Coffey Mining Pty Ltd

| La Arena Project, Peru – MINEWPER00640AB | Page: 18 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

The geographic coordinates of the main gold mineralization are:

The U.T.M. coordinates are:

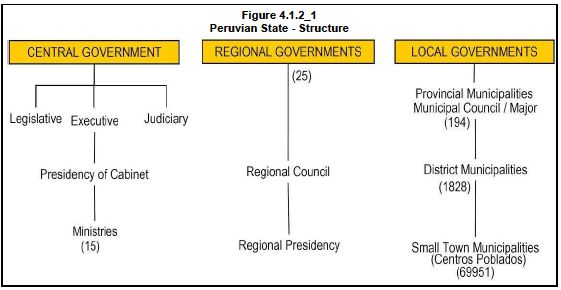

The La Arena Project is subject to various Peruvian mining laws, regulations and procedures. Mining activities in Peru are subject to the provisions of the Uniform Text of General Mining Law (“General Mining Law”), which was approved by Supreme Decree No. 14-92-EM, on June 4, 1992 and its several subsequent amendments and regulations, as well as other related laws. Under Peruvian law, the Peruvian State is the owner of all mineral resources in the ground. Rights over such mineral resources are granted to particulars by means of the “Concession System”.

The Concession System provides for the existence of four (4) different types of concessions for the mining industry, which grant the titleholder the right to perform different activities related to the mining industry, as follows:

Mining Concessions, which grant their titleholder the right to explore and exploit the mineral resources located within the boundaries of said concession. Mining Concessions are classified into metallic and non-metallic, depending on the substance, without there being any overlapping or priority between concessions of different substances within the same area;

Processing Concessions, which grant their titleholder the right to extract or concentrate the valuable part of an aggregate of minerals extracted and/or to smelt, purify or refine metals, whether using a set of physical, chemical and/or physical-chemical processes;

General Work Concessions, which grant their titleholder the right to provide ancillary services to two or more mining concessions; and,

Mining Transport Concessions, which grant their titleholder the right to install and operate non conventional continuous transportation systems for mineral products between one or several mining centres and a port or processing plant, or a refinery or one or more stretches of these routes.

Mining concessions are considered immovable assets and are therefore subject to being transferred, optioned, leased and/or granted as collateral (mortgaged) and, in general, may be subject to any transaction or contract not specifically forbidden by law. Mining concessions may be privately owned and no minimum state participation is required. Buildings and other permanent structures used in a mining operation are considered real property accessories to the concession on which they are situated.

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 19 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

| |

| 4.3.1 | Annual Validity Fees and Maintenance Obligations |

License Fees

Pursuant to article 39 of the General Mining Law, titleholders of mining concessions shall pay an annual License Fee (Derecho de Vigencia) by June 30 of each year in the amount of US$3.00 per hectare. Failure to comply with License Fee payments for two consecutive years causes the termination (caducidad) of the mining concession. According to article 59 of the General Mining Law, the payment for one year may be outstanding and the mining concessions will remain in good standing. The outstanding payment for one year can be paid within January 1 and June 30 of the following year (i.e. payment in arrears).

Minimum Production Obligation

Legislative Decree 1010, dated May 9, 2008 and Legislative Decree 1054, dated June 27, 2008 amended several articles of the General Mining Law regarding the Minimum Production Obligation, establishing a new regime for compliance with such obligation (“New MPO Regime”).

According to the New MPO Regime, titleholders of metallic mining concessions must reach a minimum level of annual production (“Minimum Production”) of at least one (1) Tax Unit or “UIT”,1 within a period of ten years, counted as from January 1st of the year following that in which title to concession was granted.

In the event the titleholder does not reach Minimum Production within the 10 year period referred to in the preceding paragraph, the mining concession will be terminated.

Nevertheless, a mining concession that did not reach Minimum Production during the 10 year period referred to above may remain in force for an additional five (5) years, to the extent the titleholder complies with the payment of a penalty equivalent to 10% of the applicable Minimum Production per hectare per year (“Penalty”), until the mining concession reaches Minimum Production.

Notwithstanding the aforementioned, even in the event the titleholder does not reach Minimum Production within the period of 15 years referred to above, the mining concession may remain in force for a period of up to five (5) additional years in the following scenarios:

if the titleholder pays the applicable Penalty and incurs in investments in the concession in the order of at least ten times the applicable Penalty; or,

in case the titleholder failed to reach Minimum Production due to events of force majeure, duly recognized and acknowledged by the Ministry of Energy and Mines.

In the event the titleholder does not reach Minimum Production within a period of 20 years counted as from the year following that in which title to concession was granted, the mining concession will be terminated.

|

| | |

| 1 Pursuant to Supreme Decree 311-2009-EF, dated December 30, 2009, the Tax Unit for the year 2010 was set at S/.3,600.00 (approximately US$1,300.00). |

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 20 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

Notwithstanding the aforementioned, the Regulations for Legislative Decree 1010 and Legislative Decree 1054, dated October 10, 2008, established that -in the case of mining concessions that were granted title on or before October 10, 2008- the term for complying with the New MPO Regime will be initiated as of January 1, 2009.

Nevertheless, according to the abovementioned regulations, in the case of mining concessions that were granted title on or before October 10, 2008 (as is the case of the mining concessions comprising La Arena), until the ten (10) year term for reaching Minimum Production established by the New MPO Regime elapses, these mining concessions will be subject to the provisions of the General Mining Law, as they stood before their amendment by Legislative Decree 1010 and Legislative Decree 1054 (“Former MPO Regime”) which will continue to apply for such period of time.

According to the Former MPO Regime, metallic mining concession titleholders must reach Minimum Production of at least US$100.00 in gross sales per hectare per year, within a period of 6 years, counted as of January 1st of the year following that in which title to concession was granted.

In the event that Minimum Production was not reached within the 6 year period, a penalty shall be paid by the titleholder in the amount of US$6.00 per hectare per year until Minimum Production is reached. Should such failure to comply continue beyond the eleventh year, the penalty will be increased to US$20.00 per hectare per year.

However, the penalty will not be charged if the titleholder evidences that investment equivalent to ten times the applicable penalty was performed in the mining concession during the previous year.

In June 2004, Peru’s Congress approved a bill to allow royalties to be charged on mining projects. The royalties are levied on a Peruvian mine’s annual sales of minerals in refined, semi-refined or concentrate form according to the international market value of minerals at the following rates:

1.0% for sales up to US$60M;

2.0% for sales between US$60M and US$120M; and

3.0% for sales greater than US$120M.

The basis to calculate the royalty is the international market value of the specific mineral, although certain deductions are allowed, such as indirect taxes, insurance, freight, storage, stow and loading expenses, as well as costs assumed according to the INCOTERMS agreed.

The royalty obligation is applied on the date an invoice is delivered or the product is delivered whichever is first. A penalty of 10% is imposed for non-payment, which is updated with interest up to the date the royalty is actually paid.

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 21 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

| |

| 4.3.3 | Ownership of Mining Rights |

Pursuant to the General Mining Law:

mining rights may be forfeited only due to a number of enumerated circumstances provided by law (i.e. non payments of the validity fees and/or noncompliance with the Minimum Production Obligation);

equal rights to explore for and exploit minerals by way of concession may be granted to either Peruvian nationals or foreigners, except on concessions located within 50km of the Peruvian international borderline, which require for foreign owners an express authorization from the State; and

the right to sell mining production freely in world markets is established. Peru has become party to agreements with the World Bank’s Multilateral Investment Guarantee Agency and with the Overseas Private Investment Corporation.

| |

| 4.3.4 | Taxation and Foreign Exchange Controls |

Corporate net income is taxed at a rate of 30% of annual net income, subject to an additional 4.1% withholding tax at the time profits are distributed to shareholders. Advance monthly payments are required on a percentage of gross income, subject to a final settlement in March of the following business year (January 1 through December 31).

There are currently no restrictions on the ability of a company operating in Peru to transfer dividends, interest, royalties or foreign currency to or from Peru or to convert Peruvian currency into foreign currency.

Congress has approved a Temporary Net Assets Tax, which applies to companies subject to the General Income Tax Regime. Net assets are taxed at a rate of 0.5% on the value exceeding Nuevo Sol 1,000,000 (approximately US$300,000). Taxpayers must file a tax return during the first 12 days of April and the amounts paid can be used as a credit against Income Tax. Companies which have not started productive operations or those that are in their first year of operation are exempt from the tax.

The Tax Administration Superintendence is the entity empowered under the Peruvian Tax Code to administer central government taxes. The Tax Administration Superintendence can enforce tax sanctions, which can result in fines, the confiscation of goods and vehicles, and the closing of a taxpayer’s offices.

| |

| 4.3.5 | Stability Agreements |

The General Mining Law provides to holders of mining rights the option of signing stability agreements with the Peruvian Government in connection with investments made to commence new mining operations or expand existing mining operations. Mining companies can obtain two complementary regimes (generally it is suitable that one company/operation have both regimes) of legal stability, the “General Legal Stability Agreement”, which is signed with PROINVERSION, a government agency to encourage private investments; and the “Mining Guarantee Agreement”, that is specific for mining companies.

