Exhibit 99.8

MANAGEMENT DISCUSSION AND ANALYSIS

FOR THE SEVEN MONTH FINANCIAL YEAR ENDED DECEMBER 31, 2011

The following management’s discussion and analysis (‘‘MD&A’’) of the financial condition and results of operations of Rio Alto Mining Limited (the “Company” or “Rio Alto”) together with its subsidiaries is as of December 31, 2011. It is intended to be read in conjunction with the Company’s audited consolidated financial statements (the “Financial Statements”) for the seven month financial year ended December 31, 2011 and year ended May 31, 2011 and other corporate filings, including the Company’s Annual Information Form for the seven month financial year ended December 31, 2011, available at www.sedar.com (“SEDAR”). The Financial Statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) and the Financial Statements and MD&A are presented in United States dollars.

This MD&A, dated March 29, 2012, contains forward-looking information and forward looking statements. Readers are referred to the cautionary statement regarding forward-looking information under the heading “Cautionary Statement on Forward Looking Information”, which forms part of this MD&A.

Management is responsible for the Financial Statements referred to in this MD&A, and provides officers’ disclosure certifications filed with securities commissions on SEDAR.

Additional information about Rio Alto may be found at the Company’s website at www.rioaltomining.com or within the Company’s SEDAR profile at www.sedar.com.

Company Overview

The Company was formed in 1987 under the laws of British Columbia, Canada. Following a continuation under the laws of Alberta, Canada and a number of name changes, the Company became Rio Alto in July 2009. The principal business of the Company is the development of the La Arena gold oxide/copper-gold project (the “La Arena Project”) in northwestern Peru. In the final quarter of fiscal 2011 the Company commenced pre-production activities at a dump leach gold mine (the “La Arena Gold Mine”) located within the La Arena Project and commenced a feasibility study on the copper-gold deposit within the La Arena Project. Commercial production levels were achieved at the La Arena Gold Mine in late December 2011.

The Company changed its fiscal and financial year end from May 31 to December 31 in November 2011; consequently, the audited consolidated financial statements are as at and for the seven month financial year ended December 31, 2011. The change was made to allow it to provide its continuous disclosure information on a comparable basis with its peer group and to align its year end with the year end of La Arena S.A. (“La Arena”), a wholly-owned subsidiary that carries on the principal business of Rio Alto. The La Arena Gold Mine approached commercial production levels in November 2011, and it was a logical time to proceed with the change.

Rio Alto has three wholly-owned subsidiaries – La Arena and Rio Alto S.A.C. each incorporated under the laws of Peru and Mexican Silver Mines (Guernsey) Limited incorporated under the laws of Guernsey.

On February 9, 2011 the Company completed the purchase of 100 per cent of La Arena, which held mining rights over approximately 21,000 hectares in Peru, including the La Arena Project. The La Arena Project is approximately 1,000 hectares and contains two mineral deposits – a gold oxide deposit that hosts the La Arena Gold Mine and an adjacent copper-gold sulphide deposit.

The Company is a producing, reporting issuer in British Columbia, Ontario and Alberta and its common shares trade on the TSX and the Bolsa de Valores de Lima under the symbol “RIO”, the OTC QX® under the symbol “RIOAF” and on the Frankfurt Stock Exchange under the symbol “A0MSLE”.

Objectives and Highlights for 2011

Rio Alto’s objectives for 2011 were to:

Complete construction and development of the La Arena Gold Mine with a capacity of 10,000 tonnes of ore per day (“tpd”);

Expand production capacity from 10,000 tpd of ore to 24,000 tpd of ore;

Produce, during construction and development, between 50,000 and 60,000 ounces of gold;

Make advance deliveries of gold under the Company’s gold prepayment agreement;

Mine and place on the leach pad ore containing 100,000 ounces of gold;

Replace ounces of gold mined by exploration to increase gold oxide resources;

Advance work on a feasibility study of the copper-gold sulphide deposit;

Review project and corporate development opportunities; and

Complete the foregoing objectives without diluting shareholders.

All but one of the 2011 objectives were achieved. Rio Alto mined in excess of 100,000 ounces of gold, but only placed ore containing 80,000 ounces on the leach pad. The other ounces mined are in stockpiles of ore and will be leached in 2012.

By December 31, 2011 the 24,000 tpd of ore to pad design capacity had been achieved. The La Arena Gold Mine started pre-production on May 6, 2011 and produced 51,396 ounces of gold in the period ended December 31, 2011.

At this time Rio Alto has made monthly deliveries under the Gold Prepayment Agreement through to December 2012.

Exploration drilling during the year within and around the Calaorco Pit of the La Arena Gold Mine added more than 400,000 ounces of in situ gold in measured and indicated resources.

Feasibility study work on the copper-gold sulphide deposit is underway and drilling associated with this work has effectively significantly increased the previous indicated and inferred sulphide resources.

During the year, management reviewed several corporate development opportunities. None of the opportunities were considered attractive enough to pursue during the seven months ended December 31, 2011. However, subsequent to year end, the Company agreed to a five-year option and purchase agreement with a private, arm’s length Colombian company to acquire up to an 80 per cent interest in the company, which holds approximately 150,000 hectares of exploration prospects within Colombia.

Funds needed for mine development were not obtained by issuing shares or other dilutive financial instruments. Development funds were provided from pre-production revenue, drawing upon a $3 million operating loan facility payable by October 2014 and expanding the amount available under the Gold Prepayment Agreement (“Prepayment Agreement”) from $25 to $50 million.

Development at La Arena Project is ongoing, with $78.8 million incurred on development activities and capital expenditures in the seven months ended December 31, 2011 (including $4.7 million of capitalized depreciation), of which $57.0 million was paid in cash, and the remainder in accounts payable as at December 31, 2011. The Company realized $65.2 million from metal production during the period. The Company had a loss of approximately $0.5 million in the seven months ended December 31, 2011 compared to a loss of $8.7 million for the year ended May 31, 2011. Included in the seven months results were an unrealized gain of $7.9 million on the Gold Purchase Agreement (“Purchase Agreement”), $1.5 million of costs relating to the Prepayment Agreement, a $0.8 million asset retirement obligation accretion charge and general and administrative expenses of $6.0 million.

Objectives for 2012

Rio Alto’s objectives for 2012 are to:

Further expand capacity at the La Arena Gold Mine to 36,000 tpd of ore to the leach pad;

Replace mined gold oxide resources through exploration;

Produce between 150,000 and 160,000 ounces of gold;

Expand the copper-gold sulphide resource and reserve through exploration;

Infill drill the first five years of anticipated copper-gold sulphide production as part of the feasibility study;

Advance the copper-gold sulphide feasibility study toward completion;

Review project and corporate development opportunities;

Continue to improve the community relations, environment, and safety teams; and

Complete these objectives without diluting shareholders.

During early 2012 the production expansion program of the La Arena Gold Mine started. One of the key elements of the program is to build a tunnel for 100-tonne trucks under the highway that runs through the La

2

Arena Project area. Permission for this tunnel was received on February 6, 2012. The estimated cost of expanding production to 36,000 tpd of ore to pad is $25 million most of which will be spent during the first half of 2012.

Exploration continues with 5 diamond drill (“DD”) rigs and 2 reverse circulation (“RC”) drilling rigs on site. The drilling plan is for approximately 60,000 meters of DD and 25,000 meters of RC for an estimated total cost of $19.5 million during the year.

On February 17, 2012 the Company presented a new resource report in respect of the La Arena Project, with estimates based on drilling completed up to September 30, 2011. The report estimated a measured and indicated resource of 100.7 million tonnes of oxide mineral grading 0.46 grams per tonne gold (containing 1,484,000 ounces of gold) and an indicated sulphide mineral resource of 312.7 million tonnes grading 0.29% copper (containing 2 billion pounds of copper) and 0.24 grams per tonne gold (containing 2.4 million ounces of gold). Ongoing drill results will be announced over the course of the year and work on the copper-gold deposit feasibility study will be advanced.

