Chief Financial Officer of CanAlaska Uranium Ltd. (TSX) and Purepoint Uranium Inc.(TSX-V). Mr. Ramachandran has over 25 years of financial reporting experience in a multitude of capacities. During the past 10 years Ram has consulted extensively on financial reporting and regulatory matters for public companies, accounting and law firms. Mr. Ramachandran has previously served as Associate Chief Accountant and Deputy Director, Corporate Finance at the Ontario Securities Commission and served as a senior member in the national office of an international accounting firm. Mr. Ramachandran also currently serves as a director of White Tiger Gold Ltd. (TSX). |

NilNil% |

Sidney Robinson

Toronto, Ont., Canada Director since March 8, 2011 | Mr. Robinson is a retired Senior Partner of Torys LLP, Toronto and New York, who practised corporate/commercial law, with emphasis on financings, mergers and acquisitions and international projects. He represented business clients based in Canada, France, Germany, Italy, Japan, Sweden and the United States. Mr. Robinson currently also sits on the Boards of Directors of two public companies listed on the TSX, Amerigo Resources Ltd. and Chartwell Seniors Housing Real Estate Investment Trust and one private company, Butterfield & Robinson Inc. |

190,0000.11% |

Notes:

| (1) | Common Shares beneficially owned, directly or indirectly, or over which control or direction is exercised, as at the Effective Date, based upon information furnished to the Corporation by the above individuals. |

| (2) | Assumes a total of 171,380, 725 Common Shares issued and outstanding as at the Effective Date. |

| (3) | Member of the Audit Committee. |

| (4) | Member of the CGC Committee. |

| (5) | Member of Health, Safety and Community Committee |

| (6) | These Common Shares are owned by Auscan Assets Limited, a company in which Alex Black has a beneficial interest. |

| (7) | These Common Shares are owned by Zeitler Holdings Corp., a company controlled by Klaus Zeitler. |

Cease Trade Orders or Bankruptcies

Other than as described below, no proposed director, within 10 years before the date of this Circular, has been a director or executive officer of any company that, while that person was acting in that capacity:

| (a) | was the subject of a cease trade or similar order, or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; |

| | |

| (b) | was subject to an event that resulted, after the director or executive officer ceased to be a director or executive officer, in the company being the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or |

| | |

| (c) | within a year of that person ceasing to act in such capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets. |

| | |

20

Personal Bankruptcies

No proposed director has within 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of such person.

Penalties and Sanctions

No proposed director has been subject to:

| (a) | any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| | |

| (b) | any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director. |

| | |

| |

| 4. | Confirmation of By-law No. 1A |

The Corporation wishes to confirm By-law No. 1A, a copy of which is attached as Appendix “A” to this Circular; which will amend the by-laws of the Corporation (being By-law No. 1). By-law No. 1A is being presented for confirmation to provide for advance notice of nominations of directors in circumstances where nominations of persons for election to the Board of Directors are made by shareholders other than pursuant to a requisition of a meeting made pursuant to the provisions of the Business Corporations Act (Alberta) (the “ABCA”) or a shareholder proposal made pursuant to the provisions of the ABCA.

The purpose of the By-law No. 1A is to foster a variety of interests of the shareholders and the Corporation by ensuring that all shareholders, including those participating in a meeting by proxy rather than in person, receive adequate notice of the nominations to be considered at a meeting and can thereby exercise their voting rights in an informed manner. In addition, the By-law should assist in facilitating an orderly and efficient meeting process.

At the Meeting, shareholders will be asked to consider, and if thought appropriate, pass an ordinary resolution substantially in the form noted below to confirm the By-law No. 1A.

“RESOLVED, as an ordinary resolution, that:

(a) the By-law No.1A substantially in the form attached as Appendix “A” to the Management Information Circular of Rio Alto Mining Limited dated April 11, 2012 is hereby approved, ratified and confirmed as a by-law of the Corporation; and

(b) any director or officer of the Corporation is hereby authorized and directed, acting for, in the name of and on behalf of the Corporation, to execute or cause to be executed, under the seal of the Corporation or otherwise and to deliver or to cause to be delivered, all such other deeds, documents, instruments and assurances and to do or cause to be done all such other acts as in the opinion of such director or officer of the Corporation may be necessary or desirable to carry out the terms of the foregoing.”

21

OTHER BUSINESS

While there is no other business other than that business mentioned in the Notice of Meeting to be presented for action by the shareholders at the Meeting, it is intended that the proxies hereby solicited will be exercised upon any other matters and proposals that may properly come before the Meeting or any adjournment or adjournments thereof, in accordance with the discretion of the persons authorized to act thereunder.