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 22 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

In order to qualify, companies must submit satisfactory documentation to the Government regarding the amount of investment.

The Peruvian Political Constitution of 1993 contains the following legal principles regarding environmental matters:

Article 2 establishes that every person has the fundamental right to live in a healthy and balanced environment to allow him to fully develop his life.

Articles 66 to 68 establish that:

it is the duty of the State to establish a National Environmental Policy, which must pursue the sustainable use of the country’s natural resources (the Ministry of the Environment published the National Environmental Policy on May 23, 2009); and,

the State is obligated to promote and preserve biodiversity, by creating protected natural areas and fostering the sustainable use of the Amazon rainforest.

The ministries and supervisory agencies for each economic sector (for example, energy and mines, industry, commerce, agriculture, transport and communications) are competent regarding the application of environmental laws and regulations to companies and projects within their respective sectors, despite the powers of regional and local governments under the Political Constitution. This is known as the "sectorial approach", which has been the Peruvian model since the 1990s.

However, under Legislative Decree 1013, approved on May 14, 2008, the government created the Ministry of the Environment to coordinate all environmental matters at the executive level. Currently, the Ministry of the Environment is still being implemented and its areas of competence being defined, but it has already assumed, and is likely to continue to assume further competencies currently held by other ministries and supervisory agencies.

The Peruvian General Environmental Law, Law No 28611, approved on October 15, 2005, establishes that companies are responsible for the emissions, effluents, discharges and other negative impacts generated as a consequence of their activities on the environment, health or natural resources.

In connection with the above, the Law on the National System for Environmental Impact Evaluation, Law 27446, approved on April 22, 2001, and its regulations (2009) establishes an obligation to have an environmental study approved by the corresponding sectorial authority before the development of projects of public or private investment that may cause negative impacts to the environment.

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 23 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

Under this law, based on their environmental risks, investment projects are classified as follows:

Category I: Projects that do not cause significant negative impacts on the environment. Titleholders of projects under Category I must file a simplified Environmental Impact Statement (“DIA”) before the corresponding authority of the relevant sector.

Category II: Projects that may cause moderate negative impacts on the environment. Titleholders of projects under Category II must file a Semi-detailed Environmental Impact Assessment (“EIAsd”) before the corresponding authority of the relevant sector.

Category III: Projects that may cause significant negative impacts on the environment. Titleholders of projects under Category III must file a full Environmental Impact Assessment (“EIA”) before the corresponding authority of the relevant sector.

In conclusion, the approval of the corresponding environmental study constitutes an essential requirement for the conduction of investment projects that involve environmental risks.

Environmental Legal Framework Applied to Mining Activities

The “Environmental Regulations for the Development of Mining and Metallurgic Activities”, approved by Supreme Decree 016-93-EM, dated May 1, 1993, and the “Regulations on Environmental Protection for the development of Mining Exploration Activities”, approved by Supreme Decree 020-2008-EM, dated April 2, 2008, are the controlling regulatory bodies that establish, among others, the environmental requirements to conduct mining activities within the country.

Regarding said legal framework, the General Bureau of Environmental Affairs (“DGAAM”) of the Ministry of Energy and Mines (“MEM”) is the competent governmental agency to approve the appropriate environmental studies required for conducting mining activities in the country, while the Environmental Inspections and Auditing Bureau (OEFA) of the Ministry of the Environment is currently the competent agency to inspect and audit mining projects and operations in order to secure compliance with environmental obligations and related commitments.

Mining Exploration Activities

In connection with the environmental aspects specifically related to the development of mining exploration projects, currently these are governed by the Regulations on Environmental Protection for the development of Mining Exploration Activities, approved by Supreme Decree 020-2008-EM.

Pursuant to the abovementioned regulations, depending on the size of the exploration activities to be conducted, mining exploration projects are classified into the following two categories:2

|

| | |

| 2 Pursuant to article 19 of Supreme Decree 020-2008-EM, the conduction of mining exploration projects where there is little or no alteration to the surface (e.g. geological and geophysical studies, topographic analysis, among others) does not require the prior approval of an environmental study. |

|

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 24 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

the area effectively disturbed is that required for the construction of a maximum of 20 drilling platforms; or,

the area effectively disturbed does not exceed a total of 10 hectares, including access roads, platforms, trenches and ancillary facilities; or,

the construction of tunnels does not exceed 50 meters in length.

In order to conduct exploration activities under this category, titleholders shall previously have a DIA duly approved by the DGAAM of the MEM.

the area effectively disturbed is that required for the construction of more than 20 drilling platforms; or

the area effectively exceeds a total of 10 hectares, including access roads, platforms, trenches and ancillary facilities; or,

the construction of tunnels exceeds 50 meters in length

In order to conduct exploration activities under this category, titleholders shall previously have an EIAsd duly approved by the DGAAM of the MEM.

Notwithstanding the above, it should be noted that the approval of the corresponding environmental study does not grant the titleholder the right to start conducting exploration activities, given that, titleholders of mineral rights are also required to obtain the following:

All governmental consents and permits legally required to conduct the activities detailed in the corresponding environmental study (e.g. authorizations for water use, for hydrocarbon storage, among others); and,

the right granted by the owner to use the surface land required for the development of the project.

Mine Development, Exploitation and Processing Activities

Pursuant to the “Environmental Regulations for the Development of Mining and Metallurgic Activities”, approved by Supreme Decree 016-93-EM, prior to conducting mine development, exploitation and processing activities, titleholders of mining concessions must have an EIA duly approved by the DGAAM of the MEM.

However, it is worth mentioning that approval of the corresponding EIA does not authorize the immediate conduct of such activities considering that, under the abovementioned regulations, before the start up of mine development, exploitation and processing activities, titleholders are required to obtain the following:

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 25 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

the surface rights required for the development of the mining project;

all other permits, licenses, authorizations and approvals required by national law, in accordance with the environmental commitments established in the corresponding EIA;

resolution of approval of the corresponding Mine Closure Plan duly approved by the DGAAM of the MEM.

Regarding the requirement mentioned in the second point, following is a list of the most common permits, licences and authorizations required for the development, exploitation and processing activities:

License for the use of water with mining purposes issued by the National Authority of Water (“ANA”).

Authorization for the discharge of industrial wastewaters issued by the National Authority of Water (“ANA”).

Authorization for the discharge of domestic wastewaters issued by the National Authority of Water (“ANA”).

Authorization for the operation of septic tanks issued by the General Bureau of Environmental Health (“DIGESA”).

Processing concession issued by the MEM.

Authorization for the operation of explosive storage.

Authorization for the operation of fuel storage facilities issued by OSINERGMIN.

Authorizations for the use of controlled chemicals and supplies issued by the Ministry of Production and the Ministry of the Interior (through the “DINANDRO”).

Authorization for the operation of telecom services issued by the Ministry of Transport and Communications.

| |

| 4.3.7 | Mine Closure and Remediation |

Exploration Activities

Regarding environmental remediation of areas affected by mining exploration activities, the “Regulations on Environmental Protection for the Development of Mining Exploration Activities”, approved by Supreme Decree 020-2008-EM, establishes that titleholders of mining exploration projects shall comply with conducting “progressive closure”, “final closure” and “post closure” measures as established in the corresponding environmental study and under the terms and conditions established therein. Any amendment of the closure measures or of its execution terms requires the prior approval of the DGAAM of the MEM.

As an exception, pursuant to the “Law on Mine Closure” – Law 28090, published on October 14, 2003, and its regulations, approved by Supreme Decree 033-2005-EM, dated August 15, 2005, titleholders of mining exploration activities that include the development of “underground works requiring the removal of more than ten thousand (10,000) tons of material or more than one thousand (1,000) tons of material with an acidity potential (AP) ratio less than three (NP/AP – 3), in representative samples,” must file an specific Mine Closure Plan prior to the start-up of an exploration project.

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 26 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

According to the aforesaid law, the concept of “Mine Closure Plan” is defined as an environmental management tool that comprises technical and legal actions intended to remediate the areas affected by the development of mining activities, which shall be performed before, during and after the closure of mining operations.

Mining Development, Exploitation and Processing

As of the date of Supreme Decree 033-2005-EM, which regulates Law 28090 above, prior to the start-up of mining activities, including mine development, exploitation and processing, titleholders are required to have a Mine Closure Plan, duly approved by the DGAAM of the MEM in order to be authorized to carry out such activities.

Regarding the above, the Peruvian legal framework covering Mine Closure Plans includes a number of financial requirements intended to secure the performance of the closure obligations by the titleholders of mining projects. In case of non-compliance, these financial requirements allow the mining authority to promptly and effectively foreclose the financial guarantees from titleholders and complete the Mine Closure Plans as approved, thus preventing the generation of mining environmental liabilities.

| |

| 4.3.8 | Workers Participation |

Under Peruvian law, every company that generates income and has more than twenty workers on its payroll is obligated to grant a share of its profits to its workers. For mining companies, the percentage of this profit-sharing benefit is 8% of taxable income. Cooperative, self-managed companies, civil partnerships and companies that do not have more than twenty workers are exempt from this profit-sharing obligation. Both permanent and contract workers must be taken into account for purposes of these laws; the only legal requirement is that such workers must be registered on a company’s payroll.