Mine Development Activities

In calendar 2011 the La Arena Gold Mine was in the pre-production phase during which revenues were netted against development costs. As part of the development program and commencing in March 2011 ore and waste was mined. From March 2011 to December 31, 2011 ore mined was 3.7 million tonnes and waste mined was 4.2 million tonnes. Of the ore mined, 1.1 million tonnes of lower grade ore was stockpiled for future processing. The following table sets out the materials mined:

| Dry Metric | Dry Metric | Dry Meteric | ||||||

| Tonnes of | Tonnes Ore | Tonnes of | Waste to | |||||

| Month | Ore | Au g/t | Au Ozs | Stockpiled | Au g/t | Au Ozs | Waste | Ore Ratio |

| March | 21,095 | 0.66 | 447 | - | - | - | 41,346 | 1.96 |

| April | 174,677 | 0.50 | 2,786 | - | - | - | 163,079 | 0.93 |

| May | 57,881 | 0.58 | 2,954 | - | - | - | 311,833 | 1.98 |

| June | 197,444 | 0.53 | 3,352 | - | - | - | 272,716 | 1.38 |

| July | 360,214 | 0.43 | 5,002 | - | - | - | 290,860 | 0.81 |

| August | 512,567 | 0.60 | 9,869 | 35,215 | 0.18 | 200 | 323,175 | 0.59 |

| September | 227,299 | 1.19 | 8,682 | 91,655 | 0.41 | 1,194 | 230,344 | 0.72 |

| October | 336,351 | 1.52 | 16,480 | 269,003 | 0.68 | 5,844 | 637,954 | 1.05 |

| November | 291,277 | 1.70 | 15,883 | 345,737 | 0.58 | 6,430 | 953,519 | 1.50 |

| December | 241,053 | 1.99 | 15,415 | 402,283 | 0.70 | 9,010 | 957,546 | 1.49 |

| Total/Average | 2,519,858 | 1.00 | 80,869 | 1,143,894 | 0.62 | 22,678 | 4,182,371 | 1.14 |

One of Rio Alto’s objectives for the 2011 was to mine and place ore containing 100,000 ounces of gold on the leach pad. It became apparent in July that engineering delays would result in the late completion of the leach pad expansion restricting irrigation capacity. As a result, 1.1 million tonnes of material with a weighted average grade of 0.62 Au g/t was stockpiled and will be placed on the pad in the future. Ore placed on pad amounted to 2.5 million tonnes with a weighted average grade of 1.00 Au g/t. Consequently, ore placed on the pad containing approximately 81,000 ounces fell 19,000 ounces short of the objective. This is partially compensated for by the approximately 23,000 ounces of gold that has been mined and will be leached in 2012 now that the Phase 2 leach pad expansion is complete. Total mined ore amounted to 3.7 million tonnes with a weighted average grade of 0.88 Au g/t. Waste mined was 4.2 million tonnes resulting in a waste to ore ratio of 1.14:1.

Another objective was to pour, during construction, 50,000 to 60,000 ounces of gold. This objective was achieved with gold production being a little over 51,000 ounces. A related objective was to make deliveries in satisfaction of the Company’s Prepayment Agreement in advance of the scheduled delivery dates. At December 31, 2011 deliveries totaling 10,203 ounces of gold had been made. These deliveries satisfied delivery requirements to August 2012. Subsequent to year end, further deliveries were made that satisfied delivery requirements to December 2012. The following table sets out gold ounce production, sales and prepayment deliveries in 2011:

3

| Ounces of gold | |||

| To Settle | |||

| Month | Refined | Sold | Prepayment |

| May | 2,660 | 2,171 | 489 |

| June | - | - | - |

| July | 3,277 | 2,789 | 489 |

| August | 6,108 | 5,619 | 489 |

| September | 7,515 | 6,537 | 978 |

| October | 7,109 | 6,132 | 978 |

| November | 12,490 | 9,761 | 2,729 |

| December | 12,237 | 4,859 | 4,053 |

| Total | 51,396 | 37,868 | 10,203 |

At December 31, 2011 there were 3,325 ounces of gold in the Company’s account at a refinery, which were delivered to the Company in January 2012. Also in inventory at December 31, 2011 were approximately 3,841 ounces of gold contained within solution and upon carbon within the processing circuit at the La Arena Gold Mine.

Subsequent to the yearend and to the date of this MD&A, Rio Alto made additional deliveries in satisfaction of the Prepayment Agreement amounting to 3,971 ounces of gold. Future gold delivery requirements in respect of this agreement will, depending on the price of gold at the time of delivery, fall within a range between 37,941 ounces and 51,331 ounces as follows:

| Gold ounces to be delivered | |||

| Maximum | Notional | Minimum | |

| Gold price | Less than $950 | $1,150- $1250 | More than $1,450 |

| Monthly - December 2012 to October 2014 | 2,232 | 1,941 | 1,650 |

| Total | 51,331 | 44,636 | 37,941 |

La Arena Gold Mine Costs

Mine productivity during development of the La Arena Gold Mine was hampered by various civil construction challenges, start up efforts, and by limited process plant and mining fleet capacity. During November and December operations started to approach planned daily production rates. During these months operating costs per tonne of ore mined (including the cost of mining and depositing waste material) were $8.69 per tonne. Mine productivity and operating costs will continue to be adversely affected by the ongoing expansion program until its completion in mid-2012.

Mine site costs, per tonne of ore, by functional area for November and December 2011 were:

4

The major cost elements for mining include equipment rental, diesel, materials (mostly blasting materials) and labour. Processing costs are dominated by materials (chemicals), diesel generated electrical power and labour. Other costs elements include services and health, safety and community relations costs.

The mine site cost elements for November and December of 2011 were:

Equipment rental is for the mining fleet which consists of 14 one hundred tonne trucks, two 18.5 cubic meter shovels, 2 blast hole drilling rigs and various support equipment for road maintenance, personnel movement and other services.

Diesel is used to operate the mining fleet, the support vehicles and electrical generators. Materials include blasting agents and chemicals used to leach and process doré. Services include blasting, assaying and security. Health, safety, environment and community relations include supplies, training and donations.

Costs are subject to inflationary pressures. The 2011 Peruvian inflation rate was 4.1%. Rio Alto voluntarily granted a wage increase somewhat greater than the inflation rate in order to promote good employee relations. Consequently, labour costs are likely to be somewhat higher during 2012 than in the recent past.

The La Arena Gold Mine is supported from the Company’s principal business office in Lima. For the seven month period ended December 31, 2011 Lima office costs amounted to $2.7 million consisting of: human resources $2.0 million; travel to the mine site $76,000; office rent and related charges $0.5 million; legal and

5

audit $68,000; consulting and various other charges of $54,000. While approximately 60% of these costs have been capitalized in the past, it is expected that they will be expensed as general and administrative costs starting in January 2012, as commercial production has commenced.

Operating costs may also be affected by changes in the Peruvian nuevo sol (“sol” or “S/.”) to US dollar exchange rate. From January 2009 to December 2011 the sol has consistently appreciated relative to the US dollar from S/.1 = $0.32 to S/.1 = $0.37. During that three-year period, the sol was at a low of S/.1 = $0.31 in March 2009, averaged S/.1 = $0.32 and finished 2011 at S/.1 = $0.37. Costs most affected, in the short term, by continued appreciation of the sol relative to the dollar are labour and diesel. In the long term virtually all costs incurred in Peru would be affected. If during 2012 the sol appreciates by 5% relative to the dollar, diesel costs would likely increase by approximately $0.085 per tonne of ore mined and labour would likely increase by $0.081 per tonne of ore mined.

Although operating costs would increase by continued sol appreciation, the Company has a S/.72.7 million ($25.6 million) Impuesto General a las Ventas (“IGV”) receivable from the Peruvian government that would also appreciate and partially offset the cash impact of the cost increase.