GENERAL

Unless otherwise directed, it is management’s intention to vote proxies in favor of the resolutions set forth herein. All ordinary resolutions require, for the passing of the same, a simple majority of the votes cast at the Meeting by the holders of Common Shares.

ADDITIONAL INFORMATION

Additional information relating to the Corporation is available on SEDAR at www.sedar.com. Financial information of the Corporation’s most recently completed financial year is provided in the Corporation’s comparative financial statements and management discussion and analysis available on SEDAR. Securityholders may also contact the Corporation to request copies of the Corporation’s financial statements and MD&A. Further information concerning the Audit Committee, including the text of the Audit Committee Charter, is included in the Annual Information Form of the Corporation for the seven-month financial year ended December 31, 2011. A copy of the Annual Information Form is available on SEDAR at www.sedar.com

22

SCHEDULE “A”

BY-LAW NO. 1A

BE IT ENACTED AND IT IS HEREBY ENACTED as a by-law of RIO ALTO MINING LIMITED (hereinafter called the “Corporation”) as follows:

ADVANCE NOTICE OF NOMINATION OF DIRECTORS

| 1. | By-law No. 1 of the by-laws of the Corporation is hereby amended by adding thereto, following Section 18 thereof and preceding Section 19 thereof, the following: |

“18A Nomination of Directors – Subject only to the Act, only persons who are nominated in accordance with the following procedures shall be eligible for election as directors of the Corporation. Nominations of persons for election to the Board may be made at any annual meeting of shareholders, or at any special meeting of shareholders if one of the purposes for which a special meeting was called was the election of directors, (a) by or at the direction of the Board or an authorized officer of the Corporation, including pursuant to a notice of meeting, (b) by or at the direction or request of one or more shareholders pursuant to a proposal made in accordance with the provisions of the Act or a requisition of the shareholders made in accordance with the provisions of the Act or (c) by any person (a “Nominating Shareholder”) (i) who, at the close of business on the date of the giving of the notice provided for below in this Section 18A and on the record date for the notice of such meeting, is entered in the securities register as a holder of one or more shares carrying the right to vote at such meeting, or who beneficially owns shares that are entitled to be voted at such meeting and (ii) who complies with the notice procedures set forth below in this Section 18A:

| A. | In addition to any other applicable requirements, for a nomination to be made by a Nominating Shareholder, such person must have given timely notice thereof in proper written form to the secretary of the Corporation at the registered office of the Corporation in accordance with this Section 18A. |

| | |

| B. | To be timely, a Nominating Shareholder’s notice to the secretary of the Corporation must be made (a) in the case of an annual meeting of shareholders, not less than 35 nor more than 65 days prior to the date of the annual meeting of shareholders; provided, however, that in the event that the annual meeting of shareholders is called for at a date that is less than 50 days after the date (the “Notice Date”) on which the first public announcement of the date of the annual meeting was made, notice by the Nominating Shareholder may be made not later than the close of business on the tenth (10th) day following the Notice Date; and (b) in the case of a special meeting( which is not also an annual meeting) of shareholders called for the purpose of electing directors (whether or not called for other purposes), not later than the close of business on the fifteenth (15th) day following the day on which the first public announcement of the date of the special meeting of shareholders was made. Notwithstanding the foregoing, the Board may, in its sole discretion, waive any requirement in this paragraph (B). In no event shall any adjournment or postponement of a Meeting of Shareholders or the announcement thereof commence a new time period for the giving of a Nominating Shareholder’s notice as described above. |

| | |

| C. | To be in proper written form, a Nominating Shareholder’s notice to the secretary of the Corporation must set forth (a) as to each person whom the Nominating Shareholder proposes to nominate for election as a director (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person for the most recent five years, |

| | |

23

(iii) the class or series and number of shares in the capital of the Corporation which are controlled or which are owned beneficially or of record by the person as of the record date for the Meeting of Shareholders (if such date shall then have been made publicly available and shall have occurred) and as of the date of such notice, (iv) any other information relating to the person that would be required to be disclosed in a dissident’s proxy circular in connection with solicitations of proxies for election of directors pursuant to the Act and Applicable Securities Laws and (v) a personal information form in the form prescribed by the principal stock exchange on which the shares of the Corporation then trade; and (b) as to the Nominating Shareholder giving the notice, any information relating to such Nominating Shareholder that would be required to be made in a dissident’s proxy circular in connection with solicitations of proxies for election of directors pursuant to the Act and Applicable Securities Laws.