The profit-sharing amount made available to each worker is limited to 18 times the worker’s monthly salary, based upon their salary at the close of the previous tax year.

In case there is a remnant between the mentioned 8% of taxable company’s income and the limit of the workers profits participation, this remnant shall be used for the creation of a fund with the purpose of worker training and job promotion, as well as public investment projects.

| |

| 4.3.9 | Regulatory and Supervisory Bodies |

The three primary entities in Peru that regulate and supervise mining companies are the Ministry of Energy and Mines (“MEM”), the National Institute of Concessions and Mining Cadastre (“INGEMMET”), the Supervisory Entity for the Investment in Energy and Mining (“OSINERGMIN”) and, as previously described, the recently created Environmental Inspections and Auditing Bureau (“OEFA”) of the Ministry of the Environment.

The MEM promotes the integral and sustainable development of mining activities, as well as regulates all the activities in the Energy and Mines sector.

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 27 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

The INGEMMET is the Government Entity in charge of granting mining concessions, which entitles the concession holder the right to explore and exploit the area in which boundaries such concessions are located.

OSINERGMIN oversees regulatory compliance with safety, job-related health, contractors, and mine development matters, while OEFA oversees regulatory compliance with environmental regulation, investigating and sanctioning the breach of any environmental obligation.

Other Peruvian governmental agencies involved with mining companies include the:

National Service of Natural Protected Areas (SERNANP) of the Ministry of the Environment, which supervises and verifies the activities performed within the boundaries of a Natural Protected Area and its buffer zones, and provides technical opinions regarding the feasibility of developing investment projects within the boundaries on Natural Protected Areas and its buffer zones.

National Water Authority (“ANA”), which manages all waste discharges into the environment and related issues, particularly those that may affect water sources, its quality and availability, therefore approving the use of water for mining purposes.

General Bureau of Environmental Health (“DIGESA”), which supervises the quality of water for human consumption and the management of solid waste.

National Institute of Culture (“INC”), which certifies the non-existence of archaeological remains, as typically required for the EIA.

The Ministry of Internal Affairs (through the “DICSCAMEC”), which authorizes and controls the use of explosive materials and the operation of explosive shacks.

The mineral concessions pertaining to the La Arena Project have a total available area of 20,673.3926 hectares. They were fully owned and registered to Sociedad Minera Cambior Peru S.A. (SMCP), a wholly-owned subsidiary of Cambior.

Cambior was acquired by Iamgold in November 2006 and Iamgold decided to sell La Arena. To facilitate the sale, the 44 mining concessions were transferred by Iamgold to a new Peruvian company, La Arena S.A. and, to this date, these concessions are fully owned and registered to the name of La Arena S.A.

The mining concessions are in good standing. Based on publicly available information, no litigation or legal issues related to the mining concessions comprising the project are pending.

The mineral resource identified so far in the La Arena deposit is completely contained within the mining concession “Maria Angola 18”. This mining concession is free of any underlying agreements and/or royalties payable to previous private owners. However, the Ferrol N°5019, Ferrol N°5026 and Ferrol N°5027 mining concessions, which are partially overlapped by Maria Angola 18 (as detailed in Figure 4.4.2 below) are subject to a 2% Net Smelter Returns Royalty, payable to their previous owners.

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 28 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 29 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

| | |

| La Arena Project, Peru – MINEWPER00640AB | Page: 30 |

| Technical Report – 28 October 2010 | | |

Coffey Mining Pty Ltd

| | | | | | |

| Table 4.4_1

Mining Concessions Fully Owned by La Arena S.A. |

| N° | Mining Right

Code | Name | Area

(ha) | Title |

| Res. Nº | Date |

| 1 | 01-00639-94 | Florida I | 600 | 00374-95 | Feb.28, 1995 |

| | 2 | 01-00640-94 | Florida II | 600 | 08280-94 | Nov. 30, 1994 |

| 3 | 01-01087-94 | Florida III | 300 | 04901-94 | Aug. 29, 1994 |

| 4 | 01-01299-96 | F.M. 1 | 1,000 | 04525-97 | Jun. 18, 1997 |

| 5 | 01-02369-96 | Eve A | 900 | 07639-96 | Nov. 19, 1996 |

| 6 | 01-02370-96 | Eve B | 400 | 02320-97 | Mar. 26, 1997 |

| 7 | 01-03640-96 | Maria Angola 19 | 800 | 03153-97 | Apr. 28, 1997 |

| 8 | 01-02892-97 | Maria Angola 29 | 100 | 01266-98 | Mar. 31, 1998 |

| 9 | 01-00261-01 | Agua Blanca 1 | 600 | 00160-02 | Jan. 31, 2002 |

| 10 | 01-00262-01 | Agua Blanca 2 | 1,000 | 00633-01 | Jul. 26, 2001 |

| 11 | 01-01072-01 | Agua Blanca 3 | 200 | 00106-02 | Jan. 28, 2002 |

| 12 | 01-01073-01 | Agua Blanca 4 | 500 | 00144-02 | Jan. 31, 2002 |

| 13 | 01-01908-00 | Cerro Vielza 1 | 100 | 04789-00 | Nov. 27, 2000 |

| 14 | 01-00997-01 | Cerro Colorado | 100 | 00227-02 | Feb. 13, 2002 |

| 15 | 01-01026-01 | Pucaorco | 200 | 00094-02 | Jan. 28, 2002 |

| 16 | 01-00112-02 | Cerro Colorado 2 | 200 | 00823-02 | May 10, 2002 |

| 17 | 01-00288-02 | Cerro Colorado 6 | 100 | 01274-02 | Jul. 23, 2002 |

| 18 | 03-00122-02 | Alta Gracia DC | 300 | 02475-02 | Dec. 13, 2002 |

| 19 | 01-02107-02 | Colorado CBJ | 100 | 01544-03 | Jun. 23, 2003 |

| 20 | 15009027X01 | El Ferrol N°5019 | 60 | 00305-88 | Aug. 0 4, 2003 |

| 21 | 15010088X01 | El Ferrol N°5026 | 286 | 00134-91 | Mar. 18, 1991 |

| 22 | 15010314X01 | El Ferrol N°5027 | 200 | 00500-91 | Aug. 19, 1991 |

| 23 | 15007637X01 | Peña Colorada | 480.30 | 06449-94 | Oct. 19, 2004 |

| 24 | 03-00037-94 | Peña Colorada I | 670.28 | 03450-95 | Jun. 30, 1995 |

| 25 | 03-00038-94 | Peña Colorada II | 703.10 | 01906-96 | Apr. 17, 1996 |

| 26 | 03-00039-94 | Peña Colorada III | 585.70 | 02197-96 | Apr. 30, 1996 |

| 27 | 01-00639-94A | Florida I A | 400 | 02067-02 | Nov. 08, 2002 |

| 28 | 01-00640-94A | Florida II A | 400 | 02281-02 | Nov. 26, 2002 |

| 29 | 01-01087-94A | Florida III A | 700 | 02065-02 | Nov. 08, 2002 |

| 30 | 01-00001-95 | Maria Angola 18 | 805.00 | 01798-97 | Feb. 28, 1997 |

| 31 | 01-00034-95 | Maria Angola 17 | 625.47 | 05215-96 | Aug. 29, 1996 |

| 32 | 01-01417-95 | Sigrid | 300 | 00540-97 | Jan. 28, 1997 |

| 33 | 03-00001-95 | San Jose | 139.03 | 07923-96 | Nov. 20, 1996 |

| 34 | 01-01300-96 | F.M. 2 | 852.81 | 04089-96 | Jul. 26, 1996 |

| 35 | 01-01301-96 | F.M. 3 | 988.45 | 07227-96 | Oct. 30, 1996 |

| 36 | 01-01302-96 | F.M. 4 | 900 | 03701-96 | Jul. 15, 1996 |

| 37 | 01-01303-96 | F.M. 5 | 900 | 04972-97 | Aug. 26, 1997 |

| 38 | 01-02373-96 | Eve E | 100 | 07874-96 | Dec. 27, 1996 |

| 39 | 01-00576-97 | Miche 21 | 800 | 04083-97 | May 28, 1997 |

| 40 | 01-00578-97 | Miche 23 | 1,000 | 03259-97 | Jun. 24, 1997 |

| 41 | 01-01114-97 | Miche 33 | 100 | 05067-97 | Jun. 30, 1997 |

| 42 | 01-02891-97 | Maria Angola 26 | 49.16 | 01561-98 | Apr. 30, 1998 |

| 43 | 03-00046-03 | Carbonera Sanagoran Tres | 100 | 03543-03 | Nov. 05, 2003 |

| 44 | 01-01655-04 | Maria Angola 36 | 428.09 | 01930-05 | Feb. 09, 2000 |

| Total | | | 20,673.39 | | |

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 31 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| |

| 4.5 | Mining Environmental Liabilities |

By means of Ministerial Resolution No. 096-2010-MEM/DM, dated March 4, 2009, the General Mining Bureau of the Ministry of Energy and Mines has updated the “Preliminary Roster of Mining Environmental Liabilities (2006)” (“Roster”) of such ministry. From the legal review of the publicly available version of the abovementioned document, it has been identified that the following Mining Environmental Liability has been included in the Roster:

| | | | | | |

| Table 4.5_1

La Arena Project

Mining Environmental Liability |

| | Name | Type | Coordinates

UTM PSAD 56 | Mineral

Right | Titleholder of the Mineral Right |

| East | North |

| La Florida I | Mining labor | 823,378 | 9,124,708 | Florida I | - Calcáreos Industriales Perú E.I.R.L.