Results of Operations

The following table provides selected annual information for the three most recent completed financial years ended December 31, 2011 and years ended May 31, 2011 and May 31, 2010:

| (thousands of US dollars, except per share amounts) | Prepared using international financial reporting standards | Balance sheet items prepared using international financial reporting standards, Net loss and Loss per share using Canadian generally accepted accounting principles | |||||||

| For the seven months ended | For the year ended | For the year ended | |||||||

| December 31, | May 31, | May 31, | |||||||

| 2011 | 2011 | 2010 | |||||||

| Total assets | $ | 197,507 | $ | 157,944 | $ | 24,062 | |||

| Working capital | 35,050 | 20,337 | 6,204 | ||||||

| Shareholders’ equity | 115,309 | 112,036 | 23,487 | ||||||

| Net loss | (548 | ) | (8,706 | ) | (13,415 | ) | |||

| Loss per share from continuing operations | - | (0.06 | ) | (0.16 | ) | ||||

The Company had a loss of $0.5 million in the seven months ended December 31, 2011, an improvement of $8.6 million over the year ended May 31, 2011. The seven months ended December 31, 2011 included non-cash gains of $7.9 million arising from an unrealized gain on the gold derivative liability, offset by $1.5 million of costs related to the expansion of the Prepayment Agreement, $3.1 million for stock-based compensation expense, $2.8 million of general and administrative expenses, and $0.8 million for accretion expense related to the asset retirement obligation at La Arena. The year ended May 31, 2011 included non-cash gains of $1.6 million arising from an unrealized gain on the gold derivative liability, offset by $1.0 million of costs related to the establishment of the Prepayment Agreement, $4.9 million for stock-based compensation expense, $3.8 million of general and administrative expenses.

The derivative liability relates to the Purchase Agreement described in the Commitments section of this MD&A and in Note 19 to the Financial Statements. The mechanics for the calculation of the liability generally result in an increased hypothetical liability and a corresponding unrealized loss if the price of gold increases during a reporting period. Should the price of gold decrease or should the volatility of the gold price decrease during a period the liability would decrease resulting in an unrealized and unrealizable gain. The economic reality is that when the price of gold increases the Company and its shareholders should benefit despite increases in the derivative liability.

Sales of gold from the Company’s La Arena Gold Mine during fiscal 2011 resulted in a change in the Company’s

6

functional currency to the United States dollar, as the La Arena Gold Mine carries out the principal business of the Company. The functional currency of La Arena is the US dollar.

General and administration costs

General and administrative costs were $6.0 million for the seven months ended December 31, 2011, compared to $8.7 million in year ended May 31, 2011 and are comprised of costs of Vancouver office that provides services related to public company management and administration and the Lima office which supports the La Arena Project. The table below annualizes, where appropriate, the general and administration costs to compare consistent time periods and include the following:

| For the seven | |||||||

| months ended | For the year ended | ||||||

| December 31, 2011 | May 31, 2011 | ||||||

| Annualized | |||||||

| Share-based compensation | $ | 3,126,259 | $ | 3,126,259 | $ | 4,893,723 | |

| Salaries | 456,872 | 783,209 | 666,381 | ||||

| Target bonuses and severance | 440,000 | 440,000 | 832,000 | ||||

| Office and miscellaneous | 744,566 | 1,276,399 | 534,437 | ||||

| Accounting and audit | 327,829 | 561,993 | 293,074 | ||||

| Travel | 186,313 | 319,394 | 392,354 | ||||

| Investor relations | 143,631 | 246,225 | 326,043 | ||||

| Legal fees | 131,150 | 224,829 | 229,423 | ||||

| Consulting | 131,161 | 224,847 | 187,349 | ||||

| Directors’ fees | 144,500 | 247,714 | 182,084 | ||||

| Regulatory and transfer agent fees | 65,736 | 112,690 | 144,043 | ||||

| Amortization | 65,455 | 112,209 | 58,561 | ||||

| $ | 5,963,472 | $ | 7,675,767 | $ | 8,745,472 |

The discussion below compares the annualized costs to the previously reported annual period. Variances beyond this are due to comparing seven months to twelve months.

The decrease in general and administration expenses in the annualized period ended December 31, 2011 of $7.7 million compared to $8.7 million for the year ended May 31, 2011 is due primarily to decreased non-cash stock-based compensation costs and target bonuses and severance.

Stock-based compensation expense was $3.1 million for the seven months ended December 31, 2011 (and would be the same on an annualized basis because options are granted once during the year, except that newly hired executives usually receive options as an incentive) compared to $4.9 million in the year ended May 31, 2011. Stock based compensation is comprised of the amortization of the fair value of granted options over the vesting period. In the year ended May 31, 2011, the Company granted 3.7 million options with a fair value of $4.2 million. In the seven months ended December 31, 2011, the Company issued 4.2 million options with a fair value of $9.1 million. The increase in fair value is due to share price appreciation and price volatility. Fair value is recognized over the periods in which the options vest which range from immediately to over a three year period. Generally, the options granted during the seven months ended December 31, 2011 have a longer vesting period, and therefore despite the significant increase in fair value, the amount recognized is spread over a longer period. Of the existing options, there is $6.2 million of fair value to be recognized in future periods.

Salaries were $0.8 million in the annualized period ending December 31, 2011, approximately $0.1 million higher than for the year ended May 31, 2011 due to an increase in the number of employees to manage increased activities.

Management bonuses for the seven months ended December 31, 2011 of $440,000 were awarded upon productivity targets being achieved. In the year ended May 31, 2011, the Company had management bonuses of $450,000 related to the completion of the acquisition of La Arena and $388,000 for a severance related bonus payment to a former director and officer.

Office and miscellaneous expenses for the seven month period ended December 31, 2011 of $1.3 million on an annualized basis increased by 138% from the year ended May 31, 2011 due to the relocation to a larger office space as corporate activities increased.

Accounting and audit expense of $562,000 on an annualized basis increased by $269,000 due to costs related to work done in connection with the required conversion to International Financial Reporting Standards (“IFRS”), a change in the functional and reporting currency, increased annual costs due to the acquisition and

7

development of La Arena Gold Mine and other complex transactions undertaken by the Company. Some of the costs are one-time costs; however, the complexity of the Company’s accounting transactions and scope of activities have increased and will be reflected in future periods’ accounting and audit expense.

Directors’ fees were significantly higher in 2011 for the annualized year ended December 31, 2011 compared to the year ended May 31, 2011, due to the appointment of three additional non-executive directors.

Investor relations and regulatory and transfer agent fees were $359,000 on an annualized basis for the seven months ended December 31, 2011, an $111,000 decrease from the year ended May 31, 2011 as management reduced promotional efforts to focus on mine development activities.

Other expense/income items

Other expense/income items amounted to a gain of $5.4 million in the seven months ended December 31, 2011 compared to $0.3 million in the comparable year ended May 31, 2011 due primarily to an increase of $6.2 million in the unrealized gain on the Purchase Agreement, offset by accretion expense related to the asset retirement obligation at the La Arena Gold Mine.

| For the seven | ||||||

| months ended | ||||||

| December 31, | For the year ended | |||||

| 2011 | May 31, 2011 | |||||

| Unrealized gain on derivative liability | $ | 7,868,984 | $ | 1,648,876 | ||

| Cost relating to Prepayment Agreement | (1,542,451 | ) | (1,022,282 | ) | ||

| Accretion expense | (847,416 | ) | - | |||

| Foreign exchange loss | (48,137 | ) | (385,376 | ) | ||

| Other income | 3,021 | 36,204 | ||||

| $ | 5,434,001 | $ | 277,422 |

On October 15, 2010 the Company entered into a $25 million Prepayment Agreement with Red Kite Explorer Trust (“RKE”). Concurrently the Company also entered into a Purchase Agreement with RKE described in the Commitments section of this MD&A and in Note 19 to the Financial Statements and a $3 million Operating Loan Agreement. On October 20, 2011, the Company expanded the amount available under the Prepayment Agreement to $50 million with amendments to the Prepayment Agreement and the Purchase Agreement.

Each drawdown of the Prepayment Agreement is allocated between deferred revenue and a derivative liability. An option pricing model that considers changes in the gold price is used to estimate the fair value of the financial derivative embedded in the Company’s Purchase Agreement. The deferred revenue portion is the drawdown less the amount allocated to the derivative liability. At December 31, 2011 the entire $50 million prepayment facility and the $3 million operating loan had been drawn down.