| D. | No person shall be eligible for election as a director of the Corporation unless nominated in accordance with the provisions of this 18A; provided, however that nothing in this Section 18A shall be deemed to preclude discussions by a shareholder (as distinct from nominating directors) at a Meeting of Shareholders of any matter in respect of which it would have been entitled to submit a proposal pursuant to the provisions of the Act. The chairman of the meeting shall have the power and duty to determine whether a nomination was made in accordance with the procedures set forth in the foregoing provisions and, if any proposed nomination is not in compliance with such foregoing provisions, to declare that such defective nomination shall be disregarded. |

| | |

| E. | For purposes of this Section 18A, (i) “public announcement” shall mean disclosure in a press release reported by a national news service in Canada, or in a document publicly filed by the Corporation under its profile on the System of Electronic Document Analysis and Retrieval at www.sedar.com; and (ii) “Applicable Securities Laws” means the Securities Act (British Columbia) and the equivalent legislation in the other provinces and in the territories of Canada, as amended from time to time, the rules, regulations and forms made or promulgated under any such statute and the published national instruments, multilateral instruments, policies, bulletins and notices of the securities commissions and similar regulatory authorities of each of the provinces and territories of Canada. |

| | |

| F. | Notice given to the secretary of the Corporation pursuant to this Section 18A may only be given by personal delivery, facsimile transmission or by email (at such email address as stipulated from time to time by the secretary of the Corporation for the purposes of this notice), and shall be deemed to have been given and made only at the time it is served by personal delivery, email (at the address as aforesaid) or sent by facsimile transmission (provided that receipt of confirmation of such transmission has been received) to the secretary at the address of the registered offices of the Corporation; provided that if such delivery or electronic communication is made on a day which is not a business day or later than 5:00 p.m. (Calgary time) on a day which is a business day, then such a delivery or electronic communication shall be deemed to have been made on the subsequent day that is a business day.” |

| | |

| 2. | By-law No. 1, as amended from time to time, of the by-laws of the Corporation and this by-law shall be read together and shall have effect, so far as practicable, as though all the provisions thereof where contained in one by-law of the Corporation. All terms contained in this by-law which are defined in By-law No. 1, as amended from time to time, of the by-laws of the Corporation shall, for all purposes hereof, have the meanings given to such terms in the said By-law No.1 unless expressly stated otherwise or the context otherwise requires. |

| |

24

SCHEDULE “B”

CORPORATE GOVERNANCE DISCLOSURE

Corporate governance relates to the activities of the Board of Directors, the members of which are elected by and are accountable to the shareholders, and takes into account the role of the individual members of management who are appointed by the Board of Directors and who are charged with the day to day management of the Corporation. The Board of Directors is committed to sound corporate governance practices which are both in the interest of its shareholders and contribute to effective and efficient decision making.

Pursuant to the provisions of National Instrument 58-101 Disclosure of Corporate Governance Practices (“NI 58-101”) issuers are required to disclose their corporate governance practices annually and provide guidance on corporate governance practices respectively. The Board has reviewed its practices relative to the new guidelines and offers the following summary.

On an annual basis, the Board of Directors reviews the relationship each director has with the Corporation to determine whether or not their independence is maintained. When a director has no direct or indirect material relationship with the Corporation or its subsidiaries which could interfere with the director’s independent judgment, that director is considered to be independent. The Board has determined that a majority, or five of the eight current directors, are independent. Drago Kisic, Roger Norwich, Ram Ramachandran, Sidney Robinson and Klaus Zeitler have no material relationship to the Corporation. Klaus Zeitler is the Chairman of the Board of Directors and for this reason is deemed to be an “executive officer” under the definition of Executive Officer in NI 51-102. The board considers Mr. Zeitler to be independent despite the reference to his title, as he also has no material relationship with the Corporation. The three non-independent directors are Alexander Black, who is not considered independent as he is the President and Chief Executive Officer of the Corporation, Anthony Hawkshaw, who is not considered independent as he is the Chief Financial Officer of the Corporation and Victor Gobitz, who is not considered independent as he is the Chief Operating Officer of the Corporation.

The following directors of the Corporation are presently directors of other issuers that are reporting issuers (or the equivalent):

| | | | |

| Name | | Name of Reporting Issuer | |

| | | | |

| Anthony Hawkshaw | | Caza Gold Corp. | |

| Klaus Zeitler | | Amerigo Resources Ltd.

Los Andes Copper Ltd.

Western Copper Corporation

Candente Resource Corp. | |

| Sidney Robinson | | Amerigo Resources Ltd.

Chartwell Senior Housing Real Estate | |

25

| | | | |

| Name | | Name of Reporting Issuer | |

| | | Investment Trust | |

| Ram Ramachandran | | White Tiger Gold Ltd. | |