- IAMGOLD PERU S.A.

- La Arena S.A.

- Sociedad Minera Cambior Perú S.A. |

According to the “Law on Mining Environmental Liabilities” – Law 28271 and its Regulations, approved by Supreme Decree 059-2005-EM, as amended, a “Mining Environmental Liability” is defined as a facility, effluent, emission, remaining or waste dump caused by abandoned or inactive mining operations, representing a permanent and/or potential risk to human health, the ecosystem and property.

As a general rule, such law establishes that the responsibility to remediate Mining Environmental Liabilities lies with its generator. However, the aforesaid law also establishes that performing works in an area of a mining environmental liability entails the assumption of remediation obligations by the titleholder performing those works.

Third parties can voluntarily assume the remediation of mining environmental hazards. Likewise, third parties can re-use mining environmental liabilities in order to obtain precious metals, if any, after assuming the liability for the remediation of the site.

Additionally, the following environmental damages were identified by the company during the field work conducted for the purposes of the 2006 Pre-Feasibility Study:

In the vicinity there is an old mine called Tambo Chiquito Mine (former Florida Mine), which drains from a coal mine on the left bank of the Yamobamba river. This is an old underground mine located 10km South East from La Arena which was abandoned approximately 50 years ago. There are still remains from the plant, abandoned camps and offices, as well as three small waste dumps with a total of 6 000m³ of tailings which are not confined.

Drainages of residual acidity and mine water (pH 3.5) to the Tambo Chiquito Creek, which is a tributary to the Yamobamba River. However the creek is now stabilized and does not represent a significant environmental risk to the Yamobamba River at present.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 32 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

B&G Engineering declares that the environmental liabilities that may have been generated by previous exploration activities at La Arena are not significant, and that such work has been managed in an environmentally efficient way, and in close coordination with the community and/or individual owners who may also have been involved in such activities.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 33 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

| | |

| 5.1 | Project Access |

The project can be accessed via a 160km national roadway from the coastal city of Trujillo directly east towards Huamachuco, passing through Chiran, Shorey/Quiruvilca and the Alta Chicama project (Barrick Gold Corporation). The road is paved for 38km and the remainder is a good compacted material road. The road from Alta Chicama to the project site is paved. An air strip is also present at Huamachuco, a town of approximately 20,000 people located 18km from La Arena that accommodates small airplanes.

| |

| 5.2 | Physiography and Climate |

The topography in the project area is relatively smooth with undulating hills. Elevations vary between 3,000 and 3,600 meters above sea level. In general, the slopes are stable with grades varying between 16º and 27º, and the land is covered with typical vegetation from the area.

On the northern and southern flanks of the deposit localized unstable areas exist where landslides have occurred during previous rainy seasons.

The average annual temperature from compiled data is 12ºC. The maximum recorded temperature varies between 16 to 18ºC and the minimum lies between 8 and 10ºC.

Total annual rainfall varies between 750 and 850mm/a and the average total annual evaporation rate ranges between 950 and 1,000mm/a. The average relative humidity varies monthly between 73 and 90%.

Maximum precipitation usually occurs during the months of January through March while the months of June to August are the driest. The maximum daily precipitation recorded to date at the La Arena site is 34.6mm and occurred in March of 1999 while minimum precipitation was recorded in July 1998 with a total of 1.2mm.

The following information is from the November 2006 PFS:

In the area of study of the sub-basin of the Yamobamba River there are 2,559 inhabitants residing in five communities. The distribution of the inhabitants within the community is uneven. The community with the smallest number of inhabitants is Agua Blanca (11%) while the most populated one is La Colpa (25%). There are 1,136 inhabitants within the local area of study, 75% are from La Arena and the remainder from La Ramada.

A little more than half of the population (52.6%) is aged 20 years or younger and less than a fifth of the population (18.2%) is aged of 40 years or older. 29.2% of the population is between 19 and 40 years old. These results show a predominantly young population which follows the demographic pattern of the country’s rural population.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 34 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

The majority of the heads of household are men (87.5%). Nuclear families prevail, i.e. parents and children, with 62.5%. The average number of members in a household is 5.27 persons.

The young population moves temporarily or permanently in search for a job and educational services to the cities of Trujillo and the Sanchez Carrion province, mainly to Huamachuco (within the region), and to Lima (outside the region).

Immigration to the local area is of lower than that of emigration. The majority of those who now live in the local area come from surrounding rural communities.

| |

| 5.4 | Local Infrastructure and Services |

The La Arena project is a greenfields project. The current infrastructure at site includes an exploration camp and access tracks.

All future mining, processing and support activities will take place at the Project site with the exception of a small office which will be located in Salaverry on the coast to supervise concentrate shipments and offer a procurement service for the operation.

Several alternatives for power interconnection have been considered. The most likely solution will be to connect La Arena to the SEIN (National Interconnected Electrical System) through Barrick’s 138kV Trujillo Norte – Lagunas Norte transmission power line, using HIDRADINA’s concession licence to build an approximate 20km long, 22.9kV power line between the Lagunas Norte (Barrick) sub-station and the future La Arena sub-station. HIDRANDINA is a government sponsored power distributor within the La Libertad region.

HIDRANDINA, in this case, would provide La Arena with 5MW of power during seven (7) years, supplied by an electrical producer such as CELEPSA, with which La Arena is already in discussions to reach a supply agreement.

Engineering to build the 22.9kV line has been awarded to PEPSA, a known local electrical consultant, and conversations with HIDRANDINA and Barrick are underway to reach an agreement to build the power line and the sub-station, and to supply any future power needs to La Arena. Rio Alto estimates that an agreement with HIRDRANDINA and Barrick will be reached and power line constructed prior to Q3 2011.

The estimated power demand for the gold oxide project will not exceed 4.5Mw for a 24,000t/d plant. For the future sulphide project the power demand is estimated to increase to 20Mw which will require upgrading HIDRANDINA’s power line.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 35 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

There are no formal water supply schemes in the Project area. Water for the project will be extracted from groundwater, adjacent water courses and through recycling and reuse of water wherever reasonably practicable.

The locations and areas for waste dump and tailings storage, dump leach pads, processing plant and other infrastructure are discussed in Section 18 and all of this infrastructure lies well within the boundaries of La Arena S.A.’s mining properties.

As the Project currently stands it is estimated that approximately 1,015ha of surface lands will be required in total for both the gold oxide and copper-gold sulphide projects, out of which 718ha have been acquired. The gold oxide project requires approximately 700ha which has all been acquired.

About 90% of the area to acquire is composed of individual titles registered in the Public Registry (SUNARP), allowing direct negotiation with the owner.

The amounts paid on the purchase of the surface land have averaged 9.3 thousand soles (approximately $3,300) and ranged between 1 and 45 thousand soles per hectare ($330 to $16,000/ha). The purchase program of surface land is continuing at the present time and the prices that have been agreed recently are in the order of $8000/ha, which falls within the historical averages and continue to represent the current value for surface land in the area.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 36 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| 6 | HISTORY |

| | |

| 6.1 | Ownership History |

The deposit was first discovered by Cambior geologists in December 1994. Cambior staked a claim for mining concessions of 1,800ha over the deposit in January 1995. A further 70,000ha of mining concessions were claimed in 1996, most of which have been allowed to lapse or have been sold. The mining concessions making up the La Arena Project passed to Iamgold following its acquisition of Cambior.

The geological exploration work completed at La Arena includes:

First half 1996 – detailed surface geochemistry and 1,502m of diamond drilling in 6 holes.

Second half 1996 – 2,240m of diamond drilling in 10 holes.

1997 – 4,958m of diamond drilling in 32 holes.

1998 – 10,900m of diamond drilling in 58 holes.

Between 1999 and 2003 – following a pre-feasibility study, unfavourable economical conditions did not allow the project to progress.

Between 2003 and 2006 – five drilling campaigns were completed for 33,705m of diamond drilling in 213 holes and 1,186m of RC drilling in 11 holes.

2007 – 5,500m of diamond drilling in 21 holes.

2009 – Excavation of 10 pits for channel and bulk sampling.

2009 – Completed 2,900m of drilling to sterilize locations for the gold oxide Project infrastructure locations.

The accumulated drilling over the La Arena deposit area to end of December 2007 reached 59,991m in 351 holes and 4,120m dug in 60 trenches completed in 2004.

The results of the drilling campaigns have been incorporated in a number of resource estimates as detailed below.