In the seven months ended December 31, 2011, the Company had a $7.9 million unrealized gain related to the revaluation of the derivative liability related to the Purchase Agreement. Under the Purchase Agreement, RKE had the option to buy up to 622,210 ounces of gold based on the lower of prices quoted on either the London Gold Market AM Fixing Price as published by the London Bullion Market Association or the Comex (1st Position) Settlement Price over defined periods of time. With the expansion of the Purchase Agreement from $25 million to $50 million in October 2011, this Purchase Agreement was also amended whereby the number of ounces that RKE may buy includes all of the ounces of the produced from the Calaorco and Ethel Pits within the La Arena Gold Mine, which at December 31, 2011 is estimated to be 634,600 ounces. The Purchase Agreement is accounted for as a written call option as RKE has the right, but not the obligation to purchase the gold. An option pricing model that considers changes in the gold price was used to estimate the fair value of the financial derivative relating to the written option. Subsequent changes, due to revised estimates, in fair value are reflected in profit or loss.

The derivative liability related to the Purchase Agreement is $4.6 million at December 31, 2011 compared to $12.4 million at May 31, 2011. The Company recognized an unrealized gain on the derivative liability related to the Purchase Agreement of $7.9 million in the seven months ended December 31, 2011. The gold price increased from $1,536 at May 31, 2011 to $1,575 at December 31, 2011, which generally results in an increase in the liability, however in the seven months ended December 31, 2011, the liability decreased significantly due

8

primarily to a reduction in the defined periods of time for the quoted market price to be established from an estimated 14 days to 7 days for 95% of the gold purchased by RKE. The gain of $1.6 million in the year ended May 31, 2011 was due to decreased volatility in the gold price between inception and May 31, 2011.

At May 31, 2011, the Company recorded an asset retirement obligation of $14.8 million for the La Arena Gold Mine. The accretion related to this obligation was $0.8 million for the seven months ended December 31, 2011. In July 2011, the Company submitted to the Peruvian government a closure plan for the La Arena gold mine. The estimated undiscounted value of the closure obligation is $34.7 million. The closure plan was approved in February 2012 and the Company is required to post a bond of approximately $3.2 million in January 2013. The reclamation and closure activities include land and water rehabilitation, demolition of buildings and mine facilities, on-going care and maintenance and other costs. The majority of the work is planned to be done in 2017 – 2019, with care and maintenance continuing until 2024.

Peru Taxes

The Peruvian mining tax system was revised during 2011. The Company is subject to the revised system.

On September 14, 2011 the executive branch of the Peruvian Government submitted three bills to the Congress for consideration and approval. On September 21, 2011 an amendment of the bills was submitted to Congress. These bills created two new forms of taxation on mining enterprises and one bill modified the existing royalty on sales of mineral resources. Of the two new forms of tax, one applies to Rio Alto. The modified royalty also applies to the Company.

The two amended bills applicable to Rio Alto may be summarized as:

Special Mining Tax (“SMT”)

The SMT is applied on operating mining income based on a sliding scale of rates ranging up to 8.40%. The tax liability would be determined and payable on a quarterly basis. As a tax on operating profit, normal operating costs excluding interest are deducted from revenue, an operating profit margin is determined and a progressive tax rate would be applied on the Operating Profit Margin Ratio. The Operating Profit Margin Ratio is determined by the following formula:

Ratio = Operating Income / Mining Operating Revenue X 100.

Where:

Mining Operating Revenue equals revenue from the sale of mineral resources adjusted for final settlement payments to account for weight, assay and final metal pricing differences, and

Operating Income equals Mining Operating Revenue less cost of goods sold and operating expenditures calculated for accounting purposes. Exploration expenditures must be allocated on a pro rata basis over the life of the producing mine to which they relate and are not deductible in the period in which they are incurred.

Modified Royalty Based on Operating Income (“MR”)

The MR revises the mining royalty enacted in 2004 that required a payment ranging from 1% to 3% of the commercial sales value of mineral resources. The MR is applied on the Company’s operating income, rather than sales and is payable quarterly (the previous royalty was payable monthly). The amount payable is determined on a sliding scale with marginal rates ranging up to 12% applied to operating margin, subject to a minimum royalty of 1% of the sales value of mineral resources. As the Company’s operating margin increases the marginal rate of the royalty increases. The basis of the royalty (operating income) and the effective royalty rate would be calculated by following the same rules used to determine the tax liability under the SMT.

Under Peruvian law, workers in the mining industry are entitled to participate in a company’s income before income tax. This participation amounts to 8% of income before income subject to income tax. The corporate income tax after deduction of worker participation is 30%. The following table sets out, for illustration purposes, the calculation of the total Peruvian tax burden under the assumptions illustrated and further assumes that a 45% operating profit margin was achieved:

9

| Per Cent of Revenue | ||

| Mineral product sales proceeds | 100.00 | % |

| Costs: | ||

Supplies & services | ||

Salaries | ||

Depreciation of plant & equipment | ||

Amortization of intangibles | ||

Exploration related to sales proceeds | ||

| Subtotal | 55.00 | % |

| Operating Margin | 45.00 | % |

| Modified Royalty | 3.33 | % |

| Special Mining Tax | 4.80 | % |

| Interest Expense | 1.00 | % |

| Tax Losses Applied | 2.00 | % |

| Income Before Worker Profit Share | 33.87 | % |

| Worker Profit Share | 2.71 | % |

| Income Before Income Tax | 31.16 | % |

| Income Tax | 9.35 | % |

| Net Income | 21.81 | % |

| Total Taxes | 20.19 | % |

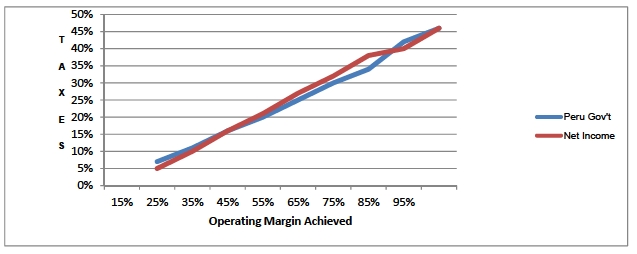

The integration of elements of the Peruvian tax system serves to align the Government’s economic interest with mining companies’ interest; such that, as a company’s net income increases the Government and the company share in the increase in virtually the same manner. The following chart, using the same assumptions as applied in the preceding table and varying the assumed operating profit margin, illustrates that as a company’s operating margin increases the percentage of revenue resulting in net income increases and the total tax burden increases at virtually the same rate.

Liquidity and Capital Resources

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company manages liquidity risk through forecasting its cash flows from operations and anticipating investing and financing activities. Senior management and the board of directors review and approve planned expenditures. Management believes that the ability to fund operations through cash generated from operations is sufficient to meet the sustaining capital and operating requirements. Expansion of the La Arena Gold Mine and completion of the feasibility study for the copper-gold deposit will be funded from the Company’s working capital. Development of the copper-gold sulphide project may, depending on the timing of the expenditures, require additional financing.

The Company’s cash receipts are from the mining and sale of mineral products; however, the profitability of developing and producing mineral products is affected by many factors including the cost of operations,

10

variations in the grade of ore mined, metal recovered and the price of metals. Depending on the price of metals and other factors, the Company may determine that it is impractical to continue production. Metals prices have fluctuated widely in recent years and are affected by many factors beyond the Company’s control including changes in international investment patterns, economic growth rates, political developments, sales or accumulation of metal reserves by governments, and shifts in private supplies of and demands for metals. The supply of metals consists of a combination of mine production, recycled material and existing stocks held by governments, producers, financial institutions and consumers. If the market price for metals falls below the Company’s full production cost and remains at such levels for any sustained period of time, the Company will experience losses and may decide to discontinue operations or development of other projects at one or more of its properties.

The Company’s cash balance at December 31, 2011 was $25.9 million, which was an increase of $14.4 million from the year ended May 31, 2011. Working capital of $35.0 million (including the IGV receivable of $25.6 million) at December 31, 2011 increased by $14.7 million from $20.3 million at May 31, 2011 due to the drawdown of $28.5 million from RKE, offset by operating and continued development costs.

The increases in cash, cash equivalents and working capital were due to the following activities:

Operating Activities:

Cash used in operating activities were $23.0 million in the seven months ended December 31, 2011 compared to $8.5 million in the year ended May 31, 2011.

During the seven months ended December 31, 2011, the Company had a loss of $0.5 million, which after adjusting for non-cash items of $5.7 million resulted in cash outflows before changes in non-cash working capital of $6.3 million, which primarily reflects general and administrative cost of $2.8 million and $1.5 million of cost relating to the Prepayment Agreement and current taxes of $2.0 million.

During the financial year ended May 31, 2011, the Company had a loss of $8.7 million, which after adjusting for non-cash charges of $3.5 million resulted in cash outflows before changes in non-cash working capital of $5.2 million. The cash outflows resulted primarily from cash general and administrative costs of $3.9 million and costs relating to the Gold Prepayment and related agreements of $1.0 million.

Changes in non-cash working capital resulted in a $16.7 million cash outflow in the seven months ended December 31, 2011 compared to cash outflows of $3.3 million in the year ended May 31, 2011. The outflows in seven months ended December 31, 2011 included $9.0 million charged to inventory of metal, ore and supplies during the pre-production phase, which, along with development expenditures caused an $11.6 million increase in the IGV receivable related to value added tax on expenditures. These were partially offset by a $2.5 million increase in accounts payable related to working capital items and current income taxes payable of $2.0 million. The outflows in the year ended May 31, 2011 included $3.8 million increase in the IGV receivable, related to development costs, increases in inventory of $3.9 million offset by $4.9 million related to a reduction in prepaid development costs.

Under Peruvian law the Impuesto General a las Ventas (“IGV”) is a tax imposed at a rate of 18 per cent of the value of any goods or services purchased. IGV is generally refundable within the year in which it is paid. Refund applications may only be made by companies that are trading within Peru and collecting IGV from customers, by exporters or by companies that have an agreement with the tax authority for the early collection of IGV. Once the Company exports mineral production and files the necessary tax statements, it will be eligible for refunds of IGV. As at December 31, 2011, the Company has an IGV receivable of $25.6 million (May 31, 2011 - $14.0 million, June 1, 2010 - $0.4 million).

Financing Activities:

Net cash received from financing activities during the seven months ended December 31, 2011 was $29.2 million compared to $112.9 million in the year ended May 31, 2011.

On October 15, 2010 the Company entered into a $25 million Prepayment Agreement with RKE. Concurrently the Company entered into a Purchase Agreement with RKE described in the Commitments section of this MD&A and in Note 19 to the Financial Statements and a $3 million Operating Loan Agreement, as described in Note 17 to the Financial Statements. On October 20, 2011, the Company expanded the Prepayment Agreement to $50 million with amendments to the Prepayment Agreement and the Purchase Agreement. In the year ended May 31, 2011, the Company drew down $24.5 million and in the seven month period December 31, 2011 drew the remaining $25.5 million available under the Purchase Agreement and also drew the $3 million

11

operating loan. Cost relating to this financing was $1.0 million in the year ended May 31, 2011 and $1.5 million in the seven months ended December 31, 2011.

In the year ended May 31, 2011 proceeds of $79.2 million, net of share issue costs of $5.7 million were received on the issue of 50,326,257 common shares under private placements. An additional $0.6 million related to the receipt of subscriptions receivable outstanding at the beginning of the fiscal period that were received in fiscal 2011. Proceeds of $8.0 million were received on the conversion of 8,468,250 common share purchase warrants and $0.6 million were received on shares issued upon the exercise of 1,727,500 stock options.

In the seven months ended December 31, 2011 proceeds of $0.3 million were received on the conversion of 126,270 common share purchase warrants and $0.4 million were received on shares issued upon the exercise of 1,062,500 stock options

Investing Activities:

In the seven month period ended December 31, 2011, investing activities provided net cash of $8.1 million due to pre-production cash receipts that were capitalized. Cash used in the year ended May 31, 2011 was $98.8 million.

The investing activities in the seven months ended December 31, 2011 were to principally develop the La Arena Project and consisted of additions to mineral properties and plant and equipment. Additions to plant and equipment were $20.5 million, of which $15.8 million was paid in cash and the remaining amount was in accounts payable at the end of the period. Additions to mineral properties were $58.3 million, of which $41.3 million was paid in cash, $12.4 million was included in accounts payable at December 31, 2011, and $4.7 million was related to depreciation of plant and equipment which is capitalized to mineral properties during the pre-production phase. Mineral property additions included $20.4 million of pre-production costs. The preproduction revenues of $71.6 million on the sale of 48,071 ounces were included in mineral properties, of which $6.4 million was a non-cash delivery of gold partially to settle the Prepayment Agreement. All of the development work was for the La Arena Gold Mine, except $4.3 million related to the copper-gold sulphide project.

In February 2011, Rio Alto exercised its option to acquire 100% of La Arena S.A. upon a payment of $48.8 million. Cash acquired in this transaction was $5.5 million. Throughout the year ended May 31, 2011, the Company spent $55.4 million to develop the La Arena Gold Mine comprised of $18.7 million for capital assets and $36.7 million on property development.

Summary of Quarterly Results

The following table provides selected information for the most recent quarters ended December 31, 2011:

| (thousands of US dollars, except per share amounts) | Prepared using International financial reporting standards | Prepared using Canadian generally accepted accounting principles | |||||||||||||||||||||

| For the four months ended | For the three months ended, | ||||||||||||||||||||||

| December 31, | August 31, | May 31, | February 28, | November 30, | August 31, | May 31, | February 28, | ||||||||||||||||

| 2011 | 2011 | 2011 | 2011 | 2010 | 2010 | 2010 | 2010 | ||||||||||||||||

| Total assets | $ | 197,507 | $ | 166,287 | $ | 157,944 | $ | 127,847 | $ | 51,285 | $ | 29,442 | $ | 26,594 | $ | 25,953 | |||||||

| Working capital | 35,050 | 7,739 | 20,337 | 6,242 | 14,462 | 4,943 | 5,807 | 4,349 | |||||||||||||||

| Shareholders’ equity | 115,309 | 102,090 | 112,036 | 111,752 | 44,690 | 28,965 | 23,487 | 23,980 | |||||||||||||||

| Net income (loss) | 9,715 | (10,263 | ) | (1,377 | ) | (2,587 | ) | (3,837 | ) | (904 | ) | (9,908 | ) | (1,216 | ) | ||||||||

| Income (loss) per share from continuing operations | 0.06 | (0.06 | ) | (0.01 | ) | (0.02 | ) | (0.03 | ) | (0.01 | ) | (0.12 | ) | (0.01 | ) | ||||||||

In the past, expenses increased or decreased as a result of stock-based compensation expense, income tax provisions and gains/losses on the derivative liability relating to the Purchase Agreement. During the quarter ended December 31, 2011, the Company charged $2.8 million of stock based-compensation expense and realized a gain of $16.4 million on the derivative liability, for a net gain of $13.6 million. Excluding these three items the quarterly loss would have been $3.9 million, which is in-line with the loss of $3.8 million in the corresponding quarter November 30, 2010 of the prior year. Now that the La Arena Gold Mine is producing, income and expenses will, for the most part, be determined by metal prices and operations.