Legacy resources set out in Table 6.3_1 and quoted elsewhere in this Report are not National Instrument 43-101 compliant. The reader is advised that these estimates should not be relied upon for any decision making purposes. A NI 43-101 report was produced for La Arena in March 2008 by Coffey Mining. As no new resource drilling has been completed since this date, the resource model has not been updated from the March 31, 2008 report.

The estimation of resource at La Arena has been completed as tabulated below in Table 6.3_1. Previous work reported the resources so-called mineable, in-pit resources and these results have been tabulated as such.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 37 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| | | | | |

| Table 6.3_1

La Arena Project

Resource History |

|

|

| Date | Gold Price

US$/oz | La Arena Mineable, In-Pit Resources | Cutoff

(Au g/t) | Source |

| Oct. 1997 | 350 | All categories: 16.1Mt @ 1.12g Au/t (580,000oz) | 0.3 | Oct. 97 conceptual pre-feasibility study |

| Nov. 1999 | 350 | All categories: 17.7Mt @ 0.92g Au/t (519,600oz) | 0.3 | Dec. 99 Pre-feasibility study |

| | June 2000 | 285 | All categories: 10.8Mt @ 1.15g Au/t (303,700oz) | 0.3 (?) | Scoping Study (4,000 tpd heap leach) |

| Aug 2006 | 550 | Measured & Indicated

Gold oxide: 37.4Mt @ 0.59g/t ( 713,000oz)

Porphyry: 102.3Mt @ 0.39g/t (1.3Moz), 0.48% Cu (1,070.9M lbs) | 0.19g/t Au

0.3% Cu equ. | 10 Aug. 2006 Cambior press release |

| Nov. 2006 | 550 | Measured & Indicated

Heap leach ore: 35.1Mt @ 0.44g/t ( 688,100oz)

Mill ore: 93 Mt @ 0.38g/t (1.1Moz), 0.47% Cu (968.9M lbs) | 0.19g/t Au

0.3% Cu equ. | Pre-Feasibility Study |

| Feb. 2007 | 550 | Measured & Indicated

Heap leach ore: 26.8Mt @ 0.65g/t ( 557,400oz) | 0.20g/t Au | Oxide Option Scoping Study |

A resource estimate was completed by Cambior in July 2003 which included the resources at a deposit (El Toro) which is outside the La Arena project area. The results of this estimation have not been included.

The most recent resource estimates for the La Arena deposit were completed by Iamgold in December 2006 and August 2007. The December 2006 Resources (Table 6.3_2) were confined within a pit shell based on US$550/oz Au and US$1.50/lb Cu. The majority (74%) of the resource tonnes are in copper-rich mineralization largely in primary and secondary porphyry (Cu ≥ 300ppm) with the remainder (26%) in copper-poor mineralization largely in oxide sandstone (Cu < 300ppm).

| | | | | | | | |

| Table 6.3_2

La Arena Au-Cu Project

In-Pit Resource by Iamgold (December 31st 2006) |

| | Tonnes

(Mt) | Au Grade

(g/t) | Cu Grade

(%) | Ag Grade

(g/t) | Mo Grade

(ppm) | Au

(‘000 oz) | Cu

(‘000 lbs) |

| “measured” | 25.9 | 0.53 | 0.16 | 0.32 | 25.1 | 443 | 91,967 |

| | ”indicated” | 113.7 | 0.43 | 0.39 | 0.19 | 42.1 | 1,554 | 986,826 |

| “measured” +

“indicated” | 139.6 | 0.45 | 0.35 | 0.21 | 38.9 | 1,997 | 1,078,793 |

| “inferred” | 9.9 | 0.28 | 0.33 | 0.15 | 49.3 | 89 | 71,067 |

In 2007 Iamgold completed a 5,000m drilling program targeting oxide mineralization along the west side of the planned pit. An updated resource evaluation in August 2007 (Table 6.3_3) included the results of this drilling and included the molybdenum and silver content. Resources were confined within a pit shell based on US$550/oz Au, US$1.50/lb Cu, US$10/lb Mo and US$10/oz Ag.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 38 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

Coffey Mining does not support the Measured classification of the 2007 (and 2006) resource. Following detailed review and validation, Coffey Mining adopted the latest grade estimate by Iamgold (August 31, 2007) but reclassified the Measured category to Indicated. In Section 17.1 of this report the La Arena Mineral Resource is reported according to current 43-101 standards for reporting of mineral estimates.

| | | | | | | | | | |

| Table 6.3_3

La Arena Au-Cu Project

Updated In-Pit Mineral Resource by Iamgold (August 31st 2007) |

| | Tonnes

(Mt) | Au Grade

(g/t) | Cu Grade

(%) | Ag Grade

(g/t) | Mo Grade

(ppm) | Au

(‘000 oz) | Cu

(‘000 lbs) | Ag

(‘000 oz) | Mo

(‘000 lbs) |

| “measured” | 25.5 | 0.51 | 0.17 | 0.31 | 26.3 | 414 | 97,962 | 250 | 1,477 |

| | ”indicated” | 123.0 | 0.41 | 0.40 | 0.20 | 42.3 | 1,636 | 1,078,760 | 781 | 11,472 |

| “measured” +

“indicated” | 148.5 | 0.43 | 0.36 | 0.22 | 39.6 | 2,050 | 1,176,722 | 1,031 | 12,949 |

| “inferred” | 10.7 | 0.26 | 0.34 | 0.17 | 53.4 | 91 | 80,835 | 58 | 1,265 |

There has been no production from the La Arena property.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 39 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| 7 | GEOLOGICAL SETTING |

| | |

| 7.1 | Regional Geology |

The La Arena deposit is located in the Huamachuco region, in the eastern flank of the Cordillera Occidental of northern Peru. The region displays a particularly rich endowment of metals (Cu-Au-Ag) occurring in porphyry and epithermal settings, including the Lagunas Norte mine at Alto Chicama, the Comarsa mine, La Virgen mine, Shahuindo exploration project and Tres Cruces development project.

The regional geology comprises:

Tertiary Calipuy Group Cordilleran arc volcanics covering the western sector, intruded by upper Miocene subvolcanic bodies of andesitic and dacitic composition.

Folded and faulted Mesozoic sedimentary sequences in the eastern sector, comprising of Cretaceous shallow marine sediments varying from upper carbonate-rich to lower Chimu Formation quartz sandstones with local coal beds, and Upper Jurassic Chicama deep marine shales, siltstones and sandstones.

Precambrian and Paleozoic basement to the east and coastal batholith to the west.

Tertiary intrusive rocks.

The structural grain of the region trends NW-SE, consistent with the trend in this portion of the Andes. Two other structural trends are developed in NE-SW and N-S directions. Several deposits and geochemical anomalies are associated with the intersection of these structures.

The major Huamachuco dome intrusive affects the Mesozoic sedimentary sequence, whereby the dome margins are the most intensively altered and display surface gold anomalies and mineralization.

Regional geology, lineaments, intrusives, mines and prospects are shown in Figure 7.1_1.

The Mesozoic sedimentary sequences on the La Arena property consist of dark grey slates and carbonaceous shales of the Upper Jurassic Chicama Formation, whitish quartzites, sandstones and siltstones of the Lower Cretaceous Chimu Formation, thin limestone horizons of the Santa Formation, pinkish shales and brown sandstones of the Carhuaz Formation, white quartzites of the Farrat Formation, and grey blue limestone units of the Inca, Chulec and Pariatambo Formations.

The Tertiary volcanic sequences consist essentially of andesitic and dacitic tuff and agglomerate horizons in the base interbedded with andesitic lavas of the Calipuy Group.

Tertiary intrusive rocks are emplaced along the fold axes, showing laccolitic stock forms such as La Arena. Other intrusives display more typical hypabyssal shapes, such as the Alizar and Agua Blanca stocks.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 40 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 41 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

Over 30% of the property is covered with quaternary moraine-alluvial deposits (Figure 7.2_1).

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 42 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| 8 | DEPOSIT TYPES |

| | |

| 8.1 | Introduction |

The region displays a particularly rich endowment of metals (Cu-Au-Ag) occurring in porphyry and epithermal settings, including the Lagunas Norte mine at Alto Chicama, the Comarsa mine, La Virgen mine, Shahuindo exploration project and Tres Cruces development project.

| |

| 8.2 | Porphyry Copper Deposits |

The North Porphyry, South Porphyry and Dacite Breccia deposits of La Arena are associated with the porphyry copper deposit type. Porphyry copper deposits are associated with porphyritic intrusive rocks. The mineralization occurs as disseminations along hairline fractures as well as within larger veins, which often form a stockwork. The mineralization typically contain between 0.4 and 1% copper with smaller amounts of other metals such as molybdenum, silver and gold. They are formed when large quantities of hydrothermal solutions carrying small quantities of metals pass through fractured rock within and around the intrusive and deposit the metals.

Porphyry copper deposits are the largest source of copper and are found in North and South America, Europe, Asia, and Pacific islands.

| |

| 8.3 | Epithermal Gold Deposits |

The Calaorco Breccia and Ethel Breccia Au oxide mineralization of La Arena are associated with Epithermal deposit types. Epithermal gold deposits form in hydrothermal systems related to volcanic activity. These systems, while active, discharge to the surface as hot springs or fumaroles.

Epithermal gold deposits occur largely in volcano-plutonic arcs (island arcs as well as continental arcs) associated with subduction zones, with ages similar to those of volcanism. The deposits form at shallow depth, <1km, and are hosted mainly by volcanic rocks.

There are two end-member styles of epithermal gold deposits, high sulfidation (HS) and low sulfidation (LS). The two deposit styles form from fluids of distinctly different chemical composition in contrasting volcanic environment. The Calaorco and Ethel breccia deposits are of the LS style.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 43 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

The tectonic feature of the La Arena property is dominated by a main fault oriented NW-SE and an overturned anticline emplaced along the same structural trend which seems to control the locations of the main intrusive porphyries and mineralization. Two other major structural trends are developed in the region and are expressed through visible faults or major lineaments and/or evidenced by the presence of intrusive bodies and altered areas in the NE-SW and N-S directions.

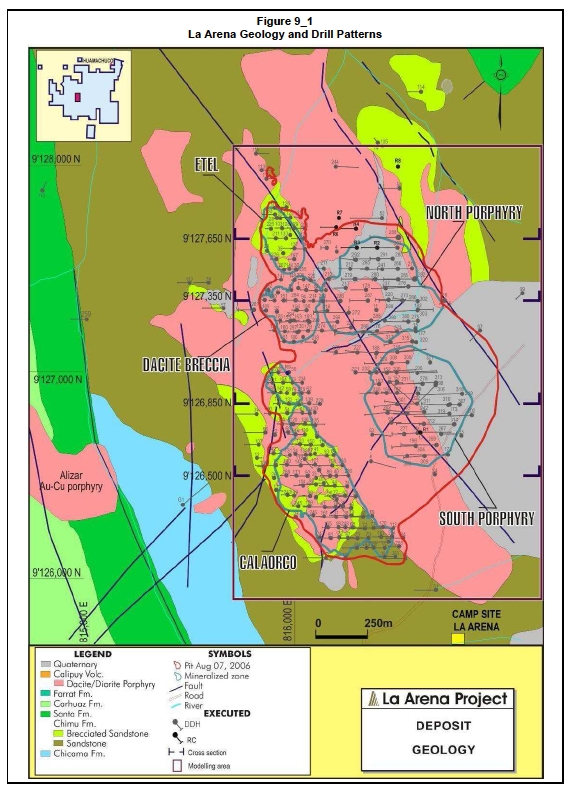

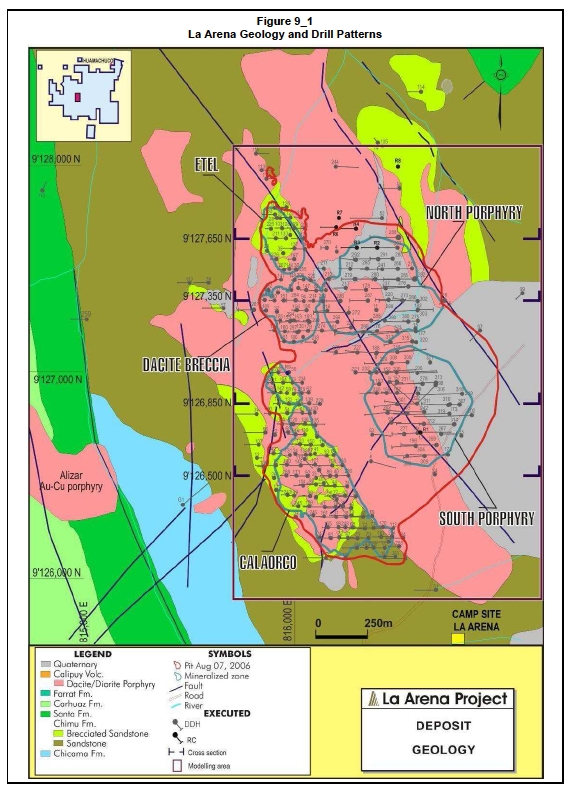

La Arena occurs as Au-Ag mineralization within a quartzite cap to a porphyry Au-Cu intrusion:

| | | |

| | | Calaorco Breccia | Au oxide mineralization mainly occurring in sandstone breccia and fractured sandstone. |

| | | |

| | Ethel Breccia | smaller body of Au oxide mineralization located in the northern portion of La Arena. |

| | | |

| | North Porphyry | mostly made up of secondary and primary Au-Cu mineralization in diorite porphyry located southeast of Ethel. |

| | | |

| | South Porphyry | main body of primary Au-Cu mineralization in diorite porphyry, with minor secondary and oxide mineralization. |

| | | |

| | Dacite Breccia | secondary and primary Cu mineralization in dacitic porphyry located between Calaorco and Ethel. |

The La Arena geology and drill patterns are shown in Figure 9_1. The vast majority of drilling has been completed on east-west sections, with a small number of holes intersecting the mineralization along other directions.

The mineralization extends 2.2km north-south (9,125,900mN to 9,128,100mN), 1.1km east-west (815,700mE to 816,800mE) and 900m in elevation (2,700mRL to 3,600mRL). Continuity of the mineralization is generally excellent and improves with lower grade cutoffs, which is characteristic of this type of deposit.

Alteration associated with the epithermal gold mineralization of the Calaorco and Ethel Breccias has been described by site geologists as argillic alteration, advanced argillic alteration, and silicification.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 44 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 45 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

Epithermal Au mineralization occurs adjacent to the Au-Cu porphyry along sedimentary-intrusive contacts and roof pendant areas. The mineralization is largely oxidized. Mineralization styles have been subdivided into:

| | | |

| | | Sandstone-quartzite breccia | high Au grades and anomalous As and Sb. Pods of mineralization are developed around fingers of porphyry. |

| | | |

| | Dacite porphyry breccia | moderate Au grades. |

| | | |

| | Hydrothermal breccia | vertical pipe-like character (Ethel Breccia) and moderate to isolated high Au grades. |

| | | |

| | Colluvial deposits | in the north and south extremities of the Calaorco Breccia, with moderate and anomalous Au grades. |

The quartzite-sandstone sequence that hosts the Calaorco Breccia dips moderately to the east. This direction has been interpreted by Iamgold to control the Au mineralization. However, surface mapping has identified a NE trending breccia-fracture system, which according to Corbett (2004) may be the main host to the Au mineralization and thereby provide a sub-vertical control to the mineralization.

Alteration associated with the Au-Cu porphyry has been described as potassic zone, phallic alteration, intermediate argillic alteration, propylitic alteration, and argillic alteration.

Porphyry Au-Cu mineralization is associated with a quartz-sulphide stockwork zone, with little to moderate oxidation. Three mineralization events have been recognized by site geologists, namely a weak pre-mineral event, a strong early-mineral event, and a moderate late-mineral event. Mineralization styles have been subdivided into:

| | | |

| | | Oxide zone | contains Au mineralization associated with goethite and hematite, with Cu content to less than 300ppm. It is up to 40m deep in the North Porphyry and hardly exists in the South Porphyry. |

| | | |

| | Secondary zone | enriched with Cu, mainly in the form of chalcosite. Its thickness varies from 20m in the North Porphyry to 5m in the South Porphyry. |

| | | |

| | Primary zone | carries most of the Au-Cu mineralization, typically in quartz-pyrite-chalcopyrite and sporadic molybdenite. |

Several vein types have been described for the porphyry mineralization at La Arena. Earliest “A” type veins generally consist of quartz only, have diffuse margins, and often correlate with the strongest Au grades. They are cut by B type quartz-sulphide veins that are often banded or have sulphide developed along their axes. Subsequent D type pyrite veins cut all other veins.

The porphyry complex has been interpreted by Iamgold to dip steeply to the east and display an upward flaring geometry (many holes are inclined to the west). Meldrum (2005) suggests that geometries of vertical cylinders or cupolas and clustering may be more appropriate.

Two post-mineralization dykes cross-cut the units, one associated with moderate disseminated pyrite and the other sterile and andesitic.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 46 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

Accumulated drilling over the La Arena deposit area totalled 59,991m in 351 holes and 4,120m for 60 trenches, plus 2,900m of RC sterilisation drilling, as is discussed in following sections. In addition to the La Arena development project, the property includes several prospects that have been defined by a combination of soil geochemistry and exploration diamond drilling. (i.e. Cerro Colorado, El Alizar porphyry, Agua Blanca epithermal and porphyry, Pena Colorado and La Florida).

Most exploration has been focused on the La Arena deposit. Additional mineral occurrences and geochemical anomalies have been identified in the wider area of the property, but all have very limited drilling.

Four anomalies have been identified at La Florida in the southern part of the property:

The Huangacocha Au anomaly in Chimu sandstone has been explored by 10 E-W orientated diamond core holes over a strike extent of 0.5km. The best holes intersected 84m @ 0.6g/t Au (DDH09), 64m @ 1.0g/t Au (DDH13), 26m @ 0.5g/t Au (DDH20), 12m @ 1.0g/t Au (DDH12) and 12m @ 0.2g/t (DDH19). Highest sample grades are 9.1g/t Au (DDH09) and 8.7g/t Au (DDH13). The mineralization appears to correlate to ENE structural breccia zones of up to 20m wide. Outcrop at Huangacocha ends in terminal moraine to the north.