12

Commitments:

| (a) | In the normal course of business the Company enters into contracts and performs business activities that give rise to commitments for future minimum payments. The following table summarizes the maturities of the Company’s financial liabilities and commitments: | |

| December 31, 2011 | ||||||||||

| Within 1 year | 2 to 5 years | Over 5 years | Total | |||||||

| Accounts payable | $ | 27,481,352 | $ | - | $ | - | $ | 27,481,352 | ||

| Deferred revenue | 4,250,823 | 25,258,707 | - | 29,509,530 | ||||||

| Derivative liability | 934,144 | 3,192,617 | 432,337 | 4,559,098 | ||||||

| Office leases | 258,287 | 750,169 | 35,626 | 1,044,082 | ||||||

| Asset retirement obligation | - | 3,186,480 | 31,553,520 | 34,740,000 | ||||||

| Operating loan | - | 3,000,000 | - | 3,000,000 | ||||||

| Total | $ | 32,924,606 | $ | 35,387,973 | $ | 32,021,483 | $ | 100,334,062 | ||

| (b) | Under the Prepayment Agreement, the Company is obligated to deliver gold to discharge its sales obligation. The monthly delivery obligation may vary depending on the price of gold at the time of delivery and will fall within a range between 37,941 and 51,331 ounces as described herein. As of March 29, 2012 the company has delivered 14,174 ounces of gold in satisfaction of the delivery commitments to November 2012. See Note 19 of the Consolidated Financial Statements for a description of the delivery terms under the Prepayment Agreement. | |

| (c) | The Company also entered into a Purchase Agreement with RKE whereby RKE agrees to buy up to all of the gold ounces from the Calaorco and Ethel pits based on the lower of prices quoted on either the London Gold Market AM Fixing Price as published by the London Bullion Market Association or the Comex (1st Position) Settlement Price over defined periods of time. See Note 19 to the Financial Statements for a description of the delivery terms under the Purchase Agreement. | |

| (d) | Rio Alto took down $3 million under the Operating Loan Facility with RKE on September 2, 2011. This obligation bears interest at a rate of 3-month LIBOR plus 6 per cent compounded annually and is due on or before October 2, 2014. | |

| (e) | Under Peruvian law La Arena was required to file, by July 20, 2011, an independently prepared mine closure plan for the La Arena Gold Mine. The closure plan was prepared for La Arena by a government approved independent engineering company and filed within the prescribed time limit. The plan was approved by Peruvian authorities in 2012 and requires the posting of a bond or other financial assurance in the amount of approximately $3.2 million within the first 12 days of 2013. The estimated closure cost total is $34.7 million, consisting of $12.4 million of progressive closure expenditures to occur in approximately the 7th and 8th years of the life of the La Arena Gold Mine; $17.1 million of closure costs to occur in the 9th year of the mine life and approximately $5.2 million of post-closure monitoring costs during the five years subsequent to the mine closure. See Note 18 of the Consolidated Financial Statements, for a description of the Company’s asset retirement obligation (“ARO”) and the assumptions used in determining the $14.8 million ARO recognized in the balance sheet. |

Refer to events subsequent to December 31, 2011 for commitments entered into after the seven month financial year ended December 31, 2011.

Related Party Transactions

Transactions with related parties, for the seven month period ended December 31, 2011, are described in Note 27 to the Financial Statements and are summarized below:

With the exception of the housing loan, amounts owing to or from related parties are non interest bearing, unsecured and due on demand. The transactions were in the normal course of operations.

| a. | The following related party transactions and balances for the seven months ended December 31, 2011 are: |

13

| Seven months | ||||||||

| ended December | Year ended | |||||||

| Related party | Nature of the relationship | Nature of the transaction | 31, 2011 | May 31, 2011 | ||||

| Somji Consulting | A company controlled by a former director of the Company, who resigned his position in February, 2011. | Management fees, bonuses, office rent and administrative services. | Nil | $ | 809,124 | |||

| Various individuals | Directors of the Company | Directors’ fees, management fees and travel allowances. | 158,100 | 181,894 | ||||

| Davis LLP | A law firm in which the Company’s corporate secretary is a partner. Resigned as a director in October 2011. | Expensed in to general and administrative costs, legal fee | 107,187 | 257,455 | ||||

| Prize Mining and Philippine Metals | A public company and a private company with a director in common with the Company. | Office rent | 4,415 | 31,586 | ||||

| Amerigo Resources | A company whose President, CEO and director is also a director of the Company | Reimbursement of shared office expense | 1,499 | 23,127 | ||||

| Individual | A key employee who works in the management of mine operations | Housing loan | 380,000 | Nil | ||||

| b. | Key management are those personnel, other than the directors, having the authority and responsibility for planning, directing and controlling the Company and includes the Chief Executive Officer and Chief Financial Officer. Remuneration for key management is: |

|

| For the seven | |||||||

| months ended | For the year ended | ||||||

| December 31, 2011 | May 31, 2011 | ||||||

| Salaries (i) | $ | 281,817 | $ | 442,147 | |||

| Benefits (i) | 5,537 | 7,165 | |||||

| Bonuses (i) | 440,000 | 218,935 | |||||

| Share options (ii) | 268,463 | 439,952 | |||||

| $ | 995,817 | $ | 1,108,199 |

| (i) | The salaries, benefits and bonuses are included in general and administrative expenses and mineral properties and evaluation properties. | |

| (ii) | The options are included in administrative expenses as share based compensation expense. | |

|

| c. | Included in accounts receivable at the end of the period is $5,039 (May 31, 2011 - $27,320; June 1, 2010 - $46,315) from related parties. Included in accounts payable at the end of the period is $9,834 (May 31, 2011 - $214,759; June 1, 2010 - $72,248) from related parties. |

Financial Instruments

Use of derivatives

The Purchase Agreement described under “Other Items” and the Commitments sections of this MD&A is characterized as a written option for accounting purposes and is carried as a liability. Gains or losses arising from the periodic revaluation of the liability are credited to or charged against operations.A more detailed description of the accounting for this option is presented in Note 19 to the Financial Statements.

Fair values

The carrying values of cash and cash equivalents, receivables, promissory note receivable, accounts payable and accrued liabilities and due to related parties approximate their fair values due to their short term to maturity. The derivative liability, embedded within the Purchase Agreement, is carried at fair value and is estimated by an option pricing model that considers changes in the price of gold. In the seven months ended December 31, 2011, the Company recognized a gain of $7.9 million related to the revaluation of the derivative liability. The

14

IGV receivable is denominated in Peruvian Nuevo Soles (“sol”) and its carrying amount will vary as the sol to US dollar exchange rate changes; however, the IGV receivable partially hedges the Company’s sol denominated operating costs.

Liquidity risk

Liquidity risk is managed by maintaining sufficient cash balances to meet current working capital requirements. The Company’s cash and cash equivalents are invested in business accounts or guaranteed investment certificates with chartered banks that are available on demand.

Credit risk

The Company’s credit risk is primarily attributable to its liquid financial assets and doré and would arise from the non-performance by counterparties of contractual financial obligations. The Company limits its exposure to credit risk on liquid assets by maintaining its cash with high-credit quality financial institutions and shipments of doré are insured with reputable underwriters. Management believes the risk of loss of the Company’s liquid financial assets and doré to be minimal. Taxes receivable result from prepayments to the Peruvian and Canadian governments and management believes that the credit risk concentration with respect to these receivables is minimal.

Currency risk

The Company operates in Canada and Peru and is therefore exposed to foreign exchange risk arising from transactions denominated in foreign currencies.

The operating results and the financial position of the Company are reported in US dollars. Prior to June 2011 the functional currency of Rio Alto Mining Limited, the parent company, was the Canadian dollar. Sales of gold at the Company’s La Arena Gold Mine during 2011 caused management to review the functional currency exposure of the parent company and management concluded that the currency exposure was the United States dollar. Therefore, the functional currency of the parent company was deemed to be the United States dollar. Fluctuations of operating currencies (the Canadian dollar and sol) in relation to the US dollar will have an impact upon the reported results of the Company and may also affect the value of the Company’s assets and liabilities. The Company has not entered into any agreements or purchased any instruments to hedge possible currency risk.

Interest risk

The Company invests its cash in instruments that are redeemable at any time without penalty, thereby reducing its exposure to interest rate fluctuations. Other interest rate risks arising from the Company’s operations are not considered material.

Commodity Price risk

The Company is exposed to price risk with respect to commodity prices. The ability of the Company to operate and develop its mineral properties and its future profitability are directly related to the market price of precious and base metals and oil. The Company monitors commodity prices to determine whether changes in operating or development plans are necessary. The future gold production, with the exception of the Purchase Agreement (Note 19) is un-hedged in order to provide shareholders with exposure to changes in the market gold price.

Critical Accounting Estimates

The preparation of the Company’s consolidated financial statements requires management to make judgments, estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Estimates and assumptions are continually evaluated and are based on management’s experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. Actual results could differ from these estimates by a material amount.