The Paloquiam Cu anomaly has been explored by 2 diamond core holes (DDH11 and DDH21), but no significant intercepts were found.

The South Au anomaly in breccia and strongly fractured siltstone has been explored by 2 diamond core holes and by 10m spaced channel samples in a 120m road cut. One hole returned 20m @ 0.2g/t Au (DDH01), and the other hole returned a highest assay of 0.39g/t Au. Favourable grades (>1g/t Au) were encountered in the road cut sampling.

The North Au anomaly in steeply fractured sandstone and minor siltstone has been explored by 2 diamond core holes. The highest sample grade was 0.46g/t Au. The highest grade in surface samples was 0.8g/t Au. Sludge return samples had insignificant Au grades. According to Iamgold the drill direction was sub-optimal.

Agua Blanca is both an epithermal (breccia) and porphyry (dacite) target. Six holes were drilled at the prospect, 3 diamond core holes and 3 reverse circulation holes. The best hole was an RC hole drilled towards the SSW, with 70m @ 0.7g/t Au. Limited sampling of the outcrop has been conducted to date. Arsenic values are high, up to 1.86% As.

Exploration surveys and interpretations completed to date within the La Arena project have largely been planned, executed and supervised by expatriate and national Cambior and Iamgold personnel, supplemented by consultants and contractors for more specialized or technical roles. The data is considered to be of good quality (Sections 11 to 14).

The exploration targets are considered to readily justify further exploration and have the potential to significantly add to the resource inventory of the La Arena Project.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 47 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| 11 | DRILLING |

| | |

| 11.1 | Introduction |

The principal methods used for exploration drilling at La Arena have been diamond core drilling (DDH) and reverse circulation percussion drilling (RC). In addition, 60 surface trenches were completed, totalling 4,120m in length.

Table 11.1_1 summarizes pertinent drilling statistics. The deposit has been drilled at a nominal spacing of 50m in the brecciated sandstone and 65m in the porphyry.

| | | | |

| Table 11.1_1

La Arena Project

Summary Drilling Statistics |

| Total drillholes | 351 | Total metres drilled | 59,991 |

| | RC holes (excluding sterilisation holes) | 11 | RC metres | 1,186 |

| Diamond holes | 340 | Diamond core metres | 58,805 |

| Core samples | 29,017 | RC samples | 592 |

| 11.2 | Drilling Procedures |

| | |

| 11.2.1 | Diamond Drilling Procedures |

All diamond drilling was completed by Sociedad Minera Cambior Peru S.A (SMCP). Most diamond core holes were drilled HQ diameter and about 40% of the holes were drilled NQ diameter from 1999 to 2005.

Based upon inspection of core trays of 5 holes and review of the available reports, Coffey Mining considers that diamond core drilling has been carried out to expected industry standards.

| |

| 11.2.2 | Reverse Circulation Drilling Procedures |

A total of 11 reverse circulation holes (1,186m) were completed by AK Drilling. The production rate was reported as poor due to bad ground conditions and abundant underground water. Limited RC drilling was also tested on the La Arena porphyry with reportedly better production and recoveries.

The poor recoveries described in the RC drilling has resulted in lower confidence in this data and further RC drilling was not undertaken. Shallow RC sterilisation drilling in 2009 returned good recovery and successfully sterilized the area of planned gold oxide project infrastructure

Drillholes were generally drilled to the west at between 60 to 70 degrees dip. Holes were targeted to perpendicularly intersect the main trend of mineralization. The La Arena deposit has been drilled at a nominal spacing of 50m in the brecciated sandstone and 65m in the porphyry.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 48 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

The three-dimensional modelling methods applied in resource estimation accurately reflect the morphology of the mineralized zones.

| 11.4 | Surveying Procedures |

| | |

| 11.4.1 | Accuracy of Drillhole Collar Locations |

Drillhole collars were surveyed by Eagle Mapping Ltd. using total station and differential GPS. Survey accuracy is reported as +/-0.5m.

Accuracy of the survey measurements meets acceptable industry standards.

| |

| 11.4.2 | Downhole Surveying Procedures |

Prior to the 2005 drilling campaign, holes were surveyed using acid test every 50m. This method uses acid, in a glass test tube, the acid etching the tube and indicating the inclination or dip of the hole. It is carried out by lowering the tube down the hole to the desired depth, for each reading. Magnetic azimuth readings are not obtained by this method.

Also tropari survey measurements are noted in the drillhole logs. A tropari is a directional surveying instrument that gives inclination and magnetic azimuth and can be used in open holes or through rods 36mm (1.40 inches) or larger. Accuracy to +/-0.5 degrees is claimed by the manufacturer.

After hole 172, down-the-hole surveys were collected with a SingleSmart Flexit tool with a reported accuracy of +/-0.2 degrees, recording both dip and azimuth. Real-time recording tools were used from 2007 onwards.

Accuracy of the down-the-hole survey measurements meets acceptable industry standards. Post acid test holes were found to deviate in azimuth by an average 3.2º and have a tendency to steepen in dip by an average 2.9º. Sample locations in all holes, including acid test holes for which no azimuth data is available, are considered by Coffey Mining to have been determined with sufficient accuracy for the purpose of resource estimation.

| |

| 11.5 | Sterilisation Drilling 2009 |

A total of 48 RC holes were drilled between September and November 2009 to ensure planned gold oxide Project infrastructure would not be placed in areas of potential economic mineralization. As shown in Figure 11.5_1 the holes were drilled to the south, east and north of the expected sulphide project pit limits to assess a planned waste dump to the south, planned gold oxide project infrastructure to the east and the planned gold oxide dump leach pad and ADR plant to the north.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 49 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 50 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

There was only weak mineralization and low gold and copper grades returned in 5 of the 48 holes, as shown in Table 11.5_1. As shown in Figure 11.5_1 holes 19, 20 and 21 are located at the southern end of the Calaorcco pit and does not impact the planned waste dump. Holes 31 and 39 to the north are of no economic interest.

| | | | |

| Table 11.5_1

La Arena Project

Sterilisation Drilling Results |

| Hole Number | Hole Depth (m) | Mineralization (length and grade) |

| Au | Cu |

| 09RC-LA-019 | 50 | 0-50m 0.17ppm | |

| | 09RC-LA-020 | 50 | In places 0.13ppm | |

| 09RC-LA-022 | 50 | 0-18m 0.15ppm | |

| 09RC –LA-031 | 50 | | 20-50m 0.1% |

| 09RC-LA-039 | 50 | 0-12m 0.15ppm | |

Although the sterilization drilling has successfully sterilised the top 50m from economic mineraliization, there are anomalous Cu and Au results returned that could indicate deeper mineralisation associated with Porphyry mineralization. This would require deeper holes to provide a higher confidence of sterilisation.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 51 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| 12 | SAMPLING METHOD AND APPROACH |

| | |

| 12.1 | Diamond Core Sampling |

HQ and NQ diameter diamond core was sampled at lengths on average of 2m. During earlier exploration programs the core was chiselled in half. More recently the core was cut lengthways with a diamond saw and half-core was sent for assay. Samples were numbered and collected in individual plastic bags with sample tags inserted inside. Each sample batch was made up of approximately 73 samples, including 2 quality control blanks, 2 standards and 2 field duplicates. Each work order consisted of a rice bag with samples along with an order list of which one copy was sent to the laboratory in Lima and another copy retained on site. Bags were closed with tie-wraps.

Core mark-up and sampling has been conventional and appropriate. Core is not orientated for structural measurements. Coffey Mining recommends orienting core in future.

Core inspection by Coffey Mining showed that some holes contain uncut core billets of approximately 10cm long that have not been sampled, presumably for geotechnical stress testing and/or bulk density determinations. Coffey Mining also noted that the core that had been split using the chisel method, the remaining half core was completely fractured. The silicified core was not well split using this technique.

| |

| 12.2 | Reverse Circulation Sampling |

RC samples were collected at 2m intervals and quartered in riffle splitters. Sub-samples weighed approximately 2kg and were collected in cloth-lined sample bags.

Wet sample procedures, sample and reject storage, and sample security were not documented in the reports made available to Coffey Mining.

| |

| 12.3 | Surface Trench Sampling |

Digging and sampling procedures for the surface trenches were not available. The trench data was used in a very broad manner to help model the mineralized zones, but was not included in the actual resource estimation.

Diamond core was logged in detail for geological, structural and geotechnical information, including RQD and core recovery. Whole core was routinely photographed. Review by Coffey Mining of selected geological logs against actual core showed no significant discrepancies or inconsistencies.

Diamond core and RC chip logging have been conventional and appropriate.