Matters that require management to make significant judgments, estimates and assumptions in determining carrying values include, but are not limited to:

15

| a. | Mineral reserves |

Proven and probable mineral reserves are the economically mineable parts of the Company’s measured and indicated mineral resources demonstrated by at least a preliminary feasibility study. The Company estimates its proven and probable mineral reserves and measured and indicated and inferred mineral resources based on information compiled by appropriately qualified persons. The estimation of future cash flows related to proven and probable mineral reserves is based upon factors such as assumptions related to foreign exchange rates, commodity prices, future capital requirements, metal recovery factors and production costs along with geological assumptions and judgments made in estimating the size and grade of ore bodies. Changes in proven and probable mineral reserves or measured and indicated and inferred mineral resource estimates may impact the carrying value of mineral properties, plant and equipment, asset retirement obligations, recognition of deferred tax amounts and amortization.

| b. | Purchase price allocation |

Applying the acquisition method to asset or business acquisitions requires each identifiable asset and liability to be measured at its acquisition-date fair value. The determination of acquisition-date fair values requires that management make assumptions about future events and estimates about the future recoverability of assets. The assumptions and estimates used to determining the fair value of the net assets acquired require a high degree of judgment, and include estimates of mineral reserves or resources acquired, future metal prices, the amount of and the timing of the receipt of revenue and the disbursements for operating and capital costs, and discount rates. Changes in any of the assumptions or estimates used in determining the fair value of acquired assets and liabilities could impact the amounts assigned to assets and liabilities in the purchase price allocation.

| c. | Amortization |

Plant, equipment and other facilities used directly in mining activities are amortized using the units-of-production (“UOP”) method over a period not to exceed the estimated life of the related ore body based on recoverable metals to be mined from proven and probable mineral reserves. Mobile and other equipment are amortized, net of residual value, on a straight-line basis, over their useful lives, which are not to exceed the estimated life of the related ore body.

The calculation of the UOP rate and life of the ore body, and therefore the annual amortization expense, could be materially affected by changes in the underlying estimate of recoverable metals or other estimates. Changes in estimates may result from differences between actual future production and current forecasts of future production, expansion of mineral reserves through exploration activities, differences between estimated and actual costs of mining and differences in metal prices used in the estimation of mineral reserves.

Significant judgment is involved in the determination of useful life and residual values for the computation of amortization and no assurance can be given that the actual useful lives or residual values will not differ significantly from current assumptions.

| d. | Inventories |

Refined metal, doré and work in process inventories and mined ore are valued at the lower of average production cost or net realizable value. Doré represents a bar containing predominantly gold by value which must be refined offsite to return fine gold or silver in readily saleable form. Net realizable value is the estimated receipt from sale of the inventory in the normal course of business, less any anticipated costs to be incurred prior to its sale. The production cost of inventories is determined on a weighted average basis and includes cost of raw materials, direct labour, contract mining charges, overhead and depreciation, depletion and amortization of mineral properties.

The recovery of gold and by products from oxide ores is achieved through a leaching process at the La Arena Gold Mine. Under this method, ore is placed on leach pads where it is treated with a chemical solution that extracts gold contained in the ore. The majority of the gold in ore is recovered over a period of up to 30 days. The resulting gold rich or “pregnant” leach solution is further processed in a plant where the gold and silver are recovered in doré form. Operating costs at each stage of the process are deferred and included in work in process inventory based on current mining and leaching costs. Costs are removed from inventory as ounces of doré are produced at the average cost per recoverable ounce of gold. Estimates of recoverable gold are calculated from the measured quantities of ore placed on the pad, the grade of ore placed on the leach pad (based on assay analysis), testing of leach solutions and a recovery percentage (based on testing of solution and ongoing monitoring of the rate of gold recovery).

16

Consumable supplies and spare parts to be used in production are valued at the lower of weighted average cost or net realizable value.

| e. | Commencement of commercial production |

The Company assesses the stage of each mine under construction to determine when a property reaches the stage when it is substantially complete and ready for its intended use. Criteria used to assess when a property has commenced commercial production include, among other considerations:

The level of capital expenditures incurred relative to the expected costs to complete;

The completion of a reasonable period of testing of the mine plant and equipment;

The ability to produce saleable metals;

The attainment of relevant permits;

The ability to sustain ongoing production; and

Achievement of pre-determined production targets.

When management determines that a property has commenced commercial production, costs deferred during development are reclassified to property, plant and equipment and amortized. Management determined that the La Arena Gold Mine achieved commercial production levels in January 2012.

| f. | Asset retirement obligation |

The Company assesses its provision for reclamation and remediation on an annual basis or when new information or circumstances merit a re-assessment. Significant estimates and assumptions are made in determining the provision for reclamation and remediation, including estimates of the extent and costs of the activities, technological changes, regulatory changes, foreign exchange rates, inflation rates and discount rates. The provision for asset retirement obligations represents management’s best estimate of the present value of the future reclamation and remediation obligation. Actual expenditures may differ from the recorded amount.

Changes to the provision for reclamation and remediation are recorded with a corresponding change to the carrying value of the related asset. If the increase in the asset results in the asset exceeding the recoverable value, that portion of the increase is charged to expense.

| g. | Deferred income taxes |

The Company recognizes the deferred tax benefit of deferred income tax assets to the extent their recovery is probable. Assessing the recoverability of deferred tax assets requires management to make significant estimates of future taxable profit. In addition, future changes in tax laws could limit the ability of the Company to obtain tax deductions from deferred income and resource tax assets.

| h. | Derivative liability |

An option pricing model that considers changes in the US dollar price of gold is used to estimate the fair value of the financial derivative embedded in the Purchase Agreement described in Note 19 to the Financial Statements. The principal assumption used in the option pricing model is the volatility, over time, of the US dollar price of gold. Changes in this assumption may significantly affect the fair value estimate.

| i. | Share-based payments |

Share-based payments are determined using the Black-Scholes Option Pricing Model based on estimated fair values of all share-based awards at the date of grant. The Black-Scholes Option Pricing Model utilizes assumptions such as expected price volatility, the expected life of the option and the number of options that may be forfeited. Changes in these input assumptions may affect the fair value estimate.

| j. | Impairment of long lived assets |

Annually, or more frequently as circumstances require (such as a substantive decrease in metal prices, an increase in operating costs, a decrease in mineable resources or a change in foreign taxes or exchange rates), reviews are undertaken to evaluate the carrying value of the mining properties, mineral properties and plant and equipment considering, among other factors: the carrying value of each type of asset; the economic feasibility of continued operations; the use, value or condition of assets when not in operation; and changes in circumstances that affect decisions to reinstall or dispose of assets.

17

Impairment is considered to exist if the recoverable amount is less than the carrying amount of the assets.

Future cash flows used to assess recoverability are estimated based on expected future production, recoverability of resources, commodity prices, foreign exchange rates, operating costs, reclamation costs and capital costs. Management’s estimate of future cash flows is subject to risks and uncertainties, including the discount rate assumption. It is possible that changes in estimates may occur that affect management’s estimate of the recoverability of the investments in long lived assets. To the extent that the carrying amount of assets exceeds the recoverable amount, the excess is charged to expense.

Fair value is determined with reference to estimates of future discounted cash flow or to recent transactions involving dispositions of similar properties. Management believes that the estimates applied in the impairment assessment are reasonable; however, such estimates are subject to significant uncertainties and judgments. Although management has made its best estimate of these factors based on current and expected conditions, it is possible that the underlying assumptions could change significantly and impairment charges may be required in future periods. Such charges could be material.

Changes in Accounting Standards

Accounting standards effective January 1, 2012

Financial instruments disclosure

In October 2010, the IASB issued amendments to IFRS 7 - Financial Instruments: Disclosures that expand the disclosure requirements in relation to transferred financial assets. The amendments are effective for annual periods beginning on or after July 1, 2011, with earlier application permitted. The Company does not anticipate these amendments to have a significant impact on its consolidated financial statements.

Income taxes

In December 2010, the IASB issued an amendment to IAS 12 - Income Taxes that provides a practical solution to determining the recovery of investment properties as it relates to the accounting for deferred income taxes. This amendment is effective for annual periods beginning on or after January 1, 2012, with earlier application permitted. The Company does not anticipate this amendment to have a significant impact on its consolidated financial statements.