Core recovery has been recorded for all drillholes at 2m intervals. Core recovery is generally 90-95% or higher and infrequently 70-80% or less. The lower recoveries occur mainly in the more weathered, upper parts of the deposit.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 52 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| 13 | SAMPLE PREPARATION, ANALYSES AND SECURITY |

| | |

| 13.1 | Sample Security |

Reference material is retained and stored on site, including half-core and photographs generated by diamond drilling, and duplicate pulps and residues of all submitted samples. All pulps are stored at the La Arena exploration camp.

| |

| 13.2 | Sample Preparation and Analysis |

The flow sheet for drill core sample preparation and analysis is included as Figure 13.2_1. Samples were digitally weighed, dried to a maximum of 120ºC (for wet samples), crushed to 70% < 2mm (10 mesh), riffle split to 250g, and pulverized to 85% < 75µm (200 mesh). 50g pulps were submitted for chemical analysis. These procedures were in place since 2003.

The sample preparation methods for the samples submitted prior to 2003 are not documented in the reports made available to Coffey Mining.

Chemical analysis at the primary laboratory (ALS Chemex since 2005) and the secondary laboratory (CIMM Peru) consisted of fire assay (FA) with atomic absorption spectrometry (AAS) finish, using 50g sub-samples. Those samples that analysed ≥ 5g/t Au were analysed using gravimetric methods

For Cu and Ag (and Mo, Pb, Zn, As, Sb and Bi) multi-acid (four) digestion AAS was used. Hg was analysed using cold vapour AAS. Until the end of 2004 the core samples from drillholes 1 to 125 were processed by CIMM Peru as the primary laboratory. The assay methods for the samples submitted prior to 2005 are not documented in the reports made available to Coffey Mining.

| |

| 13.3 | Adequacy of Procedures |

Of the dry, crushed samples 3% of each batch were 2mm sieve tested by ALS Chemex, usually the first samples of a batch. Crusher jaws were calibrated and the crushing time adjusted if the test samples did not meet the criteria. A same percentage of sample pulps were tested for passing 75µm and the pulverization was repeated if deemed inadequate.

Typical results for the size testing of crushed and pulverized samples are shown in Figure 13.3_1 and Figure 13.3_2, respectively.

Sufficient quality control data exists in report format to allow a review of the analytical performance of the assay laboratories from 2004 onwards (see Section 14).

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 53 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 54 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 55 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| |

| 14.1 | Analytical Quality Control Procedures |

Until the end of 2004 the core samples from drillholes 1 to 125 were processed by CIMM Peru as the primary laboratory.

In June 2004 a rigorous QAQC program was implemented and consisted of:

Standards and blanks inserted at a rate of 1:30.

Field duplicates inserted at a rate of 1:30.

Coarse (crushed) rejects submitted to the primary laboratory at a rate of 1:20.

Pulp rejects submitted to the primary laboratory at a rate of 1:30.

Pulp duplicates submitted to the primary laboratory at a rate of 1:15.

Pulp duplicates submitted to secondary laboratory at a rate of 1:20.

Internal quality control by the laboratory consisted of 2 standards, 2 blanks, 2 duplicates from sample rejects, and 2 laboratory duplicates. ALS Chemex is an international company that has an ISO 9001:2000 certification at all their laboratories.

Coffey Mining reviewed the results obtained for standards, blanks, rejects and duplicates as presented in the graphs in the Appendix to the La Arena Pre-feasibility Study (November 2006) (PFS) and has no significant concerns about accuracy and precision that have been achieved since 2004 (see below).

There appears to have been no routine quality control program for the La Arena sampling and assaying prior to 2004.

| |

| 14.2 | Routine Independent Quality Control |

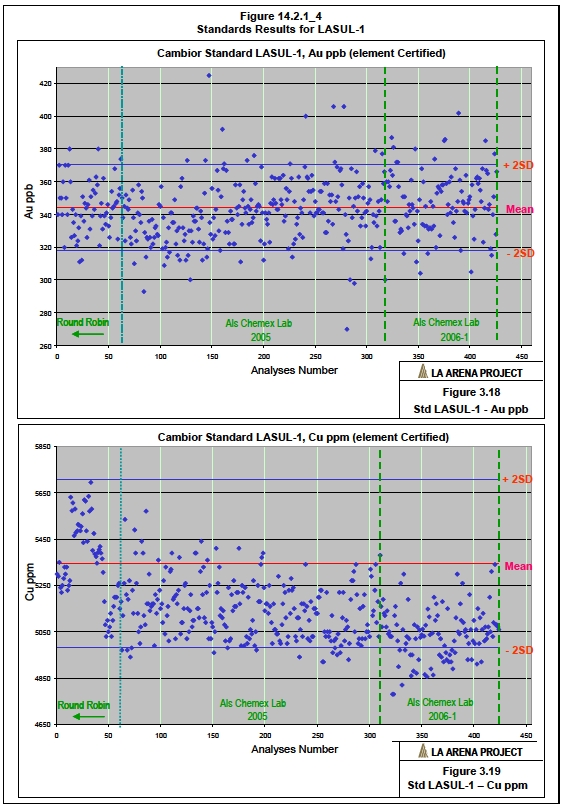

One standard reference material (LAOx-2) was included in the sample stream analysed by CIMM Peru laboratories during the trench sampling campaign in 2004. From January 2005 four different standards were used for independent quality control of analyses by the primary laboratory (ALS Chemex in Lima) and secondary laboratory (CIMM Peru). The standards were prepared with material from La Arena and certified by the ALS Chemex – La Serena Chile laboratory on the basis of round robin analyses.

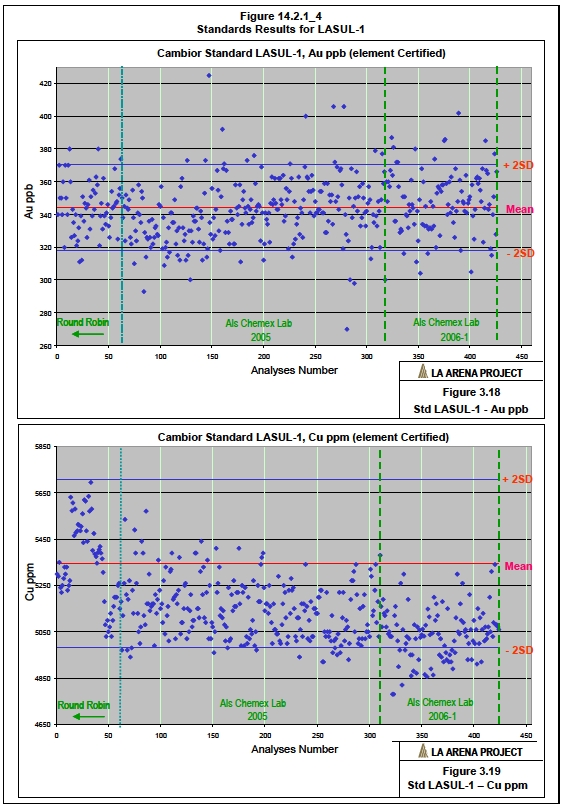

Statistics for the certified standards are included in Table 14.2.1_1.

| |

| La Arena Project, Peru – MINEWPER00640AB | Page: 56 |

| Technical Report – 28 October 2010 | |

Coffey Mining Pty Ltd

| | | | | | | | | |

| Table 14.2.1_1

Certified Elements Standards |

|

| Standard | Au ppb | Cu ppm |

| Mean | +2SD | -2SD | RSD% | Mean | +2SD | -2SD | RSD% |

| LAOx-1 | 396 | 425.5 | 366.5 | 3.7 | 203.6 | 216.7 | 190.5 | 3.2 |

| LAOx-2 | 798.8 | 855.6 | 742.1 | 3.6 | 114.6 | 121.6 | 107.5 | 3.1 |

| LAOx-3 | 2381.6 | 2628.4 | 2134.8 | 5.2 | 294.9 | 313.3 | 276.6 | 3.1 |

| LASUL-1 | 344.2 | 370.4 | 318 | 3.8 | 5344.8 | 5706.7 | 4983 | 3.4 |

| Standard | Hg ppb | As ppm |

| Mean | +2SD | -2SD | RSD% | Mean | +2SD | -2SD | RSD% |

| LAOx-1 | | | | | 278.2 | 312.8 | 243.6 | 6.2 |

| LAOx-2 | 2143.8 | 2435.8 | 1851.7 | 6.8 | 452.5 | 489.4 | 415.7 | 4.1 |

| LAOx-3 | 4761.9 | 5170.3 | 4353.6 | 4.3 | 768.4 | 814.6 | 722.1 | 3 |

Certified Au and Cu results prepared by Iamgold for the standards submitted during the period 2004-2006 are presented in Figures 14.2.1_1, 14.2.1_2, 14.2.1_3 and 14.2.1_4 for standards LAOx-1, LAOx-2, LAOx-3 and LASUL-1, respectively.

In general Au tends to be slightly over-estimated and Cu tends to be slightly under-estimated, though generally within 2 Standard Deviation limits. Coffey Mining has not reviewed the round robin results for the standards.

Coffey Mining is satisfied that the level of accuracy achieved by the primary assay laboratories (CIMM Peru and ALS Chemex) is within industry accepted limits.