Accounting standards effective January 1, 2013

Consolidation

In May 2011, the IASB issued IFRS 10 - Consolidated Financial Statements (“IFRS 10”), which supersedes SIC 12 and the requirements relating to consolidated financial statements in IAS 27 - Consolidated and Separate Financial Statements. IFRS 10 is effective for annual periods beginning on or after January 1, 2013, with earlier application permitted under certain circumstances. IFRS 10 establishes control as the basis for an investor to consolidate its investees; and defines control as an investor’s power over an investee with exposure, or rights, to variable returns from the investee and the ability to affect the investor’s returns through its power over the investee.

In addition, the IASB issued IFRS 12 - Disclosure of Interests in Other Entities (“IFRS 12”), which combines and enhances the disclosure requirements for the Company’s subsidiaries, joint arrangements, associates and unconsolidated structured entities. The requirements of IFRS 12 include reporting of the nature of risks associated with the Company’s interests in other entities and the effects of those interests on the Company’s consolidated financial statements.

Concurrently with the issuance of IFRS 10, IAS 27 and IAS 28 - Investments in Associates (“IAS 28”) were revised and reissued as IAS 27 - Separate Financial Statements and IAS 28 - Investments in Associates and Joint Ventures to align with the new consolidation guidance.

The Company is evaluating the effect that the above standards may have on its consolidated financial statements.

Joint arrangements

18

In May 2011, the IASB issued IFRS 11 - Joint Arrangements (“IFRS 11”), which supersedes IAS 31 - Interests in Joint Ventures and SIC-13 - Jointly Controlled Entities - Non-Monetary Contributions by Venturers. IFRS 11 is effective for annual periods beginning on or after January 1, 2013, with earlier application permitted under certain circumstances. Under IFRS 11, joint arrangements are classified as joint operations or joint ventures based on the rights and obligations of the parties to the joint arrangements. A joint operation is a joint arrangement whereby the parties that have joint control of the arrangement (“joint operators”) have rights to the assets and obligations for the liabilities relating to the arrangement. A joint venture is a joint arrangement whereby the parties that have joint control of the arrangement (“joint venturers”) have rights to the net assets of the arrangement. IFRS 11 requires that a joint operator recognize its portion of assets, liabilities, revenues and expenses of a joint arrangement, while a joint venturer recognizes its investment in a joint arrangement using the equity method. The Company does not anticipate this amendment to have a significant impact on its consolidated financial statements.

Fair value measurement

In May 2011, as a result of the convergence project undertaken by the IASB and the US Financial Accounting Standards Board, to develop common requirements for measuring fair value and for disclosing information about fair value measurements, the IASB issued IFRS 13 - Fair Value Measurement (“IFRS 13”). IFRS 13 is effective for annual periods beginning on or after January 1, 2013, with earlier application permitted. IFRS 13 defines fair value and sets out a single framework for measuring fair value, which is applicable to all IFRSs that require or permit fair value measurements or disclosures about fair value measurements. IFRS 13 requires that when using a valuation technique to measure fair value, the use of relevant observable inputs should be maximized while unobservable inputs should be minimized.

The Company does not anticipate the application of IFRS 13 to have a material impact on its consolidated financial statements.

Financial statement presentation

In June 2011, the IASB issued amendments to IAS 1 - Presentation of Financial Statements (“IAS 1”) that require an entity to group items presented in the Statement of Comprehensive Income into two groups on the basis of whether they may be reclassified to earnings subsequent to initial recognition or not reclassified to earnings subsequent to initial recognition. For those items presented before taxes, the amendments to IAS 1 also require that the taxes related to the two separate groups be presented separately. The amendments are effective for annual periods beginning on or after July 1, 2012, with earlier adoption permitted.

The Company does not anticipate the application of the amendments to IAS 1 to have a material impact on its consolidated financial statements.

Employee Benefits

In June 2011, the IASB issued amendments to IAS 19 - Employee Benefits (“IAS 19”) that introduced changes to the accounting for defined benefit plans and other employee benefits. The amendments include elimination of the option to defer, or recognize in full in earnings, actuarial gains and losses and instead mandates the immediate recognition of all actuarial gains and losses in other comprehensive income and requires use of the same discount rate for both the defined benefit obligation and expected asset return when calculating interest cost. Other changes include modification of the accounting for termination benefits and classification of other employee benefits.

The Company does not anticipate the application of the amended IAS 19 to have a material impact on its consolidated financial statements.

Stripping Costs in the Production Phase of a Surface Mine

This new interpretation, issued by the International Accounting Standards Board in October 2011, clarifies when production stripping should lead to the recognition of an asset and how that asset should be measured, both initially and in subsequent periods. IFRIC 20 - Stripping Costs in the Production Phase of a Surface Mine (“IFRIC 20”) applies to the costs incurred to remove mine waste materials to gain access to mineral ore deposits during the production phase of a surface mine.

The main features of IFRIC 20 are as follows:

19

• If the benefit from the stripping activity is realized in the form of inventory produced, the entity accounts for the costs in accordance with IAS 2 Inventories. If the benefit is improved access to the ore, the entity recognizes the costs as an addition to an existing asset.

• The stripping activity asset is measured in the same way as the existing asset of which it is a part (at cost or revalued amount less depreciation or amortization and less impairment losses).

• Depreciation or amortization is calculated over the expected useful life of the identified component of the ore body that becomes more accessible as a result of the stripping activity.

The interpretation is effective for annual periods beginning on or after January 1, 2013. The Company adopted the provisions of this interpretation in 2012. The application of IFRIC 20 does not have a material impact on the Company’s consolidated financial statements.

Accounting standards effective January 1, 2015

Financial instruments

The IASB intends to replace IAS 39 - Financial Instruments: Recognition and Measurement (“IAS 39”) in its entirety with IFRS 9 - Financial Instruments (“IFRS 9”) in three main phases. IFRS 9 will be the new standard for the financial reporting of financial instruments that is principles-based and less complex than IAS 39. In November 2009 and October 2010, phase 1 of IFRS 9 was issued and amended, respectively, which addressed the classification and measurement of financial assets and financial liabilities. IFRS 9 requires that all financial assets be classified as subsequently measured at amortized cost or at fair value based on the Company’s business model for managing financial assets and the contractual cash flow characteristics of the financial assets. Financial liabilities are classified as subsequently measured at amortized cost except for financial liabilities classified as at fair value through profit and loss, financial guarantees and certain other exceptions. In response to delays to the completion of the remaining phases of the project, on December 16, 2011, the IASB issued amendments to IFRS 9 which deferred the mandatory effective date of IFRS 9 from January 1, 2013 to annual periods beginning on or after January 1, 2015. The amendments also provided relief from the requirement to restate comparative financial statements for the effects of applying IFRS 9.

The Company will monitor the evolution of this standard to evaluate the impact it may have on its consolidated financial statements.

International Financial Reporting Standards

The Financial Statements are the Company’s first audited consolidated financial statements prepared under International Financial Reporting Standards (“IFRS”). IFRS represent standards and interpretations approved by the International Accounting Standards Board (“IASB”) and are comprised of IFRSs, International Accounting Standards (“IASs”), and interpretations issued by the IFRS Interpretations Committee (“IFRICs”) or the former Standing Interpretations Committee (“SICs”). The Company’s significant accounting policies are described in note 3 of the Financial Statements.

The Company implemented its conversion from Canadian GAAP to IFRS on June 1, 2010. There were no significant issues noted during the reporting process for the Company’s seven-month period ended December 31, 2011.

The effects of the transition to IFRS on equity, total comprehensive income and reported cash flows are presented in below and are further explained in the notes that the accompany the tables.

First-time adoption and exemptions applied

Upon transition to IFRS, IFRS 1 mandates certain exceptions to IFRS and permits certain exemptions from full retrospective application. The Company has applied the mandatory exceptions and elected certain optional exemptions.

Mandatory exceptions:

| a. | Financial assets and liabilities that have been de-recognized before 1 January 2005 under previous Canadian GAAP have not been recognized under IFRS. | |

| b. | The Company used estimates under IFRS that are consistent with those applied under Canadian GAAP (with adjustments for accounting policy differences). |

20

Optional exemptions applied:

| a. | The Company elected not apply IFRS 2 Share-based Payments to equity instruments that were granted prior to the Transition Date. |